UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

xANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010 | For the fiscal year ended December 31, 2011 |

OR

o¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number 001-09148

THE BRINK’S COMPANY

(Exact name of registrant as specified in its charter)

| | Virginia | | 54-1317776 | |

| | (State or other jurisdiction of | | (I.R.S. Employer | |

| | incorporation or organization) | | Identification No.) | |

| | | | | |

| | P.O. Box 18100, | | | |

| | 1801 Bayberry Court | | | |

| | Richmond, Virginia | | 23226-8100 | |

| | (Address of principal executive offices) | | (Zip Code) | |

| | | | | |

| | Registrant’s telephone number, including area code | | (804) 289-9600 | |

| | | | | |

| | Securities registered pursuant to Section 12(b) of the Act: | | | |

| | | | Name of each exchange on | |

| | Title of each class | | which registered | |

| | The Brink’s Company Common Stock, Par Value $1 | | New York Stock Exchange | |

| | | | | |

| | Securities registered pursuant to Section 12(g) of the Act: None | | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yesx No o¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yeso¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yesx No o¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x⌧

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filerx Accelerated filero¨ Non-accelerated filero¨ Smaller reporting company o¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yeso¨ No x

As of February 21, 2011,2012, there were issued and outstanding 46,540,41546,873,022 shares of common stock. The aggregate market value of shares of common stock held by non-affiliates as of June 30, 2010,2011, was $906,581,912.$1,383,834,551.

Documents incorporated by reference: Part III incorporates information by reference from portions of the Registrant’s definitive 20112012 Proxy Statement to be filed pursuant to Regulation 14A.

THE BRINK’S COMPANY

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 20102011

TABLE OF CONTENTS

PART I

| | | Page |

| Item 1. | Business | 21 |

| Item 1A. | Risk Factors | 109 |

| Item 1B. | Unresolved Staff Comments | 1514 |

| Item 2. | Properties | 1514 |

| Item 3. | Legal Proceedings | 15 |

| Item 4. | [Removed and Reserved]Mine Safety Disclosures | 15 |

| | | |

| | Executive Officers of the Registrant | 16 |

| | | |

| | PART II | |

| | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer | |

| | Purchases of Equity Securities | 17 |

| Item 6. | Selected Financial Data | 19 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 20 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 6768 |

| Item 8. | Financial Statements and Supplementary Data | 6970 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 119117 |

| Item 9A. | Controls and Procedures | 119117 |

| Item 9B. | Other Information | 119117 |

| | | |

| | PART III | |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 120118 |

| Item 11. | Executive Compensation | 120118 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 120118 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 120118 |

| Item 14. | Principal Accountant Fees and Services | 120118 |

| | | |

| | PART IV | |

| | | |

| Item 15. | Exhibits and Financial Statement Schedules | 121119 |

Based in Richmond, Virginia, The Brink’s Company is a premier provider of secure logistics and security solutions, including the transportation of valuables, cash logistics and other security-related services to banks and financial institutions, retailers, government agencies, mints, jewelers and other commercial operations around the world. Other services provided are armored transportation, automated teller machine (“ATM”) replenishment and servicing; network infrastructure services; secure global transportation of valuables (“Global Services”); guarding services (including airport security or “Aviation Security"); currency deposit processing and cash management services. Cash management services include cash logistics services (“Cash Logistics”),; deploying and servicing safes and safe control device sdevices (e.g. our patented CompuSafe® service),; coin sorting and wrapping, integrated check and cash processing services (“Virtual Vault Services”), and; providing bill payment acceptance and processing services to utility companies and other billers (“Payment Services”); and guarding services (including airport security or “Aviation Security”). The Brink’s Company, along with its subsidiaries, is referred to as “we,” “our,” “Brink’s,” or “the Company” throughout this Form 10-K.

Brink’s brand and reputation spansspan across the globe. Our international network serves customers in more than 100 countries and employs approximately 71,000 people. Our operations include approximately 1,100 facilities and 12,80012,900 vehicles. Our globally recognized brand, global infrastructure, expertise, longevity and heritage are important competitive advantages. Over the past several years, we have changed from a conglomerate (with operations in the U.S. monitored home security, heavy-weight freight transportation, coal and other natural resource industries) into a company focused solely on the security industry.

Our operating segments consist of four geographies: Latin America; Europe, Middle East, and Africa (“EMEA”); Latin America; Asia Pacific; and North America, which are aggregated into two reportable segments: International and North America. Financial information related to our two reportable segments (International and North America) and non-segment income and expenses areis included in the consolidated financial statements on pages 69–118.70–116.

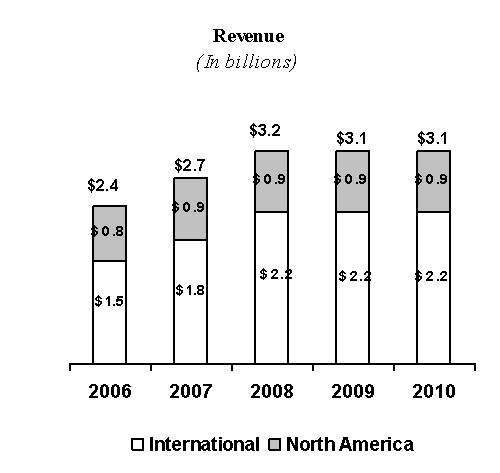

A significant portion of our business is conducted internationally, with 76%81% of our $3$3.9 billion in revenues earned outside the United States. In the fourth quarter of 2010, we completed an acquisition in Mexico and another in Canada. We expect that these operations will generate approximately $450 to 500 million in revenues in 2011. Financial results are reported in U.S. dollars and are affected by fluctuations in the relative value of foreign currencies. Our business is also subject to other risks customarily associated with operating in foreign countries including changing labor and economic conditions, political instability, restrictions on repatriation of earnings and capital, as well as nationalization, expropriation and other forms of restrictive government actions. The future ef fectseffects of these risks cannot be predicted. Additional information about risks associated with our foreign operations is provided on pages 11, 439, 45 and 68.69.

We have significant liabilities associated with our retirement plans, a portion of which has been funded. See pages 51–5353–56 and 57–6159–63 for more information on these liabilities. Additional risk factors are described on pages 10–14.9–12.

Available Information and Corporate Governance Documents

The following items are available free of charge on our website (www.brinks.com) as soon as reasonably possible after filing or furnishing them with the Securities and Exchange Commission (the “SEC”):

| · | Annual reports on Form 10-K |

| · | Quarterly reports on Form 10-Q |

| · | Current reports on Form 8-K, and amendments to those reports |

In addition, the following documents are also available free of charge on our website:

| · | Corporate governance policies |

| · | Business Code of Ethics |

| · | The charters of the following committees of our Board of Directors (the “Board”): Audit and Ethics, Compensation and Benefits, and Corporate Governance and Nominating |

Printed versions of these items will be mailed free of charge to shareholders upon request. Such requests can be made by contacting the Corporate Secretary at 1801 Bayberry Court, P. O. Box 18100, Richmond, Virginia 23226-8100.

General

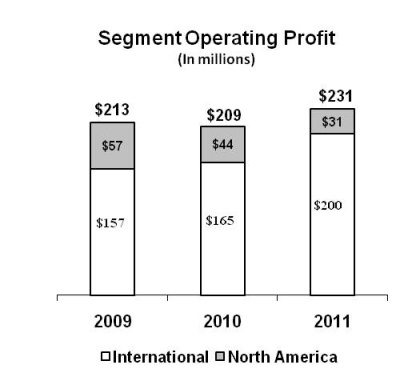

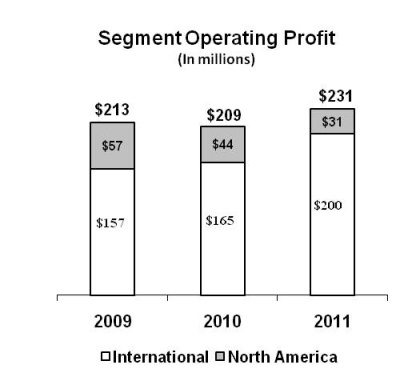

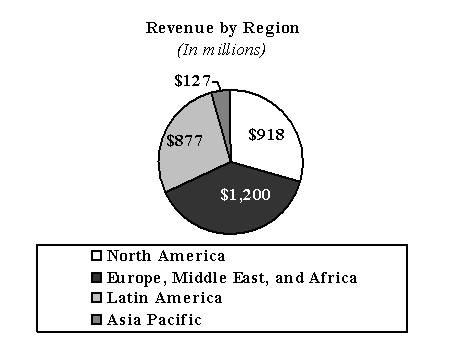

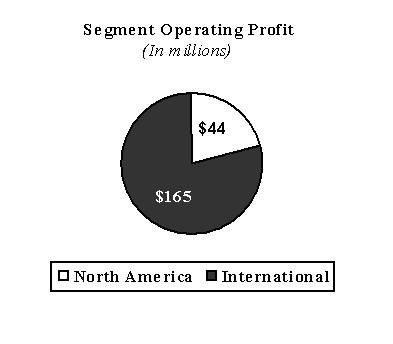

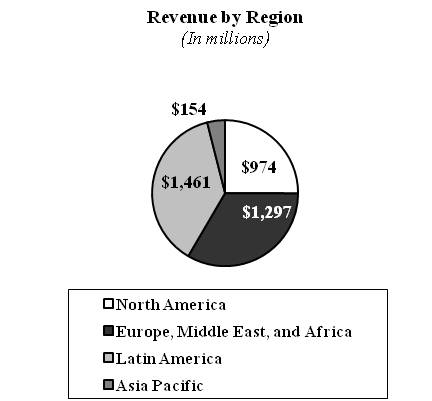

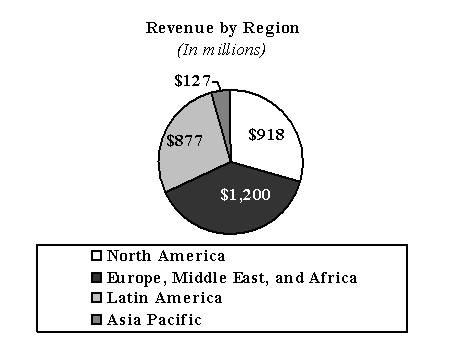

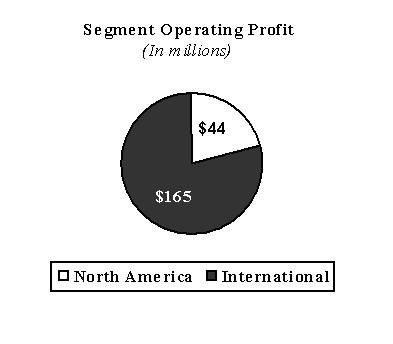

Our 20102011 segment operating profit was $209$231 million on revenues of $3.1$3.9 billion, resulting in a segment operating profit margin of 6.7%5.9%.

GAAP

Non-GAAP*

| | Amounts may not add due*Reconciliation to rounding.GAAP results is found on page 42 |

Amounts may not add due to rounding.

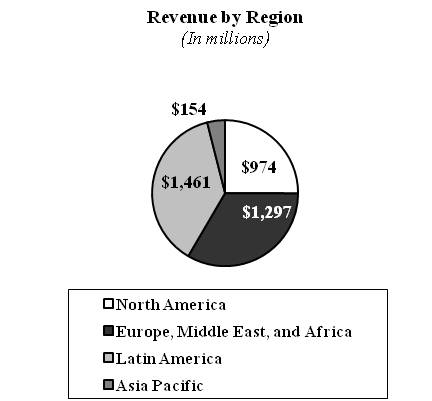

Brink’s operations are located around the world with the majority of our revenues (71%(75%) and segment operating profits (79%(86%) are earned outside of North America.

Brink’s serves customers in over 100 countries. We have ownership interests in operations in approximately 50 countries and have agency relationships with other companies in other countries to complete our global network. Brink’s ownership interests in subsidiaries and affiliated companies ranged from 36% to 100% at December 31, 2010.2011. In some instances, local laws limit the extent of Brink’s ownership interest.

International operations hashave three regions: Latin America; Europe, Middle East and Africa (“EMEA”); Latin America and Asia Pacific. On a combined basis, international operations generated 20102011 revenues of $2.2$2.9 billion (71%(75% of total) and segment operating profit of $165$200 million (79% of total).

Brink’s EMEA generated $1.2 billion in revenues in 2010 or (38% of Brink’s total 2010 revenues) and operates 261 branches in 24 countries. Its largest operations are in France, the Netherlands and Germany. In 2010, France accounted for $533 million or 44% of EMEA revenues (17%(86% of total).

Brink’s Latin America generated $877 million$1.5 billion in revenues in 2010 (28%2011 (38%) and operates 388275 branches in nine12 countries. Its largest operations are in Mexico, Brazil, Venezuela and Colombia. Mexico had $415 million or 28% of Latin American revenues (11% of total) in 2011. Brazil accounted for $303$387 million or 35%26% of Latin American revenues (10% of total) in 2010.2011. Venezuela accounted for $186$269 million or 21%18% of Latin American revenues (6%(7% of total) in 2010. Mexico had $52 million of2011.

Brink’s EMEA generated $1.3 billion in revenues in 2011 (33% of Brink’s total 2011 revenues) and operates 262 branches in 26 countries. Its largest operations are in France, Germany and the last two monthsNetherlands. In 2011, France accounted for $567 million or 44% of 2010.EMEA revenues (15% of total).

Brink’s Asia-Pacific generated $127$154 million in revenues in 20102011 (4%) and operates 106110 branches in nineten countries.

North American operations include 181147 branches in the U.S. and 5359 branches in Canada. North American operations generated 20102011 revenues of $918$974 million (29%(25% of total) and segment operating profit of $44$31 million (21%(14% of total). We have included our newly acquired Mexican operations with our International – Latin America region.

The largest eightnine Brink’s operations (U.S., France, Mexico, Brazil, Venezuela, Canada, Colombia, Germany and the Netherlands, Colombia, Canada and Germany)Netherlands) accounted for $2.3$3.0 billion or 74%77% of total 20102011 revenues.

| (In millions) | | 2010 | | | % total | | | % change | | | 2009 | | | % total | | | % change | | | 2008 | | | % total | | | % change | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues by region: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EMEA: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

France | | $ | 533 | | | | 17 | | | | (13 | ) | | $ | 615 | | | | 20 | | | | (12 | ) | | $ | 698 | | | | 22 | | | | 11 | |

Other | | | 667 | | | | 21 | | | | 4 | | | | 642 | | | | 20 | | | | (3 | ) | | | 661 | | | | 21 | | | | 18 | |

Total | | | 1,200 | | | | 38 | | | | (5 | ) | | | 1,257 | | | | 40 | | | | (7 | ) | | | 1,359 | | | | 43 | | | | 14 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Latin America: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Brazil | | | 303 | | | | 10 | | | | 17 | | | | 258 | | | | 8 | | | | 33 | | | | 194 | | | | 6 | | | | 20 | |

Venezuela | | | 186 | | | | 6 | | | | (51 | ) | | | 376 | | | | 12 | | | | 7 | | | | 351 | | | | 11 | | | | 56 | |

Other | | | 388 | | | | 12 | | | | 44 | | | | 271 | | | | 9 | | | | 6 | | | | 256 | | | | 8 | | | | 23 | |

Total | | | 877 | | | | 28 | | | | (3 | ) | | | 905 | | | | 29 | | | | 13 | | | | 801 | | | | 25 | | | | 35 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Pacific | | | 127 | | | | 4 | | | | 61 | | | | 79 | | | | 2 | | | | 10 | | | | 72 | | | | 2 | | | | 15 | |

| Total International | | | 2,204 | | | | 71 | | | | (2 | ) | | | 2,241 | | | | 71 | | | | - | | | | 2,232 | | | | 70 | | | | 21 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

North America | | | 918 | | | | 29 | | | | 3 | | | | 894 | | | | 29 | | | | (4 | ) | | | 932 | | | | 30 | | | | 5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Revenues | | $ | 3,122 | | | | 100 | | | | - | | | $ | 3,135 | | | | 100 | | | | (1 | ) | | $ | 3,164 | | | | 100 | | | | 16 | |

| Amounts may not add due to rounding. |

| | (In millions) | | 2011 | | % total | | % change | | | 2010 | | % total | | % change | | | 2009 | | % total | | % change | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Revenues by region: | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Latin America: | | | | | | | | | | | | | | | | | | | | | |

| | | | Mexico | $ | 415.2 | | 11 | | fav | | $ | 51.7 | | 2 | | - | | $ | - | | - | | - | |

| | | | Brazil | | 386.8 | | 10 | | 28 | | | 303.3 | | 10 | | 18 | | | 257.6 | | 8 | | 33 | |

| | | | Venezuela | | 269.2 | | 7 | | 45 | | | 185.9 | | 6 | | (51) | | | 376.1 | | 12 | | 7 | |

| | | | Other | | 389.5 | | 10 | | 16 | | | 336.5 | | 11 | | 24 | | | 271.0 | | 9 | | 6 | |

| | | | | Total | | 1,460.7 | | 38 | | 66 | | | 877.4 | | 28 | | (3) | | | 904.7 | | 29 | | 13 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | EMEA | | | | | | | | | | | | | | | | | | | | | |

| | | | France | | 567.2 | | 15 | | 6 | | | 533.0 | | 17 | | (13) | | | 615.2 | | 20 | | (12) | |

| | | | Other | | 729.7 | | 19 | | 9 | | | 666.8 | | 21 | | 4 | | | 642.3 | | 20 | | (3) | |

| | | | | Total | | 1,296.9 | | 33 | | 8 | | | 1,199.8 | | 38 | | (5) | | | 1,257.5 | | 40 | | (7) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Asia Pacific | | 153.7 | | 4 | | 22 | | | 126.5 | | 4 | | 61 | | | 78.7 | | 2 | | 10 | |

| | Total International | | 2,911.3 | | 75 | | 32 | | | 2,203.7 | | 71 | | (2) | | | 2,240.9 | | 71 | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | North America | | 974.2 | | 25 | | 6 | | | 917.8 | | 29 | | 3 | | | 894.1 | | 29 | | (4) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total Revenues | $ | 3,885.5 | | 100 | | 24 | | $ | 3,121.5 | | 100 | | - | | $ | 3,135.0 | | 100 | | (1) | |

| | Amounts may not add due to rounding. |

Geographic financial information related to revenues and long-lived assets is included in the consolidated financial statements on page 86.

Services

Our primary services include:

| · | Cash-in-transit (“CIT”) – armored vehicle transportation |

| · | Automated teller machine (“ATM”) – replenishment and servicing, network infrastructure services |

| · | Global Services – transportation of valuables globally |

| · | Cash Logistics – supply chain management of cash |

| · | Payment Services – consumers pay utility and other bills at payment locations |

| · | Guarding Services – including airport security |

Brink’s typically provides customized services under separate contracts designed to meet the distinct needs of customers. Contracts usually cover an initial term of at least one year and range up to five years, depending on the service. The contracts generally remain in effect after the initial term until canceled by either party.

Core Services (54% of total revenue in 2010)2011)

CIT and ATM Services are core services we provide to customers throughout the world. Core services generated approximately $1.7$2.1 billion of revenues in 2010.2011.

CIT – Serving customers since 1859, our success in CIT is driven by a combination of rigorous security practices, high-quality customer service, risk management and logistics expertise. CIT services generally include the secure transportation of:

| · | cash between businesses and financial institutions such as banks and credit unions, |

| · | cash, securities and other valuables between commercial banks, central banks and investment banking and brokerage firms, and |

| · | new currency, coins, bullion and precious metals for central banks and other customers. |

ATM Services – We manage nearly 94,00092,000 ATM units worldwide for banks and other cash dispensing operators. We provide cash replenishment, monitoring and forecasting capabilities, deposit pickup and processing services. Advanced online tools deliver consolidated electronic reports for simplified reconciliation. With our recent acquisition in Canada, we acquired the capability toWe assist financial institutions in managing the processes and infrastructure that are critical to the deployment of ATM networks and electronic payment networks.

High-value Services (35%(36% of total revenue in 2010)2011)

Our core services, combined with our brand and global infrastructure, provide a substantial platform from which we offer additional high-value services. High-value services generated approximately $1.1$1.4 billion of revenues in 2010.2011.

Global Services – Serving customers in more than 100 countries, Brink’s is a leading global provider of secure logistics for valuables including diamonds, jewelry, precious metals, securities, currency, high-tech devices, electronics and pharmaceuticals. The comprehensive suite of services provides packing, pickup, secure storage, inventory management, customs clearance, consolidation and secure transport and delivery through a combination of armored vehicles and secure air and sea transportation to leverage our extensive global network. Our specialized diamond and jewelry operations have offices in the major diamond and jewelry centers of the world.

Cash Logistics – Brink’s offers a fully integrated approach to managing the supply chain of cash, from point-of-sale through transport, vaulting, bank deposit and related credit. Cash Logistics services include:

| · | money processing and cash management services, |

| · | deploying and servicing “intelligent” safes and safe control devices, including our patented CompuSafeâ service, |

| · | integrated check and cash processing services (“Virtual Vault”), and |

Money processing services generally include counting, sorting and wrapping currency. Other currency management services include cashier balancing, counterfeit detection, account consolidation and electronic reporting. Retail and bank customers use Brink’s to count and reconcile coins and currency, prepare bank deposit information and replenish coins and currency in specific denominations.

Brink’s offers a variety of advanced technology applications, including online cash tracking, cash inventory management, check imaging for real-time deposit processing, and a variety of other web-based information tools that enable banks and other customers to reduce costs while improving service to their customers.

Brink’s CompuSafeâ service offers customers an integrated, closed-loop system for preventing theft and managing cash. We market CompuSafe services to a variety of cash-intensive customers such as convenience stores, gas stations, restaurants, retail chains and entertainment venues. Once the specialized safe is installed, the customer’s employees deposit currency into the safe’s cassettes, which can only be removed by Brink’s personnel. Upon removal, the cassettes are securely transported to a vault for processing where contents are verified and transferred for deposit. Our CompuSafe system features currency-recognition and counterfeit-detection technology, multi-lang uagemulti-language touch screens and an electronic interface between the point-of-sale, back-office systems and external banks. Our electronic reporting interface with external banks enables our CompuSafe Serviceservice customers to receive same-day credit on their cash balances, even if the cash remains on the customer’s premises.

Virtual Vault services combine CIT, Cash Logistics, vaulting and electronic reporting technologies to help banks expand into new markets while minimizing investment in vaults and branch facilities. In addition to secure storage, we process deposits, provide check imaging and reconciliation services, currency inventory management, ATM replenishment orders, and electronically transmit debits and credits.

We believe the quality and scope of our cash processing and information systems differentiate our Cash Logistics services from competitive offerings.

Payment Services – We provide bill payment acceptance and processing services to utility companies and other billers. Consumers can pay their bills at our payment locations or locations that we operate on behalf of billers and bank customers.

Commercial Security Systems – In certain markets in Asia-Pacific and Europe, we provide commercial security system services. The services include the design and installation of the security systems, including alarms, motion detectors, closed-circuit televisions, digital video recorders, access control systems including card and biometric readers, electronic locks, and optical turnstiles. Monitoring services may also be provided after systems have been installed.

Other Security Services (11%(10% of total revenue in 2010)2011)

Security and Guarding – We protect airports, offices, warehouses, stores, and public venues with electronic surveillance, access control, fire prevention and highly trained patrolling personnel.

Our guarding services are generally offered in European markets, including France, Germany, Luxembourg and Greece. A significant portion of this business involves long-term contracts related primarily to guarding services at airports and embassies. Generally, other guarding contracts are for a one-year period, the majority of which are extended. Our security officers are typically stationed at customer sites, and responsibilities include detecting and deterring specific security threats.

Growth Strategy

Our growth strategy is summarized below:

| · | Maximize profits in developed markets (primarily North America and Europe) |

| · | Accelerate productivity and cost control efforts. |

| · | Invest in higher-margin solutions; shift revenue mix to High-value servicesServices (primarily Cash Logistics and Global Services). |

| · | Invest in emerging markets by acquiring businesses that meet internal metrics for projected growth, profitability and return on investment. |

| · | Invest in adjacent security-related markets where we can create value for customers with our brand, security expertise, global infrastructure and other competitive advantages. Current examples include commercial security and payment processing. |

Industry and Competition

Brink’s competes with large multinational, regional and smaller companies throughout the world. Our largest multinational competitors are G4S plc (headquartered in the U.K.); Loomis AB, formerly a division of Securitas AB (Sweden); Prosegur, Compania de Seguridad, S.A. (Spain); and Garda World Security Corporation (Canada).

We believe the primary factors in attracting and retaining customers are security expertise, service quality, and price. Our competitive advantages include:

| · | reputation for a high level of service and security |

| · | risk management and logistics expertise |

| · | global infrastructure and customer base |

| · | proprietary cash processing and information systems |

| · | proven operational excellence |

| · | high-quality insurance coverage and general financial strength |

Our cost structure is generally competitive, although certain competitors may have lower costs due to a variety of factors, including lower wages, less costly employee benefits, or less stringent security and service standards.

Although we face competitive pricing pressure in many markets, we resist competing on price alone. We believe our high levels of service and security, as well as value added solutions differentiate us from competitors.

The availability of high-quality and reliable insurance coverage is an important factor in our ability to attract and retain customers and manage the risks inherent in our business. We purchase insurance coverage for losses in excess of what we consider to be prudent levels of self-insurance. Our insurance policies cover losses from most causes, with the exception of war, nuclear risk and certain other exclusions typical in such policies.

Insurance for security is provided by different groups of underwriters at negotiated rates and terms. Premiums fluctuate depending on market conditions. The security loss experience of Brink’s and, to a limited extent, other armored carriers affects our premium rates.

Revenues are generated from charges per service performed or based on the value of goods transported. As a result, revenues are affected by the level of economic activity in various markets as well as the volume of business for specific customers. CIT and ATM contracts usually cover an initial term of at least one year and in many cases one to three years, and generally remain in effect thereafter until canceled by either party. Contracts for Cash Logistics are typically longer. Costs are incurred when preparing to serve a new customer or to transition away from

an existing customer. Operating profit is generally stronger in the second half of the year, particularly in the fourth quarter, as economic activity is typically stronger during this period.

As part of the spin-off of our former monitored home security business, Brink’s Home Security Holdings, Inc. (“BHS”), we agreed to not compete with BHS in the United States, Canada and Puerto Rico with respect to certain activities related to BHS’s security system monitoring and surveillance business until October 31, 2013.

Service Mark and Patents

BRINKS is a registered service mark in the U.S. and certain foreign countries. The BRINKS mark, name and related marks are of material significance to our business. We own patents expiring in 2011 and 2012 for certain coin sorting and counting machines. We also own patents for safes, including our integrated CompuSafeâ service, which expire between 2015 and 2022. These patents provide us with important advantages; however, we are not dependent on the existence of these patents.

We have licensed the Brink’s name to a limited number of companies, including a distributor of security products (padlocks, door hardware, etc.) offered for sale to consumers through major retail chains.

Government Regulation

Government Regulation

Our U.S. operations are subject to regulation by the U.S. Department of Transportation with respect to safety of operations, equipment and financial responsibility. Intrastate operations in the U.S. are subject to state regulation. Our International operations are regulated to varying degrees by the countries in which we operate.

Employee Relations

At December 31, 2010,2011, our company had approximately 71,000 full-time and contract employees, including approximately 9,0008,000 employees in the United States (of whom approximately 1,000800 were classified as part-time employees) and approximately 62,00063,000 employees outside the United States. At December 31, 2010, 2011, Brink’s was a party to twelve collective bargaining agreements in North America with various local unions covering approximately 1,9002,000 employees. The agreements have various expiration dates from 20112012 to 2015. Outside of North America, approximately 57%56% of branch employees are members of labor or employee organizations. We believe our employee relations are satisfactory.

Acquisitions

We have grown in the last several years partially as a result of acquiring security-related businesses in various markets to meet our Growth Strategy objectives. Our largest recent acquisitions in the last two years were in Brazil and India in 2009 and Mexico and Canada in 2010 and Brazil and India in 2009.2010. In addition, we made some smaller but strategically important acquisitions. We did not make any significant acquisitions in emerging markets including Russia and China.2011. Below is a summary of our recent acquisitions. See note 6 to the consolidated financial statements for more information on these acquisitions.

Mexico. We acquired a controlling interest in Servicio Pan Americano de Proteccion, S.A. de C.V. (“SPP”), a CIT, ATM and money processing business, for $60 million in November 2010. We previously owned a 20.86% interest in SPP and we acquired an additional 78.89% of the outstanding shares. In compliance with Mexican law, the remaining 0.25% noncontrolling interest is held by a Mexican company. SPP is the largest secure logistics company in Mexico and this acquisition expands our operations in one of the world’s largest CIT markets. SPP has approximately $400 million in annual revenues with approximately 12,000 full-time and contract employees, 80 branches and 1,350 armored vehicles acros s its nationwide network of CIT, ATM and money processing operations.

Canada. We acquired Threshold Financial Technologies Inc. (“Threshold”) from Versent Corporation for $39 million in December 2010. Threshold is a leading provider of payments solutions in Canada, specializing in managed ATM and transaction processing services for financial institutions and retailers. Threshold’s annual revenue is approximately $48 million, about half of which is generated by providing outsourced ATM network administration and transaction processing solutions. The company, which employs approximately 125 people, also owns and operates a network of private-label ATMs in Canada.

2009

Brazil. We acquired two businesses, Sebival-Seguranca Bancaria Industrial e de Valores Ltda. and Setal Servicos Especializados, for $48 million in January 2009. The acquisitions expanded our CIT and payment processing operations into the mid-western region of Brazil.

India. We acquired additional shares of Brink’s Arya, a CIT and Global Services business, in September 2009, increasing our ownership from 40% to 78% for $22 million.

China. We acquired a majority stake in ICD Limited, a commercial security business in the Asia-Pacific region in September 2009. ICD designs, installs, maintains and manages commercial security systems with offices in Hong Kong, India, Singapore and Australia, and has approximately 200 employees.

2010

France. We acquired Est Valeurs S.A., a provider of CIT and cash services in Eastern France, in March 2010. Est Valeurs employs approximately 100 people and had 2009 revenue of $13 million.

Russia. We acquired a majority stake in a Russian cash processing business in April 2010 that complements a Russian CIT business that was acquired in January 2009. With principal operations in Moscow and approximately 500 employees, the combined operations offer a full range of CIT, ATM, money processing and Global Services operations for domestic and international markets.

China. We acquired a majority stake in ICD Limited, a commercial security business in the Asia-Pacific region in September 2009. ICD designs, installs, maintains and manages commercial security systems with offices in Hong Kong, India, Singapore and Australia, and has approximately 200 employees.

Panama. We acquired the remaining outstanding shares in an armored transportation operation in Panama in February 2009. We previously owned 49% of the company.

Jordan.Mexico. We acquired a majority stakecontrolling interest in Servicio Pan Americano de Proteccion, S.A. de C.V. (“SPP”), a Jordan CIT, ATM and Global Servicesmoney processing business, for $60 million in February 2011.November 2010. We previously owned a 20.86% interest in SPP and we acquired an additional 78.89% of the outstanding shares. In compliance with Mexican law, the remaining 0.25% noncontrolling interest is held by a 45% ownership interest. The Jordanian operations employ approximately 90 people.Mexican trust. SPP is the

largest secure logistics company in Mexico and this acquisition expands our operations in one of the world’s largest CIT markets. SPP has approximately $400 million in annual revenues with approximately 12,000 full-time and contract employees, 80 branches and 1,350 armored vehicles across its nationwide network of CIT, ATM and money processing operations.

Canada. We acquired Threshold Financial Technologies Inc. (“Threshold”) from Versent Corporation for $39 million in December 2010. Threshold is a leading provider of payments solutions in Canada, specializing in managed ATM and transaction processing services for financial institutions and retailers. Threshold’s annual revenue is approximately $48 million, about half of which is generated by providing outsourced ATM network administration and transaction processing solutions. The company, which employs approximately 125 people, also owns and operates a network of private-label ATMs in Canada.

2011

There were no significant acquisitions in 2011.

2012

France. We acquired Kheops, SAS, a provider of logistics software and related services, for approximately $17 million in January 2012. This acquisition gives us proprietary control of software used primarily in our cash-in-transit and money processing operations in France.

DISCONTINUED OPERATIONS

Brink’s Home Security Holdings, Inc.

On October 31, 2008, we completed the 100% spin-off of Brink’s Home Security Holdings, Inc. (“BHS”). BHS offered monitored security services in North America primarily for owner-occupied, single-family residences. To a lesser extent, BHS offered security services for commercial and multi-family properties. BHS typically installed and owned the on-site security systems and charged fees to monitor and service the systems.

As part of the spin-off, we agreed not to compete with BHS in the United States, Canada and Puerto Rico with respect to certain activities related to BHS’s security system monitoring and surveillance business until October 31, 2013.

In connection with the spin-off, we entered into certain agreements with BHS to define responsibility for obligations arising before and after the spin-off, including obligations relating to liabilities of the businesses, employees, taxes and intellectual property. We entered into a Brand Licensing Agreement with BHS. Under the agreement, BHS licensed the rights to use certain trademarks, including trademarks that contain the word “Brink’s” in the United States, Canada and Puerto Rico. In exchange for these rights, BHS agreed to pay a royalty fee equal to 1.25% of its net revenues during the period after the spin-off until the expiration date of the agreement. This royalty income is recorded in continuing operations within other operating income and expense.

On June 28, 2010, we amended our Brand Licensing Agreement with the successor by merger to BHS. The amended agreement (i) fixed a termination date of August 15, 2010, for the Brand Licensing Agreement and established a fixed royalty amount of $2.8 million for the period beginning April 1, 2010, and ending on the termination date, and (ii) provided the successor with the right to extend the termination date to August 27, 2010, for an additional payment of $0.3 million. During the third quarter, the successor exercised its right to extend the termination date. The royalty income related to the amended agreement was recognized ratably from April 1, 2010, through the termination date.

Former Coal BusinessBusinesses

We have significant liabilities related to benefit plans that pay medical costs for retirees of our former coal operations. A portion of these liabilities havehas been funded. We expect to have ongoing expenses within continuing operations and future cash outflow for these liabilities. See notes 3 and 17 to the consolidated financial statements for more information.

We operate in highly competitive industries.

We compete in industries that are subject to significant competition and pricing pressures in most markets. Because we believe we have competitive advantages such as brand name recognition and a reputation for a high level of service and security, we resist competing on price alone. However, continued pricing pressure from competitors or failure to achieve pricing based on the competitive advantages identified above could affect our customer base or pricing structure and have an adverse effect on our business, financial condition, results of operations and cash flows. In addition, given the highly competitive nature of our industries, it is important to develop new solutions and product and service offerings to help retain and expand our customer base. Failure to develop, sell and execute new solutions and offerings in a timely and efficient manner could also negatively affect our ability to retain our existing customer base or pricing structure and have an adverse effect on our business, financial condition, results of operations and cash flows.

Decreased use of cash could have a negative impact on our business.

The proliferation of payment options other than cash, including credit cards, debit cards, stored-value cards, mobile payments and on-line purchase activity, could result in a reduced need for cash in the marketplace and a decline in the need for physical bank branches and retail stores. To mitigate this risk, we are developing new lines of business, but there is a risk that these initiatives may not offset the risks associated with our traditional cash-based business.

We have significant operations outside the United States.

We currently serve customers in more than 100 countries, including approximately 50 countries where we operate subsidiaries. Eighty-one percent (81%) of our revenue in 2011 came from operations outside the U.S. We expect revenue outside the U.S. to continue to represent a significant portion of total revenue. Business operations outside the U.S. are subject to political, economic and other risks inherent in operating in foreign countries, such as:

| · | the difficulty of enforcing agreements, collecting receivables and protecting assets through foreign legal systems; |

| · | trade protection measures and import or export licensing requirements; |

| · | difficulty in staffing and managing widespread operations; |

| · | required compliance with a variety of foreign laws and regulations; |

| · | enforcement of our global compliance program in foreign countries with a variety of laws, cultures and customs; |

| · | varying permitting and licensing requirements in different jurisdictions; |

| · | foreign ownership laws; |

| · | changes in the general political and economic conditions in the countries where we operate, particularly in emerging markets; |

| · | threat of nationalization and expropriation; |

| · | higher costs and risks of doing business in a number of foreign jurisdictions; |

| · | laws or other requirements and restrictions associated with organized labor; |

| · | limitations on the repatriation of earnings; |

| · | fluctuations in equity, revenues and profits due to changes in foreign currency exchange rates, including measures taken by governments to devalue official currency exchange rates; |

| · | inflation levels exceeding that of the U.S; and |

| · | inability to collect for services provided to government entities which have become illiquid or have difficulty paying their debts. |

We are exposed to certain risks when we operate in countries that have high levels of inflation, including the risk that:

| · | the rate of price increases for services will not keep pace with the cost of inflation; |

| · | adverse economic conditions may discourage business growth which could affect demand for our services; |

| · | the devaluation of the currency may exceed the rate of inflation and reported U.S. dollar revenues and profits may decline; and |

| · | these countries may be deemed “highly inflationary” for U.S. generally accepted accounting principles (“GAAP”) purposes. |

We manage these risks by monitoring current and anticipated political and economic developments, monitoring adherence to our global compliance program and adjusting operations as appropriate. Changes in the political or economic environments of the countries in which we operate could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our growth strategy may not be successful.

One element of our growth strategy is to extend our brand, strengthen our brand portfolio and expand our geographic reach through active programs of selective acquisitions. While we may identify numerous acquisition opportunities, our due diligence examinations and positions that we may take with respect to appropriate valuations and other transaction terms and conditions may hinder our ability to successfully complete acquisitions to achieve our strategic goals. In addition, acquisitions present risks of failing to achieve efficient and effective integration, strategic objectives and anticipated revenue improvements and cost savings. There can be no assurance that:

| · | we will be able to acquire attractive businesses on favorable terms, |

| · | all future acquisitions will be accretive to earnings, or |

| · | future acquisitions will be rapidly and efficiently integrated into existing operations. |

We have significant retirement obligations. Poor investment performance of retirement plan holdings could unfavorably affect our liquidity and results of operations.

We have substantial pension and retiree medical obligations, a portion of which have been funded. The amount of these obligations is significantly affected by factors that are not in our control, including interest rates used to determine the present value of future payment streams, investment returns, medical inflation rates, participation rates and changes in laws and regulations. Our liabilities for these plans increased significantly in 2008 primarily as a result of a decline in value of plan investments. To improve the funded status of The Brink’s Company Pension-Retirement Plan, we made a voluntary $150 million cash and stock contribution in 2009. The funded status of the plan was approximately 71% as of December 31, 2011. Based on actuarial assumptions at the end of 2011, we expect that we will be required to make contributions totaling $228 million to The Brink’s Company Pension-Retirement Plan over a six-year period ending in 2017. This could adversely affect our liquidity and our ability to use our resources to make acquisitions and to otherwise grow our business. The net periodic costs of our retirement plans in 2010 and 2011 were adversely affected by the investment losses sustained in 2008, and although plan investments have partially recovered in the last two years, we anticipate that expenses in future years will continue to be affected as the unrecognized losses are recognized into earnings. If these investments have additional losses, our future cash requirements and costs for these plans will be further adversely affected.

Earnings of our Venezuelan operations may not be transferred to non-Venezuelan subsidiaries for the foreseeable future, which will restrict our ability to use these earnings and cash flows for general corporate purposes such as reducing our debt.

Under a June 2010 law in Venezuela, exchanging local currency for U.S. dollars requires the approval of the government’s central bank. Approved transactions may not exceed $350,000 per legal entity per month. We believe the law will limit the repatriation of cash from Venezuela for the foreseeable future, and as a result, will reduce the amount of cash in the future that could be used for general corporate purposes, including reducing our debt. At December 31, 2011, our Venezuelan subsidiaries held $1.3 million of cash and short-term investments denominated in U.S. dollars and $8.9 million of cash denominated in bolivar fuertes.

Our earnings and cash flow could be materially affected by increased losses of customer valuables.

We purchase insurance coverage for losses of customer valuables for amounts in excess of what we consider prudent deductibles and/or retentions. Insurance is provided by different groups of underwriters at negotiated rates and terms. Coverage is available to us in major insurance markets, although premiums charged are subject to fluctuations depending on market conditions. Our loss experience and that of other armored carriers affects premium rates charged to us. We are self-insured for losses below our coverage limits and recognize expense up to these limits for actual losses. Our insurance policies cover losses from most causes, with the exception of war, nuclear risk and various other exclusions typical for such policies. The availability of high-quality and reliable insurance coverage is an important factor in order for us to obtain and retain customers and to manage the risks of our business. If our losses increase, or if we are unable to obtain adequate insurance coverage at reasonable rates, our financial condition, results of operations and cash flows could be materially and adversely affected.

We have risks associated with confidential individual information.

In the normal course of business, we collect, process and retain sensitive and confidential information about individuals. Despite the security measures we have in place, our facilities and systems, and those of third-party service providers, could be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming or human errors or other similar events. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential information, whether by us or by third-party service providers, could damage our reputation, expose us to the risks of litigation and liability, disrupt our business or otherwise have a material adverse effect on our business, financial condition, results of operations and cash flows.

ITEM 1A. RISK FACTORSNegative publicity to our name or brand could lead to a loss of revenue or profitability.

We are in the security business and our success and longevity are based to a large extent on our reputation for trust and integrity. Our reputation or brand, particularly the trust placed in us by our customers, could be negatively impacted in the event of perceived or actual breaches in our ability to conduct our business ethically, securely and responsibly. Any damage to our brand could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Failures of our IT system could have a material adverse effect on our business.

We are exposedheavily dependent on our information technology (IT) infrastructure. Significant problems with our infrastructure, such as telephone or IT system failure, computer viruses or other third-party tampering with IT systems, or failure to risk in the operation ofdevelop new technology platforms to support new initiatives and product and service offerings, could halt or delay our businesses. Some of these risks are commonability to all companies doingservice our customers, hinder our ability to conduct and expand our business in the industries in whichand require significant remediation costs. In addition, we operatecontinue to evaluate and some are uniqueimplement upgrades to our business. In addition, thereIT systems. We are aware of inherent risks associated with investing inreplacing these systems, including accurately capturing data and system disruptions, and believe we are taking appropriate action to mitigate these risks through testing, training, and staging implementation. However, there can be no assurances that we will successfully launch these systems as planned or that they will occur without disruptions to our common stock. These risk factors should be considered carefully when evaluating the companyoperations. Any of these events could have a material adverse effect on our business, financial condition, results of operations and its businesses.cash flows.

We may not realize the expected benefits of strategic acquisitions because of integration difficulties and other challenges, which may adversely affect our financial condition, results of operations or cash flows.

Our ability to realize the anticipated benefits from recent acquisitions will depend, in part, on successfully integrating each business with our company as well as improving operating performance and profitability through our management efforts and capital investments. The risks to a successful integration and improvement of operating performance and profitability include, among others, failure to implement our business plan, unanticipated issues in integrating operations with ours, unanticipated changes in laws and regulations, labor unrest resulting from union operations, regulatory, environmental and permitting issues, the effect on our internal controls and compliance with the regulatory requirements under the Sarbanes-Oxley Act of 2002, and difficulties in fully identifying and evaluating potential liabilities, risks and operating issues. The occurrence of any of these events may adversely affect our expected benefits of the recent acquisitions and may have a material adverse effect on our financial condition, results of operations or cash flows.

The inability to access capital or significant increases in the cost of capital could adversely affect our business.

Our ability to obtain adequate and cost-effective financing depends on our credit ratings as well as the liquidity of financial markets. A negative change in our ratings outlook or any downgrade in our current investment-grade credit ratings by our rating agencies could adversely affect our cost and/or access to sources of liquidity and capital. Additionally, such a downgrade could increase the costs of borrowing under available credit lines. Disruptions in the capital and credit markets could adversely affect our ability to access short-term and long-term capital. Our access to funds under short-term credit facilities is dependent on the ability of the participating banks to meet their funding commitments. Those banks may not be able to meet their funding commitments if they experience shortages of capital and liquidity. Longer disruptio ns in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives, or failures of significant financial institutions could adversely affect our access to capital needed for our business.

We have significant retirement obligations. Poor investment performance of retirement plan holdings could unfavorably affect our liquidity and results of operations.

We have substantial pension and retiree medical obligations, a portion of which have been funded. The amount of these obligations is significantly affected by factors that are not in our control, including interest rates used to determine the present value of future payment streams, investment returns, medical inflation rates, participation rates and changes in laws and regulations. Our liabilities for these plans increased significantly in 2008 primarily as a result of a decline in value of plan investments. To improve the funded status of The Brink’s Company Pension-Retirement Plan, we made a voluntary $150 million cash and stock contribution in 2009. The funded status of the plan was approximately 80% as of December 31, 2010. Based on actuarial assumptions at the end of 2010, we expect that we will be required to make contributions totaling $136 million to The Brink’s Company Pension-Retirement Plan over a five-year period ending in 2016. This could adversely affect our liquidity and our ability to use our resources to make acquisitions and to otherwise grow our business. The net periodic costs of our retirement plans in 2009 and 2010 were adversely affected by the investment losses sustained in 2008, and although plan investments have partially recovered in the last two years, we anticipate that expenses in future years will continue to be affected as the unrecognized losses are recognized into earnings. If these investments have additional losses, our future cash requirements and costs for these plans will be further adversely affected.

We have significant operations outside the United States.

We currently serve customers in more than 100 countries, including approximately 50 countries where we operate subsidiaries. Seventy-six percent (76%) of our revenue in 2010 came from operations outside the U.S. We expect revenue outside the U.S. to continue to represent a significant portion of total revenue. Business operations outside the U.S. are subject to political, economic and other risks inherent in operating in foreign countries, such as:

· | the difficulty of enforcing agreements, collecting receivables and protecting assets through foreign legal systems; |

· | trade protection measures and import or export licensing requirements; |

· | difficulty in staffing and managing widespread operations; |

· | required compliance with a variety of foreign laws and regulations; |

· | varying permitting and licensing requirements in different jurisdictions; |

· | foreign ownership laws; |

· | changes in the general political and economic conditions in the countries where we operate, particularly in emerging markets; |

· | threat of nationalization and expropriation; |

· | higher costs and risks of doing business in a number of foreign jurisdictions; |

· | laws or other requirements and restrictions associated with organized labor; |

· | limitations on the repatriation of earnings; |

· | fluctuations in equity, revenues and profits due to changes in foreign currency exchange rates, including measures taken by governments to devalue official currency exchange rates; and |

· | inflation levels exceeding that of the U.S. |

We are exposed to certain risks when we operate in countries that have high levels of inflation, including the risk that:

· | the rate of price increases for services will not keep pace with the cost of inflation; |

· | adverse economic conditions may discourage business growth which could affect demand for our services; |

· | the devaluation of the currency may exceed the rate of inflation and reported U.S. dollar revenues and profits may decline; and |

· | these countries may be deemed “highly inflationary” for U.S. generally accepted accounting principles (“GAAP”) purposes. |

We try to manage these risks by monitoring current and anticipated political and economic developments and adjusting operations as appropriate. Changes in the political or economic environments of the countries in which we operate could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Restructuring charges may be required in the future.

There is a possibility we will take restructuring actions in one or more of our markets in the future to reduce expenses if a major customer is lost, if recurring operating losses continue, or if one of the risks described above in connection with our foreign operations materializes. These actions could result in significant restructuring charges at these subsidiaries, including recognizing impairment charges to write down assets, and recording accruals for employee severance and operating leases. These charges, if required, could significantly and materially affect results of operations and cash flows.

Earnings of our Venezuelan operations may not be repatriated for the foreseeable future, which will restrict our ability to use these earnings and cash flows for general corporate purposes such as reducing our U.S. debt.

Under a June 2010 law in Venezuela, exchanging local currency for U.S. dollars requires the approval of the government’s central bank. Approved transactions may not exceed $350,000 per legal entity per month. We believe the law will limit the repatriation of cash from Venezuela for the foreseeable future, and as a result, will reduce the amount of cash in the future that could be used for general corporate purposes, including reducing our U.S. debt. At December 31, 2010, our Venezuelan subsidiaries held $3.3 million of cash and short-term investments denominated in U.S. dollars and $18.2 million of cash denominated in bolivar fuertes.

We operate in highly competitive industries.

We compete in industries that are subject to significant competition and pricing pressures in most markets. Because we believe we have competitive advantages such as brand name recognition and a reputation for a high level of service and security, we resist competing on price alone. However, continued pricing pressure could affect our customer base or pricing structure and have an adverse effect on our business, financial condition, results of operations and cash flows.

Our earnings and cash flow could be materially affected by increased losses of customer valuables.

We purchase insurance coverage for losses of customer valuables for amounts in excess of what we consider prudent deductibles and/or retentions. Insurance is provided by different groups of underwriters at negotiated rates and terms. Coverage is available to us in major insurance markets, although premiums charged are subject to fluctuations depending on market conditions. Our loss experience and that of other armored carriers affects premium rates charged to us. We are self-insured for losses below our coverage limits and recognize expense up to these limits for actual losses. Our insurance policies cover losses from most causes, with the exception of war, nuclear risk and various other exclusions typical for such policies. The availability of high-quality and reliable ins urance coverage is an important factor in order for us to obtain and retain customers and to manage the risks of our business. If our losses increase, or if we are unable to obtain adequate insurance coverage at reasonable rates, our financial condition, results of operations and cash flows could be materially and adversely affected.

We have risks associated with confidential individual information.

In the normal course of business, we collect, process and retain sensitive and confidential information about individuals. Despite the security measures we have in place, our facilities and systems, and those of third-party service providers, could be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming or human errors or other similar events. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential information, whether by us or by third-party service providers, could damage our reputation, expose us to the risks of litigation and liability, disrupt our business or otherwise have a material adverse effect on our business, financial condition, results of operations and cash flows.

We operate in regulated industries.

Our U.S. operations are subject to regulation by the U.S. Department of Transportation with respect to safety of operations and equipment and financial responsibility. Intrastate operations in the U.S. are subject to regulation by state regulatory authorities and interprovincial operations in Canada are subject to regulation by Canadian and provincial regulatory authorities. Our international operations are regulated to varying degrees by the countries in which we operate. Many countries have permit requirements for security services and prohibit foreign companies from providing different types of security services.

Changes in laws or regulations could require a change in the way we operate, which could increase costs or otherwise disrupt operations. In addition, failure to comply with any applicable laws or regulations could result in substantial fines or revocation of our operating permits and licenses. If laws and regulations were to change or we failed to comply, our business, financial condition, results of operations and cash flows could be materially and adversely affected.

FailuresOur inability to access capital or significant increases in our cost of capital could adversely affect our IT system could have a material adverse effectbusiness.

Our ability to obtain adequate and cost-effective financing depends on our business.credit ratings as well as the liquidity of financial markets. A negative change in our ratings outlook or any downgrade in our current investment-grade credit ratings by the rating agencies could adversely affect our cost and/or access to sources of liquidity and capital. Additionally, such a downgrade could increase the costs of borrowing under available

11

We are heavily dependent on our information technology (IT) infrastructure. Significant problems with our infrastructure, such as telephone or IT system failure, computer viruses or other third-party tampering with IT systems,

credit lines. Disruptions in the capital and credit markets could halt or delayadversely affect our ability to serviceaccess short-term and long-term capital. Our access to funds under short-term credit facilities is dependent on the ability of the participating banks to meet their funding commitments. Those banks may not be able to meet their funding commitments if they experience shortages of capital and liquidity. Longer disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives, or failures of significant financial institutions could adversely affect our customers, hinderaccess to capital needed for our ability to conduct our business and require significant remediation costs. In addition, we continue to evaluate and implement upgrades to our IT systems. We are aware of inherent risks associated with replacing these systems, including accurately capturing data and system disruptions, and believe we are taking appropriate action to mitigate these risks through testing, training, and staging implementation. However, there can be no assurances that we will successfully launch these systems as planned or tha t they will occur without disruptions to our operations. Any of these events could have a material adverse effect on our business, financial condition, results of operations and cash flows.business.

We have retained obligations from the sale of BAX Global.

In January 2006 we sold BAX Global. We retained some of the obligations related to these operations, primarily for taxes owed prior to the date of sale and for any amounts paid related to one pending litigation matter for which we paid $11.5 million in 2010. In addition, we provided indemnification customary for these sorts of transactions. Future unfavorable developments related to these matters could require us to record additional expenses or make cash payments in excess of recorded liabilities. The occurrence of these events could have a material adverse affect on our financial condition, results of operations and cash flows.

We are subject to covenants for our credit facilities.facilities and for our unsecured notes.

We haveOur credit facilities withas well as our unsecured notes are subject to financial covenants, including a limit on the ratio of debt to earnings before interest, taxes, depreciation, and amortization, limits on the ability to pledge assets, limits on the total amount of indebtedness we can incur, limits on the use of proceeds of asset sales and minimum coverage of interest costs. Although we believe none of these covenants are presently restrictive to operations, the ability to meet the financial covenants can be affected by changes in our results of operations or financial condition. We cannot provide assurance that we will meet these covenants. A breach of any of these covenants could result in a default under existing credit facilities. Upon the occurrence of an event of default under any of our credit facilities, the lenders could c ausecause amounts outstanding to be immediately payable and terminate all commitments to extend further credit. The occurrence of these events would have a significant effect on our liquidity and cash flows.

Our growth strategy may not be successful.

One element of our growth strategy is to extend our brand, strengthen our brand portfolio and expand our geographic reach through active programs of selective acquisitions. While we may identify numerous acquisition opportunities, our due diligence examinations and positions that we may take with respect to appropriate valuations and other transaction terms and conditions may hinder our ability to successfully complete acquisitions to achieve our strategic goals. In addition, acquisitions present risks of failing to achieve efficient and effective integration, strategic objectives and anticipated revenue improvements and cost savings. There can be no assurance that:

· | we will be able to acquire attractive businesses on favorable terms, |

· | all future acquisitions will be accretive to earnings, or |

· | future acquisitions will be rapidly and efficiently integrated into existing operations. |

Our effective income tax rate could change.

We serve customers in more than 100 countries, including approximately 50 countries where we operate subsidiaries, all of which have different income tax laws and associated income tax rates. Our effective income tax rate can be significantly affected by changes in the mix of pretax earnings by country and the related income tax rates in those countries. In addition, our effective income tax rate is significantly affected by the ability to realize deferred tax assets, including those associated with net operating losses. Changes in income tax laws, income apportionment, or estimates of the ability to realize deferred tax assets, could significantly affect our effective income tax rate, financial position and results of operations.

We have certain environmental and other exposures related to our former coal operations.

We may incur future environmental and other liabilities that are presently unknown in connection with our former coal operations, which could materially and adversely affect our financial condition, results of operations and cash flows.

We may be exposed to certain regulatory and financial risks related to climate change.

Growing concerns about climate change may result in the imposition of additional environmental regulations to which we are subject. Some form of federal regulation may be forthcoming with respect to greenhouse gas emissions (including carbon dioxide) and/or "cap and trade" legislation. The outcome of this legislation may result in new regulation, additional charges to fund energy efficiency activities or other regulatory actions. Compliance with these actions could result in the creation of additional costs to us, including, among other things, increased fuel prices or additional taxes or emission allowances. We may not be able to recover the cost of compliance with new or more stringent environmental laws and regulations from our customers, which could adversely affect our business. Furthermore, the potential effe ctseffects of climate change and related regulation on our customers are highly uncertain and may adversely affect our operations.

Forward-Looking Statements

This document contains both historical and forward-looking information. Words such as “anticipates,” “estimates,” “expects,” “projects,” “intends,” “plans,” “believes,” “may,” “should” and similar expressions may identify forward-looking information. Forward-looking information in this document includes, but is not limited to, statements regarding expected revenue growthfuture performance of The Brink’s Company and earnings,its global operations, including organic revenue growth and segment operating profit margin in 2011,2012, the pursuit of growth through acquisitions in developed, emerging and adjacent markets, employee relations, liabilities, expenses and cash outflows related to former operations, including benefit plansthe percentage of total revenues from outside the United States, future contributions to pay retiree medical costs,our Pension-Retirement Plan, the repatriation of cash from our Venezuelan operations, the outcome of pending litigation including litigation in Belgium, and the anticipated financial effect of the disposition of these matters, the pursuit of higher margin business opportunities, investments in information technology, profit growth in Mexico and Latin America, improved margins in North America and Europe, growth of our Cash Logistics services,Global Services business, the acquisition of new vehicles in the United States with capital leases, expected non-segment income and expenses, 2012 projected interest expense, the realization of deferred tax assets, our anticipated

effective tax rate for 20112012 and our tax position, the reinvestment of earnings on operations outside the U.S., 2011 projected interest expense, capital expenditures,United States, net income attributable to noncontrolling interests, projected currency impact on revenue, capital expenditures, capital leases and depreciation and amortization, the funding of our acquisition strategy and pension obligations, the trend of capital expenditures exceeding depreciation and amortization, the ability to meet liquidity needs, future payment of bonds issued by the Peninsula Ports Authority of Virginia, the abilityregistration and issuance of shares of common stock to meet liquidity needs,satisfy pension contribution requirements, estimated contractual obligations for the next five years and beyond, projected contributions, expenses and payouts for the U.S. retirement plans and the non-U.S. pension plans and the expected long-term rate of return and funded status of the primary U.S. pension plan, expected liability for and future contributions to the UMWA pla ns,plans, liability for black lung obligations, the effectprojected impact of accounting rule changes,a new excise tax on the UMWA plans, our ability to obtain U.S. dollars to operate our business in Venezuela at the SITME rate, the repatriationeffect of cash from our Venezuelan operations,accounting rule changes, the deductibilityperformance of goodwill,counterparties to hedging agreements, the recognition of unrecognized tax positions, future amortizations into net periodic pension cost, the recognitiondeductibility of unrecognized tax positions, the purchase of additional shares of Brink’s Arya,goodwill, projected minimum repayments of long-term debt, the replacement of operating leases, future minimum lease payments, and minimum future lease payments.the recognition of costs related to stock option grants. Forward-looking information in this document is subject to known and unknown risks, uncertainties, and contingencies, which could cause actual results, performance or achievements to differ materially from those that are anticipated.