UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| | |

| þ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | FOR THE FISCAL YEAR ENDED DECEMBER 31, 20172018 |

OR

|

| | |

| o | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | FOR THE TRANSITION PERIOD FROM __________TO __________ |

Commission file number: 001-32743

EXCO RESOURCES, INC.

(Exact name of Registrant as specified in its charter)

|

| | |

Texas (State of incorporation) | | 74-1492779 (I.R.S. Employer Identification No.) |

| | | |

12377 Merit Drive, Suite 1700, Dallas, Texas (Address of principal executive offices) | | 75251 (Zip Code) |

Registrant’s telephone number, including area code: (214) 368-2084

Securities registered pursuant to Section 12 (b) of the Act: None

Securities registered pursuant to Section 12 (g) of the Act: Common Shares, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | |

Large accelerated filer o | | Accelerated filer o |

Non-accelerated filer oþ | | Smaller reporting company þ |

Emerging growth company o | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

As of March 8, 2018,2019, the registrant had 21,630,46421,584,514 outstanding common shares, par value $0.001 per share, which is its only class of common shares. As of the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the registrant's common shares held by non-affiliates was approximately $29,307,000.$1,501,809.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file an amendment on Form 10-K/A not later than 120 days after the close of the fiscal year ended December 31, 2017.2018. Portions of such amendment will be incorporated by reference into Part III, Items 10-14 of this Annual Report on Form 10-K.

EXCO RESOURCES, INC.

TABLE OF CONTENTS

EXCO RESOURCES, INC.

PART I

Item 1. Business

General

Unless the context requires otherwise, references in this Annual Report on Form 10-K to “EXCO,” “EXCO Resources,” “Company,” “we,” “our,” and “us” are to EXCO Resources, Inc. and its consolidated subsidiaries.

We have provided definitions of terms commonly used in the oil and natural gas industry in the “Glossary of selected oil and natural gas terms” section of this Annual Report on Form 10-K.

We are an independent oil and natural gas company engaged in the exploration, exploitation, acquisition, development and production of onshore U.S. oil and natural gas properties with a focus on shale resource plays. Our principal operations are conducted in certain key U.S. oil and natural gas areas including Texas, Louisiana and the Appalachia region. Our primary strategy focuses on the exploitation and development of our shale resource plays and the pursuit of leasing and acquisition opportunities.

Bankruptcy proceedings under Chapter 11

On January 15, 2018 ("Petition Date"), the Company and certain of its subsidiaries, including EXCO Services, Inc., EXCO Partners GP, LLC, EXCO GP Partners OLP, LP, EXCO Partners OLP GP, LLC, EXCO Operating Company, LP, EXCO Midcontinent MLP, LLC, EXCO Holding (PA), Inc., EXCO Production Company (PA), LLC, EXCO Resources (XA), LLC, EXCO Production Company (WV), LLC, EXCO Land Company, LLC, EXCO Holding MLP, Inc., Raider Marketing, LP, Raider Marketing GP, LLC (collectively, the “Filing Subsidiaries” and, together with the Company, the “Debtors”), filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code (“Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of Texas (“Court”). The Chapter 11 cases are being jointly administered under the caption In Re EXCO Resources, Inc., Case No. 18-30155 (MI) ("Chapter 11 Cases"). The Court granted all of the first day motions filed by the Debtors that were designed primarily to minimize the impact of the Chapter 11 proceedings on our operations, customers and employees. We will continue to operate our businesses as “debtors in possession” under the jurisdiction of the Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Court. We expect to continue our operations without interruption during the pendency of the Chapter 11 proceedings.

DIP Credit Agreement

On January 22, 2018, we closed a debtor-in-possession credit agreement (“DIP Credit Agreement”) with lenders including affiliates of Fairfax Financial Holdings Limited (“Fairfax”), Bluescape Resources Company LLC (“Bluescape”) and JPMorgan Chase Bank, N.A. (collectively the “DIP Lenders”). The DIP Credit Agreement includes a senior secured debtor-in-possession revolving credit facility in an aggregate principal amount of $125.0 million (“Revolver A Facility”) and a senior secured debtor-in-possession revolving credit facility in an aggregate principal amount of $125.0 million (“Revolver B Facility”, and together with the Revolver A Facility, the “DIP Facilities”). Proceeds from the DIP Facilities were used to repay all obligations outstanding under our previous revolving credit agreement ("EXCO Resources Credit Agreement") and will provide additional liquidity to fund our operations during the Chapter 11 Cases. On January 15, 2019, we entered into an amendment to the DIP Credit Agreement to extend the maturity date from January 22, 2019 to May 22, 2019. See further discussion of the DIP Credit Agreement in “Note 5. Debt” in the Notes to our Consolidated Financial Statements.

Impact on our indebtedness

The commencement of the Chapter 11 Cases constituted an event of default that accelerated our obligations under the EXCO Resources Credit Agreement, senior secured 1.5 lien notes due March 20, 2022 (“1.5 Lien Notes”), senior secured 1.75 lien term loans due October 26, 2020 (“1.75 Lien Term Loans”), senior unsecured notes due September 15, 2018 (“2018 Notes”), and senior unsecured notes due April 15, 2022 (“2022 Notes”). These debt instruments provide that as a result of the commencement of the Chapter 11 Cases, the principal and interest due thereunder shall be immediately due and payable. Any efforts to enforce such payment obligations under the debt instruments are automatically stayed as a result of the commencement of the Chapter 11 Cases, and the creditors’ rights of enforcement with respect to the debt instruments are subject to the applicable provisions of the Bankruptcy Code. On February 22, 2018, the Court approved our ability to make

adequate protection payments for interest on the DIP Credit Agreement and the 1.5 Lien Notes. See further discussion of the impact in “Note 5. Debt” in the Notes to our Consolidated Financial Statements.

Rejection of executory contracts

Subject to certain exceptions, under the Bankruptcy Code, the Debtors may assume, assign, or reject certain executory contracts and unexpired leases subject to the approval of the Court and fulfillment of certain other conditions. The rejection of an executory contract or unexpired lease is generally treated as a breach as of the Petition Date of such executory contract or unexpired lease and, subject to certain exceptions, relieves the Debtors of performing their future obligations under such executory contract or unexpired lease but may give rise to a general unsecured claim against the Company or the applicable Filing Subsidiaries for damages caused by such rejection.

During March 2018, the Court approved the rejection of certain executory contracts related to the sale, marketing and transportation of natural gas in the North Louisiana region. On November 19, 2018, the Court approved an agreement to settle any claims related to a minimum volume commitment for gathering services in the East Texas and North Louisiana regions.

On August 9, 2018, the Court approved the rejection of the office lease for our corporate headquarters in Dallas, Texas. We subsequently entered into a new lease for a reduced amount of square footage in the same office building with a term through December 31, 2022. See further discussion of the impact of the rejection and settlement of executory contracts as part of “Note 1. Organization and basis of presentation” in the Notes to our Consolidated Financial Statements.

Status of plan of reorganization

On October 1, 2018, the Debtors filed a Settlement Joint Chapter 11 Plan of Reorganization (the “October 2018 Plan”) and related Disclosure Statement with the Court. As is customary in bankruptcy proceedings, the Debtors subsequently filed amendments to the October 2018 Plan and related Disclosure Statement with the Court. The distributions under the October 2018 Plan were expected to be funded with: (i) cash on hand; (ii) a new revolving credit facility; (iii) a new second lien debt instrument; (iv) the equity in the reorganized Company; and, (v) the D&O Proceeds, as defined below.

On November 5, 2018, the Court authorized us to solicit acceptances of the October 2018 Plan and approved the Disclosure Statement and other related solicitation materials and procedures necessary to approve the October 2018 Plan. Simultaneous with the solicitation process, we initiated a marketing process for the issuance of the new revolving credit facility and the new second lien debt instrument. During the course of the marketing process, oil prices experienced a significant decline and overall market conditions worsened. As a result, we were not able to obtain the exit financing required to consummate the October 2018 Plan. On February 15, 2019, the Court approved a motion to extend the filing exclusivity period through April 1, 2019 and the solicitation exclusivity period through May 31, 2019.

On March 8, 2019, the Debtors filed a Second Amended Joint Chapter 11 Plan of Reorganization (“March 2019 Plan”) and related Disclosure Statement with the Court. The March 2019 Plan provides for either a reorganization of the Debtors as a going concern or the sale of the Debtors’ assets (“All Asset Sale”). The Debtors will make a final determination regarding which path to pursue by the date of the hearing to approve the Disclosure Statement. The March 2019 Plan included the following key elements:

Holders of the DIP Credit Agreement will receive payment in full in cash with proceeds from either a new revolving credit facility (“Exit Facility”) or, in the event of an All Asset Sale, proceeds from the sale of assets;

Holders of allowed 1.5 Lien Notes claims will receive either their pro rata share of a new mandatorily convertible security or, in the event of an All Asset Sale, the liens securing such allowed claim;

Holders of allowed 1.75 Lien Term Loans claims will receive either their pro rata share of the equity in the reorganized Company representing the value attributable to encumbered assets or, in the event of an All Asset Sale, the liens securing such allowed claim;

Holders of the Second Lien Term Loans, 2018 Notes, 2022 Notes, allowed general unsecured claims and deficiency claims associated with the 1.75 Lien Term Loans will receive either their pro rata share of equity in the reorganized Company representing the value attributable to unencumbered assets, or in the event of an All Asset Sale, proceeds attributable to the sale of the unencumbered assets (“Unsecured Claims Recovery”);

Holders of existing equity interests in EXCO shall not receive a distribution and the equity interests will be deemed canceled, discharged, released and extinguished; and

The carriers of directors’ and officers’ liability insurance coverage related to the Debtors will contribute $13.4 million (“D&O Proceeds”) to the Debtors in exchange for full and final settlement of potential claims and causes of action against current and former directors and officers.

The March 2019 Plan does not release the Debtors or holders of claims of the 1.5 Lien Notes and 1.75 Lien Term Loans from certain causes of action. The litigation of these causes of action will be managed by a trustee appointed by the committee of unsecured creditors of the Debtors and will not occur until after the confirmation of the March 2019 Plan. If any of the disputed claims are successfully prosecuted, this could materially impact the aforementioned recoveries for holders of allowed claims. If some or all of the 1.5 Lien Notes claims or 1.75 Lien Term Loans claims are deemed to be unsecured claims following the successful prosecution of a secured claims challenge, the holders of such 1.5 Lien Notes claims and 1.75 Lien Term Loans claims will receive their pro rata share of the Unsecured Claims Recovery. We have not received consents from any creditors in support of the March 2019 Plan. Therefore, our ability to confirm the March 2019 Plan is subject to a high degree of uncertainty.

For the duration of the Chapter 11 proceedings, our operations and our ability to develop and execute our business plan are subject to risks and uncertainties associated with Chapter 11 proceedings described in "Item 1A. Risk Factors”. As a result of these risks and uncertainties, our assets, liabilities, shareholders' equity, officers and/or directors could be significantly different following the conclusion of the Chapter 11 Cases, and the description of our operations, properties and capital plans included in this annual report may not accurately reflect our operations, properties and capital plans following the Chapter 11 Cases. See further discussion of the Chapter 11 Cases in "Note 17. Subsequent events"1. Organization and basis of presentation" in the Notes to our Consolidated Financial Statements.

Our business strategy

Our primary strategy focuses on the exploitation and development of our shale resource plays and the pursuit of leasing and acquisition opportunities. Our liquidity and ability to maintain compliance with debt covenants have been negatively impacted by the prolonged depressed oil and natural gas price environment, levels of indebtedness, and gathering, transportation and certain other commercial contracts. We define liquidity as cash and restricted cash plus the unused borrowing base under certain revolving credit agreements ("Liquidity").

During 2017, we focused on restructuring our balance sheet to improve our Liquidity and financial condition. On March 15, 2017, we closed a series of transactions including the issuance of $300.0 million in aggregate principal amount of senior secured 1.5 lien notes due March 20, 2022 ("1.5 Lien Notes"), the exchange of $682.8 million in aggregate principal amount of our senior secured second lien term loans due October 26, 2020 ("Second Lien Term Loans") for a like amount of senior secured 1.75 lien term loans due October 26, 2020 ("1.75 Lien Term Loans," and such exchange, the "Second Lien Term Loan Exchange") and the issuance of warrants to purchase our common shares. The terms of the indenture governing the 1.5 Lien Notes and the credit agreement governing the 1.75 Lien Term Loans allow for interest payments in cash, common shares or, in certain circumstances, additional indebtedness (such interest payments in common shares or additional indebtedness, "PIK Payments"), subject to certain restrictions and limitations. Concurrently with the issuance of the 1.5 Lien Notes and as a condition precedent thereto, on March 15, 2017, we amended our credit agreement ("EXCO Resources Credit Agreement") to,

among other things, permit the issuance of the 1.5 Lien Notes and the exchanges of Second Lien Term Loans, reduce the borrowing base thereunder to $150.0 million and modify certain financial covenants. See further discussion of these transactions as part of "Note 5. Debt" in the Notes to our Consolidated Financial Statements. The principal purpose of issuing the 1.5 Lien Notes and the Second Lien Term Loan Exchange was to alleviate our substantial cash interest payment burden and improve our Liquidity. Our initial expectation was to make PIK Payments in common shares on the 1.5 Lien Notes and the 1.75 Lien Term Loans throughout the remainder of 2017 and 2018. On June 20, 2017, we paid interest on the 1.75 Lien Term Loans in common shares, which resulted in the issuance of 2,745,754 common shares ("PIK Shares"). On September 20, 2017, we paid $17.0 million and $26.2 million of interest on the 1.5 Lien Notes and 1.75 Lien Term Loans, respectively, through the issuance of additional 1.5 Lien Notes and 1.75 Lien Term Loans. However, certain limitations and restrictions within our debt agreements prevented us from making PIK Payments in subsequent periods.

In order to improve our Liquidity, we entered into a purchase and sale agreement on April 7, 2017 to divest our oil and natural gas properties and surface acreage in South Texas for a total purchase price of $300.0 million, subject to customary closing conditions and adjustments. However, we were not able to meet the closing conditions due to the alleged termination of a long-term natural gas sales contract that was required to be in full force and effect as of the closing date. As a result, the purchase and sale agreement was terminated as of August 15, 2017. We are currently in litigation with the party to the natural gas sales contract as a result of their alleged termination of the contract. See further discussion of this transaction as part of "Note 3. Acquisitions, divestitures and other significant events" in the Notes to our Consolidated Financial Statements.

On September 7, 2017, we announced that our Board of Directors delegated authority to the Audit Committee of the Board of Directors ("Audit Committee") to explore strategic alternatives to strengthen our balance sheet and maximize the value of the Company, which included, but was not limited to, seeking a comprehensive out-of-court restructuring or reorganization under Chapter 11 of the Bankruptcy Code. At the direction of the Audit Committee, we retained PJT Partners LP as financial advisors and Alvarez & Marsal North America, LLC as restructuring advisors, and continued to engage Kirkland & Ellis LLP as legal advisors to assist the Company with the restructuring process. We initiated discussions with our stakeholders to evaluate the feasibility of a consensual in-court or out-of-court restructuring.

Due to liquidity constraints and limitations and restrictions on our ability to pay interest in cash, commons shares or additional indebtedness, we did not make our interest payment on the 1.75 Lien Term Loans that was due on December 20, 2017 or the interest payment on the Second Lien Term Loans that was due on December 26, 2017. In anticipation of certain events of default related to compliance with financial covenants and the failure to pay interest on certain debt instruments, we entered into agreements with certain holders of the EXCO Resources Credit Agreement, 1.5 Lien Notes, and 1.75 Lien Term Loans to forbear from exercising their rights and remedies as a result of an event of default under the debt instruments until January 15, 2018.

Despite our significant efforts to improve our financial condition, we continued to face increasing liquidity concerns. As of December 31, 2017, our Liquidity was $55.5 million. On January 15, 2018, the Company and the Filing Subsidiaries filed voluntary petitions for relief under Chapter 11 of the Bankruptcy Code. We were not able to reach an agreement with our creditors for a plan of reorganization prior to commencement of the Chapter 11 Cases. Therefore, the outcome of the Chapter 11 process is subject to a high degree of uncertainty and is dependent upon factors outside of our control, including actions of the Court and our creditors.

On January 22, 2018, we closed a Debtor-in-Possession Credit Agreement (“DIP Credit Agreement”) with lenders including affiliates of Fairfax Financial Holdings Limited ("Fairfax"), Bluescape Resources Company LLC ("Bluescape") and JPMorgan Chase Bank, N.A. (collectively the "DIP Lenders"). The DIP Credit Agreement includes a senior secured debtor-in-possession revolving credit facility in an aggregate principal amount of $125.0 million (“Revolver A Facility”) and a senior secured debtor-in-possession revolving credit facility in an aggregate principal amount of $125.0 million (“Revolver B Facility”, and together with the Revolver A Facility, the “DIP Facilities”). The proceeds from the DIP Facilities were used to refinance all obligations outstanding under the EXCO Resources Credit Agreement and will provide additional liquidity to fund our operations during the Chapter 11 process. See further discussion of the DIP Credit Agreement in "Note 17. Subsequent events" in the Notes to our Consolidated Financial Statements.

We continue to engage in discussions with our creditors regarding the terms of a financial restructuring plan. In conjunction with this process, we will explore potential strategic alternatives to maximize value for the benefit of our stakeholders, which may include a sale of certain or substantially all of our assets under Section 363 of the Bankruptcy Code, a plan of reorganization to equitize certain indebtedness as an alternative to the sale process, or a combination thereof.

Our strengths

High quality asset base in attractive regions

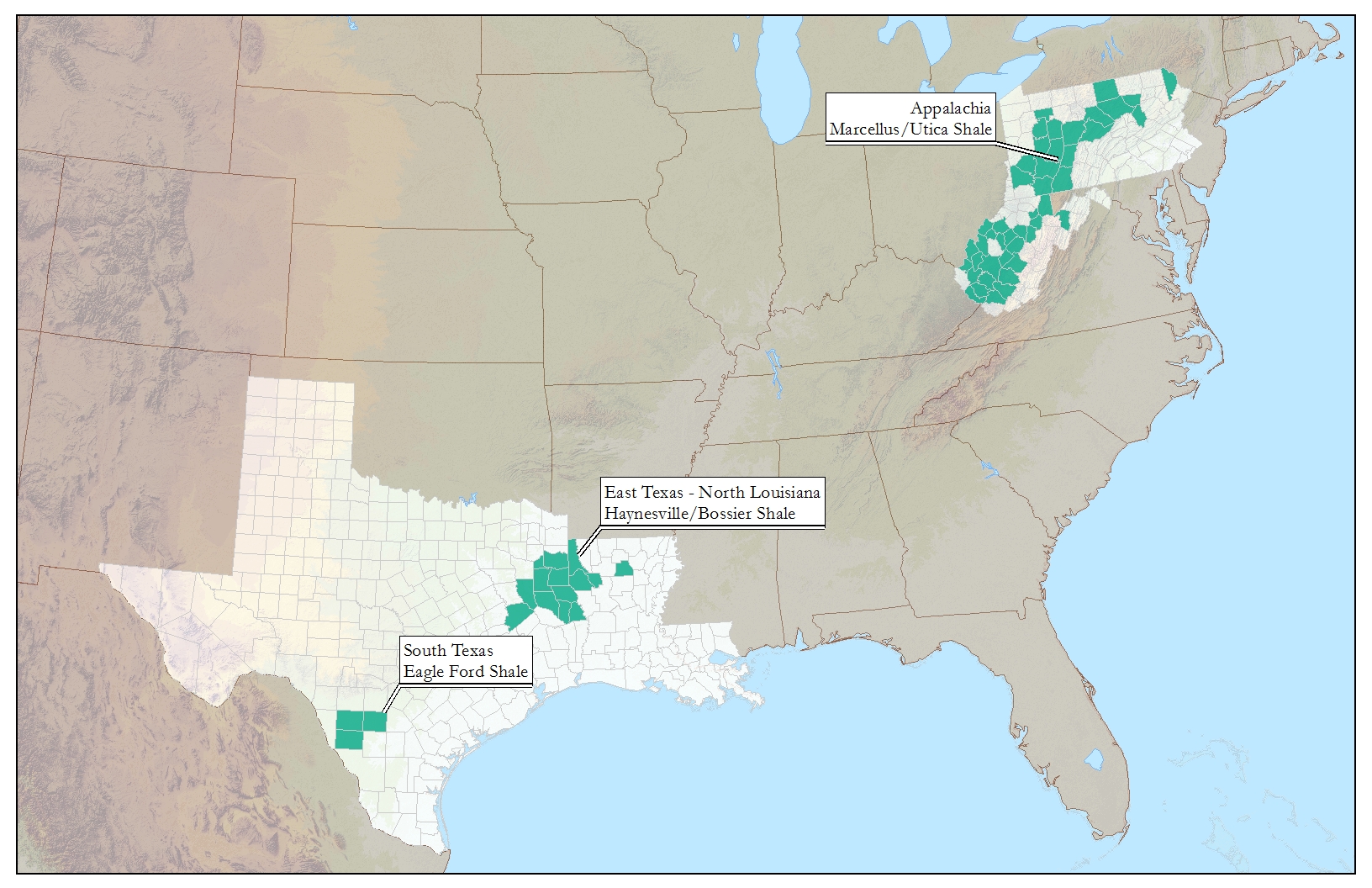

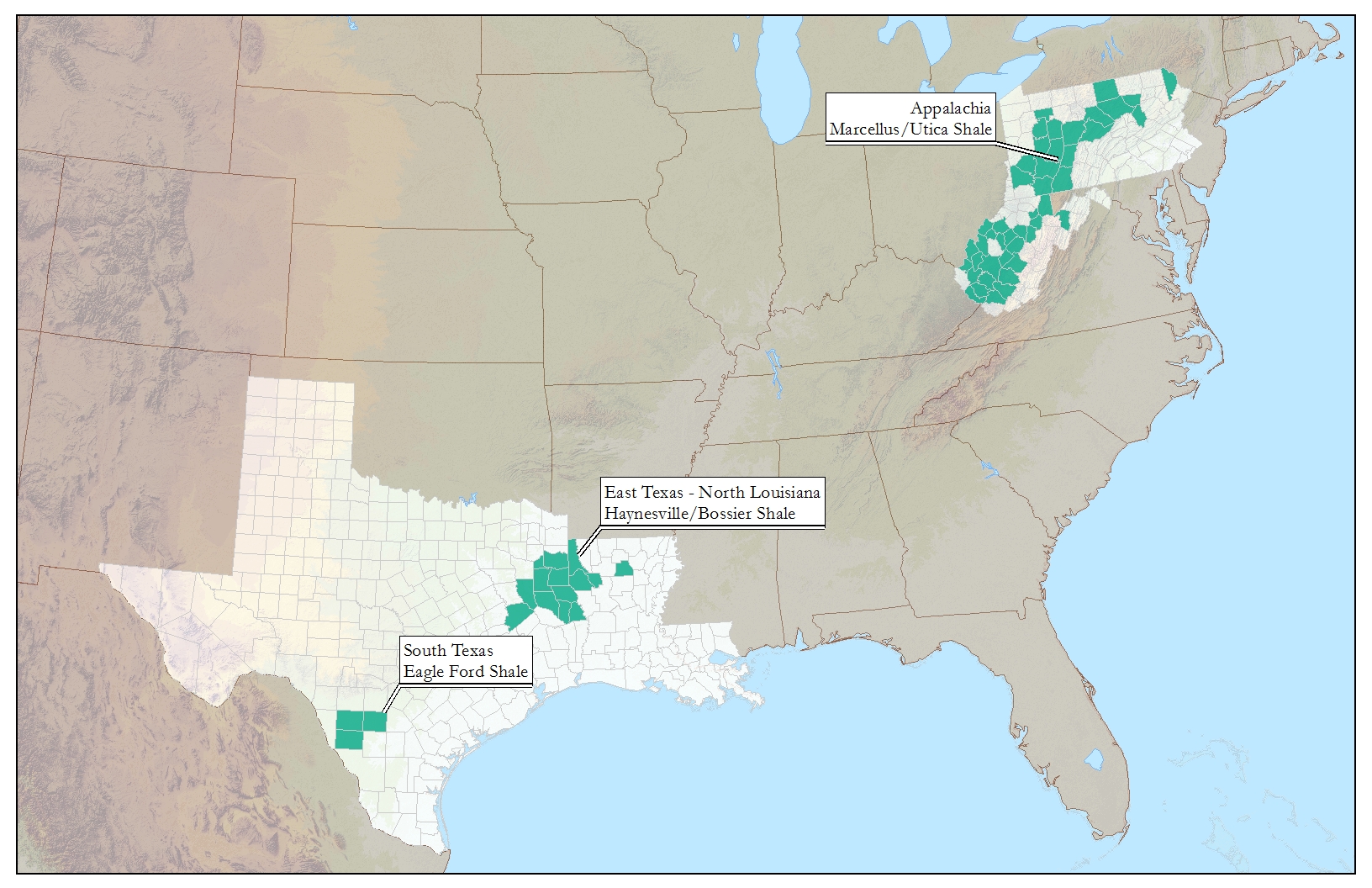

Our core areas have an extensive inventory of drilling opportunities that provide the option to allocate capital to enhance our returns in various commodity price environments. In addition, a significant portion of our acreage is held-by-production, which allows for the development of these properties within an optimum time frame. We hold significant acreage positions in three prominent oil and natural gas regions in the United States:

East Texas and North Louisiana - we currently hold approximately 84,900 net acres in the Haynesville and Bossier shales;

South Texas - we currently hold approximately 49,700 net acres in the Eagle Ford shale; and

Appalachia - we held approximately 125,600 net acres prospective for the Marcellus shale and approximately 40,000 net acres prospective for the Utica shale predominantly located in the dry gas window as of December 31, 2017. On February 27, 2018, we closed a settlement agreement with a wholly owned subsidiary of Royal Dutch Shell, plc, ("Shell") to resolve arbitration regarding our right to participate in an area of mutual interest in the Appalachia region ("Appalachia JV Settlement"). The settlement approximately doubled our interests in the aforementioned acreage in the Appalachia region. See further discussion of this settlement as part of "Note 17. Subsequent events" in the Notes to our Consolidated Financial Statements.

Our properties are generally characterized by:

multi-year inventory of development drilling and exploitation projects;

high drilling success rates;

significant unproved reserves and resources; and

long reserve lives.

We have extensive amounts of technical and operational expertise within the Haynesville and Bossier shales. We have accumulated significant amounts of contiguous acreage and are one of the largest operators within this region. Our economies of scale and operational expertise have allowed us to efficiently develop our assets and minimize our costs through greater utilization of multi-well pads and existing infrastructure and facilities. We are dedicated to the continuous improvement and innovation of well designs in order to maximize our return on capital. In recent years, we have achieved improvements in well performance through the use of extended laterals, increased use of proppant and other changes to our completion design.

We have applied our technical and operational expertise from other shale plays to our development of the Eagle Ford shale. We have realized significant improvements in our drilling performance, and the optimization of our well design has yielded strong results.

Our position in the Marcellus and Utica shales requires low maintenance capital as a substantial portion of our acreage is held-by-production, which gives us flexibility to control the timing of our development activities in the region.

Operational control

We operate a significant portion of our properties, which allows us to manage our operating costs and better control capital expenditures as well as the timing of development and exploitation activities. Therefore, we are able to allocate our capital to the most attractive projects based on commodity prices, rates of return and industry trends. As of December 31, 2017, we operated 869 of our 1,181 gross wells, or wells representing approximately 91% of our Proved Developed Reserves.

Skilled technical personnel and experienced team

Our management team has extensive industry experience in acquiring, exploring, exploiting and developing oil and natural gas properties. We have developed a workforce of highly skilled technical and operational personnel who have been successful in developing our shale resources. We leverage our technical expertise to exploit our asset base in an efficient and cost-effective manner. We believe our technical expertise gives us a competitive advantage in our key operating areas.

Development plans for 2018

Our plans for 2018 include a limited development program focused on the Haynesville shale in North Louisiana and the Eagle Ford shale in South Texas. The development of the Haynesville shale includes limited drilling and the completion of certain wells drilled in the prior year. Our development program for the Eagle Ford shale includes the drilling and completion of certain wells that will preserve the value of certain acreage with leasehold obligations. Our development plans also include limited capital allocated to participate in the development of non-operated wells, maintenance capital and leasehold costs. The capital expenditures associated with the development plans are highly concentrated in the first half of 2018.

Summary of geographic areas of operations

The following tables set forth summary operating information attributable to our principal geographic areas of operation as of December 31, 2017:2018:

| | | Areas | | Total Proved Reserves (Bcfe) (1) | | PV-10 (in millions) (1) (2) | | Average daily net production (Mmcfe/d) (3) | | Total Proved Reserves (Bcfe) (1) | | PV-10 (in millions) (1) (2) | | Average daily net production (Mmcfe/d) (3) |

| North Louisiana | | 318.3 |

| | $ | 226.8 |

| | 175 |

| | 285.5 |

| | $ | 280.0 |

| | 163 |

|

| East Texas | | 68.1 |

| | 65.8 |

| | 36 |

| | 59.4 |

| | 58.0 |

| | 24 |

|

| South Texas | | 66.3 |

| | 132.5 |

| | 18 |

| | 90.1 |

| | 304.9 |

| | 28 |

|

| Appalachia and other | | 114.2 |

| | 57.7 |

| | 26 |

| | 225.6 |

| | 114.5 |

| | 51 |

|

| Total | | 566.9 |

| | $ | 482.7 |

| | 255 |

| | 660.6 |

| | $ | 757.4 |

| | 266 |

|

| | | Areas | | Total gross acreage | | Total net acreage | | Total gross acreage | | Total net acreage |

| North Louisiana | | 102,300 |

| | 56,000 |

| | 101,400 |

| | 55,500 |

|

| East Texas | | 111,600 |

| | 42,100 |

| | 110,000 |

| | 41,100 |

|

| South Texas | | 103,000 |

| | 49,700 |

| | 100,800 |

| | 48,500 |

|

| Appalachia and other | | 398,300 |

| | 180,700 |

| | 382,200 |

| | 342,800 |

|

| Total | | 715,200 |

| | 328,500 |

| | 694,400 |

| | 487,900 |

|

| |

| (1) | The total Proved Reserves and PV-10 as of December 31, 20172018 were prepared in accordance with the rules and regulations of the Securities and Exchange Commission ("SEC"). |

| |

| (2) | The PV-10 data used in this table was based on reference prices using the simple average of the spot prices for the trailing 12 month period using the first day of each month beginning on January 1, 20172018 and ending on December 1, 2017,2018, of $2.98$3.10 per Mmbtu for natural gas and $51.34$65.56 per Bbl for oil, in each case adjusted for geographical and historical differentials. Market prices for oil and natural gas are volatile (see “Item 1A. Risk Factors - Risks Relating to Our Business”). We believe that PV-10, while not a financial measure in accordance with generally accepted accounting principles in the United States ("GAAP"), is an important financial measure used by investors and independent oil and natural gas producers for evaluating the relative significance of oil and natural gas properties and acquisitions due to tax characteristics which can differ significantly among comparable companies. The total Standardized Measure, a measure recognized under GAAP, as of December 31, 20172018 was $482.7$757.4 million. The Standardized Measure represents the PV-10 after giving effect to income taxes and is calculated in accordance with the Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 932, Extractive Activities, Oil and Gas ("ASC 932"). Our tax basis in the associated properties exceeded the pre-tax cash inflows and, as a result, there is no difference in Standardized Measure and PV-10 for all years presented. The amount of estimated future plugging and abandonment costs, the PV-10 of these costs and the Standardized Measure were determined by us. We do not designate our derivative financial instruments as hedges and accordingly, do not include the impact of derivative financial instruments when computing the Standardized Measure. |

| |

| (3) | The average daily net production rate was calculated based on the average daily rate during the final month of the year ended December 31, 2017.2018. |

Our development and exploitation project areas

East Texas and North Louisiana

Our operations in East Texas and North Louisiana are focused on the Haynesville and Bossier shales, which are primarily located in Shelby, Harrison, Panola, San Augustine and Nacogdoches Counties in Texas and DeSoto and Caddo Parishes in Louisiana. Our acreage in this region is predominantly held-by-production. The Haynesville shale is located at depths of 12,000 to 14,500 feet and is being developed with horizontal wells that typically have 4,500 to 10,000 foot laterals. The lateral lengths of future wells to be drilled in this region are dependent on factors including our acreage position and nearby existing wells. The Bossier shale lies just above certain portions of the Haynesville shale and also contains rich deposits of natural gas. The geographic position of our properties in the Haynesville and Bossier shales provides us access to nearby markets with favorable natural gas price indices compared to the rest of the country.

North Louisiana

Our position in the Holly area of North Louisiana consists of 30,70030,800 net acres in DeSoto Parish and 12,80011,700 net acres in Caddo Parish, which are predominantly held-by-production. At December 31, 2017,2018, we had a total of 425434 gross (232.9(236.5 net) operated wells flowing to sales. Our development activities in North Louisiana during 2017 featured a modified Haynesville shale well design, which included2018 primarily focused on the usecompletion of approximately 3,500 pounds of proppant per lateral foot and lateral lengths ranging from 4,500 to 10,000 feet. We drilled 2913 gross (17.9(7.4 net) operated wells drilled in prior year and turned-to-sales 12drilling of 6 gross (8.4(3.6 net) operated wells in the Haynesville shale during 2017. As of December 31, 2017, we had 17 gross (9.3 net) wells that were drilled and waiting on completion or in various stages of the completion process.wells. Including non-operated volumes, our average natural gas production was approximately 175163 net Mmcfe per day during December 2017.

2018. During March 2018, the Court approved the rejection of certain executory contracts related to the sale, marketing and transportation of natural gas in the North Louisiana region. During November 2018, the Court approved an agreement to settle any claims related to a minimum volume commitment for the gathering of natural gas production in the East Texas and North Louisiana regions. The rejection and settlement of these agreements resulted in a significant improvement in our realized natural gas price differentials, gathering expenses, and transportation expenses. We plan to drill 1 gross (0.7(0.6 net) operated well in the Haynesville shale during the first quarter of 2018. We plan to2019 and complete 11 gross (6.7(6.2 net) operated wells in the Haynesville shale during the first quarterthree quarters of 2018, which consists of2019. In addition, we plan to perform refracs on 3 gross (1.5 net) wells drilled in prior year. Asutilizing an improved design that includes a result, we will have 7 gross (3.3 net) operated wells in the Haynesville shale that will be waiting on completion at the end of the first quarter of 2018. Due to capital constraints, these wells are not expected to be completed until 2019.cemented liner and increased proppant volumes.

East Texas

Our operations in East Texas are focused on the Haynesville and Bossier shales. Our acreage is primarily located in Harrison, Panola, Shelby, San Augustine and Nacogdoches Counties in Texas and is predominantly held-by-production. The Haynesville and Bossier shales in East Texas are being developed with horizontal wells that typically have 6,000 to 7,500 foot laterals. Our position in the Shelby area of East Texas primarily consists of 31,40030,400 net acres and includes approximately 9,8009,700 net acres subject to continuous drilling obligations. We plan to drill, or participate with another operator in drilling, on the acreage subject to the continuous drilling obligation in the future to hold the acreage. Excluding the acreage subject to the continuous drilling obligation, approximately 91%96% of our net acres are held-by-production in the Shelby area.

As of December 31, 2017,2018, we had a total of 104102 gross (47.0(45.9 net) operated wells flowing to sales. Our development in this region during 20172018 was limited to the participation in certain non-operated wells. Including non-operated volumes, our average natural gas production was approximately 3624 net Mmcfe per day during December 2017.

2018. Our plans for 20182019 include the participation in non-operated wells that will satisfy our continuous drilling obligation in the southern portion of the region. In addition, we plan to participate in certain non-operated wells to evaluate the potential for modifications toappraise our spacingposition in Harrison and extentPanola Counties. Our position in Harrison and Panola Counties consists of development in the Haynesville and Bossier shales.5,400 net acres.

South Texas

Our position in this region includes approximately 49,70048,500 net acres, of which approximately 93%95% are held-by-production. Our South Texas acreage covers portions of Zavala, Dimmit and Frio Counties. Our acreage in the Eagle Ford shale is in the oil window and averages 375 feet in gross thickness at true vertical depths ranging from 5,400 to 6,800 feet. Our lateral lengths range from 5,000 to 10,000 feet and the total measured depth averages 14,600 feet. Our acreage in the area also includes additional upside in formations such as the Austin Chalk, Buda, Georgetown and Pearsall formations.

As of December 31, 2017,2018, we had a total of 225236 gross (97.6(107.9 net) operated horizontal wells flowing to sales. Including non-operated volumes, our average oil production in South Texas was approximately 3,0004,700 net barrels of oil equivalent per day during December 2017. We entered into an agreement2018. Our ability to divest our assets in South Texas during 2017; however,transport or sell the sale was not consummatednatural gas from this region has been limited since we were not able to satisfy certain closing conditions due to the alleged termination of a long-term natural gas sales contract that was requiredby the primary purchaser of our natural gas in May 2017. As a result, we commenced flaring natural gas in January 2018. We are evaluating operational and commercial solutions for the natural gas production in order to be in full force and effect asavoid significant curtailments of our oil production. See further discussion of the closing date. We did not allocate development capitalrisks related to our ability to sell or transport natural gas from this region during 2017 in anticipation of the potential sale. In late 2017, we initiated a limited"Item 1A. Risk Factors". Our development program thatduring 2018 focused on the Eagle Ford shale, which included drilling 214 gross (1.6(11.3 net) operated wells and plan to continue development in this region during 2018.

completing 16 gross (12.9 net) operated wells. We plan to drill 1026 gross (8.0(8.5 net) and turn-to-sales 1223 gross (9.6(7.4 net) operated wells in the Eagle Ford shale during 2018. Our2019. In addition, our plans for 2019 include the construction of an electrical distribution network over the core development program in this region is designedarea that will provide a more efficient cost structure to preserveoperate the value of certain acreage with leasehold obligations, primarily due to lease expirations, continuous drilling obligations and offset well obligations. The development is primarily focused on Zavala and Frio Counties.field.

Appalachia

Our operations in the Appalachia region have primarily included testing and selectively developing the Marcellus shale with horizontal drilling. As of December 31, 2017,2018, we held approximately 177,700339,800 net acres in the Appalachia region, including approximately 125,600234,800 net acres prospective for the Marcellus shale and approximately 40,00069,000 net acres prospective for the dry gas window of the Utica shale in Pennsylvania. Drilling, completion and production activities in Pennsylvania target the Marcellus shale as well as deeper formations including the Utica shale at depths ranging from 5,000 to more than 12,000 feet. Approximately 92% of our acreage is held-by-production, which allows us to control the timing of the development of this region.

As of December 31, 2017, we operated a total of 115 gross (41.0 net) horizontal wells in the Marcellus shale. We did not allocate development capital to this region during 2017. Including non-operated volumes, our production in the Appalachia region was approximately 26 net Mmcfe per day during December 2017. In recent years, we have limited our development of the Marcellus shale due to wide regional natural gas price differentials. These differentials continue to be volatile; however, the differentials in the region have the potential to be favorably impacted by the expansion of infrastructure and other sources of demand for natural gas in the Northeast region in future years. We have an extensive inventory of undeveloped locations prospective for the Marcellus and Utica shales that has potential to provide attractive rates of return in an improved commodity price environment. Our plans for 2018 are limited to turning-to-sales 1 gross (0.5 net) well in Sullivan County, Pennsylvania that was drilled in prior years. We do not have any producing wells in the dry gas window of the Utica shale; however, we are currently assessing the potential of the formation to determine the extent of future development.

On February 27, 2018, we closed a settlement agreement with a subsidiary of Shell to resolve arbitration regarding our right to participate in an area of mutual interest in the Appalachia region. The settlement increased our acreage in the Appalachia region by approximately 177,700 net acres, and the production from the additional interests in producing wells acquired was 26 net Mmcfe per day during December 2017. See further discussion of this settlement as part of "Note 17. Subsequent3. Acquisitions, divestitures and other significant events" in the Notes to our Consolidated Financial Statements. Drilling, completion and production activities in Pennsylvania target the Marcellus shale as well as deeper formations including the Utica shale at depths ranging from 5,000 to more than 12,000 feet. Approximately 98% of our acreage is held-by-production, which allows us to control the timing of the development of this region.

As of December 31, 2018, we operated a total of 116 gross (83.3 net) horizontal wells in the Marcellus shale. During 2018, we turned-to-sales 1 gross (0.9 net) operated Marcellus shale well in Northeast Pennsylvania that was previously awaiting the connection of a pipeline. Including non-operated volumes, our production in the Appalachia region was approximately 51 net Mmcfe per day during December 2018. In recent years, we have limited our development of the Marcellus shale due to wide regional natural gas price differentials. These differentials continue to be volatile; however, the differentials in the region narrowed during 2018 and have the potential to be favorably impacted by the expansion of infrastructure and other sources of demand for natural gas in the Northeast region in future years. We have an extensive inventory of undeveloped locations prospective for the Marcellus and Utica shales that has potential to provide attractive rates

of return through enhanced completion designs and an improved commodity price environment. Our plans for 2019 include drilling and turning-to-sales 2 gross (1.9 net) operated Marcellus shale wells in Northeast Pennsylvania. These wells will feature an enhanced completion design that includes increased proppant volumes and tighter cluster spacing, which has proven to be effective on recent wells in the region. We do not have any producing wells in the dry gas window of the Utica shale; however, we are currently assessing the potential of the formation to determine the extent of future development. Our plans for 2019 include drilling and turning-to-sales 1 gross (1.0 net) operated appraisal well targeting the dry gas window of the Utica shale in Central Pennsylvania.

Our hydraulic fracturing activities

Oil and natural gas may be recovered from our properties through the use of sophisticated drilling and hydraulic fracturing techniques. Hydraulic fracturing involves the injection of water, sand, gel and chemicals under pressure into formations to fracture the surrounding rock and stimulate production. Our hydraulic fracturing activities are primarily focused in the Eagle Ford shale in South Texas, Haynesville and Bossier shales in East Texas and North Louisiana and Marcellus shale in the Appalachia region. Predominantly all of our Proved Reserves are associated with shale assets in these areas.

Although the cost of each well will vary, the costs associated with the hydraulic fracturing portion of the well on average represent the following percentages of the total costs of drilling and completing a well: 35-40%40-50% in the Haynesville and Bossier shale formation; 30-40%45-55% in the Eagle Ford shale formation; and 25-35%35-45% in the Marcellus shale formation. These costs may increase in future periods as a result of higher levels of proppant utilized in the completion of our shale wells.

We review best practices and industry standards to comply with regulatory requirements in the protection of potable water sources when drilling and completing our wells. Protective practices include, but are not limited to, setting multiple strings of protection pipe across potable water sources and cementing these pipe strings to surface, continuously monitoring the hydraulic fracturing process in real time and disposing of non-recycled produced fluids in authorized disposal wells at depths below the potable water sources. In addition, we actively seek methods to minimize the environmental impact of our hydraulic fracturing operations in all of our operating areas.

For more information on the risks of hydraulic fracturing, see “Item 1A. Risk Factors - Our business exposes us to liability and extensive regulation on environmental matters, which could result in substantial expenditures”expenditures” and “Item 1A. Risk Factors - Federal, state and local legislation and regulatory initiatives relating to hydraulic fracturing could result in increased costs and additional operating restrictions or delays"delays".

Marketing arrangements

We produce oil and natural gas. We do not refine or process the oil or natural gas we produce. We sell the majority of the oil we produce under contracts using market sensitive pricing. The majority of our oil contracts are based on NYMEX pricing, which is typically calculated as the average of the daily closing prices of oil to be delivered one month in the future. We also sell a portion of our oil at F.O.B. field prices posted by the principal purchaser of oil where our producing properties are located. Our sales contracts are of a type common within the industry, and we usually negotiate a separate contract for each area. Generally, we sell our oil to purchasers and refiners near the areas of our producing properties.

We sell the majority of our natural gas under individually negotiated gas purchase contracts using market sensitive pricing. Our sales contracts vary in length from spot market sales of a single day to term agreements that may extend up to a year. Our natural gas customers primarily include natural gas marketing companies. The natural gas purchase contracts define the terms and conditions unique to each of these sales. The price received for natural gas sold on the spot market varies daily, reflecting changing market conditions.

We may be unable to market all of the oil or natural gas we produce. If our oil and natural gas cannot be marketed, we may be unable to negotiate favorable pricing and contractual terms. Changes in oil or natural gas prices may significantly affect our revenues, cash flows, the value of our oil and natural gas properties and the estimates of recoverable oil and natural gas reserves. Further, significant declines in the prices of oil or natural gas may have a material adverse effect on our business and on our financial condition.

We engage in oil and natural gas production activities in geographic regions where, from time to time, the supply of oil or natural gas available for delivery exceeds the demand. If this occurs, companies purchasing oil or natural gas in these areas may reduce the amount of oil or natural gas that they purchase from us. If we cannot locate other buyers for our production or for any of our oil or natural gas reserves, we may shut-in our oil or natural gas wells for certain periods of time. Furthermore, we may shut-in our oil and natural gas wells if regional market prices decrease to a level that is uneconomical to produce. If

this occurs, we may incur additional payment obligations under our oil and natural gas leases and, under certain circumstances, the oil and natural gas leases might be terminated. Economic conditions, particularly depressed oil and natural gas prices, may negatively impact the liquidity and creditworthiness of our purchasers and may expose us to risk with respect to the ability to collect payments for the oil and natural gas we deliver.

Raider Marketing, LP ("Raider") is a wholly owned subsidiary of EXCO and is the contractual counterparty by operation of Texas law to all of EXCO's gathering, transportation and marketing contracts in Texas and Louisiana. Raider purchases and resells natural gas from third-party producers as well as oil and natural gas from operated wells in Texas and Louisiana, and charges a fee for marketing services to certain working interest owners in the related wells.

The availability of a ready market and the prices for oil and natural gas are dependent upon a number of factors that are beyond our control. These factors include, among other things:

supply and demand for oil and natural gas and expectations regarding supply and demand;

the level of domestic and international production;

the availability of imported oil and natural gas;

federal regulations applicable to the export of, and construction of export facilities for, oil and natural gas;

political and economic conditions and events in foreign oil and natural gas producing nations, including embargoes, sanctions, continued hostilities in the Middle East and other sustained military campaigns, and acts of terrorism or sabotage;

the ability of members of the Organization of Petroleum Exporting Countries to agree to and maintain oil price and production controls;

domestic and international government regulation, legislation and policies, including levying tariffs on oil and natural gas imports;

the cost and availability of transportation and pipeline systems with adequate capacity;

the cost and availability of other competitive fuels;

fluctuating and seasonal demand for oil, natural gas and refined products;

concerns about global warming or other conservation initiatives and the extent of governmental price controls and regulation of production;

regional price differentials and quality differentials of oil and natural gas;

the availability of refining capacity;

technological advances affecting oil and natural gas production and consumption;

weather conditions and natural disasters;

foreign and domestic government relations; and

overall domestic and global economic conditions.

Accordingly, in light of the many uncertainties affecting the supply and demand for oil, natural gas and refined petroleum products, we cannot accurately predict the prices or marketability of oil and natural gas from any producing well in which we have or may acquire an interest.

Our oil and natural gas reserves

Our Proved Reserves as of December 31, 20172018 were approximately 566.9660.6 Bcfe, of which approximately 68%52% were located in the Haynesville/Bossier shales, 20%34% in the Marcellus shale and 12%14% in the Eagle Ford shale.

The following table summarizes our Proved Reserves as of December 31, 2018, 2017 2016 and 2015.2016. This information was prepared in accordance with the rules and regulations of the SEC. The comparability of our reserves is impacted by commodity prices, purchases and sales of reserves in place, production, revisions of previous estimates, changes in our development plans, and discoveries and extensions. See "Management's discussion and analysis of oil and natural gas reserves" for a summary of the changes in our Proved Reserves.

| | | | | As of December 31, | | As of December 31, |

| | | 2017 (3) | | 2016 (3) | | 2015 | | 2018 (3) | | 2017 (3) | | 2016 (3) |

| Oil (Mbbls) | | | | | | | | | | | | |

| Developed | | 9,412 |

| | 10,168 |

| | 12,056 |

| | 13,302 |

| | 9,412 |

| | 10,168 |

|

| Undeveloped | | — |

| | — |

| | 8,383 |

| | — |

| | — |

| | — |

|

| Total | | 9,412 |

| | 10,168 |

| | 20,439 |

| | 13,302 |

| | 9,412 |

| | 10,168 |

|

| | | | | | | | | | | | | |

| Natural gas (Mmcf) | | | | | | | | | | | | |

| Developed | | 510,451 |

| | 415,719 |

| | 364,932 |

| | 580,781 |

| | 510,451 |

| | 415,719 |

|

| Undeveloped | | — |

| | — |

| | 419,742 |

| | — |

| | — |

| | — |

|

| Total | | 510,451 |

| | 415,719 |

| | 784,674 |

| | 580,781 |

| | 510,451 |

| | 415,719 |

|

| | | | | | | | | | | | | |

| Equivalent reserves (Mmcfe) | | | | | | | | | | | | |

| Developed | | 566,924 |

| | 476,727 |

| | 437,268 |

| | 660,590 |

| | 566,924 |

| | 476,727 |

|

| Undeveloped | | — |

| | — |

| | 470,040 |

| | — |

| | — |

| | — |

|

| Total | | 566,924 |

| | 476,727 |

| | 907,308 |

| | 660,590 |

| | 566,924 |

| | 476,727 |

|

| | | | | | | | | | | | | |

| PV-10 (in millions) (1) | | | | | | | | | | | | |

| Developed | | $ | 482.7 |

| | $ | 310.9 |

| | $ | 359.4 |

| | $ | 757.4 |

| | $ | 482.7 |

| | $ | 310.9 |

|

| Undeveloped | | — |

| | — |

| | 42.7 |

| | — |

| | — |

| | — |

|

| Total | | $ | 482.7 |

| | $ | 310.9 |

| | $ | 402.1 |

| | $ | 757.4 |

| | $ | 482.7 |

| | $ | 310.9 |

|

| | | | | | | | | | | | | |

| Standardized Measure (in millions) (2) | | $ | 482.7 |

| | $ | 310.9 |

| | $ | 402.1 |

| | $ | 757.4 |

| | $ | 482.7 |

| | $ | 310.9 |

|

| |

| (1) | The PV-10 is based on the following average spot prices, in each case adjusted for historical differentials. Prices presented on the table below are the trailing 12 month simple average spot price at the first of the month for natural gas at Henry Hub and West Texas Intermediate ("WTI") crude oil at Cushing, Oklahoma. |

| | | | | Average spot prices | | Average spot prices |

| | Oil (per Bbl) | | Natural gas (per Mmbtu) | | Oil (per Bbl) | | Natural gas (per Mmbtu) |

| December 31, 2018 | | | $ | 65.56 |

| | $ | 3.10 |

|

| December 31, 2017 | | $ | 51.34 |

| | $ | 2.98 |

| | 51.34 |

| | 2.98 |

|

| December 31, 2016 | | 42.75 |

| | 2.48 |

| | 42.75 |

| | 2.48 |

|

| December 31, 2015 | | 50.28 |

| | 2.59 |

| |

| |

| (2) | There is no difference in Standardized Measure and PV-10 for all years presented as our tax basis in the associated properties exceeded the pre-tax cash inflows. We believe that PV-10, while not a financial measure in accordance with GAAP, is an important financial measure used by investors and independent oil and natural gas producers for evaluating the relative significance of oil and natural gas properties and acquisitions due to tax characteristics, which can differ significantly among comparable companies. The Standardized Measure represents the PV-10 after giving effect to income taxes, and is calculated in accordance with ASC 932. |

| |

| (3) | All of our undeveloped locations that meet the technical definition of Proved Undeveloped Reserves were reclassified to unproved reserves during 2016 due to the uncertainty regarding the financing required to develop these reserves. These reserves remainedbased on engineering guidelines remain classified as unproved due to our inability to meet the Reasonable Certainty criteria for recording Proved Undeveloped Reserves, as prescribed under the SEC requirements, asbecause the uncertainty regarding our availability of capital required to develop these reserves still existed at December 31, 2018, 2017 and 2016. We have a significant amount of reserves that would meet the criteria to be classified as Proved Undeveloped Reserves if we were able to demonstrate the financial capability to execute a development plan. |

Management has established, and is responsible for, internal controls designed to provide reasonable assurance that the estimates of Proved Reserves are computed and reported in accordance with rules and regulations promulgated by the SEC as well as established industry practices used by independent engineering firms and our peers. These internal controls include documented process workflows and qualified professional engineering and geological personnel with specific reservoir experience. Our internal processes and controls surrounding this process are routinely tested. We also retain outside independent engineering firms to prepare estimates of our Proved Reserves. Senior management reviews and approves our reserve estimates, whether prepared internally or by third parties. Our Strategic Development and Reserves DirectorChief Operating Officer oversaw our outside independent engineering firms, Netherland, Sewell & Associates, Inc. ("NSAI"), and Ryder Scott Company, L.P. ("Ryder Scott") in connection with the preparation of their estimates of our Proved Reserves as of December 31, 2017.2018. We also regularly communicate with our outside independent engineering firms throughout the year regarding technical and operational matters critical to our reserve estimations. Our Strategic Development and Reserves Director has over 13 years of experience in the oil and natural gas industry with a focus on reserves valuation. He is a graduate of the University of Oklahoma with dual degrees in Energy Management and Finance. In addition, he is an active participant in industry reserves seminars and professional industry groups. Our Chief Operating Officer, and our Strategic Development and Reserves Director, with input from other members of senior management, areis responsible for the selection of our third-party engineering firms and review of the reports generated by such firms. Our Chief Operating Officer has over 2627 years of experience in the oil and natural gas industry and is a graduate of Texas Tech University with a degree in Petroleum Engineering. During his career, he has had multiple responsibilities in technical or leadership roles including asset management, drilling and completions, production engineering, reservoir engineering and reserves management, economic evaluations and field development in U.S. onshore and international projects. The third-party engineering reports are also provided to the Audit Committee.

Our estimated Proved Reserves and future net cash flows for our shale properties in all regions except South Texas were prepared by NSAI as of December 31, 2017, 20162018 and 2015.2017. Our estimated Proved Reserves and future net cash flows for our shale properties in the South Texas region were prepared by Ryder Scott as of December 31, 2017, 20162018 and 2015. During 2016, we sold substantially all of our remaining non-shale properties. The estimates of Proved Reserves and future net cash flows for our non-shale properties as of December 31, 2015 were prepared by Lee Keeling and Associates, Inc. ("Lee Keeling").2017. Differences may exist between reserve quantities and values as presented in this Form 10-K and the reports of third party engineering firms filed herewith due to the exclusion of certain properties from the reports of third party engineering firms and immaterial differences in the calculations performed by the reserves evaluation software utilized by management and the third party engineering firms for estimating reserves and values.

NSAI and Ryder Scott and Lee Keeling are independent petroleum engineering firms that perform a variety of reserve engineering and valuation assessments for public and private companies, financial institutions and institutional investors. NSAI and Ryder Scott and Lee Keeling have performed these services for over 50 years. Our internal technical employees responsible for reserve estimates and interaction with our independent engineers include employees and corporate officers with petroleum and other engineering degrees and relevant industry experience.

Estimates of oil and natural gas reserves are projections based on a process involving an independent third party engineering firm's communication with EXCO's engineers and geologists, the collection of any and all required geological, geophysical, engineering and economic data, and such firm's complete external preparation of all required estimates and are forward-looking in nature. These reports rely on various assumptions, including definitions and economic assumptions required by the SEC, including the use of constant oil and natural gas pricing, use of current and constant operating costs and capital costs. We also make assumptions relating to availability of funds and timing of capital expenditures for development of our Proved Undeveloped Reserves. These reports should not be construed as the current market value of our Proved Reserves. The process of estimating oil and natural gas reserves is also dependent on geological, engineering and economic data for each reservoir. Because of the uncertainties inherent in the interpretation of this data, we cannot ensure that the Proved Reserves will ultimately be realized. Our actual results could differ materially. See “Note 16. Supplemental information relating to oil and natural gas producing activities (unaudited)” in the Notes to our Consolidated Financial Statements for additional information regarding our oil and natural gas reserves and the Standardized Measure.

NSAI and Ryder Scott and Lee Keeling also examined our estimates with respect to reserve categorization, using the definitions for Proved Reserves set forth in SEC Regulation S-X Rule 4-10(a) and SEC staff interpretations and guidance. In preparing an estimate of our Proved Reserves and future net cash flows attributable to our interests, NSAI and Ryder Scott and Lee Keeling did not independently verify the accuracy and completeness of information and data furnished by us with respect to ownership interests, oil and natural gas production, well test data, historical costs of operation and development, product prices, or any agreements relating to current and future operations of the properties and sales of production. However, if in the course of the examination anything came to the attention of NSAI or Ryder Scott, or Lee Keeling, which brought into question the validity or sufficiency of any such information or data, NSAI or Ryder Scott or Lee Keeling did not rely on such information or

data until they had satisfactorily resolved their questions relating thereto or had independently verified such information or data. NSAI and Ryder Scott and Lee Keeling determined that their estimates of Proved Reserves conform to the guidelines of the SEC, including the criteria of Reasonable Certainty, as it pertains to expectations about the recoverability of Proved Reserves in future years, under existing economic and operating conditions, consistent with the definition in Rule 4-10(a)(24) of SEC Regulation S-X.

Management's discussion and analysis of oil and natural gas reserves

The following discussion and analysis of our proved oil and natural gas reserves and changes in our Proved Reserves is intended to provide additional guidance on the operational activities, transactions, economic and other factors which significantly impacted our estimate of Proved Reserves as of December 31, 20172018 and changes in our Proved Reserves during 2017.2018. This discussion and analysis should be read in conjunction with “Note 16. Supplemental information relating to oil and natural gas producing activities (unaudited)” in the Notes to our Consolidated Financial Statements, and in “Item 1A. Risk Factors” addressing the uncertainties inherent in the estimation of oil and natural gas reserves elsewhere in this Annual Report on Form 10-K. The following table summarizes the changes in our Proved Reserves from January 1, 20172018 to December 31, 2017.2018.

| | | | | Oil (Mbbls) | | Natural gas (Mmcf) | | Equivalent natural gas (Mmcfe) | | Oil (Mbbls) | | Natural gas (Mmcf) | | Equivalent natural gas (Mmcfe) |

| Proved Developed Reserves | | 9,412 |

| | 510,451 |

| | 566,924 |

| | 13,302 |

| | 580,781 |

| | 660,590 |

|

| Proved Undeveloped Reserves | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Total Proved Reserves | | 9,412 |

| | 510,451 |

| | 566,924 |

| | 13,302 |

| | 580,781 |

| | 660,590 |

|

| The changes in reserves for the year are as follows: | | | | | | | | | | | | |

| January 1, 2017 | | 10,168 |

| | 415,719 |

| | 476,727 |

| |

| January 1, 2018 | | | 9,412 |

| | 510,451 |

| | 566,924 |

|

| Purchases of reserves in place | | — |

| | 50,456 |

| | 50,456 |

| | — |

| | 118,415 |

| | 118,415 |

|

| Discoveries and extensions | | 13 |

| | 21,880 |

| | 21,958 |

| | 1,387 |

| | 22,482 |

| | 30,804 |

|

| Revisions of previous estimates: | | | | | | | | | | | | |

| Changes in price | | 679 |

| | 30,200 |

| | 34,274 |

| | 690 |

| | 5,726 |

| | 9,866 |

|

| Other factors | | (290 | ) | | 72,332 |

| | 70,593 |

| |

| Performance and other factors | | | 3,170 |

| | 22,486 |

| | 41,502 |

|

| Sales of reserves in place | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Production | | (1,158 | ) | | (80,136 | ) | | (87,084 | ) | | (1,357 | ) | | (98,779 | ) | | (106,921 | ) |

| December 31, 2017 | | 9,412 |

| | 510,451 |

| | 566,924 |

| |

| December 31, 2018 | | | 13,302 |

| | 580,781 |

| | 660,590 |

|

Purchases of reserves in place

PurchasesThe 118.4 Bcfe of purchases of reserves in place primarilyfor natural gas related to theour acquisition of incremental interests in certain oil and natural gas properties that we operate and undeveloped acreage in the North Louisiana region. The acquisitions increased Proved Reserves by 50.5 Bcfe during for the year ended December 31, 2017. Our Proved Reserves will increase in the future as a result of the Appalachia JV Settlement that closed on February 27, 2018. The Proved Reserves related toacquired in the Appalachia JV Settlement were approximately 114.2 Bcfe aspredominantly consists of December 31, 2017.proved producing properties in the Marcellus shale.

Discoveries and extensions

Proved Reserve additions from discoveries and extensions were 22.030.8 Bcfe for the year ended December 31, 2017,2018, primarily due to the development of operated wells in the Eagle Ford shale and non-operated wells in the Haynesville and Bossier shales in North Louisiana.shale.

Revisions of previous estimates

Our revisions of previous estimates included upward revisions to our Proved Reserve quantities of 104.951.4 Bcfe. The increase in commodity prices contributed to 34.39.9 Bcfe of the upward revisions, which extended the economic life of certain producing properties when using prices prescribed by the SEC. This change in price was primarily driven by the increase in the trailing 12 month average of oil and natural gas prices. The trailing 12 month average oil price increased from $42.75 per Bbl for the year ended December 31, 2016 to $51.34 per Bbl for the year ended December 31, 2017 to $65.56 per Bbl for the year ended December 31, 2018 and the trailing 12 month average natural gas price increased from $2.48 per Mmbtu for the year ended December 31, 2016 to $2.98 per Mmbtu for the year ended December 31, 2017.

2017 to $3.10 per Mmbtu for the year ended December 31, 2018.

In addition, our revisions of previous estimates included 70.641.5 Bcfe due to performance and other factors. The revisions were primarily due to the reclassification of wells to Proved Reserves during 20172018 that were previously reclassified to unproved reserves in prior years due to capital constraints. These reclassifications primarily related to conversions of wells to Proved Developed Reserves as a result of our development activities in the North Louisiana region.and South Texas regions.

Oil and natural gas production

Total oil and natural gas production in 20172018 was 87.1106.9 Bcfe, which included approximately 3.52.8 Bcfe in production from extensions and discoveries that were not reflected in our Proved Reserves at January 1, 2017.2018.

Proved Undeveloped Reserves

All of our undeveloped locations that meet the technical definition of Proved Undeveloped Reserves were reclassified to unproved reserves during 2016 due to the uncertainty regarding the financing required to develop these reserves. These reserves remainedbased on engineering guidelines are classified as unproved due to our inability to meet the Reasonable Certainty criteria for recording Proved Undeveloped Reserves, as prescribed under the SEC requirements, asbecause the uncertainty regarding our availability of capital required to develop these reserves still existed at December 31, 2017 and 2016.2018. During 2017,2018, we converted certain unproved reserves to Proved Developed Reserves as a result of our drilling and completion activities. However, we did not report any changes in our Proved Undeveloped Reserves for the year ended December 31, 2017.2018. We have a significant amount of reserves that would meet the criteria to be classified as Proved Undeveloped Reserves if we were able to demonstrate the financial capability to execute a development plan.

Impacts of changes in reserves on depletion rate and statements of operations in 20172018

Our depletion rate decreasedincreased to $0.57$0.74 per Mcfe in 20172018 from $0.71$0.57 per Mcfe in 2016.2017. The decreaseincrease was primarily due to the increaseadditional costs associated with our development of the South Texas and North Louisiana regions. In particular, the development of oil producing assets in South Texas results in a higher depletion rate when calculated on per Mcfe basis compared to the rest of our Proved Reserves during 2017.properties.

Our production, prices and expenses

The following table summarizes revenues, net production, average sales price per unit and costs and expenses associated with the production of oil and natural gas. Certain reclassifications have been made to prior period information to conform to current period presentation.

| | | | | Year Ended December 31, | | Year Ended December 31, |

| (in thousands, except production and per unit amounts) | | 2017 | | 2016 | | 2015 | | 2018 | | 2017 | | 2016 |

| Revenues, production and prices: | | | | | | | | | | | | |

| Oil: | | | | | | | | | | | | |

| Revenue | | $ | 57,693 |

| | $ | 67,317 |

| | $ | 102,787 |

| | $ | 90,614 |

| | $ | 57,693 |

| | $ | 67,317 |

|

| Production sold (Mbbls) | | 1,158 |

| | 1,769 |

| | 2,342 |

| | 1,357 |

| | 1,158 |

| | 1,769 |

|

| Average sales price per Bbl | | $ | 49.82 |

| | $ | 38.05 |

| | $ | 43.89 |

| | $ | 66.78 |

| | $ | 49.82 |

| | $ | 38.05 |

|

| Natural gas: | | | | | | | | | | | | |

| Revenue | | $ | 201,137 |

| | $ | 181,332 |

| | $ | 226,471 |

| | $ | 281,977 |

| | $ | 201,137 |

| | $ | 181,332 |

|

| Production sold (Mmcf) | | 80,136 |

| | 93,829 |

| | 109,926 |

| | 98,779 |

| | 80,136 |

| | 93,829 |

|

| Average sales price per Mcf | | $ | 2.51 |

| | $ | 1.93 |

| | $ | 2.06 |

| | $ | 2.85 |

| | $ | 2.51 |

| | $ | 1.93 |

|

| Costs and expenses: | | | | | | | | | | | | |

| Oil and natural gas operating costs per Mcfe | | $ | 0.40 |

| | $ | 0.33 |

| | $ | 0.43 |

| | $ | 0.39 |

| | $ | 0.40 |

| | $ | 0.33 |

|

We had two areas that exceeded 15% of our total Proved Reserves as of December 31, 2017.2018. The Holly field in North Louisiana and the Marcellus shale in Appalachia represented approximately 56%43% and 20%34% of our total Proved Reserves, respectively. The following table provides additional information related to our Holly and Marcellus shale areas:

| | | | Year Ended December 31, | Year Ended December 31, |

| | 2017 | | 2016 | | 2015 | 2018 |

| 2017 |

| 2016 |

| Holly area: | | | | | | | | | | |

| Natural gas production sold (Mmcf) | 53,368 |

| | 55,290 |

| | 73,863 |

| 70,104 |

| | 53,368 |

| | 55,290 |

|

| Average price per Mcf | $ | 2.60 |

| | $ | 2.00 |

| | $ | 2.18 |

| $ | 2.94 |

| | $ | 2.60 |

| | $ | 2.00 |

|

| Oil and natural gas operating costs per Mcf | 0.32 |

| | 0.23 |

| | 0.22 |

| 0.29 |

| | 0.32 |

| | 0.23 |

|

| Marcellus shale: | | | | | | | | | | |

| Natural gas production sold (Mmcf) | 9,863 |

| | 10,851 |

| | 12,133 |

| 17,829 |

| | 9,863 |

| | 10,851 |

|

| Average price per Mcf | $ | 2.14 |

| | $ | 1.50 |

| | $ | 1.39 |

| $ | 2.51 |

| | $ | 2.14 |

| | $ | 1.50 |

|

| Oil and natural gas operating costs per Mcf | 0.17 |

| | 0.12 |

| | 0.22 |

| 0.24 |

| | 0.17 |

| | 0.12 |

|

Our interest in productive wells

The following table quantifies information regarding productive wells (wells that are currently producing oil or natural gas or are capable of production), including temporarily shut-in wells. The number of total gross oil and natural gas wells excludes any multiple completions. Gross wells refer to the total number of physical wells in which we hold a working interest, regardless of our percentage interest. A net well is not a physical well, but is a concept that reflects the actual total working interests we hold in all wells. We compute the number of net wells by totaling the percentage interests we hold in all our gross wells.

| | | | | At December 31, 2017 | | At December 31, 2018 |

| | | Gross wells (1) | | Net wells | | Gross wells (1) | | Net wells |

| | | Oil | | Natural gas | | Total | | Oil | | Natural gas | | Total | | Oil | | Natural gas | | Total | | Oil | | Natural gas | | Total |

| Producing region: | | | | | | | | | | | | | | | | | | | | | | | | |

| North Louisiana | | — |

| | 644 |

| | 644 |

| | — |

| | 246.7 |

| | 246.7 |

| | — |

| | 677 |

| | 677 |

| | — |

| | 251.2 |

| | 251.2 |

|

| East Texas | | — |

| | 151 |

| | 151 |

| | — |

| | 51.5 |

| | 51.5 |

| | — |

| | 157 |

| | 157 |

| | — |

| | 50.3 |

| | 50.3 |

|

| South Texas | | 243 |

| | 1 |

| | 244 |

| | 100.3 |

| | 0.1 |

| | 100.4 |

| | 255 |

| | 1 |

| | 256 |

| | 111.3 |

| | 0.1 |

| | 111.4 |

|

| Appalachia and other | | 2 |

| | 140 |

| | 142 |

| | 0.1 |

| | 41.4 |

| | 41.5 |

| | 1 |

| | 156 |

| | 157 |

| | — |

| | 85.5 |

| | 85.5 |

|

| Total | | 245 |

| | 936 |

| | 1,181 |

| | 100.4 |

| | 339.7 |

| | 440.1 |

| | 256 |

| | 991 |

| | 1,247 |

| | 111.3 |

| | 387.1 |

| | 498.4 |

|

| |

| (1) | As of December 31, 2017,2018, we did not hold interests in any wells with multiple completions. |

As of December 31, 2017,2018, we operated 869888 gross (418.4(473.6 net) wells, which represented approximately 91%90% of our Proved Developed Reserves.

Our drilling activities

Our drilling activities are primarily focused on horizontal drilling in shale plays, particularly in the Haynesville, Bossier, Eagle Ford and Marcellus shales. The following tables summarize our approximate gross and net interests in the operated wells we drilled during the periods indicated and refer to the number of wells completed during the period, regardless of when drilling was initiated.

|

| | | | | | | | | | | | | | | | | | |

| | | Development wells |

| | | Gross | | Net |

| | | Productive | | Dry | | Total | | Productive | | Dry | | Total |

| Year ended December 31, 2017 (1) | | 10 |

| | — |

| | 10 |

| | 6.8 |

| | — |

| | 6.8 |

|

| Year ended December 31, 2016 (2) | | 15 |

| | — |

| | 15 |

| | 9.2 |

| | — |

| | 9.2 |

|

| Year ended December 31, 2015 (3) | | 63 |

| | — |

| | 63 |

| | 25.3 |

| | — |

| | 25.3 |

|

| | | Exploratory wells |

| | | Gross | | Net |

| | | Productive | | Dry | | Total | | Productive | | Dry | | Total |

| Year ended December 31, 2017 (1) | | 2 |

| | — |

| | 2 |

| | 1.6 |

| | — |

| | 1.6 |

|

| Year ended December 31, 2016 | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Year ended December 31, 2015 (3) | | 5 |

| | — |

| | 5 |

| | 3.9 |

| | — |

| | 3.9 |

|

|

| | | | | | | | | | | | | | | | | | |

| | | Development wells |

| | | Gross | | Net |

| | | Productive | | Dry | | Total | | Productive | | Dry | | Total |