|

| | |

| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM 10-K |

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d)15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 31, 20132016 |

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission file number:File Number: 001-07982 |

| RAVEN INDUSTRIES, INC. |

| (Exact name of registrant as specified in its charter) |

|

| | | | |

| | South Dakota | | 46-0246171 | |

| | (State or other jurisdiction of incorporation)incorporation or organization) | | (IRS Employer Identification No.) | |

| | 205 E. 6th Street, P.O. Box 5107, Sioux Falls, SD | | 57117- 5107 | |

| | (Address of principal executive offices) | | (zip code)(Zip Code) | |

| | Registrant's telephone number including area code (605) 336-2750 | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | Title of Each Class:each class: | | Name of Each Exchangeeach exchange on which Registeredregistered | |

| | Common Stock, $1 par value | | The NASDAQ Stock Market | |

| Securities registered pursuant to Section 12(g) of the Act: None |

| | | | | |

|

| | | | |

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | o | Yes | þ | No |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | o | Yes | þ | No |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | þ | Yes | o | No |

Indicate by checkmarkcheck mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter)during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | þ | Yes | o | No |

| Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter)is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | þ | | | |

|

| | | | | |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. |

| Large accelerated filer | þ | | | Accelerated filer | o |

| Non-accelerated filer | o | | | Smaller reporting company | o |

| (Do not check if a smaller reporting company) | | | |

|

| | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.)Act). | o | Yes | þ | No |

|

| | | | |

The aggregate market value of the registrant's common stock held by non-affiliates at July 31, 20122015 was approximately $1,172,470,556.$724,165,854. The aggregate market value was computed by reference to the closing price as reported on the NASDAQ Global Select Market, $32.73,$19.43, on July 31, 2012,2015, which was as of the last business day of the registrant's most recently completed second fiscal quarter. The number of shares outstanding on March 22, 20132016 was 36,332,923.36,279,928. |

| DOCUMENTS INCORPORATED BY REFERENCE |

The definitive proxy statement relating to the registrant's Annual Meeting of Shareholders, to be held May 23, 2013,24, 2016, is incorporated by reference into Part III to the extent described therein. |

| | | | | |

|

| | | |

| PART I | | |

| Item 1. | BUSINESS | | |

| Item 1A. | RISK FACTORS | | |

| Item 1B. | UNRESOLVED STAFF COMMENTS | | |

| Item 2. | PROPERTIES | | |

| Item 3. | LEGAL PROCEEDINGS | | |

| Item 4. | MINE SAFETY DISCLOSURES | | |

| | | | |

| PART II | | |

| Item 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES | | |

| | Quarterly Information | | |

| | Stock Performance | | |

| Item 6. | SELECTED FINANCIAL DATA | | |

| | Eleven-year Financial Summary | | |

| | Business Segments | | |

| Item 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | |

| | Executive Summary | | |

| | Results of Operations - Segment Analysis | | |

| | Outlook | | |

| | Liquidity and Capital Resources | | |

| | Off-Balance Sheet Arrangements and Contractual Obligations | | |

| | Critical Accounting Estimates | | |

| | Accounting Pronouncements | | |

| | Forward-Looking Statements | | |

| Item 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | |

| Item 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | | |

| | Management's Report on Internal Control Over Financial Reporting | | |

| | Report of Independent Registered Public Accounting Firm | | |

| | Consolidated Balance Sheets | | |

| | Consolidated Statements of Income and Comprehensive Income | | |

| | Consolidated Statements of Shareholders' Equity | | |

| | Consolidated Statements of Cash Flows | | |

| | Notes to Consolidated Financial Statements | | |

| Item 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | | |

| Item 9A. | CONTROLS AND PROCEDURES | | |

| Item 9B. | OTHER INFORMATION | | |

| | | | |

| PART III | | |

| Item 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | | |

| Item 11. | EXECUTIVE COMPENSATION | | |

| Item 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS | | |

| Item 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | | |

| Item 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | | |

| | | | |

| PART IV | | |

| Item 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULE | | |

| INDEX TO EXHIBITS | | |

| SIGNATURES | | |

| SCHEDULE II | | |

Raven Industries, Inc. (the Company or Raven) was incorporated in February 1956 under the laws of the State of South Dakota and began operations later that same year. RavenThe Company is a diversified technology company providing a variety of products to customers within the industrial, agricultural, energy, construction, and military/aerospacedefense markets. The Company markets its products around the world and has its principal operations in the United States of America. Raven began operations as a manufacturer of high-altitude research balloons before diversifying into the industrial, agricultural, energy, constructionproduct lines that extended from technologies and military/aerospace markets.production methods of this original balloon business. The Company employs approximately 1,400910 people and is headquartered at 205 E. Sixth Street, Sioux Falls, SD 57104 - telephone (605) 336-2750. The Company's Internet address is http://www.ravenind.com and its common stock trades on the NASDAQ Global Select Market under the ticker symbol RAVN. The Company has adopted a Code of Conduct applicable to all officers, directors and employees, which is available on the website. Information on the Company's website is not part of this filing.

All reports (including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and current reports on Form 8-K) and proxy and information statements filed with the Securities and Exchange Commission (SEC) are available through a link from the Company's website to the SEC website. All such information is available as soon as reasonably practicable after it has been electronically filed. Filings can also be obtained free of charge by contacting the Company or the SEC. The SEC can be contacted through the SEC'sits website at http://www.sec.gov or by contactingthrough the SEC's Office of FOIA/PA Operations at 100 F Street N.E., Washington, DC 20549-2736, or by calling the SEC at 1-800-SEC-0330.1-800-732-0330.

BUSINESS SEGMENTS

The Company has three unique operating units, or divisions, that are also its reportable segments: Applied Technology Division (Applied Technology), Engineered Films Division (Engineered Films), and Aerostar Division (Aerostar). Many of the past and present product lines are an extension of technology and production methods developed in the original balloon business. Product lines have been grouped in these segments based on common technologies, production methods, and inventories; however, more than one business segment may serve each of the product markets identified above. The Company measures the profitability performance of its segments primarily based on their operating income excluding administrative and general expenses. Other expense and income taxes are not allocated to individual operating segments, and assets not identifiable to an individual segment are included as corporate assets. Segment information is reported consistent with the Company's management reporting structure.

During fiscal 2013, the Company realigned the assets and team members of its Electronic Systems Division and deployed them into the Company's Aerostar and Applied Technology Divisions. The Company adjusted its segment information, retrospectively, for all periods presented in this Annual Report on Form 10-K to reflect this change in segment reporting.

|

| |

Business segment financial information is found on the following pages:pages of this Annual Report on Form 10-K (Form 10-K): |

| Business Segments |

| Results of Operations – Segment Analysis |

| Note 13. Business Segments and Major Customer Information |

Applied Technology

Applied Technology designs, manufactures, sells and services innovative precision agriculture products and information management tools that help growers reduce costs and improve farm yields around the world. The Applied Technology product families include field computers, application controls, GPS-guidance and assisted-steering systems, automatic boom controls, yield monitoring planter controls and an integrated real-time kinematic (RTK) navigation and information platform called SlingshotTM. As a result of the realignment of the Company's Electronic Systems Division, these product families also include motor controls. The Company's investments in Site-Specific Technology Development Group, Inc. (SST), a software company, and the continued build-out of the Slingshot API platform have positioned Applied Technology to provide an information platform of choice that improves grower decision-making and business efficiencies for our agriculture retail partners.

Applied Technology sells its precision agriculture control products to both original equipment manufacturers (OEMs) and through aftermarket distribution in the United States and in most major agriculture areas around the world. Applied Technology has personnel and third-party distribution representatives located in the U.S. and key geographic areas throughout the world, including Canada, Europe, the former Soviet Republics, South Africa, South America, Australia and China. The Company's competitive

advantage in this segment is designing and selling easy to use, reliable and value-added products that are supported by an industry leading service and support team.

Engineered Films

Engineered Films produces high-performance plastic films and sheeting for industrial, energy, construction, geomembrane and agricultural applications.

The Company's sales force sells plastic sheeting to independent third-party distributors in each of the various markets it serves. The Company extrudes a significant portion of the film converted for its commercial products and believes it is one of the largest sheeting converters in the United States. Engineered Films believes its ability to both extrude and convert films allows it to provide a more customized solution to customer needs. A number of suppliers of sheeting compete with Raven on both price and product availability. Engineered Films is the Company's most capital-intensive business segment, requiring regular investments in new extrusion capacity along with printers and conversion equipment. This segment's capital expenditures were $11.5 million in fiscal 2013, $10.9 million in fiscal 2012 and $8.5 million in fiscal 2011.

Aerostar

Aerostar designs and manufactures high-altitude research balloons, tethered aerostats and radar processing systems. These products can be integrated with additional third-party sensors to provide research, communications and situational awareness to government and commercial customers. Aerostar's sales to the U.S. government or U.S. government agencies as a prime or sub-contractor include military parachutes, uniforms and protective wear. It also manufactures other sewn and sealed products on a contract basis as well as being a total solutions provider of electronics manufacturing services since the realignment of the Electronic Systems Division. Sales are made in response to competitive bid requests. High-altitude research balloons are sold directly to government agencies (usually funded by the National Aeronautics and Space Administration) or commercial users. Aerostar is the only balloon supplier for high-altitude research in the United States.

Through the recent acquisition of Vista Research, Inc. (Vista) and a separate business venture that is majority-owned by the Company, Aerostar pursues potential product and support services contracts for agencies and instrumentalities of the U.S. government. The acquisition of Vista in January 2012 positioned the Company to meet growing global demand for lower-cost detection and tracking systems used by government and law enforcement agencies. As a leading provider of surveillance systems that enhance the effectiveness of radar using sophisticated algorithms, Vista will also allow Aerostar to enhance its tethered aerostat security solutions.

MAJOR CUSTOMER INFORMATION

One customer accounted for 10% or more of consolidated sales in fiscal 2013. Sales to West Texas Plastics Limited, a customer in the Engineered Films Division, accounted for 11% of consolidated sales in both fiscal 2013 and 2012. In addition to this customer, sales to Goodrich Corporation, a customer of Aerostar, accounted for 10% of consolidated sales in fiscal 2012. As expected, revenue from this customer has continued to decline from 10% and 13%, respectively, of consolidated sales in fiscal 2012 and 2011. No other customers accounted for 10% of consolidated sales in fiscal 2012 or 2011.

SEASONAL WORKING CAPITAL REQUIREMENTS

Some seasonal demand exists in Applied Technology's agricultural market. Applied Technology builds product in the fall for winter and spring delivery. Certain sales to agricultural customers offer spring payment terms for fall and early winter shipments. The resulting fluctuations in inventory and accounts receivable have required, and may require, seasonal short-term financing.

FINANCIAL INSTRUMENTS

The principal financial instruments that the Company maintains are cash, cash equivalents, short-term investments, accounts receivable, accounts payable and acquisition-related contingent payments. The Company manages the interest rate, credit and market risks associated with these accounts through periodic reviews of the carrying value of assets and liabilities and establishment of appropriate allowances in connection with Company policies. The Company does not use off-balance sheet financing, except to enter into operating leases.

The Company uses derivative financial instruments to manage foreign currency risk. The use of these financial instruments has had no material effect on consolidated results of operations, financial condition or cash flows.

RAW MATERIALS

The Company obtains a wide variety of materials from several vendors. Principal materials include numerous electronic components for Aerostar and Applied Technology, various plastic resins for Engineered Films and fabrics for Aerostar. Engineered Films has experienced volatile resin prices over the past three years. Price increases could not always be passed on to customers due to weak demand and a competitive pricing environment. Aerostar experiences variability in lead times for components as business cycles impact demand. However, predicting future material shortages and the related potential impact on Raven is not possible.

PATENTS

The Company owns a number of patents. However, Raven does not believe that its business, as a whole, is materially dependent on any one patent or related group of patents. It believes the successful manufacture and sale of its products generally depend more upon its technical expertise, speed to market and manufacturing skills.

RESEARCH AND DEVELOPMENT

The business segments conduct ongoing research and development efforts. Most of the Company's research and development expenditures are directed toward new products in the Applied Technology, Engineered Films and Aerostar Divisions. Total Company research and development costs are presented on the Consolidated Statements of Income and Comprehensive Income.

ENVIRONMENTAL MATTERS

Except as described below, the Company believes that, in all material respects, it is in compliance with applicable federal, state and local environmental laws and regulations. Expenditures incurred in the past relating to compliance for operating facilities have not significantly affected the Company's capital expenditures, earnings or competitive position.

In connection with the sale of substantially all of the assets of the Company's Glasstite, Inc. subsidiary in fiscal 2000, the Company has agreed to assume responsibility for the investigation and remediation of any pre-October 29, 1999, environmental contamination at the Company's former Glasstite pickup-truck topper facility in Dunnell, Minnesota, as required by the Minnesota Pollution Control Agency (MPCA) or the United States Environmental Protection Agency (EPA).

The Company and the purchasers of the Company's Glasstite subsidiary conducted environmental assessments of the properties. Although these assessments continue to be evaluated by the MPCA on the basis of the data available, the Company believes that any activities that might be required as a result of the findings of the assessments will not have a material effect on the Company's results of operations, financial position or cash flows. The company had $53 thousand accrued at January 31, 2013, representing its best estimate of probable costs to be incurred related to these matters.

BACKLOG

As of February 1, 2013, the Company's order backlog totaled $51.1 million. Backlog amounts as of February 1, 2012 and 2011 were $66.6 million and $76.0 million, respectively. Because the length of time between order and shipment varies considerably by business segment and customers can change delivery schedules or potentially cancel orders, the Company does not believe that backlog, as of any particular date, is necessarily indicative of actual net sales for any future period.

EMPLOYEES

As of January 31, 2013, the Company had 1,379 employees, 1,327 in an active status. Following is a summary of active employees by segment: Applied Technology - 539; Engineered Films - 236; Aerostar - 458; Corporate Services - 94. Management believes its employee relations are satisfactory.

|

| | |

EXECUTIVE OFFICERS | | |

| | |

Name, Age and Position | | Biographical Data |

Daniel A. Rykhus, 48 | | Mr. Rykhus became the Company's President and Chief Executive Officer in 2010. He joined Raven in 1990 as Director of World Class Manufacturing, was General Manager of the Applied Technology Division from 1998 through 2009, and served as Executive Vice President from 2004 through 2010. |

President and Chief Executive Officer | |

| |

| | |

Thomas Iacarella, 59 | | Mr. Iacarella joined Raven in 1991 as Corporate Controller and has been the Company's Chief Financial Officer and Treasurer since 1998. Prior to joining the Company, he held positions with Tonka Corporation and the accounting firm now known as Ernst & Young. |

Vice President and Chief Financial Officer | |

| |

| | |

Stephanie Herseth Sandlin, 42 | | Ms. Herseth Sandlin joined Raven in August 2012 as General Counsel and Vice President of Corporate Development and also became the Company's Secretary in March 2013. Prior to joining Raven, Ms. Herseth Sandlin was a partner at OFW Law in Washington, D.C. from 2011 to 2012 and served as South Dakota's lone member of the United States House of Representatives from 2004 through 2011.

|

General Counsel and Vice President of Corporate Development | |

| |

| | |

Janet L. Matthiesen, 55 | | Ms. Matthiesen joined Raven in 2010 as Director of Administration and has been the Company's Vice President of Human Resources since April 2012. Prior to joining Raven, Ms. Matthiesen was a Human Resource Manager at Science Applications International Corporation from 2002 to 2010.

|

Vice President - Human Resources | |

| |

| | |

Matthew T. Burkhart, 37 | | Mr. Burkhart was named Division Vice President and General Manager of the Applied Technology Division on February 1, 2010. He joined Raven in 2008 as Director of Sales and became General Manager - Applied Technology Division on February 1, 2009. Prior to joining the Company, he was a Branch Manager for Johnson Controls.

|

Division Vice President and General Manager - | |

Applied Technology Division | |

| | |

Anthony D. Schmidt, 41 | | Mr. Schmidt was named Division Vice President and General Manager of the Engineered Films Division on February 1, 2012. He joined Raven in 1995 in the Applied Technology Division performing various leadership roles within manufacturing and engineering. He transitioned to Engineered Films Division in September 2011 as Manufacturing Manager. |

Division Vice President and General Manager - | |

Engineered Films Division | |

| | |

Lon E. Stroschein, 38 | | Mr. Stroschein was named Vice President and General Manager of the Aerostar Division in October 2010. He joined Raven in 2008 as International Sales Manager for Applied Technology. Prior to joining Raven, he was a bank vice president and was a member of the executive staff for a U.S. Senator.

|

Division Vice President and General Manager - | |

Aerostar Division | |

| |

Note 15 Business Segments and Major Customer Information

Applied Technology

Applied Technology designs, manufactures, sells, and services innovative precision agriculture products and information management tools that help growers reduce costs, decrease inputs, and improve farm yields around the world. The Applied Technology product families include field computers, application controls, GPS-guidance and assisted-steering systems, automatic boom controls, planter controls, and harvest controls. Applied Technology's services include high-speed in-field Internet connectivity and cloud-based data management. The Company's investment in Site-Specific Technology Development Group, Inc. (SST), a software company, and the continued build-out of the Slingshot™ platform have positioned Applied Technology as an information platform that improves grower decision-making and business efficiencies for our agriculture retail partners.

Applied Technology sells its precision agriculture control products to both original equipment manufacturers (OEMs) and through aftermarket distribution partners in the United States and in most major agricultural areas around the world. Applied Technology has personnel and third-party distribution representatives located in the U.S. and key geographic areas throughout the world. The Company's competitive advantage in this segment is designing and selling easy to use, reliable, and innovative value-added products that are supported by an industry-leading service and support team.

Engineered Films

Engineered Films produces high-performance plastic films and sheeting for energy, agricultural, construction, geomembrane, and industrial applications.

Engineered Films primarily sells plastic sheeting to independent third-party distributors in each of the various markets it serves. Through the acquisition of Integra Plastics, Inc. (Integra) in November 2014, Engineered Films also leverages a direct sales channel in the division’s energy market. The Company extrudes a significant portion of the film converted for its commercial products and believes it is one of the largest sheeting converters in the United States in the markets it serves. Engineered Films believes its ability to both extrude and convert films allows it to provide a more customized solution to customers. A number of suppliers of sheeting compete with the Company on both price and product availability. Engineered Films is the Company's most capital-intensive business segment, and historically has made sizable investments in new extrusion capacity and conversion equipment. This segment's capital expenditures were $10.8 million in fiscal 2016, $8.2 million in fiscal 2015, and $6.7 million in fiscal 2014.

Aerostar

Aerostar serves the defense/aerospace and situational awareness markets. Aerostar's products include high-altitude balloons, tethered aerostats, and radar processing systems. These products can be integrated with additional third-party sensors to provide research, communications, and situational awareness capabilities to governmental and commercial customers. Aerostar’s growth strategy emphasizes the design and manufacture of proprietary products in these markets. In previous years, Aerostar also provided contract manufacturing services. During this last year the Company largely exited this business. Net sales from contract manufacturing in fiscal 2016 were $4.7 million, compared to $31.7 million in fiscal 2015 and $51.3 million in fiscal 2014. The planned wind-down of contract manufacturing is now complete.

The acquisition of Vista Research, Inc. (Vista) in January 2012 positioned the Company to meet global demand for lower-cost target detection and tracking systems used by government agencies. Through Vista and a separate business venture that is majority-owned by the Company, Aerostar pursues potential product and support services contracts for agencies and instrumentalities of the U.S. government as well as sales of advanced radar systems, high-altitude balloons, and aerostats in international markets. In some cases, such sales will be Direct Commercial Sales to foreign governments rather than Foreign Military Sales through the U.S. government.

Aerostar sells to government agencies or commercial users primarily as a sub-contractor. The projects Aerostar bids on can be large-scale, with opportunities in the $10-$50 million range. Further, Direct Commercial Sales to foreign governments often involve large contracts subject to frequent delays because of budget uncertainties, regional military conflicts, and protracted negotiation processes. The timing of contract wins results in volatility in Aerostar’s results.

MAJOR CUSTOMER INFORMATION

No customers accounted for 10% or more of consolidated sales in fiscal 2016. Sales to Brawler Industrial Fabrics, a customer in the Engineered Films Division, accounted for 14%, and 13% of consolidated sales in fiscal years 2015 and 2014.

SEASONAL WORKING CAPITAL REQUIREMENTS

Some seasonal demand exists in Applied Technology's agricultural market. Applied Technology builds product in the fall for winter and spring delivery. Certain sales to agricultural customers offer spring payment terms for fall and early winter shipments. The resulting fluctuations in inventory and accounts receivable have required, and may require, seasonal short-term financing.

Engineered Films also sees seasonal demand peak in the second and third fiscal quarters.

FINANCIAL INSTRUMENTS

The principal financial instruments that the Company maintains are cash, cash equivalents, short-term investments, accounts receivable, accounts payable, and acquisition-related contingent payments. The Company manages the interest rate, credit, and market risks associated with these accounts through periodic reviews of the carrying value of assets and liabilities and establishment of appropriate allowances in accordance with Company policies. The Company does not use off-balance sheet financing, except to enter into operating leases.

The Company uses derivative financial instruments to manage foreign currency risk. The use of these financial instruments has had no material effect on consolidated results of operations, financial condition, or cash flows.

RAW MATERIALS

The Company obtains a wide variety of materials from numerous vendors. Principal materials include electronic components for Aerostar and Applied Technology, various plastic resins for Engineered Films, and fabrics for Aerostar. Engineered Films has experienced volatile resin prices over the past three years. Price increases could not always be passed on to customers due to weak demand and a competitive pricing environment. Predicting future material volatility and the related potential impact on the Company is not possible.

PATENTS

The Company owns a number of patents. The Company does not believe that its business, as a whole, is materially dependent on any one patent or related group of patents. As the Company continues to develop more technology-based offerings, protection of the Company’s intellectual property has become an increasingly important strategic objective. Along with a more aggressive posture toward patenting new technology and protecting trade secrets, the Company has restrictions on the disclosure of our technology to industry and business partners to ensure that our intellectual property is maintained and protected.

RESEARCH AND DEVELOPMENT

The business segments conduct ongoing research and development efforts. Most of the Company's research and development expenditures are directed toward new product development, particularly in the Applied Technology Division. Total Company research and development costs are presented in the Consolidated Statements of Income and Comprehensive Income.

ENVIRONMENTAL MATTERS

The Company believes that, in all material respects, it is in compliance with applicable federal, state and local environmental laws and regulations. Expenditures incurred in the past relating to compliance for operating facilities have not significantly affected the Company's capital expenditures, earnings, or competitive position.

In connection with the sale of substantially all of the assets of the Company's Glasstite, Inc. subsidiary in fiscal 2000, the Company agreed to assume responsibility for the investigation and remediation of any pre-October 29, 1999, environmental contamination at the Company's former Glasstite pickup-truck topper facility in Dunnell, Minnesota, as required by the Minnesota Pollution Control Agency (MPCA) or the United States Environmental Protection Agency.

The Company and the purchasers of the Company's Glasstite subsidiary conducted environmental assessments of the properties. Although these assessments continue to be evaluated by the MPCA on the basis of the data available, the Company believes that any activities that might be required as a result of the findings of the assessments will not have a material effect on the Company's results of operations, financial position, or cash flows. The Company had $37 thousand accrued at January 31, 2016, representing its best estimate of probable costs to be incurred related to this and all other environmental matters.

BACKLOG

As of February 1, 2016, the Company's order backlog totaled approximately $18.6 million. Backlog amounts as of February 1, 2015 and 2014 were $26.7 million and $51.8 million, respectively. Because the length of time between order and shipment varies considerably by business segment and customers can change delivery schedules or potentially cancel orders, the Company does not believe that backlog, as of any particular date, is necessarily indicative of actual net sales for any future period.

EMPLOYEES

As of January 31, 2016, the Company had approximately 910 employees. Following is a summary of active employees by segment: Applied Technology - 363; Engineered Films - 298; Aerostar - 175; and Corporate Services - 75. Management believes its employee relations are satisfactory.

|

| | |

| EXECUTIVE OFFICERS | | |

| | |

| Name, Age and Position | | Biographical Data |

| Daniel A. Rykhus, 51 | | Mr. Rykhus became the Company's President and Chief Executive Officer in 2010. He joined the Company in 1990 as Director of World Class Manufacturing, was General Manager of the Applied Technology Division from1998 through 2009, and served as Executive Vice President from 2004 through 2010. |

| President and Chief Executive Officer | |

| |

| | |

| Steven E. Brazones, 42 | | Mr. Brazones joined the Company in December 2014 as its Vice President, Chief Financial Officer, and Treasurer. From 2002 to 2014, Mr. Brazones held a variety of positions with H.B. Fuller Company. Most recently, he served as H.B. Fuller's Americas Region Finance Director. Previously, he served as the Assistant Treasurer and the Director of Investor Relations. Prior to his tenure with H.B. Fuller, Mr. Brazones held various roles at Northwestern Growth. |

| Vice President and Chief Financial Officer | |

| |

| |

| | |

| Stephanie Herseth Sandlin, 45 | | Ms. Herseth Sandlin joined the Company in August 2012 as General Counsel and Vice President of Corporate Development and also became the Company's Secretary in March 2013. Prior to joining the Company, Ms. Herseth Sandlin was a partner at OFW Law in Washington, D.C. from 2011 to 2012 and served as South Dakota's lone member of the United States House of Representatives from 2004 through 2011. |

| General Counsel and Vice President of Corporate Development | |

| |

| | |

| Janet L. Matthiesen, 58 | | Ms. Matthiesen joined the Company in 2010 as Director of Administration and has been the Company's Vice President of Human Resources since 2012. Prior to joining Raven, Ms. Matthiesen was a Human Resource Manager at Science Applications International Corporation from 2002 to 2010.

|

| Vice President of Human Resources | |

| |

| | |

| Brian E. Meyer, 53 | | Mr. Meyer was named Division Vice President and General Manager of the Applied Technology Division in May 2015. He joined the Company in 2010 as Chief Information Officer. Prior to joining the Company, Mr. Meyer was an information and technology executive in the health insurance industry and vice president of systems development in the property and casualty insurance industry.

|

| Division Vice President and General Manager - | |

| Applied Technology Division | |

| | |

| Anthony D. Schmidt, 44 | | Mr. Schmidt was named Division Vice President and General Manager of the Engineered Films Division in 2012. He joined the Company in 1995 in the Applied Technology Division performing various leadership roles within manufacturing and engineering. He transitioned to Engineered Films Division in 2011 as Manufacturing Manager. |

| Division Vice President and General Manager - | |

| Engineered Films Division | |

FORWARD-LOOKING STATEMENTS

Certain statements contained in this report are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the expectations, beliefs, intentions or strategies regarding the future. Without limiting the foregoing, the words “anticipates,” “believes,” “expects,” “intends,” “may,” “plans” and similar expressions are intended to identify forward-looking statements. The Company intends that all forward-looking statements be subject to the safe harbor provisions of the Private Securities Litigation Reform Act. Although the Company believes that the expectations reflected in such forward-looking statements are based on reasonable assumptions, there is no assurance that such assumptions are correct or that these expectations will be achieved. Such assumptions involve important risks and uncertainties that could significantly affect results in the future. These risks and uncertainties include, but are not limited to, those relating to weather conditions and commodity prices, which could affect certain of the Company's primary markets, such as agriculture and construction and oil and gas well drilling; or changes in competition, raw material availability, technology or relationships with the Company's largest customers, any of which could adversely impact any of the Company's product lines, as well as other risks described below. The foregoing list is not exhaustive and the Company disclaims any obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements.

RISKS RELATING TO THE COMPANY

Raven operates in markets that involve significant risks,The Company's business is subject to many of whichrisks. Set forth below are beyond the Company's control. Based on current information, the Company believes that the following identifies the most significant risk factors that could affect its businesses. However,important risks we face. In evaluating our business and your investment in us, you should also consider the risks and uncertainties the Company faces are not limited to those discussed below. There could be other unknowninformation presented in or unpredictable economic, business, competitive or regulatory factors, including factors that the Company currently believes to be immaterial, that could have material adverse effectsincorporated by reference into this Annual Report on the Company's financial position, liquidity and results of operations. Past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods.Form 10-K.

Weather conditions could affect certain of the Company's markets such as agriculture and construction.

The Company's Applied Technology Division is largely dependent on the ability of farmers, and agricultural subcontractors known asservice providers, and custom operators to purchase agricultural equipment that includes its products. If such farmers experience adverse weather conditions resulting in poor growing conditions, or experience unfavorable crop prices or expenses, potential buyers may be less likely to purchase agricultural equipment. Conversely, if farmers experience favorable weather and growing conditions, high yields could result in unfavorable crop prices and lower farm income making potential buyers less likely to purchase agricultural equipment. Accordingly, weather conditions may adversely affect sales in the Applied Technology Division.

Weather conditions can also adversely affect sales in the Company's Engineered Films Division. To the extent weather conditions curtail construction or agricultural activity, such as a late spring or drought, sales of the segment's plastic sheeting willwould likely decrease.

Seasonal, weather-related and market demand variation could also affect quarterly results. If expected sales are deferred in a fiscal quarter while inventory has been built and operating expenses incurred, financial results could be negatively impacted.

Price fluctuations in and shortages of raw materials could have a significant impact on the Company's ability to sustain and grow earnings.

The Company's Engineered Films Division consumes significant amounts of plastic resin, the costscost of which reflectdepends upon market prices for natural gas and oil and other market forces. These prices are subject to worldwide supply and demand as well as other factors beyond the control of the Company. Although the Engineered Films Division is sometimes able to pass on such price increases to its customers, significant variations in the cost of plastic resins can affect the Company's operating results from period to period. Unusual supply disruptions, such as one caused by a natural disaster, could cause suppliers to invoke “force majeure” clauses in their supply agreements, causing shortages of material. Success in offsetting higher raw material costs with price increases is largely influenced by competitive and economic conditions and could vary significantly depending on the market served. If the Company is not able to fully offset the effects of materialadverse materials availability and correspondingly higher costs, financial results could be adversely affected.

Electronic components used by both the Applied Technology Division and Aerostar Division, are sometimes in short supply, impacting our ability to meet customer demand.

If a supplier of raw materials or components were unable to deliver due to shortage or financial difficulty, any of the Company's segments could be adversely affected.

Fluctuations in commodity prices can increase our costs and decrease our sales.

Agricultural income levels are affected by agricultural commodity prices and input costs. As a result, changes in commodity prices that reduce agricultural income levels could have a negative effect on the ability of growers and their contractorsservice providers to purchase the Company's precision agriculture products manufactured by its Applied Technology Division.

Exploration for oil and natural gas fluctuates with their price.price and recent energy market conditions suggest that while end-market conditions are not likely to deteriorate further, they are not likely to improve in the near term. Plastic sheeting manufactured and sold by our Engineered Films Division is sold as pit and pond liners to contain water used in the drilling process. Lower prices for oil and natural gas could reduce exploration activities and demand for our products.

Plastic sheeting manufacturemanufacturing uses plastic resins, which can be subject to changechanges in price as the cost of natural gas or oil changes. Accordingly, volatility in oil and natural gas prices may negatively affect our raw material costs and cost of goods sold orand potentially cause us to changeincrease prices, which could adversely affect our sales andand/or profitability.

Failure to develop and market new technologies and products could impact the Company's competitive position and have an adverse effect on the Company's financial results.

The Company's operating results in its Applied Technology, and to a lesser extent, its Engineered Films, and Aerostar are largely dependent ondepend upon the ability to renew the pipeline of new products and to bring those products to market. This ability could be adversely affected by difficulties or delays in product development such as the inability to identify viable new products, successfully complete research and development, obtain relevant regulatory approvals, obtain intellectual property protection or gain market acceptance of new products and services. Because of the lengthy development process, technological challenges, and intense competition, there can be no assurance that any of the products the Company is currently developing, or could begin to develop in the future, will achieve substantial commercial success. Technical advancements in products may also increase the risk of product failure, increasing product returns or warranty claims and settlements. In addition, sales of the Company's new products could replace sales of some of its current products, offsetting the benefit of even a successful product introduction.

The Company's electronic manufacturing services business is dependent on a small numbersales of customersproducts which are specialized and faceshighly technical in nature are subject to uncertainties, start-up costs and inefficiencies, as well as market, competitive, and compliance risks.

The Company's electronic manufacturing services (EMS) business in the Aerostar Division is dependent on a small number of customers. Accordingly, the EMS revenue is dependentCompany’s growth strategy relies on the continued growth, viability and financial stability of its customers, which consist of original equipment manufacturers of avionics and secure telecommunication equipment. Future sales are dependent on the success of the Company's customers, some of which operate in businesses associated with rapid technological change and consequent product obsolescence. Developments adverse to major customers or their products, or the failure of a major customer to pay for components or services, could have an adverse effect on EMS revenue.

Further, the Aerostar Division competes against many providers of electronics manufacturing services. Certain competitors have substantially greater resources and more geographically diversified international operations than Aerostar. This segment may also be at a competitive disadvantage with respect to price when compared to manufacturers with lower cost structures, particularly those with more offshore facilities located where labor and other costs are lower. The Company also faces competition from the manufacturing operations of current and future customers, who are continually evaluating the merits of manufacturing products internally against the advantages of outsourcing to EMS providers. Accordingly, to compete effectively, Aerostar must continue to provide technologically advanced manufacturing services, maintain strict quality standards, respond flexibly and rapidly to customers' design and schedule changes and deliver products globally on a reliable basis at competitive prices. Customersmanufacture of proprietary products. Highly technical, specialized product inventories may cancel their orders, change production quantitiesbe more susceptible to fluctuations in market demand. If demand is unexpectedly low, write-downs or delay production.impairments of such inventory may become necessary. Either of these outcomes could adversely affect our results of operations. Start-up costs and inefficiencies related to new or transferred programs can adversely affect operating results and such costs may not be recoverable in a proprietary product environment because the Company may not receive reimbursement from its customers for such costs.

Competition in agriculture markets could come from our current customers if original equipment manufacturers develop and integrate precision agriculture technology products themselves rather than purchasing from third parties, reducing demand for Applied Technology’s products.

Regulatory restrictions could be placed on hydraulic fracturing because of environmental and health concerns, reducing demand for Engineered Film’s products. For Engineered Films, the development of alternative technologies, such new programsas closed loop drilling processes that would reduce the need for pit liners in energy exploration, could also reduce demand for the Company’s products.

Aerostar’s future growth relies on sales of high-altitude balloons, advanced radar systems, and aerostats to international markets. In some cases, such sales will be Direct Commercial Sales to foreign governments rather than Foreign Military Sales through the U.S. government. Direct Commercial Sales to foreign governments often involve large contracts subject to frequent delays because of budget uncertainties, regional military conflicts, and protracted negotiation processes. Such delays could adversely affect our results of operations. The nature of these markets for Vista's radar systems and Aerostar's aerostats makes these products particularly susceptible to fluctuations in market demand. Demand fluctuations and the likelihood of delays in sales involving large contracts for such products also increase the risk of these products becoming obsolete, increasing risk associated with expected sales of such products. The value of aerostat and radar systems inventory at January 31, 2016 is approximately $12 million. This valuation is based on an estimate that the market demand for these products will be sufficient in future periods such that these inventories will be sold at a price greater than carrying value. Write-downs or transferred programsimpairment of the value of such products carried in inventory could adversely affect our results of operations. To the extent products become obsolete or anticipated sales are canceled.not realized, our expected future cash flows could be adversely impacted. An impairment could adversely impact the Company's results of operations and financial condition.

Sales of certain of Aerostar’s products into international markets increase the compliance risk associated with regulations such as The International Traffic in Arms Regulations (ITAR), as well as others, exposing the Company to fines and its employees to fines, imprisonment, or civil penalties. Potential consequences of a material violation of such regulations include damage to our reputation, litigation, and increased costs.

The Company's Aerostar segment depends on the U.S. government for a significant portion of its sales, creating uncertainty in the timing of and funding for projected contracts.

A significant portion of Aerostar's sales are to the U.S. government or U.S. government agencies as a prime or sub-contractor. Government spending has historically been cyclical. A decrease in U.S. government defense or near-space research spending or changes in spending allocationallocations could result in one or more of the Company's programs being reduced, delayed, or terminated. Reductions in the Company's existing programs, unless offset by other programs and opportunities, could adversely affect its ability to sustain and grow its future sales and earnings. The Company's U.S. government sales are funded by the federal budget, which operates on an October-to-September fiscal year. Changes in congressional schedules, negotiations for program funding levels, reduced program funding due to U.S government debt limitations, automatic budget cuts ("sequestration") or unforeseen world events can interrupt the funding for a program or contract. Funds for multi-year contracts can be changed in subsequent years in the appropriations process.

In addition, themany U.S. government has increasingly relied on indefinite delivery, indefinite quantity (IDIQ) contracts and other procurement vehicles that are subject to a competitive bidding and funding process even after the award of the basic contract, adding an additional element of uncertainty to future funding levels. Delays in the funding process or changes in funding can impact the timing of available funds or can lead to changes in program content or termination at the government's convenience. The loss of anticipated funding or the termination of multiple or large programs could have an adverse effect on the Company's future sales and earnings.

The Company derives a portion of its revenues from foreign markets, which subjects the Company to business risks, including risk of changes in government policies and laws or worldwide economic conditions.

The Company's sales outside the U.S. were $49.3$27.8 million in fiscal 2013,2016, representing 12%11% of consolidated net sales. The Company's financial results could be affected by changes in trade, monetary and fiscal policies, laws and regulations, or other activities of U.S. and non-U.S. governments, agencies and similar organizations.organizations, along with changes in worldwide economic conditions. These conditions include, but are not limited to, changes in a country's or region's economic or political conditions;condition; trade regulations affecting production, pricing, and marketing of products; local labor conditions and regulations; reduced protection of intellectual property rights in some countries; changes in the regulatory or legal environment; restrictions on currency exchange activities; the impact of fluctuations in foreign currency exchange rates, which may affect product demand and may adversely affect the profitability of our products in U.S. dollars in foreign markets where payments are made in the local currency; burdensome taxes and tariffstariffs; and other trade barriers. International risks and uncertainties also include changing social and economic conditions, terrorism, political hostilities and war, difficulty in enforcing agreements or collecting receivables, and increased transportation or other shipping costs. Any of these such risks could lead to reduced sales and reduced profitability associated with such sales.

Adverse economic conditions in the major industries the Company serves may materially affect segment performance and consolidated results of operations.

The Company's results of operations are impacted by the market fundamentals of the primary industries served. Significant declines of economic activity in the agricultural, oil and gas exploration, construction, industrial, aerospace/aviation, communication, defense and other major markets served may adversely affect segment performance and consolidated results of operations.

The Company may pursue or complete acquisitions which represent additional risk and could impact future financial results.

The Company's business strategy includes the potential for future acquisitions. Acquisitions involve a number of risks including integration of the acquired company with the Company's operations and unanticipated liabilities or contingencies related to the acquired company. Further, business strategies supported by the acquisition may be in perceived, or actual, opposition to strategies of certain of our customers and our business could be materially adversely affected if those relationships are terminated and the expected strategic benefits are delayed or are not achieved. The Company cannot ensure that the expected benefits of any future acquisitionsacquisition will be realized. Costs could be incurred on pursuits or proposed acquisitions that have not yet or may not close which could significantly impact the operating results, financial condition, or cash flows. Additionally, after the acquisition, unforeseen issues could arise which adversely affect the anticipated returns or which are otherwise not recoverable as an adjustment to the purchase price. Other acquisition risks include delays in realizing benefits from the acquired companies or products; difficulties due to lack of or limited prior experience in any new product or geographic markets we enter; unforeseen adjustments, charges or write-offs; unforeseen losses of customers or,of, or suppliers to, acquired businesses; difficulties in retaining key employees of the acquired businesses; or challenges arising from increased geographic diversity and complexity of our operations.operations and our information technology systems.

Total goodwill and intangible assets account for approximately $31.0$60.6 million, or 11%20%, of Raven'sthe Company's total assets as of January 31, 2013.2016. The Company evaluates goodwill and intangible assets for impairment annually, or when evidence of potential impairment exists. The annual impairment test is based on several factors requiring judgment. Principally, a significant decrease in expected cash flows or changes in market conditions may indicate potential impairment of recorded goodwill or intangible assets. Our expected future cash flows are dependent on several factors including revenue growth in certain of our product lines and an expectation that the pricing in commodities markets will recover in future periods. Our expected future cash flows could be adversely impacted if our anticipated revenue growth is not realized or if pricing in commodities markets does not recover in future periods. An impairment wouldcould adversely impact the Company's results of operations and financial condition.

The Company may fail to continue to attract, develop and retain key management and other key employees, which could negatively impact our operating results.

We depend on the performance of our senior management team and other key employees, including experienced and skilled technical personnel. The loss of certain members of our senior management, including our Chief Executive Officer, could negatively impact our operating results and ability to execute our business strategy. Our future success will also depend in part upon our ability to attract, train, motivate, and retain qualified personnel.

The Company may fail to protect its intellectual property effectively, or may infringe upon the intellectual property of others. others.

The Company has developed significant proprietary technology and other rights that are used in its businesses. The Company relies on trade secret, copyright, trademark, and patent laws and contractual provisions to protect the Company's intellectual property. While the Company takes enforcement of these rights seriously, other companies such as competitors or analogous persons in related markets in which the Company does not participate may attempt to copy or use the Company's intellectual property for their own benefit.

In addition, intellectual property of others also has an impact on the Company's ability to offer some of its products and services for specific uses or at competitive prices. Competitors' patents or other intellectual property may limit the Company's ability to offer products and services to its customers. Any infringement or claimed infringement of the intellectual property rights of others could result in litigation and adversely affect the Company's ability to continue to provide, or could increase the cost of providing, products and services.

Intellectual property litigation is very costly and could result in substantial expense and diversions of the Company's resources, both of which could adversely affect its businesses and financial condition and results. In addition, there may be no effective legal recourse against infringement of the Company's intellectual property by third parties, whether due to limitations on enforcement of rights in foreign jurisdictions or as a result of other factors.

Technology failures or cyber-attacks on the Company's systems could disrupt the Company's operations or the functionality of its products and negatively impact the Company's business.

The Company increasingly relies on information technology systems to process, transmit, and store electronic information. In addition, a significant portion of internal communications, as well as communication with customers and suppliers depends on

information technology. Further, the products in our Applied Technology segment depend upon GPS and other systems through which our products interact with government computer systems and other centralized information sources. We are exposed to the risk of cyber incidents in the normal course of business. Cyber incidents may be deliberate attacks for the theft of intellectual property or other sensitive information or may be the result of unintentional events. Like most companies, the Company's information technology systems may be vulnerable to interruption due to a variety of events beyond the Company's control, including, but not limited to, natural disasters, terrorist attacks, telecommunications failures, computer viruses, hackers, and other security issues. Further, attacks on centralized information sources could affect the operation of our products or cause them to malfunction. The Company has technology security initiatives and disaster recovery plans in place to mitigate the Company's risk to these vulnerabilities, but these measures may not be adequate or implemented properly to ensure that the Company's operations are not disrupted. Potential consequences of a material cyber incident include damage to our reputation, litigation, and increased cyber security protection and remediation costs. Such consequences could adversely affect our results of operations.

|

| |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

Raven's corporate office is at an owned premises located in Sioux Falls, South Dakota. TheAlong with the corporate headquarters building, the Company also owns separate manufacturing facilities for each of our business segments as well as various warehouses, training, and product development facilities. facilities in the immediate Sioux Falls area.

In addition to theseits Sioux Falls facilities, Applied Technology hasowns a product development facility in Austin, Texas and aan idle manufacturing facility located in St. Louis, Missouri;Missouri that is actively being marketed for sale. Applied Technology also leases manufacturing, research, and Aerostaroffice facilities in Middenmeer, Netherlands and Geel, Belgium and office/warehouse space in Stockholm, Saskatchewan Canada. In addition, Applied Technology leases smaller research and office facilities in South Dakota.

Engineered Films has additional owned production and conversion facilities located in Madison and Brandon, South Dakota and Midland, Texas.

Aerostar owns manufacturing, sewing, and research facilities located in Huron and Madison, South Dakota, and Sulphur Springs, Texas. AerostarAerostar's subsidiary Vista also leases facilities in Arlington, Virgina;Virginia and in Monterey, Chatsworth, and Chatsworth,Sunnyvale, California.

Most of the Company's manufacturing plants also serve as distribution centers and contain offices for sales, engineering, and manufacturing support staff. The Company believes that its properties are suitable and adequate to meet existing production needs. Additionally,Although there is idle capacity available in the Engineered Films Division, the productive capacity in the Company's facilities is substantially being utilized.used. The Company also owns approximately 6.229.6 acres of undeveloped land adjacent to the other owned property, which is available for expansion.

The following is the approximate square footage of the Company's owned or leased facilities by segment: Applied Technology - 170,000;182,000; Engineered Films - 310,000;606,000; Aerostar - 275,000;331,000; and Corporate - 150,000.150,000.

The Company is responsible for investigation and remediation of environmental contamination at one of its sold facilities (see Item 1, Business - Environmental Matters of this Annual Report on Form 10-K). In addition, the Company is involved as a defendantparty in lawsuits, claims, regulatory inquiries, or disputes arising in the normal course of its business. The potential costs and liability of such claims cannot be determined at this time. Management believes that any liability resulting from these claims will be substantially mitigated by insurance coverage. Accordingly, management does not believe the ultimate outcome of these matters will be significant to its results of operations, financial position or cash flows.

|

| |

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

|

| |

| PART II | |

| | |

| ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Raven'sThe Company's common stock is traded on the NASDAQ Global Select Market under the ticker symbol RAVN. The following table shows quarterly unaudited financial results, quarterly high and low salestrade prices per share of Raven'sthe Company's common stock, as reported by NASDAQ, and dividends declared for the periods indicated:

| | | QUARTERLY INFORMATION (UNAUDITED) | QUARTERLY INFORMATION (UNAUDITED) | | QUARTERLY INFORMATION (UNAUDITED) |

| (Dollars in thousands, except per-share amounts) | (Dollars in thousands, except per-share amounts) | | (Dollars in thousands, except per-share amounts) |

| | | Net Sales | Gross Profit | Operating Income | Pre-tax Income | Net Income Attributable to Raven | Net Income Per Share (a) (b) | Common Stock Market Price (b) | Cash Dividends Per Share | | | Net Sales | Gross Profit | Operating Income | Pre-tax Income | Net Income Attributable to Raven | Net Income Per Share(a) | Common Stock Market Price | Cash Dividends Per Share |

| | | | |

| | | Basic | Diluted | High | Low | (b) | | Basic | Diluted | High | Low |

| FISCAL 2013 | | | |

| FISCAL 2016 | | FISCAL 2016 | |

| First Quarter | First Quarter | $ | 117,915 |

| $ | 41,135 |

| $ | 28,432 |

| $ | 28,380 |

| $ | 19,043 |

| $ | 0.53 |

| $ | 0.52 |

| $ | 35.56 |

| $ | 28.16 |

| $ | 0.105 |

| | First Quarter | $ | 70,273 |

| $ | 20,359 |

| $ | 7,214 |

| $ | 7,170 |

| $ | 4,855 |

| $ | 0.13 |

| $ | 0.13 |

| $ | 22.85 |

| $ | 16.91 |

| $ | 0.13 |

|

| Second Quarter | Second Quarter | 101,674 |

| 30,064 |

| 17,407 |

| 17,311 |

| 11,546 |

| 0.32 |

| 0.32 |

| 37.73 |

| 28.59 |

| 0.105 |

| | Second Quarter | 67,518 |

| 17,858 |

| 6,429 |

| 6,163 |

| 4,191 |

| 0.11 |

| 0.11 |

| 22.36 |

| 18.52 |

| 0.13 |

|

| Third Quarter | Third Quarter | 97,011 |

| 29,575 |

| 16,372 |

| 16,316 |

| 10,859 |

| 0.30 |

| 0.30 |

| 34.61 |

| 26.78 |

| 0.105 |

| | Third Quarter | 67,611 |

| 16,171 |

| (2,727 | ) | (2,850 | ) | (1,581 | ) | (0.04 | ) | (0.04 | ) | 19.53 |

| 15.77 |

| 0.13 |

|

| Fourth Quarter | Fourth Quarter | 89,575 |

| 26,899 |

| 15,481 |

| 15,639 |

| 11,097 |

| 0.31 |

| 0.30 |

| 28.19 |

| 23.01 |

| 0.105 |

| | Fourth Quarter | 52,827 |

| 11,397 |

| 176 |

| 299 |

| 1,024 |

| 0.03 |

| 0.03 |

| 19.61 |

| 13.87 |

| 0.13 |

|

| Total Year | Total Year | $ | 406,175 |

| $ | 127,673 |

| $ | 77,692 |

| $ | 77,646 |

| $ | 52,545 |

| $ | 1.45 |

| $ | 1.44 |

| $ | 37.73 |

| $ | 23.01 |

| $ | 0.42 |

| | Total Year | $ | 258,229 |

| $ | 65,785 |

| $ | 11,092 |

| $ | 10,782 |

| $ | 8,489 |

| $ | 0.23 |

| $ | 0.23 |

| $ | 22.85 |

| $ | 13.87 |

| $ | 0.52 |

|

| | | | | | |

| FISCAL 2012 | | | |

| FISCAL 2015 | | FISCAL 2015 | |

| First Quarter | First Quarter | $ | 101,541 |

| $ | 32,936 |

| $ | 23,533 |

| $ | 23,520 |

| $ | 15,716 |

| $ | 0.44 |

| $ | 0.43 |

| $ | 30.96 |

| $ | 23.60 |

| $ | 0.09 |

| | First Quarter | $ | 102,510 |

| $ | 31,766 |

| $ | 16,532 |

| $ | 16,453 |

| $ | 11,038 |

| $ | 0.30 |

| $ | 0.30 |

| $ | 40.06 |

| $ | 30.29 |

| $ | 0.12 |

|

| Second Quarter | Second Quarter | 90,344 |

| 28,130 |

| 18,674 |

| 18,598 |

| 12,461 |

| 0.34 |

| 0.34 |

| 29.80 |

| 24.68 |

| 0.09 |

| | Second Quarter | 94,485 |

| 25,658 |

| 10,696 |

| 10,637 |

| 7,719 |

| 0.21 |

| 0.21 |

| 34.56 |

| 27.75 |

| 0.12 |

|

| Third Quarter | Third Quarter | 93,300 |

| 27,254 |

| 16,875 |

| 16,871 |

| 11,390 |

| 0.32 |

| 0.32 |

| 32.44 |

| 21.62 |

| 0.09 |

| | Third Quarter | 91,292 |

| 24,339 |

| 10,159 |

| 10,087 |

| 6,783 |

| 0.19 |

| 0.18 |

| 30.74 |

| 22.13 |

| 0.13 |

|

| Fourth Quarter | Fourth Quarter | 96,326 |

| 27,872 |

| 16,559 |

| 16,709 |

| 11,002 |

| 0.31 |

| 0.30 |

| 34.65 |

| 25.09 |

| 0.09 |

| | Fourth Quarter | 89,866 |

| 21,483 |

| 6,414 |

| 6,324 |

| 6,193 |

| 0.16 |

| 0.16 |

| 26.56 |

| 20.75 |

| 0.13 |

|

| Total Year | Total Year | $ | 381,511 |

| $ | 116,192 |

| $ | 75,641 |

| $ | 75,698 |

| $ | 50,569 |

| $ | 1.40 |

| $ | 1.39 |

| $ | 34.65 |

| $ | 21.62 |

| $ | 0.36 |

| | Total Year | $ | 378,153 |

| $ | 103,246 |

| $ | 43,801 |

| $ | 43,501 |

| $ | 31,733 |

| $ | 0.86 |

| $ | 0.86 |

| $ | 40.06 |

| $ | 20.75 |

| $ | 0.50 |

|

| | | | | | |

| FISCAL 2011 | | | |

| FISCAL 2014 | | FISCAL 2014 | |

| First Quarter | First Quarter | $ | 85,030 |

| $ | 27,171 |

| $ | 19,505 |

| $ | 19,557 |

| $ | 12,945 |

| $ | 0.36 |

| $ | 0.36 |

| $ | 15.90 |

| $ | 13.27 |

| $ | 0.08 |

| | First Quarter | $ | 103,680 |

| $ | 34,916 |

| $ | 20,934 |

| $ | 20,736 |

| $ | 14,003 |

| $ | 0.38 |

| $ | 0.38 |

| $ | 34.04 |

| $ | 25.46 |

| $ | 0.12 |

|

| Second Quarter | Second Quarter | 73,174 |

| 20,389 |

| 12,623 |

| 12,529 |

| 8,353 |

| 0.23 |

| 0.23 |

| 19.09 |

| 14.33 |

| 0.08 |

| | Second Quarter | 93,421 |

| 26,735 |

| 12,568 |

| 12,349 |

| 8,333 |

| 0.23 |

| 0.23 |

| 35.68 |

| 28.82 |

| 0.12 |

|

| Third Quarter | Third Quarter | 85,823 |

| 24,887 |

| 17,866 |

| 17,883 |

| 11,833 |

| 0.32 |

| 0.32 |

| 21.06 |

| 15.00 |

| 0.71 |

| (c) | Third Quarter | 104,938 |

| 31,940 |

| 18,132 |

| 18,089 |

| 12,289 |

| 0.34 |

| 0.34 |

| 34.83 |

| 28.38 |

| 0.12 |

|

| Fourth Quarter | Fourth Quarter | 70,681 |

| 18,982 |

| 10,209 |

| 10,313 |

| 7,406 |

| 0.21 |

| 0.21 |

| 24.80 |

| 20.01 |

| 0.08 |

| | Fourth Quarter | 92,638 |

| 25,763 |

| 12,360 |

| 12,449 |

| 8,278 |

| 0.23 |

| 0.23 |

| 42.99 |

| 32.64 |

| 0.12 |

|

| Total Year | Total Year | $ | 314,708 |

| $ | 91,429 |

| $ | 60,203 |

| $ | 60,282 |

| $ | 40,537 |

| $ | 1.12 |

| $ | 1.12 |

| $ | 24.80 |

| $ | 13.27 |

| $ | 0.95 |

| | Total Year | $ | 394,677 |

| $ | 119,354 |

| $ | 63,994 |

| $ | 63,623 |

| $ | 42,903 |

| $ | 1.18 |

| $ | 1.17 |

| $ | 42.99 |

| $ | 25.46 |

| $ | 0.48 |

|

(a) | Net income per share is computed discretely by quarter and may not add to the full year. | | Net income per share is computed discretely by quarter and may not add to the full year. |

(b) | All per-share and market data reflect the July 2012 two-for-one stock split. | | |

(c) | A special dividend of $0.63 per share was paid during the third quarter of fiscal 2011. | | |

As of January 31, 2013,2016, the Company had approximately 10,40012,800 beneficial holders, which includes a substantial numberamount of the Company's common stock held byof record by banks, brokers, and other financial institutions.

On November 3, 2014, the Company announced that its Board of Directors (Board) had authorized a $40.0 million stock buyback program. During fiscal 2016, the Company made purchases of 1,602,545 common shares under this plan for a total cost of $29.3 million or $18.31 per share. None of these common shares were repurchased during the fourth quarter of fiscal 2016. There is approximately $10.7 million still available for share repurchases under this Board-authorized program which remains in place until such time as the authorized spending limit is reached or is otherwise revoked by the Board.

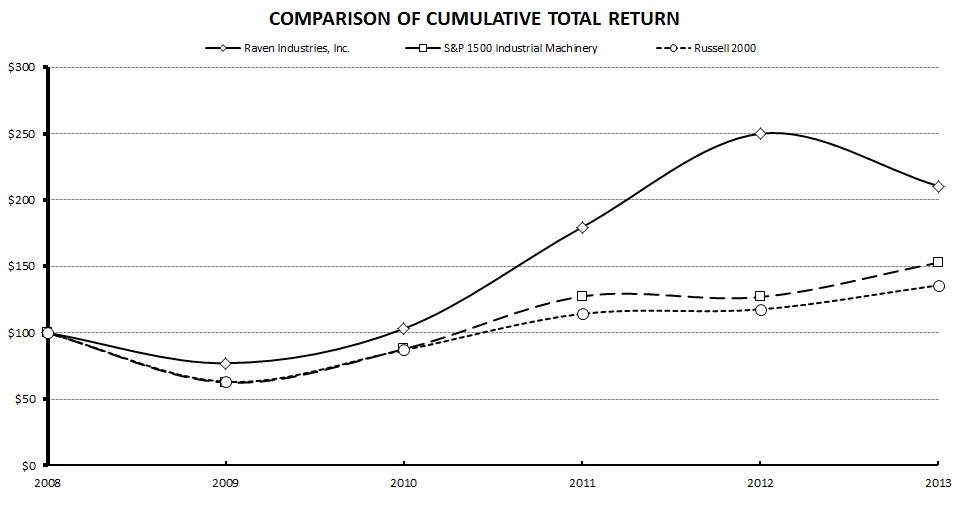

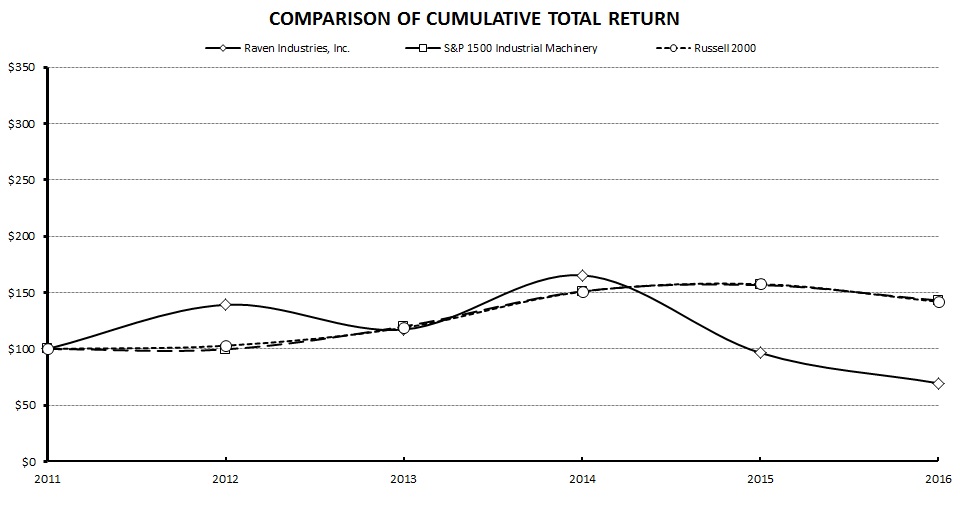

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN AMONG RAVEN INDUSTRIES, INC.,

S&P 1500 INDUSTRIAL MACHINERY INDEX AND RUSSELL 2000 INDEX

Raven outperformed its industrial peersThe above graph compares the cumulative total shareholders return on the Company's stock with the cumulative return of the S&P 1500 Industrial Machinery Index and the overall market in shareholder return.Russell 2000 index. Investors who bought $100 of the Company's stock on January 31, 20082011, held this for five years and reinvested the dividends would have seen its value increasedecrease to $201.5169.48. Stock performance on the graph is not necessarily indicative of future price performance.

| | | | | Years Ended January 31, | | 5-Year | | Years Ended January 31, | | 5-Year |

| Company / Index | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | | CAGR(a) | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | | 2016 | | CAGR(a) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Raven Industries, Inc. | | $ | 100.00 |

| | $ | 77.08 |

| | $ | 103.15 |

| | $ | 179.62 |

| | $ | 250.00 |

| | $ | 201.51 |

| | 16.1 | % | | $ | 100.00 |

| | $ | 139.18 |

| | $ | 117.20 |

| | $ | 165.39 |

| | $ | 96.45 |

| | $ | 69.48 |

| | (7.0 | )% |

| S&P 1500 Industrial Machinery Index | | 100.00 |

| | 62.52 |

| | 87.71 |

| | 127.43 |

| | 126.95 |

| | 152.92 |

| | 8.9 | % | | 100.00 |

| | 99.63 |

| | 120.00 |

| | 151.19 |

| | 156.74 |

| | 142.97 |

| | 7.4 | % |

| Russell 2000 Index | | 100.00 |

| | 63.15 |

| | 87.04 |

| | 114.34 |

| | 117.61 |

| | 135.81 |

| | 6.3 | % | | 100.00 |

| | 102.86 |

| | 118.78 |

| | 150.88 |

| | 157.53 |

| | 141.90 |

| | 7.3 | % |

(a) compound annual growth rate (CAGR) | (a) compound annual growth rate (CAGR) | | | | | | | | | | | | | (a) compound annual growth rate (CAGR) | | | | | | | | | | | | |

(This page is intentionally left blank)

|

| |

| ITEM 6. | SELECTED FINANCIAL DATA |

| | ELEVEN-YEAR FINANCIAL SUMMARY | | (Dollars and shares in thousands, except employee counts and per-share amounts) | | For the years ended January 31, | |

| (In thousands, except employee counts and per-share amounts) | | | For the years ended January 31, |

| | | 2013 | | 2012 | | 2011 | | 2016 | | 2015 | | 2014 |

| OPERATIONS | | | | | | | | | | | | |

| Net sales | | $ | 406,175 |

| | $ | 381,511 |

| | $ | 314,708 |

| | $ | 258,229 |

| | $ | 378,153 |

| | $ | 394,677 |

|

| Gross profit | | 127,673 |

| | 116,192 |

| | 91,429 |

| | 65,785 |

| | 103,246 |

| | 119,354 |

|

Operating income | | 77,692 |

| | 75,641 |

| | 60,203 |

| | 11,092 |

| | 43,801 |

| | 63,994 |

|

Income before income taxes | | 77,646 |

| | 75,698 |

| | 60,282 |

| | 10,782 |

| | 43,501 |

| | 63,623 |

|

| Net income attributable to Raven Industries, Inc. | | $ | 52,545 |

| | $ | 50,569 |

| | $ | 40,537 |

| | 8,489 |

| | 31,733 |

| | 42,903 |

|

| Net income % of sales | | 12.9 | % | | 13.3 | % | | 12.9 | % | | 3.3 | % | | 8.4 | % | | 10.9 | % |

| Net income % of beginning equity | | 29.1 | % | | 35.8 | % | | 30.4 | % | |

| Net income % of average equity | | | 3.0 | % | | 11.4 | % | | 18.2 | % |

Cash dividends(a)(b) | | $ | 15,244 |

| | $ | 13,025 |

| | $ | 34,095 |

| | $ | 19,426 |

| | $ | 18,519 |

| | $ | 17,465 |

|

| FINANCIAL POSITION | | | | | | | | | | | | |

| Current assets | | $ | 156,748 |

| | $ | 147,559 |

| | $ | 128,181 |

| | $ | 125,733 |

| | $ | 170,979 |

| | $ | 169,405 |

|

| Current liabilities | | 33,061 |

| | 40,646 |

| | 34,335 |

| | 18,819 |

| | 31,843 |

| | 29,819 |

|

| Working capital | | $ | 123,687 |

| | $ | 106,913 |

| | $ | 93,846 |

| | $ | 106,914 |

| | $ | 139,136 |

| | $ | 139,586 |

|

| Current ratio | | 4.74 |

| | 3.63 |

| | 3.73 |

| | 6.68 |

| | 5.37 |

| | 5.68 |

|

| Property, plant and equipment | | $ | 81,238 |

| | $ | 61,894 |

| | $ | 41,522 |

| | $ | 116,162 |

| | $ | 117,513 |

| | $ | 98,076 |

|

| Total assets | | 273,210 |

| | 245,703 |

| | 187,760 |

| | 306,610 |

| | 362,873 |

| | 301,819 |

|

| Long-term debt, less current portion | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Raven Industries, Inc. shareholders' equity | | $ | 221,346 |

| | $ | 180,499 |

| | $ | 141,214 |

| | $ | 268,791 |

| | $ | 305,153 |

| | $ | 251,362 |

|

| Long-term debt / total capitalization | | — | % | | — | % | | — | % | | — | % | | — | % | | — | % |

| Inventory turnover (cost of sales / average inventory) | | 5.4 |

| | 5.4 |

| | 5.6 |

| | 3.6 |

| | 4.9 |

| | 5.2 |

|

| CASH FLOWS PROVIDED BY (USED IN) | | | | | | | | | | | | |

| Operating activities | | $ | 76,456 |

| | $ | 43,831 |

| | $ | 42,085 |

| | $ | 44,008 |

| | $ | 60,083 |

| | $ | 52,836 |

|

| Investing activities | | (29,930 | ) | | (40,313 | ) | | (11,418 | ) | | (11,074 | ) | | (29,986 | ) | | (31,615 | ) |

| Financing activities | | (23,007 | ) | | (15,234 | ) | | (33,834 | ) | | (50,684 | ) | | (30,665 | ) | | (17,354 | ) |

| Change in cash | | 23,511 |

| | (11,721 | ) | | (3,121 | ) | |

| Change in cash and cash equivalents | | | (18,167 | ) | | (1,038 | ) | | 3,634 |

|