UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 20112012 — Commission File No. 0-2989

COMMERCE BANCSHARES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Missouri | | 43-0889454 |

| (State of Incorporation) | | (IRS Employer Identification No.) |

1000 Walnut,

| | |

Kansas City, MO

| | 64106 (Zip Code) |

| (Address of principal executive offices) | | (Zip Code) |

| (816) 234-2000 | | |

| (Registrant’s telephone number, including area code) | | |

|

| | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | |

TItleTitle of class | | Name of exchange on which registered |

| $5 Par Value Common Stock | | NASDAQ Global Select Market |

| | | |

| Securities registered pursuant to Section 12(g) of the Act: |

NONE

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by checkmarkcheck mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Act. (Check one):

|

| | | |

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

| | | (Do not check if a smaller reporting company) | |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

As of June 30, 20112012, the aggregate market value of the voting stock held by non-affiliates of the Registrant was approximately $3,322,000,0002,949,000,000.

As of February 6, 20128, 2013, there were 88,963,09190,689,096 shares of Registrant’s $5 Par Value Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement for its 20122013 annual meeting of shareholders, which will be filed within 120 days of December 31, 2011,2012, are incorporated by reference into Part III of this Report.

|

| | | |

| Commerce Bancshares, Inc. | | |

| | | | |

| Form 10-K | | | |

| | | | |

| INDEX | | | Page |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | | |

| |

| | |

| |

PART I

General

Commerce Bancshares, Inc., a bank holding company as defined in the Bank Holding Company Act of 1956, as amended, was incorporated under the laws of Missouri on August 4, 1966. Through a second tier wholly-owned bank holding company, it owns all of the outstanding capital stock of Commerce Bank (the “Bank”), which is headquartered in Missouri. The Bank engages in general banking business, providing a broad range of retail, corporate, investment, trust, and asset management products and services to individuals and businesses. Commerce Bancshares, Inc. also owns, directly or through the Bank, various non-banking subsidiaries. Their activities include underwriting credit life and credit accident and health insurance, selling property and casualty insurance (relating to consumer loans made by the Bank), private equity investment, securities brokerage, mortgage banking, and leasing activities. A list of Commerce Bancshares, Inc.'s subsidiaries is included as Exhibit 21.

In June 2011, the Bank, which formerly was a national banking association, became a state chartered Federal Reserve member bank. The Bank’s main regulator was changed from the Office of the Comptroller of the Currency to supervision by both the Federal Reserve Bank of Kansas City and the Missouri Division of Finance. The Bank’s deposits continue to be fully insured by the FDIC in accordance with applicable laws and regulations.

Commerce Bancshares, Inc. and its subsidiaries, (collectively, the "Company") is one of the nation’s top 50 bank holding companies, based on asset size. At December 31, 20112012, the Company had consolidated assets of $20.622.2 billion, loans of $9.29.8 billion, deposits of $16.818.3 billion, and equity of $2.2 billion. All of the Company’s operations conducted by its subsidiaries are consolidated for purposes of preparing the Company’s consolidated financial statements. The Company does not utilize unconsolidated subsidiaries or special purpose entities to provide off-balance sheet borrowings or securitizations.

The Company’s goal is to be the preferred provider of targeted financial services in its communities, based on strong customer relationships. It believes in building long-term relationships based on top quality service, a strong risk management culture, and a strong balance sheet with industry-leading capital levels. The Company operates under a super-community banking format which incoporatesincorporates large bank product offerings coupled with deep local market knowledge, augmented by experienced, centralized support in select critical areas. The Company’s focus on local markets is supported by thean experienced team of managers assigned to each market and is also reflected in its financial centers and regional advisory boards, which are comprised of local business persons, professionals and other community representatives, who assist the Company in responding to local banking needs. In addition to this local market, community-based focus, the Company offers sophisticated financial products available at much larger financial institutions.

The Company's banking facilities are located throughout Missouri, Kansas, and central Illinois, as well as Tulsa, Oklahoma and Denver, Colorado. Its two largest markets include St. Louis and Kansas City, which serve as the central hubs for the entire company.Company.

The markets the Bank serves, being located in the lower Midwest, provide natural sites for production and distribution facilities and also serve as transportation hubs. The economy has been well-diversified in these markets with many major industries represented, including telecommunications, automobile, aircraft and general manufacturing, health care, numerous service industries, food production, and agricultural production and related industries. In addition, several of the Illinois markets are located in areas with some of the most productive farmland in the world. The real estate lending operations of the Bank are centered in its lower Midwestern markets. Historically, these markets have generally tended to be less volatile than in other parts of the country. While the decline in the national real estate market resulted in significantly higher real estate loan losses during 2009, 2010 and 2011recent years for the banking industry, management believes the diversity and nature of the Bank’s markets has resulted in lower real estate loan losses in these markets and is a key factor in the Bank’s relatively lower loan loss levels.levels during this period.

From time to time, the Company evaluates the potential acquisition of various financial institutions. In addition, the Company regularly considers the potential disposition of certain of its assets and branches. The Company seeks merger or acquisition partners that are culturally similar, have experienced management and possess either significant market presence or have potential for improved profitability through financial management, economies of scale and expanded services. The Company has not transacted any significant acquisitions or sales during the past several years.

The Company employed 4,270 persons on a full-time basis and 608 persons on a part-time basis at December 31, 2012. The Company provides a variety of benefit programs including a 401(k) plan as well as group life, health, accident, and other insurance. The Company also maintains training and educational programs designed to address the significant and changing regulations facing the financial services industry and prepare employees for positions of increasing responsibility.

Competition

The Company faces intense competition from hundreds of financial service providers. It competes with national and state banks for deposits, loans and trust accounts, and with savings and loan associations and credit unions for deposits and consumer lending products. In addition, the Company competes with other financial intermediaries such as securities brokers and dealers, personal loan companies, insurance companies, finance companies, and certain governmental agencies. With the passage of the

Gramm-Leach-Bliley Financial Modernization Act of 1999, competition has increased over time from institutions not subject to the same regulatory restrictions as domestic banks and bank holding companies. The Company generally competes on the basis of customer service and responsiveness to customer needs, reputation, interest rates on loans and deposits, lending limits, and customer convenience, such as location of offices. The Company has approximately 13% of the deposit market share in Kansas City and approximately 9% of the deposit market share in St. Louis.

Operating Segments

The Company is managed in three operating segments. The Consumer segment includes the retail branch network, consumer installment lending, personal mortgage banking, consumer debit and credit bank card activities. It provides services through a network of 201204 full-service branches, a widespread ATM network of 405403 machines, and the use of alternative delivery channels

such as extensive online banking and telephone banking services. In 2011,2012, this retail segment contributed 27%23% of total segment pre-tax income. The Commercial segment provides a full array of corporate lending, merchant and commercial bank card products, leasing, and international services, as well as business and government deposit and cash management services. Fixed income investments are sold to individuals and institutional investors through the Capital Markets Group, which is also included in this segment. In 2011,2012, the Commercial segment contributed 58%63% of total segment pre-tax income. The Wealth segment provides traditional trust and estate tax planning services, brokerage services, and advisory and discretionary investment portfolio management services to both personal and institutional corporate customers. This segment also manages the Company’s family of proprietary mutual funds, which are available for sale to both trust and general retail customers. At December 31, 20112012, the Wealth segment managed investments with a market value of $14.9$17.0 billion and administered an additional $12.4$13.3 billion in non-managed assets. Additional information relating to operating segments can be found on pages 4745 and 89.88.

Government Policies

The Company's operations are affected by federal and state legislative changes, by the United States government, and by policies of various regulatory authorities, including those of the numerous states in which they operate. These include, for example, the statutory minimum legal lending rates, domestic monetary policies of the Board of Governors of the Federal Reserve System, United States fiscal policy, international currency regulations and monetary policies, the U.S. Patriot Act, and capital adequacy and liquidity constraints imposed by federal and state bank regulatory agencies.

Supervision and Regulation

The following information summarizes existing laws and regulations that materially affect the Company's operations. It does not discuss all provisions of these laws and regulations and it does not include all laws and regulations that affect the Company presently or may affect the Company in the future.

General

The Company, as a bank holding company, is primarily regulated by the Board of Governors of the Federal Reserve System under the Bank Holding Company Act of 1956 (BHC Act). Under the BHC Act, the Federal Reserve Board’s prior approval is required in any case in which the Company proposes to acquire all or substantially all of the assets of any bank, acquire direct or indirect ownership or control of more than 5% of the voting shares of any bank, or merge or consolidate with any other bank holding company. With certain exceptions, the BHC Act also prohibits the Company from acquiring direct or indirect ownership or control of more than 5% of any class of voting shares of any non-banking company. Under the BHC Act, the Company may not engage in any business other than managing and controlling banks or furnishing certain specified services to subsidiaries and may not acquire voting control of non-banking companies unless the Federal Reserve Board determines such businesses and services to be closely related to banking. When reviewing bank acquisition applications for approval, the Federal Reserve Board considers, among other things, the Bank’s record in meeting the credit needs of the communities it serves in accordance with the Community Reinvestment Act of 1977, as amended (CRA). Under the terms of the CRA, banks have a continuing obligation, consistent with safe and sound operation, to help meet the credit needs of their communities, including providing credit to individuals residing in low- and moderate-income areas. The Bank has a current CRA rating of “outstanding”.

The Company is required to file with the Federal Reserve Board various reports and additional information the Federal Reserve Board may require. The Federal Reserve Board also makes regular examinations of the Company and its subsidiaries. The Company’s banking subsidiary is a state chartered Federal Reserve member bank and is subject to regulation, supervision and examination by the Federal Reserve Bank of Kansas City and the State of Missouri Division of Finance. The Bank is also subject to regulation by the Federal Deposit Insurance Corporation (FDIC). In addition, there are numerous other federal and state laws and regulations which control the activities of the Company and the Bank, including requirements and limitations relating to capital and reserve requirements, permissible investments and lines of business, transactions with affiliates, loan limits, mergers and acquisitions, issuance of securities, dividend payments, and extensions of credit. If the Company fails to comply with these or other applicable laws and regulations, it may be subject to civil monetary penalties, imposition of cease and desist orders or other

written directives, removal of management and, in certain circumstances, criminal penalties. This regulatory framework is intended primarily for the protection of depositors and the preservation of the federal deposit insurance funds, not for the protection of security holders. Statutory and regulatory controls increase a bank holding company’s cost of doing business and limit the options of its management to employ assets and maximize income.

In addition to its regulatory powers, the Federal Reserve Bank affects the conditions under which the Company operates by its influence over the national supply of bank credit. The Federal Reserve Board employs open market operations in U.S. government securities and oversees changes in the discount rate on bank borrowings, changes in the federal funds rate on overnight inter-bank borrowings, and changes in reserve requirements on bank deposits in implementing its monetary policy objectives. These methods are used in varying combinations to influence the overall level of the interest rates charged on loans and paid for deposits, the price of the dollar in foreign exchange markets, and the level of inflation. The monetary policies of the Federal Reserve have a significant effect on the operating results of financial institutions, most notably on the interest rate environment. In view of changing conditions in the national economy and in the money markets, as well as the effect of credit policies of monetary and fiscal authorities, no prediction can be made as to possible future changes in interest rates, deposit levels or loan demand, or their effect on the financial statements of the Company.

The financial industry operates under laws and regulations that are under constant review by various agencies and legislatures and are subject to sweeping change. The Company currently operates as a bank holding company, as defined by the Gramm-Leach-Bliley Financial Modernization Act of 1999 (GLB Act), and the Bank qualifies as a financial subsidiary under the Act, which allows it to engage in investment banking, insurance agency, brokerage, and underwriting activities that were not available to banks prior to the GLB Act. The GLB Act also included privacy provisions that limit banks’ abilities to disclose non-public information about customers to non-affiliated entities.

The Company must also comply with the requirements of the Bank Secrecy Act (BSA). The BSA is designed to help fight drug trafficking, money laundering, and other crimes. Compliance is monitored by the Federal Reserve. The BSA was enacted to prevent banks and other financial service providers from being used as intermediaries for, or to hide the transfer or deposit of money derived from, criminal activity. Since its passage, the BSA has been amended several times. These amendments include the Money Laundering Control Act of 1986. which made money laundering a criminal act, as well as the Money Laundering Suppression Act of 1994 which required regulators to develop enhanced examination procedures and increased examiner training to improve the identification of money laundering schemes in financial institutions.

The USA PATRIOT Act, established in 2001. substantially broadened the scope of U.S. anti-money laundering laws and regulations by imposing significant new compliance and due diligence obligations, creating new crimes and penalties and expanding the extra-territorial jurisdiction of the United States. The regulations impose obligations on financial institutions to maintain appropriate policies, procedures and controls to detect, prevent and report money laundering and terrorist financing, and the regulations include significant penalties for non-compliance.

Subsidiary Bank

Under Federal Reserve policy, the bank holding company, Commerce Bancshares, Inc. (the "Parent"), is expected to act as a source of financial strength to its bank subsidiary and to commit resources to support it in circumstances when it might not otherwise do so. In addition, any capital loans by a bank holding company to any of its subsidiary banks are subordinate in right of payment to deposits and to certain other indebtedness of such subsidiary banks. In the event of a bank holding company’s bankruptcy, any commitment by the bank holding company to a federal bank regulatory agency to maintain the capital of a subsidiary bank will be assumed by the bankruptcy trustee and entitled to a priority of payment.

Substantially all of the deposits of the Bank are insured up to the applicable limits by the Bank Insurance Fund of the FDIC, generally up to $250,000 per depositor, for each account ownership category. Through December 31, 2012, all non-interest bearing transaction accounts are fully guaranteed by the FDIC for the entire amount of the account. The Bank pays deposit insurance premiums to the FDIC based on an assessment rate established by the FDIC for Bank Insurance Fund member institutions. The FDIC has established a risk-based assessment system under which institutions are classified and pay premiums according to their perceived risk to the federal deposit insurance funds. In February 2011, under the provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act, (discussed further below), the FDIC issued a final rule changing its assessment base from total domestic deposits to average total assets minus average tangible equity. The rule altered other adjustments in the current assessment system for heavy use of unsecured liabilities, secured liabilities and brokered deposits, and added an adjustment for holdings of unsecured bank debt. For banks with more than $10 billion in assets, the FDIC 's new rule changed the assessment rate, abandoning the previous method for determining premiums, which were based on bank supervisory ratings, debt issuer ratings and financial ratios. Instead, the new rule reliesinstead relying on a scorecard designed to measure financial performance and ability to withstand stress, in addition to measuring the FDIC’s exposure should the bank fail. The new rule was effective for quarters beginning April 1, 2011. Because the Company has maintained a strong balance sheet with solid amounts of capital and has not offered many of the complex financial

products that were prevalent in the marketplace, the risk-based FDIC insurance assessments under the new methods were less than amounts calculated under the old assessment methods. Accordingly, the Company's FDIC insurance expense in 20112012 was $13.1$10.4 million, a decrease of $6.1$2.7 million as compared to 2010.FDIC expense in 2011. In late 2009, member institutions were required to prepay their quarterly FDIC premiums. The Bank made a prepayment of $68.7 million in 2009, and the current unused balance at December 31, 2012 was $25.4 million. A refund of the unused balance is expected to be received in the second quarter of 2013.

Payment of Dividends

The Federal Reserve Board may prohibit the payment of cash dividends to shareholders by bank holding companies if their actions constitute unsafe or unsound practices. The principal source of the Parent's cash revenues is cash dividends paid by the Bank. The amount of dividends paid by the Bank in any calendar year is limited to the net profit of the current year combined with the retained net profits of the preceding two years, and permission must be obtained from the Federal Reserve Board for dividends exceeding these amounts. The payment of dividends by the Bank may also be affected by factors such as the maintenance of adequate capital.

Capital Adequacy

The Company is required to comply with the capital adequacy standards established by the Federal Reserve. These capital adequacy guidelines generally require bank holding companies to maintain minimum total capital equal to 8% of total risk-adjusted assets and off-balance sheet items (the “Total Risk-Based Capital Ratio”), with at least one-half of that amount consisting of Tier I, or core capital, and the remaining amount consisting of Tier II, or supplementary capital. Tier I capital for bank holding companies generally consists of the sum of common shareholders’ equity, qualifying non-cumulative perpetual preferred stock, a limited amount of qualifying cumulative perpetual preferred stock and minority interests in the equity accounts of consolidated subsidiaries, less goodwill and other non-qualifying intangible assets. Tier II capital generally consists of hybrid capital instruments, term subordinated debt and, subject to limitations, general allowances for loan losses. Assets are adjusted under the risk-based guidelines to take into account different risk characteristics.

In addition, the Federal Reserve also requires bank holding companies to comply with minimum leverage ratio requirements. The leverage ratio is the ratio of a banking organization’s Tier I capital to its total consolidated quarterly average assets (as defined for regulatory purposes), net of the allowance for loan losses, goodwill and certain other intangible assets. The minimum leverage ratio for bank holding companies is 4%. At December 31, 20112012, the CompanyBank was “well-capitalized” under regulatory capital adequacy standards, as further discussed on page 93.91.

In December 2010,June 2012, the Federal Reserve released for comment a proposal to enact in the United States the international agreement referred to as Basel Committee on Banking Supervision ("the Basel Committee") presented to the public the Basel III rules text, which proposes new global regulatory standards on bank capital adequacy and liquidity. The Basel Committee continued to refine Basel III during 2011 and seeks to strengthen global capital and liquidity rules with the goal of promoting a more resilient banking sector. The framework sets out tougher capital requirements, the introduction of a new leverage ratio calculation, higher requirements for minimum capital ratios, and higher risk-weightings for assets, as they relate to capital calculations. Basel III also establishes two minimum standards for liquidity to promote short-term resilience, as well as resilience over a longer period of time through a stable maturity structure of assets and liabilities.

III. Capital and liquidity standards consistent with Basel III will be formally implemented in the United States through a series of rulemakings.rules. The U.S. bank agencies intendproposed rules include higher capital requirements and would raise minimum capital levels, redefine the significant inputs to issuethe capital ratio calculation, and be phased in over a noticeperiod of years from 2013 through 2019. The initial comment period for the proposed rulemaking during the first quarter ofrules ended in October 2012, and a final rule later in November 2012, the year thateffective date for initial Basel III implementation was delayed. A new implementation date has yet to be announced. The Company believes its current capital ratios would implementbe higher than those required in the Basel III capital reforms. While it continues to evaluate the impact of this framework on its operations and reporting, the Company's capital ratios as of December 31, 2011 are well in excess of those minimum ratios proposedproposal issued by both Basel III and the Federal Reserve.

Recent Significant Legislation

The financial industry operates under laws and regulations that are under constant review by various agencies and legislatures and are subject to sweeping change. The Gramm-Leach-Bliley Financial Modernization Act of 1999 (GLB Act) contained major changes in laws that previously kept Affecting the banking industry largely separate from the securities and insurance industries. The GLB Act authorized the creation of a new kind of financial institution, known as a “financial holding company”, and a new kind of bank subsidiary, called a “financial subsidiary”, which may engage in a broader range of investment banking, insurance agency, brokerage, and underwriting activities. The GLB Act also included privacy provisions that limit banks’ abilities to disclose non-public information about customers to non-affiliated entities. Banking organizations are not required to become financial holding companies, but instead may continue to operate as bank holding companies, providing the same services they were authorized to provide prior to the enactment of the GLB Act. The Company currently operates as a bank holding company.

The Company must also comply with the requirements of the Bank Secrecy Act (BSA). The BSA is designed to help fight drug trafficking, money laundering, and other crimes. Compliance is monitored by the Federal Reserve. The BSA was enacted to prevent banks and other financial service providers from being used as intermediaries for, or to hide the transfer or deposit of money derived from, criminal activity. Since its passage, the BSA has been amended several times. These amendments include the Money Laundering Control Act of 1986 which made money laundering a criminal act, as well as the Money Laundering Suppression Act of 1994 which required regulators to develop enhanced examination procedures and increased examiner training to improve the identification of money laundering schemes in financial institutions.

In 2001, the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA PATRIOT Act) was signed into law. The USA PATRIOT Act substantially broadened the scope of U.S. anti-money laundering laws and regulations by imposing significant new compliance and due diligence obligations, creating new crimes and penalties and expanding the extra-territorial jurisdiction of the United States. The U.S. Treasury Department issued a number of regulations implementing the USA PATRIOT Act that apply certain of its requirements to financial institutions such as the Company’s broker-dealer subsidiary. The regulations impose obligations on financial institutions to maintain appropriate policies, procedures and controls to detect, prevent and report money laundering and terrorist financing.

The Credit Card Accountability, Responsibility, and Disclosure Act of 2009 (the Credit CARD Act) was signed into law in May 2009. It is comprehensive credit card legislation that aims to establish fair and transparent practices relating to open end consumer credit plans. Included in the Credit CARD Act was an extension of payment periods (with no late fees) from 14 days to 21 days, the advance warning period for significant changes to credit card accounts was extended from 15 days to 45 days, and opt-out provisions were made available to customers. Additionally, the Credit CARD Act included provisions governing when rate increases can be applied on late accounts, requirements for clearer disclosures of terms before opening an account, and prohibitions on charging over-limit fees and double-cycle billing, as well as new rules related to interest rate reinstatements on formerly overdue accounts and gift card expiration dates and inactivity fees.

The Federal Reserve issued new regulations, effective July 1, 2010, which prohibited financial institutions from assessing fees for paying ATM and one-time debit card transactions that overdraw consumer accounts unless the consumer affirmatively consents to the financial institution’s overdraft practices. The Company implemented new procedures to solicit and capture required customer consents and, effective July 1, 2010, prohibited such ATM and one-time debit card transactions causing overdrafts, unless an opt-in consent has been received. As not all customers provided such consent, these new regulations resulted in lower deposit fee income for subsequent periods. For 2011, overdraft fees were $40.9 million, as compared to $51.1 million in 2010.

In March 2010, legislation was passed which expanded Pell Grants and Perkins Loan programs and required all colleges and universities to convert to direct lending programs with the U.S. government as of July 1, 2010. Previously, colleges and universities had the choice of participating in either direct lending with the U.S. government or a program whereby loans were originated by banks but guaranteed by the U.S. government. The Company terminated its guaranteed student loan origination business effective July 1, 2010 and sold most of its student loan portfolios in 2010.

In July 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) was signed into law. The Dodd-Frank Act is sweeping legislation intended to overhaul regulation of the financial services industry. Its goals are to establishindustry and requires rulemaking and reports over the next several years. Among its many provisions, the Dodd-Frank Act established a new council of “systemic risk” regulators, createcreated a new consumer protection division within the Federal Reserve, empowerempowers the Federal Reserve to supervise the largest, most complex financial companies, allowallows the government to seize and liquidate failing financial companies, and givegives regulators new powers to oversee the derivatives market. The provisions of the Dodd-Frank Act are so extensive that full implementation may require several years, and an assessment of its full effect on the Company is not possible at this time.

In June 2011, the Federal Reserve, under the provisions of the Dodd-Frank Act, approved a final debit card interchange rule that significantly limits the amount of debit card interchange fees charged by banks. The new rule caps an issuer’s base fee at 21 cents per transaction and allows additional fees to help cover fraud losses. The new pricing is a reduction of approximately 45% when compared to previous market rates. The new rule also limits network exclusivity, requiring issuers to ensure that a debit card transaction can be carried on two unaffiliated networks: one signature-based and one PIN-based. The new rules apply to bank issuers with more than $10 billion in assets and taketook effect in phases, with the base fee cap effective October 1, 2011 and the network exclusivity rule effective on April 1, 2012. As a result of this rule, the Company's debit card revenues declined approximately $7.1 million in the fourth quarter of 2011 as compared to the third quarter of 2011.

The Dodd-Frank Act also established the Consumer Financial Protection Bureau (CFPB) and authorizes it to supervise certain consumer financial services companies and large depository institutions and their affiliates for consumer protection purposes.

Subject to the provisions of the Act, the CFPB has responsibility to implement, examine for compliance with, and enforce “Federal consumer financial law.” As a depository institution, the Company will be subject to examinations by the CFPB, which will focus on the Company’s ability to detect, prevent, and correct practices that present a significant risk of violating the law and causing consumer harm.

In December 2011,October 2012, the Federal Reserve, Board issued proposed rulesas required by the Dodd-Frank Act, approved new stress testing regulations applicable to strengthen regulation and supervision of large bank holdingcertain financial companies and systemically important nonbank financial firms. The proposal applies to all U.S. bank holding companies with total consolidated assets of $50 billion or more with some provisions affecting banks withthan $10 billion or morebut less than $50 billion. The rule requires that these financial companies, including Commerce Bancshares, conduct stress tests on an annual basis. The stress tests will have an as-of date of September 30, 2013 using scenarios provided by the Federal Reserve in assets. These rules are meant to implementNovember of the Dodd-Frank Act's sections 165same year, and 166. The proposed rules include a wide range of measures in areas such as capital, liquidity, credit exposure, stress testing, risk management, and early remediation requirements. As a bank holding company with $10 billion or more in assets, the rules would require that the Company create a risk committeeis required to submit regulatory reports to the Federal Reserve on its stress tests by March 31, 2014. During June 2015, the Company will be required to make public disclosures of the Boardresults of Directors and chief risk officer,tests performed as well as require that the Company conduct its own annual stress-tests and publish a summary of the results.September 30, 2014.

Competition

The Company’s locations in regional markets throughout Missouri, Kansas, central Illinois, Tulsa, Oklahoma, and Denver, Colorado face intense competition from hundreds of financial service providers. The Company competes with national and state banks for deposits, loans and trust accounts, and with savings and loan associations and credit unions for deposits and consumer lending products. In addition, the Company competes with other financial intermediaries such as securities brokers and dealers, personal loan companies, insurance companies, finance companies, and certain governmental agencies. The passage of the GLB Act, which removed barriers between banking and the securities and insurance industries, has resulted in greater competition among these industries. The Company generally competes on the basis of customer service and responsiveness to customer needs, interest rates on loans and deposits, lending limits, and customer convenience, such as location of offices. Within the St. Louis and Kansas City, Missouri markets, the Company has approximately 9% of deposit market share.

Employees

The Company and its subsidiaries employed 4,237 persons on a full-time basis and 623 persons on a part-time basis at December 31, 2011. The Company provides a variety of benefit programs including a 401K plan as well as group life, health, accident, and other insurance. The Company also maintains training and educational programs designed to prepare employees for positions of increasing responsibility.

Available Information

The Company’s principal offices are located at 1000 Walnut, Kansas City, Missouri (telephone number 816-234-2000). The Company makes available free of charge, through its Web site at www.commercebank.com, reports filed with the Securities and Exchange Commission as soon as reasonably practicable after the electronic filing. These filings include the annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports.

Statistical Disclosure

The information required by Securities Act Guide 3 — “Statistical Disclosure by Bank Holding Companies” is located on the pages noted below.

|

| | | | |

| | | | Page |

| I. | | Distribution of Assets, Liabilities and Stockholders’ Equity; Interest Rates and Interest Differential | 21, 52-5520, 50-53 |

|

| II. | | Investment Portfolio | 36-38,35-37, 73-78 |

|

| III. | | Loan Portfolio | |

| | | Types of Loans | 25 |

|

| | | Maturities and Sensitivities of Loans to Changes in Interest Rates | 2625 |

|

| | | Risk Elements | 31-3630-35 |

|

| IV. | | Summary of Loan Loss Experience | 29-3128-30 |

|

| V. | | Deposits | 52,50, 79-80 |

|

| VI. | | Return on Equity and Assets | 1716 |

|

| VII. | | Short-Term Borrowings | 80 |

|

Making or continuing an investment in securities issued by Commerce Bancshares, Inc., including its common stock, involves certain risks that you should carefully consider. If any of the following risks actually occur, its business, financial condition or results of operations could be negatively affected, the market price for your securities could decline, and you could lose all or a part of your investment. Further, to the extent that any of the information contained in this Annual Report on Form 10-K constitutes forward-looking statements, the risk factors set forth below also are cautionary statements identifying important factors that could cause the Company’s actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of Commerce Bancshares, Inc.

Difficult market conditions have adversely affected the Company’s industry and may continue to do so.

Given the concentration of the Company’s banking business in the United States, it is particularly exposed to downturns in the U.S. economy. The economic trends which began in 2008, such as declines in the housing market (e.g., falling home prices and increasing foreclosures), unemployment and under-employment, have negatively impacted the credit performance of mortgage loans and resulted in significant write-downs of asset values by financial institutions, including government-sponsored entities as well as major commercial and investment banks. These write-downs, initially of mortgage-backed securities and other complex financial instruments, but spreading to various classes of real estate, commercial and consumer loans in turn, have caused many financial institutions to seek additional capital, to merge with larger and stronger institutions and, in some cases, to fail. Reflecting concern about the stability of the financial markets generally and the strength of counterparties, many lenders and institutional investors have reduced or ceased providing funding to borrowers.institutions. The weak U.S. economy and tightening of credit during recent years led to a lack of consumer confidence, increased market volatility and widespread reduction of business activity generally. The resulting economic pressure on consumers and lack of confidence in the financial markets has adversely affected the Company’s business, financial condition and results of operations through higher levels of loan losses and lower loan demand. WhileMore recently, the economy has seen improvementbegun to stabilize. The housing market has improved over recent years, and asset write-downs have slowed. However, there remain risks that could undermine the more recent improvements in the past year, significant uncertainty remains and management does not expect significant economic growth in the near future.economy's stabilization.

In particular, the Company may face the following risks in connection with these market conditions:

Unemployment has improved over recent years but remains at historically high levels. Continued high unemployment levels and weak economic activity and other market developments may affect consumer confidence levels and may cause declines in consumer credit usage, adverse changes in payment patterns, and higher loan delinquencies and default rates. These could impact the Company’s future loan losses and provision for loan losses, as a significant part of the Company’s business includes consumer and credit card lending.

Reduced levels of economic activity may also cause declines in financial service transactions, including bank card, corporate cash management and other fee businesses, as well as the fees earned by the Company on such transactions.

The Company’s ability to assess the creditworthiness of its customers may be impaired if the models and approaches it uses to select, manage, and underwrite its customers become less predictive of future behaviors, causing higher future credit losses.

The process used to estimate losses inherent in the Company’s loan portfolio requires difficult, subjective, and complex judgments, including forecasts of economic conditions and how these economic predictions might impair the ability of

its borrowers to repay their loans. If an instance occurs that renders these predictions no longer capable of accurate estimation, this may in turn impact the reliability of the process.

Competition in the industry could intensify as a result of the increasing consolidation of financial services companies in connection with current market conditions, thereby reducing market prices for various products and services which could in turn reduce Company revenues.

Though bank failures slowed during 2011 and 2012 as compared to 2009 and 2010, failures during this period remained higher than historical levels. Due to higher bank failures in recent years and continued uncertainty about the future, the Company may be required to pay high levels of FDIC premiums for extended periods of time.

The U.S. economy is also affected by foreign economic events, such as the European debt crisis that developed during the past year. Although the Company does not hold foreign debt, global conditions affecting interest rates, business export activity, capital expenditures by businesses, and investor confidence may negatively affect the Company by means of reduced loan demand or reduced transaction volume with the Company.

The United States is faced with large debts outstanding and a significant debate by Congress on how to address this situation. Automatic spending cuts scheduled by law to go into effect in March2013, or revisions to this law by Congress, could result in lower government spending and thus slow economic growth in the short-term. Should this occur, unemployment could increase, demand for business and consumer loans and other financial products could decline, and credit losses could increase, thus reducing the Company's profitability.

Significant changes in banking laws and regulations could materially affect the Company’s business.

As a result of the recent banking crisis, a significant increase in bank regulation has occurred. A number of new laws and regulations have already been implemented, including those which reduce overdraft fees, credit card revenues, and revenues from student lending activities. These recently adopted regulations have resulted in lower revenues and higher operating costs. As discussed in Item 1, the Dodd-Frank Act passed in July 2010. The Act2010 contains significant new and complex regulations for all financial institutions. Among its many provisions are rules which establishestablished a new council of “systemic risk” regulators, createcreated a new consumer protection division within the Federal Reserve, empower the Federal Reserve to supervise the largest, most complex financial companies, allow the government to seize and liquidate failing financial companies, and give regulators new powers to oversee the derivatives market. The Dodd-Frank Act also mandated new rules on debit card interchange fees, as discussed previously.

Because the Company has maintained a strong balance sheet and has not offered many of the complex financial products that were prevalent in the marketplace, there are a number of provisions within the Dodd-Frank Act, including higher capital standards, improved lending transparency and risk-based FDIC insurance assessments, that management does not expect to negatively affect the Company’s future financial results. However, the Company has already been significantly affected by enacted regulation on debit cards, and a number of provisions within the law such as limitations on debit card fees andinclude the potential for higher costs due to increased regulatory and compliance burdens, which will result in lower revenues or raiseincreasing costs tofor the Company. In addition to these and other new regulations which are already in place and are discussed above, the Company will likely face increased regulation of the industry. Increased regulation, along with possible changes in tax laws and accounting rules, may have a significant impact on the way the Company conducts business, implements strategic initiatives, engages in tax planning and makes financial disclosures. Compliance with such regulation may divert resources from other areas of the business and limit the ability to pursue other opportunities.

The performance of the Company is dependent on the economic conditions of the markets in which the Company operates.

The Company’s success is heavily influenced by the general economic conditions of the specific markets in which it operates. Unlike larger national or other regional banks that are more geographically diversified, the Company provides financial services primarily throughout the states of Missouri, Kansas, and central Illinois, and has recently expanded into Oklahoma, Colorado and other surrounding states. As the Company does not have a significant presence in other parts of the country, a prolonged economic downtown in these markets could have a material adverse effect on the Company’s financial condition and results of operations.

Significant changes in federal monetary policy could materially affect the Company’s business.

The Federal Reserve System regulates the supply of money and credit in the United States. Its polices determine in large part the cost of funds for lending and investing by influencing the interest rate earned on loans and paid on borrowings and interest bearing deposits. Credit conditions are influenced by its open market operations in U.S. government securities, changes in the member bank discount rate, and bank reserve requirements. Changes in Federal Reserve Board policies are beyond the Company’s control and difficult to predict, and such changes may result in lower interest margins and a continued lack of demand for credit products.

The soundness of other financial institutions could adversely affect the Company.

The Company’s ability to engage in routine funding transactions could be adversely affected by the actions and commercial soundness of other financial institution counterparties. Financial services institutions are interrelated as a result of trading, clearing, counterparty or other relationships. The Company has exposure to many different industries and counterparties and routinely executes transactions with counterparties in the financial industry, including brokers and dealers, commercial banks, investment

banks, mutual funds, and other institutional clients. Transactions with these institutions include overnight and term borrowings, interest rate swap agreements, securities purchased and sold, short-term investments, and other such transactions. As a result of this exposure, defaults by, or rumors or questions about, one or more financial services institutions or the financial services industry generally, could lead to market-wide liquidity problems and defaults by other institutions. Many of these transactions expose the Company to credit risk in the event of default of its counterparty or client, while other transactions expose the Company to liquidity risks should funding sources quickly disappear. In addition, the Company’s credit risk may be exacerbated when the collateral held cannot be realized or is liquidated at prices not sufficient to recover the full amount of the exposure due to the Company. Any such losses could materially and adversely affect results of operations.

The Company’s asset valuation may include methodologies, estimations and assumptions which are subject to differing interpretations and could result in changes to asset valuations that may materially adversely affect its results of operations or financial condition.

The Company uses estimates, assumptions, and judgments when certain financial assets and liabilities are measured and reported at fair value. Assets and liabilities carried at fair value inherently result in a higher degree of financial statement volatility. Fair values and the information used to record valuation adjustments for certain assets and liabilities are based on quoted market prices and/or other observable inputs provided by independent third-party sources, when available. When such third-party information is not available, fair value is estimated primarily by using cash flow and other financial modeling techniques utilizing assumptions such as credit quality, liquidity, interest rates and other relevant inputs. Changes in underlying factors, assumptions, or estimates in any of these areas could materially impact the Company’s future financial condition and results of operations.

During periods of market disruption, including periods of significantly rising or high interest rates, rapidly widening credit spreads or illiquidity, it may be difficult to value certain assets if trading becomes less frequent and/or market data becomes less observable. There may be certain asset classes in active markets with significant observable data that become illiquid due to the current financial environment. In such cases, certain asset valuations may require more subjectivity and management judgment. As such, valuations may include inputs and assumptions that are less observable or require greater estimation. Further, rapidly changing and unprecedented credit and equity market conditions could materially impact the valuation of assets as reported within the Company’s consolidated financial statements, and the period-to-period changes in value could vary significantly. Decreases in value may have a material adverse effect on results of operations or financial condition.

The Company’s investment portfolio values may be adversely impacted by changing interest rates and deterioration in the credit quality of underlying collateral within the various categories of investment securities it owns.

The Company generally invests in securities issued by municipal entities, government-backed agencies or privately issued securities that are highly rated by credit rating agenciesand evaluated at the time of purchase, however, these securities are subject to changes in market value due to changing interest rates and implied credit spreads. Recently,Over the past several years, budget deficits and other financial problems in a number of states and political subdivisions have been reported in the media. While the Company maintains rigorous risk management practices over bonds issued by municipalities, further credit deterioration in these bonds could occur and result in losses. Certain mortgage and asset-backed securities represent beneficial interests which are collateralized by residential

mortgages, credit cards, automobiles, mobile homes or other assets. While these investment securities are highly rated at the time of initial investment, the value of these securities may decline significantly due to actual or expected deterioration in the underlying collateral, especially residential mortgage collateral. Market conditions have resulted in a deterioration in fair values for non-guaranteed mortgage-backed and other asset-backed securities. Under accounting rules, when the impairment is due to declining expected cash flows, some portion of the impairment, depending on the Company’s intent to sell and the likelihood of being required to sell before recovery, must be recognized in current earnings. This could result in significant non-cash losses.

The Company is subject to interest rate risk.

The Company’s net interest income is the largest source of overall revenue to the Company, representing 62% of total revenue. Interest rates are beyond the Company’s control, and they fluctuate in response to general economic conditions and the policies of various governmental and regulatory agencies, in particular, the Federal Reserve Board. Changes in monetary policy, including changes in interest rates, will influence the origination of loans, the purchase of investments, the generation of deposits, and the rates received on loans and investment securities and paid on deposits. Management believes it has implemented effective asset and liability management strategies to reduce the potential effects of changes in interest rates on the Company’s results of operations. However, any substantial, prolonged change in market interest rates could have a material adverse effect on the Company’s financial condition and results of operations.

Future loan losses could increase.

The Company maintains an allowance for loan losses that represents management’s best estimate of probable losses that have been incurred at the balance sheet date within the existing portfolio of loans. The level of the allowance reflects management’s continuing evaluation of industry concentrations, specific credit risks, loan loss experience, current loan portfolio quality, present economic, political and regulatory conditions and unidentified losses inherent in the current loan portfolio. Although the loan losses have declined significantly in 2011,2012, they continue to remainhad been at elevated levels byduring the period 2007 through 2011 when compared to historical standards,experience, particularly in residential construction, consumer, and credit card loans, due to the past deterioration in the housing industry and general economic conditions in recent years. UntilWhile the housing sector and overall economy beginhave begun to slowly recover, it is likely that these higher loan loss levels will continue. Whilebusiness activities across a range of industries continue to face difficulties due to the Company’slack of consumer spending and the lack of liquidity in the global credit loss ratios remain below industry averages, continued economic deterioration andmarkets. A continuation or worsening of current financial market conditions could result in further loan losses, which may negatively affect itsthe Company's results of operations and could further increase levels of its allowance. In addition, the Company’s allowance level is subject to review by regulatory agencies, and that review could result in adjustments to the allowance. See the section captioned “Allowance for Loan Losses” in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, of this report for further discussion related to the Company’s process for determining the appropriate level of the allowance for possible loan loss.

The Company is subject to both interest rate and liquidity risk.

DueWith oversight from its Asset-Liability Management Committee, the Company devotes substantial resources to monitoring its liquidity and interest rate risk on a weak economymonthly basis. The Company's net interest income is the largest source of overall revenue to the Company, representing 62% of total revenue. The interest rate environment in which the Company operates fluctuates in response to general economic conditions and diminished risk appetite duringpolicies of various governmental and regulatory agencies, particularly the last several years, individuals and businesses have increased the Company's deposits significantly. During 2011, total deposits increased by approximately $1.7 billion. At the same time,Federal Reserve Board. Changes in monetary policy, including changes in interest rates, will influence loan originations, deposit generation, demand for loansinvestments and revenues and costs for earning assets and liabilities.

Additionally the Company manages its balance sheet in order to maximize its net interest income from its net earning assets while insuring that there is ample liquidity to meet fluctuating cash flows coming from either funding sources or its earning assets.

Since the end of 2008, a weakened U.S. economy has remained weak, and therefore,resulted in significant growth in deposits was utilizedfrom both consumers and businesses. From 2008 through 2012, total deposits grew by $5.5 billion. During the same period, the Federal Reserve reduced interest rates to increaseunprecedented low levels. Loan demand remained weak through this period, and the size of the Company'sCompany invested these new deposits in its investment securities portfolio, to $9.4which grew by $5.9 billion atfrom 2008 through 2012. At December 31, 2011. As a result2012 the Company's loan to deposit ratio at December 31, 2011rate was 55%56%, a sign of strong liquidity. Investment securities generally carry lower rates than loans, and was an indication of a strong balance sheet withas these securities have grown, interest margins have been pressured. Furthermore the Company attempts to diversify its investment portfolio while keeping duration short, in order to ensure it is always able to meet liquidity needs for future changes in loans or deposit balances.

While loans grew in 2012 by 7% as the economy strengthened somewhat, the low liquidity risk. However, shouldinterest rate environment in which all banks operate will continue to pressure the Company's interest margins. Should the demand for loans increase in the future while customer deposits begin todeposit balances decline significantly, the Company's liquidity risk could change, andas it is dependent on itsthe Company's ability to manage maturities within its investment portfolio which would be used to fund loan growth.

these changing cash flows.

The Company operates in a highly competitive industry and market area.

The Company operates in the financial services industry, which is facing a rapidly changing environment having numerous competitors including other banks and insurance companies, securities dealers, brokers, trust and investment companies and mortgage bankers. Consolidation among financial service providers is likely to occur, and there are many new changes in technology, product offerings and regulation. As consolidation occurs, larger regional banks may acquire smaller banks in our market and add to existing competition. These new banks may lower fees in an effort to grow market share, which could result in a loss of customers and lower fee revenue for the Company. The Company must continue to make investments in its products and delivery systems to stay competitive with the industry as a whole, or its financial performance may suffer.

The Company’s reputation and future growth prospects could be impaired if events occur which breach its customers’ privacy.

The Company relies heavily on communications and information systems to conduct its business, and as part of its business, the Company maintains significant amounts of data about its customers and the products they use. Additionally, customers rely on online bank products. While the Company has policies and procedures and safeguards designed to prevent or limit the effect of failure, interruption or security breach of its information systems, there can be no assurances that any such failures, interruptions or security breaches will not occur; or if they do occur, that they will be adequately addressed. In addition to unauthorized access, denial-of-service attacks could overwhelm Company Web sites and prevent the Company from adequately serving customers. Should any of the Company's systems become compromised, the reputation of the Company could be damaged, relationships with existing customers may be impaired, the compromise could result in lost business, and as a result, the Company could incur significant expenses trying to remedy the incident.

The Company may not attract and retain skilled employees.

The Company’s success depends, in large part, on its ability to attract and retain key people. Competition for the best people can be intense, and the Company spends considerable time and resources attracting and hiring qualified people for its various business lines and support units. The unexpected loss of the services of one or more of the Company’s key personnel could have a material adverse impact on the Company’s business because of their skills, knowledge of the Company’s market, and years of industry experience, as well as the difficulty of promptly finding qualified replacement personnel.

| |

| Item 1b. | UNRESOLVED STAFF COMMENTS |

None

The main offices of the Bank are located in the larger metropolitan areas of its markets in various multi-story office buildings. The Bank owns its main offices and leases unoccupied premises to the public. The larger offices include:

| | | Building | Net rentable square footage | % occupied in total | % occupied by bank | Net rentable square footage | % occupied in total | % occupied by bank |

922 Walnut Kansas City, MO | 256,000 |

| 95 | % | 93 | % | 256,000 |

| 95 | % | 93 | % |

1000 Walnut Kansas City, MO | 403,000 |

| 83 |

| 38 |

| 403,000 |

| 85 |

| 38 |

|

811 Main Kansas City, MO | 237,000 |

| 100 |

| 100 |

| 237,000 |

| 100 |

| 100 |

|

8000 Forsyth Clayton, MO | 178,000 |

| 95 |

| 92 |

| 178,000 |

| 97 |

| 97 |

|

1551 N. Waterfront Pkwy Wichita, KS | 120,000 |

| 99 |

| 32 |

| 120,000 |

| 97 |

| 32 |

|

Various installment loan, credit card, trust and safe deposit functions operate out of leased offices in downtown Kansas City, Missouri. Also, during 2011 the Company transferred its credit card operations from Omaha, Nebraska, to Kansas City. The Company has an additional 196199 branch locations in Missouri, Illinois, Kansas, Oklahoma and Colorado which are owned or leased, and 162158 off-site ATM locations.

The information required by this item is set forth in Item 8 under Note 18, Commitments, Contingencies and Guarantees on page 105.104.

| |

| Item 4. | MINE SAFETY DISCLOSURES |

NoneNot applicable

Executive Officers of the Registrant

The following are the executive officers of the Company as of February 22, 20122013, each of whom is designated annually. There are no arrangements or understandings between any of the persons so named and any other person pursuant to which such person was designated an executive officer.

|

| |

| Name and Age | Positions with Registrant |

Jeffery D. Aberdeen, 5859 | Controller of the Company since December 1995. He is also Controller of the Company’s subsidiary bank, Commerce Bank. |

| | |

Kevin G. Barth, 5152 | Executive Vice President of the Company since April 2005 and Executive Vice President of Commerce Bank since October 1998. Senior Vice President of the Company and Officer of Commerce Bank prior thereto. |

| | |

| Jeffrey M. Burik, 54 | Senior Vice President of the Company since February 2013. Executive Vice President of Commerce Bank since November 2007. |

| |

Daniel D. Callahan, 5456 | Executive Vice President and Chief Credit Officer of the Company since December 2010 and Senior Vice President of the Company since April 2005 and Vice President of the Company prior thereto. Executive Vice President of Commerce Bank since May 2003. |

| | |

Sara E. Foster, 5152 | Executive Vice President of the Company since February 10, 2012 and Senior Vice President of the Company since February 1998. |

| | |

David W. Kemper, 6162 | Chairman of the Board of Directors of the Company since November 1991, Chief Executive Officer of the Company since June 1986, and1986. He was President of the Company sincefrom April 1982.1982 until February 2013. He is Chairman of the Board, President and Chief Executive Officer of Commerce Bank. He is the son of James M. Kemper, Jr. (a former Director and former Chairman of the Board of the Company), the brother of Jonathan M. Kemper, Vice Chairman of the Company, and father of John W. Kemper.Kemper, President and Chief Operating Officer of the Company. |

| | |

John W. Kemper, 3335 | President and Chief Operating Officer of the Company since February 2013, and Executive Vice President and Chief Administrative Officer of the Company since February 10, 2012 and Senior Vice President of the Company prior thereto. Senior Vice President of Commerce Bank since January 2009. Prior to his employment with Commerce Bank in August 2007, he was employed as an engagement manager with a global management consulting firm, managing strategy and operations projects primarily focused in the financial service industry. He is the son of David W. Kemper, Chairman President, and Chief Executive Officer of the Company and nephew of Jonathan M. Kemper, Vice Chairman of the Company. |

| | |

Jonathan M. Kemper, 5859 | Vice Chairman of the Company since November 1991 and Vice Chairman of Commerce Bank since December 1997. Prior thereto, he was Chairman of the Board, Chief Executive Officer, and President of Commerce Bank. He is the son of James M. Kemper, Jr. (a former Director and former Chairman of the Board of the Company), the brother of David W. Kemper, Chairman President, and Chief Executive Officer of the Company, and uncle of John W. Kemper.Kemper, President and Chief Operating Officer of the Company. |

| | |

Charles G. Kim, 5152 | Chief Financial Officer of the Company since July 2009. Executive Vice President of the Company since April 1995 and Executive Vice President of Commerce Bank since January 2004. Prior thereto, he was Senior Vice President of Commerce Bank, N.A. (Clayton, MO), a former subsidiary of the Company.Bank. |

| | |

Seth M. Leadbeater, 6162 | Vice Chairman of the Company since January 2004. Prior thereto he was Executive Vice President of the Company. He has been Vice Chairman of Commerce Bank since September 2004. Prior thereto he was Executive Vice President of Commerce Bank and President of Commerce Bank, N.A. (Clayton, MO).Bank. |

| | |

Michael J. Petrie, 5556 | Senior Vice President of the Company since April 1995. Prior thereto, he was Vice President of the Company. |

| | |

Robert J. Rauscher, 5455 | Senior Vice President of the Company since October 1997. Senior Vice President of Commerce Bank prior thereto. |

| | |

V. Raymond Stranghoener, 6061 | Executive Vice President of the Company since July 2005 and Senior Vice President of the Company prior thereto. |

PART II

| |

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Commerce Bancshares, Inc.

Common Stock Data

The following table sets forth the high and low prices of actual transactions in the Company’s common stock and cash dividends paid for the periods indicated (restated for the 5% stock dividend distributed in December 20112012).

| | | | Quarter | High | Low | Cash Dividends |

| 2012 | | First | $ | 39.31 |

| $ | 35.78 |

| $ | .219 |

|

| | Second | 39.05 |

| 34.45 |

| .219 |

|

| | | | | | | | | Third | 40.70 |

| 35.91 |

| .219 |

|

| Quarter | High | Low | Cash Dividends | Fourth | 38.70 |

| 34.69 |

| 1.648 | * |

| 2011 | First | $ | 40.64 |

| $ | 36.70 |

| $ | .219 |

| First | $ | 38.70 |

| $ | 34.96 |

| $ | .209 |

|

| | Second | 41.81 |

| 38.14 |

| .219 |

| Second | 39.82 |

| 36.33 |

| .209 |

|

| | Third | 41.90 |

| 31.65 |

| .219 |

| Third | 39.91 |

| 30.14 |

| .209 |

|

| | Fourth | 38.67 |

| 31.49 |

| .219 |

| Fourth | 36.83 |

| 29.99 |

| .209 |

|

| 2010 | First | $ | 37.97 |

| $ | 34.06 |

| $ | .213 |

| First | $ | 36.16 |

| $ | 32.44 |

| $ | .203 |

|

| | Second | 39.20 |

| 32.22 |

| .213 |

| Second | 37.34 |

| 30.68 |

| .203 |

|

| | Third | 36.59 |

| 31.84 |

| .213 |

| Third | 34.85 |

| 30.32 |

| .203 |

|

| | Fourth | 38.66 |

| 32.71 |

| .213 |

| Fourth | 36.82 |

| 31.16 |

| .203 |

|

| 2009 | First | $ | 38.36 |

| $ | 24.01 |

| $ | .207 |

| |

| | Second | 33.91 |

| 25.68 |

| .207 |

| |

| | Third | 34.54 |

| 26.73 |

| .207 |

| |

| | Fourth | 36.63 |

| 31.01 |

| .207 |

| |

* Includes a special dividend of $1.429 per share

Commerce Bancshares, Inc. common shares are listed on the Nasdaq Global Select Market (NASDAQ) under the symbol CBSH. The Company had 4,2184,135 shareholders of record as of December 31, 20112012.

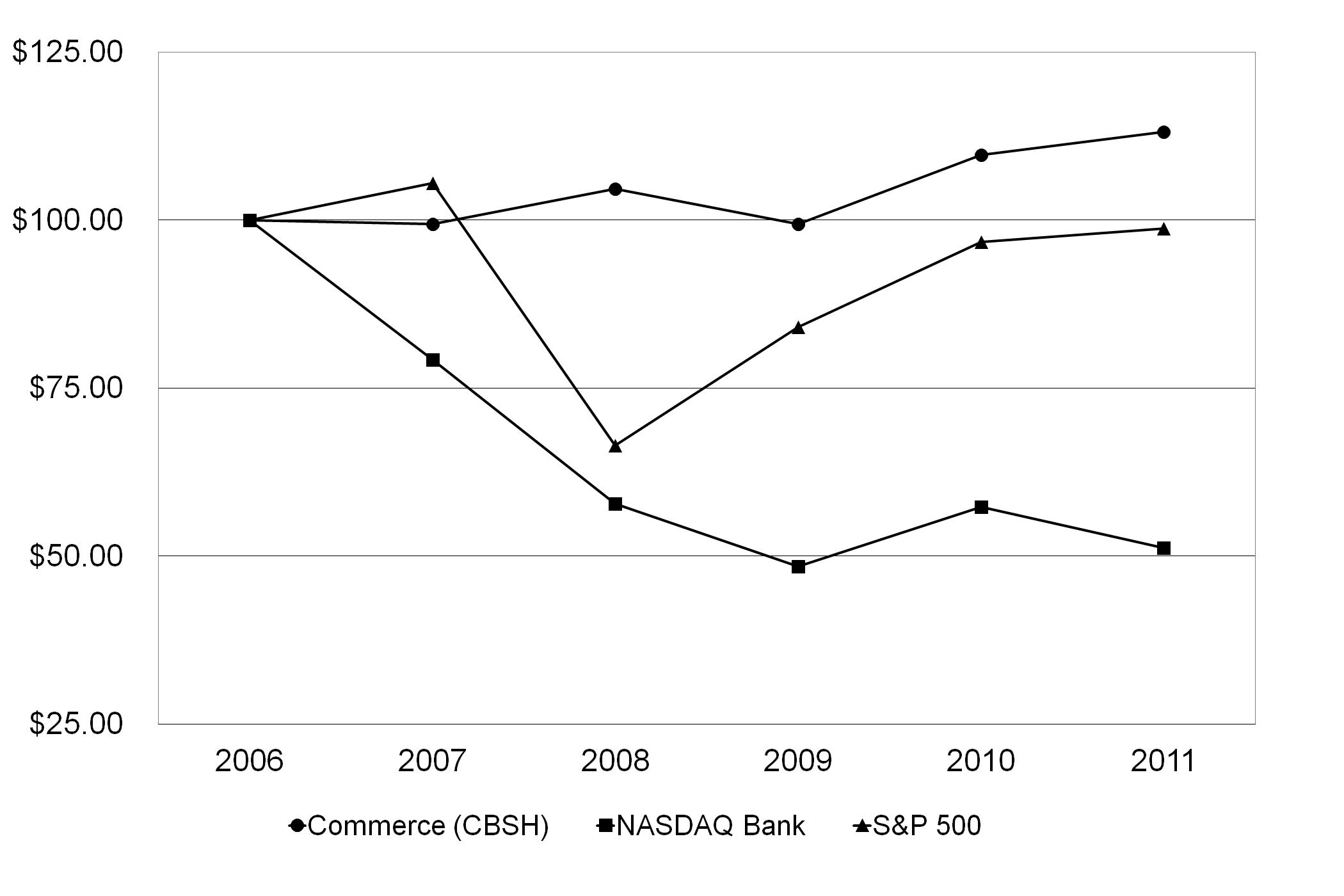

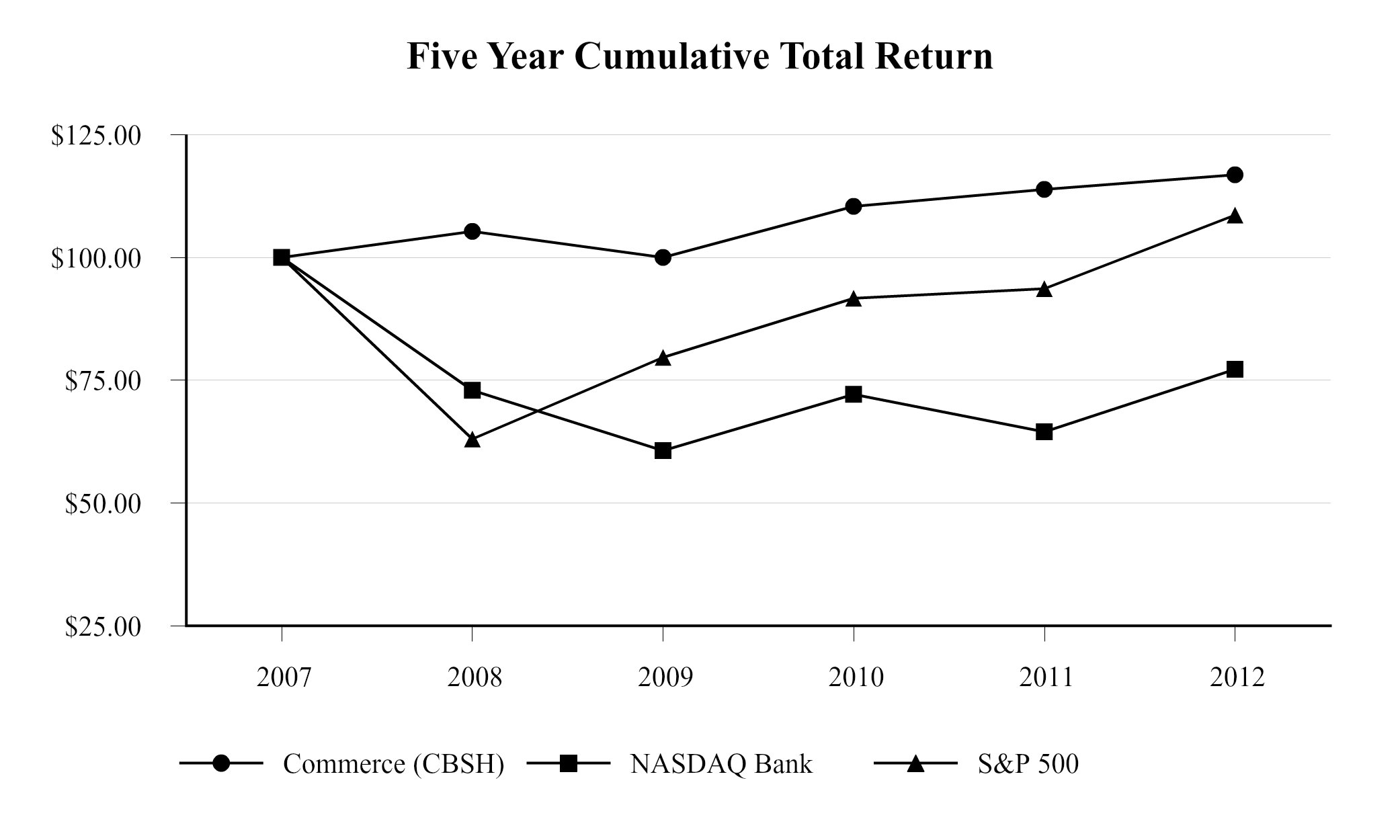

Performance Graph

The following graph presents a comparison of Company (CBSH) performance to the indices named below. It assumes $100 invested on December 31, 20062007 with dividends invested on a Total Returncumulative total shareholder return basis.

Five Year Cumulative Total Return

| | | | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

|

| Commerce (CBSH) | 100.00 |

| 99.38 |

| 104.66 |

| 99.39 |

| 109.66 |

| 113.11 |

| 100.00 |

| 105.31 |

| 100.00 |

| 110.34 |

| 113.81 |

| 116.78 |

|

| NASDAQ Bank | 100.00 |

| 79.26 |

| 57.79 |

| 48.42 |

| 57.29 |

| 51.19 |

| 100.00 |

| 72.91 |

| 60.66 |

| 72.13 |

| 64.51 |

| 77.18 |

|

| S&P 500 | 100.00 |

| 105.50 |

| 66.47 |

| 84.06 |

| 96.71 |

| 98.76 |

| 100.00 |

| 63.00 |

| 79.67 |

| 91.67 |

| 93.61 |

| 108.59 |

|

The following table sets forth information about the Company’s purchases of its $5 par value common stock, its only class of stock registered pursuant to Section 12 of the Exchange Act, during the fourth quarter of 2011.2012.

|

| | | | | | | | | |

| Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Program | Maximum Number that May Yet Be Purchased Under the Program |

| October 1—31, 2011 | 438 |

|

| $38.80 |

| 438 |

| 823,677 |

|

| November 1—30, 2011 | — |

| — |

| — |

| 3,000,000 |

|

| December 1—31, 2011 | 700 |

|

| $36.40 |

| 700 |

| 2,999,300 |

|

| Total | 1,138 |

|

| $37.32 |

| 1,138 |

| 2,999,300 |

|

|

| | | | | | | | | |

| Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Program | Maximum Number that May Yet Be Purchased Under the Program |

| October 1—31, 2012 | 329,095 |

|

| $37.83 |

| 329,095 |

| 2,572,965 |

|

| November 1—30, 2012 | 444,277 |

|

| $38.01 |

| 444,277 |

| 2,128,688 |

|

| December 1—31, 2012 | 1,070 |

|

| $35.06 |

| 1,070 |

| 2,127,618 |

|

| Total | 774,442 |

|

| $37.93 |

| 774,442 |

| 2,127,618 |

|

The Company’s stock purchases shown above were made under authorizations by the Board of Directors. Under the most recent authorization in November 2011, 2,999,300July 2012 of 3,000,000 shares, 2,127,618 shares remained available for purchase at December 31, 20112012.

| |

| Item 6. | SELECTED FINANCIAL DATA |

The required information is set forth below in Item 7.

| |

| Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Forward-Looking Statements

This report may contain “forward-looking statements” that are subject to risks and uncertainties and include information about possible or assumed future results of operations. Many possible events or factors could affect the future financial results and performance of the Company. This could cause results or performance to differ materially from those expressed in the forward-looking statements. Words such as “expects”, “anticipates”, “believes”, “estimates”, variations of such words and other similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in, or implied by, such forward-looking statements. Readers should not rely solely on the forward-looking statements and should consider all uncertainties and risks discussed throughout this report. Forward-looking statements speak only as of the date they are made. The Company does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made or to reflect the occurrence of unanticipated events. Such possible events or factors include the risk factors identified in Item 1a Risk Factors and the following: changes in economic conditions in the Company’s market area; changes in policies by regulatory agencies, governmental legislation and regulation; fluctuations in interest rates; changes in liquidity requirements; demand for loans in the Company’s market area; changes in accounting and tax principles; estimates made on income taxes; and competition with other entities that offer financial services.

Overview

Commerce Bancshares, Inc. and its subsidiaries (the "Company") operates as a super-community bank offering an array of sophisticated financial products delivered with high-quality, personal customer service. It is the largest bank holding company headquartered in Missouri, with its principal offices in Kansas City and St. Louis, Missouri. Customers are served from approximately 360 locations in Missouri, Kansas, Illinois, Oklahoma and Colorado using delivery platforms which include an extensive network of branches and ATM machines, full-featured online banking, and a central contact center.

The core of the Company’s competitive advantage is its focus on the local markets it services and its concentration on relationship banking and high touch service. In order to enhance shareholder value, the Company grows its core revenue by expanding new and existing customer relationships, utilizing improved technology, and enhancing customer satisfaction.

Various indicators are used by management in evaluating the Company’s financial condition and operating performance. Among these indicators are the following:

Net income and growth in earnings per share — Net income attributable to Commerce Bancshares, Inc. was $256.3$269.3 million, an increase of 15.6%5.1% compared to the previous year. The return on average assets was 1.32%1.30%. Diluted earnings per share increased 17.5%7.8% in 20112012 compared to 2010.2011.