UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20162018

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

COMMISSION FILE NO. 001-10308

AVIS BUDGET GROUP, INC.

(Exact name of Registrant as specified in its charter)

|

| | |

| DELAWARE | | 06-0918165 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | |

6 SYLVAN WAY PARSIPPANY, NJ | | 07054 |

| (Address of principal executive offices) | | (Zip Code) |

973-496-4700

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

| | |

| TITLE OF EACH CLASS | | NAME OF EACH EXCHANGE ON WHICH REGISTERED |

| Common Stock, Par Value $.01 | | The NASDAQ Global Select Market |

Preferred Stock Purchase Right | | The NASDAQ Global Select Market |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. oþ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o |

Smaller reporting company o | Emerging growth company o | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

As of June 30, 2016,2018, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $2,911,952,460$2,564,141,255 based on the closing price of its common stock on the NASDAQ Global Select Market. All executive officers and directors of the registrant have been deemed, solely for the purpose of the foregoing calculation, to be “affiliates” of the registrant.

As of January 31, 2017,2019, the number of shares outstanding of the registrant’s common stock was 85,991,536.75,769,075.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be mailed to stockholders in connection with the registrant’s 2019 annual stockholders’ meeting scheduled to be held on May 16, 2017of stockholders (the “Annual Proxy Statement”) are incorporated by reference into Part III hereof.

TABLE OF CONTENTS

| | | | | |

| Item | Description | Page | Description | Page |

| | | |

| | PART I | | PART I | |

| 1 | | | | |

| 1A | | | | |

| 1B | | | | |

| 2 | | | | |

| 3 | | | | |

| 4 | | | | |

| | | |

| | PART II | | PART II | |

| 5 | | | | |

| 6 | | | | |

| 7 | | | | |

| 7A | | | | |

| 8 | | | | |

| 9 | | | | |

| 9A | | | | |

| 9B | | | | |

| | | |

| | PART III | | PART III | |

| 10 | | | | |

| 11 | | | | |

| 12 | | | | |

| 13 | | | | |

| 14 | | | | |

| | | |

| | PART IV | | PART IV | |

| 15 | | | | |

| | | | | |

FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report on Form 10-K may be considered “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. The forward-looking statements contained herein are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by any such forward-looking statements. Forward-looking statements include information concerning our future financial performance, business strategy, projected plans and objectives. These statements may be identified by the fact that they do not relate to historical or current facts and may use words such as “believes,” “expects,” “anticipates,” “will,” “should,” “could,” “may,” “would,” “intends,” “projects,” “estimates,” “plans,” and similar words, expressions or phrases. The following important factors and assumptions could affect our future results and could cause actual results to differ materially from those expressed in such forward-looking statements:

the high level of competition in the vehicle rentalmobility industry, including from new companies or technology, and the impact such competition may have on pricing and rental volume;

a change in travel demand, including changes in airline passenger traffic;

a change in our fleet costs as a result of a change in the cost of new vehicles, manufacturer recalls, disruption in the supply of new vehicles, and/or a change in the price at which we dispose of used vehicles either in the used vehicle market or under repurchase or guaranteed depreciation programs;

the results of operations or financial condition of the manufacturers of our cars, which could impact their ability to perform their payment obligations under our agreements with them, including repurchase and/or guaranteed depreciation arrangements, and/or their willingness or ability to make cars available to us or the rental car industry as a whole on commercially reasonable terms or at all;

a change in travel demand, including changes or disruptions in airline passenger traffic;

any change in economic conditions generally, particularly during our peak season or in key market segments;

our ability to continue to achieve and maintain cost savings and successfully implement our business strategies;

our ability to obtain financing for our global operations, including the funding of our vehicle fleet through the issuance of asset-backed securities and use of the global lending markets;

an occurrence or threat of terrorism, pandemic disease, natural disasters, military conflict, or civil unrest or political instability in the locations in which we operate;

any substantial changes in the cost or supply of fuel, vehicle parts, energy, labor or other resources on which we depend to operate our business;

our ability to continue to successfully implement our business strategies, achieve and maintain cost savings and adapt our business to changes in mobility;

political, economic or commercial instability in the countries in which we operate, and our ability to conform to multiple and conflicting laws or regulations in those countries;

our dependence on third-party distribution channels, third-party suppliers of other services and co-marketing arrangements with third parties;

our dependence on the performance and retention of our senior management and key employees;

risks related to completed or future acquisitions or investments that we may pursue, including the incurrence of incremental indebtedness to help fund such transactions and our ability to promptly and effectively integrate any acquired businesses or capitalize on joint ventures, partnerships and other investments;

our ability to utilize derivative instruments, and the impact of derivative instruments we utilize, which can be affected by fluctuations in interest rates, gasoline prices and exchange rates, changes in government regulations and other factors;

our ability to accurately estimate our future results;

any major disruptions in our communication networks or information systems;

our exposure to uninsured or unpaid claims in excess of historical levels;

risks associated with litigation, governmental or regulatory inquiries, or any failure or inability to comply with laws, regulations or contractual obligations or any changes in laws, regulations or contractual obligations, including with respect to personally identifiable information and taxes;consumer privacy, labor and employment, and tax;

risks related to protecting the integrity of, and preventing unauthorized access to, our information technology systems or those of our third-party vendors, and protecting the confidential information of our employees and customers against security breaches, including physical or cybersecurity breaches, attacks, or other disruptions, and compliance with privacy and data protection regulation;

any impact on us from the actions of our licensees, dealers, third-party vendors and independent contractors;

any substantialmajor disruptions in our communication networks or information systems;

risks related to tax obligations and the effect of future changes in the cost or supply of fuel, vehicle parts, energy, labor or other resources on which we depend to operate our business;tax laws and accounting standards;

risks related to our indebtedness, including our substantial outstanding debt obligations, potential interest rate increases, and our ability to incur substantially more debt;

our ability to obtain financing for our global operations, including the funding of our vehicle fleet through the issuance of asset-backed securities and use of the global lending markets;

our ability to meet the financial and other covenants contained in the agreements governing our indebtedness;

risks related to tax obligations and the effect of future changes in accounting standards;

risks related to completed or future acquisitions or investments that we may pursue, including any incurrence of incremental indebtedness to help fund such transactions and our ability to promptly and effectively integrate any acquired businesses;

risks related to protecting the integrity ofaccurately estimate our information technology systems and the confidential information of our employees and customers against security breaches, including cyber-security breaches;future results; and

other business, economic, competitive, governmental, regulatory, political or technological factors affecting our operations, pricing or services, including uncertainty and instability related to potential withdrawal of countries from the European Union.services.

We operate in a continuously changing business environment and new risk factors emerge from time to time. New risk factors, factors beyond our control, or changes in the impact of identified risk factors may cause actual results to differ materially from those set forth in any forward-looking statements. Accordingly, forward-looking statements should not be relied upon as a prediction of actual results. Moreover, we do not assume responsibility for the accuracy and completeness of those statements. Other factors and assumptions not identified above, including those discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” set forth in Item 7, in “Risk Factors” set forth in Item 1A and in other portions of this Annual Report on Form 10-K, may contain forward-looking statements and involve uncertainties that could cause actual results to differ materially from those projected in such statements.

Although we believe that our assumptions are reasonable, any or all of our forward-looking statements may prove to be inaccurate and we can make no guarantees about our future performance. Should unknown risks or uncertainties materialize or underlying assumptions prove inaccurate, actual results could differ materially from past results and/or those anticipated, estimated or projected. Except to the extent of our obligations under the federal securities laws, weWe undertake no obligation to release any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. For any forward-looking statements contained in any document, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

PART I

Except as expressly indicated or unless the context otherwise requires, the “Company,” “Avis Budget,” “we,” “our” or “us” means Avis Budget Group, Inc. and its subsidiaries. “Avis,” “Budget,” “Budget Truck,” “Zipcar,” “Payless,” “Apex,” “Maggiore”“Maggiore,” “Morini Rent,” “Turiscar” and “France Cars”“FranceCars” refer to our Avis Rent A Car System, LLC, Budget Rent A Car System, Inc., Budget Truck Rental, LLC, Zipcar, Inc., Payless Car Rental, Inc., Apex Car Rentals, Maggiore Rent S.p.A., Morini S.p.A., Turiscar Group and AAA France Cars SAS operations, respectively, and, unless the context otherwise requires, do not include the operations of our licensees, as further discussed below.

We are a leading global provider of vehicle rental and car sharing services, operatingmobility solutions through our three of the most recognized brands, in the industry through Avis, Budget and Zipcar. We are a leading vehicle rental operatorZipcar, together with several other brands, well recognized in North America, Europe, Australia, New Zealand and certain other regions we serve.their respective markets. We and our licensees operate the Avis and Budget brands in approximately 180 countries throughout the world. We generally maintain a leading share of airport car rental revenue in North America, Europe Australia and New Zealand,Australasia, and we operate one of the leading truck rental businesses in the United States.

Our brands are differentiated tobrands help us meet a wide range of customer mobility needs throughout the world. Avis is a leading vehicle rental car supplierbrand positioned to serve the premium commercial and leisure segments of the travel industry, andindustry. Budget is a leading vehicle rental vehicle supplierbrand focused primarily on more value-conscious segments of the industry. Our Zipcar brand is one of the world’s leading car sharing networks offering an alternative to traditional vehicle rental and ownership.

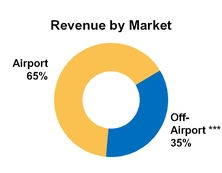

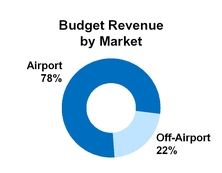

On average, our rental fleet totaled approximately 600,000nearly 650,000 vehicles in 2018 and we completed more than 3940 million vehicle rental transactions worldwide in 2016.worldwide. We generate approximately 70%65% of our vehicle rental revenue from on-airport locations and approximately 30%35% of our revenue from off-airport locations. We also license the use of the Avis, Budget, Zipcar and BudgetPayless trademarks to licensees in areas in which we do not operate directly. Our brands have an extended global reach with more than 11,000 car and truck rental locations throughout the world, including approximately 5,0004,600 car rental locations operated by our licensees. We believe that Avis, Budget and Zipcar enjoy complementary demand patterns with mid-week commercial demand balanced by weekend leisure demand.

Our Zipcar brand is the world’s leading car sharing company, with more than one million members in the United States, Canada and Europe. We operate Budget Truck, one of the leading truck rental businesses in the United States, with a fleet of approximately 22,000 vehicles that operate through a network of approximately 1,000 dealer-operated and 480 Company-operated locations throughout the continental United States. We also own Payless, a car rental brand that operates in the deep-value segment of the industry;industry in the United States and certain other international regions; Apex, which is a leading deep-value car rental brand in New Zealand and Australia; Maggiore aand Morini Rent, leading vehicle rental brands in Italy; Turiscar, a well-established car rental brand in Italy;Portugal; and France Cars,FranceCars, which operates one of the largest light commercial vehicle fleets in France. We also have investments in certain of our Avis and Budget licensees outside of the United States, including joint ventures in India and China.

Founded in 1946, Avis is believed to be the first company to rent cars from airport locations. Avis expanded its geographic reach throughout the United States through growth in licensed and Company-operated locations in the 1950s and 1960s. In 1963, Avis introduced its award winning “We try harder®” advertising campaign, which was recognized as one of the top ten advertising campaigns of the 20th century by Advertising Age magazine.

HFS Incorporated acquired Avis in 1996 and merged with our predecessor company in 1997, with the combined entity being renamed Cendant Corporation. The Company is a Delaware corporation headquartered in Parsippany, New Jersey.

In 2002, Cendant acquired the Budget brand and Budget vehicle rental operations in North America, Australia and New Zealand. Budget was founded in 1958 as a car rental company for the value-conscious vehicle rental

customer and grew its business rapidly during the 1960s, expanding its rental car offerings throughout North America and significantly expanding its Budget truck rental business in the 1990s.

In 2006, Cendant completed the sales and spin-offs of several significant subsidiaries and changed its name to Avis Budget Group, Inc. In 2011, we expanded our international operations with the acquisition of Avis Europe, which was previously an independently-owned licensee operating the Avis and Budget brands in Europe, the Middle East and Africa, and the Avis brand in Asia. Upon the completion of the acquisition of Avis Europe, the Avis and Budget brands were globally re-united under a single company, making Avis Budget Group one of the largest vehicle rental companies in the world.

In 2013, we acquired Zipcar, the world’s leading car sharing company, to further increase our growth potential and our ability to better serve a greater variety of our customers’ mobility needs. In 2012 and 2013, we acquired our Apex and Payless brands, respectively, which allowed us to expand our presence in the deep-value segment of the car rental industry. In 2014, we also acquired our long-standing Budget licensee for Southern California and Las Vegas, which further expanded our Company-operated locations in the United States. In 2015, we acquired the operations of our former Avis and Budget licensees in Brazil, Norway, Sweden and Denmark; our Avis licensee in Poland; and Maggiore, a leading provider of vehicle rental services in Italy. In 2016, we acquired France Cars, a privately held vehicle rental company based in France, to significantly expand our presence in the French market. These acquisitions have allowed us to further expand our global footprint of Company-operated locations.

We have a long history of innovation in the vehicle rental and car sharing business, including:

in 1973, we launched our proprietary Wizard system, a constantly updated information-technology system that is the backbone of our operations;

in 1987, we introduced our Roving Rapid Return program, powered by a handheld computer device that allows customers to bypass the car return counter;

in 1996, we became one of the first car rental companies to accept online reservations;

in 2000, we introduced Avis Interactive, the first Internet-based reporting system in the car rental industry;

in 2009, we launched what we believe to be the first car rental iPhone application in the United States;

in 2012, we believe that our Avis brand became the first in the industry to offer mobile applications to customers on all major mobile platforms;

in 2015, our Avis brand was the first in the industry to offer an Android application that allows customers to use voice-activated technology to make, confirm or cancel their car rental reservations;

in 2015, our Avis brand was the first U.S. car rental company to offer an application for the Apple Watch, which enables our customers to email themselves a car rental receipt and view current, upcoming and past car rental reservations from their wrists;

in 2015, we continued to expand our use of yield management systems, which the Company designed to help optimize its decision-making with respect to pricing and fleet management; and

in 2016, we introduced Avis Now, a mobile app-enabled rental process that provides Avis customers with greater control of their rental experience using their smartphone or tablet device.

Our Zipcar operations have been a constantly innovating pioneer in using advanced vehicle technologies as the first car sharing company in the United States to develop a self-service solution to manage the complex interactions of real-time, location-based activities inherent in a large-scale car sharing operation, including new member application, reservations and keyless vehicle access, fleet management and member management. Zipcar was also the first to allow members to reserve the specific make, model and type of car by phone, Internet or wireless mobile device. In 2015, Zipcar introduced Instant Join and Drive, a technology innovation that

dramatically reduces the time it takes to become a Zipcar member, and the flexibility to make both round-trip and one-way reservations.

Since becoming an independent vehicle rental services company in 2006, we have focused on strengthening our brands, our operations, our technology, our competitiveness and our profitability. In conjunction with these efforts, we have implemented process improvements impacting virtually all areas of the business; realized significant cost savings through the integration of acquired businesses with our pre-existing operations; achieved reductions in operating and selling, general and administrative expenses, including significant reductions in staff; assessed location, segment and customer profitability to address less-profitable aspects of our business; implemented price increases and changes to our sales, marketing and affinity programs to improve profitability; and sought to better optimize our acquisition, deployment and disposition of fleet in order to lower costs and better meet customer demand.

We categorize our operations into two reportingreportable business segments:

Americas, which provides and licenses the Company’s brands to third parties for vehicle rentals and ancillary products and services in North America, South America, Central America and the Caribbean, and operates the Company’s car sharing business in certain of these markets; and

International, which provides and licenses the Company’s brands to third parties for vehicle rentals and ancillary products and services in Europe, the Middle East, Africa, Asia Australia and New Zealand,Australasia, and operates the Company’s car sharing business in certain of these markets.

The following table presents key operating metrics for eachAdditional discussion of our two reporting segments:

|

| | | | | | | |

| | | Total 2016 Rental Days | | Average 2016 Time and Mileage (“T&M”) Revenue per Day | | Average 2016 Rental Fleet Size |

| Americas | | 101 | million | | $40.38 | | 385,000 |

| International | | 46 | million | | $32.01 | | 177,000 |

| Total Company | | 147 | million | | | | 562,000 |

________

Note: Operating metrics exclude Zipcarreportable segments is included in the Item 7. “Management’s Discussion and U.S. truck rental operations, which had average fleetsAnalysis of 14,000Financial Condition and 22,000 vehicles, respectively.

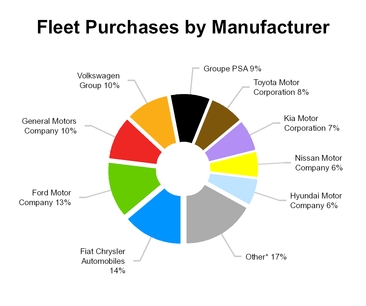

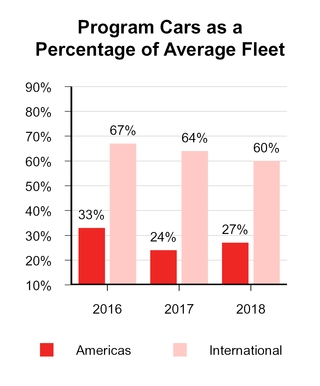

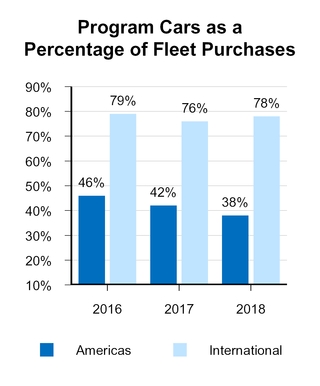

The following graphs present the compositionResults of our rental daysOperations” and our average rental fleet in 2016, by segment:

Financial data for our segments and geographic areas are reported in Note 19-Segment Information19 to ourthe Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K.

Avis was founded in 1946 and is believed to be the first company to rent cars from airport locations. Since its founding, Avis has expanded its business throughout the United States and internationally, becoming one of the largest and most recognized car rental brands in the world. In 1996, Avis was acquired by HFS Incorporated and in 1997 merged with our predecessor company, with the combined entity being renamed Cendant Corporation. In 2006, Cendant spun off several significant subsidiaries and changed its name to Avis Budget Group, Inc. The Company is a Delaware corporation headquartered in Parsippany, New Jersey.

Budget was founded in 1958 to appeal to the value-conscious car rental customer. In 2002, we acquired the Budget brand and certain Budget vehicle rental operations, including the Budget truck rental business. In 2011, we acquired Avis Europe, an independently-owned Company licensee, to expand our international operations and globally reunite the Avis and Budget brands. In 2012 and 2013, we acquired our Apex and Payless brands, respectively, which allowed us to expand our presence in the deep-value segment of the car rental industry. In 2013, we acquired Zipcar, one of the world’s leading car sharing networks, to better serve a greater variety of our customers’ mobility needs. In 2015, we acquired Maggiore, a leading provider of vehicle rental services in Italy. In 2016, we acquired FranceCars, a privately held vehicle rental company based in France, which significantly expanded our presence in the French market. In 2018, we acquired Morini, which focuses on rentals of cars, vans and refrigerated trucks in Northern Italy, and Turiscar, a well-established vehicle rental company in Portugal, and also invested in our licensee in Greece. These acquisitions have allowed us to continue to expand our global footprint of Company-operated locations and brand presence.

Our objective is to strategically acceleratedrive sustainable, profitable growth for our growth, strengthen our global position as a leading provider of vehicle rental services, enhance our customers’ rental experience, control costs and drive efficiency throughout the organization. We expect to achieve our goalsCompany by focusing our efforts on the following coredelivering strategic initiatives:

Strategically Accelerate Growth. We have pursued and will continue to pursue numerous opportunities intended to increase our revenues and make disproportionate contributions to our earnings. For instance:

| |

◦ | We are focused on promoting car class upgrades, adjusting our mix of vehicles to match customer demand, growing our rentals to small-business and international travelers, increasing the number of rentals that customers book through our own websites and mobile applications, increasing the proportion of transactions in which customers prepay us, and expanding our ancillary revenues derived from offering additional ancillary products and services to the rental transactions of an increasing percentage of our customers. We believe these efforts will not only enhance the rental experience, but also generate incremental revenue and add to profitability. |

| |

◦ | We are focused on yield management and pricing optimization in an effort to increase the rental fees we earn per rental day. We have implemented, and plan to continue to implement, new technology systems that strengthen our yield management and enable us to tailor our product, service and price offerings not only to meet our customers’ needs, but also in response to actions taken by our competitors. We expect to continue to adjust our pricing to bolster profitability and match changes in demand. |

| |

◦ | We continue to see significant growth opportunities related to our Zipcar brand. We expect to increase our Zipcar membership base by growing the number of businesses, government agencies and universities that Zipcar serves within its existing markets, as well as expanding the brand into new markets where our existing car rental presence will help enable the introduction of Zipcar’s car sharing services. We expect that such growth will include making more Zipcars available at airport locations, offering one-way usage of Zipcars at certain locations, cross-marketing partnerships through our well-established corporate and affinity relationships and expanding our car sharing footprint outside of the United States. |

| |

◦ | We continue to focus on addressing the need of the deep-value segment of the vehicle rental industry with our Payless and Apex brands and look to increase our profitability in this segment as we grow our revenues. |

Strengthening Our Global Position. While we currently operate, either directly or through licensees, in approximately 180 countries around the world, we will continue to strengthen and further expand our global footprint through organic growth and potentially through acquisitions, joint ventures, licensing agreements or other relationships:

| |

◦ | In countries where we have Company-operated locations, we will continue to identify opportunities to add new rental locations, to grant licenses to independent third parties for regions where we do not currently operate and/or do not wish to operate directly, to strengthen the presence of our brands and to re-acquire previously granted license rights in certain cases. |

| |

◦ | In countries operated by licensees, including our joint ventures in India and China, we will seek to ensure that our licensees are well positioned to realize the growth potential of our brands in those countries and are aggressively growing their presence in those markets, and we expect to consider the re-acquisition of previously granted license rights in certain cases. |

| |

◦ | Zipcar represents a substantial growth opportunity for us as we believe that there are numerous geographic markets outside the United States, particularly in Europe and the Asia Pacific region, where Zipcar’s proven car sharing model can be utilized to meet substantial, currently unmet transportation needs. |

Enhancing Customers’ Rental Experience. We are committed to serving our customers and enhancing their rental experience, including through our Customer Led, Service Driven™ initiative, which isinitiatives aimed at improving our customers’ rental experience with ourwinning and retaining customers through differentiated brands our systems and our employees. Following extensive reviews of the ways, places and occasions in which our brands, our systems and our employees interact with existing and potential customers, we have implemented actions that further enhance the service we provide at these customer “touch points.” For example:

| |

◦ | With significant input from our customers, we created our Avis Now mobile application, which provides our Avis customers a new and innovative way to control many elements of their rental experience via their smartphone or tablet device. Through the Avis Now application, our customers are able to view which cars are available in real-time; exchange or upgrade a car prior to or while on the rental lot; confirm, cancel or extend a rental; add ancillary products; return a car without assistance; view their rental agreement; confirm their fuel level at beginning and end of rental as well as miles driven; and obtain assistance on demand.

|

| |

◦ | We offer Avis PreferredSelect & Go™, a vehicle-choice program for customers, have revised our rental agreements and receipts to improve transparency, and offer mobile applications to accept reservations and to better communicate with customers. We have also continued improving the overall customer experience by focusing on our understanding of and improving upon our customer service practices, soliciting more feedback from our customers and expanding our customer-service-oriented training of our employees.

|

| |

◦ | We continue to upgrade our technology, to make the reservation, pick-up and return process more convenient and user-friendly, with a particular emphasis on enabling and simplifying our customers’ online interactions with us. |

We expect to continue to invest in these efforts, with a particular emphasis on self-service technologies that we believe will allow us to serve customers more effectively and efficiently.

Controlling Costs and Driving Efficiency throughout the Organization.We have continued our efforts to rigorously control costs. We continue to aggressively reduce expenses throughout our organization, and we have consistently eliminated or reduced significant costs through the integration of acquired businesses. In addition:

| |

◦ | We continued to develop and implement our Performance Excellence process improvement initiative to increase efficiencies, reduce operating costs and create sustainable cost savings using LEAN, Six Sigma and other tools. This global initiative has generated substantial savings since its implementation and is expected to continue to provide incremental benefits. |

| |

◦ | We have taken significant actions to further streamline our administrative and shared-services infrastructure through a restructuring program that identifies and replicates best practices, leverages the scale and capabilities of third-party service providers, and will increase the global standardization and consolidation of non-rental-location functions over time. |

| |

◦ | We have implemented initiatives to integrate our acquired businesses, to realize cost efficiencies from combined maintenance, systems, technology and administrative infrastructure, as well as fleet utilization benefits and savings by combining our car rental and car sharing fleets at times to reduce the number of unutilized vehicles. |

| |

◦ | We have also continued to implement technology solutions, including self-service voice reservation technology, mobile communications with customers and fleet optimization technologies to reduce costs, and we will further continue to pursue innovative solutions to support our strategic initiatives. |

We believe such steps will continue to aid our financial performance.

In 2016, we continued to refine our strategies to further emphasize supporting and strengthening our brands,products, increasing our margins and seizingvia revenue growth and operational efficiency opportunities asand enhancing our leadership in the evolving mobility solutions continue to evolve. Inindustry.

Supporting and Strengthening Our Brands

In executing our strategy, we plan towill continue to position our distinct and well-recognized global brands to focus on different segments of customer demand, complemented by our other brands in their respective regional markets. With Avis as a premium brand preferred moreWhile our brands address different use-cases and target customers, we achieve efficiencies by corporate and upscale leisure travelers, Budget as a mid-tier brand preferred more by value-conscious travelers, Payless as a deep-value brand, Maggiore, France Cars and Apex as well-recognized regional brands and Zipcar offering its members an economical alternative to car ownership, we believe we are able to target a broad range of demand, particularly since the brands often sharesharing the same operational and administrative infrastructure while providing differentiated though consistently high levelsvalue propositions tailored to each of customer service.our brands.

We currently operate our brands, either directly or through independent operators and licensees around the world and we plan to continue to strengthen and further expand our global footprint through organic growth and, potentially, through acquisitions, joint ventures, licensing agreements or other relationships:

In countries where we have Company-operated locations, we will continue to identify opportunities to add new rental locations, to grant licenses to independent third parties for areas where we do not currently operate and do not wish to operate directly, to strengthen the presence of our brands and in certain cases to re-acquire previously granted license rights.

In countries operated by licensees or partners, we will seek to ensure that those businesses are well positioned to realize the growth potential of our brands in those countries and are growing their presence in those markets, and in certain cases we will continue to consider the re-acquisition of previously granted license rights.

In countries where we have either Company-operated or licensee-operated locations, we will also continue to identify opportunities to leverage our Zipcar brand and its car sharing model, which allows us to fulfill the expanding urban mobility needs of customers.

Since our Avis brand represents approximately 60%58% of our revenue and is recognized as a global leader in vehicle rental, services, we are particularly focused on maintaining and building its reputation as a reliably high-quality service provider. Our Avis Preferred loyalty program, which offers our customers the ability to bypass the rental

counter and also earn reward points, coupled with our continued investment in technology, including the roll-out of our Avis Now mobile application and new Avis websites, is aand our growing fleet of connected cars, are all key partparts of our efforts. We have also increased our marketing activities in support ofefforts to enhance the Avis and Budget brands.

experience for our customers.

We aim to provide a range of vehicles, products and services and pricing,at competitive prices, to useleverage various marketing channels and to maintain marketing affiliations and corporate account contracts that complement each brand’s positioning. We plan toalso continue to invest in our brands through a variety of efforts, including television commercials, print advertisements andboth on-line and off-line marketing. We continue to see particular growth opportunities for Budget and our Budget brandother local brands in Europe, as Budget’sthe share of airport car rentals for Budget is significantly smaller in Europe than in certain other parts of the world,world.

To further support and for Zipcar internationally, wherestrengthen our brands, we are committed to serving our customers and enhancing their rental experience through new organic offerings that optimize our brands, our systems and our employees. We frequently solicit feedback from and survey our customers to better understand their needs and we have implemented actions to enhance our services, including the brand’s provenfollowing:

We created our Avis mobile application to provide a higher quality end-to-end user experience, building upon direct feedback from customers to re-design the rental experience to meet their needs. Our Avis mobile application allows customers to reserve, update and cancel reservations, choose their car, sharing model can be expanded into numerous geographic markets.exchange or upgrade their vehicle, add ancillary products, extend rentals, return the vehicle with one click, view and share current and past rental receipts to expedite expense processing, review rental agreement details and the vehicle’s insurance card, and, in the case of connected vehicles, lock and unlock the vehicle, confirm their fuel level at the beginning and end of their rental as well as miles driven, using their mobile device;

In executingWe continue to upgrade our technology and the ways it can further serve our customers, to make the vehicle reservation, pick-up and return processes more convenient and user-friendly, with a particular emphasis on enabling and simplifying our customers’ online transactions. We have partnered with other technology and product companies to continuously improve the user experience through various mobile and technology capabilities. These include working with Amazon to allow for voice-controlled access to our services through Amazon Alexa enabled devices; and

We piloted and subsequently launched “Curbside Delivery” services in select U.S. airport markets, in which customers can bring their car to the Avis and Budget return lot, where an Avis or Budget employee will drive them to their appointed terminal or gate and complete the vehicle return process transaction at the curb.

We will continue to invest in these and other innovative efforts, with a particular emphasis on technologies, services and products that will allow us to not only serve customers more effectively and efficiently, but offer new brand-differentiating options.

Margins and Operational Efficiency

Our strategy we are keenlyis focused on identifying and implementing actions that willto increase our margins over the next several years. We see significant potential in the areas of optimizingopportunities that optimize our pricing and customer mix andmix; increase sales of ancillary products and services; optimizingservices through new product and service development; optimize our procurement processes; refine the deployment and disposition of vehicles including increased(e.g. increasing the use of non-auction channels for selling our cars; continuing tovehicles); drive operational efficiency in our business; and applying connected-car/apply connected car/in-vehicle systems and other emerginginnovative mobility technologies in our operations. Our margins have increased significantly from 2010 to 2016, and we see opportunities to continue the trend of longer-term margin growth.

We also believe that new technologiescontinue to pursue opportunities intended to drive our margins and evolving customer preferences that favor the rental or sharing of vehicles rather than personal car ownership represent important opportunities for us to meet newincrease our revenues and growing consumer and commercial demand for the types ofprofitability, including:

Offering our customers useful ancillary products and services, promoting car class upgrades, adjusting our mix of vehicles to match customer demand; repositioning our sales strategy to focus on the most profitable segments, increasing the number of rentals that we provide. We seecustomers book directly through our Zipcar brand expanding into new marketswebsites and providing new transportation solutions,mobile applications and increasing the proportion of “Pay Now” transactions by which customers prepay for rentals.

Investing in yield management and pricing analytics tools, such as one-way trips,our Revenue Management System, to both shapeincrease the profits we earn per rental day. We have implemented, and satisfy consumers’ needs. In addition, we believe there are substantial opportunities forplan to continue deploying, new technology systems that strengthen our Avisyield management decisions and Budget brandsenable us to benefit and grow as mobility solutions and vehicle-related technologies evolve.tailor our product,

service and price offerings to meet our customers’ needs and react quickly to shifting market conditions. We operate in a highly competitive industry,will continue to adjust our pricing to improve profitability and manage our results can be impacted by external factors, such as travel demand and uncertain economic conditions in various parts of the world. We seek to mitigate our exposure to risks in numerous ways, including delivering upon the core strategic initiatives described above and through continued optimization of fleet levels to match changes in demand for vehicle rentals, maintenance of liquidity to funddemand.

Managing and improving our fleet decisions to better optimize and drive the purchase, deployment, and disposition of our fleet to lower costs and meet customer demand, grow our direct-to-dealer and consumer sales performance, reduce maintenance and repair expenses, better optimize our salvage costs, reduce the risk of damage to our vehicles, and improve fleet utilization benefits and savings by combining our vehicle rental and car sharing fleets when appropriate which we believe will create significant financial benefits.

Seeking opportunities where our investments will generate strong margin returns, including expanding rental locations, acquiring and integrating existing licensees in key markets, participating in joint ventures and acquiring leading local brands.

Increasing our Zipcar membership base within its existing markets, as well as expanding the brand into new markets.

We also continued to focus our efforts on rigorously controlling our costs, aggressively reducing expenses and increasing efficiencies throughout our organization by:

Implementing process improvements throughout our business to increase efficiencies, reduce operating costs and create sustainable cost savings.

Achieving reductions in underlying direct operating and selling, general and administrative expenses, including reductions in staff where and when appropriate.

Assessing location, segment and transaction profitability to address less-profitable aspects of our business and focus on the more-profitable accounts that will help drive increased margins.

Deploying changes to our sales, marketing and affinity programs to improve profitability.

Integrating our acquired businesses, to realize cost efficiencies from combined maintenance, systems, technology and administrative infrastructure.

Implementing innovative technological solutions like self-service voice reservation technology, mobile communications with customers and fleet optimization technologies to reduce costs.

We believe such operational improvements will continue to assist and in some cases, drive our financial performance.

Our Evolving Mobility Platform

We believe our Company is well-positioned as a global leader in the evolving mobility marketplace. Mobility is more than providing a clean reliable car of choice for a customer to use to get from point A to point B; it also means providing our customers the choice to rent a vehicle or share a vehicle, and to do so by the year, month, week, day, hour or fraction of an hour. Mobility means our customers, using their smartphones or tablets, can customize their experiences with our products, services, and employees, bypass the counter or change their minds about the make or model of a vehicle and review their options on their mobile device right up to the moment they exit the parking lot. Mobility also means providing customers with choices even on the shortest trips, including how they want to be transported to or from their rental vehicles at the airport or by providing them with real time data about the wait time for the next shuttle.

When our customers return their rental vehicles to our fleet, whether at an airport or off-airport facility or a designated customer parking spot, our preferred customers can receive their complete charges for their transaction including gas, ancillary products use, and any other applicable charges, via email or text, within minutes of their proper return of the vehicle. In the future we intend to deliver more data content to our customers in their vehicles and to their devices that will provide them with customized access to useful information they want to know about, including eating, shopping, lodging, emergency assistance and tips on just enjoying the location they are visiting.

With our connected cars, mobility means being able to collect data about the car that will improve customer service and vehicle safety. It also means that we will be able to provide a new suite of services for clients who are looking to utilize our operational experience and our operations,technology to maintain and adjustmentsmanage their own fleets, and provide supply chain services with quality and precision at levels that exceed their ability to do so themselves.

Our current and growing list of business partnerships with other mobility service providers in adjacent business models allows us to offer more options to our business and leisure customers to satisfy a wide variety of mobility needs.

For our shareholders, mobility means seizing opportunities that will increase our overall value through strategies that expand the use of our technologies, fleet and employees, open new markets, increase revenue and margins across all our brands; and maintain our strength as an innovator in the size, natureexpanding mobility market.

Since 2017, we have undertaken several initiatives and termsentered into partnerships in support of our relationshipsstrategy, including:

Exceeding our goal of having more than 100,000 connected vehicles in our U.S. Avis fleet in 2018, delivering both customer benefits and operational efficiencies, including entering into agreements with Ford and Toyota to connect all their vehicles in our U.S. Avis fleet. We also expect to expand connected vehicles in Europe during 2019, bringing us closer to our goal of having a 100% global connected fleet;

Our launch of our first-ever Mobility Lab in the Kansas City, Missouri area, utilizing fully connected vehicles that allows us to leverage our capabilities to deliver operational efficiencies through on-demand inventory counts, mileage management and automated maintenance notifications that enhance and optimize the Company’s fleet management capabilities;

Our integration with Amazon Alexa, which allows travelers to book and manage their car rental reservations through the voice platform on Amazon Echo;

Our partnership with Waymo, an Alphabet Inc. company, through which we are offering fleet support and maintenance services for their growing fleet of autonomous vehicles in Phoenix, Arizona. This provides a unique opportunity to grow our understanding of the support and operational maintenance requirements for self-driving vehicles at the fleet level, including staffing and facility requirements;

Our focus on emerging technologies through our collaboration with various international and local technology incubators;

Our partnership with Lyft, in which we are enabling Lyft drivers across North America the ability to use Avis vehicles on a monthly and weekly basis as an alternative to using their own personal vehicle;

Our partnership with Brightline in Florida, the only privately owned and operated passenger rail service in the United States, in which we offer Brightline passengers and those living or working near Brightline’s stations convenient access to Avis and Zipcar vehicles that can be reserved via integration with the Brightline app; and

Our use of Amazon Web Services’ (“AWS”) Connected Vehicle Solution to build our data analytics platform, providing highly secure and scalable cloud services and allows us to leverage AWS’ capabilities for artificial intelligence, machine learning, and data management to develop a wide variety of innovative connected vehicle manufacturers.applications and mobility services.

We are committed to finding new and innovative ways of thinking and operating, and to leverage our technology, employees, global presence and capabilities to be leaders among the contributors that are now shaping the evolving mobility market.

|

|

| OUR BRANDS AND OPERATIONS |

OUR BRANDS

Our Avis, Budget and Zipcar brands are three of the most recognized brands in our industry. We believe that we enjoy significant benefits from operating our Avisbrands with services and Budget brandsproducts targeted to target different rental customers but shareand sharing the same maintenance facilities, fleet management systems, technology and administrative infrastructure. In addition, we are able to recognize significant benefits and savings by combining our car rental and car sharing maintenance activities and fleets at times to reduce the number of unutilized carsincrease our fleet utilization efficiency and to meet demand peaks. We believe that Avis, Budget and Zipcar all enjoy complementary demand patterns with mid-week commercial demand balanced by weekend leisure demand. We also operate the Apex and Payless brands, which operate in the deep-value segment of the car rental industry, and augmentaugmenting our Avis, Budget and Zipcar brands. In addition, our Maggiore and Morini brands in Italy, FranceCars brand in France and Turiscar brand in Portugal further extend the range of vehicle use occasions we are able to serve.

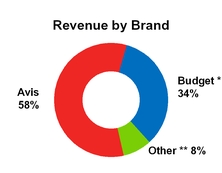

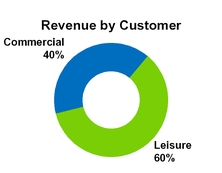

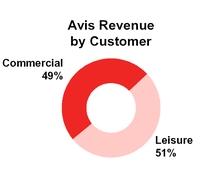

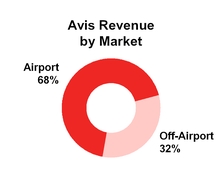

The following graphs present the approximate composition of our revenue by brand, customer and market in 2018.

| |

| ** | Includes Zipcar and other operating brands. |

*** Includes Budget Truck and Zipcar.

Avis

The Avis is a leadingbrand provides high-quality vehicle rental car supplier positionedand other mobility solutions at price points generally above non-branded and value-branded vehicle rental companies to serve the premium commercial and leisure segments of the travel industry. The Avis brand provides high-quality car rental services at price points generally above non-branded and value-branded national car rental companies. We operate or license the Avis carvehicle rental system (the “Avis System”), one of the largest carglobal vehicle rental systems, in the world, comprised ofat approximately 5,500 locations worldwide, including in virtually all of the largest commercial airports and cities in the world.

We operateThe Avis System is comprised of an approximately 2,750 Avis carequal number of company-owned and licensee vehicle rental locations worldwide, in both the on-airport and off-airport, or local, rental markets. The table below presents the approximate number of locations that comprise the Avis System as of December 31, 2018.

|

| | | | | | | | |

| | Avis System Locations* |

| | Americas | | International | | Total |

| Company-operated locations | 1,550 |

| | 1,300 |

| | 2,850 |

|

| Licensee locations | 700 |

| | 1,950 |

| | 2,650 |

|

| Total Avis System Locations | 2,250 |

| | 3,250 |

| | 5,500 |

|

| |

| * | Certain locations support multiple brands. |

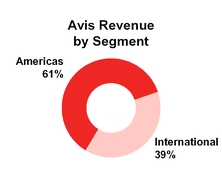

In 2016,2018, our company-operated Avis operationslocations generated total world-wide revenue of approximately $5.1$5.3 billion, of which approximately 63% (or $3.2 billion)$2.6 billion was derived from operationscommercial customers and approximately $3.6 billion was derived from customers renting at airports. The following graphs present the approximate composition of our Avis revenue by segment, customer and market in the Americas. In addition, we2018.

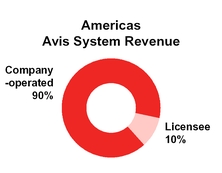

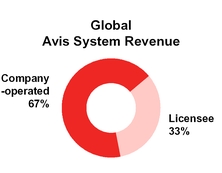

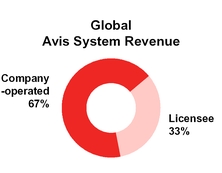

We also license the Avis brandSystem to other independent commercial owners inwho operate approximately 2,750half of our locations throughout the world. In 2016, approximately 71% of the Avis System total revenue was generated by our Company-operated locationsworldwide and the remainder was generated by locations operated by independent licensees, which generally pay royalty fees to us based on a percentage of applicable revenue.

The table below presents In 2018, approximately 33% of the approximate number of locations that comprise theglobal Avis System:

|

| | | | | | | | |

| | Avis System Locations |

| | Americas | | International | | Total |

| Company-operated locations | 1,550 |

| | 1,200 |

| | 2,750 |

|

| Licensee locations | 700 |

| | 2,050 |

| | 2,750 |

|

| Total Avis System Locations | 2,250 |

| | 3,250 |

| | 5,500 |

|

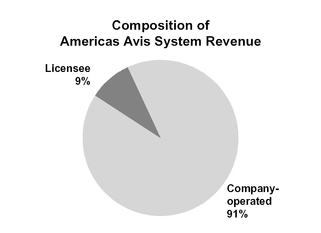

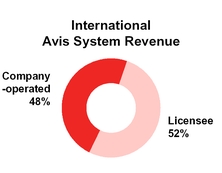

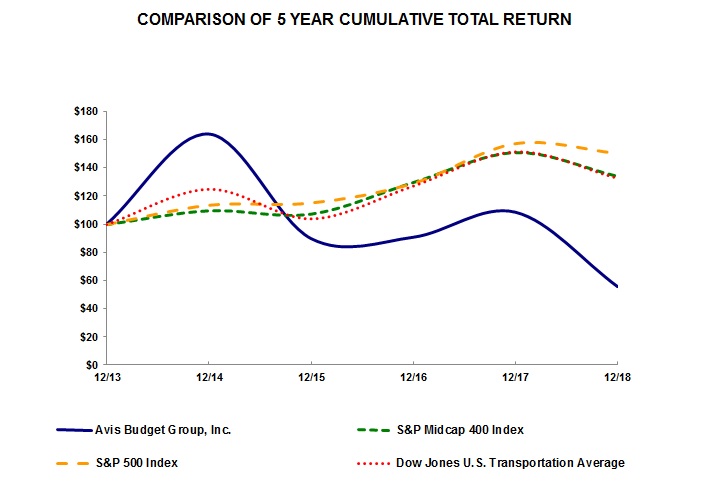

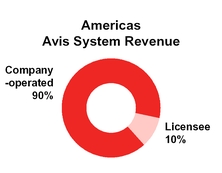

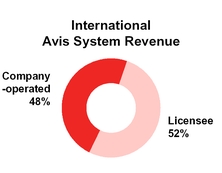

System revenue was generated by our licensees. The graphs below present the approximate composition of the Americas Avis System revenue and global Avis System revenue in 2016:2018.

In 2016, Avis derived approximately $1.8 billion and $1.8 billion (or 50% and 50%) of its vehicle rental revenue from commercial and leisure customers, respectively, and $2.5 billion and $1.1 billion (or 70% and 30%) of its vehicle rental revenue from customers renting at airports and locally, respectively.

We offer Avis customers a variety of premium services, including:

the Avis Now,mobile application, which allows customers a new and innovative way to control many elements of their rental experience via their mobile application-enabled process thatdevices without the need to visit the rental counter. The Avis mobile application also allows customers to reserve, confirm, choose or upgradetrack Avis shuttle buses to rental locations, find their car, add ancillary products, openvehicle, and close or extend rentals,locate nearby gas stations and in the case of certain connected vehicles, lock and unlock the vehicle, using their smartphone or tablet device.

parking facilities;

Avis Preferred, a frequent renter rewards program that offers counter bypasscounter-bypass at major airport locations and reward points for every dollar spent on vehicle rentals and related products;

the Avis Preferred Select & Go, a service that allows customers at certain locations to select an alternate vehicle or upgrade their vehicle choice without visiting the rental counter;

Avis Signature Series, a selection of luxury vehicles including BMWs,Mercedes, Jaguars, Corvettes, Mercedes and Maseratis;

rental of portable GPS navigation units, tablets and in-dash satellite radio service;others;

availability of premium, sport and performance vehicles as well as eco-friendly vehicles, including gasoline/electric hybrids;

roadside assistance;access to portable navigation units, tablets and in-dash satellite radio service;

e-receipts;

a 100% smoke-free carAvis rental fleet in North America;

services such as roadside assistance, fuel service options, e-receipts, electronic toll collection services that allow customers to pay highway tolls without waiting in toll booth lines;

lines, and amenities such as Avis Access, a full range of special products and services for drivers and passengers with disabilities;

Curbside Delivery, a service that provides customers at select airport locations in the United States with the added convenience of being dropped off at the airport terminal in the same car that they rented;

for our corporate customers, Avis Interactive,Budget Group Business Intelligence, a proprietary managementcustomer reporting solution that provides a centralized reporting tool that allowsand customer reporting portal for all corporate clients around the globe. This enables them to easily view and analyze their rental activity, via the Internet, permitting these clientsthem to better manage their travel budgets and monitor employee compliance with applicable travel policies; and

supporting online interactions withapplications that serve our customers through various mobile and technology platforms, including an application for the Apple Watch devices and an Android application featuring voice-activated reservations.

Avis has been named the leading car rental company in customer loyalty in the Brand Keys Customer Loyalty Engagement Index for the seventeen consecutive years. In addition, Avis was named to the 2016 Brand Keys Loyalty Leaders List and received numerous other awards.voice-controlled access through Amazon Alexa enabled devices.

Budget

The Budget brand is a leading supplier of vehicle rental car supplierand other mobility solutions focused primarily on more value-conscious segments of the industry.customers. We operate or license the Budget vehicle rental system (the “Budget System”), which is comprised of approximately 4,050 carvehicle rental locations and represents one of the largest car rental systems in the world. The Budget System encompasses locations at most of the largest airports and cities in the world.

We operate approximately 2,050 Budget car rental locations worldwide. In 2016, our Budget car rental operations generated total revenue of approximately $2.5 billion, of which 83% (or $2.1 billion) was derived from operations in the Americas. We also license the Budget System to independent commercial owners who operate approximately 2,000 locations worldwide. In 2016, approximately 71% of the Budget System total revenue was generated by our Company-operated locations with the remainder generated by locations operated by independent licensees, which generally pay royalty fees to us based on a percentage of applicable revenue.

The table below presents the approximate number of locations that comprise the Budget System:System as of December 31, 2018.

| | | | Budget System Locations | Budget System Locations* |

| | Americas | | International | | Total | Americas | | International | | Total |

| Company-operated locations | 1,400 |

| | 650 |

| | 2,050 |

| 1,375 |

| | 875 |

| | 2,250 |

|

| Licensee locations | 650 |

| | 1,350 |

| | 2,000 |

| 650 |

| | 1,100 |

| | 1,750 |

|

| Total Budget System Locations | 2,050 |

| | 2,000 |

| | 4,050 |

| 2,025 |

| | 1,975 |

| | 4,000 |

|

| |

| * | Certain locations support multiple brands. |

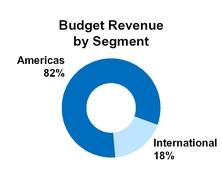

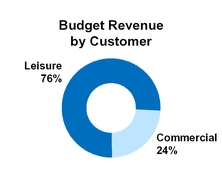

In 2018, our company-operated Budget vehicle rental operations generated total revenue of approximately $2.7 billion, of which approximately $2.0 billion was derived from leisure customers and $2.1 billion was derived from customers renting at airports. The following graphs present the approximate composition of our Budget revenue by segment, customer and market in 2018.

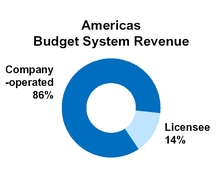

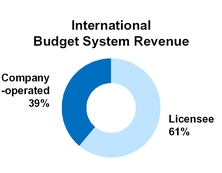

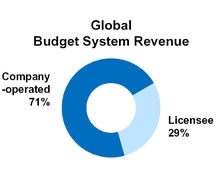

We also license the Budget System to independent commercial owners who operate approximately half of our locations worldwide and generally pay royalty fees to us based on a percentage of applicable revenue. In 2018, approximately 29% of the global Budget System revenue was generated by our licensees. The graphs below present the approximate composition of the Americas Budget System revenue and global Budget System revenue in 2016:2018.

In 2016, Budget derived approximately $1.3 billion and $435 million (or 75% and 25%) of its vehicle rental revenue from leisure and commercial customers, respectively, and $1.3 billion and $427 million (or 75% and 25%) of its vehicle rental revenue from customers renting at airports and locally, respectively.

Budget offers its customers several products and services similar to Avis, such as portable GPS navigation units,refueling options, roadside assistance, electronic toll collection, curbside dropoff and other supplemental rental products, emailed receipts and refueling options, as well as aspecial rental rates for frequent renters. In addition, Budget’s mobile application that allows customers to reserve, modify and cancel reservations on their smartphone, special rental rates for frequent rentersmobile device, and Budget’sits Fastbreak service, an expeditedexpedites rental service for frequent travelers.

In 2016, Budget received numerous awards, including for its award-winning loyalty program, Unlimited Rewards®, which was selected by Travel Weekly as a 2016 Gold Magellan Award Winner.

Zipcar

Founded in 2000, Zipcar operates the world’s leading membership-based car sharing network that provides “wheels when you want them” to more than one million members, also known as “Zipsters,” in over 30 major metropolitan areas, over 550 college campuses and in more than 500 cities and towns across the United States, Canada and Europe. Zipcar provides its members self-service vehicles in reserved parking spaces located in residential neighborhoods, business districts, college campuses, business office complexes and airports.

Our members may reserve vehicles by the hour or by the day at rates that include gasoline, insurance and other costs associated with vehicle ownership, and they can make their reservations through Zipcar’s reservation system, which is available by phone, Internet or through the Zipcar application on their smartphone. Our members have the flexibility to choose from a variety of makes and models of vehicles depending on their specific needs and desires for each trip and the available Zipcars in their neighborhoods. The flexibility and affordability of our service, as well as broader consumer trends toward responsible and sustainable living, provide a significant platform for future growth.

We continue to make substantial investment in refining, innovating and enhancing Zipcar’s operations and fleet management systems, and we have integrated numerous elements of Zipcar’s operations and fleet management into our existing processes. We believe that the experience that we have gained and continue to accumulate while growing and operating our network is a key advantage, informing our decisions regarding our existing operations and services as well as our plans for expansion.

Zipcar offers its members the freedom of on-demand access to a fleet of vehicles at any hour of the day or night, in their neighborhood or in any of our Zipcar cities and locations. Benefits to members include:

Cost-effective alternative to car ownership - Members pay for time they reserve the vehicle and have no responsibility for the additional costs and hassles associated with car ownership, including parking, gasoline, taxes, registration, insurance, maintenance and lease payments.

Convenience and accessible fleet - Zipcars are interspersed throughout local neighborhoods, colleges and corporate campuses where they are parked in reserved parking spaces and garages within an easy walk of where our members live, study and work. Members can book a designated vehicle online, by phone or via their mobile device, unlock the selected vehicle using a keyless entry card (called a “Zipcard”), and drive away. Because each Zipcar has a designated parking space, members are spared the often time-consuming undertaking of finding an available parking spot.

Freedom and control - We provide our members with much of the freedom associated with car ownership while being complementary to public transportation options. Like car owners, our members can choose when and where they want to drive. They also have the added benefit of being able to choose, based upon the readily available Zipcars in their neighborhoods, the make, model and type of vehicle they want to drive based on their specific needs and desires for each trip.

Responsible and sustainable living - We are committed to providing our members with socially responsible, sustainable options that support the global environment, their communities and city livability. Studies show that car sharing reduces the number of miles driven, the number of personally-owned vehicles on the road and carbon emissions.

Zipcar for Universities - We provide college students, faculty, staff and local residents living in or near rural and urban campuses with access to Zipcars. Zipcars are located on over 550 college and university campuses. Our program for universities helps university administrators maximize the use of limited parking space on campus and reduce campus congestion while providing an important amenity for students, faculty, staff and local residents. In some cases, Zipcar may be the only automobile transportation available to students, since many traditional rental car services have higher age restrictions.

Zipcar for Business - We provide companies with a business-friendly alternative to providing company cars with car-sharing programs that give their employees convenient, on-demand access to vehicles at exclusive rates. Zipcar for Business also allows easy billing, enabling members to charge driving to the driver or directly to their employer.

In 2016, we expanded Zipcar’s ONE>WAY program in selected markets, allowing members in more locations to take on-demand one-way trips. We also opened the first pilot of Zipcar’s “floating” car sharing product in Brussels, allowing members to drive one-way and leave the car in any designated space. The Zipcar brand has continued to be recognized as the world’s leading car sharing network and for the quality of the customer experience it offers.

Budget Truck

Our Budget Truck rental business is one of the largest local and one-way truck rental businesses in the United States. OurAs of December 31, 2018, our Budget Truck fleet is comprised of approximately 22,00018,000 vehicles that are rented through a network of approximately 1,000 dealers640 dealer-operated and 480430 Company-operated locations throughout the continental United States. These dealers are independently-owned businesses that generally operate other retail service businesses. In addition to their principal businesses, the dealers rent our light- and medium-duty trucks to consumers and to our commercial accountscustomers and are responsible for collecting payments on our behalf. The dealers receive a commission on all truck and ancillary equipment rentals. The Budget Truck rental business serves both the consumer and light commercial sectors. The consumer sector consists primarily of individuals who rent trucks to move household goods on either a one-way or local basis. The light commercial sector consists of a wide range of businesses that rent light- to medium-duty trucks, which we define as trucks having a gross vehicle weight of less than 26,000

pounds, for a variety of commercial applications.

Zipcar

Zipcar operates one of the world’s leading membership-based car sharing networks, which provides its members on-demand access to vehicles in over 500 cities and towns and at more than 600 college campuses around the world. Zipcar provides its members on-demand, self-service vehicles in reserved parking spaces located in neighborhoods, business districts, office complexes, college campuses and airports, as an alternative to car ownership. Members can reserve vehicles online, on a mobile device or over the phone, by the minute, hour or by the day, at rates that include gasoline, insurance and other costs associated with vehicle ownership. In 2018, we widened Zipcar’s product offering by launching our Zipcar Commuter product, which is now available in 11 major markets in North America and provides unlimited, sole access to a vehicle and dedicated parking spot for Zipcar members who commute outside of the city for work. We also began offering our Zipcar “Flex” product in London providing for one-way rentals that are typically at a lower price than ride-hailing services.

Other Brands

Our Payless brand is a leading rental car supplier positioned to serve the deep-value segment of the carvehicle rental industry. We operate or license the Payless brand, which is comprised of approximately 240 vehicle rental280 locations worldwide, including approximately 90120 Company-operated locations and more than 150160 locations operated by licensees. Company-operated Payless locations are primarily located in North America, the majority of which are at or near major airports. Payless’ base T&Mrental fees are often lower than those of larger, more

established brands, but Payless has historically achieved a greater penetration of ancillary products and services with its customers. The Payless business model allows the Company to extend the life cyclelife-cycle of a portion of our fleet, as we “cascade” certain vehicles that exceed certain Avis and Budget age or mileage thresholds to be used by Payless.

Our Apex brand operates primarily in the deep-value segment of the carvehicle rental industry in New Zealand and Australia, where we have approximately 25 Apex30 rental locations. Apex operates its own rental fleet, separate from Avis and Budget vehicles and generally older and less expensive than vehicles offered by Avis, Budget and other traditional car rental companies.vehicles. Apex generates substantially all of its reservations through its proprietary websites andas well as its contact center and online travel agencies and typically has a greater than averagegreater-than-average length of rental. The substantial majority of Apex operates rental locations are at, or near, major airport locations.airports and in several metropolitan cities.

Our Maggiore brand is a leading vehicle rental brand in Italy, where we operate or license more than 130approximately 140 rental locations under the Maggiore name. Our Maggiore brand has a strong domestic reputation in the commercial, leisure and insurance replacement/leasing segments and benefits from a strong presence at airport, off-airport and railway locations. We have integrated numerous elementslocations, and benefits from the integration of Maggiore’sour existing operations and fleet management intoexpertise. In addition, our existing processes. recently acquired Morini brand is a leading vehicle rental brand in Italy, which offers rental of cars, vans and refrigerated vehicles. We operate or license more than 40 rental locations under the Morini name throughout the country.

Our France CarsFranceCars brand operates one of the largest light commercial vehicle fleets in France from more than 60approximately 85 rental locations. Withlocations and leverages our existing operational processes and local customer base.

Our recently acquired Turiscar brand is a leading vehicle rental brand in Portugal, primarily in the purchase of France Cars in December 2016, we further increased our ability to serve customers’ needs for vans andcorporate market, including light truckscommercial vehicles, from approximately 25 rental locations throughout France.the country.

RESERVATIONS, MARKETING AND SALES

Reservations

Our customers can make vehicle rental reservations through our brand-specific websites and through our toll-free reservation centers, by calling a specific location directly, through our brand-specific mobile applications, through online travel agencies, through travel agents or through selected partners, including many major airlines, associations and retailers. Travel agents can access our reservation systems through all major global distribution systems, (“GDSs”), which provide information with respect to rental locations, vehicle availability and applicable rate structures.

Our Zipcar members may reserve cars by the minute, hour or by the day through Zipcar’s reservation system, which is accessible through the Zipcar website, through the Zipcar application on their smartphone or by phone.

We also provide two-way SMS texting, enabling us to proactively reach out to members during their reservation via their mobile device to manage their reservation, including instant reservation extension.

In 2016, we generated approximately 29% of our vehicle rental reservations through our brand-specific websites, 10% through our contact centers, 25% through GDSs, 14% through online travel agencies, 12% through direct-connect technologies and 10% through other sources. Virtually all of our Zipcar car sharing reservations were generated online or through our Zipcar mobile applications. We use a voice reservation system that allows customers to conduct certain transactions such as confirmation, cancellation and modification of reservations using self-service interactive voice response technology. In addition to our Zipcar mobile applications, we have also developed Avis and Budget mobile applications for various mobile platforms, allowing our customers to more easily manage their car rental reservations on their mobile devices.

Marketing and Sales

We support our brands through a range of marketing channels and campaigns, including traditional media, such as television radio and print advertising, as well as Internet and email marketing, social media and wireless mobile device applications. We market through sponsorships of major sports entities such as the PGA Tour, the New York Yankees, the Toronto Maple Leafs and Toronto FC. We also market through sponsorships of charitable organizations such as the Make-A-Wish Foundation. We utilize a customer relationship management system that enables us to deliver more targeted and relevant offers to customers across both online and offline channels and allows our customers to benefit through better and more relevant marketing, improved service delivery and loyalty programs that reward frequent renters with free rental days and car class upgrades.

We use social media to promote our brands and provide our customers with the tools to interact with our brands electronically through multiple web-based platforms. We also use digital marketing activities to drive international reservations.

Our Zipcar brand also utilizes localized marketing initiatives, which include low-cost, word-of-mouth marketing strategies and the use of marketing “brand ambassadors” that target potential members on a more personal, local level. These efforts highlight simple messages that communicate the benefits of “wheels when you want them.” Zipcar members also actively recruit new members as incentivized by Zipcar’s member referral program, which awards driving credit for new member referrals.

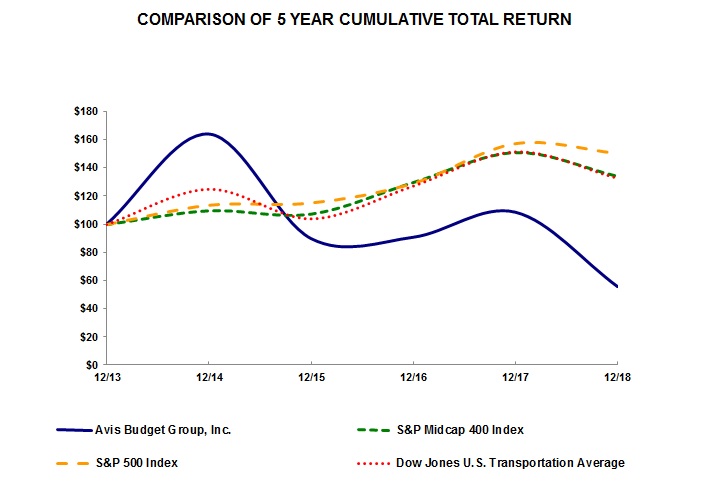

In 2016, we maintained, expanded or entered into marketing alliances with key marketing partners that include brand exposure and cross-marketing opportunities for each of the brands involved. For example, in 2016, we became the exclusive car rental partner of JetBlue Airways and JetBlue’s True Blue loyalty rewards program. We also extended our relationships with American Airlines, AARP, USAA and Aeroplan. Additionally, as the “Official Rental Car of the PGA TOUR,” Avis promoted its products and services to millions of golf enthusiasts worldwide through prominent advertising placements in PGA TOUR television broadcasts, scoreboards at tournaments, online media channels and additional official partner channels.