Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Amendment No. 1 to

FORM 10-K

10-K/AANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 20162018

Commission File Number 1-5277

(Exact name of Registrant as specified in its charter)

Missouri | | 43-0178130 |

| | |

Missouri | | 43-0178130 |

(State or other jurisdiction of | | (I.R.S. Employer |

incorporation or organization) | | Identification No.) |

One Neenah Center, 4th Floor, P.O. Box 669,2301 Industrial Drive, Neenah, Wisconsin 54957-066954956

(Address of principal executive offices)

Registrant’s telephone number, including area code: (920) 527-5000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class |

|

on Which Registered

|

Common Stock, par value $0.10 per share | | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: NoneNone

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ýx NO o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO xý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ýx NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ýx NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§232.405) is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form��Form 10-K or any amendment to this Form 10-K. ýx

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company,” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | |

Large Accelerated Filer x | | |

| | Smaller Reporting Company o |

(Do not check if a smaller reporting company)Emerging growth company o | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). YES o NO xý

The aggregate market value of the voting and non-voting common equity held by nonaffiliates of the Registrant on

June 30, 2016,29, 2018, based on a closing price of $51.49$42.21 per share as reported on the New York Stock Exchange, was $4,876,642,461.$3,841,516,355.As of

February 15, 2017,13, 2019, the Registrant had 92,450,46891,165,312 shares of Common Stock issued and outstanding.

Documents IncorporatedTable of Contents

EXPLANATORY NOTE

This Amendment No. 1 to Form 10-K/A (the “Amendment”) amends the Annual Report on Form 10-K of Bemis Company, Inc. (the “Company” “our” “us” or “we”) for the year ended December 31, 2018, which was originally filed with the Securities and Exchange Commission (the “SEC”) on February 15, 2019 (the “Original Filing”), and is being filed solely for the purpose of providing certain information required by Reference

Items 10, 11, 12, 13, and 14 of Part III.PortionsThis information was previously omitted from the Original Filing in reliance on General Instruction G(3) to Form 10-K, which permits the information in the above-referenced items to be incorporated in the Form 10-K by reference from our definitive proxy statement if such statement is filed no later than 120 days after our fiscal year end. We are filing this Amendment to include Part III information in our Form 10-K because a definitive proxy statement containing this information will not be filed by us within 120 days after the end of the Proxy Statement - Annual Meetingfiscal year covered by the Form 10-K. The reference on the cover of Shareholders May 4, 2017 -the Original Filing to the incorporation by reference to portions of a definitive proxy statement or amendment to our Form 10-K into Part III of the Original Filing is hereby deleted.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended, Part III, Items 10 through 14 of the Original Filing are hereby amended and restated in their entirety, and Part IV, Item 15 of the Original Filing is hereby amended and restated in its entirety, with the only change being the addition of Exhibits 31.3 and 31.4 filed herewith.

Except as specifically set forth herein, this Amendment does not amend or otherwise update any other information in the Original Filing. Accordingly, this Amendment should be read in conjunction with the Original Filing and with our filings with the SEC subsequent to the Original Filing.

ANNUAL REPORT ON FORM 10-K

Forward-Looking Statements

Unless otherwise indicated, references to "Bemis Company," the "Company," "we," "our," and "us" in this Annual Report on Form 10-K refer to Bemis Company, Inc. and its consolidated subsidiaries.

This Annual Report contains certain estimates, predictions, and other “forward-looking statements” (as defined in the Private Securities Litigation Reform Act of 1995, and within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended). Forward-looking statements are generally identified with the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “target,” “may,” “will,” “plan,” “project,” “should,” “continue,” “outlook,” “approximately,” “would,” “could,” or the negative thereof or other similar expressions, or discussion of future goals or aspirations, which are predictions of or indicate future events and trends and which do not relate to historical matters. Such statements are based on information available to management as of the time of such statements and relate to, among other things, expectations of the business environment in which we operate, projections of future performance (financial and otherwise), including those of acquired companies, perceived opportunities in the market and statements regarding our strategy and vision. Forward-looking statements involve known and unknown risks, uncertainties, and other factors, which may cause actual results, performance, or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

Factors that could cause actual results to differ from those expected include, but are not limited to:

The costs, availability, and terms of acquiring our raw materials (particularly for polymer resins and adhesives), as well as our ability to pass any price changes on to our customers;

Our ability to retain and build upon the relationships and sales of our key customers;

The potential loss of business or increased costs due to customer or vendor consolidation;

The ability of our foreign operations to maintain working efficiencies, as well as properly adjust to continuing changes in global politics, legislation, and economic conditions;

Variances in key exchange rates that could affect the translation of the financial statements of our foreign entities.

Our ability to effectively implement and update our global enterprise resource planning ("ERP") systems;

Our ability to realize the benefits of our acquisitions and divestitures, and whether we are able to properly integrate those businesses we have acquired;

Fluctuations in interest rates and our borrowing costs, along with other key financial variables;

A potential failure in our information technology infrastructure or applications and their ability to protect our key functions from cyber-crime and other malicious content;

Unexpected outcomes in our current and future administrative and litigation proceedings;

Changes in governmental regulations, particularly in the areas of environmental, health and safety matters, fiscal incentives, and foreign investment;

Changes in the competitive conditions within our markets, as well as changes in the demand for our goods;

Our ability to effectively introduce new products into the market and to protect or retain our intellectual property rights;

Changes in our ability to attract and retain high performance employees;

Changes in the value of our goodwill and other intangible assets;

Changes in import and export regulation that could subject us to liability or impair our ability to compete in international markets;

Our ability to manage all costs associated with our pension plan;

Changes in our credit rating; and

A failure to realize the full potential of our restructuring activities.

These and other risks, uncertainties, and assumptions identified from time to time in our filings with the Securities and Exchange Commission, including without limitation, those described under Item 1A "Risk Factors" of this Annual Report on Form 10-K and our quarterly reports on Form 10-Q, could cause actual future results to differ materially from those projected in the forward-looking statements. In addition, actual future results could differ materially from those projected in the forward-looking statements as a result of changes in the assumptions used in making such forward-looking statements.

PART I

ITEM 1 — BUSINESS

Bemis Company, Inc., a Missouri corporation (the “Registrant” or “Company”), continues a business formed in 1858. We were incorporated in 1885 as Bemis Bro. Bag Company with the name changed to Bemis Company, Inc. in 1965. We are a global manufacturer of packaging products.

Our strategic objectives are to accelerate growth, focus innovation, and continuously improve, all focused at delivering strong long-term financial performance. In support of the strategic objectives, our vision is: passionate commitment to the growth and success of our customers will make Bemis the clear choice for inspired packaging solutions.

The majority of our products are sold to customers in the food industry. Other customers include companies in the following types of businesses: chemical, agribusiness, medical, pharmaceutical, personal care, electronics, construction, and other consumer goods. Further information about our operations in our business segments and geographic areas is available in Note 20 to the Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K.

As of December 31, 2016, we had approximately 17,500 employees worldwide. Approximately 8,500 of these employees were in the U.S., with approximately 40 percent of the 6,000 hourly production employees covered by collective bargaining agreements involving six different unions. Of the approximately 9,000 employees who were outside the U.S., over half of the hourly production employees and some of the salaried workforce are covered by collective bargaining agreements and are represented by numerous unions.

Working capital fluctuates throughout the year in relation to business volume and other marketplace conditions. We maintain inventory levels that provide a reasonable balance between obtaining raw materials at favorable prices and maintaining adequate inventory levels to enable us to fulfill our commitment to promptly fill customer orders. Manufacturing backlogs are not a significant factor in the industries in which we operate. The business of each of the reportable segments is not seasonal to any significant extent.

We are the owner or licensee of a number of United States and foreign patents and patent applications that relate to certain of our products, manufacturing processes, and equipment. We also have a number of trademarks and trademark registrations in the United States and in foreign countries. Our patents, licenses, and trademarks collectively provide a competitive advantage. However, the loss of any single patent or license alone would not have a material adverse effect on our results as a whole or those of any of our segments.

Our business activities are organized around our two reportable business segments, U.S. Packaging (65 percent of 2016 net sales) and Global Packaging (35 percent). Both internal and external reporting conform to this organizational structure. A summary of our business activities reported by our two reportable business segments follows.

U.S. Packaging Segment

The U.S. Packaging segment represents all food, consumer, and industrial products packaging-related manufacturing operations located in the United States. This segment manufactures multilayer polymer, blown and cast film structures which are then converted to produce packaging for processed and fresh meat, dairy, liquids, frozen foods, cereals, snacks, cheese, coffee, condiments, candy, pet food, bakery, lawn and garden, tissue, fresh produce, personal care and hygiene, disposable diapers, and agribusiness.

Global Packaging Segment

The Global Packaging segment includes all packaging-related manufacturing operations located outside of the United States as well as global medical device and pharmaceutical packaging-related manufacturing operations. This segment manufactures multilayer polymer, blown and cast film structures to produce packaging sold for a variety of food, medical, pharmaceutical, personal care, electronics, and industrial applications. Additional products include injection molded and thermoformed plastic and folding carton packaging. These products include processed and fresh meat, dairy, liquids, snacks, cheese, coffee, condiments, candy, bakery, tissue, fresh produce, personal care and hygiene, disposable diapers, agribusiness, pharmaceutical, and medical devices.

Marketing, Distribution, and Competition

While our sales are made through a variety of distribution channels, substantially all sales are made by our direct sales force. Sales offices and plants are located throughout North America, Latin America, Europe, and Asia-Pacific to provide prompt and economical service to thousands of customers. Our technically trained sales force is supported by product development engineers, design technicians, field service technicians, and a customer service organization.

Sales to the Kraft Heinz Company, and its subsidiaries, accounted for approximately 11 and 12 percent of our sales in 2016 and 2015, respectively. Business arrangements with them and certain large customers require a large portion of the manufacturing capacity at a few individual manufacturing sites. Any change in the business arrangement would typically occur over a period of time, which would allow for an orderly transition for both our manufacturing sites and the customer.

The major markets in which we sell our products are highly competitive. Areas of competition include service, innovation, quality, and price. This competition is significant as to both the size and the number of competing firms. Competitors include Amcor Limited, Berry Plastics Group, Inc., Bryce Corporation, Coveris Holdings S.A., Printpack, Inc., Sealed Air Corporation, Sonoco Products Company, Wipak OY, Winpak Ltd, and a variety of other privately held companies.

We consider ourselves to be a significant participant in the markets in which we serve; however, due to the diversity of our business, our precise competitive position in these markets is not reasonably determinable. Advertising is limited primarily to business and trade publications emphasizing our product features and related technical capabilities.

Raw Materials

Polymer resins and films, paper, inks, adhesives, aluminum, and chemicals constitute the major raw materials used by us. These are purchased from a variety of global industry sources, and we are not significantly dependent on any one supplier for our raw materials. While temporary industry-wide shortages of raw materials may occur, we expect to continue to successfully manage raw material supplies without significant supply interruptions. Currently, raw materials are readily available.

Environmental Matters

Our operations and the real property we own or lease are subject to broad environmental laws and regulations by multiple jurisdictions. These laws and regulations pertain to the discharge of certain materials into the environment, handling and disposition of waste, and cleanup of contaminated soil and ground water as well as various other protections of the environment. We believe that we are in substantial compliance with applicable environmental laws and regulations based on implementation of our Environmental, Health, and Safety Management System and regular audits. However, we cannot predict with certainty that we will not in the future incur liability with respect to noncompliance with environmental laws and regulations due to contamination of sites formerly or currently owned or operated by us (including contamination caused by prior owners and operators of such sites) or the off-site disposal of regulated materials, which could be material. In addition, these laws and regulations are constantly changing and we cannot always anticipate these changes.

See Note 19 to the Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K for further information regarding certain environmental matters.

Available Information

We are a large accelerated filer (as defined in Exchange Act Rule 12b-2) and are also an electronic filer. Electronically filed reports (Forms 4, 8-K, 10-K, 10-Q, S-3, S-8, etc.) can be accessed at the Securities and Exchange Commission (SEC) website (http://www.sec.gov) or by visiting the SEC’s Public Reference Room located at 100 F St., N.E., Washington, DC 20549 (call 1-202-551-8090 or 1-800-732-0330 for hours of operation). Electronically filed and furnished reports can also be accessed through our own website (http://www.bemis.com), under Investors/SEC Filings or by writing for free information, including SEC filings, to Investor Relations, Bemis Company, Inc., One Neenah Center, 4th Floor, P.O. Box 669, Neenah, Wisconsin 54957-0669, or calling (920) 527-5000. In addition, our Board Committee charters, Principles of Corporate Governance, and our Code of Conduct can be electronically accessed at our website under About Bemis/Corporate Governance or, free of charge, by writing directly to the Company, Attention: Corporate Secretary. We will post any amendment to, or waiver from, a provision of the Code of Conduct that applies to our principal executive officer, principal financial officer, principal accounting officer, and other persons performing similar functions on the Investor Relations section of our website (www.bemis.com) promptly following the date of such amendment or waiver.

Explanation of Terms Describing the Company’s Products

Aseptic packaging — Packaging used in a flash-heating process in which a food product and its packaging are sterilized separately and then combined and sealed under sterile conditions. This process retains more nutrients and uses less energy than conventional sterilization techniques and extends the shelf life of processed food without using preservatives.

Barrier products — Products that provide protection and extend the shelf life of the package contents. These products provide protection from oxygen, moisture, light, odor, or other environmental factors by combining different types of plastics and additives into a multilayered plastic package.

Cast film — A plastic film that is extruded through a straight slot die as a flat sheet during its manufacturing process.

Coextruded film — A blown or cast film extruded with multiple layers extruded simultaneously.

CSD labels — Carbonated soft drink labels.

Extruded film — A plastic film manufactured by forcing heated resin through a shaped die. This forms a tube of thin plastic film which is then expanded by an internal column of air to produce a continuous ribbon of film.

EZ Open packaging — Package technologies such as peelable closures or laser scoring used to allow the consumer easy access to a packaged product. EZ Open packaging may be combined with reclose features such as plastic zippers to allow for convenient storage of the packaged material once opened.

Film laminate — A multilayer plastic film made by laminating two or more films together with the use of adhesive or a molten plastic to achieve a barrier for the packaged contents.

Flexible pouches — A packaging option that delivers a semi-finished package, instead of rollstock, to a customer for filling product and sealing/closing the package for distribution.

Flexographic printing — The most common flexible packaging printing process using a raised rubber or alternative material image mounted on a printing cylinder.

Forming films — A flexible plastic film that is designed to take the shape determined by a cavity when subjected to heat and vacuum.

Injection molded plastic — Plastic that is created through a manufacturing process where heated plastic is injected into a die or mold.

Multipack — A film manufactured by a modified extrusion process that is used for wrapping and holding multipacks of products such as canned goods and bottles of liquids, replacing corrugate and fiberboard.

Narrow-web rolls — Films that are produced one-across at widths typically less than one meter and can be produced in either tube or roll form depending on the application.

Retort packaging — A multilayer flexible or rigid package able to withstand the thermal processing used for sterilization, similar to the process used for pressure cooking. The food is prepared and sealed in a package and then heated to approximately 250 degrees Fahrenheit under high pressure. This process extends the food product’s shelf life under normal room temperature conditions.

Rigid packaging — A form of packaging in which the shape of the package is retained as its contents are removed. Bottles, trays and clamshell packaging are examples of rigid packaging options.

Rollstock — The principal form in which flexible packaging material is delivered to a customer. Finished film wound on a core is converted in a process at the end user’s plant that forms, fills, and seals the package of product for delivery to customers.

Rotogravure printing — A high quality printing process utilizing a metal engraved cylinder.

Shrink bags/films — An extruded packaging film that is cooled, reheated, and stretched at a temperature near its melting point. The film is made to shrink around a product by an application of thermal treatment, and can be a barrier product if a layer of oxygen barrier material is added.

Specialty film — Plastic films that are produced for non-food applications and are typically used as either secondary packaging

or incorporated into a film structure to impart specific physical and /or performance characteristics.

Sterilization packaging — Packaging materials and preformed packaging systems that support the sterilization process, physical and sterile barrier protection through global distribution, and aseptic operating room presentation of life saving medical devices and technologies.

Thermoformed plastic packaging — A package formed by applying heat to a film to shape it into a tray or cavity and then sealing a flat film on top of the package after it has been filled.

Vacuum skin packaging ("VSP") — Vacuum skin packaging combines the benefits of traditional vacuum packs in terms of shelf life extension and premium second-skin presentation of meats, fish, and ready-made meals. VSP systems include multilayer high barrier top webs and adapted forming webs and trays.

ITEM 1A — RISK FACTORS

The following factors, as well as factors described elsewhere in this Form 10-K, or in other filings by the Company with the Securities and Exchange Commission, could adversely affect the Company’s consolidated financial position, results of operations or cash flows. Other factors not presently known to us or that we presently believe are not material could also affect our business operations and financial results.

Raw materials — Raw material cost increases or shortages could adversely affect our results of operations.

As a manufacturer, our sales and profitability are dependent on the availability and cost of raw materials, which are subject to price fluctuations. Inflationary and other increases in the costs of raw materials have occurred in the past and are expected to recur, and our performance depends in part on our ability to reflect changes in costs in selling prices for our products. We have generally been successful in managing the impact of higher raw material costs by increasing selling prices through our contractual pass-through mechanisms with most of our customers. The disruption of raw materials from certain single-source providers could impact our supply chain. Additionally, natural disasters, such as hurricanes, tornadoes, and fires, may also negatively impact the production or delivery capacity of our raw material suppliers in the chemical and paper industries. This could result in increased raw material costs or supply shortages, which may have a negative impact on our profitability if the cost increases are sustained sequentially over multiple periods or, in the case of a shortage, if we are unable to secure raw materials from alternative sources.

Key customers — The loss of key customers or a significant reduction in sales to those customers could significantly reduce our revenues.

Our customer base includes key (generally large) customers that are important to our success and represent a sizable portion of sales. Our required response to continued marketplace competition could result in lower than expected net pricing of our products. Furthermore, if key customers experience financial pressure, they could request more favorable contractual terms, which could place additional pressure on our margins and cash flows.

Consolidation of customer base — A significant consolidation of our customer base could negatively impact our business.

Many of our largest customers have acquired companies with similar or complementary product lines. This consolidation has increased the concentration of our business with our largest customers. Such consolidation may be accompanied by pressure from customers for lower prices, reflecting the increase in the total volume of products purchased or the elimination of a price differential between the acquiring customer and the company acquired. While we have generally been successful at managing customer consolidations, increased pricing pressures from our customers could have a material adverse effect on results of operations.

Global operations — Changing conditions in the U.S. and foreign countries, may significantly impact our reported results of operations.

We have operations globally. Our revenues and net income may be adversely affected by economic conditions, political situations, and changing laws and regulations, as to which we have no control. Additionally, our operations could be disrupted by geopolitical conditions such as boycotts and sanctions, acts of war, terrorist activity or other similar events. Such events could make it difficult or impossible to manufacture or deliver products to our customers, receive production materials from our suppliers, or perform critical functions, which could adversely affect our business globally or in certain regions. While we maintain similar manufacturing capacities at different locations and coordinate multi source supplier programs on many of our materials which would better enable us to respond to these types of events, we cannot be sure that our plans will fully protect us from all such disruptions. Similarly, more ordinary course disruptions that are directly attributable to the foreign nature of our business, such as flight and shipping delays or cancellations, could also significantly impact business operations.

Restructuring activities — Our restructuring activities and cost saving initiatives may not achieve the results we anticipate.

We have undertaken and may continue to undertake restructuring activities and cost reduction initiatives to optimize our asset base, improve operating efficiencies and generate cost savings. We cannot be certain that we will be able to complete these initiatives as planned or that the estimated operating efficiencies or cost savings from such activities will be fully realized or maintained over time. In addition, we may not be successful in migrating production from one facility to another.

Exchange rates — We have foreign currency conversion and transaction risks that may adversely affect our operating results.

In 2016, approximately 30 percent of our sales were generated by entities operating outside of the United States. Because of this, variations in exchange rates may have a sizable effect on the translation of the financial statements of our foreign entities. Our primary foreign exchange exposure is to the Brazilian Real, but we also have foreign exchange exposure to

the Euro, Argentine Peso, Mexican Peso, British Pound, and other currencies. A strengthening U.S. dollar relative to foreign currencies has a dilutive conversion effect on our financial statements. Conversely, a weakening U.S. dollar has an additive translation effect. In some cases, we sell products denominated in a currency different from the currency in which the related costs are incurred. In short, the volatility of currency exchange rates may impact our operating results.

Implementing our ERP system — We face risks related to the implementation of our global enterprise resource planning system.

We are currently engaged in a multi-year process of conforming the majority of our operations onto one global ERP system. The ERP system is designed to improve the efficiency of our supply chain and financial transaction processes, accurately maintain our books and records, and provide information important to the operation of the business to our management team. The ERP system will continue to require significant investment of human and financial resources, and we may experience significant delays, increased costs and other difficulties as a result. Any significant disruption or deficiency in the design and implementation of the ERP system could adversely affect our ability to fulfill and invoice customer orders, apply cash receipts, place purchase orders with suppliers, and make cash disbursements, and could negatively impact data processing and electronic communications among business locations, which may have a material adverse effect on our business, consolidated financial condition or results of operations. We also face the challenge of supporting our older systems and implementing necessary upgrades to those systems while we implement the new ERP system. While we have invested significant resources in planning and project management, significant implementation issues may arise.

Acquisitions and divestitures — We may not be able to successfully integrate businesses that we acquire or limit ongoing costs associated with the operations we divest.

We have made numerous acquisitions in the past and are regularly considering new acquisitions that we believe will provide meaningful opportunities to grow our business and improve performance in the future. Acquired businesses may not achieve the levels of revenue, profit, productivity, or otherwise perform as we expect. Acquisitions involve special risks, including, without limitation, the potential assumption of unanticipated liabilities and contingencies as well as difficulties in integrating acquired businesses. While we believe that our acquisitions will improve our competitiveness and future financial performance, we can give no assurance that acquisitions will be successful.

We also make strategic divestitures from time to time and we may agree to indemnify acquiring parties for certain liabilities arising from our former businesses which could negatively impact future results.

Interest rates — An increase in interest rates could reduce our reported results of operations.

At December 31, 2016, our variable rate borrowings approximated $828.1 million (which includes $400 million fixed rate notes that have been effectively converted to variable rate debt through the use of a fixed to variable rate interest rate swap). Fluctuations in interest rates can increase borrowing costs and have an adverse impact on results of operations. Accordingly, increases in short-term interest rates will directly impact the amount of interest we pay. For each one percent increase in variable interest rates, our annual interest expense would increase by approximately $8.3 million on the $828.1 million of variable rate debt outstanding as of December 31, 2016.

Information technology — A failure in our information technology systems could negatively affect our business.

We depend on information technology to record and process customers' orders, manufacture and ship products in a timely manner, and maintain the financial accuracy of our business records. Increased global information technology (“IT”) security threats and more sophisticated cyber-crime pose a potential risk to the security and availability of our IT systems, networks, and services, including those that are managed, hosted, provided, or used by third parties, as well as the confidentiality, availability, and integrity of our data. Other malicious activity, such as unauthorized access attempts, phishing, attempts at monetary theft through our IT systems, computer viruses or other malignant codes may also pose a threat to our operations. If the IT systems, networks, or service providers we rely upon fail to function properly, or if we suffer a loss or disclosure of business or other sensitive information, due to any number of causes, ranging from catastrophic events to power outages to security breaches, and our business continuity plans do not effectively and timely address these failures, we may suffer interruptions in our ability to manage operations and reputational, competitive, or business harm, which may adversely affect our business operations or financial condition.

Litigation — Litigation or regulatory developments could adversely affect our business operations and financial performance.

We are, and in the future will become, involved in lawsuits, regulatory inquiries, and governmental and other legal proceedings arising out of the ordinary course of our business. As we expand our global footprint, we become exposed to more uncertainty regarding the regulatory environment. The timing of the final resolutions to lawsuits, regulatory inquiries, and

governmental and other legal proceedings is typically uncertain. Additionally, the possible outcomes of, or resolutions to, these proceedings could include adverse judgments or settlements, either of which could require substantial payments. See “Legal Proceedings" included in Item 3 of this Annual Report on Form 10-K.

Environmental, health, and safety regulations — Changing government regulations in environmental, health, and safety matters may adversely affect our company.

Numerous legislative and regulatory initiatives have been passed and anticipated in response to concerns about Greenhouse Gas emissions and climate change. We are a manufacturing entity that utilizes petrochemical-based raw materials to produce many of our products. Increased environmental legislation or regulation could result in higher costs for us in the form of higher raw materials, as well as energy and freight costs. It is possible that certain materials might cease to be permitted to be used in our processes. We could also incur additional compliance costs for monitoring and reporting emissions and for maintaining permits. Additionally, a sizable portion of our business comes from healthcare packaging and food packaging, both highly regulated markets. If we fail to comply with these regulatory requirements, our results of operations could be adversely impacted.

Changes in market demand and competition — Changes in consumer demand or buying habits for our goods, an increase in substitutions, or significant innovation by our competitors, may adversely affect our business.

Our success depends on our ability to respond timely to changes in customer product needs and market acceptance of our products. We must produce products that meet the quality, performance, and price expectations of our customers. Additionally, because many of our products are used to package consumer goods, our sales and profitability could be negatively impacted by changes in consumer preferences for those underlying products. We also operate in a highly competitive industry. Our response to marketplace competition may result in lower than expected net pricing of our products.

Patents and proprietary technology — Our success is dependent on our ability to develop and successfully introduce new products and to develop, acquire and retain intellectual property rights.

Our success depends in large part on our proprietary technology. We rely on intellectual property rights, including patents, trademarks and trade secrets, as well as confidentiality provisions and licensing arrangements, to establish our proprietary rights. If we are unable to enforce our intellectual property rights, our competitive position may suffer. Our pending patent applications, and our pending trademark registration applications, may not be allowed or competitors may challenge the validity or scope of our patents or trademarks. In addition, our patents, trademarks and other intellectual property rights may not provide us a significant competitive advantage. We may need to spend significant resources monitoring our intellectual property rights. Our competitive position may be harmed if we cannot detect infringement and enforce our intellectual property rights quickly or at all. Competitors might avoid infringement by designing around our intellectual property rights or by developing non-infringing competing technologies. Intellectual property rights and our ability to enforce them may be unavailable or limited in some countries which could make it easier for competitors to capture market share and could result in lost revenues.

Attracting and retaining key personnel — If we are unable to attract and retain key personnel, we may be adversely affected.

Our continued success depends, in large part, on our ability to identify, attract, motivate, train and retain qualified personnel in key functions and geographic areas. Losing the services of key employees in any of our operations could make it difficult to meet our objectives. To effectively manage our global business, we will need to continue to recruit, train, assimilate, motivate and retain employees who actively promote and meet the standards of a high performance culture.

Goodwill and other intangible assets — A significant write-down of goodwill and/or other intangible assets would have a material adverse effect on our reported results of operations and net worth.

We review our goodwill balance for impairment at least once a year using the business valuation methods allowed in accordance with current accounting standards. These methods include the use of a weighted-average cost of capital to calculate the present value of the expected future cash flows of our reporting units. Future changes in the cost of capital, expected cash flows, or other factors may cause our goodwill and/or other intangible assets to be impaired, resulting in a non-cash charge against results of operations to write down these assets for the amount of the impairment. In addition, if we make changes in our business strategy or if external conditions adversely affect our business operations, we may be required to record an impairment charge for goodwill or intangibles, which would lead to decreased assets and reduced net operating results. If a significant write down is required, the charge would have a material adverse effect on our reported results of operations and net worth. We have identified the valuation of intangibles as a critical accounting estimate. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Estimates and Judgments—Intangible assets and goodwill” included in Item 7 of this Annual Report on Form 10-K.

Imports and exports — We are subject to governmental export and import controls that could subject us to liability or impair our ability to compete in international markets.

Certain of our products are subject to export controls and may be exported only with the required export license or through an export license exception. If we were to fail to comply with export licensing, customs regulations, economic sanctions and other laws, we could be subject to substantial civil and criminal penalties, including fines for the Company and incarceration for responsible employees and managers, and the possible loss of export or import privileges. In addition, if our distributors fail to obtain appropriate import, export or re-export licenses or permits, we may also be adversely affected through reputational harm and penalties. Obtaining the necessary export license for a particular sale may be time-consuming and may result in the delay or loss of sales opportunities.

Furthermore, export control laws and economic sanctions prohibit the shipment of certain products to embargoed or sanctioned countries, governments and persons. While we train our employees to comply with these regulations, we cannot assure that a violation will not occur, whether knowingly or inadvertently. Any such shipment could have negative consequences including government investigations, penalties, fines, civil and criminal sanctions, and reputational harm. Any change in export or import regulations, economic sanctions or related legislation, shift in the enforcement or scope of existing regulations, or change in the countries, governments, persons or technologies targeted by such regulations, could result in our decreased ability to export or sell our products to existing or potential customers with international operations. Any limitation on our ability to export or sell our products could adversely affect our business, financial condition and results of operations.

Funded status of pension plans — Recognition of pension liabilities may cause a significant reduction in stockholders’ equity.

In December of 2013, new amendments to our U.S. pension plan for salaried and non-union hourly employees were implemented. These amendments froze all further benefit accruals for all persons entitled to benefits under the plan. While the amendments reduced some risk related to future service costs, there is still risk associated with ongoing liability re-measurement and plan asset valuations. Current accounting standards issued by the Financial Accounting Standards Board ("FASB") require balance sheet recognition of the funded status of our defined benefit pension and postretirement benefit plans. If the fair value of our pension plans’ assets at a future reporting date decreases or if the discount rate used to calculate the projected benefit obligation ("PBO") as of that date decreases, we will be required to record the incremental change in the excess of PBO over the fair value of the assets as a reduction of stockholders’ equity. The resulting non-cash after-tax charge would represent future expense and would be recorded directly as a decrease in the Accumulated Other Comprehensive Income component of stockholders’ equity. While we cannot estimate the future funded status of our pension liability with any certainty at this time, we believe that if the market value of assets or the discount rate used to calculate our pension liability materially decreases, the adjustment could significantly reduce our stockholders’ equity. A significant reduction in stockholders’ equity may impact our compliance with debt covenants or could cause a downgrade in our credit ratings that could also adversely impact our future cost and speed of borrowing and have an adverse effect on our financial condition, results of operations and liquidity. We have identified pension assumptions as a critical accounting estimate. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Critical Accounting Estimates and Judgments — Pension costs” and “— Pension assumptions sensitivity analysis” included in Item 7 of this Annual Report on Form 10-K.

Credit rating — A downgrade in our credit rating could increase our borrowing costs and negatively affect our financial condition and results of operations.

In addition to using cash provided by operations, we regularly issue commercial paper to meet our short-term liquidity needs. Our credit ratings are important to our ability to issue commercial paper at favorable rates of interest. A downgrade in our credit rating could increase the cost of borrowing by increasing the spread over prevailing market rates that we pay for our commercial paper or the fees associated with our bank credit facility.

ITEM 1B — UNRESOLVED STAFF COMMENTS

None.

ITEM 2 — PROPERTIES

Properties utilized by us at December 31, 2016, were as follows:

U.S. Packaging Segment

This segment has 27 manufacturing plants located in 13 states, of which 26 are owned directly by us or our subsidiaries and one is leased from an outside party.

Global Packaging Segment

This segment has 32 manufacturing plants located in two states within the U.S., the Commonwealth of Puerto Rico, and eleven other countries, of which 27 are owned directly by us or our subsidiaries and five are leased from outside parties. Initial building lease terms generally provide for minimum terms of five to twenty years and have one or more renewal options.

Corporate and General

We consider our plants and other physical properties to be suitable, adequate, and of sufficient productive capacity to meet the requirements of our business. The manufacturing plants operate at varying levels of utilization depending on the type of operation and market conditions. Our executive offices, which are leased, are located in Neenah, Wisconsin.

ITEM 3 — LEGAL PROCEEDINGS

We are involved in a number of lawsuits incidental to our business, including environmental-related litigation and routine litigation arising in the ordinary course of business. Although it is difficult to predict the ultimate outcome of these cases, we believe, except as discussed below, that any ultimate liability would not have a material adverse effect on the Company’s consolidated financial condition or results of operations.

Environmental Matters

We are a potentially responsible party ("PRP") pursuant to the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (commonly known as “Superfund”) and similar state and foreign laws in proceedings associated with 17 sites around the United States and one in Brazil. These proceedings were instituted by the United States Environmental Protection Agency and certain state and foreign environmental agencies at various times beginning in 1983. Superfund and similar state and foreign laws create liability for investigation and remediation in response to releases of hazardous substances in the environment. Under these statutes, joint and several liability may be imposed on waste generators, site owners and operators, and others regardless of fault. Although these regulations could require us to remove or mitigate the effects on the environment at various sites, perform remediation work at such sites, or pay damages for loss of use and non-use values, we expect our liability in these proceedings to be limited to monetary damages. We expect our future liability relative to these sites to be insignificant, individually and in the aggregate.

We are involved in other environmental-related litigation arising in the ordinary course of business. We accrue environmental costs when it is probable that these costs will be incurred and can be reasonably estimated. Our reserve for environmental liabilities at December 31, 2016 and 2015 was $3.5 million and $5.6 million, respectively.

Brazil Tax Dispute - Goodwill Amortization

During October 2013, Dixie Toga, Ltda ("Dixie Toga") received an income tax assessment in Brazil for the tax years 2009 through 2011 that relates to the amortization of certain goodwill generated from the acquisition of Dixie Toga. The income tax assessed for those years is approximately $11.7 million, translated to U.S. dollars at the December 31, 2016 exchange rate. We expect that tax examinations for years after 2011 will include similar assessments as we continue to claim the tax benefits associated with the goodwill amortization. An ultimate adverse resolution on these assessments, including interest and penalties, could be material to our consolidated results of operations and/or cash flows.

We have been advised by our legal and tax advisors that our position with respect to the deductions is allowable under the tax laws of Brazil. We are contesting the disallowance and believe it is more likely than not the tax benefit will be sustained in its entirety and consequently have not recorded a liability. We intend to litigate the matter if it is not resolved at the administrative appeals levels. The ultimate outcome will not be determined until the Brazilian tax appeal process is complete, which could take several years. At this time, we believe that final resolution of the assessment will not have a material impact on our consolidated financial statements.

Brazil Investigation

On September 18, 2007, the Secretariat of Economic Law, a governmental agency in Brazil, which has now been replaced by the General Superintendence of the Administrative Council for Economic Defense (“CADE”), initiated an investigation into possible anti-competitive practices in the Brazilian flexible packaging industry against a number of Brazilian companies including a Dixie Toga subsidiary. The investigation relates to periods prior to our acquisition of control of Dixie Toga and its subsidiaries.

In late November 2016, the investigative arm of CADE issued an advisory opinion recommending, among other actions, the imposition of fines on Itap Bemis, a Dixie Toga subsidiary. The case will now be sent to the CADE Tribunal, which will decide to either accept or decline the recommendation. We expect that the Tribunal decision will be issued in 2017.

In the event of an adverse decision, it is difficult to predict possible fines, but based on CADE's current fining practice, the fines assessed could be as high as $60 million, depending on CADE’s determination of the applicable revenue base for the calculation of the fine. We intend to vigorously defend our position and plan to appeal any adverse decision by the Tribunal. Upon appeal, we would likely be required to post bond, deposit funds equal to the assessed fines, or provide other collateral. We are unable at this time to predict the outcome of this matter, but believe it is not probable that an adverse judgment would stand after exhausting all appeals which are likely to take several years and therefore no provision has been made in the consolidated financial statements.

ITEM 4 — MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5 — MARKET FOR REGISTRANT’S COMMON EQUITY,RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

| | | | | | | | | | | | | |

| | | (a) | | (b) | | (c) | | (d) |

| Period | | Total Number of Shares Purchased | | Average Price Paid per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Number of Shares That May Yet Be Purchased Under the Plans or Programs |

| January 1-31, 2016 | | 787,231 |

| | $ | 43.89 |

| | 787,231 |

| | 2,570,660 |

|

| February 1-29, 2016 | | 212,769 |

| | 45.88 |

| | 212,769 |

| | 22,357,891 |

|

| August 1-31, 2016 | | 889,700 |

| | 50.90 |

| | 889,700 |

| | 21,468,191 |

|

| September 1-30, 2016 | | 110,300 |

| | 52.34 |

| | 110,300 |

| | 21,357,891 |

|

| November 1-30, 2016 | | 1,000,000 |

| | 48.50 |

| | 1,000,000 |

| | 20,357,891 |

|

| | | | | | | | | |

| | | | | $ | 47.96 |

| | 3,000,000 |

| | 20,357,891 |

|

Our common stock is traded on the New York Stock Exchange under the symbol BMS. On December 31, 2016, there were 3,130 registered holders of record of our common stock. On February 4, 2016, our Board of Directors authorized an additional 20 million shares for repurchase. As of December 31, 2016, under authority granted by the Board of Directors, we have remaining authorization to repurchase an additional 20,357,891 shares of our common stock.

Dividends paid and the high and low common stock prices per share were as follows:

|

| | | | | | | | | | | | | | | | |

| For the Quarterly Periods Ended: | | March 31 | | June 30 | | September 30 | | December 31 |

| | | | | | | | | |

| 2016 | | |

| | |

| | |

| | |

|

| Dividend paid per common share | | $ | 0.29 |

| | $ | 0.29 |

| | $ | 0.29 |

| | $ | 0.29 |

|

| Common stock price per share | | |

| | |

| | |

| | |

|

| High | | 54.19 |

| | 53.88 |

| | 53.32 |

| | 51.44 |

|

| Low | | 42.45 |

| | 47.28 |

| | 49.85 |

| | 47.22 |

|

| | | | | | | | | |

| 2015 | | |

| | |

| | |

| | |

|

| Dividend paid per common share | | 0.28 |

| | 0.28 |

| | 0.28 |

| | 0.28 |

|

| Common stock price per share | | |

| | |

| | |

| | |

|

| High | | 49.44 |

| | 47.65 |

| | 47.51 |

| | 47.59 |

|

| Low | | 43.74 |

| | 43.50 |

| | 38.91 |

| | 39.48 |

|

| | | | | | | | | |

| 2014 | | |

| | |

| | |

| | |

|

| Dividend paid per common share | | 0.27 |

| | 0.27 |

| | 0.27 |

| | 0.27 |

|

| Common stock price per share | | |

| | |

| | |

| | |

|

| High | | 40.99 |

| | 41.58 |

| | 41.02 |

| | 47.20 |

|

| Low | | 37.01 |

| | 39.13 |

| | 37.72 |

| | 34.34 |

|

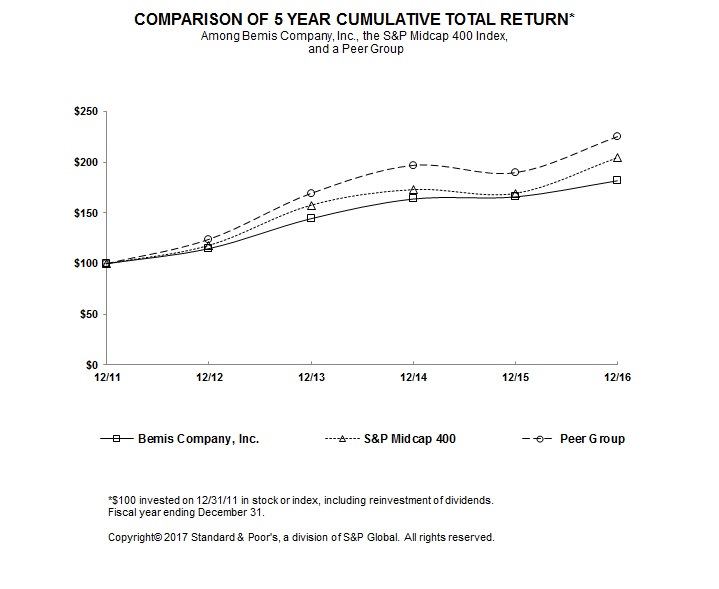

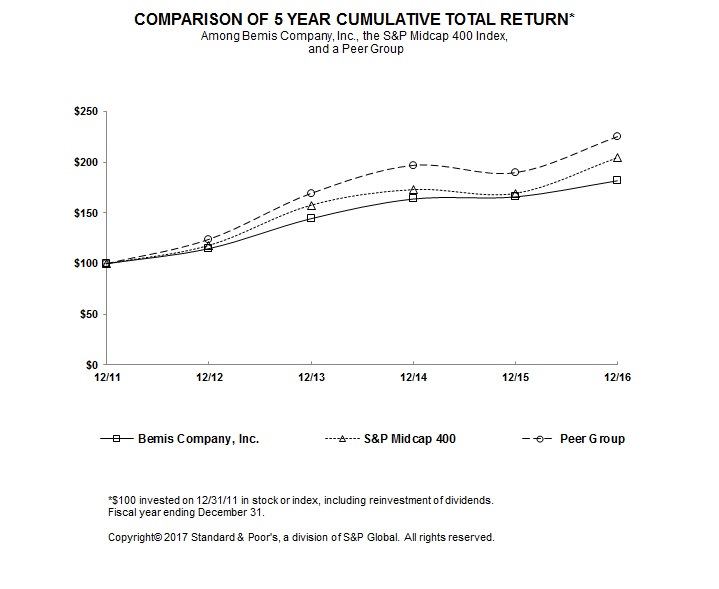

The graph below matches the cumulative 5-Year total return of holders of Bemis Company, Inc.'s common stock with the cumulative total returns of the S&P Midcap 400 index and a customized peer group of twenty one companies, which aligns with the Company's incentive compensation plans, that includes: Albemarle Corp, AptarGroup Inc., Ashland Global Holdings Inc., Avery Dennison Corporation, Ball Corporation, Berry Plastics Group Inc., Crown Holdings Inc., Graphic Packaging Holding Company, Greif Inc., Minerals Technologies Inc., Newmarket Corp, Owens-Illinois Inc., Packaging Corp. of America, Polyone Corp, RPM International Inc., Sealed Air Corporation, Sensient Technologies Corp, Silgan Holdings Inc., Sonoco Products Company, The Valspar Corporation and Westrock Co. The graph assumes that the value of the investment in our common stock, in each index, and in the peer group (including reinvestment of dividends) was $100 on 12/31/2011 and tracks it through 12/31/2016.

|

| | | | | | | | | | | | | | | | | | |

| | | 12/31/11 | | 12/31/12 | | 12/31/13 | | 12/31/14 | | 12/31/15 | | 12/31/16 |

| Bemis Company, Inc. | | 100.00 |

| | 114.83 |

| | 144.32 |

| | 163.68 |

| | 165.77 |

| | 181.62 |

|

| S&P Midcap 400 | | 100.00 |

| | 117.88 |

| | 157.37 |

| | 172.74 |

| | 168.98 |

| | 204.03 |

|

| Peer Group | | 100.00 |

| | 123.97 |

| | 169.27 |

| | 196.92 |

| | 189.73 |

| | 225.27 |

|

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

ITEM 6 — SELECTED FINANCIAL DATA

FIVE-YEAR CONSOLIDATED REVIEW

(dollars in millions, except per share amounts)

|

| | | | | | | | | | | | | | | | | | | | |

| Years Ended December 31, | | 2016 | | 2015 | | 2014 | | 2013 | | 2012 |

| Operating Data | | |

| | |

| | |

| | |

| | |

|

| Net sales | | $ | 4,004.4 |

| | $ | 4,071.4 |

| | $ | 4,343.5 |

| | $ | 4,476.6 |

| | $ | 4,583.6 |

|

| Income from continuing operations | | 236.2 |

| | 241.9 |

| | 239.1 |

| | 192.5 |

| | 148.9 |

|

| | | | | | | | | | | |

| Common Share Data | | |

| | |

| | |

| | |

| | |

|

| Basic earnings per share from continuing operations | | 2.51 |

| | 2.50 |

| | 2.39 |

| | 1.86 |

| | 1.43 |

|

| Diluted earnings per share from continuing operations | | 2.48 |

| | 2.47 |

| | 2.36 |

| | 1.85 |

| | 1.42 |

|

| Dividends per share | | 1.16 |

| | 1.12 |

| | 1.08 |

| | 1.04 |

| | 1.00 |

|

| Book value per share | | 13.59 |

| | 12.70 |

| | 14.59 |

| | 16.53 |

| | 15.88 |

|

| | | | | | | | | | | |

| Weighted-average shares outstanding for computation of diluted earnings per share | | 95.1 |

| | 97.9 |

| | 101.2 |

| | 104.0 |

| | 105.0 |

|

| Common shares outstanding at December 31, | | 92.7 |

| | 95.1 |

| | 98.2 |

| | 101.9 |

| | 103.3 |

|

| | | | | | | | | | | |

| Capital Structure and Other Data | | |

| | |

| | |

| | |

| | |

|

| Current ratio | | 2.0x |

| | 1.9x |

| | 2.7x |

| | 2.5x |

| | 2.4x |

|

| Working capital | | $ | 589.4 |

| | $ | 529.9 |

| | $ | 806.4 |

| | $ | 902.6 |

| | $ | 882.0 |

|

| Total assets | | 3,715.7 |

| | 3,489.8 |

| | 3,610.8 |

| | 4,105.6 |

| | 4,179.8 |

|

| Short-term debt | | 17.3 |

| | 35.4 |

| | 31.3 |

| | 14.9 |

| | 8.9 |

|

| Long-term debt | | 1,527.8 |

| | 1,353.9 |

| | 1,311.6 |

| | 1,416.8 |

| | 1,411.7 |

|

| Total equity | | 1,259.7 |

| | 1,207.4 |

| | 1,433.0 |

| | 1,684.8 |

| | 1,640.9 |

|

| Depreciation and amortization | | 162.1 |

| | 158.1 |

| | 180.6 |

| | 190.3 |

| | 204.3 |

|

| Capital expenditures | | 208.3 |

| | 219.4 |

| | 185.2 |

| | 139.8 |

| | 136.4 |

|

| | | | | | | | | | | |

| Number of common shareholders | | 3,130 |

| | 3,154 |

| | 3,284 |

| | 3,416 |

| | 3,481 |

|

| Number of employees | | 17,678 |

| | 17,696 |

| | 16,944 |

| | 19,106 |

| | 19,564 |

|

ITEM 7 — MANAGEMENT’S DISCUSSION AND ANALYSIS OFFINANCIAL CONDITION AND RESULTS OF OPERATIONS

Management’s Discussion and Analysis

Three Years Ended December 31, 2016

Management’s Discussion and Analysis should be read in conjunction with the Consolidated Financial Statements and related Notes included in Item 8 of this Annual Report on Form 10-K.

Three-year review of results

|

| | | | | | | | | | | | | | | | | | | | | |

| (dollars in millions) | | 2016 | | 2015 | | 2014 |

| Net sales | | $ | 4,004.4 |

| | 100.0 | % | | $ | 4,071.4 |

| | 100.0 | % | | $ | 4,343.5 |

| | 100.0 | % |

| Cost of products sold | | 3,138.2 |

| | 78.4 |

| | 3,198.0 |

| | 78.5 |

| | 3,484.4 |

| | 80.2 |

|

| Gross profit | | 866.2 |

| | 21.6 |

| | 873.4 |

| | 21.5 |

| | 859.1 |

| | 19.8 |

|

| | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | |

| Selling, general, and administrative expenses | | 392.2 |

| | 9.8 |

| | 420.0 |

| | 10.3 |

| | 416.6 |

| | 9.6 |

|

| Research and development | | 46.5 |

| | 1.2 |

| | 44.1 |

| | 1.1 |

| | 44.1 |

| | 1.0 |

|

| Restructuring and acquisition-related costs | | 28.6 |

| | 0.7 |

| | 12.1 |

| | 0.3 |

| | — |

| | — |

|

| Other operating income | | (10.4 | ) | | (0.3 | ) | | (12.4 | ) | | (0.3 | ) | | (9.3 | ) | | (0.2 | ) |

| Operating income | | 409.3 |

| | 10.2 |

| | 409.6 |

| | 10.1 |

| | 407.7 |

| | 9.4 |

|

| | | | | | | | | | | | | |

| Interest expense | | 60.2 |

| | 1.5 |

| | 51.7 |

| | 1.3 |

| | 60.8 |

| | 1.4 |

|

| Other non-operating income | | (1.8 | ) | | — |

| | (6.0 | ) | | (0.1 | ) | | (16.8 | ) | | (0.4 | ) |

| Income from continuing operations before income taxes | | 350.9 |

| | 8.8 |

| | 363.9 |

| | 8.9 |

| | 363.7 |

| | 8.4 |

|

| | | | | | | | | | | | | |

| Provision for income taxes | | 114.7 |

| | 2.9 |

| | 122.0 |

| | 3.0 |

| | 124.6 |

| | 2.9 |

|

| | | | | | | | | | | | | |

| Income from continuing operations | | 236.2 |

| | 5.9 |

| | 241.9 |

| | 5.9 |

| | 239.1 |

| | 5.5 |

|

| | | | | | | | | | | | | |

| Loss from discontinued operations | | — |

| | — |

| | (2.6 | ) | | (0.1 | ) | | (48.0 | ) | | (1.1 | ) |

| | | | | | | | | | | | | |

| Net income | | $ | 236.2 |

| | 5.9 | % | | $ | 239.3 |

| | 5.9 | % | | $ | 191.1 |

| | 4.4 | % |

| | | | | | | | | | | \ |

| | |

| Effective income tax rate | | |

| | 32.7 | % | | |

| | 33.5 | % | | |

| | 34.3 | % |

| | | | | | | | | | | | | |

| Diluted earnings per share from continuing operations | | $ | 2.48 |

| | | | $ | 2.47 |

| | | | $ | 2.36 |

| | |

Overview

Bemis Company, Inc. is a major supplier of flexible and rigid plastic packaging used by leading food, consumer products, healthcare, and other companies worldwide. Historically, about 80 percent of our total net sales are to customers in the food industry. Sales of our packaging products are widely diversified among food categories and can be found in nearly every aisle of the grocery store. Our emphasis on supplying packaging to the food industry has typically provided a more stable market environment for our U.S. Packaging and Global Packaging business segments.

Market Conditions

The markets into which our products are sold are highly competitive. Our leading market positions in packaging for perishable food and medical device products in many regions reflect our focus on value-added, proprietary products that provide food safety and sterility benefits. We also manufacture products for which our technical know-how and economies of scale offer us a competitive advantage. The primary raw materials for our business segments are polymer resins and films, paper, inks, adhesives, aluminum, and chemicals.

Sales by Geography and Category

|

| | | | | | | | | | | | |

Sales by Geographic Area (in millions) | | 2016 | | 2015 | | 2014 |

| United States | | $ | 2,820.3 |

| | $ | 2,937.8 |

| | $ | 3,040.8 |

|

| Brazil | | 483.5 |

| | 442.5 |

| | 581.5 |

|

| Other Americas | | 244.6 |

| | 273.5 |

| | 273.2 |

|

| Europe | | 263.5 |

| | 233.9 |

| | 258.8 |

|

| Asia-Pacific | | 192.5 |

| | 183.7 |

| | 189.2 |

|

| Total | | $ | 4,004.4 |

| | $ | 4,071.4 |

| | $ | 4,343.5 |

|

The categories specifically disclosed below include those that had historically benefited our profits most, due to their value-added features and functions. The introduction and success of our asset recapitalization program in recent years minimizes the usefulness of analyzing our business by these categories, as our asset recapitalization program allows us to expand margins in all areas of our business as we install new, efficient converting equipment.

The line items labeled "Other" below include a wide variety of packaging solutions for applications such as bakery goods, beverages, confectionery and snack foods, dry foods, frozen foods, lawn and garden products, and others. None of these categories within "Other" are greater than ten percent of the reportable segment's total sales.

|

| | | | | | | | | |

Sales by Category (proportion of sales) | | 2016 | | 2015 | | 2014 |

| U.S. Packaging | | | | | | |

| Meat & Cheese | | 35 | % | | 34 | % | | 33 | % |

| Dairy & Liquid | | 13 | % | | 13 | % | | 12 | % |

| Other | | 52 | % | | 53 | % | | 55 | % |

| Total | | 100 | % | | 100 | % | | 100 | % |

|

| | | | | | | | | |

| Global Packaging | | | | | | |

| Meat & Cheese | | 18 | % | | 19 | % | | 18 | % |

| Dairy & Liquid | | 12 | % | | 14 | % | | 14 | % |

| Healthcare (Medical Device & Pharmaceutical) | | 26 | % | | 26 | % | | 24 | % |

| Other | | 44 | % | | 41 | % | | 44 | % |

| Total | | 100 | % | | 100 | % | | 100 | % |

Sales within the listed categories did not significantly change. During 2015 and 2016, the success of our asset recapitalization program allowed us to pursue business across the breadth of our entire portfolio, in line with our strategy.

Restructuring

To improve efficiencies and reduce fixed costs, we initiated a restructuring program during the second quarter of 2016. As a part of this program, four Latin American facilities within the Global Packaging segment will be closed. Most of the production from these facilities will be transferred to other facilities. As of December 31, 2016, manufacturing operations have ceased at two of these four manufacturing facilities and the remaining closures are expected to be completed in 2017. We expect total project costs of approximately $28 to $30 million, with employee termination costs accounting for $15 to $16 million of the total and the balance in other restructuring costs which include fixed asset accelerated depreciation of approximately $3 million. Cost reductions from the program are expected to reach the full run rate of approximately $16 million annually during 2018. As the economic environment in Latin America continues to challenge consumers, as well as our customers in the region, this consolidation program, in part, helps us offset these headwinds and keeps us on track in achieving our long-term margin targets in the Global Packaging segment.

We recorded $21.6 million of charges associated with the restructuring program during the year ended December 31, 2016. These costs have been recorded on the consolidated statement of income as restructuring and acquisition-related costs. Cash payments in 2016 totaled $8.3 million. Cash payments in 2017 are expected to be approximately $15 million.

Discontinued Operations

On November 7, 2014, we completed the sale of our global Pressure Sensitive Materials business. Proceeds of the transaction totaled $150.5 million. Of the total proceeds, $136.9 was received in fiscal 2014 and $13.6 million was received in April 2015 which related to settlement of customary post-closing adjustments.

The Pressure Sensitive Materials business meets the criteria to be classified as a discontinued operation, which requires retrospective application to certain financial information for all periods presented. Amounts included in the consolidated statement of income have been recast to exclude Pressure Sensitive Materials amounts. The consolidated statement of cash flows for all periods includes both continuing and discontinued operations.

Loss from discontinued operations in 2015 resulted from additional impairment charges, net of tax, reflecting finalization of post-closing adjustments. Loss from discontinued operations in 2014 includes the operating results of the Pressure Sensitive Materials business, goodwill impairment charges, direct transaction costs associated with the divestiture, $25.0 million of plant closure costs associated with our Stow, Ohio facility ($0.16 per share after tax), and the associated income tax effects of these items. The pre-tax $44.7 million ($0.50 per share after tax) non-cash goodwill impairment charge is to reduce net assets held for sale to estimated fair value, less costs to sell.

Acquisitions and Other Divestitures

Acquisition of SteriPack Group

On April 29, 2016, we acquired the medical device packaging operations and related value-added services of SteriPack Group, a global manufacturer of sterile packaging solutions for medical device and pharmaceutical applications. This acquisition includes a facility in Ireland as well as packaging production assets in Malaysia and the U.S. These operations recorded annual net sales of approximately $65 million in fiscal 2015. The cash purchase price was $115.5 million.

Acquisition of Emplal Participacoes S.A.

On December 1, 2015, we acquired the rigid plastic packaging operations of Emplal Participações S.A. ("Emplal"), a privately-owned Brazilian manufacturer of plastic packaging for food and consumer applications. The acquisition supports our growth strategy to expand in markets that fit our strengths and capabilities. The cash purchase price was $66.0 million.

Divestiture of Paper Packaging Division

On March 31, 2014, we completed the sale of our Paper Packaging Division. Annual net sales by this division were approximately $160 million. Net proceeds of the transaction totaled $78.7 million. A $9.3 million pre-tax gain on the sale was recorded as part of other non-operating income during 2014.

Results of Operations

Consolidated Overview — Continuing Operations

|

| | | | | | | | | | | | |

| (in millions, except per share amounts) | | 2016 | | 2015 | | 2014 |

| Net sales | | $ | 4,004.4 |

| | $ | 4,071.4 |

| | $ | 4,343.5 |

|

| Income from continuing operations | | 236.2 |

| | 241.9 |

| | 239.1 |

|

| Diluted earnings per share from continuing operations | | 2.48 |

| | 2.47 |

| | 2.36 |

|

2016 versus 2015

Net sales for the year ended December 31, 2016 decreased 1.6 percent from the same period of 2015. The impact of currency translation reduced net sales by 3.5 percent. The Emplal Participações S.A. and SteriPack acquisitions increased net sales by 2.4 percent in the current year.

Diluted earnings per share from continuing operations for the year ended December 31, 2016 were $2.48 compared to $2.47 reported in the same period of 2015. Results for 2016 included a $0.16 per share charge for restructuring costs related primarily to planned plant closures and related severance in Latin America. Results also included a $0.07 per share charge for acquisition-related costs comprised primarily of costs associated with the Emplal Participações S.A. and SteriPack acquisitions. These costs were recorded both in operating income and interest expense. A $0.02 per share gain on the sale of land and building was also recorded in 2016. The net impact of currency translation decreased operating profit during 2016 by approximately $0.06 of total Company earnings per share. Results for 2015 included a $0.05 charge from a healthcare packaging plant closure and a $0.03 charge for acquisition-related costs comprised of direct acquisition costs associated with the Emplal Participações S.A. acquisition and charges related to contingent liabilities associated with a prior acquisition.

2015 versus 2014

Net sales for the year ended December 31, 2015 decreased 6.3 percent from the same period of 2014. Currency translation reduced net sales by 6.2 percent. The divestiture of the Paper Packaging Division in 2014 reduced sales by 0.9 percent. The acquisition of Emplal Participações S.A. in 2015 increased net sales by 0.1 percent in 2015. The remaining 0.7 percent increase in net sales represents a net benefit of increased selling prices and sales mix partially offset by an approximate 1 percent net sales reduction from lower volume.

Diluted earnings per share from continuing operations for the year ended December 31, 2015 were $2.47 compared to $2.36 reported in the same period of 2014. Results for 2015 included a $0.05 charge from a healthcare packaging plant closure and a $0.03 charge for acquisition-related costs comprised of direct acquisition costs associated with the Emplal Participações S.A. acquisition and charges related to contingent liabilities associated with a prior acquisition. The net impact of currency translation decreased earnings per share during 2015 by approximately $0.16 of total Company earnings per share. Results for 2014 included a $0.06 gain on the sale of the Paper Packaging Division.

U.S. Packaging Business Segment

Our U.S. Packaging segment represents all food, consumer, and industrial products packaging-related manufacturing operations located in the United States. Our U.S. Packaging business segment provides packaging for a variety of applications used in packaging meat and cheese, dairy and liquids, confectionery and snack foods, frozen foods, lawn and garden products, health and hygiene products, beverages, bakery goods, and dry foods.

|

| | | | | | | | | | | | |

| (dollars in millions) | | 2016 | | 2015 | | 2014 |

| Net sales | | $ | 2,621.1 |

| | $ | 2,747.5 |

| | $ | 2,860.7 |

|

| Operating profit | | 400.0 |

| | 391.8 |

| | 375.8 |

|

| Operating profit as a percentage of net sales | | 15.3 | % | | 14.3 | % | | 13.1 | % |

2016 versus 2015

U.S. Packaging net sales of $2.6 billion for the full year 2016 represented a decrease of 4.6 percent compared to the same period of 2015. Compared to the prior year, unit volumes were up nearly one percent. The decrease in net sales was driven by the contractual pass through of lower raw material costs as well as the mix of products sold, which reflects the success of our asset recapitalization program.

Operating profit increased to $400.0 million for the full year 2016, or 15.3 percent of net sales, compared to $391.8 million, or 14.3 percent of net sales, in 2015. This margin increase primarily reflects continued operational improvements attributable to manufacturing efficiencies from our asset recapitalization program.

2015 versus 2014

U.S. Packaging net sales decreased 4.0 percent in the year ended December 31, 2015 compared to the same period of 2014. The first quarter 2014 divestiture of the Paper Packaging Division reduced sales by 1.3 percent. Excluding the impact of divestitures, net sales would have decreased by 2.7 percent. Unit volumes declined by approximately 2 percent for the full year. The remaining change in net sales was driven by the contractual pass through of lower raw material costs throughout the year, partially offset by favorable sales mix.

Operating profit increased to $391.8 million in 2015, or 14.3 percent of net sales, compared to $375.8 million, or 13.1 percent of net sales in 2014. This margin improvement reflects sales mix benefits, driven by our focus on innovation, as well as continued operational improvements, primarily attributable to our asset recapitalization program.

Global Packaging Business Segment

Our Global Packaging business segment includes all of our packaging-related manufacturing operations located outside of the United States as well as our global medical device and pharmaceutical packaging manufacturing operations. Our Global Packaging business segment provides packaging to a variety of applications used in packaging meat and cheese, dairy and liquids, confectionery and snack foods, frozen foods, lawn and garden products, health and hygiene products, beverages, medical and pharmaceutical products, bakery goods, and dry foods. In the fourth quarter of 2016, the table below was recasted to more clearly reflect that operating segment performance is evaluated based on operating profit before restructuring and acquisition-related costs.

|

| | | | | | | | | | | | |

| (dollars in millions) | | 2016 | | 2015 | | 2014 |

| Net sales | | $ | 1,383.3 |

| | $ | 1,323.9 |

| | $ | 1,482.8 |

|

| Operating profit | | 114.0 |

| | 116.5 |

| | 113.3 |

|

| Operating profit as a percentage of net sales | | 8.2 | % | | 8.8 | % | | 7.6 | % |

2016 versus 2015

Global Packaging net sales for the full year 2016 of $1.4 billion represent an increase of 4.5 percent compared to the same period in 2015. Currency translation reduced net sales by 10.7 percent. Acquisitions increased net sales by 7.3 percent. Excluding the impact of currency translation and acquisitions, net sales would have increased by 7.9 percent, primarily reflecting increased selling prices along with increased unit volumes of approximately 1 percent.