CANADIAN PACIFIC RAILWAYKANSAS CITY LIMITED

FORM 10-K

TABLE OF CONTENTS

| PART I | Page | ||||||||

| Item 1. | Business | ||||||||

| Item 1A. | |||||||||

| Item | |||||||||

| Item | |||||||||

| Item 2. | Properties | ||||||||

| Item 3. | Legal Proceedings | ||||||||

| Item 4. | Mine Safety Disclosures | ||||||||

| Information about our Executive Officers | |||||||||

| PART II | |||||||||

| Item 5. | Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities | ||||||||

| Item 6. | |||||||||

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | ||||||||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | ||||||||

| Item 8. | Financial Statements and Supplementary Data | ||||||||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | ||||||||

| Item 9A. | Controls and Procedures | ||||||||

| Item 9B. | Other Information | ||||||||

Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | ||||||||

| PART III | |||||||||

| Item 10. | Directors, Executive Officers and Corporate Governance | ||||||||

| Item 11. | Executive Compensation | ||||||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | ||||||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | ||||||||

| Item 14. | Principal Accounting Fees and Services | ||||||||

| PART IV | |||||||||

| Item 15. | Exhibits, Financial Statement Schedule | ||||||||

| Item 16. | |||||||||

| Signatures | |||||||||

PART I

CPKC 2023 ANNUAL REPORT / 3

ITEM 1. BUSINESS

Company Overview

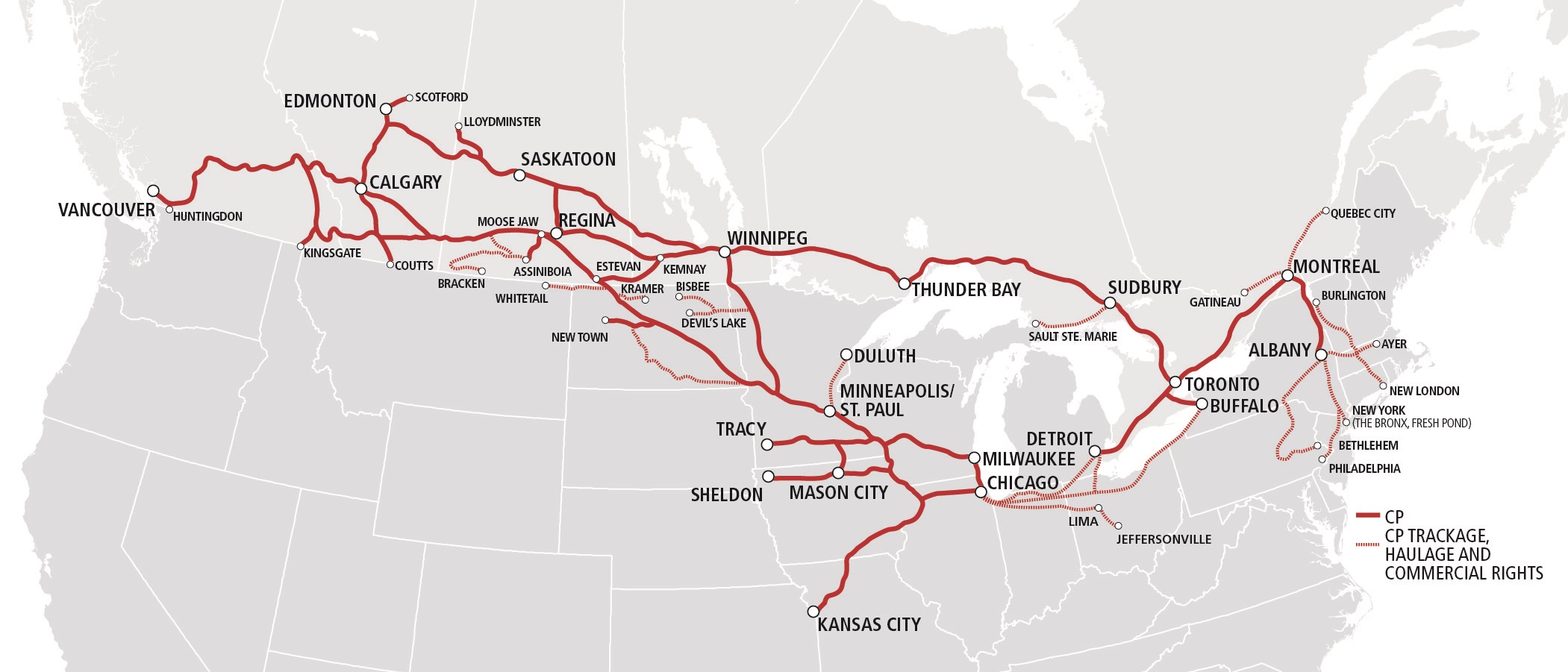

On April 14, 2023, Canadian Pacific Railway Limited (“CPRL”CPRL" or "CP") assumed control of Kansas City Southern ("KCS") (through an indirect wholly-owned subsidiary), together with its subsidiaries (“CP” or the “Company”and filed articles of amendment to change CPRL's name to Canadian Pacific Kansas City Limited ("CPKC"),. CPKC owns and operates a transcontinentalthe only freight railway inspanning Canada, and the United States (“("U.S.”"). CP's diverse, and Mexico. CPKC provides rail and intermodal transportation services over a network of approximately 20,000 miles, serving principal business mix includescentres across Canada, the U.S., and Mexico. CPKC transports bulk commodities, merchandise freight, and intermodal traffic over a network of approximately 12,500 miles, serving the principal business centres of Canada from Montreal, Quebec, to Vancouver, British Columbia ("B.C."), and the U.S. Northeast and Midwest regions. Agreements with other carriers extend the Company's market reach east of Montreal in Canada, through the U.S. and into Mexico.traffic. For additional information regarding CP'sCPKC's network and geographical locations, refer to Item 2. Properties.

For purposes of this annual report, unless the context indicates otherwise, all references herein to “CP,”“CPKC”, “the Company,” “we,”Company”, “we”, “our” and “us” refer to CPRL,Canadian Pacific Kansas City Limited and its subsidiaries, which includes KCS as a consolidated subsidiary on and from April 14, 2023. Prior to April 14, 2023, KCS was held as an equity investment accounted for by the equity method of accounting. For purposes of this annual report, unless the context indicates otherwise, all references herein to “legacy CP” refer to CPRL and its subsidiaries CPRLprior to April 14, 2023. For purposes of this annual report, unless the context indicates otherwise, all references herein to“legacy KCS” refer to KCS and one or more of its subsidiaries or one or more of CPRL's subsidiaries, as the context may require.prior to April 14, 2023. All references to currency amounts included in this annual report, including the Consolidated Financial Statements, are in Canadian dollars unless specifically noted otherwise.

Strategy

•Provide Service:Providing efficient and consistent transportation solutions for the Company’s customers. “Doing what we say we are going to do” is what drives the Company in providing a transformational journeyreliable product with a lower cost operating model. Centralized planning aligned with local execution is bringing the Company closer to become the best railroad incustomer and accelerating decision-making.

•Control Costs:Controlling and removing unnecessary costs from the organization, eliminating bureaucracy, and continuing to identify productivity enhancements are the keys to success.

•Optimize Assets:Through longer and heavier trains, and improved asset utilization, the Company is moving increased volumes with fewer locomotives and cars while unlocking capacity for future growth potential.

•Operate Safely:Each year, the Company safely moves millions of carloads of freight across North America while ensuring the safety of our people and the communities through which we operate. Safety is never to be compromised. The Company strives for continuous implementation of state-of-the-art safety technology, safety management systems, and safety culture with our employees to ensure safe, efficient operations across our network.

•Develop People: The Company recognizes that none of the other foundations can be achieved without its people. Every employee is a long-term strategy centredrailroader and the Company has established a culture focused on five key foundations:

As a Company, we remain focused on theour next level of service, productivity, service, and innovation to continue to generate sustainable value for our customers, employees, and deliver results for our shareholders.

Business Developments

4 / CPKC 2023 ANNUAL REPORT

Specific risk factors related to the KCS transaction are included in Part I, Item 1A. Risk Factors.

Other current business developments

In the fourth quarter of 2023, the Company was named to the S&P Global Dow Jones Sustainability World Index (“DJSI World”) and to the North American Index (“DJSI North America”). According to S&P Global, the DJSI North America tracks the performance of the top 20% of the largest 600 Canadian and United States companies in the U.S. for purposesS&P Global Broad Market Index that lead the field in terms of sustainability. The DJSI World tracks the performance of the Exchange Act astop 10% of the largest 2,500 companies in the S&P Global BMI that lead the field in terms of sustainability.

On June 28, 2023, CPKC, CSX Corporation ("CSX"), and Genesee & Wyoming Inc. ("G&W") announced that they have reached agreements which, when completed, will create a resultnew direct CPKC-CSX interchange connection in Alabama. As part of changesthe series of proposed transactions, CPKC and CSX will each acquire or operate portions of Meridian & Bigbee Railroad, L.L.C., a G&W-owned railway in Mississippi and Alabama, to the Company's Board, as evaluated at June 30, 2017. Although asestablish a foreign private issuer CP is no longer required to do so, the Company currently continues to file annual reports on the Form 10-K, quarterly reports on Form 10-Q,new freight corridor for shippers that connects Mexico and current reports on Form 8-KTexas with the SEC instead of filing the reporting forms available to foreign private issuers. The Company prepares and files a management proxy circular and related material under Canadian requirements.

Operations

The Company operates in only one operating segment: rail transportation. Although the Company provides a breakdown of revenue by business line, the overall financial and operational performance of the Company is analyzed as one segment due to the integrated nature of the rail network. Additional information regarding the Company's business and operations, including revenue and financial information, and information by geographic location is presented in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and Item 8. Financial Statements and Supplementary Data, Note 2528 Segmented and geographic information.

Lines of Business

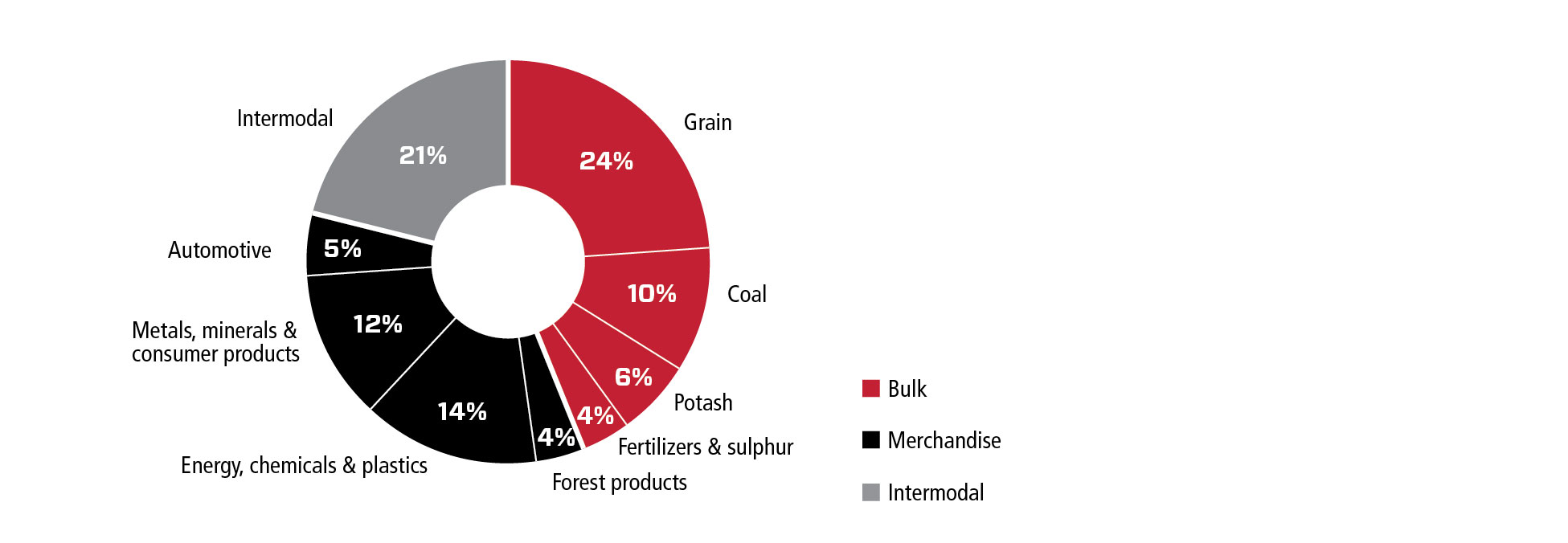

The Company transports freight consisting of bulk commodities, merchandise, freight and intermodal traffic. Bulk commodities, which typically move in large volumes across long distances, include Grain, Coal, Potash, and Fertilizers and sulphur. Merchandise freight consists of industrial and consumer products, such as energy,Forest products, Energy, chemicals and plastics, Metals, minerals and consumer products, Automotive and Forest products.Automotive. Intermodal traffic consists largely of retail goods in overseas containers that can be transported by train, ship and truck, and in domestic containers and trailers that can be moved by train and truck.

The following chart shows the Company's freight revenue by each line of business in 2017:

| 2023 Freight Revenues | ||||||||

CPKC 2023 ANNUAL REPORT / 5

BULK

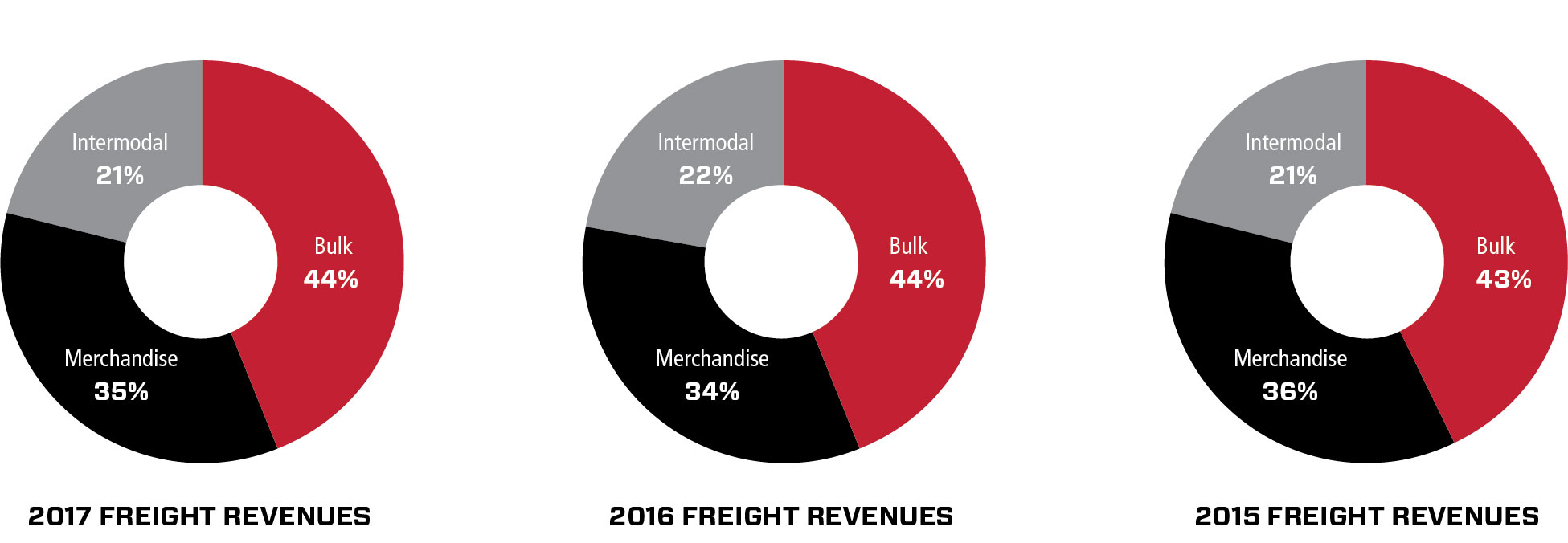

The Company’sCompany's Bulk business represented approximately 44%35% of total freightFreight revenues in 2017.2023.

Bulk includes the Grain, Coal, Potash, and Fertilizer and sulphur lines of business. Bulk traffic predominantly moves in unit train service moving from one origin to one destination by a single train without reclassification. The following charts comparechart shows the percentage of the Company's Bulk freight revenues by commodityline of business in 2017, 2016 and 2015:2023:

| 2023 Bulk Revenues | ||||||||

| (35% of Freight Revenues) | ||||||||

Grain

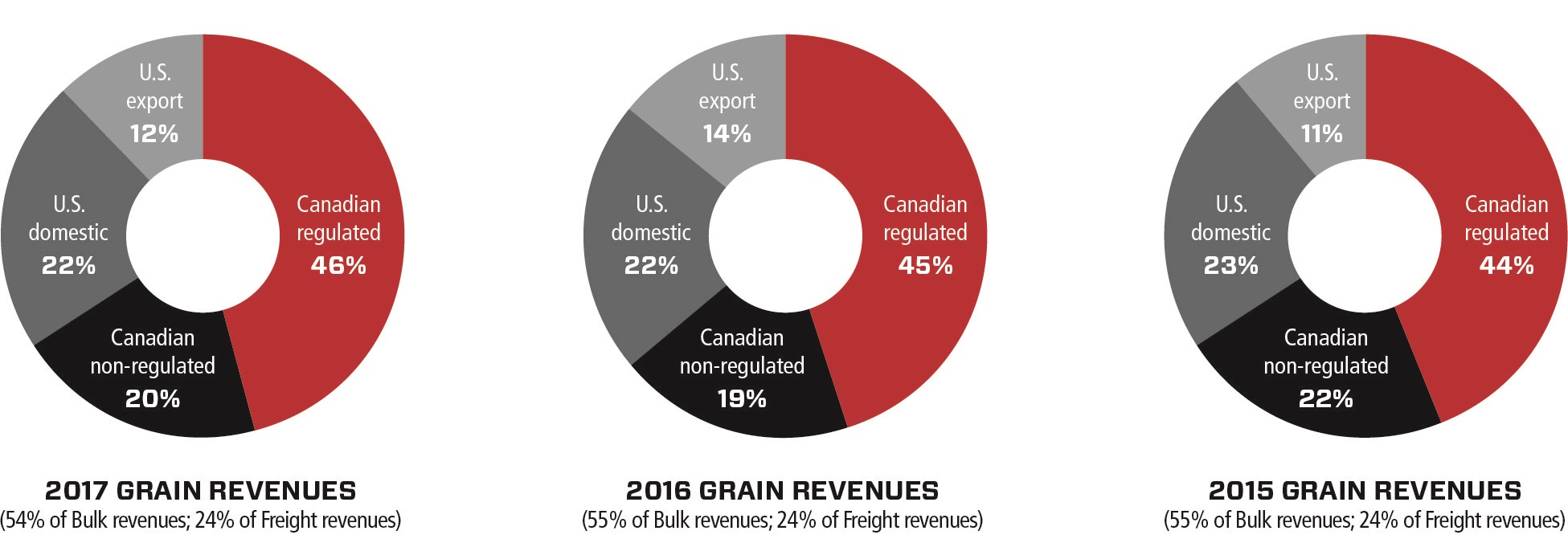

The Company’s grainGrain business represented approximately 54%58% of Bulk revenues which is 24%and 20% of total freightFreight revenues in 2017.2023.

The following charts compare the percentage of the Company's Grain freight revenues generated from Canadian and U.S. shipments in 2017, 2016 and 2015:

The following chart shows the percentage of the Company's Grain freight revenues generated from Canadian and U.S. shipments in 2023:

Canadian grain transported by CPthe Company consists of both whole grains, such as wheat, canola, durum, soybeanscanola, and pulses, andas well as processed products such as meals, oils and malt.meals. This business is centred in the Canadian Prairies (Alberta, Saskatchewan(Saskatchewan, Manitoba, and Manitoba)Alberta), with grain shipped primarily west to the Port of Vancouver, British Columbia and east to the Port of Thunder Bay, Ontario for export. Grain is also shipped to the U.S., to and eastern Canada and to Mexico for domestic consumption.

Canadian grain includes a division of business that is regulated by the Canadian government through the Canada Transportation Act (“CTA” (the “CTA”). This regulated business is subject to a maximum revenue entitlement (“MRE”). Under this regulation, railroadsthe CTA, railways can set their own rates for individual movements. However, the MRE governs aggregate revenue earned by the railroadrailway based on a formula that factors in the total volumes, length of haul, average revenue per ton, and inflationary adjustments. The regulation applies to western Canadian export grain shipments to the ports of Vancouver and Thunder Bay.

6 / CPKC 2023 ANNUAL REPORT

U.S. grain transported by CPthe Company consists of both whole grains, such as corn, wheat, durum, corn and soybeans, andas well as processed products such as meals, oilsfeed, and flour.oils. This business is centred in the states of Minnesota, North Dakota, South Dakota,U.S. Northern Plains and Iowa. Grain destined for domestic consumption moves east via Chicago, to the U.S. Northeast or is interchanged with other carriersMidwest. The Company moves U.S. grain to the U.S. Pacific Northwest and U.S. Southeast. In partnership with other railroads, CP also moves grain tofacilities in Mexico, export terminals in the U.S. Pacific Northwest, and to various other destinations across the Gulf of Mexico. Export grain traffic is shipped to ports at SuperiorU.S. and Duluth.Canada for domestic consumption.

Coal

The Company’s Coal business represented approximately 22%20% of Bulk revenues which is 10%and 7% of total freightFreight revenues in 2017.2023.

The following charts comparechart shows the percentage of the Company's Coal freight revenues generated from Canadianmetallurgical and U.S. shipmentsthermal coal in 2017, 2016 and 2015:2023:

In the U.S., CPthe Company moves primarily thermal coal from connecting railways, serving the thermal coal fields in the Powder River Basin in Montana and Wyoming, which is delivered to power-generating facilities in the U.S. Gulf Coast and the U.S. Midwest.

Potash

The Company's Potash business represented approximately 15%13% of Bulk revenues which is 6%and 5% of total freightFreight revenues in 2017.2023.

The Company’s Potash traffic moves mainly from Saskatchewan to offshore markets through the portsPort of Vancouver, B.C.,the Port of Portland, Oregon, and Thunder Bay, andthe U.S. Gulf Coast, as well as to domestic markets in the U.S.U.S Midwest. All potash shipments for export beyond Canada and the U.S. are marketed by Canpotex Limited a joint venture among Saskatchewan’s potash producers,or K+S Potash Canada. Canpotex is an export company owned equally by Nutrien Ltd. and The Mosaic Company. Independently, The Mosaic Company, Nutrien Ltd., and K+S Potash Canada. Independently, these producersCanada move domestic potash with CPthe Company primarily to the U.S. Midwest and eastern Canada for local application.

Fertilizers and Sulphur

The Company's Fertilizers and sulphur business represented approximately 9% of Bulk revenues which is 4%and 3% of total freightFreight revenues in 2017.2023.

The following charts compare the percentage of the Company's Fertilizers and sulphur freight revenues generated from wet fertilizers,Company’s fertilizer traffic includes dry fertilizers, and sulphur transportation in 2017, 2016 and 2015:

Most sulphur is produced in Alberta as a byproduct of processing sour natural gas, refining crude oil and upgrading bitumen produced in the Alberta oil sands.gas activity. Sulphur is a raw material used primarily in the manufacturing of sulphuric acid, which is used most extensively

in the production of phosphate fertilizers. Sulphuric acid is also a key ingredient in industrial processes ranging from smelting and nickel leaching to paper production.

CPKC 2023 ANNUAL REPORT / 7

MERCHANDISE

The Company’s Merchandise business represented approximately 35%45% of total freightFreight revenues in 2017.2023.

Merchandise products move in trains ofboth mixed freight and unit trains in a variety of car types. Service involves delivering products to many different customers and destinations. In addition to traditional rail service, CPthe Company moves merchandise traffic through a network of truck-rail transload facilities, expanding the reach of CP'sthe Company's network to non-rail served facilities. The following chart shows the percentage of the Company's Merchandise freight revenue by line of business in 2023:

| 2023 Merchandise Revenues | ||||||||

| (45% of Freight Revenues) | ||||||||

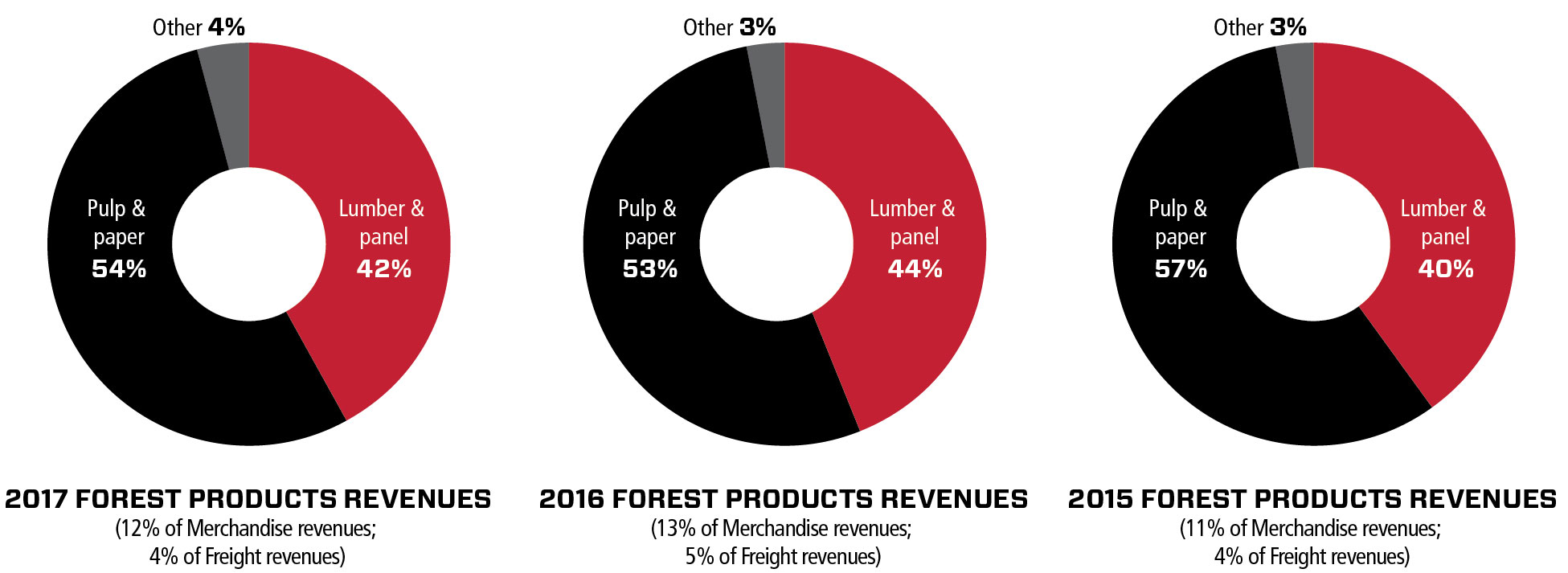

Forest Products

The Company’s Forest products business represented approximately 12% of Merchandise revenues which is 4%and 5% of total freightFreight revenues in 2017.2023.

Forest products traffic primarily includes pulp and paper andas well as lumber and panel products shipped from key producing areas in the U.S. Gulf Coast, B.C., northern Alberta, northern Saskatchewan,the U.S. Southeast, Ontario, and QuebecAlberta to destinations throughout North America.America including the U.S. Midwest, Mexico, the U.S. Southeast, the U.S. Gulf Coast, and the U.S. Northeast.

Energy, Chemicals and Plastics

The Company’s Energy, chemicals and plastics business represented approximately 41%42% of Merchandise revenues which is 14%and 19% of total freightFreight revenues in 2017.2023.

The following charts compare the percentage of the Company's Energy, chemicals and plastics freight revenues generated from petroleumCompany moves energy products biofuels, crude, chemicals and plastics shipments in 2017, 2016 and 2015:

The Company’s chemical traffic includes products such as ethylene glycol, caustic soda, methanol, sulphuric acid, styrenesoda ash, and soda ash.other chemical products. These shipments mainly originate from Alberta,the U.S. Gulf Coast, western Canada, and the U.S. Midwest the Gulf of Mexico and eastern Canada, and move to end markets in the U.S., Mexico, Canada, and overseas.

The most commonly shipped plastics products are polyethylene and polypropylene. The majority of the Company’s plastics traffic originates from the U.S. Gulf Coast and overseas.Alberta and moves to various North American destinations.

Coast. The most commonly shipped plastics products are polyethylene and polypropylene. Almost halfmajority of the Company’s plastics traffic originatescrude is now moving as DRUbitTM, a sustainable heavy crude oil specifically designed for rail transportation and produced using an innovative facility known as a Diluent Recovery Unit, which enables the removal of diluent at origin. This technology enables the safe and economical transportation of crude oil and is cost competitive with pipeline transportation. The Company transports DRUbitTM on a single line haul from the Hardisty Rail Terminal in central and northern Alberta and moves to various North American destinations.Port Arthur, Texas.

8 / CPKC 2023 ANNUAL REPORT

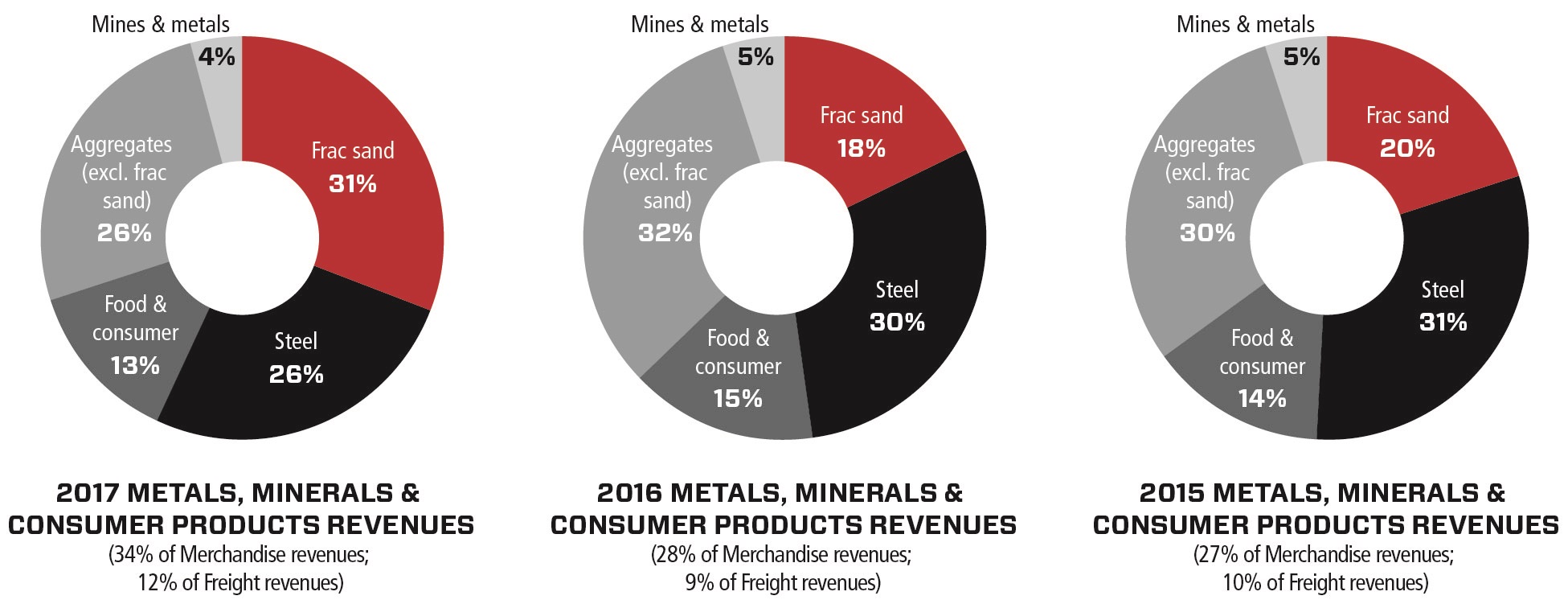

Metals, Minerals and Consumer Products

The Company’s Metals, minerals and consumer products business represented approximately 34%29% of Merchandise revenues which is 12%and 13% of total freightFreight revenues in 2017.2023.

The following charts compare the percentage of the Company's Metals, minerals and consumer products freight revenues are generated from steel, aggregates, (excluding frac sand), frac sand, steel, food and consumer products, and non-ferrous metals transportation in 2017, 2016 and 2015:

metals. Aggregate products include coarse particulate and composite materials such as frac sand, cement, sand and stone, clay gravel, limestonebentonite, and gypsum. Cement accounts for the majority of aggregate traffic and is shipped directly from production facilities in Alberta, Iowa and Ontario to energy and construction projects in North Dakota, Alberta, Manitoba and the U.S. Midwest.

The majority of frac sand originates at mines located along the Company’s network in Wisconsin and moves to Texas, the Bakken, Colorado, Ohio and other shale formations across North America.

The majority of frac sand originates at mines located along the Company's network in Wisconsin and Iowa and moves to the Bakken and Marcellus shale formations as well as other shale formations across North America.

Cement is shipped directly from production facilities in the U.S. Midwest, Alberta, Ontario, and Mexico to energy and construction projects in the U.S. Midwest, western Canada, Mexico, and western U.S.

Food, consumer, and consumerother products traffic consists of a diverse mix of goods, including railway equipment, food products, railway equipment, building materials and waste products.large domestic use appliances.

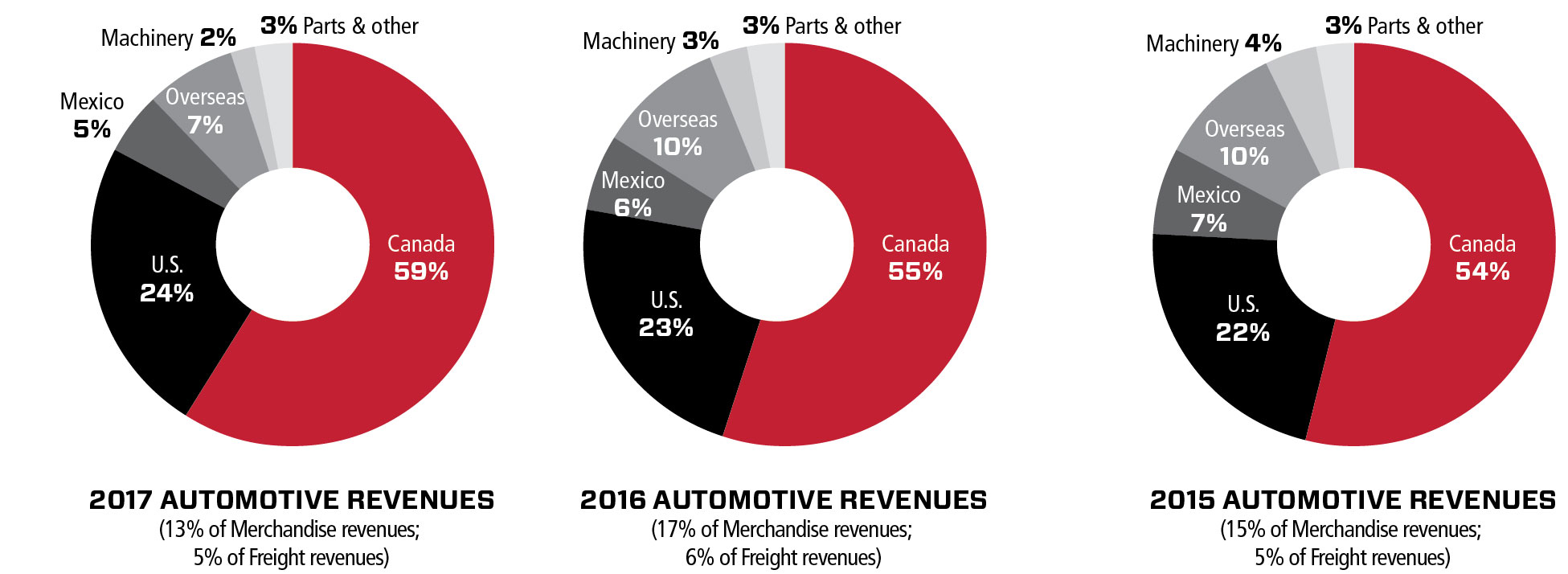

Automotive

The Company’s Automotive business represented approximately 13%17% of Merchandise revenues which is 5%and 8% of total freightFreight revenues in 2017.2023.

The following charts compare the percentage of the Company's Automotive freight revenues generated by movements of finished vehicles from Canadian, U.S., Mexican, and overseas origins, machinery, and parts and other in 2017, 2016 and 2015:

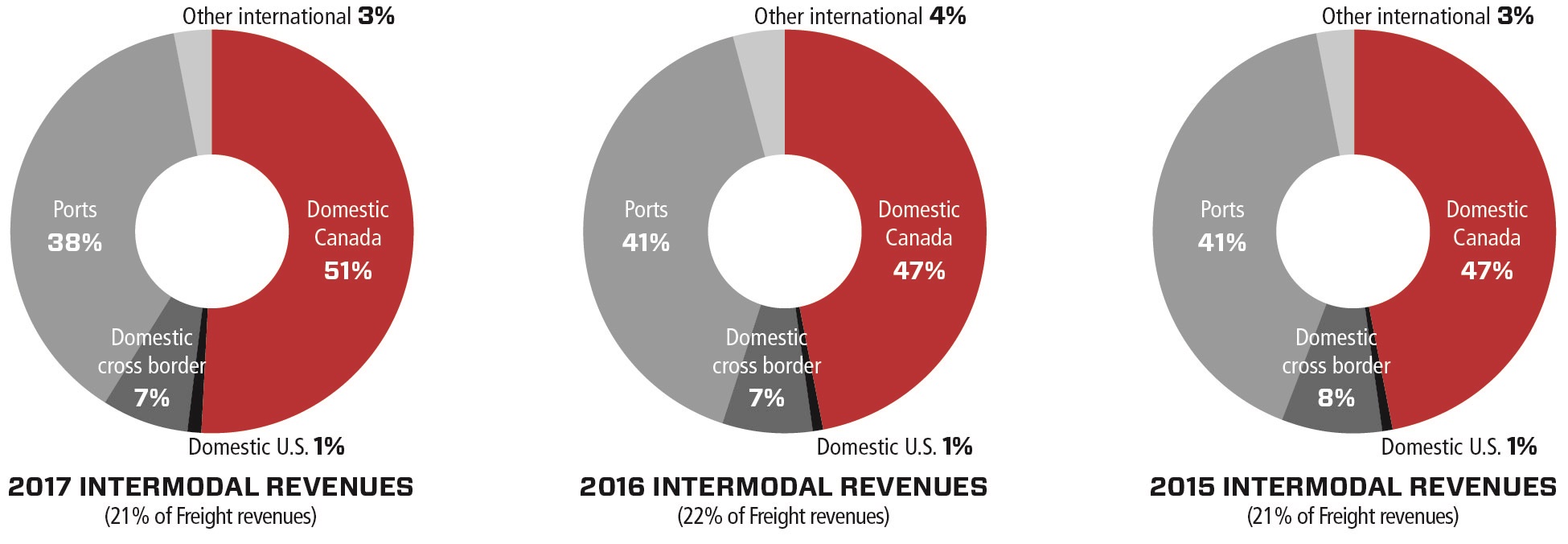

INTERMODAL

The Company’s Intermodal business represented approximately 21%20% of total freightFreight revenues in 2017.2023.

The following charts compare the percentage of the Company's Intermodal freight revenues are generated from Canada, U.S., cross border transportation, portsdomestic and Other International in 2017, 2016 and 2015:

international movements. Domestic intermodal freight consists primarily of manufactured consumer products that are predominantly moved in 53-foot containers within North America. International intermodal freight moves in marine containers to and from ports and North American inland markets. The following chart shows the percentage of the Company's Intermodal freight revenues generated from domestic intermodal and international intermodal in 2023:

| 2023 Intermodal Revenues | ||||||||

| (20% of Freight Revenues) | ||||||||

CPKC 2023 ANNUAL REPORT / 9

Domestic Intermodal

The Company's domestic business represented approximately 56% of Intermodal revenues and 11% of total freight revenues in 2023.

The Company’s domestic intermodal business moves goods from a broad spectrum of industries including wholesale, retail, wholesale, less-than truckload, full-truckload, food, forest products and various other commodities. Key service factors in domestic intermodal include consistent on-time delivery and the ability to provide door-to-door service and the availability of value-added services.service. The majority of the Company’s domestic intermodal business originates in Canada, where CPthe Company markets its services directly to retailers and manufacturers providing complete door-to-door service and maintainingmaintains direct relationships with its customers. In the U.S., and Mexico, the Company’s service is delivered mainly through intermodal marketing companiescompanies. In 2023, the Company launched the Mexico Midwest Express ("IMC"MMX"). Series premium intermodal service to provide the first truck-competitive, single-line rail service option between the U.S. Midwest and Mexico.

The Company's international business represented approximately 44% of Intermodal revenues and 9% of total freight revenues in 2023.

The Company’s international intermodal business consists primarily of containerized traffic moving between the portsPort of Vancouver and MontrealVancouver; the Port of Montréal, Québec; the Port of Lázaro Cárdenas, Michoacán; the Port of Saint John, New Brunswick; and inland points across Canada and the U.S.North America. Import traffic from the Port of Vancouver is mainly long-haul business destined for eastern Canada and the U.S. Midwest and Northeast. CPMidwest. The Company works closely with the Port of Montreal,Montréal, a major year-round East Coast gateway to Europe, to serve markets primarily in Canada and the U.S. Midwest and Canada. The Company’s U.S. Northeast service connects eastern Canada withMidwest. Import traffic from the Port of New York, offering a competitive alternativeLázaro Cárdenas is primarily destined for Mexico. The Company's access to trucks.the Port of Saint John provides the fastest rail service from the East Coast to western Canadian and U.S. markets for import from and export to Europe, South America, and Asia.

Fuel Cost Adjustment Program

The short-term volatility in fuel prices may adversely or positively impact revenues. CPThe Company employs a fuel cost adjustment program designed to respond to fluctuations in fuel prices and help reduce volatility to changing fuel prices. Fuel surcharge revenues are earned on individual shipments and are based primarily on the price of On Highway Diesel; asOn-Highway Diesel in Canada and the U.S. and the public fuel price for Petróleos Mexicanos ("PEMEX") TAR Irapuato in Mexico. As such, fuel surcharge revenue isrevenues are a function of freight volumes and fuel prices. Fuel surcharge revenues accounted for approximately 4%13% of the Company's total Freight revenues in 2017.2023. The Company is also subject to carbon taxation systems and levies in some jurisdictions in which it operates, the costs of which are passed on to the shipper. As such, fuel surcharge revenue includes carbon taxtaxes and levy recoveries.

Significant Customers

For each of the years ended December 31, 2017, 20162023 and 2015, no customer comprised more than 10% of total2022, the Company's revenues or accounts receivable.and operations were not dependent on any major customers.

Competition

The Company is subject toin the ground transportation and logistics business. The Company sees competition in this segment from other railways, motor carriers, ship and barge operators, and pipelines. Price is only one factor of importance as shippers and receivers choose a transportation service provider. Service is another factor and requirement, both in terms of transit time and reliability, which vary by shipper and commodity. As a result, the Company’s primary competition varies by commodity, geographic location and mode of available transportation. CP’s primary rail competitors are Canadian National Railway Company (“CN”), which operates throughout much of the Company’s territory in Canada, and Burlington Northern Santa Fe, LLC, including its primary subsidiary BNSF Railway Company (“BNSF”), which operates throughout much of the Company’s territory in the U.S. Midwest. Other railways also operate in parts of the Company’s territory. Depending on the specific market, competing railroadsrailways, motor carriers, and deregulated motor carriersother competitors may exert pressure on price and service levels. The Company continually evaluates the market needs and the competition. The Company responds as it deems appropriate to provide competitive services to the market. This includes developing new offerings such as transload facilities, new train services, and other logistics services.

Seasonality

Volumes and revenues from certain goods are stronger during different periods of the year. First-quarter revenues are typically lower mainly due to winter weather conditions, which results in reduced capacity under the winter operating plan with train length restrictions, the closure of the Great Lakes portsPort of Thunder Bay, and reduced transportation of retail goods. Second and third quarter revenues generally improve overcompared to the first quarter, as fertilizer volumes are typically highest during the second quarter and demand for construction-related goods is generally highest in the third quarter. Revenues are typically strongest in the fourth quarter, primarily as a result of the transportation of grain after the harvest, fall fertilizer programs, and increased demand for retail goods moved by rail. Operating income is also affected by seasonal fluctuations. Operating income is typically lowest in the first quarter due to lower freight revenue and higher operating costs associated with winter conditions.

Government Regulation

The Company’s railway operations are subject to extensive federal laws, regulations, and rules in both Canada and the U.S.,countries in which it operates, which directly affect how operations and business activities are managed.

10 / CPKC 2023 ANNUAL REPORT

Canada

The Company’s rail operations in Canada are subject to economic and safety regulation in Canada primarily by the Canadian Transportation Agency (“(the "Agency”) pursuant to authorities under the Agency”), Transport Canada, the CTA and the Railway Safety Act (“RSA”).CTA. The CTA provides shipper rateestablishes a common carrier obligation and service remedies,it indirectly regulates rates by providing shippers access to regulatory mechanisms for challenging freight rates, including final offer arbitration, competitive lineancillary charges, and access to regulated interswitching rates and compulsory inter-switching in Canada.long-haul interswitching rates; and regulatory mechanisms to challenge level of service. The Agency regulates theCTA also establishes an MRE for the movementtransportation of Canadian export grain and other agriculture products, which is administered by the Agency. Finally, the Agency makes regulatory determinations regarding the construction and abandonment of railway lines, commuter and passenger access, charges for ancillary services, and noise-relatednoise and vibration-related disputes.

The Company’s rail operations in Canada are subject to safety and security regulatory requirements enforced by Transport Canada ("TC") pursuant to the Railway Safety Act ("RSA") and the Transportation of Dangerous Goods Act (the "TDGA"). The RSA regulates safety-related aspects of railway operations in Canada.Canada, including the delegation of inspection, investigation, and enforcement powers to TC. TC is also responsible for overseeing the safe and secure transportation of dangerous goods.

Various other regulators directly and indirectly affect the Company’s operations in areas such as health, safety, environment, climate, sustainability and other matters.

U.S.

The Company’s U.S. rail operations are subject to economic regulation by the STB. The STB provides economic regulatory oversight and administers Title 49 of the United States Code and related Code of Federal Regulations. The STB has jurisdiction over railroad rate and service issues, proposed railroad mergers, and other transactions.

The Company’s U.S. operations are subject to economic and safety regulationregulations enforced by the Surface Transportation Board (“STB”) and the Federal Railroad Administration (the “FRA”), and the Pipeline and Hazardous Materials Safety Administration (“FRA”PHMSA”). The STB is an economic regulatory body with jurisdiction over railroad rate and service issues and proposed railroad mergers and other transactions. The FRA regulates safety-related aspects of the Company’s railway operations in the U.S. under the Federal Railroad Safety Act, as well as rail portions of other safety statutes. The PHMSA regulates the safe transportation of hazardous materials by rail. The Company’s U.S. rail operations are also subject to security regulations and directives by the Transportation Security Administration ("TSA"), a component of the U.S. Department of Homeland Security.

Various other regulators directly and indirectly affect the Company’s operations in areas such as health, safety, security, environmental, climate, sustainability and other matters.

Mexico

Primary regulatory oversight of the Company’s Mexican operations is provided by the Mexican Agencia Reguladora del Transporte Ferroviario (also known as Mexico's Railway Transport Regulatory Change

CPKCM must provide reports on investments, traffic volumes, theft and vandalism on the general right of way, customer complaints, fuel consumption, number of locomotives, railcars and employees, and activities around maintenance of way, sidings and spurs, among other financial information and reports. The Company may freely set rates on a non-discriminatory basis up to the maximum rates registered with the ARTF. At any time, the ARTF may request additional information regarding the determination of maximum rates and may issue recommendations with respect to rules associated with securing unattended trains;proposed rate increases. If the classification of crude being imported, handled, offered for transportARTF or transported; and the provision of information to municipalities through which dangerous goods are transported by rail. The U.S. federal government has taken similar actions. These changes did not have a material impact on CP’s operating practices.

CPKCM holds a concession from the Mexican government until June 2047, which is renewable under certain conditions for additional periods of up to 50 years (the "Concession"). CPKCM has the exclusive right to provide the freight rail service through 2037, subject to certain trackage and haulage rights granted to other parties (subrogation);freight rail concessionaires, and prevents shifting liabilitysubject to shippers from railways except through written agreement. As the implementationtrackage and haulage rights afforded to concessionaires of concessions that may be granted by the Government of various aspectsSICT to provide passenger rail service in the future. The Concession authorizes CPKCM to provide freight transportation services over north-east rail lines, which are a primary commercial corridor of the amendmentsMexican railroad system. CPKCM is still being completed,required to provide freight railroad services to all users on a fair and non-discriminatory basis and in accordance with efficiency and safety standards approved periodically by the Company is not yet ableMexican government. CPKCM has the right to determine their full impact.

CPKC 2023 ANNUAL REPORT / 11

annual concession duty equal to 1.25% of gross revenues. The Surface Transportation Extension Act of 2015 extended the deadlineARTF may request information to install and activate PTC to December 31, 2018, or December 31, 2020 under certain circumstances, allowing the Company additional time to ensure safe and effective implementation of PTC on its rail network.

Environmental Laws, Regulations and RegulationsStrategies

The Company’s operations and real estate assets are subject to extensive federal, provincial, state, and local environmental laws and regulations, including those governing air pollutants, greenhouse gas ("GHG") emissions, to the air,(please see “Sustainability-Related Laws, Regulations and Strategies” for further discussion), management and remediation of historical contaminant sites, discharges to waters and the handling, storage, transportation, and disposal of waste and other materials. If the Company is found to have violated such laws or regulations, itor to have acted in a manner that is inconsistent with regulatory expectations, such a finding could have a material adverse effect on the Company’s business, financial condition, or operating results. In addition, in operating a railway, it is possible that releases of hazardous materials during derailments or other accidents have, or may occur, that could cause harm to human health or to the environment. Costs of remediation, damages and changes in regulations could materially affect the Company’s operating results, financial condition, and reputation. Please see “Legal and Regulatory Risks” in Item 1A. Risk Factors for further discussion.

The Company has implemented an Environmental Management System to facilitate the reduction of environmental risk. Specific environmental programs are in place and designed to address areas such as locomotive air emissions, wastewater,GHG reporting, management of vegetation, wastewater, chemicals and waste, storage tanks, and fueling facilities. CPThe Company has also undertaken environmental impact assessments and risk assessments designed to identify, prevent, and mitigate environmental risks. There is continued focus on preventing spills and other incidents that have a negative impact on the environment. There is an established Strategic Emergency Response Contractorstrategic emergency response contractor network, and spill equipment kits are located across Canada and the U.S.its network to ensuresupport a rapid and efficient response in the event of an environmental incident. In addition, emergency preparedness and response plans are regularly updated and tested.

The Company has developedestablished an environmental audit program that comprehensively, systematicallyaimed at conducting thorough, systematic, and regularly assesses the Company’sroutine assessments of its facilities forto ensure compliance with legal requirements and the Company’s policies for conformanceadherence to accepted industry standards. Included in this isstandards, accompanied by a corrective action follow-up process and semi-annual review by senior management.management review.

•Maintaining an Environmental Management System to provide consistent, effective guidance and resources to the Company's employees in regard to the management of air emissions, dangerous goods and waste materials, emergency preparedness and response, petroleum products management, and water and wastewater systems;

•Planning and preparing for emergency responses to ensure all appropriate steps are taken in the event of a derailment, spill, or other incident involving a release to the environment.

Security

•The Company's Corporate Security department is committed to providing a safe and secure work environment for the Company’s employees, contractors, visitors, and other authorized persons on the Company's property, and to protecting the Company’s assets, operations, information, the public and the environment from damage, interference, and undue liability. As part of this commitment, Corporate Security is responsible for overseeing: the security of the international supply chain and its requisite programs; providing training and awareness to employees and contractors; assessing the risk and vulnerability of the Company’s properties; establishing appropriate countermeasures to secure and protect the Company’s properties and assets; and engage with customers and the public. Specifically, the Company employs the following to support these initiatives:

◦The Company’s Security Management Plan is a comprehensive, risk-based plan modelled on and developed in conjunction with the security plan prepared by the Association of American Railroads post-September 11, 2001. Under this plan, the Company routinely examines and prioritizes railway assets, physical and cyber vulnerabilities, and threats, as well as tests and revises measures to provide essential railway security;

◦The Company’s Public Safety Communication Centre (“PCC”("PSCC") operates 24 hours a day. The PCCPSCC receives reports of emergencies, dangerous or potentially dangerous conditions, and other safety and security issues from our employees, the public, and law enforcement and other government officials, andofficials. PSCC ensures that proper emergency responders and governing bodies are notified as well as governing bodies.notified; and

Sustainability - Related Laws, Regulations and Strategies

Sustainability at the Company is rooted in a long-standing legacy of building for the future. We recognize that integrating sustainability into our business processes is imperative to future growth and long-term success as an organization. We are proud to be recognized as a corporate sustainability leader in our industry.

Through ongoing engagement and collaboration across and beyond our organization, the Company continually refines our sustainability approach, including as part of our integration of KCS. Please see “Climate-Related Risks—Transition Risks" in Item 1A. Risk Factors for further discussion. We value feedback from our stakeholders, strive to learn from our performance and constantly challenge ourselves to improve our practices, including our sustainability disclosure practices.

Climate and Other Environmental, Social and Governance ("ESG") Related Laws and Regulations

In recent years, federal, state and international lawmakers and regulators have increased their focus on companies’ risk oversight, disclosures and practices in connection with climate change and other ESG matters. Recent legal developments with respect to climate- and other ESG-related matters include the rulemaking activities of securities regulatory authorities in Canada and the United States. In addition, recently enacted or proposed ESG-related statutes or regulations in certain U.S. states may impact the operations, preferences, activities and financial conditions of the Company and its customers and other stakeholders. We are monitoring these legal developments, as well as trends in climate and other ESG-related litigation and regulatory investigations, as well as their potential impact on the Company’s climate and other ESG-related activities (including its strategies, disclosure and risk management practices). Please see “Legal and Regulatory Risks” in Item 1A. Risk Factors for further discussion.

Sustainability Governance

The Company has established a clear governance structure to effectively communicate and respond to relevant ESG topics, while striving to be proactive in implementing its sustainability commitments and practices. The Board of Directors, through its committees, is responsible for the monitoring and oversight of the Company's key risks and strategies on sustainability topics. The Risk and Sustainability Committee of the Board is responsible for reviewing ESG performance against sustainability objectives, as well as strategic plans and opportunities to align sustainability objectives with long-term climate strategy.

With oversight from the President and Chief Executive Officer of the Company, implementation of the Company’s sustainability objectives is guided by a cross-functional executive Sustainability Steering Committee. Updates and progress reports on the Company's sustainability objectives and management approach to sustainability topics are regularly provided to the Risk and Sustainability Committee of the Board.

CPKC 2023 ANNUAL REPORT / 13

Climate Change

The Company recognizes that climate change presents both risks and opportunities to our business. The Company published its first Climate Strategy in 2021, outlining our approach to managing potential climate-related impacts across the business.

Over the past year, the Company has taken action to support the execution of our carbon reduction efforts, including in connection with our integration of KCS. In June 2023, the Company announced a consolidated 2030 locomotive GHG emissions reduction target using the SBTi’s sectoral-based approach for freight railroads and a well-below 2⁰C global warming scenario. The consolidated 2030 target for the Company's combined locomotive operations was validated by the SBTi.

To lead our focus on decarbonization, in 2022 we established a Carbon Reduction Task Force, composed of the Company’s industry-leading engineers and operations experts. Reporting to the Sustainability Steering Committee, the Carbon Reduction Task Force evaluates, recommends, and implements climate action measures including employee training, engagement withto reduce GHG emissions and drive performance in the direction of our science-based targets.

The Company also strives to advance implementation of our climate strategy by exploring carbon reduction opportunities that are aligned to the demands of our business. For example, the Company is building North America’s first line-haul hydrogen-powered locomotive using fuel cells and batteries to power the locomotive’s electric traction motors. In 2023, the Company continued to advance our hydrogen locomotive program, placing two converted hydrogen locomotive into service and advancing production on a third, as well the installation of hydrogen production and fueling facilities.

Human Capital Management

The Company is focused on attracting, developing, and retaining a resilient, high-performing workforce that delivers on providing service for our customers. The Company's culture is guided by the values of Accountability, Diversity, and Pride. Built on a bedrock of respect, these values drive our actions. Everything we do is grounded in precision scheduled railroading and our five foundations of Provide Service, Control Costs, Optimize Assets, Operate Safely, and Develop People.

A team of approximately 20,000 railroaders across North America underpins the Company’s success and brings value to our customers and shareholders. Accordingly, Develop People is one of the foundations of how we do business, illustrating our focus and energy towards empowering our people, providing an engaging culture, and cultivating an industry leading team.

Total Employees and Workforce

An employee is defined by the Company as an individual currently engaged in full-time, part-time, or seasonal employment with the Company. The total number of employees as of December 31, 2023, was 19,927 for CPKC, an increase of 7,173 compared to 12,754 for legacy CP only as at December 31, 2022.

Workforce is defined as total employees plus contractors and consultants. The total workforce as at December 31, 2023 was 20,038 for CPKC, an increase of 7,214 compared to 12,824 for legacy CP only as at December 31, 2022.

Unionized Workforce

Class I railways are party to collective bargaining agreements with various labour unions. The majority of the Company's employees belong to labour unions and are subject to these agreements. The Company manages collaborative relationships with union members in Canada, the U.S. and Mexico.

Unionized employees represent nearly 74% of our workforce and are represented by 75 active bargaining units.

Canada

Within Canada there are nine bargaining units representing approximately 7,200 Canadian unionized active employees. From time to time, we negotiate to renew collective agreements with various unionized groups of employees. In such cases, the collective agreements remain in effect until the bargaining process has been exhausted (pursuant to the Canada Labour Code). Three agreements are open for renewal of which one has been referred to binding Mediation/Arbitration and collective bargaining has commenced with the Teamsters Canada Rail Conference for the other two. Agreements are in place with the other six bargaining units in Canada, of which two collective agreements are effective until December 31, 2024, two are effective until December 31, 2025 and two are effective until December 31, 2026.

U.S.

In the U.S., there are currently 65 active bargaining units on nine subsidiary railroads representing approximately 4,400 unionized active employees. Agreements are in place with respect to 62 bargaining units which will expire in 2024. Negotiations are ongoing with the remaining three agreements.

14 / CPKC 2023 ANNUAL REPORT

Mexico

In Mexico, approximately 3,200 of CPKCM employees are covered by a single labour agreement. The compensation terms under this labour agreement are subject to renegotiation on an annual basis and all other benefits are subject to negotiation every two years. The current agreement terms will remain in effect until new terms have been negotiated in 2024.

Health and Safety

The Company is an industry leader in rail safety and we are committed to protecting our employees, our communities, our environment, and our customers’ goods. The Company finished 2023 with the lowest FRA train accident frequency among Class I railways: building on the CP's 17 consecutive years leading the industry. The Company's leadership approach has been the most impactful driver of the strong safety performance metrics and we are committed to continually improving on them. Aside from running trains, many of our employees work in yards, terminals, and shops across our network with machinery and heavy equipment, and often in extreme weather conditions. Their safety is of utmost importance to the Company and through 2023 we have continued to look at ways to improve safety in these areas of the operation. Operate Safely is one of our five foundations of successful railroading and it starts with knowing and following the rules. The FRA reportable train accident and personal injury frequency rates are key metrics as part of the Company's annual incentive plan.

During 2023, we rolled out our HomeSafe initiative to KCS and CPKCM tapping into the human side of safety and what it means to promote both safety engagement and feedback. HomeSafe puts everyone on the same level and empowers all employees to begin a safety conversation, no matter their role or position. Expanding HomeSafe, Safety walkabouts and other safety initiatives to the KCS and CPKCM has been instrumental in maintaining a strong safety performance in 2023.

Our reportable personal injury incidents rate per 200,000 employee-hours increased 15% to 1.16 (2022 - 1.01) and our reportable train accident rate per million train-miles increased 14% to 1.06 (2022 - 0.93). The 2022 numbers reflect legacy CP on a standalone basis. The Company’s safety performance is disclosed publicly on a quarterly basis using standardized metrics set out by the FRA.

Talent Management

The Company’s approach for talent management begins with our Human Resources department, which oversees recruitment, development, engagement, and retention with the current and future workforce and leadership of the Company.

The Management Resources and Compensation Committee of the Board of Directors reviews and informs the Company’s compensation plan and programming, and makes recommendations to the Board on succession planning for senior management and processes to identify, develop, and retain executive talent. Additionally, as part of the Company’s succession planning program, senior leaders are actively engaged in building the pool of future leaders and present their development plans to the Board.

The Company maintains a number of internal policies and processes related to recruitment, relocation, compensation, employment equity, and diversity and inclusion. The effective implementation of these policies alongside our ongoing workforce initiatives ensures the Company’s attraction and recruitment, employee development, succession, engagement, and diversity and inclusion practices are consistent and aligned with the Company’s commitments, foundations, and values.

Attraction and Recruitment

We employ a number of recruitment strategies and retention tactics to attract and retain talent across North America. The Company offers many rewarding career opportunities in a variety of roles within the organization in both operating and support functions. We base our recruitment strategy on workforce planning needs, and our goal is to have a diverse candidate pool to fill our open positions.

The Company recognizes the valuable skills and experience that veterans have gained from serving their country. We were named part of the Military Friendly® Employers in the U.S. for 2024. The Company was also named Canada's Top 100 Employers for 2024 as well as Alberta's Top 80 Employers for 2024.

The Company tracks recruitment performance and success rates to better understand which tactics, benefits, and strategic partnerships are most successful in bringing in and retaining new talent.

Training and Leadership Development

One of the Company’s five foundations is to Develop People. CPKC achieves this by providing its diverse workforce with an array of training and development opportunities.

CPKC 2023 ANNUAL REPORT / 15

Our strategy involves delivering specialized training, best practices, and skill-broadening opportunities to all employees. The Company offers a variety of emergency responders.training opportunities, including, but not limited to, technical/on-the-job training, role-specific offerings as well as optional courses. Training includes instructor-led in-person and virtual classes, blended, e-learning and self-directed online learning.

Non-union employees also complete annual performance reviews with development action plans with their leaders to set individual goals tied to the Company's five foundations and track progress against Company expectations as well as career development goals. Additionally, the Company offers a robust set of leadership development programs to support employees career growth.

The Company encourages all employees to take an active role in their career planning and development. We believe that investing in our employees leads to improved workplace morale and fosters a supportive working environment.

Diversity and Inclusion

Diversity is one of our core values. We believe that different backgrounds, experiences, and perspectives enhance creativity and innovation and encourage diversity of thought in the workplace. We are continually working on programs and opportunities to attract, retaining, and develop the best people and skill sets for the Company. The Company is committed to increasing diversity throughout all levels of the organization.

The Company recognizes the importance of Board member diversity as a critical component of objective oversight and continuous improvement. As of December 31, 2023, five of the 13 directors (38.5%) are women. Additionally, three of our male directors identify as a minority, which makes the majority of the Board of Directors (61.5%) members of "designated groups" as defined in the Employment Equity Act of Canada.

The Company has regulatory requirements to report on workforce diversity representation in Canada (Employment Equity Act) and the U.S. (Equal Employment Opportunity Commission). The Company currently collects diversity data on the following categories: women, minorities, and Indigenous peoples from employees, as shown in the table below, through voluntary self-disclosure. The Company continues to focus our efforts on attracting, recruiting, and developing a diverse workforce. This data is shared in various disclosures and government reporting, internally with employees and leaders, as well as our Board of Directors.

Year over Year Diversity Representation

Diversity Percentages(1) | 2023 | 2022 | |||||||||

| Women (U.S., Canada & Mexico) | 8 | % | 9 | % | |||||||

| Minorities (U.S. & Canada) | 20 | % | 16 | % | |||||||

| Indigenous peoples (Canada only) | 4 | % | 4 | % | |||||||

(1) Percentages are based on total active employees at year-end. The 2022 numbers reflect legacy CP employees only and the 2023 numbers reflect CPKC employees.

We pride ourselves on offering a diverse workplace with a variety of careers in both our corporate and field locations. We recruit and hire talent based on relevant skills and experience, and seek to attract the highest quality candidates regardless of gender, age, cultural heritage, or ethnic origin. One of our primary objectives is attracting, recruiting, retaining, and developing a workforce representative of the communities in which we operate.

Available Information

All references to websites (including our websiteswebsite) contained herein do not constitute incorporation by reference of information contained on such websites and such information should not be considered part of this document.

ITEM 1A. RISK FACTORS

The risks set forth in the following risk factors could have a materially adverse effect on the Company's business, financial condition, results of operations, and liquidity, and could cause those results to differ materially from those expressed or implied in the Company's forward-looking statements.statements and forward-looking information (collectively, "forward-looking statements").

The information set forth in this Item 1A. Risk Factors should be read in conjunction with the rest of the information included in this annual report, including Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8. Financial Statements and Supplementary Data.

Business and Operational Risks

As a common carrier, the Company is required by law to transport dangerous goods and hazardous materials, which could expose the Company to significant costs and claims. Railways, including CP,the Company, are legally required to transport dangerous goods and hazardous materials as part of their common carrier obligations regardless of risk or potential exposure to loss. CPThe Company transports dangerous goods and hazardous materials, including but not limited to crude oil, ethanol, and TIH materials such as chlorine gas and anhydrous ammonia. A train accident involving hazardous materials could result in significant claims against CPthe Company arising from personal injury, and property or natural resource damage, environmental penalties, and remediation obligations. Such claims, if insured, could exceed the existing insurance coverage commercially available to CP,the Company, which could have a material adverse effect on CP’sthe Company’s financial condition, operating results, and liquidity. CPThe Company is also required to comply with rules and regulations regarding the handling of dangerous goods and hazardous materials in Canada and the U.S.across its network. Noncompliance with these rules and regulations can subject the Company to significant penalties and could factor in litigation arising out of a train accident. Changes to these rules and regulations could also increase operating costs, reduce operating efficiencies and impact service delivery.

The Company faces competition from other transportation providers and failure to compete effectively could adversely affect financial results.The Company faces significant competition for freight transportation across its network, including competition from other railways, motor carriers, ship and barge operators, and pipelines. Competition is based mainly on quality of service, freight rates, and access to markets. Other transportation modes generally use public rights-of-way that are built and maintained by government entities, while the Company and other railways must use internal resources to build and maintain their rail networks. Competition with the trucking industry is generally based on freight rates, flexibility of service, and transit time performance. Any future improvements or expenditures materially increasing the quality or reducing the cost of alternative modes of transportation, or legislation that eliminates or significantly reduces the burden of the size or weight limitations currently applicable to trucking carriers, could have a material adverse effect on the Company's financial results.

The operations of carriers with which the Company interchanges may adversely affect operations. The Company's ability to provide rail services to customers across its network also depends upon its ability to maintain cooperative relationships with connecting carriers with respect to, among other matters, revenue division, car supply and locomotive availability, data exchange and communications, reciprocal switching, interchange, and trackage rights. Deterioration in the operations or services provided by connecting carriers, or in the Company's relationship with those connecting carriers, could result in the Company's inability to meet customers' demands or require the Company to use alternate train routes, which could result in significant additional costs and network inefficiencies and adversely affect our business, operating results, and financial condition.

The Company may be affected by acts of terrorism, war, or risk of war.The Company plays a critical role in the North American transportation system and therefore could become the target for acts of terrorism or war. The Company is also involved in the transportation of hazardous materials, which could result in the Company's equipment or infrastructure being direct targets or indirect casualties of terrorist attacks. Acts of terrorism, or other similar events, any government response thereto, and war or risk of war could cause significant business interruption to the Company and may adversely affect the Company’s results of operations, financial condition and liquidity.

The Company is affected by fluctuating fuel prices.Fuel expense constitutes a significant portion of the Company’s operating costs. Fuel prices can be subject to dramatic fluctuations, and significant price increases could have a material adverse effect on the Company's results of operations. The Company currently employs a fuel cost adjustment program to help reduce volatility in changing fuel prices, but the Company cannot be certain that it will always be able to fully mitigate rising or elevated fuel prices through this program. Factors affecting fuel prices include worldwide oil demand, international geopolitics, weather, refinery capacity, supplier and upstream outages, unplanned infrastructure failures, environmental and sustainability policies, and labour and political instability.

The Company relies on technology and technological improvements to operate its business. Although the Company devotes significant resources to protect its technology systems and proprietary data, there can be no assurance that the systems we have designed to prevent or limit the effects of cyber incidents or attacks will be sufficient in averting such incidents or attacks. (Please see “Item 1C. Cybersecurity” for further discussion). The Company continually evaluates attackers’ techniques, tactics and motives, and strives to be diligent in its monitoring, training, planning, and prevention. However, due to the increasing sophistication of cyber-attacks and greater complexity within our IT supply chain, the Company may be unable to anticipate or implement appropriate preventive measures to detect and respond to a security breach.

CPKC 2023 ANNUAL REPORT / 17

This includes the rising rates of reported ransomware events, human error, or other cyber-attack methods disrupting the Company’s systems or the systems of third parties. If the Company or third parties whose technology systems we rely on were to experience a significant disruption or failure of one or more of their information technology or communications systems (either as a result of an intentional cyber or malicious act, or an unintentional error), it could result in significant service interruptions, safety failures or other operational difficulties such as: unauthorized access to confidential or other critical information or systems, loss of customers, financial losses, regulatory fines, and misuse or corruption of critical data and proprietary information, which could have a material adverse effect on the Company's results of operations, financial condition, and liquidity. The Company also may experience security breaches that could remain undetected for an extended period and, therefore, have a greater impact on the services we offer. In addition, if the Company is unable to acquire or implement new technology in general, the Company may suffer a competitive disadvantage, which could also have an adverse effect on its results of operations, financial condition, and liquidity.

Human Capital Risks

The availability of qualified personnel could adversely affect the Company's operations.Changes in employee demographics, training requirements and the availability of qualified personnel, particularly locomotive engineers and trainpersons, could negatively impact the Company’s ability to meet demand for rail services. Unpredictable increases in the demand for rail services may increase the risk of having insufficient numbers of trained personnel, which could have a material adverse effect on the Company’s results of operations, financial condition and liquidity. In addition, changes in operations and other technology improvements may significantly impact the number of employees required to meet the demand for rail services.

Strikes or work stoppages adversely affect the Company's operations.Class I railways are party to collective bargaining agreements with various labour unions. The majority of the Company's employees belong to labour unions and are subject to these agreements. Disputes with regard to the terms of these agreements or the Company's potential inability to negotiate mutually acceptable contracts with these unions, have resulted in, and could in the future result in, among other things, strikes, work stoppages, slowdowns, or lockouts, which could cause a significant disruption of the Company's operations and have a material adverse effect on the Company's results of operations, financial condition, and liquidity. Additionally, future national labour agreements, or provisions of labour agreements related to health care, could significantly increase the Company's costs for health and welfare benefits, which could have a material adverse impact on its financial condition and liquidity.

Legal and Regulatory Risks

The Company is subject to significant governmental legislation and regulation over commercial, operating and environmental, climate, sustainability and other matters. The Company’s railway operations are subject to extensive federal laws, regulations and rules in both Canada and the U.S.countries it operates. Operations are subject to economic and safety regulations in Canada primarily by the Agency and Transport Canada.TC. The Company’s U.S. operations are subject to economic and safety regulation by the STB and the FRA. The Company’s Mexican operations are subject to economic and safety regulations by the SICT and ARTF. Any new rules from regulators could have a material adverse effect on the Company's financial condition, results of operations and liquidity as well as its ability to invest in enhancing and maintaining vital infrastructure. Various other regulators, including the FRA, and its sister agency within the U.S. Department of Transportation, the PHMSA, directly and indirectly affect the Company’s operations in areas such as health, safety, security, environmental and other matters. Together, the FRA and the PHMSA have broad jurisdiction over railroad operating standards and practices, including track, freight cars, locomotives, and hazardous materials requirements. In addition, the U.S. Environmental Protection Agency (“EPA”) has regulatory authority with respect to matters that impact the Company's properties and operations. Additional economic regulation of the rail industry by these regulators or the Canadianfederal and U.S. legislatures,state or provincial legislative bodies, whether under new or existing laws, including Bill C-49, if passed, which is described under the heading "Regulatory Change"may result in Part I of this Annual Report on Form 10-K,increased capital expenditures and operating costs and could have a significant negative impact on the Company’s ability to determine prices for rail services and result in a material adverse effect in the future on the Company’s business, financial position, results of operations, and liquidity in a particular year or quarter. This potential material adverse effect could also result in reduced capital spending on the Company’s rail network or in abandonment of lines.

The Company’s compliance with safetyCompany is subject to environmental laws and security regulations that may result in increased capital expenditures and operatingsignificant costs. For example, compliance with the Rail Safety Improvement Act of 2008 will result in additional capital expenditures associated with the statutorily mandated implementation of PTC. In addition to increased capital expenditures, implementation of such regulations may result in reduced operational efficiency and service levels, as well as increased operating expenses.

The Company’s operations are subject to extensive federal, state, provincial (Canada) and local environmental laws concerning, among other matters,and regulations, including those governing air pollutants, GHG emissions, management and remediation of historical contaminant sites, discharges to the air, land and waterwaters and the handling, storage, transportation, and disposal of hazardous materialswaste and wastes.other materials. (Please see “Environmental Laws, Regulations and Strategies” and “Sustainability-Related Laws, Regulations and Strategies” in Item 1. Business for further discussion). Violation of these laws and regulations can result in significant fines and penalties, as well as other potential impacts on CP’sthe Company’s operations. These laws can impose strict, and in some circumstances, joint and several liability on both current and former owners, and on operators of facilities. If the Company is found to have violated such laws or regulations or to have acted in a manner that is inconsistent with regulatory expectations, such a finding could have a material adverse effect on the Company’s business, financial condition, or operating results.

Such environmental liabilities may also be raised by adjacent landowners or third parties. In addition, in operating a railway, it is possible that releases of hazardous materials during derailments or other accidents may occur that could cause harm to human health or to the environment. Costs of remediation, damages and changes in regulations could materially affect the Company’s operating results and reputation. The Company has been, and may in the future be, subject to allegations or findings to the effect that it has violated, or is strictly liable under, environmental laws or regulations. The Company currently has obligations at existing sites for investigation, remediation and monitoring, and will likely have obligations at other sites in the future. The actual costs associated with both current and long-term liabilities may vary from the Company’s estimates due to a number of factors including, but not limited to changes in: the content or interpretation of environmental laws and regulations; required remedial actions; technology associated with site

18 / CPKC 2023 ANNUAL REPORT

investigation or remediation; and the involvement and financial viability of other parties that may be responsible for portions of those liabilities.

The Company’s Mexican operations are subject to Mexican federal and state laws and regulations relating to the protection of the environment concerning, among other matters, emissions to the air, land, and water, and the handling of hazardous materials and wastes, and are also subject to the compliance with standards for water discharge, water supply, emissions, noise pollution, hazardous substances and transportation and handling of hazardous and solid waste. The Mexican government may bring administrative and criminal proceedings, impose economic sanctions against companies that violate environmental laws, and temporarily or even permanently close non-complying facilities.

The Company is subject to claims and litigation that could result in significant expenditures. Due to the nature of its operations, the Company is exposed to the potential for claims and litigation arising out of personal injury, property damage or freight damage, employment, labour contract or other commercial disputes, and environmental, climate or sustainability, or other liability. The Company accrues for potential losses in accordance with applicable accounting standards, based on ongoing assessments of the likelihood of an adverse result in a claim or litigation together with the monetary relief or other damages sought or potentially recoverable. Material changes to litigation trends, a significant rail or other incident or series of incidents involving freight damage or loss, property damage, personal injury, or environmental, climate or sustainability, or other liability, and other significant matters could have a material adverse impact to the Company's operations, reputation, financial position or liquidity.

Supply Chain Risks

Disruptions within the supply chain could negatively affect demand for commoditiesthe Company's operational efficiencies and increase costs.The North American transportation system is integrated. The Company’s operations and service may be negatively impacted by service disruptions of other transportation links, such as ports, handling facilities, customer facilities, and other freight transported by the Company.railways. A decline orprolonged service disruption in domestic, cross border or global economic conditions that affect the supply or demand for the commodities that CP transports may decrease CP’s freight volumes and may result inat one of these entities could have a material adverse effect on CP’s financial or operating results and liquidity. Economic conditions resulting in bankruptcies of one or more large customers could have a significant impact on CP's financial position,the Company's results of operations, financial condition, and liquidity in a particular year or quarter.liquidity.

The Company faces competition from other transportation providers,is dependent on certain key suppliers of core railway equipment and failure to compete effectivelymaterials that could result in increased price volatility or significant shortages of materials, which could adversely affect results of operations, financial condition, and liquidity.The Company faces significant competition for freight transportation in CanadaDue to the complexity and the U.S.specialized nature of core railway equipment and infrastructure (including rolling stock equipment, locomotives, rail and ties), including competition from other railways, pipelines, truckingthere are a limited number of suppliers of rail equipment and barge companies. Competition is based mainly on qualitymaterials available. Should these specialized suppliers cease production or experience capacity or supply shortages, this concentration of service, freight rates and access to markets. Other transportation modes generally use public rights-of-way that are built and maintained by government entities, while CP and other railroads must use internal resources to build and maintain

Risks Related to the extentKansas City Southern Transaction

The conditions imposed by the STB’s March 15, 2023 final decision could have an adverse effect on the Company’s businesses, results of operations, financial condition, cash flows or the market value of the Company’s common stock and debt securities, or reduce the anticipated benefits of the combination. In connection with the STB's March 15, 2023 final decision, the STB imposed a number of conditions, including among others (i) commitments by the combined company to keep gateways open on commercially reasonable terms and create no new bottlenecks, (ii) environmental-related conditions, (iii) data reporting and retention requirements, and (iv) a seven-year oversight period for the STB to monitor adherence to these conditions. In addition, the Company inherits conditions previously imposed by the STB on KCS in connection with various prior KCS acquisitions, including in relation to KCS’s commitment to keep the Laredo gateway open on commercially reasonable terms in connection with its prior acquisition of The Texas Mexican Railway. Furthermore, the STB has noted its authority to issue supplemental orders to address issues or concerns that may arise in the future. These conditions could disrupt the Company’s businesses, and uncertainty about the outcome of that review could divert management’s attention and resources, and reduce the anticipated benefits of the combination, and may have an adverse effect on the combined company. Further, the combination may give rise to potential liabilities, including as a result of pending and future shareholder lawsuits and other litigation relating to the combination. In addition, the Company has incurred, and expects to incur additional, material non-recurring expenses in connection with the completion of the combination and integration activities. Any of these matters could adversely affect the businesses of, or harm the results of operations, financial condition or cash flows of the Company and the market value of the Company’s common stock and debt securities.

The Company incurred substantial indebtedness in connection with consummation of the acquisition, which may pose risks and/or intensify existing risks. Prior to the KCS acquisition closing into voting trust that occurred on December 14, 2021, the Company incurred additional indebtedness of approximately U.S. $6.7 billion and $2.2 billion notes to indirectly fund the acquisition.

The foregoing indebtedness, as well as any additional indebtedness we may incur, could have the effect, among other things, of reducing our liquidity and may limit our flexibility in responding to other business opportunities and increasing our vulnerability to adverse economic and industry conditions.

Our ability to make payments of principal and interest on our indebtedness depends upon our future performance, which will be subject to general economic, financial and business conditions, and other factors affecting our operations, many of which are beyond our control. In addition, we may be

CPKC 2023 ANNUAL REPORT / 19

required to redeem all of the outstanding 2.450% notes due 2031 and 3.000% notes due 2041 pursuant to a special mandatory redemption requirement of those notes, which could have a significant adverse impact on the business and financial condition of the Company.

Our increased indebtedness could also reduce funds available for working capital, capital expenditures, acquisitions and other general corporate purposes and may create competitive disadvantages relative to other companies with lower debt levels. If we do not covered by insurance.achieve the expected benefits and cost savings from the combination, or if the financial performance of the combined company does not meet current expectations, then our ability to service our indebtedness may be adversely impacted.

Moreover, we may be required to raise substantial additional financing to fund working capital, capital expenditures, acquisitions or other general corporate requirements. Our ability to arrange additional financing or refinancing will depend on, among other factors, our financial position and performance, as well as prevailing market conditions and other factors beyond our control. There can be no assurance that we will be able to obtain additional financing or refinancing on terms acceptable to us or at all.

The Company may be unable to integrate KCS successfully, and the Company may not experience the growth being sought from the combination. CPRL and KCS operated independently until the Control Date. Integrating KCS with CPKC will involve operational, technological and personnel-related challenges. This process is time-consuming and expensive, may disrupt the businesses of either or both of the companies and may reduce the growth opportunities sought from the combination. There can be no guarantee of the successful integration of KCS or that the combined company will realize the anticipated benefits of the business combination, whether financial, strategic or otherwise, and this may be exacerbated by changes to the economic, political and global environment in which the merged company would operates.

Risks related to Operations in Mexico