UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended November 30, 20122015

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission File No. 001-09195

KB HOME

(Exact name of registrant as specified in its charter)

|

| |

| Delaware | 95-3666267 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

10990 Wilshire Boulevard, Los Angeles, California 90024

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (310) 231-4000

Securities Registered Pursuant to Section 12(b) of the Act:

|

| |

| Title of each class | Name of each exchange on which registered |

| Common Stock (par value $1.00 per share) | New York Stock Exchange |

| Rights to Purchase Series A Participating Cumulative Preferred Stock | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of the voting common stock held by non-affiliates of the registrant on May 31, 20122015 was $637,684,7631,512,772,004, including 10,839,35110,335,461 shares held by the registrant’s grantor stock ownership trust and excluding 27,214,17413,116,459 shares held in treasury.

There were 77,221,78592,275,658 shares of the registrant’s common stock, par value $1.00 per share, outstanding on December 31, 2012.2015. The registrant’s grantor stock ownership trust held an additional 10,615,93410,135,461 shares of the registrant’s common stock on that date.

Documents Incorporated by Reference

Portions of the registrant’s definitive Proxy Statement for the 20132016 Annual Meeting of Stockholders (incorporated into Part III).

KB HOME

FORM 10-K

FOR THE YEAR ENDED NOVEMBER 30, 20122015

TABLE OF CONTENTS

|

| | |

| | | Page Number |

|

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| |

| |

|

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| |

|

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| |

|

| Item 15. | | |

| |

PART I

General

KB Home is one of the largest and most recognized homebuilding companies in the U.S. and has been building homes for more than 50nearly 60 years. We construct and sell homes through our operating divisions under the name KB Home. Unless the context indicates otherwise, the terms “we,” “our” and “us” used in this report refer to KB Home, a Delaware corporation, and its predecessors and subsidiaries.

Beginning in 1957 and continuing until 1986, our business was conducted by various subsidiaries of Kaufman and Broad, Inc. (“KBI”) and its predecessors. In 1986, KBI transferred all of its homebuilding and mortgage banking operations to us. Shortly after the transfer, we completed an initial public offering of 8% of our common stock and began operating under the name Kaufman and Broad Home Corporation. In 1989, we were spun-off from KBI, which then changed its name to Broad Inc., and we became an independent public company, operating primarily in California and France. In 2001, we changed our name to KB Home. Today, having sold our French operations in 2007, we operate a homebuilding and financial services business serving homebuyers in various markets across the U.S.

Our homebuilding operations offer a variety of new homes designed primarily for first-time, move-up and active adult homebuyers, including attached and detached single-family residential homes, townhomes and condominiums. We offer homes in development communities, at urban in-fill locations and as part of mixed-use projects. InOur homebuilding operations represent most of our business, accounting for 99.6% of our total revenues in 2015. Our financial services operations, which accounted for .4% of our total revenues in 2015, offer certain insurance products to our homebuyers and title services in certain markets. Since July 2014, our financial services operations have also provided mortgage banking services, including residential consumer mortgage loan (“mortgage loan”) originations, to our homebuyers indirectly through Home Community Mortgage, LLC (“HCM”). HCM is an unconsolidated joint venture we formed with Nationstar Mortgage LLC (“Nationstar”).

Unless the context indicates otherwise, the terms “we,” “our” and “us” used in this report we use the termrefer to KB Home, a Delaware corporation, and its predecessors and subsidiaries. Also as used in this report, “home” to refer tois a single-family residence, whether it is a single-family home or other type of residential property, and we use the termproperty; “community” to refer tois a single development in which new homes are constructed as part of an integrated plan.plan; and “community count” is the number of communities we have open for sales with at least five homes/lots left to sell.

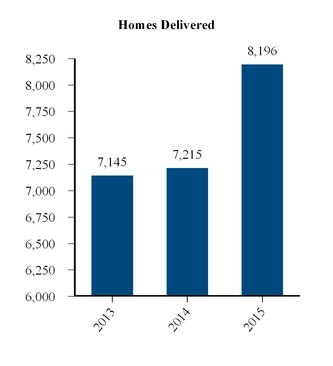

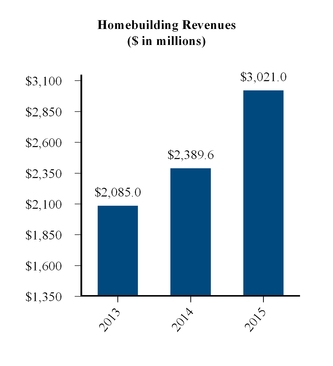

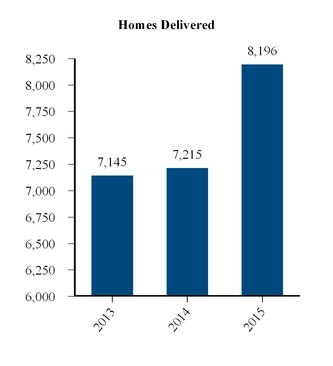

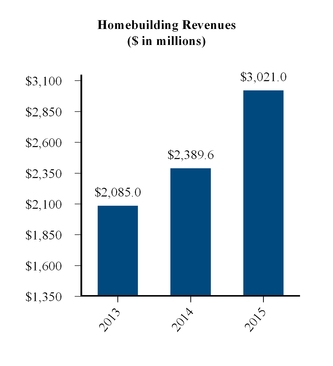

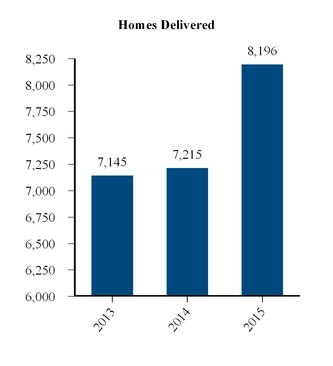

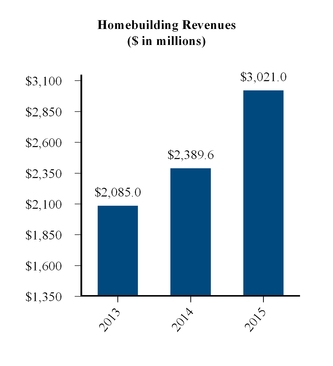

Through ourThe following charts present homes delivered and homebuilding reporting segments, we delivered 6,282 homes at an average selling price of $246,500 duringrevenues for the yearyears ended November 30, 2012, compared to 5,812 homes delivered at an average selling price of $224,600 during the year ended November 30, 2011. Our homebuilding operations represent most of our business, accounting for 99.3% of our total revenues in 20122013, 2014 and 99.2% of our total revenues in 2011.2015:

Our financial services reporting segment provides insurance services to our homebuyers in the same markets where we build homes and provides title services in the majority of our markets located within our Central and Southeast homebuilding reporting segments. In addition, since the third quarter of 2011, this segment has earned revenues pursuant to the terms of a marketing services agreement with a preferred mortgage lender that offers mortgage banking services, including mortgage loan originations, to our homebuyers. Our financial services operations accounted for .7% of our total revenues in 2012 and .8% of our total revenues in 2011.

In 2012, we generated total revenues of $1.56 billion and a net loss of $59.0 million, compared to total revenues of $1.32 billion and a net loss of $178.8 million in 2011.

Our principal executive offices are located at 10990 Wilshire Boulevard, Los Angeles, California 90024. The telephone number of our corporate headquarters is (310) 231-4000 and our primary website address is www.kbhome.com. In addition, community location and information is available at (888) KB-HOMES.

Markets

Reflecting the geographic reach of our homebuilding business, as of the date of this report, our principalwe have ongoing operations are in the 10nine states and 3339 major markets presented below. We also operate in various submarkets within these major markets. From time to time, we refer to these markets and submarkets collectively as our “served markets.” For reporting purposes, we organize our homebuilding operations into four segments — West Coast, Southwest, Central and Southeast.

|

| | | | |

| Segment | | State(s) | | Major Market(s) |

| | | | |

| West Coast | | California | | Contra Costa County, Fresno, Los Angeles, Madera, Oakland, Orange County, Riverside, Sacramento, San Bernardino, San Diego, San Francisco, San Jose, Santa Rosa-Petaluma, Stockton, Vallejo, Ventura and Yuba City |

| Southwest | | Arizona | | Phoenix and Tucson |

| | | Nevada | | Las Vegas and Reno |

| | New Mexico | | Albuquerque |

| Central | | Colorado | | Denver |

| | | Texas | | Austin, Dallas/Dallas, Fort Worth, Houston and San Antonio |

| Southeast | | Florida | | Daytona Beach, Fort Myers, Jacksonville, Lakeland, Orlando, Palm Coast, Punta Gorda, Sarasota, Sebastian-Vero Beach and Tampa |

| | | Maryland | | Washington, D.C.Baltimore and Rockville |

| | | North Carolina | | Raleigh |

| | | Virginia | | Washington, D.C. |

Segment Operating Information. The following table presents certain operating information for our homebuilding reporting segments for the years ended November��November 30, 2012, 20112015, 2014 and 20102013 (dollars in millions, except average selling price):

| | | | Years Ended November 30, | Years Ended November 30, |

| | 2012 | | 2011 | | 2010 | 2015 | | 2014 | | 2013 |

| West Coast: | | | | | | | | | | |

| Homes delivered | 1,945 |

| | 1,757 |

| | 2,023 |

| 2,258 |

| | 1,913 |

| | 2,179 |

|

| Percentage of total homes delivered | 31 | % | | 30 | % | | 27 | % | 27 | % | | 27 | % | | 31 | % |

| Average selling price | $ | 388,300 |

| | $ | 335,500 |

| | $ | 346,300 |

| $ | 587,000 |

| | $ | 569,700 |

| | $ | 467,800 |

|

| Total revenues (in millions) (a) | $ | 755.3 |

| | $ | 589.4 |

| | $ | 700.7 |

| |

| Total revenues (a) | | $ | 1,402.3 |

| | $ | 1,089.9 |

| | $ | 1,020.2 |

|

| Southwest: | | | | | | | | | | |

| Homes delivered | 683 |

| | 843 |

| | 1,150 |

| 1,311 |

| | 736 |

| | 738 |

|

| Percentage of total homes delivered | 11 | % | | 15 | % | | 16 | % | 16 | % | | 10 | % | | 10 | % |

| Average selling price | $ | 193,900 |

| | $ | 165,800 |

| | $ | 158,200 |

| $ | 284,600 |

| | $ | 271,100 |

| | $ | 237,500 |

|

| Total revenues (in millions) (a) | $ | 132.4 |

| | $ | 139.9 |

| | $ | 187.7 |

| |

| Total revenues (a) | | $ | 398.2 |

| | $ | 199.5 |

| | $ | 175.3 |

|

| Central: | | | | | | | | | | |

| Homes delivered | 2,566 |

| | 2,155 |

| | 2,663 |

| 3,183 |

| | 3,098 |

| | 2,841 |

|

| Percentage of total homes delivered | 41 | % | | 37 | % | | 36 | % | 39 | % | | 43 | % | | 40 | % |

| Average selling price | $ | 170,100 |

| | $ | 171,500 |

| | $ | 163,700 |

| $ | 252,200 |

| | $ | 223,800 |

| | $ | 198,900 |

|

| Total revenues (in millions) (a) | $ | 436.4 |

| | $ | 369.7 |

| | $ | 436.4 |

| |

| Total revenues (a) | | $ | 809.7 |

| | $ | 698.4 |

| | $ | 565.1 |

|

| Southeast: | | | | | | | | | | |

| Homes delivered | 1,088 |

| | 1,057 |

| | 1,510 |

| 1,444 |

| | 1,468 |

| | 1,387 |

|

| Percentage of total homes delivered | 17 | % | | 18 | % | | 21 | % | 18 | % | | 20 | % | | 19 | % |

| Average selling price | $ | 206,200 |

| | $ | 195,500 |

| | $ | 170,200 |

| $ | 281,900 |

| | $ | 263,600 |

| | $ | 233,900 |

|

| Total revenues (in millions) (a) | $ | 224.3 |

| | $ | 206.6 |

| | $ | 257.0 |

| |

| Total revenues (a) | | $ | 410.8 |

| | $ | 401.9 |

| | $ | 324.4 |

|

| Total: | | | | | | | | | | |

| Homes delivered | 6,282 |

| | 5,812 |

| | 7,346 |

| 8,196 |

| | 7,215 |

| | 7,145 |

|

| Average selling price | $ | 246,500 |

| | $ | 224,600 |

| | $ | 214,500 |

| $ | 354,800 |

| | $ | 328,400 |

| | $ | 291,700 |

|

| Total revenues (in millions) (a) | $ | 1,548.4 |

| | $ | 1,305.6 |

| | $ | 1,581.8 |

| |

| Total revenues (a) | | $ | 3,021.0 |

| | $ | 2,389.6 |

| | $ | 2,085.0 |

|

| |

| (a) | Total revenues include revenues from housing and land sales. |

Additional financial and operational information related to our homebuilding reporting segments, including revenues, pretax income (losses), inventories and assets, is provided below in the “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” section and in Note 2. Segment Information in the Notes to Consolidated Financial Statements in this report.

Unconsolidated Joint Ventures. The above table does not include homes delivered or revenues from unconsolidated joint ventures in which we participate. These unconsolidated joint ventures acquire and develop land in various markets where our homebuilding operations are located and, in some cases, build and deliver homes on the land developed. Over the last five years, we have reduced the number of homebuilding joint ventures in which we participate. Our unconsolidated joint ventures delivered no homes in 2012, one home in 2011, and 102 homes in 2010.

Strategy

Since 1997, we have operated our homebuilding business followingfollowed the principles of an operational business model that we call KBnxt. KBnxt provides the core framework under which we have established the primary strategic goals for our main operational objectives and near-term strategic goals.homebuilding business. We believe the principles of KBnxt set us apart from other large-productionhigh-production homebuilders and provide the foundation for our long-term growth.

KBnxt. With KBnxt, we seek to generate greaterimproved operating efficiencies and return on investment through a disciplined, fact-based and process-driven approach to homebuilding that is founded on a constant and systematic assessment of consumer preferences and market opportunities. The key principles of KBnxt include the following:

gaining a detailed understanding of consumer location and home design and interior/exterior design option preferences through regular surveys and research. In this report and elsewhere, we refer to our home designs and design options as our “products;”

managing our working capital and reducing our operating risks by primarily acquiring primarily developed and entitled land at reasonable prices in identified preferred markets with perceived high growth potentialand submarkets that meet our investment return standards and market positioning (or “marketing”) standards ;strategy;

using our knowledge of consumer preferences to design, offer, construct and deliver products that meet the needs and interests of the largest demographic of homebuyers desire;in our served markets. Historically, this demographic has been comprised of first-time and move-up homebuyers;

in general, commencing construction of a home only after we have a signed purchase contract has been signedwith a buyer and have obtained preliminary credit approval has been received;or other evidence of the buyer’s financial ability to purchase the home;

building a backlog of net orders to maintain an even flow production of homes, and minimizing the cycle time from initialthe start of construction to the delivery of homes to customers;

establishing an even flow of production of high-quality homes at the lowest possible cost;buyers; and

offering customers a distinctive homebuying experience designed to offer the best combination of value and choice through affordable basesales prices andplus the opportunity to customize their homes through choice ofas they desire by selecting a lot location within a community, elevationvarious house elevations and floor plans, and choices fornumerous interior and exterior design options and upgrades available at our KB Home Studios.design studios. As part of this process, in-house teams of sales representatives, design consultants and other personnel work with each buyer to create a home that meets the buyer’s needs and budget.

While weWe consider KBnxt to be integral to our success in the homebuilding industry,industry. However, there have been instancesmay be market-driven circumstances where market conditions have madewe believe it is necessary in our view,or appropriate to temporarily deviate from certain of itsKBnxt principles. For example, at times we have been unable to maintain an even flow production of homes in a particular area because of slow sales activity. Also, in specific targeted communities with strong demand, we have startedThese deviations may include starting construction on a small number of homes in a community before a corresponding purchase contract wascontracts are signed with buyers to more quickly meet thecustomer delivery expectations of homebuyers and generate revenues. Theserevenues; or acquiring undeveloped or unentitled land that otherwise fits within our marketing strategy and meets our investment return standards. In addition, other market-driven circumstances maycould arise in the future andthat may lead us to make specific short-term shifts from the principles of KBnxt.our KBnxt principles.

Strategic and Operational ObjectivesFocus. Guided by our KBnxt principles, we have since 2012 implemented an aggressive land acquisition and development investment strategy targeted at positioning more of our main areascommunities in attractive, land-constrained locations featuring higher-income homebuyers. We have also refined our product offerings to meet these buyers’ preferences both for larger homes with the option for more lot and product premiums and the choice of operational focus are as follows:

Asset Positioning. We seekdesign options and upgrades to maintain a long-term growth platforminclude with the construction of new home communities throughtheir homes. Over the last three years, we have invested approximately $3.57 billion in land and land development investments that enable us to own or control a forecasted three-to-five year supplyand substantially expanded our operating platform and community count. To further accelerate our growth, we have prioritized enhancing the profitability of developed or developable land in preferred locationseach home delivered and generating higher revenues, as well as improving our asset efficiency and return on invested capital. Through this integrated strategic framework and its corresponding initiatives, we have produced significant improvement in our served markets.financial results and have been profitable for each of the last three fiscal years. We manage this growth platform through an ongoing allocation of resources to capitalize on identified opportunities, which may involve withdrawing and reallocating resources from underperforming markets. We also will expand and contract our geographic footprint and corresponding resource commitments over time in line with housing market conditions, particularly prevailing and expected levels of home sales activity.

Product Sales and Customer Satisfaction. We aim to generate sales volume and high levels of customer satisfaction by providing the best combination of value, quality and choice in homes and design options along with attentive service to our core customers — first-time, move-up and active adult homebuyers. In addition to our focus on operating from new home communities in attractive locations, we believe we stand out from other homebuilders and resale homes throughcan sustain our distinct Builtprogress in 2016 by continuing to Order™ approachadvance our top strategic priorities, which are discussed further in this report, subject to homebuying and our longstanding commitment to sustainability. With Built to Order, we offer customers affordable base pricesconditions in the overall economy and the opportunity to significantly customize the floor planshousing, capital, credit and design options for their new homes. With our homes, we also offer several standard features and options that are among the most energy- and water-efficient commercially available. These features and options provide increased value to our homebuyers by helping to lower the relative cost of homeownership over time.financial markets.

Organizational and Production Efficiency. We strive to enhance our performance by aligning our management resources, personnel levels and overhead costs with our growth platform, sales activity expectations and business needs, and by streamlining and constantly improving, to the extent possible, our home construction process. In addition to even flow

production scheduling, our home construction process includes developing and refining a set of value-engineered home designs in ways that allow us to meet the needs of consumers in a variety of different markets, shorten cycle times and lower direct construction costs. It also includes taking advantage of economies of scale in contracting for building materials and skilled trade labor.

Near-Term Strategic Goals. As 2012 unfolded, the overall housing market showed increasing signs that it had stabilized and was recovering from the severe and widespread downturn that began in mid-2006, and some stronger housing markets experienced sustained positive momentum in sales activity and selling prices. Optimistic that the housing recovery could be at the beginning of a new upward business cycle for homebuilding, but mindful of the several challenges facing housing markets, we continued to execute on the following three primary integrated strategic goals that have been our focus during the past few years of the housing downturn:

achieving and maintaining profitability at the scale of prevailing market conditions, our highest priority in 2012;

generating cash and strengthening our balance sheet; and

positioning our business to capitalize on future growth opportunities.

In pursuing these goals, we have broadly transformed and refocused the scope, scale and position of our business both geographically and operationally, compared to the peak pre-housing downturn years of the prior decade, to adapt to changing housing market dynamics and volatile home sales activity. Several housing markets experienced challenging conditions during the housing downturn, which was deepened and extended by the negative impacts of the 2007-2009 economic recession and subsequent slow recovery, including high unemployment; sluggish economic growth; weak consumer confidence; elevated residential consumer mortgage loan delinquencies, defaults and foreclosures; turbulent financial and credit markets and tight mortgage lending standards and practices. These factors, to varying degrees, still affect housing markets. Given the difficult homebuilding environment, we, among other things, shifted resources from underperforming areas to markets offering perceived higher growth prospects, particularly land-constrained locations in coastal areas of California and in Texas, to maintain a solid growth platform; implemented measures to generate and conserve cash through reduced spending and asset sales, strengthen our balance sheet, improve our operating efficiencies and lower our overhead costs; and redesigned and re-engineered our products.

While these efforts to refocus our operations contributed to reduced inventory levels, lower community counts, and declines in our backlog, deliveries and revenues, and we posted operating losses, we believe they have strengthened our overall business relative to where we stood at the outset of the housing downturn and have positioned us to operate profitably to the extent there is continued progress in the present housing recovery. We generated net income in the second half of 2012 and our full-year deliveries and revenues were each higher than in 2011. In addition, our backlog at November 30, 2012, in terms of both homes and potential future housing revenues, was significantly higher than our backlog at November 30, 2011. We expect our community count to increase in 2013 largely as a result of a land acquisition initiative we began in late 2009 and accelerated in 2012, and the investments in land and land development we plan to make in 2013. We use the term “community count” to refer to the number of new home communities we have open for sales in a given period, and for this report our community count reflects as of a given period or date the number of our new home communities with at least one home left to sell.

Encouraged by the results of our efforts to reposition the company during the housing downturn and the steadily emerging indications during 2012 that the housing market is now past stabilization and into recovery, in the latter part of 2012, we expanded our primary integrated strategic goals to target both profitability and growing our business and, among other things, implemented the following initiatives:

Building on our focused geographic and operational positioning strategy of the past few years by aggressively investing in land and land development, subject to our investment return and marketing standards, in higher-performing, choice locations that feature higher household incomes within our core homebuyer demographic. These consumers are more likely to choose larger home sizes and purchase more design options, key drivers for our home selling prices and housing gross profit margins. This investment orientation, which we began in late 2009, yielded improved results in 2012, contributing to our higher revenues and average selling prices. During 2012, we invested approximately $565 million in land and land development.

Optimizing our assets by increasing revenues per new home community open for sales through an intense focus on sales performance and continued improvement in our product offerings, including our energy- and water-efficient product offerings, to meet higher-income consumers’ demand for larger home sizes and more design options. We consider a community that has one or more homes left to sell at the end of a quarter to be a “new home community open for sales.”

Broadening our performing asset base by activating certain inventory in stabilizing markets that was previously held for future development. In 2012, we identified 21 communities for activation, primarily in Florida and Arizona, representing

more than 1,000 lots. We expect to generate deliveries and to realize the associated revenues from these activated assets in 2013.

Bringing additional resources to targeted markets where we operate to further strengthen our local field management teams and talent where appropriate, while leveraging our existing infrastructure and carefully managing overhead costs, to help ensure the effective and efficient execution of our strategic initiatives. In 2012, we expanded our management teams in Northern California, Southern California and Central Texas to provide heightened attention to key submarkets within those regions.

In 2013, we intend to continue and may expand on our strategic growth initiatives, subject to conditions in the housing markets, the overall economy and the capital, credit and financial markets.

Promotional Marketing Strategy. Our promotional marketing efforts are centered on differentiating the KB Home brand in the minds of our core homebuyer demographic from resale homes and from new homes sold by other homebuilders. These efforts increasingly involve using interactive Internet-based applications, social media channels and resourcesoutlets and other evolving communication technologies. We believe that our Built to Order message and approach generate a high perceived value for our products and our company among consumers and are unique among large-production homebuilders. In marketing our Built to Order approach, we emphasize how we partner with our homebuyers to create a home built to their individual preferences in design, layout, square footage and lot location, and give them the ability to significantly customize their home with design options that suit their needs and interests. In essence, Built to Order serves as the consumer face of core elements of our KBnxt operational business model and is designed to ensure that our promotional marketing strategy and advertising campaigns are closely aligned with our overall operational focus. For greater consistency with our promotional marketing messages and in the execution of our Built to Order approach, the selling of our homes is carried out by in-house teams of sales representatives and other personnel who work personally with each homebuyer to create a home that meets the homebuyer’s preferences and budget.

Our KB Home Studiosdesign studios are a key component of the Built to Orderour distinct homebuying experience we offer to our homebuyers and help increase the revenues we generate from home sales. These showrooms, which are generally centrally located close towithin our new home communities open for sales,served markets and utilize electronic displays and virtual design tools, allow our homebuyers to selectcustomize their home by selecting from a wide variety of design options and upgrades that are available at no cost or for purchase as part of the original construction of their homes.home. The coordinated efforts of our sales representatives and KB Home Studiodesign studio consultants are intended to generate higher customer satisfaction and lead to enhanced customer retention and referrals.

SustainabilityCustomer Service. . We have made a dedicated effort to further differentiate ourselves from other homebuilders and resale homes through our ongoing commitment to become a leading national company in environmental sustainability. Under this commitment, we:

refined our products to reduce the amount of building materials needed to construct them, and have taken steps to reduce construction waste;

build all of our new homes to U.S. Environmental Protection Agency’s (“EPA”) ENERGY STAR® standards;

build an increasing percentage of our homes to meet the U.S. EPA’s Watersense® specifications for water use efficiency;

build our homes with Watersense labeled fixtures;

developed an Energy Performance Guide®, or EPG®, that informs our homebuyers of the relative energy efficiency (and related estimated monthly energy costs and potential energy cost savings) of each of our homes as designed compared to typical new and existing homes; and

introduced net-zero energy design options, in a program called ZeroHouse 2.0™, in select markets.

This commitment and the related initiatives we have implemented stem in part from growing sensitivities and regulatory attention to the potential impact that the construction and use of homes can have on the environment, and from our homebuyers’ interest in reducing this impact and in lowering their consumption of energy and water resources and their utility bills. More information about our sustainability commitment can be found in our annual sustainability reports, which we have published on our website since 2008. To date, we are the only national homebuilder to publish a comprehensive annual sustainability report. As we see environmental issues related to housing becoming increasingly important to consumers and government authorities at all levels, we intend to continue to research, evaluate and utilize new or improved products and construction and business practices consistent with our commitment. In addition to making good business sense, we believe our sustainability initiatives can help put us in a better position, compared to resales and homebuilders with less-developed programs, to comply with evolving local, state and federal rules and regulations intended to protect natural resources and to address climate change and similar environmental concerns.

Customer Service and Quality Control

Customer satisfaction is a high priority for us. Our goal is for our customers to be 100% satisfied with their new homes. Our on-site construction supervisors perform regular pre-closing quality checks and our sales representatives maintain regular contact with our homebuyers during the home construction process in an effort to ensure our homes meet our standards and our homebuyers’ expectations. We believe our prompt and courteous responses to homebuyers’ needs throughout the homebuying process help reduce post-closing repair costs, enhance our reputation for quality and service, and help encourage repeat and referral business from homebuyers and the real estate community. We also have employees who are responsible for responding to homebuyers’ post-closing needs, including warranty claims.

We provide a Information about our limited warranty on allprogram is provided in Note 15. Commitments and Contingencies in the Notes to Consolidated Financial Statements in this report.

Operational Structure. We operate our homebuilding business through divisions with experienced management teams who have in-depth local knowledge of our homes. The specific termstheir particular served markets, which helps us acquire land in preferred locations; develop communities with products that meet local demand; and conditions vary depending on the market where we do business. We generally provide a structural warranty of 10 years, a warranty on electrical, heating, cooling, plumbingunderstand local regulatory environments. Our division management teams exercise considerable autonomy in identifying land acquisition opportunities; developing land and other building systems each varying from two to five years based on geographic marketcommunities; implementing product, marketing and state law,sales strategies; and a warranty of one year for other components of a home.

Local Expertise

controlling costs. To maximize KBnxt’s effectiveness and help ensure itsmaintain consistent execution within our organization, our division management teams and other employees are continuously trained on KBnxt principles and are evaluated, in part, based on their achievement of relevant operational objectives. We also believe that our business requires in-depth knowledge of local markets in order to acquire land in preferred locations

Our corporate management and on favorable terms, to engage subcontractors, tosupport personnel develop communities that meet local demand, to anticipate consumer tastes in specific markets, and to assess local regulatory environments. Accordingly, we operate our business through divisions with trained personnel who have local market expertise. We have experienced management teams in eachoversee the implementation of our divisions. Though we centralize certainoverall operational policies and internal control standards, and perform various centralized functions, (such as promotional marketing, legal, purchasing administration, product development, architectureincluding treasury and accounting) to benefit from economies of scale, our local management exercises considerable autonomy in identifyingcash management; land acquisition opportunities, developingapproval; accounting and implementing productfinancial reporting; internal audit and sales strategies,compliance activities; and controlling costs.investor and media relations.

Community Development and Land Inventory Management

Developable land for the production of homes is a core resource for our business. Based on our current strategic plans, we seek to own or control land sufficient to meet our forecasted production goals for the next three to five years. In 2016, we intend to continue to selectively acquire or control additional land that meets our investment return and marketing standards. However, we may decide to sell certain land interests as part of our capital allocation and marketing strategy, or to monetize land previously held for future development, or for other reasons.

Our community development process generally consists of four phases: land acquisition, land development into finished lots for a community (if necessary), home construction and deliveries.delivery of completed homes to buyers. Historically, our community development process has ranged from six to 24 months in our West Coast homebuilding reporting segment, with a somewhat shorter duration in our other homebuilding reporting segments. TheOur community development process varies based on, among other things, the extent and speed of required government approvals required,and utility service activations, the overall size of a particular community, the scope of necessary site preparation activities, the type of product(s) that will be offered, weather conditions, time of year, promotional marketing results, the availability of construction resources, consumer demand, and local and general economic and housing market conditions.conditions, and other factors.

Although they vary significantly in size and complexity, our communities typically consist of 5030 to 250 lots ranging in size from 2,2001,900 to 13,00011,500 square feet. In our communities, we typically offer from three to 15 home design choices. We also generally build one to three model homes at each community so that prospective buyers can preview various products available. Depending on the community, we may offer premium lots containing more square footage, better views and/or location benefits.

The following table summarizes our community count in each Some of our homebuilding reporting segments:

|

| | | | | | | | | | | | | | | |

| As of November 30, | | West Coast | | Southwest | | Central | | Southeast | | Total |

| 2012 | | 46 |

| | 17 |

| | 91 |

| | 37 |

| | 191 |

|

| 2011 | | 72 |

| | 25 |

| | 93 |

| | 44 |

| | 234 |

|

Land Acquisition and Land Development. We continuously evaluate land acquisition opportunities as they arise against our investment return and marketing standards, balancing competing needs for financial strength, liquidity and land inventory for future growth. When we acquire land, we generally focus on land parcels containing fewer than 250with lots that are fully entitled for residential construction and are either physically developed to start home construction (referred to as “finished lots”) or partially finished. Acquiring finished or partially finished lots enables us to construct and deliver homes with minimal additional development work or expenditures. We believe this is a more efficient way to use our working capital and reduces the operating risks associated with having to develop and/or entitle land, such as unforeseen improvement costs and/or changes in market conditions. However, depending on market conditions and available opportunities, including opportunities to secure certain finished lots, we may acquire undeveloped and/or unentitled land. We may also invest in land that requires us to repurpose and re-entitle the property for residential use, such as in-fill developments. We expect that the overall balance of undeveloped, unentitled, entitled, partially finished and finished lots in our inventory will vary over time, and in

implementing our strategic growth initiatives, we may acquire a greater proportion of undeveloped or unentitled land in the future.

Consistentreasonably-priced land with our KBnxt operational business model, wefinished or partially finished lots diminishes.

We target geographic areas for potential land acquisitions and community development based on the results of periodic surveys of both new and resale homebuyers in particular markets, prevailing local economic conditions, the supply and type of homes available for sale, and other research activities. Local, in-house land acquisition specialists analyze specific geographic areas to identify desirable land acquisition targets or to evaluate whether to dispose of an existing land interest. We also use studies performed by third-party specialists. Using this internal and external data, some of the factors we consider in evaluating land acquisition targets are consumer preferences; general economic conditions; prevailing and expected home sales activity and the selling prices and pricing trends of comparable new and resale homes in the subject submarket; proximity to metropolitan areas and employment centers; population, household formation and employment and commercial growth patterns; household income levels; availability of developable land parcels at reasonable cost, including estimated costs of completing land development and selling homes; our operational scale and experience in the subject submarket; and environmental compliance matters.

We generally structure our land acquisitionsacquisition and land development activities to minimize, or to defer the timing of, expenditures which enhances our returnsin order to reduce both the market risks associated with land-related investments. While we use a variety of techniques to accomplish this, weholding land and our working capital and financial commitments, including interest and other carrying costs. We typically use contracts that in exchange for a small initial option or earnest money deposit payment give us an option or similar right to acquire land at a future date, usually at a predeterminedpre-determined price and for a small initial option pending our satisfaction with the feasibility of developing and selling homes on the land and/or earnest money deposit payment. These contracts may also permit us to partially develop thean underlying land prior to our acquisition.seller’s completion of certain obligations, such as securing entitlements, developing infrastructure or finishing lots. We refer to land subject to such option or similar contractual rights as being “controlled.” Our decision to exercise a particular land option or similar right is based on the results of our due diligence and continued market viability analysis we conduct after entering into such a contract. In some cases,Information related to our decision to exercise a land option or similar right may be conditioned on the land seller obtaining necessary entitlements, such as zoning rights and environmental and development approvals, and/or physically developing the underlying land by a pre-determined date.

In addition, we may acquire land under contracts that condition our acquisition obligation on our satisfaction with the feasibility of developing the subject land and selling homes on the land by a certain future date, consistent with our investment return and marketing standards. Our land option contracts and other similar contracts may also allow us to phase our land acquisitions and/or land development over a period of time and/or upon the satisfaction of certain conditions. We may also acquire land with seller financing that is non-recourse to us, or by workingprovided in conjunction with third-party land developers. The use of these land option contractsNote 7. Inventory Impairments and other similar contracts generally allows us to reduce the market risks associated with direct land ownership and development, and to reduce our capital and financial commitments, including interest and other carrying costs.

Our land option contracts and other similar contracts generally do not contain provisions requiring our specific performance. However, depending on the circumstances, our initial option or earnest money deposit may or may not be refundable to us if we abandon the related land option contract or other similar contract and do not complete the acquisition of the underlying land. In addition, if we abandon a land option contract or other similar contract, we usually cannot recover the pre-acquisition costs we incurred after we entered into the contract, including those related to our due diligence and other evaluation activities and/or partial development of the subject land, if any.

Before we commit to any land acquisition, our senior corporate and regional management evaluate the asset based on the results of our local specialists’ due diligence, third-party data and a set of defined financial measures, including, but not limited to, housing gross profit margin analyses and specific discounted, after-tax cash flow internal rate of return requirements. The criteria guiding our land acquisition and disposition decisions have resulted in our maintaining inventory in areas that we believe generally offer better returns for lower risk and lower our upfront investment in inventory.

Our inventories include land we are holding for future development, which is comprised of land where we have suspended development activity or development has not yet begun but is expected to occurLand Option Contract Abandonments in the future. These assets held for future development are locatedNotes to Consolidated Financial Statements in various submarkets where conditions do not presently support further investment or development, or are subject to a building permit moratorium or regulatory restrictions, or are portions of larger land parcels that we plan to build out over several years and/or parcels that have not yet been entitled and, therefore, have an extended development timeline. Land we are holding for future development also includes land where we have deferred development activity based on our belief that we can generate greater returns and/or maximize the economic performance of a community by delaying improvements for a period of time to allow earlier phases of a long-term, multi-phase community or a neighboring community to generate sales momentum or for market conditions to improve.this report.

The following table presents the number of inventory lots we owned, in various stages of development, or controlled under land option contracts andor other similar contracts in ourby homebuilding reporting segmentssegment as of November 30, 20122015 and 2011. The table does not include approximately 326 acres owned as of November 30, 2012 and November 30, 2011 that are not currently expected to be approved for subdivision into lots.2014:

| | | | Homes Under Construction and Land Under Development | | Land Held for Future Development | | Land Under Option | | Total Land Owned or Under Option | Homes Under Construction and Land Under Development | | Land Held for Future Development | | Land Under Option | | Total Land Owned or Under Option |

| | 2012 | | 2011 | | 2012 | | 2011 | | 2012 | | 2011 | | 2012 | | 2011 | 2015 | | 2014 | | 2015 | | 2014 | | 2015 | | 2014 | | 2015 | | 2014 |

| West Coast | 2,899 |

| | 3,424 |

| | 3,936 |

| | 4,102 |

| | 3,613 |

| | 1,491 |

| | 10,448 |

| | 9,017 |

| 4,526 |

| | 5,467 |

| | 2,768 |

| | 3,157 |

| | 4,126 |

| | 4,210 |

| | 11,420 |

| | 12,834 |

|

| Southwest | 1,275 |

| | 1,013 |

| | 7,743 |

| | 8,219 |

| | 534 |

| | 33 |

| | 9,552 |

| | 9,265 |

| 6,349 |

| | 6,985 |

| | 1,871 |

| | 2,255 |

| | 761 |

| | 317 |

| | 8,981 |

| | 9,557 |

|

| Central | 7,859 |

| | 7,681 |

| | 2,055 |

| | 1,837 |

| | 4,612 |

| | 3,215 |

| | 14,526 |

| | 12,733 |

| 13,793 |

| | 13,692 |

| | 1,254 |

| | 1,339 |

| | 2,700 |

| | 4,098 |

| | 17,747 |

| | 19,129 |

|

| Southeast | 1,922 |

| | 1,123 |

| | 4,934 |

| | 5,567 |

| | 3,370 |

| | 2,465 |

| | 10,226 |

| | 9,155 |

| 3,999 |

| | 4,618 |

| | 3,500 |

| | 3,879 |

| | 1,752 |

| | 2,181 |

| | 9,251 |

| | 10,678 |

|

| Total | 13,955 |

| | 13,241 |

| | 18,668 |

| | 19,725 |

| | 12,129 |

| | 7,204 |

| | 44,752 |

| | 40,170 |

| 28,667 |

| | 30,762 |

| | 9,393 |

| | 10,630 |

| | 9,339 |

| | 10,806 |

| | 47,399 |

| | 52,198 |

|

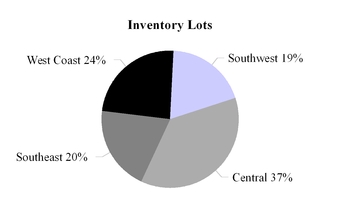

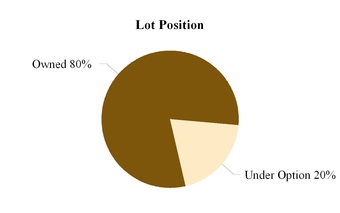

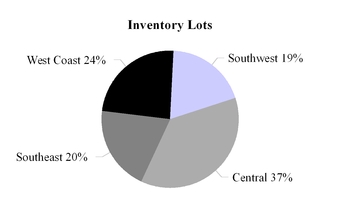

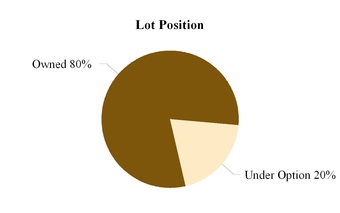

Reflecting our geographic diversity and relatively balanced operational footprint, asThe following charts present the percentage ofNovember 30, 2012, 23% of the inventory lots we owned or controlled were located in our West Coast homebuilding reporting segment, 21% were in our Southwest homebuilding reporting segment, 33% were in our Centralunder land option contracts or other similar contracts by homebuilding reporting segment and 23% were in our Southeast homebuilding reporting segment.

The following table presents the carrying valuepercentage of inventorytotal lots we owned in various stages of development, orand controlled under land option contracts and other similar contracts in our homebuilding reporting segments as of November 30, 2012 and 2011 (in thousands):2015:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Homes Under Construction and Land Under Development | | Land Held for Future Development | | Land Under Option | | Total Land Owned or Under Option |

| | 2012 | | 2011 | | 2012 | | 2011 | | 2012 | | 2011 | | 2012 | | 2011 |

| West Coast | $ | 471,650 |

| | $ | 508,731 |

| | $ | 337,229 |

| | $ | 344,702 |

| | $ | 33,718 |

| | $ | 62,370 |

| | $ | 842,597 |

| | $ | 915,803 |

|

| Southwest | 63,456 |

| | 66,770 |

| | 156,159 |

| | 163,413 |

| | 1,830 |

| | 307 |

| | 221,445 |

| | 230,490 |

|

| Central | 292,475 |

| | 265,946 |

| | 21,806 |

| | 23,086 |

| | 5,443 |

| | 2,834 |

| | 319,724 |

| | 291,866 |

|

| Southeast | 154,992 |

| | 87,144 |

| | 153,661 |

| | 195,542 |

| | 14,152 |

| | 10,784 |

| | 322,805 |

| | 293,470 |

|

| Total | $ | 982,573 |

| | $ | 928,591 |

| | $ | 668,855 |

| | $ | 726,743 |

| | $ | 55,143 |

| | $ | 76,295 |

| | $ | 1,706,571 |

| | $ | 1,731,629 |

|

Home Construction and Deliveries. Following the acquisition of land and, if necessary, the development of the land into finished lots, we typically begin constructing model homes and marketing homes for sale. The time required forWe have developed and refined a standardized set of value-engineered home designs to enhance our construction of our homes depends on the weather, time of year, availability of local trade labor and building materials and other factors.efficiency. To minimize the costs and risks of unsold homes in production, we generally begin construction of a home only whenafter we have a signed purchase contract with a homebuyer.buyer and we have obtained preliminary credit approval or other evidence of the buyer’s financial ability to purchase the home. However, cancellations of home purchase contracts prior to the delivery of the underlying homes, the construction of attached products with some unsold units, or specific strategic considerations will result in our having unsold completed or partially-completed homes in production.our inventory.

We act as the general contractor for the majority of our communities, and hire experiencedengage outside general contractors in all other instances. We, or the outside general contractors we engage, contract with a variety of independent subcontractors, who are typically locally-based, to supply the trade laborperform all land development and to procurehome construction work through their own employees or subcontractors. We do not self-perform any land development or home construction work. These independent subcontractors also supply some of the building materials required for allsuch production activities. Our contracts with ourthese independent subcontractors require that they comply with all laws applicable to their work, including laborwage and safety laws, meet performance standards, and follow local building codes and permits.

Raw Materials. Outside of land, the principal raw materials used in our production process are concrete and forest products. Other primary materials used in home construction include drywall and plumbing and electrical items. We source all of our building materials from third parties. We attempt to enhance the efficiency of our operations by using, where practical, standardized materials that are commercially available on competitive terms from a variety of outside sources. In addition, we have established national and regional purchasing programs for certain building materials, appliances, fixtures and other items that allow us to take advantage of economies of scale and garner better pricing and more reliable supplybenefit from large-quantity purchase discounts and, where available, participate in manufacturers’outside manufacturer or suppliers’supplier rebate programs. At all stagesWhen possible, we arrange for bulk purchases of production,these products at favorable prices from such manufacturers and suppliers. Although our administrativepurchasing strategies have helped us in negotiating favorable prices for raw materials, in recent years we have encountered higher prices for lumber, drywall and on-site supervisory personnel coordinate the activities of subcontractors to meet our production schedules and quality standards.concrete.

Backlog

We sell our homes under standard purchase contracts, which generally require a homebuyer to pay a deposit at the time of signing. The amount of the deposit required varies among markets and communities. Homebuyers also may be required to pay additional deposits when they select design options for their homes. Most of our home purchase contracts stipulate that if a homebuyer cancels a contract with us, we have the right to retain the homebuyer’s deposits. However, we generally permit our homebuyers to cancel their obligations and obtain refunds of all or a portion of their deposits in the event mortgage financing cannot be obtained within a certain period of time, as specified in their contract. We define our cancellation rate in a given period as the total number of contracts for new homes canceled divided by the total new (gross) orders for homes during the same period. For further discussion of our cancellation rates and the factors affecting our cancellation rates, see below under “Item 1A. Risk Factors” and “Part II — Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Our “backlog” consists of homes that are under a home purchase contract but have not yet been delivered to a homebuyer.buyer. Ending backlog represents the number of homes in backlog from the previous period plus the number of net orders (new orders for homes less cancellations) generated during the current period minus the number of homes delivered during the current period. Our backlog at any given time will be affected by cancellations, homes delivered and by our community count. Our cancellation rates and the factors affecting our cancellation rates are further discussed below in both the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections in this report. The number of homes deliveredwe deliver has historically increased from the first to the fourth quarter in any year.

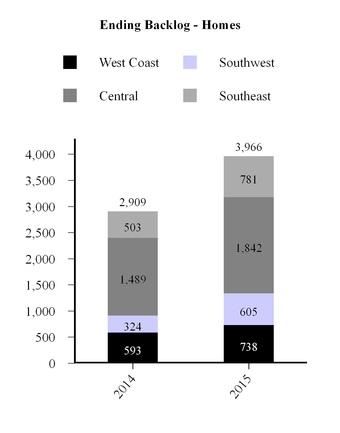

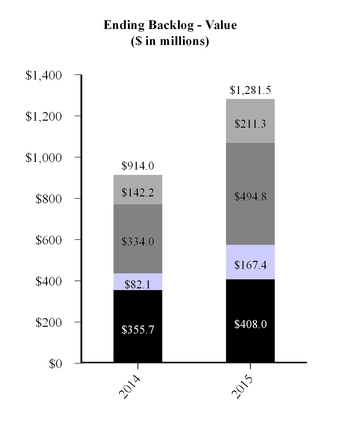

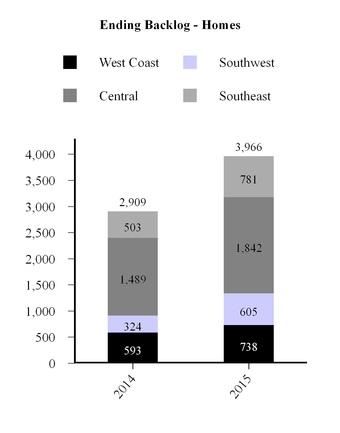

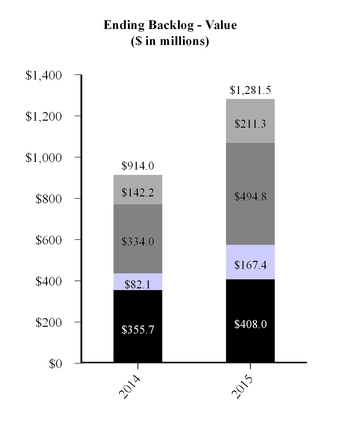

Our backlog at November 30, 2012 consisted Substantially all of 2,577 homes, an increase of 20% from the 2,156our homes in backlog at November 30, 2011. 2015 are expected to be delivered during the year ended November 30, 2016.

Our backlog at November 30, 20122015 increased 36% to 3,966 homes from 2,909 homes at November 30, 2014, largely due to a year-over-year increase in our net orders in 2015. Our backlog at November 30, 2015 represented potential future housing revenues of approximately $618.6 million,$1.28 billion, a 35%40% increase from potential future housing revenues of approximately $459.0$914.0 million at November 30, 2011, resulting from2014, reflecting the higherlarger number of homes in our backlog and a higher overall average selling price. Our backlog ratio, defined as homes delivered in the quarter as a percentageprice of backlog at the beginning of the quarter, will vary from quarter to quarter, depending on what portion of our backlog is under construction, and how many unsold homes we may sell and close within a quarter.those homes.

Our net orders for the year ended November 30, 2012 increased to 6,703 from 6,632 for the year ended November 30, 2011, representing the second consecutive year that full-year net orders have increased from the previous year. The value of the net orders we generated for the year ended November 30, 2012 increased 15% to $1.73 billion from $1.51 billion in the prior year. Our cancellation rate for the year was 31% in 2012, compared to a cancellation rate of 29% in 2011. Our cancellation rate was 35% in the fourth quarter of 2012, compared to 34% in the fourth quarter of 2011.6

The following tablescharts present our ending backlog (number of homes delivered, net orders and cancellation ratesvalue) by homebuilding reporting segment for each quarter during the years ended as of November 30, 20122014 and 20112015, and our ending backlog at the end of each quarter within those years::

|

| | | | | | | | | | | | | | | | | | | |

| | West Coast | | Southwest | | Central | | Southeast | | Total |

| Homes delivered | | | | | | | | | |

| 2012 | | | | | | | | | |

| First | 309 |

| | 170 |

| | 487 |

| | 184 |

| | 1,150 |

|

| Second | 330 |

| | 157 |

| | 536 |

| | 267 |

| | 1,290 |

|

| Third | 541 |

| | 186 |

| | 700 |

| | 293 |

| | 1,720 |

|

| Fourth | 765 |

| | 170 |

| | 843 |

| | 344 |

| | 2,122 |

|

| Total | 1,945 |

| | 683 |

| | 2,566 |

| | 1,088 |

| | 6,282 |

|

| 2011 | | | | | | | | | |

| First | 224 |

| | 158 |

| | 363 |

| | 204 |

| | 949 |

|

| Second | 353 |

| | 183 |

| | 475 |

| | 254 |

| | 1,265 |

|

| Third | 524 |

| | 232 |

| | 611 |

| | 236 |

| | 1,603 |

|

| Fourth | 656 |

| | 270 |

| | 706 |

| | 363 |

| | 1,995 |

|

| Total | 1,757 |

| | 843 |

| | 2,155 |

| | 1,057 |

| | 5,812 |

|

| Net orders | | | | | | | | | |

| 2012 | | | | | | | | | |

| First | 289 |

| | 140 |

| | 547 |

| | 221 |

| | 1,197 |

|

| Second | 600 |

| | 229 |

| | 900 |

| | 320 |

| | 2,049 |

|

| Third | 658 |

| | 154 |

| | 765 |

| | 323 |

| | 1,900 |

|

| Fourth | 619 |

| | 140 |

| | 485 |

| | 313 |

| | 1,557 |

|

| Total | 2,166 |

| | 663 |

| | 2,697 |

| | 1,177 |

| | 6,703 |

|

| 2011 | | | | | | | | | |

| First | 404 |

| | 206 |

| | 448 |

| | 244 |

| | 1,302 |

|

| Second | 542 |

| | 270 |

| | 838 |

| | 348 |

| | 1,998 |

|

| Third | 581 |

| | 259 |

| | 677 |

| | 321 |

| | 1,838 |

|

| Fourth | 490 |

| | 172 |

| | 517 |

| | 315 |

| | 1,494 |

|

| Total | 2,017 |

| | 907 |

| | 2,480 |

| | 1,228 |

| | 6,632 |

|

| | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | |

| | West Coast | | Southwest | | Central | | Southeast | | Total |

| Cancellation rates | | | | | | | | | |

| 2012 | | | | | | | | | |

| First | 34 | % | | 24 | % | | 39 | % | | 37 | % | | 36 | % |

| Second | 24 |

| | 17 |

| | 28 |

| | 28 |

| | 26 |

|

| Third | 23 |

| | 16 |

| | 35 |

| | 27 |

| | 29 |

|

| Fourth | 25 |

| | 21 |

| | 47 |

| | 31 |

| | 35 |

|

| Total | 26 | % | | 19 | % | | 37 | % | | 30 | % | | 31 | % |

| 2011 | | | | | | | | | |

| First | 15 | % | | 18 | % | | 39 | % | | 33 | % | | 29 | % |

| Second | 22 |

| | 18 |

| | 29 |

| | 24 |

| | 25 |

|

| Third | 27 |

| | 20 |

| | 34 |

| | 30 |

| | 29 |

|

| Fourth | 28 |

| | 27 |

| | 41 |

| | 33 |

| | 34 |

|

| Total | 24 | % | | 21 | % | | 35 | % | | 30 | % | | 29 | % |

| Ending backlog — homes | | | | | | | | |

| 2012 | | | | | | | | | |

| First | 443 |

| | 173 |

| | 1,078 |

| | 509 |

| | 2,203 |

|

| Second | 713 |

| | 245 |

| | 1,442 |

| | 562 |

| | 2,962 |

|

| Third | 830 |

| | 213 |

| | 1,507 |

| | 592 |

| | 3,142 |

|

| Fourth | 684 |

| | 183 |

| | 1,149 |

| | 561 |

| | 2,577 |

|

| 2011 | | | | | | | | | |

| First | 383 |

| | 187 |

| | 778 |

| | 341 |

| | 1,689 |

|

| Second | 572 |

| | 274 |

| | 1,141 |

| | 435 |

| | 2,422 |

|

| Third | 629 |

| | 301 |

| | 1,207 |

| | 520 |

| | 2,657 |

|

| Fourth | 463 |

| | 203 |

| | 1,018 |

| | 472 |

| | 2,156 |

|

| Ending backlog — value, in thousands | | | | | | |

| 2012 | | | | | | | | | |

| First | $ | 150,638 |

| | $ | 32,139 |

| | $ | 177,998 |

| | $ | 99,176 |

| | $ | 459,951 |

|

| Second | 301,652 |

| | 43,518 |

| | 237,558 |

| | 110,680 |

| | 693,408 |

|

| Third | 327,528 |

| | 40,727 |

| | 251,900 |

| | 124,589 |

| | 744,744 |

|

| Fourth | 248,790 |

| | 40,206 |

| | 204,473 |

| | 125,157 |

| | 618,626 |

|

| 2011 | | | | | | | | | |

| First | $ | 126,258 |

| | $ | 27,970 |

| | $ | 132,164 |

| | $ | 67,242 |

| | $ | 353,634 |

|

| Second | 172,147 |

| | 43,572 |

| | 199,350 |

| | 86,475 |

| | 501,544 |

|

| Third | 211,360 |

| | 51,262 |

| | 199,503 |

| | 97,205 |

| | 559,330 |

|

| Fourth | 161,987 |

| | 37,071 |

| | 168,512 |

| | 91,380 |

| | 458,950 |

|

Land and Raw Materials

Based on our current strategic plans, we strive to own or control land sufficient to meet our forecasted production goals for the next three to five years. As discussed above under “Strategy,” in 2013 we intend to acquire additional land subject to conditions in the housing markets, the overall economy and the capital, credit and financial markets. However, we may also decide to sell certain land or land interests as part of our marketing strategy or for other reasons.

The principal raw materials used in the construction of our homes are concrete and forest products. In addition, we use a variety of other construction materials in the homebuilding process, including drywall and plumbing and electrical items. We attempt to enhance the efficiency of our operations by using, where practical, standardized materials that are commercially available on competitive terms from a variety of sources. In addition, our national and regional purchasing programs for certain building

materials, appliances, fixtures and other items allow us to benefit from large quantity purchase discounts and, where available, manufacturer or supplier rebates. When possible, we arrange for bulk purchases of these products at favorable prices from manufacturers and suppliers. Although our purchasing strategies have helped us in negotiating favorable prices for raw materials, in 2012, we encountered higher prices for lumber, drywall, concrete and other materials, and labor due to increased residential construction activity, and we expect to see additional cost increases if and as the present housing recovery progresses, as discussed further below under “Competition, Seasonality, Delivery Mix and Other Factors.”

Customer Financing

Our homebuyers may obtain mortgage financing to purchase our homes from any provider of their choice. We do not directly offer mortgage banking services or originate residential consumer mortgage loans (“mortgage loans”) for our customers. Prior to late June 2011, KBA Mortgage, LLC (“KBA Mortgage”), a former unconsolidated mortgage banking joint venture of a subsidiary of ours and a subsidiary of Bank of America, N.A., provided mortgage banking services to a significant proportion of our homebuyers. KBA Mortgage ceased offering mortgage banking services after June 30, 2011.

Since the third quarter of 2011, we have had a marketing services agreement with a preferred mortgage lender that offers mortgage banking services, including mortgage loan originations, to our homebuyers who elect to use the lender. The mortgage banking services are described further below under “Part II — Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Financial Services Segment.” Our preferred mortgage lender and its respective parent company are not affiliates of ours or any of our subsidiaries. We do not have any ownership, joint venture or other interests in or with our preferred mortgage lender or its respective parent company or with respect to the revenues or income that may be generated from our preferred mortgage lender providing mortgage banking services to, or originating mortgage loans for, our homebuyers. Until the first quarter of 2012, our preferred mortgage lender was MetLife Home Loans, a division of MetLife Bank, N.A., which announced in January 2012 that it was ceasing to offer forward mortgage banking services as part of its business. In March 2012, Nationstar Mortgage LLC (“Nationstar”) became our preferred mortgage lender. Nationstar began accepting new mortgage loan applications from our homebuyers on May 1, 2012.

Employees

We employ a trained staff of land acquisition specialists, architects, planners, engineers, construction supervisors, marketing and sales personnel, and finance and accounting personnel, supplemented as necessary by outside consultants, who guide the development of our communities from their conception through the promotional marketing and delivery of completed homes.

At both December 31, 20122015 and 2011,2014, we had approximately 1,2001,680 and 1,590 full-time employees.employees, respectively. None of our employees are represented by a collective bargaining agreement.

Competition, Seasonality, Delivery Mix and Other Factors

Competition.The homebuilding industry and housing market are highly competitive with respect to selling homes; hiring trade labor,contracting for construction services, such as carpenters, roofers, electricianscarpentry, roofing, electrical and plumbers;plumbing; and acquiring attractive developable land.land, though the intensity of competition can vary and fluctuate between and within individual markets and submarkets. We compete for homebuyers, skilled trade workers and management talentconstruction resources and desirable land against numerous homebuilders, ranging from regional and national firms to small local enterprises. As to homebuyers, we primarily compete with other homebuilders on the basis of selling price, community location and amenities, availability of financing options, home designs, reputation, home construction cycle time, and the design reputation, qualityoptions and amenities, includingupgrades that can be included in a home. In some cases, this competition occurs within larger residential development projects containing separate sections designed, planned and developed by such other homebuilders. In addition, weWe also compete for homebuyers against housing alternatives other thanto new homes, including resale homes, apartments, single-family rentals and other rental housing. In certain markets experiencing heavy construction activity, there can be severe craft and at times when housing demand is high, we also compete with other homebuilders and commercial and remodeling contractors to hire skilled trade labor, primarily on the basis of preexisting relationships, contract price and volume and consistency of available work. During the housing downturn, many skilled workers leftshortages that limit independent subcontractors’ ability to supply construction for other industries, andservices to us, which in markets where there was increased residentialturn tends to drive up our costs and/or extend our production schedules. Elevated construction activity in 2012, the smaller workforce and higher demand for trade labor created shortages of certain skilled workers, driving up costs and/or extending land development and home construction schedules. This elevated residential construction activityhas also caused notablecontributed to measurable increases in the cost of certain building materials, such as lumber, drywall and concrete, reflecting in part a smaller supplier base and lower production capacity than existed before the housing downturn. In 2012,concrete. Since 2013, we also sawhave seen higher prices for desirable land amid heightened competition with homebuilders and other developers and investors, particularly in the land-constrained areas we are strategically targeting. We expect these upward cost trends in construction labor, building materials and land costs to continue and possibly intensify, in 20132016 if and as the present housing recovery progressesmarket activity grows and there is greater competition for these resources.

Seasonality. Our performance is affected by seasonal demand trends for housing. Traditionally, there has been more consumer demand for home purchases and we tend to generate more net orders in the mid- to late-springspring and early summer months (corresponding to most of our second quarter and part of our third quarters)quarter) than at other times of the year. With our Built to Orderdistinct homebuying approach and typical

home construction cycle times, this “selling season” demand results in our delivering more homes and generating

higher revenues from late summer through the fall months (corresponding to part of our third quarter and all of our fourth quarters)quarter). On a relative basis, the winter and early spring months within our first quarter and part of our second quartersquarter usually produce the fewest net orders, homes delivered and revenues, and the sequential difference from our fourth quarter to our first quarter can be significant. During the housing downturn

Delivery Mix and in 2012, these seasonal trends were somewhat less pronounced, and our overall net orders, homes delivered and revenues were generally lower than before the housing downturn. We currently expect the traditional seasonality cycle and its impact on our results to become more prominent if and as the present housing recovery progresses and the housing markets and homebuilding industry return to a more normal operating environment.

Other Factors. In addition to the overall volume of homes we sell and deliver, our results in a given period are significantly affected by the geographic mix of markets and submarkets in which we operate; the number and characteristics of the new home communities we have open for sales in those markets and submarkets; and the products we sell from those communities during the period. While there are some similarities, there are differences within and between our served markets and submarkets in terms of the quantity, size and nature of the new home communities we operate and the products we offer to consumers. These differences reflect, among other things, local homebuyer preferences; household demographics (e.g.(e.g., large families or working professionals; income levels); and geographic context (e.g.(e.g., urban or suburban; availability of reasonably-pricedreasonably priced finished lots; development constraints; residential density),; and the shifts that can occur in these factors over time. These structural factors in each market and submarketof our served markets will affect the costs we incur and the time it takes to locate, acquire rights to and develop land, open new home communities for sales, and market and build homes; the size of our homes; our selling prices (including the contribution from homebuyers’ purchases of design options)options and upgrades); and the pace at which we sell and deliver homes and close out communities.communities; and our housing gross profits and housing gross profit margins. Therefore, our results in any given period will fluctuate compared to other periods based on the proportion of homes delivered from areas with higher or lower selling prices and on the corresponding land and overhead costs incurred to generate those deliveries, as well as from our overall community count. In 2012, we targeted opening more of our new home communities for sales in higher-performing, choice locations — predominately in land-constrained areas that feature higher household incomes — where customers are more likely to choose larger home sizes and purchase more design options, key drivers for our home selling prices and housing gross profit margins. Due in part to this strategic focus, in the second, third and fourth quarters of 2012, we posted favorable year-over-year results in revenues as we delivered more homes from these submarkets. At the same time, we had modest year-over-year growth in net orders in each period due largely to sequential declines in our overall community count, as we closed out older communities more quickly than we were able to develop and open new communities in our strategically-targeted areas. In 2013, we plan to continue our approach of opening new home communities for sales in locations with the above-described demand characteristics, and we anticipate that we will have more new home communities open for sales than we did in 2012.

Financing

We do not generally finance the development of our communities with project financing. By “project financing,” we mean proceeds of loans from parties other than land sellers that are specifically obtained for, or secured by, particular communities or other inventory assets. Instead, ourOur operations have historically been funded by resultsinternally generated cash flows, public equity and debt issuances, land option contracts and other similar contracts and land seller financing, and performance bonds and letters of operations, public debt and equity financing.credit. We also have the ability to borrow funds under our unsecured revolving credit facility with various banks (“Credit Facility”). Depending on market conditions in 2013,and available opportunities, we may obtain project financing, or secure external financing with community or other inventory assets that we own or control. By “project financing,” we mean loans that are specifically obtained for, or secured by, particular communities or other inventory assets. We may also arrange or engage in equity or debt capital markets, bank loan, credit facility, project debt or other financial transactions. These transactions may include repurchases from time to time of our outstanding senior notes or other debt through tender offers, exchange offers, private exchanges, open market purchases or other means, and may include potential new issuances of equity or senior notes or other debt through public offerings, private placements or other arrangements to raise new capital for land acquisition, land development and other business purposes and/or to effect repurchasesexpand the capacity of our outstanding senior notes or other debt. Our ability to engage in such financial transactions, however, may be constrained by economic or capital markets or bank lending conditions, investor interest and/the Credit Facility or our current leverage ratios, and we can provide no assurancecash-collateralized letter of the successcredit facilities with various financial institutions (the “LOC Facilities”) or costs of anyenter into additional such transactions.facilities.

Environmental Compliance Matters and Sustainability