UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

|

| |

þ

| Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended September 30, 2018

December 31, 2019

OR

|

| |

o

| Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Transition Period from _____ to _____

Commission File Number:0-49807

WASHINGTON GAS LIGHT COMPANY

(Exact name of Registrant as Specified in Its Charter)

|

| | | | | | |

Commission

File Number

District of Columbia and Virginia | | Exact name of registrant as specified in its charter and

address of principal executive offices and telephone number

| | | | 53-0162882 |

(State or Other Jurisdiction of IncorporationIncorporation)

| | | | | | (I.R.S. Employer Identification No. |

0-55968 | | WGL Holdings, Inc.

1000 Maine Ave., S.W.

Washington, D.C. 20024

(703) 750-2000

| | Virginia | | 52-2210912 |

0-49807 | | Washington Gas Light Company

1000 Maine Ave., S.W.

Washington, D.C. 20024

(703) 750-4440

| | District of

Columbia

and Virginia

| | 53-0162882) |

1000 Maine Ave., S.W.

Washington, D.C. 20024

(Address of Principal Executive Offices and Zip Code)

(703) 750-4440

(Registrant's telephone number, including area code)

|

| | |

| Securities registered pursuant to Section 12(b) of the Act: None |

|

|

| Securities registered pursuant to Section 12(g) of the Act: |

Title of each class |

WGL Holdings, common stock, no par value |

Washington Gas Light Company preferred stock,

|

cumulative, withoutCommon stock, $1.00 par value:

|

$4.25 Series

|

$4.80 Series

|

$5.00 Seriesvalue

|

Indicate by check mark if eachthe registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

| | |

WGL Holdings, Inc. | | Yes [ ] No [ü]

|

Washington Gas Light Company | | Yes [ ] No [ü]

|

Indicate by check mark if eachthe registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [ü]

Indicate by check mark whether eachthe registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants wereregistrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes [ü] No [ ]

Indicate by check mark whether eachthe registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ü] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrants’ knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ü]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

WGL Holdings, Inc.:

|

| | | | | | |

Large Accelerated Filer o | | Accelerated Filer o | | Non-Accelerated Filer [ü] | | Smaller Reporting Company o |

| | | | | (Do not check if a smaller reporting company) | | |

Emerging growth company o

| | | | | | |

Washington Gas Light Company:

|

| | | | | | |

Large Accelerated Filer o

| | Accelerated Filer o

| | Non-Accelerated Filer [ü]

| | Smaller Reporting Company o

|

| | | | (Do not check if a smaller reporting company) | |

Emerging growth company o | | | | | | |

Indicate by check mark whether eachthe registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes [ ] No [ü]

The aggregate market value of the voting common equity held by non-affiliates of the registrant WGL Holdings, Inc., amounted to $4,250,758,369 as of March 31, 2018.

The aggregate market value of the voting common equity held by non-affiliates of the registrant, Washington Gas Light Company, amounted towas $0 as of MarchJune 30, 2019.

As of January 31, 2018.

WGL Holdings, Inc.2020, there were 46,479,536 shares of registrant common stock, no$1 par value, outstanding as of October 31, 2018: 100 shares.outstanding. All of the outstanding shares of common stock no par value, of WGL Holdings, Inc. are held by Wrangler 1SPE LLC, an indirect wholly owned subsidiary of AltaGas Ltd. as of October 31, 2018.

Washington

REDUCED DISCLOSURE FORMAT

Washington Gas Light Company, common stock, $1 par value, outstanding as of October 31, 2018: 46,479,536 shares. All of the outstanding shares of common stock, $1 par value, of Washington Gas Light Company are held by Wrangler SPE LLC (the SPE), a direct wholly ownedan indirect wholly-owned subsidiary of WGL Holdings, Inc. asAltaGas Ltd., meets the requirements set forth in General Instruction I(1)(a) and (b) of October 31, 2018.Form 10-K and is therefore filing this Form 10-K with the reduced disclosure format.

WGL Holdings, Inc.

Washington Gas Light Company

Form 10-K

For the Fiscal Year Ended September 30, 2018December 31, 2019

Table of Contents

|

| | |

| PART I | |

| |

| |

| | |

| | |

| |

| Item 1. | | |

| | | |

| | | |

| | | |

| | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| |

| | |

| PART II | |

| |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| | |

| | |

| | | |

| | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | | |

| PART III | |

| |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | | |

| PART IV | |

| |

| Item 15. | | |

| Item 16. | | |

| |

WGL Holdings, Inc.

Washington Gas Light Company

Part I

INTRODUCTIONEXPLANATORY NOTE REGARDING THIS ANNUAL REPORTFILING FORMAT

On December 28, 2018, our Board of Directors approved a change of Washington Gas Light Company's fiscal year from the period beginning on October 1 and ending on September 30 to the period beginning on January 1 and ending on December 31. This annual report on Form 10-K is a combinedfor the twelve-month period from January 1, 2019 to December 31, 2019. References in this report being filed by two separate registrants: WGL Holdings, Inc. (WGL)to "calendar year" refer to the year ended December 31. References in this report to "transition period" refer to the three-month transition period from October 1, 2018 through December 31, 2018. References in this report to "fiscal year" refer to the twelve-month period ending on September 30. For comparison purposes, the unaudited data for twelve months ended December 31, 2018 and three months ended December 31, 2017 are presented.

SAFE HARBOR FOR FORWARD-LOOKING STATEMENTS Washington Gas Light Company (Washington Gas) is an indirect, wholly owned subsidiary of, among other entities, WGL Holdings, Inc (WGL). WGL is an indirect wholly owned subsidiary of AltaGas Ltd. (AltaGas). Except where the content clearly indicates otherwise, any reference in thethis report to “WGL,“Washington Gas”,” “we,” “us”, “our” or “our” is“the Company” refers to the holding company or the consolidated entity ofWashington Gas Light Company. References to “WGL” refer to WGL Holdings, Inc. and all of its subsidiaries, including Washington Gas which is a distinct registrant that is an indirect wholly owned subsidiary of WGL. Washington Gas makes no representations as to the information contained in this report relating to WGL and its subsidiaries, other than Washington Gas.

The Management’s Discussion and Analysis of Financial Condition and Results of Operations (Management’s Discussion) included under Item 7 is divided into two major sections, one for WGL and one for Washington Gas. The Consolidated Financial Statements of WGL and the Financial Statements of Washington Gas are included under Item 8 as well as the Notes to Consolidated Financial Statements that are presented on a combined basis for both WGL and Washington Gas.

SAFE HARBOR FOR FORWARD-LOOKING STATEMENTSsubsidiaries.

Certain matters discussed in this report, excluding historical information, include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the outlook for earnings, dividends, revenues and other future financial business performance, strategies, financing plans, AltaGas Ltd.'s (AltaGas)AltaGas' integration of us and other expectations. Forward-looking statements are typically identified by words such as, but not limited to, “estimates,” “expects,” “anticipates,” “intends,” “believes,” “plans” and similar expressions, or future or conditional terms such as “will,” “should,” “would” and “could.” Forward-looking statements speak only as of the filing date of this report, and the registrants assumeregistrant assumes no duty to update them. Factors that could cause actual results to differ materially from forward-looking statements or historical performance include those discussed in Item 1A. Risk Factors and may include, but are not limited to the following:

hazards involved in the storage, transportation, moving of marketing of hydrocarbon products;

leaks, mechanical problems, incidents, or other operational issues could affect public safety and the reliability of Washington Gas’ distribution system;

the availability of natural gas supply or an inability to obtain an adequate supply of gas to satisfy present and future demands;

challenges in securing the necessary transportation or storage capacity to deliver or acquire the volume of gas necessary to meet customer demands and future growth expectations;

cyberattacks, including cyberterrorism, or other information technology security breaches or failures;

the inability to meet commitments under various orders and agreements associated with regulatory approvals for the merger could have a detrimental impact on WGL’s business, financial condition, operatingMerger;

the Merger may not achieve its expected results and prospects;

the inabilityWashington Gas may be unable to successfully be integratedintegrate into the operations of AltaGas following the merger with AltaGas and realize anticipated benefits;

changes in WGL's or AltaGas' credit ratings and disruptions in credit market conditions or other factors that may affect our access to and cost of capital;AltaGas;

the effectoccurrence of the consummation of the merger on the ability of WGL to retain customers and retain and hire key personnel;

the effect of the consummation of the merger on the ability of WGL to maintain relationships with its suppliers;

potential litigationunexpected costs in connection with the merger;Merger;

securities class action suits and derivative suits;

the levelloss of certain administrative and ratemanagement functions and services provided by AltaGas;

changes in AltaGas' strategy or relationship with Washington Gas that could affect our performance or operations;

Washington Gas Light Company

Part I

the ability to access capital and the costs at which we incurWashington Gas is able to access capital and credit markets, including changes in the credit ratings of Washington Gas, WGL, and AltaGas;

disruptions or decline in the local economy in which Washington Gas operates;

the credit-worthiness of customers; suppliers and derivatives counterparties;

changes in the value of derivative contracts and the availability of suitable derivative counterparties;

rules implementing the derivatives transaction provisions of the Dodd-Frank Act may impose costs on our derivatives activities;

failures of Washington Gas service providers that could negatively impact the Company’s business;

compliance with Section 404(a) of Sarbanes-Oxley Act;

acts of nature and expenses,catastrophic events, including terrorist acts;

an inability to attract and retain key management and sufficiently skilled operational personnel;

strikes or work stoppages by unionized employees;

changes in the costs of providing retirement plan benefits;

the extent to which we are allowed to recover from our customers, through the regulatory process, such costs and expenses relating to constructing, operating and maintaining Washington Gas’ distribution system;

the availability of natural gas and electricity supply, interstate pipeline transportation and storage capacity;

the outcome of new and existing matters before courts, regulators, government agencies or arbitrators, including those relatingrelated to our purchase of natural gas under the Antero gas supply contracts,operations and the August 2016 explosion and fire at an apartment complex in Silver Spring, Maryland;

factors beyond our control that affect the ability of natural gas producers, pipeline gatherersthe Company to earn a reasonable rate of return on its invested capital;

concerns involving climate change and natural gas processors to deliver natural gas into interstate pipelinesthe movement for delivery to the entrance points of Washington Gas' distribution system;

WGL Holdings, Inc.

Washington Gas Light Company

security breaches of our information technology infrastructure, including cyber-attacks and cyber-terrorism;

the loss of certain services provided by AltaGas;

leaks, mechanical problems, incidents or other operational issues in our natural gas distribution system, including the effectiveness of our efforts to mitigate the effects of receiving low-HHC natural gas;

changes and developments in economic, competitive, political and regulatory conditions;

unusual weather conditions and changes in natural gas consumption patterns;carbon neutral energy sources;

changes in energy commodity market conditions, including the relative prices of alternative forms of energy such as electricity, fuel oil and propane;

physical and financial risks associated with climate change;

unusual weather conditions and changes in natural gas consumption patterns;

costs associated with certain legacy operations of Washington Gas and environmental remediation efforts;

the valueoutcome of derivative contractsnew and existing matters before courts, regulators, government agencies or arbitrators;

changes to government fiscal and trade policies;

regulatory and financial risks related to pipeline safety legislation;

changes to the availability of suitable derivative counterparties;

factors affectingtax code and our ability to quantify such changes and seek recovery for the timing of construction and the effective operation of pipelinesmanner in which we have invested;

the credit-worthiness ofcorporate taxes are shared with customers; suppliers and derivatives counterparties;

changes in laws and regulations, including tax, environmental, pipeline integrity and employment laws and regulations, including the competitiveness of WGL Energy Systems, Inc. in securing future assets to continue its growth;

legislative, regulatory and judicial mandates or decisions affecting our business operations, including interpretations of the Tax Cuts and Jobs Act (Tax Act);

the timing and success of business and product development efforts and technological improvements;

the level of demand from government agencies and the private sector for commercial energy systems, and delays in federal government budget appropriations;

the pace of deregulation of energy markets and the availability of other competitive alternatives to our products and services;

changes in accounting principles and the effect of accounting pronouncements issued periodically by accounting standard-setting bodies;

our ability to manage the outsourcing of several business processes;

strikes or work stoppages by unionized employees;

acts of nature and catastrophic events, including terrorist acts;

decisions made by management and co-investors in non-controlled investees; and

changes in AltaGas’ strategy, relationship with us or performance.bodies.

All such factors are difficult to predict accurately and are generally beyond the direct control of the registrants.registrant. Readers are urged to use care and consider the risks, uncertainties and other factors that could affect the registrants’registrant’s business as described in this annual report on Form 10-K.

WGL Holdings, Inc.

Washington Gas Light Company

Part I

GLOSSARY OF KEY TERMS AND DEFINITIONS

Accelerated Pipe Replacement Programs:Programs (APRPs): Programs focused on replacement activities, targeting specific piping materials, installed years and/or locations which are undertaken on an expedited basis in an effort to improve safety, system reliability and to reduce potential greenhouse gas (GHG) emissions.

Accounting Standards Codification (ASC): The source of authoritative generally accepted accounting principles (GAAP).

Accounting Standards Update (ASU): An update issued to communicate changes to an ASC.

Active Customer Meters: Natural gas meters that are physically connected to a building structure within the Washington Gas distribution system that are receiving natural gas distribution service.

AltaGas Ltd. (AltaGas): AltaGas is a Canadian corporation that became the parent company of WGL Holdings, Inc. upon consummation of the Merger on July 6, 2018.

AltaGas Services (U.S.) Inc. (ASUS): ASUS is a wholly owned subsidiary of AltaGas. It is the parent company of all AltaGas' U.S. subsidiaries.

Area-Wide Contract: A contract between Washington Gas and the General Services Administration for utility and energy-management services.

Asset Optimization Program: A program to optimize the value of Washington Gas’ long-term natural gas transportation and storage capacity resources during periods when these resources are not being used to physically serve customers.

Bundled Service: Service in which customers purchase both the natural gas commodity and the distribution or delivery of the commodity from the local regulated utility. When customers purchase bundled service from Washington Gas, no mark-up is applied to the cost of the natural gas commodity that is passed through to customers.

Business Process Outsourcing (BPO) Agreement: An agreement whereby a service provider performs certain ongoing support functions.

CARE Ratemaking Adjustment (CRA): A billing mechanism in the state of Virginia that is designed to minimize the effect of factors such as conservation on utility net revenues.

City Gate: A point or measuring station at which a gas distribution company, such as Washington Gas, receives natural gas from an unaffiliated pipeline or transmission system.

Competitive Service Provider (CSP): Also referred to as Third-Party Marketer (see definition below).

Commercial Energy Systems: Includes the operations of WGL Energy Systems, Inc. and WGSW, Inc. and the results of operations for affiliate owned commercial distributed energy projects.

Conservation and Ratemaking Efficiency (CARE Plan): Provides for the CRA as well as cost effective conservation and energy efficient programs.

Cooling Degree Day (CDD): A measure of the variation in weather based on the extent to which the daily average temperature is above 65 degrees Fahrenheit.

Delivery Service: The regulated distribution or delivery of natural gas to retail customers. Washington Gas provides delivery service to retail customers in Washington, D.C. and parts of Maryland and Virginia.

Design Day: Washington Gas’ design day represents the maximum anticipated demand on Washington Gas’ distribution system during a 24-hour period assuming a five-degree Fahrenheit average temperature and 17 miles per hour average wind, considered to be the coldest conditions expected to be experienced in the Washington, D.C. region.

Distributed Generation Assets: Assets that use renewable energy sources including Solar Photovoltaic (Solar PV) systems, combined heat and power plants, and natural gas fuel cells to generate electricity near the point of consumption.

Earnings Before Interest, Taxes, Depreciation and Taxes (EBITAmortization (EBITDA): A non-GAAP performance measure that includes operating income, other income (expense), earnings from unconsolidated affiliates and is reduced by amounts attributable to non-controlling

WGL Holdings, Inc.

Washington Gas Light Company

Part I

interests. EBIT is used in assessing the results of each segment'sWashington Gas' operations.

Federal Energy Regulatory Commission (FERC): An independent agency of the federal government that regulates the interstate transmission of electricity, natural gas, and oil. The FERC also reviews proposals to build liquefied natural gas terminals and interstate natural gas pipelines.

Financial Contract: A contract in which no commodity is transferred between parties and only cash payments are exchanged in amounts equal to the financial benefit of holding the contract.

Washington Gas Light Company

Part I

Firm Customers: Customers whose natural gas supply will not be disrupted by the regulated utility to meet the needs of other customers. Typically, this class of customer comprises residential customers and most commercial customers.

Generally Accepted Accounting Principles (GAAP): A standard framework of accounting rules used to prepare, present and report financial statements in the United States of America.

Gross Margin: A measure calculated as operating revenues, less the associated cost of energy and applicable revenue taxes. Gross margin is used to measure the success of the retail energy-marketing segment’s core strategy for the sale of natural gas and electricity.

Hampshire: Hampshire Gas Company is a subsidiary of WGL that provides regulated interstate natural gas storage services to Washington Gas under a FERC approved interstate storage service tariff.

Heating Degree Day (HDD): A measure of the variation in weather based on the extent to which the daily average temperature falls below 65 degrees Fahrenheit.

Heavy Hydrocarbons (HHCs): Compounds, such as hexane, that Washington Gas is injecting into its distribution system to treat vaporized liquefied natural gas or domestic sources of gas that have had such HHCs removed as a result of liquids processing.

Hypothetical Liquidation at Book Value (HLBV): A balance sheet-oriented approach to the equity method of accounting which provides a methodology for allocating pre-tax GAAP income or loss to the partners. This approach calculates the amount each partner would receive in the event the partnership was liquidated at book value at the end of each measurement period.

Interruptible Customers: Large commercial customers whose service can be temporarily interrupted in order for the regulated utility to meet the needs of firm customers. These customers pay a lower delivery rate than firm customers and they must be able to readily substitute an alternate fuel for natural gas.

Liquefied Natural Gas (LNG): The liquid form of natural gas.

Lower-of-Cost or Net Realizable Value: The process of adjusting the value of inventory to reflect the lesser of its original cost or its net realizable value.

Mark-to-Market:The process of adjusting the carrying value of an asset or liability to reflect its current fair value.

Megawatt (MW): A unit of power that is equivalent to 1 million watts.

Megawatt hour (MWh): A unit of energy. A power source with a power rating of one MW that is turned on for 1 hour will use 1 MWh of energy.

Merger Agreement: A reference to the agreement, consummated July 6, 2018, governing the merger of WGL's into an agreement for WGL to combine withindirect, wholly-owned AltaGas subsidiary, with WGL continuingsurviving as a surviving corporation in the merger and becoming an indirect wholly ownedwholly-owned subsidiary of AltaGas (the Merger).

Midstream Energy Services: The midstream energy services segment includes the operations of WGL Midstream, Inc.

New Customer Meters Added: Natural gas meters that are newly connected to a building structure within the Washington Gas distribution system. Service may or may not have been activated.

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Non-Controlling Interest: The portion of equity (net assets) in a consolidated subsidiary that is not attributable directly or indirectly to WGL.

Normal Weather: A forecast of expected HDDs or CDDs based on historical HDD or CDD data.

Power Purchase Agreement (PPA): A power purchase agreement, or electricity power agreement, is a contract between two parties, one which generates the electricity and one which is looking to purchase electricity. The PPA defines all of the commercial terms for the sale of electricity between two parties.

PROJECTpipes: An accelerated pipe replacement program to replace bare and/or unprotected steel services, bare and targeted unprotected steel mains, and cast iron mainsthat provides a recovery mechanism for costs of eligible infrastructure replacements in the District of Columbia.

PSC of DC: The Public Service Commission of the District of Columbia, is a three-member board that regulates Washington Gas’ distribution operations in the District of Columbia.

PSC of MD: The Maryland Public Service Commission, is a five-member board that regulates Washington Gas’ distribution operations in Maryland.

Purchased Gas Charge (PGC): The purchased gas charge represents the cost of gas, gas transportation, gas storage services purchased and other gas related costs. The purchased gas charge is collected from customers through tariffs established by the regulatory commissions that have jurisdiction over Washington Gas.

Purchase of Receivables (POR): A program in Maryland, whereby Washington Gas purchases receivables from participating energy marketersCSPs at approved discount rates.

Regulated Utility Segment: Includes the operations of Washington Gas and the operations of Hampshire.

Renewable Energy Credits (RECs): A certificate representing the “green attributes” of one megawatt-hour (MWh) of electricity generated from renewable energy.

Retail Energy-Marketing Segment: Includes the operations of WGL Energy Services, Inc.

Return on Average Common Equity: Net income divided by average common shareholders’ equity.

Revenue Normalization Adjustment (RNA): A regulatory billing mechanism in the state of Maryland designed to stabilize the level of net revenues collected from customers by eliminating the effect of deviations in customer usage caused by variations in weather from normal levels, and other factors such as conservation.

SCC of VA: The Commonwealth of Virginia State Corporation Commission is a three-member board that regulates Washington Gas’ distribution operations in Virginia.

Sendout: The total amount of gas that flows into Washington Gas' distribution system within a certain interval of time.

Service Area: The region in which Washington Gas operates. The service area includes the District of Columbia, and the surrounding metropolitan areas in Maryland and Virginia.

SF ASD LLC (SF ASD): A wholly owned subsidiary of WGL Energy Systems.

SF Echo LLC (SF Echo): A wholly owned subsidiary of WGSW.

SFGF, LLC (SFGF): A tax equity partnership whose results of operation are consolidated into WGL's financial statements, as WGSW, Inc. is the primary beneficiary.

SFGF II, LLC (SFGF II): A tax equity partnership whose results of operation are consolidated into WGL's financial statements, as WGSW, Inc. is the primary beneficiary.

WGL Holdings, Inc.

Washington Gas Light Company

Part I

SFRC, LLC (SFRC): A tax equity partnership whose results of operation are consolidated into WGL's financial statements, as WGSW, Inc. is the primary beneficiary.

Steps to Advance Virginia’s Energy Plan (SAVE Plan): An accelerated pipe replacement planprogram that provides a recovery mechanism for costs of eligible infrastructure replacements in the state of Virginia.

Washington Gas Light Company

Part I

Strategic Infrastructure Development and Enhancement Plan (STRIDE Plan): An accelerated pipe replacement planprogram that provides a recovery mechanism for reasonable and prudent costs associated with infrastructure replacements in the state of Maryland.

Tariffs: Documents approved by the regulatory commission in each jurisdiction that set the prices Washington Gas may charge and the practices it must follow when providing utility service to its customers.

Therm: A natural gas unit of measurement that includes a standard measure for heating value. We report our natural gas sales and deliveries in therms. A therm of gas contains 100,000 British thermal units of heat, or the energy equivalent of burning approximately 100 cubic feet of natural gas under normal conditions. Ten million therms equal approximately one billion cubic feet of natural gas. A dekatherm is 10 therms and is abbreviated Dth.

Third-party Marketer: Unregulated companies that sell natural gas and electricity directly to retail customers. WGL Energy Services, an affiliate of Washington Gas, and a wholly owned subsidiary company of Washington Gas Resources Corporation, is a third-party marketer.

Tier 1 Renewable Resource: The renewable portfolio standard is divided into 2 tiers based on the electricity generation resource. Some examples of Tier 1 renewables are solar, wind, and fuel cells powered through renewables.

Unbundling: The separation of the delivery of natural gas or electricity from the sale of these commodities and related services that, in the past, were provided only by a regulated utility.

Utility Net Revenues: A non-GAAP measure used by the regulated utility segment which is calculated as operating revenues less the associated cost of gas and applicable revenue

taxes. For the regulated utility, theThe cost of gas associated with sales to customers and revenue taxes are generally pass through amounts.

Value-At-Risk: A risk measurement that estimates the largest expected loss over a specified period of time under normal market conditions within a specified probabilistic confidence interval.

Washington GasGas: :Washington Gas Light Company (Washington Gas) is an indirect, wholly owned subsidiary of, WGL Holdings, Inc. that sells and delivers natural gas primarily to retail customers in accordance with tariffs approved by the PSC of DC, the PSC of MD and the SCC of VA. As of the close of the Merger, all Washington Gas' common stock is held by Wrangler SPE LLC.among other entities, WGL.

Washington Gas Resources: Washington Gas Resources Corporation is a subsidiary of WGL Holdings, Inc. that owns the majority of the non-utility subsidiaries.

Weather Normalization Adjustment (WNA): A billing adjustment mechanism in Virginia that is designed to minimize the effect of variations from normal weather on utility net revenues.

WGL: WGL Holdings, Inc. is(WGL), a holding company that is the indirect parent company of Wrangler SPE LLC, Washington Gas Light Company and other subsidiaries.affiliated subsidiaries of Washington Gas. It is an indirect wholly owned subsidiary of AltaGas.

WGL Energy ServicesServices: :WGL Energy Services, Inc. is a subsidiary of Washington Gas Resources CorporationWGL that sells natural gas and electricity to retail customers on an unregulated basis.

WGL Energy Systems:Systems: WGL Energy Systems, Inc. is a subsidiary of Washington Gas Resources Corporation, whichWGL that provides commercial energy efficient and sustainable solutions to government and commercial clients.

WGL MidstreamMidstream: :WGL Midstream Inc. is a subsidiary of Washington Gas ResourcesWGL that engages in acquiring and optimizing natural gas storage and transportation assets.

WGL Holdings, Inc.

Washington Gas Light Company

Part I

WGSW: WGSW, Inc. is a subsidiary of Washington Gas Resources Corporation that was formed to invest in certain renewable energy projects.

Wrangler 1 LLC: Wrangler 1 LLC is an indirect wholly owned subsidiary of AltaGas Ltd. Upon close of the Merger, Wrangler 1 LLC owns all the shares of common stock of WGL.

Wrangler SPE LLC (SPE)(Wrangler): Wrangler SPE LLC is a bankruptcy remote special purpose entity whichthat owns all the shares of the common stock of Washington Gas. It was established as a wholly owned subsidiary of WGL upon consummation of the Merger with AltaGas.

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business

ITEM 1. BUSINESS

CORPORATE OVERVIEW

WGL HOLDINGS, INC.

WGL was established on November 1, 2000 as a Virginia corporation. Through our wholly owned subsidiaries, we sell and deliver natural gas and provide energy-related products and services to customers primarily in the District of Columbia and the surrounding metropolitan areas in Maryland and Virginia, although our non-utility segments provide various energy services across the United States. WGL promotes the efficient use of clean natural gas and renewable energy to improve the environment for the benefit of customers, investors, employees, and the communities it serves. On January 25, 2017, WGL entered into an Agreement and Plan of Merger (Merger Agreement) to combine with AltaGas Ltd., a Canadian Corporation (AltaGas). On July 6, 2018, the merger was consummated between AltaGas, WGL, and Wrangler Inc. (Merger Sub), a newly formed indirect wholly owned subsidiary of AltaGas. The Merger Agreement provided for the merger of the Merger Sub with and into WGL, with WGL surviving as an indirect wholly owned subsidiary of AltaGas (the Merger). In connection with the Merger, WGL established Wrangler SPE LLC., a bankruptcy remote special purpose entity (the SPE) for the purposes of owning the common stock of Washington Gas. The SPE is a wholly owned subsidiary of WGL. In addition, WGL owns all of the shares of common stock of Washington Gas Resources Corporation (Washington Gas Resources) and Hampshire Gas Company (Hampshire). Washington Gas Resources owns all of the shares of common stock of four non-utility subsidiaries that include WGL Energy Services, Inc. (WGL Energy Services), WGL Energy Systems, Inc. (WGL Energy Systems), WGL Midstream, Inc. (WGL Midstream) and WGSW, Inc. (WGSW). Additionally, several subsidiaries of WGL own interests in other entities.

For further information on the Merger, see “Safe Harbor and Forward Looking Statements” in the Introduction, Item I. Business, Item 1A. Risk Factors, and Note 20 “Merger with AltaGas Ltd.” of the Notes to Consolidated Financial Statements in this Form 10-K.

|

| | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | WGL(1)(3)

| | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Wrangler SPE LLC | | | | | | | | | | |

| | | | | | | | | | | | |

| Washington Gas

Regulated Utility

| | | Hampshire

Regulated Utility

| | | Washington Gas Resources(2)

|

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| WGL Energy Services Retail

Energy-Marketing

| | WGL Energy Systems

Commercial Energy Systems

| | | WGSW

Commercial Energy Systems

| | WGL Midstream

Midstream Energy Services

|

| | | | | | | | | | | | |

| (1)Crab Run Gas Company is an inactive, wholly owned subsidiary of WGL.

|

| (2)Holding company whose stand-alone results are reported in "other activities".

|

| (3) WGL is an indirect wholly owned subsidiary of AltaGas.

|

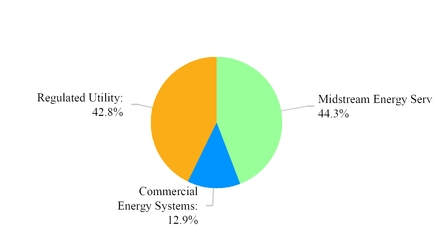

INDUSTRY SEGMENTS

Our segments include regulated utility, retail energy-marketing, commercial energy systems and midstream energy services. Transactions and activities not specifically identified in one of these four segments are reported as “Other Activities.” The four segments are described below.

REGULATED UTILITY SEGMENT

WGL Holdings, Inc.Corporate Overview

Washington Gas, Light Company

Part I

Item 1. Business (continued)

The regulated utility segment consistsan indirect wholly-owned subsidiary of Washington Gas and Hampshire and represents approximately 71% of WGL’s total assets.

Washington Gas Light Company

Washington Gas is a regulated public utility that sells and delivers natural gas to retail customers in accordance with tariffs approved by regulatory commissions in the District of Columbia and adjoining areas in Maryland, Virginia and several cities and towns in the northern Shenandoah Valley of Virginia. Washington GasAltaGas, has been engaged in the natural gas distribution business since its incorporation by an Act of Congress in 1848. Washington Gas has been aIt was incorporated in Virginia corporation sincein 1953 and a corporation ofin the District of Columbia sincein 1957. Washington Gas promotes the efficient use of clean natural gas to improve the environment for the benefit of customers, investors, employees, and the communities it serves.

Following the July 2018 merger pursuant to the Merger Agreement, Washington Gas became an indirect, majority owned subsidiary of, among other entities, AltaGas and WGL. In connection with the Merger, and at the command of Washington Gas’ regulators, WGL, the former parent entity of Washington Gas, formed a wholly owned subsidiary, Wrangler SPE LLC (Wrangler), a bankruptcy remote, special purpose entity to own the common stock of Washington Gas. Wrangler was formed for the purpose of “ring fencing” Washington Gas, that is removing Washington Gas from the bankruptcy estate of AltaGas and its affiliates in the event that any parent or affiliate entity becomes the subject of bankruptcy or insolvency proceedings.

On December 20, 2019, Washington Gas redeemed all the outstanding shares of its preferred stock. As a result, Washington Gas is now an indirect, wholly owned subsidiary of AltaGas and WGL. At December 31, 2019, we had 1,574 employees.

Products and Services

Washington Gas providesis a regulated distributionpublic utility company that sells and delivers natural gas to customers in accordance with tariffs approved by regulatory commissions in the District of Columbia and the surrounding metropolitan areas in Maryland and Virginia. At December 31, 2019, Washington Gas’ service area had a population estimated at 5.9 million and included approximately 2.2 million households and commercial structures. Washington Gas operations are such that the loss of any one customer or deliverygroup of customers would not have a significant adverse effect on its business.

Natural Gas Distribution

Washington Gas' core business is to provide regulated distribution of natural gas to retail customers under tariff rates designed to provide for a return on and return of the investment used in providing that service. The rates are also designed to provide for recovery of operating expenses and federal and state income taxes incurred in providing that service. Washington Gas also sells natural gas at no margin to customers who have not elected to purchase natural gas from unregulated third-party marketers (refer to the section entitled “Natural Gas Unbundling”). Washington Gas recovers the cost of the natural gas purchased to serve firm customers through recovery mechanisms as approved in jurisdictional tariffs. Any difference between gas costs incurred on behalf of firm customers and the gas costs recovered from those customers is deferred on the balance sheet as an amount to be collected from or refunded to customers in future periods. Therefore, increases or decreases in the cost of gas associated with sales made to firm customers have no direct effect on Washington Gas’ net revenues and net income. However, to the extent Washington Gas does not have regulatory mechanisms in place to mitigate the indirect effects of higher gas prices, such as: (i) lower natural gas consumption caused by customer conservation; (ii) increased short-term interest expense to finance a higher natural gas storage

Rates and accounts receivables balances and (iii) higher expenses for uncollectible accounts, its net income may decrease.

Washington Gas, under its asset optimization program, makes use of storage and transportation capacity resources when those assets are not required to serve utility customers. The objective of this program is to derive a profit to be shared with its utility customers. These profits are earned by entering into commodity-related physical and financial contracts with third parties (refer to the section entitled “Asset Optimization Derivative Contracts” for further discussion of the asset optimization program). Unless otherwise noted, therm deliveries reported for the regulated utility segment do not include deliveries related to the asset optimization program.

At September 30, 2018, Washington Gas’ service area had a population estimated at 5.9 million and included approximately 2.2 million households and commercial structures. Washington Gas operations are such that the loss of any one customer or group of customers would not have a significant adverse effect on its business. The following table lists the number of active customer meters and therms delivered by jurisdiction as of and for the year ended September 30, 2018 and 2017, respectively.

|

| | | | | | | | | | | |

| Active Customer Meters and Therms Delivered by Jurisdiction |

| Jurisdiction | Active Customer Meters as of September 30, 2018 | | Millions of Therms Delivered Fiscal Year Ended September 30, 2018 | | Active Customer Meters as of September 30, 2017 | | Millions of Therms Delivered Fiscal Year Ended September 30, 2017 |

| | | | | | | | |

| District of Columbia | 163,516 |

| | 298.4 |

| | 161,990 |

| | 270.6 |

|

| Maryland | 485,619 |

| | 914.7 |

| | 478,004 |

| | 742.8 |

|

| Virginia | 528,841 |

| | 673.8 |

| | 523,661 |

| | 589.1 |

|

| Total | 1,177,976 |

| | 1,886.9 |

| | 1,163,655 |

| | 1,602.5 |

|

For additional information about gas deliveries and meter statistics, refer to the section entitled “Results of Operations” in Management’s Discussion for Washington Gas.

Hampshire Gas Company

Hampshire owns full and partial interests in underground natural gas storage facilities, including pipeline delivery facilities located in and around Hampshire County, West Virginia, and operates those facilities to serve Washington Gas, which purchases all of the storage services of Hampshire. Washington Gas includes the cost of these services in the bills sent to its customers. Hampshire operates under a “pass-through” cost of service-based tariff approved by the FERC and adjusts its billing rates to Washington Gas on a periodic basis to account for changes in its investment in utility plant and associated expenses.

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (continued)

Regulatory EnvironmentMatters

Washington Gas is regulated by the PSC of DC, the PSC of MD and the SCC of VA which approve its terms of service and the billing rates that it charges to its customers. Hampshire is regulated by the FERC. The rates charged to utility customers are designed to recover Washington Gas’ operating expenses and natural gas commodity costs and to provide a return on its investmentinvested capital, including the equity in the net assets used in its firm gas sales and delivery service. For each jurisdiction in which Washington Gas operates, changes in customer usage profiles are reflected in rate case proceedings and rates are adjusted accordingly.

For a discussion of current rates and regulatory matters, refer to the section entitled “Rates and Regulatory Matters” in Management’s Discussion for Washington Gas.

District of Columbia Jurisdiction

The PSC of DC consists of three full-time members who are appointed by the Mayor with the advice and consent of the District of Columbia City Council. The term of each commissioner is four years with no limitations on the number of terms that can be served. The PSC of DC has no time limitation within which it must make decisions regarding modifications to base rates charged by Washington Gas to its customers; however, it targets resolving pending rate cases within three months of the close of record.

Maryland Jurisdiction

The PSC of MD consists of five full-time members who are appointed by the Governor with the advice and consent of the Senate of Maryland. Each commissioner is appointed to a five-year term, with no limit on the number of terms that can be served.

When Washington Gas files for a rate increase, the PSC of MD may initially suspend the proposed increase for 180 days, and then has the option to extend the suspension for an additional 30 days. If action has not been taken after 210 days, the requested rates become effective subject to refund.

Virginia Jurisdiction

The SCC of VA consists of three full-time members who are elected by the General Assembly of Virginia. Each commissioner has a six-year term with no limitation on the number of terms that can be served.

Either of two methods may be used to request a modification of existing rates. Washington Gas may file an application for a general rate increase, in which it may propose new adjustments to the cost of service that are different from those previously approved for Washington Gas by the SCC of VA, as well as a revised return on equity. The proposed rates under this process may take effect 150 days after the filing, subject to refund pending the outcome of the SCC of VA’s action on the application.

Alternatively, an expedited rate case procedure allows proposed rate increases to be effective 30 days after the filing date, subject to refund. Under this procedure, Washington Gas may not propose new adjustments for issues not approved in its last general rate case or request a change in its authorized return on common equity. Once filed, other parties may propose new adjustments or a change in the cost of capital from the level authorized in its last general rate case. The expedited rate case procedure may not be available if the SCC of VA decides that there has been a substantial change in circumstances since the last general rate case filed by Washington Gas.Analysis.

Seasonality of Business Operations

Washington Gas’ business is weather-sensitive and seasonal because the majority of its business is derived from residential and small commercial customers who use natural gas for space heating. Excluding deliveries for electric generation, 74%77% and 73%75% of the total therms delivered in Washington Gas’ service area occurred during its first and second fiscalfourth quarters for fiscalcalendar years 20182019 and 2017,2018, respectively. Washington Gas’ earnings are typically generated during these two quarters, and Washington Gas typically incurs net losses in the thirdsecond and fourth fiscalthird quarters. The seasonal nature of the business creates large variations in short-term cash requirements, primarily due to the season-to-season fluctuations in the level of customer accounts receivable, unbilled revenues and storage gas inventories. Washington Gas finances these seasonal requirements primarily through the sale

Washington Gas Light Company

Part I

Item 1. Business (continued)

of commercial paper and unsecured short-term bank loans.backed by a revolving credit facility. For information on our management of weather risk, refer to the section entitled “Weather Risk” in Management’s Discussion and Analysis. For information about management of cash requirements, refer to the section entitled “Liquidity and Capital Resources” in Management’s Discussion and Analysis.

Non-Weather Related Changes in Natural Gas Consumption Patterns

Natural gas supply requirements for the utility are also affected by changes in the natural gas consumption patterns of our customers that are driven by factors other than weather. Natural gas usage per customer may decline as customers change their consumption patterns for various reasons, including: (i) more volatile and higher natural gas prices; (ii) customer upgrades to more energy efficient appliances and building structures and (iii) a decline in the economy in the region in which we operate.

WGL Holdings, Inc.

In certain of Washington Gas Light Company

Part I

Item 1. Business (continued)

For each jurisdiction in which Washington Gas operates, changes in customer usage profiles are reflected in rate case proceedingsGas’ jurisdictions (Maryland and rates are adjusted accordingly. Changes in customer usage by existing customers that occur subsequent to rate case proceedings in Maryland generally will not change revenues because the RNA mechanism stabilizes the level of delivery charge revenues received from customers.

In Virginia, decoupling rate mechanisms for residential, small commercial and industrial and group metered apartment customers permit Washington Gas to adjust revenues for non-weather related changes in customer usage. The WNA and the CRAVirginia) there are billing mechanisms that togetherin place which are designed to eliminate the effects of bothvariance in customer usage caused by weather and other factors such as conservation.

In the District of Columbia, there is no weather normalization billing mechanism, nor does Washington Gas hedge to offset the effects of weather. As a decreaseresult, colder or warmer weather will result in customer usagevariances to financial results. On January 13, 2020, Washington Gas filed an application with the PSC of DC that occurs subsequent torequested approval for a rate case proceeding would have the effect of reducing revenues, which could be offset by additions of new customers.weather normalization billing mechanism.

Natural Gas Supply and Capacity

Capacity and Supply Requirements

Washington Gas must contract for reliable and adequate natural gas supplies, interstate pipeline capacity and storage capacity to provide natural gas to its distribution system, while considering: (i) the dynamics of the commodity supply and interstate pipeline and storage capacity markets; (ii) its own on-system natural gas peaking facilities and (iii) the characteristics of its customer base. Energy-marketing companies that sell natural gas to customers located within Washington Gas’ service territory are responsible for acquiring natural gas for their customers; however, Washington Gas allocates certain storage and pipeline capacity related to these customers in accordance with regulatory requirements.

system. Washington Gas has adopted a diversified portfolio approach designed to address constraints on supply by using multiple supply receipt points, dependable interstate pipeline transportation and storage arrangements, and its own substantial storage and peak shaving capabilities. Washington Gas’ supply and pipeline capacity plan is based on forecasted system requirements, and takes into account estimated load growth, attrition, conservation, geographic location, interstate pipeline and storage capacity and contractual limitations and the forecasted movement of customers between bundled service and delivery service. Under reduced supply conditions, Washington Gas may implement contingency plans in order to maximize the number of customers served. Contingency plans include requests to the general population to conserve and target curtailments to specific sections of the system, consistent with curtailment tariffs approved by regulators in each of Washington Gas’ three jurisdictions.

Washington Gas obtains natural gas supplies that originate from multiple regions throughout the United States. At September 30, 2018 and 2017,December 31, 2019, Washington Gas had multiple service agreements with four pipeline companies that provides firm transportation and/or storage services directly to Washington Gas’ city gates. These contracts have expiration dates ranging from fiscalcalendar years 20192020 to 2045.2044. Additionally, Washington Gas has contracted with various interstate pipeline and storage companies to add to its storage and transportation capacity and continues to monitor other opportunities to acquire or participate in additional pipeline and storage capacity to support customer growth and improve or maintain the high level of service expected by its customer base.

Asset Optimization Derivative Contracts

Under the asset optimization program, Energy-marketing companies that sell natural gas to customers located within Washington Gas’ service territory are responsible for acquiring natural gas for their customers; however, Washington Gas utilizes itsallocates certain storage and transportation capacity resources when they are not being used to serve its utility customers. Washington Gas executes commodity-related physical and financial contracts in the form of forwards, futures and options as part of an asset optimization program that is managed by its internal staff. These transactions are accounted for as derivatives. The objective of this program is to derive a profit to be shared with Washington Gas' utility customers. Washington Gas enters into these derivative transaction contracts to secure operating margins that will ultimately be shared between customers and Washington Gas. Because these sharing mechanisms are approved by our regulators in all three jurisdictions, any changes in fair value of the derivatives are recorded either through earnings for margins that are retained by Washington Gas or as regulatory assets or liabilities if the ultimate realized gains and losses will be included in the rates charged to customers.

The derivatives used under this program are subject to fair value accounting treatment which may cause significant period-to-period volatility in earnings from unrealized gains and losses associated with changes in fair value for the portion of net profits attributed to shareholders. However, this earnings volatility does not change the realized margins that Washington Gas expects to earn from these transactions. All physically and financially settled contracts under our asset optimization program are reported on a net basis in the statements of income in “Utility cost of gas.” Total net margins including unrealized gains and losses recorded to “Utility cost of gas” after sharing and management fees associated with all asset optimization transactions for the years ended September 30, 2018, 2017 and 2016, respectively, were net gains of $34.3 million, $82.9 million, and $43.8 million.

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (continued)

Refer to the sections entitled “Results of Operations — Regulated Utility Operating Results” and “Market Risk” in Management’s Discussion for further discussion of the asset optimization program and its effect on earnings.

Annual Sendout

As reflected in the table below, Washington Gas received natural gas from multiple sources in fiscal year 2018 and expects to use those same sources to satisfy customer demand in fiscal year 2019. Firm transportation denotes gas transported directly to the entry point of Washington Gas’ distribution system in contractual volumes. Transportation storage denotes volumes stored by a pipeline during the spring, summer and fall for withdrawal and delivery to the Washington Gas distribution system during the winter heating season to meet load requirements. Peak load requirements are met by: (i) underground natural gas storage at the Hampshire storage field; (ii) the local production of propane air plants located at Washington Gas-owned facilities in Rockville, Maryland (Rockville Station) and in Springfield, Virginia (Ravensworth Station) and (iii) other peak-shaving resources. Unregulated third-party marketers acquire interstate pipeline and storage capacity and the natural gas commodity on behalf of Washington Gas’ delivery service customers under customer choice programs. Washington Gas also provides transportation, storage and peaking resources to unregulated third-party marketers (refer to the section entitled “Natural Gas Unbundling”). These retail marketers have natural gas delivered to the entry point of Washington Gas’ distribution system on behalf of those utility customers that have decided to acquire their natural gas commodity on an unbundled basis, as discussed below.

Excluding the sendout of sales and deliveries of natural gas used for electric generation, the following table outlines total sendout of the system. The sources of delivery and related volumes that were used to satisfy the requirements of fiscal year 2018 and those projected for pipeline year 2019 are shown in the following table.

|

| | | | | | | | | |

Sources of Delivery for Annual Sendout |

| (In millions of therms) | | Fiscal Year |

| Sources of Delivery | | Actual 2017 | | Actual 2018 | | Projected 2019(a) |

| Firm Transportation | | 513 |

| | 643 |

| | 587 |

|

| Transportation Storage | | 398 |

| | 501 |

| | 390 |

|

| Hampshire Storage, Company-Owned Propane-Air Plants, and other Peak-Shaving Resources | | 29 |

| | 45 |

| | 29 |

|

| Unregulated Third-Party Marketers | | 783 |

| | 845 |

| | 861 |

|

| Total | | 1,723 |

| | 2,034 |

| | 1,867 |

|

(a)Based on normal weather.

Design Day Sendout

The effectiveness of Washington Gas’ capacity resource plan is largely dependent on the sources used to satisfy forecasted and actual customer demand requirements for its design day. For planning purposes, Washington Gas assumes that all interruptible customers will be curtailed on the design day. Washington Gas’ forecasted design day demand for the 2018-2019 winter season is 19.9 million therms and Washington Gas’ projected sources of delivery for design day sendout is 21.0 million therms. This provides a reserve margin of approximately 5.3%. Washington Gas plans for the optimal utilization of its storage and peaking capacity to reduce its dependency on firm transportation and to lower pipeline capacity costs. The following table reflects the sources of delivery that are projectedrelated to be used to satisfy the forecasted design day sendout estimate for fiscal year 2019.

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (continued)

|

| | | | | |

| Projected Sources of Delivery for Design Day Sendout |

| (In millions of therms) | Fiscal Year 2019 |

| Sources of Delivery | Volumes | | Percent |

| Firm Transportation | 6.8 |

| | 32 | % |

| Transportation Storage | 8.5 |

| | 41 | % |

| Hampshire Storage, Company-Owned Propane-Air Plants and other Peak-Shaving Resources | 5.5 |

| | 26 | % |

| Unregulated Third-Party Marketers | 0.2 |

| | 1 | % |

| Total | 21.0 |

| | 100 | % |

Natural Gas Unbundling

At September 30, 2018, customerCustomer choice programs for natural gas customers wereare available to all of Washington Gas’ regulated utility customers in the District of Columbia, Maryland and Virginia. These programs allow customers to purchase their natural gas from unregulated third-party marketers, rather than purchasing this commodity as part of a bundled service from the local utility. Of Washington Gas’ 1.2 million active customers at September 30, 2018, approximately 174,000 customers purchased their natural gas commodity from unregulated third-party marketers.

The following table provides the percentage of customers participating in customer choice programs in Washington Gas’ jurisdictions at September 30, 2018.

|

| | | | | | |

| Participation in Customer Choice Programs |

| At September 30, 2018 |

| Jurisdiction | Customer Class | Eligible Customers |

| | | Total | | % Participating |

District of Columbia | Firm: | | | |

| | Residential | 150,417 |

| | 9 | % |

| | Commercial | 12,954 |

| | 34 | % |

| | Interruptible | 145 |

| | 98 | % |

| Maryland | Firm: | | | |

| | Residential | 454,121 |

| | 19 | % |

| | Commercial | 31,316 |

| | 42 | % |

| | Interruptible | 180 |

| | 99 | % |

| | Electric Generation | 2 |

| | 100 | % |

| Virginia | Firm: | | | |

| | Residential | 498,790 |

| | 9 | % |

| | Commercial | 29,886 |

| | 31 | % |

| | Interruptible | 165 |

| | 95 | % |

| Total | | 1,177,976 |

| | |

When customers choose to purchase the natural gas commodity from unregulated third-partyretail marketers, Washington Gas’ net income is not affected because Washington Gas charges its customers the cost of gas without any mark-up. When customers select an unregulated third-party marketer as their gas supplier, Washington Gas continues to charge these customers to deliver natural gas through its distribution system at rates identical to the delivery portion of the bundled sales service customers. Of Washington Gas’ 1.2 million active customers at December 31, 2019, approximately 171,000 customers purchased their natural gas commodity from unregulated third-party marketers.

Asset Optimization Contracts

Washington Gas, under its asset optimization program, makes use of storage and transportation capacity resources when those assets are not required to serve utility customers. The objective of this program is to derive a profit to be shared with its utility customers. Washington Gas executes commodity-related physical and financial contracts in the form of forwards, futures and options as part of an asset optimization program that is managed by its internal staff. These transactions are accounted for as derivatives. Sharing mechanisms are approved by our regulators in all three jurisdictions, accordingly, any changes in fair

Washington Gas Light Company

Part I

Item 1. Business (continued)

value of the derivatives are recorded either through earnings for margins that are retained by Washington Gas or as regulatory assets or liabilities for realized gains and losses that will be included in the rates charged to customers.

Refer to the sections entitled “Results of Operations” and “Market Risk” in Management’s Discussion and Analysis for further discussion of the asset optimization program and its effect on earnings.

Safety and Reliability of the Natural Gas Distribution System

Maintaining and improving the public safety and reliability of Washington Gas’ distribution system is our highest priority, providingpriority. Doing so allows Washington Gas to provide benefits to both customers and investors through improved customer service. Washington Gas continually monitors and reviews changes in requirements of the codes and regulations that govern the operation of the distribution system and refines its safety practices, with a particular focus on design, construction, maintenance, operation, replacement, inspection and monitoring practices to meet or exceed these requirements. Significant changes in regulations can impact the cost of operating and maintaining our distribution system.

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (continued)

has accelerated pipe and infrastructure replacement programs in place in the District of Columbia, Maryland, and Virginia. These are long-term programs subject to both changing conditions and regulatory review and approval in five-year increments. Washington Gas is accelerating pipe and infrastructure replacement to further enhance the safety and reliability of the natural gas delivery system. Washington Gas is allowed to begin recovering the cost, including a return, for these investments immediately through approved surcharges for each accelerated pipe or infrastructure replacement program. Once new base rates are put into effect in a given jurisdiction, expenditures previously recovered through the surcharge will be collected through the new base rates.

Competition

The Natural Gas Delivery Function

The natural gas delivery function the core business of Washington Gas, continues to beis regulated by local and state regulatory commissions. In developingTo support this core business,function, Washington Gas has invested approximately $4 billion through September 30, 2018,of invested assets at December 31, 2019, to build, maintain and serve customers through safe and reliable distribution system assets. Because of the high fixed costs and significant safety and environmental considerations associated with building, operating and operatingmaintaining a natural gas distribution system, Washington Gas expects to continue being the onlysole owner and operator of a distribution system in its current franchise areas for the foreseeable future. The nature of Washington Gas’ customer base and the distance of most customers from interstate pipelines mitigate the threat of bypass ofbypassing its facilities by other potential delivery service providers.

Competition with Other Energy Products

Washington Gas faces competition based on customers’ preference for other energy products and the prices of those products compared to natural gas. In the residential market, which generates a significant portion of Washington Gas’ net income, the most significant product competition occurs between natural gas and electricity. Because the cost of electricity is affected by the cost of fuel used to generate electricity, such as natural gas, Washington Gas generally maintains a price advantage over competitive electricity supply in its service area for traditional residential uses of energy such as heating, water heating and cooking. In 2019, Washington Gas continues to attract the majority of the newadded 11,156 residential construction market in its service territory,customers and consumers’ continuing preference for natural gas allows Washington Gas to maintain a strong market presence. The following table lists the new customer meters added by jurisdiction742 commercial, interruptible and major rate class for the year ended September 30, 2018.

|

| | | | | | | | | | | | |

| New Customer Meters by Area |

| | Residential | | Commercial and Interruptible | | Group Metered Apartments | | Total |

| Maryland | | 5,692 |

| | 395 |

| | — |

| | 6,087 |

|

| Virginia | | 5,209 |

| | 344 |

| | 1 |

| | 5,554 |

|

| District of Columbia | | 818 |

| | 121 |

| | 1 |

| | 940 |

|

| Total | | 11,719 |

| | 860 |

| | 2 |

| | 12,581 |

|

group metered apartments. In the interruptible market, fuel oil is the prevalent energy alternative to natural gas. Washington Gas’ success in this market depends largely on the relationship between natural gas and oil prices. The supply of natural gas primarily is derived from domestic sources, and the relationship between supply and demand generally has the greatest impact on natural gas prices. Since the source of a large portion of oil comes from foreign countries, political events and foreign currency conversion rates can influence oil supplies and prices to domestic consumers.

Critical Factors

Factors critical to the success of the regulated utility segment include: (i) operating a safe and reliable natural gas distribution system; (ii) having sufficient natural gas supplies to meet customer demands; (iii) being competitive with other sources of energy such as electricity, fuel oil and propane; (iv) having access to sources of liquidity; (v) recovering the costs and expenses of this business in the rates charged to customers and (vi) earning a just and reasonable rate of return on invested capital.

RETAIL ENERGY-MARKETING SEGMENT

The retail energy-marketing segment consists of the operations of WGL Energy Services, which competes with regulated utilities and other unregulated third-party marketers to sell natural gas and/or electricity directly to residential, commercial and industrial customers in Maryland, Virginia, Delaware, Pennsylvania and the District of Columbia. WGL Energy Services is subject to regulation by the public service regulatory commissions of the states in which the company is authorized as a competitive service provider. These regulatory commissions: (i) authorize WGL Energy Services to provide service, (ii) review certain terms and conditions of service, (iii) establish the regulatory rules for interactions between the utility and the competitive service provider and (iv) issue orders and promulgate rules that establish the broad structure and conduct of retail energy markets. Changes to the rules, rates and orders by the regulatory commissions may affect WGL Energy Services’ financial performance.

WGL Energy Services buys natural gas and electricity with the objective of earning a profit through competitively priced sales contracts with end-users. These commodities are delivered to retail customers through the distribution systems owned by regulated utilities. Washington Gas is one of several utilities that deliver gas to, and on behalf of, WGL Energy Services.

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (continued)

Unaffiliated electric utilities deliver all of the electricity sold by WGL Energy Services. WGL Energy Services bills its customers either independently or through the billing services of the regulated utilities that deliver its commodities. Refer to Note 17—Related Party Transactions of the Notes to Consolidated Financial Statements for further discussion of our purchase of receivables program.

WGL Energy Services also sells wind and other RECs and carbon offsets to retail customers. WGL Energy Services owns solar generating assets which are dedicated to five specific customers. The results of operations for these assets are reported within the Commercial Energy Systems segment. WGL Energy Services does not own or operate any other electric generation, transmission or distribution assets.

At September 30, 2018, WGL Energy Services served approximately 108,900 residential, commercial and industrial natural gas customer accounts and approximately 101,700 residential, commercial and industrial electricity customer accounts located in Maryland, Virginia, Delaware, Pennsylvania and the District of Columbia. Its customer concentration is such that the loss of any one customer or group of customers would not have a significant adverse effect on its business.

Seasonality of Business Operations

The operations of WGL Energy Services are seasonal, with larger amounts of electricity being sold in the summer and peak winter months and larger amounts of natural gas being sold in the winter months. Working capital requirements can vary significantly during the year and these variations are financed through internally generated funds and WGL’s issuance of commercial paper and unsecured short-term bank loans. WGL Energy Services accesses these funds through the WGL money pool. For a discussion of the WGL money pool, refer to the section entitled “Money Pool” in Management’s Discussion and Analysis.

Natural Gas and Electricity Supply

WGL Energy Services contracts for storage and pipeline capacity to meet its customers’ needs primarily through transportation releases and storage services allocated from the utility companies in the various service territories in which it provides retail energy commodity.

On February 20, 2013, WGL Energy Services entered into a five-year secured supply arrangement with Shell Energy North America (US), LP (Shell Energy). Under this arrangement, WGL Energy Services has the ability to purchase the majority of its power, natural gas and related products from Shell Energy in a structure that reduces WGL Energy Services’ cash flow risk from collateral posting requirements. While Shell is intended to be the majority provider of natural gas and electricity, WGL Energy Services retains the right to purchase supply from other providers. On November 7, 2016, the supply arrangement was extended for two years, expiring in 2020.

Natural gas supplies are delivered to WGL Energy Services’ market territories through several interstate natural gas pipelines. To supplement WGL Energy Services’ natural gas supplies during periods of high customer demand, WGL Energy Services maintains gas storage inventory in storage facilities that are assigned by natural gas utilities such as Washington Gas. This storage inventory enables WGL Energy Services to meet daily and monthly fluctuations in demand and to minimize the effect of market price volatility.

The PJM Interconnection (PJM) is a regional transmission organization that regulates and coordinates generation supply and the wholesale delivery of electricity in the states and jurisdictions where WGL Energy Services operates. WGL Energy Services buys wholesale and sells retail electricity in the PJM market territory, subject to its rules and regulations.

Competition

Natural Gas. WGL Energy Services competes with regulated gas utilities and other third-party marketers to sell natural gas to customers both inside and outside of the Washington Gas service area.

Electricity. WGL Energy Services competes with regulated electric utilities and other third-party marketers to sell electricity to customers.

Marketers of natural gas and electric supply compete largely on price; therefore, gross margins are relatively small. To provide competitive pricing to its retail customers and in adherence to its risk management policies and procedures, WGL Energy Services manages its natural gas and electricity contract portfolios by attempting to closely match the commitments for gas and electricity deliveries from suppliers with requirements to serve sales customers.

WGL Energy Services’ residential and small commercial electric customer growth opportunities are significantly affected by the price for Standard Offer Service (SOS) offered by electric utilities. These rates are periodically reset for each customer class

WGL Holdings, Inc.

Washington Gas Light Company

Part I

Item 1. Business (continued)

based on the regulatory requirements in each jurisdiction. Customer growth opportunities either expand or contract due to the relationship of these SOS rates to current market prices.

For a discussion of WGL Energy Services’ exposure to and management of price risk, refer to the section entitled “Market Risk—Price Risk Related to the Non-Utility Segments” in Management’s Discussion.

Critical Factors

Factors critical to managing the retail energy-marketing segment include: (i) managing the market risk of the difference between the price committed to customers under sales contracts and the cost of natural gas and electricity needed to satisfy these commitments, including PJM costs and costs to meet renewable portfolio standards; (ii) having sufficient deliverability of natural gas and electric supplies and transportation to serve the demand of its customers, which can be affected by the ability of natural gas producers, pipeline gatherers, natural gas processors, interstate pipelines, electricity generators and regional electric transmission operators to deliver the respective commodities; (iii) access to sources of financial liquidity; (iv) managing credit risks associated with customers and suppliers; (v) controlling the level of selling, general and administrative expenses, including customer acquisition expenses and (iv) access to markets through customer choice programs or other forms of deregulation.

COMMERCIAL ENERGY SYSTEMS SEGMENT

The commercial energy systems segment consists of the operations of WGL Energy Systems, WGSW and the results of operations of wholly owned subsidiaries, consolidated tax equity and other investments and affiliate owned commercial distributed energy projects.

This segment focuses on clean and energy efficient solutions for its customers, driving earnings through (i) investing in distributed generation assets such as Solar PV systems, combined heat and power plants, and natural gas fuel cells and (ii) operating as a general contractor to upgrade the mechanical, electrical, water and energy-related infrastructure of large governmental and commercial facilities by implementing both traditional and alternative energy technologies. This segment has assets and activities across the United States.

As of September 30, 2018, this segment owned $577.1 million of operating distributed generation assets, generating a total of 342,306 megawatt hours in fiscal year 2018. Additionally, as of September 30, 2018, there was $11.0 million of signed projects under construction. These distributed generation assets drive revenue through the sale of renewable power generation under long-term power purchase agreements and the sale of renewable energy credits. As of September 30, 2018, we have $156.1 million in unamortized investment tax credits and grants related to these assets placed in service. These credits and grants are recognized as reductions in tax expense by amortizing them over the useful life of the underlying assets, typically 30 years.

Competition