UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________

FORM 10-K

_________________________________

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 28, 2015March 4, 2017

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 0-6365

_________________________________

APOGEE ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Minnesota | | 41-0919654 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

4400 West 78th Street – Suite 520, Minneapolis, MN | | 55435 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (952) 835-1874

Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of each class | | Name of each exchange on which registered |

| Common Stock, $0.33 1/3 Par Value | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” andfiler,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

| Large accelerated filer | | x | | Accelerated filer | | ¨ |

| | | | | | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

| Emerging growth company | | ¨ | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

As of August 30, 201427, 2016, the last business day of the registrant's most recently completed second fiscal quarter, the approximate aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was $1,057,000,0001,386,000,000 (based on the closing price of $36.5147.97 per share as reported on the NASDAQ Stock Market LLC as of that date).

As of April 24, 2015, 29,181,87426, 2017, 28,679,636 shares of the registrant’s common stock, par value $0.33 1/3 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required in Part III hereof is incorporated by reference to the Proxy Statement for the registrant's 20152017 Annual Meeting of Shareholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Form 10-K.

APOGEE ENTERPRISES, INC.

Annual Report on Form 10-K

For the fiscal year ended February 28, 2015March 4, 2017

TABLE OF CONTENTS

PART I

ITEM 1. BUSINESS

The Company

Apogee Enterprises, Inc. (Apogee, the Company or we) was incorporated under the laws of the State of Minnesota in 1949. The Company believes it isWe are a world leader in certain technologies involving the design and development of value-added glass solutions for enclosing commercial buildingsproducts and framing art. Unless the context otherwise requires, the terms "Company," "Apogee," "we," "us" and "our" as used herein refer to Apogee Enterprises, Inc. and its subsidiaries.services.

TheOur Company is comprised ofhas four reporting segments:segments, with three of the segments serving the commercial construction market:

The Architectural Glass segment fabricates coated, high-performance glass used globally in customized window and curtainwall systems comprising the outside skin of buildings.wall systems. For fiscal 20152017, ourthe Architectural Glass segment accounted for approximately 3433 percent of our net sales.

The Architectural Services segment primarily installs and renovates customized aluminum and glass window and curtainwall systems comprising the outside skin of buildings. It also designs, engineers and fabricates a majority of the metal systems it installs. For fiscal 2015, our Architectural Services segment accounted for approximately 25 percent of our net sales.

The Architectural Framing Systems segment designs, engineers, fabricates and fabricatesfinishes the aluminum frames used in customized aluminum and glass window, curtainwall, storefront and entrance systems comprising the outside skin and entrances of buildings. For fiscal 2015, our2017, the Architectural Framing Systems segment accounted for approximately 35 percent of our net sales.

The 32Architectural Services segment provides full-service installation of the walls of glass, windows and other curtainwall products making up the outside skin of buildings. For fiscal 2017, the Architectural Services segment accounted for approximately 24 percent of our net sales.

The Large-Scale Optical Technologies (LSO) segment manufactures value-added glass and acrylic products primarily for the custom picture framing market.and display applications. For fiscal 2015, our Large-Scale Optical Technologies2017, this segment accounted for approximately 98 percent of our net sales.

Financial information aboutOn December 14, 2016, we acquired substantially all the Company's segmentsassets of Sotawall, Inc. (now operating under the name Sotawall Limited or "Sotawall"), a privately-held designer and geographic regions can be foundfabricator of high-performance, unitized curtainwall systems for commercial construction projects based in Item 8, Note 16 to the Consolidated Financial Statements of the Company contained elsewhere in this report.

On November 5, 2013, the Company acquired all of the shares of Alumicor Limited (Alumicor). Alumicor'sToronto, Canada area, for approximately $138 million. Sotawall's results of operations arehave been included in ourthe consolidated financial statements and within the Architectural Framing Systems segment. Forsegment since the date of acquisition.

Strategy

Our overall strategy in the Architectural Glass and Architectural Framing Systems segments is to deliver growth faster than our commercial construction markets. We accomplish this through geographic and market segment expansion and new product offerings, while differentiating ourselves through superior service and lead times. In recent years, we have increased our focus on window and curtainwall retrofit and renovation of existing commercial buildings. We have seen increased interest from the non-residential and high-end multi-family residential building sectors in upgrading façades and improving energy efficiency. We consider this to be a significant opportunity for Apogee in the coming years.

In the Architectural Services segment, our emphasis is on improving margins through focused project selection, while continuing to deliver organic growth in line with our available project management capacity.

Within the LSO segment, our strategy is to grow domestically and internationally by continuing to convert the custom picture framing and fine art markets from clear uncoated glass and acrylic products to value-added products that protect art from UV damage and minimize reflection. Additionally, we have begun to enter new display markets that desire the value-added properties our glass and acrylic products provide in an effort to diversify LSO's product offerings.

We believe each of our segments has the ability to grow organically through entry into new geographies, further information, see "Acquisitionpenetration in existing geographies and introduction of Alumicor" below.new products. We also regularly evaluate business development opportunities in adjacent sectors. Any of these strategies can also be executed by acquisition or strategic alliances.

Finally, we are constantly working to improve the efficiency and productivity of our operations by implementing lean manufacturing disciplines and automation. We expect these efforts to continue to deliver gross margin expansion into the foreseeable future.

Products and Services

Apogee provides distinctive value-added glass solutions for enclosing commercial buildings and framing art. We operate in four segments as described in the following paragraphs.

Architectural Glass, Architectural ServicesFraming Systems and Architectural Framing Systems SegmentsServices segments

All of theseThese segments participate in various phases of the value chain to design, engineer, manufacturefabricate and install customized aluminumglass and glassaluminum window, curtainwall, and storefront and entrance systems for commercialcomprising the outside skin of buildings in the non-residentialcommercial, institutional and high-end multi-family residential construction markets. Through complex processes,sectors.

In our Architectural Glass segment, we add ultra-thin, high-performance coatings to uncoated architectural glass to create a variety of aesthetic characteristics, unique designs and differentenergy efficiency, including varying levels of solar energy management, especially importantaligned with the industry trend of increasingly energy-efficient buildings. We also laminate layers of glass and vinyl to create glass that helps protect against hurricanes and bomb blasts. Glass can also be temperedother severe impacts, and temper, or heat strengthen, glass to provide additional strength. In addition,Our high-performance glass is

custom made-to-order and is typically fabricated into insulating and/or laminated glass units for installation into window, curtainwall, storefront or entrance systems.

Within our Architectural Framing Systems segment, we have the ability to design and build windows,fabricate window, curtainwall, storefront and entrancesentrance systems using our customized aluminum and glass, or glass supplied by others. We also provide finishing services for the metal components used in windows and curtainwall, as well as plastic components used to frame architectural glass windowsfor other products.

By integrating technical capabilities, project management skills and walls and other products. Ourfield installation services, allowour Architectural Services segment provides design, engineering, fabrication and installation expertise for the outside skin of buildings. Our ability to efficiently design high-quality window and curtainwall systems and effectively manage the installation of building façades allows our customers to meet or exceed the timing and cost requirements of their jobs by providing efficiently designed quality window and wall systems and effectively managing the installation of the façade on their building projects.jobs.

Our product choicesand service offerings allow architects to create distinctive looks for office towers, hotels, education facilities and dormitories, health care facilities, government buildings, retail centers and multi-family residential buildings, while meeting functional requirements such as energy efficiency, hurricane, blast and other impact resistance and/or sound control.

The following table describes the products provided by these segments.

|

| | | | | | |

Products | | Product Attributes | | Participating Segment | | Description |

High-Performance Glass

| | Custom Manufactured-to-Order | | Architectural Glass | | We offer a wide range of glass colors and high-performance coatings that allow us to create unique designs, achieve specific light transmission levels and provide solar control options for energy efficiency. Additional value-added processes, such as digital printing, silk-screening and heat soaking, can be incorporated into the glass. High-performance glass is typically fabricated into custom insulating units and/or laminated units to allow for installation into window, curtainwall, storefront or entrance systems. |

Installation | | New Construction and Renovation Services | | Architectural Services | | We install curtainwall, window, storefront and entrance systems for new commercial and institutional buildings as well as for renovation of existing buildings. By integrating technical capabilities, project management skills and field installation services, we provide design, engineering, fabrication and installation expertise for the building envelope to building owners, architects and general contractors. |

Aluminum Framing | | Standard, Custom and Engineered-to-Order | | Architectural Framing Systems

and Architectural Services | | Varying degrees of customization of our window, curtainwall, storefront and entrance systems are available depending on the customer's project requirements. In-house engineering capabilities allow us to meet the architect's design requirements. Our window systems can be operable or non-operable. Our curtainwall systems may be unitized (shop fabricated) or field fabricated. Depending on the requirements, we paint or anodize the aluminum components. |

All of the businesses within the Architectural Glass, Architectural Services and Architectural Framing Systems segments manufacture their products to order. Products are shipped to the job site or other location where further assembly or installation may be required by the respective segment's customers.

Large-Scale Optical Technologies (LSO) SegmentLSO segment

The LSO segment provides coated glass and acrylic primarily for use in custom picture framing and fine artdisplay applications. The variables in the glass and acrylic used for picture framing products are theProducts vary based on size and coatings applied to give the productprovide conservation-grade UV protection, anti-reflective and anti-static properties and/or security features. The following table describes the products provided by the LSO segment.

|

| | | | |

Products and Services | | Product Attributes | | Description |

Value-Added Picture Framing Glass and Acrylic | | UV, Anti-Reflective and/ or Security Features | | Our coatings reduce the reflectivity of picture framing glass and protect pictures and art from the sun's damaging UV rays. Anti-reflective coatings on acrylic reduce glare and static charge on the surface. |

Product Demand and Distribution Channels

Architectural Glass, Architectural ServicesFraming Systems and Architectural Framing Systems SegmentsServices segments

Demand for the products and services offered by our Architectural segments is affected by changes in the North American commercial construction industries, as well as by changes in general economic conditions. Additionally, the Architectural Glass segment has an operation in Brazil and is, therefore, also impacted by Brazil's commercial construction industry and general economic conditions.

We look at several external indicators to analyze potential demand for our products and services, such as U.S. job growth, office space vacancy rates, credit and interest rates available for commercial construction projects, architectural billing statistics and material costs. We also rely on our own internal indicators to analyze demand. This includes our sales pipeline, made up of contracts in review, projects awarded or committed, and bidding activity. Our sales pipeline, together with ongoing feedback, analysis and data from our customers, architects and building owners, provide visibility into near- and medium-term future demand. Additionally, we evaluate data on U.S. non-residential construction market activity, industry analysis and longer-term trends provided by external data sources.

Our architectural products and services are used in a subsetsubsets of the construction industry that is differentiated by building type, level of customization required, customers, geographic location and project size. Published data is not readily available for the specific segments that we serve; however, we estimate demand by analyzing data for the overall U.S. and Canadian construction industry.

Building type - The construction industry is typically segmented into residential construction and non-residential construction, which includes commercial, industrial and institutional construction. Apogee is a leading supplier of architectural glass and metal framing products, as well as installation services, to the non-residential construction industry. Our products and services are primarily used in commercial buildings (office towers, hotels and retail centers) and institutional buildings (education facilities and dormitories, health care facilities and government buildings), as well as in high-end multi-family residential buildings (a subset of residential construction).

Level of customization - MostThe large majority of our projects have someinvolve a high degree of customization, as the end product or service is based on customer-specified requirements for aesthetics, and performance and size, and is designed to satisfy local building codes. All of our Architectural Glass, Architectural Services and Architectural Framing Systems businesses are involved in transforming glass, aluminum or other materials to create customized window, curtainwall, storefront and/or entrance systems that meet customer specifications. The only constant is the base materials of the products and the processes we utilize to fabricate, manufacture and/or install the products.

Customers and distribution channels - Our customers are mainly glazing subcontractors and those that influence the projects include architects, building owners, general contractors, with project design being influenced by architects and glazing subcontractors.building owners. Our high-performance architectural glass is marketedprimarily sold using a direct sales force and independent sales representatives. Our installation and renovationInstallation services are marketed by a direct sales force primarilyin certain metropolitan areas in the metropolitan areas we serve in the United States andU.S. We also where we have the ability to work with our customers in otherprovide remote project management throughout the U.S. markets. We market our custom and standard windows, curtainwall, storefront and entrance systems using a combination of a direct sales force,forces, independent sales representatives and distributors.

Geographic location - From our glass fabrication locations in the U.S., weWe primarily supply architectural glass products to customers in the U.S.,North America, with some international distributionsales of our high-performance architectural glass. We estimate the U.S. demand for architectural glass fabrication in non-residential buildings is approximately $1.3in excess of $1 billion in annual sales. From our Brazilian glass fabrication facility, we primarily supply architectural glass in Brazil, where we estimate demand to be approximately $0.3 billion in annual sales.annually. Our aluminum framing systems, including windows, curtainwall, storefront and entrances, are marketed in the U.S. and Canada, whereand we estimate demand is approximately $2.8to be in excess of $3 billion in annual sales.annually. In installation

We estimate the U.S. demand for installation services, is approximately $10.5 billion in annual sales. Within the installation services industry, Apogee iswe are one of only a few architectural glass installation companies in the U.S. to have a national presence, with 11 offices and satellite offices serving multiplewe estimate the U.S. geographies. We estimate that we are abledemand to service approximately 60 percentbe in the range of the total installation demand from our existing locations and our ability$10 to travel to other geographies where we do not have a local presence. Although installation of building glass in new commercial and institutional construction projects is the primary focus of our business, we also offer installation retrofits or renovations for the outside skin of older commercial and institutional buildings.$15 billion.

Project size - The projects on which ourOur Architectural Glass Architectural Services and Architectural Framing Systems segments bid and work vary in size. Our high-performance Architectural Glass fabrication productssegment primarily serveserves mid-size to monumental high-profile projects. Our Architectural Services segment servesFraming Systems primarily targets small and mid-size projects, and the Architectural Framing Systems segment targetsServices primarily serves mid-size and small projects.

LSO Segmentsegment

The Company's Tru Vue brand isIn our LSO segment, we have the largest domestically manufactured brand forof value-added glass and acrylic for custom picture framing. Through the Company's leadership,used in the custom picture framing industry continues to convert from clear glass to value-added glass and acrylic.market. Under thisthe Tru Vue brand, products are distributedsold primarily in North America through regionalnational and nationalregional retail chains using a direct sales force, as well as through local picture framing shops viausing an independent distribution network. The Company hasWe also been successful in supplyingsupply our glass and acrylic products to museums and public and private galleries. We also have distribution in Europegalleries and other international geographiescollections worldwide through independent distributors;distributors.

Competitive Conditions

Architectural Glass, Architectural Framing Systems and Architectural Services segments

The North American commercial construction market is highly fragmented. Competitive factors include price, product quality, product attributes and performance, reliable service, on-time delivery, lead-time, warranty and the ability to provide technical engineering and design services. To protect and enhance our competitive position, we view thismaintain strong relationships with architects, who influence the selection of products and services on a project, and with general contractors, who initiate projects and develop specifications.

In our Architectural Glass segment, we experience competition from regional glass fabricators who can provide certain products with attributes similar to our products. Within the market sector for large, complex projects, we encounter competition from international companies, which have products that may be equivalent to or have different characteristics than we provide. This international competition has strengthened in recent years due to the relative strength of the U.S. dollar.

The commercial window and storefront manufacturing industry is highly fragmented, and our Architectural Framing Systems segment competes against several national, regional and local aluminum window and storefront manufacturers, as a focus areawell as regional paint and anodizing companies. When providing installation services, our Architectural Services segment competes against national, regional and local glass installation companies.

LSO segment

Product attributes, price, quality, marketing and service are the primary competitive factors in the LSO segment. Our competitive strengths include our excellent relationships with customers, innovative marketing programs and the performance of our value-added products. We compete with certain European valued-added glass and acrylic products for future growth of this segment.picture framing.

Warranties

We offer product and service warranties that we believe are competitive for the markets in which our products and services are sold. The nature and extent of these warranties depend upon the product or service, the market and, in some cases, the customer being served. Our standard warranties are generally from two to 10 years for our architectural glass, curtainwall and window system products, while we generally offer warranties of two years or less on our other products and installation services. In the event of a claim against a product for which we have received a warranty from the supplier, we pass the claim back to our supplier. Although we carry liability insurance with very high deductibles for product failures, we reserve for warranty exposures, as our insurance does not cover warranty claims. There can be no assurance that our insurance will be sufficient to cover all product failure claims in the future; that the costs of this insurance and the related deductibles will not increase materially; or that liability insurance for product failures will be available on terms acceptable to the Company in the future.

Sources and Availability of Raw Materials

MaterialsRaw materials used within the Architectural Glass segment include flat glass, vinyl, silicone sealants and lumber. The Architectural Framing Systems segmentssegment's materials include raw glass, aluminum billet and extrusions, vinyl, metal targets, insulatedfabricated glass, spacer frames, silicone, plastic extrusions, desiccant, chemicals, paints, lumberhardware, paint and urethane.chemicals. Within the Architectural Services segment, materials used include fabricated glass, aluminum extrusions silicone, plastic extrusions and fabricated metal panels. The LSO segment mainly uses glass hard-coated acrylic, acrylic substrates, metal targets, coating materials and chemicals.

Glass manufacturers have applied surcharges to the cost of glass over the past several years to help offset increases in energy and fuel costs, which we are generally able to pass on to our customers through surcharges. We have also seen recent volatility in the cost of aluminum that is used in our window, storefront, entrance and curtainwall systems. Where possible, we have passed the changes in cost of materials on to our customers in the form of pricing adjustments and/or surcharges.

acrylics. A majority of our raw materials are readily available from a variety of domestic and international sources. While certain glass products may only be available at certain times of the year, all standard glass types and colors are available throughout the year

in reasonable quantities from multiple suppliers. Although we expect glass supply to become tighter in the U.S. due to the recent economic upturn across many industries that consume glass, including automotive manufacturing, residential construction and non-residential construction, no supplier delays or shortages are anticipated.

Trademarks and Patents

The Company hasWe have several trademarks and trade names that we believe have significant value in the marketing of our products, including APOGEE®. Trademark registrations in the United StatesU.S. are generally for a term of 10 years, renewable every 10 years as long as the trademark is used in the regular course of trade.

Within the Architectural Glass segment, VIRACON®, VIRACON VUE-50®, DIGITALDISTINCTIONS®, ROOMSIDE®, EXTREMEDGE®, BUILDING DESIGN®and STORMGUARD,GLASS IS EVERYTHING®, CLEARPOINT®, CYBERSHIELD® and STORMGUARD® are registered trademarks. GLASS IS EVERYTHING™, VIRASPAN™, CLEAR POINT™ and CYBERSHIELD™ are is an unregistered trademarks.trademark. In addition, GLASSEC®, INSULATTO® and BLINDATTO® are registered trademarks in Brazil. GLASSECVIRACON™ is an unregistered trademark in Brazil.

Within the Architectural Services segment, HARMON®, HARMON GLASS®, HI - 7000® and INNOVATIVE FACADE SOLUTIONS® and are registered trademarks. UCW-8000™, HI-8500™, HI-9000™, SMU-6000™ and HPW-250™ are unregistered trademarks.

Within the Architectural Framing Systems segment, LINETEC®, WAUSAU WINDOW AND WALL SYSTEMS®, TUBELITE®, ADVANTAGE BY WAUSAU®, 300ES®, FINISHER OF CHOICE®, THERML=BLOCK®, MAXBLOCK®, DFG®, ECOLUMINUM®, ALUMINATE®, GET THE POINT!®, FORCEFRONT®, SOTAWALL®, SOTA® and FORCEFRONTHYBRID-WALL® are registered trademarks. CUSTOM WINDOW™, INVENT™, INVENT.PLUS™, INVENT RETRO™, INVISION™, CLEARSTORY™, EPIC™, HERITAGE™, VISULINE™, SEAL™, SUPERWALL™ and SUPERWALL™CROSSTRAK™ are unregistered trademarks. ALUMICOR™ and BUILDING EXCELLENCETM are unregistered trademarks in Canada.

Within the Architectural Services segment, HARMON®, H DESIGN®, HARMON GLASS®, HI-7000® and INNOVATIVE FAÇADE SOLUTIONS® are registered trademarks. UCW-8000™, HI-8500™, HI-9000™, SMU-6000™, HPW-250™ and BUILDING TRUST IN EVERYTHING WE DO™ are unregistered trademarks.

Within the LSO segment, TRU VUE®, CONSERVATION CLEAR®, CONSERVATION MASTERPIECE ACRYLIC®, CONSERVATION REFLECTION CONTROL®, ULTRAVUE®, MUSEUM GLASS®, OPTIUM®, PREMIUM CLEAN®, REFLECTION CONTROL®, AR REFLECTION - FREEREFLECTION-FREE®, TRU VUE AR®, OPTIUM ACRYLIC®, OPTIUM MUSEUM ACRYLIC®, CONSERVATION MASTERPIECE®, STATICSHIELD®, TRULIFE® and STATICSHIELDVISTA AR® are registered trademarks. TRULIFE™TRULIFE INFINITY FRAMETM, THE DIFFERENCE IS CLEARTM and VISTA AR™TRU FRAMEABLE MOMENTSTM are unregistered trademarks.

The Company hasWe have several patents pertaining to our glass coating methods and products, including our UV coating and etch processes for anti-reflective glass for the picture framing industry.industry and fine art market, as well as a patent for an indirect daylighting device and patents for hybrid window wall/curtain wall systems and methods of installation. Despite being a point of differentiation from itsour competitors, no single patent is considered to be material to the Company.material.

Seasonality

The North American businessesWe do not experience a significant seasonal effect in our Architectural Glass, Architectural Services and Architectural Framing Systems segments experience a slight seasonal effect following the commercial construction industry. Our Brazilian Architectural Glass segment business does not have a significant seasonal trend. A bigger impact to net sales is the fact thatsegments. However, the construction industry is highly cyclical in nature and can be influenced differently by the effects of the local economies in geographies where our products are marketed.economies.

Within the LSO segment, picture framing glass and acrylic sales tend to increase in the September to December timeframe. However,September-to-December timeframe, but the timing of customer promotional activities may offset some of this seasonal impact.

Working Capital Requirements

Trade accounts receivable is the largest component of working capital for the Company, including receivables relating to contractual retention amounts that can be outstanding throughout the projecta project's duration within the Architectural Services segment. Payment terms offered to our customers are similar to those offered by others in the industry. For the Architectural Glass and Architectural Framing Systems segments, inventoryInventory requirements are not significant since these businesses make-to-order rather than build-to-stock for the majorityin any of their products. As a result, inventory levels follow customer demand for the products produced.

Sinceour segments, although the LSO segment builds-to-stock for the majority of its products, it requires greater inventory levels as it builds to stock to meet the demands of its customers.

Dependence on a Single Customer

We do not have any one customer that exceeds 10 percent of the Company's consolidated net sales. However, there are important customers within each of our segments; the loss of one or more customers could have an adverse effect on the Company.

Backlog

Backlog represents the dollar amount of revenues we expectsigned contracts or firm orders, generally as a result of a competitive bidding process, which is expected to recognizebe recognized as revenue primarily in the future from firm contracts or orders received, as well as those that are in progress.near-term. Backlog is not a term defined under generally accepted accounting principlesU.S. GAAP and is not a measure of contract profitability. We include a project within our backlog at the time a signed contract or a firm purchase order is received, generally as a result of a competitive bidding process. Backlog by reporting segment at February 28, 2015, November 29, 2014 and March 1, 2014 was as follows:

|

| | | | | | | | | | | |

| (In thousands) | February 28, 2015 | | November 29, 2014 | | March 1, 2014 |

| Architectural Glass | $ | 137,432 |

| | $ | 151,221 |

| | $ | 73,206 |

|

| Architectural Services | 287,473 |

| | 268,696 |

| | 187,471 |

|

| Architectural Framing Systems | 77,666 |

| | 88,070 |

| | 72,634 |

|

| Large-Scale Optical | 2,107 |

| | 2,100 |

| | 870 |

|

| Intersegment eliminations | (13,886 | ) | | (16,173 | ) | | (4,546 | ) |

| Total Backlog | $ | 490,792 |

| | $ | 493,914 |

| | $ | 329,635 |

|

We expect approximately $393.4 million, or 80 percent, of our February 28, 2015 backlog to be recognized in fiscal 2016, with the balance to be recognized in fiscal 2017 and beyond. We view backlog as an important statistic in evaluating the level of sales activity and short-term sales trends in our business. However, as backlog is only one indicator, and isshould not an effective indicator of our ultimate profitability, we do not believe that backlog should be used as the sole indicator of our future earningsrevenue because we have a substantial amount of the Company.

Competitive Conditions

Architectural Glass, Architectural Services and Architectural Framing Systems segments

The markets served by the Architectural Glass, Architectural Services and Architectural Framing Systems segments are very competitive, price and lead-time sensitive, and primarily affected by changes in the North American commercial construction industry, as well as changes in general economic conditions. Additionally, due to the Architectural Glass segment's operations in Brazil, it is impacted by the commercial construction industry and general economic conditions in Brazil and the surrounding region.

Interest rates, credit availability for commercial construction projects material costs, employment rates, office vacancy rates, building construction starts and office absorption rates are key indicators to the commercial construction market conditions. As each of these economic indicators moves favorably, our businesses typically experience sales growth, and vice-versa.

These segments primarily serve the custom portion of the commercial construction industry, which is generally highly fragmented. The primary competitive factors are price, product quality, reliable service, on-time delivery, warranty and the ability to provide technical engineering and design services. There is potential to offset some competitive pressures in the market for newly constructed buildings through increased renovation of the exteriors of commercial and institutional buildings using some of our segments' products and services due to their premium energy-efficiency properties.

We believewith short lead times that our domestic competition does not providebook-and-bill within the same level of custom coatings to the industryreporting period that are not included in backlog. We have strong visibility beyond backlog as our projects awarded, verbal commitments and bidding activities are monitored separately and not included in backlog.

Architectural Glass segment but regional glass fabricators can provide somewhat similar products with similar attributes. Regional glass fabricators incorporate high performance, post-temperable glass products, procured from primary glass suppliers, into their insulated glass products. The availabilitybacklog as of these products has enabled regional glass fabricators in some casesyear-end was $66.4 million, compared to bid on more complex projects than$62.4 million in the past. Since we typically target the more complexprior year, net of intersegment eliminations. This segment has strategically shortened lead-times, with capability and productivity improvements, in order to serve mid-size projects we have encountered increased competition from these regional glass fabricators. In certain regionswhere there is a higher level of the U.S., we encounter competition from international competitors on complex projects.book-and-bill activity within quarters. The backlog is all expected to be filled in fiscal 2018.

When providing glass installation services, our Architectural Services segment largely competes against regional and local construction companies and installation contractors, and periodically against other larger national companies. The commercial window and storefront manufacturing industry is highly fragmented and our Architectural Framing Systems segment competes against several major aluminum windowbacklog has grown to $245.4 million at year-end, compared to $123.0 million at the end of the prior year, due to recent increased order activity, particularly of longer lead-time contracts. The acquisition of Sotawall contributed approximately $70 million to this segment's backlog. Approximately 75 percent of the backlog in this segment is expected to be filled in fiscal 2018, with the remainder expected to be filled in fiscal 2019 and storefront manufacturers. Our architectural finishing business competes against regional paint and anodizing companies.beyond.

Our businessesBacklog in the Architectural Glass, Architectural Services and Architectural Framing Systems segments maintain significant relationships with architects, who influence the selection of products and services on a project. Additionally, throughout a construction project, the Architectural Services segment must maintain significant relationships with general contractors, who aredeclined from $320.4 million at the segment's direct customers. This isend of the prior year to $255.1 million at March 4, 2017, due to the high degree of dependence on general contractors and architects for project initiation and development of specifications. Additionally, the timing of a project depends on the schedule established by the general contractorsfirm orders and their ability to maintain this schedule. If a general contractor fails to keep a construction project on its established timeline, the timing and profitabilitysigned contracts. Approximately 67 percent of the project couldbacklog in this segment is expected to be negatively impacted.filled during fiscal 2018, with the remainder expected to be filled in fiscal 2019 and beyond.

LSO Segment

Product attributes, pricing, quality, marketing, and marketing support are the primary competitive factors inBacklog is not a significant metric for the LSO segment. The Company's competitive strengths include our excellent relationships with customerssegment, as orders are typically booked and the performance provided by our unique value-added products. While there is significant price sensitivity in regard to sales of clear glass to picture framers, there is somewhat less price sensitivity on certain of our value-added glass products due to their unique attributes. There is competition in North America with European imports of certain valued-added products for picture framing.billed within a short time frame.

Research and Development

The amount spent on research and development activities was $6.5$8.6 million,, $7.8 $8.0 million and $6.8$6.5 million in fiscal 2015, 20142017, 2016 and 2013,2015, respectively. Of this amount, $2.4$2.2 million,, $2.1 $2.4 million and $1.6$2.4 million,, respectively, waswere focused primarily upon design of custom window and curtainwall systems in accordance with customer specifications and isare included in cost of sales in the accompanying consolidated financial statements.

Environment

We use hazardous materials in our manufacturing operations, and have air and water emissions that require controls. As a result, we are subject to stringent federal, state and local regulations governing the storage and use of these materials and disposal of wastes. We contract with outside vendors to collect and dispose of waste at our production facilities in compliance with applicable environmental laws. In addition, we have procedures in place that we believe enable us to properly manage the regulated materials used in our manufacturing processes and wastes created by the production processes, and we have implemented a program to monitor our compliance with environmental laws and regulations. Although wemanufacturing processes. We believe we are currently in material compliance with such laws and regulations, current or future laws and regulations could require us to make substantial expenditures for compliance with chemical exposure, waste treatment or disposal regulations. We spent approximately $0.2 million, $0.5 million and $0.1 million in fiscal 2015, 2014 and 2013, respectively, to reduce wastewater solids and hazardous air emissions at our facilities. We expectWhile we will continue to incur environmental compliance costs to continue to comply with laws and regulations in the future for our ongoing manufacturing operations, butwe do not expect these to be material to our consolidated financial statements.

As part of the acquisition of Tubelite Inc. (Tubelite) on December 21, 2007,In fiscal 2008, we acquired aone manufacturing facility which hasthat had certain historical environmental conditions. We believe that Tubelite is a “responsible party” for certain of these historical environmental conditions, and the Company isare working to remediate those conditions. The Company believesconditions, and the remediation activities can beare being conducted without significant disruption to manufacturing operations at this facility. As of February 28, 2015, the environmental reserve balance was $1.8 million.our operations.

Employees

The Company employed 5,511 and 4,614 persons on 4,802March 4, 2017 and 4,266 persons on February 28, 2015 and March 1, 201427, 2016, respectively. At February 28, 2015, 416March 4, 2017, 624 of these employees were represented by U.S. labor unions and unions.294 of these employees were represented by labor unions in Brazil.

Acquisition of Alumicor

On November 5, 2013, the Company acquired all of the shares of Alumicor Limited, a privately held business, for $52.9 million, including cash acquired of $1.6 million. Alumicor is a window, storefront, entrance and curtainwall company primarily serving the Canadian commercial construction market. Alumicor's results of operations are included in the Architectural Framing Systems segment. Item 8, Note 6 of the Notes to the Consolidated Financial Statements contains further information regarding this acquisition.

International Sales

Information regarding export and international sales is included in Item 8, Financial Statements and Supplementary Data, within Note 16 of the Notes to theour Consolidated Financial Statements.

Available Information

The Company maintains a website at www.apog.com. Through a link to a third-party content provider, this corporate website provides free access to the Company's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the Exchange Act), as soon as reasonably practicable after electronic filing such material with, or furnishing it to, the Securities and Exchange Commission. Also available on our website are various corporate governance documents, including our Code of Business Ethics and Conduct, Corporate Governance Guidelines, and charters for the Audit, Compensation, and Nominating and Corporate Governance Committees of the Board of Directors.

EXECUTIVE OFFICERS OF THE REGISTRANT

|

| | | | | |

| Name | | Age | | Positions with Apogee Enterprises and Five-Year Employment History |

| Joseph F. Puishys | | 56 |

58 | | Chief Executive Officer and President of the Company since August 2011. President of Honeywell's Environmental and Combustion Controls division from 2008 through 2011, President of Honeywell's Building Solutions from 2005 through 2008, and President of Honeywell Building Solutions, America from 2004 to 2005. |

| James S. Porter | | 54 |

56 | | Chief Financial Officer since October 2005.2005 and Executive Vice President since 2015. Vice President of Strategy and Planning from 2002 through 2005. Various management positions within the Company since 1997. |

| Patricia A. Beithon | | 61 |

63 | | General Counsel and Secretary since September 1999. |

| Gary R. Johnson | | 53 |

55 | | Vice President, Treasurer since January 2001. Various management positions within the Company since 1995. |

| John A. Klein | | 59 |

60 | | Senior Vice President, Operations and Supply Chain Management of the Company since April 2012. Director of Operations at Cooper Industries' Power Systems Division from 2008 through 2012, and Vice President of Operations at Rexnord Industries' Bearing Division from 2005 through 2007. |

Executive officers are elected annually by the Board of Directors andto serve for a one-year period. There are no family relationships between any of the executive officers or directors of the Company.

ITEM 1A. RISK FACTORS

Our business faces many risks. Any of the risks discussed below, or elsewhere in thethis Form 10-K or our other filings with the Securities and Exchange Commission, could have a material adverse impact on our business, financial condition or results of operations.

General global economic and business conditions could negatively affect our results.

Our Architectural Glass, Architectural ServicesFraming Systems and Architectural Framing SystemsServices segments are dependent on global economic conditions and the cyclical nature of the North American commercial construction industry. The commercial construction industry is impacted negatively by volatilityglobal macroeconomic trends that, in global financial markets, including,turn, affect, among other things, volatility in securities prices, availability of credit, unemployment rates,employment levels, consumer confidence, interest rates and commodity prices. To the extent changes in these factors negatively impact the overall commercial construction industry, our revenue and profits could be significantly reduced.

Our Architectural Glass segment's operation located in Brazil is subject to the economic, political and tax conditions prevalent in the region. The economic conditions in this region are subject to different growth expectations, market weaknesses and business practices than seen in the U.S.country. We cannot predict how changing economic conditions in this regionBrazil will impact our financial results.results; however, our Brazilian operation makes up less than five percent of our net sales annually.

Our LSO segment depends on the strength of the retail custom picture framing industry. This industry is highly dependent on consumer confidence and the conditions of the U.S. economy. IfA decline in consumer confidence, declines, whether as a result of an economic slowdown, uncertainty regarding the future or other factors, our use of these strategies may not be as successfulcould result in the future, resulting in a potential decrease in net sales and operating income.

Unfavorable fluctuations in foreignForeign currency exchange rates could negatively impact our results and financial position.impacts

Our subsidiaries in Canada and Brazil report their results of operations and financial position in their relevant functional currencies (local country currency), which are then translated into U.S. Dollars.dollars. This translated financial information is included in our consolidated financial statements. The strengthening ofAs the relationship between these currencies and the U.S. Dollar in comparison to these functional currenciesdollar changes, there could havebe a negative impact on our reported results and financial position.

In addition, as the U.S. dollar strengthens against foreign currencies, imports of products into the U.S. produced by international competitors have become more price competitive and exports of our U.S.-fabricated products have become less price competitive. If we are not able to counteract these price pressures through superior quality and service, our net sales and operating income could be negatively impacted.

New competitors or specific actions of our existing competitors could adversely impact our industry position and future results.

All of our operating segments operate in competitive industries where the actions of our existing competitors or new competitors could result in a loss of customers or share of customers' demand. Changes in our competitors' products, prices or services could negatively impact our share of demand, net sales or margins.

Our Architectural Glass and Architectural Framing Systems segments have seen an increase in imports of competitive products into the U.S. from lower-cost, international suppliers that, if thisdue to the relative strength of the U.S. dollar. If imports of competitive products were to continue, could negatively impactoccur at increased levels for extended periods of time, our net sales and margins. margins could be negatively impacted.

Our LSO segment competes with several international specialty glass manufacturers that have traditionally not penetratedbeen less focused on the U.S. custom picture framing industry. AlthoughCertain of these LSO competitors have not beenrecently developed some value-added products that are able to meetcompete more directly with some products in our existing portfolio. If these competitors are able to successfully increase their product attributes and production capacity and/or increase their sales and marketing focus to the specification levelU.S. custom picture framing market, this segment's net sales and margins could be negatively impacted.

Acquisitions and related integration activities

We have completed and may complete additional acquisitions in the future to accelerate the execution of our products, upgrades to our competitor's products couldgrowth strategies, including new geographies, markets and new product introductions. While we have a negativedisciplined approach to assessing potential acquisition targets, conducting due diligence activities, and negotiating appropriate acquisition terms, there are risks inherent in completing acquisitions, including:

diversion of management’s attention from existing business activities;

difficulties or delays in integrating and assimilating information and financial systems, operations, and products of an acquired business or other business venture or in realizing projected efficiencies, growth prospects, cost savings, and synergies;

potential loss of key employees and customers of the acquired businesses or adverse effects on relationships with existing customers and suppliers;

adverse impact on net salesoverall profitability if the acquired business does not achieve the return on investment projected at the time of acquisition; and

inaccurate assessment of additional post-acquisition capital investments, undisclosed, contingent or margins.other liabilities, problems executing backlog of material supply or installation projects underway at time of acquisition, unanticipated costs, and an inability to recover or manage such liabilities and costs.

If one or more of these risks arises in a material manner, our operating results could be negatively impacted.

Our ability to effectively utilizeEffective utilization and management of our manufacturing capacity could adversely impact future results.

Near-term performance depends, to a significant degree, on our ability to increaseprovide sufficient available capacity and appropriately utilize availableexisting production capacity. The failure to successfully maintain existing capacity, investsuccessfully implement planned capacity expansions, and make additional investments in additional physical capacity and recruit necessary manufacturing labor could adversely affect our operating results.

Product quality issuesLoss of key personnel and inability to source sufficient labor

Our success depends on the skills of the Company's leadership, construction project managers and other key technical personnel, and our ability to secure sufficient manufacturing labor. Increased activity in residential and commercial construction has caused increased competition for experienced construction project managers. Additionally, some of our manufacturing facilities are located in regions that at times may experience low levels of unemployment. If we are unable to retain existing employees and/or recruit and train additional employees with the requisite skills and experience, our operating results could be adversely impacted.

Commodity price fluctuations and supply availability

Our Architectural Framing Systems and Architectural Services segments use aluminum as a significant input to their products. While we structure many of our supply agreements in a way to moderate the effects of fluctuations in the market for raw aluminum, and we are usually eventually able to pass aluminum cost increases on to our customers, short-term operating results could be negatively impacted by sudden price movements in the market for raw aluminum.

Our Architectural Glass segment uses raw glass as a significant input to its products. The supply of raw glass has become tighter due to several years of growth in automotive manufacturing and residential and non-residential construction. Although we have secured supply commitments from multiple suppliers that allow us to reach our near-term growth targets, a significant unplanned downtime at one or more of our key suppliers could negatively impact demand for our products and future profitability.operating results.

Product quality issues

We manufacture and/or install a significant portion of our products based on the specific requirements of each customer. We believe that future orders of our products or services will depend on our ability to maintain the performance, reliability and quality standards required by our customers. If our products or services have performance, reliability or quality problems, or products are installed using incompatible glazing materials or installed improperly (by us or a customer), we may experienceexperience: additional warranty and service expense; reduced or canceled orders; diminished pricing power; higher manufacturing or installation costs; or delays in the collection of accounts receivable. Additionally, performance, reliability or quality claims from our customers, with or without merit, could result in costly and time-consuming litigation that could require significant time and attention of management and involve significant monetary damages that could negatively impact our financial results.

Project management and installation issues could negatively impact future results.

The Architectural Services segment is typicallyand, occasionally, a portion of the Architectural Framing Systems segment are awarded fixed-price contracts for installation services. Often, bids are required before all aspects of a construction project are known. An underestimate in the amount of labor required and/or cost of materials for a project; a change in the timing of the delivery of product; system design errors, difficulties or errors in execution; use of incompatible glazing materials; or significant project delays, caused by us or other trades, could result in failure to achieve the expected results. Any one or more of such issues could result in losses on individual contracts that could negatively impact our operating results.

Our future profitability and cash flow are dependent on realizing expected government incentives.

We have made commitments to expand certain manufacturing facilities and make investmentsChanges in new manufacturing capabilities. Contributing to the decision to make such investments was the availability of federal, state and local incentives including tax credits, tax increment financing and grants. If the Company is not able to realize the benefits of planned incentive packages, future operating results could be negatively impacted.

A shift inarchitectural trends, building codes or consumer preferences could negatively impact the demand for our products.

Any change in commercial construction customer preference, architectural trends or building codes that reducesreduce window-to-wall ratios in non-residential construction would negatively impact net sales and operating income in our Architectural Glass, Architectural Services and Architectural Framing Systemsarchitectural-related segments. The LSO segment depends on U.S. consumers framing art and other decorative items. Any shift in customer preference away from framed art to other forms of decorative mediawall decor could negatively impact future net sales and operating income in the LSO segment.

The loss of a significant customerCustomer dependence in the LSO segment could adversely affect our results.

The LSO segment is highly dependent on a relatively small number of customers for its sales. Wesales, and we expect this to continue deriving a significant portion of our net sales from a small number of customers.in the future. Accordingly, loss of a significant customer, or a significant reduction in pricing, or a shift to a less favorable mix of value-addedvalue-

added picture framing glass or acrylic products for one of those customers, could materially reduce LSO net sales and operating results.

Our resultsResults can be volatile and differ significantly from our expectations and the expectations of analysts.analysts

Our sales and earnings guidance and external analyst estimates are largely based on our view of our business and the broader commercial construction market. Even though we have significant market intelligence through our contact with real estate developers, building owners and architects, and continually monitor micro- and macro-economic indicators of future performance of the commercial construction market, we are unable to precisely predict events that can significantly change market cycles. Failure to meet our guidance or analyst expectations for net sales and operating results may differ from Company-provided guidance and the expectations of securities analysts or investors in future periods. Our annual net sales and operating results may vary depending on a number of factors, including, but not limited to, fluctuating customer demand, delay or timing of shipments, construction delays or cancellations due to lack of financing for construction projects, changes in product and project, and market acceptance of new products. Manufacturing or operational difficulties that may arise due to quality control, or unplanned operational downtime may also adversely impact our annual net sales and operating results. In addition, competition, including new entrants into our markets, the introduction of new products by competitors, adoption of competitive technologies by our customers, or competitive pressures on prices of our products and services, could adversely impact our annual net sales and operating results. Finally, our annual net sales and operating results may vary depending on raw material pricing and the potential for disruption of supply, or changes in legislation that couldearnings would likely have an adverse impact on our labor or other costs. Our failure to meet net sales and operating result expectations would likely adversely affect the market price of our common stock.

We retain significantSignificant risk retention through self-insurance programs.programs

We obtain third-party insurance for potential losses from general liability, employment practices, workers' compensation and automobile liability risk.risk, as well as medical insurance. However, a high amount of risk is retained on a self-insured basis, partially through aour wholly-owned insurance subsidiary. Therefore, a material architectural product liability event, such as a material rework event could have a material adverse effect on our operating results.

Difficulties with ourDependence on information technology systems and potential security could adversely affect our results.threats

We have manyOur operations are dependent upon various information technology systems that are important to the operation of our businesses. These systems are used to process, transmit and store electronic information, and to manage or support our manufacturing operations and a variety of other business processes and activities. We could encounter difficulties in developing newmaintaining our existing systems, and maintaining existingdeveloping and implementing new systems. Such difficulties could lead to significant additional expenses and/or disruption in business operations and/or significant additional expenses that could adversely affect our results.

Additionally, information technology security threats are increasing in frequency and sophistication. These threats pose a risk to the security of our systems and networks, and the confidentiality, availability and integrity of our data. Should such an attack succeed, it could lead to the compromise of confidential information, manipulation and destruction of data and product specifications, production downtimes, disruption in the availability of financial data, or misrepresentation of information via digital media. The occurrence of any of these events could adversely affect our reputation and could result in litigation, regulatory action, potential liability,project delay claims, and increased costs and operational consequences of implementing further data protection matters.systems.

Use of hazardous chemicals and environmental compliance

We use hazardous chemicals in the production process of our products and are thus subjected to changes in environmental legislation.

We use hazardous chemicals in producingsome of our products. One of our facilities has certain historical environmental conditions that we believe require remediation.are in the process of being remediated. Our inability to remediate the historical environmental conditions at the facility at or below the amounts reserved therefore, could have a materialan adverse impact on future financial results. Additionally, we are subject to a variety of local, state and federal governmental regulations relating to storage, discharge, handling, emission, generation and disposal of toxic or other hazardous substances used to manufacture our products, compliance with which is expensive. Our failure to comply with current or future environmental regulations could result in the imposition of substantial fines, suspension of production, alteration of our manufacturing processes or increased costs. Our financial results could also be adversely impacted by rising energy and material costs associated with environmental regulations.

A loss of key personnel could negatively impact near-term results.

Our success depends on the skills, experience and efforts of our executive management and other key personnel. If, for any reason, one or more senior executives or key personnel were not to remain active in our Company, our financial results could be adversely affected.

ITEM 1B. UNRESOLVED STAFF COMMENTS

NoneNone.

ITEM 2. PROPERTIES

The following table lists, by segment, the Company's major facilitiesproperties as of February 28, 2015March 4, 2017, the general use of the facility and whether it is owned or leased by the Company..

|

| | | | | | | | | |

Facility | | Property Location | | Owned/ Leased | | Size (sq. ft.) | | Function |

Architectural Glass Segment | | | | segment | | | | |

Viracon | | Owatonna, MN | | Owned | | 868,500 |

| | Mfg/AdminManufacturing/Administrative |

Viracon | | Owatonna, MN | | Owned | | 136,050 |

| | Mfg/Admin |

Viracon | | Owatonna, MN | | Leased | | 160,000 |

| | Warehouse |

Viracon | | Statesboro, GA | | Owned | | 397,200 |

| | Mfg/Manufacturing/Warehouse |

Viracon | | St. George, UT | | Owned | | 236,000 |

| | Mfg/Manufacturing/Warehouse |

GlassecViracon | | Nazaré Pulista,Paulista, Brazil | | Owned(1) | | 100,000 |

| | Mfg/Admin |

| | | | | | | | |

Architectural Services Segment | | | | | | | | |

Harmon, Inc. Headquarters | | Minneapolis, MN | | Leased | | 12,954 |

| | Admin |

Harmon, Inc. | | West Chester, OH | | Leased | | 156,000 |

| | Mfg |

Harmon, Inc. | | Garland, TX | | Leased | | 114,025 |

| | Mfg |

Harmon, Inc. | | Glen Burnie, MD | | Leased | | 72,377 |

| | Mfg |

Harmon, Inc. | | Orlando, FL | | Leased | | 49,000 |

| | Mfg |

| | | | | | | | Manufacturing/Administrative |

Architectural Framing Systems Segment | | | | segment | | | | |

Wausau, Window and Wall Systems | | Wausau, WI | | Owned | | 370,400 | Manufacturing/Administrative

| | Mfg/Admin |

Wausau Window and Wall Systems | | Stratford, WI | | Owned | | 67,000 |

| | MfgManufacturing |

Linetec | | Wausau, WI | | Owned | | 430,000 |

| | Mfg/Admin |

Tubelite | | Reed City, MI | | Owned | | 245,000 |

| | MfgManufacturing |

Tubelite | | Walker, MI | | Leased | | 123,125 | Manufacturing/Administrative

| | Mfg/Admin |

Tubelite | | Dallas, TX | | Leased | | 47,500 |

| | MfgManufacturing |

Alumicor | | Ontario,Toronto, ON Canada | | Leased | | 180,329 |

| | Mfg/Manufacturing/Warehouse/AdminAdministrative |

Alumicor | | Ontario,Toronto, ON Canada | | Owned | | 55,000Manufacturing |

Brampton, ON Canada | | Mfg |

| Leased | | Manufacturing/Warehouse/Administrative |

| Architectural Services segment | | | | |

LSO SegmentMinneapolis, MN | | Leased | | Administrative |

| West Chester, OH | | Leased | | Manufacturing |

| Garland, TX | | Leased | | Manufacturing |

| Glen Burnie, MD | | Leased | | Manufacturing |

| Orlando, FL | | Leased | | Manufacturing |

| LSO segment | | | | |

Tru Vue | | McCook, IL | | Owned | | 300,000 | Manufacturing/Warehouse/Administrative

| | Mfg/Admin |

Tru Vue | | Faribault, MN | | Owned | | 274,600 | Manufacturing/Administrative

| | Mfg/Admin |

| | | | | | | | |

| Other | | | | | | | | |

Apogee Headquarters | | Minneapolis, MN | | Leased | | 19,237 |

| | AdminAdministrative |

| |

| (1) | This is an owned facility; however, the land is leased from the city. |

In addition to the locations listed above, the Architectural Services segment business operates 11 leased locations, serving multiple markets.

One of the Viracon facilities, a portion of the Wausau Window and Wall Systems facility, a portion of the Linetec facility and the Tru Vue facilities were constructed with the use of proceeds from industrial revenue bonds issued by their applicable cities. These properties are considered owned since, at the end of the bond term, title reverts to the Company.

ITEM 3. LEGAL PROCEEDINGS

The Company has been a party to various legal proceedings incidental to its normal operating activities. In particular, like others in the construction supply and services industry, the Company's construction supply and services businesses are routinely involved in various disputes and claims arising out of construction projects, sometimes involving significant monetary damages or product replacement. The Company has also been subject to litigation arising out of general liability, employment practices, workers' compensation general liability and automobile claims. Although it is very difficult to accurately predict the outcome of such proceedings, facts currently available indicate that no such claims will result in losses that would have a material adverse effect on the results of operations, cash flows or financial condition of the Company.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicableapplicable.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Apogee common stock is traded on the NASDAQ Stock Market LLC (Nasdaq) under the ticker symbol APOG.

As of April 8, 20152017, there were approximately 1,2781,197 shareholders of record and 7,71516,162 shareholders for whom securities firms acted as nominees.

The following chart shows the quarterly range and year-end closing pricesprice for one share of the Company's common stock over the past fivethree fiscal years.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First | | Second | | Third | | Fourth | | Year-end |

| | | Low | High | | Low | High | | Low | High | | Low | High | | Close |

| 2015 | | $ | 28.28 |

| $ | 35.64 |

| | $ | 29.21 |

| $ | 36.68 |

| | $ | 35.07 |

| $ | 47.02 |

| | $ | 37.83 |

| $ | 48.03 |

| | $ | 45.85 |

|

| 2014 | | 23.06 |

| 30.26 |

| | 22.20 |

| 29.41 |

| | 27.25 |

| 36.09 |

| | 30.97 |

| 37.73 |

| | 34.23 |

|

| 2013 | | 12.17 |

| 16.44 |

| | 14.14 |

| 17.20 |

| | 15.80 |

| 23.31 |

| | 22.20 |

| 26.62 |

| | 26.21 |

|

| 2012 | | 12.42 |

| 14.82 |

| | 8.21 |

| 13.45 |

| | 7.79 |

| 11.54 |

| | 9.42 |

| 15.05 |

| | 12.60 |

|

| 2011 | | 12.57 |

| 16.89 |

| | 9.05 |

| 13.89 |

| | 8.76 |

| 12.05 |

| | 10.79 |

| 14.72 |

| | 13.92 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First | | Second | | Third | | Fourth | | Year-end |

| | | Low | High | | Low | High | | Low | High | | Low | High | | Close |

| 2017 | | $ | 39.93 |

| $ | 45.94 |

| | $ | 41.50 |

| $ | 48.88 |

| | $ | 39.96 |

| $ | 49.17 |

| | $ | 47.64 |

| $ | 59.38 |

| | $ | 58.19 |

|

| 2016 | | 42.35 |

| 56.27 |

| | 49.60 |

| 60.16 |

| | 43.90 |

| 57.86 |

| | 34.52 |

| 50.53 |

| | 39.41 |

|

| 2015 | | 28.28 |

| 35.64 |

| | 29.21 |

| 36.68 |

| | 35.07 |

| 47.02 |

| | 37.83 |

| 48.03 |

| | 45.85 |

|

Dividends

TheQuarterly, the Board of Directors quarterly evaluates declaring dividends based on operating results, available funds and the Company's financial condition. Cash dividends have been paid each quarter since 1974. The chart below shows quarterly and annual cumulative cash dividends per share for the past fivethree fiscal years.

|

| | | | | | | | | | | | | | | | | | | | |

| | | First | | Second | | Third | | Fourth | | Total |

| 2015 | | $ | 0.1000 |

| | $ | 0.1000 |

| | $ | 0.1000 |

| | $ | 0.1100 |

| | $ | 0.4100 |

|

| 2014 | | 0.0900 |

| | 0.0900 |

| | 0.0900 |

| | 0.1000 |

| | 0.3700 |

|

| 2013 | | 0.0900 |

| | 0.0900 |

| | 0.0900 |

| | 0.0900 |

| | 0.3600 |

|

| 2012 | | 0.0815 |

| | 0.0815 |

| | 0.0815 |

| | 0.0815 |

| | 0.3260 |

|

| 2011 | | 0.0815 |

| | 0.0815 |

| | 0.0815 |

| | 0.0815 |

| | 0.3260 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| | | First | | Second | | Third | | Fourth | | Total |

| 2017 | | $ | 0.1250 |

| | $ | 0.1250 |

| | $ | 0.1250 |

| | $ | 0.1400 |

| | $ | 0.5150 |

|

| 2016 | | 0.1100 |

| | 0.1100 |

| | 0.1100 |

| | 0.1250 |

| | 0.4550 |

|

| 2015 | | 0.1000 |

| | 0.1000 |

| | 0.1000 |

| | 0.1100 |

| | 0.4100 |

|

Purchases of Equity Securities by the Company

The following table provides information with respect to purchases made by the Company of its own stock during the fourth quarter of fiscal 20152017:

|

| | | | | | | | | | | | |

| Period | Total Number of Shares Purchased (a) | | Average Price Paid per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (b) | | Maximum Number of Shares that May Yet Be Purchased under the Plans or Programs (b) |

| November 30, 2014 through December 27, 2014 | 1,680 |

| | $ | 41.58 |

| | — |

| | 767,368 |

|

| December 28, 2014 through January 24, 2015 | 13,480 |

| | 43.09 |

| | — |

| | 767,368 |

|

| January 25, 2015 through February 28, 2015 | 2,614 |

| | 45.30 |

| | — |

| | 767,368 |

|

| Total | 17,774 |

| | $ | 43.89 |

| | — |

| | 767,368 |

|

|

| | | | | | | | | | | | |

| Period | Total Number of Shares Purchased (a) | | Average Price Paid per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (b) | | Maximum Number of Shares that May Yet Be Purchased under the Plans or Programs (b) |

| November 27, 2016 through December 31, 2016 | 180 |

| | $ | 50.04 |

| | — |

| | 942,367 |

|

| January 1, 2017 through January 28, 2017 | 3,185 |

| | 55.55 |

| | — |

| | 942,367 |

|

| January 29, 2017 through March 4, 2017 | 1,625 |

| | 57.98 |

| | — |

| | 942,367 |

|

| Total | 4,990 |

| | $ | 56.15 |

| | — |

| | 942,367 |

|

(a) The shares in this column represent shares that were surrendered to us by plan participants in order to satisfy stock-for-stock option exercises or withholding tax obligations related to stock-based compensation.

(b) In April 2003,fiscal 2004, the Board of Directors authorized the repurchase of 1,500,000 shares of Company stock, which was announced on April 10, 2003. In January 2008,Subsequently, the Board of Directors increased the authorization by 750,000 shares, which was announced on January 24, 2008. In October 2008, the Board of Directors increased the authorization2008; by 1,000,000 shares, which was announced on October 8, 2008.2008; and by 1,000,000 shares, which was announced on January 13, 2016. The Company's repurchase program does not have an expiration date.

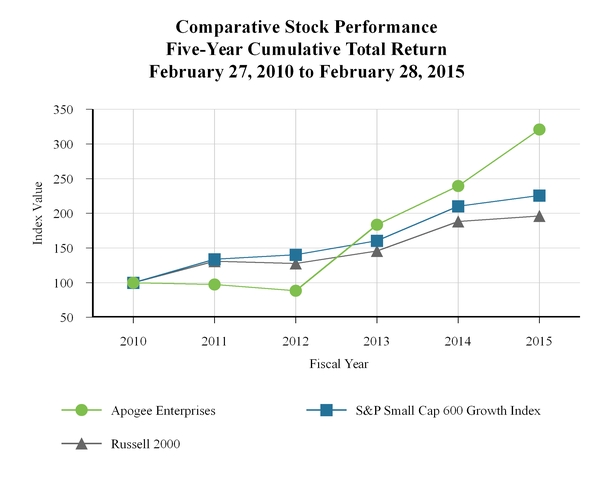

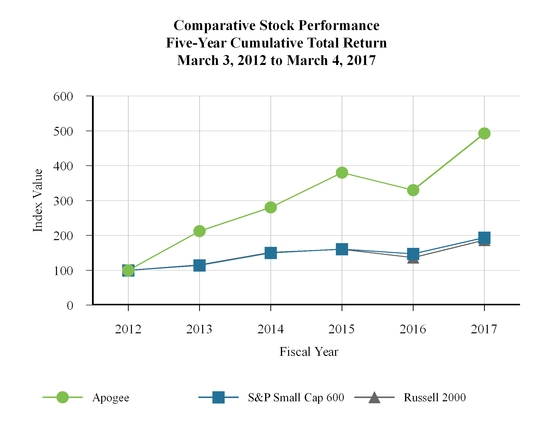

Comparative Stock Performance

The line graph below compares the cumulative total shareholder return on a $100 investment in our common stock for the last five fiscal years with the cumulative total return on a $100 investment in the Standard & Poor's Small Cap 600 Growth Index and the Russell 2000 Index. ThisThe graph assumes a $100an investment in each of Apogee, the Standard & Poor's Small Cap 600 Growth Index and the Russell 2000 Index at the close of trading on February 27, 2010,March 3, 2012, and also assumes the reinvestment of all dividends.

| | | | Fiscal 2010 | Fiscal 2011 | Fiscal 2012 | Fiscal 2013 | Fiscal 2014 | Fiscal 2015 | 2012 | | 2013 | | 2014 | | 2015 | | 2016 | | 2017 |

| Apogee | $ | 100.00 |

| $ | 97.41 |

| $ | 88.17 |

| $ | 183.41 |

| $ | 239.54 |

| $ | 320.85 |

| $ | 100.00 |

| | $ | 212.10 |

| | $ | 280.52 |

| | $ | 379.99 |

| | $ | 329.79 |

| | $ | 492.41 |

|

| S&P Small Cap 600 Growth Index | 100.00 |

| 133.88 |

| 140.37 |

| 160.30 |

| 210.33 |

| 225.62 |

| 100.00 |

| | 114.19 |

| | 149.83 |

| | 160.72 |

| | 147.48 |

| | 193.42 |

|

| Russell 2000 Index | 100.00 |

| 130.77 |

| 127.66 |

| 145.53 |

| 188.21 |

| 196.22 |

| 100.00 |

| | 115.68 |

| | 151.59 |

| | 160.12 |

| | 136.57 |

| | 186.43 |

|

For the fiscal year ended February 28, 2015, our primary business activities included architectural glass (approximately 34 percent of net sales), architectural services (approximately 25 percent of net sales), architectural framing systems (approximately 32 percent of net sales) and large-scale optical technologies (approximately 9 percent of net sales). We are not aware of any competitors, public or private, that are similar to us in size and scope of business activities. Most of our direct competitors are either privately owned or divisions of larger, publicly owned companies.

ITEM 6. SELECTED FINANCIAL DATA

The following information should be read in conjunction with Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations, included in Item 7 of this Report, and our consolidated financial statements and related notes, included in Item 8 - Financial Statements and Supplementary Data.of this Report.

|

| | | | | | | | | | | | | | | | | | |