UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 20222023

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | | | | | | |

| Commission File Number: | | 1-10777 |

| | |

| AMBAC FINANCIAL GROUP, INC. |

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 13-3621676 |

| (State of incorporation) | | (I.R.S. employer identification no.) |

| One World Trade Center | New York | NY | | 10007 |

| (Address of principal executive offices) | | (Zip code) |

| | | | | | | | | | | |

| (212) | 658-7470 | |

| (Registrant’s telephone number, including area code) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | AMBC | | New York Stock Exchange |

Warrants | | AMBC WS | | New York Stock Exchange |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer”, “smaller reporting company”and"emerging growth company" in Rule 12b-2 of the Exchange Act): (Check one):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the Registrant as of the close of business on June 30, 20222023 was $510,068,047.$623,109,150. As of February 24, 2023,26, 2024, there were 45,287,11245,195,370 shares of Common Stock, par value $0.01 per share, were outstanding.

Documents Incorporated By Reference

Portions of the Registrant’s Proxy Statement related to its annual meeting of stockholders are incorporated by reference in this Form 10-K in response to Part III Items 10, 11, 12, 13, and 14.

AMBAC FINANCIAL GROUP, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

| | | | | | | | | | | | | | | | | | | | |

| |

| | | | |

| Item Number | Page | | Item Number | Page |

| | | PART II (CONTINUED) | |

| 1 | | | | | | |

| | | | | | |

| Description of the Business | | | | U.S. Insurance Statutory Basis Financial Results | |

| | | | | Ambac UK Financial Results Under UK Accounting Principles | |

| | | | | | |

| | | | 7A | Quantitative and Qualitative Disclosures about Market Risk | |

| | | | 8 | | |

| | | | 9 | | |

| 1A | | | | 9A | | |

| 1B | | | | 9B | | |

| 2 | | | | | |

| 3 | | | | 10 | | |

| 4 | | | | 11 | | |

| | | 12 | | |

| 5 | | | | 13 | | |

| 6 | | | | 14 | | |

| 7 | | | | | |

| Executive Summary | | | 15 | | |

| Critical Accounting Policies and Estimates | | | | | |

| | | | | | |

| | | | | | |

| | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| |

| | | | |

| Item Number | Page | | Item Number | Page |

| | | PART II (CONTINUED) | |

| 1 | | | | | | |

| | | | | | |

| Description of the Business | | | | U.S. Insurance Statutory Basis Financial Results | |

| | | | | Ambac UK Financial Results Under UK Accounting Principles | |

| | | | | | |

| | | | 7A | Quantitative and Qualitative Disclosures about Market Risk | |

| | | | 8 | | |

| | | | 9 | | |

| 1A | | | | 9A | | |

| 1B | | | | 9B | | |

| 1C | | | | | |

| 2 | | | | 10 | | |

| 3 | | | | 11 | | |

| 4 | | | | 12 | | |

| | | 13 | | |

| 5 | | | | 14 | | |

| 6 | | | | | |

| 7 | | | | 15 | | |

| Executive Summary | | | | | |

| Critical Accounting Policies and Estimates | | | | | |

| | | | | | |

| | | | 16 | Form 10-K Summary | |

| | | | | |

| | | | | | |

CAUTIONARY STATEMENT PURSUANT TO THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

In this Annual Report, we have included statements that may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words such as “estimate,” “project,” “plan,” “believe,” “anticipate,” “intend,” “planned,” “potential” and similar expressions, or future or conditional verbs such as “will,” “should,” “would,” “could,” and “may,” or the negative of those expressions or verbs, identify forward-looking statements. We caution readers that these statements are not guarantees of future performance. Forward-looking statements are not historical facts but instead represent only our beliefs regarding future events, which may by their nature be inherently uncertain and some of which may be outside our control. These statements may relate to plans and objectives with respect to the future, among other things which may change. We are alerting you to the possibility that our actual results may differ, possibly materially, from the expected objectives or anticipated results that may be suggested, expressed or implied by these forward-looking statements. Important factors that could cause our results to differ, possibly materially, from those indicated in the forward-looking statements include, among others, those discussed under “Risk Factors” in Part I, Item 1A in this Annual Report on Form 10-K.

Any or all of management’s forward-looking statements here or in other publications may turn out to be incorrect and are based on management’s current belief or opinions. Ambac Financial Group’s (“AFG”) and its subsidiaries’ (collectively, “Ambac” or the “Company”) actual results may vary materially, and there are no guarantees about the performance of Ambac’s securities. Among events, risks, uncertainties or factors that could cause actual results to differ materially are: (1) the high degree of volatility in the price of AFG’s common stock; (2) uncertainty concerning the Company’s ability to achieve value for holders of its securities, whether from Ambac Assurance Corporation (“AAC”) and its subsidiaries or from the specialty property and casualty insurance business, the insurance distribution business, or related businesses; (3) inadequacy of reserves established for losses and loss expenses and the possibility that changes in loss reserves may result in further volatility of earnings or financial results; (4) potential for rehabilitation proceedings or other regulatory intervention or restrictions against AAC; (5) credit risk throughout Ambac’s business, including but not limited to credit risk related to insured residential mortgage-backed securities, student loan and other asset securitizations, public finance obligations (including risks associated with Chapter 9 and other restructuring proceedings), issuers of securities in our investment portfolios, and exposures to reinsurers; (6) our inability to effectively reduce insured financial guarantee exposures or achieve recoveries or investment objectives; (7) ourAAC’s inability to generate the significant amount of cash needed to service ourits debt and financial obligations, and ourits inability to refinance ourits indebtedness; (8) Ambac’sAAC’s substantial indebtedness could adversely affect itsthe Company’s financial condition and operating flexibility; (9) Ambac may not be able to obtain financing or raise capital on acceptable terms or at all due to its substantial indebtedness and financial condition; (10) greater

than expected underwriting losses in the Company’s

specialty property and casualty insurance business; (11) failure of specialty insurance program partners to properly market, underwrite or administer policies; (12) inability to obtain reinsurance coverage on expected terms; (13) loss of key relationships for production of business in specialty property and casualty and insurance distribution businesses or the inability to secure such additional relationships to produce expected results; (14) the impact of catastrophic public health, environmental or natural events, or global or regional conflicts, on significant portions of our insured portfolio;conflicts; (15) credit risks related to large single risks, risk concentrations and correlated risks; (16) risks associated with adverse selection as Ambac’s financial guarantee insurance portfolio runs off; (17) the risk that Ambac’s risk management policies and practices do not anticipate certain risks and/or the magnitude of potential for loss; (18) restrictive covenants in agreements and instruments that impair Ambac’s ability to pursue or achieve its business strategies; (19) adverse effects on operating results or the Company’s financial position resulting from measures taken to reduce financial guarantee risks in its insured portfolio; (20) disagreements or disputes with Ambac's insurance regulators; (21) loss of control rights in transactions for which we provide financial guarantee insurance; (22) inability to realize expected recoveries of financial guarantee losses; (23) risks attendant to the change in composition of securities in the Ambac’s investment portfolio; (24) adverse impacts from changes in prevailing interest rates; (25) events or circumstances that result in the impairment of our intangible assets and/or goodwill that was recorded in connection with Ambac’s acquisitions; (26) risks associated with the expected discontinuance of the London Inter-Bank Offered Rate; (27) factors that may negatively influence the amount of installment premiums paid to Ambac; (28)(27) the risk of litigation, and regulatory inquiries, investigations, claims or investigations,proceedings, and the risk of adverse outcomes in connection therewith; (29)(28) the Company’s ability to adapt to the rapid pace of regulatory change; (30)(29) actions of stakeholders whose interests are not aligned with broader interests of Ambac's stockholders; (31)(30) system security risks, data protection breaches and cyber attacks; (32)(31) regulatory oversight of Ambac Assurance UK Limited (“Ambac UK”) and applicable regulatory restrictions may adversely affect our ability to realize value from Ambac UK or the amount of value we ultimately realize; (33)(32) failures in services or products provided by third parties; (34)(33) political developments that disrupt the economies where the Company has insured exposures; (35)(34) our inability to attract and retain qualified executives, senior managers and other employees, or the loss of such personnel; (36)(35) fluctuations in foreign currency exchange rates; (37)(36) failure to realize our business expansion plans or failure of such plans to create value; (38)(37) greater competition for our specialty property and casualty insurance business and/or our insurance distribution business; (39)(38) loss or lowering of the AM Best rating for our property and casualty insurance company subsidiaries; (40)(39) disintermediation within the insurance industry or greater competition from technology-based insurance solutions; (41)solutions or non-traditional insurance markets; (40) changes in law or in the functioning of the healthcare market that impair the business model of our accident and health managing general underwriter; and (42)(41) other risks and uncertainties that have not been identified at this time.

| Ambac Financial Group, Inc. 12022 FORM 10-K

| | | | | | | | |

| Ambac Financial Group, Inc | 1 | 2023 Form 10-K |

Item 1. Business

INTRODUCTION

Ambac Financial Group, Inc. ("AFG"), headquartered in New York City, is a financial services holding company incorporated in the State of Delaware on April 29, 1991. References to “Ambac,” the “Company,” “we,” “our,” and “us” are to AFG and its subsidiaries, as the context requires. Ambac operates three principal businesses:

•Legacy Financial Guarantee ("LFG") Insurance — Ambac's financial guarantee business includes the activities of Ambac Assurance Corporation ("AAC") and its wholly owned subsidiaries, including Ambac Assurance UK Limited (“Ambac UK”) and Ambac Financial Services LLC ("AFS"). Both AAC and Ambac UK are financial guarantee insurance companies that have been in run-off, having not underwritten any new business since 2008. AFS usesis AAC's legacy interest rate derivatives to hedge interest rate risk in AAC's insurance and investment portfolios.swap provider which is also currently being run-off.

•Specialty Property and Casualty Insurance — Ambac's specialty property and casualty program business ("Specialty Property and Casualty Insurance program business. CurrentlyInsurance") includes five admitted carriers and an excess and surplus lines (“E&S” or “nonadmitted”) insurer, Everspan Indemnity Insurance Company (all carriers collectively,carrier (collectively, “Everspan”). Three of the five admitted carriers were acquired in 2022. Everspan carriers have an AM Best rating of 'A-' (Excellent).

•Insurance Distribution — Ambac's specialty property and casualty ("P&C") insurance distribution business which could include Managing General Agents and Underwritersincludes managing general agents/underwriters (collectively "MGAs" or "MGA/Us"), and insurance wholesalers, brokers and other distribution businesses, currently includes Xchange Benefits, LLC (“Xchange”) a P&C MGA specializing in accident and health products, All Trans Risk Solutions, LLC ("All Trans"), an MGA/U specializing in commercial automobile insurance for specific "for-hire" auto clauses, and Capacity Marine Corporation ("Capacity Marine"), a wholesale and retail brokerage and reinsurance intermediary specializing in marine and international risk. Refer to Note 4. Business Combination in this Annual Report on Form 10-K, for further information relating to these acquisitions.operating as part of Cirrata Group.

Beginning in the first quarter of 2022, the Company began reporting these three business operations as segments; see Note 3. Segment Information for further information.

AFG, on a standalone basis, had $223$211 million in net assets (excluding its investment in subsidiaries) and net operating loss carry-forwards of $3,454$3,400 million ($1,8241,760 million of which is allocated to AAC) at December 31, 2022.2023. See Schedule II for more information on the holding company.

Strategies to Enhance Shareholder Value

The Company's primary goal is to maximize long-term shareholder value through the execution of keytargeted strategies for its (i) Specialty Property and Casualty Insurance and Insurance Distribution businesses and (ii) Legacy Financial Guarantee Insurance.Insurance business.

Specialty Property and Casualty Insurance and Insurance Distribution strategic priorities include:

•Growing aour Specialty Property and Casualty Insurance business which generatesto generate underwriting profits and an attractive return on capital from a diversified portfolio of commercial and personal liability risks accessed primarily through program administrators.

•Building anExpanding our Insurance Distribution business based on deep domain knowledge in specialty and niche classes of

risk which generate attractive margins at scale. This will be achieved through acquisitions, establishing new business “de-novo” formationbusinesses “de-novo,” and incubation,organic growth and product expansiondiversification supported by a centralized technology led shared services offering.

•Making opportunistic investments that are strategic to both the Specialty Property and Casualty Insurance and Insurance Distribution businesses.

Legacy Financial Guarantee Insurance strategic priorities include:

•Actively managing, de-risking and mitigating insured portfolio risk, and pursuing recoveryrecoveries of previously paid losses.

•Improving operating efficiency and optimizing our asset and liability profile.

•Exploring strategic options to further maximize value for AFG.

DESCRIPTION OF THE BUSINESS

Legacy Financial Guarantee Insurance:

Financial guarantee insurance policies provide an unconditional and irrevocable guarantee which protects the holder of a debt obligation against non-payment when due of the principal and interest on the obligations guaranteed. Pursuant to such guarantees, AAC and Ambac UK make payments if the obligor responsible for making payments fails to do so when due. AAC and Ambac UK last wrote the last insurance policypolicies in 2008 and have been in run-off ever since.

Financial guarantee revenues consist mostly of premiums earned from run-off insurance contracts, net of reinsurance, and income on investments held in AAC's and Ambac UK's investment portfolios. Financial guarantee expenses consist of: (i) loss and commutation payments; (ii) loss adjustment expenses; (iii) interest expense on debt, (iv) operating expenses and (v) insurance intangible amortization.

Ambac's Legacy Financial Guarantee Insurance business strategy is to increase the residual value of AAC and Ambac UK with the ultimate goal of monetizing such value through (i) dividends and capital distributions while managing their active run-off; (ii) one or more reinsurance transactions or other de-risking transactions that will accelerate or enhance the ability of AAC and/or Ambac UK to pay dividends and make capital distributions; (iii) the sale of all or portions of AAC and/or Ambac UK,UK; or (iv) other strategic transactions to accelerate and/or enhance the above-stated corporate strategy.

Ambac and its advisors are actively discussing strategic options for its Legacy Financial Guarantee Insurance business with interested parties. While we anticipate that these discussions will be completed in 2024 there can be no assurance that we will ultimately complete any strategic initiative.

AAC and Ambac UK have been reducing risk within their insured portfolios and focusing on exposures to financially stressed municipal entities and asset-

| Ambac Financial Group, Inc. 22022 FORM 10-K

backed securitiesinsured exposures as well as large and concentrated exposures. Opportunities for remediating losses on poorly performing

| | | | | | | | |

| Ambac Financial Group, Inc | 2 | 2023 Form 10-K |

insured transactionsexposures depend on a number of factors including market conditions, the structure of the underlying risk, and associated policy,the perception of AAC’s or Ambac UK’s creditworthiness, as well as counterparty specific factors. AAC'sTheir ability to remediate risk and commute policies may be limited by available liquidity. Additionally, AAC and Ambac UK are actively managing their regulatory frameworks and seeking to optimize capital allocation in a complex insured portfolioportfolios that includesinclude long duration obligations.

The execution of Ambac’s strategy to increase and monetize the residual value of its investment in AAC is subject to significant risk as well as the restrictions set forth in the Settlement Agreement, dated as of June 7, 2010, as amended (the "Settlement Agreement"), by and among AAC, Ambac Credit Products LLC ("ACP"), AFG and certain counterparties to credit default swaps with ACP that were guaranteed by AAC, as well as the Stipulation and Order among the OCI, AFG and AAC that became effective on February 22, 2024 (the “Stipulation and Order”), replacing the Stipulation and Order that became effective on February 12, 2018, as amended (the “2018 Stipulation and Order”), each of which requires the Office of the Commissioner of Insurance for the State of Wisconsin (“OCI”("OCI"), AFG and AAC that became effective on February 12, 2018, as amended (the “Stipulation and Order”), each of which requires OCI and, under certain circumstances, holders of the debt instruments benefiting from such restrictions,surplus notes, to approve certain actions taken by or in respect of AAC. In exercising its approval rights, OCI will act for the benefit of policyholders, and will not take into account the interests of AFG. See Note 1. Background

•The Settlement Agreement limits certain activities of AAC and Business Descriptionits subsidiaries, such as issuing indebtedness; engaging in mergers and similar transactions; disposing of assets; making restricted payments; creating or permitting liens; engaging in transactions with affiliates; modifying or creating tax sharing agreements; and taking certain actions with respect to surplus notes (among other restrictions and limitations). The Settlement Agreement includes certain allowances with respect to these activities and generally requires the approval of OCI and, in some cases, holders of surplus notes issued pursuant to the Consolidated Financial StatementsSettlement Agreement, for consents, waivers or amendments.

•The Stipulation and Order requires AAC to maintain a level of surplus and contingency reserves as regards policyholders which provide reasonable security against contingencies affecting AAC’s financial position that are not otherwise fully covered by reserves or reinsurance; discount loss reserves in a manner approved by OCI; maintain OCI’s Runoff Capital Framework (as defined and described below) according to parameters specified by OCI; pay the costs of consultants and other experts retained by OCI; refrain from certain affiliate transactions and the payment of any dividend or other distribution without the prior non-disapproval of OCI; notify OCI of events that would or would be reasonably likely to cause a material adverse effect to AAC or its affiliates; obtain OCI’s non-disapproval to exercise certain control rights with respect to certain policies that were previously allocated to the Segregated Account of AAC; obtain OCI’s approval for non-ordinary course transactions involving consideration to be paid by AAC of $100 million or more; and obtain OCI’s approval of any changes to AAC’s investment policy or derivative use plan. The Stipulation and Order also requires AFG to use its best efforts to preserve the use of

NOLs for the benefit of AAC and its subsidiaries. The Stipulation and Order differs from the 2018 Stipulation and Order in that the 2018 Stipulation and Order (i) did not refer to OCI’s Runoff Capital Framework; (ii) included certain affirmative covenants concerning books and records, and reporting of information or events, that were not included in this Annual Reportthe Stipulation and Order; and (iii) contained a more restrictive limitation on Form 10-Ktransactions with affiliates. The Stipulation and Order has no fixed term and may be terminated or modified only with the approval of OCI. OCI reserved the right to modify or terminate the Stipulation and Order in a manner consistent with the interests of policyholders, creditors and the public generally.

The execution of Ambac’s strategy to increase the value of its investment in AAC may be affected by a new capital framework developed and implemented by OCI to assist OCI with making decisions related to capital management at AAC ("OCI's Runoff Capital Framework"). OCI’s Runoff Capital Framework applies risk-based and other adjustments to AAC’s assets and insured liabilities, as determined by OCI in its sole discretion. OCI’s Runoff Capital Framework allows AAC to understand the likely impact of various developments and actions now or in the future on AAC’s capital position thereunder. No changes in AAC’s current management of the business are required by OCI’s Runoff Capital Framework. AAC’s ability to use capital for further information.

Financial guarantee revenues consist mostlypotential future deleveraging transactions or distributions will require AAC to sustain an excess of premiums earned from run-off insurance contracts, netrisk-adjusted assets over risk-adjusted insured liabilities according to OCI’s Runoff Capital Framework, and to obtain OCI’s approval, and there can be no assurance that OCI will approve any such use of reinsurance,capital. The results of OCI’s Runoff Capital Framework are expected to vary over time based on changes in AAC’s financial position, insured portfolio developments, the impact of strategic actions taken by AAC, the impact of asset/liability management by AAC and, income on investments held in AAC'spossibly, changes to the inputs and Ambac UK's investment portfolios. Financial guarantee expenses consist of: (i) loss and commutation payments; (ii) loss adjustment expenses; (iii) interest expense on debt, (iv) operating expenses and (v) insurance intangible amortization.assumptions utilized by OCI.

AAC has a significant amount of debt outstanding in the form of principal and accrued but unpaid interest on surplus notes. Surplus notes are treated as capital for regulatory purposes as the obligation to pay principal and interest on them is subordinated to the obligation to pay policyholder claims and such payments cannot be made without the explicit authorization of the OCI. OCI is developing a new capital framework ("OCI's Runoff Capital Framework") to assist OCI with making decisions related to AAC's capital and liquidity management. OCI's Runoff Capital Framework is not yet complete and therefore we are not able to predict the results of such and what it may mean for our Legacy Financial Guarantee strategy, particularly as it relates to deleveraging AAC and distributing capital to AFG.

AAC’s ability to pay dividends to AFG has also been significantly restricted by the deterioration of AAC’s financial condition and by regulatory, legal and contractual restrictions. Substantial uncertainty remains as to AAC's ability to pay dividends to AFG and the timing of any such dividends, which constrains AFG's liquidity. Refer to "Dividend Restrictions, Including Contractual Restrictions" below and to Note 9.8. Insurance Regulatory Restrictions to the Consolidated Financial Statements included in this Annual Report on Form 10-K, for more information on dividend payment restrictions.

Interest rate derivative transactions arewere executed through AFS, a wholly-owned subsidiary of AAC. InterestAll remaining interest rate derivative positions, which are substantially economically hedged, relate to legacy financial guarantee customer swaps. Until the second quarter of 2023, interest rate derivatives arewere also used to partially hedge interest rate risk in the financial

| | | | | | | | |

| Ambac Financial Group, Inc | 3 | 2023 Form 10-K |

guarantee insurance and investment portfolios. Accordingly, interest rate derivatives are positionedAFS continues to benefit from rising rates. AFS isbe required to post collateral in excess of the market value of certain interest rate derivatives when they are in a mark-to-market loss position. EarlyWhile not anticipated, early termination of AFS’s derivatives could result in losses. AFS has borrowed cash and securities from AAC to help support its collateral and margin posting requirements termination payments and other cash needs. Given the reduction in the size of the financial guarantee insured portfolio, recent interest rate increases and other considerations, the size of the interest rate derivatives portfolio was materially reduced in the fourth quarter of 2022 and may be further reduced or eliminated in the future. AFS also maintains a few interest rate derivatives with legacy financial guarantee customers, the exposure to which is fully hedged.

Ambac manages a variety of risks inherent in its businesses, including credit, market, liquidity, operational and legal. These risks are identified, measured, and monitored through a variety of control mechanisms, which are in place at different levels throughout the organization. See “Quantitative and Qualitative Disclosures About Market Risk” included in Part II, Item 7A in this Annual Report on Form 10-K for further information.

Risk Management

Ambac’s financial guarantee insurance policies expose the Company to the direct credit risk of the assets and/or obligor supporting the guaranteed obligation. In addition, insured transactions expose Ambac to indirect risks that may increase our overall risk, such as credit risk separate from, but correlated with, our direct credit risk; market; model; economic, including the risk of economic recession; natural disaster; pandemic and mortality or other non-credit type risks. Please refer to Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Financial Guarantees in Force” section below for details on the financial guarantee insured portfolio.

The Risk Management Group ("RMG") is primarily responsible for the development, implementation and oversight of loss mitigation strategies, surveillance and remediationmanagement of the insured financial guarantee portfolio, including Surveillance and Risk Remediation (including through the pursuit of recoveries in respect of paid claims and commutations of policies). Our ability to execute certain risk management activities may be limited by the restrictions set forth in the Settlement Agreement and the Stipulation and Order, andamong other constraints, potentially includingconstraints. To the extent OCI's approval is required in connection with risk management activities, OCI's decisions may be guided by OCI's Runoff Capital Framework. See Note 1. Background and Business Description to the Consolidated Financial Statements included in this Annual Report on Form 10-K for further information.

Ambac’s RMG has an organizational structure designed around four primary areas of focus: Surveillance, Risk Remediation, Credit Risk Management and Loss Reserving and Analytics.

Surveillance

Surveillance is focused on the early identification of potential stress and/or credit deterioration and the related analysis of credit exposures in the insured portfolio. Additionally,

| Ambac Financial Group, Inc. 32022 FORM 10-K

Surveillance evaluates the impact of changes in the economic, regulatory or political environment on the insured portfolio.

Analysts perform periodic credit reviews of insured exposures according to a schedule based on the risk profile of the guaranteed obligations or as necessitated by specific credit events or other macro-economic variables. Risk-adjusted surveillanceSurveillance strategies have been developed for each bond type with review periods and scope of review based upon each bond type’s risk profile. The risk profile is assessed regularly in response to our own experience and judgments or external factors such as the economic environment and industry trends. The focus of a credit review is to assess performance, identify credit trends and recommend credit classifications, ratings and changes to a

transaction or bond type’s review period and surveillance requirements. Please refer to Note 2. Basis of Presentation and Significant Accounting Policies to the Consolidated Financial Statements included in this Annual Report on Form 10-K for further discussion of the various credit classifications utilized by Ambac. If a problem is detected, the Surveillance group will then work with the Risk Remediation group on a loss mitigation plan, as necessary.

The insured portfolio contains exposures that are correlated and/or concentrated. RMG's surveillance activities include identifying these types of exposures and identifying the risks that would or could trigger credit deterioration across these related exposures. This is the case with student loans and residential mortgage-backed securities ("RMBS"), for example, which have several correlations including those associated with consumer lending, unemployment, interest rates and home prices. In the future, Ambac’s portfolio may be subject to similar credit deterioration arising from concentrated and/or correlated risks. Examples of other such risks that could impact our portfolio, and that our surveillance is designed to monitor include the impact of potential municipal bankruptcy contagion, the impact of tax reform on state and municipal bond issuers, the impact of large scalelarge-scale domestic military spending or troop level cutbacks on our privatized military housing portfolio and event risk such as pandemics (e.g., COVID-19), natural disasters or other regional stresses. Most such risks cannot be predicted and may materialize unexpectedly or develop rapidly. Although our surveillance allows us to connect the event and stress to the related exposures and assign an adverse credit classification and estimate losses across the affected credits, when necessary, we may not have adequate resources or contractual rights and remedies to mitigate loss arising from such risks.

Watchlist and Adversely Classified Credits

Watch list and adversely classified credits are tracked closely and are discussed as part of scheduled RMG credit meetings. A summary of developments regarding adversely classified credits and credit trends is also provided to AFG’s, AAC’s and Ambac UK's Boards of Directors no less than quarterly.

Ambac assigns internal credit ratings to individual exposures as part of the Surveillance process. These internal credit ratings, which represent Ambac’s independent judgments, are based upon underlying credit parameters consistent with the exposure type.

Risk Remediation

Risk Remediation activities are centered on exposure reduction and loss mitigation related to the insured portfolio. In particular, the focus is on reducing exposure to credits that have negative developing trends, the potential for future adverse development or are already adversely classified by, among other things, exercising rights and remedies, which may help to mitigate losses in the event of further deterioration or events of default, or, as available, working with an issuer to refinance, defease or otherwise retire debt.

Loss mitigation focuses on the execution of commutation and related claims reduction or workout strategies for policies with potential future claims. For certain adversely classified, survey

list and watch list credits (as described in Note 2. Basis of Presentation and Significant Accounting Policies to the Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K), risk remediation or loss

| | | | | | | | |

| Ambac Financial Group, Inc | 4 | 2023 Form 10-K |

mitigation plans are developed and implemented that may include actions such as working with the issuer, trustee, bond counsel, servicer and other interested parties in an attempt to remediate the problem and minimize AAC’sAmbac’s exposure to potential loss. Other actions could include working with bond holders and other economic stakeholders to negotiate, structure and execute solutions, such as commutations. In addition, reinsurance is used as a remediation tool to reduce exposure to certain targeted policies and large concentrations.

Adversely classified, survey list and watch list credits are tracked closely as part of the risk remediation process and are discussed at regularly scheduled Credit Risk Management meetings (see discussion following in “Credit Risk Management”). In some cases, the RMG will engage restructuring or workout experts, attorneys and/or other consultants with appropriate expertise in the targeted loss mitigation area to assist in examining the underlying contracts or collateral, providing industry specific advice and/or executing strategies.

Credit Risk Management ("CRM")

The CRM function manages the decision process for all material matters that affect credit exposures within the insured portfolio. CRM provides a forum for credit assessment discussions and approvals and drives consistency and timeliness. The scope of credit matters under the purview of CRM includes material amendments, consents and waivers, credit review scheduling, credit classifications, rating designations, review of watch list or adversely classified credits, sector reviews and overall portfolio reviews and risk mitigation updates. Formal plans or transactions that relate to risk remediation, loss mitigation or restructuring may also require AAC Risk Committee approval, as described below in the section entitled, "Enterprise Risk Management."

Control Rights

In certain domestic and international structured finance transactions, structured public finance transactions, public-private partnerships and other transactions, AAC and Ambac UK may be the control party as a result of insuring a transaction’s senior class or tranche of debt obligations. The control party may direct specified parties, usually the trustee, to take or not take certain actions following contractual defaults or trigger events. Control rights and the scope of direction and remedies vary considerably among our insured transactions. Because AAC and Ambac UK are party to and/or have certain rights in documents supporting transactions in the insured portfolio, they may receive requests for amendments, consents and waivers (“ACW”). Decisions to approve or reject ACWs are made by AAC’s and Ambac UK’s risk management groups based upon certain credit factors, such as the issuer’s ability to repay the bonds and the bond’s security features and structure.

Watch List and Adversely Classified Credits

Watch list and adversely classified credits are tracked closely by the RMG teams and discussed as part of the CRM process. The review schedule for adversely classified credits is tailored to the

| Ambac Financial Group, Inc. 42022 FORM 10-K

remediation plan to track and prompt timely action and proper internal and external resourcing. A summary of developments regarding adversely classified credits and credit trends is also provided to AFG’s, AAC’s and Ambac UK's Boards of Directors no less than quarterly.

Ambac assigns internal credit ratings to individual exposures as part of the surveillance process. These internal credit ratings, which represent Ambac’s independent judgments, are based upon underlying credit parameters consistent with the exposure type.

Loss Reserving and Analytics ("LRA")

The LRA function manages the quarterly loss reserving process for insured portfolio credits with projected policy claims. It also supports the development, operation and/or maintenance of various analytical models used in the loss reserving process as well as in other risk management functions.

P&C Industry Overview

We operate within the $800$875 billion U.S. P&C insurance market with a particular focus on the commercial MGA/U program market both on an Admitted and Excess & Surplus Lines ("E&S") basis.

Admitted and E&S Insurance

Insurance carriers sell commercial P&C products in the United States through one of two markets: the Admitted market and the E&S market.

The Admitted insurance market, which has highly regulated rates and policy forms, is more consistent in price and coverage. In the E&S market, there is increased flexibility in pricing, terms, and conditions in response to evolving market dynamics, and E&S carriers can tailor insurance products to facilitate coverage that would not otherwise be attainable. This unique flexibility lends itself to providing specialist solutions for unique risks, which has driven meaningful growth within the E&S market over the last decade which has exceededexceeding the growth rate of the Admitted market.

According to data from AM Best, the E&S market generated approximately $83$99 billion of direct written premium in 2021 or 10%2022 an increase of 19.2% over the prior year and and represents over 11% of the industry direct premium volume. The E&S market is more heavily focused in commercial lines and accounted for over 20%21% of total commercial direct written premium for the first time in 2021.2022. For the period of 20112012 through 20212022 the E&S

sector had a compound annual growth rate of 10%11% compared to 5% for the overall U.S. P&C sector.

Everspan presently has five admitted carriers, which are wholly-owned except as indicated below: Everspan Insurance Company; Greenwood Insurance Company; Consolidated National Insurance Company; 21st Century AutoConsolidated Specialty Insurance Company of New Jersey;Company; and Providence Washington Insurance Company of which it owns 90.1%(90.1% owned). Everspan Indemnity Insurance Company ("Everspan Indemnity"), an E&S carrier, which is eligible to write business in all U.S. states and territories, is also part of Everspan.

MGA/U Program Market

It is estimated that U.S. MGA/Us generate between $70 to $100 billion of direct premiums.premiums in 2023. We believe there are significant advantages to the MGA/U business model when it comes to capturing the opportunity in the E&S market and propelling profitable growth. MGA/Us are specialized types of insurance agents or brokers that are vested with underwriting authority from an insurer, administering programs and negotiating contracts on their behalf. This is a particularly useful vehicle for P&C insurers as MGA/Us tend to participate in the E&S market where specialized expertise is needed to underwrite policies. Additionally, MGA/Us are cost effective means for an insurer or reinsurer to access or grow a particular class of business they find attractive given the MGA/U already possesses product expertise and distribution capabilities.

TheAccording to data from AM Best, the MGA/U sector is one of fastest growing segments of the U.S. P&C insurance market doubling in size between 2011with 2022 direct premium written of $68 billion, an increase of 14% over the prior year, and 2020, with loss ratios consistently lower than the P&C sector overall. In 2021,2022, AM Best identified 654 MGAs in the U.S. market was estimated by a leading broker to have over 1,000 MGA/Us with 700 identifiedlikely several hundred additional MGAs not counted in statutory filings and another 350 estimated to fallthat group as their premium production falls below the filing threshold. We believe the growth in the MGA/U and program space is likely to continue as the industry continues its move towards increased specialization.

Specialty Property and Casualty Insurance

Everspan’s strategy as a hybrid insurer is to generate sustainable and profitable, long-term specialty property and casualty program insurance business with a focus on diverse classes of commercial and personal liability risks across an expanding roster of MGA/U partners.

As a hybrid insurerspecialty property and casualty program group. Everspan may retain a percentage of the business it underwrites. Everspan's management team has significant years of experience in the program insurance businessand reinsurance sectors and has long-standing and broad relationships with MGA/Us, reinsurers, brokers, producers and third-party claims administrators ("TPAs"). Everspan sources business through program administrators and managing general agents, reinsurers, brokers, producers and others. Everspan is developing long-term relationships with its distribution partners. Subject to Everspan's operational oversight, Everspan engages these third parties to market and administer policies and handle claims within defined authorities on Everspan's behalf.

Everspan is focused on generating strong underwriting results and programstable fee income fromas part of its participatory frontingspecialty program business model.

| | | | | | | | |

| Ambac Financial Group, Inc | 5 | 2023 Form 10-K |

For the year ended December 31, 2022,2023, Everspan issued insurance policies generating $146generated $273 million of gross written premium, of which Everspan retained approximately 20%29%, including assumed written premiums. Everspan retained approximately 17% of its direct written premiums, with the balance primarily ceded to quota share reinsurers.

The following table sets forth our largest lines of business for the year ended December 31, 2022:

| Ambac Financial Group, Inc. 52022 FORM 10-K

| | | | | | | | | | | |

($ in millions)

Year Ended December 31, | 2022 | | 2021 |

| Gross written premiums by line of business: | | | |

| Commercial auto liability | $ | 117.2 | | | $ | 12.6 | |

| Commercial auto physical damage | 12.6 | | | — | |

| General liability | 6.0 | | | — | |

| Excess liability | 4.8 | | | 0.5 | |

| Surety | 4.4 | | | — | |

| Other | 1.3 | | | — | |

| Gross written premiums | $ | 146.4 | | | $ | 13.0 | |

Everspan may retain up to 30% of risk on each direct program and will reinsure the remainder to reinsurers and other providers of risk capital. These reinsurers may be domestic and foreign (re)insurersreinsurers and institutional risk investors (capacity providers) that want access.

While underwriting direct business produced by MGA/Us is Everspan's primary means of distribution, Everspan also selectively assumes reinsurance to specificfurther its goal of writing a diversified book of specialty P&C business while efficiently managing its exposure limits. For example, the Company would evaluate, and may write certain lines, including those with catastrophe risk or Workers’ Compensation on an assumed basis. Everspan may participate as a reinsurer on up to 30% of U.S. propertya program, which is in line with its strategy to retain up to 30% of risk per program. Participation as a reinsurer will affect the retention ratio as Everspan's portion of assumed premiums is reflected fully in both Gross and casualty insuranceNet Written Premiums.

The following table sets forth gross written premiums (direct and assumed) by line of business that they may not havefor the required licensesyears ended December 31, 2023 and filings to otherwise insure.2022:

| | | | | | | | | | | |

($ in millions)

Year Ended December 31, | 2023 | | 2022 |

| Commercial auto liability | $ | 122 | | | $ | 117 | |

| Excess liability | 41 | | | 5 | |

| General liability | 27 | | | 6 | |

| Surety | 26 | | | 4 | |

| Non-standard auto | 20 | | | — | |

| Workers Compensation | 20 | | | — | |

| Commercial auto physical damage | 12 | | | 13 | |

| Other | 6 | | | 1 | |

| Gross written premiums | $ | 273 | | | $ | 146 | |

Everspan purchases reinsurance to manage its net retention on individual risks and overall exposure to losses, while providing it with the ability to offer policies with sufficient limits to meet producer and policyholder needs. Generally, reinsurance contracts are specific to a program and are purchased on an annual basis, andrenewed annually, at which time they are subject to renegotiation at renewal.renegotiation. The key contractual provisions include, but are not limited to, those relating to the scope of business reinsured, ceding commissions, fronting fees, required reports to reinsurers, responsibility for taxes, arbitration in the event of a dispute resolution, any required collateral, and Everspan's termination rights when, among other triggers, a reinsurer defaults (such as by failing to collateralize its obligations when required) or its financial strength falls below an agreed level. Everspan’s ceded reinsurance contracts do not legally discharge Everspan from its primary liability for the full amount of the policies, and Everspan will be required to pay the loss and bear collection risk if a reinsurer fails to meet its obligations under the reinsurance agreement.

Everspan mitigates this credit risk by selecting well capitalized, highly rated, authorized capacity providers, or requiring that the capacity provider post collateral, typically in the form of letters

of credit issued by or trust accounts in the custody of NAIC-qualified financial institutions, to secure the reinsured risks.

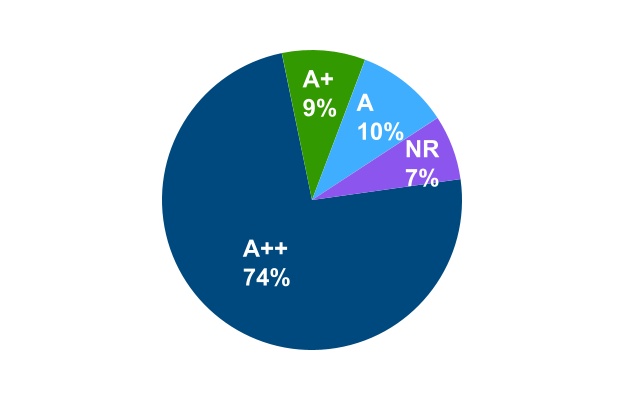

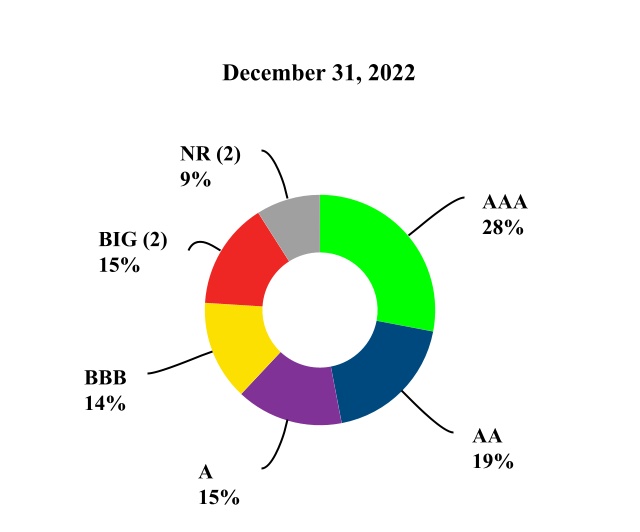

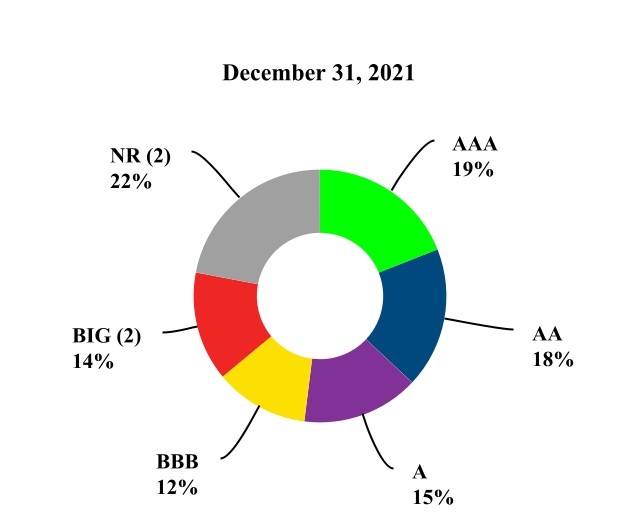

The following graph shows our reinsurance carriers' AM Best rating based on share of ceded premium for the year endingended December 31, 2022:2023:

(1)NR represents reinsurance carriers not rated by AM Best. Generally, under the terms of reinsurance contracts with such carriers the reinsurer is required to post collateral to Everspan.

See Note 8.7. Insurance Contracts to the Consolidated Financial Statements included in Part II, Item 8 in this Annual Report on Form 10-K for further information on reinsurance recoverables, including the evaluation for credit impairments.

Competitive Strengths:

Specialty Property and Casualty Insurance is a competitive industry. Everspan believes that it can successfully operate in this industry in part based upon the following competitive strengths.

•Experience — Everspan has an experienced leadership team across underwriting, pricing, claims, and business development with an average tenure of over 30 years in the insurance industry.

•Underwriting Focused Strategy — Everspan is driven by underwriting performance, which is achieved via comprehensive diligence and monitoring of MGA/U partners from our in-house pricing actuaries, claims executive,executives, and program managers. This underwriting focus also aides in achieving and maintaining support from the reinsurance partners.

•Risk Appetite — Everspan may retain up to 30% of the risk it underwrites. This meaningful participation serves to align interests with our reinsurers.

•Commitment to Program Distribution — Everspan does not have any direct distribution capability as it is committed to the program market distributed through MGA/Us. As a result, Everspan does not have channel conflicts which would compete with programs partners in underwriting business.

•Nimble Platform — A simplified organizational structure which allows Everspan to be efficient and quick in responding to the needs of program partners as well as finding customized solutions. We believe this provides a

| | | | | | | | |

| Ambac Financial Group, Inc | 6 | 2023 Form 10-K |

competitive advantage to the more traditional competitors in the market.

| Ambac Financial Group, Inc. 62022 FORM 10-K

•Aligned Ownership — Everspan has a stable ownership structure which is equally focused on long-term value creation based on strong underwriting performance. This alignment of interest and strategic vision allows Everspan to leverage resources across the CompanyAmbac and access capital for future initiatives.

Competition:

Everspan faces competition from program business market participants such as Accelerant, Specialty, Accredited America, Benchmark, Insurance Company, Clear Blue, Insurance Group, Core Specialty, Falls Lake, Insurance, Fortegra, Insurance Group, Obsidian, Spinnaker, State National, Transverse, Insurance Group, and Trisura. Most of these entities have both admitted and E&S carriers. Competition may take the form of lower cedingprogram fees, broader coverages, greater product flexibility, higher coverage limits, greater customer service or higher financial strength ratings by independent rating agencies. Few barriers exist to prevent existing insurers from entering target markets within the property and casualty industry. Market conditions and capital capacity influence the degree of competition at any point in time.

During periods of excess underwriting capacity, as defined by the availability of capital, competition can result in lower pricing and less favorable policy terms and conditions for insurers. During periods of reduced underwriting capacity, pricing and policy terms and conditions are generally more favorable for insurers. Historically, the performance of the property and casualty insurance industry has tended to fluctuate in cyclical periods of price competition and excess underwriting capacity, followed by periods of high premium rates and shortages of underwriting capacity. At any given time, Everspan's portfolio of insurance products could experience varying combinations of these characteristics. This cyclical market pattern can be more pronounced in the specialty insurance and reinsurance markets in which Everspan competes than in the standard insurance market. For the last several years the property and casualty industry has been in a period of high premium rates with a shortage of underwriting capacity. While not anticipated to end in the short-term, this cyclical period will eventually end, perhaps unexpectedly. The end of this favorable cycle could have negative consequences for Everspan's growth and profitability prospects.

Business Acquisition and Program Partner Selection:

With our focus on generating long-term underwriting profitability, we are selective in adding new program partners. We look for program partners that share our vision of underwriting performance and return expectations and consequently are selective about with whom we partner. As of December 31, 2023, we have 23 programs with 19 MGA/Us. In 20222023 we reviewed over 180 submissions and agreed to contract 11 new programs with nineeight new MGA/Us and two MGA/Us with an existing relationship, while renewing or extending twelve programs with eleven incumbent MGA/Us. Included in 2023 new programs are two executed via assumed reinsurance.

As noted above, most of Everspan’s programs are sourced either from MGA/Us or through other third parties, such as reinsurance brokers, that are seeking to provide customized insurance

solutions that require a carrier with a high rating from AM Best. Everspan works with MGA/Us that leverage both data and technology to streamline or improve the underwriting process.

Everspan may also source programs as a reinsurer. Accessing programs as a reinsurer provides Everspan the ability to diversify its risk profile, efficiently manage its exposure limits and underwrite programs in a cost efficient manner, amongst other benefits.

For each new opportunity that Everspan chooses to evaluate, an initial evaluation of the MGA/U is conducted, including an assessment of its underwriting approach, philosophy, size, quality of management, past performance, future performance targets and, above all, compatibility with Everspan’s operating model, risk appetite, and existing book of business. Everspan conducts substantial due diligence on all program partners led by the Underwriting Risk Committee which is chaired by Everspan’s Chief Underwriting Officer. As part of the diligence process, Everspan works closely with potential MGA/Us to design program underwriting guidelines, ongoing reporting and auditing requirements. Everspan also typically requires the producing partner to retain underwriting risk or otherwise align incentives with program underwriting performance.

Additionally, as part of the diligence process for each program, Everspan will perform a review of the claims management function, typically performed by a TPA, which in some cases are managed by the MGA/U or producing partner. Diligence focuses on claims handling and litigation management, compliance, finance, governance, staff and vendor management, data and IT.

After due diligence is completed and acceptable reinsurers are identified, each program is presented to the Underwriting Risk Committee for final approval. The Underwriting Risk Committee will consider recommendations made by the credit subcommittee regarding the financial strength of the MGA/Us and/or reinsurers.

Ongoing monitoring:Monitoring:

For active programs, Everspan authorizes MGA/Us to underwrite and bind coverages in accordance with approved underwriting guidelines and delegates authority to the TPA for claims adjustment and payment. Everspan closely monitors each MGA/U and TPA’s adherence to the agreed upon underwriting and claims guidelines. Everspan will conduct periodic reviews of loss experience, rate levels, reserves and the overall financial health of the MGA/U and TPA and hold monthly underwriting meetings with both the MGA/U and TPA. Underwriting and claims data is provided by the MGA/Us and TPAs monthly. Additionally, Everspan conducts underwriting, claims and accounting audits, generally on-site, at least once a year for MGA/U and TPA partners which administer a material amount of Everspan's business. Everspan determines whether it will continue to participate on a program no less than annually, generally at the anniversary date of the program. The renewal process entails an assessment, with Underwriting Risk Committee participation, of the program's operating performance, profitability, and available reinsurance capacity. Everspan maintains the right to terminate relationships with its MGA/Us and TPAs. Reasons to terminate a relationship include

| | | | | | | | |

| Ambac Financial Group, Inc | 7 | 2023 Form 10-K |

an inability to produce targeted underwriting results, writing exposures outside of agreed upon risk tolerances, delinquency in meeting reporting requirements, a change of strategic direction, or failure to meet collateral or other commitments to Everspan.

Ratings:

Everspan carriers have an AM Best FSRfinancial strength ratings ("FSR") of 'A-' (Excellent) and Financial Strength Category of Class VIII. Risk is shared among the Everspan carriers via a reinsurance agreement and an intercompany pooling agreement (the "Everspan Pool"). We view this rating and financial size category as a competitive advantage in the marketplace. Ratings are an important factor in assessing Everspan’s competitive position, operation capabilities and risk management in the insurance industry.

| Ambac Financial Group, Inc. 72022 FORM 10-K

Insurance Distribution

Ambac’s Insurance Distribution business, Cirrata Group ("Cirrata"), has a strategy to build a diversified portfolio of MGA/Us and other insurance distributors covering various P&C products. Ambac plans to grow theits existing Insurance Distribution business using several strategies, including (i) organic growth, (ii) additional acquisitions and/or partnerships, and (iii) hiring experienced underwriting teams to incubate start-up MGA/Us. Key criteria include a track record of profitability and a seasoned management team. Insurance underwritten through Ambac's MGA/Us may utilize Everspan as an insurance carrier, but willare not be required to do so, depending on strategic and operational considerations. The Insurance Distribution business derives its revenues from commissions, fees, and other non-risk bearing means of compensation. For the years ended December 31, 2022 and 2021, Insurance Distribution generated gross commission revenue of $31 million and $26 million, respectively.

The following table sets forth our Premiums PlacedCirrata's premiums placed by line of business:

| ($ in millions)

Year ended December 31, | ($ in millions)

Year ended December 31, | 2022 | | 2021 | ($ in millions)

Year ended December 31, | 2023 | | 2022 |

| Premiums placed by line of business: | |

| Employee stop loss | Employee stop loss | $ | 72 | | | $ | 71 | |

| Limited and Short-term medical | 48 | | | 45 | |

| Limited & short-term medical | |

| Commercial auto | Commercial auto | 11 | | | — | |

| Marine | |

| Professional liability | |

| Other | Other | 4 | | | 2 | |

| Premiums placed | Premiums placed | $ | 135 | | | $ | 117 | |

Cirrata's portfolio at December 31, 20222023, includes the following entities:

Xchange — On December 31, 2020, Ambac acquired aowns an 80% controlling interest in Xchange.Xchange Benefits, LLC ("Xchange"). Xchange operates through specialty producers in accident and health ("A&H") sectors across the U.S. which are typically not targeted by large direct writers and to whom Xchange can provide customized offerings. Xchange conducts business through approximately ten insurance carriers and dozens of agents and other distributors.

Xchange's main products for which it is delegated underwriting authority by insurance carriers include:

•Employer Stop Loss ("ESL") — provides protection for self-insured employers by serving as a reimbursement mechanism for catastrophic claims, both specific and in aggregate exceeding pre-determined levels.

•Limited Benefit Medical ("LM") — designed for those not covered byas a supplement to traditional Affordable Care Act medical programs and sold primarily through affinity groups, providing a variety of medically related benefits such as inpatient hospital stays, diagnostic services or physician visits.

•Short-term Medical ("STM") — sold primarily through affinity groups, providing non Affordable Care Act comprehensive medical coverage for short durations (i.e. less than one year).

•Xchange Re ("MGA/U") / Distribution Re ("Captive") — in January 2023, Xchange launched two new growth initiatives; Xchange Re an A&H reinsurance MGA/U and Distribution Re

a protected cell captive insurance company domiciled in Tennessee which will mainly insure high deductible medical stop loss plans. Xchange does not intend to accept or retain any risk from Distribution Re.

All Trans — Effective November 1, 2022, Ambac acquired aan 85% controlling interest in All Trans.Trans Risk Solutions, LLC ("All Trans"). All Trans is a full service managing general underwriter with delegated underwriting authority in commercial automobile insurance for specific "for-hire" auto classes, specifically focused on theclasses; principally private school bus motor coach, and livery operators. In 2024, AllTrans launched a new program primarily focussed on charter buses. All Trans' track record of performance has allowed the company to maintain a consistconsistent panel of insurance carriers withand client relationships, several of the relationships goingwhich go back over 25 years.

Capacity Marine — Effective November 1, 2022, Ambac acquired aan 80% controlling interest in Capacity Marine.Marine Corporation ("Capacity Marine"). Capacity Marine is a wholesale and retail brokerage and reinsurance intermediary specializing in more sophisticated marine and international risk in expsoures such as ports, terminals, and stevedores.

Riverton — Effective August 1, 2023, Ambac acquired an 80% controlling interest in Riverton Insurance Agency, Corp. ("Riverton"). Riverton offers professional liability insurance programs to licensed architects, engineers, construction managers and real estate professionals. Riverton's retail agency places professional liability for real estate agents with various markets.

In addition to existing MGA/Us and acquisitions, de novo MGA/U formations will be a core element of the Insurance Distribution segment's growth strategy. In 2022, Cirrata hired two business leaders with plans to launch MGA/Us in 2023.

Cirrata's businesses are compensated for their services primarily by commissions paid by insurance carriers for underwriting, structuring and/or administering polices and, in some cases for managing claims under agency agreements. Commission revenues are usually based on a percentage of the premiums paid by the insured.placed. The businesses are also eligible to receive profit sharing contingent commissions on certain programs based on the underwriting results of the policies they write, which may cause some variability in revenue and earnings recognition.

Gross Commission revenues in 2022 were predominantlyexperience seasonality during the year, primarily from Xchange whose ESL programs are generallymostly underwritten in January and July resulting in revenue and earnings concentrations in the first and third quarters each calendar year. Given the recent acquisitions and potential de

| | | | | | | | |

| Ambac Financial Group, Inc | 8 | 2023 Form 10-K |

novo launches, this seasonality is likelyexpected to become more muted over time.

Core expensesExpenses at Cirrata include commissions the businesses pay to their independent agents / agents/producers, and compensation for their management and staff.staff and intangible asset amortization from acquisitions. Commission expenses are a variable cost as we pay a percentage of premiums written to the agents / agents/producers.

Insurance Distribution generated gross commission revenue of $51 million and $31 million during the years ended December 31, 2023 and 2022, respectively and net commission revenue (gross commissions less commission expenses) of $22 million and $13 million, respectively.

Commission revenue and expense growth will be driven by the businesses' continued expansion and diversification of its products across regions, products, and carriers.

Competitive Strengths:

•Deep specialty domain knowledge — Our Insurance Distribution businesses are anchored by a deep specialty domain knowledge in their respective classes of business. This knowledge is key to generating the underwriting results necessary to maintain long-standing carrier relationships.

| Ambac Financial Group, Inc. 82022 FORM 10-K

•Long standing carrier relationships — Our MGA/Us strive towards long and durable carrier relationships supported by a focus on underwriting profitability. P&C insurance is a cyclical industry with opportunistic players entering and exiting the business. We believe that growing multi-year carrier relationships are evidence of the value created by our MGA/U, a value which we believe should sustain through routine market cycles.

•Strong distribution relationships — Distribution relationships provide value in several ways. First, carrier partners are looking for both underwriting expertise and distribution access when working with MGA/Us. In addition the quality of distribution relationships helps in allowing our MGA/Us access to higher quality risks from the wholesale and retail agents which we believe over time will help produce better underwriting results..

Competition:

The MGA/U insurance sector is highly competitive, and firms actively compete with Cirrata's businesses for customers and insurance carrier capacity.

•The ESL market is increasing in size as large companies continue to transition from fully insured to self-funded. As the market size increases, capital is flowing into the market, butmaking prices and margins remain stable.competitive. Blue Cross, UnitedHealth, CIGNA and Aetna are the largest writers. Competition also comes from large direct writers such as Tokio Marine, HCC and Sun Life as well as smaller carriers such as Gerber Life writing through other MGA/U firms.

•For LM and STM, overall market conditions remain stable. The overall market is large as entrepreneurs, and the unemployed and others seek options for individual insurance. Competition for Xchange's business comes from

both direct carriers and other intermediaries and, depending on the product, may include Blue Cross, UnitedHealth, CIGNA, Aetna, Tokio Marine, Houston Casualty Company, Sun Life, United Health, Axis, Chubb, and National General.

•In the commercial auto "for-hire" classes All Trans competes with a variety of carriers both national and regional. Overall, carriers have been cutting back on their participation and or capacity in commercial auto due to poor underwriting performance, which has benefited All Trans which is focused on narrower niche classes of risk within the larger commercial auto sector. This competitive environment has allowed All Trans to price properly and provide strong underwriting results. All Trans competes with Lancer insurance, National Interstate, Utica, RLI and various other MGA/U companies.

•In professional liability markets, overall market conditions remain stable. Riverton competes with RLI, CNA, Hartford and various other MGA/U companies.

ENTERPRISE RISK MANAGEMENT

The Company's policies and procedures relating to risk assessment and risk management are overseen by its Board of Directors. The Board of Directors takes an enterprise-wide approach to risk management oversight that is designed to support the Company's business plans at a level of risk considered by the Board to be reasonable. A fundamental part of risk assessment and risk management is not only understanding the risks the Company faces and what steps management is

taking to manage those risks, but also understanding what level of risk is appropriate for the Company. The Board of Directors periodically reviews the Company's business plan, factoring risk management into account. It also approves the Company's risk appetite statements, which articulate the Company's tolerance for certain risks and describes the general types of risk that the Company accepts, within certain parameters, or attempts to avoid.

While the Board of Directors has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibilities related to risk assessment and risk management, and management has responsibility for managing the risks to which the Company is exposed and reporting on such matters to the Board of Directors and applicable Board committees.

•The Audit Committee oversees the management of risks associated with the integrity of Ambac’s financial statements and its compliance with legal and regulatory requirements. In addition, the Audit Committee discusses policies with respect to risk assessment and risk management, including major financial risk exposures and the steps management has taken to monitor and control such exposures. The Audit Committee reviews with management, internal auditors and independent auditors Ambac's critical accounting policies, Ambac's system of internal controls over financial reporting and the quality and appropriateness of disclosure and content in the financial statements and other external financial communications.

| | | | | | | | |

| Ambac Financial Group, Inc | 9 | 2023 Form 10-K |

•The Compensation Committee oversees the management of risk primarily associated with our ability to attract, motivate and retain quality talent (particularly executive talent) and with setting financial incentives that do not motivate undue risk-taking.

•The Governance and Nominating Committee oversees the management of risk primarily associated with Ambac’s ability to attract and retain quality directors, Ambac’s corporate governance programs and practices and our compliance therewith, including integration of ESG and sustainability policies, practices and goals into the Company's business strategy and decision making. Additionally, the Governance and Nominating Committee oversees the processes for evaluation of the performance of the Board of Directors and its committees each year and considers risk management effectiveness as part of its evaluation. This committee also reviews succession plans for Ambac's executive officers, including the Chief Executive Officer. The Governance and Nominating Committee also performs oversight of the business ethics and compliance program, and reviews compliance with Ambac’s Code of Business Conduct.

•The Strategy Committee oversees the management of risk and risk appetite primarily with respect to strategic plans and initiatives.

The Board of Directors receives quarterly updates from Board committees and the Board provides guidance to individual committee activities, as appropriate.

| Ambac Financial Group, Inc. 92022 FORM 10-K

In order to assist the Board of Directors in overseeing Ambac’s risk management, Ambac uses enterprise risk management, a company-wide process that involves the Board of Directors, management and other personnel in an integrated effort to identify, assess and manage a broad range of risks (e.g., credit, financial, legal, liquidity, market, model, operational, regulatory, reputational and strategic), that may affect the Company’s ability to execute on its corporate strategy and fulfill its business objectives. The Enterprise Risk Committee (“ERC”), which is a management committee, is comprised of executive and senior level management responsible for assisting in the management of the Company’s risks on an individual and aggregate basis. The ERC produces the relevant risk management information for executive and senior management and the Board of Directors.

Ambac management has established other management committees to assist in managing the risks throughout the enterprise. These committees will meet monthly or as needed on an ad hoc basis.

•The AAC Risk Committee's objective is to provide oversight of the key risk remediation issues impacting AAC. The purview of the committee is to review and approve risk remediation activities for the financial guarantee insured portfolio. Additionally, the Risk Committee will provide oversight and review new risk remediation structures or approaches in connection with risk remediation plans or anticipated transactions. Members of the Risk Committee include the CEO, Head of Risk Management, CFO and senior managers from throughout risk, corporate services, operations, legal and finance.

•The Disclosure Committee's objective is to assist the CEO and CFO in their responsibilities to design, establish, maintain and evaluate the effectiveness of disclosure controls and procedures. Members of the Disclosure Committee include the CEO, CFO, Chief Accounting Officer, General Counsel, Chief Operating Officer, Head of Risk Management and senior managers from finance and legal.

•The AAC Reserve Committee's objective is to provide oversight and review of the reserving process at AAC and AUK.Ambac UK. The committee reviews and discusses, on at least a quarterly basis, reserve-related developments and key metrics and assumptions, including, but not limited to, credit, economic, interest rates, legal and regulatory. The committee gives approval to proceed with the development of loss estimates and related projections utilized in developing the consolidated quarterly reserves of the legacy financial guaranteeLegacy Financial Guarantee Insurance business. Members of the Reserve Committee include the CEO, Head of Risk Management, CFO, General Counsel and senior managers throughout risk, legal and finance.

•The Everspan established an Underwriting Risk CommitteeCommittee' in 2021s objective is to provide oversight of the active underwriting operations of Everspan, develop underwriting parameters, and assist the Boards of the Everspan companies in overseeing the integrity and effectiveness of Everspan’s underwriting risk management framework. Members of the committee include the CEO, key members of Everspan management and other senior managers or advisors of

Ambac. Additionally, a Reinsurance and Program Administrator Credit Risk sub-committee was established at the direction of the Underwriting Risk Committee to assist with the management of credit risk emanating from ceded reinsurance and program administrators.

The Company’s Enterprise Risk Management efforts build upon the foundation of an effective internal control environment. The design of any risk management or control system must reflect the fact that there are resource constraints, and the benefits must be considered relative to their costs. As a result, the possibility of material financial loss remains regardless of the Company’s Enterprise Risk Management efforts. An investor should carefully consider the risks and all of the other information set forth in this annual report, including the discussions included in Item 1A. Risk Factors, Item 7A. Quantitative and Qualitative Disclosures About Market Risk, and Item 8. Financial Statements and Supplementary Data.

AVAILABLE INFORMATION

Our Internet address is www.ambac.com. We make available through the investor relations section of our web site, annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and any amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as well as proxy statements, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission. Our Investor Relations Department can be contacted at Ambac Financial Group, Inc., One World Trade Center, 41st Floor, New York, New York 10007, Attn: Investor Relations,Relations; telephone: 212-208-3222 212-208-3222;

| | | | | | | | |

| Ambac Financial Group, Inc | 10 | 2023 Form 10-K |

email: ir@ambac.com. The reference to our website address does not constitute inclusion or incorporation by reference of the information contained on our website in this Annual Report on Form 10-K or other filings with the SEC and the information contained on our website is not part of this document.

INSURANCE REGULATORY MATTERS AND OTHER RESTRICTIONS

Regulatory Matters