UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| | | | | |

| x | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 20172023 |

OR

| | | | | |

| ¨ | |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number 1-10258

TREDEGAR CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Virginia | | 54-1497771 |

| | |

Virginia | | 54-1497771 |

(State or other jurisdiction

of incorporation or organization)

| | (I.R.S. Employer

Identification No.)

|

| | | |

1100 Boulders Parkway, Richmond, Virginia

| | |

Richmond, | Virginia | | 23225 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 804-330-1000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock | TG | New York Stock Exchange |

Preferred Stock Purchase Rights | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ¨.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Large accelerated filer | | o | o | Accelerated filer | x | Smaller reporting company | | o |

| | | | | |

| Non-accelerated filer | | o(Do not check if a smaller reporting company) | | Emerging growth company | | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 20172023 (the last business day of the registrant’s most recently completed second fiscal quarter): $391,348,943*$278,307,771*

Number of shares of Common Stock outstanding as of January 31, 2018: 33,014,831 (33,030,190 as of June 30, 2017)

March 8, 2024: 34,430,769 | | | | | |

| |

| * | In determining this figure, an aggregate of 7,283,5497,361,458 shares of Common Stock beneficially owned by Floyd D. Gottwald, Jr., John D. Gottwald, William M. Gottwald, and James T. Gottwald and the members of their immediate families has been excluded because the shares are deemed to be held by affiliates. The aggregate market value has been computed based on the closing price in the New York Stock Exchange on June 30, 2017.2023. |

Documents Incorporated By Reference

Portions of the Tredegar Corporation Proxy Statement for the 20182024 Annual Meeting of Shareholders (the “Proxy Statement”) are incorporated by reference into Part III of this Form 10-K.

Index to Annual Report on Form 10-K

Year Ended December 31, 20172023

| | | | | | | | | | | |

| | Page |

| | | |

| | | Page |

| | | |

Part I | | | |

| Business | | | | |

| | | |

| | | |

| Properties | 1C. | | | |

| Legal Proceedings | 2. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Selected Financial Data | | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| |

*Items | 11, 13 and 14 and portions of Items 10 and 12 are incorporated by reference from the Proxy Statement. |

PART I

Item 1. BUSINESS

Description of Business

Tredegar Corporation (“Tredegar”), a Virginia corporation incorporated in 1988, is engaged, through its subsidiaries, in the manufacture of aluminum extrusions, polyethylene (“PE”) plastic films and polyester (“PET”) films and aluminum extrusions. The financial information related to Tredegar’s polyethylene plastic films, polyester films and aluminum extrusions segments and related geographical areas included in Note 5 of the Notes to Financial Statements is incorporated herein by reference.films. Unless the context requires otherwise, all references herein to “Tredegar,” “the Company,” “we,” “us” or “our” are to Tredegar Corporation and its consolidated subsidiaries.

The Company's reportable business segments are Aluminum Extrusions, PE Films and Flexible Packaging Films (also referred to as “Terphane”).

On September 1, 2023, the Company announced that it had entered into a definitive agreement to sell Terphane to Oben Group (the “Contingent Terphane Sale”). Completion of the sale is contingent upon the satisfaction of customary closing conditions, including the receipt of certain competition filing approvals by authorities in Brazil and Columbia. For more information see “Status of Current Corporate Strategic Initiatives - Agreement to Sell Terphane” in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report on Form 10-K for the year ended December 31, 2023 (“Form 10-K”).

Aluminum Extrusions.Extrusions

PE Films

PE Films manufactures plastic films, elasticsAluminum Extrusions, also referred to as Bonnell Aluminum, produces high-quality, soft and laminate materials primarily utilized in personal care materials, surface protection films,medium strength alloyed aluminum extrusions, custom fabricated and specialtyfinished, for the building and optical lighting applications. These products are manufactured atconstruction, automotive and transportation, consumer durables goods, machinery and equipment, electrical and renewable energy, and distribution markets. Bonnell Aluminum has manufacturing facilities located in the United States (“U.S.”).

Aluminum Extrusions manufactures mill (unfinished), The Netherlands, Hungary, China, Brazilmachined, anodized and India. PE Filmspainted, and thermally improved aluminum extrusions for sale directly to fabricators and distributors. It also manufactures and sells branded product lines: Futura TransitionsTM by Bonnell Aluminum (flooring trims) and TSLOTSTM by Bonnell Aluminum (structural aluminum framing systems). Aluminum Extrusions competes in all of its marketsprimarily on the basis of product innovation, quality, service and price. Sales are made predominantly in the U.S. The end-use markets for Aluminum Extrusions are cyclical and seasonal in nature.

Personal Care. Tredegar’s Personal Care unit is a global supplierThe end-uses in each of apertured, elastic and embossed films, laminate materials, and polyethylene and polypropylene overwrap films for personal care markets, including:

Aluminum Extrusions’ primary market segments include: | | | | | | | | |

| Major Markets | | End-Uses |

| • | |

| Building & construction (“B&C”)- nonresidential | | Apertured filmCommercial windows and laminate materials for use as topsheet in feminine hygiene products, baby diapersdoors, curtain walls, storefronts and adult incontinence products (including materials sold under the ComfortAire™, ComfortFeel™entrances, automatic entry doors, walkway covers, ducts, louvers and FreshFeel™ brand names);vents, office wall panels, partitions and interior enclosures, acoustical walls and ceilings, point of purchase displays, pre-engineered structures, and flooring trims (Futura TransitionsTM by Bonnell Aluminum)

|

| |

•B&C - residential | | Elastic materials for use as components for baby diapers, adult incontinence products

Residential windows and feminine hygiene products (including components sold under the ExtraFlex™doors, shower and FlexAire™ brand names); |

| tub enclosures, railing and support systems, venetian blinds, and swimming pools |

•Automotive & transportation | | Automotive and light truck structural components, battery enclosures for electric vehicles, after-market automotive accessories, grills for heavy trucks, travel trailers and recreation vehicles |

| Consumer durables | | Office furniture, pleasure boats, refrigerators and freezers, appliances and sporting goods |

| Machinery & equipment | | Three-dimensional apertured film transfer layers for baby diapersMaterial handling equipment, conveyor systems, medical equipment, industrial fans and adult incontinence products sold under the AquiDry®aluminum framing systems (TSLOTSTM by Bonnell Aluminum)

|

Distribution (metal service centers specializing in stock and AquiDry Plus™ brand names;release programs and custom fabrications to small manufacturers) | | Various custom profiles including storm shutters, pleasure boat accessories, theater set structures and various standard profiles (including rod, bar, tube and pipe) |

| Electrical & renewable energy | | Lighting fixtures, electronic apparatus, solar panel brackets and rigid and flexible conduits |

Thin-gauge films that are readily printable

Aluminum Extrusions’ net sales (sales less freight) by market segment for the years ended December 31, 2023, 2022 and convertible on conventional processing equipment for overwrap for bathroom tissue and paper towels; and

Polypropylene films for various industrial applications, including tape and automotive protection.2021 is shown below: | | | | | | | | | | | | | | | | | | | | |

% of Aluminum Extrusions Net Sales1 by Market Segment |

| | 2023 | | 2022 | | 2021 |

| B&C: | | | | | |

| Nonresidential | 56% | | 53% | | 50% |

| Residential | 8% | | 10% | | 10% |

| Automotive | 10% | | 8% | | 8% |

| Specialty: | | | | | |

| Consumer durables | 8% | | 10% | | 10% |

| Machinery & equipment | 9% | | 10% | | 8% |

| Electrical | 6% | | 4% | | 6% |

| Distribution | 3% | | 5% | | 8% |

| Total | 100% | | 100% | | 100% |

| 1. The Company uses net sales as its measure of revenues from external customers at the segment level. For more business segment information, see Note 13 “Business Segments” to the Consolidated Financial Statements included in Item 15. “Exhibits and Financial Statement Schedules” of this Form 10-K (“Item 15”). |

In 2017, 20162023, 2022 and 2015, personal care materials2021, Aluminum Extrusions net sales accounted for approximately 27%70%, 30%71% and 33%67% of Tredegar’s consolidated net sales, (sales less freight)respectively.

Open Orders. Overall open orders in Aluminum Extrusions were approximately $48.0 million, or 14 million pounds, at December 31, 2023 compared to approximately $136.0 million, or 41 million pounds, at December 31, 2022, a decrease of $88.0 million, or approximately 65%. This level is below the quarterly range of 21 to 27 million pounds in 2019 before pandemic-related disruptions that resulted in long lead times, driving a peak in open orders of approximately 100 million pounds during the first quarter of 2022. We believe that current open orders are below pre-pandemic levels due to higher interest rates, tighter lender requirements and the increase in remote working, which particularly impacts the non-residential B&C end-use market. In addition, data indicates that aluminum extrusion imports increased significantly in recent years, especially during the pandemic, and some of Aluminum Extrusions’ customers may have sourced, and continue to source, aluminum extrusions from continuing operations, respectively.producers outside the U.S. Sales volume for Aluminum Extrusions, which the Company believes is cyclical and seasonal in nature due to its end-use markets, was 138.5 million pounds in 2023, 174.7 million pounds in 2022 and 183.4 million pounds in 2021.

Surface Protection.Raw Materials. The primary raw materials used by Aluminum Extrusions consist of aluminum ingot, aluminum scrap and various alloys, which are purchased from domestic and foreign producers in open-market purchases and under annual contracts. Refer to Item 7A. "Quantitative and Qualitative Disclosures About Market Risk” of this Form 10-K (“Item 7A”) for additional information on aluminum price trends. Aluminum Extrusions believes that it has adequate supply agreements for aluminum raw materials in 2024.

PE Films

PE Films produces surface protection films, polyethylene overwrap films and films for other markets. Tredegar’s Surface Protection unit produces single- and multi-layer surface protection films sold under the UltraMask®UltraMask®, ForceField™, ForceField™ PEARL®, Pearl A™ and ForceField PEARL™Obsidian™ brand names. These films, which are manufactured at facilities in the U.S. and China, support manufacturers of optical and other specialty substrates used in high-technology applications, most notably protecting high-value components of flat panel and flexible displays used in televisions, monitors, notebooks, smart phones,smartphones, tablets, e-readers, and digital signage, semiconductors and automobiles during the manufacturing and transportation process. The Obsidian™ series of products is designed for usage in automotive applications. In 2017, 20162023, 2022 and 2015, surface protection films2021, PE Films accounted for approximately 11%, 11% and 10%, respectively,15% of Tredegar’s consolidated net sales, from continuing operations.respectively.

Bright View Technologies. Tredegar’s Bright View unit designs and manufactures a range of specialty film-based components that provide tailored functionality for the global engineered optics market. By leveraging multiple technology platforms, including film capabilities and its patented microstructure technology, Bright View offers high performance optical management solutions for a wide range of applications including LED illumination.

PE Films’ net sales by market segment over the last three years is shown below:

|

| | | | | |

| % of PE Films Net Sales by Market Segment * |

| | 2017 | | 2016 | | 2015 |

| Personal Care | 70% | | 72% | | 75% |

| Surface Protection | 28% | | 25% | | 23% |

| Bright View | 2% | | 3% | | 2% |

| Total | 100% | | 100% | | 100% |

| | | | | | |

| * See previous discussion by market segment for comparison of net sales to the Company’s consolidated net sales for significant market segments for each of the years presented. |

Raw Materials. The primary raw materials used by PE Films in polyethylene and polypropylene films are low density, linear low density and high density polyethylene and polypropylene resins. These raw materials are obtained from domestic and foreign suppliers at competitive prices. Refer to Item 7A for additional information on resin price trends. PE Films believes that there will be an adequate supply of polyethylene and polypropylene resins in the foreseeable future.

Research and Development. Tredegar’s spending for research and development (“R&D”) activities in 2023, 2022 and 2021 was primarily related to PE Films. During the third quarter of 2023, the Company adopted a plan to close the PE Films also buys polypropylene-based nonwoven fabrics based on the resins previously noted and styrenic block copolymers, and it believes theretechnical center in Richmond, VA. Future R&D activities will be an adequate supply of these raw materialsperformed at the facility in Pottsville, PA. R&D spending by the PE Films was approximately $2.9 million, $5.3 million and $5.7 million in 2023, 2022 and 2021, respectively.

Customers. PE Films’ products are sold primarily in the foreseeable future.

Customers. PE Films sells to many branded product producers throughout the world,U.S. and Asia, with the top fivefour customers, collectively, comprising 68%, 69% and 73%87% of its net sales in 2017, 20162023 and 2015, respectively. Its largest88% in 2022 and 2021. No single PE Films customer is The Procter & Gamble Company (“P&G”). Net sales to P&G totaled $122 million in 2017, $129 million in 2016 and $164 million in 2015 (these amounts include film sold to third parties that converted the film into materials used with products manufactured by P&G).exceeds 10% of Tredegar’s consolidated net sales. For additional information, see “ItemItem 1A. Risk“Risk Factors” of this Form 10-K (“Item 1A”).

Flexible Packaging Films

Flexible Packaging Films is comprised of Terphane Holdings LLC (“Terphane”). Flexible Packaging Films produces PET-based films for use in packaging applications that have specialized properties, such as heat resistance, strength, barrier protection and the ability to accept high-quality print graphics. These differentiated, high-value films are primarily manufactured in Brazil and sold in Latin America and the U.S. under the Terphane®, Sealphane® and SealphaneEcophane® brand names. Major end uses include food packaging and industrial applications. In 2017, 2016 and 2015, Flexible Packaging Films accounted for approximately 12%, 14% and 12%, respectively, of Tredegar’s consolidated net sales from continuing operations. Flexible Packaging Films competes in all of its markets on the basis of product quality, service and price. In 2023, 2022 and 2021, Terphane accounted for approximately 19%, 19% and 18% of Tredegar’s consolidated net sales, respectively.

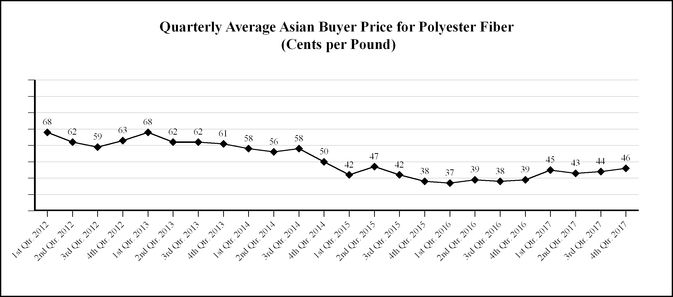

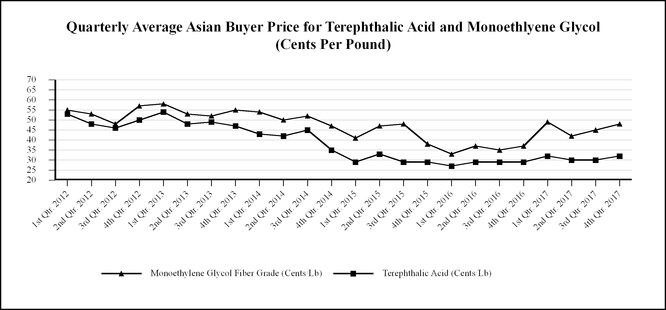

Raw Materials. The primary raw materials used by Flexible Packaging Films to produce polyester resins are purified terephthalic acid (“PTA”) and monoethylene glycol (“MEG”). Flexible Packaging Films also purchases additionalother polyester resins directly from suppliers. All of theseThese raw materials are obtained from domestic Brazilian suppliers and foreign suppliers at competitive prices. Terphane continues to monitor cost escalations to adjust selling prices as market dynamics permit and Flexible Packaging Films believes that there will be an adequate supply of polyester resins, as well as PTA and MEG in the foreseeable future.

Aluminum Extrusions

The William L. Bonnell Company, Inc., known in the industry as Bonnell Aluminum, and its operating divisions, AACOA, Inc. and Futura Industries Corporation (“Futura”) (together, “Aluminum Extrusions”), produce high-quality, soft-alloy and medium-strength aluminum extrusions primarily Refer to Item 7A for building and construction, automotive, consumer durables, machinery and equipment, electrical and distribution markets. Aluminum Extrusions manufactures mill (unfinished), anodized and painted (coated) and fabricated aluminum extrusions for sale directly to fabricators and distributors, and it competes primarilyadditional information on the basis of product quality, service and price. Futura designs and manufactures a wide range of extruded aluminum products for a number of industries and end markets, including branded flooring trims and aluminum framing systems (TSLOTSTM), as well as OEM (original equipment manufacturer) components for electronics, store fixture, transportation, medical, marine, retail, solar and other applications. Sales are made predominantly in the U.S.

On February 15, 2017, Bonnell Aluminum acquired Futura on a net debt-free basis for approximately $92 million ($87 million net of a $5 million refund expected in 2018 from an earnoutresin price adjustment mechanism). The acquisition was funded using Tredegar’s revolving credit agreement and treated as an asset purchase for U.S. federal income tax purposes. Futura, located in Clearfield, Utah, has a national sales presence and particular strength in the western U.S.

The end-uses in each of Aluminum Extrusions’ primary market segments include:

|

| | |

Major Markets | | End-Uses |

| | |

Building & construction - nonresidential | | Commercial windows and doors, curtain walls, storefronts and entrances, walkway covers, ducts, louvers and vents, office wall panels, partitions and interior enclosures, acoustical walls and ceilings, point of purchase displays, pre-engineered structures, and flooring trims |

| | |

Building & construction - residential | | Shower and tub enclosures, railing and support systems, venetian blinds, swimming pools and storm shutters |

| | |

Automotive | | Automotive and light truck structural components, spare parts, after-market automotive accessories, grills for heavy trucks, travel trailers and recreation vehicles |

| | |

Consumer durables | | Furniture, pleasure boats, refrigerators and freezers, appliances and sporting goods |

| | |

Machinery & equipment | | Material handling equipment, conveyors and conveying systems, medical equipment, and aluminum framing systems (TSLOTSTM)

|

| | |

Distribution (metal service centers specializing in stock and release programs and custom fabrications to small manufacturers) | | Various custom profiles including storm shutters, pleasure boat accessories, theater set structures and various standard profiles (including rod, bar, tube and pipe) |

| | |

Electrical | | Lighting fixtures, solar panels, electronic apparatus and rigid and flexible conduits |

Aluminum Extrusions’ net sales by market segment over the last three years is shown below:

|

| | | | | | |

| % of Aluminum Extrusions Net Sales by Market Segment* |

| | 2017 | | 2016 | | 2015 |

| Building and construction: | | | | | |

| Nonresidential | 51% | | 59% | | 59% |

| Residential | 9% | | 6% | | 6% |

| Automotive | 8% | | 9% | | 8% |

| Specialty: | | | | | |

| Consumer durables | 12% | | 11% | | 11% |

| Machinery & equipment | 7% | | 6% | | 5% |

| Electrical | 7% | | 3% | | 6% |

| Distribution | 6% | | 6% | | 5% |

| | | | | | |

| Total | 100% | | 100% | | 100% |

| *Includes Futura as of its acquisition date of February 15, 2017. |

In 2017, 2016 and 2015, nonresidential building and construction accounted for approximately 26%, 27% and 26% of Tredegar’s consolidated net sales from continuing operations, respectively.

Raw Materials. The primary raw materials used by Aluminum Extrusions consist of aluminum ingot, aluminum scrap and various alloys, which are purchased from domestic and foreign producers in open-market purchases and under short-term contracts. Aluminum Extrusions believes that it has adequate long-term supply agreements for aluminum and other required raw materials and supplies in the foreseeable future.

trends.

General

Intellectual Property. Tredegar considers patents, licenses and trademarks to be significantmaterial to PE Films. As ofOn December 31, 2017,2023, PE Films held 266 issued37 patents (63 of which are issued in the(including 6 U.S.) patents), and 10866 registered trademarks (9 of which are issued in the(including 4 U.S.) registered trademarks). Flexible Packaging Films held 1 U.S. patent which was issued in the U.S. and 1317 registered trademarks (2 of which are(including 4 U.S. registered in the U.S.)trademarks). Aluminum Extrusions held no U.S. patents and 3 U.S. registered trademarks (alltrademarks. As of which are registered in the U.S.). TheseDecember 31, 2023, these patents havehad remaining terms ranging from 1of 0.5 to 2017 years. Tredegar also has licenses under patents owned by third parties.

Research and Development. Tredegar’s spending for research and development (“R&D”) activities in 2017, 2016 and 2015 was primarily related to PE Films. PE Films has technical centers in Durham, North Carolina; Richmond, Virginia; and Terre Haute, Indiana. Flexible Packaging has a technical center in Bloomfield, New York. R&D spending by the Company was approximately $18.3 million, $19.1 million and $16.2 million in 2017, 2016 and 2015, respectively.

Backlog. Backlogs are not material to the operations in PE Films or Flexible Packaging Films. Overall backlog for continuing operations in Aluminum Extrusions was approximately $46.2 million at December 31, 2017 compared to approximately $27.1 million at December 31, 2016, an increase of $19.1 million, or approximately 70%. Backlog at December 31, 2017 included $5.7 million for Futura. Net sales for Aluminum Extrusions, which the Company believes is cyclical in nature, was $466.8 million in 2017, $360.1 million in 2016 and $375.5 million in 2015. Net sales for Futura since it was acquired on February 15, 2017 were $71.0 million.

Government Regulation.The Company’s operations are subject to various local, state, federal and foreign government regulations, including environmental, privacy and anti-corruption and anti-bribery laws and regulations.

U.S. laws concerning the environment to which the Company’s domestic operations are or may be subject to include among others, the Clean Water Act, the Clean Air Act, the Resource Conservation and Recovery Act, the Occupational Safety and Health Act, the National Environmental Policy Act, the Toxic Substances Control Act, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), regulations promulgated under these acts, and other federal, state or local laws or regulations governing environmental matters. Compliance with these laws is an important consideration because Tredegar uses hazardous materials in some of its operations, is a generator of hazardous waste, and wastewater from the Company’s operations is discharged to various types of wastewater management systems. Under CERCLA and other laws, Tredegar may be subject to financial exposure for costs associated with waste management and disposal, even if the Company fully complies with applicable environmental laws.

The U.S. Environmental Protection Agency has adopted regulations under the Clean Air Act relating to emissions of carbon dioxide and other greenhouse gases (“GHG”), including mandatory reporting and permitting requirements. Several of the Company’s manufacturing operations result in emissions of carbon dioxide or GHG and are subject to the current GHG regulations. The Company’s compliance with theseenvironmental regulations has yet to require significant expenditures. The cost of compliance with any future GHG legislation or regulations is not presently determinable, but Tredegar does not anticipate compliance to have a material adverse effect on its consolidated financial condition, results of operations and cash flows based on information currently available.

Tredegar is also subject to the governmental regulations in the countries where it conducts business.

At December 31, 2017, the Company believes that it was in substantial compliance with all applicablecapital expenditures; however, environmental laws, regulations and permits in the U.S. and other countries where it conducts business. Environmental standards tend to become more stringent over time. InTherefore, in order to maintain substantial compliancecomply with such standards,current or future environmental legislation or regulations, the Company may be requiredsubject to incur additional capital expenditures, operating expenses or other compliance costs, the amounts and timing of which are not presently determinable, but which could be significant, inincluding constructing new facilities or in modifying existing facilities. Furthermore,

Like environmental regulations, current or future privacy and anti-corruption and anti-bribery legislation or regulations may subject the Company to additional capital expenditures, operating expenses or other compliance costs, the amounts and timing of which are not presently determinable but could be significant. Any failure to comply with current or future laws and regulations, including environmental, privacy and anti-corruption and anti-bribery laws and regulations, could subject Tredegar to substantial penalties, fines, costs and expenses. For further discussion regarding certain environmental, privacy and anti-corruption and anti-bribery laws and regulations to which the Company is subject, see Item 1A below.

Human Capital Management.

Overview

Tredegar employed approximately 3,2001,900 people at December 31, 2017.2023 located in the U.S., Brazil, and Asia, of which 75% are located in the U.S. Approximately 15% of the Company’s employees are represented by labor unions located in the U.S. under various collective bargaining agreements with varying durations and expiration dates, none of which expire before 2025. All of Tredegar’s Brazilian employees are represented by a national labor union. Generally, the total number of employees of Tredegar does not significantly fluctuate throughout the year. However, acquisition or divestiture activity, or changes in the level of business activity may impact employee levels.

Health and Safety

Tredegar has continuously exceeded the industry standards for safety in each of its respective manufacturing sectors. The Company uses various forms of employee safety metrics to assess the health and safety performance of its Aluminum Extrusions, PE Films and Flexible Packaging operations, including employee safety data which is available on the Company’s website at www.tredegar.com/about-tredegar/our-broader-commitments/committed-to-our-employees/.

Additionally, Aluminum Extrusions has on-site health clinics at its Carthage and Clearfield facilities. These clinics allow Aluminum Extrusions to invest in its people, provide more personal and more thorough healthcare to employees, and enhance the employer-employee relationship. Collectively, the Carthage and Clearfield clinics serve over 600 employees.

Talent and Development

The Company believes its employees are its most valuable asset and are critical to the success of the Company. The Company seeks to retain employees by offering competitive wages, benefits and training opportunities. To assess and monitor employee retention and engagement, the Company surveys employees and takes actions to address areas of employee concern. The annual employee engagement survey results are presented to Tredegar’s Board of Directors (“Board”). Additionally, the objectives of our executive compensation programs are to attract, motivate and retain highly qualified executive officers. To accomplish these objectives, the Company relies on a pay strategy that emphasizes performance-based compensation through annual and long-term incentives. The Company believes that this pay strategy creates a strong link between pay and performance and aligns with our business strategy of generating strong operating results and shareholder value creation while controlling fixed costs.

The Company is committed to holistically supporting our employees both at work and in their communities by:

•Strictly following all applicable health, safety and non-discrimination laws in each country;

•Promoting the highest standards for employee health and safety through innovative programs; and

•Providing opportunities for community outreach and supporting programs that enhance the lives of children and families.

Inclusion and Diversity

Tredegar strictly complies with all applicable state, local and international laws governing nondiscrimination in employment in every location where Tredegar and its businesses have facilities to ensure healthy and positive working conditions. This applies to all terms and conditions of employment, including recruiting, hiring, job assignments, promotion, termination, layoff, recall, transfer, leaves of absence, compensation and training. All applicants and employees are treated with the same high level of respect regardless of their race, creed, color, religion, sex, sexual orientation, gender identity, age, pregnancy, national origin, ethnicity, political affiliation, union membership, marital status, citizenship status, veteran status, disability or other protected category. Employees who experience or witness discriminatory behavior are encouraged to report such behavior to their supervisor, Human Resources or Tredegar’s toll-free anonymous reporting hotline. Additionally, the Company spends significant resources in developing its employees. Among the five core principles of the “The Tredegar Way” that the Company uses to guide its organization, the “Leadership” principle is focused on building a team of motivated and engaged leaders at every level of the Company. Each business unit has identified specific action plans to promote the Leadership principle among its employees. Action plans include talent development, skills training, reinforcement of strong cultural values, and robust systems to ensure a safe working environment.

Information About Our Executive Officers. See Item 10. “Directors, Executive Officers and Corporate Governance” of this Form 10-K.

Available Information and Corporate Governance Documents. Tredegar’s Internetwebsite address is www.tredegar.com. The Company makes available, free of charge through its website, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after such documents are electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”). Information filed electronically with the SEC can be accessed on its website at www.sec.gov. In addition, the Company’s Corporate Governance Guidelines, Code of Conduct, and the

charters of the Audit, Executive Compensation, and Nominating and Governance Committees and Climate Change Risk Assessment and many other corporate policies are available on Tredegar’s website and are available in print without charge, to any shareholder upon request by contacting Tredegar’s Corporate Secretary at 1100 Boulders Parkway, Richmond, Virginia 23225. The information on or that can be accessed through the Company’s website is not, and shall not be deemed to be, a part of this Annual Report on Form 10-K for the year ended December 31, 2017 (“Form 10-K”) or incorporated into other filings it makes with the SEC.

Forward-looking and Cautionary Statements

Some of the information contained in this Form 10-K may constitute “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. When the Company uses the words “believe,” “estimate,” “anticipate,” “appear to,” “expect,” “project,” “plan,” “likely,” “may” and similar expressions, it does so to identify forward-looking statements. Such statements are based on the Company's then current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those addressed in the forward-looking statements. It is possible that the Company's actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in or implied by these forward-looking statements. Accordingly, you should not place undue reliance on these forward-looking statements. For risks and important factors that could cause actual results to differ from expectations, refer to the reports that Tredegar files with or furnishes the SEC from time-to-time, including the risks and important factors set forth in Item 1A. Readers are urged to review and consider carefully the disclosures Tredegar makes in the reports Tredegar files with or furnishes to the SEC. Tredegar does not undertake, and expressly disclaims any duty, to update any forward-looking statement to reflect any change in management’s expectations or any change in conditions, assumptions or circumstances on which such statements are based, except as required by applicable law.

Item 1A. RISK FACTORS

There are a number of risks and uncertainties that could have a material adverse effect on the Company’s businesses and its consolidated financial condition, results of operations or cash flows. The following risk factors should be considered, in addition to the other information included in this Form 10-K, when evaluating Tredegar and its businesses.

Risks Related to Tredegar’s Corporate Strategic Initiatives and Indebtedness

•The planned divestiture of Terphane to Oben Group is subject to a number of conditions beyond our control. On September 1, 2023, the Company announced that it had entered into a definitive agreement to sell Terphane to Oben Group. Completion of the sale is contingent upon the satisfaction of customary closing conditions, including the receipt of certain competition filing approvals by authorities in Brazil and Colombia. On October 27, 2023, the Company filed the requisite competition forms with the Administrative Council for Economic Defense (“CADE”) in Brazil, which the Company views as the primary competition authority regarding this matter. This filing followed a pre-filing phase for CADE’s initial review. CADE’s maximum deadline for completing its review is no later than November 18, 2024. The merger review regarding the transaction was cleared by the Colombian authority in early February 2024.

As usual, it cannot be predicted with certainty whether all of the required closing conditions will be satisfied, waived or if other uncertainties may arise. While the regulatory review process is ongoing and in line with the Company’s expectations, regulators could impose additional requirements or obligations as conditions for their approval, which may be burdensome. If such closing conditions are not met or additional obligations are imposed, the proposed sale may not be consummated, encounter delays, or experience other issues that are not currently anticipated.

•The Company’s failure to successfully transition to the reporting requirements for its asset-based revolving credit facility (“ABL Facility”), which matures on June 30, 2026, or an unexpected downturn in the markets could adversely impact the Company’s financial position and results of operations. On December 27, 2023, the Company entered into the ABL Facility, which provides the Company with $180 million senior secured asset-based revolving credit facility that will expire on June 30, 2026. The ABL Facility amended the Company’s existing $200 million revolving, secured credit facility that was cash flow-based. Availability under the ABL Facility is governed by a borrowing base, determined by the application of specified advance rates against eligible assets, including a portion of trade accounts receivable, inventory, cash and cash equivalents, owned real properties, and owned machinery and equipment.

A number of factors could affect the Company’s ability to successfully complete its transition from its prior cash flow-based revolving credit facility to the current asset-based facility. These factors include:

•Failure to establish processes associated with the ABL Facility’s reporting requirements, which are currently on a monthly basis but could change to a weekly cadence if at any time the borrowing availability falls below 10% of the maximum aggregate principal amount. Failure to timely report could result in an Event of Default (as defined in the ABL Facility), which if not waived, would permit the lenders, at their option, to accelerate all outstanding debt under the ABL Facility. Should the lenders elect to accelerate the debt under the ABL Facility,

a cross-default would be triggered under the Terphane Brazil Loan (as defined below in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Form 10-K (“Item 7”)).

•Because the Company is currently subject to a Cash Dominion Period (as defined in Item 7), it is required to borrow cash to fund working capital, capital expenditures, business development activity, and other general corporate purposes, which limits its financial flexibility;

•Advances on accounts receivable and inventory are subject to change based on periodic commercial finance examinations and appraisals, and the real property, machinery and equipment values included in the borrowing base are subject to change based on periodic appraisals, which could reduce borrowing availability under the ABL Facility; and

•If a Material Adverse Effect (as defined in the ABL Facility) has occurred, the Company will not be able to continue to borrow under the ABL Facility.

In addition, a significant deterioration in the Company’s accounts receivable or inventory levels due to depressed economic conditions, weak consumer spending, turmoil in the credit markets or other factors, could restrict its ability to service its indebtedness or borrow additional funds.

Upon the earlier of March 31, 2025 or the date the Company receives the proceeds from the Contingent Terphane Sale (the “ABL Adjustment Date”), borrowing availability under the ABL Facility will be reduced from $180 million to $125 million. If the Contingent Terphane Sale is not completed by the ABL Adjustment Date, the Company may have to undertake alternative financing plans, subject to the limitations imposed by the ABL Facility, including limitations on its ability to:

•refinance or restructure its indebtedness;

•sell assets; and

•raise additional capital.

The Company may be unable to implement alternative financing plans on commercially reasonable terms or at all, and any such alternative financing plans might be insufficient to allow it to make principal and interest payments on its indebtedness required as a result of the ABL Adjustment Date and the reduction of borrowing availability under the ABL Facility to $125 million. The Company’s ability to restructure or refinance its indebtedness will depend on, among other things, its existing financial condition, projections of business conditions, sales, Credit EBITDA, net cash flow, net leverage and the condition of the capital markets at such time. Any refinancing of the Company’s indebtedness could be at higher interest rates and could require it to comply with additional covenants, which could further restrict the Company’s business operations.

Noncompliance with any of the covenants of the ABL Facility could result int an Event of Default, which if not cured or waived, would permit the lenders, at their option, to accelerate all outstanding debt under the ABL Facility.

Risks Related to All Tredegar’s Businesses

•Recent macroeconomic factors, including inflation, high interest rates, recession risks and other lagging effects of the COVID-19 pandemic, have caused downturns in key markets and created other commercial disruptions, which have and could further adversely impact our businesses.Products sold to key end-use markets, including the B&C and consumer electronics markets, represent a significant portion of our revenue. Because these markets are tied closely to overall economic performance, macroeconomic factors have and could further cause changes to demand for our products. These factors include: (i) inflation; (ii) high interest rates; (iii) recession risks; (iv) disruptions to supply chains; (v) other interruptions of international and regional commerce; and (vi) other lagging effects of the COVID-19 pandemic. Price erosion may occur as competitors become more aggressive in pricing practices. To the extent that these factors reduce demand for our products, our business, financial position, results of operations and cash flows could be adversely impacted.

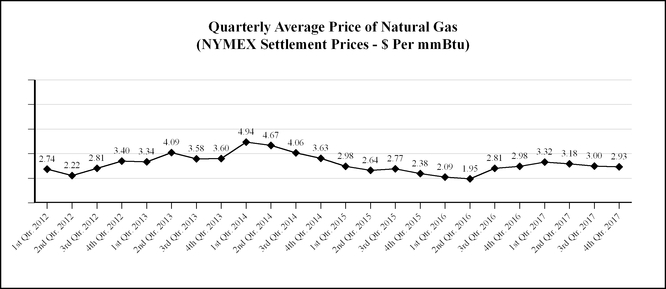

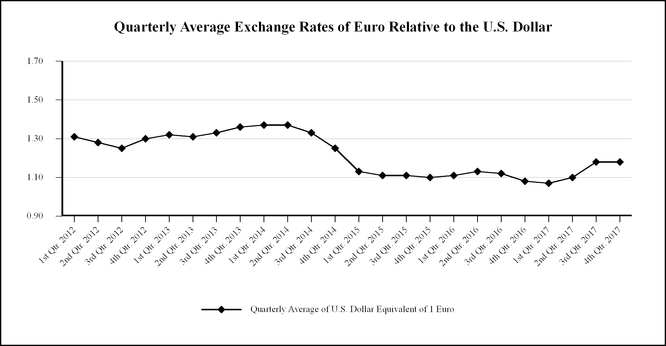

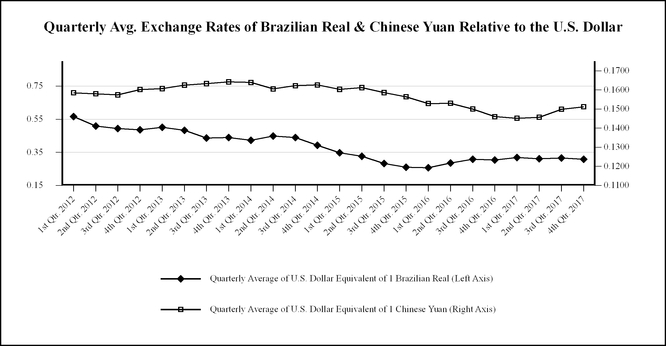

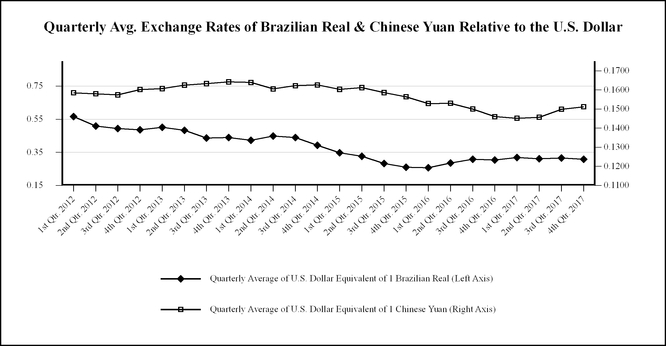

•Tredegar’s performance is influenced by costs incurred by its operating companies, including the cost of raw materials and energy. These costs include the cost of aluminum (the raw material on which Aluminum Extrusions primarily depends), resin (the raw material on which PE Films primarily depends), PTA and MEG (the raw materials on which Flexible Packaging Films primarily depends), natural gas (the principal fuel necessary for Aluminum Extrusions’ plants to operate), electricity, diesel fuel and paint. Aluminum, resin and natural gas prices are volatile as shown in the charts in Item 7A. The Company attempts to mitigate the effects of increased costs through price increases and contractual pass-through provisions, but there are no assurances that higher prices can effectively be passed through to customers or that Tredegar will be able to offset fully or on a timely basis the effects of higher costs. Further, the Company’s cost control efforts may not be sufficient to offset any increases in raw materials, energy or other costs.

•Our failure to continue to attract, develop and retain certain key officers or employees could adversely affect our businesses. Our success depends upon the efforts and abilities of key personnel, many of whom are longstanding employees. The loss of any of these key personnel could deplete our institutional knowledge base and negatively affect our ability to efficiently operate our businesses. Certain roles have experienced high turnover in recent years, and we are experiencing an increasingly competitive labor market. Increased employee turnover could hinder our ability to execute our business strategy and adversely affect our business, financial condition, results of operations and cash flows.

•Disruptions at one of the Company’s major manufacturing facilities could negatively impact financial results. Tredegar believes it has implemented measures to minimize the risks of disruption at its facilities. However, a disruption could occur as a result of any number of events: an equipment failure with repairs requiring long lead times, labor stoppages or shortages, cybersecurity attacks, utility disruptions, constraints on the supply or delivery of critical raw materials, and severe weather conditions, including potential flooding at the Aluminum Extrusions facility located in Carthage, TN, which is located in a 50-year flood plain. A material disruption in one of the Company’s operating locations could negatively impact production and the Company’s consolidated financial condition, results of operations and cash flows.

Risks Related to Aluminum Extrusions

•Sales volume and profitability of Aluminum Extrusions is cyclical and seasonal and highly dependent on economic conditions of end-use markets in the U.S., particularly in the construction sector. Aluminum Extrusions’ end-use markets can be cyclical and subject to seasonal swings in volume. In addition, changes in architectural design, demographic, and/or remote work trends could negatively impact the overall commercial construction industry. Because of the capital-intensive nature and level of fixed costs inherent in the aluminum extrusions business, the percentage drop in earnings before interest, taxes, depreciation and amortization (“EBITDA”) from ongoing operations in a cyclical downturn will likely exceed the percentage drop in volume. In addition, during an economic slowdown, excess industry capacity often drives increased pricing pressure in many end-use markets as competitors seek to protect their position with key customers. Any benefits associated with cost reductions and productivity improvements may not be sufficient to offset the adverse effects on profitability from pricing and margin pressure and higher bad debts (including a greater chance of loss associated with customers defaulting on fixed-price forward sales contracts) that usually accompany a downturn.

•Unfairly traded imports of aluminum extrusions could injure or threaten with injury America’s domestic aluminum extrusions industry, which could have an adverse effect on the financial condition, results of operations and cash flows of Aluminum Extrusions.

1.Failure to prevent foreign competitors from evading anti-dumping and countervailing duties, or failure to reinstate the Aluminum Tariff on aluminum extrusions, could adversely impact Aluminum Extrusions. In 2018, the U.S. imposed tariffs of 10% on aluminum ingot and semi-finished aluminum imported into the U.S. from certain countries; however, in December 2020, the Department of Commerce (“DOC”) introduced a tariff exclusion process, granting applicants with tariff exclusions. In response to large and increasing volumes of unfairly traded imports of extrusions associated with these tariff exclusions, a coalition of U.S. domestic producers filed petitions with the DOC and U.S. International Trade Commission (“ITC”). In November 2023, the ITC found that there is a reasonable indication that the American aluminum extrusions industry is materially injured or threatened with injury due to imports from 14 countries, including China. The ITC’s preliminary determination found that subject import volumes were significant and increasing, and that with regard to pricing, subject imports predominantly undersold the domestic product by volume in each year of the period of investigation. On March 5, 2024, the DOC announced its preliminary finding that the governments of China, Indonesia, Mexico and Turkey unfairly subsidize their aluminum extrusion industries. The DOC calculated a range of affirmative preliminary countervailing duties from each country. A preliminary anti-dumping determination for these four countries and the 10 other countries included in the initial petition is expected in May 2024. The Company expects the final ITC vote to occur in late 2024. A failure by, or the inability of, U.S. trade officials to restore the import tariff in its full format could have an adverse effect on the businesses, financial condition, results of operations and cash flows of Aluminum Extrusions.

2.The duty-free importation of goods allowed under the United States-Mexico-Canada Agreement (“USMCA”), or other free trade agreements or duty-preference regimes, could result in lower demand for aluminum extrusions made in the U.S. As noted above, in March 2018, the U.S. imposed tariffs of 10% on aluminum ingot and semi-finished aluminum imported into the U.S. from certain countries, including countries from which Aluminum Extrusions has historically sourced aluminum products. In September 2019, the U.S., Canada and Mexico entered into the USMCA. As a result of the 10% tariffs on aluminum ingot imported to the U.S. and the duty-free importation of goods allowed under USMCA, aluminum extrusions made in Canada and Mexico that are able to take advantage of duty-preference programs upon importation into the United States are free of the

10% tariff and can now be imported into and sold in the U.S. at very competitive prices. This could result in lower demand for aluminum extrusions made in the U.S., which could negatively affect Aluminum Extrusions’ business, results of operations, financial condition and cash flows.

•The markets for Aluminum Extrusions’ products are highly competitive with product quality, service, delivery performance and price being the principal competitive factors. Aluminum Extrusions has approximately 1,100 customers that are in a variety of end-use markets within the broad categories of building and construction, distribution, automotive and other transportation, machinery and equipment, electrical and consumer durables. No single Aluminum Extrusions’ customer exceeds 4% of consolidated net sales. Future success and prospects depend on Aluminum Extrusions’ ability to provide superior service, high quality products, timely delivery and competitive pricing to retain existing customers and participate in overall industry cross-cycle growth. Failure in any of these areas could lead to a loss of customers, which could have an adverse effect on the business, financial condition, results of operations and cash flows of Aluminum Extrusions.

•The failure to successfully implement the new enterprise resource planning and manufacturing execution systems could adversely impact the Aluminum Extrusions business and results of operations. InJanuary 2022, Aluminum Extrusions commenced the implementation of new enterprise resource planning and manufacturing execution systems (“ERP/MES”) across all locations of the Aluminum Extrusions business. The implementation of these systems is a major undertaking from a financial, management, and personnel perspective. The implementations have been more difficult, time consuming and costly (approximately $21 million of spending to date) than expected. This project, which was expected to be completed in 2024, has been reorganized with an extended implementation period, due to the implementation of stringent spending measures to control financial leverage. As a result, the earliest “go-live” date for the new ERP/MES is 2025. There can be no assurance that these systems will be beneficial to the extent anticipated. Any additional disruptions, delays or deficiencies in the design and implementation of the new systems could adversely affect our financial position, results of operations and cash flows.

Risks Related to PE Films

•PE Films is highly dependent on sales associated with its top five customers, the largest of which is P&G.relatively few large customers. PE Films’ top fivefour customers comprised approximately 26%10%, 29%10% and 32%13% of Tredegar’s consolidated net sales in 2017, 20162023, 2022 and 2015, respectively, with net sales to P&G alone comprising approximately 13%, 16% and 19% in 2017, 2016 and 2015,2021, respectively. The loss or significant reduction of sales associated with one or more of these customers without replacement by new business could have a materialan adverse effect on the Company. Surface Protection sales have been adversely impacted by weak market demand and competitive pricing. Customer demand for electronics has continued to deteriorate since the third quarter of 2022, causing manufacturers in the supply chain to experience reduced capacity utilization and inventory corrections. Consequently, results of operations for PE Films have been adversely impacted by weak demand for Surface Protection products.

While PE Films is undertaking efforts to expand its customer base, there can be no assurance that such efforts will be successful, or that they will offset any loss of sales and profits associated with large customer declines.

•The failure of PE Films’ customers to achieve success or maintain market share could adversely impact PE Films’ sales and operating margins. PE Films’ plastic films are used in the production of various consumer products sold worldwide. Our customers’ ability to successfully develop, manufacture and market those products is integral to PE Films’ success. Cyclical downturns and changing consumer preferences, particularly those driven by changes in technology, may negatively affect businesses that use PE Films’ plastic film products, which could adversely affect sales and operating margins. Other factors that could adversely affect the business include by way of example, (i) failure by a key customer to achieve success or maintain share in markets in which they sell products containing PE Films’ materials, including as a result of customer preferences for products other than plastics, (ii) key customers using products developed by others that replace PE Films’ business with such customer,customers, (iii) delays in a key customer rolling out products utilizing new technologies developed by PE Films, and (iv) operational decisions by a key customer that result in component substitution, inventory reductions and similar changes. While PE Films is undertaking efforts to expand its customer base, there can be no assurance that such efforts will be successful, or that they will offset any delay or loss of sales and profits associated with these large customers.

In recent years, PE Films lost substantial sales volume due to product transitions and incurred other sales losses associated with various customers. PE Films anticipates a significant product transition after 2018 in the personal care operating segment of the PE Films reporting segment. PE Films currently estimates that this will adversely impact the annual sales of the business unit by $70 million sometime between 2019 and 2021. PE Films has been increasing its R&D spending (an increase of $6 million in 2017 versus 2014), expects to invest capital, and is accelerating sales and marketing efforts to capture growth and diversify its customer base and product offerings in personal care products, but there can be no assurance that such efforts will be successful or that they will offset any loss of business due to product transitions. The overall timing and net change in personal care’s revenues and profits and capital expenditures needed to support growth during this transition period are uncertain at this time.

PE Films also anticipates that, over the next few years, there is an increased risk that a portion of its film used in surface protection applications will be made obsolete by possible customer product transitions to less costly alternative processes or materials. PE Films estimates on a preliminary basis that the annual adverse impact on ongoing operating profit from customer shifts to alternative processes or materials in surface protection is in the range of $5 to $10 million. Given the technological and commercial complexity involved in bringing these alternative processes or materials to market, PE Films is very uncertain as to the timing and ultimate amount of the possible transitions. In response, the Company is aggressively pursuing new surface protection products, applications and customers, but there can be no assurance that such efforts will be successful or that they will offset any loss of business due to product transitions.

PE Films and its customers operate in highly competitive markets. PE Films competes on product innovation, quality, price and service, and its businesses and their customers operate in highly competitive markets. Global market conditions continue to exacerbate the Company’s exposure to margin compression due to competitive forces, especially as certain products move into the later stages of their product life cycles. In addition, the changing dynamics of consumer products retailing, including the impact of on-line retailers such as Amazon, is creating price and margin pressure on the customers of PE Films’ personal care business. While PE Films continually works to identify new business opportunities with new and existing customers, primarily through the development of new products with improved performance and/or cost characteristics, there can be no assurances that such efforts will be successful or that they will offset business lost from competitive dynamics or customer product transitions.

Failure of PE Films’ customers, who are subject to cyclical downturns, to achieve success or maintain market share could adversely impact PE Films’ sales and operating margins. PE Films’ plastic films serve as components for, or are used in the production of, various consumer products sold worldwide. A customer’s ability to successfully develop, manufacture and market those products is integral to PE Films’ success. Also, consumers of premium products made with or using PE Films’ components may shift to less premium or less expensive products, reducing the demand for PE Films’ plastic films. Cyclical downturns may negatively affect businesses that use PE Films’ plastic film products, which could adversely affect sales and operating margins.

•The Company’s inability to protect its intellectual property rights or its infringement of the intellectual property rights of others could have a materialan adverse impact on PE Films. PE Films operates in an industry where its significant customers and competitors have substantial intellectual property portfolios. The continued success of PE Films’ business depends on its ability not only to protect its own technologies and trade secrets, but also to develop and sell new products

that do not infringe upon existing patents or threaten existing customer relationships.patents. Intellectual property litigation is very costly and could result in substantial expense and diversions of Company resources, both of which could adversely affect its consolidated financial condition, results of operations and cash flows. In addition, there may be no effective legal recourse against infringement of the Company’s intellectual property by third parties, whether due to limitations on enforcement of rights in foreign jurisdictions or as a result of other factors.

•Rising trade tensions could cause an increase in the cost of PE Films’ products or otherwise negatively impact the Company. A portion of PE Film’s business involves imports to and from the U.S. and other countries where the

Company produces and sells its products. Trade tensions have been rising between the U.S. and other countries, particularly China. An unstable economic environmentincrease in tariffs and other trade barriers between the U.S. and China, or between the U.S. and other countries, could cause an increase in the cost of PE Films’ products or otherwise negatively impact the production and sale of the Company’s products in world markets.

•Further impairment of the Surface Protection reporting unit’s goodwill could have a disruptivenon-cash adverse impact on PE Films’ supply chain. Certain raw materials used in manufacturing PE Films’ products are sourced from single suppliers, and PE Filmsour results of operations. The Company assesses goodwill for impairment when events or circumstances indicate that the carrying value may not be able to quicklyrecoverable, or, inexpensively re-source from other suppliers.at a minimum, on an annual basis (December 1st of each year). The riskvaluation of damage or disruption to its supply chain may increase ifgoodwill depends on a variety of factors, including macroeconomic conditions, industry and when different suppliers consolidate their product portfolios, experiencemarket considerations, cost factors and overall financial distress or disruption of manufacturing operations. Failure to take adequate steps to effectively manage such events, which are intensified when a product is procured from a single supplier or location, could adversely affect PE Films’ consolidated financial condition, results of operations and cash flows,performance, as well as require additional resourcesCompany and reporting unit factors, and goodwill impairment valuations can be sensitive to restore its supply chain.

Our cost saving initiatives may not achieve the results we anticipate. PE Films has undertaken and will continue to undertake cost reduction initiatives to consolidate certain production, improve operating efficiencies and generate cost savings. PE Films cannot be certain that it will be able to complete these initiatives as planned or that the estimated operating efficiencies or cost savings fromassumptions associated with such activities will be fully realized or maintained over time. In addition, PE Films may not be successful in moving production to other facilities or timely qualifying new production equipment.factors. Failure to complete these initiativessuccessfully achieve projections could adversely affect PE Films’ financial condition, results of operations and cash flows.

result in future impairments.Risks Related to Flexible Packaging Films

•Overcapacity in Latin American polyester film production and a history of uncertain economic conditions in Brazil could adversely impact the financial condition, results of operations and cash flows of Flexible Packaging Films. Competition in Brazil, Terphane’s primary market, has been exacerbated by global overcapacity in the polyester industry generally, and by particularly acute overcapacity in Latin America. Additional PET capacity from a competitor in Latin America came on line in September 2017. These factors, plus a recent period of unfavorable economic and political conditions in Brazil, have resulted in significant competitive pricing pressures and U.S. Dollar equivalent margin compression.

For flexible packaging films produced in Brazil, variable conversion, fixed conversion and sales, general and administrative costs for operations in Brazil have been adversely impacted by inflation in Brazil that is higher than in the U.S. Flexible Packaging Films is exposed to additional foreign exchange translation risk because almost 90% of Flexible Packaging Films’ Brazilian sales are quoted or priced in U.S. Dollars while a large part of its Brazilian costs are quoted or priced in Brazilian Real. This mismatch, together with a variety of economic variables impacting currency exchange rates, causes volatility that could negatively or positively impact operating profit for Flexible Packaging Films.

Tredegar has attempted to mitigate these impacts through new product offerings, cost saving measures, a currency hedge entered into in 2017, and manufacturing efficiency initiatives, but these efforts to-date have not been sufficient to prevent a significant decline in the operating profit for Flexible Packaging Films since the acquisition of Terphane in October 2011 and continuing efforts may not be successful, which could further adversely impact Flexible Packaging Films’ financial condition, results of operations and cash flows.

Governmentalgovernmental failure to extend anti-dumping duties in Brazil on imported products or prevent competitors from circumventing such duties could adversely impact Flexible Packaging Films. In recent years, excess global capacity in the industry has led to increased competitive pressures from imports into Brazil. The Company believes that these conditions have shifted the competitive environment from a regional to a global landscape and have driven price convergence and lower product margins for Flexible Packaging Films. Favorable anti-dumping rulings or countervailing duties are in effect for products imported from China, Egypt, India, Mexico, UAE and Turkey. In January 2018, the Brazilian government opened new anti-dumping investigations for products imported fromUnited Arab Emirates, Peru and Bahrain. Competitors not currently subject to anti-dumping duties may choose to utilize their excess capacity by selling product in Brazil, which may result in pricing pressures that Flexible Packaging Films may not be able to offset with cost savings measures and/or manufacturing efficiency initiatives. There can be no assurance that efforts

In May 2021, the Brazilian authorities concluded the sunset review relating to imposethe anti-dumping constraints on productsprocess for polyester film imported to Brazil from PeruChina, India and Bahrain, orEgypt, and decided to extend duties beyond 2018 on productsfor another five years. However, due to its doubts that films would continue to be imported from certain otherChina and Egypt, the government immediately suspended the implementation of the tariffs for those countries willbut agreed that if in the future there were volumes imported from China or Egypt which were harming the Brazilian market, authorities may promptly reinstate tariffs. Importing from Egypt increased in Brazil during 2023; therefore, Terphane requested the application of anti-dumping tariffs for Egypt, which was accepted by the Brazilian Government. These tariffs went into effect starting in November 2023. For films imported from India, the Brazilian authorities also reviewed measures against countervailing duties and extended those for five years as well.

In February 2024, the Brazilian Government determined that the anti-dumping measures against Mexico and United Arab Emirates should be successful.

extended for a five-year period and anti-dumping measures against Turkey should be removed.

Aluminum Extrusions

Sales volume and profitability•A history of Aluminum Extrusions is cyclical and seasonal and highly dependent onuncertain economic conditions of end-use markets in the U.S., particularly in the construction sector. Aluminum Extrusions’ end-use markets can be cyclical and subject to seasonal swings in volume. Because of the capital intensive nature and level of fixed costs inherent in the aluminum extrusions business, the percentage drop in operating profits in a cyclical downturn will likely exceed the percentage drop in volume. In addition, during an economic slowdown, excess industry capacity often drives increased pricing pressure in many end-use markets as competitors protect their position with key customers. Any benefits associated with cost reductions and productivity improvements may not be sufficient to offset the adverse effects on profitability from pricing and margin pressure and higher bad debts (including a greater chance of loss associated with customers defaulting on fixed-price forward sales contracts) that usually accompany a downturn. In addition, higher energy costs can further reduce profits unless offset by price increases or cost reductions and productivity improvements.

Failure to prevent competitors from circumventing anti-dumping and countervailing duties, or a reduction in such duties,Brazil could adversely impact Aluminum Extrusions. As of April 2017, the antidumping duty and countervailing duty orders on aluminum extrusions from China will remain in place until the next five-year review of the orders. Chinese and other overseas manufacturers continue to try to circumvent the antidumping and countervailing orders to avoid duties. A failure by, or the inability of, U.S. trade officials to curtail efforts to circumvent these duties, or the potential reduction of applicable duties pursuant to annual reviews of the orders, could have a material adverse effect on the financial condition, results of operations and cash flows of Aluminum Extrusions.

The imposition of tariffs or duties on imported aluminum products could significantly increase the price of Aluminum Extrusions’ mainFlexible Packaging Films. For flexible packaging films produced in Brazil, selling prices and key raw material which could adversely impact demand for its products. On April 27, 2017, President Trump directedcosts are principally determined in U.S. Dollars and are impacted by local economic conditions and local and global competitive dynamics. Flexible Packaging Films is exposed to foreign exchange translation risk (its functional currency is the U.S. Department of Commerce (“DOC”) to begin an investigation under Section 232Brazilian Real) because almost 90% of the Trade Expansion Act regarding the effects on U.S. economicsales of Flexible Packaging Films business unit in Brazil (“Terphane Ltda.”) and national security of aluminum imports into the U.S. On January 19, 2018, the DOC formally submitted to President Trump the resultssubstantially all of its investigation, which included recommendationsrelated raw material costs are quoted or priced in U.S. Dollars while its variable conversion, fixed conversion and sales, general and administrative costs before depreciation & amortization (collectively “Terphane Ltda. Operating Costs”) are quoted or priced in Brazilian Real. This mismatch, together with a variety of economic variables impacting currency exchange rates, causes volatility that could negatively or positively impact EBITDA from ongoing operations for Flexible Packaging Films. While Flexible Packaging Films hedges this exposure on a short-term basis with foreign exchange forward rate contracts, the DOC thatexposure continues to exist beyond the President impose tariffs or quotas, or both, on imports intohedging periods.

Other Business Risks

•A failure in the U.S. of primary aluminum and semi-fabricated aluminum products. The President has 90 days to decide on any potential action based on the findings of the investigation. It is unknown at this time if the President will take any actionCompany’s information technology systems as a result of cybersecurity attacks or other causes could negatively affect Tredegar’s business. The Company depends on information technology (“IT”) to record and process customer orders, manufacture and ship products in a timely manner, secure its production processes and know-how, maintain the Section 232 investigation,financial accuracy of its business records and if action is taken, what the impactmaintain personally identifiable information of that action would be on Bonnell Aluminum. However, the Presidentits employees. An IT system failure due to computer viruses, internal or external security breaches, cybersecurity attacks or other malicious causes could impose tariffs or quotas on aluminum importsdisrupt our operations and prevent us from being able to process transactions with our customers, operate our manufacturing facilities and properly report transactions in a timely manner. Increased global IT security threats and cyber-crime pose a potential risk to the U.S. Bonnell Aluminumsecurity and availability of the Company’s IT systems, networks and services, including those that are managed, hosted, provided or used by third parties, as well as to the confidentiality, availability and integrity of the Company’s data. Additionally, increased cybersecurity risk arises due to certain employees working remotely. To date, interruptions of the Company’s IT systems have been infrequent, and Tredegar

has not experienced a material cybersecurity incident. A significant prolonged failure of or security breach of the IT systems, networks or service providers the Company relies upon, or a loss or disclosure of business or other major U.S. aluminum extruders are net importerssensitive information, or personally identifiable information, as a result of aluminum raw materials. If high tariffs are imposed on imported aluminum ingots purchased by Bonnell, then the aggregate cost of aluminum extrusions produced by Bonnell could rise significantly. Bonnell would expect to be able to pass through the higher aluminum costs to its customers. However, a higher cost for aluminum extrusionscybersecurity incident or other cause, could result in product substitutions in place of aluminum extrusions, which could materially and negatively affect Bonnell and other U.S. aluminum extrusion businesses and their results of operations. If tariffs were imposed on all primary aluminum imports into the U.S., then aluminum extruders located outside the U.S. who were not subject to similar tariffs in the country where they produced extrusions, could have a price advantage relative to U.S.-based aluminum extruders.

Competition from China could increase significantly if China is granted market economy status by the World Trade Organization. China has launched a formal complaint at the World Trade Organization challenging its non-market economy status, claiming that as of December 11, 2016, China’s transition period as a non-market economy under its Accession Protocolsubstantial costs to the World Trade Organization ended. China believes with respectCompany, damage to all Chinese-made products that it should receive market economy statusthe Company’s reputation, regulatory enforcement actions and the rights attendant to that status under World Trade Organization rules. The U.S. and the European Union have each rejected that interpretation. If China is granted market economy status, the extent to which the U.S. antidumping laws will be able to limit unfair trade practices from China will likely be limited because the U.S. government will be forced to utilize Chinese prices and costs that do not reflect market principles in antidumping duty investigations involving China, which would ultimately limit the level of antidumping duties applied to unfairly traded Chinese imports. The volume of unfairly traded imports of Chinese aluminum extrusions would likely increase as a result and this, in turn, would likely create substantial pricing pressure on Aluminum Extrusions’ productslawsuits and could have a material adverse effect onadversely affect the financial condition,Company’s business, results of operations, and cash flows of Aluminum Extrusions.