SECURITIES AND EXCHANGE COMMISSION

|

| ☒ | |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 27, 2015

31, 2018Commission file number:

1-6615

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

| | |

| Delaware | | 95-2594729 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

26600 Telegraph Road, Suite 400 | |

Southfield, Michigan | | 4803448033 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code:

(248)(248) 352-7300Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ]☐ No [X]

☒Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ]☐ No [X]

☒Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X]☒ No [ ]

☐Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X]☒ No [ ]

☐Indicate by check mark if the disclosure of delinquent filers pursuant to Item 405 of RegulationS-K (§ 229.405) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form10-K or any amendment to thisForm 10-K. [X]

☐Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” andfiler,” “smaller reporting company” and “emerging growth company” in Rule12b-2 of the Exchange Act.

|

| | | | | |

Large accelerated filer [ ] | | ☐ | | Accelerated filer [X] | | ☒ |

| | | |

Non-accelerated filer [ ] | | ☐ | | Smaller reporting company [ ] | | ☐ |

| | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Act). Yes [ ]☐ No [X]

☒The aggregate market value of the registrant’s $0.01 par value common equity held bynon-affiliates as of the last business day of the registrant’s most recently completed second quarter was $499,546,000,$447,709,967, based on a closing price of $18.69.$17.90. On March 4, 2016,February 28, 2019, there were 25,436,58225,019,237 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s

2016 Annual2019 Proxy Statement, to be filed with the Securities and Exchange Commission within 120 days after the close of the registrant’s fiscal year, are incorporated by reference into Part III of thisForm 10-K.

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

ANNUAL REPORT ON FORM10-K

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by us or on our behalf. We have included or incorporated by reference in this Annual Report on Form10-K (including in the sections entitled "Risk Factors"“Risk Factors” and "Management’s“Management’s Discussion and Analysis of Financial Condition and Results of Operations"Operations”), and from time to time our management may make statements that may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Exchange Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based upon management'smanagement’s current expectations, estimates, assumptions and beliefs concerning future events and conditions and may discuss, among other things, anticipated future performance (including sales and earnings), expected growth, future business plans and costs and potential liability for environmental-related matters. Any statement that is not historical in nature is a forward-looking statement and may be identified by the use of words and phrases such as “expects,” “anticipates,” “believes,” “will,” “will likely result,” “will continue,” “plans to” and similar expressions. These statements include our belief and statements regarding general automotive industry and market conditions and growth rates, as well as general domestic and international economic conditions.

Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of the company,Company, which could cause actual results to differ materially from such statements and from the company'sCompany’s historical results and experience. These risks, uncertainties and other factors include, but are not limited to, those described in Part I, - Item 1A, - Risk Factors“Risk Factors” and Part II - Item 7, - "Management's“Management’s Discussion and Analysis of Financial Condition and Results of Operations"Operations” of this Annual Report on Form10-K and elsewhere in the Annual Report and those described from time to time in our futureother reports filed with the Securities and Exchange Commission.

Readers are cautioned that it is not possible to predict or identify all of the risks, uncertainties and other factors that may affect future results and that the risks described herein should not be considered to be a complete list. Any forward-looking statement speaks only as of the date on which such statement is made, and the companyCompany undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

PART I

Description of Business and Industry

TheOur principal business of Superior Industries International, Inc. (referred to herein as the “company” or in the first person notation “we,” “us” and “our”) is the design and manufacture of aluminum wheels for sale to original equipment manufacturers ("OEMs"). We are one of the largest suppliers of cast aluminum wheels to the world's leading automobile and light truck manufacturers, with wheel manufacturing operations in the United States and Mexico. Products made in our North American facilities are delivered primarily to automotive assembly operations(OEMs) in North America for global OEMs.and Europe and aftermarket distributors in Europe. We employ approximately 8,000 employees, operating in nine manufacturing facilities in North America and Europe with a combined annual manufacturing capacity of approximately 21 million wheels. We believe we are the #1 North American aluminum wheel manufacturer, the #3 European aluminum wheel manufacturer and the #1 European aluminum wheel aftermarket manufacturer and supplier. Our OEM aluminum wheels accounted for approximately 92% of our sales in 2018 and are primarily are sold for factory installation as either optional or standard equipment, on many vehicle models manufactured by BMW, Fiat Chrysler Automobiles N.V. ("FCA")BMW-Mini, Daimler AG Company(Mercedes-Benz, AMG, Smart), FCA, Ford, General Motors ("GM"), Mitsubishi,GM, Honda, Jaguar-Land Rover, Mazda, Nissan, Renault, Peugeot, PSA, Subaru, Tesla,Suzuki, Toyota, VW Group (Volkswagen, Audi, Skoda, Porsche, Bentley) and Volkswagen.

Volvo. We

have gone through a transformation overalso sell aluminum wheels to the

last several years asEuropean aftermarket under the brands ATS, RIAL, ALUTEC and ANZIO. North America and Europe represent the principal markets for our products, but we have

shifted our manufacturinga global presence and diversified customer base

from higher cost to lower cost sources. With the diversificationconsisting of North American, European and

increased demands for more customized premium wheels, we have made investments in engineering and design. With these investments, we are enhancing our capabilities to become a leader in premium wheels. We have doubled the wheel finishes that we offer in the last couple of years and we have developed patents, which is all part of our strategic evolution to become a competitive full line manufacturer of aluminum wheels. Another part of our evolution was to move our corporate office to Southfield, Michigan to be closer to many of our customers so we can further strengthen relationships and partner with them to design world class products. We have made significant strides with our customers over the last year as evidenced by receiving the 2015 supplier of the year award from GM. With the addition of our new facility in Mexico we have expanded our manufacturing capacity to allow for growth in the next couple of years.Asian OEMs. We continue to

explore and implement operating improvementsdeliver on our strategic plan to

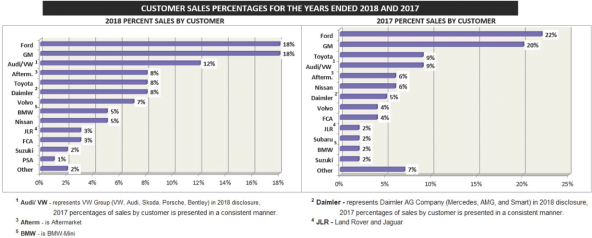

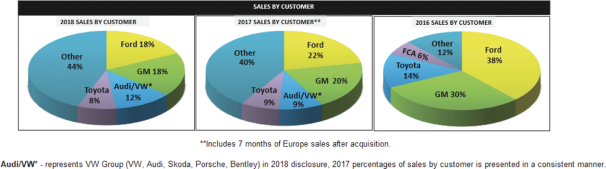

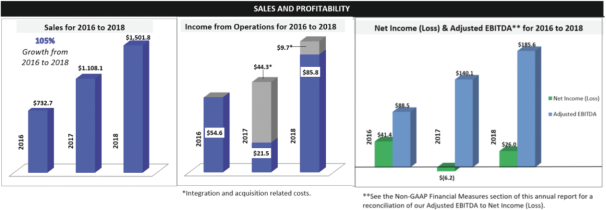

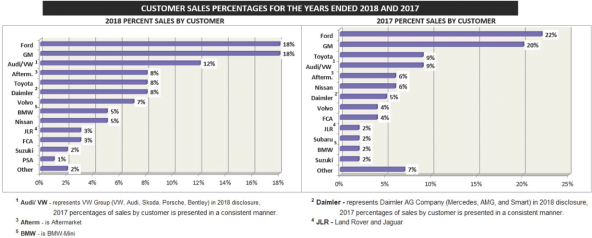

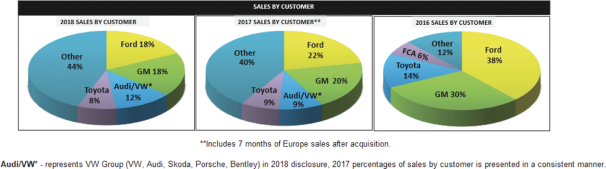

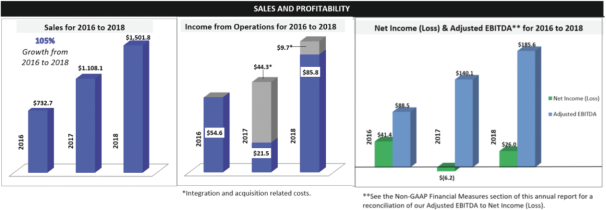

further expand manufacturing capacity with relatively low capital investment. We are also investigatingbe one of the leading light vehicle aluminum wheel suppliers globally, delivering innovative wheel solutions to our customers.As a result of the acquisition opportunities to further enhance the value and drive the growth of our business.European operations on May 30, 2017, we have broadened our product portfolio and acquired a significant customer share with European OEMs includingBMW-Mini, Daimler AG Company, Jaguar-Land Rover, VW Group and Volvo. The charts below showacquisition was not only complementary in terms of customers, market coverage and product offering but also very much aligned with our major customersstrategic direction with a priority focus on larger diameter wheels and premium finishes providing enhanced opportunity for higher value-added content. Our global reach encompasses sales to the ten largest OEMs in the world. The following chart shows our manufacturing capacitysales by headcount split between lower costcustomer for the years ended December 31, 2018 and higher cost sourced labor.

Our industry2017.

Demand for our products is mainly driven by light-vehicle production levels in North America and to a much lesser extent in South America. TheEurope. North American light-vehicle production level, in 2015,2018 was 17.417.0 million vehicles, a 30.6 percent or 0.5 million unit, increase over 2014. We track annualdecrease compared to 2017. In Western and Central Europe, light vehicle production rates based on information from

Ward's Automotive Group. The North American annual production levels of automobiles and light-duty trucks (including SUV's, vans and "crossover vehicles") continue the trend of growth since the 2009 recession. Current economic conditions, low consumer interest rates and relatively inexpensive gas prices have been generally supportive of market growth and, in addition, the relatively high average age of vehicles on the road appears to be contributing to higher rates of vehicle replacement. Itlevel was reported in 2015 that the average age of all light vehicles in the U.S. increased to an all-time high of 11.5 years, according to IHS Automotive.

In 2014, production of automobiles and light-duty trucks in North America reached 16.9 million units, an increase of 5 percent over 2013. Production in 2013 reached 16.1 million units, an increase of 0.7 million, or 5 percent, from 15.418.5 million vehicles, in 2012.

We were initially incorporated in Delaware in 1969 and reincorporated in California in 1994. In 2015, we moved our headquarters from Van Nuys, California to Southfield, Michigan and reincorporated in Delaware in 2015. Our stock is traded on the New York Stock Exchange under the symbol "SUP."

Raw Materials

The raw materials used in manufacturing our products are readily available and are obtained through numerous suppliers with whom we have established trade relations. We purchase aluminum for the manufacture of our aluminum wheels, which accounted for the vast majority of our total raw material requirements during 2015.a 2.1 percent decrease over 2017. The majority of our aluminum requirementscustomers’ wheel programs are met throughawarded one, two or three years in advance. Our purchase orders with certain major producers, with physical supply coming from North American locations. Generally, the ordersOEMs are fixed astypically specific to minimum and maximum quantities of aluminum, which the producers must supply during the term of the orders. During 2015, we were able to successfully secure aluminum commitments from our primary suppliers to meet production requirements and we anticipate being able to source aluminum requirements to meet our expected level of production in 2016. We procure other raw materials through numerous suppliers with whom we have established trade relationships.

When market conditions warrant, we also may enter into purchase commitments to secure the supply of certain commodities used in the manufacture of our products, such as aluminum, natural gas and other raw materials. We had purchase commitments for the delivery of natural gas through the end of 2015. These natural gas contracts were considered to be derivatives under U.S. generally accepted accounting principles ("GAAP"), and when entering into these contracts, it was expected that we would take full delivery of the contracted quantities of natural gas over the normal course of business. Accordingly, at inception, these contracts qualified for the normal purchase, normal sale ("NPNS") exemption provided under U.S. GAAP.

a particular vehicle model.Customer Dependence

We have proven our ability to be a consistent producer of high quality aluminum wheels with the capability to meet our customers'customers’ price, quality, delivery and service requirements. We continually strive to continually enhance our

relationships with our customers through continuous improvement programs, not only through our manufacturing operations but in the engineering, design, development and quality areas as well. These key business relationships have resulted in multiple vehicle supply contract awards with our key customers over the past year.

Ford, GM Toyota and FCAVW Group were our only customers individually accounting for 10 percent or more of our consolidated trade sales in 2018, with Toyota accounting for more than 10 percent of our consolidated trade sales.in 2016 only. Net sales to these customers in 2015, 20142018, 2017 and 20132016 were as follows (dollars in millions):

|

| | | | | | | | | | | | |

| | | 2015 | | 2014 | | 2013 |

| | | Percent of Net Sales | | Dollars | | Percent of Net Sales | | Dollars | | Percent of Net Sales | | Dollars |

| Ford | | 44% | | $315.1 | | 44% | | $321.6 | | 45% | | $349.7 |

| GM | | 24% | | $175.6 | | 24% | | $175.8 | | 24% | | $186.4 |

| Toyota | | 14% | | $104.5 | | 12% | | $88.3 | | 12% | | $92.1 |

| FCA | | 8% | | $56.3 | | 10% | | $72.0 | | 10% | | $78.1 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2018 | | | 2017 | | | 2016 | |

| | | Percent of

Net Sales | | | Dollars | | | Percent of

Net Sales | | | Dollars | | | Percent of

Net Sales | | | Dollars | |

Ford | | | 18 | % | | $ | 272.6 | | | | 22 | % | | $ | 248.8 | | | | 38 | % | | $ | 271.4 | |

GM | | | 18 | % | | $ | 265.3 | | | | 20 | % | | $ | 217.5 | | | | 30 | % | | $ | 216.4 | |

VW Group | | | 12 | % | | $ | 183.9 | | | | 9 | % | | $ | 94.3 | | | | <1 | % | | $ | 2.8 | |

Toyota | | | 8 | % | | $ | 114.0 | | | | 9 | % | | $ | 103.8 | | | | 14 | % | | $ | 98.4 | |

In addition, sales to Daimler AG Company and Nissan exceeded five percent of our consolidated sales during 2018 and 2017.BMW-Mini and Volvo exceeded five percent of our consolidated sales in 2018 and Fiat Chrysler and Nissan were at or exceeded 5% of our sales in 2016. The change in sales over the three-year period was primarily driven by the acquisition of our European operations. The loss of all or a substantial portion of our sales to Daimler AG Company, Ford, GM, Nissan, Toyota, or FCAVolvo, VW Group, andBMW-Mini would have a significant adverse effect on our financial results. See also Item 1A, - Risk“Risk Factors,” of this Annual Report.

Raw Materials

The raw materials used in manufacturing our products are readily available and are obtained through numerous suppliers with whom we have established trade relationships. Aluminum accounted for the vast majority of our total raw material requirements during 2018. Our aluminum requirements are met through purchase orders with major global producers. During 2018, we successfully secured aluminum commitments from our primary suppliers sufficient to meet our production requirements, and we anticipate being able to source aluminum requirements to meet our expected level of production in 2019. We procure other raw materials through numerous suppliers with whom we have established trade relationships.

When market conditions warrant, we may also enter into purchase commitments to secure the supply of certain other commodities used in the manufacture of our products, such as natural gas, electricity and other raw materials.

We establish price adjustment clauses with our OEM customers to minimize the aluminum price risk. In the aftermarket, we use hedging products to secure our aluminum purchase prices.

Foreign Operations

We manufacture a significant portion of our North American products in Mexico that are sold bothfor sale in the United States, Canada and Mexico. Net sales of wheels manufactured in our Mexico operations in 20152018 totaled $550.7$673.2 million and represented 7684 percent of our total net sales. The portion of our products producedsales in Mexico versus the United States will increaseNorth America as compared to $608.0 million and 83 percent in 2016, as we expect to achieve full commercial production at a new wheel plant in Mexico for most of 2016.2017. Net property, plant and equipment used in our operations in Mexico totaled $190.4$221.5 million at December 31, 2015, including $112.22018 and $214.5 million related to our recently completed wheel plant.at December 31, 2017. The overall cost for us to manufacture wheels in Mexico is currently is lower than in the United States, due to lower labor costs as a result of lower prevailing wage rates.

Similarly, we manufacture the majority of our products for the European market in Poland, for sale throughout Europe. For the year ended December 31, 2018, net sales of wheels manufactured in Poland were $421.8 million and 60 percent of total net European sales versus $220.4 million and 59 percent in the seven months following the acquisition in 2017. Net property, plant and equipment used in our operations in Poland totaled $221.0 million at

December 31, 2018 versus $227.3 million at December 31, 2017. Similar to our Mexican operations, the overall cost to manufacture wheels in Poland is substantially lower than in both the U.S., in particular, because of reduced labor costUnited States and Germany at the present time due principally to lower prevailing wage rates. Such current advantageslabor costs.

Net Sales Backlog

Our customers typically award programs one, two or three years before actual production is scheduled to manufacturing our productbegin. Each year, the automotive manufacturers introduce new models, update existing models and discontinue certain models. In this process, we may be selected as the supplier on a new model, we may continue as the supplier on an updated model or we may lose a new or updated model to a competitor. Our estimated net sales may be impacted by various assumptions, including new program vehicle production levels, customer price reductions, currency exchange rates and program launch timing. Our customers may terminate the awarded programs or reduce order levels at any time, based on market conditions or change in Mexico can be affected by changes in cost structures, trade protection laws, policies and other regulations affecting trade and investments, social, political, labor,portfolio direction. Therefore, expected net sales information does not represent firm commitments or general economic conditions in Mexico. Other factorsfirm orders. We estimate that can affect the business and financial resultswe have been awarded programs covering approximately 84 percent of our Mexican operations include, but are not limited to, valuation ofmanufacturing capacity over the peso, availability and competency of personnel and tax

regulations in Mexico. See also Item 1A- Risk Factors - International Operations and Item 1A - Risk Factors - Foreign Currency Fluctuations.

Net Sales Backlog

We receive OEM purchase orders to produce aluminum wheels typically for multiple modelnext three years. These purchase orders are typically for one year for vehicle wheel programs that usually last three to five years. We manufacture and ship based on customer release schedules, normally provided on a weekly basis, which can vary in part due to changes in demand, industry and/or customer maintenance cycles, new program introductions or dealer inventory levels. Accordingly, even though customer purchase orders cover multiple model years, our management does not believe that our firm backlog is a meaningful indicator of future operating results.

Competition in the market for aluminum wheels is based primarily on price, technology, quality, delivery, and overall customer service. We are one of the leading suppliers of aluminum wheels for OEM installations in the world,service, price, quality and are the largest producer in North America.technology. We currently supply approximately 2019 percent and 13 percent of the aluminum wheels installed on passenger cars and light-duty trucks in North America. America and Europe, respectively.

Competition is global in nature with growinga significant volume of exports from Asia into North America. There are several competitors with facilities in North America but we estimate that we have more than twice the North American production capacity of any competitor based on our current estimation.competitor. Some of the key competitors in North America include Central Motor Wheel of America (“CMWA”), CITIC Dicastal Co., Ltd., Prime Wheel Corporation, Enkei and Ronal. Key European competitors include Ronal, Borbet, Maxion and CMS. We are the leading manufacturer of alloy wheels in the European aftermarket, where the competition is highly fragmented. Key competitors include Alcar, Brock, Borbet, ATU and Mak. See also Item 1A, - Risk“Risk Factors,” of this Annual Report. Other

Steel and other types of road wheels such as those made of steel, also compete with our products. Aluminum wheel usage on passenger cars, crossovers, SUV’s and light-duty trucks continues to dominate in North America. According to

Ward'sWard’s Automotive Group, the aluminum wheel penetration rate on passenger cars and light-duty trucks in the U.S.North America was 7988 percent for the 2015 model year and 81 percent for the 20142018 model year compared to 8087 percent for the 2013 model year. We expect the ratio of2017. Although similar industry data is not available for Europe, we estimate aluminum wheel penetration continues to steel wheelsmarginally increase year-over-year with further opportunity to remain relatively stable. However, severalincrease. Several factors can affect thisthe aluminum wheel penetration rate including price, fuel economy requirements and styling preference.preferences. Although aluminum wheels are currently are more costly than steel, aluminum is a lighter material than steel, which is desirable for fuel efficiency, better ride & handling and generally viewed as aesthetically superior to steel and, thus, more desirable to the OEMs and their customers.

Our policy is to continuously review, improve and develop our engineering capabilities to satisfy our customer requirements in the most efficient and cost effectivecost-effective manner available. We strive to achieve this objective by attracting and retaining top engineering talent and by maintaining the lateststate-of-the-art computer technology to support engineering development. A fully staffedFully developed engineering center,centers located in Fayetteville, Arkansas, supportsand in Lüdenscheid, Germany support our research and development manufacturing needs.development. We also have a technical sales centerfunction at our corporate headquarters in Southfield, Michigan that maintains a complement of engineering staff centrally located near some of our largest customers'customers’ headquarters and engineering and purchasing offices. Aftermarket wheels are developed in Bad Dürkheim.

Research and development costs (primarily engineering and related costs), which are expensed as incurred, are included in cost of sales in our consolidated income statements. Amounts expended on researchResearch and development costs during each of the last three years were $2.6$5.7 million in 2015; $4.42018, $7.7 million in 2014;2017 and $4.8$3.8 million in 2013.

2016.Government Regulation

Safety standards in the manufacture of vehicles and automotive equipment have been established under the National Traffic and Motor Vehicle Safety Act of 1966.1966, as amended. We believe that we are in compliance with all federal standards currently applicable to OEM suppliers and to automotive manufacturers.

Our manufacturing facilities, like most other manufacturing companies, are subject to solid waste, water and air pollution control standards mandated by federal, state and local laws. Violators of these laws are subject to fines and, in extreme cases, plant closure. We believe our facilities are in material compliance with all presently applicable standards. However, costs related to environmental protection may grow due to increasingly stringent laws and regulations. The cost of environmental compliance was approximately $0.7 million in 2015;2018, $0.6 million in 2017 and $0.4 million in 2014; and $0.5 million in 2013.2016. We expect that future environmental compliance expenditures will approximate these levels and will not have a material effect on our consolidated financial position. Furthermore,position or results of operations. However, climate change legislation or regulations restricting emission of "greenhouse gases"“greenhouse gases” could result in increased operating costs and reduced demand for the vehicles that use our products. See also Item 1A, - Risk“Risk Factors - Environmental MattersWe are subject to various environmental laws” of this Annual Report.

As of December 31, 2015,2018, we had approximately 3,0508,000 full-time employees and 260 contract employees compared to approximately 3,0007,800 full-time employees and 350 contract employees at December 31, 2014.2017. As of December 31, 2016, we had approximately 4,189 full-time employees and 682 contract employees. None of our employees in North America are covered by a collective bargaining agreement.

Superior Industries Europe AG’s (“SEAG’s”) subsidiary, Superior Industries Production Germany GmbH (“SPG”), is a member of the employers’ association for the metal and electronic industry in North Rhine-Westphalia e.V. (Metall und Elektro-Industrie NORDRHEIN-WESTPFALEN e.V.) and is subject to various collective bargaining agreements entered into by the employers’ association with the trade union IG Metall. These collective bargaining agreements include provisions relating to wages, holiday, and partial retirement. It is estimated that approximately 432 employees of SEAG employed at SPG in Germany were unionized and/or subject to collective bargaining agreements in 2018. SPG and Superior Industries Automotive Germany GmbH (operating a joint workers’ council) operate a statutory workers’ council and Superior Industries Production (Poland) Sp. z o.o. (“SPP”) operates a voluntary workers’ council.Fiscal Year End

OurFiscal year 2018 started on January 1, 2018 and ended December 31, 2018. The fiscal year isfor 2017 consisted of the 52- or 53-week period ending generallyended December 31, 2017. Thus, 2018 reflects one less calendar week of North America operations than in 2017. The 2016 fiscal year consisted of the52-week period ended on December 25, 2016. Historically our fiscal year ended on the last Sunday of the calendar year. TheWhile our European operations historically reported on a calendar year end, these fiscal years 2015, 2014periods aligned as of December 31, 2017. Beginning in 2018, both our North American and 2013 comprisedEuropean operations are on a calendar fiscal year with each month ending on the 52-week periods ended on December 27, 2015, December 28, 2014 and December 29, 2013, respectively.last day of the calendar month. For convenience of presentation, all fiscal years are referred to as beginning as of January 1, and ending as of December 31, but actually reflect our financial position and results of operations for the periods described above.

We operate as a single integrated businesshave aligned our executive management structure, organization and as such, have only one operating segment - automotive wheels.operations to focus on our performance in our North American and European regions. Financial information about this segment and geographic areasour operating segments is contained in

Note 5 - Business Segments6, “Business Segments” in the Notes to Consolidated Financial Statements in Item 8, - Financial“Financial Statements and Supplementary DataData” of this Annual Report.

The automotive industry is cyclical and varies based on the timing of consumer purchases of vehicles, which in turn varyvaries based on a variety of factors such as general economic conditions, availability of consumer credit, interest rates and fuel costs. While there have been no significant seasonal variations in the past few years, production schedules in our industry can vary significantly from quarter to quarter to meet the scheduling demands of our customers.

Typically, our aftermarket business experiences two seasonal peaks, which require substantially higher levels of production. The higher demand for aftermarket wheels from our customers occurs in March and October leading into the spring and winter peak consumer selling seasons.History

We were initially incorporated in Delaware in 1969. Our entry into the OEM aluminum wheel business in 1973 resulted from our successful development of manufacturing technology, quality control and quality assurance techniques that enabled us to satisfy the quality and volume requirements of the OEM market for aluminum wheels. The first aluminum wheel for a domestic OEM customer was a Mustang wheel for Ford. We reincorporated in California in 1994, and in 2015, we moved our headquarters from Van Nuys, California to Southfield, Michigan and reincorporated in Delaware. On May 30, 2017, we acquired a majority interest in Uniwheels AG, which is a European supplier of OEM and aftermarket aluminum wheels. Uniwheels AG was renamed in 2018 to Superior Industries Europe AG. Our stock is traded on the New York Stock Exchange under the symbol “SUP.”

Available Information

Our Annual Report on Form10-K, quarterly reports on Form10-Q and any amendments thereto are available, without charge, on or through our website, www.supind.com, under “Investors,“Investor Relations,” as soon as reasonably practicable after they are filed electronically with the Securities and Exchange Commission ("SEC"(“SEC”). The public may read and copy any materials filed with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website, www.sec.gov, which contains these reports, proxy and information statements and other information regarding the company. Also included on our website, www.supind.com, under "Investor,"“Investor Relations,” is our Code of Conduct, which, among others, applies to our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer. Copies of all SEC filings and our Code of Conduct are also available, without charge, upon request from Superior Industries International, Inc., Shareholder Relations, 26600 Telegraph Road, Suite 400, Southfield, MI 48034.

Michigan 48033.The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements and other information related to issuers that file electronically with the SEC. The content on any website referred to in this Annual Report on Form10-K is not incorporated by reference in this Annual Report on Form 10-K unless expressly noted.

ITEM 1A - RISK FACTORS

10-K.The following discussion of risk factors contains “forward-looking” statements, which may be important to understanding any statement in this Annual Report or elsewhere. The following information should be read in conjunction with Item 7, - Management's“Management’s Discussion and Analysis of Financial Condition and Results of Operations ("(“MD&A"&A”)” and Item 8, - Financial“Financial Statements and Supplementary DataData” of this Annual Report.

Our business routinely encounters and addresses risks and uncertainties. Our business, results of operations, and financial condition and cash flows could be materially adversely affected by the factors described below. Discussion about the important operational risks that our business encounters can also be found in the MD&A section and in the business description in Item 1, - Business“Business” of this Annual Report. Below, we have described our present view of the most significant risks and uncertainties we face. Additional risks and uncertainties not presently known to us, or that we currently do not consider significant, could also potentially impair our business, results of operations, financial condition and financial condition.cash flows. Our reactions to these risks and uncertainties as well as our competitors'competitors’ and customers’ reactions will affect our future operating results.

Risks Relating To Our Company

The automotive industry is cyclical and volatility in the automotive industry could adversely affect our financial performance.

The majority ofSubstantially all our sales are made in domesticto the European and U.S. markets and almost exclusively within North America.automotive markets. Therefore, our financial performance depends largely on conditions in the European and U.S. automotive industry, which in turn can be affected significantly by broad economic and financial market conditions. Consumer demand for automobiles is subject to considerable volatility as a result of consumer confidence in general economic conditions, levels of employment, prevailing wages, fuel prices and the availability and cost of consumer credit. With steady improvement in the North American automotive industry since the global recession that began in 2008, vehicle production levels in 2015 reached the highest level in the last decade. However, there can be no guarantee that the improvements in recent years will be sustained or that reductions from current production levels will not occur in future periods.credit, as well as changing consumer preferences. Demand for aluminum wheels can be further affected by other factors, including pricing and performance comparisons to competitive materials such as steel. Finally, the demand for our products is influenced by shifts of market share between vehicle manufacturers and the specific market penetration of individual vehicle platforms being sold by our customers.

Decreases in demand for automobiles in Europe and the United States could adversely affect the valuation of our productive assets, results of operations, financial condition and cash flows.A limited number of customers represent a large percentage of our sales. The loss of a significant customer or decrease in demand could adversely affect our operating results.

Ford, GM, Toyota, and FCA,VW Group, together, represented approximately 9056 percent in 2018, 60 percent in 2017 and 82 percent of our total wheel sales in 2015.2016. Despite the decrease in the combined percentage of our four largest customers in 2018 and 2017, a loss of a significant customer or decrease in demand still remains a risk. Our OEM customers are not required to purchase any minimum amount of products from us. Increasingly global procurement practices, the pace of new vehicle introduction and demand for price reductions may make it more difficult to maintain long-term supply arrangements with our customers, and there are no guarantees that we will be able to negotiate supply arrangements with our customers on terms acceptable to us in the future. The contracts we have entered into with most of our customers provide that we will manufacture wheels for a particular vehicle model, rather than manufacture a specific quantity of products. Such contracts range from one year to the life of the model (usually three to five years), typically arenon-exclusive and do not require the purchase by the customer of any minimum number of wheels from us. Therefore, a significant decrease in consumer demand for certain key models or group of related models sold by any of our major customers, or a decision by a manufacturer not to purchase from us, or to discontinue purchasing from us, for a particular model or group of models, could adversely affect our results of operations, financial condition and cash flows.

We operate in a highly competitive industry and efforts by our competitors to gain market share could adversely affect our financial condition.

Our new operations at a recently constructed facility in Mexico may not achieve the expected benefits.

In anticipation of continued growth in demand for aluminum wheels in the North American market, we constructed a new manufacturing facility in Mexico. Initial commercial production at this facility began in early 2015. performance.The new manufacturing facility entailsglobal automotive component supply industry is highly competitive. Competition is based on a number of risks,factors, including delivery, overall customer service, price, quality, technology and available capacity to meet customer demands. Some of our competitors are companies, or divisions or subsidiaries of companies, which are larger and have greater financial and other resources than we do. We cannot ensure that our products will be able to compete successfully with the products of these competitors. In particular, our ability to increase manufacturing capacity typically requires significant investments in facilities, equipment and personnel. The majority of our operating facilities are at full or near to full capacity levels which may cause us to incur labor costs at premium rates in order to meet customer requirements, experience increased maintenance expenses or require us to replace our machinery and equipment on an accelerated basis. Furthermore, the nature of the markets in which we compete has attracted new entrants, particularly fromlow-cost countries. As a result, our sales levels and margins continue to be adversely affected by pricing pressures reflective of significant competition from producers located inlow-cost foreign markets, such as China, Morocco, and Turkey. Such competition with lower cost structures poses a significant threat to our ability to compete internationally and domestically. These factors have led to our customers awarding business to foreign competitors in the past, and they may continue to do so in the future. In addition, any of our competitors may foresee the course of market development more accurately, develop products that are superior to our products, have the ability to ramp-up commercial production within theproduce

similar products at a lower cost and time-frame estimated andor adapt more quickly to attract a sufficient number of skilled workers to meet the needs of the new facility. Additionally, our assessment of the projected benefits associated with the construction of a new manufacturing facility is subject to a number of estimates and assumptions, including future demand fortechnologies or evolving customer requirements. Consequently, our products which in turn are subjectmay not be able to significant economic, competitive and other uncertainties that are beyond our control. Operating results could be unfavorably impacted by start-up costs until production levels at the new facility reach planned levels. Additionally, our overall ability to increase total company revenues in the future can be affected by factors affecting the volume of products manufactured at our existing factories.

compete successfully with competitors’ products.We experience continual pressure to reduce costs.

The global vehicle market is highly competitive at the OEM level, which drives continual cost-cutting initiatives by our customers. Customer concentration, relative supplier fragmentation and product commoditization have translated into continual pressure from OEMs to reduce the price of our products. It is possible that pricing pressures beyond our expectations could intensify as OEMs pursue restructuring and cost-cutting initiatives. If we are unable to generate sufficient production cost savings in the future to offset such price reductions, our gross margin rate of profitability and cash flows could be adversely affected. In addition, changes in OEMs'OEMs’ purchasing policies or payment practices could have an adverse effect on our business. Our OEM customers typically attempt to qualify more than one wheel supplier for the programs we participate inon and for programs we may bid on in the future. As such, our OEM customers are able to negotiate favorable pricing or may decrease sales volume.wheel orders from us. Such actions may result in decreased sales volumes and unit price reductions for our company,the Company, resulting in lower revenues, gross profit, operating income and cash flows.

We operate in a highly competitive industry.

The automotive component supply industry is highly competitive, both domestically and internationally. Competition is based on a number of factors, including price, technology, quality, delivery and overall customer service and available capacity to meet

customer demands. Some of our competitors are companies, or divisions or subsidiaries of companies, which are larger and have greater financial and other resources than we do. We cannot ensure that our products will be able to compete successfully with the products of these competitors. In particular, our ability to increase manufacturing capacity typically requires significant investments in facilities, equipment and personnel. Our operating facilities are at full or near to full capacity levels which may cause us to incur labor costs at premium rates in order to meet customer requirements, experience increased maintenance expenses or require us to replace our machinery and equipment on an accelerated basis. Furthermore, the nature of the markets in which we compete has attracted new entrants, particularly from low cost countries. As a result, our sales levels and margins continue to be adversely affected by pricing pressures reflective of significant competition from producers located in low-cost foreign markets, such as China. Such competition with lower cost structures poses a significant threat to our ability to compete internationally and domestically. These factors have led to our customers awarding business to foreign competitors in the past, and they may continue to do so in the future. In addition, any of our competitors may foresee the course of market development more accurately, develop products that are superior to our products, have the ability to produce similar products at a lower cost, or adapt more quickly to new technologies or evolving customer requirements. Consequently, our products may not be able to compete successfully with competitors' products.

Our international operations make us vulnerable to risks associated with doing business in foreign countries.

We manufacture a substantial portion of our products in Mexico, have a minor investment in a wheel manufacturing company in India and we sell our products internationally. Accordingly, unfavorable changes in foreign cost structures, trade protection laws, regulations and policies affecting trade and investments and social, political, labor, or economic conditions in a specific country or region, among other factors, could have a negative effect on our business and results of operations. Legal and regulatory requirements differ among jurisdictions worldwide. Violations of these laws and regulations could result in fines, criminal sanctions, prohibitions on the conduct of our business, and damage to our reputation. Although we have policies, controls, and procedures designed to ensure compliance with these laws, our employees, contractors, or agents may violate our policies.

Fluctuations in foreign currencies may adversely impact our financial condition.

Due to the growth of our operations outside of the United States, we have experienced increased exposure to foreign currency gains and losses in the ordinary course of our business. As a result, fluctuations in the exchange rate between the U.S. dollar, the Mexican peso and any currencies of other countries in which we conduct our business may have a material impact on our financial condition, as cash flows generated in foreign currencies may be used, in part, to service our U.S. dollar-denominated liabilities, or vice versa.

In addition, due to customer requirements, we have experienced a significant shift in the currency denominated in our contracts with our customers. As a result of this change, we currently project that in 2016 and beyond the vast majority of our revenues will be denominated in the US dollar, rather than a more balanced mix of U.S. dollar and Mexican peso. In the past we have relied upon significant revenues denominated in the Mexican peso to provide a "natural hedge" against foreign exchange rate changes impacting our peso denominated costs incurred at our facilities in Mexico. Accordingly, the foreign exchange exposure associated with peso denominated costs is a growing risk and could have a material adverse effect on our operating results.

Fluctuations in foreign currency exchange rates may also affect the value of our foreign assets as reported in U.S. dollars, and may adversely affect reported earnings and, accordingly, the comparability of period-to-period results of operations. Changes in currency exchange rates may affect the relative prices at which we and our foreign competitors sell products in the same market. In addition, changes in the value of the relevant currencies may affect the cost of certain items required in our operations. We cannot ensure that fluctuations in exchange rates will not otherwise have a material adverse effect on our financial condition or results of operations, or cause significant fluctuations in quarterly and annual results of operations.

We may enter into foreign currency forward and option contracts with financial institutions to protect against foreign exchange risks associated with certain existing assets and liabilities, certain firmly committed transactions and forecasted future cash flows. We have implemented a program to hedge a portion of our material foreign exchange exposures, typically for up to 36 months. However, we may choose not to hedge certain foreign exchange exposures for a variety of reasons, including but not limited to accounting considerations and the prohibitive economic cost of hedging particular exposures. There is no guarantee that our hedge program will effectively mitigate our exposures to foreign exchange changes which could have material adverse effects on our cash flows and results of operations.

Increases in the costs and restrictions on availability of raw materials could adversely affect our operating margins and cash flow.

Generally, we obtain our raw materials, supplies and energy requirements from various sources. Although we currently maintain alternative sources, our business is subject to the risk of price increases and periodic delays in delivery. Fluctuations in the prices

of raw materials may be driven by the supply/demand relationship for that commodity or governmental regulation. In addition, if any of our suppliers seek bankruptcy relief or otherwise cannot continue their business as anticipated, the availability or price of raw materials could be adversely affected.

Although we are able to periodically pass certain aluminum cost increases on to our customers, we may not be able to pass along all changes in aluminum costs and our customers are not obligated to accept energy or other supply cost increases that we may attempt to pass along to them. In addition, fixed price natural gas contracts that expire in the future may expose us to higher costs that cannot be immediately recouped in selling prices. This inability to pass on these cost increases to our customers could adversely affect our operating margins and cash flow, possibly resulting in lower operating income and profitability.

Interruption in our production capabilities could reduce our operating results.

An interruption in production capabilities at any of our facilities as a result of equipment failure, interruption of raw materials or other supplies, labor disputes or other reasons could result in our inability to produce our products, which would reduce our sales and operating results for the affected period and harm our customer relationships. We have, from time to time, undertaken significant re-tooling and modernization initiatives at our facilities, which, in the past have caused, and in the future may cause, unexpected delays and plant underutilization, and such adverse consequences may continue to occur as we continue to modernize our production facilities. In addition, we generally deliver our products only after receiving the order from the customer and thus typically do not hold large inventories. In the event of a production interruption at any of our manufacturing facilities, even if only temporary, or if we experience delays as a result of events that are beyond our control, delivery times to our customers could be severely affected. Any significant delay in deliveries to our customers could lead to premium freight costs and other performance penalties, as well as contract cancellations, and cause us to lose future sales and expose us to other claims for damages. Our manufacturing facilities are also subject to the risk of catastrophic loss due to unanticipated events such as fires, earthquakes, explosions or violent weather conditions. We have in the past, and may in the future, experience plant shutdowns or periods of reduced production which could have a material adverse effect on our results of operations or financial condition.

Similarly, it also is possible that our customers may experience production delays or disruptions for a variety of reasons, which could include supply-chain disruption for parts other than wheels, equipment breakdowns or other events affecting vehicle assembly rates that impact us, work stoppages or slow-downs at factories where our products are consumed, or even catastrophic events such as fires, disruptive weather conditions or natural disasters. Such disruptions at the customer level may cause the affected customer to halt or limit the purchase of our products.

Aluminum and alloy pricing may have a material effect on our operating margins and results of operations.

The cost of aluminum is a significant component in the overall cost of a wheel and in our selling prices to OEM customers. The price for aluminum we purchase is adjusted monthly based primarily on changes in certain published market indices, but the timing of such adjustments is based on specific customer agreements and can vary from monthly to quarterly. As a result, the timing of aluminum price adjustments flowing through sales rarely will match the timing of such changes in cost, and can result in fluctuations to our gross profit. This is especially true during periods of frequent increases or decreases in the market price of aluminum.

The aluminum we use to manufacture wheels also contains additional alloying materials, including silicon. The cost of alloying materials also is a component of the overall cost of a wheel. The price of the alloys we purchase is also based on certain published market indices; however, most of our customer agreements do not provide price adjustments for changes in market prices of alloying materials. Increases or decreases in the market prices of these alloying materials could have a material effect on our operating margins and results of operations.

Implementing a new enterprise resource planning system could interfere with our business or operations.

We are in the process of implementing a new enterprise resource planning (ERP) system. This project requires a significant investment of capital and human resources, the re-engineering of many processes of our business, and the attention of many personnel who would otherwise be focused on other aspects of our business. Should the system not be implemented successfully, or if the system does not perform in a satisfactory manner once implementation is complete, our business and operations could be disrupted and our results of operations negatively affected, including our ability to report accurate and timely financial results.

We are from time to time subject to litigation, which could adversely impact our financial condition or results of operations.

The nature of our business exposes us to litigation in the ordinary course of our business. We are exposed to potential product liability and warranty risks that are inherent in the design, manufacture and sale of automotive products, the failure of which could result in property damage, personal injury or death. Accordingly, individual or class action suits alleging product liability or

warranty claims could result. Although we currently maintain what we believe to be suitable and adequate product liability insurance in excess of our self-insured amounts, we cannot assure you that we will be able to maintain such insurance on acceptable terms or that such insurance will provide adequate protection against potential liabilities. In addition, if any of our products prove to be defective, we may be required to participate in a recall. A successful claim brought against us in excess of available insurance coverage, if any, or a requirement to participate in any product recall, could have a material adverse effect on our results of operations or financial condition. We cannot give assurance that any current or future claims will not adversely affect our cash flows, financial condition or results of operations.

We may be unable to successfully implement cost-saving measures or achieve expected benefits under our plans to improve operations.

As part of our ongoing focus on being a low-cost provider ofto provide high quality products, we continually analyze our business to further improve our operations and identify cost-cutting measures. We may be unable to successfully identify or implement plans targeting these initiatives, or fail to realize the benefits of the plans we have already implemented, as a result of operational difficulties, a weakening of the economy or other factors. Cost reductions may not fully offset decreases in the prices of our products due to the time required to develop and implement cost reduction initiatives. Additional factors such as inconsistent customer ordering patterns, increasing product complexity and heightened quality standards are making it increasingly more difficult to reduce our costs. It is possible that asthe costs we incur costs to implement improvement strategies themay negatively impact on our financial position, results of operations and cash flow may be negative.

flow.We may be unable to successfully launch new products and/or achieve technological advances.

In order to compete effectively compete in the automotive supply industry, we must be able to launch new products and adopt technology to meet our customers' demandcustomers’ demands in a timely manner. However, we cannot ensure that we will be able to install and certify the equipment needed for new product programs in time for the start of production, or that the transitioning of our manufacturing facilities and resources under new product programs will not impact production rates or other operational efficiency measures at our facilities. In addition, we cannot ensure that our customers will execute the launch of their new product programs on schedule. We are also subject to the risks generally associated with new product introductions and applications, including lack of market acceptance, delays in product development and customer approvals. For example, we recently completed the construction of a Physical Vapor Deposition (“PVD”) finishing facility. PVD is a wheel coating process that creates a bright chrome-like surface in a more environmentally friendly manner than traditional chrome plating. Various commercial opportunities are being evaluated, while at the same time this facility continues to undergo trial testing to meet customer quality criteria. As a result, existing purchase orders for the PVD process will continue to be satisfied using alternative finishing processes. The global automotive industry is experiencing a period of significant technological change. As a result, the success of our business requires us to develop and/or incorporate leading technologies, including PVD and other finishing capabilities such as surface printing, laser etching, and5-Axis milling. Such technologies are subject to rapid obsolescence and may not be proven feasible on a volume production basis, have a demand with our customers, meet our customer’s specifications or prove profitable to us. Our failure to satisfy any of these criteria with respect to a particular technology could result in our not pursuing the development of that technology, expensing any unamortized investment costs and abandoning or seeking an alternative use for any impacted technology. Our inability to maintain access to these

technologies (either through development or licensing) may adversely affect our ability to compete. If we are unable to successfully develop new technologies, differentiate our products, maintain alow-cost footprint or compete effectively with technology-focused new market entrants, we may lose market share or be forced to operate properly. Further, changesreduce prices, thereby lowering our margins. Any such occurrences could adversely affect our financial condition, operating results and cash flows.

International trade agreements and our international operations make us vulnerable to risks associated with doing business in competitive technologies may render certainforeign countries that can affect our business, financial condition and results of operations.

We manufacture a substantial portion of our products obsoletein Mexico, Germany and Poland and we sell our products internationally. Accordingly, unfavorable changes in foreign cost structures, trade protection laws, tariffs on aluminum, regulations and policies affecting trade and investments and social, political, labor or less attractive. economic conditions in a specific country or region, among other factors, could have a negative effect on our business and results of operations. Legal and regulatory requirements differ among jurisdictions worldwide. Violations of these laws and regulations could result in fines, criminal sanctions, prohibitions on the conduct of our business and damage to our reputation. Although we have policies, controls and procedures designed to ensure compliance with these laws, our employees, contractors, or agents may violate our policies.

As a result of changes to U.S. administrative policy, among other possible changes, there may be (i) changes to existing trade agreements, such as the North American Free Trade Agreement (“NAFTA”) and its anticipated successor agreement, the U.S.-Mexico-Canada Agreement (“USMCA”), which is still subject to approval by the United States, Mexico and Canada; (ii) greater restrictions on free trade generally; and (iii) significant increases in tariffs on goods imported into the United States, particularly tariffs on products manufactured in Mexico. It remains unclear what the U.S. administration or foreign governments, including China, will or will not do with respect to tariffs, NAFTA, USMCA or other international trade agreements and policies. A trade war, other governmental action related to tariffs or international trade agreements, changes in United States social, political, regulatory and economic conditions or in laws and policies governing foreign trade, manufacturing, development and investment in the territories and countries where we currently manufacture and sell products, and any resulting negative sentiments towards the United States as a result of such changes, likely would have an adverse effect on our business, financial condition, results of operations and cash flows.

Cost of manufacturing our products in Mexico, Germany and Poland may be affected by tariffs imposed by the United States, trade protection laws, policies and other regulations affecting trade and investments, social, political, labor, or general economic conditions. Other factors that can affect the business and financial results of our Mexican, German, Polish and U.S. operations include, but are not limited to, changes in cost structures, currency effects of the Mexican Peso, Euro and Polish Zloty, availability and competency of personnel and tax regulations.

Fluctuations in foreign currencies may adversely impact our financial results.

Due to our operations outside of the United States, we experience exposure to foreign currency gains and losses in the ordinary course of our business. We settle transactions between currencies - i.e., in particular, Mexican Peso to U.S. dollar, Euro to U.S. dollar and Euro to Polish Zloty. To the extent possible, we attempt to match the timing and magnitude of transaction settlements between currencies to create a “natural hedge.” Based on our current business model and levels of production and sales activity, the net imbalance between currencies depends on specific circumstances. While changes in the terms of the contracts with our customers will create an imbalance between currencies that we hedge with foreign currency forward or option contracts, there can be no assurances that our hedging program will effectively offset the impact of the imbalance between currencies or that the net transaction balance will not change significantly in the future.

The foreign currency forward or option contracts we enter into with financial institutions are designed to protect against foreign exchange risks associated with certain existing assets and liabilities, certain firmly committed

transactions and forecasted future cash flows. We have a program to hedge a portion of our material foreign exchange exposures, typically for up to 48 months. However, we may choose not to hedge certain foreign exchange exposures for a variety of reasons including, but not limited to, accounting considerations and the prohibitive economic cost of hedging particular exposures. There is no guarantee that our hedge program will effectively mitigate our exposures to foreign exchange changes which could have material adverse effects on our cash flows and results of operations.

Fluctuations in foreign currency exchange rates may also affect the value of our foreign assets as reported in U.S. dollars, and may adversely affect reported earnings and, accordingly, the comparability ofperiod-to-period results of operations. Changes in currency exchange rates may affect the relative prices at which we and our foreign competitors sell products in the same market. In addition, changes in the value of the relevant currencies may affect the cost of certain items required in our operations. We cannot ensure that fluctuations in exchange rates will not otherwise have a material adverse effect on our financial condition or results of operations or cause significant fluctuations in quarterly and annual results of operations.

Our substantial indebtedness could adversely affect our financial condition

We have a significant amount of indebtedness. As of December 31, 2018, our total debt was $684.9 million ($664.5 million, net of unamortized debt issuance costs of $20.4 million), and we had availability of $156.6 million under the Senior Secured Credit Facilities, as well as 30.0 million Euros under a secured European revolving line of credit. The interest expense on indebtedness will remain significantly higher than historical interest expense (in particular, relative to the time prior to the acquisition of the European Operations) and could adversely affect our financial condition.

Subject to the limits contained in the Credit Agreement governing the Senior Secured Credit Facilities and the indenture governing the Notes (the “Indenture”) and our other debt instruments, we may be able to incur substantial additional debt from time to time to finance working capital, capital expenditures, investments or acquisitions, or for other purposes. If we do so, the risks related to our high level of debt could intensify.

In addition, the Indenture and the Credit Agreement governing the Senior Secured Credit Facilities and our other debt instruments contain restrictive covenants that will limit our ability to engage in activities that may be in our long-term best interest. Our failure to comply with those covenants could result in an event of default which, if not cured or waived, could result in the acceleration of the maturity of all of our debt.

We may not be able to generate sufficient cash to service all of our indebtedness, including the Notes or our redeemable preferred stock, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to anticipate changes in technologymake scheduled payments or to refinance our debt obligations or redeemable preferred stock depends on our financial and operating performance, which is subject to prevailing economic, industry and competitive conditions and to successfully developcertain financial, business, economic and introduce newother factors beyond our control. We may not be able to maintain a sufficient level of cash flow from operating activities to permit us to pay the principal, premium, if any, and enhanced productsinterest on the Notes, redeemable preferred stock and our other indebtedness.

If our cash flows and capital resources are insufficient to fund our debt service obligations, including payments with respect to our redeemable preferred stock, we may be forced to reduce or delay capital expenditures, sell assets, seek additional capital or seek to restructure or refinance our indebtedness, including the Notes. Our ability to restructure or refinance our debt will depend on the condition of the capital and credit markets and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations and limit our financial flexibility. In addition, any failure to make payments of interest and principal on our outstanding indebtedness and redeemable preferred stock on a timely basis will bewould likely result in a significant factor inreduction of our credit

rating, which could harm our ability to remain competitive.incur additional indebtedness. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations, including (i) redemption of our redeemable preferred stock at a redemption price of $300.0 million (2.0 times stated value) or the product of the number of common shares into which the redeemable preferred stock could be converted (5.3 million shares currently) and the then current market price of our common stock and (ii) the repurchase of the Notes or redemption of the redeemable preferred stock upon a change of control or repurchase of the Notes upon sales of certain assets. In the absence of such cash flows and resources, we could face substantial liquidity problems and might be required to sell material assets or operations to attempt to meet our debt service and other obligations. The Credit Agreement governing the Senior Secured Credit Facilities and the Indenture restrict our ability to conduct asset sales and/or use the proceeds from asset sales. We may not be able to consummate these asset sales to raise capital or sell assets at prices and on terms that we believe are fair, and any proceeds that we do receive may not be adequate to meet any debt service obligations then due, including payments due with respect to our redeemable preferred stock. If we cannot meet our debt service obligations, the holders of our debt may accelerate our debt and, to the extent such debt is secured, foreclose on our assets. In such an event, we may not have sufficient assets to repay all of our debt.

The terms of the Credit Agreement governing the Senior Secured Credit Facilities, the Indenture, and other debt instruments, as well as the documents governing other debt that we may incur in the future may, restrict our current and future operations, particularly our ability to respond to changes or to take certain actions.

The Indenture, the Credit Agreement governing the Senior Secured Credit Facilities, and our other debt instruments, and the documents governing other debt that we may incur in the future may, contain a number of restrictive covenants that impose significant operating and financial restrictions on us and may limit our ability to engage in acts that may be in our long-term best interests, including restrictions on our ability to:

incur additional indebtedness and guarantee indebtedness;

engage in mergers or consolidations or sell all or substantially all of our assets;

sell, transfer or otherwise dispose of assets;

make investments, acquisitions, loans or advances or other restricted payments;

pay dividends or distributions, repurchase our capital stock or make certain other restricted payments;

prepay, redeem, or repurchase any subordinated indebtedness;

designate our subsidiaries as unrestricted subsidiaries;

enter into agreements which limit the ability of ournon-guarantor subsidiaries to pay dividends or make other payments to us; and enter into certain transactions with our affiliates.

In addition, the restrictive covenants in the Credit Agreement governing the Senior Secured Credit Facilities and other debt instruments require us to maintain specified financial ratios and satisfy other financial condition tests to the extent subject to certain financial covenant conditions. Our failureability to successfullymeet those financial ratios and timely launchtests can be affected by events beyond our control. We may not meet those ratios and tests.

A breach of the covenants or restrictions under the Indenture governing the Notes, under the Credit Agreement governing the Senior Secured Credit Facilities, or under other debt instruments could result in an event of default under the applicable indebtedness. Such a default may allow the creditors under such facility to accelerate the related debt, which may result in the acceleration of any other debt to which a cross-acceleration or cross-default provision applies. In addition, an event of default under the Credit Agreement governing our Senior Secured Credit Facilities would permit the lenders under our revolving credit facility to terminate all commitments to extend further credit under that facility. Furthermore, if we were unable to repay the amounts due and payable

under the Senior Secured Credit Facilities or under other secured debt instruments, those lenders could proceed against the collateral granted to them to secure that indebtedness. We have pledged substantially all of our assets as collateral under the Senior Secured Credit Facilities. In the event our lenders or holders of the Notes accelerate the repayment of our borrowings, we may not have sufficient assets to repay that indebtedness or be able to borrow sufficient funds to refinance it. Even if we are able to obtain new productsfinancing, it may not be on commercially reasonable terms or adopton terms acceptable to us. As a result of these restrictions, we may be:

limited in how we conduct our business;

unable to raise additional debt or equity financing to operate during general economic or business downturns; or

unable to compete effectively or to take advantage of new technologies,business opportunities. These restrictions, along with restrictions that may be contained in agreements evidencing or governing other future indebtedness, may affect our ability to grow or pursue other important initiatives in accordance with our growth strategy.

Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

Borrowings under our Senior Secured Credit Facilities are at variable rates of interest and expose us to interest rate risk. If interest rates increase, our debt service obligations on the variable rate indebtedness will increase even though the amount borrowed remains the same, and our net income and cash flows, including cash available for servicing our indebtedness, would correspondingly decrease. As of December 31, 2018, approximately $382.8 million of our debt was variable rate debt. Our anticipated annual interest expense on $382.8 million variable rate debt at the current rate of 6.3 percent would be $24.1 million. We have entered into interest rate swaps exchanging floating for fixed rate interest payments in order to reduce interest rate volatility. As of December 31, 2018, we have executed interest rate swaps for $90.0 million, maturing $25.0 million March 31, 2019, $30.0 million September 30, 2019, and $35.0 million December 31, 2019. In addition, on January 10, 2019 we entered into additional interest rate swaps for $200 million, maturing $50 million September 30, 2022 and $150 million December 31, 2022. In the future, we may again enter into interest rate swaps to reduce interest rate volatility. However, we may not maintain interest rate swaps with respect to all of our variable rate indebtedness, and any swaps we enter into may not fully mitigate our interest rate risk.

In addition, the interest rates under our Senior Secured Credit Facilities are calculated using LIBOR. On July 27, 2017, the Financial Conduct Authority (the authority that regulates LIBOR) announced that it intends to stop compelling banks to submit rates for the calculation of LIBOR after 2021 and it is unclear whether new methods of calculating LIBOR will be established. If LIBOR ceases to exist after 2021, a failurecomparable or successor reference rate as approved by the Administrative Agent under the Credit Agreement will apply or such other reference rate as may be agreed by the Company and the lenders under the Credit Agreement. The U.S. Federal Reserve, in conjunction with the Alternative Reference Rates Committee, is considering replacing U.S. dollar LIBOR with a newly created index, calculated based on repurchase agreements backed by treasury securities. It is not possible to predict the effect of these changes, other reforms or the establishment of alternative reference rates in the United Kingdom, the United States or elsewhere. To the extent these interest rates increase, our customers to successfully launch new programs,interest expense will increase, which could adversely affect our results. financial condition, operating results and cash flows.

We are subject to taxation related risks in multiple jurisdictions.

We are a U.S.-based multinational company subject to tax in multiple U.S. and foreign tax jurisdictions. Significant judgment is required in determining our global provision for income taxes, deferred tax assets or liabilities and in evaluating our tax positions on a worldwide basis. While we believe our tax positions are consistent with the tax laws in the jurisdictions in which we conduct our business, it is possible that these positions may be overturned by jurisdictional tax authorities, which may have a significant impact on our global

provision for income taxes. Tax laws are dynamic and subject to change as new laws are passed and new interpretations of the law are issued or applied. We are also subject to ongoing tax audits. These audits can involve complex issues, which may require an extended period of time to resolve and can be highly subjective. Tax authorities may disagree with certain tax reporting positions taken by us and, as a result, assess additional taxes against us. We regularly assess the likely outcomes of these audits in order to determine the appropriateness of our tax provision.