UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20202023

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission file number 1-10235

IDEX CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 36-3555336 |

| (State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | | | |

| 3100 Sanders Road, | Suite 301, | Northbrook, | Illinois | | 60062 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code:

(847) 498-7070

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of Each Classeach class | Trading Symbol(s) | Name of Each Exchangeeach exchange on Which Registeredwhich registered |

| Common Stock, par value $.01 per share | IEX | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant:registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (232.405(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | | Accelerated filer ☐ | | Non-accelerated filer ☐ | | Smaller reporting company | ☐ |

| | | | | | |

| Emerging growth company | ☐ | | | | | | | |

| | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No þ

The aggregate market value, as of the last business day of the registrant’s most recently completed second fiscal quarter, of the common stock (based on the June 30, 20202023 closing price of $158.04)$215.26) held by non-affiliates of IDEX Corporation was $11,866,931,226.$16,267,670,265.

The number of shares outstanding of IDEX Corporation’s common stock, par value $.01 per share, as of February 22, 202116, 2024 was 75,889,737.75,644,654.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement with respect to the IDEX Corporation 20212024 annual meeting of stockholders (the “2021“2024 Proxy Statement”) are incorporated by reference into Part III of this Form 10-K.

Table of Contents

| | | | | | | | | | | | | | |

| PART I. |

| Item 1. | | | |

| Item 1A. | | | |

| Item 1B. | | | |

| Item 1C. | | | |

| Item 2. | | | |

| Item 3. | | | |

| Item 4. | | | |

| | |

| PART II. |

| Item 5. | | | |

| Item 6. | | | |

| Item 7. | | | |

| Item 7A. | | | |

| Item 8. | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Item 9. | | | |

| Item 9A. | | | |

| Item 9B. | | | |

| Item 9C. | | | |

| | |

| PART III. |

| Item 10. | | | |

| Item 11. | | | |

| Item 12. | | | |

| Item 13. | | | |

| Item 14. | | | |

| | |

| PART IV. |

| Item 15. | | | |

| Item 16. | | | |

| | | |

| |

PART I

Cautionary Statement Under the Private Securities Litigation Reform Act

This report contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements may relate to, among other things, the Company’s expected organic salesfull year 2024 focus and the assumptions underlying these expectations, plant and equipment capacity for future growth, the expected timingduration of supply chain challenges, anticipated future acquisition behavior and capital deployment, expectations regarding customer destocking efforts and future order stabilization and lead time, expectations regarding market sector contraction, recovery, stabilization or growth, availability of cash and financing alternatives and the anticipated benefits of the Company’s acquisition of Abel Pumps, L.P. and certain of its affiliates, and the anticipated continuing effects of the coronavirus pandemic, including with respect to the Company's sales, improvements in the Company’s end markets, facility closures, supply chains and access to capital, capital expenditures,recent acquisitions, cost reductions, cash flow, revenues, earnings, market conditions, global economies and operating improvements, and are indicated by words or phrases such as “anticipates,” “estimates,” “plans,” “guidance,” “expects,” “projects,” “forecasts,” “should,” “could,” “will,” “management believes,” “the Company believes,” “the Company intends” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this report.

The risks and uncertainties include, but are not limited to, the following: the duration of the coronavirus pandemic and the continuing effects of the coronavirus pandemic on our ability to operate our business and facilities, on our customers, on supply chains and on the U.S. and global economy generally; economic and political consequences resulting from terrorist attacks and wars; levels of industrial activity and economic conditions in the U.S. and other countries around the world;world, including uncertainties in the financial markets and adverse developments affecting the financial services industry; pricing pressures, including inflation and rising interest rates, and other competitive factors and levels of capital spending in certain industries, all of which could have a material impact on order rates and the Company’s results, particularlyresults; the impact of catastrophic weather events, natural disasters and public health threats; economic and political consequences resulting from terrorist attacks and wars, which could have an adverse impact on the Company's business by creating disruptions in light of the low levels of order backlogs it typically maintains;global supply chain and by potentially having an adverse impact on the global economy; the Company’s ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; cybersecurity incident; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the Company operates; developments with respect to trade policy and tariffs; interest rates; capacity utilization and the effect this has on costs; labor markets; supply chain conditions; market conditions and material costs; risks related to environmental, social and corporate governance issues, including those related to climate change and sustainability; and developments with respect to contingencies, such as litigation and environmental matters, and the other risk factors discussed inItem 1A, “Risk Factors” of this annual report. The forward-looking statements included here are only made as of the date of this report, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances, except as may be required by law. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented here.

PART I

Item 1. Business.

Business.

Overview

IDEX Corporation (“IDEX,”IDEX” or the “Company,” “us,” “our,” or “we”“Company”) is a Delaware corporation incorporated on September 24, 1987. The Company is an applied solutions businessprovider serving niche markets worldwide. IDEX is a high-performing global enterprise committed to making trusted solutions that sells an extensive array of pumps, valves, flow metersimprove lives and other fluidics systems andare mission critical components and engineered products to customers in a variety of markets around the world.everyday life. Substantially all of the Company’s business activities are carried out through over 50 wholly-owned subsidiaries.subsidiaries with shared values of Trust, Team and Excellence. IDEX’s diverse family of businesses is innovative and inquisitive in its quest to solve customers’ most challenging applied technology problems. These businesses operate with a high degree of autonomy, yet are all united by employing The IDEX Difference, a philosophy of great teams who embrace the 80/20 principle while remaining hyper-focused on serving customers. IDEX was incorporated in Delaware on September 24, 1987.

End Markets and Products

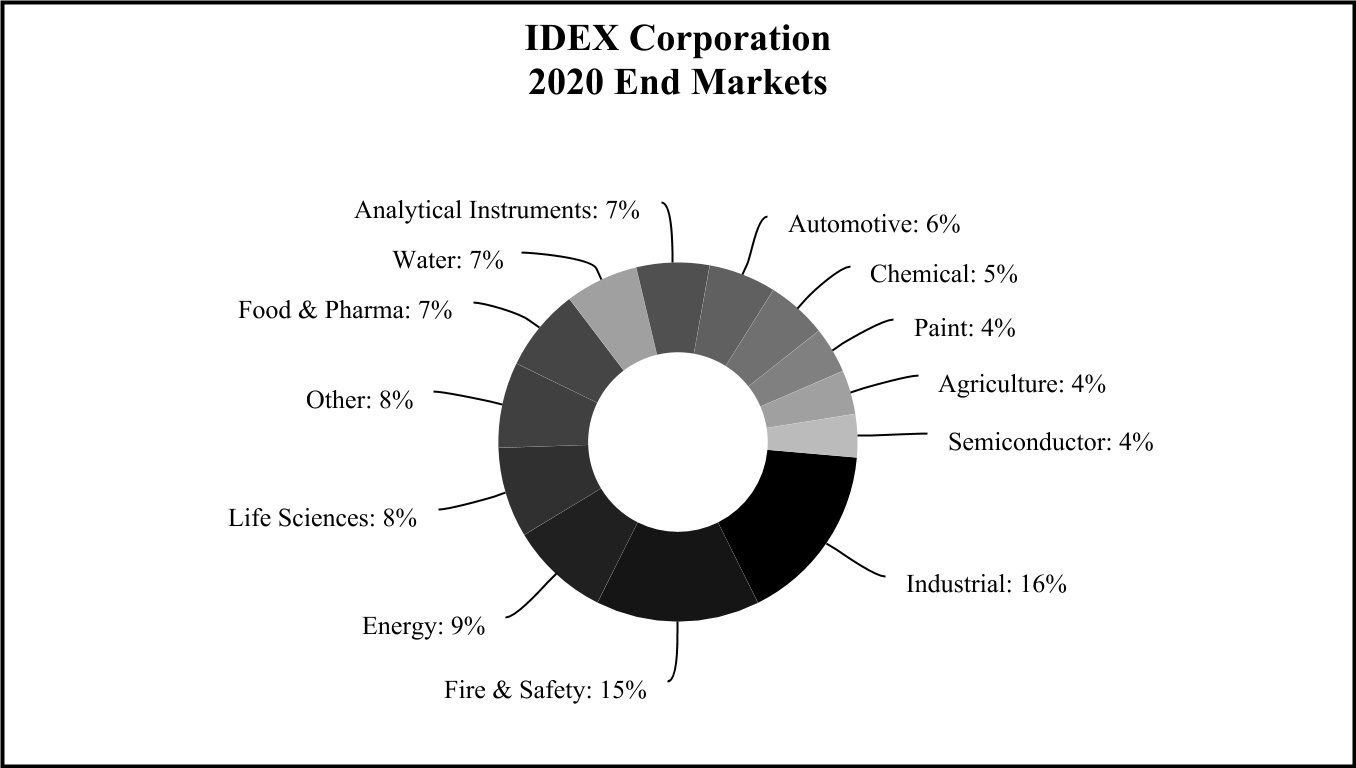

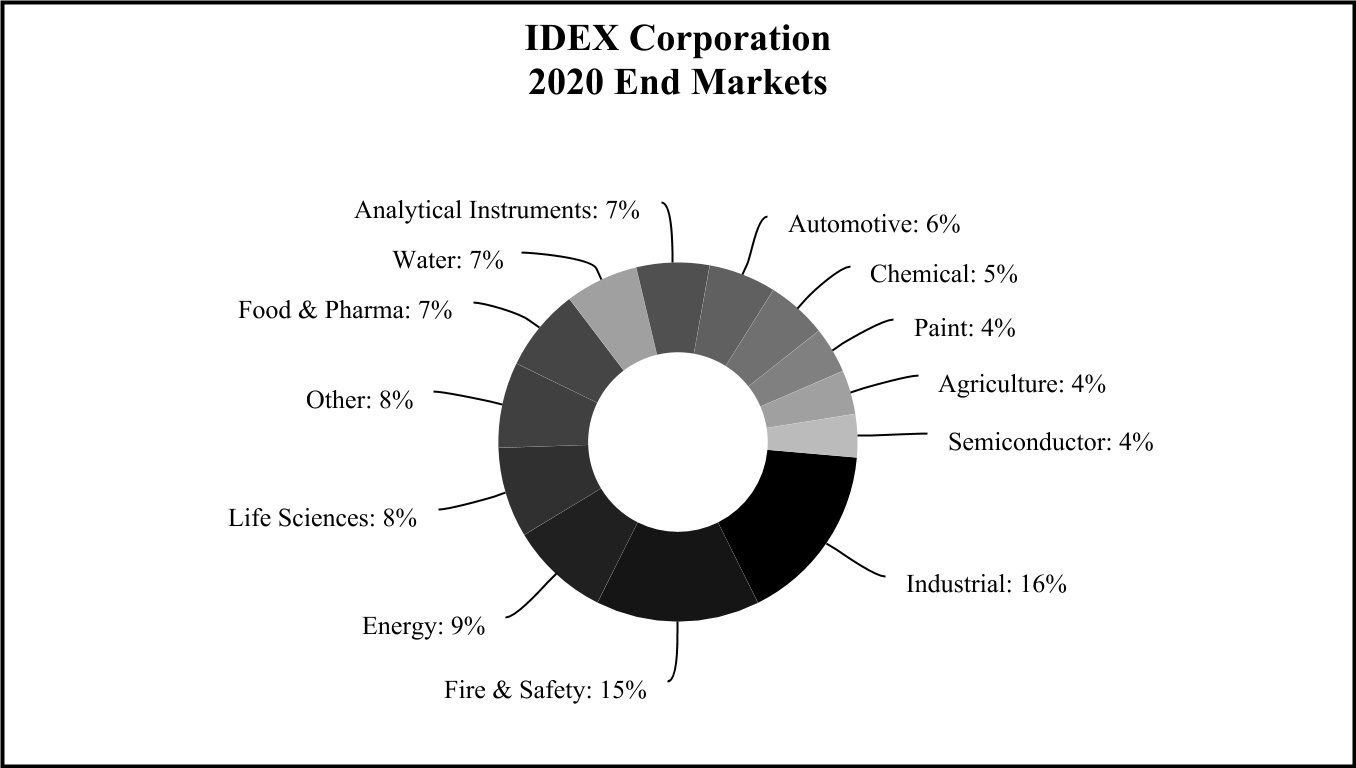

The following table summarizes the percentage of total IDEX sales generated by each end market:

The Company has three reportable business segments: Fluid & Metering Technologies (“FMT”), Health & Science Technologies (“HST”) and Fire & Safety/Diversified Products (“FSDP”). Within our three reportableThe segments the Company maintains 13 platforms where weare structured around how to best serve customer needs, with each segment consisting of businesses that have product and end market similarities as well as common distribution methods and production processes. This structure enables management efficiency, aligns IDEX’s operations with its focus on organic growth, strategic acquisitions and strategic acquisitions. Each of our 13 platforms is also a reporting unit that we annually test for goodwill impairment.capital allocation priorities and provides transparency about the Company’s performance to external stakeholders.

The FMT segment contains the Energy platform (comprised of Corken, Liquid Controls, SAMPI, Toptech and Flow Management Devices, LLC (“Flow MD”)), the Valves platform (comprised of Alfa Valvole, Richter and Aegis), the Water platform (comprised of Pulsafeeder, OBL, Knight, ADS, Trebor and iPEK), the Pumps platform (comprised of Viking and Warren Rupp) and the Agriculture platform (comprised of Banjo). The HST segment contains the Scientific Fluidics & Optics platform (comprised of Eastern Plastics, Rheodyne, Sapphire Engineering, Upchurch Scientific, ERC, CiDRA Precision Services, thinXXS, CVI Melles Griot, Semrock, Advanced Thin Films and FLI), the Sealing Solutions platform (comprised of Precision Polymer Engineering, FTL Seals Technology, Novotema, SFC Koenig and Velcora), the Gast platform, the Micropump platform and the Material Processing Technologies platform (comprised of Quadro, Fitzpatrick, Microfluidics and Matcon). The FSDP segment is comprised of the Fire & Safety platform (comprised of Class 1, Hale, Godiva, Akron Brass, Weldon, AWG Fittings, Dinglee, Hurst Jaws of Life, Lukas and Vetter), the BAND-IT platform and the Dispensing platform.

IDEX believes that each of its reporting units is a leader in its productproducts and service areas.services. The Company also believes that its strong financial performance has been attributable to its ability to design and engineer specialized quality products coupled with its ability to successfully identify, acquire and integrate strategic acquisitions. The table below illustrates the three reportable segments and the reporting units within each segment.

| | | | | | | | | | | | | | |

| FMT | | HST | | FSDP |

| | | | |

| Pumps | | Scientific Fluidics & Optics | | Fire & Safety |

| Water | | Sealing Solutions | | Dispensing |

| Energy | | Performance Pneumatic Technologies | | BAND-IT |

| Valves | | Material Processing Technologies | | |

| Agriculture | | | | |

The table below illustrates the share of Net sales and Adjusted EBITDA contributed by each segment on the basis of total segments (not total Company) for the years ended December 31, 2023 and 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2023 | Year Ended December 31, 2022 |

| FMT | | HST | | FSDP | | FMT | | HST | | FSDP |

| Net sales | 38% | | 40% | | 22% | | 37% | | 42% | | 21% |

Adjusted EBITDA(1) | 42% | | 37% | | 21% | | 39% | | 42% | | 19% |

(1) Segment Adjusted EBITDA excludes the impact of unallocated corporate costs of $84.6 million and $85.7 million for the years ended December 31, 2023 and 2022, respectively.

FLUID & METERING TECHNOLOGIES SEGMENT

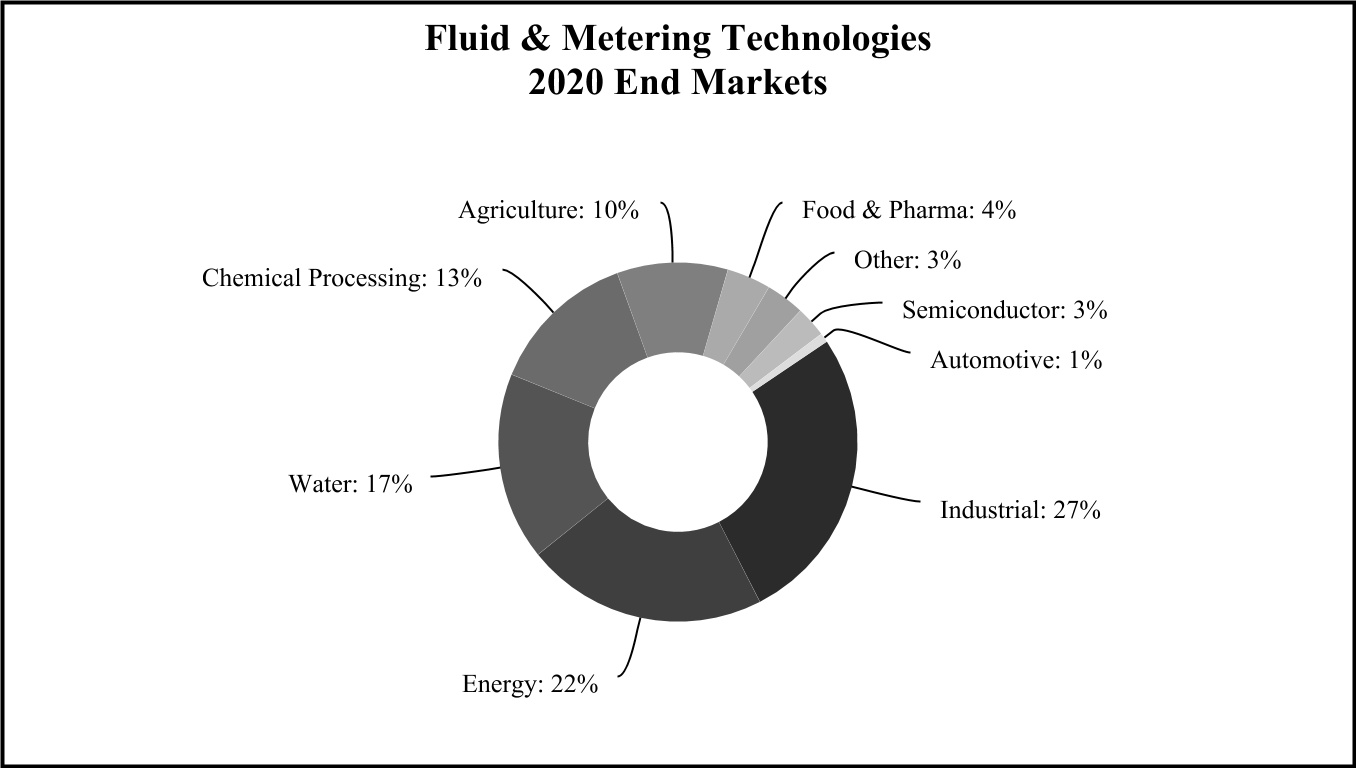

The Fluid & Metering TechnologiesFMT segment designs, produces and distributes positive displacement pumps, valves, small volume provers, flow meters, injectors and other fluid-handling pump modules and systems and provides flow monitoring and other services for the food, chemical, general industrial, water and wastewater, agriculture and energy industries. Fluid & Metering Technologies application-specific

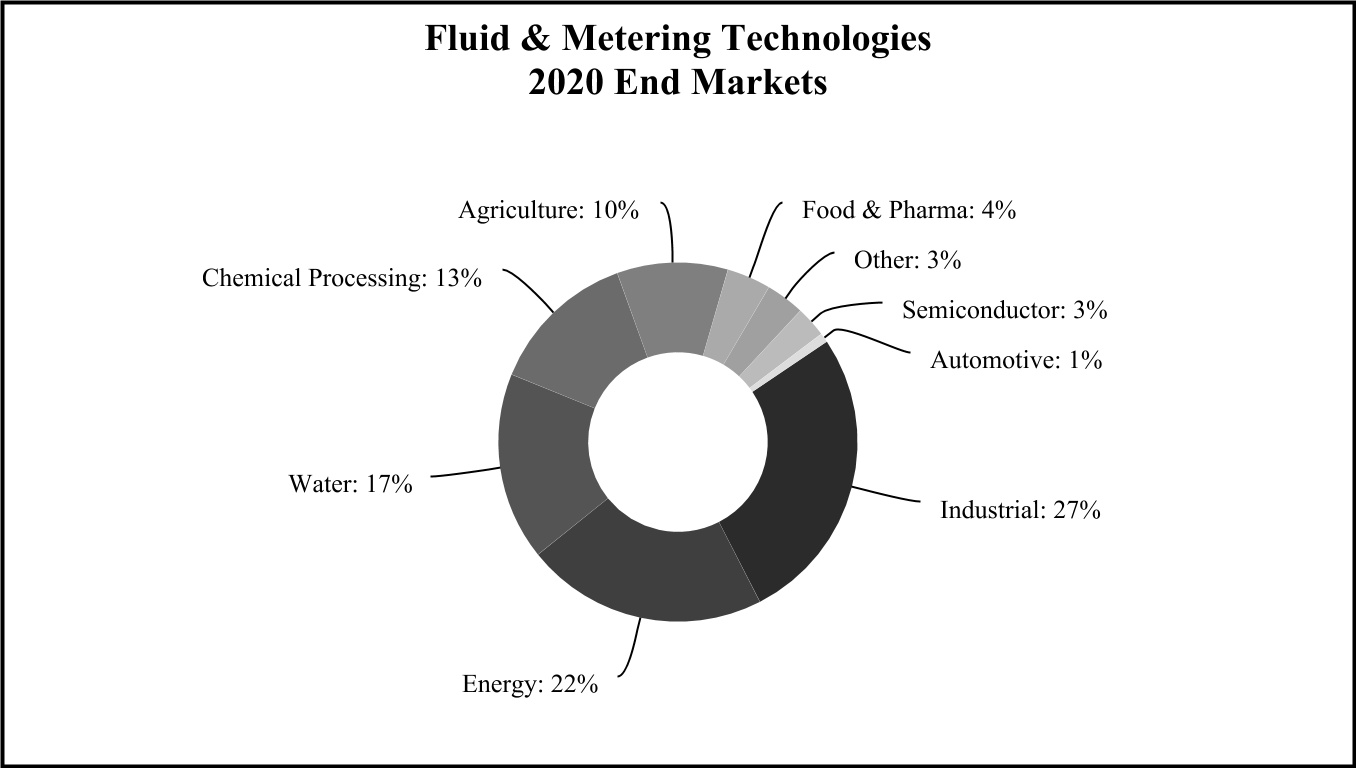

The following table summarizes the percentage of total FMT sales generated by each end market:

The following discussion describes the reporting units included in the FMT segment:

Pumps. Pumps is a leading manufacturer of rotary internal gear, external gear, vane and rotary lobe pumps, custom-engineered original equipment manufacturer pumps, strainers, gear reducers and engineered pump systems. Pumps primarily uses independent distributors to market and meteringsell its products. Pumps is comprised of the following businesses:

•Viking Pump is a global leader in pumping solutions, with products including internal gear, external gear, vane, lobe and circumferential piston pumps, as well as parts, kits and accessories designed to support customers worldwide. With a focus on industrial applications like chemicals, polyurethane foam and asphalt; energy applications like oil transfer and glycol dehydration; and hygienic applications like biopharma, food and beverage, Viking Pump delivers proven liquid transfer pumping solutions for a wide variety of thin to viscous applications. Viking Pump maintains operations in Cedar Falls, Iowa, with locations in Windsor, Canada (Viking Pump Canada), Shannon, Ireland (IDEX Pump Technologies) and Eastbourne, England (Viking Pump Hygienic).

•Warren Rupp manufactures air-operated double diaphragm pump products(which includes Sandpiper and Versamatic products) used for abrasive and semisolid materials as well as for applications where product degradation is a concern or where electricity is not available or should not be used. Warren Rupp products primarily serve the chemical, paint, food processing, electronics, construction, utilities, oil and gas, mining and industrial maintenance markets. Warren Rupp maintains operations in Mansfield, Ohio.

•ABEL designs and manufactures highly engineered reciprocating positive displacement pumps used for mine dewatering, back filling, transfer of mine tailings, municipal sledge and wastewater applications in a diverse rangevariety of end markets including industrial infrastructure (fossil fuels, refined and alternative fuels andmining, power, water and wastewater), chemical processing, agriculture, foodwastewater as well as other general industries. ABEL maintains operations in Büchen, Germany and beverage, pulpMansfield, Ohio and paper, transportation, plastics and resins, electronics and electrical, construction and mining, pharmaceutical and bio-pharmaceutical, machinery and numerous other specialty niche markets.has a facility in Madrid, Spain.

Fluid & Metering•ADS’ products and services provide comprehensive integrated solutions that enable industry, municipalities and government agencies to analyze and measure the capacity, quality and integrity of wastewater collection systems, including the maintenance and construction of such systems. ADS maintains operations in Huntsville, Alabama and various other locations in the United States, Canada and Australia.

•iPEK, Envirosight and WinCan combined are the leading providers of integrated solutions for managing the complete lifecycle of water infrastructure assets and process workflows. Their products and solutions include sewer crawlers, inspection and monitoring systems and software applications that allow teams to identify, anticipate and correct water system issues, automate and simplify inspection processes, improve infrastructure asset management and support distributed teams and cloud-based collaboration. MyTana and Pipeline Renewal Technologies accounted for 38%design and build products used to clean and repair infrastructure in the sewer and drain industry. iPEK maintains operations in Hirschegg, Austria and Sulzberg, Germany. Envirosight and Pipeline Renewal Technologies maintain operations in Randolph, New Jersey and Callery, Pennsylvania. WinCan has development centers in Murten, Switzerland and Krakow, Poland. MyTana maintains operations in St. Paul, Minnesota. All entities have various sales and service outlets across the United States and Europe.

•Trebor is a leader in high-purity fluid handling products, including air-operated diaphragm pumps and deionized water-heating systems. Trebor products are used in the manufacturing of IDEX’s salessemiconductors, disk drives and flat panel displays. Trebor maintains operations in eachWest Jordan, Utah.

•Pulsafeeder products are used to introduce precise amounts of 2020, 2019fluids into processes to manage water quality and 2018, respectively, with approximately 44% of its 2020 sales to customers outside the U.S. The segment accounted for 40%, 44%chemical composition. Its markets include industrial and 42% of total segment operating incomemunicipal water and wastewater treatment, oil and gas, power generation, chemical and hydrocarbon processing and swimming pools. Pulsafeeder serves these markets by producing hydraulic and mechanical diaphragm pumps, rotary pumps, peristaltic pumps and controllers. Pulsafeeder maintains operations in 2020, 2019Rochester, New York and 2018, respectively.Punta Gorda, Florida.

Energy. Energy consists of the Company’s Corken, Liquid Controls, SAMPI, Toptech and Flow MD businesses. Energy is a leading supplier of flow meters, small volume provers, electronic registration and control products, rotary vane and turbine pumps, reciprocating piston compressors and terminal automation control systems. ApplicationsEnergy is comprised of the following businesses:

•Advanced Flow Solutions (“AFS”) consists of the Company’s Corken, Liquid Controls and SAMPI businesses. Products for Liquid Controls and SAMPI consist of positive displacement flow meters andas well as electronic registration and control products, including mobile and stationary metering installations for wholesale and retail distribution of petroleum and liquefied petroleum gas, aviation refueling and industrial metering and dispensing of refined liquids and gases. Corken products consist of positive-displacementpositive displacement rotary vane pumps, single and multistage regenerative turbine pumps and small horsepower reciprocating piston compressors. compressors in the oil, gas and industrial markets. AFS maintains operations in Oklahoma City, Oklahoma (Corken and Liquid Controls products) and Altopascio, Italy (SAMPI products).

•Toptech supplies terminal automation hardware and software to control and manage inventories as well as transactional data and invoicing to customers in the oil, gas and refined-fuels markets. Toptech maintains operations in Longwood, Florida and Zwijndrecht, Belgium.

•Flow MD engineers and manufactures small volume provers that ensure custody transfer accuracy in the oil and gas industry. Energy maintains facilities in Lake Bluff, Illinois (Liquid Controls products); Longwood, Florida and Zwijndrecht, Belgium (Toptech products); Oklahoma City, Oklahoma (Corken andmarket. Flow MD products); Altopascio, Italy (SAMPI products); andmaintains operations in Phoenix, Arizona (Flow MD products). Approximately 33% of Energy’s 2020 sales were to customers outside the U.S.Arizona.

Valves. Valves consists of the Company’s Alfa Valvole, Richter and Aegis businesses. Valves is a leader in the design, manufacture and sale of specialty valve products for use in the chemical, petro-chemical, energy and sanitary markets as well as a leading producer of fluoroplastic lined corrosion-resistant magnetic drive and mechanical seal pumps, shut-off, control and safety valves for corrosive, hazardous, contaminated, pure and high-purity fluids. Valves is comprised of the following businesses:

•Richter and Aegis produce superior solutions for demanding and complex pump and valve applications in the process industry as well as specialty chemical processing valves for use in the chemical, petro-chemical, pharmaceutical, energy and battery industries. Richter and Aegis maintain operations in Kempen, Germany; Suzhou, China; Vadodara, India and Geismar, Louisiana.

•Alfa Valvole’sValvole and OBL manufacture specialty valve products are used in various industrial fields for fluid control, in both gas and liquid form, in all sectors of plant engineering, cosmetics, detergents, food industry, electric energy, pharmaceutical, chemical plants, petrochemical plants, oil, heating/air conditioning and also on ships, ferries and marine oil platforms. Richter’s products offer superior solutions for demandingAlfa Valvole and complex pump and valve applications in the process industry. Aegis produces specialty chemical processing valves for use in the chemical, petro-chemical, chlor-alkali and pulp and paper industries. Valves maintainsOBL maintain operations in Casorezzo, Italy (Alfa Valvole products); Cedar Falls, Iowa, Kempen, Germany and Suzhou, China (Richter products); and Geismar, Louisiana (Aegis products). Approximately 83% of Valves’ 2020 sales were to customers outside the U.S.Cassorezzo, Italy.

Water. Water consists of the Company’s ADS, iPEK, Knight, Trebor, Pulsafeeder and OBL businesses. Water is a leading provider of metering technology, flow monitoring products and underground surveillance services for wastewater markets, alloy and non-metallic gear pumps, peristaltic pumps, transfer pumps as well as dispensing equipment for industrial

laundries, commercial dishwashing and chemical metering. ADS’ products and services provide comprehensive integrated solutions that enable industry, municipalities and government agencies to analyze and measure the capacity, quality and integrity of wastewater collection systems, including the maintenance and construction of such systems. iPEK supplies remote controlled systems used for infrastructure inspection. Knight is a leading manufacturer of pumps and dispensing equipment for industrial laundries, commercial dishwashing and chemical metering. Trebor is a leader in high-purity fluid handling products, including air-operated diaphragm pumps and deionized water-heating systems. Trebor products are used in the manufacturing of semiconductors, disk drives and flat panel displays. Pulsafeeder products (which also include OBL products) are used to introduce precise amounts of fluids into processes to manage water quality and chemical composition as well as peristaltic pumps. Its markets include water and wastewater treatment, oil and gas, power generation, pulp and paper, chemical and hydrocarbon processing and swimming pools. Water maintains operations in Huntsville, Alabama and various other locations in the United States, Canada and Australia (ADS products and services); Hirschegg, Austria and Sulzberg, Germany (iPEK products); Rochester, New York, Punta Gorda, Florida, and Milan, Italy (Pulsafeeder products); West Jordan, Utah (Trebor products); Irvine, California, Mississauga, Ontario, Canada, and Lewes, England (Knight products); and a maquiladora in Ciudad Juarez, Chihuahua, Mexico (Knight products). Approximately 45% of Water’s 2020 sales were to customers outside the U.S.

Pumps. Pumps consists of the Company’s Viking and Warren Rupp businesses. Pumps is a leading manufacturer of rotary internal gear, external gear, vane and rotary lobe pumps, custom-engineered OEM pumps, strainers, gear reducers and engineered pump systems. Viking’s products consist of external gear pumps, strainers and reducers and related controls used for transferring and metering thin and viscous liquids sold under the Viking and Wright Flow brands. Viking products primarily serve the chemical, petroleum, pulp and paper, plastics, paints, inks, tanker trucks, compressor, construction, food and beverage, personal care, pharmaceutical and biotech markets. Warren Rupp products (which include Versa-Matic products) are used for abrasive and semisolid materials as well as for applications where product degradation is a concern or where electricity is not available or should not be used. Warren Rupp products, which include air-operated double diaphragm pumps, primarily serve the chemical, paint, food processing, electronics, construction, utilities, oil and gas, mining and industrial maintenance markets. Pumps maintains operations in Cedar Falls, Iowa (Viking and Wright Flow products); Eastbourne, England (Wright Flow products); Shannon, Ireland (Viking and Blagdon products); and Mansfield, Ohio (Warren Rupp products). Pumps primarily uses independent distributors to market and sell its products. Approximately 42% of Pumps’ 2020 sales were to customers outside the U.S.

Agriculture. Agriculture consists of the Company’s Banjo business. following businesses:

•Banjo is a provider of special purpose, severe-duty pumps, valves, fittings and systems used in liquid handling. Banjo is based in Crawfordsville, Indiana with distribution facilities in Didam, The Netherlands and Valinhos, Brazil. Its products are used in agriculture (approximately 71% of revenue)agricultural and industrial (approximately 29%applications. Banjo maintains operations in Crawfordsville, Indiana and has distribution facilities in Didam, the Netherlands and Valinhos, Brazil.

•KZValve is a leading manufacturer of revenue)electric valves and controllers used primarily in agricultural applications. Approximately 21% of Banjo’s 2020 sales were to customers outside the U.S.KZValve maintains operations in Greenwood, Nebraska.

HEALTH & SCIENCE TECHNOLOGIES SEGMENT

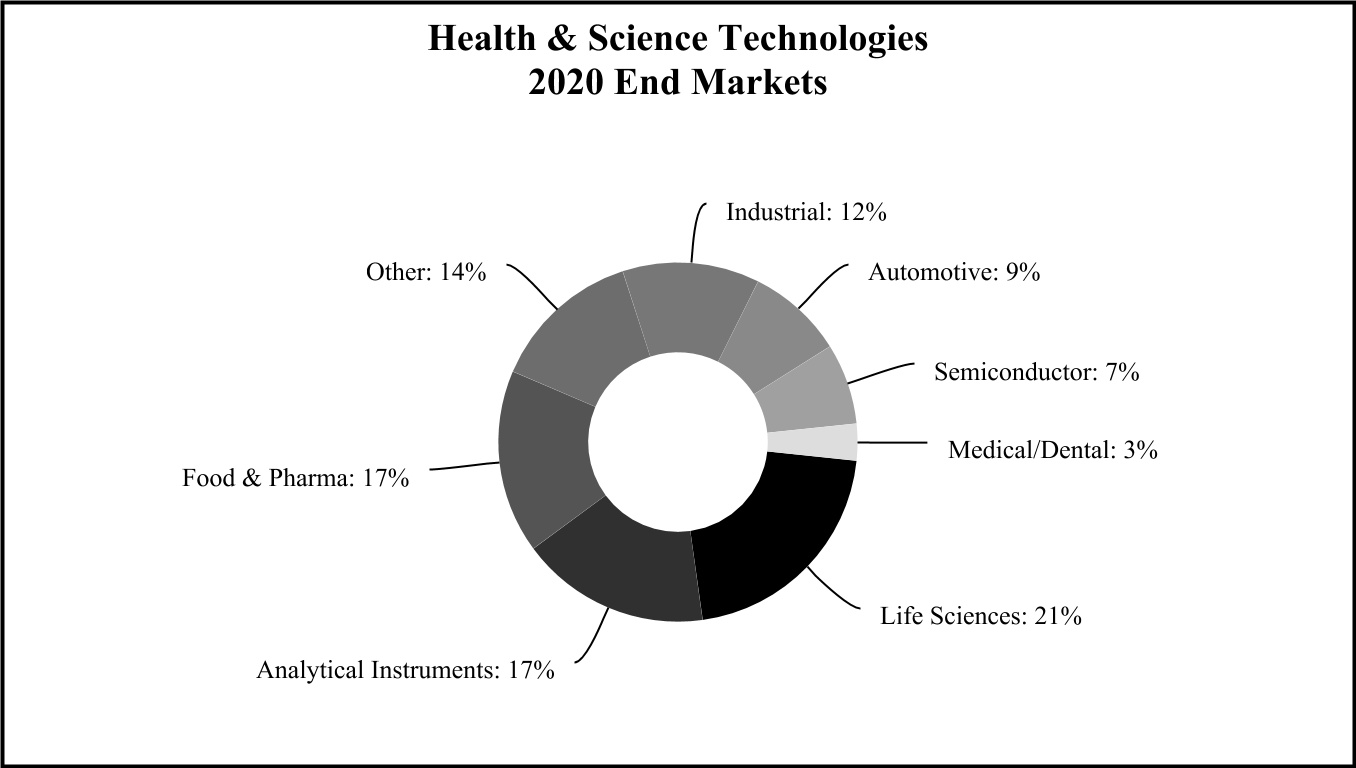

The Health & Science TechnologiesHST segment designs, produces and distributes a wide range of precision fluidics, rotary lobe pumps, centrifugal and positive displacement pumps, roll compactionpowder and liquid processing technologies, drying systems, used in beverage, food processing, pharmaceutical and cosmetics,micro-precision components, pneumatic components and sealing solutions, including very high precision, low-flow rate pumping solutions required in analytical instrumentation, clinical diagnostics and drug discovery, high performance molded and extruded sealing components, custom mechanical and shaft seals, for a variety of end markets including food and beverage, marine, chemical, wastewater and water treatment, engineered hygienic mixers and valves, for the global biopharmaceutical industry, biocompatible medical devices and implantables, air compressors used in medical, dental and industrial applications,blowers, optical components and coatings, for applications in the fields of scientific research, defense, biotechnology, aerospace, telecommunications and electronics manufacturing, laboratory and commercial equipment used in the production of micro and nano scale materials, precision photonic solutions used in life sciences, research and defense markets and precision gear and peristaltic pump technologies that meet exacting original equipment manufacturer specifications.

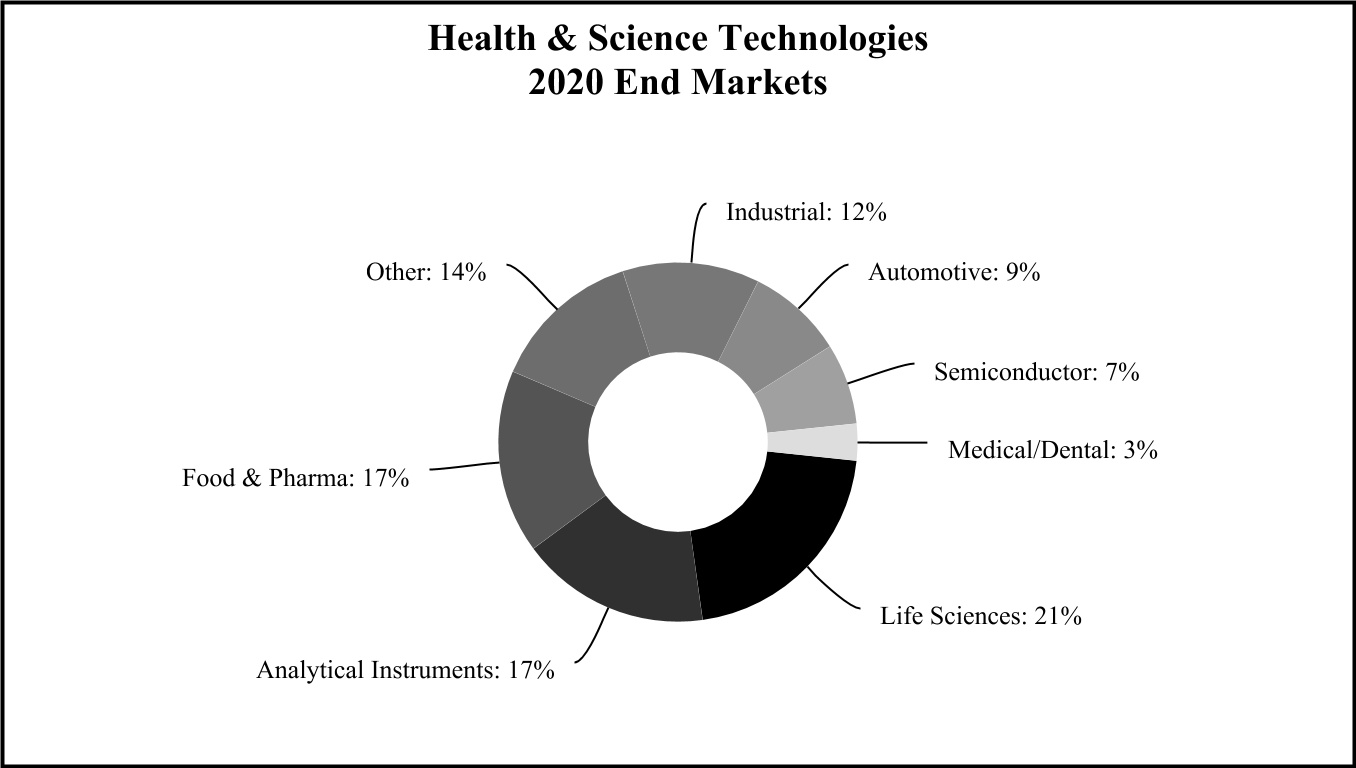

Health & Science Technologies accounted for 38%, 37% and 36% of IDEX’s sales in 2020, 2019 and 2018, respectively, with approximately 57% of its 2020 sales to customers outsideThe following table summarizes the U.S. The segment accounted for 35%, 31% and 32%percentage of total segment operating incomeHST sales generated by each end market:

The following discussion describes the reporting units included in 2020, 2019 and 2018, respectively.the HST segment:

Scientific Fluidics & Optics.Scientific Fluidics & Optics is a global authority in life science fluidics, optics, microfluidics and photonics and the movement of liquids and gases in critical applications, offering a diverse set of technologies, expertise, capabilities and product solutions across numerous market segments. Scientific Fluidics & Optics is comprised of the following businesses:

•IDEX Health & Science (“IH&S”) consists of the Company’s Eastern Plastics, Rheodyne, Sapphire Engineering, Upchurch Scientific, ERC, CiDRA Precision Services, thinXXS, CVI Melles Griot, Semrock, Advanced Thin FilmsIH&S Life Science Fluidics, IH&S Life Science Optics and FLI businesses. Eastern Plastics products, which consistIH&S Microfluidics. The IH&S Life Science Fluidics technology and product portfolio consists of high-precision integrated fluidics and associated engineeredcolumn hardware, degassers, fluidic connections, fluidic manifolds, are used in a broad set of end markets including medical diagnostics, analytical instrumentation and laboratory automation. Rheodyne products consist of injectors, valves, fittings and accessories for the analytical instrumentation market. These products are used by manufacturers of high pressure liquid chromatography (“HPLC”) equipment servicing the pharmaceutical, biotech, life science, food and beverage, and chemical markets. Sapphire Engineering and Upchurch Scientific products consist of fluidic components and systems for the analytical, biotech and diagnostic instrumentation markets, such as fittings, precision-dispensing pumps and valves, tubing and integrated tubing assemblies, filterpump components, sensors, and other micro-fluidic and nano-fluidic components as well as advanced column hardware and accessories for the high performance liquid chromatography market. The products produced by Sapphire Engineering and Upchurch Scientific primarily serve the pharmaceutical, drug discovery, chemical, biochemical processing, genomics/proteomics research, environmental labs, food/agriculture, medical lab, personal care and plastics/polymer/rubber production markets. ERC manufactures gas liquid separations and detection solutions for the life science, analytical instrumentation and clinical chemistry markets. ERC’s products consist of in-line membrane vacuum degassing solutions, refractive index detectors, valves and ozone generation systems. CiDRA Precision Services’ products consistfluidics sub-systems. The IH&S Life Science Optics technology and product portfolio consists of microfluidic components serving the life science, healthillumination light engines, optical filters, optical subsystems, sensors, cameras and industrial markets andcamera imaging objectives. IH&S Microfluidics includes thinXXS isMicrotechnology, a global leader in the design, manufacturedeveloping and sale ofproducing microfluidic systems, components and consumables serving the point of care veterinarydiagnostic and life sciencedigital polymerase chain reaction markets. CVI Melles Griot is a global leader in the design and manufacture of precision photonic solutions used inIH&S serves the life science research, semiconductor, securityoptics, chromatography, mass spectrometry, in-vitro diagnostics/biotech fluidics and defensefluidic connections markets. CVI Melles Griot’s innovative products are focused on the generation, control and productive use of light for a variety of key science and industrial applications. Products consist of specialty lasers and light sources, electro-optical components, specialty shutters, opto-mechanical assemblies and components. In addition, CVI Melles Griot produces critical components for life science research, electronics manufacturing, military and other industrial applications, including lenses, mirrors, filters and polarizers. These components are utilizedIH&S maintains operations in a number of important applications such as spectroscopy, cytometry (cell counting), guidance systems for target designation, remote sensing, menology and optical lithography. Semrock is a provider of optical filters for biotech and analytical instrumentation in the life science market. Semrock’s optical filters are produced using state-of-the-art manufacturing processes which enable it to offer its customers significant improvements in instrument performance and reliability. Advanced Thin Films specializes in optical components and coatings for applications in the fields of scientific research, defense, aerospace, telecommunications and electronics manufacturing. Advanced Thin Films’ core competence is the design and manufacture of filters, splitters,Bristol, Connecticut; Carlsbad, California; Middleboro,

reflectorsMassachusetts; Oak Harbor, Washington; Rochester, New York; Rohnert Park, California; Zweibruken, Germany and mirrors withSaitama, Japan.

•IDEX Optical Technologies consists of Advanced Thin Films, CVI Laser Optics, CVI Infrared Optics and Iridian Spectral Technologies. The technology and product portfolio consists of polarization optics, windows, optical filters, beamsplitters, lenses, waveplates, monolithic, optics, lens assemblies, imaging assemblies, shutters optical subsystems and detector integration. IDEX Optical Technologies serves the precise physical properties required to support their customers’ most challengingsemiconductor metrology, satellite optical communications, defense, aerospace and cutting-edge optical applications. The Precision Photonics portion of its business specializes in optical components and coatings for applications in the fields of scientific research, aerospace,remote sensing, additive manufacturing, laser material processing, laser communications, telecommunications and electronics manufacturing. FLIlife science markets. The businesses maintain operations in Albuquerque, New Mexico; Boulder, Colorado; Didam, the Netherlands; Whetstone, England; and Ottawa, Canada.

•Muon Group manufactures highly precise flow paths in a variety of materials that enable the movement of various liquids and gases in critical applications within the medical, semiconductor, food processing, digital printing and filtration markets. The group includes LouwersHanique, Veco, Millux, Tecan and Atul, which have critical technical expertise in precision and tolerances for different materials, from metals and glass to plastics and ceramics. The business maintains operations in Hapert, the Netherlands; Eerbeek, the Netherlands; Wijchen, the Netherlands; Dorset, England; and Pune, India.

•STC Material Solutions specializes in the design development and productionmanufacturing of low-noise cooled charge-coupled device (“CCD”)technical ceramics and high speed, high-sensitivity scientific complementary metal-oxidehermetic sealing products in mission critical applications within the semiconductor, (“CMOS”) cameras for the astronomyaerospace and life sciencedefense, industrial technology, medical technology and energy markets. Scientific Fluidics & Optics has facilitiesThe business maintains operations in Bristol, Connecticut (Eastern Plastics products); Rohnert Park, California (Rheodyne products); Middleboro, Massachusetts (Sapphire Engineering products); Oak Harbor, Washington (Upchurch Scientific products); Kawaguchi, Japan (ERC products); Wallingford, Connecticut (CiDRA Precision Services products); Zweibrücken, Germany (thinXXS products); Albuquerque, New Mexico, Rochester, New York, Leicester, England and Didam, The Netherlands (CVI Melles Griot products); Rochester, New York (Semrock products); Boulder, Colorado (Advanced Thin Films products); and Lima, New York (FLI products). Approximately 54% of Scientific Fluidics & Optics’ 2020 sales were to customers outside the U.S.St. Albans, Vermont, with additional operations in Santa Ana, California.

Sealing Solutions. Sealing Solutions consistsfocuses on providing special seals and related products and solutions in diversified markets. Sealing Solutions is comprised of the Company’s Precision Polymer Engineering, FTL Seals Technology, Novotema, SFC Koenig and Velcora businesses. following businesses:

•Precision Polymer Engineering is a provider of proprietary high performance seals and advanced sealing solutions for a diverse range of global industries and applications, including hazardous duty, analytical instrumentation, semiconductor, process technologies, oil and gas, pharmaceutical, electronics and food applications. Precision Polymer Engineering is headquarteredmaintains operations in Blackburn, England withand has an additional manufacturing facility in Brenham, Texas. Precision Polymer Engineering also entered into a joint venture with a third party to manufacture and sell high performance elastomer seals for the oil and gas industry to customers within the Kingdom of Saudi Arabia as well as export these high performance elastomer seals outside of the Kingdom of Saudi Arabia. The joint venture is headquarteredmaintains operations in Damman,Dammam, Saudi Arabia.

•FTL Seals Technology locatedmaintains operations in Leeds, England and specializes in the design and application of high integrity rotary seals, specialty bearings and other custom products for the mining, power generation and marine markets. Novotema, located in Villongo, Italy, is a leader in the design, manufacture and sale of specialty sealing solutions for use in the building products, gas control, transportation, industrial and water markets.

•SFC Koenig is a producer of highly engineered expanders and check valves for critical applications across the transportation, hydraulic, aviation and medical markets. SFC Koenig is basedmaintains operations in Dietikon, Switzerland withand has additional facilities in North Haven, Connecticut,Connecticut; Illerrieden, Germany and Suzhou, China. Velcora and its operating subsidiaries under the

•The Roplan namebusinesses are headquartered in Sweden with operations in China, the United Kingdom and the United States. Roplan is a global manufacturermanufacturers of custom mechanical and shaft seals for a variety of end markets including food and beverage, marine, chemical, wastewater and water treatment. Approximately 75% of Sealing Solutions’ 2020 sales were to customers outside the U.S.Roplan maintains operations in Sweden and also has operations in Ningbo, China; Berkshire, England and Madison, Wisconsin.

Gast.Performance Pneumatic Technologies. The Performance Pneumatic Technologies provides specialized, high-performing air moving technologies across a wide array of industries. Performance Pneumatic Technologies is comprised of the following businesses:

•Gast business is a leading manufacturer of air-moving products, includingwith a core technology around fractional horsepower (under 1 hp) air motors, low-range and medium-rangecompressors, vacuum pumps vacuum generators, regenerative blowers and fractional horsepower compressors.air motors. Gast products are used in a variety of long-life applications requiring a quiet, clean source of moderate vacuum or pressure. Gast productspressure and primarily serve the medical equipment, environmental equipment, computers and electronics, printing machinery, paint mixing machinery, packaging machinery, graphic arts and industrial manufacturing markets. BasedGast maintains operations in Benton Harbor, Michigan Gast alsoand has a logistics and commercial center in Redditch, England. Approximately 27%

•Airtech designs and manufactures a wide range of Gast’s 2020 sales were to customers outside the U.S.highly-engineered pressure technology products, with a core technology around high performance blowers (2 hp and above) and pneumatic valves for a variety of end markets, including alternative energy, food processing, medical, packaging and transportation. Airtech maintains operations in Rutherford, New Jersey and has other manufacturing operations in Linthicum Heights, Maryland; Wilmington, North Carolina; Werneck, Germany and Shenzhen, China.

Micropump. Micropump, headquartered in Vancouver, Washington, is a leader in small, precision-engineered, magnetically and electromagnetically driven rotary gear, piston and centrifugal pumps. Micropump products are used in low-flow abrasive and corrosive applications. Micropump products primarily serve the continuous ink-jet printing, medical equipment, chemical processing, pharmaceutical, refining, laboratory, electronics, textiles, peristaltic metering pumps, analytical process controllers and sample preparation systems markets. Approximately 73%Table of Micropump’s 2020 sales were to customers outside the U.S.Contents

Material Processing Technologies. Material Processing Technologies consistsprovides process equipment and global support service solutions that meet customer specific requirements with a focus in the pharmaceutical, food, battery and chemical markets. Material Processing Technologies is comprised of the Company’sfollowing businesses:

•IDEX MPT, Inc., which includes Quadro, Steridose, Fitzpatrick, Steridose, Microfluidics, and Matcon, businesses. maintains operations in Waterloo, Canada; Westwood, Massachusetts; Delran, New Jersey; Evesham, England; Ahmedebad, India and Shanghai, China.

◦Quadro is a leading provider of particle controlpowder processing solutions for the pharmaceutical, food, personal care and bio-pharmaceuticalchemical markets. Based in Waterloo, Canada, Quadro’s core capabilities include fine milling, emulsification and special handling of liquid and solid particulates for laboratory,laboratories, through the pilot phase andto full scale up with production scale processing.

◦Steridose is a leading designer and manufacturer of magnetic coupled mixers and diaphragm valves for the global biopharmaceutical industry.

◦Fitzpatrick is a global leader in the design and manufacture of process technologies for the pharmaceutical food and personal care markets.chemical sectors. Fitzpatrick designs and manufactures customized size reduction and roll compaction and drying systems to support their customers’ product development and manufacturing processes. Fitzpatrick is headquartered in Waterloo, Canada. In June 2020, the Steridose business was moved from an operating subsidiary of Velcora to an operating subsidiary of Quadro. Steridose develops engineered hygienic mixers and valves for the global biopharmaceutical industry.

◦Microfluidics is a global leader in the design and manufacture of laboratory and commercialproduction equipment used in the production of micro and nano scale materials for the pharmaceutical, biologics, personal care and chemical markets. Microfluidics is the exclusive producer of the Microfluidizer family of high shear fluid processors for uniform particle size reduction,nano-emulsion formation, lipid nanoparticle creation, robust cell disruption and nanoparticle creation. Microfluidics isparticle size reduction.

also based in Waterloo, Canada and has offices in Newton, Massachusetts. Matcon is a global leader in creating flexible material processing solutions for high value powders used in the manufacture of foods, pharmaceuticals, food,batteries, plastics and fine chemicals. Matcon’s innovative products consist of the original cone valve powder discharge system and filling, mixing and packaging systems, all of which support its customers’ automation and process requirements. These products are critical to its customers’ need to maintain clean, reliable and repeatable formulations of prepackaged foods and pharmaceuticals while helping them achieve lean and agile manufacturing. Matcon is located in Evesham, England. Approximately 63% of Material Processing Technologies’ 2020 sales were to customers outside the U.S.

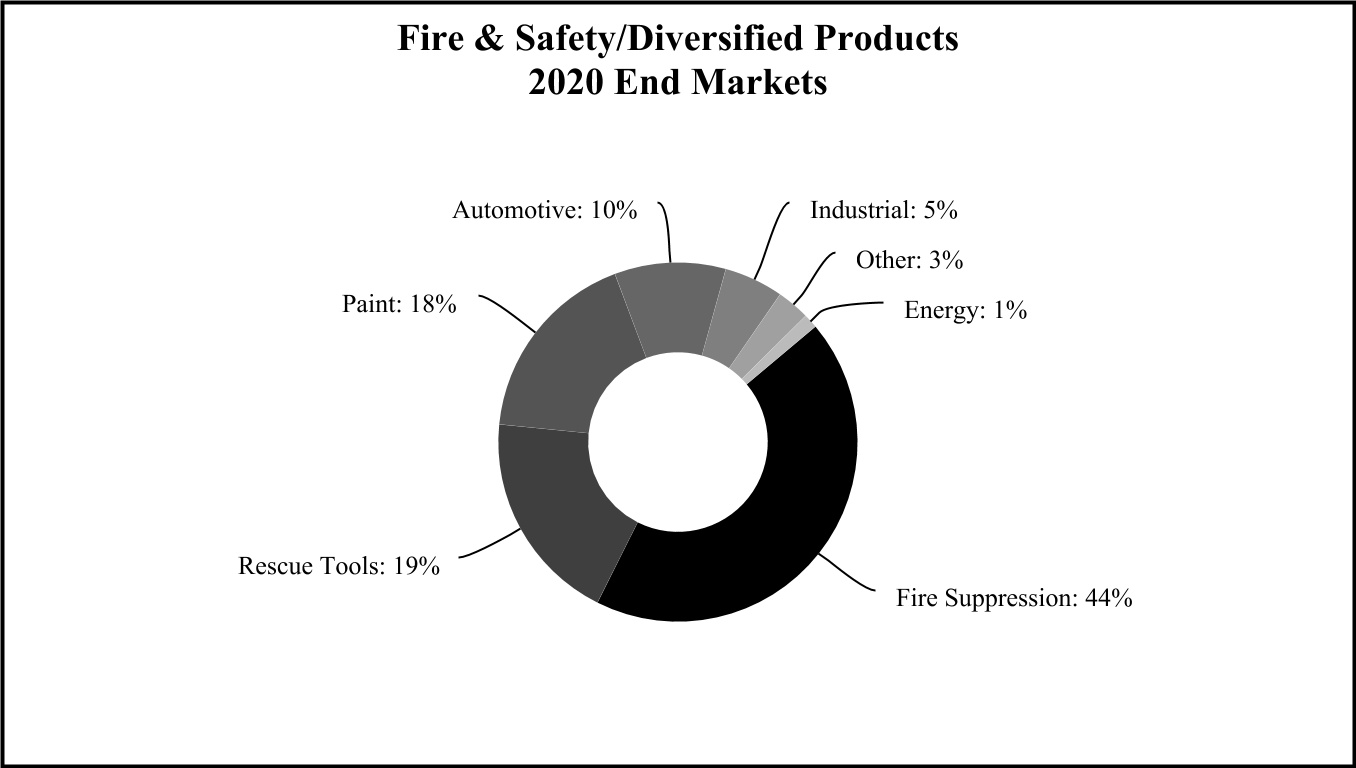

FIRE & SAFETY/DIVERSIFIED PRODUCTS SEGMENT

The Fire & Safety/Diversified ProductsFSDP segment designs, produces and distributes firefighting pumps, valves and controls, rescue tools, lifting bags and other components and systems for the fire and rescue industry,industry; engineered stainless steel banding and clamping devices used in a variety of industrial and commercial applicationsapplications; and precision equipment for dispensing, metering and mixing colorants and paints used in a variety of retail and commercial businesses around the world.

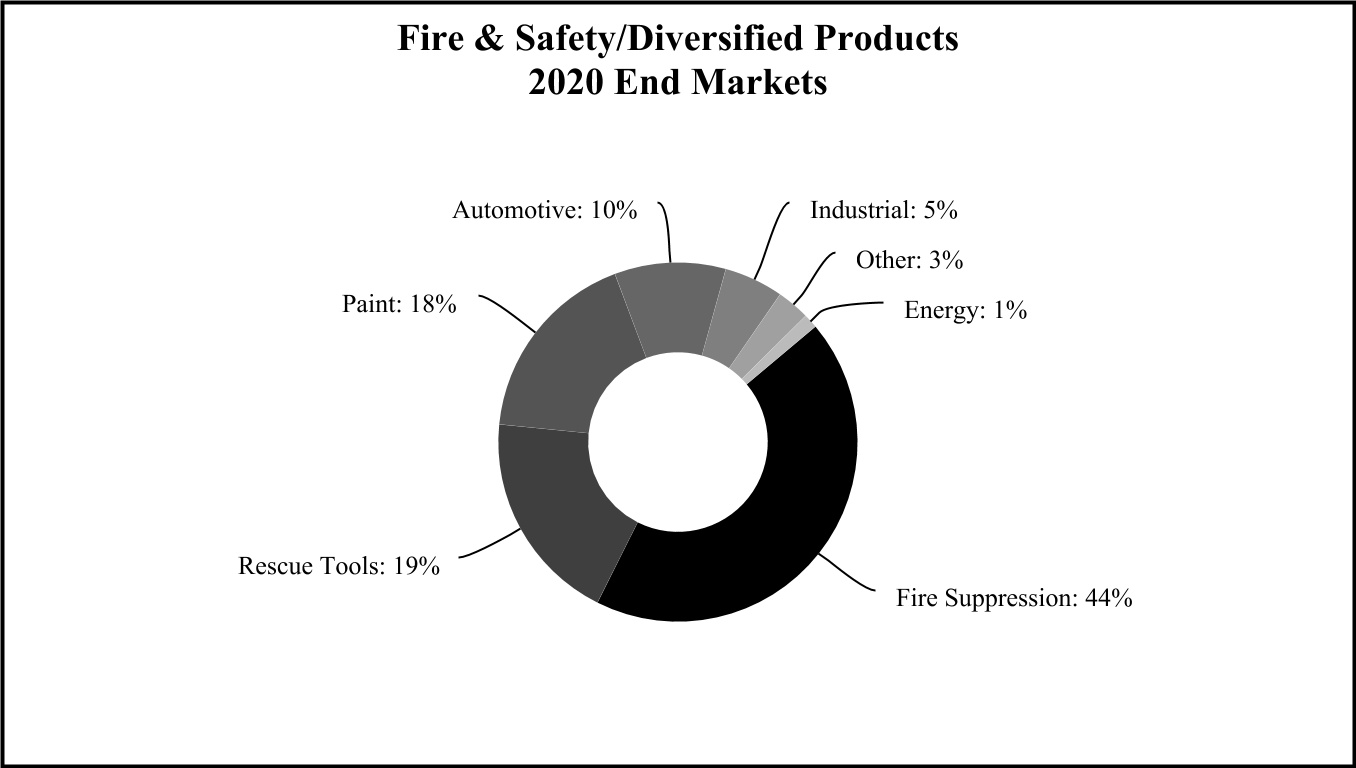

The Fire & Safety/Diversified Products segment accounted for 24%, 25% and 26% of IDEX’s sales in 2020, 2019 and 2018, respectively, with approximately 52% of its 2020 sales to customers outsidefollowing table summarizes the U.S. The segment accounted for 25%, 25% and 26%percentage of total segment operating incomeFSDP sales generated by each end market:

The following discussion describes the reporting units included in 2020, 2019 and 2018, respectively.the FSDP segment:

Fire & Safety. Fire & Safety consists of the Company’s Class 1, Hale, Godiva, Akron Brass, Weldon, AWG Fittings, Dinglee, Hurst Jaws of Life, Lukas and Vetter businesses which produce truck-mounted and portable fire pumps, stainless steel and brass valves, monitors, apparatus valves, nozzles, foam and compressed air foam systems, pump modules and pump kits, electronic controls and information systems, conventional and networked electrical systems and mechanical components for the fire rescue and specialty vehicle markets,markets. Safety businesses produce hydraulic, battery, gas and electric-operated rescue equipment, hydraulic re-railing equipment, hydraulic tools for industrial applications, recycling cutters, pneumatic lifting and sealing bags for vehicle and aircraft rescue, environmental protection and disaster control and shoring equipmentjumping cushions for vehicular or structural collapse.building rescue for the rescue market. Fire & Safety’s customers are OEMsoriginal equipment manufacturers as well as public and private fire and rescue organizations. Fire & Safety maintains facilitiesoperations in Ocala, Florida (Class 1 and Hale products); Warwick, England (Godiva products); Wooster and Columbus, Ohio (Akron Brass and Weldon products); Ballendorf, Germany (AWG Fittings products); Shelby, North Carolina (Hurst Jaws of LifeLife® products); Tianjin, China (Dinglee products); Erlangen, Germany (Lukas products); and Zulpich, Germany (Vetter products). Approximately 50% of Fire & Safety’s 2020 sales were to customers outside the U.S.

7Dispensing. Dispensing businesses produce precision equipment for dispensing, metering and mixing colorants and paints used in a variety of retail and commercial businesses around the world. Dispensing is a global supplier of such equipment focused on the architectural paints segment used in retail and commercial stores, hardware stores, home centers and paint and specialized stores as well as in some industrial settings. Dispensing maintains operations in Sassenheim, the Netherlands; Wheeling, Illinois and Sandani, India as well as multiple sales offices around the world.

BAND-IT. BAND-IT is a leading producer of high-quality stainless steel banding, buckles and clamping systems. The BAND-IT brand is highly recognized worldwide. BAND-IT products are used for securing exhaust system heat and sound shields, airbags, industrial hose fittings, traffic signs and signals, electrical cable shielding, identification and bundling and in numerous other industrial and commercial applications. BAND-IT products primarily serve the automotive, transportation equipment, oilaerospace, energy,

utility, municipal, cable management and gas, general industrial maintenance, electronics, electrical, communications, aerospace, utility, municipal and subsea marine markets. BAND-IT is basedmaintains operations in Denver, Colorado, with additional operations in Staveley, England. Approximately 44% of BAND-IT’s 2020 sales were to customers outside the U.S.

Dispensing. Dispensing produces precision equipment for dispensing, metering and mixing colorants and paints used in a variety of retail and commercial businesses around the world. Dispensing is a global supplier of precision-designed tinting, mixing, dispensing and measuring equipment for auto refinishing and architectural paints. Dispensing products are used in retail and commercial stores, hardware stores, home centers, department stores, automotive body shops as well as point-of-purchase dispensers. Dispensing maintains facilities in Sassenheim, The Netherlands, Wheeling, Illinois, Unanderra, Australia and Milan, Italy as well as IDEX shared manufacturing facilities in India and China. Approximately 66% of Dispensing’s 2020 sales were to customers outside the U.S.

INFORMATION APPLICABLE TO THE COMPANY’S BUSINESS IN GENERAL AND ITS SEGMENTS

Competitors

The Company’s businesses participate in highly competitive markets. IDEX believes that the principal points of competition are product quality, design and engineering capabilities, product development, conformity to customer specifications, quality of post-sale support, timeliness of delivery and effectiveness of ourthe Company’s distribution channels.

Principal competitors of the Fluid & Metering TechnologiesFMT segment are the Pumps Group (Maag, Blackmer(Blackmer, Wilden and WildenEbsray products) of Dover Corporation (with respect to pumps and small horsepower compressors used in liquefied petroleum gas distribution facilities, rotary gear pumps and air-operated double-diaphragm pumps); Milton Roy LLCand Ingersoll Rand’s Precision and Science Technologies (PST) division (with respect to metering, control, rotary gear pumps and controls); and Tuthill Corporation (with respect to rotary gearair operated double-diaphragm pumps).

Principal competitors of the Health & Science TechnologiesHST segment are the Thomas division of Ingersoll Rand (with respect to vacuum pumps and compressors); Thermo Scientific Dionex products (with respect to analytical instrumentation); Parker Hannifin (with respect to sealing devices); Valco Instruments Co., Inc. (with respect to fluid injectorsconnections, degassers and valves); and Gooch & Housego PLCAlluxa (with respect to electro-opticfilters); Jenoptik (with respect to optical assemblies in life sciences); and precision photonics solutions used inTecan Trading AG (with respect to the life sciencesscience fluidics market).

The principalPrincipal competitors of the Fire & Safety/Diversified ProductsFSDP segment are Waterous Company, a unit of American Cast Iron Pipe Company (with respect to truck-mounted firefighting pumps); Holmatro, Inc. (with respect to rescue tools); Corob S.p.A. (with respect to dispensing and mixing equipment for the paint industry); and Panduit Corporation (with respect to stainless steel bands, buckles and clamping systems).

Customers

None of ourIn 2023, the Company did not have any customers in 2020that accounted for more than two percent3% of net sales. Since the Company serves a wide variety of markets, customer concentrations are not significant.

International

The Company’s products and services are available worldwide, with manufacturing operations in more than 20 countries. The businesses located outside the U.S. are primarily based in Germany, India, the Netherlands, the United Kingdom, Italy, Switzerland, Canada and China. The Company’s geographic diversity allows it to draw on the skills of a global workforce, provides greater stability to its operations, allows the Company to drive economies of scale, provides revenue streams that may help offset economic trends that are specific to individual economies and offers the Company an opportunity to access new markets for products.

The following table illustrates sales to customers within and outside the U.S. as a percentage of total sales for total IDEX as well as by segment and by reporting unit for the year ended December 31, 2023:

| | | | | | | | | | | | | | |

| | Domestic | | International |

| FMT | | 56% | | 44% |

| Pumps | | 57% | | 43% |

| Water | | 57% | | 43% |

| Energy | | 64% | | 36% |

| Valves | | 13% | | 87% |

| Agriculture | | 75% | | 25% |

| | | | |

| HST | | 44% | | 56% |

| Scientific Fluidics & Optics | | 40% | | 60% |

| Sealing Solutions | | 21% | | 79% |

| Performance Pneumatic Technologies | | 81% | | 19% |

| Material Processing Technologies | | 37% | | 63% |

Micropump(1) | | 21% | | 79% |

| | | | |

| FSDP | | 52% | | 48% |

| Fire & Safety | | 53% | | 47% |

| Dispensing | | 46% | | 54% |

| BAND-IT | | 56% | | 44% |

| | | | |

| IDEX | | 50% | | 50% |

(1) Revenue from Micropump, Inc. (“Micropump”) (sold on August 3, 2023) has been included in the Company’s Consolidated Statements of Income through the date of disposition. See Note 2 in Part II, Item 8, “Financial Statements and Supplementary Data” for further detail.

Shared Services

The Company has production facilities in Suzhou, China, Vadodara, India and Ahmedabad, India that support multiple business units. The Company completed an expansion of its China facility in late 2022 and its India facility in 2023 in an effort to increase its footprint in these emerging markets as the Company believes there is tremendous potential for growth across all segments. In addition, the Company expanded its facilities in Singapore and Dubai in 2022 to support growth in Southeast Asia and the Middle East. IDEX also has personnel in China, India, Dubai, Mexico, Latin America and Singapore that provide sales, marketing, product design, engineering and sourcing support to its business units in those regions, as well as personnel in various locations in South America, Southeast Asia, the Middle East, Korea and Japan to support sales and marketing efforts in those regions.

Raw Materials

The Company uses a wide variety of raw materials which are generally purchased from a large number of independent sources around the world. The Company believes it has an adequate supply of raw materials necessary to meet demand. The Company is exposed to fluctuations in commodity pricing and inflation and attempts to control these impacts through increased prices to customers and various other programs with its suppliers.

Suppliers

The Company manufactures many of the parts and components used in its products. Substantially all materials, parts and components purchased by the Company are available from a large number of independent sources around the world. The Company believes it has a sufficient number of suppliers necessary to meet demand but continues to actively evaluate its current suppliers and identify alternative sources to manage supply chain constraints, if needed.

Inventory and Backlog

The Company is a short cycle business and backlog is not generally considered a significant factor as relatively short delivery periods and rapid inventory turnover are characteristic of most of the Company’s products. Even still, the Company regularly and systematically adjusts production schedules and quantities based on the flow of incoming orders. While backlog was elevated in recent years due to global supply chain constraints, which extended lead times, shifted customer order patterns and resulted in increased inventory to support production, customer destocking efforts in 2023 have resulted in orders stabilizing with backlog and lead times returning to more normalized levels. The Company remains focused on delivering products and services to customers and continues to actively manage inventory levels. Further, the Company has not historically experienced significant order cancellations and does not expect significant order cancellations in the future.

Government Regulations

Our compliance with federal, state and local laws and regulations, including those related to environmental, international trade, labor and employment, human rights, tax, anti-bribery and competition matters, did not have a material effect upon our capital expenditures, earnings or competitive position during the fiscal year ended December 31, 2023.

Employees

At December 31, 2020,2023, the Company had 7,075approximately 8,800 employees. Approximately 7%4% of its employees are covered by various collective bargaining agreements in the U.S. were represented by labor unions, withwhich will expire at various contracts expiring through November 2023.times between now and June 2028. There are no collective bargaining agreements in the U.S. that will expire within one year. Management believes that the Company has a positive relationship with its employees. The Company historically has been able to renegotiate its collective bargaining agreements satisfactorily, with its last work stoppage occurring in March 1993.

HumanCapitalManagement

We recognizeThe Company recognizes that ourits success would not be possible without the valuable contributions of our workforce. Investmentits workforce and is committed to creating a work environment where employees can thrive and grow. Our workplaces promote entrepreneurialism and autonomy while providing a strong safety net of benefits, training and personal development. Investments in our peopleattracting, retaining and developing great teams enables usthe Company to accomplish ourits goals and deliver innovative customer solutions. OurThe Company’s corporate Human Capital strategy is overseen by ourits Chief Human Resource Officer (“CHRO”). Annually, the CHRO presents a talent review to the Company’s Board of Directors. As part ofDirectors focused on senior leader team development, the review, the team details each enterprise-levelhuman capital strategy action plan and succession planning for senior leadership position and outlines succession plansmanagement to ensure that the Board is informed of the Company’sand to seek alignment on plans about human capital management for business continuity and success.

OurThe Company’s workforce advancement strategy succeedsis focused through investment in three pillars: skill-building for the entire workforce, leadership development aligned with the Company’s methodology and fostering a greatpremier culture. OurThe Company’s approach to trainingperformance management, talent development, talent management and educationemployee engagement helps drive long-term value by providing our employees with opportunities to develop skillsdo and be their best both individually and as teams:teams.

•

As part of our Organizational Talent Cycle process, we conduct regular in-depth talent reviews of our workforce teams and culture with business leaders, identify “stretch” opportunities to grow team members and connect our decentralized businesses by moving skilled employees from one business unit to another as opportunities and interest arise. Employees and leaders have performance and development conversations throughout the year, talking about business and development goals, reviewing progress, recognizing accomplishments, giving balanced feedback and identifying opportunities for improvement. Open, honest dialog about performance, development and career growth supports our values of Trust, Team and Excellence and The IDEX Difference, building trust and helping us fulfill our purpose.

The Company offers agile development solutions to support unique needs and drive long-term value. Employees have access to resources that enhance and build capabilities for success in their current position or future roles, including specific individual development plans and local training and development programs. Each year, the Company invests in a Global Leadership Conference for senior leaders to align on strategic vision and priorities and build core leadership skills. In support of our growth strategy and culture, the Company also sponsors accelerated, on-the-job learning for key leaders in our pipeline through a variety of sources, including the IDEX Academy, which is our primary platform forAcademy’s global leadership development programs. These programs local development programsprovide opportunities for emerging leaders across geographies and specific individual development plans.businesses to come together to practice and apply new leadership behaviors, share best practices, solve business challenges and build strong support networks. Our learning curriculum includes instructor-led, self-paced and blended solutions that have been created internally or sourced from external partners. These trainingsofferings also help to develop future and potential leaders in the IDEX leadership methodology. Additionally, the Company sponsored over 150 senior leaders

to participate in a coaching skill-building program in 2023 with continued on-the-job performance support and reinforcement designed to accelerate the growth and development of our high-performing talent and further promote our growth culture.

•WeThe Company also enableenables employee development and growth by offering our full-timeeligible U.S. employees who have at least six months of service the abilityopportunity to participate in ourthe Tuition Reimbursement program. Through the program, employees can have certain expenses from secondary educational institutions reimbursed up to $5,250 per year.

•The Company also built the IDEX Accelerating Management Potential (“I-AMP”) Collegiate Talent Program in 2018 to give early career professionals the opportunity to learn the Company’s values and business, and to grow within our Company in both full-time and internship roles. Since the program began, over 75 percent of participants have represented either gender or ethnic minority groups, and we will continue our focus on providing opportunities for diverse early career professionals through I-AMP.

•We prioritizeprioritizes hiring team members who will embrace ourthe team-driven culture and also placeplaces considerable emphasis on leveraging the talented employees within ourthe Company’s internal pipeline, filling many leadership positions with Company employees.

•AcrossPart of the enterprise,IDEX Difference is building and engaging great teams. Employee engagement is essential to create a diverse, inclusive and equitable culture where all employees thrive and have an equal opportunity to do and be their best. We believe our goal is to achieveemployees have a high level of engagement as the Company’s employee engagement index remains above the average for manufacturing company top quartile employee engagementcompanies at 74 percent, as measured by ourthe Company’s employee engagement survey. GivenThe Company’s investments in people have led to significant increases in favorability for career development for all employees. Additionally, the challenges thatimportant capability-building investments of the COVID-19 pandemic broughtGlobal Leadership Conference and coaching programs have positively impacted senior leader perceptions of learning and development, support for skill and career development and increased confidence of being able to the work environment, we are thrilled that our employees are staying engaged as we remain in the 85th percentile among manufacturing companies with employee engagementachieve career goals at 78%.IDEX.

Diversity, Equity & Inclusion

The Company has always recognized diversity as foundational to creativity and resilience; the three pillars of Innovation, Diversity and Excellence form the acronym that is the Company’s name, IDEX. Gender, ethnic, cultural and other human diversity is critical to the Company’s success.

In 2022, the Company launched its Diversity, Equity and Inclusion (“DEI”) strategic roadmap. In 2023, progress against the strategic roadmap included: (1) implementation of mentoring based on employee resource groups (“ERGs”) and talent development networks; (2) delivery of Inclusive Leadership Training; (3) increased participation in IDEX ERGs; (4) continuation of IDEX’s performance-based DEI goals for senior leaders; and (5) expansion of talent development and recruiting efforts.

IDEX has built a reputation as a respected employer with a welcoming culture, where 80% of employees feel a strong sense of belonging, according to our 2023 employee engagement survey.

The Company’s Board of Directors now comprises 30% women and 30% members who identify with racial/ethnic minority groups. Additionally, the representation of women in leadership at the Company remained steady in 2023. From 2022 to 2023, and as of December 31, 2023, the percentage of women globally in senior leadership roles remained constant at 31%. The percentage of women globally in people leadership roles remained at 22%. During the same time period, and as of December 31, 2023, the number of racial/ethnic minority senior leaders in the U.S. increased from 21% to 22%, and the number of racial/ethnic minority people managers in the U.S. increased from 19% to 20%. The foregoing representation numbers do not include employee populations associated with acquisitions completed in 2023.

Further, the Company has conducted pay equity analyses for U.S. employees since 2018 to ensure that employees’ actual pay was substantially similar to their predicted pay. Where appropriate, the Company provided base pay adjustments for employees that were outliers from their predicted pay, further reinforcing the Company’s commitment to diversity and a culture of inclusion, equality and respect.

Employee Pay and Benefits

Attracting and retaining top talent is critical to the success of the Company’s business. We offerThe Company offers a highly competitive pay and benefits package for our employees in all the markets where we operate.it operates. The performance-based pay packages provide many employees with short-term performance incentives. WeThe Company also provideprovides equity-based, long-term incentives to the Company’sits senior leaders.

The Company’s U.S. employees can participate in twoa 401(k) retirement plansplan and thean Employee Stock Purchase Plan, which allows an employee to purchase IDEX stock through payroll deductions.

Diversity, Equity & Inclusion

The Company has always recognized diversity as foundational to creativity and resilience; the three pillars of Innovation, Diversity and Excellence form the acronym that is our name, IDEX. Gender, ethnic, cultural and other human diversity is critical to our success.

In 2020, the Company engaged a Diversity, Equity & Inclusion (“DE&I”) coach to work with the CEO and entire Executive Leadership Team to further the DE&I strategic framework. In 2021, the Company intends to fill the currently vacant executive role for DE&I, which will report directly to the CEO.

At least once per year, the Board of Directors reviews employee diversity performance through its CHRO-led senior talent review. Additionally, the Company tracks diversity performance of the top 400 leaders and provides regular updates to the Board on how leadership demographics are changing over time. The Board has also recently pledged to include a DE&I topic on the agenda of every regularly scheduled Board meeting moving forward. In 2020, we increased representation for both women and people of color in our leadership ranks. Since 2018, we have increased the number of senior leaders globally who are women by more than 27% and leaders in the U.S. who are racially or ethnically diverse of color by 23%.

Further, the Company has been conducting pay equity analysis for U.S. employees since 2018 to ensure that employees’ actual pay was substantially similar to their predicted pay. Where appropriate, we provided base pay adjustments for employees that were outliers from their predicted pay, further reinforcing the Company’s commitment to diversity and a culture of inclusion, equality and respect.

Workplace Health & Safety

We are proud to manufacture product components that save lives; this would not be possible without the health and safety of our employees and contractors. The Company’s Employee Health & Safety (“EH&S”) Vision Policy outlines our approach for health and safety governance and applies to all of the Company’s business units and provides for both monthly and annual

risk assessments which are reviewed by the Company’s senior leaders. We also require safety trainings on topics such as CPR, electrical safety, ergonomics, first aid and machine guarding that all business unit employees must complete every year.Workplace Health & Safety

WeThe Company is committed to providing a workplace that is safe for all of our employees, contractors, business partners and visitors. The commitment to Environmental, Health, and Safety (“EH&S”) begins at the corporate and executive level. The program is overseen by the EH&S Senior Director and the Chief Sustainability Officer, both of whom are part of the Legal Department. Each of the Company’s businesses employ local EH&S specialists. These individuals and local safety committees, in conjunction with the corporate team, form the basis of the global EH&S program. The Company’s corporate EH&S policies are a key part of the global EH&S program. They apply to all of the Company’s businesses and each business is expected to comply with policies and all EH&S laws and regulations. In addition to the corporate policies, each business develops and implements its own health and safety policies tailored to the local business.

The Company also encourage all our full-timeencourages employees enrolled in ourthe U.S. Healthcare Benefit Plan to participate in ourthe third-party operated Wellness Program which provides access to annual biometric screenings, health evaluations and wellness credits that can be earned for meeting individual wellness goals each year. AIn addition, a number of ourthe business units organize complementary wellness programs, including walking clubs, health fairs and lunch“lunch and learnslearns” with nutritionists for their employees.

At the beginning of the COVID-19 pandemic, we acted quickly, forming the IDEX COVID-19 Task Force to protect our employees from the virus, focusing on our safety-first approach. Among other safety measures, we also implemented COVID-19 Temporary PayWorker Rights and Benefits Policy for employees who regularly work 20 or more hours per week, which provided four weeks of leave with 100% pay and benefits, in order to assist employees impacted by COVID-19 circumstances with additional flexibility.

SuppliersProtection

The Company manufactures many ofbelieves that a respectful workplace is free from unlawful discrimination and harassment, and this involves more than just compliance with the parts and components used in its products. Substantially all materials, parts and components purchased by the Company are available from multiple sources.

Inventory and Backlog

law. The Company regularlystrives to create a work environment that is free of inappropriate and systematically adjusts production schedulesunprofessional behavior and quantities based onconsistent with the flow of incoming orders. Backlogs typically are limitedCompany’s values – a place where everyone is invited to two months of production. While total inventory levels also may be affected by changes in orders, the Company generally triesdo their best every day and feel free to maintain relatively stable inventory levels based on its assessment of the requirements of the various industries served.

Raw Materials

The Company uses a wide variety of raw materials which are generally available from a number of sources. As a result, shortages fromreport any single supplier have not had, and are not likely to have a material impact on operations.

Shared Services

concerns. The Company has production facilitiespolicies, procedures and regular training in Suzhou, Chinaplace to protect its workforce and Vadodara, India that support multiple business units. IDEXprevent workplace harassment and discrimination. This includes a global Code of Business Conduct & Ethics policy where employees agree to follow and receive annual training. The Company also has personnel in China, India, Dubai, Mexico, Latin America and Singapore that provide sales and marketing, product design and engineering and sourcing supportmaintains a global hotline where employees are encouraged (and can choose to its business units as well as personnel in various locations in South America, the Middle East, Korea and Japanremain anonymous) to support sales and marketing efforts of IDEX businesses in those regions.

Segment Information

For segment financial information for the years 2020, 2019 and 2018, including financial information about foreign and domestic sales and operations, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 14 of the Notes to Consolidated Financial Statements in Part II, Item 8, “Financial Statements and Supplementary Data.”

report any concerns or issues.

Information about Our Executive Officers

Set forth below are the names of the executive officers of the Company, their ages, years of service, the positions held by them and their business experience during the past five years.experience.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Years of

Service | | Position |

| Eric D. Ashleman | | 53 | | 12 | | Chief Executive Officer and President |

| William K. Grogan | | 42 | | 9 | | Senior Vice President and Chief Financial Officer |

| Denise R. Cade | | 58 | | 5 | | Senior Vice President, General Counsel and Corporate Secretary |

| Melissa S. Flores | | 38 | | 10 | | Senior Vice President-Chief Human Resources Officer |

| Daniel J. Salliotte | | 54 | | 16 | | Senior Vice President-Corporate Development |

| Michael J. Yates | | 55 | | 15 | | Vice President and Chief Accounting Officer |

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Years of

Service | | Position |

| Eric D. Ashleman | | 56 | | 15 | | Chief Executive Officer and President |

| Abhishek Khandelwal* | | 47 | | 11 | | Senior Vice President and Chief Financial Officer |

| Lisa M. Anderson | | 47 | | 7 | | Senior Vice President, General Counsel and Corporate Secretary |

| Melissa S. Flores | | 41 | | 13 | | Senior Vice President and Chief Human Resources Officer |

| Roopa Unnikrishnan | | 52 | | 2 | | Senior Vice President, Strategy and Corporate Development |

*Mr. Khandelwal rejoined IDEX in November 2023 after previously serving in various roles from 2010 to 2020.

Mr. Ashleman has served as President and Chief Executive Officer since December 2020. Prior to that, Mr. Ashleman was Senior Vice President and Chief Operating Officer from July 2015 to December 2020, Vice President-Group Executive of the Company’s Health & Science TechnologiesHST and Fire & Safety/Diversified ProductsFSDP segments from January 2014 through July 2015 and President-Group Executive of the Company’s Fire & Safety/Diversified ProductsFSDP segment from 2011 through January 2014. Mr. Ashleman joined IDEX in 2008 as the President of Gast Manufacturing.

Mr. GroganKhandelwal has served as Senior Vice President and Chief Financial Officer since January 2017.November 2023. Prior to that,rejoining IDEX, Mr. GroganKhandelwal served as Chief Financial Officer of Multi-Color Corporation, a manufacturer of printed labels for consumer goods, from January 2022 through November 2023, and as Senior Vice President and Chief Financial Officer of CIRCOR International, a pump & valve systems and custom engineering & design company, from April 2020 through December 2021. From 2010 through March 2020, Mr. Khandelwal held a number of senior finance roles within IDEX, serving most recently as Vice President of Finance Operations, from July 2015 through January 2017. From January 2012 through July 2015, Mr. Grogan was Vice President-FinanceTreasury and Financial Planning & Analysis for the Company’s Health & Science Technologies and Fire & Safety/Diversified Products segments.Company.

Ms. CadeAnderson has served as Senior Vice President, General Counsel and Corporate Secretary since February 2022. Prior to that, Ms. Anderson served as Vice President, Associate General Counsel and Assistant Secretary from December 2017 through February 2022 after joining IDEX as Assistant General Counsel in October 2015.2016. Prior to joining IDEX, Ms. Cade wasAnderson served