UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 20222023 |

OR

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number 1-10258

TREDEGAR CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Virginia | | 54-1497771 |

(State or other jurisdiction

of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

| 1100 Boulders Parkway, | | |

Richmond, | Virginia | | 23225 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 804-330-1000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock | TG | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | o | Accelerated filer | x | Smaller reporting company | | o |

| | | | | |

| Non-accelerated filer | | o | | Emerging growth company | | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 20222023 (the last business day of the registrant’s most recently completed second fiscal quarter): $266,141,470*$278,307,771*

Number of shares of Common Stock outstanding as of March 10, 2023:8, 2024: 34,016,68934,430,769

| | | | | |

| * | In determining this figure, an aggregate of 7,351,3317,361,458 shares of Common Stock beneficially owned by Floyd D. Gottwald, Jr., John D. Gottwald, William M. Gottwald, and James T. Gottwald and the members of their immediate families has been excluded because the shares are deemed to be held by affiliates. The aggregate market value has been computed based on the closing price in the New York Stock Exchange on June 30, 2022.2023. |

Documents Incorporated By Reference

Portions of the Tredegar Corporation Proxy Statement for the 20232024 Annual Meeting of Shareholders (the “Proxy Statement”) are incorporated by reference into Part III of this Form 10-K.

Index to Annual Report on Form 10-K

Year Ended December 31, 20222023

PART I

Item 1. BUSINESS

Description of Business

Tredegar Corporation (“Tredegar”) is engaged, through its subsidiaries, in the manufacture of aluminum extrusions, polyethylene (“PE”) plastic films and polyester (“PET”) films. Unless the context requires otherwise, all references herein to “Tredegar,” “the Company,” “we,” “us” or “our” are to Tredegar Corporation and its consolidated subsidiaries.

The Company's reportable business segments are Aluminum Extrusions, PE Films and Flexible Packaging Films.Films (also referred to as “Terphane”).

On October 30, 2020,September 1, 2023, the Company completedannounced that it had entered into a definitive agreement to sell Terphane to Oben Group (the “Contingent Terphane Sale”). Completion of the sale is contingent upon the satisfaction of its personal care films business (“Personal Care Films”). The transaction excludedcustomary closing conditions, including the packaging film linesreceipt of certain competition filing approvals by authorities in Brazil and related operations located at the Pottsville, Pennsylvania manufacturing site (“Pottsville Packaging”), which are now being reported with the Surface Protection component of PE Films. Commencing in the third quarter of 2020, all historical results for Personal Care Films have been presented as discontinued operations.

Columbia. For more information on this transaction, see Note 15 “Discontinued Operations”“Status of Current Corporate Strategic Initiatives - Agreement to the Consolidated Financial Statements includedSell Terphane” in Item 15. “Exhibits7. “Management’s Discussion and Analysis of Financial Statement Schedules” (“Item 15”)Condition and Results of Operations” of this Annual Report on Form 10-K for the year ended December 31, 20222023 (“Form 10-K”).

Aluminum Extrusions

Aluminum Extrusions, also referred to as Bonnell Aluminum, produces high-quality, soft and medium strength alloyed aluminum extrusions, custom fabricated and finished, for the building and construction, automotive and transportation, consumer durables goods, machinery and equipment, electrical and renewable energy, and distribution markets. Bonnell Aluminum has manufacturing facilities located in the United States (“U.S.”).

Aluminum Extrusions manufactures mill (unfinished), machined, anodized and painted, and thermally improved aluminum extrusions for sale directly to fabricators and distributors. It also manufactures and sells branded product lines: Futura TransitionsTM by Bonnell Aluminum (flooring trims) and TSLOTSTM by Bonnell Aluminum (structural aluminum framing systems). Aluminum Extrusions competes primarily on the basis of product quality, service and price. Sales are made predominantly in the U.S. The end-use markets for Aluminum Extrusions are cyclical and seasonal in nature.

The end-uses in each of Aluminum Extrusions’ primary market segments include: | | | | | | | | |

| Major Markets | | End-Uses |

| | |

| Building & construction (“B&C”)- nonresidential | | Commercial windows and doors, curtain walls, storefronts and entrances, automatic entry doors, walkway covers, ducts, louvers and vents, office wall panels, partitions and interior enclosures, acoustical walls and ceilings, point of purchase displays, pre-engineered structures, and flooring trims (Futura TransitionsTM by Bonnell Aluminum) |

Building & constructionB&C - residential | | Residential windows and doors, shower and tub enclosures, railing and support systems, venetian blinds, and swimming pools |

| Automotive & transportation | | Automotive and light truck structural components, battery enclosures for electric vehicles, after-market automotive accessories, grills for heavy trucks, travel trailers and recreation vehicles |

| Consumer durables | | Office furniture, pleasure boats, refrigerators and freezers, appliances and sporting goods |

| Machinery & equipment | | Material handling equipment, conveyor systems, medical equipment, industrial fans and aluminum framing systems (TSLOTSTM by Bonnell Aluminum) |

| Distribution (metal service centers specializing in stock and release programs and custom fabrications to small manufacturers) | | Various custom profiles including storm shutters, pleasure boat accessories, theater set structures and various standard profiles (including rod, bar, tube and pipe) |

| Electrical & renewable energy | | Lighting fixtures, electronic apparatus, solar panel brackets and rigid and flexible conduits |

Aluminum Extrusions’ net sales (sales less freight) by market segment for the years ended December 31, 2023, 2022 2021 and 20202021 is shown below: | % of Aluminum Extrusions Net Sales1 by Market Segment | % of Aluminum Extrusions Net Sales1 by Market Segment | % of Aluminum Extrusions Net Sales1 by Market Segment |

| | | 2022 | | 2021 | | 2020 | | 2023 | | 2022 | | 2021 |

| Building and construction: | |

| B&C: | |

| Nonresidential | |

| Nonresidential | |

| Nonresidential | Nonresidential | 53% | | 50% | | 56% | 56% | | 53% | | 50% |

| Residential | Residential | 10% | | 10% | | 9% | Residential | 8% | | 10% |

| Automotive | Automotive | 8% | | 8% | | 8% | Automotive | 10% | | 8% |

| Specialty: | Specialty: | |

| Consumer durables | Consumer durables | 10% | | 10% | | 10% |

| Consumer durables | |

| Consumer durables | | 8% | | 10% |

| Machinery & equipment | Machinery & equipment | 10% | | 8% | | 7% | Machinery & equipment | 9% | | 10% | | 8% |

| Electrical | Electrical | 4% | | 6% | | 4% | Electrical | 6% | | 4% | | 6% |

| Distribution | Distribution | 5% | | 8% | | 6% | Distribution | 3% | | 5% | | 8% |

| Total | Total | 100% | | 100% | | 100% | Total | 100% | | 100% |

1. The Company uses net sales from continuing operations as its measure of revenues from external customers at the segment level. For more business segment information, see Note 13 “Business Segments” to the Consolidated Financial Statements in Item 15. | | 1. The Company uses net sales as its measure of revenues from external customers at the segment level. For more business segment information, see Note 13 “Business Segments” to the Consolidated Financial Statements included in Item 15. “Exhibits and Financial Statement Schedules” of this Form 10-K (“Item 15”). | | 1. The Company uses net sales as its measure of revenues from external customers at the segment level. For more business segment information, see Note 13 “Business Segments” to the Consolidated Financial Statements included in Item 15. “Exhibits and Financial Statement Schedules” of this Form 10-K (“Item 15”). |

In 2023, 2022 2021 and 2020,2021, Aluminum Extrusions net sales accounted for approximately 71%70%, 67%71% and 63%67% of Tredegar’s consolidated net sales, respectively.

Open Orders. Overall open orders in Aluminum Extrusions waswere approximately $48.0 million, or 14 million pounds, at December 31, 2023 compared to approximately $136.0 million, or 41 million pounds, at December 31, 2022, compared to approximately $306.4 million, or 97 million pounds, at December 31, 2021, a decrease of $170.4$88.0 million, or approximately 56%65%. The reductionThis level is below the quarterly range of 21 to 27 million pounds in 2019 before pandemic-related disruptions that resulted in long lead times, driving a peak in open orders in 2022 compared to 2021 is primarily due to order cancellations as customers report high inventory levels. During the second half of 2022, the Company has observed order cancellations as customers report high inventory levels. Aluminum Extrusions expects the confluence of orders, cancellations and shipments to drive open orders to pre-COVID-19, normalized levelsapproximately 100 million pounds during the first halfquarter of 2023. The outlook for demand2022. We believe that current open orders are below pre-pandemic levels due to higher interest rates, tighter lender requirements and shipmentsthe increase in 2023 remains uncertain given recessionary concerns.remote working, which particularly impacts the non-residential B&C end-use market. In addition, data indicates that aluminum extrusion imports increased significantly in recent years, especially during the pandemic, and some of Aluminum Extrusions’ customers may have sourced, and continue to source, aluminum extrusions from producers outside the U.S. Sales volume for Aluminum Extrusions, which the Company believes is cyclical and seasonal in nature due to its end-use markets, was 138.5 million pounds in 2023, 174.7 million pounds in 2022 and 183.4 million pounds in 2021 and 186.4 million pounds in 2020.2021.

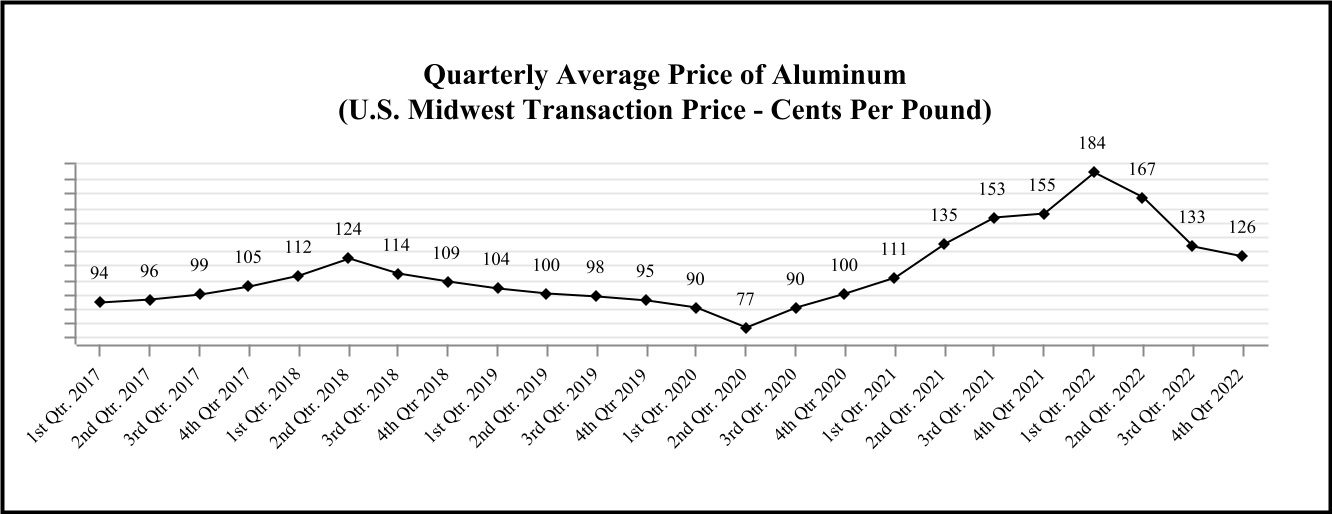

Raw Materials. The primary raw materials used by Aluminum Extrusions consist of aluminum ingot, aluminum scrap and various alloys, which are purchased from domestic and foreign producers in open-market purchases and under annual contracts. Refer to Item 7a.7A. "Quantitative and Qualitative Disclosures About Market Risk” of this Form 10-K (“Item 7a”7A”) for additional information on aluminum price trends. Aluminum Extrusions believes that it has adequate supply agreements for aluminum raw materials in 2023 despite continued supply chain cost increases related to paint, chemicals, packaging and other non-aluminum raw materials.2024.

PE Films

PE Films produces surface protection films, polyethylene overwrap films and films for other markets. Tredegar’s Surface Protection unit produces single- and multi-layer surface protection films sold under the UltraMask®, ForceField™, ForceField PEARL®, Pearl A™, Lithyn™ and Obsidian™ brand names. These films, which are manufactured at facilities in the U.S. and China, support manufacturers of optical and other specialty substrates used in high-technology applications, most notably protecting high-value components of flat panel and flexible displays used in televisions, monitors, notebooks, smartphones, tablets, e-readers, digital signage, semiconductors and automobiles during the manufacturing and transportation process. Tredegar’s Lithyn™ Series represents a new class of tapes for wafer thinning, singulation and transportation designed to enable customers’ to overcome processing challenges and reduce costs. The Obsidian™ series of products is designed for usage in automotive applications. In 2023, 2022 2021 and 2020,2021, PE Films accounted for approximately 11%, 15%11% and 19%15% of Tredegar’s consolidated net sales, respectively.

In October 2020, the Surface Protection unit assumed responsibility for Pottsville Packaging, which was previously reported within the Personal Care component of PE Films. Pottsville Packaging produces thin-gauge films as overwrap for bathroom tissue and paper towels.

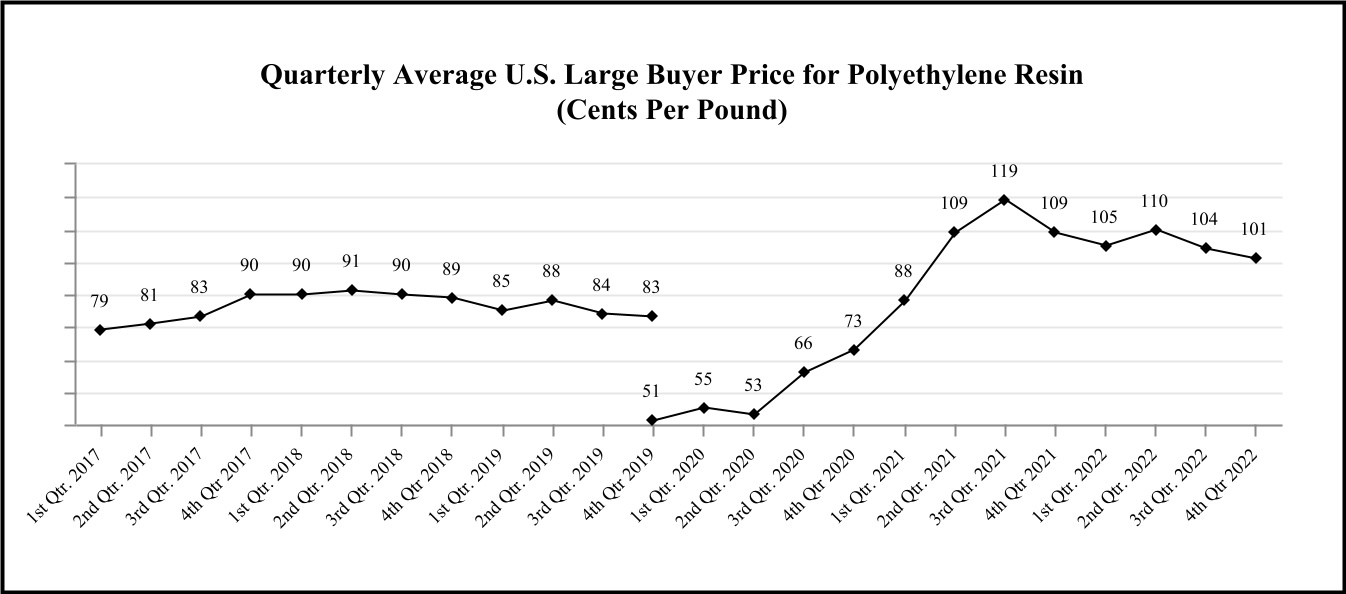

Raw Materials. The primary raw materials used by PE Films are polyethylene and polypropylene resins. These raw materials are obtained from domestic and foreign suppliers at competitive prices. Refer to Item 7a7A for additional information on resin price trends. PE Films believes that there will be an adequate supply of polyethylene and polypropylene resins in the foreseeable future.

Research and Development. Tredegar’s spending for research and development (“R&D”) activities in 2023, 2022 2021 and 20202021 was primarily related to PE Films. During the third quarter of 2023, the Company adopted a plan to close the PE Films technical center in Richmond, VA. Future R&D activities will be performed at the facility in Pottsville, PA. R&D spending by the PE Films was approximately $2.9 million, $5.3 million and $5.7 million in 2023, 2022 and $7.7 million in 2022, 2021, and 2020, respectively.

Customers. PE Films’ products are sold primarily in the U.S. and Asia, with the top four customers, collectively, comprising 88%, 88% and 84%87% of its net sales in 2023 and 88% in 2022 2021 and 2020, respectively.2021. No single PE Films customer exceeds 10% of Tredegar’s consolidated net sales. For additional information, see Item 1A. “Risk Factors” of this Form 10-K (“Item 1A”).

Flexible Packaging Films

Flexible Packaging Films is comprised of Terphane Holdings LLC (“Terphane”). Flexible Packaging Films produces PET-based films for use in packaging applications that have specialized properties, such as heat resistance, strength, barrier protection and the ability to accept high-quality print graphics. These differentiated, high-value films are primarily manufactured in Brazil and sold in Latin America and the U.S. under the Terphane®, Sealphane® and Ecophane® brand names. Major end uses include food packaging and industrial applications. Flexible Packaging Films competes in all of its markets on the basis of product quality, service and price. In 2023, 2022 2021 and 2020,2021, Terphane accounted for approximately 19%, 18%19% and 18% of Tredegar’s consolidated net sales, respectively.

Raw Materials. The primary raw materials used by Flexible Packaging Films to produce polyester resins are purified terephthalic acid (“PTA”) and monoethylene glycol (“MEG”). Flexible Packaging Films also purchases other polyester resins directly from suppliers. These raw materials are obtained from Brazilian and foreign suppliers at competitive prices. Terphane continues to monitor cost escalations to adjust selling prices as market dynamics permit and believes that there will be an adequate supply of polyester resins, PTA and MEG in the foreseeable future. Refer to Item 7a7A for additional information on resin price trends.

General

Intellectual Property. Tredegar considers patents, licenses and trademarks to be material to PE Films. On December 31, 2022,2023, PE Films held 4337 patents (including 6 U.S. patents), and 7666 registered trademarks (including 4 U.S. registered trademarks). Flexible Packaging Films held 1 U.S. patent and 17 registered trademarks (including 4 U.S. registered trademarks). Aluminum Extrusions held no U.S. patents and 3 U.S. registered trademarks. As of December 31, 2022,2023, these patents had remaining terms of 1.50.5 to 17 years.

Government Regulation. The Company’s operations are subject to various local, state, federal and foreign government regulations, including environmental, privacy and anti-corruption and anti-bribery laws and regulations.

U.S. laws concerning the environment to which the Company’s domestic operations are or may be subject to include the Clean Water Act, the Clean Air Act, the Resource Conservation and Recovery Act, the Occupational Safety and Health Act, the National Environmental Policy Act, the Toxic Substances Control Act, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), regulations promulgated under these acts, and other federal, state or local laws or regulations governing environmental matters. Compliance with these laws is an important consideration because Tredegar uses hazardous materials in some of its operations, is a generator of hazardous waste, and wastewater from the Company’s operations is discharged to various types of wastewater management systems. Under CERCLA and other laws, Tredegar may be subject to financial exposure for costs associated with waste management and disposal, even if the Company fully complies with applicable environmental laws.

The U.S. Environmental Protection Agency has adopted regulations under the Clean Air Act relating to emissions of carbon dioxide and other greenhouse gases (“GHG”), including mandatory reporting and permitting requirements. Several of the Company’s manufacturing operations result in emissions of carbon dioxide or GHG and are subject to the current GHG regulations. The Company’s compliance with environmental regulations has yet to require significant capital expenditures; however, environmental standards tend to become more stringent over time. Therefore, in order to comply with current or future environmental legislation or regulations, the Company may be subject to additional capital expenditures, operating expenses or other compliance costs, the amounts and timing of which are not presently determinable, but which could be significant, including constructing new facilities or modifying existing facilities.

Like environmental regulations, current or future privacy and anti-corruption and anti-bribery legislation or regulations may subject the Company to additional capital expenditures, operating expenses or other compliance costs, the amounts and timing of which are not presently determinable but could be significant. Any failure to comply with current or future laws and regulations, including environmental, privacy and anti-corruption and anti-bribery laws and regulations, could subject Tredegar

to substantial penalties, fines, costs and expenses. For further discussion regarding certain environmental, privacy and anti-corruption and anti-bribery laws and regulations to which the Company is subject, see Item 1A below.

Human Capital Management.

Overview

Tredegar employed approximately 2,3001,900 people at December 31, 20222023 located in the U.S., Brazil, and Asia, of which 80%75% are located in the U.S. Approximately 18%15% of the Company’s employees are represented by labor unions located in the U.S. under various collective bargaining agreements with varying durations and expiration dates, none of which expire before 2025. All of Tredegar’s Brazilian employees are represented by a national labor union. Generally, the total number of employees of Tredegar does not significantly fluctuate throughout the year. However, acquisition or divestiture activity, or changes in the level of business activity may impact employee levels.

Health and Safety

Tredegar has continuously exceeded the industry standards for safety.safety in each of its respective manufacturing sectors. The Company uses various forms of employee safety metrics to assess the health and safety performance of its Aluminum Extrusions, PE Films and Flexible Packaging operations, including employee safety data which is available on the Company’s website at https://tredegar.com/www.tredegar.com/about-tredegar/our-broader-commitments/committed-to-our-employees/.

Additionally, Aluminum Extrusions has on-site health clinics at its Carthage and Clearfield facilities. These clinics allow Aluminum Extrusions to invest in its people, provide more personal and more thorough healthcare to employees, and enhance the employer-employee relationship. TheCollectively, the Carthage and Clearfield clinics serve over 500 and 300 employees, respectively.600 employees.

Talent and Development

The Company believes its employees are its most valuable asset and are critical to the success of the Company. The Company seeks to retain employees by offering competitive wages, benefits and training opportunities. To assess and monitor employee retention and engagement, the Company surveys employees and takes actions to address areas of employee concern. The annual employee engagement survey results are presented to Tredegar’s Board of Directors (“Board”). Additionally, the objectives of our executive compensation programs are to attract, motivate and retain highly qualified executive officers. To accomplish these objectives, the Company relies on a pay strategy that emphasizes performance-based compensation through annual and long-term incentives. The Company believes that this pay strategy creates a strong link between pay and performance and aligns with our business strategy of generating strong operating results and shareholder value creation while controlling fixed costs.

The Company is committed to holistically supporting our employees both at work and in their communities by:

•Strictly following all applicable health, safety and non-discrimination laws in each country;

•Promoting the highest standards for employee health and safety through innovative programs; and

•Providing opportunities for community outreach and supporting programs that enhance the lives of children and families.

Inclusion and Diversity

Tredegar strictly complies with all applicable state, local and international laws governing nondiscrimination in employment in every location where Tredegar and its businesses have facilities to ensure healthy and positive working conditions. This applies to all terms and conditions of employment, including recruiting, hiring, job assignments, promotion, termination, layoff, recall, transfer, leaves of absence, compensation and training. All applicants and employees are treated with the same high level of respect regardless of their race, creed, color, religion, sex, sexual orientation, gender identity, age, pregnancy, national origin, ethnicity, political affiliation, union membership, marital status, citizenship status, veteran status, disability or other protected category. Employees who experience or witness discriminatory behavior are encouraged to report such behavior to their supervisor, Human Resources or Tredegar’s toll-free anonymous reporting hotline. Additionally, the Company spends significant resources in developing its employees. Among the five core principles of the “The Tredegar Way” that the Company uses to guide its organization, the “Leadership” principle is focused on building a team of motivated and engaged leaders at every level of the Company. Each business unit has identified specific action plans to promote the Leadership principle among its employees. Action plans include talent development, skills training, reinforcement of strong cultural values, and robust systems to ensure a safe working environment.

Information About Our Executive Officers. See Item 10. “Directors, Executive Officers and Corporate Governance” of this Form 10-K.

Available Information and Corporate Governance Documents. Tredegar’s website address is www.tredegar.com. The Company makes available, through its website, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after such documents are electronically filed

with, or furnished to, the Securities and Exchange Commission (“SEC”). Information filed electronically with the SEC can be accessed on its website at www.sec.gov. In addition, the Company’s Corporate Governance Guidelines, Code of Conduct, the

charters of the Audit, Executive Compensation, Nominating and Governance Committees and Climate Change Risk Assessment and many other corporate policies are available on Tredegar’s website and are available in print to any shareholder upon request by contacting Tredegar’s Corporate Secretary at 1100 Boulders Parkway, Richmond, Virginia 23225. The information on or that can be accessed through the Company’s website is not, and shall not be deemed to be, a part of this Form 10-K or incorporated into other filings it makes with the SEC.

Forward-looking and Cautionary Statements

Some of the information contained in this Form 10-K may constitute “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. When the Company uses the words “believe,” “estimate,” “anticipate,” “appear to,” “expect,” “project,” “plan,” “likely,” “may” and similar expressions, it does so to identify forward-looking statements. Such statements are based on the Company's then current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those addressed in the forward-looking statements. It is possible that the Company's actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in or implied by these forward-looking statements. Accordingly, you should not place undue reliance on these forward-looking statements. For risks and important factors that could cause actual results to differ from expectations, refer to the reports that Tredegar files with or furnishes the SEC from time-to-time, including the risks and important factors set forth in Item 1A. Readers are urged to review and consider carefully the disclosures Tredegar makes in the reports Tredegar files with or furnishes to the SEC. Tredegar does not undertake, and expressly disclaims any duty, to update any forward-looking statement to reflect any change in management’s expectations or any change in conditions, assumptions or circumstances on which such statements are based, except as required by applicable law.

Item 1A. RISK FACTORS

There are a number of risks and uncertainties that could have a material adverse effect on the Company’s businesses and its consolidated financial condition, results of operations or cash flows. The following risk factors should be considered, in addition to the other information included in this Form 10-K, when evaluating Tredegar and its businesses.

Risks Related to Tredegar’s Corporate Strategic Initiatives and Indebtedness

•The planned divestiture of Terphane to Oben Group is subject to a number of conditions beyond our control. On September 1, 2023, the Company announced that it had entered into a definitive agreement to sell Terphane to Oben Group. Completion of the sale is contingent upon the satisfaction of customary closing conditions, including the receipt of certain competition filing approvals by authorities in Brazil and Colombia. On October 27, 2023, the Company filed the requisite competition forms with the Administrative Council for Economic Defense (“CADE”) in Brazil, which the Company views as the primary competition authority regarding this matter. This filing followed a pre-filing phase for CADE’s initial review. CADE’s maximum deadline for completing its review is no later than November 18, 2024. The merger review regarding the transaction was cleared by the Colombian authority in early February 2024.

As usual, it cannot be predicted with certainty whether all Tredegarof the required closing conditions will be satisfied, waived or if other uncertainties may arise. While the regulatory review process is ongoing and in line with the Company’s expectations, regulators could impose additional requirements or obligations as conditions for their approval, which may be burdensome. If such closing conditions are not met or additional obligations are imposed, the proposed sale may not be consummated, encounter delays, or experience other issues that are not currently anticipated.

•The Company’s failure to successfully transition to the reporting requirements for its asset-based revolving credit facility (“ABL Facility”), which matures on June 30, 2026, or an unexpected downturn in the markets could adversely impact the Company’s financial position and results of operations. On December 27, 2023, the Company entered into the ABL Facility, which provides the Company with $180 million senior secured asset-based revolving credit facility that will expire on June 30, 2026. The ABL Facility amended the Company’s existing $200 million revolving, secured credit facility that was cash flow-based. Availability under the ABL Facility is governed by a borrowing base, determined by the application of specified advance rates against eligible assets, including a portion of trade accounts receivable, inventory, cash and cash equivalents, owned real properties, and owned machinery and equipment.

A number of factors could affect the Company’s ability to successfully complete its transition from its prior cash flow-based revolving credit facility to the current asset-based facility. These factors include:

•Failure to establish processes associated with the ABL Facility’s reporting requirements, which are currently on a monthly basis but could change to a weekly cadence if at any time the borrowing availability falls below 10% of the maximum aggregate principal amount. Failure to timely report could result in an Event of Default (as defined in the ABL Facility), which if not waived, would permit the lenders, at their option, to accelerate all outstanding debt under the ABL Facility. Should the lenders elect to accelerate the debt under the ABL Facility,

a cross-default would be triggered under the Terphane Brazil Loan (as defined below in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Form 10-K (“Item 7”)).

•Because the Company is currently subject to a Cash Dominion Period (as defined in Item 7), it is required to borrow cash to fund working capital, capital expenditures, business development activity, and other general corporate purposes, which limits its financial flexibility;

•Advances on accounts receivable and inventory are subject to change based on periodic commercial finance examinations and appraisals, and the real property, machinery and equipment values included in the borrowing base are subject to change based on periodic appraisals, which could reduce borrowing availability under the ABL Facility; and

•If a Material Adverse Effect (as defined in the ABL Facility) has occurred, the Company will not be able to continue to borrow under the ABL Facility.

In addition, a significant deterioration in the Company’s accounts receivable or inventory levels due to depressed economic conditions, weak consumer spending, turmoil in the credit markets or other factors, could restrict its ability to service its indebtedness or borrow additional funds.

Upon the earlier of March 31, 2025 or the date the Company receives the proceeds from the Contingent Terphane Sale (the “ABL Adjustment Date”), borrowing availability under the ABL Facility will be reduced from $180 million to $125 million. If the Contingent Terphane Sale is not completed by the ABL Adjustment Date, the Company may have to undertake alternative financing plans, subject to the limitations imposed by the ABL Facility, including limitations on its ability to:

•refinance or restructure its indebtedness;

•sell assets; and

•raise additional capital.

The Company may be unable to implement alternative financing plans on commercially reasonable terms or at all, and any such alternative financing plans might be insufficient to allow it to make principal and interest payments on its indebtedness required as a result of the ABL Adjustment Date and the reduction of borrowing availability under the ABL Facility to $125 million. The Company’s ability to restructure or refinance its indebtedness will depend on, among other things, its existing financial condition, projections of business conditions, sales, Credit EBITDA, net cash flow, net leverage and the condition of the capital markets at such time. Any refinancing of the Company’s indebtedness could be at higher interest rates and could require it to comply with additional covenants, which could further restrict the Company’s business operations.

Noncompliance with any of the covenants of the ABL Facility could result int an Event of Default, which if not cured or waived, would permit the lenders, at their option, to accelerate all outstanding debt under the ABL Facility.

Risks Related to All Tredegar’s Businesses

•Recent macroeconomic factors, including inflation, high interest rates, recession risks and other lagging effects of the COVID-19 pandemic, have caused downturns in key markets and created other commercial disruptions, which have and could further adversely impact our businesses.Products sold to key end-use markets, including the B&C and consumer electronics markets, represent a significant portion of our revenue. Because these markets are tied closely to overall economic performance, macroeconomic factors have and could further cause changes to demand for our products. These factors include: (i) inflation; (ii) high interest rates; (iii) recession risks; (iv) disruptions to supply chains; (v) other interruptions of international and regional commerce; and (vi) other lagging effects of the COVID-19 pandemic. Price erosion may occur as competitors become more aggressive in pricing practices. To the extent that these factors reduce demand for our products, our business, financial position, results of operations and cash flows could be adversely impacted.

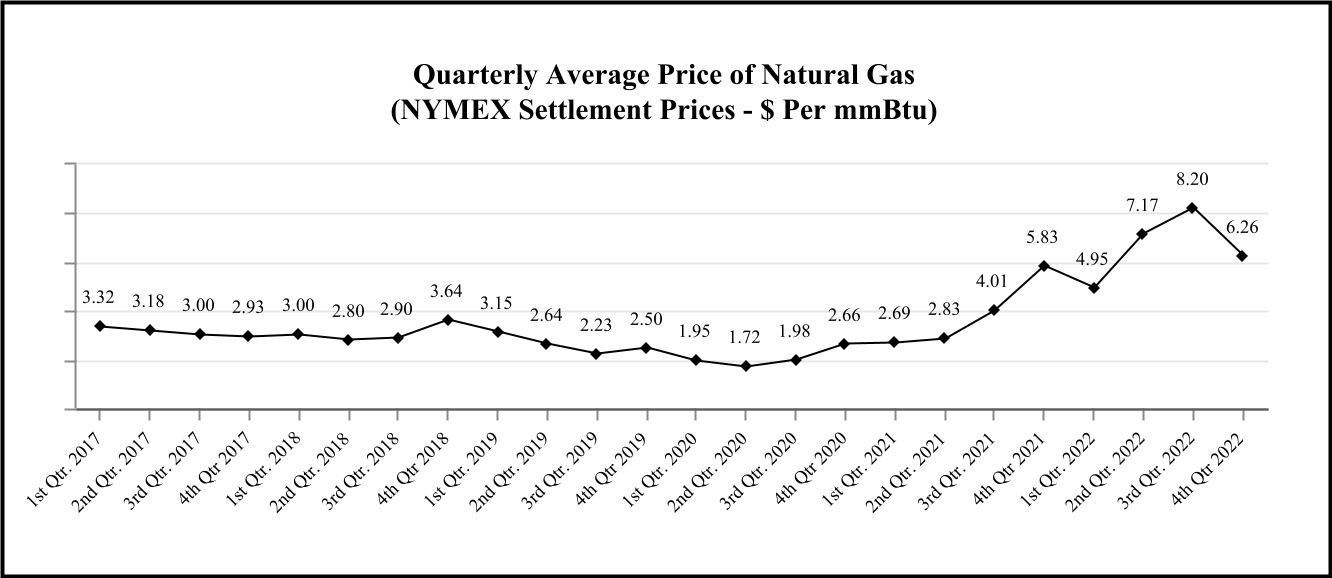

•Tredegar’s performance is influenced by costs incurred by its operating companies, including for example, the cost of raw materials and energy. These costs include the cost of aluminum (the raw material on which Aluminum Extrusions primarily depends), resin (the raw material on which PE Films primarily depends), PTA and MEG (the raw materials on which Flexible Packaging Films primarily depends), natural gas (the principal fuel necessary for Aluminum Extrusions’ plants to operate), electricity, diesel fuel and paint. Aluminum, resin and natural gas prices are volatile as shown in the charts in Item 7a. The Company continues to face inflationary pressures, including notable increases in costs for raw materials, labor and freight. Additionally, geopolitical tensions, including deteriorating relations between the United States and Russia resulting from the invasion of Russia into Ukraine, could result in the implementation of additional economic sanctions, tariffs, import-export restrictions and retaliatory actions that all have the potential to adversely impact the cost of raw materials and energy.7A. The Company attempts to mitigate the effects of increased costs through price increases and contractual pass-through provisions, but there are no assurances that higher prices can effectively be passed through to customers or that Tredegar will be able to offset fully or on a timely basis the effects of higher raw material and energy costs through price increases or pass-through arrangements.costs. Further, the Company’s cost control efforts may not be sufficient to offset any increases in raw material,materials, energy or other costs.

•Material disruptionsOur failure to continue to attract, develop and retain certain key officers or employees could adversely affect our businesses. Our success depends upon the efforts and abilities of key personnel, many of whom are longstanding employees. The loss of any of these key personnel could deplete our institutional knowledge base and negatively affect our ability to efficiently operate our businesses. Certain roles have experienced high turnover in recent years, and we are experiencing an increasingly competitive labor market. Increased employee turnover could hinder our ability to execute our business strategy and adversely affect our business, financial condition, results of operations and cash flows.

•Disruptions at one of the Company’s major manufacturing facilities could negatively impact financial results. Tredegar believes it has implemented measures to minimize the risks of disruption at its facilities. However, a disruption could occur as a result of any number of events: an equipment failure with repairs requiring long lead times, labor stoppages or shortages, cybersecurity attacks, utility disruptions, constraints on the supply or delivery of critical raw materials, and severe weather conditions, including potential flooding at the Aluminum Extrusions facility located in Carthage, TN, which is located in a 50-year flood plain. A material disruption in one of the Company’s operating locations could negatively impact production and the Company’s consolidated financial condition, results of operations and cash flows.

•A failure in the Company’s information technology systems as a result of cybersecurity attacks or other causes could negatively affect Tredegar’s business. The Company depends on information technology (“IT”) to record and process customer orders, manufacture and ship products in a timely manner, secure its production processes and know-how, maintain the financial accuracy of its business records and maintain personally identifiable information of its employees. An IT system failure due to computer viruses, internal or external security breaches, cybersecurity attacks or other malicious causes could disrupt our operations and prevent us from being able to process transactions with our customers,

operate our manufacturing facilities and properly report transactions in a timely manner. Increased global IT security threats and cyber-crime pose a potential risk to the security and availability of the Company’s IT systems, networks and services, including those that are managed, hosted, provided or used by third parties, as well as to the confidentiality, availability and integrity of the Company’s data. Additionally, increased cybersecurity risk arises due to certain employees working remotely. To date, interruptions of the Company’s IT systems have been infrequent and have not had a material impact on the Company’s operations. A significant prolonged failure of or security breach of the IT systems, networks or service providers the Company relies upon, or a loss or disclosure of business or other sensitive information, or personally identifiable information, as a result of a cybersecurity incident or other cause, could result in substantial costs to the Company, damage to the Company’s reputation, regulatory enforcement actions and lawsuits and could adversely affect the Company’s results of operations, financial condition or cash flows.

•Our failure to continue to attract, develop and retain certain key officers or employees could adversely affect our businesses. Our success depends upon the efforts and abilities of key personnel, many of whom are longstanding employees. The loss of any of these key personnel could deplete our institutional knowledge base and negatively affect our ability to efficiently operate our businesses. Certain roles have experienced high turnover in recent years, and we are experiencing an increasingly competitive labor market. Job market dynamics have been impacted by macroeconomic conditions, the effects of the COVID-19 pandemic and the “great resignation.” Increased employee turnover could hinder our ability to execute our business strategy and adversely affect our business, financial condition, results of operations and cash flows.

•The Company has identified material weaknesses in its internal control over financial reporting. The Company’s failure to establish and maintain effective internal control over financial reporting and to maintain effective disclosure controls and procedures increases the risk of a material misstatement in its consolidated financial statements, and its failure to meet its reporting and financial obligations, could, in turn, have a negative impact on its financial condition. Since 2019, a total of $7.6 million has been incrementally spent on remediation efforts for management’s outside consultant and design, hiring (including hiring replacements due to high turnover) and training activities.

Maintaining effective internal control over financial reporting is an integral part of producing reliable financial statements. As discussed in Item 9A. “Controls and Procedures” of this Form 10-K (“Item 9A”), the Company’s management concluded that the Company’s internal control over financial reporting was not effective for the periods referred to therein as a result of certain deficiencies that were determined to constitute material weaknesses in the Company’s internal control over financial reporting. Specifically, the Company did not sufficiently attract, develop, and retain competent resources to fulfill internal control responsibilities and did not have an effective information and communication process that identified and assessed the source of and controls necessary to ensure the reliability of information used in financial reporting. As a consequence of these material weaknesses, the Company did not effectively design, implement and operate process-level controls across its financial reporting processes.

Under standards established by the Public Company Accounting Oversight Board, a material weakness is defined as a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis.

As of December 31, 2022, the Company continues to revise and execute management’s remediation plan, including the implementation of the new and revised internal controls over financial reporting. The results of management’s testing of the design, implementation and operating effectiveness of controls identified that the Company continued to have material weaknesses in its internal control over financial reporting as of December 31, 2022; however, the material weaknesses existing as of December 31, 2022 were limited to certain discrete items within the previously identified material weaknesses as described further in Item 9A.

While progress has been made since 2019, including the remediation of a significant number of process-level control deficiencies throughout our financial reporting processes, the Company experienced significant turnover in positions relevant to its internal control over financial reporting during 2021 and 2022 that impacted the effectiveness of prior training programs and management’s ability to implement control activities that operated for a sufficient period of time to allow management, through testing, to conclude that the control activities were operating effectively during 2022.

To remediate the material weaknesses described in Item 9A, the Company, with the oversight of the Audit Committee and the assistance of management’s outside consultant, has continued to revise its remediation strategy. The Company is in the process of implementing certain changes in its internal controls to remediate the material weaknesses described above. As the Company continues to evaluate and work to improve its internal control over financial reporting and disclosure controls and procedures, management may determine to take additional measures to address control deficiencies or modify the remediation plan. The Company cannot provide assurance, however, as to when it will remediate all such weaknesses, nor can it be certain of whether additional actions will be required or the costs of any such actions. Moreover, the Company cannot provide assurance that additional material weaknesses will not arise in the future. The material

weaknesses cannot be considered remediated until the applicable controls have operated for a sufficient period of time and management has concluded, through testing, that these controls are operating effectively.

The material weaknesses discussed in Item 9A did not result in material misstatements of the Company’s financial statements as of and for the years ended December 31, 2022, 2021 and 2020 or in the intervening interim periods during those respective years. Any failure to remediate the material weaknesses, or the development of new material weaknesses in its internal control over financial reporting, could result in material misstatements in the Company’s consolidated financial statements and cause it to fail to meet its reporting and financial obligations, which in turn could have a negative impact on its financial condition.

•Tredegar has an underfunded defined benefit (pension) plan. Tredegar sponsors a pension plan that covers certain hourly and salaried employees in the U.S. The plan was closed to new participants in 2007, and substantially frozen to benefit accruals for active participants in 2014. As of January 31, 2018, the plan no longer accrued benefits associated with crediting employees for service, thereby freezing all future benefits under the plan. On February 10, 2022, Tredegar announced the initiation of a process to terminate and settle its frozen defined benefit pension plan. In connection therewith, on February 9, 2022, the Company borrowed funds under its revolving credit agreement to contribute $50 million to the pension plan (the “Special Contribution”) to reduce its underfunding and as part of a program within the pension plan to hedge or fix the expected future contributions that will be needed by the Company through the settlement process. The settlement process has been delayed because of longer-than-expected review times with the Internal Revenue Service (“IRS”). The Company does not expect issues with receiving approval from the IRS and is hopeful that the entire process will be completed by the end of 2023. As of December 31, 2022, the plan was underfunded under U.S. generally accepted accounting principles (“GAAP”) measures by $28 million. The Company expects there will be no required minimum contributions to the pension plan until final settlement. The ultimate settlement benefit obligation may differ from the projected benefit obligation (“PBO”) of $246 million as of December 31, 2022, depending on market factors for buyers of pension obligations at the time of settlement. Additionally, factors that could cause actual future contributions by the Company to settle the pension plan to differ from expectations include, without limitation, differences between the ultimate settlement benefit obligation and the PBO, census data, administrative costs, the effectiveness of hedging activities and discounts required to liquidate non-public securities held by the plan.

•Tredegar is subject to current and future governmental regulation, including environmental laws and regulations, and could become exposed to material liabilities and costs associated with such regulation. The Company is subject to regulation by local, state, federal and foreign governmental authorities. New laws and regulations, or changes to existing laws, including those relating to environmental matters (including global climate change and plastic products), and privacy matters, could subject Tredegar to significant additional capital expenditures, operating expenses or other compliance costs. Moreover, future developments in federal, state, local and international laws and regulations, including environmental laws, are difficult to predict. Environmental laws and privacy restrictions have become and are expected to continue to become increasingly strict. As a result, Tredegar expects to be subject to new environmental and privacy laws and regulations. However, any such changes are uncertain and, therefore, it is not possible for the Company to predict with certainty the amount of additional capital expenditures or operating expenses that could be necessary for compliance with respect to any such changes.

The Company is subject to the U.S. Foreign Corrupt Practices Act, Brazilian anti-corruption laws and similar anti-bribery laws in other jurisdictions, which generally prohibit companies and their intermediaries from making improper payments to foreign officials for the purpose of obtaining or retaining business. Although we have policies and procedures designed to facilitate compliance with these laws and regulations, our employees, contractors and agents may take actions in violation of our policies. Any such violation, even if prohibited by our policies, could adversely affect our business and/or our reputation. See Government Regulation in Item 1. “Business” of this Form 10-K for a further discussion of this risk factor.

•Noncompliance with any of the covenants in the Company’s $375 million revolving credit facility, as amended and restated on June 29, 2022, which matures in June 2027, could result in all debt under the agreement outstanding at such time becoming due and limiting the Company’s borrowing capacity, which could have a material adverse effect on its consolidated financial condition and liquidity. The credit agreement governing Tredegar’s revolving credit facility contains restrictions and financial covenants that, if violated, could restrict the Company’s operational and financial flexibility. Failure to comply with these covenants could result in an event of default, which if not cured or waived, would result in all outstanding debt under the revolving credit facility at such time becoming due, which could have a material adverse effect on the Company’s consolidated financial condition and liquidity.

•Our results of operations, financial condition and cash flows have been, and may continue to be, impacted by the Coronavirus (“COVID-19”). The COVID-19 pandemic has adversely affected the economy of the United States and other countries around the world, including affecting labor supply and causing supply chain disruptions. While some of the economic impacts resulting from COVID-19 have eased and many COVID-19 related restrictions have been lifted or relaxed due to advancements in COVID-19 vaccination, testing, and treatment, a rise in infection rates, the emergence of new COVID-19 variants, or any future pandemic could result in, among other things, a reduction in orders placed by our customers who could be closing or curtailing their own operations. We may also experience labor shortages and supply chain disruptions, including product and raw material shortages, delays, and price increases as a result of the COVID-19 pandemic or any future pandemic. Our suppliers, contractors, and third-party logistic providers may continue to experience disruptions and delays stemming from labor and supply challenges, and significant disruptions in transport and logistics services due to facility closures, labor constraints, and other challenges. These challenges may impact our ability to maintain sufficient inventory and to accurately predict demand or lead times, which may inhibit our ability to service customer demand. Additionally, addressing shortages from our current suppliers may require the Company to procure products from new suppliers or through brokers with whom we have a limited or no prior relationship.

Providing an estimate for the ongoing impact of COVID-19 pandemic on the Company’s business is difficult given the evolving nature of COVID-19 and the likelihood that any impact would be affected by factors outside of our control. Such factors may include the severity, duration and spread of COVID-19 and emerging variants, the actions that have been or may be taken by the governments of countries affected, and the ability of our customers and consumers to remain in operation and pay for the products purchased on a timely basis. Additionally, to the extent the COVID-19 pandemic or any future pandemic adversely affects our business, financial condition, or results of operations, it may heighten other risks described in this section.

Risks Related to Aluminum Extrusions

•Sales volume and profitability of Aluminum Extrusions is cyclical and seasonal and highly dependent on economic conditions of end-use markets in the U.S., particularly in the construction sector. Aluminum Extrusions’ end-use markets can be cyclical and subject to seasonal swings in volume. In addition, changes in architectural design, demographic, and/or remote work trends could negatively impact the overall commercial construction industry. Because of the capital-intensive nature and level of fixed costs inherent in the aluminum extrusions business, the percentage drop in earnings before interest, taxes, depreciation and amortization (“EBITDA”) from ongoing operations in a cyclical downturn will likely exceed the percentage drop in volume. In addition, during an economic slowdown, excess industry capacity often drives increased pricing pressure in many end-use markets as competitors seek to protect their position with key customers. Any benefits associated with cost reductions and productivity improvements may not be sufficient to offset the adverse effects on profitability from pricing and margin pressure and higher bad debts (including a greater chance of loss associated with customers defaulting on fixed-price forward sales contracts) that usually accompany a downturn. In addition, higher energy costs can reduce profits unless offset by price increases or cost reductions and productivity improvements.

Starting in third quarter of 2022, the Company observed slowing order input and order cancellations as customers reported high inventory levels. There can be no assurance as to the extent and timing of the recovery of sales volumes and profits for Aluminum Extrusions, especially since there can be a lag in the recovery of its end-use markets in comparison to the overall economic recovery.

•The failure to successfully implementUnfairly traded imports of aluminum extrusions could injure or threaten with injury America’s domestic aluminum extrusions industry, which could have an adverse effect on the new enterprise resource planning and manufacturing execution systems could adversely impact the Aluminum Extrusions business and results of operations. InJanuary 2022, Aluminum Extrusions obtained approval from the Board to engage in the implementation project of a new enterprise resource planning and manufacturing execution systems (“ERP/MES”) across all locations of the Aluminum Extrusions business. The ERP/MES project commenced in 2022 and is expected to cost a total of approximately $30 million over a two-year time span. The implementation of these systems is a major undertaking from a financial management, and personnel perspective. The implementations may prove to be more difficult, costly, or time consuming than expected, and there can be no assurance that these systems will be beneficial to the extent anticipated. Any disruptions, delays or deficiencies in the design and implementation of the new systems could adversely affect our financial position,condition, results of operations and cash flows; additionally, any disruptions, delays or deficiencies could adversely affect our remediation efforts with respect to the effectivenessflows of our internal controls over financial reporting.Aluminum Extrusions.

•1.Failure to prevent foreign competitors from evading anti-dumping and countervailing duties, or failure to reinstate the Aluminum Tariff on aluminum extrusions, could adversely impact Aluminum Extrusions. Chinese and other overseas manufacturers continue to try to evade the anti-dumping and countervailing orders to avoid duties. On October 3, 2022, the U.S. International Trade Commission (“ITC”) extended the anti-dumping (“AD”) and countervailing duty (“CVD”) orders against aluminum extrusions from China, for a period of five years. In 2018, the U.S. imposed tariffs of 10% on aluminum ingot and semi-finished aluminum imported into the U.S. from certain countries.However,countries; however, in December 2020, the Department of Commerce (“DOC”) introduced a tariff exclusion process, granting applicants with tariff exclusions. In response to large and increasing volumes of unfairly traded imports of extrusions associated with these tariff exclusions, a coalition of U.S. domestic producers filed petitions with the DOC and U.S. International Trade Commission (“ITC”). In November 2023, the ITC found that there is a reasonable indication that the American aluminum extrusions industry is materially injured or threatened with injury due to imports from 14 countries, including China. The ITC’s preliminary determination found that subject import volumes were significant and increasing, and that with regard to pricing, subject imports predominantly undersold the domestic product by volume in each year of the period of investigation. On March 5, 2024, the DOC announced its preliminary finding that the governments of China, Indonesia, Mexico and Turkey unfairly subsidize their aluminum extrusion industries. The DOC calculated a range of affirmative preliminary countervailing duties from each country. A

preliminary anti-dumping determination for these four countries and the 10 other countries included in the initial petition is expected in May 2024. The Company expects the final ITC vote to occur in late 2024. A failure by, or the inability of, U.S. trade officials to restore the import tariff in its full format could have a materialan adverse effect on the businesses, financial condition, results of operations and cash flows of Aluminum Extrusions.

•2.The duty-free importation of goods allowed under the United States-Mexico-Canada Agreement (“USMCA”), or other free trade agreements or duty-preference regimes, could result in lower demand for aluminum extrusions made in the U.S., which could materially and negatively affect Aluminum Extrusions’ business and results of operations. As noted above, in March 2018, the U.S. imposed tariffs of 10% on aluminum ingot and semi-finished aluminum imported into the U.S. from certain countries, including countries from which Aluminum Extrusions has historically sourced aluminum products. In September 2019, the U.S., Canada and Mexico entered into the USMCA. As a result of the 10% tariffs on aluminum ingot imported to the U.S. and the duty-free importation of goods allowed under USMCA, or other trade agreement regimes or duty-preference programs, aluminum extrusions from outside the United Statesmade in Canada and Mexico that are able to take advantage of duty-preference programs upon importation into the United States made in Canada and Mexico are free of the

10% tariff and can now be imported into and sold in the U.S. at very competitive prices. This could result in lower demand for aluminum extrusions made in the U.S., which could materially and negatively affect Aluminum Extrusions’ business, and results of operations.operations, financial condition and cash flows.

•The markets for Aluminum Extrusions’ products are highly competitive with product quality, service, delivery performance and price being the principal competitive factors. Aluminum Extrusions has approximately 1,2001,100 customers that are in a variety of end-use markets within the broad categories of building and construction, distribution, automotive and other transportation, machinery and equipment, electrical and consumer durables. No single Aluminum Extrusions’ customer exceeds 4% of consolidated net sales. Future success and prospects depend on Aluminum Extrusions’ ability to provide superior service, high quality products, timely delivery and competitive pricing to retain existing customers and participate in overall industry cross-cycle growth. Failure in any of these areas could lead to a loss of customers, which could have an adverse material effect on the business, financial condition, results of operations and cash flows of Aluminum Extrusions.

•The failure to successfully implement the new enterprise resource planning and manufacturing execution systems could adversely impact the Aluminum Extrusions business and results of operations. InJanuary 2022, Aluminum Extrusions commenced the implementation of new enterprise resource planning and manufacturing execution systems (“ERP/MES”) across all locations of the Aluminum Extrusions business. The implementation of these systems is a major undertaking from a financial, management, and personnel perspective. The implementations have been more difficult, time consuming and costly (approximately $21 million of spending to date) than expected. This project, which was expected to be completed in 2024, has been reorganized with an extended implementation period, due to the implementation of stringent spending measures to control financial leverage. As a result, the earliest “go-live” date for the new ERP/MES is 2025. There can be no assurance that these systems will be beneficial to the extent anticipated. Any additional disruptions, delays or deficiencies in the design and implementation of the new systems could adversely affect our financial position, results of operations and cash flows.

Risks Related to PE Films

•PE Films is highly dependent on sales associated with relatively few large customers. PE Films’ top four customers comprised approximately 10%, 13%10% and 16%13% of Tredegar’s consolidated net sales in 2023, 2022 2021 and 2020,2021, respectively. The loss or significant reduction of sales associated with one or more of these customers without replacement by new business could have a materialan adverse effect on the Company. Surface Protection sales have been adversely impacted by weak market demand and competitive pricing. Customer demand for electronics has continued to deteriorate since the third quarter of 2022, causing manufacturers in the supply chain to experience reduced capacity utilization and inventory corrections. In addition, these depressed market conditions, which are expected to continueConsequently, results of operations for most of the first half of 2023, arePE Films have been adversely impacting mix through reduced sales to our highest value-added customers and products.

The Company previously reported the risk that a portion of its film products used in surface protection applications would be made obsoleteimpacted by customer product transitions, which principally relate to one customer, to less costly alternative processes or materials. The Company estimates that these transitions, which were complete as of the second quarter of 2022, resulted in a total decline of $7 million in pre-tax income from continuing operations as reported under GAAP and EBITDA from ongoing operations during 2022 versus 2021.

Theweak demand for Surface Protection business is continuing to experience competitive pricing pressures, unrelated to the customer product transitions, that adversely impacted pre-tax income from continuing operations as reported under GAAP and EBITDA from ongoing operations by approximately $5.5 million in 2022 versus 2021. To offset the adverse impact of the customer transitions and pricing pressures, the Company is aggressively pursuing sales of new surface protection products, applications and customers and driving production efficiencies and cost savings.products.

While PE Films is undertaking efforts to expand its customer base, there can be no assurance that such efforts will be successful, or that they will offset any loss of sales and profits associated with customer transitions and other large customer declines.

•FailureThe failure of PE Films’ customers who are subject to cyclical downturns, to achieve success or maintain market share could adversely impact PE Films’ sales and operating margins. PE Films’ plastic films are used in the production of various consumer products sold worldwide. A customer’sOur customers’ ability to successfully develop, manufacture and market those products is integral to PE Films’ success. Cyclical downturns and changing consumer preferences, particularly those driven by changes in technology, may negatively affect businesses that use PE Films’ plastic film products, which could adversely affect sales and operating margins. Other factors that could adversely affect the business include (i) failure by a key customer to achieve success or maintain share in markets in which they sell products containing PE Films’ materials, including as a result of customer preferences for products other than plastics, (ii) key customers using products developed by others that replace PE Films’ business with such customers, (iii) delays in a key customer rolling out products utilizing new technologies developed by PE Films, and

(iv) operational decisions by a key customer that result in component substitution, inventory reductions and similar changes.

•The Company’s inability to protect its intellectual property rights or its infringement of the intellectual property rights of others could have a materialan adverse impact on PE Films. The continued success of the PE Films’ business depends on its ability not only to protect its own technologies and trade secrets, but also to develop and sell new products that do not infringe upon existing patents. Intellectual property litigation is very costly and could result in substantial expense and diversions of Company resources, both of which could adversely affect its consolidated financial condition, results of operations and cash flows. In addition, there may be no effective legal recourse against infringement of the Company’s intellectual property by third parties, whether due to limitations on enforcement of rights in foreign jurisdictions or as a result of other factors.

•Disruptions to PE Films’ supply chain could have a material adverse impact on PE Films. Certain raw materials used in manufacturing PE Films’ products are sourced from single suppliers, and PE Films may not be able to quickly or inexpensively re-source from other suppliers. The risk of damage or disruption to its supply chain may increase if and when different suppliers consolidate their product portfolios, experience financial distress or disruption of manufacturing operations (such as, for example, the impact of hurricanes on petrochemical production). Failure to take adequate steps to effectively manage such events, which are intensified when a product is procured from a single supplier or location, could adversely affect PE Films’ consolidated financial condition, results of operations and cash flows, and also require additional resources to restore its supply chain.

•Rising trade tensions could cause an increase in the cost of PE Films’ products or otherwise negatively impact the Company. A portion of PE Film’s business involves imports to and from the U.S. and other countries where the

Company produces and sells its products. Trade tensions have been rising between the U.S. and other countries, particularly China. An increase in tariffs and other trade barriers between the U.S. and China, or between the U.S. and other countries, could cause an increase in the cost of PE Films’ products or otherwise negatively impact the production and sale of the Company’s products in world markets.

•AnFurther impairment of the Surface Protection reporting unit’s goodwill could have a material non-cash adverse impact on our results of operations. The Company assesses goodwill for impairment when events or circumstances indicate that the carrying value may not be recoverable, or, at a minimum, on an annual basis (December 1st of each year). The valuation of goodwill depends on a variety of factors, including macroeconomic conditions, industry and market considerations, cost factors and overall financial performance, as well as companyCompany and reporting unit factors, and goodwill impairment valuations can be sensitive to assumptions associated with such factors. Failure to successfully achieve projections could result in future impairments. Impairment to the Surface Protection reporting unit’s goodwill may also be caused by factors outside the Company’s control, such as increasing competitive pricing pressures, weak consumer electronic market demand, lower than expected sales and profit growth rates, and various other factors. Significant and unanticipated changes could require a non-cash charge for impairment in a future period, which may significantly affect the Company’s results of operations in the period of such charge.

Risks Related to Flexible Packaging Films

•Overcapacity in Latin American polyester film production and governmental failure to extend anti-dumping duties in Brazil on imported products or prevent competitors from circumventing such duties could adversely impact Flexible Packaging Films. In recent years, excess global capacity in the industry has led to increased competitive pressures from imports into Brazil. The Company believes that these conditions have shifted the competitive environment from a regional to a global landscape and have driven price convergence and lower product margins for Flexible Packaging Films. Favorable anti-dumping rulings or countervailing duties are in effect for products imported from China, Egypt, India, Mexico, United Arab Emirates, Peru and Bahrain. Competitors not currently subject to anti-dumping duties may choose to utilize their excess capacity by selling product in Brazil, which may result in pricing pressures that Flexible Packaging Films may not be able to offset with cost savings measures and/or manufacturing efficiency initiatives.

In May 2021, the Brazilian authorities concluded the sunset review relating to the anti-dumping process for polyester film imported from China, India and Egypt, and decided to extend duties for another five years. However, due to its doubts that films would continue to be imported from China and Egypt, the government immediately suspended the implementation of the tariffs for those countries but agreed that if in the future there were volumes imported from China or Egypt which were harming the Brazilian market, authorities may promptly reinstate tariffs. Importing from Egypt increased in Brazil during 2023; therefore, Terphane requested the application of anti-dumping tariffs for Egypt, which was accepted by the Brazilian Government. These tariffs went into effect starting in November 2023. For films imported from India, the Brazilian authorities also reviewed measures against countervailing duties and extended those for five years as well.

In February 2024, the Brazilian Government determined that the anti-dumping measures against Mexico and United Arab Emirates should be extended for a five-year period and anti-dumping measures against Turkey should be removed.

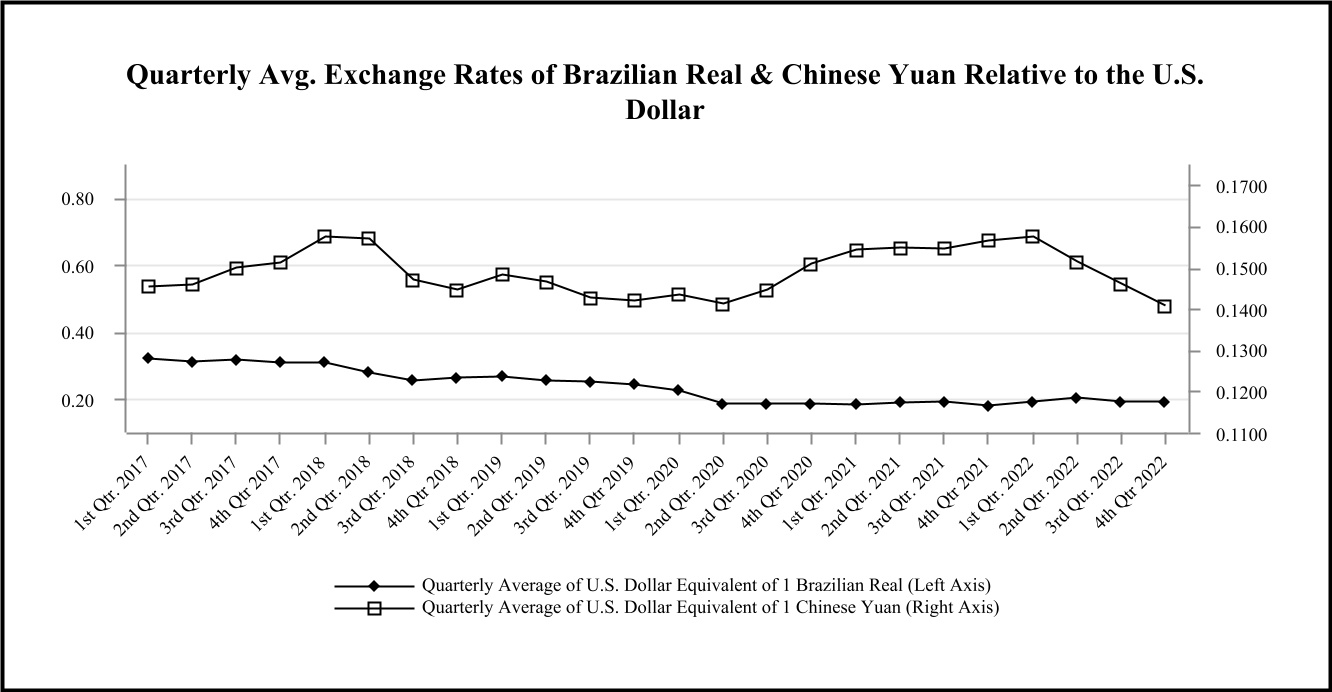

•A history of uncertain economic conditions in Brazil could adversely impact the financial condition, results of operations and cash flows of Flexible Packaging Films. For flexible packaging films produced in Brazil, selling prices and key raw material costs are principally determined in U.S. Dollars and are impacted by local economic conditions and local and global competitive dynamics. Flexible Packaging Films is exposed to foreign exchange translation risk (its functional currency is the Brazilian Real) because almost 90% of the sales of Flexible Packaging Films business unit in Brazil (“Terphane Ltda.”) and substantially all of its related raw material costs are quoted or priced in U.S. Dollars while its variable conversion, fixed conversion and sales, general and administrative costs before depreciation & amortization (collectively “Terphane Ltda. Operating Costs”) are quoted or priced in Brazilian Real. This mismatch, together with a variety of economic variables impacting currency exchange rates, causes volatility that could negatively or positively impact EBITDA from ongoing operations for Flexible Packaging Films. While Flexible Packaging Films hedges this exposure on a short-term basis with foreign exchange forward rate contracts, the exposure continues to exist beyond the hedging periods.

Other Business Risks

•Overcapacity in Latin American polyester film production and governmentalA failure to extend anti-dumping duties in Brazil on imported products or prevent competitors from circumventing such duties could adversely impact Flexible Packaging Films. In recent years, excess global capacity in the industry has led to increased competitive pressures from imports into Brazil. Company’s information technology systems as a result of cybersecurity attacks or other causes could negatively affect Tredegar’s business. The Company believesdepends on information technology (“IT”) to record and process customer orders, manufacture and ship products in a timely manner, secure its production processes and know-how, maintain the financial accuracy of its business records and maintain personally identifiable information of its employees. An IT system failure due to computer viruses, internal or external security breaches, cybersecurity attacks or other malicious causes could disrupt our operations and prevent us from being able to process transactions with our customers, operate our manufacturing facilities and properly report transactions in a timely manner. Increased global IT security threats and cyber-crime pose a potential risk to the security and availability of the Company’s IT systems, networks and services, including those that these conditionsare managed, hosted, provided or used by third parties, as well as to the confidentiality, availability and integrity of the Company’s data. Additionally, increased cybersecurity risk arises due to certain employees working remotely. To date, interruptions of the Company’s IT systems have shifted the competitive environment from a regional to a global landscapebeen infrequent, and have driven price convergence and lower product margins for Flexible Packaging Films. Favorable anti-dumping rulings or countervailing duties are in effect for products imported from China, Egypt, India, Mexico, United Arab Emirates, Turkey, Peru and Bahrain. Competitors not currently subject to anti-dumping duties mayTredegar

choose to utilize their excess capacity by selling product in Brazil, which mayhas not experienced a material cybersecurity incident. A significant prolonged failure of or security breach of the IT systems, networks or service providers the Company relies upon, or a loss or disclosure of business or other sensitive information, or personally identifiable information, as a result of a cybersecurity incident or other cause, could result in pricing pressures that Flexible Packaging Films may notsubstantial costs to the Company, damage to the Company’s reputation, regulatory enforcement actions and lawsuits and could adversely affect the Company’s business, results of operations, financial condition or cash flows.

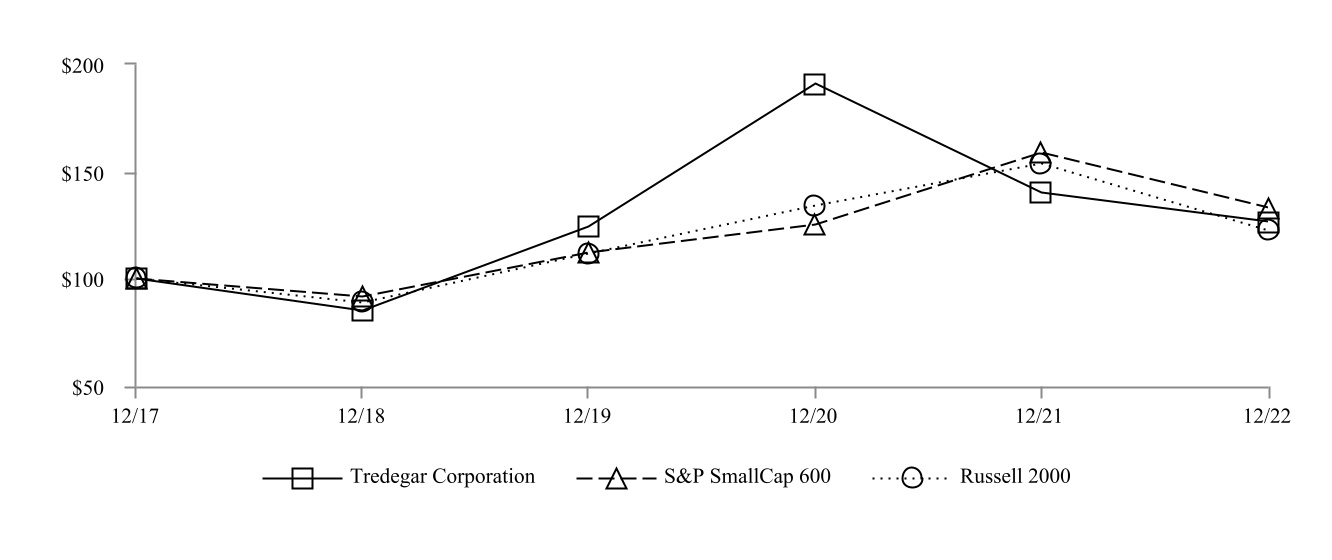

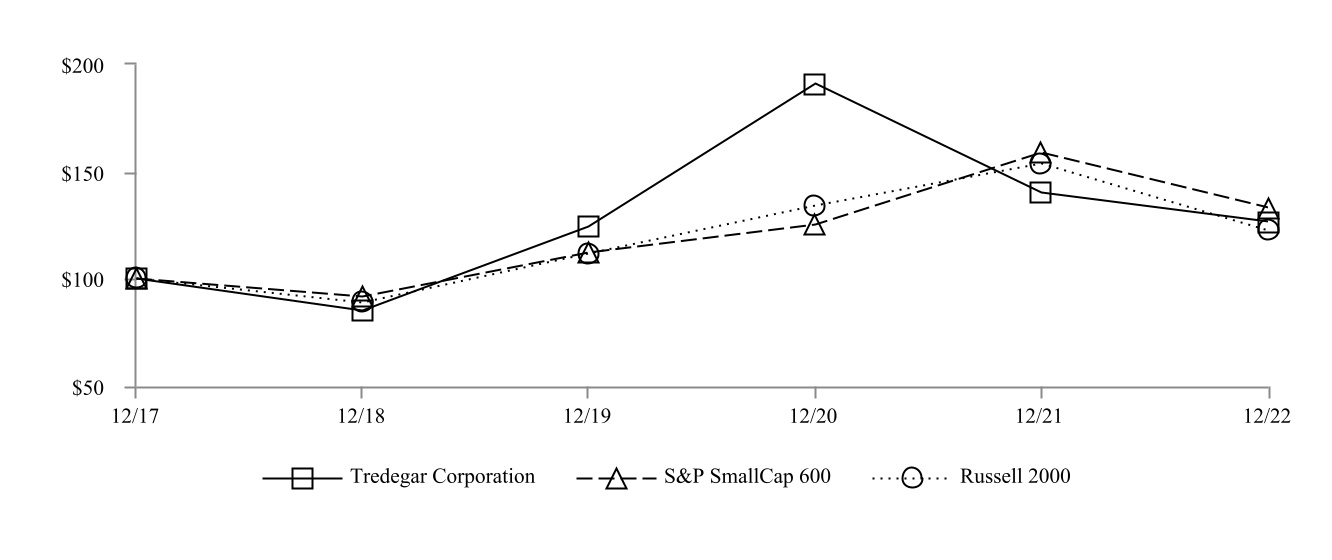

•The Company’s results of operations, financial condition and cash flows have been and could be ableimpacted by the macroeconomic effects of a pandemic.The COVID-19 pandemic had multiple adverse effects on the global economy, including short-term impacts affecting labor supply and causing supply chain disruptions which led to offsetinflationary pressures. In addition, the pandemic resulted in certain after-shocks and structural shifts, which have adversely impacted Tredegar’s markets.