falseDecember 31, 20202020FY000087450112-31YesLarge Accelerated FilerfalsefalsefalseP3YP5YP14Y4,3244,351321929,5811,9025,53637,0191,8862029-12-312040-12-312029-12-312029-12-312040-12-312034-01-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 20202023

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

| | | | | | | | |

| Commission File Number: | | 1-10777 |

| | |

| AMBAC FINANCIAL GROUP, INC. |

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 13-3621676 |

| (State of incorporation) | | (I.R.S. employer identification no.) |

| One World Trade Center | New York | NY | | 10007 |

| (Address of principal executive offices) | | (Zip code) |

| | | | | | | | | | | |

| (212) | 658-7470 | |

| (Registrant’s telephone number, including area code) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | AMBC | | New York Stock Exchange |

Warrants | | AMBC WS | | New York Stock Exchange |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer”, “smaller reporting company”and"emerging growth company" in Rule 12b-2 of the Exchange Act): (Check one):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the Registrant as of the close of business on June 30, 20202023 was $655,986,870.$623,109,150. As of February 26, 2021,2024, there were 45,850,46845,195,370 shares of Common Stock, par value $0.01 per share, were outstanding.

Documents Incorporated By Reference

Portions of the Registrant’s proxy statement forProxy Statement related to its 2021 annual meeting of stockholders are incorporated by reference in this Form 10-K in response to Part III Items 10, 11, 12, 13, and 14.

AMBAC FINANCIAL GROUP, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

| | | | | | | | | | | | | | | | | | | | |

| |

| | | | |

| Item Number | Page | | Item Number | Page |

| | | PART II (CONTINUED) | |

| 1 | | | | 7A | Quantitative and Qualitative Disclosures about Market Risk | |

| | | | 8 | | |

| Description of the Business | | | 9 | | |

| | | | 9A | | |

| | | | 9B | | |

| | | | | |

| 1A | | | | 10 | | |

| 1B | | | | 11 | | |

| 2 | | | | 12 | | |

| 3 | | | | 13 | | |

| 4 | | | | 14 | | |

| | | | |

| 5 | | | | 15 | | |

| 6 | | | | | | |

| 7 | | | | | | |

| | | | | | |

| Executive Summary | | | | | |

| Critical Accounting Policies and Estimates | | | | |

| | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | |

| Ambac UK Financial Results Under UK Accounting Principles | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| |

| | | | |

| Item Number | Page | | Item Number | Page |

| | | PART II (CONTINUED) | |

| 1 | | | | | | |

| | | | | | |

| Description of the Business | | | | U.S. Insurance Statutory Basis Financial Results | |

| | | | | Ambac UK Financial Results Under UK Accounting Principles | |

| | | | | | |

| | | | 7A | Quantitative and Qualitative Disclosures about Market Risk | |

| | | | 8 | | |

| | | | 9 | | |

| 1A | | | | 9A | | |

| 1B | | | | 9B | | |

| 1C | | | | | |

| 2 | | | | 10 | | |

| 3 | | | | 11 | | |

| 4 | | | | 12 | | |

| | | 13 | | |

| 5 | | | | 14 | | |

| 6 | | | | | |

| 7 | | | | 15 | | |

| Executive Summary | | | | | |

| Critical Accounting Policies and Estimates | | | | | |

| | | | | | |

| | | | 16 | Form 10-K Summary | |

| | | | | |

| | | | | | |

CAUTIONARY STATEMENT PURSUANT TO THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

In this Annual Report, we have included statements that may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words such as “estimate,” “project,” “plan,” “believe,” “anticipate,” “intend,” “planned,” “potential” and similar expressions, or future or conditional verbs such as “will,” “should,” “would,” “could,” and “may,” or the negative of those expressions or verbs, identify forward-looking statements. We caution readers that these statements are not guarantees of future performance. Forward-looking statements are not historical facts but instead represent only our beliefs regarding future events, which may by their nature be inherently uncertain and some of which may be outside our control. These statements may relate to plans and objectives with respect to the future, among other things which may change. We are alerting you to the possibility that our actual results may differ, possibly materially, from the expected objectives or anticipated results that may be suggested, expressed or implied by these forward-looking statements. Important factors that could cause our results to differ, possibly materially, from those indicated in the forward-looking statements include, among others, those discussed under “Risk Factors” in Part I, Item 1A ofin this Annual Report on Form 10-K.

Any or all of management’s forward-looking statements here or in other publications may turn out to be incorrect and are based on management’s current belief or opinions. Ambac’sAmbac Financial Group’s (“AFG”) and its subsidiaries’ (collectively, “Ambac” or the “Company”) actual results may vary materially, and there are no guarantees about the performance of Ambac’s securities. Among events, risks, uncertainties or factors that could cause actual results to differ materially are: (1) the highly speculative naturehigh degree of AFG’s common stock and volatility in the price of AFG’s common stock; (2) Ambac's inabilityuncertainty concerning the Company’s ability to realize the expected recoveries, including RMBS litigation recoveries, included inachieve value for holders of its financial statements which would have a materially adverse effect onsecurities, whether from Ambac Assurance Corporation's ("AAC"Corporation (“AAC”) financial condition and may lead to regulatory intervention;its subsidiaries or from the specialty property and casualty insurance business, the insurance distribution business, or related businesses; (3) failure to recover claims paid on Puerto Rico exposures or realization of losses in amounts higher than expected; (4) increases to loss and loss expense reserves; (5) inadequacy of reserves established for losses and loss expenses and the possibility that changes in loss reserves may result in further volatility of earnings or financial results; (6) uncertainty concerning the Company’s ability to achieve value(4) potential for holders of its securities, whether from AAC and its subsidiaries or from transactions or opportunities apart from AAC and its subsidiaries, including new business initiatives relating to the specialty property and casualty program insurance business, the managing general agency/underwriting business, or related businesses; (7) potential of rehabilitation proceedings or other regulatory intervention or restrictions against AAC; (8) increased fiscal stress experienced by issuers of public finance obligations or an increased incidence of Chapter 9 filings or other restructuring proceedings by public finance issuers, including an increased risk of loss on revenue bonds of distressed public finance issuers due to judicial decisions adverse to revenue bond holders; (9) our inability to mitigate or remediate losses, commute or reduce insured exposures or achieve recoveries or investment objectives, or the failure of any transaction intended to accomplish one or more of these objectives to deliver anticipated results; (10) insufficiency or unavailability of collateral to pay secured obligations; (11)(5) credit risk throughout Ambac’s business, including but not limited to credit risk related to insured residential mortgage-backed securities, student loan and other asset securitizations, public finance obligations and exposures to

reinsurers; (12) the impact of catastrophic environmental or natural events, including catastrophic public health events like the COVID-19 pandemic, on significant portions of our insured and investment portfolios; (13) credit risks related to large single risks, risk concentrations and correlated risks; (14) the risk that Ambac’s risk management policies and practices do not anticipate certain risks and/or the magnitude of potential for loss; (15)(including risks associated with adverse selection as Ambac’sChapter 9 and other restructuring proceedings), issuers of securities in our investment portfolios, and exposures to reinsurers; (6) our inability to effectively reduce insured portfolio runs off; (16) Ambac’sfinancial guarantee exposures or achieve recoveries or investment objectives; (7) AAC’s inability to generate the significant amount of cash needed to service its debt and financial obligations, and its inability to refinance its indebtedness; (8) AAC’s substantial indebtedness could adversely affect itsthe Company’s financial condition and operating flexibility; (17)(9) Ambac may not be able to obtain financing or raise capital on acceptable terms or at all due to its substantial indebtedness and financial condition; (18) Ambac may(10) greater than expected underwriting losses in the Company’s

specialty property and casualty insurance business; (11) failure of specialty insurance program partners to properly market, underwrite or administer policies; (12) inability to obtain reinsurance coverage on expected terms; (13) loss of key relationships for production of business in specialty property and casualty and insurance distribution businesses or the inability to secure such additional relationships to produce expected results; (14) the impact of catastrophic public health, environmental or natural events, or global or regional conflicts; (15) credit risks related to large single risks, risk concentrations and correlated risks; (16) risks associated with adverse selection as Ambac’s financial guarantee insurance portfolio runs off; (17) the risk that Ambac’s risk management policies and practices do not be able to generateanticipate certain risks and/or the significant amountmagnitude of cash needed to service its debt and financial obligations, and may not be able to refinance its indebtedness; (19)potential for loss; (18) restrictive covenants in agreements and instruments maythat impair Ambac’s ability to pursue or achieve its business strategies; (20)(19) adverse effects on operating results or the Company’s financial position resulting from measures taken to reduce financial guarantee risks in its insured portfolio; (21)(20) disagreements or disputes with Ambac's insurance regulators; (22) default by one or more of Ambac's portfolio investments, insured issuers or counterparties; (23)(21) loss of control rights in transactions for which we provide insurance duefinancial guarantee insurance; (22) inability to a finding that Ambac has defaulted; (24) adverse tax consequences or other costs resulting from the characterizationrealize expected recoveries of the AAC’s surplus notes or other obligations as equity; (25)financial guarantee losses; (23) risks attendant to the change in composition of securities in the Ambac’s investment portfolio; (26)(24) adverse impacts from changes in prevailing interest rates; (27) our results of operation may be adversely affected by(25) events or circumstances that result in the impairment of our intangible assets and/or goodwill that was recorded in connection with Ambac’s acquisition of 80% of the membership interests of Xchange; (28) risks associated with the expected discontinuance of the London Inter-Bank Offered Rate; (29)acquisitions; (26) factors that may negatively influence the amount of installment premiums paid to the Ambac; (30) market risks impacting assets in the Ambac’s investment portfolio or the value of our assets posted as collateral in respect of interest rate swap transactions; (31) risks relating to determinations of amounts of impairments taken on investments; (32)(27) the risk of litigation, and regulatory inquiries, investigations, claims or investigations,proceedings, and the risk of adverse outcomes in connection therewith, which could have a material adverse effect on Ambac’s business, operations, financial position, profitability or cash flows; (33)therewith; (28) the Company’s ability to adapt to the rapid pace of regulatory change; (29) actions of stakeholders whose interests are not aligned with broader interests of the Ambac's stockholders; (34)(30) system security risks, data protection breaches and cyber attacks; (35) changes in accounting principles or practices that may impact Ambac’s reported financial results; (36)(31) regulatory oversight of Ambac Assurance UK Limited ("(“Ambac UK"UK”) and applicable regulatory restrictions may adversely affect our ability to realize value from Ambac UK or the amount of value we ultimately realize; (37) operational risks, including with respect to internal processes, risk and investment models, systems and employees, and(32) failures in services or products provided by third parties; (38) Ambac’s financial position(33) political developments that may prompt departures of key employees and may impactdisrupt the its abilityeconomies where the Company has insured exposures; (34) our inability to attract and retain qualified executives, senior managers and employees; (39)other employees, or the loss of such personnel; (35) fluctuations in foreign currency exchange rates could adversely impactrates; (36) failure to realize our business expansion plans or failure of such plans to create value; (37) greater competition for our specialty property and casualty insurance business and/or our insurance distribution business; (38) loss or lowering of the insured portfolio in the event of loss reserves or claim payments denominated in a currency other than US dollarsAM Best rating for our property and the value of non-US dollar denominated securities in our investment portfolio; (40)casualty insurance company subsidiaries; (39) disintermediation within the insurance industry that negatively impacts our managing general agency/underwriting business; (41)or greater competition from technology-based insurance solutions or non-traditional insurance markets; (40) changes in law or in the functioning of the healthcare market that impair the business model of our accident and health managing general underwriter; and (42)(41) other risks and uncertainties that have not been identified at this time.

| Ambac Financial Group, Inc. 1 2020 FORM 10-K |

| | | | | | | | |

| Ambac Financial Group, Inc | 1 | 2023 Form 10-K |

Item 1. Business

INTRODUCTION

Ambac Financial Group, Inc. ("AFG"), headquartered in New York City, is a financial services holding company incorporated in the State of Delaware on April 29, 1991. References to “Ambac,” the “Company,” “we,” “our,” and “us” are to AFG and its subsidiaries, as the context requires. Ambac's business operations include:Ambac operates three principal businesses:

•Legacy Financial Guarantee ("FG"LFG") Insurance — Ambac's financial guarantee business includes the activities of Ambac Assurance Corporation ("Ambac Assurance" or "AAC"AAC") and its wholly owned subsidiarysubsidiaries, including Ambac Assurance UK Limited (“Ambac UK”), legacy and Ambac Financial Services LLC ("AFS"). Both AAC and Ambac UK are financial guarantee businesses, both of whichinsurance companies that have been in runoffrun-off, having not underwritten any new business since 2008. AFS is AAC's legacy interest rate swap provider which is also currently being run-off.

•Specialty Property &and Casualty Program Insurance — CurrentlyAmbac's specialty property and casualty program business ("Specialty Property and Casualty Insurance") includes five admitted carriers and an excess and surplus lines (“E&S” or “nonadmitted”) carrier Everspan Insurance Company and nonadmitted carrier Everspan Indemnity Insurance Company (collectively, "Everspan" or the "Everspan Group"“Everspan”). This platform, which receivedEverspan carriers have an A- Financial Strength Rating from A.M.AM Best in February 2021, is expected to launch new underwriting programs in 2021.rating of 'A-' (Excellent).

•Managing General Agency / UnderwritingInsurance Distribution — CurrentlyAmbac's insurance distribution business includes Xchange Benefits, LLCmanaging general agents/underwriters (collectively "MGAs" or "MGA/Us") and Xchange Affinity Underwriting Agency, LLC (collectively, “Xchange”) a property and casualty Managing General Underwriterinsurance brokers operating as part of which AFG acquired 80% on December 31, 2020. Refer toCirrata Group.

Beginning in 2022, the Company began reporting these three business operations as segments; see Note 3. Business CombinationSegment Information for further information relating to this acquisition.information.

AFG, has $366on a standalone basis, had $211 million in net assets (excluding its investment in subsidiaries) and net operating loss carry-forwards of $3,639$3,400 million ($2,1821,760 million of which is allocated to AAC) at December 31, 2020.2023. See Schedule II for more information on the holding company.

As of and for the year ended December 31, 2020, management reviewed financial information, allocated resources and measured financial performance on a consolidated basis and accordingly the Company had a single reportable segment. As a result of the acquisition of Xchange and the expected launch of the Everspan Group platform, segments will be re-evaluated in 2021.

Corporate Strategy:Strategies to Enhance Shareholder Value

The Company's primary goal is to maximize long-term shareholder value through executing the following key strategies:execution of targeted strategies for its (i) Specialty Property and Casualty Insurance and Insurance Distribution businesses and (ii) Legacy Financial Guarantee Insurance business.

Specialty Property and Casualty Insurance and Insurance Distribution strategic priorities include:

•Active runoffGrowing our Specialty Property and Casualty Insurance business to generate underwriting profits from a diversified portfolio of AACcommercial and its subsidiariespersonal liability risks accessed primarily through transaction terminations, commutations, restructurings, and reinsurance with a focus on our watch list credits and known and potential future adversely classified credits, that we believe will improve our risk profile, and maximizing the risk-adjusted return on invested assets;program administrators.

•Ongoing rationalizationExpanding our Insurance Distribution business based on deep domain knowledge in specialty and niche classes of Ambac's capital

risk which generate attractive margins at scale. This will be achieved through acquisitions, establishing new businesses “de-novo,” and liability structures;organic growth and diversification supported by a centralized technology led shared services offering.

•Making opportunistic investments that are strategic to both the Specialty Property and Casualty Insurance and Insurance Distribution businesses.

Legacy Financial Guarantee Insurance strategic priorities include:

•Actively managing, de-risking and mitigating insured portfolio risk, and pursuing recoveries of previously paid losses.

•Loss recovery through active litigation managementImproving operating efficiency and exercise of contractualoptimizing our asset and legal rights;

•Ongoing review of the effectiveness and efficiency of Ambac's operating platform; andliability profile.

•Further expanding into specialty property and casualty program insurance, managing general agency/underwriting and potentially other insurance and insurance related businesses that will generate long-term shareholderExploring strategic options to further maximize value with attractive risk-adjusted returns and meet other preestablished criteria.for AFG.

DESCRIPTION OF THE BUSINESS

Legacy Financial Guarantee Insurance Business:

Ambac's Financial Guarantee strategy is to increase the value of its investment in AAC and Ambac UK. With regards to AAC, this strategy is subject to the restrictions set forth in the Settlement Agreement, dated as of June 7, 2010 (the "Settlement Agreement"), by and among AAC, Ambac Credit Products LLC ("ACP"), AFG and certain counterparties to credit default swaps with ACP that were guaranteed by AAC, as well as the Stipulation and Order (as defined in Note 1. Background and Business Description to the Consolidated Financial Statements included in Part II, Item 8 of this Form 10-K) and in the indenture for the Tier 2 Notes (as defined in Note 1. Background and Business Description to the Consolidated Financial Statements included in Part II, Item 8 of this Form 10-K), each of which requires OCI (as defined below) and, under certain circumstances, holders of the debt instruments benefiting from such restrictions, to approve certain actions taken by or in respect of AAC. In exercising its approval rights, OCI will act for the benefit of policyholders, and will not take into account the interests of AFG. See Note 1. Background and Business Description to the Consolidated Financial Statements included in Part II, Item 8 in this Form 10-K for further information.Insurance:

Financial guarantee insurance policies provide an unconditional and irrevocable guarantee which protects the holder of a debt obligation against non-payment when due of the principal and interest on the obligations guaranteed. Pursuant to such guarantees, AAC and Ambac UK make payments if the obligor responsible for making payments fails to do so when due. AAC and Ambac UK last wrote insurance policies in 2008 and have been in run-off ever since.

Financial guarantee revenues consist mostly of premiums earned from run-off insurance contracts, net of reinsurance.reinsurance, and income on investments held in AAC's and Ambac UK's investment portfolios. Financial guarantee expenses consist of: (i) loss and commutation payments; (ii) loss adjustment expenses; (iii) interest expense on debt, (iv) operating expenses and (iv)(v) insurance intangible amortization.

Ambac's Legacy Financial Guarantee Insurance business strategy is to increase the residual value of AAC and Ambac UK with the ultimate goal of monetizing such value through (i) dividends and capital distributions while managing their active run-off; (ii) one or more reinsurance transactions or other de-risking transactions that will accelerate or enhance the ability of AAC and/or Ambac UK to pay dividends and make capital distributions; (iii) the sale of all or portions of AAC and/or Ambac UK; or (iv) other strategic transactions to accelerate and/or enhance the above-stated corporate strategy.

Ambac and its advisors are actively discussing strategic options for its Legacy Financial Guarantee Insurance business with interested parties. While we anticipate that these discussions will be completed in 2024 there can be no assurance that we will ultimately complete any strategic initiative.

AAC and Ambac UK have been working toward reducing uncertaintiesrisk within their insured portfolios such asfocusing on exposures to financially stressed municipal entities (including Puerto Rico)insured exposures as well as large and asset-backed securities (including residential mortgage-backed securities ("RMBS")concentrated exposures. Opportunities for remediating losses on poorly performing

| | | | | | | | |

| Ambac Financial Group, Inc | 2 | 2023 Form 10-K |

insured exposures depend on a number of factors including market conditions, the structure of the underlying risk, the perception of AAC’s or Ambac UK’s creditworthiness, as well as counterparty specific factors. Their ability to remediate risk and student loan-backed securities).commute policies may be limited by available liquidity. Additionally, AAC and Ambac UK are actively prosecuting legal claims (including RMBS-related lawsuits brought by AAC), managing their regulatory frameworks and seeking to optimize capital allocation in a challenging environmentcomplex insured portfolios that includesinclude long duration obligationsobligations.

The execution of Ambac’s strategy to increase and attemptingmonetize the value of its investment in AAC is subject to retain key employees.

Opportunities for remediating losses on poorly performing insured transactions also depend on market conditions, including the perceptionrestrictions set forth in the Settlement Agreement, dated as of AAC’s creditworthiness, the structure of the underlying riskJune 7, 2010, as amended (the "Settlement Agreement"), by and associated policyamong AAC, Ambac Credit Products LLC ("ACP"), AFG and certain counterparties to credit default swaps with ACP that were guaranteed by AAC, as well as other

•The Settlement Agreement limits certain activities of AAC and its subsidiaries, such as issuing indebtedness; engaging in mergers and similar transactions; disposing of assets; making restricted payments; creating or permitting liens; engaging in transactions with affiliates; modifying or creating tax sharing agreements; and taking certain actions with respect to surplus notes (among other restrictions and limitations). The Settlement Agreement includes certain allowances with respect to these activities and generally requires the approval of OCI and, in some cases, holders of surplus notes issued pursuant to the Settlement Agreement, for consents, waivers or amendments.

| Ambac Financial Group, Inc. •2 2020 FORM 10-K |

TableThe Stipulation and Order requires AAC to maintain a level of Contentssurplus and contingency reserves as regards policyholders which provide reasonable security against contingencies affecting AAC’s financial position that are not otherwise fully covered by reserves or reinsurance; discount loss reserves in a manner approved by OCI; maintain OCI’s Runoff Capital Framework (as defined and described below) according to parameters specified by OCI; pay the costs of consultants and other experts retained by OCI; refrain from certain affiliate transactions and the payment of any dividend or other distribution without the prior non-disapproval of OCI; notify OCI of events that would or would be reasonably likely to cause a material adverse effect to AAC or its affiliates; obtain OCI’s non-disapproval to exercise certain control rights with respect to certain policies that were previously allocated to the Segregated Account of AAC; obtain OCI’s approval for non-ordinary course transactions involving consideration to be paid by AAC of $100 million or more; and obtain OCI’s approval of any changes to AAC’s investment policy or derivative use plan. The Stipulation and Order also requires AFG to use its best efforts to preserve the use ofcounterparty specific factors. AAC'sNOLs for the benefit of AAC and its subsidiaries. The Stipulation and Order differs from the 2018 Stipulation and Order in that the 2018 Stipulation and Order (i) did not refer to OCI’s Runoff Capital Framework; (ii) included certain affirmative covenants concerning books and records, and reporting of information or events, that were not included in the Stipulation and Order; and (iii) contained a more restrictive limitation on transactions with affiliates. The Stipulation and Order has no fixed term and may be terminated or modified only with the approval of OCI. OCI reserved the right to modify or terminate the Stipulation and Order in a manner consistent with the interests of policyholders, creditors and the public generally.

The execution of Ambac’s strategy to increase the value of its investment in AAC may be affected by a new capital framework developed and implemented by OCI to assist OCI with making decisions related to capital management at AAC ("OCI's Runoff Capital Framework"). OCI’s Runoff Capital Framework applies risk-based and other adjustments to AAC’s assets and insured liabilities, as determined by OCI in its sole discretion. OCI’s Runoff Capital Framework allows AAC to understand the likely impact of various developments and actions now or in the future on AAC’s capital position thereunder. No changes in AAC’s current management of the business are required by OCI’s Runoff Capital Framework. AAC’s ability to commute policiesuse capital for potential future deleveraging transactions or purchase certain investments may alsodistributions will require AAC to sustain an excess of risk-adjusted assets over risk-adjusted insured liabilities according to OCI’s Runoff Capital Framework, and to obtain OCI’s approval, and there can be limitedno assurance that OCI will approve any such use of capital. The results of OCI’s Runoff Capital Framework are expected to vary over time based on changes in AAC’s financial position, insured portfolio developments, the impact of strategic actions taken by available liquidity.AAC, the impact of asset/liability management by AAC and, possibly, changes to the inputs and assumptions utilized by OCI.

The deteriorationAAC has a significant amount of AAC'sdebt outstanding in the form of principal and Ambac UK's financial condition beginning in 2007 has prevented these companies from being ableaccrued but unpaid interest on surplus notes. Surplus notes are treated as capital for regulatory purposes as the obligation to write new financial guaranty business. Not writing new business haspay principal and continuesinterest on them is subordinated to negatively impact Ambac’s operationsthe obligation to pay policyholder claims and financial results. such payments cannot be made without the explicit authorization of the OCI.

AAC’s ability to pay dividends and, as a result, AFG’s liquidity, haveto AFG has also been significantly restricted by the deterioration of AAC’s financial condition and by regulatory, legal and contractual restrictions. It is highly unlikely that AAC will be ableSubstantial uncertainty remains as to make dividend paymentsAAC's ability to pay dividends to AFG forand the foreseeable future.timing of any such dividends, which constrains AFG's liquidity. Refer to "Dividend Restrictions, Including Contractual Restrictions" below and to Note 9.8. Insurance Regulatory Restrictions to the Consolidated Financial Statements included in Part II, Item 8 in this Annual Report on Form 10-K, for more information on dividend payment restrictions.

Interest rate derivative transactions arewere executed through Ambac Financial Services (“AFS”),AFS, a wholly-owned subsidiary of AAC. The primary activityAll remaining interest rate derivative positions, which are substantially economically hedged, relate to legacy financial guarantee customer swaps. Until the second quarter of AFS is2023, interest rate derivatives were also used to partially hedge interest rate risk in the financial

| | | | | | | | |

| Ambac Financial Group, Inc | 3 | 2023 Form 10-K |

guarantee insurance and investment portfolios. Accordingly, interest rate derivatives are positionedAFS continues to benefit from rising rates. Under agreements governing interest rate derivative positions, AFS generally mustbe required to post collateral or margin in excess of the market value of the swaps and futures contracts. All AFS derivative contracts containing ratings-based downgrade triggers that could resultcertain interest rate derivatives when they are in collateral or margin posting or a termination have been triggered. Amark-to-market loss position. While not anticipated, early termination of AFS’s derivatives could result in losses. AFS has borrowed cash and securities from AAC to help support its collateral and margin posting requirements previous termination payments and other cash needs.

Credit risks relating to interest rate derivative positions primarily relate to the default of a counterparty. AFS's interest rate derivatives generally consist of centrally cleared swaps, US treasury futures and some over-the-counter ("OTC") swaps with financial guarantee customers or bank counterparties. Counterparty default exposure is mitigated through the use of industry standard collateral posting agreements or margin posting requirements.

•Cleared swaps, futures and OTC derivatives with bank counterparties require margin or collateral to be posted up to or in excess of the market value of the interest rate derivatives. Interest rate derivative contracts entered into with financial guarantee customers are not subject to collateral posting agreements. In some cases, interest rate derivatives between Ambac and financial guarantee customers are placed through a third party financial intermediary and similarly do not require collateral posting.

•Credit risk associated with financial guarantee customer derivatives and credit derivatives, is managed through the risk management processes described in the Risk Management Group section below.

Ambac manages a variety of market risks inherent in its businesses, including credit, market, liquidity, operational and legal. These risks are identified, measured, and monitored through a variety of control mechanisms, which are in place at different levels throughout the organization. See “Quantitative

and Qualitative Disclosures About Market Risk” included in Part II, Item 7A in this Annual Report on Form 10-K for further information.

Segregated Account

In March 2010, AAC established a segregated account pursuant to Wisconsin Stat. §611.24(2) (the “Segregated Account”) to segregate certain segments of AAC’s liabilities. The Office of the Commissioner of Insurance for the State of Wisconsin (“OCI” (which term shall be understood to refer to such office as regulator of AAC and to refer to the Commissioner of Insurance for the State of Wisconsin as rehabilitator of the Segregated Account (the “Rehabilitator”), as the context requires)) commenced rehabilitation proceedings in the Wisconsin Circuit Court for Dane County (the “Rehabilitation Court”) with respect to the Segregated Account (the “Segregated Account Rehabilitation Proceedings”) in order to permit OCI to facilitate an orderly run-off and/or settlement of the liabilities allocated to the Segregated Account pursuant to the provisions of the Wisconsin Insurers Rehabilitation and Liquidation Act. AAC, itself, did not enter rehabilitation proceedings.

A plan of rehabilitation for the Segregated Account, as amended (the "Segregated Account Rehabilitation Plan"), became effective on June 12, 2014. On September 25, 2017 the Rehabilitator filed a motion in the Rehabilitation Court seeking entry of an order approving an amendment to the Segregated Account Rehabilitation Plan (the "Second Amended Plan of Rehabilitation"). Following the conclusion of a Confirmation Hearing on January 22, 2018, the Rehabilitation Court entered an order granting the Rehabilitator's motion and confirming the Second Amended Plan of Rehabilitation. On February 12, 2018 (the "Effective Date"), the Second Amended Plan of Rehabilitation became effective. Consequently, the rehabilitation of the Segregated Account was concluded. Refer to Note 1. Background and Business Description to the Consolidated Financial Statements included in Part II, Item 8 in this Form 10-K, for more information on the Segregated Account and the Segregated Account Rehabilitation Proceedings.

Risk Management

Ambac’s financial guarantee insurance policies and credit derivative contracts expose the Company to the direct credit risk of the assets and/or obligor supporting the guaranteed obligation. In addition, insured transactions expose Ambac to indirect risks that may increase our overall risk, such as credit risk separate from, but correlated with, our direct credit risk; market; model; economic;economic, including the risk of economic recession; natural disasterdisaster; pandemic and mortality or other non-credit type risks. Please refer to Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Financial Guarantees in Force” section below for details on the financial guarantee insured portfolio.

The Risk Management Group ("RMG") is primarily responsible for the development, implementation and oversight of loss mitigation strategies, surveillance and remediationmanagement of the insured financial guarantee portfolio, including Surveillance and Risk Remediation (including through the pursuit of recoveries in respect of paid claims and commutations of policies). Our ability to execute certain risk management activities may be limited by the restrictions set forth in the Settlement Agreement and the Stipulation and Order, andamong other constraints. To the indenture for the Tier 2 Notes.extent OCI's approval is required in connection with risk management activities, OCI's decisions may be guided by OCI's Runoff Capital Framework. See Note 1. Background and

| Ambac Financial Group, Inc. 3 2020 FORM 10-K |

Business Description to the Consolidated Financial Statements included in Part II, Item 8 in this Annual Report on Form 10-K for further information.

Ambac’s RMG has an organizational structure designed around four primary areas of focus: Surveillance Risk Remediation, Credit Risk Management and Loss Reserving and Analytics.

Surveillance

This group's focus is focused on the early identification of potential stress and/or credit deterioration in connection withand the related analysis of credit exposures in the insured portfolio and the related credit analysis associated with these and other insured portfolio exposures.portfolio. Additionally, Surveillance will evaluateevaluates the impact of changes in the economic, regulatory or political environment on the insured portfolio.

Analysts in this group perform periodic credit reviews of insured exposures according to a schedule based on the risk profile of the guaranteed obligations or as necessitated by specific credit events or other macro-economic variables. Risk-adjusted surveillanceSurveillance strategies have been developed for each bond type with review periods and scope of review based upon each bond type’s risk profile. The risk profile is assessed regularly in response to our own experience and judgments or external factors such as the economic environment and industry trends. The focus of a credit review is to assess performance, identify credit trends and recommend appropriate credit classifications, ratings and changes to a

transaction or bond type’s review period and surveillance requirements. Please refer to Note 2. Basis of Presentation and Significant Accounting Policies to the Consolidated Financial Statements included in Part II, Item 8 in this Annual Report on Form 10-K for further discussion of the various credit classifications utilized by Ambac. If a problem is detected, the Surveillance group will then work with the Risk Remediation group on a loss mitigation plan, as necessary.

The insured portfolio contains exposures that are correlated and/or concentrated. RMG's surveillance activities include identifying these types of exposures and identifying the risks that would or could trigger credit deterioration across these related exposures. This is the case with student loans and RMBS,residential mortgage-backed securities ("RMBS"), for example, which have several correlations including those associated with consumer lending, unemployment, interest rates and home prices. In the future, Ambac’s portfolio may be subject to similar credit deterioration arising from concentrated and/or correlated risks. Examples of other such risks that could impact our portfolio, and that our surveillance is designed to monitor include the impact of potential municipal bankruptcy contagion, the impact of tax reform on state and municipal bond issuers,large-scale domestic military spending or the impact of large scale domestic militarytroop level cutbacks on our privatized military housing portfolio orand event risk such as pandemics (e.g., COVID-19), natural disasters or other regional stresses. Most such risks cannot be predicted and may materialize unexpectedly or develop rapidly. Although our surveillance allows us to connect the event and stress to the related exposures and assign an adverse credit classification and estimate losses across the affected credits, when necessary, we may not have adequate resources or contractual rights and remedies to mitigate loss arising from such risks.

Watchlist and Adversely Classified Credits

Watch list and adversely classified credits are tracked closely and are discussed as part of scheduled RMG credit meetings. A summary of developments regarding adversely classified credits and credit trends is also provided to AFG’s, AAC’s and Ambac UK's Boards of Directors no less than quarterly.

Ambac assigns internal credit ratings to individual exposures as part of the Surveillance process. These internal credit ratings, which represent Ambac’s independent judgments, are based upon underlying credit parameters consistent with the exposure type.

Risk Remediation

Risk Remediation's focus isRemediation activities are centered on exposure reduction and loss mitigation avoiding defaults, and restructuring related to the insured portfolio. In particular, this group focusesthe focus is on reducing exposure to credits that have current negative developing trends, have the potential for future adverse development or are already adversely classified by, among other things, securingexercising rights and remedies, both of which may help to mitigate losses in the event of further deterioration or eventevents of default, or, as available, working with an issuer to refinance, defease or otherwise retire debt.

Loss mitigation and restructuring focuses on the analysis, implementation and execution of commutation and related claims reduction defeasance or workout strategies for policies with potential future claims. Efforts are focused on minimizing claims and maximizing recoveries, typically following an event of default. The emphasis on reducing risk is centered on reducing exposure on a prioritized basis.

For certain adversely classified, survey list and watch list credits RMG analysts will develop(as described in Note 2. Basis of Presentation and implement aSignificant Accounting Policiesto the Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K), risk remediation or loss

| | | | | | | | |

| Ambac Financial Group, Inc | 4 | 2023 Form 10-K |

mitigation planplans are developed and implemented that couldmay include actions such as working with the issuer, trustee, bond counsel, servicer and other interested parties in an attempt to remediate the problem and minimize AAC’sAmbac’s exposure to potential loss. Other actions could include working with bond holders and other economic stakeholders to negotiate, structure and execute solutions, such as commutations. In addition, reinsurance is used as a remediation tool to reduce exposure to certain targeted policies and large concentrations.

Adversely classified, survey list and watch list credits are tracked closely by RMG analysts as part of the risk remediation process and are discussed at regularly scheduled meetings with Credit Risk Management (see discussion following in “Credit Risk Management”). In some cases, the RMG will engage restructuring or workout experts, attorneys and/or other consultants with appropriate expertise in the targeted loss mitigation area to assist management in examining the underlying contracts or collateral, providing industry specific advice and/or executing strategies.

We have established cross-functional teams in key areas of focus, comprised of personnel both within the RMG and in other departments, to target proactive mitigation and remediation of losses and potential future losses associated with certain credits and sectors in the insured portfolio. An example of such efforts includes the teams of professionals focused on the review and enforcement of contractual representations and warranties ("R&W") supporting RMBS policies. Members of these cross-functional teams will often work with external experts in the pursuit of risk reduction efforts.

Credit Risk Management ("CRM")

The CRM function manages the decision process for all material matters that affect credit exposures within the insured portfolio. CRM provides a forum for independent assessments, reviews and approvals and drives consistency and timeliness. The scope of credit matters under the purview of CRM includes material amendments, consents and waivers, evaluation of remediation or loss mitigation plans, credit review scheduling, credit classifications, rating designations, review of watch list or adversely classified credits, sector reviews and overall portfolio

| Ambac Financial Group, Inc. 4 2020 FORM 10-K |

reviews. Formal plans or transactions that relate to risk remediation, loss mitigation or restructuring may also require Risk Committee approval.

Control Rights

In certain domestic and international structured finance transactions, including certain structured public finance transactions, public-private partnerships and other transactions, AAC and Ambac UK may be the control party as a result of insuring thea transaction’s senior class or tranche of debt obligations. The control party may direct specified parties, usually the trustee, to take or not take certain actions following contractual defaults or trigger events. Control rights and the scope of direction and remedies vary considerably among our insured transactions. Because AAC and Ambac isUK are party to and/or hashave certain rights in documents supporting transactions in the insured portfolio, Ambac frequently receivesthey may receive requests for amendments, consents and waivers (“ACWs”ACW”). RMG reviews, analyzes and processes all requests for ACWs. The decisionDecisions to approve or reject ACWs isare made by AAC’s and Ambac UK’s risk management groups based upon certain credit factors, such as the issuer’s ability to repay the bonds and the bond’s security features and structure. As part

P&C Industry Overview

We operate within the $875 billion U.S. P&C insurance market with a particular focus on the commercial MGA/U program market both on an Admitted and Excess & Surplus Lines ("E&S") basis.

Admitted and E&S Insurance

Insurance carriers sell commercial P&C products in the United States through one of two markets: the Admitted market and the E&S market.

The Admitted insurance market, which has highly regulated rates and policy forms, is more consistent in price and coverage. In the E&S market, there is increased flexibility in pricing, terms, and conditions in response to evolving market dynamics, and E&S carriers can tailor insurance products to facilitate coverage that would not otherwise be attainable. This unique flexibility lends itself to providing solutions for unique risks, which has driven meaningful growth within the E&S market over the last decade exceeding the growth rate of the CRM process, membersAdmitted market.

According to data from AM Best, the E&S market generated approximately $99 billion of direct written premium in 2022 an increase of 19.2% over the prior year and and represents over 11% of the RMG review, analyzeindustry direct premium volume. The E&S market is more heavily focused in commercial lines and process all requestsaccounted for ACWs.

As a partover 21% of total commercial direct written premium for the Segregated Account Rehabilitation Proceedings,first time in 2022. For the Rehabilitation Court enjoined certain actions by other parties to preserve AAC’s control rights that could otherwise have lapsed or been compromised. Pursuant toperiod of 2012 through 2022 the Second Amended Plan of Rehabilitation and orders of the Rehabilitation Court, such protections continue after the conclusion of the Segregated Account Rehabilitation Proceedings.

Watch List and Adversely Classified Credits

Watch list and adversely classified credits are tracked closely by the appropriate RMG teams and discussed as part of the CRM process.Adversely classified credit meetings include members of RMG and other groups within the Company, as necessary. As part of the review, relevant information, along with the plan for corrective actions and a reassessment of the credit’s rating and credit classification is considered. Internal and/or external counsel generally review the documents underlying any problem credit and, if applicable, an analysis is prepared outlining Ambac’s rights and potential remedies, the duties of all parties involved and recommendations for corrective actions. Ambac also meets with relevant parties to the transaction as necessary. The review schedule for adversely classified credits is tailored to the remediation plan to track and prompt timely action and proper internal and external resourcing. A summary of developments regarding adversely classified credits and credit trends is also provided to AFG’s, AAC’s and Ambac UK's Board of Directors no less than quarterly.

Ambac assigns internal credit ratings to individual exposures as part of the surveillance process. These internal credit ratings, which represent Ambac’s independent judgments, are based upon underlying credit parameters consistent with the exposure type.

Loss Reserving and Analytics ("LRA")

LRA manages the quarterly loss reserving process for insured portfolio credits with projected policy claims. It also supports the development, operation and/or maintenance of various analytical models used in the loss reserving process as well as inE&S

other risk management functions. LRA workssector had a compound annual growth rate of 11% compared to 5% for the overall U.S. P&C sector.

Everspan presently has five admitted carriers, which are wholly-owned except as indicated below: Everspan Insurance Company; Greenwood Insurance Company; Consolidated National Insurance Company; Consolidated Specialty Insurance Company; and Providence Washington Insurance Company (90.1% owned). Everspan Indemnity Insurance Company ("Everspan Indemnity"), an E&S carrier, which is eligible to write business in all U.S. states and territories, is also part of Everspan.

MGA/U Program Market

It is estimated that U.S. MGA/Us generate between $70 to $100 billion of direct premiums in 2023. We believe there are significant advantages to the MGA/U business model when it comes to capturing the opportunity in the E&S market and propelling profitable growth. MGA/Us are specialized types of insurance agents or brokers that are vested with surveillanceunderwriting authority from an insurer, administering programs and risk remediation analysts responsiblenegotiating contracts on their behalf. This is a particularly useful vehicle for P&C insurers as MGA/Us tend to participate in the E&S market where specialized expertise is needed to underwrite policies. Additionally, MGA/Us are cost effective means for an insurer or reinsurer to access or grow a particular credit onclass of business they find attractive given the development, reviewMGA/U already possesses product expertise and implementationdistribution capabilities.

According to data from AM Best, the MGA/U sector is one of fastest growing segments of the U.S. P&C insurance market with 2022 direct premium written of $68 billion, an increase of 14% over the prior year, and loss reserve scenariosratios consistently lower than the P&C sector overall. In 2022, AM Best identified 654 MGAs in the U.S. market with likely several hundred additional MGAs not counted in that group as their premium production falls below the filing threshold. We believe the growth in the MGA/U and related analysis.program space is likely to continue as the industry continues its move towards increased specialization.

Specialty Property &and Casualty Program Insurance

TheEverspan’s strategy is to generate sustainable and profitable, long-term specialty property & casualty program insurance business currently includes admitted carrier Everspan Insurance Company and nonadmitted carrier Everspan Indemnity Insurance Company (collectively, “Everspan Group”). Everspan Group received a Class VIII, A- Financial Strength Rating from A.M. Best Rating Services, Inc. in February 2021, has capital in excess of $100 million, and is expected to begin writing new property and casualty specialty insurance programs in the first half of 2021. Everspan Group is pursuingprogram business with a sustainable, long term niche property/casualty program strategy withfocus on diverse classes of commercial and personal liability risks across an expanding roster of MGA/U partners.

As a specialty property and plans to sourcecasualty program group. Everspan may retain a percentage of the business it underwrites. Everspan's management team has significant years of experience in the program insurance and reinsurance sectors and has long-standing and broad relationships with MGA/Us, reinsurers, brokers, producers and third-party claims administrators ("TPAs"). Everspan sources business through diverse channels including Managing General Agents,program administrators and managing general agents, reinsurers, brokers, producers and others. Subject to Everspan's operational oversight, Everspan Group'sengages these third parties to market and administer policies and handle claims within defined authorities on Everspan's behalf.

Everspan is focused on generating strong underwriting results and stable fee income as part of its specialty program business model will rely on third party producers or capacity providersmodel.

| | | | | | | | |

| Ambac Financial Group, Inc | 5 | 2023 Form 10-K |

For the year ended December 31, 2023, Everspan generated $273 million of gross written premium, of which Everspan retained approximately 29%, including assumed written premiums. Everspan retained approximately 17% of its direct written premiums, with the balance primarily ceded to provide the infrastructure associated with policy administration, claims handling and other insurance company services. quota share reinsurers.

Everspan Group may retain up to 30% of it gross written premiumsrisk on each direct program and to the extent applicable, will reinsure the remainder to reinsurers and other providers of risk capital. WithThese reinsurers may be domestic and foreign reinsurers and institutional risk investors (capacity providers).

While underwriting direct business produced by MGA/Us is Everspan's primary means of distribution, Everspan also selectively assumes reinsurance to further its strong capital base,goal of writing a diversified book of specialty P&C business while efficiently managing its exposure limits. For example, the Company would evaluate, and may write certain lines, including those with catastrophe risk or Workers’ Compensation on an assumed basis. Everspan Groupmay participate as a reinsurer on up to 30% of a program, which is in line with its strategy to retain up to 30% of risk per program. Participation as a reinsurer will affect the retention ratio as Everspan's portion of assumed premiums is reflected fully in both Gross and Net Written Premiums.

The following table sets forth gross written premiums (direct and assumed) by line of business for the years ended December 31, 2023 and 2022:

| | | | | | | | | | | |

($ in millions)

Year Ended December 31, | 2023 | | 2022 |

| Commercial auto liability | $ | 122 | | | $ | 117 | |

| Excess liability | 41 | | | 5 | |

| General liability | 27 | | | 6 | |

| Surety | 26 | | | 4 | |

| Non-standard auto | 20 | | | — | |

| Workers Compensation | 20 | | | — | |

| Commercial auto physical damage | 12 | | | 13 | |

| Other | 6 | | | 1 | |

| Gross written premiums | $ | 273 | | | $ | 146 | |

Everspan purchases reinsurance to manage its net retention on individual risks and overall exposure to losses, while providing it with the ability to offer policies with sufficient limits to meet producer and policyholder needs. Generally, reinsurance contracts are specific to a program and are renewed annually, at which time they are subject to renegotiation. The key contractual provisions include, but are not limited to, those relating to the scope of business reinsured, ceding commissions, required reports to reinsurers, dispute resolution, any required collateral, and Everspan's termination rights when, among other triggers, a reinsurer defaults (such as by failing to collateralize its obligations when required) or its financial strength falls below an agreed level. Everspan’s ceded reinsurance contracts do not legally discharge Everspan from its primary liability for the full amount of the policies, and Everspan will be differentiatedrequired to pay the loss and bear collection risk if a reinsurer fails to meet its obligations under the reinsurance agreement.

Everspan mitigates this credit risk by selecting well capitalized, highly rated, authorized capacity providers, or requiring that the capacity provider post collateral, typically in the specialtyform of letters

of credit issued by or trust accounts in the custody of NAIC-qualified financial institutions, to secure the reinsured risks.

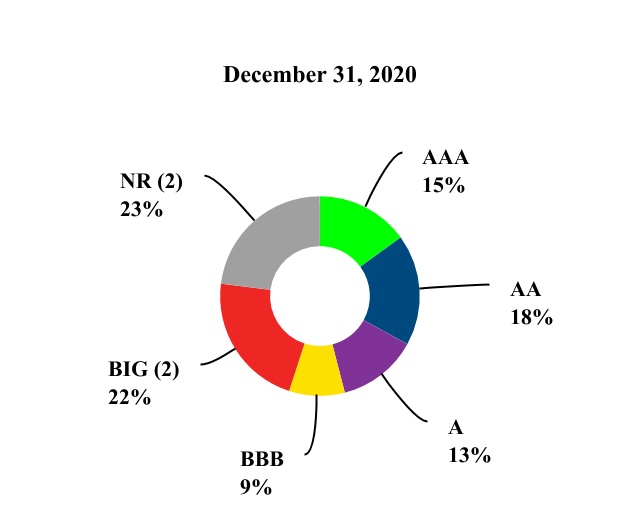

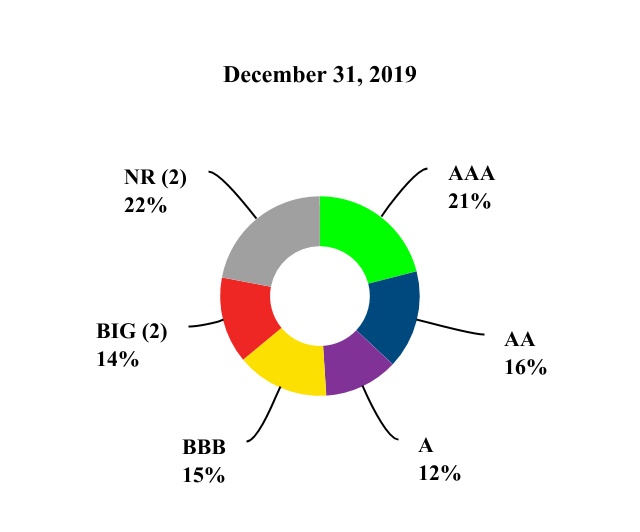

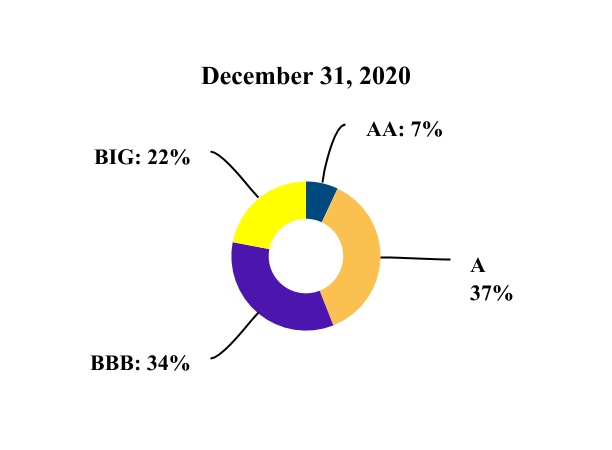

The following graph shows our reinsurance carriers' AM Best rating based on share of ceded premium for the year ended December 31, 2023:

(1)NR represents reinsurance carriers not rated by AM Best. Generally, under the terms of reinsurance contracts with such carriers the reinsurer is required to post collateral to Everspan.

SeeNote 7. Insurance Contracts to the Consolidated Financial Statements included in Part II, Item 8 in this Annual Report on Form 10-K for further information on reinsurance recoverables, including the evaluation for credit impairments.

Competitive Strengths:

Specialty Property and Casualty Insurance is a competitive industry. Everspan believes that it can successfully operate in this industry in part based upon the following competitive strengths.

•Experience — Everspan has an experienced leadership team across underwriting, pricing, claims, and business development with an average tenure of over 30 years in the insurance industry.

•Underwriting Focused Strategy — Everspan is driven by underwriting performance, which is achieved via comprehensive diligence and monitoring of MGA/U partners from our in-house pricing actuaries, claims executives, and program insurancemanagers. This underwriting focus also aides in achieving and maintaining support from reinsurance partners.

•Risk Appetite — Everspan may retain up to 30% of the risk it underwrites. This meaningful participation serves to align interests with our reinsurers.

•Commitment to Program Distribution — Everspan does not have any direct distribution capability as it is committed to the program market distributed through MGA/Us. As a result, Everspan does not have channel conflicts which would compete with its focusprograms partners in underwriting business.

•Nimble Platform — A simplified organizational structure which allows Everspan to be efficient and quick in responding to the needs of program partners as well as finding customized solutions. We believe this provides a

| | | | | | | | |

| Ambac Financial Group, Inc | 6 | 2023 Form 10-K |

competitive advantage to the more traditional competitors in the market.

•Aligned Ownership — Everspan has a stable ownership structure which is equally focused on long-term value creation based on strong underwriting results, risk retention, long-term relationships,performance. This alignment of interest and the avoidance of channel conflicts.strategic vision allows Everspan to leverage resources across Ambac and access capital for future initiatives.

Competition:

Everspan Group hired a management team with a successful track record in specialty program insurance business and relationships with Managing General Agents, brokers, producers and third party claims administrators.

The specialty property & casualty program insurance business will generate income from (i) ceding fees, by offering carrier capacity to specialty general agents and other producers who sell, control and administer books of insurance business that are supported by third parties that assume reinsurance risk and (ii) net insurance underwriting income from any retained risk. Its core expenses will include compensation, agent commissions and other overhead costs.

Everspan Group will facefaces competition from long standing program business market participants such as Accelerant, Benchmark, Clear Blue, Core Specialty, Falls Lake, Fortegra, Obsidian, Spinnaker, State National, as well as more recent entrants such as Clear Blue Insurance Group, Spinnaker Insurance Company, TrisuraTransverse, and Accredited SuretyTrisura. Most of these entities have both admitted and Casualty Company, Inc. Everspan Group will also compete with new companies that continue to be formed to enter the insurance markets, particularly companies with new or "disruptive" technologies or business models.E&S carriers. Competition may take the form of lower prices,program fees, broader coverages, greater product flexibility, higher coverage limits, higher quality servicesgreater customer service or higher financial strength ratings by independent rating agencies.

Few barriers exist to prevent existing insurers from entering target markets within the property and casualty industry. Market conditions and capital capacity influence the degree of competition at any point in time.

During periods of excess underwriting capacity, as defined by the availability of capital, competition can result in lower pricing and less favorable policy terms and conditions for insurers. During periods of reduced

| Ambac Financial Group, Inc. 5 2020 FORM 10-K |

underwriting capacity, pricing and policy terms and conditions are generally more favorable for insurers. Historically, the performance of the property and casualty insurance industriesindustry has tended to fluctuate in cyclical periods of price competition and excess underwriting capacity, followed by periods of high premium rates and shortages of underwriting capacity. At any given time, Everspan Group'sEverspan's portfolio of insurance products could experience varying combinations of these characteristics. This cyclical market pattern can be more pronounced in the specialty insurance and reinsurance markets in which Everspan Group competes than in the standard insurance market.

Managing General Agency / Underwriting

On December 31, 2020, Ambac acquired 80% of For the membership interests of Xchange. Formed in 2010, Xchange is a specialty-niche,last several years the property and casualty Managing General Underwriterindustry has been in a period of high premium rates with a shortage of underwriting capacity. While not anticipated to end in the short-term, this cyclical period will eventually end, perhaps unexpectedly. The end of this favorable cycle could have negative consequences for Everspan's growth and profitability prospects.

Business Acquisition and Program Partner Selection:

With our focus on generating long-term underwriting profitability, we are selective in adding new program partners. We look for program partners that share our vision of underwriting performance and return expectations and consequently are selective about with whom we partner. As of December 31, 2023, we have 23 programs with 19 MGA/Us. In 2023 we reviewed over 180 submissions and agreed to contract 11 new programs with eight new MGA/Us and two MGA/Us with an existing relationship, while renewing or extending twelve programs with eleven incumbent MGA/Us. Included in 2023 new programs are two executed via assumed reinsurance.

As noted above, most of Everspan’s programs are sourced either from MGA/Us or through other third parties, such as reinsurance brokers, that are seeking to provide customized insurance

solutions that require a carrier with a high rating from AM Best. Everspan works with MGA/Us that leverage both data and technology to streamline or improve the underwriting process.

Everspan may also source programs as a reinsurer. Accessing programs as a reinsurer provides Everspan the ability to diversify its risk profile, efficiently manage its exposure limits and underwrite programs in a cost efficient manner, amongst other benefits.

For each new opportunity that Everspan chooses to evaluate, an initial evaluation of the MGA/U is conducted, including an assessment of its underwriting approach, philosophy, size, quality of management, past performance, future performance targets and, above all, compatibility with Everspan’s operating model, risk appetite, and existing book of business. Everspan conducts substantial due diligence on all program partners led by the Underwriting Risk Committee which is chaired by Everspan’s Chief Underwriting Officer. As part of the diligence process, Everspan works closely with potential MGA/Us to design program underwriting guidelines, ongoing reporting and auditing requirements. Everspan also typically requires the producing partner to retain underwriting risk or otherwise align incentives with program underwriting performance.

Additionally, as part of the diligence process for each program, Everspan will perform a review of the claims management function, typically performed by a TPA, which in some cases are managed by the MGA/U or producing partner. Diligence focuses on claims handling and litigation management, compliance, finance, governance, staff and vendor management, data and IT.

After due diligence is completed and acceptable reinsurers are identified, each program is presented to the Underwriting Risk Committee for final approval. The Underwriting Risk Committee will consider recommendations made by the credit subcommittee regarding the financial strength of the MGA/Us and/or reinsurers.

Ongoing Monitoring:

For active programs, Everspan authorizes MGA/Us to underwrite and bind coverages in accordance with approved underwriting guidelines and delegates authority to the TPA for claims adjustment and payment. Everspan closely monitors each MGA/U and TPA’s adherence to the agreed upon underwriting and claims guidelines. Everspan will conduct periodic reviews of loss experience, rate levels, reserves and the overall financial health of the MGA/U and TPA and hold monthly underwriting meetings with both the MGA/U and TPA. Underwriting and claims data is provided by the MGA/Us and TPAs monthly. Additionally, Everspan conducts underwriting, claims and accounting audits, generally on-site, at least once a year for MGA/U and TPA partners which administer a material amount of Everspan's business. Everspan determines whether it will continue to participate on a program no less than annually, generally at the anniversary date of the program. The renewal process entails an assessment, with Underwriting Risk Committee participation, of the program's operating performance, profitability, and available reinsurance capacity. Everspan maintains the right to terminate relationships with its MGA/Us and TPAs. Reasons to terminate a relationship include

| | | | | | | | |

| Ambac Financial Group, Inc | 7 | 2023 Form 10-K |

an inability to produce targeted underwriting results, writing exposures outside of agreed upon risk tolerances, delinquency in meeting reporting requirements, a change of strategic direction, or failure to meet collateral or other commitments to Everspan.

Ratings:

Everspan carriers have an AM Best financial strength ratings ("MGU"FSR") focused of 'A-' (Excellent) and Financial Strength Category of Class VIII. Risk is shared among the Everspan carriers via a reinsurance agreement and an intercompany pooling agreement (the "Everspan Pool"). We view this rating and financial size category as a competitive advantage in the marketplace. Ratings are an important factor in assessing Everspan’s competitive position, operation capabilities and risk management in the insurance industry.

Insurance Distribution

Ambac’s Insurance Distribution business, Cirrata Group ("Cirrata"), has a strategy to build a diversified portfolio of MGA/Us and other insurance distributors covering various P&C products. Ambac plans to grow its existing Insurance Distribution business using several strategies, including (i) organic growth, (ii) additional acquisitions and/or partnerships, and (iii) hiring experienced underwriting teams to incubate start-up MGA/Us. Key criteria include a track record of profitability and a seasoned management team. Insurance underwritten through Ambac's MGA/Us may utilize Everspan as an insurance carrier, but are not be required to do so, depending on strategic and operational considerations.

The following table sets forth Cirrata's premiums placed by line of business:

| | | | | | | | | | | |

($ in millions)

Year ended December 31, | 2023 | | 2022 |

| Employee stop loss | $ | 76 | | | $ | 72 | |

| Limited & short-term medical | 54 | | | 48 | |

| Commercial auto | 62 | | | 11 | |

| Marine | 19 | | | 1 | |

| Professional liability | 12 | | | — | |

| Other | 6 | | | 4 | |

| Premiums placed | $ | 231 | | | $ | 135 | |

Cirrata's portfolio at December 31, 2023, includes the following entities:

Xchange — Ambac owns an 80% controlling interest in Xchange Benefits, LLC ("Xchange"). Xchange operates through specialty producers in accident and health ("A&H") products. Below is a descriptionsectors across the U.S. which are typically not targeted by large direct writers and to whom Xchange can provide customized offerings. Xchange conducts business through approximately ten insurance carriers and dozens of its largestagents and other distributors.

Xchange's main products for which it providesis delegated underwriting services:authority by insurance carriers include:

•Employer Stop Loss ("ESL") — provides protection for self-insured employers by serving as a reimbursement mechanism for catastrophic claims, both specific and in aggregate exceeding pre-determined levels.

•Limited Benefit Medical ("LM") — designed for those not covered byas a supplement to traditional Affordable Care Act medical programs and sold primarily through affinity groups, providing a variety of medically related benefits such as inpatient hospital stays, diagnostic services or physician visits.

•Short-term Medical ("STM") — sold primarily through affinity groups, providing non Affordable Care Act comprehensive medical coverage for short periods of timedurations (i.e. less than one year).

Xchange's management team,•Xchange Re ("MGA/U") / Distribution Re ("Captive") — in January 2023, Xchange launched two new growth initiatives; Xchange Re an A&H reinsurance MGA/U and Distribution Re a protected cell captive insurance company domiciled in Tennessee which retained 20% ownershipwill mainly insure high deductible medical stop loss plans. Xchange does not intend to accept or retain any risk from Distribution Re.

All Trans — Effective November 1, 2022, Ambac acquired an 85% controlling interest in All Trans Risk Solutions, LLC ("All Trans"). All Trans is a full service managing general underwriter with delegated underwriting authority in commercial automobile insurance for specific "for-hire" auto classes; principally private school bus operators. In 2024, AllTrans launched a new program primarily focussed on charter buses. All Trans' track record of performance has allowed the business, has significant longstanding relationships with carriers, agents, policyholders, affinity groups and reinsurers. Xchange conducts business through approximately sevencompany to maintain a consistent panel of insurance carriers and dozensclient relationships, several of which go back over 25 years.

Capacity Marine — Effective November 1, 2022, Ambac acquired an 80% controlling interest in Capacity Marine Corporation ("Capacity Marine"). Capacity Marine is a wholesale and retail brokerage and reinsurance intermediary specializing in more sophisticated marine and international risk in expsoures such as ports, terminals, and stevedores.

Riverton — Effective August 1, 2023, Ambac acquired an 80% controlling interest in Riverton Insurance Agency, Corp. ("Riverton"). Riverton offers professional liability insurance programs to licensed architects, engineers, construction managers and real estate professionals. Riverton's retail agency places professional liability for real estate agents with various markets.

In addition to existing MGA/Us and other distributors.acquisitions, de novo MGA/U formations will be a core element of the Insurance Distribution segment's growth strategy.

Xchange isCirrata's businesses are compensated for itstheir services primarily by commissions paid by insurance companiescarriers for underwriting, structuring and/or administering polices and, in the case of ESL,some cases for managing claims under an agency agreement.agreements. Commission revenues are usually based on a percentage of the premiums paid by the insured. Xchange isplaced. The businesses are also eligible to receive profit sharing contingent commissions on certain programs (mostly LM and STM) based on the underwriting results of the policies it writes,they write, which may cause some variability in revenue and earningearnings recognition. Business written byCommission revenues experience seasonality during the year, primarily from Xchange is generally concentratedwhose ESL programs are mostly underwritten in January and July which may result isresulting in revenue and earnings concentrations in the first and third quarters each calendar year. Xchange's core expensesGiven the recent acquisitions and potential de

| | | | | | | | |

| Ambac Financial Group, Inc | 8 | 2023 Form 10-K |

novo launches, this seasonality is expected to become more muted over time.

Expenses at Cirrata include commissions it paysthe businesses pay to itstheir independent agents andagents/producers, compensation for itstheir management and staff and intangible asset amortization from acquisitions. Commission expenses are a variable cost as we pay a percentage of premiums written to the agents/producers.

Insurance Distribution generated gross commission revenue of $51 million and $31 million during the years ended December 31, 2023 and 2022, respectively and net commission revenue (gross commissions less commission expenses) of $22 million and $13 million, respectively.

Commission revenue and expense growth will be driven by the businesses' continued expansion and diversification of its products across regions, products, and carriers.

Competitive Strengths:

•Deep specialty domain knowledge — Our Insurance Distribution businesses are anchored by a deep specialty domain knowledge in their respective classes of business. This knowledge is key to generating the underwriting results necessary to maintain long-standing carrier relationships.

•Long standing carrier relationships — Our MGA/Us strive towards long and durable carrier relationships supported by a focus on underwriting profitability. P&C insurance is a cyclical industry with opportunistic players entering and exiting the business. We believe that growing multi-year carrier relationships are evidence of the value created by our MGA/U, a value which currently total 20 individuals.we believe should sustain through routine market cycles.