| Location | Approximate Square Footage | Use | |||||||

| North America: | |||||||||

345 Park Avenue San Jose, CA 95110, USA | 378,000 | Research, product development, sales and marketing, and administration | |||||||

321 Park Avenue San Jose, CA 95110, USA | 321,000 | Research, product development, sales and marketing | |||||||

151 Almaden Boulevard San Jose, CA 95110, USA | 267,000 | Product development, sales and administration | |||||||

601 and 625 Townsend Street San Francisco, CA 94103, USA | 272,000 | (1) | Research, product development, sales, marketing and administration | ||||||

801 N. 34th Street-Waterfront Seattle, WA 98103, USA | 182,000 | (2) | Product development, sales, technical support and administration | ||||||

550 East Timpanagos Circle Orem, UT 84097, USA | 148,000 | Research, product development, sales, marketing and administration | |||||||

10182 Telesis Court San Diego, CA 92121, USA | 61,000 | (3) | Product development, sales and marketing | ||||||

21 Hickory Drive Waltham, MA 02451, USA | 108,000 | (4) | Research, product development, sales and marketing | ||||||

250 Brannan Street San Francisco, CA 94107, USA | 35,000 | Product development, sales and marketing | |||||||

7930 Jones Branch Drive McLean, VA 22102, USA | 34,000 | Sales and marketing | |||||||

1540 Broadway New York, NY 10036, USA | 27,000 | Sales and marketing | |||||||

343 Preston Street Ottawa, Ontario K1S 5N4, Canada | 122,000 | Research, product development, sales, marketing and administration | |||||||

| India: | |||||||||

Adobe Towers, 1-1A, Sector 25A Noida, U.P. | 191,000 | Product development | |||||||

| Adobe Towers, Plot #6, Sector 127 Expressway, Noida, U.P. | 65,000 | Product development | |||||||

Salapuria Infinity, 3rd Floor #5, Bannerghatta Road Bangalore | 126,000 | Research and product development | |||||||

rates.

| Location | Approximate Square Footage | Use | ||||

| North America: | ||||||

| 345 Park Avenue San Jose, CA 95110, USA | 378,000 | Research, product development, sales, marketing and administration | ||||

| 321 Park Avenue San Jose, CA 95110, USA | 321,000 | Research, product development, sales, marketing and administration | ||||

| 151 Almaden Boulevard San Jose, CA 95110, USA | 267,000 | Product development, sales and administration | ||||

| 601 and 625 Townsend Street San Francisco, CA 94103, USA | 346,000 | Research, product development, sales, marketing and administration | ||||

| 801 N. 34th Street-Waterfront Seattle, WA 98103, USA | 182,000 | (2) | Product development, sales, technical support and administration | |||

410 Townsend Street | 47,000 | Research, product development, sales, marketing and administration | ||||

| 3900 Adobe Way Lehi, UT 84043, USA | 281,000 | (3) | Research, product development, sales, marketing and administration | |||

21 Hickory Drive Waltham, MA 02451, USA | 108,000 | (4) | Research, product development, sales and marketing | |||

29

| Location | Approximate Square Footage | Use | ||||

McLean, VA 22102, USA

(5)

| Sales and marketing | ||||||||||

| 1540 Broadway New York, NY 10036, USA | 37,000 | Sales and marketing | ||||||||

| 343 Preston Street Ottawa, Ontario K1S 5N4, Canada | 122,000 | (6) | Research, product development, sales, marketing and administration | |||||||

| India: | ||||||||||

| Adobe Towers, 1-1A, Sector 25A Noida, U.P. | 191,000 | Product development and administration | ||||||||

Adobe Towers, Plot #6, Sector 127 Expressway, Noida, U.P. | 80,000 | Product development and administration | ||||||||

Salapuria Infinity, Ground Floor, 1st Floor, 3rd Floor #5, Bannerghatta Road, Bangalore | 160,000 | Research and product development | ||||||||

| Japan: | ||||||||||

Gate City Osaki East Tower 1-11 Osaki Shinagawa-ku, Tokyo | 56,000 | Product development, sales and marketing | ||||||||

| China: | ||||||||||

Block A, SP Tower, 11th, 19th, 21st & 22nd Floors Block B, SP Tower, 19th Floor Block D, SP Tower, 10th Floor Tsinghua Science Park, Yard 1 Zhongguancun Donglu, Haidian District Beijing | 94,000 | |||||||||

| Research and product development | ||||||||||

| Romania: | ||||||||||

26 Z Timisoara Blvd, Anchor Plaza Lujerului, Sector 6 Bucharest | 71,000 | Research and product development | ||||||||

| UK: | ||||||||||

| 49,000 | Product development, sales, marketing and administration | |||||||||

| Germany: | ||||||||||

| Grosse Elbstrasse 27 Hamburg | 36,000 | Research and product development | ||||||||

_________________________________________

(1) | The total square footage is 346,000, of which we occupy 272,000 square feet, or approximately 79% of this facility; 74,000 square feet is unoccupied basement space. |

(2) | The total square footage is 182,000, of which we occupy 162,000 square feet, or approximately 89% of this facility. The remaining square footage is subleased. |

(3) | The total square footage is |

(4) | In May 2013, management approved a plan to sell the land, building and other assets located in Waltham, Massachusetts. We finalized its sale in September 2013. See Note 6 of our Notes to Consolidated Financial Statements for further information regarding the sale of the Waltham property. |

(5) | The total square footage is 34,000, of which we occupy 31,000 square feet, or approximately 91% of this facility. The remaining square footage is subleased. |

30

(6) | The total square footage is 122,000, of |

In general, all facilities are in good condition, suitable for the conduct of our business and are operating at an average capacity of approximately 82%87%.

In connection with disputes relating to the validity or alleged infringement of third-party intellectual property rights, including patent rights, we have been, are currently and may in the future be subject to claims, negotiations or complex, protracted litigation. Intellectual property disputes and litigation may be very costly and can be disruptive to our business operations by diverting the attention and energies of management and key technical personnel. Although we have successfully defended or resolved past litigation and disputes, we may not prevail in any ongoing or future litigation and disputes. Third-party intellectual property disputes could subject us to significant liabilities, require us to enter into royalty and licensing arrangements on unfavorable terms, prevent us from licensing certain of our products or offering certain of our services, subject us to injunctions restricting our sale of products or services, cause severe disruptions to our operations or the markets in which we compete, or require us to satisfy indemnification commitments with our customers including contractual provisions under various license arrangements and service agreements.

Between September 23, 2009May 4, 2011 and September 25, 2009, threeJuly 14, 2011, five putative class action lawsuits were filed in the Fourth Judicial DistrictSanta Clara Superior Court for Utah County, Provo Department, State of Utah, seeking to enjoin Adobe’s acquisition of Omniture, Inc. and to recover damagesAlameda Superior Court in California. On September 12, 2011, the event the transaction were to close. The cases were captioned Miner v. Omniture, Inc., et. al.consolidated into In Re High-Tech Employee Antitrust Litigation (“Miner”HTEAL”), Barrell v. Omniture, Inc. et. al., (“Barrell”), and Lodhia v. Omniture, Inc. et al., (“Lodhia”). At a hearing on October 20, 2009, the court consolidated the Miner, Barrell, and Lodhia cases into a single case under the Lodhia caption and denied the plaintiffs’ motion to preliminarily enjoin the closing of the transaction. On December 30, 2 009, the plaintiffs served the defendants with a consolidated amended complaint for damages arising out of the closing of the transaction. In the consolidated amended complaint, plaintiffs alleged that the members of Omniture’s board of directors breached their fiduciary duties to Omniture’s stockholders by failing to seek the highest possible price for Omniture and that both Adobe and Omniture induced or aided and abetted in the alleged breach. The plaintiffs also alleged that the Schedule 14D-9 Solicitation/Recommendation Statement filed by Omniture on September 24, 2009 in connection with the transaction contained inadequate disclosures and was materially misleading. Plaintiffs sought unspecified damages on behalf of the former public stockholders of Omniture. On March 8, 2010, Adobe and the other defendants moved to dismiss the complaint for failure to state a claim. The court heard oral argument on the motion in November 2010 and the court granted the defendants’ motion to dismiss the complaint with prejudice.

The trial is currently scheduled to be held in May 2014.

In connection with our anti-piracy efforts, conducted both internallyaddition to intellectual property disputes and through organizations such as the Business Software Alliance, from time to timeother litigation matters described above, we undertake litigation against alleged copyright infringers. Such lawsuits may lead to counter-claims alleging improper use of litigation or violation of other local laws. We believe we have valid defenses with respect to such counter-claims; however, it is possible that our consolidated financial position, cash flows or results of operations could be affected in any particular period by the resolution of one or more of these counter-claims.

We make a provision for a liability when it is both probable that a liability has been incurred and the amount of the loss can be reasonably estimated. These provisions are reviewed at least quarterly and adjusted to reflect the impacts of negotiations, settlements, rulings, advice of legal counsel and other information and events pertaining to a particular case. Unless otherwise specifically disclosed here or in our Notes to Consolidated Financial Statements , we have determined that no provision for liability nor disclosure is required related to any claim against us because: (a) there is not a reasonable possibility that a loss exceeding amounts already recognized (if any) may be incurred with respect to such claim; (b) a reasonably possible loss or range of loss cannot be estimated; or (c) such estimate is immaterial.

All legal costs associated with litigation are expensed as incurred. Litigation is inherently unpredictable. However, we believe that we have valid defenses with respect to the legal matters pending agains t Adobe.against us. It is possible, nevertheless, that our consolidated financial position, cash flows or results of operations could be negatively affected by an unfavorable resolution of one or more of such proceedings, claims or investigations.

In connection with our anti-piracy efforts, conducted both internally and through organizations such as the Business Software Alliance, from time to time we undertake litigation against alleged copyright infringers. Such lawsuits may lead to counter-claims alleging improper use of litigation or violation of other laws. We believe we have valid defenses with respect to such counter-claims; however, it is possible that our consolidated financial position, cash flows or results of operations could be affected in any particular period by the resolution of one or more of these counter-claims.

31

ITEM 4. (REMOVED AND RESERVED)MINE SAFETY DISCLOSURES

Not applicable.

PART II

Market Information for Common Stock

Our common stock is traded on the NASDAQ Global Select Market under the symbol “ADBE.” The following table sets forth the high and low sales price per share of our common stock for the periods indicated.

| Price Range | ||||||||||||||||

| High | Low | |||||||||||||||

| Fiscal 2010: | ||||||||||||||||

| Price Range | ||||||||||||||||

| High | Low | |||||||||||||||

| Fiscal 2013: | ||||||||||||||||

| First Quarter | $ | 37.86 | $ | 31.45 | $ | 39.83 | $ | 34.70 | ||||||||

| Second Quarter | $ | 36.51 | $ | 30.94 | $ | 47.01 | $ | 40.46 | ||||||||

| Third Quarter | $ | 33.52 | $ | 26.34 | $ | 48.39 | $ | 42.72 | ||||||||

| Fourth Quarter | $ | 33.11 | $ | 25.60 | $ | 57.55 | $ | 45.88 | ||||||||

| Fiscal Year | $ | 37.86 | $ | 25.60 | $ | 57.55 | $ | 34.70 | ||||||||

| Fiscal 2009: | ||||||||||||||||

| Fiscal 2012: | ||||||||||||||||

| First Quarter | $ | 24.29 | $ | 16.70 | $ | 33.73 | $ | 26.46 | ||||||||

| Second Quarter | $ | 28.18 | $ | 15.98 | $ | 34.70 | $ | 29.82 | ||||||||

| Third Quarter | $ | 33.43 | $ | 26.34 | $ | 33.92 | $ | 30.02 | ||||||||

| Fourth Quarter | $ | 36.90 | $ | 31.00 | $ | 34.61 | $ | 31.44 | ||||||||

| Fiscal Year | $ | 36.90 | $ | 15.98 | $ | 34.70 | $ | 26.46 | ||||||||

Stockholders

According to the records of our transfer agent, there were 1,6241,367 holders of record of our common stock on January 21, 2011.17, 2014. Because many of such shares are held by brokers and other institutions on behalf of stockholders, we are unable to estimate the total number of stockholders represented by these record holders.

Dividends

We did not declare or pay any cash dividends on our common stock during fiscal 20102013 or fiscal 2009.2012. Under the terms of our credit agreement and lease agreements, we are not prohibited from paying cash dividends unless payment would trigger an event of default or one currently exists. We do not anticipate paying any cash dividends in the foreseeable future.

Issuer Purchases of Equity Securities

Below is a summary of stock repurchases for the three months ended December 3, 2010. November 29, 2013. See Note 1413 of our Notes to Consolidated Financial Statements for information regarding our stock repurchase programs.

Period | Shares Repurchased | Average Price Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans | Approximate Dollar Value that May Yet be Purchased Under the Plan(1) | |||||||||||

(in thousands, except average price per share) | |||||||||||||||

| Beginning repurchase authority | 1,334,265 | ||||||||||||||

| August 31—September 27, 2013 | |||||||||||||||

| Shares repurchased | 2,826 | $ | 47.50 | 2,826 | $ | (134,265 | ) | ||||||||

| September 28—October 25, 2013 | |||||||||||||||

| Shares repurchased | 2,589 | $ | 51.51 | 2,589 | $ | (133,333 | ) | ||||||||

| October 26—November 29, 2013 | |||||||||||||||

| Shares repurchased | 2,513 | $ | 54.71 | 2,513 | $ | (137,456 | ) | (2) | |||||||

| Total | 7,928 | 7,928 | $ | 929,211 | |||||||||||

_________________________________________

Period | Shares Repurchased | Average Price Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans | Approximate Dollar Value that May Yet be Purchased Under the Plan(1) | ||||||||||||||

| (in thousands, except average price per share) | ||||||||||||||||||

Beginning repurchase authority | $ | 1,332,869 | ||||||||||||||||

| September 4—October 1, 2010 | ||||||||||||||||||

Shares repurchased | 4,734 | $ | 28.06 | 4,734 | $ | (132,869 | ) | |||||||||||

| October 2—October 29, 2010 | ||||||||||||||||||

Shares repurchased | 7,398 | $ | 27.04 | 7,398 | $ | (200,000 | ) | (2) | ||||||||||

| October 30—December 3, 2010 | ||||||||||||||||||

Shares repurchased | — | $ | — | — | $ | — | ||||||||||||

Total | 12,132 | 12,132 | $ | 1,000,000 | ||||||||||||||

(1) | We currently have authority granted by our Board of Directors |

(2) | In October |

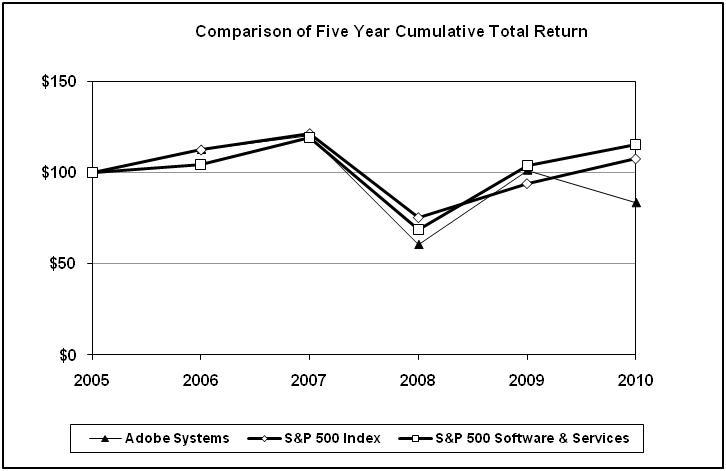

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||||||||

Adobe Systems | $ | 100.00 | $ | 112.53 | $ | 120.50 | $ | 60.28 | $ | 101.17 | $ | 83.33 | ||||||||||||

S&P 500 Index | $ | 100.00 | $ | 112.51 | $ | 121.53 | $ | 75.24 | $ | 93.97 | $ | 107.62 | ||||||||||||

| S&P 500 Software & Services Index | $ | 100.00 | $ | 104.44 | $ | 119.25 | $ | 68.41 | $ | 103.74 | $ | 115.44 |

The following selected consolidated financial data (presented in thousands, except per share amounts and employee data) is derived from our consolidated financial statements.Consolidated Financial Statements. As our operating results are not necessarily indicative of future operating results, this data should be read in conjunction with the consolidated financial statementsConsolidated Financial Statements and notes thereto, and with Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

| Fiscal Years | Fiscal Years | |||||||||||||||||||||||||||||||||||||||

| 2010 | 2009(1) | 2008 | 2007 | 2006 | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||||||||||||||

| Operations: | ||||||||||||||||||||||||||||||||||||||||

Revenue | $ | 3,800,000 | $ | 2,945,853 | $ | 3,579,889 | $ | 3,157,881 | $ | 2,575,300 | $ | 4,055,240 | $ | 4,403,677 | $ | 4,216,258 | $ | 3,800,000 | $ | 2,945,853 | ||||||||||||||||||||

Gross profit | $ | 3,396,498 | $ | 2,649,121 | $ | 3,217,259 | $ | 2,803,187 | $ | 2,282,843 | $ | 3,468,683 | $ | 3,919,895 | $ | 3,778,385 | $ | 3,396,498 | $ | 2,649,121 | ||||||||||||||||||||

Income before income taxes | $ | 943,151 | $ | 701,520 | $ | 1,078,508 | $ | 947,190 | $ | 679,727 | $ | 356,141 | $ | 1,118,794 | $ | 1,035,230 | $ | 943,151 | $ | 701,520 | ||||||||||||||||||||

Net income | $ | 774,680 | $ | 386,508 | $ | 871,814 | $ | 723,807 | $ | 505,809 | $ | 289,985 | $ | 832,775 | $ | 832,847 | $ | 774,680 | $ | 386,508 | ||||||||||||||||||||

| Net income per share: | ||||||||||||||||||||||||||||||||||||||||

Basic | $ | 1.49 | $ | 0.74 | $ | 1.62 | $ | 1.24 | $ | 0.85 | $ | 0.58 | $ | 1.68 | $ | 1.67 | $ | 1.49 | $ | 0.74 | ||||||||||||||||||||

Diluted | $ | 1.47 | $ | 0.73 | $ | 1.59 | $ | 1.21 | $ | 0.83 | $ | 0.56 | $ | 1.66 | $ | 1.65 | $ | 1.47 | $ | 0.73 | ||||||||||||||||||||

| Shares used to compute basic net income per share | 501,372 | 494,731 | 497,469 | 519,045 | 524,470 | |||||||||||||||||||||||||||||||||||

| Shares used to compute diluted net income per share | 513,476 | 502,721 | 503,921 | 525,824 | 530,610 | |||||||||||||||||||||||||||||||||||

Cash dividends declared per common share | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||

Financial position:(2) | ||||||||||||||||||||||||||||||||||||||||

Financial position:(1) | ||||||||||||||||||||||||||||||||||||||||

Cash, cash equivalents and short-term investments | $ | 2,468,015 | $ | 1,904,473 | $ | 2,019,202 | $ | 1,993,854 | $ | 2,280,879 | $ | 3,173,752 | $ | 3,538,353 | $ | 2,911,692 | $ | 2,468,015 | $ | 1,904,473 | ||||||||||||||||||||

Working capital | $ | 2,147,962 | $ | 1,629,071 | $ | 1,972,504 | $ | 1,720,441 | $ | 2,208,688 | $ | 2,520,281 | $ | 3,125,314 | $ | 2,520,672 | $ | 2,147,962 | $ | 1,629,071 | ||||||||||||||||||||

Total assets | $ | 8,141,148 | $ | 7,282,237 | $ | 5,821,598 | $ | 5,713,679 | $ | 5,962,548 | $ | 10,380,298 | $ | 10,040,229 | $ | 8,991,183 | $ | 8,141,148 | $ | 7,282,237 | ||||||||||||||||||||

Debt and capital lease obligations, non- current | $ | 1,513,662 | $ | 1,000,000 | $ | 350,000 | $ | — | $ | — | ||||||||||||||||||||||||||||||

| Debt and capital lease obligations, non-current | $ | 1,499,297 | $ | 1,496,938 | $ | 1,505,096 | $ | 1,513,662 | $ | 1,000,000 | ||||||||||||||||||||||||||||||

Stockholders’ equity | $ | 5,192,387 | $ | 4,890,568 | $ | 4,410,354 | $ | 4,649,982 | $ | 5,151,876 | $ | 6,724,634 | $ | 6,665,182 | $ | 5,783,113 | $ | 5,192,387 | $ | 4,890,568 | ||||||||||||||||||||

| Additional data: | ||||||||||||||||||||||||||||||||||||||||

Worldwide employees | 9,117 | 8,660 | 7,544 | 6,794 | 6,068 | 11,847 | 11,144 | 9,925 | 9,117 | 8,660 | ||||||||||||||||||||||||||||||

_________________________________________

(1) |

| Information associated with our financial position is as of the Friday closest to November 30 for the five fiscal periods through |

The following discussion should be read in conjunction with our consolidated financial statementsConsolidated Financial Statements and notesNotes thereto.

ACQUISITIONS

During fiscal 2013, we completed our acquisitions of privately held Neolane, a leader in cross-channel campaign management technology for $616.7 million and privately held Behance, an online social media platform to showcase and discover creative work for $111.1 million. During fiscal 2013, we began integrating Neolane and Behance into our Digital Marketing and Digital Media reportable segments, respectively. The impact of these acquisitions were not material to our Consolidated Financial Statements.

During fiscal 2011, we completed six business combinations and two asset management and social collaboration solutions based in Basel, Switzerland and Boston, Massachusetts for approximately $248.3 million. Day’s Web solutions combinedacquisitions with our existing enterprise portfolio will enable customers to better integrate their global Web presence and business applications in support of acquiring, servicing and retaining customers.aggregate purchase prices totaling $328.3 million. We have included the financial results of Daythe business combinations in our consolidated results of operations beginning on the respective acquisition date however the impact of this acquisition was not material to our consolidated balance sheets and results of operations. Following the closing, we integrated Day as a product line within our Enterprise segment for financial reporting purposes.dates.

See Note 2 of our Notes to Consolidated Financial Statements for further information regarding these acquisitions.acquisitions.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

In preparing our consolidated financial statementsConsolidated Financial Statements in accordance with GAAP and pursuant to the rules and regulations of the SEC, we make assumptions, judgments and estimates that affect the reported amounts of assets, liabilities, revenue and expenses, and related disclosures of contingent assets and liabilities. We base our assumptions, judgments and estimates on historical experience and various other factors that we believe to be reasonable under the circumstances. Actual results could differ materially from these estimates under different assumptions or conditions. On a regular basis, we evaluate our assumptions, judgments and estimates. We also discuss our critical accounting policies and estimates with the Audit Committee of the Board of Directors.

We believe that the assumptions, judgments and estimates involved in the accounting for revenue recognition, stock-based compensation, business combinations, goodwill impairment and income taxes have the greatest potential impact on our consolidated financial statements.Consolidated Financial Statements. These areas are key components of our results of operations and are based on complex rules which requirerequiring us to make judgments and estimates, so we consider these to be our critical accounting policies.

Historically, our assumptions, judgments and estimates relative to our critical accounting policies have not differed materially from actual results.

Revenue Recognition

Our revenue is derived from the licensing of perpetual, time-based and subscription software products, associated software maintenance and support plans, custom software development and consulting services and training. To a lesser extent our revenue includes non-software related hosting services, custom hosting development and consulting services, training and technical support and training for hosting services.

support.

We recognize revenue when all four revenue recognition criteria have been met: persuasive evidence of an arrangement exists, we have delivered the product or performed the service, the fee is fixed or determinable and collection is probable. Determining whether and when some of these criteria have been satisfied often involves assumptions and judgments that can have a significant impact on the timing and amount of revenue we report.

We enter into multiple element revenue arrangements in which a customer may purchase a combination of software, upgrades, maintenance and support, hosting services and consulting.

For our software and software relatedsoftware-related multiple element arrangements, we must: (1) determine whether and when each element has been delivered; (2) determine whether undelivered products or services are essential to the functionality of the delivered products and services; (3) determine the fair value of each undelivered element using VSOE,vendor-specific objective evidence (“VSOE”), and (4) allocate the total price among the various elements. VSOE of fair value is used to allocate a portion of the price to the undelivered elements and the residual method is used to allocate the remaining portion to the delivered elements. Absent VSOE, revenue is deferred until the earlier of the point at which VSOE of fair value exists for any undelivered element or until all elements of the arrangement have been delivered. However, if the only undelivered element is maintenance and support, the entire arra ngementarrangement fee is recognized ratably over the performance period. Changes in assumptions or judgments or changes to the

35

elements in a software arrangement could cause a material increase or decrease in the amount of revenue that we report in a particular period.

We determine VSOE for each element based on historical stand-alone sales to third parties or from the stated renewal rate for the elements contained in the initial arrangement. In determining VSOE, we require that a substantial majority of the selling prices for a product or service fall within a reasonably narrow pricing range.

training.

For multiple elementmultiple-element arrangements containing our non-software services, we mustmust: (1) determine whether and when each element has been delivered; (2) determine fair value of each element using the selling price hierarchy of VSOE of fair value, TPEselling price, third-party evidence (“TPE”) of selling price or BESP,best-estimated selling price (“BESP”), as applicable,applicable; and (3) allocate the total price among the various elements based on the relative selling price method.

We determine BESP for a product or service by considering multiple factors including, but not limited to, major product groupings, geographies, market conditions, competitive landscape, internal costs, gross margin objectives and pricing practices. Significant pricingPricing practices taken into consideration include historic contractually stated prices, volume discounts where applicable and our price lists. The most common fact pattern that emerged through analyzing these factors supports a BESP closely tied to Adobe’s list prices. The determination of BESP is made through consultation with and formal approval by our management, taking into consideration our go-to-market strategy.

We regularly review VSOE and have established a review process for TPE and BESP and maintain internal controls over the establishment and updates of these estimates. There was no material impact to revenue during the year ended December 3, 2010 resulting from changes in VSOE, TPE or BESP, nor do we expect a material impact from such changes in the near term.

Product revenue is recognized when the above criteria are met. We reduce the revenue recognized for estimated future returns, price protection and rebates at the time the related revenue is recorded. In determining our estimate for returns and in accordance with our internal policy regarding global channel inventory which is used to determine the level of product held by our distributors on which we have recognized revenue, we rely upon historical data, the estimated amount of product inventory in our distribution channel, the rate at which our product sells through to the end user, product plans and other factors. Our estimated provisions for returns can vary from what actually occurs. Product returns may be more or less than what was estimated. The amount of inventory in the channel could be different than what is estimated. Our est imateestimate of the rate of sell throughsell-through for product in the channel could be different than what actually occurs. There could be a delay in the

release of our products. These factors and unanticipated changes in the economic and industry environment could make our return estimates differ from actual returns, thus materially impacting our financial position and results of operations.

In the future, actual returns and price protection may materially exceed our estimates as unsold products in the distribution channels are exposed to rapid changes in consumer preferences, market conditions or technological obsolescence due to new platforms, product updates or competing products. While we believe we can make reliable estimates regarding these matters, these estimates are inherently subjective. Accordingly, if our estimates change, our returns and price protection reserves would change, which would impact the total net revenue we report.

We recognize revenues for hosting services that are based on a committed number of transactions ratably beginning on the date the customer commences use of our services and continuing through the end of the customer term. Over-usage fees, and fees billed based on the actual number of transactions from which we capture data, are billed in accordance with contract terms as these fees are incurred. We record amounts that have been invoiced in accounts receivable and in deferred revenue or revenue, depending on whether the revenue recognition criteria have been met.

Our consulting revenue is recognized on a time and materials basis and is measured monthly based on input measures, such as on hours incurred to date compared to total estimated hours to complete, with consideration given to output measures, such as contract milestones, when applicable.

36

Business Combinations

We allocate the purchase price of acquired companies to the tangible and intangible assets acquired and liabilities assumed, assumed equity awards, as well as to in-process research and development based upon their estimated fair values at the acquisition date. The purchase price allocation process requires management to make significant estimates and assumptions, especially at the acquisition date with respect to intangible assets, deferred revenue obligations and equity assumed.

Although we believe the assumptions and estimates we have made are reasonable, they are based in part on historical experience and information obtained from the management of the acquired companies and are inherently uncertain. Examples of critical estimates in valuing certain of the intangible assets we have acquired or may acquire in the future include but are not limited to:

future expected cash flows from software license sales, subscriptions, support agreements, consulting contracts and acquired developed technologies and patents;

the acquired company’s trade name and trademarks as well as assumptions about the period of time the acquired trade name and trademarks will continue to be used in the combined company’s product portfolio; and

In connection with the purchase price allocations for our acquisitions, we estimate the fair value of the deferred revenue obligations assumed. The estimated fair value of the support obligations is determined utilizing a cost build-up approach. The cost build-up approach determines fair value by estimating the costs related to fulfilling the obligations plus a normal profit margin. The estimated costs to fulfill the obligations are based on the historical costs related to fulfilling the obligations.

In connection with the purchase price allocations for our acquisitions, we estimate the fair value of the equity awards assumed. The estimated fair value is determined utilizing a modified binomial option pricing model which assumes employees exercise their stock options when the share price exceeds the strike price by a certain dollar threshold. If the acquired company has significant historical data on their employee’s exercise behavior, then this threshold is determined based upon the acquired company’s history. Otherwise, our historical exercise experience is used to determine the exercise threshold. Zero coupon yields implied by U.S. Treasury issues,issuances, implied volatility for our common stock and our historical forfeiture rate are other inputs to the binomial model.

Unanticipated events and circumstances may occur which may affect the accuracy or validity of such assumptions, estimates or actual results.

Goodwill Impairment

We complete our goodwill impairment test on an annual basis, during the second quarter of our fiscal year, or more frequently, if changes in facts and circumstances indicate that an impairment in the value of goodwill recorded on our balance sheet may exist. In order to estimate the fair value of goodwill, we typically estimate future revenue, consider market factors and estimate our future cash flows. Based on these key assumptions, judgments and estimates, we determine whether we need to record an impairment charge to reduce the value of the asset carried on our balance sheet to its estimated fair value. Assumptions, judgments and estimates about future values are complex and often subjective. They can be affected by a variety of factors, including external factors such as industry and economic trends, and internal factors such as c hangeschanges in our business strategy or our internal forecasts. Although we believe the assumptions, judgmentsassumptions, judgments and estimates we have made in the past have been reasonable and appropriate, different assumptions, judgments and estimates could materially affect our reported financial results.

We completed our annual impairment test in the second quarter of fiscal 20102013 and determined there was no impairment. We currently believe thatThe results of our annual impairment test indicate there is no significant risk of future material goodwill impairment in any of our reporting units.

Accounting for Income Taxes

We use the asset and liability method of accounting for income taxes. Under this method, income tax expense is recognized for the amount of taxes payable or refundable for the current year. In addition, deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the financial reporting and tax bases of assets and liabilities, and for operating losses and tax credit carryforwards. Management must make assumptions, judgments and estimates

37

to determine our current provision for income taxes and also our deferred tax assets and liabilities and any valuation allowance to be recorded against a deferred tax asset.

Our assumptions, judgments and estimates relative to the current provision for income taxes take into account current tax laws, our interpretation of current tax laws and possible outcomes of current and future audits conducted by foreign and domestic tax authorities. We have established reserves for income taxes to address potential exposures involving tax positions that could be challenged by tax authorities. In addition, we are subject to the continual examination of our income tax returns by the IRS and other domestic and foreign tax authorities, including a current examination by the IRS forof our

fiscal 20082010, 2011 and 20092012 tax returns. TheseWe expect future examinations are expected to focus on our intercompany transfer pricing practices as well as other matters. Although we believeWe regularly assess the likelihood of outcomes resulting from these examinations to determine the adequacy of our assumptions, judgmentsprovision for income taxes and estimates are reasonable, changes in tax laws or our interpretation of tax laws and the resolution ofhave reserved for potential adjustments that may result from the current andexaminations. We believe such estimates to be reasonable; however, the final determination of any future tax auditsof these examinations could significantly impact the amounts provided for income taxes in our consolidated financial statements.

Consolidated Financial Statements.

Our assumptions, judgments and estimates relative to the value of a deferred tax asset take into account predictions of the amount and category of future taxable income, such as income from operations or capital gains income. Actual operating results and the underlying amount and category of income in future years could render our current assumptions, judgments and estimates of recoverable net deferred taxes inaccurate. Any of the assumptions, judgments and estimates mentioned above could cause our actual income tax obligations to differ from our estimates, thus materially impacting our financial position and results of operations.

We are a United States-based multinational company subject to tax in multiple U.S. and foreign tax jurisdictions. A significant portion of our foreign earnings for the current fiscal year were earned by our Irish subsidiaries. In addition to providing for U.S. income taxes on earnings from the U.S., we provide for U.S. income taxes on the earnings of foreign subsidiaries unless the subsidiaries' earnings are considered permanently reinvested outside the U.S. While we do not anticipate changing our intention regarding permanently reinvested earnings, if certain foreign earnings previously treated as permanently reinvested are repatriated, the related U.S. tax liability may be reduced by any foreign income taxes paid on these earnings.

Our income tax expense has differed from the tax computed at the U.S. federal statutory income tax rate due primarily to discrete items and to earnings considered as permanently reinvested in foreign operations. Unanticipated changes in our tax rates could affect our future results of operations. Our future effective tax rates could be unfavorably affected by changes in the tax rates in jurisdictions where our income is earned, by changes in, or our interpretation of, tax rules and regulations in the jurisdictions in which we do business, by unanticipated decreases in the amount of earnings in countries with low statutory tax rates, by lapses of the availability of the U.S. research and development tax credit, or by changes in the valuation of our deferred tax assets and liabilities. The United States, countries in the European Union and other countries where we do business have been considering changes in relevant tax, accounting and other laws, regulations and interpretations, including changes to tax laws applicable to corporate multinationals such as Adobe. These potential changes could adversely affect our effective tax rates or result in other costs to us.

Recent Accounting Pronouncements

In December 2011, the FASB amended the accounting standards to increase the prominence of other comprehensive income (“OCI”) by eliminating the option to present components of OCI as part of the statement of changes in shareholders’ equity and requires the components of OCI to be presented either in a single continuous statement of comprehensive income or in two consecutive statements. We adopted the amended accounting standards at the beginning of our first quarter of fiscal 2013 by electing to present consolidated statements of comprehensive income separate from the consolidated statements of income.

The amended accounting standards only impact the financial statement presentation of OCI and do not change the components that are recognized in net income or OCI. The adoption had no impact on the Company’s financial position or results of operations.

38

Recent Accounting Pronouncements Not Yet Effective

There have been no new accounting pronouncements not yet effective that have significance, or potential significance, to our Consolidated Financial Statements.

RESULTS OF OPERATIONS

Overview of 2013

For fiscal 2013, we reported financial results consistent with the continued execution of our plans for our two strategic growth areas, Digital Media and Digital Marketing, while continuing to market and license a broad portfolio of products and solutions.

We are a market leader in the fast-growing category addressed by our Digital Marketing segment. Our Adobe Marketing Cloud offering includes six solutions addressing the expanding needs of marketers, the newest of which is Adobe Campaign—a cross-channel campaign management tool that we added to our portfolio with the acquisition of Neolane during our third quarter of fiscal 2013.

Revenue from Adobe Marketing Cloud increased 26% and 35% during fiscal 2013 and 2012, respectively, compared to the year ago periods. Helping to drive this performance was strong adoption of our Adobe Experience Manager (“AEM”) offering and the addition of Neolane in mid-third quarter of fiscal 2013.

AEM, our fastest growing digital marketing solution, has typically been licensed by our customers as an on-premise offering where license revenue is recognized at the time of the transaction. In the past year, we introduced a managed services offering of AEM for which revenue is recognized ratably. We expect continued adoption of the newer managed services offering, which will increasingly migrate AEM revenue to recurring revenue in this segment. Given the comparisons involving more new license revenue being recognized over time versus past license revenue being recognized up front, we anticipate this trend may impact overall Adobe Marketing Cloud revenue in the near term.

Within our Digital Media segment, in May 2012 we delivered Adobe Creative Cloud, our subscription-based offering for creating and publishing content and applications. Creative Cloud is our next-generation offering that supersedes our historical model of licensing our creative products with perpetual licenses. We continue to implement strategies that will accelerate awareness, consideration and purchase of subscriptions to the offering. Key aspects of the value Creative Cloud provides include more frequent product updates, storage and access to user files stored in the cloud with syncing of files across users' machines, community-based features and services through our acquisition of Behance in December 2012, digital publishing and app creation capabilities, and lower entry point pricing for cost-sensitive customers.

In May 2013 we announced we would exclusively deliver new creative product innovations and features to Creative Cloud subscribers, and that Adobe Creative Suite 6 (“CS6”), which was released in May 2012, would be the last major update we provide for perpetual licensees. While we continue to offer CS6 on a perpetual licensing basis moving forward, we expect revenue for it to sequentially decline as our customers increasingly migrate to Creative Cloud.

We offer Creative Cloud for individuals and for teams, and we enable larger enterprise customers to acquire Creative Cloud capabilities through Enterprise Term License Agreements (“ETLAs”). The three Creative Cloud offerings address the multiple routes to market we use to license our creative software to targeted customers. Adoption of Creative Cloud is transforming our business model and we expect this to drive higher long-term revenue growth through an expansion of our customer base by acquiring new users through a lower cost of entry and delivery of additional features and value, as well as keeping existing customers current on our latest release. This model will drive our revenue to be more recurring and predictable as revenue is recognized ratably.

We have implemented, and will continue to implement, strategies that accelerate adoption of our Creative Cloud subscription model, causing our traditional perpetual license revenue to decline. These strategies include increasing the value Creative Cloud users receive, as well as targeted promotions and offers that attract past customers and potential users to try out and ultimately subscribe to Creative Cloud.

During fiscal 2013, adoption of our Creative Cloud subscription offering continued to accelerate, which has and will continue to cause our traditional perpetual license revenue to decline and, in turn, has caused total net revenue in fiscal 2013 to decline compared with fiscal 2012. As anticipated, during this transition expenses did not and are not expected to decline in correlation to the decrease in revenue, which has adversely affected our net income and operating margin throughout fiscal 2013. However, over time we expect this business model transition will significantly increase our long-term revenue growth rate by attracting new

39

users, keeping our end user base current and thereby driving higher revenue. Additionally, our shift to a subscription model will increase the amount of recurring revenue that is ratably recognized, driven by broader Creative Cloud adoption over the next several years. We began to see the impact of this shift in fiscal 2013.

To assist with the understanding of this transition and the related shift in revenue described above, we are using certain performance metrics to assess the health and trajectory of our overall Digital Media segment.These metrics include the total number of current paid subscriptions and Annualized Recurring Revenue (“ARR”). We define ARR as the sum of:

the number of current paid subscriptions, multiplied by the average subscription price paid per user per month, multiplied by twelve months; plus,

twelve months of contract value of ETLAs where the revenue is ratably recognized over the life of the contract.

ARR should be viewed independently of revenue, deferred revenue and unbilled deferred revenue as ARR is a performance metric and is not intended to be combined with any of these items.

We exited fiscal 2013 with 1.4 million paid Creative Cloud subscriptions, up from 0.3 million at the end of fiscal 2012. Total Creative ARR exiting fiscal 2013 was $768.0 million, up from $155.0 million exiting fiscal 2012, demonstrating the progress we have made with our transformation in this business.

Our Digital Media business also includes our Document Services products and solutions, including Acrobat. In fiscal 2013 we continued to drive solid adoption of our Acrobat family of products primarily through license agreements with enterprise customers. During fiscal 2013, a higher percentage of these agreements were ETLAs, which like ETLAs with our creative customers, cause more revenue to be recognized over time rather than at the time of contract signing. This has caused reported Document Services revenue in fiscal 2013 to decline compared to revenue achieved in fiscal 2012, with the benefit of ETLAs improving our growth potential over time. In addition to Acrobat, we also drove strong adoption of subscription based services including Acrobat cloud services and our EchoSign e-signing solution. Combined, adoption of Acrobat through ETLAs and our Document Services subscription offerings helped grow Document Services ARR to $143.0 million exiting fiscal 2013, up from $49.0 million at the end of fiscal 2012.

Financial Performance Summary for Fiscal 2013

We continue to derive the majority of our revenue from perpetual licenses. However, consistent with our strategy, during fiscal 2013, our subscription revenue as a percentage of total revenue increased to 28% from 15% and 11% as compared to fiscal 2012 and 2011, respectively, as we transition more of our business to a subscription-based model.

Total Digital Media ARR of approximately $911.0 million as of November 29, 2013 increased by approximately $707.0 million, or 347%, from approximately $204.0 million as of November 30, 2012. The increase in our Digital Media ARR is primarily due to increases in the number of paid Creative Cloud individual and team subscriptions and adoption of our enterprise Creative Cloud offering through our ETLAs.

Our total deferred revenue of $828.8 million as of November 29, 2013 increased by $209.2 million, or 34% from November 30, 2012, primarily due to increases in ETLAs and renewals for our Adobe Marketing Cloud services.

Cost of revenue of $586.6 million increased by $102.8 million, or 21%, during fiscal 2013, from $483.8 million in fiscal 2012, and $45.9 million or 10% during fiscal 2012 from $437.9 million in fiscal 2011. These increases are primarily due to increases in costs associated with compensation and related benefits driven by additional headcount and increased hosting and server costs associated with our subscription and SaaS offerings.

Operating expenses of $3,046.0 million increased by $306.3 million or 11%, during fiscal 2013, from $2,739.7 million in fiscal 2012, and $60.6 million, or 2% in fiscal 2012 from $2,679.1 million in fiscal 2011. These increases are primarily due to increases in costs associated with compensation and related benefits driven by additional headcount.

Net income of $290.0 million decreased by $542.8 million, or 65%, during fiscal 2013 from $832.8 million in fiscal 2012. The decrease is primarily due to the revenue model becoming more ratable as well as the cost and expense increases stated above. Net income during fiscal 2012 remained stable compared to fiscal 2011.

40

Net cash flow from operations of $1,151.7 million during fiscal 2013 decreased by $347.9 million, or 23%, as compared to fiscal 2012 primarily due to lower net income as discussed above. Net cash flow from operations during fiscal 2012 remained stable compared to fiscal 2011.

Revenue (dollars in millions)

| Fiscal 2013 | Fiscal 2012 | Fiscal 2011 | % Change 2013-2012 | % Change 2012-2011 | ||||||||||||||

| Product | $ | 2,470.1 | $ | 3,342.8 | $ | 3,416.5 | (26 | )% | (2 | )% | ||||||||

| Percentage of total revenue | 61 | % | 76 | % | 81 | % | ||||||||||||

| Subscription | 1,137.9 | 673.2 | 458.6 | 69 | % | 47 | % | |||||||||||

| Percentage of total revenue | 28 | % | 15 | % | 11 | % | ||||||||||||

| Services and support | 447.2 | 387.7 | 341.2 | 15 | % | 14 | % | |||||||||||

| Percentage of total revenue | 11 | % | 9 | % | 8 | % | ||||||||||||

| Total revenue | $ | 4,055.2 | $ | 4,403.7 | $ | 4,216.3 | (8 | )% | 4 | % | ||||||||

As described in Note 118 of our Notes to Consolidated Financial Statements for information regarding, we have the effect of new accounting pronouncements on our financial statements.

Fiscal 2010 | Fiscal 2009 | Fiscal 2008 | % Change 2010-2009 | % Change 2009-2008 | ||||||||||||||

Product | $ | 3,159.2 | $ | 2,684.8 | $ | 3,354.6 | 18 | % | (20 | )% | ||||||||

Percentage of total revenue | 83 | % | 91 | % | 94 | % | ||||||||||||

Subscription | 386.8 | 74.6 | 41.9 | * | 78 | % | ||||||||||||

Percentage of total revenue | 10 | % | 3 | % | 1 | % | ||||||||||||

Services and support | 254.0 | 186.5 | 183.4 | 36 | % | 2 | % | |||||||||||

Percentage of total revenue | 7 | % | 6 | % | 5 | % | ||||||||||||

Total revenue | $ | 3,800.0 | $ | 2,945.9 | $ | 3,579.9 | 29 | % | (18 | )% | ||||||||

Our subscription revenue is comprised primarily of fees we charge for our subscription and hosted service offerings including certain of our hosted online business optimization services.Adobe Marketing Cloud services and Creative Cloud. We recognize subscription revenuesrevenue ratably over the term of agreements with our customers, beginning on the commencement of the service. We expect our subscription revenue will continue to increase as a result of our investments in new SaaS and subscription models. We also expect this to increase the amount of recurring revenue we generate as a percent of our total revenue. Of the $386.8$1,137.9 million, $673.2 million and $74.6$458.6 million in subscription revenue for the fiscal years 20102013, 2012 and 2009,2011, respectively, approximately $309.1$663.1 million, $553.2 million and $22.2$429.2 million, respectively, is from our OmnitureDigital Marketing segment, with the remaining amounts substantially representing our other businessDigital Media segment offerings.

Our services and support revenue is comprised of consulting, training and maintenance and support, primarily related to the licensing of our enterprise, developer and platform products and the sale of our hosted online business optimizationAdobe Marketing Cloud services. Our support revenue also includes technical support and developer support to partners and developer organizations related to our desktop products. Our maintenance and support offerings, which entitle customers to receive product upgrades and enhancements or technical support, depending on the offering, are generally recognized ratably over the term of the arrangement.

Segments

In fiscal 2010,2013, we categorized our products into the following segments: Creative Solutions, Knowledge Worker, Enterprise, Omniture, Platform,

Digital Media—Our Digital Media segment provides tools and solutions that enable individuals, small businesses and enterprises to create, publish, promote and monetize their digital content anywhere. Our customers include traditional content creators, web application developers and digital media professionals, as well as their management in marketing departments and agencies, companies and publishers.

Digital Marketing—Our Digital Marketing segment provides solutions and services for how digital advertising and marketing are created, managed, executed, measured and optimized. Our customers include digital marketers, advertisers, publishers, merchandisers, web analysts, chief marketing officers, chief information officers and chief revenue officers.

Print and Publishing—Our Print and Publishing products.

41

Segment Information (dollars in millions)

Fiscal 2010 | Fiscal 2009 | Fiscal 2008 | % Change 2010-2009 | % Change 2009-2008 | ||||||||||||||

Creative Solutions | $ | 2,056.5 | $ | 1,702.1 | $ | 2,072.8 | 21 | % | (18 | )% | ||||||||

Percentage of total revenue | 54 | % | 58 | % | 58 | % | ||||||||||||

Knowledge Worker | 654.4 | 557.6 | 757.7 | 17 | % | (26 | )% | |||||||||||

Percentage of total revenue | 18 | % | 19 | % | 21 | % | ||||||||||||

Enterprise | 355.0 | 300.9 | 306.2 | 18 | % | (2 | )% | |||||||||||

Percentage of total revenue | 9 | % | 10 | % | 9 | % | ||||||||||||

Omniture | 360.6 | 26.3 | — | * | * | |||||||||||||

Percentage of total revenue | 9 | % | 1 | % | — | % | ||||||||||||

Platform | 178.9 | 181.0 | 231.6 | (1 | )% | (22 | )% | |||||||||||

Percentage of total revenue | 5 | % | 6 | % | 6 | % | ||||||||||||

| Print and Publishing | 194.6 | 178.0 | 211.6 | 9 | % | (16 | )% | |||||||||||

Percentage of total revenue | 5 | % | 6 | % | 6 | % | ||||||||||||

Total revenue | $ | 3,800.0 | $ | 2,945.9 | $ | 3,579.9 | 29 | % | (18 | )% | ||||||||

| Fiscal 2013 | Fiscal 2012 | Fiscal 2011 | % Change 2013-2012 | % Change 2012-2011 | ||||||||||||||

| Digital Media | $ | 2,625.9 | $ | 3,101.9 | $ | 3,070.2 | (15 | )% | 1 | % | ||||||||

| Percentage of total revenue | 65 | % | 70 | % | 73 | % | ||||||||||||

| Digital Marketing | 1,228.8 | 1,085.0 | 927.8 | 13 | % | 17 | % | |||||||||||

| Percentage of total revenue | 30 | % | 25 | % | 22 | % | ||||||||||||

| Print and Publishing | 200.5 | 216.8 | 218.3 | (8 | )% | (1 | )% | |||||||||||

| Percentage of total revenue | 5 | % | 5 | % | 5 | % | ||||||||||||

| Total revenue | $ | 4,055.2 | $ | 4,403.7 | $ | 4,216.3 | (8 | )% | 4 | % | ||||||||

Fiscal 20102013 Revenue Compared to Fiscal 20092012 Revenue

Digital Media

Revenue from Creative Solutions increased $354.4Digital Media decreased $476.0 million during fiscal 2010year 2013 as compared to fiscal 20092012, primarily due to continued strong licensingadoption of CS4 during fiscal 2010 until the releaseCreative Cloud and ETLAs as we continue to transition more of CS5,our business to a subscription-based model.

Revenue related to our creative professional products, which include our Creative Suite editions and CS point products as well as strongCreative Cloud, decreased during fiscal 2013 as compared to fiscal 2012 due to continued customer adoption of CS5 beginningCreative Cloud subscription offerings, released in May 2012. We continue to anticipate accelerated adoption of Creative Cloud for individuals, teams and enterprises, for which revenue is recognized over time, and that this adoption has and will continue to cause our traditional perpetual license revenue to decline.

Revenue associated with our other creative products increased during fiscal2013 as compared to fiscal 2012, primarily due to increases associated with distribution of third-party software via Flash Player downloads and our Digital Publishing Suite. These increases were partially offset by decreases in revenue associated with our Photoshop Elements family of products.

For our creative offerings, the total number of perpetual units licensed decreased while the number of subscription units licensed increased during fiscal 2013 as compared to fiscal 2012. Unit average selling prices for our perpetual units licensed decreased during the year ended fiscal 2013 as compared to fiscal 2012.

Document Services revenue, which includes our Acrobat product family, decreased slightly during fiscal 2013 as compared to fiscal 2012, primarily due to the continued shift to ETLAs offset by increased Document Exchange Services revenue including revenue generated from our EchoSign e-signing service.

Within Document Services, excluding large enterprise license agreement deals, the number of units licensed decreased while the unit average selling prices increased during fiscal 2013 as compared to fiscal 2012.

Digital Marketing

Revenue from Digital Marketing increased $143.8 million during fiscal 2013 as compared to fiscal 2012. The increase was primarily due to continued revenue growth associated with our Adobe Marketing Cloud, which increased 26% during fiscal 2013, as compared to the year ago period and includes Adobe Campaign revenue from our recent acquisition of Neolane. The increase noted above was partially offset by expected declines in revenue associated with our legacy products during fiscal 2013.

Print and Publishing

Revenue from Print and Publishing decreased during fiscal 2013 as compared to fiscal 2012, primarily due to increased ETLAs for some products in this group.

Fiscal 2012 Revenue Compared to Fiscal 2011 Revenue

Digital Media

Revenue from Digital Media remained relatively stable during fiscal 2012 as compared to fiscal 2011, due to solid demand for our Acrobat family of products as well as the continued momentum of the CS6 launch in the second quarter of the fiscal year. The increase was driven largely2012, offset by a 23% increase in bothbetter than expected growth associated with our subscription offerings.

42

Revenue related to our creative professional products, which included our Creative SuitesSuite editions and PhotoshopCS point product revenueproducts as well as Creative Cloud, decreased slightly during fiscal 2012 as compared to fiscal 2011 due to higher than expected customer adoption of Creative Cloud and point product subscriptions. The decreases in revenue associated with our creative professional products were offset in part by growth associated with the prior year. The overallMay 2012 release of new Photoshop point products for which the previous release occurred in fiscal 2010.

Revenue associated with our other creative products increased during fiscal 2012 as compared to fiscal 2011 primarily due to increases associated with third-party toolbar distribution via Flash Player downloads as well as continued demand related to the May 2012 release of Adobe Lightroom 4.

For our creative offerings, the total number of perpetual units licensed remained relatively stable while the number of subscription units licensed increased 23% whenduring fiscal 2012 as compared to fiscal 2009.2011. Unit average selling prices excluding large enterprise license agreement (“ELA”) deals, remained relatively stablefor our perpetual units licensed decreased during fiscal 20102012 as compared to fiscal 2009.2011.

Digital Marketing

Revenue from Platform decreased $2.1Digital Marketing increased $157.2 million, or 17% during fiscal 2010 as2012when compared to fiscal 2009. The decrease was2011, primarily due to lower developer toolcontinued growth of our Adobe Marketing Cloud, which increased 35% year-over-year and includes revenue based ongenerated from products associated with our fiscal 2012 acquisition of Efficient Frontier. Also contributing to the inclusion of developer tools within some CS5 suites,growth in revenue was our Adobe Connect hosted offering. As expected, increases in these areas were offset in part by an increasea decrease in distribution revenue from OEM relationshipsassociated with companies suchAdobe LiveCycle product offerings as Google, where we offer their technologies as part of the download of Flash Player, Shockwave Playercontinued to shift our focus to our Adobe Marketing Cloud.

Print and Reader and generate revenue through successful installations of these technologies.Publishing

Revenue from Print and Publishing increased $16.6 millionremained relatively stable during fiscal 20102012 as compared to fiscal 20092011 primarily due to an improved economic environmentdecreases in certain markets and geographies, the launch of new products,legacy product revenue, offset by increases in fees received for engineeringconsulting services and royalties related to PostScript products.

Fiscal 2010 | Fiscal 2009 | Fiscal 2008 | % Change 2010-2009 | % Change 2009-2008 | Fiscal 2013 | Fiscal 2012 | Fiscal 2011 | % Change 2013-2012 | % Change 2012-2011 | |||||||||||||||||||||||||||

Americas | $ | 1,859.0 | $ | 1,382.6 | $ | 1,632.8 | 34 | % | (15 | )% | $ | 2,134.4 | $ | 2,196.4 | $ | 2,044.6 | (3 | )% | 7 | % | ||||||||||||||||

Percentage of total revenue | 49 | % | 46 | % | 46 | % | 53 | % | 50 | % | 49 | % | ||||||||||||||||||||||||

EMEA | 1,168.2 | 928.9 | 1,229.2 | 26 | % | (24 | )% | 1,129.2 | 1,294.6 | 1,317.4 | (13 | )% | (2 | )% | ||||||||||||||||||||||

Percentage of total revenue | 31 | % | 32 | % | 34 | % | 28 | % | 29 | % | 31 | % | ||||||||||||||||||||||||

Asia | 772.8 | 634.4 | 717.9 | 22 | % | (12 | )% | |||||||||||||||||||||||||||||

| APAC | 791.6 | 912.7 | 854.3 | (13 | )% | 7 | % | |||||||||||||||||||||||||||||

Percentage of total revenue | 20 | % | 22 | % | 20 | % | 19 | % | 21 | % | 20 | % | ||||||||||||||||||||||||

Total revenue | $ | 3,800.0 | $ | 2,945.9 | $ | 3,579.9 | 29 | % | (18 | )% | $ | 4,055.2 | $ | 4,403.7 | $ | 4,216.3 | (8 | )% | 4 | % | ||||||||||||||||

Fiscal 20102013 Revenue by Geography Compared to Fiscal 20092012 Revenue by Geography

Fiscal 2012 Revenue by Geography Compared to Fiscal 2011 Revenue by Geography

Overall revenue for fiscal 2012 increased in the Americas and APAC and declined slightly in EMEA when compared to fiscal 2011. Revenue in the Americas increased during fiscal 2012 primarily due to revenue increases in Digital Media and Digital Marketing, offset slightly by a decline in Print and Publishing revenue. Despite the launch of CS5CS6 in May 2012, the economic

43

conditions in Europe and the weakening of the Euro and British Pound against the U.S. Dollar caused revenue in EMEA to decline slightly during fiscal 2012 compared with fiscal 2011. Revenue in APAC increased across all reportable segments during fiscal 2012 as compared with fiscal 2011. Within each geographical region, the fluctuations in revenue by reportable segment were attributable to the factors noted in the second quarter of fiscal 2010 as well as additional revenue from Omniture which we acquired in the fourth quarter of fiscal 2009. Increased revenue in our Knowledge Worker and Enterprise business segments also contributed to the increase as well as an improved economy across all geographies.

segment information above.

Included in the overall increasechange in revenue for fiscal 2013 and fiscal 2012 were impacts associated with foreign currency. The U.S. dollar strengthened against both the Euro and British pound causing revenue in EMEA measured in U.S. dollars to decrease by approximately $18.4 million and $3.3 million, respectively,currency as compared to fiscal 2009. Revenue in Japan measured in U.S. dollars was favorably impacted by approximately $23.7 million due to the strength of the Yen against the U.S. dollar as compared to fiscal 2009. The Australian dollar also strengthened against the U.S. dollar resulting in a favorable impact to revenue of approximately $12.1 million during fiscal 2010. We had no comparable impact to revenue from the Australian dollar during fiscal 2009.shown below. Our currency hedging program is used to mitigate a portion of the foreign currency impact to rev enue. During revenue.

| (in millions) | Fiscal 2013 | Fiscal 2012 | |||||

| Revenue impact: | Increase/(Decrease) | ||||||

| EMEA: | |||||||

| Euro | $ | 9.1 | $ | (46.9 | ) | ||

| British Pound | (3.9 | ) | (1.8 | ) | |||

| Other currencies | 0.6 | (1.1 | ) | ||||

| Total EMEA | 5.8 | (49.8 | ) | ||||

| Japanese Yen | (63.6 | ) | 6.0 | ||||

| Other currencies | (5.6 | ) | 1.5 | ||||

| Total revenue impact | (63.4 | ) | (42.3 | ) | |||

| Hedging impact: | |||||||

| EMEA | 3.7 | 23.4 | |||||

| Japanese Yen | 32.3 | 7.3 | |||||

| Total hedging impact | 36.0 | 30.7 | |||||

| Total impact | $ | (27.4 | ) | $ | (11.6 | ) | |

During fiscal 2010, our2013, the U.S. Dollar generally strengthened against the Japanese Yen and other Asian currencies causing revenue in APAC measured in U.S. Dollar equivalents to decrease compared with the same reporting period last year. This decrease was partially offset by the favorable impact to revenue measured in EMEA currencies as the U.S. Dollar generally weakened against these currencies. Our EMEA and Yen currency hedging program related to EMEA and Japanprograms resulted in hedging gains of $19.5 million and $0.6 million, respectively.

During fiscal 2012, the U.S. Dollar strengthened against the Euro, British Pound and other EMEA currencies causing revenue were impacts associated with foreign currency. Revenue in EMEA measured in U.S. dollars decreased approximately $47.1 million, dueDollar equivalents to decrease compared with the strength ofsame reporting period last year. This decrease was offset in part by the favorable impact to revenue measured in Japanese Yen and other Asian currencies as the U.S. dollarDollar weakened against the Euro, as compared to fiscal 2008.these currencies. Our EMEA and Yen currency hedging program is used to mitigate a portion of the foreign currency impact to revenue. Revenue in Asia measured in U.S. dollars was favorably impacted by approximately $32.8 million due to the strength of the Yen against the U.S. dollar as compared to fiscal 2008. During fiscal 2009, our currency hedging program related to the Euro and Yenprograms resulted in hedging gains of $25.8 million and $1.2 million, respectively.

during fiscal 2012 as noted in the table above.

See Item 7A, Quantitative and Qualitative Disclosures About Market Risk regarding foreign currency risks.

Note 18 of our Notes to Consolidated Financial Statements for further geographic information.

Product Backlog

The actual amount of product backlog at any particular time may not be a meaningful indicator of future business prospects. Shippable backlog is comprised of unfulfilled orders, excluding those associated with new product releases, those pending credit review and those not shipped due to the application of our global inventory policy. OurWe had minimal shippable backlog at the end of the fourth quarter of fiscal 2010 was approximately 5% of fourth quarter2013 and fiscal 2010 revenue.2012. We had minimalexpect that our shippable backlog will continue to be insignificant in future periods.

The deferred revenue balance on our consolidated balance sheet does not represent the total contract value of annual or multi-year, non-cancellable subscription agreements. Unbilled deferred revenue represents expected future billings which are contractually committed under our existing subscription, SaaS and managed services agreements that have not been invoiced and are not recorded in deferred revenue within our financial statements. Our presentation of unbilled deferred revenue backlog may differ from that of other companies in the industry. As of November 29, 2013, we had unbilled deferred revenue backlog of approximately $1.0 billion.

We expect that the amount of unbilled deferred revenue backlog will change period over period due to certain factors, including the timing and duration of large customer subscription, SaaS and managed service agreements, varying billing cycles of these agreements, the timing of customer renewals, the timing of when unbilled deferred revenue backlog is to be billed, changes

44

in customer financial circumstances and foreign currency fluctuations. Additionally, the unbilled deferred revenue backlog for multi-year subscription agreements that are billed annually is typically higher at the endbeginning of the third quartercontract period, lower prior to renewal and increases when the agreement is renewed. Accordingly, fluctuations in unbilled deferred revenue backlog may not be a reliable indicator of fiscal 2010. Our shippable backlog atfuture business prospects and the end of the fourth quarter of fiscal 2009 was approximately 9% of fourth quarter fiscal 2009 revenue.related revenue associated with these contractual commitments.

Cost of Revenue (dollars in millions)

Fiscal 2010 | Fiscal 2009 | Fiscal 2008 | % Change 2010-2009 | % Change 2009-2008 | ||||||||||||||

Product | $ | 127.5 | $ | 180.6 | $ | 243.2 | (29 | )% | (26 | )% | ||||||||

Percentage of total revenue | 3 | % | 6 | % | 7 | % | ||||||||||||

Subscription | 195.6 | 48.3 | 23.2 | * | * | |||||||||||||

Percentage of total revenue | 5 | % | 2 | % | 1 | % | ||||||||||||

Services and support | 80.4 | 67.8 | 96.2 | 19 | % | (30 | )% | |||||||||||

Percentage of total revenue | 2 | % | 2 | % | 3 | % | ||||||||||||

Total cost of revenue | $ | 403.5 | $ | 296.7 | $ | 362.6 | 36 | % | (18 | )% | ||||||||

| Fiscal 2013 | Fiscal 2012 | Fiscal 2011 | % Change 2013-2012 | % Change 2012-2011 | ||||||||||||||

| Product | $ | 138.2 | $ | 121.7 | $ | 125.7 | 14 | % | (3 | )% | ||||||||

| Percentage of total revenue | 3 | % | 3 | % | 3 | % | ||||||||||||

| Subscription | 278.1 | 219.1 | 194.0 | 27 | % | 13 | % | |||||||||||

| Percentage of total revenue | 7 | % | 5 | % | 5 | % | ||||||||||||

| Services and support | 170.3 | 143.0 | 118.2 | 19 | % | 21 | % | |||||||||||

| Percentage of total revenue | 4 | % | 3 | % | 3 | % | ||||||||||||

| Total cost of revenue | $ | 586.6 | $ | 483.8 | $ | 437.9 | 21 | % | 10 | % | ||||||||

Product

Cost of product revenue includes product packaging, third-party royalties, excess and obsolete inventory, amortization related to localization costs, purchased intangibles and acquired rights to use technology and the costs associated with the manufacturing of our products.

% Change 2010-2009 | % Change 2009-2008 | |||||||

Amortization of purchased intangibles | (23 | )% | (12 | )% | ||||

Amortization of acquired rights to use technology | 1 | (8 | ) | |||||

Localization costs related to our product launches | (7 | ) | (1 | ) | ||||

Royalty cost | (5 | ) | (1 | ) | ||||

Cost of sales | 4 | (2 | ) | |||||

Various individually insignificant items | 1 | (2 | ) | |||||

Total change | (29 | )% | (26 | )% | ||||

% Change 2013-2012 | % Change 2012-2011 | ||||

| Amortization of purchased intangibles and technology license arrangements | 27 | % | (1 | )% | |

| Cost of sales | (8 | ) | (6 | ) | |

| Excess and obsolete inventory | (4 | ) | 2 | ||

| Various individually insignificant items | (1 | ) | 2 | ||

| Total change | 14 | % | (3 | )% | |

Cost of product revenue increased during fiscal 2013 as compared to fiscal 2012 primarily due to an increase in amortization of purchased intangibles and technology license arrangements offset by decreases in cost of sales and excess and obsolete inventory. Amortization of purchased intangibles decreased during fiscal 2010and technology license arrangements increased as compared to fiscal 2009 and decreased during fiscal 2009 as compared to fiscal 2008, due to decreases in amortization of $46.4 million and $80.0 million, respectively, associated with intangible assets purchased through the Macromedia acquisition which were fully amortized during fiscal 2009.

Cost of product revenue decreased during fiscal 20102012 as compared to fiscal 2009 was2011 primarily due to CS4 products becomingdecrease in cost of sales and amortization of purchase intangibles, offset by increases in excess and obsolete inventory. Cost of sales decreased primarily due to a decrease in packaging costs associated with our CS6 products. Amortization of purchased intangibles decreased primarily due to certain intangible assets purchased through our acquisitions in prior years that were fully amortized at the end ofin fiscal 2009, offset in part2012. Excess and obsolete inventory increased primarily due to increased reserve requirements for Adobe Creative Suite 5 and Adobe Creative Suite 5.5 products necessitated by the launch of CS5 products duringCS6 in the second quarter of fiscal 2010.

2012.

Subscription

Cost of subscription revenue consists of expenses related to operating our network infrastructure, including depreciation expenses and operating lease payments associated with computer equipment, data center costs, salaries and related expenses of network operations, implementation, account management and technical support personnel, amortization of intangible assets and allocated overhead. We enter into contracts with third-parties for the use of their data center facilities and our data center costs largely consist of the amounts we pay to these third-parties for rack space, power and similar items.

45

Cost of subscription revenue increased due to the following:

% Change 2013-2012 | % Change 2012-2011 | ||||

| Hosted server costs | 23 | % | 7 | % | |

| Amortization of purchased intangibles | 4 | 6 | |||

| Total change | 27 | % | 13 | % | |

Cost of subscription revenue increased induring fiscal 20102013 as compared to fiscal 2009 as a result2012 primarily due to increased hosted server costs and amortization of purchased intangibles. Hosted server costs increased primarily due to increases in data center costs related to higher transaction volumes in our Adobe Marketing Cloud and Creative Cloud services, depreciation expense from higher capital expenditures in prior years and compensation and related benefits driven by additional headcount, including from our acquisition of OmnitureNeolane in the fourth quarterfiscal 2013. Amortization of fiscal 2009 and the additionpurchased intangibles increased primarily due to increased amortization of its related data center costs. Also included in cost of subscription revenue for fiscal 2010 is $58.4 million of amortization expense related to intangible assets acquiredpurchased associated with our acquisitions of Behance and Neolane in conjunction with this acquisition.

fiscal 2013.

Cost of subscription revenue increased induring fiscal 20092012 as compared to fiscal 2008 as a result2011 primarily due to increased hosted server costs and amortization of purchased intangibles. Hosted server costs increased primarily due to increases in compensation and related benefits driven by additional headcount and hosting expenses associated with the launch of our Creative Cloud services in the second quarter of fiscal 2012. Also contributing to the increase in hosted server costs is the increase in depreciation expense from higher capital expenditures in prior years and data center costs related to higher transaction volumes in our Adobe Marketing Cloud and Creative Cloud services. Amortization of purchased intangibles increased primarily due to increased amortization of intangible assets associated with our acquisition of OmnitureEfficient Frontier in the fourthfirst quarter of fiscal 2009 and the addition of its related data center costs.

2012.

Services and Support

Cost of services and support revenue is primarily comprised of employee-related costs and associated costs incurred to provide consulting services, training and product support.

Cost of services and support revenue increased during fiscal 2013 as compared to fiscal 2012 primarily due to increases in third-party fees related to training and consulting services provided to our customers and compensation and related benefits driven by additional headcount, including headcount from our acquisition of Neolane in fiscal 2013.

Cost of services and support revenue increased during fiscal 20102012 as compared to fiscal 2009,2011 primarily due to increases in costs associated with compensation and related benefits driven by additional headcount, as a result ofincluding headcount from our acquisition of Omniture.Efficient Frontier.

Operating Expenses (dollars in millions)

Fiscal 2010 | Fiscal 2009 | Fiscal 2008 | % Change 2010-2009 | % Change 2009-2008 | ||||||||||||||

Research and development | $ | 680.3 | $ | 565.1 | $ | 662.1 | 20 | % | (15 | )% | ||||||||

Percentage of total revenue | 18 | % | 19 | % | 18 | % | ||||||||||||

Sales and marketing | $ | 1,244.2 | $ | 981.9 | $ | 1,089.3 | 27 | % | (10 | )% | ||||||||

Percentage of total revenue | 33 | % | 33 | % | 30 | % | ||||||||||||

General and administrative | $ | 383.5 | $ | 298.7 | $ | 337.3 | 28 | % | (11 | )% | ||||||||

Percentage of total revenue | 10 | % | 10 | % | 9 | % | ||||||||||||

Restructuring charges | $ | 23.3 | $ | 41.3 | $ | 32.1 | (44 | )% | 29 | % | ||||||||

Percentage of total revenue | 1 | % | 1 | % | 1 | % | ||||||||||||

| Amortization of purchased intangibles and incomplete technology | $ | 72.1 | $ | 71.6 | $ | 68.2 | 1 | % | 5 | % | ||||||||