0000811156cms:CMSEnergyNotePayableMember2021-12-310000811156us-gaap:DiscontinuedOperationsHeldforsaleMembercms:EnerBankMember2022-03-012022-03-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20212023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____to_____

| | | | | | | | |

| Commission File Number | Registrant; State of Incorporation; Address; and Telephone Number | IRS Employer Identification No. |

| 1-9513 | CMS ENERGY CORPORATION | 38-2726431 |

(A Michigan Corporation)

One Energy Plaza, Jackson, Michigan 49201

(517) 788‑0550

| | | | | | | | |

| 1-5611 | CONSUMERS ENERGY COMPANY | 38-0442310 |

(A Michigan Corporation)

One Energy Plaza, Jackson, Michigan 49201

(517) 788‑0550

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| CMS Energy Corporation Common Stock, $0.01 par value | | CMS | | New York Stock Exchange |

| CMS Energy Corporation 5.625% Junior Subordinated Notes due 2078 | | CMSA | | New York Stock Exchange |

| CMS Energy Corporation 5.875% Junior Subordinated Notes due 2078 | | CMSC | | New York Stock Exchange |

| CMS Energy Corporation 5.875% Junior Subordinated Notes due 2079 | | CMSD | | New York Stock Exchange |

| CMS Energy Corporation Depositary Shares, each representing a 1/1,000th interest in a share of 4.200% Cumulative Redeemable Perpetual Preferred Stock, Series C | | CMS PRC | | New York Stock Exchange |

| Consumers Energy Company Cumulative Preferred Stock, $100 par value: $4.50 Series | | CMS-PB | | New York Stock Exchange |

| | | | | | | | |

| Securities registered pursuant to Section 12(g) of the Act: | None | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

| CMS Energy Corporation: | Yes | ☒ | No | ☐ | | Consumers Energy Company: | Yes | ☒ | No | ☐ | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. |

| CMS Energy Corporation: | Yes | ☐ | No | ☒ | | Consumers Energy Company: | Yes | ☐ | No | ☒ | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

| CMS Energy Corporation: | Yes | ☒ | No | ☐ | | Consumers Energy Company: | Yes | ☒ | No | ☐ | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S‑T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). |

| CMS Energy Corporation: | Yes | ☒ | No | ☐ | | Consumers Energy Company: | Yes | ☒ | No | ☐ | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act. |

| CMS Energy Corporation: | | | | | | Consumers Energy Company: | | | | | |

| Large accelerated filer | | ☒ | | | | Large accelerated filer | | ☐ | | | |

| Non‑accelerated filer | | ☐ | | | | Non‑accelerated filer | | ☒ | | | |

| Accelerated filer | | ☐ | | | | Accelerated filer | | ☐ | | | |

| Smaller reporting company | | ☐ | | | | Smaller reporting company | | ☐ | | | |

| Emerging growth company | | ☐ | | | | Emerging growth company | | ☐ | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

| CMS Energy Corporation: | | ☐ | | | | Consumers Energy Company: | | ☐ | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. |

| CMS Energy Corporation: | | ☒ | | | | Consumers Energy Company: | | ☒ | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. |

| CMS Energy Corporation: | | ☐ | | | | Consumers Energy Company: | | ☐ | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). |

| CMS Energy Corporation: | | ☐ | | | | Consumers Energy Company: | | ☐ | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). |

| CMS Energy Corporation: | Yes | ☐ | No | ☒ | | Consumers Energy Company: | Yes | ☐ | No | ☒ | |

The aggregate market value of CMS Energy voting and non‑voting common equity held by non‑affiliates was $17.113$17.063 billion for the 289,652,428290,440,980 CMS Energy Corporation Common Stock shares outstanding on June 30, 20212023 based on the closing sale price of $59.08$58.75 for CMS Energy Corporation Common Stock, as reported by the New York Stock Exchange on such date. There were no shares of Consumers common equity held by non‑affiliates as of June 30, 2021.2023.

There were 289,760,265294,443,620 shares of CMS Energy Corporation Common Stock outstanding on January 14, 2022.12, 2024. On January 14, 2022,12, 2024, CMS Energy held all 84,108,789 outstanding shares of common stock of Consumers.

Documents incorporated by reference in Part III: CMS Energy’s and Consumers’ proxy statement relating to their 20222024 Annual Meetings of Shareholders to be held May 6, 2022.3, 2024.

CMS Energy Corporation

Consumers Energy Company

Annual Reports on Form 10-K10‑K to the Securities and Exchange Commission for the Year Ended December 31, 20212023

Table of Contents

Glossary

Certain terms used in the text and financial statements are defined below.

| | |

| 2022 Form 10‑K |

2016Each of CMS Energy’s and Consumers’ Annual Report on Form 10‑K for the year ended December 31, 2022 |

|

| 2023 Energy Law |

Michigan’s Public Acts 341229, 230, 231, 233, 234, and 342235 of 20162023 |

|

| 3G |

| Third generation technology |

|

| 4G |

| Fourth generation technology |

|

| ABATE |

| Association of Businesses Advocating Tariff Equity |

|

| ABO |

| Accumulated benefit obligation; the liabilities of a pension plan based on service and pay to date, which differs from the PBO in that it does not reflect expected future salary increases |

|

| AFUDC |

| Allowance for borrowed and equity funds used during construction |

|

| AOCI |

| Accumulated other comprehensive income (loss) |

|

| ARO |

| Asset retirement obligation |

|

| ASC 715 |

| Financial Accounting Standards Board Accounting Standards Codification Topic 715, Retirement Benefits |

|

|

|

|

| Audit Committee |

| The Audit Committee of the Board, which is composed entirely of independent directors. |

|

|

| Aviator Wind |

| Aviator Wind Holdings, LLC, a VIE in which Aviator Wind Equity Holdings holds a Class B membership interest |

|

| | |

| Aviator Wind Equity Holdings |

Aviator Wind Equity Holdings, LLC, a VIE in which Grand River Wind, LLC, a wholly owned subsidiary of CMS Enterprises,NorthStar Clean Energy, has a 51‑percent interest |

|

| Bay Harbor |

| A residential/commercial real estate area located near Petoskey, Michigan, in which CMS Energy sold its interest in 2002 |

|

| bcf |

| Billion cubic feet |

|

| Board |

| Board of Directors of CMS Energy and Consumers |

|

|

|

|

|

|

|

| CAO |

| Chief Accounting Officer |

|

|

|

|

| | |

| CCR |

| Coal combustion residual |

|

| CDC

| U.S. Centers for Disease Control and Prevention

|

| CEO |

| Chief Executive Officer |

|

| CERCLA |

| Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended |

|

| CFO |

| Chief Financial Officer |

|

| city-gate contract |

| An arrangement made for the point at which a local distribution company physically receives gas from a supplier or pipeline |

|

| Clean Air Act |

| Federal Clean Air Act of 1963, as amended |

|

| Clean Energy Plan |

Consumers’ long-term strategy for delivering clean, reliable, resilient, and affordable energy to its customerscustomers; this plan was originally outlined and approved in Consumers’ 2018 integrated resource plan and subsequently updated and approved through the increased use of energy efficiency and customer demand management programs, additional renewable energy generation, and conservation voltage reductionits 2021 integrated resource plan |

|

| Clean Water Act |

| Federal Water Pollution Control Act of 1972, as amended |

|

| | |

| CMS Capital |

| CMS Capital, L.L.C., a wholly owned subsidiary of CMS Energy |

|

| CMS Energy |

CMS Energy Corporation and its consolidated subsidiaries, unless otherwise noted; the parent of Consumers CMS Enterprises, and until October 1, 2021, EnerBank; on October 1, 2021, EnerBank was acquired by Regions Bank |

|

CMS Enterprises |

CMS Enterprises Company, a wholly owned subsidiary of CMSNorthStar Clean Energy |

|

|

|

|

| CMS ERM |

CMS Energy Resource Management Company, a wholly owned subsidiary of CMS Enterprises, formerly known as CMS Marketing, Services and Trading CompanyNorthStar Clean Energy |

|

|

|

|

| CMS Gas Transmission |

| CMS Gas Transmission Company, a wholly owned subsidiary of NorthStar Clean Energy |

|

|

|

|

|

| CMS Generation Michigan Power |

CMS Generation Michigan Power L.L.C., a wholly owned subsidiary of HYDRA‑CO Enterprises, Inc., a wholly owned subsidiary of CMS EnterprisesNorthStar Clean Energy |

|

| CMS Land |

| CMS Land Company, a wholly owned subsidiary of CMS Capital, L.L.C., a wholly owned subsidiary of CMS Energy |

|

|

|

|

| Consumers |

| Consumers Energy Company and its consolidated subsidiaries, unless otherwise noted; a wholly owned subsidiary of CMS Energy |

|

| Consumers 2014 Securitization Funding |

| Consumers 2014 Securitization Funding LLC, a wholly owned consolidated bankruptcy-remote subsidiary of Consumers and special-purpose entity organized for the sole purpose of purchasing and owning securitization property, issuing securitization bonds, and pledging its interest in securitization property to a trustee to collateralize the securitization bonds |

|

COVID‑19Consumers 2023 Securitization Funding |

Coronavirus disease 2019,Consumers 2023 Securitization Funding LLC, a respiratory illnesswholly owned consolidated bankruptcy-remote subsidiary of Consumers and special-purpose entity organized for the sole purpose of purchasing and owning securitization property, issuing securitization bonds, and pledging its interest in securitization property to a trustee to collateralize the securitization bonds |

|

| Covert Generating Station |

A 1,200-MW natural gas-fueled generation station that was declaredacquired by Consumers in May 2023 from New Covert Generating Company, LLC, a pandemic in March 2020 and to which public and private agencies initially responded by instituting social-distancing and other measures designed to slow the spread of the diseasenon-affiliated company |

|

|

|

|

| Craven |

Craven County Wood Energy Limited Partnership, a VIE in which HYDRA‑CO Enterprises, Inc., a wholly owned subsidiary of CMS Enterprises,NorthStar Clean Energy, has a 50-percent interest |

|

| | |

| CSAPR |

| Cross-State Air Pollution Rule of 2011, as amended |

|

| DB Pension Plan A |

| Defined benefit pension plan of CMS Energy and Consumers, including certain present and former affiliates and subsidiaries, created as of December 31, 2017 for active employees who were covered under the defined benefit pension plan that closed in 2005 |

|

| DB Pension Plan B |

| Defined benefit pension plan of CMS Energy and Consumers, including certain present and former affiliates and subsidiaries, amended as of December 31, 2017 to include only retired and former employees who were covered under the defined benefit pension plan that closed in 2005 |

|

| | |

| DB Pension Plans |

| Defined benefit pension plans of CMS Energy and Consumers, comprising DB Pension Plan A and DB Pension Plan B |

|

| DB SERP |

| Defined Benefit Supplemental Executive Retirement Plan |

|

| DCCP |

| Defined Company Contribution Plan |

|

| DC SERP |

| Defined Contribution Supplemental Executive Retirement Plan |

|

|

|

|

| DIG |

Dearborn Industrial Generation, L.L.C., a wholly owned subsidiary of Dearborn Industrial Energy, L.L.C., a wholly owned subsidiary of CMS EnterprisesNorthStar Clean Energy |

|

|

|

|

| Dodd-Frank Act |

| Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 |

|

| DTE Electric |

| DTE Electric Company, a non‑affiliated company |

|

| EEI |

| Edison Electric Institute, an association representing all U.S. investor-owned electric companies |

|

|

| EGLE |

Michigan Department of Environment, Great Lakes, and Energy formerly known as Michigan Department of Environmental Quality |

|

| | |

| Endangered Species Act |

| Endangered Species Act of 1973, as amended |

|

| EnerBank |

EnerBank USA, until October 1, 2021, a wholly owned subsidiary of CMS Capital; onCapital until October 1, 2021 EnerBank was acquired by Regions Bank |

|

| energy waste reduction |

The reduction of energy consumption through energy efficiency and demand-side energy conservation, as established under the 2016 Energy LawMichigan law |

|

| Entergy

| Entergy Corporation, a non‑affiliated company

|

| EPA |

| U.S. Environmental Protection Agency |

|

| EPS |

| Earnings per share |

|

| | |

| ERCOT |

| Electric Reliability Council of Texas |

|

| Exchange Act |

| Securities Exchange Act of 1934 |

|

|

|

|

| Federal Power Act |

| Federal Power Act of 1920 |

|

|

|

|

|

| FERC |

| Federal Energy Regulatory Commission |

|

|

|

|

| First Mortgage Bond Indenture |

| Indenture dated as of September 1, 1945 between Consumers and The Bank of New York Mellon, as Trustee, as amended and supplemented |

|

| FTR |

| Financial transmission right |

|

| GAAP |

| U.S. Generally Accepted Accounting Principles |

|

| GCC |

| Gas Customer Choice, which allows gas customers to purchase gas from alternative suppliers |

|

| | |

| GCR |

| Gas cost recovery |

|

| Genesee |

Genesee Power Station Limited Partnership, a VIE in which HYDRA‑CO Enterprises, Inc., a wholly owned subsidiary of CMS Enterprises,NorthStar Clean Energy, has a 50-percent interest |

|

| Good Neighbor Plan |

| A plan issued by the EPA which secures significant reductions in ozone-forming emissions of NOx from power plants and industrial facilities |

|

|

|

|

| Grayling |

Grayling Generating Station Limited Partnership, a VIE in which HYDRA‑CO Enterprises, Inc., a wholly owned subsidiary of CMS Enterprises,NorthStar Clean Energy, has a 50-percent interest |

|

| GWh |

| Gigawatt-hour, a unit of energy equal to one billion watt-hours |

|

|

|

|

| Internal Revenue Code |

| Internal Revenue Code of 1986, as amended |

|

| IRP |

| Integrated resource plan |

|

| | |

| IRS |

| Internal Revenue Service |

|

| IT |

| Information Technology |

|

|

| kV |

| Thousand volts, a unit used to measure the difference in electrical pressure along a current |

|

| kVA |

| Thousand volt-amperes, a unit used to reflect the electrical power capacity rating of equipment or a system |

|

| kWh |

| Kilowatt-hour, a unit of energy equal to one thousand watt-hours |

|

| LIBOR

| London Interbank Offered Rate

|

| Ludington |

| Ludington pumped-storage plant, jointly owned by Consumers and DTE Electric |

|

| | |

| MATS |

| Mercury and Air Toxics Standards, which limit mercury, acid gases, and other toxic pollution from coal‑fueled and oil‑fueled power plants |

|

|

|

|

| MCV Facility |

A 1,647 MW1,647-MW natural gas-fueled, combined-cycle cogeneration facility operated by the MCV Partnership |

|

| MCV Partnership |

| Midland Cogeneration Venture Limited Partnership, a non-affiliated company |

|

| MCV PPA |

| PPA between Consumers and the MCV Partnership |

|

|

|

|

| METC |

| Michigan Electric Transmission Company, LLC, a non‑affiliated company |

|

| MGP |

| Manufactured gas plant |

|

|

|

|

MIOSHAMigratory Bird Treaty Act |

Michigan Occupational Safety and Health AdministrationMigratory Bird Treaty Act of 1918, as amended |

|

|

|

|

| MISO |

| Midcontinent Independent System Operator, Inc. |

|

| mothball |

| To place a generating unit into a state of extended reserve shutdown in which the unit is inactive and unavailable for service for a specified period, during which the unit can be brought back into service after receiving appropriate notification and completing any necessary maintenance or other work; generation owners in MISO must request approval to mothball a unit, and MISO then evaluates the request for reliability impacts |

|

| MPSC |

| Michigan Public Service Commission |

|

| MRV |

| Market-related value of plan assets |

|

| MW |

| Megawatt, a unit of power equal to one million watts |

|

| MWh |

| Megawatt-hour, a unit of energy equal to one million watt-hours |

|

| | |

| NAAQS |

| National Ambient Air Quality Standards |

|

| Natural Gas Act |

| Natural Gas Act of 1938 |

|

| NERC |

| North American Electric Reliability Corporation, a non‑affiliated company responsible for developing and enforcing reliability standards, monitoring the bulk power system, and educating and certifying industry personnel |

|

| Newport Solar |

| Newport Solar, LLC, a wholly owned subsidiary of Newport Solar Holdings |

|

| Newport Solar Holdings |

| Newport Solar Holdings III, LLC, a VIE in which Newport Solar Equity Holdings LLC, a wholly owned subsidiary of Grand River Solar, LLC, a wholly owned subsidiary of NorthStar Clean Energy, holds a Class B membership interest |

|

| NorthStar Clean Energy |

| NorthStar Clean Energy Company, a wholly owned subsidiary of CMS Energy, formerly known as CMS Enterprises Company |

|

| NOx |

| Nitrogen oxides |

|

| NPDES |

| National Pollutant Discharge Elimination System, a permit system for regulating point sources of pollution under the Clean Water Act |

|

| NREPA |

| Part 201 of Michigan’s Natural Resources and Environmental Protection Act of 1994, as amended |

|

|

|

|

NSRNWO Holdco |

New Source Review,NWO Holdco, L.L.C., a construction-permitting program under theVIE in which NWO Holdco I, LLC, a wholly owned subsidiary of Grand River Wind, LLC, a wholly owned subsidiary of NorthStar Clean Air ActEnergy, holds a Class B membership interest |

|

| OPEB |

Other Post-Employment Benefitspost-employment benefits |

|

| | |

| OPEB Plan |

| Postretirement health care and life insurance plans of CMS Energy and Consumers, including certain present and former affiliates and subsidiaries |

|

| | |

| OSHA |

| Occupational Safety and Health Administration |

|

| Palisades

| Palisades nuclear power plant, sold by Consumers to Entergy in 2007

|

| PBO |

| Projected benefit obligation |

|

| PCB |

| Polychlorinated biphenyl |

|

| PFAS |

| Per- and polyfluoroalkyl substances |

|

| PHMSA

| U.S. Department of Transportation’s Pipeline and Hazardous Materials Safety Administration

|

| PISP |

| Performance Incentive Stock Plan |

|

| PJM |

| PJM Interconnection Inc. |

|

| PPA |

| Power purchase agreement |

|

| PSCR |

| Power supply cost recovery |

|

| PURPA |

| Public Utility Regulatory Policies Act of 1978 |

|

| RCRA |

| Federal Resource Conservation and Recovery Act of 1976 |

|

| REC |

| Renewable energy credit |

|

| | |

| Regions Bank

| A subsidiary of Regions Financial Corporation, a non-affiliated company

|

| ROA |

| Retail Open Access, which allows electric generation customers to choose alternative electric suppliers pursuant to Michigan’s Public Acts 141 and 142 of 2000, as amended |

|

| S&P |

| Standard & Poor’s Financial Services LLC |

|

|

| SEC |

| U.S. Securities and Exchange Commission |

|

| | |

| securitization |

| A financing method authorized by statute and approved by the MPSC which allows a utility to sell its right to receive a portion of the rate payments received from its customers for the repayment of securitization bonds issued by a special-purpose entity affiliated with such utility |

|

| Series C preferred stock |

| CMS Energy 4.200 percent cumulative redeemable perpetual preferred stock, Series C, with a liquidation value of $25,000 per share |

|

|

|

|

| SOFR |

| Secured overnight financing rate calculated and published by the Federal Reserve Bank of New York and selected as the recommended alternative to replace the London Interbank Offered Rate for dollar-denominated financial contracts by the Alternative Reference Rates Committee |

|

| TAES |

| Toshiba America Energy Systems Corporation, a non-affiliated company |

|

| TBJH |

| TBJH Inc., a non-affiliated company |

|

| TCJA |

| Tax Cuts and Jobs Act of 2017 |

|

| Term SOFR |

| The rate per annum that is a forward-looking term rate based on SOFR |

|

| T.E.S. Filer City |

T.E.S. Filer City Station Limited Partnership, a VIE in which HYDRA‑CO Enterprises, Inc., a wholly owned subsidiary of CMS Enterprises,NorthStar Clean Energy, has a 50-percent interest |

|

| Toshiba |

| Toshiba Corporation, a non-affiliated company |

|

| USW |

| United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union, AFL-CIO-CLC |

|

| UWUA |

| Utility Workers Union of America, AFL-CIO |

|

| VEBA trust |

| Voluntary employees’ beneficiary association trusts accounts established specifically to set aside employer-contributed assets to pay for future expenses of the OPEB Plan |

|

| | |

| VIE |

| Variable interest entity |

|

| Wolverine Power |

| Wolverine Power Supply Cooperative, Inc., a non-affiliated company |

|

Filing Format

This combined Form 10-K10‑K is separately filed by CMS Energy and Consumers. Information in this combined Form 10-K10‑K relating to each individual registrant is filed by such registrant on its own behalf. Consumers makes no representation regarding information relating to any other companies affiliated with CMS Energy other than its own subsidiaries.

CMS Energy is the parent holding company of several subsidiaries, including Consumers and CMS Enterprises. CMS Energy was also the parent holding company of EnerBank until October 1, 2021 when EnerBank was acquired by Regions Bank.NorthStar Clean Energy. None of CMS Energy, CMS Enterprises,NorthStar Clean Energy, nor any of CMS Energy’s other subsidiaries (other than Consumers) has any obligation in respect of Consumers’ debt securities or preferred stock and holders of such securities should not consider the financial resources or results of operations of CMS Energy, CMS Enterprises,NorthStar Clean Energy, nor any of CMS Energy’s other subsidiaries (other than Consumers and its own subsidiaries (in relevant circumstances)) in making a decision with respect to Consumers’ debt securities or preferred stock. Similarly, neither Consumers nor any other subsidiary of CMS Energy has any obligation in respect of securities of CMS Energy.

Forward-LookingForward-looking Statements and Information

This Form 10-K10‑K and other CMS Energy and Consumers disclosures may contain forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. The use of “might,“anticipates,” “may,“assumes,” “believes,” “could,” “should,” “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “goals,” “guidance,” “intends,” “may,” “might,” “objectives,” “plans,” “projects,“possible,” “forecasts,“potential,” “predicts,” “assumes,“projects,” “seeks,” “should,” “targets,” “will,” and other similar words is intended to identify forward-looking statements that involve risk and uncertainty. This discussion of potential risks and uncertainties is designed to highlight important factors that may impact CMS Energy’s and Consumers’ businesses and financial outlook. CMS Energy and Consumers have no obligation to update or revise forward-looking statements regardless of whether new information, future events, or any other factors affect the information contained in the statements. These forward-looking statements are subject to various factors that could cause CMS Energy’s and Consumers’ actual results to differ materially from the results anticipated in these statements. These factors include, but are not limited to, the following, all of which are potentially significant:

•the impact and effect of recent events, such as worsening trade relations, geopolitical tensions, war, acts of terrorism, and the COVID-19 pandemic, the responseresponses to the COVID-19 pandemic,these events, and related economic disruptions including, but not limited to, labor shortages, inflation, energy price volatility, and supply chain disruptions all of which could impact CMS Energy’s and Consumers’ workforce, operations, revenues, expenses, uncollectible accounts, energy efficiency programs, pension funding, PSCR and GCR costs, capital investment programs, cash flows, liquidity, maintenance of existing assets, and other operating expenses

•the impact of new regulation by the MPSC, FERC, and other applicable governmental proceedings and regulations, including any associated impact on electric or gas rates or rate structures

•potentially adverse regulatory treatment, oreffects of a failure to receive timely regulatory orders affecting Consumers that are or could come before the MPSC, FERC, or other governmental authorities, or effects of a government shutdown

•changes in the performance of or regulations applicable to MISO, METC,Michigan Electric Transmission Company, LLC (a non‑affiliated company), pipelines, railroads, vessels, or other service providers that CMS Energy, Consumers, or any of their affiliates rely on to serve their customers

•the adoption of or challenges to federal or state laws or regulations or changes in applicable laws, rules, regulations, principles, or practices, or in their interpretation, such as those related to energy policy, ROA, PURPA,the Public Utility Regulatory Policies Act of 1978, infrastructure integrity or

security, cybersecurity, gas pipeline safety, gas pipeline capacity, energy waste reduction, the environment, regulation or deregulation, reliability, COVID-19 vaccination and testing requirements, health care reforms, (including comprehensive health care reform enacted in 2010), taxes, accounting matters, climate change, air emissions, renewable energy, the Dodd-Frank Act, and other business issues that could have an impact on CMS Energy’s, Consumers’, or any of their affiliates’ businesses or financial results

•factors affecting, disrupting, interrupting, or otherwise impacting CMS Energy’s or Consumers’ facilities, utility infrastructure, operations, or backup systems, such as costs and availability of personnel, equipment, and materials; weather conditions;and climate, including catastrophic weather-related damage and extreme temperatures; natural disasters; catastrophic weather-related damage;fires; smoke; scheduled or unscheduled equipment outages; maintenance or repairs; contractor performance; environmental incidents; failures of equipment or materials; electric transmission and distribution or gas pipeline system constraints; interconnection requirements; political and social unrest; general strikes; the government and/or paramilitary response to political or social events; and changes in trade policies or regulationsregulations; accidents; explosions; physical disasters; global pandemics; cyber incidents; vandalism; war or terrorism; and the ability to obtain or maintain insurance coverage for these events

•the ability of CMS Energy and Consumers to execute cost-reduction strategies

•potentially adverse regulatory or legal interpretations or decisions regarding environmental matters, or delayed regulatory treatment or permitting decisions that are or could come before agencies such as EGLE, the EPA, FERC, and/or the U.S. Army Corps of Engineers, and potential environmental remediation costs associated with these interpretations or decisions, including those that may affect Consumers’ coal ash management or routine maintenance, repair, and replacement classification under NSR regulationsNew Source Review, a construction-permitting program under the Clean Air Act

•changes in energy markets, including availability, price, and priceseasonality of electric capacity and the timing and extent of changes in commodity prices and availability and deliverability of coal, natural gas, natural gas liquids, electricity, oil, gasoline, diesel fuel, and certain related products

•the price of CMS Energy common stock, the credit ratings of CMS Energy and Consumers, capital and financial market conditions, and the effect of these market conditions on CMS Energy’s and Consumers’ interest costs and access to the capital markets, including availability of financing to CMS Energy, Consumers, or any of their affiliates

•the potential effectsability of the future transition from LIBORCMS Energy and Consumers to an alternative reference interest rate in the credit and capital marketsexecute their financing strategies

•the investment performance of the assets of CMS Energy’s and Consumers’ pension and benefit plans, the discount rates, mortality assumptions, and future medical costs used in calculating the plans’ obligations, and the resulting impact on future funding requirements

•the impact of the economy, particularly in Michigan, and potential future volatility in the financial and credit markets on CMS Energy’s, Consumers’, or any of their affiliates’ revenues, ability to collect accounts receivable from customers, or cost and availability of capital

•changes in the economic and financial viability of CMS Energy’s and Consumers’ suppliers, customers, and other counterparties and the continued ability of these third parties, including those in bankruptcy, to meet their obligations to CMS Energy and Consumers

•population changes in the geographic areas where CMS Energy and Consumers conduct business

•national, regional, and local economic, competitive, and regulatory policies, conditions, and developments

•loss of customer demand for electric generation supply to alternative electric suppliers, increased use of self-generation including distributed generation, or energy waste reduction, andor energy storage

•loss of customer demand for natural gas due to alternative technologies or fuels or electrification

•ability of Consumers to meet increased renewable energy demand due to customers seeking to meet their own sustainability goals in a timely and cost-efficient manner

•the reputational or other impact on CMS Energy and Consumers of the failure to achieve ambitionsor make timely progress on their greenhouse gas reduction goals related to reducing their impact on climate change

•adverse consequences of employee, director, or third-partythird‑party fraud or non‑compliance with codes of conduct or with laws or regulations

•federal regulation of electric sales, including periodic re‑examination by federal regulators of CMS Energy’s and Consumers’ market-based sales authorizations

•any event, change, development, occurrence, or circumstance that could impact the 2021 IRP filing or give rise to the terminationimplementation of the associated purchase agreements,Clean Energy Plan, including any action by a regulatory authority or other third party to prohibit, delay, or impair or deny approval for or consent to the 2021 IRP or the consummationimplementation of the proposed acquisitionsClean Energy Plan

•the availability, cost, coverage, and terms of insurance, the stability of insurance providers, and the ability of Consumers to recover the costs of any insurance from customers

•the effectiveness of CMS Energy’s and Consumers’ risk management policies, procedures, and strategies, including strategies to hedge risk related to interest rates and future prices of electricity, natural gas, and other energy-related commodities

•factors affecting development of electric generation projects, gas transmission, and gas and electric distribution infrastructure replacement, conversion, and expansion projects, including factors related to project site identification, construction material pricing, schedule delays, availability of qualified construction personnel, permitting, acquisition of property rights, community opposition, environmental regulations, and government approvals

•potential disruption to, interruption of, or other impacts on facilities, utility infrastructure, operations, or backup systems due to accidents, explosions, physical disasters, global pandemics, cyber incidents, civil unrest, vandalism, war, or terrorism, and the ability to obtain or maintain insurance coverage for these eventsactions

•changes or disruption in fuel supply, including but not limited to supplier bankruptcy and delivery disruptions

•potential costs, lost revenues, reputational harm, or other consequences resulting from misappropriation of assets or sensitive information, corruption of data, or operational disruption in connection with a cyberattack or other cyber incident

•potential disruption to, interruption or failure of, or other impacts on information technology backup or disaster recovery systems

•technological developments in energy production, storage, delivery, usage, and metering

•the ability to implement and integrate technology successfully, including artificial intelligence

•the impact of CMS Energy’s and Consumers’ integrated business software system and its effects on their operations, including utility customer billing and collections

•adverse consequences resulting from any past, present, or future assertion of indemnity or warranty claims associated with assets and businesses previously owned by CMS Energy or Consumers, including claims resulting from attempts by foreign or domestic governments to assess taxes on or to impose environmental liability associated with past operations or transactions

•the outcome, cost, and other effects of any legal or administrative claims, proceedings, investigations, or settlements

•the reputational impact on CMS Energy and Consumers of operational incidents, violations of corporate policies, regulatory violations, inappropriate use of social media, and other events

•restrictions imposed by various financing arrangements and regulatory requirements on the ability of Consumers and other subsidiaries of CMS Energy to transfer funds to CMS Energy in the form of cash dividends, loans, or advances

•earnings volatility resulting from the application of fair value accounting to certain energy commodity contracts or interest rate contracts

•changes in financial or regulatory accounting principles or policies (e.g., the adoption of the hypothetical liquidation at book value method of accounting for certain non-regulated renewable energy projects)

•other matters that may be disclosed from time to time in CMS Energy’s and Consumers’ SEC filings, or in other public documents

All forward-looking statements should be considered in the context of the risk and other factors described above and as detailed from time to time in CMS Energy’s and Consumers’ SEC filings. For additional details regarding these and other uncertainties, see Item 1A. Risk Factors; Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Outlook; and Item 8. Financial Statements and Supplementary Data—Notes to the Consolidated Financial Statements—Note 2, Regulatory Matters and Note 3, Contingencies and Commitments.

Part I

Item 1. Business

General

CMS Energy

CMS Energy was formed as a corporation in Michigan in 1987 and is an energy company operating primarily in Michigan. It is the parent holding company of several subsidiaries, including Consumers, an electric and gas utility;utility, and CMS Enterprises,NorthStar Clean Energy, primarily a domestic independent power producer and marketer. CMSConsumers’ customer base consists of a mix of primarily residential, commercial, and diversified industrial customers. NorthStar Clean Energy, was also the parent holding company of EnerBank, an industrial bank located in Utah, until October 1, 2021 when EnerBank was acquired by Regions Bank. Consumers serves individuals and businesses operating in the alternative energy, automotive, chemical, food, and metal products industries, as well as a diversified group of other industries. CMS Enterprises, through its subsidiaries and equity investments, is engaged in domestic independent power production, including the development and operation of renewable generation, and the marketing of independent power production.

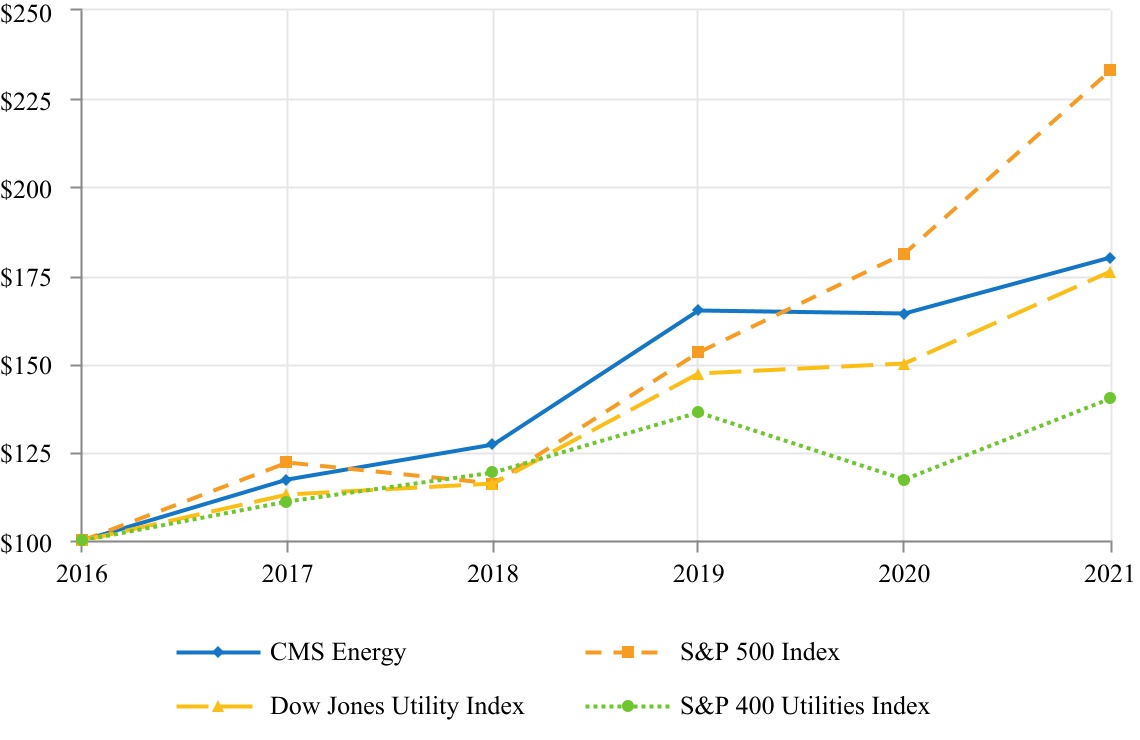

CMS Energy manages its businesses by the nature of services each provides, and operates principally in three business segments: electric utility; gas utility; and enterprises,NorthStar Clean Energy, its non‑utility operations and investments. Consumers’ consolidated operations account for the substantial majority of CMS Energy’s total assets, income, and operating revenue. CMS Energy’s consolidated operating revenue was $7.5 billion in 2023, $8.6 billion in 2022, and $7.3 billion in 2021, $6.4 billion in 2020, and $6.6 billion in 2019.2021.

For further information about operating revenue, income, and assets and liabilities attributable to all of CMS Energy’s business segments and operations, see Item 8. Financial Statements and Supplementary Data—CMS Energy Consolidated Financial Statements and Notes to the Consolidated Financial Statements.

Consumers

Consumers has served Michigan customers since 1886. Consumers was incorporated in Maine in 1910 and became a Michigan corporation in 1968. Consumers owns and operates electric generation and distribution facilities and gas transmission, storage, and distribution facilities. It provides electricity and/or natural gas to 6.8 million of Michigan’s 10 million residents. Consumers’ rates and certain other aspects of its business are subject to the jurisdiction of the MPSC and FERC, as well as to NERC reliability standards, as described in Item 1. Business—CMS Energy and Consumers Regulation.

Consumers’ consolidated operating revenue was $7.2 billion in 2023, $8.2 billion in 2022, and $7.0 billion in 2021, $6.2 billion in 2020, and $6.4 billion in 2019.2021. For further information about operating revenue, income, and assets and liabilities attributable to Consumers’ electric and gas utility operations, see Item 8. Financial Statements and Supplementary Data—Consumers Consolidated Financial Statements and Notes to the Consolidated Financial Statements.

Consumers owns its principal properties in fee, except that most electric lines, gas mains, and renewable generation projects are located below or adjacent to public roads or on land owned by others and are accessed by Consumers through easements, leases, and other rights. Almost all of Consumers’ properties are subject to the lien of its First Mortgage Bond Indenture. For additional information on Consumers’ properties, see Item 1. Business—Business Segments—Consumers Electric Utility—Electric Utility Properties and Business Segments—Consumers Gas Utility—Gas Utility Properties.

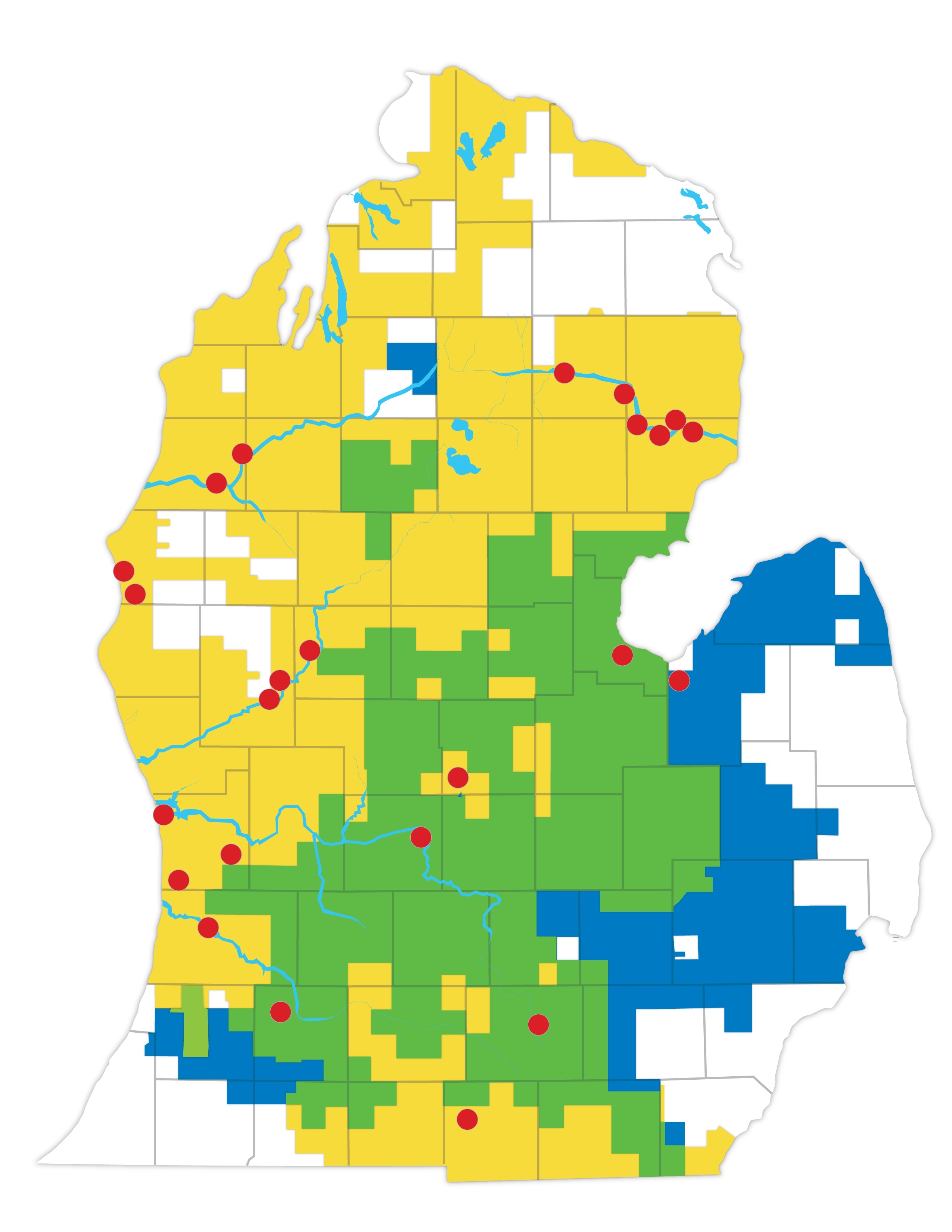

In 2021,2023, Consumers served 1.9 million electric customers and 1.8 million gas customers in Michigan’s Lower Peninsula. Presented in the following map are Consumers’ service territories:

| | | | | | | | | | | |

| | | |

| | |

| | |

| | |

| | |

| | |

| | Electric service territory |

| | |

| | Gas service territory |

| | |

| | Combination electric and gas service territory |

| |

| | |

| • | | Electric generation and battery storage facilities |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

CMS Energy and Consumers—The Triple Bottom Line

For information regarding CMS Energy’s and Consumers’ purpose and impact on the “triple bottom line” of people, planet, and profit, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Executive Overview.

Business Segments

Consumers Electric Utility

Electric Utility Operations: Consumers’ electric utility operations, which include the generation, purchase, distribution, and sale of electricity, generated operating revenue of $4.7 billion in 2023, $5.4 billion in 2022, and $5.0 billion in 2021, and $4.4 billion in 2020 and 2019.2021. Consumers’ electric utility customer base consists of a mix of primarily residential, commercial, and diversified industrial customers in Michigan’s Lower Peninsula.

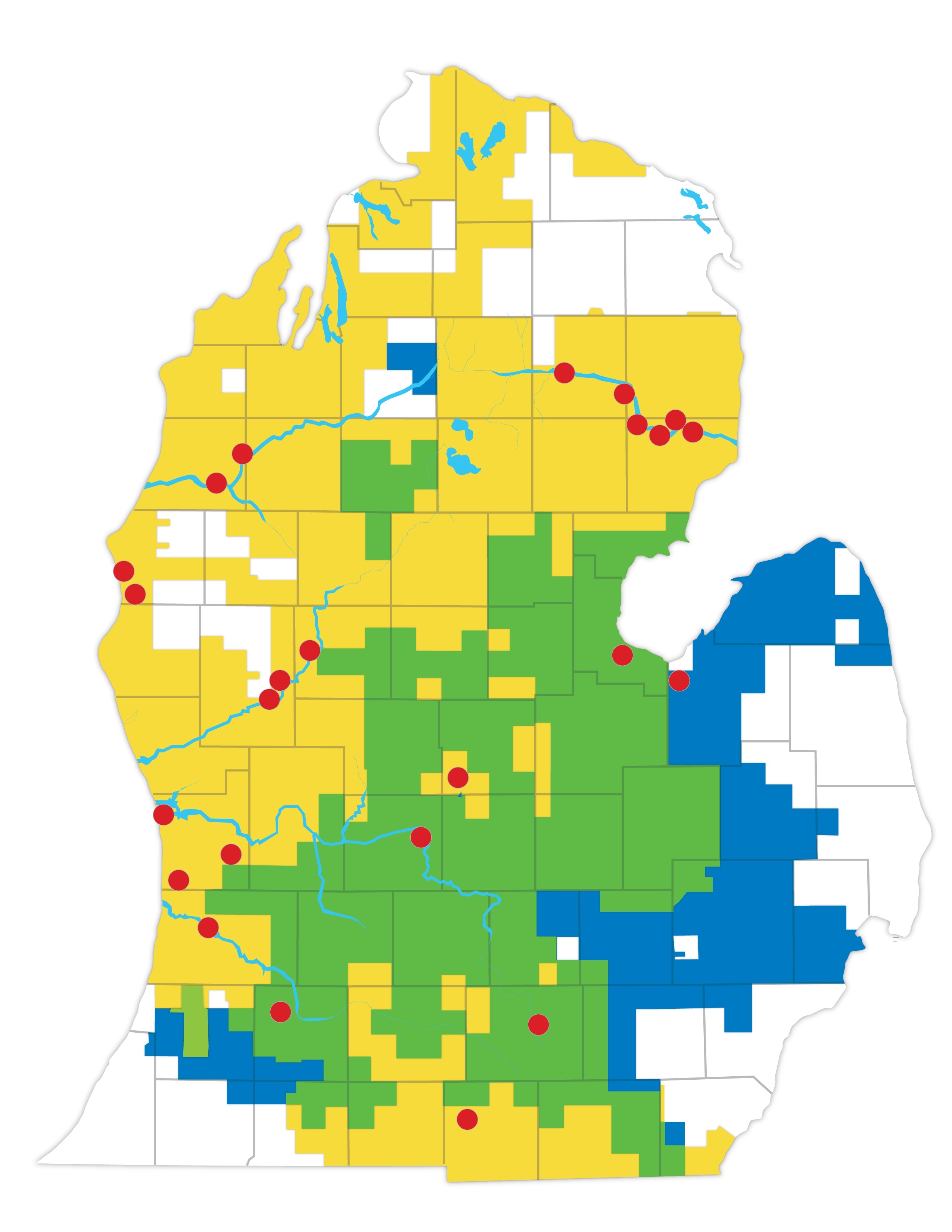

Presented in the following illustration is Consumers’ 20212023 electric utility operating revenue of $5.0$4.7 billion by customer class:

Consumers’ electric utility operations are not dependent on a single customer, or even a few customers, and the loss of any one or even a few of Consumers’ largest customers is not reasonably likely to have a material adverse effect on Consumers’ financial condition.

In 2021,2023, Consumers’ electric deliveries were 36 billion kWh, which included ROA deliveries of three billion kWh, resulting in net bundled sales of 33 billion kWh. In 2020,2022, Consumers’ electric deliveries were 3537 billion kWh, which included ROA deliveries of three billion kWh, resulting in net bundled sales of 3234 billion kWh.

Consumers’ electric utility operations are seasonal. The consumption of electric energy typically increases in the summer months, due primarily to the use of air conditioners and other cooling equipment.

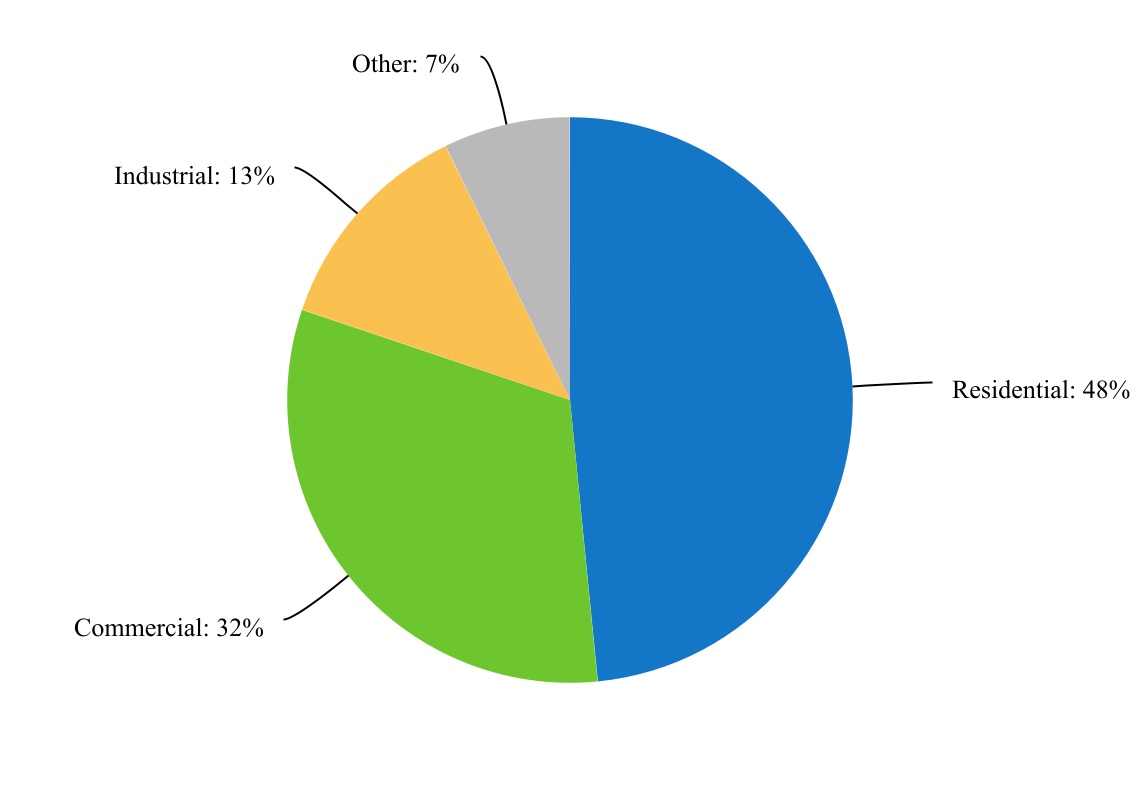

Presented in the following illustration are Consumers’ monthly weather-normalized electric deliveries (deliveries adjusted to reflect normal weather conditions) to its customers, including ROA deliveries, during 20212023 and 2020:2022:

Consumers’ 20212023 summer peak demand was 7,9518,067 MW, which included ROA demand of 581549 MW. For the 2020-20212022-2023 winter season, Consumers’ peak demand was 5,3865,358 MW, which included ROA demand of 465430 MW. As required by MISO reserve margin requirements, Consumers owns or controls, through long-term PPAs and short-term capacity purchases, all of the capacity required to supply its projected firm peak load and necessary reserve margin for summer 2022.2024.

Electric Utility Properties: Consumers owns and operates electric generation and distribution facilities. For details about Consumers’ electric generation facilities, see the Electric Utility Generation and Supply Mix section that follows this Electric Utility Properties section. Consumers’ distribution system consists of:

•208270 miles of high-voltage distribution overhead lines operating at 138 kV

•4four miles of high-voltage distribution underground lines operating at 138 kV

•4,4284,645 miles of high-voltage distribution overhead lines operating at 46 kV and 69 kV

•1918 miles of high-voltage distribution underground lines operating at 46 kV

•82,47482,049 miles of electric distribution overhead lines

•9,3959,708 miles of underground distribution lines

•1,0931,099 substations with an aggregate transformer capacity of 2628 million kVA

•threefour battery facilities with storage capacity of 2ten MWh

Consumers is interconnected to the interstate high-voltage electric transmission system owned by METC and operated by MISO. Consumers is also interconnected to neighboring utilities and to other transmission systems.

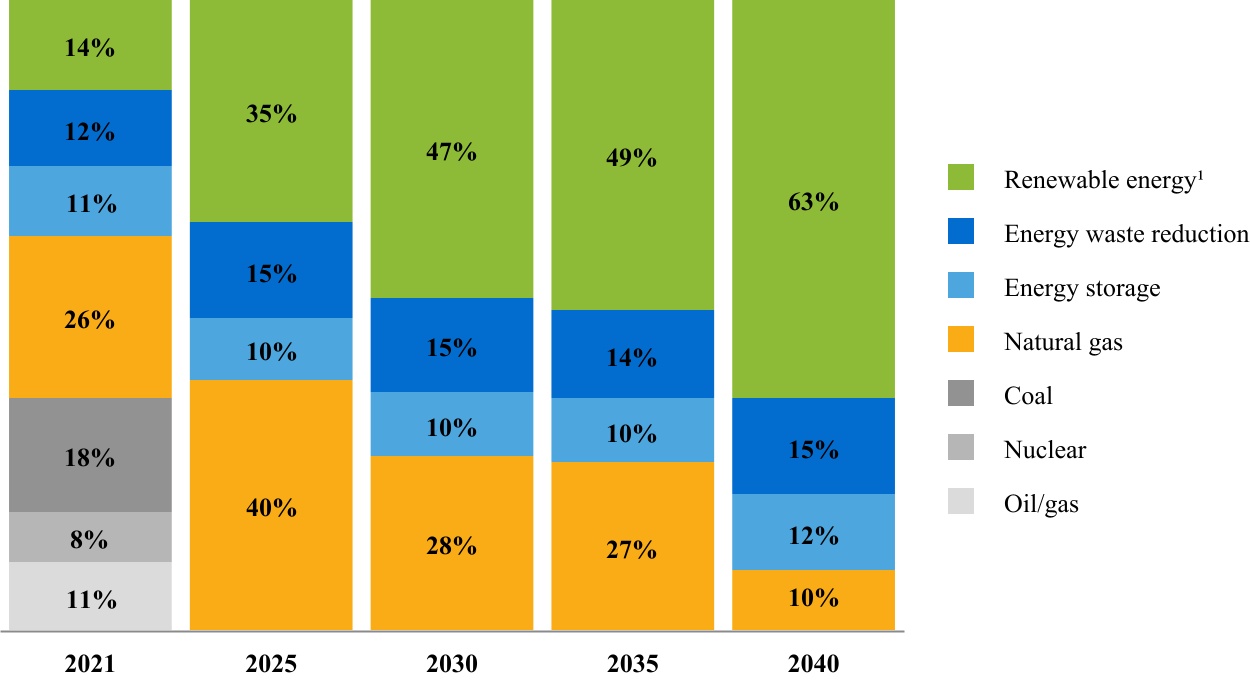

Electric Utility Generation and Supply Mix: During 2020,Consumers’ Clean Energy Plan details its strategy to meet customers’ long-term energy needs. The Clean Energy Plan was most recently revised and approved by

the MPSC in June 2022. Under Michigan’s integrated resource planning process, Consumers announcedis required to file proposed updates to its Clean Energy Plan before or in 2027; these updates will outline a path to meeting the requirements of the 2023 Energy Law that was enacted in Michigan in November 2023.

Consumers’ Clean Energy Plan provides the foundation for its goal of achievingto achieve net-zero carbon emissions from its electric business by 2040. This goal includes not only emissions from

Consumers’ owned generation, but also emissions from the generation of power purchased through long-term PPAs and from the MISO energy market.

Consumers expects to meet 90 percent of its customers’ needs with clean energy sources by 2040 through execution of its 2021 IRP,Clean Energy Plan, which calls for replacing its coal-fueled generation predominantly with investment in renewable energy. CarbonNew technologies and carbon offset measures including, but not limited to, carbon sequestration, methane emission capture, and forest preservation, and reforestation may be used to close the gap to achieving net-zero carbon emissions. Specifically, the 2021 IRP provides for a full transition away from coal-fueled generation by the end of 2025 and includes the retirement of

In accordance with its Clean Energy Plan, Consumers retired the D.E. Karn oil/gas-fueled and coal-fueled generating units in June 2023 and plans to retire the J.H. Campbell coal-fueled generating units in 2025. In order to continue providing controllable sources of electricity to customers while expanding its investment in renewable energy, Consumers purchased the Covert Generating Station, a natural gas-fueled generating facility, in May 2023. For further information on Consumers’ progress towards its net-zero carbon emissions goal, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Executive Overview.

Presented in the following table are details about Consumers’ 20212023 electric generation and supply mix:

| | | | | | | | | | | | | | | | | |

| Name and Location (Michigan) | Number of Units and Year Entered Service | 2021

Generation Capacity

(MW) | 1

| 2021

Electric Supply

(GWh) | |

| Coal steam generation | | | | | |

J.H. Campbell 1 & 2 – West Olive2 | 2 Units, 1962-1967 | 600 | | | 3,123 | | |

J.H. Campbell 3 – West Olive2,3 | 1 Unit, 1980 | 788 | | | 4,784 | | |

D.E. Karn 1 & 2 – Essexville4 | 2 Units, 1959-1961 | 487 | | | 2,954 | | |

| | 1,875 | | | 10,861 | | |

| Oil/Gas steam generation | | | | | |

D.E. Karn 3 & 4 – Essexville4 | 2 Units, 1975-1977 | 934 | | | 128 | | |

| Hydroelectric | | | | | |

| Ludington – Ludington | 6 Units, 1973 | 927 | | 5 | (321) | | 6 |

| Conventional hydro generation – various locations | 35 Units, 1906-1949 | 76 | | | 398 | | |

| | 1,003 | | | 77 | | |

| Gas combined cycle | | | | | |

| Jackson – Jackson | 1 Unit, 2002 | 541 | | | 2,141 | | |

| Zeeland – Zeeland | 3 Units, 2002 | 531 | | | 2,839 | | |

| | 1,072 | | | 4,980 | | |

| Gas combustion turbines | | | | | |

| Zeeland (simple cycle) – Zeeland | 2 Units, 2001 | 316 | | | 454 | | |

| Wind generation | | | | | |

Cross Winds® Energy Park – Tuscola County | 114 Turbines,

2014, 2018, and 2019 | 35 | | | 661 | | |

Lake Winds® Energy Park – Mason County | 56 Turbines, 2012 | 13 | | | 239 | | |

| Gratiot Farms Wind Project – Gratiot County | 60 Turbines, 2020 | 24 | | | 354 | | |

| Crescent Wind Farm – Hillsdale County | 60 Turbines, 2021 | 25 | | | 316 | | |

| | 97 | | | 1,570 | | |

| Solar generation | | | | | |

| Solar Gardens – Allendale and Kalamazoo | 15,100 Panels, 2016 | 3 | | | 6 | | |

| Total owned generation | | 5,300 | | | 18,076 | | |

Purchased power7 | | | | | |

| Coal generation – T.E.S. Filer City | | 60 | | | 494 | | |

Gas generation – MCV Facility8 | | 1,240 | | | 4,753 | | |

| Other gas generation – various locations | | 160 | | | 1,109 | | |

Nuclear generation – Palisades8 | | 792 | | | 6,901 | | |

| Wind generation – various locations | | 43 | | | 1,010 | | |

| Solar generation – various locations | | 37 | | | 140 | | |

| Other renewable generation – various locations | | 220 | | | 1,258 | | |

| | 2,552 | | | 15,665 | | |

Net interchange power9 | | — | | | 645 | | |

| Total purchased and interchange power | | 2,552 | | | 16,310 | | |

| Total supply | | 7,852 | | | 34,386 | | |

| Less distribution and transmission loss | | | | 1,786 | | |

| Total net bundled sales | | | | 32,600 | | |

| | | | | | | | | | | | | | | | | |

| Name and Location (Michigan) | Number of Units and Year Entered Service | 2023

Generation Capacity

(MW) | 1

| 2023

Electric Supply

(GWh) | |

| Coal steam generation | | | | | |

J.H. Campbell 1 & 2 – West Olive2 | 2 Units, 1962-1967 | 617 | | | 2,025 | | |

J.H. Campbell 3 – West Olive2,3 | 1 Unit, 1980 | 784 | | | 4,260 | | |

D.E. Karn 1 & 2 – Essexville4 | 2 Units, 1959-1961 | — | | | 599 | | |

| | 1,401 | | | 6,884 | | |

| Oil/Gas steam generation | | | | | |

| D.E. Karn 3 & 4 – Essexville | 2 Units, 1975-1977 | 1,200 | | | 14 | | |

| Hydroelectric | | | | | |

| Ludington – Ludington | 6 Units, 1973 | 1,115 | | 5 | (349) | | 6 |

| Conventional hydro generation | 35 Units, 1906-1949 | 77 | | | 376 | | |

| | 1,192 | | | 27 | | |

| Gas combined cycle | | | | | |

Covert Generating Station – Covert7 | 3 Units, 2004 | 1,088 | | | 4,654 | | |

| Jackson – Jackson | 1 Unit, 2002 | 538 | | | 1,937 | | |

| Zeeland – Zeeland | 3 Units, 2002 | 532 | | | 3,418 | | |

| | 2,158 | | | 10,009 | | |

| Gas combustion turbines | | | | | |

| Zeeland (simple cycle) – Zeeland | 2 Units, 2001 | 318 | | | 1,200 | | |

| Wind generation | | | | | |

| Crescent Wind Farm – Hillsdale County | 2021 | 150 | | | 356 | | |

Cross Winds® Energy Park – Tuscola County | 2014-2019 | 231 | | | 669 | | |

| Gratiot Farms Wind Project – Gratiot County | 2020 | 150 | | | 342 | | |

| Heartland Farms Wind Project – Gratiot County | 2023 | — | | | 1 | | |

Lake Winds® Energy Park – Mason County | 2012 | 101 | | | 242 | | |

| | 632 | | | 1,610 | | |

| Solar generation | | | | | |

| Solar Gardens – Allendale, Cadillac, and Kalamazoo | 2016-2021 | 5 | | | 7 | | |

| Total owned generation | | 6,906 | | | 19,751 | | |

Purchased power8 | | | | | |

| Coal generation – T.E.S. Filer City | | 60 | | | 318 | | |

Gas generation – MCV Facility9 | | 1,240 | | | 6,029 | | |

| Other gas generation | | 152 | | | 1,215 | | |

| Wind generation | | 385 | | | 970 | | |

| Solar generation | | 307 | | | 554 | | |

| Other renewable generation | | 210 | | | 1,061 | | |

| | 2,354 | | | 10,147 | | |

Net interchange power10 | | — | | | 4,532 | | |

| Total purchased and interchange power | | 2,354 | | | 14,679 | | |

| Total supply | | 9,260 | | | 34,430 | | |

| Less distribution and transmission loss | | | | 1,699 | | |

| Total net bundled sales | | | | 32,731 | | |

1RepresentsWith the exception of wind and solar generation, the amount represents generation capacity during the summer months (planning year 20212023 capacity as reported to MISO and limited by interconnection service limits). For wind and solar generation, the amount represents installed capacity during the effective load-carrying capability.summer months, except for Heartland Farms Wind Project, which began operation in December 2023.

2Consumers plans to retire these generating units in 2025, subject to MPSC approval.2025.

3Represents Consumers’ share of the capacity of the J.H. Campbell 3 unit, net of the 6.69-percent6.69‑percent ownership interest of the Michigan Public Power Agency and Wolverine Power Supply Cooperative, Inc, each a non-affiliatednon‑affiliated company.

4Consumers plans to retireretired these generating units in 2023, subject to MPSC approval.June 2023.

5Represents Consumers’ 51-percent51‑percent share of the capacity of Ludington. DTE Electric holds the remaining 49-percent49‑percent ownership interest.

6Represents Consumers’ share of net pumped-storage generation. The pumped-storage facility consumes electricity to pump water during off-peak hours for storage in order to generate electricity later during peak‑demand hours.

7Consumers completed the purchase of this facility in May 2023.

8Represents purchases under long-term PPAs.

89For information about Consumers’ long-term PPAsPPA related to the MCV Facility, and Palisades, see Item 8. Financial Statements and Supplementary Data—Notes to the Consolidated Financial Statements—Note 3, Contingencies and Commitments—Contractual Commitments.

910Represents purchases from the MISO energy market.

Presented in the following table are the sources of Consumers’ electric supply for the last three years:

| | GWh | GWh | GWh |

| Years Ended December 31 | Years Ended December 31 | 2021 | 2020 | 2019 | Years Ended December 31 | 2023 | 2022 | 2021 |

| Owned generation | Owned generation | |

| Gas | |

| Gas | |

| Gas | |

| Coal | Coal | 10,861 | | 7,960 | | 9,776 | |

| Gas | 5,555 | | 5,883 | | 6,289 | |

| Renewable energy | Renewable energy | 1,974 | | 1,505 | | 1,258 | |

| Oil | Oil | 7 | | 6 | | 5 | |

Net pumped storage1 | Net pumped storage1 | (321) | | (371) | | (308) | |

| Total owned generation | Total owned generation | 18,076 | | 14,983 | | 17,020 | |

Purchased power2 | Purchased power2 | |

| Gas generation | Gas generation | 5,862 | | 7,346 | | 6,812 | |

| Nuclear generation | 6,901 | | 6,898 | | 6,946 | |

| Gas generation | |

| Gas generation | |

| Renewable energy generation | Renewable energy generation | 2,408 | | 2,225 | | 2,387 | |

| Coal generation | Coal generation | 494 | | 513 | | 462 | |

Net interchange power3 | 645 | | 2,655 | | 2,059 | |

Nuclear generation3 | |

Net interchange power4 | |

| Total purchased and interchange power | Total purchased and interchange power | 16,310 | | 19,637 | | 18,666 | |

| Total supply | Total supply | 34,386 | | 34,620 | | 35,686 | |

1Represents Consumers’ share of net pumped-storage generation. During 2021,2023, the pumped-storage facility consumed 1,1511,269 GWh of electricity to pump water during off-peak hours for storage in order to generate 830920 GWh of electricity later during peak-demand hours.

2Represents purchases under long-term PPAs.

3Represents purchases from a nuclear generating facility that closed in May 2022.

4Represents purchases from the MISO energy market.

During 2021,2023, Consumers acquired 4743 percent of the electricity it provided to customers through long-term PPAs and the MISO energy market. Consumers offers its generation into the MISO energy market on a day-ahead and real-time basis and bids for power in the market to serve the demand of its customers. Consumers is a net purchaser of power and supplements its generation capability with purchases from the MISO energy market to meet its customers’ needs during peak-demand periods.market.

At December 31, 2021,2023, Consumers had future commitments to purchase capacity and energy under long-term PPAs with various generating plants. These contracts require monthly capacity payments based on the plants’ availability or deliverability. The payments for 20222024 through 2048 are estimated to total $8.0$7.2 billion and, for each of the next five years, range from $0.6$0.7 billion to $0.8 billion annually. These amounts may vary depending on plant availability and fuel costs. For further information about Consumers’ future capacity and energy purchase obligations, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Capital Resources and Liquidity—Other Material Cash Requirements and Item 8. Financial Statements and Supplementary Data—Notes to the Consolidated Financial Statements—Note 3, Contingencies and Commitments—Contractual Commitments.

During 2021, 32 percent of the energy Consumers provided to customers was generated by its coal-fueled generating units, which burned six million tons of coal and produced a combined total of 10,861 GWh of electricity. In order to obtain the coal it needs, Consumers enters into physical coal supply contracts.

At December 31, 2021, Consumers had future commitments to purchase coal through 2023; payment obligations under these contracts totaled $116 million. Most of Consumers’ rail-supplied coal contracts have fixed prices, although some contain market-based pricing. Consumers’ vessel-supplied coal contracts have fixed base prices that are adjusted monthly to reflect changes to the fuel cost of vessel transportation. At December 31, 2021, Consumers had 95 percent of its 2022 expected coal requirements under contract, as well as a 23-day supply of coal on hand.

In conjunction with its coal supply contracts, Consumers leases a fleet of railcars and has transportation contracts with various companies to provide rail and vessel services for delivery of purchased coal to Consumers’ generating facilities. Consumers’ coal transportation contracts are future commitments and expire on various dates through 2025; payment obligations under these contracts totaled $533 million at December 31, 2021.

During 2021, 162023, 33 percent of the energy Consumers provided to customers was generated by its natural gas‑fueled generating units, which burned 4083 bcf of natural gas and produced a combined total of 5,55511,221 GWh of electricity.

In order to obtain the gas it needs for electric generation fuel, Consumers’ electric utility purchases gas from the market near the time of consumption, at prices that allow it to compete in the electric wholesale market. For units 3 & 4 of D.E. Karnthe Covert Generating Station and for the Jackson and Zeeland plants, Consumers utilizes an agent that owns firm transportation rights to each plant to purchase gas from the market and transport the gas to the facilities. For units 3 & 4 of D.E. Karn, Consumers holds gas transportation contracts to transport to the plant gas that Consumers or an agent purchase from the market.

During 2023, 20 percent of the energy Consumers provided to customers was generated by its coal-fueled generating units, which burned four million tons of coal and produced a combined total of 6,884 GWh of electricity. In order to obtain the coal it needs, Consumers enters into physical coal supply contracts.

At December 31, 2023, Consumers had future commitments to purchase coal during 2024 and 2025; payment obligations under these contracts totaled $56 million. Most of Consumers’ rail-supplied coal contracts have fixed prices, although some contain market-based pricing. At December 31, 2023, Consumers had 77 percent of its 2024 expected coal requirements under contract, as well as a 67‑day supply of coal on hand.

In conjunction with its coal supply contracts, Consumers leases a fleet of railcars and has transportation contracts with various companies to provide rail services for delivery of purchased coal to Consumers’ generating facilities. Consumers’ coal transportation contracts are future commitments and expire on various dates through 2025; payment obligations under these contracts totaled $213 million at December 31, 2023.

Electric Utility Competition: Consumers’ electric utility business is subject to actual and potential competition from many sources, in both the wholesale and retail markets, as well as in electric generation, electric delivery, and retail services.

Michigan law allows electric customers in Consumers’ service territory to buy electric generation service from alternative electric suppliers in an aggregate amount capped at ten percent of Consumers’ sales, with certain exceptions. At December 31, 2021,2023, electric deliveries under the ROA program were at the ten‑percent limit. Of Consumers’ 1.9 million electric customers, fewerFewer than 300 or 0.02 percent,of Consumers’ electric customers purchased electric generation service under the ROA program. For additional information, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Outlook—Consumers Electric Utility Outlook and Uncertainties.

Consumers also faces competition or potential competition associated with industrial customers relocating all or a portion of their production capacity outside of Consumers’ service territory for economic reasons; municipalities owning or operating competing electric delivery systems; and customer self-generation. Consumers addresses this competition in various ways, including:

•aggressively controlling operating, maintenance, and fuel costs and passing savings on to customers

•providing renewable energy options and energy waste reduction programs

•providing competitive rate-design options, particularly for large energy-intensive customers

•offering tariff-based incentives that support economic development

•monitoring activity in adjacent geographical areas

Consumers Gas Utility

Gas Utility Operations: Consumers’ gas utility operations, which include the purchase, transmission, storage, distribution, and sale of natural gas, generated operating revenue of $2.4 billion in 2023, $2.7 billion in 2022, and $2.1 billion in 2021, $1.8 billion in 2020, and $1.9 billion in 2019.2021. Consumers’ gas utility customer base consists of a mix of primarily residential, commercial, and diversified industrial customers in Michigan’s Lower Peninsula.

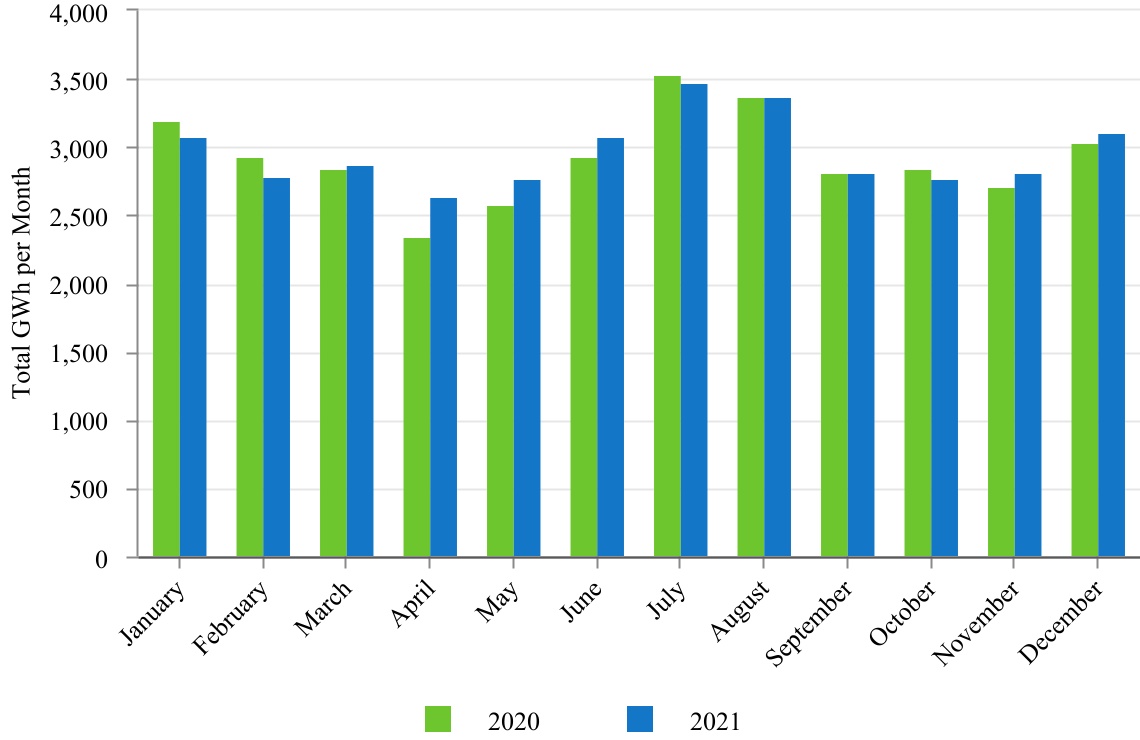

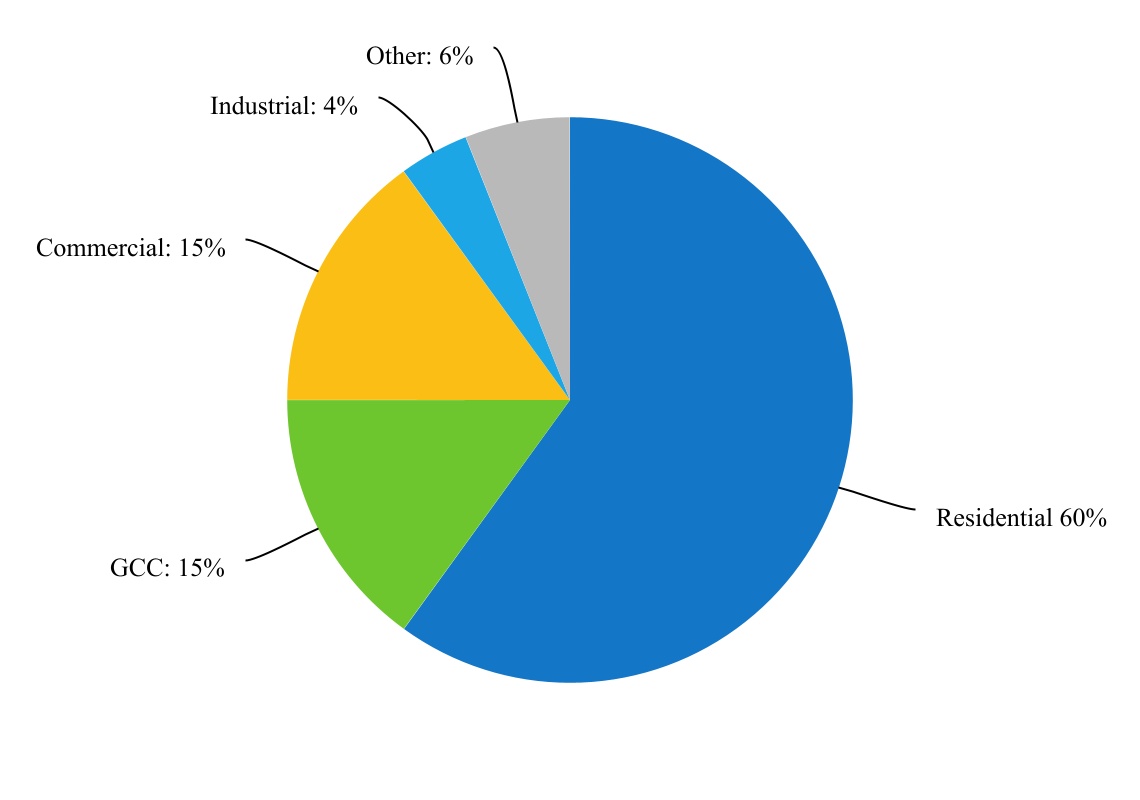

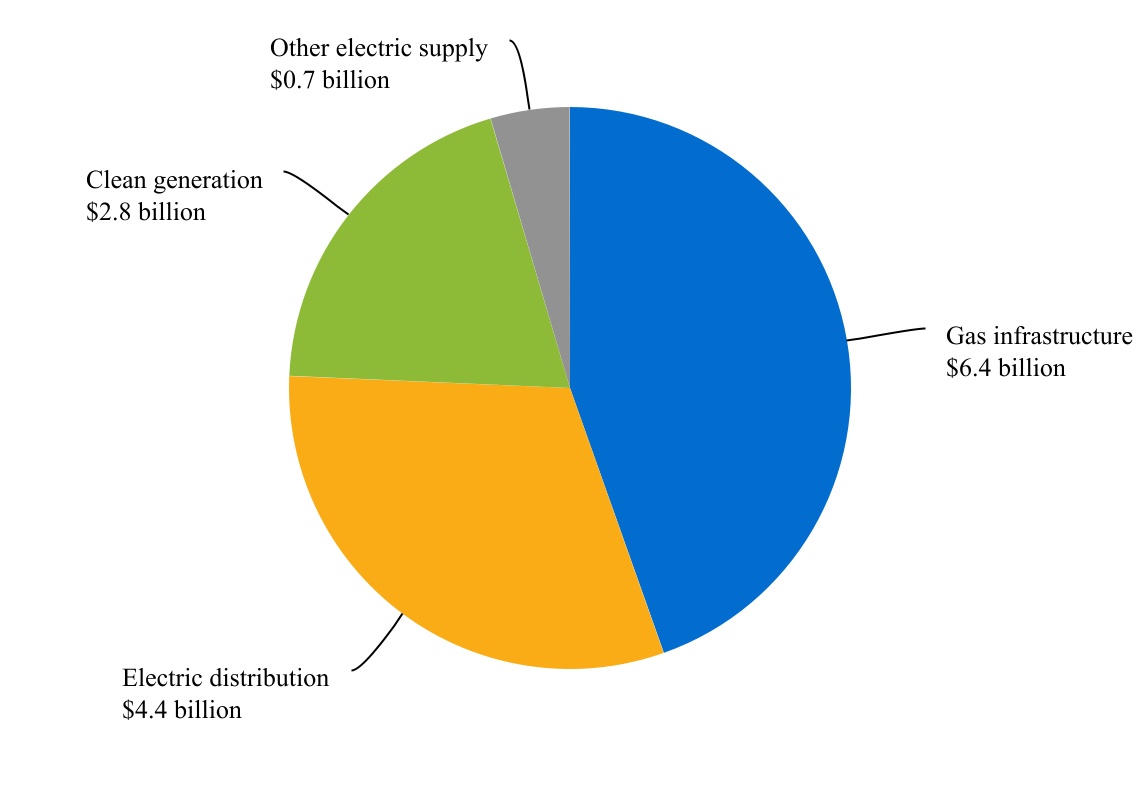

Presented in the following illustration is Consumers’ 20212023 gas utility operating revenue of $2.1$2.4 billion by customer class:

Consumers’ gas utility operations are not dependent on a single customer, or even a few customers, and the loss of any one or even a few of Consumers’ largest customers is not reasonably likely to have a material adverse effect on Consumers’ financial condition.

In 2021,2023, deliveries of natural gas through Consumers’ pipeline and distribution network, including off-system transportation deliveries, totaled 347375 bcf, which included GCC deliveries of 3331 bcf. In 2020,2022, deliveries of natural gas through Consumers’ pipeline and distribution network, including off-system transportation deliveries, totaled 360391 bcf, which included GCC deliveries of 3634 bcf. Consumers’ gas utility operations are seasonal. The consumption of natural gas typically increases in the winter, due primarily to colder temperatures and the resulting use of natural gas as heating fuel. Consumers injects natural gas into storage during the summer months for use during the winter months. During 2021, 462023, 45 percent of the natural gas supplied to all customers during the winter months was supplied from storage.

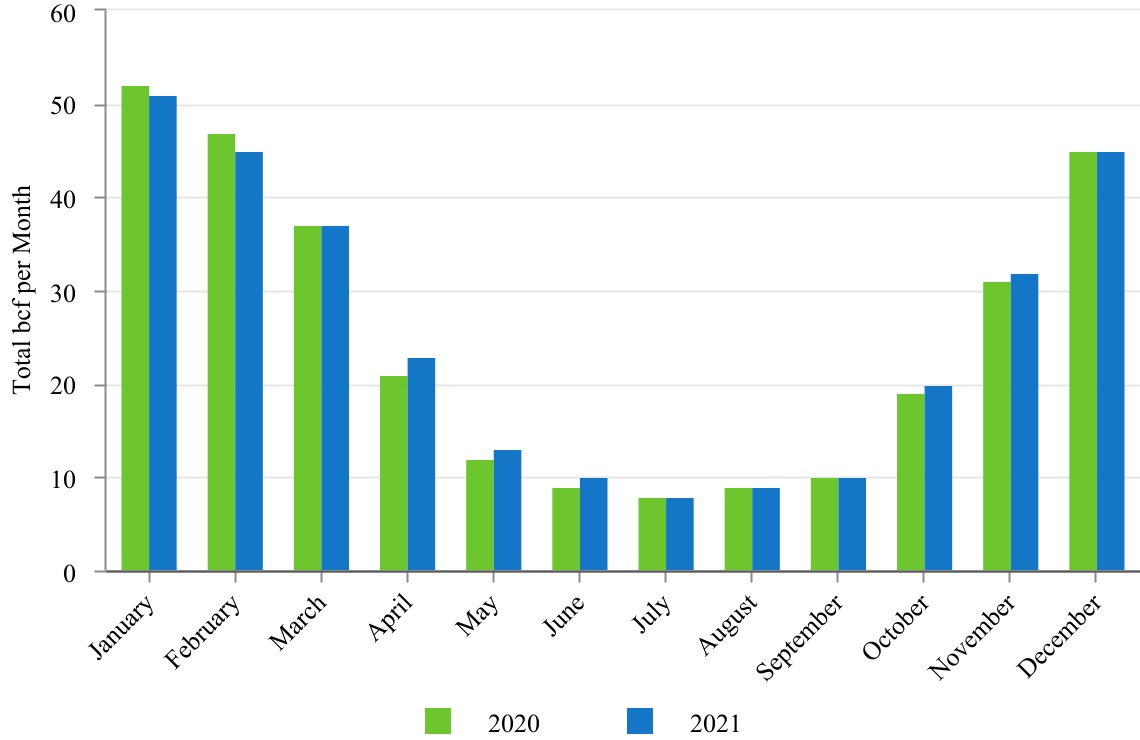

Presented in the following illustration are Consumers’ monthly weather-normalized natural gas deliveries (deliveries adjusted to reflect normal weather conditions) to its customers, including GCC deliveries, during 20212023 and 2020:2022:

Gas Utility Properties: Consumers’ gas transmission, storage, and distribution system consists of:

•2,3922,371 miles of transmission lines

•15 gas storage fields with a total storage capacity of 309 bcf and a working gas volume of 151154 bcf

•28,06528,277 miles of distribution mains

•eight compressor stations with a total of 149,817157,893 installed and available horsepower

In 2019, Consumers releasedUnder its Methane Reduction Plan, whichConsumers has set a goal of net-zero methane emissions from its natural gas delivery system by 2030. Consumers plans to reduce methane emissions from its system by about 80 percent, from 2012 baseline levels, by accelerating the replacement of aging pipe, rehabilitating or retiring outdated infrastructure, and adopting new technologies and practices. The remaining emissions will likely be offset by purchasing and/or producing renewable natural gas. For further information on Consumers’ progress towards its net-zero methane emissions goal, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Executive Overview.

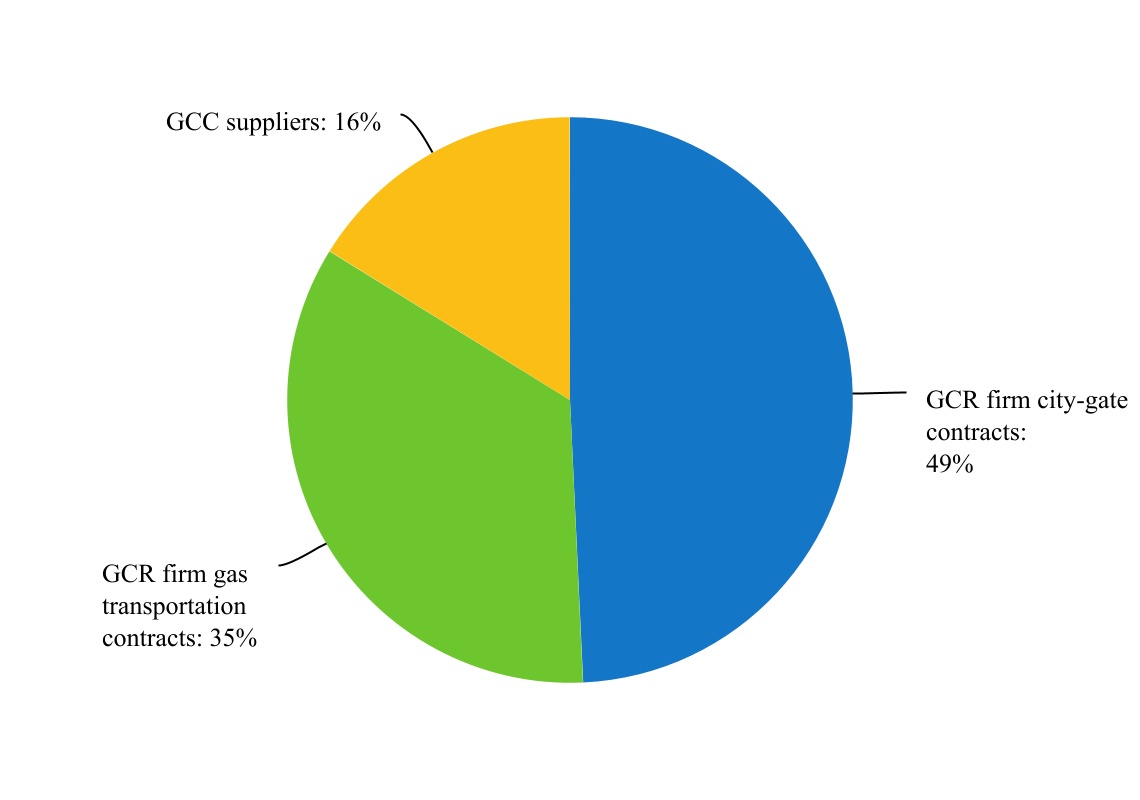

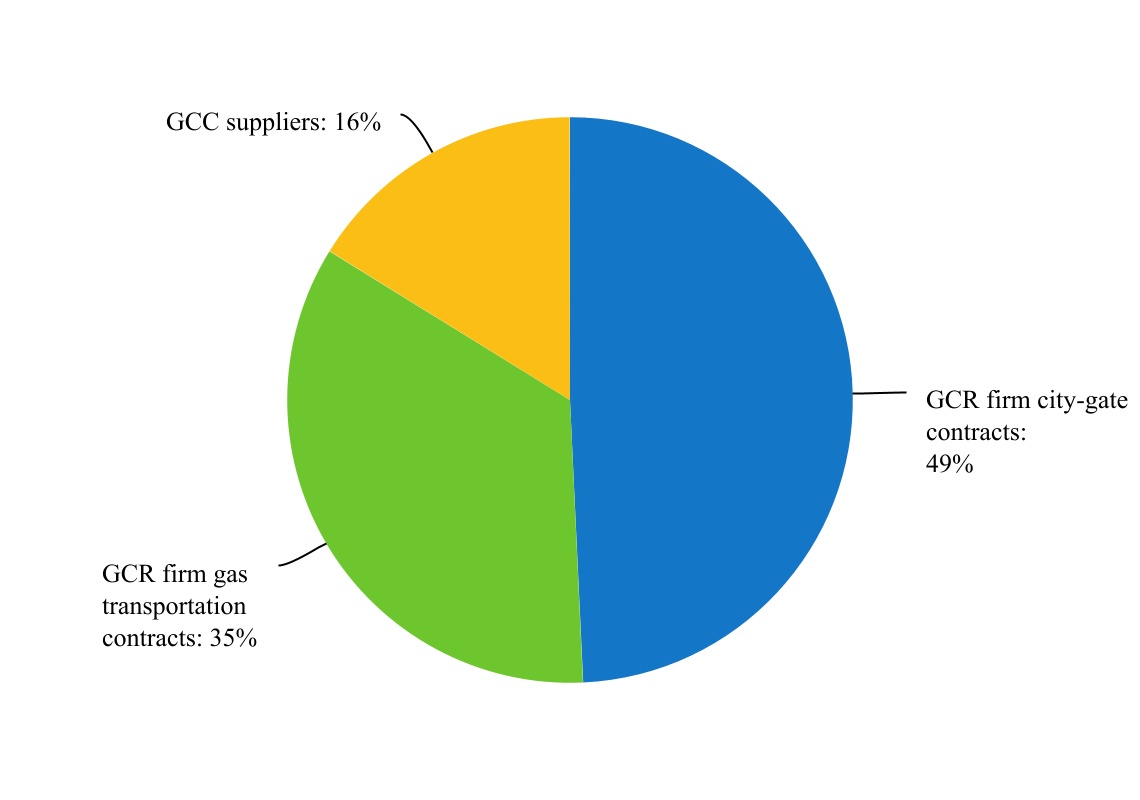

Gas Utility Supply: In 2021,2023, Consumers purchased 8485 percent of the gas it delivered from U.S. suppliers. The remaining 1615 percent was purchased from authorized GCC suppliers and delivered by Consumers to customers in the GCC program. Presented in the following illustration are the supply arrangements for the gas Consumers delivered to GCC and GCR customers during 2021:2023:

Firm city-gate and firm gas transportation or firm city-gate contracts are those that define a fixed amount, price, and delivery time frame. Consumers’ firm gas transportation contracts are with Panhandle Eastern Pipe Line Company and Trunkline Gas Company, LLC, each a non‑affiliated company. Under these contracts, Consumers purchases and transports gas to Michigan for ultimate delivery to its customers. Consumers’ firm gas transportation contracts expire on various dates through 2023 and provide for the delivery of 372028 with planned contract volumes providing 34 percent of Consumers’ total forecasted gas supply requirements in 2022.for 2024. Consumers purchases the balance of its required gas supply under firm city-gate contracts and through authorized suppliers under the GCC program.

Gas Utility Competition: Competition exists in various aspects of Consumers’ gas utility business. Competition comes from GCC and transportation programs; system bypass opportunities for new and existing customers; and from alternative fuels and energy sources, such as propane, oil, and electricity.

Enterprises Segment—Non-Utility

NorthStar Clean Energy—Non-utility Operations and Investments

CMS Energy’s enterprises segment,NorthStar Clean Energy, through various subsidiaries and certain equity investments, is engaged in domestic independent power production, including the development and operation of renewable generation, and the marketing of independent power production. The enterprises segment’sNorthStar Clean Energy’s operating revenue was $297 million in 2023, $445 million in 2022, and $308 million in 2021, $229 million in 2020, and $248 million in 2019.

Independent Power Production: Presented in the following table is information about the independent power plants in which CMS Energy had an ownership interest at December 31, 2021:2023:

| | Location | Location | Ownership Interest

(%) | Primary Fuel Type | Gross Capacity

(MW) | 1

| 2021 Net Generation

(GWh) | Location | Ownership Interest

(%) | Primary Fuel Type | Gross Capacity

(MW) | 1

| 2023 Net Generation

(GWh) |

| Dearborn, Michigan | Dearborn, Michigan | 100 | | Natural gas2 | 770 | | | 4,087 | |

Jackson County, Arkansas2 | |

| Gaylord, Michigan | Gaylord, Michigan | 100 | | Natural gas2 | 134 | | | 7 | |

| Paulding County, Ohio | 100 | | Wind | 105 | | | 260 | |

| Paulding County, Ohio | Paulding County, Ohio | 100 | | Solar and storage | 3 | | | 4 | |

| Comstock, Michigan | Comstock, Michigan | 100 | | Natural gas2 | 76 | | | 38 | |

| Delta Township, Michigan | Delta Township, Michigan | 100 | | Solar | 24 | | | 42 | |

| Phillips, Wisconsin | Phillips, Wisconsin | 100 | | Solar | 3 | | | 5 | |

| Paulding County, Ohio | |

| Coke County, Texas | Coke County, Texas | 51 | | Wind | 525 | | | 1,793 | |

| Filer City, Michigan | Filer City, Michigan | 50 | | Coal | 73 | | | 489 | |

| New Bern, North Carolina | New Bern, North Carolina | 50 | | Wood waste | 50 | | | 314 | |

| Flint, Michigan | Flint, Michigan | 50 | | Wood waste | 40 | | | 121 | |

| Grayling, Michigan | Grayling, Michigan | 50 | | Wood waste | 38 | | | 204 | |

| Total | Total | | 1,841 | | | 7,364 | |

1Represents the intended full-load sustained output of each plant. The amount of capacity relating to CMS Energy’s ownership interest was 1,4831,658 MW and net generation relating to CMS Energy’s ownership interest was 7,130 GWh at December 31, 2021.2023.

2DIG, CMS Generation Michigan Power, and CMS ERM have entered into an agreement to sell these plants to ConsumersThis project began operations in 2025, subject to MPSC approval.October 2023.

The operating revenue from independent power production was $64 million in 2023, $58 million in 2022, and $48 million in 2021, and $32 million in 2020 and 2019.2021.

Energy Resource Management: CMS ERM purchases and sells energy commodities in support of CMS Energy’s generating facilities with a focus on optimizing CMS Energy’s independent power production portfolio. In 2021,2023, CMS ERM marketed two bcf of natural gas and 6,3056,828 GWh of electricity. Electricity marketed by CMS ERM was generated by independent power production of the enterprises segmentNorthStar Clean Energy and by unrelated third parties. CMS ERM’s operating revenue was $233 million in 2023, $387 million in 2022, and $260 million in 2021, $197 million in 2020, and $216 million in 2019.2021.

Enterprises SegmentNorthStar Clean Energy Competition: The enterprises segmentNorthStar Clean Energy competes with other independent power producers. The needs of this market are driven by electric demand and the generation available.

CMS Energy and Consumers Regulation

CMS Energy, Consumers, and their subsidiaries are subject to regulation by various federal, state, and local governmental agencies, including those described in the following sections. If CMS Energy, Consumers, or Consumerstheir subsidiaries failed to comply with applicable laws and regulations, they could become subject to fines, penalties, or disallowed costs, or be required to implement additional compliance, cleanup, or remediation programs, the cost of which could be material. For more information on the potential impacts of government regulation affecting CMS Energy, Consumers, and Consumers,their subsidiaries, see Item 1A. Risk Factors, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Outlook, and Item 8. Financial Statements and Supplementary Data—Notes to the Consolidated Financial Statements—Note 2, Regulatory Matters.

FERC and NERC

CMS Energy and its affiliates and subsidiaries are subject to regulation by FERC has exercisedin a number of areas. FERC regulates certain aspects of Consumers’ electric business, including, but not limited jurisdiction over several independent powerto, compliance with FERC accounting rules, wholesale electric and transmission rates, operation of licensed hydroelectric generating plants, corporate mergers and exempt wholesale generators in which CMS Enterprises has ownership interests, as well as over CMS ERM, CMS Gas Transmission,the sale and DIG. FERC’s jurisdiction includes, among other things, acquisitions, operations, disposalspurchase of certain assets, and facilities, services provided and rates charged,issuance of securities, and conduct among affiliates. FERC also has limited jurisdiction over holding company matters with respectregulates the tariff rules and procedures administered by MISO and other independent system operators/regional transmission organizations, including wholesale electric markets and interconnection of new generating facilities to CMS Energy.the transmission system. FERC, in connection with NERC and with regional reliability organizations, also regulates generation and transmission owners and operators, load serving entities, purchase and saleload-serving entities, and others with regard to reliability of the bulk power system.

FERC also regulates limited aspects of Consumers’ gas business, principally compliance with FERC capacity release rules, shipping rules, the prohibition againstof certain buy/sell transactions, and the price-reporting rule.

FERC also regulates certain aspectsholding company matters, interlocking directorates, and other issues affecting CMS Energy. In addition, similar to FERC’s regulation of Consumers’ electric operations, including compliance withand gas businesses, FERC accounting rules,has jurisdiction over several independent power plants, PURPA-qualifying facilities, and exempt wholesale generators in which NorthStar Clean Energy has ownership interests, as well as over NorthStar Clean Energy itself, CMS ERM, CMS Gas Transmission, and transmission rates, operation of licensed hydroelectric generating plants, transfers of certain facilities, corporate mergers, and issuances of securities.DIG.

MPSC

Consumers is subject to the jurisdiction of the MPSC, which regulates public utilities in Michigan with respect to retail utility rates, accounting, utility services, certain facilities, certain asset transfers, corporate mergers, and other matters.

The Michigan Attorney General, ABATE, the MPSC Staff, residential customer advocacy groups, environmental organizations, and certain other parties typically participate in MPSC proceedings concerning Consumers. These parties often challenge various aspects of those proceedings, including the prudence of Consumers’ policies and practices, and seek cost disallowances and other relief. The parties also have appealed significant MPSC orders.

Rate Proceedings: For information regarding open rate proceedings, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Outlook and Item 8. Financial Statements and Supplementary Data—Notes to the Consolidated Financial Statements—Note 2, Regulatory Matters.

Other Regulation

The U.S. Secretary of Energy regulates imports and exports of natural gas and has delegated various aspects of this jurisdiction to FERC and the U.S. Department of Energy’s Office of Fossil Fuels.

The U.S. Department of Transportation’s Office of Pipeline Safety regulates the safety and security of gas pipelines through the Natural Gas Pipeline Safety Act of 1968 and subsequent laws.

The Transportation Security Administration, an agency of the U.S. Department of Homeland Security, regulates certain activities related to the safety and security of natural gas pipelines.

Energy Legislation

In November 2023, Michigan enacted the 2023 Energy Law, which among other things: