Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES þ NO ¨☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO þ☐ No ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference toof the registrant as of December 31, 2021, the last business day of the registrant’s most recently completed second fiscal quarter, was $96.3 million based upon the closing price at whichreported for such date on the Farmer Bros. Co. common stock was sold on December 30, 2011 was $61.5 million.Nasdaq Global Select Market.

|

| | |

PART I | | |

ITEM 1. | Business | |

ITEM 1A. | Risk Factors | |

ITEM 1B. | Unresolved Staff Comments | |

ITEM 2. | Properties | |

ITEM 3. | Legal Proceedings | |

ITEM 4. | Mine Safety Disclosures | |

| | |

PART II | | |

| | |

ITEM 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

ITEM 6. | Selected Financial Data | |

ITEM 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

ITEM 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

ITEM 8. | Financial Statements and Supplementary Data | |

ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

ITEM 9A. | Controls and Procedures | |

ITEM 9B. | Other Information | |

| | |

| PART III | | |

| |

|

| ITEM 10. | | 1

|

| ITEM 11. | | 9

|

| ITEM 12. | | 33

|

| ITEM 13. | | 36

|

| ITEM 14. | | |

| | 38

|

| PART IV | | |

| |

|

| ITEM 15. | | 40

|

SIGNATURES | | 45

|

EXPLANATORY NOTE

Farmer Bros. Co. (“Farmer Bros.” or the “Company”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to its Form 10-K for the fiscal year ended June 30, 2022, which was filed with the Securities and Exchange Commission (the “SEC”) on September 2, 2022 (the “Original Filing”).

This Amendment is being filed for the purpose of providing the information required by Items 10 through 14 of Part III of Form 10-K. This information was previously omitted from the Original Filing in reliance on General Instruction G(3) to Form 10-K, which permits the above-referenced Items to be incorporated in the Annual Report on Form 10-K by reference from a definitive proxy statement, if such definitive proxy statement is filed no later than 120 days after the last day of the Company’s fiscal year on June 30, 2022.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the cover page to the Original Filing and Items 10 through 14 of Part III of the Original Filing are hereby amended and restated in their entirety. In addition, pursuant to Rule 12b-15 under the Exchange Act, the Company is including Item 15 of Part IV, solely to file the certifications required under Section 302 of the Sarbanes-Oxley Act of 2002 with this Amendment.

Except as described above, no other changes have been made to the Original Filing. This Amendment does not affect any other section of the Original Filing not otherwise discussed herein and continues to speak as of the date of the Original Filing. The Company has not updated the disclosures contained in the Original Filing to reflect any events that occurred subsequent to the date of the Original Filing. Accordingly, this Amendment should be read in conjunction with the Company’s other filings made with the SEC subsequent to the filing of the Original Filing.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this annual report on Form 10-K are not based on historical fact

This Amendment and

are forward-looking statementsother documents we file with the SEC contain “forward-looking statements” within the meaning of

federal securities lawsSection 27A of the Securities Act of 1933, as amended (the “Securities Act”), and

regulations. These statementsSection 21E of the Exchange Act, that are based on

management’s current expectations,

assumptions, estimates,

forecasts and

observationsprojections about us, our future performance, our financial condition, our products, our business strategy, our beliefs and our management’s assumptions. In addition, we, or others on our behalf, may make forward-looking statements in press releases or written statements, or in our communications and discussions with investors and analysts in the normal course of

future eventsbusiness through meetings, webcasts, phone calls and

include any statements that do not directly relate to any historical or current fact.conference calls. These forward-looking statements can be identified by the use of words like “anticipates,” “estimates,” “projects,” “expects,” “plans,” “believes,” “intends,” “will,”

“could,” “may,” “assumes” and other words of similar meaning.

OwingThese statements are based on management’s beliefs, assumptions, estimates and observations of future events based on information available to

our management at the

time the statements are made and include any statements that do not relate to any historical or current fact. These statements are not guarantees of future performance and they involve certain risks, uncertainties

inherent in forward-looking statements, actualand assumptions that are difficult to predict. Actual outcomes and results

couldmay differ materially from

thosewhat is expressed, implied or forecast by our forward-looking statements due in part to the risks, uncertainties and assumptions set forth in

forward-looking statements. We intend these forward-looking statements to speak only at the timePart I, Item 1.A., Risk Factors as well as Part II, Item 7, Management’s Discussion and Analysis of this reportFinancial Condition and do not undertake to update or revise these statements as more information becomes available except as required under federal securities laws and the rules and regulationsResults of Operations, of the

Original Filing, as well as those discussed elsewhere in the Original Filing and other factors described from time to time in our filings with the SEC.

Factors that could cause actual results to differ materially from those in forward-looking statements include, but are not limited to, disruption to our business and customers from the COVID-19 pandemic (including the effects of emerging and novel variants of the virus and any virus containment measures such as stay-at-home orders or government mandates) and severe winter weather, levels of consumer confidence in national and local economic business conditions, the duration and magnitude of the pandemic’s impact on labor conditions, the success of our strategy to recover from the effects of the pandemic, the success of our turnaround strategy, the impact of capital improvement projects, the adequacy and availability of capital resources to fund our existing and planned business operations and our capital expenditure requirements, the relative effectiveness of compensation-based employee incentives in causing improvements in our performance, the capacity to meet the demands of our large national account customers, the extent of execution of plans for the growth of our business and achievement of financial metrics related to those plans, our success in retaining and/or attracting qualified employees, our success in adapting to technology and new commerce channels, the effect of the capital markets as well as other external factors on stockholder value, fluctuations in availability and cost of green coffee, competition, organizational changes, the impacteffectiveness of a weakerour hedging strategies in reducing price and interest rate risk, changes in consumer preferences, our ability to achieve sustainability goals in ways that do not materially impair profitability, changes in the strength of the economy, including any effects from inflation, business conditions in the coffee industry and food industry in general, our continued success in attracting new customers, variances from budgeted sales mix and growth rates, weather and special or unusual events, changes in the quality or dividend stream of third parties’ securities and other investment vehicles in which we have invested our assets, as well as other risks described in this reportAmendment and other factors described from time to time in our filings with the SEC.

Given these risks and uncertainties, you should not rely on forward-looking statements as a prediction of actual results. Any or all of the forward-looking statements contained in this Amendment and any other public statement made by us, including by our management, may turn out to be incorrect. We are including this cautionary note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise, except as required under federal securities laws and the rules and regulations of the SEC.

PART IIII

|

| |

Item 1.10. | BusinessDirectors, Executive Officers and Corporate Governance |

OverviewDirectors

Farmer Bros. Co.

At the 2019 Annual Meeting of Stockholders, stockholders approved the proposal to amend and restate the Company’s Certificate of Incorporation to provide for the phased-in declassification of the Board of Directors. Prior to that time, the Board of Directors was divided into three classes, each class consisting, as nearly as possible, of one-third of the total number of directors, with members of each class serving for a three-year term. Each year only one class of directors was subject to a stockholder vote. Class I consisted of three directors whose term of office will expire at the 2022 Annual Meeting, Class II consisted of two directors whose term of office expired at the 2020 Annual Meeting, and Class III consisted of one director, whose term of office expired at the 2021 Annual Meeting of Stockholders. Beginning at the 2020 Annual Meeting, any director elected to the Board shall be for a one-year term.

The authorized number of directors is set forth in the Company’s Certificate of Incorporation and shall consist of not less than five nor more than nine members, the exact number of which shall be fixed from time to time by resolution of the Board of Directors. The authorized number of directors is currently eight. In no event shall a decrease in the number of directors remove or shorten the term of any incumbent director. Any vacancy on the Board of Directors that results from an increase in the number of directors may be filled by a majority of the directors then in office, provided that a quorum is present, and any other vacancy occurring on the Board of Directors may be filled by a majority of the directors then in office, even if less than a quorum, or by the sole remaining director. Any director elected to fill a vacancy not resulting from an increase in the number of directors will have the same remaining term as that of his or her predecessor.

All of the directors were elected to their current terms by the stockholders. There are no family relationships among any directors or executive officers of the Company. Except as disclosed below, none of the directors are a director of any other publicly held company.

Set forth below are the biographies of each Director, including their ages and positions and offices held with the Company.

Allison M. Boersma, age 57, has served on our Board since 2017 and is currently the Chief Financial Officer and Chief Operating Officer of BRG Sports Inc., a Delaware corporation (including its consolidated subsidiaries unlesscorporate holding company of leading brands that design, develop and market innovative sports equipment, protective products, apparel and related accessories. The company’s core football brand, Riddell, is the context otherwise requires,industry leader in football helmet technology and innovation. Ms. Boersma has served as the “Company,” “we,” “our” or “Farmer Bros.”)finance and operations leader for BRG Sports since April 2016, responsible for financial oversight, including planning, treasury and risk management; leadership of global sourcing, manufacturing and distribution; strategic planning and acquisitions; and manufacturing strategy. Ms. Boersma has also served as Chief Financial Officer and Chief Operating Officer of Riddell Inc., issince May 2014, and Senior Vice President Finance and Chief Financial Officer of Riddell, from February 2009 to May 2014. Previously, Ms. Boersma was a manufacturer, wholesalerfinance executive with Kraft Foods, a multinational confectionery, food and distributorbeverage conglomerate, for over 17 years, with various positions of coffee, teaincreasing responsibility, including serving as Senior Director Finance, Global Procurement, from May 2007 to February 2009, with leadership and culinary products. We areoversight of commodity hedging and risk management, including for coffee; execution of global strategies to improve supplier performance; commodity tracking and derivative accounting. Other positions with Kraft included Controller, Grocery Sector; Controller, Meals Division; Director, Sales Finance, Kraft Food Services Division; and Senior Manager, Corporate Financial Business Analysis. Ms. Boersma began her career as a direct distributorSenior Auditor with Coopers & Lybrand. Ms. Boersma received her undergraduate degree in Accountancy from the University of coffeeIllinois Champaign-Urbana, and her Masters of Management, Marketing and Finance, from JL Kellogg Graduate School of Management.

Stacy Loretz-Congdon, age 63, has served on our Board since 2018. She retired at the end of 2016 after 26 years of service at Core-Mark, one of the largest marketers of fresh and broad-line supply solutions to restaurants, hotels, casinos, hospitalsthe convenience retail industry in North America, where she served in various capacities, including as Senior Vice President, Chief Financial Officer and other foodservice providers,Assistant Secretary from December 2006 to May 2016 and a providerExecutive Advisor from May 2016 through December 2016. From January 2003 to December 2006, Ms. Loretz-Congdon served as Core-Mark’s Vice President of private brand coffee programsFinance and Treasurer and from November 1999 to Quick Serve Restaurants ("QSR's"), grocery retailers, national drugstore chains, restaurant chains, convenience stores, and independent coffee houses, nationwide. We were foundedJanuary 2003 served as Core-Mark’s Corporate Treasurer. Ms. Loretz-Congdon joined Core-Mark in 1912, were incorporated in California in 1923, and reincorporated in Delaware in 2004. We operate in one business segment.

Business Strategy

Our mission is to “sell great coffee, tea and culinary products and provide superior service—one customer1990. Ms. Loretz-Congdon’s experience at a time.” We reach our customers in two ways: through our nationwide Direct-Store-Delivery (“DSD”) networkCore-Mark included oversight of approximately 500 delivery routes, 117 branch warehouses and six distribution centers, and by using the distribution channels of our national retail and institutional customers. We differentiate ourselves in the marketplace through our customer service model. We offer value-added servicesall finance functions, including beverage equipment service, menu solutions, wherein we recommend products, how these products are prepared in the kitchen and presented on the menu, and hassle-free inventory and product procurement management to our foodservice customers. These services are conducted primarily in person through Regional Sales Representatives, or RSR’s, who develop personal relationships with chefs, restaurant owners and food buyers at their drop off locations. We also provide comprehensive coffee programs, including private brand development, green coffee procurement, category management, and supply chain management to our national retail customers.

We manufacture and distribute products under our own brands,all corporate finance disciplines, strategy execution, risk mitigation, investor relations, as well as under private labelsinvolvement with benefits, executive compensation and technology initiatives. During her tenure as Senior Vice President and Chief Financial Officer, Ms. Loretz-Congdon served on behalf of certain customers. Our branded products are sold primarily into the foodservice channel, and are comprised of both national and regional brands. National foodservice brands include The Artisan Collection by Farmer Brothers™, Farmer Brothers®, Superior®, Metropolitan®, Island Medley Iced Tea®, Farmer Brothers Spice Products™, Sierra Tea™ and Orchard Hills Estate™. Regional foodservice and retail brands include Cain's®, Ireland® and McGarvey®.

Since 2007, Farmer Bros. has achieved growth, primarily through the acquisition in 2007 of Coffee Bean Holding Co., Inc., a Delaware corporation ("CBH"), the parent company of Coffee Bean International, Inc., an Oregon corporation (“CBI”), a specialty coffee manufacturer and wholesaler headquartered in Portland, Oregon,Information Technology Steering Committee and the Investment Committee at Core-Mark, as well as a board member of all Core-Mark subsidiaries. Core-Mark was a Fortune 500, publicly traded company listed on the Nasdaq Global Market until September 2021 when it merged with Performance Food Group Company, NYSE. In 2015, Ms. Loretz-Congdon was named as one of the Top 50 female CFOs in the Fortune 500 by Business Insider and Woman of the Year by Convenience Store News. Ms. Loretz-Congdon is an NACD Board Leadership Fellow. Prior to joining Core-Mark, Ms. Loretz-Congdon was an auditor for Coopers & Lybrand. Ms. Loretz-Congdon received her Bachelor of Science degree in Accounting from California State University, San Francisco.

Charles F. Marcy, age 72, is a food industry consultant. He served as Chief Executive Officer of Turtle Mountain, LLC, a privately held natural foods company, and the maker of the So Delicious brand of dairy free products from May 2013 until April 2015. Prior to this, he was a principal with Marcy & Partners, Inc., providing strategic planning and acquisition consulting to consumer products companies. Mr. Marcy served as President and Chief Executive Officer and a member of the Board of Directors of Healthy Food Holdings, a holding company for branded “better-for-you” foods and the maker of YoCrunch Yogurt and Van’s Frozen Waffles from 2005 through April 2010. Previously, Mr. Marcy served as President, Chief Executive Officer and a Director of Horizon Organic Holdings, then a publicly traded company listed on Nasdaq with a leading market position in 2009 from Sara Lee Corporation (“Sara Lee”) of certain assets used in connection with its DSD coffeethe organic food business in the United States (the “DSDand the United Kingdom, from 1999 to 2005. Mr. Marcy also previously served as President and Chief Executive Officer and a member of the Board of Directors of the Sealright Corporation, a manufacturer of food and beverage packaging and packaging systems, from 1995 to 1998. From 1993 to 1995, Mr. Marcy was President of the Golden Grain Company, a subsidiary of Quaker Oats Company and maker of the Near East brand of all-natural grain-based food products. From 1991 to 1993, Mr. Marcy was President of National Dairy Products Corp., the dairy division of Kraft General Foods. From 1974 to 1991, Mr. Marcy held various senior marketing and strategic planning roles with Sara Lee Corporation and Kraft General Foods. Mr. Marcy currently serves as First Vice Chair on the Board of Trustees of Washington and Jefferson College and has served on the Board of Directors of B&G, Foods, Inc. (“B&G”), a manufacturer and distributor of shelf-stable food and household products across the United States, Canada and Puerto Rico and a publicly traded company listed on the New York Stock Exchange, since 2010. Mr. Marcy served on the Strategy Committee and currently serves as a member of the Audit Committee, a member of the Compensation Committee and a member of the Risk Committee of the Board of Directors of B&G. Mr. Marcy received his undergraduate degree in Mathematics and Economics from Washington and Jefferson College, and his MBA from Harvard Business School. Mr. Marcy is an NACD Board Leadership Fellow and has demonstrated his commitment to boardroom excellence by completing NACD’s advanced corporate governance program for directors. Mr. Marcy has served on the Company’s Board of Directors since 2014 and is currently a member of the Nominating and Corporate Governance Committee and Chair of the Compensation Committee.

D. Deverl Maserang II, age 59, is President and Chief Executive Officer of the Company, since September 2019. Prior to joining the Company, from 2017 to 2019, Mr. Maserang served as President and Chief Executive Officer of Earthbound Farm Organic, a global leader in organic food and farming. From 2016 to 2017, Mr. Maserang served as Managing Partner of TADD Holdings, a business advisory firm. From 2013 to 2016, Mr. Maserang was Executive Vice President Global Supply Chain for Starbucks Corporation, a global coffee roaster and retailer, where he was responsible for end-to-end supply chain operations globally spanning manufacturing, engineering, procurement, distribution, planning, transportation, inventory management and worldwide sourcing. Prior to that, he held leadership roles at Chiquita Brands International, Peak Management Group, FreedomPay, Installation Included, Pepsi Bottling Group and United Parcel Service. Mr. Maserang received his Bachelor of Science degree from Texas Tech University.

Christopher P. Mottern, age 78, has served as Chairman of the Board of Directors since January 2020. He acted as interim President and Chief Executive Officer of Farmer Bros. Co. from May through October 2019. Prior to joining Farmer Bros. Co. in his interim role, Mr. Mottern was an independent business consultant. He served as President and Chief Executive Officer of Peet’s Coffee Business”).& Tea, Inc., a specialty coffee and tea company, from 1997 to 2002 and a director of Peet’s Coffee & Tea, Inc., from 1997 through 2004. From 1992 to 1996, Mr. Mottern served as President of The Heublein Wines Group, a manufacturer and marketer of wines, now part of Diageo plc, a multinational alcoholic beverage company. From 1986 through 1991, he served as President and Chief Executive Officer of Capri Sun, Inc., one of the largest single-service juice drink manufacturers in the United States. He has served as a director, including lead director, and member of the finance committee, of a number of private companies. Mr. Mottern received his undergraduate degree in Accounting from the University of Connecticut.

Our product line

Alfred Poe, age 73, has served on our Board of Directors since 2020 and is specifically focusedcurrently the Chief Executive Officer of AJA Restaurant Corp., serving as such since 1999. From 1997 to 2002, he was the Chief Executive Officer of Superior Nutrition Corporation, a provider of nutrition products. He was Chairman of the Board and Chief Executive Officer of MenuDirect Corporation from 1997 to 1999. Mr. Poe was a Corporate Vice President of Campbell Soup Company from 1991 through 1996. From 1993 through 1996, he was the President of the Campbell’s Meal Enhancement Group. From 1982 to 1991, Mr. Poe held various positions, including Vice President, Brands Director and Commercial Director with Mars, Inc. Mr. Poe currently serves on the Board of Directors of B&G, Foods, Inc., a manufacturer and distributor of shelf-stable food and household products across the United States, Canada and Puerto Rico and a publicly traded company listed on the New York Stock Exchange, since 1997. Mr. Poe has previously served on the boards of directors of Centerplate, Inc. and State Street Bank.

John D. Robinson, age 63, has served on our Board since 2021 and is currently an operating partner focusing on food and beverage opportunities at Sequel Holdings, a private equity firm, serving in such role since 2017. Currently, Mr. Robinson serves as CEO of Chairmans Foods, a Sequel portfolio company. Prior to joining Sequel, from 2009 to 2015, Mr. Robinson was Managing Partner for Rutherford Wine Studios LLC, dba The Ranch Winery, a wine co-packing and processing facility in Napa Valley, CA, which was sold to E&J Gallo Winery in 2015. Prior to that, he held leadership roles at Morningstar Foods, Dean Foods Company and Robinson Dairy. Mr. Robinson received a Bachelor of Science in Business Administration from the University of Arizona.

Waheed Zaman, age 62, has served on our Board since September 2021 and is currently the Chief Executive Officer of W&A Consulting, a consulting and advisory firm, where he advises senior executives on transformational change and consults with leaders and teams on personal success and leadership practices to ensure organizational effectiveness and strategy execution, serving as such since April 2017. He also serves as Advisor to Thematiks, a business research company. From April 2013 to March 2017, he was the Senior Vice President, Chief Corporate Strategy & Administrative Officer at the Hershey Company, a food manufacturer. Prior to that, he held leadership roles at Chiquita Brands International and Procter & Gamble. Mr. Zaman holds a bachelor’s degree with a double major in Computer Science and Policy Studies from Dartmouth College.

Executive Officers

The following table sets forth the executive officers of the Company as of the date hereof. At each annual meeting of the Board of Directors, the Board of Directors formally re-appoints the executive officers, and all executive officers serve at the pleasure of the Board of Directors. No executive officer has any family relationship with any director or nominee, or any other executive officer.

| Name | | Age | | Title | | Executive Officer Since |

D. Deverl Maserang II(1) | | 59 | | President and Chief Executive Officer | | 2019 |

| Scott R. Drake | | 53 | | Chief Financial Officer | | 2020 |

| Amber D. Jefferson | | 51 | | Chief Human Resources Officer | | 2021 |

| Ruben E. Inofuentes | | 55 | | Chief Supply Chain Officer | | 2019 |

| Maurice S.J. Moragne | | 58 | | Chief Sales Officer | | 2020 |

| Jared Vitemb | | 39 | | Vice President, General Counsel, Chief Compliance Officer and Secretary | | 2022 |

(1) For D. Deverl Maserang, II, please see his biography under “Directors” above.

Scott R. Drakejoined the Company as Chief Financial Officer in March 2020. As Chief Financial Officer, Mr. Drake’s current responsibilities include overseeing the Finance and Accounting functions. Prior to joining the Company, Mr. Drake served as Senior Vice President of Finance and Treasurer of GameStop Corp., an omnichannel video game retailer, from July 2015 to March 2020, where he was responsible for financial planning and analysis, treasury, risk management and events/travel functions. From 2001 through 2015, Mr. Drake held various senior management positions with 7-Eleven, Inc., an international convenience store chain, most recently as their Vice President of Finance, Strategy and Communications. Prior to 2001, he held finance and accounting positions with Arthur Andersen, La Madeleine French Bakery and Café, Coca-Cola Enterprises and Coopers & Lybrand. Mr. Drake received a B.B.A. in Finance and Accounting and an M.B.A. in Corporate Finance from Texas A&M University. He is a Certified Public Accountant.

Amber D. Jeffersonjoined the Company as Chief Human Resources Officer in October 2021. As Chief Human Resources Officer, Ms. Jefferson’s responsibilities include overseeing the Human Resources, Risk Management and Safety functions. Prior to joining the Company, Ms. Jefferson served as Head of Human Resources KNA Sales & e-Commerce at the Kellogg Company, a global consumer packaged goods company specializing in cereal, cookies, crackers, natural organic and salty snacks production from October 2012 to October 2021, where she was responsible for leading all facets of talent strategies, organizational effectiveness, leadership & capability development, and day-to-day HR operations across the North America region. From 2012 through 2018, Ms. Jefferson held HR leadership roles across various divisions within Kellogg including their Away From Home and Walmart business. Prior to 2012, she held leadership roles with Brinker International, Sabre, Texas Health Resources, The American Lung Association and The American Red Cross. Ms. Jefferson received a Bachelor of Science degree from Texas A&M University and a Master of Science in Healthcare Administration and a Master of Business Administration from Texas Woman’s University.

Ruben E. Inofuentesjoined the Company as Chief Supply Chain Officer in November 2019. As Chief Supply Officer, Mr. Inofuentes’ current responsibilities include overseeing the operations, manufacturing, logistics, procurement, coffee brewing equipment, research and development, green coffee buying, sustainability, supply and demand planning and quality functions. Prior to joining the Company, Mr. Inofuentes served as the Chief Operations Officer of JR286, Inc. (“JR286”), a sports equipment and accessories company from 2005 to 2019, where he was responsible for developing platforms to enable aggressive growth plans and market strategies. Prior to joining JR286, from 2003 to 2005, Mr. Inofuentes was the Vice President of Supply Chain Services for Advocare International, LP, a dietary supplement company. He was responsible for procurement, inventory planning, manufacturing, transportation, logistics, and information technology. Mr. Inofuentes received his undergraduate degree in Industrial Engineering from Iowa State University.

Maurice S. J. Moragnejoined the Company as Chief Sales Officer in June 2020. As Chief Sales Officer, Mr. Moragne’s current responsibilities include oversight of the company’s sales and marketing organizations. Prior to joining the Company, Mr. Moragne served as Chief Executive Officer, Chief Sales Officer and Co-Founder of International Agriculture Group LLC, an ingredient technology company, from August 2015 to June 2020, where he was responsible for managing investor financing, as well as assembling sales, marketing and technical teams. From July 2011 to July 2015, Mr. Moragne served as General Manager of the Chiquita Fruit Solutions business division of Chiquita Brands International, Inc., an agriculture production company, where he directed the daily operations, including oversight of Accounting, Finance, IT, Sales, Logistics, Quality, Operations, R&D, Marketing, Innovation, and Customer Service operations. Prior to 2011, he held various management positions with Naturipe Foods, LLC, Chiquita Brands International, Inc., L’Oreal and British American Tobacco. Mr. Moragne received a B.A. in Political Science and Government from Edinboro University of Pennsylvania.

Jared Vitembjoined the Company as Vice President, General Counsel, Chief Compliance Officer and Secretary in March 2022. Mr. Vitemb’s current responsibilities include overseeing the Company’s Legal and Compliance functions. Prior to joining the Company, Mr. Vitemb held various positions with FTS International Services, Inc., an oilfield services company, from September 2017 to March 2022, where he last served as Senior Vice President, General Counsel, Chief Compliance Officer and Secretary. From March 2014 to September 2017, Mr. Vitemb worked as an in-house attorney for Dean Foods Company, a dairy processing and distribution company. Prior to 2014, he was in private practice, primarily with the law firm of Gardere Wynne Sewell LLP in Dallas, Texas. Mr. Vitemb received a B.A. in History and a J.D. from The University of Texas.

Corporate Governance

Board Meeting and Attendance

The Board of Directors held seven meetings during the year ended June 30, 2022 (“fiscal 2022”), including four regular meetings and three special meetings. During fiscal 2022, each director attended at least 75% of the total number of meetings of the Board of Directors (held during the period for which he or she served as a director) and committees of the Board on which he or she served (during the periods that he or she served). The independent directors generally meet in executive session in connection with each regularly scheduled Board meeting. Under the Company’s Corporate Governance Guidelines, continuing directors are expected to attend the Company’s annual meeting of stockholders absent a valid reason. Seven of eight directors who were then serving were present at the 2021 Annual Meeting of Stockholders.

Charters; Code of Conduct and Ethics; Corporate Governance Guidelines

The Board of Directors maintains charters for its committees, including the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, and the ad hoc Technology Committee. In addition, the Board of Directors has adopted a written Code of Conduct and Ethics for all employees, officers and directors. The Board of Directors maintains Corporate Governance Guidelines as a framework to promote the functioning of the Board and its committees and to set forth a common set of expectations as to how the Board should perform its functions. Current standing committee charters, the Code of Conduct and Ethics and the Corporate Governance Guidelines are available on the Company’s website at www.farmerbros.com. Information contained on the website is not incorporated by reference in, or considered part of, this Amendment.

Board Committees

The Board of Directors has three standing committees: the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Summary information about each of these committees is set forth below.

Additionally, from time to time, the Board of Directors has established ad hoc or other committees, on an interim basis, to assist the Board with its consideration of specific matters, and it expects to continue to do so as it may determine to be prudent and advisable in the future. In December 2021, the Board of Directors established an ad hoc Technology Committee for the purpose of assisting with the review of the technological and cybersecurity needs of the markets we serve: restaurants, hotels, casinos, hospitals and other foodservice providers, as well as private brand retailers in the QSR, grocery, drugstore, restaurant, convenience store and independent coffeehouse channels. Our product line of over 3,000 SKU's (excluding private label), includes roasted coffee, liquid coffee, coffee-related products such as coffee filters, sugar and creamers, assorted teas, cappuccino, cocoa, spices, gelatins and puddings, soup bases, gravy and sauce mixes, pancake and biscuit mixes, and jellies and preserves. For the past three fiscal years, sales of roasted coffee products represented approximately 50% of our total sales and no single product other than roasted coffee accounted for more than 10% of our total sales.Company (the “Technology Committee”).

Coffee purchasing, roasting and packaging takes place at our Torrance, California; Portland, Oregon; and Houston, Texas plants. Spice blending and packaging takes place at our Torrance, California plant. Our distribution centers include our Torrance, Portland and Houston plants, and distribution centers in Northlake, Illinois; Oklahoma City, Oklahoma; and Moonachie, New Jersey. In July 2011, we closed our distribution center in Fridley, Minnesota.

We are focused on distributing our owned brands through our DSD network, while continuing to support and grow our private brand national accounts customers. To provide value to our current and potential customers, in fiscal 2012, we made the following investments:Audit Committee

•Specialty coffee: We have developed

The Audit Committee is a specialty line of coffees called "The Artisan Collection by Farmers Brothers™." Pre-launched at the National Restaurant Association tradeshow in May 2012, this new line of coffees establishes an owned brand presence in the growing specialty coffee market, leveraging the blending, roasting and packaging capabilities of CBI.

•Unified brand: We have developed a unified corporate identity for our business nationwide that is reflected in our updated packaging, our website, many of our fleet vehicles, and in all of our sales materials.

•Optimized portfolio: In fiscal 2012, we continued to optimize and simplify our product portfolio. We eliminated over

1,000 SKU's and plan to eliminate a significant number of additional SKU's in fiscal 2013. These SKU reductions allow us to focus our resources on promoting and supporting fewer brands while lowering inventory and production costs.

•Service improvements: We have invested in sales and training for all of our RSRs, allowing us to expand the role we play as beverage consultants for our DSD customers.

We have also made the following investments to support our private brand national accounts business:

•Coffee industry leadership: Through our dedication to the craft of sourcing, blending and roasting coffee, and our leadership positions with the Specialty Coffee Association of America, World Coffee Research and Coffee Quality Institute, we work to help shape the futurestanding committee of the coffee industry. We believe that due to our commitment to the industry and our leadership roleBoard of Directors established in shaping the industry's future, large retail and foodservice operators are drawn to workingaccordance with us.

•Market insight: We have developed a market insight capability internally that reinforces our business-to-business positioning as a thought leader in the coffee industry. We provide trend insights that help our customers create winning products and integrated marketing strategies for their own coffee brands.

•Sustainability leadership: Due to our proactive efforts in counting carbon, creating programs for waste and energy reduction, and creating farmer relationship programs abroad, we are in a unique position to help retailers and foodservice operators create differentiated coffee sustainability programs such as carbon neutrality programs, direct trade coffee programs, and packaging material reductions.

Raw Materials and Supplies

Our primary raw material is green coffee, an agricultural commodity. The bulkSection 3(a)(58)(A) of the world's green coffee supplies is grown outside the United States and can be subjectExchange Act. The Audit Committee’s principal purposes are to volatile price fluctuations. Weather, real or perceived supply shortages, speculation in the commodity markets, political unrest, labor actions, currency fluctuations, armed conflict in coffee producing nations, and government actions, including treaties and trade controls between the U.S. and coffee producing nations can affect the price of green coffee. Green specialty coffees sell at a premium to other green coffees due to the inability of producers to increase supply in the short run to meet rising demand. As a result, the price spread between specialty coffee and non-specialty coffee is likely to widen as demand for specialty coffee continues to increase.

Green coffee prices can also be affected by the actions of producer organizations. The most prominent of these are the Colombian Coffee Federation, Inc. (CCF) and the International Coffee Organization (ICO). These organizations seek to increase green coffee prices largely by attempting to restrict supplies, thereby limiting the availability of green coffee to coffee consuming nations. As a result, these organizations or others may succeed in raising green coffee prices.

Other raw materials used in the manufacture of our tea and culinary products include a wide variety of spices, such as pepper, chilies, oregano and thyme, as well as cocoa, dehydrated milk products, salt and sugar. These raw materials are agricultural products and can be subject to wide cost fluctuations. In fiscal 2011 and in the first half of fiscal 2012, fluctuations in commodity prices, specifically coffee commodity prices, had a material effectoversee, on our operating results.

Trademarks and Licenses

We own 160 registered trademarks which are integral to customer identification of our products. It is not possible to assess the impactbehalf of the lossBoard, the accounting and financial reporting processes of such identification. Additionally, in connection with the DSD Coffee Business acquisition, the Company and Sara Lee entered into certain operational agreementsthe audit of the Company’s financial statements. As described in its charter, available on the Company’s website under Corporate Governance - Committee Charters, the Audit Committee’s responsibilities include assisting the Board of Directors in overseeing: (i) the integrity of the Company’s financial statements; (ii) the independent auditor’s qualifications and independence; (iii) the performance of the Company’s independent auditor and internal audit function; (iv) the Company’s compliance with legal and regulatory requirements relating to accounting and financial reporting matters; (v) the Company’s system of disclosure controls and procedures, internal control over financial reporting that include trademarkmanagement has established, and formula license agreements. In February 2012,compliance with ethical standards adopted by the trademark agreementsCompany; and formula license agreements(vi) the Company’s framework and guidelines with Sara Lee were assignedrespect to risk assessment and risk management. The Audit Committee is directly and solely responsible for the appointment, dismissal, compensation, retention and oversight of the work of any independent auditor engaged by the Company for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company. The independent auditor reports directly to the J.M. SmuckerAudit Committee.

During fiscal 2022, the Audit Committee held four regular meetings and three special meetings. Allison M. Boersma currently serves as Chair, and Stacy Loretz-Congdon, John D. Robinson and Waheed Zaman currently serve as members of the Audit Committee. All directors who currently serve on the Audit Committee meet the Nasdaq composition requirements, including the requirements regarding financial literacy and financial sophistication, and the Board of Directors has determined that all such directors are independent under the Nasdaq Listing Rules and the rules of the SEC regarding audit committee membership. The Board of Directors has determined that Ms. Boersma and Ms. Loretz-Congdon are “audit committee financial experts” as defined in Item 407(d) of Regulation S-K under the Exchange Act.

Compensation Committee

The Compensation Committee is a standing committee of the Board of Directors. As described in its charter, available on the Company’s website under Corporate Governance - Committee Charters, the Compensation Committee’s principal purposes are to discharge the Board’s responsibilities related to compensation of the Company’s executive officers and administer the Company’s incentive and equity compensation plans. The Compensation Committee’s objectives and philosophy with respect to the fiscal 2022 executive compensation program, and the actions taken by the Compensation Committee in fiscal 2022 with respect to the compensation of our Named Executive Officers, are described below under the heading “Compensation Discussion and Analysis.”

The Compensation Committee also is responsible for evaluating and making recommendations to the Board of Directors regarding director compensation. In addition, the Compensation Committee is responsible for conducting an annual risk evaluation of the Company’s compensation practices, policies and programs.

During fiscal 2022, the Compensation Committee held four regular meetings and three special meetings. Charles F. Marcy currently serves as Chair and Alfred Poe and John D. Robinson currently serve as members of the Compensation Committee. The Board of Directors has determined that all current Compensation Committee members are independent under the Nasdaq Listing Rules.

Compensation Committee Interlocks and Insider Participation

Messrs. Robinson, Marcy, and Poe were members of the Compensation Committee during fiscal 2022. None of the members of the Compensation Committee is or has been an executive officer of the Company, ("J.M. Smucker")nor did any of them have any relationships requiring disclosure by the Company under Item 404 of Regulation S-K. None of the Company’s executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity, an executive officer of which served as a director of the Company or member of the Compensation Committee during fiscal 2022.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is a standing committee of the Board of Directors. As described in its charter, available on the Company’s website under Corporate Governance - Committee Charters, the Nominating and Corporate Governance Committee’s principal purposes are (i) monitoring the Company’s corporate governance structure; (ii) assisting the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with corporate governance; (iii) ensuring that the Board is appropriately constituted in order to meet its fiduciary obligations, including by identifying individuals qualified to become Board members and members of Board committees, recommending to the Board director nominees for the next annual meeting of stockholders or for appointment to vacancies on the Board, and recommending to the Board membership on Board committees (including committee chairs); (iv) leading the Board in its annual review of the Board’s performance; (v) conducting the annual performance review of the Chief Executive Officer and communicating the results to the Board; and (vi) overseeing succession planning for senior management.

During fiscal 2022, the Nominating and Corporate Governance Committee held four regular meetings. Ms. Loretz-Congdon currently serves as Chair, and Charles F. Marcy, John D. Robinson and Alfred Poe currently serve as members of the Nominating and Corporate Governance Committee. The Board of Directors has determined that all current Nominating and Corporate Governance Committee members are independent under the Nasdaq Listing Rules.

Other Committees

In July 2020, the Board of Directors created an ad hoc Search Committee to assist the Nominating and Corporate Governance Committee in identifying and evaluating potential candidates for future director positions. The Search Committee no longer exists.

In December 2021, the Board of Directors established the Technology Committee for the purpose of assisting with the review of the technological and cybersecurity needs of the Company. As described in its charter, available on the Company’s website under Corporate Governance - Committee Charters, the Technology Committee’s principal purposes include: (i) overseeing the quality and effectiveness of the Company’s cybersecurity strategy; and (ii) overseeing the Company’s technology strategy. Waheed Zaman currently serves as Chair, and Allison M. Boersma and Alfred Poe currently serve as members of the Technology Committee. The Technology Committee met four times in fiscal 2022.

Board Diversity

The below Board Diversity Matrix reports self-identified diversity statistics for the Board of Directors.

| | Board Diversity Matrix (As of September 1, 2022) |

| | Total Number of Directors | 8 |

| | | Female | Male | Non-Binary |

| | Part I: Gender Identity | 2 | 6 | 0 |

| | Part II: Demographic Background |

| | African American or Black | 0 | 1 | 0 |

| | Alaskan or Native American | 0 | 0 | 0 |

| | Asian or South Asian | 0 | 1 | 0 |

| | Hispanic | 0 | 0 | 0 |

| | Pacific Islander | 0 | 0 | 0 |

| | White | 2 | 4 | 0 |

| | Two or More Races or Ethnicities | 0 | 0 | 0 |

| | LGBTQ+ | 0 | 0 | 0 |

| | Military Veterans | 0 | 1 | 0 |

| | Directors with Disabilities | 0 | 0 | 0 |

Board Leadership Structure

Under our By-Laws, the Board of Directors, in its discretion, may choose a Chairman of the Board of Directors. If there is a Chairman of the Board of Directors, such person may exercise such powers as provided in the By-Laws or assigned by the Board of Directors. Christopher P. Mottern was appointed as Chairman of the Board in January 2020. Mr. Mottern has served on our Board of Directors since 2013.

Notwithstanding the current separation of Chairman of the Board and Chief Executive Officer, our Chairman of the Board of Directors is generally responsible for soliciting and collecting agenda items from other members of the Board and the Chief Executive Officer, and the Chief Executive Officer is generally responsible for leading discussions during Board meetings. This structure allows for effective and efficient Board meetings and information flow on important matters affecting the Company. As required under the Nasdaq Listing Rules, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. The Board of Directors has determined that, other than Mr. Maserang, all members of the Board of Directors are independent and each of the Audit, Compensation, and Nominating and Corporate Governance Committees of the Board are composed solely of independent directors. Due principally to the size of the Board of Directors, the Board has not formally designated a lead independent director and believes that as a result thereof, non-employee director and executive sessions of the Board of Directors, which are attended solely by non-employee directors or independent directors, as applicable, result in an open and free flow of discussion of any and all matters that any director may believe relevant to the Company and/or its management.

Although the roles of Chairman and Chief Executive Officer are currently filled by different individuals, no single leadership model is right for all companies at all times, and the Company has no bylaw or policy in place that mandates this leadership structure. The Nominating and Corporate Governance Committee will evaluate and recommend to the Board of Directors any changes in the Board’s leadership structure.

Board’s Role in Risk Oversight

The Board of Directors recognizes that although management is responsible for identifying risk and risk controls related to business activities and developing programs and recommendations to determine the sufficiency of risk identification and the appropriate manner in which to control risk, the Board plays a critical role in the oversight of risk. The Board of Directors implements its risk oversight responsibilities by having management provide periodic briefing and informational sessions on the significant risks that the Company faces and how the Company is seeking to control risk if and when appropriate. In some cases, a Board committee is responsible for oversight of specific risk topics. For example, the Audit Committee has oversight responsibility of risks associated with financial accounting and audits, internal control over financial reporting, and the Company’s major financial risk exposures, including commodity risk and risks relating to hedging programs. Regarding cybersecurity, the Board of Directors temporarily assigned primary oversight responsibility to the Technology Committee, but placed the Chairwoman of the Audit Committee on the Technology Committee and made a second member of the Audit Committee the Chairman of the Technology Committee to ensure that the Audit Committee remained well informed of the Company’s cybersecurity risks. The Compensation Committee has oversight responsibility of risks relating to the Company’s compensation policies and practices. At each regular meeting, or more frequently as needed, the Board of Directors considers reports from the Audit Committee and Compensation Committee which provide detail on risk management issues and management’s response. The Board of Directors, as a whole, examines specific business risks in its periodic reviews of the individual business units, and also of the Company as a whole as part of an acquisition transaction between J.M. Smuckerits regular reviews, including as part of the strategic planning process, annual budget review and Sara Lee.approval, and data and cyber security review. Beyond formal meetings, the Board of Directors and its committees have regular access to senior executives, including the Company’s Chief Executive Officer and Chief Financial Officer. The Company believes that its leadership structure promotes effective Board oversight of risk management because the Board of Directors directly, and through its various committees, is regularly provided by management with the information necessary to appropriately monitor, evaluate and assess the Company’s overall risk management, and all directors are involved in the risk oversight function.

Seasonality

We experience some seasonal influences. The winter monthsCompensation-Related Risk

As part of its risk oversight role, our Compensation Committee annually considers whether our compensation policies and practices for all employees, including our executive officers, create risks that are generally the strongest sales months. However, our product line and geographic diversity provide some sales stability during the warmer months when coffee consumption ordinarily decreases. Additionally, we usually experience an increase in sales during the summer and early fall months from seasonal businesses located in vacation areas, and from grocery retailers ramping up inventory for the winter selling season.

Distribution

Most sales are made “off-truck” to our customers at their places of business by our sales representatives who are responsible for soliciting, selling and collecting from and otherwise maintaining our customer accounts. We serve our customers from six distribution centers strategically located for national coverage. Our distribution trucks are replenished from 117 branch warehouses located throughout the contiguous United States. We operate our own trucking fleet to support our long-haul distribution requirements. A portion of our products is distributed by third parties or is direct shipped via common

carrier. We maintain inventory levels at each branch warehouse to allow for minimal interruption in supply.

Customers

We serve a wide variety of customers, from small restaurants and donut shops to large institutional buyers like restaurant chains, hotels, casinos, hospitals, foodservice providers, convenience stores, gourmet coffee houses, bakery/café chains, national drugstore chains, large regional and national grocery and specialty food retailers, QSR's and gaming establishments. Within our DSD channel, we believe on-premise customer contact, our large distribution network, and our relationship-based high quality service model are integral to our past and future success. No single customer represents a significant concentration of sales. As a result, the loss of one or more of our larger customer accounts is notreasonably likely to have a material adverse effect on our results of operations.

Competition

We face competition from many sources, includingCompany. In fiscal 2022, the institutional foodservice divisions of multi-national manufacturers of retail products such as J.M. Smucker (Folgers Coffee), Dunkin' Donuts and Kraft Foods Inc. (Maxwell House Coffee), wholesale foodservice distributors such as Sysco Corporation and U.S. Foods, regional institutional coffee roasters such as S & D Coffee, Inc. and Boyd Coffee Company, and specialty coffee suppliers such as Green Mountain Coffee Roasters, Inc., Rogers Family Company, Distant Lands Coffee, Mother Parkers Tea & Coffee, Inc., and Peet’s Coffee & Tea, Inc. As manyCompensation Committee noted several design features of our customers are small foodservice operators, we also compete with club stores such as Costco and Restaurant Depot. We believe our longevity,compensation programs that reduce the qualitylikelihood of our products, our national distribution network and our comprehensive and superior customer service are the major factors that differentiate us from our competitors.

Competition is robust and is primarily based on products and price, with distribution and service often a major factor. Most of our customers rely on us for distribution; however, some of our customers use third party distribution or conduct their own distribution. Some of our customers are “price” buyers, seeking the low cost provider with little concern about service, while others find great value in the service programs we provide. We compete well when service and distribution are valued by our customers, and are less effective when only price matters. Our customer base is price sensitive, and we are often faced with price competition.

Working Capital

We finance our operations internally and through borrowings under our $85.0 million senior secured revolving credit facility with Wells Fargo Bank, National Association (“Wells Fargo”). We believe this credit facility,excessive risk-taking, including, but not limited to, the extent available, in addition to our cash flows from operations and other liquid assets, are sufficient to fund our working capital and capital expenditure requirements for the next 12 months.

Foreign Operations

We have no material revenues from foreign operations.

Other

On June 30, 2012 we employed 1,821 employees, 624 of whom are subject to collective bargaining agreements.Compliance with government regulations relating to the discharge of materials into the environment, or otherwise relating to protection of the environment, has not had a material effect on our financial condition or results of operations. The nature of our business does not provide for maintenance of or reliance upon a sales backlog. None of our business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of the government.

Available Information

Our Internet website address is http://www.farmerbros.com (the website address is not intended to function as a hyperlink, and the information contained in our website is not intended to be part of this filing), where we make available, free of charge, copies of our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K including amendments thereto as soon as reasonably practicable after filing such material electronically or otherwise furnishing it to the Securities and Exchange Commission (“SEC”).following:

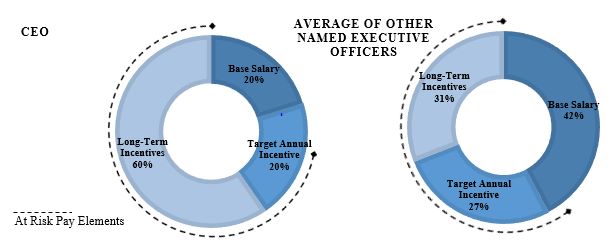

You should consider eachA good balance of the following factorsfixed and at-risk compensation, as well as an appropriate balance of cash and equity-based compensation.

Management incentive programs are based on multiple metrics, including strategic, individual and operational measures.

The Compensation Committee is directly involved in setting short- and long-term incentive performance targets and payout intervals, assessing performance against targets, and reviewing/approving the performance goals for the CEO and other informationexecutives.

Executive annual short-term incentive awards are generally capped at 200% of the target opportunity and the performance-based restricted stock units in the long-term incentive plan are capped at 180% of target opportunity.

Long-term equity awards are generally made on an annual basis which creates overlapping vesting periods and ensures that management remains exposed to the risks of their decision-making through their unvested equity-based awards for the period during which the business risks are likely to materialize.

Long-term compensation for senior executives is comprised of restricted stock units that vest ratably over three years and performance-based restricted stock units that are earned based on three-year performance goals. Company shares are inherently subject to the risks of the business, and the combination of options and performance-based restricted stock units ensure that management participates in these risks.

The number of performance-based restricted stock units ultimately earned by the Company’s executives and employees are determined at the end of a three-year performance period based on adjusted EBITDA performance and total shareholder return (“TSR”) metrics that are tracked during the performance period.

The Company has significant share ownership requirements for executives and non-employee directors. Executive officers are required to hold share-based compensation awards until meeting their ownership requirements. Company shares held by management are inherently subject to the risks of the business.

Executive compensation is benchmarked annually relative to pay levels and practices at peer companies.

The Company has a clawback policy in place that allows for recovery of incentive compensation if there is a material restatement of financial results caused by the fraud or misconduct of an individual which resulted in an over payment of incentives.

The Company prohibits employees and directors from hedging or pledging its securities.

The Compensation Committee is composed solely of independent directors and retains an independent compensation consultant to provide a balanced perspective on compensation programs and practices. The Compensation Committee approves all pay decisions for executive officers.

Stockholder Engagement

The Company has a history of actively engaging with our stockholders. We believe that strong corporate governance should include regular engagement with our stockholders. We have a long-standing, robust stockholder outreach program through which we solicit feedback on our corporate governance, executive compensation program, disclosure practices, and environmental and social impact programs and goals. Investor feedback is shared with our Board of Directors as received.

Corporate Governance Cycle and 2022 Outreach

Engagement

As part of our stockholder outreach program, and in response to the results of the say-on-pay advisory vote at our 2021 Annual Meeting, we reached out to 16 of our 29 largest stockholders in 2022, representing approximately 47% of our total shares outstanding as of our 2021 Annual Meeting, to solicit and gain a better understanding of stockholder feedback regarding our executive compensation program. Six of the 16 holders elected to participate in this report, includingcompensation-specific outreach program. The feedback we received from our consolidated financial statements and the related notes,stockholders about our executive compensation program was collected directly by members of our Compensation Committee. The Compensation Committee made changes to our plan design in evaluating our business and our prospects. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also negatively affect our business operations. If anylight of the following risks actually occurs,feedback we received during this process.

Additionally, our businessCEO and financial results could be harmed. In that case,CFO engage in meaningful dialogue with our stockholders through our quarterly earnings calls and investor-related outreach events.

Topics

Key areas of discussion included:

Corporate Governance

Executive Compensation

Inclusion and Diversity

Human Capital Management

Sustainability Programs

Supply Chain

Company Policy

Brand/Public Affairs

Risk Management

Long-term Growth Strategy

Financial Performance

For additional information, please see “2022 Stockholder Outreach” in Item 11 of this Amendment.

Delinquent Section 16(a) Reports

Section 16(a) of the trading priceExchange Act requires our directors, certain of our officers, and persons who beneficially own more than 10% of the Company’s common stock could decline.

INCREASES IN THE COST OF GREEN COFFEE COULD REDUCE OUR GROSS MARGIN AND PROFIT.

Our primary raw material is green coffee, an agricultural commodity. The bulkto file reports of stock ownership and changes in ownership (Forms 3, 4 and 5) in shares with the SEC. To our knowledge, based solely on our records and certain written representations received from our executive officers and directors, during the fiscal year ended June 30, 2022, all persons related to the Company that are required to file these insider trading reports have filed them in a timely manner, except for a Form 4 filed on May 11, 2022 for Scott R. Drake to correct the amount of securities granted to him in a transaction that occurred on September 13, 2021; a Form 4 filed on July 19, 2022 for Maurice S. J. Moragne to correct the amount of securities granted to him in a transaction that occurred on September 13, 2021; a Form 4 filed on July 19, 2022 for Ruben Inofuentes to correct the amount of securities granted to him in a transaction that occurred on September 13, 2021 and to correct the amount of securities beneficially owned by him in subsequent transactions through July 18, 2022; a Form 4 filed on July 19, 2022 for D. Deverl Maserang II to disclose reportable transactions that occurred on July 16, 2021, September 13, 2021, December 2, 2021, and July 18, 2022; and a Form 4/A filed on August 2, 2022 for Christopher P. Mottern to correct the amount of securities beneficially owned by him. Copies of the world's green coffee supply is mainly grown outside the United States andinsider trading reports can be subjectfound on the Company’s website at www.farmerbros.com.

| Item 11. | Executive Compensation |

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes our executive compensation philosophy, objectives, and programs, the decisions made under those programs and factors considered by our Compensation Committee in fiscal 2022 with respect to volatile price fluctuations. Weather, real or perceived supply shortages, speculationthe compensation of our Named Executive Officers.

Fiscal 2022 Named Executive Officers

| Name | | Title (as of June 30, 2022) |

| D. Deverl Maserang II | | President and Chief Executive Officer |

| Scott R. Drake | | Chief Financial Officer |

| Ruben E. Inofuentes | | Chief Supply Chain Officer |

| Maurice S. J. Moragne | | Chief Supply Chain Officer |

| Amber D. Jefferson | | Chief Human Resources Officer |

Executive Summary

Our executive compensation programs are designed to:

attract, retain, and motivate talented executives with competitive pay and incentives;

reward positive results by aligning the economic interests of our executive officers with those of our stockholders;

motivate executive officers to achieve our short-term and long-term goals by providing “at risk” compensation, the value of which is ultimately based on our future performance, without creating undue risk-taking behavior nor unduly emphasizing short-term performance over long-term value creation; and

maintain total compensation and relative amounts of base salary, annual, and long-term incentive compensation competitive with those amounts paid by peer companies to remain competitive in the commodity markets, political unrest, labor actions, currency fluctuations, armed conflict in coffee producing nations, and government actions, including treaties and trade controls between the U.S. and coffee producing nations, can affect the price of green coffee. In fiscal 2011, the market for green Arabica coffeetalent.

We believe that this design appropriately focuses our executive officers on the creation of long-term value without creating undue risk-taking behavior. We continued to focus on these key design elements in addressing the impact of and our response to the COVID-19 pandemic and its related impact on our compensation programs.

Impact of and Response to COVID-19

Below we summarize key actions the Company undertook to protect our employees, stockholders, business, and customers throughout COVID-19 pandemic. Management quickly responded to the revised business landscape, purposefully managed liquidity and remained focused on our strategic projects to deliver long-term stockholder value.

In fiscal 2022, although both our DSD and Direct Ship sales channels continued to be impacted by the COVID-19 pandemic, there was significant recovery in these channels throughout the year ended June 30, 2021 (“fiscal 2021”) and fiscal 2022. Net sales in fiscal 2022 increased approximately 80% per pound$71.3 million, or 18%, to $469.2 million from $397.9 million in fiscal 2021. The increase in net sales was primarily due to the continued recovery from the impact of the COVID-19 pandemic on both our DSD and Direct Ship sales channels, along with price increases and delivery surcharges implemented during fiscal 2022.

During fiscal 2022, we delivered higher gross margins compared to the prior fiscal year. Additionally, green specialty coffees sell at a premium to other green coffeesyear primarily due to the inabilitypandemic’s impact on sales volume, which had a larger impact on our higher margin customers in fiscal 2021. Overall, gross margins increased by 3.8%, from 25.4% in fiscal 2021 to 29.2% in fiscal 2022 due in part to the continued recovery from the COVID-19 pandemic. A decline in our unfavorable production variances and inventory scrap write-downs due to the closure of producersour aged Houston, Texas plant during fiscal 2021 also contributed to increasesuch increase. These improvements were partially offset by higher freight costs due to global supply chain challenges. The price increases and delivery surcharges implemented across our DSD network beginning in the short runthree months ended December 31, 2021 helped mitigate the impact of higher supply chain and product costs.

Our capital expenditures for fiscal 2022 were $15.2 million, as compared to meet rising demand. As$15.1 million in fiscal 2021, an increase of $0.1 million. This was driven by lower expansionary capital spend of $5.8 million in fiscal 2022 compared to fiscal 2021, offset by a result, the price spread between specialty coffee and non-specialty coffee is likely to widen as demand for specialty coffee continues to increase.

Green coffee prices can also be affected by the actions of producer organizations. The most prominent of these are the Colombian Coffee Federation, Inc. (CCF) and the International Coffee Organization (ICO). These organizations seek to$5.8 million increase green coffee prices largely by attempting to restrict supplies, thereby limiting the availability of green coffee to coffee consuming nations. As a result, these organizations or others may succeed in raising green coffee prices.

There can be no assurance that we will be successfulmaintenance capital spend in passing commodity price increases on to our customers without losses in sales volume or gross marginfiscal 2022. Also included in the future. Additionally, if green$15.2 million of capital expenditures in fiscal 2022 was $1.6 million for expansion projects and $10.1 million of coffee beans frombrewing equipment spend to execute several key strategic initiatives pertaining to fiscal 2022. The expansionary capital spending reductions were driven by several key initiatives put in place, including a region become unavailable or prohibitively expensive,focus on refurbished coffee brewing equipment to drive cost savings, and reductions across some capital categories due to additional cost controls put in place during the COVID-19 pandemic.

What we could be forceddid for our employees

We implemented the following measures to use alternative coffee beans or discontinue certain blends, which could adversely impactassist our sales.employees:

OUR EFFORTS TO SECURE AN ADEQUATE SUPPLY OF QUALITY COFFEES MAY BE UNSUCCESSFUL AND IMPACT OUR ABILITY TO SUPPLY OUR CUSTOMERS OR EXPOSE US TO COMMODITY PRICE RISK.

Some of the Arabica coffee beans of the quality we purchase do not trade directly on the commodity markets. Rather, we purchase these coffee beans onImplemented Company health guidelines that included social distancing, shift spacing, protective equipment, temperature monitoring and a negotiated basis from coffee brokers, exporters and growers. If any of these supply relationships with coffee brokers, exporters or growers deteriorate, we may be unable to procure a sufficient quantity of high quality coffee beans at prices acceptable to us or at all. In such case, we may not beremote work option for employees able to fulfilldo so;

Provided up to 10 additional days of sick time at no cost for certain employees in locations with a confirmed COVID-19 case or who were quarantined due to COVID-19 related symptoms/exposure;

Provided COVID-19 testing for team members on our health plan at no charge;

Extended company-paid medical benefits for employees enrolled in benefit plans who had been placed on furlough due to the demandCOVID-19 outbreak;

Reinforced access for team members to telehealth options available through our health plans; and

Reinforced availability of our existing customers, supply new customers or expand other channelsEmployee Assistance Program (EAP) that is available to all employees and their families at no cost. The EAP provides helpful tools for managing anxiety and fears for employees and their children.

What we did for our Stockholders

We engaged stockholders in direct conversations regarding our pandemic actions and corresponding changes to our compensation program;

Our Board was regularly informed about all major aspects of distribution.

Maintaining a steady supply of green coffee is essential to keep inventory levels lowour business and secure sufficient stockremains actively engaged with management. Our Board and the Compensation Committee met and continue to meet customermore frequently (relative to prior years) to understand the unique challenges we are encountering; and

Invested in and reallocated capital in a focused approach, allowing team members to continue to deliver on projects to optimize our manufacturing and distribution network during challenging times.

What we did for our Business

Recognizing that maintaining ample liquidity is key to withstanding the pandemic and emerging in a position of strength, we prudently managed cash, including:

Amended our prior credit facility in April 2021 and subsequently entered into a new $127.5 million, four-year financing arrangement, providing a lower overall cost of borrowing and reducing or eliminating several negative covenants in its prior credit facility;

| • | Amended our credit facility a second time in August 2022, providing a further reduction in the overall cost of borrowing and repayment of our term loan agreement, which resulted in the removal of several negative covenants that existed in the term loan agreement. |

Drove cost-reduction and cash preservation strategies to weather the impact of the pandemic;

Remained disciplined in capital allocation priorities, including deferring capital expenditures, as appropriate;

Focused on key initiatives that would drive our business transformation; and

Renegotiated unprofitable contracts to meet evolving business needs. To help ensure future supplies, we may purchase coffee for delivery,

Compensation Policies and Practices—Good Governance

Consistent with our commitment to strong corporate governance, in some instances, upfiscal 2022, our Board followed the compensation policies and practices described below to 18 monthsdrive performance and serve our stockholders’ long-term interests:

What We Do

Our Compensation Committee is composed solely of independent directors, and regularly meets in executive session without members of management present.

Our Compensation Committee is composed solely of independent directors, and regularly meets in executive session without members of management present. Our Compensation Committee retains an independent compensation consultant to provide it with advice on matters related to executive compensation.

Our Compensation Committee retains an independent compensation consultant to provide it with advice on matters related to executive compensation. Our Compensation Committee regularly reviews and assesses the potential risks of our compensation policies and practices.

Our Compensation Committee regularly reviews and assesses the potential risks of our compensation policies and practices. The structure of our executive compensation program includes a mix of cash and equity-based compensation, with an emphasis on performance-based compensation.

The structure of our executive compensation program includes a mix of cash and equity-based compensation, with an emphasis on performance-based compensation. The competitiveness of our executive compensation program is assessed by comparison to the compensation programs of peer group companies that are similar to us in terms of industry, annual revenue, and/or other business characteristics.

The competitiveness of our executive compensation program is assessed by comparison to the compensation programs of peer group companies that are similar to us in terms of industry, annual revenue, and/or other business characteristics. Our claw-back policy requires the recoupment of certain incentive compensation from our executive officers

Our claw-back policy requires the recoupment of certain incentive compensation from our executive officers in the