|

| | |

| | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM 10-K |

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIESEXCHANGE ACT OF 1934 |

For the fiscal year ended January 31, 20162018 |

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIESEXCHANGE ACT OF 1934 |

| For the transition period from to |

| Commission File Number: 001-07982 |

| RAVEN INDUSTRIES, INC. |

| (Exact name of registrant as specified in its charter) |

|

| | | | |

| | South Dakota | | 46-0246171 | |

| | (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) | |

| | 205 E. 6th Street, P.O. Box 5107, Sioux Falls, SD | | 57117- 5107 | |

| | (Address of principal executive offices) | | (Zip Code) | |

| | Registrant's telephone number including area code (605) 336-2750 | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | Title of each class: | | Name of each exchange on which registered | |

| | Common Stock, $1 par value | | The NASDAQ Stock Market | |

| Securities registered pursuant to Section 12(g) of the Act: None |

| | | | | |

|

| | | | |

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | oþ | Yes | þo | No |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | o | Yes | þ | No |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | þ | Yes | o | No |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website,website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter)during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | þ | Yes | o | No |

| Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter)is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | þ | | | |

|

| | | | | |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. |

| Large accelerated filer | þ | | | Accelerated filer | o |

| Non-accelerated filer | o | | | Smaller reporting company | o |

| (Do not check if a smaller reporting company) | Smaller reporting company | o |

| | | Emerging growth company | o |

|

| | | | |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | o | Yes | þ | No |

|

| | | | |

The aggregate market value of the registrant's common stock held by non-affiliates at July 31, 20152017 was approximately $724,165,854.$1,231,707,927. The aggregate market value was computed by reference to the closing price as reported on the NASDAQ Global Select Market, $19.43,$34.40, on July 31, 2015,2017, which was as of the last business day of the registrant's most recently completed second fiscal quarter. The number of shares outstanding on March 22, 201616, 2018 was 36,279,928.35,796,857. |

| DOCUMENTS INCORPORATED BY REFERENCE |

The definitive proxy statement relating to the registrant's Annual Meeting of Shareholders, to be held May 24, 2016,22, 2018, is incorporated by reference into Part III to the extent described therein. |

| | | | | |

|

| | | |

| PART I | | |

| Item 1. | BUSINESS | | |

| Item 1A. | RISK FACTORS | | |

| Item 1B. | UNRESOLVED STAFF COMMENTS | | |

| Item 2. | PROPERTIES | | |

| Item 3. | LEGAL PROCEEDINGS | | |

| Item 4. | MINE SAFETY DISCLOSURES | | |

| | | | |

| PART II | | |

| Item 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES | | |

| | Quarterly Information | | |

| | Stock Performance | | |

| Item 6. | SELECTED FINANCIAL DATA | | |

| | Eleven-yearFive-year Financial Summary | | |

| Business Segments | | |

| Item 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | |

| | Executive Summary | | |

| | Results of Operations - Segment Analysis | | |

| Outlook | | |

| | Liquidity and Capital Resources | | |

| | Off-Balance Sheet Arrangements and Contractual Obligations | | |

| | Critical Accounting Policies and Estimates | | |

| | Accounting Pronouncements | | |

| | Forward-Looking Statements | | |

| Item 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | |

| Item 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | | |

| | Management's Report on Internal Control Over Financial Reporting | | |

| | Report of Independent Registered Public Accounting Firm - Deloitte & Touche LLP | | |

| Report of Independent Registered Public Accounting Firm - PricewaterhouseCoopers LLP | | |

| | Consolidated Balance Sheets | | |

| | Consolidated Statements of Income and Comprehensive Income | | |

| | Consolidated Statements of Shareholders' Equity | | |

| | Consolidated Statements of Cash Flows | | |

| | Notes to Consolidated Financial Statements | | |

| Item 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | | |

| Item 9A. | CONTROLS AND PROCEDURES | | |

| Item 9B. | OTHER INFORMATION | | |

| | | | |

| PART III | | |

| Item 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | | |

| Item 11. | EXECUTIVE COMPENSATION | | |

| Item 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS | | |

| Item 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | | |

| Item 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | | |

| | | | |

| PART IV | | |

| Item 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULE | | |

| Item 16. | 10-K SUMMARY | | |

| INDEX TO EXHIBITS | | |

| SIGNATURES | | |

| SCHEDULE II | | |

Raven Industries, Inc. (the Company or Raven) was incorporated in February 1956 under the laws of the State of South Dakota and began operations later that same year. The Company is a diversified technology company providing a variety of products to customers within the industrial, agricultural, energy,geomembrane, construction, and aerospace/defense markets. The Company markets its products around the world and has its principal operations in the United States of America. Raven began operations as a manufacturer of high-altitude research balloons before diversifying into product lines that extended from technologies and production methods of this original balloon business. The Company employs approximately 9101,157 people and is headquartered at 205 E. Sixth6th Street, Sioux Falls, SD 57104 - telephone (605) 336-2750. The Company's Internet address is http://www.ravenind.com and its common stock trades on the NASDAQ Global Select Market under the ticker symbol RAVN. The Company has adopted a Code of Conduct applicable to all officers, directors and employees, which is available on theits website. Information on the Company's website is not part of this filing.

All reports (including Annual ReportsWe make our annual report on Form 10-K, Quarterly Reportsquarterly reports on Form 10-Q, and current reports on Form 8-K)8-K and proxy and information statements filedall amendments to those reports available, free of charge, in the “Investor Relations” section of our Internet website as soon as reasonably practicable after we electronically file these materials with, or furnish these materials to, the Securities and Exchange Commission (SEC) are available through a link from the Company's. Information on or connected to our website is neither part of, nor incorporated by reference into, this Form 10-K or any other report filed with or furnished to the SEC.

You may also read or copy any materials that we file with the SEC website. All such information is available as soon as reasonably practicable after it has been electronically filed. Filings can also be obtained free of charge by contacting the Company or the SEC. The SEC can be contacted throughat its website at http://www.sec.gov or through the SEC's Office of FOIA/PA OperationsPublic Reference Room at 100 F Street, N.E., Washington, DC 20549-2736, or20549. You may obtain additional information about the Public Reference Room by calling the SEC at 1-800-732-0330.1-800-SEC-0330. Additionally, you will find these materials on the SEC Internet site at www.sec.gov. This site contains reports, proxy statements and other information regarding issuers that file electronically with the SEC.

This Annual Report on Form 10-K (Form 10-K) contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this Form 10-K are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance, and business. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. Important factors that could cause actual results to differ materially from our expectations and other important information about forward-looking statements are disclosed under Item 1A, “Risk Factors” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations, Forward-Looking Statements” in this Form 10-K.

BUSINESS SEGMENTS

The Company has three unique operating units, or divisions, that are also its reportable segments: Applied Technology Division (Applied Technology), Engineered Films Division (Engineered Films), and Aerostar Division (Aerostar). Many of the past and present product lines are an extension of technology and production methods developed in the original balloon business. Product lines have been generally grouped in these segments based on common technologies, production methods,technology, manufacturing processes, and inventories;end-use application; however, more than onea business segment may serve eachmore than one of the product markets identified above. The Company measures the profitability performance of its segments primarily based on their operating income excluding administrativegeneral and generaladministrative expenses. Other expense and income taxes are not allocated to individual operating segments, and assets not identifiable to an individual segment are included as corporate assets. Segment information is reported consistent with the Company's management reporting structure.

|

| |

Business segment financial information is found on the following pages of this Annual Report on Form 10-K (Form 10-K):10-K: |

| Business Segments |

| Results of Operations – Segment Analysis |

| Note 15 16 Business Segments and Major Customer Information |

Applied Technology

Applied Technology designs, manufactures, sells, and services innovative precision agriculture products and information management tools that help growers reduce costs, decreasemore precisely control inputs, and improve farm yields around the world.yields. The Applied Technology product families include field computers, application controls, GPS-guidance and assisted-steeringsteering systems, automatic boom controls, injection systems, and planter controls, and harvestseeder controls. Applied Technology's services include high-speed in-field Internet connectivity and cloud-based data management. The Company's investment in Site-Specific Technology Development Group, Inc. (SST), a software company, and the continued build-out of the Slingshot™ platform have has also

positioned Applied Technology as an information platform that improves grower decision-making and achieves business efficiencies for ourits agriculture retail partners.

Applied Technology sells its precision agriculture control products to both original equipment manufacturers (OEMs) and through aftermarket distribution partners in the United States and in most major agricultural areas around the world. Applied Technology has personnel and third-party distribution representatives located in the U.S. and key geographic areas throughout the world. The Company's competitive advantage in this segment is designing and selling easy to use, reliable, and innovative value-added products that are supported by an industry-leading service and support team.

Engineered Films

Engineered Films produces high-performance plastic films and sheeting for energy,geomembrane, agricultural, construction, and industrial applications. Engineered Films acquired the assets of Colorado Lining International, Inc. (CLI) in September 2017. This acquisition enhanced the division's geomembrane market position through extended service and product offerings with the addition of new design-build and installation service components. The acquisition of CLI advanced Engineered Films’ business model into a vertically-integrated, full-service solutions provider for the geomembrane market.

Engineered Films sells both direct to end-customers and through independent third-party distributors. The majority of product sold into the construction and agriculture markets is through distributors, while sales into the geomembrane and industrial applications.

Engineered Films primarily sells plastic sheeting to independent third-party distributorsmarkets are more direct in each of the various markets it serves. Through the acquisition of Integra Plastics, Inc. (Integra) in November 2014, Engineered Films also leverages a direct sales channel in the division’s energy market.nature. The Company extrudes a significant portion of the film converted for its commercial products and believes it is one of the largest sheeting converters in the United States in the markets it serves. Engineered Films believes itsFilms' ability to both extrude and convert films, along with offering installation services for its geomembrane products, allows it to provide a more customized solution to customers. A number of suppliers of sheetingfilm manufacturers compete with the Company on both price and product availability. Engineered Films is the Company's most capital-intensive business segment, and historically has made sizable investments in new extrusion capacity and conversion equipment. This segment's capital expenditures were $8.1 million in fiscal 2018, $2.8 million in fiscal 2017, and $10.8 million in fiscal 2016, $8.2 million in fiscal 2015, and $6.7 million in fiscal 2014.2016.

Aerostar

Aerostar serves the defense/aerospaceaerospace/defense, radar and situational awarenesslighter-than-air markets. Aerostar's primary products include high-altitude (stratospheric or lighter-than-air) balloons, tethered aerostats, and radar processing systems. These products can be integrated with additional third-party sensors to provide research, communications, and situational awareness capabilities to governmental and commercial customers. Aerostar’s growth strategy emphasizes the design and manufacture of proprietary products in these markets. In previous years, Aerostar also provided contract manufacturing services. During this last year the Company largely exited this business. Net sales from contract manufacturing in fiscal 2016 were $4.7 million, compared to $31.7 million in fiscal 2015 and $51.3 million in fiscal 2014. The planned wind-down of contract manufacturing is now complete.

The acquisition of Vista Research, Inc. (Vista) in January 2012 positioned the Company to meet global demand for lower-cost target detection and tracking systems used by government agencies. Through Vista and a separate business venture that is majority-owned by the Company, Aerostar pursues potential product and support services contracts forwith agencies and instrumentalities of the U.S. government as well as sales of advanced radar systems high-altitude balloons, and aerostats in international markets. In some cases, such sales will be Direct Commercial Sales to foreign governments rather than Foreign Military Sales throughprevious years, Aerostar also provided contract manufacturing services. The Company largely exited this business and the U.S. government.planned reduction of contract manufacturing activities was completed in fiscal 2016.

Aerostar sells to government agencies oras both a prime contractor and subcontractor, and to commercial users primarily as a sub-contractor. The projects Aerostar bids on can be large-scale, with opportunities in the $10-$50 million range. Further, Direct Commercial Salessales to foreign governmentsgovernment agencies often involve large contracts subject to frequent delays because of budget uncertainties, regional military conflicts, and protracted negotiation processes. The timing and size of contract wins results incan create volatility in Aerostar’s results.

OUTLOOK

The Company is very pleased with the performance achieved by all three operating divisions throughout fiscal 2018. All three divisions achieved double-digit sales growth and the Company believes it is well positioned for the year ahead.

In fiscal 2018 Applied Technology achieved strong results in the face of challenging agricultural market conditions. The Company expects to continue to drive growth and will continue to strategically fund several long-term investments. Subsequent to the end of the fourth quarter, the division launched a strategic initiative to grow its local presence in Brazil and drive organic growth in Latin America, in order to better capitalize on one of the largest agricultural markets in the world.

Engineered Films demonstrated impressive operational discipline and sustained high plant utilization throughout fiscal 2018. The division grew sales by approximately $75 million year-over-year, and prior investments in acquisitions and manufacturing capacity drove strong growth in every market served. The division continues to see opportunities for growth and is investing in additional capacity in fiscal 2019. As for hurricane recovery efforts, the delivery of hurricane recovery film will result in sales of approximately $9 million in the first quarter and then return to significantly reduced levels consistent with prior years.

During the year, Aerostar improved its financial performance and achieved more consistency and stability in its results. The division continues to sharpen its focus on the stratospheric balloon platform, and has divested of a few non-strategic portions of its business during and subsequent to the end of fiscal 2018. Strong performance on existing programs is driving confidence for continued growth with Aerostar’s stratospheric balloon platform.

Overall, the Company is well positioned as it enters fiscal 2019 because of the actions taken and investments made to preserve and strengthen our core business. Furthermore, the Company is evaluating strategic acquisitions and will continue to invest in additional manufacturing capacity and technology development to enhance its core product lines. The Company's goal remains to generate 10 percent annualized earnings growth over the long-term, excluding unusual and generally non-recurring items.

MAJOR CUSTOMER INFORMATION

No customers accounted for 10% or more of consolidated sales in fiscal 2016. Sales to Brawler Industrial Fabrics, a customer in the Engineered Films Division, accounted for 14%, and 13% of consolidated sales in fiscal years 2015 and 2014.2018, 2017, or 2016.

SEASONAL WORKING CAPITAL REQUIREMENTS

Some seasonal demand exists in both the Applied Technology'sTechnology and Engineered Films divisions, primarily due to their respective exposure to the agricultural market. Applied Technology builds product inHowever, given the fall for winter and spring delivery. Certain sales to agricultural customers offer spring payment terms for fall and early winter shipments. The resultingoverall diversification of the Company, the seasonal fluctuations in inventory andnet working capital (accounts receivable, net plus inventories less accounts receivable have required, and may require, seasonal short-term financing.payable) are not usually significant.

Engineered Films also sees seasonal demand peak in the second and third fiscal quarters.

FINANCIAL INSTRUMENTS

The principal financial instruments that the Company maintains are cash, cash equivalents, short-term investments, accounts receivable, accounts payable, accrued liabilities, and acquisition-related contingent payments. The Company manages the interest rate, credit, and market risks associated with these accounts through periodic reviews of the carrying value of assets and liabilities and establishment of appropriate allowances in accordance with Company policies. The Company does not use off-balance sheet financing, except to enter into operating leases.

The Company does not enter into derivatives or other financial instruments for trading or speculative purposes. The Company uses derivative financial instruments to manage foreign currency balance sheet risk. The use of these financial instruments has had no material effect on consolidated results of operations, financial condition, or cash flows.

RAW MATERIALS

The Company obtains a wide variety of materials from numerous vendors. Principal materials include electronic components for Aerostar and Applied Technology and Aerostar, various plasticpolymeric resins for Engineered Films, and fabrics and film for Aerostar. Engineered Films has experienced volatile resin prices over the past three years. Price increases could not always be passed on to customers due to weak demand andand/or a competitive pricing environment. Predicting future material volatility and the related potential impact on the Company is not possible.easily estimated and the Company is unable to do so to the degree required to build reliance on such forecasts.

PATENTS

The Company owns a number of patents. The Company does not believe that its business, as a whole, is materially dependent on any one patent or related group of patents. As theThe Company continuesfocuses significant research and development effort to develop more technology-based offerings,offerings. As such, the protection of the Company’s intellectual property has becomeis an increasingly important strategic objective. Along with a morean aggressive posture toward patenting new technology and protecting trade secrets, the Company has restrictions on the disclosure of our technology to industry and business partners to ensure that our intellectual property is maintained and protected.

RESEARCH AND DEVELOPMENT

The three business segments conduct ongoing research and development efforts.(R&D) efforts to improve their product offerings and develop new products. Most of the Company's research and developmentR&D expenditures are directed toward new product development,development. R&D investment is particularly instrong within the Applied Technology Division. Total Company researchDevelopment of new technology and product enhancements within Applied Technology is a competitive differentiator and central to its long-term strategy. Engineered Films also utilizes R&D spending to develop new products and to value engineer and reformulate its products. These R&D investments deliver high-value film solutions to the markets it serves and also result in lower raw material costs and improved quality for existing product lines. Aerostar's investment in the development of new technology has a particular emphasis on its core stratospheric balloon platform. The Company's total R&D costs are presented in the Consolidated Statements of Income and Comprehensive Income.

ENVIRONMENTAL MATTERS

The Company believes that, in all material respects, it is in compliance with applicable federal, state and local environmental laws and regulations. Expenditures incurred in the past relating to compliance for operating facilities have not significantly affected the Company's capital expenditures, earnings, or competitive position.

In connection with the sale of substantially all of the assets of the Company's Glasstite, Inc. subsidiary in fiscal 2000, the The Company agreed to assume responsibility for the investigation and remediationis unaware of any pre-October 29, 1999,potential liabilities as of January 31, 2018 for any environmental contamination at the Company's former Glasstite pickup-truck topper facility in Dunnell, Minnesota, as required by the Minnesota Pollution Control Agency (MPCA) or the United States Environmental Protection Agency.

The Company and the purchasers of the Company's Glasstite subsidiary conducted environmental assessments of the properties. Although these assessments continue to be evaluated by the MPCA on the basis of the data available, the Company believesmatters that any activities that might be required as a result of the findings of the assessments will notwould have a material effect on the Company's results of operations, financial position, or cash flows. The Company had $37 thousand accrued at January 31, 2016, representing its best estimate of probable costs to be incurred related to this and all other environmental matters.

BACKLOG

As of February 1, 2016,2018, the Company's order backlog totaled approximately $18.6$40.3 million. Backlog amounts as of February 1, 20152017 and 20142016 were $26.7$25.7 million and $51.8$18.6 million, respectively. Because the length of time between order and shipment varies considerably by business segment and customers can change delivery schedules or potentially cancel orders, the Company does not believe that backlog, as of any particular date, is necessarily indicative of actual net sales for any future period.

EMPLOYEES

As of January 31, 2016,2018, the Company had approximately 910 employees.1,157 employees (including temporary workers). Following is a summary of active employees by segment: Applied Technology - 363;394; Engineered Films - 298;471; Aerostar - 175;195; and Corporate Services - 75.97. Management believes its employee relations are satisfactory.relationship with its employees is good.

|

| | |

| EXECUTIVE OFFICERS | | |

| | | |

| Name, Age, and Position | | Biographical Data |

Daniel A. Rykhus, 5153 | | Mr. Rykhus became the Company's President and Chief Executive Officer in 2010. He joined the Company in 1990 as Director of World Class Manufacturing, was General Manager of the Applied Technology Division from1998 through 2009, and served as Executive Vice President from 2004 through 2010. |

| President and Chief Executive Officer | |

| | |

| | | |

Steven E. Brazones, 4244 | | Mr. Brazones joined the Company in December 2014 as its Vice President, Chief Financial Officer, and Treasurer. From 2002 to 2014, Mr. Brazones held a variety of positions with H.B. Fuller Company. Most recently, he served as H.B. Fuller's Americas Region Finance Director. Previously, he served as the Assistant Treasurer and the Director of Investor Relations. Prior to his tenure with H.B. Fuller, Mr. Brazones held various roles at Northwestern Growth. |

| Vice President and Chief Financial Officer | |

| | |

| | |

| | | |

Stephanie Herseth Sandlin, 45Lee A. Magnuson, 62 | | Ms. Herseth SandlinMr. Magnuson joined the Company in August 2012June 2017, as General Counsel and Vice President of Corporate Developmentand General Counsel and also became the Company's Secretary in March 2013.August 2017. Prior to joining the Company, Ms. Herseth SandlinMr. Magnuson was amanaging partner at OFWof Lindquist and Vennum Law Firm's Sioux Falls, SD office for 5 years, practicing in Washington, D.C. from 2011 to 2012the areas of commercial transactions, mergers and served as South Dakota's lone member of the United States House of Representatives from 2004 through 2011. acquisitions, corporate matters, real estate and regulatory matters. |

General Counsel and Vice President of Corporate Development | |

| | |

| | | |

Janet L. Matthiesen, 5860 | | Ms. Matthiesen joined the Company in 2010 as Director of Administration and has been the Company's Vice President of Human Resources since 2012. Prior to joining Raven, Ms. Matthiesen was a Human Resource Manager at Science Applications International Corporation from 2002 to 2010.

|

| Vice President of Human Resources | |

| | |

| | | |

Brian E. Meyer, 5355 | | Mr. Meyer was named Division Vice President and General Manager of the Applied Technology Division in May 2015. He joined the Company in 2010 as Chief Information Officer. Prior to joining the Company, Mr. Meyer was an information and technology executive in the health insurance industry and vice president of systems development in the property and casualty insurance industry.

|

| Division Vice President and General Manager - Applied Technology Division | |

Applied Technology Division | |

| | | |

Anthony D. Schmidt, 4446 | | Mr. Schmidt was named Division Vice President and General Manager of the Engineered Films Division in 2012. He joined the Company in 1995 in the Applied Technology Division performing various leadership roles within manufacturing and engineering. He transitioned to Engineered Films Division in 2011 as Manufacturing Manager. |

| Division Vice President and General Manager - | |

| Engineered Films Division | |

| |

| | |

| Scott W. Wickersham, 44 | | Mr. Wickersham was named Division Vice President and General Manager of the Aerostar Division in January 2018. He joined the Company in 2010 as the Director of Product Development and Engineering Manager and has been the General Manager for the Aerostar Division since November 2015. Prior to joining the Company, Mr. Wickersham held a range of engineering and operational roles with various technology companies. |

| Division Vice President and General Manager - Aerostar Division | |

| |

RISKS RELATING TO THE COMPANY

The Company's business is subject to many risks. Set forthrisks, which by their nature are unpredictable or unquantifiable and may be unknown. In an attempt to provide you with information on potential risks the Company may encounter, we have provided below, what we believe are the most importantsignificant risks we face. In evaluatingthe Company could potentially face, based on our businessknowledge, experience, information and your investmentassumptions. The risks provided below should be assessed contemporaneously with other information contained in us, you should also considerthis Form 10-K, including Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” the risks and uncertainties addressed under "Forward-Looking Statements" on page 35, the Notes to the Consolidated Financial Statements on page 45, and other information presented in or incorporated by reference into this Annual Report on Form 10-K. The risks contained herein, as well as other statements in this 10-K are forward-looking statements and, as such, are uncertain. Such statements are

not guarantees of future performance and undue reliance should not be placed on them. The indeterminate nature of risk factors makes them subject to change, and certain risks and uncertainties could potentially cause material changes to actual results. Some of these risks may affect the entire Company, where others may only affect particular segments of our business, or may have no material affect at all.

The Company, except as required by law, disclaims any obligation to update or revise the risk factors contained herein, regardless of changes, whether as a result of new information, developments or otherwise. The risks provided in this form 10-K and in other documents filed with the SEC are not exclusive in nature and, as such, there are other potential risks and uncertainties that the Company is not aware of, or does not presently consider material in nature that could feasibly cause actual results to vary materially from expectations.

Weather conditions or natural disasters could affect certain of the Company's markets, such as agriculture and construction.construction, or the Company's primary manufacturing facilities.

The Company's Applied Technology Division is largely dependent on the ability of farmers, agricultural service providers, and custom operatorsapplicators to purchase agricultural equipment, that includesincluding its products. If such farmers, agricultural service providers, or custom applicators experience adverse weather conditions or natural disasters resulting in poor growing conditions, or experience unfavorable crop prices or expenses, potential buyers may be less likely to purchase agricultural equipment. Conversely, if farmers experience favorable weather and growing conditions, high yields could result in unfavorable crop prices and lower farm income making potential buyers less likely to purchase agricultural equipment. Accordingly, weather conditions may adversely affectincomes, sales in the Applied Technology Division.Division may be adversely affected.

Weather conditions and natural disasters can also adversely affect sales in the Company's Engineered Films Division. To the extent weather conditions or natural disasters curtail construction or agricultural activity, such as a late spring or drought, sales of the segment'sdivision's plastic sheeting would likely decrease.

Seasonal weather-related and market demandweather-related variation could also affect quarterly results. If expected sales are deferred in a fiscal quarter while inventory has been built and operating expenses incurred, financial results could be negatively impacted.

The Company’s primary manufacturing facilities for each of its operating divisions are located on contiguous properties in Sioux Falls, South Dakota. If weather-related natural disasters such as tornadoes or flooding were to occur in the area, such conditions could impede the manufacturing and shipping of products and potentially adversely affect the Company’s sales, transactions processing, and financial reporting. The Company has disaster recovery plans in place to manage the Company’s risks to these vulnerabilities but these measures may not be adequate, implemented properly, or executed timely to ensure that the Company’s operations are not disrupted. Such consequences could adversely affect our results of operations, financial condition, liquidity, and cash flows.

The loss, disruption, or material change in our business relationship with single source suppliers for particular materials, components or services, could cause a disruption in supply, or substantial increase in cost of any such products or services, and therefore could result in harm to our sales, profitability, cash flows and financial condition.

The Company obtains certain materials, components, or services from suppliers that serve as the only source of supply, or that supply the majority of the Company’s requirements of the particular material, component, or service. While these materials, components, services, or suitable replacements, could potentially be sourced from other suppliers, in the event of a disruption or loss of supply of relevant materials, components, or services for any reason, the Company may not be able to immediately find alternative sources of supply, or if found, may not be found on similar terms. If the Company’s relationship with any of these single source suppliers became challenged, or is terminated, we could have difficulty replacing these sources without causing disruption to the business.

Price fluctuations in, and shortages of, raw materials could have a significant impact on the Company's ability to sustain and grow earnings.

The Company's Engineered Films Division consumesutilizes significant amounts of plasticpolymeric resin, the cost of which depends upon market prices for natural gas and oil and other market forces. These prices are subject to worldwide supply and demand as well as other factors beyond the control of the Company.our control. Although the Engineered Films Division is sometimes able to pass on such price increases to its customers, significant variations in the cost of plasticpolymeric resins can affect the Company's operating results from period to period. Unusual supply disruptions, such as one caused by a natural disaster, could cause suppliers to invoke “force majeure” clauses in their supply agreements, causing shortages of material. Success in offsetting higher raw material costs with price increases is largely influenced by competitive and economic conditions and could vary significantly depending on the market served. Unusual supply disruptions, such as one caused by a natural disaster, could cause suppliers to invoke "force majeure" clauses in their supply agreements, causing shortages in supply of material. If the Company is not able to fully offset the effects of adverse materials availability and correspondinglyor higher costs, financial results could be adversely affected.affected, which in turn could adversely affect our results of operations, financial condition, liquidity, and cash flows.

Electronic components used by both the Applied Technology Division and Aerostar Division are sometimes in short supply, impactingwhich may impact our ability to meet customer demand.

If a supplier of raw materials or electronic components were unable to deliver due to shortage or financial difficulty, any of the Company's segments could be adversely affected.

Fluctuations in commodity prices can increase our costs and decrease our sales.

Agricultural income levels are affected by agricultural commodity prices and input costs. As a result, changes in commodity prices or input costs that reduce agricultural income levels could have a negative effect on the ability of growers and their service providers to purchase the Company's precision agriculture products manufactured by its Applied Technology Division.

Exploration for oil and natural gas fluctuates with their price and recent energy market conditions suggest that while end-market conditions are not likelysubject to deteriorate further, they are not likely to improve in the near term. Plasticvolatility. Certain plastic sheeting manufactured and sold by our Engineered Films Division is sold as pit and pond liners to contain water used in the drilling process.processes for these energy commodities. Lower prices for oil and natural gas could reduce exploration activities and demand for our products.

Plastic sheetingFilm manufacturing uses plasticpolymeric resins, which can be subject to changes in price as the cost of oil or natural gas or oil changes. Accordingly, volatility in oil and natural gas prices may negatively affect our raw material costs and cost of goods sold and potentially cause us to increase prices, which could adversely affect our sales and/or profitability.

Failure to develop and market new technologies and products could impact the Company's competitive position and have an adverse effect on the Company's financial results.

The Company's operating results in Applied Technology, Engineered Films, and Aerostar depend upon the ability to renew the pipeline of new technologies and products and to bring those productsthese to market. This ability could be adversely affected by difficulties or delays in product development, such as the inability to identify viable new products, successfully complete research and development projects, obtain relevant regulatory approvals, obtain intellectual property protection, or gain market acceptance of new products and services. Because of the lengthy development process, technological challenges, and intense competition, there can be no assurance that any of the products the Company is currently developing, or could begin to develop in the future, will achieve substantial commercial success. Technical advancements in products may also increase the risk of product failure, increasing product returns or warranty claims and settlements. In addition, sales of the Company's new products could replace sales of some of its current products, offsetting the benefit of even a successful new product introduction.

Failure to develop and maintain partnerships, alliances, and other distribution or supplier relationships could adversely impact the Company's financial results.

In certain areas of the Company’s business, continued success depends on developing and maintaining relationships with other industry participants, such as original equipment manufacturers, dealers and distributors. If the Company fails to develop and maintain such relationships, or if there is disruption of current business relationships, due to actions of the Company, its partners or competitors, our ability to effectively market and sell certain products could be harmed. The Company’s relationships with other industry participants are complex and multifaceted, and evolve over time. Often, these relationships contribute to substantial ongoing business and operations in particular markets; therefore, changes in these relationships could have an adverse impact on our sales and revenue.

Additionally, the Company uses dealer/distributor networks, some of which are affiliated with strategic and industry partners. Enlisting and retaining qualified dealers and distributors and training them in the use and selling of product offerings necessitates substantial time and resources. If we were to lose a significant dealer or distributor relationship, and were forced to identify new channels, the time and expense of training new dealers or distributors may make new-product introduction difficult and also may hinder end-user sales and adoption, which could result in decreased revenues. Additionally, the interruption of dealer coverage within specific regions or markets could cause difficulties in marketing, selling or servicing our products and could harm the Company’s business, operating results or financial condition.

The Company's sales of products whichthat are specialized and highly technical in nature are subject to uncertainties, start-up costs and inefficiencies, as well as market, competitive, and compliance risks.

The Company’s growth strategy relies on the design and manufacture of proprietary products. Highly technical, specialized product inventories may be more susceptible to fluctuations in market demand. If demand is unexpectedly low, write-downs or impairments of such inventory may become necessary. Either of these outcomes could adversely affect our results of operations. Start-up costs and inefficiencies can adversely affect operating results and such costs may not be recoverable in a proprietary product environment because the Company may not receive reimbursement from its customers for such costs.

Competition in agriculture markets could come from our current customers if original equipment manufacturers develop and integrate precision agriculture technology products themselves rather than purchasing from third parties, thereby reducing demand for Applied Technology’s products.

Regulatory restrictions could be placed on hydraulic fracturing activities because of environmental and health concerns, reducing demand for Engineered Film’s products. For Engineered Films, the development of alternative technologies, such as closed loop drilling processes that would reduce the need for pit liners in energy exploration, could also reduce demand for the Company’s products.

Aerostar’s future growth relies on sales of high-altitude balloons, as well as advanced radar systems and aerostats to international markets. In somelimited cases, such sales willmay be Direct Commercial Salesdirect commercial sales to foreign governments rather than Foreign Military Salesforeign military sales through the U.S. government. Direct Commercial Salescommercial sales to foreign governments often involve large contracts subject to frequent delays because of budget uncertainties, regional military conflicts, political instability, and protracted negotiation processes. Such delays could adversely affect our results of operations. The nature of these markets for Vista'scertain of Aerostar's advanced radar systems and Aerostar's aerostats makes these products particularly susceptible to fluctuations in market demand. Demand fluctuations and the likelihood of delays in sales involving large contracts for such products also increase the risk of these products becoming obsolete, increasing the risk associated with expected sales of such products. The value of aerostatcertain advanced radar systems and radar systemsaerostat inventory at January 31, 2016 is approximately $12 million.2018 was $1.6 million and $3.4 million, respectively. This valuation is based on an estimate that the market demand for these products will be sufficient in future periods such that these inventories will be sold at a price greater than carrying value.value and related selling costs. Write-downs or impairment of the value of such products carried in inventory could adversely affect our results of operations. To the extent products become obsolete or anticipated sales are not realized, our expected future cash flows could be adversely impacted. AnThis could also lead to an impairment, which could adversely impact the Company's results of operations and financial condition.

Sales of certain of Aerostar’s products into international markets increase the compliance risk associated with regulations such as The International Traffic in Arms Regulations (ITAR),and Foreign Corrupt Practices Act, as well as others, exposing the Company to fines and its employees to fines, imprisonment, or civil penalties. Potential consequences of a material violation of such regulations include damage to our reputation, litigation, and increased costs.

The Company's Aerostar segment depends on the U.S. government for a significant portion of its sales, creating uncertainty in the timing of and funding for projected contracts.

A significant portion of Aerostar's sales are to the U.S. government or U.S. government agencies as a prime or sub-contractor. Government spending has historically been cyclical. A decrease in U.S. government defense or near-space research spending or changes in spending allocations could result in one or more of the Company's programs being reduced, delayed, or terminated. Reductions in the Company's existing programs, unless offset by other programs and opportunities, could adversely affect its ability to sustain and grow its future sales and earnings. The Company's U.S. government sales are funded by the federal budget, which operates on an October-to-September fiscal year. Changes in congressional schedules, negotiations for program funding levels, reduced program funding due to U.S government debt limitations, automatic budget cuts ("sequestration"), or unforeseen world events can interrupt the funding for a program or contract. Funds for multi-year contracts can be changed in subsequent years in the appropriations process.

In addition, many U.S. government contracts are subject to a competitive bidding and funding process even after the award of the basic contract, adding an additional element of uncertainty to future funding levels. Delays in the funding process or changes in funding are common and can impact the timing of available funds or can lead to changes in program content or termination at the government's convenience. The loss of anticipated funding or the termination of multiple or large programs could have an adverse effect on the Company's future sales and earnings.

The Company derives a portion of its revenues from foreign markets, which subjects the Company to business risks, including risk of changes in government policies and laws or changes in worldwide economic conditions.

The Company's consolidated net sales to locations outside of the U.S. were $27.8$41.6 million in fiscal 2016,2018, representing approximately 11% of consolidated net sales. The Company's financial results could be affected by changes in trade, monetary and fiscal policies, laws and regulations, or other activities of U.S. and non-U.S. governments, agencies and similar organizations, along with changes in worldwide economic conditions. These conditions include, but are not limited to, changes in a country's or region's economic or political condition; trade regulations affecting production, pricing, and marketing of products; local labor conditions and regulations; reduced protection of intellectual property rights in some countries; changes in the regulatory or legal environment; restrictions on currency exchange activities; the impact of fluctuations in foreign currency exchange rates, which may affect product demand and may adversely affect the profitability of our products in U.S. dollars in foreign markets where payments are made in the local currency; burdensome taxes and tariffs; and other trade barriers. International risks and uncertainties also include changing social and economic conditions, terrorism, political hostilities and war, difficulty in enforcing agreements or collecting receivables, and increased transportation or other shipping costs. Any of these such risks could lead to reduced sales and reduced profitability associated with such sales.

Adverse economic conditions in the major industries the Company serves may materially affect segment performance and consolidated results of operations.

The Company's results of operations are impacted by the market fundamentals of the primary industries served. Significant declines of economic activity in the agricultural, oil and gas exploration, construction, industrial, aerospace/aviation, defense, and other major markets served may adversely affect segment performance and consolidated results of operations.

The Company may pursue or complete acquisitions which represent additional risk and could impact future financial results.

The Company's business strategy includes the potential forpursuing future acquisitions. Acquisitions involve a number of risks, including integration of the acquired company with the Company's operations and unanticipated liabilities or contingencies related to the acquired company. Further, business strategies supported by the acquisition may be in perceived, or actual, opposition to strategies of certain of our customers and our business could be materially adversely affected if those relationships are terminated and the expected strategic benefits are delayed or are not achieved. The Company cannot ensure that the expected benefits of any acquisition will be realized. Costs could be incurred on pursuits or proposed acquisitions that have not yet or may not close, which could significantly impact the operating results, financial condition, or cash flows. Additionally, after the acquisition, unforeseen issues could arise, which adversely affect the anticipated returns or which are otherwise not recoverable as an adjustment to the purchase price. Other acquisition risks include delays in realizing benefits from the acquired companies or products; difficulties due to lack of or limited prior experience in any new product or geographic markets we enter; unforeseen adjustments, charges or write-offs; unforeseen losses of customers of, or suppliers to, acquired businesses; difficulties in retaining key employees of the acquired businesses; or challenges arising from increased geographic diversity and complexity of our operations and our information technology systems.

Total goodwill and intangible assets accountaccounted for approximately $60.6$57.3 million, or 20%approximately 18%, of the Company's total assets as of January 31, 2016.2018. The Company evaluates goodwill and intangible assets for impairment annually, or when evidence of potential impairment exists. The annual impairment test is based on several factors requiring judgment. Principally, a significant decrease in expected cash flows or changes in market conditions may indicate potential impairment of recorded goodwill or intangible assets. Our expected future cash flows are dependent on several factors, including revenue growth in certain of our product lines and an expectation that the pricing in commodities markets will recover in future periods.lines. Our expected future cash flows could be adversely impacted if our anticipated revenue growth is not realized or if pricing in commodities markets does not recover in future periods. AnReductions in cash flows could result in an impairment of goodwill and/or intangible assets, which could adversely impact the Company's results of operations and financial condition.

The Company may fail to continue to attract, develop, and retain key management and other key employees, which could negatively impact our operating results.

We depend on the performance of our board of directors, senior management team and other key employees, including experienced and skilled technical personnel. The loss of certain members of our board of directors, senior management, including our Chief Executive Officer, or other key employees, could negatively impact our operating results and ability to execute our business strategy. Our future success will also depend, in part, upon our ability to attract, train, motivate, and retain qualified board members, senior management and other key personnel.

The Company may fail to protect its intellectual property effectively, or may infringe upon the intellectual property of others.

The Company has developed significant proprietary technology and other rights that are used in its businesses. The Company relies on trade secret, copyright, trademark, and patent laws and contractual provisions to protect the Company's intellectual property. While the Company takes enforcement of these rights seriously, other companies, such as competitors or persons in related markets, in which the Company does not participate may attempt to copy or use the Company's intellectual property for their own benefit.

In addition, intellectual property of others also has an impact on the Company's ability to offer some of its products and services for specific uses or at competitive prices. Competitors' patents or other intellectual property may limit the Company's ability to offer products and services to its customers. Any infringement or claimed infringement ofby the Company on the intellectual property rights of others could result in litigation and adversely affect the Company's ability to continue to provide, or could increase the cost of providing, products and services.

Intellectual property litigation is very costlyservices and negatively impact sales and profitability. Any infringement by the Company could also result in substantial expense and diversions ofjudgments against the Company's resources, both ofCompany, which could adversely affect our results of operations, financial condition, liquidity, and cash flows.

The Company could be impacted by unfavorable results or material settlement of legal proceedings.

The Company is sometimes a party to various legal proceedings and claims that arise in the ordinary course of business.

Regardless of the merit of any such claims, litigation is often very costly, time-consuming, and disruptive to the operations and business of the Company, and a distraction to management and other personnel. While these matters generally are not material in nature, it is possible a matter may arise that is material to the Company’s business.

Although the Company believes the probability of a materially adverse outcome is remote, if one or more claims were resolved against the Company in a reporting period for amounts in excess of management’s expectations, the Company’s consolidated financial statements may be materially adversely affected. Further, such an outcome could result in significant compensatory, punitive or trebled monetary damages, disgorgement of revenue or profits, remedial corporate measures or injunctive relief against the Company that could have a material adverse affect on its businesses, and financial condition, results of operation, and results. In addition, there may be no effective legal recourse against infringement of the Company's intellectual property by third parties, whether due to limitations on enforcement of rights in foreign jurisdictions or as a result of other factors.cash flows.

Technology failures or cyber-attacks on the Company's systems could disrupt the Company's operations or the functionality of its products and negatively impact the Company's business.

The Company increasingly relies on information technology systems to process, transmit, and store electronic information. In addition, a significant portion of internal communications, as well as communication with customers and suppliers, depends on

information technology. Further, the products in our Applied Technology segmentand Aerostar segments depend upon GPS and other systems through which our products interact with government computer systems and other centralized information sources. We are exposed to the risk of cyber incidents in the normal course of business. Cyber incidents may be deliberate attacks for the theft of intellectual property or other sensitive information or may be the result of unintentional events. Like mostother companies, the Company's information technology systems may be vulnerable to interruption due to a variety of events beyond the Company's control, including, but not limited to, natural disasters, terrorist attacks, telecommunications failures, computer viruses, hackers, foreign governments, and other security issues. Further, attacks on centralized information sources could affect the operation of our products or cause them to malfunction. The Company has technology security initiatives and disaster recovery plans in place to mitigatemanage the Company's risk to these vulnerabilities, but these measures may not be adequate, or implemented properly, or executed timely to ensure that the Company's operations are not significantly disrupted. Potential consequences of a material cyber incident include damage to our reputation, litigation, and increased cyber security protection and remediation costs. Such consequences could adversely affect our results of operations.

The implementation of a new enterprise resource planning (ERP) system may result in short term disruption to the Company’s operations and business, which could adversely impact the Company and damage customer relationships and brand reputation.

The Company depends heavily on its management information systems for several aspects of our business. The Company launched a company-wide initiative during the fiscal 2018 third quarter called "Project Atlas." This is a strategic long-term investment to replace the Company’s existing ERP. Project Atlas is being implemented in a phased approach and is expected to take approximately three years. If the new ERP system or legacy system are disrupted, in any material way, during implementation, the Company may occur additional expense and loss of data. Additionally, if improvements or upgrades are required to meet the evolving needs of our business, we may be required to incur significant capital expenditures or expenses in the pursuit of improvements or upgrades to the new system. These efforts could potentially increase the amount of time for implementation of the new ERP system, require expenditures above the anticipated amounts, demand the use of additional resources, distract key personnel and potentially cause short-term disruptions to our existing systems and our business. Any of these outcomes could impair the Company’s ability to achieve critical strategic initiatives and could adversely impact our sales, profitability, cash flows and financial condition.

|

| |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

Raven's corporate office is located in Sioux Falls, South Dakota. Along with the corporate headquarters building, the Company also owns separate manufacturing facilities for each of our business segments as well as various warehouses, training, and product development facilities in the immediate Sioux Falls area.

In addition to its Sioux Falls facilities, Applied Technology owns a product development facility in Austin, Texas and an idle manufacturing facility in St. Louis, Missouri that is actively being marketed for sale.Texas. Applied Technology also leases manufacturing, warehouse, research, and office facilities in Middenmeer, Netherlands and Geel, Belgium as well as in Winnipeg, Manitoba and office/warehouse space in Stockholm, Saskatchewan Canada. In addition,in Canada and in Brazil. Furthermore, Applied Technology leases smaller research and office facilities in South Dakota.

Engineered Films also has additional owned production and conversion facilities located in Madison and Brandon, South Dakota and in Midland and Pleasanton, Texas. In addition, Engineered Films leases a production and conversion facility in Parker, Colorado and Colton, California.

Aerostar also owns manufacturing, sewing, and research facilities located in Madison, South Dakota and Sulphur Springs, Texas. Aerostar's subsidiary Vista also leases facilities in Arlington, Virginia and in Monterey Chatsworth, and Sunnyvale,Chatsworth, California.

Most of the Company's manufacturing plants also serve as distribution centers and contain offices for sales, engineering, and manufacturing support staff. The Company believes that its properties are suitable and adequate to meet existing production needs. Although there is idle capacity available in the Engineered Films Division, the productive capacity in the Company's facilities is substantially being used. The Company also owns approximately 29.670 acres of undeveloped land adjacent to the other owned property, which is available for expansion.

The following is the approximate square footage of the Company's owned or leased facilities by segment: Applied Technology - 182,000;154,000; Engineered Films - 606,000;761,000; Aerostar - 331,000;285,000; and Corporate - 150,000.

The Company is responsible for investigation and remediation of environmental contamination at one of its sold facilities (see Item 1, Business - Environmental Matters of this Form 10-K). In addition, the Company is involved as a party in lawsuits, claims, regulatory inquiries, or disputes arising in the normal course of its business. Thebusiness, the potential costs and liability of such claimswhich cannot be determined at this time. Management believes that any liability resulting from these claims will be substantially mitigated by insurance coverage. Accordingly, management does not believe the ultimate outcomeoutcomes of these matters willits legal proceedings are likely to be significantmaterial to its results of operations, financial position, or cash flows. The previously disclosed patent infringement lawsuit in which Capstan Ag Systems, Inc. made certain infringement claims against the Company has been settled on a confidential basis.

The Company has insurance policies that provide coverage to various degrees for potential liabilities arising from legal proceedings.

10

|

| |

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

|

| |

| PART II | |

| | |

| ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The Company's common stock is traded on the NASDAQ Global Select Market under the ticker symbol RAVN. The following table shows quarterly unaudited financial results, quarterly high and low trade prices per share of the Company's common stock, as reported by the NASDAQ Global Select Market, and dividends declared for the periods indicated:

| | QUARTERLY INFORMATION (UNAUDITED) | (Dollars in thousands, except per-share amounts) | | | | Net Sales | Gross Profit | Operating Income | Pre-tax Income | Net Income Attributable to Raven | Net Income Per Share(a) | Common Stock Market Price | Cash Dividends Per Share | | Net Sales | Gross Profit | Operating Income (Loss) | Pre-tax Income (Loss) | Net Income (Loss) Attributable to Raven | Net Income (Loss) Per Share(a) | | Common Stock Market Price | | Cash Dividends Per Share |

| | | | Basic | Diluted | High | Low | | Basic | Diluted | | High | Low |

| FISCAL 2016 | | |

| FISCAL 2018 | | FISCAL 2018 | | | | | |

| First Quarter | First Quarter | $ | 70,273 |

| $ | 20,359 |

| $ | 7,214 |

| $ | 7,170 |

| $ | 4,855 |

| $ | 0.13 |

| $ | 0.13 |

| $ | 22.85 |

| $ | 16.91 |

| $ | 0.13 |

| First Quarter | $ | 93,535 |

| $ | 31,956 |

| $ | 18,219 |

| $ | 17,989 |

| $ | 12,348 |

| $ | 0.34 |

| $ | 0.34 |

| | $ | 31.60 |

| $ | 23.75 |

| | $ | 0.13 |

|

| Second Quarter | Second Quarter | 67,518 |

| 17,858 |

| 6,429 |

| 6,163 |

| 4,191 |

| 0.11 |

| 0.11 |

| 22.36 |

| 18.52 |

| 0.13 |

| Second Quarter | 86,610 |

| 26,513 |

| 11,700 |

| 11,637 |

| 8,235 |

| 0.23 |

| 0.23 |

| | 37.40 |

| 29.80 |

| | 0.13 |

|

Third Quarter | Third Quarter | 67,611 |

| 16,171 |

| (2,727 | ) | (2,850 | ) | (1,581 | ) | (0.04 | ) | (0.04 | ) | 19.53 |

| 15.77 |

| 0.13 |

| Third Quarter | 101,349 |

| 33,333 |

| 17,829 |

| 17,795 |

| 11,998 |

| 0.33 |

| 0.33 |

| | 35.80 |

| 26.70 |

| | 0.13 |

|

Fourth Quarter | Fourth Quarter | 52,827 |

| 11,397 |

| 176 |

| 299 |

| 1,024 |

| 0.03 |

| 0.03 |

| 19.61 |

| 13.87 |

| 0.13 |

| Fourth Quarter | 95,823 |

| 29,763 |

| 11,422 |

| 11,565 |

| 8,441 |

| 0.24 |

| 0.23 |

| | 40.85 |

| 32.06 |

| | 0.13 |

|

| Total Year | Total Year | $ | 258,229 |

| $ | 65,785 |

| $ | 11,092 |

| $ | 10,782 |

| $ | 8,489 |

| $ | 0.23 |

| $ | 0.23 |

| $ | 22.85 |

| $ | 13.87 |

| $ | 0.52 |

| Total Year | $ | 377,317 |

| $ | 121,565 |

| $ | 59,170 |

| $ | 58,986 |

| $ | 41,022 |

| $ | 1.14 |

| $ | 1.13 |

| | $ | 40.85 |

| $ | 23.75 |

| | $ | 0.52 |

|

| | | | | | | | | |

| FISCAL 2015 | | |

| FISCAL 2017 | | FISCAL 2017 | | | | | |

| First Quarter | First Quarter | $ | 102,510 |

| $ | 31,766 |

| $ | 16,532 |

| $ | 16,453 |

| $ | 11,038 |

| $ | 0.30 |

| $ | 0.30 |

| $ | 40.06 |

| $ | 30.29 |

| $ | 0.12 |

| First Quarter | $ | 68,360 |

| $ | 20,117 |

| $ | 8,050 |

| $ | 7,953 |

| $ | 5,517 |

| $ | 0.15 |

| $ | 0.15 |

| | $ | 16.86 |

| $ | 12.88 |

| | $ | 0.13 |

|

| Second Quarter | Second Quarter | 94,485 |

| 25,658 |

| 10,696 |

| 10,637 |

| 7,719 |

| 0.21 |

| 0.21 |

| 34.56 |

| 27.75 |

| 0.12 |

| Second Quarter | 67,598 |

| 18,915 |

| 6,696 |

| 6,487 |

| 4,495 |

| 0.12 |

| 0.12 |

| | 21.58 |

| 15.01 |

| | 0.13 |

|

| Third Quarter | 91,292 |

| 24,339 |

| 10,159 |

| 10,087 |

| 6,783 |

| 0.19 |

| 0.18 |

| 30.74 |

| 22.13 |

| 0.13 |

| |

Third Quarter(d) | | Third Quarter(d) | 72,522 |

| 19,839 |

| 7,389 |

| 7,116 |

| 5,741 |

| 0.16 |

| 0.16 |

| | 25.47 |

| 20.21 |

| | 0.13 |

|

| Fourth Quarter | Fourth Quarter | 89,866 |

| 21,483 |

| 6,414 |

| 6,324 |

| 6,193 |

| 0.16 |

| 0.16 |

| 26.56 |

| 20.75 |

| 0.13 |

| Fourth Quarter | 68,915 |

| 19,319 |

| 6,278 |

| 6,297 |

| 4,438 |

| 0.12 |

| 0.12 |

| | 26.90 |

| 20.80 |

| | 0.13 |

|

| Total Year | Total Year | $ | 378,153 |

| $ | 103,246 |

| $ | 43,801 |

| $ | 43,501 |

| $ | 31,733 |

| $ | 0.86 |

| $ | 0.86 |

| $ | 40.06 |

| $ | 20.75 |

| $ | 0.50 |

| Total Year | $ | 277,395 |

| $ | 78,190 |

| $ | 28,413 |

| $ | 27,853 |

| $ | 20,191 |

| $ | 0.56 |

| $ | 0.56 |

| | $ | 26.90 |

| $ | 12.88 |

| | $ | 0.52 |

|

| | | | | | | | | |

| FISCAL 2014 | | |

| FISCAL 2016 | | FISCAL 2016 | | | | | |

| First Quarter | First Quarter | $ | 103,680 |

| $ | 34,916 |

| $ | 20,934 |

| $ | 20,736 |

| $ | 14,003 |

| $ | 0.38 |

| $ | 0.38 |

| $ | 34.04 |

| $ | 25.46 |

| $ | 0.12 |

| First Quarter | $ | 70,273 |

| $ | 20,359 |

| $ | 7,214 |

| $ | 7,170 |

| $ | 4,855 |

| $ | 0.13 |

| $ | 0.13 |

| | $ | 22.85 |

| $ | 16.91 |

| | $ | 0.13 |

|

| Second Quarter | Second Quarter | 93,421 |

| 26,735 |

| 12,568 |

| 12,349 |

| 8,333 |

| 0.23 |

| 0.23 |

| 35.68 |

| 28.82 |

| 0.12 |

| Second Quarter | 67,518 |

| 17,858 |

| 6,429 |

| 6,163 |

| 4,191 |

| 0.11 |

| 0.11 |

| | 22.36 |

| 18.52 |

| | 0.13 |

|

| Third Quarter | 104,938 |

| 31,940 |

| 18,132 |

| 18,089 |

| 12,289 |

| 0.34 |

| 0.34 |

| 34.83 |

| 28.38 |

| 0.12 |

| |

Third Quarter(e) | | Third Quarter(e) | 67,611 |

| 16,972 |

| (9,823 | ) | (9,946 | ) | (6,188 | ) | (0.17 | ) | (0.17 | ) | | 19.53 |

| 15.77 |

| | 0.13 |

|

| Fourth Quarter | Fourth Quarter | 92,638 |

| 25,763 |

| 12,360 |

| 12,449 |

| 8,278 |

| 0.23 |

| 0.23 |

| 42.99 |

| 32.64 |

| 0.12 |

| Fourth Quarter | 52,827 |

| 11,785 |

| 571 |

| 694 |

| 1,918 |

| 0.05 |

| 0.05 |

| | 19.61 |

| 13.87 |

| | 0.13 |

|

| Total Year | Total Year | $ | 394,677 |

| $ | 119,354 |

| $ | 63,994 |

| $ | 63,623 |

| $ | 42,903 |

| $ | 1.18 |

| $ | 1.17 |

| $ | 42.99 |

| $ | 25.46 |

| $ | 0.48 |

| Total Year | $ | 258,229 |

| $ | 66,974 |

| $ | 4,391 |

| $ | 4,081 |

| $ | 4,776 |

| $ | 0.13 |

| $ | 0.13 |

| | $ | 22.85 |

| $ | 13.87 |

| | $ | 0.52 |

|

(a) | Net income per share is computed discretely by quarter and may not add to the full year. | |

(a) Net income per share is computed discretely by quarter and may not add to the full year. | | (a) Net income per share is computed discretely by quarter and may not add to the full year. |

(b) Fiscal year 2018 third and fourth quarters include net sales of $5.2 million and $7.9 million, respectively, related the acquisition of Colorado Lining International, Inc., as further described in Note 6 "Acquisitions of and Investments in Businesses and Technologies" of the Notes to the Consolidated Financial Statements. | | (b) Fiscal year 2018 third and fourth quarters include net sales of $5.2 million and $7.9 million, respectively, related the acquisition of Colorado Lining International, Inc., as further described in Note 6 "Acquisitions of and Investments in Businesses and Technologies" of the Notes to the Consolidated Financial Statements. |

(c) The Tax Cuts and Jobs Act, effective January 1, 2018, lowered the Company's federal statutory rate by 1.2 percentage points and benefited net income approximately $0.7 million for the fiscal year, as further described in Note 10 "Income Taxes" of the Notes to the Consolidated Financial Statements.

| | (c) The Tax Cuts and Jobs Act, effective January 1, 2018, lowered the Company's federal statutory rate by 1.2 percentage points and benefited net income approximately $0.7 million for the fiscal year, as further described in Note 10 "Income Taxes" of the Notes to the Consolidated Financial Statements.

|

(d) The fiscal year 2017 third quarter includes inventory write-downs of $2,278 for Vista as a result of discontinuing sales activities for a specific radar product line within its business, as further described in Note 7 "Goodwill, Long-Lived Assets, and Other Charges " of the Notes to the Consolidated Financial Statements. | | (d) The fiscal year 2017 third quarter includes inventory write-downs of $2,278 for Vista as a result of discontinuing sales activities for a specific radar product line within its business, as further described in Note 7 "Goodwill, Long-Lived Assets, and Other Charges " of the Notes to the Consolidated Financial Statements. |

(e) The fiscal year 2016 third quarter includes pre-contract cost write-offs of $2,933 (which is comprised of $2,075 of costs capitalized as of July 31, 2015 and additional costs of $858 capitalized during August and September 2015), a goodwill impairment loss of $11,497, a long-lived asset impairment loss of $3,813, and a reduction of $2,273 acquisition-related contingent liability for Vista. For further information regarding these impairments and other charges refer to Note 7 "Goodwill, Long-Lived Assets, and Other Charges" of the Notes to the Consolidated Financial Statements.

| | (e) The fiscal year 2016 third quarter includes pre-contract cost write-offs of $2,933 (which is comprised of $2,075 of costs capitalized as of July 31, 2015 and additional costs of $858 capitalized during August and September 2015), a goodwill impairment loss of $11,497, a long-lived asset impairment loss of $3,813, and a reduction of $2,273 acquisition-related contingent liability for Vista. For further information regarding these impairments and other charges refer to Note 7 "Goodwill, Long-Lived Assets, and Other Charges" of the Notes to the Consolidated Financial Statements.

|

As of January 31, 2016,2018, the Company had approximately 12,80012,400 beneficial holders, which includes a substantial amount of the Company's common stock held of record by banks, brokers, and other financial institutions.

On November 3, 2014, the Company announced that its Board of Directors (Board) had authorized a $40.0 million stock buyback program. Since that time, the Board has provided additional authorizations to increase the total amount authorized under the program to $75.0 million.

During fiscal 2018, the Company made purchases of 348,286 common shares under this plan at an average price of $28.71 equating to a total cost of $10.0 million. None of these common shares were repurchased during the fourth quarter of fiscal 2018. During

fiscal 2017, the Company made purchases of 484,252 common shares under this plan at an average price of $15.91 per share for a total cost of $7.7 million. None of these common shares were repurchased during the fourth quarter of fiscal 2017. During fiscal 2016, the Company made purchases of 1,602,545 common shares under this plan at an average price of $18.31 per share for a total cost of $29.3 million or $18.31 per share.million. None of these common shares were repurchased during the fourth quarter of fiscal 2016. There is approximately $10.7$28.0 million still available for share repurchases under this Board-authorized program which remains in place until such time as the authorized spending limit is reached or is otherwise revoked by the Board.

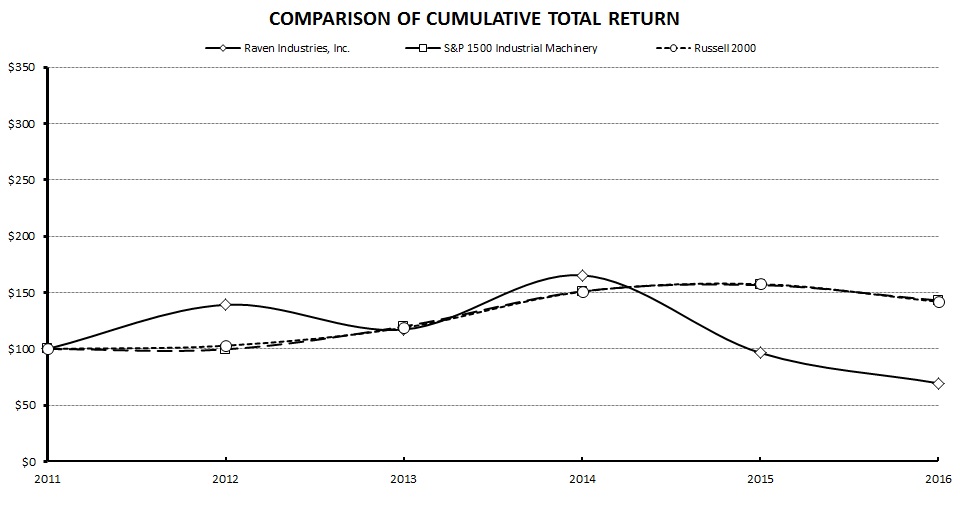

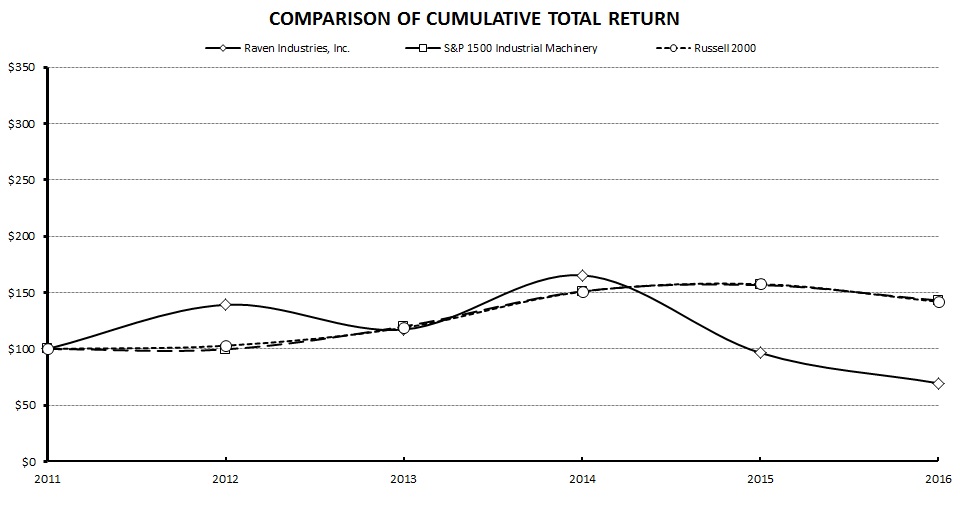

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN AMONG RAVEN INDUSTRIES, INC.,

S&P 1500 INDUSTRIAL MACHINERY INDEX, AND RUSSELL 2000 INDEX, AND THE S&P SMALL CAP 600 INDEX.

The above graph compares the cumulative total shareholders return on the Company's stock with the cumulative return of the S&P 1500 Industrial Machinery Index, and the Russell 2000 index.Index, and S&P Small Cap 600 Index. The S&P 1500 Industrial Machinery Index is being replaced by the S&P Small Cap 600 Index as the Company determined that the S&P Small Cap 600 Index more closely represents similar companies. The S&P 1500 Industrial Machinery Index remains on this chart in the year of transition for comparative purposes. Investors who bought $100 of the Company's stock on January 31, 2011,2013, held this for five years and reinvested the dividends would have seen its value decreaseincrease to $69.48.$158.77. Stock performance on the graph is not necessarily indicative of future price performance.

| | | | | Years Ended January 31, | | 5-Year | | Years Ended January 31, | | 5-Year |

| Company / Index | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | | 2016 | | CAGR(a) | | 2013 | | 2014 | | 2015 | | 2016 | | 2017 | | 2018 | | CAGR(a) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Raven Industries, Inc. | | $ | 100.00 |

| | $ | 139.18 |

| | $ | 117.20 |

| | $ | 165.39 |

| | $ | 96.45 |

| | $ | 69.48 |

| | (7.0 | )% | | $ | 100.00 |

| | $ | 141.12 |

| | $ | 82.29 |

| | $ | 59.29 |

| | $ | 101.55 |

| | $ | 158.77 |

| | 9.7 | % |

| S&P 1500 Industrial Machinery Index | | 100.00 |

| | 99.63 |

| | 120.00 |

| | 151.19 |

| | 156.74 |

| | 142.97 |

| | 7.4 | % | | 100.00 |

| | 125.99 |

| | 130.62 |

| | 119.14 |

| | 170.46 |

| | 223.32 |

| | 17.4 | % |

| Russell 2000 Index | | 100.00 |

| | 102.86 |

| | 118.78 |

| | 150.88 |

| | 157.53 |

| | 141.90 |

| | 7.3 | % | | 100.00 |

| | 127.03 |