18

Our stores located in shopping centers and malls have been and may be adversely affected by any declines in consumer traffic ofat shopping centers and malls.

The majority of our stores are located within shopping centers and malls and may benefit from the abilities that we and other anchor tenants have to generate consumer traffic. A substantial decline in mallshopping center traffic in favor of e-commerce, the development of new shopping centers and malls, the lack of availability of favorable locations within existing or new shopping centers and malls, the success of individual shopping centers and malls and the success or failure of other anchor tenants have impacted and may negatively impact our ability in the future to maintain or grow our sales in existing stores,business, as well as our ability to open new stores, which could have an adverse effect on our financial condition or results of operations.

Our business depends on third parties forLike other retailers, our stores have been impacted by changing levels of theft or vandalism, which may affect consumer traffic in our stores and cause inventory shrinkage. If we experience higher rates of inventory shrinkage at stores located in shopping centers and malls, or if we are unable to effectively reduce the production, supplyimpact of loss or deliverytheft of goods,assets, our operating results could be adversely affected. The severity or quantity of incidents, including perceptions and a disruption couldreactions, may result in lost salesreputational damage or increased costs.

The continued successloss of our operations is tied to our timely receipt of quality merchandise from third parties. Our process to identify qualified vendors and access quality products in an efficient manner on acceptable terms and cost can be complex. Violations of law with respect to quality and safety by our importers, manufacturers or distributors could result in delays in shipments and receipt of goods or damage our reputation, resulting in lost sales. These vendors may experience difficulties due to economic or political conditions or the countries in which merchandise is manufactured could become subject to new trade restrictions, including increased customs restrictions, tariffs or quotas. Additionally, changes in tax and trade policies that impact the retail industry, such as increased taxation on imported goods, could have a material adverse effect on our business, results of operations and liquidity.customer trust.

The results offrom our Creditcredit card operations could be adversely affected by changes in market conditions.conditions or laws.

Revenues earned under our program agreement with TD are indirectly subject to economic and market conditions that are beyond our control, including, but not limited to, interest rates, consumer credit availability, demand for credit, consumer debt levels, payment patterns, delinquency rates, frequency of fee waivers, frequency or volume of governmental stimulus, personal bankruptcy rates, employment trends, laws and other factors. Additionally, changes in net sales partially translate to program agreement revenues. Changes in these economic, market or regulatory conditions, customer behavior or our mix of sales and market conditionsprogram agreement revenues could impairimpact our revenues and profitability.

Our business and operations could be materially and adversely affected by supply chain disruptions, port disruptions, severe weather patterns, climate change, natural disasters, widespread pandemics, epidemics, civil unrest and other natural or man-made economic, political or environmental disruptions.

These disruptionsDisruptions, and government responses, could cause, among other things, a decreasedecreases in consumer spending that wouldcould negatively impact our sales, declines in traffic in urban centers, staffing shortages in our Supply Chain Network facilities, stores distribution centers or corporate offices, interruptions in the flow of merchandise to our stores, disruptions in the operations of our merchandise vendors or property developers, increased costs and a negative impact on our reputation and long-term growth plans.plans, which could vary based on the length and severity of the disruption. Health pandemics and epidemics, have in the past and may in the future, impact consumer and government responses, which may have an adverse impact on global economic conditions and our business, results of operations and financial condition. We also have a significant amount of our total sales, stores and square footage inon the west coastWest Coast of the United States, particularly in California, which increaseswhere we have experienced earthquakes, wildfires, flooding and power outages and shortages that increase our exposure to any market-disrupting conditions in this region.

RISKS DUE TO LEGAL AND REGULATORY FACTORSRISKS

We are subject to certain laws, litigation, regulatory matters and ethical standards, and ourcompliance or failure to comply with or adequately address developments as they arise could adversely affect our reputation and operations.

Our policies, procedures and practices and the technology we implement are designedintended to comply withaddress applicable federal, state, local and foreign laws, tariffs, rules and regulations, including those imposed by the SEC, consumer protection and other regulatory agencies, the marketplace, and foreign countries, as well as responsible business, social and environmental practices, all of which may change from time to time. ComplianceIf we, or the third parties we do business with, laws and regulationsfail to comply with these requirements and/or significant legislative changes may causeto them, our business tocould be adversely impacted, or even limit or restrict the activities of our business.impacted. In addition, if we fail to complynoncompliance with applicable laws and regulations or failure to implement responsible business, social, environmental and supply chain practices we could be subject toresult in reputational damage, to our reputation, class action lawsuits, regulatory investigations, legal costs and settlement costs,penalties, charges and payments, civil and criminal liability, increased cost of regulatory compliance, losingloss of our ability to offer or accept credit and debit card payments from our customers, restatements of our financial statements, disruption of our business, loss of customers and loss of customers.customer trust. Changes to existing and new privacy and data protection laws may increase compliance expenses and limit business opportunities and strategic initiatives, including customer engagement. Any required changes to our employment practices could result in the loss of employees, reduced sales, increased employment costs, low employee morale and harm to our business and results of operations. In addition, political and economic factors could lead to unfavorable changes in federal, state and foreign tax laws, which may affect our tax assets or liabilities and adversely affect our results of operations. We are also regularly involved in various litigation matters that arise in the ordinary course of business. Litigation or regulatory developments could adversely affect our business and financial condition.

Compliance with Section 404 of the Sarbanes-Oxley Act of 2002 requires management assessments of the effectiveness of our internal controls over financial reporting through documenting, testing, monitoring and enhancement of internal control over financial reporting. If we fail to implement or maintain adequate internal controls, we may not produce reliable financial reports or fail to prevent or detect financial fraud, which may adversely affect our financial position, investor confidence or our stock price.

Nordstrom, Inc. and subsidiaries19

Changes to accounting rules and regulations could affect our financial results or financial condition.

Accounting principles and related pronouncements, implementation guidelines and interpretations with regard to a wide variety of accounting matters that are relevant to our business, including, but not limited to, revenue recognition, merchandise inventories, leasing, goodwill, impairment ofinventory valuation, long-lived assets, stock-based compensationasset recoverability, income taxes and tax matterscontingent liabilities, including assumptions related to our Canada wind-down, are highly complex and involve subjective assumptions, estimates and judgments. Changes in these rules and regulations, changes in our interpretation or our misapplication of the rules or regulations, changes in accounting policies or changes in underlying assumptions, estimates or judgments could adversely affect our financial performance or financial position.

If Nordstrom Canada is unable to make a fair and orderly wind-down of its business operations, or if our existing reserves are not adequate to cover our ultimate liability, our financial condition and results of operations could be adversely affected. On March 2, 2023, we announced the decision to discontinue support for Nordstrom Canada’s operations. Accordingly, Nordstrom Canada commenced a wind-down of its business operations, obtaining an Initial Order from the Ontario Superior Court of Justice under the CCAA on March 2, 2023 to facilitate the wind-down in an orderly fashion. Nordstrom Canada wound down its Nordstrom and Nordstrom Rack stores across Canada, with the help of a third-party liquidator, and its Canadian e-commerce platform. The e-commerce platform ceased operations on March 2, 2023 and the in-store wind-down was completed in June 2023. As described in Note 2: Canada Wind-down in Item 8, we have incurred $284 in pre-tax charges associated with the wind-down of operations in Canada for the year ended February 3, 2024. Our reserves relating to these matters may not be adequate to cover our ultimate liability or we may suffer other losses for which we have not established reserves, although we believe that possibility is not probable. If Nordstrom Canada is unable to effectively and efficiently finalize the wind-down of business operations, or we incur additional costs, there could be a material adverse effect on the conclusion of the CCAA filing or our financial condition and results of operations.

Item 1B. Unresolved Staff Comments.

None.

Item 1C. Cybersecurity.

Nordstrom understands that establishing, executing and sustaining effective cybersecurity measures to secure our information systems and preserve the confidentiality, integrity and availability of our data is critical to the success of the business.

Management of Material Risks and Integrated Overall Risk Management

Our comprehensive risk management framework is intended to strategically incorporate cybersecurity risk management across the company, with the objective of ensuring that cybersecurity considerations underpin the decision-making processes at all organizational levels. Our risk management team collaborates closely across various Enterprise-wide business units to continually assess and address identified cybersecurity risks in alignment with business objectives. The CISO regularly updates the CTIO, Chief Financial Officer and Chief Executive Officer on material cybersecurity risks and events.

Engagement with Third Parties on Management of Cybersecurity Risk

Recognizing the dynamic nature of cybersecurity threats, Nordstrom collaborates with external experts, including assessors, consultants and examiners, to evaluate and test our cybersecurity risk preparedness. Regular exams, threat assessments and consultation on security enhancements with these third parties ensure that our cybersecurity strategies align with industry best practices.

Oversight of Third-party Risk

In the course of our business, we regularly exchange data and information with certain third parties in various ways, exposing us to risk related to the cybersecurity posture of and information management practices of those third parties. To try to mitigate this risk, we have implemented processes that may, depending upon the nature of the relationship with the third party, require security assessments and data integration design reviews prior to allowing our systems to connect with theirs. In addition, we seek to require these third parties to adhere to pre-established cybersecurity standards. Where applicable, we try to obtain contractual commitments with those third parties to ensure these security requirements are met.

Risks from Cybersecurity Threats

Nordstrom has not experienced any cybersecurity incident that has materially impacted, or that is reasonably likely to materially impact, our operations, financial condition and cash flows.

Cybersecurity Risk Management Personnel

Primary responsibility for assessing, monitoring, mitigating and managing our cybersecurity risks rests with our information security organization, led by our CISO and supported by our CTIO. The CISO, who has over 20 years of cybersecurity and technology expertise, supports a skilled information security organization that brings expertise in vulnerability management, incident response, penetration testing, regulatory compliance and other critical information security domains. Our information security team maintains certifications from recognized external security authorities such as ISC2, CompTIA, ISACA, GIAC, SANS, PCI and OffSec. The security program is assessed annually by a reputable third party to provide guidance for continuous improvement.

Monitoring and Responding to Cybersecurity Incidents

The security organization stays informed about the latest developments in cybersecurity, implements processes for regular monitoring of information systems and deploys relevant security measures. In the event of a cybersecurity incident, a formal incident response plan is in place for immediate actions and long-term strategies.

Board of Directors Oversight

The Board of Directors has oversight responsibilities regarding cybersecurity risk. At regularly scheduled meetings (at least quarterly), in addition to such additional interactions as may be necessary in specific circumstances, our Chief Executive Officer, CTIO and CISO update the Board on emerging cybersecurity risks and developments impacting Nordstrom.

Nordstrom, Inc. and subsidiaries1121

Item 2. Properties.

(Square footage amounts in thousands)

The following table summarizes the number ofSupply Chain Network and retail storeslocations we own or lease and the percentage of total store square footage represented by each listed category as of February 3, 2018:2024: | | | | | | | | | | | | | | |

| Number of locations | |

| Supply Chain Network | Nordstrom | Nordstrom Rack | Total square footage |

| Leased buildings on leased land | 2 | | 18 | 259 | | 13,525 | |

| Owned buildings on leased land | — | | 55 | — | | 10,062 | |

| Owned buildings on owned land | 8 | | 24 | 1 | | 8,250 | |

| Partly owned and partly leased | — | | 2 | — | | 544 | |

| Total | 10 | | 99 | | 260 | | 32,381 | |

|

| | | | | | | | | |

| | | Number of stores | | |

| | | Nordstrom Full-Line Stores1 |

| | Nordstrom Rack and Other2 |

| | % of total store

square footage |

|

| Leased stores on leased land | | 26 |

| | 242 |

| | 44 | % |

| Owned stores on leased land | | 63 |

| | — |

| | 37 | % |

| Owned stores on owned land | | 33 |

| | 1 |

| | 18 | % |

| Partly owned and partly leased store | | 1 |

| | — |

| | 1 | % |

| Total | | 123 |

| | 243 |

| | 100 | % |

1 Nordstrom full-line stores include U.S. full line stores, Canada full-line stores and Nordstrom Local.

2 Other includes Trunk Club clubhouses, Jeffrey boutiques and Last Chance stores.

The following table summarizes our Supply Chain Network and retail store openingscount and closures for fiscal 2017 and announced retail store openings and closures for fiscal 2018 by state/province:square footage activity: | | | | | | | | | | | | | | | | | | |

| | Count | | Square footage |

| Fiscal year | 2023 | 2022 | | | 2023 | 2022 |

| Total, beginning of year | 368 | | 367 | | | | 33,693 | | 33,982 | |

| Openings: | | | | | | |

| | | | | | |

| Nordstrom | — | | 1 | | | | — | | — | |

| Nordstrom Rack | 19 | | 2 | | | | 531 | | 55 | |

| Relocations, remodels or changes | — | | — | | | | (8) | | — | |

| Closures | (18) | | (2) | | | | (1,835) | | (344) | |

| Total, end of year | 369 | | 368 | | | | 32,381 | | 33,693 | |

|

| | | | | | | | | | | | |

| | | Number of stores |

| Fiscal year | | 2017 | | Announced 2018 |

| State/Province | | Nordstrom Full-Line Stores1 |

| | Nordstrom Rack and Other2 |

| | Nordstrom Full-Line Stores1 |

| | Nordstrom Rack and Other2 |

|

| Openings | | | | | | | | |

| U.S. | | | | | | | | |

| Arizona | | — |

| | — |

| | — |

| | 1 |

|

| California | | 1 |

| | 3 |

| | — |

| | 1 |

|

| Florida | | — |

| | 1 |

| | — |

| | — |

|

| Illinois | | — |

| | 2 |

| | — |

| | 1 |

|

| Indiana | | — |

| | 1 |

| | — |

| | — |

|

| Maryland | | — |

| | 1 |

| | — |

| | — |

|

| Minnesota | | — |

| | 2 |

| | — |

| | — |

|

| New Jersey | | — |

| | — |

| | — |

| | 1 |

|

| New York | | — |

| | 1 |

| | 1 |

| | — |

|

| Oregon | | — |

| | 1 |

| | — |

| | — |

|

| Pennsylvania | | — |

| | — |

| | — |

| | 1 |

|

| Tennessee | | — |

| | 1 |

| | — |

| | — |

|

| Texas | | — |

| | 2 |

| | — |

| | 1 |

|

| Washington | | — |

| | 2 |

| | — |

| | — |

|

| Canada | | | | | | | | |

| Alberta | | — |

| | — |

| | — |

| | 2 |

|

| Ontario | | 1 |

| | — |

| | — |

| | 4 |

|

| Total Openings | | 2 |

| | 17 |

| | 1 |

| | 12 |

|

| | | | | | | | | |

| Closures | | | | | | | | |

| California | | (1 | ) | | — |

| | — |

| | — |

|

| Oregon | | — |

| | — |

| | (1 | ) | | — |

|

| Virginia | | (1 | ) | | — |

| | — |

| | — |

|

| Total Closures | | (2 | ) | | — |

| | (1 | ) | | — |

|

1 Nordstrom full-line stores include U.S. full line stores, Canada full-line stores and Nordstrom Local.

2 Other includes Trunk Club clubhouses, Jeffrey boutiques and Last Chance stores.

The following table lists our Supply Chain Network and retail store count and square footage by state/provincestate as of February 3, 2018:2024:

|

| | | | | | | | | | | | | | | |

| Retail stores by channel | | Nordstrom Full-Line Stores1 | | Nordstrom Rack and Other2 | | Total |

| State/Province | | Count |

| Square Footage (000’s) |

| | Count |

| Square Footage (000’s) |

| | Count |

| Square Footage (000’s) |

|

| U.S. | | | | | | | | | |

| Alabama | | — |

| — |

| | 1 |

| 35 |

| | 1 |

| 35 |

|

| Alaska | | 1 |

| 97 |

| | 1 |

| 35 |

| | 2 |

| 132 |

|

| Arizona | | 2 |

| 384 |

| | 8 |

| 287 |

| | 10 |

| 671 |

|

California3 | | 31 |

| 5,192 |

| | 53 |

| 1,967 |

| | 84 |

| 7,159 |

|

| Colorado | | 3 |

| 559 |

| | 6 |

| 213 |

| | 9 |

| 772 |

|

| Connecticut | | 1 |

| 189 |

| | 1 |

| 36 |

| | 2 |

| 225 |

|

| Delaware | | 1 |

| 127 |

| | 1 |

| 32 |

| | 2 |

| 159 |

|

| Florida | | 9 |

| 1,389 |

| | 16 |

| 545 |

| | 25 |

| 1,934 |

|

| Georgia | | 2 |

| 383 |

| | 5 |

| 165 |

| | 7 |

| 548 |

|

| Hawaii | | 1 |

| 195 |

| | 2 |

| 78 |

| | 3 |

| 273 |

|

| Idaho | | — |

| — |

| | 1 |

| 37 |

| | 1 |

| 37 |

|

| Illinois | | 4 |

| 947 |

| | 16 |

| 590 |

| | 20 |

| 1,537 |

|

| Indiana | | 1 |

| 134 |

| | 2 |

| 60 |

| | 3 |

| 194 |

|

| Iowa | | — |

| — |

| | 1 |

| 35 |

| | 1 |

| 35 |

|

| Kansas | | 1 |

| 219 |

| | 1 |

| 35 |

| | 2 |

| 254 |

|

| Kentucky | | — |

| — |

| | 1 |

| 33 |

| | 1 |

| 33 |

|

| Louisiana | | — |

| — |

| | 3 |

| 90 |

| | 3 |

| 90 |

|

| Maine | | — |

| — |

| | 1 |

| 30 |

| | 1 |

| 30 |

|

| Maryland | | 4 |

| 765 |

| | 5 |

| 186 |

| | 9 |

| 951 |

|

| Massachusetts | | 4 |

| 595 |

| | 8 |

| 275 |

| | 12 |

| 870 |

|

| Michigan | | 3 |

| 552 |

| | 5 |

| 178 |

| | 8 |

| 730 |

|

| Minnesota | | 2 |

| 380 |

| | 5 |

| 173 |

| | 7 |

| 553 |

|

| Missouri | | 2 |

| 342 |

| | 2 |

| 69 |

| | 4 |

| 411 |

|

| Nevada | | 1 |

| 207 |

| | 3 |

| 101 |

| | 4 |

| 308 |

|

| New Jersey | | 5 |

| 991 |

| | 7 |

| 248 |

| | 12 |

| 1,239 |

|

| New Mexico | | — |

| — |

| | 1 |

| 34 |

| | 1 |

| 34 |

|

| New York | | 2 |

| 460 |

| | 14 |

| 473 |

| | 16 |

| 933 |

|

| North Carolina | | 2 |

| 300 |

| | 2 |

| 74 |

| | 4 |

| 374 |

|

| Ohio | | 3 |

| 549 |

| | 6 |

| 224 |

| | 9 |

| 773 |

|

| Oklahoma | | — |

| — |

| | 2 |

| 67 |

| | 2 |

| 67 |

|

| Oregon | | 4 |

| 555 |

| | 6 |

| 218 |

| | 10 |

| 773 |

|

| Pennsylvania | | 2 |

| 381 |

| | 6 |

| 214 |

| | 8 |

| 595 |

|

| Puerto Rico | | 1 |

| 143 |

| | — |

| — |

| | 1 |

| 143 |

|

| Rhode Island | | 1 |

| 206 |

| | 1 |

| 38 |

| | 2 |

| 244 |

|

| South Carolina | | — |

| — |

| | 4 |

| 104 |

| | 4 |

| 104 |

|

| Tennessee | | 1 |

| 145 |

| | 2 |

| 69 |

| | 3 |

| 214 |

|

Texas3 | | 9 |

| 1,562 |

| | 18 |

| 604 |

| | 27 |

| 2,166 |

|

| Utah | | 2 |

| 277 |

| | 4 |

| 126 |

| | 6 |

| 403 |

|

| Virginia | | 4 |

| 746 |

| | 7 |

| 268 |

| | 11 |

| 1,014 |

|

| Washington | | 7 |

| 1,392 |

| | 9 |

| 354 |

| | 16 |

| 1,746 |

|

| Washington D.C. | | — |

| — |

| | 4 |

| 115 |

| | 4 |

| 115 |

|

| Wisconsin | | 1 |

| 150 |

| | 2 |

| 67 |

| | 3 |

| 217 |

|

| Canada | | | | | | | | | |

| Alberta | | 1 |

| 142 |

| | — |

| — |

| | 1 |

| 142 |

|

| British Columbia | | 1 |

| 231 |

| | — |

| — |

| | 1 |

| 231 |

|

| Ontario | | 4 |

| 750 |

| | — |

| — |

| | 4 |

| 750 |

|

| Total | | 123 |

| 21,636 |

| | 243 |

| 8,582 |

| | 366 |

| 30,218 |

|

1 Nordstrom full-line stores include U.S. full line stores, Canada full-line stores and Nordstrom Local.

2 Other includes seven Trunk Club clubhouses, two Jeffrey boutiques and two Last Chance stores.

3 California and Texas had the highest square footage, with a combined 9,325 square feet, representing 31% of our total Company square footage.

Nordstrom, Inc. and subsidiaries13

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Supply Chain Network | | Nordstrom | | Nordstrom Rack | | Total |

| Count | Square Footage | | Count | Square Footage | | Count | Square Footage | | Count | Square Footage |

| | | | | | | | | | | |

| Alabama | — | | — | | | — | | — | | | 1 | | 27 | | | 1 | | 27 | |

| Alaska | — | | — | | | — | | — | | | 1 | | 35 | | | 1 | | 35 | |

| Arizona | — | | — | | | 1 | | 235 | | | 10 | | 337 | | | 11 | | 572 | |

| California | 4 | | 2,571 | | | 26 | | 3,669 | | | 61 | | 2,158 | | | 91 | | 8,398 | |

| Colorado | — | | — | | | 2 | | 387 | | | 8 | | 268 | | | 10 | | 655 | |

| Connecticut | — | | — | | | 2 | | 341 | | | 1 | | 36 | | | 3 | | 377 | |

| Delaware | — | | — | | | 1 | | 127 | | | 1 | | 32 | | | 2 | | 159 | |

| Florida | 1 | | 221 | | | 6 | | 1,031 | | | 17 | | 560 | | | 24 | | 1,812 | |

| Georgia | — | | — | | | 2 | | 383 | | | 4 | | 154 | | | 6 | | 537 | |

| Hawaii | — | | — | | | 1 | | 195 | | | 2 | | 78 | | | 3 | | 273 | |

| Idaho | — | | — | | | — | | — | | | 1 | | 37 | | | 1 | | 37 | |

| Illinois | — | | — | | | 4 | | 947 | | | 16 | | 594 | | | 20 | | 1,541 | |

| Indiana | — | | — | | | 1 | | 134 | | | 2 | | 60 | | | 3 | | 194 | |

| Iowa | 2 | | 1,529 | | | — | | — | | | 1 | | 35 | | | 3 | | 1,564 | |

| Kansas | — | | — | | | 1 | | 219 | | | 3 | | 90 | | | 4 | | 309 | |

| Kentucky | — | | — | | | — | | — | | | 1 | | 33 | | | 1 | | 33 | |

| Louisiana | — | | — | | | — | | — | | | 3 | | 90 | | | 3 | | 90 | |

| Maine | — | | — | | | — | | — | | | 1 | | 30 | | | 1 | | 30 | |

| Maryland | 1 | | 451 | | | 3 | | 603 | | | 6 | | 219 | | | 10 | | 1,273 | |

| Massachusetts | — | | — | | | 4 | | 595 | | | 7 | | 266 | | | 11 | | 861 | |

| Michigan | — | | — | | | 2 | | 430 | | | 5 | | 178 | | | 7 | | 608 | |

| Minnesota | — | | — | | | 2 | | 380 | | | 4 | | 134 | | | 6 | | 514 | |

| Missouri | — | | — | | | 2 | | 342 | | | 2 | | 69 | | | 4 | | 411 | |

| Nevada | — | | — | | | 1 | | 207 | | | 4 | | 132 | | | 5 | | 339 | |

| New Jersey | — | | — | | | 4 | | 817 | | | 8 | | 284 | | | 12 | | 1,101 | |

| New Mexico | — | | — | | | — | | — | | | 1 | | 34 | | | 1 | | 34 | |

| New York | — | | — | | | 5 | | 838 | | | 10 | | 354 | | | 15 | | 1,192 | |

| North Carolina | — | | — | | | 2 | | 300 | | | 2 | | 74 | | | 4 | | 374 | |

| Ohio | — | | — | | | 3 | | 549 | | | 6 | | 224 | | | 9 | | 773 | |

| Oklahoma | — | | — | | | — | | — | | | 2 | | 67 | | | 2 | | 67 | |

| Oregon | 1 | | 374 | | | 2 | | 363 | | | 7 | | 243 | | | 10 | | 980 | |

| Pennsylvania | 1 | | 976 | | | 2 | | 381 | | | 7 | | 240 | | | 10 | | 1,597 | |

| Rhode Island | — | | — | | | — | | — | | | 1 | | 38 | | | 1 | | 38 | |

| South Carolina | — | | — | | | — | | — | | | 3 | | 101 | | | 3 | | 101 | |

| Tennessee | — | | — | | | 1 | | 145 | | | 3 | | 93 | | | 4 | | 238 | |

| Texas | — | | — | | | 8 | | 1,413 | | | 21 | | 702 | | | 29 | | 2,115 | |

| Utah | — | | — | | | 2 | | 277 | | | 4 | | 130 | | | 6 | | 407 | |

| Virginia | — | | — | | | 2 | | 452 | | | 7 | | 268 | | | 9 | | 720 | |

| Washington | — | | — | | | 6 | | 1,270 | | | 12 | | 442 | | | 18 | | 1,712 | |

| Washington D.C. | — | | — | | | — | | — | | | 2 | | 66 | | | 2 | | 66 | |

| Wisconsin | — | | — | | | 1 | | 150 | | | 2 | | 67 | | | 3 | | 217 | |

| Total | 10 | | 6,122 | | | 99 | | 17,180 | | | 260 | | 9,079 | | | 369 | | 32,381 | |

Our headquarters are located in Seattle, Washington, where our offices consist of both leased and owned space. On March 2, 2023, Nordstrom Canada commenced a wind-down of its business operations (see Note 2: Canada Wind-down in Item 8 for more information).

For use by our Retail segment,As of March 19, 2024, we have:

six owned merchandise distribution centers (Portland, Oregon; Dubuque, Iowa; Ontario, California; Newark, California; Upper Marlboro, Marylandhave announced 22 Nordstrom Rack store openings in 2024, four Nordstrom Rack store openings in 2025 and Gainesville, Florida),

two owned fulfillment centers (Cedar Rapids, Iowa and Elizabethtown, Pennsylvania),

one leased fulfillment center (San Bernardino, California)closure in 2024.

Nordstrom, Inc. and subsidiaries23

three leased administrative offices (Chicago, Illinois; Los Angeles, California and New York City, New York).

For use by our Credit segment, we have one leased office building (Centennial, Colorado).

Item 3. Legal Proceedings.

We are subject from time to time to various claims and lawsuits arising in the ordinary course of business, including lawsuits alleging violations of state and/or federal wage and hour and other employment laws, privacy and other consumer-based claims. Some of these lawsuits may include certified classes of litigants, or purport or may be determined to be class or collective actions and seek substantial damages or injunctive relief, or both, and some may remain unresolved for several years. We believe the recorded reservesaccruals in our Consolidated Financial Statements are adequate in light of the probable and estimable liabilities.

On March 2, 2023, Nordstrom Canada commenced a wind-down of its business operations pursuant to a CCAA proceeding overseen by the Ontario Superior Court of Justice. See Note 2: Canada Wind-down in Item 8 for more information.

As of the date of this report, we do not believe any other currently identified claim, proceeding or litigation, either alone or in the aggregate, will have a material impact on our results of operations, financial position or cash flows. Since these matters are subject to inherent uncertainties, our view of them may change in the future.

Item 4. Mine Safety Disclosures.

None.

PART II

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities.

(Dollar and share amounts in millions, except per share amounts and where otherwise noted)

MARKET SHAREHOLDER AND DIVIDENDSHAREHOLDER INFORMATION

Our common stock, without par value, is traded on the New York Stock ExchangeNYSE under the symbol “JWN.” The approximate number of record holders of common stock as of March 12, 201811, 2024 was 154,000, based upon the number of registered and beneficial shareholders and the number of employee shareholders in the Nordstrom 401(k) Plan.4,435. On this date, we had 167,790,511163,258,218 shares of common stock outstanding.

DIVIDENDS

The high and low prices offollowing table summarizes our common stock andhistorical dividends declared for each quarterand paid per share:

| | | | | | | | |

| Fiscal year | 2023 | 2022 |

| 1st Quarter | $0.19 | | $0.19 | |

| 2nd Quarter | 0.19 | | 0.19 | |

| 3rd Quarter | 0.19 | | 0.19 | |

| 4th Quarter | 0.19 | | 0.19 | |

| Full Year | $0.76 | | $0.76 | |

Any future determination to pay cash dividends and the amount of

2017dividends will be at the discretion of the Board of Directors and 2016 are presentedwill be dependent upon our financial condition, operating results, capital requirements, contractual commitments and such other factors as the Board of Directors deems relevant (see Note 11: Shareholders’ Equity in the table below: |

| | | | | | | | | | | | |

| | | Common Stock Price | | | | |

| | | 2017 | | 2016 | | Dividends per Share |

| | | High | | Low | | High | | Low | | 2017 | | 2016 |

| 1st Quarter | | $48.45 | | $40.70 | | $59.37 | | $46.65 | | $0.37 | | $0.37 |

| 2nd Quarter | | $50.32 | | $39.53 | | $51.74 | | $35.01 | | $0.37 | | $0.37 |

| 3rd Quarter | | $49.00 | | $39.63 | | $55.23 | | $39.05 | | $0.37 | | $0.37 |

| 4th Quarter | | $53.00 | | $37.79 | | $62.82 | | $42.32 | | $0.37 | | $0.37 |

| Full Year | | $53.00 | | $37.79 | | $62.82 | | $35.01 | | $1.48 | | $1.48 |

SHARE REPURCHASES

(Dollar amounts in millions)

In February 2017, our BoardWe repurchased no shares of Directors authorized a program to repurchase up to $500 of our outstanding common stock through August 31, 2018.

Induring the fourth quarter of 2017, we made no share repurchases2023 and we had $414 of$438 remaining in share repurchase capacity as of February 3, 2018. We do not plan to2024.

See Note 11: Shareholders’ Equity in Item 8 for more information about our August 2018 and May 2022 share repurchase shares while the Group explores the possibility of making a going private proposal.programs. The actual timing, price, manner and amounts of future share repurchases, if any, will be subject to the discretion of the Board of Directors, contractual commitments, market and economic conditions and applicable SEC rules.

Nordstrom, Inc. and subsidiaries1525

STOCK PRICE PERFORMANCE

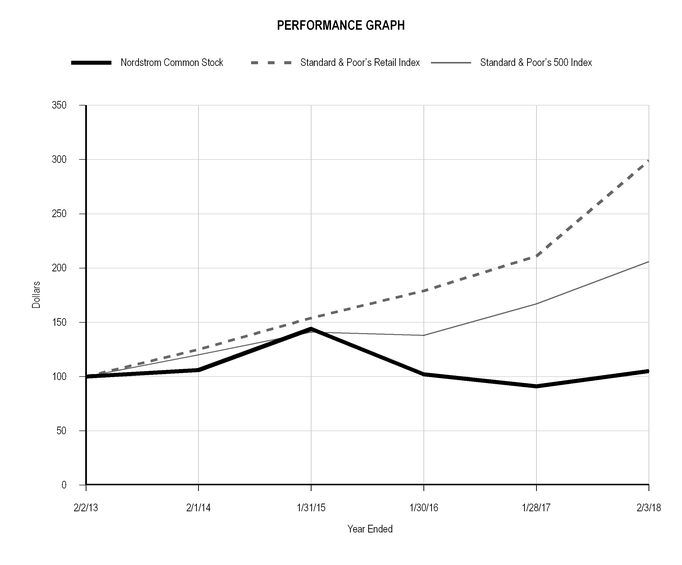

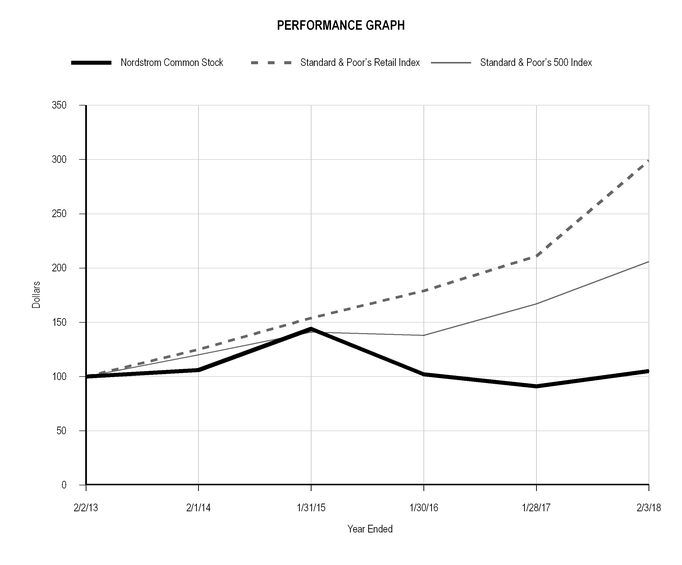

The following graph compares the cumulative total return of Nordstrom common stock, Standard & Poor’s Retail Index (“S&P Retail”) and, Standard & Poor’s 500 Index (“S&P 500”) and Nordstrom’s peer group for each of the last five fiscal years ending ended February 3, 2018. The2024. S&P Retail Index is composed of 2917 retail companies including Nordstrom, representing an industry group of the S&P 500. Our peer group is consistent with the retail peer group that we include in the Compensation Discussion and Analysis section of our Proxy Statement for our 2024 Annual Meeting of Shareholders and is weighted by the market capitalization of each component. The following graph assumes an initial investment of $100 each in Nordstrom common stock, the S&P Retail, and the S&P 500 and Nordstrom’s peer group on February 2, 20132019 and assumes reinvestment of dividends.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

End of fiscal year1 | 2018 | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 |

| Nordstrom common stock | $100 | | $85 | | $83 | | $51 | | $45 | | $46 |

| S&P Retail | $100 | | $121 | | $171 | | $181 | | $150 | | $210 |

| S&P 500 | $100 | | $122 | | $142 | | $172 | | $161 | | $199 |

| Nordstrom’s peer group | $100 | | $105 | | $118 | | $127 | | $136 | | $151 |

1 Dollar amounts are in ones.

|

| | | | | | | | | | | | | | | | | |

| End of fiscal year | 2012 |

| | 2013 |

| | 2014 |

| | 2015 |

| | 2016 |

| | 2017 |

|

| Nordstrom common stock | 100 |

| | 106 |

| | 144 |

| | 102 |

| | 91 |

| | 105 |

|

| Standard & Poor’s Retail Index | 100 |

| | 125 |

| | 154 |

| | 179 |

| | 211 |

| | 299 |

|

| Standard & Poor’s 500 Index | 100 |

| | 120 |

| | 141 |

| | 138 |

| | 167 |

| | 206 |

|

Item 6. Selected Financial Data.[Reserved]

Dollars in millions except per square foot and per share amounts

The following selected financial data are derived from the audited Consolidated Financial Statements and should be read in conjunction with Item 1A: Risk Factors, Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8: Financial Statements and Supplementary Data of this Annual Report on Form 10-K. |

| | | | | | | | | | | | | | | | | | | |

| Fiscal year | 2017 |

| | 2016 |

| | 2015 |

| | 2014 |

| | 2013 |

|

| Earnings Results | | | | | | | | | |

| Net sales |

| $15,137 |

|

|

| $14,498 |

|

|

| $14,095 |

| |

| $13,110 |

| |

| $12,166 |

|

Credit card revenues, net1 | 341 |

|

| 259 |

|

| 342 |

| | 396 |

| | 374 |

|

| Gross profit | 5,247 |

|

| 5,058 |

|

| 4,927 |

| | 4,704 |

| | 4,429 |

|

| Selling, general and administrative (“SG&A”) expenses | (4,662 | ) | | (4,315 | ) | | (4,168 | ) | | (3,777 | ) | | (3,453 | ) |

| Earnings before interest and income taxes (“EBIT”) | 926 |

|

| 805 |

|

| 1,101 |

| | 1,323 |

| | 1,350 |

|

| Net earnings | 437 |

|

| 354 |

|

| 600 |

| | 720 |

| | 734 |

|

| | | | | | | | | | |

| Balance Sheet and Cash Flow Data | | | | | | | | | |

| Cash and cash equivalents |

| $1,181 |

| |

| $1,007 |

| |

| $595 |

| |

| $827 |

| |

| $1,194 |

|

| Merchandise inventories | 2,027 |

|

| 1,896 |

| | 1,945 |

| | 1,733 |

| | 1,531 |

|

| Land, property and equipment, net | 3,939 |

|

| 3,897 |

| | 3,735 |

| | 3,340 |

| | 2,949 |

|

Total assets1 | 8,115 |

|

| 7,858 |

| | 7,698 |

| | 9,245 |

| | 8,574 |

|

Total long-term debt1 | 2,737 |

|

| 2,774 |

| | 2,805 |

| | 3,131 |

| | 3,113 |

|

Cash flow from operations1 | 1,400 |

|

| 1,658 |

| | 2,470 |

| | 1,243 |

| | 1,345 |

|

| Capital expenditures | 731 |

| | 846 |

| | 1,082 |

| | 861 |

| | 803 |

|

| | | | | | | | | | |

| Performance Metrics | | | | | | | | | |

| Net sales increase | 4.4 | % | | 2.9 | % | | 7.5 | % | | 7.8 | % | | 3.4 | % |

Comparable sales increase (decrease)2 | 0.8 | % | | (0.4 | %) | | 2.7 | % | | 4.0 | % | | 2.5 | % |

| Gross profit % of net sales | 34.7 | % | | 34.9 | % | | 35.0 | % | | 35.9 | % | | 36.4 | % |

| SG&A % of net sales | 30.8 | % | | 29.8 | % | | 29.6 | % | | 28.8 | % | | 28.4 | % |

| EBIT % of net sales | 6.1 | % | | 5.6 | % | | 7.8 | % | | 10.1 | % | | 11.1 | % |

| Capital expenditures % of net sales | 4.8 | % | | 5.8 | % | | 7.7 | % | | 6.6 | % | | 6.6 | % |

| Return on assets | 5.4 | % |

| 4.5 | % |

| 6.6 | % |

| 8.1 | % |

| 8.7 | % |

Return on invested capital (“ROIC”)3 | 9.7 | % |

| 8.4 | % |

| 10.7 | % |

| 12.6 | % |

| 13.6 | % |

| Sales per square foot |

| $506 |

| |

| $498 |

| |

| $507 |

| |

| $493 |

| |

| $474 |

|

| 4-wall sales per square foot |

| $384 |

|

|

| $392 |

|

|

| $410 |

| |

| $413 |

| |

| $408 |

|

| Inventory turnover rate | 4.67 |

| | 4.53 |

| | 4.54 |

| | 4.67 |

| | 5.07 |

|

| | | | | | | | | | |

| Per Share Information | | | | | | | | | |

Earnings per diluted share4 |

| $2.59 |

|

|

| $2.02 |

|

|

| $3.15 |

| |

| $3.72 |

| |

| $3.71 |

|

Dividends declared per share1 | 1.48 |

| | 1.48 |

| | 6.33 |

| | 1.32 |

| | 1.20 |

|

| | | | | | | | | | |

| Store Information (at year-end) | | | | | | | | | |

Nordstrom full-line stores5 | 123 |

| | 123 |

| | 121 |

| | 117 |

| | 117 |

|

Nordstrom Rack and other6 | 243 |

| | 226 |

| | 202 |

| | 175 |

| | 143 |

|

| Total square footage | 30,218,000 |

| | 29,792,000 |

| | 28,610,000 |

| | 27,061,000 |

| | 26,017,000 |

|

1 Amounts were impacted by the October 1, 2015, credit card receivable transaction. As a result of the transaction, the dividends paid in the fiscal year 2015 included a special cash dividend of $4.85 per share. For further information regarding these impacts, see Note 2: Credit Card Receivable Transaction and Note 11: Shareholders’ Equity in Item 8.

2 The 53rd week is not included in comparable sales calculations (see Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations for more information about the 53rd week).

3 See ROIC (non-GAAP financial measure) in Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional information and reconciliation to the most directly comparable GAAP financial measure.

4 Earnings per diluted share included the impact of the Trunk Club goodwill impairment charge of $1.12 per share in fiscal year 2016.

5 Nordstrom full-line stores include U.S. full line stores, Canada full-line stores and Nordstrom Local.

6 Other includes Trunk Club clubhouses, Jeffrey boutiques and Last Chance stores.

Nordstrom, Inc. and subsidiaries17

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

(Dollar share and square footageshare amounts in millions, except percentages, per share amounts and per square foot amountswhere otherwise noted)

OVERVIEW

Nordstrom isThe following MD&A provides a leading fashion retailer offering apparel, shoes, cosmetics and accessories for women, men, young adults and children. We offer an extensive selection of high-quality brand-name and private label merchandise in the U.S. and Canada. We serve customers through two brands — Nordstrom full-price and Nordstrom Rack off-price. With customers increasingly engaging with Nordstrom in multiple ways, we’re focused on providing a seamless experience across stores and online. Our operations currently consistnarrative of our Nordstrom U.S.financial performance and Canada full-line stores, Nordstrom.com, Nordstrom Rack stores, Nordstromrack.com/HauteLook, Trunk Club, Jeffrey boutiques, Last Chance clearance stores and Nordstrom Local. Our customers can participate in our Nordstrom Rewards loyalty program which allows themis intended to earn merchandise, services and other experiences. We also offer our customers a variety of payment products and services, including our Nordstrom co-branded credit cards. As we aspire to be the best fashion retailer, our customer strategy is centered on three strategic pillars: providing a differentiated product offering, delivering exceptional services and experiences, and leveraging the strength of our brand.

In 2017, net earnings were $437, or $2.59 per diluted share, which included impacts associated with the Tax Cuts and Jobs Act (the “Tax Act”), consisting of a $0.25 per share reduction related to our income tax provision and a $0.06 per share decrease for a one-time investment in our employees. We reached record sales of $15 billion in 2017. Our net sales increased 4.4%, inclusive of approximately $220 or 150 basis points from the impact of the 53rd week, while comparable sales increased 0.8% and are not inclusive of the 53rd week.

We achieved the following milestones in executing our growth plans:

Nordstrom experienced continued positive customer trends, reflecting customer growth of 4% to 33 million customers. Additionally, 9 million customers are shopping with us in multiple ways, a 6% increase over the previous year.

Generational investments, which include Nordstromrack.com/HauteLook, Canada and Trunk Club, contributed $1.5 billion in sales.

In the Nordstrom full-price business, strategic brands, including product with limited distribution and Nordstrom proprietary labels, continued to deliver outsized sales growth.

The Nordstrom Rack off-price business gained 6 million new customers with approximately one-third of off-price customers expected to cross-shop the full-price business over time.

Nordstrom Rewards loyalty program customers increased by 35% to 10.5 million. Sales from Nordstrom Rewards customers represented 51% of sales, an increase from 44% in 2016.

Looking ahead to 2018, we are executing on our three strategic pillars through a series of initiatives. On April 12, our Nordstrom Men’s Store NYC is slated to open, with our Nordstrom NYC store opening in Fall 2019. We expect this store to be the biggest and best statement of the Nordstrom brand, serving as a gateway to new customers both domestically and internationally.

We are also focusing on further integrating our digital and physical assets in our top markets in order to deliver best-in-class services and experiences to customers in those areas. We will bring our capabilities across supply chain, technology, marketing, product and services to create a digitally-connected and differentiated experience for customers to shop on their terms, starting in Los Angeles, our largest market. We believe that we will gain learnings from our experiences in the Los Angeles market that we can apply to other markets in the future.

Another key initiative for 2018 is the introduction of six Nordstrom Rack stores in Canada, where we completed our full-line store expansion plans last September. Similar to our experience in the U.S., we expect strong synergies between our full-price and off-price businesses.

Finally, we will continue to curate our assortment to provide newness and the opportunity for discovery for our customers. In our full-price business, our focus is on strategic brand growth through new launches and our existing partners. In our off-price business, leveraging our vendor partnerships enables us to offer the best brands at the best prices.

Our strategic brand partnerships and combined digital and physical assets make us uniquely positioned in the marketplace. We believe our diversified and resilient business model will continue to serve us well while creating value for our shareholders, customers and employees.

RESULTS OF OPERATIONS

Our reportable segments in 2017 are Retail and Credit. We analyze our results of operations through earnings before interest and income taxes for our Retail Business and Credit, while interest expense, income taxes and earnings per share are discussed on a total Company basis.

Similar to many other retailers, Nordstrom follows the retail 4-5-4 reporting calendar, which included an extra week in the fourth quarter of 2017 (the “53rd week”). References to 2017 relate to the 53-week fiscal year ended February 3, 2018. References to 2016 and 2015 are based on a 52-week fiscal year. However, the 53rd week is not included in the comparable sales calculations.

RETAIL BUSINESS

Our Retail Business includes our Nordstrom U.S. and Canada full-line stores, Nordstrom.com, Nordstrom Rack stores, Nordstromrack.com/HauteLook, Trunk Club, Jeffrey boutiques, Last Chance clearance stores and Nordstrom Local. For purposes of discussion and analysispromote understanding of our results of operations

of our Retail Business, we combine our Retail segment resultsand financial condition. MD&A is provided as a supplement to, and should be read in conjunction with,

revenuesItem 8: Financial Statements and expenses in the “Corporate/Other” column of Note 15: Segment Reporting in Item 8 (collectively, the “Retail Business”). Amounts in the “Corporate/Other” column include unallocated corporate expensesSupplementary Data and assets (including unallocated assets in corporate headquarters, consisting primarily of cash, land, buildings and equipment and deferred tax assets), sales return reserves, inter-segment eliminations and other adjustments to segment results necessary for the presentation of consolidated financial results in accordance with generally accepted accounting principles.Certain metrics we use to evaluate the Retail Business may not be calculated in a consistent manner among industry peers. Provided below are definitions of metrics we present within our analysis of the Retail Business:

Comparable Sales – sales from stores that have been open at least one full year at the beginning of the year

Total Company comparable sales include sales from our online channels

Gross Profit – net sales less cost of sales and related buying and occupancy costs

Inventory Turnover Rate – trailing 12-months cost of sales and related buying and occupancy costs (for all segments) divided by the trailing 4-quarter average inventory

Total Sales Per Square Foot – net sales divided by weighted-average square footage

4-wall Sales Per Square Foot – sales for Nordstrom U.S. and Canada full-line stores, Nordstrom Rack stores, Trunk Club clubhouses, Jeffrey boutiques, Last Chance clearance stores and Nordstrom Local divided by their weighted-average square footage

Summary

The following table summarizesdiscusses the results of operations for fiscal year 2023 compared with 2022.For our Retail Business:comparison and discussion of 2022 and 2021, see Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations in Part II of our 2022 Annual Report. For our discussion of market risk information for 2022, see Item 7A: Quantitative and Qualitative Disclosures About Market Risk in Part II of our 2022 Annual Report. The following discussion and analysis contains forward-looking statements and should also be read in conjunction with Item 1A: Risk Factors in Part I, as well as other cautionary statements and risks described elsewhere in this 2023 Annual Report, before deciding to purchase, hold or sell shares of our common stock. |

| | | | | | | | | | | | | | | | | | | | | |

| Fiscal year | | 2017 | | 2016 | | 2015 |

| | | Amount |

| | % of net sales1 |

| | Amount |

| | % of net sales1 |

| | Amount |

| | % of net sales1 |

|

| Net sales | |

| $15,137 |

| | 100.0 | % | |

| $14,498 |

| | 100.0 | % | |

| $14,095 |

| | 100.0 | % |

| Cost of sales and related buying and occupancy costs | | (9,877 | ) | | (65.3 | %) | | (9,434 | ) | | (65.1 | %) | | (9,161 | ) | | (65.0 | %) |

| Gross profit | | 5,260 |

| | 34.7 | % | | 5,064 |

| | 34.9 | % | | 4,934 |

| | 35.0 | % |

| Selling, general and administrative expenses | | (4,508 | ) | | (29.8 | %) | | (4,159 | ) | | (28.7 | %) | | (4,016 | ) | | (28.5 | %) |

| Goodwill impairment | | — |

| | — |

| | (197 | ) | | (1.4 | %) | | — |

| | — |

|

| Earnings before interest and income taxes | |

| $752 |

| | 5.0 | % | |

| $708 |

| | 4.9 | % | |

| $918 |

| | 6.5 | % |

1 Subtotals and totals may not foot due to rounding.

| | | | | |

| Overview | |

| Results of Operations | |

| Liquidity | |

| Capital Resources | |

| Critical Accounting Estimates | |

| Recent Accounting Pronouncements | |

Nordstrom, Inc. and subsidiaries1927

OVERVIEW

Retail Business Net SalesIn 2023, we reported net earnings of $134, or 0.9% of net sales, $0.82 per diluted share and EBIT of $251, or 1.8% of net sales. Adjusted EBIT1 was $567, or 4.0% of net sales, and Adjusted EPS1 was $2.12, which exclude the impacts of charges related to the wind-down of Canadian operations and a supply chain asset impairment and related charge.

Total company net sales decreased 5.8%, compared with 2022. This included a negative 245 basis point impact from the wind-down of Canadian operations and a positive impact of approximately $190, or 130 basis points, from the 53rd week. We saw sequential improvement in topline trends across both banners throughout the year.

We continued to manage with leaner inventories and exited 2023 with overall ending inventory levels 3% lower than the fourth quarter of 2022 and a positive sales-to-inventory spread. This lower level of inventory required fewer markdowns and helped drive 95 basis points of expansion in our gross profit as a rate of sales, compared with 2022.

We remain committed to delivering profitable growth while improving the customer experience. Our results reflect our focus throughout 2023 on our three priorities: improve Nordstrom Rack performance, increase inventory productivity and optimize our supply chain. We will continue to build on the progress we made in 2023 as we focus our efforts on three refreshed key priorities in 2024: driving Nordstrom banner growth, optimizing operationally and building on momentum at the Rack.

Driving Nordstrom banner growth – Our first priority is to drive growth at our Nordstrom banner, with a focus on digital-led growth supported by our stores. In 2024, we plan to launch our digital marketplace on Nordstrom.com, which will allow us to grow our curated online assortment to serve more customers on even more occasions through increasing our use of unowned inventory. Marketplace will allow our customers to shop more products and sizes from their favorite brands, while providing them more access to new and emerging brands. Expanding our assortment through unowned inventory has the potential to drive GMV growth in addition to providing compelling economics.

We will also focus on driving growth at our Nordstrom banner through increasing customer engagement and improving retention. We will do this through amplifying the brands that matter most to our customers and ensuring we have consistent depth in these brands across our stores and online, with our Beauty division playing a prominent role.

Optimizing operationally – We made significant progress on our supply chain initiatives in 2023, which drove improvements in customer experience and profitability. We delivered a better experience to our customers through faster delivery, lower cancellation rates and increased accuracy of inventory, while also driving cost savings. In the fourth quarter of 2023, our team delivered the sixth consecutive quarter of 50-plus basis points of improvement in variable supply chain expense savings, while at the same time improving our click-to-delivery speed.

We plan to build upon these successes in 2024, with the end goal of enhancing the customer experience through faster delivery, and improving our cost position by maximizing our inventory value throughout its lifecycle. We are making investments in systems and technology enablers to standardize and streamline our inventory processes, expanding the scale of our RFID utilization and improving the inventory movement within our business.

Building on momentum at Nordstrom Rack – In 2023, we opened 19 new stores and our intent is to open 22 new stores in 2024. We believe new Rack stores are a great investment, with returns that exceed our cost of capital and have a short payback period. Expanding our network of stores also brings our omni-channel services closer to the customer, giving them more reasons and opportunities to engage with us.

Our priority for 2024 is to continue building on our momentum from 2023 and deliver topline Rack growth, led by stores and supported by enhanced digital capabilities. We aim to deliver great brands at great prices for our customers at Nordstrom Rack, and we continue to improve by growing the most desirable brands offered, driving greater engagement and profitability at NordstromRack.com and expanding our reach and convenience with new Rack stores in key markets.

We are proud of the efforts that we undertook in 2023, as well as the outcomes that enhanced the customer experience and drove improved financial results. We are committed to delivering profitable growth while improving the customer experience, and we expect 2024 to be a year of continued momentum toward the long-term strength and durability of our business.

1 Adjusted EBIT and Adjusted EPS are non-GAAP financial measures. For a reconciliation between GAAP and non-GAAP financial measures, see Adjusted EBIT, Adjusted EBITDA, Adjusted EBIT margin and Adjusted EPS (Non-GAAP financial measures) below.

RESULTS OF OPERATIONS

In our ongoing effort to enhance the customer experience, we are focused on providing customers with a seamless retail experience across our channels. WhileCompany. We invested early in integrating our operations, merchandising and technology across our stores and online in both our Nordstrom and Nordstrom Rack banners. By connecting our digital and physical assets across Nordstrom and Nordstrom Rack, we are able to better serve customers may engage with us through multiple channels,when, where and how they want to shop. We have one Retail reportable segment and analyze our results on a total Company basis, using customer, market share, operational and net sales metrics.

We operate on a 52/53-week fiscal year ending on the Saturday closest to January 31st. References to 2023 relate to the 53-week fiscal year ending February 3, 2024. References to any other years included within this document are based on a 52-week fiscal year.

We monitor a number of key operating metrics to evaluate our performance. In addition to net sales, net earnings and other results under GAAP, two other key operating metrics we know they valueuse are GMV and inventory turnover rate. Beginning in the overall Nordstrom brand experience and view us simply as Nordstrom, which is ultimatelyfirst quarter of 2023, we made changes to how we viewcalculate these metrics to more closely align with how our business. The followingbusiness is operated. Changes in the methodologies are discussed below and prior periods have been adjusted to reflect a summarycomparable presentation.

•GMV: calculated as the total dollar value of merchandise sold through our digital platforms and stores. GMV includes net merchandise sales from inventory we own, as well as the retail value of merchandise sold under our unowned inventory models with our vendors. We use GMV as an indicator of the scale and growth of our netoperations and the impact of our unowned inventory models. Prior to the first quarter of 2023, we also included non-merchandise sales in our GMV calculation.

•Inventory Turnover Rate: calculated as the trailing 4-quarter merchandise cost of sales divided by channel forthe trailing 13-month average inventory. Inventory turnover rate is an indicator of our Retail Business:

|

| | | | | | | | | | | |

| Fiscal year | 2017 |

| | 2016 |

| | 2015 |

|

| Net sales by channel: | | | | | |

Nordstrom full-line stores - U.S.1 |

| $6,951 |

| |

| $7,186 |

|

|

| $7,633 |

|

| Nordstrom.com | 2,887 |

| | 2,519 |

|

| 2,300 |

|

| Full-price | 9,838 |

| | 9,705 |

| | 9,933 |

|

| | | | | | |

| Nordstrom Rack | 4,059 |

| | 3,809 |

| | 3,533 |

|

| Nordstromrack.com/HauteLook | 897 |

|

| 700 |

|

| 532 |

|

| Off-price | 4,956 |

| | 4,509 |

| | 4,065 |

|

| | | | | | |

Other retail2 | 614 |

| | 554 |

| | 378 |

|

| Retail segment | 15,408 |

| | 14,768 |

| | 14,376 |

|

| Corporate/Other | (271 | ) | | (270 | ) | | (281 | ) |

| Total net sales |

| $15,137 |

| |

| $14,498 |

| |

| $14,095 |

|

| | | | | | |

| Net sales increase | 4.4 | % | | 2.9 | % | | 7.5 | % |

| | | | | | |

Comparable sales increase (decrease) by channel3: | | | | | |

| Nordstrom full-line stores - U.S. | (4.2 | %) | | (6.4 | %) | | (1.1 | %) |

| Nordstrom.com | 13.1 | % | | 9.5 | % | | 15.2 | % |

| Full-price | 0.4 | % | | (2.7 | %) | | 2.3 | % |

| Nordstrom Rack | (1.9 | %) | | 0.2 | % | | (1.0 | %) |

| Nordstromrack.com/HauteLook | 25.5 | % | | 31.7 | % | | 47.4 | % |

| Off-price | 2.5 | % | | 4.5 | % | | 4.3 | % |

| Total Company | 0.8 | % | | (0.4 | %) | | 2.7 | % |

| | | | | | |

| Sales per square foot: | | | | | |

| Total sales per square foot |

| $506 |

| |

| $498 |

| |

| $507 |

|

| 4-wall sales per square foot | 384 |

| | 392 |

| | 410 |

|

| Full-line sales per square foot - U.S. | 337 |

| | 346 |

| | 370 |

|

| Nordstrom Rack sales per square foot | 497 |

| | 507 |

| | 523 |

|

1 Nordstrom full-line stores - U.S. includes Nordstrom Local.

2 Other retail includes Nordstrom Canada full-line stores, Trunk Clubsuccess in optimizing inventory volumes in accordance with customer demand. Prior to the first quarter of 2023, we calculated inventory turnover rate as the trailing 4-quarter cost of sales and Jeffrey boutiques.

3 The 53rd week is not included in comparable sales calculations.related buying and occupancy costs divided by the trailing 4-quarter average inventory.

Net Sales (2017 vs. 2016)

In 2017, totalThe following table summarizes net sales: | | | | | | | | |

| Fiscal year | 2023 | | 2022 | |

| Net sales: | | |

| Nordstrom | $9,436 | | $10,279 | |

| Nordstrom Rack | 4,783 | | 4,813 | |

| Total net sales | $14,219 | | $15,092 | |

| | |

| Net sales (decrease) increase: | | |

| Nordstrom | (8.2 | %) | 6.6 | % |

| Nordstrom Rack | (0.6 | %) | 1.1 | % |

| Total Company | (5.8 | %) | 4.8 | % |

| | |

| Digital sales: | | |

| Digital sales as a % of total net sales | 36 | % | 38 | % |

| Digital sales decrease | (10 | %) | (6 | %) |

| | |

| GMV (decrease) increase: | | |

| Nordstrom | (8.5 | %) | 6.5 | % |

| Total Company | (6.1 | %) | 4.6 | % |

Total Company net sales increased 4.4%, while comparableand GMV decreased for the full fiscal year compared with 2022. The wind-down of our Canadian operations as of March 2, 2023 had a negative impact on net sales increased 0.8%of 245 basis points compared with 2022 (see Note 2: Canada Wind-down in Item 8). During the year, we opened two Nordstrom full-line stores, including one in Canada,This was partially offset by an approximately 130 basis point positive impact and 17 Nordstrom Rack stores. The 53rd week contributed approximately $220$190 in additional net sales.

Full-price net sales which consists ofrelated to the U.S. full-line53rd week. For the full fiscal year, active and Nordstrom.com channels, increased 1.4%beauty were the strongest categories compared with 2016, while comparable sales increased 0.4%. Also on a comparable basis, full-price sales reflected an increase in the average selling price per item sold, partially offset by a decrease in the number of items sold. Kids was the top-performing merchandise category.

Off-price net sales, which consists of Nordstrom Rack and Nordstromrack.com/HauteLook channels, increased 9.9%, compared with 2016 and comparable sales increased 2.5%. Nordstromrack.com/HauteLook had a comparable sales increase of 25.5% and now represents over 18% of off-price sales. Nordstrom Rack net sales increased 6.6%, primarily attributable to 17 new store openings in 2017, while comparable sales decreased 1.9%. On a comparable basis, the average selling price per item sold and the total number of items sold decreased at Nordstrom Rack. The top-performing Nordstrom Rack merchandise category was Beauty.

2022.

20Nordstrom, Inc. and subsidiaries29

Net Sales (2016 vs. 2015)

In 2016, total CompanyNordstrom net sales increased 2.9%, while comparable salesand GMV decreased 0.4%. During the year, we opened three Nordstrom full-line stores, including two in Canada, and 21 Nordstrom Rack stores.

Full-price net sales decreased 2.3% compared with 2015, while comparable sales decreased 2.7%. Also on a comparable basis, full-price sales2022, which reflected a decrease in the total number of items sold, partially offset by an increase in the average selling price per item sold. The top-performing merchandise category was Beauty.

Off-pricewind-down of Canadian operations had a negative impact on Nordstrom banner net sales increased 10.9%,of 360 basis points, partially offset by a 120 basis point positive impact from the 53rd week, compared with 2015 and comparable sales increased 4.5%. Nordstromrack.com/HauteLook had comparable sales increase of 31.7% and represented 15% of off-price sales. 2022.

Nordstrom Rack net sales increased 7.8%, primarily attributable to 21 new store openingsdecreased compared with 2022, which reflected a decrease in 2016. On a comparable basis, the total number of items sold, increased at Nordstrom Rack, partially offset by a decreasean increase in the average selling price per item sold. Kids was the top-performingEliminating store fulfillment for Nordstrom Rack merchandise category.digital orders during the third quarter of 2022 negatively impacted Nordstrom Rack sales by approximately 300 basis points for the full fiscal year compared with 2022. This was partially offset by an approximately 150 basis point positive impact related to the 53rd week.

Retail Business Digital sales decreased compared with 2022. Eliminating store fulfillment for Nordstrom Rack digital orders during the third quarter of 2022 and sunsetting Trunk Club in the second quarter of 2022 negatively impacted digital sales by approximately 350 basis points for the full fiscal year compared with 2022.

During the year, we opened 19 Nordstrom Rack stores and relocated one Nordstrom Rack store. We closed one Nordstrom store, one Nordstrom Local service hub, one ASOS | Nordstrom store and two Nordstrom Rack stores. In addition, we deconsolidated six Nordstrom and seven Nordstrom Rack stores in Canada as of March 2, 2023 (see Note 2: Canada Wind-down in Item 8).

See Note 3: Revenue in Item 8 for information about disaggregated revenues.

Credit Card Revenues, Net

Credit card revenues, net increased $36 compared with 2022, due to increased finance charges from higher rates and outstanding balances, and revenue recognized in connection with our 2022 TD program agreement amendment. The increase was partially offset by increased credit losses.

2024 Total Revenue Outlook

In fiscal 2024, we expect a total revenue range, including retail sales and credit card revenues, of 2% decline to 1% growth compared with the 53-week fiscal 2023, which includes an approximately 135 basis point unfavorable impact from the 53rd week.

Gross Profit

The following table summarizes the Retail Business gross profit (“Retail GP”): |

| | | | | | | | | | | |

| Fiscal year | 2017 |

| | 2016 |

| | 2015 |

|

| Retail gross profit |

| $5,260 |

| |

| $5,064 |

|

|

| $4,934 |

|

| Retail gross profit as a % of net sales | 34.7 | % | | 34.9 | % |

| 35.0 | % |

| Inventory turnover rate | 4.67 |

| | 4.53 |

| | 4.54 |

|

| | | | | | | | | |

| Fiscal year | 2023 | | 2022 | | |

| Gross profit | $4,916 | | $5,073 | | |

| Gross profit as a % of net sales | 34.6 | % | 33.6 | % | |

| Inventory turnover rate | 3.58 | | 3.45 | | |

Gross Profit (2017 vs. 2016)

RetailGPprofit decreased 18 basis points in 2017 when$157, compared with 2016,2022, primarily due to higher plannedlower sales, partially offset by lower markdowns and lower buying and occupancy expenses relatedcosts. Gross profit increased 95 basis points as a rate of net sales, compared with 2022, due to new store growth for Nordstrom Racklower markdowns and Canada.Continued focuslower buying and occupancy costs, partially offset by deleverage on lower sales.

Ending inventory execution led to improvementsas of February 3, 2024 decreased 3%, compared with January 28, 2023, versus a 2% increase in sales in the fourth quarter of 2023, compared with 2022. The decrease in inventory turnover rate in 2017.

Gross Profit (2016 vs. 2015)

Our Retail GP rate was relatively flatlevels compared with 2015, reflecting higher occupancy costs associated with Nordstrom Rack and Canada store growth, in addition to increased markdowns in the first half2022 is a result of the year to realign inventory to sales trends. This was offset bycontinued strong inventory execution during the remainderdiscipline.

Selling, General and Administrative Expenses

Retail Business selling, general and administrative expenses (“Retail SG&A”) are summarized in the following table: |

| | | | | | | | | | | |

| Fiscal year | 2017 |

| | 2016 |

| | 2015 |

|

| Retail selling, general and administrative expenses |

| $4,508 |

| |

| $4,159 |

| |

| $4,016 |

|

| Retail selling, general and administrative expenses as a % of net sales | 29.8 | % | | 28.7 | % | | 28.5 | % |

Selling, General and Administrative Expenses (2017 vs. 2016)

Our Retail SG&A rate increased 99 basis points in 2017 and increased $349 compared with 2016 primarily due to planned technology and performance related expenses.

Selling, General and Administrative Expenses (2016 vs. 2015)

Our Retail SG&A rate increased 19 basis points in 2016 and increased $143 compared with 2015 primarily due to technology and fulfillment expenses.

Retail Business Goodwill Impairment

We recognized a goodwill impairment charge of $197 in 2016 related to Trunk Club (see Note 8: Fair Value Measurements in Item 8).

Nordstrom, Inc. and subsidiaries21

CREDIT SEGMENT

The Nordstrom credit and debit card products are designed to strengthen customer relationships and grow retail sales by providing loyalty benefits, valuable services and payment products. We believe our credit business allows us to build deeper relationships with our customers by fully integrating the Nordstrom Rewards loyalty program with our retail business and providing better service, which in turn fosters greater customer loyalty. Nordstrom cardholders tend to visit our stores more frequently and spend more than non-cardholders. Nordstrom private label credit and debit cards can be used at a majority of our U.S. retail businesses, while Nordstrom Visa credit cards also may be used for purchases outside of Nordstrom (“outside volume”). In 2017, we began offering a Canadian Nordstrom-branded Visa card, which can be used for purchases inside and outside of Nordstrom.

In October 2015, we completed the sale of a substantial majority of our U.S. Visa and private label credit card portfolio to TD. In November 2017, we sold the remaining balances which consisted of employee credit card receivables for the U.S. Visa and Nordstrom private label credit cards to TD (see Note 2: Credit Card Receivable Transaction in Item 8).

Summary

The table below provides a detailed view of the operational results of our Credit segment, consistent with Note 15: Segment Reporting in Item 8: |

| | | | | | | | | | | | |

| Fiscal year | | 2017 |

| | 2016 |

| | 2015 |

|

| Credit card revenues, net | |

| $341 |

| |

| $259 |

| |

| $342 |

|

| Credit expenses | | (167 | ) | | (162 | ) | | (159 | ) |

| Earnings before interest and income taxes | |

| $174 |

| |

| $97 |

| |

| $183 |

|

| | | | | | | |

Credit and debit card volume1: | | | | | | |

| Inside | |

| $5,987 |

| |

| $5,858 |

| |

| $5,953 |

|

| Outside | | 4,434 |

| | 4,160 |

| | 4,309 |

|

| Total volume | |

| $10,421 |

| |

| $10,018 |

| |

| $10,262 |

|

1 Credit and debit card volume represents sales on the total portfolio plus applicable sales taxes.

Credit Card Revenues, net

The following is a summary of our credit card revenues, net: |

| | | | | | | | | | | |

| Fiscal year | 2017 |

| | 2016 |

| | 20151 |

|

| Credit program revenues, net |

| $331 |

| |

| $246 |

| |

| $64 |

|

| Other | 10 |

| | 13 |

| | 278 |

|

| Total credit card revenues, net |

| $341 |

| |

| $259 |

| |

| $342 |

|

1 Other in fiscal year 2015 consisted of $173 of finance charge revenue, $61 in interchange fees and $44 of late fees and other revenue.

Credit program revenues, net include our portion of the ongoing credit card revenue, net of credit losses, from both sold and newly generated credit card receivables pursuant to our program agreement with TD. Asset amortization and deferred revenue recognition associated with the assets and liabilities recorded as part of the transaction are also recorded in credit program revenues, net. Revenue earned under the program agreement is impacted by the credit quality of receivables, both owned and serviced, and factors such as deteriorating economic conditions, declining creditworthiness of cardholders and the success of account management and collection activities may heighten the risk of credit losses.

Other credit card revenues included finance charge revenue, interchange fees and late fees. Finance charges represented interest earned on unpaid balances while interchange fees were earned from the use of Nordstrom Visa credit cards at merchants outside of Nordstrom. Late fees were assessed when a credit card account becomes past due. We continued to recognize revenue in this manner for credit card receivables retained (employee receivables) subsequent to the close of the October 2015 credit card receivable transaction until we sold our remaining receivables in November 2017.

Credit Card Revenues, net increased $82 in 2017 reflecting our strategic partnership with TD to responsibly grow our receivables and associated revenues and a reduction in amortization expense related to the sale of the credit card portfolio. Credit Card Revenues, net decreased $83 in 2016 due to the credit card receivable transaction and the new program agreement.

Credit Expenses

Credit expenses consist of operational, bad debt and occupancy expenses.

Credit Expenses (2017 vs. 2016)

Total credit expenses increased $5 in 2017 compared with 2016 due to an increase in costs associated with the Nordstrom Rewards loyalty program.

Credit Expenses (2016vs. 2015)

Total credit expenses increased $3 in 2016 compared with 2015 primarily due to a $64 gain partially offset by $32 of expenses incurred in 2015 associated with the credit card receivables transaction and a decrease in bad debt expense subsequent to the sale of the credit card receivables in October 2015.

TOTAL COMPANY RESULTS

Interest Expense, Net

Interest expense is summarized in the following table: | | | | | | | | | |

| Fiscal year | 2023 | | 2022 | | |

| SG&A expenses | $4,855 | | $5,046 | | |

| SG&A expenses as a % of net sales | 34.2 | % | 33.4 | % | |

|

| | | | | | | | | | | |

| Fiscal year | 2017 |

|

| 2016 |

|

| 2015 |

|

| Interest on long-term debt and short-term borrowings |

| $168 |

| |

| $147 |

| |

| $153 |

|

| Less: | | | | | |

| Interest income | (5 | ) | | (1 | ) | | — |

|

| Capitalized interest | (27 | ) | | (25 | ) | | (28 | ) |

| Interest expense, net |

| $136 |

| |

| $121 |

| |

| $125 |

|

Interest Expense, Net (2017 vs. 2016)

Interest expense, net increased $15SG&A decreased $191 in 20172023, compared with 20162022, primarily due to lower variable costs, driven by lower sales and supply chain efficiency initiatives, partially offset by higher labor costs and a net interest expense$32 supply chain asset impairment and related charge. In 2022, SG&A included a supply chain technology and related asset impairment charge of $18 related$70 and a $51 gain on sale of our interest in a corporate office building. SG&A increased 70 basis points as a rate of net sales compared with 2022, primarily due to deleverage on lower sales and higher labor costs, partially offset by supply chain efficiencies.

Canada Wind-down Costs

We recognized charges associated with the $650 debt refinancing completedwind-down of Nordstrom Canada of $284 in the first quarter of 2017year ended February 3, 2024 (see Note 7: Debt and Credit Facilities2: Canada Wind-down in Item 8).

Earnings Before Interest and Income Taxes

EBIT is summarized in the following table: | | | | | | | | | |

| Fiscal year | 2023 | | 2022 | | |

| EBIT | $251 | | $465 | | |

| EBIT as a % of net sales | 1.8 | % | 3.1 | % | |

EBIT decreased $214 and 130 basis points as a rate of net sales in 2023, compared with 2022, primarily due to $284 of expenses associated with the wind-down of Canadian operations, a $32 supply chain asset impairment and related charge and lower sales, partially offset by an improved gross profit rate and supply chain efficiency initiatives. In 2022, EBIT included a supply chain technology and related asset impairment charge of $70, a $51 gain on sale of our interest in a corporate office building, and an $18 impairment charge related to costs associated with the wind-down of Trunk Club.

Interest Expense, Net (2016 vs. 2015)

Interest expense, net is summarized in the following table: | | | | | | | | | | |

| Fiscal year | 2023 | 2022 | | | |

| Interest on long-term debt and short-term borrowings | $150 | | $150 | | | |

| | | | |

| Interest income | (33) | | (10) | | | |

| Capitalized interest | (13) | | (12) | | | |

| Interest expense, net | $104 | | $128 | | | |

Interest expense, net decreased $4$24 in 20162023 compared with 2015 2022, primarily due to the defeasancean increase in interest income from higher prevailing rates.

Nordstrom, Inc. and subsidiaries31

Income Tax Expense

Income tax expense is summarized in the following table: | | | | | | | | | | |

| Fiscal year | 2023 | 2022 | | |

| Income tax expense | $13 | | $92 | | | |

| Effective tax rate | 8.6 | % | 27.2 | % | | |

|

| | | | | | | | | | | |

| Fiscal year | 2017 |

| | 2016 |

| | 2015 |

|

| Income tax expense |

| $353 |

| |

| $330 |

| |

| $376 |

|

| Effective tax rate | 44.7 | % | | 48.2 | % | | 38.6 | % |