SECURITIES AND EXCHANGE COMMISSION

|

| |

þ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 27, 2015

31, 2017Commission file number:

1-6615

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

| | |

| Delaware | | 95-2594729 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

26600 Telegraph Road, Suite 400 | |

Southfield, Michigan | | 4803448033 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code:

(248)(248) 352-7300Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ]☐ No [X]

☒Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ]☐ No [X]

☒Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X]☒ No [ ]

☐Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X]☒ No [ ]

☐Indicate by check mark if the disclosure of delinquent filers pursuant to Item 405 of RegulationS-K (§ 229.405) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form10-K or any amendment to thisForm 10-K. [X]

☐Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” andfiler,” “smaller reporting company” and “emerging growth company” in Rule12b-2 of the Exchange Act.

|

| | | | | |

Large accelerated filer [ ] | | ☐ | | Accelerated filer [X] | | ☒ |

Non-accelerated filer [ ] | | ☐ | | Smaller reporting company [ ] | | ☐ |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Act). Yes [ ]☐ No [X]

☒The aggregate market value of the registrant’s $0.01 par value common equity held bynon-affiliates as of the last business day of the registrant’s most recently completed second quarter was $499,546,000,$486,960,608, based on a closing price of $18.69.$19.55. On March 4, 2016,February 28, 2018, there were 25,436,58224,917,025 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s

2016 Annual2018 Proxy Statement, to be filed with the Securities and Exchange Commission within 120 days after the close of the registrant’s fiscal year, are incorporated by reference into Part III of thisForm 10-K.

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

ANNUAL REPORT ON FORM10-K

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by us or on our behalf. We have included or incorporated by reference in this Annual Report on Form10-K (including in the sections entitled "Risk Factors"“Risk Factors” and "Management’s“Management’s Discussion and Analysis of Financial Condition and Results of Operations"Operations”), and from time to time our management may make statements that may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Exchange Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based upon management'smanagement’s current expectations, estimates, assumptions and beliefs concerning future events and conditions and may discuss, among other things, anticipated future performance (including sales and earnings), expected growth, future business plans and costs and potential liability for environmental-related matters. Any statement that is not historical in nature is a forward-looking statement and may be identified by the use of words and phrases such as “expects,” “anticipates,” “believes,” “will,” “will likely result,” “will continue,” “plans to” and similar expressions. These statements include our belief and statements regarding general automotive industry and market conditions and growth rates, as well as general domestic and international economic conditions.

Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of the company, which could cause actual results to differ materially from such statements and from the company'scompany’s historical results and experience. These risks, uncertainties and other factors include, but are not limited to, those described in Part I, - Item 1A, - Risk Factors“Risk Factors” and Part II - Item 7, - "Management's“Management’s Discussion and Analysis of Financial Condition and Results of Operations"Operations” of this Annual Report on Form10-K and elsewhere in the Annual Report and those described from time to time in our futureother reports filed with the Securities and Exchange Commission.

Readers are cautioned that it is not possible to predict or identify all of the risks, uncertainties and other factors that may affect future results and that the risks described herein should not be considered to be a complete list. Any forward-looking statement speaks only as of the date on which such statement is made, and the company undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

PART I

Description of Business and Industry

The principal business of Superior Industries International, Inc. (referred to herein as the “company” or in the first person notation “we,” “us” and “our”) is the design and manufacture of aluminum wheels for sale to original equipment manufacturers ("OEMs"(“OEMs”). and aftermarket customers. We believe we are one of the largest suppliers of cast aluminum wheels to the world's leading automobile and light truck manufacturers, with wheel manufacturing operations in the United States and Mexico. Products made in our#1 North American facilities are delivered primarily to automotive assembly operations in North America for global OEMs.aluminum wheel supplier, the #3 European OEM supplier and #1 European aftermarket supplier. Our OEM aluminum wheels are primarily are sold for factory installation, as either optional or standard equipment or optional equipment, on manyapproximately 180 vehicle models manufactured by Audi, BMW, Fiat Chrysler Automobiles N.V. ("FCA"(“FCA”), Ford, General Motors ("GM"(“GM”), Jaguar-Land Rover,Mercedes-Benz, Mitsubishi, Nissan, Subaru, Tesla, Toyota, Volkswagen and Volkswagen.

We have gone through a transformation overVolvo. North America and Europe represent the

last several years asprincipal markets for our products but we have

shifteda global presence and opportunities with North American, European and Asian OEMs. The following chart below included twelve months of proforma sales for our

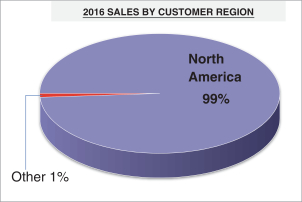

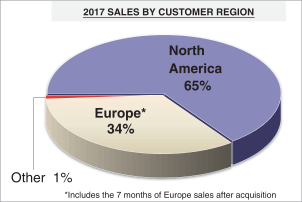

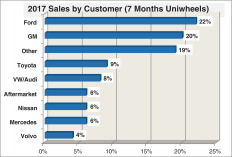

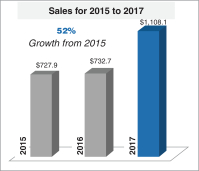

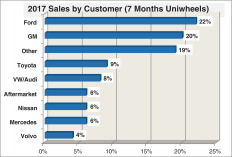

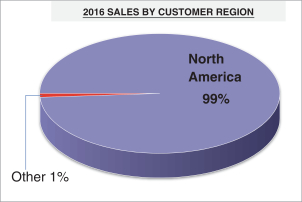

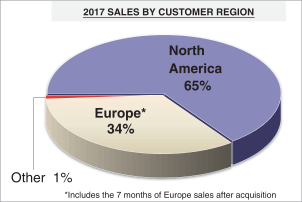

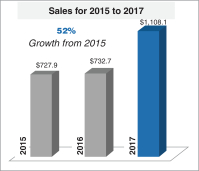

manufacturingEuropean operations for informational purposes. All of the other charts in this document include seven months of sales for our European operations, which aligns with the acquisition date. On May 30, 2017, we acquired a majority interest in Uniwheels AG (“Uniwheels”), which is also referred to as our “European operations.” |

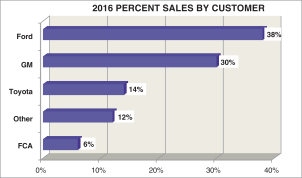

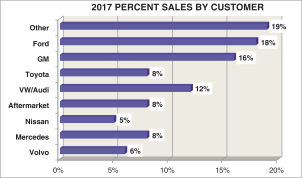

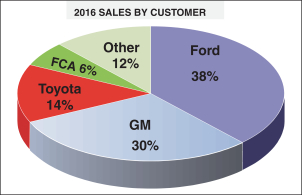

CUSTOMER SALES PERCENTAGES FOR 2016 AND 2017 ASSUMING 12 MONTHS OF UNIWHEELS |

With the acquisition of our European operations in 2017, we diversified our customer base from higher costpredominately North American to lower cost sources. Withinclude Europe and North America. The following chart demonstrates the diversification and increased demands for more customized premium wheels, we have made investmentsshift in engineering and design. With these investments, we are enhancing our capabilities to become a leader in premium wheels. We have doubled the wheel finishes that we offer in the last couple of years and we have developed patents, which is all partdiversification of our strategic evolutionbusiness from 2016 to become2017.

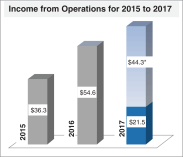

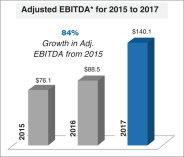

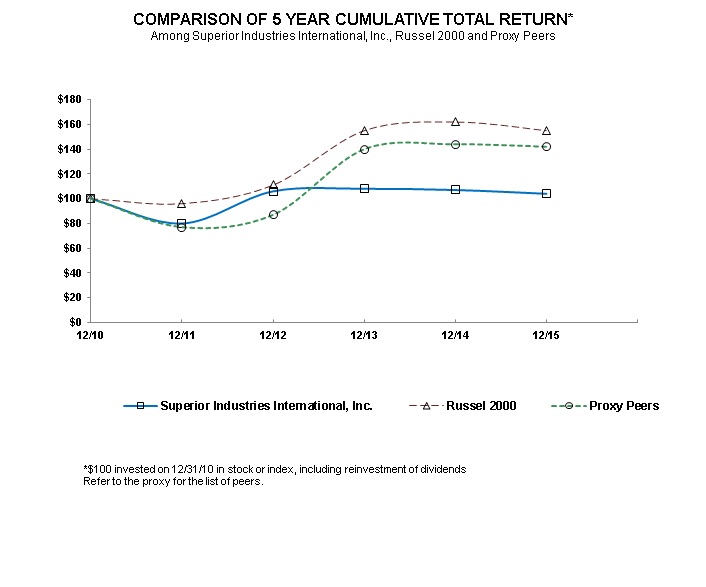

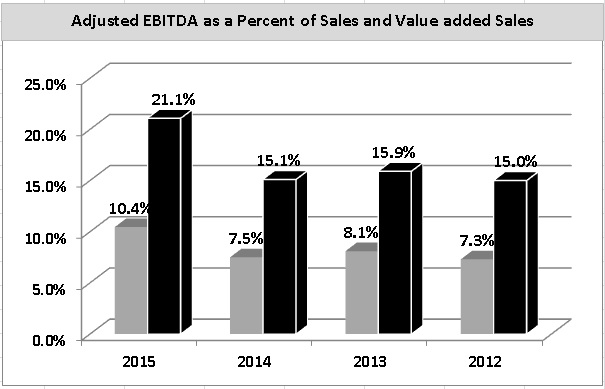

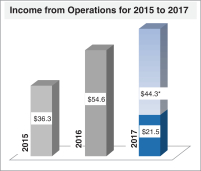

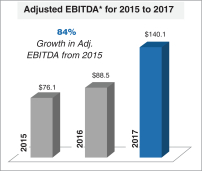

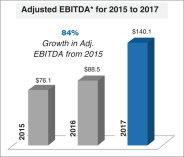

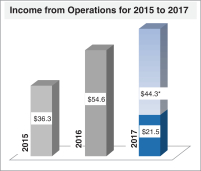

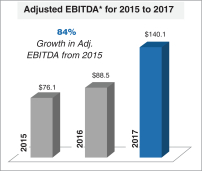

Uniwheels is a competitive full line manufacturerEuropean supplier of OEM aluminum wheels and also a supplier of European aftermarket aluminum wheels. Another part of our evolution was to move our corporate office to Southfield, Michigan to be closer to many of our customers so we can further strengthen relationships and partner with them to design world class products. We have made significant strides with our customers over the last year as evidenced by receiving the 2015 supplierAs a result of the year award from GM. With the addition of our new facility in Mexicoacquisition, we have expanded into the European market, broadened our manufacturing capacityproduct portfolio and acquired a significant customer share with European OEMs, including Audi, Jaguar-Land Rover, Mercedes Benz and Volvo. The acquisition is not only complementary in terms of customers, market coverage and product offerings but also very much aligned with our strategic direction with a focus on larger diameter wheels, premium finishes, luxury brands and specialty wheels for high performance motorsport racing vehicles, all providing enhanced opportunity for higher value added business. With the acquisition, our global reach encompasses sales to allow for growthnine of the ten largest OEMs in the next coupleworld with sales surpassing $1.1 billion. The following charts show key highlights of years.2017 and sales by major customer based on seven months of Uniwheels. The chart includes net income from operations and Adjusted EBITDA, which is a key metric we use to measure operating performance but is not calculated according to GAAP.

|

SALES BY CUSTOMER AND PROFITABILITY |

| | | | |

| |  | |  |

| | * Income from operations in 2017 includes$44.3 million in costs related to acquisition costs and integration costs. | | * See the Non-GAAP Financial Measures section of this annual report for a reconciliation of our Adjusted EBIDA to income from operations. |

Historically, the focus of the Company was on providing wheels for relatively high-volume programs with lower degrees of competitive differentiation. In order to improve our strategic position and better serve our customers, we are augmenting our product portfolio with wheels containing higher technical content and greater differentiation. We believe this direction is consistent with current trends in the market and needs of our customers. To achieve this objective, we have invested and continue to exploreinvest in new manufacturing capabilities in order to produce more sophisticated finishes and implement operating improvements to further expand manufacturing capacity with relatively low capital investment. We are also investigatinglarger diameter products, which typically provide higher value in the market. The acquisition opportunities to further enhance the value and drive the growth of our business. The charts below showEuropean operations and the construction of a new finishing facility align with this strategic mission. We have constructed a physical vapor deposition (“PVD”) finishing facility, which we believe will establish us as the first OEM automotive wheel manufacturer to have this capabilityin-house in North America and Europe. PVD is a wheel coating process that creates bright chrome-like surfaces in an environmentally friendly manner.

Demand for our major customers and our manufacturing capacity by headcount split between lower cost and higher cost sourced labor.

Our industryproducts is mainly driven by light-vehicle production levels in North America and toEurope. The North American light-vehicle production level in 2017 was 17.0 million vehicles, a much lesser extent in South America. The4.7 percent decrease from 2016. Despite this decrease, the 2017 North American production level was one of the highest in 2015,the history of the industry. In Europe, the passenger car and light duty truck vehicle production level in 2017 was 17.418.7 million vehicles, a 30.3 percent or 0.5 million unit, increase over 2014.2016. We track annual production rates based on information fromWard'sWard’s Automotive Group,.as well as other sources. The North American annual production levelsmajority of automobiles and light-duty trucks (including SUV's, vans and "crossover vehicles") continue the trend of growth since the 2009 recession. Current economic conditions, low consumer interest rates and relatively inexpensive gas prices have been generally supportive of market growth and,our customers’ wheel programs are awarded to suppliers two or three years in addition, the relatively high average age of vehicles on the road appearsadvance. Our purchase orders with OEMs are typically specific to be contributing to higher rates ofa particular vehicle replacement. It was reported in 2015 that the average age of all light vehicles in the U.S. increased to an all-time high of 11.5 years, according to IHS Automotive.

In 2014, production of automobiles and light-duty trucks in North America reached 16.9 million units, an increase of 5 percent over 2013. Production in 2013 reached 16.1 million units, an increase of 0.7 million, or 5 percent, from 15.4 million vehicles in 2012.

We were initially incorporated in Delaware in 1969 and reincorporated in California in 1994. In 2015, we moved our headquarters from Van Nuys, California to Southfield, Michigan and reincorporated in Delaware in 2015. Our stock is traded on the New York Stock Exchange under the symbol "SUP."

The raw materials used in manufacturing our products are readily available and are obtained through numerous suppliers with whom we have established trade relations. We purchasePurchased aluminum for the manufacture of our aluminum wheels, which accounted for the vast majority of

our total raw material requirements during 2015. The majority of our2017. Our aluminum requirements are met through purchase orders with certain major producers, with physical supply comingprimarily obtained from North Americanin-country production locations. Generally, thealuminum purchase orders are fixed as to minimum and maximum quantities, of aluminum, which the producers must supply and we must purchase during the term of the orders. During 2015,2017, we were able to successfully secure aluminum commitments from our primary suppliers to meet production requirements, and we anticipate being able to source aluminum requirements to meet our expected level of production in 2016.2018. We procure other raw materials through numerous suppliers with whom we have established trade relationships.

We also enter into commodity forward contracts and swaps covering up to twelve months aftermarket production volume in which the aluminum price is linked to the London Metal Exchange (LME) index. Moreover, in both our North American and European businesses, OEM wheel sale prices are adjusted for fluctuating aluminum commodity prices based on changes in commodity indices.When market conditions warrant, we may also may enter into purchase commitments to secure the supply of certain commodities used in the manufacture of our products, such as aluminum, natural gas and other raw materials. We had purchase commitments for the delivery of natural gas through the end of 2015. These natural gas contracts were considered to be derivatives under U.S. generally accepted accounting principles ("GAAP"), and when entering into these contracts, it was expected that we would take full delivery of the contracted quantities of natural gas over the normal course of business. Accordingly, at inception, these contracts qualified for the normal purchase, normal sale ("NPNS") exemption provided under U.S. GAAP.

We have proven our ability to be a consistent producer of high quality aluminum wheels with the capability to meet our customers'customers’ price, quality, delivery and service requirements. We strive to continually enhance our relationships with our customers through continuous improvement programs, not only through our manufacturing operations but in the engineering, design, development and quality areas as well. These key business relationships have resulted in multiple vehicle supply contract awards with our key customers overin the past year.

few years.Ford GM, Toyota and FCAGM were our only customers individually accounting for more than 10 percent of our consolidated trade sales.sales in 2017. Net sales to these customers, as well as Toyota, in 2015, 20142017, 2016 and 20132015 were as follows (dollars in millions):

|

| | | | | | | | | | | | |

| | | 2015 | | 2014 | | 2013 |

| | | Percent of Net Sales | | Dollars | | Percent of Net Sales | | Dollars | | Percent of Net Sales | | Dollars |

| Ford | | 44% | | $315.1 | | 44% | | $321.6 | | 45% | | $349.7 |

| GM | | 24% | | $175.6 | | 24% | | $175.8 | | 24% | | $186.4 |

| Toyota | | 14% | | $104.5 | | 12% | | $88.3 | | 12% | | $92.1 |

| FCA | | 8% | | $56.3 | | 10% | | $72.0 | | 10% | | $78.1 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2015 | | | 2016 | | | 2017 | |

| | | Percent of

Net Sales | | | Dollars | | | Percent of

Net Sales | | | Dollars | | | Percent of

Net Sales | | | Dollars | |

Ford | | | 44 | % | | $ | 315.1 | | | | 38 | % | | $ | 271.4 | | | | 22 | % | | $ | 248.8 | |

GM | | | 24 | % | | $ | 175.6 | | | | 30 | % | | $ | 216.4 | | | | 20 | % | | $ | 217.5 | |

Toyota | | | 14 | % | | $ | 104.5 | | | | 14 | % | | $ | 98.4 | | | | 9 | % | | $ | 103.8 | |

In addition, sales to Nissan and Volkswagen Group (“VW”), which includes Audi, exceeded 5 percent of sales during 2017, and sales to Mercedes and Volvo for the seven months following the acquisition of Uniwheels exceeded 5 percent during 2017 on an annualized basis. The loss of all or a substantial portion of our sales to Ford, GM, Toyota, Nissan, VW, Mercedes or FCA

Volvo would have a significant adverse effect on our financial results. See also Item 1A, - Risk Factors“Risk Factors” of this Annual Report.

We manufacture a significant portion of our North American products in Mexico that are sold both in the United States and Mexico. Net sales of wheels manufactured in our Mexico operations in 20152017 totaled $550.7$608.0 million and represented 7683.0 percent of our total net sales. Thesales in North America. We anticipate that the portion of our products produced in Mexico versus the United States will increaseremain comparable in 2016, as we expect to achieve full commercial production at a new wheel plant in Mexico for most of 2016.2018. Net property, plant and equipment used in our operations in Mexico totaled $190.4$214.5 million at December 31, 2015, including $112.2 million related to our recently completed wheel plant.2017. The overall cost for us to manufacture wheels in Mexico currently is lower than in the United States, due to lower labor costs as a result of lower prevailing wage rates.

Similarly, we manufacture the majority of our products for the European market in Poland, which are sold throughout Europe. Net sales of wheels manufactured in our Poland operations for the seven months following

the acquisition were $220.4 million and represented 58.7 percent of our total net sales in Europe in 2017. Net property, plant and equipment used in our operations in Poland totaled $227.3 million at December 31, 2017. Similar to our Mexican operations, the overall cost to manufacture wheels in Poland is substantially lower than in both the U.S., in particular, because of reduced labor costUnited States and Germany at the present time due principally to lower prevailing wage rates. Such current advantages tolabor costs.

Cost of manufacturing our product in Mexico, canGermany and Poland may be affected by changes in cost structures, tariffs imposed by the United States, trade protection laws, policies and other regulations affecting trade and investments, social, political, labor, or general economic conditions in Mexico.conditions. Other factors that can affect the business and financial results of our Mexican, German, Polish and U.S. operations include, but are not limited to, valuationcurrency effects of the peso,Peso, Euro and Zloty currencies, availability and competency of personnel and tax

regulations in Mexico. regulations. See also Item 1A- Risk1A, “Risk Factors - International OperationsOur international operations and international trade agreements make us vulnerable to risks associated with doing business in foreign countries that can affect our business, financial condition and results of operations” and Item 1A, - Risk“Risk Factors - Foreign Currency Fluctuations.

Fluctuations in foreign currencies may adversely impact our financial condition.”Net Sales Backlog

We receive OEM purchase ordersOur customers typically award programs several years before actual production is scheduled to produce aluminum wheels typically for multiple model years. These purchase orders are typically for onebegin. Each year, for vehicle wheel programs that usually last three to five years. We manufacturethe automotive manufacturers introduce new models, update existing models and ship based on customer release schedules, normally provideddiscontinue certain models. In this process, we may be selected as the supplier on a weekly basis, which can vary in part duenew model, we may continue as the supplier on an updated model or we may lose a new or updated model to changes in demand, industry and/or customer maintenance cycles,a competitor. The Company’s estimated net sales may be impacted by various assumptions, including new program introductionsvehicle production levels, customer price reductions, currency exchange rates and program launch timing. Our customers may terminate the awarded programs at any time or dealer inventoryreduce order levels. Accordingly, even though customer purchase orders cover multiple model years, our managementTherefore, expected net sales information does not believerepresent firm commitments or firm orders. We estimate that we have been awarded programs covering approximately 89 percent of our firm backlog is a meaningful indicator of future operating results.

manufacturing capacity over the next three years.Competition

Competition in the market for aluminum wheels is based primarily on price, technology, quality, delivery, and overall customer service.service, price, quality and technology. We are one of the leading supplierslargest producer of aluminum wheels for OEM installations in the world,North America and areone of the largest producer in North America.Europe. We currently supply approximately 20 percent and 14 percent of the aluminum wheels installed on passenger cars and light-duty trucks in North America. America and Europe, respectively.

Competition is global in nature with growinga significant volume of exports from Asia into North America. There are several competitors with facilities in North America but we estimate that we have more than twice the North American production capacity of any competitor basedcompetitor. Some of the key competitors in North America include Central Motor Wheel of America (“CMWA”), CITIC Dicastal Co., Ltd., Prime Wheel Corporation, and Ronal. In 2017, the European Union renewed a tariff on our current estimation.aluminum wheels from China, which lessens the competitive pressures from Chinese competitors in that market. Key European competitors include Ronal (Switzerland), Borbet (Germany) and CMS (Turkey). The accessories market, by contrast, is heavily fragmented. We are the leading manufacturer of alloy wheels in the European aftermarket. Key competitors include Alcar (Austria), Brock (Germany), Borbet (Germany), ATU (Germany) and Mak (Italy). See also Item 1A, - Risk Factors“Risk Factors” of this Annual Report. Other

Steel and other types of road wheels such as those made of steel, also compete with our products. According to

Ward'sWard’s Automotive Group, the aluminum wheel penetration rate on passenger cars and light-duty trucks in the U.S.North America was 7987 percent for the 20152017 model year and 81 percent for the 20142016 model year, compared to 8079 percent for the 20132015 model year. The aluminum wheel penetration rate on passenger cars and light-duty trucks in Europe was 70 percent in 2017. We expect the ratio of aluminum wheel penetration rate to steel wheelscontinue to remain relatively stable.increase. However, several factors can affect this rate including price, fuel economy requirements and styling preference. Although aluminum wheels currently are more costly than steel, aluminum is a lighter material than steel, which is desirable for fuel efficiency and generally viewed as aesthetically superior to steel and, thus, more desirable to the OEMs and their customers.

Our policy is to continuously review, improve and develop our engineering capabilities to satisfy our customer requirements in the most efficient and cost effectivecost-effective manner available. We strive to achieve this objective by attracting and retaining top engineering talent and by maintaining the lateststate-of-the-art computer technology to support engineering development. A fully staffedFully developed engineering center,centers located in Fayetteville, Arkansas, supportsand in Lüdenscheid, Germany support our research and development manufacturing needs. We also have a technical sales centerfunction at our corporate headquarters in Southfield, Michigan that maintains a complement of engineering staff centrally located near some of our largest customers'customers’ headquarters and engineering and purchasing offices.

Research and development costs (primarily engineering and related costs), which are expensed as incurred, are included in cost of sales in our consolidated income statements. Amounts expended on researchResearch and development costs during each of the last three years were $7.7 million in 2017, $3.8 million in 2016 and $2.6 million in 2015; $4.4 million in 2014; and $4.8 million in 2013.

2015.Government Regulation

Safety standards in the manufacture of vehicles and automotive equipment have been established under the National Traffic and Motor Vehicle Safety Act of 1966.1966, as amended. We believe that we are in compliance with all federal standards currently applicable to OEM suppliers and to automotive manufacturers.

Our manufacturing facilities, like most other manufacturing companies, are subject to solid waste, water and air pollution control standards mandated by federal, state and local laws. Violators of these laws are subject to fines and, in extreme cases, plant closure. We believe our facilities are in material compliance with all presently applicable standards. However, costs related to environmental protection may grow due to increasingly stringent laws and regulations. The cost of environmental compliance was approximately $0.6 million in 2017, $0.4 million in 2016 and $0.7 million in 2015; $0.4 million in 2014; and $0.5 million in 2013.2015. We expect that future environmental compliance expenditures will approximate these levels and will not have a material effect on our consolidated financial position. Furthermore,position or results of operations. However, climate change legislation or regulations restricting emission of "greenhouse gases"“greenhouse gases” could result in increased operating costs and reduced demand for the vehicles that use our products. See also Item 1A, - Risk“Risk Factors - Environmental MattersWe are subject to various environmental laws” of this Annual Report.

greenhouse gas emissions is on the agenda of the European authorities. As a result, the EU has made a commitment in an EU Directive to reduce emissions by at least 20 percent by the year 2020 (measured on 1990 levels). Passenger cars have been identified as a key causal factor in emissions. A central element of the regulation is an average CO2 emissions target of 95g CO2 / km per new car registration. From 2025 this target has been further tightened to an average of between 68 and 78g CO2 / km. This value should be reached by means of improvements to engine technology and innovative technologies in terms of weight reduction.Employees

As of December 31, 2015,2017, we had approximately 3,0507,800 full-time employees and 350 contract employees compared to approximately 3,0004,189 full-time employees and 682 contract employees at December 31, 2014.2016. None of our employees in North America are covered by a collective bargaining agreement. Uniwheels’ subsidiary, Uniwheels Production (Germany) GmbH (“UPG”), is a member of the employers’ association for the metal and electronic industry in North Rhine-Westphalia (METALL NRW Verband der Metall und Elektro-Industrie North Rhine-Westphalia e.V.) and is subject to various collective bargaining agreements for the metal and electronic industry in North Rhine-Westphalia entered into by the employers’ association with the trade union IG Metall. These collective bargaining agreements include provisions relating to wages, holidays, and partial retirement. It is estimated that approximately 410 employees of Uniwheels employed at UPG in Germany were unionized

and/or subject to collective bargaining agreements in 2017. UPG and Uniwheels Automotive (Germany) GmbH (operating a joint workers council) operate a statutory workers council and Uniwheels Production (Poland) Sp. z o.o. (“UPP”) operates a voluntary workers council. The increase in employees in 2017 was due to the acquisition of the Uniwheels business in Europe. See Item 7, “Management’s Discussion and Analysis of Financial Conditions and Results of Operations.”

Fiscal Year End

OurThe fiscal year isof 2017 consisted of the 52- or 53-week period ending generallyended December 31, 2017 and the 2016 and 2015 fiscal years consisted of the52-week periods ended on December 25, 2016 and December 27, 2015, respectively. Historically, our fiscal year ended on the last Sunday of the calendar year. TheUniwheels, our European operation acquired on May 30, 2017, is reported on a calendar year end. These fiscal years 2015, 2014periods align as of December 31, 2017. Beginning in 2018, both our North American and 2013 comprisedEuropean operations will be on a calendar fiscal year with each month ending on the 52-week periods ended on December 27, 2015, December 28, 2014 and December 29, 2013, respectively.last day of the calendar month. For convenience of presentation, all fiscal years are referred to as beginning as of January 1, and ending as of December 31, but actually reflect our financial position and results of operations for the periods described above.

We operate asAs a single integrated businessresult of the Uniwheels acquisition, the company expanded into the European market and as such,extended its customer base to include the principal European OEMs. As a consequence, we have only onerealigned our executive management structure, organization and operations to focus on our performance in our North American and European regions. Accordingly, we have concluded that our North American and European businesses represent separate operating segment - automotive wheels.segments in view of significantly different markets and customers within each of these regions. Financial information about this segment and geographic areasour operating segments is contained in Note 5 - Business Segments6, “Business Segments” in the Notes to Consolidated Financial Statements in Item 8, - Financial“Financial Statements and Supplementary DataData” of this Annual Report.

The automotive industry is cyclical and varies based on the timing of consumer purchases of vehicles, which in turn varyvaries based on a variety of factors such as general economic conditions, availability of consumer credit, interest rates and fuel costs. While there have been no significant seasonal variations in the past few years, production schedules in our industry can vary significantly from quarter to quarter to meet the scheduling demands of our customers.

Typically, our aftermarket business experiences two seasonal peaks, which require substantially higher levels of production. The higher demand for aftermarket wheels from our customers occurs in March and September leading into the spring and winter peak consumer selling seasons.History

We were initially incorporated in Delaware in 1969. Our entry into the OEM aluminum wheel business in 1973 resulted from our successful development of manufacturing technology, quality control and quality assurance techniques that enabled us to satisfy the quality and volume requirements of the OEM market for aluminum wheels. The first aluminum wheel for a domestic OEM customer was a Mustang wheel for Ford Motor Company. We reincorporated in California in 1994, and in 2015, we moved our headquarters from Van Nuys, California to Southfield, Michigan and reincorporated in Delaware. On May 30, 2017, we acquired a majority interest in Uniwheels, which is a European supplier of OEM and aftermarket aluminum wheels. Our stock is traded on the New York Stock Exchange under the symbol “SUP.”

Available Information

Our Annual Report on Form10-K, quarterly reports on Form10-Q and any amendments thereto are available, without charge, on or through our website, www.supind.com, under “Investors,” as soon as reasonably

practicable after they are filed electronically with the Securities and Exchange Commission ("SEC"(“SEC”). The public may read and copy any materials filed with the SEC at the SEC'sSEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at1-800-SEC-0330. The SEC also maintains a website, www.sec.gov, which contains these reports, proxy and information statements and other information regarding the company. Also included on our website, www.supind.com, under "Investor,"“Investor,” is our Code of Conduct, which, among others, applies to our Chief Executive Officer (“CEO”), Chief Financial Officer and Chief Accounting Officer. Copies of all SEC filings and our Code of Conduct are also available, without charge, upon request from Superior Industries International, Inc., Shareholder Relations, 26600 Telegraph Road, Suite 400, Southfield, MI 48034.

Michigan 48033.The content on any website referred to in this Annual Report on Form10-K is not incorporated by reference in this Annual Report on Form 10-K unless expressly noted.

10-K.

1A. Risk FactorsThe following discussion of risk factors contains “forward-looking” statements, which may be important to understanding any statement in this Annual Report or elsewhere. The following information should be read in conjunction with Item 7, - Management's“Management’s Discussion and Analysis of Financial Condition and Results of Operations ("(“MD&A"&A”)” and Item 8, - Financial“Financial Statements and Supplementary DataData” of this Annual Report.

Our business routinely encounters and addresses risks and uncertainties. Our business, results of operations and financial condition could be materially adversely affected by the factors described below. Discussion about the important operational risks that our business encounters can also be found in the MD&A section and in the business description in Item 1, - Business“Business” of this Annual Report. Below, we have described our present view of the most significant risks and uncertainties we face. Additional risks and uncertainties not presently known to us, or that we currently do not consider significant, could also potentially impair our business, results of operations and financial condition. Our reactions to these risks and uncertainties as well as our competitors'competitors’ reactions will affect our future operating results.

Risks Relating Toto Our Company

Efforts to integrate our Europe segment, including substantial integration expenses and the additional indebtedness incurred to finance our acquisition of Uniwheels, could disrupt our business and adversely impact our stock price and future business and results of operations.

Since the acquisition of Uniwheels (now referred to as our “Europe segment,” “Europe business” or “Europe operations”) on May 30, 2017 (the “Acquisition”), we have made significant strides toward integrating the two companies. However, the continuing integration of our Europe segment with our North America segment will be a complex and time-consuming process that may not be successful. The company has a limited history of integrating a significant acquisition into its business and the integration process may produce unforeseen operating difficulties and expenditures. The primary areas of focus for successfully combining our Europe segment with our North American operations may include, among others: retaining and integrating management and other key employees; realizing overall improvement in the design, engineering,start-up and production of wheel programs; aligning customer interface across the combined business; integrating information, communications and other systems; and managing the growth of the combined company. Our integration efforts could disrupt our business in the following ways, among others, and any of the following could adversely affect our business, harm our financial condition, results of operations or business prospects:

the attention of management may be directed toward the completion of the integration and other transaction-related considerations and may be diverted from theday-to-day business operations of Superior, and matters related to the Acquisition may require commitments of time and resources that could otherwise have been devoted to other opportunities that might have been beneficial to us;

our employees may experience uncertainty regarding their future roles in the combined company, which might adversely affect our ability to retain, recruit and motivate key personnel; and

customers, suppliers and other third parties with business relationships with Superior may decide not to renew or may decide to seek to terminate, change and/or renegotiate their relationships with Superior as a result of the Acquisition, whether pursuant to the terms of their existing agreements with Superior or otherwise.

There are a large number of processes, policies, procedures, operations, technologies and systems that must be integrated with the rest of our operations, including purchasing, accounting and finance, sales, billing, payroll, manufacturing, marketing and employee benefits. While we expect to incur integration and restructuring costs and other transaction-related costs following completion of the Acquisition that currently are estimated to range between $5.0 million and $7.0 million, many of the expenses that will be incurred, especially with respect to manufacturing operations are, by their nature, difficult to estimate accurately. These expenses could, particularly in the near term, exceed the savings that we expect to achieve from elimination of duplicative expenses and the realization of economies of scale and cost savings. Although we expect that the realization of efficiencies related to the integration of the businesses will offset incremental transaction, Acquisition-related and restructuring costs over time, we cannot give any assurance that this net benefit will be achieved in the near term, or at all.

Even if we successfully integrate our Europe segment with our North American operations, there can be no assurance that we will realize the anticipated benefits. The Acquisition is expected to result in various benefits for the combined company including, among others, business growth opportunities and synergies in operations, purchasing and administration. Increased competition and/or deterioration in business conditions may limit our ability to expand this business. As such, we may not be able to realize the synergies, business opportunities and growth prospects anticipated in connection with the Acquisition.

The automotive industry is cyclical and volatility in the automotive industry could adversely affect our financial performance.

The majority of our sales are made in European and domestic U.S. markets and almost exclusively within North America.markets. Therefore, our financial performance depends largely on conditions in the European and U.S. automotive industry, which in turn can be affected significantly by broad economic and financial market conditions. Consumer demand for automobiles is subject to considerable volatility as a result of consumer confidence in general economic conditions, levels of employment, prevailing wages, fuel prices and the availability and cost of consumer credit. With steady improvement in the North American automotive industry since the global recession that began in 2008, vehicle production levels in 2015 reached the highest level in the last decade. However, thereThere can be no guarantee that the improvements in recent years will be sustained or that reductions from current production levels will not occur in future periods. Demand for aluminum wheels can be further affected by other factors, including pricing and performance comparisons to competitive materials such as steel. Finally, the demand for our products is influenced by shifts of market share between vehicle manufacturers and the specific market penetration of individual vehicle platforms being sold by our customers.

A limited number of customers represent a large percentage of our sales. The loss of a significant customer or decrease in demand could adversely affect our operating results.

Ford, GM Toyota and FCA,Toyota, together, represented approximately 9082 percent of our total wheel sales in 2015.2016 and just more than half of our total consolidated combined sales in 2017. Despite the decrease in the combined percentage of our three largest customers in 2017, a loss of a significant customer or decrease in demand still remains a risk. Our OEM customers are not required to purchase any minimum amount of products from us. Increasingly global procurement practices, the pace of new vehicle introduction and demand for price reductions may make it more difficult to maintain long-term supply arrangements with our customers, and there are no guarantees that we will be able to negotiate supply arrangements with our customers on terms acceptable to us in the future. The contracts we have entered into with most of our customers provide that we will manufacture wheels for a particular vehicle model, rather than manufacture a specific quantity of products. Such contracts range from one

year to the life of the model (usually three to five years), typically arenon-exclusive and do not require the purchase by the customer of any minimum number of wheels from us. Therefore, a significant decrease in consumer demand for certain key models or group of related models sold by any of our major customers, or a decision by a manufacturer not to purchase from us, or to discontinue purchasing from us, for a particular model or group of models, could adversely affect our results of operations and financial condition.

Our new operations at a recently constructed facility in Mexico may not achieve the expected benefits.

In anticipation of continued growth in demand for aluminum wheels in the North American market, we constructed a new manufacturing facility in Mexico. Initial commercial production at this facility began in early 2015. The new manufacturing facility entails a number of risks, including the ability to ramp-up commercial production within the cost and time-frame estimated and to attract a sufficient number of skilled workers to meet the needs of the new facility. Additionally, our assessment of the projected benefits associated with the construction of a new manufacturing facility is subject to a number of estimates and assumptions, including future demand for our products, which in turn are subject to significant economic, competitive and other uncertainties that are beyond our control. Operating results could be unfavorably impacted by start-up costs until production levels at the new facility reach planned levels. Additionally, our overall ability to increase total company revenues in the future can be affected by factors affecting the volume of products manufactured at our existing factories.

We experience continual pressure to reduce costs.

The vehicle market is highly competitive at the OEM level, which drives continual cost-cutting initiatives by our customers. Customer concentration, relative supplier fragmentation and product commoditization have translated into continual pressure from OEMs to reduce the price of our products. It is possible that pricing pressures beyond our expectations could intensify as OEMs pursue restructuring and cost-cutting initiatives. If we are unable to generate sufficient production cost savings in the future to offset such price reductions, our gross margin, rate of profitability and cash flows could be adversely affected. In addition, changes in OEMs' purchasing policies or payment practices could have an adverse effect on our business. Our OEM customers typically attempt to qualify more than one wheel supplier for the programs we participate in and for programs we may bid on in the future. As such, our OEM customers are able to negotiate favorable pricing or may decrease sales volume. Such actions may result in decreased sales volumes and unit price reductions for our company, resulting in lower revenues, gross profit, operating income and cash flows.

We operate in a highly competitive industry.

The automotive component supply industry is highly competitive, both domestically and internationally. Competition is based on a number of factors, including price, technology, quality, delivery and overall customer service and available capacity to meet

customer demands. Some of our competitors are companies, or divisions or subsidiaries of companies, which are larger and have greater financial and other resources than we do. We cannot ensure that our products will be able to compete successfully with the products of these competitors. In particular, our ability to increase manufacturing capacity typically requires significant investments in facilities, equipment and personnel. Our operating facilities are at full or near to full capacity levels which may cause us to incur labor costs at premium rates in order to meet customer requirements, experience increased maintenance expenses or require us to replace our machinery and equipment on an accelerated basis. Furthermore, the nature of the markets in which we compete has attracted new entrants, particularly from low cost countries. As a result, our sales levels and margins continue to be adversely affected by pricing pressures reflective of significant competition from producers located inlow-cost foreign markets, such as China. Such competition with lower cost structures poses a significant threat to our ability to compete internationally and domestically. These factors have led to our customers awarding business to foreign competitors in the past, and they may continue to do so in the future. In addition, any of our competitors may foresee the course of market development more accurately, develop products that are superior to our products, have the ability to produce similar products at a lower cost or adapt more quickly to new technologies or evolving customer requirements. Consequently, our products may not be able to compete successfully with competitors'competitors’ products.

We experience continual pressure to reduce costs.

The vehicle market is highly competitive at the OEM level, which drives continual cost-cutting initiatives by our customers. Customer concentration, relative supplier fragmentation and product commoditization have translated into continual pressure from OEMs to reduce the price of our products. It is possible that pricing pressures beyond our expectations could intensify as OEMs pursue restructuring and cost-cutting initiatives. If we are unable to generate sufficient production cost savings in the future to offset such price reductions, our gross margin, rate of profitability and cash flows could be adversely affected. In addition, changes in OEMs’ purchasing policies or payment practices could have an adverse effect on our business. Our internationalOEM customers typically attempt to qualify more than one wheel supplier for the programs we participate in and for programs we may bid on in the future. As such, our OEM customers are able to negotiate favorable pricing or may decrease wheel orders. Such actions may result in decreased sales volumes and unit price reductions for our company, resulting in lower revenues, gross profit, operating income and cash flows.

We may be unable to successfully implement cost-saving measures or achieve expected benefits under our plans to improve operations.

As part of our ongoing focus to provide high quality products, we continually analyze our business to further improve our operations make us vulnerableand identify cost-cutting measures. We may be unable to risks associated with doing businesssuccessfully identify or implement plans targeting these initiatives, or fail to realize the benefits of the plans we have already implemented, as a result of operational difficulties, a weakening of the economy or other factors. Cost reductions may not fully offset decreases in foreign countries.

We manufacture a substantial portionthe prices of our products in Mexico, have a minor investment in a wheel manufacturing company in India and we sell our products internationally. Accordingly, unfavorable changes in foreign cost structures, trade protection laws, regulations and policies affecting trade and investments and social, political, labor, or economic conditions in a specific country or region, among other factors, could have a negative effect on our business and results of operations. Legal and regulatory requirements differ among jurisdictions worldwide. Violations of these laws and regulations could result in fines, criminal sanctions, prohibitions on the conduct of our business, and damage to our reputation. Although we have policies, controls, and procedures designed to ensure compliance with these laws, our employees, contractors, or agents may violate our policies.

Fluctuations in foreign currencies may adversely impact our financial condition.

Duedue to the growth oftime required to develop and implement cost reduction initiatives. Additional factors such as inconsistent customer ordering patterns, increasing product complexity and heightened quality standards are making it increasingly more difficult to reduce our operations outside ofcosts. It is possible that as we incur costs to implement improvement strategies, the United States, we have experienced increased exposure to foreign currency gains and losses in the ordinary course of our business. As a result, fluctuations in the exchange rate between the U.S. dollar, the Mexican peso and any currencies of other countries in which we conduct our business may have a material impact on our financial condition, as cash flows generated in foreign currencies may be used, in part, to service our U.S. dollar-denominated liabilities, or vice versa.

In addition, due to customer requirements, we have experienced a significant shift in the currency denominated in our contracts with our customers. As a result of this change, we currently project that in 2016 and beyond the vast majority of our revenues will be denominated in the US dollar, rather than a more balanced mix of U.S. dollar and Mexican peso. In the past we have relied upon significant revenues denominated in the Mexican peso to provide a "natural hedge" against foreign exchange rate changes impacting our peso denominated costs incurred at our facilities in Mexico. Accordingly, the foreign exchange exposure associated with peso denominated costs is a growing risk and could have a material adverse effect on our operating results.

Fluctuations in foreign currency exchange rates may also affect the value of our foreign assets as reported in U.S. dollars, and may adversely affect reported earnings and, accordingly, the comparability of period-to-period results of operations. Changes in currency exchange rates may affect the relative prices at which we and our foreign competitors sell products in the same market. In addition, changes in the value of the relevant currencies may affect the cost of certain items required in our operations. We cannot ensure that fluctuations in exchange rates will not otherwise have a material adverse effect on our financial condition orposition, results of operations or cause significant fluctuations in quarterly and annual results of operations.

We may enter into foreign currency forward and option contracts with financial institutions to protect against foreign exchange risks associated with certain existing assets and liabilities, certain firmly committed transactions and forecasted future cash flows. We have implemented a program to hedge a portion of our material foreign exchange exposures, typically for up to 36 months. However, we may choose not to hedge certain foreign exchange exposures for a variety of reasons, including but not limited to accounting considerations and the prohibitive economic cost of hedging particular exposures. There is no guarantee that our hedge program will effectively mitigate our exposures to foreign exchange changes which could have material adverse effects on our cash flows and results of operations.

Increases in the costs and restrictions on availability of raw materials could adversely affect our operating margins and cash flow.

Generally, we obtain our raw materials, supplies and energy requirements from various sources. Although we currently maintain alternative sources, our business is subject to the risk of price increases and periodic delays in delivery. Fluctuations in the prices

of raw materials may be driven by the supply/demand relationship for that commodity or governmental regulation. In addition, if any of our suppliers seek bankruptcy relief or otherwise cannot continue their business as anticipated, the availability or price of raw materials could be adversely affected.

Although we are able to periodically pass certain aluminum cost increases on to our customers, we may not be able to pass along all changes in aluminum costs and our customers are not obligated to accept energy or other supply cost increases that we may attempt to pass along to them. In addition, fixed price natural gas contracts that expire in the future may expose us to higher costs that cannot be immediately recouped in selling prices. This inability to pass on these cost increases to our customers could adversely affect our operating margins and cash flow possibly resulting in lower operating income and profitability.may be negative.

Interruption in our production capabilities could result in increased freight costs or contract cancellations.

In the last six months of 2016, we experienced significant operating inefficiencies primarily in one of our manufacturing facilities. The inefficiencies stemmed from a variety of issues that reduced production rates. Contributing factors to the inefficiencies included an electricity outage and unanticipated equipment reliability issues which reduced finished goods andwork-in-process inventories. We also experienced several new product launches and significantramp-up in demand for newer products for which unusually high scrap rates were occurring. Lower than normal production yields coupled with the loss of inventory safety stock resulted in a series of expedited shipments to customers. The higher than normal costs included approximately $13 million in freight expediting costs and additional costs related to the production inefficiencies. In 2017, we were able to reduce the expedited shipping costs to less than $1 million and have made strides toward improving the production inefficiencies at this plant. However, headcount at this plant remained at elevated levels in 2017 to ensure we could meet new product launches, better serve our operating results.

customers and avoid expedited shipping charges.An interruption in production capabilities at any of our facilities as a result of equipment failure, interruption of raw materials or other supplies, labor disputes or other reasons could result in our inability to produce our products, which would reduce our sales and operating results for the affected period and harm our customer relationships. We have, from time to time, undertaken significantre-tooling and modernization initiatives at our facilities, which in the past have caused, and in the future may cause, unexpected delays and plant underutilization, and such adverse consequences may continue to occur as we continue to modernize our production facilities. In addition, we generally deliver our products only after receiving the order from the customer and thus typically do not hold large inventories. In the event of a production interruption at any of our manufacturing facilities, even if only temporary, or if we experience delays as a result of events that are beyond our control, delivery times to our customers could be severely affected. Any significant delay in deliveries to our customers could lead to premium freight costs and other performance penalties, as well as contract cancellations, and cause us to lose future sales and expose us to other claims for damages. Our manufacturing facilities are also subject to the risk of catastrophic loss due to unanticipated events such as fires, earthquakes, explosions or violent weather conditions. We have in the past, and may in the future, experience plant shutdowns or periods of reduced production which could have a material adverse effect on our results of operations or financial condition.

Similarly, it also is possible that our customers may experience production delays or disruptions for a variety of reasons, which could include supply-chain disruption for parts other than wheels, equipment breakdowns or other events affecting vehicle assembly rates that impact us, work stoppages or slow-downs at factories where our products are consumed, or even catastrophic events such as fires, disruptive weather conditions or natural disasters. Such disruptions at the customer level may cause the affected customer to halt or limit the purchase of our products.

Aluminum and alloy pricing may have a material effect on our operating margins and results of operations.

The cost of aluminum is a significant component in the overall cost of a wheel and in our selling prices to OEM customers. The price for aluminum we purchase is adjusted monthly based primarily on changes in certain published market indices, but the timing of such adjustments is based on specific customer agreements and can vary from monthly to quarterly. As a result, the timing of aluminum price adjustments flowing through sales rarely will match the timing of such changes in cost, and can result in fluctuations to our gross profit. This is especially true during periods of frequent increases or decreases in the market price of aluminum.

The aluminum we use to manufacture wheels also contains additional alloying materials, including silicon. The cost of alloying materials also is a component of the overall cost of a wheel. The price of the alloys we purchase is also based on certain published market indices; however, most of our customer agreements do not provide price adjustments for changes in market prices of alloying materials. Increases or decreases in the market prices of these alloying materials could have a material effect on our operating margins and results of operations.

Implementing a new enterprise resource planning system could interfere with our business or operations.

We are in the process of implementing a new enterprise resource planning (ERP) system. This project requires a significant investment of capital and human resources, the re-engineering of many processes of our business, and the attention of many personnel who would otherwise be focused on other aspects of our business. Should the system not be implemented successfully, or if the system does not perform in a satisfactory manner once implementation is complete, our business and operations could be disrupted and our results of operations negatively affected, including our ability to report accurate and timely financial results.

We are from time to time subject to litigation, which could adversely impact our financial condition or results of operations.

The nature of our business exposes us to litigation in the ordinary course of our business. We are exposed to potential product liability and warranty risks that are inherent in the design, manufacture and sale of automotive products, the failure of which could result in property damage, personal injury or death. Accordingly, individual or class action suits alleging product liability or

warranty claims could result. Although we currently maintain what we believe to be suitable and adequate product liability insurance in excess of our self-insured amounts, we cannot assure you that we will be able to maintain such insurance on acceptable terms or that such insurance will provide adequate protection against potential liabilities. In addition, if any of our products prove to be defective, we may be required to participate in a recall. A successful claim brought against us in excess of available insurance coverage, if any, or a requirement to participate in any product recall, could have a material adverse effect on our results of operations or financial condition. We cannot give assurance that any current or future claims will not adversely affect our cash flows, financial condition or results of operations.

We may be unable to successfully implement cost-saving measures or achieve expected benefits under our plans to improve operations.

As part of our ongoing focus on being a low-cost provider of high quality products, we continually analyze our business to further improve our operations and identify cost-cutting measures. We may be unable to successfully identify or implement plans targeting these initiatives, or fail to realize the benefits of the plans we have already implemented, as a result of operational difficulties, a weakening of the economy or other factors. Cost reductions may not fully offset decreases in the prices of our products due to the time required to develop and implement cost reduction initiatives. Additional factors such as inconsistent customer ordering patterns, increasing product complexity and heightened quality standards are making it increasingly more difficult to reduce our costs. It is possible that as we incur costs to implement improvement strategies, the impact on our financial position, results of operations and cash flow may be negative.

We may be unable to successfully launch new products and/or achieve technological advances.

In order to effectively compete in the automotive supply industry, we must be able to launch new products and adopt technology to meet our customers' demandcustomers’ demands in a timely manner. However, we cannot ensure that we will be able to install and certify the equipment needed for new product programs in time for the start of production, or that the transitioning of our manufacturing facilities and resources under new product programs will not impact production rates or other operational efficiency measures at our facilities. In addition, we cannot ensure that our customers will execute the launch of their new product programs on schedule. We are also subject to the risks generally associated with new product introductions and applications, including lack of market acceptance, delays in product development and failure of products to operate properly. Further, changes in competitive technologies may render certain of our products obsolete or less attractive. Our ability to anticipate changes in technology and to successfully develop and introduce new and enhanced products on a timely basis will be a significant factor in our ability to remain competitive. Our failure to successfully and timely launch new products or adopt new technologies, or a failure by our customers to successfully launch new programs, could adversely affect our results. We cannot ensure that we will be able to achieve the technological advances that may be necessary for us to remain competitive or that certain of our products will not become obsolete.

Our international operations and international trade agreements make us vulnerable to risks associated with doing business in foreign countries that can affect our business, financial condition and results of operations.

We manufacture a substantial portion of our products in Mexico, Germany and Poland and we sell our products internationally. Accordingly, unfavorable changes in foreign cost structures, trade protection laws, tariffs on aluminum, regulations and policies affecting trade and investments and social, political, labor or economic conditions in a specific country or region, among other factors, could have a negative effect on our business and results of operations. Legal and regulatory requirements differ among jurisdictions worldwide. Violations of these laws and regulations could result in fines, criminal sanctions, prohibitions on the conduct of our business and damage to our reputation. Although we have policies, controls and procedures designed to ensure compliance with these laws, our employees, contractors, or agents may violate our policies.

Changes in North American and European Union (EU) social, political, regulatory and economic conditions or in laws and policies governing foreign trade, manufacturing, development and investment in the countries where we currently develop and sell products could adversely affect our business. A significant portion of our business activities are conducted in Mexico. Current leadership in the U.S. federal government is not supportive of certain existing international trade agreements, including the North American Free Trade Agreement (“NAFTA”). If the U.S. withdraws from or materially modifies NAFTA or certain other international trade agreements, our business, financial condition and results of operations could be adversely affected. In addition, proposals to institute a border adjustment of 20 percent for imports could have a negative impact on our operations.

Fluctuations in foreign currencies may adversely impact our financial condition.

Due to the growth of our operations outside of the United States, we have experienced increased exposure to foreign currency gains and losses in the ordinary course of our business. As a result, fluctuations in the exchange rate between the U.S. dollar, the Mexican peso, the Euro, the Polish Zloty and any currencies of other countries in which we conduct our business may have a material impact on our financial condition, as cash flows generated in foreign currencies may be used, in part, to service our U.S. dollar-denominated liabilities, or vice versa.

Fluctuations in foreign currency exchange rates may also affect the value of our foreign assets as reported in U.S. dollars, and may adversely affect reported earnings and, accordingly, the comparability ofperiod-to-period results of operations. Changes in currency exchange rates may affect the relative prices at which we and our foreign competitors sell products in the same market. In addition, changes in the value of the relevant currencies may affect the cost of certain items required in our operations. We cannot ensure that fluctuations in exchange rates will not otherwise have a material adverse effect on our financial condition or results of operations or cause significant fluctuations in quarterly and annual results of operations.

Our business requires us to settle transactions between currencies in both directions - i.e., peso to U.S. dollar, Euro to U.S. Dollar, Euro to Zloty and vice versa for all transactions. To the greatest extent possible, we attempt to match the timing and magnitude of transaction settlements between currencies to create a “natural hedge.” Based on the current business model and levels of production and sales activity, the net imbalance between currencies depends on specific circumstances. While changes in the terms of the contracts with our customers will be creating an imbalance between currencies that we are hedging with foreign currency forward contracts, there can be no assurances that our hedging program will effectively offset the impact of the imbalance between currencies or that the net transaction balance will not change significantly in the future.

To manage this risk, we may enter into foreign currency forward and option contracts with financial institutions to protect against foreign exchange risks associated with certain existing assets and liabilities, certain firmly committed transactions and forecasted future cash flows. We have a program to hedge a portion of our material foreign exchange exposures, typically for up to 42 months. However, we may choose not to hedge certain foreign exchange exposures for a variety of reasons including, but not limited to, accounting considerations and the prohibitive economic cost of hedging particular exposures. There is no guarantee that our hedge program will effectively mitigate our exposures to foreign exchange changes which could have material adverse effects on our cash flows and results of operations.

Our substantial indebtedness could adversely affect our financial condition

We have a significant amount of new indebtedness. As of December 31, 2017, our total debt was $707.9 million ($683.6 million, net of unamortized debt issuance costs of $24.3 million), and we had availability of $157.2 million under the Senior Secured Credit Facilities, as well as 30.0 million Euros under a European revolving line of credit. The interest expense on the significant amount of new indebtedness will be significantly higher than historical interest expense and could adversely affect our financial condition.

Subject to the limits contained in the Credit Agreement governing the Senior Secured Credit Facilities and the indenture governing the Notes (the “Indenture”) and our other debt instruments, we may be able to incur substantial additional debt from time to time to finance working capital, capital expenditures, investments or acquisitions, or for other purposes. If we do so, the risks related to our high level of debt could intensify.

In addition, the Indenture and the Credit Agreement governing the Senior Secured Credit Facilities contain restrictive covenants that will limit our ability to engage in activities that may be in our long-term best interest. Our failure to comply with those covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all our debt.

We may not be able to generate sufficient cash to service all of our indebtedness, including the Notes, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments or to refinance our debt obligations depends on our financial and operating performance, which is subject to prevailing economic, industry and competitive conditions and to certain financial, business, economic and other factors beyond our control. We may not be able to maintain a sufficient level of cash flow from operating activities to permit us to pay the principal, premium, if any, and interest on the Notes and our other indebtedness.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets, seek additional capital or seek to restructure or refinance our indebtedness, including the Notes. Our ability to restructure or refinance our debt will depend on the condition of the capital and credit markets and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations and limit our financial flexibility. In addition, any failure to make payments of interest and principal on our outstanding indebtedness on a timely basis would likely result in a reduction of our credit rating, which could harm our ability to incur additional indebtedness. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. In the absence of such cash flows and resources, we could face substantial liquidity problems and might be required to sell material assets or operations to attempt to meet our debt service and other obligations. The Credit Agreement governing the Senior Secured Credit Facilities and the Indenture will restrict our ability to conduct asset sales and/or use the proceeds from asset sales. We may not be able to consummate these asset sales to raise capital or sell assets at prices and on terms that we believe are fair and any proceeds that we do receive may not be adequate to meet any debt service obligations then due. For more information on the Indenture, see Exhibit 4.2 to this Annual Report onForm 10-K. If we cannot meet our debt service obligations, the holders of our debt may accelerate our debt and, to the extent such debt is secured, foreclose on our assets. In such an event, we may not have sufficient assets to repay all of our debt.

The terms of the Credit Agreement governing the Senior Secured Credit Facilities and the Indenture will, and the documents governing other debt that we may incur in the future may, restrict our current and future operations, particularly our ability to respond to changes or to take certain actions.

The Indenture and the Credit Agreement governing the Senior Secured Credit Facilities, and the documents governing other debt that we may incur in the future may, contain a number of restrictive covenants that impose

significant operating and financial restrictions on us and may limit our ability to engage in acts that may be in our long-term best interests, including restrictions on our ability to:

incur additional indebtedness and guarantee indebtedness;

create or incur liens;

engage in mergers or consolidations or sell all or substantially all of our assets;

sell, transfer or otherwise dispose of assets;

make investments, acquisitions, loans or advances or other restricted payments;

pay dividends or distributions, repurchase our capital stock or make certain other restricted payments;

prepay, redeem, or repurchase any subordinated indebtedness;

designate our subsidiaries as unrestricted subsidiaries;

enter into agreements which limit the ability of ournon-guarantor subsidiaries to pay dividends or make other payments to us; and

enter into certain transactions with our affiliates.

In addition, the restrictive covenants in the Credit Agreement governing the Senior Secured Credit Facilities require us to maintain specified financial ratios and satisfy other financial condition tests to the extent subject to certain financial covenant conditions. Our ability to meet those financial ratios and tests can be affected by events beyond our control. We may not meet those ratios and tests.

A breach of the covenants or restrictions under the Indenture governing the Notes or under the Credit Agreement governing the Senior Secured Credit Facilities could result in an event of default under the applicable indebtedness. Such a default may allow the creditors under such facility to accelerate the related debt, which may result in the acceleration of any other debt to which a cross-acceleration or cross-default provision applies. In addition, an event of default under the Credit Agreement governing our Senior Secured Credit Facilities would permit the lenders under our revolving credit facility to terminate all commitments to extend further credit under that facility. Furthermore, if we were unable to repay the amounts due and payable under the Senior Secured Credit Facilities, those lenders could proceed against the collateral granted to them to secure that indebtedness. We have pledged substantially all of our assets as collateral under the Senior Secured Credit Facilities. In the event our lenders or holders of the Notes accelerate the repayment of our borrowings, we may not have sufficient assets to repay that indebtedness or be able to borrow sufficient funds to refinance it. Even if we are able to obtain new financing, it may not be on commercially reasonable terms or on terms acceptable to us. As a result of these restrictions, we may be:

limited in how we conduct our business;

unable to raise additional debt or equity financing to operate during general economic or business downturns; or

unable to compete effectively or to take advantage of new business opportunities. These restrictions, along with restrictions that may be contained in agreements evidencing or governing other future indebtedness, may affect our ability to grow or pursue other important initiatives in accordance with our growth.