UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

T ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20142017

or

£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to _________

Commission File Number 000-07246001-37419

PDC ENERGY, INC.

(Exact name of registrant as specified in its charter)

|

| |

NevadaDelaware | 95-2636730 |

| (State of incorporation) | (I.R.S. Employer Identification No.) |

1775 Sherman Street, Suite 3000

Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: (303) 860-5800

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes T No £

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes £ No T

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes T No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £T

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| |

Large accelerated filer x | Accelerated filer o |

Non-accelerated filer £ (Do not check if a smaller reporting company) | Smaller reporting company o |

| Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. £

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes £ No T

The aggregate market value of our common stock held by non-affiliates on June 30, 20142017 was $2.2$2.8 billion (based on the closing price of $63.1543.11 per share as of the last business day of the fiscal quarter ending June 30, 2014)2017).

As of February 2, 2015,15, 2018, there were 35,991,14265,965,374 shares of our common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

We hereby incorporate by reference into this document the information required by Part III of this Form, which will appear in our definitive proxy statement to be filed pursuant to Regulation 14A for our 20152018 Annual Meeting of Stockholders.

PDC ENERGY, INC.

20142017 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

|

| | | |

| | PART I | | Page |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | PART II | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | PART III | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | PART IV | | |

| | | | |

| | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

PART I

REFERENCES TO THE REGISTRANT

Unless the context otherwise requires, references in this report to "PDC, Energy," "PDC," "the Company,the "Company," "we," "us," "our""our," or "ours" refer to the registrant, PDC Energy, Inc. and all, our wholly-owned subsidiaries consolidated for the purposes of its financial statements, including our proportionate share of the financial position, results of operations, cash flows and operating activities of our affiliated partnerships and PDC Mountaineer, LLC ("PDCM"), a joint venture owned until its sale in October 2014 50% each by PDC and Lime Rock Partners, LP. Unless the context otherwise requires, references in this report to "Appalachian Basin" refers to our operations in the Utica Shale in Ohio and Marcellus Shale in West Virginia and Pennsylvania, including PDC's proportionate share of our affiliated partnerships' and PDCM's assets, results of operations, cash flows and operating activities. See Note 1, Nature of Operations and Basis of Presentation, to our consolidated financial statements included elsewhere in this report for a description of our consolidated subsidiaries and Note 14, Assets Held for Sale, Divestitures and Discontinued Operations, for a discussion of the sale of our interest in PDCM.partnerships.

GLOSSARY OF UNITS OF MEASUREMENTS AND INDUSTRY TERMS

Units of measurements and industry terms are defined in the Glossary of Units of Measurements and Industry Terms, included at the end of this report.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 ("Securities Act") and Section 21E of the Securities Exchange Act of 1934 ("Exchange Act") regarding our business, financial condition, results of operations, and prospects. All statements other than statements of historical facts included in and incorporated by reference into this report are "forward-looking statements" within the meaning of the safe harbor provisions of the United States ("U.S.") Private Securities Litigation Reform Act of 1995. Words such as expects, anticipates, intends, plans, believes, seeks, estimatesexpect, anticipate, intend, plan, believe, seek, estimate and similar expressions or variations of such words are intended to identify forward-looking statements herein. TheseForward-looking statements relate to,include, among other things: estimated futurethings, statements regarding future: reserves, production, (including the components of such production), sales, expenses,costs, cash flows and liquidity; estimated crude oil, natural gasearnings; drilling locations and natural gas liquids (“NGLs”) reserves; the impact of prolonged depressed commodity prices; anticipated 2015zones and growth opportunities; capital projects, expenditures and opportunities;projects, including expected timinglateral lengths of additional drilling rigs; availability of sufficient funding for our 2015 capital program and sources of that funding; expected 2015 capital budget allocations; future exploration, drilling and development activities, including the number of drilling rigs we expect to run during 2015wells, drill times and number of locations; capital efficienciesrigs employed; rates of return; operational enhancements and per well reserves expected to be realized through drillingefficiencies; management of extended length laterals, tighter frac spacing and cost reductions;lease expiration issues; financial ratios; our evaluation methodanticipated sale of our customers'Utica Shale assets; certain accounting and derivative counterparties' credit risk; effectiveness of our derivative program in providing a degree of price stability; future horizontal drilling projects that are economically producible at certain commodity pricestax change impacts; midstream capacity and costs; anticipated reductions in our 2015 cost structure; potential for future impairments; potential acquisitions of additional acreage and other future transactions; electronic, cyber or physical security breaches; the impact of high line pressuresrelated curtailments; and the timing, availability, cost and effectclosing of additional midstream facilities and services going forward; the expected NYMEX differential at our two primary sales hubs; compliance with debt covenants; expected funding sources for conversion of our 3.25% convertible senior notes due 2016; compliance with government regulations; impact of the Colorado task force on oil and gas regulation and potential future ballot initiatives and legislation; the borrowing base under our credit facility; impact of litigation on our results of operations and financial position; the adequacy of existing insurance to cover operating hazardspending, and the availabilitynature of such insurance on a cost effective basis in the future; that we hold good and defensible title to our leasehold; that we do not expect to pay dividends in the foreseeable future; anticipated timing of filing of a new shelf registration statement; and our future, strategies, plans and objectives.transactions.

The above statements are not the exclusive means of identifying forward-looking statements herein. Although forward-looking statements contained in this report reflect our good faith judgment, such statements can only be based on facts and factors currently known to us. Consequently, forward-lookingForward-looking statements are inherentlyalways subject to risks and uncertainties, including known and unknown risksbecome subject to greater levels of risk and uncertainties incidentaluncertainty as they address matters further into the future. Throughout this report or accompanying materials, we may use the term “projection” or similar terms or expressions, or indicate that we have “modeled” certain future scenarios. We typically use these terms to indicate our current thoughts on possible outcomes relating to our business or the exploration for, andindustry in periods beyond the acquisition, development, production and marketing of, crude oil, natural gas and NGLs, and actual outcomes may differ materially from the results and outcomes discussedcurrent fiscal year. Because such statements relate to events or conditions further in the forward-looking statements.future, they are subject to increased levels of uncertainty.

Important factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to:

changes in worldwide production volumes and demand, including economic conditions that might impact demand;demand and prices for products we produce;

volatility of commodity prices for crude oil, natural gas, and NGLsnatural gas liquids ("NGLs") and the risk of an extended period of depressed prices;

reductions in the borrowing base under our revolving credit facility;

impact of governmental policies and/or regulations, including changes in environmental and other laws, the interpretation and enforcement related to those laws and regulations, liabilities arising thereunder, and the costs to comply with those laws and regulations;

potential declines in the value of our crude oil, natural gas, and NGLs properties resulting in further impairments;

changes in estimates of proved reserves;

inaccuracy of reserve estimatesestimated reserves and expected production rates;

potential for production decline rates from our wells being greater than expected;

timing and extent of our success in discovering, acquiring, developing, and producing reserves;

our ability to secure leases, drilling rigs, supplies and services at reasonable prices;

availability of sufficient pipeline, gathering and other transportation facilities and related infrastructure to process and transport our production and the impact of these facilities and regional capacity on the prices we receive for our production;

timing and receipt of necessary regulatory permits;

risks incidental to the drilling and operation of crude oil and natural gas wells;

losses from our gas marketing business exceeding our expectations;

difficulties in integrating our operations as a result of any significant acquisitions and acreage exchanges;

increases or changes in expenses;

availability of supplies, materials, contractors, and services that may delay the drilling or completion of our wells;

potential losses of acreage or zones due to partial or complete lease expirations or otherwise;

increases or adverse changes in construction costs and procurement costs associated with future build out of mid-stream related assets;

future cash flows, liquidity, and financial condition;

possibility that the sale of the Utica Shale properties will not close as expected;

competition within the oil and gas industry;

availability and cost of capital;

reductions in the borrowing base under our revolving credit facility;

our success in marketing crude oil, natural gas, and NGLs;

effect of crude oil and natural gas derivatives activities;

impact of environmental events, governmental and other third-party responses to such events, and our ability to insure adequately against such events;

cost of pending or future litigation;

effect that acquisitions we may pursue have on our capital expenditures;requirements;

our ability to retain or attract senior management and key technical employees; and

success of strategic plans, expectations and objectives for our future operations.

Further, we urge you to carefully review and consider the cautionary statements and disclosures, specifically those under Item 1A, Risk Factors, made in this report and our other filings with the U.S. Securities and Exchange Commission ("SEC") for further information on risks and uncertainties that could affect our business, financial condition, results of operations and cash flows. We caution you not to place undue reliance on forward-looking statements, which speak only as of the date of this report. We undertake no obligation to update any forward-looking statements in order to reflect any event or circumstance occurring after the date of this report or currently unknown facts or conditions or the occurrence of unanticipated events. All forward-looking statements are qualified in their entirety by this cautionary statement.

ITEMS 1. AND 2. BUSINESS AND PROPERTIES

The Company

We are a domestic independent exploration and production company that produces,acquires, explores, and develops acquires and exploresproperties for the production of crude oil, natural gas, and NGLs withNGLs. Our primary operations are located in the Wattenberg Field in Colorado and the Utica ShaleDelaware Basin in southeastern Ohio and, until the fourth quarter of 2014, the Marcellus Shale in northern West Virginia.Texas. Our 2015 operations in the Wattenberg Field are focused in the inner and middle core areas ofon the Niobrara and Codell plays.formations and our Delaware Basin operations are currently focused on the Wolfcamp zones. We also have operations in the Utica Shale in Southeastern Ohio; however, in February 2018, we entered into a definitive purchase and sale agreement ("PSA") for the sale of these properties for net cash proceeds of approximately $40.0 million, subject to certain customary closing adjustments. This transaction is expected to close in the first quarter of 2018.

As of December 31, 2017, we own an interest in approximately 2,9002,800 gross producing(2,300 net) productive wells, of which approximately 35032 percent are horizontal. ProductionWe operate 87 percent of 9.3 MMboe from continuing operations for the year ended December 31, 2014 representswells in which we have an interest. We produced 31.8 MMBoe in 2017, a 44 percent increase of 42% compared to 2016, including 4.2 MMBoe from the year ended Delaware Basin assets that we acquired in December 31, 2013.2016. For the month ended December 31, 2014,2017, we maintained an average production rate of 3097 MBoe per day.day, representing a 33 percent increase from December 2016. We were able to achieve this strong growth rate while maintaining a robust liquidity position, comprised of cash and cash equivalents and available capacity under our revolving credit facility totaling $880.7 million as of December 31, 2017. Our leverage ratio as of December 31, 2017, as defined in our revolving credit facility agreement, was 1.9 to 1.0. As of December 31, 2014,2017, we had approximately 250452.9 MMBoe of proved reserves, (30%32 percent of which are proved developed) with a pre-tax present valuedeveloped reserves. Approximately 58 percent of future net revenues (“PV-10”)our reserves at December 31, 2017 are liquids, which includes crude oil and NGLs. Our 452.9 MMBoe of $3.5 billion, representing increasestotal proved reserves as of 24December 31, 2017, represented an increase of 111.5 MMBoe, and $0.8 billion, respectively,or 33 percent, relative to December 31, 2013, after adjusting for2016. The additions to our proved reserves were primarily a result of extending the divestitureaverage lateral length of our Marcellus Shale dry-gas assets. Proved reserves at December 31, 2014 were comprised of approximately 64% liquidsnewly-drilled and 36% natural gas. Our proved reserve additions included further downspacing in the Wattenberg Field andexpected future wells, combined with an increase in per wellour working interest ownership in wells in areas with established reserves, in our inner core horizontal wells targetingand the Niobrara formation. PV-10 is not a financial measure under accounting principles generally acceptedaddition of proved undeveloped locations in the United States of America (“U.S. GAAP”). See Part I, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Reconciliation of Non-U.S. GAAP Financial Measures, for a definition of PV-10 and a reconciliation of our PV-10 value to our standardized measure.Delaware Basin.

The increases in our productionOn January 5, 2018, we closed an acquisition of properties from Bayswater Exploration and estimated proved reserves are primarily attributable to our successful horizontal NiobraraProduction, LLC and Codell drilling programscertain related parties in the Wattenberg Field. Future development of thecore Wattenberg Field provides(the "Bayswater Acquisition") for approximately $186 million, subject to certain customary post-closing adjustments. In addition to the opportunityapproximately $186 million of cash paid at closing, we invested approximately $15 million during 2017 to add further proved, probable and possible reserves to our portfolio through continued delineation and downspacing of the horizontal Niobrara and Codell formations. Similarly, we believe the Utica Shale provides the opportunity for additional proved, probable and possible reserves in a more favorable crude oil and natural gas pricing environment. In 2014, we spudded 116 horizontalcomplete certain drilled uncompleted wells ("DUCs") acquired in the Wattenberg Field, turned-in-line 86 horizontal wells and participated in 84 gross, 18.7 net, horizontal non-operated drilling projects. We spudded 11 horizontal Utica Shale wells in 2014 and turned-in-line eight horizontal wells.

The following table presents our proved reserve estimates as of December 31, 2014 based on a reserve report prepared by Ryder Scott Company, L.P. (“Ryder Scott”), our independent petroleum engineering consulting firm, and related information:transaction.

|

| | | | | | | | | | | | | | | |

| | Proved Reserves at December 31, 2014 | | | | | | |

| | Proved Reserves (MMBoe) | | % of Total Proved Reserves | | % Proved Developed | | % Liquids | | Proved Reserves to Production Ratio (in years) | | 2014 Production (MBoe) |

| | | | | | | | | | | | |

| Wattenberg Field | 245 | | 98 | % | | 29 | % | | 64 | % | | 28.9 | | 8,484 |

|

| Utica Shale | 5 | | 2 | % | | 77 | % | | 53 | % | | 6.5 | | 805 |

|

| Total proved reserves | 250 | | 100 | % | | 30 | % | | 64 | % | | 26.9 | | 9,289 |

|

Our Strengths

ExcellentMulti-year project inventory in premier crude oil, natural gas, and NGL plays. We have a significant operational presence in two premier U.S. onshore basins, the Wattenberg Field in Weld County, Colorado, and the Delaware Basin in Reeves and Culberson Counties, Texas. The company has identified a significant inventory of horizontal drilling opportunities withlocations in each basin which will allow us to continue to grow our proved reserves and production at attractive rates of return based on our current internal long-term commodity price projections and our current expected cost structure. Our 2018 drilling and completion operations are expected to focus on the Kersey area of the Wattenberg Field and in our oilier eastern and north central areas of the Delaware Basin, where we expect to deliver our strongest economic results.

In the Wattenberg Field, we have identified a strong liquidity position.gross operated inventory of approximately 1,500 horizontal drilling locations, including locations acquired in the Bayswater Acquisition, that consist of an average lateral length of approximately 6,300 feet per well. Our Wattenberg Field horizontal drilling locations have been substantially de-risked through multiple years of successful development from the field. In the Delaware Basin, we have identified a gross operated inventory of approximately 450 horizontal Wolfcamp drilling locations, primarily within our oilier eastern and north central focus areas, that consist of an average lateral length of approximately 7,500 feet per well. Some of these 450 locations are subject to a higher degree of uncertainty as they reflect assumptions primarily related to future downspacing that we are either in the process of testing, or have not yet tested. Our other Delaware Basin leaseholds that are not currently in our primary focus area contain an estimated 240 additional potential horizontal Wolfcamp drilling locations that typically have a higher gas to oil ratio, contain less contiguous acreage for long lateral development, or may require additional technical assessments. We believe that our inventory in the Delaware Basin may increase over time, depending upon, among other variables, successful trades to consolidate leaseholds, additional exploration and development activity in other potential zones, service cost efficiencies, and improved commodity and netback pricing.

| |

◦ | Multi-year project inventory in premier crude oil, natural gas and NGLs plays.We have a significant operational presence in two key U.S. onshore basins and have identified a substantial inventory of approximately 2,650 gross proved undeveloped and probable horizontal drilling projects. We believe that this inventory will allow us to continue to grow our reserves and production, and that, with respect to the Wattenberg Field in particular, the majority of our projects will generate attractive rates of return at current commodity prices and our expected cost structure.

|

| |

◦ | Access to liquidity.As of December 31, 2014, we had a total liquidity position of $398.4 million, comprised of $16.1 million of cash and cash equivalents and $382.3 million available for borrowing under revolving credit facility. We have no near-term debt maturities and had $56.0 million outstanding on our revolving credit facility as of December 31, 2014. In September 2014, the semi-annual redetermination of our revolving credit facility's borrowing base was completed, resulting in an increase in the borrowing base from $450 million to $700 million. We elected to maintain the aggregate commitment at $450 million. Considering the additional $250 million borrowing base available under our revolving credit facility, subject to certain terms and conditions of the agreement, our liquidity position as of December 31, 2014 would have been $648.3 million.

|

| |

◦ | Derivative program. We actively hedge our future exposure to commodity price fluctuations by entering into crude oil and natural gas collars, fixed-price swaps and basis protection swaps. As of December 31, 2014, we have hedged approximately 5,200 MBbls, or approximately 79% to 85%, of our expected crude oil production in 2015 at a weighted-average minimum price of $88.61 per Bbl and a weighted-average maximum price of $90.07 per Bbl. As of the same date, we have hedged approximately 22.5 Bcf, or approximately 74% to 79%, of our expected natural gas production in 2015 at a weighted-average minimum price of $3.90 per Mcf and and a weighted-average maximum price of $4.02 per Mcf. While our derivative program limits the upside benefits we may otherwise receive during periods of higher commodity prices, the program helps protect our cash flows, borrowing base and liquidity during periods of depressed commodity prices.

|

Track recordStrong liquidity position. As of reserve and production growth.Our proved reserves have grown from 38 MMBoe at December 31, 2009, after adjusting2017, we had a total liquidity position of $880.7 million, comprised of $180.7 million of cash and cash equivalents and $700.0 million available for subsequent divestitures,borrowing under our revolving credit facility. In November 2017, we issued $600 million principal amount of 5.75 percent unsecured senior notes due in 2026 (the "2026 Senior Notes"). The net proceeds from the offering were used to approximately 250 MMBoe at redeem our $500 million 7.75 percent senior notes due in 2022 (the "2022 Senior Notes"), fund a portion of the Bayswater Acquisition, which closed in early January 2018, and for general corporate purposes. If the Bayswater Acquisition had closed in December 2017, our liquidity position as of December 31, 2014, representing2017 would have been approximately $700 million. We intend to continue to manage our liquidity position through investment in projects with attractive rates of return, protection of cash flows on a compound annual growth rate (“CAGR”)portion of 46%. Duringour anticipated sales through the sameuse of an active commodity derivative program, and access to capital markets from time period, our proved crude oil and NGL reserves grew at a CAGR of 55%. Our annual production from continuing operations grew from 2.7 MMBoe in 2009 to 9.3 MMBoe in 2014, representing a CAGR of 28%.time.

HorizontalBalanced and diversified portfolio across two premier U.S. onshore basins. Having drilling opportunities in both the Wattenberg Field and completion experience.We have a proven track record of applying technical expertise toward developing unconventional resources through horizontal drilling and completion operations. We have transitioned to multi-well pad drilling, extended laterals, increased frac density and enhanced frac design to further optimize costs and enhance horizontal drilling efficiencies. These changes enablethe Delaware Basin allows us to allocate capital between the two basins to diversify our risk. We believe this will improve economicsoverall economic results and increase well densitydrive our future production and reserve growth. Additionally, we believe the geographical diversity of our portfolio aids in our horizontal plays.the mitigation of risks associated with a single dominant producing area, as each basin has its own operating and competitive dynamic in terms of commodity price markets, service costs, takeaway capacity, and regulatory and political considerations.

Significant operational control in our core areas.We have, and expect to continue to have, a substantial degree of operational control over our properties. As a result of successfully executing our strategy of acquiring and consolidating largely concentrated acreage positions with a high working interest,interests, we operate and manage approximately 89%87 percent of theall wells in which we have an interest.interest across all of our operating basins. Our high percentage of operated properties enablescontrol allows us to exercise a significant level of control with respect tomanage our drilling, production, operating and administrative costs, in additionand to leveragingleverage our base of technical expertise in our core operating areas. Additionally, this strategy providesOur leaseholds that are held by production further enhance our operational control by providing us flexibility in selecting drilling locations based upon differingvarious operational criteria. Our

In the Wattenberg Field, our operational control is alsoattributable to our high working interest leasehold and large contiguous acreage blocks, which have been significantly enhanced byas a result of our 2016 and 2017 acreage exchanges and the fact that a majorityBayswater Acquisition, and because substantially all of our Wattenberg Field leaseholdacreage is held by production. We remain flexible in terms of rig activity and capital deployment due to short-term rig contracts and we are confident in our ability to manage our acreage in the Wattenberg Field in order to maintain our current level of operational control. As a result, we can adjust our drilling plans if commodity prices deteriorate in order to manage cash flows from operations relative to cash flows from investing activities.

In the Delaware Basin, our average working interest in our properties that we operate is approximately 90 percent. We own and operate certain midstream assets in the Delaware Basin and believe this will allow for timely system expansion, well connections, fresh water supply for completion operations, and produced water disposal. Our leasehold in the Delaware Basin requires a more active drilling program and we have less flexibility than we do in the Wattenberg Field, in terms of managing lease expiration issues. In some cases, continuous operations will be required to maintain the underlying leasehold in the Delaware Basin. However, with our high percentage of operated leasehold in the area, we expect to have adequate control over the location and pace of our development to manage lease expirations and meet our drilling obligations in the central and eastern parts of the basin. See Item 1A. Risk Factors - Our undeveloped acreage must be drilled before lease expiration to hold the acreage by production. In highly competitive markets for acreage, failure to drill sufficient wells to hold acreage could result in a substantial lease renewal cost or, if renewal is not feasible, loss of our lease and prospective drilling opportunities.

Utilizing technology to focus on efficiency. In the Wattenberg Field, we have a proven track record of continuing improvement in both costs and productivity of our existing operations. Our efficiencies have historically been driven by a focus on the use of multi-well pad drilling, extended-reach lateral well development, increased fracture stimulation stage density, enhanced fracture stimulation completion design, and improved drilling efficiencies. In 2017, approximately 65 percent of our horizontal well spuds were mid- or extended-reach laterals that ranged from approximately 6,000 to 10,000 horizontal feet in length. We also use a mono-bore drilling design to reduce drill times and well costs. Through the combination of these techniques, our drilling team has improved our drilling efficiencies with average drill results increasing to approximately 2,700 feet drilled per day in 2017 from approximately 2,200 feet drilled per day in 2016.

Reputation for strongStrong environmental, health and safety compliance program.programs, and community outreach. We believe that we have established a positive reputation for ourfocused on establishing effective environmental, health and safety program. We believeprograms that thisare intended to promote safe working practices for our employees and contractors and to help earn the trust and respect of land owners, regulatory agencies, and public officials. This is an important advantage for uspart of our strategy and in competing in today’s intensive regulatory climate and in working with local communities in which we operate.

Community participation and outreach.public debate climate. We are also dedicated to being an active and contributing member inof the communities in which we operate. We share our success with these communities in various ways, including charitable giving and community event sponsorships. We also encourage our employees to take an active role through our charitable matching contribution fund and by participating in our “Energizing Our Community” day, during which our employees volunteer in the communities in which they work and live.

Management experienceCommodity derivative program. Our active use of commodity derivative instruments to protect our investment returns and cash flows was particularly important through the recent commodity price downturns. We have continued this program and entered into commodity derivative instruments to mitigate a portion of our short-term future exposure to commodity price fluctuations, including fixed-price swaps, crude oil and natural gas collars, basis swaps, and rollfactor swap contracts. While our commodity derivative program limits the upside benefits we may otherwise receive during periods of higher commodity prices, the program helps protect a portion of our cash flows, borrowing base, and liquidity during periods of depressed commodity prices. We strive to scale our overall hedging position to be appropriate relative to our current and expected level of indebtedness and consistent with our goals of preserving balance sheet strength and substantial liquidity, as well as our internal price view.

As of December 31, 2017, we had commodity derivatives positions covering approximately 11.9 MMBbls and 6.6 MMBbls of crude oil production for 2018 and 2019, respectively. As of the same date, we had hedged approximately 56.5 Bcf of natural gas and 1.1 MMBbls of propane for 2018. The details of these transactions are described in Item 7a. - Quantitative and Qualitative Disclosures About Market Risk.

Strong management team and operational expertise.capabilities. We have astrong and stable management, led by our executive management team. Each member of the team with a proven track recordhas between 10 and 30 years of drilling performanceexperience in the energy and a technical and operational staff withnatural resource industry. This experience collectively spans expertise in the basins in which we operate, particularly in horizontal drilling, completionland, reservoir analysis, operations, accounting, strategy, and production activities in the Wattenberg Field.general operations, and has helped us continue our growth through periods of commodity price pressure and cost inflation, and other challenging environments.

Business Strategy

Our long-term business strategy focuses on generating shareholderstockholder value through the development, acquisition, exploration, and explorationdevelopment of crude oil and natural gas properties. We are currently focused on the organic growth of our reserves, production, and cash flows inthrough organic exploration and development of our existing and acquired leasehold through horizontal drilling programs after having completed multiple transactions over the last several years to restructure and simplify our property portfolio.drilling. Our operational focus is concentrated within two basins. We pursue various midstream, marketing, and cost reduction initiatives designed to increase our per unit operating margins, while maintaining a conservative and disciplined financial strategy focused on providing sufficient liquidity and balance sheet strength to execute our business strategy.

We focus on horizontal development drilling programs in resource plays that offer repeatable results capableand the potential for attractive returns on investment in a range of drivingcommodity price environments. Our inventory of drilling locations supports our planned organic growth over the next several years. We expect our drilling and completion activity to drive increases in proved reserves, production, and cash flows. We periodicallyIn addition to development drilling, we routinely review acquisition and acreage swap opportunities in our core areas of operation as weoperations. We believe we can extract additional value from such assetstransactions through production optimization refracturing, recompletionsopportunities and increases in our working interests in our development drilling. In addition, coredrilling locations afforded by more concentrated acreage positions. As a result, once we have established a significant presence in an area, the use of bolt-on acquisitions and acreage exchanges can potentially provide synergies that result in additional economies of scale fromscale. We also pursue a combined position. Whilelimited and disciplined exploration program with the goal of replenishing our portfolio with new exploration projects capable of positioning us for significant production and reserve growth in future years.

In 2017, we believecompleted two significant acreage exchanges that consolidated certain acreage positions in the core area of the Wattenberg Field, creating two development areas that we refer to as Prairie and Plains. Both transactions involved the exchange of leasehold acreage with a limited number of wells that were in the process of being drilled and completed. Upon closing the transactions, we received an aggregate of approximately 15,900 net acres in exchange for an aggregate of approximately 16,200 net acres. The difference in net acres is primarily due to variances in working and net revenue interests and in midstream contracts.

As referenced above, we closed the Bayswater Acquisition in January 2018, acquiring approximately 7,400 net acres, 24 operated horizontal wells that were either DUCs or in-process wells at the time of closing and an estimated 220 gross drilling will remainlocations at the foundationtime of our capital program, we expect to continue our disciplined approach to acquisitions and exploratory drilling.closing.

Development drilling

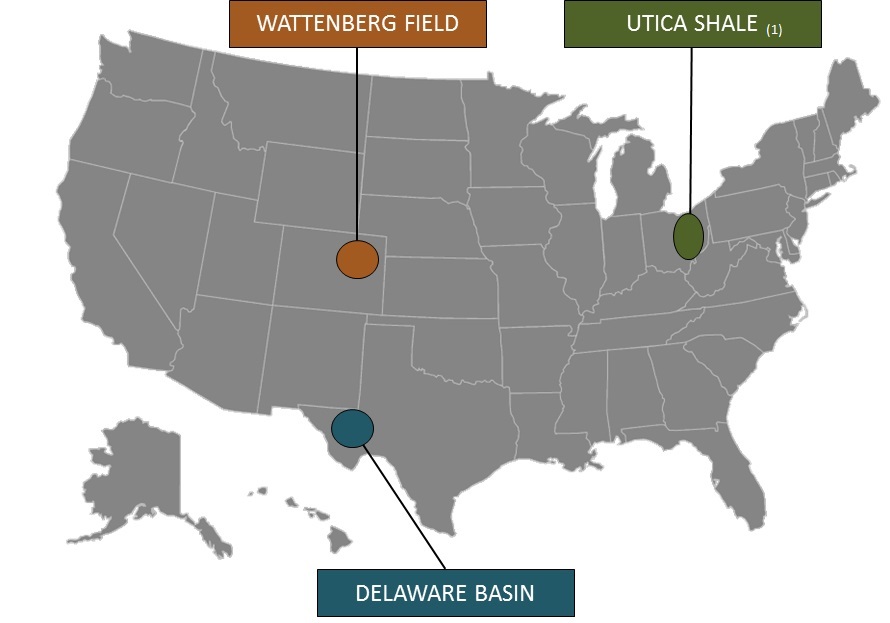

The following map presents the general locations of our development and production activities as of December 31, 2017:

(1) In February 2018, we entered into a PSA to sell the Utica Shale properties.

Our leasehold interests consist ofcover properties with developed and undeveloped crude oil, natural gas, and NGLs resources. Based uponWe own approximately 2,800 gross (2,300 net) wells in our current acreage holdings, we have identified an inventorytwo primary operating basins. Our 2018 capital investment program, which contemplates expenditures of approximately 2,650 gross proved undevelopedbetween $850 million and probable capital projects for horizontal development. Our 2015 capital program forecast$920 million, is $473 million, including $435 million of development capital and $38 million for lease acquisition and other capital expenditures. The capital program forecast is a revision to our original 2015 capital budget that was announced in December 2014 and has been adjusted for anticipated service cost reductions and lower non-operated spending, partially offset by increased working interestsprimarily focused on certain planned 2015 wells. As a result of our operational flexibility, we have allocated a significantly higher percentage of our 2015 capital program forecast to our higher-return projectscontinued execution in the Wattenberg Field inner and middle core areas.Delaware Basin using three drilling rigs and one completion crew in each basin throughout the year.

Based on our current production forecast for 2018 and assuming an average $57.50 New York Mercantile Exchange ("NYMEX") crude oil price for the year and a $3.00 NYMEX natural gas price, we expect 2018 capital investments to exceed our 2018 cash flows from operations by approximately less than $90 million. We anticipate that the proceeds received from the sale of our Utica Shale assets and a midstream dedication agreement (see the footnote titled Subsequent Events to the consolidated financial statements included elsewhere in this report), will fund approximately two-thirds of this outspend. We expect this outspend to occur during the first half of 2018, with cash flows exceeding capital investment during the second half of the year. Our leverage ratio, as defined in our revolving credit facility agreement, is expected to decrease by the end of 2018 based on production and operational cash flow growth. However, a significant deterioration in commodity prices could negatively impact our results of operations, financial condition, and future development plans. We may increase or decrease our 2018 capital investment program during the year as a result of, among other things, changes in commodity prices or our internal long-term outlook for commodity prices, requirements to hold acreage, the cost of services for drilling and well completion activities, drilling results, changes in our borrowing capacity, a significant change in cash flows, regulatory issues, requirements to maintain continuous activity on leaseholds or acquisition and/or divestiture opportunities. If such changes result in our election to deploy additional capital, amounts invested may further exceed our cash flow from operations.

Wattenberg FieldField. . Our primary focus in the Wattenberg Field isWe are drilling in the horizontal Niobrara and Codell plays. Based on our current drilling program, and considering our inventory of approximately 2,600 gross proved undeveloped and probable horizontal projects, we have nearly 20 years of drilling activity. These projects are primarily locatedplays in the core Wattenberg Field, which is further delineated between the inner, middleKersey, Prairie and outer core. In 2015, we expectPlains development areas. We plan to continue to realize additional capital efficiencies through drilling extended length laterals, tighter frac spacingdrill standard-reach lateral (“SRL”), mid-reach lateral (“MRL”), and shifting moreextended-reach lateral (“XRL”) wells in 2018, the majority of our drilling program towhich will be in the inner and middle core areasKersey area of the field. We planWells in the Wattenberg Field typically have productive horizons at depths of approximately 6,500 to enhance our completion design by decreasing7,500 feet below the spacingsurface. In 2018, we anticipate spudding and turning-in-line between frac stages from 250 feetapproximately 135 to 200 feet. With150 operated wells, as outlined below:

|

| | | | | | |

| | | SRL | | MRL | | XRL |

| Estimated average lateral length (in feet) | | 4,200 | | 6,900 | | 9,500 |

| Expected drilling days (spud-to-spud) | | 6 | | 8 | | 10 |

| Estimated percentage of 2018 wells spud | | 25% | | 45% | | 30% |

| Estimated percentage of 2018 wells turned-in-line | | 50% | | 35% | | 15% |

| Estimated cost per well (in millions) | | $2.6 | | $3.5 | | $4.4 |

Our 2018 capital investment program for the modified completion designWattenberg Field is approximately $470 million to $500 million, of more frac stages and anticipated cost structure savings, our grosswhich approximately 90 percent is expected to be invested in operated drilling and completion costs per wellactivity. The remainder of the Wattenberg Field capital investment program is expected to be used for non-operated drilling, land, and miscellaneous workover and capital projects.

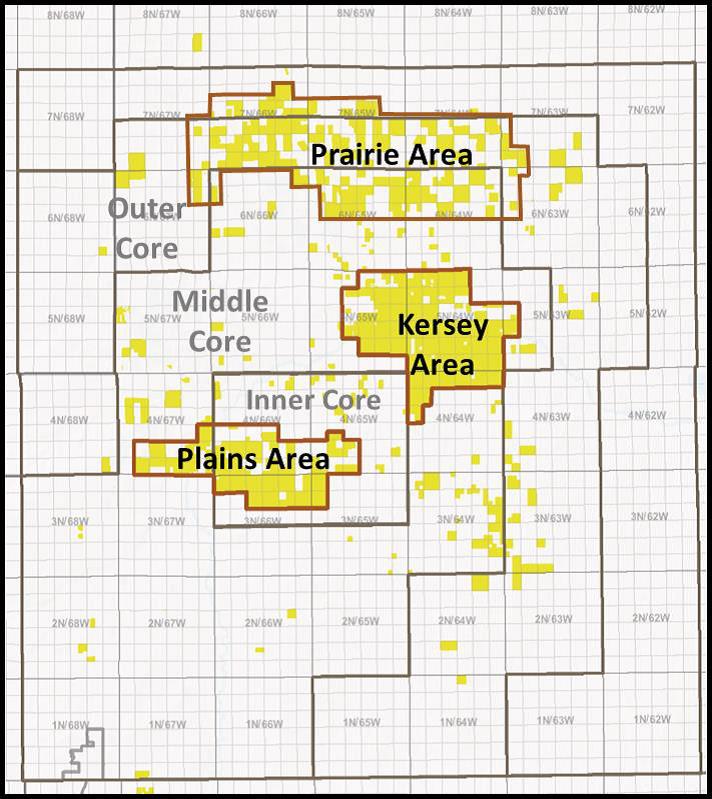

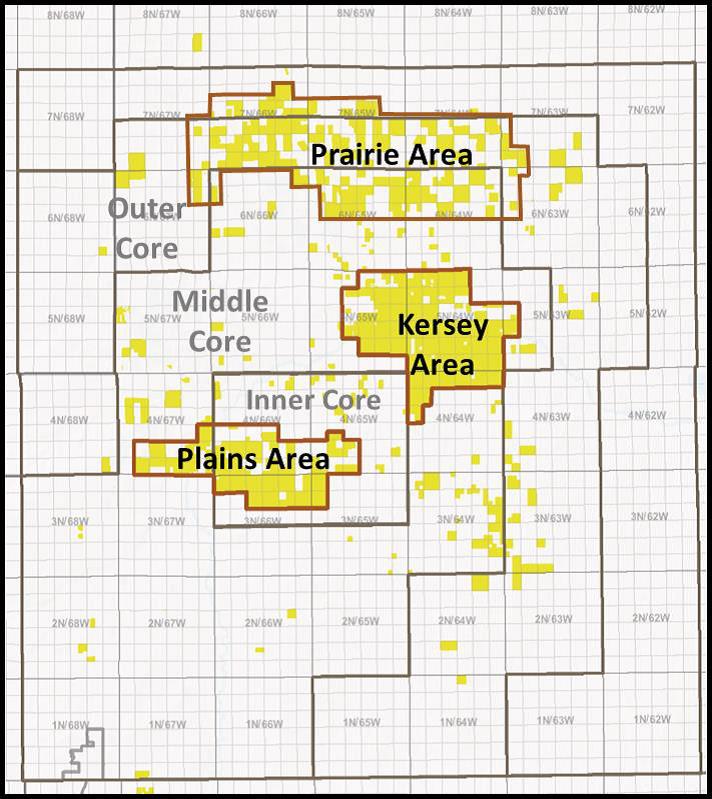

The following map presents the general locations of our development areas in the Niobrara and Codell plays of the Wattenberg Field as of December 31, 2017:

Delaware Basin. Our 2018 capital investment program for the Delaware Basin contemplates operating at a 4,000 foot length lateral arethree-rig pace throughout the year.Total capital investment in the Delaware Basin for 2018 is expected to be approximately $3.6$380 million to $420 million, of which approximately 75 percent is allocated to both spud and are expectedturn-in-line approximately 25 to be approximately $4.6 million for30 operated wells. Based on the timing of our extended 6,500operations and requirements to 7,000 foot laterals. We expect increased per well reserveshold acreage, we may elect to drill wells different from tighter frac spacing and extended laterals. Additionally,or in addition to those currently anticipated, as we are continuing to analyze the terms of the relevant leases. Our anticipated Delaware Basin drilling the majority of our wellsprogram is outlined below:

|

| | | | | |

| | SRL | | MRL | | XRL |

| Estimated average lateral length (in feet) | 5,000 | | 8,000 | | 10,000 |

| Expected drilling days (spud-to-rig release) | 30 | | 31 | | 36 |

| Estimated percentage of 2018 wells spud | 10% | | 40% | | 50% |

| Estimated percentage of 2018 wells turned-in-line | 25% | | 45% | | 30% |

| Estimated cost per well (in millions) | $9.2 | | $10.8 | | $13.2 |

Wells in the inner and middle core areas, whichDelaware Basin typically have higher per well reserves thanproductive horizons at depths of approximately 8,000 to 11,000 feet below the outer core.

Approximately $414 million of our 2015 capital program forecast is expected to be spent on development activities in the Wattenberg Field, consisting of $358 million for our operated drilling program, of which 91% is directed towards the inner and middle core, and $56 million for non-operated projects. We expect to spud approximately 119 and turn in line 109 horizontal Niobrara or Codell wells of which 40% are expected to be extended length laterals. Approximately 60% of those wells are expected to target the Niobrara formation with the remainder targeting the Codell formation. We expect to participate in approximately 85 gross, 14.2 net, non-operated horizontal opportunities in 2015.surface. We plan to investuse approximately $21 million on other10 percent of our budgeted capital expendituresfor leasing, non-operated capital, seismic, and technical studies, with the remaining 15 percent for midstream-related projects, including oil and gas gathering systems and water supply and disposal systems.

The following map presents the general locations of our Wolfcamp formation development areas in the Wattenberg Field. The 2015 capital program forecast maintains our five-rig drilling program in the Wattenberg Field and is based upon the commodity price environment experienced in the first quarterDelaware Basin as of 2015. A further deterioration of commodity prices could negatively impact our financial condition and results of operations. We may further revise our capital program forecast during the year as a result of, among other things, commodity prices, acquisitions or dispositions of assets, drilling results, changes in our borrowing capacity and/or significant changes in cash flows.December 31, 2017:

Utica Shale. During 2014, we continuedIn 2017, as part of our plan to delineate and develop our leasehold position in the Utica Shale. However, based on current low commodity prices and large natural gas price differentials in Appalachia, we elected to temporarily cease drilling indivest the Utica Shale atproperties, we engaged an investment banking firm and began actively marketing the end of 2014. We recognized an impairment charge of $158.3 million to write-down our Utica Shale producing and non-producing crude oil and natural gas properties to their estimated fair value. The impairment of undeveloped acreage is primarily on acreage located outside the condensate and wet natural gas windows of the Utica Shale. For 2015, we plan to invest a total of $35 million in the Utica Shale play to complete and turn-in-line a four-well pad that was in processfor sale; therefore, these properties are classified as held-for-sale as of December 31, 2014 and2017. In February 2018, we entered into a PSA to sell these properties for lease acquisition and other capital

expenditures. We expectnet cash proceeds of approximately $40.0 million, subject to resume our Utica Shale drilling program when commodity prices and net-back realizations rebound. We remain committed to the strong Utica Shale resource we are developing in the condensate and wet natural gas windows of the play. In 2015, we will develop production, reservoir and completion analyses from our recently drilled wells and will incorporate the data into our future drilling programs. We currently estimate that we have approximately 50 gross probable projects for horizontal drilling in the condensate and wet natural gas windows of the Utica Shale and have spudded 24 horizontal wells through December 31, 2014.

Operational and financial risk managementcertain customary closing adjustments.

We proactively employ strategies to help reduce the financial risks associated with our industry. One such strategy is to maintain a balanced production mix of liquids and natural gas. During 2014, we produced crude oil, natural gas and NGLs with a production mix of approximately 65% liquids and 35% natural gas. This strategy of a diversified commodity mix helps mitigate the financial impact from a decline in the market price of any one of our commodities. In addition, we utilize commodity-based derivative instruments to manage a substantial portion of our exposure to price volatility with regard to our crude oil and natural gas sales and natural gas marketing segments. As of December 31, 2014, we had natural gas and crude oil derivative positions in place for 2015 covering approximately5,200 MBbls of our crude oil production and approximately 22.5 Bcf of our natural gas production. Currently, we do not hedge our NGL production.Strategic acquisitions

Strategic acquisitions

We typicallyAs part of our overall growth strategy, we examine and evaluate acquisition opportunities as they present themselves and pursue the acquisition of assetsthose that may have value from producing wellsmeet our strategic plan and behind-pipe reserves, but most important, from high quality undeveloped drilling locations.that we believe will increase stockholder value. We seek properties with large undeveloped drilling upside where we believe we can utilize our operational abilitiesexpertise to grow production and proved reserves. In addition, we may pursue opportunities to exchange acreage with other producers or complete small bolt-on acquisitions in order to optimize our portfolio by consolidating and concentrating on our core assets. The creation of large, contiguous acreage blocks through the trading of properties or bolt-on acquisitions provides the opportunity to optimize drilling activities and add shareholder value.more extended-reach lateral wells to our drilling program, while increasing our working interests in the related wells. We have an experienced team of management, engineering, geosciences, and commercial professionals who identify and evaluate acquisition opportunities.

Wattenberg Field. In June 2012, We believe the Bayswater Acquisition and the acreage exchanges executed in 2016 and 2017 met the criteria. Any acquisition activity we acquired certain assets from affiliates of Merit Energy (the "Merit Acquisition") for an aggregate purchase price of $304.6 million. The acquired assets comprise approximately 30,000 net acres located almost entirelymay pursue in 2018 is expected to be focused on the core Wattenberg Field and in close proximity to our then-existing acreage position. Our total position in the core Wattenberg Field is now approximately 96,000 net acres.

Utica Shale. Over the past three years, we have acquired approximately 67,000 net acres of Utica leaseholds, targeting the condensate and wet natural gas windows of the Utica Shale play in southeastern Ohio. As an early entrant into the development of the Utica Shale, we believe we have gained valuable experience in drilling and developing the condensate and wet natural gas windows of the play.

Strategic divestitures

We continue to seek ways to optimize our asset portfolio as part of our business strategy. This may include divesting lower return assets and reinvesting in our stronger economic inventory. As a result, we have divested several assets over the past few years.

Appalachian Marcellus Shale Assets. In October 2014, we completed the sale of our entire 50% ownership interest in PDCM to an unrelated third-party for aggregate consideration, after our share of PDCM's debt repayment and other working capital adjustments, of approximately $192 million, comprised of approximately $153 million in net cash proceeds and a promissory note due in 2020 of approximately $39 million. The transaction included the buyer's assumption of our share of the firm transportation commitment related to the assets owned by PDCM, as well as our share of PDCM's natural gas hedging positions for the years 2014 through 2017. The divestiture resulted in a pre-tax gain of $76.3 million. Proceeds from the divestiture were used to reduce outstanding borrowings on our revolving credit facility and to fund a portion of our 2014 capital budget. Our proportionate share of PDCM's Marcellus Shale results of operations has been separately reported as discontinued operations in the consolidated statements of operations for all periods presented. See Note 14, Assets Held for Sale, Divestitures and Discontinued Operations, to our consolidated financial statements included elsewhere in this report for additional information regarding this divestiture.

Appalachian Shallow Upper Devonian Gas Assets. In December 2013, we divested our shallow Upper Devonian (non-Marcellus Shale) Appalachian Basin crude oil and natural gas properties previously owned directly by us, as well as through our proportionate share of PDCM, for aggregate consideration of approximately $20.6 million, of which our share of the proceeds was approximately $5.1 million. We received our proportionate share of cash proceeds and a note receivable. Concurrent with the closing of the transaction, our $6.7 million irrevocable standby letter of credit and an agreement for firm transportation services was released and novated to the buyer.

Colorado Dry Gas Assets. In June 2013, we completed the sale of our non-core Colorado dry gas assets, primarily natural gas producing properties located in the Piceance Basin, northeastern Colorado and other non-core areas, to certain affiliates of Caerus Oil and Gas LLC (“Caerus”) for consideration of $177.6 million, with an additional $17 million paid to our non-affiliated investor partners in our affiliated partnerships. The sale resulted in a pre-tax loss of $2.3 million. The proceeds from the asset disposition were used to pay down our revolving credit facility and to fund a portion of our 2013 capital budget.Delaware Basin.

Selective exploration

With the current commodity pricing environment, we do not expect our exploration activity to be significant in 2015. Historically, we have pursued a disciplined exploration program intended to replenish our portfolio of potential drilling locations and to position us for production and reserve growth in future years. We have attempted to identify potential plays in their early stages in orderWhen doing so, we attempt to accumulate significant leasehold positions

prior to competitive forces driving up the cost of entry and to invest in leasehold positions that are in the proximity ofnear existing or emerging midstream infrastructure. Our recent exploration activity has been in the Delaware Basin as there are multiple zones that have not seen development sufficient to record proved reserves. We believe such zones could provide

us with additional potential drilling locations and/or proved reserves, based upon the results of our exploratory wells. See the footnote titled Properties and Equipment - Suspended Well Costs to our consolidated financial statements included elsewhere in this report for additional details regarding our exploratory wells.

Business Segments

We divideare engaged in two operating segments: our operating activities into two segments: (1) Oiloil and Gas Explorationgas exploration and Productionproduction segment and (2) Gas Marketing.our gas marketing segment. Beginning in 2017, our gas marketing segment did not meet the quantitative thresholds to require disclosure as a separate reportable segment. All of our material operations are attributable to our exploration and production business; therefore, all of our operations are presented as a single segment for all periods presented.

Oil and Gas Exploration and Production

OurThe results of our Oil and Gas Exploration and Production segment primarily reflectsreflect revenues and expenses from the production and sale of crude oil, natural gas, and NGLs, commodity price risk management, net, and well operations and pipeline income.operations. The exploration for and production of crude oil, natural gas, and NGLs involves the acquisition or leasing of mineral rights to proved reserves and related surface rights. Prior to development of these properties, we assess the economic viability of potential well development opportunities. We then develop the reserves through the permitting, drilling and completion of crude oil and natural gas wells, which are drilled, completed and put intothen turned-in-line to production. Subsequent to completion, weWe operate and maintain the producing wells, while controllingmanaging associated production, operating, and transportation costs. Upon extractionAt the end of a well's economic life, the estimated recoverable reserves from a well it is plugged and surface disturbancedisturbances surrounding the well and producing facilities isare remediated. In some cases, we may also own a working interest in wells operated by unrelated third-parties. The Oil and Gas Exploration and Production segment's most significant customers are currently Suncor Energy Marketing, Inc., Concord Energy, LLC, and DCP Midstream, LP and Teppco Crude Oil, LLC.("DCP"). Sales to each of these parties constituteconstituted more than 10%10 percent of our 2017 revenues.

Our crude oil, natural gas and NGLs production is gathered, marketed and sold as follows:

Crude oil. We do not refine any of our crude oil production. In Given the Wattenberg Field, crude oil is sold at each individual well site and transported by the purchasers via truck, pipeline or rail to markets under various purchase contracts with monthly pricing provisions based on NYMEX pricing, adjusted for differentials. We have entered into a five-year agreement, beginning in the second quarter of 2015, which will allow crude oil sold to these purchasers to be transported via pipeline to Cushing, Oklahoma. In addition, we have signed a long term agreement for gathering of crude oil at the wellhead by pipeline from several of our wells and transportation to at least one central point in the Wattenberg Field, with a view toward reducing costs and minimizing truck traffic. In the Utica Shale, crude oil and condensate is sold to local purchasers at each individual well site based on NYMEX pricing, adjusted for differentials, and is typically transported by the purchasers via truck to local refineries, rail facilities or barge loading terminals on the Ohio River.

Natural gas. We primarily sell our natural gas to midstream service providers, marketers and utilities. Our natural gas is transported through third-party gathering systems and pipelines and we incur gathering, processing and transportation expenses to move our natural gas from the wellhead to a purchaser-specified delivery point. We generally sell the natural gas that we produce under contracts with indexed, NYMEX or CIG monthly pricing provisions, with the remaining production sold under contracts with daily pricing provisions. Virtually all of our contracts include provisions whereby prices change monthly with changesliquidity in the market with certain adjustmentsfor the sale of hydrocarbons, we believe that maythe loss of any purchaser or the aggregate loss of several customers could be made based on whether a well deliversmanaged by selling to a gathering or transmission linealternative purchasers. See Part II, Item 7,Management's Discussion and the qualityAnalysis of the natural gas. Therefore, the priceFinancial Condition and Results of the natural gas fluctuates to remain competitive with other available natural gas supplies. In certain instances, we enter into firm transportation, processingOperations - Results of Operations, Summary Operating Results, for sales, pricing, production, and sales agreements to provide for pipeline capacity to flow and sell a portion of our natural gas volumes. In the Wattenberg Field, the majority of our leasehold is dedicated to our primary midstream provider, DCP Midstream, LP, which gathers and processes wet natural gas produced in the basin and sells our residue gas to various markets. In the fourth quarter of 2014, we entered into an agreement with AKA Energy Group ("AKA") whereby we have committed production from a specified number of new horizontal wells to be drilled and completed prior to mid-2016. Pursuant to the agreement, AKA is required to install and operate, or contract for use of, facilities necessary to receive and purchase production volume committed under the agreement. In the Utica Shale, wet natural gas produced in our northern acreage is gathered and processed pursuant to a firm transportation agreement with MarkWest Utica EMG ("MarkWest") while wet natural gas produced in our southern acreage is gathered and processed by Blue Racer Midstream LLC ("Blue Racer"). We market our Utica residue gas to various purchasers based on a pipeline basis or NYMEX pricing. We are currently selling all of our residue gas from the MarkWest plant at a daily price based on the Chicago Citygate market, and plan to do so through October 2015.

NGLs. In the Wattenberg Field, all of our NGLs are sold at the tailgate of the third-party midstream service provider processing plants based on a combination of prices from the Conway hub in Kansas and Mt. Belvieu in Texas where this production is marketed. In the Utica Shale, our NGLs are fractionated and marketed by MarkWest and Blue Racer and sold based on month-to-month pricing in various markets. Our NGL production is sold under both short- and long-term contracts.

Gas Marketingoperating cost data.

Our Gas Marketing segment is comprised solely of the operating activities of our wholly-owned subsidiary Riley Natural Gas ("RNG"). RNG specializes in the purchase, aggregation and sale of natural gas production in the Appalachian Basin. Financial results from our gas marketing segment were not material to our consolidated financial statements for any of the periods presented in this report and we do not expect them to be material in the future. RNG purchases for resale natural gas produced by third-party producers, as well as natural gas produced by us in the Utica Shale. The natural gas is marketed to third-party marketers, natural gas utilities and industrial and commercial

customers through transportation services provided by regulated interstate/intrastate pipeline companies. RNG is party to long-term firm transportation, sales and processing agreements for pipeline capacity through August 2022. Following the sale of our 50% ownership interest in PDCM in October 2014, RNG's marketing activities were scaled down and are limited to purchasing, aggregating and selling natural gas production to attempt to meet such volume commitments. After the long-term firm transportation agreements expire, we expect to discontinue this segment.

For additional information regarding our business segments, see Note 17, Business Segments, to our consolidated financial statements included elsewhere in this report.

Areas of Operations

The following map presents the general locations of our development and production activities as of December 31, 2014:

Wattenberg Field, DJ Basin, Colorado. Currently, horizontal wells drilled in this area target the reservoirs in the Niobrara and Codell formations. These horizontal wells have a vertical depth ranging from approximately 6,500 to 7,500 feet, with lateral lengths of approximately 4,000 to 7,000 feet. Using pad drilling, we have increased well density in the horizontal Niobrara and Codell plays, which results in reduced per-well costs. We currently estimate that we have 2,600 gross proved undeveloped and probable horizontal projects in the Wattenberg Field drilling inventory. In addition to our horizontal drilling program, we currently operate approximately 2,450 vertical wells in the Wattenberg Field.

Utica Shale, southeastern Ohio. Wells drilled in this area primarily target the Point Pleasant member of the Utica Shale formation. Our acreage targets the condensate and wet natural gas windows of the Utica Shale play throughout southeastern Ohio. The horizontal wells have a vertical depth ranging from approximately 7,000 to 8,000 feet, with lateral lengths of approximately 4,000 to 7,500 feet. We currently estimate that we have approximately 50 gross probable projects for horizontal drilling in the condensate and wet natural gas windows of the Utica Shale.

Properties

Productive Wells

The following table presents our productive wells:

| | | | | Productive Wells | | Productive Wells |

| | | As of December 31, 2014 | | As of December 31, 2017 |

| | | Crude Oil | | Natural Gas | | Total | | Crude Oil | | Natural Gas | | Total |

| Operating Region/Area | | Gross | | Net | | Gross | | Net | | Gross | | Net | | Gross | | Net | | Gross | | Net | | Gross | | Net |

Wattenberg Field | | 403 |

| | 246.9 |

| | 2,445 |

| | 2,200.1 |

| | 2,848 |

| | 2,447.0 |

| | 811 |

| | 551.6 |

| | 1,893 |

| | 1,660.7 |

| | 2,704 |

| | 2,212.3 |

|

| Utica Shale | | 16 |

| | 12.7 |

| | 3 |

| | 3.0 |

| | 19 |

| | 15.7 |

| |

| Delaware Basin (2) | | | 47 |

| | 43.1 |

| | 4 |

| | 4.0 |

| | 51 |

| | 47.1 |

|

| Utica Shale (3) | | | 27 |

| | 22.2 |

| | 3 |

| | 3.0 |

| | 30 |

| | 25.2 |

|

| Total productive wells | | 419 |

| | 259.6 |

| | 2,448 |

| | 2,203.1 |

| | 2,867 |

| | 2,462.7 |

| | 885 |

| | 616.9 |

| | 1,900 |

| | 1,667.7 |

| | 2,785 |

| | 2,284.6 |

|

| | | | | | | | | | | | | | |

_________

(1) Additionally, the Bayswater Acquisition, which closed in January 2018, included 56 gross (19.7 net) productive crude oil

wells and 164 gross (118.7 net) productive natural gas wells.

(2) During 2017, we submitted applications to the Railroad Commission of Texas ("RRC of Texas") requesting that the

designation for 20 wells in the Delaware Basin be changed from crude oil to natural gas per their GOR analysis. The

applications are currently pending review by the RRC of Texas.

(3) In February 2018, we entered into a PSA to sell the Utica Shale properties.

Proved Reserves

The following table presents our proved reserve estimates as of December 31, 2017, based on reserve reports prepared by our independent petroleum engineering consulting firms, Ryder Scott Company, L.P. ("Ryder Scott"), and Netherland, Sewell & Associates, Inc. ("NSAI"), and related information:

|

| | | | | | | | | | | | | | | |

| | Proved Reserves at December 31, 2017 | | | | | | |

| | Proved Reserves (MMBoe) | | % of Total Proved Reserves | | % Proved Developed | | % Liquids | | Proved Reserves to Production Ratio (in years)(1) | | 2017 Production (MBoe) |

| | | | | | | | | | | | |

| Wattenberg Field | 350.8 | | 77 | % | | 33 | % | | 55 | % | | 13.1 | | 26,815 |

|

| Delaware Basin | 97.9 | | 22 | % | | 23 | % | | 67 | % | | 23.4 | | 4,184 |

|

| Utica Shale (2) | 4.2 | | 1 | % | | 100 | % | | 51 | % | | 5.1 | | 831 |

|

| Total proved reserves | 452.9 | | 100 | % | | 32 | % | | 58 | % | | 14.2 | | 31,830 |

|

_________

(1) Based on production during 2017.

(2) In February 2018, we entered into a PSA to sell the Utica Shale properties.

Our proved reserves are sensitive to future crude oil, natural gas, and NGLs sales prices and the related effect on the economic productive life of producing properties. Increases in commodity prices may result in a longer economic productive life of a property or result in recognition of more economically viable proved undeveloped reserves. Decreasesreserves, while decreases in commodity prices may result in negative impacts of this nature.

All of our proved reserves are located onshore in the U.S. Our proved reserve estimates are prepared using the definitions for proved reserves set forth in SEC Regulation S-X, Rule 4-10(a) and other applicable SEC rules. AsOur proved reserves in the Wattenberg Field and Utica Shale as of December 31, 2014, all of our proved reserves, including our proportionate share of our affiliated partnerships' reserves, have been2017 were estimated by Ryder Scott.Scott and our reserves in the Delaware Basin as of that date were estimated by NSAI. Both Ryder Scott and NSAI are independent professional engineering firms.

We have a comprehensive process that governs the determination and reporting of our proved reserves. As part of our internal control process, our reserves are reviewed annually by an internal team composed of reservoir engineers, geologists, land, and accounting personnel for adherence to SEC guidelines through a detailed review of land and accounting records,

available geological and reservoir data, and production performance data. The process includes a review of applicable working and net revenue interests and cost and performance data. The internal team compiles the reviewed data and forwards the data to Ryder Scott.Scott and NSAI, as applicable.

When preparing our reserve estimates, neither Ryder Scott did notnor NSAI independently verifyverifies the accuracy and completeness of information and data furnished by us with respect to ownership interests, production volumes, well test data, historical costs of operations and development, product prices or any agreements relating to current and future operations of properties, andor sales of production. Ryder Scott prepares an estimateand NSAI prepare estimates of our reserves in conjunction with an ongoing review by our engineers. A final comparison of data is performed to ensure that the reserve estimates are complete, determined pursuant to acceptable industry methods, and with a level of detail we deem appropriate. The final estimated reserve report isreports are prepared by Ryder Scott and NSAI and reviewed by our engineering staff and management prior to issuance by Ryder Scott.those firms.

The professional qualifications of theour internal lead engineer primarily responsible for overseeing the preparation of our reserve estimates, qualify the engineer as a Reserves Estimator, as defined in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information as promulgated by the Society of Petroleum Engineers.Engineers, qualifies this individual as a Reserve Estimator. This person holds a Bachelor of Science degree in Petroleum and Chemical Refining Engineering with a minor in Petroleum Engineering, has over 3740 years of experience in reservoir engineering, is a member of the Society of Petroleum Engineers and the Society of Petroleum Evaluation Engineers, and is a registered Professional Engineer in the State of Colorado.

The SEC's reserve rules allow the use of techniques that have been proved effective by evaluation of actual production from projects in the same reservoir or an analogous reservoir or by other observational evidence using reliable technology that establishes reasonable certainty. Reliable technology is a grouping of one or more technologies (including computational methods) that has been field tested and has been demonstrated to provide reasonably certain results with consistency and repeatability in the formation being evaluated or in an analogous formation. We used a combination of productionperformance methods, including decline curve analysis and pressure performance, wireline wellbore measurements,other computational methods, offset analogies, and seismic data and interpretation wireline formation tests, geophysical logs and core data to calculate our reserve estimates, including the material additions to the 2014 reserve estimates. All of our proved undeveloped reserves conform to the SEC five-year rule requirement as all proved undeveloped locations are scheduled, according to an adopted development plan, to be drilled within five years of eachthe location’s initial booking date. Per SEC rules, the pricing used to prepare the proved reserves is based on the unweighted arithmetic average of the first of the month prices for the preceding 12 months. The NYMEX prices used in preparing the reserves are then adjusted based on energy content, location and basis differentials and other marketing deductions to arrive at the net realized price. The SEC NYMEX prices used in the preparation of reserves are as follows:

|

| | | | | | | | | | | | |

| | | As of December 31, |

| | | 2017 | | 2016 | | 2015 |

| | | | | | | |

| Crude oil (SEC NYMEX - $/Bbl) | | $ | 51.34 |

| | $ | 42.75 |

| | $ | 50.28 |

|

| Natural gas (SEC NYMEX - $/MMBtu) | | $ | 2.98 |

| | $ | 2.48 |

| | $ | 2.59 |

|

Reserve estimates involve judgments and cannot be measured exactly. The estimates must be reviewed periodically and adjusted to reflect additional information gained from reservoir performance, new geologicalgeologic and geophysical data, and economic changes. Neither the estimated future net cash flows nor the standardized measure of discounted future net cash flows ("standardized measure") is intended to represent the current market value of our proved reserves. For additional information regarding both of these measures, as well as other information regarding our proved reserves, see the unaudited Supplemental Information Unaudited - Crude Oil and Natural Gas Information provided with our consolidated financial statements included elsewhere in this report.

The following tables provide information regarding our estimated proved reserves:

| | | | As of December 31, | As of December 31, |

| | 2014 | | 2013 (3) | | 2012 (3)(4)(5) | 2017 | | 2016 | | 2015 |

| Proved reserves | | | | | | | | | | |

Crude oil and condensate (MMBbls) | 101 |

| | 94 |

| | 59 |

| 155 |

| | 118 |

| | 99 |

|

Natural gas (Bcf) | 537 |

| | 740 |

| | 604 |

| 1,154 |

| | 834 |

| | 661 |

|

NGLs (MMBbls) | 60 |

| | 49 |

| | 33 |

| 106 |

| | 84 |

| | 64 |

|

Total proved reserves (MMBoe) | 250 |

| | 266 |

| | 193 |

| 453 |

| | 341 |

| | 273 |

|

Proved developed reserves (MMBoe) | 75 |

| | 76 |

| | 82 |

| 143 |

| | 98 |

| | 70 |

|

Estimated future net cash flows (in millions) (1) | $ | 4,938 |

| | $ | 4,323 |

| | $ | 2,756 |

| |

PV-10 (in millions) (2) | $ | 3,450 |

| | $ | 2,704 |

| | $ | 1,709 |

| |

Estimated undiscounted future net cash flows (in millions) (1) | | $ | 5,453 |

| | $ | 2,681 |

| | $ | 2,259 |

|

| | | | | | | |

Standardized measure (in millions) | $ | 2,306 |

| | $ | 1,782 |

| | $ | 1,168 |

| $ | 2,880 |

| | $ | 1,421 |

| | $ | 1,097 |

|

| | | | | | | |

PV-10 (in millions) (2) (3) | | $ | 3,212 |

| | $ | 1,675 |

| | $ | 1,338 |

|

___________

| |

| (1) | Amount represents aggregate undiscounted pre-tax future net cash flows, before income taxes, estimated by Ryder Scott and NSAI, of approximately $7.3$6.2 billion, $6.4$3.3 billion, and $4.0$2.8 billion as of December 31, 2014, 20132017, 2016, and 2012,2015, respectively, less an internally-estimated undiscounted future income tax expense of approximately $2.3$0.7 billion, $2.1$0.6 billion, and $1.2$0.5 billion, respectively. |

| |

| (2) | PV-10 is a non-U.S. GAAP financial measure. It is not intended to represent the current market value of our estimated reserves. PV-10 should not be considered in isolation or as a substitute for the standardized measure reported in accordance with U.S. GAAP, but rather should be considered in addition to the standardized measure. See Part I,II, Item 7.7, Management's Discussion and Analysis of Financial Condition and Results of Operations - Reconciliation of Non-U.S. GAAP Financial Measures, for a definition of PV-10 and a reconciliation of our PV-10 value to the standardized measure. |

| |

| (3) | Includes estimated reserve data relatedOf the PV-10 amounts, $31.6 million, $21.6 million, and $26.6 million represent amounts attributable to our MarcellusUtica Shale crude oilproperties as of December 31, 2017, 2016, and natural gas properties, which were divested in October 2014. See Note 14, Assets Held for Sale, Divestitures and Discontinued Operations,2015, respectively. In February 2018, we entered into a PSA to our consolidated financial statements included elsewhere in this report for additional details related to the divestiture ofsell these assets.properties. |

The following table sets forth information regarding estimated proved reserves for our Marcellus Shale crude oil and natural gas properties:

|

| | | | | | | |

| | As of December 31, |

| | 2013 | | 2012 |

| Proved reserves | | | |

Natural gas (Bcf) | 237 |

| | 179 |

|

Total proved reserves (MMBoe) | 40 |

| | 30 |

|

| Proved developed reserves (MMBoe) | 9 |

| | 7 |

|

Estimated future net cash flows (in millions) | $ | 394 |

| | $ | 135 |

|

| |