PART II

Item 5.Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The New York Stock Exchange is the principal market on which our common stock is traded, under the ticker symbol MAS. On January 31, 2020,2023, there were approximately 3,1002,600 holders of record of our common stock.

We expect that our practice of paying quarterly dividends on our common stock will continue, although the payment of future dividends is at the discretion of our Board of Directors and will depend upon our earnings, capital requirements, financial condition and other factors. The Board of Directors declared a quarterly dividend of $0.285 per share in the first quarter of 2023 with the intention to increase the annual dividend to $1.14 per share.

16

| Period | Total Number of Shares Purchased | Average Price Paid Per Common Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Value of Shares That May Yet Be Purchased Under the Plans or Programs | |||||||||

| 10/1/19 - 10/31/19 | 726,500 | $ | 42.52 | 726,500 | $ | 1,926,741,040 | |||||||

11/1/19 - 11/30/19 (A) | 7,869,212 | $ | 54.03 | 7,869,212 | $ | 1,501,539,755 | |||||||

| 12/1/19 - 12/31/19 | — | $ | — | — | $ | 1,501,539,755 | |||||||

| Total for the quarter | 8,595,712 | 8,595,712 | $ | 1,501,539,755 | |||||||||

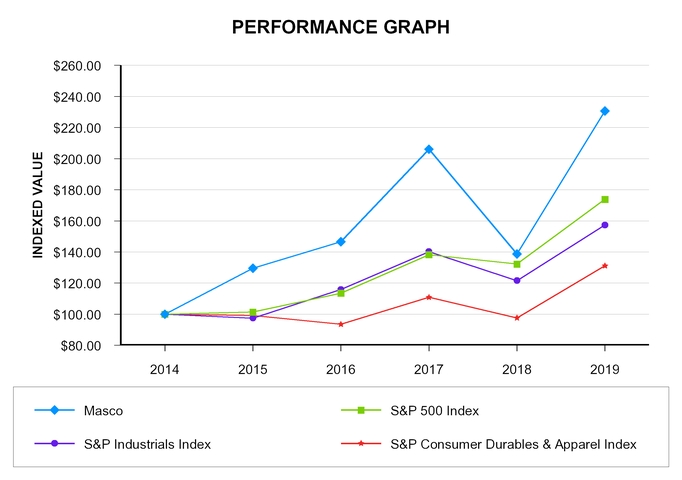

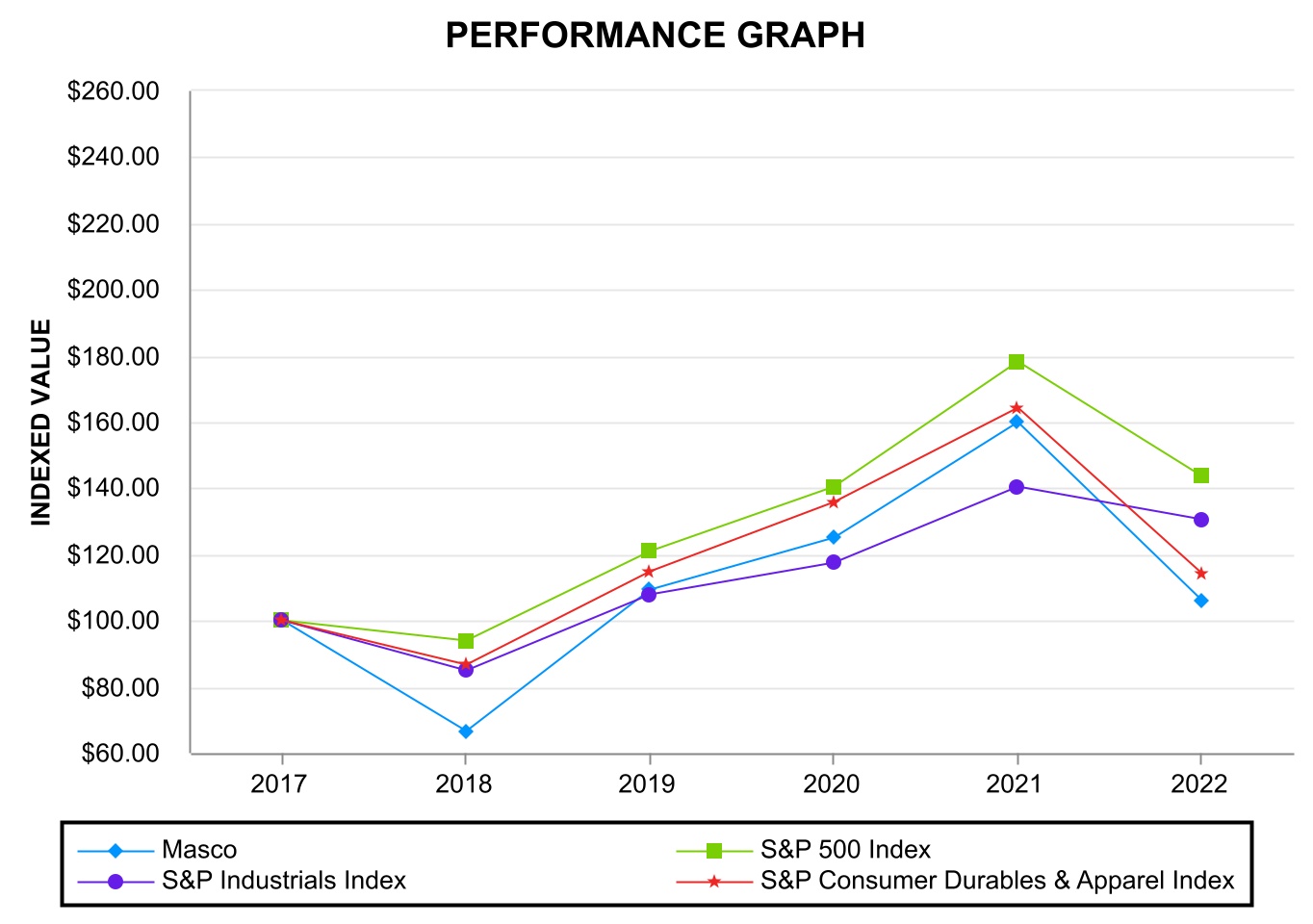

Performance Graph

The table below compares the cumulative total shareholder return on our common stock with the cumulative total return of (i) the Standard & Poor's 500 Composite Stock Index ("S&P 500 Index"), (ii) The Standard & Poor's Industrials Index ("S&P Industrials Index") and (iii) the Standard & Poor's Consumer Durables & Apparel Index ("S&P Consumer Durables & Apparel Index"), from December 31, 20142017 through December 31, 2019,2022, when the closing price of our common stock was $47.99.$46.67. The graph assumes investments of $100 on December 31, 20142017 in our common stock and in each of the three indices and the reinvestment of dividends.

The table below sets forth the value, as of December 31 for each of the years indicated, of a $100 investment made on December 31, 20142017 in each of our common stock, the S&P 500 Index, the S&P Industrials Index and the S&P Consumer Durables & Apparel Index and includes the reinvestment of dividends.

| 2018 | 2019 | 2020 | 2021 | 2022 | |||||||||||||||||||||||||

| Masco | $ | 66.55 | $ | 109.22 | $ | 125.01 | $ | 159.81 | $ | 106.21 | |||||||||||||||||||

| S&P 500 Index | $ | 93.76 | $ | 120.84 | $ | 140.49 | $ | 178.27 | $ | 143.61 | |||||||||||||||||||

| S&P Industrials Index | $ | 85.00 | $ | 107.81 | $ | 117.52 | $ | 140.32 | $ | 130.35 | |||||||||||||||||||

| S&P Consumer Durables & Apparel Index | $ | 86.69 | $ | 114.67 | $ | 135.78 | $ | 164.21 | $ | 114.07 | |||||||||||||||||||

Item 6. [Reserved]

17

| 2015 | 2016 | 2017 | 2018 | 2019 | |||||||||||||||

| Masco | $ | 129.60 | $ | 146.62 | $ | 206.07 | $ | 138.69 | $ | 230.60 | |||||||||

| S&P 500 Index | $ | 101.38 | $ | 113.51 | $ | 138.29 | $ | 132.23 | $ | 173.86 | |||||||||

| S&P Industrials Index | $ | 97.47 | $ | 115.85 | $ | 140.22 | $ | 121.58 | $ | 157.29 | |||||||||

| S&P Consumer Durables & Apparel Index | $ | 99.25 | $ | 93.48 | $ | 110.85 | $ | 97.60 | $ | 131.17 | |||||||||

| Dollars in Millions (Except Per Common Share Data) | |||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||

Net sales (1)(2) | $ | 6,707 | $ | 6,654 | $ | 6,014 | $ | 5,754 | $ | 5,513 | |||||||||

Operating profit (1)(2)(3) | 1,088 | 1,077 | 1,029 | 986 | 798 | ||||||||||||||

Income from continuing operations attributable to Masco Corporation (1)(2) | 639 | 636 | 426 | 426 | 282 | ||||||||||||||

Income per common share from continuing operations (1)(2): | |||||||||||||||||||

| Basic | $ | 2.21 | $ | 2.06 | $ | 1.34 | $ | 1.29 | $ | 0.82 | |||||||||

| Diluted | 2.20 | 2.05 | 1.33 | 1.28 | 0.81 | ||||||||||||||

| Dividends declared | 0.510 | 0.450 | 0.410 | 0.390 | 0.370 | ||||||||||||||

| Dividends paid | 0.495 | 0.435 | 0.405 | 0.385 | 0.365 | ||||||||||||||

| At December 31: | |||||||||||||||||||

Total assets (2) | $ | 5,027 | $ | 5,393 | $ | 5,534 | $ | 5,164 | $ | 5,664 | |||||||||

| Long-term debt | 2,771 | 2,971 | 2,969 | 2,995 | 2,403 | ||||||||||||||

Shareholders' (deficit) equity (2) | (56 | ) | 69 | 183 | (96 | ) | 58 | ||||||||||||

Item 7.Management's Discussion and Analysis of Financial Condition and Results of Operations.

The financialfollowing discussion and business analysis below provides information which we believe is relevant to an assessment and understanding of our consolidated financial position, results of operations and cash flows. This financial and business analysis should be read in conjunction with, theand is qualified in its entirety by, our consolidated financial statements (and notes related thereto) and related notes.

We design, manufacture and distribute branded home improvement and building products. These products are sold primarily for repair and remodeling activity and, to a lesser extent, new home construction. We sell our products through home center retailers, online retailers, wholesalers and distributors, mass merchandisers, hardware stores, homebuilders, distributors, and direct to the consumer.consumer, professional contractors and homebuilders.

Recent Trends

Due to changing market conditions, we are experiencing, and may continue to experience, lower market demand for our products. We have been experiencing, and may continue to experience, elevated commodity and other input costs, elevated transportation costs and supply chain disruptions, particularly disruptions related to our ability to source products, components and raw materials. We have also been experiencing, and may continue to experience, employee-related cost inflation and constraints in hiring qualified employees. While still elevated, we have recently seen some reduction of certain costs, and we aim to offset the segment, the absencepotential unfavorable impact of the recognition of the inventory step-up adjustment established as part of the 2018 Kichler acquisition, and the benefits associated with cost savings initiatives. These positive impacts were partially offset by an increase in commodityour costs and lower sales volume across the segment, an increase in strategic growth investmentsdemand for our products with productivity improvement, pricing, and a non-cash impairment charge related to an other indefinite-lived intangible asset for a trademark associated with lighting products.initiatives.

We regularly reviewdiscuss our estimates and assumptions, which are based upon historical experience,consolidated results as well as current economic conditionsour Business Segment and various other factors that we believe to be reasonable under the circumstances, theGeographic Area results of which formoperations for the basis for making judgments about the carrying values of certain assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates and assumptions.

18

SALES AND OPERATIONS

Net Sales

Below is a summary of our productsnet sales, in millions, for the years ended December 31, 2022 and 2021:

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | Change | |||||||||||||||

| Net sales, as reported | $ | 8,680 | $ | 8,375 | $ | 305 | |||||||||||

| Acquisitions | (11) | — | (11) | ||||||||||||||

| Divestitures | — | (32) | 32 | ||||||||||||||

| Net sales, excluding acquisitions and divestitures | 8,669 | 8,343 | 326 | ||||||||||||||

| Currency translation | 211 | — | 211 | ||||||||||||||

| Net sales, excluding acquisitions, divestitures and the effect of currency translation | $ | 8,880 | $ | 8,343 | $ | 537 | |||||||||||

Net sales for 2022 were $8.7 billion, which increased four percent compared to 2021. Excluding acquisitions, divestitures and the effect of currency translation, net sales increased six percent.

Net sales for 2022 increased primarily due to:

•Higher net selling prices across the entire company which increased sales by nine percent.

These amounts were partially offset by:

•Lower sales volume which decreased sales by three percent.

•Unfavorable foreign currency translation which decreased sales by two percent.

Gross Profit and Gross Margin

Below is transferreda summary of our gross profit, in millions, and gross margin for the years ended December 31, 2022 and 2021:

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | Favorable / (Unfavorable) | |||||||||||||||

| Gross profit | $ | 2,713 | $ | 2,863 | $ | (150) | |||||||||||

| Gross margin | 31.3 | % | 34.2 | % | (290) bps | ||||||||||||

The 2022 gross profit margin was negatively impacted by:

•Increased commodity and transportation costs.

•Higher costs due to production inefficiencies and related under absorption, as well as higher excess and obsolete inventory charges resulting from business rationalization activities.

•Lower sales volume.

•Unfavorable sales mix.

These amounts were partially offset by:

•Higher net selling prices.

19

Selling, General and Administrative Expenses

Below is a summary of our customers, whichselling, general and administrative expenses, in millions, and selling, general and administrative expenses as a percentage of net sales for the years ended December 31, 2022 and 2021:

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | (Favorable) / Unfavorable | |||||||||||||||

| Selling, general and administrative expenses | $ | 1,390 | $ | 1,413 | $ | (23) | |||||||||||

| Selling, general and administrative expenses as percentage of net sales | 16.0 | % | 16.9 | % | (90) bps | ||||||||||||

Selling, general, and administrative expenses as a percentage of net sales in 2022 was positively impacted by:

•Higher net sales resulting from favorable net selling prices.

•Lower variable compensation.

These amounts were partially offset by:

•Increased marketing costs.

Operating Profit

Below is generally ata summary of our operating profit, in millions, and operating profit margins for the time of shipment or upon delivery based on the contractual terms with our customers. We provide customer programsyears ended December 31, 2022 and incentive offerings, including special pricing2021:

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | Change | |||||||||||||||

| Operating profit, as reported | $ | 1,297 | $ | 1,405 | $ | (108) | |||||||||||

| Rationalization charges | 32 | 4 | 28 | ||||||||||||||

| Impairment charges for goodwill and other intangible assets | 26 | 45 | (19) | ||||||||||||||

| Operating profit, excluding rationalization charges and impairment charges | $ | 1,355 | $ | 1,454 | $ | (99) | |||||||||||

| Operating profit margin, as reported | 14.9 | % | 16.8 | % | (190) bps | ||||||||||||

| Operating profit margin, excluding rationalization charges and impairment charges | 15.6 | % | 17.4 | % | (180) bps | ||||||||||||

Operating profit in 2022 was negatively impacted by:

•Increased commodity and co-operative advertising arrangements, promotionstransportation costs.

•Higher costs due to production inefficiencies and related under absorption, as well as higher excess and obsolete inventory charges resulting from business rationalization activities.

•Lower sales volume.

•Unfavorable foreign currency translation.

•Increased marketing costs.

•Unfavorable sales mix.

These amounts were partially offset by:

•Higher net selling prices.

•Lower variable compensation.

•Lower goodwill and other volume-based incentives. These customer programs and incentives are considered variable consideration. We includeintangible assets impairment charges in revenue variable consideration only to the extent that itour lighting business.

20

OTHER INCOME (EXPENSE), NET

Interest Expense

Below is probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the variable consideration is resolved. This determination is made based upon known customer program and incentive offerings at the time of sale, and expected sales volume forecasts as it relates to our volume-based incentives. This determination is updated each reporting period.

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | Favorable / (Unfavorable) | |||||||||||||||

| Interest expense | $ | (108) | $ | (278) | $ | 170 | |||||||||||

The decrease in interest expense is recorded for customer incentive rebates and is generally based upon sales activity.

Other, net

Below is a $35 million impairment to one of our reporting units.

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | Favorable / (Unfavorable) | |||||||||||||||

| Other, net | $ | 4 | $ | (439) | $ | 443 | |||||||||||

Other, net, for 2022 included:

•$24 million of income from the revaluation of contingent consideration related to a $3prior acquisition.

This amount was partially offset by:

•$10 million impairmentof net periodic pension and post-retirement benefit expense.

•$6 million of losses related to equity method investments.

Other, net, for one2021 included:

•$430 million of our trade names.

•$18 million loss related to the divestiture of our Hüppe GmbH ("Hüppe") business.

•$16 million expense from the revaluation of contingent consideration related to a resultprior acquisition.

These amounts were partially offset by:

•$14 million gain recognized on the redemption of this decision, the projected benefit obligationspreferred stock of ACProducts Holding, Inc. and $6 million of related dividend income.

•$11 million of earnings related to equity method investments.

21

INCOME TAXES

Below is a summary of our income tax expense, in millions, and our effective tax rate for these plans were increasedthe years ended December 31, 2022 and 2021:

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | (Favorable) / Unfavorable | |||||||||||||||

| Income tax expense | $ | 288 | $ | 210 | $ | 78 | |||||||||||

| Effective tax rate | 24 | % | 31 | % | (7) | % | |||||||||||

Our 2021 income tax expense included $16 million due to reflect the incremental costs to terminate the plans. Upon termination in 2021, we expect to recognizeelimination of disproportionate tax effects from accumulated other comprehensive loss approximately $420income related to our debt retirement and pension plan termination and $18 million of pre-tax actuarialdue to losses and approximately $90 million of incomeproviding no tax benefit which includes approximately $11 million of tax expensein certain jurisdictions from the elimination of a disproportionate tax effect.

Refer to Note MS to the consolidated financial statements for additional information.

INCOME AND INCOME PER COMMON SHARE FROM CONTINUING OPERATIONS- ATTRIBUTABLE TO MASCO CORPORATION

Below is a summary of our income and diluted income per common share from continuing operations, in millions, except per share data, for the years ended December 31, 2022 and 2021:

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | Favorable / (Unfavorable) | |||||||||||||||

| Income from continuing operations | $ | 844 | $ | 410 | $ | 434 | |||||||||||

| Diluted income per common share from continuing operations | $ | 3.63 | $ | 1.62 | $ | 2.01 | |||||||||||

22

Business Segment and Geographic Area Results

The following table sets forth our net sales and operating profit information for our qualified defined-benefit pension plans to be $30 millioncontinuing operations by Business Segment and Geographic Area, dollars in 2020 compared with $16 million in 2019millions.

| Year Ended December 31, | Percent Change | |||||||||||||||||||

| 2022 | 2021 | 2022 vs. 2021 | ||||||||||||||||||

| Net Sales: | ||||||||||||||||||||

| Plumbing Products | $ | 5,252 | $ | 5,135 | 2 | % | ||||||||||||||

| Decorative Architectural Products | 3,428 | 3,240 | 6 | % | ||||||||||||||||

| Total | $ | 8,680 | $ | 8,375 | 4 | % | ||||||||||||||

| North America | $ | 6,978 | $ | 6,624 | 5 | % | ||||||||||||||

| International, principally Europe | 1,702 | 1,751 | (3) | % | ||||||||||||||||

| Total | $ | 8,680 | $ | 8,375 | 4 | % | ||||||||||||||

| Year Ended December 31, | Percent Change | |||||||||||||||||||

| 2022 | 2021 | 2022 vs. 2021 | ||||||||||||||||||

| Operating Profit (A): | ||||||||||||||||||||

| Plumbing Products | $ | 819 | $ | 929 | (12) | % | ||||||||||||||

| Decorative Architectural Products | 565 | 581 | (3) | % | ||||||||||||||||

| Total | $ | 1,384 | $ | 1,510 | (8) | % | ||||||||||||||

| North America | $ | 1,116 | $ | 1,214 | (8) | % | ||||||||||||||

| International, principally Europe | 268 | 296 | (9) | % | ||||||||||||||||

| Total | 1,384 | 1,510 | (8) | % | ||||||||||||||||

| General corporate expense, net | (87) | (105) | (17) | % | ||||||||||||||||

| Total operating profit | $ | 1,297 | $ | 1,405 | (8) | % | ||||||||||||||

(A). If we assumed that the future return on plan assets was 50 basis points lower than the assumed asset return and the discount rate decreased by 50 basis points, the2020pensionBefore general corporate expense, would increase by$5 million. Assuming a 0 percent asset return for our qualified domestic defined-benefit pension plans, projected 2020 total qualified defined-benefit pension plan expenses are expected to be approximately $37 million. We expect pension expense for our non-qualified defined-benefit pension plans to be $8 million in2020, consistent with the pension expense recognized in 2019.

Changes in future periods. Possible sources of taxable income

23

Plumbing Products

Sales

Net sales in the Plumbing Products segment increased two percent in 2022 due primarily to favorable net selling prices, which increased sales by seven percent, and projected future taxable income.

Operating profit in the future, an adjustmentPlumbing Products segment in 2022 was negatively impacted by increased commodity and transportation costs, higher costs due to the valuation allowance would be recordedproduction inefficiencies and related under absorption, higher excess and obsolete inventory charges resulting from business rationalization activities, unfavorable foreign currency translation, increased marketing costs and unfavorable sales mix. These amounts were partially offset by favorable net selling prices and, to a lesser extent, lower variable compensation.

Decorative Architectural Products

Sales

Net sales in the period such determination is made. The need to maintain a valuation allowance against deferred tax assets may cause greater volatilityDecorative Architectural Products segment increased six percent in our effective tax rate.

Operating Results

Operating profit in the U.S. Federal corporate tax rate from 35 percent to 21 percentDecorative Architectural Products segment in 2022 was negatively impacted by increased commodity and the additional U.S. taxes on our foreign earnings. The continued impact from U.S. tax reform may differ from our current estimatestransportation costs, lower sales volume, higher costs due to the issuanceproduction inefficiencies and finalization of future regulatory guidance.related under absorption, higher excess and obsolete inventory charges resulting from business rationalization activities, and increased marketing costs. These amounts were partially offset by favorable net selling prices and lower goodwill and other intangible assets impairment charges in our lighting business.

Operating Results

North America operating profit in 2022 was negatively impacted by increased commodity and transportation costs, lower sales volume, higher costs due to determineproduction inefficiencies and related under absorption, higher excess and obsolete inventory charges resulting from business rationalization activities, and increased marketing costs. These amounts were partially offset by favorable net selling prices, and to a lesser extent, lower variable compensation and lower goodwill and other intangible assets impairment charges in our lighting business.

International, Principally Europe

Sales

International net sales decreased three percent in 2022. In local currencies (including sales in currencies outside their respective functional currencies), net sales increased eight percent. Favorable net selling prices of plumbing products increased sales by six percent. Higher sales volume of plumbing products increased sales by five percent. These amounts were partially offset by the divestiture of our Hüppe business which businesses, if any, may not align with our long-term growth strategy.decreased sales by two percent and unfavorable sales mix which decreased sales by two percent.

24

International operating profit in 2022 was negatively impacted by increased commodity and transportation costs, unfavorable foreign currency translation, wage inflation, and unfavorable sales mix. These amounts were partially offset by favorable net selling prices and higher sales volume of plumbing products.

Liquidity and Capital Resources

Overview of Capital Structure

Historically, we have largely funded our growth through cash provided by our operations, the issuance of notes in the financial markets, bank borrowings and the issuance of our common stock, including issuances for certain mergers and acquisitions. Maintaining high levels of liquidity and focusing on cash generation are among our financial strategies. Our capital allocation strategy includes reinvesting in our business, balancing share repurchases with potential acquisitions and maintaining an appropriatea relevant dividend.

We had cash and cash investments of approximately $452 million and $926 million at December 31, 2022 and 2021, respectively. Our cash and cash investments consist of overnight interest bearing money market demand accounts, time deposit accounts, and money market mutual funds containing government securities and treasury obligations. While we attempt to diversify these investments in a prudent manner to minimize risk, it is possible that future changes in the financial markets could affect the security or availability of these investments. Of the cash and cash investments we held at December 31, 2022 and 2021, $321 million and $490 million, respectively, was held in our foreign subsidiaries. If these funds were needed for our operations in the U.S., their repatriation into the U.S. would not result in significant additional U.S. income tax or foreign withholding tax, as we have recorded such taxes on substantially all undistributed foreign earnings, except for those that are legally restricted.

Our current ratio was 1.6 to 1 and 1.8 to 1 at December 31, 2022 and 2021, respectively. The decrease in our current ratio is primarily due to the 364-day $500 million term loan that we entered into on April 26, 2022.

Our total debt as a percent of total capitalization was 102109 percent and 98 percent at December 31, 20192022 and 2018,2021, respectively. Refer to Note KL to the consolidated financial statements for additional information.

Capital Expenditures

We continue to invest in our manufacturing and Milgard businessesdistribution operations to increase our productivity, improve customer service and entered into a definitive agreementsupport product innovation. Capital expenditures for 2022 were $224 million, compared with $128 million for 2021. The increase in capital expenditures in 2022 was primarily due to sellcapacity expansion plans in our Masco Cabinetry business. With the combinedPlumbing Products and Decorative Architectural Products segments. For 2023, capital expenditures, excluding any potential future acquisitions, are expected to be approximately $250 million. Depreciation and amortization expense for 2022 totaled $145 million, compared with $151 million for 2021. For 2023, depreciation and amortization expense, excluding any potential future acquisitions, is expected to be approximately $150 million. Amortization expense totaled $33 million in 2022, compared with $40 million in 2021.

25

Senior Indebtedness

On March 4, 2021, we issued $600 million of 1.500% Notes due February 15, 2028, $600 million of 2.000% Notes due February 15, 2031 and $300 million of 3.125% Notes due February 15, 2051. We received proceeds of $722$1,495 million, net of discount, for the UKWGissuance of these Notes. The Notes are senior indebtedness and Milgard divestitures, we executed an accelerated stock repurchase agreementare redeemable at our option at the applicable redemption price. On March 22, 2021, proceeds from the debt issuances, together with cash on hand, were used to repurchase $400repay and early retire our $326 million of our common stock. This repurchase is under Masco's existing share repurchase authorization of $2.0 billion of shares of our common stock, which was approved in September 2019. During 2019, including the accelerated stock repurchase agreement, we repurchased 20.1 million shares of our common stock for cash aggregating $896 million.

On March 13, 2019,April 26, 2022, we entered into a revolving credit agreement (the "Credit Agreement"“2022 Credit Agreement”) with an aggregate commitment of $1.0 billion and a maturity date of April 26, 2027. Upon entry into the 2022 Credit Agreement, our credit agreement dated March 13, 2024. 2019, as amended, with an aggregate commitment of $1.0 billion, was terminated.

Under the 2022 Credit Agreement, at our request and subject to certain conditions, we can increase the aggregate commitment up to an additional $500 million with the current lenders or new lenders. Upon entry into the Credit Agreement, our credit agreement dated March 28, 2013, as amended, with an aggregate commitment of $750 million, was terminated. See Note KL to the consolidated financial statements.statements for additional information.

The 2022 Credit Agreement contains financial covenants requiring us to maintain (A) a net leverage ratio, as adjusted for certain items, not exceeding 4.0 to 1.0, and (B) a minimuman interest coverage ratio, as adjusted for certain items, not less than 2.5 to 1.0. We were in compliance with all covenants and no borrowings were outstanding under our 2022 Credit Agreement at December 31, 2019.2022. As of the date of this report, $69 million was borrowed and outstanding at a weighted average interest rate of 5.800%.

364-day Term Loan

On March 9, 2018,April 26, 2022, we entered into a 364-day $500 million senior unsecured delayed draw term loan due April 26, 2023 with a syndicate of lenders. The senior unsecured term loan and commitments thereunder are subject to prepayment or termination at our option and the loans will bear interest at SOFR plus a spread adjustment and 0.70%. The covenants, including the financial covenants, are substantially the same as those in the 2022 Credit Agreement. We repaid $300 million during 2022.

Corporate Development Strategy

We expect to maintain a balanced growth strategy pursuing organic growth by maximizing the full potential of our existing businesses and, as appropriate, complementing our existing business with strategic acquisitions.

In addition, we actively manage our portfolio of companies by divesting those businesses that do not align with our long-term growth strategy. We will continue to review all of our businesses to determine which businesses, if any, may not align with our long-term growth strategy.

Acquisitions

During 2021, our Hansgrohe SE subsidiary acquired substantiallya 75.1 percent equity interest in Easy Sanitary Solutions B.V., a manufacturer of shower channel drains that offers a wide range of products for barrier-free showering and bathroom wall niches, for approximately €47 million ($58 million), including $52 million of cash and $6 million of debt that will be paid out over two years. During 2021, we also acquired all of the net assetsshare capital of Kichler. The purchase price, netSteamist, Inc., a manufacturer of $2 million cash acquired, consisted of $549 million paid with cash on hand.

Divestitures

During 2021, we completed the scheduled repayment date.

26

Share Repurchases

We repurchased and retired 16.6 million shares of our common stock in 2022 for approximately $914 million. This included 0.6 million shares to offset the dilutive impact of restricted stock units granted in 2022. Effective October 20, 2022, our Board of Directors authorized the repurchase, for retirement, of up to $2.0 billion of shares of our common stock in open-market transactions or otherwise, replacing the previous Board of Directors authorization established in 2021. At December 31, 2022, we had $2.0 billion remaining under the 2022 authorization. Consistent with past practice and as part of our long-term capital allocation strategy, we anticipate using approximately $500 million of cash for share repurchases (including shares which was recordedwill be purchased to offset any dilution from restricted stock units granted as interest expense.part of our compensation programs) in 2023. Refer to Note O to the consolidated financial statements for additional information.

Dividend to holders of our Common Shares

We paid a quarterly dividend of $0.28 per common share for an annual dividend of $1.12 per share.

As part of our capital allocation strategy, the Board of Directors declared a quarterly dividend of $0.285 per share in the first quarter of 2023 with the intention to increase the annual dividend to $1.14 per share.

Other Liquidity and Capital Resource Activities

As part of our ongoing efforts to improve our cash flow and related liquidity, we work with suppliers to optimize our terms and conditions, including extending payment terms. We also facilitate a voluntary supply chain finance program (the "program") to provide certain of our suppliers with the opportunity to sell receivables due from us to participating financial institutions at the sole discretion of both the suppliers and the financial institutions. A third party administers the program; our responsibility is limited to making payment on the terms originally negotiated with our supplier, regardless of whether the supplier sells its receivable to a financial institution. We do not enter into agreements with any of the participating financial institutions in connection with the program. The range of payment terms we negotiate with our suppliers is consistent, irrespective of whether a supplier participates in the program.

All outstanding payments owed under the program are recorded within accounts payable in our consolidated balance sheets. The amounts owed to participating financial institutions under the program and included in accounts payable for our continuing operations were $29 million and $35$43 million at December 31, 20192022 and 2018,2021, respectively. We account for all payments made under the program as a reduction to our cash flows from operations and reported within our (decrease) increase in accounts payable and accrued liabilities, net, line within our consolidated statements of cash flows. The amounts settled through the program and paid to participating financial institutions were $164 million, $117$188 million and $186$220 million for our continuing operations during the years ended December 31, 2019, 2018,2022 and 2017,2021, respectively. A downgrade in our credit rating or changes in the financial markets could limit the financial institutions’ willingness to commit funds to, and participate in, the program. We do not believe such risk would have a material impact on our working capital or cash flows, as substantially all of our payments are made outside of the program.

We had cash and cash investments of approximately $697 million at December 31, 2019. Our cash and cash investments consist of overnight interest bearing money market demand accounts, time deposit accounts, and money market mutual funds containing government securities and treasury obligations. While we attempt to diversify these investments in a prudent manner to minimize risk, it is possible that future changes in the financial markets could affect the security or availability of these investments.

27

Cash Flows

Significant sources and (uses) of cash infor the past three years ended December 31, 2022 and 2021 are summarized as follows, in millions:

| 2022 | 2021 | ||||||||||

| Net cash from operating activities | $ | 840 | $ | 930 | |||||||

| Retirement of notes | — | (1,326) | |||||||||

| Purchase of Company common stock | (914) | (1,026) | |||||||||

| Cash dividends paid | (258) | (211) | |||||||||

| Dividends paid to noncontrolling interest | (68) | (43) | |||||||||

| Capital expenditures | (224) | (128) | |||||||||

| Proceeds from term loan | 500 | — | |||||||||

| Payment of term loan | (300) | — | |||||||||

| Debt extinguishment costs | — | (160) | |||||||||

| Proceeds from the exercise of stock options | 1 | 5 | |||||||||

| Acquisition of businesses, net of cash acquired | — | (57) | |||||||||

| Issuance of notes, net of issuance costs | — | 1,481 | |||||||||

| Employee withholding taxes paid on stock-based compensation | (17) | (15) | |||||||||

| Proceeds from disposition of: | |||||||||||

| Businesses, net of cash disposed | — | 5 | |||||||||

| Property and equipment | 1 | — | |||||||||

| Financial investments | 1 | 171 | |||||||||

| Payment of debt | (10) | (3) | |||||||||

| Effect of exchange rate changes on cash and cash investments | (18) | (20) | |||||||||

| Other, net | (8) | (3) | |||||||||

| Cash decrease | $ | (474) | $ | (400) | |||||||

| 2019 | 2018 | 2017 | |||||||||

| Net cash from operating activities | $ | 833 | $ | 1,032 | $ | 751 | |||||

| Retirement of notes | (201 | ) | (114 | ) | (535 | ) | |||||

| Purchase of Company common stock | (896 | ) | (654 | ) | (331 | ) | |||||

| Cash dividends paid | (144 | ) | (134 | ) | (129 | ) | |||||

| Dividends paid to noncontrolling interest | (42 | ) | (89 | ) | (35 | ) | |||||

| Capital expenditures | (162 | ) | (219 | ) | (173 | ) | |||||

| Debt extinguishment costs | (2 | ) | — | (104 | ) | ||||||

| Acquisition of businesses, net of cash acquired | — | (549 | ) | (89 | ) | ||||||

| Issuance of notes, net of issuance costs | — | — | 593 | ||||||||

| Employee withholding taxes paid on stock-based compensation | (23 | ) | (42 | ) | (33 | ) | |||||

| Proceeds from disposition of: | |||||||||||

| Businesses, net of cash disposed | 722 | — | 128 | ||||||||

| Property and equipment | 34 | 14 | 24 | ||||||||

| Financial investments | 1 | 5 | 7 | ||||||||

| Decrease in debt, net | (8 | ) | (1 | ) | (3 | ) | |||||

| Proceeds of short-term bank deposits, net | — | 108 | 112 | ||||||||

| Effect of exchange rate changes on cash and cash investments | 14 | 4 | 55 | ||||||||

| Other, net | 12 | 4 | (34 | ) | |||||||

| Cash increase (decrease) | $ | 138 | $ | (635 | ) | $ | 204 | ||||

Our working capital days were as follows:

| At December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Receivable days | 53 | 51 | |||||||||

| Inventory days | 80 | 85 | |||||||||

| Accounts payable days | 68 | 66 | |||||||||

| Working capital (receivables plus inventories, less accounts payable) as a percentage of net sales | 17.4 | % | 16.0 | % | |||||||

| At December 31, | |||||

| 2019 | 2018 | ||||

| Receivable days | 54 | 54 | |||

| Inventory days | 67 | 71 | |||

| Accounts Payable days | 68 | 69 | |||

| Working capital (receivables plus inventories, less accounts payable) as a percentage of net sales | 15.7 | % | 15.8 | % | |

Net cash provided by operations of $833$840 million consisted primarily of net income adjusted for certain non-cash items, including depreciation and amortization expense of $159 million, stock-based compensation expense and amortization expense related to in-store displays, as well as employee withholding taxes paid on stock-based compensation, which is classified as a financing activity. These amounts werebenefited from operating profit, partially offset by the net gain on the sale of Milgardchanges in working capital, primarily lower accounts payable and UKWG as well as contributions to our defined-benefit pension plans.accrued liabilities balances.

Financing Activities

Net cash used for financing activities was $1,291$1,066 million, primarily due to $896$914 million for the repurchase and retirement of Company common stock (as part of our strategic initiative to drive shareholder value), $201 million for the early retirement of our 7.125% Notes due March 15, 2020, $144 million for the payment of cash dividends, $42 million for dividends paid to noncontrolling interests and $23 million for employee withholding taxes paid on stock-based compensation. These uses of cash were slightly offset by $27 million of proceeds from the exercise of stock options.

28

Investing Activities

Net cash provided byused for investing activities was $582$230 million, primarily driven by $720$224 million of proceeds from the sale of Milgard, net of cash disposed, partially offset by $162 million for capital expenditures.

Year Ended December 31 | |||||||

| 2019 | 2018 | ||||||

| Net sales, as reported | $ | 6,707 | $ | 6,654 | |||

| Acquisitions | (65 | ) | — | ||||

| Net sales, excluding acquisitions | 6,642 | 6,654 | |||||

| Currency translation | 77 | — | |||||

| Net sales, excluding acquisitions and the effect of currency translation | $ | 6,719 | $ | 6,654 | |||

| 2019 | 2018 | 2017 | |||||||||

| Operating profit, as reported | $ | 1,088 | $ | 1,077 | $ | 1,029 | |||||

| Rationalization charges | 13 | 9 | 2 | ||||||||

| Kichler inventory step up adjustment | — | 40 | — | ||||||||

| Impairment charge for other intangible assets | 9 | — | — | ||||||||

| Operating profit, as adjusted | $ | 1,110 | $ | 1,126 | $ | 1,031 | |||||

| Operating profit margins, as reported | 16.2 | % | 16.2 | % | 17.1 | % | |||||

| Operating profit margins, as adjusted | 16.5 | % | 16.9 | % | 17.1 | % | |||||

Percent Change | |||||||||||||||||

| 2019 | 2018 | 2017 | 2019 vs. 2018 | 2018 vs. 2017 | |||||||||||||

| Net Sales: | |||||||||||||||||

| Plumbing Products | $ | 3,984 | $ | 3,998 | $ | 3,732 | — | % | 7 | % | |||||||

| Decorative Architectural Products | 2,723 | 2,656 | 2,206 | 3 | % | 20 | % | ||||||||||

| Total | $ | 6,707 | $ | 6,654 | $ | 5,938 | 1 | % | 12 | % | |||||||

| North America | $ | 5,328 | $ | 5,208 | $ | 4,568 | 2 | % | 14 | % | |||||||

| International, principally Europe | 1,379 | 1,446 | 1,370 | (5 | )% | 6 | % | ||||||||||

| Total | $ | 6,707 | $ | 6,654 | $ | 5,938 | 1 | % | 12 | % | |||||||

Divestitures not included in discontinued operations (A) | — | — | 76 | ||||||||||||||

| Total net sales | $ | 6,707 | $ | 6,654 | $ | 6,014 | 1 | % | 11 | % | |||||||

| 2019 | 2018 | 2017 | |||||||||

| Operating Profit: (B) | |||||||||||

| Plumbing Products | $ | 708 | $ | 715 | $ | 702 | |||||

| Decorative Architectural Products | 480 | 456 | 438 | ||||||||

| Total | $ | 1,188 | $ | 1,171 | $ | 1,140 | |||||

| North America | $ | 987 | $ | 954 | $ | 924 | |||||

| International, principally Europe | 201 | 217 | 216 | ||||||||

| Total | 1,188 | 1,171 | 1,140 | ||||||||

| General corporate expense, net | (100 | ) | (94 | ) | (105 | ) | |||||

Divestitures not included in discontinued operations (A) | — | — | (6 | ) | |||||||

| Total operating profit | $ | 1,088 | $ | 1,077 | $ | 1,029 | |||||

Commitments and Contingencies

Litigation

Information regarding our legal proceedings is set forth in Note TU to the consolidated financial statements, which is incorporated herein by reference.

Other Commitments

We enter into contracts, which include reasonable and customary indemnifications that are standard for the industries in which we operate. Such indemnifications include claims made against builders by homeowners for issues relating to our products and workmanship. In conjunction with divestitures and other transactions, we occasionally provide reasonable and customary indemnifications. We have never had to paynot paid a material amount related to these indemnifications, and we evaluate the probability that amounts may be incurred and record an estimated liability when probable and reasonably estimable.

Contractual Obligations

The following table provides payment obligations related to current contracts at December 31, 2022, in millions:

| Payments Due by Period | |||||||||||||||||||||||||||||||||||

| 2023 | 2024-2025 | 2026-2027 | Beyond 2027 | Other | Total | ||||||||||||||||||||||||||||||

Debt (A) | $ | 205 | $ | 6 | $ | 304 | $ | 2,644 | $ | — | $ | 3,159 | |||||||||||||||||||||||

Interest (A) | 101 | 194 | 192 | 738 | — | 1,225 | |||||||||||||||||||||||||||||

| Operating leases | 50 | 89 | 68 | 174 | — | 381 | |||||||||||||||||||||||||||||

| Currently payable income taxes | 48 | — | — | — | — | 48 | |||||||||||||||||||||||||||||

Purchase commitments (B) | 438 | 64 | 35 | — | — | 537 | |||||||||||||||||||||||||||||

Uncertain tax positions, including interest and penalties (C) | — | — | — | — | 92 | 92 | |||||||||||||||||||||||||||||

| Total | $ | 842 | $ | 353 | $ | 599 | $ | 3,556 | $ | 92 | $ | 5,442 | |||||||||||||||||||||||

(A)We assume that all debt would be held to maturity. Amounts include finance lease obligations.

(B)Excludes contracts that do not require volume commitments and open or pending purchase orders.

(C)Due to the high degree of uncertainty regarding the timing of future cash outflows associated with uncertain tax positions, we are unable to make a reasonable estimate for the year in which cash settlements may occur with applicable tax authorities.

Refer to Note N to the consolidated financial statements for defined-benefit pension plan obligations.

29

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with GAAP. The preparation of these financial statements requires us to make certain estimates and assumptions that affect or could have affected the reported amounts of assets and liabilities, disclosure of any contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. We regularly review our estimates and assumptions, which are based upon historical experience, as well as current economic conditions and various other factors that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of certain assets and liabilities and related disclosures, and future revenues and expenses, that are not readily apparent from other sources. Actual results may differ from these estimates and assumptions.

Note A to the consolidated financial statements includes our accounting policies, estimates and methods used in the preparation of our consolidated financial statements.

We believe that the following critical accounting policies are affected by significant judgments and estimates used in the preparation of our consolidated financial statements.

Revenue Recognition

We recognize revenue as control of our products is transferred to our customers, which is generally at the time of shipment or upon delivery based on the contractual terms with our customers. We provide customer programs and incentive offerings, including special pricing and co-operative advertising arrangements, promotions and other volume-based incentives. These customer programs and incentives are considered variable consideration. We include in revenue variable consideration only to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the variable consideration is resolved. This determination is made based upon known customer program and incentive offerings at the time of sale, and expected sales volume forecasts as it relates to our volume-based incentives. This determination is updated each reporting period.

Goodwill and Other Intangible Assets

We record the excess of purchase cost over the fair value of net tangible assets of acquired companies as goodwill or other identifiable intangible assets. In the fourth quarter of each year, or as events occur or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount, we complete the impairment testing of goodwill utilizing a discounted cash flow method. We selected the discounted cash flow methodology because we believe that it is comparable to what would be used by market participants. We have defined our reporting units and completed the impairment testing of goodwill at the operating segment level.

Determining market values using a discounted cash flow method requires us to make significant estimates and assumptions, including long-term projections of cash flows, market conditions and appropriate discount rates. Our judgments are based upon historical experience, current market trends, consultations with external valuation specialists and other information. While we believe that the estimates and assumptions underlying the valuation methodology are reasonable, different estimates and assumptions could result in different outcomes. In estimating future cash flows, we rely on internally generated five-year forecasts for sales and operating profits, and, currently, a two percent to three percent long-term assumed annual growth rate of cash flows for periods after the five-year forecast. We generally develop these forecasts based upon, among other things, recent sales data for existing products, planned timing of new product launches, estimated repair and remodel activity and, to a lesser extent, estimated housing starts. Our assumptions included U.S. and Eurozone Gross Domestic Product growing at approximately 1.3 percent and 1.5 percent, respectively, in 2023, and 2.0 percent and 1.5 percent, respectively, per annum over the remainder of the five-year forecast.

We utilize our weighted average cost of capital of approximately 8.75 percent as the basis to determine the discount rate to apply to the estimated future cash flows. In 2022, based upon our assessment of the risks impacting each of our businesses, we applied a risk premium to increase the discount rate to a range of 10.25 percent to 12.75 percent for our reporting units.

30

If the carrying amount of a reporting unit exceeds its fair value, an impairment loss is recognized to the extent that a reporting unit's recorded carrying value exceeds its fair value, not to exceed the carrying amount of goodwill in that reporting unit.

In the fourth quarter of 2022, we recognized a $19 million non-cash goodwill impairment charge related to a reporting unit within our Decorative Architectural Products segment due to competitive market conditions, higher inflationary costs and increased cost of capital in our lighting business. There is no remaining goodwill associated with the impaired reporting unit. A 10 percent decrease in the estimated fair value of our other reporting units would not have resulted in any additional goodwill impairment.

We review our other indefinite-lived intangible assets for impairment annually, in the fourth quarter, or as events occur or circumstances change that indicate the assets may be impaired without regard to the business unit. Potential impairment is identified by comparing the fair value of an other indefinite-lived intangible asset to its carrying value. We utilize a relief-from-royalty model to estimate the fair value of other indefinite-lived intangible assets. We consider the implications of both external (e.g., market growth, competition and local economic conditions) and internal (e.g., product sales and expected product growth) factors and their potential impact on cash flows related to the intangible asset in both the near- and long-term. We also consider the profitability of the business, among other factors, to determine the royalty rate for use in the impairment assessment.

We utilize our weighted average cost of capital of approximately 8.75 percent as the basis to determine the discount rate to apply to the estimated future cash flows. In 2022, based upon our assessment of the risks impacting each of our businesses and the nature of the other indefinite-lived intangible assets (i.e., trade name), we applied a risk premium to increase the discount rate to a range of 11.25 percent to 13.75 percent for our other indefinite-lived intangible assets.

If the carrying amount of an other indefinite-lived intangible asset exceeds its fair value, an impairment loss is recognized to the extent that an other indefinite-lived intangible asset's recorded carrying value exceeds its fair value, not to exceed the carrying amount of the other indefinite-lived intangible asset.

In the fourth quarter of 2022, we recognized a $7 million non-cash impairment charge related to a registered trademark within our Decorative Architectural Products segment due to competitive market conditions and increased cost of capital in our lighting business. As of December 31, 2022, the impaired other indefinite-lived intangible asset had a remaining net carrying value of $43 million. A 10 percent decrease in the estimated fair value of our other indefinite-lived intangibles assets would not have resulted in an impairment for any of our other indefinite-lived intangible assets.

Refer to Note H for additional information.

Income Taxes

We record deferred taxes on the future tax consequences of differences between the financial statement carrying value of our assets and liabilities and their respective tax basis. The realization of deferred tax assets depends on sufficient sources of taxable income in future periods. Possible sources of taxable income include taxable income in carryback periods, the future reversal of existing taxable temporary differences recorded as a deferred tax liability, tax-planning strategies that generate future income or gains and projected future taxable income.

If, based upon all available evidence, both positive and negative, it is more likely than not such deferred tax assets will not be realized, a valuation allowance is recorded. Significant weight is given to evidence that is objectively verifiable such as cumulative losses in recent years, however, some evidence may be based on estimates and assumptions regarding potential sources of future taxable income. Changes in these estimates and assumptions may result in a change in judgment regarding the realizability of deferred tax assets.

Refer to Note S for additional information.

Recently Adopted and Issued Accounting Pronouncements

Refer to Note A to the consolidated financial statements for discussion of recently adopted and issued accounting pronouncements, which is incorporated herein by reference.

31

| Payments Due by Period | |||||||||||||||||||||||

| 2020 | 2021-2022 | 2023-2024 | Beyond 2024 | Other | Total | ||||||||||||||||||

Debt (A) | $ | 2 | $ | 731 | $ | 5 | $ | 2,052 | $ | — | $ | 2,790 | |||||||||||

Interest (A) | 134 | 236 | 200 | 576 | — | 1,146 | |||||||||||||||||

| Operating leases | 45 | 70 | 37 | 101 | — | 253 | |||||||||||||||||

| Currently payable income taxes | 10 | — | — | — | — | 10 | |||||||||||||||||

Private equity funds (B) | — | — | — | — | 4 | 4 | |||||||||||||||||

Purchase commitments (C) | 240 | 1 | — | — | — | 241 | |||||||||||||||||

Uncertain tax positions, including interest and penalties (D) | — | — | — | — | 73 | 73 | |||||||||||||||||

| Total | $ | 431 | $ | 1,038 | $ | 242 | $ | 2,729 | $ | 77 | $ | 4,517 | |||||||||||

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

We have considered the provisions of accounting guidance regarding disclosure of accounting policies for derivative financial instruments and disclosure of quantitative and qualitative information about market risk inherent in derivative financial instruments and other financial instruments.

We are exposed to the impact of changes in interest rates and foreign currency exchange rates, particularly changes between the U.S. dollar and the European euro, British pound andsterling, Canadian dollar, Chinese renminbi, and Mexican peso, and to market price fluctuations related to our financial investments. We have insignificant involvement with derivative financial instruments and use such instruments to the extent necessary to manage exposure to foreign currency fluctuations.

At December 31, 2019,2022, we performed sensitivity analyses to assess the potential loss in the fair values of market risk sensitive instruments resulting from a hypothetical change of 10 percent in foreign currency exchange rates, a 10 percent decline in the market value of our long-term investments, or a 100 basis point change in interest rates. Based upon the analyses performed, such changes would not be expected to materially affect our consolidated financial position, results of operations or cash flows.

32

Item 8.Financial Statements and Supplementary Data.

Management's Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Our internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America.

We assessed the effectiveness of our internal control over financial reporting as of December 31, 20192022 using the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO") in Internal Control – Integrated Framework (2013). Based on this assessment, we have determined that our internal control over financial reporting was effective as of December 31, 2019.2022.

PricewaterhouseCoopers LLP (PCAOB ID 238), an independent registered public accounting firm, has audited the effectiveness of our internal control over financial reporting as of December 31, 2019,2022, as stated in their report, which is presented herein. Their report expressed an unqualified opinion on the effectiveness of our internal control over financial reporting as of December 31, 20192022 and expressed an unqualified opinion on our 20192022 consolidated financial statements. This report appears under 'Item 8. Financial Statements and Supplementary Data'is included herein under the heading "Report of Independent Registered Public Accounting Firm."

33

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of Masco Corporation

Opinions on the Financial Statements and Internal Control over Financial Reporting

We have audited the accompanying consolidated balance sheets of Masco Corporation and its subsidiaries (the “Company”) as of December 31, 20192022 and 2018,2021, and the related consolidated statements of operations, of comprehensive income (loss), of shareholders'shareholders’ equity and of cash flows for each of the three years in the period ended December 31, 2019,2022, including the related notes and financial statement schedule listed in the index appearing under Item 15(a)(2) (collectively referred to as the “consolidated financial statements”). We also have audited the Company's internal control over financial reporting as of December 31, 2019,2022, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 20192022 and 2018,2021, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 20192022 in conformity with accounting principles generally accepted in the United States of America. Also in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2019,2022, based on criteria established in Internal Control - Integrated Framework(2013) issued by the COSO.

Basis for Opinions

The Company's management is responsible for these consolidated financial statements, for maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control overOver Financial Reporting. Our responsibility is to express opinions on the Company’s consolidated financial statements and on the Company's internal control over financial reporting based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud, and whether effective internal control over financial reporting was maintained in all material respects.

Our audits of the consolidated financial statements included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinions.

Definition and Limitations of Internal Control over Financial Reporting

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the

34

company are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable

assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Critical Audit Matters

The critical audit matter communicated below is a matter arising from the current period audit of the consolidated financial statements that was communicated or required to be communicated to the audit committee and that (i) relates to accounts or disclosures that are material to the consolidated financial statements and (ii) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matter below, providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates.

Goodwill Impairment Assessments

As described in Notes A and H to the consolidated financial statements, the Company’s consolidated goodwill balance was $509$537 million as of December 31, 2019.2022. Management performs an annual impairment test of goodwill in the fourth quarter of each year, or as events occur or circumstances change that would indicate the carrying value of goodwill may be impaired. In connection with its annual assessment, management recorded a $19 million non-cash goodwill impairment charge within their Decorative Architectural Products segment. Potential impairment is identified by comparing the fair value of a reporting unit to its carrying value, including goodwill. Management estimates fair value by using a discounted cash flow model or a market approach.model. The determination of fair value using the discounted cash flow model requires management to make significant estimates and assumptions related to forecasted sales and operating profits, and the discount rate.

The principal considerations for our determination that performing procedures relating to the goodwill impairment assessments is a critical audit matter are there was(i) the significant judgment by management when developing the fair value measurements of the reporting units. This in turn led tounits; and (ii) a high degree of auditor judgment, subjectivity, and effort in performing procedures to evaluate management’s discounted cash flow model, including significant assumptions related to forecasted sales, and the discount rates. In addition, the audit effort involved the use of professionals with specialized skill and knowledge to assist in performing these procedures and evaluating the audit evidence obtained from these procedures.as applicable.

Addressing the matter involved performing procedures and evaluating audit evidence in connection with forming our overall opinion on the consolidated financial statements. These procedures included testing the effectiveness of controls relating to management’s goodwill impairment assessments, including controls over the valuation of the Company’s reporting units. These procedures also included, among others, testing management’s process for developing the fair value estimates; evaluating the appropriateness of the discounted cash flow model; testing the completeness, accuracy, and relevance of underlying data used in the model; and, evaluating the significant assumptions used by management includingrelated to forecasted sales, and the discount rates. Professionals with specialized skill and knowledge were used to assist in evaluating the Company’s discount rate assumptions.as applicable. Evaluating management’s assumptionassumptions related to forecasted sales involved evaluating whether the assumptions used were reasonable considering (i) the current and past performance of the reporting units, (ii) the consistency with external market and industry data as it relates to forecasted sales, and (iii) whether they were consistent with evidence obtained in other areas of the audit.

/s/ PricewaterhouseCoopers LLP

Detroit, Michigan

February 11, 20209, 2023

We have served as the Company’s auditor since 1959.

35

Financial Statements and Supplementary Data

MASCO CORPORATION and Consolidated Subsidiaries

CONSOLIDATED BALANCE SHEETS

December 31, 20192022 and 20182021

(In Millions, Except Share Data)

| 2022 | 2021 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash investments | $ | 452 | $ | 926 | |||||||

| Receivables | 1,149 | 1,171 | |||||||||

| Inventories | 1,236 | 1,216 | |||||||||

| Prepaid expenses and other | 109 | 109 | |||||||||

| Total current assets | 2,946 | 3,422 | |||||||||

| Property and equipment, net | 975 | 896 | |||||||||

| Goodwill | 537 | 568 | |||||||||

| Other intangible assets, net | 350 | 388 | |||||||||

| Operating lease right-of-use assets | 266 | 187 | |||||||||

| Other assets | 113 | 114 | |||||||||

| Total assets | $ | 5,187 | $ | 5,575 | |||||||

| LIABILITIES | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 877 | $ | 1,045 | |||||||

| Notes payable | 205 | 10 | |||||||||

| Accrued liabilities | 807 | 884 | |||||||||

| Total current liabilities | 1,889 | 1,939 | |||||||||

| Long-term debt | 2,946 | 2,949 | |||||||||

| Noncurrent operating lease liabilities | 255 | 172 | |||||||||

| Other liabilities | 339 | 437 | |||||||||

| Total liabilities | $ | 5,429 | $ | 5,497 | |||||||

| Commitments and contingencies (Note U) | |||||||||||

| Redeemable noncontrolling interest | 20 | 22 | |||||||||

| EQUITY | |||||||||||

| Masco Corporation's shareholders' equity: | |||||||||||

Common shares, par value $1 per share Authorized shares: 1,400,000,000; Issued and outstanding: 2022 – 225,300,000; 2021 – 241,200,000 | 225 | 241 | |||||||||

Preferred shares authorized: 1,000,000; Issued and outstanding: 2022 and 2021 – None | — | — | |||||||||

| Paid-in capital | 16 | — | |||||||||

| Retained deficit | (947) | (652) | |||||||||

| Accumulated other comprehensive income | 226 | 232 | |||||||||

| Total Masco Corporation's shareholders' deficit | (480) | (179) | |||||||||

| Noncontrolling interest | 218 | 235 | |||||||||

| Total equity | (262) | 56 | |||||||||

| Total liabilities and equity | $ | 5,187 | $ | 5,575 | |||||||

| 2019 | 2018 | ||||||

| ASSETS | |||||||

| Current Assets: | |||||||

| Cash and cash investments | $ | 697 | $ | 552 | |||

| Receivables | 997 | 990 | |||||

| Inventories | 754 | 798 | |||||

| Prepaid expenses and other | 90 | 84 | |||||

| Assets held for sale | 173 | 342 | |||||

| Total current assets | 2,711 | 2,766 | |||||

| Property and equipment, net | 878 | 885 | |||||

| Goodwill | 509 | 511 | |||||

| Other intangible assets, net | 259 | 288 | |||||

| Operating lease right-of-use assets | 176 | — | |||||

| Other assets | 139 | 90 | |||||

| Assets held for sale | 355 | 853 | |||||

| Total assets | $ | 5,027 | $ | 5,393 | |||

| LIABILITIES | |||||||

| Current Liabilities: | |||||||

| Accounts payable | $ | 697 | $ | 736 | |||

| Notes payable | 2 | 8 | |||||

| Accrued liabilities | 700 | 645 | |||||

| Liabilities held for sale | 149 | 295 | |||||

| Total current liabilities | 1,548 | 1,684 | |||||

| Long-term debt | 2,771 | 2,971 | |||||

| Other liabilities | 751 | 549 | |||||

| Liabilities held for sale | 13 | 120 | |||||

| Total liabilities | 5,083 | 5,324 | |||||

| Commitments and contingencies (Note T) | |||||||

| EQUITY | |||||||

| Masco Corporation's shareholders' equity: | |||||||

Common shares, par value $1 per share Authorized shares: 1,400,000,000; Issued and outstanding: 2019 – 275,600,000; 2018 – 293,900,000 | 276 | 294 | |||||

Preferred shares authorized: 1,000,000; Issued and outstanding: 2019 and 2018 – None | — | — | |||||

| Paid-in capital | — | — | |||||

| Retained deficit | (332 | ) | (278 | ) | |||

| Accumulated other comprehensive loss | (179 | ) | (127 | ) | |||

| Total Masco Corporation's shareholders' deficit | (235 | ) | (111 | ) | |||

| Noncontrolling interest | 179 | 180 | |||||

| Total equity | (56 | ) | 69 | ||||

| Total liabilities and equity | $ | 5,027 | $ | 5,393 | |||

See notes to consolidated financial statements.

MASCO CORPORATION and Consolidated Subsidiaries

CONSOLIDATED STATEMENTS OF OPERATIONS

For the Years Ended December 31, 2019, 20182022, 2021 and 20172020

(In Millions, Except Per Common Share Data)

| 2019 | 2018 | 2017 | |||||||||

| Net sales | $ | 6,707 | $ | 6,654 | $ | 6,014 | |||||

| Cost of sales | 4,336 | 4,327 | 3,794 | ||||||||

| Gross profit | 2,371 | 2,327 | 2,220 | ||||||||

| Selling, general and administrative expenses | 1,274 | 1,250 | 1,191 | ||||||||

| Impairment charge for other intangible assets | 9 | — | — | ||||||||

| Operating profit | 1,088 | 1,077 | 1,029 | ||||||||

| Other income (expense), net: | |||||||||||

| Interest expense | (159 | ) | (156 | ) | (279 | ) | |||||

| Other, net | (15 | ) | (14 | ) | (32 | ) | |||||

| (174 | ) | (170 | ) | (311 | ) | ||||||

| Income from continuing operations before income taxes | 914 | 907 | 718 | ||||||||

| Income tax expense | 230 | 221 | 245 | ||||||||

| Income from continuing operations | 684 | 686 | 473 | ||||||||

| Income from discontinued operations, net | 296 | 98 | 107 | ||||||||

| Net income | 980 | 784 | 580 | ||||||||

| Less: Net income attributable to noncontrolling interest | 45 | 50 | 47 | ||||||||

| Net income attributable to Masco Corporation | $ | 935 | $ | 734 | $ | 533 | |||||

| Income per common share attributable to Masco Corporation: | |||||||||||

| Basic: | |||||||||||

| Income from continuing operations | $ | 2.21 | $ | 2.06 | $ | 1.34 | |||||

| Income from discontinued operations, net | 1.03 | 0.32 | 0.34 | ||||||||

| Net income | $ | 3.24 | $ | 2.38 | $ | 1.68 | |||||

| Diluted: | |||||||||||

| Income from continuing operations | $ | 2.20 | $ | 2.05 | $ | 1.33 | |||||

| Income from discontinued operations, net | 1.02 | 0.32 | 0.33 | ||||||||

| Net income | $ | 3.22 | $ | 2.37 | $ | 1.66 | |||||

| Amounts attributable to Masco Corporation: | |||||||||||

| Income from continuing operations | $ | 639 | $ | 636 | $ | 426 | |||||

| Income from discontinued operations, net | 296 | 98 | 107 | ||||||||

| Net income | $ | 935 | $ | 734 | $ | 533 | |||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Net sales | $ | 8,680 | $ | 8,375 | $ | 7,188 | |||||||||||

| Cost of sales | 5,967 | 5,512 | 4,601 | ||||||||||||||

| Gross profit | 2,713 | 2,863 | 2,587 | ||||||||||||||

| Selling, general and administrative expenses | 1,390 | 1,413 | 1,292 | ||||||||||||||

| Impairment charges for goodwill and other intangible assets | 26 | 45 | — | ||||||||||||||

| Operating profit | 1,297 | 1,405 | 1,295 | ||||||||||||||

| Other income (expense), net: | |||||||||||||||||

| Interest expense | (108) | (278) | (144) | ||||||||||||||

| Other, net | 4 | (439) | (20) | ||||||||||||||

| (104) | (717) | (164) | |||||||||||||||

| Income from continuing operations before income taxes | 1,193 | 688 | 1,131 | ||||||||||||||

| Income tax expense | 288 | 210 | 269 | ||||||||||||||

| Income from continuing operations | 905 | 478 | 862 | ||||||||||||||

| Income from discontinued operations, net | — | — | 414 | ||||||||||||||

| Net income | 905 | 478 | 1,276 | ||||||||||||||

| Less: Net income attributable to noncontrolling interest | 61 | 68 | 52 | ||||||||||||||

| Net income attributable to Masco Corporation | $ | 844 | $ | 410 | $ | 1,224 | |||||||||||

| Income per common share attributable to Masco Corporation: | |||||||||||||||||

| Basic: | |||||||||||||||||

| Income from continuing operations | $ | 3.65 | $ | 1.63 | $ | 3.05 | |||||||||||

| Income from discontinued operations, net | — | — | 1.55 | ||||||||||||||

| Net income | $ | 3.65 | $ | 1.63 | $ | 4.60 | |||||||||||

| Diluted: | |||||||||||||||||

| Income from continuing operations | $ | 3.63 | $ | 1.62 | $ | 3.04 | |||||||||||

| Income from discontinued operations, net | — | — | 1.55 | ||||||||||||||

| Net income | $ | 3.63 | $ | 1.62 | $ | 4.59 | |||||||||||

| Amounts attributable to Masco Corporation: | |||||||||||||||||

| Income from continuing operations | $ | 844 | $ | 410 | $ | 810 | |||||||||||

| Income from discontinued operations, net | — | — | 414 | ||||||||||||||

| Net income | $ | 844 | $ | 410 | $ | 1,224 | |||||||||||

See notes to consolidated financial statements.

MASCO CORPORATION and Consolidated Subsidiaries

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

For the Years Ended December 31, 2019, 20182022, 2021 and 20172020

(In Millions)

| 2019 | 2018 | 2017 | |||||||||

| Net income | $ | 980 | $ | 784 | $ | 580 | |||||

| Less: Net income attributable to noncontrolling interest | 45 | 50 | 47 | ||||||||

| Net income attributable to Masco Corporation | $ | 935 | $ | 734 | $ | 533 | |||||

| Other comprehensive (loss) income, net of tax (Note O): | |||||||||||

| Cumulative translation adjustment | $ | 6 | $ | (31 | ) | $ | 133 | ||||

| Interest rate swaps | 2 | 2 | 3 | ||||||||

| Pension and other post-retirement benefits | (64 | ) | 9 | 63 | |||||||

| Other comprehensive (loss) income, net of tax | (56 | ) | (20 | ) | 199 | ||||||

| Less: Other comprehensive (loss) income attributable to the noncontrolling interest: | |||||||||||

| Cumulative translation adjustment | $ | (1 | ) | $ | (15 | ) | $ | 28 | |||

| Pension and other post-retirement benefits | (3 | ) | (2 | ) | 1 | ||||||

| (4 | ) | (17 | ) | 29 | |||||||

| Other comprehensive (loss) income attributable to Masco Corporation | $ | (52 | ) | $ | (3 | ) | $ | 170 | |||

| Total comprehensive income | $ | 924 | $ | 764 | $ | 779 | |||||

| Less: Total comprehensive income attributable to noncontrolling interest | 41 | 33 | 76 | ||||||||

| Total comprehensive income attributable to Masco Corporation | $ | 883 | $ | 731 | $ | 703 | |||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Net income | $ | 905 | $ | 478 | $ | 1,276 | |||||||||||

| Less: Net income attributable to noncontrolling interest | 61 | 68 | 52 | ||||||||||||||

| Net income attributable to Masco Corporation | $ | 844 | $ | 410 | $ | 1,224 | |||||||||||

| Other comprehensive (loss) income, net of tax (Note P): | |||||||||||||||||

| Cumulative translation adjustment | $ | (60) | $ | (32) | $ | 72 | |||||||||||

| Interest rate swaps | — | 7 | 1 | ||||||||||||||

| Pension and other post-retirement benefits | 54 | 384 | (18) | ||||||||||||||

| Other comprehensive (loss) income, net of tax | (6) | 359 | 55 | ||||||||||||||

| Less: Other comprehensive (loss) income attributable to the noncontrolling interest: | |||||||||||||||||

| Cumulative translation adjustment | $ | (9) | $ | (19) | $ | 20 | |||||||||||

| Pension and other post-retirement benefits | 9 | 4 | (2) | ||||||||||||||

| — | (15) | 18 | |||||||||||||||

| Other comprehensive (loss) income attributable to Masco Corporation | $ | (6) | $ | 374 | $ | 37 | |||||||||||

| Total comprehensive income | $ | 899 | $ | 837 | $ | 1,331 | |||||||||||

| Less: Total comprehensive income attributable to noncontrolling interest | 61 | 53 | 70 | ||||||||||||||

| Total comprehensive income attributable to Masco Corporation | $ | 838 | $ | 784 | $ | 1,261 | |||||||||||

See notes to consolidated financial statements.

MASCO CORPORATION and Consolidated Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended December 31, 2019, 20182022, 2021 and 20172020

(In Millions)

| 2022 | 2021 | 2020 | |||||||||||||||

| CASH FLOWS FROM (FOR) OPERATING ACTIVITIES: | |||||||||||||||||

| Net income | $ | 905 | $ | 478 | $ | 1,276 | |||||||||||

| Depreciation and amortization | 145 | 151 | 133 | ||||||||||||||

| Fair value adjustment to contingent earnout obligation | (24) | 16 | — | ||||||||||||||

| Display amortization | — | — | 2 | ||||||||||||||

| Deferred income taxes | (15) | (68) | (3) | ||||||||||||||

| Employee withholding taxes paid on stock-based compensation | 17 | 15 | 25 | ||||||||||||||

| Loss (gain) on investments, net | 5 | (25) | (3) | ||||||||||||||

| Loss (gain) on disposition of businesses, net | 1 | 18 | (602) | ||||||||||||||

| Pension and other post-retirement benefits | (3) | 312 | (32) | ||||||||||||||

| Impairment of goodwill and other intangible assets | 26 | 45 | — | ||||||||||||||

| Stock-based compensation | 49 | 61 | 45 | ||||||||||||||

| Dividends paid-in-kind | — | (6) | (10) | ||||||||||||||

| Increase in receivables | (15) | (64) | (141) | ||||||||||||||

| Increase in inventories | (43) | (350) | (89) | ||||||||||||||