UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K10-K/A

(Amendment No. 1)

(Mark One)

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL ENDED DECEMBER 31, 20132015

OR

|

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from __________________ to _________________________

Commission File Number 001-33650

NEOSTEM,CALADRIUS BIOSCIENCES, INC.

(Exact name of registrant as specified in its charter)

|

| |

| DELAWARE | 22-2343568 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| | |

420 LEXINGTON AVE, SUITE 350

106 ALLEN ROAD, FOURTH FLOOR BASKING RIDGE, NEW YORK, NEW YORK JERSEY | 1017007920 |

| (Address of principal executive offices) | (zip code) |

Registrant’s telephone number, including area code: 212-584-4180908-842-0100

Securities Registered Pursuant to Section 12(b) of the Act:

|

| | |

| | | |

| Title of Each Class | | Name of Each Exchange On Which Registered |

| Common Stock, par value $0.001 per share | | NasdaqCMThe NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this Chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| |

Large accelerated filer o | Accelerated filer ox |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company xo |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 20132015 (the last business day of the most recently completed second fiscal quarter) was approximately $92.3$94.6 million,, computed by reference to the closing sales price of $5.60$1.87 for the common stock on the NasdaqCMThe NASDAQ Capital Market reported for such date. Shares held by executive officers, directors and persons owning directly or indirectly more than 10% of the outstanding common stock have been excluded from the preceding number because such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

On March 11, 2014, 28,582,62514, 2016, 59,030,599 shares of the registrant's common stock, par value $0.001per0.001 per share, were outstanding.

EXPLANATORY NOTE

The Registrant meets the "accelerated filed" requirements as of the end of its 2013 fiscal year pursuant to Rule 12b-2 of the Securities Exchange Act of 1934, as amended. However, pursuant to Rule 12b-2 and SEC Release No. 33-8876, the Registrant (as a smaller reporting company transitioning to the larger reporting company system based on its public float as of June 30, 2013) is not required to satisfy the larger reporting company requirements until its first quarterly report on Form 10-Q for the 2014 fiscal year and thus is eligible to check the "Smaller Reporting Company" box on the cover of this Form 10-K.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

All references in thisThis Amendment No. 1 on Form 10-K/A (this “Amendment No. 1”) amends the Annual Report on Form 10-K to “we,” “us,” the “Company” and “NeoStem” mean NeoStem, Inc., including subsidiaries and predecessors, except where it is clear that the term refers only to NeoStem, Inc. This Annual Report on Form 10-K contains forward-looking statements, which involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under “Cautionary Note Regarding Forward-Looking Statements” and under “Risk Factors” and elsewhere in this Annual Report on Form 10-K.

Unless otherwise indicated to the contrary, all share numbers and per share prices in this Annual Report on Form 10-K have been retrospectively adjusted, as appropriate, to give effect to the one-for-ten reverse stock split implemented on July 16, 2013.

TABLE OF CONTENTS

|

| | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | |

| | |

| ITEM 1. BUSINESS | |

| ITEM 1A. RISK FACTORS | |

| ITEM 1B. UNRESOLVED STAFF COMMENTS | |

| ITEM 2. PROPERTIES | |

| ITEM 3. LEGAL PROCEEDINGS | |

| ITEM 4. MINE SAFTEY DISCLOSURES | |

| PART II | |

| ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | |

| ITEM 6. SELECTED FINANCIAL DATA | |

| ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

| ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

| ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | |

| ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |

| ITEM 9A. CONTROLS AND PROCEDURES | |

| ITEM 9B. OTHER INFORMATION | |

| PART III | |

| ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | |

| ITEM 11. EXECUTIVE COMPENSATION | |

| ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |

| ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | |

| ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES | |

| PART IV | |

| ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES | |

| | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as well as historical information. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or industry results, to be materially different from anticipated results, performance or achievements expressed or implied by such forward-looking statements. When used in this Annual Report on Form 10-K, statements that are not statements of current or historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “plan,” “intend,” “may,” “will,” “expect,” “believe,” “could,” “anticipate,” “estimate,” or “continue” or similar expressions or other variations or comparable terminology are intended to identify such forward-looking statements, although some forward-looking statements are expressed differently. We remind readers that forward-looking statements are merely predictions and therefore inherently subject to uncertaintities and other factors and involve known and unknown risks that could cause the actual results, performance, levels of activity or our achievements or industry results, to be materially different from any future results, performance levels of activity or our achievements or industry results expressed or implied by such forward-looking statements. Such forward looking statements appear in Item 1- "Business" and Item 7-"Management's Discussion and Analysis of Financial Condition and Results of Operations" as well as elsewhere in this Annual Report. Factors that could cause our actual results to differ materially from anticipated results expressed or implied by forward-looking statements include, among others:

our ability to manage our business despite operating losses and cash outflows;

our ability to obtain sufficient capital or strategic business arrangements to fund our operations and expansion plans, including meeting our financial obligations under various licensing and other strategic arrangements, the funding of our clinical trials for product candidates in our development programs for our CD34 Cell Program and our T Regulatory Cell Program, and the commercialization of the relevant technology;

our ability to build and maintain the management and human resources infrastructure necessary to support the growth of our business;

our ability to integrate our acquired businesses successfully and grow such acquired businesses as anticipated, including expanding our PCT business internationally;

whether a large global market is established for our cellular-based products and services and our ability to capture a meaningful share of this market;

scientific and medical developments beyond our control;

our ability to obtain and maintain, as applicable, appropriate governmental licenses, accreditations or certifications or comply with healthcare laws and regulations or any other adverse effect or limitations caused by government regulation of our business;

whether any of our current or future patent applications result in issued patents, the scope of those patents and our ability to obtain and maintain other rights to technology required or desirable for the conductfiscal year ended December 31, 2015 (the “2015 Annual Report”) of our business;

whether any potential strategic benefits of various licensing transactions will be realized and whether any potential benefits from the acquisition of these licensed technologies will be realized;

the results of our development activities, including the results of our PreSERVE Phase 2 clinical trial of AMR-001 and planned clinical trials; and

our ability to complete our planned clinical trials (or initiate other trials) in accordance with our estimated timelines due to delays associated with enrolling patients due to the novelty of the treatment, the size of the patient population and the need of patients to meet the inclusion criteria of the trial or otherwise.

The factors discussed herein, including those risks described in Item 1A. “Risk Factors” and elsewhere in this Annual Report on Form 10-K and in the Company's other periodic filingsCaladrius Biosciences, Inc. filed with the Securities and Exchange Commission (the “SEC”) whichon March 15, 2016. In this Amendment No. 1, unless the context indicates otherwise, the designations “Caladrius,” the “Company”, “we,” “us” or “our” refer to Caladrius Biosciences, Inc.

This Amendment No. 1 is being filed solely to include the information required by Item 10 - “Directors, Executive Officers and Corporate Governance”, Item 11 - “Executive Compensation”, Item 12 - “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters”, Item 13 - “Certain Relationships and Related Transactions, and Director Independence” and Item 14 - “Principal Accounting Fees and Services” of Part III of Form 10-K. The reference on the cover page of the 2015 Annual Report to the incorporation by reference of portions of our definitive proxy statement into Part III of the 2015 Annual Report is hereby deleted. Items 10, 11, 12, 13 and 14 of Part III of the 2015 Annual Report are available for review at www.sec.gov under “Search for Company Filings” could cause actual resultsamended and developments to be materially different from those expressed or implied by such statements. All forward-looking statements attributable to us are expressly qualifiedrestated in their entirety by these and other factors. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, the Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

ITEM 1. BUSINESS.

OVERVIEW

NeoStem, Inc. (“we,” “NeoStem” or the “Company”) is a leader in the emerging cellular therapy industry. We are pursuing the preservation and enhancement of human health globally through the development of cell based therapeutics that prevent, treat or cure disease by repairing and replacing damaged or aged tissue, cells and organs and restoring their normal function. We believe that cell therapy will play a large role in changing the natural history of diseases as more breakthrough therapies are developed, ultimately lessening the overall burden of disease on patients and their families as well as the economic burden that these diseases impose upon modern society.

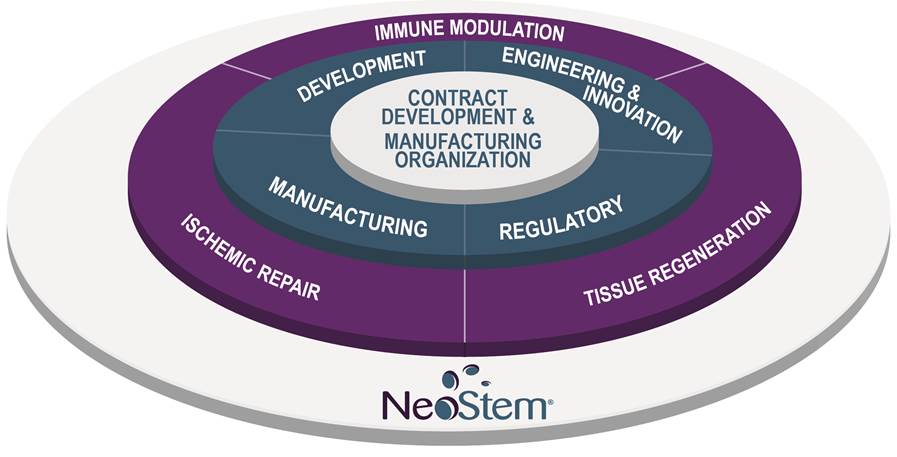

Our business includes the development of novel proprietary cell therapy products as well as a revenue generating contract development and manufacturing service business that we not only leverage for the development of our therapeutics but anticipate will benefit from the advancement in the regenerative medicine industry. The combination of our own therapeutic development business and a revenue-generating service provider business provides the Company with unique capabilities for cost effective in-house product development and immediate revenue and cash flow generation.

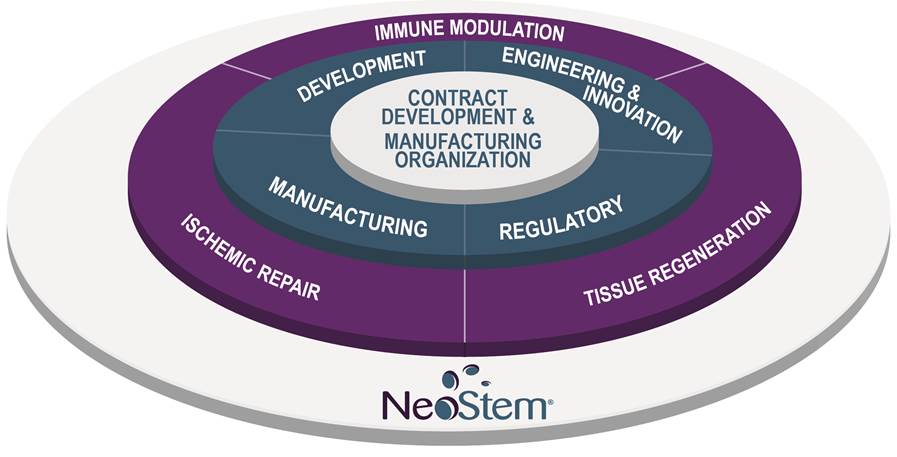

We are developing therapies to address ischemia through our CD34 Cell Program. Ischemia occurs when the supply of oxygenated blood in the body is restricted. We seek to reverse this restriction through the development and formation of new blood vessels. AMR-001 is our most clinically advanced product candidate in our CD34 Cell Program and is being developed to treat damaged heart muscle following an acute myocardial infarction (heart attack) ("AMI"). In December 2013, the Company completed enrollment in its PreSERVE AMI study. PreSERVE AMI is a randomized, double-blinded, placebo-controlled Phase 2 clinical trial testing AMR-001, an autologous (donor and recipient are the same) adult stem cell product for the treatment of patients with left ventricular dysfunction following acute ST segment elevation myocardial infarction (STEMI). With infusion of the target population of 160 patients complete, the last patient primary endpoint follow-up for this study is expected in June 2014 followed by data lock and analysis with a submission for a possible presentation of the study at the American Heart Association's Scientific Sessions to be held November 15-19, 2014. If approved by Food and Drug Administration (the "FDA ") and/or other worldwide regulatory agencies following successful completion of further trials, AMR-001 would address a significant medical need for which there is currently no effective treatment, potentially improving longevity and quality of life for those suffering a STEMI, and positioning the Company to capture a meaningful share of this worldwide market. We also expect to initiate a Phase 2 clinical trial for chronic heart failure in Europe in 2014 and are conducting preclinical studies in traumatic brain injury for which we expect data in the second half of 2014.

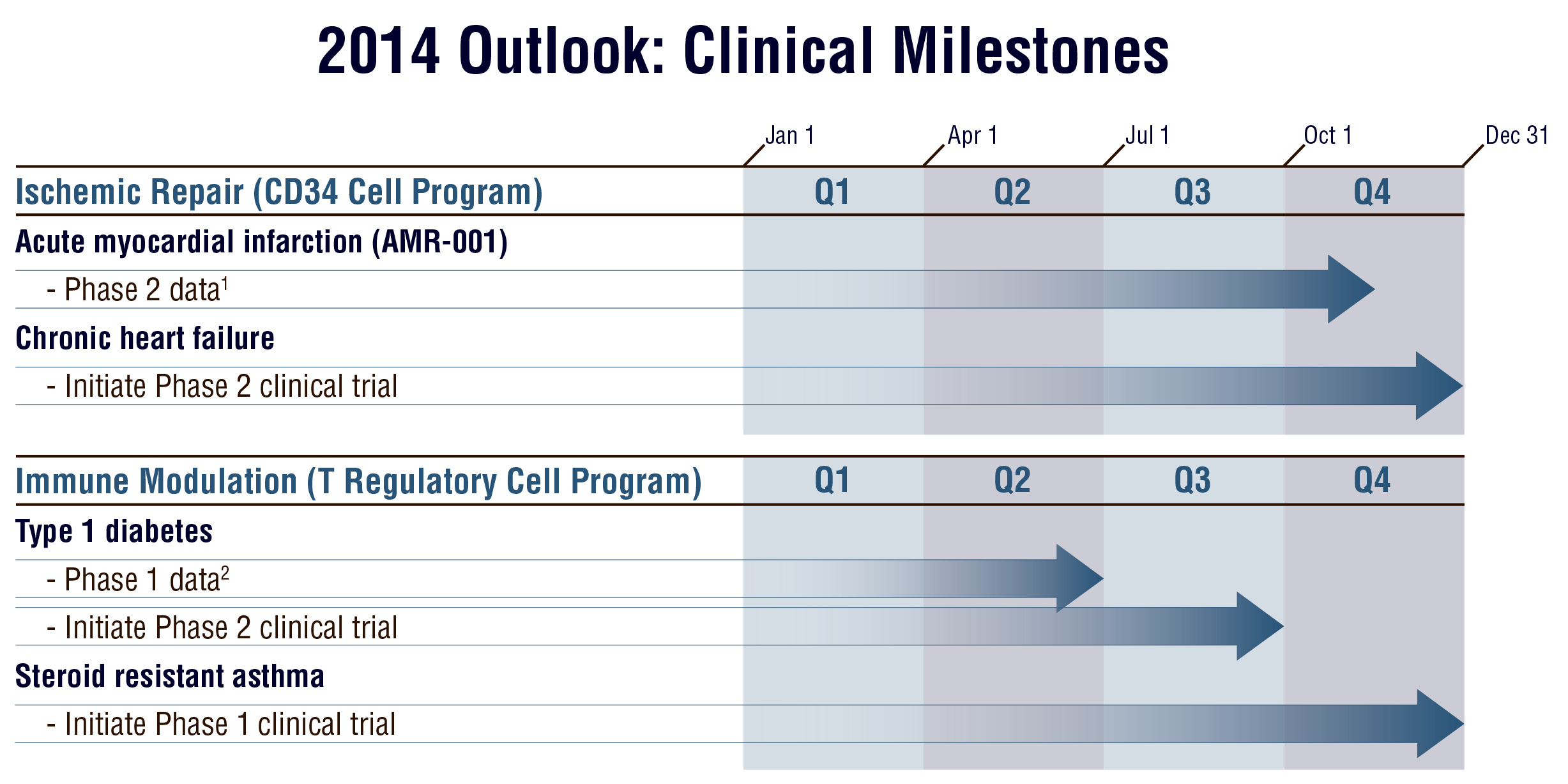

Another platform technology we are developing utilizes T Regulatory Cells ("Tregs") to treat diseases caused by imbalances in the immune system. In collaborating with Becton-Dickinson and the University of California, San Francisco, we are utilizing this technology platform of our majority-owned subsidiary, Athelos Corporation ("Athelos"), to restore immune balance by enhancing Treg cell number and function. Tregs are a natural part of the human immune system and regulate the activity of T effector cells, the cells that are responsible for protecting the body from viruses and other foreign antigen exposure. When Tregs function properly, only foreign materials are attacked by T effector cells. In autoimmune disease it is thought that deficient Treg activity permits the T effector cells to attack the body's own tissues. We plan to initiate a Phase 2 study of Treg based therapeutics to treat type 1 diabetes in 2014. We also plan to initiate a Phase 1 study in Canada of Treg based therapeutics in support of a steroid resistant asthma indication in 2014.

Pre-clinical assets include our VSEL TM (Very Small Embryonic Like) Technology regenerative medicine platform. Regenerative medicine holds the promise of improving clinical outcomes and reducing overall healthcare costs. We are working on a Department of Defense funded study of VSELsTM for the treatment of chronic wounds. Other preclinical work with VSELsTM includes exploring macular degeneration as a target indication.

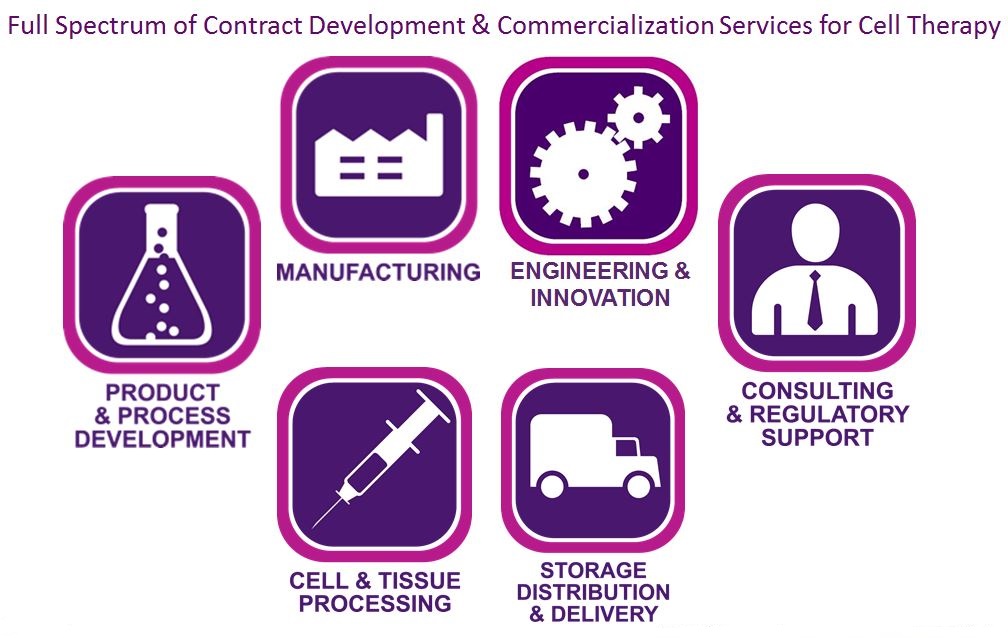

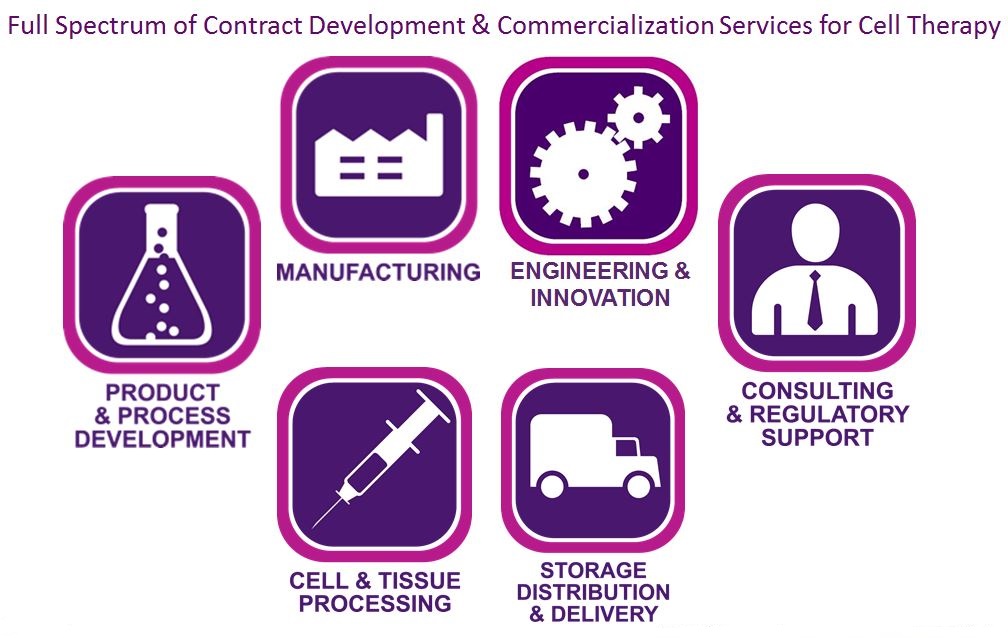

Progenitor Cell Therapy, LLC ("PCT") is a contract manufacturer that generates revenue. This wholly owned subsidiary, which we acquired in 2011, is an industry leader in providing high quality manufacturing capabilities and support to developers of cell-based therapies to enable them to improve efficiencies and profitability and reduce capital investment for their own development activities. Since its inception more than 15 years ago, PCT has provided pre-clinical and clinical current Good Manufacturing Practice (“cGMP”) development and manufacturing services to more than 100 clients. PCT has experience advancing regenerative medicine product candidates from product inception through rigorous quality standards all the way through to human testing, Biologic License Application ("BLA") filing and FDA product approval. PCT's core competencies in the cellular therapy industry include manufacturing of cell therapy-based products, engineering and innovation services, product and process development, cell and tissue processing, regulatory support, storage, distribution and delivery and consulting services. PCT has two cGMP, state-of-the art cell therapy research, development, and manufacturing facilities in New Jersey and California, serving

the cell therapy community with integrated and regulatory compliant distribution capabilities. The Company is pursuing commercial expansion of our manufacturing operations both in the U.S. and internationally.

We believe that NeoStem is ideally positioned to lead the cell therapy industry.

We are a Delaware corporation with our principal executive offices located at 420 Lexington Avenue, Suite 350, New York, New York 10170. Our telephone number is (212) 584-4180 and our corporate website address is www.neostem.com. We include our website address in this Annual Report on Form 10-K only as an inactive textual reference and do not intend it to be an active link to our website. The information on our website is not incorporated by reference in this Annual Report on Form 10-K.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports, as well as other documents we file with the U.S. Securities and Exchange Commission ("SEC"), are available free of charge through the Investor Insights section of our website as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The public can obtain documents that we file with the SEC at www.sec.gov.

This report includes the following trademarks, service marks and trade names owned by us: NeoStem, Inc.®, Amorcyte, LLC®, AthelosTM, Progenitor Cell Therapy LLCTM and VSELTM Technology. These trademarks, service marks and trade names are the property of NeoStem and its affiliates.

OVERVIEW OF THE CELL THERAPY FIELD

Regenerative medicine is defined as the process of replacing or regenerating human cells, tissues or organs to restore normal function. Among the categories of therapeutic technology platforms within this field are cell therapy; tissue engineering; tools, devices and diagnostics; and aesthetic medicine. NeoStem's business model is focused on two of these areas. First, cell therapy, in which we introduce cells (adult, donor or patient, stem cell or differentiated) into the body to prevent and treat disease; and second, tools, devices and diagnostics in which we intend to utilize engineering and innovation to automate, integrate or otherwise modify cell therapy manufacturing platforms to improve the deliverability of cellular therapeutics to patients.

All living complex organisms start as a single cell that replicates, differentiates (matures) and perpetuates in an adult organism through its lifetime. Cellular therapy is the process that uses cells to prevent, treat or cure disease, or regenerate damaged or aged tissue. To date, the most common type of cell therapy has been the replacement of mature, functioning cells such as through blood and platelet transfusions. Since the 1970s, first bone marrow and then blood and umbilical cord-derived stem cells have been used to restore bone marrow, as well as blood and immune system cells damaged by the chemotherapy and radiation that are used to treat many cancers. These types of cell therapies are standard of practice world-wide and are typically reimbursed by insurance.

Within the field of cell therapy, research and development using stem cells to treat a host of diseases and conditions has greatly expanded. Stem cells (in either embryonic or adult forms) are primitive and undifferentiated cells that have the unique ability to transform into or otherwise affect many different cells, such as white blood cells, nerve cells or heart muscle cells. NeoStem's cell therapy development efforts are focused on the use of adult stem cells; these cells are found in the bone marrow, peripheral blood, umbilical cord blood and other body organs.

There are two general classes of cell therapies: Patient Specific Cell Therapies ("PSCTs") and Off-the-Shelf Cell Therapies ("OSCTs"). In PSCTs, cells collected from a person (donor) are transplanted, with or without modification, to a patient (recipient). In cases where the donor and the recipient are the same individual, these procedures are referred to as “autologous”. In cases in which the donor and the recipient are not the same individual, these procedures are referred to as “allogeneic.” A notable form of autologous PSCT involves the use of autologous cells to create vaccines directed against tumor cells in the body and has been demonstrated to be effective and safe in clinical trials. For example, Dendreon Corporation's Provenge®, an autologous therapy PSCT for prostate cancer, received FDA approval in early 2010. NeoStem's CD34 Cell Program also focuses on PSCTs using autologous cells. Autologous cells offer a low likelihood of rejection by the patient and we believe the long-term benefits of these PSCTs can best be achieved with an autologous product. In the case of OSCT, donor cells are expanded many fold in tissue culture, and large banks of cells are frozen in individual aliquots that may result in treatments for as many as 10,000 people from a single donor tissue. By definition, OSCTs are always allogeneic in nature.

Various adult stem cell therapies are in clinical development for an array of human diseases, including autoimmune, oncologic, neurologic and orthopedic, among other indications. NeoStem, as well as other companies, are developing cell therapies that address ischemic repair and immune modulation. While no assurances can be given regarding future medical developments, we believe that the field of cell therapy holds the promise to better the human experience and minimize or ameliorate the pain and suffering from many common diseases and/or from the process of aging.

As a contract development and manufacturing organization (CDMO), PCT is currently working with a wide range of clients in the regenerative medicine industry. PCT provides us with a unique and fundamental base platform of experience with a multitude of cell types in development. PCT is strategically helping to position us in a way that allows us to participate in the cell therapy field on multiple levels as the cell therapy industry evolves. Our goal is to be recognized as a premier service provider in the regenerative medicine industry by continuing to leverage the experience and expertise of PCT as a recognized leader of cell therapy manufacturing and development in the sector.

Market Analysis

According to Robin R. Young’s Stem Cell Summit Executive Summary-Analysis and Market Forecasts 2014-2024, the U.S. stem cell therapy market is estimated to grow from an estimated $237 million in 2013 to more than $5.7 billion in 2020.

With approved cell therapy products currently being sold in the United States and abroad, and an increasing number of Phase 2 and Phase 3 trials with cell therapies underway, we believe the “promise” of cell therapy is becoming more and more clear. Cell therapies, if approved, should cut health care costs as they aim to facilitate functional restoration of damaged tissues and not just abate or moderate symptoms. Safe and efficacious cell therapies for chronic diseases could capture an increasing portion of future healthcare spending in the United States, driven both by favorable demographics and meaningful pharmacoeconomic benefit.

CELL THERAPY PRODUCT DEVELOPMENT

NeoStem has a multi-pronged research and clinical development strategy that targets three therapeutic platforms: ischemic repair (CD34 Cell Program), immune modulation (T Regulatory Cell Program) and tissue regeneration (VSELTM Technology). The following chart depicts our 2014 clinical outlook:

1. The last patient primary endpoint follow-up for this study is expected in June followed by data lock and analysis with data available in 2H 2014.

2. It is expected that this study will be presented at the American Diabetes Association’s Scientific Sessions, to be held June 13 - 17, 2014, by Study Director Dr. Jeffrey Bluestone (University of California, San Francisco) and Dr. Kevan Herold (Yale University), the Study Principal Investigator. The data from the study has been licensed by the Company from The University of California, San Francisco, and is expected to serve as the basis for initiation of a Phase 2 study by the Company.

Ischemic Repair (CD34 Cell Program)

Through our CD34 Cell Program, we are pursuing the development of therapies to address ischemia. Ischemia occurs when the supply of oxygenated blood is restricted in the body. Through this program, we seek to repair this restriction through the development and formation of new blood vessels.

Our most advanced product candidate in our CD34 Cell Program is AMR-001, a chemotactic hematopoietic stem cell product comprised of autologous bone marrow derived CD34/CXCR4 cells selected to preserve heart muscle function following an AMI (heart attack).

AMR-001 works by increasing microvascular blood flow in the heart muscle via the development and formation of new blood vessels, thereby reversing the restriction of blood supply caused by a heart attack and rescuing tissue from eventual cell death. The treatment process works as follows:

•A patient's own bone marrow is harvested and a sterile pharmaceutical composition of stem cells found in the bone marrow, enriched for CD34/CXCR4 cells, is prepared using our patented technology. Cell preparation has a 72 hour shelf life.

•The isolated cells are then infused back into the patient via catheter into the infarct-related artery 5 to 11 days following an AMI, which we believe to be the optimal time frame for cellular intervention, after the pro-inflammatory “hot phase” and prior to permanent scar formation, while the heart tissue is naturally and actively attracting CD34/CXCR4 cells.

•The cells are attracted to certain chemicals that are released in higher concentrations in oxygen-starved tissue and when they reach that tissue begin to orchestrate the process of building new blood vessels to restore blood supply and thereby enhance the function of the damaged heart muscle.

Preclinical Development

Pre-clinical animal models of induced AMI have demonstrated that CD34/CXCR4 expressing cells migrate naturally to oxygen-deprived locations. More specifically, these cells home to the viable tissue surrounding the infarcted (dead) myocardium, known as the peri-infarct zone. Moreover, CD34/CXCR4 expressing cells have been shown to be capable of inducing the development and formation of new blood vessels over time and preventing heart cell death due to chronic ischemia (chronic ischemia can occur when one's coronary arteries may become so narrowed that they limit the flow of blood to one's heart all the time, even when they are at rest). Other studies have demonstrated that the CD34/CXCR4 cells that take up residence in the peri-infarct zone are likely the cell type that affects angiogenesis (the development and formation of new blood vessels), relieves ischemia (restriction of blood supply) and prevents apoptosis (cell death). Collectively, these results provided the rationale for the clinical exploration of CD34/CXCR4 expressing cells to reduce the incidence and severity of MACE (Major Adverse Cardiac Events)after an extensive AMI.

Clinical Development Efforts

AMR-001 is currently being evaluated to determine its safety and efficacy in patients with a recent heart attack.

In December 2010, our wholly owned subsidiary Amorcyte reported results of a Phase 1 study of AMR-001 treating 31 patients with damaged heart muscle following AMI. The completed Phase 1 study of AMR-001 showed a statistically significant dose-related improvement in myocardial perfusion (the flow of blood to the heart muscle). Patients who received 10 million cells (n=5) or 15 million cells (n=4) showed statistically significant improvement in resting perfusion rates at six months as compared to patients who received 5 million cells (n=6) or the control groups (n=15), as measured by single-photon emission computerized tomography (SPECT). The study data also showed a dose-related trend towards improvement in ejection fraction (the percentage of blood pumped out of the ventricles with each heart beat), end systolic volume (the blood volume remaining in a ventricle at the end of contraction and the beginning of filling, which can be used clinically as a measurement of the adequacy of cardiac emptying), and reduction in infarct size (dead tissue caused by shutting off the blood supply).

In December 2013, we completed patient enrollment in our PreSERVE AMI Phase 2 trial, a multicenter, randomized, double-blind, placebo-controlled U.S. clinical trial to evaluate the efficacy and safety of a single intra-coronary infusion of at least 10 million cells of AMR-001, in patients with an acute ST elevation myocardial infarction (“STEMI”), a particular type of AMI,

who are shown to have reduced heart muscle function with ejection fractions of 48% or less as measured by cardiac magnetic resonance imaging ("CMR").

Individuals with reduced ventricular function after STEMI are known to be at increased risk for the development of heart failure and for subsequent hospitalizations and the need for additional procedures.

Multiple peer reviewed publications from well-regarded research laboratories and investigators indicate that AMR-001 should increase microvascular blood flow in the myocardium (heart muscle) via angiogenesis (development and formation of new blood vessels), thereby reversing post-heart attack induced restriction of blood supply and rescuing heart muscle tissue from eventual cell death, which should improve long term outcomes. At the time of a heart attack, doctors rush to open up the coronary artery, usually using a stent. AMR-001 is administered within the first 5 to 11 days following the heart attack via that same artery. With angiogenesis initiated in the peri-infarct zone (that is, the living tissue on the periphery of the dead tissue), the myocardium surrounding the site of the heart attack is preserved.

The objective of the Phase 2 study is to determine the safety and the efficacy of AMR-001 in improving cardiac function and outcomes of patients after STEMI. The primary endpoint of the study is improvement in myocardial cardiac perfusion using the resting total severity score (“RTSS”), measured by gated single photon emission computed tomography (“SPECT”) myocardial perfusion imaging (“MPI”) at six months post randomization (MPI is a non-invasive imaging test that shows how well blood flows through heart muscle), with secondary endpoints including the occurrence of MACE at 6, 12, 18, 24 and 36 months. MACE includes: premature death; recurrent heart attack; chronic heart failure; significant arrhythmias; and acute coronary syndrome. Additional secondary endpoints of the study are to determine preservation of cardiac function via CMR (Cardiac Magnetic Resonance) to measure LVEF (Left Ventricular Ejection Fraction), LVESV (Left Ventricular End Systolic Volume), LVEDV (Left Ventricular End Diastolic Volume), regional myocardial strain, infarct/peri-infarct regional wall motion abnormalities, and infarct size and Quality of Life measures questionnaires such as Kansas City Cardiomyopathy Questionnaire (“KCCQ”) & Seattle Angina Questionnaire (“SAQ”). The last patient primary endpoint follow-up for this study is expected in June 2014 followed by data lock and analysis with a submission for a possible presentation of the study at the American Heart Association's Scientific sessions to be held November 15-19, 2014.

Other Conditions

We believe that the CD34 Cell Program may be applicable to other conditions resulting from underlying ischemic injury. Published reports have provided evidence that CD34 cells administered into the coronary arteries of patients with chronic heart failure (CHF) can improve survival compared to patients treated with standard medical therapy. Accordingly, we are evaluating the potential of a CD34 product in treating CHF and treating the associated comorbidities of that disease and expect to initiate a Phase 2 clinical trial in 2014.

Under our CD34 Cell Program, we are conducting pre-clinical studies to determine if a CD34 product exerts a therapeutic effect in an animal model of traumatic brain injury for which we expect data in 2014. If these studies are positive, then we anticipate seeking partnerships to begin a full development program for this new indication.

Market Opportunity and Competition

Within the cardiovascular space alone the forecasted economic burden on society for medical care is expected to rise substantially. According to Heart Disease and Stroke Statistics--2014 Update: A Report From the American Heart Association, it is projected that by 2030, 43.9% of Americans - approximately 139 million people - will have some form of cardiovascular disease. Between 2012 and 2030, total direct medical costs of cardiovascular disease are projected to increase from $396 billion to $918 billion. Real indirect costs - due to lost productivity - for all forms of cardiovascular disease are estimated to increase more than 58% from $183 billion in 2012 to $290 billion in 2030. The combined costs are expected to increase to more than $1.48 trillion by 2030. Cell therapy offers the potential of alleviating much of the burdens of these chronic diseases in a cost-effective way.

A statistical report from Agency for Healthcare Research and Quality in 2011 surveyed the most expensive hospitalization conditions by payer and lists AMIs as the sixth most expensive condition treated in U.S. hospitals, with a national hospital bill of more than $37 billion annually. AMI patients are at significant risk of downstream adverse events including chronic heart failure, re-current AMI, significant arrhythmias, premature death or acute coronary syndrome, and thus AMI is one of the target populations in our CD34 Cell Program. In the U.S., each year there are over 160,000 patients who suffer a STEMI, the most dangerous type

of heart attack, which results from a sudden blockage of one of the arteries that supplies nutrient-rich blood to the heart muscle. Treatment of these patients post-heart attack represents a significant financial burden for many managed care programs. We expect that this burden will increase as the “baby boomer” population ages and the annual number of STEMIs likely increases. AMR-001, if approved, could provide significant pharmacoeconomic benefits for this subpopulation alone by preventing downstream cardiac adverse events.

An additional and related potential application includes chronic heart failure. According to a US News Health article publishedin 2012, chronic heart failure affects 5.7 million individuals in the U.S. alone. Each year, nearly 1 million people are hospitalized with CHF, of whom 30 - 60 % are "readmits." According to the American Heart Association, CHF is now a main or contributing cause of nearly 53,000 U.S. deaths each year.

Ischemic health maladies are not limited to the cardiac setting. According to the Centers for Disease Control (CDC), an estimated 1.7 million people annually sustain a traumatic brain injury (TBI). Like a heart attack, TBI can involve the creation of an ischemic condition in brain tissue. TBI is a contributing factor to a third (30.5%) of all injury-related deaths in the U.S. About 75% of TBIs that occur each year are concussions or other forms of mild TBI. Direct medical costs and indirect costs such as lost productivity of TBI totaled an estimated $76.5 billion in the United States in 2000.

The field of cardiovascular cell therapy development is competitive. There are a number of companies that are developing stem cell-based therapies for cardiovascular diseases, including, but not limited to, Cardio3 Biosciences SA, Capricor, Inc., MesoBlast Limited, Athersys, Inc., Pluristem Therapeutics Inc., and Cytori Therapeutics, Inc. These companies are utilizing a number of different therapeutic approaches in their development efforts. Specifically, there are both autologous and allogeneic based competitive therapies that derive cells principally from four sources: fat, peripheral blood, cord blood, and bone marrow. Of these, the allogeneic sources (where donor and recipient are different persons) face a series of technical limitations that we believe can minimize their clinical value due to durability of cell issues. AMR-001, an autologous cell therapy, has demonstrated positive Phase 1 data, a cGMP process for manufacturing and a broad portfolio of patents and patent applications including dosing related technology. As such, we believe AMR-001 is in a strong competitive position.

Immune Modulation (T Regulatory Cell Program)

We are collaborating with Becton-Dickinson and the University of California, San Francisco (UCSF) on our T Regulatory Cell program, using technology platform of our majority-owned subsidiary, Athelos Corporation ("Athelos") to pursue the development of cell therapies using a person's immune cells as a therapeutic product to treat disorders of the immune system. Many immune-mediated diseases are a result of an imbalance in the immune system whereby inflammatory cells go unchecked. Therapy using T Regulatory Cells (Treg) represents a novel approach to restoring immune balance by enhancing Treg cell number and function to inhibit pathogenic immune responses.

Preclinical and Clinical Development

Through exclusive world-wide licenses to more than 30 issued patents and patent applications, we have secured the rights to a broad patent estate within the Treg field, covering natural Tregs (nTregs), induced Tregs (iTregs) and methods of treating or preventing certain conditions and/or diseases by use of Tregs. Both types of Tregs have been shown in pre-clinical studies to be important in modulating autoimmune and inflammatory diseases. nTregs have been evaluated by others in early phase human clinical trials and shown to be safe with suggestions of clinical benefit in graft-versus-host disease. Both nTregs and iTregs have demonstrated the ability to treat conditions like diabetes, inflammatory bowel disease and organ transplant tolerance in animal models of disease.

Type 1 diabetes (also known as insulin dependent diabetes or juvenile diabetes) is caused by the autoimmune destruction of insulin-producing beta cells of the pancreas. We have established a collaboration with UCSF and the laboratories of Drs. Jeffrey Bluestone and Qizhi Tang, to collaborate on the development of a therapy for the treatment of type 1 diabetes. This collaboration, comprised of a data license, patent license and research agreement, is advancing the Company's T Regulatory Cell Program towards a Phase 2 trial, expected to be initiated in 2014 to evaluate the efficacy of autologous Tregs in Type 1 diabetes, effectively advancing this program more quickly than if the Company had developed a program for this clinical indication on its own. In this collaboration, NeoStem will sponsor and manufacture a Treg product consisting of polyclonally expanded Tregs for the planned Phase 2 trial to treat patients newly diagnosed with type 1 diabetes. The collaboration also includes research efforts to develop the next generation of Treg products for therapeutic use. Dr. Bluestone, the Study Director, and Dr. Kevan Herold (Yale University), the Study Principal Investigator, completed the Phase 1 study of autologous Tregs in type 1 diabetes and expect to report the Phase 1 results at the American Diabetes Association Scientific Sessions in Chicago being held on June 13-17, 2014, which, if positive, will support the Company's planned Phase 2 study.

Asthma, another condition caused by an imbalance in the immune system, occurs when excessive inflammation is triggered in the lungs resulting in constriction of the airways and difficulty breathing. The causes of asthma are complex, through it is known that over-activity of T-helper type 2 (Th2) cells is a common feature. Th2 cells secrete the inflammatory signals that lead to the symptoms of asthma. Existing evidence indicates that Treg cells may regulate Th2 activity and therefore may have a beneficial effect on severe asthma. Accordingly, we are planning a pilot clinical trial to assess the effect of Treg therapy on severe asthma. We expect to initiate in Canada, a Phase 1 trial of Tregs to support a steroid resistant asthma indication in 2014.

Other potential therapeutic targets for T Regulatory cells could include prevention of organ transplant rejection, graft vs. host disease (GVHD) (Tregs have been evaluated in early phase human clinical trials and have shown clinical benefit in GVHD), lupus and multiple sclerosis.

NeoStem's ongoing T Regulatory Cell Program is establishing methods to isolate and expand human nTregs for large scale manufacturing to enable our planned clinical trials.

Market Opportunity

Type 1 diabetes -- also referred to as insulin dependent diabetes or juvenile diabetes -- affects over 34 million people worldwide, or 1 in 300 children. Diabetes is the leading cause of kidney failure, new cases of adult blindness and non-traumatic lower-limb amputations. Type 1 diabetes accounts for $14.9 billion in healthcare costs in the U.S. each year.

According to the American Academy of Allergy, Asthma & Immunology, as of 2009, asthma affected 25 million people in the US and 300 million people worldwide. According to the American Lung Association, the annual direct health care cost of asthma is approximately $50.1 billion; and indirect costs (e.g. lost productivity) add another $5.9 billion, for a total of $56.0 billion. Steroid resistant asthma afflicts less than 5% of the total asthma population, but accounts for up to 50% of healthcare spending on asthma.

Tissue Regeneration (VSEL™ Technology)

Our scientists have been evaluating the therapeutic potential of so-called very small embryonic-like stem cells, which we refer to as "VSELsTM" or "VSELTM stem cells".

These cells were originally described in mice by researchers at the University of Louisville. Our research has identified cells in human blood and bone marrow that have many of the properties described for murine VSELsTM. This research includes evidence of multipotency and multi-lineage differentiation. These observations provide the groundwork for the development of VSELTM therapies to regenerate or repair damaged or diseased tissues in human subjects.

Preclinical animal models have demonstrated that highly enriched human VSELsTM, when injected in the vitreal or subretinal space can migrate and integrate into areas of damage and have the ability to differentiate and express markers of retinal stem cells, neuronal cells, and photoreceptors and thus, through further studies, may demonstrate VSELsTM potential to treat ocular diseases such as macular degeneration, retinitis pigmentosa, and other retinal degenerative diseases that have no effective treatment options today.

Therapeutic uses of VSELsTM are assessed on the basis of unmet medical need, target patient population size, regulatory strategy, and overall commercial market. Through either grant funding or NeoStem's own funding, we are exploring VSELTM treatment development for chronic wounds and retinal repair. We anticipate that a single clinical manufacturing process would be developed, and that the major pacing item will be the generation of preclinical data to support an IND application for a Phase 1 clinical trial.

VSEL Technology represents the Company’s earliest therapeutic platform of interest and while the focus of the Company’s clinical development emphasizes later stage therapeutics, we look forward to the results of the preclinical work exploring whether or not VSELs have therapeutic promise.

To further drive our development initiatives, we will continue to target key governmental agencies, congressional committees and not-for-profit organizations to contribute funds for our research and development programs. These grant awards, together with our other submitted grant applications, to the extent funded, would not only further our research efforts already underway, but potentially could launch new inquiries and further diversify our base of research partners in other areas. We have been awarded $4.5 million of grant activity toward preclinical VSEL™ research in areas such as bone repair, scleroderma, nerve regeneration and acute radiation syndrome.

Regulatory and Clinical Affairs Strategy

Our cell therapy regulatory and clinical strategy is to utilize all opportunities to discuss with regulators our development plans. We will take the opportunity to meet with regulators at various stages in our product development from preclinical to more advanced stages of development. We intend to utilize this strategy with all regulatory agencies as we move forward with the product pipeline.

Intellectual Property

CD34 Cell Program

We have sixteen granted or allowed patents (6 in the U.S. and 10 in countries outside the U.S.) covering our CD34 Cell Program, the claims of which are currently scheduled to expire between 2026 and 2030, and we have approximately 20 patent applications pending worldwide. Specifically, in the U.S. the following patents have claims covering our CD34 -based compositions and methods to treat injuries caused by vascular insufficiency:

U.S. Patent No. 7,794,705 covering a chemotactic stem cell product enriched for CD34 cells that treats injury from AMI;

U.S. Patent No. 8,088,370 covering the use of a chemotactic stem cell product enriched for CD34 cells in the repair of injury caused by vascular insufficiency, including all forms of cardiac insufficiency, such as chronic heart failure, chronic myocardial ischemia and, we believe, vascular insufficiency induced ischemic conditions beyond the cardiac setting;

U.S. Patent No. 8,343,485, 8,637,005 and application 13/686,585 offering expanded breadth in our CD34 cell composition and treatment methods in the vascular insufficiency setting; and

U.S. Patent No. 8,425,899 covering a method of treating a progressive myocardial injury caused by an ischemic condition and utilizing a multi-dosing regimen.

T Regulatory Cell Program

Through exclusive world-wide licenses of over 30 issued patents and patent applications, we have secured the rights to a broad patent estate within the Treg field, covering natural Tregs (nTregs), induced Tregs (iTregs) and methods of treating or preventing certain conditions and/or diseases by use of Tregs.

VSELTM Technology Program

NeoStem also continues prosecution of patent applications relating to methods of identifying and purifying its regenerative adult stem cell candidate (VSELsTM) as well as methods of treating an array of maladies using VSELs, including cardiac repair, bone and cartilage regeneration, ocular disease and cutaneous wound healing.

CONTRACT DEVELOPMENT AND MANUFACTURING OPERATIONS

Progenitor Cell Therapy, LLC (“PCT”), our wholly-owned subsidiary, is an internationally recognized contract development and manufacturing organization (CDMO) focused on providing exceptional service, quality and value to its clients, which include an expanding range of development stage organizations, Fortune 500 biotechnology, pharmaceutical and medical product companies, as well as leading academic research institutions. PCT's business strategy is to provide contract research, development, engineering and manufacturing services, enabling our clients to cost effectively outsource their pre-clinical, clinical and commercial development manufacturing and cell storage operations. PCT's expert, customer centric services include, but are not limited to current Good Manufacturing Practices/Good Laboratory Practices ("cGMP/GLP") manufacturing; engineering and innovation; product, process and assay development; Good Tissue Practices ("GTP") cell and tissue processing; cell and tissue sourcing and banking; distribution and delivery; and consulting and regulatory services. PCT operates two state-of-the-art, accredited and certified U.S. facilities, one in Allendale, New Jersey and the other in Mountain View, California and is looking to expand its service activities both in the U.S. and Europe during 2014.

NeoStem is also a PCT client, enabling us to cost-effectively and efficiently develop our own cell therapy products, as well as translate our own research and development efforts, capabilities and proprietary technologies into stable, reproducible, well-characterized cell therapy products, including product candidates for NeoStem's CD34 Cell Program and T Regulatory Cell program, through all stages of the commercial life of the product.

Management Experience

PCT's management team has extensive experience in domestic and internationally regulated cellular therapy development, including contract research, development and manufacturing across a broad range of science, technologies, and process operations. Team members are recognized and credentialed experts in all aspects of clinical and product development, characterization, manufacturing, delivery, and use, of cellular products and have extensive experience designing, validating, and operating cGMP/GLP cell therapy manufacturing facilities.

Informed by this experience, PCT has in the past formed companies intended to develop specific therapeutic products and leverage its capabilities to bring its own cell therapy product portfolio to market. In this regard, PCT management founded a cardiovascular cell therapy company (Amorcyte), an immunotherapy company (our 88.5% owned subsidiary Athelos) and a cGMP cord blood company (our subsidiary NeoStem Family Storage, LLC).

Service Offerings

PCT's business model is focused on helping our clients advance their respective product candidates from conception through to commercialization by reducing manufacturing risks, shortening the time to regulatory approval, and lowering the overall costs of a clinical development program. With its established facilities and infrastructure, PCT can offer our clients expertise at all stages of the product development lifecycle and cost-effective development and manufacturing services at the highest quality without the need for significant capital investment.

Since its inception more than15 years ago, PCT has served more than 100 clients and is experienced with greater than 20 different cell-based therapeutics including neuronal and skin based cells for brain and spinal cord repair, myoblast, mesenchymal cells and bone marrow derived cells for heart disease, tumor, dendritic cells and monocytes for cancer treatment, cord blood, peripheral blood, bone marrow CD34 selected cells for transplantation and islet cells for diabetes. PCT has performed more than 30,000 cell therapy procedures in its cell therapy manufacturing facilities, processed and stored over 18,000 cell therapy products (including approximately 7,000 umbilical cord blood, 10,000 blood and marrow derived stem cells and 1,000 dendritic cells) and arranged the logistics and transportation for more than 14,000 cell therapy products for clinical use by more than 6,000 patients nationwide. Importantly, PCT manufactured more than 85% of Dendreon's approved Provenge® product during its Phase 3 clinical testing, and more than 60% of all Dendreon cell therapeutics in clinical testing from 1999 through 2007.

PCT's current business development efforts target cell and tissue therapeutic product companies, academic stem cell and other cell therapy clinical trials, device companies serving the regenerative medicine sector, pharmaceutical companies with an interest in a cell or tissue therapeutic or research product, and any other potential client with needs in the manufacturing and development of a cell or tissue-based product. More specifically, PCT focuses its service offerings in the following six areas:

Manufacturing: Manufacturers of cell therapy-based products face a number of challenges, including the need for substantial capital and resource investment, limited unit sizes and process scalability, short processing turnaround times and stringent and evolving regulatory requirements. PCT's facilities, infrastructure and extensive experience provide a turn-key solution to clients to meet these challenges.

Engineering and Innovation: PCT helps clients think beyond current practices and develop long-term solutions to the unique challenges of cell therapy manufacturing. Our team accelerates use of automation, integration, closed processing and other strategies to address scale up, cost of goods, quality control and robustness of client manufacturing process. In order to bolster our unique expertise and further reduce cost of goods sold for products, PCT continually seeks innovation drivers, including new opportunities for automation in its manufacturing operations.

Product and Process Development: PCT works with clients to develop, optimize, implement and validate various aspects of cell therapy product and process development.

Cell and Tissue Processing: PCT offers a full range of cost-effective cell collection and processing services that meet cGTP standards.

Storage, Distribution and Delivery: PCT offers cryogenic storage facilities for both short- and long-term storage of tissues, primary cells and cell therapy products. In addition, PCT leverages its established logistics and distribution network to ensure a timely, secure and cost-effective point-to-point chain of control and custody.

Consulting and Regulatory Support: PCT offers our clients a full-range of scientific, technical and regulatory support along the entire spectrum of cell therapy development.

Over the next several years, we anticipate that the number of companies in the cell therapy field will continue to increase and the relative distribution of stage of development of the therapeutics will begin to skew more heavily towards Phase 2 and Phase 3 trials, and into commercial distribution. As this industry continues to develop and mature, we believe PCT is well positioned to capture a meaningful share of this larger, more profitable market. To prepare for the advancement of this industry, PCT is pursuing multiple options for commercial manufacturing capacity, both in the U.S. and internationally, with the goal of having these capabilities in place in 2014. PCT has also taken strides to expand its services into Europe.

Improving Deliverability of Cell Therapy Products through PCT's Engineering & Innovation Center

As the field of regenerative medicine matures, and an increasing number of products are reaching the marketplace, valuable lessons are being learned about the strengths and weaknesses of various business models that may allow for therapies to be delivered to a large numbers of patients. PCT's newly formed Engineering & Innovation center is working, on behalf of Neostem's internal development pipeline and for its own clients, to think beyond current practices to accelerate the use of automation, integration and other engineering strategies to address the important issues of scale up, cost of goods, and improved robustness of manufacturing process in anticipation of commercial production.

PCT is applying engineering principles to transition cell therapy science to manufacturing, and applying development by design principles, as well as structure development methodology centered on unit operations to increase the chance of successful commercial-scale manufacturing. In addition to building our internal core of engineering and innovation expertise, we are partnering with solutions providers and academic institutions to leverage existing and develop novel closed systems, single-use disposables, automation, and integration as key drivers for innovation. In this way, we believe we will be able to support the manufacture of high quality products, and a reasonable cost of goods, to meet product demand in a scalable manner as it grows throughout the commercial life of the therapeutic.

Facilities

With more than 55,000 square feet of built out development and manufacturing space in its Allendale, NJ, and Mountain View, CA facilities, PCT is a cGMP-compliant cell therapy CDMO with facilities on both the East and the West Coast of the United States. These facilities include 5,500 square feet of controlled environment rooms (CERs) or clean rooms that are unidirectional-flow, negative-pressure, International Organization for Standardization ("ISO ") designation 7 (ISO7)/Class 10,000 classified and ISO6/Class 1000, and material pass-throughs. Each CER has controlled access, live facility and equipment monitoring with automated alarm call-out, dedicated HVAC systems, and is on an uninterruptible power supply (UPS) connection, maintained by an external diesel-fueled back-power generator. Each facility also contains cell and tissue cryogenic storage rooms, with controlled access, live facility and equipment monitoring with automated alarm call-out, and UPS connection, to ensure highest level of quality control and risk mitigation for product storage.

PCT's facilities are accredited by AABB (American Association of Blood Banks) and FACT (Foundation for the Accreditation of Cellular Therapy), hold all requisite licensures, are registered with the FDA as human cells, tissues, and cellular and tissue-based products (HCT/Ps) facilities, and maintain cGMP compliant quality systems. The Allendale facility has been designed to be compliant with FDA and European Medicines Agency (EMA) standards for the manufacture of human cells for therapeutic use.

Transportation Network and Logistics

PCT seeks to maintain the highest standards in transportation and handling of our clients' cell products. A successful transportation network for cell therapies requires a completely secure point-to-point chain of control and custody; cGMP standard operating procedures in all phases of transit; a highly specialized and trained air and ground courier network; quality assurance at each transfer point; and real-time package tracking. As part of its business development process, PCT is laying the groundwork for such transportation network. We strive to maintain high standards in transportation and handling of client cell products. Currently, PCT works with validated specialty air carrier(s) that follow specific protocols for shipping medical products, including whole blood and blood products, tissue for transplantation, and diagnostic specimens and also handles cryopreserved specimens and biologics. Shipments of products are tracked as PCT and its clients develop confidence in the abilities of PCT's transportation partners.

Competition

PCT's CDMO business faces competition from other third party contract manufacturers, as well as more general competition from companies and academic and research institutions that may choose to self-manufacture rather than utilize a contract manufacturer. The two largest third party contract manufacturer competitors in the field of cell therapy are Lonza Group Ltd. and WuXi AppTec. Both of these companies are large, well-established manufacturers with financial, technical, research and development and sales and marketing resources that are significantly greater than those of PCT. In addition, both Lonza and WuXi have international capabilities that we do not currently possess though are pursuing. We also face competition from a number of other contract manufacturers that are somewhat smaller in size and have fewer resources than PCT.

More generally, we face competition inherent in any third party manufacturer's business: namely, that potential customers may instead choose to invest in their own facilities and infrastructure, affording them greater control over their products and the promise of long-term cost savings compared to a third party contract manufacturer. To be successful, we will need to convince potential customers that PCT's services are both of higher-quality and more cost-effective than could be achieved through internal manufacturing and that our experience and expertise is unique in the industry. Our ability to achieve this and to successfully compete against other contract manufacturers will depend, in large part, on our success in developing superior automation technologies that improve both the quality and profitability associated with cell therapy manufacturing.

Cord Blood and Stem Cell Processing and Storage

We provide services to treat patients with cell and tissue therapies, including the processing for blood and bone marrow stem cell transplants used following radiation and/or chemotherapy for certain cancers, in particular, leukemia, lymphoma and myeloma. We also provide services to individuals for the private collection, processing and storage of umbilical cord blood units and adult stem cells, through our subsidiary, NeoStem Family Storage, LLC. This enables healthy individuals to have their stem cells or those of their infant collected and stored for personal therapeutic use in the future, as and when needed. Our facilities on both the East and West Coast of the United States are cGMP compliant, the highest FDA standard, which we believe gives us a competitive advantage in the industry.

We believe that the perceived value of stem cell donation and storage will increase as additional indications for stem cell-based therapies are developed. Individuals may begin to view the ability to donate and store autologous adult stem cells for future personal therapeutic use as a valuable part of a “bio-insurance” program. The benefits of pre-donation include having a known supply of autologous stem cells rather than an uncertain supply of compatible allogeneic stem cells; collecting and storing the cells while healthy (since autologous stem cells may be compromised once a patient becomes sick); and storing the patient's cells earlier (since the quantity and quality of stem cells generally diminish with age).

However, currently there is no significant global market for the use of autologous stem cells and hence no significant market yet exists for their processing or their collection and storage, nor is there any guarantee that such markets will develop in the near future, or at all. While we believe that the medical community is generally supportive of cord blood and adult stem cell collection systems, medical institutions currently do not specifically recommend storage of stem cells from the cord blood or adult stem cells. Patients can currently donate their cord blood to the public cord blood collection system without charge. If medical research discovers new and more effective medical procedures that make allogeneic cord blood transplants safer and more effective than autologous modalities, the clinical advantage of storing umbilical cord blood for a child's own future therapeutic use may significantly decline. As such, we are not putting resources into marketing the services but are developing a network to enable us to capitalize on this market if the demand emerges.

GOVERNMENT REGULATION

The health care industry is one of the most highly regulated industries in the United States and abroad. Various governmental regulatory authorities, as well as private accreditation organizations, oversee and monitor the activities of individuals and businesses engaged in the development, manufacture and delivery of health care products and services. The following is a general description of certain current laws and regulations that are relevant to our business.

HCT/P Regulations

Manufacturing facilities that produce cellular therapies are subject to extensive regulation by the FDA. In particular, FDA regulations set forth requirements pertaining to establishments that manufacture human cells, tissues, and cellular and tissue-based products (“HCT/Ps”). Title 21, Code of Federal Regulations, Part 1271 provides for a unified registration and listing system, donor-eligibility, current Good Tissue Practices (“cGTP”), and other requirements that are intended to prevent the introduction, transmission, and spread of communicable diseases by HCT/Ps. More specifically, key elements of Part 1271 include:

Registration and listing requirements for establishments that manufacture HCT/Ps;

Requirements for determining donor eligibility, including donor screening and testing;

cGTP requirements, which include requirements pertaining to the manufacturer's quality program, personnel, procedures, manufacturing facilities, environmental controls, equipment, supplies and reagents, recovery, processing and process controls, labeling, storage, record-keeping, tracking, complaint files, receipt, pre-distribution shipment, distribution, and donor eligibility determinations, donor screening, and donor testing;

Adverse reaction reporting;

Labeling of HCT/Ps; and

FDA inspection, retention, recall, destruction, and cessation of manufacturing operations.

PCT currently collects, processes, stores and manufactures HCT/Ps, including the manufacture of cellular therapy products. NeoStem Family Storage also collects, processes, and stores HCT/Ps. Therefore, both PCT and NeoStem Family Storage must comply with cGTP and with the current Good Manufacturing Practices ("cGMP") requirements that apply to biological products. Cell and tissue based products may also be subject to the same approval standards, including demonstration of safety and efficacy, as other biologic and drug products if they meet certain criteria such as if the cells or tissues are more than minimally manipulated or if they are intended for a non-homologous use. Management believes that requirements pertaining to premarket approval, do not currently apply to PCT or NeoStem Family Storage because those entities are not currently investigating, marketing or selling cellular therapy products. If either PCT or NeoStem Family Storage changes its business operations in the future, the FDA requirements that apply to PCT or NeoStem Family Storage may also change.

State Regulation of Cell Therapy

Certain state and local governments regulate cell-processing facilities by requiring them to obtain other specific licenses. As required under applicable state law, PCT's New Jersey and California facilities are licensed, respectively, as a blood bank in New Jersey and as a biologics manufacturing facility in California. PCT also maintains licenses with respect to states that require licensure of out-of-state facilities that process cell, tissue and/or blood samples of residents of such states (e.g., New York and Maryland). PCT has the relevant state licenses needed for processing and is AABB (American Association of Blood Banks) accredited for this purpose. Management believes that it is in material compliance with currently applicable federal, state, and local laboratory licensure requirements, and intends to continue to comply with new licensing requirements that may become applicable in the future.

Certain states may also have enacted laws and regulations, or may be considering laws and regulations, regarding the use and marketing of stem cells or cell therapy products, such as those derived from human embryos. While these laws and regulations should not directly affect PCT's business, they could affect the business of some of PCT's clients and therefore the amount of business PCT receives from these clients.

Federal Regulation of Clinical Laboratories

The Clinical Laboratory Improvement Amendments (“CLIA”) extends federal oversight to clinical laboratories that examine or conduct testing on materials derived from the human body for the purpose of providing information for the diagnosis, prevention, or treatment of disease or for the assessment of the health of human beings. CLIA requirements apply to those laboratories that handle biological matter. CLIA requires that these laboratories be certified by the government, satisfy governmental quality and personnel standards, undergo proficiency testing, be subject to biennial inspections, and remit fees. The sanctions for failure to comply with CLIA include suspension, revocation, or limitation of a laboratory's CLIA certificate necessary to conduct business, fines, or criminal penalties. Additionally, CLIA certification may sometimes be needed when an entity, such as PCT or NeoStem Family Storage, desire to obtain accreditation, certification, or license from non-government entities for cord blood collection, storage, and processing. PCT has obtained CLIA certification for its facilities in New Jersey. We have been advised that, currently, CLIA certification is not required for our PCT facilities in California. However, to the extent that any of the activities of PCT or NeoStem Family Storage (for example, with regard to processing or testing blood and blood products) require CLIA certification, PCT intends to obtain and maintain such certification and/or licensure.

Stem Cell Therapeutic and Research Act of 2005

The Stem Cell Therapeutic and Research Act of 2005 established a national donor bank of cord blood and created a national network for matching cord blood to patients. The National Marrow Donor Program (NMDP) carries out this legislation, which entails acting as the nation's Cord Blood Coordinating Center and actively recruiting parents for cord blood donations. The NMDP also administers the National Cord Blood Inventory (NCBI), which has a goal of collecting 150,000 cord blood units that could be used to treat patients all over the United States. Importantly, the legislation also authorized federal funding to support the legislation's goals for collecting cord blood units.

Pharmaceutical and Biologic Products

Government authorities in the United States, at the federal, state and local level, and in other countries, extensively regulate, among other things, the research, development, testing, manufacture, including any manufacturing changes, packaging, storage, recordkeeping, labeling, advertising promotion, distribution, marketing, import and export of biological products such as AMR-001. The process of obtaining required regulatory approvals and the subsequent compliance with appropriate statutes and

regulations require the expenditure of substantial time and money, and there is no guarantee that we will successfully complete the steps needed to obtain regulatory approval of AMR-001 or any future product candidates. In addition, these regulations may change and our product candidates may be subject to new legislation or regulations.

In the United States, pharmaceutical and biologic products, including cellular therapies, are subject to extensive pre- and post-market regulation by the U.S. FDA. The Federal Food, Drug, and Cosmetic Act (“FD&C Act”), and other federal and state statutes and regulations, govern, among other things, the research, development, testing, manufacture, storage, recordkeeping, approval, labeling, promotion and marketing, distribution, post-approval monitoring and reporting, sampling, and import and export of pharmaceutical products. Biological products are approved for marketing under provisions of the Public Health Service Act, or PHS Act. However, because most biological products also meet the definition of “drugs” under the FD&C Act, they are also subject to regulation under FD&C Act provisions. The PHS Act requires the submission of a biologics license application (“BLA”), rather than a New Drug Application ("NDA"), for market authorization. However, the application process and requirements for approval of BLAs are similar to those for NDAs, and biologics are associated with similar approval risks and costs as drugs.

Failure to comply with applicable U.S. requirements may subject a company to a variety of administrative or judicial sanctions, such as FDA refusal to approve pending NDAs or BLAs, untitled or warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties, and criminal prosecution.

Pharmaceutical product development in the U.S. typically involves preclinical laboratory and animal tests, the submission to the FDA of a notice of claimed investigational exemption or an investigational new drug application (“IND”), which must become effective before clinical testing can commence, and adequate and well-controlled clinical trials to establish the safety and effectiveness of the drug or biologic for each indication for which FDA approval is sought. Satisfaction of FDA pre-market approval requirements typically takes many years and the actual time required may vary substantially based upon the type, complexity and novelty of the product or disease.

Preclinical tests include laboratory evaluation of product chemistry, formulation and toxicity, as well as animal trials to assess the characteristics and potential safety and efficacy of the product. The conduct of the preclinical tests must comply with federal regulations and requirements including good laboratory practices. The results of preclinical testing are submitted to the FDA as part of an IND along with other information including information about product chemistry, manufacturing and controls and a proposed clinical trial protocol. Long term preclinical tests, such as animal tests of reproductive toxicity and carcinogenicity, may continue after the IND is submitted.

Submission of an IND may not result in FDA authorization to initiate a clinical trial if FDA raises concerns or questions about the design of the clinical trial or the preclinical or manufacturing information supporting it, including concerns that human research subjects will be exposed to unreasonable health risks. A separate submission to an existing IND must also be made for each successive clinical trial conducted during product development.

Clinical trials involve the administration of the investigational new drug to healthy volunteers or patients under the supervision of a qualified investigator. Clinical trials must be conducted in compliance with federal regulations; good clinical practice, or GCP, as set forth in FDA guidance, which is meantthis Amendment No. 1. In addition, pursuant to protect the rights and health of patients and to define the roles of clinical trial sponsors, administrators, and monitors; as well as under protocols detailing the objectivesRule 13a-14(a) of the trial, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated. Each protocol involving testing on U.S. patients and subsequent protocol amendments must be submitted to the FDASecurities Exchange Act of 1934, as part of the IND. Sponsors of clinical trials of FDA regulated products,amended (the “Exchange Act”), we are including drugs and biologics, are required to register and disclosewith this Amendment No. 1 certain clinical trial information. Information related to the product, patient population, phase of investigation, study sites and investigators, and other aspects of the clinical trial is then made public as part of the registration. Sponsors are also obligated to disclose the results of their clinical trials after completion. Competitors may use this publicly available information to gain knowledge regarding the progress of development programs.