UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| | |

| þ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 20112014 |

| OR |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to |

Commission file number 1-6402-1

Service Corporation International

(Exact name of registrant as specified in its charter)

|

| | |

| Texas | | 74-1488375 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification no.) |

1929 Allen Parkway Houston, Texas (Address of principal executive offices) | | 77019 (Zip code) |

Registrant’s telephone number, including area code:

713-522-5141

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock ($1 par value) | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | |

Large accelerated filer þ | | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller Reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in the Securities Exchange Act of 1934 Rule 12b-2). Yes o No þ

The aggregate market value of the common stock held by non-affiliates of the registrant (assuming that the registrant’s only affiliates are its officers and directors) was $2,442,496,792$4,221,605,973 based upon a closing market price of $11.68$20.72 on June 30, 20112014 of a share of common stock as reported on the New York Stock Exchange.

The number of shares outstanding of the registrant’s common stock as of February 9, 201211, 2015 was 221,524,032202,902,489 (net of treasury shares).

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement in connection with its 20122015 Annual Meeting of Stockholders (Part III).

SERVICE CORPORATION INTERNATIONAL

INDEX

|

| | | | |

| | | | Page |

|

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | Mine Safety Disclosures | |

|

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

|

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

|

| | | | | |

| |

| |

GLOSSARY

The following terms are common to the deathcare industry, are used throughout this report, and have the following meanings:

Atneed — Funeral and cemetery arrangements sold after a death has occurred.

Burial Vaults — A reinforced container intended to inhibit the subsidence of the earth and house the casket after it is placed in the ground.ground, also known as outer burial containers.

Cancellation — Termination of a preneed funeral or cemetery contract, which relieves us of the obligation to provide the goods and services included in the contract. Cancellations may be requested by the customer or be initiated by us for failure to comply with the contractual terms for payment. State or provincial laws govern the amount of refund, if any, owed to the customer.

Care Trust Corpus - The deposits and net realized capital gains and losses included in a perpetual care trust that cannot be withdrawn.

Cemetery Perpetual Care or Endowment Care Fund (ECF) — A trust fund established for the purpose of maintaining cemetery grounds and property into perpetuity.perpetuity, also referred to as a perpetual care trust. Capital gains within the perpetual care trusts are generally not distributable to us, so they are not included in our revenues. However, the capital gains increase the investable perpetual care trust assets and trust corpus, increasing the potential for higher ordinary investment income in the future. Where allowable by state, capital gains can be distributed to us and they are recognized as cemetery revenues in the period earned.

Cemetery Property — Developed lots, lawn crypts, mausoleum spaces, cremation niches, and cremation memorialization property available for sale as interment rights and undeveloped land we intend to develop.

Cemetery Property Revenue — Recognized sales of cemetery property interment rights when a minimum of 10% of the sales price has been collected and the property has been constructed and is available for interment.

Cemetery Merchandise and Services — Stone and bronze memorials, markers, merchandise installations, and burial openings and closings.

Cremation — The reduction of human remains to bone fragments by intense heat.

Cremation Memorialization — Products specifically designed to commemorate and honor the life of an individual that has been cremated. These products include funeral merchandise and cemetery property types that provide for the disposition of cremated remains such as benches, boulders, statues, ossuaries, and reefs. They also include memorial walls and books where the name of the individual is inscribed but the remains have been scattered or kept by the family.

Funeral Merchandise and Services — Professional services relating to funerals and cremations and funeral-related merchandise, including caskets, casket memorialization products, burial vaults, cremation receptacles, cremation memorialization products, and flowers.

Funeral Recognized Preneed Revenue —Funeral merchandise and travel protection sold on a preneed contract and delivered before a death has occurred.

Funeral Services Performed — The number of funeral services provided after the date of death, sometimes referred to as funeral volume.

General Agency (GA) Revenues — Commissions we receive from third-party life insurance companies for life insurance policies or annuities sold to preneed customers for the purpose of funding preneed funeral arrangements. The commission rate paid is determined based on the product type sold, the length of payment terms, and the age of the insured/annuitant.

Interment — The burial or final placement of human remains in the ground.ground, in mausoleums, in cremation niches, or cremation memorialization property.

Lawn Crypt — An underground outer burial receptacle constructed of concrete and reinforced steel, which is usually pre-installed in predetermined designated areas.

Marker — A method of identifying a deceased person in a particular burial space, crypt, niche, or niche.cremation memorialization property. Permanent burial markers are usually made of bronze granite, or stone.

Maturity — When the underlying contracted merchandise is delivered or service is performed, or merchandise is delivered, typically at death. This is the point at which preneed contracts are converted to atneed contracts (note — delivery of certain merchandise and services can occur prior to death).

Mausoleum — An above ground structure that is designed to house caskets and cremation urns.

Merchandise and Service Trust — A trust account established in accordance with state or provincial law into which we deposit the required percentage of customers' payments for preneed funeral or cemetery merchandise and services. The amounts deposited can be withdrawn only after we have completed our obligations under the preneed contract or the cancellation of the contract.

Preneed — Purchase of productscemetery property interment rights and funeral and cemetery merchandise and services prior to a death occurring.

Preneed Backlog — Future revenues from unfulfilled preneed funeral and cemetery contractual arrangements.

Preneed Cemetery Production — Sales of preneed or atneed cemetery contracts. These earnings are recorded in Deferred preneed cemetery revenues until the merchandise is delivered, the service is performed, or when a minimum of 10% of the sales price has been collected and the property has been constructed and is available for interment.

Preneed Funeral Production — Sales of preneed funeral trust-funded and insurance-funded contracts. Preneed funeral trust-funded contracts are recorded in Deferred preneed funeral revenues until the merchandise is delivered or atneed cemetery contracts.the service is performed. We do not reflect the unfulfilled preneed funeral insurance-funded contract amounts in our consolidated balance sheet. The proceeds of the life insurance policies or annuity contracts will be reflected in funeral revenues as these funerals are performed by us in the future.

Sales Average — Average revenue per funeral service performed, excluding the impact of funeral recognized preneed revenue, GA revenue, and certain other revenues.

Trust Fund Income — Recognized investment earnings from our merchandise and service and perpetual care trust investments.

As used herein, “SCI”, “Company”, “we”, “our”, and “us” refer to Service Corporation International and companies owned directly or indirectly by Service Corporation International, unless the context requires otherwise.

PART I

General

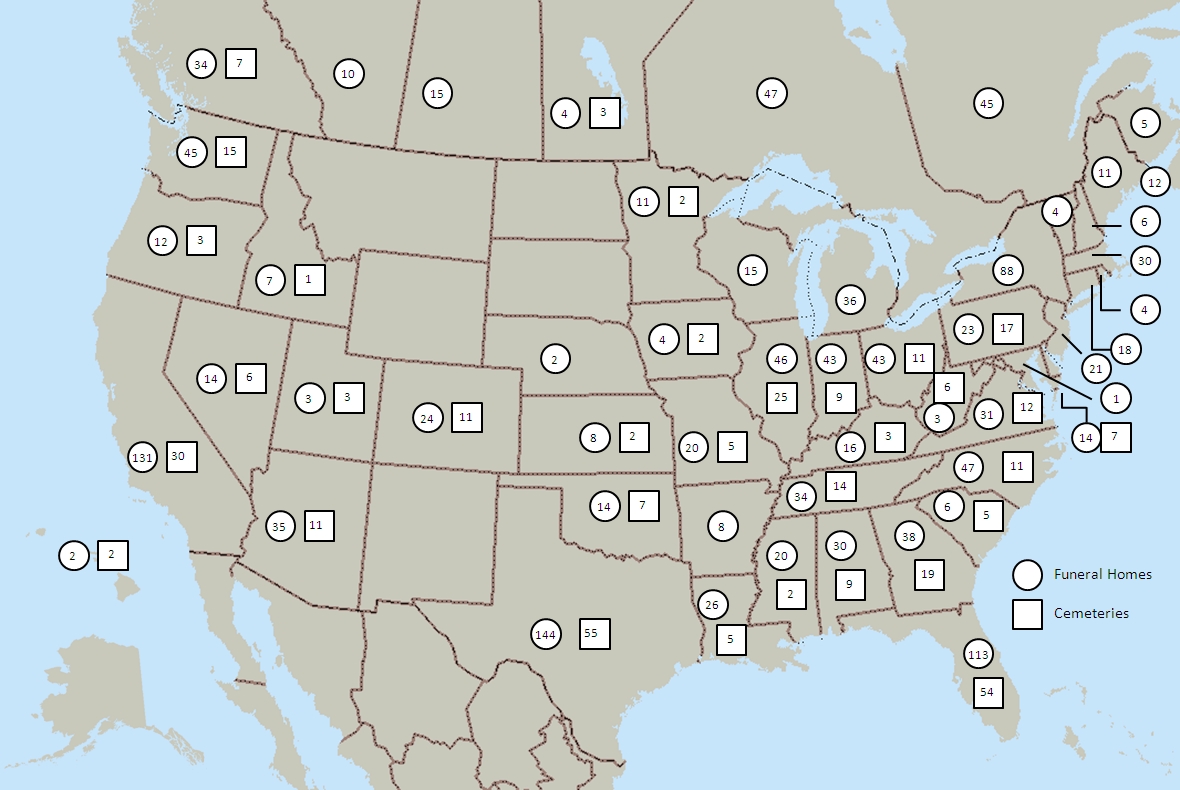

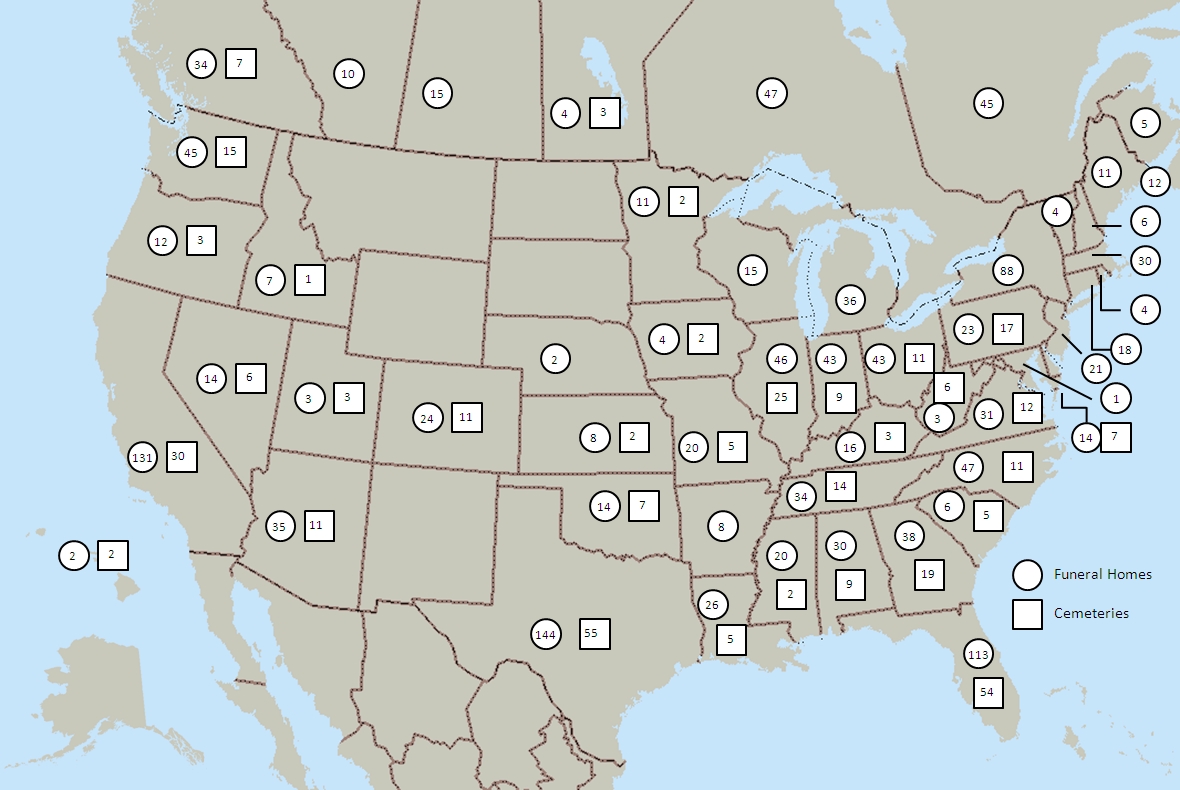

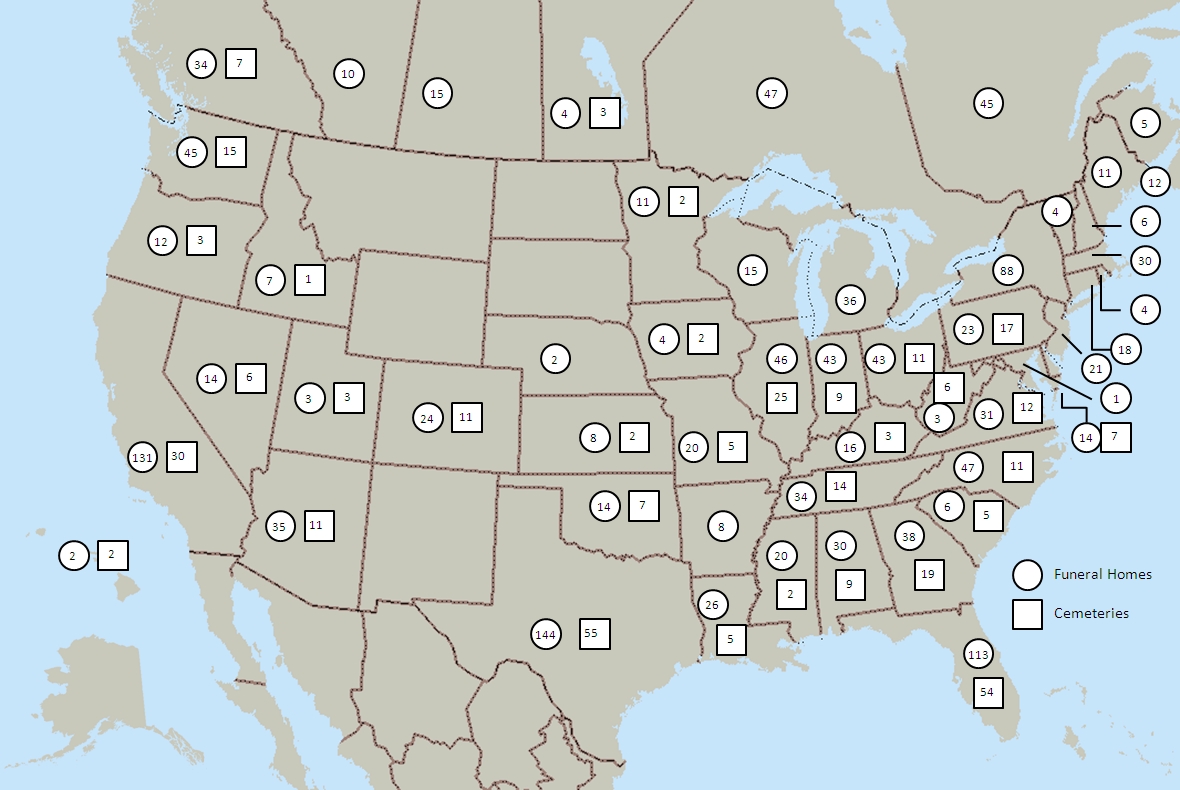

We are North America’s largest provider of deathcare products and services, with a network of funeral homes and cemeteries unequalledunequaled in geographic scale and reach. At December 31, 2011,2014, we operated 1,4231,559 funeral service locations and 374466 cemeteries (including 214258 funeral service/cemetery combination locations) in North America, which are geographically diversified across 4345 states, eight Canadian provinces, and the District of Columbia. Our funeral segment also includes operations in Germany that we intend to exit when economic valuesColumbia, and conditions are conducive to a sale.Puerto Rico. Our funeral service and cemetery operations consist of funeral service locations, cemeteries, funeral service/cemetery combination locations, crematoria, and related businesses. We sell cemetery property and funeral and cemetery productsmerchandise and services at the time of need and on a preneed basis.

History

We were incorporated in Texas in July of 1962. Our original business plan was based on efficiencies of scale, specifically reducing overhead costs by sharing resources such as embalming,preparation services, accounting, transportation, and personnel among funeral homes in a business “cluster.” After proving the plan’s effectiveness in Houston in the early 1960s, SCI set out to apply this operating strategy through the acquisition of death caredeathcare businesses in other markets. It was the beginning of a three-decade period of expansion that would create a North American network of nearly 1,400 funeral homes and cemeteries by the end of 1992. Beginning in 1993, we expanded beyond North America, acquiring major deathcare companies in Australia, the United Kingdom, and France, plus smaller holdings in other European countries and South America. By the end of 1999, our global network numbered more than 4,500 funeral service locations, cemeteries, and crematories in more than 20 countries.

During the mid to late 1990s, acquisitions of deathcare facilities became extremely competitive, resulting in increased prices for acquisitions and substantially reduced returns on invested capital. In 1999, we significantly reduced our level of acquisition activity and over the next several years implemented various initiatives to pay down debt, increase cash flow, reduce overhead costs, and increase efficiency. We divested our international businesses and many North American funeral homes and cemeteries that were either underperforming or did not fit our long-term strategy. At the same time, we began to capitalize on the strength of our network by introducing to North America the first transcontinental brand of deathcare services and products — Dignity Memorial® (See www.dignitymemorial.com). Information contained on our website is not part of this report.

In late 2006, having arrived at a position of significant financial strength and improved operating efficiency, we acquired the then second largest company in the North American deathcare industry, Alderwoods Group. By combining the two leading companies in the deathcare industry, we were able to realize more than $90 million in annual pretax cost synergies, savings, and revenue enhancement opportunities. In early 2010, we acquired the then fifth largest company in the North American deathcare industry, Keystone North America. In June of 2011, we acquired 70% of the outstanding shares of The Neptune Society, Inc. (Neptune), which is the nation's largest direct cremation organization. Subsequently, in 2013 and 2014, we acquired the remaining 30% of the outstanding shares of Neptune. In December 2013, we purchased Stewart Enterprises, Inc. (Stewart), the then second largest operator of funeral homes and cemeteries in North America.

Funeral and Cemetery Operations

Worldwide,At December 31, 2014, we have 1,4351,559 funeral service locations and 374466 cemeteries (including 214258 funeral service/cemetery combination locations) covering 4345 states, eight Canadian provinces, the District of Columbia, and Germany.Puerto Rico. See Note 16 in Part II, Item 8. Financial Statements and Supplementary Data, for financial information about our business segments and geographic areas.

Our funeral service and cemetery operations consist of funeral service locations, cemeteries, funeral service/cemetery combination locations, crematoria, and related businesses. We provide all professional services relating to funerals and cremations, including the use of funeral facilities and motor vehicles and preparation and embalming services. Funeral-related merchandise, including caskets, casket memorialization products, burial vaults, cremation receptacles, cremation memorialmemorialization products, flowers, and other ancillary products and services, is sold at funeral service locations. Our cemeteries provide cemetery property interment rights, including developed lots, lawn crypts, mausoleum spaces, lots,cremation niches, and lawn crypts,cremation memorialization property and sell cemetery-related merchandise and services, including stone and bronze memorials, markers, merchandise installations, flowers, and burial openings and closings.

We also sell preneed cemetery property interment rights and funeral and cemetery productsmerchandise and services whereby a customer contractually agrees to the terms of certain products and services to be delivered and performed in the future. We define these sales as preneed sales. As a result of such preneed sales, our backlog of unfulfilled preneed funeral and preneed cemetery contracts was $6.9$9.3 billion and $6.8$9.2 billion at December 31, 20112014 and 2010,2013, respectively.

Funeral service/cemetery combination locations are those businesses in which a funeral service location is physically located within or adjoining a cemetery that we own. Combination locations allow certain facility, personnel, and equipment costs to be

shared between the funeral service location and cemetery. Such combination facilities typically can be more cost competitive and

have higher gross margins than if the funeral and cemetery operations were operated separately. Combination locations also create synergies between funeral and cemetery preneed sales force personnel and give families added convenience to purchase both funeral and cemetery productsmerchandise and services at a single location. WithWe have the acquisitionlargest number of Alderwoods, we acquiredcombination locations in North America. Fifty-five percent of our cemeteries are part of a combination location. Our combination operations include Rose Hills, which is the largest combination operation in the United States, performing over 4,500 funeral services and 8,0007,800 cemetery interments per year.

In 20112014 our operations in the United States and Canada were organized into 2930 major markets, 4750 metro markets, and 7873 main street markets. Each market is led by a market manager or director with responsibility for funeral and/or cemetery operations and preneed sales. Within each market, the funeral homes and cemeteries share common resources such as personnel, preparation services, and vehicles. There are four market support centers in North America to assist market directors with financial, administrative, pricing, and human resource needs. These support centers are located in Houston, Miami, New York, and Los Angeles. The primary functions of the support centers are to help facilitate the execution of corporate strategies, coordinate communication between operations and the field and corporate offices, and serve as liaisons for the implementation of policies and procedures.

The following table at December 31, 20112014 provides the number of our funeral homes and cemeteries by country, and by state, territory, or province:

| | | Country, State/Territory/Province | | Number of Funeral Homes | | Number of Cemeteries | | Total | | Number of Funeral Homes | | Number of Cemeteries | | Total |

| United States | | |

| | |

| | |

| | |

| | |

| | |

|

| Alabama | | 30 |

| | 9 |

| | 39 |

| | 38 |

| | 14 |

| | 52 |

|

| Arizona | | 35 |

| | 11 |

| | 46 |

| | 34 |

| | 11 |

| | 45 |

|

| Arkansas | | 8 |

| | — |

| | 8 |

| | 12 |

| | 3 |

| | 15 |

|

| California | | 131 |

| | 30 |

| | 161 |

| | 171 |

| | 36 |

| | 207 |

|

| Colorado | | 24 |

| | 11 |

| | 35 |

| | 25 |

| | 11 |

| | 36 |

|

| Connecticut | | 18 |

| | — |

| | 18 |

| | 19 |

| | — |

| | 19 |

|

| Delaware | | | — |

| | 1 |

| | 1 |

|

| District of Columbia | | 1 |

| | — |

| | 1 |

| | 1 |

| | — |

| | 1 |

|

| Florida | | 113 |

| | 54 |

| | 167 |

| | 132 |

| | 60 |

| | 192 |

|

| Georgia | | 38 |

| | 19 |

| | 57 |

| | 37 |

| | 21 |

| | 58 |

|

| Hawaii | | 2 |

| | 2 |

| | 4 |

| | 2 |

| | 2 |

| | 4 |

|

| Idaho | | 7 |

| | 1 |

| | 8 |

| | 6 |

| | 1 |

| | 7 |

|

| Illinois | | 46 |

| | 25 |

| | 71 |

| | 49 |

| | 24 |

| | 73 |

|

| Indiana | | 43 |

| | 9 |

| | 52 |

| | 41 |

| | 9 |

| | 50 |

|

| Iowa | | 4 |

| | 2 |

| | 6 |

| | 4 |

| | 2 |

| | 6 |

|

| Kansas | | 8 |

| | 2 |

| | 10 |

| | 9 |

| | 5 |

| | 14 |

|

| Kentucky | | 16 |

| | 3 |

| | 19 |

| | 15 |

| | 5 |

| | 20 |

|

| Louisiana | | 26 |

| | 5 |

| | 31 |

| | 27 |

| | 9 |

| | 36 |

|

| Maine | | 11 |

| | — |

| | 11 |

| | 11 |

| | — |

| | 11 |

|

| Maryland | | 14 |

| | 7 |

| | 21 |

| | 16 |

| | 13 |

| | 29 |

|

| Massachusetts | | 30 |

| | — |

| | 30 |

| | 26 |

| | — |

| | 26 |

|

| Michigan | | 36 |

| | — |

| | 36 |

| | 38 |

| | — |

| | 38 |

|

| Minnesota | | 11 |

| | 2 |

| | 13 |

| | 12 |

| | 2 |

| | 14 |

|

| Mississippi | | 20 |

| | 2 |

| | 22 |

| | 17 |

| | 4 |

| | 21 |

|

| Missouri | | 20 |

| | 5 |

| | 25 |

| | 26 |

| | 9 |

| | 35 |

|

| Nebraska | | 2 |

| | — |

| | 2 |

| | 4 |

| | 2 |

| | 6 |

|

| Nevada | | 14 |

| | 6 |

| | 20 |

| | 13 |

| | 6 |

| | 19 |

|

| New Hampshire | | 6 |

| | — |

| | 6 |

| | 6 |

| | — |

| | 6 |

|

| New Jersey | | 21 |

| | — |

| | 21 |

| | 21 |

| | — |

| | 21 |

|

| New Mexico | | | 1 |

| | — |

| | 1 |

|

| New York | | 88 |

| | — |

| | 88 |

| | 87 |

| | — |

| | 87 |

|

| North Carolina | | 47 |

| | 11 |

| | 58 |

| | 59 |

| | 17 |

| | 76 |

|

| Ohio | | 43 |

| | 11 |

| | 54 |

| | 43 |

| | 13 |

| | 56 |

|

| Oklahoma | | 14 |

| | 7 |

| | 21 |

| | 14 |

| | 7 |

| | 21 |

|

| Oregon | | 12 |

| | 3 |

| | 15 |

| | 18 |

| | 4 |

| | 22 |

|

| Pennsylvania | | 23 |

| | 17 |

| | 40 |

| | 22 |

| | 16 |

| | 38 |

|

| Rhode Island | | 4 |

| | — |

| | 4 |

| |

| South Carolina | | 6 |

| | 5 |

| | 11 |

| |

| Tennessee | | 34 |

| | 14 |

| | 48 |

| |

| Texas | | 144 |

| | 55 |

| | 199 |

| |

| Utah | | 3 |

| | 3 |

| | 6 |

| |

| Vermont | | 4 |

| | — |

| | 4 |

| |

| Puerto Rico | | | 12 |

| | 9 |

| | 21 |

|

| | | Rhode Island | | | 4 |

| | — |

| | 4 |

|

| South Carolina | | | 9 |

| | 9 |

| | 18 |

|

| Tennessee | | | 40 |

| | 18 |

| | 58 |

|

| Texas | | | 162 |

| | 61 |

| | 223 |

|

| Utah | | | 4 |

| | 3 |

| | 7 |

|

| Vermont | | | 4 |

| | — |

| | 4 |

|

| Virginia | | 31 |

| | 12 |

| | 43 |

| | 39 |

| | 23 |

| | 62 |

|

| Washington | | 45 |

| | 15 |

| | 60 |

| | 44 |

| | 13 |

| | 57 |

|

| West Virginia | | 3 |

| | 6 |

| | 9 |

| | 14 |

| | 10 |

| | 24 |

|

| Wisconsin | | 15 |

| | — |

| | 15 |

| | — |

| | 3 |

| | 3 |

|

| Canada | | |

| | |

| | |

| | |

| | |

| | |

|

| Alberta | | 10 |

| | — |

| | 10 |

| | 9 |

| | — |

| | 9 |

|

| British Columbia | | 34 |

| | 7 |

| | 41 |

| | 37 |

| | 7 |

| | 44 |

|

| Manitoba | | 4 |

| | 3 |

| | 7 |

| | 4 |

| | 3 |

| | 7 |

|

| New Brunswick | | 5 |

| | — |

| | 5 |

| | 5 |

| | — |

| | 5 |

|

| Nova Scotia | | 12 |

| | — |

| | 12 |

| | 11 |

| | — |

| | 11 |

|

| Ontario | | 47 |

| | — |

| | 47 |

| | 46 |

| | — |

| | 46 |

|

| Quebec | | 45 |

| | — |

| | 45 |

| | 44 |

| | — |

| | 44 |

|

| Saskatchewan | | 15 |

| | — |

| | 15 |

| | 15 |

| | — |

| | 15 |

|

| Germany | | 12 |

| | — |

| | 12 |

| |

| Total | | 1,435 |

| | 374 |

| | 1,809 |

| |

Total (1) | | | 1,559 |

| | 466 |

| | 2,025 |

|

(1) Includes businesses held for sale at December 31, 2014.

We believe we have satisfactory title to the properties owned and used in our business, subject to various liens, encumbrances, and easements that are incidental to ownership rights and uses and do not materially detract from the value of the property. We also lease a number of facilities that we use in our business under both capital and operating leases.

At December 31, 2011,2014, we owned approximately 89%88% of the real estate and buildings used at our facilities, and the remainder of the facilities were leased. At December 31, 2011,2014, our 374466 cemeteries contained a total of approximately 26,54033,270 acres, of which approximately 60% was developed.

A map of our locations in North America is presented below:

7

Competition

Although there are several public companies that own funeral homes and cemeteries, the majority of deathcare businesses

in North America are locally-owned, independent operations. We estimate that our funeral and cemetery market share in North America is approximately 13%16% based on estimated total industry revenues. The position of a single funeral home or cemetery in any community is a function of the name, reputation, and location of that funeral home or cemetery, although competitive pricing, professional service and attention, and well-maintained locations are also important.

We believe we have an unparalleled network of funeral service locations and cemeteries that offer high-quality products and services at prices that are competitive with local competing funeral homes, cemeteries, and retail locations. Within this network, the funeral service locations and cemeteries operate under various names as most operations were acquired as existing businesses. We have co-branded our funeral operations in North America under the name Dignity Memorial®. We believe our transcontinental branding strategy gives us a strategic advantage and identity in the industry. While this branding process is intended to emphasize our seamless national network of funeral service locations and cemeteries, the original names associated with acquired operations, and their inherent goodwill and heritage, generally remain the same. For example, Geo. H. Lewis & Sons Funeral Directors is now Geo. H. Lewis & Sons Funeral Directors, a Dignity Memorial® provider.

Strategies for Growth

We believe we are well-positioned for long-term profitable growth. We are the largest company in the North American deathcare industry with unparalleled scale on both a national and local basis and are poised to benefit from the aging of America. The demographic landscape is driving our company strategy. According to the United States Census Bureau, the current number of Americans that are 60 and older is approximately 67 million. This number is expected to grow to more than 77 million by 2020, resulting in a growing number of people that will likely be interested in preneed options.

We have demonstrated that we can generate significant and consistent cash flow, even in difficult economic times. This, coupled with our financial position and liquidity, allows usthree core strategies designed to deploy our available free cash flow to enhancegrow the value of the company. Our free cash flow deployment focus is centered on strategic acquisitions, share repurchases and dividends, and opportunistic debt repurchases when we believe we can reduce liquidity riskcompany and enhance shareholder value:

Grow revenues,

Leverage our near-term maturity profile.scale, and

Our strategies for growth can be categorized in three areas as follows:Deploy capital

Target Our Customer

Grow Revenues

Under our first core strategy of growing revenues, we have a three-pronged approach that is focused on the customer and consists of 1) remaining relevant to the customer, 2) growing preneed sales, and 3) managing our footprint.

Remaining Relevant to the Customer. Remaining relevant to our customer is key to generating revenue growth in a changing customer environment. We work to meet the varying needs of our customers to give them what they want. In our funeral segment, we focus on memorialization services that will be meaningful to the customer and their family members and friends. We continue to build on our extensive consumer research to market our productsoffer contemporary product and services on a preneed basis. Our strategy to combine targeted direct mail, select media advertising, seminars and the internet is generating quality preneed sales leads. During 2011, we continued toservice offerings. We also focus on enhanced trainingthe ethnic traditions and customs important to our customers. Additionally, we emphasize the simplicity and convenience of our packaged offerings.

In our cemetery segment, we have created tiers within our cemetery product offerings to provide more choices for sales managementour customers. As with our funeral home segment, we also cater to the ethnic traditions and sales counselors and also added additional sales management resources in certain markets aimed at increasing preneed sales production and sales counselor productivity.

During 2010, we updatedcustoms important to our individual location websites and our Dignity Memorial® website (www.DignityMemorial.com) to capture customers and generate preneed sales leads via the power of the internet. We now have the ability to display obituaries on our locations’ websites that allow friends and family of the deceased to check the schedule of services, write condolences, post photos or videos, and share this information through social media. In addition, those reading the obituaries have the opportunity to learn more about Dignity Memorial® and begin developing their own funeral arrangements. Similarly, we continue to enhance and develop our Dignity Planning® website at www.DignityPlanning.com, which allows customers to make end-of-life arrangements online whether direct or through a partnership with select insurance companies.

customers. We continue to develop innovative products such as recurring floral placements and testcustomized cemetery property offerings. We have also simplified the decision-making process.

Growing Our Preneed Sales. Our preneed sales program drives revenue growth now and into the future. Within our funeral segment, our preneed sales create brand awareness, grow future market share and diversify our revenue stream in a low-inflation environment. Due to our scale, our preneed sales program is not capital intensive and gives us a competitive advantage. Within our cemetery segment, we have a focus on increasing sales force productivity combined with tiered cemetery property offerings and pricing to drive current revenue growth. Our backlog of preneed funeral and cemetery revenues at the end of 2014 was approximately $9.3 billion, which bodes well for future earnings and cash flow.

Managing Our Footprint. We will continue to manage our footprint with a customer-driven focus. Within our funeral segment, we continue to pursue strategic acquisitions and to build new productsfuneral homes in areas that provide us with the potential for scale and services including eventareas with the highest return customer categories and reception services, enhanced floral offerings, a broadermarket traits. Within our cemetery merchandise program,segment, we plan to pursue strategic acquisitions to create more opportunities to sell to Baby Boomers through our customer-driven strategy. We believe our unparalleled business footprint and other relevant contemporary products and services. We are also focused on product and service offerings that appeal specificallygeographic diversity uniquely positions us to cremation customers.benefit from the aging Baby Boomer population.

Drive Operating Discipline and Leverage Our Unparalleled Scale

Our second core strategy is leveraging our unparalleled scale, which we are addressing with a three-pronged approach-1) develop our sales organization, 2) network optimization, and 3) use our scale with our preneed trust and insurance backlog. Our size and broad geographic network of businesses gives us a significant advantage in this industry.

Develop Our Sales Organization. Over the past several years, we have invested in the infrastructure and training of our sales organization. During 2015, we will focus on enhancing the productivity and effectiveness of the sales team and growing our sales counselor headcount. We believe that our scale allows us to expand our sales organization in a manner that our competitors cannot afford to replicate.

Network Optimization.We continue to drive operating discipline and leverage our scale through the standardization ofstandardizing processes and the use of key performance metrics for staffing and other operational and administrative activities.capitalizing on new technologies. We continuallyregularly examine our purchasing spend to look for waysopportunities to consolidate our supplier base, modify processes and policies for more efficient purchasing and employ metrics to manage and improve supplier performance. In Additionally, many of our accounting and administrative functions are outsourced to third-party providers, allowing for greater efficiency.

Use Our Scale with Our Preneed Trust and Insurance Backlog.2010, With our $9.3 billion backlog, we completed implementation of a major initiative pertainingbenefit from having access to cemetery maintenance, which resultedpremier financial partners in the outsourcingindustry. For our trust investments, we have access to preeminent money managers and lower fee structures, which we believe is a low risk structure that will provide us with higher returns and lower cost of routine lawn care activitiesadministration over time. We also enjoy favorable terms with our insurance provider.

Deploy Capital

Our third core strategy is to a limited number of regional vendors and improving cemetery interment efficiency. In 2011, we benefited from streamlining the preneed funeral and cemetery arrangement and record-keeping process through technological improvements.

Manage and Grow the Footprint

We are managing our network of business locations by positioning each business location to support the preferences of its local customer base, while monitoring each marketmaximize capital deployment opportunities. Our priority for changing demographics and competitive dynamics. We are also looking to optimize our portfolio through strategic market reviews. We expect to pursue selective business expansion through construction or targetedcapital deployment is 1) acquisitions of cemeteries and funeral homes with a focus on the highest return customer categories.

Employeeslocation new builds, 2) dividends, 3) share repurchases, and 4) debt repurchases.

Acquisitions and Funeral Location New Builds.As noted above, we plan to use our capital to manage our footprint by focusing on strategic acquisitions and building new funeral homes where the expected returns are attractive and exceed our weighted average cost of capital plus a risk premium.

Dividends. We expect to continue to return capital to our shareholders in the form of dividends, subject to the approval by our Board of Directors.

Share Repurchases. Absent opportunities for strategic acquisitions, we expect to continue to repurchase shares of our common stock using a value-weighted share repurchase strategy.

Debt Repurchases. We plan to actively manage our near-term liquidity profile and leverage targets through debt repurchases when market conditions are favorable to do so.

Associates

At December 31, 2011,2014, we employed 12,720 (12,691 in North America)15,442 individuals on a full-time basis and 8,171 (8,135 in North America)8,220 individuals on a part-time basis. Of the full-time employees, 12,078associates, 14,507 were employed in the funeral and cemetery operations and 642935 were employed in corporate or other overhead activities and services. All eligible employeesassociates in the United States who so elect are covered by our group health and life insurance plans. Associates covered by a collective bargaining agreement are typically covered by union health plans and are not eligible to participate in our health insurance plan. At December 31, 2014 and 2013, there were 9,022 and 9,706 associates, respectively, who had elected to participate in our group health insurance plans. Eligible employeesassociates in the United States are participants incovered by retirement plans of SCI or various subsidiaries, while international employeesassociates are covered by other SCI (or SCI subsidiary) defined or government-mandated benefit plans. Approximately 3.3%2.9% of our employees in North Americaassociates are represented by unions. Although labor disputes occur from time to time, relations with employeesassociates are generally considered favorable.

Regulation

Our funeral home operations are regulated by the Federal Trade Commission (the “FTC”) under the FTC’s Trade Regulation Rule on Funeral Industry Practices (the “Funeral Rule”), which went into effect in 1984. The Funeral Rule defines certain acts or practices as unfair or deceptive and contains certain requirements to prevent these acts or practices. The preventive measures require a funeral provider to give consumers accurate, itemized price information and various other disclosures about funeral goods and services and prohibit a funeral provider from: (1) misrepresenting legal, crematory, and cemetery requirements; (2) embalming for a fee without permission; (3) requiring the purchase of a casket for direct cremation; and (4) requiring consumers to buy certain funeral goods or services as a condition for furnishing other funeral goods or services.

Our operations are also subject to regulations,regulation, supervision, and licensing under numerous foreign, federal, state, and local laws ordinances, and regulations including extensive regulations concerning trust funds, preneed sales of funeralas well as Canadian and cemetery products and services, and various other aspects of our business. We strive to comply in all material respects with the provisions of theseprovincial laws ordinances, and regulations. Since 1984, we have operated in the United States under the Federal Trade Commission (FTC) comprehensive trade regulation rule for the funeral industry. The rule containsFor example, state laws impose licensing requirements for funeral homes and funeral directors and regulate preneed sales including our preneed trust activities. Our facilities are subject to environmental, health, and safety regulations. We take various measures in order to comply with the Funeral Rule and laws and regulations. For example, we have established and maintain policies, procedures, and practices; we engage in training of our personnel; and we carry out ongoing reviews of our compliance efforts. We believe that we are in substantial compliance with the Funeral Rule and all laws and regulations.

Federal, state, and local legislative bodies and regulatory agencies (including Canadian legislative bodies and agencies) frequently propose new laws and regulations, some of which could have a material effect on our operations and on the deathcare industry practices, including extensive price and other affirmative disclosures and imposes mandatory itemizationin general. We cannot accurately predict the outcome of funeral goods and services.any proposed legislation or regulation or the effect that any such legislation or regulation might have on us.

Other

Our corporate headquarters are located at 1929 Allen Parkway, Houston, Texas 77019. The property consists of approximately 120,000 square feet of office space and 185,000 square feet of parking space. We own and utilize an additional building located in Houston, Texas for corporate activities containing a total of approximately 38,000 square feet of office space. We also lease approximately 29,000 square feet of office space in Houston, Texas, which we utilize for corporate activities. We own a building in Jefferson, Louisiana with approximately 98,200 square feet of office space that we use, in part, for corporate activities.

We make available free of charge, on or through our website, our annual, quarterly, and current reports and any amendments to those reports, as soon as reasonably practicable after electronically filing such reports with the Securities and Exchange Commission (SEC). Our website is http://www.sci-corp.com and our telephone number is (713) 522-5141. The SEC also maintains an internet site at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically. The public may read and copy any materials we file with the SEC at the SEC’s Public Reference

Room at 100 F Street, N.E., Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

Each of our Board of Directors’ standing committee charters, our Corporate Governance Guidelines, our Code of Ethics for Board Members, and our Code of Conduct for Officers and Employees are available, free of charge, through our website or, upon request, in print. We will post on our internet website all waivers to or amendments of our Code of Conduct for Officers and Employees, which are required to be disclosed by applicable law and rules of the New York Stock Exchange listing standards. Information contained on our website is not part of this report.

Cautionary Statement on Forward-Looking Statements

The statements in this Form 10-K that are not historical facts are forward-looking statements made in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995. These statements may be accompanied by words such as “believe”, “estimate”, “project”, “expect”, “anticipate”, or “predict” that convey the uncertainty of future events or outcomes. These statements are based on assumptions that we believe are reasonable; however, many important factors could cause our actual consolidated results in the future to differ materially from the forward-looking statements made herein and in any other documents or oral presentations made by, or on behalf of, the Company. These factors are discussed below. We assume no obligation to publicly update or revise any forward-looking statements made herein or any other forward-looking statements made by the Company, whether as a result of new information, future events, or otherwise.

Our affiliated funeral and cemetery trust funds own investments in equity securities, fixed income securities, and mutual funds, which are affected by market conditions that are beyond our control.

In connection with our preneed funeral and preneed cemetery merchandise and service sales, most affiliated funeral and cemetery trust funds own investments in equity securities, fixed income securities, and mutual funds. OurThe fair value of these investments, and our earnings and investment gains and losses on these equity securities and mutual funds are affected by financial market conditions that are beyond our control.

The following table summarizes our investment returns (realized and unrealized), excluding certain fees, on our trust funds for the years ended December 31:

| | | | 2011 | | 2010 | | 2009 | 2014 | | 2013 | | 2012 |

| Preneed funeral merchandise and service trust funds | 0.7 | % | | 12.3 | % | | 23.0 | % | 3.7 | % | | 16.6 | % | | 12.4 | % |

| Preneed cemetery merchandise and service trust funds | 0.7 | % | | 14.0 | % | | 27.3 | % | 3.4 | % | | 19.3 | % | | 13.4 | % |

| Perpetual care trust funds | 5.2 | % | | 13.0 | % | | 22.4 | % | 5.2 | % | | 7.6 | % | | 10.5 | % |

Generally, earnings or gains and losses on our trust investments are recognized and we withdraw cash when the underlying merchandise is delivered, service is performed, merchandise is delivered, or upon contract cancellation; however, our cemetery perpetual care trusts recognize earnings, and in certain states capital gains and losses, and we withdraw cash when we incur qualifying cemetery maintenance costs.

If the investments in our trust funds experience significant declines in 20122015 or subsequent years, there could be insufficient funds in the trusts to cover the costs of delivering servicesmerchandise and merchandiseservices or maintaining cemeteries in the future. We may be required to cover any such shortfall with cash flows from operations, which could have a material adverse effect on our financial condition, results of operations, or cash flows. For more information related to our trust investments, see Notes 4, 5, and 6 in Part II, Item 8. Financial Statements and Supplementary Data.

If the fair market value of these trusts, plus any other amount due to us upon delivery of the associated contracts, were to decline below the estimated costs to deliver the underlying products and services, we would record a charge to earnings to record a liability for the expected losses on the delivery of the associated contracts. As of December 31, 2011,2014, no such charge was required. For additional information, see Critical Accounting Policies, Recent Accounting Pronouncements, and Accounting Changesin Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

We may be required to replenish our affiliated funeral and cemetery trust funds in order to meet minimum funding requirements, which would have a negative effect on our earnings and cash flow.

In certain states and provinces, we have withdrawn allowable distributable earnings including unrealized gains prior to the maturity or cancellation of the related contract. Additionally, some states have laws that either require replenishment of investment

losses under certain circumstances or impose various restrictions on withdrawals of future earnings when trust fund values drop below certain prescribed amounts. In the event of market declines that result in a decrease in trust fund value, we may be required to deposit portions or all of these amounts into the respective trusts in some future period. As of December 31, 2011,2014, we had unrealized losses of $13.1$14.6 million in the various trusts within these states. See Off-Balance Sheet Arrangements, Contractual Obligations, and Commercial and Contingent Commitments in Part II, Item 7.

Our ability to execute our strategic plan depends on many factors, some of which are beyond our control.

Our strategic plan is focused on cost managementcontinued revenue growth, leverage of scale, and the continued implementation of key revenue initiatives.capital deployment. Many of the factors that impact our ability to execute our strategic plan, such as the number of deaths and general economic conditions, are beyond our control. Changes in operating conditions, such as supply disruptions and labor disputes, could negatively impact our operations. Our inability to achieve the levels ofleverage scale to drive cost savings, productivity improvements, preneed production, or earnings growth anticipated by management could affect our financial performance. Our inability to identify acquisition candidates and to complete acquisitions, divestitures, or strategic alliances as planned or to realize expected synergies and strategic benefits could impact our financial performance. Our inability to deploy capital to maximize shareholder value could impact our financial performance. We cannot give assurance that we will be able to execute any or all of our strategic plan. Failure to execute any or all of our strategic plan could have a material adverse effect on our financial condition, results of operations, orand cash flows.

Our credit agreements contain covenants that may prevent us from engaging in certain transactions.

Our bank credit facility contains, among other things, various affirmative and negative covenants that may prevent us from engaging in certain transactions that might otherwise be considered beneficial to us. The covenants limits,limit, among other things, our and our subsidiaries’ ability to:

Incur additional indebtedness (including guarantee obligations);

Create liens on assets;

Engage in certain transactions with affiliates;

Enter into sale-leaseback transactions;

Engage in mergers, liquidations, and dissolutions;

Sell assets;

Pay dividends, distributions, and other payments in respect of our capital stock;

Purchase our capital stock in the open market;

Make investments, loans, or advances;

Repay indebtedness or amend the agreements relating thereto;

Create restrictions on our ability to receive distributions from subsidiaries; and

Change our lines of business.

Our bank credit facility requires us to maintain certain leverage and interest coverage ratios. These covenants and coverage ratios may require us to take actions to reduce our indebtedness or act in a manner contrary to our strategic plan and business objectives. In addition, events beyond our control, including changes in general economic and business conditions, may affect our ability to satisfy these covenants. A breach of any of these covenants could result in a default of our indebtedness. If an event of default (if incurredunder our bank credit facility occurs, and such event of default continues unremedied for 30 days after we receive notice of such bank credit facility default) under our bank credit facility occurs,thereof, the lenders party thereto could elect to declare all amounts outstanding thereunder, together with accrued interest, immediately due and payable. Any such declaration would also result in an event of default under our Senior Indenture governing our various senior notes. For additional information, see Liquidity and Capital Resources in Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 10 in Part II, Item 8. Financial Statements and Supplementary Data.

If we lost the ability to use surety bonding to support our preneed funeral and preneed cemetery activities, we may be required to make material cash payments to fund certain trust funds.

We have entered into arrangements with certain surety companies whereby such companies agree to issue surety bonds on our behalf as financial assurance or as required by existing state and local regulations. The surety bonds are used for various business purposes; however, the majority of the surety bonds issued and outstanding have been issued to support our preneed funeral and cemetery activities. In the event all of the surety companies cancelledcanceled or did not renew our surety bonds, which generally

have twelve-month renewal periods, we would be required to either obtain replacement coverage or fund approximately $187.8$184.7 million into state-mandated trust accounts as of December 31, 2011.2014. There can be no assurance that we would be able to obtain replacement coverage at a similar cost or at all.

The funeral home and cemetery industry continues to be increasinglyis competitive.

In North America, the funeral home and cemetery industry is characterized by a large number of locally-owned, independent operations. To compete successfully, our funeral service locations and cemeteries must maintain good reputations and high professional standards, as well as offer attractive products and services at competitive prices. In addition, we must market the Company in such a manner as to distinguish us from our competitors. We have historically experienced price competition from independent funeral home and cemetery operators, monument dealers, casket retailers, low-cost funeral providers, and other non-traditionalnontraditional providers of servicesmerchandise and merchandise.services. If we are unable to successfully compete, our financial condition, results of operations, and cash flows could be materially adversely affected.

Increasing death benefits related to preneed funeral contracts funded through life insurance or annuity contracts may not cover future increases in the cost of providing a price-guaranteed funeral service.

We sell price-guaranteed preneed funeral contracts through various programs providing for future funeral services at prices prevailing when the agreements are signed. For preneed funeral contracts funded through life insurance or annuity contracts, we receive in cash a general agency commission that typically averages approximately 19.4%22% of the total sale from the third-party insurance company. Additionally, there iswe receive an increasing death benefit associated with the contract of approximately 1% per year to be received in cash at the time the funeral is performed. There is no guarantee that the increasing death benefit will cover future increases in the cost of providing a price-guaranteed funeral service, and any such excess cost could be materially adverse to our financial condition, results of operations, and future cash flows, revenues, and operating margins.flows.

The financial condition of third-party insurance companies that fund our preneed funeral contracts may impact our future revenues.

Where permitted, customers may arrange their preneed funeral contract by purchasing a life insurance or annuity policy from third-party insurance companies. The customer/policy holder assigns the policy benefits to our funeral home to pay for the preneed funeral contract at the time of need. If the financial condition of the third-party insurance companies were to deteriorate materially because of market conditions or otherwise, there could be an adverse effect on our ability to collect all or part of the proceeds of the life insurance policy, including the annual increase in the death benefit, whenif we fulfill the preneed contract at the time of need. Failure to collect such proceeds could have a material adverse effect on our financial condition, results of operations, orand cash flows.

Unfavorable results of litigation could have a material adverse impact on our financial statements.

As discussed in Note 12 of Part II, Item 8. Financial Statements and Supplementary Data, we are subject to a variety of claims and lawsuits in the ordinary course of our business. Adverse outcomes in some or all of the pending cases may result in significant monetary damages or injunctive relief against us, as litigation and other claims are subject to inherent uncertainties. There existsAny such adverse outcomes, in pending cases or other lawsuits that may arise in the possibility offuture, could have a material adverse impact on our financial position, cash flows, and results of operations, for the period in which the effect of an unfavorable final outcome becomes probable and reasonably estimable.cash flows.

Unfavorable publicity could affect our reputation and business.

Since our operations relate to life events involving emotional stress for our client families, our business is dependent on consumercustomer trust and confidence. Unfavorable publicity about our business generally or in relation to any specific location could affect our reputation and consumers’customers’ trust and confidence in our products and services, thereby having an adverse impact upon our sales and financial results as well as the price of our common stock.

If the number of deaths in our markets declines, our cash flows and revenues may decrease.

If the number of deaths in our markets declines, the number of funeral services and interments performed by us could decrease and our financial condition, results of operations, and cash flows could be materially adversely affected. Variations and seasonality of deaths throughout each year may also cause revenues to fluctuate between quarters or years.

If we are not able to respond effectively to changing consumer preferences, our market share, revenues, and profitability could decrease.

Future market share, revenues, and profits will depend in part on our ability to anticipate, identify, and respond to changing consumer preferences. We may not correctly anticipate or identify trends in consumer preferences, or we may identify them later than our competitors do. In addition, any strategies we may implement to address these trends may prove incorrect or ineffective.

The continuing upward trend in the number of cremations performed in North America could result in lower revenues and gross profit.

There is a continuing upward trend in the number of cremations performed in North America as an alternative to traditional funeral service dispositions. In our North American operations during 2011, 44.4%2014, 51.6% of the comparable funeral services we performed were cremation cases compared to 41.9%50.1% and 41.0%48.2% performed in 20102013 and 2009,2012, respectively. We continue to expand our cremation memorialization products and services, which have resulted in higherOur average revenues per cremationrevenue for cremations with service performed.is lower than that for traditional burials. If we are unable to continue to successfully expand our cremation memorialization products and services, and cremations remain a significant percentage of our funeral services, our financial condition, results of operations, and cash flows could be materially adversely affected.

Our funeral home and cemetery businesses are high fixed-cost businesses.

The majority of our operations are managed in groups called “markets”. Markets are geographical groups of funeral service locations and cemeteries that share common resources such as operating personnel, preparation services, clerical staff, motor vehicles, and preneed sales personnel. Personnel costs, the largest component of our operating expenses, are the cost components most beneficially affected by this grouping. We must incur many of these costs regardless of the number of funeral services or interments performed. Because we cannot necessarily decrease these costs when we experience lower sales volumes, a sales decline may cause our margin percentages to decline at a greater rate than the decline in revenues.

Regulation and compliance could have a material adverse impact on our financial results.

Our operations are subject to regulation, supervision, and licensing under numerous foreign, federal, state, and local laws, ordinances, and regulations, including extensive regulations concerning trust funds, preneed sales of funeral and cemetery products and services, and various other aspects of our business. For example, the funeral home industry is regulated at the federal level by the Federal Trade Commission, which requires funeral homes to take actions designed to protect consumers. Our facilities are also subject to stringent health, safety, and environmental regulations. Our pay practices, including wage and hour overtime pay, are subject to federal and state regulations. Violations of applicable laws could result in fines or sanctions against us.

Businesses in general are subject to the impact of recentregulation and major legislation, including healthcare reform. We may experience significant increases in costs as a result of business regulations and laws, which are beyond our control, including increases in the Patient Protection and Affordable Care Act and the Dodd-Frank Wall Street Reform and Consumer Protection Act. Many provisionscost of these complex laws could impact our business, and many of the provisions require implementation through regulations that have not yet been promulgated.healthcare. Although we do not knowseek to control increases in these costs, continued upward pressure on costs could reduce the ultimate impactprofitability of these laws, we expect such laws will increase our costs and the potential risks of failure to comply.business.

In addition, from time to time, governments and agencies propose to amend or add regulations or reinterpret existing regulations, which could increase costs and decrease cash flows. For example, foreign, federal, state, local, and other regulatory agencies have considered and may enact additional legislation or regulations that could affect the deathcare industry. These include regulations that require more liberal refund and cancellation policies for preneed sales of products and services, limit or eliminate our ability to use surety bonding, increase trust requirements, require the deposit of funds or collateral to offset unrealized losses of trusts, and/or prohibit the common ownership of funeral homes and cemeteries in the same market. If adopted by the regulatory authorities of the jurisdictions in which we operate, these and other possible proposals could have a material adverse effect on our financial condition, results of

operations, and cash flows.

Compliance with laws, regulations, industry standards, and customs concerning burial procedures and the handling and care of human remains is critical to the continued success of our business and any operations we may acquire. Litigation and regulatory proceedings regarding these issues could have a material adverse effect on our financial condition, results of operations, and cash flows. We are continually monitoring and reviewing our operations in an effort to ensure that we are in compliance with these laws, regulations, and standards and, where appropriate, taking appropriate corrective action.

Cemetery burial practice claims could have a material adverse impact on our financial results.

Our cemetery practices have evolved and improved over time. Most of our cemeteries have been operating for decades and, therefore, may have used practices and procedures that are outdated in comparison to today's standards. When cemetery disputes occur, we may be subjected to litigation and liability for improper burial practices, including (i)(1) burial practices of a different era that are judged today in hindsight as being outdated, and (ii)(2) alleged violations of our practices and procedures by one or more of our associates. In addition, since we acquired most of our cemeteries, we may be subject to litigation and liability based upon

actions or events that occurred before we acquired or managed the cemeteries. Claims or litigation based upon our cemetery burial practices could have a material adverse impact on our financial condition, results of operations, and cash flows.

A number of years may elapse before particular tax matters, for which we have established accruals, are audited and finally resolved.

The number of tax years with open tax audits varies depending on the tax jurisdiction. In the United States, the Internal Revenue Service is currently examining our tax returns for 1999 through 20052007 and various state jurisdictions are auditing years through 2010.2012. While it is often difficult to predict the final outcome or the timing of resolution of any particular tax matter, we believe that our accruals reflect the probable outcome of known tax contingencies. However, unfavorable settlement of any particular issue may reduce a deferred tax asset or require the use of cash.cash, which may have a material adverse impact to our financial statements. Favorable resolution could result in reduced income tax expense reported in the financial statements in the future. See Note 9 of Part II, Item 8. Financial Statements and Supplementary Data for additional information.

Declines in overall economic conditions beyond our control could reduce future potential earnings and cash flows and could result in future impairments to goodwill impairments.and/or other intangible assets.

In addition to an annual review, we assess the impairment of goodwill and/or other intangible assets whenever events or changes in circumstances indicate that the carrying value may be greater than fair value. Factors that could trigger an interim impairment review include, but are not limited to, a significant decline in our stock price, significant underperformance relative to historical or projected future operating results, and significant negative industry or economic trends. If these factors occur, we may have a triggering event, which could result in an impairment of our goodwill. Based on the results of our annual goodwill impairment test in 2011, we concluded that there was no impairment of our goodwill. However, ifand/or other intangible assets. If economic conditions worsen causing deterioration in our operating revenues, operating margins, and cash flows, we may have a triggering event that could result in an impairment of our goodwill.goodwill and/or other intangible assets. Our cemetery segment, which has a goodwill balance of $63.1$300.0 million as of December 31, 2011,2014, is more sensitive to market conditions and goodwill impairments because it is more reliant on preneed sales, which are impacted by customer discretionary spending. For additional information, see Critical Accounting Policies, Recent Accounting Pronouncements, and Accounting Changes in Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Any failure to maintain the security of the information relating to our customers, their loved ones, our associates, and our vendors could damage our reputation, could cause us to incur substantial additional costs and to become subject to litigation, and could adversely affect our operating results.

In the ordinary course of our business, we receive certain personal information, in both physical and electronic formats, about our customers, their loved ones, our associates, and our vendors. In addition, our on-line operations at our websites depend upon the secure transmission of confidential information over public networks, including information permitting electronic payments. We maintain substantial security measures and data backup systems to protect, store, and prevent unauthorized access to such information. Nevertheless, it is possible that computer hackers and others (through cyberattacks, which are rapidly evolving and becoming increasingly sophisticated, or by other means) might defeat our security measures in the future and obtain the personal information of customers, their loved ones, our associates, and our vendors that we hold. Further, our associates, contractors, or third parties with whom we do business may attempt to circumvent our security measures in order to misappropriate such information and may purposefully or inadvertently cause a breach, corruption, or data loss involving such information. A breach of our security measures or failure in our backup systems could adversely affect our reputation with our customers and their loved ones, our associates, and our vendors; as well as our operations, results of operations, financial condition, and cash flows; and could result in litigation against us or the imposition of penalties. Moreover, a security breach could require that we expend significant additional resources to upgrade further the security measures that we employ to guard such important personal information against cyberattacks and other attempts to access such information and could result in a disruption of our operations.

Our Canadian business exposes us to operational, economic, and currency risks.

Our Canadian operations represent a significant portion of our revenues. Our ability to successfully conduct operations in Canada is affected by many of the same risks we face in our U.S. operations, as well as unique costs and difficulties of managing Canadian operations. Our Canadian operations may be adversely affected by local laws, customs and regulations, as well as political and economic conditions. Significant fluctuations in exchange rates between the U.S. dollar and the Canadian dollar may adversely affect our results of operations and cash flows.

Our level of indebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry, and prevent us from fulfilling our obligations under our indebtedness.

We have a significant amount of indebtedness which could have important consequences, including the following:

it may limit our ability to obtain additional debt or equity financing for working capital, capital expenditures, acquisitions, debt service requirements, and general corporate or other purposes;

a portion of our cash flows from operations will be dedicated to the payment of principal and interest on our indebtedness, including indebtedness we may incur in the future, and will not be available for other purposes, including to finance our working capital, capital expenditures, acquisitions, and general corporate or other purposes;

it could limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate and place us at a competitive disadvantage compared to our competitors that have less debt;

it could make us more vulnerable to downturns in general economic or industry conditions or in our business, or prevent us from carrying out activities that are important to our growth;

it could increase our interest expense if interest rates in general increase because a portion of our indebtedness, including all of our indebtedness under our senior credit facilities, bears interest at floating rates; and

it could make it more difficult for us to satisfy our obligations with respect to our indebtedness, and any failure to comply with the obligations of any of our debt instruments, including any financial and other restrictive covenants, could result in an event of default under the agreements governing our other indebtedness which, if not cured or waived, could result in the acceleration of our indebtedness.

Any of the above listed factors could materially affect our business, financial condition, results of operations, and cash flows.

In addition to our high level of indebtedness, we also have significant rental and other obligations under our operating and capital leases for funeral service locations, cemetery operating and maintenance equipment, and transportation equipment. These obligations could further increase the risks described above.

Failure to maintain effective internal control over financial reporting could adversely affect our results of operations, investor confidence and our stock price.

The accuracy of our financial reporting depends on the effectiveness of our internal control over financial reporting. Internal control over financial reporting can provide only reasonable assurance with respect to the preparation and fair presentation of financial statements and may not prevent or detect misstatements because of its inherent limitations. If we do not maintain effective internal control over financial reporting or implement controls sufficient to provide reasonable assurance with respect to the preparation and fair presentation of our financial statements, we could be unable to file accurate financial reports on a timely basis, and our results of operations, investor confidence, and stock price could be materially adversely affected.

In connection with management’s assessment of internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002, as of December 31, 2014, we did not maintain effective internal control over financial reporting in relation to the compilation and review of our tax basis balance sheet and management concluded that this constitutes a material weakness. See Item 9A, Controls and Procedures, for a discussion of our internal control over financial reporting and the material weakness.

While this material weakness did not result in any material misstatement of our historical financial statements, it did result in adjustments to provision for income taxes, deferred tax assets, deferred tax liabilities, goodwill, other liabilities, income taxes, and accumulated deficit and revisions to our consolidated financial statements for fiscal years 2013 and 2012. We have revised our 2013 and 2012 financial statements in this filing, as described in Note 2 in Part II, Item 8. Financial Statements and Supplementary Data. Although we believe we are taking and previously took appropriate actions to remediate the control deficiencies we identified and to strengthen our internal control over financial reporting, we cannot assure you that we will not discover other material weaknesses in the future or that no material weakness will result from any difficulties, errors, delays, or disruptions. If the new controls we are implementing to address the material weakness do not operate effectively, if we are unsuccessful in implementing or following these new processes, or if we are otherwise unable to remediate this material weakness, we may not timely or accurately report our financial condition or results of operations. This could adversely affect investor and business partner confidence in our financial reports and our stock price.

| |

| Item 1B. | Unresolved Staff Comments. |

None.

Information regarding properties is set forth in Part I, Item 1. Business.

| |

| Item 3. | Legal Proceedings. |

Information regarding legal proceedings is set forth in Note 12 of Part II, Item 8. Financial Statements and Supplementary Data.

EXECUTIVE OFFICERS OF THE COMPANY

The following table sets forth as of February 13, 2012,2015, the name and age of each executive officer of the Company, the office held, and the year first elected an officer.

| | | Officer Name | | Age | | Position | | Year First

Became Officer | | Age | | Position | | Year First

Became Officer |

| R. L. Waltrip | | 81 |

| | Chairman of the Board | | 1962 | | 84 |

| | Chairman of the Board | | 1962 |

| Thomas L. Ryan | | 46 |

| | President and Chief Executive Officer | | 1999 | | 49 |

| | President and Chief Executive Officer | | 1999 |

| Michael R. Webb | | 53 |

| | Executive Vice President and Chief Operating Officer | | 1998 | | 56 |

| | Executive Vice President and Chief Operating Officer | | 1998 |

| J. Daniel Garrison | | 60 |

| | Senior Vice President Sales | | 1998 | |

| Eric D. Tanzberger | | | 46 |

| | Senior Vice President, Chief Financial Officer and Treasurer | | 2000 |

| Gregory T. Sangalis | | | 59 |

| | Senior Vice President, General Counsel and Secretary | | 2007 |

| Stephen M. Mack | | | 63 |

| | Senior Vice President, Operations | | 1998 |

| Sumner J. Waring, III | | | 46 |

| | Senior Vice President, Operations | | 2002 |

| Philip C. Jacobs | | 57 |

| | Senior Vice President and Chief Marketing Officer | | 2007 | | 60 |

| | Senior Vice President, Chief Marketing Officer | | 2007 |

| Stephen M. Mack | | 60 |

| | Senior Vice President Middle Market Operations | | 1998 | |

| Steven A. Tidwell | | | 53 |

| | Senior Vice President, Sales and Merchandising | | 2010 |

| Elisabeth G. Nash | | 50 |

| | Senior Vice President Operations Services | | 2004 | | 53 |

| | Senior Vice President, Operations Services | | 2004 |

| Gregory T. Sangalis | | 56 |

| | Senior Vice President General Counsel and Secretary | | 2007 | |

| Eric D. Tanzberger | | 43 |

| | Senior Vice President Chief Financial Officer and Treasurer | | 2000 | |

| Sumner J. Waring, III | | 43 |

| | Senior Vice President Operations | | 2002 | |

| Kenneth G. Myers, Jr. | | | 57 |

| | Senior Vice President, Operations | | 2014 |

| John Del Mixon, II | | | 51 |

| | Vice President, Information Technology | | 2010 |

| John H. Faulk | | 36 |

| | Vice President Business Development | | 2010 | | 39 |

| | Vice President, Business Development | | 2010 |

| Joseph A. Hayes | | 55 |

| | Vice President Ethics and Business Conduct and Assistant General Counsel | | 2007 | | 58 |

| | Vice President, Ethics and Business Conduct and Assistant General Counsel | | 2007 |

| Jane D. Jones | | 56 |

| | Vice President Human Resources | | 2005 | |

| Gerry D. Heard | | | 50 |

| | Vice President, Sales | | 2012 |

| Albert R. Lohse | | 51 |

| | Vice President Litigation and Risk Management | | 2004 | | 54 |

| | Vice President, Litigation and Risk Management | | 2004 |

| John Del Mixon, II | | 48 |

| | Vice President Information Technology | | 2010 | |

| Tammy R. Moore | | 44 |

| | Vice President and Corporate Controller | | 2010 | | 47 |

| | Vice President, Corporate Controller | | 2010 |

| Steven A. Tidwell | | 50 |

| | Vice President Main Street Market Operations | | 2010 | |

| Sarah E. Adams | | | 51 |

| | Vice President, Tax | | 2014 |