Budapest, Hungary| Location | | Description of Property | | | | | | | Industrial: | | | | | Pittsburgh, PA | | Manufacturing / Division Offices | | | Beijing, China | | Manufacturing | (1) | | Cincinnati, OH | | Manufacturing | (1) | | Germantown, WI | | Manufacturing | (1) | | Gothenburg, Sweden | | Manufacturing / Distribution | (1) | | Ixonia, WI | | Manufacturing | (1) | | Portland, OR | | Manufacturing | |

ITEM 2. | PROPERTIES, (continued) | | Tianjin City, China | | Manufacturing | (1) |

Location | | Wilsonville, OR | | Manufacturing | | Description of Property | | | | | | Marking and Fulfillment Systems: | | | | Pittsburgh, PA | | Manufacturing / Division Offices | | Gothenburg, Sweden | | Manufacturing / Distribution | (1) | Tualatin, OR | | Manufacturing | (1) | Beijing, China | | Manufacturing | (1) | Ixonia, WI | | Manufacturing | (1) | Germantown, WI | | Manufacturing | (1) | Cincinnati, OH | | Manufacturing | (1) | | | | | Merchandising Solutions: | | | | East Butler, PA | | Manufacturing / Division Offices | | Portland, OR | | Sales Office | (1) | | | | | | | Corporate Office: | | | | | Pittsburgh, PA | | General Offices | | | | | |

| (1) | These properties are leased by the Company under operating lease arrangements. Rent expense incurred by the Company for all leased facilities was approximately $31.8 million in fiscal 2015. |

| (2) | In addition to the properties listed, the Memorialization segment leases warehouse facilities totaling approximately 1.6 million square feet in 40 states under operating leases. |

All of the owned properties are unencumbered. The Company believes its facilities are generally well suited for their respective uses and are of adequate size and design to provide the operating efficiencies necessary for the Company to be competitive. The Company's facilities provide adequate space for meeting its near-term production requirements and have availability for additional capacity. The Company intends to continue to expand and modernize its facilities as necessary to meet the demand for its products.

(1) | These properties are leased by the Company under operating lease arrangements. Rent expense incurred by the Company for all leased facilities was approximately $17.7 million in fiscal 2013. |

(2) | In addition to the properties listed, the Funeral Home Products segment leases warehouse facilities totaling approximately 1.0 million square feet in 29 states under operating leases. |

All of the owned properties are unencumbered. The Company believes its facilities are generally well suited for their respective uses and are of adequate size and design to provide the operating efficiencies necessary for the Company to be competitive. The Company's facilities provide adequate space for meeting its near-term production requirements and have availability for additional capacity. The Company intends to continue to expand and modernize its facilities as necessary to meet the demand for its products.

| ITEM 3. LEGAL PROCEEDINGS. |

Matthews is subject to various legal proceedings and claims arising in the ordinary course of business. Management does not expect that the results of any of these legal proceedings will have a material adverse effect on Matthews’Matthews' financial condition, results of operations or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

| OFFICERS AND EXECUTIVE MANAGEMENT OF THE REGISTRANT |

The following information is furnished with respect to officers and executive management as of October 31, 2013:2015:

| Name | | Age | | Positions with Registrant | | | | | | | | Joseph C. Bartolacci | | 5355 | | President and Chief Executive Officer | | | | | | | | David F. Beck | | 6163 | | Vice President and Controller | Jennifer A. CicconeMarcy L. Campbell | | 4652 | | Vice President, Human Resources | | | | | | | | Brian J. Dunn | | 5658 | | GroupExecutive Vice President, Brand SolutionsStrategy and Corporate Development | | | | | | | | Steven D. Gackenbach | | 5052 | | Group President, Memorialization | | | | | | | | Robert M. Marsh | | 47 | | Treasurer | | | | | | | Steven F. Nicola | | 5355 | | Chief Financial Officer Secretary and TreasurerSecretary | | | | | | | | Paul F. Rahill | | 5658 | | President, Cremation Division | | | | | | | | David A. Schawk | | 59 | | President, SGK Brand Solutions | | | | | | | Brian D. Walters | | 4446 | | Vice President and General Counsel |

Joseph C. Bartolacci was appointed President and Chief Executive Officer effective October 1, 2006.

David F. Beck was appointed Vice President and Controller effective February 18, 2010. Prior thereto he had been Controller since September 15, 2003.

Jennifer A. CicconeMarcy L. Campbell was appointed Vice President, Human Resources effective February 19, 2009. Prior thereto,November 2014. Ms. Ciccone had beenCampbell served as Director, CorporateRegional Human Resources since 2006.from January 2013, and as Manager, Regional Human Resources from November 2005 to December 2012.

Brian J. Dunn was appointed Executive Vice President, Strategy and Corporate Development effective July 24, 2014. Prior thereto, he served as Group President, Brand Solutions effectivesince February 18, 2010. Prior thereto, he was appointed Group President, Graphics and Marking Products effective September 1, 2007 and had been President, Marking Products Division prior thereto.

Steven D. Gackenbach was appointed Group President, Memorialization effective October 31, 2011. Prior thereto he had been Chief Commercial Officer, Memorialization since January 3, 2011 when he joined the Company. Prior to joining the Company, Mr. Gackenbach served as the Senior Director of Strategy for Kraft Foods’Foods' Cheese and Dairy Division from 2002 to 2010.

Robert M. Marsh joined the Company as Treasurer in December 2014. Prior to joining the Company, Mr. Marsh was a partner of PNC Mezzanine Capital, the principal mezzanine investment business of The PNC Financial Services Group, LLC ("PNC"). Mr. Marsh joined PNC in 1997.

Steven F. Nicola was appointed Chief Financial Officer Secretary and TreasurerSecretary effective December 1, 2003.

Paul F. Rahill was appointed President, Cremation Division in October 2002.

David A. Schawk joined the Company in July 2014 as President, SGK Brand Solutions upon Matthews' acquisition of Schawk. Mr. Schawk served as Schawk's Chief Executive Officer from July 2012, and Chief Executive Officer and President for more than five years prior thereto. Mr. Schawk was a member of the Schawk Board of Directors since 1992.

Brian D. Walters was appointed Vice President and General Counsel effective February 19, 2009. Mr. Walters joined the Company as Legal Counsel in 2005.

PART II

| ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS. |

Market Information:

The authorized common stock of the Company consists of 70,000,000 shares of Class A Common Stock, $1 par value. At September 30, 2015, 32,875,067 shares were outstanding. The Company's Class A Common Stock is traded on the NASDAQ Global Select Market System under the symbol “MATW”"MATW". The following table sets forth the high, low and closing prices as reported by NASDAQ for the periods indicated:

| | | High | | | Low | | | Close | | | Fiscal 2013: | | | | | | | | | | | Quarter ended: September 30, 2013 | | $ | 40.50 | | | $ | 36.27 | | | $ | 38.08 | | | June 30, 2013 | | | 39.37 | | | | 32.81 | | | | 37.70 | | | March 31, 2013 | | | 35.31 | | | | 31.43 | | | | 34.92 | | | December 31, 2012 | | | 32.95 | | | | 27.42 | | | | 32.10 | | | | | | | | | | | | | | | | | Fiscal 2012: | | | | | | | | | | | | | | Quarter ended: September 30, 2012 | | $ | 32.90 | | | $ | 27.88 | | | $ | 29.82 | | | June 30, 2012 | | | 32.63 | | | | 28.95 | | | | 32.49 | | | March 31, 2012 | | | 34.36 | | | | 30.00 | | | | 31.64 | | | December 31, 2011 | | | 37.65 | | | | 28.59 | | | | 31.43 | |

| | High | | Low | | Close | | Fiscal 2015: | | | | | | Quarter ended: September 30, 2015 | $55.70 | | $47.46 | | $48.97 | | June 30, 2015 | 55.40 | | 47.00 | | 53.14 | | March 31, 2015 | 52.63 | | 44.48 | | 51.51 | | December 31, 2014 | 49.69 | | 41.10 | | 48.67 | | | | | | | | | Fiscal 2014: | | | | | | | Quarter ended: September 30, 2014 | $47.60 | | $40.99 | | $43.89 | | June 30, 2014 | 43.32 | | 39.54 | | 41.57 | | March 31, 2014 | 44.33 | | 37.08 | | 40.81 | | December 31, 2013 | 42.80 | | 37.58 | | 42.61 |

The Company has a stock repurchase program. Under the current authorization, the Company's Board of Directors has authorized the repurchase of a total of 2,500,000 shares of Matthews’Matthews' common stock under the program, of which 1,194,670661,022 shares remain available for repurchase as of September 30, 2013.2015. In November 2015, the Company's Board of Directors approved the continuation of its stock repurchase program and increased the authorization for stock repurchases by an additional 2,500,000 shares. The buy-back program is designed to increase shareholder value, enlarge the Company's holdings of its common stock, and add to earnings per share. Repurchased shares may be retained in treasury, utilized for acquisitions, or reissued to employees or other purchasers, subject to the restrictions ofset forth in the Company’sCompany's Restated Articles of Incorporation.

All purchases of the Company’sCompany's common stock during fiscal 20132015 were part of this repurchase program.

| ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS, (continued) |

The following table shows the monthly fiscal 20132015 stock repurchase activity:

| Period | | Total number of shares purchased | | | Average price paid per share | | | Total number of shares purchased as part of a publicly announced plan | | | Maximum number of shares that may yet be purchased under the plan | | | | | | | | | | | | | | | | | October 2012 | | | 123,000 | | | $ | 29.12 | | | | 123,000 | | | | 1,691,651 | | | November 2012 | | | 31,732 | | | | 28.91 | | | | 31,732 | | | | 1,659,919 | | | December 2012 | | | 1,000 | | | | 30.72 | | | | 1,000 | | | | 1,658,919 | | | January 2013 | | | - | | | | - | | | | - | | | | 1,658,919 | | | February 2013 | | | 41,200 | | | | 32.67 | | | | 41,200 | | | | 1,617,719 | | | March 2013 | | | 40,200 | | | | 34.41 | | | | 40,200 | | | | 1,577,519 | | | April 2013 | | | 16,691 | | | | 33.85 | | | | 16,691 | | | | 1,560,828 | | | May 2013 | | | 31,745 | | | | 38.32 | | | | 31,745 | | | | 1,529,083 | | | June 2013 | | | 119,548 | | | | 37.54 | | | | 119,548 | | | | 1,409,535 | | | July 2013 | | | 30,000 | | | | 38.65 | | | | 30,000 | | | | 1,379,535 | | | August 2013 | | | 25,000 | | | | 37.43 | | | | 25,000 | | | | 1,354,535 | | | September 2013 | | | 159,865 | | | | 37.52 | | | | 159,865 | | | | 1,194,670 | | | Total | | | 619,981 | | | $ | 34.88 | | | | 619,981 | | | | | |

| Period | | Total number of shares purchased | | | Weighted-average price paid per share | | | Total number of shares purchased as part of a publicly announced plan | | | Maximum number of shares that may yet be purchased under the plan | | | | | | | | | | | | | | | | | October 2014 | | | 10,000 | | | $ | 43.87 | | | | 10,000 | | | | 955,881 | | | November 2014 | | | 65,942 | | | | 46.54 | | | | 65,942 | | | | 889,939 | | | December 2014 | | | 97,807 | | | | 46.10 | | | | 97,807 | | | | 792,132 | | | January 2015 | | | 1,559 | | | | 46.86 | | | | 1,559 | | | | 790,573 | | | February 2015 | | | 10,000 | | | | 48.49 | | | | 10,000 | | | | 780,573 | | | March 2015 | | | 27,318 | | | | 48.17 | | | | 27,318 | | | | 753,255 | | | April 2015 | | | - | | | | - | | | | - | | | | 753,255 | | | May 2015 | | | 157 | | | | 47.97 | | | | 157 | | | | 753,098 | | | June 2015 | | | - | | | | - | | | | - | | | | 753,098 | | | July 2015 | | | - | | | | - | | | | - | | | | 753,098 | | | August 2015 | | | 55,982 | | | | 51.68 | | | | 55,982 | | | | 697,116 | | | September 2015 | | | 36,094 | | | | 49.22 | | | | 36,094 | | | | 661,022 | | | Total | | | 304,859 | | | $ | 47.78 | | | | 304,859 | | | | | |

Holders:

Based on records available to the Company, the number of registered holders of the Company's common stock was 4691,172 at

October 31, 2013.2015.

Dividends:

A quarterly dividend of $.11$.15 per share was paid for the fourth quarter of fiscal 20132015 to shareholders of record on November 25,23, 2015. The Company paid quarterly dividends of $.13 per share for each of the first three quarters of fiscal 2015 and the fourth quarter of fiscal 2014. The Company paid quarterly dividends of $.11 per share for each of the first three quarters of fiscal 2014 and the fourth quarter of fiscal 2013. The Company paid quarterly dividends of $.10 per share for each of the first three quarters of fiscal 2013 and the fourth quarter of fiscal 2012. The Company paid quarterly dividends of $.09 per share for the first three quarters of fiscal 2012 and the fourth quarter of fiscal 2011. The Company paid quarterly dividends of $.08 per share for the first three quarters of fiscal 2011 and the fourth quarter of fiscal 2010.

Cash dividends have been paid on common shares in every year for at least the past forty-fiveforty-six years. It is the present intention of the Company to continue to pay quarterly cash dividends on its common stock. However, there is no assurance that dividends will be declared and paid as the declaration and payment of dividends is at the discretion of the Board of Directors of the Company and is dependent upon many factors, including but not limited to the Company's financial condition, results of operations, cash requirements, future prospects and other factors deemed relevant by the Board.

Securities Authorized for Issuance Under Equity Compensation Plans:

See Equity Compensation Plans in Item 12 “Security"Security Ownership of Certain Beneficial Owners and Management”Management" on page 7076 of this report.

ITEM 5.MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS, (continued)

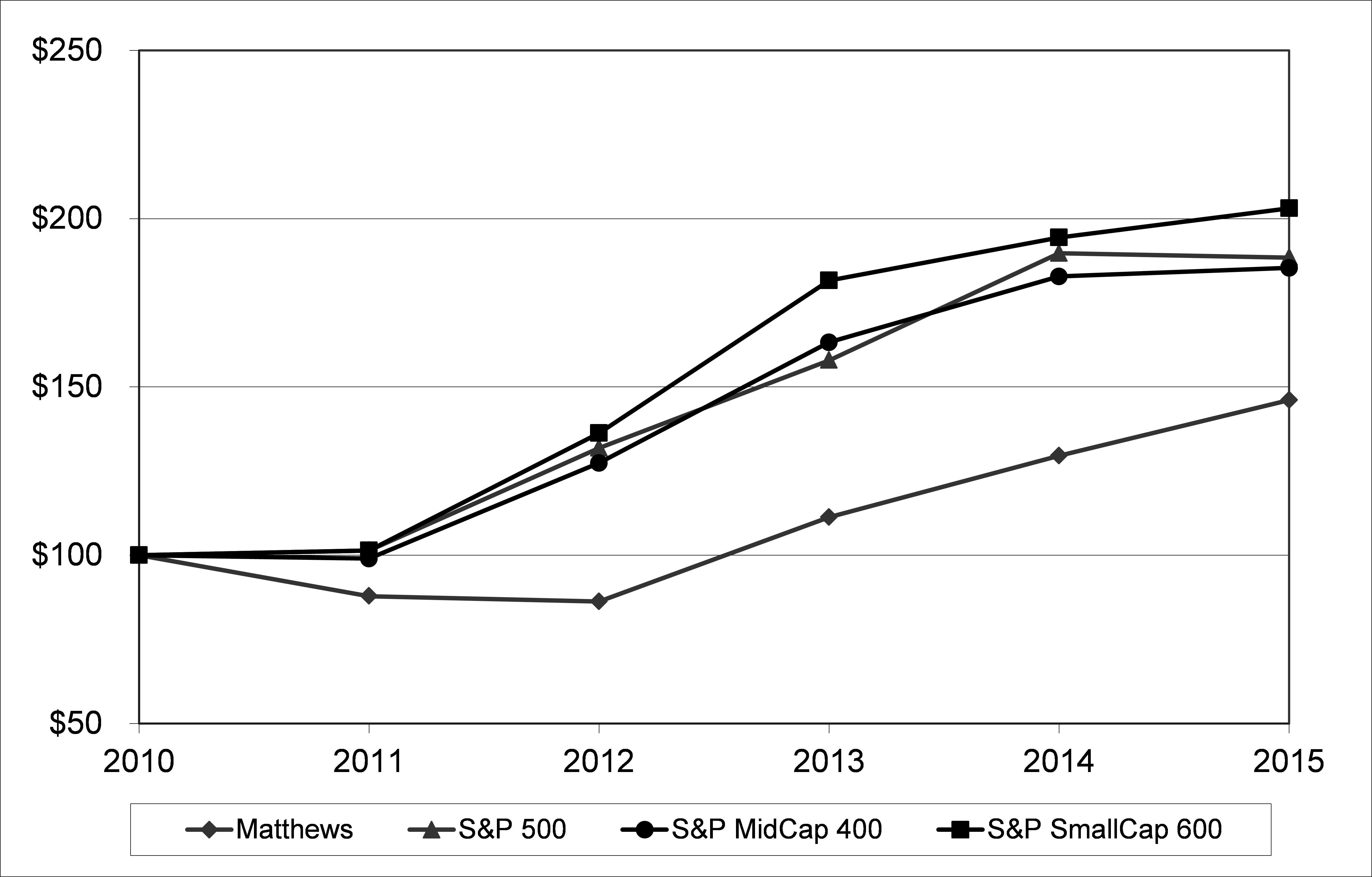

PERFORMANCE GRAPH

COMPARISON OF FIVE-YEAR CUMULATIVE RETURN * AMONG MATTHEWS INTERNATIONAL CORPORATION, S&P 500 INDEX, S&P MIDCAP 400 INDEX AND S&P SMALLCAP 600 INDEX **

* Total return assumes dividend reinvestment ** Fiscal year ended September 30

Note: Performance graph assumes $100 invested on October 1, 20082010 in Matthews International Corporation Common Stock, Standard & Poor's (S&P) 500 Index, S&P MidCap 400 Index and S&P SmallCap 600 Index. The results are not necessarily indicative of future performance.

| ITEM 6. SELECTED FINANCIAL DATA. |

| | | Years Ended September 30, | | Years Ended September 30, | | | | 2013(1) | | | 2012(2) | | | 2011(3) | | | 2010(4) | | 2009(5) | | 2015(1) | | 2014(2) | | 2013(3) | | 2012(4) | | 2011(5) | | | | (Amounts in thousands, except per share data) | | (Amounts in thousands, except per share data) | | | | (Not Covered by Report of Independent Registered Public Accounting Firm) | | (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net sales | | $ | 985,357 | | | $ | 900,317 | | | $ | 898,821 | | | $ | 821,829 | | | $ | 780,908 | | $1,426,068 | | $1,106,597 | | $985,357 | | $900,317 | | $898,821 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Operating profit | | | 95,792 | | | | 93,577 | | | | 118,516 | | | | 116,581 | | | | 101,011 | | 105,023 | | 81,522 | | 94,615 | | 92,585 | | 117,589 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Interest expense | | | 12,925 | | | | 11,476 | | | | 8,241 | | | | 7,419 | | | | 12,053 | | 20,610 | | 12,628 | | 12,925 | | 11,476 | | 8,241 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net income attributable to Matthews shareholders | | | 54,888 | | | | 55,843 | | | | 72,372 | | | | 69,057 | | | | 57,732 | | 63,449 | | 42,625 | | 54,121 | | 55,276 | | 72,106 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Earnings per common share: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Basic | | | $1.99 | | | | $1.98 | | | | $2.47 | | | | $2.32 | | | | $1.91 | | $1.93 | | $1.51 | | $1.96 | | $1.96 | | $2.46 | | Diluted | | | 1.98 | | | | 1.98 | | | | 2.46 | | | | 2.31 | | | | 1.90 | | 1.91 | | 1.49 | | 1.95 | | 1.95 | | 2.45 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Weighted-average common | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | shares outstanding: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Basic | | | 27,255 | | | | 27,753 | | | | 28,775 | | | | 29,656 | | | | 30,245 | | 32,939 | | 28,209 | | 27,255 | | 27,753 | | 28,775 | | Diluted | | | 27,423 | | | | 27,839 | | | | 28,812 | | | | 29,706 | | | | 30,318 | | 33,196 | | 28,483 | | 27,423 | | 27,839 | | 28,812 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Cash dividends per share | | | $.410 | | | | $.370 | | | | $.330 | | | | $.290 | | | | $.265 | | $.54 | | $.46 | | $.41 | | $.37 | | $.33 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total assets | | $ | 1,214,927 | | | $ | 1,128,042 | | | $ | 1,097,455 | | | $ | 993,825 | | | $ | 949,653 | | $2,163,018 | | $2,024,048 | | $1,209,262 | | $1,122,171 | | $1,092,151 | | Long-term debt, non-current | | | 351,068 | | | | 298,148 | | | | 299,170 | | | | 225,256 | | | | 237,530 | | 891,217 | | 714,027 | | 351,068 | | 298,148 | | 299,170 |

| (1) | Fiscal 2015 included pre-tax charges of $36,883 and income of $8,726, which impacted operating profit and other deductions, respectively, and also included the unfavorable effect of related adjustments of $1,334 to income tax expense. These amounts primarily consisted of acquisition-related costs, trade name write-offs, strategic cost-reduction initiatives, and losses related to a theft of funds, partially offset by a gain on the settlement of a multi-employer pension plan obligation, and the impact of the favorable settlement of litigation, net of related expenses. |

| (2) | Fiscal 2014 included net charges of approximately $41,289 (pre-tax), primarily related to acquisition-related costs, strategic cost-reduction initiatives, and litigation expenses related to a legal dispute in the Memorialization segment. Charges of $38,598 and $2,691 impacted operating profit and other deductions, respectively. In addition, fiscal 2014 included the unfavorable effect of adjustments of $1,347 to income tax expense related to non-deductible expenses related to acquisition activities. |

| (3) | Fiscal 2013 included net unusual charges of approximately $14,095$15,352 (pre-tax). Unusual charges, which primarily related to strategic cost reductioncost-reduction initiatives, incremental costs related to an ERP implementation in the Cemetery ProductsMemorialization segment, acquisition relatedacquisition-related costs and an impairment charge related to the carrying value of a trade name. The unusual charges were partially offset by a gain on the final settlement of the purchase price of the remaining ownership interest in one of the Company’sCompany's subsidiaries and the benefit of adjustments to contingent consideration. |

(2)(4) | Fiscal 2012 included net unusual charges of approximately $7,850$8,779 (pre-tax), which primarily consisted of charges related to cost reductioncost-reduction initiatives and incremental costs related to an ERP implementation in the Cemetery ProductsMemorialization segment. In addition, fiscal 2012 included the favorable effect of an adjustment of $528 to income tax expense primarily related to changes in estimated tax accruals for open tax periods. |

(3)(5) | Fiscal 2011 included the favorable effect of an adjustment of $606 to income tax expense primarily related to changes in estimated tax accruals for open tax periods. |

(4) | Fiscal 2010 included the favorable effect of an adjustment of $838 to income tax expense primarily related to changes in estimated tax accruals for open tax periods. |

(5) | Fiscal 2009 included pre-tax unusual charges of approximately $16,500, which primarily consisted of severance and other costs related to the consolidation of certain production operations within the Company’s Cemetery Products segment, costs related to operational and systems improvements in several of the Company’s other businesses, and asset adjustments resulting from current market conditions. In addition, fiscal 2009 earnings included the favorable effect of an adjustment of $1,255 to income tax expense primarily related to the Company’s ability to utilize a European tax loss carryover generated in prior years and changes in the estimated tax accruals for open tax periods. |

| ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

The following discussion should be read in conjunction with the consolidated financial statements of Matthews and related notes thereto. In addition, see "Cautionary Statement Regarding Forward-Looking Information" included in Part I of this Annual Report on Form 10-K.

The following table sets forth sales and operating profit for the Company’sCompany's SGK Brand Solutions, Memorialization and Brand Solutions businessesIndustrial segments for each of the last three fiscal years.

| | | | Years Ended September 30, | | | | Years Ended September 30, | | | 2015 | | 2014 | | 2013 | | | | 2013 | | | 2012 | | | 2011 | | | (Dollars in Thousands) | | Sales: | | | | | | | | | | | | | | | | | SGK Brand Solutions | | | $ 798,339 | | $ 497,328 | | $ 373,941 | | Memorialization | | $ | 517,911 | | | $ | 492,867 | | | $ | 507,342 | | | 508,058 | | 508,420 | | 517,911 | | Brand Solutions | | | 467,446 | | | | 407,450 | | | | 391,479 | | | | Industrial | | | 119,671 | | 100,849 | | 93,505 | | Consolidated | | $ | 985,357 | | | $ | 900,317 | | | $ | 898,821 | | | $1,426,068 | | $1,106,597 | | $ 985,357 | | | | | | | | | | | | | | | | | | | | | | Operating Profit: | | | | | | | | | | | | | | | | | | | | SGK Brand Solutions | | | $ 21,864 | | $ 2,536 | | $ 13,999 | | Memorialization | | $ | 72,931 | | | $ | 63,589 | | | $ | 84,992 | | | 70,064 | | 67,937 | | 71,754 | | Brand Solutions | | | 22,861 | | | | 29,988 | | | | 33,524 | | | | Industrial | | | 13,095 | | 11,049 | | 8,862 | | Consolidated | | $ | 95,792 | | | $ | 93,577 | | | $ | 118,516 | | | $ 105,023 | | $ 81,522 | | $ 94,615 | | | | | | | | | | | | | | | | | | | | |

Comparison of Fiscal 20132015 and Fiscal 2012:2014:

Sales for the year ended September 30, 20132015 were $985.4 million,$1.4 billion, compared to $900.3 million$1.1 billion for the year ended September 30, 2012.2014. The increase in fiscal 20132015 sales principally reflected the acquisitions of Schawk, Inc. ("Schawk") in July 2014 and Aurora Products Group, LLC ("Aurora") in August 2015, higher sales in the Funeral Home ProductsIndustrial segment, and Merchandisinghigher sales in the SGK Brand Solutions segments andsegment, exclusive of the benefitSchawk acquisition. These increases were partially offset by lower sales in the Memorialization segment, excluding Aurora. Additionally, consolidated sales for fiscal 2015 were unfavorably impacted by changes in foreign currencies against the U.S. dollar of recent acquisitions.approximately $56.9 million.

In the Memorialization businesses, Cemetery ProductsSGK Brand Solutions segment, sales for fiscal 20132015 were $226.6$798.3 million, compared to $215.9$497.3 million for fiscal 2012. The increase primarily reflected the full year impact of the acquisition of Everlasting Granite Memorial Co., Inc. (“Everlasting Granite”) in May 2012. Sales for the Funeral Home Products segment were $242.8 million for fiscal 2013 compared to $230.9 million for fiscal 2012. The increase principally resulted from higher unit volume and an improvement in product mix. Sales for the Cremation segment were $48.5 million for fiscal 2013 compared to $46.0 million a year ago. The increase principally resulted from higher sales of cremation equipment in the U.S. and the benefit of a small U.K. acquisition completed in fiscal 2012, partially offset by lower international sales. In the Company’s Brand Solutions businesses, sales for the Graphics Imaging segment in fiscal 2013 were $294.6 million, compared to $259.9 million a year ago.2014. The increase resulted principally from the acquisition of Wetzel Holding AG, Wetzel GmbHSchawk ($339.1 million), and certain related affiliates (collectively, “Wetzel”)higher sales, excluding the Schawk acquisition, in November 2012,Europe. These increases were partially offset by lowerthe unfavorable impact of changes in foreign currency values against the U.S. dollar of approximately $44.1 million. Memorialization segment sales for fiscal 2015 were $508.1 million compared to $508.4 million for fiscal 2014. The Memorialization segment sales reflected higher unit volume of caskets, higher sales of bronze and granite memorials, higher cremation equipment sales in the segment’s principal markets due to soft economic conditions, particularlyU.S. market, and the incremental impact of the Aurora acquisition ($14.4 million). These increases were offset by lower mausoleum sales, lower equipment sales in Europe. MarkingEurope and Fulfillment Systemsthe U.K., and the unfavorable impact of changes in foreign currency values against the U.S. dollar of approximately $9.7 million. Lower equipment sales in the U.K. reflected a large waste incinerator project in fiscal 2014 that did not repeat in fiscal 2015. Industrial segment sales for the year ended September 30, 20132015 were $93.5$119.7 million, compared to $74.6$100.8 million for fiscal 2012.2014. The increase resulted principally from higher sales of warehouse control systems and higher unit volume of marking products and related consumables, primarily in North America. These increases were partially offset by the unfavorable impact of changes in foreign currency values against the U.S. market and the acquisitiondollar of Pyramid Controls, Inc. and its affiliate, Pyramid Control Systems (collectively, “Pyramid”) in December 2012. Sales for the Merchandising Solutions segment were $79.4 million for fiscal 2013, compared to $73.0 million a year ago. The improvement was attributable to an increase in sales to several large customers in fiscal 2013.approximately $3.0 million.

| ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS, (continued) |

Gross profit for the year ended September 30, 20132015 was $356.5$529.4 million, or 36.2%compared to $392.5 million for fiscal 2014. Consolidated gross profit as a percent of sales compared to $336.6 million, or 37.4% of sales,was 37.1% and 35.5% for fiscal 2012.2015 and fiscal 2014, respectively. The increase in fiscal 2013 consolidated gross profit comparedprimarily reflected the impact of higher sales. Fiscal 2015 gross profit also included an expense of $1.8 million for the partial write-off of inventory step-up value related to fiscal 2012 reflected higher sales and the benefitAurora acquisition. Fiscal 2014 gross profit included an expense of recent acquisitions.$9.5 million for the write-off of inventory step-up value related to the Schawk acquisition. The decreaseimprovement in gross profit as a percentagepercent of sales primarily reflected lower margins in the Brand Solutions businesses.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS, (continued)higher fiscal 2014 write-off of inventory step-up value, and the favorable margin impact from the Schawk acquisition.

Selling and administrative expenses for the year ended September 30, 20132015 were $260.7$424.4 million, or 26.5%compared to $311.0 million for fiscal 2014. Consolidated selling and administrative expenses as a percent of sales were 29.8% for fiscal 2015, compared to $243.0 million, or 27.0% of sales, for28.1% in fiscal 2012.2014. The increase in selling and administrative expenses was primarily attributable to the impacts of recent acquisitions, unusual charges and higher sales inand the Funeral Home Products segment. The reduction inacquisitions of Schawk and Aurora. In addition, fiscal 2015 selling and administrative costs as a percentexpenses included an increase of sales was due primarily$12.1 million in intangible asset amortization related to the benefitSchawk and Aurora acquisitions, acquisition-related expenses of adjustments$37.1 million primarily related to contingent considerationthe Schawk acquisition integration activities and the Company’s cost containment efforts in fiscal 2013. Unusual charges primarily included costsAurora transaction expenses, trade name write-offs of $4.8 million and expenses related to strategic cost-structurecost-reduction initiatives acquisition-relatedof $2.2 million, partially offset by the impact of the favorable settlement of litigation, net of related expenses, in the Memorialization segment of $9.0 million. Fiscal 2014 selling and asset adjustments.administrative expenses included expenses related to acquisition activities, primarily the Schawk acquisition, of $18.2 million, the Company's strategic cost structure initiatives of $4.5 million and litigation-related expenses in the Memorialization segment of $3.0 million.

Operating profit for fiscal 20132015 was $95.8$105.0 million, compared to $93.6$81.5 million for fiscal 2012.2014. The increase in operating profit for fiscal 2013 reflected higher sales and the impact of recent acquisitions, partially offset by net unusual charges totaling approximately $14.1 million in fiscal 2013. Fiscal 2012 included net unusual charges of approximately $7.8 million.

Cemetery ProductsSGK Brand Solutions segment operating profit for fiscal 20132015 was $32.6$21.9 million, compared to $33.2$2.5 million for fiscal 2012.2014. The decrease insegment's fiscal 20132015 operating profit comparedwas favorably impacted by the Schawk acquisition, and higher sales, exclusive of the acquisition, in Europe. The SGK Brand Solutions segment fiscal 2015 operating profit included charges totaling $39.5 million representing acquisition integration expenses, trade name write-offs, and expenses related to fiscal 2012 resulted mainly from unusual chargesstrategic cost-reduction initiatives. In addition, the segment reported an $11.7 million increase in intangible asset amortization related to the Schawk acquisition. Fiscal 2015 SGK Brand Solutions segment operating profit was also unfavorably impacted by changes in foreign currency values against the U.S. dollar of approximately $5.9$4.4 million. Fiscal 2014 SGK Brand solutions segment operating profit included expenses of $17.8 million related to acquisition activities, $4.1 million related to strategic cost-structurecost-reduction initiatives, compareda $9.5 million write-off of inventory step-up value, and also reflected the benefit of a merchandising display project that did not repeat to similar unusual chargesthe same level in fiscal 2012 of approximately $5.4 million. Operating profit for the Funeral Home products segment for fiscal 2013 was $37.3 million, compared to $26.5 million for fiscal 2012. The increase in Funeral Home Products2015. Memorialization segment operating profit for fiscal 2013 primarily reflected2015 was $70.1 million, compared to $67.9 million for fiscal 2014. The Memorialization segment fiscal 2015 operating profit included the incremental impact of the Aurora acquisition, and the impact of higher sales,the favorable settlement of litigation, net of related expenses, of $9.0 million. The fiscal 2015 Memorialization segment operating profit was unfavorably impacted by charges totaling $6.4 million, primarily consisting of acquisition-related costs, and expenses related to strategic cost-reduction initiatives. In addition, the segment reported a $403,000 increase in intangible asset amortization related to the Aurora acquisition. Memorialization segment fiscal 2014 operating profit included $4.0 million of expenses related to strategic cost-reduction initiatives and $3.0 million of litigation-related expenses, and also reflected the benefit of improved production and distribution efficiencies and the benefit of adjustments to contingent consideration. These increases were partially offset by unusual charges related to strategic cost-structure initiatives. Fiscal 2012 also included the benefit of adjustments to contingent consideration, partially offset by unusual charges for severance. Net unusual items for the Funeral Home Products segment were approximately the same aggregate amounta large incineration project that did not repeat in fiscal 2013 and 2012. Cremation segment operating profit for the year ended September 30, 2013 was $3.1 million, compared to $3.9 million a year ago. Fiscal 2013 operating profit reflected the impact of higher sales in the U.S. market, partially offset by lower sales in the European and U.K. markets. In addition, Cremation segment fiscal 2013 operating profit included unusual charges related to strategic cost-structure initiatives. Graphics Imaging segment operating profit for fiscal 2013 was $9.7 million, compared to $14.8 million for 2012. The decrease in fiscal 2013 reflected lower sales (excluding the Wetzel acquisition) and the unfavorable impact of unusual items of approximately $6.3 million. The unusual charges related to acquisition activities and strategic initiatives, and an impairment charge related to the carrying value of a trade name. Graphics Imaging segment operating profit in fiscal 2012 included net unusual charges of approximately $3.4 million primarily related to acquisition activities and severance costs, partially offset by the benefit of an adjustment to contingent consideration.2015. Operating profit for the Marking and Fulfillment SystemsIndustrial segment for fiscal 20132015 was $8.9$13.1 million, compared to $10.1$11.0 million a year ago.in fiscal 2014. The decrease in Marking and Fulfillment Systems segment operating profit principally reflectedincrease primarily resulted from the impact of unusual charges related to cost-structure strategic initiatives, partially offset by the benefit of the Pyramid acquisition and higher sales in the U.S. The Merchandising Solutions segment operating profit was $4.3 million for fiscal 2013, compared to $5.1 million for fiscal 2012. The decrease principally reflected thefavorable impact of higher sales, offset by an increase in employee-related costs and unusual charges related to strategic cost-structure initiatives.sales.

Investment income for the year ended September 30, 20132015 was $2.3 million,$175,000, compared to $3.9$2.1 million for the year ended September 30, 2012.2014. The decrease principally reflected lower rates of return on investments held in trust for certain of the Company’sCompany's benefit plans. Interest expense for fiscal 20132015 was $12.9$20.6 million, compared to $11.5$12.6 million last year.in fiscal 2014. The increase in interest expense primarily reflected higher average debt levels.levels resulting from the acquisitions of Schawk in July 2014 and Aurora in August 2015.

| ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS, (continued) |

Other income (deductions), net, for the year ended September 30, 20132015 represented a decreasean increase in pre-tax income of $3.7$5.1 million, compared to a decrease in pre-tax income of $2.1$4.9 million in 2012.fiscal 2014. Other income and deductions generally include banking-related fees and the impact of currency gains or losses on certain intercompany debt.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS, (continued)debt and foreign denominated receivables and payables. Fiscal 2015 other income and deductions included an $11.5 million gain on the settlement of a multi-employer pension plan installment payment obligation. Fiscal 2014 other income and deductions included a write-off of prior deferred bank fees recognized upon the amendment of the Company's domestic Revolving Credit Facility in conjunction with the Schawk acquisition. Other income and deductions also included losses related to a theft of funds by an employee that had occurred over a multi-year period, totaling $2.3 million and $1.7 million in fiscal 2015 and fiscal 2014, respectively.

The Company's effective tax rate for fiscal 20132015 was 32.7%29.4%, compared to 34.2%34.5% for fiscal 2012. Fiscal 2012 included the favorable impact of adjustments totaling $528,000 in income tax expense primarily related to changes in the estimated tax accruals for open tax periods. Excluding this adjustment from fiscal 2012, the Company’s effective tax rate was 34.8%.2014. The decrease in the fiscal 20132015 effective tax rate, compared to fiscal 20122014, primarily reflected the benefit of the utilization of certain tax attributes as a result of legal structure reorganization in foreign jurisdictions and a relative increase in the amount of earnings generated from non-U.S. locations. The effective tax rate in fiscal 2014 included the impact of non-deductible acquisition costs relating to the Company’s European tax structure initiatives, including the fiscal 2013 benefit of a European tax loss carryback.Schawk acquisition. The difference between the Company's effective tax rate and the Federal statutory rate of 35.0% primarily reflected the impact of state taxes, offset by lower foreign income taxes.

Net earnings attributable to noncontrolling interest representedinterests was a loss of $116,000 for$161,000 in fiscal 2013,2015, compared to a lossincome of $639,000$646,000 in fiscal 2012.2014. The decrease related principallychange in net earnings attributable to higher operating income recorded by the Company’s Turkish operationnoncontrolling interests primarily reflected losses in fiscal 2013.less than wholly-owned Industrial and Memorialization businesses.

Comparison of Fiscal 20122014 and Fiscal 2011:2013:

Sales for the year ended September 30, 20122014 were $900.3 million,$1.1 billion, compared to $898.8$985.4 million for the year ended September 30, 2011. Fiscal 2012 included2013. The increase in fiscal 2014 sales principally reflected the impactacquisition of recent acquisitions, andSchawk in July 2014, higher sales in the Cremation, MarkingCompany's SGK Brand Solutions and Fulfillment SystemsIndustrial segments, the incremental impact of acquisitions completed in fiscal 2013 and Merchandising Solutions segments. These increases were offset by lower salesthe impact of significant projects in the Cemetery Products, Funeral Home ProductsSGK Brand Solutions and Graphics Imaging segments, and by the unfavorable impact of changes in the values of foreign currencies of approximately $18.4 million compared to fiscal 2011. Sales in the Cemetery Products and Funeral Home Products segments were negatively impacted by a decline in the estimated number of casketed and in-ground burial (non-cremation) deaths. In the Memorialization businesses, Cemetery Products segmentsegments. Consolidated sales for fiscal 2012 were $215.9 million compared to $224.8 million for fiscal 2011. The decrease primarily2014 also reflected lower salesthe benefit of memorial products in North America, a decrease in mausoleum sales and the unfavorable impact offavorable changes in foreign currencies against the U.S. dollar. These declinesdollar of approximately $6.2 million.

Sales for the SGK Brand Solutions segment in fiscal 2014 were partially offset by$497.3 million, compared to $373.9 million for fiscal 2013. The increase resulted principally from the acquisition of Everlasting GraniteSchawk in May 2012. Sales for the Funeral Home Products segment were $230.9 million for fiscal 2012 compared to $243.3 million for fiscal 2011, which principally resulted from a reduction in sales volume. LowerJuly 2014 ($75.1 million), higher sales volume of bronze memorials and caskets reflectedin the segment's principal markets, the incremental impact of the acquisition of Wetzel Holding AG, Wetzel GmbH and certain related affiliates (collectively, "Wetzel") in November 2012, a decline insignificant merchandising display project during the estimated numberthird and fourth fiscal quarters of casketed2014 and in-ground burial (non-cremation) deaths compared to the prior year. Sales for the Cremation segment were $46.0a $5.9 million for fiscal 2012 compared to $39.3 million for fiscal 2011. The increase principally resulted from higher sales of cremation equipment, primarily in the U.S., partially offset by the unfavorablefavorable impact of changes in foreign currency values. In the Company’s Brand Solutions businesses, sales for the Graphics Imaging segment in fiscal 2012 were $259.9 million, compared to $269.0 million for fiscal 2011. The decrease resulted principally from lower sales in the European market, and the unfavorable impact of changes in foreign currency values against the U.S. dollar. These declinesMemorialization segment sales for fiscal 2014 were $508.4 million compared to $517.9 million for fiscal 2013. The decrease primarily reflected lower unit volume of memorials and caskets and traditional cremator equipment, partially offset by a large waste incineration project in Saudi Arabia and higher mausoleum sales. Based on published CDC data, the impactCompany estimated that the number of casketed, in-ground burial deaths in the acquisition of Kroma Pre-Press Preparation Systems Industry & Trade, Inc. (“Kroma”)United States declined in fiscal 2014 compared to fiscal 2013, which was purchasedthe primary factor in July 2011. Markingthe decrease in unit volume of both memorials and Fulfillment Systemscaskets. Industrial segment sales for the year ended September 30, 20122014 were $74.6$100.8 million, compared to $61.9$93.5 million for fiscal 2011.2013. The increase wasresulted principally due tofrom higher equipment sales in the United States and the full yearincremental impact of two small acquisitions completedthe acquisition of Pyramid Control Systems ("Pyramid") in fiscal 2011, partially offset by the unfavorable impact of changes in foreign currency values. Sales for the Merchandising Solutions segment were $73.0 million for fiscal 2012, compared to $60.6 million for fiscal 2011. The improvement was attributable to an increase in sales to several large customers in fiscalDecember 2012.

Gross profit for the year ended September 30, 20122014 was $336.6$392.5 million, or 37.4%35.5% of sales, compared to $351.7$356.5 million, or 39.1%36.2% of sales, for fiscal 2011.2013. The decreasesincrease in fiscal 20122014 consolidated gross profit compared to fiscal 2013 reflected higher sales and the benefit of recent acquisitions, partially offset by higher material costs in the Memorialization segment. In addition, fiscal 2014 gross profit included an expense of $9.5 million for the write-off of inventory step-up value related to the Schawk acquisition. The decrease in gross profit as a percentage of sales compared to fiscal 2011primarily reflected lower sales, higher commodity costs, and unusual charges in severalthe impact of the Company’s segments. The unusual charges related primarily to severancewrite-off of the inventory step-up and higher material costs in several of the Company’s businesses as a result of cost structure initiatives and incremental costs related to the Company’s ERP implementation in the Cemetery ProductsMemorialization segment.

ITEM 7. | ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS, (continued) |

Selling and administrative expenses for the year ended September 30, 20122014 were $243.0$311.0 million, or 27.0%28.1% of sales, compared to $233.1$261.9 million, or 25.9%26.6% of sales, for fiscal 2011. The increase in2013. Fiscal 2014 selling and administrative expenses was attributableincluded expenses related to higher salesacquisition activities (primarily the Schawk acquisition) of $18.2 million, the Company's strategic cost structure initiatives of $4.5 million and litigation expenses of $3.0 million related to a legal dispute in the Cremation, Marking and Fulfillment Systems and Merchandising Solutions segments, and the impact of acquisitions in the Cemetery Products and Marking and Fulfillment Systems segments. In addition, fiscal 2012Memorialization segment. Fiscal 2013 selling and administrative expenses include net unusual charges in several segments. Unusual charges primarily included severance costs, incremental costsexpenses of $13.6 million related to the Company’s ERP implementationstrategic cost-reduction initiatives, $3.4 million related to acquisition activities, $1.8 million related to litigation-related expenses in the Cemetery ProductsMemorialization segment, acquisition-related expenses and $2.2 million related to asset adjustments. These charges were partially offset by unusual gains consisting of adjustments to contingent consideration liabilities, a favorable settlement on a claim related to the Company’s granite business and a gain on the sale of a business investment in China. Operating profit for fiscal 2012 was $93.6 million, compared to $118.5 million for fiscal 2011. The decrease in operating profit for fiscal 2012 reflected the impact of lower consolidated sales, higher commodity costs, a $2.1 million unfavorable impact of changes in foreign currency values against the U.S. dollar and net unusual charges totaling approximately $7.8 million.

Cemetery Products segment operating profit for fiscal 2012 was $33.2 million, compared to $52.5 million for fiscal 2011. The decrease in fiscal 2012 operating profit compared to fiscal 2011 reflected lower sales, higher bronze ingot costs, the unfavorable impact of changes in foreign currency values and net unusual charges of approximately $5.4 million related to severance and ERP implementation costs. Operating profit for the Funeral Home products segment for fiscal 2012 was $26.5 million, compared to $29.0 million for fiscal 2011. The decrease in Funeral Home Products segment operating profit for fiscal 2012 primarily reflected the impact of lower sales, higher commodity (primarily fuel) costs and unusual charges of approximately $1.7 million related to severance costs. These declines2013 expenses were partially offset by the benefit of sellingadjustments to contingent consideration of $6.2 million and distribution cost structurea gain of $3.0 million on the settlement of the purchase price of the remaining ownership interest in one of the Company's subsidiaries.

Operating profit for fiscal 2014 was $81.5 million, compared to $94.6 million for fiscal 2013. The SGK Brand Solutions segment reported operating profit of $2.5 million for fiscal 2014, compared to $14.0 million for fiscal 2013. The decrease in fiscal 2014 primarily reflected the impact of acquisition-related expenses of $17.8 million, the $9.5 million write-off of inventory step-up value and expenses related to strategic cost-reduction initiatives and an adjustment to the liability for contingent consideration. Cremationof $4.1 million. Fiscal 2013 SGK Brand solutions segment operating profit forincluded expenses of $3.2 million related to acquisition activities, $5.3 million related to strategic cost-reduction initiatives and a $1.6 million impairment charge related to the year ended September 30, 2012 was $3.9 million, compared to $3.5 million forcarrying value of a trade name. These fiscal 2011. Fiscal 2012 operating profit reflected higher sales in the U.S. market,2013 expenses were partially offset by lower marginsa gain of $3.0 million on the settlement of the purchase price of the remaining ownership interest in one the Company's subsidiaries. Excluding these net charges from both years, SGK Brand Solutions operating profit increased $12.8 million as a result of higher sales inand the European market. Graphics Imagingacquisition of Schawk. Memorialization segment operating profit for fiscal 20122014 was $14.8$67.9 million, compared to $22.4$71.8 million for fiscal 2011. The decrease in2013. Memorialization segment fiscal 2012 reflected lower sales,2014 operating profit included $4.0 million of expenses related to strategic cost-reduction initiatives and unusual chargeslitigation expenses of approximately $5.1$3.0 million related to severance costs anda legal dispute with one of its competitors. Fiscal 2013 Memorialization segment operating profit included the unfavorable impact of changes in foreign currency values. The unusual chargesexpenses of $10.1 million related to strategic cost-reduction initiatives, litigation expenses of $1.8 million, and a $6.3 million benefit of adjustments to contingent consideration. Excluding the impact of these expenses from both years, fiscal 2014 operating profit decreased by $2.5 million, compared to fiscal 2013, primarily to severance and acquisition-related costs. The declines werereflecting lower sales, partially offset by an adjustment to the liability for contingent consideration and a gain on the sale of a business investment in China.productivity benefits from strategic cost-reduction initiatives. Operating profit for the Marking and Fulfillment SystemsIndustrial segment for fiscal 20122014 was $10.1$11.0 million, compared to $7.8$8.9 million for fiscal 2011.2013. The increase in Markingsegment's fiscal 2014 and Fulfillment Systems2013 operating profit included expenses related to strategic cost-reduction initiatives of $220,000 and $1.4 million, respectively. Excluding these expenses from both years, Industrial segment operating profit principally reflected the impact of acquisitions and higher sales. The Merchandising Solutions segment operating profit was $5.1 million for fiscal 2012, compared to $3.32014 increased $1.0 million forover fiscal 2011. The increase principally reflected the impact2013, primarily as a result of higher sales.

Investment income for the year ended September 30, 20122014 was $3.9$2.1 million, compared to $1.4$2.3 million for the year ended September 30, 2011. The increase principally reflected increases in the market value of investments held in trust for certain of the Company’s benefit plans.2013. Interest expense for fiscal 20122014 was $11.5$12.6 million, compared to $8.2$12.9 million for fiscal 2011.2013. The increasedecrease in interest expense reflected higher averagelower interest rates, partially offset by increased debt levels.levels in the fourth fiscal quarter of 2014 to finance the Schawk acquisition.

Other income (deductions), net, for the year ended September 30, 20122014 represented a decrease in pre-tax income of $2.1$4.9 million, compared to an increasea decrease in pre-tax income of $298,000$3.8 million in fiscal 2011.2013. Other income and deductions generally include banking-related fees and the impact of currency gains or losses on certain intercompany debt. The increase in other deductions, net, principally reflected the write-off of prior deferred bank fees upon the amendment of the Company's domestic Revolving Credit Facility in conjunction with the Schawk acquisition. Other income and deductions also included expenses related to a theft of funds by an employee totaling $1.7 million and $1.3 million for the years ended September 30, 2014 and 2013, respectively.

The Company's effective tax rate for fiscal 20122014 was 34.2%34.5%, compared to 34.4%32.6% for fiscal 2011. Fiscal 2012 and 2011 included the favorable impact of adjustments totaling $528,000 and $606,000, respectively, in income tax expense primarily related to changes in the estimated tax accruals for open tax periods. Excluding these adjustments from both periods, the Company’s effective tax rate was 34.8% for fiscal year 2012 and 35.0% for fiscal 2011.2013. The decreaseincrease in the fiscal 20122014 effective tax rate, compared to fiscal 20112013, primarily reflected the impact of the Company’s European tax structure initiatives.non-deductible acquisition expenses in fiscal 2014. The difference between the Company's effective tax rate and the Federal statutory rate of 35.0% primarily reflected the impact of state taxes, offset by lower foreign income taxes.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS, (continued)

Net earnings attributable to noncontrolling interestinterests was a lossdeduction of $639,000$646,000 for fiscal 2012,2014, compared to net income of $1.1 million$116,000 in fiscal 2011.2013. The decreasechange related principally to the Company’s acquisition of the remaining 22% interest in Saueressig GmbH & Co. KG (“Saueressig”) in April 2011 and a net losshigher operating income recorded by the Company’s Turkish operationCompany's less than wholly-owned operations in fiscal 2012.the U.K.

ITEM 7.MANAGEMENT'S DISCUSSION AND ANALYSIS, (continued)

LIQUIDITY AND CAPITAL RESOURCES:

Net cash provided by operating activities was $109.3$141.1 million for the year ended September 30, 2013,2015, compared to $83.3$90.7 million and $97.8$108.1 million for fiscal 20122014 and 2011,2013, respectively. Operating cash flow for fiscal 2015 principally included net income adjusted for depreciation and amortization, stock-based compensation expense, trade name write-offs, and an increase in deferred taxes, partially offset by an increase in working capital items and a cash contribution of $3.3 million to the Company's principal pension plan. Operating cash flow for fiscal 2014 principally included net income adjusted for depreciation and amortization, stock-based compensation expense, and an increase in deferred taxes, partially offset by an increase in working capital items and a cash contribution of $3.0 million to the Company's principal pension plan. Operating cash flow for fiscal 2013 principally included net income adjusted for depreciation and amortization, stock-based compensation expense, and an increase in deferred taxes, partially offset by an increase in working capital items (primarily accounts receivable and inventory) and a cash contribution of $2.5 million to the Company’s principal pension plan. Operating cash flow for fiscal 2012 principally included net income adjusted for depreciation and amortization, stock-based compensation expense, and an increase in deferred taxes, partially offset by an increase in working capital items (primarily accounts receivable and inventory) and a cash contribution of $5.0 million to the Company’s principal pension plan. Operating cash flow for fiscal 2011 primarily reflected net income adjusted for depreciation and amortization, stock-based compensation expense, and an increase in deferred taxes, partially offset by a net increase in working capital items. In addition the Company made a cash contribution of $9.0 million to itsCompany's principal pension plan.

Cash used in investing activities was $98.6$263.2 million for the year ended September 30, 2013,2015, compared to $45.3$411.1 million and $106.8$98.6 million for fiscal years 20122014 and 2011,2013, respectively. Investing activities for fiscal 2015 primarily reflected capital expenditures of $48.3 million, acquisition payments (net of cash acquired) of $213.5 million, primarily for the Aurora acquisition, net proceeds of $10.4 million from the sale of a subsidiary, and payment of $12.9 million related to a letter of credit issued for a customer (see discussion below). Investing activities for fiscal 2014 primarily included payments (net of cash acquired) of $382.1 million, primarily for the Schawk acquisition, and $29.2 million for capital expenditures. Investing activities for fiscal 2013 primarily included payments (net of cash acquired) of $74.0 million for acquisitions and $24.9 million for capital expenditures. Investing activities for fiscal 2012 primarily reflected capital expenditures of $33.2 million and payments (net of cash acquired) of $12.5 million for acquisitions. Investing activities for fiscal 2011 primarily reflected payments (net of cash acquired) of $84.4 million for acquisitions and capital expenditures of $22.4 million.

Capital expenditures were $24.9$48.3 million for the year ended September 30, 2013,2015, compared to $33.2$29.2 million and $22.4$24.9 million for fiscal 20122014 and 2011,2013, respectively. Capital expenditures in fiscal 2012 were higher due to new investments in gravure equipment in Germany and Turkey and investments in ERP and e-commerce systems. Capital expenditures in each of the last three fiscal years reflected reinvestments in the Company's business segments and were made primarily for the purchase of new manufacturing machinery, equipment and facilities designed to improve product quality, increase manufacturing efficiency, lower production costs and meet regulatory requirements. Capital expenditures for the last three fiscal years were primarily financed through operating cash.

Capital spending for property, plant and equipment has averaged $26.9$34.1 million for the last three fiscal years. The increase in fiscal 2015 capital spending reflects the addition of the capital requirements of Schawk, and additional information technology capital spending related to the Company's systems integration activities, primarily arising with the Schawk acquisition. Capital spending for fiscal 20142016 is currently expected to be approximately $30.0$45.0 million. The Company expects to generate sufficient cash from operations to fund all anticipated capital spending projects.

Cash provided by financing activities for the year ended September 30, 2015 was $131.2 million, and reflected proceeds, net of repayments, on long-term debt of $179.2 million, purchases of treasury stock of $14.6 million, payment of contingent consideration of $484,000, proceeds from the sale of treasury stock (stock option exercises) of $4.0 million and payment of dividends to the Company's shareholders of $17.8 million ($0.54 per share). Cash provided by financing activities for the year ended September 30, 2014 was $338.1 million, and reflected proceeds, net of repayments, on long-term debt of $357.3 million, purchases of treasury stock of $9.9 million, payment of contingent consideration of $3.7 million, proceeds from the sale of treasury stock (stock option exercises) of $8.0 million and payment of dividends to the Company's shareholders of $13.4 million ($0.46 per share). Cash used in financing activities for the year ended September 30, 2013 was $11.8$10.8 million, reflectingand reflected proceeds, net of repayments, on long-term debt of $32.2$33.2 million, purchases of treasury stock of $21.6 million, payment of contingent consideration of $11.3 million and payment of dividends to the Company’sCompany's shareholders of $11.3 million ($0.41 per share). Cash used in financing activities for the year ended September 30, 2012 was $41.0 million, reflecting purchases of treasury stock of $31.0 million, and payment of dividends to the Company’s shareholders of $10.3 million ($0.37 per share). Cash provided by financing activities for the year ended September 30, 2011 was $10.4 million, reflecting proceeds, net of repayments, on long-term debt of $68.9 million, purchases of treasury stock of $44.6 million, proceeds from the sale of treasury stock (stock option exercises) of $1.9 million, payment of dividends to the Company’s shareholders of $9.6 million ($0.33 per share) and distributions of $6.2 million to noncontrolling interests.

The Company has a domestic Revolving Credit Facility with a syndicate of financial institutions. In connection with the acquisition of Schawk in July 2013,2014, the Company amended certain terms of the Revolving Credit Facility to increase the maximum amount of borrowings available under the facility was increased from $400.0$500.0 million to $500.0 million and the facility’s maturity was extended to July 2018.$900.0 million. Borrowings under the amended facility bear interest at LIBOR plus a factor ranging from .75% to 1.25%2.00% (1.75% at September 30, 2015) based on the Company’sCompany's leverage ratio. The leverage ratio is defined as net indebtedness divided by EBITDA (earnings before interest, taxes, depreciation and amortization). The Company is required to pay an annual commitment fee ranging from .15% to .25% (based on the Company’sCompany's leverage ratio) of the unused portion of the facility.

ITEM 7. | ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS, (continued) |

The Revolving Credit Facility requires the Company to maintain certain leverage and interest coverage ratios. A portion of the facility (not to exceed $25.0$30.0 million) is available for the issuance of trade and standby letters of credit. Outstanding borrowings on the Revolving Credit Facility at September 30, 20132015 and 20122014 were $305.0$857.4 million and $281.3$680.0 million, respectively. The weighted-average interest rate on outstanding borrowings at September 30, 20132015 and 20122014 was 2.81%2.41% and 2.83%2.53%, respectively.

The Company has entered into the following interest rate swaps:

| Effective Date | Amount | Fixed Interest Rate | Interest Rate Spread at September 30, 2013 | Maturity Date | Amount | Fixed Interest Rate | Interest Rate Spread at September 30, 2015 | Maturity Date | | May 2011 | $25 million | 1.37% | 1.25% | May 2014 | | | October 2011 | 25 million | 1.67% | 1.25% | October 2015 | $25 million | 1.67% | 1.75% | October 2015 | | November 2011 | 25 million | 2.13% | 1.25% | November 2014 | | | March 2012 | 25 million | 2.44% | 1.25% | March 2015 | | | June 2012 | 40 million | 1.88% | 1.25% | June 2022 | 40 million | 1.88% | 1.75% | June 2022 | | August 2012 | 35 million | 1.74% | 1.25% | June 2022 | 35 million | 1.74% | 1.75% | June 2022 | | September 2012 | 25 million | 3.03% | 1.25% | December 2015 | 25 million | 3.03% | 1.75% | December 2015 | | September 2012 | 25 million | 1.24% | 1.25% | March 2017 | 25 million | 1.24% | 1.75% | March 2017 | | November 2012 | 25 million | 1.33% | 1.25% | November 2015 | 25 million | 1.33% | 1.75% | November 2015 | | May 2014 | | 25 million | 1.35% | 1.75% | May 2018 | | November 2014 | | 25 million | 1.26% | 1.75% | June 2018 | | March 2015 | | 25 million | 1.49% | 1.75% | March 2019 | | September 2015 | | 25 million | 1.39% | 1.75% | September 2020 | | December 2015 | | 25 million | 1.59% | 1.75% | December 2020 |

The interest rate swaps have been designated as cash flow hedges of the future variable interest payments under the Revolving Credit Facility which are considered probable of occurring. Based on the Company’sCompany's assessment, all the critical terms of each of the hedges matched the underlying terms of the hedged debt and related forecasted interest payments, and as such, these hedges were considered highly effective.

The fair value of the interest rate swaps reflected an unrealized loss, net of unrealized gains, of $908,000 ($554,000 after tax) and $9.1$3.7 million ($5.62.2 million after tax)after-tax) and an unrealized gain, net of unrealized losses, of $330,000 ($201,000 after-tax) at September 30, 20132015 and 2012,2014, respectively, that is included in shareholders' equity as part of accumulated other comprehensive loss.income. Assuming market rates remain constant with the rates at September 30, 2013,2015, a loss (net of tax) of approximately $1.6 million$711,000 included in accumulated other comprehensive lossincome is expected to be recognized in earnings as an adjustment to interest expense over the next twelve months.

In March 2013, theThe Company, through certain of its European subsidiaries, entered intohas a credit facility with a European bank. The maximum amount of borrowings available under this facility is 25.035.0 million Euros ($33.839.3 million). Outstanding borrowings under the credit facility totaled 22.523.9 million Euros ($30.426.8 million) and 17.5 million Euros ($22.1 million) at September 30, 2013.2015 and 2014, respectively. The weighted-average interest rate on outstanding borrowings under the facility at September 30, 20132015 and 2014 was 1.37%.1.50% and 1.35%, respectively.

The Company, through its German subsidiary, Saueressig GmbH & Co. KG ("Saueressig"), has several loans with various European banks. Outstanding borrowings onunder these loans totaled 1.7734,000 Euros ($824,000) and 1.2 million Euros ($2.3 million) and 8.2 million Euros ($10.51.6 million) at September 30, 20132015 and 2012,2014, respectively. The weighted-average interest rate on outstanding borrowings of Saueressig at September 30, 20132015 and 20122014 was 4.04% and 6.10%3.96%, respectively.

The Company, through its German subsidiary, Wetzel GmbH ("Wetzel"), has several loans with various European banks. Outstanding borrowings under these loans totaled 1.9 million Euros ($2.1 million) and 2.9 million Euros ($3.6 million) at September 30, 2015 and 2014, respectively. The weighted-average interest rate on outstanding borrowings of Wetzel at September 30, 2015 and 2014 was 5.96% and 5.67%, respectively.

| ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS, (continued) |

The Company, through its wholly-owned subsidiary, Matthews International S.p.A., has several loans with various Italian banks. Outstanding borrowings on these loans totaled 5.14.3 million Euros ($4.8 million) and 5.5 million Euros ($6.9 million) and 6.3 million Euros ($8.1 million) at September 30, 20132015 and 2012,2014, respectively. Matthews International S.p.A. also has fourthree lines of credit totaling 11.411.3 million Euros ($15.412.7 million) with the same Italian banks. Outstanding borrowings on these lines were 5.64.6 million Euros ($7.65.2 million) and 3.44.8 million Euros ($4.36.1 million) at September 30, 20132015 and 2012,2014, respectively. The weighted-average interest rate on outstanding Matthews International S.p.A. borrowings at September 30, 20132015 and 20122014 was 3.16%3.33% and 3.08%3.15%, respectively.

In September 2014, a claim seeking to draw upon a letter of credit issued by the Company of $12.9 million was filed with respect to a project for a customer. In January 2015, the Company made payment on the draw to the financial institution for the letter of credit. Pursuant to an action initiated by the Company, a court order has been issued requiring these funds to ultimately be remitted to the court pending resolution of the dispute between the parties. While it is possible the resolution of this matter could be unfavorable to the Company, management has assessed the customer's claim to be without merit and, based on information available as of this filing, expects that the ultimate resolution of this matter will not have a material adverse effect on Matthews' financial condition, results of operations or cash flows. As of September 30, 2015, the Company has presented the funded letter of credit within other current assets on the Consolidated Balance Sheet.

The Company has a stock repurchase program. Under the current authorization, the Company's Board of Directors has authorized the repurchase of a total of 2,500,000 shares of Matthews’Matthews' common stock under the program, of which 1,194,670661,022 shares remain available for repurchase as of September 30, 2013.2015. In November 2015, the Company's Board of Directors approved the continuation of its stock repurchase program and increased the authorization for stock repurchases by an additional 2,500,000 shares. The buy-back program is designed to increase shareholder value, enlarge the Company's holdings of its common stock, and add to earnings per share. Repurchased shares may be retained in treasury, utilized for acquisitions, or reissued to employees or other purchasers, subject to the restrictions ofset forth in the Company’sCompany's Restated Articles of Incorporation.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS, (continued)

At September 30, 2013,2015, approximately $46.6$53.9 million of cash and cash equivalents were held by international subsidiaries whose undistributed earnings are considered permanently reinvested. The Company’sCompany's intent is to reinvest these funds in our international operations and current plans do not demonstrate a need to repatriate them to fund U.S. operations. If the Company decides at a later date to repatriate these funds to the U.S., it would be required to provide taxes on these amounts based on the applicable U.S. tax rates net of credits for foreign taxes already paid.

Consolidated working capital was $222.0$375.6 million at September 30, 2013,2015, compared to $212.5$312.9 million at September 30, 2012. The increase in working capital at September 30, 2013 primarily reflected higher accounts receivable, an increase in accrued compensation and a decrease in the current portion of estimated contingent consideration related to acquisitions.2014. Cash and cash equivalents were $58.0$72.2 million at September 30, 2013,2015, compared to $58.3$63.0 million at September 30, 2012.2014. The Company's current ratio was 2.5 and 2.2 at September 30, 20132015 and 2012.2014, respectively.

ENVIRONMENTAL MATTERS:

The Company's operations are subject to various federal, state and local laws and regulations relating to the protection of the environment. These laws and regulations impose limitations on the discharge of materials into the environment and require the Company to obtain and operate in compliance with conditions of permits and other government authorizations. As such, the Company has developed environmental, health, and safety policies and procedures that include the proper handling, storage and disposal of hazardous materials.

The Company is party to various environmental matters. These include obligations to investigate and mitigate the effects on the environment of the disposal of certain materials at various operating and non-operating sites. The Company is currently performing environmental assessments and remediation at these sites, as appropriate.

At September 30, 2013,2015, an accrual of approximately $5.3$4.3 million had been recorded for environmental remediation (of which $1.2 million was classified in other current liabilities), representing management's best estimate of the probable and reasonably estimable costs of the Company's known remediation obligations. The accrual which reflects previously established reserves assumed with the acquisition of York and additional reserves recorded as a purchase accounting adjustment, does not consider the effects of inflation and anticipated expenditures are not discounted to their present value. Changes in the accrued environmental remediation obligation from the prior fiscal year reflect payments charged against the accrual.

| ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS, (continued) |

While final resolution of these contingencies could result in costs different than current accruals, management believes the ultimate outcome will not have a significant effect on the Company's consolidated results of operations or financial position.

ACQUISITIONS:

Fiscal 2015:

In August 2015, the Company completed the acquisition of Aurora for $211.6 million (net of cash acquired), subject to a working capital adjustment. The preliminary allocation of the purchase price resulted in goodwill of $73.6 million, which was assigned to the Memorialization segment, $76.3 million of intangible assets, of which $30.5 million is not subject to amortization, $29.0 million of property, plant and equipment, and $32.6 million of other net assets, primarily working capital. Approximately $43.0 million of the goodwill is expected to be deductible for tax purposes. Aurora provides burial, cremation, and technology products to funeral home clients and distributors in the United States and Canada. In the year ended December 31, 2014, Aurora reported revenue of approximately $142.0 million. The acquisition is designed to expand the Company's memorialization product offerings and geographic distribution footprint in the United States.

Fiscal 2014:

On July 29, 2014, the Company acquired Schawk, a leading global brand development, activation and deployment company headquartered in Des Plaines, Illinois. Under the terms of the transaction, Schawk shareholders received $11.80 cash and 0.20582 shares of Matthews' common stock for each Schawk share held. Based on the closing price of Matthews' stock on July 28, 2014, the transaction represented an implied price of $20.74 per share and a total enterprise value (which included outstanding debt, net of cash acquired) of $616.7 million. Schawk provides comprehensive brand development and brand deployment services to clients primarily in the consumer packaged goods, retail and life sciences markets. Schawk creates and sells its clients' brands, produces brand assets and protects brand equities to help drive brand performance. Schawk delivers its services through more than 155 locations in over 20 countries across North and South America, Europe, Asia and Australia.

Fiscal 2013:

Acquisition spending, net of cash acquired, during the year ended September 30, 2013 totaled $74.0 million. The acquisitions were not individually significant to the Company’sCompany's consolidated financial position or results of operations, and primarily included the following:

In April 2013, the Company completed the purchase of the remaining 20% interest in Tact Group Limited (“Tact”). The Company had acquired an 80% interest in Tact in July 2009.

In March 2013, the Company completed the purchase of the remaining 38.5% interest in Kroma Pre-Press Preparation Systems Industry & Trade, Inc. ("Kroma"), completing the option arrangement in connection with the July 2011 acquisition of a 61.5% interest in Kroma.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS, (continued)

In March 2013, the Company completed the purchase of the remaining 20% interest in Furnace Construction Cremators Limited (“FCC”). The Company had acquired an 80% interest in FCC in March 2010.

In December 2012, the Company acquired Pyramid Controls, Inc. and its affiliate, Pyramid Control Systems, a provider of warehouse control systems and conveyor control solutions for distribution centers. The acquisition iswas designed to expand Matthews' fulfillment products and services in the warehouse management market. The initial purchase price for the transaction was $26.2 million, plus potential additional consideration up toof $3.7 million paid in fiscal 2014 based on future operating results.

In November 2012, the Company acquired Wetzel, a leading European provider of pre-press services and gravure printing forms, with manufacturing operations in Germany and Poland. Wetzel’sWetzel's products and services are sold primary within Europe, and the acquisition iswas designed to expand Matthews' products and services in the global graphics imaging market. The purchase price for Wetzel was 42.6 million Euros ($54.7 million) on a cash-free, debt-free basis.

The Company has completed the allocation of purchase price for all acquisitions.28

Fiscal 2012:

Acquisition spending, net of cash acquired, during the year ended September 30, 2012 totaled $12.5 million. The acquisitions were not individually material to the Company’s consolidated financial position or results of operations, and primarily included the following:

In May 2012, the Company acquired Everlasting Granite, a supplier of granite memorials, columbariums and private mausoleum estates. The transaction is intended to expand the Company’s presence and product breadth in the granite memorial business.

Fiscal 2011:

Acquisition spending, net of cash acquired, during the year ended September 30, 2011 totaled $84.4 million. The acquisitions were not individually material to the Company’s consolidated financial position or results of operations, and primarily included the following:

In August 2011, the Company acquired Lightning Pick Technologies, Inc. (“LPT”), a manufacturer that develops, installs and supports paperless order fulfillment solutions. The transaction is intended to expand the Company’s presence and product breadth in the fulfillment systems industry.

In July 2011, the Company purchased a 61.5% interest in Kroma, a leading provider of pre-press services and roto-gravure printing cylinders in Turkey. The acquisition is designed to further extend Matthews' presence as the leading provider of reprographic pre-press products and services to the European packaging and tobacco markets.

| In April 2011, the Company completed the purchase of the remaining 22% interest in Saueressig for 19.3 million Euros ($27.4 million), completing the option agreement in connection with the May 2008 acquisition of a 78% interest in Saueressig. |

| In March 2011, the Company acquired Innovative Picking Technologies, Inc. (“IPTI”), a manufacturer of paperless order fulfillment systems. The transaction is intended to expand the Company’s presence into the fulfillment systems industry. |

| In October 2010, the Company acquired Freeman Metal Products, Inc. and its affiliated companies (collectively, “Freeman”), a manufacturer and distributor of caskets. The purchase price for the acquisition was $22.8 million, plus additional consideration up to $6.0 million contingent on operating performance over the next three years. The transaction is intended to provide synergies in the manufacturing and distribution of caskets and expand the Company’s market presence in the Southeast and South Central regions of the United States. |

| ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS, (continued) |

| In October 2010, the Company acquired the remaining 25% interest in Rudolf Reproflex GmbH & Co. KG (“Reproflex”). The Company acquired a 75% interest in Reproflex in 2001. |

FORWARD-LOOKING INFORMATION:

Matthews has a three-pronged strategy to attain annual growth in earnings per share. This strategy consists of the following: internal growth (which includes organic growth, cost structure and productivity improvements, new product development and the expansion into new markets with existing products), acquisitions and share repurchases under the Company’sCompany's stock repurchase program (see "Liquidity and Capital Resources").

In developing the Company’s expectations for fiscal 2014, the following significant factors were considered.

· | Strategic cost-structure initiatives, particularly with respect to lean and sourcing, will continue, as will the unusual costs associated with the initiatives. Benefits related to strategic initiatives began to be realized late in fiscal 2013 and the Company expects such benefits to continue in fiscal 2014. |

· | The increase in the number of U.S. deaths that impacted the Memorialization businesses in fiscal 2013 are expected to moderate, suggesting a flat to slightly lower casketed death rate for fiscal 2014. |

· | Challenges resulting from the European economic weakness are expected to continue which will impact the Company’s European businesses. |

· | Recent acquisitions are expected to contribute to fiscal 2014 results.

|