UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 26, 202030, 2023

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to ________.

Commission File Number 0-2585

The Dixie Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Tennessee | | | | 62-0183370 |

| (State or other jurisdiction of incorporation of organization) | | | | (I.R.S. Employer Identification No.) |

| | | | |

| 475 Reed Road, Dalton, GA 30720 | | | | (706) 876-5800 |

| (Address of principal executive offices and zip code) | | | | (Registrant's telephone number, including area code) |

| | | | |

| Securities registered pursuant to Section 12(b) of the Act: | | | | |

| Title of Class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $3.00 par value | | DXYN | | NASDAQ Stock Market, LLC |

| | | | |

| Securities registered pursuant to Section 12(g) of the Act: | | | | |

| Title of class | | | | |

| None | | | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. ¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See definitiondefinitions of "large accelerated filer",filer," "accelerated filer" andfiler," "smaller reporting company"company," in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨Accelerated filer ¨Non-accelerated filer ¨Smaller reporting company þ Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to Section 240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes þ No

The aggregate market value of the Common Stock held by non-affiliates of the registrant on June 27, 202030, 2023 (the last business day of the registrant's most recently completed fiscal second quarter) was $10,862,025.$18,370,085. The aggregate market value was computed by reference to the closing price of the Common Stock on such date. In making this calculation, the registrant has assumed, without admitting for any purpose, that all executive officers, directors, and holders of more than 10% of a class of outstanding Common Stock, and no other persons, are affiliates. No market exists for the shares of Class B Common Stock, which is neither registered under Section 12 of the Act nor subject to Section 15(d) of the Act.

Indicate the number of shares outstanding of each of the registrant's classes of Common Stock as of the latest practicable date.

| | | | | | | | | | | | | | |

| Class | | Outstanding as of February 25, 202123, 2024 |

| Common Stock, $3.00 Par Value | | 14,557,43514,409,281 | | | shares |

| Class B Common Stock, $3.00 Par Value | | 880,3131,121,129 | | | shares |

| Class C Common Stock, $3.00 Par Value | | 0— | | | shares |

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the following document are incorporated by reference:

Proxy Statement of the registrant for annual meeting of shareholders to be held May 5, 20211, 2024 (Part III).

THE DIXIE GROUP, INC.

Index to Annual Report

on Form 10-K for

Year Ended December 26, 202030, 2023

| | | | | | | | |

| PART I | Page |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | | |

| PART II | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| PART III | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| PART IV | |

| Item 15. | | |

| Item 16. | | |

| | |

| |

| |

| | |

| | | |

| | | |

| | | |

| | |

| | | |

| | | |

| | | |

| | | |

FORWARD-LOOKING INFORMATION

This Report contains statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include the use of terms or phrases such as "expects," "estimates," "projects," "believes," "anticipates," "intends," and similar terms and phrases. Such forward-looking statements relate to, among other matters, our future financial performance, business prospects, growth strategies or liquidity. The following important factors may affect our future results and could cause those results to differ materially from our historical results; these factors include, in addition to those "Risk Factors" detailed in Item 1A of this report, and described elsewhere in this document, the cost and availability of capital, raw material and transportation costs related to petroleum price levels, the cost and availability of energy supplies, the loss of a significant customer or group of customers, the ability to attract, develop and retain qualified personnel, materially adverse changes in economic conditions generally in carpet, rug and floorcovering markets we serve and other risks detailed from time to time in our filings with the Securities and Exchange Commission.

PART I.

Item 1. BUSINESS

General

Our business consists principally of marketing, manufacturing and selling floorcovering products to high-end residential and commercial customers through our various sales forces and brands. We focus exclusively on the upper-end of the floorcovering market where we believe we have strong brands and competitive advantages with our style and design capabilities and customer relationships. Our Fabrica, Masland, and Dixie HomeDH Floors brands have a significant presence in the high-end residential floorcovering markets. Our AtlasMasland brand participates in the upper-end specified commercial marketplace. Dixie International sells all of our brands outside of the North American market.

Our business is primarily concentratedparticipates in areas of themarkets for soft floorcovering marketsfloorcoverings, which include broadloom carpet carpet tiles and rugs. However, over the past few years, thererugs, and hard surfaces, which include luxury vinyl flooring (LVF) and engineered wood. There has been a significant shift in the flooring marketplace as hard surface products have grown at a rate much faster than soft surface products. We have respondedcontinue to respond to this accelerated shift to hard surface flooring by launching several initiatives in both our residential and commercial brands. Our commercial business offers luxury vinyl flooring (“LVF”) products under the Calibré brand in the commercial markets. Within the residential markets we launchedhard surface offerings. TRUCOR™ and TRUCOR Prime™ offeringoffers a wide range of LVF products. In 2020, we experienced significant growth in sales of our TRUCOR™ family of products and our Fabrica Wood program. We continue to innovateintroduce new products in our soft floorcovering residential markets with a new tufting technology, “TECHnique”, which is being showcased in our1866 by Masland and Decor by Fabrica lines. TECHnique delivers beautiful patterns through precise yarn placementcollections, which are targeted at high end, luxury soft surface markets including wool broadloom and control at each needle. In the soft floorcovering commercial market, we have made our unique Sustaina™ backing the standard in our modular carpet tile offerings. The Sustaina™ modular tile backing system, with its very high recycled content, is an environmentally conscious PVC and polyurethane free cushion modular carpet tile backing.decorative rugs.

We have one reportable segment, Floorcovering, which is comprised of two operating segments, Residential and Commercial. We have aggregated the two operating segments into one reporting segment because they have similar economic characteristics, and the operating segments are similar in all of the following areas: (a) the nature of the products and services; (b) the nature of the production processes; (c) the type or class of customer for their products and services; (d) the methods used to distribute their products or provide their services; and (e) the nature of the regulatory environment.Floorcovering.

Our Brands

Our brands are well known, highly regarded and complementary; by being differentiated, we offer meaningful alternatives to the discriminating customer.

Fabrica markets and manufactures luxurious residential carpet, custom rugs, and engineered wood at selling prices that we believe are approximately five times the average for the residential soft floorcovering industry. Its primary customers are interior decorators and designers, selected retailers and furniture stores, luxury home builders and manufacturers of luxury motor coaches and yachts. Fabrica is among the leading premium brands in the domestic marketplace and is known for styling innovation and unique colors and patterns. Fabrica consists of extremely high quality carpets and area rugs in both nylon and wool, with a wide variety of patterns and textures. Fabrica is viewed by the trade as the premier quality brand for very high-end carpet and enjoys an established reputation as a styling trendsetter and a market leader in providing both custom and designer products to the very high-end residential sector.

Masland Residential, founded in 1866, markets and manufactures design-driven specialty carpets and rugs for the high-end residential marketplace. In addition, it offers luxury vinyl flooring products to the marketplace it serves. Its residential and commercial broadloom carpet products are marketed at selling prices that we believe are over three times the average for the residential soft floorcovering industry. Its products are marketed through the interior design community, as well as to consumers through specialty floorcovering retailers. Masland Residential has strong brand recognition within the upper-end residential market. Masland Residential competes through innovative styling, color, product design, quality and service.

Dixie HomeDH Floors provides stylishly designed, differentiated products that offer affordable fashion to residential consumers. Dixie HomeDH Floors markets an array of residential tufted broadloom carpet and rugs to selected retailers and home centers under the Dixie HomeDH Floors and private label brands. In addition, it offers luxury vinyl flooring products to the marketplace it serves. Its objective is to make the Dixie HomeDH Floors brand the choice for styling, service and quality in the more moderately priced sector of the high-end residential market. Its products are marketed at selling prices which we believe average two times the soft floorcovering industry's average selling price.

AtlasMasland is our combined brand of the former Atlas Carpet Mills and Masland Contract. We strategically re-aligned our business in 2018 by merging the two brands into one cohesive operating unit with a broader array of products but a single management, marketing, back office, manufacturing and sales structure to serve the specified commercial marketplace.Its commercial products are marketed to the architectural and specified design community and directly to commercial end users, as

well as to consumers through specialty floorcovering retailers. AtlasMasland also sells to the hospitality market with both custom designed and running line products. Utilizing computerized yarn placement technology, as well as offerings utilizing our state of the art Infinity tufting technology, this brand provides excellent service and design flexibility to the hospitality market serving upper-end hotels, conference centers and senior living markets. Its broadloom, rug product and luxury vinyl flooring offerings are designed for the interior designer in the upper-end of the hospitality market who appreciates sophisticated texture, color and patterns with excellent service. AtlasMasland has strong brand recognition within the upper-end contract market, and competes through innovative styling, color, patterns, quality and service.

Industry

We are a flooring manufacturer in an industry composed of a wide variety of companies from small privately held firms to large multinationals. In 2019,2022, according to the most recent information available, the U.S. floorcovering industry reported $27.6$37.6 billion in sales, up approximately 1.1% over 2018's7.5% from the 2021 sales of $27.3 billion.total. In 2019,2022, the primary categories of flooring in the U.S., based on sales dollars, were carpet and rug (41%(34%), luxury vinyl flooring (LVF) (17%(28%), wood (12%), ceramic tile (14%), wood (13%), stone (6%), vinyl (5%(4%), and laminate and other (4%(3%). In 2019,2022, the primary categories of flooring in the U.S., based on square feet, were carpet and rug (46%(39%), luxury vinyl flooring (LVF) (17%(32%), ceramic tile (14%(12%), vinyl (9%(6%), wood (7%(5%), laminate (4%(3%), and stone and other (3%). Each of these categoriescategories is influenced by the residential construction, commercial construction, and residential remodeling markets. These markets are influenced by many factors including consumer confidence, spending for durable goods, turnover in housing and the overall strength of the economy.

The carpet and rug category has two primary markets, residential and commercial, with the residential market making up the largest portion of the industry's sales. A substantial portion of industry shipments is made in response to replacement demand. Residential products consist of broadloom carpets and rugs in a broad range of styles, colors and textures.textures and hard surface products such as wood, luxury vinyl flooring, stone and ceramic tile. Commercial products consist primarily of broadloom carpet and modular carpet tile for a variety of institutional applications such as office buildings, restaurant chains, schools and other commercial establishments. The carpet industry also manufactures carpet for the automotive, recreational vehicle, small boat and other industries.

The Carpet and Rug Institute (the "CRI") is the national trade association representing carpet and rug manufacturers. Information compiled by the CRI suggests that the domestic carpet and rug industry is comprised of fewer than 100 manufacturers, with a significant majority of the industry's production concentrated in a limited number of manufacturers focused on the lower end of the price curve. We believe that this industry focus provides us with opportunities to capitalize on our competitive strengths in selected markets where innovative styling, design, product differentiation, focused service and limited distribution add value.

Competition

The floorcovering industry is highly competitive. We compete with other carpet, rug and hard surface manufacturers. In addition, the industry provides multiple floorcovering surfaces such as luxury vinyl tile and wood. Though soft floorcovering is still the dominant floorcovering surface, it has gradually lost market share to hard floorcovering surfaces over the last 25 years. We believe our products are among the leaders in styling and design in the high-end residential and high-end commercial carpet markets. However, a number of manufacturers produce competitive products and some of these manufacturers have greater financial resources than we do.

We believe the principal competitive factors in our primary floorcovering markets are styling, color, product design, quality and service. In the high-end residential and commercial markets, we compete with various other floorcovering suppliers. Nevertheless, we believe we have competitive advantages in several areas. We have an attractive portfolio of brands that we believe are well known, highly regarded by customers and complementary; by being differentiated, we offer meaningful alternatives to the discriminating customer. We believe our investment in new yarns and innovative tufting and dyeing technologies, strengthens our ability to offer product differentiation to our customers. In addition, we have established longstanding relationships with key suppliers for which we utilize both branded yarns andof luxury vinyl flooring and with significant customers in most of our markets. Finally, our reputation for innovative design excellence and our experienced management team enhance our competitive position. See "Risk Factors" in Item 1A of this report.

Backlog

Sales order backlog is not material to understanding our business, due to relatively short lead times for order fulfillment in the markets for the vast majority of our products.

Trademarks

Our floorcovering businesses own a variety of trademarks under which our products are marketed. Among such trademarks, the names "Fabrica", "Masland", "Dixie Home", "Atlas|Masland”"DH Floors" and "Masland Hospitality"TRUCOR™ are of greatest importance to our business. We believe that we have taken adequate steps to protect our interest in all significant trademarks.

Customer and Product Concentration

As a percentage of our net sales, one customer, a mass merchant, accounted for approximately 7% in 2020, 11% in 2019, and 13% in 2018 and as a percentage of our customer's trade accounts receivable, accounted for approximately 20% in 2020 and 18% in 2019. No other customer was more than 10 percent of our net sales during the periods presented. During 2020,2023, sales to our top ten customers accounted for approximately 10% of6% of our sales and our top 20 customers accounted for approximately 12%10% of our sales. We do not makehave a material amount of sales in foreign countries.

We do not have any single class of products that accounts for more than 10% of our sales. However, sales of our floorcovering products may be classified by significant end-user markets into which we sell, and such information for the past three years is summarized as follows:

| | | | | | | | | | | | | | | | | |

| 2020 | | 2019 | | 2018 |

| Residential floorcovering products | 79 | % | | 72 | % | | 72 | % |

| Commercial floorcovering products | 21 | % | | 28 | % | | 28 | % |

Seasonality

Our sales historically have normally reached their lowesthighest level in the second quarter (approximately 26% of our annual sales) and their lowest levels in the first quarter (approximately 23% of our annual sales), with the remaining sales being distributed relatively equally amongbetween the second, third and fourth quarters. During 2020, primarily as a result of the COVID-19 pandemic, our sales reached their lowest level in the second quarter (approximately 19% of our annual sales) with the remaining sales being distributed relatively equally among the first, third and fourth quarters. Working capital requirements have normally reached their highest levels in the thirdsecond and fourththird quarters of the fiscal year.

Environmental

Our operations are subject to federal, state and local laws and regulations relating to the generation, storage, handling, emission, transportation and discharge of materials into the environment. The costs of complying with environmental protection laws and regulations have not had a material adverse impact on our financial condition or results of operations in the past. See "Risk Factors” in Item 1A of this report.

Raw Materials

Our primary raw material is continuous filament yarn. Nylon is the primary yarn we utilize and, to a lesser extent, wool and polyester yarn is used. Additionally, we utilize polypropylene carpet backing, latex, dyes and chemicals, and man-made topical applications in the construction of our products. The volatility of petroleum prices could adversely affect our supply and cost of synthetic fibers. Our synthetic yarns are purchased primarily from domestic fiber suppliers and wool is purchased from a number of international sources. Our other raw materials are purchased primarily from domestic suppliers, although the majority of our luxury vinyl tile is sourced outside the United States. Where possible,Normally, we pass raw material price increases through to our customers; however, there can be no assurance that pricecost increases can be passed through to customers and that increases in raw material prices will not have an adverse effect on our profitability. See "Risk Factors” in Item 1A of this report. We purchase a significant portion of our primary raw material (nylon yarn) from one supplier. We believe thereThere are othermultiple sources of nylon yarn; however, an unanticipated termination or interruption of our supply arrangements could adversely affect our supplies of raw materials and could have a material effect on our operations. See "Risk Factors” in Item 1A of this report.

Utilities

We use electricity as our principal energy source, with oil or natural gas used in some facilities for dyeing and finishing operations as well as heating. We have not experienced any material problemsignificant problems or issues in obtaining adequate supplies of electricity, natural gas or oil. Energy shortages of extended duration could have an adverse effect on our operations, and price volatility could negatively impact future earnings. See "Risk Factors” in Item 1A of this report.

Working Capital

We are required to maintain significant levels of inventory in order to provide the enhanced service levels demanded by the nature of our business and our customers, and to ensure timely delivery of our products. Consistent and dependable sources of liquidity are required to maintain such inventory levels. Failure to maintain appropriate levels of inventory could materially adversely affect our relationships with our customers and adversely affect our business. See "Risk Factors” in Item 1A of this report.

Employment LevelHuman Capital Resources

At December 26, 2020, we30, 2023, our total employed 1,441 associates in our operations.was 970.

Available Information

Our internet address is www.thedixiegroup.com. We make the following reports filed by us with the Securities and Exchange Commission available, free of charge, on our website under the heading "Investor Relations":

1.annual reports on Form 10-K;

2. quarterly reports on Form 10-Q;

3. current reports on Form 8-K; and

4. amendments to the foregoing reports.

The contents of our website are not a part of this report.

Item 1A. RISK FACTORSRisk Factors

In addition to the other information provided in this Report, the following risk factors should be considered when evaluating the results of our operations, future prospects and an investment in shares of our Common Stock. Any of these factors could cause our actual financial results to differ materially from our historical results, and could give rise to events that might have a material adverse effect on our business, financial condition and results of operations.

Our financial condition and results orof operations have been and willcould likely continue to be adversely impacted in the future by the COVID-19 pandemicor other pandemics and the related downturn innegative impact on economic conditions.

TheGlobal and/or local pandemics, such as COVID-19, pandemic continues to impacthave negatively impacted areas where we operate and sell our products and services. The COVID-19 outbreak in the second quarter of 2020 had a material adverse effect on our ability to operate and our results of operations as public health organizations recommended, and many governments implemented, measures to slow and limit the transmission of the virus, including shelter in place and social distancing ordinances. Although many areasthe accessibility of vaccines and other preventive measures have lifted or reducedlessened the impact, of such orders, the continuing spread of the virusnew variants may necessitate a return of such restrictive, preventive measures which may have a material adverse effect on our business for an indefinite period of time, such as the potential shut down of certain locations, decreased employee availability, disruptions to the businesses of our selling channel partners, and others. Our suppliers and customers may also face these and other challenges, which could lead to a disruption in our supply chain as well as decreased construction and renovation spending and consumer demand for our products and services. These issues may also materially affect our current and future access to sources of liquidity, particularly our cash flows from operations, and access to financing. The long-term economic impact and near-term financial impacts of the COVID-19 pandemic, including but not limited to, potential near term or long-term risk of asset impairment, restructuring, and other charges, cannot be reliably quantified or estimated at this time due to the uncertainty of future developments.

The floorcovering industry is sensitive to changes in general economic conditions and a decline in residential or commercial construction activity or corporatehome remodeling and refurbishment could have a material adverse effect on our business.

The floorcovering industry, in which we participate, is highly dependent on general economic conditions, such as interest rate levels, consumer confidence and income, corporate and government spending, interest rate levels, availability of credit and demand for housing. We derive a majority of our sales from the replacement segment of the market. Therefore, unfavorable economic changes, thatsuch as an economic recession, could result in a significant or prolonged decline in spending for remodeling and replacement activities which could have a material adverse effect on our business and results of operations.

The residential floorcovering industrymarket is highly dependent on constructionhousing activity, including new construction, which is cyclical in nature.remodeling. The U.S. and global economies, along with the residential and commercial markets in such economies, can negatively impact the floorcovering industry and our business. Although the impact of a decline in new constructionhousing activity is typically accompanied by an increase in remodeling and replacement activity, these activities typically lag during a cyclical downturn. Additional or extended downturns could cause the industry to deteriorate in the foreseeable future.prolonged deterioration. A significant or prolonged decline in residential or commercial constructionhousing activity could have a material adverse effect on our business and results of operations.

We have had significant levels of sales in certain channels of distribution and reduction in sales through these channels could adversely affect our business.

A significant amount of our recent past sales arewere generated through a certain mass merchant retailer. We have seen aA change in strategy by this customer to emphasize products at a lower price point than we currently offer which has adversely affected ourlimited future sales opportunities with this customer. In response to this customer. Further reductions ofloss in sales through this channelvolume and other factors, we implemented our restructuring plan to consolidate our east coast manufacturing operations to better match production demand. If we are unable to maintain volume in line with expected production capacity, any excess capacity in the manufacturing facilities could adversely affect our business. Such a shift could also occur if this retailer decidedresult in an unfavorable impact on gross margins due to reduce the amount of emphasis on soft surface flooring or determine that our concentration of better goods was not advantageous to their marketing program.

We have significant levels of indebtedness that could result in negative consequences to us.

We have a significant amount of indebtedness relative to our equity. Insufficient cash flow, profitability, or the value of our assets securing our loans could have a material adverse effect on our ability to generate sufficient funds to satisfy the terms of our senior loan agreements and other debt obligations. Our senior loan agreement and term loans include certain compliance, affirmative, and financial covenants. The impact of continued operating losses on our liquidity position could affect our ability to comply with these covenants by our primary lenders. Additionally, the inability to access debt or equity markets at competitive rates in sufficient amounts to satisfy our obligations could adversely impact our business. Significant increases in interest rates tied to our floating rate debt could have a material adverse effect on our financial results. Further, our trade relations depend on our economic viability and insufficient capital could harm our ability to attract and retain customers and or supplier relationships.

Uncertainty in the credit market or downturns in the economy and our business could affect our overall availability and cost of credit.

Economic factors, including an economic recession, could have a material adverse effect on demand for our products and on our financial condition and operating results. Uncertainty in the credit markets could affect the availability and cost of credit. If banks and financial institutions with whom we have banking relationships enter receivership or become insolvent in the future, we may be unable to access, and we may lose, some or all of our existing cash and cash equivalents to the extent those funds are not insured or otherwise protected by the FDIC. Market conditions could impact our ability to obtain financing in the future, including any financing necessary to refinance existing indebtedness. The cost and terms of such financing is uncertain. Continued operating losses could affect our ability to continue to access the credit markets under our current terms and conditions. These and other economic factors could have

If we are not able to maintain a material adverse effect on demandminimum bid price of $1 per share for our productscommon stock, we may be subject to delisting from The NASDAQ Stock Market.

NASDAQ Marketplace Rule 5550(a)(2) requires that, for continued listing on the exchange, we must maintain a minimum bid price of $1 per share. We received notice from NASDAQ on September 27, 2023 that our closing bid price was below $1 per share for 30 consecutive business days. If we are not able to regain compliance before March 25, 2024, we may be eligible for an additional 180 days provided we meet other listing requirements. To the extent that we are unable to stay in compliance with the relevant NASDAQ bid price listing rule, there is a risk that our common stock may be delisted from NASDAQ, which would adversely impact liquidity of our common stock and onpotentially result in even lower bid prices for our financial condition and operating results.common stock.

Our stock price has been and could remain volatile, which could further adversely affect the market price of our stock, our ability to raise additional capital and/or cause us to be subject to securities class action litigation.capital.

The market price of our common stock has historically experienced and may continue to experience significant volatility. Our progress in restructuring our business, our quarterly operating results, our perceived prospects, lack of securities analysts’ recommendations or earnings estimates, changes in general conditions in the economy or the financial markets, adverse events related to our strategic relationships, significant sales of our common stock by existing stockholders, and other developments affecting us or our competitors could cause the market price of our common stock to fluctuate substantially. In addition, in recent years, the stock market has experienced significant price and volume fluctuations. This volatility has affected the market prices of securities issued by many companies for reasons unrelated to their operating performance and may adversely affect the price of our common stock. Such market price volatility could adversely affect our ability to raise additional capital. In addition, we may be subject to securities class action litigation as a result of volatility in the price of our common stock, which could result in substantial costs and diversion of management’s attention and resources and could harm our stock price, business, prospects, results of operations and financial condition

We face intense competition in our industry, which could decrease demand for our products and could have a material adverse effect on our profitability.

The floorcovering industry is highly competitive. We face competition from a number of domestic manufacturers and independent distributors of floorcovering products and, in certain product areas, foreign manufacturers. Significant consolidation within the floorcovering industry has caused a number of our existing and potential competitors to grow significantly larger and have greater access to resources and capital than we do. Maintaining our competitive position may require us to make substantial additional investments in our product development efforts, manufacturing facilities, distribution network and sales and marketing activities. These additional investments may be limited by our access to capital, as well as restrictions set forth in our credit facilities. Competitive pressures and the accelerated growth of hard surface alternatives have resulted in decreased demand for our soft floorcovering products and in the loss of market share to hard surface products. As a result, competition from providers of other soft surfaces has intensified and may result in decreasedlower demand for our products. In addition, we face, and will continue to face, competitive pressures on our sales priceprices and cost of our products. As a result of any of these factors, there could be a material adverse effect on our sales and profitability.

If we are unable to anticipate consumer preferences and successfully develop and introduce new, innovative and updated products, we may not be able to maintain or increase our net revenues and profitability.

Our success depends on our ability to identify and originate product trends as well as to anticipate and react to changing consumer demands in a timely manner. All of our products are subject to changing consumer preferences that cannot be predicted with certainty. In addition, long lead times for certain products may make it hard for us to quickly respond to changes in consumer demands. Recently we have seen the supply of white dyeable yarns for the commercial business decline and that has forced us to transition to new products faster than was originally intended. If we fail to successfully replace those products with equally desirable products to the marketplace, we will lose sales volume. Our newNew products may not receive consumer acceptance as consumer preferences could shift rapidly to different types of flooring products or away from these types of products altogether, and our future success depends in part on our ability to anticipate and respond to these changes. Failure to anticipate and respond in a timely manner to changing consumer preferences could lead to, among other things, lower sales and excess inventory levels, which could have a material adverse effect on our financial condition.

Raw material prices maywill vary and the inability to either offset or pass on such cost increases or avoid passing on decreases larger than the cost decrease to our customers could have a material adverse effect on our business, results of operations and financial condition.

We require substantial amounts of raw materials to produce our products, including nylon and polyester yarn, as well as wool yarns, synthetic backing, latex, and dyes. Substantially all of the raw materials we require are purchased from outside sources. The prices of raw materials and fuel-related costs varyhave increased significantly withdue to market conditions.conditions and inflationary pressures, the duration and extent of which is difficult to predict. The fact that we source a significant amount of raw materials means that several months of raw materials and work in process are moving through our supply chain at any point in time. We are sourcing the majority of our new luxury vinyl flooring and wood product lines from overseas. We are not able to predict whether commodity costs will significantly increase or decrease in the future. If commodity costs continue to increase in the future and we are not able to reduce or eliminate the effect of the cost increases by reducing production costs or implementing price increases, our profit margins could decrease. If commodity costs decline, we may experience pressures from customers to reduce our selling prices. The timing of any price reductions and decreases in commodity costs may not align. As a result, our margins could be affected.

Unanticipated termination or interruption

Disruption to suppliers of nylon yarnraw materials could have a material adverse effect on us.

Nylon yarn is the principal raw material used in our floorcovering products. A significant portion of such yarn is purchased from one supplier. Our yarn supplier is oneOne of the leading fiber suppliers within the industry and ishad been the exclusive supplier of certain innovative branded fiber technologyfibers upon which we rely.formerly relied. Access to these branded fibers is no longer available. We believe ourhave developed and are developing products and product offerings of this innovativeusing fiber technology contribute materiallysystems from other fiber suppliers, but there can be no certainty as to the competitivenesssuccess of our efforts to develop and market such products. While we believe there are other sourcesAdditionally, the supply of all nylon yarn and yarn systems has been negatively impacted by a variety of overall market factors. The cost of nylon yarns an unanticipated termination or interruptionhas risen significantly and availability of nylon yarns has been restricted. Our efforts to develop alternate sources and to diversify our currentyarn suppliers has been met with success to date; however, supply of branded nylon yarn could have a material adverse effect onconstraints may impact our ability to supplysuccessfully develop products and effectively service our products to our customers and have a material adverse impact on our competitiveness if we are unable to replace our nylon supplier with another supplier that can offer similar innovative and branded fiber products. Recently, we have had a disruption in our supply of white dyeable yarns for the commercial market place which has resulted in our taking additional charges for the write down of certain inventories. . An interruption in the supply of these or other raw materials or sourced products used in our business or in the supply of suitable substitute materials or products would disrupt our operations, which could have a material adverse effect on our business. We continually evaluate our sources of yarn and other raw materials for competitive costs, performance characteristics, brand value, and diversity of supply.

We rely on information systems in managing our operations and any system failure, cyber incident or deficiencies of such systems may have an adverse effect on our business.

Our businesses rely on sophisticated systems to obtain, rapidly process, analyze and manage data. We rely on these systems to, among other things, facilitate the purchase, manufacture and distribution of our products; receive, process and ship orders on a timely basis; and to maintain accurate and up-to-date operating and financial data for the compilation of management information. We rely on our computer hardware, software and network for the storage, delivery and transmission of data to our sales and distribution systems, and certain of our production processes are managed and conducted by computer. Any damage by unforeseen events or system failure which causes interruptions to the input, retrieval and transmission of data or increase in the service time, whether caused by human error, natural disasters, power loss, computer viruses, intentional acts of vandalism, various forms of cybercrimescyber crimes including and not limited to hacking, ransomware, intrusions and malware or otherwise, could disrupt our normal operations. ThereDepending upon the severity of the incident, there can be no assurance that we can effectively carry out our disaster recovery plan to handle thea failure of our information systems, or that we will be able to restore our operational capacity within sufficient time to avoid material disruption to our business. The occurrence of any of these events could cause unanticipated disruptions in service, decreased customer service and customer satisfaction and harm to our reputation, which could result in loss of customers, increased operating expenses and financial losses. Any such events could in turn have a material adverse effect on our business, financial condition, results of operations, and prospects.

The long-term performance of our business relies on our ability to attract, develop and retain qualified personnel.

To be successful, we must attract, develop and retain qualified and talented personnel in management, sales, marketing, product design and operations. We compete with other floorcovering companies for these employees and invest resources in recruiting, developing, motivating and retaining them. The failure to attract, develop, motivate and retain key employees could negatively affect our business, financial condition and results of operations.

We are subject to various governmental actions that may interrupt our supply of materials.

We import most of our luxury vinyl flooring ("LVF"), some of our wood offering, some of our rugs and broadloom offerings. Though currently a small part of our business, the growth in LVF products is an important product offering to provide our customers a complete selection of flooring alternatives. Recently thereThere have been trade proposals that threatened these product categories with added tariffs which would make our offerings less competitive compared to those manufactured in other countries or produced domestically. These proposals, if enacted, or if expanded, or imposed for a significant period of time, would materially interfere with our ability to successfully enter into these product categories and could have a material adverse effect upon the company'sour cost of goodssales and results of operations.

Regulatory efforts to monitor political, social, and environmental conditions in foreign countries that produce products or components of products purchased by us will necessarily add complexity and cost to our products and processes and may reduce the availability of certain products. Regulatory efforts to prevent or reduce the risk that certain flooring products or elements of such products are produced in regions where forced or involuntary labor are known or believed to occur will result in increased cost to us as we attempt to ensure that none of our products or components of our products are produced in such regions. Such increased cost may make our products less competitive.

We may experience certain risks associated with internal expansion, acquisitions, joint ventures and strategic investments.

We continually look for strategic and tactical initiatives, including internal expansion, acquisitions and investment in new products, to strengthen our future and to enable us to return to sustained growth and to achieve profitability. Growth through expansion and acquisition involves risks, many of which may continue to affect us after the acquisition or expansion. An acquired company, operation or internal expansion may not achieve the levels of revenue, profitability and production that we expect. The combination of an acquired company’s business with ours involves risks. Further, internally generated growth that involves expansion involves risks as well. Such risks include the integration of computer systems, alignment of human resource policies and the retention of valued talent. Reported earnings may not meet expectations because of goodwill and intangible asset impairment, other asset impairments, increased interest costs and issuance of additional securities or debt as a result of these acquisitions. We may also face challenges in consolidating functions and integrating our organizations, procedures, operations and product lines in a timely and efficient manner.

The diversion of management attention and any difficulties encountered in the transition and integration process could have a material adverse effect on our revenues, level of expenses and operating results. Failure to successfully manage and integrate an acquisition with our existing operations or expansion of our existing operations could lead to the potential loss of customers of the acquired or existing business, the potential loss of employees who may be vital to the new or existing operations, the potential loss of business opportunities or other adverse consequences that could have a material adverse effect on our business, financial condition and results of operations. Even if integration occurs successfully, failure of the expansion or acquisition to achieve levels of anticipated sales growth, profitability or productivity, or otherwise perform as expected, may have a material adverse effect on our business, financial condition and results of operations.

We are subject to various environmental, safety and health regulations that may subject us to costs, liabilities and other obligations, which could have a material adverse effect on our business, results of operations and financial condition.

We are subject to various environmental, safety and health and other regulations that may subject us to costs, liabilities and other obligations which could have a material adverse effect on our business. The applicable requirements under these laws are subject to amendment, to the imposition of new or additional requirements and to changing interpretations of agencies or courts. We could incur material expenditures to comply with new or existing regulations, including fines and penalties and increased costs of our operations. Additionally, future laws, ordinances, regulations or regulatory guidelines could give rise to additional compliance or remediation costs that could have a material adverse effect on our business, results of operations and financial condition. For example, producer responsibility regulations regarding end-of-life disposal could impose additional cost and complexity to our business.

The Environmental Protection Agency has declared an intent to focus on perceived risks posed by certain chemicals (principally PFOA and PFOAS) previously used by the carpet industry. New or revised regulatory actions could result in requirements that industry participants, including us, incur costs related to testing and cleanup of areas affected by such chemical usage. Other chemicals or materials historically used by the industry and us could become the focus of similar governmental action.

Various federal, state and local environmental laws govern the use of our current and former facilities. These laws govern such matters as:

•Discharge to air and water;

•Handling and disposal of solid and hazardous substances and waste, and

•Remediation of contamination from releases of hazardous substances in our facilities and off-site disposal locations.

We are a manufacturer and distributor of flooring products which require processes and materials that necessarily utilize substantial amounts of carbon-based energy and accordingly involve the emission of “greenhouse gasses.” Regulatory monitoring, reporting and, more generally, efforts to eliminate or substantially reduce “greenhouse gasses” will necessarily add complexity and cost to our products and processes decreasing profitability and consumer demand. Additionally, consumer preferences may be affected by publicly announced issues related to “greenhouse gasses” which may negatively affect demand for our products. There can be no assurance that we can cost effectively respond to any such regulatory efforts or that demand for our products can be sustained under such pressures.

Our operations also are governed by laws relating to workplace safety and worker health, which, among other things, establish noise standards and regulate the use of hazardous materials and chemicals in the workplace. We have taken, and will continue to take, steps to comply with these laws. If we fail to comply with present or future environmental or safety regulations, we could be subject to future liabilities. However, we cannot ensure that complying with these environmental or health and safety laws and requirements will not adversely affect our business, results of operations and financial condition.

We may be exposed to litigation, claims and other legal proceedings in the ordinary course of business relating to our products or business, which could have a material adverse effect on our business, results of operations and financial condition.

In the ordinary course of business, we are subject to a variety of work-related and product-related claims, lawsuits and legal proceedings, including those relating to product liability, product warranty, product recall, personal injury, and other matters that are inherently subject to many uncertainties regarding the possibility of a loss to our business. Such matters could have a material adverse effect on our business, results of operations and financial condition if we are unable to successfully defend against or resolve these matters or if our insurance coverage is insufficient to satisfy any judgments against us or settlements relating to these matters. Although we have product liability insurance, the policies may not provide coverage for certain claims against us or may not be sufficient to cover all possible liabilities. Further, we may not be able to maintain insurance at commercially acceptable premium levels. Additionally, adverse publicity arising from claims made against us, even if the claims are not successful, could adversely affect our reputation or the reputation and sales of our products.

Our business operations could suffer significant losses from natural disasters, catastrophes, fire or other unexpected events.

Many of our business activities involve substantial investments in manufacturing facilities and many products are produced at a limited number of locations. These facilities could be materially damaged by natural disasters, such as floods, tornadoes, hurricanes and earthquakes, or by fire or other unexpected events such as adverse weather conditions or other disruptions to our facilities, supply chain or our customer's facilities. We could incur uninsured losses and liabilities arising from such events, including damage to our reputation, and/or suffer material losses in operational capacity, which could have a material adverse impact on our business, financial condition and results of operations.

Item 1B.UNRESOLVED STAFF COMMENTS

None.

Item 1C. CYBERSECURITY

Cybersecurity Risk Management and Strategy

We recognize cybersecurity as a critical aspect of our overall risk management program and are committed to maintaining a cybersecurity program to protect our information assets, systems, and operations. Our cybersecurity risk management program is integrated into our overall enterprise risk management program and shares common methodologies, reporting channels and governance processes that apply across the enterprise risk management program to other legal, compliance, strategic, operational and financial risks areas. We continuously evaluate and enhance our cybersecurity program based on lessons learned, industry best practices and feedback from internal and external stakeholders.

Key aspects of our cybersecurity risk management program include:

•risk assessments designed to help identify, prioritize and mitigate potential material cybersecurity risks to our critical systems and information;

•an internal Information Technology staff responsible for managing our cybersecurity risk assessment processes, our security controls and our response to cybersecurity incidents;

•the use of external service providers, where appropriate, to assess, test or otherwise assist with aspects of our security controls;

•cybersecurity awareness training of our associates, incident response personnel and senior management;

•a cybersecurity incident response plan that includes procedures for responding to cybersecurity incidents; and

•a third-party risk management process for key service providers, suppliers, and vendors.

We did not experience a material cybersecurity incident during the year ended December 30, 2023; however, the scope and impact of any future incident cannot be predicted. See "Item 1A. Risk Factors" for more information on our cybersecurity-related risks.

Cybersecurity Governance

Our Board of Directors (the "Board") has oversight responsibility for cybersecurity risk management. The Board oversees management's ongoing activities related to our cybersecurity risk management program. The management team is responsible for the implementation and execution of our cybersecurity program. In addition, the management team provides guidance and direction on cybersecurity priorities, resource allocation and risk tolerance levels. The Board receives quarterly updates from the management team on cybersecurity matters.

Item 2. PROPERTIES

The following table lists our facilities according to location, type of operation and approximate total floor space as of February 25, 2021:23, 2024:

| | | | | | | | | | | | | | |

| Location | | Type of Operation | | Approximate Square Feet |

| Administrative: | | | | |

| Saraland, AL* | | Administrative | | 29,000 | |

| Santa Ana, CA* | | Administrative | | 4,000 | |

| Calhoun, GA | | Administrative | | 10,600 | |

| Dalton, GA* | | Administrative | | 50,800 | |

| | Total Administrative | | 94,400 | |

| | | | |

| Manufacturing and Distribution: | | |

| Atmore, AL | | Carpet Manufacturing, Distribution / Warehouse | | 610,000 | |

| Roanoke, AL | | Carpet Yarn Processing | | 204,000 | |

| Saraland, AL* | | Carpet, Rug and Tile Manufacturing, DistributionWarehouse | | 384,000 | |

| Porterville, CA* | | Carpet Yarn Processing | | 249,000 | |

| Santa Ana, CA* | | Carpet and Rug Manufacturing, Distribution | | 200,000 | |

Adairsville, GAGA* | | Samples and Rug Manufacturing, Distribution | | 292,000 | |

Calhoun, GA * | | Distribution | | 99,000 | |

| Calhoun, GA | | Carpet Dyeing & Processing | | 193,300 | |

| Eton, GA | | Carpet Manufacturing, Distribution | | 408,000 | |

Dalton,Chatsworth, GA* | | Samples Warehouse and Distribution | | 40,000161,400 | |

| | Total Manufacturing and Distribution | | 2,679,3002,701,700 | |

| | | | |

| * Leased properties | | TOTAL | | 2,773,7002,796,100 | |

In addition to the facilities listed above, we lease a small amount of office space in various locations.

In our opinion, our manufacturing facilities are well maintained and our machinery is efficient and competitive. Operations of our facilities generally vary between 120 and 168 hours per week. Substantially all of our owned properties are subject to mortgages, which secure the outstanding borrowings under our senior credit facilities.these mortgages.

Item 3. LEGAL PROCEEDINGS

We have been sued together with 3M Company and approximately 3015 other named defendants and unnamed "fictitious defendants" including various carpet manufacturers and suppliers, in four lawsuits whereby the plaintiffs seek monetary damages and injunctive relief related to the manufacture, supply, and/or use of certain chemical products in the manufacture, finishing, and treatment of carpet products in the Dalton, Georgia area. These chemical products allegedly include without limitation perflourinated compounds ("PFC") such as perflourinated acid ("PFOA") and perfluorooctane sulfonate ("PFOS"). In each lawsuit, the plaintiff(s) alleges that, as a consequence of these actions, these chemical compounds have discharged or leached into the water systems around Dalton and then flow into the waters in or near the water bodies from which the plaintiff(s) draw for drinking water.

Two of these lawsuits werecivil action filed in Alabama. The first lawsuit in Alabama was filed on SeptemberJanuary 22, 2016 by The Water Works and Sewer Board of the City of Gadsden (Alabama) in the Circuit Court of Etowah County, Alabama (styled The Water Works and Sewer Board of the City of Gadsden v. 3M Company, et al., Civil Action No. 31-CV-2016-900676.00). The second lawsuit in Alabama was filed on May 15, 2017 by The Water Works and Sewer Board of the Town of Centre (Alabama) in the Circuit Court of Cherokee County, Alabama (styled The Water Works and Sewer Board of the Town of Centre v. 3M Company, et al., Civil Action No. 13-CV- 2017-900049.00). In each of these Alabama lawsuits, the plaintiff seeks damages that include but are not limited to the expenses associated with the future installation and operation of a filtration system capable of removing from the water the chemicals that are allegedly present as a result of the manufacturing and treatment process described above. Each plaintiff requests a jury trial, does not specify an amount of damages other than an assertion that its damages exceed $10,000, and requests injunctive relief. We have answered the complaint in each of these lawsuits, intend to defend those matters vigorously, and are unable to estimate our potential exposure to loss, if any, for these lawsuits at this time.

The other two lawsuits were filed in Georgia. The first lawsuit in Georgia was filed on November 19, 2019 by the City of Rome (Georgia)2024, in the Superior Court of FloydGordon County Georgia (styled Georgia. The case is styled: Moss Land Company, LLC and Revocable Living Trust of William Darryl Edwards, by and through William Darryl Edwards, Trustee vs. City of Rome, Georgia v. 3M Company,Calhoun et al., No. 19CV02405JFL003). Civil Action Number 24CV73929. The plaintiffplaintiffs are two landowners located in Gordon County Georgia. The relief sought is compensation for alleged damages to the plaintiffs’ real property, an injunction from alleged further damage to their property and abatement of alleged nuisance related to the presence of PFAS and related chemicals on their property. The Plaintiffs allege that case also seeks damages that include without limitationsuch chemicals have been deposited on their property by the expenses associated with the future installation and operationCity of a filtration system capable of removing from the water the chemicals that are allegedly presentCalhoun as a resultbyproduct of treating water containing such chemicals used by manufacturing operations in and around Calhoun Georgia. The defendants include the manufacturingCity of Calhoun Georgia, several other carpet manufacturers, and treatment process described above. The plaintiff requests a jury trialcertain manufacturers and also seeks injunctive relief. While thesellers of chemicals containing PFAS. No specific amount of damages is unspecified, the plaintiff asserts it has spent "tens of millions" to remove the chemicals from the county's water supply and will incur additional costs related to removing such chemicals in the future.been demanded. We have not yet answered the complaint intendbut anticipate denying liability and vigorously defending the matter.

On March 1, 2024, the City of Calhoun Georgia served an answer and crossclaim for Damages and injunctive relief in the pending matter styled: In re: Moss Land Company, LLC and Revocable living Trust of William Darryl Edwards by and through William Darryl Edwards, Trustee v. The Dixie Group, Inc. In the Superior Court of Gordon County Georgia. case Number: 24CV73929. In its Answer and Crossclaim defendant Calhoun sues The Dixie Group, Inc. and other named carpet manufacturing defendants for unspecified monetary damages and other injunctive relief based on injury claimed to have resulted from defendant’s use and disposal of chemical wastewater containing PFAS chemicals. Dixie Group has advised us that it intends to deny liability and to defend the matter vigorously, and are unable to estimate our potential exposure to loss, if any, at this time.

The second lawsuit in Georgia was originally filed on November 26, 2019 and is presented as a class action lawsuit by and on behalf of a class of persons who obtain drinking water from the City of Rome, Georgia and the Floyd County Water Department (and similarly situated persons) (generally, for these purposes, residents of Floyd County) (styled Jarrod Johnson v. 3M Company, et al., Civil Action No. 19-CV-02448-JFL-003) (the "Class Action Lawsuit"). On January 10, 2020, the Class Action Lawsuit was removed to the United States District Court for the Northern District of Georgia, Rome Division (styled Jarrod Johnson v. 3M Company, et al Civil Action No. 4:20-CV-0008-AT). The plaintiffs in this case allege their damages include without limitation the surcharges incurred for the costs of partially filtering the chemicals from their drinking water. The Complaint requests a jury trial and asserts damages unspecified in amount, in addition to requests for injunctive relief. We have filed a response to the Complaint, intend to defend the matter vigorously, and are unable to estimate our potential exposure, if any, at this time.vigorously.

Item 4. MINE SAFETY DISCLOSURES

Not applicable.

Pursuant to instruction G of Form 10-K the following is included as an unnumbered item to PART I.

EXECUTIVE OFFICERS OF THE REGISTRANT

The names, ages, positions and offices held by the executive officers of the registrant as of February 25, 2021, are23, 2024, are listed below along with their business experience during the past five years.

| | | | | | | | |

| Name, Age and Position | | Business Experience During Past Five Years |

| | |

Daniel K. Frierson, 7982

Chairman of the Board, and Chief Executive Officer, Director | | Director since 1973, Chairman of the Board since 1987 and Chief Executive Officer since 1980. He is the Chairman of the Company's Executive Committee. He is past Chairman of The Carpet and Rug Institute. He serves as Director of Astec Industries, Inc. headquartered in Chattanooga, Tennessee. |

| | |

D. Kennedy Frierson, Jr., 5356

Vice President and Chief Operating Officer, Director | | Director since 2012 and Vice President and Chief Operating Officer since August 2009. Vice President and President Masland Residential from February 2006 to July 2009. President Masland Residential from December 2005 to January 2006. Executive Vice President and General Manager, Dixie Home, 2003 to 2005. Business Unit Manager, Bretlin, 2002 to 2003. |

| | |

Allen L. Danzey, 5154

Vice President and Chief Financial Officer | | Chief Financial Officer since January 2020. Director of Accounting from May 2018 to December 2019. Commercial Division Controller from July 2009 to May 2018. Residential Division Controller and Senior Accountant from February 2005 to July 2009.

|

| | |

Thomas M. Nuckols, 53Jr., 56

Vice President and President, Dixie Residential | | Vice President and President of Dixie Residential since November 2017. Executive Vice President, Dixie Residential from February 2017 to November 2017. Dupont/Invista, from 1989 to 2017, Senior Director of Mill Sales and Product Strategy from 2015 to 2017. |

| | |

W. Derek Davis, 7073

Vice President, Human Resources and Corporate Secretary | | Vice President of Human Resources since January 1991 and Corporate Secretary since January 2016. Corporate Employee Relations Director, 1988 to 1991. |

The executive officers of the registrant are generally elected annually by the Board of Directors at its first meeting held after each annual meeting of our shareholders.

PART II.

Item 5.MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our Common Stock trades on the NASDAQ Global Market under the symbol DXYN. No market exists for our Class B Common Stock.

As of February 25, 2021,23, 2024, the total number of holders of our Common Stock was approximately 3,9003,000 including an estimated 3,2002,480 shareholders who hold our Common Stock in nominee names. The total number of holders of our Class B Common Stock was 10.

Recent Sales of Unregistered Securities

None.

Issuer Purchases of Equity Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Fiscal Month Ending | | Total Number of Shares Purchased | | Average Price Paid Per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Number (or approximate dollar value) of Shares That May Yet Be Purchased Under Plans or Programs |

| October 31, 2020 | | — | | | $ | — | | | — | | | |

| November 28, 2020 | | 375,938 | | * | 1.88 | | | 375,938 | | | |

| December 26, 2020 | | — | | | — | | | — | | | |

| Three Fiscal Months Ended December 26, 2020 | | 375,938 | | | $ | 1.88 | | | 375,938 | | | $ | 2,186,275 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Fiscal Month Ending | | Total Number of Shares Purchased | (1) | Average Price Paid Per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Number (or approximate dollar value) of Shares That May Yet Be Purchased Under Plans or Programs | (1) |

| November 4, 2023 | | — | | | $ | — | | | — | | | — | | |

| December 2, 2023 | | — | | | — | | | — | | | — | | |

| December 30, 2023 | | — | | | — | | | — | | | — | | |

| Three Fiscal Months Ended December 30, 2023 | | — | | | $ | — | | | — | | | $ | — | | |

*(1) On November 4, 2020, the Company’sAugust 3, 2022, our Board of Directors approved the repurchase of up to $2.9 million$3,000 of the Company’s common stock. Such purchases would be under a Planour Common Stock. Currently, we do not have an active 10b-5-1 plan to be entered into on or after November 6, 2020, pursuant to Rule 10b5-1repurchase shares of the Securities and Exchange act. Subject to the requirements of Rule 10b5-1, the repurchase plan would permit the purchase of up to $2.9 million of the Company’s shares beginning as of November 11, 2020 and continuing until June 2021. It is intended that purchases would be conducted to come within Rule 10b-18 and would be managed by Raymond James & Associates. The plan may be amended or terminated at any time in accordance with the Rule.Common Stock.

Quarterly Financial Data, Dividends and Price Range of Common Stock

Following are quarterly financial data, dividends and price range of Common Stock for the four quarterly periods in the years ended December 26, 2020 and December 28, 2019. Due to rounding, the totals of the quarterly information for each of the years reflected below may not necessarily equal the annual totals. There is a restriction on the payment of dividends under our revolving credit facility and we have not paid any dividends in the years ended December 26, 202030, 2023 and December 28, 2019.31, 2022.

The following table provides the price range of common stock for the four fiscal quarterly periods in the years ended December 30, 2023 and December 31, 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE DIXIE GROUP, INC. |

| QUARTERLY PRICE RANGE OF COMMON STOCK |

|

| | FISCAL QUARTER |

| 2023 | | 1ST | | 2ND | | 3RD | | 4TH |

| | | | | | | | |

| Common Stock Prices: | | | | | | | | |

| High | | $ | 1.06 | | | $ | 1.36 | | | $ | 1.34 | | | $ | 0.98 | |

| Low | | 0.70 | | | 0.67 | | | 0.62 | | | 0.46 | |

| | | | | | | | |

| 2022 | | 1ST | | 2ND | | 3RD | | 4TH |

| | | | | | | | |

| Common Stock Prices: | | | | | | | | |

| High | | $ | 6.32 | | | $ | 3.44 | | | $ | 1.83 | | | $ | 1.25 | |

| Low | | 2.69 | | | 1.35 | | | 1.08 | | | 0.75 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| THE DIXIE GROUP, INC. |

| QUARTERLY FINANCIAL DATA, DIVIDENDS AND PRICE RANGE OF COMMON STOCK |

| (unaudited) (dollars in thousands, except per share data) |

| 2020 | | 1ST | | 2ND | | 3RD | | 4TH |

| Net sales | | $ | 80,578 | | | $ | 60,824 | | | $ | 85,920 | | | $ | 88,618 | |

| Gross profit | | 18,993 | | | 12,244 | | | 22,241 | | | 22,978 | |

| Operating income (loss) | | (1,336) | | | (5,625) | | | 2,563 | | | 1,479 | |

| Income (loss) from continuing operations | | (2,613) | | | (6,979) | | | 906 | | | (401) | |

| Income (loss) from discontinued operations | | (76) | | | (81) | | | (46) | | | 83 | |

| Net income (loss) | | $ | (2,689) | | | $ | (7,060) | | | $ | 860 | | | $ | (318) | |

| Basic earnings (loss) per share: | | | | | | | | |

| Continuing operations | | $ | (0.17) | | | $ | (0.46) | | | $ | 0.06 | | | $ | (0.03) | |

| Discontinued operations | | (0.01) | | | (0.01) | | | 0.00 | | | 0.01 | |

| Net income (loss) | | $ | (0.18) | | | $ | (0.47) | | | $ | 0.06 | | | $ | (0.02) | |

| Diluted earnings (loss) per share: | | | | | | | | |

| Continuing operations | | $ | (0.17) | | | $ | (0.46) | | | $ | 0.06 | | | $ | (0.03) | |

| Discontinued operations | | (0.01) | | | (0.01) | | | 0.00 | | | 0.01 | |

| Net income (loss) | | $ | (0.18) | | | $ | (0.47) | | | $ | 0.06 | | | $ | (0.02) | |

| | | | | | | | |

| Common Stock Prices: | | | | | | | | |

| High | | $ | 1.60 | | | $ | 1.04 | | | $ | 1.34 | | | $ | 2.92 | |

| Low | | 0.53 | | | 0.55 | | | 0.76 | | | 0.77 | |

| | | | | | | | |

| 2019 | | 1ST | | 2ND | | 3RD | | 4TH |

| Net sales | | $ | 88,606 | | | $ | 100,394 | | | $ | 95,447 | | | $ | 90,135 | |

| Gross profit | | 18,919 | | | 23,493 | | | 21,074 | | | 22,719 | |

| Operating loss | | (4,863) | | | 574 | | | (1,042) | | | 26,680 | |

| Loss from continuing operations | | (6,641) | | | (1,181) | | | (2,577) | | | 26,018 | |

| Income (loss) from discontinued operations | | (31) | | | (35) | | | 23 | | | (305) | |

| Net loss | | $ | (6,672) | | | $ | (1,216) | | | $ | (2,554) | | | $ | 25,713 | |

| Basic earnings (loss) per share: | | | | | | | | |

| Continuing operations | | $ | (0.42) | | | $ | (0.07) | | | $ | (0.16) | | | $ | 1.61 | |

| Discontinued operations | | (0.00) | | | (0.00) | | | (0.00) | | | (0.02) | |

| Net loss | | $ | (0.42) | | | $ | (0.07) | | | $ | (0.16) | | | $ | 1.59 | |

| Diluted earnings (loss) per share: | | | | | | | | |

| Continuing operations | | $ | (0.42) | | | $ | (0.07) | | | $ | (0.16) | | | $ | 1.60 | |

| Discontinued operations | | (0.00) | | | (0.00) | | | (0.00) | | | (0.02) | |

| Net loss | | $ | (0.42) | | | $ | (0.07) | | | $ | (0.16) | | | $ | 1.58 | |

| | | | | | | | |

| Common Stock Prices: | | | | | | | | |

| High | | $ | 1.47 | | | $ | 0.97 | | | $ | 1.50 | | | $ | 2.09 | |

| Low | | 0.70 | | | 0.34 | | | 0.51 | | | 1.04 | |

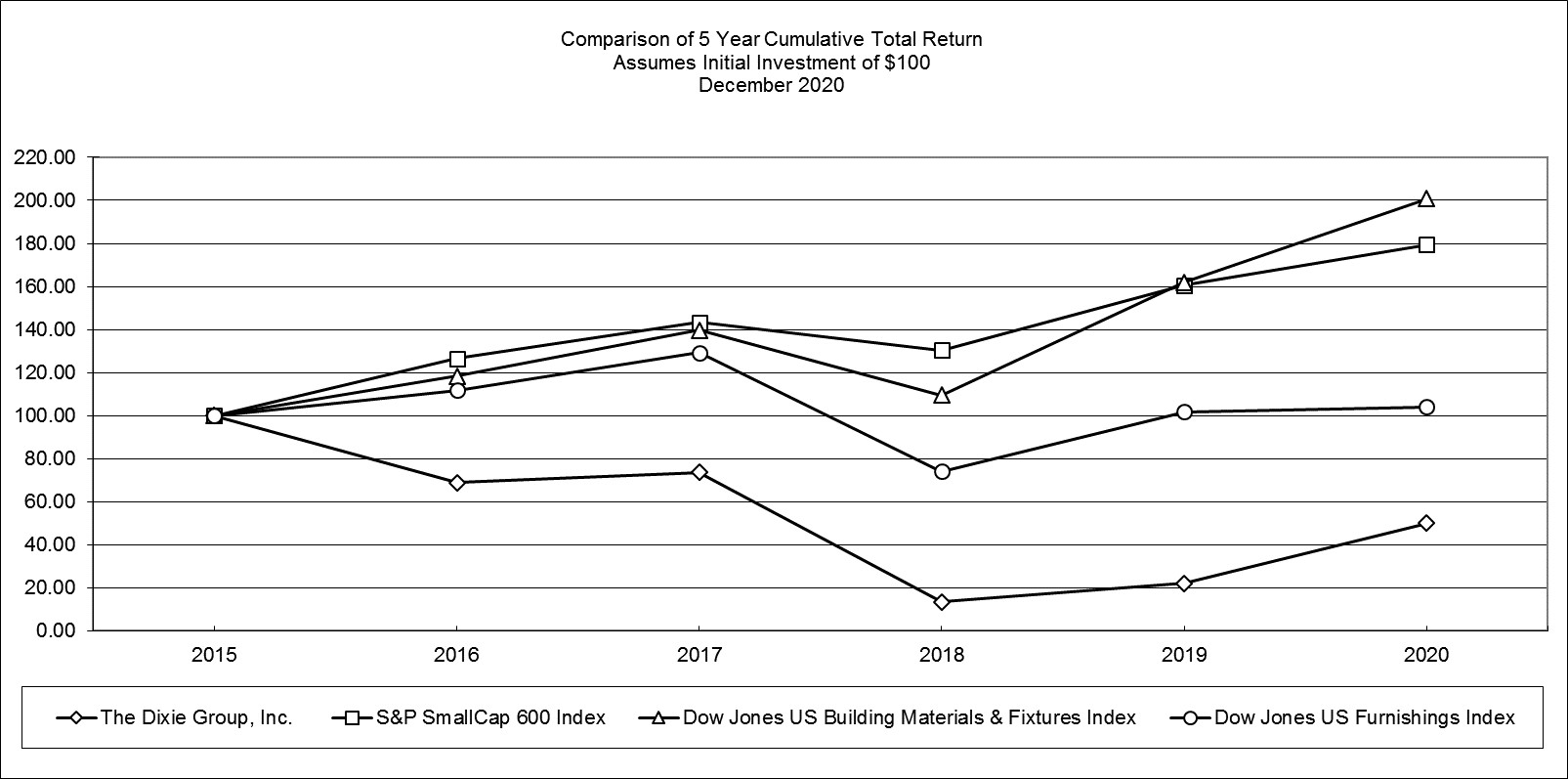

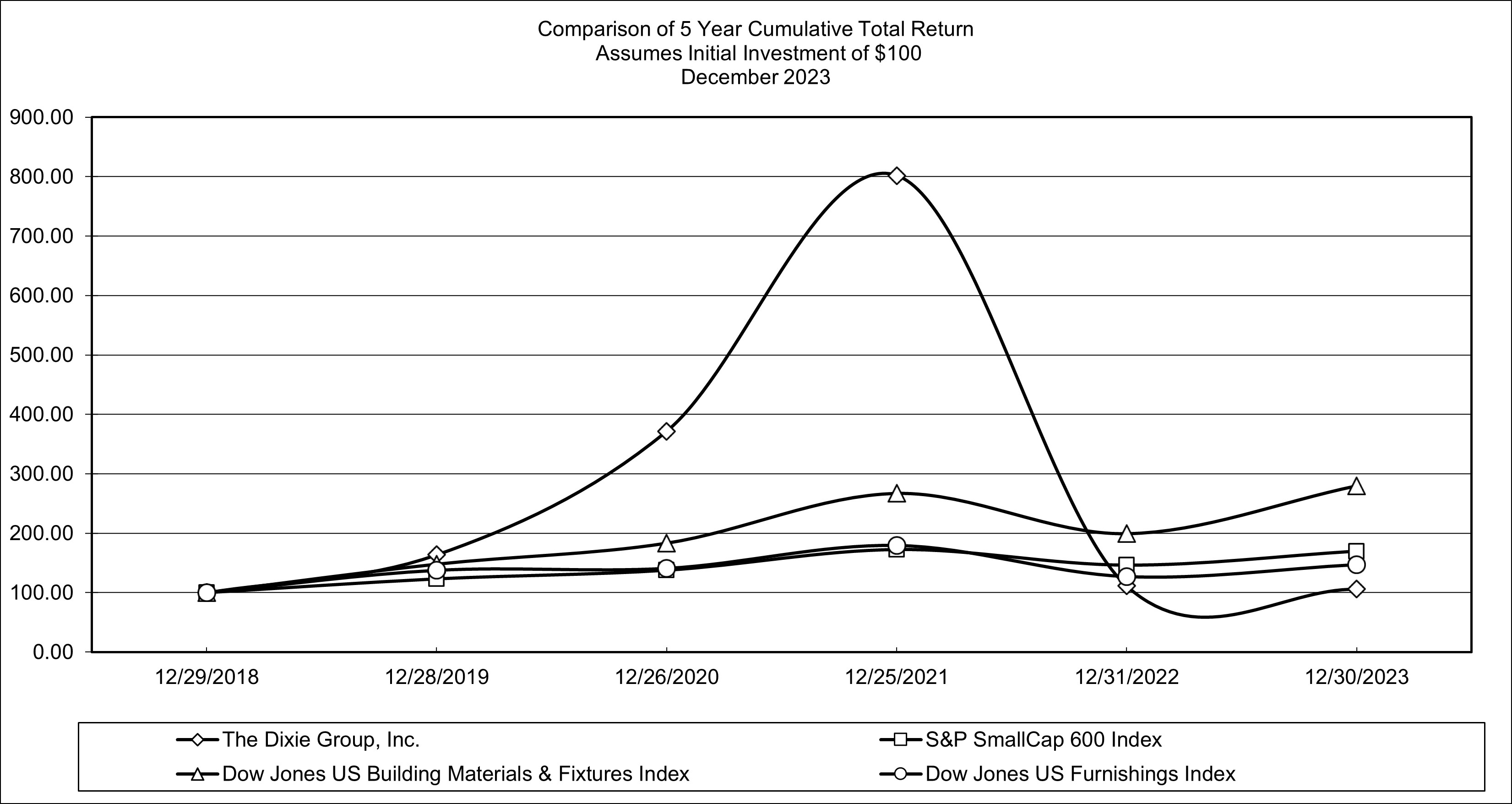

Shareholder Return Performance Presentation

We compare our performance to two different industry indices published by Dow Jones, Inc. The first of these is the Dow Jones US Furnishings Index, which is composed of publicly traded companies classified by Dow Jones in the furnishings industry. The second is the Dow Jones US Building Materials & Fixtures Index, which is composed of publicly traded companies classified by Dow Jones in the building materials and fixtures industry.

In accordance with SEC rules, setSet forth below is a line graph comparing the yearly change in the cumulative total shareholder return on our Common Stock against the total return of the Standard & Poor's Small Cap 600 Stock Index, plus both the Dow Jones US Furnishings Index and the Dow Jones US Building Materials & Fixtures Index, in each case for the five year period ended December 31, 2020.30, 2023. The comparison assumes that $100.00 was invested on December 31, 2015,29, 2018, in our Common Stock, the S&P Small Cap 600 Index, and each of the two Peer Groups, and assumes the reinvestment of dividends.

The foregoing shareholder performance presentation shall not be deemed "soliciting material" or to be "filed" with the Commission subject to Regulation 14A, or subject to the liabilities of Section 18 of the Exchange Act.

Item 6.6SELECTED FINANCIAL DATA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The Dixie Group, Inc. |

| Historical Summary |

| (dollars in thousands, except share and per share data) |

| | | | | | | | | | |

| FISCAL YEARS | | 2020 (1) | | 2019 (2) | | 2018 (3) | | 2017 (4) | | 2016 (5) |

| OPERATIONS | | | | | | | | | | |

| Net sales | | $ | 315,939 | | | $ | 374,582 | | | $ | 405,033 | | | $ | 412,462 | | | $ | 397,453 | |

| Gross profit | | 76,456 | | | 86,205 | | | 86,991 | | | 101,213 | | | 95,425 | |

| Operating income (loss) | | (2,919) | | | 21,349 | | | (15,816) | | | 3,947 | | | (3,436) | |

| Income (loss) from continuing operations before taxes | | (9,400) | | | 14,962 | | | (22,310) | | | (1,813) | | | (8,829) | |

| Income tax provision (benefit) | | (312) | | | (657) | | | (831) | | | 7,509 | | | (3,622) | |

| Income (loss) from continuing operations | | (9,088) | | | 15,619 | | | (21,479) | | | (9,322) | | | (5,207) | |

| Depreciation and amortization | | 10,746 | | | 11,440 | | | 12,653 | | | 12,947 | | | 13,515 | |

| Dividends | | — | | | — | | | — | | | — | | | — | |

| Capital expenditures | | 1,760 | | | 4,235 | | | 4,052 | | | 12,724 | | | 4,904 | |

| Assets purchased under capital leases & notes, including deposits utilized and accrued purchases | | 1,314 | | | 240 | | | 389 | | | 859 | | | 427 | |

| FINANCIAL POSITION | | | | | | | | | | |

| Total assets | | $ | 232,868 | | | $ | 247,659 | | | $ | 252,778 | | | $ | 283,907 | | | 268,987* |

| Working capital | | 78,869 | | | 88,237 | | | 96,534 | | | 105,113 | | | 81,727 | |

| Long-term debt | | 72,041 | | | 81,667 | | | 120,251 | | | 123,446 | | | 98,256 | |

| Stockholders' equity | | 63,791 | | | 73,211 | | | 58,984 | | | 79,263 | | | 87,122 | |

| PER SHARE | | | | | | | | | | |

| Income (loss) from continuing operations: | | | | | | | | | | |

| Basic | | $ | (0.59) | | | $ | 0.96 | | | $ | (1.36) | | | $ | (0.59) | | | $ | (0.33) | |

| Diluted | | (0.59) | | | 0.95 | | | (1.36) | | | (0.59) | | | (0.33) | |

| Dividends: | | | | | | | | | | |

| Common Stock | | — | | | — | | | — | | | — | | | — | |

| Class B Common Stock | | — | | | — | | | — | | | — | | | — | |

| Book value | | 4.13 | | | 4.62 | | | 3.60 | | | 4.91 | | | 5.40 | |

| GENERAL | | | | | | | | | | |

| Weighted-average common shares outstanding: | | | | | | | | | | |

| Basic | | 15,315,713 | | | 15,821,574 | | | 15,763,890 | | | 15,698,915 | | | 15,638,112 | |

| Diluted | | 15,315,713 | | | 15,925,822 | | | 15,763,890 | | | 15,698,915 | | | 15,638,112 | |

| Number of shareholders (7) | | 3,900 | | | 2,800 | | | 2,800 | | | 2,800 | | | 3,000 | |

| Number of associates | | 1,441 | | | 1,526 | | | 1,646 | | | 1,930 | | | 1,746 | |

*These periods do not have prior period adoption adjustment or the right to return asset for the ASC 606 adoption.

(1). Includes expenses of $3,752 for facility consolidation and severance expenses in 2020.