SECURITIES AND EXCHANGE COMMISSION

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

September 29, 2006

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Delaware | 04-2302115 | |||||||

| (State or | (I.R.S. Employer Identification No.) | |||||||

| 20 Sylvan Road, Woburn, Massachusetts | 01801 | ||||||

| (Address of | (Zip Code) | ||||||

| Registrant’s telephone number, including area | (781) 376-3000 |

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.25 per share | Nasdaq Global Select Market |

YesCommon Stock, $.25 par value

(Title of Class)þ

No

þ

| Large Accelerated filerþ | Accelerated filero | Non-accelerated filero |

162,876,234.

| Part of Form 10-K | Documents from which portions are incorporated by reference | |

| Part III | Portions of the Registrant’s Proxy Statement relating to the Registrant’s 2007 Annual Meeting of Stockholders to be filed on or before January 29, 2007 are incorporated by reference into Items 10, 11, 12, 13 and 14 |

Part III of this annual report incorporates by reference certain information contained in the registrant’s definitive proxy statement for the Annual Meeting of Shareholders to be held March 10, 2004, which will be filed with the Securities and Exchange Commission not later than 120 days after October 3, 2003 (the “Proxy Statement”). Except with respect to information specifically incorporated by reference in the Form 10-K, the Proxy Statement is not deemed to be filed as part hereof.

2

| • | CDMA (Code Division Multiple Access): a method for transmitting simultaneous signals over a shared portion of the spectrum | ||

| • | DigRF: the digital interface standard that defines an efficient physical interconnection between baseband and RF integrated circuits for digital cellular terminals | ||

| • | EDGE (Enhanced Data rates for Global Evolution): an enhancement to the GSM and TDMA wireless communications systems that increases data throughput to 384Kpbs | ||

| • | GPRS (General Packet Radio Service): an enhancement to the GSM mobile communications system that supports data packets | ||

| • | GSM (Global System for Mobile Communications): a digital cellular phone technology based on TDMA that is the predominant system in Europe, but is also used around the world | ||

| • | TD-SCDMA (Time Division Synchronous Code Division Multiple Access): a 3G mobile communications standard, being pursued in the People’s Republic of China by the CATT | ||

| • | WCDMA (Wideband CDMA): a 3G technology that increases data transmission rates in GSM systems by using the CDMA air interface instead of TDMA | ||

| • | WEDGE: an acronym for technology that supports both EDGE and WCDMA | ||

| • | WiFi (Wireless Fidelity): a trademark for the certification of products that meet certain standards for transmitting data over wireless networks | ||

| • | WiMAX (Worldwide Interoperability for Microwave Access): a standards-based technology enabling the delivery of last mile wireless broadband access as an alternative to cable and DSL | ||

| • | WLAN (Wireless Local Area Network): a type of local-area network that uses high-frequency radio waves rather than wires to communicate between nodes |

| • | our plans to develop and market new products, enhancements or technologies and the timing of these development programs; | ||

| • | our estimates regarding our capital requirements and our needs for additional financing; | ||

| • | our estimates of expenses and future revenues and profitability; | ||

| • | our estimates of the size of the markets for our products and services; | ||

| • | the rate and degree of market acceptance of our products; and | ||

| • | the success of other competing technologies that may become available. |

3

factors could cause results to differ materially and adversely from those expressed in the estimates made by the independent parties and by us.

INTRODUCTIONSkyworks Solutions, Inc. (“Skyworks” or the “Company”) is a leading wireless semiconductor company focused exclusively on radio frequency (“RF”)an innovator of high performance analog and complete cellular system solutions formixed signal semiconductors enabling mobile communications applications. We offerconnectivity. The Company’s power amplifiers, front-end modules RF subsystems and cellular systems to leading wireless handset and infrastructure customers.From the power amplifier, through the radio and to the baseband, we have developed one of the industry’s broadest product portfolios including leadership switches and power amplifier modules. Additionally, we offer a highly integrated direct conversion transceiverradios are at the heart of many of today’s leading-edge multimedia handsets. Leveraging core technologies, Skyworks also offers a diverse portfolio of linear products that support automotive, broadband, cellular infrastructure, industrial and have launched a comprehensive cellular system for next generation handsets.

With our extensive product portfolio and significant systems-level expertise, Skyworks is the ideal partner for both top-tier wireless manufacturers and new market entrants who demand simplified architectures, faster development cycles and fewer overall suppliers.

medical applications.

Skyworks was formed through the merger (“Merger”) of the wireless business of Conexant Systems, Inc. (“Conexant”) and Alpha Industries, Inc. (“Alpha”) on June 25, 2002.2002, pursuant to an Agreement and Plan of Reorganization, dated as of December 16, 2001, and amended as of April 12, 2002, by and among Alpha, Conexant and Washington Sub, Inc. (“Washington”), a wholly-owned subsidiary of Conexant to which Conexant spun off its wireless communications business. Pursuant to the Merger, Washington merged with and into Alpha, with Alpha as the surviving corporation. Immediately following the Merger, the CompanyAlpha purchased Conexant’s semiconductor assembly and test facility located in Mexicali, Mexico and certain related operations (the “Mexicali Operations”). For purposes of this Annual Report on Form 10-K, the Washington business and the Mexicali Operations are collectively referred to as “Washington/Mexicali”. Shortly thereafter, Alpha, which was incorporated in Delaware in 1962, changed its corporate name to Skyworks Solutions, Inc. We are headquarteredHeadquartered in Woburn, Massachusetts, and have executive offices in Irvine, California. We have design,Mass., Skyworks is worldwide with engineering, manufacturing, marketing, sales and service facilities throughout North America,Asia, Europe and the Asia/Pacific region.North America. Our Internet address iswww.skyworksinc.com. www.skyworksinc.com. We make available on our Internet website free of charge our annual reportAnnual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Section 16 filings on Forms 3, 4 and 5, and amendments to those reports as soon as practicable after we electronically filesubmit such material with the Securities and Exchange Commission (“SEC”). The information contained in our website is not incorporated by reference in this Annual Report on Form 10-K.INDUSTRY BACKGROUNDWe believe that

Skyworks believes the wireless industry is onin the vergemidst of another substantial growth cycle. Traditional voice services offered bya significant transition, with two major trends impacting the market landscape for wireless carriers are being rapidly supplemented or augmented byproducts and the emergenceway original equipment manufacturers (“OEMs”) engage semiconductor suppliers. First, there is a market share consolidation underway. By virtually all analyst estimates, 80 percent of the next-generation wireless technologieshandset market is controlled by five OEMs. Second, and WiFi-based (802.11)perhaps even more dramatic, is the number of handsets requiring both voice and high speed data functionality as consumers demand smaller handsets that include multimedia applications such as cameras, MP3 players, video streaming, gaming, Web browsing and WiFi based 802.11 wireless data applications. AllThis demand increases the relative complexity of a handset since maintaining data integrity while at the same time handling a voice session is a significant challenge. There is a greater need for compatibility among the Radio Frequency (“RF”), the analog/mixed signal and system software. As a result, OEMs today are engaging suppliers as partners, and much earlier in the development process. By contrast, in the past, handset manufacturers could mix and match power amplifiers and transceivers much more readily using various suppliers — and they did so rather routinely. Skyworks believes that going forward the link between the front-end module, radio and software is increasingly critical and can no longer be easily decoupled.4

From the power amplifier, through the radio and to the baseband, we have developed one of the industry’s broadest product portfolios including leadership switches and power amplifier modules. Additionally, we offer a highly integrated direct conversion transceiverradios are at the heart of many of today’s leading-edge multimedia handsets. Leveraging core technologies, Skyworks also offers a diverse portfolio of linear products that support automotive, broadband, cellular infrastructure, industrial and have launched a comprehensive cellular system for next generation handsets.

With our extensive product portfolio and significant systems-level expertise, Skyworks is the ideal partner for both top-tier wireless manufacturers and new market entrants who demand simplified architectures, faster development cycles and fewer overall suppliers.

medical applications.

We believe that

The cellular handset market has grown significantly overtemperature, pressure and audio information into the past five years despite the broad technology slowdown in 2001 and 2002.digital realm. According to the Semiconductor Industry Association, the total available market research firm EMC, handset sales have increased by approximately 300% from 1997 to 2002 with volume reaching 400 million units in 2002. Exiting 2002,for the worldwide penetration rate of wireless services was at 18% andanalog semiconductor segment is expected to climbapproach $50 billion in 2009. Today, this adjacent analog semiconductor market, which is characterized by longer product lifecycles and higher gross margins, is highly fragmented and diversified among various end-markets, customer bases and applications.

In parallel, handset growth is being driven by replacement units purchased by existing subscribers as carriers introduce updated models, smaller form factors, added featuresmarkets the Company has targeted: infrastructure, medical, automotive and new applications. In particular, color displays and camera phones are expected to be two major growth drivers in the coming years. According to the Shosteck Group, sales of color-display phones will increase from roughly 85 million units in 2002 to over 350 million units by 2005. Meanwhile, handsets with built-in cameras are forecasted to increase from 20 million units in 2002 to almost 250 million units by 2005. These new wireless phones will also feature higher data rate services driven by 2.5G and 3G standards such as GPRS, CDMA 2000, EDGE and WCDMA. According to EMC, the combination of new subscriber additions and higher replacement rates is expected to drive total handset sales from 400 million units in 2002 to approximately 544 million units in 2005.

In response to this rapidly growing market, handset original equipment manufacturers, or OEMs, are significantly shortening product development cycles, seeking simplified architectures and streamlining manufacturing processes. Traditional OEMs are shifting to low-cost suppliers around the world. In turn, original design manufacturers, or ODMs, and contract manufacturers, who lack RF and systems-level expertise, are entering the high-volume mobile phone market to support OEMs as well as to develop handset platforms of their own. ODMs and contract manufacturers seek to manage low-cost handset manufacturing and assembly, freeing OEMs to focus on marketing and distribution aspects of their business. Established handset manufacturers and new market entrants alike are demanding complete semiconductor system solutions that include the RF system, all baseband processing, protocol stack and user interface software, plus comprehensive reference designs and development platforms. With these solutions, traditional handset OEMs can accelerate time-to-market cycles with lower investments in engineering and system design. These solutions also enable ODMs to enter the high volume handset market without requiring significant investments in RF and systems-level expertise.

Similarly, cellular and personal communications services network operators are developing and deploying next generation services. These service providers are incorporating packet-switching capability in their networks to deliver data communications and Internet access to digital cellular and other wireless devices. Over the long term, service providers are seeking to establish a global network that can be accessed by subscribers at any time, anywhere in the world and that can provide subscribers with multimedia services. To meet this goal, OEMs that supply wireless infrastructure base stations to network operators are increasingly relying on mobile communications semiconductor suppliers that can provide highly integrated RF and mixed signal processing functionality.

Additionally, as service providers migrate cellular subscribers to data intensive next generation applications, base stations that transmit and receive signals in the backbone of cellular and personal communications services systems will be under further capacity constraints. To meet the related demand, OEMs will be challenged to increase base station transceiver performance and functionality, while reducing size, power consumption and overall system costs.

We believe that these market trends create a potentially significant opportunity for a broad-based wireless semiconductor supplier with a comprehensive product portfolio supported by specialized wireless manufacturing process technologies and a full range of systems-level expertise.

BUSINESS OVERVIEW

Skyworks is a leading wireless semiconductor company focused exclusively on RF and complete cellular system solutions for mobile communications applications. We offer front-end modules, RF subsystems and cellular systems to leading wireless handset and infrastructure customers.

Skyworks possesses a broad wireless technology capability and one of the most complete wireless communications product portfolios, coupled with customer relationships with virtually all major handset and infrastructure manufacturers. Our product portfolio includes almost every key semiconductor found within a digital cellular handset.

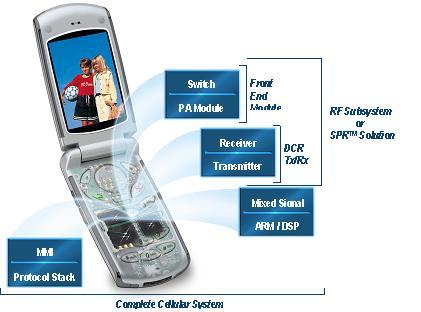

The following diagram illustrates our products that are used in a digital cellular handset:

Front End Modules — PA Modules are increasingly integrating band-select switches, t/r switches, diplexers, filters and other componentsbroadband, among others, to create a single chip front end solution

RF Subsystems/SPR™ Solution: combinesbusiness characterized by longer product lifecycles, sustained revenue profiles, diverse applications and contribution margins that are typically 10 to 15 points higher than the transceiver, PA and associated controller, SAW filters, and a switchplexer module that includes switches and low-pass filters in a compact 13x13mm MCM packagehandset business.

5

Complete Cellular Systems

Skyworks also offers a broad product portfolio addressing next-generation wireless infrastructure applications, including amplifier drivers, ceramic resonators, couplers and detectors, filters, synthesizers and front-end receivers. These components support a variety of RF and mixed signal processing functions within the wireless infrastructure.

We have a comprehensive RF and mixed signal processing and packaging portfolio, extensive circuit design libraries and a proven track record in component and system design. We believe that these capabilities position us to address the growing need of wireless infrastructure manufacturers for base station products with increased transceiver performance and functionality with reduced size, power consumption and overall system costs.

THE SKYWORKS ADVANTAGE

OUR SKYWORKS’ STRATEGYSkyworks’ vision is to become the

SKYWORKS’ STRATEGYSkyworks’ vision is to become the premierleading supplier of wireless semiconductor solutions.high performance analog and mixed signal semiconductors enabling mobile connectivity. Key elements in our strategy include:Leveraging Core Technologies

Skyworks deploys technology building blocks such as radio frequency integrated circuits, analog/mixed-signal processing cores

Skyworks’ vision is to become the leading supplier of high performance analog and mixed signal semiconductors enabling mobile connectivity. Key elements in our strategy include:

Expanding Power Amplifier and digital baseband engines as well as software across multiple product platforms.Front-End Solutions Market ShareOur products offer customers solutions that significantly speed time-to-market while dramatically reducing bill of material costs, power consumption and footprints. We believe that this approach creates economies of scale in research and development and facilitates a reduction in the timeplan to increase our current 40 percent worldwide market for key products.Increasing Integration Levels

Highshare position through higher levels of integration enhanceand continued innovation, leveraging our leading edge process and packaging technology.

Capturing Increasing Dollar Content in Third and Fourth generation ApplicationsAs the benefitsindustry migrates to multi-mode EDGE, WEDGE, WCDMA and WiMAX architectures, RF complexity in the transmit and receive chain substantially increases given simultaneous voice and high speed data communications requirements, coupled with the need for backward compatibility to existing networks. As a result, Skyworks believes that the addressable semiconductor market for our solutions essentially doubles.Gaining RF Market Share in Helios™, DigRF and WDCMAWe continue to expand our radio presence with the Helios™ platform, which bundles our single chip direct conversion transceiver and front-end module. Skyworks is now supporting the majority of tier one handset OEMs with complete radios and we look forward to even greater traction as we launch our differentiated DigRF and WCDMA solutions in the coming year.Diversifying into Adjacent Linear MarketsBy leveraging core analog, mixed signal and RF technology, Skyworks is also able to deliver solutions to broader and diverse markets that are characterized by longer product lifecycles, sustained revenue profiles and higher contribution margins than our handset business. While the addressable market for linear products by reducing production costs throughis highly fragmented, it is roughly four times the use of fewer external components, reduced board space and improved system assembly yields. By combining allsize of the necessary communications functions for a complete system solution, Skyworks can deliver additional semiconductor content, thereby offering existing and potential customers more compelling and cost-effective solutions.Capturing an Increasing Amount of Semiconductor Content

We enable our customers to start with individual components as necessary, and then migrate up the product integration ladder. We believe that our highly integrated solutions will enable these customers to speed their time to market while focusing their resources on product differentiation through a broader range of more sophisticated, next-generation features.

Diversifying Customer Base

Skyworks supports virtually every wirelesscellular handset OEM including Nokia Corporation, Motorola, Inc., Samsung Electronics Co., Sony/Ericsson and LG Electronics, Inc. as well as emerging ODMs and contract manufacturers such as BenQ, Compal, Flextronics and Quanta. With the industry’s move towards outsourcing, we believe that we are particularly well-positioned to address the growing needs of new market entrants who seek RF and system-level integration expertise.industry.

6

Delivering Operational ExcellenceThe Skyworks operations team leverages world-class manufacturing technologies and enables highly integrated modules as well as system-level solutions. Skyworks will

Skyworks’ strategy is to vertically integrate where itwe can differentiate or will otherwise enter alliances and partnerships for leading-edge capabilities. These partnerships and alliances are designed to ensure product leadership and competitive advantage in the marketplace. We are focused on achieving the industry’s shortest cycle times, highest yields and ultimately the lowest product cost structure.BUSINESS FRAMEWORKDuring the fourth fiscal quarter of 2006, Skyworks began the restructuring of its business by discontinuing its baseband operations in order to sharpen focus on its high growth core business. Skyworks’ baseband product area developed complete reference designs, incorporating the digital signal processor and software functionality, in support of tier-three handset suppliers. This initiative was complex, research and development intensive and generated substantial operating losses. As tier-one OEMs increasingly dominate the landscape, the addressable market for the Company’s baseband solutions had significantly contracted. As a result of this decision, Skyworks restructured its business to focus on its core analog and RF product markets.To address the wireless industry opportunities discussed above and to execute our strategy, we have aligned our product portfolio around two markets: mobile platforms and linear products. We believe we possess a broad technology capability and one of the most complete wireless communications product portfolios that, when coupled with key customer relationships with all major handset manufacturers, positions us well to meet industry needs. Below are just a few examples from each of our product portfolios.

7

SKYWORKS PRODUCT PORTFOLIODCR™ Transceivers Attenuators GPRS RF Subsystems Chip Capacitors GSM/GPRS/EDGE Power Amplifiers Diodes Helios™ DigRF Subsystems Directional Couplers/Detectors Helios™ EDGE RF Subsystems Hybrids Intera™ Front-End Modules Infrastructure RF Subsystems SPR® Solutions Mixers/Demodulators TD-SCDMA Power Amplifiers Modulators WCDMA/CDMA Power Amplifiers Phase Shifters Power Dividers/Combiners Receivers Switches Synthesizers/PLLs Technical Ceramics

Mobile Platforms:• DCR Transceiver (Tx/Rx):encompasses the complete RF transmit and receive functions • Front-End Modules (FEM): power amplifiers that are integrated with switches, diplexers, filters and other components to create a single package front-end solution • Power Amplifiers (PA): the module that strengthens the signal so that it has sufficient energy to reach a base station • Helios™ RF Subsystems/Single Package Radio (SPR®) Solution:combines the transceiver, the PA and associated controller, surface acoustic wave (SAW) filters, and a switchplexer into a single, multi chip module (MCM) package

Linear Products:• Attenuators:A circuit that allows a known source of power to be reduced by a predetermined factor (usually expressed as decibels) • Capacitors:a passive electronic component that stores energy in the form of an electrostatic field • Ceramic:material used in semiconductors which contain transition metal oxides that are II-VI semiconductors, such as zinc-oxide • Diodes:semiconductor devices that pass current in one direction only • Directional Coupler:a transmission coupling device for separately sampling the forward or backward wave in a transmission line • Directional Detector:intended for use in power management applications • Hybrid:monolithic circuitry that is 100% passive and offers low loss, high isolation and phase/amplitude balance • Phase Shifter:achieves its distinct sound by creating one or more notches in the frequency domain that eliminate sounds at the notch frequencies

8

• PLL (Phase-Locked Loop):is a closed-loop feedback control system that maintains a generated signal in a fixed phase relationship to a reference signal • Power Combiner:used for connecting more than one antenna to a single radio • Power Divider:passive devices designed to combine multiple antennas in a stacked antenna system, while providing a constant 50 ohm impedance over the bandwidth chosen • Switch: the component that performs the change between the transmit and receive function, as well as the band function for cellular handsets • Synthesizer:designed for tuning systems and is optimized for low-phase noise with comparison frequencies

THE SKYWORKS ADVANTAGEBy turning complexity into simplicity, we provide our customers with the following competitive advantages:• Broad multimode radio and precision analog product portfolio • Market leadership in key product segments • Solutions for all air interface standards, including CDMA2000, GSM/GPRS/EDGE, WCDMA and WLAN • Engagements with a diverse set of influential customers • Analog, RF and mixed signal design capabilities • Access to all key process technologies: GaAs HBT, PHEMT, BiCMOS, SiGE, CMOS and RF CMOS • World-class manufacturing capabilities and scale • Unparalleled level of customer service and technical support • Commitment to technology innovation

MARKETING AND DISTRIBUTIONOur products are primarily sold through a direct Skyworks sales force. This team is globally deployed across all major market regions. In some markets we supplement our direct sales effort with independent manufacturers’ representatives, assuring broader coverage of territories and customers. We also utilize distribution partners, some of which are franchised globally with others focused in specific toregional markets (e.g., Europe, North American markets.America, China and Taiwan).

We maintain an internal marketing organization that is responsible for developing sales and advertising literature, print media, such as product announcements and catalogs, as well as a variety of web-basedWeb-based content. Skyworks’ sales engagement begins at the earliest stages in a customer design. We strive to provide close technical collaboration with our customers at the inception of a new program. This partnership allows our team to facilitate customer-driven solutions, which leverage the unique strength of our portfolio while providing high value and greatly reduced time to market.reducing time-to-market.

We believe that the technical and complex nature of our products and markets demandsdemand an extraordinary commitment to close ongoing relationships with our customers. As such, we strive to expand the scope of our customer relationship to include design, engineering, manufacturing, purchasing and project management. We also employ a collaborative approach in developing these partnerships by combining the support of our design teams, applications engineers, manufacturing personnel, sales and marketing staff and senior management.9

We believe that maintaining frequent and interactive contact with our customers is paramount to our continuous efforts to provide world-class sales and service support. By listening and responding to feedback, we are able to mobilize actions to raise the level of customer satisfaction, improve our ability to anticipate future product needs, and enhance our understanding of key market dynamics. We are confident that diligence in following this path will position Skyworks to participate in numerous opportunities for growth in the future.CUSTOMERS

During fiscal year 2003, Samsung Electronics Co.

REVENUES FROM AND DEPENDENCE ON CUSTOMERS; CUSTOMER CONCENTRATIONFor information regarding customer concentration and Motorola, Inc. accountedrevenues from external customers for 15% and 11%, respectively,our reportable segment for each of the Company’s total net revenues. Duringlast three fiscal year 2002, Samsung Electronics Co. and Motorola, Inc. accounted for 35% and 11%, respectively,years, see Note 16 of the Company’s total net revenues. AsItem 8 of September 30, 2003 Samsung Electronics Co. accounted for approximately 18% of the Company’s gross accounts receivable. The foregoing percentages are basedthis Annual Report on sales representing the wireless business of Conexant’s sales for the fiscal year 2002 up to the time of the Merger, and sales of the combined company for the post-Merger period from June 26, 2002 through the end of the fiscal year and for fiscal 2003.Form 10-K.

INTELLECTUAL PROPERTY AND PROPRIETARY RIGHTSWe own or are licensed under numerous United States and foreign patents and patent applications related to our products, our manufacturing operations and processes and other activities. In addition, we own a number of trademarks and service marks applicable to certain of our products and services. We believe that intellectual property, including patents, patent applications, trade secrets and trademarks are of material importance to our business. We rely on patent, copyright, trademark, trade secret and other intellectual property laws, as well as nondisclosure and confidentiality agreements and other methods, to protect our confidential and proprietary technologies, devices, algorithms and processes.Weprocesses. We cannot guarantee that these efforts will meaningfully protect our intellectual property, and others may independently develop substantially equivalent proprietary technologies, devices, algorithms or processes. In addition, the laws of some foreign countries do not protect proprietary rights to the same extent as the laws of the United States, and effective copyright, patent, trademark and trade secret protection may not be available in those jurisdictions. In addition to protecting our proprietary technologies and processes, we strive to strengthen our intellectual property portfolio to enhance our ability to obtain cross-licenses of intellectual property from others, to obtain access to intellectual property we do not possess and to more favorably resolve potential intellectual property claims against us. WeDue to rapid technological changes in the industry, we believe that ourestablishing and maintaining a technological leadership position depends primarily on our ability to develop new innovative products through the technical competence of our engineering personnel.COMPETITIVE CONDITIONSWe compete on the basis of time to market;time-to-market, new product innovation;innovation, overall product quality and performance; price;performance, price, compliance with industry standards;standards, strategic relationships with customers;customers, and protection of our intellectual property. Certain competitors may be able to adapt more quickly than we can to new or emerging technologies and changes in customer requirements, or may be able to devote greater resources to the development, promotion and sale of their products than we can.Current and potential competitors also have established or may establish financial or strategic relationships among themselves or with our customers, resellers, suppliers or other third parties. These relationships may affect our customers’ purchasing decisions. Accordingly, it is possible that new competitors or alliances among competitors could emerge and rapidly acquire significant market share. We cannot provide assurances that we will be able to compete successfully against current and potential competitors.RESEARCH AND DEVELOPMENTOur products and markets are subject to continued technological advances. Recognizing the importance of such technological advances, we maintain a high level of research and development activities. We maintain close collaborative relationships with many of our customers to help identify market demands and target our development efforts to meet those demands. Our design centers are strategically located around the world to be in close proximity to our customers and to take advantage of key technical and engineering talent worldwide. We are focusing our development efforts on new products, design tools and manufacturing processes using our core technologies.Our research and development expenditures for fiscal 2003, 2002years ended September 29, 2006, September 30, 2005, and 2001October 1, 2004 were $151.8$164.1 million, $132.6$152.2 million, and $111.1$152.6 million, respectively.

10

RAW MATERIALSRaw materials for our products and manufacturing processes are generally available from several sources. ItWe do not carry significant inventories and it is our policy not to depend on a sole source of supply unless market or other conditions dictate otherwise. Consequently, there are limited situations where we procure certain components and services for our products from single or limited sources. We purchase materials and services against long-term agreements or onprimarily pursuant to individual purchase orders. We do not carry significant inventories andHowever, we have a limited number of long-term supply contracts with our suppliers. Certain of our suppliers consign raw materials to us at our manufacturing facilities. We request these raw materials and take title to them as they are needed in our manufacturing process. We believe we have adequate sources for the supply of raw materials and components for our manufacturing needs with suppliers located around the world.Under supply agreements entered into with Conexant and Jazz Semiconductor, we receive wafer fabrication, wafer probe and certain other services from Jazz Semiconductor. Pursuant to these supply agreements, we are committed to obtain certain minimum wafer volumes from Jazz Semiconductor. Our expected minimum purchase obligations under these supply agreements are anticipated to be approximately $39 million and $13 million in fiscal 2004 and 2005, respectively.

BACKLOGOur sales are made primarily pursuant to standard purchase orders for delivery of products, with such purchase orders officially acknowledged by us according to our own terms and conditions. Due to industry practice, which allows customers to cancel orders with limited advance notice to us prior to shipment, and with little or no penalty, we believe that backlog as of any particular date is not a reliable indicator of our future revenue levels. We also deliver product to certain external customer “hubs” (consignment) where our significant customers will pull inventory from their existing consignment inventories when required. These consignment pulls trigger revenue recognition and we periodically replenish these inventory levels.

ENVIRONMENTAL REGULATIONSFederal, state and local requirements relating to the discharge of substances into the environment, the disposal of hazardous wastes, and other activities affecting the environment have had, and will continue to have, an impact on our manufacturing operations. Thus far, compliance with environmental requirements and resolution of environmental claims havehas been accomplished without material effect on our liquidity and capital resources, competitive position or financial condition.Most of our European customers have mandated that our products comply with local and regional lead free and other “green” initiatives. We believe that our current expenditures for environmental capital investment and remediation necessary to comply with present regulations governing environmental protection, and other expenditures for the resolution of environmental claims, will not have a material adverse effect on our liquidity and capital resources, competitive position or financial condition. We cannot assess the possible effect of compliance with future requirements.CYCLICALITY;

CYCLICALITY/ SEASONALITYThe semiconductor industry is highly cyclical and is characterized by constant and rapid technological change. Product obsolescence, price erosion, evolving technical standards and shortened product life cycles may contribute to wide fluctuations in product supply and demand. These and other factors, together with changes in general economic conditions, may cause significant upturns and downturns in the industry, and in our business. We have experienced periods of industry downturns characterized by diminished product demand, production overcapacity, excess inventory levels and accelerated erosion of average selling prices. These factors may cause substantial fluctuations in our revenues and our operational performance. We have experienced these cyclical fluctuations in our business in the past and may experience cyclical fluctuations in the future.Sales of our products are also subject to seasonal fluctuation and periods of increased demand in end-user consumer applications, such as mobile handsets. This generally occurs in the last calendar quarter ending in December. Sales of semiconductor products and system solutions used in these products generally increase just prior to this quarter and continue at a higher level through the end of the calendar year.GEOGRAPHIC INFORMATIONNet

For information regarding net revenues by geographic area are presented based uponregion for each of the countrylast three fiscal years, see Note 16 of destination. Net revenues by geographic area are as follows (in thousands):Item 8 of this Annual Report on Form 10-K.11

Years Ended September 30,

2003

2002

2001

United States $ 87,691 $ 72,185 $ 63,948 Other Americas 69,559 4,615 5,455

Total Americas 157,250 76,800 69,403 South Korea 157,772 237,681 142,459 Other Asia-Pacific 218,817 114,974 23,898

Total Asia-Pacific 376,589 352,655 166,357 Europe, Middle East and Africa 83,950 28,314 24,691

$ 617,789 $ 457,769 $ 260,451

Our revenues by geography do not necessarily correlate to end handset demand by region. For example, if we sell a power amplifier module to a customer in South Korea, we record the sale within the South Korea account although that customer, in turn, may integrate that module into a product sold to a service provider (its customer) in Africa, China, Europe, the Middle East, the Americas or within South Korea.

Long-lived assets by geographic area are as follows (in thousands):

September 30,

2003

2002

United States $ 101,871 $ 109,975 Mexico 21,223 30,427 Other 4,671 3,371

$ 127,765 $ 143,773

EMPLOYEESAs of October 3, 2003, the CompanySeptember 29, 2006, we employed approximately 3,8004,000 persons. Approximately 1,100700 employees in Mexico are covered by collective bargaining agreements. In September 2006, the Company exited its baseband product area and shortly thereafter reduced its global workforce by approximately 10%. These reductions are not reflected in the aforementioned employee census. We believe our future success will depend in large part upon our continued ability to attract, motivate, develop and retain highly skilled and dedicated employees.

ITEM 1A. RISK FACTORSCERTAIN BUSINESS RISKSWe operate in a rapidly changing environment that involves a number of risks, many of which are beyond our control. This discussion highlights some of the risks, which may affect our future operating results. These are the risks and uncertainties we believe are most important for you to consider. Additional risks and uncertainties not presently known to us, which we currently deem immaterial or which are similar to those faced by other companies in our industry or business in general, may also impair our business operations. If any of the following risks or uncertainties actually occurs, our business, financial condition and operating results would likely suffer.We operate in the highly cyclical wireless communications semiconductor industry, which is subject to significant downturns.We operate primarily in the semiconductor industry, which is cyclical and subject to rapid change and evolving industry standards. From time to time, changes in general economic conditions, together with other factors, cause significant upturns and downturns in the industry. Periods of industry downturn are characterized by diminished product demand, production overcapacity, excess inventory levels and accelerated erosion of average selling prices. These characteristics, and in particular their impact on the level of demand for digital cellular handsets, may cause substantial fluctuations in our revenues and results of operations. Furthermore, downturns in the semiconductor industry may be severe and prolonged, and any prolonged delay or failure of the industry or the wireless communications market to recover from downturns would materially and adversely affect our business, financial condition and results of operations. The semiconductor industry also periodically experiences increased demand and production capacity and materials constraints, which may affect our ability to meet customer demand for our products. We have experienced these cyclical fluctuations in our business and may experience cyclical fluctuations in the future.Uncertainties involving shifting marketplace dynamics.Our operating results for fiscal 2005 and fiscal 2006 were adversely affected by shifting marketplace dynamics which favored Tier I and Tier II handset manufacturers and suppliers. Consolidation of the global handset marketplace from smaller Tier III handset customers primarily located in developing countries to Tier I and Tier II customers accelerated in fiscal 2006. This trend led to a slowdown in customer orders, increasing channel inventories and customer defaults on accounts receivable. We responded to this rapidly changing dynamic by exiting our baseband product area in the fourth quarter of fiscal 2006. While this marketplace shift only affected our baseband product area there can be no assurances that future changes in marketplace conditions in our other product areas will not materially and adversely affect our operating results. We may not be able to respond to shifting customer demand in other product areas on a timely basis, if at all, and accordingly this could result in a material and adverse impact to our operating results.We have incurred substantial operating losses in the past and may experience future losses.Our operating results for fiscal years 2002 and 2003 were adversely affected by a global economic slowdown, decreased consumer confidence, reduced capital spending, and adverse business conditions and liquidity concerns in the telecommunications and related industries. These factors led to a slowdown in customer orders, an increase in the number of cancellations and reschedulings of backlog, higher overhead costs as a percentage of our reduced net revenue, and an abrupt decline in demand for many of the end-user products that incorporate our wireless communications semiconductor products and system solutions. Although we emerged from this period of economic12

weakness in fiscal 2004, should economic conditions deteriorate for any reason, it could result in underutilization of our manufacturing capacity, reduced revenues or changes in our revenue mix, and other impacts that would materially and adversely affect our operating results. Due to this economic uncertainty, although we were profitable in fiscal 2004 and fiscal 2005, we cannot assure you that we will be able to sustain such profitability or that we will not experience future operating losses.Additionally, the conflict in Iraq, as well as other contemporary international conflicts, natural disasters, acts of terrorism, and civil and military unrest contributes to the economic uncertainty. These continuing and potentially escalating conflicts can also be expected to place continued pressure on economic conditions in the United States and worldwide. These conditions make it extremely difficult for our customers, our vendors and for us to accurately forecast and plan future business activities. If such uncertainty continues or economic conditions worsen (or both), our business, financial condition and results of operations will likely be materially and adversely affected.The wireless semiconductor markets are characterized by intense competition.The wireless communications semiconductor industry in general and the markets in which we compete in particular are intensely competitive. We compete with U.S. and international semiconductor manufacturers of all sizes in terms of resources and market share. We currently face significant competition in our markets and expect that intense price and product competition will continue. This competition has resulted in, and is expected to continue to result in, declining average selling prices for our products and increased challenges in maintaining or increasing market share. Furthermore, additional competitors may enter our markets as a result of growth opportunities in communications electronics, the trend toward global expansion by foreign and domestic competitors and technological and public policy changes. We believe that the principal competitive factors for semiconductor suppliers in our markets include, among others:• rapid time-to-market and product ramp, • timely new product innovation, • product quality, reliability and performance, • product price, • features available in products, • compliance with industry standards, • strategic relationships with customers, and • access to and protection of intellectual property.

We cannot assure you that we will be able to successfully address these factors. Many of our competitors enjoy the benefit of:• long presence in key markets, • name recognition, • high levels of customer satisfaction, • ownership or control of key technology or intellectual property, and • strong financial, sales and marketing, manufacturing, distribution, technical or other resources.

13

As a result, certain competitors may be able to adapt more quickly than we can to new or emerging technologies and changes in customer requirements or may be able to devote greater resources to the development, promotion and sale of their products than we can.Current and potential competitors have established or may in the future establish, financial or strategic relationships among themselves or with customers, resellers or other third parties. These relationships may affect customers’ purchasing decisions. Accordingly, it is possible that new competitors or alliances among competitors could emerge and rapidly acquire significant market share. Furthermore, some of our customers have divisions that internally develop or manufacture products similar to ours, and may compete with us. We cannot assure you that we will be able to compete successfully against current and potential competitors. Increased competition could result in pricing pressures, decreased gross margins and loss of market share and may materially and adversely affect our business, financial condition and results of operations.Our manufacturing processes are extremely complex and specialized.Our manufacturing operations are complex and subject to disruption, including for causes beyond our control. The fabrication of integrated circuits is an extremely complex and precise process consisting of hundreds of separate steps. It requires production in a highly controlled, clean environment. Minor impurities, contamination of the clean room environment, errors in any step of the fabrication process, defects in the masks used to print circuits on a wafer, defects in equipment or materials, human error, or a number of other factors can cause a substantial percentage of wafers to be rejected or numerous die on each wafer to malfunction. Because our operating results are highly dependent upon our ability to produce integrated circuits at acceptable manufacturing yields, these factors could have a material adverse affect on our business. In addition, we may discover from time to time defects in our products after they have been shipped, which may require us to pay warranty claims, replace products, or pay costs associated with the recall of a customer’s products containing our parts.Additionally, our operations may be affected by lengthy or recurring disruptions of operations at any of our production facilities or those of our subcontractors. These disruptions may include electrical power outages, fire, earthquake, flooding, war, acts of terrorism, health advisories or risks, or other natural or man-made disasters. Disruptions of our manufacturing operations could cause significant delays in shipments until we are able to shift the products from an affected facility or subcontractor to another facility or subcontractor. In the event of such delays, we cannot assure you that the required alternative capacity, particularly wafer production capacity, would be available on a timely basis or at all. Even if alternative wafer production or assembly and test capacity is available, we may not be able to obtain it on favorable terms, which could result in higher costs and/or a loss of customers. We may be unable to obtain sufficient manufacturing capacity to meet demand, either at our own facilities or through external manufacturing or similar arrangements with others.Due to the highly specialized nature of the gallium arsenide integrated circuit manufacturing process, in the event of a disruption at the Newbury Park, California or Woburn, Massachusetts semiconductor wafer fabrication facilities, alternative gallium arsenide production capacity would not be immediately available from third-party sources. These disruptions could have a material adverse effect on our business, financial condition and results of operations.We may not be able to maintain and improve manufacturing yields that contribute positively to our gross margin and profitability.Minor deviations or perturbations in the manufacturing process can cause substantial manufacturing yield loss, and in some cases, cause production to be suspended. Manufacturing yields for new products initially tend to be lower as we complete product development and commence volume manufacturing, and typically increase as we bring the product to full production. Our forward product pricing includes this assumption of improving manufacturing yields and, as a result, material variances between projected and actual manufacturing yields will have a direct effect on our gross margin and profitability. The difficulty of accurately forecasting manufacturing yields and maintaining cost competitiveness through improving manufacturing yields will continue to be magnified by the increasing process complexity of manufacturing semiconductor products. Our manufacturing operations will also face pressures arising from the compression of product life cycles, which will require us to manufacture new products faster and for shorter periods while maintaining acceptable manufacturing yields and quality without, in many cases, reaching the longer-term, high-volume manufacturing conducive to higher manufacturing yields and declining costs.14

We are dependent upon third parties for the manufacture, assembly and test of our products.We rely upon independent wafer fabrication facilities, called foundries, to provide silicon-based products and to supplement our gallium arsenide wafer manufacturing capacity. There are significant risks associated with reliance on third-party foundries, including:• the lack of ensured wafer supply, potential wafer shortages and higher wafer prices, • limited control over delivery schedules, manufacturing yields, production costs and quality assurance, and • the inaccessibility of, or delays in obtaining access to, key process technologies.

Although we have long-term supply arrangements to obtain additional external manufacturing capacity, the third-party foundries we use may allocate their limited capacity to the production requirements of other customers. If we choose to use a new foundry, it will typically take an extended period of time to complete the qualification process before we can begin shipping products from the new foundry. The foundries may experience financial difficulties, be unable to deliver products to us in a timely manner or suffer damage or destruction to their facilities, particularly since some of them are located in earthquake zones. If any disruption of manufacturing capacity occurs, we may not have alternative manufacturing sources immediately available. We may therefore experience difficulties or delays in securing an adequate supply of our products, which could impair our ability to meet our customers’ needs and have a material adverse effect on our operating results.Although we own and operate a test and assembly facility, we still depend on subcontractors to package, assemble and test certain of our products. We do not have long-term agreements with any of our assembly or test subcontractors and typically procure services from these suppliers on a per order basis. If any of these subcontractors experiences capacity constraints or financial difficulties, suffers any damage to its facilities, experiences power outages or any other disruption of assembly or testing capacity, we may not be able to obtain alternative assembly and testing services in a timely manner. Due to the amount of time that it usually takes us to qualify assemblers and testers, we could experience significant delays in product shipments if we are required to find alternative assemblers or testers for our components. Any problems that we may encounter with the delivery, quality or cost of our products could damage our customer relationships and materially and adversely affect our results of operations. We are continuing to develop relationships with additional third-party subcontractors to assemble and test our products. However, even if we use these new subcontractors, we will continue to be subject to all of the risks described above.We are dependent upon third parties for the supply of raw materials and components.Our manufacturing operations depend on obtaining adequate supplies of raw materials and the components used in our manufacturing processes. Although we maintain relationships with suppliers located around the world with the objective of ensuring that we have adequate sources for the supply of raw materials and components for our manufacturing needs, recent increased demand from the semiconductor industry for such raw materials and components has resulted in tighter supplies. We cannot assure you that our suppliers will be able to meet our delivery schedules, that we will not lose a significant or sole supplier, or that a supplier will be able to meet performance and quality specifications. If a supplier were unable to meet our delivery schedules, or if we lost a supplier or a supplier were unable to meet performance or quality specifications, our ability to satisfy customer obligations would be materially and adversely affected. In addition, we review our relationships with suppliers of raw materials and components for our manufacturing needs on an ongoing basis. In connection with our ongoing review, we may modify or terminate our relationship with one or more suppliers. We may also enter into other sole supplier arrangements to meet certain of our raw material or component needs. While we do not typically rely on a single source of supply for our raw materials, we are currently dependent on a sole-source supplier for epitaxial wafers used in the gallium arsenide semiconductor manufacturing processes at our manufacturing facilities. If we were to lose this sole source of supply, for any reason, a material adverse effect on our business could result until an alternate source is obtained. To the extent we enter into additional sole supplier arrangements for any of our raw materials or components, the risks associated with our supply arrangements would be exacerbated.15

Changes in the accounting treatment of share-based compensation have adversely affected our results of operations.In December 2004, the Financial Accounting Standards Board issued SFAS No. 123(R), “Share-Based Payment” to require companies to expense employee stock options for financial reporting purposes. Such equity-based award expensing has required us to value our employee stock option grants and other equity-based awards pursuant to an option valuation formula and amortize that value against our earnings over the vesting period in effect for those options. Historically we accounted for stock-based awards to employees in accordance with Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees,” and had adopted the disclosure-only alternative of SFAS No. 123, “Accounting for Share-Based Compensation.” We implemented SFAS 123(R) in the reporting period starting October 1, 2005. This change in accounting treatment has materially affected our reported results of operations as the share-based compensation expense has been and will continue to be charged directly against our reported earnings but will have no impact on cash flows from operations. We anticipate that our share-based compensation expense will approximate $24.2 million in total from fiscal 2007 through 2010. This expense projection is calculated as of September 29, 2006 and does not take into account any future equity awards that we might issue nor does it account for future actual stock-based award forfeitures. We will be required to adjust future share-based compensation expense for actual future stock option forfeitures.Our success depends upon our ability to develop new products and reduce costs in a timely manner.The wireless communications semiconductor industry generally and, in particular, the markets into which we sell our products are highly cyclical and characterized by constant and rapid technological change, rapid product evolution, price erosion, evolving technical standards, short product life cycles, increasing demand for higher levels of integration, increased miniaturization, and wide fluctuations in product supply and demand. Our operating results depend largely on our ability to continue to cost-effectively introduce new and enhanced products on a timely basis. The successful development and commercialization of semiconductor devices and modules is highly complex and depends on numerous factors, including:• the ability to anticipate customer and market requirements and changes in technology and industry standards, • the ability to obtain capacity sufficient to meet customer demand, • the ability to define new products that meet customer and market requirements, • the ability to complete development of new products and bring products to market on a timely basis, • the ability to differentiate our products from offerings of our competitors, • overall market acceptance of our products, and • the ability to obtain adequate intellectual property protection for our new products.

Our ability to manufacture current products, and to develop new products, depends, among other factors, on the viability and flexibility of our own internal information technology systems (“IT Systems”).We cannot assure you that we will have sufficient resources to make the substantial investment in research and development needed to develop and bring to market new and enhanced products in a timely manner. We will be required to continually evaluate expenditures for planned product development and to choose among alternative technologies based on our expectations of future market growth. We cannot assure you that we will be able to develop and introduce new or enhanced wireless communications semiconductor products in a timely and cost-effective manner, that our products will satisfy customer requirements or achieve market acceptance or that we will be able to anticipate new industry standards and technological changes. We also cannot assure you that we will be able to respond successfully to new product announcements and introductions by competitors or to changes in the design or specifications of complementary products of third parties with which our products interface. If we fail to16

rapidly and cost-effectively introduce new and enhanced products in sufficient quantities and that meet our customers requirements, our business and results of operations would be materially and adversely harmed.In addition, prices of many of our products decline, sometimes significantly, over time. We believe that to remain competitive, we must continue to reduce the cost of producing and delivering existing products at the same time that we develop and introduce new or enhanced products. We cannot assure you that we will be able to continue to reduce the cost of our products to remain competitive.The markets into which we sell our products are characterized by rapid technological change.The demand for our products can change quickly and in ways we may not anticipate. Our markets generally exhibit the following characteristics:• rapid technological developments and product evolution, • rapid changes in customer requirements, • frequent new product introductions and enhancements, • demand for higher levels of integration, decreased size and decreased power consumption, • short product life cycles with declining prices over the life cycle of the product, and • evolving industry standards.

These changes in our markets may contribute to the obsolescence of our products. Our products could become obsolete or less competitive sooner than anticipated because of a faster than anticipated change in one or more of the above-noted factors.The ability to attract and retain qualified personnel to contribute to the design, development, manufacture and sale of our products is critical to our success.As the source of our technological and product innovations, our key technical personnel represent a significant asset. Our success depends on our ability to continue to attract, retain and motivate qualified personnel, including executive officers and other key management and technical personnel. The competition for management and technical personnel is intense in the semiconductor industry, and therefore we cannot assure you that we will be able to attract and retain qualified management and other personnel necessary for the design, development, manufacture and sale of our products. We may have particular difficulty attracting and retaining key personnel during periods of poor operating performance, given, among other things, the use of equity-based compensation by us and our competitors. The loss of the services of one or more of our key employees or our inability to attract, retain and motivate qualified personnel, could have a material adverse effect on our ability to operate our business.If OEMs and Original Design Manufacturers (“ODMs”) of communications electronics products do not design our products into their equipment, we will have difficulty selling those products. Moreover, a “design win” from a customer does not guarantee future sales to that customer.Our products are not sold directly to the end-user, but are components or subsystems of other products. As a result, we rely on OEMs and ODMs of wireless communications electronics products to select our products from among alternative offerings to be designed into their equipment. Without these “design wins,” we would have difficulty selling our products. If a manufacturer designs another supplier’s product into one of its product platforms, it is more difficult for us to achieve future design wins with that platform because changing suppliers involves significant cost, time, effort and risk on the part of that manufacturer. Also, achieving a design win with a customer does not ensure that we will receive significant revenues from that customer. Even after a design win, the customer is not obligated to purchase our products and can choose at any time to reduce or cease use of our products, for example, if its own products are not commercially successful, or for any other reason. We cannot assure you that we17

will continue to achieve design wins or to convert design wins into actual sales, and any failure to do so could materially and adversely affect our operating results.Lengthy product development and sales cycles associated with many of our products may result in significant expenditures before generating any revenues related to those products.After our product has been developed, tested and manufactured, our customers may need three to six months or longer to integrate, test and evaluate our product and an additional three to six months or more to begin volume production of equipment that incorporates the product. This lengthy cycle time increases the possibility that a customer may decide to cancel or change product plans, which could reduce or eliminate our sales to that customer. As a result of this lengthy sales cycle, we may incur significant research and development expenses, and selling, general and administrative expenses, before we generate the related revenues for these products. Furthermore, we may never generate the anticipated revenues from a product after incurring such expenses if our customer cancels or changes its product plans.Uncertainties involving the ordering and shipment of, and payment for, our products could adversely affect our business.Our sales are typically made pursuant to individual purchase orders and not under long-term supply arrangements with our customers. Our customers may cancel orders before shipment. Additionally, we sell a portion of our products through distributors, some of whom have rights to return unsold products. We may purchase and manufacture inventory based on estimates of customer demand for our products, which is difficult to predict. This difficulty may be compounded when we sell to OEMs indirectly through distributors or contract manufacturers, or both, as our forecasts of demand will then be based on estimates provided by multiple parties. In addition, our customers may change their inventory practices on short notice for any reason. The cancellation or deferral of product orders, the return of previously sold products, or overproduction due to a change in anticipated order volumes could result in us holding excess or obsolete inventory, which could result in inventory write-downs and, in turn, could have a material adverse effect on our financial condition.In addition, if a customer encounters financial difficulties of its own as a result of a change in demand or for any other reason, the customer’s ability to make timely payments to us for non-returnable products could be impaired.In the fourth quarter of fiscal 2006, the Company recorded bad debt expense of $35.1 million. Specifically, the Company recorded charges related to two customers: Vitelcom Mobile and an Asian component distributor.Our leverage and our debt service obligations may adversely affect our cash flow.On September 29, 2006, we had total indebtedness of approximately $229.3 million, which represented approximately 25.2% of our total capitalization.As long as our 4.75 percent convertible subordinated notes due November 2007 remain outstanding, we will have debt service obligations on such notes of approximately $8.5 million per year. If we issue other debt securities in the future, our debt service obligations will increase.Based on our results of operations for fiscal 2006 and current trends, we expect our existing sources of liquidity, together with cash expected to be generated from operations and short term investments along with our ability to access financial markets for additional debt or equity financing, will allow us to sufficiently fund our research and development, capital expenditures, debt obligations (to replace existing or maturing debt instruments), purchase obligations, working capital and other cash requirements for at least the next 12 months. If necessary, among other alternatives, we may add lease lines of credit to finance capital expenditures and we may obtain other long-term debt, lines of credit and other financing.Our indebtedness could have significant negative consequences, including:increasing our vulnerability to general adverse economic and industry conditions,18

• limiting our ability to obtain additional financing, • requiring the dedication of a substantial portion of any cash flow from operations to service our indebtedness, thereby reducing the amount of cash flow available for other purposes, including capital expenditures, • limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we compete, and • placing us at a possible competitive disadvantage to less leveraged competitors and competitors that have better access to capital resources.

Despite our current debt levels, we are able to incur substantially more debt, which would increase the risks described above.Our reliance on a small number of customers for a large portion of our sales could have a material adverse effect on the results of our operations.Significant portions of our sales are concentrated among a limited number of customers. If we lost one or more of these major customers, or if one or more major customers significantly decreased its orders for our products, our business would be materially and adversely affected. Sales to our three largest customers, including sales to their manufacturing subcontractors, represented approximately 50.0% of our net revenue for fiscal 2006. We expect that our largest customers will continue to account for a substantial portion of our net revenue in fiscal 2007 and for the foreseeable future.Average product life cycles in the semiconductor industry tend to be very short.In the semiconductor industry, product life cycles tend to be short relative to the sales and development cycles. Therefore, the resources devoted to product sales and marketing may not result in material revenue, and from time to time we may need to write off excess or obsolete inventory. If we were to incur significant marketing expenses and investments in inventory that we are not able to recover, and we are not able to compensate for those expenses, our operating results would be materially and adversely affected. In addition, if we sell our products at reduced prices in anticipation of cost reductions but still hold higher cost products in inventory, our operating results would be harmed.We face a risk that capital needed for our business will not be available when we need it.We might obtain additional sources of financing in the future. Based on our results of operations for fiscal 2006 and current trends, we expect our existing sources of liquidity, together with cash expected to be generated from operations and short term investments along with our ability to access financial markets for additional debt or equity financing, will likely allow us to sufficiently fund our research and development, capital expenditures, debt obligations, purchase obligations, working capital and other cash requirements for at least the next 12 months. To the extent that existing cash and securities and cash from operations are insufficient to fund our future activities, we may need to raise additional funds through public or private equity or debt financing. Conditions existing in the U.S. capital markets, if and when we seek additional financing as well as the then current condition of the Company, will affect our ability to raise capital, as well as the terms of any such financing. We may not be able to raise enough capital to meet our capital needs on a timely basis or at all. Failure to obtain capital when required would have a material adverse effect on us.In addition, any strategic investments and acquisitions that we may make to help us grow our business may require additional capital resources. We cannot assure you that the capital required to fund these investments and acquisitions will be available in the future.19

Remaining competitive in the semiconductor industry requires transitioning to smaller geometry process technologies and achieving higher levels of design integration.In order to remain competitive, we expect to continue to transition our semiconductor products to increasingly smaller line width geometries. This transition requires us to modify the manufacturing processes for our products, design new products to more stringent standards, and to redesign some existing products. In the past, we have experienced some difficulties migrating to smaller geometry process technologies or new manufacturing processes, which resulted in sub-optimal manufacturing yields, delays in product deliveries and increased expenses. We may face similar difficulties, delays and expenses as we continue to transition our products to smaller geometry processes in the future. In some instances, we depend on our relationships with our foundries to transition to smaller geometry processes successfully. We cannot assure you that our foundries will be able to effectively manage the transition or that we will be able to maintain our foundry relationships. If our foundries or we experience significant delays in this transition or fail to efficiently implement this transition, our business, financial condition and results of operations could be materially and adversely affected. As smaller geometry processes become more prevalent, we expect to continue to integrate greater levels of functionality, as well as customer and third party intellectual property, into our products. However, we may not be able to achieve higher levels of design integration or deliver new integrated products on a timely basis, or at all.We are subject to the risks of doing business internationally.A substantial majority of our net revenues are derived from customers located outside the United States, primarily countries located in the Asia-Pacific region and Europe. In addition, we have suppliers located outside the United States, and third-party packaging, assembly and test facilities and foundries located in the Asia-Pacific region. Finally, we have our own packaging, assembly and test facility in Mexicali, Mexico. Our international sales and operations are subject to a number of risks inherent in selling and operating abroad. These include, but are not limited to, risks regarding:• currency exchange rate fluctuations, • local economic and political conditions, including social, economic and political instability, • disruptions of capital and trading markets, • inability to collect accounts receivable, • restrictive governmental actions (such as restrictions on transfer of funds and trade protection measures, including export duties, quotas, customs duties, import or export controls and tariffs), • changes in legal or regulatory requirements, • natural disasters, acts of terrorism, widespread illness and war, • limitations on the repatriation of funds, • difficulty in obtaining distribution and support, • cultural differences in the conduct of business, • the laws and policies of the United States and other countries affecting trade, foreign investment and loans, and import or export licensing requirements, • tax laws, • the possibility of being exposed to legal proceedings in a foreign jurisdiction, and • limitations on our ability under local laws to protect or enforce our intellectual property rights in a particular foreign jurisdiction.

20

Additionally, we are subject to risks in certain global markets in which wireless operators provide subsidies on handset sales to their customers. Increases in handset prices that negatively impact handset sales can result from changes in regulatory policies or other factors, which could impact the demand for our products. Limitations or changes in policy on phone subsidies in South Korea, Japan, China and other countries may have additional negative impacts on our revenues.Our operating results may be adversely affected by substantial quarterly and annual fluctuations and market downturns.Our revenues, earnings and other operating results have fluctuated in the past and our revenues, earnings and other operating results may fluctuate in the future. These fluctuations are due to a number of factors, many of which are beyond our control.These factors include, among others:• changes in end-user demand for the products (principally digital cellular handsets) manufactured and sold by our customers, • the effects of competitive pricing pressures, including decreases in average selling prices of our products, • production capacity levels and fluctuations in manufacturing yields, • availability and cost of products from our suppliers, • the gain or loss of significant customers, • our ability to develop, introduce and market new products and technologies on a timely basis, • new product and technology introductions by competitors, • changes in the mix of products produced and sold, • market acceptance of our products and our customers, and • intellectual property disputes.

The foregoing factors are difficult to forecast, and these, as well as other factors, could materially and adversely affect our quarterly or annual operating results. If our operating results fail to meet the expectations of analysts or investors, it could materially and adversely affect the price of our common stock.Global economic conditions that impact the wireless communications industry could negatively affect our revenues and operating results.Global economic weakness can have wide-ranging effects on markets that we serve, particularly wireless communications equipment manufacturers and network operators. Although the wireless communications industry has recovered somewhat from an industry-wide recession, such recovery may not continue. In addition, we cannot predict what effects negative events, such as war or other international conflicts, may have on the economy or the wireless communications industry. The continued threat of terrorism and heightened security and military action in response to this threat, or any future acts of terrorism, may cause further disruptions to the global economy and to the wireless communications industry and create further uncertainties. Further, a continued economic recovery may not benefit us in the near term. If it does not, our ability to increase or maintain our revenues and operating results may be impaired.21