FORM 10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

| | | | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended | December 31, 2022 |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from ______ to ______ |

| Commission file number | 1-10816 |

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission file number 1-10816

MGIC INVESTMENT CORPORATIONInvestment Corporation

(Exact name of registrant as specified in its charter)

|

| | | | | | | | | | |

WISCONSINWisconsin | | 39-1486475 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

| 250 E. Kilbourn Avenue | | |

MGIC PLAZA, 250 EAST KILBOURN AVENUE,Milwaukee, | Wisconsin | | 53202 |

MILWAUKEE, WISCONSIN | | 53202 |

| (Address of principal executive offices) | | (Zip Code) |

| (414) | | 347-6480 |

| (Registrant’s telephone number, including area code) |

(414) 347-6480

(Registrant’s telephone number, including area code)

Securities Registered Pursuantregistered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $1 per share | | MTG | | New York Stock Exchange |

| | |

| Title of Each Class: | Common Stock, Par Value $1 Per Share |

| | Common Share Purchase Rights |

| Name of Each Exchange on Which | |

| Registered: | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

☒Yes ☐No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

☐ Yes ☒ No

Indicate by check mark whether the Registrantregistrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrantregistrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒YesYes ☒ No ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒YesYes ☒ No ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company,” and "emerging“emerging growth company"company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | | | | | | | | | | | | | | | | | |

Large accelerated filer ☒ | ☒

| Accelerated filer ☐ |

| |

| Non-accelerated filer ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

| |

Emerging growth company ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ Yes ☒NoNO ☒

State the aggregate market value of the voting and non-voting common stockequity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the Registrant aslast business day of June 30, 2017:the registrant's most recently completed second fiscal quarter. : Approximately $4.1$4.6 billion*

MGIC Investment Corporation 2022 Form 10-K | 1

* Solely for purposes of computing such value and without thereby admitting that such persons are affiliates of the Registrant, shares held by directors and executive officers of the Registrant are deemed to be held by affiliates of the Registrant. Shares held are those shares beneficially owned for purposes of Rule 13d-3 under the Securities Exchange Act of 1934 but excluding shares subject to stock options.

Indicate the number of shares outstanding of each of the Registrant’sissuer’s classes of common stock, as of the latest practicable date: As of February 16, 2018: 370,862,19017, 2023, there were 290,428,422 shares of common stock of the registrant, par value $1.00 per share, outstanding.

The following documents have been incorporated by reference in this Form 10-K, as indicated:

|

| | | | | | | |

| Document | | Part and Item Number of Form 10-K Into Which Incorporated* |

Proxy Statement for the 20182023 Annual Meeting of Shareholders, provided such Proxy Statement is filed within 120 days after December 31, 2017.2022. If not so filed, the information provided in Items 10 through 14 of Part III will be included in an amended Form 10-K filed within such 120 day period. | | Items 10 through 14 of Part III |

* In each case, to the extent provided in the Items listed.

MGIC Investment Corporation 2022 Form 10-K | 2

MGIC Investment Corporation and Subsidiaries

|

| | | | | | | | | | |

| TABLE OF CONTENTS | Table of Contents |

| | Page No. |

| PART I | | | Page No. |

| PART I | | |

| | Item 1. | | |

| | Item 1A. | | |

| | Item 1B. | | |

| | Item 2. | | |

| | Item 3. | | |

| | Item 4. | | |

| PART II | | |

| | Item 5. | | |

| | Item 6. | Reserved. | | |

| | Item 7. | | |

| | Item 7A. | | |

| | Item 8. | | |

| | Item 9. | | |

| | Item 9A. | | |

| | Item 9B. | | |

| PART IIIItem 9C. | | |

| PART III | | |

| Item 10. | | |

| | Item 11. | | |

| | Item 12. | | |

| | Item 13. | | |

| | Item 14. | | |

| PART IV | | |

| | Item 15. | | |

| | Item 16. | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

MGIC Investment Corporation 2017 Form 10-K | 3

|

| | | | | | | | | | | | | | | |

Glossary of terms and acronyms |

MGIC Investment Corporation

2017 Form 10-K

| | | | | | | | | | | | | | | |

MGIC Investment Corporation 2022 Form 10-K | 3

GLOSSARY OF TERMS AND ACRONYMSGlossary of terms and acronyms

/ A

ARMs

Adjustable rate mortgages

ABS

Asset-backed securities

ASC

Accounting Standards Codification

Available Assets

Assets, as designated under the PMIERs, that are readily available to pay claims, and include the most liquid investments

/ B

Book or book year

A group of loans insured in a particular calendar year

BPMI

Borrower-paid mortgage insurance

/ C

CECL

Current expected credit losses

CFPB

Consumer Financial Protection Bureau

CLO

Collateralized loan obligations

CMBS

Commercial mortgage-backed securities

COVID-19 Pandemic

An outbreak of the novel coronavirus disease, later named COVID-19. The outbreak of COVID-19 was declared a pandemic by the World Health Organization and a national emergency in the United States in March 2020

CRT

Credit risk transfer. The transfer of a portion of mortgage credit risk to the private sector through different forms of transactions and structures

/ D

DAC

Deferred insurance policy acquisition costs

Debt-to-income ("DTI") ratio

The ratio, expressed as a percentage, of a borrower's total debt payments to gross income

DirectDelinquent Loan

When referringA loan that is past due on a mortgage payment. A delinquent loan is typically reported to insuranceus by servicers when the loan has missed two or risk writtenmore payments. A loan will continue to be reported as delinquent until it becomes current or in force, "direct" means beforea claim payment has been made. A delinquent loan is also referred to as a default

Delinquency Rate

The percentage of insured loans that are delinquent

Direct

Before giving effect to reinsurance

/ E

ETFsEPS

Exchange traded fundsEarnings per share

Expense ratio

The ratio, expressed as a percentage, of the underwriting and operating expenses, net and amortization of DAC of our combined insurance operations (which excludes underwriting and operating expenses of our non-insurance operations) to NPW

/ F

Fannie Mae

Federal National Mortgage Association

FCRA

Fair Credit Reporting Act

FEMA

Federal Emergency Management Agency

FHA

Federal Housing Administration

FHFA

Federal Housing Finance Agency

FHLB

Federal Home Loan Bank of Chicago, of which MGIC is a member

FICO score

A measure of consumer credit risk provided by credit bureaus, typically produced from statistical models by Fair Isaac Corporation utilizing data collected by the credit bureaus

FOMC

Federal Open Market Committee

Freddie Mac

Federal Home Loan Mortgage Corporation

MGIC Investment Corporation 2017 Form 10-K | 4

|

| | | | | | | | | | | | | | | |

|

MGIC Investment Corporation

2017 Form 10-K

|

Glossary of Terms and Acronyms (continued) |

/ G

GAAP

Generally Accepted Accounting Principles in the United States

GSEs

Collectively, Fannie Mae and Freddie Mac

MGIC Investment Corporation 2022 Form 10-K | 4

MGIC Investment Corporation and Subsidiaries

/ H

HAMP

Home Affordable Modification Program

HARP

Home Affordable Refinance Program

Home Re Entities

Unaffiliated special purpose insurers domiciled in Bermuda that participate in our aggregate XOL transactions through the ILN market.

Home Re Transactions

Excess-of-loss reinsurance transactions with the Home Re Entities

HOPA

Homeowners Protection Act

HUD

Housing and Urban Development

/ I

IADAIBNR Reserves

Individual Assistance Disaster AreaLoss reserves established on loans we estimate are delinquent, but for which the delinquency has not been reported to us

IBNR

Losses incurred but not reported

IIF

Insurance in force, which for loans insured by us, is equal to the unpaid principal balance, as reported to us

/ JILN

JCTInsurance-linked notes

Joint Committee on Taxation

/ L

LAE

Loss adjustment expenses, which includes the costs of settling claims, including legal and other expenses and general expenses of administering the claims settlement process.

Legacy book

Mortgage insurance policies written prior to 2009

Loan-to-value ("LTV") ratio

The ratio, expressed as a percentage, of the dollar amount of the first mortgage loan to the value of the property at the time the loan became insured and does not reflect subsequent housing price appreciation or depreciation. Subordinate mortgages may also be present

Long-term debt:

5.375% Notes

5.375% Senior Notes due on November 2, 2015, with interest payable semi-annually on May 1 and November 1 of each year

5% Notes

5% Convertible Senior Notes due on May 1, 2017, with interest payable semi-annually on May 1 and November 1 of each year

2% Notes

2% Convertible Senior Notes due on April 1, 2020, with interest payable semi-annually on April 1 and October 1 of each year

5.75% Notes

5.75% Senior Notes

5.25% Notes

5.25% Senior Notes due on August 15, 2023,2028, with interest payable semi-annually on February 15 and August 15 of each year

9% Debentures

9% Convertible Junior Subordinated Debentures due on April 1, 2063, with interest payable semi-annually on April 1 and October 1 of each year

FHLB Advance or the Advance

1.91% Fixed rate advance from the FHLB due on February 10, 2023, with interest payable monthly

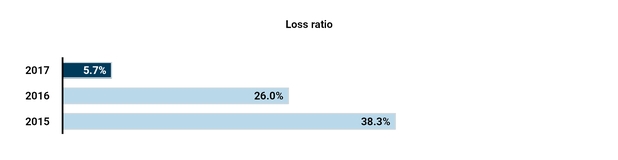

Loss ratio

The ratio, expressed as a percentage, of the sum of net incurred losses and loss adjustment expenses to NPEnet premiums earned

Low down payment loans or mortgages

Loans with less than 20% down payments

LPMI

Lender-paid mortgage insurance

/ M

MBA

Mortgage Bankers Association

MGIC Investment Corporation 2017 Form 10-K | 5

|

| | | | | | | | | | | | | | | |

|

MGIC Investment Corporation

2017 Form 10-K

|

Glossary of Terms and Acronyms (continued) |

MBS

Mortgage-backed securities

MD&A

Management's discussion and analysis of financial condition and results of operations

MGIC

Mortgage Guaranty Insurance Corporation, a subsidiary of MGIC Investment Corporation

MICMAC

MGIC IndemnityAssurance Corporation, a subsidiary of MGIC

Minimum Required Assets

The greater of $400 million or the total of the minimum amount of Available Assets that must be held under the PMIERs, which is based upon a percentageon an insurer's book of RIF weighted by certainand is calculated from tables of factors with several risk attributesdimensions, reduced for credit given for risk ceded under reinsurance transactions, and subject to a floor of $400 million

MPP

Minimum Policyholder Position, as required under certain state requirements. The “policyholder position” of a mortgage insurer is its net worth or surplus, contingency reserve and a portion of the reserves for unearned premiums

MGIC Investment Corporation 2022 Form 10-K | 5

MGIC Investment Corporation and Subsidiaries

/ N

N/A

Not applicable for the period presented

NAIC

The National Association of Insurance Commissioners

NIW

New Insurance Written, is the aggregate original principal amount of the mortgages that are insured during a period

N/M

Data, or calculation, deemed not meaningful for the period presented

NPE

The amount of premiums earned, net of premiums assumed and ceded under reinsurance agreements

NPL

Non-performing loan, which is a delinquent loan, at any stage in its delinquency

NPW

The amount of premiums written, net of premiums assumed and ceded under reinsurance agreements

/ O

OCI

Office of the Commissioner of Insurance of the State of Wisconsin

/ P

Persistency

The percentage of our insurance remaining in force from one year prior

PMI

Private Mortgage Insurance (as an industry or product type)

PMIERs

Private Mortgage Insurer Eligibility Requirements issued by the GSEseach of Fannie Mae and Freddie Mac to set forth requirements that an approved insurer must meet and maintain to provide mortgage guaranty insurance on loans delivered to or acquired by Fannie Mae or Freddie Mac, as applicable

Premium Rate

The contractual rate charged for coverage under our insurance policies

Premium Yield

The ratio of NPEpremium earned divided by the average IIF outstanding for the period measured

Primary Insurance

Insurance that provides mortgage default protection on individual loans. Primary insurance may be written on a "flow" basis, in which loans are insured in individual, loan-by-loan transactions, or on a "bulk" basis, in which each loan in a portfolio of loans is individually insured in a single bulk transaction

Profit Commission

Payments we receive from reinsurers under each of our quota share reinsurance transactions if the annual loss ratio is below levels specified in the quota share reinsurance transaction

/ Q

QSR Transaction

Quota share reinsurance transaction with a group of unaffiliated reinsurers

2015 QSR

Our QSR transaction that provided coverage on eligible NIW written prior to 2017

2017 QSR

Our QSR transaction that provided coverage on eligible NIW in 2017

2018 QSR

Our QSR transaction that provided coverage on eligible NIW in 2018

2019 QSR

Our QSR transaction that provided coverage on eligible NIW in 2019

2020 QSR

Our QSR transactions that provide coverage on eligible NIW in 2020

2021 QSR

Our QSR transactions that provide coverage on eligible NIW in 2021

2022 QSR

Our QSR transactions that provide coverage on eligible NIW in 2022

2023 QSR

Our QSR transactions that provide coverage on eligible NIW in 2023

Credit Union QSR

Our QSR transaction that provides coverage on eligible NIW from credit union institutions originated from April 1, 2020 through December 31, 2025

/ R

REMIC

Real Estate Mortgage Investment Conduit

RESPA

Real Estate Settlement Procedures Act

MGIC Investment Corporation 2022 Form 10-K | 6

MGIC Investment Corporation and Subsidiaries

RIF

Risk in force, which for an individual loan insured by us, is equal to the unpaid loan principal balance, as reported to us, multiplied by the insurance coverage percentage. RIF is sometimes referred to as exposure

MGIC Investment Corporation 2017 Form 10-K | 6

|

| | | | | | | | | | | | | | | |

|

MGIC Investment Corporation

2017 Form 10-K

|

Glossary of Terms and Acronyms (continued) |

Risk-to-capital

Under certain state regulations, the ratio of RIF, net of reinsurance and exposure on policies currently in default and for which loss reserves have been established, to the level of statutory capital

RMBS

Residential mortgage-backed securities

/ S

State Capital Requirements

Under certain state regulations, the minimum amount of statutory capital relative to risk in force (or similar measure)

/ T

TaxTILA

Truth in Lending Act

The U.S. tax reform enacted

Traditional XOL Transaction

Excess-of-loss reinsurance transaction with a group of unaffiliated reinsurers that provides coverage on December 22, 2017 and commonly referred to as the "Tax Cuts and Jobs Act"eligible NIW in 2022

/ U

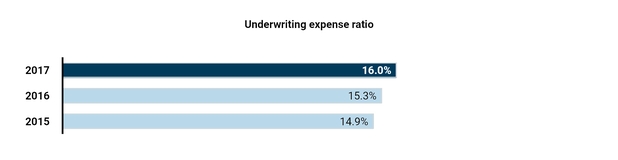

Underwriting Expense Ratioexpense ratio

The ratio, expressed as a percentage, of the underwriting and operating expenses, net and amortization of DAC of our combined insurance operations (which excludes underwriting and operating expenses of our non-insurance subsidiaries) to NPWnet premiums written

Underwriting profit

NPENet premiums earned minus incurred losses and underwriting and operating expenses

USDA

U.S. Department of Agriculture

/ V

VA

U.S. Department of Veterans Affairs

VIE

Variable interest entity

/ X

XOL Transactions

Excess-of-loss reinsurance transactions executed through the Home Re Transactions and the Traditional XOL Transaction

MGIC Investment Corporation 20172022 Form 10-K | 7

|

| | | | | | | | | | | | | | | |

Business | | | | | | | | | | | | | | | |

MGIC Investment Corporation

2017 Form 10-K

| | | | | | | | | | | | | | | |

PART I

Item 1. Business

Business.

A. General

We are a holding company and through wholly-owned subsidiaries we provide private mortgage insurance, other mortgage credit risk management solutions, and ancillary services. In 2017,2022, our net premiums writtentotal revenues were $1.0$1.2 billion and our primary NIW was $49.1$76.4 billion. As of December 31, 2017,2022, our direct primary IIF was $194.9$295.3 billion and our direct primary RIF was $50.3$76.5 billion. For further information about our results of operations, see our consolidated financial statements in Item 8 and our MD&A.&A in Item 7. As of December 31, 2017,2022, our principal mortgage insurance subsidiary, MGIC, was licensed in all 50 states of the United States, the District of Columbia, Puerto Rico and Guam. During 2017,2022, we wrote new insurance in each of those jurisdictions.

Business Strategies2023 BUSINESS STRATEGIES

Our business strategies arecontinue to be to 1) prudently grow IIF,maximize the value we create through our mortgage credit enhancement activities; 2) pursue new business opportunitiesdifferentiate ourselves through our customer experience; 3) establish a competitive advantage through our digital and analytical capabilities; 4) excel at acquiring, managing and distributing mortgage credit risk and the related capital; 5) maintain financial strength through economic cycles; and 6) foster an environment that meetembraces diversity and best positions our return objectives, 3) preserve and expand our role and that of the PMI industry in housing finance policy, 4) manage and deploy capitalpeople to optimize the creation of shareholder value and 5) expand and develop the talents of our co-workers.succeed.

2022 ACCOMPLISHMENTS

Following are several of our 20172022 accomplishments that furthered our business strategies.

•Earned $865 million of net income ($2.79 per diluted share) for the year, compared to $635 million ($1.85 per diluted share) in 2021.

•Increased NIW from $47.9 billion in 2016 to $49.1 billion in 2017 and increasedprimary IIF by more than 7%7.6% year-over-year. The

•Expanded our reinsurance program by securing quota share reinsurance covering the majority of our 2022 and 2023 NIW, is consistent with the Company's risk and return goals.

Held leadership roles in key trade associations.

Continued to enhance the reputationexecuting excess of the Companyloss reinsurance through an ILN and the industry relativetraditional reinsurance market. These transactions allow us to potential reformbetter manage our risk profile and they provide an alternative source of housing finance policy.capital.

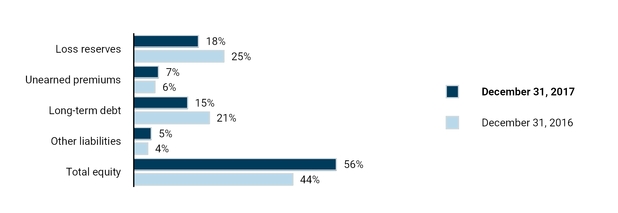

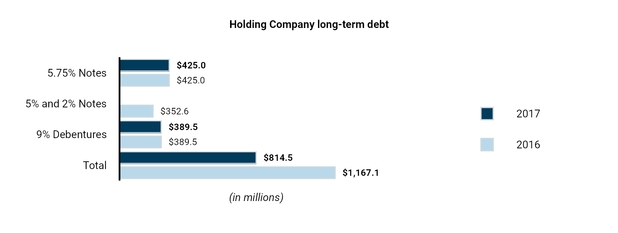

Decreased our long-term debt to shareholders' equity ratio from 46.7% as•Paid $800 million of December 31, 2016, to 26.5% as of December 31, 2017.

Increasedcash dividends from MGIC to our holding company. Maintained financial strength and capital flexibility while returning approximately $497 million in capital to shareholders:

◦Repurchased 8.7% of our shares outstanding at the beginning of the year.

◦Increased cash dividends by 25% in the second half of 2022.

•Repurchased $89 million of our 2063 Junior Convertible Debentures, which eliminated approximately 6.8 million potentially dilutive shares.

•Redeemed the outstanding principal balance of the 5.75% Senior Notes at a purchase price of $248 million plus accrued interest.

•Repaid the outstanding principal balance of the FHLB advance at a prepayment price of $156 million.

•Established a Transformation Management Office and Senior Leadership Team (the "SLT") to oversee technological investment governance and lead an enterprise-wide business prioritization process. Continued to meettransform our business processes along a number of dimensions, including modelling, pricing, data and analytics, application programming interfaces, sales and underwriting.

•Continued work on our Affordable Housing Strategy through ongoing participation in the financial requirementsAffordable Housing Advisory Board of the PMIERs with a comfortable cushion.

Maintained our traditionally low expense base.

Received upgraded ratings for MGIC from Moody'sMortgage Bankers Association and Standards and Poor's.

Negotiated a reinsurance agreement covering 2018 NIW.

Overviewsupport of the Private Mortgage Insurance IndustryUrban Institute's Housing Finance Innovation Forum, the National Housing Conference, the Coalition of Community Development Financial Institutions, the National Association of Hispanic Real Estate Professionals, the National Association of Real Estate Brokers, the National Conference of State Housing Agencies, and its Operating Environmentthe National Association of Local Housing Finance Agencies.

•Made significant progress in our diversity, equity and inclusion ("DEI") work, including the formation of a DEI Council, leadership participation in DEI Workshops, and the creation of a DEI site on the Company's intranet page.

OVERVIEW OF THE PRIVATE MORTGAGE INSURANCE INDUSTRY AND ITS OPERATING ENVIRONMENT

We established the modern PMI industry in 1957 to provide a private market alternative to federal government insurance programs. PMI covers losses from homeowner defaults on residential mortgage loans, reducing, and in some instances eliminating, the loss to the insured institution.

Fannie Mae and Freddie Mac ("the GSEs") have been the major purchasers of the mortgage loans underlying new insurance written by private mortgage insurers. The GSEs purchase residential mortgagesmortgage loans as part of their governmental mandate to provide liquidity in the secondary mortgage market. The GSEs cannot buy low down payment mortgage loans without certain forms of credit enhancement. Private mortgage insurance has generally been purchased by lenders in primary mortgage market transactions to satisfy this credit enhancement the primary form of which is PMI.requirement. Therefore, PMI facilitates the sale of low down payment mortgages in the secondary mortgage market to the GSEs and plays an important role in the housing finance system by assisting consumers, especially first-time and lower net-

MGIC Investment Corporation 2017 Form 10-K | 8

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

MGIC Investment Corporation

2017 Form 10-K

|

Business (continued) |

worthlow- and medium-wealth homebuyers, to finance homes with low down payment mortgages. PMI also reduces the regulatory capital that depository institutions are required to hold against certain low down payment mortgages that they hold as assets.

Because the GSEs have been the major purchasers of the mortgages underlying new insurance written by private mortgage insurers, the PMI industry in the U.S. is defined in large part by the requirements and practices of the GSEs. These requirements and practices, as well as those of the federal regulators that oversee the GSEs and lenders, impact the operating results and financial performance of private mortgage insurers. In 2008, the federal

MGIC Investment Corporation 2022 Form 10-K | 8

MGIC Investment Corporation and Subsidiaries

government took control of the GSEs through a conservatorship process. The FHFA is the conservator of the GSEs and has the authority to control and direct their operations.

In 2022 the past, membersGSEs submitted Equitable Housing Finance Plans to the FHFA. The Plans seek to advance equity in housing finance over a three year period and include potential changes to the GSEs’ business practices and policies. Specifically relating to mortgage insurance, (1) Fannie Mae’s Plan contemplates the creation of Congress have introduced several bills intendedspecial purchase credit program(s) ("SPCPs") targeted to changehistorically underserved borrowers with a goal of lowering costs for such borrowers through lower than standard mortgage insurance requirements; and (2) Freddie Mac’s Plan contemplates the creation of SPCPs targeted to historically underserved borrowers with the goals of (a) working with mortgage insurers to reduce costs for high LTV borrowers, and (b) updating mortgage insurance cancellation requirements. To the extent the business practices and policies of the GSEs regarding mortgage insurance coverage, costs and cancellation change, including more broadly than through SPCPs, such changes may negatively impact the FHA, however, no legislation has been enacted. The current Presidential administration has indicated that the conservatorship of the GSEs should end; however, it is unclear whether and when that would occur and how that would impact us. As a result of the matters referred to above, itmortgage insurance industry.

It is uncertain what role the GSEs, FHA and private capital, including private mortgage insurance, will play in the

domestic residential housing finance system in the

future or thefuture. The timing and impact

of any such changes on our

business. In addition, the timing of the impactbusiness of any resulting changes

on our business is uncertain.

Most meaningfulSome changes would require Congressional action to implement and it is difficult to estimate when

Congressionalany action would be final and how long any associated phase-in period may last.

See our risk factor titled “Changes in the business practices of the GSEs, federal legislation that changes their charters or a restructuring of the GSEs could reduce our revenues or increase our losses” in Item 1A.

The GSEs have private mortgage insurer eligibility requirements, or PMIERs,"PMIERs", for private mortgage insurers that insure loans delivered to or purchased by the GSEs. The financial requirements of the PMIERs require a mortgage insurer’s Available Assets to equal or exceed its Minimum Required Assets. While on an overall basis,MGIC is in compliance with the amount of Available Assets MGIC must hold in order to continuePMIERs and eligible to insure GSE loans is greaterpurchased by the GSEs. In calculating Minimum Required Assets, we receive significant credit for risk ceded under the PMIERs than the amount state regulation currently requires,our reinsurance transactions. See "Reinsurance" in this Item 1 for information about our reinsurance transactions mitigate the negative effect of the PMIERs on our returns. Seeand "Regulation – Direct Regulation" belowin this Item 1 for information about our compliance with the financial requirements of the PMIERs and about proposed changes to the PMIERs that are being recommended to the FHFA by the GSEs.

PMIERs.

The private mortgage insurance industry is greatly impacted by macroeconomic conditions that affect home loan originations and credit performance of home loans, including unemployment rates, home prices, restrictions on mortgage credit due to underwriting standards, interest rates, household formations and homeownership rates. TheDuring the years leading up to the financial crisis andof the downturn in the housing market that began in 2007 had a significant negative impact on the industry and our company. During the last several years preceding the financial crisis,2000s, the mortgage lending industry increasingly made home loans to individuals with higher risk credit profiles, at higher LTV ratios,profiles. In certain sections of this Annual Report, we discuss our insurance written in 2005-2008 separately from our insurance written in earlier and based on less documentation and verification of information regarding the borrower.later years. Beginning in 2007, job creation slowed and the housing markets began slowing in certain areas, with declines in certain other areas. In 2008 and 2009, employment in the U.S. decreased substantially and nearly all geographic areas in the U.S. experienced home price declines. Together, these conditions resulted in significant adverse developments for us and our industry and we reported a net loss in each of 2007 through 2013.industry. The operating environment for private mortgage insurers has materially improved in recent yearsafter the financial crisis, as the economy recovered.

The COVID-19 pandemic had a material impact on our 2020 financial results. The increased level of unemployment and

economic uncertainty resulted in an increase in the number of mortgage delinquencies for which we recorded increased loss reserves. After reaching 14.7% in April 2020, the unemployment rate declined through the end of 2021, and remained below 4% for most of 2022. The number of delinquent mortgages that we insure has recovered. For 2017,also declined through the end of 2022, after reaching its recent peak in June 2020. The decline in delinquent mortgages that we reportedinsure, along with favorable loss reserve development in 2022 resulted in our losses incurred significantly decreasing in 2022 compared to 2021, and our net income significantly increasing. For a discussion of $355.8 million.the various ways the COVID-19 pandemic may impact us in the future, see our Risk Factor titled "The COVID-19 pandemic may materially impact our business and future financial condition" in Item 1A.

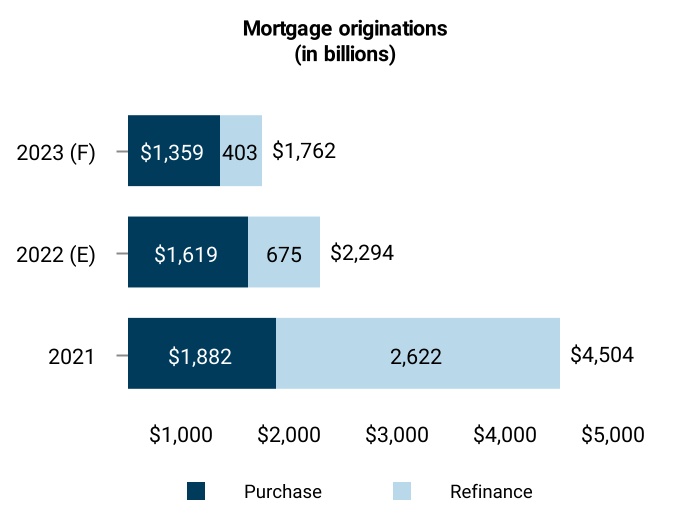

During 2017, $270In 2022, $405 billion of mortgages were insured with primary coverage by private mortgage insurers, compared to $270$585 for the full year of 2021, and $600 billion in 2016for full year 2020. The 2022 and $220 billion in 2015. These figures include $1.0 billion, $2.8 billion and $4.2 billion of bulk business and refinance transactions that2021 volumes were originated under HARP in 2017, 2016 and 2015, respectively. We do not include HARP transactions in our NIW total because we consider them a modification of the coverage on existing IIF. The 2017 volume of mortgages insured by private mortgage insurers was flat compared to 2016, as the increase in insurance on purchase mortgage originations offset the decrease in refinance transactions. Although the 2017 volume was significantly greater than the recent low in 2010 of $70 billion it remains belowand greater than the volumes of 2001 through 2007 when, on average, approximately $311 billion of mortgages were insured with primary coverage by private mortgage insurers. The high 2021 and 2020 volumes resulted, in part, from historically low interest rates driving sustained borrower demand, including for refinances, and the effect that the COVID-19 pandemic had on demand for homes.

For most of our business, we and other private mortgage insurers compete directly with federal and state governmental and quasi-governmental agencies that sponsor government-backed mortgage insurance

MGIC Investment Corporation 2017 Form 10-K | 9

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

MGIC Investment Corporation

2017 Form 10-K

|

Business (continued) |

programs, principally the FHA, VA and USDA. The publication Inside Mortgage Finance estimates that in 2017,2022, the FHA accounted for 35.6%26.7% of low down payment residential mortgages that were subject to FHA, VA, USDA or primary private mortgage insurance, up slightly from 35.5%compared to 24.7% in 2016. In the prior ten years,2021 and 23.4% in 2020. Since 2012, the FHA’s market share has been as low as 17.1% in 200723.4% (2020) and as high as 68.7% in 2009.42.1% (in 2012). Factors that influence the FHA’s market share include relative rates and fees, underwriting guidelines and loan limits of the FHA, VA, USDA, private mortgage insurers and the GSEs; lenders' perceptions of legal risks under FHA versus GSE programs; flexibility for the FHA to establish new products as a result of federal legislation and programs; returns expected to be obtained by lenders for Ginnie Mae securitization of FHA-insured loans compared to those obtained from selling loans to Fannie Mae or Freddie Macthe GSEs for securitization; and differences in policy terms, such as the ability of a borrower to cancel insurance coverage under certain circumstances. WeThe focus of the Presidential Administration on equitable housing finance and sustainable housing opportunities increases the likelihood of a reduction in the FHA’s mortgage insurance premium rates. Such a rate reduction would negatively impact our NIW; however, given the many factors that influence the FHA's market share, it is difficult to predict the impact. In addition, we also cannot predict how the factors listed above orthat affect the FHA’s share of NIW will change in the future.

Inside Mortgage Finance estimates that in 2017,2022, the VA accounted for 24.1%24.5% of all low down payment residential mortgages that were subject to FHA, VA, USDA or primary private mortgage insurance, down from 26.6%compared to 30.2% in 2016, which had been its highest level2021 and 30.9% in the prior ten years. In the prior ten years,2020. Since 2012, the VA's market share has been as low as 5.4% in 2007.22.8% (in 2013) and as high a 30.9% (in 2020). We believe that the VA’s market share has generally been increasing because of an increase ingrows as the number of borrowers that are eligible for the VA’s program whichincreases and when eligible borrowers opt to use the VA program when refinancing their

MGIC Investment Corporation 2022 Form 10-K | 9

MGIC Investment Corporation and Subsidiaries

mortgages. The VA program offers 100% LTV loans and charges a one-time funding fee that can be included in the loan amount, and because eligible borrowers have opted to use the VA program when refinancing their mortgages.

amount.

The private mortgage insurance industry also competes with alternatives to mortgage insurance, such as investors using risk mitigation and credit risk transfer techniques other than PMI, including capital market transactions structured to transfer risk of default on residentialentered into by the GSEs and banks; lenders and other investors holding mortgages investors willing to hold credit risk on their own balance sheets without credit enhancement,in portfolio and self-insuring; and “piggyback loans,” which combine a first lien loan with a second lien loan. In 2018, the GSEs initiated secondary mortgage market programs with loan level mortgage default coverage provided by various (re)insurers that are not mortgage insurers governed by PMIERs, and that are not selected by the lenders. While we view these programs as competing with traditional private mortgage insurance, we participate in them through an affiliate of MGIC.

The GSEs (and other investors) have also used other forms of credit enhancement that did not involve traditional private mortgage insurance, such as engaging in credit-linked note transactions executed in the capital markets, or using other forms of debt issuances or securitizations that transfer credit risk directly to other investors, including competitors and an affiliate of MGIC; and using other risk mitigation techniques in conjunction with reduced levels of private mortgage insurance coverage.

In addition to the FHA, VA, other governmental agencies and the alternatives to mortgage insurance discussed above, we also compete with other mortgage insurers. The level of competition, including price competition, within the private mortgage insurance industry has intensifiedremained intense over the past several years and is not expected to diminish.years. See "Our Products and Services – Sales and Marketing and Competition – Competition" below for more information about the impact on our business of competition in the private mortgage insurance industry.

In addition to being subject to the requirements and practices of the GSEs, private mortgage insurers are subject to comprehensive, detailed regulation by state insurance departments. The insurance laws of 16 jurisdictions, including Wisconsin, MGIC's domiciliary state, require a mortgage insurer to maintain a minimum amount of statutory capital relative to the RIF (or a similar measure) in order for the mortgage insurer to continue to write new business. The NAIC previously announced plans to revise the minimum capital and surplus requirements for mortgage insurers that are provided for in its Mortgage Guaranty Insurance Model Act. AIn December 2019, a working group of state regulators has been considering since 2016released an exposure draft of a revised Mortgage Guaranty Insurance Model Act and a risk-based capital framework to establish capital requirements for mortgage insurers, although no date has been establishedcertain items were not completely addressed by whichthe framework, including the treatment of ceded risk and minimum capital floors. In October 2022, the NAIC must propose revisionsworking group released a revised exposure draft of the Mortgage Guaranty Insurance Model Act that does not include changes to the capital requirements.

Due to the changing environment described above, as well as other factors discussed below, at this time the greatest uncertainty we face is whether private mortgage insurance will remain a significant credit enhancement alternative for low down payment single family mortgages. An increase in the use of alternatives to private mortgage insurance, such as credit-linked note transactions executed in the capital markets, or a possible restructuring or change in the chartersrequirements of the GSEs, could significantly affect our business. For additional information about this uncertainty, see our risk factors titled “The amount of insurance we write could be adversely affected if lenders and investors select alternatives to private mortgage insurance” and “Changes in the business practices of the GSEs, federal legislation that changes their charters or a restructuring of the GSEs could reduce our revenues or increase our losses” in Item 1A.existing Model Act.

General Information About Our CompanyGENERAL INFORMATION ABOUT OUR COMPANY

We are a Wisconsin corporation organized in 1984. Our principal office is located at MGIC Plaza, 250 East Kilbourn Avenue, Milwaukee, Wisconsin 53202 (telephone number (414) 347-6480). As used in this annual report, “we,” “our” and “us” refer to MGIC Investment Corporation’s consolidated operations or to MGIC

MGIC Investment Corporation 2017 Form 10-K | 10

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

MGIC Investment Corporation

2017 Form 10-K

|

Business (continued) |

Investment Corporation, as a separate

entity, as the context requires, and “MGIC” refers to Mortgage Guaranty Insurance Corporation.

Our revenues and losses may be materially affected by the risk factors that are included in Item 1A of this annual report. These risk factorsreport and are an integral part of this annual report. These risk factors may also cause actual results to differ materially from the results contemplated by forward looking statements that we may make. Forward looking statements consist of statements whichthat relate to matters other than historical fact. Among others, statements that include words such as we “believe,” “anticipate” or “expect,” or words of similar import, are forward looking statements. We are not undertaking any obligation to update any forward looking statements or other statements we may make even though these statements may be affected by events or circumstances occurring after the forward looking statements or other statements were made. No reader of this annual report should rely on these statements being current at any time other than the time at which this annual report was filed with the Securities and Exchange Commission.

B. Our Products and Services

Mortgage InsuranceMORTGAGE INSURANCE

In general, there are two principal types of private mortgage insurance: “primary” and “pool.”

Primary Insurance. Primary insurance provides mortgage default protection on individual loans and covers a percentage of the unpaid loan principal, delinquent interest and certain expenses associated with the default and subsequent foreclosure on the mortgage or sale approved by usof the underlying property (collectively, the “claim amount”). In addition to the loan principal, the claim amount is affected by the mortgage note rate and the time necessary to complete the foreclosure or sale process. For the past several years, the average time it took to receive a claim associated with a delinquency increased significantly from our historical experience of approximately twelve months, in part, due to new loss mitigation protocols established by servicers and to changes in some state foreclosure laws that may include, for example, a requirement for additional review and/or mediation processes. In recent quarters, the average time for servicers to process foreclosures has decreased, which has reduced the average time to receive a claim associated with new delinquent notices that do not cure. The insurer generally pays the coverage percentage of the claim amount specified in the primary policy but has the option to pay 100% of the claim amount and acquire title to the property. Primary insurance is generally written on first mortgage loans secured by owner occupied "single-family" homes, which are one-to-four family homes and condominiums. Primary insurance can be written on first liens secured by non-owner occupied single-family homes, which are referred to in the home mortgage lending industry as investor loans, and on vacation or second homes. Primary coverage can be used on any type of residential mortgage loan instrument approved by the mortgage insurer.

References in this document to amounts of insurance written or in force, risk written or in force, and other historical data related to our insurance refer only to direct (before giving effect to reinsurance) primary insurance, unless otherwise indicated. Primary insurance may be written on a flow basis, in which loans are insured in individual, loan-by-loan transactions, or may be written on a bulk basis, in which each loan in a portfolio of loans is individually insured in a single, bulk transaction. Our new primary insurance written was $49.1$76.4 billion in 2017,2022, compared to $47.9$120.2 billion in 20162021 and $43.0$112.1 billion in 2015.2020. The 2017 increase2022 decrease compared to 20162021 reflects an increasea decrease in the purchase mortgage originations we insured, offsettingas well as a decrease in the refinance transactionsmortgage originations we insured.

MGIC Investment Corporation 2022 Form 10-K | 10

MGIC Investment Corporation and Subsidiaries

The following table shows,charts show, on a direct basis, our primary IIF and primary RIF as of December 31 for the MGIC Book as of the datesyears indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Primary insurance and risk in force |

| (In billions) | | 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

| Primary IIF | | $ | 295.3 | | | $ | 274.4 | | | $ | 246.6 | | | $ | 222.3 | | | $ | 209.7 | |

| Primary RIF | | 76.5 | | | 69.3 | | | 61.8 | | | 57.2 | | | 54.1 | |

|

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Primary insurance in force and risk in force | | | December 31, |

| (in billions) | | 2017 | | 2016 | | 2015 | | 2014 | | 2013 |

| Direct Primary IIF | | $ | 194.9 |

| | $ | 182.0 |

| | $ | 174.5 |

| | $ | 164.9 |

| | $ | 158.7 |

|

| | Direct Primary RIF | | $ | 50.3 |

| | $ | 47.2 |

| | $ | 45.5 |

| | $ | 42.9 |

| | $ | 41.1 |

|

MGIC Investment Corporation 2017 Form 10-K | 11

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

MGIC Investment Corporation

2017 Form 10-K

|

Business (continued) |

For loans sold to Fannie Mae or Freddie Mac,a GSE, the coverage percentage must comply with the requirements established by the particular GSE to which the loan is delivered. The GSEs have different loan purchase programs that allow different levels of mortgage insurance coverage. Under the “charter coverage” program, on certain loans lenders may choose a mortgage insurance coverage percentage that is less than the GSEs’ “standard coverage” and only the minimum required by the GSEs’ charters, with the GSEs paying a lower price for such loans. In 2017, nearly all2022, a substantial majority of our volume was on loans with GSE standard or higher coverage.

For loans that are not sold to the GSEs, the lender determines the coverage percentage from those that we offer. Higher coverage percentages generally result in increased severity, which is the amount paid on a claim. We charge higher premium rates for higher coverage percentages. However, there can be no assurance that the higher premium rates adequately reflect the risks associated with higher coverage percentages. In accordance with GAAP for the mortgage insurance industry, loss reserves for losses are only established for policies covering delinquent loans. Because, historically,Historically, because relatively few defaultsdelinquencies occur in the early years of a book of business, the higher premium revenue from higher coverage has historically been recognized before any significant higher losses resulting from that higher coverage may be incurred. For more information, see “– Exposure“Exposure to Catastrophic Loss; Defaults;Delinquencies; Claims; Loss Mitigation – Claims.Mitigation.”

In general, mortgage insurance coverage cannot be terminated by the insurer. However, subject to certain restrictions on our rescission rights as are specified in our masterinsurance policy, and our Gold Cert Endorsement, we may terminate or rescind coverage for, among other reasons, non-payment of premium, certain material misrepresentations madeand fraud in connection with the application for the insurance policy or if the loan was never eligible for coverage under our policy. For more information including with regard to our Gold Cert Endorsement, see “– Exposure to Catastrophic Loss; Defaults; Claims; Loss Mitigation — Loss Mitigation.” Mortgage insurance coverage is renewable at the option of the insured lender, at the renewal rate fixed when the loan was initially insured. Lenders may cancel insurance written on a flow basis at any time at their option or because of mortgage repayment, which may be accelerated because of the refinancing of mortgages.

In the case of a loan purchased by Freddie Mac or Fannie Mae,a GSE, a borrower meetingmay request termination of insurance based on the home’s current value if certain conditions may requireLTV ratio and seasoning requirements are met and the mortgage servicerborrowers have an acceptable payment history. For loans seasoned between two and five years, the LTV ratio must be 75% or less, and for loans seasoned more than five years the LTV ratio must be 80% or less. If the borrower has made substantial improvements to cancel insurance upon the borrower’s request whenproperty, the principal balance ofGSEs allow for cancellation once the loan isLTV ratio reaches 80% or less of the home’s current value.

with no minimum seasoning requirement.

Mortgage insurance for loans secured by one-family, primary residences can be canceled under HOPA.the Homeowners Protection Act (“HOPA”). In general, HOPA requires a servicer to cancel the mortgage insurance if a borrower requests cancellation when the principal balance of the loan is first scheduled to reach 80% of

the original value of the property, or reaches that percentage through payments, if 1) the borrower is current on the loan and has a “good payment history” (as defined by the HOPA), 2) the borrower provides evidence as and if required by the mortgage owner, the borrower provides evidence that the value of the property has not declined below the original value, and 3) if required by the mortgage owner, the borrower certifies that the borrower’s equity in the property is not subject to a subordinate lien. Additionally, the HOPA requires mortgage insurance to terminate automatically when the principal balance of the loan is first scheduled to reach 78% of the original value of the property and the borrower is current on loan payments or thereafter becomes current. Annually, servicers must inform borrowers of their right to cancel or terminate mortgage insurance. The provisions of the HOPA described above apply only to borrower paid mortgage insurance, which is described below.

Coverage tends to continue for borrowers experiencing economic difficulties or living in areas experiencing home price depreciation. The persistency of coverage for those borrowers, coupled with cancellation of coverage for other borrowers, can increase the percentage of an insurer’s portfolio covering loans with more credit risk. This development can also occur during periods of heavy mortgage refinancing because borrowers experiencing property value appreciation are less likely to require mortgage insurance at the time of refinancing, while borrowers not experiencing property value appreciation are more likely to continue to require mortgage insurance at the time of refinancing or not qualify for refinancing at all (including if they have experienced economic difficulties) and thus remain subject to the mortgage insurance coverage.

The percentage of NIW on loans representing refinances was 11%3% for 2017,2022, compared to 20% for 20162021 and 19%36% for 2015.2020. When a borrower refinances a mortgage loan insured by us by paying it off in full with the proceeds of a new mortgage that is also insured by us, the insurance on that existing mortgage is cancelled, and insurance on the new mortgage is considered to be NIW. Therefore, continuation of our coverage from a refinanced loan to a new loan results in both a cancellation of insurance and NIW. When a lender and borrower modify a loan rather than replace it with a new one or enter into a new loan pursuant to a loan modification

MGIC Investment Corporation 2017 Form 10-K | 12

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

MGIC Investment Corporation

2017 Form 10-K

|

Business (continued) |

program, our insurance continues without being cancelled, assuming that we consent to the modification or new loan. As a result, such modifications or new loans including those modified under HARP, are not included in our NIW.

In addition to varying with the coverage percentage, our premium rates for insurance varyhave varied depending upon the perceived risk of a claim on the insured loan and thus takehave taken into account, among other things, the LTV ratio, the borrower’s credit score whetherand DTI ratio, the loan is a fixed payment loan or a non-fixed payment loan (a non-fixed payment loan is referred to innumber of borrowers, the home mortgage lending industry as an ARM),property location, the mortgage term and whether the property is the borrower’s primary residence. We generally utilizeIn recent years, the mortgage insurance industry has materially reduced its use of standard rate cards, which were fairly consistent among competitors, and correspondingly increased its use of (i)pricing systems that use a national, ratherspectrum of filed rates to allow for formulaic, risk-based pricing based on multiple attributes that may be quickly adjusted within certain parameters, and (ii) customized rate plans, both of which typically have rates lower than a regional or local, premiumthe standard rate policy. However, depending upon regional economic conditions, we have made, and may make, changes to our underwriting requirements to implement more restrictive standards in certain markets and for loan characteristics that we categorize as higher risk. Premium rates cannot be changed after the issuance of coverage.card.

The borrower’s mortgage loan instrument may require the borrower to pay the mortgage insurance premium. Our industry refers to the related mortgage insurance as “borrower-paid.”“borrower-paid” or BPMI. If the borrower is not required to pay the premium and

MGIC Investment Corporation 2022 Form 10-K | 11

MGIC Investment Corporation and Subsidiaries

mortgage insurance is required in connection with the origination of the loan, then the premium is paid by the lender, who may recover the premium through an increase in the note rate on the mortgage or higher origination fees. Our industry refers to the related mortgage insurance as “lender-paid.”“lender-paid” or LPMI. Most of our primary IIF is borrower-paid mortgage insurance.

BPMI.

There are several payment plans available to the borrower, or lender, as the case may be. Under the single premium plan, the borrower or lender pays us in advance a single payment covering a specified term exceeding twelve months. Under the monthly premium plan, the borrower or lender pays us a monthly premium payment to provide only one month of coverage. Under the annual premium plan, an annual premium is paid to us in advance, with annual renewal premiums paid in advance thereafter.

During 2017, 20162022, 2021 and 2015,2020, the single premium plan represented approximately 19%4%, 19%7% and 20%9%, respectively, of our NIW. The monthly premium plan represented approximately 81%96%, 81%93% and 79%91%, respectively. The annual premium plan represented less than 1% of NIW in each of those years. Depending onupon the actual life of a single premium policy and its premium rate relative to that of a monthly premium policy, a single premium policy may generate more or less premium than a monthly premium policy over its life.

Pool and Other Insurance. Pool insurance is generally used as an additional “credit enhancement” for certain secondary market mortgage transactions. Pool insurance generally covers the amount of the loss on a defaulted mortgage loan that exceeds the claim payment under the primary coverage, if primary insurance is required on that mortgage loan, as well as the total loss on a defaulted mortgage loan which did not require primary insurance. Pool insurance may have a stated aggregate loss limit for a pool of loans and may also have a deductible under which no losses are paid by the insurer until losses on the pool of loans exceed the deductible.

We have written no new pool riskinsurance since 2009,2008; however, for a variety of reasons, including responding to capital market alternatives to private mortgage insurancePMI and customer demands, we may write pool risk in the future. As of December 31, 2017, less than 1% of2022, our direct pool RIF was $276 million ($196 million on pool insurance. As noted in "Other Productspolicies with aggregate loss limits and Services – Other" below, an$80 million on pool policies without aggregate loss limits).

In connection with the GSEs' credit risk transfer programs, we provide insurance subsidiaryand reinsurance covering portions of MGIC has provided an immaterial amountthe credit risk related to certain reference pools of credit insurance whose structure is equivalent to pool insurance. That credit insurance is not included in discussions of pool insurance contained in this annual report.mortgages acquired by the GSEs.

MORTGAGE INSURANCE PORTFOLIO

Geographic Dispersion

Dispersion.The following tables reflect the percentage of primary RIF in the top 10 jurisdictions and top 10 core-based statistical areas for the MGIC Book at December 31, 2017. We refer to the insurance that has been written by MGIC (including MIC for portions of 2012 and 2013) as the "MGIC Book."2022.

MGIC Investment Corporation 2017 Form 10-K | 13

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Top 10 jurisdictions – RIF |

MGIC Investment Corporation

2017 Form 10-K

| |

Business (continued)California | 8.3 | % |

| Texas | 7.6 | % |

| Florida | 6.7 | % |

| Pennsylvania | 4.9 | % |

| Illinois | 4.2 | % |

| Virginia | 3.9 | % |

| North Carolina | 3.8 | % |

| Ohio | 3.7 | % |

| Georgia | 3.7 | % |

| New York | 3.5 | % |

| Total | 50.3 | % |

Dispersion of Primary Risk in Force

|

| | | | |

| | |

Top 10 jurisdictions | California | 8.4 | % |

Florida | 6.9 | % |

| Texas | 6.2 | % |

| Pennsylvania | 5.3 | % |

| Ohio | 4.6 | % |

| Illinois | 4.3 | % |

| Michigan | 3.4 | % |

| Georgia | 3.3 | % |

| Virginia | 3.3 | % |

| New York | 3.1 | % |

| Total | 48.8 | % |

|

| | | |

| | |

| Top 10 core-based statistical areas | Chicago-Naperville-Arlington Heights | 2.8 | % – RIF |

Atlanta-Sandy Springs-Roswell | 2.4 | % |

| Washington-Arlington-Alexandria | 2.43.2 | % |

| Atlanta-Sandy Springs-Roswell | Minneapolis-St. Paul-Bloomington2.7 | 2.1 | % |

| Chicago-Naperville-Arlington Heights | Houston-Woodlands-Sugar Land2.7 | 2.0 | % |

| Houston-Woodlands-Sugar Land | Philadelphia2.3 | 1.9 | % |

| Minneapolis-St. Paul-Bloomington | 1.9 | % |

| Los Angeles-Long Beach-Glendale | 1.81.7 | % |

| Phoenix-Mesa-Scottsdale | Phoenix-Mesa-Scottsdale1.7 | 1.7 | % |

| Dallas-Plano-Irving | Riverside-San Bernardino-Ontario1.6 | 1.4 | % |

| Philadelphia | Portland-Vancouver-Hillsboro1.6 | 1.4 | % |

| Riverside-San Bernardino | Total1.5 | 19.9% |

| Total | 20.9 | % |

The percentages shown above for various core-based statistical areas can be affected by changes, from time to time, in the federal government’s definition of a core-based statistical area.

MGIC Investment Corporation 20172022 Form 10-K | 1412

MGIC Investment Corporation and Subsidiaries

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

MGIC Investment Corporation

2017 Form 10-K

|

Business (continued) |

Insurance In Force by Policy Year

Year.The following table sets forth for the MGIC Book the dispersion ofand certain statistics associated with our primary IIF and RIF as of December 31, 2017,2022, by year(s) of policy origination since we began operations in 1985.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Primary insurance in force and risk in force by policy year | | Insurance in Force | | Risk in Force | Primary insurance in force and risk in force by policy year |

| Policy Year | Total (In millions) | | Percent of Total | | Total (In millions) | | Percent of Total | |

| 2004 and prior | $ | 4,629 |

| | 2.4 | % | | $ | 1,294 |

| | 2.6 | % | |

| | 2005 | 4,227 |

| | 2.2 | % | | 1,206 |

| | 2.4 | % | |

| | 2006 | 7,697 |

| | 3.9 | % | | 2,117 |

| | 4.2 | % | |

| | 2007 | 16,903 |

| | 8.7 | % | | 4,360 |

| | 8.7 | % | |

| | 2008 | 7,787 |

| | 4.0 | % | | 1,985 |

| | 3.9 | % | |

| | 2009 | 1,239 |

| | 0.6 | % | | 291 |

| | 0.6 | % | |

| | 2010 | 1,005 |

| | 0.5 | % | | 283 |

| | 0.6 | % | |

| | 2011 | 1,922 |

| | 1.0 | % | | 538 |

| | 1.0 | % | |

| | 2012 | 6,253 |

| | 3.2 | % | | 1,759 |

| | 3.5 | % | |

| | 2013 | 10,031 |

| | 5.1 | % | | 2,780 |

| | 5.5 | % | |

| | 2014 | 16,379 |

| | 8.4 | % | | 4,318 |

| | 8.6 | % | |

| | 2015 | 29,206 |

| | 15.0 | % | | 7,547 |

| | 15.0 | % | |

| | 2016 | 42,026 |

| | 21.6 | % | | 10,471 |

| | 20.8 | % | |

| | 2017 | 45,637 |

| | 23.4 | % | | 11,370 |

| | 22.6 | % | |

| | Total | $ | 194,941 |

| | 100.0 | % | | $ | 50,319 |

| | 100.0 | % | |

| ($ in millions) | | ($ in millions) | Insurance in Force | | Risk In Force | | Weighted Avg. Interest Rate | Delinquency Rate % | Cede Rate % | % of Original Remaining |

| Policy Year | | Policy Year | Total | % of Total | | Total | % of Total | |

| 2004 and prior | | 2004 and prior | $ | 1,475 | | 0.5 | % | | $ | 411 | | 0.5 | % | | 7.3 | % | 13.1 | % | — | % | N.M. |

| 2005-2008 | | 2005-2008 | 11,610 | | 3.9 | % | | 3,083 | | 4.0 | % | | 6.9 | % | 10.9 | % | — | % | 4.8 | % |

| 2009-2015 | | 2009-2015 | 6,457 | | 2.2 | % | | 1,754 | | 2.3 | % | | 4.3 | % | 4.7 | % | — | % | 3.6 | % |

| 2016 | | 2016 | 6,527 | | 2.2 | % | | 1,749 | | 2.3 | % | | 3.9 | % | 3.2 | % | — | % | 13.6 | % |

| 2017 | | 2017 | 7,839 | | 2.7 | % | | 2,059 | | 2.7 | % | | 4.2 | % | 3.8 | % | — | % | 15.9 | % |

| 2018 | | 2018 | 8,106 | | 2.7 | % | | 2,081 | | 2.8 | % | | 4.8 | % | 4.4 | % | — | % | 16.2 | % |

| 2019 | | 2019 | 17,285 | | 5.9 | % | | 4,447 | | 5.8 | % | | 4.1 | % | 2.2 | % | 1.5 | % | 26.6 | % |

| 2020 | | 2020 | 64,659 | | 21.9 | % | | 16,204 | | 21.2 | % | | 3.2 | % | 1.0 | % | 28.7 | % | 56.6 | % |

| 2021 | | 2021 | 100,796 | | 34.1 | % | | 26,004 | | 34.0 | % | | 3.1 | % | 0.9 | % | 29.2 | % | 85.5 | % |

| 2022 | | 2022 | 70,545 | | 23.9 | % | | 18,680 | | 24.4 | % | | 4.8 | % | 0.4 | % | 30.4 | % | 96.4 | % |

| Total | | Total | $ | 295,298 | | 100.0 | % | | $ | 76,472 | | 100.0 | % | | |

MGIC Investment Corporation 20172022 Form 10-K | 1513

MGIC Investment Corporation and Subsidiaries

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

MGIC Investment Corporation

2017 Form 10-K

|

Business (continued) |

Product Characteristics

Characteristics.The following table reflects, at the dates indicated and by the categories indicated, the total dollar amount of primary RIF for the MGIC Book and the percentage of that primary RIF, as determined on the basis of information available on the date of mortgage origination.

| | | | | | | | | | | |

| Characteristics of primary risk in force |

| | | |

| December 31, 2022 | | December 31, 2021 |

Primary RIF (In millions): | $ | 76,472 | | | $ | 69,337 | |

| Loan-to-value ratios: | | | |

| 95.01% and above | 15.2 | % | | 14.7 | % |

| 90.01 - 95.00% | 52.0 | % | | 50.4 | % |

| 85.01 - 90.00% | 27.2 | % | | 28.1 | % |

| 80.01 - 85.00% | 5.4 | % | | 6.4 | % |

| 80% and below | 0.2 | % | | 0.4 | % |

| Total | 100.0 | % | | 100.0 | % |

| Debt-to-income ratios: | | | |

| 45.01% and above | 15.6 | % | | 13.6 | % |

| 38.01% - 45.00% | 31.6 | % | | 31.5 | % |

| 38% and below | 52.8 | % | | 54.9 | % |

| Total | 100.0 | % | | 100.0 | % |

| Loan Type: | | | |

Fixed(1) | 99.5 | % | | 99.4 | % |

ARMs(2) | 0.5 | % | | 0.6 | % |

| Total | 100.0 | % | | 100.0 | % |

Original Insured Loan Amount:(3) | | | |

| Conforming loan limit and below | 97.3 | % | | 97.5 | % |

| Non-conforming | 2.7 | % | | 2.5 | % |

| Total | 100.0 | % | | 100.0 | % |

| Mortgage Term: | | | |

| 15-years and under | 1.1 | % | | 1.7 | % |

| Over 15 years | 98.9 | % | | 98.3 | % |

| Total | 100.0 | % | | 100.0 | % |

| Property Type: | | | |

| Single-family detached | 86.9 | % | | 86.9 | % |

| Condominium/Townhouse/Other attached | 12.5 | % | | 12.4 | % |

Other(4) | 0.6 | % | | 0.7 | % |

| Total | 100.0 | % | | 100.0 | % |

| Occupancy Status: | | | |

| Owner occupied | 97.8 | % | | 97.4 | % |

| Second home | 2.1 | % | | 2.4 | % |

| Investor property | 0.1 | % | | 0.2 | % |

| Total | 100.0 | % | | 100.0 | % |

| Documentation: | | | |

Reduced:(5) | | | |

| Stated | 0.6 | % | | 0.7 | % |

| No | 0.2 | % | | 0.3 | % |

| Full documentation | 99.2 | % | | 99.0 | % |

| Total | 100.0 | % | | 100.0 | % |

|

| | | | | | | | |

| | | | | |

| Characteristics of primary risk in force | | December 31, 2017 | | December 31, 2016 |

Primary RIF (In millions): | $ | 50,319 |

| | $ | 47,195 |

|

| | Loan-to-value ratios: | | | |

| | 95.01% and above | 13.8 | % | | 14.5 | % |

| | 90.01-95% | 52.0 | % | | 50.4 | % |

| | 85.01-90% | 28.3 | % | | 29.1 | % |

| | 80.01-85% | 4.9 | % | | 4.7 | % |

| | 80% and below | 1.0 | % | | 1.3 | % |

| | Total | 100.0 | % | | 100.0 | % |

| | Loan Type: | | | |

| | Fixed(1) | 98.2 | % | | 97.6 | % |

| | ARMs(2) | 1.8 | % | | 2.4 | % |

| | Total | 100.0 | % | | 100.0 | % |

| | Original Insured Loan Amount:(3) | | | |

| | Conforming loan limit and below | 97.6 | % | | 97.6 | % |

| | Non-conforming | 2.4 | % | | 2.4 | % |

| | Total | 100.0 | % | | 100.0 | % |

| | Mortgage Term: | | | |

| | 15-years and under | 2.1 | % | | 2.5 | % |

| | Over 15 years | 97.9 | % | | 97.5 | % |

| | Total | 100.0 | % | | 100.0 | % |

| | Property Type: | | | |

| | Single-family detached | 87.6 | % | | 87.6 | % |

| | Condominium/Townhouse/Other attached | 11.7 | % | | 11.7 | % |

| | Other(4) | 0.7 | % | | 0.7 | % |

| | Total | 100.0 | % | | 100.0 | % |

| | Occupancy Status: | | | |

| | Owner occupied | 97.3 | % | | 97.1 | % |

| | Second home | 2.0 | % | | 2.1 | % |

| | Investor property | 0.7 | % | | 0.8 | % |

| | Total | 100.0 | % | | 100.0 | % |

| | Documentation: | | | |

| | Reduced:(5) | | | |

| | Stated | 2.0 | % | | 2.5 | % |

| | No | 0.4 | % | | 0.6 | % |

| | Full documentation | 97.6 | % | | 96.9 | % |

| | Total | 100.0 | % | | 100.0 | % |

| | FICO Score:(6) | | | |

| | 740 and greater | 51.6 | % | | 49.3 | % |

| | 700 - 739 | 24.7 | % | | 24.3 | % |

| | 660 - 699 | 14.2 | % | | 15.1 | % |

| | 659 and less | 9.5 | % | | 11.3 | % |

| | Total | 100.0 | % | | 100.0 | % |

MGIC Investment Corporation 20172022 Form 10-K | 1614

MGIC Investment Corporation and Subsidiaries

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

MGIC Investment Corporation

2017 Form 10-K

|

Business (continued) |

| | | | | | | | | | | |

| Characteristics of primary risk in force |

| | | |

| December 31, 2022 | | December 31, 2021 |

FICO Score:(6) | | | |

| 760 and greater | 42.2 | % | | 42.1 | % |

| 740 - 759 | 17.7 | % | | 17.2 | % |

| 720 - 739 | 14.1 | % | | 13.7 | % |

| 700 - 719 | 11.1 | % | | 11.1 | % |

| 680 - 699 | 7.7 | % | | 7.9 | % |

| 660 - 679 | 3.3 | % | | 3.3 | % |

| 640 - 659 | 1.9 | % | | 2.2 | % |

| 639 and less | 2.0 | % | | 2.5 | % |

| Total | 100.0 | % | | 100.0 | % |

(1)Includes fixed rate mortgages with temporary buydowns (where in effect, the applicable interest rate is typically reduced by one or two percentage points during the first two years of the loan and then increased thereafter to the original interest rate), ARMs in which the initial interest rate is fixed for at least five years, and balloon payment mortgages (a loan with a maturity, typically five to seven years, that is shorter than the loan’s amortization period).

(2)Includes ARMs where payments adjust fully with interest rate adjustments. Also includes pay option ARMs and other ARMs with negative amortization features, which collectively at each of December 31, 2022 and 2021, represented and 0.1%, respectively, of primary RIF. As indicated in note (1), does not include ARMs in which the initial interest rate is fixed for at least five years. For both December 31, 2022 and 2021, ARMs with LTV ratios in excess of 90% represented 0.1%, of primary RIF, respectively.

(3)Loans within the conforming loan limit have an original principal balance that does not exceed the maximum original principal balance of loans that the GSEs will purchase. The conforming loan limit for one unit properties was $510,400 for 2020, $548,250 for 2021, and $647,200 for 2022, and is $726,200 for 2023. The limit for high cost communities has been higher and is $1,089,300 for 2023. Non-conforming loans are loans with an original principal balance above the conforming loan limit.

(4)Includes cooperatives and manufactured homes deemed to be real estate.

| |

(1)

| Includes fixed rate mortgages with temporary buydowns (where in effect, the applicable interest rate is typically reduced by one or two percentage points during the first two years of the loan), ARMs in which the initial interest rate is fixed for at least five years, and balloon payment mortgages (a loan with a maturity, typically five to seven years, that is shorter than the loan’s amortization period). |

| |

(2)

| Includes ARMs where payments adjust fully with interest rate adjustments. Also includes pay option ARMs and other ARMs with negative amortization features, which collectively at December 31, 2017 and 2016, represented 0.5% and 0.6%, respectively, of primary RIF. As indicated in note (1), does not include ARMs in which the initial interest rate is fixed for at least five years. As of December 31, 2017 and 2016, ARMs with LTV ratios in excess of 90% represented 0.4% and 0.5%, respectively, of primary RIF. |

| |

(3)

| Loans within the conforming loan limit have an original principal balance that does not exceed the maximum original principal balance of loans that the GSEs will purchase. The conforming loan limit for one unit properties was $417,000 from 2007 through 2016, $424,100 for 2017, and $453,100 for 2018. The limit for high cost communities has been higher and is $679,650 for 2018. Non-conforming loans are loans with an original principal balance above the conforming loan limit. |

| |

(4)

| Includes cooperatives and manufactured homes deemed to be real estate. |

| |

(5)

| Reduced documentation loans were originated prior to 2009 under programs in which there was a reduced level of verification or disclosure compared to traditional mortgage loan underwriting, including programs in which the borrower’s income and/or assets were disclosed in the loan application but there was no verification of those disclosures ("stated" documentation) and programs in which there was no disclosure of income or assets in the loan application ("no" documentation). In accordance with industry practice, loans approved by GSE and other automated underwriting (AU) systems under “doc waiver” programs that did not require verification of borrower income are classified by us as “full documentation.” Based in part on information provided by the GSEs, we estimate full documentation loans of this type were approximately 4% of 2007 NIW. Information for other periods is not available. We understand these AU systems granted such doc waivers for loans they judged to have higher credit quality. We also understand that the GSEs terminated their “doc waiver” programs in the second half of 2008. |

| |

(6)

| Represents the FICO score at loan origination. The weighted average “decision FICO score” at loan origination for NIW in 2017 and 2016 was 745 and 746, respectively. The FICO score for a loan with multiple borrowers is the lowest of the borrowers’ decision FICO scores. A borrower’s “decision FICO score” is determined as follows: if there are three FICO scores available, the middle FICO score is used; if two FICO scores are available, the lower of the two is used; if only one FICO score is available, it is used. A FICO score is a score based on a borrower’s credit history generated by a model developed by Fair Isaac Corporation. |

(5)Reduced documentation loans were originated prior to 2009 under programs in which there was a reduced level of verification or disclosure compared to traditional mortgage loan underwriting, including programs in which the borrower’s income and/or assets were disclosed in the loan application but there was no verification of those disclosures ("stated" documentation) and programs in which there was no disclosure of income or assets in the loan application ("no" documentation). In accordance with industry practice, loans approved by GSE and other automated underwriting (AU) systems under “doc waiver” programs that did not require verification of borrower income are classified by us as “full documentation.” We understand that the GSEs terminated their “doc waiver” programs in the second half of 2008.

(6)Represents the FICO score at loan origination. The weighted average “decision FICO score” at loan origination for NIW in 2022 was 747 compared to 749 in 2021. The FICO score for a loan with multiple borrowers is the lowest of the borrowers’ decision FICO scores. A borrower’s “decision FICO score” is determined as follows: if there are three FICO scores available, the middle FICO score is used; if two FICO scores are available, the lower of the two is used; if only one FICO score is available, it is used. A FICO score is a score based on a borrower’s credit history generated by a model developed by Fair Isaac Corporation.

MGIC Investment Corporation 2022 Form 10-K | 15

MGIC Investment Corporation and Subsidiaries

Other Products and Services

OTHER PRODUCTS AND SERVICES

Contract Underwriting. A non-insurance subsidiary of ours performsprovides contract underwriting services for lenders, underwritingpursuant to which loans are underwritten to conform to prescribed guidelines. The guidelines might be the lender's own guidelines or the guidelines of Fannie Mae, Freddie Mac or a non-GSE investor. These services are provided for loans that require private mortgage insurance as well as for loans that do not require private mortgage insurance.

Under our contract underwriting agreements, we may be required to provide certain remedies to our customers if certain standards relating to the quality of our underwriting work are not met, and we have an established reserve for such future obligations. The related contract underwriting remedy expense for each of the years ended December 31, 2017, 2016 and 2015, was immaterial to our consolidated financial statements. Claims for remedies may be made a number of years after the underwriting work was performed.