|

| |||

Delaware | 64-0500378 | |||

| (State or other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |||

39209-3409

| Title of each Class: | Name of exchange on which registered: | |||

Common Stock, $0.01 par value per share | The NASDAQ Global Select Market | |||

Yes ☒x No ☐

¨

Yes ☐¨ No ☒

x

Yes ☒x No ☐

¨

Yes ☒x No ☐

¨

Large accelerated filer | Accelerated filer | |

Non-accelerated filer (Do not check if a smaller reporting company) | Smaller reporting company | |

Emerging growth company ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨ | ||

Yes ☐¨ No ☒

x

$1,239,719,614.

1

TABLE OF CONTENTS

| Item | Page Number | ||

| 1. | |||

| 1A. | |||

| 1B. | |||

| 2. | |||

| 3. | |||

| 4. | |||

| 5. | |||

| 6. | |||

| 7. | |||

| 7A. | |||

| 8. | |||

| 9. | |||

| 9A. | |||

| 9B. | |||

| 10. | |||

| 11. | |||

| 12. | |||

| 13. | |||

| 14. | |||

| 15. | |||

|

|

| |

Item |

| Page Number | |

|

| ||

| Part I |

| |

|

| ||

| 3 | |||

1. | 3 | ||

1A. | 8 | ||

1B. | 13 | ||

2. | 13 | ||

3. | 13 | ||

4. | 15 | ||

|

|

| |

| Part II |

| |

|

|

| |

5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of |

| |

| 16 | ||

6. | 18 | ||

7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 | |

7A. | 34 | ||

8. | 35 | ||

9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 65 | |

9A. | 65 | ||

9B. | 67 | ||

|

|

| |

| Part III |

| |

|

|

| |

10. | 67 | ||

11. | 67 | ||

12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 67 | |

13. | Certain Relationships and Related Transactions, and Director Independence | 67 | |

14. | 68 | ||

|

|

| |

|

|

| |

| Part IV |

| |

|

|

| |

15. | 69 | ||

|

|

| |

| 72 | ||

2

PART I

We operate in a single segment. Our primary business

retailers.

3

market, and distribute private label specialty shell eggs to several customers.

eventually above pre-AI levels, with a younger, more productive hen population, along with reduced demand for egg products resulted in an oversupply of eggs, leading to decreased egg prices in fiscal 2017.

2018.

As a resultWe continue to upgrade and modify our facilities, and invest in new facilities, to meet changing demand as many food service customers, restaurant chains, and retailers have committed to exclusive offerings of our strategy, ourcage-free eggs over the next several years.

4

We continue to pursue opportunities to acquire companies engaged in the production and sale of shell eggs. We will continue to evaluate and selectively pursue acquisitions that will expand our shell egg production capabilities in existing markets and broaden our geographic reach. We have extensive experience identifying, valuing, executing, and integrating acquisitions and we intend to leverage that experience in the evaluation and execution of future acquisitions. We will seek to acquire regional shell egg businesses with significant market share and long-standing customer relationships. We believe enhancing our national presence will help us further strengthen our relationships with existing customers, many of whom have operations across the U.S.

5

Egg production activities are subject to risks inherent in the agriculture industry, such as weather conditions and disease. These risks are outside our control and could have a material adverse effect on our operations. The marketability of shell eggs is subject to risks such as possible changes in food consumption preferences and practices reflecting perceived health concerns.

6

Specialty Eggs.We produce specialty eggs such as Egg-Land’s Best®, Land O’ Lakes®, 4Grain®, and Farmhouse® branded eggs. Specialty eggs are intended to meet the demands of consumers who are sensitive to environmental, health and/or animal welfare issues. Specialty shell eggs are becoming a more significant segment of the shell egg market. During our fiscal 2016 an increasing number of large restaurant chains, food service companies and grocery chains, including our largest customers, announced goals to transition to a cage-free egg supply chain by specified future dates. For fiscal 2015,2017, specialty eggs accounted for 27.2%43.6% of our shell egg dollar sales and 19.8%22.9% of our shell egg dozens sold, as compared to 24.3%29.1% of shell egg dollar sales and 17.2%22.9% of shell egg dozens sold in fiscal 2014.2016. Additionally, specialty eggs sold through our co-pack arrangements accounted for an additional 2.8%3.1% of shell egg dollar sales and 1.6% of shell egg dozens sold in fiscal 2017, compared with 2.7% of shell egg dollar sales and 2.0% of shell egg dozens sold in fiscal 2015, compared with 3.8% of shell egg dollar sales and 2.7% of shell egg dozens sold in fiscal 2014.2016. We produce and process Egg-Land’s Best® and Land O’ Lakes®branded eggs under license from EB at our facilities under EB guidelines. The product is marketed to our established base of customers at premium prices compared to non-specialty shell eggs. Egg-Land’s Best® branded eggs accounted for approximately 15.5%23.2% of our shell egg dollar sales in fiscal 2015,2017, compared to 14.4%16.8% in fiscal 2014.2016. Based on dozens sold, Egg-Land’s Best® branded eggs accounted for 11.4%12.5% of dozens sold for fiscal 2015,2017, compared to 10.1%13.6% in fiscal 2014.2016. Land O’ Lakes® branded eggs are produced by hens that are fed a whole grain diet, with nofree of animal fat and no animal by-products. Farmhouse® brand eggs are produced at our facilities by cage freecage-free hens that are provided with a diet of all grain, vegetarian feed. OurWe market organic, wholesome, cage-free, vegetarian, and omega-3 eggs under our 4Grain® 4-Grain® brand, which consists of both caged and cage freecage-free eggs. Farmhouse®, Land O’ Lakes®, 4Grain® and other non-Egg-Land’s Best® specialty eggs accounted for 11.7%20.4% of our shell egg dollar sales in fiscal 2015,2017, compared to 9.9%12.3% in fiscal 2014,2016, and 8.4%10.4% of dozens sold for fiscal 2015,2017, compared to 7.1%9.3% for fiscal 2014.2016.

In addition, rules are often proposed that, if adopted as proposed, could increase our costs. For example, in April 2016 the USDA Agricultural Marketing Service proposed rules that, if adopted, will change requirements, and increase our costs to produce organic eggs. As of July 2017, the proposed rules have not become effective.

7

Employees. As of May 30, 2015,June 3, 2017, we had 2,8723,578 employees, of whom 2,1902,976 worked in egg production, processing and marketing, 175178 worked in feed mill operations and 422424 were administrative employees, including our executive officers. Approximately 4.3%3.9% of our personnel are part-time. None of our employees are covered by a collective bargaining agreement. We consider our relations with employees to be good.

under pressure and do not expect to see meaningful improvement until there is a better balance of supply and demand.

8

A decline in consumer demand for shell eggs can negatively impact our business.

| will identify suitable acquisition candidates; |

| can consummate acquisitions on acceptable terms; |

| can successfully integrate an acquired business into our operations; or |

| can successfully manage the operations of an acquired business. |

9

The consideration we pay in connection with any acquisition also affects our financial results. If we pay cash, we could be required to use a portion of our available cash to consummate the acquisition. To the extent we issue shares of our Common Stock, existing stockholders may be diluted. In addition, acquisitions may result in the incurrence of debt.

In addition, rules are often proposed that, if adopted as proposed, could increase our costs. For example, in April 2016 the USDA Agricultural Marketing Service proposed rules that, if adopted, would change requirements, and increase our costs to produce organic eggs. As of July 2017, the proposed rules have not become effective.

10

Beginning inFrom April ofthrough June 2015, our industry has experienced a significant avian influenza outbreak, primarily in the upper Midwestern United States. At the time of this filing, basedU.S. Based on several published industry estimates, we believe that approximately 13%12% of the national flock of laying hens has beenwas affected. The affected laying hens havewere either been destroyed by the disease or euthanized. The effect this outbreak has had on our industry and our company is discussed throughout this filing.report. There have been no positive tests for avian influenza at any of our locations, and we arelocations. We have significantly increasingincreased the biosecurity measures at all of our facilities,facilities; however we cannot be certain that our flocks will not be affected.

affected by AI or other diseases in the future.

11

The Adams family intendsand Baker families intend to retain ownership of a sufficient amount of Common Stock and Class A Common Stock to assure its continued ownership of over 50% of the combined voting power of our outstanding shares of capital stock. Such ownership will make an unsolicited acquisition of the Company more difficult and discourage certain types of transactions involving a change of control of our Company, including transactions in which the holders of Common Stock might otherwise receive a premium for their shares over then current market prices. In addition, certain provisions of our Certificate of Incorporation require that our Class A Common Stock be issued only to Fred R. Adams, Jr. and members of his immediate family, and if shares of our Class A Common Stock, by operation of law or otherwise, are deemed not to be owned by Mr. Adams or a member of his immediate family, the voting power of any such shares shall be automatically reduced to one vote per share. The Adams family’sand Baker families’ controlling ownership of our capital stock may adversely affect the market price of our Common Stock.

12

The efficient operation of our business depends on our information technology systems. We rely on our information technology systems to effectively manage our business data, communications, logistics, accounting and other business processes. If we do not allocate and effectively manage the resources necessary to build and sustain an appropriate technology environment, our business or financial results could be negatively impacted. In addition, our information technology systems may be vulnerable to damage or interruption from circumstances beyond our control, including systems failures, viruses, ransomware, security breaches or cyber incidents such as intentional cyber-attacks aimed at theft of sensitive data or inadvertent cyber-security compromises.

13

Egg Antitrust Litigation

Since September 25, 2008, the Company has been named as one of several defendants in numerous antitrust cases involving the United States shell egg industry. In some of these cases, the named plaintiffs allege that they purchased eggs or egg products directly from a defendant and have sued on behalf of themselves and a putative class of others who claim to be similarly situated. In other cases, the named plaintiffs allege that they purchased shell eggs and egg products directly from one or more of the defendants but sue only for their own alleged damages and not on behalf of a putative class. In the remaining cases, the named plaintiffs are individuals or companies who allege that they purchased shell eggs indirectly from one or more of the defendants - that is, they purchased from retailers that had previously purchased from defendants or other parties – and have sued on behalf of themselves and a putative class of others who claim to be similarly situated.

The Judicial Panel on Multidistrict Litigation consolidated all of the putative class actions (as well as certain other cases in which the Company was not a named defendant) for pretrial proceedings in the United States District Court for the Eastern District of Pennsylvania. The Pennsylvania court has organized the putative class actions around two groups (direct purchasers and indirect purchasers) and has named interim lead counsel for the named plaintiffs in each group.

The Direct Purchaser Putative Class Action. The direct purchaser putative class cases were consolidated into In re: Processed Egg Products Antitrust Litigation, No. 2:08-md-02002-GP, in the United States District Court for the Eastern District of Pennsylvania. On November 25, 2014, after approving the parties’ settlement of the case, the Court entered final judgment dismissing all claims against the Company with prejudice and dismissing the Company from this direct purchaser class action. On January 23, 2015, direct action plaintiffs Kraft Foods Global, Inc., General Mills, Inc., Nestle USA, Inc., and The Kellogg Company filed a motion either to exclude themselves from the settlement between the direct purchaser plaintiffs and the Company or to enlarge their time to opt-out of the settlement between the direct purchaser plaintiffs and the Company and modify the final judgment entered on November 25, 2014. On February 13, 2015, the Company filed its response in opposition. On July 1, 2015, the Court held an evidentiary hearing on this motion. The Court has not ruled on this motion.

The Indirect Purchaser Putative Class Action. The indirect purchaser putative class cases were consolidated into In re: Processed Egg Products Antitrust Litigation, No. 2:08-md-02002-GP, in the United States District Court for the Eastern District of Pennsylvania. The court granted with prejudice the defendants’ renewed motion to dismiss damages claims arising outside the limitations period applicable to most causes of action. On April 20-21, 2015, the Court held an evidentiary hearing on the indirect purchaser plaintiffs’ motion for class certification. The Court has not ruled on that motion. On July 2, 2015, the Company filed and joined several motions for summary judgment that sought either dismissal of the entire case or, in the alternative, dismissal of portions of the case. On July 2, 2015, the indirect purchaser plaintiffs filed motions for summary judgment seeking dismissal of certain affirmative defenses based on statutory immunities from federal and state antitrust laws. Briefing on the parties’ respective motions for summary judgment will continue over the next two months, and the Court has not indicated when it will rule on these motions.

The Non-Class Cases. Six of the cases in which plaintiffs do not seek to certify a class have been consolidated with the putative class actions into In re: Processed Egg Products Antitrust Litigation, No. 2:08-md-02002-GP, in the United States District Court for the Eastern District of Pennsylvania. The court granted with prejudice the defendants’ renewed motion to dismiss the non-class plaintiffs’ claims for damages arising before September 24, 2004. The parties have completed nearly all fact discovery related to these cases. On July 2, 2015, the Company filed and joined several motions for summary judgment that sought either dismissal of all of the claims in all of these cases or, in the alternative, dismissal of portions of these cases. On July 2, 2015, the non-class plaintiffs filed a motion for summary judgment seeking dismissal of certain affirmative defenses based on statutory immunities from federal antitrust law. Briefing on the parties’ respective motions for summary judgment will continue over the next two months, and the Court has not indicated when it will rule on these motions.

Allegations in Each Case. In all of the cases described above, the plaintiffs allege that the Company and certain other large domestic egg producers conspired to reduce the domestic supply of eggs in a concerted effort to raise the price of eggs to artificially high levels. In each case, plaintiffs allege that all defendants agreed to reduce the domestic supply of eggs by: (a) agreeing to limit production; (b) manipulating egg exports; and (c) implementing industry-wide animal welfare guidelines that reduced the number of hens and eggs.

The named plaintiffs in the remaining indirect purchaser putative class action seek treble damages and injunctive relief on behalf of themselves and all other putative class members in the United States. Although plaintiffs allege a class period starting on January 1, 2000 and running “through the present,” the Court ruled that the plaintiffs cannot recover damages allegedly incurred outside the state-specific statute of limitations period applicable to most causes of action asserted, with the precise damages period

14

determined on a state-by-state and claim-by-claim basis. The indirect purchaser putative class action seeks injunctive relief under the Sherman Act and damages under certain statutes and the common-law of various states.

Five of the original six non-class cases remain pending against the Company. In four of the remaining non-class cases, the plaintiffs seek damages and injunctive relief under the Sherman Act. In the other remaining non-class case, the plaintiff seeks damages and injunctive relief under the Sherman Act and the Ohio antitrust act (known as the Valentine Act).

The Pennsylvania court has entered a series of orders related to case management, discovery, class certification, and scheduling. The Pennsylvania court has not set a trial date for any of the Company’s remaining consolidated cases (non-class and indirect purchaser cases).

The Company intends to continue to defend the remaining cases as vigorously as possible based on defenses which the Company believes are meritorious and provable. While management believes that the likelihood of a material adverse outcome in the overall egg antitrust litigation has been significantly reduced as a result of the settlements described above, there is still a reasonable possibility of a material adverse outcome in the remaining egg antitrust litigation. At the present time, however, it is not possible to estimate the amount of monetary exposure, if any, to the Company because of these cases. Accordingly, adjustments, if any, which might result from the resolution of these remaining legal matters, have not been reflected in the financial statements.

Florida Civil Investigative Demand

Environmental Information Request

In July 2011, the Company received an information request from the United States Environmental Protection Agency (“EPA”) pursuant to Section 308 of the Clean Water Act (“Act”). The Request stated that the information was sought by the EPA to investigate compliance with the Act and requested information pertaining to facilities involved in animal feeding operations, which are owned or operated by the Company or its affiliates. The Company timely responded to the Request by providing information on each of the subject facilities. The EPA subsequently sent a notice of noncompliance to the Company dated March 29, 2012 related only to the Company’s Edwards, Mississippi facility. The Company previously announced a settlement with the EPA and the Mississippi Department of Environmental Quality related to the notice, and a Consent Decree memorializing the settlement was entered on June 30, 2015 in the United States of America and State of Mississippi, by and through the Mississippi Commission on Environmental Quality v. Cal-Maine Foods, Inc. Civil Action No. 3:15-cv-00278-HTW-LRA, in the U.S. District Court for the Southern District of Mississippi, Northern Division. The terms and conditions of the settlement related only to the Edwards, Mississippi facility and are not expected to have a material impact to the Company’s results of operations. Management believes the risk of material loss related to non-settled matters relating to the 2011 notice to be remote.

Miscellaneous

15

ISSUER PURCHASES OF EQUITY SECURITIES

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

| Sales Price |

|

|

| ||||||||

Fiscal Year Ended | Fiscal Quarter |

| High |

| Low |

|

| Dividends (1) | ||||||

|

|

|

|

|

|

|

|

|

|

| ||||

May 31, 2014 | First Quarter |

| $ | 25.94 |

| $ | 22.35 |

| $ | 0.034 | ||||

| Second Quarter |

|

| 27.48 |

|

| 22.92 |

|

| 0.181 | ||||

| Third Quarter |

|

| 30.31 |

|

| 24.71 |

|

| 0.296 | ||||

| Fourth Quarter |

|

| 34.88 |

|

| 27.74 |

|

| 0.217 | ||||

|

|

|

|

|

|

|

|

|

|

| ||||

May 30, 2015 | First Quarter |

| $ | 39.65 |

| $ | 34.58 |

| $ | 0.191 | ||||

| Second Quarter |

|

| 47.98 |

|

| 39.86 |

|

| 0.252 | ||||

| Third Quarter |

|

| 44.18 |

|

| 34.94 |

|

| 0.350 | ||||

| Fourth Quarter |

|

| 59.86 |

|

| 35.86 |

|

| 0.317 | ||||

| Sales Price | ||||||||||||||

| Fiscal Year Ended | Fiscal Quarter | High | Low | Dividends (1) | ||||||||||

| May 28, 2016 | First Quarter | $ | 57.94 | $ | 44.13 | $ | 0.983 | |||||||

| Second Quarter | 63.25 | 50.27 | 0.751 | |||||||||||

| Third Quarter | 56.50 | 44.94 | 0.441 | |||||||||||

| Fourth Quarter | 55.43 | 44.65 | — | |||||||||||

| June 3, 2017 | First Quarter | $ | 45.75 | $ | 40.11 | $ | — | |||||||

| Second Quarter | 46.15 | 36.50 | — | |||||||||||

| Third Quarter | 45.45 | 37.95 | — | |||||||||||

| Fourth Quarter | 41.25 | 36.35 | — | |||||||||||

| (1) | Represents dividends paid with respect to such quarter, after the end of the quarter. See “Dividends” below. |

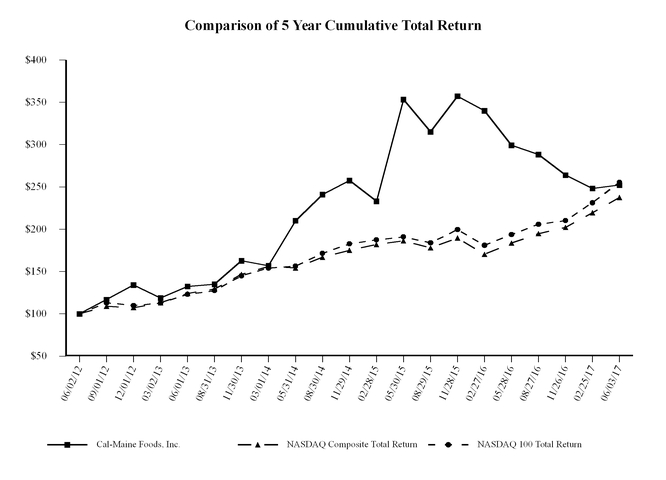

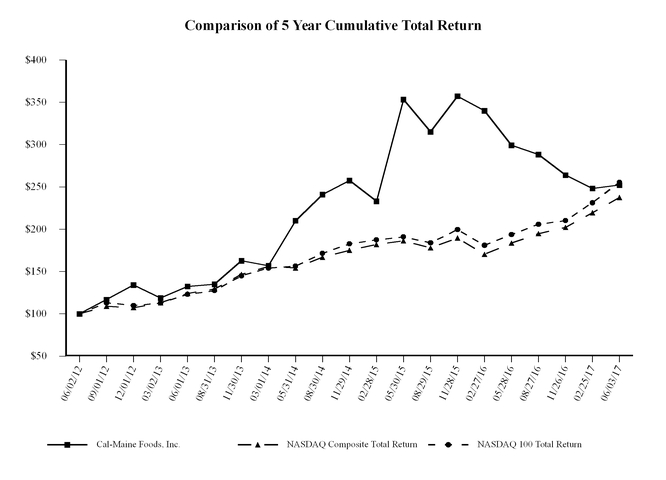

stock or index. Each date plotted indicates the last day of a fiscal quarter.

16

Recent Sales of Unregistered Securities

June 3, 2017.

Equity Compensation Plan Information | |||||||||||||||

| (a) |

| (b) | (c) | |||||||||||

| Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a) | |||||||||||||

Equity compensation plans approved by shareholders |

| — |

| — | 503,242 | ||||||||||

Equity compensation plans not approved by shareholders |

| — |

|

| — | ||||||||||

Total |

| — |

| — | 503,242 | ||||||||||

| (a) | There were no outstanding options, warrants or rights as of |

| (b) | There were no outstanding options, warrants or rights as of |

| (c) | Shares available for future issuance as of |

17

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fiscal Years Ended | |||||||||

|

|

| May 30 |

| May 31 |

| June 1 |

| June 02 |

| May 28 |

|

|

| 2015 |

| 2014 * |

| 2013 + |

| 2012 |

| 2011 |

|

|

| 52 wks |

| 52 wks |

| 52 wks |

| 53 wks |

| 52 wks |

Statement of Operations Data (in thousands, except per shares data) |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

| $ | 1,576,128 | $ | 1,440,907 | $ | 1,288,104 | $ | 1,113,116 | $ | 941,981 |

Cost of sales |

|

| 1,180,407 |

| 1,138,143 |

| 1,073,555 |

| 911,334 |

| 757,050 |

Gross profit |

|

| 395,721 |

| 302,764 |

| 214,549 |

| 201,782 |

| 184,931 |

Selling, general and administrative |

|

| 160,386 |

| 156,712 |

| 126,956 |

| 113,130 |

| 101,448 |

Legal settlement expense |

|

| - |

| - |

| 28,000 |

| - |

| - |

Operating income |

|

| 235,335 |

| 146,052 |

| 59,593 |

| 88,652 |

| 83,483 |

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net of interest income |

|

| (515) |

| (2,656) |

| (3,906) |

| (3,758) |

| (6,022) |

Loss on early extinguishment of debt |

|

| - |

| - |

| - |

| - |

| (2,648) |

Equity in income of affiliates |

|

| 2,657 |

| 3,512 |

| 3,480 |

| 7,495 |

| 4,701 |

Gain on sale of investment in Eggland’s Best® |

|

| - |

| - |

| - |

| - |

| 4,829 |

Distribution from Eggland’s Best® |

|

| - |

| - |

| - |

| 38,343 |

| - |

Patronage dividends |

|

| 6,893 |

| 6,139 |

| 14,300 |

| 6,607 |

| 4,885 |

Other, net |

|

| 2,179 |

| 8,795 |

| 2,101 |

| 1,738 |

| 2,443 |

Total other income |

|

| 11,214 |

| 15,790 |

| 15,975 |

| 50,425 |

| 8,188 |

Income before income tax and noncontrolling interest |

|

| 246,549 |

| 161,842 |

| 75,568 |

| 139,077 |

| 91,671 |

Income tax expense |

|

| 84,268 |

| 52,035 |

| 24,807 |

| 49,110 |

| 33,403 |

Net income including noncontrolling interest |

|

| 162,281 |

| 109,807 |

| 50,761 |

| 89,967 |

| 58,268 |

Less: Net income (loss) attributable to noncontrolling interest |

|

| 1,027 |

| 600 |

| 338 |

| 232 |

| (2,571) |

Net income attributable to Cal-Maine Foods, Inc. |

| $ | 161,254 | $ | 109,207 | $ | 50,423 | $ | 89,735 | $ | 60,839 |

Net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

| $ | 3.35 | $ | 2.27 | $ | 1.05 | $ | 1.88 | $ | 1.28 |

Diluted |

| $ | 3.33 | $ | 2.26 | $ | 1.05 | $ | 1.88 | $ | 1.27 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends per common share |

| $ | 1.11 | $ | 0.73 | $ | 0.38 | $ | 0.63 | $ | 0.43 |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

| 48,136 |

| 48,095 |

| 47,967 |

| 47,750 |

| 47,710 |

Diluted |

|

| 48,437 |

| 48,297 |

| 48,088 |

| 47,884 |

| 47,884 |

Balance Sheet Data (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

Working capital |

| $ | 377,027 | $ | 324,292 | $ | 284,686 | $ | 301,546 | $ | 247,559 |

Total assets |

|

| 928,653 |

| 811,661 |

| 745,627 |

| 726,316 |

| 640,843 |

Total debt (including current maturities) |

|

| 50,860 |

| 61,093 |

| 65,020 |

| 76,220 |

| 88,161 |

Total stockholders’ equity |

|

| 704,562 |

| 594,745 |

| 518,044 |

| 479,328 |

| 418,877 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating Data: |

|

|

|

|

|

|

|

|

|

|

|

Total number of layers at period-end (thousands) |

|

| 33,696 |

| 32,372 |

| 30,967 |

| 26,174 |

| 26,819 |

Total shell eggs sold (millions of dozens) |

|

| 1,063.1 |

| 1,013.7 |

| 948.5 |

| 884.3 |

| 821.4 |

* Results for fiscal 2014 include the results of operations (subsequent to acquisition) of our joint venture partner’s 50% interest in Delta Egg Farm, LLC, which was consolidated with our operations as of March 1, 2014. Prior to March 1, 2014, our equity in earnings in Delta Egg Farm, LLC are included in Equity in income of affiliates.

+ Results for fiscal 2013 include the results of operations (subsequent to acquisition) of the commercial egg assets acquired from Pilgrim’s Pride Corporation, which were consolidated with our operations as of August 10, 2012, and the commercial egg assets from Maxim Production Co., Inc., which were consolidated with our operations as of November 15, 2012.

18

| Fiscal Years Ended | ||||||||||||||||||||

| Statement of Operations Data (in thousands, except per share data) | June 3, 2017 ^ | May 28, 2016 | May 30, 2015 | May 31, 2014 * | June 1, 2013 † | |||||||||||||||

| 53 wks | 52 wks | 52 wks | 52 wks | 52 wks | ||||||||||||||||

| Net sales | $ | 1,074,513 | $ | 1,908,650 | $ | 1,576,128 | $ | 1,440,907 | $ | 1,288,104 | ||||||||||

| Cost of sales | 1,028,963 | 1,260,576 | 1,180,407 | 1,138,143 | 1,073,555 | |||||||||||||||

| Gross profit | 45,550 | 648,074 | 395,721 | 302,764 | 214,549 | |||||||||||||||

| Selling, general and administrative | 173,980 | 177,760 | 160,386 | 156,712 | 126,956 | |||||||||||||||

| Loss (gain) on disposal of fixed assets | 3,664 | (1,563 | ) | 568 | 651 | 1,496 | ||||||||||||||

| Legal settlement expense | — | — | — | — | 28,000 | |||||||||||||||

| Operating income (loss) | (132,094 | ) | 471,877 | 234,767 | 145,401 | 58,097 | ||||||||||||||

| Other income (expense): | ||||||||||||||||||||

| Interest income (expense), net | 2,785 | 3,158 | (515 | ) | (2,656 | ) | (3,906 | ) | ||||||||||||

| Equity in income of affiliates | 1,390 | 5,016 | 2,657 | 3,512 | 3,480 | |||||||||||||||

| Patronage dividends | 7,665 | 6,930 | 6,893 | 6,139 | 14,300 | |||||||||||||||

| Other, net | 5,960 | 268 | 2,747 | 9,446 | 3,597 | |||||||||||||||

| Total other income | 17,800 | 15,372 | 11,782 | 16,441 | 17,471 | |||||||||||||||

| Income (loss) before income tax and noncontrolling interest | (114,294 | ) | 487,249 | 246,549 | 161,842 | 75,568 | ||||||||||||||

| Income tax expense (benefit) | (39,867 | ) | 169,202 | 84,268 | 52,035 | 24,807 | ||||||||||||||

| Net income (loss) including noncontrolling interest | (74,427 | ) | 318,047 | 162,281 | 109,807 | 50,761 | ||||||||||||||

| Less: Net income (loss) attributable to noncontrolling interest | (149 | ) | 2,006 | 1,027 | 600 | 338 | ||||||||||||||

| Net income (loss) attributable to Cal-Maine Foods, Inc. | $ | (74,278 | ) | $ | 316,041 | $ | 161,254 | $ | 109,207 | $ | 50,423 | |||||||||

| Net income (loss) per common share: | ||||||||||||||||||||

| Basic | $ | (1.54 | ) | $ | 6.56 | $ | 3.35 | $ | 2.27 | $ | 1.05 | |||||||||

| Diluted | $ | (1.54 | ) | $ | 6.53 | $ | 3.33 | $ | 2.26 | $ | 1.05 | |||||||||

| Cash dividends per common share | $ | — | $ | 2.18 | $ | 1.11 | $ | 0.73 | $ | 0.38 | ||||||||||

| Weighted average shares outstanding: | ||||||||||||||||||||

| Basic | 48,362 | 48,195 | 48,136 | 48,095 | 47,967 | |||||||||||||||

| Diluted | 48,362 | 48,365 | 48,437 | 48,297 | 48,088 | |||||||||||||||

| Balance Sheet Data (in thousands) | ||||||||||||||||||||

| Working capital | $ | 371,527 | $ | 542,832 | $ | 407,418 | $ | 354,743 | $ | 304,681 | ||||||||||

| Total assets | 1,033,094 | 1,111,765 | 928,653 | 811,661 | 745,627 | |||||||||||||||

| Total debt (including current maturities) | 10,939 | 25,570 | 50,860 | 61,093 | 65,020 | |||||||||||||||

| Total stockholders’ equity | 844,493 | 917,361 | 704,562 | 594,745 | 518,044 | |||||||||||||||

Operating Data: | ||||||||||||||||||||

| Total number of layers at period-end (thousands) | 36,086 | 33,922 | 33,696 | 32,372 | 30,967 | |||||||||||||||

| Total shell eggs sold (millions of dozens) | 1,031.1 | 1,053.6 | 1,063.1 | 1,013.7 | 948.5 | |||||||||||||||

| ^ | Results for fiscal 2017 include the results of operations (subsequent to acquisition) of the commerical egg assets acquired from Foodonics International, Inc., which were consolidated with our operations as of October 16, 2016, and the commercial egg assets of Happy Hen Egg Farms, Inc., which were consolidated with our operations as of February 19, 2017. |

| * | Results for fiscal 2014 include the results of operations (subsequent to acquisition) of our joint venture partner’s 50% interest in Delta Egg Farm, LLC, which was consolidated with our operations as of March 1, 2014. Prior to March 1, 2014, our equity in earnings in Delta Egg Farm, LLC are included in Equity in income of affiliates. |

| † | Results for fiscal 2013 include the results of operations (subsequent to acquisition) of the commercial egg assets acquired from Pilgrim’s Pride Corporation, which were consolidated with our operations as of August 10, 2012, and the commercial egg assets from Maxim Production Co., Inc., which were consolidated with our operations as of November 15, 2012. |

Beginning in

Additionally, there continues to be uncertainty in the industry surrounding the implementation of California’s Proposition 2 and Assembly Bill 1437, which relate to egg production standards, including minimum cage space, for eggs sold in that state. This legislation was effective January 1, 2015. During January 2015, egg prices increased sharply and subsequently moderated. Currently, egg prices in California reflect a premium to other regions that is higher than historical levels. It is anticipated that future California pricesfarms will be higher than other regions of the countryenvironments that are cage-free or with equipment that can easily be converted to reflect the higher cost of production relatedcage-free, based on a timeline to the California standards. These new rules could impact future sales in California, and could also affect national egg production and supply, thereby increasing or decreasing prices throughout the country. meet our customer’s needs.

19

For fiscal 2015,2017, we produced approximately 75%84% of the total number of shell eggs sold by us, with approximately 6%8% of such shell egg production provided by contract producers. Contract producers utilize their facilities to produce shell eggs from layers owned by us. We own the shell eggs produced under these arrangements. For fiscal 2015,2017, approximately 25%16% of the total number of shell eggs sold by us waswere purchased from outside producers for resale.

ingredients in fiscal 2018.

Georgia, Alabama, and Florida. The acquisition of our joint venture partner’s 50%Company acquired Foodonics' interest in DeltaAmerican Egg Farm,Products, LLC (“Delta Egg”("AEP") and the purchasesEggland's Best franchise with licensing rights for certain markets in Alabama, Florida, and Georgia as well as Puerto Rico, Bahamas and Cuba. The Company now owns 100% of AEP. The acquired operations of Foodonics are included in the accompanying financial statements as of October 16, 2016.

February 19, 2017. The Company closed this acquisition on March 3, 2017.

|

|

|

|

|

|

|

|

|

| May 30, 2015 |

|

| May 31, 2014 |

|

| June 1, 2013 |

|

|

|

|

|

|

|

|

|

|

Net sales | 100.0 | % |

| 100.0 | % |

| 100.0 | % |

Cost of sales | 74.9 |

|

| 79.0 |

|

| 83.3 |

|

Gross profit | 25.1 |

|

| 21.0 |

|

| 16.7 |

|

Selling, general & administrative expenses | 10.2 |

|

| 10.9 |

|

| 9.9 |

|

Legal settlement expense | - |

|

| - |

|

| 2.2 |

|

Operating income | 14.9 |

|

| 10.1 |

|

| 4.6 |

|

Other income | 0.7 |

|

| 1.1 |

|

| 1.2 |

|

Income before taxes | 15.6 |

|

| 11.2 |

|

| 5.8 |

|

Income tax expense | 5.3 |

|

| 3.6 |

|

| 1.9 |

|

Net income including noncontrolling interests | 10.3 |

|

| 7.6 |

|

| 3.9 |

|

Less: Net income (loss) attributable to noncontrolling interests | 0.1 |

|

| 0.0 |

|

| 0.0 |

|

Net income attributable to Cal-Maine Foods, Inc. | 10.2 | % |

| 7.6 | % |

| 3.9 | % |

20

| June 3, 2017 | May 28, 2016 | May 30, 2015 | |||||||

| Net sales | 100.0 | % | 100.0 | % | 100.0 | % | |||

| Cost of sales | 95.8 | % | 66.0 | % | 74.9 | % | |||

| Gross profit | 4.2 | % | 34.0 | % | 25.1 | % | |||

| Selling, general and administrative | 16.2 | % | 9.3 | % | 10.2 | % | |||

| Loss (gain) on disposal of fixed assets | 0.3 | % | (0.1 | )% | — | % | |||

| Operating income (loss) | (12.3 | )% | 24.8 | % | 14.9 | % | |||

| Other income | 1.7 | % | 0.8 | % | 0.7 | % | |||

| Income (loss) before income taxes and noncontrolling interest | (10.6 | )% | 25.6 | % | 15.6 | % | |||

| Income tax expense (benefit) | (3.7 | )% | 8.9 | % | 5.3 | % | |||

| Net income (loss) including noncontrolling interest | (6.9 | )% | 16.7 | % | 10.3 | % | |||

| Less: Net income (loss) attributable to noncontrolling interest | — | % | 0.1 | % | 0.1 | % | |||

| Net income (loss) attributable to Cal-Maine Foods, Inc. | (6.9 | )% | 16.6 | % | 10.2 | % | |||

|

|

|

|

|

|

|

Fiscal Year ended |

| May 30, 2015 |

| May 31, 2014 |

| June 1, 2013 |

|

|

|

|

|

|

|

Net income attributable to Cal-Maine Foods, Inc. - (in thousands) |

| $ 161,254 |

| $ 109,207 |

| $ 50,423 |

Gross profit (in thousands) |

| 395,721 |

| 302,764 |

| 214,549 |

Net average shell egg selling price (rounded) |

| 1.43 |

| 1.36 |

| 1.30 |

Average Urner Barry Spot Egg Market Quotations1 |

| 1.53 |

| 1.43 |

| 1.35 |

Feed cost per dozen produced |

| 0.439 |

| 0.493 |

| 0.540 |

|

|

|

|

|

|

|

| Fiscal Year ended | June 3, 2017 | May 28, 2016 | May 30, 2015 | |||||||||

| Net income (loss) attributable to Cal-Maine Foods, Inc. - (in thousands) | $ | (74,278 | ) | $ | 316,041 | $ | 161,254 | |||||

| Gross profit (in thousands) | 45,550 | 648,074 | 395,721 | |||||||||

| Net average shell egg selling price (rounded) | 1.01 | 1.74 | 1.43 | |||||||||

Average Urner Barry Spot Egg Market Quotations1 | 0.85 | 1.79 | 1.53 | |||||||||

| Feed cost per dozen produced | 0.399 | 0.414 | 0.439 | |||||||||

| 1- |

|

prices.

28, 2016

21

|

|

|

|

|

|

|

|

|

|

| Fiscal Years Ended |

| Quarters Ended | ||||

|

| (52 weeks) |

| (13 weeks) | ||||

|

| May 30, 2015 |

| May 31, 2014 |

| May 30, 2015 |

| May 31, 2014 |

|

| (Amounts in thousands) |

| (Amounts in thousands) | ||||

Total net sales |

| $ 1,576,128 |

| $ 1,440,907 |

| $ 403,011 |

| $ 371,582 |

|

|

|

|

|

|

|

|

|

Non-specialty shell egg sales |

| 1,059,070 |

| 990,073 |

| 268,625 |

| 252,869 |

Specialty shell egg sales |

| 416,127 |

| 337,243 |

| 110,696 |

| 90,632 |

Co-pack specialty shell egg sales |

| 43,282 |

| 52,786 |

| 10,278 |

| 13,950 |

Other |

| 11,769 |

| 7,590 |

| 2,710 |

| 1,759 |

Net shell egg sales |

| $ 1,530,248 |

| $ 1,387,692 |

| $ 392,309 |

| $ 359,210 |

|

|

|

|

|

|

|

|

|

Net shell egg sales as a percent of total net sales |

| 97% |

| 96% |

| 97% |

| 97% |

|

|

|

|

|

|

|

|

|

Non- specialty shell egg dozens sold |

| 830,770 |

| 812,031 |

| 204,138 |

| 195,555 |

Specialty shell egg dozens sold |

| 210,606 |

| 174,364 |

| 55,699 |

| 46,681 |

Co-pack specialty shell egg dozens sold |

| 21,710 |

| 27,301 |

| 5,046 |

| 7,203 |

Total dozens sold |

| 1,063,086 |

| 1,013,696 |

| 264,883 |

| 249,439 |

|

|

|

|

|

|

|

|

|

Net average selling price per dozen |

| $ 1.429 |

| $ 1.362 |

| $ 1.471 |

| $ 1.433 |

| Fiscal Years Ended | Quarters Ended | ||||||||||||||||||||||||||

| (53 weeks) | (52 weeks) | (14 weeks) | (13 Weeks) | ||||||||||||||||||||||||

| June 3, 2017 | May 28, 2016 | June 3, 2017 | May 28, 2016 | ||||||||||||||||||||||||

| (Amounts in thousands) | (Amounts in thousands) | ||||||||||||||||||||||||||

| Total net sales | $ | 1,074,513 | $ | 1,908,650 | $ | 274,584 | $ | 303,020 | |||||||||||||||||||

| Non-specialty shell egg sales | 548,858 | 52.3 | % | 1,243,377 | 67.7 | % | 145,454 | 54.3 | % | 163,882 | 55.6 | % | |||||||||||||||

| Specialty shell egg sales | 457,617 | 43.6 | % | 534,754 | 29.1 | % | 112,744 | 42.0 | % | 118,356 | 40.2 | % | |||||||||||||||

| Co-pack specialty shell egg sales | 32,689 | 3.1 | % | 49,282 | 2.7 | % | 7,198 | 2.7 | % | 9,021 | 3.1 | % | |||||||||||||||

| Other sales | 10,423 | 1.0 | % | 10,533 | 0.5 | % | 2,594 | 1.0 | % | 3,245 | 1.1 | % | |||||||||||||||

| Net shell egg sales | $ | 1,049,587 | 100.0 | % | $ | 1,837,946 | 100.0 | % | $ | 267,990 | 100.0 | % | $ | 294,504 | 100.0 | % | |||||||||||

| Net shell egg sales as a percent of total net sales | 98 | % | 96 | % | 98 | % | 97 | % | |||||||||||||||||||

| Dozens sold: | |||||||||||||||||||||||||||

| Non-specialty shell egg | 778,538 | 75.5 | % | 791,058 | 75.1 | % | 207,428 | 76.0 | % | 189,850 | 75.0 | % | |||||||||||||||

| Specialty shell egg | 236,067 | 22.9 | % | 241,603 | 22.9 | % | 61,862 | 22.7 | % | 58,856 | 23.3 | % | |||||||||||||||

| Co-pack specialty shell egg | 16,525 | 1.6 | % | 20,936 | 2.0 | % | 3,725 | 1.3 | % | 4,371 | 1.7 | % | |||||||||||||||

| Total dozens sold | 1,031,130 | 100.0 | % | 1,053,597 | 100.0 | % | 273,015 | 100.0 | % | 253,077 | 100.0 | % | |||||||||||||||

| Net average selling price per dozen: | |||||||||||||||||||||||||||

| All shell eggs | $ | 1.007 | $ | 1.735 | $ | 0.973 | $ | 1.152 | |||||||||||||||||||

| Non-specialty shell eggs | $ | 0.705 | $ | 1.572 | $ | 0.701 | $ | 0.863 | |||||||||||||||||||

| Specialty shell eggs | $ | 1.939 | $ | 2.213 | $ | 1.823 | $ | 2.011 | |||||||||||||||||||

2017 and 2016, respectively.

This effect was particularly evident in recent quarters as non-specialty egg prices declined more than specialty egg prices. However, as non-specialty egg prices declined, we experienced some margin and volume pressures on specialty egg sales.

28, 2016. Our net average selling price for specialty eggs was $1.823 per dozen for the fiscal 2017 fourth quarter compared to $2.011 per dozen for the fiscal 2016 fourth quarter.

22

consolidated subsidiaries wholly-owned subsidiary American Egg Products, LLC (“AEP”) and our consolidated subsidiary Texas Egg Products, LLC (“TEP”). For fiscal 2015 our2017 egg product sales were $45.4$24.9 million, an increasea decrease of $3.6$45.8 million, or 8.6%64.7%, compared to $41.8$70.7 million for fiscal 2014. Our2016. Egg products volume of egg products sold for fiscal 20152017 was 51.065.3 million pounds, an increase of 2.16.8 million pounds, or 4.3%11.6%, compared to 48.958.5 million pounds for fiscal 2014.2016. In fiscal 2017, the selling price per pound was $0.382 compared to $1.213 for fiscal 2016, a decrease of 68.5%. The increasesdecrease in sales volume and market prices for egg products in the current fiscal year wereis due to increased industryreduced demand for egg products drivenand extraordinarily high prices for the prior fiscal year which reflected the shortage of supply caused by the quick serve restaurant industry as well as export sales. In fiscal 2015, the price per pound of egg products sold was $0.891 compared to $0.855 for fiscal 2014, an increase of 4.2%.

AI.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fiscal Year Ended |

| Quarter Ended | ||||||||||||||

(Amounts in thousands) |

| May 30, 2015 |

| May 31, 2014 |

| Percent Change |

| May 30, 2015 |

| May 31, 2014 |

| Percent Change | ||||||

Cost of sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Farm production |

| $ | 558,580 |

| $ | 575,392 |

| (2.9) | % |

| $ | 138,580 |

| $ | 171,140 |

| (19.0) | % |

Processing and packaging |

|

| 173,181 |

|

| 156,088 |

| 11.0 | % |

|

| 45,056 |

|

| 41,983 |

| 7.3 | % |

Outside egg purchases and other |

|

| 413,863 |

|

| 371,885 |

| 11.3 | % |

|

| 101,029 |

|

| 57,336 |

| 76.2 | % |

Total shell eggs |

|

| 1,145,624 |

|

| 1,103,365 |

| 3.8 | % |

|

| 284,665 |

|

| 270,459 |

| 5.3 | % |

Egg products |

|

| 33,886 |

|

| 33,509 |

| 1.1 | % |

|

| 8,640 |

|

| 9,436 |

| (8.4) | % |

Other |

|

| 897 |

|

| 1,269 |

| (29.3) | % |

|

| 311 |

|

| 396 |

| (21.5) | % |

Total |

| $ | 1,180,407 |

| $ | 1,138,143 |

| 3.7 | % |

| $ | 293,616 |

| $ | 280,291 |

| 4.8 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Farm production cost (per dozen produced) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Feed |

| $ | 0.44 |

| $ | 0.49 |

| (10.2) | % |

| $ | 0.41 |

| $ | 0.48 |

| (14.6) | % |

Other |

|

| 0.26 |

|

| 0.25 |

| 4.0 | % |

|

| 0.27 |

|

| 0.26 |

| 3.8 | % |

Total |

| $ | 0.70 |

| $ | 0.74 |

| (5.4) | % |

| $ | 0.68 |

| $ | 0.74 |

| (8.1) | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outside egg purchases (average cost per dozen) |

| $ | 1.41 |

| $ | 1.37 |

| 2.9 | % |

| $ | 1.43 |

| $ | 1.44 |

| (0.7) | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dozen produced |

|

| 798,842 |

|

| 750,302 |

| 6.5 | % |

|

| 201,763 |

|

| 195,630 |

| 3.1 | % |

Dozen sold |

|

| 1,063,086 |

|

| 1,013,696 |

| 4.9 | % |

|

| 264,883 |

|

| 249,439 |

| 6.2 | % |

| Fiscal Year Ended | Quarter Ended | |||||||||||||||||||||

| (53 weeks) | (52 weeks) | (14 weeks) | (13 weeks) | |||||||||||||||||||

| (Amounts in thousands) | June 3, 2017 | May 28, 2016 | Percent Change | June 3, 2017 | May 28, 2016 | Percent Change | ||||||||||||||||

| Cost of sales: | ||||||||||||||||||||||

| Farm production | $ | 598,412 | $ | 562,521 | 6.4 | % | $ | 159,482 | $ | 135,187 | 18.0 | % | ||||||||||

| Processing and packaging | 202,225 | 184,586 | 9.6 | % | 54,896 | 45,089 | 21.8 | % | ||||||||||||||

| Outside egg purchases and other | 207,495 | 464,008 | (55.3 | )% | 41,663 | 75,311 | (44.7 | )% | ||||||||||||||

| Total shell eggs | 1,008,132 | 1,211,115 | (16.8 | )% | 256,041 | 255,587 | 0.2 | % | ||||||||||||||

| Egg products | 19,766 | 48,584 | (59.3 | )% | 6,075 | 6,473 | (6.1 | )% | ||||||||||||||

| Other | 1,065 | 877 | 21.4 | % | 462 | 280 | 65.0 | % | ||||||||||||||

| Total | $ | 1,028,963 | $ | 1,260,576 | (18.4 | )% | $ | 262,578 | $ | 262,340 | 0.1 | % | ||||||||||

| Farm production cost (per dozen produced) | ||||||||||||||||||||||

| Feed | $ | 0.399 | $ | 0.414 | (3.6 | )% | $ | 0.381 | $ | 0.396 | (3.8 | )% | ||||||||||

| Other | 0.294 | 0.279 | 5.4 | % | 0.298 | 0.290 | 2.8 | % | ||||||||||||||

| Total | $ | 0.693 | $ | 0.693 | — | % | $ | 0.679 | $ | 0.686 | (1.0 | )% | ||||||||||

| Outside egg purchases (average cost per dozen) | $ | 1.01 | $ | 1.72 | (41.3 | )% | $ | 0.90 | $ | 1.11 | (18.9 | )% | ||||||||||

| Dozen produced | 870,252 | 819,307 | 6.2 | % | 237,006 | 198,950 | 19.1 | % | ||||||||||||||

| Dozen sold | 1,031,130 | 1,053,597 | (2.1 | )% | 273,015 | 253,077 | 7.9 | % | ||||||||||||||

Costthe thirteen weeks ended May 28, 2016, cost of sales forincreased $238,000, or 0.1%, from $262.3 million in the thirteen-week period ended May 30, 2015 was $293.6fourth quarter of fiscal 2016, to $262.6 million an increase of $13.3 million, or 4.8%, compared to $280.3 million forin the thirteen-week period ended May 31, 2014.current period. Feed cost per dozen for the fourth quarter of fiscal 20152017 was $0.41,$0.381, compared to $0.48$0.396 for comparablethe same quarter of fiscal 2014 fourth quarter,2016, a decrease of 14.6%3.8%.

23

|

|

|

|

|

|

|

|

| Fiscal Years Ended | ||||

|

| 52 Weeks | ||||

(Amounts in thousands) |

| May 30, 2015 |

| May 31, 2014 |

| Change |

Stock compensation expense |

| $ 2,955 |

| $ 1,794 |

| $ 1,161 |

Specialty egg expense |

| 53,966 |

| 46,298 |

| 7,668 |

Payroll and overhead |

| 31,965 |

| 29,413 |

| 2,552 |

Other expenses |

| 24,501 |

| 36,161 |

| (11,660) |

Delivery expense |

| 46,999 |

| 43,046 |

| 3,953 |

Total |

| $ 160,386 |

| $ 156,712 |

| $ 3,674 |

| Fiscal Years Ended | |||||||||||||||

| 53 Weeks | 52 Weeks | ||||||||||||||

| (Amounts in thousands) | June 3, 2017 | May 28, 2016 | Change | Change | |||||||||||

| Specialty egg | $ | 56,522 | $ | 61,294 | $ | (4,772 | ) | (7.8 | )% | ||||||

| Delivery expense | 53,282 | 49,629 | 3,653 | 7.4 | % | ||||||||||

| Payroll and overhead | 35,101 | 39,149 | (4,048 | ) | (10.3 | )% | |||||||||

| Stock compensation | 3,427 | 3,018 | 409 | 13.6 | % | ||||||||||

| Other expenses | 25,648 | 24,670 | 978 | 4.0 | % | ||||||||||

| Total | $ | 173,980 | $ | 177,760 | $ | (3,780 | ) | (2.1 | )% | ||||||

|

|

|

|

|

|

|

|

| Quarters Ended | ||||

|

| 13 Weeks | ||||

(Amounts in thousands) |

| May 30, 2015 |

| May 31, 2014 |

| Change |

Stock compensation expense |

| $ 1,290 |

| $ 753 |

| $ 537 |

Specialty egg expense |

| 14,217 |

| 12,414 |

| 1,803 |

Payroll and overhead |

| 8,920 |

| 9,507 |

| (587) |

Other expenses |

| 6,679 |

| 9,499 |

| (2,820) |

Delivery expense |

| 11,738 |

| 11,590 |

| 148 |

Total |

| $ 42,844 |

| $ 43,763 |

| $ (919) |

Selling, general, and administrative

| Quarters Ended | |||||||||||||||

| 14 Weeks | 13 Weeks | ||||||||||||||

| (Amounts in thousands) | June 3, 2017 | May 28, 2016 | Change | Change | |||||||||||

| Specialty egg | $ | 14,364 | $ | 13,768 | $ | 596 | 4.3 | % | |||||||

| Delivery expense | 13,712 | 11,945 | 1,767 | 14.8 | % | ||||||||||

| Payroll and overhead | 11,156 | 9,450 | 1,706 | 18.1 | % | ||||||||||

| Stock compensation | 947 | 843 | 104 | 12.3 | % | ||||||||||

| Other expenses | 7,816 | 6,398 | 1,418 | 22.2 | % | ||||||||||

| Total | $ | 47,995 | $ | 42,404 | $ | 5,591 | 13.2 | % | |||||||

Payroll and overhead increased $1.7 million, or 18.1%, compared to the same period of last year due to the Foodonics and Happy Hen acquisitions as well as the extra week in the fiscal 2017 fourth quarter, partially offset by reduced bonus accruals in 2017. Delivery expense increased $1.8 million for the fourteen weeks ended June 3, 2017 compared to the corresponding thirteen week period ended May 28, 2016, primarily due to the Foodonics acquisition. Other expenses for the fourteen weeks ended June 3, 2017 are up $1.4 million, or 22.2%, compared to the corresponding thirteen week period ended May 28, 2016, primarily due to an extra week in the current period, an increase in legal and audit fees in the current period, and the impact of the acquisitions.

(LOSS)

24

OTHER INCOME (EXPENSE)

Other2016.

applicable fees, was $5.5 million.

Other itemsfourth quarter of fiscal 2017.

2016.

2016.

On a comparable basis, excluding the Acquisitions, net sales for fiscal 2014 were $1,277.8 million, an increase of $90.7 million, or 7.6%, compared to net sales of $1,187.1 for fiscal 2013. Dozens sold for fiscal 2014, excluding the Acquisitions, were 884.4 million, an increase of 18.4 million, or 2.1% as compared to 866.0 million for fiscal 2013.

25