UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| | | | |

| ☒ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended July 31, 20172022 or |

| ☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from __________ to __________ |

Commission File Number: 1-7891

DONALDSON COMPANY, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 41-0222640 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

| |

| |

Delaware | 41-0222640 |

(State or other jurisdiction of

incorporation or organization)

| (I.R.S. Employer

Identification No.)

|

| |

1400 West 94th Street, Minneapolis, Minnesota | 55431 |

(Address of principal executive offices) | (Zip Code) |

1400 West 94th Street, Minneapolis, Minnesota 55431

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (952) 887-3131

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $5 Par Value$5.00 par value | DCI | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”company,” and "emerging“emerging growth company"company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| | |

| Large accelerated filerx

| Accelerated filero

|

| | |

| Non-accelerated filero (Do not check if a smaller reporting company)

| ☐ | Smaller reporting companyo | ☐ |

| | | | |

| Emerging growth companyo | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).☐ Yes ☒ No

As of January 31, 2017,2022, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant was $5,521,028,309$6,840,687,805 (based on the closing price of $41.91$55.66 as reported on the New York Stock Exchange as of that date).

As of September 20, 2017, there were approximately 129,904,8879, 2022, 122,497,515 shares of the registrant’s common stock, par value $5.00 per share, were outstanding.

Documents Incorporated by Reference

Portions of the registrant’s Proxy Statement for its 20172022 annual meeting of stockholders (the “2017“2022 Proxy Statement”) are incorporated by reference in Part III, as specifically set forth in Part III.

DONALDSON COMPANY, INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

PART I

Item 1. Business

GeneralThe Company

Founded in 1915, Donaldson Company, Inc. (Donaldson(the Company or Donaldson) is a global leader in technology-led filtration products and solutions, serving a broad range of industries and advanced markets. Donaldson’s diverse, skilled employees at over 140 locations, 74 of which are manufacturing and distribution centers, on six continents partner with customers — from small business owners to the Company) was founded in 1915world’s biggest original equipment manufacturer (OEM) brands — to solve complex filtration challenges. Customers choose Donaldson’s filtration solutions due to their stringent performance requirements, natural replacement change cycles and need for reliability.

The United States (U.S.), China and India represent the largest three individual markets for the Company’s products. Donaldson’s four regions and their contributing share of fiscal 2022 revenue are as follows: the U.S. and Canada 40.5%; Europe, Middle East and Africa (EMEA) 29.1%; Asia Pacific (APAC) 20.2%; and Latin America (LATAM) 10.2%. Below are the Company’s manufacturing and distribution centers by region.

General

The Company’s operating segments are Engine Products (Engine) and Industrial Products (Industrial). The Engine segment represents 69.6% of net sales, is organized in its present corporate form under the lawsbased on a combination of customer and products and consists of the State of Delaware in 1936.

The Company is a worldwide manufacturer of filtration systemsOff-Road, On-Road, Aftermarket and replacement parts. The Company’s core strengths are leading filtration technology, strong customer relationshipsAerospace and its global presence. Products are manufactured at 44 plants around the world and through three joint ventures.

The Company has two reporting segments:Defense business units. Within these business units, Engine Products and Industrial Products. Products in the Engine Products segmentproducts consist of replacement filters for both air and liquid filtration applications as well as exhaust and emissions. Applications include air filtration systems, liquid filtrationfuel and lube systems, for fuel, lube and hydraulic applications and exhaust and emissions systems and sensors, indicators and monitoring systems. The Engine Products segment sells to original equipment manufacturers (OEMs)OEMs in the construction, mining, agriculture, transportation, aerospace defense and truckdefense end markets and to independent distributors, OEM dealer networks, private label accounts and large equipment fleets. Products in

The Industrial segment represents 30.4% of net sales, is organized based on product type and consists of the Industrial Products segmentFiltration Solutions (IFS), Gas Turbines Systems (GTS) and Special Applications business units. Within the IFS business unit, products consist of dust, fume and mist collectors, compressed air purification systems, gas and liquid filtration for food, beverage and industrial processes. The GTS business unit products consist of air filtration systems for gas turbines,turbines. Special applications products include polytetrafluoroethylene (PTFE) membrane-based products andas well as specialized air and gas filtration systems for applications including hard disk drives and semi-conductor manufacturing. Themanufacturing and sensors, indicators and monitoring systems. Industrial Products segment sells to various dealers, distributors, OEMs of gas-fired turbines and OEMs and end users requiring clean filtration solutions and replacement filters.users.

Diverse Product Groups

The discussion below should be read in conjunction withCompany sells a diverse group of products within each segment and the risk factors discussed in Part I, Item 1A, “Risk Factors” in this Annual Report on Form 10-K (Annual Report).

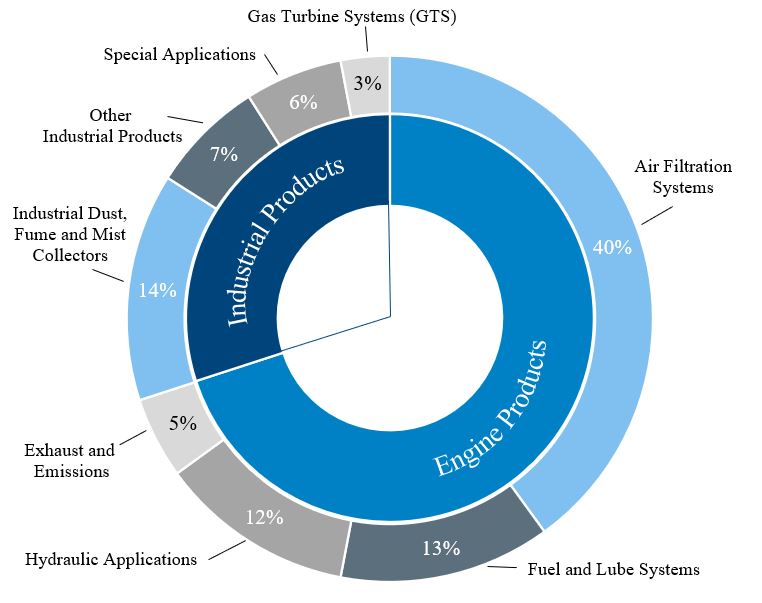

The table below showsbusiness units within the segments. Below are the diverse product groups across the Company’s two segments represented as a percentage of total fiscal 2022 net sales contributedsales.

Engine Products

Air Filtration Systems

Air filtration systems help protect engine components from abrasive wear caused by dust particles. Donaldson’s standard pleated cellulose filters are used in air filtration systems for diesel engine applications around the principal classesworld. In addition, the Company’s air filtration products include PowerCore®™ and Ultra-Web® filtration technologies. PowerCore® filtration technology is significantly more efficient and compact than standard pleated cellulose filters. PowerCore® filtration technology is a leader of similar productsfiltration for eachdiesel-powered engines and equipment, particularly for OEMs. Ultra-Web® media technology is composed of cellulose or a cellulose and synthetic substrate. It provides a durable filtration solution in high temperature and humid environments experienced by many diesel, turbine, hybrid and other powered engines. Ultra-Web® HD media technology has a fine fiber technology to create consistent inter-fiber spacing at a microscopic level. It is used in extreme fine dust environments, such as mining machinery. Air filtration systems support agricultural, construction and mining machinery, commercial vehicles, aerospace fixed wing and rotorcraft and defense ground vehicle industries.

Fuel and Lube Systems

Fuel and lube systems achieve optimal operations when contaminants are removed. The various components of the years ended July 31, 2017, 2016engine impacted include fuel injectors, valves, pumps, bearings and 2015:actuators. Fuel filters include primary and secondary particulate filters, coalescing fuel water separators, barrier fuel water separators and all-in-one filtration systems. The Company’s technology includes Synteq®™ XP filtration technology, which offers significantly higher fuel system protection and longer life under dynamic application conditions compared to commercially available alternatives. In addition, Donaldson’s Synteq® DRY and Synteq® XP coalescing technology remove significantly more water in real-world conditions than current barrier or coalescing filters on the market. Fuel and lube filtration also supports agricultural, construction and mining machinery, commercial vehicles, aerospace fixed wing and rotorcraft and defense ground vehicle industries.

Hydraulic Applications

Hydraulic applications provide filtration solutions for the same equipment that is filtered by fuel and lube systems. Applications include a suction strainer to protect the pump, high pressure filters, a charge pump or transmission filter, a return-line filter prior to the reservoir and a breather filter located on the reservoir.

|

| | | | | | | | | |

| | | Year Ended July 31, |

| | | 2017 |

| | 2016 |

| | 2015 |

|

| Engine Products segment | | | | | | |

| Off-Road | | 11 | % | | 10 | % | | 11 | % |

| On-Road | | 5 | % | | 6 | % | | 6 | % |

| Aftermarket | | 46 | % | | 43 | % | | 41 | % |

| Aerospace and Defense | | 4 | % | | 4 | % | | 5 | % |

| | | | | | | |

| Industrial Products segment | | | | | | |

| Industrial Filtration Solutions | | 22 | % | | 23 | % | | 22 | % |

| Gas Turbine Systems | | 5 | % | | 7 | % | | 8 | % |

| Special Applications | | 7 | % | | 7 | % | | 7 | % |

Total net sales contributedHydraulic oil is adversely affected by contaminants such as wear, metals and moisture. As with fuel and lube, contaminated fluid reduces performance and shortens lives of various system components including valves, pumps and actuators. Hydraulic applications support integral fluid power systems, which are used in machinery in agricultural, construction and mining machinery, commercial vehicles and aerospace fixed wing and rotorcraft industries.

Exhaust and Emissions

Exhaust products include sound-reducing mufflers used on machinery and vehicles, and diesel-powered machinery and commercial vehicles. Emission control systems include diesel particulate filters, exhaust fluid mixers and catalytic reduction substrates to reduce emissions of particulate, nitrogen oxide and other greenhouse gases. Exhaust and emissions products support agricultural, construction and mining machinery industries.

Industrial Products

IFS - Industrial Dust, Fume and Mist Collectors

Industrial air filtration equipment collects particles through an innovative bag house, or a cartridge style collector, which provides higher air-to-media capacity. Customers are supported through a global network of channel partners and services centers, which provide a quality customer experience during the principal classesdesign, installation, use, maintenance and repair of similar productsthe equipment. Technology and financial information about segment operationsfeatures are continually added, such as the Internet-of-Things technology branded as iCue™, which is being integrated into product design to further improve product performance and geographic regions appear in Note 18better connect Donaldson with its end market customers, enabling additional service opportunities. Donaldson is expanding its presence in the Notesindustrial service market. During fiscal 2022, the Company acquired Pearson Arnold Industrial Services (PAIS) headquartered in the U.S. PAIS provides equipment, parts and services for dust, mist and fume collection systems, industrial fans and compressed air systems.

Industrial dust, fume and mist collectors and filters are used within major industries including metals, mining, transportation, chemicals, food and beverage, pharmaceuticals and construction materials. For example, materials transformed in manufacturing, such as metal grinding, plasma cutting, mixing and welding, can create hazardous materials in the air, which can be collected and filtered by Donaldson’s products.

Other Industrial Products

Other industrial products consists of the following:

•compressed air filtration and purification systems, which provide sterile filtration in products such as breathing air systems, condensate management systems, dryers, filter housing, filter elements and sterile air units;

•process filtration products such as LifeTec® filters, Ultrapac™ Smart compressed air treatment system, UltraPleat™ filters and proprietary expanded PTFE membranes, which are used to Consolidated Financial Statements includedstrengthen customers’ food safety initiatives and meet stringent regulations; and

•on-compressor filtration products such as inlet, lube and air-oil separator filters, which support a clean compressor ecosystem.

Donaldson is expanding its presence in Item 8 of this Annual Report.

Thethe life sciences market. During fiscal 2022, the Company makes its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statementsacquired Solaris Biotechnology S.r.l. (Solaris) and Purilogics, LLC (Purilogics). Solaris is headquartered in Porto Mantovano, Italy, with U.S. operations based in Berkeley, California. Solaris designs and manufactures bioprocessing equipment, including bioreactors, fermenters and tangential flow filtration systems for use in food and beverage, biotechnology and other information (including amendments to those reports) available freelife sciences markets. Purilogics is headquartered in Greenville, South Carolina, and is a biotechnology company that leverages a novel technology platform for the development of charge through its websitemembrane chromatography products. Purilogics offers a broad portfolio of purification tools for a wide range of biologics. Purilogics’ proprietary formulations and processes create membranes that have significant competitive advantages, enabling faster and more cost-effective production of increasingly complex biologic drugs.

Special Applications

Special applications include the following:

•disk drive products such as advanced materials and adsorbent technologies, which control moisture and contaminants in micro environments, and help protect critical components in cloud computing;

•integrated venting solutions, which provide vents that protect devices and enclosures from pressure fluctuation, liquids and harmful contaminants, such as automotive headlight, outdoor lighting, medical venting solutions, or batteries in electric vehicles;

•semi-conductor filtration solutions, which address concerns over the presence of gas phase molecular contamination at ir.donaldson.com, as soon as reasonably practicable after it electronically files such material with (or furnishes such material to) the Securitiesfabrication, tool and Exchange Commission. Also available onpoint-of-use locations in semiconductor production; and

•PTFE membranes are the Company’s websitecore technology used in venting solutions, technical film applications and industrial laminates, which collect fine dust particles for bag house or cartridge style dust collectors.

GTS

GTS filtration components are corporate governance documents,custom-engineered air intake systems for gas turbines and industrial compressors, for both new and retrofit applications. Aftermarket filters and parts are used in a variety of applications including cartridge filters, panel and compact filters, the Company’s Code of Business Conductpulse system, inlet hood components, filter retention hardware and Ethics, Corporate Governance Guidelines, Audit Committee charter, Human Resources Committee charteraccessories. GTS filtration components are in power plants, oil and Corporate Governance Committee charter. These documents are also available in print, free of charge, to any person who requests them in writing to the attention of Investor Relations, MS 102, Donaldson Company, Inc., 1400 West 94th Street, Bloomington, Minnesota 55431. The information contained on the Company’s website is not incorporated by reference into this Annual Reportgas delivery systems, and should not be considered to be part of this report.other industrial applications and refining and processing machinery.

Seasonality

A number of the Company’s end markets are dependent on the construction, agricultural and power generation industries, which are generally stronger in the second half of the Company’s fiscal year. The first two quarters of the fiscal year also contain the traditional summer and winter holiday periods, which are typically characterized by more customer plant closures.

Competition

Principal methods of competition in both the Engine Products and Industrial Products segments are technology, innovation, price, geographic coverage, service and product performance. The Company competesparticipates in a number of highly competitive filtration markets in both segments. The Company believes it is a market leader within many of its product lines, specifically within its Off-Road and On-Road product lines for OEMs and has a significant business in the aftermarketAftermarket business for replacement filters. The Engine Products segment’s principal competitors include several large global competitors and many regional competitors, especially in the Aftermarket business. The Industrial Products segment’s principal competitors vary from country to country and include severalrange from large regional and global competitors andto a significant number of smaller competitors who compete in a specific geographical region or in a limited number of product applications.

Raw Materials

The principal raw materials that the Company uses are steel, filter media and petrochemical basedpetrochemical-based products including plastics,plastic, rubber and adhesives.adhesive products. Purchased raw materials represent approximately 60% to 65%70% of the Company’s cost of goods sold. Steel, including fabricated parts, and filter media each represent approximately 20%. The remainder is primarily made up of petroleum-based products and other raw material components.

The cost the Company paid for steel during fiscal 2017 varied by grade, but in aggregate, increased during the fiscal year. The steel cost increase was related to import restrictions placed on foreign-made steel and on a post-election run-up in steel in U.S. markets and on upward price pressure in other geographies around the world. The Company’s cost of filter media also varies by type and increased slightly year-over-year.sales. The Company operates ongoing continuous improvement efforts, which partially offset increases in bothcontinues to experience supply chain disruptions, including global logistics and labor challenges and constrained supplies of steel, petrochemical products and filter media. The cost of petroleum-based products was relatively flat year-over-year.These disruptions have increased the Company’s input costs significantly and extended lead times. The Company anticipates some continuing pressure on commodityhas undertaken steps to mitigate these negative impacts, such as increasing prices, in fiscal 2018, as compared with fiscal 2017, specifically for steelcarrying a higher level of inventories, evaluating alternative supply chain options, qualifying additional suppliers and filter media. On an ongoing basis, the Company enters into selective supply arrangements with certain of its suppliers that allow the Company to reduce volatility in its costs. The Company strives to recover or offset allmaking strategic raw material cost increases through selective price increases to its customerspurchases.

Manufacturing and the Company’s cost reduction initiatives, which include material substitution, process improvement and product redesigns.

Patents and Trademarks

The Company owns various patents and trademarks, which it considers in the aggregate to constitute a valuable asset, including patents and trademarks for products sold under the Ultra-Web®, PowerCore® and Donaldson® trademarks.

Major Customers

The Company had no customers that accounted for over 10% of net sales in the years ended July 31, 2017, 2016 or 2015. The Company had no customers that accounted for over 10% of gross accounts receivable at July 31, 2017 or July 31, 2016.

Backlog

At August 31, 2017, the backlog of orders expected to be delivered within 90 days was $395.5 million. The 90-day backlog at August 31, 2016, was $323.0 million. The increase is due to the continued strong demand across multiple product lines. Backlog is one of many indicators of business conditions in the Company’s markets. However, it is not always indicative of future results for a number of reasons, including short lead times in the Company’s replacement parts businesses and the timing of the receipt of orders, in manyas well as product mix. Backlog orders expected to be delivered within 90 days as of July 31, 2022 and 2021 were $658.5 million and $626.0 million, respectively. Backlog increased 1.4% for Engine and 15.1% for Industrial, primarily due to supply chain disruptions and higher demand.

Seasonality

Many of the Company’s end markets are generally stronger in the second half of the Company’s fiscal year. The first half of the fiscal year contains more holiday periods, which typically include more customer plant closures.

Diversification

The Company’s results of operations are affected by conditions in the global economic and geopolitical environment. Under most economic conditions, the Company’s market diversification between its diesel engine end markets and its global end markets and its diversification through technology and its OEM and industrialreplacement parts customers has helped to limit the impact of weakness in any one product line, market or geography on the consolidated operating results of the Company.

Strategy

Donaldson’s strategy is based on three main pillars to support its purpose of Advancing Filtration for a Cleaner World. The pillars are as follows:

•technology-led filtration company - Donaldson is a technology-led filtration company with world-class materials, science and conversion expertise. The Company focuses on creating and offering digitally intelligent solutions to its worldwide customers;

•diverse businesses with expanding market opportunities - Donaldson has a diverse portfolio of businesses and products that serve multiple end markets. Through organic growth execution and strategic acquisitions, Donaldson has opportunities to expand into additional end markets and geographies; and

•global presence with deep customer relationships - Donaldson’s global presence, employee development and commitment to customer relationships drives the Company’s end-to-end operational excellence and high levels of customer satisfaction. Intellectual Capital

Research and Development

During the years ended July 31, 2017, 2016 and 2015, the Company spent $54.7 million, $55.5 million and $60.2 million, respectively, onInvestment in research and development activities, which was 2.3%, 2.5%strengthens the Company’s material science capabilities and 2.5%supports development of net sales, respectively.new and improved products and solutions. Research and development expenses include basic scientific research costs such as salaries, facility costs, testing, technical information technology and administrative expenditures. Research and development expenses are for the application of scientific advances to the development of new and improved products and their uses. Substantially all commercial research and development is performed in-house. During the years ended July 31, 2022, 2021 and 2020, the Company spent $69.1 million, $67.8 million and $61.2 million, respectively, on research and development activities, which was 2.1%, 2.4% and 2.4% of net sales, respectively.

Environmental MattersIntellectual Property

The Company doesowns a broad range of intellectual property rights relating to its products and services, which it considers in the aggregate to constitute a valuable asset. These include patents, trade secrets, trademarks, copyrights and other forms of intellectual property rights in the U.S. and a number of foreign countries. The Company protects its innovations arising from research and development through patent filings and owns a portfolio of issued patents, including utility and design patents. The Company also owns various trademarks related to its products and services including Donaldson® and the turbo D logo, Ultra-Web®, PowerCore®, Downflo®, Torit®, Synteq® XP, LifeTec®, iCue™ and Tetratex®, among others. No single intellectual property right is responsible for protecting the Company’s products.

Environmental

Donaldson is subject to a wide variety of local, state and federal environmental laws and regulations in the U.S., as well as the environmental laws and regulations of other countries in which Donaldson conducts business. Donaldson strives to comply with applicable laws and regulations. Failure to comply with these regulations, however, could lead to fines and other penalties. In fiscal 2022, the Company did not anticipateexperience any material effect on its capital expenditures, earningsresults of operations or competitive position during fiscal 2018financial condition, due to compliance with government regulationsrules regulating the discharge of materials into the environment or otherwise relating to the protection of the environment.environment, nor does it expect such impact during fiscal 2023.

EmployeesHuman Capital Resources

As of July 31, 2022, the Company had approximately 14,000 full time employees, of which 61% were in production related roles. The Company’s production facilities augment their resources utilizing contingent labor. For over 100 years, the Company has been making a difference with customers, employees, investors, suppliers and communities through a collaborative and diverse workplace where every employee matters. The Company prides itself on providing innovative technologies and solutions backed by talented and dedicated employees guided by its core values.

Core Values

The Company’s purpose is to advance filtration for a cleaner world. The principles that guide this purpose are as follows:

•act with integrity - deliver on commitments and be accountable for actions;

•engage and empower people - have a richly diverse and inclusive culture, and provide opportunities for people to grow, build successful careers and make meaningful contributions;

•deliver for customers - understand, anticipate and prioritize customers’ needs, delivering differentiated products and solutions that enable their success;

•cultivate innovation - pursue innovation in everything from continuous improvement in processes to breakthrough solutions that create value and competitive advantage;

•operate safely and sustainably - committed to safety in the workplace, being good stewards of natural resources and reducing environmental impacts; and

•enrich communities - share time, resources and talent to make a positive impact.

Culture

The Company employed approximately 13,200 peopleis comprised of a diverse global team. With a broad base of capabilities, cultures and perspectives, employees reflect the communities they serve. The Company promotes a collaborative workplace. By working together, the Company’s employees can better understand and meet the customers’ needs. While the global team includes filtration industry experts, every role is recognized, and individuals’ contributions have a direct impact. The Company fosters learning and growth. To help employees continue to learn and succeed in their careers, while keeping pace with a rapidly changing global marketplace, the Company provides multiple learning opportunities and programs, including online courses and customized development plans.

Diversity, Equity and Inclusion

The Company values and welcomes employees’ unique views and contributions, knowing that together the global team can better understand and meet the needs of its worldwide operations ascustomers and communities. The Company participates in outreach and fundraising efforts for organizations focused on diversity and supporting educational opportunities to underserved students and communities.

Benefits

The Company is committed to the health, wealth and work-life balance of July 31, 2017.

Geographic Areas

Bothemployees and offers competitive benefits packages to help support individuals and their families. To support the health and well-being of employees in the U.S. and their dependents, the Company offers a discount on private health insurance policies and provides an employee assistance program. In other parts of the Company's segments serve customersworld, the Company offers competitive financial compensation packages that may include both base pay and bonus elements in all geographic regions worldwide. The United States representsaddition to social programs specific to the largest current individual marketcountries in which it operates. To help employees provide and prepare for the Company's products. Germanyfuture, the Company provides several other financial and non-financial benefits.

Employment

The Company attracts a qualified workforce through an inclusive and accessible recruiting process that utilizes online recruiting platforms, campus outreach, internships, recruitment vendor partners, job fairs and other recruitment tools. The Company seeks to retain employees by offering competitive wages, benefits and training opportunities, as well as promoting a safe and healthy workplace. The Company is committed to treating all applicants and employees with the same high level of respect regardless of their gender, ethnicity, religion, national origin, age, marital status, political affiliation, sexual orientation, veteran status, gender identity, disability or other protected status. It is the single largest market outsideCompany’s policy to comply with all applicable state, local and international laws governing non-discrimination in employment in every location where it operates. This compliance includes terms and conditions of employment, which cover recruiting, hiring, placement, promotion, termination, layoff, recall, transfer, leaves of absence, compensation and training.

Health and Safety

The Company empowers its employees and provides the United States. Financialknowledge and tools needed to make safe decisions and mitigate risks. Every employee is responsible for identifying and managing exposure to health and safety hazards and harmful environmental impacts. A variety of training methods are available to fulfill these requirements, including online learning, training, coaching or mentoring and group discussions and activities.

The Company most recently demonstrated these principles as it conceived and implemented its Coronavirus (COVID-19) pandemic response, which included implementing comprehensive protocols to help keep employees safe and healthy. Employees adapted to evolving conditions and continue to change as processes and procedures are adjusted and aligned with public health authority recommendations.

Community Service

Generations of the Company’s employees and their families give their time, energy and aid to various philanthropic efforts, addressing the needs of our local communities and helping transform lives. Organizations are supported in partnership with the Donaldson Foundation and through numerous volunteer events.

Available Information

The Company makes its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other information, including amendments to those reports, available free of charge through its website at ir.donaldson.com, as soon as reasonably practicable after it electronically files such material with, or furnishes such material to, the Securities and Exchange Commission (SEC). These filings are available on the SEC’s website at www.sec.gov. Also available on the Company’s website are corporate governance documents, including the Company’s Code of Business Conduct and Business Conduct Help Line, Corporate Governance Guidelines, Director Independence Standards, Audit Committee Charter, Human Resources Committee Charter and Corporate Governance Committee Charter. The information contained on the Company’s website is not incorporated by geographic areas appears in Note 18 in the Notes to Consolidated Financial Statements included in Item 8reference into this Annual Report and should not be considered as part of this Annual Report.report.

Item 1A. Risk Factors

There are inherentThe Company’s (we, our or us) business is subject to various risks and uncertainties associateduncertainties. The following discussion outlines what we believe to be the risk factors that could materially and adversely affect our business, reputation, financial condition and results of operations. These risk factors should be considered with ourthe Company’s cautionary comments related to forward-looking statements when evaluating information provided in this Annual Report. Risks not currently known to the Company, or the Company currently believes are immaterial, may also impair the Company’s business, reputation, financial condition and results of operations. The Company periodically reviews its strategies, processes and controls with respect to risk identification, assessment and mitigation with the audit committee of the Company’s board of directors.

Macroeconomic and Geopolitical Risks

Global Operations - we have a broad footprint and global operations that involve the manufacturing and sale of products for highly demanding customer applicationsmay present challenges.

We have operations throughout the world. Our stability, growth and profitability are subject to a number of risks of doing business globally including the following:

•political and military events, including the rise of nationalism and support for protectionist policies;

•ongoing military action by Russia in Ukraine, or in neighboring regions;

•tariffs, trade barriers and other trade restrictions;

•legal and regulatory requirements, including import, export, defense regulations, anti-corruption laws and foreign exchange controls;

•potential difficulties in staffing and managing local operations;

•credit risk of local customers and distributors;

•deterioration in economic conditions, including the effect of inflation on our customers and suppliers;

•difficulties in protecting our intellectual property; and

•local economic, political and social conditions.

Due to the global reach of our operations, our business is subject to a complex system of commercial and trade laws, regulations and policies, including those related to data privacy, trade compliance, anti-corruption and anti-bribery. We experience exposure to, and costs of complying with, these laws and regulations. Our global subsidiaries, joint venture partners and affiliates are governed by laws, rules and business practices that differ from those of the U.S. Our compliance programs may not adequately prevent or deter our employees, agents, distributors, suppliers and other third parties with whom we do business from violating laws, regulations or standards. We may incur defense costs, fines, penalties, damage to our reputation and business disruptions, which could result in an adverse effect on our results of operations, financial condition and cash flows.

Business Disruption - unexpected events, including natural disasters, may increase our cost of doing business or disrupt our operations.

There could be an occurrence of one or more unexpected events, including a terrorist attack, war or civil unrest, a weather event, a natural disaster, a pandemic or other catastrophe in countries in which we operate or in which our suppliers are located. Such an event could result in physical damage to and complete or partial closure of one or more of our headquarters, manufacturing facilities or distribution centers, temporary or long-term disruption in the supply of component products from some local and international suppliers, disruption in the transport of our products to customers and disruption of information systems. Existing insurance coverage may not provide protection for all costs that may arise from any such event. Any disruption in our operations could have an adverse impact on our ability to meet our customer needs or may require us to incur additional expense in order to produce sufficient inventory. Certain unexpected events could adversely impact our business, results of operations, financial condition and cash flows.

COVID-19 Pandemic Business Disruption - the COVID-19 pandemic had, and in the future could have, a negative effect on our business, results of operations, financial condition and cash flows.

The COVID-19 pandemic has significantly impacted the global economy and, consequently, the Company’s business and operations have been, and could continue to be, adversely affected by the COVID-19 pandemic. We experienced temporary shutdowns in certain facilities and we, our employees, suppliers or customers may be prevented in the future from conducting business activities for an indefinite period of time due to shutdowns, import or export restrictions or other preventative measures that may be requested or mandated by governmental authorities.

Further, the COVID-19 pandemic has significantly increased economic uncertainty, has led to volatility in customer demand for the Company’s products and services and has caused supply chain disruptions. These risksevents have and uncertainties could adversely impact our business, results of operations, financial condition and cash flows.

Russia and Ukraine Conflict - the ongoing military action by Russia in Ukraine could have a negative impact on the global economy which could materially adversely affect our operating performancebusiness, results of operations, financial condition and financial condition. The following discussion, along with discussions elsewherecash flows.

On February 24, 2022, Russian forces launched significant military action against Ukraine. As a result, the U.S. and other countries imposed sanctions, penalties and export controls against certain Russian entities and individuals. Although the duration and impact of the ongoing conflict in this report, outlinesUkraine are highly unpredictable, the risksconflict could lead to substantial market disruptions, including counter-sanctions, volatility in the credit available to us and uncertainties that we believe are the most materialour customers, heightened inflation and energy costs, supply chain disruptions, or delays in delivering products to our customers. Any such disruptions could have a negative impact on the global economy, which could materially adversely affect our business, at this time. results of operations, financial condition and cash flows.

Operational Risks

Supply Chain - unavailable raw materials, significant demand fluctuations and material cost inflation have and could continue to have an impact on our sales and cost of sales.

We undertake no obligationobtain raw materials, including steel, filter media, petroleum-based products and other components from third-party suppliers. We often concentrate our sourcing of some materials from one supplier or a few suppliers. We rely, in part, on our suppliers to publicly update or revise any forward-looking statements, whether as aensure they meet required quality and delivery standards. An unanticipated delay in delivery by our suppliers could result of new information, future events, or otherwise, unless required by law.

Economic Environment -in the demand forinability to deliver our products relies on economictime and industrial conditions worldwide.to meet the expectations of our customers. We have experienced, and could continue to experience, an increase in the costs of doing business, including increasing raw material prices and transportation costs, which have and could continue to have an adverse impact on our business, results of operations, financial condition and cash flows.

ChangesPersonnel - our success has been, and could in economicthe future be affected, if we are not able to attract, engage and retain qualified personnel.

Our success depends in large part on our ability to identify, recruit, engage, train and retain highly skilled, qualified and diverse personnel globally and successfully execute management transitions at leadership levels of the Company. There is competition for talent with market-leading skills and capabilities in new technologies. Additionally, in some locations we have experienced significant wage inflation due to a shortage of labor, as well as labor shortages, amid low levels of unemployment or industrial conditionsworkforce availability in these markets. We may not be able to attract and retain qualified personnel and it may be difficult for us to compete effectively, which could adversely impact our business.

Operations - complexity of manufacturing could cause inability to meet demand and result in the loss of customers.

Our ability to fulfill customer orders is dependent on our manufacturing and distribution operations. Although we forecast demand, additional plant capacity takes significant time to bring online, and thus changes in demand could result in longer lead times. We cannot guarantee we will be able to adjust manufacturing capacity, in the short-term, to meet higher customer demand. Efficient operations require streamlining processes to maintain or reduce lead times, which we may not be capable of achieving. Unacceptable levels of service for key customers may result if we are not able to fulfill orders on a timely basis or if product quality, warranty or safety issues result from compromised production. We may not be able to adjust our production schedules to reflect changes in customer demand on a timely basis. Due to the complexity of our manufacturing operations, we may be unable to timely respond to fluctuations in demand, which could adversely impact our business, results orof operations, financial condition in any particular period as our business can be sensitive to varying conditions in all major geographies and markets.cash flows.

Products - maintaining a competitive advantage requires continuingconsistent investment with uncertain returns.

We operate in highly competitive markets and have numerous competitors that may already be well-established in those markets. We expect our competitors to continue improvingto improve the design and performance of their products and to introduce new products that could be competitive in both price and performance. We believe that we have certain technological advantages over our competitors, but maintaining these advantages requires us to continuallyconsistently invest in research and development, sales and marketing and customer service and support. There is no guarantee that we will be successful in maintaining these advantages.advantages and we could encounter the commoditization of our key products. We make investments in new technologies that address increased performance and regulatory requirements around the globe. There is no guarantee that we will be successful in completing development or achieving sales of these products or that the margins on such products will be acceptable. Our financial performance may be negatively impacted if aA competitor’s successful product innovation reachescould reach the market before ours or gainsgain broader market acceptance. In addition,acceptance, which could adversely impact our business, results of operations, financial condition and cash flows.

Evolving Customer Needs - disruptive technologies may threaten our growth in certain industries.

Certain industry market trends guide decisions we make in operating the Company, and our growth could be threatened by disruptive technologies. We may be adversely impacted by changes in technology that could reduce or eliminate the demand for our products. These risks include wider adoption of technologies providing alternatives to diesel engines.engines such as electrification of equipment. Such disruptive innovation could create new markets and displace existing companies and products, resulting in significantly negative consequences for the Company. If we do not properly address future customer needs, we may be slower to adapt to such disruption, which could adversely impact our business, results of operations, financial condition and cash flows.

Competition - we participate in highly competitive markets with pricing pressure.

The businesses and product lines in which we participate are very competitive and we risk losing business based on a wide range of factors, including price,price, technology, performance, reliability and availability, geographic coverage product performance and customer service. Our customers continue to seek technological innovation, productivity gains, competitive prices, reliability and lower pricesavailability from us and their other suppliers. IfAdditionally, we aresell through a variety of channels (e.g., OEM, dealer, distributor, eCommerce) in a diverse set of highly competitive filtration markets. The variability complicates the supply chain, affects working capital needs, requires balance between relationships and drives a more targeted sales force. As a result of these and other factors, we may not be able to compete effectively, which could adversely impact our margins andbusiness, results of operations, financial condition and cash flows.

Customer Concentration and Retention - a number of our customers operate in similar cyclical industries. Economic conditions in these industries could impact our sales.

No customer accounted for 10% or more of our net sales in fiscal 2022, 2021 or 2020. However, a number of our customers are concentrated in similar cyclical industries (e.g., construction, agriculture, mining, oil and gas, transportation, power generation and disk drive), resulting in additional risk based on their respective economic conditions. Our success is also dependent on retaining key customers, which requires us to successfully manage relationships and anticipate the needs of our customers in the channels in which we sell our products. Changes in the economic conditions could materially and adversely impact our results of operations, financial condition and cash flows.

Productivity Improvements - if we do not successfully manage productivity improvements, we may not realize the expected benefits.

Our financial projections assume certain ongoing productivity improvements as a key component of our business strategy to, among other things, contain operating expenses, maintain competitiveness, increase operating efficiencies and align manufacturing capacity to demand. We may not be able to realize the expected benefits and cost savings if we do not successfully execute these plans while continuing to invest in business growth. Difficulties could be encountered or such cost savings may not otherwise be realized, which could adversely affected.impact our business, results of operations, financial condition and cash flows.

Acquisitions, Divestitures and Other Strategic Transactions - the execution of our acquisitions, divestitures and other strategic transactions may not provide the desired return on investment.

We have made and continue to pursue acquisitions and divestitures and may pursue joint ventures, strategic investments and other similar strategic transactions. Acquisitions, joint ventures and strategic investments could negatively impact our profitability and financial condition due to operating and integration inefficiencies, the incurrence of debt, contingent liabilities and amortization of expenses related to intangible assets. There are also a number of other risks involved in acquisitions including the potential loss of key customers or employees, difficulties in assimilating the acquired operations and the diversion of management’s time and attention away from other business matters. Further, during the pendency of a proposed transaction, we may be subject to risks related to a decline in the business and the risk the transaction may not close. Divestitures may involve significant challenges and risks, such as difficulty separating out portions of our business or the potential loss of revenue or negative impacts on margins. The divestitures may also result in ongoing financial or legal proceedings, such as retained liabilities, which could have an adverse impact on our results of operations, financial condition and cash flows.

Cybersecurity Risks

Cybersecurity Risks - vulnerability of our information technology systems and security.

We have many information technology systems that are important to the operation of our business, some of which are managed by third parties. These systems are used to process, transmit and store electronic information and to manage or support a variety of business processes and activities, which are critical to our operations. We could encounter difficulties in developing new systems, maintaining and upgrading our existing systems, managing access to these systems and preventing information security breaches. Additionally, we collect and store sensitive data, including intellectual property and proprietary business information, in data centers and on information technology networks.

Our data is subject to a variety of U.S. and international laws and regulations that pertain to the collection and handling of personal information. The laws require us to notify governmental authorities and affected individuals of data breaches involving certain personal information. These laws include the European General Data Protection Regulation and the California Consumer Privacy Act. Regulatory litigation or actions that could impose significant penalties may be brought against us in the event of a breach of data or alleged non-compliance with such laws and regulations.

Information technology security threats are increasing in frequency and sophistication. We have invested in protection to prevent these threats; to date none of them have been material. However, there can be no assurance our efforts will prevent all potential failures, cybersecurity attacks or breaches in our systems. These threats pose a risk to the security of our systems and networks and the confidentiality, availability and integrity of our data. Should such an attack succeed, it could lead to the compromise of confidential information, manipulation and destruction of data, defective products, production downtimes and operation disruptions. The occurrence of any of these events could adversely affect our reputation and could result in litigation, regulatory action, potential liability, increased costs and operational consequences of implementing further data protection matters. The Company maintains insurance coverage for various cybersecurity and business continuity risks, however, there can be no guarantee all costs or losses incurred will be fully insured. Vulnerabilities could lead to significant additional expenses and an adverse effect on our reputation, business, results of operations, financial condition and cash flows.

Legal and Regulatory Risks

Intellectual Property - demand for our products may be affected by new entrants that copy our products and/or infringe on our intellectual property.

The ability to protect and enforce intellectual property rights varies across jurisdictions. An inabilityWhere possible, we seek to preserve our intellectual property rights may adversely affect our financial performance.

through patents. These patents have a limited life and, in some cases, have expired or will expire in the near future. Competitors and others may also initiate litigation to challenge the validity of our intellectual property or allege that we infringe their intellectual property. We may be required to pay substantial damages if it is determined our products infringe on their intellectual property. We may also be required to develop an alternative, non-infringing product that could be costly and time-consuming, or acquire a license on terms that are not favorableunfavorable to us.

Protecting or defending against such claims could significantly increase our costs and divert management’s time and attention away from other business matters, and otherwise adversely affect our results of operations and financial condition.

Global Operations - operating globally carries risks that could negatively affect our financial performance.

We have sales and manufacturing operations throughout the world. Our stability, growth and profitability are subject to a number of risks of doing business globally that could harm our business, including:

political and military events,

legal and regulatory requirements, including import, export, defense regulations, anti-corruption laws and foreign exchange controls,

tariffs, trade barriers and other trade restrictions,

potential difficulties in staffing and managing local operations,

credit risk of local customers and distributors,

difficulties in protecting our intellectual property,

natural disasters, terrorism, war or other catastrophic events and

local economic, political and social conditions, including in the Middle East, Ukraine, China, Thailand, South Korea and other emerging markets where we do business.

Due to the international scope of our operations, we are subject to a complex system of import- and export-related laws and regulations. Any alleged or actual violations may subject us to government scrutiny, investigation and civil and criminal penalties, and may limit our ability to import or export our products or to provide services outside the United States (U.S.).

The enforcement of bribery, corruption and trade laws and regulations is increasing in frequency and complexity on a global basis. The continued geographic expansion of our business increases our exposure to, and cost of complying with, these laws and regulations. If our compliance programs do not adequately prevent or deter our employees, agents, distributors, suppliers and other third parties with whom we do business from violating anti-corruption laws, we may incur defense costs, fines, penalties, reputational damage and business disruptions.

Customer Concentration - a number of our customers operate in similar cyclical industries. Economic conditions in these industries could have a negative impact on our financial performance.

No customer accounted for ten percent or more of our net sales in fiscal 2017, 2016 or 2015. However, a number of our customers are concentrated in similar cyclical industries (construction, agriculture and mining), resulting in additional risk based on industrial conditions in those sectors. A decline in the economic conditions of these industries could result in reduced demand for our products and difficulty in collecting amounts due from our customers.

Supply Chain - unavailable or higher cost materials could impact our financial performance.

We obtain raw materials, including steel, filter media, petroleum-based products and other components, from third-party suppliers and tend to carry limited raw material inventories. An unanticipated delay in delivery by our suppliers could result in the inability to deliver on-time and meet the expectations of our customers. An increase in commodity prices could also result in lower operating margins.

Technology Investments and Security Risks - difficulties with our information technology systems and security could adversely affect our results.

We have many information technology systems that are important to the operation of our business, some of which are managed by third parties. These systems are used to process, transmit and store electronic information and to manage or support a variety of business processes and activities. We could encounter difficulties in developing new systems, maintaining and upgrading our existing systems and preventing information security breaches. Such difficulties could lead to significant additional expenses and/or disruption in business operations that could adversely affect our results.

Additionally, information technology security threats are increasing in frequency and sophistication. These threats pose a risk to the security of our systems and networks and the confidentiality, availability and integrity of our data. Should such an attack succeed, it could lead to the compromising of confidential information, manipulation and destruction of data, defective products, production downtimes and operations disruptions. The occurrence of any of these events could adversely affect our reputation and could result in litigation, regulatory action, potential liability and increased costs and operational consequences of implementing further data protection matters.

Currency - an unfavorable fluctuation in foreign currency exchange rates could adversely impact our results of operations.

We have operations in many countries, with more than one-half of our annual revenue coming from countries outside of the U.S. Each of our subsidiaries reports itsbusiness and results of operations, financial condition and financial position in its relevant functional currency, which is then translated into U.S. dollars. This translated financial information is included in our consolidated financial statements. Strengthening of the U.S. dollar in comparison to the foreign currencies of our subsidiaries has a negative impact on our results and financial position. In addition, decreased value of local currency may make it difficult for some of our customers, distributors and end users to purchase our products.cash flows.

Legal and Regulatory - costs associated with lawsuits, investigations or complying with laws and regulations may have an adverse effect on our results of operations.regulations.

We are subject to many laws and regulations in the jurisdictions in which we operate. We routinely incur costs in order to comply with these laws and regulations. We may be adversely impacted by new or changing laws and regulations that affect both our operations and our ability to develop and sell products that meet our customers’ requirements. We are involved in various product liability, product warranty, intellectual property, environmental claims and other legal proceedings that arise in and outside of the ordinary course of our business. We are subject to increasingly stringent environmental laws and regulations in the countries

in which we operate, including those governing the environment (e.g., emissions to air; discharges to water; and the generation, handling, storage, transportation, treatment and disposal of waste materials.materials) and data protection and privacy. It is not possible to predict the outcome of investigations and lawsuits, and we could incurincur judgments, fines or penalties or enter into settlements of lawsuits and claims that could have an adverse effect on our business, reputation, results of operations, and financial condition and cash flows in any particular period. In addition, we may not be able to maintain our insurance at a reasonable cost or in sufficient amounts to protect us against any losses.

Income TaxFinancial Risks

Currency - changesan unfavorable fluctuation in our effective tax rateforeign currency exchange rates could adversely impact our net income.results of operations.

We are subject to income taxeshave operations in various jurisdictions in which we operate. Our tax liabilities are dependent upon the location of earnings among these different jurisdictions. Our provision for income taxes and cash tax liability could be adversely affected by numerous factors, including income before taxes being lower than anticipated inmany countries, with lower statutory tax ratesa substantial portion of our annual revenue earned in currencies other than the U.S. dollar. We face transactional and higher than anticipatedtranslational risks associated with the fluctuations in countries with higher statutory tax rates,foreign currency exchange rates. Transactional risk arises from changes in the valuationvalue of deferred tax assetscash flows denominated in different currencies. This can be caused by supply chains that cross borders resulting in revenues and liabilities and changescosts being in tax laws and regulations. We are also subject todifferent currencies. Translational risk arises from the continuous examinationremeasurement of our income tax returns by tax authorities. The resultsfinancial statements. In addition, decreased value of audits and examinations of previously filed tax returns and continuing assessmentslocal currency may make it difficult for some of our tax exposures may have an adverse effect oncustomers, distributors and end users to purchase our provision for income taxes and cash tax liability.

Personnel -products. Each of our success may be affected if we are not able to attract, develop and retain qualified personnel.

Our success depends in large part on our ability to identify, recruit, develop and retain qualified personnel worldwide. If we are unable to meet this challenge, it may be difficult for us to execute our strategic objectives and grow our business, which could adversely affect oursubsidiaries reports its results of operations and financial condition.position in its relevant functional currency, which is then translated into U.S. dollars. This translated financial information is included in our Consolidated Financial Statements. Significant fluctuations of the U.S. dollar in comparison to the foreign currencies of our subsidiaries during discrete periods may have a negative impact on our results of operations, financial condition and cash flows.

Liquidity - changes in the capital and credit markets may negatively affect our ability to access financing.financing to support strategic initiatives.

Disruption of the global financial and credit markets may have an effect on our long-term liquidity and financial condition. During fiscal 2017, credit in the global credit markets was accessible and market interest rates remained low. We believe that our current financial resources, together with cash generated by operations, are sufficient to continue financing our operations for the next twelve months. There can be no assurance however, that the cost or availability of future borrowings will not be impacted by future capital market disruptions. Some of our existing borrowings contain covenants to maintain certain financial ratios that, under certain circumstances, could restrict our ability to incur additional indebtedness, make investments and other restricted payments, create liens and sell assets. As of July 31, 2017, the Company was in compliance with all such covenants.

The majority of our cash and cash equivalents are held by our foreign subsidiaries as over half of our earnings occur outside the U.S. Most of these funds are considered permanently reinvested outside the U.S., as the cash generated from U.S. operations plus our debt facilities are anticipated to be sufficient for our U.S. operation’s cash needs. If additional cash is required for our operations in the U.S., it may be subject to additional U.S. taxes if funds are repatriated from certain foreign subsidiaries.

Acquisitions - the execution of our acquisition strategy may not provide the desired return on investment.

We have made and continue to pursue acquisitions, including our acquisitions of Industrias Partmo S.A. (Partmo) and Hy-Pro Corporation (Hy-Pro) in fiscal 2017, Engineered Products Company (EPC) in fiscal 2016 and Northern Technical L.L.C. (Northern Technical) and IFIL USA L.L.C. (IFIL USA) in fiscal 2015. These acquisitions could negatively impact our profitability due to operating and integration inefficiencies, the incurrence of debt, contingent liabilities and amortization expenses related to intangible assets. There are also a number of other risks involved in acquisitions, including the potential loss of key customers, difficulties in assimilating the acquired operations, the loss of key employees and the diversion of management’s time and attention away from other business matters.

Impairment - if our operating units do not meet performance expectations, assets could be subject to impairment.

Our total assets include goodwill from acquisitions. We test annually whether goodwill has been impaired, or more frequently if events or changes in circumstances indicate the goodwill may be impaired. If future operating performance at one or more of our operating units were to fall significantly below forecast levels or if market conditions for one or more of our acquired businesses were to decline, we could be required to incur a non-cash charge to operating income for impairment. Any impairment in the value of our goodwill would have an adverse non-cash impact on our results of operations and reduce our net worth.

Restructuring - if we do not successfully execute our restructuring plans and realize the expected benefits, our financial performance may be adversely affected.

From time to time we have initiated restructuring programs related to our business strategy to, among other things, reduce operating expenses and align manufacturing capacity to demand. We may not be able to realize the expected benefits and cost savings if we do not successfully execute these plans. If difficulties are encountered or such cost savings are otherwise not realized, it could adversely impact our results of operations.

Internal Controls - if we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results and prevent material fraud, which could adversely affect the value of our common stock. Failure to maintain an effective system of internal control over financial reporting resulted in a material weakness during fiscal 2015.

Effective internal control over financial reporting is necessary for us to provide reliable financial reports and effectively prevent and detect material fraud. If we cannot provide reliable financial reports or prevent or detect material fraud, our operating results could be misstated. Failure to maintain an effective system of internal control over financial reporting resulted in a material weakness during fiscal 2015. Although we completed our remedial actions in response to this matter, there can be no assurances that we will be able to prevent future control deficiencies from occurring, which could cause us to incur unforeseen costs, negatively impact our results of operations, cause the market price of our common stock to decline or have other potential adverse consequences.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The Company’s principal administrative officecorporate headquarters and research facilities are located in Bloomington,Minneapolis, Minnesota. The Company’s principal EuropeanCompany also has administrative and engineering offices are located in Leuven, Belgium. The Company also has extensive operationsand research facilities in the Asia Pacificregions of EMEA, APAC and Latin America regions.

LATAM. The Company’s principal manufacturing and distribution activities are located throughout the world. The following is a summary ofworld, and the principal plants and physical properties owned or leased by the Company as of July 31, 2017. |

| | |

Americas | | Europe/Africa/Middle East |

Auburn, Alabama (E) | | Kadan, Czech Republic (I) |

Stockton, California (I)* | | Klasterec, Czech Republic (E) |

Valencia, California (E)* | | Domjean, France (E) |

Dixon, Illinois (E) | | Paris, France (E)* |

Anderson, Indiana (E)* | | Dulmen, Germany (E) |

Frankfort, Indiana (E) | | Haan, Germany (I) |

Cresco, Iowa (E) | | Ostiglia, Italy (E) |

Waterloo, Iowa (E) | | Skarbimierz, Poland (E) |

Nicholasville, Kentucky (I) | | Cape Town, South Africa (E) |

Bloomington, Minnesota (I) | | Johannesburg, South Africa (I)* |

Chesterfield, Missouri (E)* | | Abu Dhabi, United Arab Emirates (I) |

Chillicothe, Missouri (E) | | Hull, United Kingdom (E) |

Harrisonville, Missouri (I) | | Leicester, United Kingdom (I) |

Philadelphia, Pennsylvania (I) | | Asia/Pacific |

Greeneville, Tennessee (E) | | Wyong, Australia (E) |

Baldwin, Wisconsin (I) | | Wuxi, China |

Stevens Point, Wisconsin (E) | | New Delhi, India (E) |

Sao Paulo, Brazil (E)* | | Gunma, Japan (E) |

Brockville, Canada (E)* | | Rayong, Thailand (I) |

Bucaramanga, Columbia (E) | | Third-Party Logistics Providers |

Aguascalientes, Mexico (E) | | Santiago, Chile |

Monterrey, Mexico (I) | | Wuxi, China |

Distribution Centers | | Bogotá, Colombia |

Wyong, Australia | | Cartagena, Colombia |

Brugge, Belgium | | Chennai, India (E) |

Sao Paulo, Brazil* | | Mumbai, India |

Rensselaer, Indiana | | Gunma, Japan |

Jakarta, Indonesia | | Auckland, New Zealand |

Aguascalientes, Mexico | | Lima, Peru |

Lozorno, Slovakia | | Singapore |

Johannesburg, South Africa | | Greeneville, Tennessee (I) |

Seoul, South Korea* | | Laredo, Texas |

Joint Venture Facilities | | |

Most, Czech Republic (E) | | |

Champaign, Illinois (E) | | |

Jakarta, Indonesia (E) | | |

Dammam, Saudi Arabia (I) | | |

The Company’s properties are utilized for both the Engine and Industrial Products segments except as indicated with an (E) for Engine or (I) for Industrial. The Company leases certain of its facilities, primarily under long-term leases. The facilities denoted with an asterisk (*) are leased facilities. In Wuxi, China, and Bloomington, Minnesota, a portion of the activities are conducted

in leased facilities. The Company uses third-party logistics providers for some of its product distribution and neither leases nor owns the related facilities. The CompanyCompany considers its properties to be suitable for their present purposes, well-maintained and in good operating condition.

Item 3. Legal Proceedings

The Company believes the recorded estimated liability in its Consolidated Financial Statements for claims or litigation is adequate in light of the probable and estimable outcomes. Any recorded liabilities were not material to the Company’s financial position, results of operations or liquidity and the Company believes it is remote that the settlement of any of the currently identified claims or litigation will be materially in excess of what is accrued. The Company records provisions when it is probable that a liability has been incurred and the amount of the loss can be reasonably estimated. Claims and litigation are reviewed quarterly and provisions are taken or adjusted to reflect the status of a particular matter. The Company believes the estimated liability in its Consolidated Financial Statements for claims or litigation is adequate and appropriate for the probable and estimable outcomes. Liabilities recorded were not material to the Company’s financial position, results of operations or liquidity. The Company believes it is remote that the settlement of any of the currently identified claims or litigation will be materially in excess of what is accrued.

Item 4. Mine Safety Disclosures

Not applicable.

Executive Officers

Our executive officers of the Registrant

Current informationCompany as of August 31, 2017, regarding executive officers is presented below. All officers hold office until their successors are elected and qualify, or their earlier death, resignation or removal. There are no arrangements or understandings between individual officers and any other person pursuant to which the officer was selected2022 were as an executive officer.follows:

| | | Name | | Age | | Positions and Offices Held | | First Year Appointed as an Executive Officer | Name | | Age | | Positions and Offices Held | | First Year

Appointed as an

Executive Officer |

| Amy C. Becker | | 52 | | Vice President, General Counsel and Secretary | | 2014 | Amy C. Becker | | 57 | | Vice President, General Counsel and Secretary | | 2014 |

| Tod E. Carpenter | | 58 | | President and Chief Executive Officer | | 2008 | Tod E. Carpenter | | 63 | | Chairman, President and Chief Executive Officer | | 2008 |

| Sheila G. Kramer | | 58 | | Vice President, Human Resources | | 2015 | Sheila G. Kramer | | 63 | | Vice President, Human Resources | | 2015 |

| Richard B. Lewis | | Richard B. Lewis | | 51 | | Senior Vice President, Global Operations | | 2017 |

| Scott J. Robinson | | 50 | | Vice President and Chief Financial Officer | | 2015 | Scott J. Robinson | | 55 | | Senior Vice President and Chief Financial Officer | | 2015 |

| Thomas R. Scalf | | 51 | | Senior Vice President, Engine Products | | 2014 | Thomas R. Scalf | | 56 | | Senior Vice President, Engine Products | | 2014 |

| Jeffrey E. Spethmann | | 52 | | Senior Vice President, Industrial Products | | 2016 | Jeffrey E. Spethmann | | 57 | | Senior Vice President, Industrial Products | | 2016 |

| Wim Vermeersch | | 51 | | Vice President, Europe, Middle East and Africa | | 2012 | Wim Vermeersch | | 56 | | Vice President, Europe, Middle East and Africa | | 2012 |

Ms. Becker joined the Company in 1998 as Senior Counsel and Assistant Corporate Secretary and was appointed to Vice President, General Counsel and Secretary in August 2014. Ms. Becker joined the Company in 1998 and held positions as Senior Counsel and Assistant Corporate Secretary and Assistant General Counsel. Prior to joining the Company, Ms. Becker was an attorney for Dorsey and Whitney, LLP from 1991 to 1995 and was a Project Manager and Corporate Counsel for Harmon, Ltd. from 1995 to 1998.

Mr. Carpenter was appointed Chairman, President and Chief Executive Officer in November 2017. Mr. Carpenter joined the Company in 1996 and has held various positions, including Director of Operations, Gas Turbine SystemsSystems; General Manager, from 2002 to 2004;Gas Turbine Systems; General Manager, Industrial Filtration Systems Sales from 2004 to 2006; General Manager, Industrial Filtration Systems Americas in 2006;Systems; Vice President, Global Industrial Filtration Systems from 2006 to 2008;Systems; Vice President, Europe and Middle East from 2008 to 2011;East; and Senior Vice President, Engine Products from 2011 to 2014. In April 2014,Products. Mr. Carpenter was appointed Chief Operating Officer. OnOfficer in April 1, 2015, Mr. Carpenter was appointed2014 and President and Chief Executive Officer.Officer in April 2015.

Ms. Kramer was appointed Vice President, Human Resources in October 2015. Prior to joining the Company, Ms. Kramer was Vice President, Human Resources for Taylor Corporation, a print and graphics media company, from 2013 until September 2015. From 1991 to 2013, Ms. Kramer was withDuring her 22 years at Lifetouch, Inc., a photography company, where sheMs. Kramer held various human resources roles including Corporate Vice President, Human Resources from 2009 to 2013.