UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

FORM 10-K

X | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2007

/X/ ANNUALOR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM ____ TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934______

For the fiscal year ended December 31, 2005______________

or

/ / TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934Mechanical Technology, Incorporated

For the transition period from __________ to __________

Commission file number 0-6890

MECHANICAL TECHNOLOGY INCORPORATED

(Exact name of registrant as specified in its charter)

______________

New York | 0-6890 | 14-1462255 | ||

(State or of | ( | (IRS Employer Identification No.) | ||

|

| |||

|

|

Registrant's

431 New Karner Road, Albany, New York 12205

(Address of registrant’s principal executive office)

(518) 533-2200

(Registrant’s telephone number, including area code: (518) 533-2200code)

Securities registered pursuant to Section 12(b) of the Act: NONE

Securities registered pursuant to Section 12 (g) of the Act:

| |

Title of each class | Name of each exchange on which registered |

Common Stock | The NASDAQ Stock Market LLC |

( | |

Securities Registered Pursuant to Section 12(g) of | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No X |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No X |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one): |

Large Accelerated Filer Accelerated Filer Non-Accelerated Filer Smaller reporting company X |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12B-2 of the Act). Yes No X |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes¨ Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer¨ Accelerated filerx Non-accelerated filer¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12B-2 of the Act). Yes¨ Nox

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 20052007 (based on the last sale price of $3.56$1.26 per share for such stock reported by NASDAQ for that date) was approximately $101,988,058.$43,748,142. Such value excludes common stock held by executive officers, directors, and 10% or greater stockholders as of June 30, 2007. The identification of 10% or greater stockholders as of June 30, 2007 is based upon 13G and amended 13G reports publicly filed before June 30, 2007. This calculation does not reflect a determination that such parties are affiliates for any other purposes.

As of March 9, 2006,20, 2008, the Registrant had 30, 972,32538,179,888 shares of common stock outstanding.

Documents incorporated by reference: Portions of the registrant'sregistrant’s Proxy Statement for its 20062008 Annual Meeting of ShareholdersStockholders are incorporated by reference into Part III of this Form 10-K.

PART I

Item 1: Business

Overview

Unless the context requires otherwise in this Annual Report, the terms “we”, “us” and “our” refer to Mechanical Technology, Incorporated, ("MTI" or the "Company")a New York corporation, “MTI Micro” refers to MTI MicroFuel Cells, Inc., a Delaware corporation and our majority owned subsidiary, and “MTI Instruments” refers to MTI Instruments, Inc., a New York corporation was incorporated in 1961. MTI operates in two segments, the New Energy segment which is conducted through MTI MicroFuel Cells Inc. ("MTI Micro"), a majority-owned subsidiary, and the Test and Measurement Instrumentation segment, which is conducted through MTI Instruments, Inc. ("MTI Instruments"), aour wholly owned subsidiary. We have a registered trademark in the United States for “Mobion”. Other trademarks, trade names, and service marks used in this Annual Report are the property of their respective owners.

At its MTI Micro subsidiary, the Company is primarily focused on the development

We are developing and commercialization of advanced cord-freecommercializing off-the-grid rechargeable power pack technologysources for portable electronics. MTI Micro hasWe have developed a patented, proprietary direct methanol fuel cell ("DMFC") technology platform called Mobion,®, which generates electrical power using up to 100% methanol as fuel. MTI Micro'sOur proprietary fuel cell power solution consists of two primary components integrated in an easily manufactured device: the direct methanol fuel cell power engine, which we refer to as our Mobion® Chip, and methanol replacement cartridges. Our current Mobion Chip weighs less than one ounce and is small enough to fit in the palm of one’s hand. The methanol used by the technology is intendedfully biodegradable. We believe we are the only micro fuel cell developer to replacehave demonstrated power density of over 50 mW/cm2 with high energy efficiencies of 1.4 Wh/cc of methanol for handheld consumer electronic applications. For these reasons, we believe our technology offers a compelling alternative to current Lithium-Ionlithium-ion and similar rechargeable battery systems currently used by original equipment manufacturers (OEMs)and branded partners, or OEMs, in many hand heldhandheld electronic devices, such as personalmobile phones (including smart phones) and mobile phone accessories, digital assistants ("PDAs"), Smartphonescameras, portable media players, PDAs, and other accessories. The Company formed MTI MicroGPS devices. We believe our platform will facilitate the development of numerous product advantages, including small size, environmental friendliness, and simplicity of design, all critical for commercialization in the consumer market, and can be implemented as three different product options: a compact external charging device, a snap-on or attached power accessory, or an embedded fuel cell power solution. We have strategic arrangements with Samsung Electronics and the Duracell division of the Gillette Company. Our goal is to become a leading provider of portable power for handheld electronic devices and we intend to commercialize Mobion products beginning in 2009.

Our Mobion technology eliminates the need for active water recirculation pumps or the inclusion of water as a subsidiaryfuel dilutant. The water required for the electrochemical process is transferred internally within the Mobion Chip from the site of water generation on March 26, 2001 and currently owns approximately 90%the air-side of the outstanding common stockcell. This internal flow of MTI Micro. The remaining 10%water takes place without the need for any pumps, complicated re-circulation loops or other micro-plumbing tools. Our Mobion technology is ownedprotected by strategic partners, other investors,a patent portfolio that includes over 90 U.S. patent applications covering five key technologies and MTI Micro employeesmanufacturing areas.

We also design, manufacture, and board members. In addition, directors and employees of MTI Micro also hold options to purchase shares of MTI Micro common stock representing approximately .45% of MTI Micro's outstanding common stock on a fully diluted basis as of December 31, 2005. Such options are vested or will vest within the next four years.

At its MTI Instruments subsidiary, the Company designs, manufactures, and sellssell high-performance test and measurement instruments and systems. MTI Instruments was incorporated as a subsidiary on March 8, 2000 and hassystems serving three product groups:markets: general dimensional gaging,gauging, semiconductor, and aviation. These products consist ofof: electronic, computerized gaginggauging instruments for position, displacement and vibration applications for the design, manufacturing and test markets; semiconductor products for wafer characterization of semi-insulating and semi-conducting wafers for the semiconductor market;characterization; and engine balancing and vibration analysis systems for both military and commercial aircraft.

MTI also co-founded

The Portable Power Source Industry

Industry Background

Consumers demand portable electronics that offer an enhanced experience through expanded memory, improved display technologies, constant connectivity, robust software, and retains a minority interestreduced form factor. In addition, technological advances in Plug Power Inc. ("Plug Power") (Nasdaq: PLUG),semiconductor manufacturing, LED displays, memory costs and availability, wireless technologies, and software applications have resulted in a developerdramatic increase in the number of clean, reliable, on-site energy products.

New Energy Segment

Trendsportable electronic devices, their usage, and power requirements. As a result of these consumer demands and technological advances, there are a number of handheld electronic devices, such as mobile phones (including smart phones) and mobile phone accessories, digital cameras, portable media players, PDAs, and GPS devices, that have been introduced into the market. Many of these devices provide consumers and mobile professionals with the ability to communicate any time, anywhere and have effectively enabled the creation of an “always-on” environment independent of the end user’s location. This trend towards increased functionality in portable electronicselectronic devices has led to a “power gap” in which the disparity between a device’s power supply, typically a rechargeable lithium-ion battery, and its power need are creatingnot being met. This power gap leads to a growing need for longer-lastingthe end user to plug-in their devices to the electrical grid on a regular basis, which limits their ability to use these electronic devices where and when the need arises.

The Power Source Bottleneck

Improvements in rechargeable battery technology have not kept pace with the evolution of consumer electronic device performance. Over the last ten years, device performance as measured by silicon processor speed has increased by a factor of 128 times, while the energy density of lithium-ion technology has only doubled. We believe that further gains in lithium-ion technology for portable power. Consumers want increased intelligence and functionality for their portable devices. They want more memory, color screens, and convergence of several devices into a multi-purpose one (i.e. cell phones that are also digital cameras and MP3 players). More and more devices are being connected to some kind of network and increasingly used by consumers who want them on and leave them on. All these trends require more energy than current technologies - like battery technologies -

electronics will be incremental at best, as any achievable benefits may be ableoutweighed by the decreasing stability, availability, integrity, and relative safety of these higher energy output batteries. In addition to provide.their performance shortfalls, lithium-ion battery technology poses an environmental risk as the various heavy metals incorporated in these batteries require special disposal to prevent contamination of waste disposal sites.

MTI Micro expects

According to Frost and Sullivan, an independent research firm, the global battery market was approximately $14.3 billion in 2006 and is projected to increase to roughly $21.4 billion by 2012. The market for batteries can be divided into three segments: consumer, industrial, and military. Consumer battery sales represented approximately 81% of this market and are projected to represent an overwhelming majority of sales through at least 2012. The same study estimates that its proprietary technology should provide therechargeable batteries accounted for approximately $5.4 billion of this market in 2006.

OEMs are actively seeking improved power necessarysources to operate presentreplace existing rechargeable lithium-ion batteries and future generationsto power additional improvements to their mobile electronic devices. The development of new products using technologies that already exist, such as radio frequency technologies and 4G wireless capabilities, but cannot be effectively commercialized on mobile devices, will result from the availability of portable, electronicscompact, economical, rechargeable/replaceable higher energy density power sources, including micro fuel cells.

Our Solution

At the core of our solution is our proprietary Mobion Chip engine, a design architecture that embodies a reduction in the size, complexity, and their accessories. MTI Micro's Mobion® technology should last longer becausecost of its highfuel cell construction, which results in a reliable, manufacturable, and affordable power solution that we believe provides improved energy density and it may eliminateportability over competing rechargeable battery technologies. Our proprietary fuel cell power solution consists of two primary components integrated in an easily manufactured device: the need for a lengthy recharge because it can be instantly refueled (recharged) by inserting a new fuel refill of methanol or refueling with a canister.

Mobion® Technology: MTI Micro's Mobion® direct methanol fuel cellscell power engine, which we refer to as our Mobion Chip, and methanol replacement cartridges. Our Mobion Chip weighs less than one ounce and is small enough to fit in the palm of one’s hand. For these reasons, we believe that our Mobion platform is ideally suited to provide a replacement for rechargeable lithium-ion batteries. Based upon our ability to provide a compact, efficient, clean, safe, and long-lasting power source for lower power applications, we intend to initially target power solutions for applications, such as mobile phones (including smart phones) and mobile phone accessories, digital cameras, portable media players, PDAs, and GPS devices.

For handheld consumer electronic applications, we believe we are electrochemical devices that convert high energy density fuel (methanol) directly into electricity. The heart of a Mobion® fuel cell is a membrane between two catalyst layers. Thethe only micro fuel cell produces electrical current when thedeveloper to have demonstrated power density of over 50 mW/cm2 with energy efficiencies of 1.4 Wh/cc of fuel, is introduced to the anode catalyst layer. At the anode catalyst the fuel reacts to produce protons, electrons, and carbon dioxide. The membrane allows protons to pass through to the cathode catalyst layer. Electrons are forced to take an alternative path, and flow through current collectors providing power. At the cathode catalyst layer, the protons and electrons recombine and react with oxygen to form water.

Direct methanol fuel cells operate relatively silently, and at low temperatures and MTI Micro's Mobion® technology is being designed to reduce parts count and the need for complex components. The Mobion® technology platform can be customized to provide portable power for a number of applications depending on the power level, required run time and size requirements.

MTI Micro's Mobion® technology uses methanol as fuel. Methanol - a simple alcohol commonly used in windshield wiper fluid -is biodegradable and because itwhich is a liquid, it is easily storeddirect result of our Mobion platform’s ability to use 100% methanol – a widely available, environmentally friendly, inexpensive, and transported. In addition, methanol is inexpensive, readily available andbiodegradable fuel. These advantages result in its natural state has high energy density (about 4800 Wh/L). Methanol is increasingly seen as a fuel of choice in the industry

1

for micro fuel cells and it is being adopted by many in the industry because of its high energy density, packaging advantages, environmental and safety considerations and low cost.

Research and Development: MTI Micro is developing two DMFC technology platforms - low power and high power. Our low power platform is a simplified DMFC technology platform intended to eliminate many of the pumps and valves found in traditional DMFC systems. Low power applications are optimal for portable electronic applications such as PDAs, digital cameras and camera accessories. The high power platform may serve applications such as video cameras, laptops and power accessories for consumer and industrial electronics applications. There is also demand for improved power sources coming from both military and homeland securities markets for applications like unattended ground sensors and homeland security monitoring where the platform may be adapted with a few changes. MTI Micro's technology platform also focuses on using components and subsystems that use standard mass manufacturing practices. This technology platform is designed to permit MTI Micro to address the needs of applications with various power, duration and size requirements. DMFC development efforts are also focused on reliability, manufacturability, miniaturization and cost considerations, as well as compliance with codes and standards for DMFC systems. MTI Micro shipped its initial low volume Mobion® fuel cell systems in late 2004. The Company and MTI Micro recognize that significant technical and engineering challenges remain before DMFCs can become commercially viable or available.

During 2005, 2004 and 2003, the Company spent approximately $9.7, $13.0 and $8.3 million, respectively, on product development and research costs, including $3.6, $4.0 and, $3.8 million, respectively, on partially funded research and development.

Product Development and Manufacturing: The product specifications required to successfully penetrate MTI Micro's targeted markets vary depending on the device being powered. Weight, volume, peak power, environmental conditions, power duration and reliability are all factors that pose limiting thresholds on Mobion®fuel cell product introduction and acceptance. Therefore, MTI Micro will target products that have specifications that intersect its technology roadmap at various stages of development, thereby permitting the introduction of products earlier, while building its supply chain, manufacturing capabilities and key Original Equipment Manufacturers ("OEMs") relationships.

The Company believes that when commercialized, Mobion® could eventually have higher energy density and therefore provide multiple times the benefitsreduced size, cost, and complexity of existing Lithium-Ion batteries. When sold into the mass-commercial markets, Mobion®fuel cells should be able toour power a wireless electronic device for longer periods of time than Lithium Ion batteries without recharging/refueling,solution offering consumers portable on-demand power, independence from power outlets, and be instantly refueled withoutfreedom from the need to constantly recharge their devices.

Our Strategy

Our goal is to become a leading provider of portable power for a power outlet or a lengthy recharge.

MTI Micro has built a numberhandheld electronic devices. Key elements of system prototypes that demonstrate technology capabilities, operation in any orientation and operation at a range of voltages. MTI Micro also uses laboratory systems to demonstrate and test advanced concepts and technology. MTI Micro has demonstrated laboratory systems operating on 100% methanol and another laboratory system has achieved an energy density of 250 Watt hours per liter ("Wh/l"), which is comparable to that of a typical prismatic Lithium Ion battery. This lab system also achieved an energy density of 200 Watt hours per kilogram ("Wh/kg") on a weight basis. In addition, in lab systems MTI Micro extracted 1 Wh/cc from methanol and 1.25 Watt hours per gram ("Wh/g") on a weight basis. In addition, in 2005 MTI Micro demonstrated in the laboratory, a low power test unit that ran continuously on one integrated fuel tankour strategy designed to achieve greater than 380 Wh of energy inthis objective include the same size and shape as the BA5590 battery - one of the most used ba tteries in the military.following:

MTI Micro currently plans to use contract manufacturers to manufacture its Mobion®fuel cell products and has established contracts and relationships with key suppliers and contract manufacturers. MTI Micro also works with third-party suppliers to design, develop and manufacture subsystems and components of its Mobion®fuel cell products.

The commercialization of MTI Micro's Mobion® fuel cell products depends upon MTI Micro's ability to significantly reduce the costs of these systems and products, since they are currently substantially more expensive than systems and products based on existing technologies, such as rechargeable batteries. In addition to cost, MTI Micro continues to work on improving reliability, energy density, power density, life, and the overall performance of its Mobion® systems as well as reducing its size - critical components for successful penetration into the marketplace. We cannot assure that MTI Micro will be able to sufficiently reduce the cost of these systems and products without reducing their performance, reliability and longevity.

Although it is difficult to predict the development timetable and challenges of our Mobion®technology - a disruptive technology that may be able to provide multiple times the benefits of existing technologies, the Company expects to have units available for testing in the military markets by the end of 2006.

Business Strategy and Commercialization: The market for rechargeable batteries or power packs is large, well established and growing, experiencing sales of several hundred million units per year. MTI Micro's business strategy is to develop a robust, reliable, manufacturable, cost-effective Mobion® technology platforms suitable for the consumer markets and to first target military

2

and industrial markets. Potential military markets include extended life power sources for a number of applications including communication devices, sensors, soldier on-body power and other mission critical devices for the war on terror. Potential industrial markets include portable communications devices, wireless scanners, hand-held inventory control devices and electronic healthcare products. The potential consumer markets span a broad range of mass-market portable electronic devices such as PDAs, cell phones, global positioning systems and digital cameras. Initial applications in the consumer markets will be high value-added devices such as portable navigation systems, digital cameras, game players, camcorders and accessories for them. The Company then plans to penetrate into the even larger market for products such as cell phones and laptops.

As a result of discussions with its partners, government agencies, OEMs and others, MTI Micro has developed a commercialization strategy that consists of two overlapping phases (military/industrial and consumer) for market introduction of its Mobion®fuel cells. This tiered approach is intended to enable MTI Micro to gradually penetrate each of its selected markets.

To move the Company forward in 2006, the Company has set the following milestones for MTI Micro:

Increase system efficiency by 30 percent to 1.3 Wh per cc of fuel in the second quarter;Customer demonstration of a product-intent military portable power system in the third quarter;Develop a prototype for the consumer market that exceeds the energy density of Lithium Ion batteries in the third quarter;Operationally robust units available to sell for field testing in the military market by the end of 2006;Enter into an agreement with a lead consumer OEM by the end of 2006 - a year later than originally projected.

During 2005, MTI Micro's management met important milestones, including:

The development of an engineering prototype with a replaceable fuel refill for the consumer market in the second quarter;Delivery of five sensor power pack prototypes in the third quarter;Delivery of a soldier/radio power pack prototype in the third quarter;Doubled the energy density of the military's BA5590 battery in a laboratory unit during the fourth quarter;Entered into an agreement with a lead customer/partner for the development of a military product during the fourth quarter.

Business Focus.

Strategic Partnerships: MTI Micro intends to sell to multiple industries and enable OEMs to enhance existing product offerings. MTI Micro's strategy is to team with appropriate players in each of its targeted markets. In parallel with its product introduction strategy, MTI Micro plans to leverage joint development activities and other formal partnerships with key component and subsystems suppliers. MTI Micro also intends to rely heavily on OEMs as distribution channels for early military and industrial product introductions. MTI Micro anticipates that the nature of these relationships will vary, and as MTI Micro continues to mature and move forward with its product commercialization, such relationships will become increasingly important.

Strategic Agreements: The Gillette Company("Gillette"):On September 19, 2003, MTI Micro entered into a strategic alliance agreement with Gillette whereby MTI Micro, Gillette and Gillette's Duracell business unit agreed to jointly develop and commercialize complementary micro fuel cell products to power future mass market, high volume and portable consumer devices.

The agreement provides for a multi-year exclusive partnership for the design, development and commercialization of a low power direct methanol micro fuel cell power system and a compatible fuel refill system. The strategic alliance agreement has three main components. First, Gillette and MTI Micro shall work together from a technical and marketing perspective to help create a market for micro fuel cells. Second, for a period of time, MTI Micro will receive a percentage of net revenues related to Gillette's sale of fuel refills for micro fuel cells. Third, Gillette has made, and may make in the future equity investments in MTI Micro. On September 19, 2003, Gillette made an initial $1 million investment in MTI Micro common stock and may make additional investments of up to $4 million subject to agreed milestones related to technical and marketing progress. As part of the agreement, MTI agreed to provide enough funding to MTI Micro to co ver all operational costs for the first two years of the agreement and MTI satisfied this obligation in April 2004.

MTI Micro has not yet achieved the milestone necessary for the investment of the next $1 million in additional funds by Gillette. We do not expect this to occur, if at all, until late 2006 or 2007. Basedare focusing our efforts on the current rate of progress with Gillette, we anticipate that Gillette will not invest the remaining $3 million until the end of 2008, if at all.

As part of the strategic alliance, MTI Micro transferred patents and other intellectual property related to fuel refill systems to Gillette, and Gillette transferred patents and other intellectual property related to DMFCs for hand held devices to MTI Micro. The patents and other intellectual property transferred to Gillette and any other intellectual property related to fuel refill systems for fuel cells for handheld devices, will be held in a licensing pool, which either party may license upon payment of a royalty fee. Both MTI Micro and Gillette will share in royalties related to the license of any intellectual property from the licensing pool.

3

The strategic alliance agreement is terminable by either party for cause at any time. In addition, either party may terminate the agreement without cause after the completion of tasks and acceptance of all deliverables relating to the OEM marketing calls and concept product development milestone and the engineering product design milestone, as defined in the agreement and the work plan, as amended.

On August 18, 2004, MTI Micro entered into an amendment to the multi-year strategic alliance agreement. The amendment clarified the nature of the deliverables for the third and fourth milestones in the work plan; added an additional milestone; and changed the due dates for the third and fourth milestones. MTI Micro also granted a non-exclusive license to Gillette to any improvements made by MTI Micro to intellectual property developed by Gillette.

In May 2005, MTI Micro worked collaboratively with Gillette and completed milestone No. 3- the development of an engineering prototype with a replaceable fuel refill.

On June 20, 2005, MTI Micro entered into the second amendment to the multi-year strategic alliance agreement. The amendment added an additional milestone relating to product identification, suitability and OEM validation. The amendment also added an additional termination right, exercisable by either party, relating to such milestone.

E.I. du Pont de Nemours and Company ("DuPont") : MTI Micro entered into an agreement with DuPont in August 2001 for the development and commercialization of DMFCsour portable power source products. We believe this business provides a higher potential, higher growth opportunity than our test and measurement instrumentation business. We will continue to evaluate our test and measurement instrumentation business, which contributes positive operating results and cash flows, but may consider its eventual sale or other disposition.

Design for Mass Manufacturing.Our portable electronics.power source products will be manufactured using standard processes, such as injection molding and automated test and assembly, which are broadly employed throughout the electronics manufacturing industry. In preparing Mobion for commercialization, our current Mobion Chip is injection molded and is being designed for mass manufacturing. In addition, we have continued integrating more functionality into our Mobion Chip while reducing its part count to one molded piece. Our current Mobion Chip is 9ccs in size, which is small enough to fit in the palm of a hand.

Outsource Manufacturing.We plan to outsource manufacturing to expand rapidly and diversify our production capacity. This agreement expiredstrategy will allow us to maintain a variable cost model in Julywhich we do not incur most of 2004 and was subsequently extended effective July 23, 2004 for an additional two years and may be renewed annually thereafter. The parties agreed to work together to jointly optimize DuPont's Nafion®membrane technology for MTI Mobion®our manufacturing costs until our proprietary fuel cell systems.

MTI Micro is also partypower solution has been shipped and billed to a supply agreement with DuPont providing that MTI Micro must purchase a majorityour customers. We intend to concentrate on our core competencies of any membrane it purchases for its fuel cell from DuPont for a period of five years, commencing with the first commercial sale of fuel cells in volume by MTI Micro, if DuPont can meet best price and best quality in the industry. DuPont owns a minority equity interest in MTI Micro.

Flextronics International USA, Inc. ("Flextronics"): In November 2004, MTI Micro entered into a Design Services Agreement with Flextronics for designresearch and development pre-productionand product design. This approach should reduce our fixed capital expenditures and allow us to efficiently scale production.

Utilize our Technology to Provide Compelling Products.We plan to utilize our intellectual property portfolio and technological expertise

to develop and offer portable power source products across multiple electronic device markets. We intend to employ our technological expertise to reduce the overall size and weight of our portable power source products while increasing their ease of manufacturing, power capacity, and power duration and decreasing their cost. We believe that these efforts will enable us to meet customer expectations and to achieve our goal of supplying on a timely and cost-effective basis the most environmentally friendly portable power source products to our target markets. We believe our products will offer advantages in terms of performance, functionality, size, weight, and ease of use. We plan to continue enhancing our customer’s industrial design manufacturing engineering, prototypingalternatives and first article manufacturing of MTI Micro's Mobion®fuel cell systems.device functionality through innovative product development based on our existing capabilities and technological advances.

Military Contractor:In December 2005, MTI Micro signed an Early Adopter Alliance Agreement with a leading provider of intelligence, secure communications systems, government services and homeland security. As part of this agreement, the parties will work together

Capitalize on Growth Markets.We intend to determine and evaluate the use and integration of MTI Micro's Mobion® technology into the contractor's unattended ground sensor products. The two companies will cooperatecapitalize on the demonstration of unattended ground sensor prototypes, identify military qualifications processes for any resulting products, and develop a market entry strategy for those products.

SES Americom Inc. ("SES Americom"):In December 2005, MTI Micro signed a Market Development Agreement with SES Americom, a world leader in satellite services and satellite-centric networks. As partgrowth of the agreement, the parties will determine and evaluate the use and integration of MTI Micro's Mobion® technology into SES Americomelectronic device markets, including new products that may benefitbe brought about by the convergence of computing, communications, and entertainment devices. We believe our portable power source products will address the growing need for portability, connectivity, and functionality in the evolving electronic device markets. We plan to offer these power solutions to OEM customers to enable them to offer products that have advantages in terms of size, weight, power duration, and environmental friendliness. We plan to utilize our existing technologies, as well as aggressively pursue new technologies and evolving markets that demand enhanced power solutions.

Develop Strong Customer Relationships.We plan to develop strong and long-lasting customer relationships with leading electronic device OEMs and to provide them with power solutions for their products. We believe that our portable power source products will enable our OEM customers to deliver a more positive user experience and to differentiate their products from alternative energy sources such as fuel cells. The two companiesthose of their competitors. We will attempt to enhance the competitive position of our customers by providing them with innovative, distinctive, and high-quality portable power supply products on a timely and cost-effective basis. We will work jointly oncontinually to improve our portable power source products, to reduce costs, and to speed the delivery of our products. We will endeavor to streamline our designs and delivery processes through ongoing design, engineering, and production improvement efforts. We will also devote considerable effort to support our customers after the purchase of our portable power source products.

Pursue Strategic Relationships.We intend to develop and expand strategic relationships to enhance our ability to offer value-added customer solutions, penetrate new markets, and strengthen the technological leadership of our portable power source products.

Products

Portable Power Source Products

We are developing three product categories of our Mobion technology: (i) external power charger products, (ii) snap-on or attached power source products, and (iii) embedded power source products. In addition, we are working with our strategic partners and suppliers to develop disposable methanol cartridges that will be used to fuel our portable power source products. Through our alliance with Duracell, we are developing fuel cartridges that will be designed and branded for mass market identification,commercialization. Duracell has experience in the sale and distribution of portable power through its battery products, as well as in the development, distribution, and deliverysale of prototypes, qualification processesliquid products with similar safety and packaging requirements as the 100% methanol cartridges.

External Power Charger:Our design for any resulting products and the development of a market entry strategy for those products.

Recent Grants , Contracts and Developments:During 2005, Saft America Inc. ("Saft"), received a $1million contract from the US Army Communications Electronic Command ("CECOM") to develop an advanced soliderexternal power system ("HASP") for military applications. MTI Microcharger is a subcontractor understandalone device that uses a standard and widely used universal serial bus, or USB, interface as a power output connector that can be used to recharge handheld mobile devices. Our current design for the device is roughly the size of two decks of playing cards (see photo below) and employs a 100% methanol fuel cartridge, which occupies the same volume as a pack of chewing gum. Our current prototype external power charger provides up to one month of power for the typical mobile phone. It can be designed to enable a professional photographer to take over 5,000 pictures using a high end digital camera from a single fuel tank. Our device is designed to provide 2.5 watts of power from its USB interface and also offer fast charge, ultra-long run time and self-charging modes.

Mobion external power charger prototypes

Snap-on or Attached Power Source Products:Similar to aftermarket battery attachments, our snap-on direct methanol fuel cell power solution is an attached power supply that is compatible with existing portable electronic devices and offers users extended run-time power. In this agreementcategory, we envision a number of product applications, including attachments for digital cameras, portable media players, GPS devices, and has receivedother consumer and electronic products. Our initial design is a purchase order for $470,000. As part of the contract, both Saftdirect methanol fuel cell camera-grip (see photo below) that replaces comparable rechargeable lithium-ion battery-pack grips and MTI Micro are working togetheris designed to build, test and demonstrate a system that combinesprovide twice as much energy as similar rechargeable lithium-ion battery-based products. Our Mobion direct methanol fuel cell camera grip allows photographers the benefits of bothextended usage plus the freedom to refill using a methanol cartridge rather than by plugging into a wall outlet.

Sample Mobion attached power source camera-grip prototype

Embedded power source products:Our goal is to produce direct methanol fuel cells and Lithium Ion battery technology. This contract is ongoing.

In January 2006, MTI Micro was notified by the U.S. Department of Energy ("DOE") that due to a reduction in funding levels to the Hydrogen, Fuel Cells & Infrastructure Technologies Program, MTI Micro will not receive its proportion of funding in 2006 for the $6.14 million, three-year, cost-shared development contract awarded to MTI Micro on August 1, 2004. Under this contract with MTI Micro, DOE authorized $2.35 million of spending on a cost-shared basis which ultimately will result in $1.17 million of contract revenue. Since the U.S. Congress has not appropriated funding for FY2007, we cannot determine at this time if funding for FY2007 willcan be committed to this contract.

4

During 2004, the New York State Energy and Research Development Authority ("NYSERDA") modified its original contract dated March 2002 twice to reflect the addition of Phase III for $348 thousand (Enhanced Energy Conversion Efficiency of Direct Methanol Fuel Cells - Validation and Testing) and Phase IV for $202 thousand (DMFCs for traffic sensors). The project supports DMFC technology development and commercialization efforts. This contract is ongoing.

In October 2004, MTI Micro received two contracts to demonstrate energy density advantages and to quantify potential logistical advantages of its Mobion®fuel cells for the U.S. Armed Forces.

The first award was administered by the U.S. Army Research, Development and Engineering Command and totaled approximately $250 thousand. The program included the delivery of five integrated, hybrid DMFC systems to Special Operations Forces ("SOF"). These systems are targeted to provide continuous power to devices used by SOF and to deliver more than two times the energy of the battery currently used while fitting the same form factor. On September 29th, 2005 MTI Micro fulfilled the contract and delivered five prototypes for sensor applications to the U.S. Special Operations Command ("SOCOM") to evaluate new technologies for field readiness.

The second award, a Phase I Small Business Innovative Research contract from U.S. Marine Corps System Command, provided $70 thousand during 2005 to analyze and report on current regulations and requirements necessary to field DMFCs and fuel refill systems. This contract was completed in 2005.

In April 2004, MTI Micro enteredembedded into a $200 thousand contract with Cabot Superior Micro Powders ("CSMP") to evaluate the performance of CSMP's membrane electrode assembly ("MEA") for portable fuel cell application. During 2005, this contract was amended to increase the contract amount to $210 thousand. This contract was completed in 2005.

In November 2003, the Company entered into a $250 thousand contract with the Harris Corporation ("Harris") to build two prototype units of a DMFC hybrid power supply in a similar form factor of a military battery. The original agreement entered into in October 2003 for $200 thousand was modified in May 2004 increasing the contract to $250 thousand, and was again modified in 2005 to decrease the contract to $150 thousand. This contract was completed during 2005.

Marketing and Sales:In the New Energy segment, MTI Micro has an experienced sales and marketing organization. Pursuant to the Gillette strategic alliance agreement, Gillette and the Company have commenced a joint marketing effort to gather market information, generate and refine product roadmaps, establish key relationships, gather customer and OEM feedback and launch products into the marketplace. MTI Micro regularly evaluates its target market by conducting primary and secondary research and actively meeting and speaking with key industry suppliers and OEMs. In addition, MTI Micro representatives attend and speak at numerous conferences and trade shows for fuel cells, fuel cell development, batteries and other relevant target markets.

MTI Micro's Mobion® technology was recognized with four industry awards since 2004. MTI Micro received the Frost & Sullivan 2005 Fuel Cell Entrepreneurial Company of the Year award and the 2004 Technology Innovation Award, and also accepted an award from Scientific American in recognition for its business leadership. A fourth award came in 2004 from Popular Science's Best of What's New as grand winner in the general innovations category.

Competition:We anticipate that the primary competitive considerations in MTI Micro's markets will be compatibility of DMFC power sources with portable electronic devices requirementsin order to increase their run time and to provide fast charge capability by hot-swapping 100% methanol cartridges. We have developed an embedded fuel cell concept model (see photo below) designed for a smart phone and believe that this concept model highlights the anticipated future product direction for our portable power pack size, energy content, reliability and price. We also believe the first company to successfully introduce a DMFC productsource products in the commercial markets will have significant advantages over its competitors. Many of MTI Micro's competitors have much greater access to capital, resources, component supplies, manufacturing capacity and distribution channels than MTI Micro. As such, because of the nature of product development, we cannot accurately determine our competitors' progress in developing DMFCs and whether such competitors' development efforts exceed MTI Micro's development efforts to date.consumer market.

We analyze MTI Micro's competition based, in part, on two separate components of the DFMC market: (1) companies developing and providing DMFCs producing greater than three watts of energy, particularly companies focused on providing power devices for lap top computers; and (2) companies developing DMFCs producing less than three watts of energy. Within both of these categories, we have witnessed substantial changes during the last five years. Significant new competitors have emerged in Asia, Europe and in the United States. In addition, companies based in Japan, Korea, Germany and the United States have made patent filings in the United States for DMFC technologies.

Our primary focus in consumer markets is for hand held (less than 3 watt energy range) devices. Based on certain publicly available information, we believe MTI Micro's major competitors in the less than three watt energy range are large Asian companies, such as,

5

Hitachi Ltd. ("Hitachi"), Fujitsu Limited ("Fujitsu"), Samsung Electronics Co., Ltd. ("Samsung"), and Toshiba. These competitors have extensive patent portfolios and according to published reports, dedicated operations working on DMFCs and have publicly introduced prototypes. Hitachi demonstrated DMFCs in PDAs, Toshiba demonstrated DMFCs in Bluetooth headsets and in MP3 players, and Samsung has demonstrated an MP3 player. In addition, Samsung has publicly stated consumer market entry dates. We also compete with a number of smaller companies, such as, Medis Technologies Ltd., which announced a distribution and prototyping agreement with General Dynamics for military customers and a contract with Celestica in Ireland for the production of its power packs starting as early as the first quarter of 2007.

Based on certain publicly available information, we believe MTI Micro also faces significant competition in the greater than three watt energy range, and in particular from companies focused on providing power for lap top computers. In this segment, we believe our major competitors are large Japanese, Chinese, Korean and American companies, including but not limited to Canon Inc., Casio Computer Company Ltd., Nanfu Battery, Fujitsu Laboratories, UltraCell, Hitachi, Matsushita Electric Works (Panasonic), NEC, Samsung, Sanyo, and Toshiba. Each of these companies has greater access to resources than we do and, as the result of vertical integration, may have significant advantages in bringing product to market. We also consider Smart Fuel Cells AG ("Smart Fuel Cells"), based in Germany to be a significant competitor. Smart Fuel Cells has had product available in the market for three years. Other competitors include Protonex, a developer of fuel cell systems based on hydrogen PEM (proton exchan ge membrane) technology, and Millennium Cell, a developer of hydrogen battery technology for portable devices.

Intellectual Property and Proprietary Rights:MTI Micro relies on a combination of patent (both national and international), trade secret, trademark and copyright protection to protect its intellectual property ("IP"). MTI Micro's strategy is to apply for patent protection for all necessary design requirements. Additionally, MTI Micro systematically analyzes the existing IP landscape for DMFCs to determine where the greatest opportunities for developing IP exist.

In addition, MTI Micro enters into standard confidentiality agreements with its employees and consultants and seeks to control access to and distribution of its proprietary information. Even with these precautions, it may be possible for a third party to copy or otherwise obtain and use our products or technology without authorization or to develop similar technology independently. In addition, effective patent/copyright, and trade secret protection may be unavailable or limited in certain foreign countries.

As of December 31, 2005, MTI Micro has filed 76 U.S. patent applications, 21 of which have been awarded. Internationally, MTI Micro has filed 20 Patent Cooperation Treaty Applications, and 10 National Phase Patent Applications. MTI Micro has developed an extensive portfolio of patent applications in areas including fuel cell systems, components, controls, manufacturing processes and system packaging.

MTI Micro believes

Concept model of a smart phone with an

embedded Mobion power source

Advantages of our Portable Power Source Products

We believe that our portable power source products will offer the following patents are material to its business and that all of its patents may be significant to its future business activities.advantages:

|

|

|

|

|

| |

|

|

| ||

| ||

|

|

| ||

| ||

|

|

| ||

| ||

|

|

| |

|

|

| ||

|

|

|

| ||

|

|

|

|

In December 2000, MTI Micro licensed, on a non-exclusive basis, ten patent applications (eight issued and two abandoned) from Los Alamos National Laboratory ("LANL"). MTI Micro based its early DMFC systems work on these patents. MTI Micro has also licensed from LANL, on an exclusive basis, rights to European and Japanese counterpart applications for one LANL patent. In January 2005, MTI Micro and LANL modified the existing license such that it included in its entirety a total of nine issued U.S.

6

patents. No changes were made to the license fees or royalties due under such license. MTI Micro also has licensing rights and obligations with respect to IP developed under agreements with Gillette, DuPont and other vendors.

Codes and Standards: MTI Micro is a leader in the development of codes and standards associated with direct methanol fuel cells. Standards

In 2004, MTI Microwe became the world'sworld’s first company to obtain micro fuel cell safety compliance certifications for a fuel cell product from Underwriter'sUnderwriter’s Laboratory ("UL") and from CSA International ("CSA"). MTI MicroInternational. In addition, we received United Nations ("UN") packaging certification and wasour methanol cartridges were deemed compliant by the U.S. Department of Transportation for worldwide cargo shipment ofshipment. Certification is required for every commercial product prior to its methanol fuel cartridges. The methanol cartridges were manufactured by MTI Micro's manufacturing partner Flextronics, in San Jose, California.

In addition to being the first company to receive ULshipment. Based upon our previous experiences with these regulatory agencies, we do not anticipate delays associated with seeking Underwriter’s Laboratory and CSA certification, MTI Micro workedInternational product certifications for our commercial products, which are anticipated to helpbegin shipping in 2009.

Also, we helped to develop thea proposal adopted by the UN which givesUnited Nations to provide methanol fuel cartridges their owna separate classification a significant step forward for usand we worked with other micro fuel cell companies, and the industry. MTI Micro and others worked withappropriate regulatory bodies, to create agenerate the first draft of the international standards for methanol safety and use including those related to transport on commercial airplanes. At the same time, a number of presentations were made to various UN bodies in an effort to increase the understanding and acceptance of micro fuel cells and fuel cartridges.

As a result during 2005of our industry coalition efforts, the International Civil Aviation Organization's ("ICAO") safety panel recommended approval ofOrganization technical instructions and the transportationInternational Air Transport Association Dangerous Goods Regulations now permit airline passengers and crew to carry on and use of methanol fuel cells to power portable electronics in airplane passenger cabins. The action of this panel still needs to be submitted for comment to all ICAO members and then considered for final adoption by the 36-member ICAO Counc il, which could happen as early as the second quarter of 2006. If formally adopted, the regulation will go into effect on January 1, 2007. This is a key event in an on-going effort to develop regulatory acceptance ofcertain fuel cell power systems.systems and fuel cell cartridges containing methanol. The U.S. Department of Transportation is currently reviewing the International Civil Aviation Organization and International Air Transport Association air transport regulations and issued a notice of proposed rulemaking on September 20, 2007 to adopt the International Civil Aviation Organization passenger allowance and harmonize the U.S. requirements with the international standard. The public comment period on these proposed rules closed on November 19, 2007. We expect the U.S. Department of Transportation to adopt its proposed rules during 2008.

As part of the vote from ICAO's safety panel in 2005, butane and formic acid fuels were also approved but other fuels - such as hydrogen and sodium borohydride - were not approved outlining a possible barrier of entry into the business/leisure travel consumer market for those companies developing technologies with such fuels.

Test and Measurement Instrumentation SegmentProducts

MTI Instruments is

We are a world wideglobal supplier of computerized gauging instruments, metrology portable balancing equipment and inspection systems for semiconductor wafers. MTI Instruments products use state-of-the-art technology to solve complex real world applications in numerous industries including automotive, semiconductor, commercialwafers, and military aviation and data storage. MTI Instruments is currently investing in extending their sales reach and developing new product offerings. These investments include more automated and sophisticated sales and marketing management systems, expanded sales coverage in both Europe and the Far East and a concentrated focus on internet marketing. Product investments share a common theme: incorporation of our product technology into larger value added systems that enable MTI Instruments to offer the complete solutions that customers demand. MTI Instruments has industry recognized customer service and has worked with over 200 companies worldwide.

Products and Services: MTI Instruments has three product groups: General dimensional gaging, semiconductor and aviation. Our products consist of electronic, computerized gaging instruments for position, displacement and vibration applications for the design, manufacturing and test markets; semiconductor products for wafer characterization of semi-insulating and semi-conducting wafers for the semiconductor market; andjet engine balancing and vibration analysis systems for both military and commercial aircraft.systems.

General Dimensional Gaging:MTI Instruments' sensing systemsGauging:Our gauging instruments employ fiber optic, laser, and capacitance technologies to make nano-accurateprecision measurements in product design, production, and quality related processes.Gagingprocesses. Our gauging instruments include capacitance gauging systems offering ultra-high precision measurement, a fiber-optic based vibration sensor system with extremely high frequency response, a high-speed laser sensor system utilizing the latest complementary metal-oxide semiconductor/charge-coupled device technology, and a stand-alone data acquisition system that incorporates multiple sensor technologies. These products include laser, fiber-opticare targeted towards the data storage, semiconductor, and capacitance systems that measure a variety of parameters including displacement, position, vibration and dimension.automotive industries.

Listed below are selected MTI Instruments product offerings:

|

|

|

|

|

|

|

|

|

|

|

|

7

Semiconductor: MTI Instruments'Our family of wafer metrology systems range from manually operated units to fully automated systems, which test key wafer characteristics critical to producing high qualityhigh-quality chips used in the semiconductor industry. These units are used as quality control tools delivering highly precise measurements for thickness variations, bow, warp, resistivity, and flatness. These systems can be used on substrates varying widely in size and materials. Our wafer metrology systems include an automated wafer characterization system, a semi-automated, full wafer surface scanning system, and a device that provides for manual, non-contact measurements.

The semiconductor product line includes the following products:

|

|

|

|

|

|

|

|

|

|

|

|

Aviation:MTI Instruments' computer-based PBSOur portable and test cell balance systems automatically collect and record aircraft engine vibration data, identify vibration or balance troubleissues in an engine, and calculate a solution to the problem. These units are used and recommended by major aircraft engine manufacturers, and are also used extensively by the U.S. Air Force, other military and commercial airlines and gas turbine manufacturers.

MTI Instruments' aviation products include vibration analysis and engine trim balance instruments and accessories for commercial and military jets. These products are designed to quickly pinpoint engine problems and eliminate unnecessary engine removals. Selected products in this area include:

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

Technology

8

MarketingA fuel cell is an electrochemical energy conversion device, which is similar to a battery, that produces electricity from a liquid or gaseous fuel, such as methanol, and Sales:Inan oxidant, such as oxygen. Fuel cells are different from batteries in that they consume a reactant, which must be replenished, while batteries store electrical energy chemically in a closed system. Generally, the Testreactants flow in and Measurement Instrumentation segment, MTI Instruments markets itsreaction products flow out of the fuel cell. While the electrodes within a battery react and services using channelschange as a battery is charged or discharged, a fuel cell’s electrodes are catalytic and relatively stable.

The direct methanol fuel cell relies upon the reaction of distribution specificwater with methanol at the catalytic anode layer to each of its product groupsrelease protons and customer base.electrons, and form carbon dioxide. The general dimensional gaging product group markets it productselectrons pass through a combinationcircuit and generate electricity that can be used to power external devices. The protons generated through this reaction pass through the proton exchange membrane to the cathode, where they combine to form water. The anode and cathode layers of manufacturer representativesa direct methanol fuel cell are usually made of platinum particles and platinum ruthenium particles embedded on either side of a proton exchange membrane.

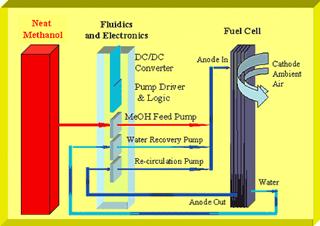

Methanol fuel cells need water at the anode and therefore pure methanol cannot be used without the provision of water via either active transport, such as the pumping of water generated at the cathode back to the anode layer (see Chart A), or a passive recirculation mechanism that incorporates pressurized internal ducts or piping. Without either an active or a passive recirculation mechanism, a direct methanol fuel cell would require the inclusion of water as a dilutant in the United States and distributors overseas. The semiconductor product group markets its products exclusively through domestic distributors and international sales representatives, whilemethanol fuel, which limits the aviation group primarily sells direct to the end user.

To supplement these efforts, the company utilizes both commercial and industrial search engines, targeted newsletters, an independent representative network and appropriate trade shows to identify and expand its customer base.

Comparisons of sales by class of products, which account for over 10 percentenergy content of the Company's consolidated sales, are shown belowdiluted fuel (see Chart B).

Direct Methanol Fuel Cell with Active Water Transport (Chart A)

Methanol Fuel Cell With Water As A Fuel Dilutant (Chart B)

Our Mobion technology eliminates the need for active water recirculation pumps or the inclusion of water as a fuel dilutant. The water required for reaction at the anode is transferred internally within the Mobion Chip from the site of water generation on the air-side of the cell through a proprietary, passive design that eliminates the need for water movement by external pumps, complicated re-circulation loops or other micro-plumbing tools (see Chart C).

Our Mobion Technology with 100% Methanol and Passive Water Recirculation (Chart C)

Our Mobion solution contains a passive water recirculation sub-system that allows for the years endedconsumption of 100% methanol, results in a reduced parts count design and offers the advantage of higher energy density than competing fuel cell technologies for portable electronic devices.

Strategic Agreements

On May 16, 2006, we entered into an alliance with Samsung Electronics Co., Ltd., or Samsung, to develop next-generation fuel cell prototypes for Samsung’s mobile phone business. We developed, and together with Samsung we jointly tested and evaluated, our Mobion technology for several Samsung mobile phone applications. We are continuing to work with Samsung on a non-exclusive collaboration under which we continue to refine our Mobion baseline product design. We will share development updates with Samsung and loan them prototypes for evaluation. Samsung may also request changes to product specifications until December 31:2008 and may purchase commercial samples as soon as they become available.

2005 | 2004 | 2003 | ||||||

(Dollars in thousands) | Sales | % | Sales | % | Sales | % | ||

Aviation | $ 3,013 | 50.12 | $ 4,027 | 53.48% | $ 2,931 | 52.84% | ||

General Gaging | 2,688 | 44.71 | 2,393 | 31.78 | 2,289 | 41.26 | ||

Semiconductor | 311 | 5.17 | 1,110 | 14.74 | 327 | 5.90 | ||

Total | $ 6,012 | 100.00% | $7,530 | 100.00% | $5,547 | 100.00% | ||

Product DevelopmentOn September 19, 2003, we entered into a strategic alliance agreement with the Duracell division of The Gillette Company, or Duracell, under which we agreed to work with Duracell to develop and Manufacturing:MTI Instruments is working on expanding its range of capacitancecommercialize complementary methanol fuel cell products to increase penetrationpower mass market, high-volume portable consumer devices. The agreement provides for a multi-year partnership for the design, development, and commercialization of a low power direct methanol fuel cell power system and a compatible fuel refill system. The arrangement provides for us to receive a percentage of net revenues related to Duracell’s sale of fuel refills for methanol fuel cells. The agreement gives Duracell the ability to make equity investments in MTI Micro. Duracell has made an initial $1.0 million investment in MTI Micro common stock and may make additional investments of up to $4.0 million, subject to agreed upon milestones related to technical and marketing progress. Any further investment by Duracell in MTI Micro will effectively dilute our ownership interest in MTI Micro, although we do not believe that such dilution will be substantial.

On August 1, 2004, we entered into new market segments and management believes thata $6.1 million cost-shared development contract with the successU.S. Department of Energy, or the enterprise depends to a large extent upon innovation, technological expertise and new product development.Initiatives are underway to bring new products to market during 2006. MTI Instruments also plans to continueDOE, for the development of advanced PBS systemsmanufacturing techniques and the optimization of our Mobion product solutions. Through February 2008, the DOE has authorized $5.5 million of spending on a cost-shared basis.

On December 13, 2007, we entered into an agreement with Trident Systems, Inc. to pursue opportunities to leverage our consumer market platform into low-power military markets. Teaming opportunities include demonstrations of unattended ground sensor prototypes powered by Mobion and evaluations and potential submissions of proposals for use inmilitary programs.

Manufacturing

We plan to outsource manufacturing of our portable power source products through third-party relationship contract manufacturers. We believe this strategy will provide us with a business model that allows us to concentrate on our core competencies of research and development and technological know-how and reduce our capital expenditures. In addition, this strategy will significantly reduce our working capital requirements for inventory because we will not incur most of our manufacturing costs until we have actually shipped our portable power source products to our customers and billed those customers for those products. To date, we have established an internal developmental pilot production line to test our design and engineering capabilities. Although we have developed an internal developmental pilot production line, we intend to rely upon third parties to forecast production requirements and have established the militarybasic design, function, and commercial markets.performance of our in-house engineering capabilities to foster the successful commercialization of our products.

MTI Instruments' latest

The commercialization of our Mobion power solution will depend upon our ability to reduce the costs of our portable power source products, as they are currently more expensive than existing rechargeable battery technologies. In addition, we continue to work on enhancing our Mobion power source, including our injection molded Mobion Chip, design to ensure its manufacturability (including engineering, verification and product offerings include: In the general gaging area,testing), design for 2004, MTI Instruments introduced the MTI-2100 Fotonic™ Sensor - a "next generation" fiber-optic sensorassembly, design for high-resolution, non-contacttestability, and design for serviceability, all of which are critical to successful high-volume production.

We assemble and test our test and instrumentation measurement of high frequency vibration and motion analysis. The amplifier replaced the MTI-2000 Fotonic Sensor. MTI Instruments also added the 1515 low-noise amplifier to its Accumeasure line. It is designed to meet the stringent requirements of brake rotor measurement applications in the automotive industry. In Semiconductors, for 2004, MTI Instruments introduced the Proforma™ 300SA - a semi-automated tool for measuring thickness, total thickness variation, bow, warp, stress and flatness of 300mm wafers. In aviation, for 2004, MTI Instruments introduced the PBS-3300 - a compact balancing and vibration diagnostics system for use in mobile test cells and distributed test stands. The PBS-3300 is currently being used to balance the AGT 1500 gas turbine engine in the U.S. Army's M1A1 tank.

MTI Instruments assembles and tests its products at itsour facilities located in Albany, New York. MTI Instruments believesWe believe that itsour existing assembly and test capacity is sufficient to meet itsour current needs and short termshort-term future requirements. Also, management believesWe believe that most of the raw materials used in our test and measurement products are readily available from a variety of vendors.

Sales and Marketing

We plan to sell our portable power source products for incorporation into the products of our OEM customers or to be sold as accessories through them. We plan to generate sales to OEM customers through direct sales employees as well as outside sales representatives and distributors. We have recently established sales representatives in South Korea and Japan.

We build awareness in our target markets through a series of targeted campaigns, which include our website, e-mails, conferences, tradeshows, and other standard marketing efforts. In addition, we monitor developments in the portable power industry through subscriptions with well known firms such as Frost and Sullivan, a wide array of publications, active public relations, updates with industry analysts and the investment community, and speaking engagements.

We market our test and measurement instrumentation products through a combination of direct sales personnel and domestic and international distributors. We expect this business to continue to achieve double digit year over year growth.

Customers

We expect that our customers for our portable power source products will include a number of the world’s largest electronic device OEMs.

Sales of our test and measurement instrumentation products to Koyo, our Japanese distributor, and the U.S. Air Force accounted for 27.8% and 26.4%, respectively, of product revenue in 2007. In 2006, sales to the U.S. Air Force and Koyo accounted for 23.1% and 22.9%, respectively, of product revenue. No other customer accounted for more than 10% of our product revenue in either 2006 or 2007.

Competition

We expect that the primary competitive factor in our portable power source business will be market acceptance of our portable power source products as an alternative power source to conventional lithium-ion and other rechargeable batteries. Market acceptance of our portable power source products will depend on a wide variety of factors, including the compatibility of direct methanol fuel cell power sources with portable electronic devices and the market’s assessment of the advantages offered by our products in terms of size, weight, power density and duration, safety, reliability, and environmental friendliness when measured against price disadvantages. We anticipate direct competition from large Asian-based companies and some of our potential OEM customers.

Competition in the sale of our measurement and instrumentation products is based on product quality, performance, price, and timely delivery. Our competitors for test and measurement instrumentation products include National Instruments, KLA-Tencor, Capacitec, Sigma Tech, Corning Tropel, Chadwick-Helmuth, ACES Systems, Micro-Epsilon, and Keyence.

Product Development

Over the past two years, we have developed and built a number of engineering prototypes used to validate our technology and to generate discussions with potential customers about the inclusion of our technology in new products. During the same period, we have created three generations of external power charger prototypes, each of which has shown a dramatic size reduction over the previous generation. Our latest external power charger prototype achieved a 60% reduction in volume over our first generation prototype.

We have improved the capabilities of our Mobion Chip technology during the last two years, which we expect will continue to evolve as we integrate greater functionality into our designs. This continuous iterative integration process is intended to reduce the size, simplify the design and construction, and reduce assembly complexity of our technology. We continue to improve the product design of the Mobion Chip and believe that future product generations will deliver performance improvements in terms of energy density, size, weight, and power duration and should be able to power wireless electronic devices for longer periods of time than rechargeable lithium-ion batteries.

Intellectual Property and Proprietary Rights: MTI Instruments reliesRights

We rely on a combination of patent (both national and international), trade secret, lawstrademark, and patentscopyright protection to establish and protect our intellectual property. Our strategy is to apply for patent protection for all significant design requirements. Additionally, we systematically analyze the proprietary rights of its products. In addition, MTI Instruments entersexisting intellectual property landscape for direct methanol fuel cells to determine where the greatest opportunities for developing intellectual property exist. We also enter into standard confidentiality agreements with itsour employees, consultants, vendors, partners and consultantspotential customers and seeksseek to control access to and distribution of itsour proprietary information. Even

As of December 31, 2007, we had filed over 90 U.S. patent applications, 43 of which have been awarded. Of the awarded patents, 34 are assigned to us and 9 are assigned to Duracell as part of our strategic alliance agreement with these precautions, it may be possiblethem. We have filed 22 Patent Cooperation Treaty Applications and have filed for National Phase Patent Protection for 12 pieces of intellectual property in multiple countries, including Japan, the European Union, and South Korea. We have developed a third partyportfolio of patent applications in areas including fuel cell systems, components, controls, manufacturing processes, and system packaging.

Research and Development

Our research and development team is responsible for advanced research, product planning, design and development, and quality assurance. Through our supply chain, we are also working with subcontractors in developing specific components of our technologies.

The primary objective of our research and development program is to copy or otherwise obtain and useadvance the development of our direct methanol fuel cell technology to enhance the commercial value of our products orand technology, without authorization oras well as to develop similar technology independently. In addition, effective patentnext generation fuel cell products.

We have incurred research and trade secret protection may be unavailable or limiteddevelopment costs of approximately $9.7 million, $12.9 million and $11.8 million for the years ended December 31, 2005, 2006, and 2007, respectively. We expect to continue to invest in certain foreign countries. MTI Instruments has one patent issued supporting its semiconductor product line.

Significant Customers: MTI Instruments' largest customers include the U.S. Air Forceresearch and companiesdevelopment in the computer, electronic, semiconductor, automotive, aerospace, aircraftfuture.

Employees

As of December 31, 2007, we had 107 employees compared with 132 as of December 31, 2006. Of these employees, 46 were involved in our portable power source business (including 25 scientists and bioengineering fields. Inengineers, of whom 18 had advanced degrees) and 46 were involved in our test and measurement instrumentation business. Fifteen of our employees are involved in corporate functions.

Properties

We presently lease two premises, one located at 325 Washington Avenue Extension, Albany, New York and the Testother at 431 New Karner Road, Albany, New York. Both leases expire at the end of 2009. The 325 Washington Avenue Extension premise consists of approximately 20,700 useable square feet of space, and Measurement Instrumentation Segment,the 431 New Karner Road consists of approximately 23,500 useable square feet of space. Together, the premises are adequate for our current and foreseeable needs.

Legal Proceedings

We are not currently involved in 2005, the U.S. Air Force accounted for $2.385 million or 39.7% of product revenues; in 2004, the U.S. Air Force accounted for $3.508 million or 46.6% of product revenues; in 2003, the U.S. Air Force accounted for $2.261 million or 40.8% of product revenues. A loss of the U.S. Air Force as a customerany legal proceeding that we believe would have a material adverse effect on this segment.

Recent Contracts: In 2002, MTI Instruments was awarded a multi-year U.S. Air Force contract to service and retrofit existing PBS-4100 jet engine balancing systems with the latest diagnostic and balancing technology could potentially generate up to a total of $8.8 million in sales for the Company between the years 2002 and 2007. As of December 31, 2005, MTI Instruments had recorded $5.3 million in orders for approximately 59% of the five-year contract's total value.

9