0000078003pfe:BiopharmaSegmentMemberpfe:AbrysvoMemberpfe:PrimaryCareMember2021-01-012021-12-31

| | |

|

| UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

|

FORM 10-K

| | | | | |

| |

| (Mark One) | |

x☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

| | | | | |

| ☐ | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period fromto

Commission file number 1-3619

PFIZER INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 13-5315170 |

| |

Delaware | 13-5315170 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| |

235 East 42nd Street New York, New York | 10017 |

(Address of principal executive offices) | (Zip Code) |

66 Hudson Boulevard East, New York, New York 10001-2192

(Address of principal executive offices) (zip code)

(212) 733-2323

(Registrant’s telephone number, including area code)

| | | | | | | | |

|

(212) 733-2323

(Registrant’s telephone number, including area code)

|

|

| |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $.05$0.05 par value | PFE | New York Stock Exchange |

Floating Rate1.000% Notes due 20192027 | PFE27 | New York Stock Exchange |

0.000% Notes due 2020 | New York Stock Exchange |

0.250% Notes due 2022 | New York Stock Exchange |

1.000% Notes due 2027 | New York Stock Exchange |

|

| |

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x☒ No o☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o☐ No x☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x☒No o☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232-405232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes x☒ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated filer☒ Accelerated filer☐Non-accelerated filer☐Smaller reporting company☐Emerging growth company ☐ |

| | | | | | | | |

Large accelerated filer x

| Accelerated filer o

| | Non-accelerated filer o

| | Smaller reporting company o

| | Emerging growth company o

|

| | | (Do not check if a smaller reporting company) | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o☐ No x☒

The aggregate market value of the voting stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter July 2, 2017, was approximately $200$207 billion. This excludes shares of common stock held by directors and executive officers at July 2, 2017.officers. Exclusion of shares held by any person should not be construed to indicate that such person possesses the power, directly or indirectly, to direct or cause the direction of the management or policies of the registrant, or that such person is controlled by or under common control with the registrant. The registrant has no non-voting common stock.

The number of shares outstanding of the registrant’s common stock as of February 20, 201815, 2024 was 5,952,864,7515,646,778,425 shares of common stock, all of one class.

| | | | | |

| |

| DOCUMENTS INCORPORATED BY REFERENCE |

Portions of the 2017 Annual Report to Shareholders | Parts I, II and IV |

Portions of the Proxy Statement for the 20182024 Annual Meeting of Shareholders | Part III |

| | | | | |

| Page |

| Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| N/A |

| |

| |

| |

| N/A |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| ITEM 9C. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | N/A |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| N/A = Not Applicable | |

| | |

| | |

Pfizer Inc. | 2017 Form 10-K | i |

Unless the context requires otherwise, references to “Pfizer,” “the Company,” “we,” “us” or “our” in this 2017 Form 10-K (defined below) refer to Pfizer Inc. and its subsidiaries. For each year presented, Pfizer’s fiscal year-end for subsidiaries operating outside the U.S. is as of and for the year ended November 30 and for U.S. subsidiaries is as of and for the year ended December 31. References to “Notes” in this Form 10-K are to the Notes to the consolidated financial statements in Item 8. Financial Statements and Supplementary Data in this Form 10-K. We also have used several other terms in this 2017 Form 10-K, most of which are explained or defined below. | | | | | |

| |

2017 Financial Report | Exhibit 13 to this 2017 Form 10-K |

2017 Form 10-K | This Annual Report on Form 10-K for the fiscal year ended December 31, 20172023 |

2018 2022 Form 10-K | Our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 |

| Proxy Statement | Proxy Statement for the 20182024 Annual Meeting of Shareholders, which will be filed no later than 120 days after December 31, 2023 |

ACAABO | U.S. Patient Protection and Affordable Care Act, as amended byAccumulated benefit obligation; represents the Health Care and Education Reconciliation Actpresent value of the benefit obligation earned through the end of the year but does not factor in future compensation increases |

| ACIP | Advisory Committee on Immunization Practices |

| ADC | Antibody-Drug Conjugate |

| Alexion | Alexion Pharma International Operations Limited, a subsidiary of AstraZeneca PLC |

| ALK | anaplastic lymphoma kinase |

| Alliance revenues | Revenues from alliance agreements under which we co-promote products discovered or developed by other companies or us |

AnacorArena | AnacorArena Pharmaceuticals, Inc. |

ANDAArray | Abbreviated New Drug ApplicationArray BioPharma Inc. |

AstellasArvinas | Arvinas, Inc. |

| Astellas | Astellas Pharma Inc., Astellas US LLC and Astellas Pharma US, Inc. |

BLAATTR-CM | transthyretin amyloid cardiomyopathy |

| Beam | Beam Therapeutics Inc. |

| Biohaven | Biohaven Pharmaceutical Holding Company Limited |

| BioNTech | BioNTech SE |

| Biopharma | Global Biopharmaceuticals Business |

| Blackstone | Blackstone Life Sciences |

| BLA | Biologics License Application |

| BMS | Bristol-Myers Squibb Company |

cGMPsBOD | Board of Directors |

| CDC | U.S. Centers for Disease Control and Prevention |

| cGMP | current Good Manufacturing Practices |

CFDACGRP | China Food and Drug Administrationcalcitonin gene-related peptide |

DEACMS | Centers for Medicare & Medicaid Services |

| Comirnaty* | Unless otherwise noted, refers to, as applicable, and as authorized or approved, the Pfizer-BioNTech COVID-19 Vaccine, the Pfizer-BioNTech COVID-19 Vaccine, Bivalent (Original and Omicron BA.4/BA.5), Comirnaty (COVID-19 Vaccine, mRNA, 2023-2024 Formula), the Pfizer-BioNTech COVID-19 Vaccine (2023-2024 Formula), Comirnaty Original/Omicron BA.1, Comirnaty Original/Omicron BA.4/BA.5 and Comirnaty XBB.1.5. |

| Consumer Healthcare JV | GSK Consumer Healthcare JV |

| COVID-19 | novel coronavirus disease of 2019 |

| DEA | U.S. Drug Enforcement Agency |

Developed MarketsEurope | U.S.,Includes the following markets: Western Europe, Scandinavian countries and Finland |

| Developed Markets | Includes the following markets: U.S., Developed Europe and Developed Rest of World |

| Developed Rest of World | Includes the following markets: Japan, Canada, Australia, South Korea, Scandinavian countries, FinlandAustralia and New Zealand |

EFPIAEC | European Federation of Pharmaceutical Industries and AssociationsCommission |

EHEMA | Essential Health |

EMA | European Medicines Agency |

| Emerging Markets | Includes, but is not limited to, the following markets: Asia (excluding Japan and South Korea), Latin America, Eastern Europe, Africa,Central Europe, the Middle East, Central EuropeAfrica and Turkey |

EUEPS | European Unionearnings per share |

| ESG | Environmental, Social and Governance |

| ESOP | employee stock ownership plan |

| EU | European Union |

| EUA | emergency use authorization |

| Exchange Act | Securities Exchange Act of 1934, as amended |

FCPAFASB | Financial Accounting Standards Board |

| FCPA | U.S. Foreign Corrupt Practices Act |

| FDA | U.S. Food and Drug Administration |

| FFDCA | U.S. Federal Food, Drug and Cosmetic Act |

HISGAAP | Hospira Infusion SystemsGenerally Accepted Accounting Principles |

| | | | | | | | |

| Pfizer Inc. | 2023 Form 10-K | i |

| | | | | |

| GBT | Global Blood Therapeutics, Inc. |

HospiraGDFV | Hospira, Inc.grant-date fair value |

ICU MedicalGenmab | ICU Medical, Inc.Genmab A/S |

IHGPD | Innovative HealthGlobal Product Development organization |

| GSK | GSK plc |

| Haleon | Haleon plc |

| HHS | U.S. Department of Health and Human Services |

| HIPAA | Health Insurance Portability and Accountability Act of 1996 |

| Hospira | Hospira, Inc. |

| IPR&D | In-processin-process research and development |

| IRA | Inflation Reduction Act of 2022 |

| IRC | Internal Revenue Code |

| IRS | U.S. Internal Revenue Service |

| IT | information technology |

| JV | joint venture |

| King | King Pharmaceuticals LLC (formerly King Pharmaceuticals, Inc.) |

| LIBOR | London Interbank Offered Rate |

| LOE | loss of exclusivity |

| MCO | managed care organization |

| mCRC | metastatic colorectal cancer |

| mCRPC | metastatic castration-resistant prostate cancer |

| mCSPC | metastatic castration-sensitive prostate cancer |

| MD&A | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| MDL | Multi-District Litigation |

| Medivation | Medivation LLC (formerly Medivation, Inc.) |

| Meridian | Meridian Medical Technologies, Inc. |

| Moody’s | Moody’s Investors Service |

| mRNA | messenger ribonucleic acid |

| MSA | Manufacturing Supply Agreement |

| Mylan | Mylan N.V. |

| Mylan-Japan collaboration | a pre-existing strategic collaboration between Pfizer and Mylan for generic drugs in Japan that terminated on December 21, 2020 |

| NAV | net asset value |

| NDA | new drug application |

| Nimbus | NimbusTherapeutics, LLC |

| nmCRPC | non-metastatic castration-resistant prostate cancer |

| nmCSPC | non-metastatic castration-sensitive prostate cancer |

| NSCLC | non-small cell lung cancer |

| NYSE | New York Stock Exchange |

| ODT | oral disintegrating tablet |

| Ono | Ono Pharmaceutical Co., Ltd. |

| OPKO | OPKO Health, Inc. |

| ORD | Oncology Research and Development |

LOEOTC | Loss of Exclusivityover-the-counter |

MCOPaxlovid* | Managed Care Organizationan oral COVID-19 treatment (nirmatrelvir tablets and ritonavir tablets) |

MedivationPBM | Medivation, Inc.pharmacy benefit manager |

NDAPBO | New Drug ApplicationProjected benefit obligation; represents the present value of the benefit obligation earned through the end of the year and factors in future compensation increases |

NYSEPC1 | New York Stock ExchangePfizer CentreOne |

OTCPGS | over-the-counter |

PBM | Pharmacy Benefit Manager |

PGS | Pfizer Global Supply |

PMDAPharmacia | Pharmaceuticals and Medical Device Agency in JapanPharmacia LLC (formerly Pharmacia Corporation) |

R&DPIE | Pfizer Investment Enterprises Pte. Ltd. (a wholly-owned finance subsidiary of Pfizer) |

| PP&E | Property, plant and equipment |

| PRAC | Pharmacovigilance Risk Assessment Committee |

| PRD | Pfizer Research and Development |

SECPrevnar family | Includes Prevnar 20/Apexxnar (pediatric and adult) and Prevnar 13/Prevenar 13 (pediatric and adult) |

| PsA | psoriatic arthritis |

| QCE | quality consistency evaluation |

| RA | rheumatoid arthritis |

| | | | | | | | |

| Pfizer Inc. | 2023 Form 10-K | ii |

| | | | | |

| RCC | renal cell carcinoma |

| R&D | research and development |

| ReViral | ReViral Ltd. |

| ROU | right of use |

| RSV | respiratory syncytial virus |

| S&P | Standard & Poor’s |

| Seagen | Seagen Inc. and its subsidiaries |

| SEC | U.S. Securities and Exchange Commission |

| SI&A | selling, informational and administrative |

| SMPA | Sumitomo Pharma America, Inc. |

| Takeda | Takeda Pharmaceutical Company Limited |

| Tax Cuts and Jobs Act or TCJA | H.R.1, “AnLegislation commonly referred to as the U.S. Tax Cuts and Jobs Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018”2017 |

U.K.Trillium | United KingdomTrillium Therapeutics ULC (formerly Trillium Therapeutics Inc.) |

U.S.TSAs | transition service arrangements |

| UC | ulcerative colitis |

| U.K. | United Kingdom |

| Upjohn Business | Pfizer’s former global, primarily off-patent branded and generics business, which included a portfolio of 20 globally recognized solid oral dose brands, including Lipitor, Lyrica, Norvasc, Celebrex and Viagra, as well as a U.S.-based generics platform, Greenstone, that was spun-off on November 16, 2020 and combined with Mylan to create Viatris |

| U.S. | United States |

| Valneva | Valneva SE |

| VBP | volume-based procurement |

| Viatris | Viatris Inc. |

| ViiV | ViiV Healthcare Limited |

| Vyndaqel family | Includes Vyndaqel, Vyndamax and Vynmac |

| WRDM | Worldwide Research, Development and Medical |

| WTO | World Trade Organization |

| Wyeth | Wyeth LLC (formerly Wyeth) |

|

| | |

Pfizer Inc. | 2017 Form 10-K | ii |

|

| |

| Pfizer at a GlanceWorking together for a healthier world

|

|

| |

| |

| |

| 9Products with Direct Product and/or Alliance Revenues of Greater than $1 Billion in 2017 |

| |

| 2 Distinct Business Segments — |

| |

| 6 Primary Therapeutic Areas in Pfizer Innovative Health —Internal Medicine, Vaccines, Oncology, Inflammation & Immunology, Rare Disease and

Consumer Healthcare

|

| |

| 4 Pfizer Essential Health Product Categories —Global Brands (Legacy Established Products & Peri-LOE Products), Sterile Injectable Pharmaceuticals, Biosimilars and Pfizer CentreOne

|

| |

| >125 Countries Where We Sell Our Products |

| |

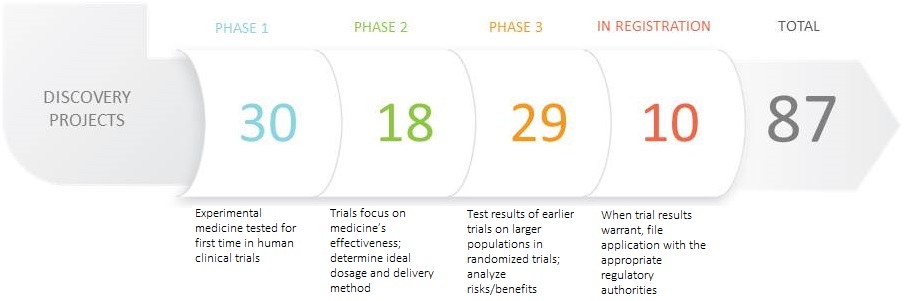

| 87Projects in Clinical Research & Development(1) |

| |

| |

| |

| 58 Manufacturing Sites Worldwide Operated*The Pfizer-BioNTech COVID-19 Vaccine (2023-2024 Formula) and certain uses of Paxlovid have not been approved or licensed by PGS(2) |

| |

| |

(1) As of January 31, 2018

(2) As of December 31, 2017

This summary does not include information that will be incorporated by reference into Part III of this 2017 Form 10-K from our 2018 Proxy Statement.

|

| | |

Pfizer Inc. | 2017 Form 10-K | iii |

ABOUT PFIZER

Pfizer Inc. is a research-based, global biopharmaceutical company. We apply science and our global resources to bring therapies to people that extend and significantly improve their lives through the discovery, development and manufacture of healthcare products. Our global portfolio includes medicines and vaccines, as well as many of the world’s best-known consumer healthcare products. We work across developed and emerging markets to advance wellness, prevention, treatments and cures that challenge the most feared diseases of our time. We collaborate with healthcare providers, governments and local communities to support and expand access to reliable, affordable healthcare around the world. Our revenues are derived from the sale of our products and, to a much lesser extent, from alliance agreements, under which we co-promote products discovered or developed by other companies or us. The majority of our revenues come from the manufacture and sale of biopharmaceutical products. The Company was incorporated under the laws of the State of Delaware on June 2, 1942.

We believe that our medicines provide significant value for both healthcare providers and patients, not only from the improved treatment of diseases but also from a reduction in other healthcare costs, such as emergency room or hospitalization costs, as well as improvements in health, wellness and productivity. We continue to actively engage in dialogues about the value of our medicines and how we can best work with patients, physicians and payers to prevent and treat disease and improve outcomes. We continue to work within the current legal and pricing structures, as well as continue to review our pricing arrangements and contracting methods with payers, to maximize patient access and minimize any adverse impact on our revenues. We remain firmly committed to fulfilling our company’s purpose of innovating to bring therapies to patients that extend and significantly improve their lives. By doing so, we expect to create value for the patients we serve and for our shareholders.

We are committed to capitalizing on growth opportunities by advancing our own pipeline and maximizing the value of our in-line products, as well as through various forms of business development, which can include alliances, licenses, joint ventures, collaborations, equity- or debt-based investments, dispositions, mergers and acquisitions. We view our business development activity as an enabler of our strategies, and we seek to generate earnings growth and enhance shareholder value by pursuing a disciplined, strategic and financial approach to evaluating business development opportunities.

Our significant recent business development activities include:

On February 3, 2017, we completed the sale of our global infusion systems net assets, HIS, to ICU Medical for up to approximately $900 million, composed of cash and contingent cash consideration, ICU Medical common stock and seller financing. HIS, which was acquired as part of the Hospira acquisition in September 2015, includes IV pumps, solutions and devices.

On December 22, 2016, for $1,045 million we acquired the development and commercialization rights to AstraZeneca’s small molecule anti-infectives business, primarily outside the U.S., which includes the newly approved EU drug Zavicefta™ (ceftazidime-avibactam), the marketed agents Merrem™/Meronem™ (meropenem) and Zinforo™ (ceftaroline fosamil), and the clinical development assets aztreonam-avibactam and ceftaroline fosamil-avibactam.

On September 28, 2016, we acquired Medivation for approximately $14.3 billion in cash ($13.9 billion, net of cash acquired). Medivation is a biopharmaceutical company focused on developing and commercializing small molecules for oncology.

On June 24, 2016, we acquired Anacor for approximately $4.9 billion in cash ($4.5 billion net of cash acquired), plus $698 million debt assumed. Anacor is a biopharmaceutical company focused on novel small-molecule therapeutics derived from its boron chemistry platform.

On September 3, 2015, we acquired Hospira, a leading provider of sterile injectable drugs and infusion technologies as well as a provider of biosimilars, for approximately $16.1 billion in cash ($15.7 billion, net of cash acquired).

For a further discussion of our strategy and our business development initiatives, see the Notes to Consolidated Financial Statements—Note 2. Acquisitions, Sale of Hospira Infusion Systems Net Assets, Research and Development and Collaborative Arrangements, Equity-Method Investments and Cost-Method Investment and the Overview of Our Performance, Operating Environment, Strategy and Outlook—Our Strategy—Our Business Development Initiatives section in our 2017 Financial Report.

Our businesses are heavily regulated in most of the countries in which we operate. In the U.S., the principal authority regulating our operations is the FDA. The Pfizer-BioNTech COVID-19 Vaccine (2023-2024 Formula) has been authorized for emergency use by the FDA regulatesunder an EUA to prevent COVID-19 in individuals aged 6 months through 11 years of age. Paxlovid has been authorized for emergency use by the FDA under an EUA for the treatment of mild-to-moderate COVID-19 in pediatric patients (12 years of age and older weighing at least 40 kg) who are at high risk for progression to severe COVID-19, including hospitalization or death. The emergency uses are only authorized for the duration of the declaration that circumstances exist justifying the authorization of emergency use of the medical product during the COVID-19 pandemic under Section 564(b)(1) of the FFDCA, unless the declaration is terminated or authorization revoked sooner. Please see the EUA Fact Sheets at www.covid19oralrx.com and www.cvdvaccine-us.com.

This Form 10-K includes discussion of certain clinical studies relating to various in-line products and/or product candidates. These studies typically are part of a larger body of clinical data relating to such products or product candidates, and the discussion herein should be considered in the context of the larger body of data. In addition, clinical trial data are subject to differing interpretations, and, even when we view data as sufficient to support the safety andand/or efficacy of the products we offera product candidate or a new indication for an in-line product, regulatory authorities may not share our views and our research, quality, manufacturing processes, product promotion, advertising and product labeling. Similar regulations exist in most other countries, and in many countries the government also regulates our prices. In the EU, the EMA regulates the scientific evaluation, supervision and safety monitoring of our products, and employs a centralized procedure formay require additional data or may deny approval of drugs for the EU and the European Economic Area countries. In Japan, the PMDA is involved in a wide range of regulatory activities, including clinical studies, approvals, post-marketing reviews and pharmaceutical safety. Health authorities in many middle and lower income countries require marketing approval by a recognized regulatory authority (i.e., similar to the authority of the FDA or EMA) before they begin to conduct their application review process and/or issue their final approval. For additional information, see the Government Regulation and Price Constraints section below.altogether.

Note: Some amounts in this 2017 Form 10-K may not add due to rounding. All percentages have been calculated using unrounded amounts. All trademarks mentioned are the property of their owners.

Our website is located at www.pfizer.com. This2017 Form 10-K, our Quarterly Reports on Form 10-Q, and our Current Reports on Form 8-K and our proxy statements, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, are, or will be, available (free of charge) on our website, in text format and, where applicable, in interactive data file format, as soon as reasonably practicable after we electronically file this material with, or furnish it to, the SEC.

Throughout this2017 Form 10-K, we “incorporate by reference” certain information from other documents filed or to be filed with the SEC, including our 2018 Proxy Statement and the 2017 Financial Report, portions of which are filed as Exhibit 13 to this 2017 Form 10-K, and which also will be contained in Appendix A to our 2018 Proxy Statement. The SEC allows us to disclose important information by referring to it in that manner. Please refer to this information. Our 2017 Annual Report to Shareholders consists of the 2017 Financial Report and the Corporate and Shareholder Information attached to the 2018 Proxy Statement. Our 2017 Financial ReportThis Form 10-K will be available on our website on or about February 22, 2018.2024. Our 2018 Proxy Statement will be available on our website on or about March 15, 2018.14, 2024.

Our 2023 Impact Report, which provides enhanced ESG disclosures, will be available on our website on or about March 14, 2024. We also have a Pfizer Investor Insights website, which includes articles on the company, its products and its pipeline, located at insights.pfizer.com. Information in our 2023 Impact Report and on the Pfizer Investor Insights website are not incorporated by reference into this Form 10-K.

We may use our website as a means of disclosing material information and for complying with our disclosure obligations under Regulation Fair Disclosure promulgated by the SEC. These disclosures are included on our website in the “Investors”“About—Investors” or “News”“Newsroom” sections. Accordingly, investors should monitor these portions of our website, in addition to following Pfizer’sour press releases, SEC filings, public conference calls and webcasts, as well as Pfizer’sour social media channels (Pfizer’s(our Facebook page, Instagram account (@Pfizerinc), YouTube page, LinkedIn page, and X (formerly known as Twitter) accounts (@Pfizer and @Pfizer_News)). The information contained on our website, our Facebook, Instagram, YouTube and LinkedIn pages and Twitteror our X accounts, (@Pfizer and @Pfizer_News)).

or any third-party website, is not incorporated by reference into this Form 10-K.

Information relating to corporate governance at Pfizer, including our Corporate Governance Principles; Director Qualification Standards; Pfizer Policies on Business Conduct (for all of our employees, including our Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer); Code of Business Conduct and Ethics for Members of the Board of Directors; information concerning our Directors; ways to

| | | | | | | | |

| Pfizer Inc. | 2023 Form 10-K | iii |

communicate by e-mail with our Directors; information concerning our Board Committees; Committee Charters; Charter of the Lead Independent Director; and transactions in Pfizer securities by Directors and Officers; as well as Chief Executive Officer and Chief Financial Officer certifications,Officers are available on our website. We will provide any of the foregoing information without charge upon written request to our Corporate Secretary, Pfizer Inc., 23566 Hudson Boulevard East, 42nd Street, New York, NY 10017.10001-2192. We will disclose any future amendments to, or waivers from, provisions of the Pfizer Policies on Business Conduct affecting our Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer and Controllerexecutive officers on our website as promptly as practicable, as may be required under applicable SEC and NYSE rules. Information relating to shareholder services, including the Computershare Investment Program, book-entry share ownership and direct deposit of dividends, is also available on our website.

The | | | | | | | | |

| Pfizer Inc. | 2023 Form 10-K | iv |

FORWARD-LOOKING INFORMATION AND FACTORS THAT MAY AFFECT FUTURE RESULTS

This Form 10-K contains forward-looking statements. We also provide forward-looking statements in other materials we release to the public, as well as public oral statements. Given their forward-looking nature, these statements involve substantial risks, uncertainties and potentially inaccurate assumptions.

We have tried, wherever possible, to identify such statements by using words such as “will,” “may,” “could,” “likely,” “ongoing,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “assume,” “target,” “forecast,” “guidance,” “goal,” “objective,” “aim,” “seek,” “potential,” “hope” and other words and terms of similar meaning or by using future dates.

We include forward-looking information containedin our discussion of the following, among other topics:

•our anticipated operating and financial performance, including financial guidance and projections;

•reorganizations, business plans, strategy, goals and prospects;

•expectations for our product pipeline, in-line products and product candidates, including anticipated regulatory submissions, data read-outs, study starts, approvals, launches, clinical trial results and other developing data; revenue contribution and projections; potential pricing and reimbursement; potential market dynamics, including patient demand, market size and utilization rates; and growth, performance, timing of exclusivity and potential benefits;

•strategic reviews, capital allocation objectives, dividends and share repurchases;

•plans for and prospects of our acquisitions, dispositions and other business development activities, and our ability to successfully capitalize on growth opportunities and prospects;

•sales, expenses, interest rates, foreign exchange rates and the outcome of contingencies, such as legal proceedings;

•expectations regarding the impact of or changes to existing or new government regulations or laws;

•our ability to anticipate and respond to and our expectations regarding the impact of macroeconomic, geopolitical, health and industry trends, pandemics, acts of war and other large-scale crises; and

•manufacturing and product supply.

In particular, forward-looking information in this Form 10-K includes statements relating to specific future actions, performance and effects, including, among others, the expected benefits of the organizational changes to our operations; our anticipated operating and financial performance; our ongoing efforts to respond to COVID-19, including our plans and expectations regarding Comirnaty and Paxlovid, and any potential future vaccines or treatments, including anticipated revenue and expectations for the commercial market for Comirnaty and Paxlovid; our expectations regarding the impact of COVID-19 on our website,business; expected patent terms; the expected impact of patent expiries and generic and biosimilar competition; the expected pricing pressures on our Facebook, YouTubeproducts and LinkedIn pagesthe anticipated impact to our business; the benefits expected from our business development transactions, including our December 2023 acquisition of Seagen; our anticipated liquidity position; the anticipated costs, savings and potential benefits from certain of our initiatives, including our enterprise-wide Realigning our Cost Base program, which we launched in October 2023, and our Transforming to a More Focused Company program; our expectations regarding the impact from the 2023 tornado on our manufacturing facility in Rocky Mount, NC; our greenhouse gas emission reduction goals; our planned capital spending; and our capital allocation framework.

Given their nature, we cannot assure that any outcome expressed in these forward-looking statements will be realized in whole or our Twitter accounts doesin part. Actual outcomes may vary materially from past results and those anticipated, estimated, implied or projected. These forward-looking statements may be affected by underlying assumptions that may prove inaccurate or incomplete, or by known or unknown risks and uncertainties, including those described in this section, in the Item 1A. Risk Factors section or in MD&A. Therefore, you are cautioned not and shall not be deemed to constitute a partunduly rely on forward-looking statements, which speak only as of the date of this 2017Form 10-K. Pfizer’s referencesWe undertake no obligation to update forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable securities law. You are advised, however, to consult any further disclosures we make on related subjects.

Some of the URLsfactors that could cause actual results to differ are identified below, as well as those discussed in the Item 1A. Risk Factors section and within MD&A. We note these factors for websites are intendedinvestors as permitted by the Private Securities Litigation Reform Act of 1995. The occurrence of any of the risks identified below, in the Item 1A. Risk Factors section, or within MD&A, or other risks currently unknown, could have a material adverse effect on our business, financial condition or results of operations, or we may be required to increase our accruals for contingencies. It is not possible to predict or identify all such factors. Consequently, you should not consider the following to be inactive textual references only.a complete discussion of all potential risks or uncertainties:

Risks Related to Our Business, Industry and Operations, and Business Development:

•the outcome of R&D activities, including the ability to meet anticipated pre-clinical or clinical endpoints, commencement and/or completion dates for our pre-clinical or clinical trials, regulatory submission dates, and/or regulatory approval and/or launch dates; the possibility of unfavorable pre-clinical and clinical trial results, including the possibility of unfavorable new pre-clinical or clinical data and further analyses of existing pre-clinical or clinical data; risks associated with preliminary, early stage or interim data; the risk that pre-clinical and clinical trial data are subject to differing interpretations and assessments, including during the peer review/publication process, in the scientific community generally, and by regulatory authorities; and whether and when additional data from our pipeline programs will be published in scientific journal publications, and if so, when and with what modifications and interpretations;

•our ability to successfully address comments received from regulatory authorities such as the FDA or the EMA, or obtain approval for new products and indications from regulators on a timely basis or at all;

•regulatory decisions impacting labeling, including the scope of indicated patient populations, product dosage, manufacturing processes, safety and/or other matters, including decisions relating to emerging developments regarding potential product impurities; uncertainties regarding the ability to obtain, and the scope of, recommendations by technical or advisory committees, and the timing of, and ability to obtain, pricing approvals and product launches, all of which could impact the availability or commercial potential of our products and product candidates;

•claims and concerns that may arise regarding the safety or efficacy of in-line products and product candidates, including claims and concerns that may arise from the outcome of post-approval clinical trials, which could impact marketing approval, product labeling, and/or availability or commercial potential;

| | | | | | | | |

| | |

| Pfizer Inc. | 20172023 Form 10-K | 1 |

•the success and impact of external business development activities, such as the recent acquisition of Seagen, including the ability to identify and execute on potential business development opportunities; the ability to satisfy the conditions to closing of announced transactions in the anticipated time frame or at all; the ability to realize the anticipated benefits of any such transactions in the anticipated time frame or at all; the potential need for and impact of additional equity or debt financing to pursue these opportunities, which has in the past and could in the future result in increased leverage and/or a downgrade of our credit ratings and could limit our ability to obtain future financing; challenges integrating the businesses and operations; disruption to business and operations relationships; risks related to growing revenues for certain acquired or partnered products; significant transaction costs; and unknown liabilities;

•competition, including from new product entrants, in-line branded products, generic products, private label products, biosimilars and product candidates that treat or prevent diseases and conditions similar to those treated or intended to be prevented by our in-line products and product candidates;

•the ability to successfully market both new and existing products, including biosimilars;

•difficulties or delays in manufacturing, sales or marketing; supply disruptions, shortages or stock-outs at our facilities or third-party facilities that we rely on; and legal or regulatory actions;

•the impact of public health outbreaks, epidemics or pandemics (such as COVID-19) on our business, operations and financial condition and results, including impacts on our employees, manufacturing, supply chain, sales and marketing, R&D and clinical trials;

•risks and uncertainties related to our efforts to continue to develop and commercialize Comirnaty and Paxlovid or any potential future COVID-19 vaccines, treatments or combinations, as well as challenges related to their manufacturing, supply and distribution, including, among others, the risk that as the market for COVID-19 products continues to become more endemic and seasonal, demand for our COVID-19 products has and may continue to be reduced or not meet expectations, or may no longer exist, which has and may continue to lead to reduced revenues, excess inventory on-hand and/or in the channel which, for Paxlovid and Comirnaty, resulted in significant inventory write-offs in 2023 and could continue to result in inventory write-offs, or other unanticipated charges; challenges related to the transition to the commercial market for our COVID-19 products; uncertainties related to the public’s adherence to vaccines, boosters, treatments or combinations; and risks related to our ability to accurately predict or achieve our revenue forecasts for Comirnaty and Paxlovid or any potential future COVID-19 vaccines or treatments;

•trends toward managed care and healthcare cost containment, and our ability to obtain or maintain timely or adequate pricing or favorable formulary placement for our products;

•interest rate and foreign currency exchange rate fluctuations, including the impact of currency devaluations and monetary policy actions in countries experiencing high inflation or deflation rates;

•any significant issues involving our largest wholesale distributors or government customers, which account for a substantial portion of our revenues;

•the impact of the increased presence of counterfeit medicines, vaccines or other products in the pharmaceutical supply chain;

•any significant issues related to the outsourcing of certain operational and staff functions to third parties;

•any significant issues related to our JVs and other third-party business arrangements, including modifications related to supply agreements or other contracts with customers including governments or other payors;

•uncertainties related to general economic, political, business, industry, regulatory and market conditions including, without limitation, uncertainties related to the impact on us, our customers, suppliers and lenders and counterparties to our foreign-exchange and interest-rate agreements of challenging global economic conditions, such as inflation or interest rate fluctuations, and recent and possible future changes in global financial markets;

•the exposure of our operations globally to possible capital and exchange controls, economic conditions, expropriation, sanctions and/or other restrictive government actions, changes in intellectual property legal protections and remedies, unstable governments and legal systems and inter-governmental disputes;

•the impact of disruptions related to climate change and natural disasters, including uncertainties related to the impact of the tornado at our manufacturing facility in Rocky Mount, NC in 2023;

•any changes in business, political and economic conditions due to actual or threatened terrorist activity, geopolitical instability, political or civil unrest or military action, including the ongoing conflicts between Russia and Ukraine and in the Middle East and the resulting economic or other consequences;

•the impact of product recalls, withdrawals and other unusual items, including uncertainties related to regulator-directed risk evaluations and assessments, including our ongoing evaluation of our product portfolio for the potential presence or formation of nitrosamines;

•trade buying patterns;

•the risk of an impairment charge related to our intangible assets, goodwill or equity-method investments;

•the impact of, and risks and uncertainties related to, restructurings and internal reorganizations, as well as any other corporate strategic initiatives and growth strategies, and cost-reduction and productivity initiatives, each of which requires upfront costs but may fail to yield anticipated benefits and may result in unexpected costs, organizational disruption, adverse effects on employee morale, retention issues or other unintended consequences;

•the ability to successfully achieve our climate goals and progress our environmental sustainability and other ESG priorities;

Risks Related to Government Regulation and Legal Proceedings:

•the impact of any U.S. healthcare reform or legislation or any significant spending reduction or cost control efforts affecting Medicare, Medicaid or other publicly funded or subsidized health programs, including the IRA, or changes in the tax treatment of employer-sponsored health insurance that may be implemented;

•U.S. federal or state legislation or regulatory action and/or policy efforts affecting, among other things, pharmaceutical product pricing, intellectual property, reimbursement or access or restrictions on U.S. direct-to-consumer advertising; limitations on

interactions with healthcare professionals and other industry stakeholders; as well as pricing pressures for our products as a result of highly competitive biopharmaceutical markets;

COMMERCIAL OPERATIONS•legislation or regulatory action in markets outside of the U.S., such as China or Europe, including, without limitation, laws related to pharmaceutical product pricing, intellectual property, medical regulation, environmental protections, reimbursement or access, including, in particular, continued government-mandated reductions in prices and access restrictions for certain biopharmaceutical products to control costs in those markets;

•legal defense costs, insurance expenses, settlement costs and contingencies, including without limitation, those related to actual or alleged environmental contamination;

•the risk and impact of an adverse decision or settlement and risk related to the adequacy of reserves related to legal proceedings;

•the risk and impact of tax related litigation and investigations;

•governmental laws and regulations affecting our operations, including, without limitation, the IRA, changes in laws and regulations or their interpretation, including, among others, changes in tax laws and regulations internationally and in the U.S., the adoption of global minimum taxation requirements outside the U.S. generally effective in most jurisdictions since January 1, 2024 and potential changes to existing tax law by the current U.S. Presidential administration and Congress, including the proposed “Tax Relief for American Families and Workers Act of 2024”;

Risks Related to Intellectual Property, Technology and Security:

•any significant breakdown or interruption of our IT systems and infrastructure (including cloud services);

•any business disruption, theft of confidential or proprietary information, security threats on facilities or infrastructure, extortion or integrity compromise resulting from a cyber-attack or other malfeasance by, but not limited to, nation states, employees, business partners or others;

•risks and challenges related to the use of artificial intelligence-based software;

•the risk that our currently pending or future patent applications may not be granted on a timely basis or at all, or any patent-term extensions that we seek may not be granted on a timely basis, if at all; and

•risks to our products, patents and other intellectual property, such as: (i) claims of invalidity that could result in LOE; (ii) claims of patent infringement, including asserted and/or unasserted intellectual property claims; (iii) claims we may assert against intellectual property rights held by third parties; (iv) challenges faced by our collaboration or licensing partners to the validity of their patent rights; or (v) any pressure, or legal or regulatory action by, various stakeholders or governments that could potentially result in us not seeking intellectual property protection or agreeing not to enforce or being restricted from enforcing intellectual property rights related to our products, including Comirnaty and Paxlovid.

ABOUT PFIZER

Pfizer Inc. is a research-based, global biopharmaceutical company. We apply science and our global resources to bring therapies to people that extend and significantly improve their lives through the discovery, development, manufacture, marketing, sale and distribution of biopharmaceutical products worldwide. We work across developed and emerging markets to advance wellness, prevention, treatments and cures that challenge the most feared diseases of our time. We collaborate with healthcare providers, governments and local communities to support and expand access to reliable, affordable healthcare around the world. The Company was incorporated under the laws of the State of Delaware on June 2, 1942.

Most of our revenues come from the manufacture and sale of biopharmaceutical products. We also sell products for the detection of certain illnesses and provide end-to-end R&D services to select innovative biotech companies. We believe that our medicines and vaccines provide significant value for healthcare providers and patients through improved treatment of diseases and improvements in health, wellness and productivity as well as by reducing other healthcare costs, such as emergency room visits or hospitalizations. We seek to enhance the value of our medicines and vaccines and actively engage in dialogues about how we can best work with patients, physicians and payors to prevent and treat disease and improve outcomes. We seek to maximize patient access and evaluate our pricing arrangements and contracting methods with payors to minimize adverse impact on our revenues within the current legal and pricing structures.

We are committed to fulfilling our purpose: Breakthroughs that change patients’ lives. Our purpose fuels everything we do and reflects both our passion for science and our commitment to patients. Our core business principles are:

1.Trust is Everything

2.Science Will Win

3.Disruption Calls for Innovation

4.Time is Life

5.Execution Makes the Difference.

In addition, Pfizer’s ESG strategy, which is integrated into our corporate strategy, focuses on six areas where we see opportunities to create a meaningful impact: product innovation; equitable access and pricing; product quality and safety; diversity, equity and inclusion; climate change; and business ethics.

We manageare committed to strategically capitalizing on growth opportunities, primarily by advancing our own product pipeline and maximizing the value of our existing products, but also through various business development activities. We view our business development activity as an enabler of our strategies and seek to generate growth by pursuing opportunities and transactions that have the potential to strengthen our business and our

| | | | | | | | |

| Pfizer Inc. | 2023 Form 10-K | 3 |

capabilities. We assess our business, assets and scientific capabilities/portfolio as part of our regular, ongoing portfolio review process and also continue to consider business development activities that will help advance our business strategy.

On December 14, 2023, we completed our acquisition of Seagen, a global biotechnology company that discovers, develops and commercializes transformative cancer medicines. With the addition of Seagen’s pipeline and its four in-line medicines (Padcev, Adcetris, Tukysa and Tivdak), Pfizer’s oncology portfolio spans multiple modalities, including ADCs, small molecules, bispecifics and other immunotherapies. In addition to the acquisition of Seagen, our significant recent business development activities in 2023 include, among others, the September 2023 divestiture of our early-stage rare disease gene therapy portfolio to Alexion. For a further discussion of our strategy and our business development initiatives, see the Overview of Our Performance, Operating Environment, Strategy and Outlooksection within MD&A and Note 2. COMMERCIAL OPERATIONS

In 2023, we managed our commercial operations through a global structure consisting of two distinct business segments: Pfizer Innovative Health (IH) and Pfizer Essential Health (EH). The IH and EH operating segments, are each led by a single manager. Eachmanager: Biopharma, our innovative science-based biopharmaceutical business, and Business Innovation, an operating segment has responsibility for itsestablished in the first quarter of 2023 that includes PC1, our contract development and manufacturing organization and a leading supplier of specialty active pharmaceutical ingredients, and Pfizer Ignite, an offering that provides strategic guidance and end-to-end R&D services to select innovative biotech companies that align with our R&D focus areas. In 2023, Biopharma was the only reportable segment. The commercial activitiesstructure within Biopharma included three broad customer groups in 2023: Primary Care, Specialty Care and for certain IPR&D projects for new investigational productsOncology.

At the beginning of 2024, we made changes in our commercial organization to incorporate Seagen and additional indications for in-line products that generally have achieved proof-of-concept. Each business has a geographic footprint across developedimprove focus, speed and emerging markets.

Some additional information aboutexecution. Specifically, within our business segments as ofBiopharma reportable segment we created the date ofPfizer Oncology Division, the filing of this 2017 Form 10-K follows:

Pfizer U.S. Commercial Division, and the Pfizer International Commercial Division: | | | | | |

| Division | Description |

| | |

| | |

IH focuses on developing and commercializing novel, value-creating medicines and vaccines that significantly improve patients’ lives, as well as products for consumer healthcare.

Key therapeutic areas include internal medicine, vaccines, oncology, inflammation & immunology, rare disease and consumer healthcare.

| | EH includes legacy brands that have lost or will soon lose market exclusivity in both developed and emerging markets, branded generics, generic sterile injectable products, biosimilars, select branded products including anti-infectives and, through February 2, 2017, HIS. EH also includes an R&D organization, as well as our contract manufacturing business. |

We expect that the IH biopharmaceutical portfolio of innovative, largely patent-protected, in-line and newly launched products will be sustained by ongoing investments to develop promising assets and targeted business development in areas of focus to help ensure a pipeline of highly-differentiated product candidates in areas of unmet medical need. The assets managed by IH are science-driven, highly differentiated and generally require a high-level of engagement with healthcare providers and consumers. | | EH is expected to generate strong consistent cash flow by providing patients around the world with access to effective, lower-cost, high-value treatments. EH leverages our biologic development, regulatory and manufacturing expertise to seek to advance its biosimilar development portfolio. Additionally, EH leverages capabilities in formulation development and manufacturing expertise to help advance its generic sterile injectables portfolio. EH may also engage in targeted business development to further enable its commercial strategies.

|

IH will have continued focus on R&D productivity and pipeline strength while maximizing the value of our recently launched brands and in-line portfolio. Our acquisitions of Anacor and Medivation expanded our pipeline in the high priority therapeutic areas of inflammation and immunology and oncology.

| | For EH, we continue to invest in growth drivers and manage the portfolio to extract additional value while seeking opportunities for operating efficiencies. This strategy includes active management of our portfolio; maximizing growth of core product segments; acquisitions to strengthen core areas of our portfolio further, such as our recent acquisition of AstraZeneca’s small molecule anti-infectives business; and divestitures to increase focus on our core strengths. In line with this strategy, on February 3, 2017, we completed the sale of Pfizer’s global infusion systems net assets, representing the infusion systems net assets that we acquired as part of the Hospira transaction, HIS, to ICU Medical.

|

Leading brands include:

- Prevnar 13/Prevenar 13

- Xeljanz

- Eliquis

- Lyrica (U.S., Japan and certain other markets)

- Enbrel (outside the U.S. and Canada)

- Ibrance

- Xtandi

- Several OTC consumer healthcare products (e.g., Advil

and Centrum)

| | Leading brands include:

- Lipitor

- Premarin family

- Norvasc

- Lyrica (Europe, Russia, Turkey, Israel and Central Asia

countries)

- Celebrex

- Viagra*

- Inflectra/Remsima

- Several sterile injectable products

|

| |

* | Viagra lost exclusivity in the U.S. in December 2017. Beginning in the first quarter of 2018, revenues for Viagra in the U.S. and Canada, which were reported in IH through December 2017, will be reported in EH (which reported all other Viagra revenues excluding the U.S. and Canada through 2017). Therefore, total Viagra worldwide revenues will be reported in EH from 2018 forward. |

For a further discussion of these operating segments, see the Innovative Health and Essential Health sections below andthe Notes to Consolidated Financial Statements—Note 18. Segment, Geographic and Other Revenue Information, including the tables therein captioned Selected Income Statement Information, Geographic Information and Significant Product Revenues, the table captioned Revenues by Segment and Geography in the Analysis of the Consolidated Statements of Income section, and the Analysis of Operating Segment Information section in our 2017 Financial Report, which are incorporated by reference.

|

| | |

Pfizer Inc.Oncology Division | 2017 Form 10-K | 2 |

The key therapeutic areas comprising our IH business segment include:

|

| | |

Therapeutic Area | Description | Key Products |

Internal Medicine | Includes innovative brandsCombines the U.S. Oncology commercial organizations, global Oncology marketing organizations and global and U.S. Oncology medical affairs from two therapeutic areas, Cardiovascular Metabolicboth Pfizer and Neuroscience and Pain, as well as regional brands. | Lyrica (outside Europe, Russia, Turkey, Israel and Central Asia countries), Chantix/Champix and Eliquis (jointly developed and commercialized with BMS)

|

Vaccines | Includes innovative vaccines brands across all ages—infants, adolescents and adults—in pneumococcal disease, meningitis and tick borne encephalitis, with a focus on healthcare-acquired infections and maternal health.

| Prevnar 13/Prevenar 13 (pediatric/adult), Trumenba and FSME-IMMUN

|

Oncology | Seagen. Includes innovative oncology brandsproduct portfolio of biologics,ADCs, small molecules, bispecifics and other immunotherapies acrossthat treat a wide range of cancers.cancers including certain types of breast cancer, genitourinary cancer and hematologic malignancies, as well as certain types of melanoma, gastrointestinal, gynecological and thoracic cancers, which includes lung cancer. |

Pfizer U.S. Commercial Division

| Ibrance, Sutent, Xalkori, InlytaIncludes the U.S. Primary Care and Xtandi (jointly developedU.S. Specialty Care customer groups, the Chief Marketing Office, the Global Chief Medical Affairs Office and commercialized with Astellas)Global Access & Value.

|

| U.S. Primary Care includes: |

•Internal medicine product portfolio of brands in cardiovascular metabolic, bone graft for spinal fusion and women’s health, as well as post-LOE brands. |

•Migraine product portfolio. |

•Vaccines product portfolio across all ages with a pipeline focus on infectious diseases with significant unmet medical need, including COVID-19. |

•Treatment for COVID-19. |

•Products for detection of COVID-19 and influenza. |

| U.S. Specialty Care includes: |

•Inflammation & immunology product portfolio of brands and Immunology | Includes innovative brandsbiosimilars for chronic immune and inflammatory diseases.

| Enbrel (outside the U.S. and Canada), Xeljanz and Eucrisa

|

•Rare Disease | Includes innovativedisease product portfolio of brands for a number of therapeutic areas with rare diseases, including hematology, neuroscience,amyloidosis, hemophilia, endocrine diseases and inherited metabolic disorders.

| BeneFix, Genotropin, and Refacto AF/Xynthasickle cell disease.

|

Consumer Healthcare•Hospital product portfolio of sterile injectable and immunoglobulin medicines. |

| Pfizer International Commercial Division | Includes over-the-counter (OTC) brands with a focus on dietary supplements, pain management, gastrointestinalthe ex-U.S. commercial and respiratory and personal care. According to Euromonitor International’s retail sales data,medical affairs organizations covering Pfizer’s entire product portfolio in 2017, Pfizer’s Consumer Healthcare business was the fifth-largest branded multi-national, OTC consumer healthcare business in the world and produced two of the ten largest selling consumer healthcare brands (Centrum and Advil) in the world. | Dietary Supplements: Centrum brands, Caltrate and Emergen-C

Pain Management: Advil brands and ThermaCare

Gastrointestinal: Nexium 24HR/Nexium Control and Preparation H

Respiratory and Personal Care: Robitussin, Advil Cold & Sinus and ChapStick

all international markets. |

In October 2017, we announced that we are reviewing strategic alternativesSelect products within Oncology, Primary Care and Specialty Care include:

•Oncology:Ibrance, Xtandi, Inlyta, Bosulif, Lorbrena, Braftovi, Mektovi, Padcev, Adcetris, Talzenna, Tukysa, Elrexfio and Tivdak

•Primary Care:

◦Internal medicine: Eliquis, the Premarin family and BMP2

◦Migraine: Nurtec ODT/Vydura and Zavzpret

◦Vaccines: Comirnaty, the Prevnar family, Abrysvo, FSME/IMMUN-TicoVac, Nimenrix and Trumenba

◦Treatment for our Consumer Healthcare business. A rangeCOVID-19: Paxlovid

◦Detection of options will be considered, including a full or partial separation ofCOVID-19 and influenza: Lucira by Pfizer

•Specialty Care:

◦Inflammation & immunology: Xeljanz, Enbrel (outside the Consumer Healthcare business from Pfizer through a spin-off, sale or other transaction,U.S. and we may ultimately determine to retainCanada), Inflectra, Cibinqo, Litfulo and Velsipity

◦Rare disease: the business. We expect that any decision regarding strategic alternatives for Consumer Healthcare would be made during 2018.Vyndaqel family, Genotropin, BeneFIX, Oxbryta, Somavert and Ngenla

◦Hospital: Sulperazon, Zavicefta, Zithromax, Medrol and Panzyga

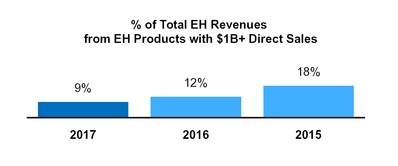

We recorded direct product and/or alliance revenues of more than $1 billion for each of seven IH products in 2017 and 2016 and for each of five IH products in 2015:

|

| | | | |

| Innovative Health $1B+ Products |

| 2017 |

| 2016 |

| 2015 |

| Prevnar 13/Prevenar 13 |

| Prevnar 13/Prevenar 13 |

| Prevnar 13/Prevenar 13 |

| Lyrica IH |

| Lyrica IH |

| Lyrica IH |

| Ibrance |

| Enbrel |

| Enbrel |

| Eliquis* |

| Ibrance |

| Viagra IH |

| Enbrel |

| Eliquis* |

| Sutent |

| Xeljanz |

| Viagra IH |

|

|

| Sutent | | Sutent | | |

* Eliquis includes alliance revenues and direct sales in 2017 and 2016. |

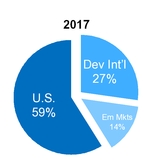

Geographic Revenues for Innovative Health*

*Dev Int’l = Developed Markets except U.S.; Em Mkts = Emerging Markets

For a discussion of certain IH products and additional information regarding theon our operating segments and products, including product revenues, of our IH business, including revenues of major IH products, see the Notes to Consolidated Financial Statements—Note 18. Segment, Geographic and Other Revenue Information and the Analysis of the Consolidated Statements of Income—Revenues—Major Products and —Revenues—Selected Product Discussion sections in our 2017 Financial Report; 17, and for additional information on the key operational revenue drivers of our IH business, see the Analysis of Operating Segment Information—Innovative Health Operating Segmentthe Consolidated Statements of Income section of our 2017 Financial Report.within MD&A. For a discussion onof the risks associated with our dependence on certain of our major products, see the Item 1A. Risk Factors—Dependence on Key In-Line Products below.Concentration section. ESSENTIAL HEALTHRESEARCH AND DEVELOPMENT

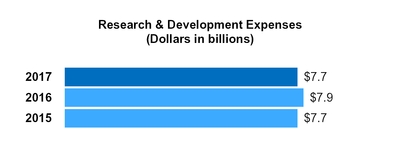

The product categories inR&D is at the heart of fulfilling our EH business segment include:purpose to deliver breakthroughs that change patients’ lives as we work to translate advanced science and technologies into the medicines and vaccines that may be the most impactful for patients. In addition to discovering and developing new products, our R&D efforts seek to add value to our existing products by improving their safety, efficacy and ease of dosing and by discovering potential new indications.

| | | | | | | | |

| Pfizer Inc. | 2023 Form 10-K | |

Product Category | Description | Key Products |

Global Brands—Legacy Established Products

| Includes products that have lost patent protection (excluding Sterile Injectable Pharmaceuticals and Peri-LOE Products). | Lipitor, Premarin family and Norvasc

|

Global Brands—

Peri-LOE Products

| Includes products that have recently lost or are anticipated to soon lose patent protection. | Lyrica (Europe, Russia, Turkey, Israel and Central Asia), Viagra*, Celebrex, Pristiq, Zyvox, Vfend, Revatio and Inspra

|

Sterile Injectable Pharmaceuticals | Includes generic injectables and proprietary specialty injectables (excluding Peri-LOE Products). | Medrol, Sulperazon, Fragmin and Tygacil

|

Biosimilars | Includes recombinant and monoclonal antibodies, primarily in inflammation, oncology and supportive care. | Inflectra/Remsima (biosimilar infliximab) (U.S. and certain international markets), Nivestim (biosimilar filgrastim) (certain European, Asian and Africa/Middle East markets) and Retacrit (biosimilar epoetin zeta) (certain European and Africa/Middle East markets)

|

Pfizer CentreOne | Includes revenues from our contract manufacturing and active pharmaceutical ingredient sales operation, including sterile injectables contract manufacturing, and revenues related to our manufacturing and supply agreements, including with Zoetis Inc.

| --4 |

| |

* | Viagra lost exclusivity in the U.S. in December 2017. Beginning in the first quarter of 2018, revenues for Viagra in the U.S. and Canada, which were reported in IH through December 2017, will be reported in EH (which reported all other Viagra revenues excluding the U.S. and Canada through 2017). Therefore, total Viagra worldwide revenues will be reported in EH from 2018 forward. |

Through February 2, 2017,Our R&D Priorities and Strategy. Our R&D priorities include:

•delivering a pipeline of highly differentiated medicines and vaccines where we have a unique opportunity to bring the most important new therapies to patients in need;

•advancing our EH business segmentcapabilities that can position us for long-term R&D leadership; and

•advancing new models for partnerships with creativity, flexibility and urgency to deliver innovation to patients as quickly as possible.

To that end, our R&D primarily focuses on our main therapeutic areas, which are inflammation and immunology, internal medicine, oncology, rare diseases, vaccines, and anti-infectives.

While a significant portion of our R&D is internal, we also included HIS, which includes Medication Management products composed of infusion pumpsseek promising chemical and related softwarebiological lead molecules and services,innovative technologies developed by others to incorporate into our discovery and development processes or projects, as well as intravenous infusionour portfolio. We do so by entering into collaboration, alliance and license agreements with universities, biotechnology companies and other firms as well as through acquisitions and investments. These collaboration, alliance and license agreements and investments allow us to share knowledge, risk and cost. They also enable us to access external scientific and technological expertise, as well as provide us the opportunity to advance our own products and in-licensed or acquired products. For information on certain of these collaborations, alliances and license arrangements and investments, see Note 2. Our R&D Operations. In 2023, we continued to strengthen our global R&D operations and pursue strategies to improve R&D productivity to achieve a sustainable pipeline that is positioned to deliver value in the near term and over time. Our R&D activity is conducted through various platform functions that support our global operations. Beginning in July 2023, in consideration of planned future investments in oncology, including large volume intravenous solutionsthe December 2023 acquisition of Seagen, we reorganized our R&D platform operations. Discovery to late-phase clinical development for oncology is performed by a new end-to-end Oncology Research and their associated administration sets. On February 3, 2017,Development (ORD) organization and discovery to late-phase clinical development for all remaining therapeutic areas is consolidated into the end-to-end Pfizer Research and Development (PRD) organization. ORD and PRD replace our former WRDM and GPD organizations, where, prior to July 2023, research units within WRDM were generally responsible for research and early-stage development assets and, prior to July 2023, GPD was generally responsible for the clinical development strategy and operational execution of clinical trials for both early- and late-stage clinical assets in Pfizer’s pipeline. In 2023, Biopharma received R&D services from ORD, PRD and the predecessor WRDM and GPD organizations. These services included IPR&D projects for new investigational products and additional indications for in-line products.

We manage R&D operations on a total-company basis through our PRD and ORD organizations described above. Specifically, the Portfolio Management Team, currently led by our Chairman and Chief Executive Officer and composed of other senior executives, is accountable for aligning resources across PRD and ORD, and for helping to ensure optimal capital allocation across the innovative R&D portfolio. We believe that this approach also serves to maximize accountability and flexibility.

We do not disaggregate total R&D expense by development phase or by therapeutic area since, as described above, we completed the saledo not manage all of HISour R&D operations by development phase or by therapeutic area. Further, as we are able to ICU Medical. adjust a significant portion of our spending quickly, we believe that any prior-period information about R&D expense by development phase or by therapeutic area would not necessarily be representative of future spending.

Our R&D Pipeline. The process of drug and biological product discovery from initiation through development and to Consolidated Financial Statements—Note 2B. Sale of Hospira Infusion Systems Net Assets to ICU Medical, Inc. (EH).

We recorded direct product revenues ofpotential regulatory approval is lengthy and can take more than $1 billionten years. As of January 30, 2024, we had the following number of projects in various stages of R&D:

Development of a single compound is often pursued as part of multiple programs. While our product candidates may or may not receive regulatory approval, new candidates entering clinical development phases are the foundation for one EH product in 2017, two EH products in 2016 and three EH products in 2015:

|

| | | | |

| Essential Health $1B+ Products |

| 2017 | | 2016 | | 2015 |

| Lipitor | | Lipitor | | Lipitor |

| | | Premarin family of products | | Lyrica EH |

| | | | | Premarin family of products |

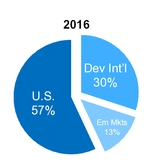

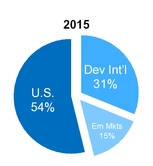

Geographic Revenues for Essential Health*

*Dev Int’l = Developed Markets except U.S.; Em Mkts = Emerging Markets

For a discussion of certain EH products and additional information regarding the revenuesfuture products. Information concerning several of our EH business, including revenuesdrug and vaccine candidates in development, as well as supplemental filings for existing products, is set forth in the Product Developments section within MD&A. The discovery and development of major EHdrugs, vaccines and biological products see the Notes to Consolidated Financial Statements—Note 18. Segment, Geographicare time consuming, costly and Other Revenue Information and the Analysis of the Consolidated Statements of Income—Revenues—Major Products and —Revenues—Selected Product Discussion sections in our 2017 Financial Report; and for additionalunpredictable. For information on the key operational revenue drivers of our EH business, see the Analysis of Operating Segment Information—Essential Health Operating Segment section of our 2017 Financial Report. For a discussion on the risks associated with our dependence on certain of our major products,R&D, see the Item 1A. Risk Factors—Dependence on Key In-Line Products below.Research and Development section.COLLABORATION AND CO-PROMOTION AGREEMENTS

We are party touse collaboration and/or co-promotion agreements relatingarrangements to enhance our development, R&D, sales and distribution of certain biopharmaceutical products, including Eliquis, Xtandi and Bavencio.which include, among others, the following:

Eliquis has been•Comirnaty is an mRNA-based coronavirus vaccine to help prevent COVID-19, which is being jointly developed and commercialized with BioNTech. Pfizer and BioNTech equally share the costs of development for the Comirnaty program. Comirnaty has been granted an approval or an authorization in many countries around the world in populations varying by country. We also share gross profits equally from commercialization of Comirnaty and are working jointly with BioNTech in our respective territories to commercialize the vaccine worldwide (excluding China, Hong Kong, Macau and Taiwan), subject to regulatory authorizations or approvals market by market. For discussion on Comirnaty, see the Overview of Our Performance, Operating Environment, Strategy and Outlook—COVID-19section within MD&A.•Eliquis (apixaban) is beingpart of the Novel Oral Anticoagulant market and was jointly developed and commercialized with BMS as an alternative treatment option to warfarin in collaboration with BMS. Pfizer fundsappropriate patients. We fund between 50% and 60% of all development costs depending on the study. Profitsstudy, and profits and losses are shared equally on a global basis, except in certain countries where Pfizer commercializes we commercialize Eliquis and pays BMS compensation based onpay a percentage of net sales. Wesales to BMS. In

| | | | | | | | |

| Pfizer Inc. | 2023 Form 10-K | 5 |

certain smaller markets we have full commercialization rights in certain smaller markets.and BMS supplies the product to us at cost plus a percentage of the net sales to end-customers in these markets. Eliquis is part of the Novel Oral Anticoagulant market; the agents in this class were developed as alternative treatment options to warfarin in appropriate patients.end-customers.

•Xtandi is being developed and commercialized through a collaboration with Astellas. The two companies share equally in the gross profits (losses) related to U.S. net sales of Xtandi. Subject to certain exceptions, Pfizer and Astellas also share equally all Xtandi commercialization costs attributable to the U.S. market. In addition, Pfizer and Astellas share certain development and other collaboration expenses, and Pfizer receives tiered royalties as a percentage of international Xtandi net sales (recorded in Other (Income)/Deductions––Net).Xtandi(enzalutamide) is an androgen receptor inhibitor that blocks multiple steps in the androgen receptor signaling pathway within tumor cells.

Bavenciocells that is being developed and commercialized in collaboration with Merck KGaA. Both companies jointly fundAstellas. We share equally in the gross profits and losses related to U.S. net sales and also share equally all Xtandi commercialization costs attributable to the U.S. market, subject to certain exceptions. In addition, we share certain development and commercialization costs,other collaboration expenses. For international net sales we receive royalties based on a tiered percentage.

•Orgovyx (relugolix) is an oral gonadotropin-releasing hormone (GnRH) receptor antagonist for the treatment of adult patients with advanced prostate cancer that is being developed and splitcommercialized with SMPA. The companies are also collaborating on Myfembree (relugolix 40 mg, estradiol 1.0 mg, and norethindrone acetate 0.5 mg) for heavy menstrual bleeding associated with uterine fibroids in premenopausal women and the management of moderate to severe pain associated with endometriosis in premenopausal women. The companies equally anyshare profits generated from selling any anti-PD-L1 or anti-PD-1

|

| | |

Pfizer Inc. | 2017 Form 10-K | 3 |

products from this collaboration. Bavencio is currently approved in metastatic Merkel cell carcinomaand allowable expenses in the U.S. for Orgovyx, and in the U.S. and Canada for Myfembree. Pfizer does not have rights outside of these markets. SMPA remains responsible for regulatory interactions and drug supply and continues to lead clinical development for the relugolix combination tablet.

•Padcev (enfortumab vedotin-ejfv) is a first-in-class ADC that is directed to Nectin-4, a protein located on the surface of cells and highly expressed in bladder cancer, that is being co-developed and jointly commercialized with Astellas. In the U.S., Europe and Japan, as well as received accelerated approvalPadcev has been approved for second line treatment ofuse with Keytruda (pembrolizumab) for adult patients with locally advanced or metastatic urothelial carcinomacancer. Other approvals and indications for Padcev vary by market. In the U.S., the companies jointly promote, and we record net sales and are responsible for all U.S. distribution activities for Padcev. The companies each bear the costs of their own sales organizations in the U.S.