PART I

PART I

NORFOLK SOUTHERN CORPORATION AND SUBSIDIARIES (NS)

Item 1. Business and Item 2. Properties

GENERAL - – Norfolk Southern Corporation (Norfolk Southern) is a Norfolk, Virginia based company that controlsowns a major freight railroad, Norfolk Southern Railway Company. Norfolk Southern Corporation was incorporated on July 23, 1980, under the laws of the Commonwealth of Virginia. Our common stock (Common Stock) is listed on the New York Stock Exchange (NYSE) under the symbol “NSC.”

Unless indicated otherwise, Norfolk Southern Corporation and its subsidiaries, including Norfolk Southern Railway Company, isare referred to collectively as NS, we, us, and our.

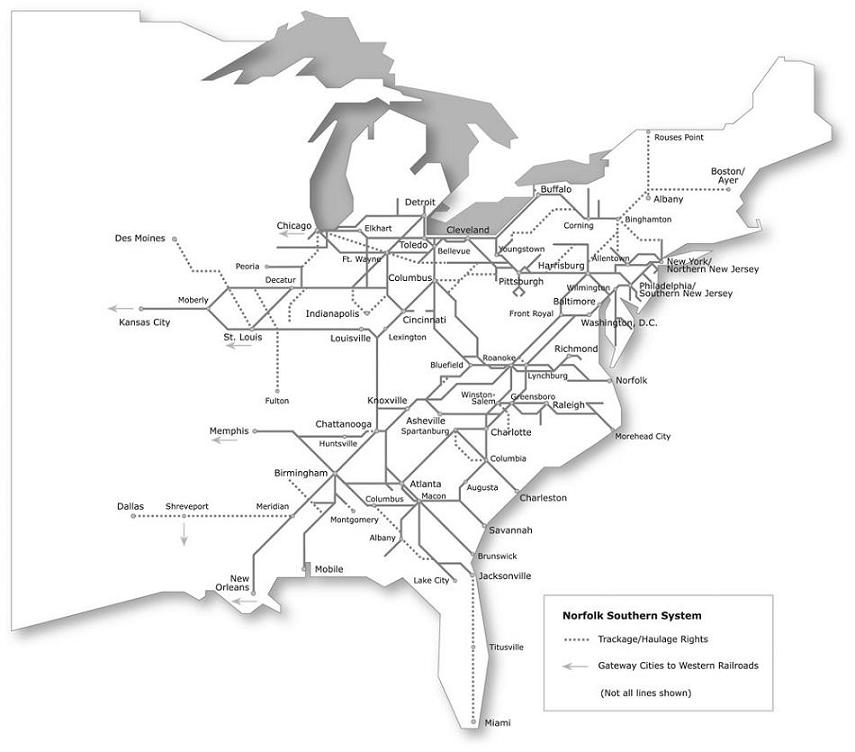

We are primarily engaged in the rail transportation of raw materials, intermediate products, and finished goods primarily in the Southeast, East, and Midwest and, via interchange with rail carriers, to and from the rest of the United States. Norfolk SouthernWe also transportstransport overseas freight through several Atlantic and Gulf Coast ports. Norfolk Southern providesWe provide comprehensive logistics services and offersoffer the most extensive intermodal network in the eastern half of the United States.

Norfolk Southern was incorporated on July 23, 1980, under the laws of the Commonwealth of Virginia. Norfolk Southern common stock (Common Stock) is listed on the New York Stock Exchange (NYSE) under the symbol “NSC.”

Norfolk Southern makesWe make available free of charge through itsour website, www.nscorp.com, itsour annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the U.S. Securities and Exchange Commission (SEC). In addition, the following documents are available on the company’sour website and in print to any shareholder who requests them:

• Corporate Governance Guidelines

• Charters of the Committees of the Board of Directors

• The Thoroughbred Code of Ethics

• Code of Ethical Conduct for Senior Financial Officers

• Categorical Independence Standards for Directors

Unless otherwise indicated, Norfolk Southern and its subsidiaries are referred to collectively as NS.

RAILROAD OPERATIONS - As of – At December 31, 2011, NS’2013, our railroads operated approximately 20,000 route miles of road in 22 states and the District of Columbia.

The system’s line reach

Our system reaches many individual industries, electric generating facilities, mines (in western Virginia, eastern Kentucky, southern and northern West Virginia, western Pennsylvania, and western Pennsylvania)southern Illinois and Indiana), distribution centers, transload facilities, and other businesses located in smaller communities in itsour service area.

Corridors with heaviest freight volume:

• New York City area to Chicago (via Allentown and Pittsburgh)

• Chicago to Macon (via Cincinnati, Chattanooga, and Atlanta)

• Appalachian coal fields of Virginia, West Virginia, and Kentucky to Norfolk, Virginia and Sandusky, Ohio

• Cleveland to Kansas City

• Birmingham to Meridian

• Memphis to Chattanooga

The miles operated, which include major leased lines between Cincinnati, Ohio, and Chattanooga, Tennessee, and an exclusive operating agreement for trackage rights over property owned by North Carolina Railroad Company, were as follows:

| | | Mileage Operated as of December 31, 2011 |

| | | | | | | | | | | | |

| | | | | Second | Passing | | | | |

| | | | | and | Track, | | | | |

| | | Miles | | Other | Crossovers | Way and | | |

| | | of | | Main | and | Yard | | |

| | | Road | | Track | Turnouts | Switching | Total | |

| | | | | | | | | | | | |

| Owned | | 15,493 | | 2,782 | | 2,005 | | 8,310 | | 28,590 | |

| Operated under lease, contract or trackage rights | | 4,648 | | 1,881 | | 381 | | 802 | | 7,712 | |

| Total | | 20,141 | | 4,663 | | 2,386 | | 9,112 | | 36,302 | |

| Mileage Operated at December 31, 2013 |

| | | | | | | | | |

| | | Second | | Passing | | | | |

| | | and | | Track, | | | | |

| Miles | | Other | | Crossovers | | Way and | | |

| of | | Main | | and | | Yard | | |

| Road | | Track | | Turnouts | | Switching | | Total |

| | | | | | | | | |

Owned | 15,181 | | 2,750 | | 1,989 | | 8,281 | | 28,201 |

Operated under lease, contract or trackage rights | 4,780 | | 1,910 | | 397 | | 831 | | 7,918 |

| | | | | | | | | |

Total | 19,961 | | 4,660 | | 2,386 | | 9,112 | | 36,119 |

| | | | | | | | | |

Triple Crown Operations - – Triple Crown Services Company (Triple Crown), an NS subsidiary,one of our subsidiaries, provides bimodal truckload transportation service primarily utilizing RoadRailer® trailers, a hybrid technology that facilitates both over-the-road and on-the-rail transportation utilizing enclosed trailers that are pulled over the highways in tractor-trailer configuration and over the rails by locomotives. In addition, Triple Crown utilizes conventional trailers that are also moved on rail flatcars. Triple Crown provides service in the eastern two-thirds of the United States, as well as Ontario and Quebec, through a network of terminals strategically located in 13 cities.

The following table sets forth certain statistics relating to NS’our railroads’ operations for the past 5 years:

| | Years Ended December 31, |

| | 2011 | | 2010 | | 2009 | | 2008 | | 2007 |

| | | | | | | | | | |

| Revenue ton miles (billions) | 192 | | 182 | | 159 | | 195 | | 196 |

| Freight train miles traveled (millions) | 75.7 | | 72.6 | | 67.5 | | 80.0 | | 81.9 |

| Revenue per ton mile | $0.0582 | | $0.0523 | | $0.0503 | | $0.0546 | | $0.0481 |

| Revenue ton miles per employee-hour worked | 3,207 | | 3,218 | | 2,900 | | 3,075 | | 3,066 |

| Ratio of railway operating expenses to railway operating revenues | 71.2% | | 71.9% | | 75.4% | | 71.1% | | 72.6% |

| Years ended December 31, |

| 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

| | | | | | | | | |

Revenue ton miles (billions) | 194 | | 186 | | 192 | | 182 | | 159 |

Freight train miles traveled (millions) | 74.8 | | 76.3 | | 75.7 | | 72.6 | | 67.5 |

Revenue per ton mile | $0.0581 | | $0.0595 | | $0.0582 | | $0.0523 | | $0.0503 |

Revenue ton miles per employee-hour worked | 3,376 | | 3,153 | | 3,207 | | 3,218 | | 2,900 |

Ratio of railway operating expenses to railway operating revenues | 71.0% | | 71.7% | | 71.2% | | 71.9% | | 75.4% |

RAILWAY OPERATING REVENUES - NS’ total– Total railway operating revenues were $11.2 billion in 2011. See the financial information by traffic segment in Part II, Item 7, “Management’s Discussion and Analysis2013. Following is an overview of Financial Condition and Results of Operations.”our three major market groups.

COAL TRAFFIC -– Coal is NS’our largest commodity group as measured by revenues. Revenues from coal accounted for about 31%23% of NS’our total railway operating revenues in 2011. NS2013. We handled a total of 177.9150.1 million tons, or 1.3 million carloads, in 2011,2013, most of which originated on NS’our lines from major eastern coal basins, with the balance from major western coal basins received via the Memphis and Chicago gateways. NS’Our coal franchise servessupports the electric generation market, serving slightly overapproximately 100 coal generation plants, as well as the export, metallurgical and industrial markets, primarily through direct rail and river, lake, and coastal facilities, including Lambert’s Point and various terminals on the Ohio River, Lambert’s Point in Norfolk, Virginia, the Port of Baltimore, and Lake Erie.

See the discussion of coal traffic,revenues and tonnage, by type of coal, in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

GENERAL MERCHANDISE TRAFFIC - General– Our general merchandise trafficmarket group is composed of five major commodity groupings: automotive; chemicals; metals

• Chemicals includes sulfur and construction; agriculture,related chemicals, petroleum products (including crude oil), chlorine and bleaching compounds, plastics, rubber, industrial chemicals, and chemical wastes.

• Agriculture, consumer products, and government;government includes soybeans, wheat, corn, fertilizer, livestock and paper, claypoultry feed, food oils, flour, beverages, canned goods, sweeteners, consumer products, ethanol, transportation equipment, and forest products. The automotive groupitems for the U.S. military.

• Metals and construction includes steel, aluminum products, machinery, scrap metals, cement, aggregates, sand, and minerals.

• Automotive includes finished vehicles for BMW, Chrysler, Ford, Motor Company, General Motors, Honda, Hyundai, Mercedes-Benz, Mitsubishi, Subaru, Toyota, and Volkswagen, and auto parts for BMW, Chrysler, Ford, Motor Company, General Motors, Honda, Hyundai, Mazda, Mitsubishi, Nissan, Subaru, Toyota, and Toyota. The chemicals group includes sulfur and related chemicals, petroleum products, chlorine and bleaching compounds, plastics, rubber, industrial chemicals, chemical wastes, and municipal wastes. The metals and construction group includes steel, aluminium products, machinery, scrap metals, cement, aggregates, bricks, and minerals. The agriculture, consumer products, and government group includes soybeans, wheat, corn, fertilizer, animal and poultry feed, food oils, flour, beverages, canned goods, sweeteners, consumer products, ethanol, and items for the military. The paper,Volkswagen.

• Paper, clay and forest products group includes lumber and wood products, pulp board and paper products, wood fibers, wood pulp, scrap paper, and clay.

In 2011, 1202013, 119 million tons of general merchandise freight, or approximately 66%62% of total general merchandise tonnage we handled, by NS, originated online.on our lines. The balance of general merchandise trafficfreight was received from connecting carriers at interterritorial gateways. TheOur principal interchange points for NS-received trafficreceived freight included Chicago, Memphis, New Orleans, Cincinnati, Kansas City, Detroit, Hagerstown, St. Louis/East St. Louis, Memphis, Detroit, Kansas City, Buffalo, Toledo, and Louisville.Meridian. General merchandise carloads handled in 20112013 were 2.32.4 million, the revenues from which accounted for 50%56% of NS’our total railway operating revenues in 2011.revenues.

See the discussion of general merchandise rail trafficrevenues by commodity group in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

INTERMODAL TRAFFIC - The– Our intermodal market group consists of shipments moving in trailers, domestic and international containers, and RoadRailer® equipment. These shipments are handled on behalf of intermodal marketing companies, international steamship lines, truckers, and other shippers. Intermodal units handled in 20112013 were

3.2 3.6 million, the revenues from which accounted for 19%21% of NS’our total railway operating revenues for the year.revenues.

See the discussion of intermodal trafficrevenues in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

FREIGHT RATES - In 2011, NS’ railroads continued their reliance on private– Private contracts and exempt price quotes as theirare our predominant pricing mechanisms. Thus, a major portion of NS’our freight business is not currently economically regulated by the federal government. In general, market forces have been substituted for government regulation and now are the primary determinant of rail service prices.

In 2011, NS’2013, our railroads were found by the STBU.S. Surface Transportation Board (STB), the regulatory board that has broad jurisdiction over railroad practices, to not be “revenue adequate” on an annual basis based on results for the year 2010.2012. The STB has not made its revenue adequacy determination for the year 2011.2013. A railroad is “revenue adequate” on an annual basis under the applicable law when its return on net investment exceeds the rail industry’s composite cost of capital. This determination is made pursuant to a statutory requirement.

PASSENGER OPERATIONS

- –Amtrak operates regularly scheduled passenger trains on

NS’our lines between the following locations:– • Alexandria and Lynchburg, Virginia

• Alexandria, Virginia and New Orleans, Louisiana

–

• Alexandria and Orange, Virginia

• Petersburg and Norfolk, Virginia

• Raleigh and Charlotte, North Carolina

–

• Selma and Charlotte, North Carolina

–

• Chicago, Illinois, and Porter, Indiana

–

• Chicago, Illinois, and Cleveland, Ohio

• Chicago, Illinois, and Pittsburgh, Pennsylvania

• Kalamazoo and Battle Creek, Michigan

– Chicago, Illinois, and Pittsburgh, Pennsylvania

– Chicago, Illinois,

• Kalamazoo and Detroit, Michigan

–

• Pittsburgh and Harrisburg, Pennsylvania

K6

Two transportation commissions of the Commonwealth of Virginia operate commuter trains on the NSour line between Manassas and Alexandria

NS leasesAlexandria.We lease the Chicago to Manhattan, Illinois, line to the Commuter Rail Division of the Regional Transportation Authority of Northeast Illinois (METRA)

NS operates.We operate freight service over lines with significant ongoing Amtrak and commuter passenger operations, and is conductingconduct freight operations over trackage owned or leased by:

– • Amtrak

–

• New Jersey Transit

–

• Southeastern Pennsylvania Transportation Authority

–

• Metro-North Commuter Railroad Company

–

• Maryland Department of Transportation

Amtrak orand various commuter agencies conduct passenger operations over trackage owned by Conrail in the Shared Assets Areas (see Note(Note 5 to the Consolidated Financial Statements)

.

NONCARRIER OPERATIONS - NS’– Our noncarrier subsidiaries engage principally in the acquisition, leasing, and management of coal, oil, gas and minerals; the development of commercial real estate; telecommunications; and the leasing or sale of rail property and equipment. In 2011,2013, no such noncarrier subsidiary or industry segment grouping of noncarrier subsidiaries met the requirements for a reportable business segment under relevant authoritative accounting guidance.

RAILWAY PROPERTY

The NS

Our railroad system extends across 22 states and the District of Columbia. The railroad infrastructure makes the companyus capital intensive with net property of approximately $24$27 billion on a historical cost basis.

Property Additions -– Property additions for the past five years were as follows (including capitalized leases):

| | | | | | Property Additions | | | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 |

| | | | | | ($ in millions) | | | |

| | | | | | | | | | | | | | | |

| Road and all other property | $ | 1,222 | | $ | 1,153 | | $ | 1,128 | | $ | 1,070 | | $ | 894 |

| Equipment | | 938 | | | 317 | | | 171 | | | 488 | | | 447 |

| Total | $ | 2,160 | | $ | 1,470 | | $ | 1,299 | | $ | 1,558 | | $ | 1,341 |

Capital

| 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

| ($ in millions) |

| | | | | | | | | | | | | | |

Road and all other property | $ | 1,421 | | $ | 1,465 | | $ | 1,222 | | $ | 1,153 | | $ | 1,128 |

Equipment | | 550 | | | 776 | | | 938 | | | 317 | | | 171 |

| | | | | | | | | | | | | | |

Total | $ | 1,971 | | $ | 2,241 | | $ | 2,160 | | $ | 1,470 | | $ | 1,299 |

Our capital spending and replacement programs are and have been designed to assure the ability to provide safe, efficient, and reliable rail transportation services. For 2012, NS has2014, we have budgeted $2.4$2.2 billion of property additions.

NS has

We have invested and will continue to invest in various projects and corridor initiatives to expand itsour rail network to increase capacity and improve transit times, while returning value to shareholders. Initiatives include the following:

�� The MidAmericaCrescent Corridor consists of a program of projects for infrastructure and other facility improvements geared toward creating seamless, high-capacity intermodal routes spanning 11 states from New Jersey to Louisiana and offering truck-competitive service along several major interstate highway corridors, including I-81, I-85, I-20, I-40, I-59, I-78, and I-75.

• The Heartland Corridor is an arrangementa seamless, high-capacity intermodal route across Virginia and West Virginia to Midwest markets.

• Meridian Speedway LLC, a joint venture with Kansas City Southern, owns and operates a 320-mile rail line between NSMeridian, Mississippi and Canadian National Railway (CN)Shreveport, Louisiana designed to share track between Chicago, St. Louis, Kentucky,increase capacity and Mississippi in order to establish more efficient routes for traffic moving between the Midwest and Southeast, including potential coal traffic moving to NS-served southeastern utility plants from CN-served Illinois Basin coal producers.

- improve service.

• Pan Am Southern LLC, a joint venture between NS andwith Pan Am Railways, Inc., isowns and operates a 155-mile main line track that runs between Mechanicville, New York and Ayer, Massachusetts, along with 281 miles of secondary and branch lines, including trackage rights in New York, Connecticut, Massachusetts, New Hampshire, and Vermont designed to increase intermodal and automotive capacity.

K7

Equipment - As of– At December 31, 2011, NS2013, we owned or leased the following units of equipment:

| | | | | | | | Capacity of |

| | | Owned* | | Leased** | | Total | Equipment |

| | | | | | | | (Horsepower) |

| Locomotives: | | | | | | | | | |

| Multiple purpose | | 3,666 | | 238 | | 3,904 | | 13,753,400 | |

| Switching | | 123 | | -- | | 123 | | 184,750 | |

| Auxiliary units | | 116 | | -- | | 116 | | -- | |

| Total locomotives | | 3,905 | | 238 | | 4,143 | | 13,938,150 | |

| | | | | | | | | | |

| Freight cars: | | | | | | | | (Tons) | |

| Hopper | | 16,969 | | 1,308 | | 18,277 | | 2,006,214 | |

| Box | | 12,928 | | 1,572 | | 14,500 | | 1,206,307 | |

| Covered hopper | | 10,671 | | 633 | | 11,304 | | 1,247,800 | |

| Gondola | | 31,381 | | 3,922 | | 35,303 | | 3,801,663 | |

| Flat | | 2,559 | | 1,072 | | 3,631 | | 336,988 | |

| Caboose | | 165 | | -- | | 165 | | -- | |

| Other | | 4,447 | | 88 | | 4,535 | | 225,212 | |

| Total freight cars | | 79,120 | | 8,595 | | 87,715 | | 8,824,184 | |

| | | | | | | | | | |

| Other: | | | | | | | | | |

| Work equipment | | 4,461 | | 313 | | 4,774 | | | |

| Vehicles | | 3,810 | | -- | | 3,810 | | | |

| Highway trailers and containers | | 7,083 | | 8,212 | | 15,295 | | | |

| RoadRailer® | | 6,399 | | 27 | | 6,426 | | | |

| Miscellaneous | | 9,790 | | 9,329 | | 19,119 | | | |

| Total other | | 31,543 | | 17,881 | | 49,424 | | | |

| | | | | | | Capacity of |

| Owned(1) | | Leased(2) | | Total | | Equipment |

| | | | | | | (Horsepower) |

Locomotives: | | | | | | | |

Multiple purpose | 3,877 | | 79 | | 3,956 | | 14,479,300 |

Auxiliary units | 131 | | - | | 131 | | - |

Switching | 105 | | - | | 105 | | 157,750 |

| | | | | | | |

Total locomotives | 4,113 | | 79 | | 4,192 | | 14,637,050 |

| | | | | | | |

| | | | | | | (Tons) |

Freight cars: | | | | | | | |

Gondola | 30,933 | | 3,533 | | 34,466 | | 3,748,088 |

Hopper | 13,072 | | 523 | | 13,595 | | 1,514,656 |

Box | 11,340 | | 1,378 | | 12,718 | | 1,062,685 |

Covered hopper | 10,251 | | 158 | | 10,409 | | 1,149,345 |

Flat | 2,362 | | 1,129 | | 3,491 | | 323,910 |

Other | 4,602 | | 14 | | 4,616 | | 221,441 |

| | | | | | | |

Total freight cars | 72,560 | | 6,735 | | 79,295 | | 8,020,125 |

| | | | | | | |

Other: | | | | | | | |

Highway trailers and containers | 9,553 | | 8,623 | | 18,176 | | |

RoadRailer® | 6,350 | | 27 | | 6,377 | | |

Work equipment | 4,547 | | 243 | | 4,790 | | |

Vehicles | 3,785 | | - | | 3,785 | | |

Miscellaneous | 15,050 | | 7,778 | | 22,828 | | |

| | | | | | | |

Total other | 39,285 | | 16,671 | | 55,956 | | |

*(1) | Includes equipment leased to outside parties and equipment subject to equipment trusts, conditional sale agreements, and capitalized leases. |

**(2) | Includes short-term and long-term operating leases. Freight cars include 791523 units leased from Consolidated Rail Corporation (CRC).Corporation. |

K8

The following table indicates the number and year built for locomotives and freight cars owned at December 31, 2011:2013:

| | | | | | | | | | | | 2002- | | 1997- | | 1996 & | | |

| | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | | 2006 | | 2001 | | Before | | Total |

| Locomotives: | | | | | | | | | | | | | | | | | |

| No. of units | 90 | | 42 | | -- | | 40 | | 90 | | 538 | | 768 | | 2,337 | | 3,905 |

| % of fleet | 2% | | 1% | | --% | | 1% | | 2% | | 14% | | 20% | | 60% | | 100% |

| | | | | | | | | | | | | | | | | | |

| Freight cars: | | | | | | | | | | | | | | | | | |

| No. of units | 3,840 | | 150 | | 514 | | 2,349 | | 1,198 | | 493 | | 4,975 | | 65,601 | | 79,120 |

| % of fleet | 5% | | --% | | 1% | | 3% | | 1% | | 1% | | 6% | | 83% | | 100% |

| | | | | | | | | | | 2004- | | 1999- | | 1998& | | |

| 2013 | | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | | 2003 | | Before | | Total |

Locomotives: | | | | | | | | | | | | | | | | | |

No. of units | 50 | | 60 | | 90 | | 42 | | - | | 568 | | 605 | | 2,698 | | 4,113 |

% of fleet | 1% | | 1% | | 2% | | 1% | | -% | | 14% | | 15% | | 66% | | 100% |

| | | | | | | | | | | | | | | | | |

Freight cars: | | | | | | | | | | | | | | | | | |

No. of units | - | | 2,025 | | 3,836 | | 150 | | 513 | | 4,031 | | 1,537 | | 60,468 | | 72,560 |

% of fleet | -% | | 3% | | 5% | | -% | | 1% | | 6% | | 2% | | 83% | | 100% |

The following table shows the average age of NS’our owned locomotive and freight car fleets at December 31, 2011,2013, and the number of retirements in 2011:information regarding 2013 retirements:

| Locomotives | Locomotives

| | | |

Average age -– in service | 22.5 years | 21.0 | 30.2 years | | | | | 30.3 years | | |

Retirements | 17 units | 44 units | | | | | 2,035 units | | 6,522 cars |

Average age -– retired | 38.7 years | 31.7 | 42.3 years |

|

| | | | 41.6 years | |

|

OngoingOur ongoing locomotive and freight car maintenance programs are intended to ensure the highest standards of safety, reliability, customer satisfaction, and equipment marketability.availability. The locomotive bad order ratio includes all units (owned and leased) out of service for required periodic inspections, every 92 days,unscheduled maintenance and program work which includes such activity as overhauls, and unscheduled maintenance.overhauls.

| | | Annual Average Bad Order Ratio | |

| | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| Locomotives | | 7.3% | | 6.7% | | 6.1% | | 5.8% | | 5.7% | |

| Freight Cars | | 5.7% | | 5.8% | | 4.5% | | 4.5% | | 4.9% | |

| Annual Average Bad Order Ratio |

| 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

Locomotives | 7.1% | | 7.1% | | 7.3% | | 6.7% | | 6.1% |

Freight cars | 4.9% | | 5.3% | | 5.7% | | 5.8% | | 4.5% |

| | | | | | | | | |

Encumbrances - – Certain railroad equipment is subject to the prior lien of equipment financing obligations amounting to approximately $69totaling $15 million as ofat December 31, 2011, and $112 million as of December 31, 2010.2013.

Track Maintenance -– Of the approximately 36,30036,119 total miles of track operated, NS had the responsibilitywe operate, we are responsible for maintaining about 29,40028,957 miles, of track, with the remainder being operated under trackage rights from other parties responsible for maintenance.

Over 80%82% of the main line trackage (including first, second, third, and branch main tracks, all excluding rail operated pursuant to trackage rights) has rail ranging from 131 to 155 pounds per yard with the standard installation currently at 136 pounds per yard. Approximately 44% of NSour lines, excluding rail operated pursuant to trackage rights, carried

20 million or more gross tons per track mile during 2011.2013.

The following table summarizes several measurements regarding NS’our track roadway additions and replacements during the past five years:

| | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| Track miles of rail installed | | 484 | | 422 | | 434 | | 459 | | 401 | |

| Miles of track surfaced | | 5,441 | | 5,326 | | 5,568 | | 5,209 | | 5,014 | |

| New crossties installed (millions) | | 2.7 | | 2.6 | | 2.7 | | 2.7 | | 2.7 | |

K9

| 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

Track miles of rail installed | 549 | | 509 | | 484 | | 422 | | 434 |

Miles of track surfaced | 5,475 | | 5,642 | | 5,441 | | 5,326 | | 5,568 |

New crossties installed (millions) | 2.5 | | 2.6 | | 2.7 | | 2.6 | | 2.7 |

Microwave System - The NS– Our microwave system, consisting of approximately 7,4006,968 radio route miles, 427421 core stations, 30 secondary stations, and five passive repeater stations, provides communications between most operating locations. TheWe use the microwave system is used primarily for voice communications, VHF radio control circuits, data and facsimile transmissions, traffic control operations, and AEI data transmissions.

Traffic Control -– Of the approximately 16,500 route miles dispatched by NS,we dispatch, about 11,025 miles are signalized, including 8,1508,200 miles of centralized traffic control (CTC) and 2,8752,825 miles of automatic block signals. Of the 8,1508,200 miles of CTC, approximately 5,0506,836 miles are controlled by data radio originating at 312336 base station radio sites.

Computers -– A computer network consisting of a centralized production and backup data center innear Atlanta, Georgia, and various distributed computers throughout the company connects the yards, terminals, transportation offices, rolling stock repair points, sales offices, and other key system locations. ��Operating and traffic data are processed and stored to provide customers with information on their shipments throughout the system. Computer systems provide current information on the location of every train and each car on line, as well as related waybill and other train and car movement data. In addition, theour computer systems are utilized to assist managementus in the performance of a

variety of functions and services, including payroll, car and revenue accounting, billing, materialsourcing, inventory management activities and controls, and special studies.

ENVIRONMENTAL MATTERS -– Compliance with federal, state, and local laws and regulations relating to the protection of the environment is aone our principal NS goal.goals. To date, such compliance has not affected materially NS’ property additions, earnings,had a material effect on our financial position, results of operations, liquidity, or competitive position. See “Legal Proceedings,” Part I, Item 3; “Personal Injury, Environmental, and Legal Liabilities” in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and Note 16 to the Consolidated Financial Statements.

EMPLOYEES -– The following table shows the average number of employees and the average cost per employee for wages and benefits:

| | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| Average number of employees | | 30,329 | | 28,559 | | 28,593 | | 30,709 | | 30,806 | |

| Average wage cost per employee | | $71,000 | | $69,000 | | $63,000 | | $66,000 | | $62,000 | |

| Average benefit cost per employee | | $39,000 | | $37,000 | | $32,000 | | $31,000 | | $30,000 | |

| 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

Average number of employees | | 30,103 | | | 30,943 | | | 30,329 | | | 28,559 | | | 28,593 |

Average wage cost per employee | $ | 72,000 | | $ | 69,000 | | $ | 71,000 | | $ | 69,000 | | $ | 63,000 |

Average benefit cost per employee | $ | 40,000 | | $ | 38,000 | | $ | 39,000 | | $ | 37,000 | | $ | 32,000 |

| | | | | | | | | | | | | | |

More than 80% of NS’our railroad employees are covered by collective bargaining agreements with various labor unions. See the discussion of “Labor Agreements” in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

GOVERNMENT REGULATION -– In addition to environmental, safety, securities, and other regulations generally applicable to all business, NS’our railroads are subject to regulation by the STB. The STB has jurisdiction over some rates, routes, fuel surcharges, conditions of service, and the extension or abandonment of rail lines. The STB also has jurisdiction over the consolidation, merger, or acquisition of control of and by rail common carriers. The Federal Railroad Administration (FRA) regulates certain track and mechanical equipment standards.

The relaxation of economic regulation of railroads, underfollowing the Staggers Rail Act of 1980, includes exemptionsincluded exemption from STB regulation of the rates and most service terms for intermodal business (trailer-on-flat-car, container-on-flat-car), rail boxcar traffic,shipments, lumber, manufactured steel, automobiles, and certain bulk commodities such as sand, gravel, pulpwood, and wood chips for paper manufacturing. Transportation contracts on theseFurther, all shipments and on regulated shipmentsthat we have under contract are effectively remove those shipmentsremoved from regulation as well for the duration of the contract. About 86%88% of NS’ freightour revenues comecomes from either exempt trafficshipments or trafficshipments moving under transportation contracts.contracts; the remainder comes from shipments moving under public tariff rates.

Efforts werehave been made in 2011over the past several years to re-subject the rail industry to increased federal economic regulation, and such efforts are expected to continue in 2012.2014. The Staggers Rail Act of 1980 which substantially balanced such regulation,the interests of shippers and rail carriers, and encouraged and enabled rail carriers to innovate, invest in their infrastructure, and compete for business, thereby contributing to the economic health of the nation and to the revitalization of the industry. Accordingly, NSwe will continue to oppose efforts to reimpose increased economic regulation.

K10

Government regulations concerning the safety and security of our railroads are discussed within the “Security of Operations” section contained herein.

COMPETITION -– There is continuing strong competition among rail, water, and highway carriers. Price is usually only one factor of importance as shippers and receivers choose a transport mode and specific hauling company. Inventory carrying costs, service reliability, ease of handling, and the desire to avoid loss and damage during transit are also important considerations, especially for higher-valued finished goods, machinery, and consumer products. Even for raw materials, semi-finished goods, and work-in progress,work-in-progress, users are increasingly sensitive to transport arrangements that minimize problems at successive production stages.

Our primary rail competitor is the CSX system;Corporation; both railroads operate throughout much of the same territory. Other railroads also operate in parts of the territory. NSWe also competescompete with motor carriers, water carriers, and with shippers who have the additional options of handling their own goods in private carriage, sourcing products from different geographic areas, and using substitute products.

Certain marketing strategies among railroads and between railroads and motor carriers enable carriersrailroads to compete more effectively in specific markets.

SECURITY OF OPERATIONS - NS has taken significant steps– We continue to take measures to provide enhanced security for the NSour rail system.

In particular, NS has developed and implemented aOur comprehensive security plan that is modeled on and was developed in conjunction with the security plan prepared by the Association of American Railroads (AAR) post September 11, 2001. The AAR Security Plan defines four Alert Levels and details the actions and countermeasures that are being applied across the railroad industry as thea terrorist threat increases or decreases. The Alert Level actions include countermeasures that will be applied in three general areas: (1) operations (including transportation, engineering, and mechanical); (2) information technology and communications; and, (3) railroad police. Although security concerns preclude public disclosure of its contents, the NS Departmentalour System Security Plan outlines the protocol within NSour company for all concerned to be notified of AAR Alert Level changes. All NSof our Operations Division employees are advised by their supervisors or train dispatchers, as appropriate, of any change in Alert Level and any additional responsibilities they may incur due to such change.

The NS

Our plan also effectively addresses and complies with U.S. Department of Transportation (DOT) security regulations pertaining to training and security plans with respect to the transportation of hazardous materials. As part of the plan, security awareness training is given to all railroad employees who directly affect hazardous material transportation safety, and this training is integrated into recurring hazardous material training and re-certification programs. Toward that end, NS,we, working closely with the National Transit Institute at Rutgers University, has developed a four-module uniform national training program. NSWe have also has worked with the Transportation Security Administration (TSA) in developing other industry training programs. More in-depth security training has been given to those select NS employees of ours who have been given specific security responsibilities, and additional, location-specific security plans have been developedare in place for certain metropolitan areas and each of the six port facilities served by NS.we serve. With respect to the ports, each facility plan has been approved by the applicable Captain of the Port and remains subject to inspection by the U.S. Coast Guard.

Additionally, NS engageswe continue to engage in close and regular coordination with numerous federal and state agencies, including the U.S. Department of Homeland Security (DHS), the TSA, the Federal Bureau of Investigation (FBI), the Federal Railroad Administration (FRA),FRA, the U.S. Coast Guard, U.S. Customs and Border Protection, and various state Homeland Security offices. As one notable example, an NSone of our Police Special AgentAgents in Charge (SAC), under the auspices of the AAR, has been assignedcontinues to serve at the National Joint Terrorism Task Force (NJTTF) operated by the FBI, and located at the National Counter Terrorism Center (NCTC) in Arlington, VAVirginia to represent and serve as liaison to the North American rail industry. This arrangement improves logistical flow of vital security and law enforcement information with respect to the rail industry as a whole, while having the post filled by an NS SAC hasone of our SACs also servedserves to foster a strong working relationship between NSus and the FBI. NSWe also has becomeare a member of the Customs-Trade Partnership Against Terrorism (C-TPAT) program sponsored by U.S. Customs. C-TPAT allows NSus to work closely with U.S. Customs and itsour customers to develop measures that will help ensure the integrity of freight shipments moving on NS,our railroads, particularly those moving to or from a foreign country. Based on participation in C-TPAT, NS haswe have ensured that itsour plan meets all current applicable security recommendations made by U.S. Customs.

K11

Similarly, NS iswe continue to be guided in itsour operations by various supplemental security action items issued by DHS and U.S. Department of Transportation (DOT),DOT, U.S. Coast Guard Maritime Security requirements, as well as voluntary security action items developed in collaboration with TSA, DOT, and the freight railroads. Many of the action items are based on lessons learned from DHS and DOT security assessments of rail corridors in High Threat Urban Areas (HTUA). Particular attention is aimed at reducing risk in HTUA by: (1) the establishment of secure storage areas for rail

cars carrying toxic-by-inhalation (TIH) materials; (2) the expedited movement of trains transporting rail cars carrying TIH materials; (3) the minimization of unattended loaded tank cars carrying TIH materials; and (4) cooperation with federal, state, local and tribal governments to identify, through risk assessments, those locations where security risks are the highest. These action items and NS’our compliance initiatives are outlined in the various departmental sections of the NS Departmentalour System Security Plan. NS hasWe have taken appropriate actions to be compliant with the TSA Final Security Rule addressing Rail Security Sensitive Materials (RSSM) to ensure these shipments are properly inspected and that positive chain-of-custody is maintained when required. NS isWe are in compliance with the Pipeline and Hazardous Materials Safety Administration (PHMSA) rail-routing regulations outlined in Docket HM-232E. NS conducts annual, on-goingWe conduct ongoing route evaluations. In 2011, as part of the FRA’s bi-annual review, this methodology and selected routes were reviewed by the Federal Railroad Administration, and found to be compliant with the regulation as part ofregulation. The next review by the annual review conducted by FRA.FRA is expected mid-year 2014.

In 2011,2013, through participation in the Transportation Community Awareness and Emergency Response (TRANSCAER) Program, NSwe provided rail accident response training to approximately 5,3164,900 emergency responders, such as local police and fire personnel, representing over 18,986 hours of emergency response training. NS also conducted railroad operations classes for FBI agents and the railroad liaison agents from NJTTF. NS’personnel. Our other training efforts throughout 20112013 included participation in 17 drills for local, state, and federal agencies. NSWe also hashave ongoing programs to sponsor local emergency responders at the Security and Emergency Response Training Course (SERTC) conducted at the AAR Transportation Technology Center in Pueblo, Colorado.

Improvements in equipment design also are expected to play a role in enhancing rail security. PHMSA, in coordination with the FRA, is amendinghas amended the Hazardous Materials Regulations to prescribe enhanced safety measures for rail transportation of TIH materials, includinghas provided interim design standards for railroad tank cars. The rule mandates commodity-specific improvements in safety features and design standards for newly manufactured DOT specification tank cars and an improved top fittings performance standard. The interim standards established in this rule will enhance the accident survivability of TIH tank cars.

Item 1A. Risk Factors

NS is

We are subject to significant governmental legislation and regulation over commercial, operating and environmental matters. Railroads are subject to the enactment of laws by Congress that could increase economic regulation of the industry. Railroads presently are subject to commercial regulation by the STB,Surface Transportation Board (STB), which has jurisdiction over some routes, rates, androutes, fuel surcharges, conditions of service, and the extension or abandonment of rail lines. The STB also has jurisdiction over consolidations, mergers,the consolidation, merger, or acquisitions involvingacquisition of control of and by rail common carriers. Additional economic regulation of the rail industry by CongressCongress or the STB, whether under new or existing laws, could have a significant negative impact on NS’our ability to determine prices for rail services and result in a material adverse effect in the future on NS’our financial position, results of operations, or liquidity in a particular year or quarter. This potential material adverse effect could also result in reduced capital spending on NS’our rail network or abandonment of lines.

Railroads are subject to safety and security regulation by the DOTU.S. Department of Transportation and the DHS,U.S. Department of Homeland Security, which regulate most aspects of NS’our operations. Compliance with the Rail Safety Improvement Act of 2008 will result in additional operating costs associated with the statutorily mandated implementation of positive train control by 2015. In addition to increased capital expenditures, implementation may result in reduced operational efficiency and service levels, as well as increased compensation and benefits expenses, and increased claims and litigation costs.

NS’

Our operations are subject to extensive federal and state environmental laws and regulations concerning, among other things, emissions to the air; discharges to waterways or ground watergroundwater supplies; handling, storage, transportation, and disposal of waste and other materials; and the cleanup of hazardous material or petroleum releases. The risk of incurring environmental liability -– for acts and omissions, past, present, and future -– is inherent in the railroad business. This risk includes property owned by NS,us, whether currently or in the past, that is or has been subject to a variety of uses, including NSour railroad operations and other industrial activity by past owners or our past and present tenants of NS.tenants.

Environmental problems that are latent or undisclosed may exist on these properties, and NSwe could incur environmental liabilities or costs, the amount and materiality of which cannot be estimated reliably at this time, with respect to one or more of these properties. Moreover, lawsuits and claims involving other unidentified environmental sites and matters are likely to arise from time to time, and the resulting liabilities could have a significant effect on our financial position, results of operations, or liquidity in a particular year or quarter.

NS, as

As a common carrier by rail, we must offer to transport hazardous materials, regardless of risk. Transportation of certain hazardous materials could create catastrophic losses in terms of personal injury and property (including environmental) damage, costs, and compromise critical parts of our rail network. A catastrophic rail accident involving hazardous materials could have a material adverse effect on our financial position, results of operations, or liquidity to the extent not covered by insurance. We have obtained insurance for potential losses for third-party liability and first-party property damages; however, insurance is available from a limited number of insurers and may not continue to be available or, if available, may not be obtainable on terms acceptable to us.

NS

We may be affected by terrorism or war. Any terrorist attack, or other similar event, any government response thereto, and war or risk of war could cause significant business interruption and may adversely affect NS’our financial position, results of operations, financial position, or liquidity in a particular year or quarter. Because NS playswe play a critical role in the nation’s transportation system, itwe could become the target of such an attack or have a significant role in the government’s preemptive approach or response to an attack or war.

Although NSwe currently maintainsmaintain insurance coverage for third-party liability arising out of war and acts of terrorism, it maintainswe maintain only limited insurance coverage for first-party property damage and damage to property in NS’our care, custody, or control caused by certain acts of terrorism. In addition, premiums for some or all of NS’our current insurance programs covering these losses could increase dramatically, or insurance coverage for certain losses could be unavailable to NSus in the future.

NS

We may be affected by general economic conditions. Prolonged negative changes in domestic and global economic conditions affecting the producers and consumers of the commodities NS carrieswe carry may have an adverse effect on its operating results,our financial position, results of operations, or liquidity.liquidity in a particular year or quarter. Economic conditions resulting in bankruptcies of one or more large customers could have a significant impact on NS’our financial position, results of operations, or liquidity in a particular year or quarter.

NS

We may be affected by climate change legislation or regulation. Concern over climate change has led to significant federal, state, and international legislative and regulatory efforts to limit greenhouse gas (GHG) emissions. Moreover, even without such legislation or regulation, government incentives and adverse publicity relating to GHG’sGHGs could affect certain of our customers and the markets for certain of the commodities we carry. Restrictions, caps, taxes, or other controls on GHG emissions, including diesel exhaust, could significantly increase NS’our operating costs, decrease the amount of traffic handled, and decrease the value of coal reserves owned by NS,we own, and thus could have an adverse effect on NS’ operating results,our financial position, and liquidity.results of operations, or liquidity in a particular year or quarter. Such restrictions could affect NS’our customers that (1) use commodities that NS carrieswe carry to produce energy, including coal, (2) use significant amounts of energy in producing or delivering the commodities NS carries,we carry, or (3) manufacture or produce goods that consume significant amounts of energy.

NS faces

We face competition from other transportation providers. NS is We are subject to competition from motor carriers, railroads and, to a lesser extent, ships, barges, and pipelines, on the basis of transit time, pricing, and the quality and reliability of service. While NS haswe have used primarily internal resources to build or acquire and maintain itsour rail system, trucks and barges have been able to use public rights-of-way maintained by public entities. Any future improvements or expenditures materially increasing the quality or reducing the cost of alternative modes of transportation in the regions in which NS operates,we operate, or legislation granting materially greater latitude for motor carriers with respect to size or weight limitations, could have a material adverse effect on itsour financial position, results of operations, or liquidity in a particular year or quarter.

The operations of carriers with which NS interchangeswe interchange may adversely affect itsour operations. NS’ Our ability to provide rail service to customers in the U.S. and Canada depends in large part upon itsour ability to maintain cooperative relationships with connecting carriers with respect to, among other matters, freight rates, revenue division, car supply and locomotive availability, data exchange and communications, reciprocal switching, interchange, and trackage rights. Deterioration in the operations of or service provided by connecting carriers, or in NS’our relationship with those connecting carriers, could result in NS’our inability to meet itsour customers’ demands or require NSus to use alternate train routes, which could result in significant additional costs and network inefficiencies.

K13

NS reliesWe rely on technology and technology improvements in itsour business operations. If NS experienceswe experience significant disruption or failure of one or more of itsour information technology systems, including computer hardware, software, and communications equipment, NSwe could experience a service interruption, a security breach, or other operational difficulties, which could have a material adverse impact on its results of operations, financial condition, and liquidity in a particular year or quarter.difficulties. Additionally, if NS doeswe do not have sufficient capital to acquire new technology or it iswe are unable to implement new technology, NSwe may suffer a competitive disadvantage within the rail industry and with companies providing other modes of transportation service, whichservice. Any of these factors could have a material adverse effect on itsour financial position, results of operations, or liquidity in a particular year or quarter.

The vast majority of NSour employees belong to labor unions, and labor agreements, strikes, or work stoppages could adversely affect itsour operations.More than 80% of NSour railroad employees are covered by collective bargaining agreements with various labor unions. If unionized workers were to engage in a strike, work stoppage, or other slowdown, NSwe could experience a significant disruption of itsour operations. Additionally, future national labor agreements, or renegotiation of labor agreements or provisions of labor agreements, could significantly increase NS’our costs for healthcare, wages, and other benefits. Any of these factors could have a material adverse impact on NS’our financial position, results of operations, or liquidity in a particular year or quarter.

NS

We may be subject to various claims and lawsuits that could result in significant expenditures. The nature of NS’our business exposes itus to the potential for various claims and litigation related to labor and employment, personal injury, commercial disputes, freight loss and other property damage, and other matters. Job-related personal injury and occupational claims are subject to the Federal Employer’s Liability Act (FELA), which is applicable only to railroads. FELA’s fault-based tort system produces results that are unpredictable and inconsistent as compared with a no-fault worker’s compensation system. The variability inherent in this system could result in actual costs being very different from the liability recorded.

Any material changes to current litigation trends or a catastrophic rail accident involving any or all of freight loss or property damage, personal injury, and environmental liability could have a material adverse effect on NS’ operatingour financial position, results financial condition, andof operations, or liquidity to the extent not covered by insurance. NS hasWe have obtained insurance for potential losses for third-party liability and first-party property damages. Specified levels of risk are retained on a self-insurance basis (currently up to $50 million and above $1 billion per occurrence and/or policy year for bodily injury and property damage to third parties and up to $25 million and above $175 million per occurrence and/or policy year for property owned by NSus or in itsour care, custody, or control). Insurance is available from a limited number of insurers and may not continue to be available or, if available, may not be obtainable on terms acceptable to NS.us.

Severe weather could result in significant business interruptions and expenditures. Severe weather conditions and other natural phenomena, including hurricanes, floods, fires, and earthquakes, may cause significant business interruptions and result in increased costs, increased liabilities, and decreased revenues, which could have an adverse effect on NS’our financial position, results of operations, or liquidity in a particular year or quarter.

Unpredictability of demand for rail services resulting in the unavailability of qualified personnel could adversely affect NS’our operational efficiency and ability to meet demand. Workforce demographics, training requirements, and the availability of qualified personnel, particularly engineers and trainmen, could each have a

negative impact on NS’our ability to meet demand for rail service. Unpredictable increases in demand for rail services may exacerbate such risks, which could have a negative impact on NS’our operational efficiency and otherwise have a material adverse effect on itsour financial position, results of operations, or liquidity in a particular year or quarter.

NS

We may be affected by supply constraints resulting from disruptions in the fuel markets or the nature of some of itsour supplier markets. NS We consumed about 475477 million gallons of diesel fuel in 2011.2013. Fuel availability could be affected by any limitation in the fuel supply or by any imposition of mandatory allocation or rationing regulations. If aA severe fuel supply shortage arosearising from production curtailments, increased demand in existing or emerging foreign markets, disruption of oil imports, disruption of domestic refinery production, damage to refinery or pipeline infrastructure, political unrest, war or other factors, NS’could have a material adverse effect on our financial position, results of operations, or liquidity in a particular year or quarter could be materially adversely affected.quarter. Also, such an event wouldcould impact NSus as well as itsour customers and other transportation companies.

K14

Due to the capital intensive nature and industry-specific requirements of the rail industry, there are high barriers of entry exist for potential new suppliers of core railroad items, such as locomotives and rolling stock equipment. Additionally, NS competeswe compete with other industries for available capacity and raw materials used in the production of certain track materials, such as rail and ties. Changes in the competitive landscapes of these limited-supplier markets could result in increased prices or materialsignificant shortages of materials that could have a material affectadverse effect on NS’our financial position, results of operations, or liquidity in a particular year or quarter.

The state of capital markets could adversely affect NS’our liquidity. NS from From time-to-time relieswe rely on the capital markets to provide some of itsour capital requirements, including the issuance of long-term debt instruments and commercial paper, as well as the sale of certain receivables. Significant instability or disruptions of the capital markets, including the credit markets, or deterioration of NS’our financial condition due to internal or external factors could restrict or eliminate NS’our access to, and/or significantly increase the cost of, various financing sources, including bank credit facilities and issuance of corporate bonds. Instability or disruptions of the capital markets and deterioration of NS’our financial condition, alone or in combination, could also result in a reduction in NS’our credit rating to below investment grade, which could prohibit or restrict NSus from accessing external sources of short- and long-term debt financing and/or significantly increase the associated costs.

Item 1B. Unresolved Staff Comments

None.

None.

Item 3. Legal Proceedings

On June 25, 2010, the Ohio Attorney General filed a complaint in the Ashtabula Court of Common Pleas alleging certain violations of water laws by NS’ coal dock in Ashtabula, Ohio and seeking injunctive relief and civil penalties. The complaint was filed simultaneously with a Consent Order for Preliminary Injunction that governs the installation of additional pollution control equipment at the dock. This matter relates to previously disclosed enforcement activity initiated by the Ohio Environmental Protection Agency in early 2008. A final Consent Order was entered by the court on August 11, 2011 and a penalty in excess of $100,000 was paid. The outcome of this proceeding did not have a material effect on NS’ financial position, results of operations, or liquidity.

On November 6, 2007, various antitrust class actions filed against NSus and other Class 1I railroads in various Federal district courts regarding fuel surcharges were consolidated in the District of Columbia by the Judicial Panel on Multidistrict Litigation. NS believesOn June 21, 2012, the court certified the case as a class action. The defendant railroads appealed this certification, and on August 9, 2013, the Court of Appeals for the District of Columbia vacated the District Court’s decision and remanded the case for further consideration. We believe the allegations in the complaints are without merit and intendsintend to vigorously defend the cases. NS doesWe do not believe that the outcome of these proceedings will have a material effect on itsour financial position, results of operations, or liquidity. A lawsuit containing similar allegations against NSus and four other major railroads that was filed on March 25, 2008, in the U.S. District Court for the District of Minnesota was voluntarily dismissed by the plaintiff subject to a tolling agreement entered into in August 2008.2008, and most recently extended in August 2013.

NS previously had outstanding two Notices

We received a Notice of Probable Violation (NPV)(NOV) issued by the PHMSATennessee Department of Environmental Conservation concerning soil runoff in connection with construction of the 5.5-mile locomotive fuel pipeline servingMemphis Regional Intermodal Facility in Rossville, Tennessee. Although we will contest liability and the railroad’s Brosnan Yard in Macon, Georgia. The NPVs were settled by NS’ paymentimposition of any penalties, exceeding $100,000. Resolutionwe describe this matter here consistent with SEC rules and requirements concerning governmental proceedings with respect to environmental laws and regulations. We do not believe that the outcome of these claims did notthis proceeding will have a material effect on NS’our financial position, results of operation,operations, or liquidity. In addition, on December 13, 2010, NS made voluntary disclosures to PHMSA regarding potential violations relative to a 5.5-mile pipeline in Goldsboro, North Carolina, that is owned by a wholly owned subsidiary and that supplies jet fuel to the United States Air Force. No further penalties are expected at this time as NS in mid-2011 retained the services of a nationally recognized pipeline operator to operate its Macon Pipeline and the Airforce pipeline.

Item 4. Mine Safety Disclosures

Not applicable.

Executive Officers of the Registrant.Registrant

Norfolk Southern’s

Our executive officers generally are elected and designated annually by the Board of Directors at its first meeting held after the annual meeting of stockholders, and they hold office until their successors are elected. Executive officers also may be elected and designated throughout the year as the Board of Directors considers appropriate. There are no family relationships among theour officers, nor any arrangement or understanding between any officer and any other person pursuant to which the officer was selected. The following table sets forth certain information, as of

at February 1, 2012,2014, relating to the executiveour officers.

Name, Age, Present Position | | Business Experience During Past Five Years |

| | |

| | |

Charles W. Moorman, 59,61,

Chairman President and

Chief Executive Officer | | Present position since February 1, 2006. |

| | |

Deborah H. Butler, 57,James A. Squires, 52,

President | | Present position since June 1, 2013. Served as Executive Vice – Administration from August 1, 2012 to June 1, 2013 .

Served as Executive Vice President – Finance and Chief Financial Officer from July 1, 2007 to August 1, 2012. |

| | |

Deborah H. Butler, 59,

Executive Vice President –

Planning and Chief

Information Officer | | Present position since June 1, 2007.

|

| | |

Cindy C. Earhart, 52,

Executive Vice President –

Administration | | Present position since June 1, 2013. Served as Vice President – Customer ServiceHuman Resources from July March 1, 20042007 to

June 1, 2007.2013. |

| | |

James A. Hixon, 58,60,

Executive Vice President –

Law and Corporate Relations | | Present position since October 1, 2005.

|

| | |

Mark D. Manion, 59,61,

Executive Vice President and

Chief Operating Officer | | Present position since April 1, 2009.

Served as Executive Vice President – Operations from October 1, 2004

|

| | |

John P. Rathbone, 59,Donald W. Seale, 61,

Executive Vice President –

Administration | | Present position since October 1, 2004. |

| | |

Donald W. Seale, 59,

Executive Vice President and

Chief Marketing Officer | | Present position since April 1, 2006. |

| | |

James A. Squires, 50,Marta R. Stewart, 56,

Executive Vice President –

Finance and Chief Financial Officer | | Present position since JulyNovember 1, 2007.2013.

Served as Executive Vice President – Financeand Treasurer from April 1, 20072009 to

July2007 and2013. Served as Senior Vice President – Financial Planningand Controller from

April20062003 to April 1, 2007.2009. |

| | |

Clyde H. Allison, Jr., 48,Thomas E. Hurlbut, 49,

Vice President and Controller | | Present position since AprilNovember 1, 2009.2013.

Served as Vice President Audit and Compliance from February 1, 2010 to November 1, 2013. Served as Assistant Vice President Corporate AccountingInternal Audit from

February 1, 2008 to April 1, 2009 and as Assistant Vice President

Accounting Operations from June 1, 2006 to February 1, 2008.2010. |

K16

PART II

NORFOLK SOUTHERN CORPORATION AND SUBSIDIARIES (NS)

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

NORFOLK SOUTHERN CORPORATION AND SUBSIDIARIES

STOCK PRICE AND DIVIDEND INFORMATION

Common Stock is owned by 33,38130,990 stockholders of record as of December 31, 20112013 and is traded on the New York Stock Exchange under the symbol “NSC.” The following table shows the high and low sales prices as reported by Bloomberg L.P. on its internet-based service and dividends per share, by quarter, for 20112013 and 2010.2012.

| | | Quarter |

| | | | | | | | | | | | |

2011 | | 1st | | | 2nd | | | 3rd | | | 4th |

| Market Price | | | | | | | | | | | |

| High | $ | 69.56 | | $ | 74.93 | | $ | 76.99 | | $ | 75.75 |

| Low | | 60.38 | | | 66.27 | | | 60.44 | | | 60.01 |

| Dividends per share | | 0.40 | | | 0.40 | | | 0.43 | | | 0.43 |

2010 | | 1st | | | 2nd | | | 3rd | | | 4th |

| Market Price | | | | | | | | | | | |

| High | $ | 56.20 | | $ | 61.15 | | $ | 59.88 | | $ | 62.99 |

| Low | | 46.31 | | | 52.19 | | | 50.50 | | | 58.37 |

| Dividends per share | | 0.34 | | | 0.34 | | | 0.36 | | | 0.36 |

| Quarter |

| | | | | | | | | | | |

2013 | 1st | | 2nd | | 3rd | | 4th |

Market Price | | | | | | | | | | | |

High | $ | 75.59 | | $ | 79.32 | | $ | 77.84 | | $ | 92.87 |

Low | | 61.63 | | | 69.55 | | | 70.73 | | | 75.82 |

Dividends per share | | 0.50 | | | 0.50 | | | 0.52 | | | 0.52 |

| | | | | | | | | | | |

| | | | | | | | | | | |

2012 | 1st | | 2nd | | 3rd | | 4th |

Market Price | | | | | | | | | | | |

High | $ | 78.24 | | $ | 74.41 | | $ | 75.10 | | $ | 67.71 |

Low | | 64.45 | | | 63.67 | | | 63.63 | | | 56.34 |

Dividends per share | | 0.47 | | | 0.47 | | | 0.50 | | | 0.50 |

ISSUER PURCHASES OF EQUITY SECURITIES

| | | | | | | | | (c) Total Number of | | (d) Maximum Number |

| | (a) Total Number | | (b) Average | | Shares (or Units) | | (or Approximate Dollar |

| | of Shares | | Price Paid | | Purchased as Part of | | Value) of Shares (or Units) |

| | (or Units) | | per Share | | Publicly Announced | | that may yet be Purchased |

Period | Purchased(1) | | (or Unit) | | Plans or Programs(2) | | Under the Plans or Programs(2) |

| | | | | | | | | | | | | | | | | | | |

| October 1-31, 2011 | | 2,584,233 | | | $ | 65.30 | | | | 2,577,686 | | | | | 19,163,350 |

| November 1-30, 2011 | | 2,207,760 | | | | 72.62 | | | | 2,201,290 | | | | | 16,962,060 |

| December 1-31, 2011 | | 1,569,107 | | | | 72.12 | | | | 1,564,115 | | | | | 15,397,945 |

| | | | | | | | | | | | | | | | | | | |

| Total | | 6,361,100 | | | | | | | | 6,343,091 | | | | | | | | |

| | | | | | | | | Total | | Maximum Number |

| | | | | | | | | Number of | | (or Approximate |

| | | | | | | Shares (or Units) | | Dollar Value) |

| | Total Number | | Average | | Purchased as | | of Shares (or Units) |

| | of Shares | | Price Paid | | Part of Publicly | | that may yet be |

| | (or Units) | | per Share | | Announced Plans | | Purchased under |

Period | | Purchased | (1) | | (or Unit) | | or Programs | (2) | | the Plans or Programs | (2) |

| | | | | | | | | | | | | | |

October 1-31, 2013 | | | 818,038 | | | $ | 78.46 | | | 808,800 | | | 38,278,367 | |

November 1-30, 2013 | | | 1,024 | | | | 87.11 | | | - | | | 38,278,367 | |

December 1-31, 2013 | | | 4,960 | | | | 90.58 | | | - | | | 38,278,367 | |

| | | | | | | | | | | | | | |

Total | | | 824,022 | | | | | | | 808,800 | | | | |

(1) | Of this amount, 18,00915,222 represents shares tendered by employees in connection with the exercise of stock options under the Long-termstockholder-approved Long-Term Incentive Plan. |

(2) | On November 22, 2005, theOur Board of Directors authorized a share repurchase program, pursuant to which up to 50125 million shares of Common Stock could be purchased through December 31, 2015.2014. On March 27, 2007, the Board of Directors amended the program and increased the number of shares that may be repurchased to

75 million, and shortened the repurchase term by five years to December 31, 2010. On July 27, 2010, NS’August 1, 2012, our Board of Directors authorized the repurchase of up to an additional 50 million shares of Common Stock through December 31, 2014.2017. |

K17

Item 6. Selected Financial Data

NORFOLK SOUTHERN CORPORATION AND SUBSIDIARIES

FIVE-YEAR FINANCIAL REVIEW

| | | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 |

| | | | | ($ in millions, except per share amounts) |

| | | | | | | | | | | | | | | | | |

| RESULTS OF OPERATIONS | | | | | | | | | | | | | | | | |

Railway operating revenues | | | $ | 11,172 | | $ | 9,516 | | $ | 7,969 | | $ | 10,661 | | $ | 9,432 |

| Railway operating expenses | | | | 7,959 | | | 6,840 | | | 6,007 | | | 7,577 | | | 6,847 |

| Income from railway operations | | | | 3,213 | | | 2,676 | | | 1,962 | | | 3,084 | | | 2,585 |

| | | | | | | | | | | | | | | | | |

| Other income - net | | | | 160 | | | 153 | | | 127 | | | 110 | | | 93 |

| Interest expense on debt | | | | 455 | | | 462 | | | 467 | | | 444 | | | 441 |

| Income before income taxes | | | | 2,918 | | | 2,367 | | | 1,622 | | | 2,750 | | | 2,237 |

| | | | | | | | | | | | | | | | | |

| Provision for income taxes | | | | 1,002 | | | 871 | | | 588 | | | 1,034 | | | 773 |

| Net income | | | $ | 1,916 | | $ | 1,496 | | $ | 1,034 | | $ | 1,716 | | $ | 1,464 |

| | | | | | | | | | | | | | | | | |

| PER SHARE DATA | | | | | | | | | | | | | | | | |

| Net income - basic | | | $ | 5.52 | | $ | 4.06 | | $ | 2.79 | | $ | 4.58 | | $ | 3.73 |

| - diluted | | | | 5.45 | | | 4.00 | | | 2.76 | | | 4.52 | | | 3.68 |

| Dividends | | | | 1.66 | | | 1.40 | | | 1.36 | | | 1.22 | | | 0.96 |

| Stockholders’ equity at year end | | | | 30.00 | | | 29.85 | | | 28.06 | | | 26.23 | | | 25.64 |

| | | | | | | | | | | | | | | | | |

| FINANCIAL POSITION | | | | | | | | | | | | | | | | |

| Total assets | | | $ | 28,538 | | $ | 28,199 | | $ | 27,369 | | $ | 26,297 | | $ | 26,144 |

| Total debt | | | | 7,540 | | | 7,025 | | | 7,153 | | | 6,667 | | | 6,368 |

| Stockholders’ equity | | | | 9,911 | | | 10,669 | | | 10,353 | | | 9,607 | | | 9,727 |

| | | | | | | | | | | | | | | | | |

| OTHER | | | | | | | | | | | | | | | | |

| Property additions | | | $ | 2,160 | | $ | 1,470 | | $ | 1,299 | | $ | 1,558 | | $ | 1,341 |

| | | | | | | | | | | | | | | | | |

| Average number of shares outstanding (thousands) | | | | 345,484 | | | 366,522 | | | 367,077 | | | 372,276 | | | 389,626 |

| Number of stockholders at year end | | | | 33,381 | | | 35,416 | | | 37,486 | | | 35,466 | | | 36,955 |

| Average number of employees: | | | | | | | | | | | | | | | | |

| Rail | | | | 29,933 | | | 28,160 | | | 28,173 | | | 30,241 | | | 30,336 |

| Nonrail | | | | 396 | | | 399 | | | 420 | | | 468 | | | 470 |

| Total | | | | 30,329 | | | 28,559 | | | 28,593 | | | 30,709 | | | 30,806 |

| 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

| ($ in millions, except per share amounts) |

RESULTS OF OPERATIONS | | | | | | | | | | | | | | |

Railway operating revenues | $ | 11,245 | | $ | 11,040 | | $ | 11,172 | | $ | 9,516 | | $ | 7,969 |

Railway operating expenses | | 7,988 | | | 7,916 | | | 7,959 | | | 6,840 | | | 6,007 |

Income from railway operations | | 3,257 | | | 3,124 | | | 3,213 | | | 2,676 | | | 1,962 |

| | | | | | | | | | | | | | |

Other income – net | | 233 | | | 129 | | | 160 | | | 153 | | | 127 |

Interest expense on debt | | 525 | | | 495 | | | 455 | | | 462 | | | 467 |

Income before income taxes | | 2,965 | | | 2,758 | | | 2,918 | | | 2,367 | | | 1,622 |

| | | | | | | | | | | | | | |

Provision for income taxes | | 1,055 | | | 1,009 | | | 1,002 | | | 871 | | | 588 |

| | | | | | | | | | | | | | |

Net income | $ | 1,910 | | $ | 1,749 | | $ | 1,916 | | $ | 1,496 | | $ | 1,034 |

| | | | | | | | | | | | | | |

PER SHARE DATA | | | | | | | | | | | | | | |

Net income – basic | $ | 6.10 | | $ | 5.42 | | $ | 5.52 | | $ | 4.06 | | $ | 2.79 |

– diluted | | 6.04 | | | 5.37 | | | 5.45 | | | 4.00 | | | 2.76 |

Dividends | | 2.04 | | | 1.94 | | | 1.66 | | | 1.40 | | | 1.36 |

Stockholders’ equity at year end | | 36.55 | | | 31.08 | | | 30.00 | | | 29.85 | | | 28.06 |

| | | | | | | | | | | | | | |

FINANCIAL POSITION | | | | | | | | | | | | | | |

Total assets | $ | 32,483 | | $ | 30,342 | | $ | 28,538 | | $ | 28,199 | | $ | 27,369 |

Total debt | | 9,448 | | | 8,682 | | | 7,540 | | | 7,025 | | | 7,153 |

Stockholders’ equity | | 11,289 | | | 9,760 | | | 9,911 | | | 10,669 | | | 10,353 |

| | | | | | | | | | | | | | |

OTHER | | | | | | | | | | | | | | |

Property additions | $ | 1,971 | | $ | 2,241 | | $ | 2,160 | | $ | 1,470 | | $ | 1,299 |

| | | | | | | | | | | | | | |

Average number of shares outstanding (thousands) | | 311,916 | | | 320,864 | | | 345,484 | | | 366,522 | | | 367,077 |

Number of stockholders at year end | | 30,990 | | | 32,347 | | | 33,381 | | | 35,416 | | | 37,486 |

Average number of employees: | | | | | | | | | | | | | | |

Rail | | 29,698 | | | 30,543 | | | 29,933 | | | 28,160 | | | 28,173 |

Nonrail | | 405 | | | 400 | | | 396 | | | 399 | | | 420 |

| | | | | | | | | | | | | | |

Total | | 30,103 | | | 30,943 | | | 30,329 | | | 28,559 | | | 28,593 |

See accompanying Consolidated Financial Statementsconsolidated financial statements and notes thereto.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Norfolk Southern Corporation and Subsidiaries

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with the Consolidated Financial Statements and Notes and the Selected Financial Data.

OVERVIEW

With globalOVERVIEW

We are one of the nation’s premier transportation companies. Our Norfolk Southern Railway Company subsidiary operates approximately 20,000 miles of road in 22 states and domestic economies reflecting pent-up demand, NS’the District of Columbia, serves every major container port in the eastern United States, and provides efficient connections to other rail carriers. We operate the most extensive intermodal network in the East and are a major transporter of coal, automotive, and industrial products.

Our net income grew for the second consecutive year. NS’ 2011 net income rose 28% asincreased 9% in 2013, compared with 2012, and earnings per share improved 12%, reflecting improved operating results, a result oflarge gain from a 20% increase in income from railway operationsnonoperating transaction, and a lower effective income tax rate. Railway operatingshare repurchases. Higher revenues increased 17% as a result of higher average revenue per unit (including fuel surcharges) and increased traffic volume. Railway operating expenses increased 16%, reflecting higher fuel prices and increased traffic volume. Thenetwork efficiencies improved our railway operating ratio (a measure of the amount of operating revenues consumed by operating expenses) improvedfrom 71.7% in 2012 to 71.2%, as compared with 71.9%71.0% in 2010.the current year.

Cash provided by operating activities totaled $3.2$3.1 billion, which along with proceeds from borrowings and cash on hand, and proceeds from borrowings allowed for property additions, dividends, share repurchases, and debt repayments, and dividend payments.repayments. During 2011, 30.2 million shares of Common Stock were2013, we repurchased at a total cost of $2.1 billion. Since inception of the stock repurchase program in 2006, NS has repurchased and retired 109.68.3 million shares of Common Stock at a total cost of $6.2$627 million. Since inception of our stock repurchase program in 2006, we have repurchased and retired 136.7 million shares of Common Stock at a total cost of $8.1 billion. At December 31, 2011,2013, cash, cash equivalents, and short-term investments totaled $301 million.$1.6 billion.

Looking forward to 2012, NS expects

In 2014, we expect revenues to increase, reflecting higher traffic volumes but at a more moderate pace than seen in 2011 given the slow-growing economy, and higher average revenue per unit thatvolumes. We will meet or slightly exceed the rate of rail inflation. NS plans to continue to focus on safety, improvingcost control, productivity, service levels, and operational efficiency, and maintaining aan ongoing market-based approach to pricing.

SUMMARIZED RESULTS OF OPERATIONS

2011

2013 Compared with 2010with 2012

Net income in 20112013 was $1.9 billion, or $6.04 per diluted share, up $161 million, or 9%, compared with $1.7 billion, or $5.37 per diluted share, in 2012, a reflection of a 4% increase in income from railway operations, in addition to the favorable impact of the recognition of the gain from the sale of certain assets to the Michigan Department of Transportation (MDOT), which benefited net income by $60 million and earnings per share by $0.19. Railway operating revenues rose 2%, while operating expenses increased 1%, driven largely by higher volume-related expenses.

2012 Compared with 2011

Net income in 2012 was $1.7 billion, or $5.37 per diluted share, down $167 million, or 9%, compared with

$1.9 billion, or $5.45 per diluted share, up $420 million, or 28%, compared with $1.5 billion, or $4.00 per diluted share, in 2010.2011. The increasedecrease in net income was primarily due to higherlower income from railway operations, lower nonoperating income items, higher interest expense on debt, and a lowerhigher effective income tax rate (see Note(Note 3). Railway operating revenues increased $1.7 billion,decreased modestly, $132 million, reflecting higher average revenue per unit, including fuel surcharges, and higher traffic volumes. Railway operating expenses increased

$1.1 billion, principally due to higher fuel prices and volume-related expenses.

Oil prices affect NS’ results of operations in a variety of ways and can have an overall favorable or unfavorable impact in any particular period. In addition to the impact of oil prices on general economic conditions and traffic volume, oil prices directly affect NS’ revenues through market-based fuel surcharges and contract escalators (see “Railway Operating Revenues”) and also affect fuel costs (see “Railway Operating Expenses”). For 2011, excluding the impact of increased consumption, the increase in fuel surcharge revenue was greater than the increase in fuel expense. Future changes in oil prices may cause volatility in operating results that could be material to a particular year or quarter.

2010 Compared with 2009

Net income in 2010 was $1.5 billion, or $4.00 per diluted share, up $462 million, or 45%, compared with $1.0 billion, or $2.76 per diluted share, in 2009. The increase in net income was primarily due to higher income from railway operations that was offset in part by higher income taxes (see Note 3). Railway operating revenues increased $1.5 billion, reflecting higher traffic volumes and higherlower average revenue per unit, including fuel surcharges. Railway operating expenses increased $833also decreased modestly, $43 million, primarily duelargely driven by the absence of the $58 million unfavorable arbitration ruling in 2011 and declines related to network efficiency and productivity gains, offset by higher depreciation and intermodal volume-related expenses and fuel prices.expenses.

K19

DETAILED RESULTS OF OPERATIONS

Railway OperatingOperating Revenues

Railway operating revenues were $11.2 billion in 2011, $9.52013, $11.0 billion in 2010,2012, and $8.0$11.2 billion in 2009.2011. The following table presents a three-year comparison of revenues, volumes, and average revenue per unit by market group.

| | | Revenues | | Units | | | Revenue per Unit |

| | | 2011 | | | 2010 | | | 2009 | | 2011 | | 2010 | | 2009 | | | 2011 | | | 2010 | | | 2009 | |

| | | ($ in millions) | | (in thousands) | | | ($ per unit) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Coal | $ | 3,458 | | $ | 2,719 | | $ | 2,264 | | 1,619.6 | | 1,556.7 | | 1,418.5 | | $ | 2,135 | | $ | 1,747 | | $ | 1,596 | |