0000895417els:HillcrestMember2021-12-310000895417els:PineAcresResortMemberels:StateMember2021-01-012021-12-31false2023FY0000895417P1MP1Mhttp://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrent33.3333.3333.333.53.50000895417els:StateMemberels:CarefreeCoveMember2023-01-012023-12-310000895417els:CityMemberels:SeasideMember2023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 20212023

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to Commission File Number: 1-11718

EQUITY LIFESTYLE PROPERTIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Maryland | | | | 36-3857664 |

| (State or other jurisdiction of incorporation) | | | (IRS Employer Identification Number) |

| Two North Riverside Plaza, Suite 800 | | Chicago, | Illinois | | 60606 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

(312) 279-1400

Registrant's telephone number, including area code

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 Par Value | ELS | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging Growth Company | ☐ |

| Non-accelerated filer | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates was approximately $12,709.2$12,290.1 million as of June 30, 20212023 based upon the closing price of $74.31$66.89 on such date using beneficial ownership of stock rules adopted pursuant to Section 13 of the Securities Exchange Act of 1934 to exclude voting stock owned by Directors and Officers, some of whom may not be held to be affiliates upon judicial determination.

As of February 17, 2022, 185,935,36416, 2024, 186,492,242 shares of the Registrant's common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Part III incorporates by reference portions of the Registrant's Proxy Statement relating to the Annual Meeting of Stockholders to be held on April 26, 2022.30, 2024.

Equity LifeStyle Properties, Inc.

TABLE OF CONTENTS

| | | | | | | | | | | |

| | | |

| | | | Page |

| PART I. | | | |

| | | |

| Item 1. | Business | |

| Item 1A. | Risk Factors | |

| Item 1B. | Unresolved Staff Comments | |

| Item 1C. | Cybersecurity | |

| Item 2. | Properties | |

| Item 3. | Legal Proceedings | |

| Item 4. | Mine Safety Disclosures | |

| | | |

| PART II. | | | |

| | | |

| Item 5. | Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| Item 6. | [Reserved] | |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

| | Forward-Looking Statements | |

| Item 8. | Financial Statements and Supplementary Data | |

| Item 9. | Changes In and Disagreements with Accountants on Accounting and Financial Disclosure | |

| Item 9A. | Controls and Procedures | |

| Item 9B. | Other Information | |

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |

| | | |

| PART III. | | | |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | |

| Item 11. | Executive Compensation | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

| Item 14. | Principal Accounting Fees and Services | |

| | | |

| PART IV. | | | |

| | | |

| Item 15. | Exhibits, Financial Statement Schedules | |

| Item 16. | Form 10-K Summary | |

PART I

Item 1. Business

Equity LifeStyle Properties, Inc.

General

Equity LifeStyle Properties, Inc. (“ELS”), a Maryland corporation, together with MHC Operating Limited Partnership (the “Operating Partnership”) and its other consolidated subsidiaries (the “Subsidiaries”), are referred to herein as “we,” “us,” and “our”. We are a fully integrated owner of lifestyle-oriented properties (“Properties”) consisting of property operations and home sales and rental operations primarily within manufactured home (“MH”) and recreational vehicle (“RV”) communities and marinas. We were formed in December 1992 to continue the property operations, business objectives and acquisition strategies of an entity that had owned and operated Properties since 1969. Commencing with our taxable year ended December 31, 1993, we have elected to be taxed as a real estate investment trust (“REIT”) for U.S. federal income tax purposes.

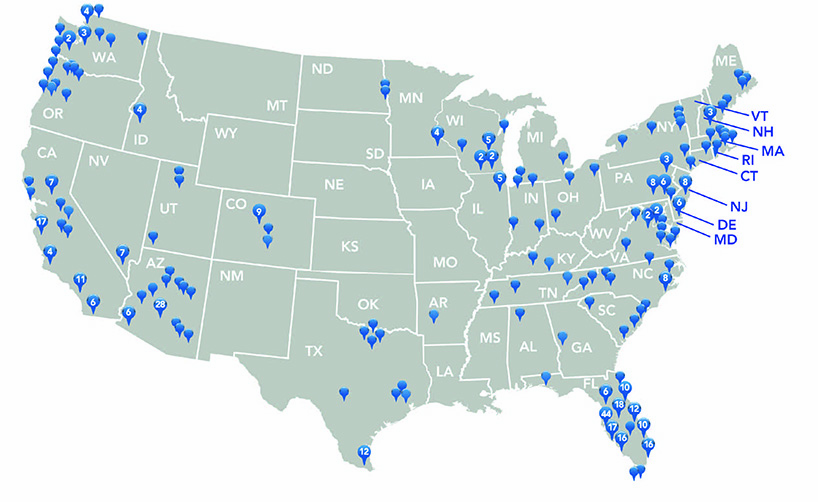

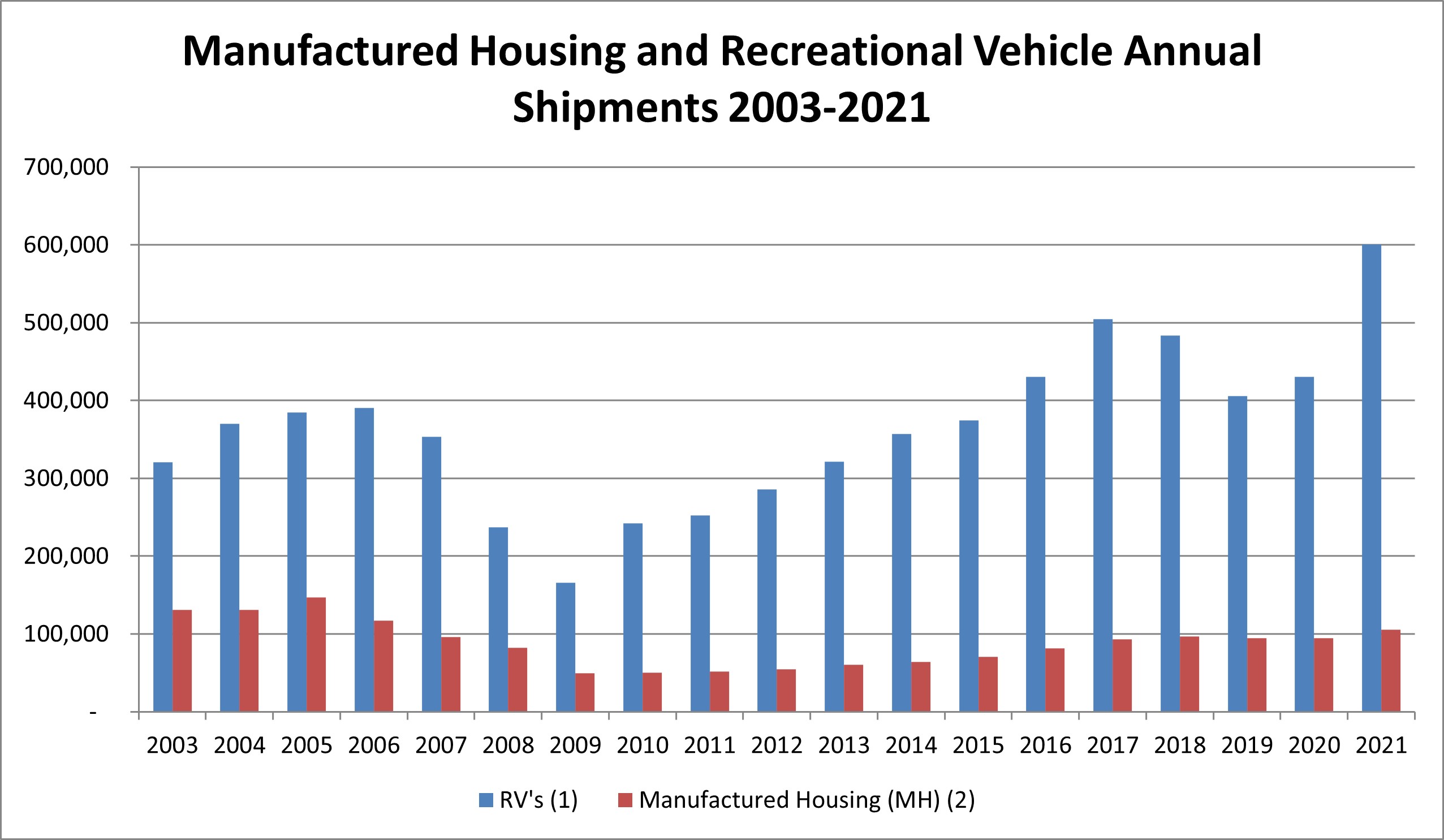

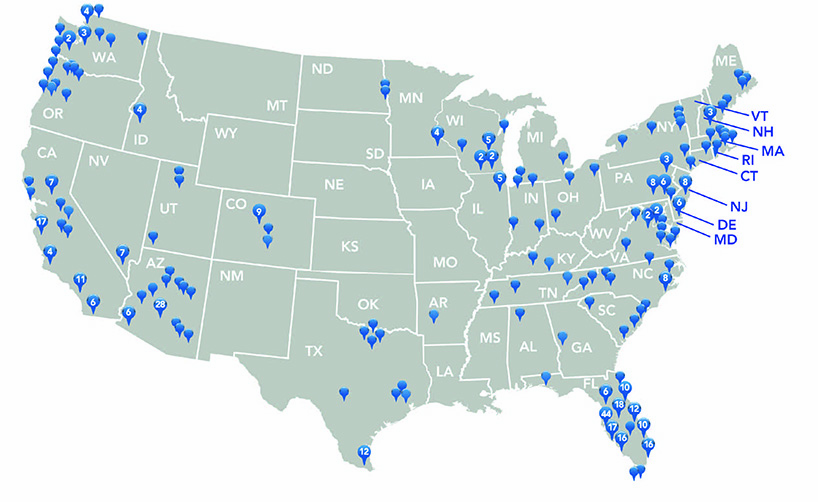

We have a unique business model where we own the land which we lease to customers who own manufactured homes and cottages, RVs and/or boats either on a long-term or short-term basis. Our customers may lease individual developed areas (“Sites”) or enter into right-to-use contracts, also known as membership subscriptions, which provide them access to specific Properties for limited stays. Compared to other types of real estate companies, our business model is characterized by low maintenance costs and low customer turnover costs. Our portfolio is geographically diversified across highly desirable locations near retirement and vacation destinations and urban areas across the United States. We have more than 110 Properties with lake, river or ocean frontage and more than 120 Properties within 10 miles of the coastal United States. Our Properties generally attract retirees, vacationing families, second homeowners and first-time homebuyers by providing a community experience and a lower-cost home ownership alternative.

We are one of the nation's largest real estate networks with a portfolio of 444451 Properties (including joint venture Properties) consisting of 169,296172,465 Sites located throughout 35 states in the U.S. and British Columbia in Canada as of December 31, 2021.2023.

Our Properties are generally designed and improved for housing options of various sizes and layouts that are produced off-site by third-party manufacturers, installed and set on designated Sites within the Properties. Manufactured homes and cottages can range from approximately 400 to over 2,000 square feet. Properties may also have Sites that can accommodate RVs of varying sizes. We also have marinas that offer boat slip and dry storage rentals. In addition to centralized entrances, internal road systems and designated Sites, our Properties generally provide a clubhouse for social activities and recreation and other amenities, which can include swimming pools, shuffleboard courts, tennis courts, pickleball courts, golf courses, lawn bowling, restaurants, laundry facilities, cable television and internet service. Some Properties provide utilities, including water and sewer service, through municipal or regulated utilities, while others provide these services to customers from on-site facilities.

Our Formation

Our Properties are primarily owned by our Operating Partnership and managed internally by affiliates of our Operating Partnership. We are the general partner of the Operating Partnership. We contributed the proceeds from our various equity offerings, including our initial public offering, to the Operating Partnership. In exchange for these contributions, we received units of common interests in the partnership (“OP Units”) equal to the number of shares of common stock that have been issued in such equity offerings.

We have elected to be taxed as a REIT for U.S. federal income tax purposes. Since certain activities, if performed by us, may not be qualifying REIT activities under the Internal Revenue Code of 1986, as amended (the “Code”), we have formed taxable REIT subsidiaries (each, a “TRS”). Our primary TRS is Realty Systems, Inc. (“RSI”) which, along with owning several Properties, is engaged in the business of purchasing, selling and leasing factory-built homes located in Properties owned and managed by us. RSI also offers home sale brokerage services to our residents who may choose to sell their homes rather than relocate them when moving from a Property. Subsidiaries of RSI also operate ancillary activities at certain Properties, such as golf courses, pro shops, stores and restaurants.

The financial results of the Operating Partnership and Subsidiaries are included in our consolidated financial statements, which can be found beginning on page F-1 of this Form 10-K.

Operating Strategies

Our operating strategy is to own and operate the highest quality Properties in sought-after locations near retirement and vacation destinations and urban areas across the United States. Through management of desirable Properties that provide an exceptional customer experience, we create communities valued by residents and guests while delivering value for stockholders.

We focus on Properties that have strong cash flows and plan to hold such Properties for long-term investment and capital appreciation. In determining cash flow potential, we evaluate our ability to attract high quality customers to our Properties and to retain customers who take pride in the Property and in their homes. Our operating, investment and financing initiatives include:

•Consistently providing high levels of services and amenities in attractive surroundings to foster a strong sense of community and pride of home ownership;

•Efficiently managing the Properties to add value, grow occupancy, maintain competitive market rents and control expenses;

•Incorporating environmental, social and governance (“ESG”) considerations into our business and ensuring sustainability is embedded in our business operations;

•Achieving growth and increasing property values through strategic expansion and, where appropriate, renovation of the Properties;

•Utilizing technology to evaluate potential acquisitions, identify and track competing properties, attract new customers and monitor existing and prospective customer satisfaction;

•Selectively acquiring properties that offer opportunities for us to add value and enhance or create property concentrations in and around retirement or vacation destinations and urban areas to capitalize on operating synergies;

•Selectively acquiring parcels of land adjacent to our Properties that offer opportunities for us to expand our existing communities with additional Sites;

•Selecting joint venture partners that share business objectives, growth initiatives and risk profiles similar to ours;

•Managing our capital structure in order to maintain financial flexibility, minimize exposure to interest rate fluctuations and maintain an appropriate degree of leverage to maximize return on capital; and

•Developing and maintaining relationships with various capital providers.

These initiatives and their implementation were determined by our management team and ratified by our Board of Directors and may be subject to change or amendment at any time.

Acquisitions and Dispositions

We invest in properties in sought-after locations near retirement and vacation destinations and urban areas across the United States with a focus on delivering value for residents and guests as well as stockholders. Over the last decade, we have continued to increase the number of Properties in our portfolio (including joint venture Properties), from approximately 377 Properties with over 139,000 Sites to 451 Properties with approximately 172,500 Sites as of December 31, 2023. During the year ended December 31, 2023, we acquired one RV community. We also acquired two land parcels adjacent to certain Properties consisting of approximately two developable acres. We continually review the Properties in our portfolio to ensure we are delivering on our business and customer service objectives. Over the last five years, we redeployed capital to Properties in markets we believe have greater long-term potential and sold five all-age MH communities located in Indiana and Michigan that were not aligned with our long-term goals.

We believe there continues to be opportunities for property acquisitions. Based on industry reports, we estimate there are approximately 50,000 MH properties and approximately 8,700 RV properties (excluding government owned properties) in North America and approximately 4,500 marinas in the U.S. Many of these properties are not operated by large owners/operators and approximately 3,800 of the MH properties, 1,300 of the RV properties and 500 of the marinas contain 200 sites or more. We believe this fragmentation provides us the opportunity to purchase additional properties. We also believe we have a competitive advantage in the acquisition of additional properties due to our experienced management, significant presence in major real estate markets and access to capital resources. We utilize market information systems to identify and evaluate acquisition opportunities, including the use of a market database to review the primary economic indicators of the various locations in which we expect to expand our operations. We are actively seeking to acquire and at any given time are engaged in various stages of negotiations relating to the possible acquisition of additional properties, which may include outstanding contracts to acquire properties that are subject to the satisfactory completion of our due diligence review.

Acquisitions will be financed with the most efficient available sources of capital, which may include undistributed Funds from Operations (“FFO”), issuance of additional equity securities, including under an at-the-market (“ATM”) equity offering program that we expect to put in place shortly, sales of investments and collateralized and uncollateralized borrowings, including our existing line of credit. In addition, we have acquired and expect to acquire properties in transactions that include the issuance of OP Units as consideration for the acquired properties. We believe that an acquisition structure that includes our Operating Partnership has permitted and will permit us to acquire additional properties in transactions that may defer all or a portion of the sellers' tax consequences.

When evaluating potential acquisitions, we consider, among others, the following factors:

•Current and projected cash flows of the property;

•Geographic area and the type of property;

•Replacement cost of the property, including land values, entitlements and zoning;

•Location, construction quality, condition and design of the property, including vacant land and its location relative to one or more of our existing properties;

•Potential for capital appreciation of the property;

•Terms of tenant leases or usage rights;

•Climate risk;

•REIT tax compliance;

•Sellers' reputation;

•Opportunity to enhance the customer experience and add value through management expertise;

•Potential for economies of scale through property concentrations;

•Potential for economic growth and the tax and regulatory environment of the community in which the property is located;

•Potential for expansion, including increasing the number of Sites;

•Occupancy and demand by customers for properties of a similar type in the vicinity;

•Prospects for liquidity through sale, financing or refinancing of the property;

•Competition from existing properties and the potential for the construction of new properties in the area; and

•Working capital demands.

When evaluating potential dispositions, we consider, among others, the following factors:

•Whether the Property meets our current investment criteria;

•Our desire to exit certain non-core markets and reallocate the capital into core markets; and

•Our ability to sell the Property at a price that we believe will provide an appropriate return for our stockholders.

When investing capital, we consider all potential uses of the capital, including returning capital to our stockholders. Our Board of Directors periodically reviews the conditions under which we may repurchase our stock. These conditions include, but are not limited to, market price, balance sheet flexibility, other opportunities and capital requirements.

Property Expansions

Development - Current Portfolio. An integral part of our growth and investment strategy is to evaluate each Property for expansion opportunities. Investment evaluation consists of reviewing the following: local market conditions, demographic trends, zoning and entitlements, infrastructure requirements, financial feasibility, projected performance and property operations. When justified, development of land available for expansion (“Expansion Sites”) allows us to leverage existing facilities and amenities. We believe our ability to increase density translates to greater value creation and cash flows through operational efficiencies. Overall, approximately 124 of our Properties have potential Expansion Sites, offering approximately 6,500 available acres. Refer to Item 2. Properties, which includes detail regarding the developable acres available at each property.

Acquisition - Expanding Portfolio. In selecting acquisition targets, we focus on properties with existing operations in place and contiguous Expansion Sites. Underwriting a project with these features allows us to access the previously untapped potential of such properties. For example, over the past three years, we have acquired 31 Properties and 7 land parcels that contain approximately 1,000 acres for future expansion.

Human Capital ManagementAcquisitions and Dispositions

We recognize that our success is driven by our employees. We invest in our employees and are committed to developing our employees’ skills and leadership abilities. As a result, we believe our employees are dedicated to building strong, innovative and long-term relationships with each other and with our residents and guests.

We have an annual average of approximately 4,100 full-time, part-time and seasonal employees dedicated to carrying out our operating philosophy while focusing on delivering an exceptional customer experience for our residents and guests. Our property operations are managed internally by affiliates of the Operating Partnership and are coordinated by an on-site team of employees that typically includes a manager, clerical staff and maintenance workers.

The on-site team at each Property is primarily responsible for providing maintenance and care to the property itself as well as customer service and at times, coordinating lifestyle-oriented activities for our residents and guests. Direct supervision of on-site management is the responsibility of our regional vice presidents and regional and district managers, who have substantial experience addressing customer needs and creating innovative approaches to provide an exceptional experience for residents and guests, which we believe also creates value for our stockholders, through focused and effective property management. Complementing the field management staff are approximately 500 full-time employees in our home and regional offices who assist in all functions related to the management of our Properties.

We are committed to attracting and retaining a diverse workforce and to providing a safe and inclusive environment where our team members are encouraged to demonstrate their unique skill sets and bring a personal touch to their work. We are committed to maintaining workplaces free from discrimination or harassment on the basis of color, race, sex, national origin, ethnicity, religion, age, disability, sexual orientation, gender identification or expression or any other status protected by applicable law. We value the many contributions of a diverse workforce and understand that diverse backgrounds bring diverse perspectives, resulting in unique insights.

We provide equal employment opportunities to all persons, in accordance with the principles and requirements of the Equal Employment Opportunities Commission and the principles and requirements of the Americans with Disabilities Act. As of December 31, 2021, more than 50% of our workforce self-identified as female and more than 50% of our management positions are held by individuals self-identifying as female. To attract diverse applicants, we have partnered with third parties and post openings to a wide variety of job boards. We also have an annual internship program designed to, among other things, create a pipeline of qualified candidates for positions within the Company and to attract diverse candidates. We recognize the importance of experienced leadership and as of December 31, 2021, the average tenure for the executive team was 16 years. The average age of our team members is 49, with ages spanning multiple generations, similar to our residents and guests.

ELS is a place where talent is recognized and internal growth is promoted. Our employees are fairly compensated, without regard to gender, race and ethnicity and routinely recognized for outstanding performance. Our compensation program is designed to attract and retain talent. We continually assess and strive to enhance employee satisfaction and engagement. All employees are supported with a strong training and development program and a well-rounded benefits plan to help them maintain their health and financial well-being. Employees are offered flexibility to meet personal and family needs.

Whether we are working with customers or vendors, our actions are guided by a clear set of established principles. We hold ourselves accountable for ethical business practices. All employees, management and our Board of Directors are expected to act with honesty, integrity, fairness and respect. To support this culture, all team members receive annual compliance training focused on compliant and ethical interactions with peers, residents, guests, vendors and others in our communities and offices.

Providing a safe and healthy work environment for our team members is a top priority and we empower them to take ownership in this effort. Each employee is assigned a safety-related training curriculum tailored to their job responsibilities. All employees are encouraged to report any conditions in their workplace that raise health or safety concerns without fear of retaliation.

In addition to foundational safety and compliance training, team members participate in virtual and in-person learning experiences including formal new employee and manager development programs, a “Knowledge Power Day” program providing office-based employees an opportunity to be fully immersed in the day-to-day operations at our communities, customer experience training focused on varying elements that support our values for property team members and diversity, equity and inclusion programs to support the sense of belonging, awareness and connection at ELS. We encourage our employees to take time away from work to focus on their physical and mental well-being and offer a comprehensive benefit package that includes five mental health and well-being days, paid parental and paid family leave programs that exceed minimum regulatory requirements and paid volunteer time off. In addition, we offer a competitive 401(k) plan that provides for an employer match of up to 4% with 100% vesting of all contributions immediately upon eligibility and an Employee Stock Purchase Plan providing a 15% discount for all eligible employees.

Our Formation

Our Properties are primarily owned by our Operating Partnership and managed internally by affiliates of our Operating Partnership. We are the general partner of the Operating Partnership. We contributed the proceeds from our various equity offerings, including our initial public offering, to the Operating Partnership. In exchange for these contributions, we received units of common interests in the partnership (“OP Units”) equal to the number of shares of common stock that have been issued in such equity offerings.

We have elected to be taxed as a REIT for U.S. federal income tax purposes. Since certain activities, if performed by us, may not be qualifying REIT activities under the Internal Revenue Code of 1986, as amended (the “Code”), we have formed taxable REIT subsidiaries (each, a “TRS”). Our primary TRS is Realty Systems, Inc. (“RSI”) which, along with owning several Properties, is engaged in the business of purchasing, selling and leasing factory-built homes located in Properties owned and managed by us. RSI also offers home sale brokerage services to our residents who may choose to sell their homes rather than relocate them when moving from a Property. Subsidiaries of RSI also operate ancillary activities at certain Properties, such as golf courses, pro shops, stores and restaurants.

The financial results of the Operating Partnership and Subsidiaries are included in our consolidated financial statements, which can be found beginning on page F-1 of this Form 10-K.

Operating Strategies

Our operating strategy is to own and operate the highest quality Propertiesproperties in sought-after locations near retirement and vacation destinations and urban areas across the United States. Through management of desirable Properties that provide an exceptional customer experience, we create communities valued byStates with a focus on delivering value for residents and guests whileas well as stockholders. Over the last decade, we have continued to increase the number of Properties in our portfolio (including joint venture Properties), from approximately 377 Properties with over 139,000 Sites to 451 Properties with approximately 172,500 Sites as of December 31, 2023. During the year ended December 31, 2023, we acquired one RV community. We also acquired two land parcels adjacent to certain Properties consisting of approximately two developable acres. We continually review the Properties in our portfolio to ensure we are delivering value for stockholders.on our business and customer service objectives. Over the last five years, we redeployed capital to Properties in markets we believe have greater long-term potential and sold five all-age MH communities located in Indiana and Michigan that were not aligned with our long-term goals.

We focusbelieve there continues to be opportunities for property acquisitions. Based on Properties thatindustry reports, we estimate there are approximately 50,000 MH properties and approximately 8,700 RV properties (excluding government owned properties) in North America and approximately 4,500 marinas in the U.S. Many of these properties are not operated by large owners/operators and approximately 3,800 of the MH properties, 1,300 of the RV properties and 500 of the marinas contain 200 sites or more. We believe this fragmentation provides us the opportunity to purchase additional properties. We also believe we have strong cash flows and plan to hold such Properties for long-term investment and capital appreciation. In determining cash flow potential, we evaluate our ability to attract high quality customersa competitive advantage in the acquisition of additional properties due to our Propertiesexperienced management, significant presence in major real estate markets and access to retain customers who take pridecapital resources. We utilize market information systems to identify and evaluate acquisition opportunities, including the use of a market database to review the primary economic indicators of the various locations in which we expect to expand our operations. We are actively seeking to acquire and at any given time are engaged in various stages of negotiations relating to the Propertypossible acquisition of additional properties, which may include outstanding contracts to acquire properties that are subject to the satisfactory completion of our due diligence review.

Acquisitions will be financed with the most efficient available sources of capital, which may include undistributed Funds from Operations (“FFO”), issuance of additional equity securities, including under an at-the-market (“ATM”) equity offering program that we expect to put in place shortly, sales of investments and collateralized and uncollateralized borrowings, including our existing line of credit. In addition, we have acquired and expect to acquire properties in their homes. Our operating, investmenttransactions that include the issuance of OP Units as consideration for the acquired properties. We believe that an acquisition structure that includes our Operating Partnership has permitted and financing initiatives include:will permit us to acquire additional properties in transactions that may defer all or a portion of the sellers' tax consequences.

When evaluating potential acquisitions, we consider, among others, the following factors:

•Consistently providing high levelsCurrent and projected cash flows of services and amenities in attractive surroundings to foster a strong sense of community and pride of home ownership;the property;

•Efficiently managingGeographic area and the Properties to add value, grow occupancy, maintain competitive market rents and control expenses;type of property;

•Incorporating environmental, socialReplacement cost of the property, including land values, entitlements and governance (“ESG”) considerations into our business and ensuring sustainability is embedded in our business operations;zoning;

•Achieving growthLocation, construction quality, condition and increasing property values through strategic expansion and, where appropriate, renovationdesign of the Properties;property, including vacant land and its location relative to one or more of our existing properties;

•Utilizing technology to evaluate potential acquisitions, identify and track competing properties and monitor existing and prospective customer satisfaction;Potential for capital appreciation of the property;

•Selectively acquiring properties that offer opportunities for us to add value and enhanceTerms of tenant leases or create property concentrations in and around retirement or vacation destinations and urban areas to capitalize on operating synergies;usage rights;

•Selectively acquiring parcelsClimate risk;

•REIT tax compliance;

•Sellers' reputation;

•Opportunity to enhance the customer experience and add value through management expertise;

•Potential for economies of land adjacent to our Properties that offer opportunitiesscale through property concentrations;

•Potential for us to expand our existing communities with additionaleconomic growth and the tax and regulatory environment of the community in which the property is located;

•Potential for expansion, including increasing the number of Sites;

•Selecting joint venture partners that share business objectives, growth initiativesOccupancy and risk profilesdemand by customers for properties of a similar to ours;type in the vicinity;

•ManagingProspects for liquidity through sale, financing or refinancing of the property;

•Competition from existing properties and the potential for the construction of new properties in the area; and

•Working capital demands.

When evaluating potential dispositions, we consider, among others, the following factors:

•Whether the Property meets our capital structure in order to maintain financial flexibility, minimize exposure to interest rate fluctuations and maintain an appropriate degree of leverage to maximize return on capital; andcurrent investment criteria;

•DevelopingOur desire to exit certain non-core markets and maintaining relationships with variousreallocate the capital providers.into core markets; and

These initiatives and their implementation were determined by•Our ability to sell the Property at a price that we believe will provide an appropriate return for our management team and ratified bystockholders.

When investing capital, we consider all potential uses of the capital, including returning capital to our stockholders. Our Board of Directors periodically reviews the conditions under which we may repurchase our stock. These conditions include, but are not limited to, market price, balance sheet flexibility, other opportunities and may be subjectcapital requirements.

Property Expansions

Development - Current Portfolio. An integral part of our growth and investment strategy is to change or amendmentevaluate each Property for expansion opportunities. Investment evaluation consists of reviewing the following: local market conditions, demographic trends, zoning and entitlements, infrastructure requirements, financial feasibility, projected performance and property operations. When justified, development of land available for expansion (“Expansion Sites”) allows us to leverage existing facilities and amenities. We believe our ability to increase density translates to greater value creation and cash flows through operational efficiencies. Overall, approximately 124 of our Properties have potential Expansion Sites, offering approximately 6,500 available acres. Refer to Item 2. Properties, which includes detail regarding the developable acres available at any time.each property.

Acquisition - Expanding Portfolio. In selecting acquisition targets, we focus on properties with existing operations in place and contiguous Expansion Sites. Underwriting a project with these features allows us to access the previously untapped potential of such properties. For example, over the past three years, we have acquired 31 Properties and 7 land parcels that contain approximately 1,000 acres for future expansion.

Acquisitions and Dispositions

We invest in properties in sought-after locations near retirement and vacation destinations and urban areas across the United States with a focus on delivering value for residents and guests as well as stockholders. Over the last decade, we have continued to increase the number of Properties in our portfolio (including joint venture Properties), from approximately 382377 Properties with over 141,000139,000 Sites to 444451 Properties with over 169,200approximately 172,500 Sites as of December 31, 2021.2023. During the year ended December 31, 2021,2023, we acquired 17 Properties (fiveone RV communities, eleven marinas, and a parcel of land occupied by a portion of an RV community) with 6,774 Sites.community. We also acquired threetwo land parcels adjacent to certain Properties consisting of approximately 700two developable acres. We continually review the Properties in our portfolio to ensure we are delivering on our business and customer service objectives. Over the last five years, we redeployed capital to Properties in markets we believe have greater long-term potential and sold five all-age MH communities located in Indiana and Michigan that were not aligned with our long-term goals.

We believe there continues to be opportunities for property acquisitions. Based on industry reports, we estimate there are approximately 50,000 MH properties and approximately 8,0008,700 RV properties (excluding government owned properties) in North America and approximately 4,500 marinas in the U.S. Many of these properties are not operated by large owners/operators and approximately 3,7003,800 of the MH properties, 1,1001,300 of the RV properties and 500 of the marinas contain 200 sites or more. We believe this relatively high degree of fragmentation provides us the opportunity to purchase additional properties. We also believe we have a competitive advantage in the acquisition of additional properties due to our experienced management, significant presence in major real estate markets and access to capital resources. We utilize market information systems to identify and evaluate acquisition opportunities, including the use of a market database to review the primary economic indicators of the various locations in which we expect to expand our operations. We are actively seeking to acquire and are engaged at any given time are engaged in various stages of negotiations relating to the possible acquisition of additional properties, which may include outstanding contracts to acquire properties that are subject to the satisfactory completion of our due diligence review.

Acquisitions will be financed fromwith the most efficient available sources of capital, which may include undistributed Funds from Operations (“FFO”), issuance of additional equity securities, including under ouran at-the-market (“ATM”) equity offering program that we expect to put in place shortly, sales of investments and collateralized and uncollateralized borrowings, including our existing line of credit and issuance of debt securities.credit. In addition, we have acquired and expect to acquire properties in transactions that include the issuance of OP Units as consideration for the acquired properties. We believe that an acquisition structure that includes our Operating Partnership has permitted and will permit us to acquire additional properties in transactions that may defer all or a portion of the sellers' tax consequences.

When evaluating potential acquisitions, we consider, among others, the following factors:

•Current and projected cash flows of the property;

•Geographic area and the type of property;

•Replacement cost of the property, including land values, entitlements and zoning;

•Location, construction quality, condition and design of the property, including vacant land and its location relative to one or more of our existing properties;

•Potential for capital appreciation of the property;

•Terms of tenant leases or usage rights;

•Climate risk;

•REIT tax compliance;

•Sellers' reputation;

•Opportunity to enhance the customer experience and add value through management expertise;

•Potential for economies of scale through property concentrations;

•Potential for economic growth and the tax and regulatory environment of the community in which the property is located;

•Potential for expansion, including increasing the number of Sites;

•Occupancy and demand by customers for properties of a similar type in the vicinity;

•Prospects for liquidity through sale, financing or refinancing of the property;

•Competition from existing properties and the potential for the construction of new properties in the area; and

•Working capital demands.

When evaluating potential dispositions, we consider, among others, the following factors:

•Whether the Property meets our current investment criteria;

•Our desire to exit certain non-core markets and reallocate the capital into core markets; and

•Our ability to sell the Property at a price that we believe will provide an appropriate return for our stockholders.

When investing capital, we consider all potential uses of the capital, including returning capital to our stockholders. Our Board of Directors periodically reviews the conditions under which we may repurchase our stock. These conditions include, but are not limited to, market price, balance sheet flexibility, other opportunities and capital requirements.

Property Expansions

Development - Current Portfolio. An integral part of our growth and investment strategy is to evaluate each Property for expansion opportunities. Investment evaluation consists of reviewing the following: local market conditions, demographic trends, zoning and entitlements, infrastructure requirements, financial feasibility, projected performance and property operations. When justified, development of land available for expansion (“Expansion Sites”) allows us to leverage existing facilities and amenities. We believe our ability to increase density translates to greater value creation and cash flows through operational efficiencies. Overall, approximately 123124 of our Properties and four land parcels have potential Expansion Sites, offering approximately 6,500 available acres. Refer to Item 2. Properties, which includes detail regarding the developable acres available at each property.

Acquisition - Expanding Portfolio. In selecting acquisition targets, we focus on properties with existing operations in place and contiguous Expansion Sites. Underwriting a project with these features allows us to access the previously untapped potential of such properties. For example, over the past three years, we have acquired 4131 Properties four non-operating ground up development assets and 117 land parcels that contain approximately 1,5001,000 acres for future expansion.

Human Capital Management

We recognize that our success is driven by our employees. We invest in our employees and are committed to developing our employees’ skills and leadership abilities. As a result, we believe our employees are dedicated to building strong, innovative and long-term relationships with each other and with our residents and guests.

We have an annual average of approximately 4,000 full-time, part-time and seasonal employees dedicated to carrying out our operating philosophy while focusing on delivering an exceptional customer experience for our residents and guests. Our property operations are managed internally by affiliates of the Operating Partnership and are coordinated by an on-site team of employees that typically includes a manager, clerical staff and maintenance workers.

The on-site team at each Property is primarily responsible for providing maintenance and care to the property itself as well as customer service and, at times, coordinating lifestyle-oriented activities for our residents and guests. Direct supervision of on-site management is the responsibility of our regional vice presidents and regional and district managers, who have substantial experience addressing customer needs and creating innovative approaches to provide an exceptional experience for residents and guests, which we believe also creates value for our stockholders, through focused and effective property management. Complementing the field management staff are approximately 500 full-time employees in our home and regional offices who assist in all functions related to the management of our Properties.

For more information on our human capital management, please see the section below on our Sustainability Strategy.

Sustainability Strategy

ELS’ commitment to sustainability embracestakes a holistic approach which aims to support our business model, minimize our environmental impact, maintain a safe and healthy workplace and uphold a high standard of business ethics and conduct. We understand the value of continuing to focus on sustainable practices and the highest standard of business ethics and practices, as they are critical to our overall success and building long-term stakeholder value. With a dedicated Sustainabilitysustainability team, we are committed to incorporating ESG principles into our business operations in collaboration with heads of departments.department heads.

In 2019, we formed anOur Environmental, Social and Governance Taskforce (“ESG Taskforce”) to supportsupports our on-going commitment to environmental, social, governance and other public policy matters relevant to us (collectively “ESG Matters”). Led by the sustainabilitySustainability team and overseen by our Executive Vice President and Chief Operating Officer, the ESG Taskforce is comprised of a cross-functional team of employees from asset management, investor relations, compliance, communications, operations, marketing, risk management, financial reporting, legal and human resources.employees.

The ESG Taskforce reports on ESG Matters to the Compensation, Nominating and Corporate Governance Committee of the Board of Directors and senior management. The Compensation, Nominating and Corporate Governance Committee is responsible for the review of our ESG strategy, initiatives and policies. Additionally, the Audit Committee of the Board of

Directors is responsible for the discussion and review of policies with respect to risk assessment and risk management, including, but not limited to, human rightscapital, climate, cyber security and other ESG risks. The Strategic Planning Committee further assists the Board in assessing ESG strategies. Quarterly committee meetings with the Board include educational briefings from management regarding a wide variety of strategic initiatives, including ESG-related matters.

At ELS, sustainability is at the core of Our Nature through Uniting People, Places & Purpose.

Our People.People: Team Members. With a culture of recognition and reputation for excellence, our employees are empowered to take ownership in their jobs and make a difference. ELS is a place where talent is recognized and internal growth is promoted, making it an ideal organization in which to develop a long and successful career.

We are committed to attracting and retaining a diverse workforce and to providing a safe and inclusive environment where our team members are encouraged to demonstrate their unique skill sets and bring a personal touch to their work. We are committed to maintaining workplaces free from discrimination or harassment on the basis of color, race, sex, national origin, ethnicity, religion, age, disability, sexual orientation, gender identification or expression or any other status protected by applicable law. We value the many contributions of a diverse workforce and understand that diverse backgrounds bring diverse perspectives, resulting in unique insights. Our Diversity Council is a cross-functional team formed to help guide and support the Company's ongoing commitment to diversity, equity and inclusion practices for employees, candidates and customers.

We provide equal employment opportunities to all persons, in accordance with the principles and requirements of the Equal Employment Opportunities Commission and the principles and requirements of the Americans with Disabilities Act. As of December 31, 2023, more than 50% of our workforce self-identified as female and more than 50% of our management positions are held by individuals self-identifying as female. To attract diverse applicants, we partner with third parties and post openings to a wide variety of job boards. We also have an annual internship program designed to, among other things, create a pipeline of qualified candidates for positions within the Company and to attract diverse candidates. We recognize the importance of experienced leadership and as of December 31, 2023, the average tenure for the executive team was 18 years. The average age of our employees is 51, with ages spanning multiple generations, similar to our residents and guests.

Our employees are fairly compensated, without regard to gender, race and ethnicity and routinely recognized for outstanding performance. Our compensation program is designed to attract and retain talent. All employees are supported with a strong training and development program and a well-rounded benefits plan to help them maintain their health and financial well-being. Employees are offered flexibility to meet personal and family needs. We encourage our employees to take time away from work to focus on their physical and mental well-being and offer a comprehensive benefit package includingthat includes five mental health and well-being days, for employees, paid parental and paid family leave programs that exceed minimum regulatory requirements, back up child care services, pet insurance, paw-ternity leave and paid volunteer time off. In addition, we offer a competitive 401(k) plan that provides for an employer match of up to 4% with 100% vesting of all contributions immediately upon eligibility and an Employee Stock Purchase Plan providing a 15% discount for all eligible employees.

Providing a safe and healthy work environment for our team members is a top priority and we empower them to take ownership in this effort. Each employee is assigned a safety-related training curriculum tailored to their job responsibilities. All employees are encouraged to report any conditions in their workplace that raise health or safety concerns without fear of retaliation.

ELS is a place where talent is recognized and internal growth is promoted. In addition to foundational safety and compliance training, team members participate in virtual and in-person learning experiences including formal new employee and manager development programs, a formal mentorship program, a “Knowledge Power Day” program providing office-based employees an opportunity to be fully immersed in the day-to-day operations at our communities, customer experience training focused on varying elements that support our values for property team members and diversity, equity and inclusion programs to support the sense of belonging, awareness and connection at ELS. We conduct annual performance, career development and compensation reviews for all employees to reward our employees based on merit and their contributions.

We continually assess and strive to enhance employee satisfaction and engagement. We solicit employee feedback and measure engagement through a variety of employee surveys. We look forward to inviting employees to participate in additional pulse surveys annually with focus on engagement and the overall employee experience.

Our People: Residents & Guests: ELS works to create a comfortable and welcoming environment for everyone – residents, guests and employees. With a culture of recognition and reputation for excellence, ELS teammates are empowered to take ownership in their jobs and help our customers create lasting memories. Our dedicated on-site management teams are encouraged to be ambassadors of their communities and are committed to consistently delivering an exceptional experience for our residents and guests. Hearing directly from our customers is critical, and the number of platforms through which our

customers can contact us continues to grow. This customer feedback helps us to make informed business decisions focusing on the safety and health of our residents, guests and employees, while ensuring a positive experience for all.

Our People: Giving Back: ELS believes in supporting the communities we operate as well as the greater communities in which we live, work and play. In order to maximize our efforts at giving back, we leverage a multi-pronged approach to delivering on this commitment, which includes a focus on employee engagement, community giving, strategic sponsorship and nonprofit impact.

All benefits eligible employees can take paid time off annually to volunteer atwith a charitable organization of their choice. EmployeesTeam members are encouraged to use this time to make a difference in their communities.

communities and utilized over 8,500 Community Impact hours during the year ended December 31, 2023. Making a positive impact in the greater communities in which we operate not only helps us make a difference in the lives of others, but also enhances our knowledge of and connection to the people and places we serve. Throughout our Properties across North America, we work to create a comfortable and welcoming environment for everyone – residents, guests and employees. People helping people is the norm, and our Making a Difference in Our Communities program is designed to foster and support these acts of goodwill, generosity and neighborly care. Our strategic sponsorships leverage our communities to give back. Funded through the generosity of our employees and friends of ELS, ConsiderOthers is a 501(c)(3) non-profit

charity that provides financial and other assistance to our residents and employees. Our Making a Difference in Our Communities initiative supports the generosity given in response to COVID-19. From creating care packages, to delivering hot meals, to making face masks and more, we have seen so many examples of neighbors reaching out to help neighbors, working together to help first responders and providing benefit to their greater communities. These acts of kindness enhance the bonds our customers have with each other and to our communities. We are proud to help foster these efforts in our communities.

Our Places. Our Properties are located where our customers aspire to be – where they want to live, work and grow, where they want to retire or raise their family and where they want to vacation and spend their valued leisure time. We consider it a great responsibility to own and operate lifestyle-oriented properties among diverse landscapes and natural habitats and to ensure our properties remain desirable destinations for future generations. We are committed to maintaining biodiversity across our portfolio and operating assets that are connected to their local and natural environments. As a result, the consideration of environmental factors has always been part of our culture in the daily operation of our business.

Through sustainable practices,Our Journey at ELS encompasses a three-part strategy to manage our impact, while also focusing on how we can provide environmental benefit beyond our own operations. Our focus is on reducing operational impact, enabling customer impact and enhancing positive impact. Underpinning Our Journey is a practice of continual innovation. We aim to reduce emissions from our operations through our investments in resource conservation, efficiency and renewable energy programs. We enable customer conservation and efficiency by providing recycling and composting offerings, promoting water and energy reduction through education and technology and pursuing community-level certifications and procuring ENERGY STAR® certified homes to save our residents money and energy. We are committed to preserving biodiversity within our portfolio and providing outdoor access to our guests and residents. Our natural capital both within our properties and beyond through our collaboration with American Forests has positive climate benefits.

At ELS, we are taking actionsteps to use resources efficientlyreduce our carbon footprint and reduce our impact on the environment. environment, including energy management, water management and waste management. Our environmental metrics consist primarily of the impact of our customers on our properties as well as ELS operational impacts. We have designed our strategy to reduce ELS’ impact and promote the benefits of our properties, while enabling our customers to share in this journey with us. Lloyd's Register Quality Assurance ("LRQA") was retained to provide independent assurance of our 2022 environmental metrics to a limited level of assurance and materiality.

At ELS, we focus on operating sustainable communities for our guests and residents to enjoy and believe community-level certifications provide the best representation of our sustainable business practices on our properties. Our focus extends beyond efficient buildings to sustainable communities through the National Association of RV Parks & Campgrounds ("ARVC")’s Plan-It Green Friendly Park Program for our RV communities and state-level Clean Marina designations. Both programs provide external validation and recognition of our communities’ implementation of best practices to promote a more sustainable operation.

We are committed to seeking opportunitiesmaintaining biodiversity across our portfolio and creating assets that are connected to expandtheir natural and local environments. The Manufactured Housing Institute ("MHI") recognized Colony Cove in Ellenton, FL with its 2023 Leadership in Sustainability Award for planting more than 4,000 trees on a 1.5-acre peninsula in the use of renewable energy throughout our portfolio. Some of our Properties have on-site solar systemscommunity, creating a beneficial microforest. The annual MHI awards recognize communities that reduce our greenhouse gas emissions, reduce electricity expensedeliver extraordinary resident experiences due to their all-around excellence in operations, professionalism, amenities and are a valued amenity we can offer our guests through RV covered storage areas. We are investing in efficient, innovative and smart technology and infrastructure to enhance resident relations, simplify operations and ensure regulatory compliance. We continue to invest in our water and electric meter program to replace submeters with a real time automatic meter reading system to monitor usage and proactively identify water leaks and wasted energy. We are consistently improving the quality of our housing stock through the purchase of ENERGY STAR® certified homes, where available.community involvement.

Our Purpose. It is of the utmost importance to us that we maintain the highest level of ethical standards in our processes, customs and policies. Whether we are working with customers or vendors, our actions are guided by a clear set of established principles. We hold ourselves accountable for ethical business practices. All facets of ELS, employees, management and our Board of Directors, are expected to act with honesty, integrity, fairness and respect. We haveTo support this culture, all team members

receive annual compliance training focused on compliant and ethical interactions with peers, residents, guests, vendors and others in our communities and offices.

Our Board of Directors recognizes that corporate governance is a developing and dynamic area warranting periodic review. Policies are in place and reviewed on an ESG policyannual basis to incorporate ESG considerations into our businesssupport this purpose. All publicly available policies are reviewed and a Human Rights and Labor Rights Statement that confirms our policies on the topics of Fair Labor Practices, Child Labor, Forced Labor and Human Trafficking, Health and Safety, Diversity and Inclusion and Ethical Conduct.approved by senior management. To help employees report potential misconduct, we have a confidential multi-lingual Alertline for reporting Ethics and Compliance concerns and a confidential hotline for all employees to report workplace health and safety concerns.

We have a stakeholder engagement approach that enables us to understand our stakeholders’ perceptions and concerns, encourages regular dialogue and leverages industry frameworks to communicate our ESG impacts. Our 2022 Sustainability Report references the Global Reporting Initiative ("GRI"), Sustainability Accounting Standards Board ("SASB") and Task Force on Climate-related Financial Disclosures ("TCFD") frameworks. Further information on our sustainability strategy and ESG efforts can be found on our website at https://www.equitylifestyleproperties.com/sustainability. The information on our internet site is not part of, nor incorporated into, this annual report on Form 10-K.

Leases or Usage Rights

At our Properties, a typical lease for the rental of a Site between us and the owner or renter of a home is month-to-month or for a one-year term, renewable upon the consent of both parties or, in some instances, as provided by statute. These leases are cancellable, depending on applicable law, for non-payment of rent, violation of Property rules and regulations or other specified defaults. Long-term leases are in effect at approximately 15,0108,258 Sites in 1124 of our MH Properties. Some of these leases are subject to rental rate increases based on the Consumer Price Index (“CPI”), in some instances allowing for pass-throughs of certain items such as real estate taxes, utility expenses and capital expenditures. Generally, adjustments to our rental rates, if appropriate, are made on an annual basis.

In Florida, which represents 38.3% of total sites and 44.0%45.3% of total property operating revenues, in connection with offering a Site in a MH community for rent, the MH community owner must deliver to the prospective resident a prospectus required by Florida Statutes Chapter 723.011, which must first be approved by the state's regulatory agency. The prospectus contains certain required disclosures regarding the community, the rights and obligations of the MH community owner and residents and a copy of the lease agreement. A prospectus may describe what factors the MH community owner can use to justify a rental rate increase and may contain limitations on the rights of the MH community to increase rental rates. However, in the absence of such limitations, the MH community owner may increase rental rates to market, subject to certain advance notice requirements and a statutory requirement that the rental increase and rental rates be reasonable. See further discussion below related to rent control legislation.

At Properties zoned for RV use, we have entered into agreements with residents who have usage rights on an annual basis and we have long-term relationships with many of our seasonal and transient residents and guests, who typically enter into short-term rental agreements. Generally, these residents and guests cannot live full time on these Properties for reasons including their seasonal nature. Many of them also leave deposits to reserve a Site for the following year.

Properties operated under the Thousand Trails brand are primarily utilized to serve subscription members. Available Sites within these Properties may also be utilized by non-members. A membership subscription grants the member access to these Properties on a continuous basis of up to 14 days in exchange for an annual payment. In addition, members are eligible to upgrade their subscriptions, which increase usage rights during the membership term. Each membership upgrade requires a non-refundable upfront payment, for which we offer financing options to eligible members. Most of the subscription contracts provide for an annual dues increase, usually based on increases in the CPI.

Regulations and Insurance

General. Our Properties are subject to a variety of laws, ordinances and regulations, including regulations relating to recreational facilities such as swimming pools, clubhouses and other common areas, regulations relating to providing utility services, such as electricity, and regulations relating to operating water and wastewater treatment facilities at certain Properties. We believe that each Property has all material permits and approvals necessary to operate. We renew these permits and approvals in the ordinary course of business.

Insurance. Our Properties are insured against risks that may cause property damage and business interruption, including events such as fire, flood, earthquake, or windstorm. The relevant insurance policies contain deductible requirements, coverage limits and particular exclusions. Our current property and casualty insurance policies with respect to our MH and RV Properties, which we plan to renew, expire on April 1, 2022.2024. We have a $125.0 million loss limit per occurrence limit with respect to our

MH and RV all-risk property insurance program, includingwhich includes approximately $50.0 million of coverage per occurrence for named windstorms. Thiswindstorms, which include, for example, hurricanes. The loss limit is subject to additional sub-limits as set forth in the policy form, including, among others, a $25.0 million aggregate loss limit for earthquakesearthquake(s) in California. The deductibles for this policy primarily range from a $500,000 minimum to 5.0% per unit of insurance for most catastrophic events. For most catastrophic events, there is an additional one-time aggregate deductible of $2$10.0 million, which is capped at $1$5.0 million per occurrence. We have separate insurance policies with respect to our marina Properties. Those casualty policies which we recently renewed,will expire on November 1, 20222024 and the property insurance program, which we plan to renew, expires on April 1, 20222024. The marina property insurance program has a $25.0 million per occurrence limit, subject to self-insurance and has a minimum deductible of $100,000.$100,000 plus, for named windstorms, 5.0% per unit of insurance subject to a $500,000 minimum. A deductible indicates our maximum exposure, subject to policy limits and sub-limits, in the event of a loss.

Rent Control Legislation. At certain Properties, state and local rent control laws dictate the structure of rent increases and in some cases, outline the ability to recover the costs of capital improvements. Enactment of such laws has been considered at various times in other jurisdictions. We presently expect to continue to maintain Properties and may purchase additional properties in markets that are either subject to rent control or in which rent related legislation exists or may be enacted. For example, Florida law requires that rental increases be reasonable and Delaware law requires rental increases greater than the changes in the CPI to be justified. Also, certain jurisdictions in California in which we own Properties limit rent increases to changes in the CPI or some percentage of the CPI. As part of our effort to realize the value of Properties subject to restrictive regulations, we have initiated lawsuits at times against various municipalities imposing such regulations in an attempt to balance the interests of our stockholders with the interests of our residents and guests.

Membership Properties. Many states also have consumer protection laws regulating right-to-use or campground membership sales and the financing of such sales. Some states have laws requiring us to register with a state agency and obtain a permit to market (see Item 1A. Risk Factors). At certain Properties primarily used as membership campgrounds, state statutes limit our ability to close a Property unless a reasonable substitute Property is made available for members to use.

Industry

We believe that demand for manufactured housing, RV communities and marinas will continue to outpace supply in the near future. We expect much of this demand will continue to come from baby boomers, who may seek an active RV lifestyle or a permanent retirement or vacation establishment. In addition, we expect the exposure to Generation X, Millennials and Gen Z will contribute to the demand, as these groups focus on affordability, prefer housing quality over size and pursue unique experiences. We believe that our Properties and our business model provide an attractive destination for customers as they seek value in their housing and recreational options. Positive trends in categories such as customer demographics, the quality of manufactured housing construction and limited property supply, among others, fuel our belief that our Properties are well positioned for the future:

•Barriers to Entry: We believe that the supply of new properties in locations we target will be constrained by barriers to entry. While we have seen a modest increase in ground-up development, primarily of RV properties, the most significant barrier continues to be the difficulty of securing zoning permits from local authorities.authorities, particularly in geographic areas we target for investment. This has been the result of (i) the public perception of manufactured housing and (ii) the fact that MH and RV communities generate less tax revenue than conventional housing properties because the homes are treated as personal property (a benefit to the

homeowner) rather than real property. Further, the length of time between investment in a property's development and the attainment of stabilized occupancy and the generation of profit is significant. The initial development of the infrastructure may take up to three years and once a property is ready for occupancy, it may be difficult to attract customers to an empty property.

•Customer Base: We believe that properties tend to achieve and maintain a stable rate of occupancy due to the following factors: (i) customers typically own their own homes, (ii) properties tend to foster a sense of community as a result of amenities, such as clubhouses and recreational and social activities, (iii) customers often sell their homes in-place (similar to site-built residential housing), resulting in no interruption of rental payments to us and (iv) moving a factory-built home from one property to another involves substantial cost and effort.

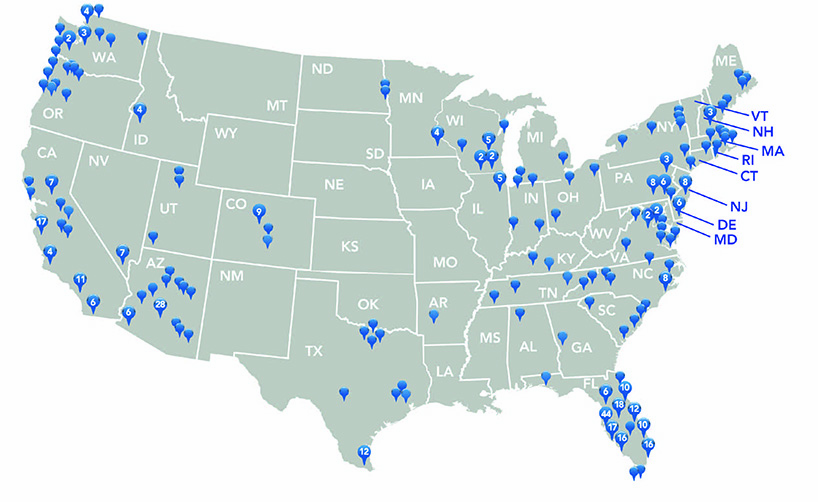

•Lifestyle Choice: There are currently over 1 million RV camp sites in privately owned RV parks and campgrounds in the United States per the National Association of RV Parks and Campgrounds (“ARVC”). According to the Recreational Vehicle Industry Association (the “RVIA”) in 2021, RV ownership has reached record levels. More than 11.2 million households now own an RV, a 26% increase since 2011 and a 62% increase since 2001. RV ownership is split almost equally between those over and under the age of 55, with significant growth among 18 to 34 year-olds, who now make up 22% of the market. The 73 million people born in the United States from 1946 to 1964, or “baby boomers,” make up one of the largest and fastest growing segments in this market. According to the RVIA, data

suggested that RV sales are expected to benefit from an increase in demand from those born in the United States from 1980 to 2003, or millennials and Gen Z, over the coming years. The study showed that both age groups are becoming RVers for life with 84% of 18-to-34-year-olds planning to buy another RV in the next 5 years. The consumers most likely to purchase RVs, according to a study conducted with Nielsen in 2016 by Go RVing, a coalition of RV industry trade groups, are families searching for adventures, individuals looking for locations with natural beauty and opportunities for outdoor sports and recreation and kid-free adult adventurers enjoying the freedom, convenience and low-cost options of RVs. Ownership is spread widely not only across age levels but also across genders, as well as household income and education. According to “The 20212023 North American Camping Report”, the use of RVs as a primary camping accommodation by campers increased 14.7%29.3% from 2019 to 2020.2022. In 2022, 15 million households went RVing at some point, including the more than 11.2 million RV owners.

According to the U.S. Census Bureau in 2019, every day 10,000 Americans turn 65 years old and all baby boomers will be at least age 65 by 2030. We believe that this population segment, seeking an active lifestyle, will provide opportunities for our future growth. As RV owners age and move beyond the more active RV lifestyle, they will often seek permanent retirement or vacation establishments. Manufactured homes and cottages have become an increasingly popular housing alternative. According to 20182023 U.S. Census Bureau National Population Projections figures, the population of people ages 55 and older is expected to grow 17%15% within the next 15 years.

We believe that the housing choices in our Properties are especially attractive to such individuals throughout this lifestyle cycle. Our Properties offer an appealing amenity package, close proximity to local services, social activities, low maintenance and a secure environment. In fact, many of our Properties allow for this cycle to occur within a single Property.

The National Marine Manufacturers Association (“NMMA”) released its 20202022 U.S. Recreational Boating Statistical Abstract in June 2021. In a record year for the boating industry, 2020’s totalJanuary 2024. Total recreational marine expenditures during 2022 reached a high of $49.4$59.3 billion, a 14.2%4.4% and 37.1% increase over 2019. NMMA’s data show 415,000 first-time boat buyers entered2021 and 2019, respectively. According to NMMA, an estimated 85 million Americans go boating each year.

According to the market in 2020.

The U.S. Bureau of Economic Analysis (“BEA”) published figures confirming that the level of, demand for recreational marine purchases has continued in 2021, with boat spending almost 50% higher than before the pandemic. According to the BEA,2022, as boating and fishing represent the second largest outdoor recreation activities in the U.S., with $23.6$32.4 billion in current-dollar value added to the economy.

•Construction Quality: The Department of Housing and Urban Development's (“HUD”) standards for manufactured housing construction quality are the only federal standards governing housing quality of any type in the United States. Manufactured homes produced since 1976 have received a “red and silver” government seal certifying that they were built in compliance with the federal code. The code regulates manufactured home design and construction, strength and durability, fire resistance and energy efficiency and the installation and performance of heating, plumbing, air conditioning, thermal and electrical systems. In newer homes, top grade lumber and dry wall materials are common. Also, manufacturers are required to follow the same fire codes as builders of site-built structures. In 1994, following the devastation left by Hurricane Andrew, HUD introduced regulations that established different wind zones across the country. As a result, any homes set in place since 1994 must be able to withstand wind speeds of 70 miles per hour in Zone 1, 100 miles per hour in Zone 2 and 110 miles per hour in Zone 3. While most of the United States is designated wind Zone 1, areas most likely to be impacted by hurricanes are either Zone 2 or Zone 3.

Although construction of cottages, which are generally smaller homes, do not come under the same HUD regulations, they are built and certified in accordance with National Fire Protection Association (“NFPA”) 1192-15 and American National Standards Institute (“ANSI”) A119.5 consensus standards for park model recreational vehicles and have many of the same quality features. The RVIA operates a safety standards and inspection program that requires member manufacturers of all recreation vehicles, including park model RVs, to certify that each unit built complies with the requirements of the applicable standards.

•Comparability to Site-Built Homes: Since inception, the manufactured housing industry has experienced a trend toward multi-section homes. The average current manufactured homes are approximately 1,471 square feet. Many such homes have nine-foot or vaulted ceilings, fireplaces and as many as four bedrooms and closely resemble single-family ranch-style site-built homes at a fraction of the price. At our Properties, there is an active resale or rental market for these larger homes. According to the 2020 U.S. Census American Community Survey, manufactured homes represent 7.5% of single-family housing units.

•Second Home and Vacation Home Demographics: The National Association of Realtors (“NAR”) recently released their 2021 Vacation Home Counties Report in 2021, which indicated that vacation home sales have been surgingsurged throughout the pandemic. In 2020, vacation home sales rose by 16.4%, outpacing the 5.6% growth in total existing-home sales. Vacation home sales have continued to pick up during January-April 2021, rising by 57.2% year-over-year, more than twice the 20% growth in total existing-home sales during the same period. The median existing home sales price on average rose by 14.2% in vacation home counties, compared to 10.1% in non-vacation home counties. The share of vacation home sales to total existing-home sales increased to 6.7% in the first four months of 2021, up from a 5% share in 2019. According to the NAR, the surge in the demand for vacation homes has occurred during the pandemic when people have been able to work from home, students are schooled virtually, people are taking safety precautions and staying away from crowded areas and with urban-based recreation limited by social distancing regulations.