UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| X | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the Fiscal Year ended December 31, 20112014 |

OR

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | Commission File Number 1-7908 |

ADAMS RESOURCES & ENERGY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 74-1753147 | 17 South Briar Hollow Lane SteSuite 100 | 77027 |

| | | Houston, Texas | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) | (Address of Principal executive offices) | (Zip Code) |

Registrant'sRegistrant’s telephone number, including area code: (713) 881-3600

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, $.10 Par Value | NYSE AmexMKT |

Indicate by check mark whether the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ___NO _X X___

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.YES ____ NO _X_

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports,reports) and (2) has been subject to the filing requirements for the past 90 days. YES_YES X_X NO ___

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES_

X_YES X NO ___

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. _X_ X

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See definition of “large‟large accelerated filer”, ‟accelerated filer” and “accelerated filer and smaller‟smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ____ Accelerated filer ____ X

Non-accelerated filer _X_____ Smaller reporting company _____

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act).

YES ___NO _X_

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of the close of business on June 30, 20112014 was $52,992,199$172,042,728 based on the closing price of $25.34$78.13 per one share of common stock as reported on the NYSE AMEX ExchangeMKT for such date. A total of 4,217,596 shares of Common Stock were outstanding at March 10, 2012.1, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Annual Meeting of Stockholders to be held May 16, 201214, 2015 are incorporated by reference into Part III of this report.

PART I

Forward-Looking Statements –Safe Harbor Provisions

This annual report on Form 10-K for the year ended December 31, 2014 contains certain forward-looking statements covered by the safe harbors provided under federal securities law and regulations. To the extent such statements are not recitations of historical fact, such forward-looking statements involve risks and uncertainties. In particular, statements under the captions (a) Production and Reserve Information, (b) Regulatory Status and Potential Environmental Liability, (c) Management’s Discussion and Analysis of Financial Condition and Results of Operations, (d) Critical Accounting Policies and Use of Estimates, (e) Quantitative and Qualitative Disclosures about Market Risk, (f) Income Taxes, (g) Concentration of Credit Risk, (h) Price Risk Management Activities, and (i) Commitments and Contingencies, among others, contain forward-looking statements. Where the Company expresses an expectation or belief regarding future results or events, such expression is made in good faith and believed to have a reasonable basis in fact. However, there can be no assurance that such expectation or belief will actually result or be achieved.

With the uncertainties of forward looking statements in mind, the reader should consider the risks discussed elsewhere in this report and other documents filed by the Company with the Securities and Exchange Commission (the ‟SEC”) from time to time and the important factors described under ‟Item 1A. Risk Factors” that could cause actual results to differ materially from those expressed in any forward-looking statement made by or on behalf of the Company.

Items 1 and 2. BUSINESS AND PROPERTIES

Forward-Looking Statements –Safe Harbor Provisions

This annual report on Form 10-K for the year ended December 31, 2011 contains certain forward-looking statements covered by the safe harbors provided under Federal securities law and regulations. To the extent such statements are not recitations of historical fact, forward-looking statements involve risks and uncertainties. In particular, statements under the captions (a) Production and Reserve Information, (b) Regulatory Status and Potential Environmental Liability, (c) Management’s Discussion and Analysis of Financial Condition and Results of Operations, (d) Critical Accounting Policies and Use of Estimates, (e) Quantitative and Qualitative Disclosures about Market Risk, (f) Income Taxes, (g) Concentration of Credit Risk, (h) Price Risk Management Activities, and (i) Commitments and Contingencies, among others, contain forward-looking statements. Where the Company expresses an expectation or belief regarding future results or events, such expression is made in good faith and believed to have a reasonable basis in fact. However, there can be no assurance that such expectation or belief will actually result or be achieved.

With the uncertainties of forward looking statements in mind, the reader should consider the risks discussed elsewhere in this report and other documents filed by the Company with the Securities and Exchange Commission from time to time and the important factors described under “Item 1A. Risk Factors” that could cause actual results to differ materially from those expressed in any forward-looking statement made by or on behalf of the Company.

Business Activities

Adams Resources & Energy, Inc. (“(‟ARE”), a Delaware corporation organized in 1973, and its subsidiaries (collectively, the "Company"‟Company”), are engaged in the business of marketing crude oil natural gas and petroleum products,marketing, tank truck transportation of liquid chemicals, and oil and gas exploration and production. Adams Resources & Energy, Inc. is a Delaware corporation organized in 1973. The Company’s headquarters are located in 23,450 square feet of office space located at 17 South Briar Hollow Lane Suite 100, Houston, Texas 77027 and the telephone number of that address is (713) 881-3600. The revenues, operating results and identifiable assets of each industry segment for the three years ended December 31, 20112014 are set forth in Note 8 of Notes(8) to the Consolidated Financial Statements included elsewhere herein.

Marketing Segment SubsidiariesSubsidiary

Gulfmark Energy, Inc. (“(‟Gulfmark”), a subsidiary of ARE, purchases crude oil and arranges sales and deliveries to refiners and other customers. Activity is concentrated primarily onshore in Texas and Louisiana with additional operations in Michigan and New Mexico. During 2011,North Dakota. Gulfmark purchased approximately 81,600 barrels per day of crude oil at the wellhead or lease level. Gulfmark also operates 148205 tractor-trailer rigs and maintains over 54121 pipeline inventory locations or injection stations. Gulfmark has the ability to barge oil from threefour oil storage facilities along the intercoastal waterway of Texas and Louisiana and maintains 180,000400,000 barrels of storage capacity at certain of the dock facilities in order to access waterborne markets for its products. During 2014, Gulfmark purchased approximately 117,100 barrels per day of crude oil at the field (wellhead) level. Gulfmark delivers physical supplies to refiner customers or enters into commodity exchange transactions with third parties when the cost of theto exchange is less than the alternate cost incurred in transportingto transport or storingstore the crude oil. During 2011,2014, Gulfmark had sales to fourtwo customers that comprised 18.220.3 percent 15.4 percent, 13.4 percent, and 11.314.0 percent, respectively, of total Company wide revenues. Management believes that a loss of any of these customers would not have a material adverse effect on the Company’s operations. See alsodiscussion under ‟Concentration of Credit Risk” in Note 3 of Notes(3) to Consolidated Financial Statements.

Adams Resources Marketing, Ltd. (“ARM”), a subsidiary of ARE, operates as a wholesale purchaser, distributor and marketer of natural gas. ARM’s focus is onOperating results for the purchase of natural gas at the producer level. During 2011, ARM purchased approximately 208,000 million british thermal units (“mmbtu’s”) of natural gas per day at the wellhead and pipeline pooling points. Business is concentrated among approximately 60 independent producers with the primary production areas being the Louisiana and Texas Gulf Coast and the offshore Gulf of Mexico region. ARM provides value added services to its customers by providing access to common carrier pipelines and handling daily volume balancing requirements as well as risk management services.

Ada Resources, Inc. (“Ada”), a subsidiary of ARE, marketed branded and unbranded refined petroleum products such as motor fuels and lubricants. In February 2012, the Company sold substantially all equipment, inventory and contracts associated with this operation. The company retained Ada’s former distribution and warehousing facility located on 5.5 Company-owned acres in Houston, Texas. See Note (10) of Notes to Financial Statements for additional discussion.

Operating resultsmarketing segment are sensitive to a number of factors. Such factors include commodity location, grades of product, individual customer demand for grades or location of product, localized market price structures, availability of transportation facilities, actual delivery volumes that vary from expected quantities, and the timing and costs to deliver the commodity to the customer.

Transportation Segment Subsidiary

Service Transport Company (“(‟STC”), a subsidiary of ARE, transports liquid chemicals on a "for hire"‟for hire” basis throughout the continental United States and Canada. Transportation service is provided to over 400 customers under multiple load contracts in addition to loads covered under STC’s standard price list. Pursuant to regulatory requirements, STC holds a Hazardous Materials Certificate of Registration issued by the United States.States Department of Transportation (“(‟DOT”). STC operates 285308 truck tractors of which 12285 are Company owned with 23 independent owner-operator unitsunits. The Company also owns and maintains 447operates 509 tank trailers. In addition, STC maintainsoperates truck terminals in Houston, Corpus Christi, and Nederland, Texas as well as Baton Rouge (St. Gabriel), Louisiana and Mobile (Saraland), Alabama. Transportation operations are headquartered at a terminal facility situated on 22 Company-owned acres in Houston, Texas. This property includes maintenance facilities, an office building, tank wash rack facilities and a water treatment system. The St. Gabriel, Louisiana terminal is situated on 11.5 Company-owned acres and includes an office building, maintenance bays and tank cleaning facilities.

STC is compliant with International Organization for Standardization (“(‟ISO”) 9001:2000 Standard. The scope of this Quality System Certificate covers the carriage of bulk liquids throughout STC’s area of operations as well as the tank trailer cleaning facilities and equipment maintenance. STC’s quality management process is one of its major assets. The practice of using statistical process control covering safety, on-time performance and customer satisfaction aids continuous improvement in all areas of quality service. In addition to its ISO 9001:2000 practices, the American Chemistry Council recognizes STC as a Responsible CareÓ Partner. Responsible Care Partners serve the chemical industry and implement and monitor the seven Codes of Management Practices. The seven codes address compliance and continuing improvement in (1) Community Awareness and Emergency Response, (2) Pollution Prevention, (3) Process Safety, (4) Distribution, (5) Employee Health and Safety, (6) Product Stewardship, and (7) Security.

Oil and Gas Segment Subsidiary

Adams Resources Exploration Corporation (“(‟AREC”), a subsidiary of ARE, is actively engaged in the exploration and development of domestic oil and natural gas properties primarily in Texas and the south central region of the United States. AREC’s offices are maintained in Houston and the Company holds an interest in 405514 producing wells of which 4129 are Company operated.

Producing Wells--The following table sets forth the Company'sCompany’s gross and net productive wells as of December 31, 2011.2014. Gross wells are the total number of wells in which the Company has an interest, while net wells are the sum of the fractional interests owned.

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Texas | | | 247 | | | | 8.11 | | | | 149 | | | | 11.46 | | | | 396 | | | | 19.57 | |

| Other | | | 93 | | | | 3.42 | | | | 25 | | | | .61 | | | | 118 | | | | 4.03 | |

| | | | 340 | | | | 11.53 | | | | 174 | | | | 12.07 | | | | 514 | | | | 23.60 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Texas | | | 99 | | | | 9.80 | | | | 158 | | | | 12.35 | | | | 257 | | | | 22.15 | |

| Other | | | 94 | | | | 4.32 | | | | 54 | | | | 5.42 | | | | 148 | | | | 9.74 | |

| | | | 193 | | | | 14.12 | | | | 212 | | | | 17.77 | | | | 405 | | | | 31.89 | |

Acreage--The following table sets forth the Company'sCompany’s gross and net developed and undeveloped acreage as of December 31, 2011.2014. Gross acreage represents the Company’s direct ownership and net acreage represents the sum of the fractional interests owned. The Company’s developed acreage is held by current production while undeveloped acreage is held by oil and gas leases with various remaining terms, production from six months to three years.non-owned shallow wells, or other contractual provisions delaying termination of leasehold rights. The Company’s ownership in undeveloped acreage is substantially all in the form of a non-operated minority interest. As such, the Company relies on the third party operator to manage the lease holdings.

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Texas | | | 122,884 | | | | 10,924 | | | | 217,802 | | | | 17,849 | | | | 128,780 | | | | 10,556 | | | | 118,731 | | | | 13,911 | |

| Kansas | | | 150 | | | | 15 | | | | 18,157 | | | | 1,815 | | | | 1,018 | | | | 51 | | | | 14,784 | | | | 739 | |

| North Dakota | | | | - | | | | - | | | | 13,000 | | | | 1,300 | |

| Other | | | 8,202 | | | | 1,072 | | | | 1,701 | | | | 675 | | | | 3,478 | | | | 339 | | | | 6,065 | | | | 2,120 | |

| | | | 131,236 | | | | 12,011 | | | | 237,660 | | | | 20,339 | | | | 133,276 | | | | 10,946 | | | | 152,580 | | | | 18,070 | |

Drilling Activity--The following table sets forth the Company'sCompany’s drilling activity for each of the three years ended December 31, 2011.2014. All drilling activity was onshore in Texas, Louisiana Arkansas and Kansas.

| | | | | | | | | | | | | | | | | | | |

| | | Gross | | | Net | | | Gross | | | Net | | | Gross | | | Net | | | Gross | | | Net | | | Gross | | | Net | | | Gross | | | Net | |

| Exploratory wells drilled | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| - Productive | | | - | | | | - | | | | - | | | | - | | | | 2 | | | | .10 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| - Dry | | | 8 | | | | .87 | | | | 12 | | | | .67 | | | | 7 | | | | .94 | | | | 4 | | | | .40 | | | | 3 | | | | .38 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Development wells drilled | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| - Productive | | | 75 | | | | 2.10 | | | | 41 | | | | 1.77 | | | | 24 | | | | 1.35 | | | | 46 | | | | .83 | | | | 77 | | | | 1.40 | | | | 109 | | | | 2.40 | |

| - Dry | | | 3 | | | | .18 | | | | - | | | | - | | | | 2 | | | | .10 | | | | 3 | | | | .43 | | | | - | | | | - | | | | - | | | | - | |

| | | | 86 | | | | 3.15 | | | | 53 | | | | 2.44 | | | | 35 | | | | 2.49 | | | | 53 | | | | 1.66 | | | | 80 | | | | 1.78 | | | | 109 | | | | 2.40 | |

Production and Reserve Information--The Company'sCompany’s estimated net quantities of proved oil and natural gas reserves and the standardized measure of discounted future net cash flows, calculated at a 10% discount rate, for the three years ended December 31, 2011,2014, are presented in the table below (in thousands):

| | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Crude oil (thousands of barrels) | | | 292 | | | | 267 | | | | 242 | | | | 318 | | | | 368 | | | | 307 | |

| Natural gas (thousands of mcf) | | | 9,661 | | | | 7,794 | | | | 7,248 | | | | 5,611 | | | | 6,286 | | | | 8,837 | |

| Standardized measure of discounted future | | | | | | | | | | | | | |

| net cash flows from oil and natural gas reserves | | $ | 20,931 | | | $ | 16,672 | | | $ | 9,305 | | |

| Standardized measure of oil and gas reserves | | | $ | 15,744 | | | $ | 17,836 | | | $ | 16,355 | |

The estimated value of oil and natural gas reserves and future net revenues from oil and natural gas reserves was made by the Company'sCompany’s independent petroleum engineers. The reserve value estimates provided at each of December 31, 2011, 20102014, 2013 and 20092012 are based on market prices of $95.85, $76.14$89.60, $94.99 and $58.43$93.85 per barrel for crude oil and $5.42, $4.69 $5.26 and $4.05$3.51 per mcfthousand cubic feet (‟mcf”) for natural gas, respectively. For 2011 and 2010, suchSuch prices were based on the unweighted arithmetic average of the prices in effect on the first day of the month for each month of the respective twelve month periods as required by Security and Exchange Commission (“SEC”)SEC regulations. For 2009,The prices reported in the price reflects the market price on December 31, 2009. The price reportedreserve disclosures for natural gas includesinclude the value of associated natural gas liquids. Hydrocarbon prices declined significantly during the fourth quarter of 2014. Realized domestic crude oil prices averaged in the $54 per barrel range during the month of December with additional price declines continuing into 2015.

Reserve estimates are based on many subjective factors. The accuracy of reservethese estimates depends on the quantity and quality of geological data, production performance data, and reservoir engineering data, the pricing assumptions utilized as well as the skill and judgment of petroleum engineers in interpreting such data. The process of estimating reserves requires frequent revision of estimates as additional information is made available through drilling, testing, reservoir studies and acquiring historical pressure and production data. In addition, the discounted present value of estimated future net revenues should not be construed as the fair market value of oil and natural gas producing properties. Such estimatesreserve valuations do not necessarily portray a realistic assessment of current value or future performance of such properties. Such revenueThese calculations are based on estimates as to the timing of oil and natural gas production, and there is no assurance that the actual timing of production will conform to or approximate such estimates.calculations. Also, certain assumptions have been made with respect to pricing. The estimates assume prices will remain constant from the date of the engineer's estimates,engineer’s assessment, except for changes reflected under natural gas sales contracts. There can be no assurance that actual future prices will not vary as industry conditions, governmental regulation and other factors impact the market price for oil and natural gas.

The Company'sCompany’s net oil and natural gas production for the three years ended December 31, 20112014 was as follows:

| Years Ended | | Crude Oil | | | Natural | |

December 31, | | (barrels) | | | Gas (mcf) | |

| 2011 | | | 61,500 | | | | 1,895,000 | |

| 2010 | | | 54,000 | | | | 1,365,000 | |

| 2009 | | | 49,500 | | | | 1,304,000 | |

| Years Ended | | Crude Oil | | | Natural | |

December 31, | | (barrels) | | | Gas (mcf) | |

| 2014 | | | 127,300 | | | | 1,133,000 | |

| 2013 | | | 102,300 | | | | 1,608,000 | |

| 2012 | | | 98,100 | | | | 2,608,000 | |

Certain financial information relating to the Company'sCompany’s crude oil and natural gas exploration division revenues and earnings is summarized as follows:

| | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Average oil and condensate | | | | | | | | | | | | | | | | | | |

sales price per barrel | | $ | 93.23 | | | $ | 77.09 | | | $ | 58.10 | | | $ | 63.64 | | | $ | 79.15 | | | $ | 84.39 | |

| Average natural gas | | | | | | | | | | | | | | | | | | | | | | | | |

| sales price per mcf | | $ | 4.39 | | | $ | 5.02 | | | $ | 4.43 | | | $ | 4.65 | | | $ | 3.75 | | | $ | 2.94 | |

| Average production cost, per equivalent | | | | | | | | | | | | | | | | | | | | | | | | |

| barrel, charged to expense | | $ | 16.79 | | | $ | 13.99 | | | $ | 13.25 | | | $ | 21.42 | | | $ | 15.54 | | | $ | 13.14 | |

(1) Average oil and condensate prices include the value of associated natural gas liquids.

The Company has had no reports to federal authorities or agencies of estimated oil and gas reserves. The Company is not obligated to provide any fixed and determinable quantities of oil or gas in the future under existing contracts or agreements associated with its oil and gas exploration and production segment.

Environmental Compliance and Regulation

The Company is subject to an extensive variety of evolving United States federal, state and local laws, rules and regulations governing the storage, transportation, manufacture, use, discharge, release and disposal of product and contaminants into the environment, or otherwise relating to the protection of the environment. Presented below is a non-exclusive listing of the environmental laws that potentially impact the Company’s activities.

| - | The Solid Waste Disposal Act, as amended by the Resource Conservation and Recovery Act of 1976, as amended. |

| - | Comprehensive Environmental Response, Compensation and Liability Act of 1980 ("CERCLA"(‟CERCLA” or "Superfund"‟Superfund”), as amended. |

| - | The Clean Water Act of 1972, as amended. |

| - | Federal Oil Pollution Act of 1990, as amended. |

| - | The Clean Air Act of 1970, as amended. |

| - | The Toxic Substances Control Act of 1976, as amended. |

| - | The Emergency Planning and Community Right-to-Know Act. |

| - | The Occupational Safety and Health Act of 1970, as amended. |

| - | Texas Solid Waste Disposal Act. |

| - | Texas Oil Spill Prevention and Response Act of 1991, as amended. |

Railroad Commission of Texas (“(‟RRC”)--The RRC regulates, among other things, the drilling and operation of oil and natural gas wells, the operation of oil and gas pipelines, the disposal of oil and natural gas production wastes, and certain storage of unrefined oil and gas. RRC regulations govern the generation, management and disposal of waste from such oil and natural gas operations and provide for the clean up of contamination from oil and natural gas operations. The RRC has promulgated regulations that provide for civil and/or criminal penalties and/or injunctive relief for violations of the RRC regulations.

Louisiana Office of Conservation--This agency has primary statutory responsibility for regulation and conservation of oil, gas, and other natural resources in the State of Louisiana. Their objectives are to (i) regulate the exploration and production of oil, natural gas and other hydrocarbons;hydrocarbons, (ii) control and allocate energy supplies and distribution thereof, and (iii) protect public safety and the State’s environment from oilfield waste, including the regulation of underground injection and disposal practices.

State and Local Government Regulation--Many states are authorized by the United States Environmental Protection Agency (“(‟EPA”) to enforce regulations promulgated under various federal statutes. In addition, there are numerous other state and local authorities that regulate the environment, some of which impose more stringent environmental standards than federal laws and regulations. The penalties for violations of state law vary, but typically include injunctive relief and recovery of damages for injury to air, water or property andas well as fines for non-compliance.

Oil and Gas Operations--The Company'sCompany’s oil and gas drilling and production activities are subject to laws and regulations relating to environmental quality and pollution control. One aspect of the Company'sCompany’s oil and gas operation is the disposal of used drilling fluids, saltwater, and crude oil sediments. In addition, low-level naturally occurring radiation may, at times, occur with the production of crude oil and natural gas. The Company'sCompany’s policy is to comply with environmental regulations and industry standards. Environmental compliance has become more stringent and the Company, from time to time, may be required to remediate past practices. Management believes that such required remediation in the future, if any, will not have a material adverse impact on the Company'sCompany’s financial position or results of operations.

All states in which the Company owns producing oil and gas properties have statutory provisions regulating the production and sale of crude oil and natural gas. Regulations typically require permits for the drilling of wells and regulate the spacing of wells, the prevention of waste, protection of correlative rights, the rate of production, prevention and clean-up of pollution, and other matters.

Marketing OperationsTrucking Activities--The Company'sCompany’s marketing facilities are subject to a number of state and federal environmental statutes and regulations, including the regulation of underground fuel storage tanks. While the Company has not owned or operated underground tanks for more than 10 years, historically the Company was an owner and operator of underground storage tanks. The EPA's Office of Underground Tanks and applicable state laws establish regulations requiring owners or operators of underground fuel tanks to demonstrate evidence of financial responsibility for the costs of corrective action and the compensation of third parties for bodily injury and property damage caused by sudden and non-sudden accidental releases arising from operating underground tanks. In addition, the EPA requires the installation of leak detection devices and stringent monitoring of the ongoing condition of underground tanks. Should leakage develop in an underground tank, the operator is obligated for clean up costs. During the period when the Company operated underground tanks, it secured insurance covering both third party liability and clean up costs.

Transportation Operations--The Company's tanktransportation businesses operate truck operations are conductedfleets pursuant to authority of the DOT and various state regulatory authorities. The Company's transportationTrucking operations must also be conducted in accordance with various laws relating to pollution and environmental control. Interstate motor carrier operations are subject tocontrol as well as safety requirements prescribed by states and the DOT. Matters such as weight and dimension of equipment are also subject to federal and state regulations. DOTThese regulations also require mandatory drug testing of drivers and require certain tests for alcohol levels in drivers and other safety personnel. The trucking industry is subject to possible regulatory and legislative changes such as increasingly stringent environmental regulationsrequirements or limits on vehicle weight and size. Regulatory change may affect the economics of the industry by requiring changes in operating practices or by changing the demand for private and common or contract carrier services or the cost of providing truckload services. In addition, the Company’s tank wash facilities are subject to increasingly stringent local, state and federal environmental regulations.

The Company has implemented security procedures for drivers and terminal facilities. Satellite tracking transponders installed in the power units are used to communicate en route emergencies to the Company and to maintain constant information as to the unit’s location. If necessary, the Company’s terminal personnel will notify local law enforcement agencies. In addition, the Company is able to advise a customer of the status and location of their loads. Remote cameras and better lighting coverage in the staging and parking areas have augmented terminal security.

Regulatory Status and Potential Environmental Liability--The operations and facilities of the Company are subject to numerous federal, state, and local environmental laws and regulations including those described above, as well as associated permitting and licensing requirements. The Company regards compliance with applicable environmental regulations as a critical component of its overall operation, and devotes significant attention to providing quality service and products to its customers, protecting the health and safety of its employees, and protecting the Company’s facilities from damage. Management believes the Company has obtained or applied for all permits and approvals required under existing environmental laws and regulations to operate its current business. Management has reported that the Company is not subject to any pending or threatened environmental litigation or enforcement actions which could materially and adversely affect the Company'sCompany’s business. The Company has, where appropriate, implemented operating procedures at each of its facilities designed to assure compliance with environmental laws and regulation. However, given the nature of the Company’s business, the Company is subject to environmental risks and the possibility remains that the Company'sCompany’s ownership of its facilities and its operations and activities could result in civil or criminal enforcement and public as well as private actions against the Company, which may necessitate or generate mandatory clean up activities, revocation of required permits or licenses, denial of application for future permits, and/or significant fines, penalties or damages, any and all of which could have a material adverse effect on the Company. See “Item 1A. Risk Factors – Environmental liabilities and environmental regulations may have an adverse effect on the Company.” At December 31, 2011,2014, the Company is unaware of any unresolved environmental issues for which additional accounting accruals are necessary.

Employees

At December 31, 20112014, the Company employed 780870 persons, 1514 of whom were employed in the exploration and production of oil and gas, 345401 in the marketing of crude oil, natural gas and petroleum products, 399436 in transportation operations, and 2119 in administrative capacities. None of the Company'sCompany’s employees are represented by a union. Management believes its employee relations are satisfactory.

Federal and State Taxation

The Company is subject to the provisions of the Internal Revenue Code of 1986, as amended (the “Code”‟Code”). In accordance with the Code, the Company computes its income tax provision based on a 35 percent tax rate. The Company'sCompany’s operations are, in large part, conducted within the State of Texas. Texas operations are subject to a one-half percent state tax on its revenues net of cost of goods sold as defined by the state. Oil and gas activities are also subject to state and local income, severance, property and other taxes. Management believes the Company is currently in compliance with all federal and state tax regulations.

On February 27, 2012, the Company completed the sale of certain assets previously associated with the Company’s refined products marketing segment. Assets sold included equipment, tanks and trucks, as well as all refined petroleum product inventories and substantially all supplier and customer contracts associated with this business segment. With the consummation of this transaction, the Company exited the refined petroleum products marketing business. The Company’s former refined petroleum products operation was active in the distribution and sale of lube oils and motor fuels such as gasoline and diesel. Sales proceeds totaled $2,000,000 plus the market value of inventories. The Company will continue to collect any outstanding accounts receivable and satisfy all account payable obligations associated with this business. See discussion under “Subsequent Event” in Note 10 to the Consolidated Financial Statements.

Available Information

The Company is required to file periodic reports as well as other information with the Securities and Exchange Commission (“SEC”)SEC within established deadlines. Any document filed with the SEC may be viewed or copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Additional information regarding the Public Reference Room can be obtained by calling the SEC at (800) SEC-0330. The Company’s SEC filings are also available to the public through the SEC’s web site located at http://www.sec.gov.

The Company maintains a corporate website at http://www.adamsresources.com, on which investors may access free of charge the annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports as soon as is reasonably practicable after filing or furnishing such material with the SEC. Additionally, the Company has adopted and posted on its website a Code of Business Ethics designed to reflect requirements of the Sarbanes-Oxley Act of 2002, NYSE AmexMKT Exchange rules and other applicable laws, rules and regulations. The Code of Business Ethics applies to all of the Company’s directors, officers and employees. Any amendment to the Code of Business Ethics will be posted promptly on the Company’s website. The information contained on or accessible from the Company’s website does not constitute a part of this report and is not incorporated by reference herein. The Company will provide a printed copy of any of these aforementioned documents free of charge upon request by calling ARE at (713)-881-3600 881-3600 or by writing to:

Adams Resources & Energy, Inc.

ATTN: Richard B. Abshire

17 South Briar Hollow Lane, SteSuite 100

Houston, Texas 77027

Item 1A. RISK FACTORS

Economic developments could damage operations and materially reduce profitability and cash flows.

Potential disruptions in the credit markets and concerns about global economic growth could have a significant adverse impact on global financial markets and commodity prices. Such factors could contribute to a decline in the Company’s stock price and corresponding market capitalization. Should commodity prices experience a period of rapid decline, future earnings will be reduced. Since the Company has noneither bank debt obligations nor covenants tied to its stock price, potential declines in the Company’s stock price do not affect the Company’s liquidity or overall financial condition. Should the capital and credit markets experience volatility and the availability of funds remainsbecome limited, the Company’s customers and suppliers may incur increased costs associated with issuing commercial paper and/or other debt instruments and this, in turn, could adversely affect the Company’s ability to secure supply and make profitable sales.

General economic conditions could reduce demand for chemical based trucking services.

Customer demand for the Company’s products and services is substantially dependent upon the general economic conditions for the United States which are cyclical in nature. In particular, demand for liquid chemical truck transportation services is dependent on activity within the petrochemical sector of the U. S.U.S. economy. Chemical sector demand typically varies with the housing and auto markets as well as the relative strength of the U. S.U.S. dollar to foreign currencies. A relatively strong U.S. dollar exchange rate may be adverse to the Company’s transportation operation since it tends to suppress export demand for petrochemicals which is adverse to the Company’s transportation operation.petrochemicals. Conversely, a weak U. S.U.S. dollar exchange rate tends to stimulate export demand for petrochemicals.

The Company’s business is dependent on the ability to obtain trade and other credit.

The Company’s future development and growth depends, in part, on its ability to successfully obtain credit from suppliers and other parties. Trade credit arrangements are relied upon as a significant source of liquidity for capital requirements not satisfied by operating cash flow.

Should global financial markets and economic conditions disrupt and reduce stability in general, and the solvency of creditors specifically, the availability of funding from credit markets would be reduced as many lenders and institutional investors would enact tighter lending standards, refuse to refinance existing debt on terms similar to current debt or, in some cases, cease to provide funding to borrowers. These issues coupled with weak economic conditions would make it more difficult for the Company and its suppliers and customers to obtain funding.

If the Company is unable to obtain trade or other forms of credit on reasonable and competitive terms, itsthe ability to continue its marketing and exploration businesses, pursue improvements, and continue future growth will be limited. There is no assurance that the Company will be able to maintain future credit arrangements on commercially reasonable terms.

The financial soundness of customers could affect the Company’s business and operating results

Constraints in the financial markets and other macro-economic challenges that might affect the economy of the United States and other parts of the world could cause the Company’s customers to experience cash flow concerns. As a result, if customers’ operating and financial performance deteriorates, or if they are unable to make scheduled payments or obtain credit, customers would not be able to pay, or may delay payment of, accounts receivable owed to the Company. Any inability of current and/or potential customers to pay for services may adversely affect the Company’s financial condition and results of operations.

Counterparty credit default could have an adverse effect on the Company.

The Company’s revenues are generated under contracts with various counterparties. Resultscounterparties and results of operations wouldcould be adversely affected as a result ofby non-performance by any of these counterparties of their contractual obligations under the various contracts. A counterparty’s default or non-performance could be caused by factors beyond the Company’s control. A default could occur as a result of circumstances relating directly to the counterparty, or due to circumstances caused by other market participants having a direct or indirect relationship with such counterparty. The Company seeks to mitigate the risk of default by evaluating the financial strength of potential counterparties; however, despite mitigation efforts, contractual defaults by counterparties may occur from time to time.

Escalating diesel fuel prices could have an adverse effect on the Company

As an integral part of the Company’s marketing and transportation businesses, the Company operates a fleet of over 400approximately 500 truck-tractors and diesel fuel costs are a significant component of operating expense. Such costs generally fluctuate with increasing and decreasing world crude oil prices. While the Company attempts to recoup rising diesel fuel costs through the pricing of its services, to the extent such costs escalate, operating earnings will generally be adversely affected.

Fluctuations in oil and gas prices could have an adverse effect on the Company.

The Company’s future financial condition, revenues, results of operations and future rate of growth are materially affected by oil and natural gas prices. Oil and natural gas prices that historically have been volatile and are likely to continue to be volatile in the future. Moreover, oil and natural gas prices depend on factors outside the control of the Company. These factors include:

| · | supply and demand for oil and gas and expectations regarding supply and demand; |

| · | political conditions in other oil-producing countries, including the possibility of insurgency or war in such areas; |

| · | economic conditions in the United States and worldwide; |

| · | governmental regulations and taxation; |

| · | impact of energy conservation efforts; |

| · | the price and availability of alternative fuel sources; |

| · | availability of local, interstate and intrastate transportation systems; and |

Revenues are generated under contracts that must be renegotiated periodically.

Substantially all of the Company’s revenues are generated under contracts which expire periodically or which must be frequently renegotiated, extended or replaced. Whether these contracts are renegotiated, extended or replaced is often subject to factors beyond the Company’s control. Such factors include sudden fluctuations in oil and gas prices, counterparty ability to pay for or accept the contracted volumes and, most importantly, an extremely competitive marketplace for the services offered by the Company. There is no assurance that the costs and pricing of the Company’s services can remain competitive in the marketplace or that the Company will be successful in renegotiating its contracts.

Anticipated or scheduled volumes will differ from actual or delivered volumes.

The Company’s crude oil and natural gas marketing operation purchases initial production of crude oil and natural gas at the wellhead under contracts requiring the Company to accept the actual volume produced. The resale of such production is generally under contracts requiring a fixed volume to be delivered. The Company estimates its anticipated supply and matches such supply estimate for both volume and pricing formulas with committed sales volumes. Since actual wellhead volumes produced will never equal anticipated supply, the Company’s marketing margins may be adversely impacted. In many instances, any losses resulting from the difference between actual supply volumes compared to committed sales volumes must be absorbed by the Company.

Environmental liabilities and environmental regulations may have an adverse effect on the Company.

The Company’s business is subject to environmental hazards such as spills, leaks or any discharges of petroleum products and hazardous substances. These environmental hazards could expose the Company to material liabilities for property damage, personal injuries, and/or environmental harms, including the costs of investigating and rectifying contaminated properties.

Environmental laws and regulations govern many aspects of the Company’s business, such as drilling and exploration, production, transportation and waste management. Compliance with environmental laws and regulations can require significant costs or may require a decrease in production. Moreover, noncompliance with these laws and regulations could subject the Company to significant administrative, civil, and/or criminal fines and/or penalties.

Operations could result in liabilities that may not be fully covered by insurance.

Transportation of hazardous materials and the exploration and production of crude oil and natural gas business involves certain operating hazards such as well blowouts, automobile accidents, explosions, fires and pollution. Any of these operating hazards could cause serious injuries, fatalities or property damage, which could expose the Company to liability. The payment of any of these liabilities could reduce, or even eliminate, the funds available for exploration, development, and acquisition, or could result in a loss of the Company’s properties and may even threaten survival of the enterprise.

Consistent with the industry standard, the Company’s insurance policies provide limited coverage for losses or liabilities relating to pollution, with broader coverage provided for sudden and accidental occurrences. Insurance might be inadequate to cover all liabilities. Moreover, from time to time, obtaining insurance for the Company’s line of business can become difficult and costly. Typically, when insurance cost escalates, the Company may reduce its level of coverage and more risk may be retained to offset cost increases. If substantial liability is incurred and damages are not covered by insurance or exceed policy limits, the Company’s operation and financial condition could be materially adversely affected.

Changes in tax laws or regulations could adversely affect the Company.

The Internal Revenue Service, the United States Treasury Department, and Congress and the states frequently review federal or state income tax legislation. The Company cannot predict whether, when, or to what extent new federal or state tax laws, regulations, interpretations or rulings will be adopted. Any such legislative action may prospectively or retroactively modify tax treatment and, therefore, may adversely affect taxation of the Company.

The Company’s business is subject to changing government regulations.

Federal, state or local government agencies may impose environmental, labor or other regulations that increase costs and/or terminate or suspend operations. The Company’s business is subject to federal, state and local laws and regulations. These regulations relate to, among other things, the exploration, development, production and transportation of oil and natural gas. Existing laws and regulations could be changed, and any changes could increase costs of compliance and costs of operations.

Several proposals are before state legislators and the U.S. Congress that, if implemented, would either prohibit the practice of hydraulic fracturing or subject the process to regulation under state regulation or the Safe Drinking Water Act. The Company routinely participates in wells where fracturing techniques are utilized to expand the available space for natural gas and oil to migrate toward the well-bore. ItThis is typically done at substantial depths in very tight formations. Although it is not possible at this time to predict the final outcome of the legislation regarding hydraulic fracturing, any new state or federal restrictions could result in increased compliance costs or additional operating restrictions.

Estimating reserves, production and future net cash flow is difficult.

Estimating oil and natural gas reserves is a complex process that involvesrequiring significant interpretations and assumptions. It requires interpretation of technical data and assumptions relating to economic factors such as future commodity prices, production costs, severance and excise taxes, capital expenditures and remedial costs, and the assumed effect of governmental regulation. As a result, actual results may differ from the Company’s estimates. Also, the use of a 10 percent discount factor for reporting purposes, as prescribed by the SEC, may not necessarily represent the most appropriate discount factor, given actual interest rates and risks to which the Company’s business is subject. Any significant variations from the Company’s valuations could cause the estimated quantities and net present value of the Company’s reserves to differ materially.

The reserve data included in this report is only an estimate. The reader should not assume that the present values referred to in this report represent the current market value of the Company’s estimated oil and natural gas reserves. The timing of the production and the expenses from development and production of oil and natural gas properties will affect both the timing of actual future net cash flows from the Company’s proved reserves and their present value.

The Company’s business isexploration operations are dependent on the ability to replace reserves.

Future success depends in part on the Company’s ability to find, develop and acquire additional oil and natural gas reserves. WithoutAbsent ongoing successful acquisition or exploration activities, reserves and revenues will decline as a result of current reserves being depleted by production. The successful acquisition, development or exploration of oil and natural gas properties requiresis dependent upon an assessment of recoverable reserves, future oil and natural gas prices and operating costs, potential environmental and other liabilities, and other factors. These assessmentsfactors are necessarily inexact. As a result, the Company may not recover the purchase price and/or the development costs of a property from the sale of production from the property, or may not recognize an acceptable return from properties acquired. In addition, exploration and development operations may not result in any increases in reserves. Exploration or development may be delayed or cancelled as a result of inadequate capital, compliance with governmental regulations, or price controls or mechanical difficulties. In the future, the cost to find or acquire additional reserves may become prohibitive.

RevenuesOil and gas segment revenues are dependent on the ability to successfully complete drilling activity.

Drilling and exploration are one of the main methods of replacing reserves. However, drilling and exploration operations may not result in any increases in reserves for various reasons. Drilling and exploration may be curtailed, delayed or cancelled as a result of:

| · | lack of acceptable prospective acreage; |

| · | inadequate capital resources; |

| · | compliance with governmental regulations; and |

| · | mechanical difficulties. |

Moreover, the costs of drilling and exploration may greatly exceed initial estimates. In such a case, the Company would be required to make additional expenditures to develop its drilling projects. Such additional and unanticipated expenditures could adversely affect the Company’s financial condition and results of operations.

Security issues exist relating to drivers, equipment and terminal facilitiesfacilities.

The Company transports liquid combustible materials such as gasoline andincluding petrochemicals, and such materials may be a target for terrorist attacks. While the Company employs a variety of security measures to mitigate the risk of such eventsrisks, no assurance can be given that such events will not occur.

Current and future litigation could have an adverse effect on the Company.

The Company is currently involved in severalcertain administrative and civil legal proceedings inas part of the ordinary course of its business. Moreover, as incidental to operations, the Company sometimes becomes involved in various lawsuits and/or disputes. Lawsuits and other legal proceedings can involve substantial costs, including the costs associated with investigation, litigation and possible settlement, judgment, penalty or fine. Although insurance is maintained to mitigate these costs, there can be no assurance that costs associated with lawsuits or other legal proceedings will not exceed the limits of insurance policies. The Company’s results of operations could be adversely affected if a judgment, penalty or fine is not fully covered by insurance.

The Company is subject to risks associated with climate change.

Potential climate change and costs associated with its impact and efforts to regulate “greenhouse‟greenhouse gas” (“GHG's”(‟GHG”) emissions have the potential to adversely affect the Company’s business including negatively impacting (i) the costs it incurs in providing its products and services, including costs to operate and maintain its facilities, install new emission controls on its facilities, acquire allowances to authorize its GHG emissions, pay any taxes related to GHG emissions, administer and manage a GHG emissions program, pay higher insurance premiums or accept greater risk of loss in areas affected by adverse weather and coastal regions in the event of rising sea levels, (ii)levels. In addition, the demand for and consumption of its products and services (due to change in both costs and weather patterns), and (iii) the economic health of the regions in which itthe Company operates, all of which could have a material adverse effect on the Company’s business, financial condition, results of operations and cash flows.

The Company is subject to risks related to cybersecurity.

The Company is subject to cybersecurity risks and may incur increasing costs in connection with its efforts to enhance and ensure security and in response to actual or attempted cybersecurity attacks.

Substantial aspects of the Company’s business depend on the secure operation of its computer systems and websites. Security breaches could expose the Company to a risk of loss, misuse, or interruption of sensitive and critical information and functions, including its own proprietary information and that of its customers, suppliers and employees and functions that affect the operation of the business.employees. Such lossesbreaches could result in operational impacts, reputational harm, competitive disadvantage, litigation, regulatory enforcement actions, and liability. While the Company devotes substantial resources to maintaining adequate levels of cybersecurity, there can be no assurance that it will be able to prevent all of the rapidly evolving types of cyber attacks. Actual or anticipated attacks and risks may cause the Company to incur increasing costs for technology, personnel and services to enhance security or to respond to occurrences.

If the Company’s security measures are circumvented, proprietary information may be misappropriated, its operations may be disrupted, and its computers or those of its customers or other third parties may be damaged. Compromises of the Company’s security may result in an interruption of operations, violation of applicable privacy and other laws, significant legal and financial exposure, damage to its reputation, and a loss of confidence in its security measures.

Item 1B1B. UNRESOLVED STAFF COMMENTS

None.

Item 3. LEGAL PROCEEDINGS

AREC is named as a defendant in a number of Louisiana based suits involving alleged environmental contamination from prior drilling operations. Such suits typically allege improper disposal of oilfield wastes in earthen pits with one suit alleging subsidence contributing of the formation of a sink hole. AREC is currently involved in three such suits. The suits are styled LePetit Chateau Deluxe v. Adams Resources Exploration Corporation dated March 2004, Gustave J. LaBarre, Jr., et. al. v. Adams Resources Exploration Corporation et al dated October 2012 and Henning Management, LLC v. Adams Resources Exploration Corporation dated November 2013. Each suit involves multiple industry defendants with substantially larger proportional interest in the properties except all the larger defendants have settled their claims in the LePetit Chateau Deluxe matter. The plaintiffs in each of these matters are seeking unspecified compensatory and punitive damages. In August 2014, AREC was dismissed from a similar suit styled Edward Conner, et al v. Adams Resources Exploration Corporation dated October 2013. While management does not believe that a material adverse effect will result from the claims, significant attorney fees will be incurred to defend these items. As of December 31, 2014 and 2013, the Company has accrued $500,000 and $200,000, respectively, of future legal and/or settlement costs for these matters.

From time to time as incident to its operations, the Company may becomebecomes involved in various accidents, lawsuits and/or disputes. Primarily as an operator of an extensive trucking fleet, the Company is a party to motor vehicle accidents, worker compensation claims andor other items of general liability as would beare typical for the industry. ManagementIn addition, the Company has extensive operations that must comply with a wide variety of tax laws, environmental laws and labor laws, among others. Should an incident occur, management evaluates the claim based on its nature, the facts and circumstances and the applicability of insurance coverage. To the extent management believes that such event may impact the financial condition of the Company, is presently unawaremanagement will estimate the monetary value of any claims against the Company that are either outsideclaim and make appropriate accruals or disclosure as provided in the scope of insurance coverage, or that may exceed the level of insurance coverage, and could potentially represent a material adverse effect on the Company’s financial position or results of operations.appropriate accounting literature guidelines.

Item 4. MINE SAFETY DISCLOSURES

Not ApplicableApplicable.

PART II

| Item 5. | MARKET FOR THE REGISTRANT'SREGISTRANT’S COMMON STOCK, RELATED SECURITY HOLDERSTOCKHOLDER MATTERS, AND ISSUER REPURCHASEPURCHASES OF EQUITY SECURITIES |

The Company'sCompany’s common stock is traded on the NYSE Amex, formerly known as the American Stock Exchange,MKT under the ticker symbol “AE”‟AE”. The following table sets forth the high and low sales prices of the common stock as reported by the NYSE AmexMKT for each calendar quarter since January 1, 2010.2013.

| | | | | | | |

| | | | | | | | | | | | | |

| 2011 | | | | | | | |

| 2014 | | | | | | | |

| First Quarter | | $ | 31.30 | | | $ | 22.46 | | | $ | 90.28 | | | $ | 57.19 | |

| Second Quarter | | | 30.50 | | | | 22.51 | | | | 81.50 | | | | 56.08 | |

| Third Quarter | | | 29.07 | | | | 18.73 | | | | 79.61 | | | | 44.26 | |

| Fourth Quarter | | | 29.50 | | | | 18.90 | | | | 50.54 | | | | 38.58 | |

| | | | | | | | | | | | | | | | | |

| 2010 | | | | | | | | | |

| 2013 | | | | | | | | | |

| First Quarter | | $ | 23.39 | | | $ | 17.40 | | | $ | 55.82 | | | $ | 33.75 | |

| Second Quarter | | | 19.95 | | | | 15.25 | | | | 70.80 | | | | 43.00 | |

| Third Quarter | | | 21.49 | | | | 16.00 | | | | 71.77 | | | | 54.86 | |

| Fourth Quarter | | | 24.95 | | | | 17.86 | | | | 70.01 | | | | 47.46 | |

At March 12, 2012 there were approximately 235 shareholders of record of the Company's common stock and the closing stock price was $45.71 per share. The Company has no securities authorized for issuance under equity compensation plans. The Company made no repurchases of its stock during 20112014 and 2010.2013.

OnDuring each of March, June, September and December 15, 2011,2014 the Company paid an annualto its common shareholders a quarterly cash dividend of $.57$.22 per common share. In each of June, September and December 2013 the Company paid a quarterly cash dividend of $.22 per common share to its common stockholders of record on December 1, 2011. On December 15, 2010, the Company paid an annual cash dividend of $.54 per common share to common stockholders of record on December 1, 2010.stockholders. Such dividends totaled $2,404,000$3,711,544 and $2,277,540$2,783,658 for each of 20112014 and 2010,2013, respectively.

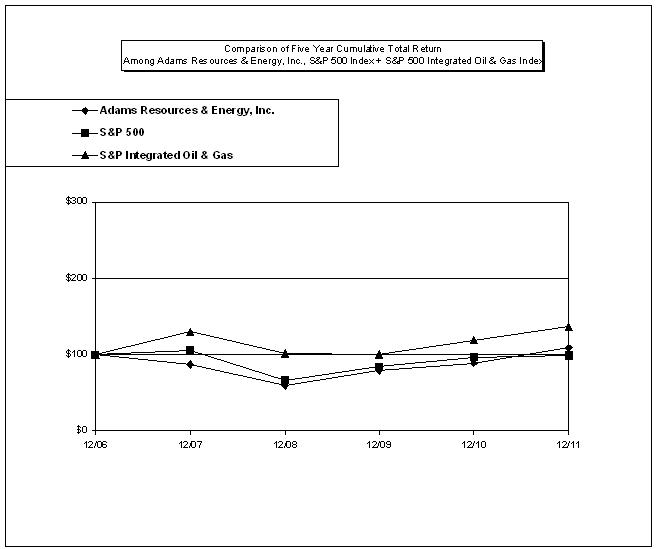

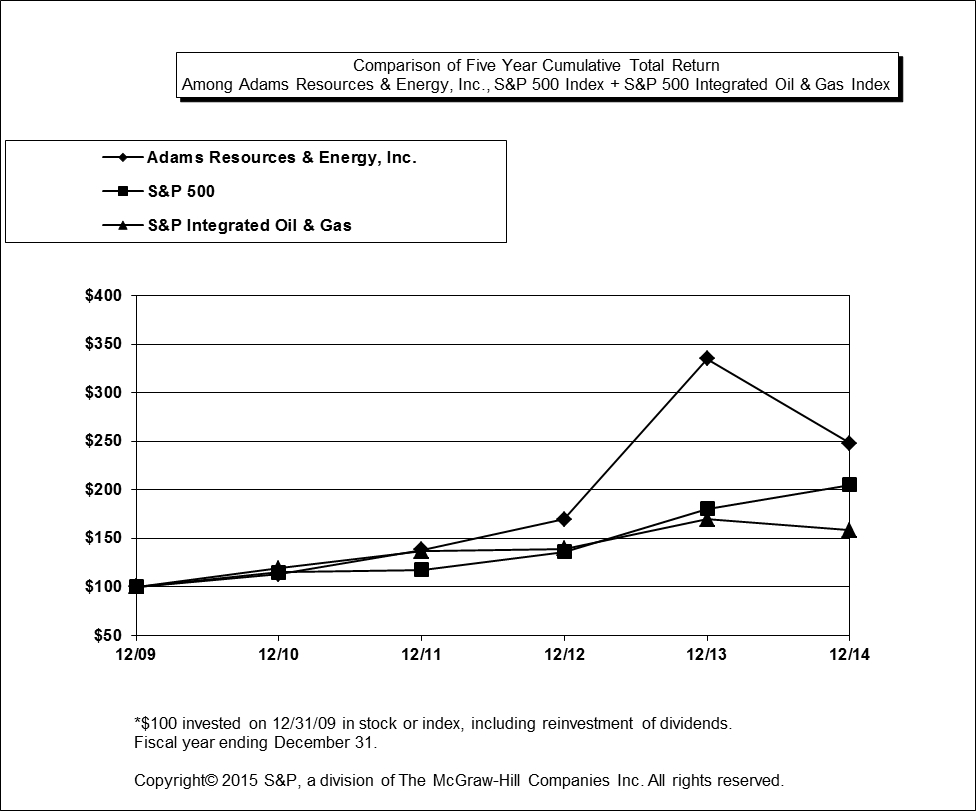

Performance Graph

The performance graph shown below was prepared under the applicable rules of the SEC based on data supplied by Research Data Group. The purpose of the graph is to show comparative total stockholder returns for the Company versus other investment options for a specified period of time. The graph was prepared based upon the following assumptions:

| 1. | $100.00 was invested on December 31, 20062009 in the Company’s common stock, the S&P 500 Index, and the S&P 500 Integrated Oil and Gas Index. |

| 2. | Dividends are reinvested on the ex-dividend dates. |

Note: The stock price performance shown on the graph below is not necessarily indicative of future price performance.

| | Dec06 | Dec07 | Dec08 | Dec09 | Dec10 | Dec11 | 12/09 | 12/10 | 12/11 | 12/12 | 12/13 | 12/14 |

| | | |

| Adams Resources & Energy, Inc. | 100.00 | 86.99 | 59.46 | 78.90 | 89.03 | 108.97 | 100.00 | 112.83 | 138.10 | 169.55 | 334.76 | 247.79 |

| S&P 500 | 100.00 | 105.49 | 66.46 | 84.05 | 96.71 | 98.75 | 100.00 | 115.06 | 117.49 | 136.30 | 180.44 | 205.14 |

| S&P Integrated Oil & Gas | 100.00 | 129.85 | 101.56 | 100.25 | 119.14 | 136.73 | 100.00 | 118.84 | 136.39 | 139.41 | 169.42 | 158.02 |

Item 6. SELECTED FINANCIAL DATA

FIVE YEAR REVIEW OF SELECTED FINANCIAL DATA

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (In thousands, except per share data) | | | (In thousands, except per share data) | |

| Revenues: | | | | | | |

| Marketing | | $ | 3,136,838 | | | $ | 2,144,082 | | | $ | 1,889,583 | | | $ | 4,074,677 | | | $ | 2,558,545 | | | $ | 4,050,497 | | | $ | 3,863,057 | | | $ | 3,292,948 | | | $ | 2,961,176 | | | $ | 2,005,301 | |

| Transportation | | | 63,501 | | | | 56,867 | | | | 44,895 | | | | 67,747 | | | | 63,894 | | | | 68,968 | | | | 68,783 | | | | 67,183 | | | | 63,501 | | | | 56,867 | |

| Oil and natural gas | | | 14,060 | | | | 11,021 | | | | 8,650 | | | | 17,248 | | | | 13,783 | | | | 13,361 | | | | 14,129 | | | | 15,954 | | | | 14,060 | | | | 11,021 | |

| | | $ | 3,214,399 | | | $ | 2,211,970 | | | $ | 1,943,128 | | | $ | 4,159,672 | | | $ | 2,636,222 | | | $ | 4,132,826 | | | $ | 3,945,969 | | | $ | 3,376,085 | | | $ | 3,038,737 | | | $ | 2,073,189 | |

| Operating earnings (loss): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Marketing | | $ | 50,596 | | | $ | 16,724 | | | $ | 17,487 | | | $ | (2,704 | ) | | $ | 20,152 | | | $ | 20,854 | | | $ | 40,369 | | | $ | 46,145 | | | $ | 49,237 | | | $ | 13,530 | |

| Transportation | | | 8,521 | | | | 6,623 | | | | 2,128 | | | | 4,245 | | | | 5,504 | | | | 4,750 | | | | 5,180 | | | | 10,253 | | | | 8,521 | | | | 6,623 | |

| Oil and gas operations | | | (16,794 | ) | | | (1,757 | ) | | | (3,625 | ) | | | (3,348 | ) | | | (2,853 | ) | | | (10,038 | ) | | | (2,113 | ) | | | (5,835 | ) | | | (16,797 | ) | | | (1,801 | ) |

| Oil and gas property sale | | | 2,923 | | | | - | | | | - | | | | - | | | | 12,078 | | | | 2,528 | | | | - | | | | 2,203 | | | | 2,923 | | | | - | |

| General and administrative | | | (9,713 | ) | | | (9,044 | ) | | | (9,589 | ) | | | (9,667 | ) | | | (10,974 | ) | | | (8,613 | ) | | | (9,060 | ) | | | (8,810 | ) | | | (8,678 | ) | | | (7,858 | ) |

| | | | 35,533 | | | | 12,546 | | | | 6,401 | | | | (11,474 | ) | | | 23,907 | | | | 9,481 | | | | 34,376 | | | | 43,956 | | | | 35,206 | | | | 10,494 | |

| Other income (expense): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest income | | | 237 | | | | 191 | | | | 125 | | | | 1,103 | | | | 1,741 | | | | 301 | | | | 198 | | | | 190 | | | | 237 | | | | 191 | |

| Interest expense | | | (8 | ) | | | (36 | ) | | | (25 | ) | | | (187 | ) | | | (134 | ) | | | (2 | ) | | | (24 | ) | | | (10 | ) | | | (8 | ) | | | (36 | ) |

| Earnings (loss) from continuing operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| before income taxes | | | 35,762 | | | | 12,701 | | | | 6,501 | | | | (10,558 | ) | | | 25,514 | | | | 9,780 | | | | 34,550 | | | | 44,136 | | | | 35,435 | | | | 10,649 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income tax (provision) benefit | | | (12,831 | ) | | | (4,070 | ) | | | (2,352 | ) | | | 4,986 | | | | (8,458 | ) | |

| Income tax (provision) | | | | (3,561 | ) | | | (12,429 | ) | | | (16,664 | ) | | | (12,717 | ) | | | (3,352 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net earnings (loss) | | $ | 22,931 | | | $ | 8,631 | | | $ | 4,149 | | | $ | (5,572 | ) | | $ | 17,056 | | |

| Earnings from continuing | | | | | | | | | | | | | | | | | | | | | |

| Operations | | | | 6,219 | | | | 22,121 | | | | 27,472 | | | | 22,718 | | | | 7,297 | |

| Earnings (loss) from discontinued | | | | | | | | | | | | | | | | | | | | | |

| operations, net of taxes | | | | 304 | | | | (511 | ) | | | 319 | | | | 213 | | | | 1,334 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Net earnings | | | $ | 6,523 | | | $ | 21,610 | | | $ | 27,791 | | | $ | 22,931 | | | $ | 8,631 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Earnings (Loss) Per Share | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted earnings (loss) per share | | $ | 5.44 | | | $ | 2.05 | | | $ | .98 | | | $ | (1.32 | ) | | $ | 4.04 | | |

| From continuing operations | | | | 1.48 | | | | 5.24 | | | | 6.51 | | | | 5.39 | | | | 1.73 | |

| From discontinued operations | | | | .07 | | | | (.12 | ) | | | .08 | | | | (.05 | ) | | | .32 | |

| Basic and diluted earnings per share | | | $ | 1.55 | | | $ | 5.12 | | | $ | 6.59 | | | $ | 5.34 | | | $ | 2.05 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends per common share | | $ | .57 | | | $ | .54 | | | $ | .50 | | | $ | .50 | | | $ | .47 | | | $ | .88 | | | $ | .66 | | | $ | .62 | | | $ | .57 | | | $ | .54 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Position | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash | | $ | 37,066 | | | $ | 29,032 | | | $ | 16,806 | | | $ | 18,208 | | | $ | 23,697 | | | $ | 80,184 | | | $ | 60,733 | | | $ | 47,239 | | | $ | 37,066 | | | $ | 29,032 | |

| Net working capital | | | 48,871 | | | | 39,978 | | | | 38,372 | | | | 41,559 | | | | 50,572 | | | | 82,342 | | | | 79,561 | | | | 58,474 | | | | 48,871 | | | | 39,978 | |

| Total assets | | | 378,840 | | | | 301,305 | | | | 249,401 | | | | 210,926 | | | | 357,075 | | | | 340,814 | | | | 448,082 | | | | 419,501 | | | | 378,840 | | | | 301,305 | |

| Long-term debt | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Shareholders’ equity | | | 110,682 | | | | 90,155 | | | | 83,801 | | | | 81,761 | | | | 89,442 | | | | 157,497 | | | | 154,685 | | | | 135,858 | | | | 110,682 | | | | 90,155 | |

| Dividends on common shares | | | 2,404 | | | | 2,277 | | | | 2,109 | | | | 2,109 | | | | 1,982 | | | | 3,711 | | | | 2,783 | | | | 2,615 | | | | 2,404 | | | | 2,277 | |

Notes:

- | In 2014, 2012 and 2011, and 2007, certain oil and natural gas producing properties were sold for $4.1 million, $3.6 million and $6.6 million and $14.9 million producing net gains of $2.5 million, $2.2 million and $2.9 million and $12.1 million, respectively. |

The 2014, 2013, 2012 and 2011 oil and gas operating losses include property impairments totaling $8.0 million, $2.6 million, $4.7 million and $14.8 million, respectively. These impairments were recorded following declining crude oil prices in 2014, unfavorable drilling results in 2013 and declining natural gas prices in 2012 and 2011.

- | The 2011 oil and gas operating loss primarily resulted from property impairments totaling $14.8 million recorded as a result of declining natural gas prices. |

| Item 7. MANAGEMENT'SItem 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Results of Operations

- Marketing

Marketing Crude oil marketing revenues, operating earnings, depreciation and depreciationcertain costs are as follows (in thousands):

| | | | | | | | | | |

| Revenues | | | | | | | | | |

| Crude oil | | $ | 2,961,176 | | | $ | 2,005,301 | | | $ | 1,770,600 | |

| Natural gas | | | 6,251 | | | | 10,592 | | | | 14,232 | |

| Refined products | | | 169,411 | | | | 128,189 | | | | 104,751 | |

| Total | | $ | 3,136,838 | | | $ | 2,144,082 | | | $ | 1,889,583 | |

| | | | | | | | | | | | | |

| Operating Earnings (loss) | | | | | | | | | | | | |

| Crude oil | | $ | 49,237 | | | $ | 13,530 | | | $ | 15,404 | |

| Natural gas | | | 2,147 | | | | 3,073 | | | | 2,749 | |

| Refined products | | | (788 | ) | | | 121 | | | | (666 | ) |

| Total | | $ | 50,596 | | | $ | 16,724 | | | $ | 17,487 | |

| | | | | | | | | | | | | |

| Depreciation | | | | | | | | | | | | |

| Crude oil | | $ | 3,724 | | | $ | 2,320 | | | $ | 1,997 | |

| Natural gas | | | 3 | | | | 44 | | | | 166 | |

| Refined products | | | 375 | | | | 503 | | | | 533 | |

| Total | | $ | 4,102 | | | $ | 2,867 | | | $ | 2,696 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Revenues | | $ | 4,050,497 | | | $ | 3,863,057 | | | $ | 3,292,948 | |

| | | | | | | | | | | | | |

| Operating earnings | | $ | 20,854 | | | $ | 40,369 | | | $ | 46,145 | |

| | | | | | | | | | | | | |

| Depreciation | | $ | 9,626 | | | $ | 7,682 | | | $ | 5,945 | |

| | | | | | | | | | | | | |

| Driver commissions | | $ | 21,744 | | | $ | 19,478 | | | $ | 15,151 | |

| | | | | | | | | | | | | |

| Insurance | | $ | 7,446 | | | $ | 7,659 | | | $ | 5,241 | |

| | | | | | | | | | | | | |

| Fuel | | $ | 14,851 | | | $ | 13,808 | | | $ | 11,617 | |

Supplemental volume and price information is:information:

| | | | | | | | | | | | | | | | | | | |

Field Level Purchases per day (1) | | | | | | | | | | | | | | | | | | |

| Crude Oil – barrels | | | 81,600 | | | | 69,000 | | | | 66,100 | | | | 117,100 | | | | 106,000 | | | | 89,200 | |

| Natural Gas – mmbtu’s | | | 208,000 | | | | 258,000 | | | | 363,000 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Purchase Price | | | | | | | | | | | | | | | | | | | | | | | | |

| Crude Oil – per barrel | | $ | 96.77 | | | $ | 77.20 | | | $ | 58.32 | | | $ | 89.40 | | | $ | 99.57 | | | $ | 99.66 | |

| Natural Gas – per mmbtu | | $ | 3.93 | | | $ | 4.28 | | | $ | 3.75 | | |

| | (1) Reflects the volume purchased from third parties at the oil and natural gas field level and pipeline pooling points.of operations. |

Comparison 2011 to 2010

CrudeIncreasing crude oil revenues grewin 2014 and 2013 relative to 2012 resulted from increased field level purchase volumes partially offset by 47 percentreduced average prices in 2011 due to both volume and price increases. Average crude oil prices increased 25 percent and crude oil lease level volumes improved by 18 percent2014, as shown in the table above. The field level purchase volume growth was a result ofVolume increases stemmed from new production from expanded drilling activityestablished by the Company’s customer base in the Eagle Ford shale trend of South Texas.Texas beginning in 2011, coupled with new operations established during 2013 in the Bakken field of North Dakota. While revenues were increasing during 2014, the Company’s accounts receivable balance as of December 31, 2014 was reduced by 41 percent relative to December 31, 2013. This apparent contradiction results because year-end accounts receivable balances are substantially based on crude oil sales activity for the month of December only. Crude oil prices declined significantly in December 2014 leading to the reduced accounts receivable balance. By comparison, crude oil supply prices in December 2014 were in the $54 per barrel range versus $93 per barrel in December 2013. Reported amounts and values for crude oil inventories as of December 31, 2014 were similarly affected relative to such reported amounts for 2013.

| - | Field Level Operating Earnings (Non GAAP Measure) |

CrudeTwo significant factors affecting comparative crude oil segment operating earnings increased significantly in 2011 due to widening unit gross margins. This result stems from South Texas sourcedare inventory valuations and forward commodity contract (derivatives or mark-to-market) valuations. As a purchaser and shipper of crude oil, selling at a discount to world oil prices due to its relative abundance in relation to the infrastructure available to deliver such oil to market. In addition, during the second quarter of 2011, the Company completed constructionholds inventory in storage tanks and third-party pipelines. Inventory sales turnover occurs approximately every three days, but the quantity held in stock at the end of a barge terminal facility at the Portgiven period is reasonably consistent. As a result, during periods of Victoria, Texas. This facility allows the Company to increase margins on its gathered production in the area by barging it to more advantageous markets.

Increasingincreasing crude oil prices, also boosted operating earnings during 2011. The average acquisition price of crude oil moved from $88 per barrel at the beginning of the year to $98 per barrel for December 2011, resulting inCompany recognizes inventory liquidation gains totaling $3,021,000. Similarly,while during 2010,periods of falling prices, the Company recognizes inventory liquidation and valuation losses. Over time, these gains and losses tend to offset and have limited impact on cash flow. While crude oil prices rose fromfluctuated during 2014, 2013 and 2012, the $75 per barrel range in January to the $88 per barrel range by December 2010 producing a $2,272,000net impact yielded inventory liquidation gain.valuation losses totaling $14,247,000, $3,824,000 and $1,596,000, respectively. As of December 31, 2011,2014, the Company held 182,728292,355 barrels of crude oil inventory at ana composite average price of $98.36$46.11 per barrel. As of December 31, 2013, the Company held 303,633 barrels of crude oil inventory at a composite average price of $90.06 per barrel.

Diesel fuel expense which tends to fluctuate in tandem withCrude oil marketing operating earnings are also affected by the valuations of the Company’s forward month commodity contracts (derivative instruments) as of the various report dates. Such non-cash valuations are calculated and recorded at each period end based on the underlying data existing as of such date. The Company generally enters into these derivative contracts as part of a pricing strategy based on crude oil prices also has a significant impact on operating earnings. A relatively low levelpurchases at the wellhead (field level). Only those contracts qualifying as derivative instruments are accorded fair value treatment while the companion contracts to purchase crude oil at the wellhead (field level) are not subject to fair value treatment. For derivative instruments, the recognition of diesel fuel costs during 2009, served to improve comparative operating earnings for such year relative to 2010. Diesel fuel cost were elevated in 2011 due to increased prices‟mark-to-market” gains and an approximate 50 unit expansion of the truck fleet engaged to handle added volumes. losses is required at each period end.

The impact on crude oil segment operating earnings fromof inventory liquidation gainsliquidations and diesel fuel costderivative valuations is summarized as followsin the following reconciliation from a GAAP to a non-GAAP measure (in thousands):

| | | | | | | | | | |

| | | | | | | | | | |

| As reported segment operating earnings | | $ | 20,854 | | | $ | 40,369 | | | $ | 46,145 | |

| Add (less) - | | | | | | | | | | | | |

| Inventory liquidation (gains) losses | | | 14,247 | | | | 3,824 | | | | 1,596 | |

| Derivative valuation (gains) losses | | | (312 | ) | | | 193 | | | | 2,001 | |

| | | | | | | | | | | | | |

Field level operating earnings(1) | | $ | 34,789 | | | $ | 44,386 | | | $ | 49,742 | |

| | | | | | | | | | |

| As reported operating earnings | | $ | 49,237 | | | $ | 13,530 | | | $ | 15,404 | |

| Inventory liquidation (gains) | | | (3,021 | ) | | | (2,272 | ) | | | (5,780 | ) |

| | | | | | | | | | | | | |

| | | $ | 46,216 | | | $ | 11,258 | | | $ | 9,624 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Diesel fuel expense | | $ | 9,982 | | | $ | 6,001 | | | $ | 4,612 | |

| (1) | Such designation is unique to the Company and is not comparable to any similar measures developed by industry participants. The Company utilizes such data to evaluate the profitability of its operations. |