SECURITIES AND EXCHANGE COMMISSION

__________________

FORM 10-K

_______________

(Mark One)

X .ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year EndedAugust 31, 2011

.TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from ________ to ______

VOLITIONRX LIMITED

(Exact name of registrant as specified in its charter)

| (x) | |

Delaware | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES ACT OF 1934 |

000-30402 | 91-1949078 |

| For the fiscal year ended August 31, 2010 |

( ) | TRANSACTION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the transaction period from to |

| |

| Commission File Number 0-25707

|

STANDARD CAPITAL CORPORATION |

(Exact name of registrant as specified in charter) |

Delaware | 91-1949078 |

State or other jurisdiction of incorporation or organization | (I.R.S. Employee Identificationh No.) |

557 M. Almeda Street

Metro Manila, Philippines

Commission File Number) | (IRS Employer |

(Addressof Incorporation) | | Identification Number) |

| 150 Orchard Road Orchard Plaza 08-02 Singapore 238841 (Address of principal executive offices) | |

| (201) 618-1750 | |

| (Zip Code)Registrant’s Telephone Number)

Copy of all Communications to: Carrillo Huettel, LLP 3033 5th Avenue, Suite 400 San Diego, CA 92103 Phone: 619-546-6100 Fax: 619-546-6060 | |

Issuer’s telephone number |

| Securities registered pursuant to section 12 (b) of the Act: |

Title of each share

None

| Name of each exchange on which registered

None

|

| Securities registered pursuant to Section 12 (g) of the Act: |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined byin Rule 405 of the Securities Act [ ] Act.

Yes [X] .No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d)15(d) of the Act. [ ]

Yes [ ] .No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the pastpreceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [ ]

Yes [X] X .No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website,Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 232.405 of this chapter) during the proceedingpreceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [ ]

Yes [ ] .No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’sregistrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendmentsamendment to this Form 10-K [ ]

10-K. .Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smallsmaller reporting company. See definitiondefinitions of “large"large accelerated filer”, “accelerated filer”filer," "accelerated filer" and “small"smaller reporting company”company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer � 0;[ ]

| | | |

Large accelerated filer | . | Accelerated filer | . |

Non-accelerated filer | .(Do not check if a smaller reporting company) | Smaller reporting company | X. |

Non-accelerated filer [ ] (Do not check if a small reporting company) Small reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] .No [X]

State theThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference toof the registrant as of February 28, 2011 was $NIL based upon the price ($NIL) at which the common equitystock was last sold or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recentrecently completed second fiscal quarter.

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicatequarter, multiplied by the

approximate number of shares

outstanding of

eachcommon stock held by persons other than executive officers, directors and five percent stockholders of the registrant without conceding that any such person is an “affiliate” of the registrant for purposes of the federal securities laws. Our common stock is currently quoted on the Over-The-Counter Bulletin Board under the symbol “VNRX.OB”.

As of November 28, 2011, there were 8,120,652shares of the registrant’s classes of$0.001 par value common stock as of the latest practicable date:

September 15, 2010: 2,285,000 common shares

DOCUMENTS INCORPORATED BY REFERENCE

Listed hereunder the following documents ifDocuments incorporated by reference and the Partreference: None

Table of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; (3) Any prospectus filed pursuant to Rule 424 (b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 31, 1980).

TABLE OF CONTENTS

| PART 1 | |

| | Page |

| PART I | |

ITEM 1. | Business. | 4 |

Item 1 | Business | 4 |

ITEM 1A.Item 1A | Risk Factors.Factors | 517 |

Item 1B | Unresolved Staff Comments | 17 |

ITEM 1B.Item 2 | Unresolved Staff Comments.Properties | 817 |

Item 3 | Legal Proceedings | 17 |

ITEM 2.Item 4 | Properties.[REMOVED AND RESERVED] | 817 |

| | |

ITEM 3. | Legal Proceedings.PART II | 8 |

| | |

ITEM 4.Item 5 | Submission of Matters to Vote of Securities Holders | 8 |

| | |

PART II | | 9 |

| | |

ITEM 5. | Market for Registrant’sRegistrant's Common Equity, Related Stockholder Matters and Issuer PurchasePurchases of Equity Securities.Securities | 918 |

Item 6 | Selected Financial Data | 18 |

ITEM 6Item 7 | Selected Financial Information. | 9 |

| | |

ITEM 7. | Management’sManagement's Discussion and Analysis of Financial ConditionsCondition and Results of Operations.Operations | 1019 |

Item 7A | | |

ITEM 7A. | Quantitative and Qualitative DisclosureDisclosures about Market Risk.Risk | 1221 |

Item 8 | Financial Statements and Supplementary Data | F-1 |

ITEM 8.Item 9 | Financial Statement and Supplementary Data. | 12 |

| | |

ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.Disclosure | 1322 |

Item 9A | | |

ITEM 9A | Controls and Procedures. | 13 |

| | |

ITEM 9A(T) | Controls and Procedures | 1422 |

Item 9B | Other Information | 23 |

ITEM 9B | Other information | 14 |

| PART III | |

PART III | | 14 |

Item 10 | | |

ITEM 10. | Directors and Executive Officers and Corporate Governance.Governance | 1424 |

Item 11 | Executive Compensation | 31 |

ITEM 11.Item 12 | Executive Compensation. | 17 |

| | |

ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.Matters | 1832 |

Item 13 | | |

ITEM 13. | Certain Relationships and Related Transactions and Director Independence. | 1933 |

Item 14 | Principal Accountant Fees and Services | 33 |

ITEM 14 | Principal Accounting Fees and Services. | 20 |

| PART IV | |

PART IV | | |

Item 15 | Exhibits | 35 |

ITEM 15. | Exhibits, Financial Statement Schedules | 21 |

| | |

| SIGNATURES | 22 |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

·

The availability and adequacy of our cash flow to meet our requirements;

·

Economic, competitive, demographic, business and other conditions in our local and regional markets;

·

Changes or developments in laws, regulations or taxes in our industry;

·

Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities;

·

Competition in our industry;

·

The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business;

·

Changes in our business strategy, capital improvements or development plans;

·

The availability of additional capital to support capital improvements and development; and

·

Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC.

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Term

Except as otherwise indicated by the context, references in this report to “Company”, “we”, “us”, “our” and “VNRX” are references to VolitionRX Limited. All references to “USD” or United States Dollars refer to the legal currency of the United States of America.

ITEM 1. BUSINESS

Corporate History and Organization

StandardThe Company was incorporated on September 24, 1998 and has no subsidiaries and no affiliated companies. It has not been in bankruptcy, receivership or similar proceedings since its inception. Nor has it been involved in any material reclassification, merger, consolidation or purchase or sale of any significant assets not in the ordinary courseState of business. Standard’s executive offices are located at 557 M. Almeda Street, Metro Manila, Philippines.

Delaware under the name Standard

Capital Corporation. The original business plan of the Company was

engaged into acquire and develop mineral properties. The Company leased the

exploration ofrights to explore a

mineralmining claim known as the

“Standard”Standard (the “Standard Claim”), but allowed the

propertylease to

lapseexpire in February

2008 and2008. The Company no longer has any rights to the minerals on the Standard

Claim nor does it have any liabilities attached to the

claim itself.claim.

On September 26, 2011, the Company, then under the name Standard Capital Corporation, and its controlling stockholders (the “Controlling Stockholders”) entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with Singapore Volition Pte Limited, a Singapore registered company (“Singapore Volition”) and the shareholders of Singapore Volition (the “Volition Shareholders”), whereby the Company acquired 6,908,652 (100%) shares of common stock of Singapore Volition (the “Volition Stock”) from the Volition Shareholders. In exchange for the Volition Stock, the Company issued 6,908,652 shares of its common stock to the Volition Shareholders. The Share Exchange Agreement closed on October 6, 2011.

As a result of the Share Exchange Agreement, Singapore Volition became our wholly-owned operating subsidiary and the Company now intends to carry on the business of Singapore Volition as its primary business. Singapore Volition has two subsidiaries, Belgian Volition SA, a Belgium registered company (“Belgian Volition”), and HyperGenomics Pte Limited, a Singapore registered company (“HyperGenomics Pte Limited”). Singapore Volition owns 99.9% of the issued and outstanding shares of Belgian Volition and 100% of the issued and outstanding shares of HyperGenomics Pte Limited.

On September 22, 2011, the Company filed a Certificate for Renewal and Revival of Charter (“Certificate for Renewal”) with the Secretary of State of Delaware, to reinstate the Company’s Certificate of Incorporation. Pursuant to Section 312(1) of the Delaware General Corporation Law, the Company was revived under the new name of "VolitionRX Limited." The name change to VolitionRX Limited was approved by FINRA on October 7, 2011 and became effective on October 11, 2011.

Description of Our Business

The Company is referred to as being ina life sciences company focused on meeting the “pre-exploration” stage by its auditors. This term is generally used in Financial Accounting Standards to describe a company seeking to develop its ideasurgent need for accurate, fast, inexpensive and products. Standard is notscalable tests for detecting and diagnosing cancer and other diseases. We are in the development stage with regardsof our operations and are in the process of discovering, developing and commercializing diagnostic tests. We believe that our tests will be able to any mineral claim since at present it has no mineral claim. Standardbetter detect and characterize cancer and other disease states than existing methods, which in turn will provide better patient outcomes and contain healthcare costs. We focus on blood-based tests that we intend to sell through various channels within the United States and throughout the world, subject to regulatory clearance or approval.

We do not anticipate earning revenues until such time as we able to fully market our products. For these reasons, our auditors stated in their report on our audited financial statements that they have substantial doubt that we will be able to continue as a going concern without further financing. The ability of the Company to continue as a going concern is purely an exploration company which presently is seeking an exploration property.

Standard has no revenue to date from its prior exploration activities on the Standard claim, anddependent upon its ability to

affectsuccessfully accomplish its

plans for the future will depend on the availabilityplan of

financing. Such financingoperations described herein and eventually attain profitable operations.

We anticipate that any additional funding that we require will be required to acquire a new mineral and to explore it to a stage where a decision can be made by management as to whether an ore reserve exists and can be successfully brought into production. Standard anticipates obtaining such funds from its directors and officers, financial institutions or by way of the sale of its capital stock in the future, but there can be no assurance that Standard will be successful in obtaining additional capital for exploration activities in the futureform of equity financing from the sale of its capital stockour common stock. However, there is no assurance that we will be able to raise sufficient funding from the sale of our common stock. The risky nature of our business enterprise places debt financing beyond the credit-worthiness required by most banks or typical investors of corporate debt until such time as our products are available on the market. We do not have any arrangements in otherwise raising substantial capital.

Standard

The Market

Everyone in the world has, or will be, touched by the effects of cancer. It is responsibleone of the world’s most deadly diseases, accounting for filing various forms witharound 13% of annual global deaths.1 In the United States Securitiesalone, there are 13.8 million cancer survivors. By 2020, this figure is expected to rise to 18.1 million and Exchange Commission (the “SEC”)the cost of cancer to the U.S. is projected to reach $158 billion.2 These figures are mirrored in all regions of the world and will continue to grow as populations age. This is a large potential market of which diagnostics will be a significant part.

Inevitably, the chances of surviving cancer are greatly improved by early detection and diagnosis, however, there is currently no screening test for cancer in general, and very few effective mass screening tests for specific cancers. Further, current methods of cancer diagnosis are not cost effective and cannot provide accurate results. The inadequacy of existing diagnostic products means that most cancers are only diagnosed once the cancer is well established. By this stage, it will often have spread beyond the primary tumor (metastatic cancers), making it substantially more difficult to treat. Early, non-invasive, accurate cancer diagnosis remains a great unmet medical need and a huge commercial opportunity. For these reasons cancer diagnostics is an active field of research and development both academically and in industry.

The global In-Vitro Diagnostics (IVD) market is forecast to grow at a rate of 6% to reach $50.0 billion in 2012, driven by the increasing health care demands of an ageing population. The market has been growing at a rate of 5-6% in recent years, reaching a value of $36.5 billion in 2007.3 The largest IVD market segment is diabetes diagnostics with a value of $10 billion.4 The cancer IVD market comprising cancer blood and tissue biopsy tests was $4.7 billion in 2008 and growing at 11%.5

Of this the two largest IVD market segments are:

·

Histology, immunohistochemistry and cytology of tissue samples (45% of IVD sales or approximately $2 billion). These are mostly used to confirm cancer diagnosis post-surgery and to determine cancer sub-type; and

·

Immunoassays, mostly of blood samples (30% of IVD sales or approximately $1.5 billion). These are mostly used to monitor for disease progress and relapse. This market segment includes Nucleosomics products which are blood immunoassay tests for modified histones for the diagnosis and prognosis of cancer.

The IVD market (all disease areas) is highly consolidated with the top 10 companies taking an 80% market share. Roche Diagnostics is the largest single company by market share with 20%. Siemens and Abbott both have 12% market share.6 The cancer IVD market also contains many smaller development companies developing and selling novel products, such as Form 10Kthe Company.

The Company is responding to the need for early, accurate diagnostic tests with its proprietary NucleosomicsTM (“NuQTM”) technology and Form 10Q.

1

Cancer - Fact sheet N°297,World Health Organization, [online], Available at: http://www.who.int/mediacentre/factsheets/fs297/en/index.html,[accessed 8.23.2011]

2

Mariotto AB et al., Projections of the cost of cancer care in the United States: 2010-2020. Jan 19, 2011,JNCI, Vol 103, No.2

3

The Top Ten Global In-Vitro Diagnostics Companies, March 6, 2009, [online], Available at: http://store.business-insights.com/Product/?productid=BI00021-001, [accessed 8.29.2011]

4

Diagnostics: Testing systems prove their worth, July 1, 2008, [online], Available at: http://www.ft.com/cms/s/0/47c5ec16-477e-11dd-93ca-000077b07658,dwp_uuid=322c9222-4712-11dd-876a-0000779fd2ac.html, [accessed 8.29.2011]

5

Cancer IVD market expands to meet customer demand, May 1, 2008, [online], Available at: http://www.ivdtechnology.com/article/cancer-ivd-market-expands-meet-customer-demand, [accessed 8.29.2011]

6

The Top Ten Global In-Vitro Diagnostics Companies, March 6, 2009, [online], Available at: http://store.business-insights.com/Product/?productid=BI00021-001, [accessed 8.29.2011]

Our Products

The shareholdersCompany’s existing products, as well as those that are currently in the development pipeline, are described in detail below:

NuQTM Suite of Epigenetic Cancer Blood Tests

Epigenetics is the science of how genes are switched “on” or “off” in the body’s cells. A major factor controlling the switching “on” and “off” is the structuring of DNA. The DNA in every human cell is not a random string but wound around protein complexes in a “beads on a string” structure. Each individual “bead” with associated DNA coiled around it is called a nucleosome. These nucleosomes then form additional structures with increasingly dense packing, culminating in chromosomes containing hundreds of thousands of nucleosomes.

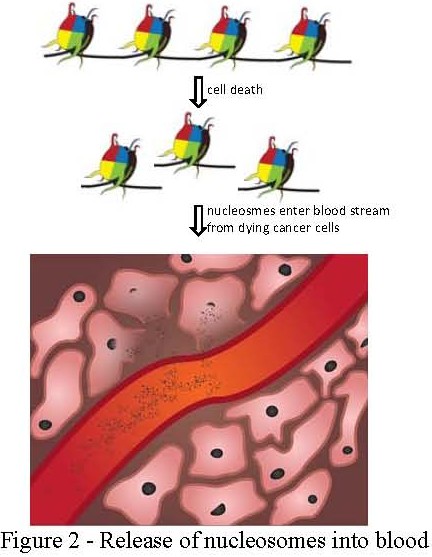

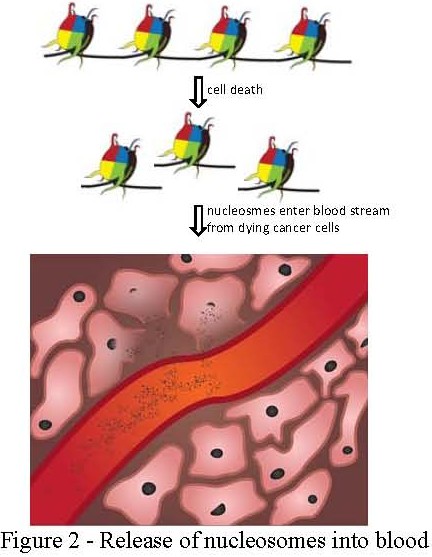

Cancer is characterized by uncontrolled and rapid cell growth and also by an approximately matched, but slightly less, rapid cell death rate. When the cells die, the DNA is chopped up into individual nucleosomes which are released into the blood as summarized in Figure 2 below. When cells break up, they end up in the bloodstream to be recycled back into the body. When a cancer is present, the number of cells being recycled is far higher than in a healthy body, so the system is overwhelmed, leaving the excess broken-up pieces, including the nucleosomes, in the blood.

The structure of nucleosomes is not uniform but subject to immense variety. It is has been known for 4 or 5 years that nucleosomes in cancer cells are different in structure from those in healthy cells.1 The Company has developed tests for some of the major nucleosome varieties and we have shown that we can detect the nucleosome patterns that are specific to cancer in the blood. Furthermore, we have shown that the nucleosome varieties also differ between cancer types (to distinguish for example between cancer of the pancreas, colon or mouth).

1

Fraga MF et al., “Loss of acetylation at Lys16 and trimethylation at Lys20 of histone H4 is a common hallmark of human cancer”,Nature Genetics, Vol 37 (4), p391-400, 2005

Blood nucleosome levels are raised in conditions other than cancer including in auto-immune disease, inflammatory disease, endometriosis, sepsis, and in the immediate aftermath of major trauma (for example following a heart attack, surgery or car accident). The Company’s primary focus is on cancer but we will also pursue diagnostic opportunities in other disease areas.

The Company’s NuQTMblood test products fall into 4 main types and will complement each other to provide a total solution:

·

NuQTM: A general test for the detection of the level of all nucleosomes in a patient’s blood.

·

NuQ-XTM: We currently have two tests in the NuQ-XTM family. They are tests for the detection of nucleosomes containing specific nucleotides are used as a blood test for the presence of cancer. So far we have tested blood samples from lung, colon, pancreatic and oral cancer patients taken on diagnosis prior to treatment. To date, every blood sample taken from patients with cancer that we have tested is clearly positive in both of the NuQ-XTM tests (100%). All blood samples taken from healthy patients have tested clearly negative in both tests (0%). Further clinical testing is necessary, but NuQ-XTM tests have great potential to fulfil the “holy grail” of a simple screening blood test for cancer.

·

NuQ-VTM: We currently have four tests in the NuQ-VTM family. These are tests for the detection of nucleosomes containing specific histone variantsand are used as a blood test for cancer. Additionally, we have found that the pattern of blood levels of the different types of histone variants in nucleosomes is different for different cancer types. NuQ-VTM test levels are raised in 85% of blood samples taken from patients with cancer that we have tested to date and, as well as detecting cancer, the patterns can distinguish between different cancer types. The Company will develop further NuQ-VTM tests to distinguish all the main cancer types and to increase the cancer detection rate of NuQ-VTM even higher from 85%.

·

NuQ-MTM: We currently have one test in the NuQ-MTM family. This test is for the detection of nucleosomes containing modified histones, the proteins that package and order DNA into nucleosomes, and can be used as a blood test for cancer. Our development work with this family of tests is at an earlier stage. The Company will develop many more such tests and the intention is to use them in a similar way to that described for the NuQ-VTM tests above.

We believe our products will enable doctors to screen for cancer using a NuQ-XTM test with a high detection rate (we have observed a 100% detection rate to date) and, if cancer is detected, to use NuQ-MTM and NuQ-VTM tests to investigate which cancer is present (up to 85% accuracy of those tested to date).

The Company will bring its suite of NuQTM blood tests to the market at the end of 2011 to meet the strong need for cancer diagnostics.

NuQTM Research Products

The Company has already developed a number of NuQTM tests that it is using for clinical validation. In addition to their application in diagnostics, these products are useful research tools and will be marketed for research use.

The Company is currently organizing the manufacture of its first research use products and will commence sales in late 2011. The research products are semi-manual kits for the simultaneous analysis of 96 blood samples (the usual format for research products). The most expensive component in the manufacture of products are the pairs of antibodies employed. Initially these will be bought in or licensed in at a cost of $14-$94 per kit (for the lowest and highest cost pair we are currently using), but the Company has commenced development of its own antibodies which will reduce costs to less than $10 per kit. Other production costs are less than $30 per kit. Total initial production costs will be around $50-$125 (or $2-$4 per test as samples are usually tested in duplicate, so that a 96 well kit can be used to analyze some 48 samples) and we anticipate a subsequent drop in the production price the first year to approximately $40 per kit. The selling price will be in the region of $700 - $1200. A mock-up of a typical kit is shown in Figure 3 below.

The NuQTM research use kits are run on simple instrumentation available from a wide range of suppliers and found in every research laboratory and hospital. Our own instrument, on which we develop and run the NuQTM tests is shown in Figure 4 below.

NuQTM Clinical Diagnostic Products

There are three main segments to the clinical market addressed by the Company’s products, and the NuQTM tests will be adapted for each of these segments.

·

Centralized High-Throughput, Hospital Laboratories

Centralized laboratories test thousands of blood samples taken from patients everyday mostly using fully automated enzyme-linked immunosorbent assay (“ELISA”) systems, commonly known as random access analyzers, usually supplied by one of the global diagnostics companies. Tests run on ELISA systems use components of the immune system and chemicals to detect immune responses in the body. ELISA instruments are used in all major hospital for the analysis of thousands of blood samples every day and can run dozens of different ELISA tests in any combination on any sample and for many samples simultaneously. The systems are highly automated and rapid (as little as 10 minutes for many tests), and can be run at low costs. A typical example of an ELISA system is shown below in Figure 5. Our NuQTMproducts are all ELISA tests; thus, we anticipate that our tests will be adopted quickly in the healthcare market because ELISA tests are widely used and well understood by clinicians and laboratory staff.

The patient diagnostics market is much larger than the research use market. However, healthcare providers operate strong cost control policies, and the global diagnostics companies that manufacture random access analyzers (e.g. Abbott) compete on market share and operate on a low price/high volume basis. The analyzers themselves are usually provided at no immediate cost in which the laboratory is “given” the instrument in return for agreeing to purchase minimum test numbers at given prices for a given time (this is somewhat similar to consumer mobile telephone contracts in which the phone itself is provided “free”). When the contract is complete the customer gets a “free upgrade” to the latest instrument upon signing a new contract.

One option open to the Company is to license our NuQTM technology on a non-exclusive basis to a global diagnostics company, with an estimated revenue on such a license of approximately $10 per test. The other option, which is the usual way that small innovative companies with high value ELISA products enter the centralized laboratory market, is to sell manual and/or semi-automated 96 well ELISA plates for use by these laboratories. In this way, small ELISA diagnostic companies are able to command prices in the range of $20-40 per test, dependent on the clinical benefit and health care cost saving benefits of the particular test. We have conducted end user research with the heads of centralized laboratories and we believe the Company’s products will command the high end of this price range.

·

Point-of-Care Devices: These are small instruments that perform tens of ELISA tests per day rapidly on blood taken from a finger prick. The instruments can be found in any oncology clinic and tests can be performed during patient consultations. The Company will contract with an instrument manufacturer to produce these instruments for point-of-care NuQTM testing for the oncologist’s office, general doctor’s office or at home testing. See Figure 6 for an example of a point-of-care device. The Company expects to enter the point-of-care clinical market in 2013, as the Company will first need to adapt its tests to these small instruments and demonstrate their success in the greater diagnostics market before these products will be adopted by others in the industry.

·

Disposable Home Use or Doctor’s Office Tests: These tests are single shot disposable devices which can be purchased over the counter at any chemist shop that test a drop of blood taken from a finger prick. The test is administered at a doctor’s office using a point-of-care device or at home using a home testing kit, neither of which require laboratory involvement. Thus, the patient experiences considerably lower costs using these tests as compared to traditional laboratory tests.

The Company will contract with a specialist company to adapt the NuQTM tests to this doctor office or home use system and contract with their manufacture. The sale of these tests will initially be for professional use only and will likely be released at a later time for non-professional use. Figure 7 below shows a basic home use test on the left which displays the results of the test in the two windows, similar to a pregnancy test. The test on the right is more sophisticated and plugs into a meter or the USB port of a computer for analysis and interpretation.

The self-use home testing kit market is massive in size and potentially highly profitable, as the format is very easy to use and reproduce and does not rely on laboratory processing. There are currently no useful diagnostics tests suitable for mass screening for cancer in general through a simple point-of-care or self-use home testing kit. About 30% of the population in developed countries are over the age of 50 and would be likely candidates for mass cancer screening, were such at home tests available. On a 5-yearly screen basis, the Company estimates this represents some 40 million tests per annum in the U.S. and Europe, for which we would expect to conservatively sell at a price of at least $30-40 per test. The tests are expected to cost approximately $5-6 each to manufacture. Given that the price charged to the user should be approximately $30-$40, the margin appears very attractive and the cost benefit to the patient compelling. The potential total market size for NuQTM self-tests is over a billion dollars annually, based on 30 million test sales worldwide per year.

HyperGenomicsTM

The Company is in the process of developing its HyperGenomicsTM tests, which will be administered once cancer has been detected to accurately determine the specific subtype of disease and to help decide the most appropriate therapy. Selecting the correct treatment approach can significantly improve outcome, reduce side effects and deliver cost savings. The Company believes the hypergenomic technology has the potential to be as ground breaking and revolutionary as our NuQTM suite of tests, as HyperGenomicsTM-based tests would provide detailed information on the specific cancer and the individual’s prognosis, and would help guide treatment.

The Company estimates that 10 million biopsy tests are performed annually in the U.S. with over a million in prostate cancer alone. Around 240,000 of these are positive and would be suited for hypergenomic profiling. A similar number are performed in Europe and in the rest of the world. Such tests command high prices. For example Mammaprint, a prognostic gene array for predicting breast cancer recurrence, has a list price of $4250/€2675 with over 14,000 tests carried out since approval by the FDA in 2007. On the reasonable basis that a HyperGenomicsTM test would be priced comparatively, the potential annual market size for HyperGenomicsTM tests would be in the hundreds of millions of dollars within 5 years.

The Company will spend the fourth quarter of 2011 and the first quarter of 2012 in technical validation of this technology. In parallel, a pre-assembled kit will be developed to service the rapidly expanding life-science/epigenetics research community and will complement the Nu-QTM range of epigenetics research tools and kits. In addition to continued method refinement of the HyperGenomicsTM technology, the Company will develop a robust bioinformatics platform, which shall combine the HyperGenomicsTM technology with computer science and information technology, to process and analyze data and store information. The Company expects its HyperGenomicsTM products to be rolled out onto the market within the next two years.

Endometriosis Test

Endometriosis is a progressive gynecological condition that affects one in ten women of childbearing age and approximately 176 million women worldwide. The disease is the leading cause of infertility in women, with up to 40% of all infertile women suffering from endometriosis. There is currently no existing non-surgical diagnostic test for endometriosis. Diagnosis is typically made via invasive and expensive laparoscopy, followed by a histological examination of any lesions found to confirm the diagnosis. Due to difficulties in this process, the diagnosis can take approximately 9 years from when the symptoms appear. The lack of a suitable screening test has also held up development of a cure for the disease.

Singapore Volition acquired the patent application for an endometriosis test in June 2011 and the Company is now in the process of developing the test, based on its existing NuQTM technology. The test will be a simple blood test taken at two stages of a woman’s menstrual cycle, during menses and partway through the month. If the two measurements show quantitative differences in total nucleosome level, endometriosis is indicated.

Hypothesis-testing and clinical proof of concept work (to demonstrate that the test is feasible or has the potential to be used and effective) on the endometriosis test is currently being carried out in the Company’s laboratory. The Company will continue with validation of its NuQTM based endometriosis tests through the fourth quarter of 2011. The Company will review the best ways of commercializing a product in the late first quarter of 2012 if the validations continue to prove its diagnostic potential. If the Company is successful in developing a reliable test, we believe that there would be significant interest from large pharmaceutical companies in partnering with the Company.

Product Development

The Company’s first products, the epigenetic cancer blood tests based on our proprietary NuQTMtechnology, are in development and will be released for research use by the first quarter of 2012.

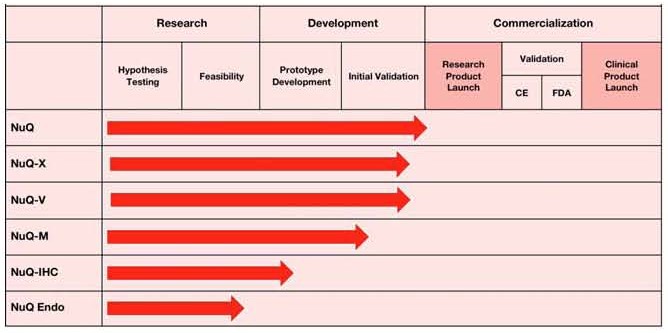

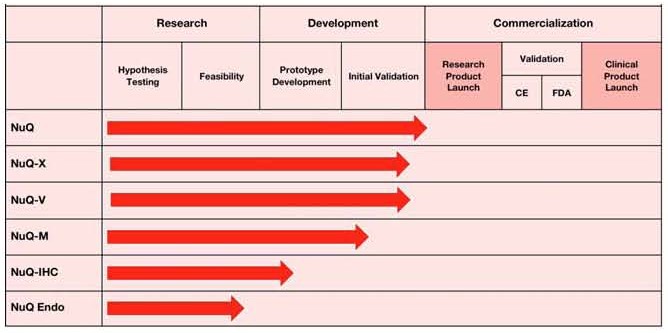

The Company will focus its energies in 2012 on bringing its NuQTM, NuQ-XTM and NuQ-VTM products to the market, while secondarily working on the proof of concepts and validations for NuQ-MTM, Hypergenomics (“NuQ-IHC”) and Endometriosis (“NuQ Endo”) products.

A graphic representation of the developmental stage of each of the Company’s product lines at the end of third quarter of 2011 is as follows:

Plan of Operations / Sales and Marketing Strategy

The first use of our NuQTM products will be for research, as the research market has lower regulatory barriers and is faster to adopt new products than the clinical diagnostics sector. We believe that by selling our products in the research market, we will drive awareness of our Company and our products which in turn, will lead to future sales in both the research and clinical markets. The Company’s products will be available for purchase in the first quarter of 2012 to researchers via the Company’s product website, http://www.nucleosomics.com. Initially, the Company will provide its products to four carefully chosen opinion leaders to provide further validation and product feedback. The Company intends to choose a sales partner for its NuQTM research products in the first quarter of 2012, which will further drive sales in this market. Additionally, the Company will manufacture an initial run of 1,000 NuQTM kits in late fourth quarter of 2011. We expect our first revenues to be generated from the sales of these kits to researchers, closely followed by sales of NuQ-VTM and NuQ- XTMin the research market.

Further, it is expected that the Company will obtain CE Marking for its products in late 2012 which will allow for the NuQTM tests to be used in a clinical setting in Europe. FDA approval is expected in 2013 which will allow for clinical use of our products in the U.S. Once the products have received the requisite approval from the FDA and CE Marking, the Company will begin selling its products for both research and clinical use, starting in Europe, followed by the U.S. and then the rest of the world, with a focus on Asia. The Company will use the following methods to generate revenues from its NuQTM products:

·

Direct Sales: As the Company wants to get its products to market as quickly as possible, direct sales will be the first path to market the suite of NuQTM products as well as all of the Company’s other products when they are first available for sale. Initial sales will be achieved through strong existing contacts, a dedicated product website and a distribution agent to handle the physical logistics.

·

Product Sales Partners: When sales volumes increase, the vast majority of sales of diagnostic and research products will be carried out using contracted sales and marketing partners. This will be organized by territory, by region and end user, e.g. clinical vs. research.

·

Distribution Agreements: Distribution agreements will be used primarily in markets and territories where the Company has no real prospect of obtaining traction alone or where the entry barriers are high. The Company will enter into tightly drawn distribution agreements outlining the territory and sectors to be covered. Control will be maintained by the Company through strict oversight and by centralized production centers that will provide supplies to distributors.

The Company’s NuQTM products will require several dynamic and evolving sales models tailored to different worldwide markets, users and products. The Company has decided to focus its sales strategy on the initial research markets in 2012 and develop a flexible strategy for its clinical products through the second and third quarters of 2012. We predict relatively low sales to researchers initially, but expect rapid growth as our products become standard, progressing to large volumes of tests sold to centralized laboratories and eventually reaching the mass diagnostics testing market. The exact nature of the ideal sales strategy will evolve and be developed by the Company as the list of products and markets grow.

Intellectual Property

The Company holds seven families of patents covering its current product pipeline. Three of these are licensed form world-class research institutions, two are patents authored by Belgian Volition and two are patents authored by Singapore Volition. The Company will continue to apply for patents for further developments. The Company’s IP gives it a very strong and varied base from which to protect both its suite of NuQTM products and other products under development as it continues to make innovative breakthroughs.

NucleosomicsTM IP

·

Singapore Volition holds an exclusive license to the following patent from Chroma Therapeutics Limited:

Nucleosomics WO2005019826: Detection of Histone Modifications in Cell-Free Nucleosomes (Patent that underlies the NuQ-MTM tests)

Priority: August 18, 2003

Status: Granted in Europe; Pending in U.S.

·

Singapore Volition holds the worldwide exclusive license in “the field of cancer diagnosis and cancer prognosis” for the following patent from the European Molecular Biology Laboratory:

EMBL Variant Patent WO2011000573: Diagnostic Method for Predicting the Risk of Cancer Recurrence based on MacroH2A Isoforms

Priority: July 2, 2009

Status: Pending Worldwide

·

Belgian Volition authored the following patent application covering its total NuQTM assay technology:

NuQ Patent UK1115099.2 and U.S. 61530300:Method for Detecting Nucleosomes

Priority: September 1, 2011

Status: Pending Worldwide

·

Belgian Volition authored the following patent application covering its NuQ-VTM technology:

NuQ-V Patent UK1115098.4 andU.S. 61530304: Method for Detecting Nucleosomes containing Histone Variants

Priority: September 1, 2011

Status: Pending Worldwide

·

Singapore Volition authored the following patent application covering its NuQ-XTM technology:

NuQ-X Patent UK1115095.0 and U.S. 61530295: Method for detecting Nucleosomes containing Nucleotides

Priority: September 1, 2011

Status: Pending Worldwide

HyperGenomicsTM IP

·

HyperGenomics Pte Limited holds a worldwide exclusive licence to the following patent application from Imperial College, London:

HyperGenomics WO03004702: Method for Determining Chromatin Structure

Priority: July 5, 2001

Status: Pending in Europe and U.S.

Endometriosis IP

·

Singapore Volition authored the following patent application for its endometriosis test:

Endometriosis Diagnostic UK1012662.1: Method for Detecting the Presence of a Gynaecological Growth

Priority: July 19, 2011

Status: Pending Worldwide

Future IP Strategy

Both the NuQTM and HyperGenomicsTM technologies will continue to give rise to multiple products in the cancer and other diagnostic fields. The Company’s strategy is to protect thetechnologies with patents in Europe and the U.S. Following product development, each product,based on the technologies, will be further protected individually by new patent filings worldwide.

This will provide:

·

Ensured market exclusivity through a double layer of patent protection (primarily the protection of the underlying technology on which all the tests are based and, secondarily, specific patent protection for each product).

·

A full 20-year protection for each new product developed (e.g. a NuQTM product developed in 2010 would continue to be protected in all markets until 2030, beyond expiration of the parent technology patent in 2023).

Trademarks

Singapore Volition has applied for trademarks for the following terms:

·

Nucleosomics

·

HyperGenomics

·

NuQ (covers associated brand names including NuQ-M, NuQ-V, NuQ-Endo, etc.)

The Company is entitled to use “TM” in association with these terms until final decisions on the registration of the applications are due in early 2012.

Government Approval

All of the Company’s NuQTM suite of products are non-invasive, meaning they cannot harm the subject other than through misdiagnosis. As a general principle, to achieve regulatory approval the Company would only need to prove that the products work according to the claims that the Company makes.

The Company’s strategy is to begin selling products for research purposes that require minimal regulatory approval, while simultaneously going through the process of obtaining regulatory approval for the products to be used clinically on cancer patients. The Company will first focus on the regulatory process in Europe, due to the granted patent for NuQTMand lighter regulatory requirements for the Company’s initial lab products. This will be followed closely by the regulatory process in the U.S. and in the rest of the world. Planning for the rest of the world is being undertaken and will be initiated after CE Marking (described below). In many territories the European CE Mark is sufficient to place products on the market and, where it is not, it often simplifies the regulation processes.

Europe – CE Marking

Conformité Européenne (“CE”) Marking is a rough equivalent of the United States’ Food and Drug Administration (“FDA”) approvals process, although is a somewhat lighter regime. Manufacturers in the European Union (“EU”) and abroad must meet CE Marking requirements where applicable in order to market their products in Europe. The CE Mark certifies that a product has met EU health, safety, and environmental requirements, which ensure consumer safety. To receive the CE Mark, the Company must meet certain standards and follow certain procedures as set forth in the In Vitro Diagnostic Medical Devices Directive which applies to the Company’s diagnostic products.

European national agencies, such as Customs authorities and/or the Departments of Health, Industry and Labor, conduct market surveillance to ensure the provisions of the applicable Directive have been met for products marketed within the EU. In pursuit of this goal, surveillance authorities will: i) visit commercial, industrial and storage premises on a regular basis; ii) visit work places and other premises where products are put into service and used; iii) organize random checks; and iv) take samples of products for examination and testing. If a product is found to be noncompliant, corrective action will depend on and be appropriate to the level of noncompliance. Others responsible for the noncompliance of the product will be held accountable as well. Penalties, which may include imprisonment, are determined by national law.

In compliance with the In Vitro Diagnostic Medical Devices Directive and the CE Marking process, the Company has ensured that all development and validation is carried out in a manner consistent with regulatory approval and has maintained proper records so that its products can be approved as quickly and simply as possible. The Company has engaged a regulatory consultant to ensure that all of its procedures are fully compliant. Further, the Company is working with EU regulatory professionals to obtain market approval and begin clinical validation.

The Company expects that CE Mark approval for the Company’s first clinical products will be achieved by the end of 2012, at which point the first sales of our clinical products can occur in Europe. Further, the Company expects that FDA approval in the U.S. will follow approximately 9 months later in 2013. FDA approval is more expensive and will take at least twice as long as CE Marking in Europe.

U.S. – FDA Approval

The Company’s diagnostic products are considered by the FDA to be “medical devices”. Among other things, the FDA regulates the research, testing, manufacturing, safety, labeling, storage, recordkeeping, pre-market clearance or approval, marketing and promotion, and sales and distribution of medical devices in the U.S. to ensure that medical devices distributed domestically are safe and effective for their intended uses. In addition, the FDA regulates the export of medical devices manufactured in the U.S. to international markets.

Unless an exemption applies, each medical device that we wish to market in the U.S. must first receive either clearance of a 510(k) pre-market notification or approval of a Product Market Application (“PMA”) from the FDA. The FDA’s 510(k) clearance process usually takes from three to twelve months, but it can take significantly longer and clearance is never guaranteed. The process of obtaining PMA approval is much more costly, lengthy and uncertain. It generally takes from one to three years or even longer and approval is not guaranteed.

The FDA decides whether a device must undergo either the 510(k) clearance or PMA approval process based upon statutory criteria. These criteria include the level of risk that the agency determines is associated with the device and a determination of whether the product is a type of device that is similar to devices that are already legally marketed. Devices deemed to pose relatively less risk are placed in either Class I or II. Class III devices are those devices which are deemed by the FDA to pose the greatest risk, such as life-sustaining, life-supporting or implantable devices, have a new intended use, or use advanced technology that is not substantially equivalent to that of a legally marketed device. In the U.S., cancer diagnostics are considered Class III products, the highest classification (in Europe, cancer diagnostics are not in the high classification group (except for home use). As such, most of the Company’s products will likely have to undergo the full PMA process of the FDA.

A clinical trial may be required in support of a 510(k) submission and is generally required for a PMA application. These trials generally require an effective Investigational Device Exemption (“IDE”), from the FDA for a specified number of patients, unless the product is exempt from IDE requirements or deemed a non significant risk device eligible for more abbreviated IDE requirements. The IDE application must be supported by appropriate data, such as animal and laboratory testing results. Clinical trials may begin 30 days after the submission of the IDE application unless the FDA or the appropriate institutional review boards at the clinical trial sites place the trial on clinical hold.

Once the application and approval process is complete and the product is placed on the market, regardless of the classification or pre-market pathway, it remains subject to significant regulatory requirements. The FDA may impose limitations or restrictions on the uses and indications for which the product may be labeled and promoted. Medical devices may only be marketed for the uses and indications for which they are cleared or approved. FDA regulations prohibit a manufacturer from promoting a device for an unapproved, or “off-label” use. Manufacturers that sell products to laboratories for research or investigational use in the collection of research data are similarly prohibited from promoting such products for clinical or diagnostic tests.

Further, our manufacturing processes and those of our suppliers are required to comply with the applicable portions of the FDA’s Quality Systems Regulations, which cover the methods and documentation of the design, testing, production, processes, controls, quality assurance, labeling, packaging and shipping of our products. Domestic facility records and manufacturing processes are subject to periodic unscheduled inspections by the FDA. The FDA also may inspect foreign facilities that export products to the U.S.

The FDA has broad regulatory and enforcement powers. If the FDA determines that we have failed to comply with applicable regulatory requirements, it can impose a variety of enforcement actions ranging from public warning letters, fines, injunctions, consent decrees and civil penalties to suspension or delayed issuance of approvals, seizure or recall of our products, total or partial shutdown of production, withdrawal of approvals or clearances already granted, and criminal prosecution. The FDA can also require us to repair, replace or refund the cost of products that we manufactured or distributed. Furthermore, the regulation and enforcement of diagnostics and equipment by the FDA is an evolving area that is subject to change. While we believe that we are in compliance with the current regulatory requirements and policies of the FDA, the FDA may impose more rigorous regulations or policies that may expose us to enforcement actions or require a change in our business practices. If any of these events were to occur, it could materially adversely affect us.

Planned Clinical Validations / Clinical Trials

The Company has commenced background work to prepare for clinical validations and trials for the approvals process in Europe and North America.

Government Regulations

The health care industry, and thus our business, is subject to extensive federal, state, local and foreign regulation. Some of the pertinent laws have not been definitively interpreted by the regulatory authorities or the courts, and their provisions are open to a variety of subjective interpretations. In addition, these laws and their interpretations are subject to change.

Both federal and state governmental agencies continue to subject the health care industry to intense regulatory scrutiny, including heightened civil and criminal enforcement efforts. As indicated by work plans and reports issued by these agencies, the federal government will continue to scrutinize, among other things, the marketing of diagnostic health care products. The federal government also has increased funding in recent years to fight health care fraud, and various agencies, such as the U.S. Department of Justice, the Office of Inspector General of the Department of Health and Human Services, or OIG, and state Medicaid fraud control units, are coordinating their enforcement efforts.

We must also comply with numerous other federal, state, and local laws relating to such matters as safe working conditions, environmental protection, industrial safety, and hazardous substance disposal. We may incur significant costs to comply with such laws and regulations in the future, and lack of compliance could have material adverse effects on our operations.

We believe that we have structured our business operations to comply with applicable legal requirements. However, it is possible that governmental entities or other third parties could interpret these laws differently and assert otherwise.

Competition

We face competition in the cancer diagnostic market primarily from companies such as Abbott Laboratories Inc., Cepheid Inc., Philips, GE Healthcare, Siemens, Gen-Probe Incorporated, MDxHealth SA, EpiGenomics AG, Roche Diagnostics and Sequenom, Inc. We believe that our products compete with those offered by our competitors primarily on the basis of their cost-effectiveness, ease of use, mass screening potential, non-invasiveness, advanced technology, compatibility with ELISA systems, accuracy and strong IP position.

Many of our competitors have substantially greater financial, technical, and other resources and larger, more established marketing, sales and distribution systems than we do. Many of our competitors also offer broader product lines outside of the diagnostic testing market, and many have greater brand recognition than we do. Moreover, our competitors may make rapid technological developments that may result in our technologies and products becoming obsolete before we recover the expenses incurred to develop them or before they generate significant revenue. Our success will depend, in part, on our ability to develop our products in a timely manner, keep our products current with advancing technologies, achieve market acceptance of our products, gain name recognition and a positive reputation in the healthcare industry, and establish successful marketing, sales and distribution efforts.

WHERE YOU CAN GET ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any material filed by Standardour reports or other filings made with the SEC at the SEC’s Public Reference Room, located at 100 F Street, N.E., Washington, DC 20549. The shareholders mayYou can obtain information on the operations of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that containsYou can also access these reports proxy and information statements, and other information which Standard has filedfilings electronically withon the SEC by assessing the website using the following address: http://SEC’s web site,www.sec.gov. Standard has no website at this time.

Planned Business

The following discussion should be read in conjunction with the information contained in the financial statements of Standard and the notes, which form an integral part of the financial statements, which are attached hereto.

The financial statements mentioned above have been prepared in conformity with accounting principles generally accepted in the United States of America and are stated in United States dollars.

Standard presently has minimal day-to-day operations; consisting mainly of identifying a new mineral claim and preparing the reports filed with the SEC as required.

Our shareholders and any future investors must be awareWe are a smaller reporting company as defined by Rule 12b-2 of the following risk factors prior to investing in Standard’s common stock. It must be emphasized that Standard, if anySecurities Exchange Act of these risks become fact, may have to cease operations1934 and our shareholders and any future investors could lose part or all of their investment.

RISKS ASSOCIATED WITH OUR COMMON STOCK

1. Penny stock rules may make buying or selling of our shares difficult.

The trading in our shares is subject to the “Penny Stock” rules. The SEC has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. These rules require that any broker-dealer who recommends our shares to persons other than prior customers and accredited investors, must prior to the sale, make a special written suitability determination for the purchaser and receive the purchaser’s written agreement to execute the transaction. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure explaining the penny stock market and the risks associated with trading in the penny stock market. In add ition, broker-dealers must disclose commissions payable to both the broker-dealer and the registered representative and current quotations for the securities they offer. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in our shares, which could severely limit their market price and liquidity of our shares. Broker-dealers who sell penny stocks to certain types of investors are not required to comply withprovide the Commission’s regulations concerning the transfer of penny stock. These regulations require broker-dealers to:

- | Make a suitability determination prior to selling a penny stock to the purchaser; |

- | Receive the purchaser’s written consent to the transaction; and |

- | Provide certain written disclosures to the purchaser. |

From our standpoint, it might be difficult for us to induce new investors to purchase shares since they might not want to be involved in a penny stock company. Future investors must be aware that our shares are in the classification of a penny stock and therefore be subject to the rules mentioned above and the various limitations associated with these rules.

2. | We may, in the future, conduct offerings of our common stock in which case all shareholdings will be diluted. |

In the future, we may conduct offerings of shares to finance our exploration activities on a new mineral claim. If we decide to raise money through offerings in the future all shareholders will be diluted.

3. | There are certain internal and external forces will affect the value of our trading shares. |

The stock market has experienced extreme volatility in recent years and may continue to do so in the future. We cannot be sure an active public market for our shares will develop or if an active market should develop that it would continue. The price for our shares is determined in the marketplace and may be influenced by many factors, including both internal and external forces as follows:

- variations in our financial results compared to companies similar to ours; especially in the exploration of a new mineral claim compared to other exploration properties in North America;

- changes in earnings estimates, if any, by industry research analysts for our Company or for similar companies in the same industry;

- future investors' or other market participants' perceptions of our Company as a current or future investment; and

- general or regional economic conditions normally have a wide impact on the price of shares trading on the stock market and our Company’s shares are affected by changes in such conditions.

The problem we encounter with a volatile stock market, which we have no control over, is that we might not require funds when the market price of our shares are high but when the price is lower we might require funds to maintain the Company. This would result in having to issue additional shares during lower prices; resulting in a greater dilution effect on our shareholders.

4. | We may not be able to maintain a quotation of our common stock on the OTC Bulletin Board due to not filing the required information as it is due, which would make it more difficult for an investor to sell our shares. |

We cannot guarantee that it will always be available for quotation. The OTCBB is not an issuer listing service, market or exchange. Although the OTCBB does not have any listing requirements per se, to be eligible in maintaining a quotation on the OTCBB, issuers must remain current in their filings with the SEC. Securities already quoted on the OTCBB that become delinquent in their required filings will be removed following a 30 or 60 day grace period if they do not make their required filing during that time.

5. We are not planning to declare a dividend in either cash or shares in the near future.

We are not planning to declare a dividend in either cash or shares in the near future since our policy will be to retain any earnings received for the future exploration of any mineral claims obtained by us. Dividends are only declared by your Directors when they feel that surplus funds can be distributed to the shareholders without encroaching upon working capital of our Company.

7. | We want to advise our shareholders and future investors that the purchase of shares in our Company involves a high degree of risk. |

An investment in the shares of our Company is highly speculative and involves a high degree of risk. For example, the Company is a start-up situation and the failure rate for most start-up companies is high. Any person considering an investment in our shares should be fully aware that they could lose their entire investment.

RISK FACTORS ASSOCIATED WITH STANDARD

1. | Our auditors have indicated, in their opinion report, a concern regarding the going concern status of our Company. |

The auditors have expressed a concern regarding whether our Company will continue as a going concern if it does not receive adequate financing to meet its obligations. The auditors are indicating there might be substantial doubt regarding our Company’s continuation as an operating concern over the next twelve months. If our directors are unwilling to advance us some funds to maintain our Company in good standing, there is the possibility that we might cease to be an operating company. As a shareholder of our Company you should read the auditors’ report and Note 6 to the audited financial statements included ininformation under this Form 10K.

2. | We lack an operating history and have accumulated losses, which are expected to continue into the future. |

Since inception, we have not realized any revenue to date and have no operating history upon which an evaluation of our future success or failure can be made. The accumulated loss since February 24, 1998 is $217,237. Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

- | Our ability to successfully acquire and explore a new mineral claim; |

- | Our ability to generate future revenues from a viable ore reserve on a new mineral claim; and |

- | Our ability to reduce our exploration costs in order to increase our profit margins. |

As in most mineral claims, the chances of success of identifying and developing an ore reserve are extremely remote. The majority of mining companies never find an ore reserve and therefore are never profitable.

3. | Presently we have only three employees and will require additional employees if and when we acquire another mineral claim. |

We currently only have three employees, the President, Alexander Magallano, Chief Financial Officer and Chief Accounting Officer, Gordon Brooke and Secretary Treasurer, Rudy Perez. There is a substantial risk we may not have the funds necessary to hire additional employees that would be needed in any future exploration program on a new mineral claim.

4. | We may not be able to raise money for exploration when needed due to the prevailing price of gold which is beyond our control. |

Even with gold prices having increased over the past year, there is reluctance in the investment community to consider speculative ventures such as exploration companies. With this reluctance, we might find it difficult to raise any money and therefore inhibit any future exploration on a new mineral claim when acquired. When gold prices are lower, we will have a difficult time to attract money even if we have started to identify gold showings on a future acquired mineral claim. The market price of gold is beyond our control and will greatly affect our raising of money.

5. | We will have to compete with both large and small mining companies for such things as money, properties of merit, workers and supplies. |

In both the United States and Canada, there are many large and small mining companies each trying to explore and, hopefully, eventually developing their mineral properties into a producing mine. We are not in direct conflict with the larger mining companies in North America such as Newmont Mining Corp., Inco Limited, Barrick Gold Corp. and Teck Cominco Limited, to name a few. These larger companies have the available money to explore their properties and the professional personnel to assist in the exploration process. Unless a major mineral reserve is discovered by us in the future on a new mineral claim, the larger mining companies would have no interest in either developing the claim themselves or joint venturing with us. The competition to us would be from the smaller explorati on companies who are competing for money to explore their mineral claims and in hiring professional staff to assist them. There is only a limited amount of money available for exploration as well as professional personnel during the exploration season. We might not be able to attract either the money or professional personnel due to the other smaller exploration companies having more money and better known mineral properties.

6. | We are a small Company without much money to devote to a full exploration program |

| on a new and not identified mineral claim. |

The small size of our Company and the present lack of money means a limited exploration program on any claim we acquire in the future. Unless adequate money is raised, we will be unable to devote the time necessary to fully explore a claim. With only a limited budget for exploration activities, we will not have many employees to perform the exploration activities on any mineral claim. By limiting our operations, it will take longer to explore a future acquired mineral claim. Our shareholders should be aware that it might take a number of years to realize any exploration results from our claim due to the present lack of exploration money.

7. | We do not carry a policy for key man insurance, which in the event we wish to replace our management team funds will not be available to do so. |

We have not subscribed to a key man insurance policy in the event that our current directors and officers either depart from our Company or meet an untimely end. There will be no proceeds from insurance to allow us to attract individuals to replace them and it is unlikely we will have extra money on hand to be allocated for this purpose.

8. No asset to build our future on.

We do not have any assets since the lapse of the Standard claim. We have not identified any new mineral claim to date to acquire and there is the possibility we might never identify a mineral claim of merit which we can explore and, hopefully, discover a commercially viable ore body. Until this occurs, we have no assets to build our future on which limits the possibilities of us obtaining fund through a public offering of our shares.

item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

There are no unresolved staff comments outstanding at the present time.

ITEM 2. PROPERTIES

Our principal executive office is located at 150 Orchard Road, Orchard Plaza 08-02, Singapore 238841. We currently rent this space for approximately $1,500 a month. Currently, this space is sufficient to meet our needs, however, once we expand our business to a significant degree, we will have no mineral claims since we allow the Standard claim to lapse in February 2008 without maintaining it in good standing.find a larger space. We havedo not yet identified another mineral claim and it might take months before we are able to do so.

The Company's Main Product

When the Company identifies and purchases a new mineral claim its primary product will be the sale of minerals, both precious and commercial. It must be borne in mind that no minerals may be found oncurrently own any new mineral claim.

Investment Policies

The Company does not have an investment policy at this time. Any excess funds it has on hand will be deposited in interest bearing notes such as term deposits or short term money instruments. There are no restrictions on what the directors are able to invest. Presently the Company does not have any excess funds to invest.

ITEM 3. LEGAL PROCEEDINGS

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no legal proceedings in which our director, officer or any affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to which Standard is a party, nor to the best of management’s knowledge are any material legal proceedings contemplated.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITIES HOLDERS

There has been no Annual General Meeting of Stockholders since November 2005. Management has not yet determined a date for holding the next Annual General Meeting of Stockholders.

IIITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDERS MATTERS AND ISSUER PURCHASE OF EQUITY SECURITIES |

Since inception, StandardITEM 5.

MARKET FOR THE COMPANY’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock

Our common stock is currently quoted on the OTC Bulletin Board. Our common stock has been quoted on the OTC Bulletin Board since April 12, 2007 under the symbol “SNDC.OB.” Effective October 11, 2011 our symbol was changed to “VNRX.OB” to reflect the Company’s name change. Because we are quoted on the OTC Bulletin Board, our securities may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if they were listed on a national securities exchange.

| | |

Fiscal Quarter | High | Low |

First Fiscal Quarter (Sept. 1, 2010 – Nov. 30, 2010) | -- | -- |

Second Fiscal Quarter (Dec. 1, 2010 – Feb. 28, 2011) | -- | -- |

Third Fiscal Quarter (Mar. 1, 2011 – May 31, 2011) | -- | -- |

Fourth Fiscal Quarter (June 1, 2011 – Aug. 31, 2011) | -- | -- |

First Fiscal Quarter (Sept. 1, 2011 – Nov. 30, 2011) | 3.00 | 1.50 |

Record Holders

As at November 28, 2011, an aggregate of 8,120,652 shares of our common stock were issued and outstanding and were owned by approximately 81 holders of record, based on information provided by our transfer agent.

Recent Sales of Unregistered Securities

Other than as previously disclosed, none.

Re-Purchase of Equity Securities

None.

Dividends

We have not paid any cash dividends on itsour common stock since inception and it does notpresently anticipate that itall earnings, if any, will paybe retained for development of our business and that no dividends on our common stock will be declared in the foreseeable future. As at August 31, 2010, Standard had 46 shareholders; threeAny future dividends will be subject to the discretion of theseour Board of Directors and will depend upon, among other things, future earnings, operating and financial conditions, capital requirements, general business conditions and other pertinent facts. Therefore, there can be no assurance that any dividends on our common stock will be paid in the future.

Securities Authorized for Issuance Under Equity Compensation Plans

At the Annual General Meeting held on February 20, 2004, the shareholders are anapproved a Stock Option Plan (the “Option Plan”) whereby a maximum of 5,000,000 common shares were authorized but unissued to be granted to directors, officers, consultants and directors.

non-employees who assisted in the development of the Company. The value of the stock options to be granted under the Option Grants and Warrants outstanding since Inception.

Plan will be determined using the Black-Scholes valuation model. No stock options have been granted since Standard’s inception.

under this Plan. On October 6, 2011, the Company terminated the Option Plan.

There are no outstanding warrants or conversion privileges for Standard’s shares.

ITEM 6. SELECTED FINANCIAL INFORMATION

The following summary financial data was derived from our audited financial statementsOn November 17, 2011, the Company adopted and approved the 2011 Equity Incentive Plan (the “Plan”), for the year ended August 31, 2010. The following figures represent only a summary of what is contained in the audited financial statements. By review the Item 7 entitled “Management’s Discussiondirectors, officers, employees and Analysis of Financial Condition and Results of Operations” and the attached audited financial statements and the notes thereto will assist you in better understanding our financial position.

Statement of Operations

| | For the year ended August 31, 2010 | September 24, 1998 (date of incorporation) to August 31, 2010 |

| | | |

| Revenue | $ - | $ - |

Impairment of mineral claims acquisition costs Exploration costs | - - | 5,000 12,617 |

| General and Administrative | 10,947 | 199,620 |

| Net loss | (10,947) | (217,237) |

| | | |

| Weighted average shares outstanding (basic) | 2,285,000 | |

| Weighted average shares outstanding (diluted) | 2,285,000 | |

| Net loss per share (basic) | $ (0.01) | |

| Net loss per share (diluted) | $ (0.01) | |

Balance Sheet

Cash | $ 485

| |

Total assets | 485 | |

Total liabilities | 114,772 | |

Total Stockholders’ deficiency | $ (114,287)

| |

| ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS |

Corporate Organization and History Within Last Five years

The Company was incorporated on September 24, 1998 under the lawskey consultants of the

State of Delaware. The Company's Articles of Incorporation currently provide thatCompany. Pursuant to the Plan, the Company is authorized to issue

200,000,000nine hundred thousand (900,000) restricted shares,

of common stock,$0.001 par value,

$0.001 per share.of the Company’s Common Stock.

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION