Washington, D.C. 20549

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YESYes ☐ NONo ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YESYes ☐ NONo ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YESYes ☒ NONo ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES ☐ NOYes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

The aggregate market value of the voting stock held by non-affiliates of the registrant as of September 30, 20192022 was $365,217,231$457,460,183 based on the last sale price of such stock as quoted by The Nasdaq Global Select Market on such date.

The number of shares of common stock, $0.25 par value per share, outstanding as of May 29, 202019, 2023 was 17,998,098.36,722,665.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements regarding the plans and objectives of management for future operations.operations and future performance (including the internal rate of return to the Company). Any such forward-looking statements may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations are generally identifiable by use of the words “may,” “predict,” “will,” “continue,” “likely,” “would,” “could,” “should,” “expect,” “anticipate,” “potential,” “estimate,” “indicate,” “seek,” “believe,” “target,” “intend,” “plan,” or “project” or the negative of these words or other variations on these words or comparable terminology. These forward-looking statements involve risks and uncertainties and are based on assumptions that may be incorrect, and we cannot assure you that the projections included in these forward-looking statements will come to pass. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those expressed or implied by the forward-looking statements. We believe these factors include, but are not limited to, the following:

•our future operating results;

•market conditions and our ability to access debt and equity capital and our ability to manage our capital resources effectively;

•the timing of cash flows, if any, from the operations of our portfolio companies;

•our business prospects and the prospects of our existing and prospective portfolio companies;

•the financial condition and ability of our existing and prospective portfolio companies to achieve their objectives;

•the adequacy of our cash resources and working capital;

•our ability to recover unrealized losses;

•our expected financings and investments;

•our contractual arrangements and other relationships with third parties;

•the impact of fluctuations in interest ratesrate volatility, including the decommissioning of LIBOR, and inflation on our business;business and our portfolio companies;

•the impact of a protracted decline in the liquidity of credit markets on our business;

•our ability to operate as a BDCbusiness development company and to qualify and maintain our qualification as a RIC,regulated investment company, including the impact of changes in laws or regulations, including the tax reform, governing our operations or the operations of our portfolio companies;

•our ability to operate our wholly owned subsidiary, Capital Southwest SBIC I, LP, as a small business investment company;

•the dependence of our future success on the general economy and its impact on the industries in which we invest;

•the impact of supply chain disruptions and labor shortages on our portfolio companies;

•changes in laws and regulations, changes in political, economic or industry conditions, and changes in the interest rate environment or other conditions affecting the financial and capital markets, including changes resulting from or in response to, or potentially even the absence of changes as a result of, the impact of the COVID-19 pandemic;

•our ability to successfully invest any capital raised in an offering;

•the return or impact of current and future investments;

•the performance and the valuation of our investments in portfolio companies, particularly those having no liquid trading market;

•our regulatory structure and tax treatment; and

•the timing, form and amount of any dividend distributions; anddistributions.

•uncertainties associated with the impact from the COVID-19 pandemic, including: its impact on the global and U.S. capital markets and the global and U.S. economy; the length and duration of the COVID-19 outbreak in the United States as well as worldwide and the magnitude of the economic impact of that outbreak; the effect of the COVID-19 pandemic on our business prospects and the operational and financial performance of our portfolio companies, including our and their ability to achieve their respective objectives; and the effect of the disruptions caused by the COVID-19 pandemic on our ability to continue to effectively manage our business.

For a discussion of these and other factors that could cause our actual results to differ materially from forward-looking statements contained in this Annual Report, please see the discussion under “Risk Factors” in Item 1A.

We have based the forward-looking statements included in this Annual Report on Form 10-K on information available to us on the date of this Annual Report on Form 10-K. You should not place undue reliance on these forward-looking statements and you should carefully consider all of the factors identified in this report that could cause actual results to differ. We assume no obligation to update any such forward-looking statements, unless we are required to do so by applicable law.

PART I

Item 1. Business

ORGANIZATION

Capital Southwest Corporation which (“we, refer to as “we,” “our,” “us,” “CSWC,” or the “Company”), a Texas corporation, is an internally managed closed-end, non-diversified investment company that has elected to be regulated as a business development company, or BDC, under the Investment Company Act of 1940, as amended, or the 1940 Act. Because CSWC is internally managed, all of the executive officers and other employees are employed by CSWC. Therefore, CSWC does not pay any external investment advisory fees, but instead directly incurs the operating costs associated with employing investment and portfolio management professionals.

Since September 30, 2015, we have pursued a credit-focused investing strategy. We specialize in providing customized financing to middle market companies in a broad range of industry segments located primarily in the United States. We invest primarily in debt securities, including senior debt and second lien, and also invest in preferred stock and common stock alongside our debt investments or through warrants. Our common stock currently trades on The Nasdaq Global Select Market under the ticker symbol “CSWC.”

We were organized as a Texas corporation on April 19, 1961. Until September 1969, we operated as a small business investment company, or SBIC, licensed under the Small Business Investment Act of 1958. At that time, we transferred to our wholly-owned subsidiary, Capital Southwest Venture Corporation, or CSVC, certain assets including our SBIC license. CSVC was a closed-end, non-diversified investment company registered under the 1940 Act. Effective June 14, 2016, CSVC was dissolved and its SBIC license was surrendered. All assets held in CSVC were transferred to us upon dissolution. Prior to March 30, 1988, we were registered as a closed-end, non-diversified investment company under the 1940 Act. On that date, we elected to be treated as a BDC under the 1940 Act. As a BDC, we are required to comply with certain regulatory requirements. For instance, we generally have to invest at least 70% of our assets in “qualifying assets,” including securities of private or thinly traded public U.S. companies, cash, cash equivalents, U.S. government securities and high quality debt investments that mature in one year or less. In addition, effective April 25, 2019, we are allowed to borrow money such that our asset coverage, as defined in the 1940 Act, equals at least 150% after such borrowing. Additionally, the Board of Directors approved a resolution whichthat limits the Company's issuance of senior securities such that the asset coverage ratio, taking into account any such issuance, would not be less than 166%, at any time after the effective date.

We have elected, and intend to qualify annually, to be treated for U.S. federal income tax purposes as a regulated investment company, or RIC, under Subchapter M of the U.S. Internal Revenue Code of 1986, as amended, or the Code. As such, we generally will not havebe subject to pay corporate-level U.S. federal income tax at corporate rates on any ordinary income or capital gains that we timely distribute to our shareholders as dividends. To continue to maintain our RIC tax treatment, we must meet specified source-of-income and asset diversification requirements and distribute annually at least 90% of our ordinary income and realized net short-term capital gains in excess of realized net long-term capital losses, if any. Depending on the level of taxableWe will be subject to U.S. federal income earned in a tax, year, we may choose to carry forward taxable income in excess of current year distributions into the next year and paypossibly a 4% U.S. federal excise tax, on such income. Any such carryover taxableany income mustthat we do not timely distribute to our shareholders. Our U.S. federal income tax liability may be distributed through a dividend declared prior to filing the final tax return relatedreduced to the extent that we make certain distributions during the following calendar year that generated such taxable income.and satisfy other procedural requirements.

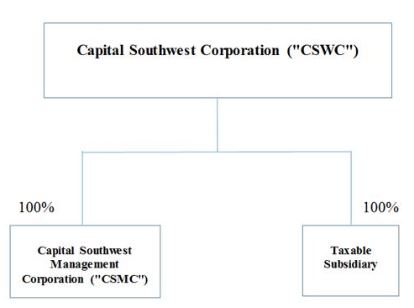

Capital Southwest Management Corporation, or CSMC, our wholly-owned subsidiary, is our management company. CSMC generally incurs all normal operating and administrative expenses, including, but not limited to, salaries and related benefits, rent, equipment and other administrative costs required for day-to-day operations.

We also haveCSWC has a direct wholly-ownedwholly owned subsidiary that has elected to be treated as an association taxable as a taxable entitycorporation for U.S. federal income tax purposes (the “Taxable Subsidiary”). The primary purpose of the Taxable Subsidiary is to permit us to hold certain interests in portfolio companies that are organized as limited liability companies, or LLCs (or other forms of pass-through entities) and still allow us to satisfy the RIC tax requirement that at least 90% of our gross income for U.S. federal income tax purposes must consist of qualifying investment income. The Taxable Subsidiary is taxedsubject to U.S. federal income tax at normal corporate tax rates based on its taxable income.

On September 30, 2015, we completedApril 20, 2021, our wholly owned subsidiary, Capital Southwest SBIC I, LP (“SBIC I”) received a license from the spin-off, which we referU.S. Small Business Administration (the “SBA”) to as the Share Distribution, of CSW Industrials, Inc., or CSWI. CSWI is now an independent publicly traded company. The Share Distribution was effected through a tax-free, pro-rata distribution of 100% of CSWI’s common stock to our shareholders. Each of our shareholders received one share of CSWI common stock for every one share of our common stock on the record date, September 18, 2015. Cash was paid in lieu of any fractional shares of CSWI common stock.

Following the Share Distribution, we have maintained operationsoperate as an internally managed BDCSBIC under Section 301(c) of the Small Business Investment Act of 1958, as amended. SBIC I has an investment strategy substantially similar to ours and pursuedmakes similar types of investments in accordance with SBA regulations. SBIC I and its general partner are consolidated for U.S. GAAP reporting purposes, and the portfolio investments held by it are included in the consolidated financial statements. See “Regulation as a credit-focused investing strategy akinSmall Business Investment Company” below for more information about the regulations applicable to similarly structured organizations. We intend to continue to provide capital to middle-market companies. We invest primarily in debt securities, including senior debt, second lien and subordinated debt, and also invest in preferred stock and common stock alongside our debt investments or through warrants.SBIC I.

The following diagram depicts our organizational structure:

Employees

As of March 31, 2020, we had twenty-two employees, each of whom was employed by our management company, CSMC. These employees include our corporate officers, investment and portfolio management professionals and administrative staff. All of our employees are located in our principal executive offices in Dallas, Texas.

Corporate Information

Our principal executive offices are located at 5400 Lyndon B. Johnson Freeway,8333 Douglas Avenue, Suite 1300,1100, Dallas, Texas 75240.75225. We maintain a website at www.capitalsouthwest.com. You can review the filings we have made with the Securities and Exchange Commission, or the SEC, free of charge on EDGAR, the Electronic Data Gathering, Analysis, and Retrieval System of the SEC, accessible at http://www.sec.gov. We also make available free of charge on our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, any amendments to those reports and any other reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, or the Exchange Act, as soon as reasonably practicable after filing these reports with the SEC. Information on our website is not incorporated by reference into

this Annual Report on Form 10-K and you should not consider that information to be part of this Annual Report on Form 10-K. The charters adopted by the committees of our Board of Directors are also available on our website.

OVERVIEW OF OUR BUSINESS

We are an internally managed closed-end, non-diversified investment company that has elected to be regulated as a BDC under the 1940 Act. We specialize in providing customized debt and equity financing to lower middle market, or LMM, companies and debt capital to upper middle market, or UMM, companies in a broad range of investment segments located primarily in the United States. Our investment objective is to produce attractive risk-adjusted returns by generating current income from our debt investments and capital appreciation from our equity and equity related investments. Our investment strategy is to partner with business owners, management teams and financial sponsors to provide flexible financing solutions to fund growth, changes of control, or other corporate events. We invest primarily in senior debt securities, secured by security interests in portfolio company assets. We also invest in equity interests in our portfolio companies alongside our debt securities.

We focus on investing in companies with histories of generating revenues and positive cash flow, established market positions and proven management teams with strong operating discipline. We primarilyOur core business is to target senior debt investments and equity investments in LMM companies, as well ascompanies. We also opportunistically target first and second lien syndicated loans in UMM companies. Our target LMM companies typicallygenerally have annual earnings before interest, taxes, depreciation and amortization, or EBITDA, between $3.0 million and $15.0$20.0 million, and our LMM investments generally range in size from $5.0 million to $25.0$35.0 million. Our UMM investments generally include syndicated first and second lien loans in companies with EBITDA generally greater than $50.0$20.0 million, and our UMM investments typically range in size from $5.0 million to $15.0$20.0 million.

We seek to fill the financing gap for LMM companies, which historically have had more limited access to financing from commercial banks and other traditional sources. The underserved nature of the LMM creates the opportunity for us to meet the financing needs of LMM companies while also negotiating favorable transaction terms and equity participation. Our ability to invest across a LMM company’s capital structure, from secured loans to equity securities, allows us to offer portfolio companies a comprehensive suite of financing options. Providing customized financing solutions is important to LMM companies. We generally seek to partner directly with financial sponsors, entrepreneurs, management teams and business owners in making our investments. Our LMM debt investments typically include senior loans with a first lien on the assets of the portfolio company. Our LMM debt investments typically have a term of between five and seven years from the original investment date. We also often seek to invest in the equity securities of our LMM portfolio companies.

Our investments in UMM companies primarily consist of direct investments in or secondary purchases of interest bearing debt securities in privately held companies that are generally larger in size than the LMM companies included in our portfolio. Our UMM debt investments are generally secured by either a first or second priority lien on the assets of the portfolio company and typically have an expected duration of between three and seven years from the original investment date.

We offer managerial assistance to our portfolio companies and provide them access to our investment experience, direct industry expertise and contacts. Our obligation to offer to make available significant managerial assistance to our portfolio companies is consistent with our belief that providing managerial assistance to a portfolio company is important to its business development activities.

Because we are internally managed, we do not pay any external investment advisory fees, but instead directly incur the operating costs associated with employing investment and portfolio management professionals. We believe that our internally managed structure provides us with a beneficial operating expense structure when compared to other publicly traded and privately held investment firms that are externally managed, and our internally managed structure allows us the opportunity to leverage our non-interest operating expenses as we grow our investment portfolio.

Recent Developments

On March 31, 2023, Moody's Investors Service, Inc. assigned CSWC an investment grade long-term issuer rating of Baa3 with a stable outlook.

On April 22, 2020,26, 2023, the Board of Directors declared a total dividend of $0.51$0.59 per share, comprised of a regular dividend of $0.41$0.54 and a supplemental dividend of $0.10,$0.05, for the quarter ended June 30, 2020.2023. The record date for the dividend is June 15, 2020.2023. The payment date for the dividend is June 30, 2020.2023.

On May 28, 2020,April 26, 2023, pursuant to Rule 2a-5 under the 1940 Act, the Board of Directors declareddesignated a total dividendcommittee of $0.51 per share, comprisedcertain officers of a regular dividendthe Company as the Board's valuation designee (the “Valuation Designee”) to determine the fair value of $0.41 and a supplemental dividendthe

Company's investments that do not have readily available market quotations, subject to the oversight of the Board of Directors, effective beginning as of the fiscal quarter ended Septemberending June 30, 2020. The record date for the dividend is September 15, 2020. The payment date for the dividend is September 30, 2020.2023.

Our BusinessInvestment Strategy

Our business strategy isWe intend to achieve our investment objective of producing attractive risk-adjusted returns by generating current income from our debt investments and realizing capital appreciation from our equity and equity-related investments. We have adopted the following businessinvestment strategies to achieve our investment objective:

•Leveraging the Experience of Our Management Team. Our senior management team has extensive experience investing in and lending to middle market companies across changing market cycles. The members of our management team have diverse investment backgrounds, with prior experience at BDCs in the capacity of senior officers. We believe this extensive experience provides us with an in-depth understanding of the strategic, financial and operational challenges and opportunities of the middle market companies in which we invest. We believe this understanding allows us to select and structure better investments and to efficiently monitor and provide managerial assistance to our portfolio companies.

•Applying Rigorous Underwriting Policies and Active Portfolio Management. Our senior management team has implemented rigorous underwriting policies that are followed in each transaction. These policies include a thorough analysis of each potential portfolio company’s competitive position, financial performance, management team operating discipline, growth potential and industry attractiveness, which we believe allows us to better assess the company’s prospects. After investing in a company, we monitor the investment closely, typically receiving monthly, quarterly and annual financial statements. Senior management, together with the deal team and accounting and finance departments, generally meets at least monthlyquarterly to analyze and discuss in detail the company’s financial performance and industry trends. We believe that our initial and ongoing portfolio review process allows us to effectively monitor effectively the performance and prospects of our portfolio companies.

•Investing Across Multiple Companies, Industries, Regions and End Markets. We seek to maintain a portfolio of investments that is appropriately diverse among various companies, industries, geographic regions and end markets. This portfolio balance is intended to mitigate the potential effects of negative economic events for particular companies, regions, industries and end markets. However, we may from time to time hold securities of an individual portfolio company that comprise more than 5% of our total assets and/or more than 10% of the outstanding voting securities of the portfolio company. For that reason, we are classified as a non-diversified investment company that has elected to be regulated as a BDC under the 1940 Act.

•Utilizing Long-Standing Relationships to Source Deals. Our senior management team and investment professionals maintain extensive relationships with entrepreneurs, financial sponsors, attorneys, accountants, investment bankers, commercial bankers and other non-bank providers of capital who refer prospective portfolio companies to us. These relationships historically have generated significant investment opportunities. We believe that our network of relationships will continue to produce attractive investment opportunities.

•Focusing on Underserved Markets. The middle market has traditionally been underserved. We believe that operating margin and growth pressures, as well as regulatory concerns, have caused many financial institutions to de-emphasize services to middle market companies in favor of larger corporate clients and more liquid capital market transactions. We also invest in securities that would be rated below investment grade if they were rated. We believe these dynamics have resulted in the financing market for middle market companies being underserved, providing us with greater investment opportunities.

•Focus on Established Companies. We generally invest in companies with established market positions, proven management teams with strong operating discipline, histories of generating revenues, and recurring cash flow streams. We believe that those companies generally possess better risk adjusted return profiles than earlier stage companies that are building their management teams and establishing their revenue base. We also believe that established companies in our target size range generally provide opportunities for capital appreciation.

•Capital Structures Appropriate for Potential Industry and Business Volatility. Our investment team spends significant time understanding the performance of both the target portfolio company and its specific industry throughout a full economic cycle. The history of each specific industry and target portfolio company will demonstrate a different level of potential volatility in financial performance. We seek to understand this dynamic thoroughly and invest our

capital at leverage levels in the capital structure that will remain within enterprise value and in securities that will receive interest payments if such downside volatility were to occur.

•Providing Customized Financing Solutions. We offer a variety of financing structures and have the flexibility to structure our investments to meet the needs of our portfolio companies. We primarily invest in senior debt securities coupled with equity interests. We believe our ability to customize financing structures makes us an attractive partner to middle market companies.

INVESTMENT CRITERIA AND OBJECTIVES

Our investment team has identified the following investment criteria that we believe are important in evaluating prospective investment opportunities. However, not all of these criteria have been or will be met in connection with each of our investments:

Companies with •Positive and Sustainable Cash Flow: We generally seek to invest in established companies with sound historical financial performance.

•Excellent Management: Management teams with a proven record of achievement, exceptional ability, unyielding determination and integrity. We believe management teams with these attributes are more likely to manage the companies in a manner that protects and enhances value.

Industry: •Competitive Advantages in Markets: We primarily focus on companies having competitive advantages in their respective markets and/or operating in industries with barriers to entry, which may help protect their market position.

•Strong Private Equity Sponsors: We focus on developing relationships with leading private equity firms in order to partner with these firms and provide them capital to support the acquisition and growth of their portfolio companies.

•Appropriate Risk-Adjusted Returns: We focus on and price opportunities to generate returns that are attractive on a risk-adjusted basis, taking into consideration factors in addition to the ones depicted above, including credit structure, leverage levels and the general volatility and potential volatility of cash flows.

We have an investment committee that is responsible for all aspects of our investment process relating to investments made by us. The current members of the investment committee are Bowen Diehl, Chief Executive Officer,Officer; Michael Sarner, Chief

Financial Officer, Douglas Kelley, Managing Director,Officer; Josh Weinstein, Senior Managing Director,Director; and William Thomas,Ramona Rogers-Windsor, a member of the Board of Directors.Directors and a non-voting, observer of the investment committee.

Investment Process

Our investment strategy involves a team approach, whereby our investment team screens potential transactions before they are presented to the investment committee for approval. Transactions that are either above a certain hold size or outside our general investment policy will also be reviewed and approved by the Board of Directors. Our investment team generally categorizes the investment process into six distinctive stages:

•Deal Generation/Origination: Deal generation and origination is maximized through long-standing and extensive relationships with private equity firms, leveraged loan syndication desks, brokers, commercial and investment bankers, entrepreneurs, service providers such as lawyers and accountants, and current and former portfolio companies and investors.

•Screening: Once it is determined that a potential investment has met our investment criteria, we will screen the investment by performing preliminary due diligence, which could include discussions with the private equity firm, management team, loan syndication desk, etc. Upon successful screening of the proposed investment, the investment team makes a recommendation to move forward and prepares an initial screening memo for our investment committee. We then issue either a non-binding term sheet (in the case of a directly originated transaction), or submit an order to the loan syndication desk (in the case of a large-market syndicated loan transaction).

•Term Sheet: In a directly originated transaction, the non-binding term sheet will typically include the key economic terms of our investment proposal, along with exclusivity, confidentiality, and expense reimbursement provisions, amongas well as other terms relevant to the particular investment. Upon acceptance of the term sheet, we will begin our formal due diligence process. In a syndicated loan transaction, rather than a formal term sheet, we will submit an order for an allocation to the syndicated loan desk.

•Due Diligence: Due diligence is performed under the direction of our senior investment professionals, and involves our entire investment team as well as certain external resources who together perform due diligence to understand the

relationships among the prospective portfolio company’s business plan, operations, financial performance, and legal risks. On our directly originated transactions, our due diligence often will often include (1) conducting site visits with management and key personnel; (2) performing a detailed review of historical and projected financial statements, often with a third-party accounting firm, to evaluate the target company’s normalized cash flow; (3) creating our own detailed modeling projections, including a downside case which attempts to project how the business would perform in a recession based on past operating history of either the company or the industry; (4) interviewing key customers and suppliers; (5) evaluating company management, including a formal background check; (6) reviewing material contracts; (7) conducting an industry, market and strategy analysis; and (8) obtaining a review by legal, environmental or other consultants. In instances where a financial sponsor is investing in the equity in a transaction, we will leverage work done by the financial sponsor for purposes of our due diligence. In syndicated loan transactions, our due diligence may exclude direct customer and supplier interviews, and will consist of a detailed review of reports from the financial sponsor or syndication agent for industry and market analysis and legal and environmental diligence.

•Document and Close: Upon completion of a satisfactory due diligence review, our investment team presents its written findings to the investment committee. For transactions that are either over a certain hold size or outside our general investment policy, the investment team will present the transaction to our Board of Directors for approval. Upon approval forof the investment, we re-confirm our regulatory company compliance, process and finalize all required legal documents and fund the investment.

•Post-Investment: We continuously monitor the status and progress of our portfolio companies, as well as our investment thesis developed at the time of investment. We offer managerial assistance to our portfolio companies and provide them access to our investment experience, direct industry expertise and contacts. The same investment team leader that was involved in the investment process will continue to be involved in the portfolio company post-investment. This approach provides continuity of knowledge and allows the investment team to maintain a strong business relationship with the financial sponsor, business owner and key management of our portfolio companies. As part of the monitoring process, members of our investment team will analyze monthly, quarterly and annual financial statements against previous periods, review financial projections, meet with the financial sponsor and management (when necessary), attend board meetings (when appropriate) and review all compliance certificates and covenants. Our investment team generally meets once each monthquarter with senior management to review the performance of each of our portfolio companies.

We utilize an internally developed investment rating system to rate the performance of and monitor the expected level of returns for each debt investment in our portfolio. The investment rating system takes into account both quantitative and qualitative factors of the portfolio company and the investments held therein, including each investment’s expected level of returns and the collectability of our debt investments, comparisons to competitors and other industry participants and the portfolio company’s future outlook. The ratings are not intended to reflect the performance or expected level of returns of our equity investments.

•Investment Rating 1 represents the least amount of risk in our portfolio. The investment is performing materially above underwriting expectations and the trends and risk factors are generally favorable. The investment generally has a higher probability of being prepaid in part or in full.

•Investment Rating 2 indicates the investment is performing as expected at the time of underwriting and the trends and risk factors are generally favorable to neutral. All new loans are initially rated 2.

•Investment Rating 3 involves an investment performing below underwriting expectations and the trends and risk factors are generally neutral to negative. The portfolio company or investment may be out of compliance with financial covenants and interest payments may be impaired, however principal payments are generally not past due.

•Investment Rating 4 indicates that the investment is performing materially below underwriting expectations, the trends and risk factors are generally negative and the risk of the investment has increased substantially. Interest and principal payments on our investment are likely to be impaired.

Determination of Net Asset Value

Quarterly Determinations

We determine our net asset value, or NAV, per share on a quarterly basis. The NAV per share is equal to our total assets minus liabilities divided by the total number of shares of common stock outstanding.

We determine in good faith the fair value of our portfolio investments pursuant to a valuation policy in accordance with Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurements and Disclosures (“ASC 820”) and a valuation process approved by our Board of Directors and in accordance with the 1940 Act. Our valuation policy is intended to provide a consistent basis for determining the fair value of the portfolio.

We undertake a multi-step valuation process each quarter in connection with determining the fair value of our investments. The valuation process is led by the finance department in conjunction with the investment teams and senior management. Valuations of each portfolio security are prepared quarterly by the finance department using updated portfolio company financial and operational information. Each investment valuation is also subject to review by the executive officers and investment teams.

In conjunction with the internal valuation process, we have engaged multiple independent consulting firms that specialize in financial due diligence, valuation and business advisory services to provide third-party valuation reviews of the majority of our investments on a quarterly basis. OurAs of March 31, 2023, our Board of Directors is ultimately responsible for overseeing, reviewing and approving, in good faith, our determination of the fair value of each investment in our portfolio. Beginning as of the fiscal quarter ending June 30, 2023, pursuant to Rule 2a-5 under the 1940 Act, the Board of Directors has designated a valuation committee comprised of certain officers of the Company (the "Valuation Committee") as its valuation designee to determine the fair value of the Company's investments that do not have readily available market quotations, subject to the oversight of the Board of Directors.

Determinations in Connection with our Offerings

The 1940 Act prohibits us from selling shares of our common stock at a price below the current NAV per share of such stock, with certain exceptions. One such exception is prior shareholder approval of issuances below current NAV per share, provided that our Board of Directors determines that such sale is in the best interests of the Company and its shareholders. We do not intend to seek shareholder authorization to sell shares of our common stock below the then current NAV per share of our common stock at our 2023 annual meeting of shareholders. However, in the event we change our position, we will seek requisite approval of our shareholders.

In connection with each offering of shares of our common stock, our Board of Directors or an authorized committee thereofValuation Committee is required by the 1940 Act to make the determination of whether we are selling shares of our common stock at a price below our then current NAV at the time at which the sale is made. Ourmade, subject to the oversight of the Board of Directors or an authorized committee thereofDirectors. Our Valuation Committee considers the following factors, among others, in making such determination:

•the NAV of our common stock disclosed in the most recent periodic report we filed with the SEC;

•our management’s assessment of whether any material change in the NAV has occurred (including through the realization of net gains on the sale of our investments) from the period beginning on the date of the most recently disclosed NAV per share of our common stock and ending as of a time within 48 hours (excluding Sundays and holidays) of the sale of our common stock; and

•the magnitude of the difference between (i) a value that our Board of Directors or an authorized committee thereofValuation Committee has determined reflects the current (as of a time within 48 hours, excluding Sundays and holidays) NAV of our common stock, which is based upon the NAV disclosed in the most recent periodic report we filed with the SEC, as adjusted to

reflect our management’s assessment of any material change in the NAV since the date of the most recently disclosed NAV, and (ii) the offering price of the shares of our common stock in the proposed offering.

Moreover, to the extent that there is even a remote possibility that we may (i) issue shares of our common stock at a price below the then current NAV of our common stock at the time at which the sale is made or (ii) trigger the undertaking (which we providedwould provide to the SEC) to suspend the offering of shares of our common stock if the NAV fluctuates by certain amounts in certain circumstances, our Board of Directors or an authorized committee thereofValuation Committee will elect, in the case of clause (i) above, either to postpone the offering until such time that there is no longer the possibility of the occurrence of such event or to undertake to determine NAV within two days prior to any such sale to ensure that such sale will not be below our then current NAV, and, in the case of clause (ii) above, to comply with such undertaking or to undertake to determine NAV to ensure that such undertaking has not been triggered.

These processes and procedures are part of our compliance policies and procedures. Records are made contemporaneously with all determinations described in this section and these records are maintained with other records we are required to maintain under the 1940 Act.

COMPETITION

We compete for attractive investment opportunities with other financial institutions, including BDCs, junior capital lenders, and banks. We believe we are able to be competitive with these entities primarily on the basis of the experience and contacts of our management team and our responsive and efficient investment analysis and decision-making processes. However, many of our competitors are substantially larger and have considerably greater financial, technical and marketing resources than we do. Furthermore, our competitors may have a lower cost of funds and many have access to funding sources that are not available to us. In addition, certain of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments, establish more relationships, and build their market shares. Likewise, many of our competitors are not subject to the regulatory restrictions and valuation requirements that the 1940 Act imposes on us as a BDC. See “Risk Factors—Risks Related to Our Business and Structure—We operate in a highly competitive market for investment opportunities.”

We cannot assure you that the competitive pressures we face will not have a material adverse effect on our business, financial condition and results of operations. In addition, because of this competition, we may be unable to take advantage of attractive investment opportunities and may be unable to identify and make investments that satisfy our investment objectives or meet our investment goals.

HUMAN CAPITAL

Our employees are vital to our success as an internally managed BDC. The long-term success of our business and the success of our investment strategy depends on our people. We strive to attract, develop and retain our employees by offering advancement and promotion opportunities, attractive compensation and benefit packages and a close-knit culture. The departure of our key investment and operations personnel could cause our operating results to suffer.

Our investment strategy depends heavily on the business owners, management teams, and financial sponsors of our portfolio companies and their respective employees, contractors and service providers. In our investment process, the analysis of these individuals is a critical part of our overall investment underwriting process and as a result we carefully review the qualifications and experience of the portfolio company’s business owners and management team and their employment practices. We strive to partner with business owners, management teams, and financial sponsors whose business practices reflect our core values.

We also strive to recruit talented and driven individuals who share our values. Our recruiting efforts utilize strong relationships with a variety of sources from which we recruit. We offer selected students investment analyst internships, which are expected to lead to permanent roles for high performing and high potential interns. Through our internship program, interns who want to become investment analysts have the opportunity to see the full investment process from origination to closing, as well as post-closing portfolio management activities. We routinely promote from within, promoting current employees who have shown the technical ability, attitude, interest and the initiative to take on greater responsibility.

We have designed a compensation structure, including an array of benefit plans and programs, that we believe is attractive to our current and prospective employees. For certain employees, our compensation strategy also includes an equity incentive plan, which we have structured to further align the interests of our employees with our shareholders, and to cultivate a strong sense of ownership and commitment to the Company. Through our performance review processes, our employees are annually evaluated by supervisors and our senior management team to ensure employees continue to develop and advance as expected. We provide a workplace designed to enable our employees to balance work, family and family-related situations including flexible working arrangements. Our employees have access to a parental leave program for birth, adoption placement or foster child placement. We are committed to creating and maintaining an atmosphere where all employees feel welcomed, valued, respected and heard so that they feel motivated and encouraged to contribute fully to their careers, the Company and our communities.

We are committed to fostering a workplace conducive to the open communication of any concerns regarding unethical, fraudulent or illegal activities. We seek to promote a safe environment that is free of harassment or bullying. We do not tolerate discrimination or harassment of any kind, including, but not limited to, sexual, gender identity, race, religion, ethnicity, age, or disability, among others. We seek feedback from employees on matters related to their employment or our operations including its financial statement disclosures, accounting, internal accounting controls or auditing matters. Under our Whistleblower Policy, each employee of the Company has the ability to confidentially report via a dedicated, confidential reporting hotline questionable or improper accounting, internal controls, auditing matters, disclosure, or fraudulent business practices or other illegal or unethical behavior. We seek to protect the confidentiality of those making reports of possible misconduct and our

Whistleblower Policy prohibits retaliation against those who report activities believed in good faith to be a violation of any law, rule, regulation or internal policy. Our Code of Business Conduct establishes applicable policies, guidelines, and procedures that promote ethical practices and conduct by the Company and all its employees, officers, and directors. Our Whistleblower Policy and Code of Business Conduct can be found on our website at www.capitalsouthwest.com/governance.

As of March 31, 2023, we had twenty-six employees. These employees include our corporate officers, investment and portfolio management professionals and administrative staff. All of our employees are located in our principal executive offices in Dallas, Texas.

LEVERAGE

We borrow funds to make investments, a practice known as “leverage,” in an attempt to increase returns to our shareholders. Effective April 25, 2019, we are allowed to borrow amounts such that our asset coverage, as calculated in accordance with the 1940 Act, equals at least 150% after such borrowing. Additionally, the Board of Directors approved a resolution whichthat limits the Company's issuance of senior securities such that the asset coverage ratio, taking into account any such issuance, would not be less than 166%, at any time after the effective date. The amount of leverage that we employ at any particular time will depend on management’s and our Board of Directors’ assessments of portfolio mix, prevailing market advance rates, and other market factors at the time of any proposed borrowing. See “Risk Factors – Risks Related to Our Business and Structure – Because we borrow money to make investments, the potential for gain or loss on amounts invested in us is magnified and may increase the risk of investing in us.” On August 11, 2021, we received an exemptive order from the SEC to permit us to exclude the senior securities issued by SBIC I or any future SBIC subsidiary of the Company from the definition of "senior securities" in the asset coverage requirement applicable to the Company under the 1940 Act.

We intend to continue borrowing under the Credit Facilityour senior secured credit facility (the "Credit Facility") in the future, and we may increase the size of the Credit Facility, add additional credit facilities, or otherwise issue additional debt securities or other evidences of indebtedness in the future, although there can be no assurance that we will be able to do so.

See "Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Liquidity and Capital Resources" as well as Note 5 to our consolidated financial statements for the year ended March 31, 20202023 for information regarding the Credit Facility the issuance of the December 2022 Notes and the issuance of the October 2024 Notes.

BROKERAGE ALLOCATION AND OTHER PRACTICES

Since we generally acquire and dispose of our investments in privately negotiated transactions, we infrequently use brokers in the normal course of our business. Our investment team is primarily responsible for the execution of the publicly traded securities portion of our portfolio transactions4.50% Notes due 2026 (the "January 2026 Notes") and the allocation of brokerage commissions. We do not expect to execute transactions3.375% Notes due 2026 (the "October 2026 Notes").

through any particular broker or dealer, but will seek to obtain the best net results for us, taking into account such factors as price (including the applicable brokerage commission or dealer spread), size of order, difficulty of execution, and operational facilities of the firm and the firm’s risk and skill in positioning blocks of securities. While we will generally seek reasonably competitive trade execution costs, we will not necessarily pay the lowest spread or commission available. Subject to applicable legal requirements, we may select a broker based partly upon brokerage or research services provided to us. In return for such services, we may pay a higher commission than other brokers would charge if we determine in good faith that such commission is reasonable in relation to the services provided. We did not pay any brokerage commissions during the three years ended March 31, 2020.

DIVIDEND REINVESTMENT PLAN

We have adopted a dividend reinvestment plan, or DRIP, that provides for the reinvestment of dividends on behalf of our shareholders.shareholders in shares of our common stock. Under the DRIP, if we declare a dividend, registered shareholders who have opted into the DRIP as of the dividend record date will have their dividend automatically reinvested into additional shares of our common stock. The share requirements of the DRIP are satisfied through open market purchases of common stock by the DRIP plan administrator. Shares purchased in the open market to satisfy the DRIP requirements will be valued based upon the average price of the applicable shares purchased by the DRIP plan administrator, before any associated brokerage or other costs.

ELECTION TO BE REGULATED AS A BUSINESS DEVELOPMENT COMPANY

We are a closed-end, non-diversified investment company that has elected to be treatedregulated as a BDC under the 1940 Act. In addition, we have elected, and intend to qualify annually, to be treated as a RIC.RIC for U.S. federal income tax purposes. Our election to be regulated as a BDC and our election to be treated as a RIC for U.S. federal income tax purposes have a significant impact on our operations. Some of the most important effects on our operations of our election to be regulated as a BDC and our election to be treated as a RIC are outlined below.

•We report our investments at market value or fair value with changes in value reported through our Consolidated Statements of Operations.

In accordance with the requirements of the 1940 Act and Article 6 of Regulation S-X, we report all of our investments, including debt investments, at market value or, for investments that do not have a readily available market value, at their “fair value” as determined in good faith by our Board of Directors. Changes in these values are reported through our Consolidated Statements of Operations under the caption of “net change in unrealized appreciation on investments.” See “Determination of Net Asset Value” above.

•We intend to distribute substantially all of our income to our shareholders. We generally will be requiredsubject to payU.S. federal income taxestax only on the portion of our taxable income we do not timely distribute to shareholders (actually or constructively).

As a RIC, so long as we meet certain minimum distribution, source of income, and asset diversification requirements, we generally are requiredsubject to pay U.S. federal income taxestax only, and possibly a 4% U.S. federal excise tax, on the portion of our taxable income and gains that we do not timely distribute (actually or constructively) and certain built-in gains. Depending onOur U.S. federal income tax liability may be reduced to the level of taxable income earned in a tax year,extent that we may choose to carry forward taxable income in excess of current yearmake certain distributions intoduring the nextfollowing calendar year and pay a 4% U.S. federal excise tax on such income. Any such carryover taxable income must be distributed through a dividend declared prior to filing the final tax return related to the year that generated such taxable income.satisfy other procedural requirements. We intend to distribute to our shareholders substantially all of our income. We may, however, make deemed distributions to our shareholders of any retained net long-term capital gains. If this happens, our shareholders will be treated as if they received an actual distribution of the net capital gains and reinvested the net after-tax proceeds in us. Our shareholders also may be eligible to claim a tax credit (or, in certain circumstances, a tax refund) equal to their allocable share of the corporate-level U.S. federal income tax we pay on the deemed distribution. See “Material U.S. Federal Income Tax Considerations.” We met the minimum distribution requirements for tax years 20182021 and 20172020 and intend to meet the minimum distribution requirements for tax year 2019.2022. We continually monitor our distribution requirements with the goal of ensuring compliance with the Code.

In addition, we have a Taxable Subsidiary that holds a portion of one or more of our portfolio investments that are listed on the Consolidated Schedule of Investments. The Taxable Subsidiary is consolidated for financial reporting purposes in accordance with U.S. Generally Accepted Accounting Principles, or GAAP, so that our consolidated financial statements reflect our investments in the portfolio companies owned by the Taxable Subsidiary. The purpose of the Taxable Subsidiary is to permit us to hold certain interests in portfolio companies that are organized as limited liability companies, or LLCs (or other forms of pass-through entities) and still satisfy the RIC tax requirement that at least 90% of our gross income for U.S. federal income tax purposes must consist of qualifying investment income. Absent the Taxable Subsidiary, a proportionate amount of any gross income of a partnership or

LLC (or other pass-through entity) portfolio investment generally would flow through directly to us. To the extent that such income did not consist of investment income, it could jeopardize our ability to qualify as a RIC and therefore cause us to incur significant amounts of corporate-level U.S. federal income taxes. Where interests in LLCs (or other pass-through entities) are owned by the Taxable Subsidiary, the income from those interests is taxed to the Taxable Subsidiary and does not flow through to us, thereby helping us preserve our RIC status and resultant tax advantages. The Taxable Subsidiary is not consolidated for U.S. federal income tax purposes and may generate U.S. federal income tax expense as a result of its ownership of the portfolio companies. This U.S. federal income tax expense, if any, is reflected in our Consolidated Statements of Operations.

•Our ability to use leverage as a means of financing our portfolio of investments is limited.

As a BDC, we are required to meet a coverage ratio of total assets to total senior securities of at least 150%, which became effective April 25, 2019. Additionally, the Board of Directors approved a resolution whichthat limits the Company's issuance of senior securities such that thatour asset coverage ratio, taking into account any such issuance, would not be less than 166%, at any time after the effective date. For this purpose, senior securities include all borrowings and any preferred stock we may issue in the future. Additionally, our ability to utilize leverage as a means of financing our portfolio of investments may be limited by this asset coverage requirement. While the use of leverage may enhance returns if we meet our investment objective, our returns may be reduced or eliminated if our returns on investments are less than the costs of borrowing. On August 11, 2021, we received an exemptive order from the SEC to permit us to exclude the senior securities issued by SBIC I or any future SBIC subsidiary of the Company from the definition of senior securities in the asset coverage requirement applicable to the Company under the 1940 Act.

•We are required to comply with the provisions of the 1940 Act applicable to business development companies.

As a BDC, we are required to have a majority of directors who are not “interested persons” as such term is(as defined in Section 2(a)(19) of the 1940 Act.Act) of the Company. In addition, we are required to comply with other applicable provisions of the 1940 Act, including those requiring the adoption of a code of ethics, maintaining a fidelity bond and placing and maintaining itsour securities and similar investments in custody. See “Regulation as a Business Development Company” below.

Regulation as a Business Development Company

We have elected to be regulated as a BDC under the 1940 Act. The 1940 Act contains prohibitions and restrictions relating to transactions between BDCs and their affiliates and principal underwriters as well as their respective affiliates. The 1940 Act requires that a majority of the members of the board of directors of a BDC be persons other than “interested persons,” as defined in the 1940 Act. In addition, the 1940 Act provides that we may not change the nature of our business so as to cease to be, or to withdraw our election as, a BDC unless approved by holders of a majority of our outstanding voting securities.

The 1940 Act defines “a majority of the outstanding voting securities” as the lesser of (1) 67% or more of the voting securities of holders present or represented by proxy at a meeting if the holders of more than 50% of our outstanding voting securities are present or represented by proxy or (2) more than 50% of our voting securities.

The following is a brief description of the 1940 Act provisions applicable to BDCs, which is qualified in its entirety by reference to the full text of the 1940 Act and rules issued thereunder by the SEC.SEC:

•Generally, BDCs must offer, and must provide upon request, significant managerial assistance available to certaineligible portfolio companies. In general, as a BDC, a company must, among other things: (1) be a domestic company; (2) have registered a class of its securities pursuant to Section 12 of the Exchange Act; (3) operate for the purpose of investing in the securities of certain types of eligible portfolio companies, includingwhich may include early stage or emerging companies and businesses sufferingbankrupt, insolvent or just recovering from financial distressdistressed companies (see following paragraph); (4) offer to make available significant managerial assistance to such eligible portfolio companies; and (5) file a proper notice of election with the SEC.

•An eligible"eligible portfolio companycompany" generally is a domestic company that is not a regulated or private investment company or a financial company (such as brokerage firms, banks, insurance companies and investment banking firms) and that: (1) does not have a class of securities listed on a national securities exchange; (2) has a class of securities listed on a national securities exchange with an equity market capitalization of less than $250 million; or (3) is controlled by the BDC itself or together with others and, as a result of such control, the BDC has an affiliated person on the board of directors of the company. The 1940 Act presumes that a person has “control” of a portfolio company if that person owns at least 25% of its outstanding voting securities.

•As a BDC, we are required to provide and maintain a bond issued by a reputable fidelity insurance company to protect against larceny and embezzlement. Furthermore, as a BDC, we are prohibited from protecting any director or officer against any liability to us or our shareholders arising from any act or omission constituting willful malfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of that person’s office.

•We are required to adopt and implement written policies and procedures reasonably designed to prevent violation of the federal securities laws, review these policies and procedures annually for their adequacy and the effectiveness of their implementation and designate a chief compliance officer who reports directly to the Board of Directors to be responsible for administering these policies and procedures.

On March 23, 2018, the Small Business Credit Availability Act (the “SBCAA”) was signed into law and, among other things, instructs the SEC to issue rules or amendments to rules allowing BDCs to use the same registration, offering and communication processes that are available to operating companies. The rules and amendments specified by the SBCAA became self-implementing on March 24, 2019. On April 8, 2020, the SEC adopted rules and amendments to implement certain provisions of the SBCAA (the “Final Rules”) that, among other things, modify the registration, offering, and communication processes available to BDCs relating to: (i) the shelf offering process to permit the use of short-form registration statements on Form N-2 and incorporation by reference; (ii) the ability to qualify for Well-Known Seasoned Issuer status; (iii) the immediate or automatic effectiveness of certain filings made in connection with continuous public offerings; and (iv) communication processes and prospectus delivery. In addition, the SEC adopted rules that will require BDCs to comply with certain structured data and inline XBRL requirements. The Final Rules will generally become effective on August 1, 2020, except that a BDC eligible to file short-form registration statements on Form N-2, like the Company, must comply with the Inline XBRL structure data requirements for its financial statements, registration statement cover page, and certain prospectus information by August 1, 2022.

Qualifying Assets

The 1940 Act provides that we may not make an investmentacquire any assets other than "qualifiying assets" specified in non-qualifying assetsthe 1940 Act unless at the time of the investment at least 70% of the value of our total assets (measured as of the date of our most recently filed financial statements) consists of qualifying assets. Qualifying assets include: (1) securities of eligible portfolio companies; (2) securities of certain companies that were eligible portfolio companies at the time we initially acquired their securities and in which we retain a substantial interest; (3) securities of certain controlled companies; (4) securities of certain bankrupt, insolvent or distressed companies; (5) securities received in exchange for or distributed in or with respect to any of the foregoing; and (6) cash items, U.S. government securities and high-quality short-term debt.

Significant Managerial Assistance to Portfolio Companies

In orderBDCs generally must offer, and must provide upon request, significant managerial assistance to countcertain of their portfolio securities as qualifying assets forcompanies, except in circumstances where either (i) the purpose of the qualifying assets requirement, we must either control theBDC controls such issuer of the securities or must offer to make available to(ii) the issuer of the securities significant managerial assistance. However, where we purchaseBDC purchases such securities in conjunction with one or more other persons acting together and one of the other persons in the group may makemakes available such managerial assistance. Making available managerial assistance means, among other things, any arrangement whereby the BDC, through its directors, officers or employees, offers to provide, and, if accepted, provides, significant guidance and counsel concerning the management, operations or business objectives and policies of a portfolio company.

Temporary Investments

Pending investment in other types of “qualifyingqualifying assets,” as described above, our investments may consist of cash, cash equivalents, U.S. government securities, short-term investments in secured debt investments, independently rated debt investments, and diversified bond funds, which we refer to as temporary investments.

Senior Securities

BDCs generally have been permitted by the 1940 Act, under specific conditions, to issue multiple classes of debt and one class of stock senior to its common stock if its asset coverage, as defined by the 1940 Act, is at least 200% immediately after each such issuance. However, recent legislation has modified the 1940 Act by allowingallows a BDC to increase the maximum amount of leverage it may incur by reducing the minimum asset coverage ratio from 200% to 150%, if certain requirements under the 1940 Act are met. On April 25, 2018, the Board of Directors unanimously approved the application of the recently modified asset coverage requirements set forth in Section 61(a)(2) of the 1940 Act. As a result, effective April 25, 2019, the minimum asset coverage ratio applicable to the Company was decreased from 200% to 150%, which became effective April 25, 2019.. Additionally, the Board of Directors also approved a resolution whichthat limits the Company’s issuance of senior securities such that the asset coverage ratio, taking into account any such issuance, would not be less than 166%, at any time after the effective date. We are required to make certain disclosures on our website and in SEC filings regarding, among other things, the receipt of approval to reduce itsour asset coverage requirement to 150%, itsour leverage capacity and usage, and risks related to leverage.

As of March 31, 2020,2023, we had $154.0$235.0 million, $77.1$140.0 million and 75.0$150.0 million in total aggregate principal amount of debt outstanding under our Credit Facility, December 2022the January 2026 Notes and the October 20242026 Notes, respectively. As of March 31, 2020,2023, our asset coverage for borrowed amounts was 189%235%.

In addition, while any preferred stock or publicly traded debt securities are outstanding, we may be prohibited from making distributions to our shareholders or the repurchasing of such securities or shares unless we meet the applicable asset coverage ratios at the time of the distribution or repurchase. We may also borrow amounts up to 5% of the value of our total assets for temporary or emergency purposes without regard to asset coverage. Under specific conditions, we are also permitted by the 1940 Act to issue warrants.

Common Stock

We are not generally able to issue and sell our common stock at a price below NAV per share. We may, however, sell our common stock, warrants, options or rights to acquire our common stock at a price below the then current NAV of theour common stock if our Board of Directors determines that such sale is in our best interests and that of our shareholders, and our shareholders approve such sale. In any such case, the price at which our securities are to be issued and sold may not be less than a price which, in the determination of our Board of Directors, closely approximates the market value of such securities (less any distributing commission or discount). We do not intend to seek shareholder authorization to sell shares of our common stock below the then current NAV per share of our common stock at our 20202023 annual meeting of shareholders. See "Risk Factors - Risks Relating to Our Business and Structure - Regulations governing our operation as a BDC will affect our ability to, and the way in which we, raise additional capital."

Code of Ethics and Code of Conduct

We adopted a code of ethics pursuant to Rule 17j-1 under the 1940 Act that establishes procedures for personal investments and restricts certain personal securities transactions. Personnel subject to the code may invest in securities for their personal investment accounts, including securities that may be purchased or held by us, so long as those investments are made in accordance with the code’s requirements. We have also adopted a code of conduct that applies to our Chief Executive Officer, Chief Financial Officer (or persons performing similar functions), our Board of Directors, and all other employees. This code sets forth policies that these executives and employees must follow when performing their duties. The code of ethics and code of conduct are available on the Company website at www.capitalsouthwest.com/governance.

Proxy Voting Policies and Procedures

We vote proxies relating to our portfolio securities in a manner in which we believe is consistent with the best interest of our shareholders. We review on a case-by-case basis each proposal submitted to a shareholder vote to determine its impact on the portfolio securities held by us. Although we generally vote against proposals that we expect would have a negative impact on our portfolio securities, we may vote for such a proposal if there exists compelling long-term reasons to do so. Our proxy voting decisions are made by the investment team that is responsible for monitoring the investments. To ensure that our vote is not the product of a conflict of interest, we require that anyone involved in the decision-making process discloses to our Chief Compliance Officer any potential conflict of which he or she is aware. Shareholders may obtain information, without charge, regarding how we voted proxies with respect to our portfolio securities by making a written request for proxy voting information to: Chief Financial Officer c/o Capital Southwest Corporation, 5400 Lyndon B. Johnson Freeway,8333 Douglas Avenue, Suite 1300,1100, Dallas, Texas 75240.75225.

Compliance Policies and Procedures

We have adopted and implemented written policies and procedures reasonably designed to prevent violation of the U.S. federal securities laws, and we are required to review these compliance policies and procedures annually for their adequacy and the effectiveness of their implementation, andimplementation. We are further required to designate a Chief Compliance Officer to be responsible for administering these policies and procedures. Michael S. Sarner serves as our Chief Compliance Officer.

Exemptive Relief

On October 26, 2010, we received an exemptive order from the SEC permitting usThe right to issuegrant restricted stock awards under the 2010 Restricted Stock Award Plan (the "2010 Plan") terminated on July 18, 2021, ten years after the date that the 2010 Plan was approved by the Company's shareholders pursuant to our executive officersits terms.

In connection with the termination of the 2010 Plan, the Company’s Board of Directors and certain keyshareholders approved the Capital Southwest Corporation 2021 Employee Restricted Stock Award Plan (the "2021 Employee Plan"), which became effective on July 28, 2021, as part of the compensation package for its employees, or the Original Order.terms of which are, in all material respects, identical to the 2010 Plan. On August 22, 2017,July 19, 2021, we received an exemptive order that supersedes the Original Order, or the Exemptive Order, and in additionprior exemptive order relating to the relief granted under2010 Plan (the “Order”) to permit the Original Order, allows usCompany to (i) issue restricted stock as part of the compensation package for its employees in the 2021 Employee Plan, and (ii) withhold shares of the Company’s common stock or purchase shares of the Company’s common stock from the participants to satisfy tax withholding obligations relatedrelating to the vesting of restricted stock granted pursuant to the 20102021 Employee Plan. In addition, the Company's Board of Directors and shareholders approved the Capital Southwest Corporation 2021 Non-Employee Director Restricted Stock Award Plan or(the "Non-Employee Director Plan"), which became effective on July 27, 2022, as part of the 2010 Plan,compensation package for non-employee directors of the Board of Directors. In connection therewith, on May 16, 2022, we received an exemptive order that supersedes the Order (the "Superseding Order") and to paycovers both employees and non-employee directors of the exercise priceBoard of options to purchase shares of our common stock granted pursuant to the 2009 Stock Incentive Plan, or the 2009 Plan.Directors.

Other

We may also be prohibited under the 1940 Act from knowingly participating in certain transactions with our affiliates without the prior approval of our Board of Directors who are not interested persons and, in some cases, prior approval by the SEC. The prior approval of the SEC is not required, however, where a transaction involves no negotiation of terms other than price.

We expect to periodically be examined by the SEC for compliance with the 1940 Act.

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following discussion is a general summary of the material U.S. federal income tax considerations applicable to us and to an investment in our shares. This summary does not purport to be a complete description of the income tax considerations applicable to us or to investors in such an investment. For example, we have not described tax consequences that we assume to be generally known by investors or certain considerations that may be relevant to certain types of holders subject to special treatment under U.S. federal income tax laws, including shareholders subject to the alternative minimum tax, tax-exempt organizations, insurance companies, dealers in securities, pension plans and trusts, financial institutions, U.S. shareholders (as defined below) whose functional currency is not the U.S. dollar, persons who mark-to-market our shares and persons who hold our shares as part of a “straddle,” “hedge” or “conversion” transaction. This summary assumes that investors hold shares of our common stock as capital assets (within the meaning of the Code). The discussion is based upon the Code, Treasury regulations, and administrative and judicial interpretations, each as of the date of this Annual Report on Form 10-K and all of which are subject to change, possibly retroactively, which could affect the continuing validity of this discussion. This summary does not discuss any aspects of U.S. estate or gift tax or foreign, state or local tax. It does not discuss the special treatment under U.S. federal income tax laws that could result if we invested in tax-exempt securities or certain other investment assets.

For purposes of our discussion, a “U.S. shareholder” means a beneficial owner of shares of our common stock that is for U.S. federal income tax purposes:

•A citizen or individual resident of the United States;

•A corporation, or other entity treated as a corporation, for U.S. federal income tax purposes, created or organized in or under the laws of the United States or any state thereof ofor the District of Columbia;

•An estate, the income of which is subject to U.S. federal income taxation regardless of its source; or

•A trust if (1) a U.S. court is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust, or (2) it has a valid election in place to be treated as a U.S. person.

For purposes of our discussion, a “Non-U.S.“non-U.S. shareholder” means a beneficial owner of shares of our common stock that is neither a U.S. shareholder nor a partnership (including an entity treated as a partnership for U.S. federal income tax purposes).

If an entity treated as a partnership for U.S. federal income tax purposes (a “partnership”) holds shares of our common stock, the tax treatment of a partner or member of the partnership will generally depend upon the status of the partner or member and the activities of the partnership. A prospective shareholder that is a partner or member in a partnership holding shares of our common stock should consult his, her or its tax advisors with respect to the purchase, ownership and disposition of shares of our common stock.

Tax matters are very complicated and the tax consequences to an investor of an investment in our shares will depend on the facts of his, her, or its particular situation. We encourage investors to consult their own tax advisors regarding the specific consequences of such an investment, including tax reporting requirements, the applicability of U.S. federal, state, local and foreign tax laws, eligibility for the benefits of any applicable tax treaty and the effect of any possible changes in the tax laws.

Taxation as a Regulated Investment Company

Election to be Taxed as a RIC