UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

2023 or

| | | | | |

| ☐ | |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-3280

Public Service Company of Colorado

(Exact name of registrant as specified in its charter)

For the transition period from _____ to _____ | | |

| 001-03280 |

| (Commission File Number) |

| | |

| Public Service Company of Colorado |

| (Exact name of registrant as specified in its charter) |

|

| | | | | | | | | | | | | | |

| Colorado | | 84-0296600 |

(State or other jurisdictionOther Jurisdiction of incorporationIncorporation or organization)Organization) | | (I.R.S.IRS Employer Identification No.) |

| | | | |

| 1800 Larimer, Suite 1100 | Denver | Colorado | | 80202 |

(Address of principal executive offices)Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (303) 571-7511 | | | | | |

| 303 | 571-7511 |

| (Registrant’s Telephone Number, Including Area Code) |

Securities registered pursuant to Section 12(b) of the Act:None | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| N/A | | N/A | | N/A |

Securities registered pursuant to sectionSection 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x☒ Yes ¨☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨☐ Yes x☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x☒ Yes ¨☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 andof Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x☒ Yes ¨☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.☐ Large accelerated filer ☐ Accelerated filer ☒ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company |

| | |

Large accelerated filer ¨

| | Accelerated filer ¨

|

Non-accelerated filer x

| | Smaller reporting company ¨

|

(Do not check if smaller reporting company) | | Emerging growth company ¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.¨☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨☐ Yes x☒ No

As of Feb. 23, 2018,21, 2024, 100 shares of common stock, par value $0.01 per share, were outstanding, all of which were held by Xcel Energy Inc., a Minnesota corporation.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Item 14 of Form 10-K is set forth under the heading “Independent Registered Public Accounting Firm – Audit and Non-Audit Fees” in Xcel Energy Inc.’s definitive Proxy Statement for the 20182024 Annual Meeting of StockholdersShareholders which definitive Proxy Statement is expected to be filed with the SEC on or about April 3, 2018. 9, 2024.Such information set forth under such heading is incorporated herein by this reference hereto.

Public Service Company of Colorado meets the conditions set forth in General Instructions I(1)(a) and (b) of Form 10-K and is therefore filing this form with the reduced disclosure format permitted by General Instruction I(2).

TABLE OF CONTENTS

Index

| | | | | | | | |

| PART I | | |

PART I | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 1A — | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Item 1B — | | |

| Item 1C — | | |

| Item 2 — | | |

Item 3 — | | |

Item 4 — | | |

| | |

| PART II | | |

Item 5 — | | |

Item 6 — | | |

Item 7 — | | |

Item 7A — | | |

Item 8 — | | |

Item 9 — | | |

Item 9A — | | |

Item 9B — | | |

| Item 9C — | | |

| | |

| PART III | | |

Item 10 — | | |

Item 11 — | | |

Item 12 — | | |

Item 13 — | | |

Item 14 — | | |

| | |

| PART IV | | |

Item 15 — | | |

Item 16 — | |

|

| | |

| |

This Form 10-K is filed by PSCo. PSCo is a wholly owned subsidiary of Xcel Energy Inc. Additional information on Xcel Energy is available in various filings with the SEC. This report should be read in its entirety.

PART I

Item l — Business

DEFINITION OF ABBREVIATIONS AND INDUSTRY TERMS

Definitions of Abbreviations

| | | | | |

| Xcel Energy Inc.’s Subsidiaries and Affiliates (current and former) |

| NCE | New Century Energies, Inc.

| NSP-Minnesota | Northern States Power Company, a Minnesota corporation |

| NSP-Wisconsin | Northern States Power Company, a Wisconsin corporation |

| PSCo | Public Service Company of Colorado |

PSRISPS | P.S.R. Investments, Inc. |

SPS | Southwestern Public Service Company |

| Utility subsidiaries | NSP-Minnesota, NSP-Wisconsin, PSCo and SPS |

| WYCO | WYCO Development, LLC |

| Xcel Energy | Xcel Energy Inc. and its subsidiaries |

| | | | | |

| |

| Federal and State Regulatory Agencies |

CFTCCPUC | Commodity Futures Trading Commission |

CPUC | Colorado Public Utilities Commission |

D.C. CircuitDOT | United States Court of Appeals for the District of Columbia Circuit |

DOT | United States Department of Transportation |

| EPA | United States Environmental Protection Agency |

| FERC | Federal Energy Regulatory Commission |

| IRS | Internal Revenue Service |

| NERC | North American Electric Reliability Corporation |

| PHMSA | Pipeline and Hazardous Materials Safety Administration |

| SEC | Securities and Exchange Commission |

| | | | | |

| |

| Electric, Purchased Gas and Resource Adjustment Clauses |

| DSM | Demand side management |

DSMCAECA | Demand side management cost adjustment |

ECA | Retail electric commodity adjustment |

| GCA | Gas cost adjustment |

PCCAPSIA | Purchased capacity cost adjustment |

PSIA | Pipeline system integrity adjustment |

RESARES | Renewable energy standard adjustment |

| | | | | |

| Other |

SCAAFUDC | Steam cost adjustment |

TCA | Transmission cost adjustment |

WCA | Windsource® cost adjustment

|

| |

Other Terms and Abbreviations |

AFUDC | Allowance for funds used during construction |

| ALJ | Administrative law judgeLaw Judge |

| APBO | Accumulated postretirement benefit obligation

| ARO | Asset retirement obligation |

ASCARRR | FASBApplication for Rehearing, Reargument, or Reconsideration |

| ASC | Financial Accounting Standards Board Accounting Standards Codification |

ASUC&I | FASB Accounting Standards Update |

C&I | Commercial and Industrial |

CAISOCCR | California Independent System OperatorCoal combustion residuals |

CAACCR Rule | Clean Air ActFinal rule (40 CFR 257.50 - 257.107) published by the EPA regulating the management, storage and disposal of CCRs as a nonhazardous waste |

CACJACEO | Clean Air Clean Jobs ActChief executive officer |

CO2

CFO | Carbon dioxide |

| Chief financial officer |

| CIG | Colorado Interstate Gas Company, LLC |

| CPCN | Certificate of public convenience and necessity

| CPP | Clean Power Plan

| |

| CWIP | Construction work in progress |

| ERCOT | Electric Reliability Council of Texas

| |

| | | | | |

| ETR | Effective tax rate |

| FASB | Financial Accounting Standards Board

| GAAP | Generally accepted accounting principles |

| GHG | Greenhouse gas |

IRCIPP | Internal Revenue CodeIndependent power producing entity |

ITCISO | Independent System Operator |

| ITC | Investment tax credit |

JOAMGP | Joint operating agreement |

MGP | Manufactured gas plant |

| MISO | Midcontinent Independent Transmission System Operator, Inc.

Moody’s | Moody’s Investor Services |

MWTG | Mountain West Transmission Group |

| Native load | Customer demand of retail and wholesale customers whereby a utility has an obligation to serve under statute or long-term contract.contract |

| NAV | Net asset value |

| NOL | Net operating loss |

NOxO&M | Nitrogen oxide |

O&M | Operating and maintenance |

OCIPIM | Other comprehensive incomePerformance Incentive Mechanism |

PJMPFAS | PJM Interconnection, LLCPer- and PolyFluoroAlkyl Substances |

PMPost-65 | Particulate matterPost-Medicare |

| PPA | Purchased power agreement |

PRPPre-65 | Potentially responsible partyPre-Medicare |

PSIAPTC | Pipeline system integrity adjustment

|

PTC | Production tax credit |

PVREC | Photovoltaic |

R&E | Research and experimentation |

REC | Renewable energy credit |

| ROE | Return on equity |

RPSROU | Renewable portfolio standardsRight-of-use |

SIPRTO | State implementation planRegional Transmission Organization |

SO2

S&P | Sulfur dioxideStandard & Poor’s Global Ratings |

SPPSERP | Supplemental executive retirement plan |

| SPP | Southwest Power Pool, Inc. |

Standard & Poor’sTCJA | Standard & Poor’s Ratings Services |

TCJA | 2017 federal tax reform enacted as Public Law No: 115-97, commonly referred to as the Tax Cuts and Jobs Act

|

| VaR | Value at Risk |

MeasurementsVIE | Variable interest entity |

KVWACC | KilovoltsWeighted Average Cost of Capital |

| | | | | |

| Measurements |

KWhBcf | Kilowatt hoursBillion cubic feet |

MMBtuKV | Kilovolts |

| KWh | Kilowatt hours |

| MMBtu | Million British thermal units |

| MW | Megawatts |

| MWh | Megawatt hours |

GWh | Gigawatt hours |

COMPANY OVERVIEW

| | |

| Where to Find More Information |

PSCo was incorporated in 1924 under the laws of Colorado. PSCo is a utility engaged primarilywholly owned subsidiary of Xcel Energy Inc., and Xcel Energy’s website address is www.xcelenergy.com. Xcel Energy makes available, free of charge through its website, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after the reports are electronically filed with or furnished to the SEC. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically at http://www.sec.gov. The information on Xcel Energy’s website is not a part of, or incorporated by reference in, this annual report on Form 10-K.

| | |

| Forward-Looking Statements |

Except for the generation, purchase, transmission, distributionhistorical statements contained in this report, the matters discussed herein are forward-looking statements that are subject to certain risks, uncertainties and saleassumptions. Such forward-looking statements, including those relating to future sales, future expenses, future tax rates, future operating performance, estimated base capital expenditures and financing plans, projected capital additions and forecasted annual revenue requirements with respect to rider filings, expected rate increases to customers, expectations and intentions regarding regulatory proceedings, and expected impact on our results of electricityoperations, financial condition and cash flows of resettlement calculations and credit losses relating to certain energy transactions, as well as assumptions and other statements are intended to be identified in Colorado.this document by the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “objective,” “outlook,” “plan,” “project,” “possible,” “potential,” “should,” “will,” “would” and similar expressions. Actual results may vary materially. Forward-looking statements speak only as of the date they are made, and we expressly disclaim any obligation to update any forward-looking information. The following factors, in addition to those discussed elsewhere in this Annual Report on Form 10-K for the fiscal year ended Dec. 31, 2023 (including risk factors listed from time to time by PSCo also purchases, transports, distributesin reports filed with the SEC, including “Risk Factors” in Item 1A of this Annual Report on Form 10-K), could cause actual results to differ materially from management expectations as suggested by such forward-looking information: operational safety; successful long-term operational planning; commodity risks associated with energy markets and sellsproduction; rising energy prices and fuel costs; qualified employee workforce and third-party contractor factors; violations of our Codes of Conduct; our ability to recover costs; changes in regulation; reductions in our credit ratings and the cost of maintaining certain contractual relationships; general economic conditions, including recessionary conditions, inflation rates, monetary fluctuations, supply chain constraints and their impact on capital expenditures and/or the ability of PSCo to obtain financing on favorable terms; availability or cost of capital; our customers’ and counterparties’ ability to pay their debts to us; assumptions and costs relating to funding our employee benefit plans and health care benefits; tax laws; uncertainty regarding epidemics, the duration and magnitude of business restrictions including shutdowns (domestically and globally), the potential impact on the workforce, including shortages of employees or third-party contractors due to quarantine policies, vaccination requirements or government restrictions, impacts on the transportation of goods and the generalized impact on the economy; effects of geopolitical events, including war and acts of terrorism; cybersecurity threats and data security breaches; seasonal weather patterns; changes in environmental laws and regulations; climate change and other weather events; natural disaster and resource depletion, including compliance with any accompanying legislative and regulatory changes; costs of potential regulatory penalties and wildfire damages in excess of liability insurance coverage; regulatory changes and/or limitations related to the use of natural gas as an energy source; challenging labor market conditions and our ability to retail customersattract and transportsretain a qualified workforce; and our ability to execute on our strategies or achieve expectations related to environmental, social and governance matters including as a result of evolving legal, regulatory and other standards, processes, and assumptions, the pace of scientific and technological developments, increased costs, the availability of requisite financing, and changes in carbon markets.

| | | | | | | | | | | | | | | | | |

| | | | | |

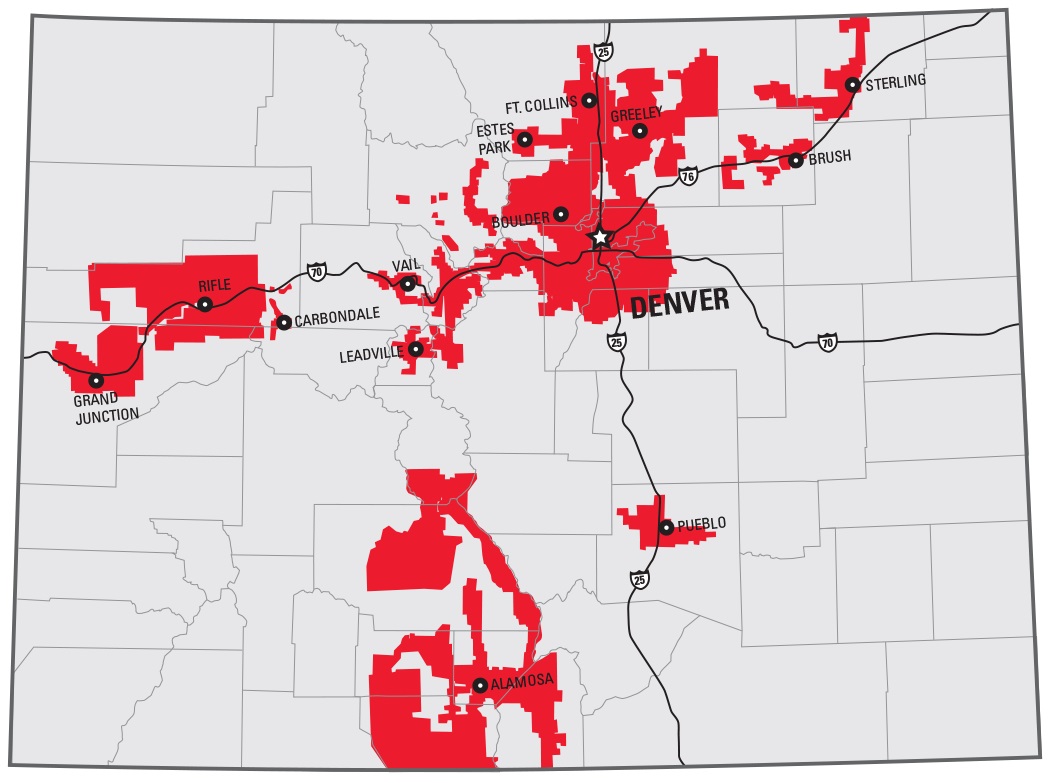

| Electric customers | 1.6 million | | | | PSCo was incorporated in 1924 under the laws of Colorado. PSCo conducts business in Colorado and generates, purchases, transmits, distributes and sells electricity in addition to purchasing, transporting, distributing and selling natural gas to retail customers and transporting customer-owned natural gas. |

| Natural gas customers | 1.5 million | | |

| Total assets | $24.6 billion | | |

| Rate Base (estimated) | $16.9 billion | | |

| GAAP ROE | 7.32% | | |

| Electric generating capacity | 6,203 MW | | |

| Gas storage capacity | 32.1 Bcf | | |

| Electric transmission lines (conductor miles) | 25,000 miles | | |

| Electric distribution lines (conductor miles) | 80,000 miles | | |

| Natural gas transmission lines | 2,000 miles | | | |

| Natural gas distribution lines | 23,000 miles | | | |

| | | | |

| | | | |

Electric operations consist of energy supply, generation, transmission and distribution activities. PSCo provideshad electric utility service to approximately 1.5sales volume of 33,811 (millions of KWh), 1.6 million customers and natural gas utility service to approximately 1.4electric revenues of $3,731 million customers. All of PSCo’s retail electric operating revenues were derived from operations in Colorado. Although PSCo’s large C&I electric retail customers are comprised of many diversified industries, a significant portion of PSCo’s large C&I electric sales include: fabricated metal products, communications and health services. For small C&I customers, significant electric retail sales include the following industries: real estate and dining establishments. Generally, PSCo’s earnings contribute approximately 35 percent to 45 percent of Xcel Energy’s consolidated net income.for 2023.

| | | | | | | | | | | | | | | | | | | | |

| Electric Operations (percentage of total) | | Sales Volume | | Number of Customers | | Revenues |

| Residential | | 28 | % | | 86 | % | | 35 | % |

| C&I | | 54 | | | 11 | | | 49 | |

| Other | | 18 | | | 3 | | | 17 | |

The wholesale customers served by PSCo comprised approximately 14 percent of its total KWh sold in 2017.

Retail Sales/Revenue Statistics (a)

PSCo owns the following direct subsidiaries: 1480 Welton, Inc. and United Water Company, both of which own certain real estate interests; and Green and Clear Lakes Company, which owns water rights and certain real estate interests. PSCo also holds a controlling interest in several other relatively small ditch and water companies. | | | | | | | | | | | | | | |

| | 2023 | | 2022 |

| KWH sales per retail customer | | 17,781 | | | 18,456 | |

| Revenue per retail customer | | $ | 2,006 | | | $ | 2,074 | |

| Residential revenue per KWh | | 13.69 | ¢ | | 13.62 | ¢ |

| C&I revenue per KWh | | 9.90 | ¢ | | 9.86 | ¢ |

| Total retail revenue per KWh | | 11.28 | ¢ | | 11.24 | ¢ |

PSCo conducts its utility business in the following reportable segments: regulated electric utility, regulated natural gas utility and all other. (a)See Note 156 to the consolidated financial statements for further discussion relating to comparative segment revenues,information.

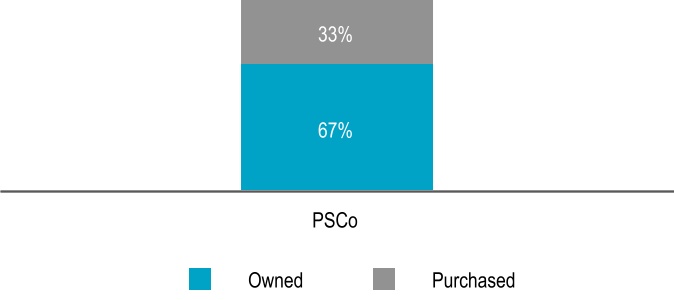

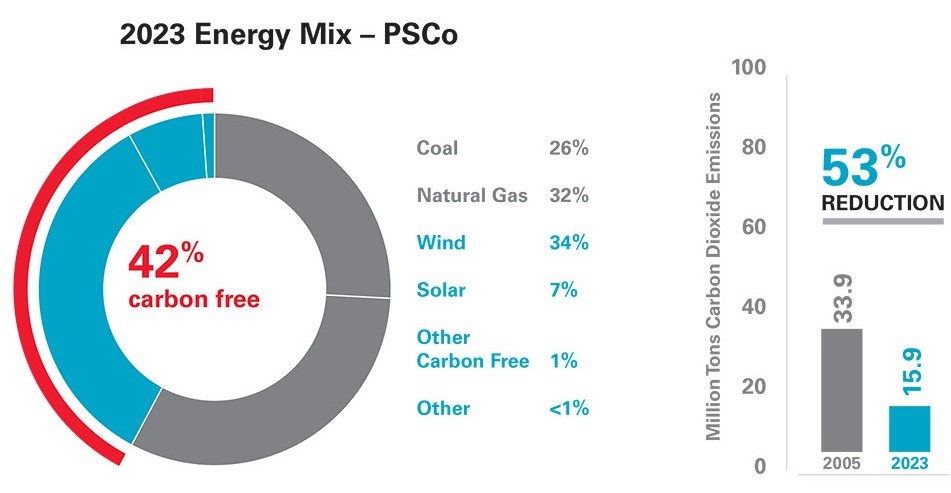

Owned and Purchased Energy Generation — 2023

Electric Energy Sources

Total electric energy generation by source for the year ended Dec. 31:

Carbon–Free

PSCo’s carbon–free energy portfolio includes wind, hydroelectric and solar power from both owned generating facilities and PPAs. Carbon–free percentages will vary year over year based on system additions, commodity costs, weather, system demand and transmission constraints.

See Item 2 — Properties for further information.

Wind

Wind capacity is shown as net incomemaximum capacity. Net maximum capacity is attainable only when wind conditions are sufficiently available

Owned — Owned and related financialoperated wind farms with corresponding capacity:

| | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2022 |

| Wind Farms | | Capacity (MW) | | Wind Farms | | Capacity (MW) |

| 2 | | | 1,059 | | | 2 | | | 1,059 | |

PPAs — Number of PPAs with capacity range: | | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2022 |

| PPAs | | Range (MW) | | PPAs | | Range (MW) |

| 17 | | | 23 — 301 | | 17 | | | 23 — 301 |

Current contracted wind capacity for PPAs was 3,026 MW and 3,023 MW in 2023 and 2022, respectively.

In 2023, the average cost of wind energy was $7 per MWh for owned generation and $42 per MWh under existing PPAs. In 2022, the average cost of wind energy was $11 per MWh for owned generation and $38 per MWh under existing PPAs.

PSCo anticipates development of approximately 1,850 MW of wind generation resources (1,550 MW Company Owned, 300 MW as PPAs), as part of the Colorado Resource Plan.

Solar

PPAs — Solar PPAs capacity by type:

| | | | | | | | | | | |

| Type | | Capacity (MW) | |

| Distributed Generation | | 887 | | |

| Utility-Scale | | 1,530 | | (a) |

| Total | | 2,417 | | |

(a)Includes battery storage capacity of 225 MW.

The average cost of solar energy under existing PPAs was $34 per MWh and $69 per MWh in 2023 and 2022, respectively.

PSCo anticipates development of approximately 1,700 MW of solar generation resources (650 MW Company Owned, 1,050 MW as PPAs) as part of the Colorado Resource Plan.

Other

PSCo’s other carbon-free energy portfolio includes hydro from owned generating facilities.

PSCo anticipates development of approximately 1,850 MW of storage capacity (400 MW Company Owned, 1,450 MW as PPAs) as part of the Colorado Resource Plan.

See Item 2 — Properties for further information.

Fossil Fuel

ELECTRIC UTILITY OPERATIONS

Public Utility Regulation

Summary of Regulatory Agencies and Areas of Jurisdiction— PSCo is regulated by the CPUC with respect to its facilities, rates, accounts, services and issuance of securities. PSCo is regulated by the FERC for its wholesale electric operations, accounting practices, hydroelectric licensing, wholesale sales for resale, transmission of electricity in interstate commerce, compliance with the NERC electric reliability standards, asset transactions and mergersPSCo’s fossil fuel energy portfolio includes coal and natural gas transactionspower from both owned generating facilities and PPAs.

See Item 2 — Properties for further information.

Coal

PSCo owns and operates coal units with approximately 1,650 MW of total 2023 net summer dependable capacity, which provided 26% of the PSCo energy mix in interstate commerce. PSCo is not presently a member2023.

Approved early coal plant retirements:

| | | | | | | | | | | | | | | | | |

| Year | | Plant Unit | | Capacity (MW) | |

| 2025 | | Comanche 2 | | 330 | |

| 2025 | | Craig 1 | | 42 | (a) |

| 2025 | | Pawnee (b) | | 505 | |

| 2027 | | Hayden 2 | | 98 | (a) |

| 2028 | | Hayden 1 | | 135 | (a) |

| 2028 | | Craig 2 | | 40 | (a) |

| 2030 | | Comanche 3 | | 500 | (a) |

(a)Based on PSCo’s ownership interest.

(b)Reflects conversion from coal to natural gas.

Coal Fuel Cost — Delivered cost per MMBtu of an RTOcoal consumed for owned electric generation and does not operate within an RTO energy market. PSCo is authorized by the FERC to make wholesale electric sales at market-based prices to customers outside PSCo’s balancing authority area.percentage of total fuel requirements (coal and natural gas):

| | | | | | | | | | | | | | |

| | Coal |

| | Cost | | Percent |

| 2023 | | $ | 1.57 | | | 54 | % |

| 2022 | | 1.48 | | | 55 | |

Fuel, Purchased Energy and Conservation Cost-Recovery Mechanisms —

Natural Gas

PSCo has several retail adjustment clausesseven natural gas plants with approximately 3,300 MW of total 2023 net summer dependable capacity, which provided 32% of the PSCo energy mix in 2023.

Natural gas supplies, transportation and storage services for power plants are procured to provide an adequate supply of fuel. Remaining requirements are procured through a liquid spot market. Generally, natural gas supply contracts have variable pricing that recover fuel, purchased energyis tied to natural gas indices. Natural gas supply and other resource costs:transportation agreements include obligations for the purchase and/or delivery of specified volumes or payments in lieu of delivery.

ECANatural Gas Cost — Recovers fuel and purchased energy costs. Short-term sales margins are shared with retail customers through the ECA. The ECA is revised quarterly.

PCCA — Recovers purchased capacity payments.

SCA — Recovers the difference between PSCo’s actualDelivered cost per MMBtu of fuelnatural gas consumed for owned electric generation and the amountpercentage of these costs recovered under its base steam service rates. The SCA rate is revised on a quarterly basis.

total fuel requirements (coal and natural gas):DSMCA — Recovers DSM, interruptible service costs and performance initiatives for achieving energy savings goals.

| | | | | | | | | | | | | | |

| | Natural Gas |

| | Cost | | Percent |

| 2023 | | $ | 3.06 | | | 46 | % |

| 2022 | | 7.09 | | | 45 | |

RESA — Recovers the incremental costsPSCo anticipates development of compliance with the RES with a maximumapproximately 650 MW of two percentCompany Owned natural gas generation, as part of the customer’s bill.

Colorado Resource Plan to help ensure resiliency and reliability.WCA — Premium service for customers who choose to pay for renewable resources.

TCA — Recovers costs associated with transmission investment outside of rate cases.

CACJA — Recovers costs associated with the CACJA.

PSCo recovers fuel and purchased energy costs from its wholesale electric customers through a fuel cost adjustment clause approved by the FERC. PSCo’s wholesale customers pay the full cost of certain renewable energy purchase and generation costs through a fuel clause and in exchange receive RECs associated with those resources. The wholesale customers pay their jurisdictional allocation of production costs through a fully forecasted formula rate with true-up.

Capacity and Demand

Uninterrupted system peak demand and occurrence date:

| | | | | | | | | | | | | | | | | | | | |

| System Peak Demand (MW) |

| 2023 | | 2022 |

| 6,909 | | | July 24 | | 6,821 | | | Sept. 6 |

Transmission

Transmission lines deliver electricity over long distances from power sources to substations closer to customers. A strong transmission system ensures continued reliable and affordable service, ability to meet state and regional energy policy goals, and support for a diverse generation mix, including renewable energy. PSCo owns more than 24,000 conductor miles of transmission lines across its service territory.

PSCo plans to build approximately 550 additional conductor miles of transmission lines related to the Colorado Power Pathway project estimated to be complete in 2027.

See Item 2 - Properties for further information.

Distribution

Distribution lines allow electricity to travel at lower voltages from substations directly to customers. PSCo has a vast distribution network, owning and operating approximately 80,000 conductor miles of distribution lines across our service territory.

See Item 2 - Properties for further information.

Natural gas operations consist of purchase, transportation and distribution of natural gas to end-use residential, C&I and transport customers. PSCo had natural gas deliveries of 289,163 (thousands of MMBtu), 1.5 million customers and natural gas revenues of $1,734 million for 2023.

| | | | | | | | | | | | | | | | | | | | |

Natural Gas

(percentage of total) | | Deliveries | | Number of Customers | | Revenues |

| Residential | | 35 | % | | 92 | % | | 64 | % |

| C&I | | 16 | | | 7 | | | 26 | |

| Transportation and other | | 49 | | | 1 | | | 10 | |

Sales/Revenue Statistics (a)

| | | | | | | | | | | | | | |

| | 2023 | | 2022 |

| MMBtu sales per retail customer | | 101 | | | 103 | |

| Revenue per retail customer | | $ | 1,061 | | | $ | 1,147 | |

| Residential revenue per MMBtu | | 10.97 | | | 11.14 | |

| C&I revenue per MMBtu | | 9.66 | | | 10.40 | |

| Transportation and other revenue per MMBtu | | 0.95 | | | 1.07 | |

(a)See Note 6 to the consolidated financial statements for further information.

Capability and Demand

Natural gas supply requirements are categorized as firm or interruptible (customers with an alternate energy supply).

Maximum daily output (firm and interruptible) and occurrence date:

| | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2022 |

| MMBtu | | Date | | MMBtu | | Date |

| 2,190,155 | | | Jan. 30 | | 2,243,552 | | | Dec. 22 |

Natural Gas Supply and Cost

PSCo seeks natural gas supply, transportation and storage alternatives to yield a diversified portfolio, which increases flexibility, decreases interruption, financial risks and economical rates. In addition, PSCo conducts natural gas price hedging activities approved by its state’s commissions.

Average delivered cost per MMBtu of natural gas for regulated retail distribution:

PSCo has natural gas supply transportation and storage agreements that include obligations for purchase and/or delivery of specified volumes or to make payments in lieu of delivery.

Seasonality

Demand for electric power and natural gas is affected by seasonal differences in the weather. In general, peak sales of electricity occur in the summer months and peak sales of natural gas occur in the winter months. As a result, the overall operating results may fluctuate substantially on a seasonal basis. Additionally, PSCo’s electric utility for each of the last three yearsoperations have historically generated less revenues and the forecast for 2018, assuming normalincome when weather conditions is as follows:

|

| | | | | | | | | | | |

| | System Peak Demand (in MW) |

| | 2017 | | 2016 | | 2015 | | 2018 Forecast |

| PSCo | 6,671 |

| | 6,585 |

| | 6,284 |

| | 6,462 |

|

The peak demand for PSCo’s system typically occursare warmer in the winter and cooler in the summer. Decoupling mechanisms mitigate the impacts of weather in certain jurisdictions. PSCo’s electric decoupling mechanism expired in September.

Competition

PSCo is subject to public policies that promote competition and development of energy markets. PSCo’s industrial and large commercial customers have the ability to generate their own electricity. In addition, customers may have the option of substituting other fuels or relocating their facilities to a lower cost region.

Customers have the opportunity to supply their own power with distributed generation including solar generation and can currently avoid paying for most of the fixed production, transmission and distribution costs incurred to serve them.

Colorado has incentives for the development of rooftop solar, community solar gardens and other distributed energy resources. Distributed generating resources are potential competitors to PSCo’s electric service business with these incentives and federal tax subsidies.

The 2017 system peakFERC has continued to promote competitive wholesale markets through open access transmission and other means. PSCo’s wholesale customers can purchase energy from competing generation resources and transmission services from other service providers to serve their native load.

FERC Order No. 1000 established competition for ownership of certain new electric transmission facilities under Federal regulations. Some states have state laws that allow the incumbent a Right of First Refusal to own these transmission facilities.

FERC Order 2222 requires that RTO and ISO markets allow participation of aggregations of distributed energy resources. This order is expected to incentivize distributed energy resource adoption, however implementation is expected to vary by RTO/ISO and the near, medium, and long-term impacts of Order 2222 remain unclear.

PSCo has franchise agreements with cities subject to periodic renewal; however, a city could seek alternative means to access electric power or gas, such as municipalization. No municipalization activities are occurring presently.

While facing these challenges, PSCo believes its rates and services are competitive with alternatives currently available.

Public Utility Regulation

See Item 7 for discussion of public utility regulation.

Environmental Regulation

Our facilities are regulated by federal and state agencies that have jurisdiction over air emissions, water quality, wastewater discharges, solid and hazardous wastes or substances. Certain PSCo activities require registrations, permits, licenses, inspections and approvals from these agencies.

PSCo has received necessary authorizations for the construction and continued operation of its generation, transmission and distribution systems. Our facilities strive to operate in compliance with applicable environmental standards and related monitoring and reporting requirements.

However, it is not possible to determine what additional facilities or modifications to existing or planned facilities will be required as a result of changes to regulations, interpretations or enforcement policies or what effect future laws or regulations may have. We may be required to incur expenditures in the future for remediation of historic and current operating sites and other waste treatment, storage and disposal sites.

There are significant environmental regulations to encourage use of clean energy technologies and regulate emissions of GHGs. PSCo has undertaken numerous initiatives to meet current requirements and prepare for potential future regulations, reduce GHG emissions and respond to state renewable and energy efficiency goals. Future environmental regulations may result in substantial costs.

Emerging Environmental Regulation

Clean Air Act

Power Plant Greenhouse Gas Regulations— In May 2023, the EPA published proposed rules addressing control of CO2 emissions from the power sector. The rule proposed regulations for new natural gas generating units and emission guidelines for existing coal and certain natural gas generation. The proposed rules create subcategories of coal units based on planned retirement date and subcategories of natural gas combustion turbines and combined cycle units based on utilization. The CO2 control requirements vary by subcategory. Until final rules are issued, it is not certain what the impact will be on PSCo. PSCo believes that the cost of these initiatives or replacement generation would be recoverable through rates based on prior state commission practices.

Coal Ash Regulation

In May 2023, the EPA published proposed rules to regulate legacy CCR surface impoundments at inactive facilities and previously exempt areas where CCR was placed directly on land at regulated CCR facilities under the CCR Rule for the first time. The proposed rule would subject these areas to the CCR Rule requirements, including groundwater monitoring, corrective action, closure, and post-closure care requirements, among other requirements, with several of the deadlines accelerated.

The EPA has committed to a May 2024 publication date for those new rules. It is also anticipated that the EPA may issue other CCR proposed rules in 2024 and 2025 that further expand the scope of the CCR Rule. Until final rules are issued, it is not certain what the impact will be on PSCo. PSCo. believes that the cost of these initiatives would be recoverable through rates based on prior state commission practices.

Emerging Contaminants of Concern

PFAS are man-made chemicals that are widely used in consumer products and can persist and bio-accumulate in the environment. PSCo does not manufacture PFAS but because PFAS are so ubiquitous in products and the environment, it may impact our operations.

In September 2022, the EPA proposed to designate two types of PFAS as “hazardous substances” under the CERCLA. In March 2023, the EPA published a proposed rule that would establish enforceable drinking water standards for certain PFAS chemicals.

Final rules are expected in 2024. Costs are uncertain until a final rule is published.

The proposed rules could result in new obligations for investigation and cleanup. PSCo is monitoring changes to state laws addressing PFAS. The impact of these proposed regulations is uncertain.

Effluent Limitation Guidelines

In March 2023, the EPA released a proposed rule under the Clean Water Act, setting forth proposed Effluent Limitations Guidelines and Standards for steam generating coal plants. This proposed rule establishes more stringent wastewater discharge standards for bottom ash transport water, flue-gas desulfurization wastewater, and combustion residuals leachate from steam electric power plants, particularly coal-fired power plants. The impact of these proposed regulations is uncertain until a final rule is published.

Other

Our operations are subject to workplace safety standards under the Federal Occupational Safety and Health Act of 1970 (“OSHA”) and comparable state laws that regulate the protection of worker health and safety. In addition, the Company is subject to other government regulations impacting such matters as labor, competition, data privacy, etc. Based on information to date and because our policies and business practices are designed to comply with all applicable laws, we do not believe the effects of compliance on our operations, financial condition or cash flows are material.

As of Dec. 31, 2023, PSCo had 2,352 full-time employees and ten part-time employees, of which 1,878 were covered under collective-bargaining agreements.

Xcel Energy, which includes PSCo, is subject to a variety of risks, many of which are beyond our control. Risks that may adversely affect the business, financial condition, results of operations or cash flows are described below. Although the risks are organized by heading, and each risk is described separately, many of the risks are interrelated. These risks should be carefully considered together with the other information set forth in this report and future reports that Xcel Energy files with the SEC.

While we believe we have identified and discussed below the key risk factors affecting our business, there may be additional risks and uncertainties that are not presently known or that are not currently believed to be significant that may adversely affect our business, financial condition, results of operations or cash flows in the future.

Oversight of Risk and Related Processes

PSCo’s Board of Directors is responsible for the oversight of material risk and maintaining an effective risk monitoring process. Management and the Board of Directors have responsibility for overseeing the identification and mitigation of key risks.

PSCo maintains a robust compliance program and promotes a culture of compliance, beginning with the tone at the top. The risk mitigation process includes adherence to our Code of Conduct and compliance policies, operation of formal risk management structures and overall business management. PSCo further mitigates inherent risks through formal risk committees and corporate functions such as internal audit, and internal controls over financial reporting and legal.

Management identifies and analyzes risks to determine materiality and other attributes such as timing, probability and controllability. Identification and risk analysis occurs formally through risk assessment conducted by senior management, the financial disclosure process, hazard risk procedures, internal audit and compliance with financial and operational controls. Management also identifies and analyzes risk through the business planning process, development of goals and establishment of key performance indicators, including identification of barriers to implementing our strategy. The business planning process also identifies likelihood and mitigating factors to prevent the assumption of inappropriate risk to meet goals.

Management communicates regularly with the Board of Directors and its sole stockholder regarding risk. Senior management presents and communicates a periodic risk assessment to the Board of Directors, providing information on the risks that management believes are material, including financial impact, timing, likelihood and mitigating factors. The Board of Directors regularly reviews management’s key risk assessments, which includes areas of existing and future macroeconomic, financial, operational, policy, environmental, safety and security risks.

The oversight, management and mitigation of risk is an integral and continuous part of the Board of Directors’ governance of PSCo. Processes are in place to confirm appropriate risk oversight, as well as identification and consideration of new risks.

Risks Associated with Our Business

Operational Risks

Our natural gas and electric generation/transmission and distribution operations involve numerous risks that may result in accidents and other operating risks and costs.

Our natural gas transmission and distribution activities include inherent hazards and operating risks, such as leaks, explosions, outages and mechanical problems. Our electric generation, transmission and distribution activities include inherent hazards and operating risks such as contact, fire and outages. These risks could result in loss of life, significant property damage, environmental pollution, impairment of our operations and substantial financial losses to employees, third-party contractors, customers or the public. We maintain insurance against most, but not all, of these risks and losses.

The occurrence of these events, if not fully covered by insurance, could have a material effect on our financial condition, results of operations and cash flows as well as potential loss of reputation.

Other uncertainties and risks inherent in operating and maintaining PSCo's facilities include, but are not limited to:

•Risks associated with facility start-up operations, such as whether the facility will achieve projected operating performance on schedule and otherwise as planned.

•Failures in the availability, acquisition or transportation of fuel or other supplies.

•Impact of adverse weather conditions and natural disasters, including, tornadoes, avalanches, icing events, floods, high winds and droughts.

•Performance below expected or contracted levels of output or efficiency.

•Availability of replacement equipment.

•Availability of adequate water resources and ability to satisfy water intake and discharge requirements.

•Availability or changes to wind patterns.

•Inability to identify, manage properly or mitigate equipment defects.

•Use of new or unproven technology.

•Risks associated with dependence on a specific type of fuel or fuel source, such as commodity price risk, availability of adequate fuel supply and transportation and lack of available alternative fuel sources.

•Increased competition due to, among other factors, new facilities, excess supply, shifting demand and regulatory changes.

Additionally, compliance with existing and potential new regulations related to the operation and maintenance of our natural gas infrastructure could result in significant costs. The PHMSA is responsible for administering the DOT’s national regulatory program to assure the safe transportation of natural gas, petroleum and other hazardous materials by pipelines. The PHMSA continues to develop regulations and other approaches to risk management to assure safety in design, construction, testing, operation, maintenance and emergency response of natural gas pipeline infrastructure. We have programs in place to comply with these regulations and systematically monitor and renew infrastructure over time; however, a significant incident or material finding of non-compliance could result in penalties and higher costs of operations.

Our natural gas and electric transmission and distribution operations are dependent upon complex information technology systems and network infrastructure, the failure of which could disrupt our normal business operations, which could have a material adverse effect on our ability to process transactions and provide services.

Our utility operations are subject to long-term planning and project risks.

Most utility investments are planned to be used for decades. Transmission and generation investments typically have long lead times and are planned well in advance of in-service dates and typically subject to long-term resource plans. These plans are based on numerous assumptions such as: sales growth, customer usage, commodity prices, economic activity, costs, regulatory mechanisms, customer behavior, available technology and public policy. Our long-term resource plan is dependent on our ability to obtain required approvals, develop necessary technical expertise, allocate and coordinate sufficient resources and adhere to budgets and timelines.

In addition, the long-term nature of both our planning processes and our asset lives are subject to risk. The utility sector is undergoing significant change (e.g., increases in energy efficiency, wider adoption of distributed generation and shifts away from fossil fuel generation to renewable generation). Customer adoption of these technologies and increased energy efficiency could result in excess transmission and generation resources, downward pressure on sales growth, and potentially stranded costs if we are not able to fully recover costs and investments.

The magnitude and timing of resource additions and changes in customer demand may not coincide with evolving customer preference for generation resources and end-uses, which introduces further uncertainty into long-term planning. Efforts to electrify the transportation and building sectors to reduce GHG emissions may result in higher electric demand and lower natural gas demand over time. New data centers and crypto mining facilities could generate significant increase in demand. Higher electric demand may require us to adopt new technologies and make significant transmission and distribution investments including advanced grid infrastructure, which increases exposure to overall grid instability and technology obsolescence. Evolving stakeholder preference for lower emissions from generation sources and end-uses, like heating, may impact our resource mix and put pressure on our ability to recover capital investments in natural gas generation and delivery. Multiple states may not agree as to the appropriate resource mix, which may lead to costs to comply with one jurisdiction that are not recoverable across all jurisdictions served by the same assets.

We require inputs such as coal, natural gas and water. Lack of availability of these resources could jeopardize long-term operations of our facilities or make them uneconomic to operate.

Our utility operations are highly dependent on suppliers to deliver components in accordance with short and long-term project schedules.

Our products contain components that are globally sourced from suppliers. A shortage of key components in which an alternative supplier is not identified could significantly impact operations and project plans for PSCo and our customers. Such impacts could include timing of projects and the potential for project cancellation. Failure to adhere to project budgets and timelines could adversely impact our results of operations, financial condition or cash flows.

We are subject to commodity risks and other risks associated with energy markets and energy production.

A significant increase in fuel costs could cause a decline in customer demand, adverse regulatory outcomes and an increase in bad debt expense which may have a material impact on our results of operations. Despite existing fuel cost recovery mechanisms, higher fuel costs could significantly impact our results of operations if costs are not recovered. Delays in the timing of the collection of fuel cost recoveries could impact our cash flows and liquidity.

A significant disruption in supply could cause us to seek alternatives at potentially higher costs. Additionally, supply shortages may not be fully resolved, which negatively impacts our ability to provide services to our customers. Failure to provide service due to disruptions may also result in fines, penalties or cost disallowances through the regulatory process. Also, significantly higher energy or fuel costs relative to sales commitments negatively impacts our cash flows and results of operations.

We also engage in wholesale sales and purchases of electric capacity, energy and energy-related products as well as natural gas. In many markets, emission allowances and/or RECs are also needed to comply with various statutes and commission rulings. As a result, we are subject to market supply and commodity price risk.

Commodity price changes can affect the value of our commodity trading derivatives. We mark certain derivatives to estimated fair market value on a daily basis. Settlements can vary significantly from estimated fair values recorded and significant changes from the assumptions underlying our fair value estimates could cause earnings variability. The management of risks associated with hedging and trading is based, in part, on programs and procedures which utilize historical prices and trends.

Public perception often does not distinguish between pass through commodity costs and base rates. High commodity prices that are passed through to customer bills could impact our ability to recover costs for other improvements and operations.

Due to the uncertainty involved in price movements and potential deviation from historical pricing, PSCo is unable to fully assure that its risk management programs and procedures would be effective to protect against all significant adverse market deviations. In addition, PSCo cannot fully assure that its controls will be effective against all potential risks. If such programs and procedures are not effective, PSCo’s results of operations, financial condition or cash flows could be materially impacted.

Failure to attract and retain a qualified workforce could have an adverse effect on operations.

The competition for talent has become increasingly prevalent, and we have experienced increased employee turnover due to the condition of the labor market and decisions related to strategic workforce planning. In addition, specialized knowledge and skills are required for many of our positions, which may pose additional difficulty for us as we work to recruit, retain and motivate employees in this climate.

Failure to hire, adequately train replacement employees, transfer knowledge/expertise or future availability and cost of contract labor may adversely affect the ability to manage and operate our business. Inability to attract and retain these employees could adversely impact our results of operations, financial condition or cash flows.

Our businesses have collective bargaining agreements with labor unions. Failure to renew or renegotiate these contracts could lead to labor disruptions, including strikes or boycotts. Such disruptions or any negotiated wage or benefit increases could have a material adverse impact to our results of operations, financial condition or cash flows.

National unionization efforts could affect our business, as an increase in unionized workers could challenge our operational efficiency and increase costs.

Our operations use third-party contractors in addition to employees to perform periodic and ongoing work.

We rely on third-party contractors to perform operations, maintenance and construction work. Our contractual arrangements with these contractors typically include performance and safety standards, progress payments, insurance requirements and security for performance. Poor vendor performance or contractor unavailability could impact ongoing operations, restoration operations, regulatory recovery, our reputation and could introduce financial risk or risks of fines.

Our employees, directors, third-party contractors, or suppliers may violate or be perceived to violate our Codes of Conduct, which could have an adverse effect on our reputation.

We are exposed to risk of employee or third-party contractor fraud or misconduct. All employees and members of the Board of Directors are subject to compliance with our Code of Conduct and are required to participate in annual training. Additionally, suppliers are subject to compliance with our Supplier Code of Conduct. PSCo does not tolerate discrimination, violations of our Code of Conduct or other unacceptable behaviors. However, it is not always possible to identify and deter misconduct by employees and other third-parties, which may result in governmental investigations, other actions or lawsuits. If such actions are taken against us we may suffer loss of reputation and such actions could have a material effect on our financial condition, results of operations and cash flows.

We are a wholly owned subsidiary of Xcel Energy Inc. Xcel Energy Inc. can exercise substantial control over our dividend policy and business and operations and may exercise that control in a manner that may be perceived to be adverse to our interests.

All of the members of our Board of Directors, as well as many of our executive officers, are officers of Xcel Energy Inc. Our Board of Directors makes determinations with respect to a number of significant corporate events, including the payment of our dividends.

We have historically paid quarterly dividends to Xcel Energy Inc. If Xcel Energy Inc.’s cash requirements increase, our Board of Directors could decide to increase the dividends we pay to Xcel Energy Inc. to help support Xcel Energy Inc.’s cash needs. This could adversely affect our liquidity. The most restrictive dividend limitation for PSCo is imposed by its credit facility, which limits the debt-to-total capitalization ratio.

See Note 5 to the consolidated financial statements for further information.

Financial Risks

Our profitability depends on our ability to recover costs and changes in regulation may impair our ability to recover costs from our customers.

We are subject to comprehensive regulation by federal and state utility regulatory agencies, including siting and construction of facilities, customer service and the rates that we can charge customers.

The profitability of our operations is dependent on our ability to recover the costs of providing energy and utility services and earn a return on capital investment. Our rates are generally regulated and are based on an analysis of our costs incurred in a test year. We are subject to both future and historical test years depending upon the regulatory jurisdiction. Thus, the rates we are allowed to charge may or may not match our costs at any given time. Rate regulation is premised on providing an opportunity to earn a reasonable rate of return on invested capital.

There can also be no assurance that our regulatory commissions will judge all our costs to be prudent, which could result in disallowances, or that the regulatory process will always result in rates that will produce full recovery.

Overall, management believes prudently incurred costs are recoverable given the existing regulatory framework. However, there may be changes in the regulatory environment that could impair our ability to recover costs historically collected from customers, or we could exceed caps on capital costs required by commissions and result in less than full recovery.

Changes in the long-term cost-effectiveness or to the operating conditions of our assets may result in early retirements of utility facilities. While regulation typically provides cost recovery for these types of changes, there is no assurance that regulators would allow full recovery of all remaining costs.

Higher than expected inflation or tariffs may increase costs of construction and operations. Also, rising fuel costs could increase the risk that we will not be able to fully recover our fuel costs from our customers.

Adverse regulatory rulings (including changes in recovery mechanisms) or the imposition of additional regulations could have an adverse impact on our results of operations and materially affect our ability to meet our financial obligations, including debt payments and the payment of dividends on common stock.

Any reductions in our credit ratings could increase our financing costs and the cost of maintaining certain contractual relationships.

Our credit ratings are subject to change and our credit ratings may be lowered or withdrawn by a rating agency. Significant events including disallowance of costs, use of historic test years, elimination of riders or interim rates, increasing depreciation lives, lower returns on equity, changes to equity ratios and impacts of tax policy may impact our cash flows and credit metrics, potentially resulting in a change in our credit ratings. In addition, our credit ratings may change as a result of the differing methodologies or change in the methodologies used by the various rating agencies.

Any credit ratings downgrade could lead to higher borrowing costs or lower proceeds from equity issuances. It could also impact our ability to access capital markets. Also, we may enter into contracts that require posting of collateral or settlement if credit ratings fall below investment grade.

We are subject to capital market and interest rate risks.

Utility operations require significant capital investment. As a result, we frequently need to access capital markets. Any disruption in capital markets could have a material impact on our ability to fund our operations. Capital market disruption and financial market distress could prevent us from issuing commercial paper, issuing new securities or cause us to issue securities with unfavorable terms and conditions, such as higher interest rates or lower proceeds from equity issuances. Higher interest rates on short-term borrowings with variable interest rates could also have an adverse effect on our operating results.

We are subject to credit risks.

Credit risk includes the risk that our customers will not pay their bills, which may lead to a reduction in our cash flow and liquidity and an increase in bad debt expense. Credit risk is comprised of numerous factors including the price of products and services provided, the economy and unemployment rates.

Credit risk also includes the risk that counterparties that owe us money or product will become insolvent and may breach their obligations. Should the counterparties fail to perform, we may be forced to enter into alternative arrangements. In that event, our financial results could be adversely affected and incur losses.

We may have direct credit exposure in our short-term wholesale and commodity trading activity to financial institutions trading for their own accounts or issuing collateral support on behalf of other counterparties. We may also have some indirect credit exposure due to participation in organized markets, (e.g., SPP, Midcontinent Independent System Operator, Inc. and California ISO), in which any credit losses are socialized to all market participants.

We have additional indirect credit exposure to financial institutions from letters of credit provided as security by power suppliers under various purchased power contracts. If any of the credit ratings of the letter of credit issuers were to drop below investment grade, the supplier would need to replace that security with an acceptable substitute. If the security were not replaced, the party could be in default under the contract.

As we are a subsidiary of Xcel Energy Inc., we may be negatively affected by events impacting the credit or liquidity of Xcel Energy Inc. and its affiliates.

If either S&P or Moody’s Investor Services were to downgrade Xcel Energy Inc.’s debt securities below investment grade, it would increase Xcel Energy Inc.’s cost of capital and restrict its access to the capital markets. This could limit Xcel Energy Inc.’s ability to contribute equity or make loans to us or may cause Xcel Energy Inc. to seek additional or accelerated funding from us in the form of dividends. If such event were to occur, we may need to seek alternative sources of funds to meet our cash needs.

As of Dec. 31, 2023, Xcel Energy Inc. and its utility subsidiaries had approximately $24.9 billion of long-term debt and $1.3 billion of short-term debt and current maturities. Xcel Energy Inc. provides various guarantees and bond indemnities supporting some of its subsidiaries by guaranteeing the payment or performance by these subsidiaries for specified agreements or transactions.

Xcel Energy also has other contingent liabilities resulting from various tax disputes and other matters. Xcel Energy Inc.’s exposure under the guarantees is based upon the net liability of the relevant subsidiary under the specified agreements or transactions. The majority of Xcel Energy Inc.’s guarantees limit its exposure to a maximum amount that is stated in the guarantees.

As of Dec. 31, 2023, Xcel Energy had the following guarantees outstanding:

•$951 million for performance and payment of Capital Services, LLC contracts for wind and solar generating equipment, with immaterial exposure.

•$100 million for performance on tax credit sale agreements of its subsidiaries, with immaterial exposure.

•$75 million for performance and payment of surety bonds for the benefit of itself and its subsidiaries, with total exposure that cannot be estimated at this time.

If Xcel Energy Inc. were to become obligated to make payments under these guarantees and bond indemnities or become obligated to fund other contingent liabilities, it could limit Xcel Energy Inc.’s ability to contribute equity or make loans to us, or may cause Xcel Energy Inc. to seek additional or accelerated funding from us in the form of dividends. If such event were to occur, we may need to seek alternative sources of funds to meet our cash needs.

Increasing costs of our defined benefit retirement plans and employee benefits may adversely affect our results of operations, financial condition or cash flows.

We have defined benefit pension and postretirement plans that cover most of our employees. Assumptions related to future costs, return on investments, interest rates and other actuarial assumptions have a significant impact on our funding requirements of these plans. Estimates and assumptions may change. In addition, the Pension Protection Act sets the minimum funding requirements for defined benefit pension plans. Therefore, our funding requirements and contributions may change in the future. Also, the payout of a significant percentage of pension plan liabilities in a single year due to high numbers of retirements or employees leaving PSCo would trigger settlement accounting and could require PSCo to recognize incremental pension expense related to unrecognized plan losses in the year liabilities are paid. Changes in industry standards utilized in key assumptions (e.g., mortality tables) could have a significant impact on future obligations and benefit costs.

Increasing costs associated with health care plans may adversely affect our results of operations.

Increasing levels of large individual health care claims and overall health care claims could have an adverse impact on our results of operations, financial condition or cash flows. Health care legislation could also significantly impact our benefit programs and costs.

Federal tax law may significantly impact our business.

PSCo collects estimated federal, state and local tax payments through their regulated rates. Changes to federal tax law may benefit or adversely affect our earnings and customer costs. Tax depreciable lives and the value/availability of various tax credits or the timeliness of their utilization may impact the economics or selection of resources. If tax rates are increased, there could be timing delays before regulated rates provide for recovery of such tax increases in revenues. In addition, certain IRS tax policies such as tax normalization may impact our ability to economically deliver certain types of resources relative to market prices.

Macroeconomic Risks

Economic conditions impact our business.

Our operations are affected by economic conditions, which correlates to customers/sales growth (decline). Economic conditions may be impacted by recessionary factors, rising interest rates and insufficient financial sector liquidity leading to potential increased unemployment, which may impact customers’ ability to pay their bills which could lead to additional bad debt expense.

PSCo faces competitive factors, which could have an adverse impact on our financial condition, results of operations and cash flows. Further, worldwide economic activity impacts the demand for PSCo occurredbasic commodities necessary for utility infrastructure, which may inhibit our ability to acquire sufficient supplies. We operate in a capital intensive industry and federal trade policy could significantly impact the cost of materials we use. There may be delays before these additional material costs can be recovered in rates.

The oil and gas industry represents our largest commercial and industrial customer base. Oil and natural gas prices are sensitive to market risk factors which may impact demand.

We face risks related to health epidemics and other outbreaks, which may have a material effect on July 19, 2017. The 2017 system peak demand was higher than 2016our financial condition, results of operations and cash flows.

Health epidemics impact countries, communities, supply chains and markets. Uncertainty continues to exist regarding epidemics; the duration and magnitude of business restrictions including shutdowns (domestically and globally); the potential impact on the workforce including shortages of employees and third-party contractors due to warmer Julyquarantine policies, vaccination requirements or government restrictions; impacts on the transportation of goods, and the generalized impact on the economy.

We cannot ultimately predict whether an epidemic will have a material impact on our future liquidity, financial condition or results of operations. Nor can we predict the impact on the health of our employees, our supply chain or our ability to recover higher costs associated with managing an outbreak.

Operations could be impacted by war, terrorism or other events.

Our generation plants, fuel storage facilities, transmission and distribution facilities and information and control systems may be targets of terrorist activities. Any disruption could impact operations or result in a decrease in revenues and additional costs to repair and insure our assets. These disruptions could have a material impact on our financial condition, results of operations or cash flows. The potential for terrorism has subjected our operations to increased risks and could have a material effect on our business. We have incurred increased costs for security and capital expenditures in response to these risks. The insurance industry has also been affected by these events and the availability of insurance may decrease. In addition, insurance may have higher deductibles, higher premiums and more restrictive policy terms.

A disruption of the regional electric transmission grid, interstate natural gas pipeline infrastructure or other fuel sources, could negatively impact our business, brand and reputation. Because our facilities are part of an interconnected system, we face the risk of possible loss of business due to a disruption caused by the actions of a neighboring utility.

We also face the risks of possible loss of business due to significant events such as severe storms, temperature extremes, wildfires, widespread pandemic, generator or transmission facility outage, pipeline rupture, railroad disruption, operator error, sudden and significant increase or decrease in wind generation or a workforce disruption.

In addition, major catastrophic events throughout the world may disrupt our business. While we have business continuity plans in place, our ability to recover may be prolonged due to the type and extent of the event. PSCo participates in a global supply chain, which includes materials and components that are globally sourced. A prolonged disruption could result in the delay of equipment and materials that may impact our ability to connect, restore and reliably serve our customers.

A major disruption could result in a significant decrease in revenues, additional costs to repair assets, and an adverse impact on the cost and availability of insurance, which could have a material impact on our results of operations, financial condition or cash flows.

A cybersecurity incident or security breach could have a material effect on our business.

We operate in an industry that requires the continued operation of sophisticated information technology, control systems and network infrastructure. In addition, we use our systems and infrastructure to create, collect, use, disclose, store, dispose of and otherwise process sensitive information, including Company data, customer energy usage data, and personal information regarding customers, employees and their dependents, contractors and other individuals.

Our generation, transmission, distribution and fuel storage facilities, information technology systems and other infrastructure or physical assets, as well as information processed in our systems (e.g., information regarding our customers, employees, operations, infrastructure and assets) could be affected by cybersecurity incidents, including those caused by human error.

The utility industry has been the target of several attacks on operational systems and has seen an increased volume and sophistication of cybersecurity incidents from international activist organizations, other countries and individuals. We expect to continue to experience attempts to compromise our information technology and control systems, network infrastructure and other assets. To date, no cybersecurity incident or attack has had a material impact on our business or results of operations.

Cybersecurity incidents could harm our businesses by limiting our generation, transmission and distribution capabilities, delaying our development and construction of new facilities or capital improvement projects to existing facilities, disrupting our customer operations or causing the release of customer information, all of which would likely receive state and federal regulatory scrutiny and could expose us to liability.

Our generation, transmission systems and natural gas pipelines are part of an interconnected system. Therefore, a disruption caused by the impact of a cybersecurity incident on the regional electric transmission grid, natural gas pipeline infrastructure or other fuel sources of our third-party service providers’ operations, could also negatively impact our business.

Generative Artificial Intelligence, such as large language models like ChatGPT, present a range of challenges and potential risks as we consider impacts to the business. These challenges involve navigating the complexities of creating and deploying AI models that generate content autonomously. Data privacy, legal concerns, and security issues are all risks as this technology continues to be adopted.

Our supply chain for procurement of digital equipment and services may expose software or hardware to these risks and could result in a breach or significant costs of remediation. We are unable to quantify the potential impact of cybersecurity threats or subsequent related actions. Cybersecurity incidents and regulatory action could result in a material decrease in revenues and may causesignificant additional costs (e.g., penalties, third-party claims, repairs, insurance or compliance) and potentially disrupt our supply and markets for natural gas, oil and other fuels.

We maintain security measures to protect our information technology and control systems, network infrastructure and other assets. However, these assets and the information they process may be vulnerable to cybersecurity incidents, including asset failure or unauthorized access to assets or information. A failure or breach of our technology systems or those of our third-party service providers could disrupt critical business functions and may negatively impact our business, our brand, and our reputation. The cybersecurity threat is dynamic and evolves continually, and our efforts to prioritize network protection may not be effective given the constant changes to threat vulnerability.

While the Company maintains insurance relating to cybersecurity events, such insurance is subject to a number of exclusions and may be insufficient to offset any losses, costs or damages experienced. Also, the market for cybersecurity insurance is relatively new and coverage available for cybersecurity events is evolving as the industry matures.

Our operating results may fluctuate on a seasonal and quarterly basis and can be adversely affected by milder weather.

Our electric and natural gas utility businesses are seasonal and weather patterns can have a material impact on our operating performance. Demand for electricity is often greater in the summer and winter months associated with cooling and heating. Because natural gas is heavily used for residential and commercial heating, the demand depends heavily upon weather patterns. A significant amount of natural gas revenues are recognized in the first and fourth quarters related to the heating season. Accordingly, our operations have historically generated less revenues and income when weather conditions are milder in the winter and cooler in the summer. Unusually mild winters and summers could have an adverse effect on our financial condition, results of operations or cash flows.

Public Policy Risks

Increased risks of regulatory penalties could negatively impact our business.

The Energy Act increased civil penalty authority for violation of FERC statutes, rules and orders. FERC can impose penalties of up to $1.5 million per violation per day, particularly as it relates to energy trading activities for both electricity and natural gas. In addition, NERC electric reliability standards and critical infrastructure protection requirements are mandatory and subject to potential financial penalties. Also, the PHMSA, Occupational Safety and Health Administration and other federal agencies have the authority to assess penalties.

In the event of serious incidents, these agencies may pursue penalties. In addition, certain states have the authority to impose substantial penalties. If a serious reliability, cybersecurity or safety incident did occur, it could have a material effect on our results of operations, financial condition or cash flows.

The continued use of natural gas for both power generation and gas distribution have increasingly become a public policy advocacy target. These efforts may result in a limitation of natural gas as an energy source for both power generation and heating, which could impact our ability to reliably and affordably serve our customers.

In recent years, there have been various local and state agency proposals within and outside our service territories that would attempt to restrict the use and availability of natural gas. If such policies were to prevail, we may be forced to make new resource investment decisions which could potentially result in stranded costs if we are not able to fully recover costs and investments and impact the overall reliability of our service.

Environmental Policy Risks

We may be subject to legislative and regulatory responses to climate change, with which compliance could be difficult and costly.

Legislative and regulatory responses related to climate change may create financial risk as our facilities may be subject to additional regulation at either the state or federal level in the future. International agreements could additionally lead to future federal or state regulations.