UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 10-K

R Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 20102011

OR

o Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from ______ to ______

Commission File Number 001-34257

UNITED FIRE & CASUALTY COMPANYGROUP, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Iowa | | 42-064432745-2302834 |

| (State of Incorporation) | | (IRS Employer Identification No.) |

|

|

| 118 Second Avenue SE |

| PO Box 73909 |

| Cedar Rapids, Iowa 52407-3909 |

| (Address of principal executive offices) (Zip Code) |

Registrant’s telephone num ber,number, including area code: (319) 399-5700

Securities Registered Pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

Common Stock, $3.33 1/3$0.001 par value | | The NASDAQ StockGlobal Select Market LLC |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES £ NO R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES £ NO R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subje ctsubject to such filing requirements for the past 90 days. YES R NO £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES £R NO £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer £ | | Accelerated filer R | | Non-accelerated filer £ | | Smaller reporting company £ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES £ NO R

The aggregate market value of voting stock held by nonaffiliates of the registrant as of June 30, 2010,2011, was approximately $433.0 million.$372.7 million. For purposes of this calculation, all directors and executive officers of the registrant are considered affiliates. As of February 24, 2011, 26,195,552March 13, 2012, 25,506,809 shares of common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Form 10-K incorporates by reference certain information from the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A of the Securities Exchange Act of 1934, as amended, for its annual stockholders meeting to be held on May 18, 201116, 2012.

FORM 10-K TABLE OF CONTENTS

|

| |

| | PAGE |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| Exhibit 12 |

| Exhibit 21 |

| Exhibit 23.1 |

| Exhibit 23.2 |

| Exhibit 23.3 |

| Exhibit 31.1 |

| Exhibit 31.2 |

| Exhibit 32.1 |

| Exhibit 32.2 |

United Fire & Casualty CompanyGroup, Inc. Form 10-K | 20102011

PART I.

ITEM 1. BUSINESS

|

|

| FORWARD-LOOKING INFORMATION |

It is important to note that our actual results could differ materially from those projected in forward-looking statements. Information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained in Part I, Item 1A, “Risk Factors,” and Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The terms “United Fire,” “United Fire Group,“Company,” “we,” “us,” or “our” refer, as the context requires, to United Fire Group, Inc., United Fire & Casualty Company, United Fire Group, Inc. and its consolidated subsidiaries and affiliates, or to United Fire & Casualty Company and its consolidated subsidiaries and affiliate, as the context requires.affiliates. We are engaged in the business of writing property and casualty insurance and life insurance and selling annuities. United Fire & Casualty Company was incorporated in Iowa in January 1946. Our principal executive office is located at 118 Second Avenue SE, P.O. Box 73909, , Cedar Rapids, Iowa 52407-3909. Telephone: 319-399-5700.

Holding Company

On February 1, 2012, we completed a holding company reorganization (the "Reoganization") of United Fire Group, Inc., United Fire & Casualty Company, and UFC MergeCo, Inc., an Iowa corporation formed for the purpose of facilitating the Reorganization. The Reorganization Agreement was approved and adopted by United Fire & Casualty Company stockholders at a special meeting of stockholders, held on January 24, 2012.

The Reorganization Agreement provided for the merger of United Fire & Casualty Company with UFC MergeCo, Inc., with United Fire & Casualty Company surviving the Merger as a wholly owned subsidiary of United Fire Group, Inc.. Each share of common stock, par value $3.33 1/3 per share, of United Fire & Casualty Company issued and outstanding immediately prior to the effective time of the Merger into one duly issued, fully paid and nonassessable share of common stock, par value $0.001 per share, of United Fire Group, Inc. At the time of completion of the Reorganization, the separate existence of UFC MergeCo, Inc. terminated. In addition, each outstanding option to purchase or other right to acquire shares of United Fire & Casualty Company Common Stock was automatically converted into an option to purchase or right to acquire, upon the same terms and conditions, an identical number of shares of United Fire Group, Inc. Common Stock.

Upon completion of the Reorganization, United Fire Group, Inc., an Iowa corporation, replaced United Fire & Casualty Company, an Iowa corporation, as the publicly held corporation, and the holders of United Fire & Casualty Company Common Stock now hold the same number of shares and same ownership percentage of United Fire Group, Inc. as they held of United Fire & Casualty Company immediately prior to the Reorganization. On February 2, 2012, shares of United Fire Group, Inc. Common Stock commenced trading on the NASDAQ Global Select Market under the symbol “UFCS.”

The directors and executive officers of United Fire Group, Inc. immediately following the Reorganization are the same individuals who were directors and executive officers, respectively, of United Fire & Casualty Company immediately prior to the Reorganization.

Employees

As of December 31, 20102011, we employed 640868 full-time employees and 1426 part-time employees. We are not a party to any collective bargaining agreement.

United Fire Group, Inc. Form 10-K | 2011

Reportable Segments

We report our operations in two business segments: property and casualty insurance and life insurance. Our property and casualty insurance segment is comprised of commercial lines insurance, including surety bonds, personal lines insurance and assumed insurance. Our life insurance segment is comprised of deferred and immediate annuities, universal life insurance products and traditional life insurance products. in A table reflecting revenues, net income and assets attributable to our operating segments is included in Part II, Item 8, Note 1110 “Segment Information.” All intercompany balances have been eliminated in consolidation.

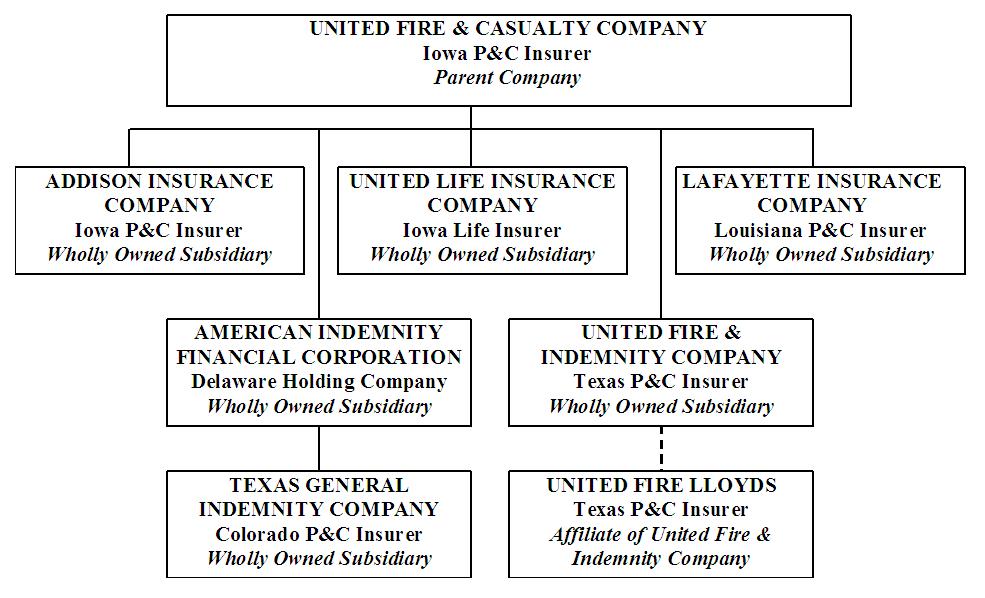

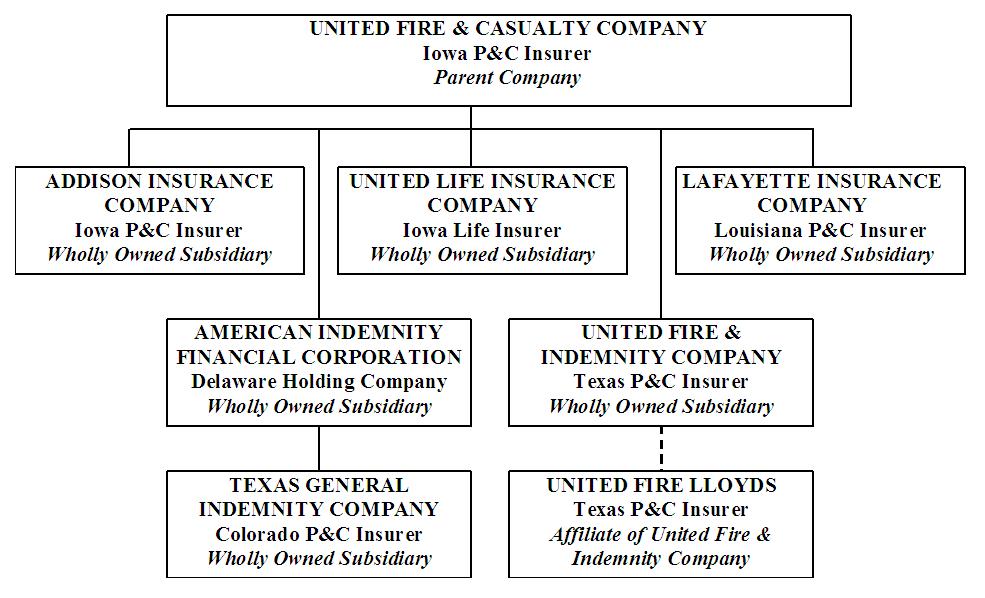

Our organizational structure is as follows:

United Fire & Casualty Company Form 10-K | 2010

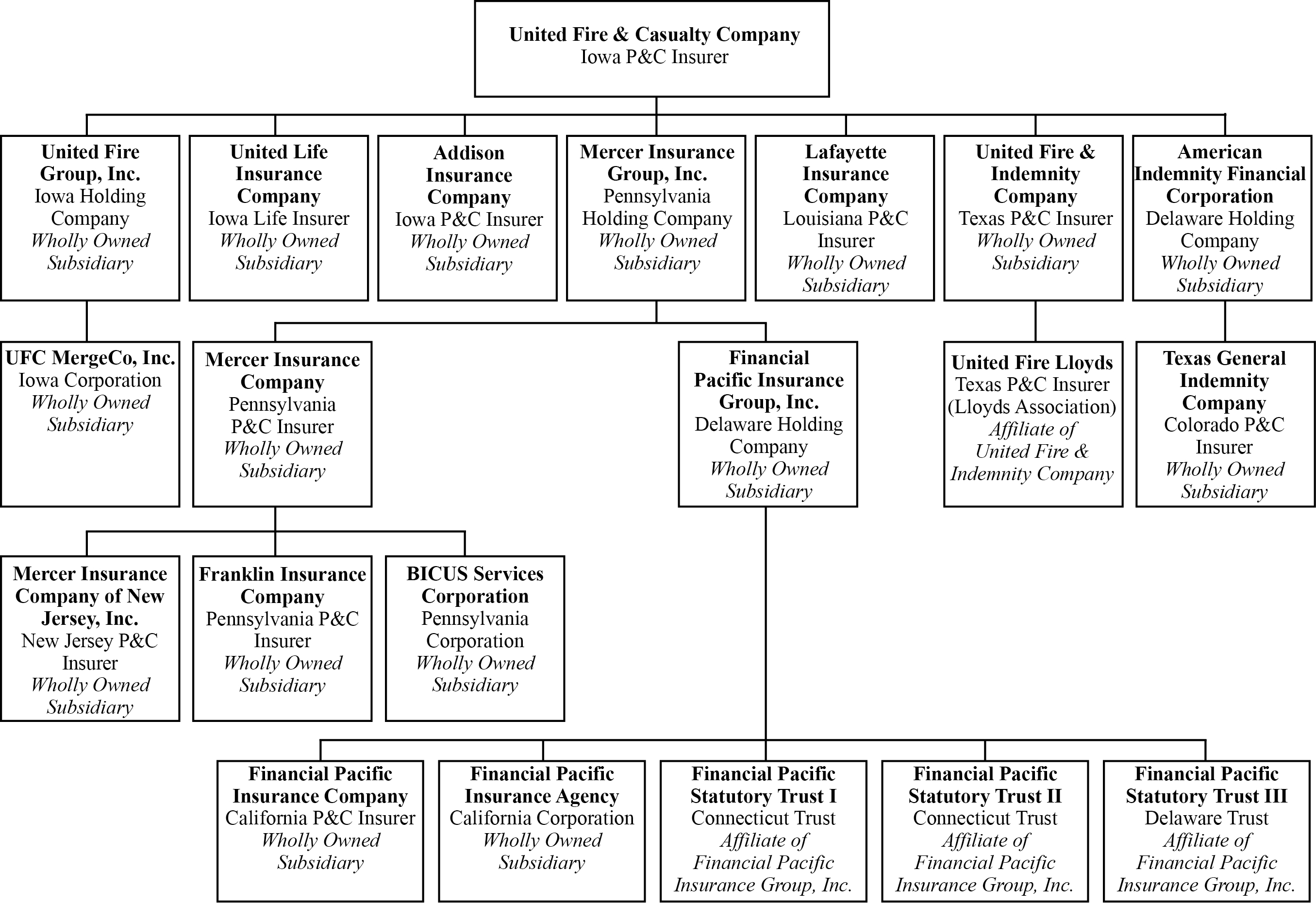

(1) United Fire is the sole shareholder of Red Oak Acquisition Corp. (“Red Oak”), a corporation formed under the laws of the Commonwealth of Pennsylvania on November 24, 2010. We formed Red Oak for the purpose of facilitating our planned acquisition of Mercer Insurance Group, Inc. (“Mercer”). In connection with our acquisition of Mercer, we expect that Red Oak will merge with and into Mercer and will then cease to exist as a separate corporation.All of our property and casualty insurance subsidiaries belong to one of two reinsurance pooling arrangement, with the exception of American Indemnity Financial Corporation and Te xasTexas General Indemnity Company, are members of an intercompany reinsurance pooling arrangement. The insurance entities of Mercer Insurance Group, Inc. ("Mercer Insurance Group") participated in their own pooling arrangement in 2011, which was in place when we acquired Mercer Insurance Group on March 28, 2011. Effective January 1, 2012, one pooling arrangement exists to cover all participating insurance subsidiaries of United Fire Group, Inc. Pooling arrangements permit the participating companies to rely on the capacity of the entire pool’s capital and surplus, rather than being limited to policy exposures of a size commensurate with each participant’s own surplus level. Under such arrangements, the members share substantially all of the insurance business that is written and allocate the combined premiums, losses and expenses based on percentages defined in the arrangement.

Our life insurance segment consists solely of the operations of United Life Insurance Company.

Available Information

United Fire Group provides free and timely access to all companyCompany reports filed with the Securities and Exchange Commission (“SEC”) in the Investor Relations section of our website at www.unitedfiregroup.com. Select “SEC Filings” to view the list of filings, which includes:

| |

• | Annual reports (Form 10-K) |

| |

• | Quarterly reports (Form 10-Q) |

| |

• | Current reports (Form 8-K) |

| |

• | Beneficial ownership reports (Forms 3, 4 and 5) |

| |

• | Amendments to reports filed or furnished pursuant to Section 13(a), 15(d) or 16(a) of the Exchange Act. |

Annual reports (Form 10-K)

Quarterly reports (Form 10-Q)

Current reports (Form 8-K)

Beneficial ownership reports (Forms 3, 4 and 5)

Amendments to reports filed or furnished pursuant to Section 13(a), 15(d) or 16(a) of the Exchange Act.

Such reports are made available as s oonsoon as reasonably practicable after they are filed with or furnished to the SEC.

United Fire &a mp; Casualty Company Form 10-K | 2010

Our Code of Ethics is also available at www.unitedfiregroup.com in the Investor Relations section. To view it, select “Corporate Governance” and then “Code of Ethics.”

Free paper copies of any materials that we file with or furnish to the SEC can also be obtained by writing to Investor Relations, United Fire Group, Inc., P.O. Box 73909, Cedar Rapids, Iowa 52407-3909. In addition, you may read and copy any materials we file with or furnish to the SEC at the SEC Public Reference Room, 100 F Street, NE, Washington, D.C. 20549. For obtainingmore information on the operation of the SEC Public Reference Room, call the SEC at 1-800-SEC-0330.

The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Pending PurchaseAcquisition of Mercer Insurance Group, Inc.

On November 30, 2010,March 28, 2011, we announced our entry into a definitive agreement to acquireacquired 100 percent of the outstanding common stock of Mercer Insurance Group Inc. (“Mercer”)for $191.5 million; the acquisition was funded through a combination of cash and $79.9 million of short-term debt. Accordingly, the results of operations for Mercer Insurance Group have been included in a transaction valued at approximately $191.0 million. The transaction is subject to customary conditions, including approval by the stockholdersaccompanying

United Fire stockholders is not required, and there is no financing cond ition to completeGroup, Inc. Form 10-K | 2011

Consolidated Financial Statements from that date forward. After the transaction.

Mercer offers commercial and personal lines of insurance to businesses and individuals principally in New Jersey, Pennsylvania, Arizona, California, Nevada and Oregonacquisition, we market our products through its insurance subsidiaries: Mercer Insurance Company, Mercer Insurance Company of New Jersey, Inc., Financial Pacific Insurance Company and Franklin Insurance Company.

There is no overlap between the agency networks of United Fire and Mercer, as Mercer primarily markets in six Western and Mid-Atlantic states in which we have no appointedover 1,300 independent property and casualty agencies. FollowingIn addition, the closing of the transaction, we will market through approximately 1,400 independent agents in 43 states plus the District of Columbia,acquisition allows us to diversify ing our exposure to weather and other catastrophe risks across our geographic markets. Also following

This transaction was accounted for under the completionacquisition method using Mercer Insurance Group historical financial information and applying fair value estimates to the acquired assets, liabilities and commitments as of the transaction, the combined company will be ableacquisition date. For additional information related to build on common conservative underwritingthis acquisition, see Note 16 “Business Combinations” contained in Part II, Item 8, “Financial Statements and investment cultures.Supplementary Data.”

United Fire Group, Inc. Form 10-K | 2011

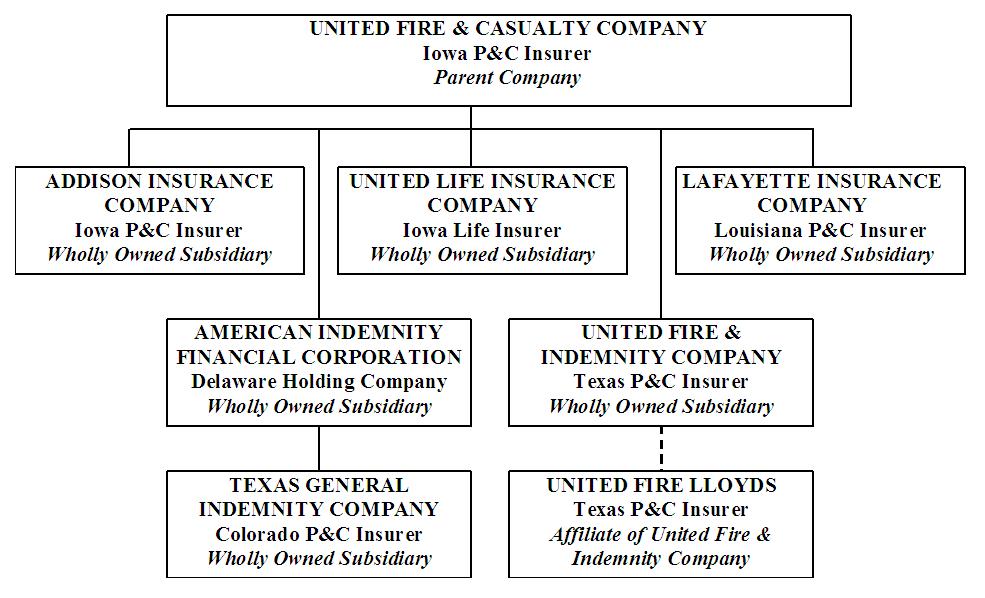

Our organizational structure as of December 31, 2011 is as follows:

United Fire Group, Inc. Form 10-K | 2011

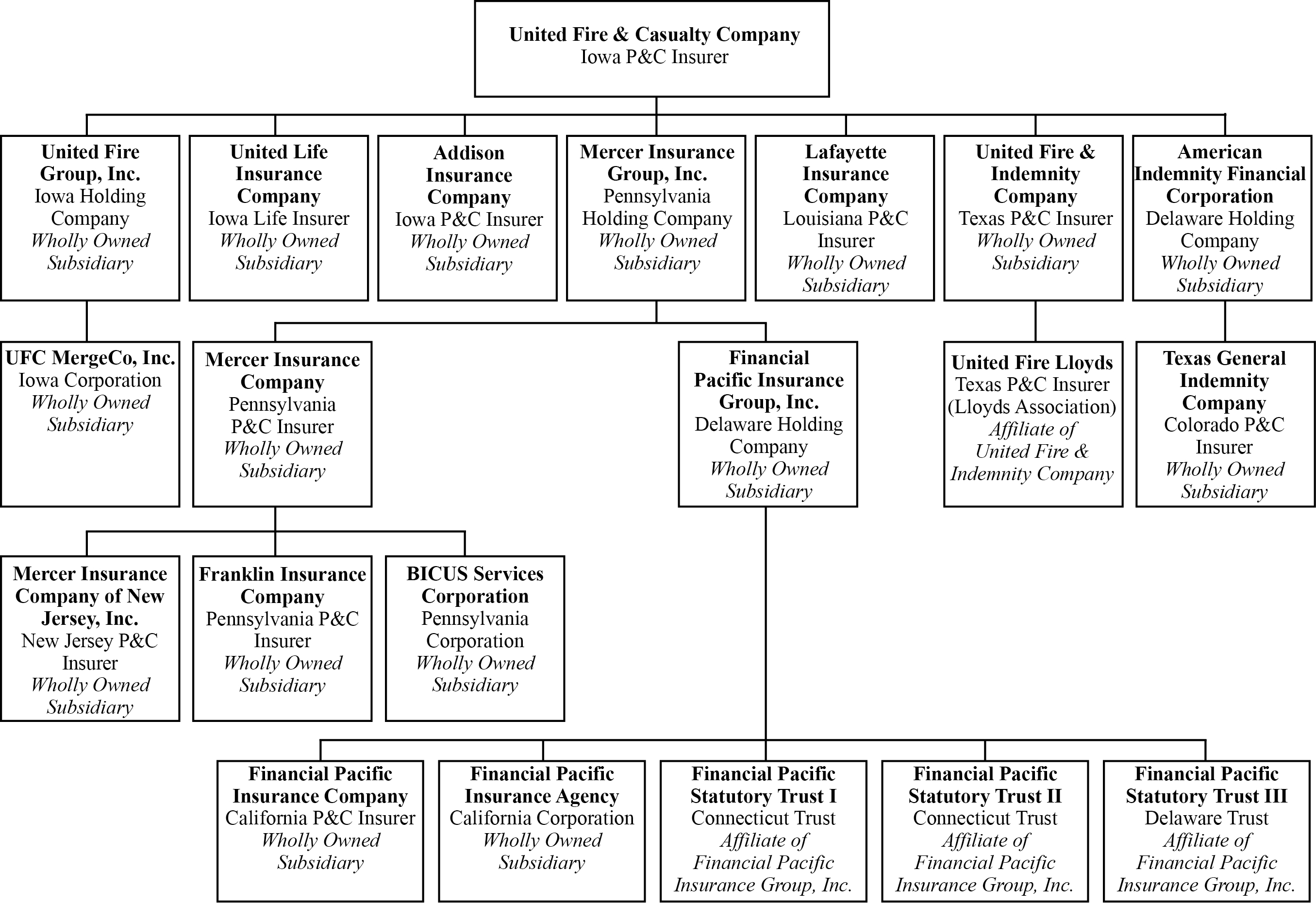

Our organizational structure as of February 1, 2012 is as follows:

United Fire Group, Inc. Form 10-K | 2011

We market our products through our home office in Cedar Rapids, Iowa, and twofour regional locations: Westminster, Colorado, a suburb of Denver,Denver; Galveston, Texas; Pennington, New Jersey; and Galveston, Texas.Rocklin, California.

We are licensed as a property and casualty insurer in 43 states, primarily in the Midwest, West and South, plus the District of Columbia. We have 7961,302 independent agencies representing us and our property and casualty insurance subsidiaries. In 2011, 2010 2009 and 20082009 the direct statutory premiums written forby our property and casualty insurance operations were distributed as follows:

| | | | Years Ended December 31, | % of Total | Years Ended December 31, | % of Total |

| (In Thousands) | 2010 | 2009 | 2008 | 2010 | 2009 | 2008 | 2011 | 2010 | 2009 | 2011 | 2010 | 2009 |

| Texas | $ | 68,655 | | $ | 69,900 | | $ | 70,301 | | 15.8 | % | 15.4 | % | 14.5 | % | $ | 74,845 |

| $ | 68,655 |

| $ | 69,900 |

| 12.9 | % | 15.8 | % | 15.4 | % |

| Iowa | 68,373 | | 69,515 | | 66,926 | | 15.7 | | 15.3 | | 13.8 | | 73,762 |

| 68,373 |

| 69,515 |

| 12.7 |

| 15.7 |

| 15.3 |

|

| California | | 61,500 |

| 13 |

| 6 |

| 10.6 |

| — |

| — |

|

| Missouri | 40,342 | | 41,185 | | 42,242 | | 9.3 | | 9.1 | | 8.7 | | 42,202 |

| 40,342 |

| 41,185 |

| 7.3 |

| 9.3 |

| 9.1 |

|

| Louisiana | 37,263 | | 41,743 | | 42,467 | | 8.6 | | 9.2 | &nb sp; | 8.8 | | 36,685 |

| 37,263 |

| 41,743 |

| 6.3 |

| 8.6 |

| 9.2 |

|

| New Jersey | | 33,793 |

| — |

| — |

| 5.8 |

| — |

| — |

|

| Illinois | 31,330 | &nbs p; | 33,465 | | 39,606 | | 7.2 | | 7.4 | | 8.2 | | 32,241 |

| 31,330 |

| 33,465 |

| 5.6 |

| 7.2 |

| 7.4 |

|

| Colorado | 28,775 | | 33,938 | | 46,763 | | 6.6 | | 7.5 | | 9.7 | | 29,250 |

| 28,775 |

| 33,938 |

| 5.0 |

| 6.6 |

| 7.5 |

|

| All Other States | 160,968 | | 164,300 | | 175,733 | | 36.8 | | 36.1 | | 36.3 | | 196,610 |

| 160,955 |

| 164,294 |

| 33.8 |

| 36.8 |

| 36.1 |

|

Direct Premiums Written (1) | $ | 435,706 | | $ | 454,046 | | $ | 484,038 | | 100.0 | % | 100.0 | % | 100.0 | % | $ | 580,888 |

| $ | 435,706 |

| $ | 454,046 |

| 100.0 | % | 100.0 | % | 100.0 | % |

| |

| (1) | The Statutory Financial MeasuresMeasurement of Results section of Part II, Item 7, defines data prepared in accordance with statutory accounting practices, which is a comprehensive basis of accounting other than U.S. GAAP. |

United Fire & Casualty Company Form 10-K | 2010

Our life insurance subsidiary is licensed in 2833 states, primarily in the Midwest and West, and is represented by 956950 independent agencies. In 2011, 2010 2009 and 20082009 the direct statutory premiums written forby our life insurance operations were distributed as follows:

| | | | Years Ended December 31 | % of Total | Years Ended December 31 | % of Total |

| (In Thousands) | 2010 | 2009 | 2008 | 2010 | 2009 | 2008 | 2011 | 2010 | 2009 | 2011 | 2010 | 2009 |

| Iowa | $ | 45,336 | | $ | 94,658 | | $ | 83,148 | | 32.6 | % | 36.8 | % | 41.9 | % | $ | 51,132 |

| $ | 45,336 |

| $ | 94,658 |

| 29.7 | % | 32.6 | % | 36.8 | % |

| Minnesota | | 20,409 |

| 11,875 |

| 23,128 |

| 11.9 |

| 8.5 |

| 9.0 |

|

| Illinois | | 17,643 |

| 13,629 |

| 17,720 |

| 10.2 |

| 9.8 |

| 6.9 |

|

| Nebraska | | 16,553 |

| 11,317 |

| 33,103 |

| 9.6 |

| 8.1 |

| 12.9 |

|

| Wisconsin | 13,942 | | 21,548 | | 21,026 | | 10.0 | | 8.4 | | 10.6 | | 16,507 |

| 13,942 |

| 21,548 |

| 9.6 |

| 10.0 |

| 8.4 |

|

| Illinois | 13,629 | | 17,720 | | 15,020 | | 9.8 | | 6.9 | | 7.6 | | |

| Minnesota | 11,875 | | 23,128 | | 15,675 | | 8.5 | | 9.0 | | 7.9 | | |

| Nebraska | 11,317 | | 33,103 | | 15,813 | | 8.1 | | 12.9 | | 8.0 | | |

| All Other States | 42,901 | | 67,083 | | 47,899 | | 31.0 | | 26.0 | | 24.0 | | 49,915 |

| 42,901 |

| 67,083 |

| 29.0 |

| 31.0 |

| 26.0 |

|

Direct Statutory Premium Written (1) | $ | 139,000 | | $ | 257,240 | | $ | 198,581 | | 100.0 | % | 100.0 | % | 100.0 | % | |

Direct Statutory Premiums Written (1) | | $ | 172,159 |

| $ | 139,000 |

| $ | 257,240 |

| 100.0 | % | 100.0 | % | 100.0 | % |

| |

| (1) | The Statutory Financial MeasuresMeasurement of Results section of Part II, Item 7, defines data prepared in accordance with statutory accounting practices, which is a comprehensive basis of accounting other than U.S. GAAP. |

We staff our regional offices with underwriting, claims and marketing representatives and administrative technicians, all of whom provide support and assistance to the independent agencies. Also, home office staff technicians and specialists provide support to our subsidiaries, regional offices and independent agencies. We use management reports to monitor subsidiary and regional offices for overall results and conformity to our business policies.

United Fire Group, Inc. Form 10-K | 2011

Incorporated by reference from Note 10 “Segment Information” contained in Part II, Item 8, “Financial Statements and Supplementary Data.”

Property and Casualty Insurance Segment

The property and casualty insurance industry is highly competitive. We com petecompete with numerous property and casualty insurance companies in the regional and national market, many of which are substantially larger and have considerably greater financial and other resources. Except for regulatory considerations, there are limited barriers to entry into the insurance industry. Our competitors may be domestic or foreign, as well as licensed or unlicensed. The exact number of competitors within the industry is not known. Insurers compete on the basis of reliability, financial strength and stability, ratings, underwriting consistency, service, business ethics, price, performance, capacity, policy terms and coverage conditions.

In addition, because our products are marketed exclusively through independent insurance agencies, most of which represent more than one company, we face competition wit hinwithin each agency.agency and, competition to retain qualified independent agents. Our competitors include companies that market their products through agents, as well as companies that sell insurance directly to their customers.

Because we rely solely on independent agencies, we offer a competitive commissions program and a rewarding profit-sharing plan as incentives for agents to place high-quality property and casualty insurance business with us. We estimate property and casualty insurance agencies will receive profit-sharing payments of $7.09.7 million in 20112012, based on business produced by the agencies in 20102011. In 20102011 for 20092010 business, agencies received $5.77.0 million in profit-sharing payments and in 20092010 for 20082009 business, agencies received $7.45.7 million in payments.

Our competitive advantages include our commitment to:

| |

• | Strong agency relationships — |

Strong agency relationships —

| |

| ◦ | The average tenure of our employees, is 14.0approximately 12.0 years, which allows our agents to work with the same, highly-experienced personnel each day. |

| |

| ◦ | Our organization is relatively flat, allowing our agents to be close to the highest levels of management and ensuring that our agents will receive answers quickly to their questions. |

United Fire & Casualty Company Form 10-K | 2010

| |

| ◦ | We have relatively fewer agents appointed to each state than our peers,competitors, which is valued by our agents, as they do not have to compete with other agents in their area to represent our company.the Company. |

| |

• | Exceptional service — our agents and policyholders always have the option to speak with a real person. |

| |

• | Fair and prompt claims handling — we view claims as an opportunity to prove to our customers that they have chosen the right insurance company. |

| |

• | Disciplined underwriting — we empower our underwriters with the knowledge and tools needed to make good decisions for our company. |

| |

• | Superior loss control services — our loss control representatives make multiple visits to businesses and job sites each year to ensure safety. |

| |

• | Effective and efficient use of technology — we use technology to provide enhanced service to our agents and policyholders, not to replace our personal relationships, but to reinforce them.

|

Exceptional service — our agents and policyholders always have the option to speak with a real person.

Fair and prompt claims handling — we view claims as an opportunity to prove to our customers that they have chosen the right insurance company.

Disciplined underwriting — we empower our underwriters with the knowledge and tools needed to make good decisions for the Company.

Superior loss control services — our loss control representatives make multiple visits to businesses and job sites each year to ensure safety.

Effective and efficient use of technology — we use technology to provide enhanced service to our agents and policyholders, not to replace our personal relationships, but to reinforce them.

United Fire Group, Inc. Form 10-K | 2011

Life Insurance Segment

We also encounter significant competition in all lines of our life and fixed annuity business from other life insurance companies and other providers of financial services. Since our products are marketed exclusively through independent life insurance agencies that typically represent more than one company, we face competition within our agencies. Competitors include companies that market their products through agents, as well as companies that sell directly to their customers. Given the nature of the insurance industry, the exact number of competitors within the industry is not known.

To attract and maintain relationships with our independent life insurance agencies, we offer competitive commission rates and other sales incentives. Our life insurance segment achieves a competitive advantage by offering products that are simple and straightforward, by providing outstanding customer service, by being accessible to our agents and customers, and by using technology in a variety of ways to assist our agents and improve the delivery of service to our policyholders.

Incorporated by reference from Note 1110 “Segment Information” contained in Part II, Item 8, “Financial Statements and Supplementary Data.” Additionally, for a detailed discussion of our operating results by segment, refer to the Results of Operations section in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Incorporated by reference from Note 54 “Reinsurance” contained in Part II, Item 8, “Financial Statement sStatements and Supplementary Data.”

Property and Casualty Insurance Segment

Property insurance indemnifies an insured with an interest in physical property for loss of, or damage to, such property or the loss of its income-producing abilities. Casualty insurance primarily covers liability for damage to property of, or injury to, a person or entity other than the insured. In most cases, casualty insurance also obligates the insurance company to provide a defense for the insured in litigation, arising out of events covered by the policy.

United Fire & Casualty Company Form 10-K | 2010

We are required by applicable insurance laws and regulations to maintain reservesLiabilities for the payment of loss and loss settlement expenses (“loss reserves”). Loss reserves arereflect management’s best estimates at a given point in time of what we expect to pay for claims that have been reported and those that have been incurr edincurred but not reported (“IBNR”), based on facts, circumstances and historical trends then known.

The determination of reserves, particularly those relating to liability lines of insurance, reflects significant judgment factors. If, during the course of our regular monitoring of reserves, we determine that coverages previously written are incurring higher than expected losses, we will take action that may include, among other things, increasing the related reserves. Any adjustments we make to reserves are reflected in operating results in the year in which we make those adjustments. As required by state law, we engage an independent actuary, Regnier Consulting Group, Inc. (“Regnier”), to render an opinion as to the adequacy of the statutory reserves we establish annually. The actuarial opinion is filed in those states where we are licensed. On a quar terlyquarterly basis, Regnier reviews our direct loss reserves for adequacy.

We do not discount loss reserves based on the time value of money. However, we consider inflation in the reserving process by reviewing cost trends, loss settlement expenses, historical reserving results and likely future economic conditions. There are no material differences between our reserves established under U.S. generally accepted accounting principles (“GAAP”) and our statutory reserves.

United Fire Group, Inc. Form 10-K | 2011

The following table sets forth a reconciliation of our beginning and ending net reserves for unpaid losses and loss settlement expenses for 20102011, 20092010 and 20082009:

| | | (In Thousands) | | | | | | | | | | |

| Years Ended December 31 | 2010 | | 2009 | | 2008 | 2011 | | 2010 | | 2009 |

Gross liability for losses and loss settlement expenses

at beginning of year | $ | 606,045 | | | $ | 586,109 | | | $ | 496,083 | | $ | 603,090 |

| | $ | 606,045 |

| | $ | 586,109 |

|

| Ceded loss and loss settlement expenses | (33,754 | ) | | (52,508 | ) | | (38,800 | ) | (39,000 | ) | | (33,754 | ) | | (52,508 | ) |

Net liability for losses and loss settlement expenses

at beginning of year | $ | 572,291 | | | $ | 533,601 | | | $ | 457,283 | | $ | 564,090 |

| | $ | 572,291 |

| | $ | 533,601 |

|

| Reserves acquired in Mercer Insurance Group acquisition, net | | 252,598 |

| | — |

| | — |

|

| Beginning balance, as adjusted | | $ | 816,688 |

| | $ | 572,291 |

| | $ | 533,601 |

|

Losses and loss settlement expenses incurred

for claims occurring during | | | | | |

| |

| |

|

| Current year | $ | 335,315 | | | $ | 339,506 | | | $ | 392,801 | | $ | 468,926 |

| | $ | 335,315 |

| | $ | 339,506 |

|

| Prior years | (45,878 | ) | | 26,215 | | | 548 | | (61,095 | ) | | (45,878 | ) | | 26,215 |

|

| Total incurred | $ | 289,437 | | | $ | 365,721 | | | $ | 393,349 | | $ | 407,831 |

| | $ | 289,437 |

| | $ | 365,721 |

|

Losses and loss settlement expense payments

for claims occurring during | | | | | |

| |

| |

|

| Current year | $ | 132,592 | | | $ | 131,507 | | | $ | 176,882 | | $ | 253,175 |

| | $ | 132,592 |

| | $ | 131,507 |

|

| Prior years | 165,046 | | | 195,524 | | | 140,149 | | 146,653 |

| | 165,046 |

| | 195,524 |

|

| Total paid | $ | 297,638 | | | $ | 327,031 | | | $ | 317,031 | | $ | 399,828 |

| | $ | 297,638 |

| | $ | 327,031 |

|

Net liability for losses and loss settlement expenses

at end of year | $ | 564,090 | | | $ | 572,291 | | | $ | 533,601 | | $ | 824,692 |

| | $ | 564,090 |

| | $ | 572,291 |

|

| Ceded loss and loss settlement expenses | 39,000 | | | 33,754 | | | 52,508 | | |

Ceded loss and loss settlement expenses(1) | | 120,359 |

| | 39,000 |

| | 33,754 |

|

Gross liability for losses and loss settlement expenses

at end of year | $ | 603,090 | | | $ | 606,045 | | | $ | 586,109 | | $ | 945,051 |

| | $ | 603,090 |

| | $ | 606,045 |

|

(1) Reflects our acquisition of Mercer Insurance Group in 2011.

The table on the following page illustrates the change in our estimate of loss reserves for our property and casualty insurance companies for the years 20002001 through 2009.2010. The first section shows the amount of the liability, as originally reported, at the end of each calendar year in our Consolidated Financial Statements. These reserves represent the estimated amount of losses and loss settlement expenses for losses arising in that year and all prior years that are unpaid at the end of each year, including an estimate for our IBNR losses, net of applicable ceded reinsurance. The second section displays the cumulative amount of net losses and loss settlement expenses paid for each year with respect to that liability. The third secti onsection shows the re-estimated amount of the previously recorded liability based on experience as of the end of each succeeding year. The estimate is increased or decreased as more information

United Fire & Casualty Company Form 10-K | 2010

becomes known about the losses for individual years. The last section compares the latest re-estimated amount with the original estimate. Conditions and trends that have affected development of loss reserves in the past may not necessarily exist in the future. Accordingly, it would not be appropriate to extrapolateproject future redundancies or deficiencies based on this table.

Amounts shown in the 2011 column of the table include both 2011 and prior to 2011 accident year development for Mercer Insurance Group, which was acquired on March 28, 2011 and accounted for under the acquisition method.

United Fire Group, Inc. Form 10-K | 2011

| | | (In Thousands) | | | | | | | | |

| Years Ended December 31 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| | | | | |

Gross liability for loss and loss

settlement expenses | $ | 358,032 | | $ | 363,819 | | $ | 392,649 | | $ | 427,049 | | $ | 464,889 | | $ | 620,100 | | $ | 518,886 | | $ | 496,083 | | $ | 586,109 | | $ | 606,045 | | $ | 603,090 | | $ | 363,819 |

| $ | 392,649 |

| $ | 427,049 |

| $ | 464,889 |

| $ | 620,100 |

| $ | 518,886 |

| $ | 496,083 |

| $ | 586,109 |

| $ | 606,045 |

| $ | 603,090 |

| $ | 945,051 |

|

Ceded loss and loss settlement

expenses | 37,526 | | 36,909 | | 35,760 | | 27,309 | | 28,609 | | 60,137 | | 40,560 | | 38,800 | | 52,508 | | 33,754 | | 39,000 | | 36,909 |

| 35,760 |

| 27,309 |

| 28,609 |

| 60,137 |

| 40,560 |

| 38,800 |

| 52,508 |

| 33,754 |

| 39,000 |

| 120,359 |

|

Net liability for loss and loss

settlement expenses | $ | 320,506 | | $ | 326,910 | | $ | 356,889 | | $ | 399,740 | | $ | 436,280 | | $ | 559,963 | | $ | 478,326 | | $ | 457,283 | | $ | 533,601 | | $ | 572,291 | | $ | 564,090 | | $ | 326,910 |

| $ | 356,889 |

| $ | 399,740 |

| $ | 436,280 |

| $ | 559,963 |

| $ | 478,326 |

| $ | 457,283 |

| $ | 533,601 |

| $ | 572,291 |

| $ | 564,090 |

| $ | 824,692 |

|

| Cumulative net paid as of: | | | |

| One year later | $ | 110,516 | | $ | 112,546 | | $ | 107,271 | | $ | 100,895 | | $ | 110,016 | | $ | 230,455 | | $ | 148,593 | | $ | 140,149 | | $ | 195,524 | | $ | 165,046 | | | $ | 112,546 |

| $ | 107,271 |

| $ | 100,895 |

| $ | 110,016 |

| $ | 230,455 |

| $ | 148,593 |

| $ | 140,149 |

| $ | 195,524 |

| $ | 165,046 |

| $ | 146,653 |

| |

| Two years later | 166,097 | | 172,538 | | 172,1 58 | | 167,384 | | 166,592 | | 321,110 | | 235,975 | | 265,361 | | 304,622 | | | 172,538 |

| 172,158 |

| 167,384 |

| 166,592 |

| 321,110 |

| 235,975 |

| 265,361 |

| 304,622 |

| 260,872 |

| |

| Three years later | 204,792 | | 215,002 | | 214,307 | | 203,861 | | 213,144 | | 380,294 | | 332,768 | | 345,092 | | | 215,002 |

| 214,307 |

| 203,861 |

| 213,144 |

| 380,294 |

| 332,768 |

| 345,092 |

| 373,765 |

| |

| Four years later | 230,889 | | 240,973 | | 237,150 | | 231,278 | | 242,579 | | 456,919 | | 390,763 | | | | | 240,973 |

| 237,150 |

| 231,278 |

| 242,579 |

| 456,919 |

| 390,763 |

| 392,676 |

| |

| Five years later | 245,677 | | 252,969 | | 253,026 | | 250,787 | | 264,015 | | 502,455 | | | 252,969 |

| 253,026 |

| 250,787 |

| 264,015 |

| 502,455 |

| 422,669 |

| |

| Six years later | 252,153 | | 264,311 | | 265,304 | | 263,631 | | 276,214 | | | ; | | 264,311 |

| 265,304 |

| 263,631 |

| 276,214 |

| 527,136 |

| |

| Seven years later | 259,621 | | 273,153 | | 273,066 | | 272,826 | | | | | | 273,153 |

| 273,066 |

| 272,826 |

| 282,654 |

| |

| Eight years later | 264,713 | | 277,868 | | 280,152 | | | | 277,868 |

| 280,152 |

| 277,645 |

| |

| ; Nine years later | 266,912 | | 282,970 | | | | | | | |

| Nine years later | | 282,970 |

| 283,635 |

| |

| Ten years later | 269,794 | | | | | | | 285,334 |

| |

| Net liability re-estimated as of: | | | | |

| End of year | $ | 320,506 | | $ | 326,910 | | $ | 356,889 | | $ | 399,740 | | $ | 436,280 | | $ | 559,963 | | $ | 478,326 | | $ | 457,283 | | $ | 533,601 | | $ | 572,291 | | $ | 564,090 | | $ | 326,910 |

| $ | 356,889 |

| $ | 399,740 |

| $ | 436,280 |

| $ | 559,963 |

| $ | 478,326 |

| $ | 457,283 |

| $ | 533,601 |

| $ | 572,291 |

| $ | 564,090 |

| $ | 824,692 |

|

| One year later | 273,469 | | 315,854 | | 344,590 | | 361,153 | | 358,796 | | 534,998 | | 433,125 | | 457,831 | | 559,816 | | 526,413 | | & nbsp; | 315,854 |

| 344,590 |

| 361,153 |

| 358,796 |

| 534,998 |

| 433,125 |

| 457,831 |

| 559,816 |

| 526,413 |

| 502,995 |

| |

| Two years later | 290,872 | | 323,354 | | 340,502 | | 331,693 | | 330,137 | | 508,774 | | 453,474 | | 502,177 | | 547,824 | | | 323,354 |

| 340,502 |

| 331,693 |

| 330,137 |

| 508,774 |

| 453,474 |

| 502,177 |

| 547,824 |

| 497,136 |

| |

| Three years later | 300,011 | | 321,168 | | 324,582 | | 317,187 | | 319,335 | | 538,451 | | 497,629 | | 503,992 | | | | 321,168 |

| 324,582 |

| 317,187 |

| 319,335 |

| 538,451 |

| 497,629 |

| 503,992 |

| 537,912 |

| |

| Four years later | 302,884 | | 318,125 | | 313,745 | | 309,146 | | 326,340 | | 574,484 | | 500,071 | | | 318,125 |

| 313,745 |

| 309,146 |

| 326,340 |

| 574,484 |

| 500,071 |

| 503,720 |

| |

| Fiv e years later | 298,428 | | 309,033 | | 308,304 | | 316,227 | | 327,626 | &nbs p; | 582,343 | | | | | |

| Five years later | | 309,033 |

| 308,304 |

| 316,227 |

| 327,626 |

| 582,343 |

| 507,507 |

| |

| Six years later | 296,296 | | 307,790 | | 312,188 | | 314,522 | | 327,741 | | | | | | 307,790 |

| 312,188 |

| 314,522 |

| 327,741 |

| 592,772 |

| |

| Seven years later | 293,579 | | 311,367 | | 314,680 | | 316,705 | | | 311,367 |

| 314,680 |

| 316,705 |

| 322,875 |

| |

| Eight years lat er | 297,844 | | 312,433 | | 316,378 | | | |

| Eight years later | | 312,433 |

| 316,378 |

| 311,385 |

| |

| Nine years later | 297,022 | | 313,953 | | | 313,953 |

| 310,478 |

| |

| Ten years later | 297,275 | | | | | | 309,044 |

| |

| Net redundancy (deficiency) | $ | 23,231 | | $ | 12,957 | | $ | 40,511 | | $ | 83,035 | | $ | 108,539 | | $ | (22,380 | ) | $ | (21,745 | ) | $ | (46,709 | ) | $ | (14,223 | ) | $ | 45,878 | | | $ | 17,866 |

| $ | 46,411 |

| $ | 88,355 |

| $ | 113,405 |

| $ | (32,809 | ) | $ | (29,181 | ) | $ | (46,437 | ) | $ | (4,311 | ) | $ | 75,155 |

| $ | 61,095 |

| |

| Net re-estimated liability | 297,275 | | 313,953 | | 316,378 | | 316,705 | | 327,741 | | 582,343 | | 500,071 | | 503,992 | | 547,824 | | 526,413 | | | 309,044 |

| 310,478 |

| 311,385 |

| 322,875 |

| 592,772 |

| 507,507 |

| 503,720 |

| 537,912 |

| 497,136 |

| 502,995 |

| |

Re-estimated ceded loss an d loss

settlement expenses | $ | 33,877 | | $ | 43,086 | | $ | 43,776 | | $ | 38,522 | | $ | 38,381 | | $ | 91,535 | | $ | 57,459 | | $ | 50,990 | | $ | 56,884 | | $ | 41,042 | | | |

Re-estimated ceded loss and loss

settlement expenses | | $ | 44,288 |

| $ | 44,980 |

| $ | 39,724 |

| $ | 39,582 |

| $ | 97,622 |

| $ | 63,562 |

| $ | 57,220 |

| $ | 64,209 |

| $ | 48,366 |

| $ | 49,198 |

| |

| Gross re-estimated liability | $ | 331,152 | | $ | 357,039 | | $ | 360,154 | | $ | 355,227 | | $ | 366,122 | | $ | 673,878 | | $ | 557,530 | | $ | 554,982 | | $ | 604,708 | | $ | 567,455 | | | $ | 353,333 |

| $ | 355,459 |

| $ | 351,109 |

| $ | 362,457 |

| $ | 690,394 |

| $ | 571,069 |

| $ | 560,940 |

| $ | 602,121 |

| $ | 545,502 |

| $ | 552,193 |

| |

| Gross redundancy (deficienc y) | $ | 26,880 | | $ | 6,780 | | $ | 32,495 | | $ | 71,822 | | $ | 98,767 | | $ | (53,778 | ) | $ | (38,644 | ) | $ | (58,899 | ) | $ | (18,599 | ) | $ | 38,590 | | | |

| Gross redundancy (deficiency) | | $ | 10,486 |

| $ | 37,190 |

| $ | 75,940 |

| $ | 102,432 |

| $ | (70,294 | ) | $ | (52,183 | ) | $ | (64,857 | ) | $ | (16,012 | ) | $ | 60,543 |

| $ | 50,897 |

| |

For a more detailed discussion of our loss reserves, refer to the “Critical Accounting Estimates” section in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 6,5, “Reserves for Loss and Loss Settlement Expenses” contained in Part II, Item 8, “Financial Statements and Supplementary Data.”

Life Insurance Segment

We calculate the policy reserves reported in our Consolidated Financial Statements in accordance with GAAP. For our fixed annuities and universal life policies, we establish a benefit reserve at the time of policy issuance in an amount equal to the deposits received. Subsequently, we adjust the benefit reserve for any additional deposits, interest credited and partial or complete withdrawals, as well as insurance and other expense charges. We base policy reserves for other life products on the projected contractual benefits and expenses and interest rates

United Fire & Casualty Company Form 10-K | 2010

appropriate to those products. We base reserves for accident and health products, which are a minor portion of our reserves, on appropriate morbidity tables.

We determine reserves for statutory purposes based upon mortality rates and interest rates specified by Iowa state law. Our life insurance subsidiary’s reserves meet or exceed the minimum statutory requirements. Griffith, Ballard &

United Fire Group, Inc. Form 10-K | 2011

Company (“Griffith”), an independent actuary, assists us in developing and analyzing our reserves on both a GAAP and statutory basis.

For further discussion of our life insurance segment’s reserves, seerefer to the “Critical Accounting Estimates” containedsection in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Incorporated by reference from Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations, ,”” under the headings “Investments” and “Critical Accounting Estimates”; Part II, Item 7A, “Quantitative and Qualitative Disclosures about Market Risk”; and Note 1 “Significant Accounting Policies” under the headings “Investments” and “Securities Lending,“Investments,” Note 2 “Summary of Investments,” and Note 3 “Fair Value of Financial Instruments,” contained in Part II, Item 8, “Financial Statements and Supplementary Data.”

We are not aware of any currently proposed or recently enacted state or federal regulation that would have a material impact on our operations. Additionally, we cannot predict whether any specific state or federal measures will be adopted to change the nature or scope of the regulation of the insurance business or what effect any particular measures might have on us.

State Regulation

We are subject to extensive regulation, primarily at the state level. The method, extent and substance of such regulation varies by state, but generally has its source in statutes that establish standards and requirements for conducting the business of insurance and that delegate regulatory authority to a state regulatory agency. In general, such regulation is intended for the protection of those who purchase or use our insurance products, and not our stockholders. These rules have a substantial effect on our business and relate to a wide variety of matters including:

| |

• | insurance company licensing and examination and the licensing of agents and adjusters; |

| |

• | price setting or premium rates; |

| |

• | approval of policy forms; |

| |

• | the nature, quality and concentration of investments; |

| |

• | participation in shared markets and guaranty funds; |

| |

• | restrictions on transactions between our subsidiaries and their affiliates; |

insurance company licensing and examination and the licensing of agents and adjusters;

price setting or premium rates;

trade practices;

approval of policy forms;

accounting methods;

the nature, quality and concentration of investments;

claims practices;

participation in shared markets and guaranty funds;

reserve adequacy;

insurer solvency;

restrictions on transactions between our subsidiaries and their affiliates;

restrictions on the payment of dividends;

underwriting standards;

United Fire & Casualty CompanyGroup, Inc. Form 10-K | 20102011

| |

• | restrictions on the payment of dividends; |

| |

• | underwriting standards; |

| |

• | advertising and marketing practices; and |

| |

• | the collection, remittance and reporting of certain taxes and fees. |

advertising and marketing practices; and

the collection, remittance and reporting of certain taxes and fees.

The state laws and regulations that have the most significant effect on our insurance operations and financial reporting are discussed below.

Insurance Holding Company Regulation

We are regulated as an insurance holding company system in the states of domicile of our property and casualty insurance companies and life insurance subsidiary: Iowa (United Fire & Casualty Company, United Life Insurance Company, and Addison Insurance Company), California (Financial Pacific Insurance Company), Louisiana (Lafayette Insurance Company), New Jersey (Mercer Insurance Company of New Jersey, Inc.), Pennsylvania (Mercer Insurance Company and Franklin Insurance Company, Texas (United Fire & Indemnity Company and United Fire Lloyds), and Colorado (Texas General Indemnity Company). With the acquisition of Mercer, we will be regulated by three additional domicile states: Pennsylvania (Mercer Insurance Company and Franklin Insurance Company), New Jersey (Mercer Insurance Company of New Jersey, Inc.), and California (Financial Pacific Insurance Company). These regulations require that we annually furnish financial and other information about the operations of the individual companies within our holding company system. Generally, the insurance codes of these states provide that notice to the state insurance commissioner is required before finalizing any transaction affecting the ownership or control of an insurer and before finalizing certain material t ransactionstransactions between an insurer and any person or entity inwithin its holding company group.system. In addition, some of those transactions cannot be finalized without the commissioner’scommissioner's prior approval.

Stockholder Dividends

Our capacity to pay dividends, and that of our subsidiaries, is regulated by the laws of the applicable state of domicile. Under these laws, insurance companies must provide advance informational notice to the domicile state insurance regulatory authority prior to payment of any dividend or distribution to its stockholders. Prior approval from the state insurance regulatory authority must be obtained before payment of an extraordinary dividend as defined under the state’s insura nceinsurance code. In all cases, we may pay ordinary dividends only from our earned surplus. Refer to the Market Information section of Part II, Item 5, “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities,” and Note 76 “Statutory Reporting, Capital Requirements and Dividends and Retained Earnings Restrictions,” contained in Part II, Item 8, “Financial Statements and Supplementary Data” for additional information about the dividends we paid during 20102011.

Price Regulation

Nearly all states have insurance laws requiring personal property and casualty insurersus to file rate schedules, policy or coverage forms, and other information withinwith the state’sstate's regulatory authority. In many cases,certain states, rate schedules, policy forms, or both, must be approved prior to use. While insurance laws vary from state to state, their objectives are generally the same: an insurance rate cannot be excessive, inadequate or unfairly discriminatory. The speed with which we can change our rates in response to competition or in response to increasing costs depends, in part, on the willingness of state regulators to allow adequate rates for the business that we write.

Investment Regulation

Insurance companiesWe are subject to various state regulations that requirerequiring investment portfolio diversification and that limitlimiting the concentration of investmentinvestments we may maintain in certain asset categories. Failure to comply with these regulations leads to the treatment of nonconforming investments as nonadmitted assets for purposes of measuring statutory surplus. Further, in some instances, thesestate regulations require us to sell certain nonconforming investments.

United Fire & Casualty Company Form 10-K | 2010

Exiting Geographic Markets; Canceling and Nonrenewing Policies

Most states regulate our ability to exit a market. For example, states limit, to varying degrees, our ability to cancel and nonrenew insurance policies. Some states prohibit us from withdrawing one or more types of insurance busines sbusiness from the state, except with stateupon prior regulatory approval. Regulations that limit policy cancellation and nonrenewal may restrict our ability to exit unprofitable markets.

United Fire Group, Inc. Form 10-K | 2011

Insurance Guaranty Associations

Each state has insurance guaranty association laws. Membership in a state’sstate's insurance guaranty association is generally mandatory for insurers wishing to do business in that state. Under these laws, associations may assess their members for certain obligations that insolvent insurance companies have to their policyholders and claimants. Typically, states assess each solvent member in an amount related to that member’smember's proportionate share of business written by all members within the stat e.state. Most state guaranty associations allow solvent insurers to recoup the assessments they are charged through future rate increases, surcharges or premium tax credits. However, there is no assurance that we will ultimately recover these assessments. We cannot predict the amount and timing of any future assessments or refunds under these laws.

Shared Market and Joint Underwriting Plans

State insurance regulations often require insurers to participate in assigned risk plans, reinsurance facilities and joint underwriting associations. These are mechanisms that generally provide applicants with various basic types of basic insurance coverage that may not otherwise be available to them inthrough voluntary markets. Such mechanisms ar eare most commonly instituted for automobile and workers’workers' compensation insurance, but many states also mandate participation in Fair Access to Insurance Requirements (“FAIR”) Plans or Windstorm Plans, which provide basic property coverage. Participation is based upon the amount of a company’scompany's voluntary market share in a particular state for the classes of insurance involved. Policies written through these mechanisms may require different underwriting standards and may pose greater risk than those written through our voluntary application process.

Statutory Accounting

For public reporting, insurance companies prepare financial statements in accordance with GAAP. However, state laws require us to calculate and report certain data according to statutory accounting rules as defined in the National Association of Insurance Commissioner’sCommissioner's (“NAIC”) Accounting Practices and Procedures Manual. While not a substitute for any GAAP measure of performance, statutory data frequently is used by industry analysts and other recognized reporting sources to facilitate comparisons of the performance of insurance companies.

Insurance Reserves

State insurance laws require that insurance companies analyze the adequacy of their reserves annually. Our appointed actuaries must submit an opinion that our reserves are adequate for policy claims-paying obligations and related expense s.expenses.

Financial Solvency Ratios

The NAIC annually calculates 13 financial ratios to assist state insurance regulators in monitoring the financial condition of insurance companies. A “usual range” of results for each of these ratios is used by insurance regulators as a benchmark. Departure from the usual range on four or more of the ratios could lead to inquiries from individual state insurance departments as to certain aspects of a company’scompany's business. In addition to the financial ratios, states also require us to calculate a minimum capital requirement for each of our insurance companies based on individual company insurance risk factors. These “risk-based capital” resul tsresults are used by state insurance regulators to identify companies that require regulatory attention or the initiation of regulatory action. At December 31, 20102011, all of our insurance companies had capital well in excess of the required levels.

United Fire & Casualty Company Form 10-K | 2010

Federal Regulation

Although the federal government and its regulatory agencies generally do not directly regulate the business of insurance, federal initiatives often have an impact on our business. Some of the current and proposed federal measures that may significantly affect our business are discussed below.

Dodd-Frank Act

In July 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) was signed

United Fire Group, Inc. Form 10-K | 2011

into law. The Dodd-Frank Act marks a profound increase in the regulation of the financial services industry. Among other things, the Dodd-Frank Act forms within the Treasury Department a Federal Insurance Office that is charged with monitoring all aspects of the insurance industry, gathering data, and conducting a study on methods to modernize and improve the insurance regulatory system in the United States. A report on this study is required to be delivered to Congress within 18 months after enactment of the Dodd-Frank Act and could be influential in reshaping the current state-based insurance regulatory system and/or introducing a direct federal role in suchinsurance regulation. The Dodd-Frank Act also requires, among other things: (i) a nonbinding stockholder vote on executive compensation at least once every three years; (ii) a vote, at least once every six years, on the frequency of the nonbinding stockholder vote on executive compensation; and (iii) that all members of our compensation committee be independent.

In response to the Dodd-Frank Act, the SEC has issued, or is expected to issue proposedpropose, rules regarding a variety of disclosure and governance matters, including director independence, director and officer hedging andactivities, executive compensation clawback policies, compensation advisor independence, pay versus performance disclosures, internal pay comparison,equity disclosures, and shareholder proxy access.

Health Care Reform Acts

In March 2010, the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 (collectively the “2010 Acts”) were signed into law. The 2010 Acts may have a material impact on health care providers and insurers, employers and individuals. The 2010 Acts will impact employers and businesses differently, depending on the size of the organization. Certain provisions of the 2010 Acts became effective during the open enrollment period for our employee benefit plans (November 2010), while other provisions of the 2010 Acts will become effective in future years. The 2010 Acts could require changes to, among other things, our current employee benefit plans, our information technology infrastructure, and our administrative and accounting processes. The ultimate extent and cost of these changes cannot be determined at this time and are being evaluated and updated as related regulations and interpretations of the 2010 Acts become available.

|

|

| FINANCIAL STRENGTH RATING |

Our financial strength, as measured by statutory accounting principles, is regularly reviewed by an independent rating agency that assigns a rating based upon criteria such as results of operations, capital resources and minimum policyholders’ surplus requirements.

Our family of property

United Fire & Casualty Company and casualty insurers hasMercer Insurance Group pooled groups have each received a group rating of “A” (Excellent) with a “negative” outlook from A.M. Best Company (“A.M. Best”). Within the group, allAll of our property and casualty insurers have an “A” (Excellent) rating, except one non-pooled insurance subsidiary that is in a runoff status, which A.M. Best has designated as NR-3NR (Rating Procedure Inapplicable). Our life insurance subsidiary has received an “A-” (Excellent) rati ngrating with a “stable” outlook from A.M. Best. According to A.M. Best, companies rated “A” and “A-” have “an excellent ability to meet their ongoing obligations to policyholders.”

An insurer’s financial strength rating is one of the primary factors evaluated by those in the market to purchase insurance. A poor rating indicates that there is an increased likelihood that the insurer could become insolvent and therefore not able to fulfill its obligations under the insurance policies it issues. This rating can also affect an insurer’s level of premium writings, the lines of business it can write and, for insurers like us that are also public registrants, the market value of its securities.

United Fire & Casualty Company Form 10-K | 2010

We provide the following discussion of risks and uncertainties relevant to our business. These are factors that we believe could cause our actual results to differ materially from expected and historical results. We could also be adversely affected by other factors, in addition to those listed here. We have set forth additional information concerning factors that could cause actual results to differ materially from those in the forward-looking statements in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Risks Relating to Our Business

| |

• | The incidence, frequency and severity of catastrophe losses are unpredictable and may adversely affect the results of our operations, liq uidity and financial condition. |

The incidence, frequency and severity of catastrophe losses are unpredictable and may adversely affect the results of our operations, liquidity and financial condition.

Our property and casualty insurance operations expose us to claims arising from catastrophic events affecting multiple policyholders, which can be caused by various natural and man-made disasters, including, but not limited to, hurricanes, tornadoes, windstorms, hailstorms, fires, explosions, earthquakes, tropical storms and terrorist acts. Property damage resulting from catastrophes is the greatest risk of loss we face in the ordinary course of our

United Fire Group, Inc. Form 10-K | 2011

business. We have exposure for catastrophe losses under both our commercial insurance policies and our personal insurance policies. In addition, our automobile and inland marine business exposes us to losses arising from floods and other perils.

Longer-term weather trends may be changing and new types of catastrophe losses may be developing due to climate change,change; a phenomenon that has been associated with extreme weather events linked to rising temperatures, including effects on global weather patterns, greenhouse gases, sea, land and air temperature, sea levels, rain and snow. The emerging science regarding climate change and its connection to extreme weather events is far from conclusive. If a connection to increased extreme weather events related to climate change is ultimately proven true, this could increase the frequency and severity of catastrophe losses we experience in both coastal and non-coastal areas.

Because the occurrence and severity of catastrophes are inherently unpredictable and may vary significantly from year to year, hist oricalhistorical results of operations may not be indicative of future results of operations. In addition, as with catastrophe losses generally, it can take a long time for us to determine our ultimate losses associated with a particular catastrophic event. As our claims experience for a particular catastrophe develops, we may be required to adjust our reserves to reflect our revised estimates of the total cost of claims. Catastrophes may also negatively affect our ability to write new business. Increases in the value and geographic concentration of insured property could impact claims severity for future catastrophic events. In addition, severity may increase after catastrophic events, as the demand for resources such as building materials and labor to repair damaged structures may inflate costs, and the amount of salvage value received for damaged property may decline.

| |

• | Our reserves for property and casualty insurance losses and costs related to settlement of property and casualty losses and our life reserves for future policy benefits may be inadequate, which would have an unfavorable impact on our financial results. |

Our reserves for property and casualty insurance losses and costs related to settlement of property and casualty insurance losses and our life insurance reserves for future policy benefits may be inadequate, which would have an unfavorable impact on our financial results.

Our reserves for claims and future policy benefits may prove to be inadequate, which may result in future charges to earnings and/or a downgrade of our financial strength rating or the financial strength ratings of our insurance company subsidiaries.

We establish property and casualty insurance loss reserves based on assumptions and estimates of damages and liabilities incurred. On a quarterly basis, Regnier, the independent actuary for our property and casualty insurance segment, estimates property and casualty insurance product reserves based on many assumptions to validate the reasonableness of our claims reserves.

Our property and casualty insurance loss reserves are only estimates; we determine the amount of these loss reserves based on our best estimate and judgment of the losses and costs we will incur on existing insurance policies. Because of the uncertainties that surround estimating loss reserves, we cannot precisely determine the ultimate amounts of benefits

United Fire & Casualty Company Form 10-K | 2010

and claims that we will pay or the timing of payment of benefits and claims. For a detailed discussion of our reserving process and the factors we consider in estimating reserves, refer to the Critical Accounting Estimates section in Part II, Item 7, “Management’s“Management's Discussion and Analysis of Financial Condition and Results of Operations.”

Actual losses and loss settlement expenses paid might exceed our reserves. If our loss reserves are insufficient, or if we believe our loss reserves are insufficient to cover our actual loss and loss settlement expenses, we will have to increase our loss reserves and incur charges to our earnings, which could indicate that premium levels were insufficient. These charges may be material.

Griffith, the independent actuary for our life insurance segment, calculates life insurance product reserves based on our assumptions, including estimated premiums we will receive over the assumed life of the policy, the timing of the event covered by the insurance policy and the amount of benefits or claims to be paid. As such, deviations from one or more of these assumptions could result in a material adverse impact on our Consolidated Financial Statements.

| |

• | The cyclical nature of the property and casualty insurance business may affect our financial performance. |

United Fire Group, Inc. Form 10-K | 2011

The cyclical nature of the property and casualty insurance business may affect our financial performance.

The financial results of companies in the property and casualty insurance industry historically have been cyclical in nature, characterized by periods of severe price competition and excess underwriting capacity (commonly referred to as “soft” markets), followed by periods of high premium rates and shortages of underwriting capacity (commonly referred to as “hard” markets). We expect these cycles to continue. Premium rates for property and casualty insurance are influenced by factors that are outside of our control, including market and competitive conditions and regulatory issues. Soft market conditions could require u sus to reduce premiums, limit premium increases, or discontinue offering one or more of our insurance products in one or more states, resulting in a reduction in our premiums written and in our profit margins and revenues. The demand for property and casualty insurance can also vary significantly, rising as the overall level of economic activity increases and falling as that activity decreases. Fluctuations in demand and competition could produce underwriting results that would have a negative impact on the results of our operations and financial condition.

| |

• | We are subject to interest rate fluctuations and declines in the value of investments held in our investment portfolio due to various market factors that could negatively affect our profitability. |

We are subject to interest rate fluctuations and declines in the value of investments held in our investment portfolio due to various market factors that could negatively affect our profitability.

We are subject to the negative effects of interest rate fluctuations and to declines in the value of our investment portfolio, due to changes in market valuations and changes in credit quality related to individual investments. Some of our interest-sensitive products, principally our fixed annuities, expose us to the risk that changes in interest rates will reduce our “spread,” which is the difference between the rates we are required to pay under these contracts and the rate of return we are able to earn on our investments, intended to support our obligations under these contracts.

During periods when the interest rates paid on interest-sensitive insurance products are rising, we may not be able to reinvest our invested assets to achieve the higher rate of return necessary to compensate for the higher interest rates we must pay to keep these products competitive in the marketplace. Consequently, we may have to accept a lower spread and therefore lower profitability, or face a decline in sales of these products and a loss of related assets.

During periods of declining interest rates, we may be unable to achieve similar rates of return on our reinvested or maturing assets. Moreover, this risk may be exacerbated by borrowers prepaying fixed income securities, commercial mortgages, and mortgag e-backedmortgage-backed securities held in our investment portfolio in order to refinance at lower rates. Because we are only entitled to reset the interest rates on our annuities at limited, pre-established intervals, and because many of our annuity contracts have guaranteed interest rates, the profitability of these products could decrease or even become negative.

Due to the reinvestment risk described above, a decline in market interest rates available on investments could also reduce our return from investments of capital that do not support particular policy obligations, which could also have a material adverse effect on our results of operations. The adverse effect on us from fluctuations in interest

United Fire & Casualty Company Form 10-K | 2010

rates may be exacerbated b ecausebecause we currently maintain, and intend to continue to maintain, a large portion (92.5(93.4 percent at December 31, 2010)2011) of our investment portfolio in fixed income securities, particularly corporate bonds, including our portfolio of trading securities. The fair value of these investments generally increases or decreases in an inverse relationship with changes in interest rates. We classify the majority (99.2(99.4 percent, at December 31, 2010)2011) of our fixed income securities, including our entire portfolio of trading securities, as available-for-sale. We report the value of those investments at their current fair value. Accordingly, fluctuations in interest rates may result in fluctuations in the valuation of our fixed income investments, which would affect our stockholders’stockholders' equity.

Fluctuations in interest rates may cause increased surrenders and with drawalswithdrawals from our life insurance and annuity products. In periods of rising interest rates, surrenders and withdrawals of life insurance policies and annuity contracts, along with policy loans, may increase as policyholders seek to buy products with perceived higher returns. These surrenders, withdrawals and policy loans may also require us to accelerate the amortization of deferred policy acquisition costs, which would increase our expenses in the current period.

Terrorism and the threat of terrorism within the U.S. and abroad, ongoing military and other actions, and heightened

United Fire Group, Inc. Form 10-K | 2011

security measures, may cause significant volatility in the equity markets and in interest rates. Such activities may result in loss of life, property damage, disruptions to commerce and reduced economic activity. Some of the assets in our investment portfolio may be adversely affected by declines in the equity markets or changes in interest rates caused by these activities.

The fair value of securities in our investment portfolio may also fluctuate, depending on general economic and market conditions or events relating to a particular issuer of securities. Changes in the fair value of securities in our investment portfolio could result in realized or unrealized investment losses, thereby affecting our stockholders’stockholders' equity.

We are exposed to the chance that issuers of bonds that we hold will not be able to pay principal or interest when due. Defaults and other impairments may cause write-downs in the value of the bonds we hold. Pervasive deterioration in the c reditcredit quality of issuers, changes in interest rate levels and changes in interest rate spreads between types of investments could significantly affect the value of our invested assets and our earnings.

| |

• | Continued difficult conditions in the global capital markets and the economy generally may materially and adversely affect our business and results of operations. |

Continued difficult conditions in the global capital markets and the economy generally may materially and adversely affect our business and results of operations.

Our results of operations are materially affected by conditions in the global capital markets and the economy generally, both in the U.S. and elsewhere around the world. Recently, concerns over the slow economic recovery, level of U.S. national debt, the U.S. mortgage market, inflation levels, energy costs and geopolitical issues have contributed to increased volatility and diminished expectations for the economy and global capital markets going forward. These factors, combined with volatile oil prices, reduced business and consumer confidence and continued high unemployment, have negatively impacted the U.S. economy. These concerns expanded to include a broad range of mortgage- and asset-backed and other fixed income securities, including those rated investment grade. Although liquidity has improved, the market for fixed income instruments continues to experience some price volatility, credit downgrade events and elevated probabilities of default.

Factors such as consumer spending, business in vestment,investment, government spending, the volatility and strength of the capital markets, investor and consumer confidence and inflation levels all affect the business and economic environment and, ultimately, the amount and profitability of our business. In an economic downturn characterized by higher unemployment, lower family income, lower corporate earnings, lower business investment, negative investor sentiment and lower consumer spending, the demand for our insurance products could be adversely affected. Our policyholders may choose to defer paying insurance premiums or stop paying insurance premiums altogether. In addition, we may experience an elevated incidence of claims and lapses or surrenders of policies. Adverse changes in the economy could negatively affect our net income and could have a material adverse effect on our business, results of operations and financial condition.

Our investment portfolio contains various types of municipal bonds that expose us to the risk of default.

14

United Fire & Casualty Company Form 10-K | 2010

| |

• | Our investment portfolio contains various types of municipal bonds that expose us to the risk of default. |

At December 31, 2010, 25.22011, 25.3 percent of our total investment portfolio at fair market value, and 27.227.5 percent of our total fixed maturity securitiesinvestments at fair market value, were invested in tax-exempt municipal bonds.bonds that are primarily tax-exempt. During or following an economic downturn, our municipal bond portfolio could be subject to a higher risk of default or impairment due to declining municipal tax bases and revenue. The pr olongedprolonged economic downturn that began in 2008 has resulted in many states and local governments operating under deficits or projected deficits. The severity and duration of these deficits could adversely impact the collectability and valuation of our municipal bond portfolio.

| |

• | Unauthorized data access and other security breaches could have an adverse impact on our business and reputation. |

Unauthorized data access and other security breaches could have an adverse impact on our business and reputation.

Our business and operations rely on secure and efficient processing, storage and transmission of customer and companyCompany data, including personally identifiable information. Our ability to effectively operate our business depends upon our ability and the ability of certain third parties, including vendors and business partners, to access our computer systems to perform necessary business functions, such as providing quotes and product pricing, billing and

United Fire Group, Inc. Form 10-K | 2011

processing premiums, administering claims, and reporting our financial results. Our business and operations also depend upon our ability to safeguard personally identifiable information and other confidential and proprietary information belonging to us and our policyholders. Our systems may be vulnerable to unauthorized access and hackers, computer viruses, and other scenarios in which our data may be compromised.

Security breaches and other improper accessing of data in our facilities, networks or databases, or those of our vendors may occur, exposing us to liability and having an adverse impact on our business. Moreover, any compromise of the security of our data could harm our reputation, which could affect our business and results of operations. There can be no assurances that we will be able to implement security measures adequate to prevent every security breach.

| |

• | The effects of emerging claim and coverage iss ues and class action litigation on our business are uncertain. |

The effects of emerging claim and coverage issues and class action litigation on our business are uncertain.

As industry practices and legal, judicial, social and other environmental conditions change, unexpected and unintended issues related to claims and coverage may emerge. These issues may adversely affect our business by either extending coverage beyond our underwriting intent or by increasing the number and/or size of claims. Examples of these issues include:

| |

• | Judicial expansion of policy coverage and the impact of new theories of liability. |

| |

• | An increase of plaintiffs targeting property and casualty insurers, including us, in purported class action litigation regarding claims handling and other practices. |

| |

• | An increase in the variety, number and size of claims relating to liability losses, which often present complex coverage and damage valuation questions. |

| |

• | Adverse changes in loss cost trends, including, but not limited to, inflationary pressure in medical costs; auto repair costs; and labor a nd materials costs to rebuild damaged structures. |

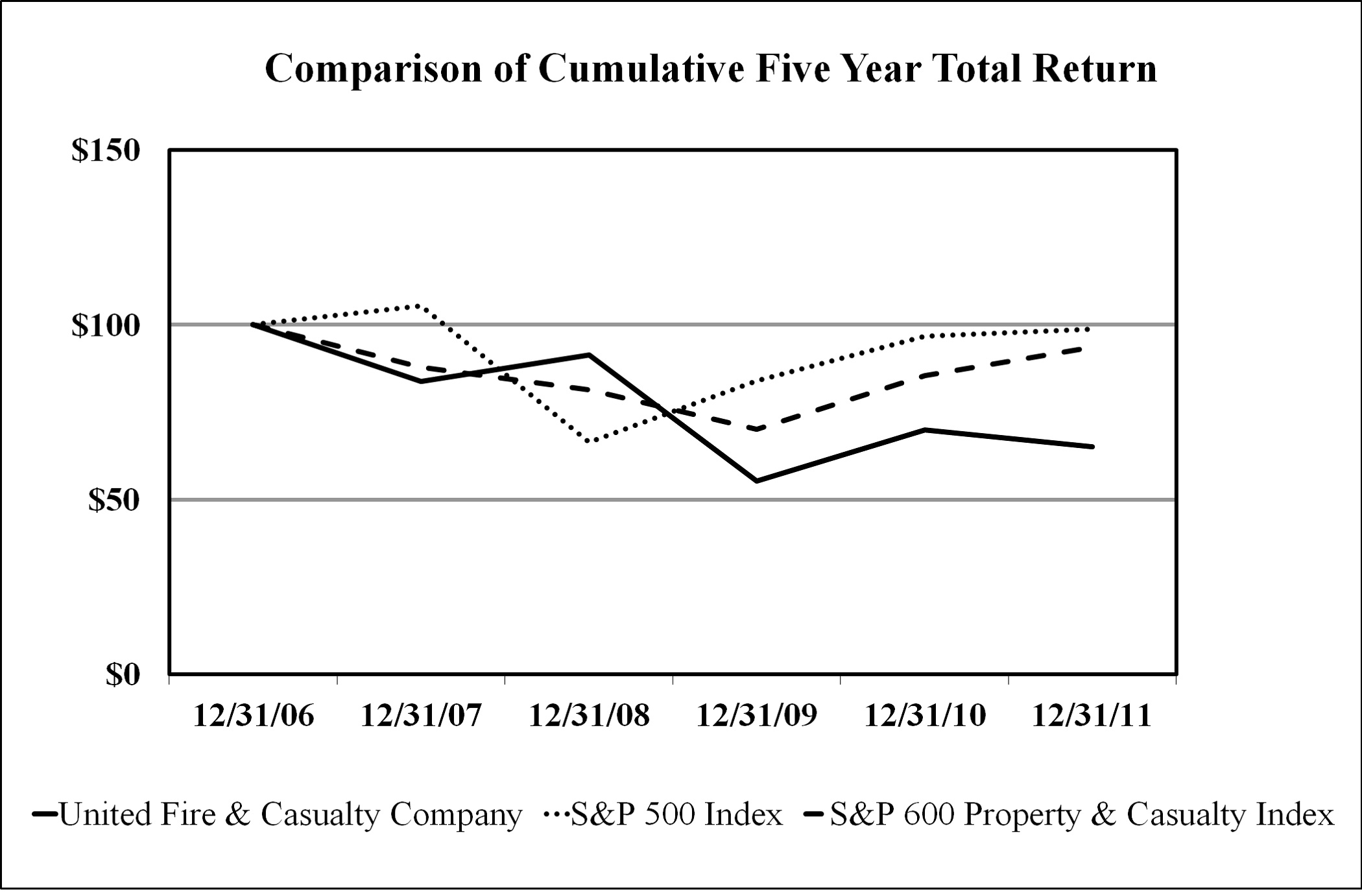

In addition, we have been the target of a number of class action lawsuits arising from Hurricane Katrina, relating to allegations of improper claims settlement practices, misrepresentations in the scope of coverage and other matters. It is difficult to predict both the ultimate outcome of these lawsuits, and the impact if any, they will have on our businessof new theories of liability.