UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K10-K/A

(Amendment No. 1)

(Mark One)

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 20222023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number 1-9444

CEDAR FAIR, L.P.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 34-1560655 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

One Cedar Point Drive, Sandusky, Ohio 44870-5259

(Address of principal executive offices) (Zip Code)

(419) 626-0830

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Depositary Units (Representing

Limited Partner Interests) | FUN | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☑ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☑ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☑ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☑ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☑ | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☑ No

The aggregate market value of Depositary Units held by non-affiliates of the Registrant based on the closing price of such units on June 24, 202223, 2023 of $42.80$39.99 per unit was approximately $2,404,874,220.$2,016,277,365.

Number of Depositary Units representing limited partner interests outstanding as of February 10, 2023: 51,930,650April 19, 2024: 51,252,360 units

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Form 10-K incorporates by reference certain information from the Registrant's definitive proxy statement to be used in connection with its annual meeting of limited partner unitholders to be held in May 2023.None

************

Page 1 of 5954 pages

CEDAR FAIR, L.P.

20222023 FORM 10-K10-K/A CONTENTS

PART IEXPLANATORY NOTE

Unless the context otherwise indicates, all references to "we," "us," "our,"This Amendment on Form 10-K/A (the "Amendment" or the "Partnership" in this"Form 10-K/A") amends the Annual Report on Form 10-K refer toof Cedar Fair, L.P. together("Cedar Fair" or the "Partnership") for the year ended December 31, 2023, as filed with its affiliated companies.the Securities and Exchange Commission ("SEC") on February 16, 2024 (the "Original Form 10-K"). This Amendment is being filed solely for the purpose of disclosing information required in Part III that the Partnership will not be incorporating by reference to a definitive proxy statement. No other parts or disclosures from the Original Form 10-K are included in this Amendment other than Parts III and IV below, and except as required to reflect the matters set forth in such included disclosure, this Amendment does not reflect events or developments that have occurred after the date of the Original Form 10-K and does not modify or update disclosures presented in the Original Form 10-K in any way.

Among other things, forward-looking statements made in the Original Form 10-K have not been revised to reflect events, results, or developments that occurred or facts that have become known to us after the date of the Original Form 10-K (other than as discussed above), and such forward-looking statements should be read in their historical context. Accordingly, this Amendment should be read in conjunction with our filings made with the SEC subsequent to the filing of the Original Form 10-K.

PART III

ITEM 1. BUSINESS.10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

We are one of the largest regional amusement park operators in the world with 13 properties in our portfolio consisting of amusement parks, water parks and complementary resort facilities. We are a publicly traded Delaware limited partnership formed in 1987 and managed by Cedar Fair Management, Inc. ("CFMI"), an Ohio corporation (the "General Partner"), whose shares are heldowned by an Ohio trust. Our parkstrust, is the General Partner of the Partnership and has full responsibility for the management of the Partnership. For additional information, see Note 1 in the Notes to the Consolidated Financial Statements of the Original Form 10-K.

Board of Directors

The Board of Directors of CFMI (the "Board of Directors" or "Board") is currently comprised of eight directors. The directors are family-oriented, with recreational facilities for peopledivided into three classes: Class I, Class II, and Class III, and each class consists of all ages,three directors except Class III. Matthew A. Ouimet was in Class III and provide clean and attractive environments with exciting rides and immersive entertainment. We generate revenue from sales of admission to our amusement parks and water parks, from purchases of food, merchandise and games both inside and outside our parks, andresigned from the saleBoard of accommodations and other extra-charge products.

Our parks operate seasonally exceptDirectors effective September 1, 2023. A successor for Knott's Berry Farm, which is typically open daily on a year-round basis. Our seasonal parks are generally open daily from Memorial Day until Labor Day. OutsideMr. Ouimet has not been elected. The term of daily operations, our seasonal parks are open during select weekends, including at most propertieseach director in each respective class expires in the fourth quarter for Halloweenyear noted below when the director's successor is duly elected and winter events. As a result, a substantial portion of our revenues from these seasonal parks are generated from Memorial Day through Labor Day with the major portion concentrated during the peak vacation months of July and August.

The demographic groups that are most important to our business are families and young people ages 12 through 24. Families are believed to be attracted by a combination of rides, live entertainment and the clean, wholesome atmosphere. Young people are believed to be attracted by the action-packed rides. We conduct active television, radio, newspaper and internet advertising campaigns in our major market areas geared toward these two groups.

IMPACT OF COVID-19 PANDEMIC

The novel coronavirus (COVID-19) pandemic had a material impact on our business in 2020, had a continuing negative impact in 2021 and may have a longer-term negative effect. Beginning on March 14, 2020, we closed our properties for several months in response to the spread of COVID-19 and local government mandates. We ultimately resumed partial operations at 10 of our 13 properties in 2020, operating in accordance with local and state guidelines. We delayed the opening of our U.S. properties for the 2021 operating season until May 2021 and opened our Canadian property in July 2021. Upon opening in 2021, we operated with capacity restrictions, guest reservations, and other operating protocols in place. As vaccination distribution efforts continued during the second quarter of 2021 and we were able to hire additional labor, we removed most capacity restrictions, guest reservation requirements and other protocols at our U.S. properties beginning in July 2021. Canada's Wonderland operated with capacity restrictions, guest reservations, and other operating protocols in place throughout 2021.

Each of our properties opened for the 2022 operating season as planned and without restrictions. We currently anticipate continuing to operate without restrictions for the 2023 operating season. However, we have and may continue to adjust future park operating calendars as we respond to changes in guest demand, labor availability and any federal, provincial, state and local restrictions. Our future operations are dependent on factors beyond our knowledge or control, including any future actions taken to contain the COVID-19 pandemic and changing risk tolerances of our employees and guests regarding health matters.

DESCRIPTION OF OUR PARKS

Cedar Point

Cedar Fair's flagship park, Cedar Point, was first developed as a recreational area in 1870. Located on a peninsula in Sandusky, Ohio bordered by Lake Erie between Cleveland and Toledo, Cedar Point serves a six-state region which includes nearly all of Ohio and Michigan, western Pennsylvania and New York, northern West Virginia and Indiana, as well as southwestern Ontario, Canada. Attractive to both families and thrill-seekers, the park features 18 roller coasters, including many record-breakers, and three children's areas. Located adjacent to the park is Cedar Point Shores Water Park, a separately gated water park featuring more than 15 water rides and attractions. Cedar Point also features four hotels, three marinas, an upscale campground, and the nearby Cedar Point Sports Center which features both indoor and outdoor sports facilities. Cedar Point's four hotels include:

Hotel Breakers - the park's largest hotel and only hotel located on the Cedar Point peninsula, featuring various dining and lounge facilities, a mile-long beach, lake swimming, a conference/meeting center, an indoor pool and multiple outdoor pools;

Castaway Bay Indoor Waterpark Resort - a year-round hotel located adjacent to the entrance to the park featuring tropical, Caribbean themed hotel rooms centered around an indoor water park, as well as a marina and dining facilities;

Cedar Point's Express Hotel - a limited-service seasonal hotel located adjacent to the entrance to the park; and

Sawmill Creek Resort - a year-round resort lodge located near Cedar Point in Huron, Ohio, featuring a golf course, marina, half-mile beach, dining and shopping facilities, and a conference/meeting center.qualified.

Knott's Berry FarmClass II Directors serving until 2024:

| | | | | | | | | | | | | | |

| Name | | Age | | Position(s) |

| | | | |

Michelle M.

Frymire | | 57 | | | Michelle McKinney Frymire has extensive executive-level and financial experience with both public and private companies. Most recently, she served as CEO of CWT (formerly Carlson Wagonlit Travel), a leader in travel management technology, from May 2021 to May 2022, when she steered the company through the pandemic, driving the company’s global strategy and overseeing significant investment in the company’s product and technology platforms. As a travel management platform, CWT was heavily impacted by the COVID-19 pandemic and with the support of nearly all of its debt holders CWT filed a pre-packaged Chapter 11 bankruptcy on November 11, 2021, in the U.S. Bankruptcy Court for the Southern District of Texas. CWT’s plan of reorganization was approved by the Bankruptcy Court the following day, on November 12, 2021, and CWT was able to exit Chapter 11 on November 19, 2021. Prior to serving as CEO, Ms. Frymire served as president and CFO of CWT, in charge of global business strategy and transformation. Prior to joining CWT, Frymire was CFO for U.S. Risk Insurance Group, LLC, a privately owned specialty lines underwriting manager and wholesale broker, from 2017 to 2019. From 2015 to 2017, she served as CFO for Service King Collision Repair Centers, an auto body collision repair company. From 2009 to 2015, Frymire served in a variety of roles for The Service Master Companies, Inc., a residential and commercial services company, most recently as vice president, corporate FP&A and strategy, as well as CFO for TruGreen, a lawn and landscape service provider, from 2009 to 2013. From 2005 to 2009, Frymire was CFO, vacation ownership for Starwood Hotels & Resorts Worldwide, Inc., a former hospitality company. From 1998 to 2005, Frymire served in a variety of roles for Delta Air Lines, Inc. (NYSE: DAL), a global airline carrier, including vice president of finance - marketing, international, network and technology. From 1991 to 1998, she served in a variety of finance roles for Continental Airlines, a former global airline carrier, and American Airlines (NASDAQ: AAL), a global airline carrier. Ms. Frymire serves as a board director for Sonder (NASDAQ: SOND), a hospitality company, where she sits on the audit committee and chairs the nominating, corporate governance & social responsibility committee. Ms. Frymire also serves as a board director for NCR Atleos (NYSE: NATL), where she sits on the compensation committee and chairs the nominating and governance committee. Ms. Frymire previously served on the board of Spirit Realty Capital (NYSE: SRC), a triple net lease REIT, from April 2021 until the company was sold in January 2024. At Cedar Fair, Ms. Frymire has served as a director since October 2022 and serves as a member of the Audit Committee and People, Culture & Compensation Committee. Ms. Frymire is qualified to serve on the Board of Directors as a result of her extensive executive-level and financial experience, including in the technology, travel and hospitality sectors, as well as her corporate governance experience. |

Daniel J.

Hanrahan | | 66 | | | Daniel J. Hanrahan brings more than 40 years of experience, including from a variety of sales and marketing, general manager, president and chief executive officer roles across the consumer packaged goods, retail, travel and hospitality sectors. In January 2020, he was appointed Chairman of the Board of Directors. He served as the president and chief executive officer and director of the Regis Corporation (NYSE: RGS), a global leader in beauty salons and cosmetology, from August 2012 through April 2017. Prior to joining Regis, he served as president and CEO of Celebrity Cruises, a cruise line and division of Royal Caribbean Cruises (NYSE: RCL), from 2007 to 2012. He was promoted to president in 2005 and to CEO in 2007 after his highly successful management of the sales and marketing division for Royal Caribbean. Prior to joining Royal Caribbean, Mr. Hanrahan served in executive-level positions with Polaroid Corporation and Reebok International Ltd. In 2004, he was named one of the “Top 25 Extraordinary Minds in Hospitality Sales and Marketing” by Hospitality and Sales Marketing Association International. From 2017 to 2021, Mr. Hanrahan was a director and member of the audit committee at Lindblad Expeditions Holdings, Inc. (NASDAQ: LIND), a global provider of expedition cruises and adventure travel experiences. He joined the board of Foss Swim Schools, a Prairie Capital company, in April 2019. Mr. Hanrahan joined Sycamore Partners as an advisor in 2021. At Cedar Fair, Mr. Hanrahan has served as a director since June 2012. Mr. Hanrahan is qualified to serve on the Board of Directors primarily as a result of his significant executive-level experience across a wide spectrum of consumer-facing brands, including in the retail, travel and hospitality sectors, as well as his more than 40 years of experience in sales and marketing. |

| Jennifer Mason | | 54 | | | Jennifer Mason is global officer, treasurer and risk management at Marriott International, Inc. (NASDAQ: MAR), a hospitality company with over 30 brands and nearly 8,700 properties in 139 countries and territories. In her role at Marriott, she oversees global capital markets and hotel financing, financial strategy and capital allocation, financial risk management, and global capital transactions and treasury services. Ms. Mason is also responsible for the company’s global risk management function including insurance, claims, business continuity and global safety and security. Prior to her current role, Ms. Mason was CFO for Marriott’s U.S. & Canada division, with accountability for financial management including responsibilities for the continent's P&L, budgeting, forecasting, cash management, internal controls, asset management and feasibility. Since 1992, Ms. Mason has held several other leadership positions at Marriott, including senior vice president of IT business partnership & planning, as well as senior vice president, sales & marketing planning support. In her first 16 years with Marriott, Ms. Mason held several positions of increasing responsibility in internal audit, corporate financial planning & analysis, lodging finance and business development. She was regional director for the Mid-Atlantic region and vice president, finance business partner for sales and marketing, before serving in her senior vice president roles. At Cedar Fair, Ms. Mason has served as a director since October 2022 and is a member of the Audit Committee and Nominating and Corporate Governance Committee. She is qualified to serve on the Board of Directors as a result of her executive-level experience within the hospitality sector, including her experience in financial and risk management leadership positions. |

Knott's Berry Farm, located near Los Angeles in Buena Park, California, first opened in 1920 and was acquired by the Partnership in 1997. The park is one

Class I Directors serving until 2025:

| | | | | | | | | | | | | | |

| Name | | Age | | Position(s) |

| | | | |

| Louis Carr | | 67 | | | Louis Carr is president of Media Sales for BET Media Group, a leading provider of quality entertainment, music, news and public affairs television programming for the African-American audience and a subsidiary of Paramount Global (NASDAQ: PARA). Mr. Carr has been with BET Networks for 37 years and is recognized as one of the most influential and prominent African Americans in the media and marketing industries. In 2016, Mr. Carr earned the Diversity Award from the Hyatt Corporation and another Lifetime Achievement Award from the Patricia Martin Legacy celebration honoring his work around diversity from both a personal and professional standpoint. In 2023, Mr. Carr was inducted into the Advertising Hall of Fame and awarded the Chicago Advertising Federation Silver Medal Award. He has also been recognized by theboardiQ as a Top 100 Hall of Fame African American and was named one of the Most Influential Black Corporate Directors by Savoy Magazine. He has also been listed on NAMIC’s Most Influential African Americans list in the cable industry several times. Mr. Carr has served on the boards of the Ad Council; International Radio and Television Society (IRTS); American Advertising Federation (AAF); the Video Advertising Board (VAB), formerly the CAB; and Boys Hope Girls Hope. He currently serves on the board of the United States Track and Field Foundation and Drake University. Utilizing his B.A. in Journalism from Drake University, he has become a compelling author, writing two books titled Dirty Little Secrets and The Little Black Book: Daily Motivations for Business and Personal Growth. At Cedar Fair, Mr. Carr has served as a director since 2020 and is the Chair of the Nominating and Corporate Governance Committee. Mr. Carr is qualified to serve on the Board of Directors primarily as a result of his more than 35 years of experience as an entertainment, media, and advertising executive. |

D. Scott

Olivet | | 62 | | | D. Scott Olivet is the chief executive officer of Renegade Brands, an investment company that primarily invests in apparel and other consumer companies; chief executive officer of DSO Advisors, which provides strategic, brand and organizational effectiveness consulting and executive coaching services; and an operating partner at Altamont Capital Partners, a private equity firm. From 2013 to 2019, Mr. Olivet served as chief executive officer of the coordinating and shared services entity for a portfolio of Altamont Capital owned businesses. From 2011 to 2012, Mr. Olivet served as full-time chairman of Collective Brands Inc. From 2009 to 2011, Mr. Olivet served as chief executive officer of RED Digital Cinema Camera company. From 2005 to July 2009, Mr. Olivet served as chief executive officer and director of Oakley, a manufacturer of sports performance equipment, then served as chairman of the board from July 2009 to February 2011. Prior to joining Oakley, he served as vice president of NIKE Subsidiaries and New Business Development where he was responsible for the Hurley, Converse, Cole Haan, Bauer Hockey, and Starter brands; senior vice president of Real Estate, Store Design, and Construction with Gap Inc., with responsibility across Gap, Banana Republic, and Old Navy brands; and as a partner with Bain & Company where he was also the leader of the worldwide practice in organizational effectiveness and change management. Mr. Olivet serves as executive chairman of RED Digital Cinema, an American manufacturer of digital cinematography tools, a position he has held since July 2009. Mr. Olivet also serves as chairman of Future Stitch since July 2018, director of Reef since October 2018, and director of Brixton Manufacturing since October 2014. He has previously served on the boards of Oakley, Collective Brands, Skullcandy, Fox Racing, Mervin Manufacturing, Dakine, HUF, and Hybrid Apparel. At Cedar Fair, Mr. Olivet has served as a director since 2013, is the Chair of the People, Culture & Compensation Committee and is a member of the Nominating and Corporate Governance Committee. Mr. Olivet is qualified to serve on the Board of Directors primarily as a result of his particular knowledge and professional experience in retail, merchandising, marketing, finance, strategy, technology, international business, and multi-division general management experience from his past public board experience and service as president and CEO of a nationally recognized company that conducts business in the retail industry. |

Carlos A.

Ruisanchez | | 53 | | | Carlos A. Ruisanchez is a seasoned executive with extensive strategy, finance and senior management experience in the hospitality industry, including casinos, hotels, restaurants and entertainment businesses. He is the co-founder of Sorelle Capital, a firm focused on investing in and helping grow companies in the hospitality, consumer, and real estate sectors. Mr. Ruisanchez also serves as an independent director of Southwest Gas Holdings (NYSE: SWX). Prior to Sorelle, he served as president and chief financial officer and board member of Pinnacle Entertainment, Inc. (NASDAQ: PNK), a leading regional gaming entertainment company, until its sale in October 2018. Mr. Ruisanchez joined Pinnacle in August 2008 as its executive vice president, strategic planning and development. He became Pinnacle's chief financial officer in 2011, president and chief financial officer in 2013, and board member in 2016. During his tenure at Pinnacle, Mr. Ruisanchez, in addition to leading all of Pinnacle's finance and analytic functions, led all merger, acquisition and divestiture activities, and new development representing billions of dollars of transactions. Prior to joining Pinnacle, he worked at Bear, Stearns & Co. Inc., an investment banking firm, since 1997 and most recently served as senior managing director responsible for corporate clients in the gaming, lodging and leisure industries, as well as financial sponsor banking relationships. At Cedar Fair, Mr. Ruisanchez has served as a director since 2019, is the Chair of the Audit Committee and is a member of the People, Culture & Compensation Committee. Mr. Ruisanchez's extensive experience as a senior executive in the finance and entertainment industries provides the Board of Directors with expertise in operations, accounting, corporate finance, real estate, corporate governance, regulatory and risk assessment issues. |

Amusement Today's international survey. Adjacent to Knott's Berry Farm is Knott's Soak City, a separately gated seasonal water park that features multiple water rides and attractions. Knott's Berry Farm also features the Knott's Berry Farm Hotel, a full-service hotel located adjacent to Knott's Berry Farm featuring a pool, fitness facilities and meeting/banquet facilities.

Canada's Wonderland,Class III Directors serving until 2026:

| | | | | | | | | | | | | | |

| Name | | Age | | Position(s) |

| | | | |

| Nina Barton | | 50 | | | Nina Barton is a consumer packaged goods executive with more than 25 years of experience, including extensive marketing experience. She was most recently the CEO of Vytalogy Wellness, a modern wellness company with vitamin and supplement brands, from July 2021 to November 2023. In this role, Ms. Barton was responsible for leading the company’s more than 600 employees and driving the strategy and growth of its vitamin and supplement brands, Natrol and Jarrow Formulas. Prior to Vytalogy Wellness, Ms. Barton spent more than 10 years in leadership positions across various categories at The Kraft Heinz Company (NASDAQ: KHC), a multinational food company. Most recently, she served as the global chief growth officer at Kraft and was responsible for leading their global strategy, including eCommerce, R&D and marketing. Prior to joining Kraft in 2011, Ms. Barton held numerous marketing and leadership positions at multinational consumer packaged goods companies, including Johnson & Johnson (NYSE: JNJ), L’Oréal and Procter & Gamble (NYSE: PG). At Cedar Fair, Ms. Barton has served as a director since 2023 and is a member of the Audit Committee. Ms. Barton is qualified to serve on the Board of Directors as a result of her past experiences across multiple consumer-facing brands, as well as her many years of marketing experience. |

Richard A.

Zimmerman | | 63 | | | Richard A. Zimmerman has been president and chief executive officer of Cedar Fair since January 2018 and a member of the Board of Directors since April 2019. Prior to becoming CEO, Mr. Zimmerman served as president and chief operating officer from October 2016 to December 2017 and served as chief operating officer from October 2011 to October 2016. Prior to that, he was appointed as executive vice president in November 2010 and as regional vice president in June 2007. He has been with Cedar Fair since 2006, when it acquired Kings Dominion. Mr. Zimmerman was vice president and general manager of Kings Dominion from 1998 through 2007. He also is a senior advisor at Velocity Capital Management, a private equity firm that invests in the sports, media and entertainment sectors. Mr. Zimmerman's leadership and management skills and his insights from his experience as Cedar Fair's president and chief executive officer provide guidance, operational knowledge and management perspective to the Board. |

Executive Officers

Information regarding executive officers of the Partnership is included in the Original Form 10-K under the caption "Supplemental Item. Information about our Executive Officers" in Item 1 of Part I and is incorporated herein by reference.

Director Nominations

There were no material changes to the nomination procedures by which unitholders may recommend nominees to our Board of Directors, as described in our most recent proxy statement.

Audit Committee

The Partnership has a combination amusementseparately designated standing audit committee (the "Audit Committee"). The Audit Committee is responsible for appointing and water park located near Torontomeeting with our independent registered public accounting firm and for assisting the Board in Vaughan, Ontario, first opened in 1981its oversight of the financial statement reporting, internal audit and was acquiredrisk management functions. The Audit Committee meets frequently during the year and discusses with management and our independent registered public accountant: (1) current business trends affecting the Partnership; (2) major risks facing the Partnership; (3) steps management has taken to monitor and control such risks; and (4) adequacy of internal controls that could significantly affect the Partnership's financial statements. The Audit Committee reviews the Partnership's enterprise risk management process for identification of and response to risks related to cyber-security and data protection, and other risks that may materially impact the business. The Audit Committee Chair provides the Board with regular reports concerning its risk oversight activities.

The Audit Committee consists of Carlos A. Ruisanchez (Chair), Nina Barton, Michelle M. Frymire and Jennifer Mason. All committee members are independent directors under New York Stock Exchange ("NYSE") listing standards and as required under Section 301 of the Sarbanes-Oxley Act of 2002. Mr. Ruisanchez and Mses. Frymire and Mason qualify as Audit Committee Financial Experts as defined by the Partnership in 2006. It contains numerous attractions, including 18 roller coasters,SEC.

Code of Conduct and is oneEthics and Corporate Governance Guidelines

Our Corporate Governance Guidelines, Code of Conduct and Ethics, and the charters of the most attended amusement parks in North America. Canada's Wonderland is inBoard committees provide the framework for the governance of the Partnership.

The Corporate Governance Guidelines cover, among other things, the composition and functions of the Board, the qualifications and responsibilities of directors, director independence, the selection process for new directors, Board committees, compensation of the Board and the responsibilities of the Chairman of the Board.

We have adopted and maintain a culturally diverse metropolitan market with large populationsCode of different ethnicitiesConduct and national origins. Each year the park showcases an extensive entertainmentEthics that covers all directors, officers and special event line-up which includes cultural festivals.

Kings Island

Kings Island, a combination amusement and water park located near Cincinnati, Ohio, first opened in 1972 and was acquired byemployees of the Partnership and its subsidiaries. The Code of Conduct and Ethics requires, among other things, that the directors, officers and employees exhibit and promote the highest standards of honest and ethical conduct, avoid conflicts of interest, comply with laws, rules and regulations, and otherwise act in 2006. Kings Island is also onethe Partnership's best interest.

We intend to post amendments to or waivers from the Partnership's Corporate Governance Guidelines and Code of Conduct and Ethics on our Investor Relations website at http://ir.cedarfair.com. No waivers have been made or granted prior to the date of this Form 10-K/A.

Availability of Corporate Governance Documents

Our Corporate Governance Guidelines, Code of Conduct and Ethics, and charters for each of the most attended amusement parks in North America. The park features a children's area that has been consistently named onecommittees of the "Best Kids' AreaBoard are available on our Investor Relations website at http://ir.cedarfair.com. A printed copy of each of these documents is available, without charge, by sending a written request to: Cedar Fair L.P., One Cedar Point Drive, Sandusky, Ohio 44870-5259, Attention: Investor Relations, or by sending an email to investing@cedarfair.com.

Unit Ownership Guidelines

The Board maintains unit ownership guidelines for our Chief Executive Officer and his direct reports. The Chief Executive Officer is required to hold units having a value of at least four times his base salary, and his direct reports are required to hold units with a value of at least two times their base salaries. Furthermore, the Chief Executive Officer and his direct reports are not permitted to sell any units until (1) he or she has met the unit ownership guidelines, and (2) the sale would not result in his or her ownership falling below the unit ownership guidelines. The Chief Executive Officer's direct reports currently include the Chief Operating Officer, the Executive Vice President and Chief Financial Officer, the Executive Vice President and Chief Legal Officer and Corporate Secretary, and the Senior Vice President, Corporate Strategy. Executives have five years from becoming an executive officer to gain compliance with the guidelines. The Board reviews compliance with the guidelines annually. As of April 19, 2024, the Chief Executive Officer and his direct reports were all in compliance with the guidelines. Units held directly or beneficially owned, units held in benefit plans (e.g., in 401(k) accounts), performance units (as if earned at 100% of target), vested and unvested restricted units and phantom units will be counted for purposes of determining compliance with the unit ownership guidelines.

The Board also maintains unit ownership guidelines for the directors. The guidelines require directors (excluding the Chief Executive Officer) to accumulate units equal to at least five times the annual cash retainer within five years of becoming a director. Furthermore, directors are not permitted to sell any units until (1) he or she has met the unit ownership guidelines, and (2) the sale would not result in his or her ownership falling below the unit ownership guidelines. The Chief Executive Officer is required to maintain ownership consistent with the executive requirements. As of April 19, 2024, all directors were in compliance with the guidelines or are expected to meet the guidelines in the World"prescribed time frame.

Anti-Hedging Policy

Certain forms of hedging or monetization transactions, such as zero-cost collars and forward sale contracts, allow a director, officer or employee to lock in much of the value of his or her unit holdings, often in exchange for all or part of the potential for upside appreciation in the unit. These transactions allow the director, officer or employee to continue to own the covered securities, but without the full risks and rewards of ownership. When that occurs, the director, officer or employee may no longer have the same objectives as the Company's other unitholders. Therefore, directors, officers, and employees are prohibited from engaging in any such transaction.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than 10% of our common shares, to file with the SEC reports of ownership of our securities on Form 3 and changes in reported ownership on Form 4 or Form 5, as applicable. Such directors, executive officers and greater than 10% unitholders are also required by SEC rules to furnish us with copies of all Section 16(a) forms filed.

Based solely upon a review of the reports furnished to us, or written representations from reporting persons that all other reportable transactions were reported, we believe that during the year ended December 31, 2023, our directors, executive officers and greater than 10% unitholders timely filed all reports they were required to file under Section 16(a).

ITEM 11. EXECUTIVE COMPENSATION.

Compensation Discussion and Analysis

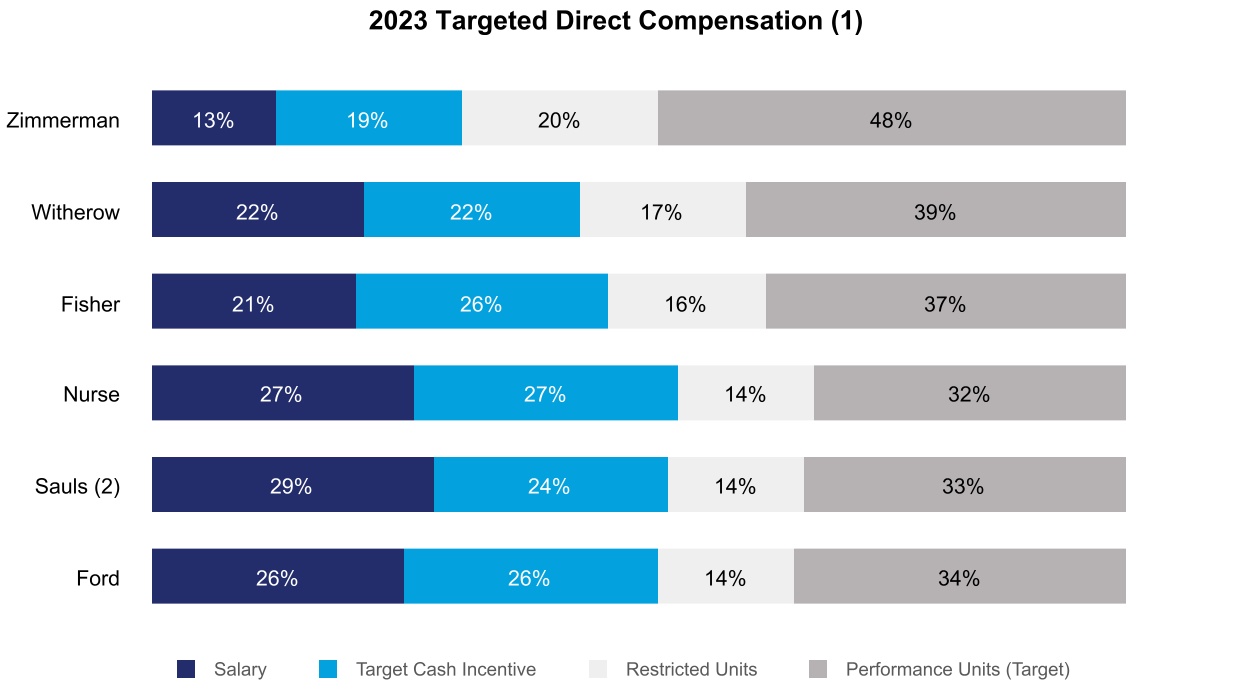

This Compensation Discussion and Analysis describes our compensation philosophy and objectives, the material elements of our named executive officer compensation, and how and why we have arrived at specific compensation policies and decisions. Following the summary is a detailed discussion of the compensation awarded to, earned by, and/or paid to the following individuals, who were the named executive officers for 2023:

•Amusement Today. The park's market area includes Cincinnati, DaytonRichard A. Zimmerman, President and Columbus, Ohio; Louisville and Lexington, Kentucky; and Indianapolis, Indiana.Chief Executive Officer;

Carowinds•Tim V. Fisher, Chief Operating Officer;

Carowinds,•Brian M. Nurse, Executive Vice President, Chief Legal Officer and Corporate Secretary;

•Monica R. Sauls, Senior Vice President and Chief Human Resources Officer; and

•Kelley S. Ford, Former Executive Vice President and Chief Marketing Officer.

This information should be read in conjunction with the compensation tables, related narratives, and notes contained later in this Form 10-K/A.

SUMMARY

Overview

Cedar Fair has a combination amusementlong-standing track record of creating value for our unitholders. We believe our compensation program design supports our continued delivery of results and water park located in Charlotte, North Carolina, first opened in 1973incentivizes the high-performing executive team. Our 2023 approach:

•Continued to emphasize performance-based compensation;

•Maintained a straightforward design, consistent with our overall compensation philosophy and was acquired by the Partnership in 2006. Carowinds' major markets include Charlotte, Greensboro, and Raleigh, North Carolina;objectives as well as Greenvillealigned with unitholder value creation; and Columbia, South Carolina. The park also features Camp Wilderness Resort, an upscale campground,

•Continued to reflect our desire to attract and retain critical talent and incentivize our team to further optimize and drive business results in direct alignment with our unitholders’ interests and long-term value creation.

We had a strong operating year despite unusually inclement weather, particularly at our California parks, that impacted our results during the first quarter of 2023. This resulted in reduced attendance and lower season pass sales as compared to 2022. We reassessed our pricing strategy and cost savings initiatives and implemented changes during the last six months of 2023. Our efforts led to stronger results during the second half of 2023 and a SpringHill Suitesmeaningful increase in season-long product sales for the 2024 operating season. We progressed against our capital allocation priorities, including strengthening our balance sheet, accelerating the return of capital to our unitholders, and reinvesting in growth opportunities. In November 2023, we entered into a definitive merger agreement to combine with Six Flags Entertainment Corporation ("Six Flags") (such agreement, the "merger agreement" and the merger transactions contemplated thereby, the "merger"). The closing of the merger is subject to receipt of regulatory approvals and satisfaction of other customary closing conditions.

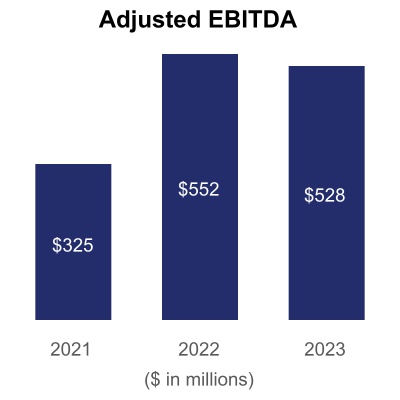

We set challenging targets for 2023 in both our cash and equity incentive programs. This resulted in 91.7% achievement of the annual financial target and a resulting payout of 39.7%-43.1% of target for our 2023 cash incentive awards. 2023 was also the first year for which performance against the goals was measured under our 2021-2025 performance units. The 2021-2025 performance unit awards have three components: (1) functional currency Adjusted EBITDA goals (up to 200% of the target units); (2) net leverage ratio reduction goals (a potential additional 50% of the target units); and (3) un-levered pre-tax free cash flow goals (a potential additional 50% of the target units). As to (1), we achieved 97.3% of the functional currency Adjusted EBITDA goal for 2023, resulting in payouts of 80% on that component of the 2021-2025 performance unit awards. As to (2), we achieved our net leverage ratio reduction goal for 2023, which will result in full payouts of that component of the awards in March 2025, subject to continuous employment requirements. As to (3), we did not achieve our un-levered pre-tax free cash flow target for 2023. The 2021-2025 performance award program provides additional opportunities to earn the remaining potential units for the functional currency Adjusted EBITDA and un-levered pre-tax free cash flow components of the award, based on targets for 2024 and, if applicable, 2025.

Compensation Philosophy and Objectives

Our executive compensation program is designed to: (1) incentivize our key employees to drive superior results; (2) give key employees a proprietary and vested interest in our growth and performance; and (3) enhance our ability to attract, retain and motivate exceptional leaders upon whom, in large measure, our sustained growth, progress, and profitability depend. We believe our executive compensation program should be directly tied to board-approved annual and long-range plans that align with unitholder interests. Our program is designed to directly tie compensation to Company performance and to reward individual

performance. Our incentive awards directly tie to Company achievement of Adjusted EBITDA and un-levered pre-tax free cash flow goals. Adjusted EBITDA represents earnings before interest, taxes, depreciation, amortization, other non-cash items, and adjustments as defined in our credit agreement. We use Adjusted EBITDA as a key performance measure because it closely tracks core operating performance across park operating units. Further, Adjusted EBITDA is widely used by Marriott hotel located adjacentanalysts, investors, direct industry peers, and other comparable companies to evaluate operating performance. We also use un-levered pre-tax free cash flow goals, which we have viewed to be an effective measure for our long-term awards in light of our post-pandemic strategic focus on strengthening the park entrance. balance sheet and execution of a more dimensionalized capital allocation strategy that balances growth, deleveraging, distribution and return of capital to our unitholders.

Our unitholder-approved incentive plan allows us to provide a mix of compensation that drives our management team to achieve strong annual results and to deliver long-term value for all unitholders. Our compensation structure provides us with flexibility to evolve our compensation program from year to year as our business, the market, or the industry requires while remaining true to our overall compensation philosophy and long-term value enhancing approach. We are focused on taking the appropriate actions when they are necessary. We have used this flexibility over the years to respond to external impacts, including the impact of COVID-19 in previous years, consistent with our ongoing priority of aligning executive compensation and unitholder interests, while ensuring we attract and retain key talent and incenting them to make decisions that drive long-term unitholder value. We emphasize protecting the health and safety of our guests and associates, enhancing liquidity, and using metrics that are resilient to business disruptions.

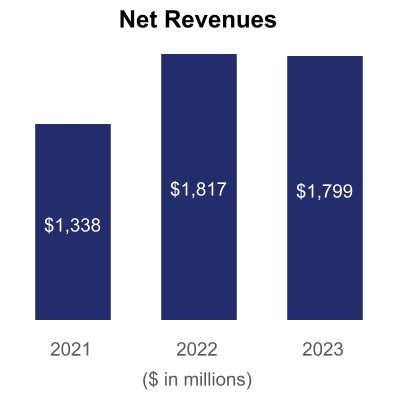

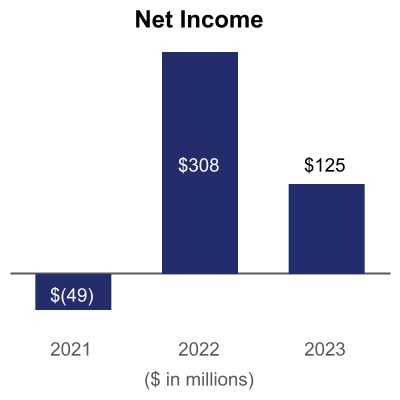

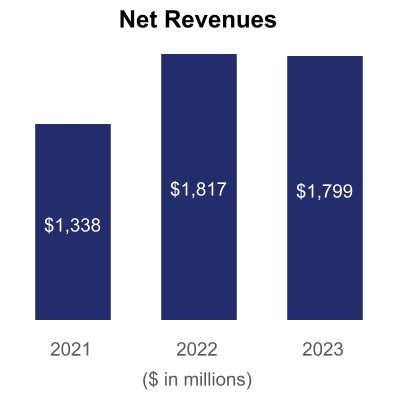

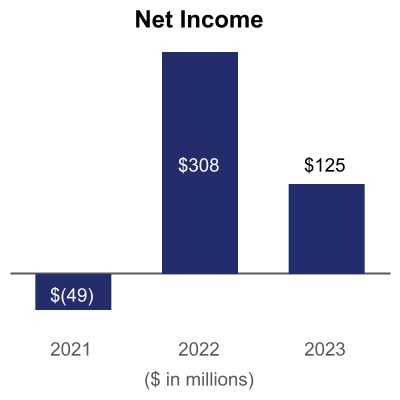

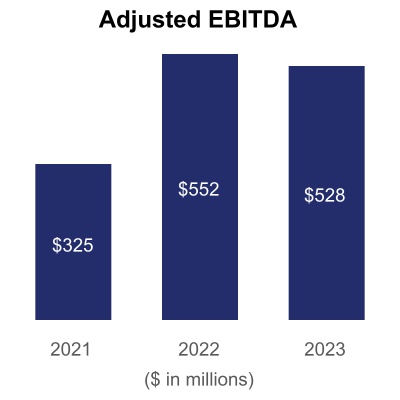

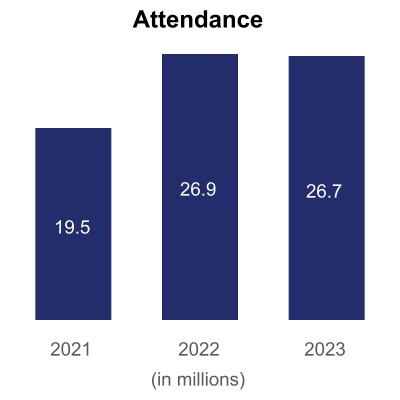

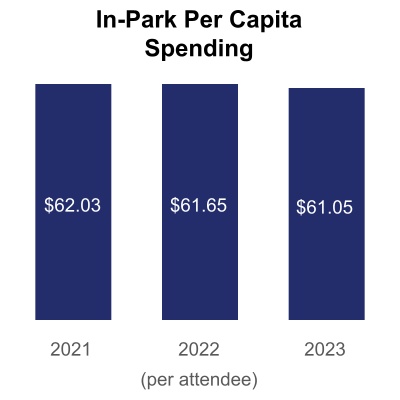

Company Performance During 2023

The SpringHill Suites is a Marriott franchise operated by Cedar Fair.graphs below illustrate some of our key performance metrics for each of the last three fiscal years. The hotel is open year-round and features suites, an outdoor pool, fitness center and bar.

Kings Dominion

Kings Dominion, a combination amusement and water park located near Richmond, Virginia, first opened in 1975 and2021 period was acquiredsignificantly disrupted by the PartnershipCOVID-19 pandemic.

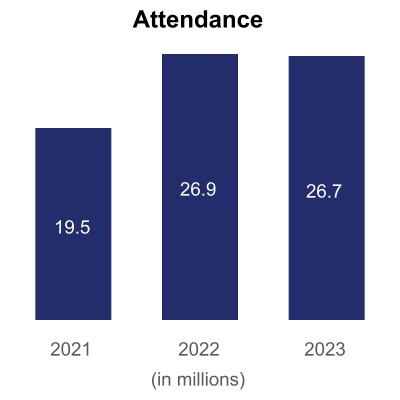

In 2023, we achieved net revenues of $1.8 billion, net income of $125 million, and Adjusted EBITDA of $528 million. Net income in 2006. The park's market area includes Richmond and Norfolk, Virginia; Raleigh, North Carolina; Baltimore, Maryland and Washington, D.C. Additionally, the park offers Kings Dominion Camp Wilderness Campground, an upscale campground.

California's Great America

California's Great America,2022 included a combination amusement and water park located in Santa Clara, California, first opened in 1976 and was acquired by the Partnership in 2006. The park draws its visitors primarily from San Jose, San Francisco, Sacramento, Modesto and Monterey, among other cities in northern California. On June 27, 2022, we sold$155 million gain on sale of the land at California's Great America. Concurrently with the sale, we entered into a lease contract that allows us to operate the park during a six-year term, and we have an option to extendthrough the term for an additional five years. The lease is subject to early termination by the buyer with at least two years' prior notice.

Dorney Park

Dorney Park, a combination amusement and water park located in Allentown, Pennsylvania, was first developed as a summer resort area in 1884 and was acquired by the Partnership in 1992. Dorney Park's major markets include Philadelphia, Lancaster, Harrisburg, York, Scranton, Wilkes-Barre, Hazleton and the Lehigh Valley, Pennsylvania; New York City; and New Jersey.

Worlds of Fun

Worlds of Fun, which opened in 1973 and was acquired by the Partnership in 1995, is a combination amusement and water park located in Kansas City, Missouri. Worlds of Fun serves a market area centered in Kansas City, as well as most of Missouri and portions of Kansas and Nebraska. Worlds of Fun also features Worlds of Fun Village, an upscale campground.

Valleyfair

Valleyfair, which opened in 1976 and was acquired by the Partnership's predecessor in 1978, is a combination amusement and water park located near Minneapolis-St. Paul in Shakopee, Minnesota. Valleyfair's market area is centered in Minneapolis-St. Paul, but the park also draws visitors from other areas in Minnesota and surrounding states.

Michigan's Adventure

Michigan's Adventure, which opened in 1956 as Deer Park and was acquired by the Partnership in 2001, is a combination amusement and water park located in Muskegon, Michigan. Michigan's Adventure serves a market area principally from central and western Michigan and eastern Indiana.

Schlitterbahn Waterpark & Resort New Braunfels

Schlitterbahn Waterpark & Resort New Braunfels began as a resort in 1966, was introduced as a water park in 1979 and was acquired by the Partnership in 2019. The park is consistently rated the best water park in the industry by Amusement Today's international survey and is one of the most attended water parks in North America. The park, located in New Braunfels, Texas, features many river rides, water slides and attractions along the Comal River. The Resort at Schlitterbahn New Braunfels includes hotel rooms, suites, cabins, luxury suites and vacation homes. Schlitterbahn Waterpark & Resort New Braunfels’ major markets include San Antonio, Austin and Houston, Texas.

Schlitterbahn Waterpark Galveston

Schlitterbahn Waterpark Galveston opened in 2006 and was acquired by the Partnership in 2019. The park is one of the most attended water parks in North America. The park, located in Galveston, Texas, features many water attractions including an award-winning water coaster and a one-mile long river system. Schlitterbahn Waterpark Galveston serves a market area centered in Houston, Texas, as well as the tourism population in Galveston Island, Texas, a barrier island on the Texas Gulf Coast.

CAPITAL EXPENDITURES

We believe that annual park attendance is influenced by annual investments in our properties, including new attractions and infrastructure, among other factors. Capital expenditures are planned on a seasonal basis with most expenditures made prior to the beginning of the peak2027 operating season. Capital expenditures made

Attendance in a calendar year may differ materially2023 totaled 26.7 million, decreasing 247,000 visits, or less than 1%, from amounts identified with a particular operating season because of timing considerations such as weather conditions, site preparation requirements and availability of ride components, which may result in accelerated or delayed expenditures around calendar year-end. Due to the effects of the COVID-19 pandemic, some capital expenditures were suspended in 2020 and 2021 in order to maintain flexibility and retain liquidity.

COMPETITION

We compete for discretionary spending with all aspects of the recreation industry within our primary market areas, including other destination and regional amusement parks. We also compete with other forms of entertainment and recreational activities, including movies, sports events, restaurants and vacation travel.

The principal competitive factors in the amusement park industry include the uniqueness and perceived quality of the rides and attractions in a particular park, proximity to metropolitan areas, the atmosphere and cleanliness of the park, and the quality and variety of the food and immersive entertainment available. We believe that our parks feature a variety of high-quality rides and attractions, restaurants, gift shops and family atmosphere to make them highly competitive with other parks and forms of entertainment.

GOVERNMENT REGULATION

Our operations are subject to regulatory requirements, such as those relating to employment practices, environmental requirements, and other regulatory matters. We are subject to extensive federal and state employment laws and regulations, including wage and hour laws and other pay practices and employee record-keeping requirements. We may be required to incur costs to comply with these requirements, and the costs of compliance, investigation, remediation, litigation, and resolution of regulatory matters could be substantial.

We also are subject to federal, state and local environmental laws and regulations such as those relating to water resources; discharges to air, water and land; the handling and disposal of solid and hazardous waste; and the cleanup of properties affected by regulated materials. Under these laws and regulations, we may be required to investigate and clean up hazardous or toxic substances or chemical releases from current or formerly owned or operated facilities or to mitigate potential environmental risks. Environmental laws typically impose cleanup responsibility and liability without regard to whether the relevant entity knew of or caused the presence of the contaminants. The costs of investigation, remediation or removal of regulated materials may be substantial, and the presence of those substances, or the failure to remediate a property properly, may impair our ability to use, transfer or obtain financing with respect to our property.

Currently, we believe we are in substantial compliance with applicable requirements under these laws and regulations. However, such requirements have generally become stricter over time, and there can be no assurance that new requirements, changes in enforcement policies or newly discovered conditions relating to our properties or operations will not require significant expenditures in the future.

All rides are inspected daily by both our maintenance and ride operations personnel before being placed into operation for our guests. The parks are also periodically inspected by our insurance carrier and, at all parks except Valleyfair, Worlds of Fun, Schlitterbahn Waterpark New Braunfels, Schlitterbahn Waterpark Galveston and Carowinds' South Carolina rides, by state or county ride-safety inspectors. Valleyfair, Worlds of Fun, Schlitterbahn Waterpark New Braunfels, Schlitterbahn Waterpark Galveston and Carowinds each contract with a third party to inspect our rides pursuant to Minnesota, Missouri, Texas and South Carolina law, respectively, and submit the third-party report to the respective state agency. Additionally, all parks have added ride maintenance and operation inspections completed by third party qualified inspectors to make sure our standards are being maintained.

HUMAN CAPITAL

We employ approximately 4,400 full-time employees and employed approximately 48,800 seasonal and part-time employees in 2022, many of whom are high school and college students. We house some of our seasonal employees in dormitories owned by us at Cedar Point, Kings Island, Carowinds, Kings Dominion and Valleyfair, or rented by us at Dorney Park, Worlds of Fun, Schlitterbahn Waterpark New Braunfels and Schlitterbahn Waterpark Galveston. Approximately 260 of our employees are represented by labor unions. We believe we maintain good relations with our employees.

Our employee guidelines and policies are founded on our cornerstones of safety, service and cleanliness and our core values of integrity, courtesy and inclusiveness. Our highest priority continues to be the safety and well-being of our guests and employees. We continue to monitor developments of the COVID-19 pandemic, as well as federal, state and local guidelines, and update our safety protocols based on the most recent recommendations and requirements. We are committed to equal opportunity employment and prohibit harassment or discrimination of any kind. We have adopted an open door policy to encourage an honest employer-associate relationship, which includes a confidential hotline available to all employees. As part of our commitment to our core values, we created a diversity, equity and inclusion ("DE&I") council and provided DE&I training to our employees in 2021. In 2022, we published our first Environmental, Social and Governance ("ESG") Strategy Report to establish an enterprise-wide framework to address ESG issues. The framework includes the prioritization of five key strategic pillars: Safety, Associate Happiness, Community, Environment, and Operations and Governance. The report included the introduction of the Associate Happiness Model, focusing on DE&I, and the Cedar Fair Safety Model, focusing on the safety of our employees and guests.

We maintain training programs for new employees, including safety training specific to job responsibilities. We participate in the J-1 Visa program providing cultural and educational exchange opportunities for our associates. We also have partnered with Bowling Green State University to create the Cedar Fair Resort and Attraction Management program, a bachelor's degree program, which is housed in downtown Sandusky, Ohio in a facility jointly owned by the Partnership and a third party developer. The bachelor's degree program prepares students for management careers at Cedar Fair parks or a similar establishment. We encourage a promote-from-within policy.

Our executive compensation program is designed to incentivize our key employees to drive superior results, to give key employees a vested interest in our growth and performance, and to enhance our ability to attract and retain exceptional managerial talent. Our executive compensation program rewards both successful individual performance and the consolidated operating results of the Partnership by directly tying compensation to our performance.

AVAILABLE INFORMATION

Copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K and all amendments to those reports as filed or furnished with the SEC are available without charge upon written request to our Investor Relations Office or through our website (www.ir.cedarfair.com).

We use our website www.ir.cedarfair.com as a channel of distribution of information. The information we post through this channel may be deemed material. Accordingly, investors should monitor this channel, in addition to following our news releases, SEC filings, and public conference calls and webcasts. The contents of our website, including without limitation the ESG Strategy Report referenced above, shall not be deemed to be incorporated herein by reference.

The SEC maintains an Internet site at http://www.sec.gov that contains our reports, proxy statements and other information.

SUPPLEMENTAL ITEM. Information about our Executive Officers

| | | | | | | | | | | | | | |

Name | | Age | | Position(s) |

| | | | |

Richard A. Zimmerman | | 62 | | | Richard Zimmerman has been President and Chief Executive Officer since January 2018 and a member of the Board of Directors since April 2019. Prior to becoming CEO, he served as President and Chief Operating Officer from October 2016 through December 2017 and served as Chief Operating Officer from 2011 through 2016. Prior to that, he was appointed as Executive Vice President in 2010 and as Regional Vice President in 2007. He has been with Cedar Fair since 2006, when Kings Dominion was acquired. Richard served as Vice President and General Manager of Kings Dominion from 1998 through 2006. |

Brian C. Witherow | | 56 | | | Brian Witherow has served as Executive Vice President and Chief Financial Officer since 2012. Prior to that, he served as Vice President and Corporate Controller beginning in 2005. Brian has been with Cedar Fair in various other positions since 1995. |

Tim V. Fisher | | 62 | | | Tim Fisher joined Cedar Fair as Chief Operating Officer in December 2017. Prior to joining Cedar Fair, he served as Chief Executive Officer of Village Roadshow Theme Parks International, an Australian-based theme park operator, since March 2017. Prior to this appointment with Village Roadshow Theme Parks International, Tim served as Chief Executive Officer of Village Roadshow Theme Parks since 2009. |

Brian M. Nurse | | 51 | | | Brian Nurse joined Cedar Fair as Executive Vice President, Chief Legal Officer and Secretary in November 2021. Prior to joining Cedar Fair, he served as Senior Vice President, General Counsel and Secretary for World Wrestling Entertainment, Inc. ("WWE"), an integrated media and entertainment company, from September 2018 to November 2020. Prior to joining WWE, Brian served as Vice President, Associate General Counsel and Secretary at Nestle Waters North America, Inc., a former division of Nestle S.A. which is a multinational food and drink corporation, from 2012 to 2018. Prior to that, he was Senior Legal Counsel for North American beverage/soft drink brands at PepsiCo, Inc., a multinational food, snack and beverage corporation, from 2003 to 2012. |

Kelley S. Ford | | 58 | | | Kelley Ford has served as Executive Vice President and Chief Marketing Officer since 2012. Prior to joining Cedar Fair, she served as Senior Vice President, Marketing Planning Director for TD Bank from 2010 through 2012. Prior to joining TD Bank, Kelley served as Senior Vice President of Brand Strategy and Management at Bank of America from 2005 through 2010. |

David R. Hoffman | | 54 | | | Dave Hoffman has served as Senior Vice President and Chief Accounting Officer since 2012. Prior to that, he served as Vice President of Finance and Corporate Tax since 2010. He served as Vice President of Corporate Tax from 2006 through 2010. Prior to joining Cedar Fair, Dave served as a business advisor with Ernst & Young from 2002 through 2006. |

Charles E. Myers | | 59 | | | Charles Myers joined Cedar Fair as Senior Vice President, Creative Development in June 2019. Prior to joining Cedar Fair, he held a variety of Senior Leadership roles including Show Design, Production Management and Producing at Walt Disney Imagineering, the research and development arm of the Walt Disney Company, from 2013 to June 2019. Prior to this, he served as Senior Vice President, Licensing, Project Development & Business Development of Paramount Pictures from 2002 to 2013. |

ITEM 1A. RISK FACTORS.

Risks Related to the Amusement Park Industry

Instability in economic conditions could impact our business, including our results of operations and financial condition.

Uncertain or deteriorating economic conditions, including during inflationary and recessionary periods, may adversely impact attendance figures and guest spending patterns at our parks as uncertain economic conditions affect our guests' levels of discretionary spending. Both attendance and in-park spending at our parks are key drivers of our revenues and profitability, and reductions in either can directly and negatively affect revenues and profitability. A decrease in discretionary spending due to a decline in consumer confidence in the economy, an economic slowdown or deterioration in the economy could adversely affect the frequency with which our guests choose to attend our parks and the amount that our guests spend on our products when they visit.

Periods of inflation or economic downturn could also impact our ability to obtain supplies and services and increase our operating costs. We continue to see some inflationary effects and supply chain disruptions on our business, which may continue or worsen. In addition, the existence of unfavorable general economic conditions may also hinder the ability of those with which we do business, including vendors, concessionaires and customers, to satisfy their obligations to us. The materialization of these risks could lead to a decrease in our revenues, operating income and cash flows.

The COVID-19 pandemic has adversely impacted our business and may continue to adversely impact our business, as well as intensify certain risks we face, for an unknown length of time.

Since 2020, the COVID-19 pandemic has had a material negative impact on our business. On March 14, 2020, we closed our properties in response to federal and local recommendations and restrictions to mitigate the spread of COVID-19. We were ultimately able to resume partial operations, subject to capacity, social distancing mandates and other governmental restrictions, at 10 of our 13 properties on a staggered basis in 2020. We operated all of our properties in 2021. However, 2021 operating seasons were delayed and certain restrictions remained in place at some of our properties. Each of our properties opened for the 2022 operating season as planned and without restrictions.

Consumer behavior and preferences changed in response to the effects of the COVID-19 pandemic and may remain changed both in the short term and long term, including impacts on discretionary consumer spending due to significant economic uncertainty and changing risk tolerances of our employees and guests regarding health matters. In 2020, we experienced lower demand upon reopening our properties resulting in a material decrease in revenues generated. In 2021 and 2022, attendance improved, but we experienced lower demand at certain times and at certain properties. Future significant volatility or reductions in demand for, or interest in, our parks could materially adversely impact attendance, in-park2022. In-park per capita spending and revenue. In addition, we could experience damagein 2023 declined $0.60, or 1%, from 2022. Out-of-park revenues reached a new high in 2023, increasing $10 million, or 5%, compared to our brand and reputation due to actual or perceived health risks associated with our parks or the amusement park industry which could have a similar material adverse effect on attendance, in-park per capita spending and revenue. We may also continue to experience operational risks due to the COVID-19 pandemic, including limitations on our ability to recruit and train employees in sufficient numbers to fully staff our parks as a result of changing risk tolerances.2022.

Because our amusement and water parks are the primary sources of net income and operating cash flows, any future mandated or voluntary closures or other operating restrictions would adversely impact our business and financial results. Our parks are geographically located throughout the United States and in Canada. The duration and severity of the COVID-19 pandemic and the related restrictions at any one location could result in a potentially disproportionate amount of risk if concentrated amongst our largest properties.

We have not previously experienced the level of disruption caused by the COVID-19 pandemic. It is difficult for management to estimate future performance under these conditions, and the ultimate impact of the COVID-19 pandemic on our business, results of operations and financial condition cannot be reasonably predicted.

The high fixed cost structure of amusement park operations can result in significantly lower margins, profitability and cash flows if attendance levels do not meet expectations.

A large portion of our expense is relatively fixed because the costs for full-time employees, maintenance, utilities, advertising and insurance do not vary significantly with attendance. These fixed costs may increase and may not be able to be reduced at a rate proportional with ongoing attendance levels. If cost-cutting efforts are insufficient or are impractical, we could experience a material decline in margins, profitability and cash flows. Such effects can be especially pronounced during periods of economic contraction or slow economic growth.

Bad or extreme weather conditions can adversely impact attendance at our parks, which in turn would reduce our revenues.

Because most of the attractions at our parks are outdoors, attendance at our parks can be adversely affected by continuous bad or extreme weather and by forecasts of bad or mixed weather conditions, which would negatively affect our revenues. We believe that our ownership of many parks in different geographic locations reduces, but does not completely eliminate, the effect that adverse weather can have on our consolidated results.

Our insurance coverage may not be adequate to cover all possible losses that we could suffer, and our insurance costs may increase.

Although we carry liability insurance to cover possible incidents, there can be no assurance that our coverage will be adequate to cover liabilities, that we will be able to obtain coverage at commercially reasonable rates, or that we will be able to obtain adequate coverage should a catastrophic incident occur at our parks or at other parks. Companies engaged in the amusement park business may be sued for substantial damages in the event of an actual or alleged incident. An incident occurring at our parks or at competing parks could reduce attendance, increase insurance premiums, and negatively impact our operating results.

Unanticipated construction delays in completing capital improvement projects in our parks and resort facilities, significant ride downtime, or other unplanned park closures could adversely affect our revenues.

A principal competitive factor for an amusement park is the uniqueness and perceived quality of its rides and attractions in a particular market area. Accordingly, the regular addition of new rides and attractions is important, and a key element of our revenue growth is strategic capital spending on new rides and attractions. Any construction delays could adversely affect our attendance and our ability to realize revenue growth. Further, when rides, attractions, or an entire park, have unplanned downtime and/or closures, our revenue could be adversely affected.

There is a risk of accidents or other incidents occurring at amusement and water parks, which may reduce attendance and negatively impact our revenues.

The safety of our guests and employees is one of our top priorities. Our amusement and water parks feature thrill rides. There are inherent risks involved with these attractions, and an accident or a serious injury at any of our parks could result in negative publicity and could reduce attendance and result in decreased revenues. In addition, accidents or injuries at parks operated by our competitors could influence the general attitudes of amusement park patrons and adversely affect attendance at our parks. Other types of incidents such as food borne illnesses and disruptive, negative guest behavior which have either been alleged or proved to be attributable to our parks or our competitors could adversely affect attendance and revenues.

Extended disruptions to our technology platforms may adversely impact our sales and revenues.

A large portion of our sales are processed online and utilize third party technology platforms. Our increased dependence on these technology platforms may adversely impact our sales, and therefore our revenues, if key systems are disrupted for an extended period of time.

Risks Related to Our Strategy

Our growth strategy may not achieve the anticipated results.

Our future success will depend on our ability to grow our business, including fully recovering from the effects of the COVID-19 pandemic. We grow our business through acquisitions and capital investments to improve our parks through new rides and attractions, as well as in-park product offerings and product offerings outside of our parks. Our growth and innovation strategies require significant commitments of management resources and our investments may not grow our revenues at the rate we expect or at all. As a result, we may not be able to recover the costs incurred in developing new projects and initiatives, or to realize their intended or projected benefits, which could have a material adverse effect on our business, financial condition or results of operations.

We compete for discretionary spending and discretionary free time with many other entertainment alternatives and are subject to factors that generally affect the recreation and leisure industry, including general economic conditions.

Our parks compete for discretionary spending and discretionary free time with other amusement, water and theme parks and with other types of recreational activities and forms of entertainment, including movies, sporting events, restaurants and vacation travel. Our business is also subject to factors that generally affect the recreation and leisure industries and are not within our control. Such factors include, but are not limited to, general economic conditions, including relative fuel prices, and changes in consumer tastes and spending habits. There may be a material adverse effect on our business, financial condition or results of operations if we are unable to effectively compete with other entertainment alternatives.

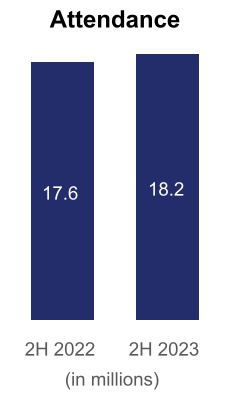

The operating seasonOur 2023 results were impacted by unusually inclement weather, particularly at most of our California parks, is of limited duration, which can magnify the impact of adverse conditions or events occurring within that operating season.

Twelve of our properties are seasonal and are generally open daily from Memorial Day through Labor Day. Outside of daily operations, our seasonal properties are typically open during select weekends, including at most properties in the fourth quarter for Halloween and winter events. As a result, a substantial portion of our revenues from these seasonal parks are generated from Memorial Day through Labor Day with the major portion concentrated during the peak vacationfirst quarter of 2023. This resulted in reduced attendance and lower season pass sales as compared to 2022. We reassessed our pricing strategy and cost savings initiatives and implemented changes during the last six months of July and August. Consequently, when adverse conditions or events occur2023. Our efforts led to stronger results during the operating season, particularly during the peak vacation monthssecond half of July2023, including expanded margins and August or the important fall season, there is only a limited period of time during which the impact of those conditions or events can be mitigated. Accordingly, the timing of such conditions or events may have a disproportionate adverse effect upon our revenues.

Risks Related to Human Capital

Increased costs of labor and employee health and welfare benefits may impact our results of operations.

Labor is a primary component in the cost of operating our business. Increased labor costs, due to competition, inflationary pressures, increased federal, state or local minimum wage requirements, and increased employee benefit costs, including health care costs, could adversely impact our operating expenses. Over the past two to three years, we experienced a meaningful increase in seasonal labor rate in orderseason-long product sales for the 2024 operating season. The graphs below illustrate some our key performance metrics for the second half of 2023 as compared to recruit employees in a challenging labor market. Continued increases to both market wage ratesthe second half of 2022. Our 2023 and the statutory minimum wage rates could also materially impact our future seasonal labor rates. It is possible that these changes could significantly increase our labor costs, which would adversely affect our operating2022 results and cash flows.

Our business depends on our ability to meet our workforce needs.

Our success depends on our ability to attract, motivate and retain qualified employees to keep pacewere not comparable with our needs. If2021 results due to the effects of the COVID-19 pandemic.

For additional information regarding attendance, in-park per capita spending, out of park revenues, and Adjusted EBITDA, including how we are unable to do so, our resultsdefine and use those measures and a reconciliation of operationsAdjusted EBITDA from net income, see Item 7. Management’s Discussion and cash flows may be adversely affected. We employAnalysis of Financial Condition and Results of Operations on pages 18-24 of the Original Form 10-K. For a significant workforce each season. We recruit year-round to fill thousandsreconciliation of staffing positions to ensure the appropriate workforce is in place at the right time. There is no assurance that we will be able to recruitin-park and hire adequate personnel as the business requires or that we will not experience material increases in the cost of securing our workforce in the future.

If we lose key personnel, our business may be adversely affected.

Our success depends in part upon a number of key employees, including our senior management team, whose members have been involved in the leisure and hospitality industries for an average of more than 20 years. The loss of services of our key employees or our inability to replace our key employees could cause disruption in important operational, financial and strategic functions and have a material adverse effect on our business.

Risks Related to Our Capital Structure

The amount of our indebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry and prevent us from fulfilling our obligations under our debt agreements.

We had $2.3 billion of outstanding indebtedness as of December 31, 2022 (before reduction of debt issuance costs).

The amount of our indebtedness could have important consequences. For example, it could:

•limit our ability to borrow money for our working capital, capital expenditures, debt service requirements, strategic initiatives or other purposes;

•limit our flexibility in planning or reacting to changes in business and future business operations; and

In addition, we may not be able to generate sufficient cash flow from operations, or be able to draw under our revolving credit facility or otherwise, in an amount sufficient to fund our liquidity needs, including the payment of principal and interest on our debt obligations. If ourThese results, strong cash flows, and capital resources are insufficient to service our indebtedness, we may be forced to reduce or delay capital expenditures, suspend partnership distributions, sell assets, seek additional capital or restructure or refinance our indebtedness. These alternative measures may not be successful and may not permitthe prior year sale-leaseback of the land at California's Great America allowed us to meetprogress against our scheduled debt service obligations. Our ability to restructure or refinance our debt in the future will depend on the conditioncapital allocation priorities coming out of the COVID-19 pandemic, including accelerating the return of capital to investors, strengthening the balance sheet, and credit marketsreinvesting in growth opportunities. Recent achievements and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. In addition,current initiatives include the terms of our existing or future debt agreements, including our credit agreement and the indentures governing our notes, may restrict us from adopting some of these alternatives. In the absence of sufficient operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. We may not be able to consummate those dispositions for fair market value or at all. Furthermore, any proceeds that we could realize from any such dispositions may not be adequate to meet our debt service obligations then due.following:

| | | | | | | | |

| Accelerating Return to Investors | Strengthening the Balance Sheet | Reinvesting in Growth Opportunities |