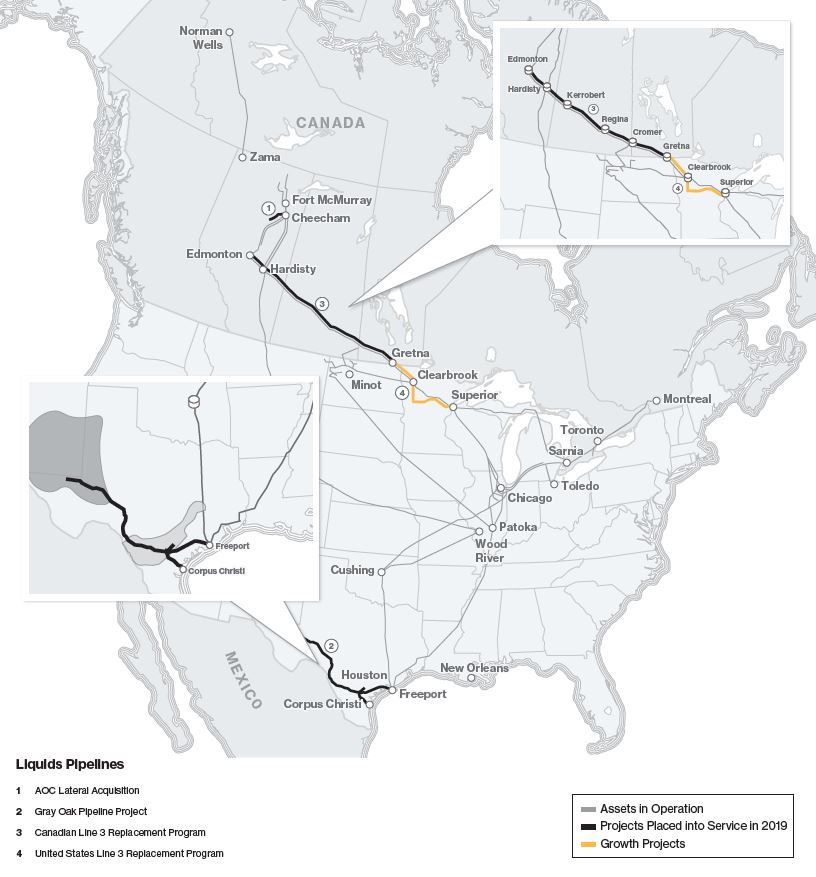

Liquids Pipelines consists of pipelines and related terminals in Canada and the United States that transport various grades of crude oil and other liquid hydrocarbons.

MAINLINE SYSTEM

The Mainline System is comprised of the Canadian Mainline and the Lakehead System. The Canadian Mainline is a common carrier pipeline system which transports various grades of oil and other liquid hydrocarbons within western Canada and from western Canada to the Canada/United States border near Gretna, Manitoba and Neche, North Dakota and from the United States/Canada border near Port Huron, Michigan and Sarnia, Ontario to eastern Canada and the northeastern United States. The Canadian Mainline includes six adjacent pipelines with a combined capacity of approximately 2.9 million barrels per day (bpd) that connect with the Lakehead System at the Canada/United States border, as well as five pipelines that deliver crude oil and refined products into eastern Canada and the northeastern United States. We have operated, and frequently expanded, the Canadian Mainline since 1949. The Lakehead System is the portion of the Mainline System in the United States. It is an interstate common carrier pipeline system regulated by FERC, and is the primary transporter of crude oil and liquid petroleum from western Canada to the United States.

Competitive Toll Settlement

The Competitive Toll Settlement (CTS) is the current framework governing tolls paid for products shipped on the Canadian Mainline, with the exception of Lines 8 and 9 which are tolled on a separate basis. The 10-year settlement was negotiated by representatives of Enbridge, the Canadian Association of Petroleum Producers and other shippers on the Canadian Mainline. It was approved by the Canada Energy Regulator (CER), formerly the National Energy Board on June 24, 2011 and took effect on July 1, 2011. The CTS provides for a Canadian Local Toll (CLT) for deliveries within western Canada, as well as an International Joint Tariff (IJT) for crude oil shipments originating in western Canada, on the Canadian Mainline, and delivered into the United States, via the Lakehead System, and into eastern Canada. The IJT tolls are denominated in United States dollars. The IJT is designed to provide shippers on the Mainline System with a stable and competitive long-term toll, thereby preserving and enhancing throughput on both the Canadian Mainline and the Lakehead System. The CLT and the IJT are adjusted annually, on July 1 of each year, at a rate equal to 75% of the Canadian Gross Domestic Product at Market Price Index published by Statistics Canada.

Although the CTS has a 10-year term, it does not require shippers to commit to certain volumes. Shippers nominate volumes on a monthly basis and we allocate capacity to maximize the efficiency of the Canadian Mainline.

Local tolls for service on the Lakehead System are not affected by the CTS and continue to be established pursuant to the Lakehead System’s existing toll agreements, as described below.Under the terms of the IJT agreement, the Canadian Mainline’s share of the IJT relating to pipeline transportation of a batch from any western Canada receipt point to the United States border is equal to the IJT applicable to that batch’s United States delivery point less the Lakehead System’s local toll to that delivery point. This amount is referred to as the Canadian Mainline IJT Residual Benchmark Toll and is denominated in United States dollars.

Lakehead System Local Tolls

Transportation rates are governed by the FERC for deliveries from the Canada/United States border near Neche, North Dakota, Clearbrook, Minnesota and other points to principal delivery points on the Lakehead System. The Lakehead System periodically adjusts these transportation rates as allowed under the FERC’s index methodology and tariff agreements, the main components of which are index rates and the Facilities Surcharge Mechanism. Index rates, the base portion of the transportation rates for the Lakehead System, are subject to an annual adjustment which cannot exceed established ceiling rates as approved by the FERC. The Facilities Surcharge Mechanism allows the Lakehead System to recover costs associated with certain shipper-requested projects through an incremental surcharge in addition to the existing index rates, and is subject to annual adjustment on April 1 of each year.

Mainline System Contracting

On December 19, 2019, we submitted an application to the CER to implement contracting on our Mainline System. The application for contracted and uncommitted service included the associated terms, conditions and tolls of each service, which would be offered in an open season following approval by the CER. The tolls and services would replace the current CTS that is in place until June 30, 2021. If a replacement agreement is not in place by that time, the CTS tolls will continue on an interim basis.

For further information, refer to Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Recent Developments - Mainline System Contracting.

REGIONAL OIL SANDS SYSTEM

The Regional Oil Sands System includes five intra-Alberta long-haul pipelines; the Athabasca Pipeline, Waupisoo Pipeline, Woodland Pipeline, Wood Buffalo Extension/Athabasca Twin pipeline system and the Norlite Pipeline System (Norlite), as well as two large terminals: the Athabasca Terminal located north of Fort McMurray, Alberta and the Cheecham Terminal, located south of Fort McMurray, Alberta. The Regional Oil Sands System also includes numerous laterals and related facilities which provide access for oil sands production to the system. The Regional Oil Sands System currently serves twelve producing oil sands projects.

The combined capacity of the intra-Alberta long-haul pipelines is approximately 930,000 bpd to Edmonton and 1,370,000 bpd into Hardisty, with Norlite providing approximately 218,000 bpd of diluent capacity into the Fort McMurray region. The Woodland Pipeline and Norlite are joint ventures, 50/50 between us and Imperial Oil Resources Ventures Limited and ExxonMobil Canada Properties, and 70/30 with Keyera Corp., respectively. The Regional Oil Sands System is anchored by long-term agreements with multiple oil sands producers that include provisions for the recovery of some of the operating costs of this system.

GULF COAST AND MID-CONTINENT

Gulf Coast includes Seaway Crude Pipeline System (Seaway Pipeline), Flanagan South Pipeline (Flanagan South), Spearhead Pipeline and Gray Oak Pipeline, as well as the Mid-Continent System comprised of the Cushing Terminal.

Seaway Pipeline

We have a 50% interest in the 1,078-kilometer (670-mile) Seaway Pipeline, including the 805-kilometer (500-mile), 30-inch diameter long-haul system between Cushing, Oklahoma and Freeport, Texas, as well as the Texas City Terminal and Distribution System which serve refineries in the Houston and Texas City areas. Seaway Pipeline also includes 8.8 million barrels of crude oil storage tank capacity on the Texas Gulf Coast.

The flow direction of Seaway Pipeline was reversed in 2012, enabling it to transport crude from the oversupplied hub in Cushing, Oklahoma to the Gulf Coast. Further pump station additions and modifications were completed in early 2013, increasing capacity available to shippers from an initial 150,000 bpd to approximately 400,000 bpd, depending on crude slate. In late 2014, a second line, the Seaway Pipeline Twin, was placed into service to more than double the existing capacity to 950,000 bpd. Seaway Pipeline also includes a 161-kilometer (100-mile) pipeline from the Enterprise Crude Houston crude oil terminal in Houston, Texas to the Port Arthur/Beaumont, Texas refining center.

Flanagan South

Flanagan South is a 950-kilometer (590-mile), 36-inch diameter interstate crude oil pipeline that originates at our terminal at Flanagan, Illinois, a delivery point on the Lakehead System, and terminates in Cushing, Oklahoma. Flanagan South and associated pumping stations were completed in the fourth quarter of 2014. Flanagan South has a capacity of approximately 600,000 bpd.

Spearhead Pipeline

Spearhead Pipeline is a long-haul pipeline that delivers crude oil from Flanagan, Illinois, a delivery point on the Lakehead System, to Cushing, Oklahoma. The Spearhead pipeline was originally placed into service in 2006 and has a capacity of approximately 193,000 bpd.

Gray Oak Pipeline

The Gray Oak pipeline is a 1,368-kilometer (850-mile) crude oil system, which runs from the Permian Basin in West Texas to the United States gulf coast. The Gray Oak pipeline has an expected average annual capacity of 900,000 bpd and transports light crude oil. We have an effective 22.8% interest in the pipeline. Initial in-service for the pipeline commenced in November 2019 with full in-service expected in the second quarter of 2020.

Mid-Continent System

The Mid-Continent System is comprised of storage terminals at Cushing, Oklahoma (Cushing Terminal), consisting of over 80 individual storage tanks ranging in size from 78,000 to 570,000 barrels. Total storage shell capacity of Cushing Terminal is approximately 20 million barrels. A portion of the storage facilities are used for operational purposes, while the remainder are contracted to various crude oil market participants for their term storage requirements.Contract fees include fixed monthly storage fees, throughput fees for receiving and delivering crude to and from connecting pipelines and terminals, as well as blending fees.

OTHER

Other includes Southern Lights Pipeline, Express-Platte System, Bakken System and Feeder Pipelines and Other.

Southern Lights Pipeline

Southern Lights Pipeline is a single stream pipeline that ships diluent from the Manhattan Terminal near Chicago, Illinois to three western Canadian delivery facilities, located at the Edmonton and Hardisty terminals in Alberta and the Kerrobert terminal in Saskatchewan. This 180,000 bpd 16/18/20-inch diameter pipeline was placed into service in 2010. Both the Canadian portion of Southern Lights Pipeline (Southern Lights Canada) and the United States portion of Southern Lights Pipeline (Southern Lights US) receive tariff revenues under long-term contracts with committed shippers. Southern Lights Pipeline capacity is 90% contracted with the remaining 10% of the capacity (18,000 bpd) assigned for shippers to ship uncommitted volumes.

Express-Platte System

The Express-Platte System consists of the Express pipeline and the Platte pipeline, and crude oil storage of approximately 5.6 million barrels. It is an approximate 2,736-kilometer (1,700-mile) crude oil transportation system, which begins in Hardisty, Alberta, and terminates in Wood River, Illinois. The Express pipeline carries crude oil to United States refining markets in the Rocky Mountains area, including Montana, Wyoming, Colorado and Utah. The Platte pipeline, which interconnects with the Express pipeline in Casper, Wyoming, transports crude oil predominantly from the Bakken shale and western Canada to refineries in the midwest. Express pipeline capacity is typically committed under long-term take-or-pay contracts with shippers. A small portion of Express pipeline capacity and all of the Platte pipeline capacity is used by uncommitted shippers who pay only for the pipeline capacity they actually use in a given month.

Bakken System

The Bakken System consists of the North Dakota System and the Bakken Pipeline System. The North Dakota System services the Bakken in North Dakota, and is comprised of a crude oil gathering and interstate pipeline transportation system. The gathering system provides delivery to Clearbrook, Minnesota for service on the Lakehead system or a variety of interconnecting pipeline and rail export facilities. The interstate portion of the system has both Unites States and Canadian components that extend from Berthold, North Dakota into Cromer, Manitoba.

Tariffs on the United States portion of the North Dakota System are governed by the FERC and include a local tariff. The Canadian portion is categorized as a Group 2 pipeline, and as such, its tolls are regulated by the CER on a complaint basis. Tolls on the interstate pipeline system are based on long-term take-or-pay agreements with anchor shippers.

We have an effective 27.6% interest in the Bakken Pipeline System, which connects the Bakken formation in North Dakota to markets in eastern PADD II and the United States Gulf Coast. The Bakken Pipeline System consists of the Dakota Access Pipeline from the Bakken area in North Dakota to Patoka, Illinois, and the Energy Transfer Crude Oil Pipeline from Patoka, Illinois to Nederland, Texas. Current capacity is 570,000 bpd of crude oil with the potential to be expanded through additional pumping horsepower. The Bakken Pipeline System is anchored by long-term throughput commitments from a number of producers.

Feeder Pipelines and Other

Feeder Pipelines and Other includes a number of liquids storage assets and pipeline systems in Canada and the United States.

Key assets included in Feeder Pipelines and Other are the Hardisty Contract Terminal and Hardisty Storage Caverns located near Hardisty, Alberta, a key crude oil pipeline hub in western Canada and the Southern Access Extension (SAX) pipeline which originates in Flanagan, Illinois and delivers to Patoka, Illinois. On July 1, 2014, Marathon executed an agreement with us to become an owner (35%) in SAX, thereby forming the Illinois Extension Pipeline Company (IEPC). We have a 65% ownership in IEPC. SAX was placed into service in December 2015 with the majority of its capacity commercially secured under long-term take-or-pay contracts with shippers.

Feeder Pipelines and Other also includes Patoka Storage, the Toledo pipelinesystem and the Norman Wells (NW) System. Patoka Storage is comprised of four storage tanks with 480,000 barrels of shell capacity located in Patoka, Illinois. The Toledo pipeline system connects with the Lakehead System and delivers to Ohio and Michigan. The NW System transports crude oil from Norman Wells in the Northwest Territories to Zama, Alberta and has a cost-of-service rate structure based on established terms with shippers.

COMPETITION

Other competing carriers available to ship western Canadian liquid hydrocarbons to markets in Canada, the United States and internationally represent competition to our liquids pipelines network. Competition amongst existing pipelines is based primarily on the cost of transportation, access to supply, the quality and reliability of service, contract carrier alternatives and proximity to markets.

Competition also arises from proposed pipelines that seek to access markets currently served by our liquids pipelines, such as proposed projects to the Gulf Coast and from proposed projects enhancing infrastructure in the Alberta regional oil sands market. The Mid-Continent and Bakken systems also face competition from existing pipelines, proposed future pipelines and existing and alternative gathering facilities. Competition for storage facilities in the United States includes large integrated oil companies and other midstream energy partnerships. Additionally, volatile crude price differentials and insufficient pipeline capacity on either our or competitors' pipelines can make transportation of crude oil by rail competitive, particularly to markets not currently serviced by pipelines.

We believe that our liquids pipelines continue to provide attractive options to producers in the Western Canadian Sedimentary Basin (WCSB) and North Dakota due to our competitive tolls and flexibility through our multiple delivery and storage points. We also employ long-term agreements with shippers, which mitigates competition risk by ensuring consistent supply to our liquids pipelines network. Our current complement of growth projects to expand market access and to enhance capacity on our pipeline system are expected to provide shippers reliable and long-term competitive solutions for liquids transportation. We have a proven track record of successfully executing projects to meet the needs of our customers and our existing right-of-way for the Mainline System also provides a competitive advantage as it can be difficult and costly to obtain rights-of-way for new pipelines traversing new areas. In addition, we are currently pursuing the offering of contracted service on the Mainline System which would further contribute to mitigating competition risk.

SUPPLY AND DEMAND

We have an established and successful history of being the largest transporter of crude oil to the United States, the world’s largest market for crude oil. While United States demand for Canadian crude oil production will support the use of our infrastructure for the foreseeable future, North American and global crude oil supply and demand fundamentals are shifting, and we have a role to play in this transition by developing long-term transportation options that enable the efficient flow of crude oil from supply regions to end-user markets.

The International Energy Agency 2019 World Energy Outlook indicated that upstream investment in 2019 demonstrated a continued upward trend. International prices weakened in 2019 compared to the previous year with United States tensions with China and continued supply growth outside of the Organization of Petroleum Exporting Countries (OPEC). World oil demand rose marginally over the year however, supply grew at a faster pace. The United States continued to increase its productive capacity, supported by its crude oil exports growing to over 3 million bpd in September 2019.

In western Canada, lack of export pipeline capacity resulted in the rapid buildup of inventories and discounts to the price of western Canadian crude. Western Canadian Select discounts peaked at over US$50 per barrel against West Texas Intermediate (WTI) in October 2018. This, in turn, resulted in the Alberta Government approving a plan to lease 4,400 rail cars to add approximately 120,000 bpd of rail export capacity for the industry by the end of 2020 and the adoption of a production curtailment policy directing the industry in the province to shut in 325,000 bpd starting January 1, 2019. The aim of this policy was to both draw down inventories by approximately 20 million barrels and return crude discounts to more historical norms. The policy calls for curtailment levels to be reduced as inventory levels decline and new pipeline and rail capacity come on line. Western Canadian crude prices responded almost immediately upon the release of the curtailment adoption notice, with discounts narrowing to approximately US$10 per barrel. The discount at this level would imply that rail is not financially attractive, and hence frustrating the government's efforts to draw down inventories. Rail movements dropped by more than 200,000 bpd between December 2018 and February 2019 as differentials were narrow enough that it was not economic to ship crude by rail in the first quarter of 2019. The differentials widened to above $10 per barrel in subsequent quarters to support the return of crude by rail. Throughout the year, the curtailment levels declined to a year end restriction of 75,000 bpd with an expectation that Alberta production volumes will continue to increase in 2020.

Notwithstanding the current price environment and Alberta policies, our Mainline System has thus far continued to be highly utilized. Mainline throughput as measured at the Canada/United States border at Gretna, Manitoba saw record deliveries of 2.845 million bpd in December 2019, slightly higher than our previous record in July 2019. The Mainline System continues to be subject to apportionment, as nominated volumes currently exceed capacity on portions of the system. The impact of a low crude oil price environment on the financial performance of our Liquids Pipelines business is expected to be relatively modest given the cost effectiveness of our Mainline toll and commercial arrangements which underpin many of the pipelines providing a significant measure of protection against volume fluctuations. Our Mainline System is well positioned to continue to provide safe and efficient transportation which will enable western Canadian and Bakken production to reach attractive markets in the United States and eastern Canada at a competitive cost relative to other alternatives.

The fundamentals of oil sands production and discounts for western Canadian crude have caused some sponsors to reconsider the timing of future projects. While recently updated forecasts continue to reflect long-term supply growth from the WCSB, the projected pace of growth is slower than previous forecasts as companies continue to assess the viability of capital investments in light of the current price environment and ongoing uncertainty with respect to the timing and completion of new pipeline systems proposed by our competitors.

Over the long term, continued growth in global energy consumption is expected to be primarily driven by emerging economies in regions outside theOrganization for Economic Cooperation and Development (OECD), mainly in India and China. In North America, demand growth for transportation fuels is expected to moderate due to vehicle fuel efficiencies and increasing sales of electric vehicles. Accordingly, there is a strategic opportunity to establish tide-water export facilities to service North American producers wanting access to global markets.

Global crude oil production is expected to continue to grow through 2035, primarily in North America, Brazil and OPEC. Growth in supply from OPEC is partly due to the expected recovery of Iraqi and Libyan production. Over the longer term, North American production from tight oil plays is expected to grow as technology continues to improve well productivity and efficiencies. The pace of growth in North America and level of investment in the WCSB could be tempered in future years by a number of factors including a sustained period of low crude oil prices and corresponding production decisions by OPEC, increasing environmental regulation and prolonged approval processes for new pipelines with access to tide-water for export or to United States markets.

In recent years, the combination of relatively flat domestic demand, growing supply and long lead time to build pipeline infrastructure led to a fundamental change in the North American crude oil landscape. The inability to move increasing inland supply to markets resulted in a divergence between WTI and world pricing, resulting in lower netbacks for North American producers. The impact of price differentials has been even more pronounced for western Canadian producers as insufficient pipeline infrastructure resulted in a further discounting of Alberta crude relative to WTI. Canadian pipeline export capacity is expected to remain fully utilized, resulting in continued apportionment on our Mainline System and incremental production utilizing non-pipeline transportation services (e.g. rail and trucks) until such time as sufficient pipeline capacity is made available. Over the longer term, however, we believe pipelines will continue to be the most reliable, safe and cost-effective means of transportation.

Our role in helping to address the evolving supply and demand fundamentals and alleviating price discounts for producers and supply costs to refiners is through optimization of throughput on our existing liquids pipelines systems and through investment in new pipelines and related infrastructure to provide expanded transportation capacity and sustainable connectivity to alternative markets. Progress on the development and construction of our commercially secured growth projects is discussed in Part II. Item 7.Management's Discussion and Analysis of Financial Condition and Results of Operations - Growth Projects - Commercially Secured Projects.

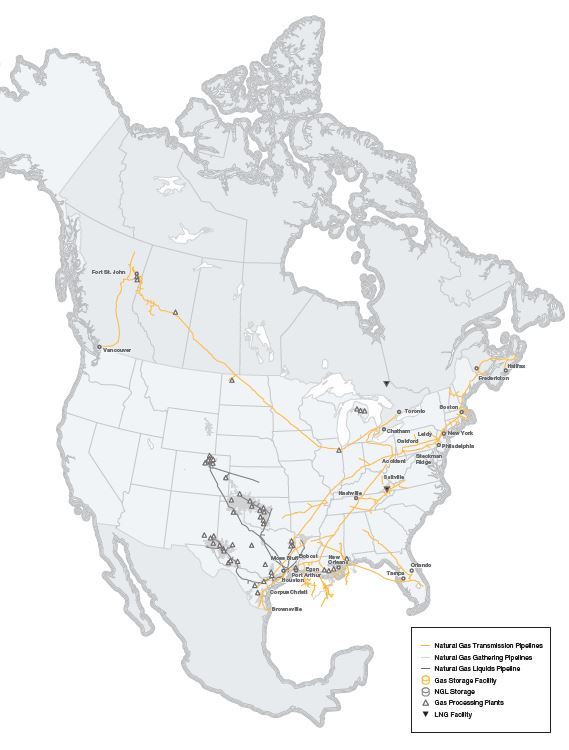

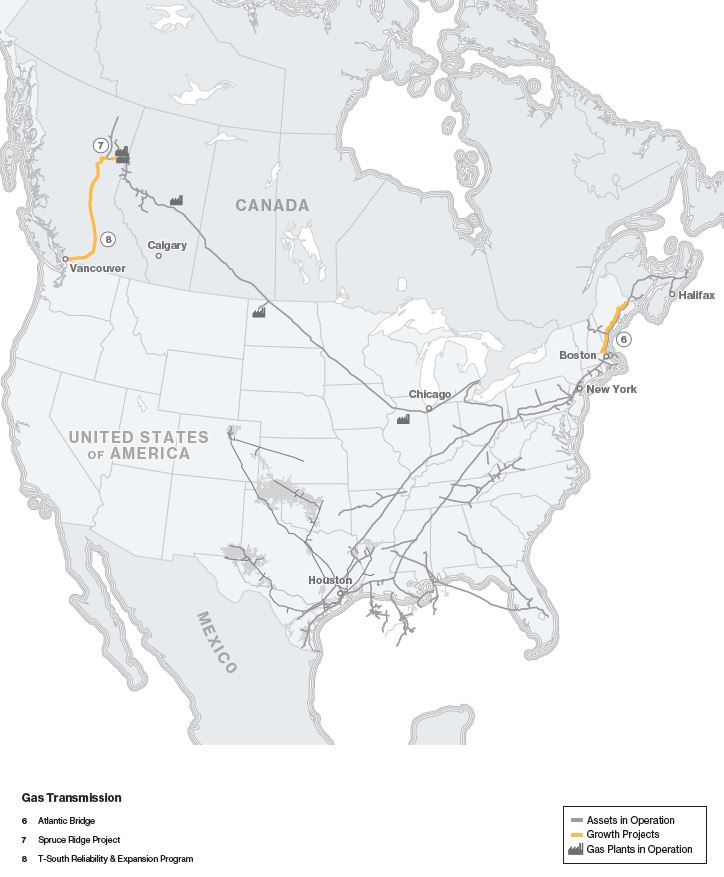

GAS TRANSMISSION AND MIDSTREAM

Gas Transmission and Midstream consists of our investments in natural gas pipelines and gathering and processing facilities in Canada and the United States, including US Gas Transmission, Canadian Gas Transmission, US Midstream and other assets.

US GAS TRANSMISSION

US Gas Transmission includes ownership interests in Texas Eastern, Algonquin, M&N U.S., East Tennessee, Gulfstream, Sabal Trail Transmission (Sabal Trail), NEXUS, Valley Crossing, Southeast Supply Header (SESH), Vector Pipeline L.P. (Vector) and certain other gas pipeline and storage assets. The US Gas Transmission business primarily provides transmission and storage of natural gas through interstate pipeline systems for customers in various regions of the northeastern, southern and midwestern United States.

The Texas Eastern natural gas transmission system extends approximately 2,735-kilometers (1,700-miles) from producing fields in the Gulf Coast region of Texas and Louisiana to Ohio, Pennsylvania, New Jersey and New York. Texas Eastern's onshore system consists of approximately 14,597-kilometers (9,070-miles) of pipeline and associated compressor stations. Texas Eastern is also connected to four affiliated storage facilities that are partially or wholly-owned by other entities within the US Gas Transmission business.

The Algonquin natural gas transmission system connects with Texas Eastern’s facilities in New Jersey and extends approximately 402-kilometers (250-miles) through New Jersey, New York, Connecticut, Rhode Island and Massachusetts where it connects to M&N U.S. The system consists of approximately 1,835-kilometers (1,140-miles) of pipeline with associated compressor stations. We have a 92% interest in the Algonquin natural gas transmission system.

M&N U.S. is an approximately 563-kilometer (350-mile) mainline interstate natural gas transmission system, including associated compressor stations, which extends from northeastern Massachusetts to the border of Canada near Baileyville, Maine. M&N U.S. is connected to the Canadian portion of the Maritimes & Northeast Pipeline system (M&N Canada) (see Gas Transmission and Midstream - Canadian Gas Transmission). We have a 78% interest in M&N U.S.

East Tennessee’s natural gas transmission system crosses Texas Eastern’s system at two locations in Tennessee and consists of two mainline systems totaling approximately 2,470-kilometers (1,535-miles) of pipeline in Tennessee, Georgia, North Carolina and Virginia, with associated compressor stations. East Tennessee has a LNG storage facility in Tennessee and also connects to the Saltville storage facilities in Virginia.

Gulfstream is an approximately 1,199-kilometer (745-mile) interstate natural gas transmission system with associated compressor stations, operated jointly with The Williams Companies, Inc. Gulfstream transports natural gas from Mississippi, Alabama, Louisiana and Texas, crossing the Gulf of Mexico to markets in central and southern Florida. We have a 50% interest in Gulfstream.

Sabal Trail is an approximately 829-kilometer (515-mile) pipeline that provides firm natural gas transportation to Florida Power & Light Company for its power generation needs and to a Duke Energy Florida natural gas plant. Facilities include a pipeline, laterals and various compressor stations. The pipeline infrastructure is located in Alabama, Georgia and Florida, and adds approximately 1.1 billion cubic feet per day (bcf/d) of new capacity enabling the access of onshore shale gas supplies once approved future expansions are completed. We have a 50% interest in Sabal Trail.

NEXUS is an approximately 410-kilometer (255-mile) interstate natural gas transmission system with associated compressor stations. NEXUS transports natural gas from our Texas Eastern system in Ohio to our Vector interstate pipeline in Michigan, with capacity of approximately 1.5 bcf/d. Through its interconnect with Vector, NEXUS provides a connection to Dawn Hub, the largest integrated underground storage facility in Canada and one of the largest in North America, located in southwestern Ontario adjacent to the Greater Toronto Area. We have a 50% interest in NEXUS.

Valley Crossing is an approximately 274-kilometer (170-mile) intrastate natural gas transmission system, with associated compressor stations. The pipeline infrastructure is located in Texas and provides market access of up to 2.6 bcf/d to the Comisión Federal de Electricidad, Mexico’s state-owned utility.

SESH is an approximately 467-kilometer (290-mile) natural gas transmission system with associated compressor stations, owned and operated jointly with Enable Gas Transmission, LLC. SESH extends from the Perryville Hub in northeastern Louisiana where the shale gas production of eastern Texas, northern Louisiana and Arkansas, along with conventional production, is reached from six major interconnections. SESH extends to Alabama, interconnecting with 14 major north-south pipelines and three high-deliverability storage facilities. We have a 50% interest in SESH.

Vector is a 560-kilometer (348-mile) pipeline that transports 1.3 bcf/d of natural gas from Joliet, Illinois in the Chicago area to parts of Indiana, Michigan and Ontario. We have a 60% interest in Vector.

Transmission and storage services are generally provided under firm agreements where customers reserve capacity in pipelines and storage facilities. The vast majority of these agreements provide for fixed reservation charges that are paid monthly regardless of the actual volumes transported on the pipelines or injected or withdrawn from our storage facilities, plus a small variable component that is based on volumes transported, injected or withdrawn, which is intended to recover variable costs.

Interruptible transmission and storage services are also available where customers can use capacity if it exists at the time of the request and are generally at a higher toll than long-term contracted rates. Interruptible revenues depend on the amount of volumes transported or stored and the associated rates for this service. Storage operations also provide a variety of other value-added services including natural gas parking, loaning and balancing services to meet customers’ needs.

CANADIAN GAS TRANSMISSION

On July 4, 2018, we entered into agreements to sell our British Columbia Field Services business to Brookfield Infrastructure Partners L.P. and its institutional partners. Separate agreements were entered into for those facilities governed by provincial regulations and those governed by federal regulations. On October 1, 2018, we closed the sale of the provincially regulated facilities and on December 31, 2019, we closed the sale of the federally regulated facilities. For further information, refer to Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Recent Developments - Asset Monetization and Item 8. Financial Statements and Supplementary Data - Note 8. Acquisitions and Dispositions.

On May 28, 2019, we completed the sale of our federally regulated natural gas gathering and processing assets in the Grizzly Valley area of British Columbia to Sukunka Natural Resources Inc., a subsidiary of Canadian Natural Resources Limited.

Canadian Gas Transmission still includes British Columbia Pipeline, M&N Canada, Alliance Pipeline and certain other midstream gas pipelines, gathering, processing and storage assets.

British Columbia Pipeline has approximately 2,900-kilometers (1,800-miles) of transmission pipeline in British Columbia and Alberta, as well as associated mainline compressor stations and provides fee-for-service based natural gas transmission services.

M&N Canada is an approximately 885-kilometer (550-mile) interprovincial natural gas transmission mainline system which extends from Goldboro, Nova Scotia to the United States border near Baileyville, Maine. M&N Canada is connected to M&N U.S. For further information, refer to Gas Transmission and Midstream - US Gas Transmission. We have a 78% interest in M&N Canada.

Alliance Pipeline is a 3,000-kilometer (1,864-mile) integrated, high-pressure natural gas transmission pipeline and approximately 860-kilometers (534-miles) of lateral pipelines and related infrastructure. It transports liquids-rich natural gas from northeast British Columbia, northwest Alberta and the Bakken area in North Dakota to the Alliance Chicago gas exchange hub downstream of the Aux Sable NGL extraction and fractionation plant at Channahon, Illinois. The majority of transportation services provided by Alliance Pipeline are under firm agreements, which provide for fixed reservation charges that are paid monthly regardless of actual volumes transported on the pipeline. Alliance Pipeline also provides interruptible transmission services where customers can use capacity if it is available at the time of request. We have a 50% interest in Alliance Pipeline.

The majority of transportation services provided by Canadian Gas Transmission are under firm agreements, which provide for fixed reservation charges that are paid monthly regardless of actual volumes transported on the pipeline, plus a small variable component that is based on volumes transported to recover variable costs. Canadian Gas Transmission also provides interruptible transmission services where customers can use capacity if it is available at the time of request. Payments under these services are based on volumes transported.

US MIDSTREAM

US Midstream includes a 42.7% interest in each of Aux Sable Liquid Products LP and Aux Sable Midstream LLC, and a 50% interest in Aux Sable Canada LP (collectively, Aux Sable). Aux Sable Liquid Products LP owns and operates an NGL extraction and fractionation plant at Channahon, Illinois, outside Chicago, near the terminus of Alliance Pipeline. Aux Sable also owns facilities upstream of Alliance Pipeline that facilitate deliveries of liquids-rich gas volumes into the pipeline for further processing at the Aux Sable plant. These facilities include the Palermo Conditioning Plant and the Prairie Rose Pipeline in the Bakken area of North Dakota, owned and operated by Aux Sable Midstream US; and Aux Sable Canada’s interests in the Montney area of British Columbia, comprising the Septimus Pipeline and the Septimus and Wilder Gas Plants.

US Midstream also includes a 50% investment in DCP Midstream, LLC (DCP Midstream), which indirectly owns approximately 57% of DCP Midstream, LP, including limited partner and general partner interests. DCP Midstream, LP is a master limited partnership, with a diversified portfolio of assets, engaged in the business of gathering, compressing, treating, processing, transporting, storing and selling natural gas; producing, fractionating, transporting, storing and selling NGLs; and recovering and selling condensate. DCP Midstream, LP owns and operates more than 49 plants and approximately 99,780-kilometers (62,000-miles) of natural gas and natural gas liquids pipelines, with operations in 17 states across major producing regions.

OTHER

Other consists primarily of our offshore assets. Enbridge Offshore Pipelines is comprised of 11 active natural gas gathering and FERC regulated transmission pipelines and four active oil pipelines. These pipelines are located in four major corridors in the Gulf of Mexico, extending to deepwater developments, and include almost 2,100-kilometers (1,300-miles) of underwater pipe and onshore facilities with total capacity of approximately 6.5 bcf/d.

COMPETITION

Our natural gas transmission and storage businesses compete with similar facilities that serve our supply and market areas in the transmission and storage of natural gas. The flow pattern of natural gas is changing across North America due to emerging supply sources and evolving demand centers, which creates competition for growth opportunities. The principal elements of competition are location, rates, terms of service, flexibility and reliability of service.

The natural gas transported in our business competes with other forms of energy available to our customers and end-users, including electricity, coal, propane, fuel oils, and renewable energy. Factors that influence the demand for natural gas include price changes, the availability of natural gas and other forms of energy, levels of business activity, long-term economic conditions, conservation, legislation, governmental regulations, the ability to convert to alternative fuels, weather and other factors.

Competition exists in all of the markets our businesses serve. Competitors include interstate and intrastate pipelines or their affiliates and other midstream businesses that transport, gather, treat, process and market natural gas or NGLs. Because pipelines are generally the most efficient mode of transportation for natural gas over land, the most significant competitors of our natural gas pipelines are other pipeline companies.

SUPPLY AND DEMAND

Our gas transmission assets make up one of the largest natural gas transportation networks in North America, driving connectivity between prolific supply basins and major demand centers within the continent. Our systems have been integral to the transition in natural gas fundamentals over the last decade, and will continue to play a part as the energy landscape evolves. Shifts in production and consumption, both domestic and foreign, will require that we continue to serve as a critical link between markets.

In 2010, natural gas production in each of the Appalachian and Permian basins were less than 5.0 bcf/d each. Today, these regions produce more than 50.0 bcf/d of natural gas on a combined basis. Improved technology and increased shale gas drilling has increased the supply of low-cost natural gas. As well, there has been and continues to be a corresponding increase in demand for our natural gas infrastructure in North America. Through a series of expansions and reversals on our core systems, combined with the execution of greenfield projects and strategic acquisitions, we have been able to meet the needs of producers and consumers alike. Our US Gas Transmission systems were initially designed to transport natural gas from the Gulf Coast to the supply starved northeast markets. Our asset base now has the capability to transport diverse supply to the northeast, southeast, midwest, and gulf coast markets on a fully subscribed and highly utilized basis.

The northeast market continues its role as a predominantly supply constrained region with steady growth. Natural gas demand in the northeast is expected to grow by 2.5 bcf/d through 2040, driven by continued commercial and residential load growth. Natural gas leads the fuel mix of the Independent System Operator New England market at more than 40 percent. The bidirectional capabilities offered by our system allow us to deliver both domestic and imported supplies to our regional customers, 75 percent of whom are end users with a contract renewal rate of over 99 percent. The region has seen an increase in natural gas supply due to the development of the Marcellus and Utica shales in the Appalachia region.

Demand for natural gas in the southeast region is forecast to increase by 4.0 bcf/d through 2040. Generating capacity in Florida is expected to grow 15 percent by 2026, the majority of which is projected to be natural gas-fired. The southeast market is linked to multiple, highly liquid supply pools that include the Marcellus and Utica shale developments, offering consistent supply and stable pricing to a growing population of end-use customers across our multiple systems under long term, utility-like arrangements.

With connectivity to Appalachian and western Canadian supply through our systems, the midwest market has access to two of the lowest cost gas producing regions on the continent. As demand in the region is expected to continue to grow by approximately 3.0 bcf/d over the next two decades, maintaining this link will remain important. Flexibility in supply for this market is especially critical to maintaining liquidity and price stability as natural gas continues to replace coal-fired generation.

Gulf coast demand growth is being driven by an ongoing wave of gas-intensive petrochemical facilities which are now starting to enter service, along with power generation, an increase in the volume of LNG exports and additional pipeline exports to Mexico. Demand in the region is anticipated to grow by more than 19.0 bcf/d through 2040. The gulf coast market has been the beneficiary of low cost capacity on our assets as the relationship between supply and market centers has shifted. Such cost effective capacity is difficult to access or replicate, offering existing shippers and transporters stability of capacity and utilization. Tide water market access and proximity to Mexico continue to make this region a platform of global trade as pipeline, LNG and Liquefied Petroleum Gas (LPG) exports see strong growth. The United States exported approximately 4.0 bcf/d of natural gas from the gulf coast region at the end of 2019 with an export capacity of approximately 10.0 bcf/d scheduled to be in service by 2021.

Despite there being strong growth in both supply and demand in the United States, a lack of adequate transportation capacity has placed downward pressure on local natural gas pricing. The Appalachian Basin has seen price differentials of $1.00 to $2.00 per million British Thermal Units (MMBtu) relative to Henry Hub in the gulf coast over the last few years. Unlike the dry gas production of the Marcellus, natural gas production growth in the Permian Basin is a result of robust crude oil production taking place in the region. Associated gas supplies from the region increased by approximately 10.0 bcf/d over the past two years and growth is forecasted to continue for the next decade. Until new natural gas transportation capacity begins to come online through the early 2020s, the natural gas prices in the region will continue to remain low relative to other producing regions.

Western Canada is experiencing a similar phenomenon to that of the Permian, with the local markets experiencing very low or even negative prices for natural gas as transportation bottlenecks continue. One of the few vital links to demand centers in the pacific northwest are our own systems in the region which operate near full capacity. As demand for supply out of the WCSB continues to grow, driven largely by NGL production and local oil sands production, the need for new natural gas and NGL infrastructure will continue to rise.

Global energy demand is expected to increase approximately 25 percent by 2040, according to the International Energy Agency, driven primarily by economic growth in non-OECD countries. Natural gas will play an important role in meeting this energy demand as gas consumption is anticipated to grow by approximately 40 percent during this period as one of the world’s fastest growing energy sources. North American exports will play a significant part in meeting global demand, underscoring the ability of our assets to remain highly utilized by shippers, and highlighting the need for incremental transportation solutions across North America. In response to these global fundamentals, we believe we are well positioned to provide value-added solutions to shippers. We are responding to the need for regional infrastructure with additional investments in Canadian and United States gas transportation facilities. Progress on the development and construction of our commercially secured growth projects is discussed in Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Growth Projects - Commercially Secured Projects.

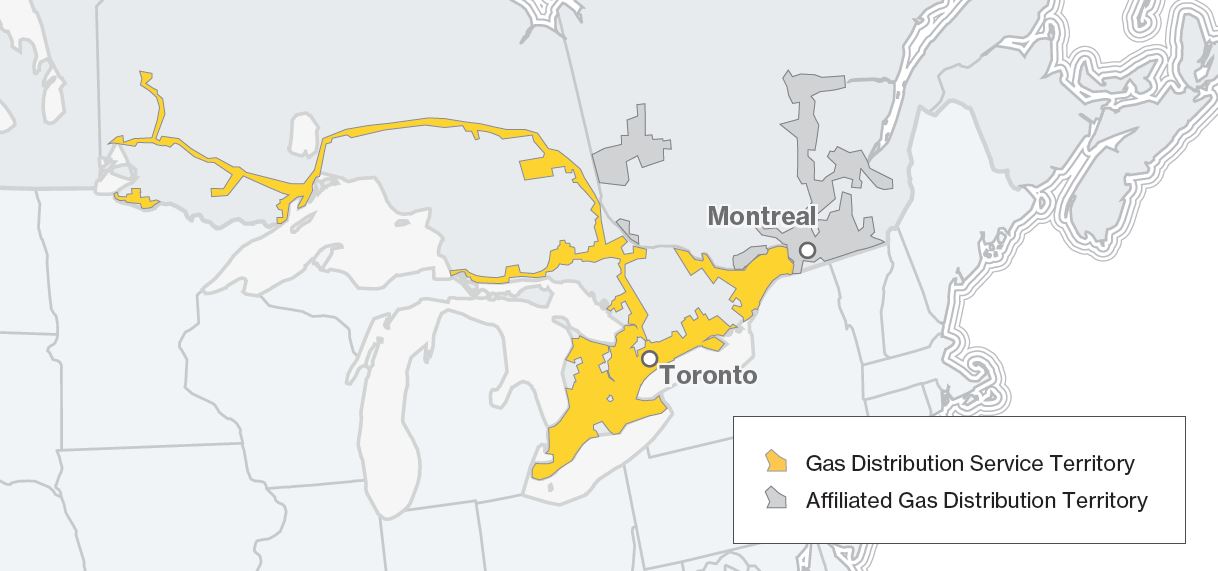

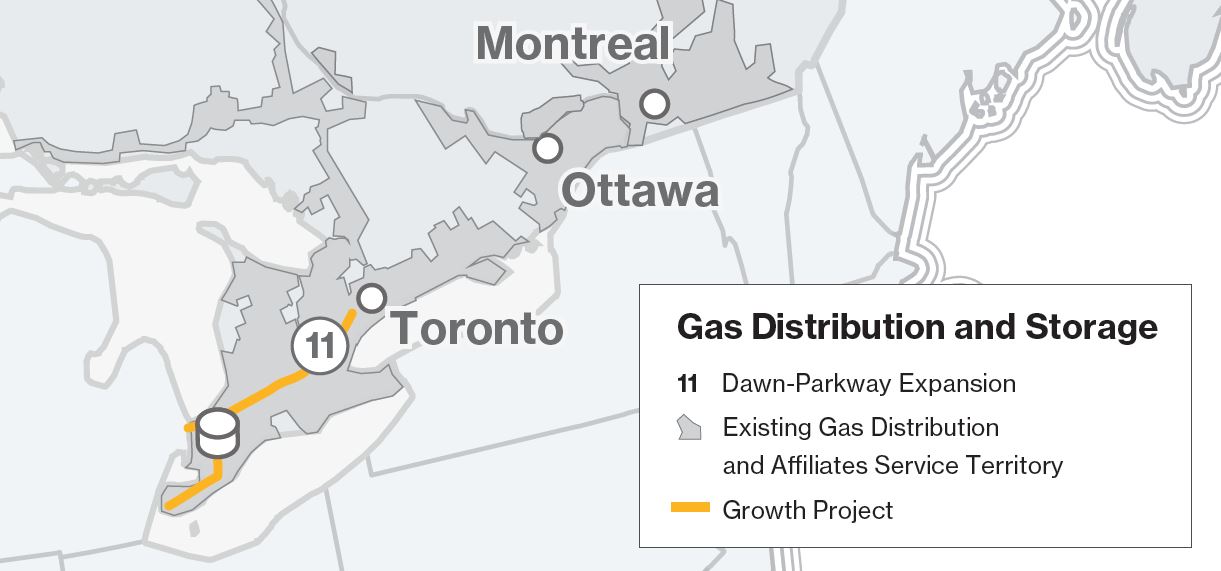

GAS DISTRIBUTION AND STORAGE

Gas Distribution and Storage consists of our natural gas utility operations, the core of which is Enbridge Gas Inc. (Enbridge Gas), which serves residential, commercial and industrial customers throughout Ontario. This business segment also includes natural gas distribution activities in Québec and an investment in Noverco Inc. (Noverco).

Enbridge Gas Distribution Inc. (EGD) and Union Gas Limited (Union Gas) were amalgamated on January 1, 2019. The amalgamated company has continued as Enbridge Gas. The amalgamation creates the single largest natural gas utility in North America in terms of send-out volumes, and third largest in terms of number of customers. We expect that the ongoing amalgamation will drive efficiencies and synergies, leverage greater supply-chain strength, create new opportunities for growth and form a stronger platform to deliver strong, provide predictable returns to shareholders and superior value and service to customers.

On October 1, 2019, we closed the sale of Enbridge Gas New Brunswick Inc. (EGNB) to Liberty Utilities (Canada) LP and on November 1, 2019, we closed the sale of St. Lawrence Gas Company, Inc. to Liberty Utilities Co., both wholly-owned subsidiaries of Algonquin Power & Utilities Corp. For further information, refer to Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Recent Developments - Asset Monetization and Item 8. Financial Statements and Supplementary Data - Note 8. Acquisitions and Dispositions.

ENBRIDGE GAS

Enbridge Gas is a rate-regulated natural gas distribution utility with storage and transmission services and has been in operation for approximately 170 years. Enbridge Gas serves approximately 3.8 million residential, commercial and industrial customers across Ontario.

There are three principal interrelated aspects of the natural gas distribution business in which Enbridge Gas is directly involved: Distribution, Transportation and Storage.

Distribution

Enbridge Gas’ principal source of revenue arises from distribution of natural gas to customers. The services provided to residential, small commercial and industrial heating customers are primarily on a general service basis, without a specific fixed-term or fixed-price contract. The services provided to larger commercial and industrial customers are usually on an annual contract basis under firm or interruptible service contracts. Under a firm contract, Enbridge Gas is obligated to deliver natural gas to the customer up to a maximum daily volume. The service provided under an interruptible contract is similar to that of a firm contract, except that it allows for service interruption at Enbridge Gas’ option to meet seasonal or peak demands. The Ontario Energy Board (OEB) approves rates for both contract and general services. The distribution system consists of approximately 151,000-kilometers (93,800-miles) of pipelines that carry natural gas from the point of local supply to customers.

Customers have a choice with respect to natural gas supply. Customers may purchase and deliver their own natural gas into Enbridge Gas’ distribution system or alternatively they may choose a system supply option, whereby customers purchase natural gas from Enbridge Gas’ supply portfolio. To acquire the necessary volume of natural gas to serve its customers, Enbridge Gas maintains a diversified natural gas supply portfolio, acquiring supplies on a delivered basis in Ontario, as well as acquiring supply from multiple supply basins across North America.

Transportation

Enbridge Gas contracts for firm transportation service, primarily with TransCanada Pipelines Limited (TransCanada), Vector Pipeline Limited Partnership and NEXUS Gas Transmission Pipeline, to meet its annual natural gas supply requirements. The transportation service contracts are not directly linked with any particular source of natural gas supply. Separating transportation contracts from natural gas supply allows Enbridge Gas flexibility in obtaining its own natural gas supply and accommodating the requests of its direct purchase customers for assignment of TransCanada capacity. Enbridge Gas forecasts the natural gas supply needs of its customers, including the associated transportation and storage requirements.

In addition to contracting for transportation service, Enbridge Gas offers firm and interruptible transportation services on its own Dawn-Parkway pipeline system. Enbridge Gas’ transmission system consists of approximately 5,500-kilometers (3,418-miles) of high-pressure pipeline, five mainline compressor stations and has an effective peak daily demand capacity of 7.6 bcf/d. Enbridge Gas’ transmission system also links an extensive network of underground storage pools at the Tecumseh Gas Storage facility and Dawn Hub (collectively, Dawn) to major Canadian and United States markets, and forms an important link in moving natural gas from western Canada and United States supply basins to central Canadian and northeastern United States markets.

As the supply of natural gas in areas close to Ontario continues to grow, there is an increased demand to access these diverse supplies at Dawn and transport them along the Dawn-Parkway pipeline system to markets in Ontario, eastern Canada and the northeastern United States. Enbridge Gas delivered 1,860 Bcf of gas through its distribution and transmission system in 2019. A substantial amount of Enbridge Gas’ transportation revenue is generated by fixed annual demand charges, with the average length of a long-term contract being approximately 13 years and the longest remaining contract term being 21 years.

Storage

Enbridge Gas’ business is highly seasonal as daily market demand for natural gas fluctuates with changes in weather, with peak consumption occurring in the winter months. Utilization of storage facilities permits Enbridge Gas to take delivery of natural gas on favorable terms during off peak summer periods for subsequent use during the winter heating season. This practice permits Enbridge Gas to minimize the annual cost of transportation of natural gas from its supply basins, assists in reducing its overall cost of natural gas supply and adds a measure of security in the event of any short-term interruption of transportation of natural gas to Enbridge Gas’ franchise areas.

Enbridge Gas’ storage facility at Dawn is located in southwestern Ontario, and has a total working capacity of approximately 272 bcf in 34 underground facilities located in depleted gas fields. Dawn is the largest integrated underground storage facility in Canada and one of the largest in North America. Approximately 181 bcf, at their respective current heat values, of the total working capacity is available to Enbridge Gas for utility operations. Enbridge Gas also has storage contracts with third parties for 17 bcf of storage capacity.

Dawn offers customers an important link in the movement of natural gas from western Canadian and United States supply basins to markets in central Canada and the northeast United States. Dawn's configuration provides flexibility for injections, withdrawals and cycling. Customers can purchase both firm and interruptible storage services at Dawn. Dawn offers customers a wide range of market choices and options with easy access to upstream and downstream markets. During 2019, Dawn provided services such as storage, balancing, gas loans, transport, exchange and peaking services to over 200 counterparties.

A substantial amount of Enbridge Gas’ storage revenue is generated by fixed annual demand charges, with the average length of a long-term contract being approximately four years and the longest remaining contract term being 17 years.

NOVERCO

Noverco is a holding company that wholly-owns Énergir, LP (Energir), formerly known as Gaz Metro Limited Partnership, a natural gas distribution company operating in the province of Quebec, with interests in subsidiary companies operating gas transmission, gas distribution and power distribution businesses in the Province of Québec and the State of Vermont. Energir serves approximately 525,000 residential and industrial customers and is regulated by the Québec Régie de l’énergie and the Vermont Public Utility Commission. Noverco also holds, directly and indirectly, an investment in our common shares. We own an equity interest in Noverco through ownership of 38.9% of its common shares and an investment in its preferred shares.

GAZIFÈRE

We wholly own Gazifère, a natural gas distribution company that serves approximately 43,000 customers in western Québec, a market not served by Energir. Gazifère is regulated by the Québec Régie de l’énergie.

COMPETITON

Enbridge Gas’ distribution system is regulated by the OEB and is subject to regulation in a number of areas, including rates. Enbridge Gas is not generally subject to third-party competition within its distribution franchise areas.

Enbridge Gas competes with other forms of energy available to its customers and end-users, including electricity, coal, propane and fuel oils. Factors that influence the demand for natural gas include weather, price changes, the availability of natural gas and other forms of energy, the level of business activity, conservation, legislation, governmental regulations, the ability to convert to alternative fuels and other factors.

SUPPLY AND DEMAND

We expect that demand for natural gas in North America will continue to see low annual growth over the long term with continued growth in peak day demands. Some modest growth driven by low natural gas prices is expected to continue given the significant price advantage relative to alternate energy options, with specific interest coming from communities that are not currently serviced by natural gas. Enbridge Gas continues to focus on promoting conservation and energy efficiency by undertaking activities focused on reducing natural gas consumption through various demand side management programs offered across all markets. We expect demand for natural gas in the greater Toronto metropolitan area to continue to grow due to favorable population growth supplemented by the expansion of other communities served by our system.

The storage and transportation marketplace continues to respond to changing natural gas supply dynamics including a robust supply environment. In recent years, the robust North American gas supply balance, due mainly to the development of shale gas volumes including the Alberta, British Columbia, Marcellus and Utica shale areas, has resulted in lower commodity prices and narrower seasonal price spreads. Unregulated storage values are primarily determined based on the difference in value between winter and summer natural gas prices. Storage values have been relatively stable to slightly rising as the North American natural gas supply and demand slowly returned to a more balanced position.

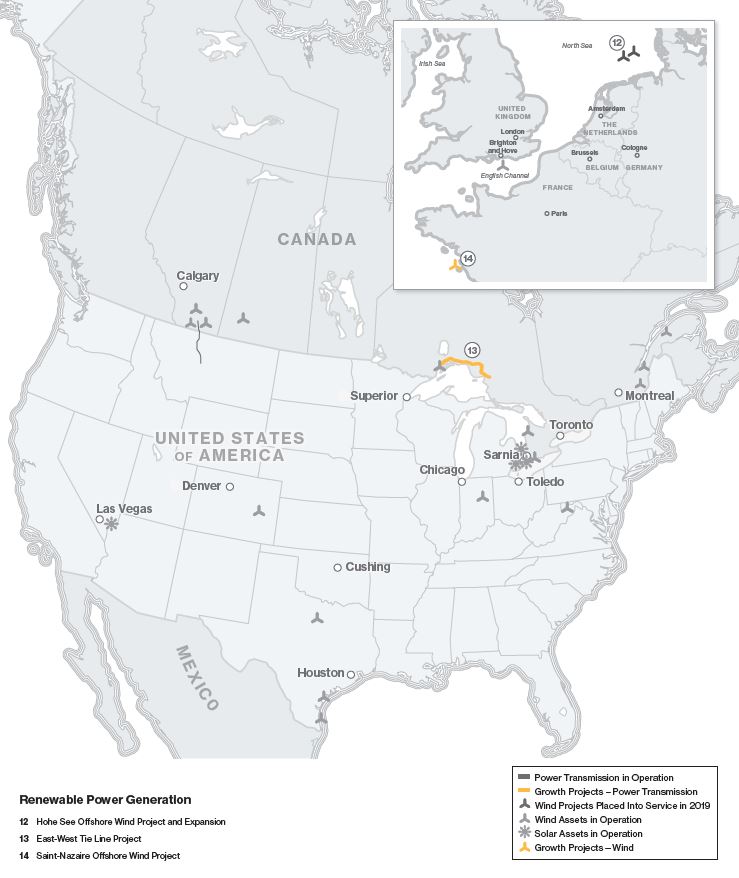

RENEWABLE POWER GENERATION

Renewable Power Generation consists primarily of investments in wind and solar assets, as well as geothermal, waste heat recovery, and transmission assets. In North America, assets are primarily located in the provinces of Alberta, Saskatchewan, Ontario, and Québec and in the states of Colorado, Texas, Indiana and West Virginia. In Europe, Enbridge holds equity interests in operating offshore wind facilities in the coastal waters of the United Kingdom and Germany, as well as in several projects under active development in France. Further, we are pursuing new European development opportunities through Maple Power Ltd., a joint venture in which we hold a 50% interest.

Combined Renewable Power Generation investments represent approximately 1,991 MW of net generation capacity. Of this amount, approximately:

1,392 MW is generated by North American wind facilities;

255 MW is generated by European offshore wind facilities;

240 MW is generated by the Saint-Nazaire Offshore Wind project, currently under construction; and

78 MW is generated by North American solar facilities.

The vast majority of the power produced from these wind facilities is sold under long-term power purchase agreements.

Renewable Power Generation includes the Montana-Alberta Tie-Line (MATL), a 300 MW transmission line which runs from Great Falls, Montana to Lethbridge, Alberta. In the fourth quarter of 2019, we committed to a plan to sell the MATL transmission assets. The purchase and sale agreement was signed in January 2020. Subject to certain regulatory approvals and customary closing conditions, the transaction is expected to close in the first quarter of 2020.

JOINT VENTURES / EQUITY INVESTMENTS

Effective August 1, 2018, the investments in the Canadian renewable assets and two of the United States renewable assets are held within a joint venture in which we maintain a 51% interest and continue to manage, operate, and provide administrative support.

We also own interests in European offshore wind facilities through the following joint ventures:

| | | | |

| |

• | | a 24.9% interest in Rampion Offshore, located in the United Kingdom, which went into service April 2018;

|

| |

• | a 25% interest in Hohe See Offshore and its subsequent expansion, located in Germany, which went into service October 2019 and January 2020, respectively; and

|

a 50% interest in the Saint-Nazaire Offshore Wind project, located in France, that is currently under construction.

COMPETITION

Our Renewable Power Generation assets operate in the North American and European power markets, which are subject to competition and supply and demand fundamentals for power in the jurisdictions in which they operate. The majority of revenue is generated pursuant to long-term power purchase agreements or has been substantially hedged. As such, the financial performance is not significantly impacted by fluctuating power prices arising from supply/demand imbalances or the actions of competing facilities during the term of the applicable contracts. However, the renewable energy sector includes large utilities, small independent power producers and private equity investors, which are expected to aggressively compete for new project development opportunities and for the right to supply customers when contracts expire.

To grow in an environment of heightened competition, we strategically seek opportunities to collaborate with well-established renewable power developers and financial partners and to target regions with commercial constructs consistent with our low risk business model. In addition, we bring to bear the expertise of completing and delivering large scale infrastructure projects.

SUPPLY AND DEMAND

The renewable power generation network in North America is expected to undergo significant growth over the next 20 years due to the replacement of older sources of electricity generation. On the demand side, North American economic growth over the longer term is expected to drive growing electricity demand, although continued efficiency gains are expected to make the economy less energy-intensive and temper demand growth. On the supply side, legislation is expected to accelerate the retirement of aging coal-fired generation plants, resulting in a requirement for significant new generation capacity and extending project lives and/or power purchase agreements of preferred technologies. While coal and nuclear facilities will continue to be core components of power generation in North America, gas-fired and renewable energy facilities, including biomass, hydro, solar and wind (the latter of which make up the bulk of our assets), are expected to be the preferred sources to replace coal-fired generation due to their lower carbon intensities. In addition, changes in the administration in the jurisdictions within which we operate, or in societal views, could result in a significant policy shift or pressure to accelerate low carbon transition.

In the near-term, uncertainty over the availability of tax or other government incentives in various jurisdictions, the ability to secure long-term power purchase agreements through government or investor-owned power authorities and low market prices of electricity may hinder the pace of future new renewable capacity development. However, continued improvement in technology and manufacturing capacity in the past few years has reduced capital costs and improved yield factors associated with renewable energy generation. These positive developments are expected to render renewable energy more competitive and support ongoing investment over the long-term, regardless of available incentives. Related growth opportunities could include repowering projects to increase output from and extend project-life of our existing facilities.

In Europe, the renewable energy outlook is positive, especially for offshore wind in countries with long coastlines and densely populated areas. According to the European Wind Energy Association, by 2030, wind energy capacity in Europe is expected to be 320 Gigawatts (GW), including 66 GW of offshore capacity as compared to 18.5 GW at the end of 2018.There is also wide public support for carbon reduction targets and broader adoption of renewable generation across all governmental levels. We, through our European joint ventures, continue to invest in offshore wind projects in the United Kingdom, France, and Germany to meet the growing demand.

ENERGY SERVICES

The Energy Services businesses in Canada and the United States undertake physical commodity marketing activity and logistical services to manage our volume commitments on various pipeline systems. Energy Services provides energy marketing services to North American refiners, producers, and other customers.

Energy Services is primarily focused on servicing customers across the value chain and capturing value from quality, time, and location price differentials when opportunities arise. To execute these strategies, Energy Services transports and stores on both Enbridge-owned and third party assets using a combination of contracted long-term and short-term pipeline, storage tank, railcar, and truck capacity agreements.

COMPETITION

Energy Services’ earnings are primarily generated from arbitrage opportunities which, by their nature, can be replicated by competitors. An increase in market participants entering into similar arbitrage strategies could have an impact on our earnings. Efforts to mitigate competition risk include diversification of the marketing business by transacting at the majority of major hubs in North America and establishing long-term relationships with clients and pipelines.

ELIMINATIONS AND OTHER

Eliminations and Other includes operating and administrative costs and the impact of foreign exchange hedge settlements, which are not allocated to business segments. Eliminations and Other also includes new business development activities and corporate investments.

OPERATIONAL, ENVIRONMENTAL AND ECONOMIC REGULATION

LIQUIDS PIPELINES

Operational Regulation

We are subject to numerous operational rules and regulations mandated by governments or applicable regulatory authorities, breaches of which could result in fines, penalties, operating restrictions and an overall increase in operating and compliance costs.

In the United States, our interstate pipeline operations are subject to pipeline safety laws and regulations administered by the Pipeline and Hazardous Materials Safety Administration (PHMSA) of the United States Department of Transportation (DOT). These laws and regulations require us to comply with a significant set of requirements for the design, construction, maintenance and operation of our interstate pipelines. These laws and regulations, among other things, include requirements to monitor and maintain the integrity of our pipelines and determine the pressures at which our pipelines can operate.

PHMSA has designed an Integrity Verification Process intended to create standards to verify maximum allowable operating pressure, and to improve and expand integrity management processes. Additionally, PHMSA has established standards for storage facilities. There remains uncertainty as to how these standards will be implemented, but it is expected that the changes will impose additional costs on new pipeline projects as well as on existing operations. In this climate of increasingly stringent regulation, pipeline failure or failures to comply with applicable regulations could result in reduction of allowable operating pressures as authorized by PHMSA, which would reduce available capacity on our pipelines. Should any of these risks materialize, it may have an adverse effect on our operations, earnings, cash flows and financial condition.

In Canada, our pipeline operations are subject to pipeline safety regulations overseen by the CER or provincial regulators. Applicable legislation and regulations require us to comply with a significant set of requirements for the design, construction, maintenance and operation of our pipelines. Among other obligations, this regulatory framework imposes requirements to monitor and maintain the integrity of our pipelines.

As in the United States, several legislative changes addressing pipeline safety in Canada have recently been enacted. The changes evidence an increased focus on the implementation of management systems to address key areas such as emergency management, integrity management, safety, security and environmental protection. Other legislative changes have created authority for the CER to impose administrative monetary penalties for non-compliance with the regulatory regime it administers, as well as to impose financial requirements for future abandonment and major pipeline releases.

Environmental Regulation

We are also subject to numerous environmental laws and regulations affecting many aspects of our present and future operations, including air emissions, water quality, wastewater discharges, solid waste and hazardous waste. These laws and regulations generally require us to obtain and comply with a wide variety of environmental licenses, permits and other approvals.

In particular, in the United States, compliance with major Clean Air Act regulatory programs is likely to cause us to incur significant capital expenditures to obtain permits, evaluate off-site impacts of our operations, install pollution control equipment, and otherwise assure compliance. Some states in which we operate are implementing new emissions limits to comply with 2008 ozone standards regulated under the National Ambient Air Quality Standards. In 2015, the ozone standards were lowered even further from 75 parts per billion (ppb) to 70 ppb, which may require states to implement additional emissions regulations. The precise nature of these compliance obligations at each of our facilities has not been finally determined and may depend in part on future regulatory changes. In addition, compliance with new and emerging environmental regulatory programs may significantly increase our operating costs compared to historical levels.

In the United States, climate change action is evolving at state, regional and federal levels. The Supreme Court decision in Massachusetts v. Environmental Protection Agency in 2007 established that GHG emissions were pollutants subject to regulation under the Clean Air Act. Pursuant to federal regulations, we are currently subject to an obligation to report our GHG emissions at our largest emitting facilities, but are not generally subject to limits on emissions of GHGs. In addition, a number of states have joined regional GHG initiatives, and a number are developing their own programs that would mandate reductions in GHG emissions. Public interest groups and regulatory agencies are increasingly focusing on the emission of methane associated with natural gas development and transmission as a source of GHG emissions. However, as the key details of future GHG restrictions and compliance mechanisms remain undefined, the likely future effects on our business are highly uncertain.

For its part, Canada has reaffirmed its strong preference for a harmonized approach with that of the United States. In 2019, the Government of Canada implemented a federal system of carbon pricing. The pricing applies to provinces and territories that are not in compliance with the federal requirements.

Due to the speculative outlook regarding any United States federal and state policies, we cannot estimate the potential effect of proposed GHG policies on our future consolidated results of operations, financial position or cash flows. However, such legislation or regulation could materially increase our operating costs, require material capital expenditures or create additional permitting, which could delay proposed construction projects.

Economic Regulation

Our liquids pipelines also face economic regulation risk. Broadly defined, economic regulation risk is the risk that governments or regulatory agencies change or reject proposed or existing commercial arrangements including permits and regulatory approvals for new projects. The Mainline System and other liquids pipelines are subject to the actions of various regulators, including the CER and FERC, with respect to the tariffs and tolls of those operations. The changing or rejecting of commercial arrangements, including decisions by regulators on the applicable tariff structure or changes in interpretations of existing regulations by courts or regulators, could have an adverse effect on our revenues and earnings. Delays in regulatory approvals on projects such as our U.S. L3R Program, could result in cost escalations and construction delays, which also negatively impact our operations.

GAS TRANSMISSION AND MIDSTREAM

Operational Regulation

The span of regulation risks that apply to the Liquids Pipeline business as described above under Liquids Pipelines also applies to the Gas Transmission and Midstream business. Most of our United States gas transmission operations are regulated by the FERC. The FERC regulates natural gas transmission in United States interstate commerce including the establishment of rates for services. The FERC also regulates the construction of United States interstate natural gas pipelines and storage facilities, including the extension, enlargement and abandonment of facilities. In addition, certain operations are subject to oversight by state regulatory commissions. To the extent that the natural gas intrastate pipelines that transport or store natural gas in interstate commerce provide services under Section 311 of the Natural Gas Policy Act of 1978, they are subject to FERC regulations. The FERC may propose and implement new rules and regulations affecting interstate natural gas transmission and storage companies, which remain subject to the FERC’s jurisdiction. These initiatives may also affect certain transmission of gas by intrastate pipelines. We reached an agreement with Texas Eastern shippers and filed a Stipulation and Agreement with the FERC on October 28, 2019. We expect a decision from the FERC in the second quarter of 2020, upon which we will begin recognizing updated rates within our results of operations.

Our operations are subject to the jurisdiction of the Environmental Protection Agency and various other federal, state and local environmental agencies. Our United States interstate natural gas pipelines and certain of DCP Midstream’s gathering and transmission pipelines are also subject to the regulations of the DOT concerning pipeline safety.

The intrastate natural gas and NGL pipelines owned by us and DCP Midstream are subject to state regulation. DCP Midstream's interstate NGL transportation pipelines are subject to FERC regulation. The natural gas gathering and processing activities of DCP Midstream are not subject to FERC regulation.

Our Canadian operations are governed by various federal and provincial agencies with respect to pipeline safety, including the CER, the Transportation Safety Board and the Ontario Technical Standards and Safety Authority.

Our Canadian natural gas transmission operations are subject to regulation by the CER or the provincial agencies in Canada, such as the OEB. These agencies have jurisdiction similar to the FERC for regulating rates, the terms and conditions of service, the construction of additional facilities and acquisitions. We are in the process of negotiating a rate settlement agreement with our British Columbia Pipeline shippers. Since the expiration of our previous Settlement Agreement at the end of 2019, we have been charging interim rates as approved by the CER.

GAS DISTRIBUTION AND STORAGE

Operational Regulation

Our gas distribution and storage utility operations are regulated by the OEB and the Québec Régie de l’énergie, among others. Regulators’ future actions may differ from current expectations or future legislative changes may impact the regulatory environments in which we operate. To the extent that the regulators’ future actions are different from current expectations, the timing and amount of recovery or refund of amounts recorded on the Consolidated Statements of Financial Position, or amounts that would have been recorded on the Consolidated Statements of Financial Position in absence of the effects of regulation, could be different from the amounts that are eventually recovered or refunded.

We seek to mitigate operational regulation risk. We retain dedicated professional staff and maintain strong relationships with customers, intervenors and regulators. This strong regulatory relationship continued in 2019 following the OEB’s Decision and Order to approve Enbridge Gas’ application for 2019 rates. The Decision and Order approved an effective date for base rates of April 1, 2019, and the inclusion of incremental capital module amounts to allow for the recovery of incremental capital investments.

Enbridge Gas' distribution rates, beginning in 2019, are set under a five-year incentive regulation (IR) framework using a price cap mechanism. The price cap mechanism establishes new rates each year through an annual base rate escalation at inflation less a 0.3% productivity factor, annual updates for certain costs to be passed through to customers, and where applicable, the recovery of material discrete incremental capital investments beyond those that can be funded through base rates. The IR framework includes the continuation and establishment of certain deferral and variance accounts, as well as an earnings sharing mechanism that requires Enbridge Gas to share equally with customers, any earnings in excess of 150 basis points over the annual OEB approved return on equity (ROE).

Environmental Regulation

Our workers, operations and facilities are subject to municipal, provincial and federal legislation which regulate the protection of the environment and the health and safety of workers. Environmental legislation primarily includes regulation of discharges to air, land and water; management and disposal of hazardous waste; the assessment and management of contaminated sites; and the reporting and reduction of GHG emissions.

Gas distribution system operation, as with any industrial operation, has the potential risk of abnormal or emergency conditions, or other unplanned events that could result in spills or emissions in excess of permitted levels. These events could result in injuries to workers or the public, adverse impacts to the environment in which we operate within, property damage or regulatory violations including order and fines. We could also incur future liability for soil and groundwater contamination associated with past and present site activities.

In addition to gas distribution, we also operate storage facilities and small oil and brine productions in southwestern Ontario. Environmental risk associated with these facilities is the potential for unplanned releases. In the event of a release, remediation of the affected area would be required. There would also be potential for fines, orders or charges under environmental legislation, and potential third-party liability claims by any affected land owners.

The gas distribution system and our other operations must maintain environmental approvals and permits from regulators to operate. As a result, these assets and facilities are subject to periodic inspections and/or audits. Annual reports, such as the Annual Written Summary Report are submitted to the Ontario Ministry of Environment, Conservation and Parks (MECP) and other regulators to demonstrate we are in good standing with our Environmental Compliance Approvals. Failure to maintain regulatory compliance could result in operational interruptions, fines, and/or orders for additional pollution control technology or environmental mitigation. As environmental requirements and regulations become more stringent, the cost to maintain compliance and the time required to obtain approvals has increased.

As with previous years, in 2019, we reported GHG emissions to Environment and Climate Change Canada (ECCC), the Ontario MECP, and a number of voluntary reporting programs. Emissions from Ontario combustion sources were verified in detail by a third-party accredited verifier with no material discrepancies found. Additionally, operational emissions from venting, fugitive and natural gas distribution emissions were reported to the MECP starting in 2017 in accordance with Ontario regulations.

Enbridge Gas utilizes emissions data management processes and systems to help with the data capture and mandatory and voluntary reporting needs. Quantification methodologies and emission factors will continually be updated in the system as required. Enbridge Gas continues to work with industry associations to refine quantification methodologies and emissions factors, as well as best management practices to minimize emissions.

In October 2018, the federal government confirmed that Ontario is subject to the federal government’s carbon pricing program, otherwise known as the Federal Carbon Pricing Backstop Program. This program consists of two components: an output-based pricing system (OBPS) and carbon charge levied on fossil fuels, including natural gas.

The OBPS component began on January 1, 2019. Under OBPS, a registered facility will have a facility-specific annual emission limit which is based on the relevant output-based standard for its level of production. Enbridge Gas has registered with ECCC as an emitter in the OBPS program and will have an annual compliance obligation associated with its natural gas pipeline transmission system. Annually, Enbridge Gas is required to report its emissions covered under the OBPS, have the emissions report verified by an accredited third-party verifier and remit payment for any emissions that exceed the facility-specific emission limit.