| | | | | | | | | | | | | | | | | | | | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

|

FORM 10-K |

| (Mark One) | | |

| | ☒ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 20202022 |

| |

| |

OR |

| | ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________ to __________. |

|

| Commission File No. 001-11241 |

|

CATERPILLAR FINANCIAL SERVICES CORPORATION (Exact name of Registrant as specified in its charter) |

Delaware (State or other jurisdiction of incorporation or organization) | 37-1105865 (I.R.S. Employer Identification No.) |

2120 West End Ave., Nashville, Tennessee (Address of principal executive offices) | 37203-0001 (Zip Code) |

Registrant'sRegistrant’s telephone number, including area code: (615) 341-1000

|

| | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | Medium-Term Notes, Series H,

3.300% Notes Due 2024 | CAT/24 | New York Stock Exchange

|

| Securities registered pursuant to Section 12(g) of the Act: None |

The Registrant is a wholly-owned subsidiary of Caterpillar Inc. and meets the conditions set forth in General Instruction (I)(1)(a) and (b) of Form 10-K, and is therefore filing this Form with the reduced disclosure format.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large“large accelerated filer," "accelerated” “accelerated filer," "smaller” “smaller reporting company"company” and "emerging“emerging growth company"company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management'smanagement’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

As of February 17, 2021, 115, 2023, one share of common stock of the registrant was outstanding, which is owned by Caterpillar Inc.

| | | | | | | | | | | |

| TABLE OF CONTENTS |

| | | | Page |

| | Business | 4 |

| | | Risk Factors | 7 |

| | | Unresolved Staff Comments | 14 |

| | | Properties | 14 |

| | | Legal Proceedings | 14 |

| | | Mine Safety Disclosures | 14 |

| | Market for Registrant'sRegistrant’s Common Equity, Related Stockholder Matters

and Issuer Purchases of Equity Securities | 14 |

| Item 6. | [Reserved] | |

| | | Management'sManagement’s Discussion and Analysis of Financial

Condition and Results of Operations | 15 |

| | | Quantitative and Qualitative Disclosures About Market Risk | 27 |

| | | Financial Statements and Supplementary Data | 2827 |

| | | Changes in and Disagreements With Accountants on Accounting and

Financial Disclosure | 2827 |

| | | Controls and Procedures | 28 |

| | | Other Information | 28 |

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 28 |

| Item 10. | Directors, Executive Officers and Corporate Governance | * |

| Item 11. | Executive Compensation | * |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | * |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | * |

| | Principal Accounting Fees and Services | 29 |

| | Exhibits and Financial Statement Schedules | 29 |

| Item 16. | Form 10-K Summary | 31 |

* Item omitted because no answer is called for or item is not applicable.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report on Form 10-K may be considered "forward-looking statements"“forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements may relate to future events or our future financial performance, which may involve known and unknown risks and uncertainties and other factors that may cause our actual results, levels of activity, performance or achievement to be materially different from those expressed or implied by any forward-looking statements. From time to time, we may also provide forward-looking statements in oral presentations to the public or in other materials we issue to the public. Forward-looking statements give current expectations or forecasts of future events about the company. You may identify these statements by the fact that they do not relate to historical or current facts and may use words such as "believes," "expects," "estimates," "anticipates," "will," "should," "plan," "forecast," "target," "guide," "project," "intend," "could"“believes,” “expects,” “estimates,” “anticipates,” “will,” “should,” “plan,” “forecast,” “target,” “guide,” “project,” “intend,” “could” and similar words or phrases. These statements are only predictions. Actual events or results may differ materially due to factors that affect international businesses, including the challenges of the ongoing COVID-19 pandemic, changes in economic conditions including but not limited to inflation, disruptions in the global financial and credit markets, and changes in laws, regulations and political stability, as well as factors specific to Caterpillar Financial Services Corporation (“Cat FinancialFinancial”) and the markets we serve, including the market’s acceptance of our products and services, the creditworthiness of our customers, interest rate and currency rate fluctuations and estimated residual values of leased equipment. These risk factors may not be exhaustive. We operate in a continually changing business environment, and new risk factors emerge from time to time. We cannot predict these new risk factors, nor can we assess the impact, if any, of these new risk factors on our businesses or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those projected in any forward-looking statements. Accordingly, forward-looking statements should not be relied upon as a prediction of actual results. All of the forward-looking statements are qualified in their entirety by reference to the factors discussed under the captions "Risk Factors"“Risk Factors” and "Management’s“Management’s Discussion and Analysis of Financial Condition and Results of Operations"Operations” in this Form 10-K and could cause results to differ materially from those projected in the forward-looking statements. Cat Financial undertakes no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You may, however, consult any related disclosures we may make in our subsequent Form 10-Q and Form 8-K reports filed with the Securities and Exchange Commission ("SEC"(“SEC”).

General

Caterpillar Financial Services Corporation was organized in 1981 in the State of Delaware (together with its subsidiaries, "Cat“Cat Financial," "the” “the Company," "we"” “we” or "our"“our”). We are a wholly-owned finance subsidiary of Caterpillar Inc. (together with its other subsidiaries, "Caterpillar"“Caterpillar” or "Cat"“Cat”) and our corporate headquarters is located in Nashville, Tennessee.

Nature of Operations

We provide retail and wholesale financing to customers and dealers around the world for Caterpillar products and services, as well as financing for vehicles and power generation facilities and marine vessels that, in most cases, incorporate Caterpillar products. Retail financing is primarily comprised of installment sale contracts and other equipment-related loans, working capital loans, finance leases and operating leases. Wholesale financing to Caterpillar dealers consists primarily of inventory and rental fleet financing. In addition, we purchase short-term wholesale trade receivables from Caterpillar. The various financing plans offered by Cat Financial are designed to support sales of Caterpillar products and generate financing income for Cat Financial. A significant portion of our activity is conducted in North America, withand we have additional offices and subsidiaries in Latin America, Asia/Pacific, Europe Africa and the Middle East.Africa. Cat Financial has almostover 40 years of experience providing financing for Caterpillar products and services, contributing to our knowledge of asset values, industry trends, financing structures and customer needs.

The Company’s retail loans (totaling 49 percent*) include:

•Loans that allow customers and dealers to use their Caterpillar equipment or other assets as collateral to obtain financing.

•Installment sale contracts, which are equipment loans that enable customers to purchase equipment with a down payment or trade-in and structurestructured payments over time.

The Company’s retail leases (totaling 37 percent*) include:

•Finance (non-tax) leases, where the lessee for tax purposes is considered to be the owner of the equipment during the term of the lease, that either require or allow the customer to purchase the equipment for a fixed price at the end of the term.

•Tax leases that are classified as either operating or finance leases for financial accounting purposes, depending on the characteristics of the lease. For tax purposes, we are considered the owner of the equipment.

•Governmental lease-purchase plans in the U.S. that offer low interest rates and flexible terms to qualified non-federal government agencies.

The Company purchases short-term trade receivables from Caterpillar (12 percent*).Caterpillar.

The Company’s wholesale loans and leases (2 percent*) include inventory/rental programs, which provide assistance to dealers by financing their new Caterpillar inventory and rental fleets.

*Indicates the percentage of total portfolio as of December 31, 2020. We define total portfolio as Finance receivables, net plus Equipment on operating leases, net.

Competitive Environment

We operate in a highly competitive environment, with financing for users of Caterpillar equipment and services available through a variety of sources, principally commercial banks and finance and leasing companies. Our competitors include Wells FargoEquipment Finance Inc., Banc of America Leasing & Capital LLC, BNP Paribas Leasing Solutions Limited, Australia and New Zealand Banking Group Limited, Societe GeneralSociété Générale S.A. and various other banks and finance companies. In addition, many of the manufacturers that compete with Caterpillar also own financial subsidiaries, such as John Deere Capital Corporation, Komatsu Financial L.P., Volvo Financial Services and Kubota Credit Corporation, which utilize many below-market interest rate programs (funded by the manufacturer) to support machine sales. We and Caterpillar work together with Caterpillar to provide a broad array of financial merchandising programs to compete around the world.

We provide financing only when certain criteria are met. Credit decisions are based on a variety of credit quality factors, including prior payment experience, customer financial information, credit ratings, loan-to-value ratios and other internal metrics. We typically maintain a security interest in retail-financed equipment and require physical damage insurance coverage on financed equipment. We finance a significant portion of Caterpillar dealers'dealers’ sales and inventory of Caterpillar equipment throughout the world (see Note 1514 of Notes to Consolidated Financial Statements for more information regarding our segments and geographic areas). Our competitive position is improved by marketing programs offered in conjunction with Caterpillar and/or Caterpillar dealers. Under these programs, Caterpillar, or the dealer, funds an amount at the outset of the transaction, which we then recognize as revenue over the term of the financing. We believe that these marketing programs provide Cat Financial a significant competitive advantage in financing Caterpillar products.

In certain instances, our operations are subject to supervision and regulation by state, federal and various foreign governmental authorities and may be subject to various laws and judicial and administrative decisions imposing various requirements and restrictions which, among other things, (i) regulate credit granting activities and the administration of loans, (ii) establish maximum interest rates, finance charges and other charges, (iii) require disclosures to customers and investors, (iv) govern secured transactions, (v) set collection, foreclosure, repossession and other trade practices and (vi) regulate the use and reporting of information related to a borrower'sborrower’s credit experience. Our ability to comply with these and other governmental and legal requirements and restrictions affects our operations.

We also have agreements with Caterpillar that are significant to our operations. These agreements provide us with certain types of operational and administrative support from Caterpillar such as the administration of employee benefit plans, financial support, funding support and various forms of corporate services that are integral to the conduct of our business. For more information on these agreements, please refer to Note 1413 of Notes to Consolidated Financial Statements.

Human Capital

Core Values

Caterpillar’s global workforce is united by Our Values in Action, Caterpillar’s Code of Conduct. Integrity, Excellence, Teamwork, Commitment and Sustainability provide the foundation for our values-based culture. Our diversity and inclusion principles are embedded in our values. Our values unite and reflect our diverse cultures, languages, geographies and business.businesses.

Health and Safety

The health and safety of our employees is an important focus at Cat Financial and we strive to continually reduce our recordable injuries. In 2020,2022, the Company achieved a recordable injury frequency rate of 0.08,0.00, compared to the 20192021 recordable injury frequency rate of 0.04.

The COVID-19 pandemic has further reinforced the importance of a safe and healthy workforce. In response to the pandemic, the Company implemented safeguards to protect our essential employees, including increased frequency of cleaning and disinfecting, social distancing practices, face coverings, temperature screening and other measures consistent with specific regulatory requirements and guidance from health authorities. We also instituted travel restrictions and remote work for employees who were able to work from home.

Talent Development and Training

In addition to our focus on values and safety, we strive to continually attract, develop, engage, and retain a high-performing diverse global team that executes our enterprise strategy of long-term profitable growth.

We are committed to employee development and helping employees reach their full potential by making on-going investments in our team. Our global internships and finance and information services career programs provide development opportunities for early career employees. We also have a continual focus on strengthening technical, professional and leadership capabilities at every level. Strategic talent reviews and succession planning occur at a minimum, annually, across our business.

Our leadership development programs and our focus on encouraging a variety of experiences help employees broaden understanding and increase perspective. For example, we conduct a bi-annual leadership experience for global leaders to strengthen Caterpillar leadership attributes and utilize our global learning platform to build speed to competency by job role.

Diversity and Inclusion

We are committed to fostering a diverse workforce and an inclusive environment. Our 9 Employee Resource Groups (ERGs)(“ERGs”), sponsored and supported by leadership, are integral to ensuring different voices and perspectives contribute to our strategy for long term profitable growth. Our ERGs partner with recruiters to help build relationships and recruit diverse talent through campus relationships and the Thurgood Marshall College Fund.

Our ERGs further engage our employees, helping contribute to development and retention. For example, Caterpillar’s Latino Connection sponsors a mentoring program that connects diverse employees with senior leaders who can support their career goals through on-the-job project experience and leadership development. Additionally, WE Lead, Women Enabling Leadership, is sponsored by our Women’s Initiative Network and engages female employees in early to mid-level management to help strengthen our female leader pipeline.

Compensation, Benefits and Employee Insights

Providing competitive benefits and compensation underpins our commitment to our engaged and productive employees. Our pay-for-performance philosophy aligns employee’s individual contributions, behaviorsattributes and business results with individual rewards. Our comprehensive Total Health programs focus on purpose, as well as physical, emotional, financial, and social health. The annual Employee Insights Survey provides all employees the opportunity to confidentially share their perspectives and engages leaders to listen, learn and respond to employee feedback.

Employment

Management aligns employment levels with the needs of the business. We believe we have the appropriate human capital resources to successfully operate and deliver our enterprise strategy. As of December 31, 2020,2022, we employed about 2,0002,100 full-time persons of whom approximately half were located outside the United States.In the United States, most employees are at-will employees and, therefore, not subject to any type of employment contract or agreement. Outside the United States, the Company enters into employment contracts and agreements in those countries in which such relationships are mandatory or customary. The provisions of these agreements generally correspond in each case with the required or customary terms in the subject jurisdiction.

Available Information

The Company files electronically with the SEC required reports on Form 8-K, Form 10-Q, Form 10-K and registration statements on Form S-3 and other forms or reports as required. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports filed or furnished with the SEC are available free of charge through Caterpillar Inc.’s website (www.caterpillar.com/secfilings) as soon as reasonably practicable after filing with the SEC. Copies may also be obtained free of charge by writing to: Legal Dept., Caterpillar Financial Services Corporation, 2120 West End Ave., Nashville, Tennessee 37203-0001. In addition, the public may obtain more detailed information about our parent company, Caterpillar Inc., by visiting its website (www.caterpillar.com). None of the information contained at any time on our website, Caterpillar’s website or the SEC’s website is incorporated by reference into this document.

The statements in this section describe material risks to our business and may contain "forward-looking statements"“forward-looking statements” that are subject to the caption "CAUTIONARY“CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS"STATEMENTS” presented prior to Item 1 of this report. The statements in this section should also be considered carefully in conjunction with "Management’s“Management’s Discussion and Analysis of Financial Condition and Results of Operations"Operations” and the "Notes“Notes to Consolidated Financial Statements"Statements” to this Form 10-K. The risk factors described below are a cautionary discussion of risks, uncertainties and assumptions that we believe are significant to our business. These are factors that, individually or in the aggregate, we believe could make our actual results differ materially from expected or past results. Because it is impossible to predict or identify all such factors, the following factors should not be considered to be a complete discussion of risks, uncertainties and assumptions.

RISKS RELATED TO COVID-19

The COVID-19 pandemic could materially adversely affect our business, results of operations and/or financial condition

COVID-19 was identified in late 2019 and has spread globally. The rapid spread has resulted in weaker demand and constrained supply and the implementation of numerous measures to try to contain the virus, such as travel bans and restrictions, quarantines, shelter in place orders and shutdowns. These factors have impacted and may continue to impact all or portions of Caterpillar’s workforce and operations.

The COVID-19 pandemic caused a global recession and it is uncertain when a sustained economic recovery may occur. The COVID-19 pandemic has also significantly increased economic and demand uncertainty and has led to a decrease in demand for Caterpillar’s products and services and caused supply chain disruptions. Economic uncertainties could continue to affect demand for Caterpillar’s products and services, the value of equipment financed or leased and the demand for financing and the financial condition and credit risk of our dealers and customers.

Uncertainties related to the magnitude and duration of the COVID-19 pandemic, including new strains, may significantly adversely affect Caterpillar’s and our business. These uncertainties include: the duration and impact of the resurgence in COVID-19 cases in any country, state, or region; prolonged reduction or closure of the Caterpillar’s operations, or a delayed recovery in Caterpillar’s operations; disruptions in its supply chain; increased logistics costs; the impact of the pandemic on our customers and dealers; requests by our customers or dealers for payment deferrals and contract modifications; and the impact of disruptions in the global capital markets and/or declines in our financial performance or credit ratings, which could impact our ability to obtain funding in the future. It is unclear when a sustained economic recovery could occur and what a recovery may look like. All of these factors could materially and adversely affect our business, results of operations and/or financial condition.

The ultimate impact of the COVID-19 pandemic on the Company’s financial and operational results will be determined by the length of time that the pandemic continues, its effect on the demand for the Caterpillar’s products and services, as well as the effect of governmental regulations imposed in response to the pandemic. The overall magnitude of the COVID-19 pandemic and the continued fluidity of the situation could materially and adversely impact our business, results of operations and/or financial condition.

FINANCIAL RISKS

Disruptions or volatility in global financial markets could adversely impact the industries and markets in which we serve and operate

Continuing to meet our cash requirements over the long-term could require substantial liquidity and access to varied sources of funds, including capital and credit markets. Global economic conditions have caused and may cause volatility and disruptions in the capital and credit markets. While we have continued to maintain access to key global medium-term note and commercial paper markets, there can be no assurance that such markets will continue to represent a reliable source of financing. If global economic conditions were to deteriorate, we could face materially higher financing costs, become unable to access adequate funding to operate and grow our business and/or meet our debt service obligations as they mature, and we could be required to draw upon contractually committed lending agreements primarily provided by global banks and/or by seeking other funding sources. However, under extreme market conditions, there can be no assurance that such agreements and other funding sources would be availablesufficient or sufficient.even available. Any of these events could negatively impact our business, results of operations and financial condition.

The extent of any impact on our ability to meet our funding or liquidity needs would depend on several factors, including our operating cash flows, the duration of any market disruptions, changes in counterparty credit risk, the impact of government intervention in financial markets, including the effects of any programs or legislation designed to increase or restrict liquidity for certain areas of the market, general credit conditions, the volatility of equity and debt markets, our credit ratings and credit capacity and the cost of financing and other general economic and business conditions. Market disruption and volatility may also lead to a number ofnumerous other risks in connection with these events, including but not limited to:

•Market developments that may affect the demand for Caterpillar products and/or customer confidence levels and may cause declines in the demand for financing and adverse changes in payment patterns, causing increases in delinquencies and default rates, which could impactincrease our write-offs and provision for credit losses;

•The process we use to estimate losses inherent in our credit exposure requires a high degree of management’s judgment regarding numerous subjective, qualitative factors, including forecasts of economic conditions and how economic predictors might impair the ability of our borrowers to repay their loans. If financial market disruption and volatility is experienced, the accuracy of these judgments may be impacted;

•Our ability to engage in routine funding transactions or borrow from other financial institutions on acceptable terms or at all could be adversely affected by disruptions in the capital markets or other events, including actions by rating agencies and deteriorating investor expectations; and

•Because our lending agreements are primarily with financial institutions, their ability to perform in accordance with any of our underlying agreements could be adversely affected by market volatility and/or disruptions in the equity and credit markets.

Failure to maintain our credit ratings wouldcould increase our cost of borrowing and could adversely affect our cost of funds, liquidity, competitive position and access to capital markets

Each of CaterpillarCaterpillar’s and Cat Financial'sFinancial’s costs of borrowing and their respective ability to access the capital markets are affected not only by market conditions but also by the short-termshort- and long-term credit ratings assigned to ourtheir respective debt by the major credit rating agencies. These ratings are based, in significant part, on each of Caterpillar'sCaterpillar’s and Cat Financial'sFinancial’s performance as measured by financial metrics such as net worth, interest coverage and leverage ratios, as well as transparency with rating agencies and timeliness of financial reporting. There can be no assurance that Caterpillar and Cat Financial will be able to maintain their credit ratings. We receive debt ratings from the major credit rating agencies. Moody's long- and short-term ratings of Caterpillar and Cat Financial are A3 and Prime-2 ("low-A"), while other major credit rating agencies maintain a "mid-A" debt rating. A downgrade of our credit rating by any of the major credit rating agencies wouldcould result in increased borrowing costs and could adversely affect Caterpillar'sCaterpillar’s and ourCat Financial’s liquidity, competitive position and access to the capital markets, including restricting, in whole or in part, access to the commercial paper market.market and other sources of funding. There can be no assurance that the commercial paper market will continue to be a reliable source of short-term financing for Cat Financial or an available source of short-term financing for Caterpillar. An inability to access the capital markets could have a materialan adverse effect on our cash flows,flow, results of operations and financial condition.

Changes in interest rates, foreign currency exchange rates or market liquidity conditions could adversely affect our earnings and/or cash flows

ChangesThe Federal Reserve Bank of United States began to increase benchmark interest rates in March 2022 and has indicated it may continue to raise benchmark interest rates in an effort to curb the upward inflationary pressure on the cost of goods and services across the United States. Such increases in interest rates foreign currency exchange rates and other changes to market liquidity conditions could have a materialan adverse impact on Caterpillar's and our earnings and cash flows. Because our financial results are reported in U.S. dollars, but our operations are conducted internationally, currency exchange rates can have a significant impact on our business results. Additionally, because a significant number of ourthe loans made by us are made at fixed interest rates, our business results are subject to fluctuations in interest rates. Certain loans made by us and various financing extended to us are made at variable rates that use LIBOR as a benchmark for establishing the interest rate. Changes in interest rates and market liquidity conditions could have an adverse impact on our earnings and cash flows. Because a significant number of the loans made by us are made at fixed interest rates, our business results are subject to fluctuations in interest rates.

Certain loans made by us and various financing extended to us are made at variable rates that use LIBOR as a benchmark for establishing the interest rate. LIBOR is the subject of recent proposals for reform. On July 27, 2017, the United Kingdom’s Financial Conduct Authority ("FCA"(“FCA”) announced that it intends to stop persuading or compelling banks to submit LIBOR rates after 2021. On November 18, 2020,Immediately following the LIBOR publication on December 31, 2021, ICE Benchmark Administration ("IBA"(“IBA”), the administrator of USD LIBOR, announced plans to consult on its intention to cease ceased the publication of all GBP, EUR, CHF and JPY LIBOR settings, immediately followingas well as the one-week and two-month USD LIBOR publication on December 31, 2021.tenors. On November 30, 2020, IBA, with the support of the United States Federal Reserve and the FCA, announced plans to consult on ceasing publication of USD LIBOR on December 31, 2021 for only the one week and two monthall other remaining USD LIBOR tenors and on June 30, 2023 for all other USD LIBOR tenors.2023. While the November 30th30 announcement extendsextended the transition period to June 2023, the United States Federal Reserve concurrently issued a statement advising banks to stop new USD LIBOR issuances by the end of 2021. These reforms may causeFurther, on March 15, 2022, the Consolidated Appropriations Act of 2022, which includes the Adjustable Interest Rate (LIBOR) Act, was signed into law in the U.S. This legislation establishes a uniform benchmark replacement process for financial contracts maturing after June 30, 2023 that do not contain clearly defined or practicable fallback provisions. The legislation also creates a safe harbor that shields lenders from litigation if they choose to utilize a replacement rate recommended by the Federal Reserve. The Alternative Reference Rate Committee, a committee convened by the Federal Reserve that includes major market participants, has identified the Secured Overnight Financing Rate, or SOFR, a new index calculated by short-term repurchase agreements, backed by Treasury securities, as its preferred alternative rate for LIBOR. At this time, it is not possible to predict how markets will respond to SOFR or other alternative reference rates as the transition away from the LIBOR to cease to exist, new methods of calculating LIBORbenchmarks is anticipated in coming years. There continue to be establisheduncertainties regarding the transition from LIBOR, including but not limited to the need to renegotiate certain terms of our loan agreements with LIBOR as the referenced rate, which could require us to incur significant expense and may subject us to disputes or litigation over the establishmentappropriateness or comparability to LIBOR of an alternativethe replacement reference rate(s). Several offerings of securities that include such an alternative reference rate have now been completed by other companies.rates. The consequences of these developments are uncertaincannot be entirely predicted and could have an adverse impact on the market value for or value of LIBOR-linked securities, loans, derivatives, and other financial obligations or extensions of credit held by or due to us, as well as the revenue and expenses associated with those securities, loans and financial instruments. Cat Financial has

We created a cross-functional team that will assessassesses risk across multiple categories as it relates to the use of LIBOR in securities, loans, derivatives, and other financial obligations or extensions of credit held by or due to us. Other changes in market interest rates may influence our borrowing costs and could reduce our earnings and cash flows, our returns on financial investments and the valuation of derivative contracts. We manage interest rate and market liquidity risks through a variety of techniques that include a match funding strategy, the selective use of derivatives and a broadly diversified funding program. There can be no assurance, however, that fluctuations in interest rates and market liquidity conditions will not have an adverse impact on Caterpillar and our earnings and cash flows. If any of the variety of instruments and strategies we use to hedge our exposure to these types of risk is ineffective, this may have an adverse impact on our earnings and cash flows. Please see "-Macroeconomic“-Macroeconomic Risks - Changes in Government Monetary or Fiscal Policies May Negatively Impact Results"Results” below for further discussion of changes in interest rates.

In addition, because we make a significant number of loans in currencies other than the U.S. dollar, fluctuations in foreign currency exchange rates could also reduce our earnings and cash flows. There has been, and may continue to be, volatility in currency exchange rates as a result of the United Kingdom’s withdrawal from the European Union (commonly known as "Brexit"“Brexit”), especially between the U.S. dollar and the British pound.

We also rely on a number ofnumerous diversified global debt capital markets and funding programs to provide liquidity for our global operations, including commercial paper, medium-term notes, retail notes, variable denomination floating rate demand notes and bank loans. Significant changes in market liquidity conditions could impact our access to funding and the associated funding cost and reduce our earnings and cash flows.

We manage interest rate, foreign currency exchange rate and market liquidity risks with a variety of techniques that include a match-funding strategy that addresses interest rate risk by aligning the interest rate profile (fixed or floating rate and duration) of our debt portfolio with the interest rate profile of our receivables portfolio within predetermined ranges on an ongoing basis, the selective use of derivatives and a broadly diversified funding program. There can be no assurance, however, that fluctuations in interest rates, currency exchange rates and market liquidity conditions will not have a material adverse impact on our earnings and cash flows. If any of the variety of instruments and strategies we use to hedge our exposure to these various types of risk is ineffective, we may experience an adverse impact on our earnings and cash flows.

Our business is significantly influenced by the credit risk associated with our customers and an increase in delinquencies, repossessions or net losses could adversely affect our results

Our business is significantly influenced by the credit risk associated with our customers. The creditworthiness of each customer and the rate of delinquencies, repossessions and net losses on customer obligations are directly impacted by several factors, including, but not limited to, relevant industry (particularly construction-related industries) and economic conditions, the availability of capital, the experience and expertise of the customer'scustomer’s management team, commodity prices, interest rates, political events and the sustained value of the underlying collateral. Any increase in delinquencies, repossessions and net losses on customer obligations could have a material adverse effect on our earnings and cash flows.

In addition, although we evaluate and adjust our allowance for credit losses related to past due and non-performing receivables on a regular basis, adverse economic conditions or other factors that might cause deterioration of the financial health of our customers could change the timing and level of payments received and necessitate an increase in our estimated losses, which could also have a material adverse effect on our earnings and cash flows.

A decrease in the residual value of the equipment that we finance could adversely affect our results

Declines in the residual value of equipment financed by us may reduce our earnings. The residual value of leased equipment is determined based on its estimated end-of-term market value at the time of the expiration of the lease term. We estimate the residual value of leased equipment at the inception of the lease based on a number ofnumerous factors, including historical wholesale market sales prices, past remarketing experience and any known significant market/product trends. If estimated end-of-term market values significantly decline due to economic factors, obsolescence or other adverse circumstances, we may not realize such residual value, which could reduce our earnings.

Restrictive covenants in our debt agreements could limit our financial and operating flexibility

Cat Financial and certain subsidiaries have credit agreements under which we borrow or have the ability tocan borrow funds for use in our respective businesses that are utilized primarily for general corporate purposes. Certain of these agreements include covenants relating to our financial performance and financial position. The two most significant financial covenants included in these agreements are: (1) a leverage ratio covenant that requires us to maintain a ratio of consolidated debt to consolidated net worth of not greater than 10 to 1, calculated (i) on a monthly basis as the average of the leverage ratios determined on the last day of each of the six preceding calendar months and (ii) at each December 31; and (2) an interest coverage ratio that requires us to maintain a ratio of (i) profit excluding income taxes, interest expense and net gain/(loss) from interest rate derivatives to (ii) interest expense of not less than 1.15 to 1, in each case, calculated at the end of each calendar quarter for the rolling four-quarter period then most recently ended for us and our subsidiaries on a consolidated basis in accordance with generally accepted accounting principles. In addition, we are restricted in several of our agreements from terminating, amending or modifying our support agreement with Caterpillar. We are also restricted in our ability to incur secured indebtedness or consolidate, merge or sell assets. Similarly, we are also bound by covenants in various agreements that involve Caterpillar and its obligation to maintain a consolidated net worth of not less than $9 billion at all times during each fiscal year.

Although we do not believe any of these covenants presently materially restrict our operations, our ability to meet any one particular financial covenant may be affected by events that could be beyond our control and could result in material adverse consequences that negatively impact our business, results of operations and financial condition. These consequences may include the acceleration of repayment of amounts outstanding under certain of our credit agreements, the triggering of an obligation to redeem certain debt securities, the termination of existing unused credit commitments by our lenders, the refusal by our lenders to extend further credit under one or more of our credit agreements or the lowering or modification of our credit ratings, including those of any of our subsidiaries. We cannot provide assurance that we will continue to comply with each credit covenant, particularly if we were to encounter challenging and volatile market conditions.

MACROECONOMIC RISKS

Changes in government monetary or fiscal policies may negatively impact our results

Most countries where Caterpillar products and services are sold have established central banks to regulate monetary systems and influence economic activities, generally by adjusting interest rates. Interest rate changes affect overall economic growth, which in turn affects Caterpillar'sCaterpillar’s sales and our financing activities. Interest rate changes may also affect customers'customers’ ability to finance machine purchases, can change the optimal time to keep machines in a fleet and can impact the ability of Caterpillar'sCaterpillar’s suppliers to finance the production of parts and components necessary to manufacture and support Caterpillar products.

Central banks and other policy arms of many countries may take actions to vary the amount of liquidity and credit available in an economy. The impact from a change in liquidity and credit policies could negatively affect the customers and markets we serve or our suppliers, create supply chain inefficiencies and could adversely impact our business, results of operations and financial condition.

Government policies on taxes and spending also affect our business. Throughout the world, government spending finances a significant portion of infrastructure development, such as highways, rail systems, airports, sewer and water systems, waterways and dams. Tax regulations determine asset depreciation lives and impact the after-tax returns on business activity and investment, both of which influence investment decisions. Unfavorable developments, such as decisions to reduce public spending or to increase taxes, could negatively impact our results.

Our global operations are exposed to political and economic risks, commercial instability and global events beyond our control in the countries in which we operate

Our global operations are dependent upon products manufactured, purchased, sold and financed in the U.S. and internationally, including in countries with political and economic instability or uncertainty. Some countries have greater political and economic volatility and greater vulnerability to infrastructure and labor disruptions than others. Operating in different regions and countries exposes us to a number ofnumerous risks, including:

•Multiple and potentially conflicting legal and regulatory requirements that are subject to change, including but not limited to, those legal and regulatory requirements described in Item 1 of this report under the heading Competitive Environment;

•Imposition of currency restrictions, restrictions on repatriation of earnings or other restraints;

•Imposition of new or additional tariffs or quotas;

•Difficulty of enforcing agreements and collecting receivables through foreign legal systems;

•Withdrawal from or modification of trade agreements or the negotiation of new trade agreements;

•Imposition of new or additional trade and economic sanctions laws imposed by the U.S. or foreign governments;

•WarThe occurrence of catastrophic events, including fire, flood, tsunami or acts of terrorism;other weather event, power loss, telecommunications failure, software or hardware malfunctions, pandemics (including the COVID-19 pandemic), cyber-attack, war, terrorist attack or other catastrophic events that our disaster recovery plans do not adequately address; and

•Political and economic instability or civil unrest that may severely disrupt economic activity in affected countries.

The occurrence of one or more of these events may negatively impact our business, results of operations and financial condition. For example, the COVID-19 pandemic has had, and continues to have, a significant impact around the world, prompting governments and businesses to take unprecedented measures in response. Such measures have included travel bans and restrictions, quarantines, shelter in place orders and shutdowns. These measures have impacted and may continue to impact all or portions of each of Caterpillar's and our workforce and operations and the operations of our customers, dealers and suppliers. Although certain restrictions related to the COVID-19 pandemic have eased, uncertainty continues to exist regarding such measures and potential future measures. Current material and component shortages, logistics constraints and labor inefficiencies have limited and could continue to limit Caterpillar's and our ability to meet customer demand, which could have a material adverse effect on our business, results of operations and/or financial condition. In addition, the COVID-19 pandemic has significantly increased economic and customer demand uncertainty, has caused inflationary pressure in the U.S. and elsewhere and has led to volatility in customer demand for Caterpillar's and our products and services and caused supply chain disruptions. Economic uncertainties could continue to affect customer demand for Caterpillar's and our products and services, the value of the equipment financed or leased, the demand for financing and the financial condition and credit risk of our customers and dealers.

OPERATIONAL RISKS

The success of our business depends upon the demand for Caterpillar’s products

Our primary business is to provide retail and wholesale financing alternatives for Caterpillar products to customers and dealers and is therefore largely dependent upon the demand for Caterpillar'sCaterpillar’s products and customers'customers’ willingness to enter into financing or leasing agreements, which may be negatively affected by challenging global economic conditions. As a result, a significant or prolonged decrease in demand could have a material adverse effect on our business, financial condition, results of operations and cash flows. The demand for Caterpillar'sCaterpillar’s products and our products and services is influenced by a number ofnumerous factors, including:

•General world economic conditions and the level of energy, mining, construction and manufacturing activity;

•Changes and uncertainties in the monetary and fiscal policies of various governmental and regulatory entities;

•Fluctuations in demand and prices for certain commodities;

•Fluctuations in currency exchange rates and interest rates;

•Political, economic and legislative changes;

•Caterpillar’s ability to produce products that meet customers'customers’ needs;

•Caterpillar’s ability to maintain key dealer relationships;

•The ability of Caterpillar dealers to sell Caterpillar products and their practices regarding inventory control; and

•Changes in pricing policies by Caterpillar or its competitors.

Any significant adverse changes to these factors could negatively impact our results.

Changes in the marketing, operational or administrative support that we receive from Caterpillar could adversely affect our results

We participate in certain marketing programs offered in conjunction with Caterpillar and/or Caterpillar dealers that allow us to offer financing to customers at interest rates that are below market rates. These marketing programs provide us with a significant competitive advantage in financing Caterpillar products. Any change in these marketing programs or reduction in our ability to offer competitively priced financing to customers could reduce the percentage of Caterpillar products financed by us, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. Caterpillar also provides us with other types of operational and administrative support, such as the administration of employee benefit plans, which is integral to the conduct of our business. Any changes in the levels of support from Caterpillar could also negatively impact our results.

The success of our business depends on our ability to develop, produce and market quality products and services that meet our customers’ needs

We operate in a highly competitive environment, with financing for users of Caterpillar equipment available through a variety of sources, principally commercial banks and finance and leasing companies. Increasing competition may adversely affect our business if we are unable to match the products and services of our competitors. Also, as noted above, any changes to the marketing programs offered in conjunction with Caterpillar and/or Caterpillar dealers, which allow us to offer financing to customers at interest rates that are below market rates, could have a materially adverse effect on our business.

Increased information technology security threats and more sophisticated computer crime pose a risk to our systems, networks, products and services

We rely upon information technology systems and networks, some of which are managed by third parties, in connection with a variety of business activities. Additionally, we collect and store sensitive information relating to our business, customers, dealers, suppliers and employees. Operating these information technology systems and networks and processing and maintaining this data in a secure manner, is critical to our business operations and strategy. Information technology security threats -- from user error to cybersecurity attacks designed to gain unauthorized access to our systems, networks and data -- are increasing in frequency and sophistication. Cybersecurity attacks may range from random attempts to coordinated and targeted attacks, including sophisticated computer crime and advanced persistent threats. These threats pose a risk to the security of our systems and networks and the confidentiality, availability and integrity of our data. Cybersecurity attacks could also include attacks targeting customer data or the security, integrity and/or reliability of the hardware and software installed in our products. It is possible that our information technology systems and networks, or those managed or provided by third parties, could have vulnerabilities, which could go unnoticed for a period of time. While various procedures and controls have been and are being utilized to mitigate such risks, there can be no guarantee that the actions and controls we have implemented and are implementing, or which we cause or have caused third party service providers to implement, will be sufficient to protect our systems, information or other property.

We have experienced cyber security threats and vulnerabilities in our systems and those of our third-party providers, and we have experienced viruses and attacks targeting our information technology systems and networks. Such prior events, to date, have not had a material impact on our financial condition, results of operations or liquidity. However, the potential consequences of a future material cybersecurity attack include reputational damage, litigation with third parties, government enforcement actions, penalties, disruption to systems, unauthorized release of confidential or otherwise protected information, corruption of data and increased cybersecurity protection and remediation costs, which in turn could adversely affect our competitiveness, results of operations and financial condition. Due to the evolving nature of such security threats, the potential impact of any future incident cannot be predicted. Further, the amount of insurance coverage we maintain may be inadequate to cover claims or liabilities relating to a cybersecurity attack.

In addition, data we collect, store and process isare subject to a variety of U.S. and international laws and regulations, such as the European Union'sUnion’s General Data Protection Regulation that became effective in May 2018 and the California Consumer Privacy Act that became effective in January 2020, each of which carry, in many cases, significant potential penalties for noncompliance.

LEGAL & REGULATORY RISKS

Our global operations are subject to a wide-range of trade and anti-corruption laws and regulations

Due to the international scope of our operations, we are subject to a complex system of laws and regulations, including U.S. regulations issued by the Office of Foreign Assets Control. Any alleged or actual violations may subject us to increased government scrutiny, investigation and civil and criminal penalties and may limit our ability to provide financing outside the U.S. and/or potentially require us to divest portions of our existing portfolio under certain circumstances. Furthermore, embargoes and sanctions imposed by the U.S. and other governments prohibiting providing financing to specific persons or countries may expose us to potential criminal and civil sanctions. We cannot predict the nature, scope or effect of future regulatory requirements to which our operations might be subject or, in certain locations, the way existing laws might be administered or interpreted.

In addition, the U.S. Foreign Corrupt Practices Act and similar anti-corruption laws of other countries generally prohibit companies and their intermediaries from making improper payments or providing anything of value to improperly influence foreign government officials for the purpose of obtaining or retaining business or obtaining an unfair advantage. Recent years have seen a substantial increase in the global enforcement of anti-corruption laws. Our continued operation and expansion outside the U.S., including in developing countries, expose us to the risk of such violations. Violations of anti-corruption laws by our employees or intermediaries acting on our behalf may result in severe criminal or civil sanctions, could disrupt our business, and could result in an adverse effect on our reputation, business, results of operations or financial condition.

New regulations or changes in financial services regulation could adversely impact our results of operations and financial condition

Our operations are highly regulated by governmental authorities in the locations where we operate, which can impose significant additional costs and/or restrictions on our business. In the U.S. for example, certain of our activities are subject to the U.S. Dodd-Frank Wall Street Reform and Consumer Protection Act, which includes extensive provisions regulating the financial services industry. As a result, we have become and could continue to become subject to additional regulatory costs that could be significant and could have an adverse effect on our results of operations and financial condition. Changes in or additional regulations in the U.S. or internationally impacting the financial services industry could also add significant cost or operational constraints that might have an adverse effect on our results of operations and financial condition.

We may incur additional tax expense or become subject to additional tax exposure

We are subject to income taxes in the U.S. and numerous other jurisdictions. Our future results of operations could be adversely affected by changes in the effective tax rate as a result of a change in the mix of earnings between U.S. and non-U.S. jurisdictions or among jurisdictions with differing statutory tax rates, changes in our overall profitability, changes in tax laws or treaties or in their application or interpretation, changes in tax rates, changes in generally accepted accounting principles, changes in the valuation of deferred tax assets and liabilities, changes in the amount of earnings indefinitely reinvested in certain non-U.S. jurisdictions, the results of audits and examinations of previously filed tax returns and continuing assessments of our tax exposures. We are also subject to the continuous examination of our income tax returns by the U.S. Internal Revenue Service and other tax authorities. We regularly assess the likelihood of an adverse outcome resulting from these examinations. If our effective tax rates were to increase or if the ultimate determination of our taxes owed is for an amount in excess of amounts previously accrued, our operating results, cash flows and financial condition could be adversely affected.

Changes in accounting guidance could have an adverse effect on our results of operations

Our consolidated financial statements are subject to the application of generally accepted accounting principles, which is periodically revised and/or expanded. Accordingly, from time to time we are required to adopt new or revised accounting guidance and related interpretations issued by recognized authoritative bodies, including the Financial Accounting Standards Board and the SEC. Market conditions have prompted accounting standard setters to issue new guidance, which further interprets or seeks to revise accounting pronouncements related to various transactions, as well as to issue new guidance expanding disclosures. The impact of accounting pronouncements that have been issued but not yet implemented is disclosed in our annual and quarterly reports on Form 10-K and quarterly reports on Form 10-Q. An assessment of proposed guidance is not provided, as such proposals are subject to change through the exposure process and, therefore, their effects on our financial statements cannot be meaningfully assessed. It is possible that future accounting guidance we are required to adopt or future changes in accounting principles could change the current accounting treatment that we apply to our consolidated financial statements and that such changes could have a material adverse effect on our business, results of operations and financial condition.

| | | | | |

| Item 1B. | Unresolved Staff Comments. |

None.

Our corporate headquarters are located in Nashville, Tennessee. We maintain forty-sixAdditional offices in total, of which nine are located in North America (eight ininside and outside the U.S. and one in Canada), twenty-one are located in Europe, one is located in Africa, one is located in the Middle East, nine are located in Asia/Pacific and five are located in Latin America (see Note 15 of Notes to Consolidated Financial Statements for more information regarding our segments and geographic areas).United States. All of our offices, are leased, except forother than our corporate headquarters building.building, are leased.

| | | | | |

| Item 3. | Legal Proceedings. |

We are involved in unresolved legal actions that arise in the normal course of business. Although it is not possible to predict with certainty the outcome of our unresolved legal actions, we believe that these unresolved legal actions will neither individually nor in the aggregate have a material adverse effect on our consolidated results of operations, financial position or liquidity.

| | | | | |

| Item 4. | Mine Safety Disclosures. |

Not applicable.

| | | | | |

| Item 5. | Market for Registrant'sRegistrant’s Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity Securities. |

Our stock is not publicly traded. Caterpillar Inc. is the owner of our one outstanding share. Cash dividends of $300$275 million, $25$850 million and $400$300 million were paid to Caterpillar in 2022, 2021 and 2020, 2019 and 2018, respectively.

| | | | | |

| Item 7. | Management'sManagement’s Discussion and Analysis of Financial Condition and Results of Operations. |

This Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with our audited financial statements and related notes included elsewhere in this report and our discussion of significant risks to the company’s business under Part I, Item 1A. Risk Factors of this report.

OVERVIEW

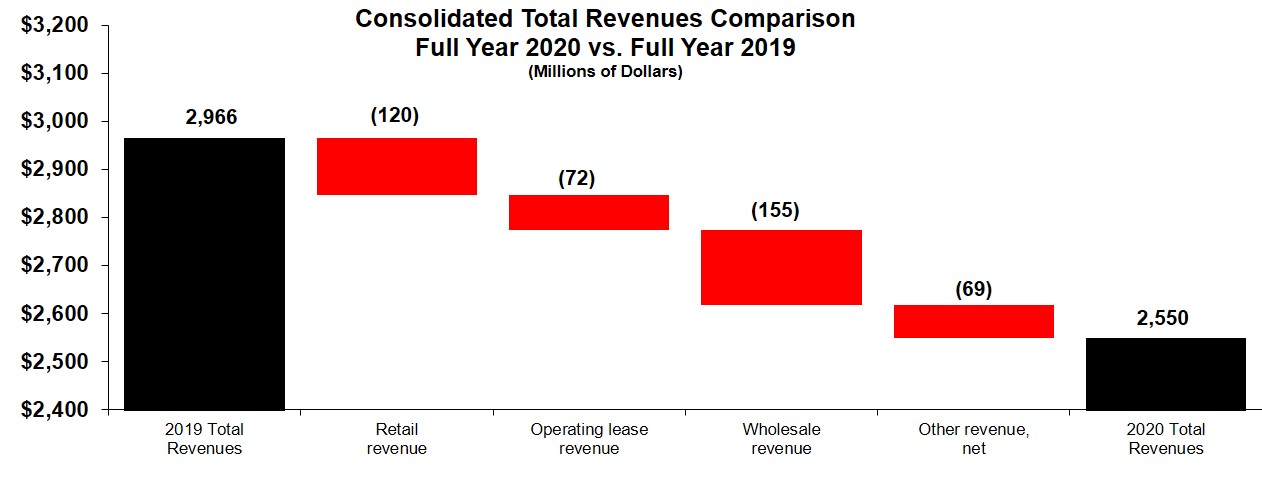

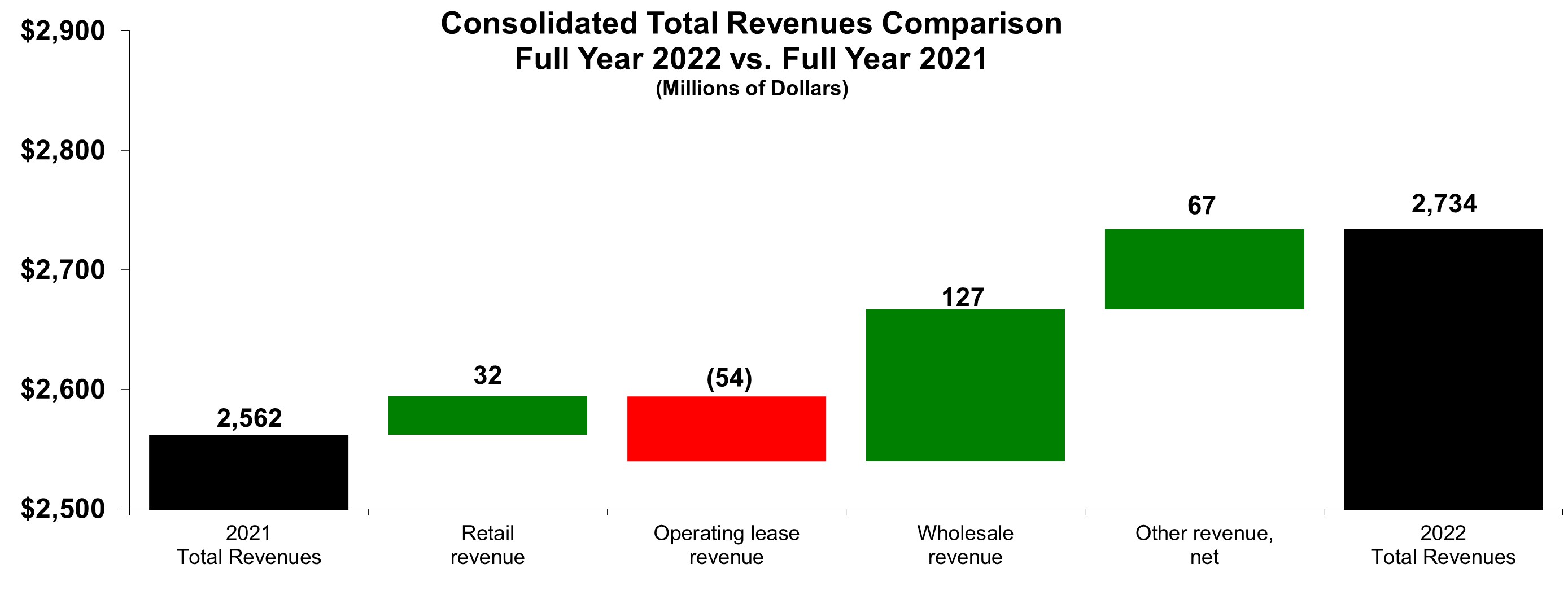

We reported revenues of $2.55$2.73 billion for 2020, a decrease2022, an increase of $416$172 million, or 147 percent, compared with 2019.$2.56 billion for 2021. Profit was $293$535 million for 2020, a $1172022, an increase of $30 million, or 296 percent, decrease from 2019.compared with $505 million for 2021.

The decreaseincrease in revenues was primarily due to a $190$151 million unfavorablefavorable impact from lowerhigher average financing rates and a $151$55 million favorable impact from returned or repossessed equipment, partially offset by a $38 million unfavorable impact from lower average earning assets.

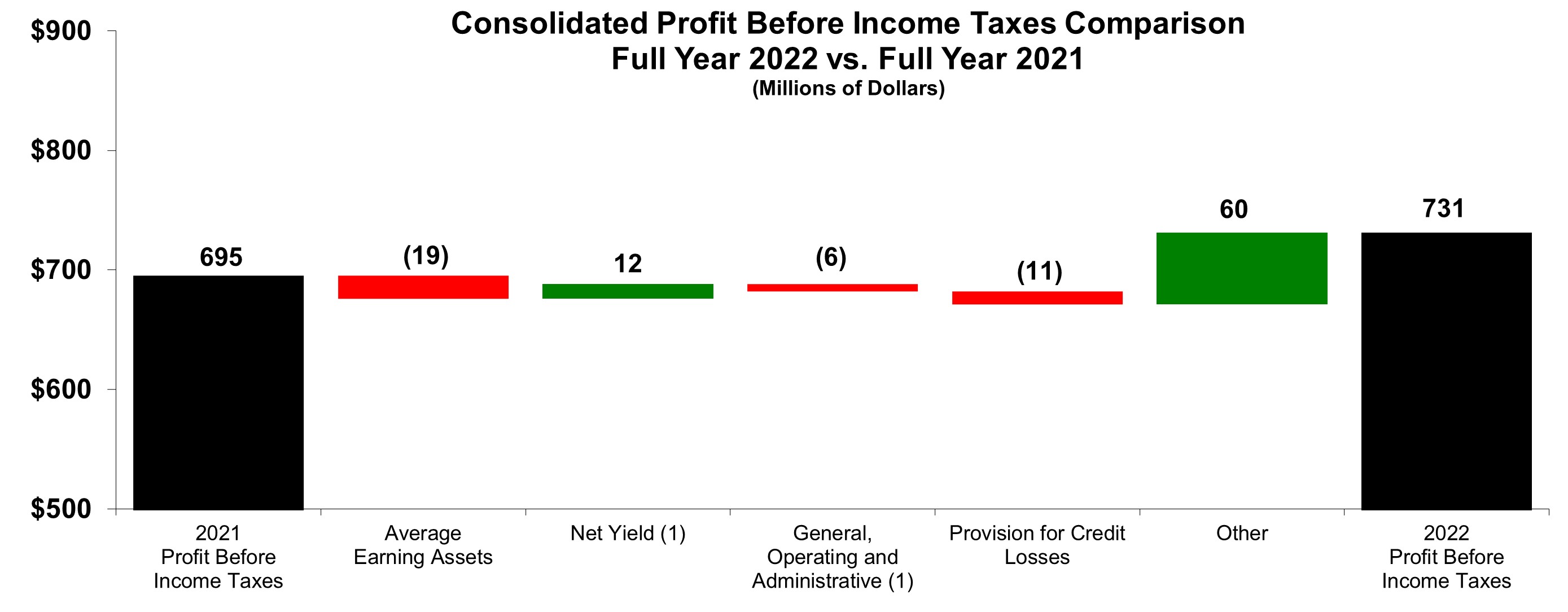

Profit before income taxes was $434$731 million for 2020, a $1942022, an increase of $36 million, or 315 percent, decrease from 2019.compared with $695 million for 2021. The decreaseincrease was primarily due to a $104$55 million increase in provision for credit losses,favorable impact from returned or repossessed equipment, partially offset by a $69$19 million unfavorable impact from lower average earning assets, a $52 million decrease in net yield on average earning assets and a $36 million unfavorable impact from returned or repossessed equipment. These unfavorable impacts were partially offset by an $82 million decrease in general, operating and administrative expenses, primarily due to lower incentive compensation.assets.

The provision for income taxes reflected an annual tax rate of 2926 percent for 2020, compared with 31 percent for 2019. The decrease in the annual tax rate was primarily due to changes in the geographic mix of profits.both 2022 and 2021.

During 2020,2022, retail new business volume was $10.76$11.36 billion, a decrease of $1.13$1.74 billion, or 913 percent, from 2019.compared with $13.10 billion for 2021. The decrease was driven by lower volume across all segments with the exception of an increase in Asia/Pacific.Latin America.

At the end of 2020,2022, past dues were 3.491.89 percent, compared with 3.141.95 percent at the end of 2019. Past dues increased primarily due to the impact of the COVID-19 pandemic, partially offset by decreases in the Caterpillar Power Finance, EAME and Latin American portfolios.2021. Write-offs, net of recoveries, were $222$46 million for 2020,2022, compared with $237$205 million for 2019.2021. As of December 31, 2020,2022, the allowance for credit losses totaled $479$346 million, or 1.771.29 percent of finance receivables, compared with $424$337 million, or 1.501.22 percent of finance receivables at December 31, 2019.2021.

Response to COVID-19 and Global Business Conditions

We continue to implement safeguards in our facilities to protect team members, including increased frequency of cleaning and disinfecting, social distancing practices and other measures consistent with specific governmental requirements and guidance from health authorities and continue

Caterpillar continues to monitor a variety of external factors around the situation closely.world, such as supply chain disruptions, inflationary cost and labor pressures. We remainare monitoring the potential downstream impacts from these factors on our business, while remaining focused on portfolio health and continuecontinuing to provide qualified customers and dealers with new loans and leases to support their current and future business needs.

We continue to closely monitor the events in Russia and Ukraine and have evaluated our exposure in these countries.

20202022 COMPARED WITH 20192021

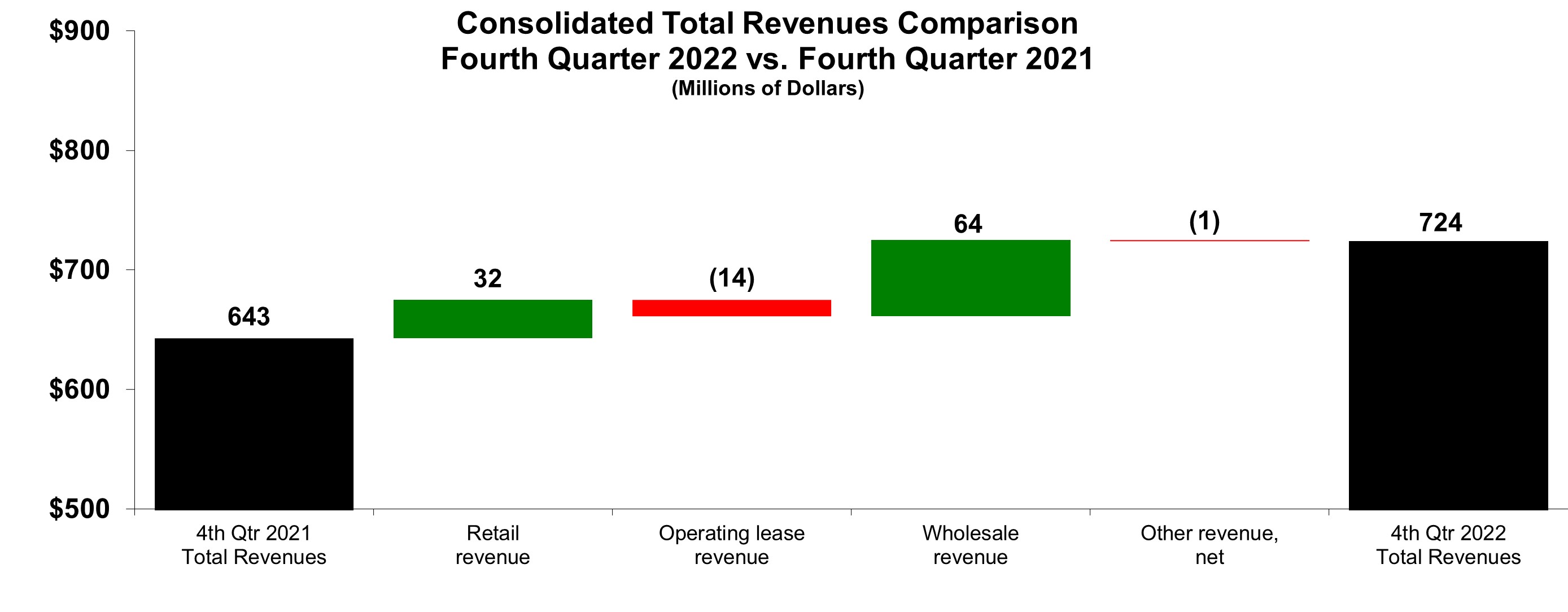

Consolidated Total Revenues

The chart above graphically illustrates reasons for the change in Consolidated Total Revenuesconsolidated total revenues between 20192021 (at left) and 20202022 (at right). Items favorably impacting total revenues appear as upward stair steps with corresponding dollar amounts above each bar, while items negatively impacting total revenues appear as downward stair steps with dollar amounts reflected in parentheses above each bar. Management utilizes these charts internally to visually communicate results.

Retail revenue for 20202022 was $1.25$1.23 billion, a decreasean increase of $120$32 million from 2019.2021. The decreaseincrease was due to a $101$62 million unfavorablefavorable impact from lowerhigher interest rates on retail finance receivables, andpartially offset by a $19$30 million unfavorable impact from lower average earning assets. For the year ended December 31, 2020,2022, retail average earning assets were $22.57$22.18 billion, a decrease of $317$581 million from 2019.2021. The average yield was 5.535.54 percent for 2020,2022, compared with 5.985.26 percent in 2019.2021.

Operating lease revenue for 20202022 was $965$888 million, a decrease of $72$54 million from 2019.2021. The decrease was primarily due to a $38 million unfavorable impact from lower average earning assets. Additionally, during the third quarter of 2020, we updated our accounting convention for recognizing revenue and depreciation on operating leases from a monthly to a daily basis. This update resulted in a $29 million unfavorable impact to operating lease revenue which was mostly offset by a $24 million favorable impact to depreciation on equipment leased to others.

Wholesale revenue for 2020 was $336 million, a decrease of $155 million from 2019. The decrease was due to an $87$66 million unfavorable impact from lower average earning assets, andpartially offset a $68$15 million unfavorablefavorable impact from lowerhigher rental rates on operating leases.

Wholesale revenue for 2022 was $441 million, an increase of $127 million from 2021. The increase was due to a $110 million favorable impact from higher interest rates on wholesale finance receivables.receivables and a $17 million favorable impact from higher average earning assets. For the year ended December 31, 2020,2022, wholesale average earning assets were $4.44$4.51 billion, a decreasean increase of $954$232 million from 2019.2021. The average yield was 7.589.77 percent for 2020,2022, compared with 9.107.34 percent in 2019.2021.

Other revenue, net items were as follows:

| | (Millions of dollars) | (Millions of dollars) | | (Millions of dollars) | |

| | 2020 | | 2019 | | Change | | 2022 | | 2021 | | Change |

| Finance receivable and operating lease fees (including late charges) | Finance receivable and operating lease fees (including late charges) | | $ | 49 | | | $ | 61 | | | $ | (12) | | Finance receivable and operating lease fees (including late charges) | | $ | 58 | | | $ | 56 | | | $ | 2 | |

| Fees on committed credit facility extended to Caterpillar | | — | | | 5 | | | (5) | | |

| | Net gain (loss) on returned or repossessed equipment | | Net gain (loss) on returned or repossessed equipment | | 81 | | | 26 | | | 55 | |

| Interest income on Notes receivable from Caterpillar | Interest income on Notes receivable from Caterpillar | | 14 | | | 26 | | | (12) | | Interest income on Notes receivable from Caterpillar | | 17 | | | 14 | | | 3 | |

| Net loss on returned or repossessed equipment | | (74) | | | (38) | | | (36) | | |

| Miscellaneous other revenue, net | Miscellaneous other revenue, net | | 11 | | | 15 | | | (4) | | Miscellaneous other revenue, net | | 20 | | | 13 | | | 7 | |

| Total Other revenue, net | Total Other revenue, net | | $ | — | | | $ | 69 | | | $ | (69) | | Total Other revenue, net | | $ | 176 | | | $ | 109 | | | $ | 67 | |

|

There was a $19$47 million unfavorable impact from currency on revenues in 2020.2022. Currency represents the net translation impact resulting from changes in foreign currency exchange rates versus the U.S. dollar and is included in all financial statement line items and each of the items included in the above analysis.

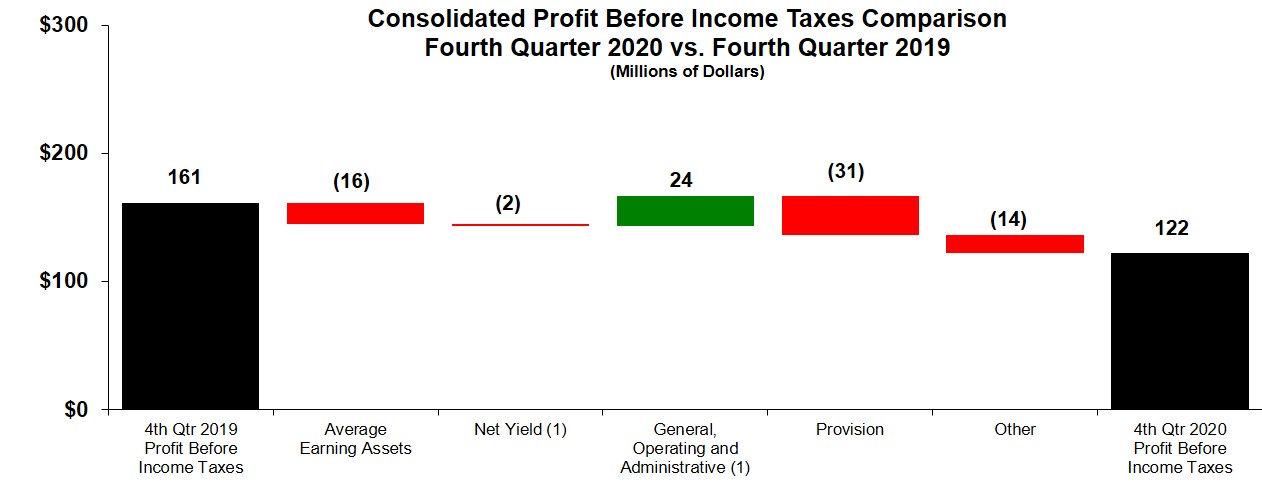

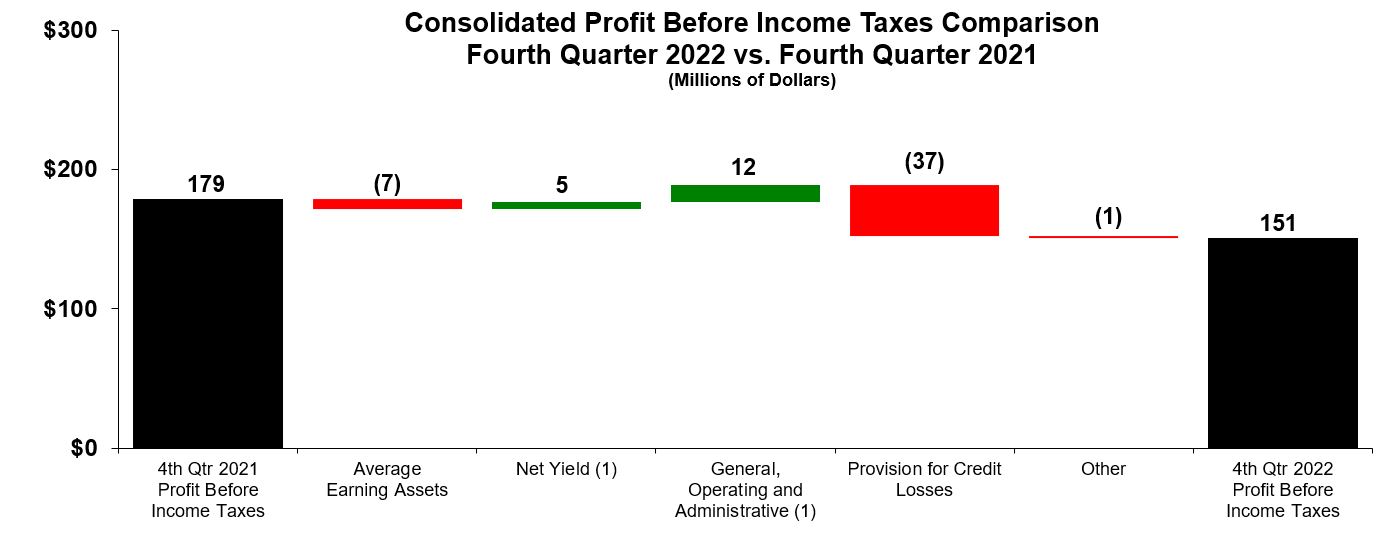

Consolidated Profit Before Income Taxes

(1) Analysis excludes $19$15 million and $20$18 million in offsetting revenues and expenses for property taxes on operating leases for 20202022 and 2019,2021, respectively.

The chart above graphically illustrates reasons for the change in Consolidated Profit Before Income Taxesconsolidated profit before income taxes between 20192021 (at left) and 20202022 (at right). Items favorably impacting profit before income taxes appear as upward stair steps with corresponding dollar amounts above each bar, while items negatively impacting profit before income taxes appear as downward stair steps with dollar amounts reflected in parentheses above each bar. Management utilizes these charts internally to visually communicate results.

Profit before income taxes was $434$731 million for 2020,2022, an increase of 36 million, or 5 percent, compared with $628$695 million for 2019.2021. The decreaseincrease was primarily due to a $104$55 million increase in provision for credit losses,favorable impact from returned or repossessed equipment, partially offset by a $69$19 million unfavorable impact from lower average earning assets, a $52 million decrease in net yield on average earning assets and a $36 million unfavorable impact from returned or repossessed equipment. These unfavorable impacts were partially offset by an $82 million decrease in general, operating and administrative expenses, primarily due to lower incentive compensation.assets.

There was an $8a $13 million unfavorable impact from currency on profit before income taxes in 2020.2022. Currency represents the net translation impact resulting from changes in foreign currency exchange rates versus the U.S. dollar and is included in all financial statement line items and each of the items included in the above analysis.

Provision for Income Taxes

The provision for income taxes reflected an annual tax rate of 2926 percent for 2020, compared with 31 percent for 2019. The decrease in the annual tax rate was primarily due to changes in the geographic mix of profits.both 2022 and 2021.

Finance Receivables and Equipment on Operating Leases

New Business Volume

| | (Millions of dollars) | (Millions of dollars) | | (Millions of dollars) | |

| | 2020 | | 2019 | | Change | | 2022 | | 2021 | | Change |

| New retail financing | New retail financing | | $ | 9,645 | | | $ | 10,320 | | | $ | (675) | | New retail financing | | $ | 10,211 | | | $ | 11,867 | | | $ | (1,656) | |

| New operating lease activity | New operating lease activity | | 1,114 | | | 1,571 | | | (457) | | New operating lease activity | | 1,144 | | | 1,230 | | | (86) | |

| New wholesale financing | New wholesale financing | | 33,485 | | | 43,714 | | | (10,229) | | New wholesale financing | | 47,749 | | | 40,393 | | | 7,356 | |

| Total | Total | | $ | 44,244 | | | $ | 55,605 | | | $ | (11,361) | | Total | | $ | 59,104 | | | $ | 53,490 | | | $ | 5,614 | |

|

New retail financing decreased due to lower volume across all segments with the exception of North America and Asia/Pacific.an increase in Latin America. New operating lease activity (which is substantially related to retail) decreased due to lower rentals of Cat equipment mostly in North America and Mining.equipment. New wholesale financing decreasedincreased primarily due to lowerhigher purchases of trade receivables from Caterpillar.

Total Managed Portfolio

We define total portfolio as Finance receivables, net plus Equipment on operating leases, net. We also manage and service receivables and leases that have been sold by us to third parties with limited or no recourse in order to mitigate our concentration of credit risk with certain customers. These assets are not available to pay our creditors. Total managed portfolio as of December 31, was as follows:

| | (Millions of dollars) | (Millions of dollars) | | (Millions of dollars) | |

| | 2020 | | 2019 | | Change | | 2022 | | 2021 | | Change |

| Finance receivables, net | Finance receivables, net | | $ | 26,575 | | | $ | 27,832 | | | $ | (1,257) | | Finance receivables, net | | $ | 26,441 | | | $ | 27,177 | | | $ | (736) | |

| Equipment on operating leases, net | Equipment on operating leases, net | | 3,366 | | | 3,583 | | | (217) | | Equipment on operating leases, net | | 2,911 | | | 3,123 | | | (212) | |

| Total portfolio | Total portfolio | | $ | 29,941 | | | $ | 31,415 | | | $ | (1,474) | | Total portfolio | | $ | 29,352 | | | $ | 30,300 | | | $ | (948) | |

| | Retail loans, net | Retail loans, net | | $ | 139 | | | $ | 186 | | | $ | (47) | | Retail loans, net | | $ | 68 | | | $ | 107 | | | $ | (39) | |

| Operating leases | | Operating leases | | 21 | | | 23 | | | (2) | |

| Retail leases, net | Retail leases, net | | 56 | | | 81 | | | (25) | | Retail leases, net | | 23 | | | 19 | | | 4 | |

| Operating leases | | 24 | | | 26 | | | (2) | | |

| Total off-balance sheet managed assets | Total off-balance sheet managed assets | | $ | 219 | | | $ | 293 | | | $ | (74) | | Total off-balance sheet managed assets | | $ | 112 | | | $ | 149 | | | $ | (37) | |

| | Total managed portfolio | Total managed portfolio | | $ | 30,160 | | | $ | 31,708 | | | $ | (1,548) | | Total managed portfolio | | $ | 29,464 | | | $ | 30,449 | | | $ | (985) | |

|

Total Portfolio Metrics

At the end of 2020,2022, past dues were 3.491.89 percent, compared with 3.141.95 percent at the end of 2019. Past dues increased primarily due to the impact of the COVID-19 pandemic, partially offset by decreases in the Caterpillar Power Finance, EAME and Latin American portfolios.2021. Total non-performing finance receivables, which represent finance receivables currently on non-accrual status, were $567$234 million and $805$288 million at December 31, 20202022 and 2019,2021, respectively. Total non-performing finance receivables as a percentage of our finance receivables were 2.100.87 percent and 2.851.05 percent at December 31, 20202022 and 2019,2021, respectively.

As it relates to COVID-19, we provided payment relief through Cat Financial Customer Care Programs launched globally, including account modifications to accommodate customer needs. Generally, the Customer Care Programs provided payment relief for customers that were current in their payment obligations and included payment deferrals of three months, with the option to extend for an additional three months. Additionally, we continue to respond to government requirements to adjust the repayment terms for customers, as required. Since the start of the pandemic, modification requests were received from customers representing approximately 25 percent of the customer portfolio. Most customers who have exited the modification period have resumed payments and have not requested additional relief.

Our allowance for credit losses as of December 31, 20202022 was $479$346 million, or 1.771.29 percent of finance receivables, compared with $424$337 million, or 1.501.22 percent, as of December 31, 2019.2021. The allowance is subject to an ongoing evaluation based on many quantitative and qualitative factors, including past loss experience, known and inherent risks in the portfolio, adverse situations that may affect the borrower’s ability to repay, estimated value of underlying collateral and economic forecasts. We believe our allowance is sufficient to provide for losses over the remaining life of our finance receivable portfolio as of December 31, 2020.2022.

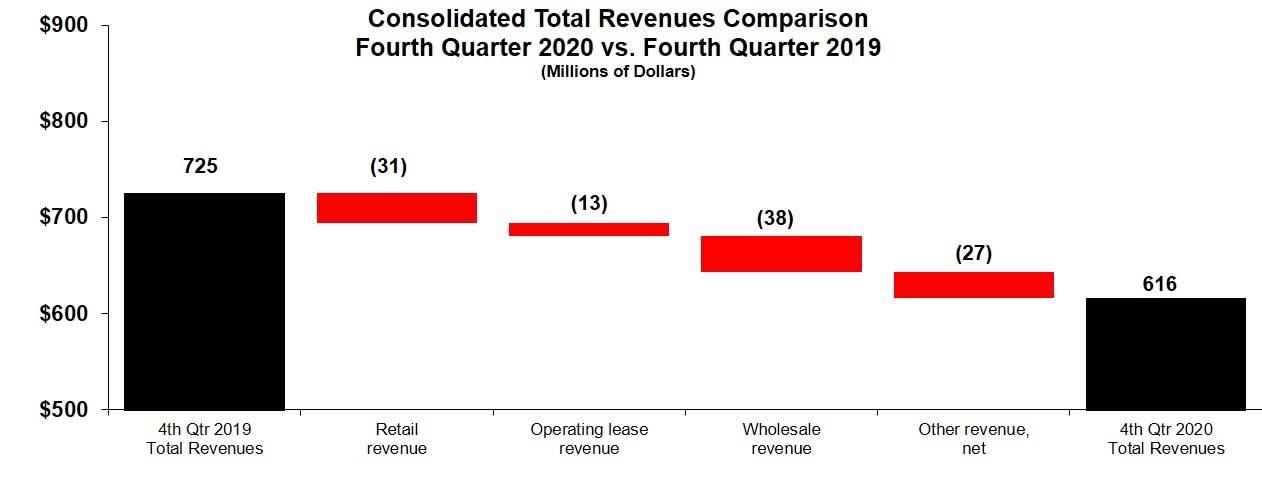

FOURTH QUARTER 2020 VS.2022 COMPARED WITH FOURTH QUARTER 20192021

CONSOLIDATED STATEMENTS OF PROFIT (UNAUDITED)

(Dollars in Millions)

| | | | | | | | | | | | | | |

| | Three Months Ended

December 31, |

| | | 2020 | | 2019 |

| Revenues: | | | | |

| Retail finance | | $ | 307 | | | $ | 338 | |

| Operating lease | | 247 | | | 260 | |

| Wholesale finance | | 78 | | | 116 | |

| Other, net | | (16) | | | 11 | |

| Total revenues | | 616 | | | 725 | |

| | | | |

| Expenses: | | | | |

| Interest | | 129 | | | 188 | |

| Depreciation on equipment leased to others | | 194 | | | 202 | |

| General, operating and administrative | | 113 | | | 138 | |

| Provision for credit losses | | 49 | | | 18 | |

| Other | | 10 | | | 8 | |

| Total expenses | | 495 | | | 554 | |

| | | | |

| Other income (expense) | | 1 | | | (10) | |

| | | | |

| Profit before income taxes | | 122 | | | 161 | |

| | | | |

| Provision for income taxes | | 24 | | | 52 | |

| | | | |

| Profit of consolidated companies | | 98 | | | 109 | |

| | | | |

| Less: Profit attributable to noncontrolling interests | | 2 | | | 5 | |

| | | | |

Profit(1) | | $ | 96 | | | $ | 104 | |

| | | | |