UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended

December 31, 2014

2015

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period From

(Not Applicable)

Commission File Number 001-36636

CITIZENS FINANCIAL GROUP, INC.

(Exact name of the registrant as specified in its charter)

|

| | |

| Delaware | | 05-0412693 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

One Citizens Plaza, Providence, RI 02903

(Address of principal executive offices, including zip code)

(401) 456-7000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [X] Yes [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

| | | |

| Large accelerated filer | [ ]X] | Accelerated filer | [ ] |

| Non-accelerated filer (Do not check if a smaller reporting company) | [X] ] | Smaller reporting company | [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X] No

The aggregate market value of voting stock held by nonaffiliates of the Registrant was $8,672,625,866 (based on the June 30, 2015 closing price of

Citizens Financial Group, Inc. common shares of $27.31 as reported on the New York Stock Exchange). There were 545,901,116527,811,625 shares of Registrant'sRegistrant’s common stock ($0.01 par value) outstanding on February 1, 2015.

2016.

Documents incorporated by reference

Portions of Citizens Financial Group, Inc.’s proxy statement to be filed with the United States Securities and Exchange Commission in connection with Citizens Financial Group, Inc.’s 20152016 annual meeting of stockholders (the “Proxy Statement”) are incorporated by reference into Part III hereof. Such Proxy Statement will be filed within 120 days of Citizens Financial Group, Inc.’s fiscal year ended December 31, 2014.2015.

CITIZENS FINANCIAL GROUP, INC.

FORWARD-LOOKING STATEMENTS

GLOSSARY OF ACRONYMS AND TERMS

The following listing provides a comprehensive reference of common acronyms and terms we regularly use in our financial reporting:

|

| | |

| AFS | | Available for Sale |

| ALLL | | Allowance for Loan and Lease Losses |

| AOCI | | Accumulated Other Comprehensive Income (Loss) |

| ASU | | Accounting Standards Update |

| ATM | | Automated Teller Machine |

| BHC | | Bank Holding Company |

| bps | | Basis Points |

| C&I | | Commercial and Industrial |

| Capital Plan Rule | | Federal Reserve’s Regulation Y Capital Plan Rule |

| CBNA | | Citizens Bank, N.A. |

| CBPA | | Citizens Bank of Pennsylvania |

| CCAR | | Comprehensive Capital Analysis and Review |

| CCO | | Chief Credit Officer |

| CET1 | | Common Equity Tier 1 |

| CEO | | Chief Executive Officer |

| CFPB | | Consumer Financial Protection Bureau |

| Citizens or CFG or the Company | | Citizens Financial Group, Inc. and its Subsidiaries |

| CLTV | | Combined Loan-to-Value |

| CLO | | Collateralized Loan Obligation |

| CMO | | Collateralized Mortgage Obligation |

| CRA | | Community Reinvestment Act |

| CRE | | Commercial Real Estate |

| CRO | | Chief Risk Officer |

| CSA | | Credit Support Annex |

| DFAST | | Dodd-Frank Act Stress Test |

| DIF | | Deposit Insurance Fund |

| Dodd-Frank Act | | The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 |

| DTA | | Deferred Tax Assets |

| EPS | | Earnings Per Share |

| ESPP | | Employee Stock Purchase Program |

| ERISA | | Employee Retirement Income Security Act of 1974 |

| Fannie Mae (FNMA) | | Federal National Mortgage Association |

| FASB | | Financial Accounting Standards Board |

| FDIA | | Federal Deposit Insurance Act |

| FDIC | | Federal Deposit Insurance Corporation |

| FHLB | | Federal Home Loan Bank |

| FICO | | Fair Isaac Corporation (credit rating) |

| FINRA | | Financial Industry Regulation Authority |

| FRB | | Federal Reserve Bank |

| FRBG | | Federal Reserve Board of Governors |

| Freddie Mac (FHLMC) | | Federal Home Loan Mortgage Corporation |

| FTE | | Full Time Equivalent |

CITIZENS FINANCIAL GROUP, INC.

|

| | |

| FTP | | Funds Transfer Pricing |

| GAAP | | Accounting Principles Generally Accepted in the United States of America |

| GDP | | Gross Domestic Product |

| GLBA | | Gramm-Leach-Bliley Act of 1999 |

| Ginnie Mae (GNMA) | | Government National Mortgage Association |

| HELOC | | Home Equity Line of Credit |

| HLS | | Home Lending Solutions |

| HTM | | Held To Maturity |

| IPO | | Initial Public Offering |

| LCR | | Liquidity Coverage Ratio |

| LGD | | Loss Given Default |

| LIBOR | | London Interbank Offered Rate |

| LIHTC | | Low Income Housing Tax Credit |

| LTV | | Loan-to-Value |

| MBS | | Mortgage-Backed Securities |

| MSA | | Metropolitan Statistical Area |

| MSR | | Mortgage Servicing Right |

| NSFR | | Net Stable Funding Ratio |

| NYSE | | New York Stock Exchange |

| OCC | | Office of the Comptroller of the Currency |

| OCI | | Other Comprehensive Income |

| OFAC | | Office of Foreign Assets Control |

| OIS | | Overnight Index Swap |

| OTC | | Over the Counter |

| PD | | Probability of Default |

| peers or peer banks or peer regional banks | | BB&T, Comerica, Fifth Third, KeyCorp, M&T, PNC, Regions, SunTrust and U.S. Bancorp |

| RBS | | The Royal Bank of Scotland Group plc or any of its subsidiaries |

| REITs | | Real Estate Investment Trusts |

| ROTCE | | Return on Average Tangible Common Equity |

| RPA | | Risk Participation Agreement |

| RWA | | Risk-weighted Assets |

| SBO | | Serviced by Others loan portfolio |

| SCA | | Strategic Client Acquisition |

| SEC | | United States Securities and Exchange Commission |

| SVaR | | Stressed Value-at-Risk |

| TDR | | Troubled Debt Restructuring |

| VaR | | Value-at-Risk |

CITIZENS FINANCIAL GROUP, INC.

FORWARD-LOOKING STATEMENTS

FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements within the Private Securities Litigation Reform Act of 1995. AnyStatements regarding potential future share repurchases and future dividends are forward-looking statements. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “initiatives,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.”

Forward-looking statements are based upon the current beliefs and expectations of management, and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. We caution you, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation:

negativeNegative economic conditions that adversely affect the general economy, housing prices, the job market, consumer confidence and spending habits which may affect, among other things, the level of nonperforming assets, charge-offs and provision expense;

theThe rate of growth in the economy and employment levels, as well as general business and economic conditions;

ourOur ability to implement our strategic plan, including the cost savings and efficiency components, and achieve our indicative performance targets;

ourOur ability to remedy regulatory deficiencies and meet supervisory requirements and expectations;

liabilitiesLiabilities and business restrictions resulting from litigation and regulatory investigations;

ourOur capital and liquidity requirements (including under regulatory capital standards, such as the Basel III capital standards) and our ability to generate capital internally or raise capital on favorable terms;

theThe effect of the current low interest rate environment or changes in interest rates on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgages held for sale;

changesChanges in interest rates and market liquidity, as well as the magnitude of such changes, which may reduce interest margins, impact funding sources and affect the ability to originate and distribute financial products in the primary and secondary markets;

theThe effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin;

financialFinancial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) and other legislation and regulation relating to bank products and services;

aA failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors or other service providers, including as a result of cyber attacks;cyber-attacks;

management’sManagement’s ability to identify and manage these and other risks; and

anyAny failure by us to successfully replicate or replace certain functions, systems and infrastructure provided by The Royal Bank of Scotland Group plc (“RBS Group”).

RBS.

In addition to the above factors, we also caution that the amount and timing of any future common stock dividends or share repurchases will depend on our financial condition, earnings, cash needs, regulatory constraints, capital requirements (including requirements of our subsidiaries), and any other factors that our Board of Directors deems relevant in making such a determination. Therefore, there can be no assurance that we will pay any dividends to holders of our common stock, or as to the

CITIZENS FINANCIAL GROUP, INC.

FORWARD-LOOKING STATEMENTS

amount of any such dividends. In addition, the timing and manner of the sale of RBS Group’s remaining ownership of our common stock remains uncertain, and we have no control over the manner in which RBS Group may seek to divest such remaining shares. Any such sale could harm the price of our shares of common stock. See “Risk Factors — Risks Related to our Common Stock” in Part I, Item 1A, included elsewhere in this report.

More information about factors that could cause actual results to differ materially from those described in the forward-looking statements can be found under “Risk Factors” in Part I, Item 1A, included elsewhere in this report.

Percentage changes, per share amounts, and ratios presented in this report are calculated using whole dollars.

CITIZENS FINANCIAL GROUP, INC.

PART I

ITEM 1. BUSINESS

Headquartered in Providence, Rhode Island, with $132.9$138.2 billion of total assets as of December 31, 2014,2015, we arewere the 13th largest retail bank holding company in the United States (according to SNL Financial).States.(1) Our approximately 17,700 employeescolleagues strive to meet the financial needs of customers and prospects through approximately 1,200 branches operating in an 11-state footprint across the New England, Mid-Atlantic and Midwest regions and through our online, telephone and mobile banking platforms. Our branch banking footprint contained approximately 30 million households and 3.1 million businesses as of December 31, 2015.(1)We also maintain over 100 retail and commercial non-branch offices located both in our banking footprint and in eleven other states and the District of Columbia.

Columbia largely contiguous to our footprint. We deliver a comprehensive range of retail and commercial banking products and services to more than five million individuals, institutions and companies. Our 11-state branch banking footprint contains approximately 29.9 million households and 3.1 million businesses according to SNL Financialcompanies and as of December 31, 2014, approximately 75%2015 nearly 70% of our loans were to customers located in our footprint.footprint and eight contiguous states where we maintain offices.

Our primary subsidiaries are Citizens Bank, N.A. (“CBNA”),CBNA, a national banking association whose primary federal regulator is the Office of the Comptroller of the Currency (“OCC”),OCC, and Citizens Bank of Pennsylvania (“CBPA”),CBPA, a Pennsylvania-chartered savings bank regulated by the Department of Banking of the Commonwealth of Pennsylvania and supervised by the Federal Deposit Insurance Corporation (“FDIC”)FDIC as its primary federal regulator.

Our History

In September 2014, Citizens Financial Group (CFG: NYSE) became a publicly-traded company in the largest traditional bank IPO in U.S. history. Following three subsequent follow on equity offerings in March, July, and November of 2015, Citizens is now fully separated from RBS.

Our history dates back to High Street Bank, founded in 1828, which established Citizens Savings Bank in 1871. Citizens Savings Bank acquired a controlling interest in its founder by the 1940s, renaming the entity Citizens Trust Company. By 1981, we had grown to 29 branches in Rhode Island with approximately $1.0 billion of assets, and in 1988 we became a wholly-owned subsidiary of RBS. Over the following two decades, we grew substantially through a series of over 25 strategic bank acquisitions, which greatly expanded our footprint throughout New England and into the Mid-Atlantic and the Midwest, transforming us from a local retail bank into one of the largest retail U.S. bank holding companies.

Business Segments

We offer a broad set of banking products and services through our two operating segments — Consumer Banking and Commercial Banking — with a focus on providing local delivery and a differentiated customer experience. Because we operate in a highly competitive industry and believe that banking should have a personal touch, we have programs in place to train and prepare our colleagues to deliver a consistent, high-quality experience through every customer interaction. Furthermore, weWe seek to ensure that customers select us as their primary banking partner by taking the time to understand their banking needs and we tailor our full range of products and services accordingly. To that end, our Consumer Banking value proposition is based on providing simple, easy to understand product offerings and a convenient banking experience with a more personalized approach. Commercial Banking focuses on offering a client-centric experience by leveraging an in-depth understanding of our clients’ and prospects’ businesses in order to proactively provide a solutions-oriented “Thought Leadership” value proposition.

The following table presents certain financial information for our segments as of and for the year ended December 31, 2014 and as of and for the year ended December 31, 2013:segments:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of and for the Year Ended December 31, 2014 | | As of and for the Year Ended December 31, 2013 |

| |

| | (in millions) | Consumer Banking | | Commercial Banking | | Other (1) |

| | Consolidated | | Consumer Banking | | Commercial Banking | | Other (1) |

| | Consolidated |

| | | | | | | | | | | | | | | | | |

| | Total loans and leases and loans held for sale (average) |

| $47,745 |

| |

| $37,683 |

| |

| $4,316 |

| |

| $89,744 |

| |

| $45,106 |

| |

| $34,647 |

| |

| $6,044 |

| |

| $85,797 |

|

| | Total deposits and deposits held for sale (average) | 68,214 |

| | 19,838 |

| | 4,513 |

| | 92,565 |

| | 72,158 |

| | 17,516 |

| | 3,662 |

| | 93,336 |

|

| | Net interest income (expense) | 2,151 |

| | 1,073 |

| | 77 |

| | 3,301 |

| | 2,176 |

| | 1,031 |

| | (149 | ) | | 3,058 |

|

| | Noninterest income | 899 |

| | 429 |

| | 350 |

| | 1,678 |

| | 1,025 |

| | 389 |

| | 218 |

| | 1,632 |

|

| | Total revenue | 3,050 |

| | 1,502 |

| | 427 |

| | 4,979 |

| | 3,201 |

| | 1,420 |

| | 69 |

| | 4,690 |

|

| | Net income (loss)(2) |

| $182 |

| |

| $561 |

| |

| $122 |

| |

| $865 |

| |

| $242 |

| |

| $514 |

| |

| ($4,182 | ) | |

| ($3,426 | ) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Year Ended December 31, |

| 2015 | | 2014 |

| (in millions) | Consumer Banking | | Commercial Banking | | Other (2) |

| | Consolidated | | Consumer Banking | | Commercial Banking | | Other (2) |

| | Consolidated |

| Total average loans and leases and loans held for sale |

| $51,484 |

| |

| $41,593 |

| |

| $3,469 |

| |

| $96,546 |

| |

| $47,745 |

| |

| $37,683 |

| |

| $4,316 |

| |

| $89,744 |

|

| Total average deposits and deposits held for sale | 69,748 |

| | 23,473 |

| | 5,933 |

| | 99,154 |

| | 68,214 |

| | 19,838 |

| | 4,512 |

| | 92,564 |

|

| Net interest income | 2,198 |

| | 1,162 |

| | 42 |

| | 3,402 |

| | 2,151 |

| | 1,073 |

| | 77 |

| | 3,301 |

|

| Noninterest income | 910 |

| | 415 |

| | 97 |

| | 1,422 |

| | 899 |

| | 429 |

| | 350 |

| | 1,678 |

|

| Total revenue | 3,108 |

| | 1,577 |

| | 139 |

| | 4,824 |

| | 3,050 |

| | 1,502 |

| | 427 |

| | 4,979 |

|

| Noninterest expense | 2,456 |

| | 709 |

| | 94 |

| | 3,259 |

| | 2,513 |

| | 652 |

| | 227 |

| | 3,392 |

|

| Net income (loss) |

| $262 |

| |

| $579 |

| |

| ($1 | ) | |

| $840 |

| |

| $182 |

| |

| $561 |

| |

| $122 |

| |

| $865 |

|

(1) According to SNL Financial.

(2) Includes the financial impact of non-core, liquidating loan portfolios and other non-core assets and liabilities, our treasury activities, wholesale funding activities, securities portfolio, community development assets and other unallocated assets, liabilities, revenues, provision for credit losses and expenses not attributed to the Consumer Banking or Commercial Banking segments. For a description of non-core assets, see “Management's“Management’s Discussion and Analysis of Financial Condition and Results of Operations — Analysis of Financial Condition — December 31, 20142015 Compared with December 31, 20132014 — Loans and Leases — Non-Core Assets” in Part II, Item 7, included elsewhere in this report.

(2) Includes a goodwill impairment charge of $4.4 billion ($4.1 billion after tax) in 2013. For more information, see “Management's Discussion and Analysis of Financial Condition and Results of Operations — Results of Operations — Year Ended December 31, 2014 Compared with Year Ended December 31, 2013 — Net Income (Loss)” in Part II, Item 7 and Note 8 “Goodwill” to our audited Consolidated Financial Statements in Part II, Item 8, included elsewhere in the report.

CITIZENS FINANCIAL GROUP, INC.

BUSINESS

Our History

In September 2014, Citizens Financial Group (CFG: NYSE) became a publicly-traded company in the largest traditional bank IPO in U.S. history. Following three subsequent follow on equity offerings in March, July, and November of 2015, Citizens is now fully separated from RBS.

Our history dates back to High Street Bank, founded in 1828, which established Citizens Savings Bank in 1871. Citizens Savings Bank acquired a controlling interest in its founder by the 1940s, renaming the entity Citizens Trust Company. By 1981, we had grown to 29 branches in Rhode Island with approximately $1.0 billion of assets, and in 1988 we became a wholly-owned subsidiary of RBS. Over the following two decades, we grew substantially through a series of over 25 strategic bank acquisitions, which greatly expanded our footprint throughout New England and into the Mid-Atlantic and the Midwest, transforming us from a local retail bank into one of the largest retail U.S. bank holding companies.

Business Segments

We offer a broad set of banking products and services through our two operating segments — Consumer Banking Segmentand Commercial Banking — with a focus on providing local delivery and a differentiated customer experience. We seek to ensure that customers select us as their primary banking partner by taking the time to understand their banking needs and we tailor our full range of products and services accordingly.

The following table presents certain financial information for our segments:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Year Ended December 31, |

| 2015 | | 2014 |

| (in millions) | Consumer Banking | | Commercial Banking | | Other (2) |

| | Consolidated | | Consumer Banking | | Commercial Banking | | Other (2) |

| | Consolidated |

| Total average loans and leases and loans held for sale |

| $51,484 |

| |

| $41,593 |

| |

| $3,469 |

| |

| $96,546 |

| |

| $47,745 |

| |

| $37,683 |

| |

| $4,316 |

| |

| $89,744 |

|

| Total average deposits and deposits held for sale | 69,748 |

| | 23,473 |

| | 5,933 |

| | 99,154 |

| | 68,214 |

| | 19,838 |

| | 4,512 |

| | 92,564 |

|

| Net interest income | 2,198 |

| | 1,162 |

| | 42 |

| | 3,402 |

| | 2,151 |

| | 1,073 |

| | 77 |

| | 3,301 |

|

| Noninterest income | 910 |

| | 415 |

| | 97 |

| | 1,422 |

| | 899 |

| | 429 |

| | 350 |

| | 1,678 |

|

| Total revenue | 3,108 |

| | 1,577 |

| | 139 |

| | 4,824 |

| | 3,050 |

| | 1,502 |

| | 427 |

| | 4,979 |

|

| Noninterest expense | 2,456 |

| | 709 |

| | 94 |

| | 3,259 |

| | 2,513 |

| | 652 |

| | 227 |

| | 3,392 |

|

| Net income (loss) |

| $262 |

| |

| $579 |

| |

| ($1 | ) | |

| $840 |

| |

| $182 |

| |

| $561 |

| |

| $122 |

| |

| $865 |

|

(1) According to SNL Financial.

(2) Includes the financial impact of non-core, liquidating loan portfolios and other non-core assets and liabilities, our treasury activities, wholesale funding activities, securities portfolio, community development assets and other unallocated assets, liabilities, revenues, provision for credit losses and expenses not attributed to the Consumer Banking serves retail customersor Commercial Banking segments. For a description of non-core assets, see “Management’s Discussion and small businessesAnalysis of Financial Condition and Results of Operations — Analysis of Financial Condition — December 31, 2015 Compared with annual revenues of up to $25 million through a network that as of December 31, 2014 — Loans and Leases — Non-Core Assets” in Part II, Item 7, included approximately 1,200 branches operatedelsewhere in an 11-state footprint across the New England, Mid-Atlantic and Midwest regions, as well as through online, telephone and mobile banking platforms. Consumer Banking products and services include deposit products, mortgage and home equity lending, student loans, auto financing, credit cards, business loans, wealth management and investment services. Our Consumer Banking value proposition is based on providing simple, easy to understand product offerings and a convenient banking experience with a more personalized approach.

Consumer Banking is focused on winning, expanding and retaining customers through its value proposition: “Simple. Clear. Personal.” and is committed to delivering a differentiated experience through convenience and service. We were named by this report.Money Magazine in its 2014 list of “The Best Banks in America” for the second year in a row and were cited for the level of customer convenience available through the branch network, customer contact center, and access to banking specialists via instant messaging.

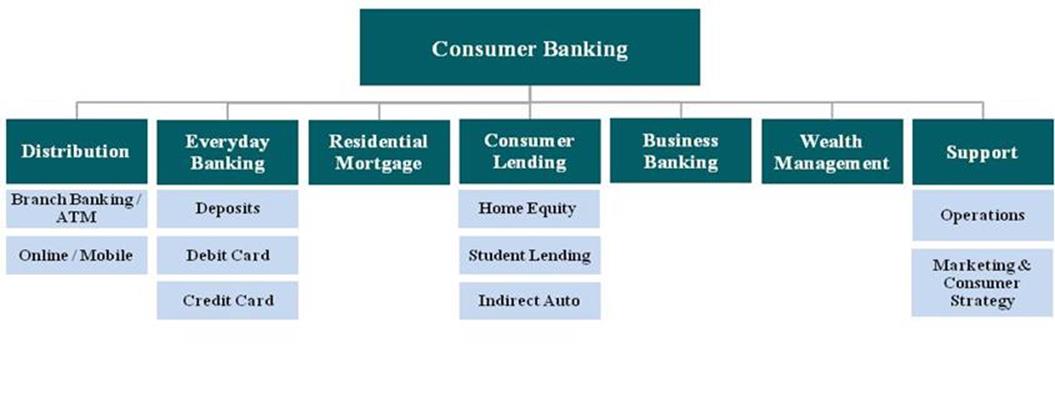

Consumer Banking accounted for $49.9 billion, or 56%, of outstanding loan balances in our operating segments as of December 31, 2014 and is organized around the customer products and services as follows:

Distribution: Provides a multi-channel distribution system with a network of approximately 1,200 branches, including over 345 in-store locations, as well as approximately 3,200 ATMs and a workforce of approximately 7,000 branch full-time equivalent (“FTE”) employees, which is complemented by a network of over 1,100 specialists covering home lending, wealth management and business banking. Our online and mobile capabilities offer customers the convenience of paying bills, transferring money between accounts and from person to person, in addition to a host of other everyday transactions through a robust digital platform. Lastly, the customer contact center provides customers with extended access to services.

Everyday Banking: Provides customers with deposit and payment products and services, including checking, savings, money market, certificates of deposit, debit cards, credit cards and overdraft protection. The business included approximately 2.2 million checking households and $67.0 billion in deposits as of December 31, 2014.

Home Lending Solutions (“HLS”): Offers home equity loans, home equity lines of credit (“HELOCs”) and residential mortgages primarily in footprint and in select out-of-footprint states through a direct-to-consumer call center and a mortgage loan officer base of over 410 as of December 31, 2014. We ranked sixth nationally in HELOCs by outstanding balances as of December 31, 2014, according to SNL Financial. Our HLS business maintains relatively conservative underwriting practices. Home equity originations in 2014 of $4.2 billion had a weighted average FICO score of 789 and an average loan-to-value ratio of 63%. In addition, 2014 mortgage originations of $3.7 billion had a weighted average FICO score of 765 and loan-to-value of 71%.

Indirect Auto Finance: Provides financing for the purchase of both new and used vehicles through a network of over 6,700 automotive dealerships in 43 states as of December 31, 2014. We implemented a new origination platform in October 2013 that has facilitated more granular credit and pricing strategies which will enable us to optimize risk-adjusted returns. Our underwriting strategy, which has historically focused on serving super-prime borrowers, continues to focus on serving high quality borrowers through prudent expansion of originations across a broader credit spectrum to include predominantly prime borrowers. As a result, we have been able to increase organic originations and have entered into a flow purchase agreement with a third party to accelerate our move into the prime space. The business ranked 10th nationally among regulated depository institutions by outstanding balances as of December 31, 2014, according to SNL Financial, and ranked in the top five in three of our top nine markets according to

CITIZENS FINANCIAL GROUP, INC.

BUSINESS

Autocount based on third quarter 2014 loan originations. 2014 origination volume of $6.4 billion had a weighted average FICO score of 759.

Student Lending: Offers a variety of student loan products including the TruFit Student Loan program, which features no origination, application or disbursement fees, competitive rates and a choice of repayment options. We launched the Student Lending business in 2009 and have expanded to partner with over 1,300 higher education schools in all 50 states. TruFit loan origination volume has increased from $112 million in 2010 to $305 million in 2014 and 2014 originations had a weighted-average FICO score of 779. We also launched the Education Refinance Loan product in January 2014, which provides consumers a way to refinance or consolidate multiple existing private and federal student loans. We originated approximately $230 million of these loans in 2014 with a weighted-average FICO score of 786.

Business Banking: Serves small and medium enterprise businesses with annual revenues of up to $25 million through a combination of branch-based employees, business banking officers and relationship managers. As of December 31, 2014, we employed a team of approximately 335 bankers with loans outstanding of $3.0 billion and deposit balances of $12.9 billion.

Wealth Management: Provides a full range of advisory services to clients with an array of banking, investment and insurance products and services through a sales force which includes more than 305 financial consultants, over 130 premier bankers and nine private banker teams. As of December 31, 2014, wealth management had approximately $4.1 billion in assets under management and $17.8 billion in investment brokerage assets.

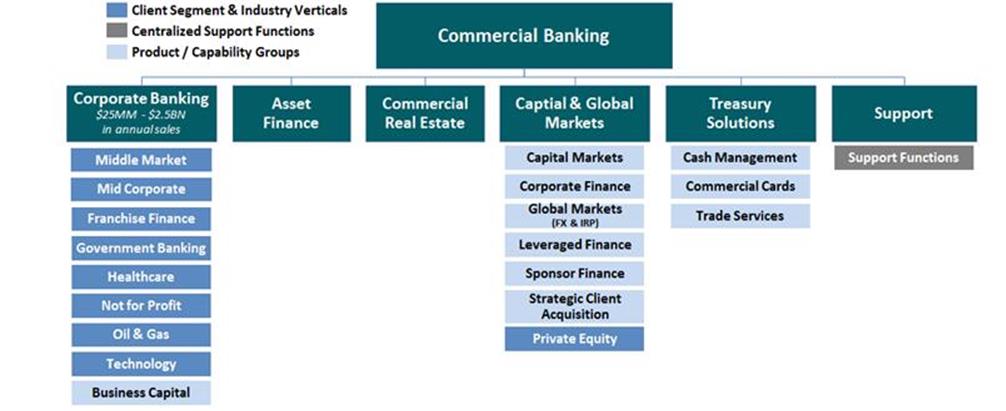

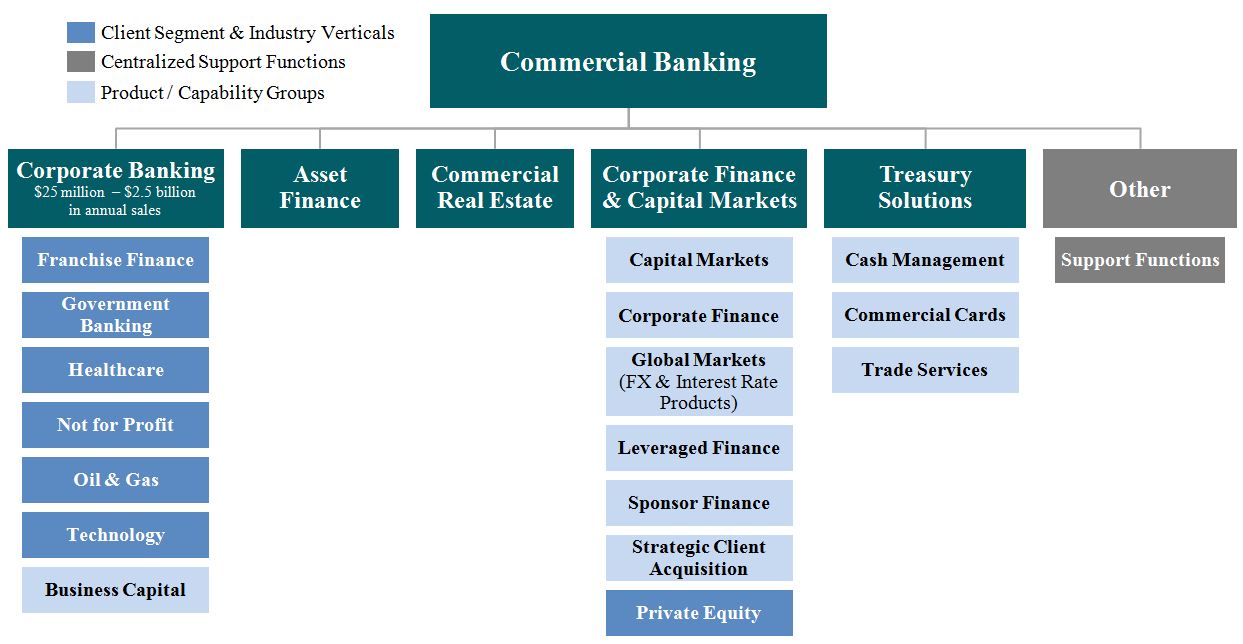

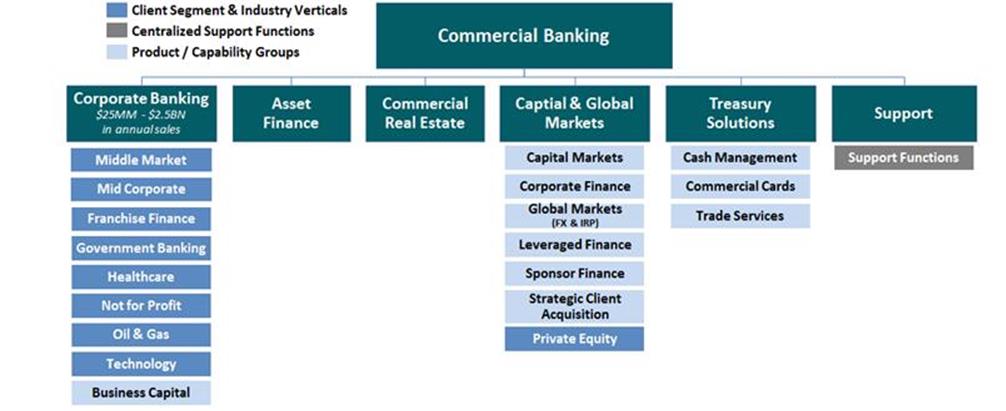

Commercial Banking Segment

Commercial Banking primarily targets companies and institutions with annual revenues of $25 million to $2.5 billion and strives to be the lead bank for its clients. Commercial Banking offers a broad complement of financial products and solutions, including lending and leasing, trade financing, deposit and treasury management, foreign exchange and interest rate risk management, corporate finance and debt and equity capital markets capabilities. Commercial Banking provides thought leadership by leveraging an in-depth understanding of our clients' and prospects' businesses to proactively deliver compelling financial solutions with quality execution. While activity is concentrated within the 11-state footprint, Commercial Banking pursues business opportunities nationally on a targeted basis in a way that reinforces its core footprint business.

We believe our Commercial Banking segment provides a compelling value proposition based on “Thought Leadership” for clients. Results are evidenced by a top five ranking in both client penetration and number of lead relationships in middle market banking within the footprint based on Greenwich Associates research (Citizens - Footprint - $25-500 million - Full Year 2014 survey). In addition, Commercial Banking strengthened its market share in loan syndications from 25th by dollar volume of syndicated loans and 18th by number of syndicated loans in 2010 to 10th by dollar volume and 8th by number of syndicated middle market loan deals for full year 2014, according to the Thomson Reuters Overall National Middle Market Bookrunner league table.

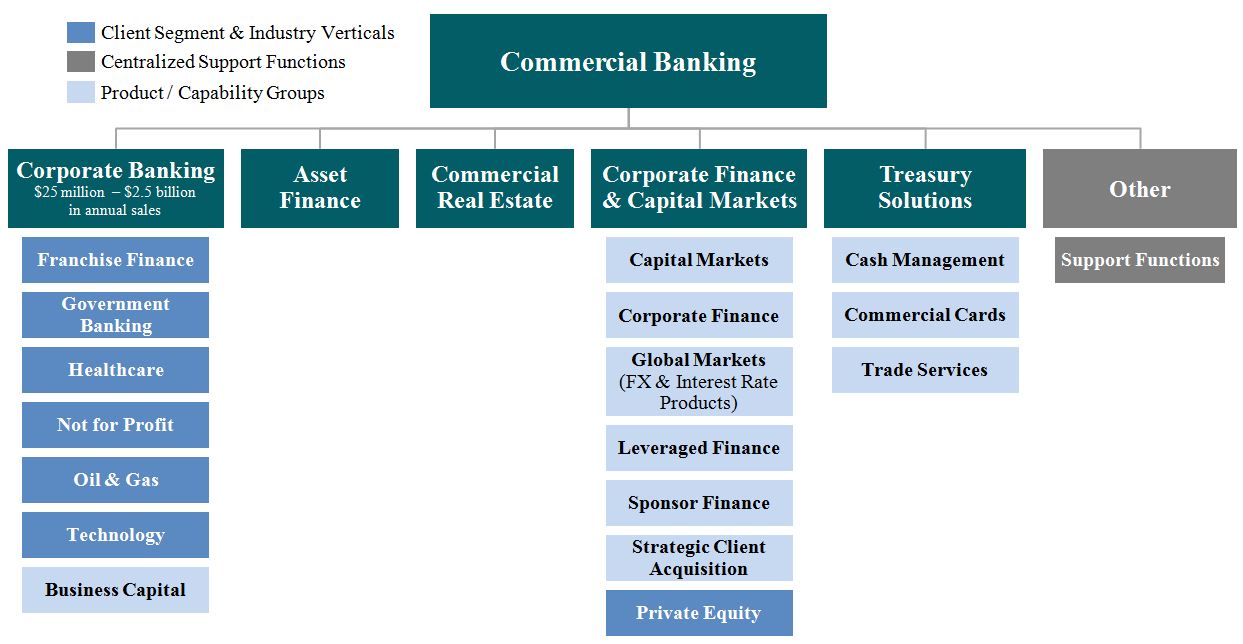

Commercial Banking is structured along lines of business, as well as product groups. Both the Corporate Finance & Capital Markets and the Treasury Solutions product groups support all lines of business. These business lines and product groups work in teams to understand and determine client needs and provide comprehensive solutions to meet those needs. New clients are acquired through a coordinated approach to the market ranging from leveraging deep industry knowledge in specialized banking groups to deploying a regional coverage approach for middle market businesses with targeted profiles that are headquartered in its branch geographic footprint.

CITIZENS FINANCIAL GROUP, INC.

Commercial Banking accounted for $39.9 billion, or approximately 44%, of total loans outstanding in our operating segments as of December 31, 2014, and is organized as follows:

Corporate Banking: Targets domestic commercial and industrial clients, serving middle-market companies with annual gross revenues of $25 million to $500 million and mid-corporate companies with annual revenues of $500 million to $2.5 billion. The business offers a broad range of products, including lines of credit, term loans, commercial mortgages, domestic and global treasury management solutions, trade services, interest rate products and foreign exchange. The average revenue mix is approximately 70% interest income and 30% fee income. Loans are extended on both a secured and unsecured basis, and are substantially all at floating rates of interest. Corporate Banking is a general lending practice, however there are specialty industry verticals addressing U.S. subsidiaries of foreign corporations, technology, government entities, healthcare, not-for-profit and educational institutions, security alarm services, professional firms, franchise finance and business capital (asset-based lending). Additionally, we recently created an energy vertical and in the fourth quarter of 2014 acquired from RBS Group an experienced team of lending professionals and a portfolio of reserve-based lending commercial loans with an outstanding principal balance of $417 million.

Asset Finance: Offers loan and tax- and non-tax-oriented leases for long-lived assets such as rail cars. The team also offers equipment financing term loans for middle-market and mid-corporate companies located in its branch footprint, as well as Fortune 500 companies throughout the United States. All transactions are secured by the assets financed and commitments tend to be fully drawn and most leases and loans are fixed rate. Areas of industry specialization include energy, utilities, and chemicals. The business also deploys dedicated teams to financing corporate aircraft.

Commercial Real Estate (“CRE”): Provides customized debt capital solutions for middle market and institutional developers and investors as well as real estate investment trusts (“REITs”). CRE provides financing for projects in the office, multi-family, industrial, core retail, healthcare and hospitality sectors. Loan types include construction financing, term debt and lines of credit. Most loans are secured by commercial real estate properties and all are non-owner occupied. Any owner-occupied commercial real estate would be originated through our Corporate Banking business.

Corporate Finance & Capital Markets: Delivers to customers through four key product groups including debt capital markets, corporate finance, global markets and strategic client acquisitions.

Capital Markets originates structures and underwrites multibank credit facilities and targets middle market, mid-corporate and private equity sponsors with a focus on offering value-added ideas to optimize their capital structure. From 2010 through 2014, Capital Markets was involved in closing 485 transactions and served in the lead-left role on 226 transactions and as joint-lead arranger on 259 transactions.

CITIZENS FINANCIAL GROUP, INC.

Corporate Finance provides advisory services to middle-market and mid-corporate companies, including mergers and acquisitions, equity private placements and capital structure advisory. The team works closely with industry sector specialists within debt capital markets on proprietary transaction development which serves to originate deal flow in multiple bank products.

Global Markets is a customer-facing business providing foreign exchange and interest rate risk management services. The lines of business include the centralized leveraged finance team, which provides underwriting and portfolio management expertise for all leveraged transactions and relationships; the private equity team, which serves the unique and time-sensitive needs of private equity firms, management companies and funds; and the sponsor finance team, which provides acquisition and follow-on financing for new and recapitalized portfolio companies of key sponsors.

Strategic Client Acquisition (“SCA”) was created to accelerate new client relationships through active participation in primary and secondary loan markets. The team efficiently sources transactions through long-established relationships in traditional pro rata markets as well as institutional, or term loan B, markets across all sectors. The combination of pro rata and term loan B tranches allows SCA’s traditional banking team to forge new relationships and accelerate existing relationship development while generating accretive returns.

Treasury Solutions: Supports all lines of business in Commercial Banking and Business Banking with treasury management solutions, including domestic and international cash management, commercial cards and trade finance. Treasury Solutions provides products to solve client needs related to receivables, payables, information reporting and liquidity management. Treasury Solutions serves small business banking clients (up to $500,000 annual revenue) up to large mid-corporate clients (over $2.5 billion annual revenue).

Our History

In September 2014, Citizens Financial Group (CFG: NYSE) became a publicly-traded company in the largest traditional bank initial public offering (“IPO”)IPO in U.S. history. The IPO represented an important stepFollowing three subsequent follow on equity offerings in our planned separationMarch, July, and November of 2015, Citizens is now fully separated from RBS Group, which has announced its plans to monetize its remaining ownership stake by the end of 2016.RBS.

Our history dates back to High Street Bank, founded in 1828, which established Citizens Savings Bank in 1871. Citizens Savings Bank acquired a controlling interest in its founder by the 1940s, renaming the entity Citizens Trust Company. By 1981, we had grown to 29 branches in Rhode Island with approximately $1.0 billion of assets, and in 1988 we became a wholly-owned subsidiary of RBS Group.RBS. Over the following two decades, we grew substantially through a series of over 25 strategic bank acquisitions, including:

In 1988, we acquired Fairhaven Savings Bank in Massachusetts, our first retail banking expansion beyond Rhode Island;

In 1996, we moved beyond southern New England when RBS and Bank of Ireland combined their New England banking operations through the merger of Citizens and First NH Bank in New Hampshire;

In 1999 and 2000, we acquired the commercial banking group of State Street Corporation and Boston-based UST Corporation, including its U.S. Trust branches in the Boston area; these acquisitions doubled the size of our Massachusetts operations and made us New England’s second-largest bank, with more than $30.0 billion in assets;

In 2001, we acquired the regional banking business of Mellon Financial Corporation, which included $14.4 billion in deposits, expanding our retail network outside of New England to Pennsylvania, Delaware and New Jersey; and

In 2004, we completed the largest transaction in our history by acquiring Charter One, which operated approximately 680 branches in nine states, and had $41.3 billion in assets, and expanded our branch footprint into New York, Vermont, Michigan, Ohio, Illinois and Indiana.

These acquisitions greatly expanded our footprint throughout New England and into the Mid-Atlantic and the Midwest, transforming us from a local retail bank into one of the largest retail U.S. bank holding companies.

Business Segments

We offer a broad set of banking products and services through our two operating segments — Consumer Banking and Commercial Banking — with a focus on providing local delivery and a differentiated customer experience. We seek to ensure that customers select us as their primary banking partner by taking the time to understand their banking needs and we tailor our full range of products and services accordingly.

The following table presents certain financial information for our segments:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Year Ended December 31, |

| 2015 | | 2014 |

| (in millions) | Consumer Banking | | Commercial Banking | | Other (2) |

| | Consolidated | | Consumer Banking | | Commercial Banking | | Other (2) |

| | Consolidated |

| Total average loans and leases and loans held for sale |

| $51,484 |

| |

| $41,593 |

| |

| $3,469 |

| |

| $96,546 |

| |

| $47,745 |

| |

| $37,683 |

| |

| $4,316 |

| |

| $89,744 |

|

| Total average deposits and deposits held for sale | 69,748 |

| | 23,473 |

| | 5,933 |

| | 99,154 |

| | 68,214 |

| | 19,838 |

| | 4,512 |

| | 92,564 |

|

| Net interest income | 2,198 |

| | 1,162 |

| | 42 |

| | 3,402 |

| | 2,151 |

| | 1,073 |

| | 77 |

| | 3,301 |

|

| Noninterest income | 910 |

| | 415 |

| | 97 |

| | 1,422 |

| | 899 |

| | 429 |

| | 350 |

| | 1,678 |

|

| Total revenue | 3,108 |

| | 1,577 |

| | 139 |

| | 4,824 |

| | 3,050 |

| | 1,502 |

| | 427 |

| | 4,979 |

|

| Noninterest expense | 2,456 |

| | 709 |

| | 94 |

| | 3,259 |

| | 2,513 |

| | 652 |

| | 227 |

| | 3,392 |

|

| Net income (loss) |

| $262 |

| |

| $579 |

| |

| ($1 | ) | |

| $840 |

| |

| $182 |

| |

| $561 |

| |

| $122 |

| |

| $865 |

|

(1) According to SNL Financial.

(2) Includes the financial impact of non-core, liquidating loan portfolios and other non-core assets and liabilities, our treasury activities, wholesale funding activities, securities portfolio, community development assets and other unallocated assets, liabilities, revenues, provision for credit losses and expenses not attributed to the Consumer Banking or Commercial Banking segments. For a description of non-core assets, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Analysis of Financial Condition — December 31, 2015 Compared with December 31, 2014 — Loans and Leases — Non-Core Assets” in Part II, Item 7, included elsewhere in this report.

CITIZENS FINANCIAL GROUP, INC.

BUSINESS

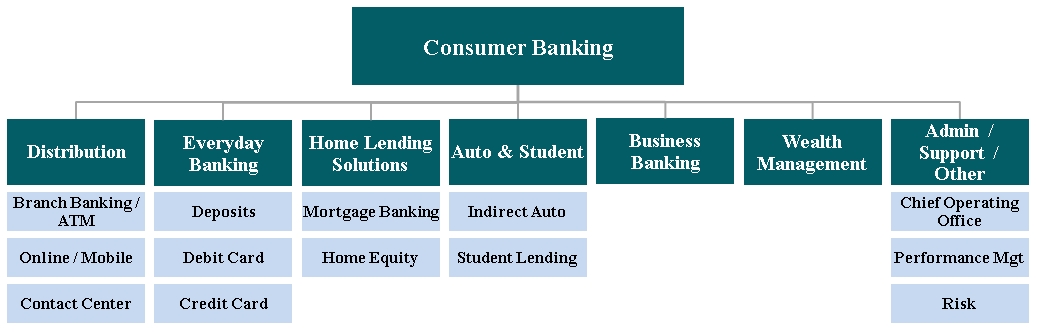

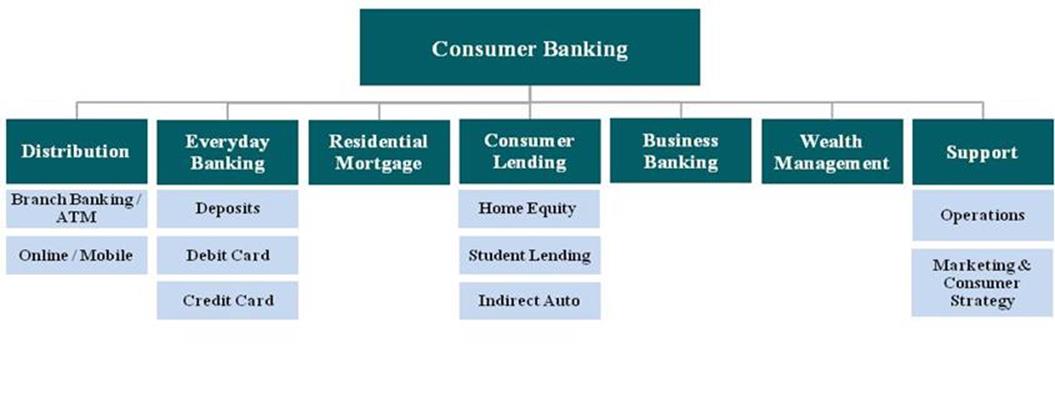

Consumer Banking Segment

Consumer Banking serves retail customers and small businesses with annual revenues of up to $25 million through a network that as of December 31, 2015 included approximately 1,200 branches operating in an 11-state footprint across the New England, Mid-Atlantic and Midwest regions, as well as through online, telephone and mobile banking platforms. Consumer Banking products and services include deposit products, mortgage and home equity lending, student loans, auto financing, credit cards, business loans, wealth management and investment services.

Consumer Banking is focused on winning, expanding and retaining customers through its value proposition: “Simple. Clear. Personal.” and is committed to delivering a differentiated experience through convenience and service. We were named one of the “Most Reputable Banks” in the country, according to the American Banker/Reputation Institute Survey of Bank Reputations released in 2015, which focused on factors including products, corporate citizenship, financial performance and company leadership.

Consumer Banking accounted for $51.5 billion, or 55%, of average loans and leases (including loans held for sale) in our operating segments as of December 31, 2015 and is organized around the customer products and services as follows:

Distribution: Provides a multi-channel distribution system a workforce of approximately 7,000 branch colleagues with a network of approximately 1,200 branches, including over 340 in-store locations, as well as approximately 3,200 ATMs. Our network includes approximately 1,300 specialists covering savings and investments, lending needs and business banking. Our online and mobile capabilities offer customers the convenience of paying bills, transferring money between accounts and from person to person, in addition to a host of other everyday transactions through a robust digital platform.

Distribution: Provides a multi-channel distribution system a workforce of approximately 7,000 branch colleagues with a network of approximately 1,200 branches, including over 340 in-store locations, as well as approximately 3,200 ATMs. Our network includes approximately 1,300 specialists covering savings and investments, lending needs and business banking. Our online and mobile capabilities offer customers the convenience of paying bills, transferring money between accounts and from person to person, in addition to a host of other everyday transactions through a robust digital platform.Everyday Banking: Provides customers with deposit and payment products and services, including checking, savings, money market, certificates of deposit, debit cards, credit cards and overdraft protection. The business included approximately 2.2 million checking households and $53.8 billion in average deposits as of December 31, 2015.

Residential Mortgage: Our mortgage business is primarily in footprint and in select out-of-footprint states through a direct-to-consumer call center and a mortgage loan officer base of over 440 as of December 31, 2015. In October of 2015, we brought together the end-to-end mortgage business to maximize talent, strengthen our service quality front-to-back, and simplify how the business operates. Full year 2015 mortgage originations totaled $5.7 billion with a weighted average FICO score of 763 and loan-to-value of 73%.

Consumer Lending: Provides home equity, personal unsecured lines and loans, student lending, and auto finance products. Aligning these lending products enabled sales and operations synergies, sharing of best practices, and better prioritization of resources to maximize growth opportunities.

Home Equity: Offers home equity loans and home equity lines of credit. We originated $4.0 billion of HELOCs in 2015 and were ranked sixth nationally by outstanding balances as of September 30, 2015(1) and ranked in the top 5 in 8 of our top 9 markets for HELOC originations.(2)

(1) According to SNL Financial.

(2) According to Equifax as of September 30, 2015.

CITIZENS FINANCIAL GROUP, INC.

BUSINESS

Student Lending: We launched the Student Lending business in 2009 and have expanded to partner with nearly 2,400 high-quality not-for-profit higher education schools in all 50 states. InSchool loan origination volume has increased from $112 million in 2010 to $387 million in 2015 with a weighted-average FICO score of 771. We launched the Education Refinance Loan (“ERL”) product in January 2014, which provides those who have entered the workforce a way to refinance or consolidate multiple existing private and federal student loans. We originated approximately $230 million ERL loans in 2014 and approximately $1.1 billion in 2015 with a weighted average FICO score of 781.

Indirect Auto Finance: Provides new and used vehicle financing to prime borrowers through a network of over 6,800 automotive dealerships in 43 states as of December 31, 2015. We implemented a new origination platform in October 2013 that has facilitated more granular credit and pricing strategies which will enable us to optimize risk-adjusted returns. The business ranked seventh nationally among regulated depository institutions by outstanding balances as of September 30, 2015(1) with 2015 origination volume of $7.0 billion with a weighted average FICO score of approximately 744.

Business Banking: Serves businesses with annual revenues of up to $25 million through a combination of branch-based employees, business banking officers and relationship managers. As of December 31, 2015, we employed a team of over 360 bankers with loans outstanding of $3.0 billion and average deposit balances of $13.3 billion.

Wealth Management: Provides a full range of advisory services to clients with an array of banking, investment and insurance products and services through a sales force which includes more than 315 financial consultants, over 160 premier bankers and 13 private banker teams. As of December 31, 2015, wealth management had approximately $6.5 billion in assets under management (including $2.4 billion of separately managed accounts) and $12.9 billion in investment brokerage assets.

Commercial Banking Segment

Commercial Banking primarily targets companies and institutions with annual revenues of $25 million to $2.5 billion and strives to be the lead bank for its clients. Commercial Banking offers a broad complement of financial products and solutions, including lending and leasing, deposit and treasury management, foreign exchange and interest rate risk management, corporate finance and debt and equity capital markets capabilities. Commercial Banking provides “Thought Leadership” by leveraging an in-depth understanding of our clients’ and prospects’ businesses to proactively deliver compelling financial solutions with quality execution. Commercial Banking focuses each business unit in sectors that maximize its ability to be relevant and deliver value added solutions to our clients. In middle-market, this involves a business unit highly focused on our 11-state footprint. In vertical market-oriented businesses, our focus is national within our areas of expertise.

We believe our Commercial Banking segment provides a compelling value proposition based on “Thought Leadership” for clients. Results are evidenced by a fifth place ranking for client penetration and a fourth place ranking for number of lead relationships in middle-market banking within the footprint.(2)

Commercial Banking is structured along lines of business, as well as product groups. Both the Capital & Global Markets and the Treasury Solutions product groups support all lines of business. These business lines and product groups work in teams to understand and determine client needs and provide comprehensive solutions to meet those needs. New clients are acquired through a coordinated approach to the market ranging from leveraging deep industry knowledge in specialized banking groups to a geographic coverage model targeting organizations headquartered in the branch geographic footprint.

(1) According to SNL Financial.

(2) According to Greenwich Associates syndicated market research.

CITIZENS FINANCIAL GROUP, INC.

BUSINESS

Commercial Banking accounted for $41.6 billion, or approximately 45%, of average loans and leases (including loans held for sale) in our operating segments as of December 31, 2015, and is organized as follows:

Corporate Banking: Targets domestic commercial and industrial clients, serving middle-market companies with annual gross revenues of $25 million to $500 million and mid-corporate companies with annual revenues of $500 million to $2.5 billion. The business offers a broad range of products, including lines of credit, term loans, commercial mortgages, domestic and global treasury management solutions, trade services, interest rate products and foreign exchange. Loans are extended on both a secured and unsecured basis, and are substantially all at floating rates of interest. Corporate Banking is a general lending practice, however there are specialty industry verticals addressing U.S. subsidiaries of foreign corporations, technology, government entities, healthcare, oil and gas, not-for-profit and educational institutions, professional firms, franchise finance, and business capital (asset-based lending).

Asset Finance: Offers equipment financing term loans and leases for middle-market and mid-corporate companies, as well as Fortune 500 companies. All transactions are secured by the assets financed and commitments tend to be fully drawn and most leases and loans are fixed rate. Areas of industry specialization include energy, utilities, and chemicals. The business also has expertise in financing corporate aircraft and tax- and non-tax-oriented leases for other long-lived assets such as rail cars.

Commercial Real Estate: Provides customized debt capital solutions for middle-market operators, institutional developers and investors as well as REITs. CRE provides financing for projects in the office, multi-family, industrial, retail, healthcare and hospitality sectors. Loan types include term debt, lines of credit, as well as construction financing. Most loans are secured by commercial real estate properties and are typically non-owner occupied. Owner-occupied commercial real estate is typically originated through our Corporate Banking business.

Capital & Global Markets: Delivers to clients through key product groups including Capital Markets, Corporate Finance, and Global Markets

Capital Markets originates, structures and underwrites multi-bank credit facilities targeting middle-market, mid-corporate and private equity sponsors with a focus on offering value-added ideas to optimize their capital structure. From 2010 through 2015, Capital Markets was involved in closing 607 lead or co-lead transactions.

Corporate Finance provides advisory services to middle-market and mid-corporate companies, including mergers and acquisitions, equity private placements and capital structure advisory. The team works closely with industry sector specialists within debt capital markets on proprietary transaction development which serves to originate deal flow in multiple bank products.

Global Markets is a customer-facing business providing foreign exchange and interest rate risk management services. The lines of business include the centralized leveraged finance team, which provides underwriting and portfolio management expertise for all leveraged transactions and relationships; the private equity team, which serves the unique and time-sensitive needs of private equity firms, management companies and funds; and the sponsor finance team, which provides acquisition and follow-on financing for new and recapitalized portfolio companies of key sponsors.

CITIZENS FINANCIAL GROUP, INC.

BUSINESS

Treasury Solutions: Supports all lines of business in Commercial Banking and Business Banking with treasury management solutions, including domestic and international cash management, commercial credit cards and trade finance. Treasury Solutions provides products to solve client needs related to receivables, payables, information reporting and liquidity management. Treasury Solutions serves small business banking clients (up to $500,000 annual revenue) up to large mid-corporate clients (over $2.5 billion annual revenue).

Our Competitive Strengths

Our long operating history, through a range of challenging economic cycles, forms the basis forof our competitive strengths. From our community bank roots, we bring a commitment to strong customer relationships, local service and an active involvement in the communities we serve. Our acquisitions enabled us to develop significant scale in highly desirable markets and broad product capabilities. The actions taken since the global financial crisis have resulted in a business model with solid asset quality, a stable core deposit mix and a superior capital position. In particular, we believe that the following strengths differentiate us from our competitors and provide a strong foundation from which to execute our strategy to deliver enhanced growth, profitability and returns.

| |

| • | Significant Scale with Strong Market Penetration in Attractive Geographic Markets: We believe our market share and scale in our footprint is central to our success and growth. With approximately 1,200 branches, approximately 3,200 ATMs, approximately 17,700 employees,colleagues, and over 100 non-branch offices as well as our online, telephone and mobile banking platforms, we serve more than five million individuals, institutions and companies. As of June 30, 2014,2015, we ranked second by deposit market share in the New England region (Maine, New Hampshire, Vermont, Massachusetts, Rhode Island and Connecticut), and we ranked in the top five in nine of our key metropolitan statistical areas (“MSAs”),MSAs, including Boston, Providence, Philadelphia, Pittsburgh and Cleveland according to SNL Financial.Cleveland.(1) We believe this strong market share in our core regions, which have relatively diverse economies and affluent demographics, will help us achieve our long-term growth objectives. The following table sets forth information regarding our competitive position in our principal MSAs. |

The following table sets forth information regarding our competitive position in our principal MSAs:

| | | (dollars in millions) | | |

MSA | Total Branches | Deposits | Market Rank (1) | Market Share (1) | Total Branches | Deposits | Market Rank | Market Share |

| Boston, MA | 206 | $26,937 | 2 | 14.9% | 204 | $29,167 | 2 | 15.5% |

| Philadelphia, PA | 181 | 14,307 | 5 | 4.4 | 186 | 16,642 | 5 | 5.2 |

| Providence, RI | 100 | 10,544 | 1 | 29.5 | 100 | 11,065 | 1 | 29.8 |

| Pittsburgh, PA | 128 | 7,505 | 2 | 8.6 | 127 | 9,375 | 2 | 9.6 |

| Cleveland, OH | 58 | 5,207 | 4 | 9.2 | 57 | 5,698 | 3 | 8.9 |

| Detroit, MI | 90 | 4,374 | 8 | 4.2 | 90 | 4,768 | 8 | 4.1 |

| Manchester, NH | 22 | 4,250 | 1 | 39.9 | 21 | 4,639 | 1 | 38.3 |

| Albany, NY | 25 | 3,139 | 2 | 13.1 | 25 | 2,660 | 2 | 12.7 |

| Buffalo, NY | 41 | 1,582 | 4 | 4.4 | 41 | 1,706 | 4 | 4.3 |

| Rochester, NY | 34 | 1,520 | 4 | 9.6 | 34 | 1,578 | 5 | 9.5 |

Source: FDIC, June 2014.2015. Excludes “non-retail banks” as defined by SNL Financial. The scope of “non-retail banks” is subject to the discretion of SNL Financial, but typically includes: industrial bank and non-depository trust charters, institutions with over 20% brokered deposits (of total deposits), institutions with over 20% credit card loans (of total loans), institutions deemed not to broadly participate in the banking services market, and other nonretail competitor banks.

| |

| • | Strong Customer Relationships: We focus on building strong customer relationships by delivering a consistent, high-quality level of service supported by a wide range of products and services. We believe that we provide a distinctive customer experience characterized by offering the personal touch of a local bank with the product selection of a larger financial institution. Our Consumer Banking cross-sell efforts have improved to 5.1 products and services per retail household as of December 31, 2015 compared to 4.4 products and services as of December 31, 2010. Additionally, the overall customer satisfaction index continued to improve in the New England region (up 1% from 2014 to 2015).(1)(2) | Excludes “non-retail banks” as defined by SNL Financial. The scope In addition, we maintained our top 10 ranking in the overall national middle market bookrunner league table (by number of “non-retail banks” is subjectsyndicated loans) for the full year 2015(3) and received a number 1 rank in our Net Promoter Score compared to the discretiontop four competitors in our footprint based on rolling four-quarter data through September 30, 2015.(1) Net Promoter Score is a customer loyalty metric, which is calculated by subtracting the percentage of SNL Financial, but typically includes: industrial bank and non-depository trust charters, institutions with over 20% brokered deposits (of total deposits), institutions with over 20% credit card loans (of total loans), institutions deemed not to broadly participate incustomers who on a scale of 1-10 are detractors (rating 0-6) from the banking services market, and other nonretail competitor banks.percentage of customers who are promoters (rating 9-10). |

Strong Customer Relationships:(1) We focus on building strong customer relationships by delivering a consistent, high-quality level of service supported by a wide range of products and services. We believe that we provide a distinctive customer experience characterized by offering the personal touch of a local bank with the product selection of a larger financial institution. Our Consumer Banking cross-sell efforts have improvedAccording to 5.0 products and services per retail household as of December 31, 2014 compared to 4.4 products and services as of December 31, 2010. Additionally, the overall customer satisfaction index asGreenwich Associates syndicated market research.

(2) As measured by J.D. Power and Associates improved 6.5% in the New England region from 2013Associates.

(3) According to 2014. Our ability to provide a unique customer experience is also evidenced by our Commercial Banking middle market team ranking among the top five in customer and lead bank penetration, with a 10% market penetration in our footprint based on Greenwich Associates’ rolling four-quarter data as of December 31, 2014.Thomson Reuters.

Stable, Low-Cost Core Deposit Base: We have a strong funding profile, with $95.7 billion of total deposits as of December 31, 2014, consisting of 27% in noninterest-bearing deposits and 73% in interest-bearing deposits. Noninterest-bearing deposits provide a lower-cost funding base, and we grew this base to $26.1 billion at December 31, 2014, up 32% from $19.7 billion at December 31, 2010. For the year ended December 31, 2014, our total average cost of deposits was 0.17%, down from 0.23% for the year ended December 31, 2013, 0.40% for the year ended December 31, 2012, 0.54% for the year ended December 31, 2011 and 0.77% for the year ended December 31, 2010.

CITIZENS FINANCIAL GROUP, INC.

BUSINESS

Superior Capital Position: We are among the most well capitalized large regional banks in the United States, with a Tier 1 common equity ratio of 12.4% compared to a peer average of 10.4% as of December 31, 2014 according to SNL Financial. Our peer regional banks consist of BB&T, Comerica, Fifth Third, KeyCorp, M&T, PNC, Regions, SunTrust and U.S. Bancorp. Our fully phased-in pro forma Basel III Common Equity Tier 1 (“CET1”) ratio at December 31, 2014 was 12.1%. Our strong capital position provides us the financial flexibility to continue to invest in our businesses and execute our strategic growth initiatives. Through recent capital optimization efforts, we have sought to better align our capital base with that of our bank peers by reducing our Tier 1 common equity capital and increasing other Tier 1 and Tier 2 capital levels. Most recently, we executed a capital exchange transaction with RBS Group on October 8, 2014 which involved the issuance of $334 million of Tier 2 subordinated debt and the simultaneous repurchase of 14.3 million shares of common stock owned by RBS Group. In addition, we plan to continue our strategy of capital optimization by exchanging an additional $500 million to $750 million of common equity with the issuance of preferred stock, subordinated debt, or senior debt in 2015 and 2016, subject to regulatory approval and market conditions.

Solid Asset Quality Throughout a Range of Credit Cycles: Our experienced credit risk professionals and conservative credit culture, combined with centralized processes and consistent underwriting standards across all business lines, have allowed us to maintain strong asset quality through a variety of business cycles. As a result, we weathered the global financial crisis better than our peers: for the two-year period ending December 31, 2009, net charge-offs averaged 1.63% of average loans compared to a peer average of 1.76% according to SNL Financial. More recently, the credit quality of our loan portfolio has continued to improve with nonperforming assets as a percentage of total assets of 0.86% at December 31, 2014 compared to 1.20% and 1.55% as of December 31, 2013 and 2012, respectively. Net charge-offs declined substantially to 0.36% of average loans in 2014 versus 0.59% in 2013. Our allowance for loan and lease losses was 1.28% of total loans at December 31, 2014 compared with 1.42% as of December 31, 2013. We believe the high quality of our loan portfolio provides us with significant capacity to prudently seek to add more attractive, higher yielding risk-adjusted returns while still maintaining appropriate risk discipline and solid asset quality.

Experienced Management Team Supported by a High-Performing and Talented Workforce: Our leadership team of seasoned industry professionals is supported by a highly motivated, diverse set of managers and employees committed to delivering a strong customer value proposition. Our highly experienced and talented executive management team, whose members have more than 20 years of banking experience on average, provideprovides strong leadership to deliver on our overall business objectives. We have recently made selective additions to our management team and added key business line leaders. Bruce Van Saun, our Chairman and CEO, has more than 30 years of financial services experience including four years as RBS Group Finance Director. Earlier in his career, Mr. Van Saun held a number of senior positions at The Bank of New York Mellon, Deutsche Bank, Wasserstein Perella Group and Kidder Peabody & Co. We continued to attract top talent throughout 2015. Don McCree recently joined the bank as our Vice Chairman and Head of Commercial Banking, and Eric Aboaf became our Chief Financial Officer. Mr. McCree previously served in a number of senior leadership positions over the course of 31 years at JPMorgan Chase & Co., and Mr. Aboaf most recently held the role of global Treasurer at Citigroup Inc. In addition, we have also hired new leadership in our mortgage and wealth businesses to drive growth in those key areas.

Stable, Low-Cost Core Deposit Base: We have a strong funding profile, with $102.5 billion of total deposits as of December 31, 2015, consisting of 27% in noninterest-bearing deposits and 73% in interest-bearing deposits. Noninterest-bearing deposits provide a lower-cost funding base, and we grew this base to $27.6 billion at December 31, 2015, up 40% from $19.7 billion at December 31, 2010. For the year ended December 31, 2015, our total average cost of deposits was 0.24%, up from 0.17% for the year ended December 31, 2014, 0.23% for the year ended December 31, 2013, 0.40% for the year ended December 31, 2012 and 0.54% for the year ended December 31, 2011.

| |

| • | Superior Capital Position: We are among the most well capitalized large regional banks in the United States, with a CET1 ratio of 11.7% as of December 31, 2015 compared to a peer average of 10.4%(1) as of December 31, 2015. Our strong capital position provides us the financial flexibility to continue to invest in our businesses and execute our strategic growth initiatives. Through recent capital optimization efforts, we have sought to better align our capital base with that of our peers banks by reducing our common equity Tier 1 capital and increasing other Tier 1 and Tier 2 capital levels. We continued our capital optimization strategy in 2015 by repurchasing $500 million of common stock funded by the issuance of $250 million of preferred stock and $250 million of subordinated debt. |

| |

| • | Solid Asset Quality Throughout a Range of Credit Cycles: Our experienced credit risk professionals and prudent credit culture, combined with centralized processes and consistent underwriting standards across all business lines, have allowed us to maintain strong asset quality through a variety of business cycles. As a result, we weathered the global financial crisis better than our peers: for the two-year period ending December 31, 2009, net charge-offs averaged 1.63% of average loans compared to a peer average of 1.76%.(1) More recently, the credit quality of our loan portfolio has continued to improve with nonperforming assets as a percentage of total assets of 0.80% at December 31, 2015 compared to 0.86% and 1.20% as of December 31, 2014 and 2013, respectively. Net charge-offs declined substantially to 0.30% of average loans in 2015 versus 0.36% in 2014. Our ALLL was 1.23% of total loans at December 31, 2015 compared with 1.28% as of December 31, 2014. We believe the high quality of our loan portfolio provides us with capacity to prudently seek to add more attractive, higher yielding risk-adjusted returns while still maintaining appropriate risk discipline and solid asset quality. |

Commitment to Communities: Community involvement is one of our principal values and we strive to contribute to a better quality of life by serving the communities across our footprint through employee volunteer efforts, a foundation that funds a range of non-profit organizations and executives that provide board leadership to community organizations. These efforts contribute to a culture that seeks to promote positive employee morale and provide differentiated brand awareness in the community relative to peer banks, while also making a positive difference within the communities we serve. Employees gave more than 59,00070,000 volunteer hours companywide in 20142015 and also served on approximately 480over 550 community boards across our footprint. We believe our strong commitment to our communities provides a competitive advantage by strengthening customer relationships and increasing loyalty.

Business Strategy

Building on our core strengths, our objective is to be a top-performing bank that delivers well for each of our stakeholders by offering the best possible banking experience for customers. We plan to achieve this by leveraging our strong customer relationships, leading market share rankings in attractive markets, customer-centric colleagues, and our high quality balance sheet.

Our strategy is designed to maximize the full potential of our business and drive sustainable growth and enhanced profitability. As a core measure of success, our two- to three-yearmedium-term financial targets include a Return on Tangible Common Equity ("ROTCE")ROTCE ratio of greater than 10% and an efficiency ratio in the 60% range. Our financial targets are based on numerous assumptions including the yield curve evolving consistent with market implied forward rates as of February 28, 2014, and that macroeconomic and competitive conditions are consistent with those used in our planning assumptions.

(1) According to SNL Financial.

CITIZENS FINANCIAL GROUP, INC.

BUSINESS

While our strategic plan and our ROTCE target and its components are presented with numerical specificity and we believe such targets to be reasonable given the uncertainties surrounding our assumptions, including possible regulatory restrictions on activities we intend to pursue, there are significant risks that these assumptions may not be realized and thus our goals may not be achieved. Accordingly, our actual results may differ from these targets and the differences may be material and adverse, particularly if actual events adversely differ from one or more of our key assumptions. We caution investors not to place undue reliance on any of these assumptions or targets.

We intend to deliver on this by adhering to the following strategic principles:

Offer customers a differentiated experience through the quality of our colleagues, products and services, and foster a culture around customer-centricity, commitment to excellence, leadership, teamwork and integrity.

Build a great brand that invokes trust from customers and reinforces our value proposition of being “Simple. Clear. Personal.” for Consumer customers and providing solutions-oriented “Thought Leadership” to Commercial clients.

Deliver attractive risk-adjusted returns by making good capital and resource allocation decisions, being good stewards of our resources, and rigorously evaluating our execution.

Operate with a strong balance sheet with regards to capital, liquidity and funding, coupled with a well-defined and prudent risk appetite.

Maintain a balanced business mix between Commercial Banking and Consumer Banking.

Position the bank as a ‘community leader’ that makes a positive impact on the communities and local economies we serve.

In order to successfully execute on these principles, we have developed the following strategic priorities, each of which are underpinned by a series of initiatives as summarized below. We have made solid progress on our strategic priorities and the underlying initiatives over the past year, due primarily to the strength of our business model, management team, culture of accountability and risk management framework.

management.

Position Consumer Banking to deliver improved capabilities and profitability: Consumer Banking offers a “Simple. Clear. Personal.” value proposition to our customers. The focus is on building strong customer relationships along with a robust product portfolio that is designed to be simple and easy to understand while creating a fair value exchange for our customers. The following initiatives are being implemented to execute against our value proposition:

ReenergizeRe-energize household growth and deepen relationships.relationships— We strive to grow and deepen existing customer relationships by delivering a differentiated customer experience. We believe this approach will enable us to win, retain and expand customer relationships, as well as increase cross-sell and share of wallet penetration. We will also continue to invest in our online and mobile channels and optimize our distribution network. We recently launched an effort to improve multi-channel sales effectiveness, with the goal of deepening customer relationships using a needs based approach (“Citizens Checkup”).

Expand and enhance Wealth Management— We view our wealth management business as an opportunity for continued growth and as vital to deepening the customer relationship and improving fee income generation.

Build a strong residential mortgageResidential Mortgage business.— Recognizing the critical importance of the mortgage product to the customer experience and relationship, we are building out our mortgage team and platform to achieve a solid market share position and generate consistent origination volumes. We are focused on improving penetration with our existing customer base and increasing our origination mix of conforming loans.

Invest in and grow Business Banking. We have recognized that strengthening efforts in the business banking market is critical to grow profitable relationships and drive scalable growth of the franchise.

Expand and enhance Wealth Management. We view our wealth management business as an opportunity for continued growth and as vital to deepening the customer relationship and improving fee income generation.

Grow our Auto business. Our auto initiative supports diversification of revenue generation outside of our traditional retail distribution channels.

Drive growth in Education FinanceStudent Lending and installment loans.— We have identified the underserved private student lending market as an attractive source of risk-adjusted revenue growth. We are well-positioned for growth in student lending with a unique education refinance product that serves a critical borrower need. We also have strong expertise in unsecured based lending based on a partnership with Apple.

11Invest in and grow Business Banking— We have recognized that strengthening efforts in the business banking market is critical to grow profitable relationships and drive scalable growth of the franchise. We view this as an important source for loans, deposits, and cash management revenue.

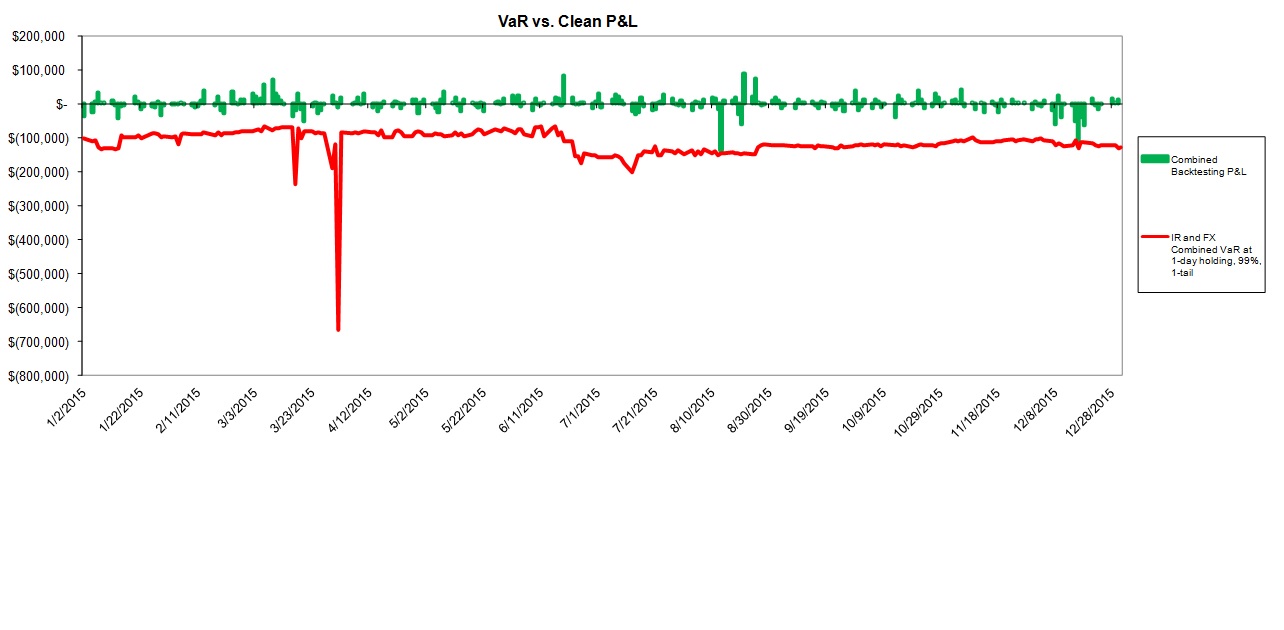

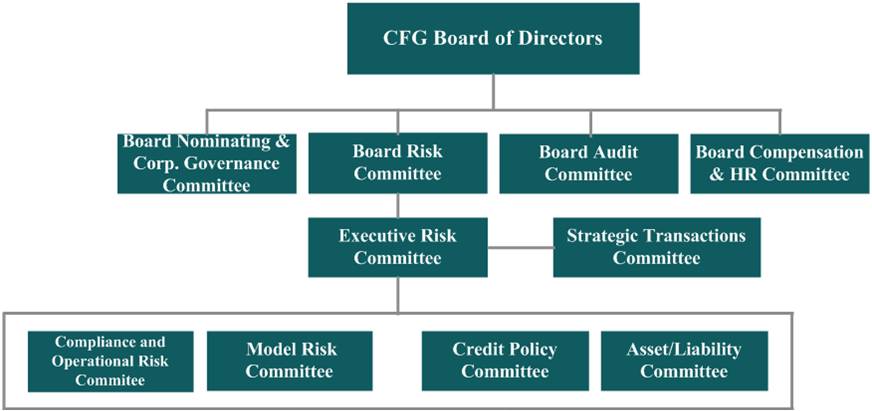

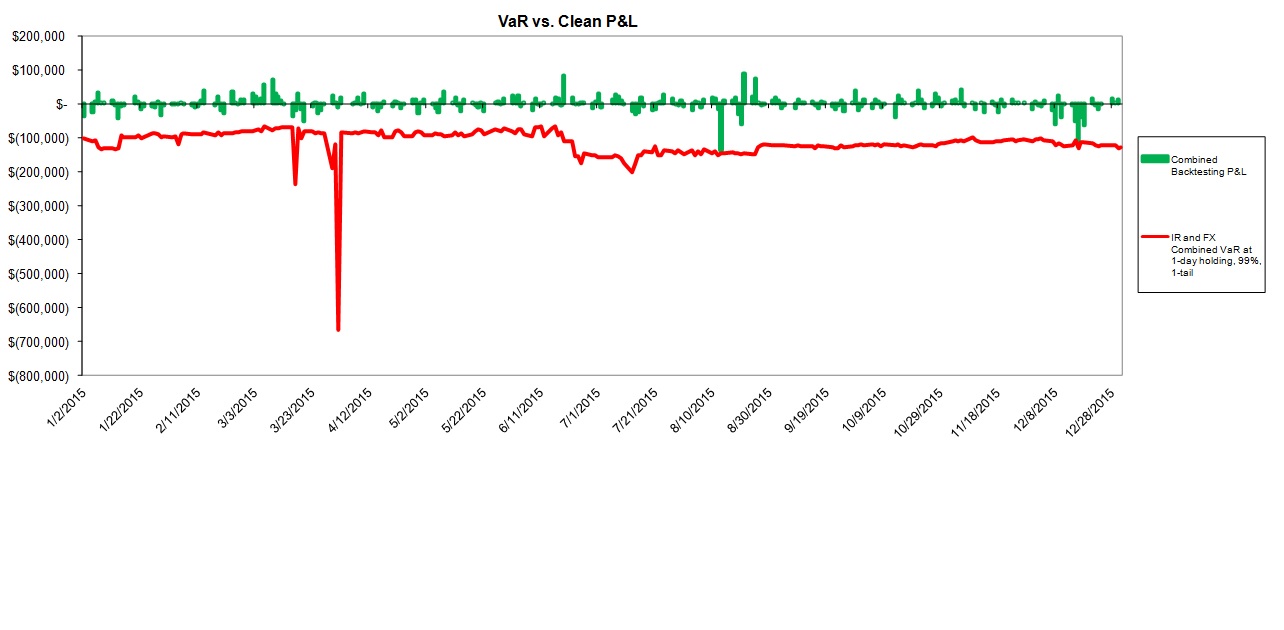

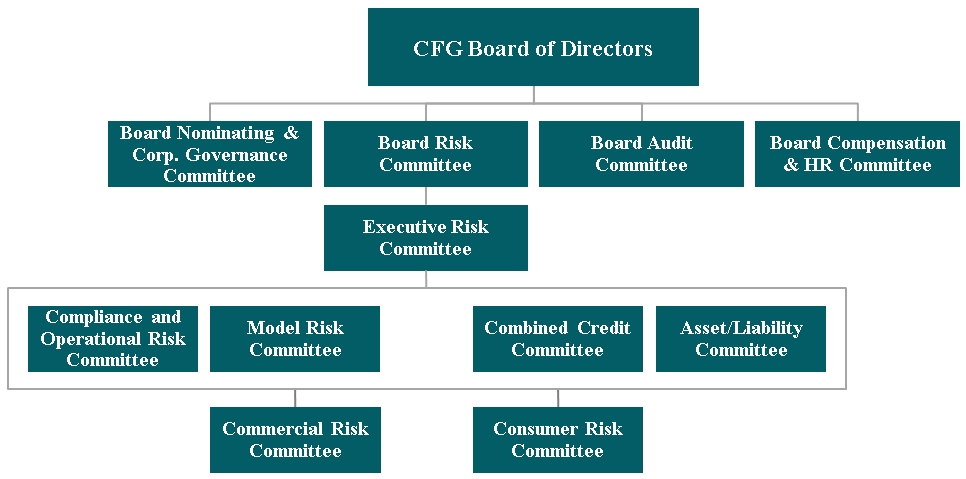

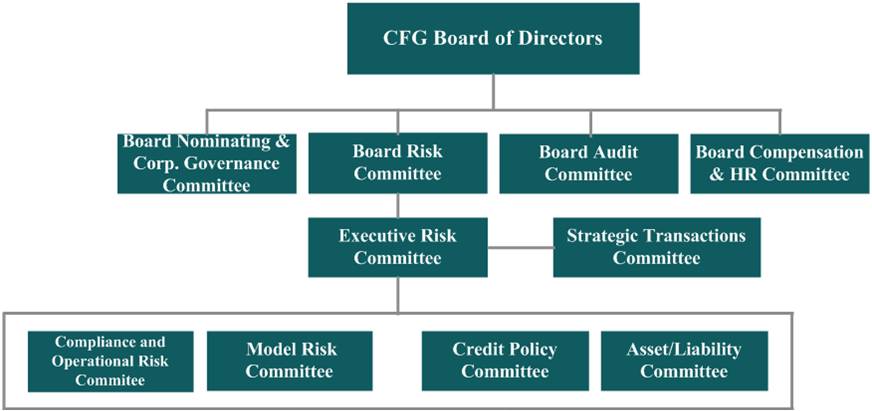

CITIZENS FINANCIAL GROUP, INC.Optimize indirect Auto business— Our auto initiative supports diversification of revenue generation outside of our traditional retail distribution channels. We continue to optimize this business through prudent expansion of originations across a broader credit spectrum to include predominantly prime borrowers and enhancing our pricing strategy to price loans in more granular ways (e.g., vehicle type, geography).