UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

T ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20122013

or

£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to _________

Commission File Number 000-07246

PDC ENERGY, INC.

(Exact name of registrant as specified in its charter)

|

| |

| Nevada | 95-2636730 |

| (State of incorporation) | (I.R.S. Employer Identification No.) |

1775 Sherman Street, Suite 3000

Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: (303) 860-5800

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes T No £

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes £ No T

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes T No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| |

Large accelerated filer x | Accelerated filer o |

Non-accelerated filer £ (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes £ No T

The aggregate market value of our common stock held by non-affiliates on June 30, 20122013 was $735,547,9441.5 billion (based on the then closing price of $24.5251.48 per share)share as of the last business day of the fiscal quarter ending June 30, 2013).

As of February 8, 20137, 2014, there were 30,316,67035,754,597 shares of our common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

We hereby incorporate by reference into this document the information required by Part III of this Form, which will appear in our definitive proxy statement to be filed pursuant to Regulation 14A for our 20132014 Annual Meeting of Stockholders.

PDC ENERGY, INC.

20122013 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

|

| | | |

| | PART I | | Page |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | PART II | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | PART III | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | PART IV | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

PART I

REFERENCES TO THE REGISTRANT

At our annual meeting of stockholders held on June 7, 2012, the stockholders approved a change of the Company's legal name from Petroleum Development Corporation to PDC Energy, Inc. Reflecting this change, on July 16, 2012, our common stock began trading on the NASDAQ Global Select Market under the ticker symbol "PDCE." Information contained on or linked to our website, www.pdce.com, is not part of this report and is not hereby incorporated by reference and should not be considered part of this report.

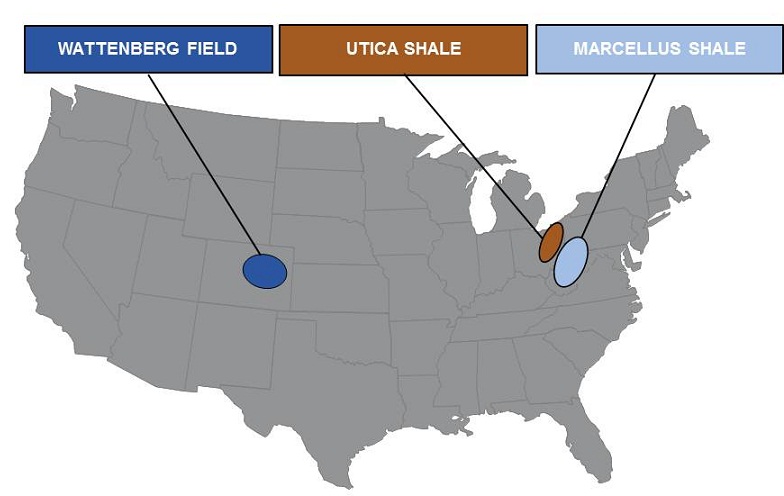

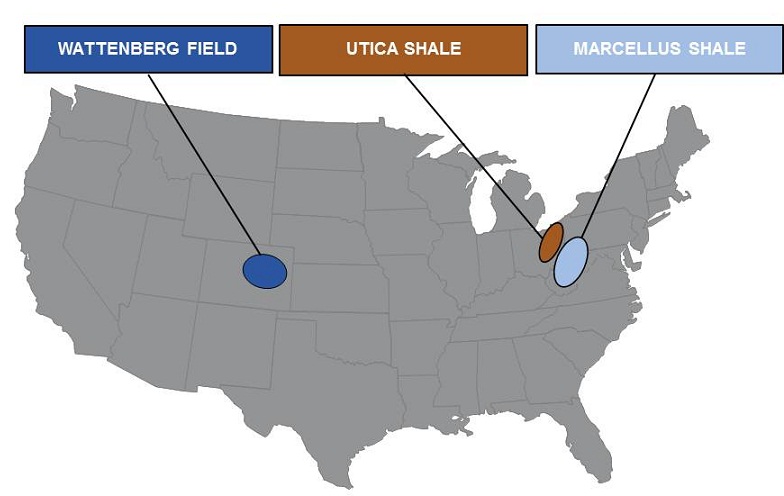

Unless the context otherwise requires, references in this report to "PDC Energy," "PDC," "the Company," "we," "us," "our,""our" or "ours" or "ourselves" refer to the registrant, PDC Energy, Inc. and all subsidiaries consolidated for the purposes of its financial statements, including our proportionate share of the financial position, results of operations, cash flows and operating activities of our affiliated partnerships and PDC Mountaineer, LLC ("PDCM"), a joint venture currently owned 50% each by PDC and Lime Rock Partners, LP, formed for the purpose of exploring and developing the Marcellus Shale formation in the Appalachian Basin.LP. Unless the context otherwise requires, references in this report to "Appalachian Basin" includesrefers to our operations in the Utica Shale in Ohio and Marcellus Shale in West Virginia and Pennsylvania, including PDC's proportionate share of our affiliated partnerships' and the PDCM's assets, results of operations, cash flows and operating activities.

See Note 1, Nature of Operations and Basis of Presentation, to our consolidated financial statements included elsewhere in this report for a description of our consolidated subsidiaries.

GLOSSARY OF UNITS OF MEASUREMENTS AND INDUSTRY TERMS

Units of measurements and industry terms are defined in the Glossary of Units of Measurements and Industry Terms, included at the end of this report, are set in boldface type the first time they appear.report.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 ("Securities Act") and Section 21E of the Securities Exchange Act of 1934 ("Exchange Act") regarding our business, financial condition, results of operations and prospects. All statements other than statements of historical facts included in and incorporated by reference into this report are "forward-looking statements" within the meaning of the safe harbor provisions of the United States ("U.S.") Private Securities Litigation Reform Act of 1995. Words such as expects, anticipates, intends, plans, believes, seeks, estimates and similar expressions or variations of such words are intended to identify forward-looking statements herein. These statements relate to, among other things: estimated crude oil, natural gas and natural gas liquids (“NGLs”(“NGLs”) and crude oil reserves;reserves; future production (including the components of such production), sales, expenses, cash flows margins and liquidity; our evaluation method of our customers' and derivative counterparties' credit risk is appropriate and consistent with those used by other market participants; anticipated capital projects, expenditures and opportunities, including drilling locations and downspacing potential;opportunities; future exploration, drilling and development activities; our drilling programs and number of locations; expected timing of additional drilling rigs in the Wattenberg Field and Utica Shale; availability of additional midstream facilities and services, in the Wattenberg Field and timing of that availability;availability and related benefits to us; availability of sufficient funding for our 2014 capital program and sources of that funding; potential for infrastructure projects to improveexpected 2014 capital budget allocations; acquisitions of additional Utica Shale acreage; expected use of the remaining net proceeds from our NGL pricing; ourAugust 2013 equity offering; the impact of high line pressures; compliance with debt covenants andcovenants; expected funding sources for conversion of our 3.25% convertible senior notes due 2016; compliance with government regulations; potential future transactions; the renewal of a letter of creditborrowing base under our revolving credit facility; adequacyimpact of litigation on our insurance; the future effectresults of contracts, policiesoperations and procedures we believe to be customary;financial position; effectiveness of our derivative program in providing a degree of price stability; our future dividend policy; closing of, and expected proceeds from, our pending asset disposition;that we do not expect to pay dividends in the foreseeable future; and our future strategies, plans and objectives.

The above statements are not the exclusive means of identifying forward-looking statements herein. Although forward-looking statements contained in this report reflect our good faith judgment, such statements can only be based on facts and factors currently known to us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, including known and unknown risks and uncertainties incidental to the exploration for, and the acquisition, development, production and marketing of crude oil, natural gas NGLs and crude oil,NGLs, and actual outcomes may differ materially from the results and outcomes discussed in the forward-looking statements.

Important factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to:

changes in worldwide production volumes and worldwide demand, including economic conditions that might impact demand;

volatility of commodity prices for crude oil, natural gas NGLs and crude oil;NGLs;

the impact of governmental policies and/or regulations, including changes in environmental and other laws, the interpretation and enforcement related to those laws and regulations, liabilities arising thereunder and the costs to comply with those laws and regulations;

potential declines in the valuesvalue of our crude oil, natural gas and crude oilNGLs properties resulting in impairments;

changes in estimates of proved reserves;

reserves;inaccuracy of reserve estimates and expected production rates;

potential for production decline rates from our wells to bebeing greater than expected;

timing and extent of our success in discovering, acquiring, developing and producing reserves;

our ability to acquiresecure leases, drilling rigs, supplies and services at reasonable prices;

timing and receipt of necessary regulatory permits;

risks incidental to the drilling and operation of natural gas and crude oil wells;

our future cash flows, liquidity and financial condition;

competition in the oil and gas industry;

availability and cost of capital to us;

reductions in the borrowing base under our revolving credit facility;

availability of sufficient pipeline, gathering and other transportation facilities and related infrastructure to process and transport our production, particularly in the Wattenberg Field and the Utica Shale, and the impact of these facilities and regional capacity on the prices we receive for our production;

timing and receipt of necessary regulatory permits;

risks incidental to the drilling and operation of crude oil and natural gas wells;

our future cash flows, liquidity and financial condition;

competition within the oil and gas industry;

availability and cost of capital;

reductions in the borrowing base under our revolving credit facility;

our success in marketing crude oil, natural gas NGLs and crude oil;NGLs;

effect of natural gas and crude oil derivatives activities;

impact of environmental events, governmental and other third-party responses to such events, and our ability to insure adequately against such events;

cost of pending or future litigation;

effect that acquisitions we may pursue have on our capital expenditures;

potential obstacles to completing our pending asset disposition or other transactions, in a timely manner or at all, and purchase price or other adjustments relating to those transactions that may be unfavorable to us;

our ability to retain or attract senior management and key technical employees; and

success of strategic plans, expectations and objectives for our future operations of the Company.operations.

Further, we urge you to carefully review and consider the cautionary statements and disclosures, specifically those under Item 1A, Risk Factors, made in this report and our other filings with the U.S. Securities and Exchange Commission ("SEC") for further information on risks and uncertainties that could affect our business, financial condition, results of operations and cash flows. We caution you not to place undue reliance on forward-looking statements, which speak only as of the date of this report. We undertake no obligation to update any forward-looking statements in order to reflect any event or circumstance occurring after the date of this report or currently unknown facts or conditions or the occurrence of unanticipated events. All forward-looking statements are qualified in their entirety by this cautionary statement.

ITEMS 1. AND 2. BUSINESS AND PROPERTIES

The Company

We are a domestic independent exploration and production company that produces, develops, acquires develops,and explores and producesfor crude oil, natural gas and NGLs and crude oil with primary operations in the Western and Eastern regions of the United States. Our Western Operating Region is primarily focused on development in the Wattenberg Field in Colorado, particularlythe Utica Shale in southeastern Ohio and the Appalachia-Marcellus Shale in northern West Virginia. Our operations in the Wattenberg Field are focused on the liquid-rich horizontal Niobrara and Codell plays. In our Eastern Operating Region, weWe are currently focused onfocusing our Ohio development activity in the liquid-rich portion of the Utica Shale play in Ohio. Weand are also pursuing horizontal development in the Marcellus Shale in northern West Virginia through our 50% joint venture interest in PDCM. We own an interest in approximately 7,2003,100 gross producing wells, and maintained an average production rateof which 249 are horizontal. Production of 135.67.4 MMcfe per dayMMboe from continuing operations for the year ended December 31, 2013 represents an increase of 35% compared to the year ended December 31, 2012, which was comprised of 65.3% natural gas, 10.2% NGLs and 24.5% crude oil. This represents production growth of 10.2% from continuing operations as compared to. For the yearmonth ended December 31, 20112013., we maintained an average production rate of 27 MBoe per day. As of December 31, 20122013, we had approximately 1.2266 TcfeMMBoe of proved reserves with a pre-tax present value of future net revenues (“PV-10”) value, whichof $2.7 billion, representing an increase of 73 MMBoe and $1.0 billion, respectively, relative to the totals as of December 31, 2012. The percentage of our proved reserves represented by crude oil and NGLs rose to 54% as of December 31, 2013, up from 48% as of December 31, 2012. PV-10 is not a financial measure under Accounting Principles Generally Accepted in the United States of America (“U.S. GAAP”), of $1.7 billion, representing growth of 141 Bcfe and $359 million, respectively, relative to the totals as of December 31, 2011. The percentage of our proved reserves represented by NGLs and crude oil rose to 48% as of December 31, 2012, up from 34% as of December 31, 2011. See Part I, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Reconciliation of Non-U.S. GAAP Financial Measures, for a definition of PV-10%PV-10 and a reconciliation of our PV-10%PV-10 value to our standardized measure.measure.

The increase in our estimated proved reserves and production is primarily attributable to liquid-richour successful horizontal Niobrara and Codell drilling activitiesprogram in the Wattenberg Field. Future development of the Wattenberg Field provides the opportunity to add further proved, probable and possible ("3P") reserves to our portfolio through continued delineation and downspacing of the horizontal Niobrara and Codell formations. Recently, we completed and are producing from our first 16 horizontal wells per section downspacing project in the Wattenberg Field. In 2013, we spudded 70 horizontal wells in the Wattenberg Field, and our June 2012 acquisition54 of certain Wattenberg Field properties and related assets from affiliates of Merit Energy (the "Merit Acquisition") for $304.6 million, after certain post-closing adjustments. The acquired assets comprise approximately 29,800 net acres, after post-closing adjustments, located almost entirely in the core Wattenberg Field with significant overlay with our existing acreage position. We believe that the Merit Acquisition should provide us with an opportunity to continue our rapid growth in the Wattenberg Field and to substantially increase our oil and NGL production. We drilled 37 horizontal Niobrara and Codell wells,which were completed, 160 refracture and recompletion projects and participated in 19 49 gross, 10.4 net, horizontal non-operated drilling projects in the Wattenberg Field in 2012.

In our Eastern Operating Region, we have acquired an estimated 45,000 net acres targeting the wet gas and crude oil windows of the Utica Shale in southeast Ohio.projects. Our year-end 20122013 proved reserves do not include reserves associated with our Utica Shale properties.properties, where we have acquired approximately 48,000 net acres. We drilled and completed twospudded 11 horizontal Utica Shale wells in 2012, both2013, nine of which are currently shut-in awaiting pipeline connections. We also drilled one vertical Utica Shale wellwere completed and completed two vertical Utica test wells in 2012 for the primary purpose of providing engineering and geological data in support of the horizontal play. In addition,connected to a gathering line. PDCM drilled three and completed sixspudded 14 horizontal Marcellus wells and constructed various midstream projects in 2012.2013, 10 of which were completed as of year-end.

The following table presents our historical proved reserve estimates as of December 31, 20122013 based on a reserve report prepared by Ryder Scott Company, L.P. (“Ryder Scott”), our independent petroleum engineering consulting firm:

|

| | | | | | | | | | | | | | |

| | Proved Reserves at December 31, 2012 | | | | | | |

| | Proved Reserves (Bcfe) | | % of Total Proved Reserves | | % Proved Developed | | % Liquids | | Proved Reserves to Production Ratio (in years) | | Production (MMcfe) |

| Western | | | | | | | | | | | |

| Wattenberg Field | 893.5 | | 77 | % | | 41 | % | | 62 | % | | 33.4 | | 26,748 |

| Other | 84.6 | | 8 | % | | 100 | % | | 1 | % | | 5.1 | | 16,672 |

| Total Western | 978.1 | | 85 | % | | 46 | % | | 56 | % | | 22.5 | | 43,420 |

| Eastern | | | | | | | | | | | |

| Appalachian Basin | 178.8 | | 15 | % | | 23 | % | | — | % | | 28.9 | | 6,192 |

| Total Eastern | 178.8 | | 15 | % | | 23 | % | | — | % | | 28.9 | | 6,192 |

| Total proved reserves | 1,156.9 | | 100 | % | | 42 | % | | 48 | % | | 23.3 | | 49,612 |

|

| | | | | | | | | | | | | | | |

| | Proved Reserves at December 31, 2013 | | | | | | |

| | Proved Reserves (MMBoe) | | % of Total Proved Reserves | | % Proved Developed | | % Liquids | | Proved Reserves to Production Ratio (in years) | | Production (MBoe) |

| | | | | | | | | | | | |

| Wattenberg Field | 212 | | 79.7 | % | | 29.7 | % | | 64.0 | % | | 35.7 | | 5,938 |

|

| Utica Shale | 14 | | 5.4 | % | | 23.8 | % | | 48.6 | % | | 63.8 | | 225 |

|

| Appalachia-Marcellus Shale | 40 | | 14.9 | % | | 23.3 | % | | — | % | | 31.2 | | 1,266 |

|

| Total proved reserves | 266 | | 100.0 | % | | 28.4 | % | | 53.6 | % | | 35.8 | | 7,430 |

|

On February 4, 2013, we entered into a purchase and sale agreement with certain affiliates of Caerus Oil and Gas LLC (“Caerus”), pursuant to which we have agreed to sell to Caerus our Piceance Basin, NECO and certain non-core Colorado oil and gas properties, leasehold mineral interests and related assets, including derivatives, for aggregate cash consideration of approximately $200 million, subject to certain adjustments. As of December 31, 2012, total estimated proved reserves related to these assets were 84.6 Bcfe. See Note 19, Subsequent Events, to our consolidated financial statements included elsewhere in this report for additional information regarding the planned divestiture. There can be no assurance we will be successful in closing such divestiture.2

In addition to our oil and gas exploration and production activities, we engage in natural gas marketing through our subsidiary Riley Natural Gas (“RNG”).

Our Strengths

Multi-year project inventory targeting highly economicin premier crude oil, natural gas and NGL production growth.NGLs plays. We have a significant operational presence in three key U.S. onshore basins and have identified a substantial inventory of approximately 4,1003,600 gross capitalhorizontal drilling projects, across our assets.as well as a substantial number of refracture and recompletion opportunities. This inventory of horizontal drilling projects includes approximately 3,300 gross2,800 projects in the liquid-rich Wattenberg Field, of which approximately 1,400 are horizontal Niobrara and Codell proved and probable locations that we expect to be capable of providing liquid-rich production growth for the next several years at attractive rates of return based on current strip prices. Potential downspacing of future drill sites would provide the opportunity for additional locations. In the core area of the Wattenberg Field, we have achieved an average of 335 MBoe gross reserves per horizontal well, with approximately 75% liquids contribution. In the Appalachian Basin, we have approximately 600 gross Marcellus Shale drilling locations in inventory, of which approximately 360 gross wells in our core focus area would be expected to generate reserves of 5 to 7 Bcfe per well. In addition, our leasehold position in the emerging Utica Shale play is expected to provide approximately 200 horizontal drilling opportunities in liquid rich areas. With the development of the horizontal Niobrara and Codell and exploration and delineation of acreageprojects in the Utica Shale we are focused on transitioning our portfolio to a higher mix of oil and NGLs that we believe is capable of delivering higher margins and improved capital efficiencies.600 projects in the Marcellus Shale.

Track record of reserve and production growth. Our proved reserves have grown from 323 Bcfe55 MMBoe at December 31, 20062008 to approximately 1.2 Tcfe266 MMBoe at December 31, 2012,2013, representing a compound annual growth rate (“CAGR”) of 23.7%37%. During the same time period, our proved crude oil and NGL reserves grew at a CAGR of 52.7%57%. Our annual production grew from 16.9 Bcfe in 2006 to 49.6 Bcfe in 2012 from continuing operations grew from 3.2 MMBoe in 2008 to 7.4 MMBoe in 2013, representing a CAGR of 19.7%18%.

Horizontal drilling and completion experience. We have a proven track record of applying technical expertise toward developing unconventional resources through horizontal drilling and completion operations, having drilled 108 Niobrara, Codell, Marcellus and Uticaor participated in 249 horizontal wells, as of including 144 horizontal wells during the year ending December 31, 2012.2013. We have beguntransitioned to multi-well pad drilling to further optimize costs and enhance horizontal drilling efficiencies. Pad drilling enables us to streamline the transition to increased well density in all our horizontal plays.

Access to liquidity.As of December 31, 2013, we had a total liquidity position of $647.0 million, comprised of $193.2 million of cash and cash equivalents and $453.8 million available for borrowing under revolving credit facilities. In August 2013, we completed a public offering of 5,175,000 shares of our common stock, at a price to us of $53.37 per share, for net proceeds of approximately $276 million, after deducting offering expenses and underwriting discounts. We expect to use the horizontal Niobrararemaining net proceeds from the offering to fund a portion of our 2014 capital program and Codell plays.for general corporate purposes. We have no near-term debt maturities and have had no draws on our revolving credit facility since June 2013.

Cash flow management through commodity derivative instruments. We actively hedge our future exposure to commodity price fluctuations by entering into oil and natural gas swaps, collars and basis protection swaps to the extent possible. As of December 31, 2013, we have hedged approximately 2,000 gross horizontal proved4,112 MBbls of our crude oil production for 2014 at a weighted-average minimum price of $89.06 per Bbl and probable locationsa weighted-average maximum price of $94.01 per Bbl. As of December 31, 2013, we have hedged approximately 20 Bcf of our natural gas production in inventory from our Wattenberg and Marcellus positions. Our current leasehold position in the emerging Utica Shale play is expected to provide approximately 200 horizontal drilling opportunities in liquid-rich areas.2014 at a weighted-average minimum price of $4.03 per Mcf.

Significant operational control in our core areas. As a result of successfully executing our strategy over time of acquiring largely concentrated acreage positions with a high working interest,, we operate and manage approximately 89%91% of our oil and natural gas properties.the wells in which we have an interest. Our high percentage of operated properties enables us to exercise a significant level of control with respect to drilling, production, operating and administrative costs, in addition to leveraging our base of technical expertise in our core operating areas.

Access to liquidity.As of December 31, 2012, we had $2.5 million of cash and cash equivalents and $396.1 million available for

borrowing under our revolving credit facility. We have no near-term debt maturities, although we periodically repay borrowings outstanding under our revolving credit facility. We actively hedge our future exposure to commodity price fluctuations by entering into oil and natural gas swaps and collars. We have hedged approximately 28.7 Bcf of our natural gas production for 2013 at an average minimum price of $4.15 per Mcf. We have hedged approximately 2,326 MBbls of our oil production in 2013 at an average minimum price of $88.75 per Bbl. As of December 31, 2012, the net fair value of all of our hedges was approximately $30.3 million.

Management experience and operational expertise. We have a management team with a proven track record of drilling performance and a technical and operational staff with significant expertise in the basins in which we operate, particularly within horizontal well developmentdrilling, completion and production activities.

Business Strategy

Our long-term business strategy focuses on generating shareholder value through the acquisition, exploration and development of crude oil and natural gas properties; we are currently focused on the organic growth of our reserves, production and cash flows in our high-value, liquid-rich horizontal drilling programs. We also engage in targeted exploratory drilling of unconventional resourcesprograms after having completed multiple transactions to restructure and maintain an active acquisition program. Wesimplify our property portfolio over the last several years. Additionally, we pursue various midstream, marketing and cost reduction initiatives designed to increase our per unit operating margins and we maintain a conservative and disciplined financial strategy focused on providing sufficient liquidity and balance sheet strength to execute our business strategy.

Drill and DevelopDevelopment drilling

Our leasehold interests consist of developed and undeveloped crude oil, natural gas and NGLs and crude oil resources located inresources. Based upon our Western and Eastern Operating Regions. Based on our priorcurrent acreage holdings, and recent acquisitions, we have identified a substantial inventory of approximately 4,1003,600 gross capital projects for horizontal development, primarily through horizontal drilling in high-return, liquid-rich plays, as well as refractureplays. We have established a capital budget of $631 million for 2014 for drilling in the Wattenberg Field and recompletion opportunities.the Utica Shale and for other miscellaneous projects. Additionally, PDCM has established a capital budget for the Marcellus Shale, of which $16 million is our proportionate share.

Western Operating RegionWattenberg Field. Our primary focus in the liquid-rich Wattenberg Field is drilling in the horizontal Niobrara and Codell plays. We have beguntransitioned to multi-well pad drilling to further optimize costs and enhance horizontal drilling efficiencies in the Wattenberg Field. Pad drilling enables us to streamline the transition to increased well density in the horizontal Niobrara and Codell plays. We also maintain a vertical drilling inventory in the Niobrara and Codell formations. We currently estimate that we have 3,300 gross capital projects, which include over 1,400 gross proved and probable projects for the horizontal Niobrara and Codell.field. Depending upon commodity prices and the number of drilling rigs operating, we believe that thisour inventory of approximately 2,800 gross 3P horizontal projects in the field, together with refracturing and vertical Codell well opportunities, provides us with over 1020 years of drilling activity.

Of Approximately $467 million of our total2014 capital budget of $324 million for 2013, approximately 75%, or $245 million, is expected to be spent on development activities substantially allin the field, the majority of which is expected to be invested in the Wattenberg Field for an expanded horizontal Niobrara and Codell drilling program and participation in various non-operated projects.program. We plan to run a two-rigfour-rig program in the Wattenberg Field through the secondfirst quarter of the year2014 and add a thirdfifth drilling rig during the thirdsecond quarter. Under thisApproximately $100 million of the total Wattenberg Field capital budget is allocated for non-operated horizontal drilling program, weprojects. We expect to drill and operate approximately 63115 horizontal Niobrara or Codell wells and expect to participate in 2013.approximately

Additionally, we operate natural gas assets75 to 100 non-operated horizontal opportunities in the Piceance Basin in western Colorado and in northeast Colorado ("NECO"), where we focused on production optimization and increasing operating margins in 2012. On February 4, 2013, we entered into a purchase and sale agreement with certain affiliates of Caerus, pursuant to which we have agreed to sell our Piceance Basin, NECO and certain non-core Colorado oil and gas properties, leasehold mineral interests and related assets, including derivatives. See Note 19, Subsequent Events, to our consolidated financial statements included elsewhere in this report for additional information regarding the planned divestiture. There can be no assurance we will be successful in closing such divestiture.2014.

Eastern Operating RegionUtica Shale. We continue to delineate and develop our leasehold position in the Utica Shale. To date, we have drilled two vertical test wells to collect geologic data and two horizontal wells to test the productivity of the acreage. We currently estimate that we have approximately 200 gross projects for horizontal drilling in the Utica Shale.Shale and have spudded 13 horizontal wells through December 31, 2013. We are currently running a one-rig program in the Utica Shale and plan on adding a second drilling rig during the second half of 2014. In 2013,2014, we expect to devote approximately $53$162 million of our 20132014 capital program primarily toward drilling and completion activity and acquisition of additional acreage in the Utica Shale, where weShale. We plan to drill approximately five18 horizontal wells targeting the wet gas and crude oilcondensate windows of the play.play in 2014.

Our other focus in the Eastern Operating Region is onAppalachia-Marcellus Shale. In 2013, PDCM drilled 14 gross (7 net) and completed 10 gross (5 net) horizontal drillingwells in the Marcellus Shale in West Virginia. In 2012, PDCM completed a total of six gross (three net) horizontal wells and constructed various midstream assets to gather and compress its Marcellus gas. We currently estimate that we have approximately 600 gross projects for horizontal drilling in the Marcellus Shale. PDCM has elected to temporarily suspend drilling activities in the Marcellus Shale. In 2014, PDCM currently expects to drill a totalfocus on completion operations on the remaining four horizontal wells that were in-process as of 14 gross horizontal Marcellus wells in 2013.December 31, 2013 and on the continued development of midstream infrastructure.

Strategically acquireStrategic acquisitions

We typically pursue the acquisition of assets that have a balance of value in producing wells, behind-pipe reserves and high-quality undeveloped drilling locations. In 2010, we began seekingWe seek liquid-rich properties with large undeveloped drilling upside where we believe we can utilize our operational abilities to add shareholder value. We have an experienced team of management, engineering, geosciences and geosciencescommercial professionals who identify and evaluate acquisition opportunities.

Wattenberg Field. In June 2012, we completed theacquired certain assets from affiliates of Merit AcquisitionEnergy (the "Merit Acquisition") for an aggregate purchase price of approximately $304.6 million, after certain post-closing adjustments. We financed the purchase with cash from the May 2012 offering of our common stock and a draw on our revolving credit

facility.. The acquired assets comprise approximately 29,80030,000 net acres after post-closing adjustments, located almost entirely in the core Wattenberg Field and with significant overlay within close proximity to our existingthen-existing acreage position. Following the closing of the Merit Acquisition, our total position in the core Wattenberg Field is now approximately 98,60097,000 net acres.

DuringUtica Shale. Since 2011, and 2012, we have acquired approximately 45,00048,000 net acres of Utica leaseholds, targeting the crude oil and wet natural gas and crude oil windows of the Utica Shale play throughout southeastern Ohio, for a purchase price of approximately $92.3 million.Ohio. As an early entrant into the development of the Utica Shale, we believe we have gained valuable experience and expertise in proactively addressing title and other issues associated with the development of the play.

Appalachia-Marcellus Shale. In October 2011, PDCM acquired 100% of the membership interests of Seneca-Upshur Petroleum, LLC ("Seneca-Upshur”) from an unrelated third-party for $139.2 million, of which our proportionate share was $69.6 million. The acquisition included approximately 1,340 gross wells producing natural gas from the shallow Upper Devonian Shale and Mississippian formationsformation and all rights and depths to an estimated 100,000 net acres in West Virginia, of which 90,000 acres are prospective for the Marcellus Shale.

Strategic divestitures

We continue to seek ways to optimize our asset portfolio as part of our business strategy. This may include divesting lower return assets and reinvesting in our stronger economic inventory. As a result, we have divested several assets over the past few years.

Colorado Dry Gas Assets. In June 2013, we completed the sale of our non-core Colorado dry gas assets, primarily natural gas producing properties located in the Piceance Basin, northeastern Colorado and other non-core areas, to certain affiliates of Caerus Oil and Gas LLC (“Caerus”) for consideration of $177.6 million, with an additional $17 million paid to our non-affiliated investor partners in our affiliated partnerships. The sale resulted in a pre-tax loss of $2.3 million. The proceeds from the asset disposal were used to pay down our revolving credit facility and to fund a portion of our 2013 capital budget.

Appalachian Shallow Upper Devonian Gas Assets. In October 2013, we executed a purchase and sale agreement for the sale of substantially all our shallow Upper Devonian (non-Marcellus Shale) Appalachian Basin crude oil and natural gas properties owned directly by us, as well as through our proportionate share of PDCM. The properties consisted of approximately 3,500 gross shallow producing wells, related facilities and associated leasehold acreage, limited to the Upper Devonian and shallower formations. Substantially all of the acreage acquired is held by production and isdivestiture closed in close proximity to PDCM's existing properties. Pursuant toDecember 2013 for aggregate consideration of approximately $20.6 million, of which our joint venture interest in PDCM, our portionshare of the purchase priceproceeds was approximately $69.65.1 million, subject to certain post-closing adjustments. Concurrent with the closing of the transaction, our $6.7 million irrevocable standby letter of credit and we hold a 50% interest in bothan agreement for firm transportation services were released and novated to the wellsbuyer. We retained all zones, formations and acreage acquired.intervals below the Upper Devonian formation, including the Marcellus Shale, Utica Shale and Huron Shale, as well as all Marcellus-related midstream assets.

In 2010,Permian Basin. During the fourth quarter of 2011, we initiated a plan to purchase our affiliated partnerships. Ascompleted the sale of December 31, 2012, we had acquiredcertain non-core Permian assets for a total of 12 affiliated partnerships for an aggregate purchase price of $107.713.2 million. The acquisitionIn December 2011, we executed a purchase and sale agreement with a subsidiary of these partnerships have provided us with immediate growthConcho Resources Inc. (“COG”), for the sale of our remaining Permian Basin assets and closed the transaction in both production and proved reserves from assets in which we currently own an operated working interest.February 2012. Total proceeds received were $189.2 million.

Manage operationalOperational and financial risk management

We focus on horizontal development drilling programs in resource plays that offer repeatable results capable of driving growth in reserves, production and cash flows. We regularlyperiodically review acquisition opportunities in our core areas of operation as we believe we can extract additional value from such assets through production optimization, refractures andrefracturing, recompletions and development drilling. In addition, core

acquisitions can potentially provide synergies that result in economies of scale from a combined position. While we believe development drilling will remain the foundation of our capital programs, we expect to continue our disciplined approach to acquisitions and exploratory drilling, both of which have the potential to identify new development opportunities.drilling.

We believe we proactively employ strategies to help reduce the financial risks associated with the oil and gasour industry. One such strategy is to maintain a balanced production mix of liquids and natural gas. During 2013, we produced crude oil, natural gas and liquids. Our Western Operating Region produces natural gas, NGLs and crude oil, with a production mix of approximately 60.5%53% liquids and 47% natural gas to 39.5% liquids during 2012. We expect that the Merit Acquisition and our horizontal drilling program will allow us to substantially increase our crude oil and NGL production. While our legacy properties in the Eastern Operating Region primarily produce natural gas, our Ohio properties are prospective in the wet gas and crude oil windows of the Utica Shale.gas. This strategy of a diversified commodity mix helps to mitigate the financial impact from a decline in the market price inof any one of our commodities. In addition, we utilize commodity-based derivative instruments to manage a substantial portion of our exposure to price volatility with regard to our crude oil and natural gas and crude oil sales and natural gas marketing. As of December 31, 2012,2013, we had natural gas and crude oil derivative positions in place for 20132014 covering approximately 28.7 Bcfe of our natural gas production and approximately 2,3264,112 MBbls of our crude oil production and approximately 20 Bcf of our natural gas production. Currently, we do not hedge our NGL production. See Part II, Item 7A, Quantitative and Qualitative Disclosures aboutAbout Market Risk, for a detailed summary of our open derivative positions.

Selective exploration

We believe that ourHistorically, we have pursued a disciplined exploration program has the potentialintended to consistently replenish our portfolio with new exploration projects capable of positioningand to position us for significant production and reserve growth in future years. Due to the continued decline in natural gas prices, weOur efforts have focused our efforts towardon liquid-rich plays to take advantage of the current attractive economics associated with crude oil and NGL weightedNGL-weighted projects. We strivehave attempted to identify potential plays in their early stages in an attemptorder to accumulate significant leasehold positions prior to competitive forces driving up the cost of entry. We seek investmententry and to invest in leasehold positions that arewere in the proximity of existing or emerging pipeline infrastructures. We believe the leasehold we acquired targeting themidstream infrastructure. The Utica Shale meets these criteria and we see the derisking and delineation of this leasehold aswas our primary exploration focus during for 2013.the past few years. Our operations in the Utica Shale have now shifted to developmental drilling and delineation. We do not expect significant exploration activity in 2014, as our main focus is expected to be on organic growth through developmental drilling.

Business Segments

We divide our operating activities into two segments: (1) Oil and Gas Exploration and Production and (2) Gas Marketing.

Oil and Gas Exploration and Production

Our Oil and Gas Exploration and Production segment primarily reflects revenues and expenses from the production and sale of crude oil, natural gas and NGLs. The prices we receive for our crude oil, natural gas and NGLs vary based on the terms of applicable purchase contracts.

Crude oil. We do not refine any of our crude oil production. In the Wattenberg Field, crude oil is sold at each individual well site and transported by the purchasers via truck, pipeline or rail to local and non-local markets under various purchase contracts with monthly pricing provisions based on a differential to the average monthly NYMEX price. In the Utica Shale, crude oil.oil and condensate is sold to local purchasers at each individual well site based on a differential to the average monthly NYMEX price and is typically transported by the purchasers via truck to local refineries, rail facilities or barge loading terminals on the Ohio River. We currently have no long-term firm transportation agreements related to our crude oil production.

Natural gas. We primarily sell our natural gas to midstream service providers, marketers, utilities, industrial end-users and other wholesale purchasers. We generally sell the natural gas that we produce under contracts with indexed or NYMEX monthly pricing provisions, with the remaining production sold under contracts with daily pricing provisions. Virtually all of our contracts include provisions whereinwhereby prices change monthly with changes in the market, for whichwith certain adjustments that may be made based on whether a well delivers

to a gathering or transmission line and the quality of the natural gas. Therefore, the price of the natural gas fluctuates to remain competitive with other available natural gas supplies. AsIn certain instances, we enter into firm transportation, processing and sales agreements to provide for pipeline capacity to flow and sell a result, our revenues from the sale of natural gas, holding production volume constant, increase as market prices increase and decrease as market prices decline. We believe that the pricing provisionsportion of our natural gas contractsvolumes. In some cases, in order to meet pipeline specifications, our natural gas must be processed before we can transport it. We also have interruptible transportation agreements in place in certain areas where adequate transportation capacity is believed to be available. We may also enter into firm sales agreements to ensure that we are customaryselling to a purchaser who has contracted for pipeline capacity. See Note 11, Commitments and Contingencies - Firm Transportation, Processing and Sales Agreements, to our consolidated financial statements included elsewhere in this report for a discussion of our long-term firm sales, processing and transportation agreements for pipeline capacity. In the Wattenberg Field, the majority of our leasehold is dedicated to our primary midstream provider, DCP Midstream, which gathers and processes wet natural gas produced in the industry.basin and sells our residue gas to various markets. In the Utica Shale, wet natural gas produced in our northern acreage is gathered and processed pursuant to a firm transportation agreement with Markwest Utica EMG while wet natural gas produced in our southern acreage is gathered and processed by Blue Racer Midstream LLC. We market our Utica residue gas to various purchasers based on pipeline basis or NYMEX pricing. In the Appalachia-Marcellus Shale, our dry natural gas is gathered and transported to a market hub pursuant to a firm transportation agreement with Equitrans LP and an interruptible agreement with Momentum. We sell the dry natural gas to various marketers at a price primarily based on spot gas delivered to the Texas Eastern Transmission pipeline M-2 point, less transportation costs.

NGLs. TheWe produce NGLs in the Wattenberg Field and Utica Shale. In the Wattenberg Field, the majority of our NGLs are sold at the tailgate of DCP Midstream processing plants based on prices of NGL deliveries to one NGL marketerthe Conway hub in Kansas. In the Wattenberg Field.Utica Shale, the majority of our NGLs are fractionated and marketed by Markwest Utica EMG and Blue Racer Midstream LLC and

sold based on month-to-month pricing in various markets. Our NGL production is sold under both short- and long-term purchase contracts with monthly pricing provisions based on an average daily price.

Crude oil. We do not refine any of our crude oil production. We sell our crude oil to oil marketers and refiners. Our crude oil production is sold to purchasers at or near our wells under both short- and long-term purchase contracts with monthly pricing provisions based on an average daily price.

contracts.

We enter into financial derivatives in order to reduce the impact of possible price volatility regarding the physical sales market. See Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations: Results of Operations - Commodity Price Risk Management, Net, Natural Gas and Crude Oil Derivative Activities, Item 7A, Quantitative and Qualitative Disclosures about Market Risk, and and Note 4, Derivative Financial Instruments, to our consolidated financial statements included elsewhere in this report.

Our Oil and Gas Exploration and Production segment also reflects revenues and expenses related to well operations and pipeline services. We are paid a monthly operating fee for the portion of each well we operate that is owned by others, including our affiliated partnerships. We believe the fee is competitive with rates charged by other operators in the area. As we acquire the working interest of our non-affiliated investor partners in our affiliated partnerships, revenues related to well operations and pipeline services will decrease.

We construct, own and operate gathering systems in some of our areas ofAppalachia-Marcellus Shale operations. Pipelines and related facilities can represent a significant portion of the capital costs of developing wells, particularly in new areas located at a distance from existing pipelines. We consider these costs in the evaluation of our leasing, development and acquisition opportunities.

Our natural gas is transported through our own and third-party gathering systems and pipelines and we incur gathering, processing and transportation expenses to move our natural gas from the wellhead to a purchaser-specified delivery point. These expenses vary based upon the volume and distance shipped, as well as the fee charged by the third-party processor or transporter. Like most producers, we rely on our third-party midstream service providers to construct compression, gathering and processing facilities to keep pace with our production growth. As a result, the timing and availability of additional facilities going forward is beyond our control. Capacity on these gathering systems and pipelines is occasionally interruptedreduced due to operational issues, repairs or improvements. A portion of our natural gas is transported under interruptible contracts and the remainder under firm transportation agreements, either directly with RNGour subsidiary Riley Natural Gas ("RNG"), or through third-party processors or marketers. Therefore, interruptions in natural gas sales could result if pipeline space is constrained. As discussed in Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations - Operational Overview, our 2012Our Wattenberg Field production was adversely affectedimpacted by high line pressures experiencedon the gathering system operated by our principal third-party providerDCP Midstream during the spring and summer months of natural gas gathering, processing2012 and transportation facilities2013. We, and other operators in the Wattenberg Field. The high line pressure was the result of a series of operational issues and capacity constraints, primarily in the second and third quarters. The operational issues included downtime on downstream third-party NGL transportation and fractionation facilities and abnormally warm weather, which limited third-party gathering system compression capacity. Wefield, are working closely with our primary midstream provider whoDCP Midstream in the Wattenberg Field, which is implementing a multi-year facility expansion capableprogram. The program is increasing midstream system capacity and helping to mitigate the impact of significantly increasing long-termincreased production volumes on system pressures. Although we expect system pressures to fluctuate and constrain production from time to time, we believe that this expansion will provide the additional gathering and processing capacity in the Wattenberg Field. However, we do not expect the impact of this increased capacitysystem necessary to substantially benefit us until late 2013. Whileincrease our ability to market these volumes of natural gas has been only infrequently limited or delayed, if transportation space is restricted or is unavailable, our production and cash flows from the affected properties could be adversely affected.

In certain instances, we enter into firm transportation agreements to provide for pipeline capacity to flow and sell a portion of our natural gas volumes. In order to meet pipeline specifications, we are required, in some cases, to process our natural gas beforeconfidence that we can transport it. We typically contract with third parties in the NECO area ofcontinue to produce and market our Western Operating Region and our Eastern Operating Region for firm transportation of our natural gas. We also may enter into firm sales agreements to ensure that we are selling to a purchaser who has contracted for pipeline capacity. See Note 11, Commitments and Contingencies - Firm Transportation Agreements, to our consolidated financial statements included elsewhere in this report for our long-term firm sales, processing and transportation agreements for pipeline capacity.

Our crude oil production is marketed directly to purchasers in the Wattenberg Field area under a combination of annual and short-term monthly agreements. The majority of our crude oil is delivered to local area refineries with other volumes being either trucked or shipped via pipeline out of the Wattenberg area.production.

See Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations - Results of Operations, Summary Operating Results, for production, sales, pricespricing and lifting cost data for each of the years in the three-year period ended December 31, 2012.data.

Gas Marketing

Our Gas Marketing segment is comprised solely of the operating activities of RNG. RNG specializes in the purchase, aggregation and sale of natural gas production in the Eastern Operating Region.Utica Shale and Appalachia-Marcellus Shale. RNG purchases for resale natural gas produced by third-party producers, as well as natural gas produced by us PDCM and our affiliated partnerships.PDCM. The natural gas is marketed to third-party marketers, natural gas utilities and industrial and commercial customers, either directly through our gathering system or through transportation services provided by regulated interstateinterstate/intrastate pipeline companies. Additionally, RNG markets our natural gas production in the NECO area.

For additional information regarding our business segments, see Note 18,17, Business Segments, to our consolidated financial statements included elsewhere in this report.

Areas of Operations

The following map presents the general locations of our development production and explorationproduction activities as of December 31, 2012. With the divestiture of our Permian Basin assets on February 28, 2012, our development, production and exploration efforts are primarily focused in two geographic areas of the U.S.

___________

(1) 2013On February 4, 2013, we entered into a purchase and sale agreement with certain affiliates of Caerus, pursuant to which we have agreed to sell our Piceance Basin, NECO and certain non-core Colorado oil and gas properties, leasehold mineral interests and related assets, including derivatives. See Note 19, Subsequent Events, to our consolidated financial statements included elsewhere in this report for additional information regarding the planned divestiture. There can be no assurance we will be successful in closing such divestiture..

Western Operating Region

Our primary focus in the Western Operating Region for 2013, and we expect for the next several years, is on horizontal Niobrara and Codell development drilling. We divide our Western Operating Region into the following areas:

Wattenberg Field area, DJ Basin, Colorado. Currently, horizontal wells drilled in this area are horizontal wells targetingtarget the liquid-rich reservoirs in the Codell and Niobrara formations.formations where we have acquired approximately 97,000 net acres. These horizontal wells have a vertical depth rangeranging from approximately 7,0006,500 to 8,0007,500 feet, with an average lateral lengthlengths of approximately 4,000 feet. We drill multi-well pads to further optimize costs and enhance horizontal drilling efficiencies in the Wattenberg Field.5,000 feet. Pad drilling enables us to streamline the transition to increased well density in the horizontal Niobrara and Codell plays.plays and optimize costs. We currently estimate that we have approximately 3,3002,800 gross projects, including over 1,400 proved and probable horizontal capital projects in the liquid-rich Wattenberg Field.Field in inventory, as well as other refracture and vertical Codell well opportunities.

In June 2012, we completed an acquisition of approximately 29,800 net acres in the core area, which positions us as the third largest producer and leaseholder in the core Wattenberg area. We estimate that the Wattenberg Field has approximately 400 horizontal drilling locations based on 4 gross wells per section for our proved undeveloped reserves ("PUDs"). Additional potential upside exists as we continue testing the Codell formation and plan to test downspacing to 10 gross wells per section in the play as part of our 2013 horizontal program, which is the basis for our estimate of over 1,400 horizontal wells in our proved and probable inventory.

Piceance Basin, Colorado. Wells in thisUtica Shale area, predominately target natural gas from the Williams Fork formation. For 2012, we removed all PUD reserves in the Piceance Basin due to low natural gas prices. Our 2012 Piceance natural gas reserves were 66.5 Bcfe, or approximately 6% of our total proved equivalent reserves. Our Piceance reserves represent approximately 2% of our

PV-10% as of December 31, 2012. See table in the Properties - Proved Reserves section below for information regarding our proved reserves and PV-10% as of December 31, 2012.

The majority of the wells drilled in this area are drilled directionally from multi-well drilling pads, generally range from two to ten wells per pad and range from 7,000 to 9,500 feet in depth. Reserves in this area originate from multiple sandstone reservoirs in the Mesaverde Williams Fork formation. Well spacing is approximately ten acres per well.

Northeastern Colorado.southeastern Ohio. Wells drilled in this area range from 1,500 to 3,000 feet in depth andprimarily target natural gas reserves in the shallow Niobrara reservoir. Well spacing is approximately 40 acres per well.

As noted above, on February 4, 2013, we entered into a purchase and sale agreement with Caerus pursuant to which Caerus agreed to purchase our Piceance Basin, NECO and other non-core Colorado leasehold mineral interests and various other assets within these basins for an aggregate cash considerationPoint Pleasant member of approximately $200 million, subject to post-closing adjustments. The cash consideration is subject to customary adjustments, including adjustments based upon title and environmental due diligence, and by certain firm transportation obligations and natural gas hedging positions that will be assumed by Caerus as part of the transaction. The effective date of the transaction is January 1, 2013. We intend to use the proceeds from the sale to repay a portion of amounts outstanding under our revolving credit facility and partially fund our 2013 capital program. There can be no assurance we will be successful in closing such divestiture.

Eastern Operating Region

Our primary focus in the Eastern Operating Region is on horizontal drilling in the Utica Shale in southeastern Ohio and the Marcellus Shale play in northern West Virginia.

Utica Shale, Ohio. formation. We have acquired approximately 45,00048,000 net acres targeting the condensate and wet natural gas and crude oil windows of the Utica Shale play throughout southeastern Ohio. To date,Ohio and we currently estimate that we have drilled and completed twoapproximately 200 gross projects for horizontal wellsdrilling in Guernsey County that are currently waiting on first production, as well as two stratigraphic vertical test wells to collect engineering and geologic data to test the productivity of the acreage.Utica Shale. The horizontal wells have a vertical depth rangeranging from approximately 7,000 to 8,000 feet, with lateral lengths of approximately 7,000 feet, with an average lateral length of 4,000 to 7,500 feet.

MarcellusAppalachia-Marcellus Shale area, West Virginia. Through our joint venture,Wells drilled in this area are primarily horizontal wells targeting the Marcellus Shale. PDCM we have over 236,000has approximately 66,000 net acres in the Appalachian Basin, with approximately 152,000 acres prospective for the Marcellus Shale, the majority of which is in northern West Virginia.Shale. PDCM is primarily focused on horizontal drilling and has approximately 600 gross Marcellus Shale gross drilling locations on the West Virginia acreage. These horizontal wells have a vertical depth rangeranging from approximately 7,000 to 8,000 feet, with lateral lengths ranging fromof approximately 4,000 to 6,0006,500 feet.

In additionDecember 2013, PDCM closed on a transaction pursuant to our ownership interest inwhich substantially all of the wells held by PDCM, we own an interest in approximately 236 gross (77.9 net) natural gas and crude oil wells in West Virginia and Pennsylvania.producing from the shallow Upper Devonian Shale formation (non-Marcellus Shale) were sold.

Properties

Productive Wells

The following table presents our productive wells:wells:

|

| | | | | | | | | | | | | | | | | | |

| | | Productive Wells |

| | | As of December 31, 2012 |

| | | Natural Gas | | Crude Oil | | Total |

| Operating Region/Area | | Gross | | Net | | Gross | | Net | | Gross | | Net |

| Western | | | | | | | | | | | | |

| Wattenberg Field | | 2,523 |

| | 2,181.2 |

| | 91 |

| | 71.8 |

| | 2,614 |

| | 2,253.0 |

|

| Other | | 1,057 |

| | 800.7 |

| | — |

| | — |

| | 1,057 |

| | 800.7 |

|

| Total Western | | 3,580 |

| | 2,981.9 |

| | 91 |

| | 71.8 |

| | 3,671 |

| | 3,053.7 |

|

| Eastern | | | | | | | | | | | | |

| Appalachian Basin | | 3,565 |

| | 1,654.5 |

| | 6 |

| | 3.7 |

| | 3,571 |

| | 1,658.2 |

|

| Total Eastern | | 3,565 |

| | 1,654.5 |

| | 6 |

| | 3.7 |

| | 3,571 |

| | 1,658.2 |

|

| Total productive wells | | 7,145 |

| | 4,636.4 |

| | 97 |

| | 75.5 |

| | 7,242 |

| | 4,711.9 |

|

| | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | |

| | | Productive Wells |

| | | As of December 31, 2013 |

| | | Crude Oil | | Natural Gas | | Total |

| Operating Region/Area | | Gross | | Net | | Gross | | Net | | Gross | | Net |

| Wattenberg Field | | 207 |

| | 138.1 |

| | 2,497 |

| | 2,156.7 |

| | 2,704 |

| | 2,294.8 |

|

| Utica Shale | | 10 |

| | 7.7 |

| | 3 |

| | 3.0 |

| | 13 |

| | 10.7 |

|

| Appalachia-Marcellus Shale | | — |

| | — |

| | 374 |

| | 140.5 |

| | 374 |

| | 140.5 |

|

| Total productive wells | | 217 |

| | 145.8 |

| | 2,874 |

| | 2,300.2 |

| | 3,091 |

| | 2,446.0 |

|

| | | | | | | | | | | | | |

Proved Reserves

Our proved reserves are sensitive to future crude oil, natural gas NGLs and crude oilNGLs sales prices and the related effect on the economic productive life of producing properties. Increases in commodity prices may result in a longer economic productive life of a property or result in recognition of more economically viable proved undeveloped reserves to be recognized.reserves. Decreases in commodity prices may result in negative impacts of this nature.

All of our proved reserves are located onshore in the U.S. Our proved reserve estimates are prepared with respect to reserve categorization, using the definitions for proved reserves set forth in SEC Regulation S-X, Rule 4-10(a) and subsequentapplicable SEC staff regulations, interpretations and guidance. As of December 31, 2012,2013, all of our proved reserves, including the reserves of all subsidiaries consolidated for the purposes of our financial statements, have been estimated by independent petroleum engineers.Ryder Scott.

We have a comprehensive process that governs the determination and reporting of our proved reserves. As part of our internal control process, our reserves are reviewed annually by an internal team composed of reservoir engineers, geologists and accounting personnel for adherence to SEC guidelines through a detailed review of land records, available geological and reservoir data, as well as production performance data. The process includes a review of applicable working and net revenue interests and cost and performance data. The internal team compiles the reviewed data and forwards the data to anthe independent engineering firm engaged to estimate our reserves.

Our proved reserve estimates as of December 31, 20122013 were based on a reserve report prepared by Ryder Scott. When preparing our reserve estimates, Ryder Scott did not independently verify the accuracy and completeness of information and data furnished by us with respect to ownership interests, production volumes, well test data, historical costs of operations and development, product prices or any agreements relating to current and future operations of properties and sales of production.

Ryder Scott prepares an estimate of our reserves in conjunction with an ongoing review by our engineers. A final comparison of data is performed to ensure that the reserve estimates are complete, determined bypursuant to acceptable industry methods and towith a level of detail we deem appropriate. Ryder Scott'sThe final estimated reserve report is reviewed and approved by our engineering staff and management.management prior to issuance by Ryder Scott.

The professional qualifications of the internal lead engineer primarily responsible for overseeing the preparation of our reserve estimates meetqualify the standards ofengineer as a Reserves Estimator, as defined in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information as promulgated by the Society of Petroleum Engineers. This position is currently being held by an employee who holds a Bachelor of Science degree in Petroleum and Chemical Refining Engineering with a minor in Petroleum Engineering, has over 3536 years of experience in reservoir engineering, is a member of the Society of Petroleum Engineers and the Society of Petroleum Evaluation Engineers and is a registered Professional Engineer in the State of Colorado.

The SEC's reserve rulesrule has expanded the technologies that a registrant may use to establish reserves. The SEC now allows use of techniques that have been proved effective by actual production from projects in the same reservoir or an analogous reservoir, or by other evidence using reliable technology that establishes reasonable certainty. Reliable technology is a grouping of one or more technologies (including computational methods) that has been field tested and has been demonstrated to provide reasonably certain results with consistency and repeatability in the formation being evaluated or in an analogous formation.

All of our proved undeveloped reserves conform to the SEC five-year rule requirement as all proved undeveloped locations are scheduled, according to an adopted development plan, to be drilled within five years of each location’s initial booking date.

We used a combination of production and pressure performance, wireline wellbore measurements, offset analogies, seismic data and interpretation, wireline formation tests, geophysical logs and core data to calculate our reserve estimates, including the material additions to the 20122013 reserve estimates.

Reserve estimates involve judgments and therefore, cannot be measured exactly. The estimates must be reviewed periodically and adjusted to reflect additional information gained from reservoir performance, new geological and geophysical data and economic changes. Neither the estimated future net cash flows nor the standardized measure of discounted future net cash flows ("standardized measure") is intended to represent the current market value of our proved reserves. For additional information regarding both of these measures, as well as other information regarding our proved reserves, see the unaudited Supplemental Information - Crude Oil and Natural Gas and Crude Oil Information provided with our consolidated financial statements included elsewhere in this report. The following tables provide information regarding our estimated proved reserves:

|

| | | | | | | | | | | |

| | As of December 31, |

| | 2012 (5) | | 2011 (4)(5) | | 2010 (4)(5) |

| Proved reserves | | | | | |

Natural gas (MMcf) | 604,038 |

| | 672,145 |

| | 657,306 |

|

Crude oil and condensate (MBbls) (1) | 59,310 |

| | 37,636 |

| | 23,236 |

|

NGLs (MBbls) (1) | 32,827 |

| | 19,588 |

| | 10,649 |

|

Total proved reserves (MMcfe) | 1,156,860 |

| | 1,015,489 |

| | 860,616 |

|

Proved developed reserves (MMcfe) (2) | 490,515 |

| | 471,347 |

| | 301,141 |

|

Estimated future net cash flows (in millions) | $ | 2,756 |

| | $ | 2,290 |

| | $ | 1,315 |

|

PV-10% (in millions) (3) | $ | 1,709 |

| | $ | 1,350 |

| | $ | 693 |

|

Standardized measure (in millions) | $ | 1,168 |

| | $ | 941 |

| | $ | 488 |

|

|

| | | | | | | | | | | |

| | As of December 31, |

| | 2013 | | 2012 (3)(4) | | 2011 (3)(4)(5) |

| Proved reserves | | | | | |

Crude oil and condensate (MMBbls) | 94 |

| | 59 |

| | 38 |

|

Natural gas (Bcf) | 740 |

| | 604 |

| | 672 |

|

NGLs (MMBbls) | 49 |

| | 33 |

| | 20 |

|

Total proved reserves (MMBoe) | 266 |

| | 193 |

| | 169 |

|

Proved developed reserves (MMBoe) | 76 |

| | 82 |

| | 79 |

|

Estimated future net cash flows (in millions) (1) | $ | 4,323 |

| | $ | 2,756 |

| | $ | 2,290 |

|

PV-10 (in millions) (2) | $ | 2,704 |

| | $ | 1,709 |

| | $ | 1,350 |

|

Standardized measure (in millions) | $ | 1,782 |

| | $ | 1,168 |

| | $ | 941 |

|

___________

| |

| (1) | Approximately 49%Amount represents undiscounted pre-tax future net cash flows estimated by Ryder Scott of the increase in crude oilapproximately $6.4 billion, $4.0 billion and condensate and 38%$3.2 billion as of the increase in NGLs from December 31, 2013, 2012 and 2011, to December 31, 2012 is due to the additionrespectively, less an internally estimated future income tax expense of horizontal Niobraraapproximately $2.1 billion, $1.2 billion and Codell proved developed and undeveloped reserves in the Wattenberg Field.

$0.9 billion, respectively. |

| |

| (2) | Approximately 73% of the increase in proved developed reserves from December 31, 2010 to December 31, 2011 was due to the reclassification of our estimated Wattenberg refracture reserves from PUDs to proved developed as a result of the greater cost differential between the cost of a refracture versus the cost of drilling a new well. |

| |

(3) | PV-10%PV-10 is a non-U.S. GAAP financial measure. This non-U.S. GAAP measures is not a measure of financial or operating performance under U.S. GAAP and it is not intended to represent the current market value of our estimated reserves. PV-10%PV-10 should not be considered in isolation or as a substitute for the standardized measure reported in accordance with U.S. GAAP, but rather should be considered in addition to the standardized measure. See Part I, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Reconciliation of Non-U.S. GAAP Financial Measures, for a definition of PV-10%PV-10 and a reconciliation of our PV-10%PV-10 value to the standardized measure. |

| |

| (3) | Includes estimated reserve data related to our Piceance and NECO assets which were divested in June 2013. See Note 14, Assets Held for Sale, Divestitures and Discontinued Operations, to our consolidated financial statements included elsewhere in this report for additional details related to the divestiture of our Piceance and NECO assets. |

The following table sets forth information regarding estimated proved reserves for our Piceance and NECO assets:

|

| | | | | | | |

| | As of December 31, |

| | 2012 | | 2011 |

| Proved reserves | | | |

Crude oil and condensate (MMBbls) | 0.1 |

| | 0.4 |

|

Natural gas (Bcf) | 84 |

| | 354 |

|

Total proved reserves (MMBoe) | 14 |

| | 59 |

|

Proved developed reserves (MMBoe) | 14 |

| | 24 |

|

Estimated future net cash flows (in millions) | $ | 43 |

| | $ | 32 |

|

| |

| (4) | Includes estimated reserve data related to our shallow Upper Devonian (non-Marcellus Shale) Appalachian Basin crude oil and natural gas properties, which were divested in December 2013. See Note 14, Assets Held for Sale, Divestitures and Discontinued Operations, to our consolidated financial statements included elsewhere in this report for additional details related to these assets. |

The following table sets forth information regarding estimated proved reserves for our shallow Upper Devonian (non-Marcellus Shale) Appalachian Basin crude oil and natural gas properties:

|

| | | | | | | |

| | As of December 31, |

| | 2012 | | 2011 |

| Proved reserves | | | |

Natural gas (Bcf) | 11 |

| | 20 |

|

Total proved reserves (MMBoe) | 2 |

| | 3 |

|

Proved developed reserves (MMBoe) | 2 |

| | 3 |

|

Estimated future net cash flows (in millions) | $ | 3 |

| | $ | 15 |

|

| |

| (5) | Includes estimated reserve data related to our Permian assets, which were classified as held for sale as of December 31, 2011. On2011 and divested in February 28, 2012, the divestiture closed.2012. See Note 14, Assets Held for Sale, Divestitures and Discontinued Operations, to our consolidated financial statements included elsewhere in this report for additional details related to the divestiture of our Permian assets. |

The following table sets forth information regarding estimated proved reserves for our Permian assets:

|

| | | | | | | |

| | As of December 31, |

| | 2011 | | 2010 |

| Proved reserves | | | |

Natural gas (MMcf) | 6,242 |

| | 4,979 |

|

Crude oil and condensate (MBbls) | 7,825 |

| | 3,331 |

|

NGLs (MBbls) | 1,971 |

| | 1,190 |

|

Total proved reserves (MMcfe) | 65,018 |

| | 32,105 |

|

Proved developed reserves (MMcfe) | 15,940 |

| | 11,416 |

|

Estimated future net cash flows (in millions) | $ | 348 |

| | $ | 129 |

|

| |

(5) | Includes estimated reserve data related to our Piceance and NECO assets, which are to be divested pursuant to a purchase and sale agreement entered into on February 4, 2013. See Note 19, Subsequent Events, to our consolidated financial statements included elsewhere in this report for additional details related to the planned divestiture of our Piceance and NECO assets. |

The following table sets forth information regarding estimated proved reserves for our Piceance and NECO assets:

|

| | | | | | | | | | | |

| | As of December 31, |

| | 2012 | | 2011 | | 2010 |

| Proved reserves | | | | | |

Natural gas (MMcf) | 83,656 |

| | 354,080 |

| | 454,886 |

|

Crude oil and condensate (MBbls) | 148 |

| | 441 |

| | 548 |

|

NGLs (MBbls) | — |

| | — |

| | — |

|

Total proved reserves (MMcfe) | 84,544 |

| | 356,726 |

| | 458,174 |

|

Proved developed reserves (MMcfe) | 84,544 |

| | 141,802 |

| | 142,949 |

|

Estimated future net cash flows (in millions) | $ | 43 |

| | $ | 32 |

| | $ | 52 |

|

|

| | | | | | | | | | | | | | | |

| | | As of December 31, 2012 |

| Operating Region/Area | | Natural Gas

(MMcf) | | NGLs (MBbls) | | Crude Oil and Condensate (MBbls) | | Natural Gas

Equivalent

(MMcfe) | | Percent |

| Proved developed | | | | | | | | | | |

| Western | | | | | | | | | | |

| Wattenberg Field | | 158,192 |

| | 14,353 |

| | 20,226 |

| | 365,666 |

| | 74 | % |

| Piceance Basin | | 65,609 |

| | — |

| | 148 |

| | 66,497 |

| | 14 | % |

| Other | | 18,047 |

| | — |

| | — |

| | 18,047 |

| | 4 | % |

| Total Western | | 241,848 |

| | 14,353 |

| | 20,374 |

| | 450,210 |

| | 92 | % |

| Eastern | | | | | | | | | | |

| Appalachian Basin | | 40,077 |

| | — |

| | 38 |

| | 40,305 |

| | 8 | % |

| Total Eastern | | 40,077 |

| | — |

| | 38 |

| | 40,305 |

| | 8 | % |

| Total proved developed | | 281,925 |

| | 14,353 |

| | 20,412 |

| | 490,515 |

| | 100 | % |

| Proved undeveloped | | | | | |

| | | | |

| Western | | | | | |

| | | | |

| Wattenberg Field | | 183,618 |

| | 18,474 |

| | 38,898 |

| | 527,850 |

| | 79 | % |

| Total Western | | 183,618 |

| | 18,474 |

| | 38,898 |

| | 527,850 |

| | 79 | % |

| Eastern | | | | | | | | | | |

| Appalachian Basin | | 138,495 |

| | — |

| | — |

| | 138,495 |

| | 21 | % |

| Total Eastern | | 138,495 |

| | — |

| | — |

| | 138,495 |

| | 21 | % |

| Total proved undeveloped | | 322,113 |

| | 18,474 |

| | 38,898 |

| | 666,345 |

| | 100 | % |

| Proved reserves | | | | | | | | | | |

| Western | | | | | | | | | | |

| Wattenberg Field | | 341,810 |

| | 32,827 |

| | 59,124 |

| | 893,516 |

| | 77 | % |

| Piceance Basin | | 65,609 |

| | — |

| | 148 |

| | 66,497 |

| | 6 | % |