P&G and Tredegar have had a successful long-term relationship based on cooperation, product innovation and continuous process improvement. The loss or significant reduction in sales associated with P&G would have a material adverse effect on our business.

Research and Development and Intellectual Property. Film Products has technical centers in Richmond, Virginia; Terre Haute, Indiana; Chieti, Italy; and Shanghai, China; and holds 189 issued patents (73 of which are issued in the U.S.) and 110 trademarks (10 of which are issued in the U.S.). Expenditures for research and development (“R&D”) have averaged $7.4 million annually over the past three years. Aluminum Extrusions

The William L. Bonnell Company, Inc. and its subsidiaries (together, "Aluminum Extrusions") produce soft-alloy aluminum extrusions primarily for building and construction, distribution, transportation, machinery and equipment, electrical and consumer durables markets.

Aluminum Extrusions manufactures mill (unfinished), anodized (coated) and painted aluminum extrusions for sale directly to fabricators and distributors that use our extrusions to produce window components, curtain walls and storefronts, tub and shower doors, industrial and agricultural machinery and equipment, ladders, bus bars, automotive parts, snowmobiles and tractor-trailer shapes, among other products. Sales are made primarily in the United States and Canada, principally east of the Rocky Mountains. Aluminum Extrusions competes primarily on the basis of product quality, service and price.

Aluminum Extrusions sales volume by market segment over the last three years is shown below:

| | | | | | by Market Segment | | | | | 2006 | | 2005 | | 2004 | | | Building and construction: | | | | | | | | | Commercial | | | 48 | | | 44 | | | 41 | | | Residential | | | 14 | | | 18 | | | 21 | | | Distribution | | | 19 | | | 16 | | | 13 | | | Transportation | | | 9 | | | 9 | | | 10 | | | Machinery and equipment | | | 5 | | | 6 | | | 7 | | | Electrical | | | 3 | | | 4 | | | 5 | | | Consumer durables | | | 2 | | | 3 | | | 3 | | | Total | | | 100 | | | 100 | | | 100 | |

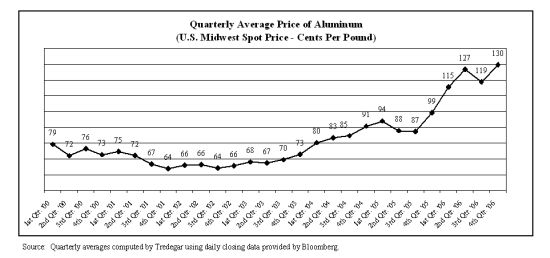

Raw Materials. The primary raw materials used by Aluminum Extrusions consist of aluminum ingot, aluminum scrap and various alloys, which are purchased from domestic and foreign producers in open-market purchases and under short-term contracts. We believe there will be an adequate supply of aluminum and other required raw materials and supplies in the immediate future.

Intellectual Property. Aluminum Extrusions holds two U.S. patents and two U.S. trademarks.

General

Patents, Licenses and Trademarks. Tredegar considers patents, licenses and trademarks to be of significance for Film Products. We routinely apply for patents on significant developments in this business. Our patents have remaining terms ranging from 1 to 19 years. We also have licenses under patents owned by third parties.

Research and Development. Tredegar’s spending for R&D activities in 2006, 2005 and 2004 was related to Film Products and AFBS, Inc. (formerly known as Therics, Inc.). R&D spending at Film Products was approximately $8.1 million in 2006, $6.6 million in 2005 and $7.5 million in 2004.

On June 30, 2005, substantially all of the assets of AFBS, a wholly-owned subsidiary of Tredegar, were sold or assigned to a newly-created limited liability company, Therics, LLC, controlled and managed by an individual not affiliated with Tredegar. AFBS received a 17.5% equity interest in Therics, LLC, valued at $170,000 and a 3.5% interest in Theken Spine, LLC, valued at $800,000, along with potential future payments based on the sale of certain products by Therics, LLC. AFBS had operating losses of $3.5 million during the first six months of 2005 and $9.8 million in 2004. There was no R&D spending at AFBS in 2006. R&D spending at AFBS was approximately $2.4 million in 2005 and $7.8 million in 2004.

Backlog. Backlogs are not material to our operations.

Government Regulation. Laws concerning the environment that affect or could affect our domestic operations include, among others, the Clean Water Act, the Clean Air Act, the Resource Conservation Recovery Act, the Occupational Safety and Health Act, the National Environmental Policy Act, the Toxic Substances Control Act, the Comprehensive Environmental Response, Compensation and Liability Act ("CERCLA"), as amended, regulations promulgated under these acts, and any other federal, state or local laws or regulations governing environmental matters. We believe that we are in substantial compliance with all applicable laws, regulations and permits. In order to maintain substantial compliance with such standards, we may be required to incur expenditures, the amounts and timing of which are not presently determinable but which could be significant, in constructing new facilities or in modifying existing facilities.

Employees. Tredegar employed approximately 3,000 people at December 31, 2006.

Available Information and Corporate Governance Documents. Our Internet address is www.tredegar.com. We make available, free of charge through our website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such documents are electronically filed with, or furnished to, the SEC. Information filed electronically with the SEC can be accessed on its website at www.sec.gov. In addition, our Corporate Governance Guidelines, Code of Conduct and the charters of our Audit, Executive Compensation and Nominating and Governance Committees are available on our website and are available in print, without charge, to any shareholder upon request by contacting Tredegar’s Corporate Secretary at 1100 Boulders Parkway, Richmond, Virginia 23225. The information on our website is not, and shall not be deemed to be, a part of this report or incorporated into other filings we make with the SEC.

There are a number of risks and uncertainties that can have a material effect on the operating results of our businesses and our financial condition. These risk factors include, but are not limited to, the following:

General

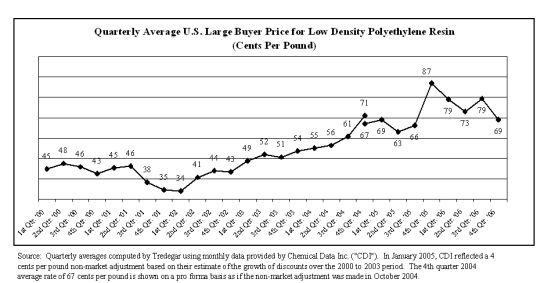

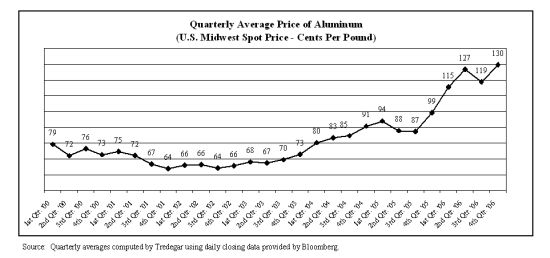

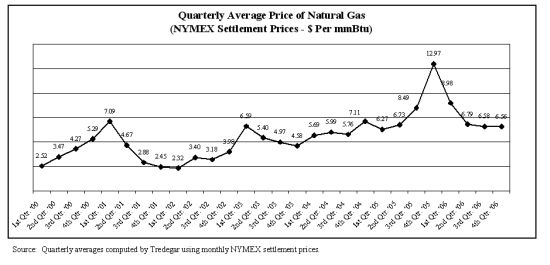

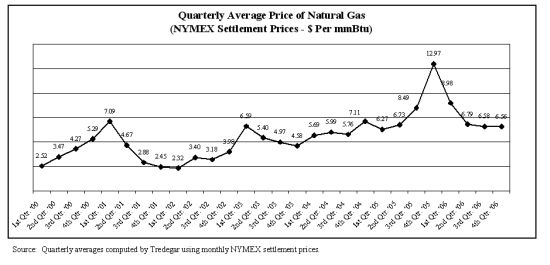

| · | Our future performance is influenced by costs incurred by our operating companies including, for example, the cost of energy and raw materials. These costs include, without limitation, the cost of resin (the raw material on which Film Products primarily depends), aluminum (the raw material on which Aluminum Extrusions primarily depends), natural gas (the principal fuel necessary for Aluminum Extrusions’ plants to operate), electricity and diesel fuel. Resin, aluminum and natural gas prices have risen significantly, and may continue to do so in the future. Tredegar attempts to mitigate the effects of increased costs through price increases and contractual pass-through provisions, but there are no assurances that higher prices can effectively be passed through to our customers or that we will be able to offset fully or on a timely basis the effects of higher raw material costs through price increases or pass-through arrangements. Further, there is no assurance that cost control efforts will be sufficient to offset any additional future declines in revenue or increases in energy, raw material or other costs. |

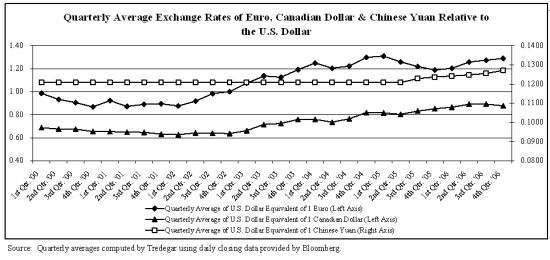

| · | Our substantial international operations subject us to risks of doing business in foreign countries, which could adversely affect our business, financial condition and results of operations. Risks inherent in international operations include the following, by way of example: changes in general economic conditions, potential difficulty enforcing agreements and intellectual property rights, staffing and managing widespread operations, restrictions on foreign trade or investment, restrictions on the repatriation of income, fluctuations in exchange rates, imposition of additional taxes on our foreign income, nationalization of private enterprises and unexpected adverse changes in foreign laws and regulatory requirements. |

| · | Non-compliance with any of the covenants in our $300 million credit facility could result in all outstanding debt under the agreement becoming due, which could have an adverse effect on our financial condition or liquidity. The credit agreement governing our credit facility contains restrictions and financial covenants that could restrict our financial flexibility. Our failure to comply with these covenants could result in an event of default, which if not cured or waived, could have an adverse effect on our financial condition and liquidity. |

Film Products

| · | Film Products is highly dependent on sales associated with one customer, P&G. P&G comprised approximately 23% of Tredegar Corporation’s net sales in 2006, 25% in 2005 and 27% in 2004. The loss or significant reduction of sales associated with P&G would have a material adverse effect on our business. See discussion beginning on page 31 regarding theOther P&G-related factors that could adversely affect our business include, by way of example, (i) failure by P&G domestic backsheet business.Researchto achieve success or maintain share in markets in which P&G sells products containing our materials, (ii) operational decisions by P&G that result in component substitution, inventory reductions and Developmentsimilar changes and Intellectual Property.(iii) delays in P&G rolling out products utilizing new technologies developed by Tredegar. While we have undertaken efforts to expand our customer base, there can be no assurance that such efforts will be successful, or that they will offset any delay or loss of sales and profits associated with P&G.

|

| · | Growth of Film Products depends on our ability to develop and deliver new products at competitive prices, especially in the personal care market. Personal care products are now being made with a variety of new materials and the overall cycle for changing materials has accelerated. While we have substantial technical centersresources, there can be no assurance that our new products can be brought to market successfully, or if brought to market successfully, at the same level of profitability and market share of replaced films. A shift in Terre Haute, Indiana; Lake Zurich, Illinois; Chieti, Italy;customer preferences away from our technologies, our inability to develop and Shanghai, China;deliver new profitable products, or delayed acceptance of our new products in domestic or foreign markets, could have a material adverse effect on our business. In the long term, growth will depend on our ability to provide innovative materials at a cost that meets our customers’ needs. |

| · | Continued growth in Film Products' sale of high value protective film products is not assured.A shift in our customers' preference to new or different products could have a material adverse effect on our sale of protective films. Similarly, a decline in consumer demand for notebook computers or liquid crystal display (LCD) monitors or a decline in the rate of growth in purchases of LCD televisions could have a significant negative impact on protective film sales. |

| · | Our inability to protect our intellectual property rights or our infringement of the intellectual property rights of others could have a significant adverse impact on Film Products. Film Products operates in a field where our significant customers and holds 53 U.S.competitors have substantial intellectual property portfolios. The continued success of this business depends on our ability not only to protect our own technologies and trade secrets, but also to develop and sell new products that do not infringe upon existing patents or threaten existing customer relationships. An unfavorable outcome in any intellectual property litigation or similar proceeding could have a significant adverse impact on Film Products. |

| · | As Film Products expands its personal care business, we have greater credit risk that is inherent in broadening our customer base. |

Aluminum Extrusions

| · | Sales volume and 15 U.S. trademarks. Expenditures for research and development (“R&D”) have averaged $7.6 million per year over the past three years.Aluminum Extrusions

profitability of Aluminum Extrusions is comprisedcyclical and highly dependent on economic conditions of The William L. Bonnell Company, Inc. and its subsidiaries (together, “Aluminum Extrusions”), which produce soft-alloy aluminum extrusions primarily for building and construction, distribution, transportation, electrical, consumer durables, and machinery and equipment markets. Aluminum Extrusions manufactures mill (unfinished), anodized (coated) and painted aluminum extrusions for sale directly to fabricators and distributors that use our extrusions to produce curtain walls, architectural shapes, tub and shower doors, window components, ladders, bus bars, tractor-trailer shapes, automotive parts and snowmobiles, among other products. Sales are made primarilyend-use markets in the United States and Canada, principally eastparticularly in the construction, distribution and transportation industries. Our market segments are also subject to seasonal slowdowns during the winter months. Because of the Rocky Mountains. Aluminum Extrusions competes primarilyhigh degree of operating leverage inherent in our operations (generally constant fixed costs until full capacity utilization is achieved), the percentage drop in operating profits in a cyclical downturn will likely exceed the percentage drop in volume. Any benefits associated with cost reductions and productivity improvements may not be sufficient to offset the adverse effects on profitability from pricing and margin pressure and higher bad debts that usually accompany a downturn. In addition, higher energy costs and the basisappreciation of the U.S. Dollar equivalent value of the Canadian Dollar can further reduce profits unless offset by price increases or cost reductions and productivity improvements.

|

| · | The markets for our products are highly competitive with product quality, service, delivery performance and price.price being the principal competitive factors. Aluminum Extrusions sales volume by market segment over the last three years is shown below: |

| |

| | | | % of Aluminum Extrusions Sales Volume

by Market Segment | |

|---|

| |

| | | | 2003

| | 2002

| | 2001

| |

|---|

| | | | Building and construction: | | | | | | | | | | | | | | | | | | | Residential | | | | 30 | | | 26 | | | 27 | | | | | | | | | Commercial | | | | 31 | | | 35 | | | 31 | | | | | | | | | Distribution | | | | 15 | | | 15 | | | 17 | | | | | | | | | Transportation | | | | 10 | | | 10 | | | 10 | | | | | | | | | Electrical | | | | 6 | | | 6 | | | 7 | | | | | | | | | Consumer durables | | | | 4 | | | 4 | | | 3 | | | | | | | | | Machinery and equipment | | | | 4 | | | 4 | | | 5 | | | | | | |

| | | | | | Total | | | | 100 | | | 100 | | | 100 | | | | | | |

| |

Raw Materials. The primary raw materials used by Aluminum Extrusions consist of aluminum ingot, aluminum scrap and various alloys, which are purchased from domestic and foreign producers in open-market purchases and under short-term contracts. We believe there will be adequate supply of aluminum and other required raw materials and supplies in the immediate future.

Intellectual Property. Aluminum Extrusions holds three U.S. patents and four U.S. trademarks.

Therics

Located in Princeton, New Jersey, Therics currently employs 44 people. Therics began developing tissue-engineered products in 1996. Its primary focus is on commercializing products made from the TheriForm®process, a unique microfabrication technology used to create precise three-dimensional products. The process creates complex scaffolds for efficacious tissue in-growth. With this technology, the company has developed and recently launched an initial family of implants used in bone grafting procedures. Bone grafting procedures are performed by orthopaedic surgeons and neurosurgeons.

2

|

Therics’ initial synthetic bone graft implants, which have received clearance from the U.S. Food and Drug Administration (the “FDA”), are made from beta-tricalcium phosphate (“(beta)-TCP”). (beta)-TCP has proven effective as a reliable bone substitutearound 1,800 customers in a variety of orthopaedicend-use markets within the broad categories of building and neurosurgical applications. Studies have shown itconstruction, distribution, transportation, machinery and equipment, electrical and consumer durables. No single customer exceeds 4% of Aluminum Extrusion’s net sales. Due to be equivalent to or better than autograft in healing defects. Unlike other materials that may remainthe diverse customer mix across many end-use markets, we believe the industry generally tracks the real growth of the overall economy (historical cross-cycle volume growth has been in the body for3% range).

|

| During improving economic conditions, excess industry capacity is absorbed and pricing pressure becomes less of a factor in many of our end-use markets. Conversely, during an extended periodeconomic slowdown, excess industry capacity often drives increased pricing pressure in many end-use markets as competitors protect their position with key customers. Because the business is susceptible to these changing economic conditions, Aluminum Extrusions targets complex, customized, service-intensive business with more challenging requirements which is competitively more defensible compared to higher volume, standard extrusion applications. |

| Foreign imports, primarily from China, represent a growing portion of time, the body resorbs (beta)-TCP as bone healing occurs, providing a conduit for bone formation without impeding the body’s abilityNorth American aluminum extrusion market. Foreign competition to heal. Therics alsodate has been primarily large volume, standard extrusion profiles that impact some of our less strategic end-use markets. Market share erosion in other end-use markets human demineralized bone matrix (“DBM”) powder and allograft implantsremains possible.

|

| There can be no assurance that it purchases from approved tissue donor banks. DBM and other bio-additives are typically mixed and used as filler and may be used in conjunction with other bone grafting materials to induce bone in-growth. Therics expects to offer bone grafting implants made from a unique and proprietary combination of DBM and (beta)-TCP later in 2004. We expect this new product will further improve the opportunity for bone in-growth. Sales for the orthobiologics market in the U.S., which includes bone substitutes, allograft bone/tissue, tissue-engineered substances and growth factors/bone proteins, was projected by Millennium Research Group to grow to $1.4 billion by 2006 from $706 million in 2002. Sales for the segment of this market most comparable to Therics’ initial family of bone grafting implants and DBM powder were estimated at $401 million in 2002. Therics products are sold through a network of independent sales representatives.

We believe therewe will be adequate supply of (beta)-TCP in the immediate future. There are a limited number of suppliers of DBMable to maintain current margins and we currentlyprofitability. Our continued success and prospects depend on the largest of the concerns for our source of supply. A disruption of DBM supply would adversely affect our ability to meet sales goals.

Therics relies on a combination of patent, trademark, copyrightretain existing customers and trade secret laws to protect the company’s proprietary technologies and products. Therics owns or holds exclusive rights to 34 issued patents and has more than 32 U.S. and foreign patent applications pending. Therics spent approximately $11.2 millionparticipate in 2003, $12.5 million in 2002 and $13 million in 2001 on R&D activities.

Therics had no revenues and an operating loss of $11.7 million in 2003, revenues of $208,000 and an operating loss of $13.1 million in 2002 and revenues of $450,000 and an operating loss of $12.9 million in 2001. Revenues recognized by Therics to date relate entirely to payments received for R&D support. As of December 31, 2003, Tredegar had invested approximately $65 million in Therics. Therics’ identifiable assets included in Tredegar’s consolidated balance sheet were $8.9 million at December 31, 2003, including goodwill and intangible assets of $4.7 million. Therics also has future rental commitments under noncancelable operating leases through 2011 (most of which contain sublease options) totaling $11.1 million at December 31, 2003.

overall industry cross-cycle growth. |

| Patents, Licenses and Trademarks. Tredegar considers patents, licenses and trademarks to be of significance for UNRESOLVED STAFF COMMENTS

|

None.

General

Most of the improved real property and the other assets used in our operations are owned, and none of the owned property is subject to an encumbrance that is material to our consolidated operations. We consider the plants, warehouses and other properties and assets owned or leased by us to be in generally good condition.

We believe that the capacity of our plants is adequate to meet our immediate needs. Our plants generally have operated at 50-95% of capacity. Our corporate headquarters, which is leased, is located at 1100 Boulders Parkway, Richmond, Virginia 23225.

Our principal plants and facilities are listed below:

Film Products and Therics. We routinely apply for patents on significant developments in each of these businesses. Our patents have remaining terms ranging from 1 to 17 years. We also have licenses under patents owned by third parties. Research and Development. Tredegar spent approximately $18.8 million in 2003, $20.3 million in 2002 and $20.3 million in 2001 on R&D activities related to continuing operations.Backlog. Backlogs are not material to our operations.

Government Regulation. Laws concerning the environment that affect or could affect our domestic operations include, among others, the Clean Water Act, the Clean Air Act, the Resource Conservation Recovery Act, the Occupational Safety and Health Act, the National Environmental Policy Act, the Toxic Substances Control Act, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), as amended, regulations promulgated under these acts, and any other federal, state or local laws or regulations governing environmental matters. We believe that we are in substantial compliance with all applicable laws, regulations and permits. In order to maintain substantial compliance with such standards, we may be required to incur expenditures, the amounts and timing of which are not presently determinable but which could be significant, in constructing new facilities or in modifying existing facilities.

3

|

Employees. Tredegar employed approximately 3,000 people at December 31, 2003.

Available Information and Corporate Governance Documents.Our Internet address iswww.tredegar.com. We make available, free of charge through our web site, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such documents are electronically filed with, or furnished to, the SEC. In addition, our Corporate Governance Guidelines, Code of Conduct and the charters of our Audit, Executive Compensation and Nominating and Governance Committees are available on our web site and are available in print, without charge, to any shareholder upon request by contacting Tredegar’s Corporate Secretary at 1100 Boulders Parkway, Richmond, Virginia 23225.

|

General

Most of the improved real property and the other assets used in our operations are owned, and none of the owned property is subject to an encumbrance that is material to our consolidated operations. We consider the plants, warehouses and other properties and assets owned or leased by us to be in generally good condition.

We believe that the capacity of our plants is adequate to meet our immediate needs. Our plants generally have operated at 50-95% of capacity. Our corporate headquarters is located at 1100 Boulders Parkway, Richmond, Virginia 23225.

Our principal plants and facilities are listed below:

|

Film Products

| | Principal Operations

| Locations in the United States

Lake Zurich, Illinois Pottsville, Pennsylvania Red Springs, North Carolina (leased) Richmond, Virginia (technical center) (leased) Terre Haute, Indiana (technical center and production facility) | | Locations in Foreign Countries

| | LaGrange, Georgia

Lake Zurich, Illinois (technical

center and production

facility)

New Bern, North Carolina

(closing in 2004)

Pottsville, Pennsylvania

Terre Haute, Indiana

(technical center and

production facility) | Chieti, Italy (technical center)

Guangzhou, China

Kerkrade, The Netherlands

Rétság, Hungary

Roccamontepiano, Italy

San Juan, Argentina

São Paulo, Brazil

Shanghai, China | | Principal Operations Production of plastic films

nonwovens and laminate materials |

Aluminum Extrusions

| | Principal Operations

| Locations in the United States

Carthage, Tennessee Kentland, Indiana Newnan, Georgia | | Locations in Canada

| | Carthage, Tennessee

Kentland, Indiana

Newnan, Georgia | Aurora, Ontario

Pickering, Ontario

Richmond Hill, Ontario

Ste Thérèse, Québec

Woodbridge, Ontario (leased) | | Principal Operations Production of aluminum extrusions, fabrication and finishing |

ThericsItem 3. Therics leases space in Princeton, New Jersey.

4

| LEGAL PROCEEDINGS |

On June 23, 2005, the United States Environmental Protection Agency, Region 4 (“EPA”), issued an Administrative Order (Docket No. CAA-04-2005-1838, the “Order”) under the Clean Air Act (as amended from time to time, the “Act”) alleging certain violations by Aluminum Extrusions’ Carthage, Tennessee facility of the refrigerant management regulations promulgated pursuant to the Act. The Order alleged that the violations occurred primarily in 2002 and 2003.

The Order required Aluminum Extrusions to either replace the cooling system at issue or retrofit it with an EPA approved non-ozone depleting substance. The Order further required Aluminum Extrusions to comply with certain applicable provisions of the Act and to provide certified documentation verifying compliance with the Order. Aluminum Extrusions was required to comply with all terms of the Order within 180 days from issuance.

Aluminum Extrusions fulfilled all obligations imposed by the Order during 2005, and reported that fact in a letter to the EPA dated October 25, 2005. Although Aluminum Extrusions has not admitted any violations to the EPA pursuant to the Order, Aluminum Extrusions elected to replace the affected cooling system and incurred related replacement costs of approximately $110,000.

Pursuant to a Consent Agreement and Final Order (“CAFO”) that became effective May 9, 2006, Aluminum Extrusions (i) paid a civil penalty of $30,422 and (ii) undertook a supplemental environmental project ("SEP") in an amount of at least $208,170 ("Minimum SEP Expenditure"). The CAFO requires that the SEP be fully implemented within one year of the CAFO's effective date. On July 6, 2006, Aluminum Extrusions completed the SEP at a cost of $296,432. Management sent a report to the EPA in the fourth quarter of 2006 indicating that it believes that the SEP was completed in a satisfactory and timely manner. If, however, the EPA rules that the SEP was not completed satisfactorily or failed to spend at least the Minimum SEP Expenditure, Aluminum Extrusions could be responsible under the CAFO for additional penalties of up to $91,000.

A consent order was entered into by the Environmental Protection Division, Department of Natural Resources, State of Georgia and The William L. Bonnell Company relating to alleged violations of the conditions and limitations contained in the National Pollutant Discharge Elimination System Permit No. GA0000507 (the “Permit”) for our wastewater treatment facility in Newnan, Georgia. The consent order was in effect through December 31, 2003. We agreed to pay penalties until the Permit issues associated with our wastewater treatment facility were resolved. We believe that the issues have been resolved and expect aggregate payments under the consent order to equal $160,000 (paid over a period ranging from the third quarter of 2001 to the first quarter of 2004).

|

Item 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

None.

Item 5. | MARKET FOR TREDEGAR’S COMMON EQUITY, AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Prices of Common Stock and Shareholder Data

Our common stock is traded on the New York Stock Exchange (“NYSE”) under the ticker symbol TG. We have no preferred stock outstanding. There were 39,286,079 shares of common stock held by 3,482 shareholders of record on December 31, 2006. The following table shows the reported high and low closing prices of our common stock by quarter for the past two years.

| | | | | | | | | 2006 | | 2005 | | | | | High | | Low | | High | | Low | | | First quarter | | $ | 16.65 | | $ | 13.06 | | $ | 20.19 | | $ | 16.08 | | | Second quarter | | | 16.89 | | | 13.84 | | | 17.56 | | | 14.52 | | | Third quarter | | | 16.94 | | | 14.39 | | | 16.67 | | | 12.09 | | | Fourth quarter | | | 23.32 | | | 16.31 | | | 13.16 | | | 11.76 | |

The closing price of our common stock on February 20, 2007 was $23.86.

Dividend Information

We have paid a dividend every quarter since becoming a public company in July 1989. During 2006, 2005 and 2004, our quarterly dividend was 4 cents per share. All decisions with respect to the declaration and payment of dividends will be made by the Board of Directors in its sole discretion based upon earnings, financial condition, anticipated cash needs, restrictions in our credit agreement and such other considerations as the Board deems relevant. See Note 8 beginning on page 59 for the restrictions contained in our credit agreement related to minimum shareholders’ equity required and aggregate dividends permitted.

Issuer Purchases of Equity Securities

During 2006, 2005 and 2004, we did not purchase any shares of our common stock in the open market. Under a standing authorization from our board of directors announced on August 8, 2006, we may purchase up to 5 million shares in the open market or in privately negotiated transactions at prices management deems appropriate.

Annual Meeting

Our annual meeting of shareholders will be held on May 17, 2007, beginning at 9:00 a.m. EDT at Lewis Ginter Botanical Garden, 1800 Lakeside Avenue, Richmond, Virginia, 23229. We expect to mail formal notice of the annual meeting, proxies and proxy statements to shareholders on or about March 28, 2007.

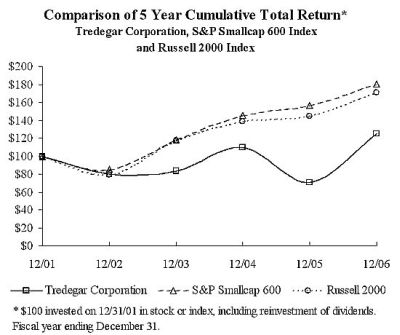

Comparative Tredegar Common Stock Performance

The following graph compares cumulative total shareholder returns for Tredegar, the S&P 600 Stock Index (an index comprised of companies with market capitalizations similar to Tredegar) and the Russell 2000 Index for the five years ended December 31, 2006. Tredegar is part of both the S&P SmallCap 600 Index and Russell 2000 Index. Inquiries

Inquiries concerning stock transfers, dividends, dividend reinvestment, consolidating accounts, changes of address, or lost or stolen stock certificates should be directed to:

National City Bank Dept. 5352 Corporate Trust Operations P.O. Box 92301 Cleveland, Ohio 44101-4301 Phone: 800-622-6757 E-mail: shareholder.inquiries@nationalcity.com All other inquiries should be directed to:

Tredegar Corporation Investor Relations Department 1100 Boulders Parkway Richmond, Virginia 23225 Phone: 800-411-7441 E-mail: invest@tredegar.com Web site: www.tredegar.com

Quarterly Information

We do not generate or distribute quarterly reports to shareholders. Information on quarterly results can be obtained from our website. In addition, we file quarterly, annual and other information electronically with the SEC, which can be accessed on its website at www.sec.gov.

Market Prices of Common Stock and Shareholder Data Our common stock is traded on the New York Stock Exchange under the ticker symbol TG. We have no preferred stock outstanding. There were 38,176,821 shares of common stock held by 4,547 shareholders of record on December 31, 2003.

The following table shows the reported high and low closing prices of our common stock by quarter for the past two years.

|

| |

| | | | 2003

| | 2002

| |

|---|

| | High

| | Low

| | High

| | Low

| |

|---|

| | | | First quarter | | | $ | 15.08 | | $ | 10.60 | | $ | 19.75 | | $ | 16.85 | | | | | | | | | Second quarter | | | | 15.67 | | | 11.96 | | | 24.72 | | | 18.90 | | | | | | | | | Third quarter | | | | 16.76 | | | 14.03 | | | 23.07 | | | 16.25 | | | | | | | | | Fourth quarter | | | | 16.52 | | | 14.62 | | | 17.65 | | | 12.25 | | | | | | |

| |

Dividend Information

We have paid a dividend every quarter since becoming a public company in July 1989. During 2001, 2002 and 2003, our quarterly dividend was 4 cents per share.

All decisions with respect to payment of dividends will be made by the Board of Directors based upon earnings, financial condition, anticipated cash needs and such other considerations as the Board deems relevant. See Note 8 beginning on page 57 for minimum shareholders’ equity required and aggregate dividends permitted.

5

|

Annual Meeting

Our annual meeting of shareholders will be held on April 29, 2004, beginning at 9:30 a.m. EDT at the University of Richmond’s Jepson Alumni Center in Richmond, Virginia. We expect to mail formal notice of the annual meeting, proxies and proxy statements to shareholders on or about March 8, 2004.

Inquiries

Inquiries concerning stock transfers, dividends, dividend reinvestment, consolidating accounts, changes of address, or lost or stolen stock certificates should be directed to:

National City Bank

Dept. 5352

Corporate Trust Operations

P.O. Box 92301

Cleveland, Ohio 44193-0900

Phone: 800-622-6757

E-mail: shareholder.inquiries@nationalcity.com

All other inquiries should be directed to:

Tredegar Corporation

Investor Relations Department

1100 Boulders Parkway

Richmond, Virginia 23225

Phone: 800-411-7441

E-mail: invest@tredegar.com

Web site: www.tredegar.com

Quarterly Information

We do not generate or distribute quarterly reports to shareholders. Information on quarterly results can be obtained from our web site and from quarterly reports on Form 10-Q filed with the SEC.

|

Legal Counsel

| Independent Registered Public Accounting Firm | Hunton & Williams LLP

Richmond, Virginia | Independent Accountants

PricewaterhouseCoopers LLP

Richmond, Virginia |

The tables that follow on pages 7-13 present certain selected financial and segment information for the eight years ended December 31, 2003.

6

|

The tables that follow on pages 10-16 present certain selected financial and segment information for the eight years ended December 31, 2006. EIGHT-YEAR SUMMARY | | | | | | | | | | | | | Tredegar Corporation and Subsidiaries | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Years Ended December 31 | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | | (In Thousands, Except Per-Share Data) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Results of Operations (a): | | | | | | | | | | | | | | | Sales | | $ | 1,116,525 | | $ | 956,969 | | $ | 861,165 | | $ | 738,651 | | $ | 753,724 | | $ | 779,157 | | $ | 879,475 | | $ | 828,015 | | | Other income (expense), net | | | 1,444 | (b) | | (544 | ) (c) | | 15,604 | (d) | | 7,853 | | | 546 | | | 1,255 | | | 1,914 | | | 972 | | | | | | 1,117,969 | | | 956,425 | | | 876,769 | | | 746,504 | | | 754,270 | | | 780,412 | | | 881,389 | | | 828,987 | | | Cost of goods sold | | | 944,839 | (b) | | 810,621 | (c) | | 717,120 | (d) | | 606,242 | | | 582,658 | | | 618,323 | | | 706,817 | | | 648,254 | | | Freight | | | 28,096 | | | 24,691 | | | 22,398 | | | 18,557 | | | 16,319 | | | 15,580 | | | 17,125 | | | 15,221 | | | Selling, general & administrative expenses | | | 68,360 | (b) | | 64,723 | (c) | | 60,030 | (d) | | 53,341 | | | 52,252 | | | 47,954 | | | 47,321 | | | 44,675 | | | Research and development expenses | | | 8,088 | | | 8,982 | | | 15,265 | | | 18,774 | | | 20,346 | | | 20,305 | | | 15,305 | | | 11,500 | | | Amortization of intangibles | | | 149 | | | 299 | | | 330 | | | 268 | | | 100 | | | 4,914 | | | 5,025 | | | 3,430 | | | Interest expense | | | 5,520 | | | 4,573 | | | 3,171 | | | 6,785 | | | 9,352 | | | 12,671 | | | 17,319 | | | 9,088 | | | Asset impairments and costs associated with exit and disposal activities | | | 4,080 | (b) | | 16,334 | (c) | | 22,973 | (d) | | 11,426 | (e) | | 3,884 | (f) | | 16,935 | (g) | | 23,791 | (h) | | 4,628 | (i) | | Unusual items | | | - | | | - | | | - | | | 1,067 | (e) | | (6,147 | ) (f) | | (971 | ) (g) | | (762 | ) (h) | | - | | | | | | 1,059,132 | | | 930,223 | | | 841,287 | | | 716,460 | | | 678,764 | | | 735,711 | | | 831,941 | | | 736,796 | | | Income from continuing operations before income taxes | | | 58,837 | | | 26,202 | | | 35,482 | | | 30,044 | | | 75,506 | | | 44,701 | | | 49,448 | | | 92,191 | | | Income taxes | | | 20,636 | (b) | | 9,973 | | | 9,222 | (d) | | 10,717 | | | 26,881 | | | 13,950 | (g) | | 18,135 | | | 32,728 | | | Income from continuing operations (a) | | | 38,201 | | | 16,229 | | | 26,260 | | | 19,327 | | | 48,625 | | | 30,751 | | | 31,313 | | | 59,463 | | | Discontinued operations (a): | | | | | | | | | | | | | | | | | | | | | | | | | | | Income (loss) from venture capital investment activities | | | - | | | - | | | 2,921 | | | (46,569 | ) | | (42,428 | ) | | (16,627 | ) | | 83,640 | | | (4,626 | ) | | Income (loss) from operations of Molecumetics | | | - | | | - | | | - | | | 891 | | | (8,728 | ) | | (5,768 | ) | | (3,577 | ) | | (2,189 | ) | | Income from discontinued energy segment | | | - | | | - | | | - | | | - | | | - | | | 1,396 | | | - | | | - | | | Income (loss) from discontinued operations (a) | | | - | | | - | | | 2,921 | | | (45,678 | ) | | (51,156 | ) | | (20,999 | ) | | 80,063 | | | (6,815 | ) | | Net income (loss) | | $ | 38,201 | | $ | 16,229 | | $ | 29,181 | | $ | (26,351 | ) | $ | (2,531 | ) | $ | 9,752 | | $ | 111,376 | | $ | 52,648 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Diluted earnings (loss) per share: | | | | | | | | | | | | | | | | | | | | | | | | | | | Continuing operations (a) | | $ | .98 | | $ | .42 | | $ | .68 | | $ | .50 | | $ | 1.25 | | $ | .79 | | $ | .80 | | $ | 1.54 | | | Discontinued operations (a) | | | - | | | - | | | .08 | | | (1.19 | ) | | (1.32 | ) | | (.54 | ) | | 2.06 | | | (.18 | ) | | Net income (loss) | | $ | .98 | | $ | .42 | | $ | .76 | | $ | (.69 | ) | $ | (.07 | ) | $ | .25 | | $ | 2.86 | | $ | 1.36 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Refer to notes to financial tables on page 16. | | | | | | | | | | |

| EIGHT-YEAR SUMMARY |

| | Tredegar Corporation and Subsidiaries | | | | Years Ended December 31 | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | | 1997 | | 1996 | |

|---|

|

|---|

| (In thousands, except per-share data) |

|---|

| | | Results of Operations (a): | | | | | | | | | | | | | | | | | | | | | | | | | | | | Sales | | | $ | 738,651 | | $ | 753,724 | | $ | 779,157 | | $ | 879,475 | | $ | 828,015 | | $ | 705,024 | | $ | 586,466 | | $ | 530,063 | | | Other income (expense), net | | | | 7,853 | | | 546 | | | 1,255 | | | 1,914 | | | 972 | | | 1,749 | | | 3,135 | | | 2,109 | |

| | | | | | 746,504 | | | 754,270 | | | 780,412 | | | 881,389 | | | 828,987 | | | 706,773 | | | 589,601 | | | 532,172 | |

| | Cost of goods sold | | | | 606,242 | | | 582,658 | | | 618,323 | | | 706,817 | | | 648,254 | | | 553,184 | | | 457,896 | | | 417,014 | | | Freight | | | | 18,557 | | | 16,319 | | | 15,580 | | | 17,125 | | | 15,221 | | | 10,946 | | | 8,045 | | | 6,548 | | | Selling, general & administrative expenses | | | | 53,341 | | | 52,252 | | | 47,954 | | | 47,321 | | | 44,675 | | | 37,127 | | | 36,659 | | | 39,477 | | | Research and development expenses | | | | 18,774 | | | 20,346 | | | 20,305 | | | 15,305 | | | 11,500 | | | 5,995 | | | 6,475 | | | 4,708 | | | Amortization of intangibles | | | | 268 | | | 100 | | | 4,914 | | | 5,025 | | | 3,430 | | | 205 | | | 50 | | | 256 | | | Interest expense | | | | 6,785 | | | 9,352 | | | 12,671 | | | 17,319 | | | 9,088 | | | 1,318 | | | 1,952 | | | 2,176 | | | Plant shutdowns, asset impairments | | | | and restructurings | | | | 11,426 | (b) | | 3,884 | (c) | | 16,935 | (d) | | 23,791 | (e) | | 4,628 | (f) | | 664 | (g) | | — | | | 1,288 | (i) | | Unusual items | | | | 1,067 | (b) | | (6,147 | )(c) | | (971 | )(d) | | (762 | )(e) | | — | | | (765 | )(g) | | (2,250 | )(h) | | (12,715 | )(i) |

| | | | | | 716,460 | | | 678,764 | | | 735,711 | | | 831,941 | | | 736,796 | | | 608,674 | | | 508,827 | | | 458,752 | |

| | Income from continuing operations | | | | before income taxes | | | | 30,044 | | | 75,506 | | | 44,701 | | | 49,448 | | | 92,191 | | | 98,099 | | | 80,774 | | | 73,420 | | | Income taxes | | | | 10,717 | | | 26,881 | | | 13,950 | (d) | | 18,135 | | | 32,728 | | | 32,094 | (g) | | 28,339 | | | 25,553 | |

| | Income from continuing operations (a) | | | | 19,327 | | | 48,625 | | | 30,751 | | | 31,313 | | | 59,463 | | | 66,005 | | | 52,435 | | | 47,867 | |

| | Discontinued operations (a): | | | | Income (loss) from venture capital | | | | investment activities | | | | (46,569 | ) | | (42,428 | ) | | (16,627 | ) | | 83,640 | | | (4,626 | ) | | 394 | | | 8,883 | | | 1,369 | | | Income (loss) from operations of Molecumetics | | | | 891 | | | (8,728 | ) | | (5,768 | ) | | (3,577 | ) | | (2,189 | ) | | (2,243 | ) | | (2,872 | ) | | (4,201 | ) | | Income from discontinued energy segment | | | | — | | | — | | | 1,396 | | | — | | | — | | | 4,713 | | | — | | | — | |

| | Income (loss) from discontinued operations (a) | | | | (45,678 | ) | | (51,156 | ) | | (20,999 | ) | | 80,063 | | | (6,815 | ) | | 2,864 | | | 6,011 | | | (2,832 | ) |

| | Net income (loss) | | | $ | (26,351 | ) | $ | (2,531 | ) | $ | 9,752 | | $ | 111,376 | | $ | 52,648 | | $ | 68,869 | | $ | 58,446 | | $ | 45,035 | |

| | | | | | Diluted earnings (loss) per share: | | | | Continuing operations (a) | | | $ | .50 | | $ | 1.25 | | $ | .79 | | $ | .80 | | $ | 1.54 | | $ | 1.71 | | $ | 1.33 | | $ | 1.22 | | | Discontinued operations (a) | | | | (1.19 | ) | | (1.32 | ) | | (.54 | ) | | 2.06 | | | (.18 | ) | | .07 | | | .15 | | | (.07 | ) |

| | Net income (loss) | | | $ | (.69 | ) | $ | (.07 | ) | $ | .25 | | $ | 2.86 | | $ | 1.36 | | $ | 1.78 | | $ | 1.48 | | $ | 1.15 | |

|

Refer to notes to financial tables on page 13.

7

|

EIGHT-YEAR SUMMARY | | | | | | | | | | | Tredegar Corporation and Subsidiaries | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Years Ended December 31 | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | | (In Thousands, Except Per-Share Data) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Share Data: | | | | | | | | | | | | | | | | | | | Equity per share | | $ | 13.15 | | $ | 12.53 | | $ | 12.45 | | $ | 11.72 | | $ | 12.08 | | $ | 12.53 | | $ | 13.07 | | $ | 9.88 | | | Cash dividends declared per share | | | .16 | | | .16 | | | .16 | | | .16 | | | .16 | | | .16 | | | .16 | | | .16 | | | Weighted average common shares outstanding during the period | | | 38,671 | | | 38,471 | | | 38,295 | | | 38,096 | | | 38,268 | | | 38,061 | | | 37,885 | | | 36,992 | | | Shares used to compute diluted earnings per share during the period | | | 38,931 | | | 38,597 | | | 38,507 | | | 38,441 | | | 38,869 | | | 38,824 | | | 38,908 | | | 38,739 | | | Shares outstanding at end of period | | | 39,286 | | | 38,737 | | | 38,598 | | | 38,177 | | | 38,323 | | | 38,142 | | | 38,084 | | | 37,661 | | | Closing market price per share: | | | | | | | | | | | | | | | | | | | | | | | | | | | High | | | 23.32 | | | 20.19 | | | 20.25 | | | 16.76 | | | 24.72 | | | 21.70 | | | 32.00 | | | 32.94 | | | Low | | | 13.06 | | | 11.76 | | | 13.00 | | | 10.60 | | | 12.25 | | | 15.30 | | | 15.00 | | | 16.06 | | | End of year | | | 22.61 | | | 12.89 | | | 20.21 | | | 15.53 | | | 15.00 | | | 19.00 | | | 17.44 | | | 20.69 | | | Total return to shareholders (j) | | | 76.6 | % | | (35.4 | )% | | 31.2 | % | | 4.6 | % | | (20.2 | )% | | 9.9 | % | | (14.9 | )% | | (7.3 | )% | | | | | | | | | | | | | | | | | | | | | | | | | | | | Financial Position: | | | | | | | | | | | | | | | | | | | | | | | | | | | Total assets | | | 781,787 | | | 781,758 | | | 769,474 | | | 753,025 | | | 837,962 | | | 865,031 | | | 903,768 | | | 792,487 | | | Cash and cash equivalents | | | 40,898 | | | 23,434 | | | 22,994 | | | 19,943 | | | 109,928 | | | 96,810 | | | 44,530 | | | 25,752 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Income taxes recoverable from sale of venture capital portfolio | | | - | | | - | | | - | | | 55,000 | | | - | | | - | | | - | | | - | | | Debt | | | 62,520 | | | 113,050 | | | 103,452 | | | 139,629 | | | 259,280 | | | 264,498 | | | 268,102 | | | 270,000 | | | Shareholders' equity (net book value) | | | 516,595 | | | 485,362 | | | 480,442 | | | 447,399 | | | 462,932 | | | 477,899 | | | 497,728 | | | 372,228 | | | Equity market capitalization (k) | | | 888,256 | | | 499,320 | | | 780,066 | | | 592,889 | | | 574,845 | | | 724,706 | | | 664,090 | | | 779,112 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Refer to notes to financial tables on page 16. | | | | | | | | | | | | | | | |

| EIGHT-YEAR SUMMARY |

| | Tredegar Corporation and Subsidiaries | | |

|---|

| Years Ended December 31 | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | | 1997 | | 1996 | |

|---|

|

|---|

| (In thousands, except per-share data) |

|---|

| | | Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | Equity per share | | | $ | 11.72 | | $ | 12.08 | | $ | 12.53 | | $ | 13.07 | | $ | 9.88 | | $ | 8.46 | | $ | 7.34 | | $ | 5.79 | | | Cash dividends declared per share | | | | .16 | | | .16 | | | .16 | | | .16 | | | .16 | | | .15 | | | .11 | | | .09 | | | Weighted average common shares outstanding during the period | | | | 38,096 | | | 38,268 | | | 38,061 | | | 37,885 | | | 36,992 | | | 36,286 | | | 36,861 | | | 36,624 | | | Shares used to compute diluted earnings | | | | per share during the period | | | | 38,441 | | | 38,869 | | | 38,824 | | | 38,908 | | | 38,739 | | | 38,670 | | | 39,534 | | | 39,315 | | | Shares outstanding at end of period | | | | 38,177 | | | 38,323 | | | 38,142 | | | 38,084 | | | 37,661 | | | 36,661 | | | 37,113 | | | 36,714 | | | Closing market price per share: | | | | High | | | | 16.76 | | | 24.72 | | | 21.70 | | | 32.00 | | | 32.94 | | | 30.67 | | | 24.65 | | | 15.13 | | | Low | | | | 10.60 | | | 12.25 | | | 15.30 | | | 15.00 | | | 16.06 | | | 16.13 | | | 12.54 | | | 6.83 | | | End of year | | | | 15.53 | | | 15.00 | | | 19.00 | | | 17.44 | | | 20.69 | | | 22.50 | | | 21.96 | | | 13.38 | | | Total return to shareholders (j) | | | | 4.6 | % | | (20.2 | )% | | 9.9 | % | | (14.9 | )% | | (7.3 | )% | | 3.1 | % | | 65.0 | % | | 87.8 | % | | | | | | Financial Position: | | | | Total assets | | | | 753,025 | | | 837,962 | | | 865,031 | | | 903,768 | | | 792,487 | | | 457,178 | | | 410,937 | | | 341,077 | | | Cash and cash equivalents | | | | 19,943 | | | 109,928 | | | 96,810 | | | 44,530 | | | 25,752 | | | 25,409 | | | 120,065 | | | 101,261 | | | Income taxes recoverable from sale of | | | | venture capital portfolio | | | | 55,000 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | Debt | | | | 139,629 | | | 259,280 | | | 264,498 | | | 268,102 | | | 270,000 | | | 25,000 | | | 30,000 | | | 35,000 | | | Shareholders’ equity (net book value) | | | | 447,399 | | | 462,932 | | | 477,899 | | | 497,728 | | | 372,228 | | | 310,295 | | | 272,546 | | | 212,545 | | | Equity market capitalization (k) | | | | 592,889 | | | 574,845 | | | 724,706 | | | 664,090 | | | 779,112 | | | 824,873 | | | 814,940 | | | 491,050 | |

|

SEGMENT TABLES Tredegar Corporation and Subsidiaries | Net Sales (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Segment | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | | (In Thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Film Products | | $ | 511,169 | | $ | 460,277 | | $ | 413,257 | | $ | 365,501 | | $ | 376,904 | | $ | 382,740 | | $ | 380,202 | | $ | 342,300 | | | Aluminum Extrusions | | | 577,260 | | | 471,749 | | | 425,130 | | | 354,593 | | | 360,293 | | | 380,387 | | | 479,889 | | | 461,241 | | | AFBS (formerly Therics) | | | - | | | 252 | | | 380 | | | - | | | 208 | | | 450 | | | 403 | | | 161 | | | Total ongoing operations (m) | | | 1,088,429 | | | 932,278 | | | 838,767 | | | 720,094 | | | 737,405 | | | 763,577 | | | 860,494 | | | 803,702 | | | Divested operations (a): | | | | | | | | | | | | | | | | | | | | | | | | | | | Fiberlux | | | - | | | - | | | - | | | - | | | - | | | - | | | 1,856 | | | 9,092 | | | Total net sales | | | 1,088,429 | | | 932,278 | | | 838,767 | | | 720,094 | | | 737,405 | | | 763,577 | | | 862,350 | | | 812,794 | | | Add back freight | | | 28,096 | | | 24,691 | | | 22,398 | | | 18,557 | | | 16,319 | | | 15,580 | | | 17,125 | | | 15,221 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Sales as shown in Consolidated Statements of Income | | $ | 1,116,525 | | $ | 956,969 | | $ | 861,165 | | $ | 738,651 | | $ | 753,724 | | $ | 779,157 | | $ | 879,475 | | $ | 828,015 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Refer to notes to financial tables on page 16. | | | | | | | | | |

Refer to notes to financial tables on page 13.

8

|

SEGMENT TABLES Tredegar Corporation and Subsidiaries Operating Profit | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Segment | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | | (In Thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Film Products: | | | | | | | | | | | | | | | | | | | | | | | | | | | Ongoing operations | | $ | 57,645 | | $ | 44,946 | | $ | 43,259 | | $ | 45,676 | | $ | 72,307 | | $ | 61,787 | | $ | 47,112 | | $ | 59,554 | | | Plant shutdowns, asset impairments and restructurings, net of gains on sale of assets and related income from LIFO inventory liquidations | | | 221 | (b) | | (3,955 | ) (c) | | (10,438 | ) (d) | | (5,746 | ) (e) | | (3,397 | ) (f) | | (9,136 | ) (g) | | (22,163 | ) (h) | | (1,170 | ) (i) | | Unusual items | | | - | | | - | | | - | | | - | | | 6,147 | (f) | | - | | | - | | | - | | | Aluminum Extrusions: | | | | | | | | | | | | | | | | | | | | | | | | | | | Ongoing operations | | | 22,031 | | | 19,302 | | | 22,637 | | | 15,117 | | | 27,304 | | | 25,407 | | | 52,953 | | | 56,501 | | | Plant shutdowns, asset impairments and restructurings, net of gains on sale of assets | | | (1,434 | ) (b) | | 122 | (c) | | (10,553 | ) (d) | | (644 | ) (e) | | (487 | ) (f) | | (7,799 | ) (g) | | (1,628 | ) (h) | | - | | | Gain on sale of land | | | | | | | | | - | | | 1,385 | | | - | | | - | | | - | | | - | | | Other | | | - | | | - | | | 7,316 | (d) | | - | | | - | | | - | | | - | | | - | | | AFBS (formerly Therics): | | | | | | | | | | | | | | | | | | | | | | | | | | | Ongoing operations | | | - | | | (3,467 | ) | | (9,763 | ) | | (11,651 | ) | | (13,116 | ) | | (12,861 | ) | | (8,024 | ) | | (5,235 | ) | | Loss on investment in Therics, LLC | | | (25 | ) | | (145 | ) | | - | | | - | | | - | | | - | | | - | | | - | | | Plant shutdowns, asset impairments and restructurings | | | (637 | ) (b) | | (10,318 | ) (c) | | (2,041 | ) (d) | | (3,855 | ) (e) | | - | | | - | | | - | | | (3,458 | ) (i) | | Unusual items | | | - | | | - | | | - | | | (1,067 | ) (e) | | - | | | - | | | - | | | - | | | Divested operations (a): | | | | | | | | | | | | | | | | | | | | | | | | | | | Fiberlux | | | - | | | - | | | - | | | - | | | - | | | - | | | (264 | ) | | 57 | | | Unusual items | | | - | | | - | | | - | | | - | | | - | | | - | | | 762 | (h) | | - | | | Total | | | 77,801 | | | 46,485 | | | 40,417 | | | 39,215 | | | 88,758 | | | 57,398 | | | 68,748 | | | 106,249 | | | Interest income | | | 1,240 | | | 586 | | | 350 | | | 1,183 | | | 1,934 | | | 2,720 | | | 2,578 | | | 1,419 | | | Interest expense | | | 5,520 | | | 4,573 | | | 3,171 | | | 6,785 | | | 9,352 | | | 12,671 | | | 17,319 | | | 9,088 | | | Gain on sale of corporate assets | | | 56 | | | 61 | | | 7,560 | | | 5,155 | | | - | | | - | | | - | | | 712 | | | Loss from write-down of investment in Novalux | | | - | (b) | | 5,000 | (c) | | - | | | - | | | - | | | - | | | - | | | - | | | Stock option-based compensation costs | | | 970 | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | Corporate expenses, net | | | 13,770 | | | 11,357 | | | 9,674 | | | 8,724 | (e) | | 5,834 | | | 2,746 | (g) | | 4,559 | | | 7,101 | | | Income from continuing operations before income taxes | | | 58,837 | | | 26,202 | | | 35,482 | | | 30,044 | | | 75,506 | | | 44,701 | | | 49,448 | | | 92,191 | | | Income taxes | | | 20,636 | (b) | | 9,973 | | | 9,222 | | | 10,717 | | | 26,881 | | | 13,950 | (g) | | 18,135 | | | 32,728 | | | Income from continuing operations | | | 38,201 | | | 16,229 | | | 26,260 | | | 19,327 | | | 48,625 | | | 30,751 | | | 31,313 | | | 59,463 | | | Income (loss) from discontinued operations (a) | | | - | | | - | | | 2,921 | | | (45,678 | ) | | (51,156 | ) | | (20,999 | ) | | 80,063 | | | (6,815 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Net income (loss) | | $ | 38,201 | | $ | 16,229 | | $ | 29,181 | | $ | (26,351 | ) | $ | (2,531 | ) | $ | 9,752 | | $ | 111,376 | | $ | 52,648 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Refer to notes to financial tables on page 16. | | | | | | | | | |

| SEGMENT TABLES | | Tredegar Corporation and Subsidiaries | | | | Net Sales (l) |

| | | | Segment | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | | 1997 | | 1996 | |

|---|

|

|---|

| (In thousands) |

|---|

| | | Film Products | | | $ | 365,501 | | $ | 376,904 | | $ | 382,740 | | $ | 380,202 | | $ | 342,300 | | $ | 286,965 | | $ | 298,862 | | $ | 257,306 | | | Aluminum Extrusions | | | | 354,593 | | | 360,293 | | | 380,387 | | | 479,889 | | | 461,241 | | | 395,455 | | | 266,585 | | | 219,044 | | | Therics | | | | — | | | 208 | | | 450 | | | 403 | | | 161 | | | — | | | — | | | — | |

| | Total ongoing operations (n) | | | | 720,094 | | | 737,405 | | | 763,577 | | | 860,494 | | | 803,702 | | | 682,420 | | | 565,447 | | | 476,350 | | | Divested operations (a): | | | | Fiberlux | | | | — | | | — | | | — | | | 1,856 | | | 9,092 | | | 11,629 | | | 10,596 | | | 10,564 | | | Molded Products | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 21,131 | | | Brudi | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 13,380 | | | Other (m) | | | | — | | | — | | | — | | | — | | | — | | | 29 | | | 2,378 | | | 2,090 | |

| | Total net sales | | | | 720,094 | | | 737,405 | | | 763,577 | | | 862,350 | | | 812,794 | | | 694,078 | | | 578,421 | | | 523,515 | | | Add back freight | | | | 18,557 | | | 16,319 | | | 15,580 | | | 17,125 | | | 15,221 | | | 10,946 | | | 8,045 | | | 6,548 | |

| | Sales as shown in Consolidated | | | | Statements of Income | | | $ | 738,651 | | $ | 753,724 | | $ | 779,157 | | $ | 879,475 | | $ | 828,015 | | $ | 705,024 | | $ | 586,466 | | $ | 530,063 | |

|

SEGMENT TABLES Tredegar Corporation and Subsidiaries | Identifiable Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Segment | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | | (In Thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Film Products | | $ | 498,961 | | $ | 479,286 | | $ | 472,810 | | $ | 422,321 | | $ | 379,635 | | $ | 367,291 | | $ | 367,526 | | $ | 360,517 | | | Aluminum Extrusions | | | 209,395 | | | 214,374 | | | 210,894 | | | 185,336 | | | 176,631 | | | 185,927 | | | 210,434 | | | 216,258 | | | AFBS (formerly Therics) | | | 2,420 | | | 2,759 | | | 8,613 | | | 8,917 | | | 10,643 | | | 9,931 | | | 9,609 | | | 9,905 | | | Subtotal | | | 710,776 | | | 696,419 | | | 692,317 | | | 616,574 | | | 566,909 | | | 563,149 | | | 587,569 | | | 586,680 | | | General corporate | | | 30,113 | | | 61,905 | | | 54,163 | | | 61,508 | | | 52,412 | | | 40,577 | | | 30,214 | | | 22,419 | | | Income taxes recoverable from sale of venture capital investment portfolio | | | - | | | - | | | - | | | 55,000 | | | - | | | - | | | - | | | - | | | Cash and cash equivalents | | | 40,898 | | | 23,434 | | | 22,994 | | | 19,943 | | | 109,928 | | | 96,810 | | | 44,530 | | | 25,752 | | | Identifiable assets from ongoing operations | | | 781,787 | | | 781,758 | | | 769,474 | | | 753,025 | | | 729,249 | | | 700,536 | | | 662,313 | | | 634,851 | | | Divested operations (a): | | | | | | | | | | | | | | | | | | | | | | | | | | | Fiberlux | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | 7,859 | | | Discontinued operations (a): | | | | | | | | | | | | | | | | | | | | | | | | | | | Venture capital | | | - | | | - | | | - | | | - | | | 108,713 | | | 158,887 | | | 236,698 | | | 145,028 | | | Molecumetics | | | - | | | - | | | - | | | - | | | - | | | 5,608 | | | 4,757 | | | 4,749 | | | Total | | $ | 781,787 | | $ | 781,758 | | $ | 769,474 | | $ | 753,025 | | $ | 837,962 | | $ | 865,031 | | $ | 903,768 | | $ | 792,487 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Refer to notes to financial tables on page 16. | | | | | | | | | | | | | | | | | | | | | | | | | |

Refer to notes to financial tables on page 13.

9

|

SEGMENT TABLES Tredegar Corporation and Subsidiaries | Depreciation and Amortization | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Segment | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | | (In Thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Film Products | | $ | 31,847 | | $ | 26,673 | | $ | 21,967 | | $ | 19,828 | | $ | 20,085 | | $ | 22,047 | | $ | 23,122 | | $ | 18,751 | | | Aluminum Extrusions | | | 12,323 | | | 11,484 | | | 10,914 | | | 10,883 | | | 10,506 | | | 11,216 | | | 9,862 | | | 9,484 | | | AFBS (formerly Therics) | | | - | | | 437 | | | 1,300 | | | 1,641 | | | 463 | | | 2,262 | | | 1,782 | | | 1,195 | | | Subtotal | | | 44,170 | | | 38,594 | | | 34,181 | | | 32,352 | | | 31,054 | | | 35,525 | | | 34,766 | | | 29,430 | | | General corporate | | | 111 | | | 195 | | | 241 | | | 270 | | | 353 | | | 329 | | | 315 | | | 253 | | | Total ongoing operations | | | 44,281 | | | 38,789 | | | 34,422 | | | 32,622 | | | 31,407 | | | 35,854 | | | 35,081 | | | 29,683 | | | Divested operations (a): | | | | | | | | | | | | | | | | | | | | | | | | | | | Fiberlux | | | - | | | - | | | - | | | - | | | - | | | - | | | 151 | | | 498 | | | Discontinued operations (a): | | | | | | | | | | | | | | | | | | | | | | | | | | | Venture capital | | | - | | | - | | | - | | | - | | | - | | | - | | | 18 | | | 22 | | | Molecumetics | | | - | | | - | | | - | | | - | | | 527 | | | 2,055 | | | 1,734 | | | 1,490 | | | Total | | $ | 44,281 | | $ | 38,789 | | $ | 34,422 | | $ | 32,622 | | $ | 31,934 | | $ | 37,909 | | $ | 36,984 | | $ | 31,693 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Capital Expenditures, Acquisitions and Investments | | | | | | | | | | | | | | | | | | | | | | | | Segment | | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | | | 2000 | | | 1999 | | | (In Thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Film Products | | $ | 33,168 | | $ | 50,466 | | $ | 44,797 | | $ | 57,203 | | $ | 24,063 | | $ | 24,775 | | $ | 53,161 | | $ | 25,296 | | | Aluminum Extrusions | | | 7,381 | | | 11,968 | | | 10,007 | | | 8,293 | | | 4,799 | | | 8,506 | | | 21,911 | | | 16,388 | | | AFBS (formerly Therics) | | | - | | | 36 | | | 275 | | | 219 | | | 1,621 | | | 2,340 | | | 1,730 | | | 757 | | | Subtotal | | | 40,549 | | | 62,470 | | | 55,079 | | | 65,715 | | | 30,483 | | | 35,621 | | | 76,802 | | | 42,441 | | | General corporate | | | 24 | | | 73 | | | 572 | | | 93 | | | 60 | | | 519 | | | 384 | | | 606 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Capital expenditures for ongoing operations | | | 40,573 | | | 62,543 | | | 55,651 | | | 65,808 | | | 30,543 | | | 36,140 | | | 77,186 | | | 43,047 | | | Divested operations (a): | | | | | | | | | | | | | | | | | | | | | | | | | | | Fiberlux | | | - | | | - | | | - | | | - | | | - | | | - | | | 425 | | | 812 | | | Discontinued operations (a): | | | | | | | | | | | | | | | | | | | | | | | | | | | Venture capital | | | - | | | - | | | - | | | - | | | - | | | - | | | 86 | | | - | | | Molecumetics | | | - | | | - | | | - | | | - | | | 793 | | | 2,850 | | | 2,133 | | | 1,362 | | | Total capital expenditures | | | 40,573 | | | 62,543 | | | 55,651 | | | 65,808 | | | 31,336 | | | 38,990 | | | 79,830 | | | 45,221 | | | Acquisitions and other | | | - | | | - | | | 1,420 | | | 1,579 | | | - | | | 1,918 | | | 6,316 | | | 215,227 | | | Novalux investment | | | 542 | | | 1,095 | | | 5,000 | | | - | | | - | | | - | | | - | | | - | | | Venture capital investments | | | - | | | - | | | - | | | 2,807 | | | 20,373 | | | 24,504 | | | 93,058 | | | 81,747 | | | Total | | $ | 41,115 | | $ | 63,638 | | $ | 62,071 | | $ | 70,194 | | $ | 51,709 | | $ | 65,412 | | $ | 179,204 | | $ | 342,195 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Refer to notes to financial tables on page 16. | | | | | | | | | | | | | |

| SEGMENT TABLES | | Tredegar Corporation and Subsidiaries | | | | Operating Profit |

| | | | Segment | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | | 1997 | | 1996 | |

|---|

|

|---|

| (In thousands) |

|---|

| | | Film Products: | | | | | | | | | | | | | | | | | | | | | | | | | | | | Ongoing operations | | | $ | 45,676 | | $ | 72,307 | | $ | 61,787 | | $ | 47,112 | | $ | 59,554 | | $ | 53,786 | | $ | 50,463 | | $ | 43,158 | | | Plant shutdowns, asset impairments | | | | and restructurings | | | | (5,746 | )(b) | | (3,397 | )(c) | | (9,136 | )(d) | | (22,163 | )(e) | | (1,170 | )(f) | | — | | | — | | | (1,288 | )(i) | | Unusual items | | | | — | | | 6,147 | (c) | | — | | | — | | | — | | | — | | | — | | | 1,968 | (i) |

| | Aluminum Extrusions: | | | | Ongoing operations | | | | 15,117 | | | 27,304 | | | 25,407 | | | 52,953 | | | 56,501 | | | 47,091 | | | 32,057 | | | 23,371 | | | Plant shutdowns, asset impairments | | | | and restructurings | | | | (644 | )(b) | | (487 | )(c) | | (7,799 | )(d) | | (1,628 | )(e) | | — | | | (664 | )(g) | | — | | | — | | | Gain on sale of land | | | | 1,385 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | Unusual items | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | Therics: | | | | Ongoing operations | | | | (11,651 | ) | | (13,116 | ) | | (12,861 | ) | | (8,024 | ) | | (5,235 | ) | | — | | | — | | | — | | | Plant shutdowns, asset impairments | | | | and restructurings | | | | (3,855 | )(b) | | — | | | — | | | — | | | (3,458 | )(f) | | — | | | — | | | — | | | Unusual items | | | | (1,067 | )(b) | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | Divested operations (a): | | | | Fiberlux | | | | — | | | — | | | — | | | (264 | ) | | 57 | | | 1,433 | | | 845 | | | 1,220 | | | Molded Products | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,011 | | | Brudi | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 231 | | | Other (m) | | | | — | | | — | | | — | | | — | | | — | | | (428 | ) | | (267 | ) | | (118 | ) | | Unusual items | | | | — | | | — | | | — | | | 762 | (e) | | — | | | 765 | (g) | | 2,250 | (h) | | 10,747 | (i) |

| | Total | | | | 39,215 | | | 88,758 | | | 57,398 | | | 68,748 | | | 106,249 | | | 101,983 | | | 85,348 | | | 80,300 | | | Interest income | | | | 1,183 | | | 1,934 | | | 2,720 | | | 2,578 | | | 1,419 | | | 2,279 | | | 4,959 | | | 2,956 | | | Interest expense | | | | 6,785 | | | 9,352 | | | 12,671 | | | 17,319 | | | 9,088 | | | 1,318 | | | 1,952 | | | 2,176 | | | Gain on sale of corporate assets | | | | 5,155 | | | — | | | — | | | — | | | 712 | | | — | | | — | | | — | | | Corporate expenses, net | | | | 8,724 | (b) | | 5,834 | | | 2,746 | (d) | | 4,559 | | | 7,101 | | | 4,845 | | | 7,581 | | | 7,660 | |

| | Income from continuing operations | | | | before income taxes | | | | 30,044 | | | 75,506 | | | 44,701 | | | 49,448 | | | 92,191 | | | 98,099 | | | 80,774 | | | 73,420 | | | Income taxes | | | | 10,717 | | | 26,881 | | | 13,950 | (d) | | 18,135 | | | 32,728 | | | 32,094 | (g) | | 28,339 | | | 25,553 | |

| | Income from continuing operations | | | | 19,327 | | | 48,625 | | | 30,751 | | | 31,313 | | | 59,463 | | | 66,005 | | | 52,435 | | | 47,867 | | | (Loss) income from discontinued operations (a) | | | | (45,678 | ) | | (51,156 | ) | | (20,999 | ) | | 80,063 | | | (6,815 | ) | | 2,864 | | | 6,011 | | | (2,832 | ) |

| | | | | | Net income (loss) | | | $ | (26,351 | ) | $ | (2,531 | ) | $ | 9,752 | | $ | 111,376 | | $ | 52,648 | | $ | 68,869 | | $ | 58,446 | | $ | 45,035 | |

|

NOTES TO FINANCIAL TABLES

(In Thousands, Except Per-Share Data) Refer to notes to financial tables on page 13.

10

|

| SEGMENT TABLES | | Tredegar Corporation and Subsidiaries | | | | Identifiable Assets |

| | | | Segment | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | | 1997 | | 1996 | |

|---|

|

|---|

| (In thousands) |

|---|

| | | Film Products | | | $ | 422,321 | | $ | 379,635 | | $ | 367,291 | | $ | 367,526 | | $ | 360,517 | | $ | 132,241 | | $ | 123,613 | | $ | 116,520 | | | Aluminum Extrusions | | | | 185,336 | | | 176,631 | | | 185,927 | | | 210,434 | | | 216,258 | | | 201,518 | | | 101,855 | | | 83,814 | | | Therics | | | | 8,917 | | | 10,643 | | | 9,931 | | | 9,609 | | | 9,905 | | | — | | | — | | | — | |

| | Subtotal | | | | 616,574 | | | 566,909 | | | 563,149 | | | 587,569 | | | 586,680 | | | 333,759 | | | 225,468 | | | 200,334 | | | General corporate | | | | 61,508 | | | 52,412 | | | 40,577 | | | 30,214 | | | 22,419 | | | 23,905 | | | 21,357 | | | 22,608 | | | Income taxes recoverable from sale of | | | | venture capital investment portfolio | | | | 55,000 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | Cash and cash equivalents | | | | 19,943 | | | 109,928 | | | 96,810 | | | 44,530 | | | 25,752 | | | 25,409 | | | 120,065 | | | 101,261 | |

| | Identifiable assets from ongoing operations | | | | 753,025 | | | 729,249 | | | 700,536 | | | 662,313 | | | 634,851 | | | 383,073 | | | 366,890 | | | 324,203 | | | Divested operations (a): | | | | Fiberlux | | | | — | | | — | | | — | | | — | | | 7,859 | | | 7,811 | | | 6,886 | | | 6,203 | | | Other (m) | | | | — | | | — | | | — | | | — | | | — | | | — | | | 983 | | | 1,619 | | | Discontinued operations (a): | | | | Venture capital | | | | — | | | 108,713 | | | 158,887 | | | 236,698 | | | 145,028 | | | 61,098 | | | 33,628 | | | 6,141 | | | Molecumetics | | | | — | | | — | | | 5,608 | | | 4,757 | | | 4,749 | | | 5,196 | | | 2,550 | | | 2,911 | |

| | Total | | | $ | 753,025 | | $ | 837,962 | | $ | 865,031 | | $ | 903,768 | | $ | 792,487 | | $ | 457,178 | | $ | 410,937 | | $ | 341,077 | |

|

Refer to notes to financial tables on page 13.

11

|

| SEGMENT TABLES | | Tredegar Corporation and Subsidiaries | | | | Depreciation and Amortization |

| | | | Segment | 2003 | | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | | 1997 | | 1996 | |

|---|

|

|---|

| (In thousands) |

|---|

| | | Film Products | | | $ | 19,828 | | $ | 20,085 | | $ | 22,047 | | $ | 23,122 | | $ | 18,751 | | $ | 11,993 | | $ | 10,947 | | $ | 11,262 | | | Aluminum Extrusions | | | | 10,883 | | | 10,506 | | | 11,216 | | | 9,862 | | | 9,484 | | | 8,393 | | | 5,508 | | | 5,407 | | | Therics | | | | 1,641 | | | 463 | | | 2,262 | | | 1,782 | | | 1,195 | | | — | | | — | | | — | |

| | Subtotal | | | | 32,352 | | | 31,054 | | | 35,525 | | | 34,766 | | | 29,430 | | | 20,386 | | | 16,455 | | | 16,669 | | | General corporate | | | | 270 | | | 353 | | | 329 | | | 315 | | | 253 | | | 254 | | | 313 | | | 390 | |

| | Total ongoing operations | | | | 32,622 | | | 31,407 | | | 35,854 | | | 35,081 | | | 29,683 | | | 20,640 | | | 16,768 | | | 17,059 | | | Divested operations (a): | | | | Fiberlux | | | | — | | | — | | | — | | | 151 | | | 498 | | | 544 | | | 515 | | | 507 | | | Molded Products | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,261 | | | Brudi | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 550 | | | Other (m) | | | | — | | | — | | | — | | | — | | | — | | | — | | | 135 | | | 161 | | | Discontinued operations (a): | | | | Venture capital | | | | — | | | — | | | — | | | 18 | | | 22 | | | 21 | | | — | | | — | | | Molecumetics | | | | — | | | 527 | | | 2,055 | | | 1,734 | | | 1,490 | | | 1,260 | | | 996 | | | 780 | |

| | Total | | | $ | 32,622 | | $ | 31,934 | | $ | 37,909 | | $ | 36,984 | | $ | 31,693 | | $ | 22,465 | | $ | 18,414 | | $ | 20,318 | |

| | | | | | Capital Expenditures, Acquisitions and Investments |

| | | | | | Segment | | | | 2003 | | | 2002 | | | 2001 | | | 2000 | | | 1999 | | | 1998 | | | 1997 | | | 1996 | |

| | (In thousands) | | | | Film Products | | | $ | 57,203 | | $ | 24,063 | | $ | 24,775 | | $ | 53,161 | | $ | 25,296 | | $ | 18,456 | | $ | 15,354 | | $ | 11,932 | | | Aluminum Extrusions | | | | 8,293 | | | 4,799 | | | 8,506 | | | 21,911 | | | 16,388 | | | 10,407 | | | 6,372 | | | 8,598 | | | Therics | | | | 219 | | | 1,621 | | | 2,340 | | | 1,730 | | | 757 | | | — | | | — | | | — | |

| | Subtotal | | | | 65,715 | | | 30,483 | | | 35,621 | | | 76,802 | | | 42,441 | | | 28,863 | | | 21,726 | | | 20,530 | | | General corporate | | | | 93 | | | 60 | | | 519 | | | 384 | | | 606 | | | 115 | | | 28 | | | 143 | |

| | Capital expenditures for ongoing | | | | operations | | | | 65,808 | | | 30,543 | | | 36,140 | | | 77,186 | | | 43,047 | | | 28,978 | | | 21,754 | | | 20,673 | | | Divested operations (a): | | | | Fiberlux | | | | — | | | — | | | — | | | 425 | | | 812 | | | 1,477 | | | 530 | | | 417 | | | Molded Products | | | | — | | | �� | | | — | | | — | | | — | | | — | | | — | | | 1,158 | | | Brudi | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 104 | | | Other (m) | | | | — | | | — | | | — | | | — | | | — | | | — | | | 5 | | | 14 | | | Discontinued operations (a): | | | | Venture capital | | | | — | | | — | | | — | | | 86 | | | — | | | 54 | | | — | | | — | | | Molecumetics | | | | — | | | 793 | | | 2,850 | | | 2,133 | | | 1,362 | | | 3,561 | | | 366 | | | 1,594 | |

| | Total capital expenditures | | | | 65,808 | | | 31,336 | | | 38,990 | | | 79,830 | | | 45,221 | | | 34,070 | | | 22,655 | | | 23,960 | | | Acquisitions and other | | | | 1,579 | | | — | | | 1,918 | | | 6,316 | | | 215,227 | | | 72,102 | | | 13,469 | | | — | | | Venture capital investments | | | | 2,807 | | | 20,373 | | | 24,504 | | | 93,058 | | | 81,747 | | | 35,399 | | | 20,801 | | | 3,138 | |

| | Total | | | $ | 70,194 | | $ | 51,709 | | $ | 65,412 | | $ | 179,204 | | $ | 342,195 | | $ | 141,571 | | $ | 56,925 | | $ | 27,098 | |

|

Refer to notes to financial tables on page 13.

12

|

NOTES TO FINANCIAL TABLES |

| (In thousands, except per-share amounts) |

| (a) | In 2004, discontinued operations include a gain of $2,921 after-taxes primarily related to the reversal of a business and occupancy tax contingency accrual upon favorable resolution. The accrual was originally recorded in connection with our venture capital investment operation. In 2003, we sold substantially all of our venture capital investment portfolio. In 2002, we ceased operations at Molecumetics, one of our biotechnology units, and sold its tangible assets. The operating results associated with the venture capital investment portfolio and Molecumetics have been reported as discontinued operations. In 2003, discontinued operations also include a gain of $891 after-taxes on the sale of intellectual property of Molecumetics and a loss on the divestiture of the venture capital investment portfolio of $46,269 after-taxes. Discontinued operations in 2002 also include a loss on the disposal of Molecumetics of $4,875 after-taxes. In 1994, we divested our coal subsidiary, The Elk Horn Coal Corporation, and our remaining oil and gas properties. As a result of these events, we report the Energy segment as discontinued operations. In 2001, discontinued operations include a gain of $1,396 for the reversal of an income tax contingency accrual upon favorable conclusion of IRS examinations through 1997. The accrual was originally recorded in conjunction with the sale of The Elk Horn Coal Corporation. In 1998,We divested our coal subsidiary, The Elk Horn Coal Corporation, and our remaining oil and gas properties in 1994. As a result of these events, we report the Energy segment as discontinued operations include gains for the reimbursement of payments made by us to the United Mine Workers of America Combined Benefit Fund (the "Fund") and the reversal of a related accrued liability established to cover future payments to the Fund.operations. On March 28, 1996,April 10, 2000, we sold Molded Products. During the second quarter of 1996, we completed the sale of Brudi.Fiberlux. The operating results of Molded ProductsFiberlux were historically reported as part of the Plastics segment on a combined basis with Film Products and Fiberlux. Likewise, results for Brudi were combined with Aluminum Extrusions and reported as part of the Metal Products segment. Accordingly, results for Molded Products and Brudi have been included in continuing operations. We began reporting Molded Products and Brudi separately in our segment disclosures in 1995 after announcing our intent to divest these businesses. Fiberlux was sold on April 10, 2000.Products. |

| (b) | Plant shutdowns, asset impairments and restructurings for 2006 include a net gain of $1,454 associated with the shutdown of the films manufacturing facility in LaGrange, Georgia, including a gain of $2,889 for related LIFO inventory liquidations (included in "Cost of goods sold" in the consolidated statements of income) and a gain of $261 on the sale of related property and equipment (included in "Other income (expense), net" in the consolidated statements of income), partially offset by severance and other costs of $1,566 and asset impairment charges of $130, charges of $1,020 for asset impairments in Film Products, a charge of $920 related to expected future environmental costs at the aluminum extrusions facility in Newnan, Georgia (included in "Cost of goods sold" in the consolidated statements of income), charges of $727 for severance and other employee-related costs in connection with restructurings in Film Products ($213) and Aluminum Extrusions ($514), and charges of $637 related to the estimated loss on the sub-lease of a portion of the AFBS (formerly Therics) facility in Princeton, New Jersey. Income taxes in 2006 include a reversal of a valuation allowance of $577 for deferred tax assets associated with capital loss carry-forwards recorded with the write-down of the investment in Novalux in 2005. Outside appraisal of the value of corporate assets, primarily real estate, performed in December 2006, indicates that realization of related deferred tax assets is more likely than not. |