UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

[ü] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 20142015 |

or

|

| |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number:

1-6523

Exact name of registrant as specified in its charter:

Bank of America Corporation

State or other jurisdiction of incorporation or organization:

Delaware

IRS Employer Identification No.:

56-0906609

Address of principal executive offices:

Bank of America Corporate Center

100 N. Tryon Street

Charlotte, North Carolina 28255

Registrant’s telephone number, including area code:

(704) 386-5681

Securities registered pursuant to section 12(b) of the Act:

|

| | | | |

| | Title of each class | | Name of each exchange on which registered | |

| | Common Stock, par value $0.01 per share | | New York Stock Exchange | |

| | | | London Stock Exchange | |

| | | | Tokyo Stock Exchange | |

| | Warrants to purchase Common Stock (expiring October 28, 2018) | | New York Stock Exchange | |

| | Warrants to purchase Common Stock (expiring January 16, 2019) | | New York Stock Exchange | |

| | Depositary Shares, each representing a 1/1,000th interest in a share of 6.204% Non-Cumulative Preferred Stock, Series D | | New York Stock Exchange | |

| | Depositary Shares, each representing a 1/1,000th interest in a share of Floating Rate Non-Cumulative Preferred Stock, Series E | | New York Stock Exchange | |

| | Depositary Shares, each representing a 1/1,000th interest in a share of 6.625% Non-Cumulative Preferred Stock, Series I | | New York Stock Exchange | |

| | Depositary Shares, each representing a 1/1,000th interest in a share of 6.625% Non-Cumulative Preferred Stock, Series W | | New York Stock Exchange | |

| | Depositary Shares, each representing a 1/1,000th interest in a share of 6.500% Non-Cumulative Preferred Stock, Series Y | | New York Stock Exchange | |

| | 7.25%Depositary Shares, each representing a 1/1,000th interest in a share of 6.200% Non-Cumulative Perpetual Convertible Preferred Stock, Series LCC | | New York Stock Exchange | |

|

| | | | |

| | Title of each class | | Name of each exchange on which registered | |

| 7.25% Non-Cumulative Perpetual Convertible Preferred Stock, Series L | | New York Stock Exchange | |

| | Depositary Shares, each representing a 1/1,200th interest in a share of Bank of America Corporation Floating Rate Non-Cumulative Preferred Stock, Series 1 | | New York Stock Exchange | |

| | Depositary Shares, each representing a 1/1,200th interest in a share of Bank of America Corporation Floating Rate Non-Cumulative Preferred Stock, Series 2 | | New York Stock Exchange | |

| | Depositary Shares, each representing a 1/1,200th interest in a share of Bank of America Corporation 6.375% Non-Cumulative Preferred Stock, Series 3 | | New York Stock Exchange | |

| | Depositary Shares, each representing a 1/1,200th interest in a share of Bank of America Corporation Floating Rate Non-Cumulative Preferred Stock, Series 4 | | New York Stock Exchange | |

| | Depositary Shares, each representing a 1/1,200th interest in a share of Bank of America Corporation Floating Rate Non-Cumulative Preferred Stock, Series 5 | | New York Stock Exchange | |

| | 6.75% Trust Preferred Securities of Countrywide Capital IV (and the guarantees related thereto) | | New York Stock Exchange | |

| | 7.00% Capital Securities of Countrywide Capital V (and the guarantees related thereto) | | New York Stock Exchange | |

| | 6% Capital Securities of BAC Capital Trust VIII (and the guarantee related thereto) | | New York Stock Exchange | |

| | Floating Rate Preferred Hybrid Income Term Securities of BAC Capital Trust XIII (and the guarantee related thereto) | | New York Stock Exchange | |

| | 5.63% Fixed to Floating Rate Preferred Hybrid Income Term Securities of BAC Capital Trust XIV (and the guarantee related thereto) | | New York Stock Exchange | |

| | MBNA Capital B Floating Rate Capital Securities, Series B (and the guarantee related thereto) | | New York Stock Exchange | |

| | Trust Preferred Securities of Merrill Lynch Capital Trust I (and the guarantee of the Registrant with respect thereto) | | New York Stock Exchange | |

| | Trust Preferred Securities of Merrill Lynch Capital Trust II (and the guarantee of the Registrant with respect thereto) | | New York Stock Exchange | |

| | Trust Preferred Securities of Merrill Lynch Capital Trust III (and the guarantee of the Registrant with respect thereto) | | New York Stock Exchange | |

| 7% Trust Originated Preferred Securities of Merrill Lynch Preferred Capital Trust III and 7% Partnership Preferred Securities of Merrill Lynch Preferred Funding III, L.P. (and the guarantee of the Registrant with respect thereto) | | New York Stock Exchange | |

| 7.12% Trust Originated Preferred Securities of Merrill Lynch Preferred Capital Trust IV and 7.12% Partnership Preferred Securities of Merrill Lynch Preferred Funding IV, L.P. (and the guarantee of the Registrant

with respect thereto)

| | New York Stock Exchange | |

| 7.28% Trust Originated Preferred Securities of Merrill Lynch Preferred Capital Trust V and 7.28% Partnership Preferred Securities of Merrill Lynch Preferred Funding V, L.P. (and the guarantee of the Registrant

with respect thereto)

| | New York Stock Exchange | |

| Market Index Target-Term Securities®Linked to the S&P 500® Index, due February 27, 2015

| | NYSE Arca, Inc. | |

| Market Index Target-Term Securities®Linked to the Dow Jones Industrial AverageSM, due March 27, 2015

| | NYSE Arca, Inc. | |

| Market Index Target-Term Securities®Linked to the Dow Jones Industrial AverageSM, due April 24, 2015

| | NYSE Arca, Inc. | |

| Market Index Target-Term Securities®Linked to the Dow Jones Industrial AverageSM, due May 29, 2015

| | NYSE Arca, Inc. | |

| Market Index Target-Term Securities®Linked to the Dow Jones Industrial AverageSM, due June 26, 2015

| | NYSE Arca, Inc. | |

| Market Index Target-Term Securities®Linked to the S&P 500® Index, due July 31, 2015

| | NYSE Arca, Inc. | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No ü

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No ü

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ü No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ü No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ü

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer ü | | Accelerated filer | | Non-accelerated filer | | Smaller reporting company |

| | | | | (do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No ü

The aggregate market value of the registrant’s common stock (“Common Stock”) held on June 30, 20142015 by non-affiliates was approximately $161,628,224,532178,230,659,544 (based on the June 30, 20142015 closing price of Common Stock of $15.3717.02 per share as reported on the New York Stock Exchange). As of February 24, 201523, 2016, there were 10,519,566,82910,325,631,017 shares of Common Stock outstanding.

Documents incorporated by reference: Portions of the definitive proxy statement relating to the registrant’s annual meeting of stockholders scheduled to be held on May 6, 2015April 27, 2016 are incorporated by reference in this Form 10-K in response to Items 10, 11, 12, 13 and 14 of Part III.

Table of Contents

Bank of America Corporation and Subsidiaries

|

| | |

| | 1Bank of America 201420151

| | |

Part I

Bank of America Corporation and Subsidiaries

Item 1. Business

Bank of America Corporation (together, with its consolidated subsidiaries, Bank of America, we or us) is a Delaware corporation, a bank holding company (BHC) and a financial holding company. When used in this report, “the Corporation” may refer to Bank of America Corporation individually, Bank of America Corporation and its subsidiaries, or certain of Bank of America Corporation’s subsidiaries or affiliates. As part of our efforts to streamline the Corporation’s organizational structure and reduce complexity and costs, the Corporation has reduced and intends to continue to reduce the number of its corporate subsidiaries, including through intercompany mergers.

Bank of America is one of the world’s largest financial institutions, serving individual consumers, small- and middle-market businesses, institutional investors, large corporations and governments with a full range of banking, investing, asset management and other financial and risk management products and services. Our principal executive offices are located in the Bank of America Corporate Center, 100 North Tryon Street, Charlotte, North Carolina 28255.

Bank of America’s website is www.bankofamerica.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (Exchange Act) are available on our website at http://investor.bankofamerica.com under the heading Financial Information SEC Filings as soon as reasonably practicable after we electronically file such reports with, or furnish them to, the U.S. Securities and Exchange Commission (SEC). In addition,Also, we make available on http://investor.bankofamerica.com under the heading Corporate Governance: (i) our Code of Conduct (including our insider trading policy); (ii) our Corporate Governance Guidelines (accessible by clicking on the Governance Highlights link); and (iii) the charter of each active committee of our Board of Directors (the Board) (accessible by clicking on the committee names under the Committee Composition link), and we also intend to disclose any amendments to our Code of Conduct, or waivers of our Code of Conduct on behalf of our Chief Executive Officer, Chief Financial Officer or Chief Accounting Officer, on our website. All of these corporate governance materials are also available free of charge in print to stockholders who request them in writing to: Bank of America Corporation, Attention: Office of the Corporate Secretary, Hearst Tower, 214 North Tryon Street, NC1-027-20-05, Charlotte, North Carolina 28255.

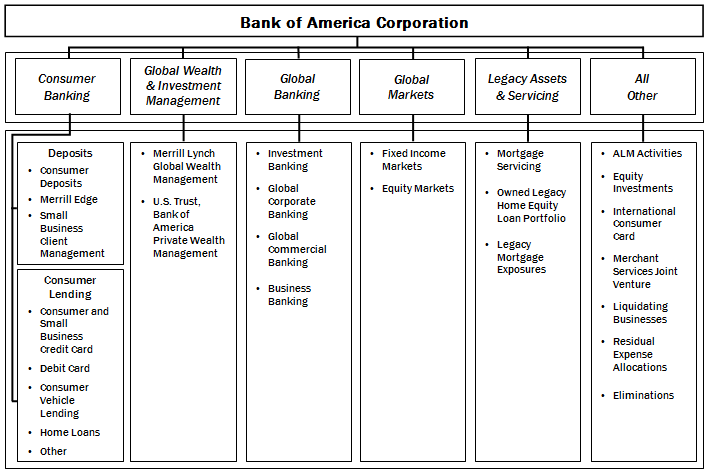

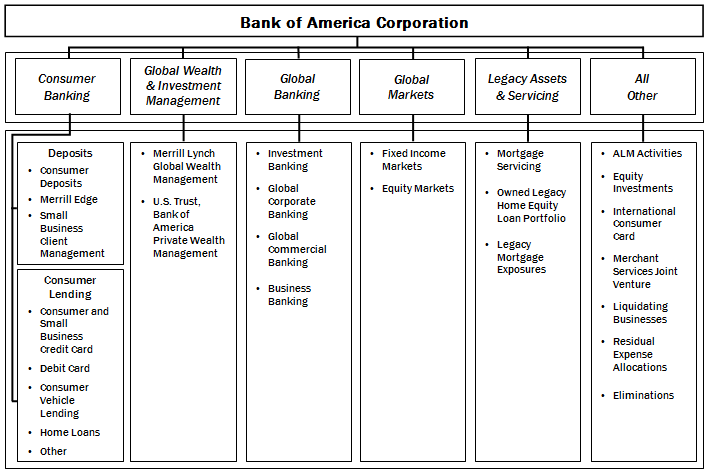

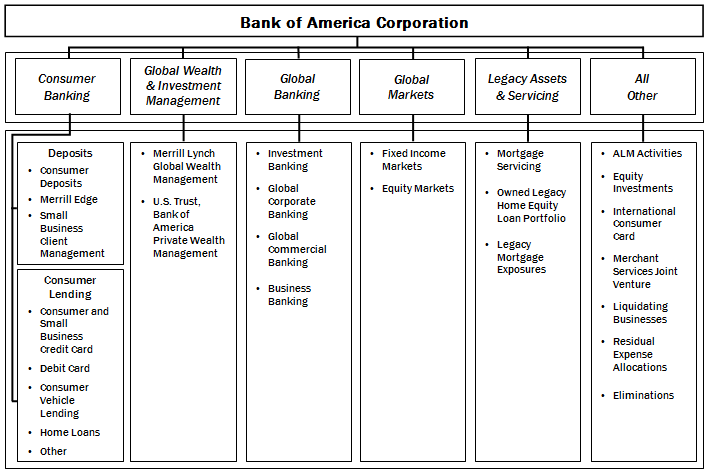

Segments

Through our banking and various nonbank subsidiaries throughout the U.S. and in international markets, we provide a diversified range of banking and nonbank financial services and products through five business segments: Consumer & Business Banking (CBB), Consumer Real Estate Services (CRES), Global Wealth & Investment Management (GWIM), Global Banking, Global Markets and Global MarketsLegacy Assets & Servicing (LAS),, with the remaining operations recorded in All Other. Effective January 1, 2015, to align the segments with how we manage the businesses in 2015, the Corporation changed its basis of segment presentation as follows: the Home Loans subsegment within CRES was moved to CBB, and Legacy Assets

& Servicing became a separate segment. Also, a portion of the Business Banking business, based on the size of the client relationship, was moved from CBB to Global Banking. Prior periods will be restated in our quarterly 2015 filings with the SEC under Section 13(a) or 15(d) of the Exchange Act, to conform to the new segment alignment. Additional information related to our business segments and the products and services they provide is included in the information set forth on pages 3432 through 4946 of Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) and Note 24 – Business Segment Information to the Consolidated Financial Statements in Item 8.

Financial Statements and Supplementary Data (Consolidated Financial Statements).

Competition

We operate in a highly competitive environment. Our competitors include banks, thrifts, credit unions, investment banking firms, investment advisory firms, brokerage firms, investment companies, insurance companies, mortgage banking companies, credit card issuers, mutual fund companies, and e-commerce and other internet-based companies. We compete with some of these competitors globally and with others on a regional or product basis.

Competition is based on a number of factors including, among others, customer service, quality and range of products and services offered, price, reputation, interest rates on loans and deposits, lending limits, and customer convenience. Our ability to continue to compete effectively also depends in large part on our ability to attract new employees and retain and motivate our existing employees, while managing compensation and other costs.

Employees

As of December 31, 20142015, we had approximately 224,000213,000 full-time equivalent employees. None of our domestic employees are subject to a collective bargaining agreement. Management considers our employee relations to be good.

Government Supervision and Regulation

The following discussion describes, among other things, elements of an extensive regulatory framework applicable to BHCs, financial holding companies, banks and broker-dealers, including specific information about Bank of America.

We are subject to an extensive regulatory framework applicable to BHCs, financial holding companies and banks and other financial services entities. U.S. federal regulation of banks, BHCs and financial holding companies is intended primarily for the protection of depositors and the Deposit Insurance Fund (DIF) rather than for the protection of stockholders and creditors.

General

We are subject to an extensive regulatory framework applicable to BHCs, financial holding companies and banks and other financial services entities.

As a registered financial holding company and BHC, the Corporation is subject to the supervision of, and regular inspection by, the Board of Governors of the Federal Reserve System (Federal Reserve). Our U.S. banking subsidiaries (the Banks) organized as national banking associations are subject to regulation, supervision and examination by the Office of the Comptroller of

the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve. The Consumer Financial Protection Bureau (CFPB) regulates consumer financial products and services.

U.S. financial holding companies, and the companies under their control, are permitted to engage in activities considered “financial in nature” as defined by the Gramm-Leach-Bliley Act and related Federal Reserve interpretations. Unless otherwise limited by the Federal Reserve, a financial holding company may engage directly or indirectly in activities considered financial in nature provided the financial holding company gives the Federal Reserve after-the-fact notice of the new activities. The Gramm-Leach-Bliley Act also permits national banks to engage in activities considered financial in nature through a financial subsidiary, subject to certain conditions and limitations and with the approval of the OCC. If the Federal Reserve finds that any of our Banks is not “well-capitalized” or “well-managed,” we would be required to enter into an agreement with the Federal Reserve to comply with all applicable capital and management requirements, which may contain additional limitations or conditions relating to our activities.

The Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 permits a BHC to acquire banks located in states other than its home state without regard to state law, subject to certain conditions, including the condition that the BHC, after and as a result of the acquisition, controls no more than 10 percent of the total amount of deposits of insured depository institutions in the U.S. and no more than 30 percent or such lesser or greater amount set by state law of such deposits in that state. At December 31, 2014, we held approximately 11 percent of the total amount of deposits of insured depository institutions in the U.S.

The 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (Financial Reform Act) restricts acquisitions by a financial institution if, as a result of the acquisition, the total liabilities of the financial institution would exceed 10 percent of the total liabilities of all financial institutions in the U.S. At December 31, 2014, our liabilities did not exceed 10 percent of the total liabilities of all financial institutions in the U.S.

We are also subject to various other laws and regulations, as well as supervision and examination by other regulatory agencies, all of which directly or indirectly affect our operations and management and our ability to make distributions to stockholders. Our U.S. broker-dealer subsidiaries are subject to regulation by and supervision of the SEC, the New York Stock Exchange and the Financial Industry Regulatory Authority; our commodities businesses in the U.S. are subject to regulation by and supervision of the U.S. Commodity Futures Trading Commission (CFTC); our U.S. derivatives activity is subject to regulation and supervision of the CFTC and National Futures Association or the SEC, and in the case of the Banks, certain banking regulators; and our

insurance activities are subject to licensing and regulation by state insurance regulatory agencies.

Our non-U.S. businesses are also subject to extensive regulation by various non-U.S. regulators, including governments, securities exchanges, central banks and other regulatory bodies, in the jurisdictions in which those businesses operate. For example, our financial services operations in the U.K. are subject to regulation by and supervision of the Prudential Regulatory Authority (PRA) for prudential matters, and the Financial Conduct Authority (FCA) for the conduct of business matters.

Financial Reform Act

The Financial Reform Act enacted sweeping financial regulatory reform across the financial services industry, including significant changes regarding capital adequacy and capital planning, stress testing, resolution planning, derivatives activities, prohibitions on proprietary trading and restrictions on debit interchange fees. As a result of the Financial Reform Act, we have altered and will continue to alter the way in which we conduct certain businesses. Our costs and revenues could continue to be negatively impacted as additional final rules of the Financial Reform Act are adopted.

Resolution Planning

As a BHC with greater than $50 billionWe are also subject to various other laws and regulations, as well as supervision and examination by other regulatory agencies, all of assets, the Corporation is requiredwhich directly or indirectly affect our operations and management and our ability to make distributions to stockholders. For instance, our broker-dealer subsidiaries are subject to both U.S. and international regulation, including supervision by the SEC, the New York Stock Exchange and the Financial Industry Regulatory Authority, among others; our commodities businesses in the U.S. are subject to regulation by and supervision of the U.S. Commodity Futures Trading Commission (CFTC); our U.S. derivatives activity is subject to regulation and supervision of the CFTC and National Futures Association or the SEC, and in the case of the Banks, certain banking regulators; our insurance activities are subject to licensing and regulation by state insurance regulatory agencies; and our consumer financial products and services are regulated by the Consumer Financial Protection Bureau (CFPB).

Our non-U.S. businesses are also subject to extensive regulation by various non-U.S. regulators, including governments, securities exchanges, central banks and other regulatory bodies, in the jurisdictions in which those businesses operate. For example, our financial services operations in the U.K. are subject to regulation by and supervision of the Prudential Regulatory Authority for prudential matters, and the Financial Conduct Authority for the conduct of business matters.

Source of Strength

Under the Financial Reform Act and Federal Reserve policy, BHCs are expected to act as a source of financial strength to each subsidiary bank and to commit resources to support each such subsidiary. Similarly, under the FDIC to annually submit a plan for a rapid and orderly resolutioncross-guarantee provisions of the Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA), in the event of material financial distressa loss suffered or failure.

A resolution plan is intendedanticipated by the FDIC, either as a result of default of a banking subsidiary or related to FDIC assistance provided to such a subsidiary in danger of default, the affiliate banks of such a subsidiary may be a detailed roadmapassessed for the orderly resolutionFDIC’s loss, subject to certain exceptions.

Transactions with Affiliates

Pursuant to Section 23A and 23B of a BHC and material entities pursuant to the U.S. Bankruptcy Code and other applicable resolution regimes under one or more hypothetical scenarios assuming no extraordinary government assistance.

If both the Federal Reserve and the FDIC determine that our plan is not credible and the deficiencies are not cured in a timely manner,Act, as implemented by the Federal Reserve andReserve’s Regulation W, the FDIC may jointly impose on us more stringent capital, leverage or liquidity requirements or restrictions on our growth, activities or operations. A description of our plan is available on the Federal Reserve and FDIC websites.

Similarly, in the U.K., the PRA has issued rules requiring the submission of significant information about certain U.K.-incorporated subsidiaries and other financial institutions, as well as branches of non-U.K. banks located in the U.K. (including information on intra-group dependencies, legal entity separation and barriers to resolution) to allow the PRA to develop resolution plans. As a result of the PRA review, we could be required to take certain actions over the next several years which could impose operating costs and potentially result in the restructuring of certain business and subsidiaries.

The Volcker Rule

The Volcker Rule prohibits insured depository institutions and companies affiliated with insured depository institutions (collectively, banking entities) from engaging in short-term proprietary trading of certain securities, derivatives, commodity futures and options for their own account. The Volcker Rule also imposes limits on banking entities’ investments in, and other relationships with, hedge funds and private equity funds, although the Federal Reserve extended the conformance period for certain existing covered investments and relationships to July 2016 (with indications that the conformance period may be further extended to July 2017). The Volcker Rule provides exemptions for certain activities, including market-making, underwriting, hedging, trading in government obligations, insurance company activities, and organizing and offering hedge funds and private equity funds. The Volcker Rule also clarifies that certain activities are not prohibited, including acting as agent, broker or custodian. A banking entity with significant trading operations, such as the Corporation, is required to establish a detailed compliance program to comply with the restrictions of the Volcker Rule. We exited our stand-alone proprietary trading business in 2011 and continue to wind down our Global Principal Investments operations.

Derivatives

Our derivatives operationsBanks are subject to extensive regulation both inrestrictions that limit certain types of transactions between the Banks and their nonbank affiliates. In general, U.S. banks are subject to quantitative and internationally. Inqualitative limits on extensions of credit, purchases of assets and certain other transactions involving its nonbank affiliates. Additionally, transactions between U.S. banks and their nonbank affiliates are required to be on arm’s length terms and must be consistent with standards of safety and soundness.

Deposit Insurance

Deposits placed at U.S. domiciled banks (U.S. banks) are insured by the U.S.,FDIC, subject to limits and conditions of applicable law and the FDIC’s regulations. Pursuant to the Financial Reform Act, broadensFDIC insurance coverage limits were permanently increased to $250,000 per customer. All insured depository institutions are required to pay assessments to the scopeFDIC in order to fund the Deposit Insurance Fund (DIF).

The FDIC is required to maintain at least a designated minimum ratio of derivative instrumentsthe DIF to insured deposits in the U.S. The Financial Reform Act requires the FDIC to assess insured depository institutions to achieve a DIF ratio of at least 1.35 percent by September 30, 2020. The FDIC has adopted new regulations that establish a long-term target DIF ratio of greater than two percent. The DIF ratio is currently below the required targets and the FDIC has adopted a restoration plan that may result in increased deposit insurance assessments. Deposit insurance assessment rates are subject to regulationchange by requiring clearingthe FDIC and exchange trading of certain derivatives; imposing new capital, margin, reporting, registration and business conduct requirements for certain market participants; and imposing position limits on certain over-the-counter (OTC) derivatives. Additionally, in Europe,will be impacted by the European Commission and European Securities and Markets Authority (ESMA) have been granted authority to adopt and implement the European Market Infrastructure Regulation (EMIR), which regulates OTC derivatives, central counterpartiesoverall economy and the trade repositories,stability of the banking industry as a whole. For more information regarding deposit insurance, see Item 1A. Risk Factors – Regulatory, Compliance and imposes requirements for certain market participants with respect to derivatives reporting, OTC derivatives clearing, business conduct and collateral. The adoption of many of these U.S. and European Union (EU) regulations is ongoing and their ultimate impact remains uncertain.Legal Risk on page 11.

Capital, Liquidity and Operational Requirements

As a financial services holding company, we and our bank subsidiaries are subject to the risk-based capital guidelines issued by the Federal Reserve and other U.S. banking regulators, including the FDIC and the OCC. These rules are complex and are evolving as U.S. and international regulatory authorities propose and enact enhanced capital and liquidity rules. The Corporation seeks to manage its capital position to maintain sufficient capital to meet these regulatory guidelines and to support our business activities. These evolving capital and liquidity rules are likely to influence our planning processes for, and may require additional, regulatory capital and liquidity, planning processes, and require additional capital and liquidity, and mayas well as impose additional operational and compliance costs on the Corporation. In addition, the Federal Reserve and the OCC have adopted guidelines that

establish minimum standards for the design, implementation and board oversight of BHC’s and national banks’ risk governance frameworks. The Federal Reserve has also proposed rules which would require us to maintain minimum amounts of long-term debt meeting specified eligibility requirements.

For more information on regulatory capital rules, capital composition and pending or proposed regulatory capital changes, see Capital Management – Regulatory Capital in the MD&A on page 59,54, and Note 16 – Regulatory Requirements and Restrictions to the Consolidated Financial Statements, which are incorporated by reference in this Item 1.

Distributions

We are subject to various regulatory policies and requirements relating to capital actions, including payment of dividends and common stock repurchases. Many of our subsidiaries, including our bank and broker-dealer subsidiaries, are subject to laws that restrict dividend payments, or authorize regulatory bodies to block or reduce the flow of funds from those subsidiaries to the parent company or other subsidiaries. Additionally, the applicable federal regulatory authority is authorized to determine, under certain circumstances relating to the financial condition of a bank or BHC, that the payment of dividends would be an unsafe or unsound practice and to prohibit payment thereof. For instance, Federal Reserve regulations require major U.S. BHCs to submit a capital plan as part of an annual Comprehensive Capital Analysis and Review (CCAR). The purpose of the CCAR is to assess the capital planning process of the BHC, including any planned capital actions, such as payment of dividends on common stock and common stock repurchases.

Our ability to pay dividends is also affected by the various minimum capital requirements and the capital and non-capital standards established under the Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA).FDICIA. The right of the Corporation, our stockholders and our creditors to participate in

any distribution of the assets or earnings of our subsidiaries is further subject to the prior claims of creditors of the respective subsidiaries.

If the Federal Reserve finds that any of our Banks are not “well-capitalized” or “well-managed,” we would be required to enter into an agreement with the Federal Reserve to comply with all applicable capital and management requirements, which may contain additional limitations or conditions relating to our activities. Additionally, the applicable federal regulatory authority is authorized to determine, under certain circumstances relating to the financial condition of a bank or BHC, that the payment of dividends would be an unsafe or unsound practice and to prohibit payment thereof.

For more information regarding the requirements relating to the payment of dividends, including the minimum capital requirements, see Note 13 – Shareholders’ Equity and Note 16 – Regulatory Requirements and Restrictions to the Consolidated Financial Statements.

Many of our subsidiaries, including our bank and broker-dealer subsidiaries, are subject to laws that restrict dividend payments, or authorize regulatory bodies to block or reduce the flow of funds from those subsidiaries to the parent company or other subsidiaries.

Resolution Planning

As a BHC with greater than $50 billion of assets, the Corporation is required by the Federal Reserve and the FDIC to annually submit a plan for a rapid and orderly resolution in the event of material financial distress or failure.

Such resolution plan is intended to be a detailed roadmap for the orderly resolution of a BHC and material entities pursuant to the U.S. Bankruptcy Code and other applicable resolution regimes under one or more hypothetical scenarios assuming no extraordinary government assistance.

If both the Federal Reserve and the FDIC determine that the Corporation’s plan is not credible and the deficiencies are not cured in a timely manner, the Federal Reserve and the FDIC may jointly impose on us more stringent capital, leverage or liquidity requirements or restrictions on our growth, activities or operations. A description of our plan is available on the Federal Reserve and FDIC websites.

The FDIC also requires the annual submission of a resolution plan for Bank of America, N.A. (BANA), which must describe how the insured depository institution would be resolved under the bank resolution provisions of the Federal Deposit Insurance Act. A description of this plan is also available on the FDIC’s website.

We continue to make substantial progress to enhance our resolvability, including simplifying our legal entity structure and business operations, and increasing our preparedness to implement our resolution plan, both from a financial and operational standpoint.

Similarly, in the U.K., rules have been issued requiring the submission of significant information about certain U.K.-incorporated subsidiaries and other financial institutions, as well as branches of non-U.K. banks located in the U.K. (including information on intra-group dependencies, legal entity separation and barriers to resolution) to allow the Bank of England to develop resolution plans. As a result of the Bank of England’s review of the submitted information, we could be required to take certain actions over the next several years which could increase operating

costs and potentially result in the restructuring of certain businesses and subsidiaries.

For more information regarding our resolution, see Item 1A. Risk Factors – Regulatory, Compliance and Legal Risk on page 11.

Insolvency and the Orderly Liquidation Authority

Under the Federal Deposit Insurance Act, the FDIC may be appointed receiver of an insured depository institution if it is insolvent or in certain other circumstances. In addition, under the Financial Reform Act, when a systemically important financial institution (SIFI) such as the Corporation is in default or danger of default, the FDIC may be appointed receiver in order to conduct an orderly liquidation of such institution. In the event of such appointment, the FDIC could, among other things, invoke the orderly liquidation authority, instead of the U.S. Bankruptcy Code, if the Secretary of the Treasury makes certain financial distress and systemic risk determinations. The orderly liquidation authority is modeled in part on the Federal Deposit Insurance Act, but also adopts certain concepts from the U.S. Bankruptcy Code.

In 2013, the FDIC issued a notice describing its preferred “single point of entry” strategy for resolving systemically important financial institutions. Under this approach, the FDIC could replace a distressed BHC with a bridge holding company, which could continue operations and result in an orderly resolution of the underlying bank, but whose equity is held solely for the benefit of creditors of the original BHC. Furthermore, the Federal Reserve Board has indicated that it will be proposing regulations regarding the minimum levels of long-term debt required for BHCs to ensure there is adequate loss absorbing capacity in the event of a resolution. The orderly liquidation authority contains certain differences from the U.S. Bankruptcy Code. For example, in certain circumstances, the FDIC could permit payment of obligations it determines to be systemically significant (e.g., short-term creditors or operating creditors) in lieu of paying other obligations (e.g., long-term creditors) without the need to obtain creditors’ consent or prior court review. The insolvency and resolution process could also lead to a large reduction or total elimination of the value of a BHC’s outstanding equity, as well as impairment or elimination of certain debt.

Deposit Insurance

Deposits placed at U.S. domiciled banks (U.S. banks) are insured byIn 2013, the FDIC subject to limits and conditionsissued a notice describing its preferred “single point of applicable law and the FDIC’s regulations. Pursuant to the Financial Reform Act, FDIC insurance coverage limits were permanently increased to $250,000 per customer. All insured depository institutions are required to pay assessments toentry” strategy for resolving SIFIs. Under this approach, the FDIC could replace a distressed BHC with a bridge holding company, which could continue operations and result in order to fund the Deposit Insurance Fund (DIF).

The FDIC is required to maintain at least a designated minimum ratioan orderly resolution of the DIFunderlying bank, but whose equity is held solely for the benefit of creditors of the original BHC.

Furthermore, the Federal Reserve Board has proposed regulations regarding the minimum levels of long-term debt required for BHCs to insured depositsensure there is adequate loss absorbing capacity in the U.S. The Financial Reform Act requires the FDIC to assess insured depository institutions to achieveevent of a DIF ratio of at least 1.35 percent by September 30, 2020. The FDIC has adopted new regulations that establish a long-term target DIF ratio of greater than two percent. The DIF ratio is currently below the required targets and the FDIC has adopted a restoration plan that may result in increased deposit insurance assessments. Deposit insurance assessment rates are subject to change by the FDIC and will be impacted by the overall economy and the stability of the banking industry as a whole. resolution.

For more information regarding deposit insurance,our resolution, see Item 1A. Risk Factors – Regulatory, Compliance and Legal Risk on page 12.11.

SourceLimitations on Acquisitions

The Riegle-Neal Interstate Banking and Branching Efficiency Act of Strength1994 permits a BHC to acquire banks located in states other than its home state without regard to state law, subject to certain conditions, including the condition that the BHC, after and as a result of the acquisition, controls no more than 10 percent of the total amount of deposits of insured depository institutions in the U.S. and no more than 30 percent or such lesser or greater amount set by state law of such deposits in that state. At December 31, 2015, we held approximately 11 percent of the total amount of deposits of insured depository institutions in the U.S.

According toIn addition, the Financial Reform Act and Federal Reserve policy, BHCs are expected to act asrestricts acquisitions by a source of financial strength to each subsidiary bank and to commit resources to support each such subsidiary. Similarly, under the cross-guarantee provisions of FDICIA, in the event of a loss suffered or anticipated by the FDIC, eitherinstitution if, as a result of defaultthe acquisition, the total liabilities of the financial institution would exceed 10 percent of the total liabilities of all financial institutions in the U.S. At December 31, 2015, our liabilities did not exceed 10 percent of the total liabilities of all financial institutions in the U.S.

The Volcker Rule

The Volcker Rule prohibits insured depository institutions and companies affiliated with insured depository institutions (collectively, banking entities) from engaging in short-term proprietary trading of certain securities, derivatives, commodity futures and options for their own account. The Volcker Rule also imposes limits on banking entities’ investments in, and other relationships with, hedge funds and private equity funds, although the Federal Reserve extended the conformance period for certain existing covered investments and relationships to July 2016 (with indications that the conformance period may be further extended to July 2017). The Volcker Rule provides exemptions for certain activities, including market-making, underwriting, hedging, trading in government obligations, insurance company activities, and organizing and offering hedge funds and private equity funds. The Volcker Rule also clarifies that certain activities are not prohibited, including acting as agent, broker or custodian. A banking entity with significant trading operations, such as the Corporation, is required to establish a detailed compliance program to comply with the restrictions of the Volcker Rule.

Derivatives

Our derivatives operations are subject to extensive regulation globally. Various regulations have been promulgated since the financial crisis, including those under the U.S. Financial Reform Act, the European Union (EU) Markets in Financial Instruments Directive II/Regulation and the European Market Infrastructure Regulation, that regulate or will regulate the derivatives market by: requiring clearing and exchange trading of certain derivatives; imposing new capital, margin, reporting, registration and business conduct requirements for certain market participants; and imposing position limits on certain over-the-counter (OTC) derivatives. In response to global prudential regulator concerns that the closeout of derivatives transactions during the resolution of a banking subsidiary or relatedSIFI could impede resolution efforts and potentially destabilize markets, SIFIs, including the Corporation, together with the International Swaps and Derivatives Association, Inc. (ISDA) developed a protocol amending ISDA Master Agreements to provide for contractual recognition of stays of termination rights under various statutory resolution regimes and a contractual stay on certain cross-default rights. The original protocol was superseded by the ISDA 2015 Universal Resolution Stay Protocol (2015 Protocol), which took effect January 1, 2016, and expanded the financial contracts covered by the original protocol to also include industry forms of repurchase agreements and securities lending agreements. Dealers representing 23 SIFIs have adhered to the 2015 Protocol. Global prudential regulators are beginning

FDIC assistance provided to such a subsidiary in dangerpromulgate regulations requiring regulated firms, including the Corporation and many of default,its subsidiaries, to amend financial contracts to impose the affiliate banksterms of such a subsidiary may be assessed for the FDIC’s loss, subject to certain exceptions.2015 Protocol. The adoption of many of these regulations is ongoing and their ultimate impact remains uncertain.

Consumer Regulations

Our consumer businesses are subject to extensive regulation and oversight by federal and state regulators. Certain federal consumer finance laws to which we are subject, including, but not limited to, the Equal Credit Opportunity Act, the Home Mortgage Disclosure Act, the Electronic Fund Transfer Act, the Fair Credit Reporting Act, the Real Estate Settlement Procedures Act, (RESPA), the Truth in Lending Act (TILA) and Truth in Savings Act, are enforced by the CFPB. Other federal consumer finance laws, such as the Servicemembers Civil Relief Act, are enforced by the Officer of the Comptroller of the Currency.

Transactions with Affiliates

Pursuant to Section 23A and 23B of the Federal Reserve Act, as implemented by the Federal Reserve’s Regulation W, the Banks are subject to restrictions that limit certain types of transactions between the Banks and their nonbank affiliates. In general, U.S. banks are subject to quantitative and qualitative limits on extensions of credit, purchases of assets and certain other transactions involving its nonbank affiliates. Additionally, transactions between U.S. banks and their nonbank affiliates are required to be on arm’s length terms and must be consistent with standards of safety and soundness.OCC.

Privacy and Information Security

We are subject to many U.S. federal, state and international laws and regulations governing requirements for maintaining policies and procedures to protect the non-public confidential information of our customers.customers and employees. The Gramm-Leach-Bliley Act requires the Banks to periodically disclose Bank of America’s privacy policies and practices relating to sharing such information and enables retail customers to opt out of our ability to share information with unaffiliated third parties under certain circumstances. Other laws and regulations, at both the international, federal and state level, impact our ability to share certain information with affiliates and non-affiliates for marketing and/or non-marketing purposes, or to contact customers with marketing offers. The Gramm-Leach-Bliley Act also requires the Banks to implement a comprehensive information security program that includes administrative, technical and physical safeguards to ensure the security and confidentiality of customer records and information. These security and privacy policies and procedures for the protection of personal and confidential information are in effect across all businesses and geographic locations. The October 6, 2015 ruling by the European Court of Justice that the U.S. EU Safe Harbor is invalid has impacted the ability of certain vendors who relied upon the Safe Harbor to provide services to us. While an EU-U.S. Privacy Shield agreement to replace the EU-U.S. Safe Harbor has been announced, the timing of adoption and implementation is uncertain. We also expect the EU to adopt a Data Protection Regulation, which will replace the existing EU Data Protection Directive. The impacts of the anticipated EU Data Protection Regulation are uncertain at this time.

|

| | |

| | 5Bank of America 201420155

| | |

Item 1A. Risk Factors

In the course of conducting our business operations, we are exposed to a variety of risks, some of which are inherent in the financial services industry and others of which are more specific to our own businesses. The discussion below addresses the most significant factors, of which we are currently aware, that could affect our businesses, results of operations and financial condition. Additional factors that could affect our businesses, results of operations and financial condition are discussed in Forward-looking Statements in the MD&A on page 22.21. However, other factors not discussed below or elsewhere in this Annual Report on Form 10-K could also adversely affect our businesses, results of operations and financial condition. Therefore, the risk factors below should not be considered a complete list of potential risks that we may face.

Any risk factor described in this Annual Report on Form 10-K or in any of our other Securities and Exchange Commission (SEC)SEC filings could by itself, or together with other factors, materially adversely affect our liquidity, cash flows, competitive position, business, reputation, results of operations, capital position or financial condition, including by materially increasing our expenses or decreasing our revenues, which could result in material losses.

General Economic and Market Conditions Risk

Our businesses and results of operations may be adversely affected by the U.S. and international financial markets, U.S. and non-U.S. fiscal and monetary policy, and economic conditions generally.

Our businesses and results of operations are affected by the financial markets and general economic, market, political and social conditions in the U.S. and abroad, including factors such as the level and volatility of short-term and long-term interest rates, inflation, home prices, unemployment and under-employment levels, bankruptcies, household income, consumer spending, fluctuations in both debt and equity capital markets and currencies, liquidity of the global financial markets, the availability and cost of capital and credit, investor sentiment and confidence in the financial markets, political risks, the sustainability of economic growth in the U.S., Europe, China and Japan, and economic, market, political and social conditions in several larger emerging market countries. The deteriorationContinued economic challenges include under-employment, declines in energy prices, the ongoing low interest rate environment, restrained growth in consumer demand, the strengthening of the U.S. Dollar versus other currencies, and continued risk in the consumer and commercial real estate markets. Deterioration of any of these conditions could adversely affect our consumer and commercial businesses, our securities and derivatives portfolios, our level of charge-offs and provision for credit losses, the carrying value of our deferred tax assets, our capital levels and liquidity, and our results of operations.

Despite improving labor markets in For instance, the past year and recent sharp declines in energy costs, an elevated level of under-employment and household debt, the prolonged low interest rate environment and a strengthening U.S. Dollar, along with a continued sluggish recovery in the consumer real estate market and certain commercial real estate markets in the U.S., pose challenges for domestic economic performance and the financial services industry. The elevated level of under-employment and modest wage growth have directly impaired consumer finances and pose risks to the financial services industry.

Continued uncertainty in a number of housing markets and still elevated levels of distressed and delinquent mortgages remain risks to the housing market. The current environment of heightened scrutiny of financial institutions has resulted in increased public awareness of and sensitivity to banking fees and practices. Mortgage and housing market-related risks may be accentuated by attempts to forestall foreclosure proceedings, as well as state

and federal investigations into foreclosure practices by mortgage servicers. Each of these factors may adversely affect our fees and costs.

The recent sharp drop in oil prices, while likely a net positive for the U.S. economy, may also add distressstress to select regional markets that are energy industry-dependentindustry dependent and may negatively impact certain commercial and consumer loan portfolios.

Our businesses and results of operations are also affected by domestic and international fiscal and monetary policy. The actions ofFor example, the recent rate increase by the Federal Reserve in the U.S. and continued easing at many central banks internationally regulate the supply of money and credit in the global financial system. Their policies affectimpact our cost of funds for lending, investing and capital raising activities and the return we earn on those loans and investments, both of which affect our net interest margin. Theinvestments. Central bank actions of the Federal Reserve in the U.S. and central banks internationallycan also can affect the value of financial instruments

and other assets, such as debt securities and mortgage servicing rights (MSRs), and itstheir policies also can affect our borrowers, potentially increasing the risk that they may fail to repay their loans. Our businesses and earnings are also affected by the fiscal or other policies that are adopted by the U.S. government, various U.S. regulatory authorities, and non-U.S. governments and regulatory authorities. Changes in domestic and international fiscal and monetary policies are beyond our control and difficult to predict but could have an adverse impact on our capital requirements and the costs of running our business.

For more information about economic conditions and challenges discussed above, see Executive Summary – 20142015 Economic and Business Environment in the MD&A on page 23.22.

Liquidity Risk

Liquidity Risk is the Potential Inability to Meet Our ContractualExpected or Unexpected Liquidity Needs While Continuing to Support our Business and Contingent Financial Obligations, On- or Off-balance Sheet, as they Become Due.

Adverse changes to our credit ratings from the major credit rating agencies could significantly limit our access to funding or the capital markets, increase our borrowing costs, or trigger additional collateral or funding requirements.

Our borrowing costs and ability to raise funds are directly impacted by our credit ratings. In addition, credit ratings may be important to customers or counterparties when we compete in certain markets and when we seek to engage in certain transactions, including OTC derivatives. Credit ratings and outlooks are opinions expressed by rating agencies on our creditworthiness and thatCustomer Needs Under a Range of our obligations or securities, including long-term debt, short-term borrowings, preferred stock and other securities, including asset securitizations. Our credit ratings are subject to ongoing review by the rating agencies, which consider a number of factors, including our own financial strength, performance, prospects and operations as well as factors not under our control.

Currently, the Corporation’s long-term/short-term senior debt ratings and outlooks expressed by the rating agencies are as follows: Baa2/P-2 (Stable) by Moody’s Investors Service, Inc. (Moody’s); A-/A-2 (Negative) by Standard & Poor’s Ratings Services (S&P); and A/F1 (Negative) by Fitch Ratings (Fitch). The rating agencies could make adjustments to our credit ratings at any time, including as a result of a determination to no longer incorporate an uplift for U.S. government support. There can be no assurance that downgrades will not occur.

A reduction in certain of our credit ratings could negatively affect our liquidity, access to credit markets, the related cost of funds, our businesses and certain trading revenues, particularly in those businesses where counterparty creditworthiness is critical. If the short-term credit ratings of our parent company, bank or broker-dealer subsidiaries were downgraded by one or more levels, we may suffer the potential loss of access to short-term funding sources such as repo financing, and/or increased cost of funds.

In addition, under the terms of certain OTC derivative contracts and other trading agreements, in the event of a downgrade of our credit ratings or certain subsidiaries’ credit ratings, counterparties to those agreements may require us or certain subsidiaries to provide additional collateral, terminate these contracts or agreements, or provide other remedies. At December 31, 2014, if the rating agencies had downgraded their long-term senior debt ratings for us or certain subsidiaries by one incremental notch, the amount of additional collateral contractually required by derivative contracts and other trading agreements would have been approximately $1.4 billion, including $1.1 billion for Bank of America, N.A. (BANA). If the rating agencies had downgraded their long-term senior debt ratings for these entities by an additional incremental notch, approximately $2.8 billion in additional incremental collateral, including $1.9 billion for BANA would have been required.

Also, if the rating agencies had downgraded their long-term senior debt ratings for us or certain subsidiaries by one incremental notch, the derivative liability that would be subject to unilateral termination by counterparties as of December 31, 2014 was $1.8 billion against which $1.5 billion of collateral has been posted. If the rating agencies had downgraded their long-term senior debt ratings for us and certain subsidiaries by a second incremental notch, the derivative liability that would be subject to unilateral termination by counterparties as of December 31, 2014 was an incremental $3.9 billion, against which $3.0 billion of collateral has been posted.

While certain potential impacts are contractual and quantifiable, the full consequences of a credit ratings downgrade to a financial institution are inherently uncertain, as they depend upon numerous dynamic, complex and inter-related factors and assumptions, including whether any downgrade of a firm’s long-term credit ratings precipitates downgrades to its short-term credit ratings, and assumptions about the potential behaviors of various customers, investors and counterparties.

For more information about our credit ratings and their potential effects to our liquidity, see Liquidity Risk – Credit Ratings in the MD&A on page 68 and Note 2 – Derivativesto the Consolidated Financial Statements.Economic Conditions.

If we are unable to access the capital markets, continue to maintain deposits, or our borrowing costs increase, our liquidity and competitive position will be negatively affected.

Liquidity is essential to our businesses. We fund our assets primarily with globally sourced deposits in our bank entities, as well as secured and unsecured liabilities transacted in the capital markets. We rely on certain secured funding sources, such as repo markets, which are typically short-term and credit-sensitive in

nature. We also engage in asset securitization transactions, including with the government-sponsored enterprises (GSEs), to fund consumer lending activities. Our liquidity could be adversely affected by any inability to access the capital markets; illiquidity or volatility in the capital markets; unforeseen outflows of cash, including customer deposits, funding for commitments and contingencies; increased regulatory liquidity requirements onfor our bankingU.S. or international banks and their nonbank subsidiaries imposed by their home countries;subsidiaries; or negative perceptions about our short- or long-term business prospects, including downgrades of our credit ratings. Several of these factors may arise due to circumstances beyond our control, such as a general market disruption, negative views about the financial services industry generally, changes in the regulatory environment, actions by credit rating agencies or an operational problem that affects third parties or us.

Our cost of obtaining funding is directly related to prevailing market interest rates and to our credit spreads. Credit spreads are the amount in excess of the interest rate of U.S. Treasury securities, or other benchmark securities, of a similar maturity that we need to pay to our funding providers. Increases in interest rates and our credit spreads can increase the cost of our funding. Changes in our credit spreads are market-driven and may be influenced by market perceptions of our creditworthiness. Changes to interest rates and our credit spreads occur continuously and may be unpredictable and highly volatile.

For more information about our liquidity position and other liquidity matters, including credit ratings and outlooks and the policies and procedures we use to manage our liquidity risks, see Liquidity Risk in the MD&A on page 60.

Adverse changes to our credit ratings from the major credit rating agencies could significantly limit our access to funding or the capital markets, increase our borrowing costs, or trigger additional collateral or funding requirements.

Our borrowing costs and ability to raise funds are directly impacted by our credit ratings. In addition, credit ratings may be important to customers or counterparties when we compete in

certain markets and when we seek to engage in certain transactions, including OTC derivatives. Credit ratings and outlooks are opinions expressed by rating agencies on our creditworthiness and that of our obligations or securities, including long-term debt, short-term borrowings, preferred stock and other securities, including asset securitizations. Our credit ratings are subject to ongoing review by the rating agencies, which consider a number of factors, including our own financial strength, performance, prospects and operations as well as factors not under our control such as the likelihood of the U.S. government providing meaningful support to the Corporation or its subsidiaries in a crisis.

The rating agencies could make adjustments to our credit ratings at any time, and there can be no assurance that downgrades will not occur.

A reduction in certain of our credit ratings could negatively affect our liquidity, access to credit markets, the related cost of funds, our businesses and certain trading revenues, particularly in those businesses where counterparty creditworthiness is critical. If the short-term credit ratings of our parent company, bank or broker-dealer subsidiaries were downgraded by one or more levels, we may suffer the potential loss of access to short-term funding sources such as repo financing, and/or increased cost of funds.

In addition, under the terms of certain OTC derivative contracts and other trading agreements, in the event of a downgrade of our credit ratings or certain subsidiaries’ credit ratings, counterparties to those agreements may require us or certain subsidiaries to provide additional collateral, terminate these contracts or agreements, or provide other remedies.

While certain potential impacts are contractual and quantifiable, the full consequences of a credit ratings downgrade to a financial institution are inherently uncertain, as they depend upon numerous dynamic, complex and inter-related factors and assumptions, including whether any downgrade of a firm’s long-term credit ratings precipitates downgrades to its short-term credit ratings, and assumptions about the potential behaviors of various customers, investors and counterparties.

For information about the amount of additional collateral required and derivative liabilities that would be subject to unilateral termination at December 31, 2015 if the rating agencies had downgraded their long-term senior debt ratings for the Corporation or certain subsidiaries by each of two incremental notches, see Credit-related Contingent Features and Collateral in 65Note 2 – Derivativesto the Consolidated Financial Statements.

For more information about our credit ratings and their potential effects to our liquidity, see Liquidity Risk – Credit Ratings in the MD&A on page 63 and Note 2 – Derivativesto the Consolidated Financial Statements.

A downgrade in the U.S. government’s sovereign credit rating, or in the credit ratings of instruments issued, insured or guaranteed by related institutions, agencies or instrumentalities, could result in risks to the Corporation and its credit ratings and general economic conditions that we are not able to predict.

The ratings and perceived creditworthiness of instruments issued, insured or guaranteed by institutions, agencies or instrumentalities directly linked to the U.S. government could also be correspondingly affected by any downgrade. Instruments of this nature are often held as trading, investment or excess liquidity positions on the balance sheets of financial institutions, including the Corporation, and are widely used as collateral by financial institutions to raise cash in the secured financing markets. A

downgrade of the sovereign credit ratings of the U.S. government and perceived creditworthiness of U.S. government-related obligations could impact our ability to obtain funding that is collateralized by affected instruments, as well as affecting the pricing of that funding when it is available. A downgrade may also adversely affect the market value of such instruments.

We cannot predict if, when or how any changes to the credit ratings or perceived creditworthiness of these organizations will affect economic conditions. The credit rating for the Corporation or its subsidiaries could be directly or indirectly impacted by a downgrade of the U.S. government’s sovereign rating. In addition, the Corporation presently delivers a portion of the residential mortgage loans it originates into GSEs, agencies or instrumentalities (or instruments insured or guaranteed thereby). We cannot predict if, when or how any changes to the credit ratings of these organizations will affect their ability to finance residential mortgage loans.

A downgrade of the sovereign credit ratings of the U.S. government or the credit ratings of related institutions, agencies or instrumentalities would exacerbate the other risks to which the Corporation is subject and any related adverse effects on our business, financial condition and results of operations.

Bank of America Corporation is a holding company and we depend upon our subsidiaries for liquidity, including our ability to pay dividends to shareholders.shareholders and to fund payments on our other obligations. Applicable laws and regulations, including capital and liquidity requirements, mayand actions taken pursuant to our resolution plan could restrict our ability to transfer funds from our subsidiaries to Bank of America Corporation or other subsidiaries.

Bank of America Corporation, as the parent company, is a separate and distinct legal entity from our banking and nonbank subsidiaries. We evaluate and manage liquidity on a legal entity basis. Legal entity liquidity is an important consideration as there are legal and other limitations on our ability to utilize liquidity from one legal entity to satisfy the liquidity requirements of another, including the parent company. For instance, the parent company depends on dividends, distributions and other payments from our banking and nonbank subsidiaries to fund dividend payments on our common stock and preferred stock and to fund all payments on our other obligations, including debt obligations. Many of our subsidiaries, including our bank and broker-dealer subsidiaries, are subject to laws that restrict dividend payments, or authorize regulatory bodies to block or reduce the flow of funds from those subsidiaries to the parent company or other subsidiaries. In addition, ourOur bank and broker-dealer subsidiaries are subject to restrictions on their ability to lend or transact with affiliates and to minimum regulatory capital and liquidity requirements, as well as restrictions on their ability to use funds deposited with them in bank or brokerage accounts to fund their businesses.

In addition, we have arrangements with our key operating subsidiaries regarding the implementation of our preferred single point of entry resolution strategy, which restrict the ability of these subsidiaries to provide funds to us through distributions and advances upon the occurrence of certain severely adverse capital and liquidity conditions.

Additional restrictions on related party transactions, increased capital and liquidity requirements and additional limitations on the use of funds on deposit in bank or brokerage accounts, as well as lower earnings, can reduce the amount of funds available to meet the obligations of the parent company and even require the parent company to provide additional funding to such subsidiaries. Also, additional liquidity may be required at each subsidiary entity.

Regulatory action of that kind could impede access to funds we need to make payments on our obligations or dividend payments. In addition, our right to participate in a distribution of assets upon a subsidiary’s liquidation or reorganization is subject to the prior claims of the subsidiary’s creditors. For more information regarding our ability to pay dividends, see Capital Management in the MD&A on page 5953 and Note 13 – Shareholders’ Equity to the Consolidated Financial Statements.

Credit Risk

Credit Risk is the Risk of Loss Arising from the Inability or Failure of a Borrower or Counterparty to Meet its Obligations.

Economic or market disruptions, insufficient credit loss reserves or concentration of credit risk may result in an increase in the provision for credit losses, which could have an adverse effect on our financial condition and results of operations.

A number of our products expose us to credit risk, including loans, letters of credit, derivatives, debt securities, trading account assets and assets held-for-sale. The financial condition of our consumer and commercial borrowers and counterparties could adversely affect our earnings.

Global and U.S. economic conditions may impact our credit portfolios. To the extent economic or market disruptions occur, such disruptions would likely increase the risk that borrowers or counterparties would default or become delinquent on their obligations to us. Increases in delinquencies and default rates could adversely affect our consumer credit card, home equity, residential mortgage and purchased credit-impaired (PCI) portfolios through increased charge-offs and provision for credit losses. Additionally, increased credit risk could also adversely affect our commercial loan portfolios with weakened customer and collateral positions.

We estimate and establish an allowance for credit losses for losses inherent in our lending activities (including unfunded lending commitments), excluding those measured at fair value, through a charge to earnings. The amount of allowance is determined based on our evaluation of the potential credit losses included within our loan portfolios. The process for determining the amount of the allowance requires difficult and complex judgments, including loss forecasts of economic conditions andon how borrowers will react to thosecurrent economic conditions. The ability of our borrowers or counterparties to repay their obligations will likely be impacted by changes in economic conditions, which in turn could impact the accuracy of our forecasts.loss forecasts and allowance estimate. There is also the chance that we will fail to accurately identify the appropriate economic indicators or that we will fail to accurately estimate their impacts.

We may suffer unexpected losses if the models and assumptions we use to establish reserves and make judgments in extending credit to our borrowers or counterparties become less predictive of future events. Although we believe that our allowance for credit losses was in compliance with applicable accounting standards at December 31, 2014,2015, there is no guarantee that it

will be sufficient to address future credit losses, particularly if economic conditions deteriorate. In such an event, we may increase the size of our allowance, which reduces our earnings.

In the ordinary course of our business, we also may be subject to a concentration of credit risk in a particular industry, country, counterparty, borrower or issuer. A deterioration in the financial condition or prospects of a particular industry or a failure or

downgrade of, or default by, any particular entity or group of entities could negatively affect our businesses and the processes by which we set limits and monitor the level of our credit exposure to individual entities, industries and countries may not function as we have anticipated. While our activities expose us to many different industries and counterparties, we routinely execute a high volume of transactions with counterparties in the financial services industry, including brokers-dealers, commercial banks, investment banks, insurers, mutual and hedge funds, and other institutional clients. This has resulted in significant credit concentration with respect to this industry. Financial services institutions and other counterparties are inter-related because of trading, funding, clearing or other relationships. As a result, defaults by, or even rumors or questions about the financial stability of one or more financial services institutions, or the financial services industry generally, could lead to market-wide liquidity disruptions, losses and defaults. Many of these transactions expose us to credit risk in the event of default of a counterparty. In addition, our credit risk may be heightened by market risk when the collateral held by us cannot be realized or is liquidated at prices not sufficient to recover the full amount of the loan or derivatives exposure due to us.

In the ordinary course of business, we also enter into transactions with sovereign nations, U.S. states and U.S. municipalities. Unfavorable economic or political conditions, disruptions to capital markets, currency fluctuations, changes in energyoil prices, social instability and changes in government policies could impact the operating budgets or credit ratings of sovereign nations, U.S. states and U.S. municipalities and expose us to credit risk.

We also have a concentration of credit risk with respect to our consumer real estate, including home equity lines of credit (HELOCs), consumer credit card and commercial real estate portfolios, which represent a large percentage of our overall credit portfolio. In addition, our commercial portfolios include exposures to certain industries, including the energy sector, which may result in higher credit losses for the company due to adverse business conditions, market disruptions or greater volatility in those industries as the result of low energy prices or other factors. Economic downturns have adversely affected these portfolios. Continued economic weakness or deterioration in real estate values or household incomes could result in higher credit losses.

For more information about our credit risk and credit risk management policies and procedures, see Credit Risk Management in the MD&A on page 7065 and Note 1 – Summary of Significant Accounting Principles to the Consolidated Financial Statements.

Our derivatives businesses may expose us to unexpected risks and potential losses.

We are party to a large number of derivatives transactions, including credit derivatives. Our derivatives businesses may expose us to unexpected market, credit and operational risks that could cause us to suffer unexpected losses. Severe declines in asset values, unanticipated credit events or unforeseen circumstances that may cause previously uncorrelated factors to become correlated (and vice versa) may create losses resulting from risks not appropriately taken into account in the development, structuring or pricing of a derivative instrument. The terms of certain of our OTC derivative contracts and other trading agreements provide that upon the occurrence of certain specified events, such as a change in our credit ratings, we may be required to provide additional collateral or to provide other remedies, or our

|

| | |

| | 8Bank of America 201482015 | | |

to provide additional collateral or to provide other remedies, or our counterparties may have the right to terminate or otherwise diminish our rights under these contracts or agreements.

Many derivative instruments are individually negotiated and non-standardized, which can make exiting, transferring or settling some positions difficult. Many derivatives require that we deliver to the counterparty the underlying security, loan or other obligation in order to receive payment. In a number of cases, we do not hold, and may not be able to obtain, the underlying security, loan or other obligation.

In the event of a downgrade of the Corporation’s credit ratings, certain derivative and other counterparties may request we substitute BANA (which has generally had equal or higher credit ratings than the Corporation’s) as counterparty for certain derivative contracts and other trading agreements. The Corporation’s ability to substitute or make changes to these agreements to meet counterparties’ requests may be subject to certain limitations, including counterparty willingness, regulatory limitations on naming BANA as the new counterparty and the type or amount of collateral required. It is possible that such limitations on our ability to substitute or make changes to these agreements, including naming BANA as the new counterparty, could adversely affect our results of operations.

Derivatives contracts, including new and more complex derivatives products, and other transactions entered into with third parties are not always confirmed by the counterparties or settled on a timely basis. While a transaction remains unconfirmed, or during any delay in settlement, we are subject to heightened credit, market and operational risk and, in the event of default, may find it more difficult to enforce the contract. In addition, disputes may arise with counterparties, including government entities, about the terms, enforceability and/or suitability of the underlying contracts. These factors could negatively impact our ability to effectively manage our risk exposures from these products and subject us to increased credit and operating costs and reputational risk. For more information on our derivatives exposure, see Note 2 – Derivatives to the Consolidated Financial Statements.

Market Risk

Market Risk is the Risk that Changes in Market Conditions May Adversely Impact the Value of Assets or Liabilities or Otherwise Negatively Impact Earnings. Market Risk is Inherent in the Financial Instruments Associated with our Operations, Including Loans, Deposits, Securities, Short-term Borrowings, Long-term Debt, Trading Account Assets and Liabilities, and Derivatives.

Increased market volatility and adverse changes in other financial or capital market conditions may increase our market risk.

Our liquidity, cash flows, competitive position, business, results of operations and financial condition are affected by market risk factors such as changes in interest and currency exchange rates, equity and futures prices, the implied volatility of interest rates, credit spreads and other economic and business factors. These market risks may adversely affect, among other things, (i) the value of our on- and off-balance sheet securities, trading assets, other financial instruments, and MSRs, (ii) the cost of debt capital and our access to credit markets, (iii) the value of assets under management (AUM), (iv) fee income relating to AUM, (v) customer

allocation of capital among investment alternatives, (vi) the volume