UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 10-K

_________________

| (Mark One) |

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, |

or

| [_] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

|

Commission File Number: 001-36769

_____________________

FRP HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

_____________________

| 47-2449198 | ||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 200 W. Forsyth St., | 32202 | |

| (Address of principal executive offices) | (Zip Code) |

(904)396-5733

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Symbol | Name of each exchange on which registered | |||

| Common Stock, $.10 par value | |||||

| FRPH | NASDAQ | ||||

Securities registered pursuant to Section 12(g) of the Act: None

_________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [_] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [_] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [_]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [_]

| 1 |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [_] | Accelerated filer | |

| Non-accelerated filer | Smaller reporting company | |

| Emerging growth company | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [_]

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [_]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [_] No [X]

The number of shares of the registrant’s stock outstanding as of March 15, 201928, 2022 was 9,950,821.. The aggregate market value of the shares of Common Stock held by non-affiliates of the registrant as of June 30, 2018,2021, the last day of business of our most recently completed second fiscal quarter, was $537,622,063.$413,410,236. Solely for purposes of this calculation, the registrant has assumed that all directors, officers and ten percent (10%) shareholders of the Company are affiliates of the registrant.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the FRP Holdings, Inc. 20182021 Annual Report to Shareholders are incorporated by reference in Parts I and II.

Portions of the FRP Holdings, Inc. Proxy Statement which will be filed with the Securities and Exchange Commission not later than March 31, 20192022 are incorporated by reference in Part III.

| 2 |

FRP HOLDINGS, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2021

TABLE OF CONTENTS

| 3 |

Preliminary Note Regarding Forward-Looking Statements.

Certain matters discussed in the report contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.amended (the “Exchange Act”). The words or phrases “anticipate,” “estimate,” ”believe,“believe,” “budget,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target” and similar expressions identify forward-looking statements. Such statements reflect management’s current views with respect to financial results related to future events and are based on assumptions and expectations that may not be realized and are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, financial or otherwise, may differ, perhaps materially, from the results discussed in the forward-looking statements. Risk factors discussed in Item 1A of this Form 10-Q10-K and other factors that might cause differences, some of which could be material, include, but are not limited to: the impact of the Covid-19 Pandemic on our operations and financial results; the possibility that we may be unable to find appropriate investment opportunities; levels of construction activity in the markets served by our mining properties; demand for flexible warehouse/office facilities in the Baltimore-Washington-Northern Virginia area; demand for apartments in Washington D.C.:, Richmond, Virginia and Greenville, South Carolina; our ability to obtain zoning and entitlements necessary for property development; the impact of lending and capital market conditions on our liquidity, our ability to finance projects or repay our debt; general real estate investment and development risks; vacancies in our properties; risks associated with developing and managing properties in partnership with others; competition; our ability to renew leases or re-lease spaces as leases expire; illiquidity of real estate investments; bankruptcy or defaults of

tenants; the impact of restrictions imposed by our credit facility; the level and volatility of interest rates; environmental liabilities; inflation risks; cyber security risks; as well as other risks listed from time to time in our SEC filings, including but not limited to, our annual and quarterly reports. We have no obligation to revise or update any forward-looking statements, other than as imposed by law, as a result of future events or new information. Readers are cautioned not to place undue reliance on such forward-looking statements.

These forward-looking statements are made as of the date hereof based on management’s current expectations, and the Company does not undertake an obligation to update such statements, whether as a result of new information, future events or otherwise. Additional information regarding these and other risk factors may be found in the Company’s other filings made from time to time with the Securities and Exchange Commission.

PART I

Item 1. BUSINESS.

FRP Holdings, Inc., a Florida corporation (the “Company”) was incorporated on April 22, 2014 in connection with a corporate reorganization that preceded the Spin-off of Patriot Transportation Holding, Inc. The Company’s successorpredecessor issuer was formed on July 20, 1998. The business of the Company is conducted through our wholly-owned subsidiaries FRP Development Corp., a Maryland corporation, and Florida Rock Properties, Inc., a Florida corporation, and the various subsidiaries of each.

Our Business.FRP Holdings, Inc. (the “Company”)The Company is a holding company engaged in various real estate businesses. TheOur business segments of the Company include:are: (i) leasing and management of commercial properties owned by the Company (the “Asset Management Segment”), (ii) leasing and management of mining royalty land owned by the Company (the “Mining Royalty Lands Segment”), (ii)(iii) real property acquisition, entitlement, development and construction primarily for apartment, retail, warehouse, and office buildings either alone or through joint ventures (the “Development Segment”), (iv) ownership, leasing and management of a residential apartment buildingbuildings through joint ventures (the “Stabilized Joint Venture Segment”).

On May 21, 2018, theThe Asset Management Segment owns, leases and manages commercial properties. The Company completed the disposition of 40 industrial warehouse properties and three additional land parcels to an affiliate of Blackstone Real Estate Partners VIII, L.P. for $347.2 million. Onemillion on May 21, 2018 and sold an additional industrial warehouse property valued atto the same buyer on June 28, 2019 for $11.7 million, was excluded fromleaving only two commercial properties and one industrial acquisition (Cranberry Run Business Park, which we purchased in 2019) in the sale due to the tenant exercising its right of first refusal to purchase the property. These properties comprised substantially all the assets of our Asset Management segment and have been reclassified as discontinued operations for all periods presented.

TheSegment. In July 2020 we sold our property located at 1801 62nd Street which was placed in service on April 1, 2019. During the fourth quarter of 2021 we completed construction on two buildings in our Hollander Business Park. These assets are now a part of the Asset Management Segment owns, leasesSegment. Our overall business strategy includes the re-deployment of the warehouse portfolio sales proceeds into asset classes across various business segments that will allow management to exploit its knowledge and manages commercial properties. Price, location, rental space availability, flexibility of designexpertise, including mixed-use properties, raw land, existing buildings, and property management services are the major factors that affect competitionstrategic partnerships located in the office rental market. The Company experiences considerable competition in all of its markets. Our tenants are not concentrated in any one particular industry.core markets with growth potential.

Our Mining Royalty Lands Segment owns several properties comprising approximately 15,000 acres currently under lease for mining rents or royalties (not including theand an additional 4,280 acres owned inthrough our Brooksville joint venture with Vulcan Materials).Materials. Other than one location in Virginia, all of theseour mining properties are located in Florida and Georgia.

Our Development Segment owns and continuously monitors the “highest and best use” of parcels of land that are in various stages of development. The overall strategy for this segment is to convert all of our non-income producing property into income-producing property through (i) an orderly process of constructing new apartment, retail, warehouse, and office buildings to be operated by the Company or (ii) a sale to, or joint venture with, third parties. Additionally, our Development segmentSegment will form joint ventures on new developments of land not previously owned by the Company. Since 1990, one of our primary strategies in this segment has been to acquire, entitle and ultimately develop commercial and industrial business parks providing 5–15 building pads which we typically convert into warehouse or office buildings. To date, our management team has converted 32 of these pads into developed buildings. Our typical practice has been to transfer these assets to the Asset Management Segment on the earlier to occur of (i) commencement of rental revenue or (ii) issuance of the certificate of occupancy. We have also occasionally sold several of these pad sites over time to third parties.

The Stabilized Joint Venture Segment owns, leasesincludes joint ventures which own, lease and manages a 305-unit residential apartment building with approximately 18,000 sq. ft. of first floor retail space.manage buildings that have met our initial lease up criteria. We have renamed this segment from RiverFront on the Anacostia to the Stabilized Joint Venture segment as we intend to transfer additional joint ventures from our Development segmentSegment into this segment as they reach stabilization. Stabilization occurs when our minimum percentage leased goal is achieved.

Competition.As a developer, we compete with numerous developers, owners and operators of real estate,

| 5 |

many of whom own properties similar to ours in the same submarkets in which our properties are located. Price, location, rental space availability, flexibility of design and property management services are the major factors that affect competition.

Customers.In the Mining Royalty Lands segment,Segment, we have a total of five tenants currently leasing our mining locations, and one particular tenant (VulcanVulcan Materials Company)Company (“Vulcan” or “Vulcan Materials”) accounted for 29.9%23.0% of the

Company’s consolidated revenues in 2018.2021. An event affecting Vulcan’s ability to perform under its lease agreements could materially impact the Company’s results.

Sales and Marketing.We use national brokerage firms to assist us in marketing our vacant properties. Our hands on in-house management team focuses on tenant satisfaction during the life of the lease which we have found to be very beneficial with respect to our tenant renewal success rate over the years.

Financial Information.Financial information is discussed by industry segment in Note 1210 to the consolidated financial statements included in the accompanying 20182021 Annual Report to Shareholders, which is incorporated herein by reference.

Impact of the COVID-19 Pandemic. We have continued operations throughout the pandemic and have made every effort to act in accordance with national, state, and local regulations and guidelines. During 2020, Dock 79 and The Maren most directly suffered the impacts to our business from the pandemic due to our retail tenants being unable to operate at capacity, the lack of attendance at the Washington Nationals baseball park and the rent freeze imposed by the District. In 2021, the Delta and Omicron variants of the virus impacted our businesses, but because of the vaccine and efforts to reopen the economy, while still affected, they were not impacted to the extent that they were in 2020. It is possible that this version of the virus and its succeeding variants may impact our ability to lease retail spaces in Washington, D.C. and Greenville. We expect our business to be affected by the pandemic for as long as government intervention and regulation is required to combat the threat.

Environmental Matters.The Company incurs costs from time to time to investigate and remediate environmental contamination on its real estate.estate, in particular, in connection with our Development Segment. The Company's mining leases contain provisions under which the lessee is responsible for environmental liabilities and reclamation of mining sites at least to the extent required by law.

Seasonality.Human Capital.The Company’s business is subject to limited seasonality factors due to the cyclical nature of our mining customers’ businesses. Revenues generally decline slightly during winter months.

Employees.The Company employed 1014 people and was provided services by 3three executive officers under a related party agreement at December 31, 2018.2021. Our small but dedicated workforce has extraordinarily low turnover, and the average tenure of our employee is 11.74 years. We are committed to an inclusive and diverse culture and do not tolerate any sort of discrimination. We maintain a whistleblower hotline allowing employees to report complaints on an anonymous basis.

Company Website.The Company’s website may be accessed atwww.frpholdings.com. www.frpdev.com. All of our filings with the Securities and Exchange Commission are accessible through our website promptly after filing. This includes annual reports on Form 10-K, proxy statements, quarterly reports on Form 10-Q, current reports filed or furnished on Form 8-K and all related amendments.

Item 1A. RISK FACTORS.

Our future results may be affected by a number of factors over which we have little or no control. The following issues, uncertainties, and risks, among others, should be considered in evaluating our business and outlook. Also, note that additional risks not currently identified or known to us could also negatively impact our business or financial results.

Risks Relating to the COVID-19 Pandemic

The current pandemic of the novel coronavirus COVID-19 could materially and adversely impact or

| 6 |

disrupt our financial condition, results of operations, cash flows and performance.

The financial performance of our stabilized mixed-use properties in Washington, D.C. has been adversely affected by the COVID-19 pandemic due to restrictions on the operation of local businesses, the rent freeze on lease renewals imposed in Washington, D.C. (through December 31, 2021), and the lack of fan attendance at the Washington Nationals baseball park in 2020. At this time, the Company is not certain the degree to which these factors will continue to impact Dock 79, The Maren. and Bryant Street, which could adversely affect our financial condition, results of operations and cash flows.

Additionally, the COVID-19 pandemic could materially and adversely affect our ability to complete pending and planned construction projects in a timely manner due to restrictions imposed on construction activities, delays in the permitting process or delays in the supply of materials or labor necessary for construction due to ongoing supply chain disruptions.

Risks Relating to our Business

A decline in the economic conditions in Baltimore and Washington, D.C. markets could adversely affect our business.

Nearly all of our commercial and residential/mixed use properties are located in the Baltimore area and Washington, D.C. We are, therefore, subject to increased exposure (positive or negative) to economic and other competitive factors specific to markets in confined geographic areas. Our operations may also be affected if too many competing properties are built in these markets. An economic downturn in these markets resulting from factors outside of our control could adversely affect our operation. Such a downturn could be triggered by such factors as the downsizing or relocation of government jobs, increased work from home opportunities, crime or acts of terrorism. We cannot be sure that these markets will continue to grow or demand the type of assets in our portfolio.

Since the Spin-off of Patriot, FRP has shared executives with Patriot so those executives do not devote their full time and attention to the Company.

Under the terms of the now amended Transition Services Agreement between FRP and Patriot, Patriot now provides the services of two of its executive officers to FRP. John D. Milton, Jr. serves as General Counsel for Patriot and John D. Klopfenstein, Controller and Chief Accounting Officer, serves in the same capacity with FRP under the Transition Services Agreement. John D. Klopfenstein spends approximately 50% of his time working for FRP pursuant to the terms of the Transition Services Agreement and both companies share in 50%

of the costs (including overhead); John D. Milton, Jr. spends about 25% of his time working for Patriot and 75% of his time for FRP and his costs (including overhead) are shared in these proportions. FRP could be adversely impacted by lack of the full-time focus of these executives during the term of the Transition Services Agreement. In addition, these executives may face conflicts of interest, or the appearance thereof, if there is a dispute under the agreements between Patriot and FRP or a future business transaction.

We conduct a significant portion of our operations through joint ventures, which may lead to disagreements with our joint venture partners and adversely affect our interests in the joint ventures.

We currently are a party to several joint ventures relating to Phase I and Phase II of our Riverfront on the Anacostia development, our Brooksville property and our Maryland office park development. Wewe may enter into additional joint ventures in the future. In each of our existing joint ventures, the consent of our joint venture partner is required to take certain actions, and in some cases will share equal voting control. Our joint venture partners, as well as future partners, may have interests that are different from ours which may result in conflicting views as to the conduct of the joint ventures. In the event that we have a disagreement with a joint venture partner as to the resolution of a particular issue to come before the joint venture, or as to the conduct or management of the joint venture generally, we may not be able to resolve such disagreement in our favor and such a disagreement could have a material adverse effect on our interest in the joint venture or on the business of the joint venture generally.

Our business may be adversely affected by seasonal factors and harsh weather conditions.

The Mining Royalty Lands Segment and the Development Segment could be adversely affected by reduced construction and mining activity during periods of inclement weather. These factors could cause our operating results to fluctuate from quarter to quarter. An occurrence of unusually harsh or long-lasting inclement weather such as hurricanes, tornadoes and heavy snowfalls could have an adverse effect on our operations and profitability.

Our business could be negatively impacted by cyberattacks targeting our computer and telecommunications systems and infrastructure, or targeting those of our third-party service providers.

Our business, like other companies in our industry, has become increasingly dependent on digital technologies, including technologies that are managed by third-party service providers on whom we rely to help us collect, host or process information. Such technologies are integrated into our business operations. Use of the internet and other public networks for communications, services, and storage, including "cloud"

| 7 |

computing, exposes all users (including our business) to cybersecurity risks.

While we and our third-party service providers commit resources to the design, implementation, and monitoring of our information systems, there is no guarantee that our security measures will provide absolute security. Despite these security measures, we may not be able to anticipate, detect, or prevent cyberattacks, particularly because the methodologies used by attackers change frequently or may not be recognized until launched, and because attackers are increasingly using techniques designed to circumvent controls and avoid detection. We and our third-party service providers may therefore be vulnerable to security events that are beyond our control, and we may be the target of cyber-attacks, as well as physical attacks, which could result in information security breaches and significant disruption to our business.

Our revenues depend in part on construction sector activity, which tends to be cyclical.

Our Mining Royalty Lands Segment revenues are derived from royalties on construction aggregates mined on our properties. Thus, our results depend in part on residential, commercial and infrastructure construction activity and spending levels. The construction industry in our markets tends to be cyclical. Construction activity and spending levels vary across our markets and are influenced by interest rates, inflation, consumer spending habits, demographic shifts, environmental laws and regulations, employment levels and the availability of funds for public infrastructure projects. Economic downturns may lead to recessions in the construction industry, either in individual markets or nationally.

Our operations are subject to various environmental laws and regulations, the violation of which could result in substantial fines or penalties.

Liability for environmental contamination on real property owned by the Company may include the following costs, without limitation: investigation and feasibility study costs, remediation costs, litigation costs, oversight costs, monitoring costs, institutional control costs, penalties from state and federal agencies and third-party claims. These costs could be substantial and in extreme cases could exceed the value of the contaminated property. Moreover, on-site operations may be suspended until certain environmental contamination is remediated and/or permits are received, and governmental agencies can impose permanent restrictions on the manner in which a property may be used depending on the extent and nature of the contamination. This may result in a breach of the terms of the lease entered into with our tenants. Governmental agencies also may create liens on contaminated sites for damages it incurred to address such contamination. In addition, the presence of hazardous substances at, on, under or from a property may adversely affect our ability to sell the property or borrow funds using the property as collateral, thus harming our financial condition.

The presence of contaminated material at our RiverFrontRiverfront on the Anacostia development site will subject us to substantial environmental liability and costs as construction proceeds.

With respect to our RiverFrontPhases III and IV of the Riverfront on the Anacostia site in Washington, D.C., preliminary environmental testing has indicated the presence of contaminated material that will have to be specially handled in excavation in conjunction with construction. While we have recovered and will continue to seek partial reimbursement for these costs from neighboring property owners, we still expect to incur significant environmental costs in connection with construction.

During the quarter ending December 31, 2015, management successfully completed negotiations and entered into a $3.0 million settlement of environmental claims on all four phases against our former tenant at the Riverfront on the Anacostia property and continues to pursue settlement negotiations with other potentially responsible parties.The total remediation expense for Phase I of this development was $1.833 million.

The Company executed a letter of intent with MRP Realty in May 2016 to develop Phase II of the Riverfront on the Anacostia project and recorded an estimated environmental remediation expense of $2.0 million for the Company’s estimated liability under the proposed agreement. The Company substantially completed the remediation and reduced the estimated liability in the quarter ending September 30, 2018 by $465,000.

The Company has no obligation to remediate this contamination on Phases III and IV of the development until such time as it makes a commitment to commence construction on each phase. The Company's actual expense to address this issue may be materially higher or lower than the expense previously recorded depending upon the actual costs incurred.

Our operations could be adversely affected by climate change and climate change regulations.

Climate change presents an array of risks to real estate companies due to sea level rise, flooding, extreme weather, stronger storms and human migration. [We have accounted for the risk of flooding and sea level rise in the design of our Riverfront on the Anacostia development.] Future developments, including potential “second life” uses of our mining properties, could be impacted by these factors and the impacts that they have

| 8 |

on human behavior.

Uninsured losses could significantly reduce our earnings.

We self-insure for a portion of our claims exposure resulting from workers’ compensation, auto liability, general liability and employees’ health insurance. We also are responsible for our legal expenses relating to such claims. We maintain insurance above the amounts for which we self-insure with licensed insurance carriers. Although we believe the aggregate insurance limits should be sufficient to cover reasonably expected claims, it is possible that one or more claims could exceed our aggregate coverage limits. Additionally, there are certain losses, such as losses from hurricanes, terrorism, wars or earthquakes, where insurance is limited or not economically justifiable. If the Company experiences an uninsured loss of real property, we could lose both the invested capital and anticipated revenues associated with such property. We accrue currently for estimated incurred losses and expenses and periodically evaluate and adjust our claims accrued liability to reflect our experience. However, ultimate results may differ from our estimates, which could result in losses greater than accrued amounts.

We may be unable to renew leases or re-lease properties as leases expire.

When a lease expires, a tenant may elect not to renew it. If that occurs, we may not be able to lease the property on similar terms. The terms of renewal or re-lease (including the cost of required renovations and concessions to tenants) may be less favorable than the prior lease. If we are unable to lease all or substantially all of our properties, or if the rental rates upon such re-leasing are significantly lower than expected rates, our cash generated before debt repayments and capital expenditures may be adversely affected.

We may be unable to lease currently vacant properties.

If we are unable to obtain leases sufficient to cover carrying costs, then our cash flows may be adversely affected.

The bankruptcy or insolvency of significant tenants with long-term leases may adversely affect income produced by our properties.

Should tenants default on their obligations, our cash flow would be adversely affected, and we may not be able to find another tenant to occupy the space under similar terms or may have to make expenditures to retrofit or divide the space. Additionally, we may have to incur a non-cash expense for a significant amount of deferred

rent revenue generated from the accounting requirement to straight-line rental revenues. The bankruptcy or insolvency of a major tenant may also adversely affect the income produced by a property. If any of our tenants become a debtor in a case under the U.S. Bankruptcy Code, we cannot evict that tenant solely because of its bankruptcy. The bankruptcy court may authorize the tenant to reject and terminate its lease with the Company. Our claim against such a tenant for unpaid future rent would be subject to a statutory limitation that may be substantially less than the remaining rent actually owed to us under the tenant’s lease. Any shortfall in rent payments could adversely affect our cash flow.

Our inability to obtain necessary approvals for property development could adversely affect our profitability.

We may be unable to obtain, or incur delays in obtaining, necessary zoning, land-use, building, occupancy and other required governmental permits and authorizations, which could result in increased costs or abandonment of certain projects. Before we can develop a property, we must obtain a variety of approvals from local and state governments with respect to such matters as zoning, density, parking, subdivision, site planning and environmental issues. Legislation could impose moratoriums on new real estate development or land-use conversions from mining to development. These factors may reduce our profit or growth and may limit the value of these properties.

Real estate investments are not as liquid as other types of assets.

| 9 |

The illiquid nature of real estate investments may limit our ability to react promptly to changes in economic or other conditions. In addition, significant expenditures associated with real estate investments, such as mortgage payments, real estate taxes and maintenance costs, are generally not reduced when circumstances cause a reduction in income from the investments. Thus, the illiquid nature of our real estate investments could adversely affect our profitability under certain economic conditions.

Our debt service obligations may have adverse consequences on our business operations.

We use debt to finance our operations, including acquisitions of properties. As of December 31, 2021, we had outstanding non-recourse mortgage indebtedness of $180,070,000, secured by developed real estate properties having a carrying value of $263,214,000. Our use of debt may have adverse consequences, including the following:

| · | Our cash flows from operations may not be sufficient to meet required payments of principal and interest. |

| · | We may be forced to dispose of one or more of our properties, possibly on disadvantageous terms, to make payments on our debt. |

| · | We may default on our debt obligations, and the lenders may foreclose on our properties that collateralize those loans. |

| · | A foreclosure on one of our properties could create taxable income without any accompanying cash proceeds to pay the tax. |

| · | We may not be able to refinance or extend our existing debt. |

| · | The terms of any refinancing or extension may not be as favorable as the terms of our existing debt. |

| · | We may not be able to issue debt on unencumbered properties under reasonable terms to finance growth of our portfolio of properties. |

| · | We may be subject to a significant increase in the variable interest rates on our unsecured and secured lines of credit, which could adversely impact our operations. |

| · | Our debt agreements have yield maintenance requirements that result in a penalty if we prepay loans. |

On May 21, 2018 in conjunction with the sale of the warehouse business the Companies mortgages notes were prepaid and the credit line with First Tennessee Bank, N.A. was terminated. As of December 31, 2018, we had outstanding non-recourse mortgage indebtedness of $90,000,000, secured by developed real estate properties having a carrying value of $138,762,000.

Our uncollateralized revolving credit agreement restricts our ability to engage in some business activities.

Our uncollateralized revolving credit agreement contains customary negative covenants and other financial and operating covenants that, among other things:

| · | restricts our ability to incur certain additional indebtedness; |

| · | restricts our ability to make certain investments; |

| · | restricts our ability to merge with another company; |

| · | restricts our ability to pay dividends; |

| · | requires us to maintain financial coverage ratios; and |

| · | requires us to not encumber certain assets except as approved by the lenders. |

These restrictions could cause us to default on our unsecured line of credit or negatively affect our operations.

The replacement of LIBOR with an alternative reference rate may adversely affect interest expense related to outstanding debt.debt and our financial results.

On July 27, 2017, theThe United Kingdom’s Financial Conduct Authority or FCA,(FCA) has announced that it would phase out LIBOR as a benchmark by the end of 2021. It is unclear whether new methods of calculating LIBORJune 30, 2023. We will be established such that it continues to exist after 2021. When LIBOR ceases to exist, we may need to amend the credit and loan agreementsagree upon a replacement index with our lenders, which would require an amendment to our borrowing arrangements that utilizeuse LIBOR as a factor in determining the interest rate based on(including our credit agreement with Wells Fargo), and the interest rate thereunder will likely change.

| 10 |

The U.S. Federal Reserve, in conjunction with the Alternative Reference Rates Committee, a steering committee comprised of large U.S. financial institutions, is considering replacing U.S. dollar LIBOR with a new standard that is established, if any. index, the Secured Overnight Financing Rate (SOFR), calculated using short-term repurchase agreements backed by Treasury securities. Whether or not SOFR, or another alternative reference rate, attains market traction as a LIBOR replacement tool remains in question.

The transition to an alternative rate will require careful and deliberate consideration and implementation so as to not disrupt the stability of financial markets. There is no guarantee that a transition from LIBOR to an alternative will not result in financial market disruptions, significant increases in benchmark rates, or borrowing costs to borrowers, any of which could have an adverse effect on our business, results of operations and financial condition. Furthermore, any changes announced by the FCA, U.S. Federal Reserve, or other regulators in the method pursuant to which the reference rates are determined may result in a sudden or prolonged increase or decrease in the reported reference rates, which could have an adverse effect on our interest payments and our results of operations and financial condition.

Fluctuations in value of Bond Portfolio and losses on bonds sold.our investments U.S. Treasury debt.

As of December 31, 2018,2021, the Company had total investments of $165,212,000$24,926,000 in corporate bonds with maturities ranging from 2020 through 2024.U.S Treasury Notes which mature in late 2023. The Company measures the fair value of these investments on a quarterly basis and recognizes the unrealized gain or loss in its comprehensive income. As a result, the Company’s comprehensive income will be impacted by factors outside our control such as fluctuations in interest rates that impact the value of our investment portfolio. The Company could incur losses should it sell the bondsNotes prior to maturity or if the bond issuer does not redeem the bond at par.maturity.

Our Asset Management and Development Segments face competition from numerous sources.

As a developer of apartments, retail, flexible warehouse and office space, we compete with numerous developers, owners and operators of real estate, many of whom own properties similar to ours in the same submarkets in which our properties are located. If our competitors offer space at rental rates below current market rates, or below the rental rates we currently charge our tenants, we may lose potential tenants and we may be pressured to reduce our rental rates to an amount lower than we currently charge in order to retain tenants when our tenants’ leases expire. As a result, our financial condition, results of operations, cash flow and ability to satisfy our debt service obligations could be materially adversely affected.

Construction costs may be higher than anticipated.

Our long-term business plan includes a number of construction projects. The construction costs of these projects may exceed original estimates and possibly make the completion of a property uneconomical. Building material commodity shortages, supply chain disruptions, construction delays or stoppages or rapidly escalating construction costs may out-pace market rents, which would adversely affect our profits. The market environment and existing lease commitments may not allow us to raise rents to cover these higher costs.

Risks Relating to our Common Stock

Certain shareholders have effective control of a significant percentage of FRP's common stock and likely will controlwould have significant influence on the outcome of any shareholder vote.

As of December 31, 2018,2021, our Chief Executive Officer, John D. Baker, II beneficially owned approximately 13.9%14.9% of the outstanding shares of our common stock (80.2%(79.4% of such shareswhich are held in trusttrusts under which voting power is shared with other family members) and certainmembers of his family who are (i) officers or directors of the company, (ii) required to report their beneficial ownership on Schedule 13D or Schedule 13G, or (iii) are members of his immediate family beneficially own, collectively, an additional 18.7%20.9% of the outstanding shares of our common stock. As a result, these individuals effectively may have the ability to direct the election of all members of our board of directors and to exercise a controlling influence over its business and affairs, including any determinations with respect to mergers or other business combinations involving the

| 11 |

Company, its acquisition or disposition of assets, its borrowing of monies, its issuance of any additional securities, its repurchase of common stock and its payment of dividends.

Provisions in our articles of incorporation and bylaws and certain provisions of Florida law could delay or prevent a change in control of FRP.

The existence of some provisions of our articles of incorporation and bylaws and Florida law could discourage, delay or prevent a change in control of FRP that a shareholder may consider favorable. These include provisions:

These provisions apply even if a takeover offer may be considered beneficial by some shareholders and could delay or prevent an acquisition that our board of directors determines is not in the Company’s or the shareholders’ best interests.

FRP may issue preferred stock with terms that could dilute the voting power or reduce the value of our common stock.

Our articles of incorporation authorize us to issue, without the approval of our shareholders, one or more classes or series of preferred stock having such designations, powers, preferences and relative, participating, optional and other rights, and such qualifications, limitations or restrictions as our board of directors generally may determine. The terms of one or more classes or series of preferred stock could dilute the voting power or reduce the value of FRP's common stock. For example, FRP could grant holders of preferred stock the right to elect some number of its directors in all events or on the happening of specified events or the right to veto specified transactions. Similarly, the repurchase or redemption rights or dividend, distribution or liquidation preferences FRP could assign to holders of preferred stock could affect the residual value of the common stock.

Institutional investor focus on environmental, social and governance issues may impact our stock price.

Many large institutional investors focus on sustainability in managing investment risks, portfolio design and dealing with companies in which the invest. This focus extends to climate change and the plan for transitioning to a net-zero economy, diversity and inclusion and other human resource matters, and social and governance issues and corporate social responsibility. While we are proud of the returns to shareholders and our sustainable practices in construction and environmental management, we recognize our responsibility to focus on these key issues that impact our long-term sustainability. Our failure to demonstrate this commitment could dissuade institutional investors from holding our stock, which would result in downward pressure on our stock price.

Item 1B. UNRESOLVED STAFF COMMENTS.

None.

Item 2. PROPERTIES.

The Company owns (predominately in fee simple but also through ownership of interests in joint ventures) overapproximately 20,000 acres of land in Florida, Georgia, Maryland, Virginia, DelawareSouth Carolina, and the District of Columbia. This land is generally held by the Company in four distinct segmentssegments: (i) Asset Management Segment (land owned and operated as income producing rental properties in the form of commercial properties), (ii) Mining Royalty Lands Segment (land owned and leased to mining companies for royalties or rents), (iii) Development Segment (land owned and held for investment to be further developed for future income production or sales to third parties), and (iv) Stabilized Joint Venture Segment (a 305-unit apartment building with retail on the first floor)(ownership, leasing and management of buildings through joint ventures).

Asset Management Segment.As of December 31, 2021, the Asset Management Segment owned four commercial properties in fee simple as follows:

1) 34 Loveton Circle in suburban Baltimore County, Maryland consists of one office building totaling 33,708 square feet which is 95.1% occupied (16% of the space is occupied by the Company for use as our Baltimore headquarters). The property is subject to commercial leases with various tenants.

2) 155 E. 21st Street in Duval County, Florida was an office building property that remains under lease through March 2026. We permitted the tenant to demolish all structures on the property during 2018.

3) Cranberry Run Business Park in Hartford County, Maryland consists of five office buildings totaling 267,737 square feet which are 81.0% occupied and 100.0% leased. The property is subject to commercial leases with various tenants.

4) Hollander 95 Business Park in Baltimore City, Maryland consists of two buildings totaling 145,590 square feet that were completed in the fourth quarter of 2021 and are 29.1% leased.

On May 21, 2018, the Company completed the disposition of 40 industrial warehouse properties and three additional land parcels to an affiliate of Blackstone Real Estate Partners VIII, L.P. for $347.2 million. OneThe Company sold an additional warehouse property, valued at $11.7 millionwhich was excluded from the initial sale due to the tenant exercising its right of first refusal to purchase the property. Theseproperty, to the same buyer for $11.7 million on June 28, 2019. The warehouse portfolio sale resulted in the disposition of all of the Company’s industrial flex/office warehouse properties comprised substantially allprior to the assets of our Asset Management segmentsale date and constituted a major strategic shift and, as a result, these properties have been reclassified as discontinued operations for all periods presented.presented in the financial statements filed herewith.

As of December 31, 2018, the Asset Management Segment owned three commercial properties as follows:

1) 34 Loveton Circle in suburban Baltimore County, Maryland consists of one office building totaling 33,708 square feet (24% of the space is occupied by the Company for use as our Baltimore headquarters).

2) 7030 Dorsey Run Road in Howard County, Maryland consists of one office building totaling 63,122 square feet.

3) 155 E. 21stStreet in Duval County, Florida was an office building property that remains under lease through March 2026. We permitted the tenant to demolish all structures on the property during 2018.

Mining Royalty Lands Segment – Mining Properties.Segment.

Introduction. The following table summarizes

Pursuant to amendments to Regulation S-K of the Company'sSecurities Act of 1933 (“Regulation S-K”) adopted by the Securities and Exchange Commission in 2018, effective for fiscal years beginning on or after January 1, 2021, registrants with material mining operations must disclose certain information in their Securities and Exchange Act filings concerning mineral resources and mineral reserves, in accordance with to Subpart 1300 of Regulation S-K. This section of Item 2 provides summary information about our overall portfolio of mining royalty lands and estimated reserves at December 31, 2018 a substantial portion of which are leased to Vulcan Materials.properties.

| Tons of | |||||||||

| Tons Sold | Estimated | ||||||||

| in Year | Reserves | ||||||||

| Ended | at | ||||||||

| 12/31/2018 | 12/31/2018 | ||||||||

| (000’s) | (000’s) | ||||||||

| The Company owns nine locations | |||||||||

| currently being mined in Grandin, | |||||||||

| Ft. Myers, Keuka, Newberry, | |||||||||

| and Astatula, Florida; Columbus, | |||||||||

| Macon, and Tyrone, Georgia; | |||||||||

| and Manassas, Virginia comprising approximately 12,742 acres. | 7,704 | 449,302 | |||||||

| The Company owns four locations that | |||||||||

| are leased for mining but are not currently | |||||||||

| being mined in Marion County and Lake Louisa and Lake Sand in Lake County, | |||||||||

Florida and Forest Park Georgia comprising approximately 2,452 acres. | 0 | 73,369 | |||||||

Our mining leases do not require tenants to furnish technical report summaries that meet the requirements of Rule 1302, and the Company does not otherwise have access to the technical data required to determine precise amounts of each class of mineral resource or probable or proven resources. In accordance with Rule 1303(a)(3), the Company is providing all required information in its possession or which it can obtain without incurring an unreasonable burden or expense.

This table excludes

The Company periodically engages consultants to examine reserve estimates and geological studies conducted by tenants and their industry professionals.

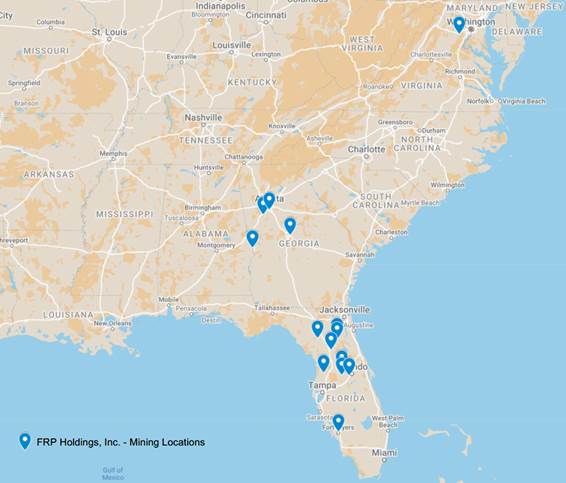

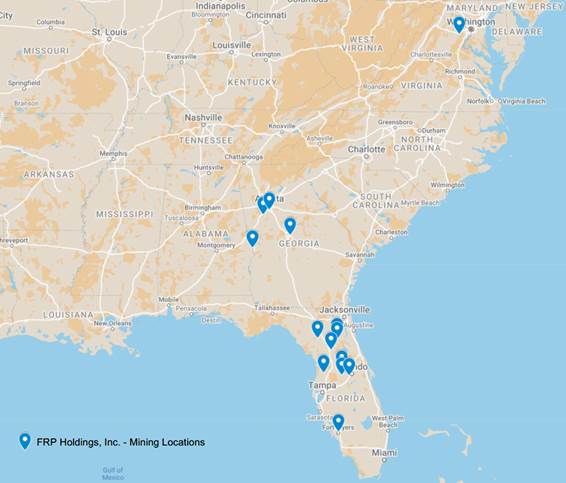

Locations. The following map presents the Brooksville,locations of the Company’s mining properties, which are discussed by segment (as reported in the Company’s financial statements) below:

Mining Properties. The Company owns a fee simple interest in 13 open pit aggregates quarries located in Florida, property,Georgia and Virginia, which comprise approximately 4,280 acres, as it was transferred on October 4, 200615,000 total acres. The Company’s quarries are subject to a joint venturemining leases with various tenants, including Vulcan Materials, Martin Marietta, Cemex, Argos, and The Concrete Company. Aggregates consist of crushed stone, sand, gravel, fill dirt, limestone and calcium and are used primarily in construction applications.

Nine of the Company’s quarries (located in Grandin, FL, Fort Myers, FL, Keuka, FL, Newberry, FL, Astatula, FL, Columbus, GA, Macon, GA, Tyrone, GA, and Manassas, VA; comprising 12,649 acres in the aggregate) are currently being mined, and four of the Company’s quarries (located in Marion County, FL, Lake Louisa, FL, and Lake Sand, FL and Forest Park, GA; comprising 2,452 acres in the aggregate) are leased but are not currently being mined. Our typical mining lease requires the tenant to pay the Company (“Vulcan Materials” or “Vulcan”)a royalty based on the number of tons of mined materials sold from our mining property during a given fiscal year multiplied by a percentage of the average annual sales price per ton sold. In certain locations, typically where the reserves on the property have been depleted but the tenant still has a need for future development.the leased land, we collect a minimum annual rental amount. In the fiscal years ended December 31, 2021, 2020 and 2019, aggregate tons sold with respect to the Company’s mining properties were approximately 7,575,000, 8,206,000 and 7,815,000, respectively.

In May 2014, the Company entered into an amendment to our lease agreementwith Vulcan for our Ft.Fort Myers location requiring that the mining be accelerated and that the mining plan be conformed to accommodate the future construction of up to 105 residential dwelling units around the mined lakes. In return, the Company agreedgranted

| 14 |

Lee County an option to sell Lee Countypurchase a right of way for a connector road that would benefit the residential area on our property and to place a conservation easement on part of the property. In Aprilproperty, which the County exercised in 2020. Mining activity commenced in 2017 following Lee County issuedCounty’s issuance of a Mine Operating Permit that permits mining activity to take place on land owned by the Company in Ft. Myers. This action fully entitled the property and allowedmine operating permit allowing Vulcan to begin production. Mining commenced in September 2017.

In November 2017, Lake County commissioners voted to approve a permit to Cemex to mine the Company’s land in Lake Louisa, Florida. The county should issueissued the mining permit duringin July 2019. After an environmental survey and completing the work necessary to prepare this site to become an active sand mine, Cemex expects to begin mining during 2020.by March 2023.

Brooksville Joint Venture. Additionally, through a joint venture with Vulcan Materials, the Company owns a 50% interest in 4,280 acres of mixed-use property in Brooksville, Florida, a portion of which comprises an aggregates quarry that is mined by Vulcan Materials. The Company entered into the joint venture in 2006 for the purpose of jointly owning and developing the land as a mixed-use community. In April 2011, the Florida Department of Community Affairs issued its final order approving the development of the project consisting of 5,800 residential dwelling units and over 600,000 square feet of commercial and 850,000 of light industrial uses. Zoning for the project was approved by the County in August 2012. Vulcan Materials still mines on the property and the Company receives 100% of the royalty on all tons sold at the Brooksville property. During 2017, the Company extended the mining lease on this property for an additional ten years (through 2032) in exchange for an increase in production of 100,000 tons by December 31, 2023. In the fiscal years ended December 31, 2021, 2020, and 2019, aggregate tons sold were approximately 280,000, 285,000 and 295,000, respectively.

Other Properties. The Company also owns an additional 107 acres of investment property in Brooksville, Florida.

Development Segment – Warehouse/Office Land.

At December 31, 2021, this segment owned the following future development parcels:

| 1) | 6 acres of horizontally developed land with 101,750 square feet in one industrial building under construction at Hollander 95 Business Park in Baltimore City, Maryland. |

| 2) | 55 acres of land that will be capable of supporting over 625,000 square feet of industrial product located at 1001 Old Philadelphia Road in Aberdeen, Maryland. |

| 3) | 17 acres of land in Harford County, Maryland that will support 250,000 square feet of industrial development. |

Development Segment – Land Held for Investment or Sale.

At December 31, 2021, this segment owned the following development parcels:

| 1) | Riverfront on the Anacostia: The Riverfront on the Anacostia property is a 5.8-acre parcel of real estate in Washington, D.C. that fronts the Anacostia River and is adjacent to the Washington Nationals Baseball Park. A revised Planned Unit Development (PUD) plan was approved in 2012 and permits the Company to develop, in four phases, a four-building, mixed-use project, containing approximately 1,161,050 square feet. The approved development includes numerous publicly accessible open spaces and a waterfront esplanade along the Anacostia River. The first phase (now known as Dock 79), which was completed through a joint venture with MRP Realty, and which consisted of a single building with residential and retail uses, became our fourth business segment in July 2017, now known as the Stabilized Joint Venture Segment. The second phase (now known as The Maren), also completed through a joint venture with MRP Realty and consists of a single building with residential and retail uses, was added to the Stabilized Joint Venture Segment effective March 31, 2021. The final two phases, Phase 3 and Phase 4 remain under a first-stage PUD approval expiring April 5, 2023, permitting 599,545 square feet of development. |

| 15 |

| 2) | Hampstead Trade Center: The Hampstead Trade Center property in Hampstead, Carroll County, Maryland is a 118-acre parcel located adjacent to the State Route 30 bypass. The parcel was previously zoned for industrial use, but our request for rezoning for residential use was approved in December 2018. Management believes this to be a higher and better use of the property. We are fully engaged in the formal process of seeking PUD entitlements for this tract, which is now known as “Hampstead Overlook”. |

| 3) | Bryant Street: On December 24, 2018 the Company and MRP Realty formed four partnerships to purchase and develop approximately five acres of land at 500 Rhode Island Ave NE, Washington, D.C. This property is the first phase of the Bryant Street Master Plan. The property is located in an Opportunity Zone, which provides tax benefits in the new communities development program as established by Congress in the Tax Cuts and Jobs Act of 2017. This first phase is a mixed-use development which supports 487 residential units and 91,661 square feet of first floor and stand-alone retail on approximately five acres of the roughly 12-acre site. Construction is complete and leasing efforts are under way. |

| 4) | 1800 Half Street: On December 20, 2019 the Company and MRP formed a joint venture to acquire and develop a mixed-use project located at 1800 Half Street, Washington, D.C. This property is located in the Buzzard Point area of Washington, DC, less than half a mile downriver from Dock 79 and the Maren. It lies directly between our two acres on the Anacostia currently under lease by Vulcan and Audi Field, the home stadium of the DC United. The project is located in an Opportunity Zone, which provides tax benefits in the new communities’ development program as established by Congress in the Tax Cuts and Jobs Act of 2017. The ten-story structure will have 344 apartments and 11,246 square feet of ground floor retail. |

| 5) | Square 664E: The Company’s Square 664E property is approximately two acres situated on the Anacostia River at the base of South Capitol Street less than half a mile down river from our Riverfront on the Anacostia property. This property is currently under lease to Vulcan Materials for use as a concrete batch plant through 2026. In March 2017, reconstruction of the bulkhead was completed at a cost of $4.2 million in anticipation of future high-rise development. |

| 6) | .408 Jackson: In December 2019, the Company entered into a joint venture with a new partner, Woodfield Development, for the acquisition and development of a mixed-use project known as “.408 Jackson” in Greenville, South Carolina. Woodfield specializes in Class-A multi-family, mixed use developments primarily in the Carolinas and DC. The project is located across the street from Greenville’s minor league baseball stadium and will hold 227 multi-family units and 4,539 square feet of retail space. It is located in an Opportunity Zone, which provides tax benefits in the new communities’ development program as established by Congress in the Tax Cuts and Jobs Act of 2017. |

| 7) | Riverside: In December 2019, the Company entered into a joint venture with Woodfield Development for the acquisition and development of a 200-unit multi-family apartment project located at 1430 Hampton Avenue, Greenville, South Carolina. The project is located in an Opportunity Zone, which provides tax benefits in the new communities’ development program as established by Congress in the Tax Cuts and Jobs Act of 2017. |

| 8) | Windlass Run: In March 2016, the Company entered into an agreement with St. Johns Properties Inc., a Baltimore development company, to jointly develop the remaining lands of our Windlass Run Business Park, located in Middle River, Maryland, into a multi-building business park consisting of approximately 329,000 square feet of single-story office space. The project will take place in several phases, with construction of the first phase, which includes two office buildings and two retail buildings totaling 100,030-square-feet (inclusive of 27,950 retail), commenced in the fourth quarter of 2017 and was completed in January 2019. At December 31, 2021 Phase I was 48.0% leased and 46.7% occupied, the subsequent phases will follow as each phase is stabilized. |

| 16 |

Stabilized Joint Venture Segment.

At December 31, 2021, this segment owned the following stabilized joint ventures:

| 1) | Dock 79: Dock 79 (Phase I of the Riverfront on the Anacostia development) is a 305-unit residential apartment building with approximately 14,430 square feet of first floor retail space. The property is situated on approximately 2.1 acres of land located on Potomac Avenue in Washington, DC, across the street from the Nationals Park. |

| 2) | The Maren: The Maren (Phase II of the Riverfront on the Anacostia development) is a 264-unit residential apartment building with 6,758 square feet of retail space. |

| 3) | DST Hickory Creek: In July 2019, the Company completed a like-kind exchange by reinvesting $6,000,000 into a Delaware Statutory Trust (DST) known as CS1031 Hickory Creek DST. The DST owns a 294-unit garden-style apartment community located in Henrico County, Virginia known as Hickory Creek, which consists of 19 three-story apartment buildings containing 273,940 rentable square feet. Hickory Creek was constructed in 1984 and substantially renovated in 2016. The Company is 26.649% beneficial owner and receives monthly distributions. |

Item 3. LEGAL PROCEEDINGS.

None.

Item 4. MINE SAFETY DISCLOSURES.

None.

| 17 |

PART II

Item 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

There were approximately 333 holders of record of FRP Holdings, Inc. common stock, $.10 par value, as of December 31, 2021. The Company's common stock is traded on the Nasdaq Stock Market (Symbol FRPH).

Price Range of Common Stock. Information concerning stock prices is included under the caption "Quarterly Results" on page 9 of the Company's 2021 Annual Report to Shareholders, and such information is incorporated herein by reference.

Dividends. The Company has not paid a cash dividend in the past and it is the present policy of the Board of Directors not to pay cash dividends. Information concerning restrictions on the payment of cash dividends is included in Note 4 to the consolidated financial statements included in the accompanying 2021 Annual Report to Shareholders, and such information is incorporated herein by reference.

Securities Authorized for Issuance Under Equity Compensation Plans. Information regarding securities authorized for issuance under equity compensation plans is included in Item 12 of Part III of this Annual Report on Form 10-K, and such information is incorporated herein by reference.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

| Total | ||||||||||||||||||

| Number of | ||||||||||||||||||

| Shares | ||||||||||||||||||

| Purchased | Approximate | |||||||||||||||||

| As Part of | Dollar Value of | |||||||||||||||||

| Total | Publicly | Shares that May | ||||||||||||||||

| Number of | Average | Announced | Yet Be Purchased | |||||||||||||||

| Shares | Price Paid | Plans or | Under the Plans | |||||||||||||||

| Period | Purchased | per Share | Programs | or Programs (1) | ||||||||||||||

| October 1 through October 31 | — | $ | — | — | $ | 9,363,000 | ||||||||||||

| November 1 through November 30 | — | $ | — | — | $ | 9,363,000 | ||||||||||||

| December 1 through December 31 | — | $ | — | — | $ | 9,363,000 | ||||||||||||

| Total | — | $ | — | — | ||||||||||||||

(1) On February 4, 2015, the Board of Directors authorized management to expend up to $5,000,000 to repurchase shares of the Company’s common stock from time to time as opportunities arise. On December 5, 2018, the Board of Directors approved a $10,000,000 increase in the Company’s stock repurchase authorization. On August 5, 2019, the Board of Directors approved a $10,000,000 increase in the Company’s stock repurchase authorization. On May 6, 2020, the Board of Directors approved a $10,000,000 increase in the Company’s stock repurchase authorization. On August 26, 2020, the Board of Directors approved a $10,000,000 increase in the Company’s stock repurchase authorization.

Item 6. [RESERVED]

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION.

Information required in response to Item 7 is included under the caption "Management’s Discussion and Analysis of Financial Condition and Results of Operation" on pages 10 through 21 of the Company’s 2021 Annual Report to Shareholders, and such information is incorporated herein by reference.

| 18 |

Item 7.A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Interest Rate Risk - We are exposed to the impact of interest rate changes through our variable-rate borrowings under our Credit Agreement with Wells Fargo.

Under the Wells Fargo Credit Agreement, the applicable margin for borrowings at December 31, 2021 was Daily 1-Month LIBOR plus 1.0%. The applicable margin for such borrowings will be increased in the event that our debt to capitalization ratio as calculated under the Wells Fargo Credit Agreement Facility exceeds a target level.

The Company did not have any variable rate debt outstanding at December 31, 2021, so a sensitivity analysis was not performed to determine the impact of hypothetical changes in interest rates on the Company’s results of operations and cash flows.

For our debt instruments with variable interest rates, changes in interest rates affect the amount of interest expense incurred. The following table presents the principal cash flow payments associated with our outstanding debt by year, weighted average interest rates on debt outstanding each year-end, and fair value of total debt as of December 31, 2021 (dollars in thousands):

| 2022 | 2023 | 2024 | 2025 | 2026 | Thereafter | Total | Fair Value | ||||||||||||||||||||||||

| Fixed rate debt | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 180,070 | $ | 180,070 | $ | 174,111 | |||||||||||||||

| Average interest for fixed rate debt | 3.03 | % | 3.03 | % | 3.03 | % | 3.03 | % | 3.03 | % | 3.03 | % | 3.03 | % | |||||||||||||||||

Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

Information required in response to this Item 8 is included under the caption "Quarterly Results" on page 9 and on pages 22 through 41 of the Company's 2021 Annual Report to Shareholders. Such information is incorporated herein by reference.

Item 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

None.

Item 9A. CONTROLS AND PROCEDURES.

CONCLUSION REGARDING THE EFFECTIVENESS OF DISCLOSURE CONTROLS AND PROCEDURES

Under the supervision and with the participation of our management, including our principal executive officer, principal financial officer and chief accounting officer, we conducted an evaluation of our disclosure controls and procedures, as such terms are defined under Rule 13a-15(e) promulgated under the Exchange Act. Based on this evaluation, our principal executive officer, our principal financial officer and our chief accounting officer concluded that our disclosure controls and procedures were effective as of the end of the period covered by this Annual Report.

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a-15(f). Under the supervision and with the participation of our management, including our principal executive officer, principal financial officer and principal accounting officer, we conducted an evaluation of the effectiveness of our internal control over

| 19 |

financial reporting based on the framework in the Internal Control-Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based on our evaluation under the framework in the Internal Control-Integrated Framework (2013), our management concluded that our internal control over financial reporting was effective as of December 31, 2021.

This Annual Report does not include an attestation report of our Independent Registered Public Accounting Firm, Hancock Askew & Co., LLP, regarding internal control over financial reporting. Management’s report was not subject to attestation by our Independent Registered Public Accounting Firm pursuant to rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this Annual Report.

CHANGE IN INTERNAL CONTROL OVER FINANCIAL REPORTING

During the fourth quarter of 2021, there were no changes in our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

INHERENT LIMITATIONS OVER INTERNAL CONTROLS

Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements for external purposes in accordance with generally accepted accounting principles. Our internal control over financial reporting includes those policies and procedures that:

| i. | pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets; |

| ii. | provide reasonable assurance that transactions are recorded as necessary to permit preparation of consolidated financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of our management and directors; and |

| iii. | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the consolidated financial statements. |

Internal control over financial reporting cannot provide absolute assurance of achieving financial reporting objectives because of its inherent limitations, including the possibility of human error and circumvention by collusion or overriding of controls. Accordingly, even an effective internal control system may not prevent or detect material misstatements on a timely basis. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions or that the degree of compliance with the policies or procedures may deteriorate.

ITEM 9B. OTHER INFORMATION.

None.

ITEM 9C. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS.

Not applicable.

| 20 |

PART III

Item 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

The Company has adopted a Financial Code of Ethical Conduct applicable to its principal executive officers, principal financial officers and principal accounting officers. A copy of this Financial Code of Ethical Conduct is filed as Exhibit 14 to this Form 10-K. The Financial Code of Ethical Conduct is also available on our web site at www.frpdev.com/investor-relations/corporate-governance/.

The rest of the information required in response to this Item 10 is included under the captions “Board of Directors & Corporate Governance”, “Our Executive Officers”, “Securities Ownership” in the Company's Proxy Statement, and such information is incorporated herein by reference. The Proxy Statement will be filed with the Securities and Exchange Commission not later than March 31, 2022.

Item 11. EXECUTIVE COMPENSATION.

Information required in response to this Item 11 is included under the caption “Executive Compensation” in the Company's Proxy Statement, and such information is incorporated herein by reference. The Proxy Statement will be filed with the Securities and Exchange Commission not later than March 31, 2022.

Item 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

Equity Compensation Plan Information

| Number of Securities | ||||||||

| remaining available | ||||||||

| Number of Securities | for future issuance | |||||||

| to be issued upon | Weighted average | under equity | ||||||

| exercise of | exercise price of | compensation plans | ||||||

| outstanding options, | outstanding options, | (excluding securities | ||||||

| warrants and rights | warrants and rights | reflected in column (a)) | ||||||

| Plan Category | (a) | (b) | (c) | |||||

| Equity compensation plans | ||||||||

| approved by security holders | 154,532 | (1) | $ | 37.93 | (2) | 403,499 | (1) | |

| Equity compensation plans | ||||||||

| not approved by security holders | 0 | 0 | 0 | |||||

| Total | 154,532 | $ | 37.93 | 403,499 |

| 1. | Column (a) includes 150,829 stock options granted under our 2016 Equity Incentive Plan and 2006 Stock Incentive Plan and 3,703 performance share awards granted under our 2016 Equity Incentive Plan. Each performance share award shown in the table represents a right to receive, subject to the satisfaction of certain performance criteria and the recipient’s continued service to the Company, a number of shares of restricted stock, which number will be calculated after the applicable performance period by dividing the pre-determined value of each award by the closing price of our common stock on the date the restricted stock is issued. The aggregate value of the performance share awards shown in table is $215,000. For illustrative purposes, the maximum |

| 21 |

payout of the performance share awards has been assumed, and the number of performance share awards has been calculated using our closing stock price on March 2, 2022 ($58.06). The performance share awards are subject to partial or complete forfeiture if the vesting criteria are not met. Because some or all of the performance share awards may not vest, and because the number of shares of restricted stock to be issued thereunder is dependent on future stock prices, columns (a) and (c) may overstate or understate expected dilution.

| 2. | Because there is no exercise price associated with the performance share awards, the weighted-average exercise price does not take the performance share awards into account. |

The remainder of the information required in response to this Item 12 is included under the captions “Securities Ownership” in the Company's Proxy Statement, and such information is incorporated herein by reference. The Proxy Statement will be filed with the Securities and Exchange Commission not later than March 31, 2022.

Item 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

Information required in response to this Item 13 is included under the captions “Related Party Transactions” and “Board of Directors & Corporate Governance” in the Company's Proxy Statement, and such information is incorporated herein by reference. The Proxy Statement will be filed with the Securities and Exchange Commission not later than March 31, 2022.

Item 14. PRINCIPAL ACCOUNTING FEES AND SERVICES.

Our independent registered accounting firm is Hancock Askew & Co., LLP, Jacksonville, Florida, Firm 794. Information required in response to this Item 14 is included under the captions “Proposal 2: The Auditor Proposal” in the Company’s Proxy Statement, and such information is incorporated herein by reference. The Proxy Statement will be filed with the Securities and Exchange Commission not later than March 31, 2022.

PART IV

Item 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULE.

(a) (1) Financial Statements.

The response to this item is submitted as a separate section. See Index to Financial Statements on page 27 of this Form 10-K.

(3) Exhibits.

The response to this item is submitted as a separate section. See Exhibit Index on pages 25 through 26 of this Form 10-K.

Item 16. FORM 10-K SUMMARY.

None.

| 22 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| FRP Holdings, Inc. | ||||

Date: March 30, 2022 | By | JOHN D. BAKER II | ||

| John D. Baker II | ||||

| Chief Executive Officer | ||||

| (Principal Executive Officer) | ||||

| By | JOHN D. BAKER, III | |||

| John D. Baker, III | ||||

| Treasurer and Chief Financial Officer | ||||

| (Principal Financial Officer) | ||||

| By | JOHN D. KLOPFENSTEIN | |||

| John D. Klopfenstein | ||||

| Controller and Chief Accounting | ||||

| Officer (Principal Accounting Officer) | ||||

| 23 |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities indicated on March 30, 2022.

/s/ John D. Baker II John D. Baker II Executive Chairman and Chief Executive Officer | /s/ Charles E. Commander III Charles E. Commander III Director |

| (Principal Executive Officer) | |

/s/ John D. Baker, III John D. Baker, III Treasurer and Chief Financial Officer (Principal Financial Officer) | /s/ H. W. Shad III H. W. Shad III Director |

/s/ John D. Klopfenstein John D. Klopfenstein Controller and Chief Accounting Officer (Principal Accounting Officer) | /s/ Martin E. Stein, Jr. Martin E. Stein, Jr. Director |

/s/ William H. Walton William H. Walton Director | /s/Margaret Wetherbee Margaret Wetherbee Director |

| 24 |

FRP HOLDINGS, INC.

FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2021

EXHIBIT INDEX

| Item | 15(a)(3) |

| 25 |

| 26 |

FRP HOLDINGS, INC.

INDEX TO FINANCIAL STATEMENTS

(Item 15(a) (1) and 2))

| Page | ||||

| Consolidated Financial Statements: | ||||

| Consolidated balance sheets at December 31, 2021 and 2020 | 54 | |||

| For the years ended December 31, 2021, 2020 and 2019 | ||||

| Consolidated statements of income | 52 | |||

| Consolidated statements of comprehensive income | 53 | |||