00000708582022FYFALSEhttp://fasb.org/us-gaap/2022#AccountingStandardsUpdate201613Memberhttp://fasb.org/us-gaap/2022#OtherAssetshttp://fasb.org/us-gaap/2022#OtherAssetshttp://fasb.org/us-gaap/2022#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2022#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2022#OtherReceivableshttp://fasb.org/us-gaap/2022#OtherReceivables.0550.00100.04000.00080.040033.3333.3333.3325252525http://fasb.org/us-gaap/2022#NoninterestIncomeOtherOperatingIncome http://fasb.org/us-gaap/2022#TradingGainsLosseshttp://fasb.org/us-gaap/2022#NoninterestIncomeOtherOperatingIncome http://fasb.org/us-gaap/2022#TradingGainsLosseshttp://fasb.org/us-gaap/2022#NoninterestIncomeOtherOperatingIncome http://fasb.org/us-gaap/2022#TradingGainsLosseshttp://fasb.org/us-gaap/2022#NoninterestIncomeOtherOperatingIncome http://fasb.org/us-gaap/2022#TradingGainsLosseshttp://fasb.org/us-gaap/2022#NoninterestIncomeOtherOperatingIncome http://fasb.org/us-gaap/2022#TradingGainsLosseshttp://fasb.org/us-gaap/2022#NoninterestIncomeOtherOperatingIncome http://fasb.org/us-gaap/2022#TradingGainsLosseshttp://fasb.org/us-gaap/2022#OtherComprehensiveIncomeAvailableforsaleSecuritiesAdjustmentNetOfTaxPortionAttributableToParent http://fasb.org/us-gaap/2022#OtherComprehensiveIncomeForeignCurrencyTransactionAndTranslationAdjustmentNetOfTaxPortionAttributableToParent http://fasb.org/us-gaap/2022#OtherComprehensiveIncomeLossFinancialLiabilityFairValueOptionAfterTaxAndReclassificationAdjustmentAttributableToParenthttp://fasb.org/us-gaap/2022#OtherComprehensiveIncomeAvailableforsaleSecuritiesAdjustmentNetOfTaxPortionAttributableToParent http://fasb.org/us-gaap/2022#OtherComprehensiveIncomeForeignCurrencyTransactionAndTranslationAdjustmentNetOfTaxPortionAttributableToParent http://fasb.org/us-gaap/2022#OtherComprehensiveIncomeLossFinancialLiabilityFairValueOptionAfterTaxAndReclassificationAdjustmentAttributableToParenthttp://fasb.org/us-gaap/2022#OtherComprehensiveIncomeAvailableforsaleSecuritiesAdjustmentNetOfTaxPortionAttributableToParent http://fasb.org/us-gaap/2022#OtherComprehensiveIncomeForeignCurrencyTransactionAndTranslationAdjustmentNetOfTaxPortionAttributableToParent http://fasb.org/us-gaap/2022#OtherComprehensiveIncomeLossFinancialLiabilityFairValueOptionAfterTaxAndReclassificationAdjustmentAttributableToParent0000070858bac:CreditCardandDirectIndirectConsumerMemberbac:RefreshedFICOScoreGreaterThanOrEqualTo740Memberus-gaap:CreditCardReceivablesMember2021-12-310000070858bac:CorporateSecuritiesandOtherMember2021-01-012021-12-31 UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☑ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

| |

| EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2022

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES [Ÿ]

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

|

or

|

| |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number:

1-6523

Exact name of registrant as specified in its charter:

Bank of America Corporation

State or other jurisdiction of incorporation or organization:

Delaware

IRS Employer Identification No.:

56-0906609

Address of principal executive offices:

Bank of America Corporate Center

100 N. Tryon Street

Charlotte, North Carolina 28255

Registrant’s telephone number, including area code:

(704) 386-5681

Securities registered pursuant to section 12(b) of the Act:

|

| | | | | | | |

| | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |

| Common Stock, par value $0.01 per share | BAC | New York Stock Exchange | |

| Warrants to purchase Common Stock (expiring October 28, 2018) | | New York Stock Exchange | |

| Warrants to purchase Common Stock (expiring January 16, 2019) | | New York Stock Exchange | |

| Depositary Shares, each representing a 1/1,000th interest in a share of 6.204% Non-Cumulative Preferred Stock, Series D

| BAC PrE | New York Stock Exchange | |

| of Floating Rate Non-Cumulative Preferred Stock, Series E |

Depositary Shares, each representing a 1/1,000th interest in a share of Floating Rate Non-Cumulative Preferred Stock, Series E

| BAC PrB | New York Stock Exchange | |

| of 6.000% Non-Cumulative Preferred Stock, Series GG |

Depositary Shares, each representing a 1/1,000th interest in a share of 6.625% Non-Cumulative Preferred Stock, Series I

| BAC PrK | New York Stock Exchange | |

| of 5.875% Non-Cumulative Preferred Stock, Series HH |

| 7.25% Non-Cumulative Perpetual Convertible Preferred Stock, Series L | BAC PrL | New York Stock Exchange |

| Depositary Shares, each representing a 1/1,200th interest in a share | BML PrG | New York Stock Exchange |

| of Bank of America Corporation Floating Rate |

| Non-Cumulative Preferred Stock, Series 1 |

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Depositary Shares, each representing a 1/1,200th interest in a share | BML PrH | New York Stock Exchange |

| of Bank of America Corporation Floating Rate |

| Non-Cumulative Preferred Stock, Series 2 |

| Depositary Shares, each representing a 1/1,200th interest in a share | BML PrJ | New York Stock Exchange |

| of Bank of America Corporation Floating Rate |

| Non-Cumulative Preferred Stock, Series 4 |

| Depositary Shares, each representing a 1/1,200th interest in a share | BML PrL | New York Stock Exchange |

| of Bank of America Corporation Floating Rate |

| Non-Cumulative Preferred Stock, Series 5 |

| Floating Rate Preferred Hybrid Income Term Securities of BAC Capital | BAC/PF | New York Stock Exchange |

| Trust XIII (and the guarantee related thereto) |

| 5.63% Fixed to Floating Rate Preferred Hybrid Income Term Securities | BAC/PG | New York Stock Exchange |

| of BAC Capital Trust XIV (and the guarantee related thereto) |

| Income Capital Obligation Notes initially due December 15, 2066 of | MER PrK | New York Stock Exchange |

| Bank of America Corporation |

| Senior Medium-Term Notes, Series A, Step Up Callable Notes, due | BAC/31B | New York Stock Exchange |

| November 28, 2031 of BofA Finance LLC (and the guarantee |

| of the Registrant with respect thereto) |

Depositary Shares, each representing a 1/1,000th interest in a share of 6.625% Non-CumulativePreferred Stock, Series W

| BAC PrM | New York Stock Exchange | |

| of 5.375% Non-Cumulative Preferred Stock, Series KK |

Depositary Shares, each representing a 1/1,000th interest in a share of 6.500% Non-Cumulative Preferred Stock, Series Y

| BAC PrN | New York Stock Exchange | |

| of 5.000% Non-Cumulative Preferred Stock, Series LL |

Depositary Shares, each representing a 1/1,000th interest in a share of 6.200% Non-Cumulative Preferred Stock, Series CC

| BAC PrO | New York Stock Exchange | |

| of 4.375% Non-Cumulative Preferred Stock, Series NN |

| Depositary Shares, each representing a 1/1,000th interest in a share | BAC PrP | New York Stock Exchange |

of 6.000%4.125% Non-Cumulative Preferred Stock, Series EE | | New York Stock Exchange | |

| PP |

| | | | |

| | | | |

| Title of each class | | Name of each exchange on which registered | |

| 7.25% Non-Cumulative Perpetual Convertible Preferred Stock, Series L | | New York Stock Exchange | |

| Depositary Shares, each representing a 1/1,200th1,000th interest in a share | BAC PrQ | New York Stock Exchange |

of Bank of America Corporation Floating Rate4.250% Non-Cumulative Preferred Stock, Series 1 | | New York Stock Exchange | QQ |

| Depositary Shares, each representing a 1/1,200th1,000th interest in a share | BAC PrS | New York Stock Exchange |

of Bank of America Corporation Floating Rate4.750% Non-Cumulative Preferred Stock, Series 2 | | New York Stock Exchange | |

| Depositary Shares, each representing a 1/1,200th interest in a share of Bank of America Corporation 6.375% Non-Cumulative Preferred Stock, Series 3 | | New York Stock Exchange | |

| Depositary Shares, each representing a 1/1,200th interest in a share of Bank of America Corporation Floating Rate Non-Cumulative Preferred Stock, Series 4 | | New York Stock Exchange | |

| Depositary Shares, each representing a 1/1,200th interest in a share of Bank of America Corporation Floating Rate Non-Cumulative Preferred Stock, Series 5 | | New York Stock Exchange | |

| 7.00% Capital Securities of Countrywide Capital V (and the guarantees related thereto) | | New York Stock Exchange | |

| Floating Rate Preferred Hybrid Income Term Securities of BAC Capital Trust XIII (and the guarantee related thereto) | | New York Stock Exchange | |

| 5.63% Fixed to Floating Rate Preferred Hybrid Income Term Securities of BAC Capital Trust XIV (and the guarantee related thereto) | | New York Stock Exchange | |

| MBNA Capital B Floating Rate Capital Securities, Series B (and the guarantee related thereto) | | New York Stock Exchange | |

| Trust Preferred Securities of Merrill Lynch Capital Trust I (and the guarantee of the Registrant with respect thereto) | | New York Stock Exchange | |

| Trust Preferred Securities of Merrill Lynch Capital Trust III (and the guarantee of the Registrant with respect thereto) | | New York Stock Exchange | |

| Senior Medium-Term Notes, Series A, Step Up Callable Notes, due November 28, 2031 of BofA Finance LLC (and the guarantee of the Registrant with respect thereto) | | New York Stock Exchange | SS |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o☑No ☑☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o☐ No☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑No o☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Large accelerated filer☑ | ☑ | | Accelerated filero | ☐ | | Non-accelerated filero | ☐ | | Smaller reporting companyo |

| | | | | | Emerging growth company o

|

| | | | (do not check if a smaller reporting company) | | ☐ |

Emerging growth company☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o☐ No ☑

TheAs of June 30, 2022, the aggregate market value of the registrant’s common stock (“Common Stock”) held on June 30, 2017 by non-affiliates was approximately $239,643,149,085 (based on the June 30, 2017 closing price of Common Stock of $24.26 per share as reported on the New York Stock Exchange).$250,136,457,342. At February 21, 2018,2023, there were 10,243,688,8968,003,839,222 shares of Common Stock outstanding.

Documents incorporated by reference: Portions of the definitive proxy statement relating to the registrant’s 2023 annual meeting of stockholders scheduled to be held on April 25, 2018shareholders are incorporated by reference in this Form 10-K in response to Items 10, 11, 12, 13 and 14 of Part III.

Table of Contents

Bank of America Corporation and Subsidiaries

Part I

Bank of America Corporation and Subsidiaries

Item 1. Business

Bank of America Corporation is a Delaware corporation, a bank holding company (BHC) and a financial holding company. When used in this report, “Bank of America,” “the Corporation”Corporation,” “we,” “us” and “our” may refer to Bank of America Corporation individually, Bank of America Corporation and its subsidiaries, or certain of Bank of America Corporation’s subsidiaries or affiliates. As part of our efforts to streamline the Corporation’s organizational structure and reduce complexity and costs, the Corporation has reduced and intends to continue to reduce the number of its corporate subsidiaries, including through intercompany mergers.

Bank of America is one of the world’s largest financial institutions, serving individual consumers, small- and middle-market businesses, institutional investors, large corporations and governments with a full range of banking, investing, asset management and other financial and risk management products and services. Our principal executive offices are located in the

Bank of America Corporate Center, 100 North Tryon Street, Charlotte, North Carolina 28255.

Bank of America’s website is www.bankofamerica.com, and the Investor Relations portion of our website is http:https://investor.bankofamerica.com. We use our website to distribute company information, including as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. We routinely post and make accessible financial and other information, including environmental, social and governance (ESG) information, regarding usthe Corporation on our website. Accordingly, investorsInvestors should monitor our website, including the Investor Relations portion of our website, in addition to following our press releases, SECU.S. Securities and Exchange Commission (SEC) filings, public conference calls and webcasts. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (Exchange Act) are available on the Investor Relations portion of our website under the heading

Financial Information SEC Filings as soon as reasonably practicable after we electronically file such reports with, or furnish them to, the U.S. SecuritiesSEC and Exchange Commission (SEC).at the SEC’s website, www.sec.gov. Notwithstanding the foregoing, the information contained on our website as referenced in this paragraph, or otherwise in this Annual Report on Form 10-K, is not incorporated by reference into this Annual Report on Form 10-K. Also, we make available on the Investor Relations portion of our website under the heading Corporate Governance:website: (i) our Code of Conduct (including our insider trading policy);Conduct; (ii) our Corporate Governance Guidelines (accessible by clicking on the Governance Highlights link);Guidelines; and (iii) the charter of each active committee of our Board of Directors (the Board) (accessible by clicking on. Our Code of Conduct constitutes a “code of ethics” and a “code of business conduct and ethics” that applies to the committee names underrequired

individuals associated with the Committee Composition link).Corporation for purposes of the respective rules of the SEC and the New York Stock Exchange. We also intend to disclose any amendments to our Code of Conduct orand waivers of our Code of Conduct on behalfrequired to be disclosed by the rules of our Chief Executive Officer, Chief Financial Officer or Chief Accounting Officer,the SEC and the New York Stock Exchange on the Investor Relations portion of our website. All of these corporate governance materials are also available free of charge in print to shareholders who request them in writing to: Bank of America Corporation, Attention: Office of the Corporate Secretary, Hearst Tower, 214Bank of America Corporate Center, 100 North Tryon Street, NC1-027-18-05,NC1-007-56-06, Charlotte, North Carolina 28255.

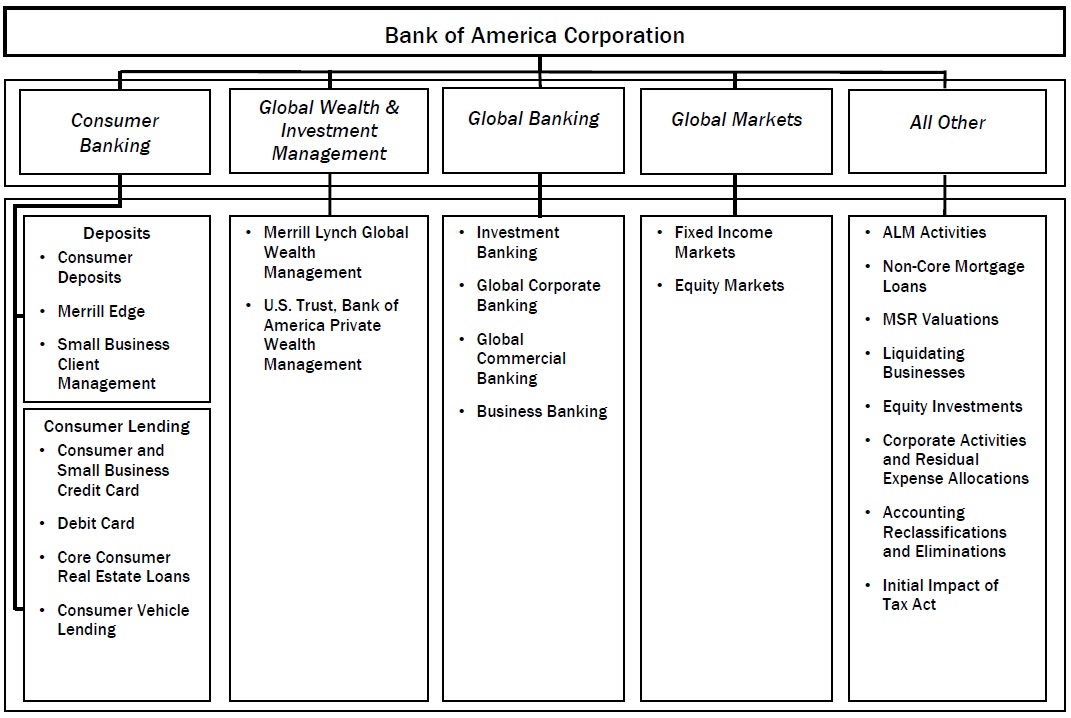

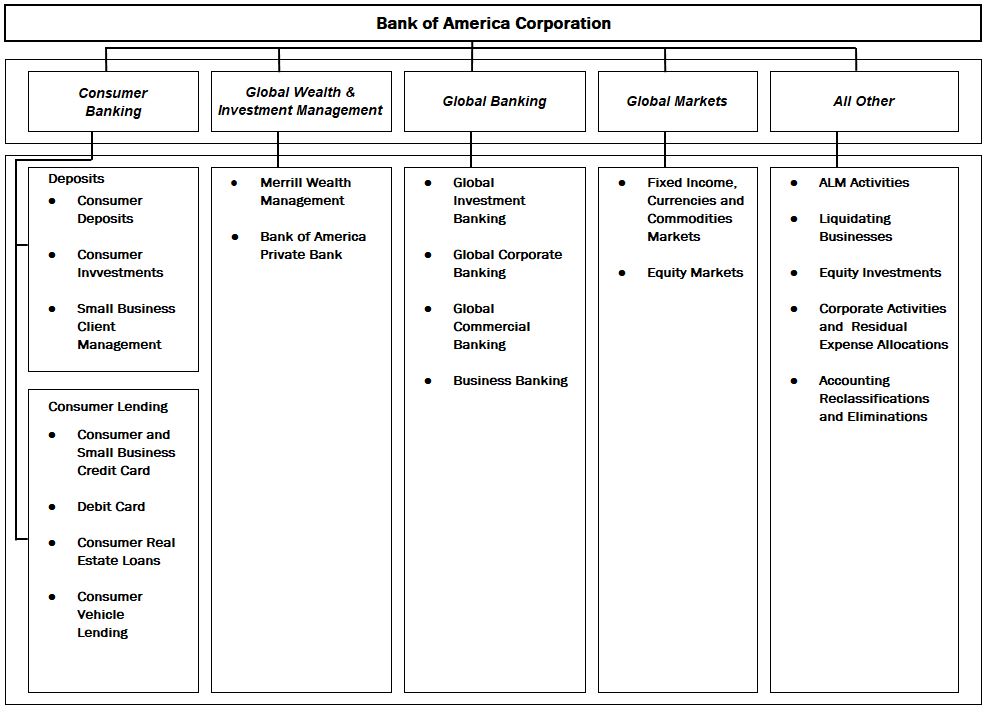

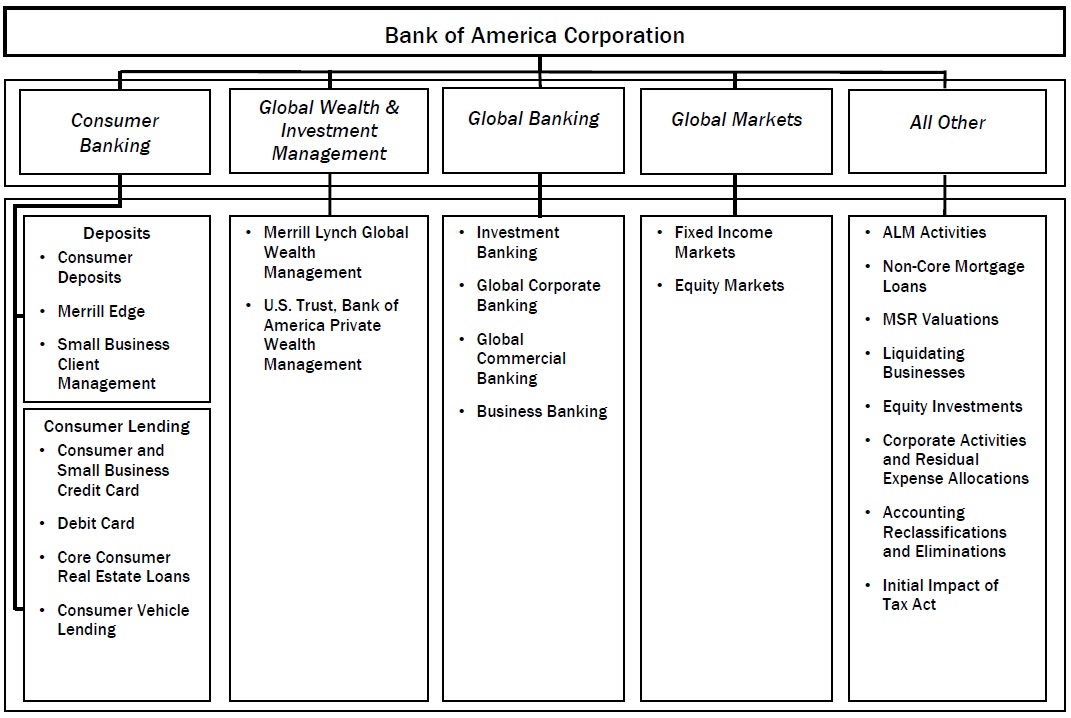

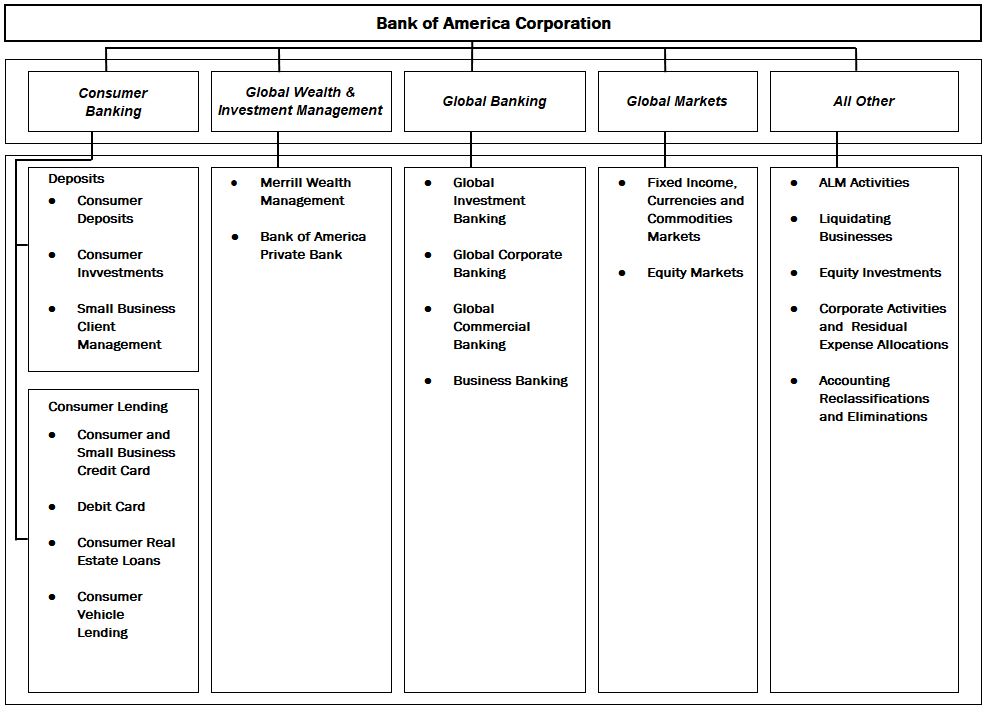

Segments

Through our bankingvarious bank and various nonbank subsidiaries throughout the U.S. and in international markets, we provide a diversified range of banking and nonbank financial services and products through four business segments: Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking and Global Markets, with the remaining operations recorded in All Other. Additional information related to our business segments and the products and services they provide is included in the information set forth on pages 3037 through 3946 of Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) and Note 23 – Business Segment Informationto the Consolidated Financial Statements in Item 8. Financial Statements and Supplementary Data (Consolidated Financial Statements).Statements.

Competition

We operate in a highly competitive environment. Our competitors include banks, thrifts, credit unions, investment banking firms, investment advisory firms, brokerage firms, investment companies, insurance companies, mortgage banking companies, credit card issuers, mutual fund companies, hedge funds, private equity firms, and e-commerce and other internet-based companies.companies, including merchant banks and companies providing nonbank financial services. We compete with some of these competitors globally and with others on a regional or productproduct-specific basis. We are increasingly competing with firms offering products solely over the internet and with non-financial companies, including firms utilizing emerging technologies, such as digital assets, rather than, or in addition to, traditional banking products.

Competition is based on a number of factors including, among others, customer service and convenience, the pricing, quality and range of products and services offered, price, reputation, interest rates on loans and deposits, lending limits, the quality and customer convenience.delivery of our technology and our reputation, experience and relationships in relevant markets. Our ability to continue to compete effectively also depends in large part on our ability to attract new employees and develop, retain and motivate our existing employees, while managing compensation and other costs.

Employees

Human Capital Resources

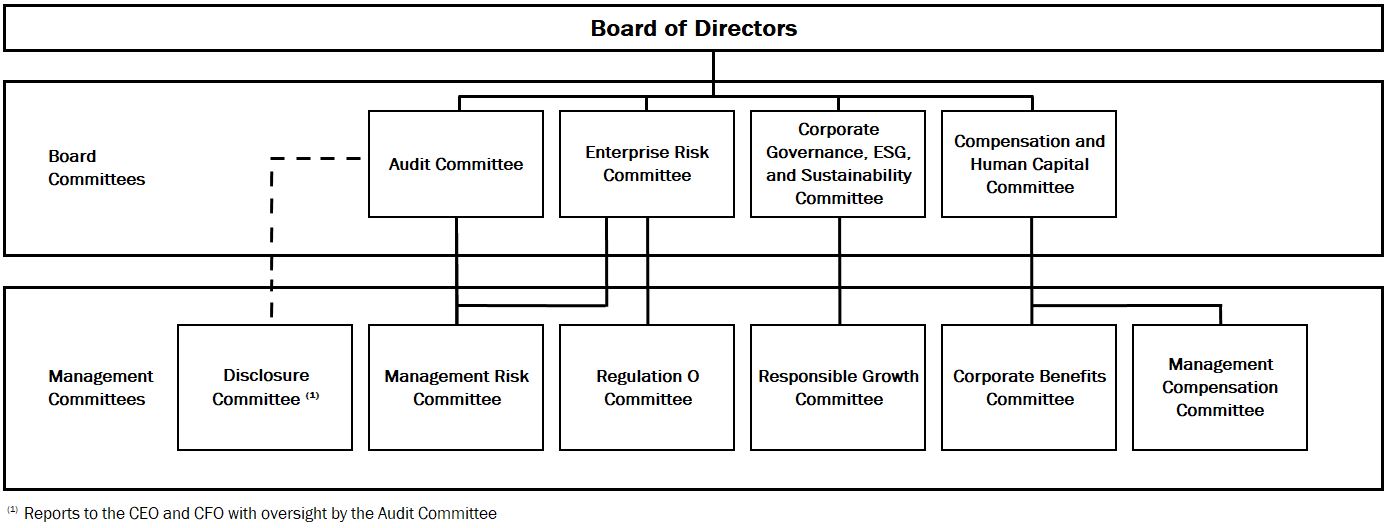

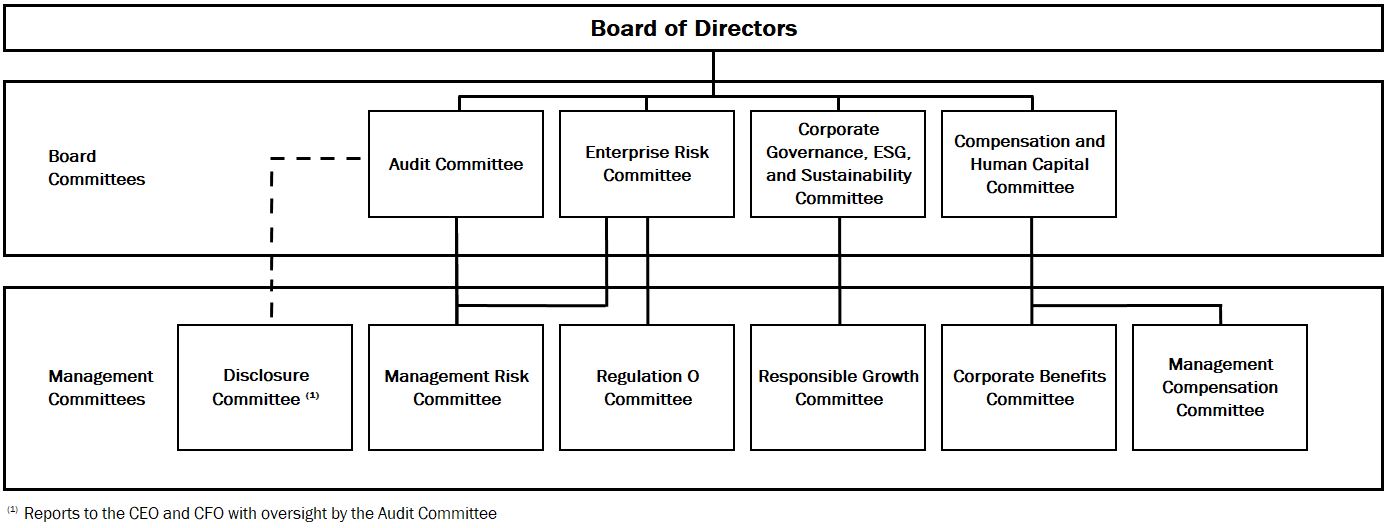

We strive to make Bank of America a great place to work for our employees. We value our employees and seek to establish and maintain human resource policies that are consistent with our core values and help to realize the power of our people. Our Board and its Compensation and Human Capital Committee provide oversight of our human capital management strategies, programs and practices. The Corporation’s senior management provides regular briefings on human capital matters to the Board and its Committees to facilitate the Board’s oversight.

At December 31, 2017, we had2022 and 2021, the Corporation employed approximately 209,000 employees.217,000 and 208,000 employees, of which 79 percent and 80 percent were located in the U.S. None of our domesticU.S. employees are subject to a collective bargaining agreement. Management considersAdditionally, in 2022 and 2021, the Corporation’s compensation and benefits expense was $36.4 billion and $36.1 billion, or 59 percent and 61 percent, of total noninterest expense.

Diversity and Inclusion

The Corporation’s commitment to diversity and inclusion starts at the top with oversight from our Board and CEO. The Corporation’s senior management sets the diversity and inclusion goals, and the Chief Human Resources Officer and Chief Diversity & Inclusion Officer partner with our CEO and senior management to drive our diversity and inclusion strategy, programs, initiatives and policies. The Global Diversity and Inclusion Council, which consists of senior executives from every line of business and region, is chaired by our CEO and has been in place for over 20 years. The Council sponsors and supports business, operating unit and regional diversity and inclusion councils to align with enterprise diversity strategies and goals.

Our practices and policies have resulted in strong representation across the Corporation where our broad employee population mirrors the clients and communities we serve. We have a Board and senior management team that are 53 percent and 55 percent racially, ethnically and gender diverse. The following table presents diversity metrics for our global employees who self-identified as women and our U.S.-based employees who self-identified as people of color, including those who self-identified as Asian, Black/African American and Hispanic/Latino. These workforce diversity metrics are reported regularly to the senior management team and to the Board.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Diversity Metrics as of December 31, 2022 |

| | | | | | |

| Total Employees | | Top Three Management Levels | | Managers at All Levels |

| Global employees | | | | | |

| Women | 50 | % | | 42 | % | | 42 | % |

| U.S.-based employees | | | | | |

| People of color | 50 | | | 26 | | | 42 | |

| Asian | 14 | | | 11 | | | 14 | |

| Black/African American | 14 | | | 8 | | | 10 | |

| Hispanic/Latino | 19 | | | 6 | | | 16 | |

We invest in our talent by offering a range of development programs and resources that allow employees to develop and progress in their careers. We reinforce our commitment to diversity and inclusion by investing internally in our employee relationsnetworks and by facilitating enterprise-wide learning and conversations about various diversity and inclusion topics and issues. Further, we partner with various external organizations, which focus on advancing diverse talent. We also have practices in place for attracting and retaining diverse talent, including campus recruitment. For example, in 2022, 44 percent of our global campus hires were women and, in the U.S., 59 percent were people of color.

Employee Engagement and Talent Retention

As part of our ongoing efforts to be good.make the Corporation a great place to work, we have conducted a confidential annual Employee Engagement Survey (Survey) for nearly two decades. The Survey results are reviewed by the Board and senior management and used to assist in reviewing the Corporation’s human capital strategies, programs and practices. In 2022, 85 percent of the Corporation’s employees participated in the Survey, and our Employee Engagement Index, an overall measure of employee satisfaction with the Corporation, was 85 percent. Our turnover among employees was 13 percent in 2022 and 12 percent in 2021.

Additionally, the Corporation provides a variety of resources to help employees grow in their current roles and build new skills, including resources to help employees find new opportunities, re-skill and seek leadership positions. The learning and development strategy is grounded in the development of horizontal skills delivered throughout the organization. Senior leaders, managers and teammates are onboarded and build horizontal skills, as well as role-specific skills, to help drive high performance. This approach also helps facilitate internal mobility and promotion of talent to build a bench of qualified managers and leaders. In 2022, more than 30,000 employees found new roles within the Corporation, and we delivered more than 11 million hours of training and development to our teammates through Bank of America Academy. Additionally, our Board oversees CEO and senior management succession planning, which is formally reviewed at least annually.

Fair and Equitable Compensation

The Corporation is committed to racial and gender pay equity by striving to compensate all of our employees fairly and equitably. We maintain robust policies and practices that reinforce our commitment, including reviews conducted by a third-party consultant with oversight from our Board and senior management. In 2022, our review covered our regional hubs (U.S., U.K., France, Ireland, Hong Kong and Singapore) and India and showed that compensation received by women, on average, was greater than 99 percent of that received by men in comparable positions. In the U.S., compensation received by people of color was, on average, greater than 99 percent of that received by teammates who are not people of color in comparable positions.

We also strive to pay our employees fairly based on market rates for their roles, experience and how they perform. We regularly benchmark against other companies both within and outside our industry to help confirm our pay is competitive. In 2021, the Corporation announced it would increase its minimum hourly wage for U.S. employees to $25 per hour by 2025. In June 2022, as a next step, the Corporation increased its hourly minimum wage for U.S. employees to $22 per hour. In addition, in January 2023, for the sixth year since 2017, we announced that we recognized our teammates with Sharing Success compensation awards for their efforts during 2022. Approximately 96 percent of employees globally will receive an award in the first quarter of 2023.

Health and Wellness – 2022 Focus

The Corporation is also committed to supporting employees’ physical, emotional and financial wellness by offering flexible and competitive benefits, including comprehensive health and insurance benefits and wellness resources. During 2022, we continued efforts to support our employees through the ongoing health crisis resulting from Coronavirus Disease 2019 (COVID-19). We provided no-cost COVID-19 testing and teammates with incentives for getting the vaccine and booster. We also held on-site flu and COVID-19 vaccine and booster clinics.

We continued our efforts around providing affordable access to healthcare, including offering no-cost, 24/7 access to virtual general medical and behavioral health resources to help our enrolled U.S. teammates stay healthy, both physically and emotionally. We kept U.S. health insurance premiums unchanged for teammates earning less than $50,000 for the tenth year in a row, and had nominal premium increases for teammates earning from $50,000 up to $100,000 for the sixth year in a row. We provided in-network generic prescription medications at no cost for teammates enrolled in a U.S. bank medical PPO or Consumer Direct plan, along with continuing preventative care medications at no cost for all U.S. medical plans.

We offer an extensive benefit package and support work-life balance for our teammates, which includes in the U.S., 16 weeks of paid parental leave for both primary and secondary

caregivers and backup dependent care (50 days of child and adult backup care per year). We doubled the number of no-cost confidential counseling sessions from six to 12 for all employees and family members and now offer 12 globally.

For more information about our human capital management, see the Corporation’s website and 2022 Annual Report to shareholders that will be available on the Investor Relations portion of our website in March 2023 (the content of which is not incorporated by reference into this Annual Report on Form 10-K).

Government Supervision and Regulation

The following discussion describes, among other things, elements of an extensive regulatory framework applicable to BHCs, financial holding companies, banks and broker-dealers, including specific information about Bank of America.

We are subject to an extensive regulatory framework applicable to BHCs, financial holding companies and banks and other financial services entities. U.S. federal regulation of banks, BHCs and financial holding companies is intended primarily for the protection of depositors and the Deposit Insurance Fund (DIF) rather than for the protection of shareholders and creditors.

As a registered financial holding company and BHC, the Corporation is subject to the supervision of, and regular inspection by, the Board of Governors of the Federal Reserve System (Federal Reserve). Our U.S. bank subsidiaries (the Banks), organized as national banking associations, are subject to regulation, supervision and examination by the Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve. In addition, the Federal Reserve and the OCC have adopted guidelines that establish minimum standards for the design, implementation and board oversight of BHCs’ and national banks’ risk governance frameworks. U.S. financial holding companies, and the companies under their control, are permitted to engage in activities considered “financial in nature” as defined by the Gramm-Leach-Bliley Act and related Federal Reserve interpretations. Unless otherwise limited by the Federal Reserve,The Corporation's status as a financial holding company may engage directly or indirectlyis conditioned upon maintaining certain eligibility requirements for both the Corporation and its U.S. depository institution subsidiaries, including minimum capital ratios, supervisory ratings and, in activities considered financial in nature provided the case of the depository institutions, at least satisfactory Community Reinvestment Act ratings. Failure to be an eligible financial holding company givescould result in the Federal Reserve after-the-fact noticelimiting Bank of the new activities. The Gramm-Leach-Bliley Act also permits national banks to engage inAmerica's activities, considered financial in nature through a financial subsidiary,including potential acquisitions. Additionally, we are subject to certain conditionsa significant number of laws, rules and limitationsregulations that govern our businesses in the U.S. and within the approvalother jurisdictions in which we operate, including permissible activities, minimum levels of the OCC.capital and liquidity, compliance risk management, consumer products and sales practices, anti-money laundering and anti-corruption, government sanctions, privacy, data protection and executive compensation, among others.

The scope of the laws and regulations and the intensity of the supervision to which we are subject have increased in recentover the past several years, inbeginning with the response to the 2008 financial crisis, as well as other factors such as technological and market changes. In addition, the banking and financial services sector is subject to substantial regulatory enforcement and fines. Many of these changes have occurred as a result of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (the Financial Reform Act). We cannot assess whether there will be any additional major changes in the regulatory environment and expect that our business will remain subject to continuing and extensive regulation and supervision.

We are also subject to various other laws and regulations, as well as supervision and examination by other regulatory agencies, all of which directly or indirectly affect our operations andentities, management and our ability to make distributions to shareholders. For instance, our broker-dealer subsidiaries are subject to both U.S. and international regulation, including supervision by the SEC, theFinancial Industry Regulatory Authority and New York Stock Exchange, and the Financial Industry Regulatory Authority, among others; our futures commission merchant subsidiaries supporting commodities and derivatives businesses in the U.S. are subject to regulation by and supervision of the U.S. Commodity Futures Trading Commission (CFTC); our U.S. derivatives activity is subject to regulation and supervision of the CFTC and, National Futures Association, or the SEC,Chicago Mercantile Exchange, and in the case of the Banks, certain banking regulators; our insurance activities are subject to licensing and regulation by state insurance regulatory agencies; and our consumer financial products and services are regulated by the Consumer Financial Protection Bureau (CFPB).

Our non-U.S. businesses are also subject to extensive regulation by various non-U.S. regulators, including governments, securities exchanges, prudential regulators, central banks and other regulatory bodies, in the jurisdictions in which those businesses operate. For example, our financial services operationsentities in the United Kingdom (U.K.), Ireland and France are subject to regulation

by and supervision of the Prudential Regulatory Authority for prudential matters, and the Financial Conduct Authority (FCA) for, the conductEuropean Central Bank and Central Bank of business matters.Ireland, and the Autorité de Contrôle Prudentiel et de Résolution and Autorité des Marchés Financiers, respectively.

Source of Strength

Under the Financial Reform Act and Federal Reserve policy, BHCs are expected to act as a source of financial strength to each subsidiary bank and to commit resources to support each such subsidiary. Similarly, under the cross-guarantee provisions of the Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA), in the event of a loss suffered or anticipated by the FDIC, either as a result of default of a bank subsidiary or related to FDIC assistance provided to such a subsidiary in danger of default, the affiliate banks of such a subsidiary may be assessed for the FDIC’s loss, subject to certain exceptions.

Transactions with Affiliates

Pursuant to Section 23A and 23B of the Federal Reserve Act, as implemented by the Federal Reserve’s Regulation W, the Banks are subject to restrictions that limit certain types of transactions between the Banks and their nonbank affiliates. In general, U.S.

banks are subject to quantitative and qualitative limits on extensions of credit, purchases of assets and certain other transactions involving itstheir nonbank affiliates. Additionally, transactions between U.S. banks and their nonbank affiliates are required to be on arm’s length terms and must be consistent with standards of safety and soundness.

Deposit Insurance

Deposits placed at U.S. domiciled banks (U.S. banks) are insured by the FDIC, subject to limits and conditions of applicable law and the FDIC’s regulations. Pursuant to the Financial Reform Act, FDIC insurance coverage limits are $250,000 per customer.depositor, per insured bank for each account ownership category. All insured depository institutions are required to pay assessments to the FDIC in order to fund the DIF.

The FDIC is required to maintain at least a designatedstatutory minimum ratio of the DIF to insured deposits in the U.S. The Financial Reform Act requires the FDIC to assess insured depository institutions to achieve a DIF ratio of at least 1.35 percent by September 30, 2020. The FDICand has adopted regulations that establishestablished a long-term targetgoal of a two percent DIF ratioratio. As of greater than two percent. Thethe date of this report, the DIF ratio is currently below the required targetsstatutory minimum ratio and the FDIC’s long-term goal. In October 2022, the FDIC has adopted a restoration plan that may resultincludes an increase in increased deposit insurance assessments. In 2016,assessments across the industry of two basis points (bps). The FDIC implemented a surchargehas indicated that it intends to accelerate compliance withmaintain such assessment rates for the 1.35 percentage requirement.foreseeable future. Deposit insurance assessment rates are subject to change by the FDIC and will be impacted by the overall economy and the stability of the banking industry as a whole. For more information regarding deposit insurance, see Item 1A. Risk Factors – Regulatory, Compliance and Legal on page 12.17.

Capital, Liquidity and Operational Requirements

As a financial holding company, we and our bank subsidiaries are subject to the regulatory capital and liquidity guidelinesrules issued by the Federal Reserve and other U.S. banking regulators, including the FDICOCC and the OCC.FDIC. These rules are complex and are evolving as U.S. and international regulatory authorities propose and enact enhanced capital and liquidityamendments to these rules. The Corporation seeks to manage its capital position to maintain sufficient capital to meetsatisfy these regulatory guidelinesrules and to support our business activities. These continually evolving rules are likely to influence our planning processes for, and may require additional regulatory capital and liquidity, as well as impose additional operational and compliance costs on the Corporation. In addition, the Federal Reserve and the OCC have adopted guidelines that establish minimum standards for the design, implementation and board oversight of BHCs’ and

national banks’ risk governance frameworks. The Federal Reserve has also issued a final rule requiring us to maintain minimum amounts of long-term debt meeting specified eligibility requirements.

For more information on regulatory capital rules, capital composition and pending or proposed regulatory capital changes, see Capital Management – Regulatory Capital in the MD&A on page 45,49, and Note 16 – Regulatory Requirements and Restrictions to the Consolidated Financial Statements, which are incorporated by reference in this Item 1.

Distributions

We are subject to various regulatory policies and requirements relating to capital actions, including payment of dividends and common stock repurchases. For instance, Federal Reserve regulations require major U.S. BHCs to submit a capital plan as part of an annual Comprehensive Capital Analysis and Review (CCAR). The purpose of the CCAR for the Federal Reserve is to assess the capital planning process of the BHC, including any planned capital actions, such as payment of dividends and common stock repurchases.

Our ability to pay dividends is also affected by the variousand make common stock repurchases depends in part on our ability to maintain regulatory capital levels above minimum capital requirements and the capitalplus buffers and non-capital standards established under the FDICIA. The rightTo the extent that the Federal Reserve increases our stress capital buffer (SCB), global systemically important bank (G-SIB) surcharge or countercyclical capital buffer, our returns of capital to shareholders, including dividends and common stock repurchases, could decrease. As part of its CCAR, the Federal Reserve conducts stress testing on parts of our business using hypothetical economic scenarios prepared by the Federal Reserve. Those scenarios may affect our CCAR stress test results, which may impact the level of our SCB. For example, based on the results of our 2022 CCAR stress test, the Corporation’s SCB increased to 3.4 percent, and the Corporation’s G-SIB surcharge is expected to increase to 3.0 percent on January 1, 2024. Additionally, the Federal Reserve could impose limitations or prohibitions on taking capital actions such as paying or increasing dividends or repurchasing common stock. For example, as a result of the economic uncertainty resulting from the pandemic, in the second half of 2020, the Federal Reserve introduced certain limitations to capital distributions for all large banks, including the Corporation, our shareholders and our creditors to participate in any distribution of the assets or earnings of our subsidiaries is further subject to the prior claims of creditors of the respective subsidiaries.which were removed effective July 1, 2021.

If the Federal Reserve finds that any of our Banks are not “well-capitalized” or “well-managed,” we would be required to enter into an agreement with the Federal Reserve to comply with all applicable capital and management requirements, which may contain additional limitations or conditions relating to our activities. Additionally, the applicable federal regulatory authority is authorized to determine, under certain circumstances relating to the financial condition of a bank or BHC, that the payment of dividends would be an unsafe or unsound practice and to prohibit payment thereof.

For more information regarding the requirements relating to the payment of dividends, including the minimum capital requirements, see Note 13 – Shareholders’ Equity and Note 16 – Regulatory Requirements and Restrictionsto the Consolidated Financial Statements.Statements.

Many of our subsidiaries, including our bank and broker-dealer subsidiaries, are subject to laws that restrict dividend payments, or authorize regulatory bodies to block or reduce the flow of funds from those subsidiaries to the parent company or other subsidiaries. The rights of the Corporation, our shareholders and our creditors to participate in any distribution of the assets or earnings of our subsidiaries are further subject to the prior claims of creditors of the respective subsidiaries.

Resolution Planning

As a BHC with greater than $50$250 billion of assets, the Corporation is required by the Federal Reserve and the FDIC to periodically submit a plan for a rapid and orderly resolution in the event of material financial distress or failure.

Such resolution plan is intended to be a detailed roadmap for the orderly resolution of athe BHC, andincluding the continued operations or solvent wind down of its material entities, pursuant to the U.S. Bankruptcy Code and other applicable resolution regimes under one or more hypothetical scenarios assuming no extraordinary government assistance.

If both the Federal Reserve and the FDIC determine that the BHC’s plan is not credible, the Federal Reserve and the FDIC may jointly impose more stringent capital, leverage or liquidity requirements or restrictions on growth, activities or operations. A descriptionsummary of our plan is available on the Federal Reserve and FDIC websites.

The FDIC also requires the submission of a resolution plan for Bank of America, N.A. (BANA),National Association, which must describe how the insured depository institution would be resolved under the bank resolution provisions of the Federal Deposit Insurance Act. A description of this plan is available on the FDIC’s website.

We continue to make substantial progress to enhance our resolvability, including simplifyingwhich includes continued improvements to our legal entity structure and business operations, and increasing our preparedness capabilities to implement our resolution plan, both from a financial and operational standpoint.

Similarly, inAcross international jurisdictions, resolution planning is the responsibility of national resolution authorities (RA). Among those, the jurisdictions with the greatest impact to the Corporation’s subsidiaries are the U.K., Ireland and France, where rules have been issued requiring the submission of significant information about certain U.K.-incorporatedlocally incorporated subsidiaries and other financial institutions, as well as the Corporation’s banking branches of non-U.K. banks located in the U.K. (including information on intra-group dependencies, legal entity separation and barriersthose jurisdictions that are deemed to resolution) to allow the Bank of England to developbe material for resolution plans.planning purposes. As a result of the Bank of England’sRA's review of the submitted information, we could be required to take certain actions over the next several years whichthat could increase operating costs and potentially result in the restructuring of certain businesses and subsidiaries.

For more information regarding our resolution plan, see Item 1A. Risk Factors – Liquidity on page 6.9.

Insolvency and the Orderly Liquidation Authority

Under the Federal Deposit Insurance Act, the FDIC may be appointed receiver of an insured depository institution if it is insolvent or in certain other circumstances. In addition, under the Financial Reform Act, when a systemically important financial institution (SIFI) such as the Corporation is in default or danger of default, the FDIC may be appointed receiver in order to conduct an orderly liquidation of such institution. In the event of such appointment, the FDIC could, among other things, invoke the orderly liquidation authority, instead of the U.S. Bankruptcy Code, if the Secretary of the Treasury makes certain financial distress and systemic risk determinations. The orderly liquidation authority is modeled in part on the Federal Deposit Insurance Act, but also adopts certain concepts from the U.S. Bankruptcy Code.

The orderly liquidation authority contains certain differences from the U.S. Bankruptcy Code. For example, in certain circumstances, the FDIC could permit payment of obligations it determines to be systemically significant (e.g., short-term creditors or operating creditors) in lieu of paying other obligations (e.g., long-term creditors) without the need to obtain creditors’ consent or prior court review. The insolvency and resolution process could also lead to a large reduction or total elimination of the value of a BHC’s outstanding equity, as well as impairment or elimination of certain debt.

Under the FDIC’s “single point of entry” strategy for resolving SIFIs, the FDIC could replace a distressed BHC with a bridge holding company, which could continue operations and result in an orderly resolution of the underlying bank, but whose equity is held solely for the benefit of creditors of the original BHC.

Furthermore, the Federal Reserve Board has finalized regulations regarding therequires that BHCs maintain minimum levels of long-term debt required for BHCs to provide adequate loss absorbing capacity in the event of a resolution.

For more information regarding our resolution, see Item 1A. Risk Factors – Liquidity on page 6.9.

Limitations on Acquisitions

The Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 permits a BHC to acquire banks located in states other than its home state without regard to state law, subject to certain conditions, including the condition that the BHC, after and as a

result of the acquisition, controls no more than 10 percent of the total amount of deposits of insured depository institutions in the U.S. and no more than 30 percent or such lesser or greater amount set by state law of such deposits in that state. At June 30, 2017,2022, we held greater than 10 percent of the total amount of deposits of insured depository institutions in the U.S.

In addition, the Financial Reform Act restricts acquisitions by a financial institution if, as a result of the acquisition, the total liabilities of the financial institution would exceed 10 percent of the total liabilities of all financial institutions in the U.S. At June 30, 2017,2022, our liabilities did not exceed 10 percent of the total liabilities of all financial institutions in the U.S.

The Volcker Rule

The Volcker Rule prohibits insured depository institutions and companies affiliated with insured depository institutions (collectively, banking entities) from engaging in short-term proprietary trading of certain securities, derivatives, commodity futures and options for their own account. The Volcker Rule also imposes limits on banking entities’ investments in, and other relationships with, hedge funds and private equity funds. The Volcker Rule provides exemptions for certain activities, including market-making,market making, underwriting, hedging, trading in government obligations, insurance company activities and organizing and offering hedge funds and private equity funds. The Volcker Rule also clarifies that certain activities are not prohibited, including acting as agent, broker or custodian. A banking entity with significant trading operations, such as the Corporation, is required to maintain a detailed compliance program to comply with the restrictions of the Volcker Rule.

Derivatives

Our derivatives operations are subject to extensive regulation globally. These operations are subject to regulation under the Financial Reform Act, the EUEuropean Union (EU) Markets in Financial Instruments Directive and Regulation, the European Market Infrastructure Regulation, analogous U.K. regulatory regimes and similar regulatory regimes in other jurisdictions that regulate or will regulate the derivatives markets in which we operate by, among other things: requiring clearing and exchange trading of certain derivatives; enforcing existing or imposing new capital, margin, reporting, registration and business conduct requirements for certain market participants; imposing position limits on certain over-the-counter (OTC) derivatives; and imposing derivatives trading transparency requirements; and requiring registration as swap dealers, major swap participants or analogous regulated entities. Mostrequirements. These regulations of derivativesare already in effect in many markets in which we operate are already in effect.operate.

In addition, many G-20 jurisdictions, including the U.S., U.K., Germany and Japan, have adopted resolution stay regulations to address concerns that the close-out of derivatives and other financial contracts in resolution could impede orderly resolution of global systemically important banks (G-SIBs),G-SIBs, and additional jurisdictions are expected to follow suit. We and 24 other G-SIBs have adhered to a protocol amendingIn addition, the EU has implemented EU-wide resolution stay requirements. Generally, these resolution stay regulations require amendment of certain financial contracts to provide for contractual recognition of stays of termination rights under

various statutory resolution regimes and a stay on the exercise of cross-default rights based on an affiliate’s entry into U.S. bankruptcyinsolvency proceedings. Resolution regulations may also require contractual recognition by the counterparty that amounts owed may be written down or converted into equity as part of a bail in. As resolution stay regulations of a particular jurisdiction applicable to us go into effect, we amend impacted financial contracts in compliance with such regulations.regulations either as a regulated entity or as a counterparty facing a regulated entity in such jurisdiction.

Consumer Regulations

Our consumer businesses are subject to extensive regulation and oversight by federal and state regulators. Certain federal consumer finance laws to which we are subject, including but not limited to, the Equal Credit Opportunity Act, the Home Mortgage Disclosure

Act, the Electronic Fund Transfer Act, the Fair Credit Reporting Act, the Real Estate Settlement Procedures Act, theunfair, deceptive, or abusive acts or practices (UDAAP), Truth in Lending Act and Truth in Savings Act, are enforced by the CFPB. Other federal consumer finance laws, such as the Servicemembers Civil Relief Act, are enforced by the OCC.

Privacy and Information Security

We are subject to many U.S. federal, state and international laws and regulations governing requirements for maintaining policies and procedures to protectregarding the disclosure, use and protection of the non-public confidential information of our customers and employees. The Gramm-Leach-Bliley Act requires us to periodically disclose Bank of America’s privacy policies and practices relating to sharing such information and enables retail customers to opt out of our ability to share information with unaffiliated third parties, under certain circumstances. The Gramm-Leach-Bliley Act and other laws also require us to implement a comprehensive information security program that includes administrative, technical and physical safeguards to provide the security and confidentiality of customer records and information. Security and privacy policies and procedures for the protection of personal and confidential information are in effect across all businesses and geographic locations.

Other laws and regulations, at the international, federal and state level, impact our ability to share certain information with affiliates and non-affiliates for marketing and/or non-marketing purposes, or to contact customers with marketing offers. The Gramm-Leach-Blileyoffers and establish certain rights of consumers in connection with their personal information. For example, California’s Consumer Privacy Act also requires us(CCPA), as modified by the California Privacy Rights Act (CPRA), provides consumers with the right to implement a comprehensive information security program that includes administrative, technicalknow what personal data is being collected, know whether their personal data is sold or disclosed and physical safeguards to providewhom and opt out of the security and confidentialitysale of customer records and information. These security and privacy policies and procedures fortheir personal data, among other rights. In addition, in the protection of personal and confidential information are in effect across all businesses and geographic locations. The European Union (EU) has adoptedEU, the General Data Protection Regulation (GDPR) which replacesreplaced the Data Protection Directive and related implementing national laws in its member states. The CCPA's, CPRA's and GDPR’s impact on the Member States. TheCorporation was assessed and addressed through comprehensive compliance date forimplementation programs. These existing and evolving legal requirements in the GDPR is May 25, 2018. It will have impacts across the enterpriseU.S. and impact assessments are underway. Meanwhile other legislation, regulatory activity (the proposed e-Privacy Regulation, elements of the Fourth Money Laundering Directive) andabroad, as well as court proceedings and any impact of bilateral U.S. and EU political developments onchanging guidance from regulatory bodies with respect to the validity of cross-border data transfer mechanisms from the EU, continue to lend uncertainty to privacy compliance in the EU.globally.

Item 1A. Risk Factors

In the course of conducting our business operations, we are exposed to a variety of risks, some of which are inherent in the financial services industry and others of which are more specific to our own businesses. The discussion below addresses the most significantour material risk factors of which we are currently aware, thataware. Any risk factor, either by itself or together with other risk factors, could materially and adversely affect our businesses, results of operations, andcash flows and/or financial condition. Additional factors that could affectReferences to third parties may include their upstream and downstream service providers who may also contribute to our businesses, results of operations and financial condition are discussed in Forward-looking Statements in the MD&A on page 19. However, otherrisks. Other factors not discussed belowcurrently known to us or elsewhere in this Annual Report on Form 10-Kthat we currently deem immaterial could also adversely affect our businesses, results of operations, andcash flows and/or financial condition. Therefore, the risk factors below should not be considered a complete listall of the potential risks that we may face. For more information on how we manage risks, see Managing Risk in the MD&A on page 41.46. For more information about the risks contained in the Risk Factors section, see Item 1. Business on page 2, MD&A on page 26 and Notes to Consolidated Financial Statements on page 94.

Any risk factor described in this Annual Report on Form 10-K or in any of our other SEC filings could by itself, or together with other factors, materially adversely affect our liquidity, competitive position, business, reputation, results of operations, capital position or financial condition, including by materially increasing our expenses or decreasing our revenues, which could result in material losses.

MarketMarket

Our business and results of operationsWe may be adversely affected by the U.S. and international financial markets, U.S.fiscal, monetary, and non-U.S. fiscal and monetaryregulatory policies, and economic conditions generally.conditions.

Financial markets and generalGeneral economic, political, social and socialhealth conditions in the U.S. and abroad includingaffect financial markets and our business. In particular, global markets may be affected by the level and volatility of interest rates, unexpectedavailability and market conditions of financing, changes in market financing conditions, gross domestic product (GDP), economic growth or its sustainability, inflation, supply chain disruptions, consumer spending, employment levels, labor shortages, challenging labor market conditions, wage stagnation, federal government shutdowns, energy prices, home prices, commercial property values, bankruptcies, a default by a significant market participant or class of counterparties, including companies in emerging markets, fluctuations or other significant changes in both debt and equity capital markets and currencies, liquidity, the continued transition from InterBank Offered Rates (IBORs) and other benchmark rates to alternative reference rates (ARRs), the impact of volatility of digital assets on the global financial markets,broader market, the growth of global trade and commerce, trade policies, the availability and cost of capital and credit, disruption of communication, transportation or energy infrastructure, recessionary fears and investor sentimentsentiment. Global markets, including energy and confidence,commodity markets, may be adversely affected by the current or anticipated impact of climate change, acute and/or chronic extreme weather events or natural disasters, the emergence or continuation of widespread health emergencies or pandemics, cyberattacks, military conflict, terrorism, or other geopolitical events. Market fluctuations may impact our margin requirements and affect our liquidity. Any sudden or prolonged market downturn, as a result of the above factors or otherwise, could result in a decline in net interest income and noninterest income and adversely affect our results of operations and financial condition, including capital and liquidity levels. High inflation, elevated interest rate levels, supply chain disruptions, and the sustainability of economic growth all affect our business.Russia/Ukraine conflict, including the related energy impact in Europe, have adversely impacted and may continue to adversely impact financial markets and macroeconomic conditions and could result in additional market volatility and disruptions.

In the U.S. and abroad,Global uncertainties surroundingregarding fiscal and monetary policies present economic challenges. Actions taken by the Federal Reserve or other central banks, including the planned reductionchanges in itstarget rates, balance sheet management and other central bankslending facilities, are beyond our control and difficult to predict, andparticularly in a high inflation environment. This can affect interest rates and the value of financial instruments and other assets, such as debt

securities, and mortgage servicing rights (MSRs),impact our borrowers and potentially increase delinquency rates and may also raise government debt levels, adversely affect businesses and household incomes and increase uncertainty surrounding monetary policy. Monetary policy in response to high inflation has led to a significant increase in market interest rates and a flattening and/or inversion of the yield curve. This has resulted in and may continue to result in volatility of equity and other markets, further volatility of the U.S. dollar, a widening in credit spreads and higher interest rates and recessionary concerns, and could result in elevated unemployment, which could impact investor risk appetite and our borrowers, potentially increasing delinquency rates. It is also possible that high inflation may limit the scope of monetary support, including cuts to the federal funds rate, in the event of an economic downturn, resulting in a more protracted period of a flat and/or inverted yield curve.

ChangesAny future change in monetary policy by the Federal Reserve, in an effort to stimulate the economy or otherwise, resulting in lower interest rates would likely result in lower revenue through lower net interest income, which could adversely affect our results of operations. Additionally, changes to existing U.S. laws and regulatory policies and evolving priorities, including those related to financial regulation, taxation, international trade, fiscal policy, climate change (including efforts to transition to a low-carbon economy) and healthcare, may adversely impact us. For example,U.S. or global economic activity and our customers', our counterparties' and our earnings and operations. Globally, many central banks are simultaneously reducing monetary accommodation through interest rate or balance sheet policy, which has contributed and may continue to contribute to elevated financial and capital market volatility and significant changes to asset values. While higher interest rates have positively impacted our net interest income, higher interest rates have negatively impacted and could continue to negatively impact deposits, loan demand and funding costs. If the U.S. government’s debt ceiling limit is not raised, the ramifications could result in market volatility, ratings downgrades and limit fiscal policy initiatives, may increase uncertainty surroundingresponses to recessionary conditions. This could have a negative and potentially severe impact on the formulationU.S. and direction of U.S. monetary policy,world economy and volatility of interest rates. Higher U.S.financial and capital markets, including higher interest rates, relativehigher volatility, lower asset values, lower liquidity, downgrades to other major economies could increase the likelihood ofU.S. debt, and a more volatile and appreciatingweakened U.S. dollar.

Changes to certaininternational trade and investment policies orby the U.S. could negatively impact financial markets. Escalation of tensions between the U.S. and the People’s Republic of China (China) could lead to further U.S. measures could upsetthat adversely affect financial markets, and disrupt world trade and commerce.commerce and lead to trade retaliation, including through the use of tariffs, foreign exchange measures or the large-scale sale of U.S. Treasury bonds. Any restrictions on the activities of businesses, could also negatively affect financial markets.

Any of theseThese developments could adversely affect our consumer and commercial businesses, ourcustomers, securities and derivatives portfolios, including the risk of lower re-investment rates within those portfolios, our level of charge-offs and provision for credit losses, the carrying value of our deferred tax assets, our capital levels, andour liquidity and the costs of running our business, and our results of operations.

For more information about economic conditions and challenges discussed above, see Executive Summary – 2017 Economic and Business Environment in the MD&A on page 19.

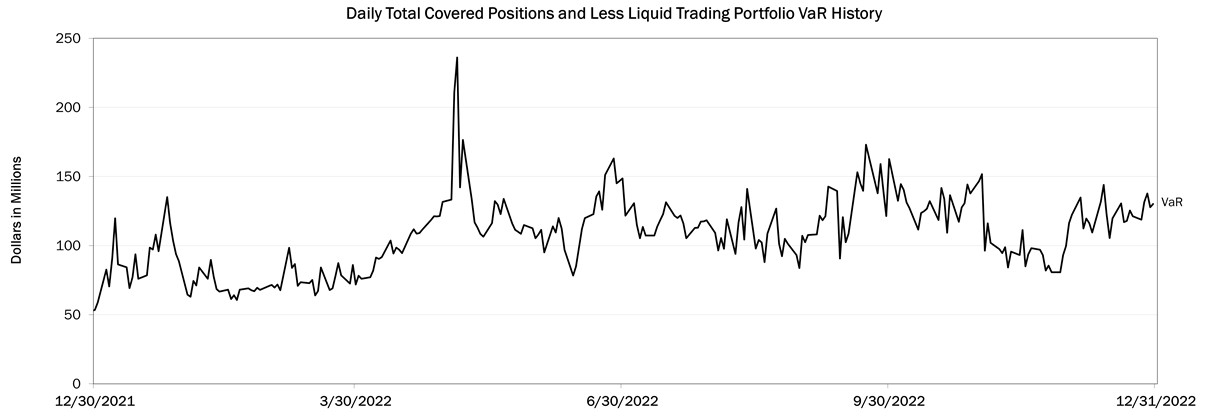

Increased market volatility and adverse changes in other financial or capital market conditions may increase our market risk.

Our liquidity, competitive position, business, results of operations and financial condition are affected by market risks such as changes in interest and currency exchange rates, fluctuations in equity, commodity and futures prices, trading volumes and prices of securitized products, the implied volatility of interest rates and credit spreads and other economic and

business factors. These market risks may adversely affect, among other things, (i) the value of our securities, including our on- and off-balance sheet securities, trading assets and other financial instruments, and MSRs, (ii) the cost of debt capital and our access to credit markets, (iii) the value of assets under management (AUM), (iv) fee income relating to AUM, (v) customer allocation of capital among investment alternatives, (vi) the volume of client activity in our trading operations, (vii) investment banking, underwriting and other capital market fees, (viii)which have already been negatively impacted, the general profitability and risk level of the transactions in which we engage and (ix) our competitiveness with respect to deposit pricing. For example, theThe value of certain of our assets is sensitive to changes in market interest rates. If the Federal

Reserve or a non-U.S. central bank changes or signals a change in monetary policy, market interest rates or credit spreads could be affected, which could adversely impact the value of such assets. In addition, the ongoing lowChanges to fiscal policy, including expansion of U.S. federal deficit spending and resultant debt issuance, could also affect market interest rate environmentrates. If interest rates decrease, our results of operations could be negatively impacted, including future revenue and recentearnings growth. The continued flattening and/or inversion of the yield curve could also negatively impact our liquidity, financial condition or results of operations, including future revenue and earnings growth.earnings.

We use variousOur models and strategies to assess and control our market risk exposures but those are subject to inherent limitations. For more information regarding models and strategies, see Item 1A. Risk Factors – Other on page 15. In times of market stress or other unforeseen circumstances, previously uncorrelated indicators may become correlated and vice versa. These types ofSuch changes to the relationship between market movementsparameters may limit the effectiveness of our hedging strategies and cause us to incur significant losses. These changesChanges in correlation can be exacerbated where other market participants are usinguse risk or trading models with assumptionassumptions or algorithms that are similar to ours. In these and other cases, it may be difficult to reduce our risk positions due to activity of other market participants or widespread market dislocations, including circumstances where asset values are declining significantly or no market exists for certain assets. To the extent thatexists. Where we own securities that do not have an established liquid trading market or are otherwise subject to restrictions on sale or hedging, or where the degree of accessible liquidity declines significantly, we may not be able to reduce our positions and therefore reduce our riskrisks associated with such positions. In addition, challenging market conditionsholdings, so we may also adversely affect our investment banking fees.suffer larger than expected losses when adverse price movements take place. This risk can be exacerbated where we hold a position that is large relative to the available liquidity.

For more information about market risk and our market risk management policies and procedures, see Market Risk Management in the MD&A on page 76.

WeIf asset values decline, we may incur losses if the value of certain assets declines, including dueand negative impacts to changes in interest ratescapital and prepayment speeds.liquidity requirements.

We have a large portfolio of financial instruments, including among others, certain loans and loan commitments, loans held-for-sale, securities financing agreements, asset-backed secured financings, long-term deposits, long-term debt, trading account assets and liabilities, derivative assets and liabilities, available-for-sale (AFS) debt andsecurities, marketable equity securities other debt securities, certain MSRs and certain other assets and liabilities that we measure at fair value.value and are subject to valuation and impairment assessments. We determine the fairthese values of these instruments based on applicable accounting guidance, which, for financial instruments measured at fair value, requires an entity to base fair value on exit price and to maximize the use of observable inputs and minimize the use of unobservable inputs in fair value measurements. The fair values of these financial instruments include adjustments for market liquidity, credit quality, funding impact on certain derivatives and other transaction-specific factors, where appropriate.

Gains or losses on these instruments can have a direct impact on our results of operations, including higher or lower mortgage banking income and earnings, unless we have effectively hedged our exposures. For example, decreases in interest rates and increases in mortgage prepayment speeds, which are influenced by interest rates and other factors such as reductions in mortgage insurance premiums and origination costs, could adversely impact the value of our MSR asset, causing a significant acceleration of purchase premium amortization on our mortgage portfolio, because a decline in long-term interest rates shortens the expected lives of the securities, and adversely affects our net interest margin. Conversely, increasesIncreases in interest rates may result in a decreasefurther decreases in residential mortgage loan originations.originations and could impact the origination of corporate debt. In addition,

increases in interest rates or changes in spreads may continue to adversely impact the fair value of debt securities and, accordingly, for debt securities classified as AFS,available for sale, may continue to adversely affect accumulated other comprehensive income and, thus, capital levels. These market moves could also adversely impact our regulatory liquidity requirements. Any decreases in interest rates may increase prepayment speeds of certain assets, and, therefore, could adversely affect net interest income. Changes in interest rates also may impact the value of mortgage service rights retained.

Fair values may be impacted by declining values of the underlying assets or the prices at which observable market transactions occur and the continued availability of these transactions.transactions or indices. The financial strength of counterparties, with whom we have economically hedged some of our exposure to these assets, also will affect the fair value of these assets. Sudden declines and volatility in the prices of assets may curtail or eliminate trading activities in these assets, which may make it difficult to sell, hedge or value these assets. The inability to sell or effectively hedge assets reduces our ability to limit losses in such positions, and the difficulty in valuing assets may increase our risk-weighted assets (RWA), which requires us to maintain additional capital and increases our funding costs. Asset valuesValues of AUM also directly impact revenues in our wealth management and related advisory businesses. We receivebusinesses for asset-based management fees based on the value of our clients’ portfolios or investments in funds managed by us and in some cases, we also receive performance fees based on increases in the value of such investments.fees. Declines in asset values can reduce the value of our clients’ portfolios or fund assets, which in turnAUM can result in lower fees earned for managing such assets.

For more information on fair value measurements, see Note 20 – Fair Value Measurements to the Consolidated Financial Statements. For more information on our asset management businesses, see GWIM in the MD&A on page 33. For more information on interest rate risk management, see Interest Rate Risk Management for the Banking Book in the MD&A on page 81.

Liquidity

If we are unable to access the capital markets, continue to maintainhave prolonged net deposits outflows, or our borrowing costs increase, our liquidity and competitive position will be negatively affected.

Liquidity is essential to our businesses. We fund our assets primarily with globally sourced deposits in our bank entities, as well as secured and unsecured liabilities transacted in the capital markets. We rely on certain secured funding sources, such as repo markets, which are typically short-term and credit-sensitive in nature.credit-sensitive. We also engage in asset securitization transactions, including with the government-sponsored enterprises (GSEs), to fund consumer lending activities. Our liquidity could be adversely affected by any inability to access the capital markets;markets, illiquidity or volatility in the capital markets;markets, the decrease in value of eligible collateral or increased collateral requirements (including as a result of credit concerns for short-term borrowing), changes to our relationships with our funding providers based on real or perceived changes in our risk profile;profile, prolonged federal government shutdowns, or changes in regulations, guidance or guidanceGSE status that impact our funding avenuesfunding. Additionally, our liquidity or ability to access certain funding sources;cost of funds may be negatively impacted by the refusalunwillingness or inability of the Federal Reserve to act as lender of last resort;resort, unexpected simultaneous draws on lines of credit, slower customer payment rates, restricted access to the assets of prime brokerage clients, the withdrawal of or failure to attract customer deposits or invested funds (which could result from attrition driven by customers seeking higher yielding deposits or securities products, customer desire to utilize an alternative financial institution perceived to be safer, changes in customer spending behavior due to inflation, decline in the economy or other drivers resulting in an increased need for cash), increased regulatory liquidity, capital and margin requirements for our U.S. or international banks and their nonbank subsidiaries; significantsubsidiaries, which could result in the inability to transfer liquidity internally and inefficient funding, changes in patterns of intraday liquidity usage resulting from a counterparty or technology failure or other idiosyncratic event or failure or

default by a significant market participant or third party such as a(including clearing agentagents, custodians, central banks or custodian; reputational issues; or negative perceptions aboutcentral counterparty clearinghouses (CCPs)). These factors also have the potential to increase our short- or long-term business prospects, including downgrades ofborrowing costs and negatively impact our credit ratings. liquidity.

Several of these factors may arise due to circumstances beyond our control, such as a general market volatility, disruption, shock or shock,stress, the emergence or continuation of widespread health emergencies or pandemics, Federal Reserve policy decisions (including fluctuations in interest rates or Federal Reserve balance sheet composition), negative views or loss of confidence about us or the financial services industry generally or due to a specific news event, changes in the regulatory environment or governmental fiscal or monetary policies, actions by credit rating agencies or an operational problem that affects third parties or us. The impact of these potentially sudden events, whether within our control or not, could include an inability to sell assets or redeem investments, or unforeseen outflows of cash, including customer deposits,the need to draw on liquidity facilities, the reduction of financing balances and the loss of equity secured funding, debt repurchases to support the secondary market or meet client requests, the need for additional funding for commitments and contingencies as well asand unexpected collateral calls, among other things.

Our liquidity and cost of obtaining funding ismay be directly related to investor behavior, debt market disruption, firm specific concerns or prevailing market conditions, including changes in interest and currency exchange rates, significant fluctuations in equity and tofutures prices, lower trading volumes and prices of securitized products and our credit spreads. Credit spreads are the amount in excess of the interest rate of U.S. Treasury securities, or other benchmark securities, of a similar maturity that we need to pay to our funding providers. Increases in interest rates and our credit spreads can increase the cost of our funding.funding and result in mark-to-market or credit valuation adjustment exposures. Changes in our credit spreads are market-drivenmarket driven and may be influenced by market perceptions of our creditworthiness.creditworthiness, including changes in our credit ratings or changes in broader financial market and macroeconomic conditions. Changes to interest rates and our credit spreads occur continuously and may be unpredictable and highly volatile. Additionally, concentrationsWe may also experience net interest margin compression as a result of offering higher than expected deposit rates in order to attract and maintain deposits. Concentrations within our funding profile, such as maturities, currencies or counterparties, can reduce our funding efficiency.